Form 165 - Leave period reporting/election

File info: application/pdf · 7 pages · 1.34MB

Form 165 - Leave period reporting/election

Please read the instructions on page 3 and 4 before completing this form. ... Group Number. OMERS Membership Number. F165 - Mar. 2021. Contact. Employer.

Extracted Text

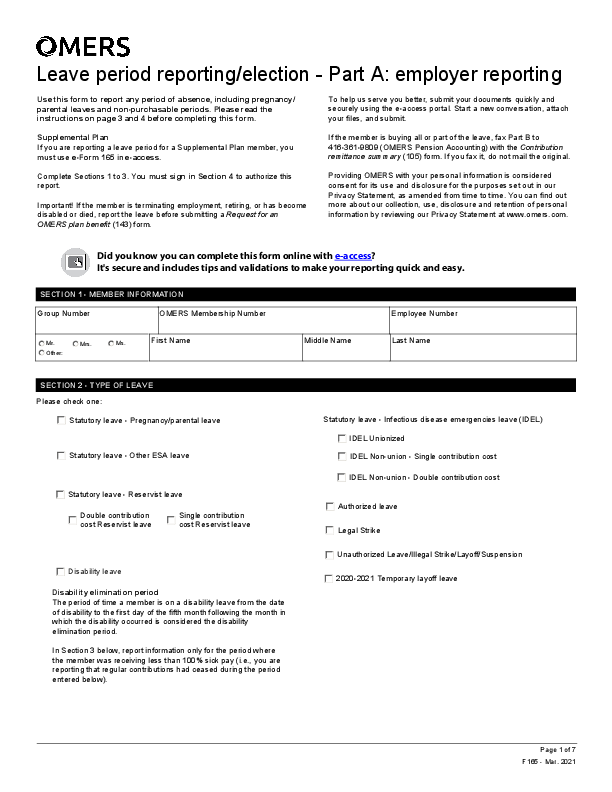

Leave period reporting/election - Part A: employer reporting Use this form to report any period of absence, including pregnancy/ parental leaves and non-purchasable periods. Please read the instructions on page 3 and 4 before completing this form. Supplemental Plan If you are reporting a leave period for a Supplemental Plan member, you must use e-Form 165 in e-access. Complete Sections 1 to 3. You must sign in Section 4 to authorize this report. Important! If the member is terminating employment, retiring, or has become disabled or died, report the leave before submitting a Request for an OMERS plan benefit (143) form. To help us serve you better, submit your documents quickly and securely using the e-access portal. Start a new conversation, attach your files, and submit. If the member is buying all or part of the leave, fax Part B to 416-361-9809 (OMERS Pension Accounting) with the Contribution remittance summary (105) form. If you fax it, do not mail the original. Providing OMERS with your personal information is considered consent for its use and disclosure for the purposes set out in our Privacy Statement, as amended from time to time. You can find out more about our collection, use, disclosure and retention of personal information by reviewing our Privacy Statement at www.omers.com. Did you know you can complete this form online with e-access? It's secure and includes tips and validations to make your reporting quick and easy. SECTION 1 - MEMBER INFORMATION Group Number OMERS Membership Number Employee Number Mr. Mrs. Ms. Other: First Name Middle Name Last Name SECTION 2 - TYPE OF LEAVE Please check one: Statutory leave - Pregnancy/parental leave Statutory leave - Other ESA leave Statutory leave - Reservist leave Double contribution cost Reservist leave Single contribution cost Reservist leave Disability leave Disability elimination period The period of time a member is on a disability leave from the date of disability to the first day of the fifth month following the month in which the disability occurred is considered the disability elimination period. In Section 3 below, report information only for the period where the member was receiving less than 100% sick pay (i.e., you are reporting that regular contributions had ceased during the period entered below). Statutory leave - Infectious disease emergencies leave (IDEL) IDEL Unionized IDEL Non-union - Single contribution cost IDEL Non-union - Double contribution cost Authorized leave Legal Strike Unauthorized Leave/Illegal Strike/Layoff/Suspension 2020-2021 Temporary layoff leave Page 1 of 7 F165 - Mar. 2021 Group Number OMERS Membership Number SECTION 3 - LEAVE INFORMATION If the leave spans two or more calendar years (i.e. open-ended leave), enter each year separately. Does this service period include an open-ended leave? Yes No DEEMED CONTRIBUTORY EARNINGS (for period) MEMBER COST Scattered Date leave started days? (m/d/y) Date leave ended (m/d/y) Credited service (months) Pay periods in leave year Contributory earnings in typical pay period Paid this leave Paid following year RPP year (carry-forward) contributions RCA contributions Yes $ $ $ $ $ Scattered Date leave started days? (m/d/y) Date leave ended (m/d/y) Credited service (months) Pay periods in leave year Contributory earnings in typical pay period Paid this leave Paid following year RPP year (carry-forward) contributions RCA contributions Yes $ $ $ $ $ Scattered Date leave started days? (m/d/y) Yes Date leave ended (m/d/y) Credited service (months) Pay periods in leave year Contributory earnings in typical pay period Paid this leave Paid following year RPP year (carry-forward) contributions RCA contributions $ $ $ $ $ Member cost for Member cost total periods � for total periods RPP � RCA $ $ Reminder � Supplemental Plan If you are reporting a disability leave for a Supplemental Plan member, you must use e-Form 165 in e-access. MATCHING EMPLOYER COST (applicable to leaves which fall under the Employment Standards Act) - see page 3 RPP RCA contributions contributions $ $ SECTION 4 - EMPLOYER AUTHORIZATION Employer Title Phone Fax Contact Email Authorized Signature Date (m/d/y) Page 2 of 7 F165 - Mar. 2021 Employer Instructions Non-purchasable leaves Complete only Part A. In the chart in Section 3 fill in the following fields: � Scattered days (if appropriate) � Date leave started � Date leave ended � Credited service For OMERS purposes, there are two different ways that reservist leaves are costed depending on whether or not an employer has elected to share in the cost of the purchase of a reservist leave. If the member does not elect to purchase the reservist leave, the member will receive eligible service for the period of the reservist leave not purchased - under both costing methods. Leave all of the other fields blank. Purchasable leaves Send Part A to OMERS and provide the member with Part B immediately upon their return from leave. Send Part B to OMERS as soon as the member completes and signs it. If the member is buying all or part of the leave: � Payment for the leave must be made after the leave has ended. � Enter the details of the payment in the space provided on the Form 105 � Contribution Remittance Summary. � Fax Part B of this form to OMERS with the Form 105. Scattered days (maximum 20 per year) You can combine up to 20 scattered days taken off each calendar year and report them as one leave. In the chart in Section 3 of Part A: � Check Yes under Scattered days. � Only enter the year in which the scattered days occurred in the Date leave started field. � Leave the Date leave ended field blank. � Fill in the other fields. If purchasable, complete Part B for the member. Employment Standards Act (ESA) leaves Rules applying to statutory leaves which fall under the ESA are outlined in these instructions. The following leaves are ESA leaves. � Bereavement leave that occurs on or after January 1, 2019 � Child death leave that occurs on or after January 1, 2018 � Crime-related child death or disappearance leave that occurred from October 29, 2014 to December 31, 2017; Crime-related child disappearance leave that occurs on or after January 1, 2018 � Critically ill child care leave that occurred from October 29, 2014 to December 2, 2017; Critical illness leave (to include both children and adult family members) with any medical certificate issued on or after December 3, 2017 � Declared emergency leave � Domestic or sexual violence leave that occurs on or after January 1, 2018 � Family caregiver leave that occurs on or after October 29, 2014 � Family medical leave � Family responsibility leave that occurs on or after January 1, 2019 � Infectious disease emergencies leave that occurs on or after January 25, 2020 � Organ donor leave � Personal emergency leave that occurred from September 4, 2001 to December 31, 2018 � Pregnancy/parental leave (including extension for stillbirth and miscarriage that occurs on and after January 1, 2018) � Reservist leave � Reservist leave periods of postponement � Sick leave that occurs on or after January 1, 2019 Member cost The member cost for an ESA leave is single contributions. The employer pays the matching amount. For all other purchasable leaves, the member cost is double contributions and there is no cost to the employer. There are three options available for the Infectious disease emergencies leave on this form. For more information on which option is correct, please reference the COVID-19 update on omers.com or the Employer Administration Manual. Normally, deemed earnings are based on the contributory earnings immediately before the leave. However, because scattered days can occur throughout the year, the member earnings may change. Instead of using the deemed earnings for each of the scattered days, you can use the earnings in a typical pay period (i.e., one salary rate) as if the earnings were in effect for the entire period. Open-ended leaves Complete all of Part A. In Section 3, leave the "Date leave ended" field blank. To close an open-ended leave previously reported, report the second part of the leave with a January 1 start date to the end date. If the leave is purchasable, complete a copy of Part B for each calendar year of the leave: � a copy for the first part of the leave (from start date to December 31); � a copy for the second part of the leave (from January 1 to the end date) if the leave ends that year, or from January 1 to December 31 if the leave continues to the next calendar year. Give copies of Part B to the member so they can decide whether to buy all, part or none of the leave. If the member subsequently decides to buy all or part of the leave, report the election through Part B, and send the payment to OMERS along with the Form 165. Credited service Report in months, to two decimal places. This is the credited service the member will lose if the leave is not purchased or it is a non-purchasable leave. Pay periods in leave year Enter the total pay periods in the year. Contributory earnings in a typical pay period A typical pay period refers to the member's regular pay schedule. For example, for a 26-period pay schedule, enter the member's deemed earnings for the two-week period immediately before the leave. If you are reporting scattered days, see above. If the member declines the purchase, then decides to buy it before the deadline, the employer is not required to pay the matching contributions. Page 3 of 7 F165 - Mar. 2021 Employer Instructions - cont'd Deemed contributory earnings (for period) See the Employer Administration Manual for the definition of deemed contributory earnings. For each period, separate carry-forward earnings from earnings paid in the leave year. Example: A member who is on leave for all of December 2007 would have been paid for the last week of December in January 2008. In the Paid this leave year field, enter the deemed earnings for the first three weeks of December. In the Paid following year field, enter the deemed earnings for the last week of December. Retirement Compensation Arrangement (RCA) If the member is paying double contributions (i.e., the member and the matching employer contributions), do not include RCA contributions in the purchase cost. (The member's pension entitlement for the leave period is permanently capped.) For an example, see the Employer Administration Manual. Disability leave � Can occur any time a member is considered totally disabled (absent from work as a result of the disability). � The period of time from the date of disability to the first day of the fifth month following the month in which the disability occurred is considered the disability elimination period. � It is your responsibility to determine if this period of time that the member is absent is due to illness or injury. � Following the elimination period, a member may qualify for a disability waiver or a disability pension. Revised PA Report a revised PA if a PA was previously reported for this period and this election is being made on or before April 30 of the year following the year in which the leave ended. This does not apply to ESA leaves. Please refer to Pension adjustment (PA) reporting section for more information on ESA leaves). Purchase deadline The purchase deadline is the earlier of the end of the year following the year in which the leave ended or the date a Form 143 benefit claim is submitted for the member. A member has until December 31 of the year following the year in which the leave ends (or 30 days from the date OMERS issues their Pension Options form when a termination or retirement occurs) to purchase the leave. Exception: For members who return from a leave of absence in 2020 or 2021, the deadline to purchase the leave is December 31 two years following the year the leave ended (or 30 days from the date OMERS issues their Pension Options form when a termination or retirement occurs). Transfers from RRSPs If the member is transferring funds from an RRSP to pay for all or part of the leave, send a completed T2033 to OMERS with the payment. RRSP transfers are not an option if the member is purchasing a disability leave. Pension adjustment (PA) reporting ESA leaves: Assume the member will purchase the leave. Exclude the leave in the PA only if the member declines the purchase prior to you submitting the T4 to the Canada Revenue Agency (CRA). For authorized leaves/legal strikes: Include the leave in the PA only if the member has elected to purchase before April 30 of the year following the year in which the leave ended. If the election is made after April 30, OMERS will apply for a Past Service Pension Adjustment (PSPA). Member initially declines the purchase: If the member chooses not to purchase the period and later decides to purchase it, and if the decision is made on or before April 30 of the year following the year in which the leave ended, you must report a PA. If the election is made after April 30, OMERS will apply for a Past Service Pension Adjustment (PSPA). Page 4 of 7 F165 - Mar. 2021 Leave period reporting & purchase - Part B: member election Your employer has provided details of your leave below. Please take the following steps to select whether and how you would like to purchase your leave period. Step1: Read the Member Instructions on the last page before completing this form. Step2: Complete Section 3. Step3: Complete and sign Section 4. Providing OMERS with your personal information is considered consent for its use and disclosure for the purposes set out in our Privacy Statement, as amended from time to time. You can find out more about our collection, use, disclosure and retention of personal information by reviewing our Privacy Statement at www.omers.com. SECTION 1 - MEMBER INFORMATION (to be completed by the employer) Group Number OMERS Membership Number Employee Number SECTION 2 - PURCHASE INFORMATION (to be completed by the employer) Scattered days? Date leave started (m/d/y) Date leave ended (m/d/y) MEMBER COST FOR: Credited service (months) All of the period One month of credited service* Yes $ $ Scattered days? Date leave started (m/d/y) Date leave ended (m/d/y) Credited service (months) All of the period One month of credited service* Yes $ $ Scattered days? Date leave started (m/d/y) Date leave ended (m/d/y) Credited service (months) All of the period One month of credited service* Yes $ $ Member cost for total periods $ *Leave blank if the period is less than one month Purchase Deadline Purchase Deadline (m/d/y) After the purchase deadline, the leave can only be purchased as a buy-back. The cost of a buy-back reflects the current value of the future benefit and is generally more costly. SECTION 3 - PURCHASE OPTIONS & PAYMENT METHOD (to be completed by the member) I am electing to purchase (select one): All of my leave at the total cost indicated above. Part of my leave: Cost of Partial Purchase $ If you would like to buy a specific amount of service (e.g., 2.5 months) and you don't know the cost associated with the purchase, see the instructions on the last page or contact OMERS Member Services or your employer. None of my leave. How are you paying? Cheque Amount $ *RRSP transfers are not an option if you are purchasing a disability leave. and/or and/or Transfer from my RRSP* Amount $ Transfer from my AVC Amount $ Page 5 of 7 F165 - Mar. 2021 OMERS Membership Number SECTION 4 - SIGNATURE (to be completed by the member) I understand that I have until the purchase deadline shown above or the date any benefit claim is submitted to OMERS (whichever is earlier) to purchase my leave at the cost shown in Section 2. I acknowledge I have read the Member Instructions and understand the implications of my election timing and cost. Mr. Other: Apt/Unit Mrs. Ms. Address First Name Middle Name City Last Name Province Postal Code Member's Signature Date (m/d/y) FOR EMPLOYER USE ONLY: Are you going to submit a Form 143 � Request for an OMERS plan benefit for this member? Yes No Are you reporting a PA for this leave period? Yes No If yes, and this election is made before April 30 of the year following the year in which the leave ended, report a revised PA for each year: Revised PA $ Year Revised PA $ Year Page 6 of 7 F165 - Mar. 2021 Member Instructions Please complete Sections 3 and 4 of this form, regardless of whether or not you decide to purchase the leave. Give the completed form to your employer. If you are purchasing the leave with cash, give your payment to your employer, and if you are paying by cheque, make the cheque payable to your employer. Your employer will send the payment to OMERS. If you are purchasing the leave by RRSP or Additional Voluntary Contributions (AVC), the transfer is made directly to OMERS. See Transfer from RRSP/AVC in this section. Making the decision When deciding whether or not to purchase your leave, consider: Your pension Purchasing credited service in OMERS increases your future pension and may allow you to retire earlier. A small investment today can add up over your lifetime. To see how much the extra service increases your pension, and how long it will take before your investment pays off, use our online Retirement Planner, accessible through myOMERS at www.omers.com. Leaves and Pension Adjustment (PA) Reporting For statutory leaves that are governed by the Employment Standards Act, 2000, such as pregnancy/parental or emergency leaves, your employer must include the leave period in the PA calculation, unless you decline to purchase the leave in writing before April 30 of the year following the year you return from leave. Important! If you decline the purchase of a statutory leave, then decide to buy it before the purchase deadline, your cost may increase from single to double contributions as your employer may not pay the matching contributions. For all other leaves, the timing of your election to purchase the leave period will determine whether it is captured in the PA calculation or whether a Past Service Pension Adjustment (PSPA) is required. See below for more details. If you provide your election to your employer before April 30 following the year you return from leave, your employer will either include the purchase in the PA calculation that is reported on your T4 for that calendar year or, if your T4 was already issued, the PA will be amended. The PA will reduce your available RRSP room. If you provide your election to your employer after April 30 following the year you return from leave, your employer does not include the purchase in the PA calculation. The purchase will need to be approved by Canada Revenue Agency (CRA) to ensure you have RRSP room. OMERS will submit the PSPA application to the CRA on your behalf. If approved, we will proceed with completing the purchase. Important! If you make your election before April 30, you will be credited with service and your contributory earnings for the leave period. Contributory earnings are used to calculate your Best Average Earnings for the OMERS pension formula. Elections made after April 30 are only credited with service. If your statutory leave was included in your PA calculation, you will be credited with both service and contributory earnings, regardless of the timing of your election. Maximum Purchase Limits The amount of leave period an individual can purchase that includes contributory earnings is capped at: � Total of 5 years of leaves of absence, and � an additional 3 years for pregnancy/parental leaves Important! Any purchase after the limit is reached must be approved by CRA and will only be credited with service. Contributory earnings for this period will not be included. Leave Purchase Deadlines Important! There is a purchase deadline shown in Section 2. OMERS must receive your payment before the deadline. If the deadline passes, the service can still be purchased under the OMERS buy-back provision. The cost of a buy-back reflects the current value of the future benefit you are buying and is generally more costly. If you terminate employment or retire prior to the deadline indicated on this form and wish to proceed with the leave period purchase, you will have to complete the purchase within a 30-day deadline that OMERS will provide. Transfers from RRSP or AVC If you are transferring funds from an RRSP or AVC to pay for all or part of your leave, send a completed T2033 to OMERS. Contact OMERS for any AVC questions. RRSP transfers are not an option if you are purchasing a disability leave. Scattered days Up to 20 scattered days taken off in any calendar year can be combined and reported as one leave. Your employer will check Yes under Scattered days in the chart in Section 2 to indicate the leave is a combination of several shorter leaves. Example: If you had a 2-day leave in March, a 4-day leave in September, and a 2-day leave in November, this could be reported as one 8-day leave. Partial purchases You can choose to buy part of a leave. If you know exactly how much you want to spend, enter the amount in the Cost of partial purchase field in Section 3. If you know how much credited service you want to buy, use the cost of one month of credited service (last column in the chart) to calculate the cost of the partial purchase. Example: You need 3.3 months of credited service to retire early with 30 years of service, and one month of credited service costs $59.76. Therefore, the cost of your partial purchase is: 3.3 months x $59.76 = $197.21 Page 7 of 7 F165 - Mar. 2021