File info: application/pdf · 13 pages · 130.25KB

Document preview and download links are below.

Extracted Text

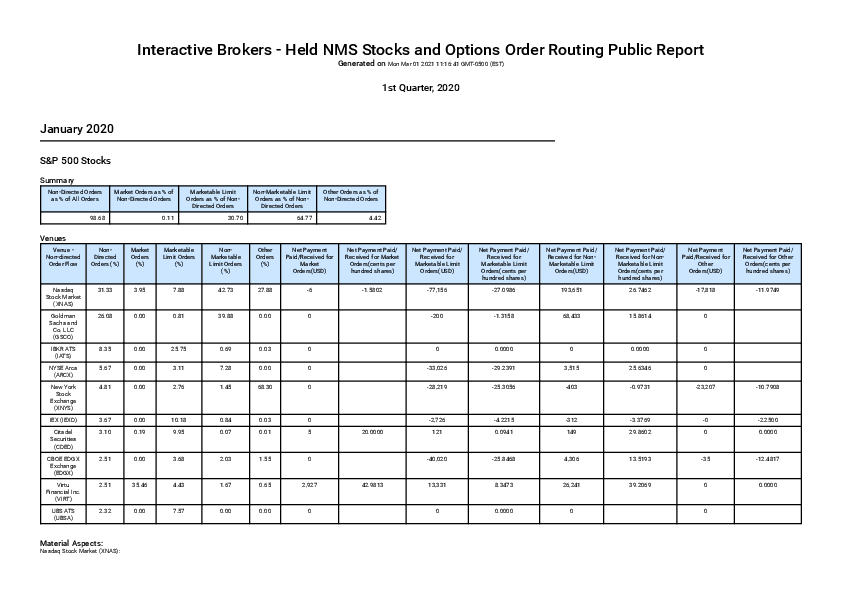

Interactive Brokers - Held NMS Stocks and Options Order Routing Public Report Generated on Mon Mar 01 2021 11:16:41 GMT-0500 (EST) 1st Quarter, 2020 January 2020 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders 98.68 0.11 Marketable Limit Orders as % of Non- Directed Orders 30.70 Non-Marketable Limit Orders as % of Non- Directed Orders 64.77 Other Orders as % of Non-Directed Orders 4.42 Venues Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Nasdaq Stock Market (XNAS) Goldman Sachs and Co. LLC (GSCO) IBKR ATS (IATS) NYSE Arca (ARCX) New York Stock Exchange (XNYS) IEX (IEXD) Citadel Securities (CDED) CBOE EDGX Exchange (EDGX) Virtu Financial Inc. (VIRT) UBS ATS (UBSA) 31.33 26.08 8.35 5.67 4.81 3.67 3.10 2.51 2.51 2.32 3.95 0.00 0.00 0.00 0.00 0.00 0.19 0.00 35.46 0.00 7.88 0.81 25.75 3.11 2.76 10.18 9.95 3.68 4.43 7.57 42.73 39.88 27.88 0.00 0.69 0.03 7.28 0.00 1.45 68.30 0.84 0.03 0.07 0.01 2.03 1.55 1.67 0.65 0.00 0.00 -6 0 0 0 0 0 5 0 2,927 0 -1.5802 20.0000 42.9813 -77,156 -200 0 -33,026 -28,219 -2,726 121 -40,020 13,331 0 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -27.0986 -1.3158 0.0000 -29.2391 -25.3056 -4.2215 0.0941 -25.8468 8.3473 0.0000 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 193,651 68,433 0 3,515 -403 -312 149 4,306 26,241 0 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) 26.7462 Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) -17,818 -11.9749 15.8614 0 0.0000 25.6346 -0.9731 0 0 -23,207 -10.7908 -3.3769 29.8602 13.5193 39.2069 -0 -2.2500 0 0.0000 -35 -12.4817 0 0.0000 0 Material Aspects: Nasdaq Stock Market (XNAS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Goldman Sachs and Co. LLC (GSCO): IBKR may receive volume discounts that are not passed on to clients. IBKR ATS (IATS): IBKR operates the IBKR ATS in accordance with SEC Regulation ATS, on which it executes IBKR client orders against each other or against one or more professional liquidity providers who send orders into the IBKR ATS. Order executions on the IBKR ATS are faster, eliminate exchange fees, and may offer Price Improvement. Statistical information regarding the quality of executions for orders effected through the IBKR ATS (e.g., average execution speed, percentage of orders receiving Price Improvement, etc.) is available on the IBKR website at: https://ibkr.com/ regulatoryreports. NYSE Arca (ARCX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. New York Stock Exchange (XNYS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Citadel Securities (CDED): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. CBOE EDGX Exchange (EDGX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Virtu Financial Inc. (VIRT): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. January 2020 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders 97.78 0.09 Marketable Limit Orders as % of Non- Directed Orders 31.30 Non-Marketable Limit Orders as % of Non- Directed Orders 60.76 Other Orders as % of Non-Directed Orders 7.85 Venues Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Nasdaq 33.06 2.01 8.70 44.22 44.16 -33 Stock Market (XNAS) Goldman 19.14 0.00 0.29 31.36 0.00 0 Sachs and Co. LLC (GSCO) NYSE Arca 9.08 0.00 4.06 10.76 16.25 0 (ARCX) IBKR ATS 6.33 0.00 18.86 0.56 1.06 0 (IATS) CBOE EDGX 4.43 0.00 5.40 4.42 0.70 0 -9.5209 -647,598 -731 -290,545 0 -392,461 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -26.5154 -1.3081 -27.4303 0.0000 -24.8094 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 1,301,020 500,961 121,002 0 28,201 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) 22.1200 Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) -49,996 -10.6100 15.6217 0 25.8398 0.0000 9.5096 -23,823 0 -504 -13.2206 0.0000 -16.1892 Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Exchange (EDGX) New York 3.88 Stock Exchange (XNYS) IEX (IEXD) 3.83 Citadel 3.69 Securities (CDED) UBS ATS 2.92 (UBSA) Virtu 2.33 Financial Inc. (VIRT) CBOE BZX 2.15 Exchange (BATS) 0.01 0.00 0.30 0.00 35.89 0.01 2.51 11.04 11.59 9.33 4.64 2.64 0.83 33.00 0 0.62 0.03 0.11 0.01 0.00 0.00 1.36 0.25 1.93 2.00 0 141 0 27,903 -4 19.6821 42.8873 -30.0000 -190,452 -11,506 463 0 36,540 -151,773 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -27.5379 -4.4143 0.0653 0.0000 3.8517 -28.0800 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 7,781 -1,043 786 0 34,837 29,613 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) 6.0026 -45,169 -10.7387 -3.2685 19.4371 30.9517 17.5311 -2 0 0 0 -1,846 -7.3410 0.0000 0.0000 -8.8463 Material Aspects: Nasdaq Stock Market (XNAS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Goldman Sachs and Co. LLC (GSCO): IBKR may receive volume discounts that are not passed on to clients. NYSE Arca (ARCX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. IBKR ATS (IATS): IBKR operates the IBKR ATS in accordance with SEC Regulation ATS, on which it executes IBKR client orders against each other or against one or more professional liquidity providers who send orders into the IBKR ATS. Order executions on the IBKR ATS are faster, eliminate exchange fees, and may offer Price Improvement. Statistical information regarding the quality of executions for orders effected through the IBKR ATS (e.g., average execution speed, percentage of orders receiving Price Improvement, etc.) is available on the IBKR website at: https://ibkr.com/ regulatoryreports. CBOE EDGX Exchange (EDGX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. New York Stock Exchange (XNYS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Citadel Securities (CDED): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. Virtu Financial Inc. (VIRT): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. CBOE BZX Exchange (BATS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. January 2020 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders 99.70 0.08 Marketable Limit Orders as % of Non- Directed Orders 5.81 Non-Marketable Limit Orders as % of Non- Directed Orders 48.67 Other Orders as % of Non-Directed Orders 45.44 Venues Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) NYSE Arca Options (ARCO) Nasdaq Options Market (XNDQ) Cboe EDGX Options Exchange (EDGO) Nasdaq PHLX (XPHL) Chicago Board Options Exchange (XCBO) Nasdaq ISE (XISX) NYSE American Options (AMXO) CBOE C2 Exchange (C2OX) 21.76 17.25 13.88 12.47 7.99 6.75 6.07 4.54 30.51 0.20 0.43 1.38 4.42 16.52 1.62 6.11 6.46 11.80 7.11 9.39 7.59 4.54 1.62 6.12 26.54 18.59 808 34.03 0.00 -80 0.62 28.97 40 7.96 17.71 11 2.72 13.69 -751 0.56 11.53 13.65 0.80 -2,443 41 4.15 4.76 808 13.5362 -48.9024 12.8339 4.9607 -41.3232 -24.2461 11.8944 35.1618 -270,119 -384,268 293,293 -21,767 386,167 -361,228 576,260 -574,187 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -52.8832 -34.2086 39.9732 -2.2565 43.2153 -35.5278 304.0371 -44.2383 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 869,619 1,507,258 19 94,190 -177,188 -1 276,175 37,755 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) 64.2325 Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) 836,997 40.3912 48.1113 0 1.9332 873,373 51.6436 9.2238 -43.1773 171,081 -619,304 11.4024 -24.1586 -0.0341 11.9773 440,291 5,027 32.0187 16.0825 42.5373 40,803 8.1637 Material Aspects: NYSE Arca Options (ARCO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Nasdaq Options Market (XNDQ): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Cboe EDGX Options Exchange (EDGO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Nasdaq PHLX (XPHL): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Chicago Board Options Exchange (XCBO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Nasdaq ISE (XISX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. NYSE American Options (AMXO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. CBOE C2 Exchange (C2OX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. February 2020 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders 98.94 0.14 Marketable Limit Orders as % of Non- Directed Orders 31.14 Non-Marketable Limit Orders as % of Non- Directed Orders 64.52 Other Orders as % of Non-Directed Orders 4.20 Venues Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Nasdaq Stock Market (XNAS) Goldman Sachs and Co. LLC (GSCO) IBKR ATS (IATS) New York Stock Exchange (XNYS) NYSE Arca (ARCX) IEX (IEXD) Citadel Securities (CDED) CBOE EDGX Exchange (EDGX) Virtu Financial Inc. (VIRT) UBS ATS 33.58 21.02 9.13 6.75 4.91 3.65 3.35 3.12 2.48 2.41 5.59 0.00 0.00 0.00 0.00 0.00 25.56 0.00 17.52 0.00 8.72 0.93 28.05 2.45 3.30 9.89 9.69 3.37 4.13 7.73 45.90 32.14 29.55 0.00 0.61 0.00 4.91 67.11 6.02 0.00 0.89 0.03 0.44 0.24 3.15 0.92 1.79 0.27 0.00 0.00 -15 0 0 0 0 0 1,697 0 1,761 0 -6.3245 43.9674 43.0000 -89,200 -332 0 -32,770 -38,309 -3,502 4,313 -35,879 5,507 0 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -25.3632 -2.2627 0.0000 -27.4543 -28.5557 -4.5070 2.8033 -24.9460 3.6572 0.0000 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 284,863 77,202 0 12,761 4,992 -402 3,511 2,784 49,962 0 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) 26.2351 Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) -18,222 -11.6818 15.6301 0 0.0000 16.2338 0 -35,301 -16.5227 23.1550 -3.5159 28.8646 14.3060 39.3785 0 -0 -4.0135 0 0.0000 -103 -21.2391 0 0.0000 0 Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) (UBSA) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for NonMarketable Limit Orders(USD) Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Material Aspects: Nasdaq Stock Market (XNAS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Goldman Sachs and Co. LLC (GSCO): IBKR may receive volume discounts that are not passed on to clients. IBKR ATS (IATS): IBKR operates the IBKR ATS in accordance with SEC Regulation ATS, on which it executes IBKR client orders against each other or against one or more professional liquidity providers who send orders into the IBKR ATS. Order executions on the IBKR ATS are faster, eliminate exchange fees, and may offer Price Improvement. Statistical information regarding the quality of executions for orders effected through the IBKR ATS (e.g., average execution speed, percentage of orders receiving Price Improvement, etc.) is available on the IBKR website at: https://ibkr.com/ regulatoryreports. New York Stock Exchange (XNYS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. NYSE Arca (ARCX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Citadel Securities (CDED): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. CBOE EDGX Exchange (EDGX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Virtu Financial Inc. (VIRT): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. February 2020 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders 98.05 0.10 Marketable Limit Orders as % of Non- Directed Orders 28.51 Non-Marketable Limit Orders as % of Non- Directed Orders 65.27 Other Orders as % of Non-Directed Orders 6.13 Venues Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Nasdaq 35.19 2.18 9.51 45.70 43.27 -20 Stock Market (XNAS) -5.8288 -723,279 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -26.9026 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 1,405,692 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) 23.0211 Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) -50,296 -10.4676 Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Goldman Sachs and Co. LLC (GSCO) NYSE Arca (ARCX) IBKR ATS (IATS) CBOE EDGX Exchange (EDGX) New York Stock Exchange (XNYS) Citadel Securities (CDED) IEX (IEXD) UBS ATS (UBSA) CBOE BZX Exchange (BATS) Virtu Financial Inc. (VIRT) 18.16 8.29 5.93 5.73 4.54 3.48 3.37 2.59 2.20 2.05 0.00 0.00 0.00 0.00 0.00 23.98 0.00 0.00 0.01 20.29 0.39 4.94 19.75 4.82 2.67 11.10 10.56 9.08 2.75 4.51 27.65 0.00 8.86 17.91 0.45 0.08 6.63 0.47 2.67 33.16 0.44 0.14 0.55 0.02 0.00 0.00 1.96 2.29 1.13 0.14 0 0 0 0 0 6,553 0 0 -3 8,657 37.8080 -30.0000 42.1095 -1,500 -413,001 0 -354,378 -245,651 16,022 -13,560 0 -170,309 23,727 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -2.7549 -27.6420 0.0000 -24.8245 -27.6762 1.7506 -4.5567 0.0000 -28.0238 2.3859 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 568,318 153,774 0 39,654 69,227 10,606 -1,100 0 53,246 61,351 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) 15.8411 Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) 0 26.2877 0.0000 7.1679 14.6265 -26,406 0 -420 -71,563 -13.3861 -14.6857 -16.1086 18.4484 -3.1900 21.0350 31.0562 0 -2 0 -1,641 0 0.0000 -5.2171 -8.1378 0.0000 Material Aspects: Nasdaq Stock Market (XNAS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Goldman Sachs and Co. LLC (GSCO): IBKR may receive volume discounts that are not passed on to clients. NYSE Arca (ARCX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. IBKR ATS (IATS): IBKR operates the IBKR ATS in accordance with SEC Regulation ATS, on which it executes IBKR client orders against each other or against one or more professional liquidity providers who send orders into the IBKR ATS. Order executions on the IBKR ATS are faster, eliminate exchange fees, and may offer Price Improvement. Statistical information regarding the quality of executions for orders effected through the IBKR ATS (e.g., average execution speed, percentage of orders receiving Price Improvement, etc.) is available on the IBKR website at: https://ibkr.com/ regulatoryreports. CBOE EDGX Exchange (EDGX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. New York Stock Exchange (XNYS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Citadel Securities (CDED): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. CBOE BZX Exchange (BATS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Virtu Financial Inc. (VIRT): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. February 2020 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders 99.65 0.08 Marketable Limit Orders as % of Non- Directed Orders 6.58 Non-Marketable Limit Orders as % of Non- Directed Orders 50.54 Other Orders as % of Non-Directed Orders 42.80 Venues Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) NYSE Arca Options (ARCO) Nasdaq Options Market (XNDQ) Cboe EDGX Options Exchange (EDGO) Nasdaq PHLX (XPHL) CBOE C2 Exchange (C2OX) Nasdaq ISE (XISX) Chicago Board Options Exchange (XCBO) NYSE American Options (AMXO) 20.55 18.16 10.82 10.62 9.19 8.28 6.98 5.80 23.92 0.32 0.48 1.48 6.24 26.27 17.67 1.15 5.54 12.41 8.10 9.73 5.48 3.70 9.68 1.78 27.57 34.32 14.56 0.00 1,456 -109 0.42 23.54 9 7.27 14.72 4.15 15.73 0.60 18.02 2.79 11.49 -51 1,018 -2,538 -1,269 10.82 0.49 105 16.0228 -48.6637 13.0000 -9.6660 36.1452 -24.4587 -31.5251 12.0000 -260,491 -357,856 300,576 -18,998 -484,507 -267,587 285,787 567,193 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -53.0564 -30.1854 24.9802 -1.8461 -44.4713 -31.7007 30.7888 303.4869 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 1,018,616 1,872,974 99 124,517 38,289 39,142 -215,239 271,210 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) 63.4324 Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) 579,660 41.0214 49.1669 0 5.6938 806,337 50.2220 10.6179 42.9420 83.7703 -44.5283 171,076 192,197 434,895 -926,696 12.5021 14.7328 34.8534 -35.8605 11.9895 4,008 14.2463 Material Aspects: NYSE Arca Options (ARCO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Nasdaq Options Market (XNDQ): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Cboe EDGX Options Exchange (EDGO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Nasdaq PHLX (XPHL): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. CBOE C2 Exchange (C2OX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Nasdaq ISE (XISX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Chicago Board Options Exchange (XCBO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. NYSE American Options (AMXO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. March 2020 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders 99.07 0.16 Marketable Limit Orders as % of Non- Directed Orders 34.83 Non-Marketable Limit Orders as % of Non- Directed Orders 62.43 Other Orders as % of Non-Directed Orders 2.57 Venues Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Nasdaq Stock Market (XNAS) Goldman Sachs and Co. LLC (GSCO) IBKR ATS (IATS) IEX (IEXG) Citadel Securities (CDED) NYSE Arca (ARCX) UBS ATS 32.04 25.90 8.33 4.62 4.16 3.87 3.45 2.98 0.00 0.00 0.00 32.82 0.00 0.00 9.22 1.01 22.44 11.28 10.32 3.68 9.91 45.02 40.93 28.00 0.00 0.83 0.00 1.09 0.36 0.80 0.38 4.14 0.00 0.00 0.00 -15 0 0 0 6,150 0 0 -7.4382 43.4460 -253,919 -682 0 -10,922 10,395 -115,531 0 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -24.8984 -2.0066 0.0000 -4.4787 2.7636 -28.8006 0.0000 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 680,714 489,915 0 -1,502 10,299 11,407 0 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) 25.4662 Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) -23,591 -10.4988 15.6881 0 0.0000 -3.5397 27.7860 25.7908 0 -2 -8.4434 0 0.0000 0 0 Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) (UBSA) New York 2.83 0.00 3.11 Stock Exchange (XNYS) Virtu 2.66 11.33 4.92 Financial Inc. (VIRT) CBOE BZX 2.13 0.00 4.34 Exchange (BATS) CBOE BYX 2.11 0.00 1.19 Exchange (BATY) 0.01 67.69 1.48 0.19 0.89 2.32 2.69 0.52 0 2,736 0 0 42.9922 -124,154 4,532 -118,789 4,087 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -28.5211 1.1587 -26.4574 4.3242 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 24 44,075 10,414 239 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) 2.2147 -50,938 -16.9945 35.0338 17.9935 3.5128 0 0.0000 -161 -12.7575 -9 -13.5326 Material Aspects: Nasdaq Stock Market (XNAS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Goldman Sachs and Co. LLC (GSCO): IBKR may receive volume discounts that are not passed on to clients. IBKR ATS (IATS): IBKR operates the IBKR ATS in accordance with SEC Regulation ATS, on which it executes IBKR client orders against each other or against one or more professional liquidity providers who send orders into the IBKR ATS. Order executions on the IBKR ATS are faster, eliminate exchange fees, and may offer Price Improvement. Statistical information regarding the quality of executions for orders effected through the IBKR ATS (e.g., average execution speed, percentage of orders receiving Price Improvement, etc.) is available on the IBKR website at: https://ibkr.com/ regulatoryreports. Citadel Securities (CDED): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. NYSE Arca (ARCX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. New York Stock Exchange (XNYS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Virtu Financial Inc. (VIRT): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. CBOE BZX Exchange (BATS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. CBOE BYX Exchange (BATY): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. March 2020 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders 98.07 0.12 Marketable Limit Orders as % of Non- Directed Orders 33.67 Non-Marketable Limit Orders as % of Non- Directed Orders 61.30 Other Orders as % of Non-Directed Orders 4.91 Venues Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Nasdaq Stock Market (XNAS) Goldman Sachs and Co. LLC (GSCO) NYSE Arca (ARCX) IBKR ATS (IATS) Citadel Securities (CDED) IEX (IEXD) UBS ATS (UBSA) CBOE EDGX Exchange (EDGX) CBOE BZX Exchange (BATS) New York Stock Exchange (XNYS) Virtu Financial Inc. (VIRT) 34.61 19.10 9.03 5.27 4.36 4.11 3.69 3.10 3.09 2.57 2.28 1.53 0.00 0.00 0.00 27.05 0.00 0.00 0.00 0.01 0.01 10.01 10.42 0.35 6.05 14.81 11.67 10.98 10.95 5.04 3.91 2.69 5.07 47.46 40.75 -21 30.96 0.00 0 9.78 20.43 0.45 0.00 0.63 0.29 0.67 0.04 0.00 0.00 2.27 0.23 2.70 2.35 0.02 33.64 0 0 15,297 0 0 0 0 -0 0.90 0.26 8,062 -5.5962 38.5174 -10.0000 42.8440 -1,414,870 -2,101 -860,279 0 34,931 -32,092 0 -666,688 -412,892 -458,009 22,742 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -24.2410 -2.7833 -24.9177 0.0000 2.1260 -5.0256 0.0000 -23.1165 -26.7370 -26.5531 1.2298 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 3,028,282 1,203,295 341,845 0 22,794 -2,633 0 42,591 71,865 260 50,885 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) 21.0088 Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) -47,660 -8.9609 14.1662 0 23.2848 0.0000 16.9971 -3.4972 6.7181 16.6342 3.4364 -34,072 0 0 -1 0 -461 -2,452 -77,762 -11.1683 0.0000 -5.0653 -15.6850 -12.1159 -14.3532 23.6412 0 0.0000 Material Aspects: Nasdaq Stock Market (XNAS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Goldman Sachs and Co. LLC (GSCO): IBKR may receive volume discounts that are not passed on to clients. NYSE Arca (ARCX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. IBKR ATS (IATS): IBKR operates the IBKR ATS in accordance with SEC Regulation ATS, on which it executes IBKR client orders against each other or against one or more professional liquidity providers who send orders into the IBKR ATS. Order executions on the IBKR ATS are faster, eliminate exchange fees, and may offer Price Improvement. Statistical information regarding the quality of executions for orders effected through the IBKR ATS (e.g., average execution speed, percentage of orders receiving Price Improvement, etc.) is available on the IBKR website at: https://ibkr.com/ regulatoryreports. Citadel Securities (CDED): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. CBOE EDGX Exchange (EDGX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. CBOE BZX Exchange (BATS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. New York Stock Exchange (XNYS): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Virtu Financial Inc. (VIRT): IBKR-LITE clients are generally charged zero commission for NMS stock and ETF orders. IBKR-LITE orders are generally routed to select over-the-counter market-makers for handling. IBKR's agreements with the Market Makers provide Interactive Brokers payment for order flow from each Market Maker for trades executed with that Market Maker. March 2020 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders 99.89 0.07 Marketable Limit Orders as % of Non- Directed Orders 3.10 Non-Marketable Limit Orders as % of Non- Directed Orders 45.51 Other Orders as % of Non-Directed Orders 51.33 Venues Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) NYSE Arca Options (ARCO) Nasdaq Options Market (XNDQ) Cboe EDGX Options Exchange (EDGO) Nasdaq PHLX (XPHL) CBOE C2 Exchange (C2OX) Nasdaq ISE (XISX) Chicago Board Options Exchange 18.55 15.90 13.37 12.15 9.74 9.63 7.76 31.75 0.24 0.10 1.58 7.08 25.90 10.62 4.02 11.56 10.42 11.57 2.95 4.77 12.47 22.79 34.14 15.65 0.00 7,615 -194 3.32 22.48 3 5.60 18.00 3.46 15.73 1.16 17.41 5.86 9.15 32 1,985 -2,637 -708 51.8820 -48.0000 13.0000 5.0647 37.0282 -20.0442 -27.9791 -182,564 -392,128 192,904 246,727 -266,312 -78,440 573,066 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) -56.4862 -32.5996 13.2587 26.6327 -44.4225 -15.4973 60.5431 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 1,269,412 3,166,912 64,319 174,397 63,495 97,459 -212,754 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) 63.0247 Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) 570,268 41.0873 51.5096 0 12.9468 1,139,750 49.1459 14.6935 42.6507 82.8817 -16.0550 188,687 369,984 442,139 -767,450 12.6345 30.8553 33.0766 -29.5956 Venue Non-directed Order Flow NonDirected Orders (%) Market Orders (%) Marketable Limit Orders (%) NonMarketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) (XCBO) NYSE 3.70 1.05 1.29 7.59 0.41 76 American Options (AMXO) 12.0000 420,951 Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) 346.4105 Net Payment Paid/ Received for NonMarketable Limit Orders(USD) 212,650 Net Payment Paid/ Received for NonMarketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) 11.9887 6,152 11.9105 Material Aspects: NYSE Arca Options (ARCO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Nasdaq Options Market (XNDQ): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Cboe EDGX Options Exchange (EDGO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Nasdaq PHLX (XPHL): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. CBOE C2 Exchange (C2OX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Nasdaq ISE (XISX): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Chicago Board Options Exchange (XCBO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. NYSE American Options (AMXO): IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients.