Casio Cash Register 140Cr Users Manual User's

Casio-140Cr-Owners-Manual-590329 casio-140cr-owners-manual-590329

140Cr-User-English 140cr-user-english

140CR to the manual fd613cac-5e0a-4a5e-af54-2c512f8ec04c

140CR_user_NA 140CR_user_NA_EN 140CR | Cash Registers (For North American customers) | Manuals | CASIO

2015-01-21

: Casio Casio-Casio-Cash-Register-140Cr-140Cr-Users-Manual-242866 casio-casio-cash-register-140cr-140cr-users-manual-242866 casio pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 46

START-UP is QUICK and EASY!

Simple to use!

20 departments and 120 PLUs

Automatic Tax Calculations

Calculator function

User's Manual

140CR

Electronic Cash Register

CASIO COMPUTER CO., LTD.

6-2, Hon-machi 1-chome

Shibuya-ku, Tokyo 151-8543, Japan

CI

2

E

INTRODUCTION

IMPORTANT

FOR PROGRAMMING ASSISTANCE

PLEASE CALL TOLL FREE

1-800-638-9228

Thank you very much for purchasing this CASIO electronic cash register.

START-UP is QUICK and EASY!

Part-1 of this User's Manual can help you make a quick start.

Once you have mastered the QUICK START operations, you will undoubtedly

want to expand your use of this machine by studying other sections of Part-2.

Power Supply

Your cash register is designed to operate on

standard household current (120 V, 50/60 Hz).

Do not overload the outlet by plugging in too

many appliances.

Cleaning

Clean the cash register exterior with a soft cloth

which has been moistened with a solution of a

mild neutral detergent and water, and wrung out.

Be sure that the cloth is thoroughly wrung out to

avoid damage to the printer.

Never use paint thinner, benzene, or other vola-

tile solvents.

CASIO Authorized Service Centers

If your CASIO product needs repair, or you

wish to purchase replacement parts, please call

1-800-YO-CASIO.

Original Carton/Package

If for any reason, this product is to be returned

to the store where purchased, it must be packed

in the original carton/package.

Location

Locate the Cash register on a fl at, stable sur-

face, away from heaters or areas exposed to di-

rect sunlight, humidity or dust.

The mains plug on this equipment must be used to disconnect mains power.

Please ensure that the socket outlet is installed near the equipment and shall be easily

accessible.

3

E

INTRODUCTION

Safety precautions

• To use this product safely and correctly, read this manual thoroughly and operate as instructed.

After reading this guide, keep it close at hand for easy reference.

Please keep all informations for future reference.

• Always observe the warnings and cautions indicated on the product.

About the icons

In this guide various icons are used to highlight safe operation of this product and to prevent injury to the operator and

other personnel and also to prevent damage to property and this product. The icons and defi nitions are given below.

Indicates that there is a risk of severe injury or death if used incorrectly.

Indicates that injury or damage may result if used incorrectly.

Icon examples

To bring attention to risks and possible damage, the following types of icons are used.

The symbol indicates that it includes some symbol for attracting attention (including warning). In this triangle the

actual type of precautions to be taken (electric shock, in this case) is indicated.

The symbol indicates a prohibited action. In this symbol the actual type of prohibited actions (disassembly, in this

case) will be indicated.

The symbol indicates a restriction. In this symbol the type of actual restriction (removal of the power plug from an

outlet, in this case) is indicated.

Warning!

Handling the register

Should the register malfunction, start to emit smoke or a strange odor, or otherwise behave abnormally,

immediately shut down the power and unplug the AC plug from the power outlet. Continued use creates the

danger of fi re and electric shock.

• Contact CASIO service representative.

Do not place containers of liquids near the register and do not allow any foreign matter to get into it. Should

water or other foreign matter get into the register, immediately shut down the power and unplug the AC plug

from the power outlet. Continued use creates the danger of short circuit, fi re and electric shock.

• Contact CASIO service representative.

Should you drop the register and damage it, immediately shut down the power and unplug the AC plug from

the power outlet. Continued use creates the danger of short circuit, fi re and electric shock.

• Attempting to repair the register yourself is extremely dangerous. Contact CASIO service representative.

Never try to take the register apart or modify it in any way. High-voltage components inside the register create

the danger of fi re and electric shock.

• Contact CASIO service representative for all repair and maintenance.

Power plug and AC outlet

Use only a proper AC electric outlet. Use of an outlet with a different voltage from the rating creates the danger

of malfunction, fi re, and electric shock. Overloading an electric outlet creates the danger of overheating and

fi re.

Make sure the power plug is inserted as far as it will go. Loose plugs create the danger of electric shock,

overheating, and fi re.

• Do not use the register if the plug is damaged. Never connect to a power outlet that is loose.

4

E

INTRODUCTION

Warning!

Use a dry cloth to periodically wipe off any dust built up on the prongs of the plug. Humidity can cause poor

insulation and create the danger of electric shock and fi re if dust stays on the prongs.

Do not allow the power cord or plug to become damaged, and never try to modify them in any way. Continued

use of a damaged power cord can cause deterioration of the insulation, exposure of internal wiring, and short

circuit, which creates the danger of electric shock and fi re.

• Contact CASIO service representative whenever the power cord or plug requires repair or maintenance.

Caution!

Do not place the register on an unstable or uneven surface. Doing so can cause the register — especially

when the drawer is open — to fall, creating the danger of malfunction, fi re, and electric shock.

Do not place the register in the following areas.

• Areas where the register will be subject to large amounts of humidity or dust, or directly exposed to hot or cold air.

• Areas exposed to direct sunlight, in a close motor vehicle, or any other area subject to very high temperatures.

The above conditions can cause malfunction, which creates the danger of fi re.

Do not overlay bend the power cord, do not allow it to be caught between desks or other furniture, and never

place heavy objects on top of the power cord. Doing so can cause short circuit or breaking of the power cord,

creating the danger of fi re and electric shock.

Be sure to grasp the plug when unplugging the power cord from the wall outlet. Pulling on the cord can

damage it, break the wiring, or cause short, creating the danger of fi re and electric shock.

Never touch the plug while your hands are wet. Doing so creates the danger of electric shock. Pulling on the

cord can damage it, break the wiring, or cause short, creating the danger of fi re and electric shock.

At least once a year, unplug the power plug and use a dry cloth or vacuum cleaner to clear dust from the area

around the prongs of the power plug.

Never use detergent to clean the power cord, especially power plug.

Keep small parts out of the reach of small children to make sure it is not swallowed accidentally.

5

E

Basic Components and Accessories

Contents

Getting to know your cash register .......................................................................... 6

Daily Job Flow ......................................................................................................... 8

Part-1 QUICK START OPERATION ................................................................. 9

(You can operate this ECR on a basic level by reading the following sections)

1. Initialization ....................................................................................................... 9

2. Loading Paper .................................................................................................. 10

3. Basic Programming for QUICK START – TIME/DATE ...................................... 11

4. Basic Operation after Basic Programming ........................................................ 12

5. Daily Management Report ................................................................................ 15

Part-2 CONVENIENT OPERATION ..................................................................

17

(Please keep these sections to expand your use.)

1. Various Programming ....................................................................................... 17

2. Various Operations ........................................................................................... 27

Part-3 CALCULATOR FUNCTION ...................................................................

34

1. Calculator Mode ................................................................................................ 34

Part-4 USEFUL INFORMATION .......................................................................

36

1. Troubleshooting ................................................................................................ 36

2. Specifi cations .................................................................................................... 36

3. Warranty Card .................................................................................................. 45

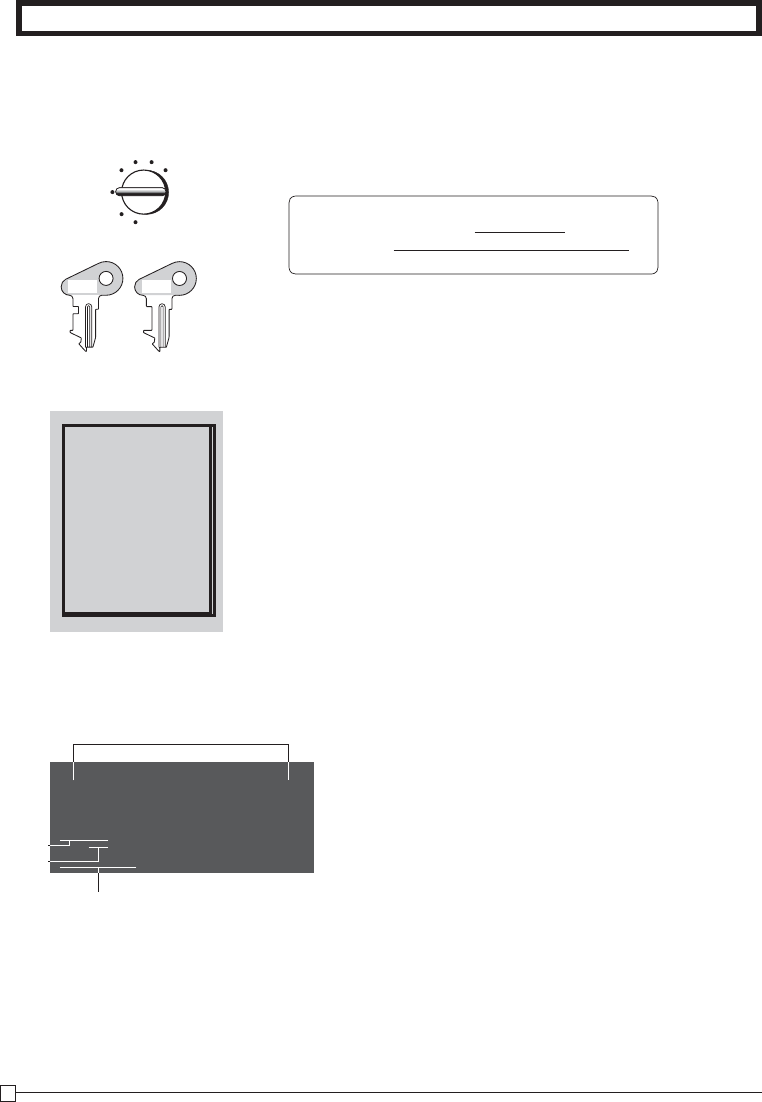

Printer cover

Operator display

Mode switch

Keyboard

Drawer Accessories

Roll paper 1 pc

Mode keys OP key 1 pc

PGM key 1 pc

Drawer keys 2 pcs

User's manual 1 pc

Magnetic plate* 1 pc

* Use this plate for tacking the notes

received from customer.

Weld lines

Lines may be visible on the exterior of the product. These are “weld lines” that result from the plastic molding process.

They are not cracks or scratches.

6

E

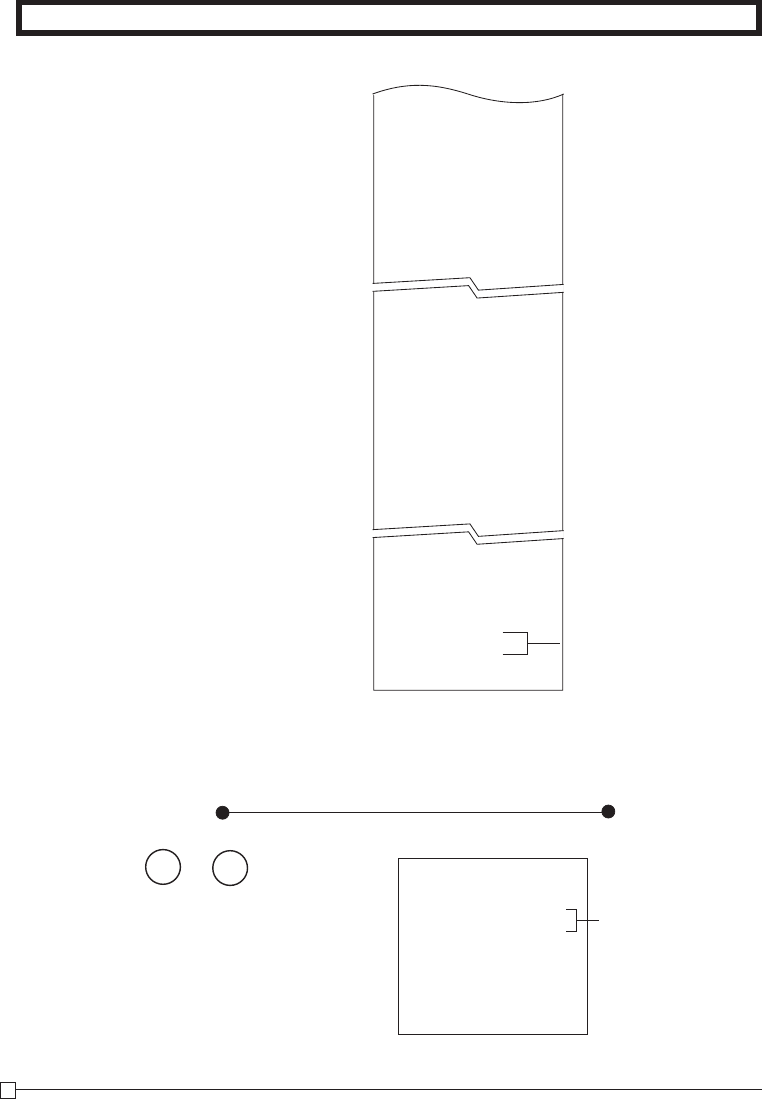

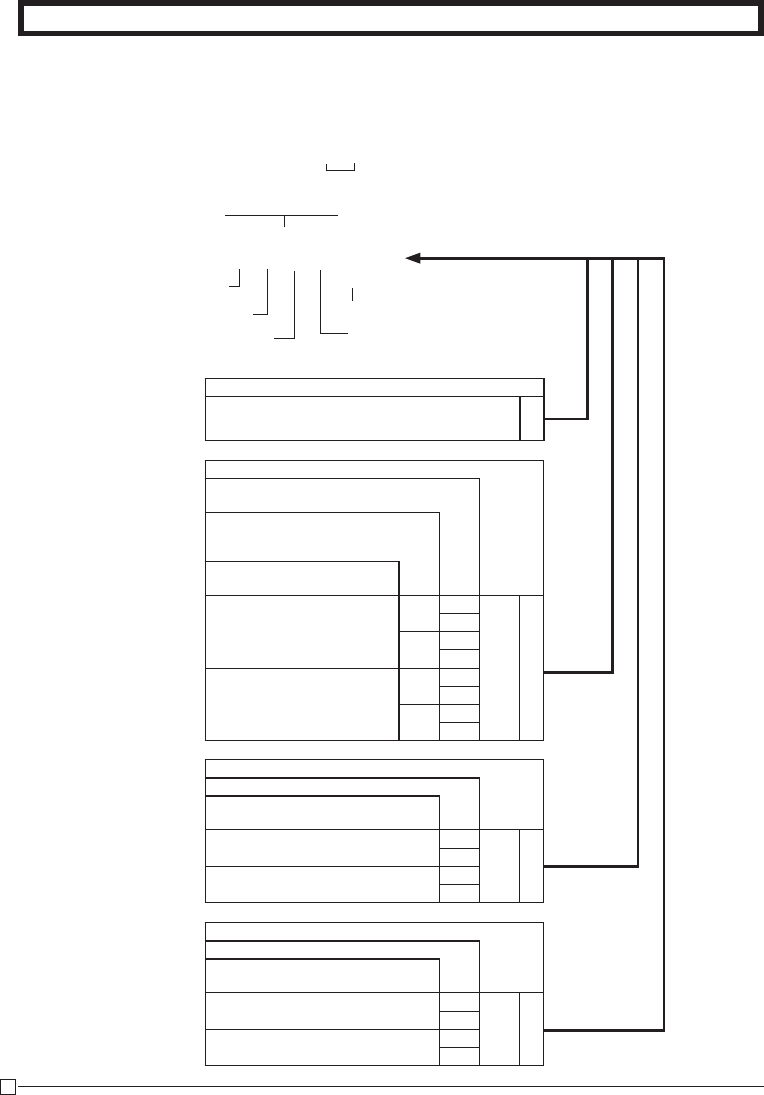

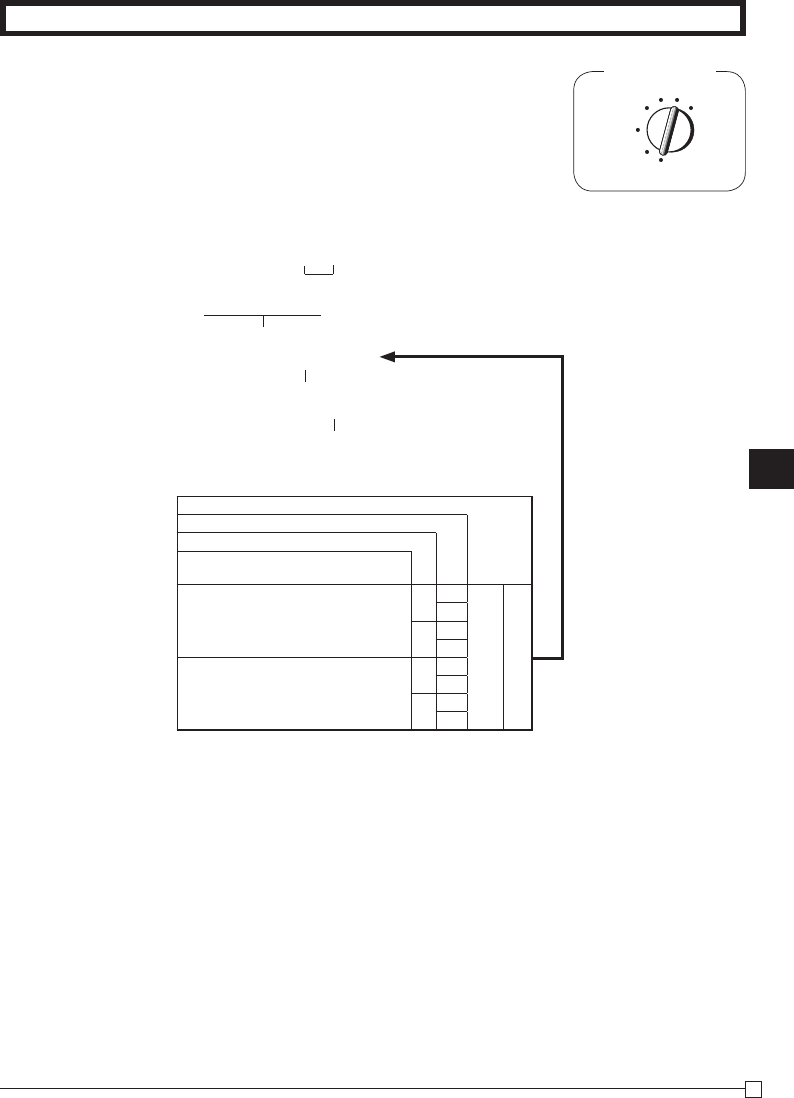

Mode Switch

Getting to know your cash register

Note:

An error is gen-

erated (E01 dis-

played) whenever

the position of the

Mode Switch is

changed during

registration.

The position of the Mode Switch controls the type of operations you

can perform on the cash register. The PROGRAM key (marked PGM)

can be select any Mode Switch setting, while OPERATOR key (marked

OP) can be used to select OFF, REG or CAL only.

OFF

In this position, the power of the cash register is off.

REG (Register)

This is the position used for registration of normal transactions.

RF (Refund)

This is the position used for registration of refunds.

CAL (Calculator)

This is the position used for calculator mode.

PGM (Programming)

This is the position used to program the cash register to suit the

needs of your store.

X (Read)

This is the position used to produce reports of daily sales totals with-

out clearing the totals.

Z (Reset)

This is the position used to produce reports of daily sales totals. This

setting clears the totals.

OP

PGM

GETTING TO KNOW YOUR CASH REGISTER

Display

! Department Number Display

Anytime you press a department key to register a unit

price, the corresponding department number appears

here.

@ PLU Number Display

Anytime you perform a PLU registration, the corre-

sponding PLU number appears here.

!

# Number of Repeat Display

Anytime you perform "repeat registration" (page 12),

the number of repeats appears here.

Note that only one digit is displayed for the number of

repeats.

$ Numeric Display

Entered values (unit prices or quantities) and calcu-

lated values (subtotals, totals or change amount due)

are displayed here. The capacity of the display is 8

digits.

This part of the display can be used to show the cur-

rent time or date between registration (page 31).

PGM RF OFF REG CAL X Z

OP key ● ● ●

PGM key ● ● ● ● ● ● ●

OP key PGM key

REG

OFF

RF PGM

XCAL Z

7

E

GETTING TO KNOW YOUR CASH REGISTER

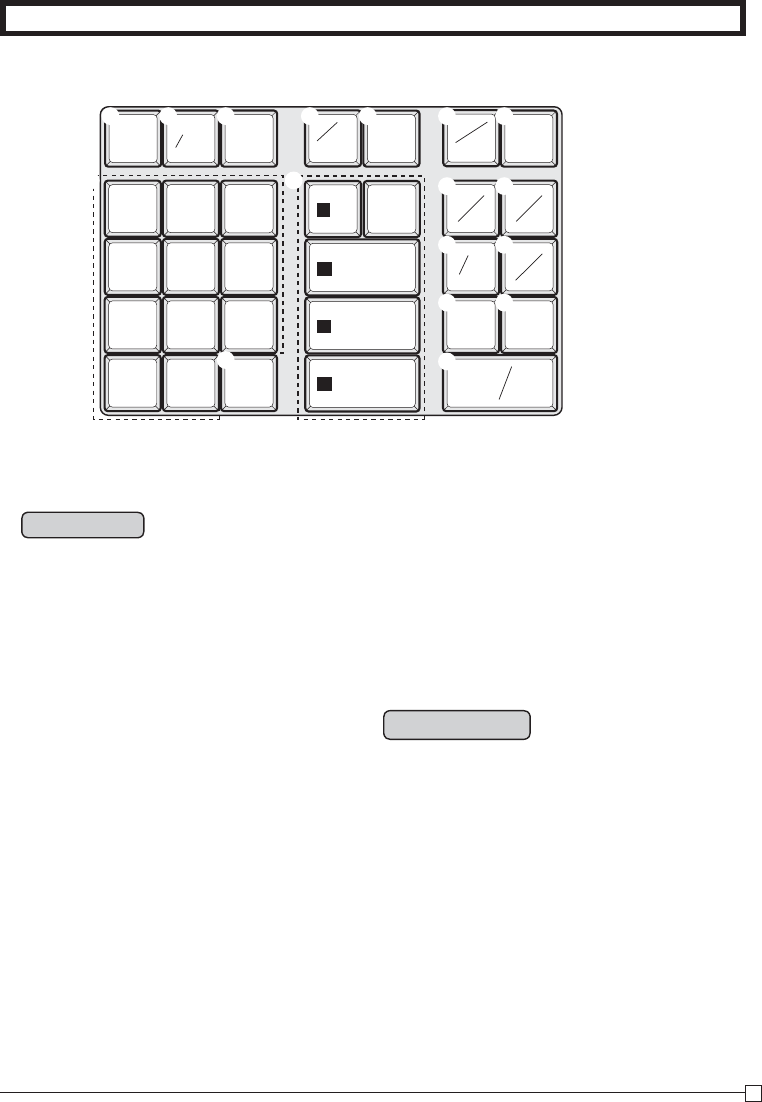

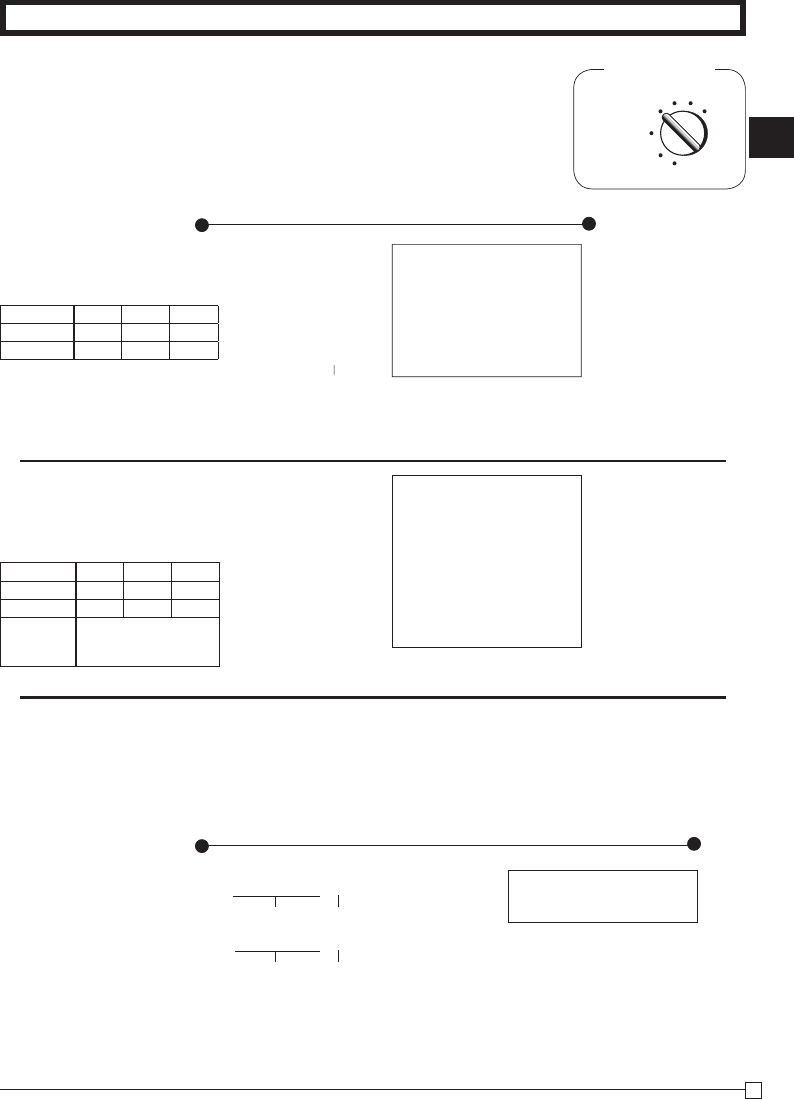

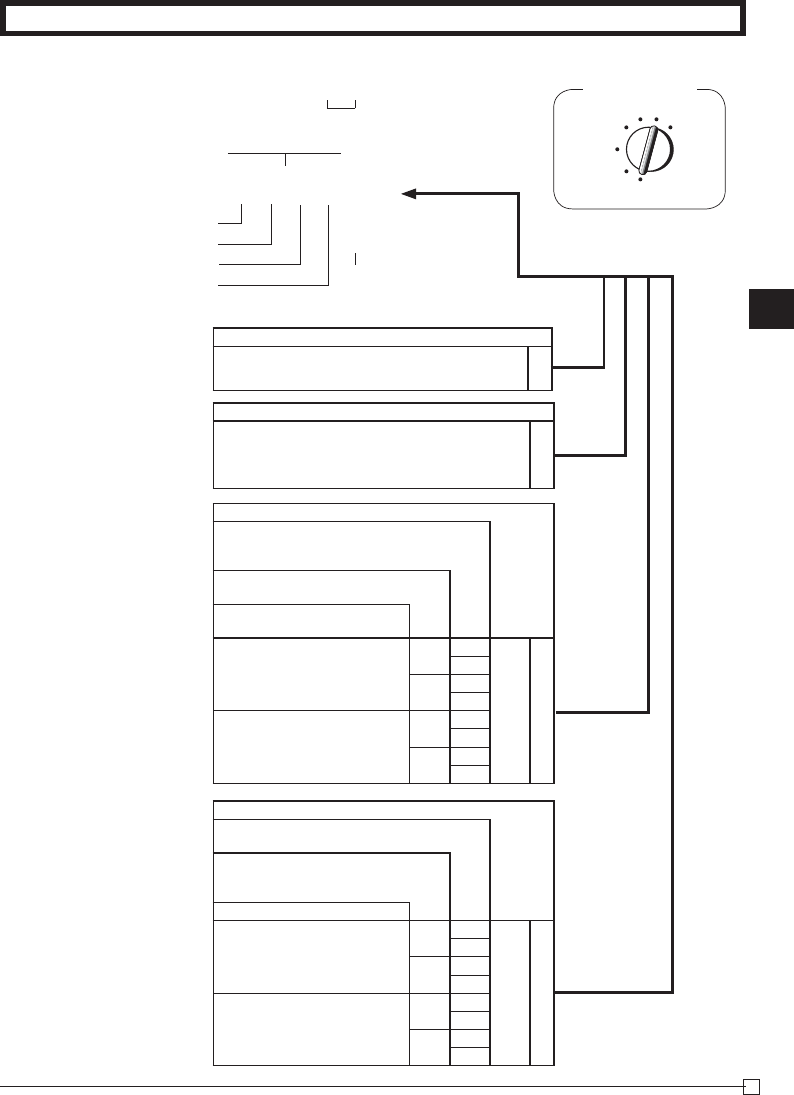

Keyboard

7

1

0

4

8

2

00

5

9

3

.

6

FEED PLU

DEPT

SHIFT

ERR.

CORR

—

DATE

TIME

CHK

SUB

TOTAL

T/S2

PO

T/S1

RA

NS

#

s

FOR

CLK# TAX

PGM

%

AC

=

CA AMT

TEND

C

CH

w

9/14/19

5

10/15/20

s

6/11/16

7/12/17

8/13/18

1

2

3

4

TAXABLE

NON-TAX

'

"

#

%

& (

$

Certain keys have two functions; one for register mode and one for calculator mode.

In this manual, we will refer to specifi c keys as noted below to make the operations as easy to

understand as possible:

Register Mode

Calculator Mode

# t AC key

% i Memory Recall key

^ :

Percent key

Q m Drawer Open key

R p Equal key

T

?, Z, ~ >, '

Numeric keys and 2-zero key

Y

" Decimal key

U H, J, K, L

Arithmetic Operation key

! l Feed key

@

h

Multiplication/Split pricing/Date Time key

# t Clear key

$

g Minus/Error Correction key

% i PLU (Price Look Up) key

^ :

Percent/Cashier ID No. Assignment key

&

~ Tax Program key

* c

Received on Account/Tax Status Shift 1 key

( v Paid Out/Tax Status Shift 2 key

) j

Reference Number/Department Shift key

Q m Check/No Sale key

W k Subtotal key

E u Charge key

R p Cash Amount Tendered key

T

?, Z, ~ >, '

Numeric keys and 2-zero key

Y

" Decimal key

U G, S, D, F, [

Department keys

• Department 6 through 20 are specifi ed by

pressing the j key respectively as follows:

jG ~ j[ →

Department 6 ~ 10

jjG ~ jj[ →

Department 11 ~ 15

jjjG

~ jjj[

→

Department 16 ~ 20

8

E

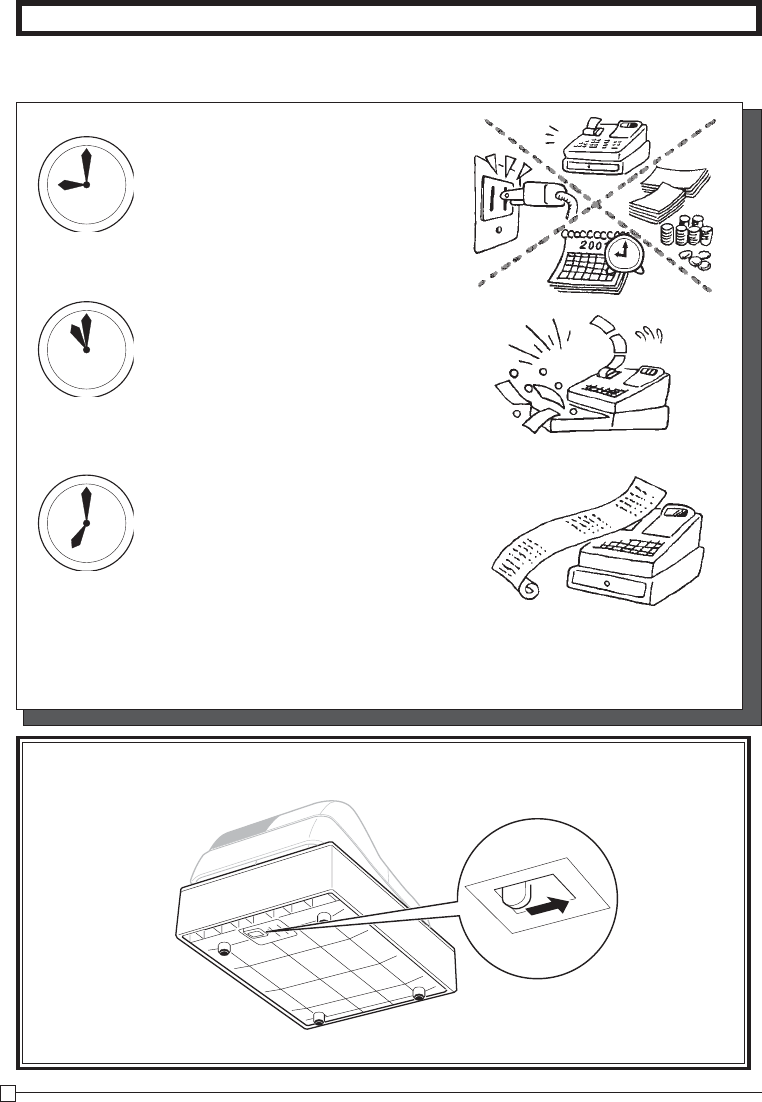

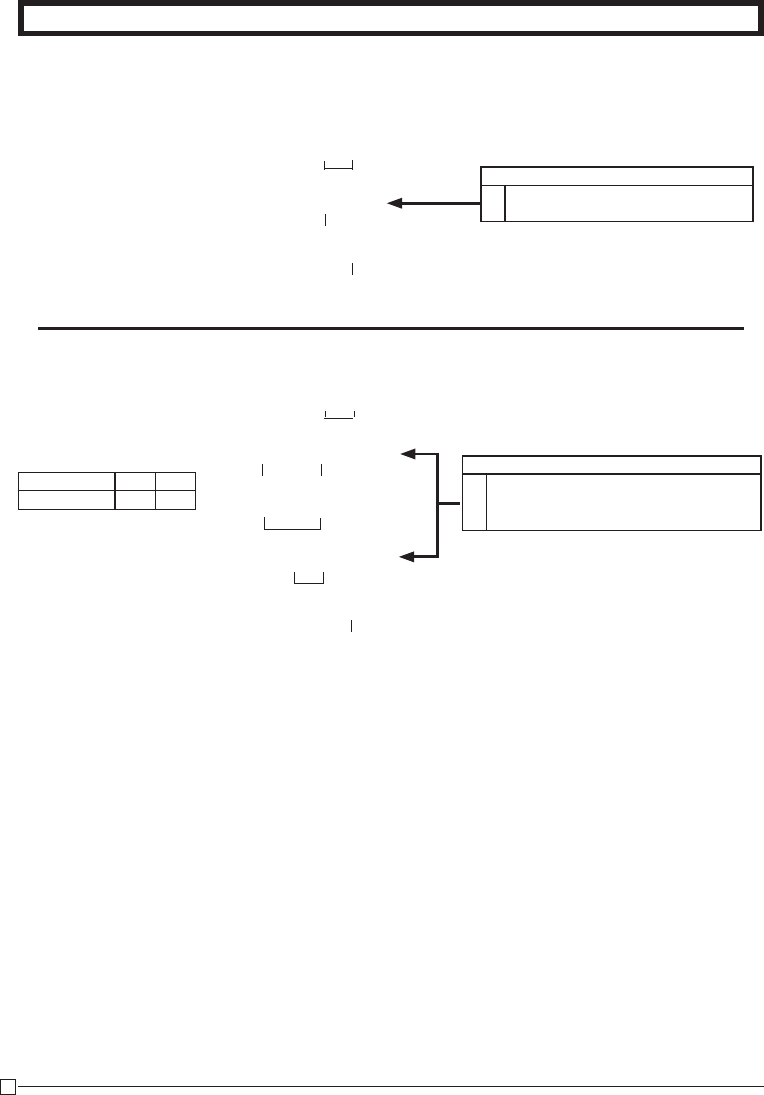

Daily Job Flow

Daily Job Flow

Before Opening The Store

1. Plugged in?

2. Enough Roll Paper? Page-10

3. Date and Time is correct? Page-31

4. Enough small change in the draw-

er? Page-32

While The Store Is Open

1. Registrations. Page-12~

2. Issuing latest daily sales total if

needed.

(Generating report by Mode Switch

to X position.) Page-15

After Closing The Store

1. Issuing Daily Sales Total.

(Resetting report by Mode Switch to

Z position.) Page-15

2. Picking up money in the drawer.

Page-32

3. Turn the Mode Switch to OFF.

Other

1. Troubleshooting Page-36

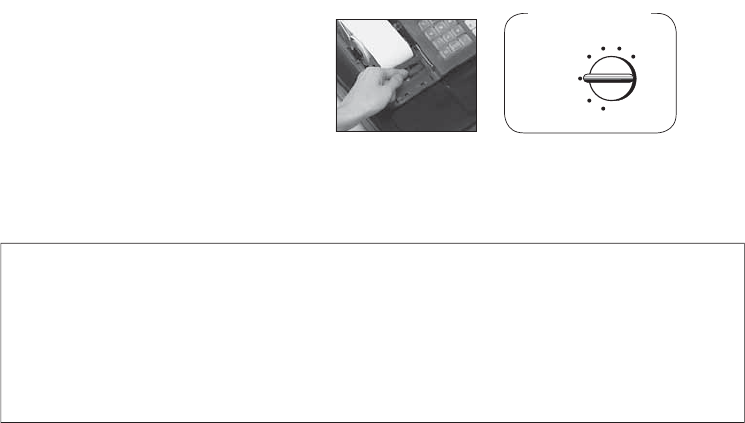

When the cash drawer does not open!

In case of power failure or the machine is in malfunction, the cash drawer does not open automatically. Even in

these cases, you can open the cash drawer by pulling drawer release lever (see below).

Important!

The drawer will not open, if it is locked with a drawer lock key.

9

Part-1

9

E

Part-1 QUICK START OPERATION

QUICK START OPERATION

Part-1

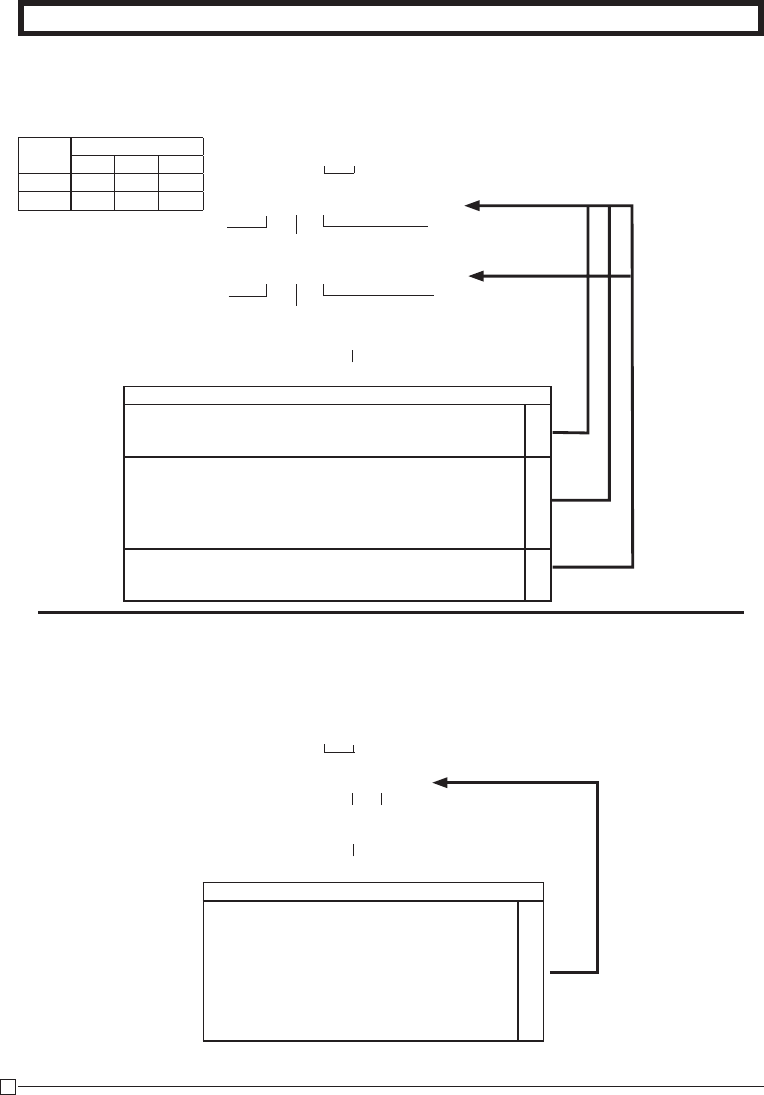

1. Initialization and Loading Memory Protection Battery

Important

You must initialize

the Cash register and

install the memory

protection batteries

before you can pro-

gram the cash regis-

ter.

◗ To initialize the cash register

1. Set the Mode Switch to OFF.

2. Load the memory protection batteries.

3. Plug the power cord of the cash register into an AC outlet.

4. Set the Mode Switch to REG.

◗ To load the memory protection batteries

1. Remove the printer cover.

2. Open the battery compartment cover.

3. Load 3 new SUM-3 ("AA") type batteries into the compartment.

Be sure that the plus (+) and minus (–) ends of each battery are

facing in the directions indicated by the illustrations inside the

battery compartment (Figure 1).

4. Replace the memory protection battery compartment cover

back into place.

5. Replace the printer paper and printer cover.

REPLACE MEMORY PROTECTION BATTERIES AT LEAST

ONCE EVERY YEAR.

(Figure 1)

10

E

Part-1 QUICK START OPERATION

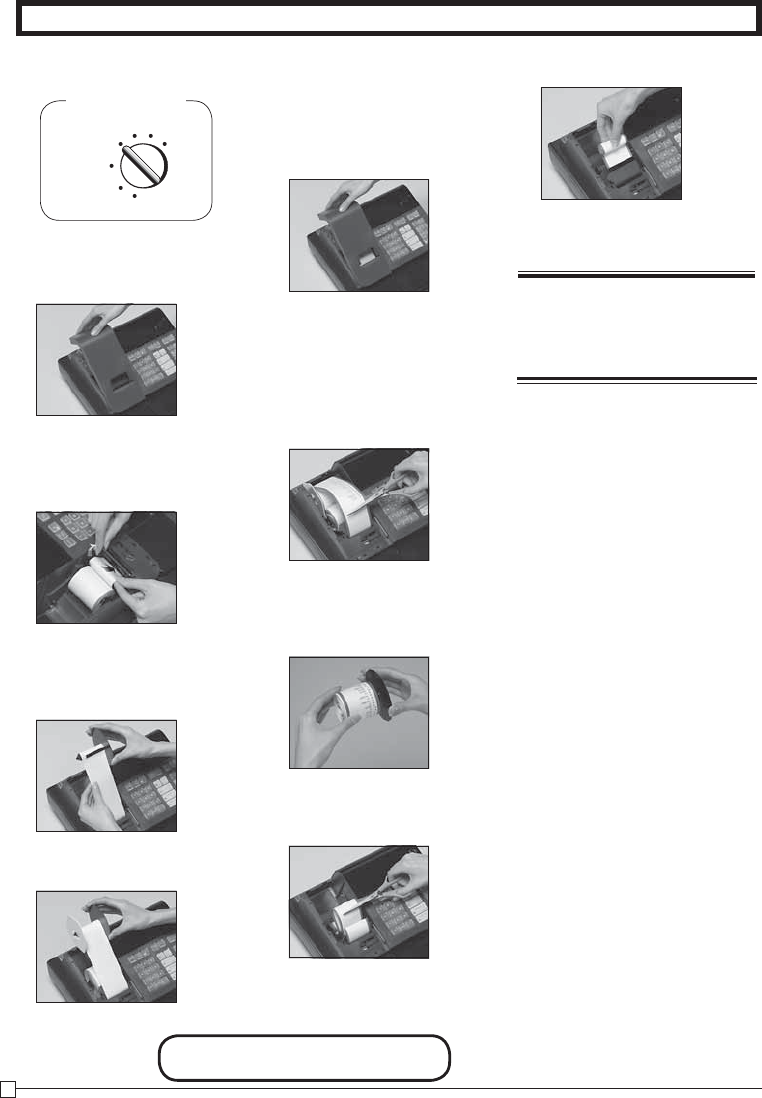

1. To load journal paper

! Remove the printer cover by

lifting up the back.

@ Put a roll of journal paper

into the holder.

# Cut the leading end of the

roll paper with scissors and

insert the paper into the inlet.

$ Press the l key until 20 or

30 cm of paper is fed from

the printer.

% Roll the paper onto the take-

up reel a few turns.

^ Set the left plate of the take-

up reel and place the reel

into the register.

* Load new paper following the

instructions above, and re-

place the printer cover.

& Press the l key to take up

any slack in the paper.

* Replace the printer cover by

placing the cover’s front tab

into the register’s groove.

2. To remove journal paper

! Remove the printer cover fol-

lowing the instructions above.

@ Press the l key until ap-

proximately 20cm of the pa-

per is fed from the printer.

# Cut off the roll paper.

$ Remove the take-up reel

from the printer and take off

the left plate of the reel.

% Remove the journal paper

from the take-up reel.

^ Cut off the paper left in the

printer and press the l key

until the remaining paper is

fed out from the printer.

&

Remove the core of the pa-

per.

2. Loading Paper Roll And Replacing The Printer’s Ink Roll

Mode Switch

REG

OFF

RF PGM

CAL Z

X

◗ To load receipt paper

! To use the printer to print re-

ceipts, follow steps 1 through

4 of “To load journal paper”.

@ Pass the leading end of the

receipt paper through the

printer cover’s paper outlet

and replace the printer cover.

# Tear off any excess paper.

Default printer setting is for

Journal.To print receipts, please

refer to 1-7-3 on page 22 to

switch the printer for Receipt or

Journal.

Options: Roll paper – P-5860

Ink Roll – IR-40

11

Part-1

11

E

Part-1 QUICK START OPERATION

3. Basic Programming for QUICK START

Mode Switch

REG

OFF

RF

PGM

CAL X Z

FOR PROGRAMMING ASSISTANCE, PLEASE CALL TOLL FREE 1-800-638-9228

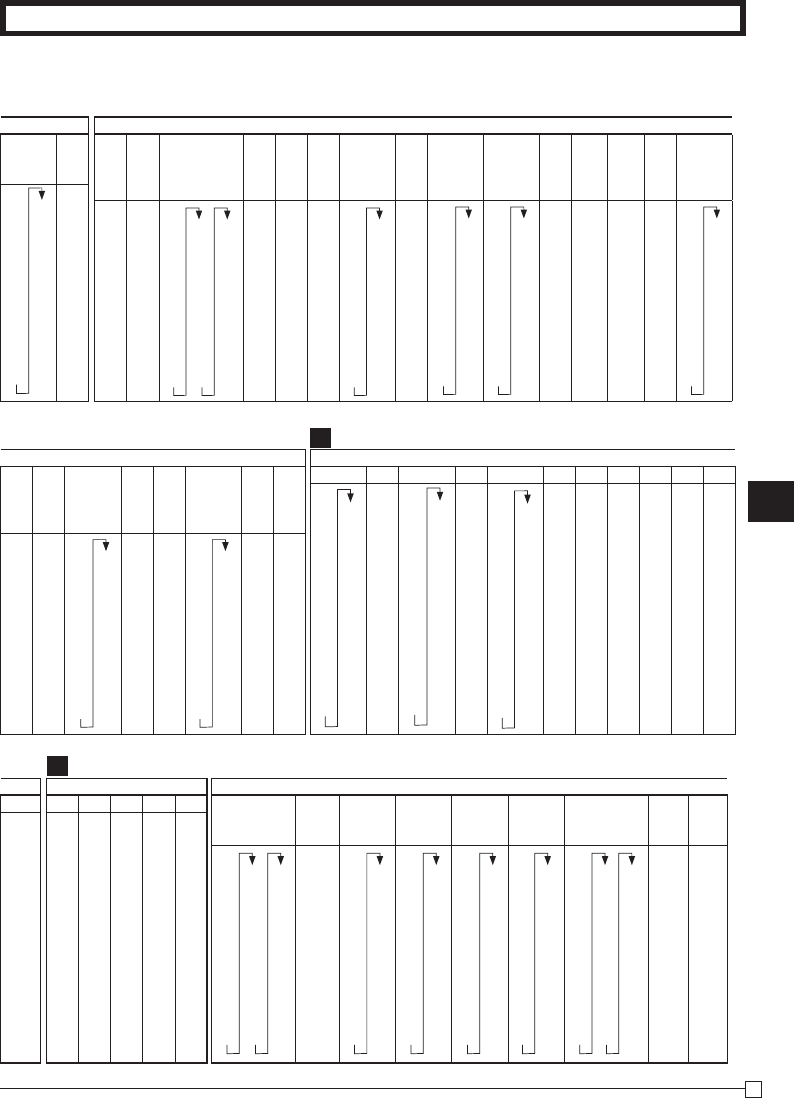

Procedure Purpose

1. Turn the mode switch to PGM position. Programming

2. When the display shows blinking “0”, such as 00-00-00 ,

enter current date in Month, Day, Year order.

Example: January 8, 2010: enter ?Z?<Z?

• Enter 6-digit, last 2 digits for year set. (

2010 → 10)

• By pressing

y, this procedure returns one by one.

Setting the

current date

3. When the display shows blinking “0”, such as 00-00 ,

enter current time in Hour, Minute order.

Example: 1:18 PM, enter ZCZ<

• Enter 4-digit, use 24-hour system.

• By pressing

y, this procedure returns one by one.

• If you want to adjust the date/ time, please refer to page 31 of this manual.

Setting the

current time

4. Input the desired fl at tax rate to the appropriate department key.

(This procedure below programs fl at tax rate only. If your tax table has break points, refer

to page 24 of this manual.)

A) Press the

~

key.

B) Enter tax rate. (Example: For 6% enter “6”, 5.75% enter “5.75”.)

C) Press the appropriate department key.

D) Repeat step B) and C) to set other department key.

E) Press the k key to end tax programming.

Note: In case of setting the wrong tax rate to the key, please enter ? and press those

department keys above, and quit this procedure by pressing k key, and start from

the beginning of this procedure.

Please start with the department 2 key (taxable department). Department 1 key is

initialized as non taxable.

Setting the tax

rates

Example 1:

Set state tax 4% to department 2, 3 key.

~

Start tax program.

4S

Enter tax rate and press dept key.

4D

Enter tax rate and press dept key.

k

To end the setting.

Example 2:

Set state tax 5% to department 2 and 7% to

department 3 key.

~

Start tax program.

5S

Enter tax rate and press dept key.

7D

Enter tax rate and press dept key.

k

To end the setting.

12

E

Part-1 QUICK START OPERATION

Z?? S

j

X?? [

jjC? [

k

B?? p

Z?? S

S

C h

ZCB S

k

p

C h

ZX h

Z?' S

k

p

REG

OFF

RF PGM

CAL Z

X

4. Basic Operation after Basic Programming

Whenever an error is generated, the input fi gures reset to 0.

All printout samples are journal images and the header (date, time

and consecutive no.) are eliminated from the samples.

Mode Switch

4-1 Open the drawer

without a sale

Note:

Printout

Operation

02 •1•00 t1

10 •2•00

15 •0•30

•1•00 T

•0•04 t1

•3•34 S

•5•00 C

•1•66 G

Unit Price Department 2

Department 10

Quantity Multiple key

Unit Price Department 2

02 •1•00 t1

02 •1•00 t1

3 X

•1•35 @

02 •4•05 t1

•6•05 T

•0•24 t1

•6•29 C

Note that repeated registration can be used with unit prices up to 6 digits long.

3 X

12

•10•00 @

02 •2•50 t1

•2•50 T

•0•10 t1

•2•60 C

Sales Quantity Multiple key

Package Quantity Multiple key

Package Price

Cash amount tendered

Departments 6 through 10, 11 through 15, 16 through 20 can also be regis-

tered in combination with the j and G, S, D, F or [ keys, respec-

tively. The j key should be entered just before entering unit price manually.

m •••••••••• N

4-2 Basic operation

4-3 Multiple regis-

tration on the

same items

4-4 Split sales of

packaged items

— No Sales Symbol

—

Department No

.

/Unit Price

— Taxable Subtotal

— Tax

— Subtototal

—

Cash Amount Tendered

—

Change Amount Due

— Repeat

— Sales Quantity

— Unit Price

— Sales Quantity

— Package Quantity

— Unit Price

Example

Unit Price $1.00 $2.00 $0.30

Quantity 1 1 1

Dept. 2 10 15

Cash

Amount

tendered

$5.00

Example

Unit Price $1.00 $1.35

Quantity 2 3

Dept. 2 2

Example

Unit Price 12$10.00

Quantity 3

Dept. 2

Department 15

Part-1

13

E

Part-1 QUICK START OPERATION

Z?? G

X?? S

C?? G

k

u

X?? G

C?? S

V?? G

k

B?? p

u

V?? y

Z?? G

REG

OFF

RF PGM

CAL Z

X

Mode Switch

Operation

4-5 Charge sales

You cannot perform the amount tendered operation using the u key.

Corrections can be made while you are registering the item (before you

press a department key), or after it has already been registered into the

memory (by pressing a department key).

Example

1. Entered 400 for unit

price by mistake

instead of 100.

Operation Printout

4-6 Split cash/

charge sales

01 •1•00

—

Cash Amount Tendered

— Charge Sales

4-7 Corrections

4-7-1 Before you

press a depart-

ment key

Wrong entry Clears the last item entered.

Correct entry Registered Department 1

y

key clears the last item entered.

Printout

Charge key

01 •1•00

02 •2•00 t1

01 •3•00

•2•00 T

•0•08 t1

•6•08 H

01 •2•00

02 •3•00 t1

01 •4•00

•3•00 T

•0•12 t1

•9•12 S

•5•00 C

•4•12 H

— Charge Sales

Example

Unit Price $1.00 $2.00 $3.00

Quantity 1 1 1

Dept. 1 2 1

Example

Unit Price $2.00 $3.00 $4.00

Quantity 1 1 1

Dept. 1 2 1

Cash

Amount

tendered

$5.00

14

E

Part-1 QUICK START OPERATION

X?? h

y

B h

X?? S

Z? h

ZB? y

Z? h

Z?B D

BB? G

g

B?B G

C h

XX? S

g

C h

XC? S

Operation Printout

2. Entered unit price

fi rst instead of

quantity and then

pressed h.

Multiplication

Clears the last item entered.

Multiplication

Registered Department 2

Quantity

Quantity

Quantity

Wrong entry Clears the last item entered.

Correct entry Registered Department 3

Multiplication

4-7-2 After you

pressed a depart-

ment key

Cancels the last item registered.

Registered Department 1

2. Entered unit price 220

by mistake instead of

230 and pressed a

department key.

Multiplication

Quantity

Cancels the last item registered.

Wrong entry

5 X

•2•00 @

02 •10•00 t1

3 X

•2•20 @

02 •6•60 t1

-6•60 V

3 X

•2•30 @

02 •6•90 t1

01 •5•50

-5•50 V

01 •5•05

10 X

•1•05 @

03 •10•50

3. Entered 150 for unit

price by mistake

instead of 105.

Example

1. Entered unit price 550

by mistake instead of

505 and pressed a

department key.

Correct entry Registered Department 2

Unit price

Unit price

g

key cancels the last registered item.

Wrong entry

Correct entry

Part-1

15

E

Part-1 QUICK START OPERATION

01-08-10

19-35 0073 1

0001 Z

01 48

•50•10

02 28

•76•40

03 17

•85•80

04 4

•76•00

05 1

•6•50

06 1

•1•00

19 2

•1•00

20 5

•10•00

108 *

•316•80 *

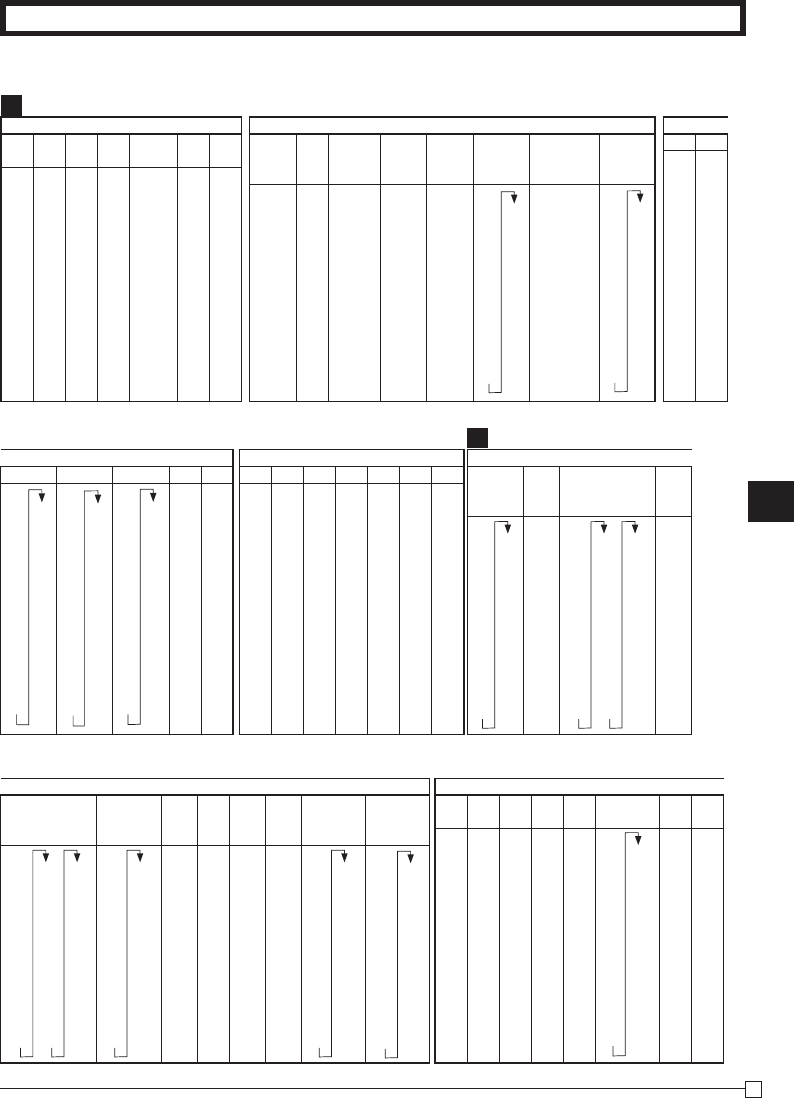

5. Daily Management Report

This section tells you the procedures to use to produce reports of the transac-

tion data stored in the cash register's memory.

Important

Remember that when you issue a reset (Z) report, the data that is reported is cleared from the applicable total-

izers. To view data without clearing totalizers, issue a read (X) report.

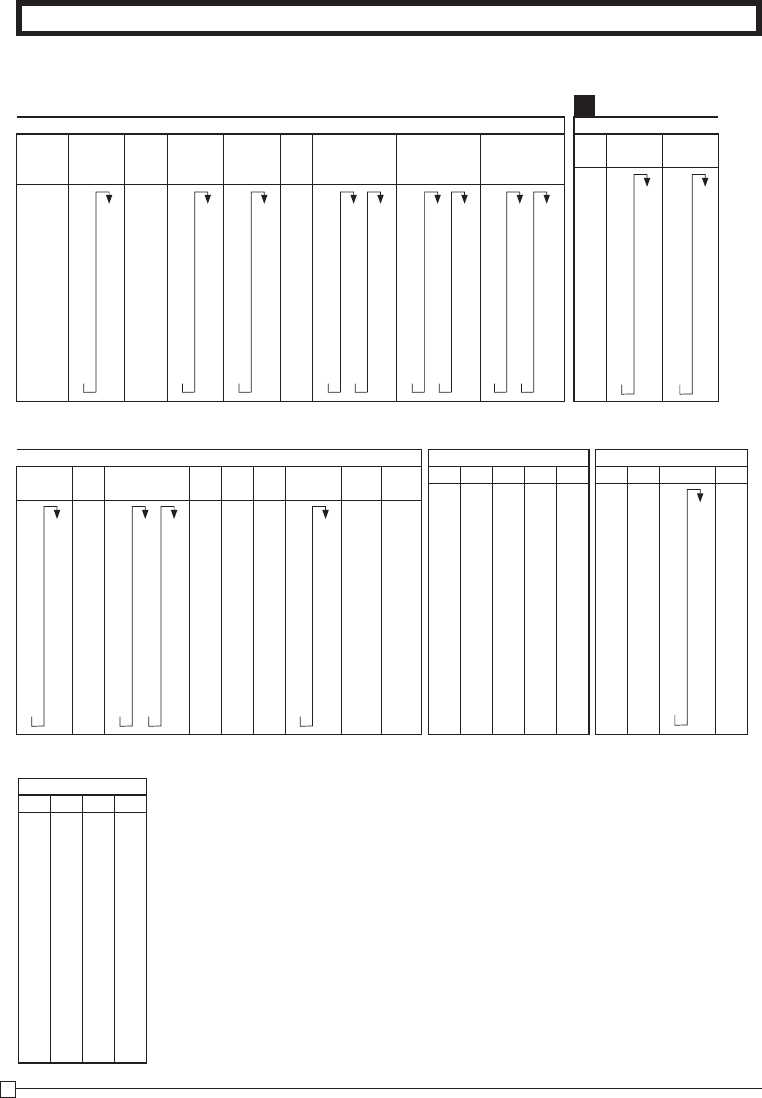

5-1 Financial Report

Printout

Operation

h

p

p

— Date

— Time/Consecutive No.

— Read Symbol

— Gross Sales No. of Items

— Gross Sales Amount

— Net Sales No. of Customers

— Net Sales Amount

— Cash Total in Drawer

— Charge Total in Drawer

— Check Total in Drawer

5-2-1 Daily Read/Reset

Report

5-2 General Control

Read/Reset

Report

Z (Reset) report

Printout

Operation

— Date

—

Time/Consecutive No. /Clerk

No.

—

Non-resettable Sales No.

of Resets*

1

/RESET Symbol*

1

— No. of Items/Dept. No.

— Amount

— Gross Sales No. of Items

— Gross Sales Amount

01-08-10

14-27 0072

X

67 *

•270•48 *

38 n

•271•24 n

•197•57 C #

•18•19 H #

•45•18 * K

Mode Switch

REG

OFF

RF

PGM

CAL Z

X

Mode Switch to

X

(Read)

Mode Switch to

Z

(Reset)

Mode Switch

REG

OFF

RF

Z

CAL X

PGM

16

E

Part-1 QUICK START OPERATION

* X (Read) report is the same except *1 and *2.

5-2-2 Periodic Read/

Reset Report

Printout

Operation

•0•50 -

•0•66 % -

•105•10 T

•4•20 t1

•75•60 * T

•3•97 t ™

46 n

•325•13 n

•325•13 1

44 C

•203•91 C

3 H

•16•22 H

2 K

•105•00 K

•6•00 R

•10•00 P

3 V

1 r

•3•00 r

5 C X

1 N

•199•91 C #

•16•22 H #

•105•00 * K

000000

0325•13

Non-resettable Grand Sales Total

(printed only on RESET report)*

2

Z? p 01-08-10

19-50 0074

10 •••• X

X

67 *

•270•73 *

38 n

•271•24 n

— Date

— Time/Consecutive No.

Periodic

Read Symbol

— Gross Sales No. of Items

— Gross Sales Amount

— Net Sales No. of Customers

— Net Sales Amount

— Reduction Amount

—

Premium/Discount Amount

— Taxable Amount 1

— Tax Amount 1

— Taxable Amount 2

— Tax Amount 2

— Net Sales No. of Customers

— Net Sales Amount

— Clerk 1 Sales Amount

(Refer to 2-10 Cashier Assignment)

— Cash Sales Count

— Cash Sales Amount

— Charge Sales Count

— Charge Sales Amount

— Check Sales Count

— Check Sales Amount

—

Received on Account Amount

— Paid Out Amount

— Error Correction Count

— RF Mode Count

— RF Mode Amount

— No. of p key operation in

CAL mode

— No-sales Count

— Cash in Drawer

— Charge in Drawer

— Check in Drawer

Mode Switch to

Z

or

X

Part-2

17

E

Part-2 CONVENIENT OPERATION

Z k

Z?? G

XX? S

ZZ?? D

k

Z k

X"B :

k

Z k~

mGSDF[

cjGjSjDjFj[

k

CONVENIENT OPERATION

Part 2

1. Various Programming

1-1 Unit price for

Departments

Mode Switch

1-2 Rate for per-

cent key

P appears in mode display

• Unit prices within the range of 0.01~9999.99.

• The rate within the range of 00.01 to 99.99%.

1-3 To change tax

status for

Departments

REG

OFF

RF

PGM

CAL X Z

(To end the setting)

P appears in mode display

P appears in mode display

(For Dept. 1)

(For Dept. 2)

(For Dept. 3)

Select key

from list A

Taxable status 1

(To end the setting)

For Depts. 6, 7, 8, 9 and 10

For Depts. 1, 2, 3, 4 and 5

Tax status for the Departments are fi xed as follows:

Department 2: Taxable status 1.

Departments 1, 3~20: Non-Taxable status.

Example

Unit Price $1.00 $2.20 $11.00

Dept. 1 2 3

Example

Discount Rate 2.5%

Example

Status Non-

Taxable Taxable

Dept. 1 ~ 5 6 ~ 10

Selections

Taxable status 1 c

A

Taxable status 2 v

Taxable status 1 and 2 cv

Taxable status 3 u

Taxable status 1, 2 and 3 cvu

Taxable status 4 h

Non-taxable status m

18

E

Part-2 CONVENIENT OPERATION

C k

?VZ G

?BZ S

k

Z k~

m:

k

1-4 Status for

Department

1-5 Status for percent key

1-5-1 To change tax-

able status for the

percent key

Taxable status 1 is fi xed for the percent key.

Example

Change Percent key

registration as a Non-

taxable.

P3 appears in mode display

Select a number

from list A Select a number from list B

Normal department

Maximum No. of digits to be 5

For Dept. 1

Select a number

from list C

For Dept. 2

Single item sale

department

P appears in mode display

(To end the setting)

(To end the setting)

Select key from list A (For percent key)

Selections

Normal department ?

A

Minus department Z

No limitation for manually entered price. ?

B

Maximum number of digits for manually entered price.

(1 ~ 7 digits) Z ~ M

To prohibit manual price entries. < or >

Normal sales (not a single-item sale) department ?

C

Set as a single-item sale department Z

Example

Depts. Selections

ABC

1 041

2 051

Selections

Taxable status 1 c

A

Taxable status 2 v

Taxable status 1 and 2 cv

Taxable status 3 u

Taxable status 1, 2 and 3 cvu

Taxable status 4 h

Non-taxable status m

Part-2

19

E

Part-2 CONVENIENT OPERATION

C k

ZZ :

k

Z k~

mg

k

Mode Switch

REG

OFF

RF

PGM

CAL X Z

1-5-2 Status for

percent key

Select a number

from list A

Select a number

from list B

P3 appears in mode display

(To end the setting)

Non-taxable status is fi xed for the minus key.

1-6 Taxable Status

for minus key

P appears in mode display

Minus key

(To end the setting)

Select key from list A

Example

Change minus key

registrations

Non-taxable status.

Selections

Rounding of results produced by Percent Key operation.

A

Round off (1.544=1.54; 1.545=1.55) ?

Round up (1.544=1.55; 1.545=1.55) Z

Cut off (1.544=1.54; 1.545=1.54) X

Program Percent Key to register discounts (%–). ?

B

Program Percent Key to register premiums (%+). Z

Program Percent Key to function as a Manual Tax key.

X

Example

Round Up

Percent %+

Selections

Taxable status 1 c

A

Taxable status 2 v

Taxable status 1 and 2 cv

Taxable status 3 u

Taxable status 1, 2 and 3 cvu

Taxable status 4 h

Non-taxable status m

20

E

Part-2 CONVENIENT OPERATION

C k

?NXX k

???? p

k

1-7-1 To set general

controls

1-7 General features

P3 appears in mode display

(To end the setting)

Program code No.

Select a number from list B

Select a number from list A

Select a number from list D

Selections

Maintain key buffer during receipt issue in

REG mode.

Reset the transaction number to

zero whenever a General Control

Reset Report is issued.

Allow credit balance registra-

tion.

No

Ye s Ye s ?

B

No Z

No Ye s X

No C

Ye s

Ye s Ye s V

No B

No Ye s N

No M

Selections

Allow partial cash amount tendered.

Allow partial check amount ten-

dered.

Ye s Ye s ?

C

No X

No Ye s V

No N

Selections

Use the ' key as a 000 key.

Cashier assignment systems (sign

on) is used.

No No ?

D

Ye s Z

Ye s No X

Ye s C

Selections

Time display format: HH-MM ?

A

Time display format: HH-MM SS V

Select a number from list C

Part-2

21

E

Part-2 CONVENIENT OPERATION

C k

?BXX k

???? p

k

1-7-2 To set printing

controls

REG

OFF

RF

PGM

CAL X Z

P3 appears in mode display

(To end the setting)

Program code No.

Select a number from list A

Select a number from list B

Select a number from list C

Select a number from list D

Mode Switch

Selections

Print RF switch mode refund count/

amount on the General Control Read/Re-

set Reports.

Print the grand sales total on the

General Control Reset Reports.

Print the time on the receipt

and journal.

Ye s

No Ye s ?

C

No Z

Ye s Ye s X

No C

No

No Ye s V

No B

Ye s Ye s N

No M

Selections

Print the consecutive number on the re-

ceipt/journal.

Print the subtotal on the receipt/

journal when the Subtotal Key is

pressed.

Skip item print on journal.

No

No Ye s ?

D

No Z

Ye s Ye s X

No C

Ye s

No Ye s V

No B

Ye s Ye s N

No M

Selections

Use the printer to print a journal. ?

A

Use the printer to print receipts. Z

Selections

Print zero-total line on the General Control

Read/Reset Reports ?

B

Do not print zero-total line on the General

Control Read/Reset Reports. Z

22

E

Part-2 CONVENIENT OPERATION

C k

ZiZ p

Z?? i

Z? p

k

1-7-3 Printer switch for

Receipt or Journal

The printer is fi xed as journal after initial-

ized operation.

P3 appears in mode display

Z k

Z u

k

P appears in mode display

(To end the setting)

• Printer selection to print a journal or

receipts can also be set on proce-

dures 1-7-2 “To set printing controls”.

1-8 PLU setting

1-8-1 Linkage with

Departments

• 120 PLUs can be set.

• When the linked department is not speci-

fi ed, the PLU is linked to department 20.

• Status for a single-item sale and tax status

are followed the specifi ed linked depart-

ment.

Select a number from list A

(To end the setting)

Dept. No. to be linked

Select numbers from list A

PLU No.

PLU No.

Selections

A

Use the printer to print a journal. ?

Use the printer to print receipts. Z

Selections

A

Linked to dept. 20. ?

Linked depts. 1~20 respectively.

Z~ X?

Example

To print a receipt.

Example

PLU No. 1 100

Link Dept. No 1 10

Part-2

23

E

Part-2 CONVENIENT OPERATION

Z k

Z i

Z?? p

X i

C?? p

k

C k

?CXN k

??? p

k

1-8-2 Unit Prices

for PLUs

P appears in mode display

PLU No.

Unit Price

PLU No.

Unit Price

(To end the setting)

• Unit prices within the range of $0.01~999.99.

Mode Switch

REG

OFF

RF

PGM

CAL X Z

1-9 To control

Tax Status

printing

(To end the setting)

P3 appears in mode display

Program set code No.

Select a

number

from list B

Select a

number

from list A

Enter “0”

(fi xed code)

Selections

Print taxable amount.

Print taxable amount and tax

amount for Add-in.

Ye s Ye s ?

B

No Z

No Ye s X

No C

Selections

Print Tax status symbols. ?

A

Do not print Tax status symbols. X

Example

Print taxable amount and tax

amount for Add-in.

Example

PLU No. 1 2

Unit Price $1.00 $3.00

24

E

Part-2 CONVENIENT OPERATION

1-10 To program

Tax Table

Last code for 4%

P3 appears in mode display

1st code for 4%

(to end the setting)

ALABAMA

4%

0

1

1

10

30

54

73

110

5%

0

1

1

10

29

49

69

89

110

6%

0

1

1

8

24

41

58

6%

0

1

1

9

20

40

55

70

90

109

If your tax table is not a fl at table (includes break points), fi nd the tax table for your state on pages

37 through 44 of this manual. Follow the procedures below to set the tax tables.

Example 1: Set Alabama state tax 4%.

Program set code No. for tax table 1

C k

? Z X B k

? p

Z p

Z p

Z ? p

C ? p

B V p

M C p

Z Z ? p

k

P3 appears in mode display

Program set code No. for Tax table 2

5.25% tax

50 for Round off and 02 for Add On

(to end the setting)

COLORADO

5.25%

5.25

5002

C k

? X X B k

B " X B p

B ? ? X p

k

Example 2: Set Colorado state tax 5.25%.

• This sample programming can set only tax rate, but not for a tax break point.

• You can set tax table 3 and 4 by the set code No. 0325 (for table 3) and 0425 (for table 4)

Tax status for the Departments and function keys are fi xed as follows:

Department 2: Taxable status 1.

Departments 1, 3~20: Non-Taxable status.

Percent key: Taxable status 1.

Minus key: Non-Taxable status.

• See page 17 (department key), 18 (percent key), 19 (minus key) to change the fi xed tax status.

Note: If your table has break points, set it to this table (tax table 1).

Mode Switch

REG

OFF

RF

PGM

CAL X Z

Part-2

25

E

Part-2 CONVENIENT OPERATION

1-11 Printing to

read All

Preset Data

p

Printout

Operation

1-11-1 Printing preset

data except

PLU settings

01-08-10

14-24 0070

X

01••••1•00

01-041

02••••2•20

02-051

03•••11•00

03-041

20••••0•00

00-000

-••••••03

2•5 %

03-11

0122••••12

0222••0000

0522••0022

0622••0000

1022•••••0

0326•••002

0125••••••

0•0000 %

0001

0001

10

30

54

73

110

0225••••••

5•2500 %

5002

0000

01-08-10

— Date

— Time/Consecutive No.

— Read Symbol

— Dept. No./Unit Price

— Tax Status/Normal Dept./

Digit Limit/Single Item

— Minus/Tax Status

— Percent Rate/%+ or %–

— Tax Status/Percent Key Control

— Date/Add Mode Control (fi xed)

— Print Control

— General Control

— Calculation Control

— Tax Control

— Tax Table 1

Break Points Control

— Tax Table 2

— Rounding Specifi cations/

Tax System Specifi cations

Mode Switch

REG

OFF

RF

PGM

CAL X Z

Tax Status

Printout Meaning Printout Meaning Printout Meaning

00 Non taxable 06 Taxable 1 & 3 12 Taxable 1, 2 & 4

01 Taxable 1 07 Taxable 1 & 4 13 Taxable 1, 3 & 4

02 Taxable 2 08 Taxable 2 & 3 14 Taxable 2, 3 & 4

03 Taxable 3 09 Taxable 2 & 4 15 All taxable

04 Taxable 4 10 Taxable 3 & 4

05 Taxable 1 & 2 11 Taxable 1, 2 & 3

26

E

Part-2 CONVENIENT OPERATION

01-08-10

14-26 0073

X

001•••1•00

01

002•••2•00

02

003•••3•00

03

004•••4•00

099•••0•00

19

100••10•00

20

01-08-10

REG

OFF

RF

PGM

CAL X Z

Mode Switch

1-11-2 Printing pre-

set PLU set-

tings

Printout

Operation

— Date

— Time/Consecutive No.

— Read symbol

— PLU No./Unit Price

— Linked department

Z p

Part-2

27

E

Part-2 CONVENIENT OPERATION

G

S

S

V hD

k

B??? p

B? D

Z?? S

B? D

k

p

2-1 Registration using

preset price

for Departments.

2. Various Operations

Mode Switch

REG

OFF

RF PGM

CAL Z

X

(Programming: See page 17)

Printout

Operation

2-2 Single-Item Sales

(Programming: See page 18)

For this example, Dept. 1 is programmed for a single-item-sale.

(Programming: See page 23.)

Single-item sale cannot be fi nalized if an item is registered previ-

ously.

— Unit Price

— Unit Price

— Repeat

— Multiplication Symbol

— Unit Price

— Cash Amount Tendered

— Change

02 •1•00 t1

03 •0•50

•1•00 T

•0•04 t1

•1•54 C

03 •0•50

•0•50 C

01 •1•00

02 •2•20 t1

02 •2•20 t1

4 X

•11•00 @

03 •44•00

•4•40 T

•0•18 t1

•49•58 S

•50•00 C

•0•42 G

— Cash Sales

— Taxable Amount

— Tax

— Cash Sales

Example

Unit Price $1.00 $2.20 $11.00

Quantity 1 2 4

Depts. 1 2 3

Amount

Tendered $50.00

Example 1

Status Single item sale

Unit Price $0.50

Quantity 1

Dept. 3

Example 2

Status Normal Single item sale

Unit Price $1.00 $0.50

Quantity 1 1

Dept. 2 3

28

E

Part-2 CONVENIENT OPERATION

01 •1•00

•0•10 t #

02 •2•00 t1

•2•00 T

•0•08 t1

•3•18 C

2-3 Check Sales

Printout

Operation

2-4 Change the Tax

Status

Mode Switch

REG

OFF

RF PGM

CAL Z

X

2-5 Manual Tax

04 •35•00

04 •35•00

•70•00 K— Check Sales

— Manual Tax Symbol

: key is programmed to function as a Manual Tax key (see page 19).

CB?? F

F

k

m

c

Z?? G

X?? S

p

Z?? G

Z? :

X?? S

p

01 •1•00 t1

02 •2•00 t1

•3•00 T

•0•12 t1

•3•12 C

Example

Unit Price $35.00

Quantity 2

Depts. 4

Example

Unit Price $1.00 $2.00

Quantity 1 1

Depts. 1 2

Preset Status Non-

Taxabl e Taxable 1

This

Registration Taxable 1 Taxable 1

Example

Unit Price $1.00 $2.00

Quantity 1 1

Depts. 1 2

Part-2

29

E

Part-2 CONVENIENT OPERATION

(Programming: See page 23)

Z i

i

V h

X i

p

Z i

C??? S

XB?? D

k

X??? p

m

001 •1•00 t1

001 •1•00 t1

4 X

•2•00 @

002 •8•00 t1

•10•00 T

•0•40 t1

•10•40 C

(Programming: See page 22)

• For this example, linked department 1 is programmed for a single-item-sale.

• Single-item sale cannot be fi nalized if an item is registered previously.

001 •1•00 t1

•1•00 T

•0•04 t1

•1•04 C

PLU No.

— Taxable Status Symbol

— Taxable Amount

— Tax

02 •30•00 t1

03 •25•00

•30•00 T

•1•20 t1

•56•20 S

•20•00 C

•36•20 K

PLU No.

— Repeat

— Multiplication Symbol

— Preset Unit Price

— Cash Amount Tendered

2-6 PLU operation

2-7 PLU Single-Item Sale

2-8 Split cash/

check sales

Example

PLU No. 1 2

Unit Price $1.00 $2.00

Quantity 2 4

Link Dept. No. 2 2

Cash Amount

tendered $10.40

Example

PLU No. 1

Status Single item sale

Unit Price $1.00

Quantity 1

Example

Unit Price $30.00 $25.00

Quantity 1 1

Depts. 2 3

Cash Amount

tendered $20.00

Check $36.20

30

E

Part-2 CONVENIENT OPERATION

Z?? S

X?? D

k

p

Mode Switch

2-9 Refund

RF

OFF

REG

PGM

CAL Z

X

Printout

Operation

After you fi nish RF mode operation, be sure to re-

turn the Mode Switch to the REG (register) setting.

2-10 Cashier

Assignment

(Programming: See page 20)

Mode Switch

In any mode

REG, RF, CAL,

X or Z,

except PGM

• Currently assigned cashier (or clerk) ID number is printed on the receipt or journal for each trans-

action.

• The assigned clerk memory number is automatically signed off when the mode key is set to OFF

position.

• The assigned cashier (or clerk) sales totals with ID number are printed on the receipt or journal

when you perform daily X/Z sales report.

13-55 0040 r

02 •1•00 t1

03 •2•00

•1•00 T

•0•04 t1

•3•04 C

— Refund Mode Symbol

Cashier assignment system is used to control each cashier (or clerk) sales total. When you select

this function on page 20, you can get 8 cashiers (or clerk) sales data.

Cashier assignment must be performed prior to starting registration or any other operation, except

Program mode.

Select a number

from list A

Selections

Sign off (cancel) the assignment of cashier ID No.

?

A

Assign a cashier ID No. 1 through 8. Z ~ <

Example

Unit Price $1.00 $2.00

Quantity 1 1

Depts. 2 3

Z :

Part-2

31

E

Part-2 CONVENIENT OPERATION

13-5#

01-08-10

~00

h

h

y

Mode Switch

REG

OFF

RF PGM

CAL Z

X

2-11 Other registrations

2-11-1 Reading the

Time and Date

• Flashes per second

Display

Operation

Month/Date/Year

Hour/Minute

Adjusting the Time

Display

Operation

Zk

ZCB<h

y

• Enter current time in 24 hour system.

p ~00

13-58 02

~00

Current Time: Hour Minute

Example

Current time = 13:58

• Turn the Mode Switch to PGM.

Adjusting the Date

Display

Operation

Zk

?Z?<Z?h

y

• Enter current date in 6 digits.

• Enter the last 2 digits for year set. (2010 → 10)

p ~00

01-08-10

~00

Current date: Month Day Year

Example

Current date = January 8, 2010

• Turn the Mode Switch to PGM.

REG

OFF

RF

PGM

CAL X Z

Mode Switch

REG

OFF

RF

PGM

CAL X Z

Mode Switch

32

E

Part-2 CONVENIENT OPERATION

ZXCV

BNM< j

Z??? v

N?? c

ZXCV

BNM< j

B? S

p

Z?? S

X?? S

k

B? g

p

Printout

Operation

Mode Switch

REG

OFF

RF PGM

CAL Z

X

02 •1•00 t1

02 •2•00 t1

•3•12 S

-0•50

•3•00 T

•0•12 t1

•2•62 C

2-11-5 Reduction on

subtotal

Example

Amount due reduced by

$0.50. — See page 21 to print

the subtotal line.

2-11-4 Registering

identifi cation

numbers

2-11-2 Paid out from

cash in drawer

Printout

Operation

Printout

Operation

Printout

Operation

A reference number or ID number of up to 8 digits can be registered

prior to any transaction.

•6•00 R— Received On Account

Amount

12345678 #

13-57 0041

•10•00 P

— Reference Number

— Paid Out Amount

Enter reference No.

2-11-3 Cash

received on

account

12345678 #

13-59 0046

02 •0•50 t1

•0•50 T

•0•02 t1

•0•52 C

— Reference No. or ID No.

Part-2

33

E

Part-2 CONVENIENT OPERATION

Z?? G

:

X?? S

C?? G

k

M :

p

?Z p

?Z p

2-12 PLU report

Mode Switch

REG

OFF

RF

Z

CAL X

PGM

REG

OFF

RF

PGM

CAL Z

XMode Switch

Operation Printout

—

Report code/Reset Counter

— PLU No./No. of items

— Amount

— PLU total count

— PLU total amount

01-08-10

19-35 0073

01 0001 Z

001 12

•12•00

002 27

100 90

•180•00

1284

•10856•89

2-11-6 Premium/ Dis-

count

• 2.5% premium/discount

(programmed to : key)

applied to fi rst item.

• Be sure to use k key when

you wish to apply a premium/

discoung to the subtotal.

• 7% premium/discount applied

to transaction total.

• For programming the : key

as percent minus or percent

plus, see page 19.

• For programming percent

rate, see page 17.

01 •1•00

2•5 % -

-0•03

02 •2•00 t1

01 •3•00

•5•97 S

7 %-

-0•42 t1

•1•86 T

•0•07 t1

•5•62 C

Premium Discount

*1 Premium/ Discount Rate

*2 Premium/ Discount Amount

*3 Subtotal

*4 Premium/ Discount Rate

*5 Premium/ Disount Amount

Mode Switch to

X

(Read)

Mode Switch to

Z

(Reset)

01 •1•00

2•5 %

•0•03

02 •2•00 t1

01 •3•00

•6•03 S

7 %

•0•42 t1

•2•14 T

•0•09 t1

•6•54 C

— *1

— *2

— *3

— *4

— *5

— *1

— *2

— *3

— *4

— *5

34

E

t

BHZ t

BHCJX p

XCJBNKM< p

VKCJNLC"BH< p

ZB??KZX :

CALCULATOR FUNCTION

Part 3

1-1 Calculation

examples

1. Calculator

Mode

While registering at REG

mode, you can switch

to CAL mode and then

return to REG mode to

resume the registration.

Mode Switch

CAL

OFF

RF PGM

X

REG Z

Operation Display

5+3–2=

(23–56)×78=

(4×3–6)÷3.5+8=

12% on 1500

1-2 Memory recall

REG

OFF

RF PGM

CAL Z

X

Mode Switch

Recalls the current amount onto the display.

– during registration: current subtotal

– registration has been completed: the last amount

Memory recall

Operation Display

On REG mode

Recalls the current result by pressing p key at CAL mode on the dis-

play.

Operation Printout

Example

Recall the current result at

CAL mode during registration,

and register the cash amount

due for each person.

01 •10•00

01 •20•00

•30•00 S

•10•00 C

•10•00 C

•10•00 C

•0•00 G

(Cancels item entered.)

Memory recall

&

-257$

)7142857

18~

ç ~

1~

Z?'GX?'G

iLC p

i p

i p

i p

On CAL mode

Example

Divide the current subtotal

$30.00 at REG mode by 3

(to divide the bill between 3

people).

On REG mode

Part-3

35

E

Mode Switch

REG

OFF

RF

PGM

CAL X Z

1-3 Setting for calcu-

lator operation

P3 appears in mode display

Select a number from list A.

(To end the setting)

Program Code No.

* Drawer does not open during registration procedures even if you press

p or m by turning the mode switch to CAL position.

C k

Z?XX k

? p

k

Selections

Open drawer whenever p is pressed.*

Open drawer whenever m is pressed.*

Print No. of Equal key operations on

General Control X and Z reports.

Ye s

No No ?

A

Ye s Z

Ye s No X

Ye s C

No

No No V

Ye s B

Ye s No N

Ye s M

Part-3 CALCULATOR FUNCTION

36

E

Tax Tables

USEFUL INFORMATION

Part 4

1. Troubleshooting

Symptom/Problem Most common causes Solutions

1 E01 appears on the display. Changing modes without complet-

ing transaction.

Return mode switch to where it stops buzz-

ing and press p.

2 E08 appears on the display. Sign on operation is not performed. Prior to starting registration of any other

operation, press Z~< and then :.

3 E94 appears on the display. Printer paper is jammed.

Remove jammed paper. Turn Mode switch

to OFF then turn to ON, or Turn power OFF

and then turn power ON.

4No date on receipt.

Paper is not advancing enough. Printer is programmed as a journal. Program printer to print receipts.

5Drawer opens up after ringing up

only one time.

Department is programmed as a

single item dept. Program the dept. as a normal dept.

6Not clearing totals at end of day

after taking report. Using X mode to take out reports. Use Z mode to take out reports.

7

Programming is lost whenever

register is unplugged or there is

a power outage.

Bad or no batteries. Put in new batteries and program again.

8Register is inoperative.

Can’t get money out of drawer. No power. Pull lever underneath register at rear.

Note: If you cannot resolve your diffi culty, please feel free to call your dealer or 1-800-638-9228.

2. Specifi cations

INPUT METHOD

Entry: 10-key system; Buffer memory 8 keys (2-key roll over)

Display (LED): Amount 8 digits (zero suppression); Department/PLU No.; No. of repeats

PRINTER

Journal: 14 digits (Amount 10 digits, Symbol 3 digits)

(or Receipt) Automatic paper roll winding (journal)

Paper roll: 58 mm × 80 mm ∅ (Max.)

CALCULATIONS

Entry 8 digits; Registration 7 digits; Total 8 digits

CALCULATOR FUNCTION

8 digits; Arithmetic calculations; Percent calculations

Memory protection batteries:

The effective service life of the memory protection batteries 3 (UM-3, or R6P (SUM-3) type

batteries) is approximately one year from installation into the machine.

Power source/Power consumption: See the rating plate.

Operating temperature: 32°F to 104°F (0°C to 40°C)

Humidity: 10 to 90%

Dimensions: 7 3/8"(H)×13"(W)×14 3/16"(D) with S drawer

(188 mm(H)×330 mm(W)×360 mm(D))

Weight: 9 lbs (4 kg) with S drawer

Specifi cations and design are subject to change without notice.

Part-4

37

E

Tax Tables

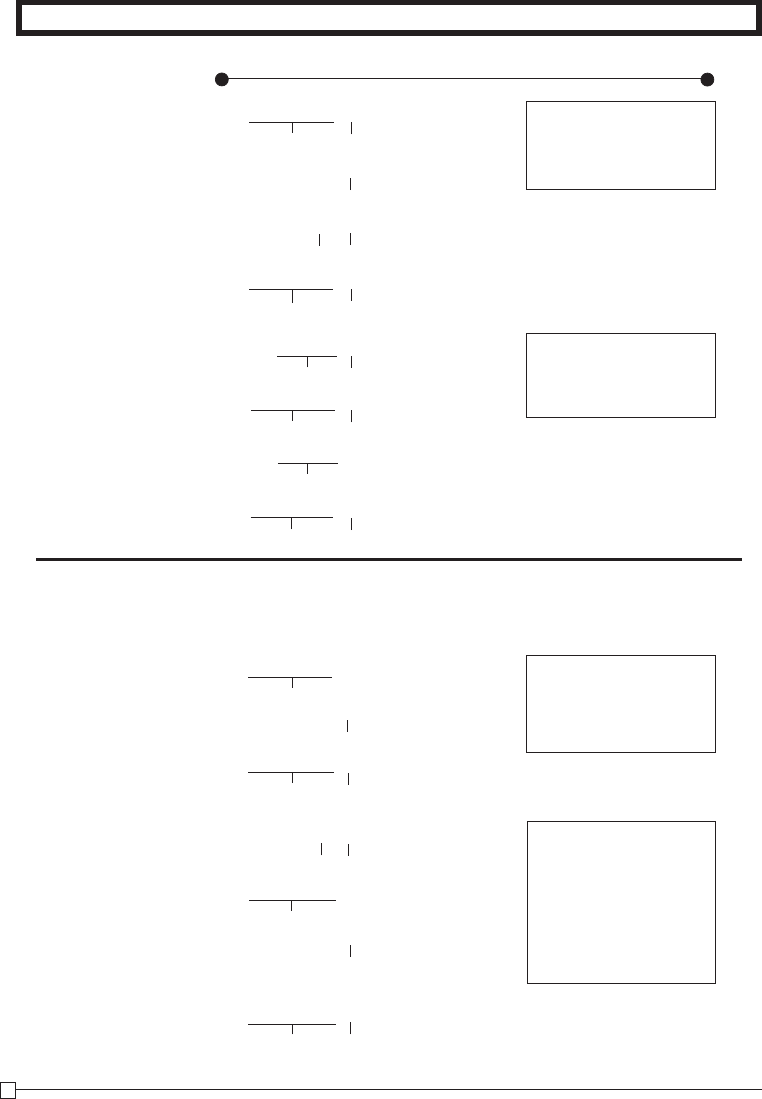

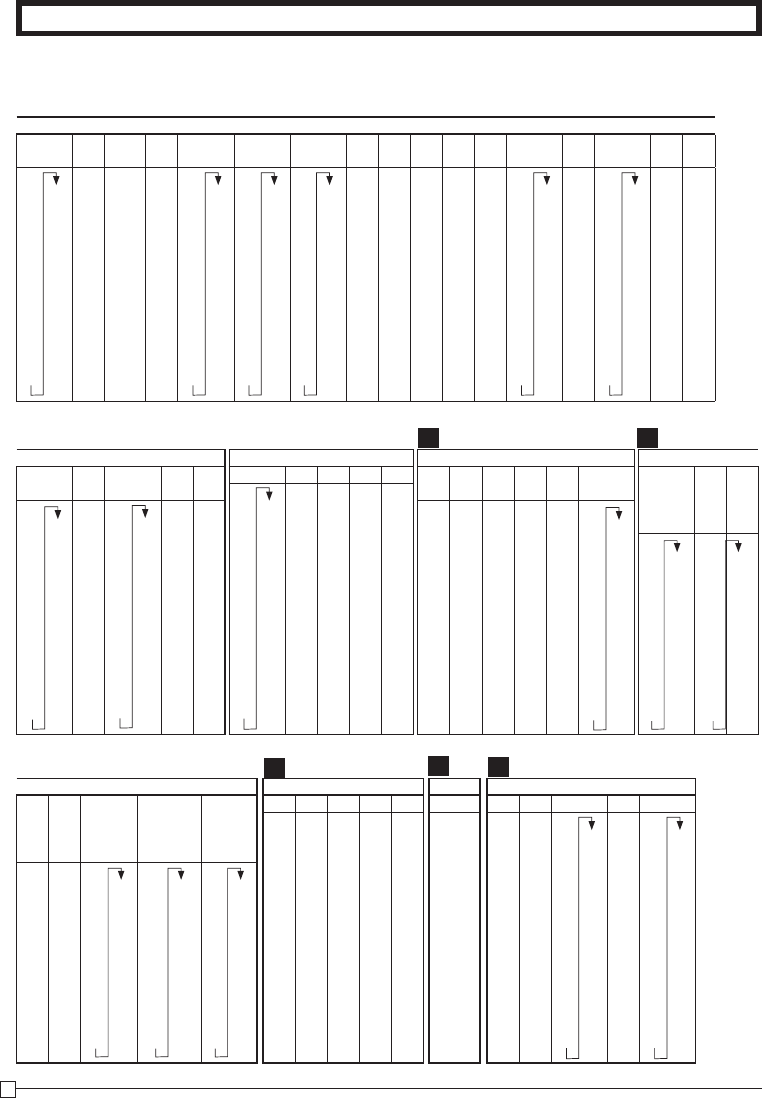

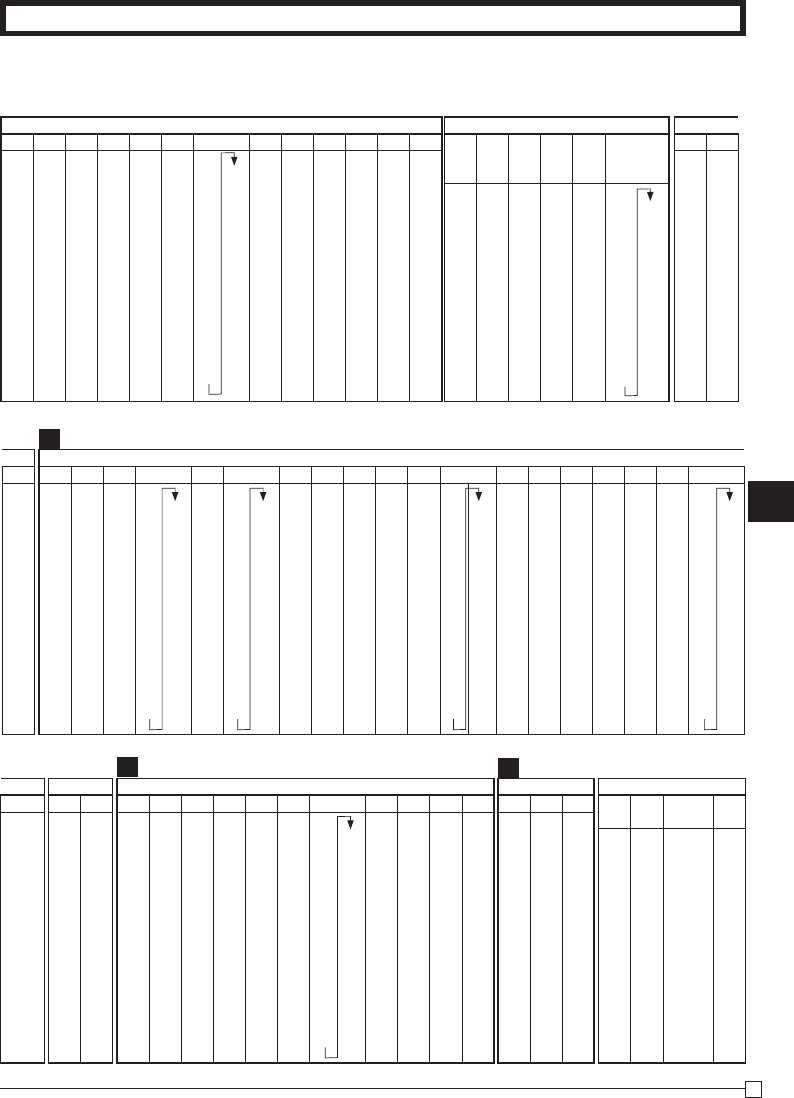

Tax Tables for USA

ALABAMA

4% 5% 6% 6% 6% 7% 8%

(4+1+1)

0000 0 00

1111 1 11

1111 1 11

10 10 8 9 10 7 6

30 29 24 20 20 21 18

54 49 41 40 36 35 31

73 69 58 55 54 49 43

110 89 70 70 64 56

110 90 85 78 68

109 110 92 81

107 93

106

ALASKA

HOMER/

KENAI,SEWARD

KENAI

SELDOVIA

HAINES

JUNEAU

KENAI

& SOLDOTNA

2% 3% 3% 4% 4% 5% 5% 6%

0 0 0 0 0 0 177 0 6 159

1 1 1 1 1 1 184 1 2 179

1 4 4 2 1 6 218 1 29 199

25 34 25 19 12 13 9 29 219

75 49 34 37 37 25 29 49 239

83 75 62 46 49 69 259

116 127 75 69 89 259

150 155 79 89 109 279

183 177 118 109 109 300

216 227 127 129

151 159

ARIZONA

6% 6.5% 6.7% 6.8% 7%

0 175 0 161 0 156 6.8 0

1 191 1 176 1 171 5002 1

9 7 192 7 186 1

10 7 207 7 201 7

22 23 223 22 216 21

39 38 238 37 231 35

56 53 253 52 246 49

73 69 269 67 261 64

90 84 284 82 276 78

107 99 299 97 291 92

125 115 111 107

141 130 126

158 146 141

ARKANSAS

3% 4% 5% 6% 6.8% 7% 7.5%

0000000

1111111

1111212

14 12 10 8 6 7 6

44 37 20 24 19 21 19

74 40 41 33 35 33

114 60 58 46 49 46

80 64

110 78

92

107

CALIFORNIA

LOS ANGELS

10%

7% 7.25% 7.25% 7.5% 7.75% 8.25% 8.5% PARKING

0 121 278 7.25 117 7.25 0 7.75 8.25 0 99 0 99

1 135 292 5002 131 5002 1 5002 5002 1 111 1 99

8 149 307 0 3 1 123 11 104

10 164 10 6 5 135 99 114

20 178 20 19 17 147 99 124

33 192 32 33 29 158 99 134

47 207 46 46 41 170 99 144

62 221 60 59 52 182 99 154

76 235 74 73 64 194 99

91 249 88 76 205 99

107 267 103 88 99

ARIZONA

4% 5%

00

11

15

12 10

37 27

47

68

89

109

CALIFORNIA

6%

6.25%

6.5%

6.75%

0 141 0 0 130 299 6.75

1 158 1 1 146 5002

7 7 7 161 0

10 10 10 176 10

22 21 20 192 20

39 37 35 207 34

56 54 51 223 48

73 70 67 238 64

90 86 83 253 80

108 103 99 269 96

124 119 115 284 111

COLORADO

1.5% 2%

2.5%

3% 3.5% 3.6%

3.85%

4%

00000026400

11111129111

11132531922

33 24 19 17 17 17 347 16 17

99 74 59 49 42 41 375 37 37

166 83 71 69 63 62

233 116 99 97

149 128 124

183 157 152

185 180

214 208

242 236

A

C

38

E

Tax Tables

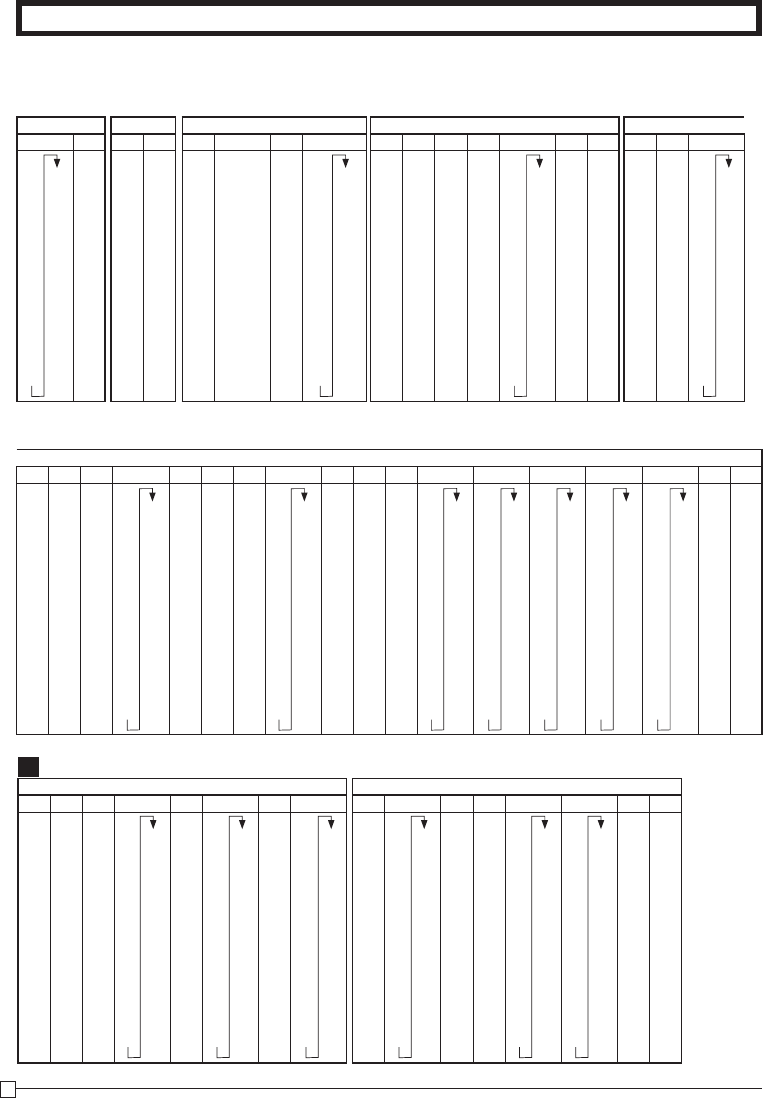

COLORADO

LOVELAND

4.5% 5% 5%

5.25%

5.5% 5.6% 5.75%

6% 6.1%

6.35%

6.4%

6.45%

6.5%

6.6% 7%

7.01%

7.1%

0 211 0 0 5.25 0 172 0 168 0 165 0 6.1 6.35 6.4 6.45 0 146 6.6 0 135 7.01 7.1

1 233 1 1 5002 1 190 1 186 1 182 1 5002 5002 5002 5002 1 161 5002 1 149 5002 5002

5 255 2 1 6 209 7 204 8 199 2 0 0 0 2 176 4 17

17 277 17 18 17 227 16 222 17 217 17 17 17 17 17 192 17 21

33 299 29 18 27 245 25 240 26 24 23 207 21 35

55 49 51 45 263 43 43 41 38 223 35 49

77 68 63 281 61 60 58 53 49 64

99 84 81 299 79 78 74 69 64

122 118 99 97 95 84 78

144 118 115 113 99 92

166 136 132 130 115 107

188 154 150 147 130 121

COLORADO

7.2%

7.25%

7.3% 7.5% 8%

0 131 7.25 0 130 0 0

1 145 5002 1 143 1 1

2 159 3 157 3 1

17 173 6 171 17 6

20 187 20 19 18

34 201 34 33 31

48 215 47 46 43

62 229 61 59 56

76 243 75 73 68

90 256 89 81

104 102 93

118 116 106

CONNECTICUT

5.25%

6% 7% 7.5% 8%

01980000

12181111

2 2131

16 8766

27 24 21 19 18

46 41 35 33 31

65 58 49 46

84 74 64 56

103 91 78 73

122 108 92

141 124 107

160

179

DISTRICT OF COLUMBIA

D.C. D.C.

D.C. D.C. D.C. D.C.

5%

5.75%

6% 6% 8% 9%

0 5.75 0 0 0 0 105

1 5002 1 1 1 1 116

101116127

10 8 12 8 12 6 138

22 17 24 16 16 149

42 35 41 27 27 161

62 53 58 39 38

82 71 74 50 49

110 89 91 62 61

112 108 75 72

90 83

112 94

FLORIDA

PANANA

CITY

BEACH

6% 6.2% 6.5% 7% 7.5%

0 6.2 0 107 0 109 0 93

1 5002 1 123 1 1 106

1 1 138 1 1 120

9 9 153 9 9 133

16 15 169 14 13 146

33 30 184 28 26 160

50 46 209 42 40 173

66 61 57 53 186

83 76 71 66 209

109 92 85 80

GEORGIA

3% 4%

5% 6% 7%

00000

11111

11111

10 10 10 10 7

35 25 20 20 21

66 50 40 35 35

110 75 60 50 49

110 80 67 64

110 85 78

110 92

107

HAWAII

4%

0

1

1

12

37

IDAHO

3% 4%

4.5% 5% 6%

0 0 0 227 0 0 170

111 11

122 22

15 11 15 11 11

42 32 27 25 20

72 57 49 45 37

115 71 53

93 70

115 87

137 103

160 120

183 137

205 153

FLORIDA

4% 5%

5.25%

0 175 0 5.25

1 209 1 5002

51

99

25 20

50 40

75 60

109 80

125 109

150

D F

GHI

Part-4

39

E

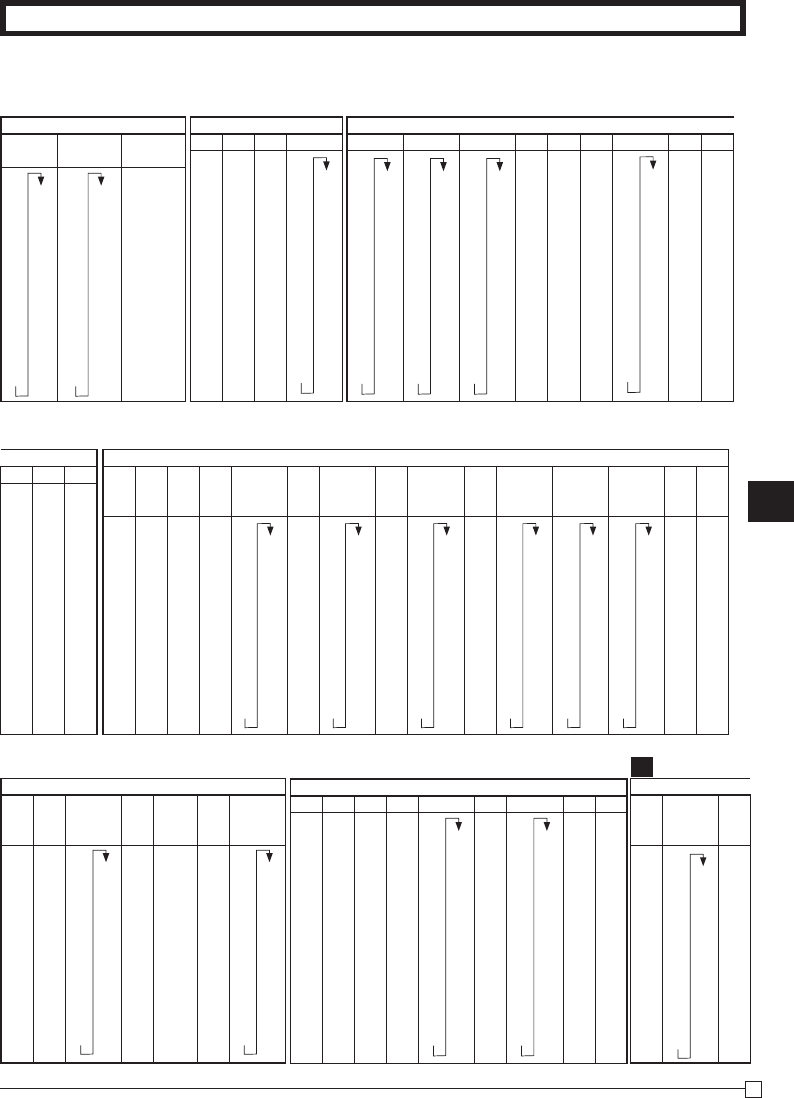

Tax Tables

ILLINOIS

1%

1.25%

2% 5% 6%

6.25%

6.5%

6.75%

7% 7.5%

7.75%

8%

8.75%

00000001616.75007.7508.75

11111111765002 1 1 5002 1 5002

1116111192 11010

49 39 24 12 8 7 7 207 8 6 6 6 5

148 119 74 25 24 23 23 22 19 18

46 41 38 36 33 31

67 58 53 50 46

88 69 65

109 84 79

129 99 93

115 108

130

146

INDIANA

MARION

County

RESTAU-

RANT

1% 4%

5% 5% 6% 7%

000000121

111111135

121217149

49 15 9 15 9 7 164

148 37 29 37 29 20 178

62 49 49 35 193

62 49 49

87 69 64

112 89 78

137 109 92

107

IOWA

6%

0

1

1

8

24

41

58

74

91

108

KANSAS

2.5% 3%

3.1%

3.25% 3.5% 3.75% 4% 4.1% 4.5% 5%

5.25%

5.5%

5.65%

5.9% 6%

6.15%

6.4% 6.5% 9.5%

0 0 3.1 0 323 0 0 279 0 4.1 0 0 5.25 0 190 5.65 5.9 0 6.15 6.4 6.5 0 110

1 1 5002 1 353 1 1 306 1 5002 1 1 5002 1 209 5002 5002 1 5002 5002 5002 1 121

1101384113331011 1 0070001131

1916161541514133591212119 9 8888775142

59 49 46 42 39 386 37 33 29 27 24 15 152

99 83 76 71 66 413 62 55 45 41 26 163

139 116 107 99 93 87 77 63 58 36 173

179 138 128 119 112 99 81 74 47 184

169 157 146 122 99 91 57 194

199 185 173 144 118 108 68

230 199 166 136 124 78

261 226 188 154 141 89

292 253 211 172 158 99

KENTUCKY

5%

6%

00

11

62

10 8

25 24

46 41

67 58

88 74

109

129

LOUISIANA

2%

3% 4% 4.5% 5% 6% 6% 7% 7.5% 8% 9%

00000001610000

11111111761111

222162171921271

24 16 12 11 10 8 7 207 7 6 4 5

74 49 37 33 27 24 23 223 21 19 16 16

124 82 62 55 47 41 38 238 35 33 29 27

174 116 87 77 67 58 53 253 49 46 42 38

224 149 112 99 87 74 69 269 64 59 55 49

122 109 84 284 67 61

144 129 99 299 80 72

166 115 315 93 83

188 130 330 106 94

211 146 105

MAINE

5%

6% 7%

007

112

110

10 9 7

20 16 21

40 33 35

60 50 49

80 66 64

110 83 78

109 92

100

MARYLAND

Meals Tax

4% 5% 5% 6%

0000

1111

2273

24 19 99 19

25 20 99 20

50 40 99 33

99 50

99 66

100 83

120 100

140 116

IOWA

4%

5%

00

11

31

12 9

37 29

50

75

KANSAS

10%

0

1

1

4

14

24

34

44

54

64

74

84

94

K

LM

40

E

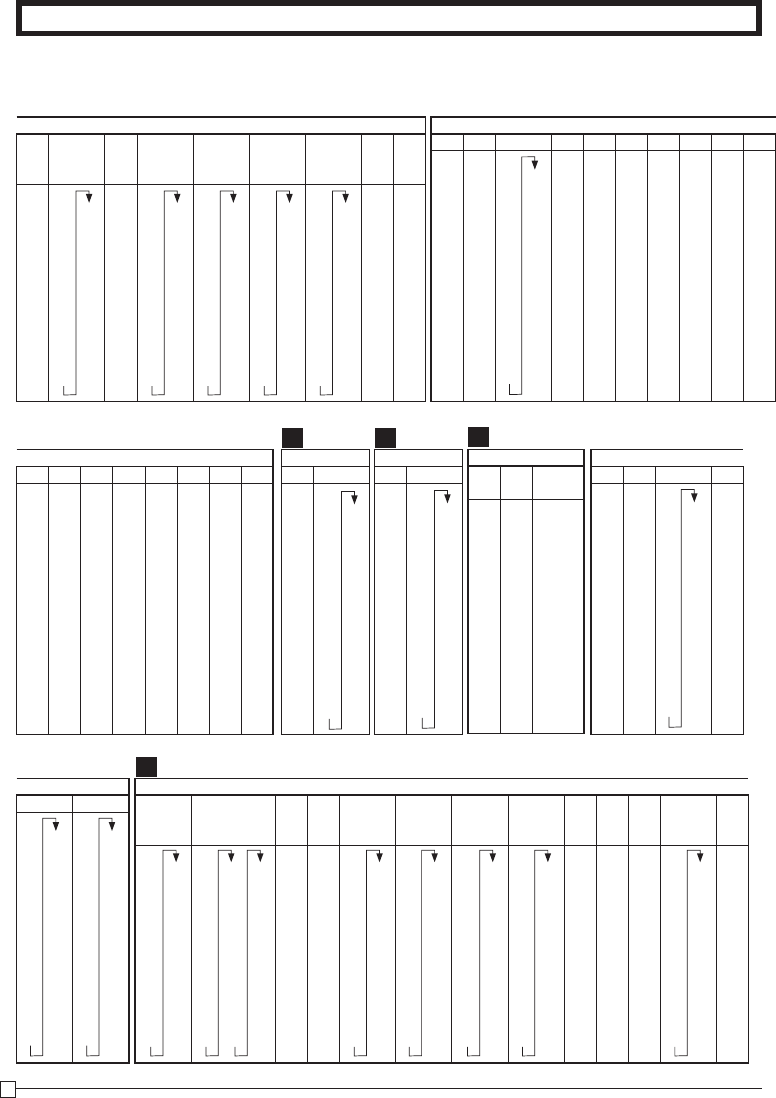

Tax Tables

MASSACHUSETTS

4.625%

5%

0 227 0

1 248 1

13 270 1

10 291 9

32 313 29

54 335

75 356

97 378

118 399

140 421

162 443

183

205

MICHIGAN

4%

6%

00

11

72

12 10

31 24

54 41

81 58

108 74

135 91

162 108

187 124

MINNESOTA

6%

6.5% 7% 8.5%

0 0 161 0 0 123

1 1 176 1 1 135

1 1 192 1 1 147

8 7 207 7 5 158

24 23 21 17 170

41 38 35 29 182

58 53 49 41 194

69 64 52 205

84 78 64

99 92 76

115 107 88

130 99

146 111

MISSISSIPPI

5%

6% 7% 8% 8.5% 9%

9.25%

0000012309.25

1111113515002

6111114710

11 8 7 6 5 158 5 5

26 24 21 18 17 170 16

47 41 35 31 29 182 27

68 58 49 43 41 194 38

88 74 64 56 52 205 49

109 91 78 68 64 61

129 105 92 81 76 72

107 93 88 83

106 99 94

111 105

MISSOURI

4.725%

4.75%

4.8% 4.975%

5.05%

5.1%

5.225%

5.6%

5.625% 5.725%

6.1% 6.225%

6.3% 6.425% 6.475%

6.55%

6.725% 7.225%

000021100

5.225

0 187 0

5.725

0 0 168 0 166 0 163 0 162 0 160

6.725 7.225

1 1 1 1 1 1 5002 1 205 1 5002 1 1 184 1 182 1 178 1 177 1 175 5002 5002

4 3 3 1 5 1 15 223 1 1 2 200 8 198 1 194 13 193 9 190

10 10 10 10 9 9 8 241 8 8 8 216 7 214 7 210 7 208 7

31 22 31 30 19 29 26 258 26 24 24 232 23 230 23 225 23 223 22

52 43 52 50 39 49 44 276 44 40 40 248 39 246 38 241 38 239 38

74 65 72 70 59 68 62 294 62 57 56 265 55 54 256 54 254 53

95 86 93 90 79 88 80 312 79 73 72 71 70 272 69 270 68

116 107 114 110 98 107 98 330 97 90 88 87 85 287 84 285 83

137 128 135 130 118 115 348 115 104 103 101 100 301 99

158 149 156 150 138 133 366 133 120 119 116 115 316 114

179 170 177 170 158 151 383 151 136 134 132 131 332 129

201 190 178 160 168 152 150 147 146 145

NEBRASKA

3%

3.5% 4% 4.5% 5% 5.5% 6% 6.5%

0 0 0 0 233 0 0 190 0 0 161

1 1 1 1 255 1 1 209 1 1 176

3 3 2 6 277 2 2 227 1 1 192

16 14 14 14 299 14 14 8 7 207

49 42 37 33 322 29 27 24 23

83 71 62 55 49 45 41 38

116 99 77 63 58 53

149 128 99 81 69

183 157 122 99 84

185 144 118 99

214 166 136 115

242 188 154 130

271 211 172 146

NEVADA

3%

3.5%

5.75%

6% 6.25% 6.5%

6.75%

7%

0 0 299 5.75 0 0 167 0 161 6.75 0

1 1 326 5002 1 1 183 1 176 5002 1

2 6 357 2 2 199 1 192 0 1

14 14 8 7 215 7 207 7 7

49 38 24 23 23 22 21

83 64 41 39 38 37 35

116 88 58 55 53 49

149 118 74 71 69 64

157 87 84 78

185 103 99 92

214 119 115 107

242 135 130

271 151 146

MISSOURI

4.225%

4.6% 4.625%

0 0 0 227

1 1 1 248

1 1 13 270

11 10 10 291

35 32 32 313

59 54 54 335

82 76 75 356

97 97 378

118 399

140 421

162 443

183

205

N

Part-4

41

E

Tax Tables

NEW HAMPSHIRE

Rooms & Meals Rooms & Meals

7% 7% 8%

0 129 0 128 0

1 143 1 142 1

8 158 8 157 4

14 172 35 171 35

26 186 35 185 35

39 201 38 200 35

51 50 37

63 62 50

75 74 62

88 87

101 100

115 114

NEW JERSEY

3% 3.5% 6% 7%

0000150

1111164

1118178

17 14 10 10 192

41 42 22 21 207

71 71 38 35

117 100 56 50

128 72 64

157 88 78

185 110 92

214 107

121

135

NEW MEXICO

3.75% 4.25%

4.375%

4.5%

4.875% 5.175%

5.25%

5.375% 5.575%

0 280 0 247 0 239 0

4.875 5.175

0 199

5.375 5.575

1 306 1 270 1 1 5002 5002 1 217 5002 5002

6 333 1 294 4 1 11

13 359 11 317 11 11 9

40 35 341 34 33 28

67 58 364 57 55 47

93 82 388 79 78 66

120 105 411 102 100 85

146 129 125 122 104

173 152 148 144 123

200 176 171 167 142

226 199 194 189 161

253 223 217 211 180

NEW MEXICO

5.75% 6.187%

6.1875%

5.75 0

6.187

5002 1 5002

40

98

23

40

56

72

88

104

120

136

153

NEW YORK

SUFFOLK

ERIE

County

4% 5%

5.25% 5.75%

6%

6.25%

6.5%

6.75%

7%

7.25%

7.5% 8% 8%

8.25%

8.5%

0 0 5.25 5.75 0 141 0 0 130 6.75 0 121 7.25 0 113 0 105 0 106 8.25 8.5

1 1 5002 5002 1 158 1 1 146 5002 1 135 5002 1 126 1 119 1 118 5002 5002

5 6 7 7 1 161 8 149 8 139 10 131 9 131

12 10 10 10 7 176 10 164 10 10 144 10

33 27 22 22 23 192 20 178 18 17 17

58 47 38 38 38 207 33 192 31 29 29

83 67 56 54 53 47 207 45 42 42

112 87 72 70 69 62 58 55 54

137 109 88 86 84 76 71 67 67

129 108 103 99 91 85 80 79

124 119 115 107 99 92 92

NORTH CAROLINA

CHEROKEE

Reservations

3% 4% 4.5% 5% 6% 6% 6.5%

0 0 0 188 0 0 0 0 130

1 1 1 211 1 1 1 1 146

4 5 6 233 6 2 2 1 161

9 9 9 255 8 10 8 7 179

35 29 25 277 23 24 24 22 192

70 59 53 299 48 41 41 38 207

116 84 75 322 67 58 58 53

149 112 95 85 74 74 69

183 137 122 109 91 84

216 144 129 108 99

166 124 115

NORTH DAKOTA

3% 4% 4% 5% 5.5% 6% 6.5% 7% 8%

0 0 0 0 0 182 0 0 170 0 0

1 1 1 1 1 200 1 1 185 1 1

3 5 2 2 2 219 3 2 200 2 3

15 15 15 15 15 15 15 216 15 15

33 31 25 20 19 17 31 231 15 15

67 51 50 40 37 34 47 29 25

100 71 75 55 50 62 43 38

133 100 100 73 67 77 58 50

166 125 125 91 84 93 72 63

200 110 108 86 75

128 124 100 88

146 139 115 100

164 154

OHIO

5% 5.5%

5.75%

0 0 146 5.75

1 1 164 5002

2 2 182

15 15 200

20 18 218

40 36

54

72

90

109

127

O

42

E

Tax Tables

OHIO

MEIGS

CUYAHOGA

Co. Co.

6% 6%

6.25%

6.5% 6.75% 7% 7%

7.35% 7.75%

0 0 134 0 0 123 0 118 0 115 0 115 0 7.75

1 1 1 1 138 1 133 1 128 1 128 1 5002

2 3 2 3 153 3 148 3 3 3

15 16 15 15 169 15 162 15 15 15

17 17 16 15 184 15 177 15 15 15

34 34 32 30 200 29 192 28 28 27

50 50 46 215 44 42 42 41

67 67 61 230 59 57 57 55

83 83 76 74 71 71 68

100 100 92 88 85 85 82

117 117 107 103 100 100 96

OKLAHOMA

2% 3% 3.25% 4%

4.25%

4.5% 5%

5.25%

6%

6.25%

0 0 0 323 0 4.25 0 0 5.25 0 0

1 1 1 353 1 5002 1 1 5002 1 1

1 1 7 384 1 2 1 1 1

24 16 15 415 12 11 9 8 7

74 49 46 446 37 33 29 24 23

83 76 476 55 41

116 107 507 77 58

138 538 99

169 569 121

199 599 144

230

261

292

OKLAHOMA

6.725%

7%

7.25%

7.375%

8%

8.25% 9.25%

10.25%

6.725

0 7.25

7.375

0000

5002 1 5002 5002 1 1 1 1

6 01141

8 66654

22 18 18 16 14

37 31 30 27 24

51 42 37 34

65 54 48 43

79 66 59

94 78 70

108 90 81

122 103 91

PENNSYLVANIA

6% 7%

0 0 150

1 1 150

1 5 167

10 10 184

17 17 210

34 34 217

50 50 234

67 50 250

84 67 250

110 84

110

117

134

ROHDE ISLAND

6% 7%

0 0 149

1 1 164

6 5 178

9 7 192

26 21 207

42 35 221

57 49 235

73 64 249

90 78 264

106 92

123 107

140 121

135

SOUTH CAROLINA

CHARESTON

4% 5% 6%

00 0

11 1

56 2

10 10 10

25 20 24

50 40 41

75 60 41

112 80 58

137 109 74

129 91

108

124

SOUTH DAKOTA

6.5% 7%

0 161 0 149

1 176 1

1 192 4

7 207 7

23 21

38 35

53 49

69 64

84 78

99 92

115 107

130 121

146 135

TENNESSEE

COUNTY

TAX

4.5% 5.5% 6%

6.25%

6.5% 6.75% 7% 7.25% 7.5%

7.75%

8% 8%

8.25%

0 188 0 154 354 0 0 0 130 0 125 0 121 0 117 0 7.75 0 0 106 8.25

1 211 1 172 372 1 1 1 146 1 140 1 1 130 1 5002 1 1 118 5002

1 11 190 390 2 2 2 161 8 155 2 10 144 2 2 2

11 10 209 10 10 10 176 10 170 10 10 158 10 10 10

33 27 227 24 23 23 192 22 185 21 20 172 19 18 18

55 45 245 41 39 38 207 37 199 35 34 185 33 31 31

77 63 263 58 55 53 223 51 214 49 48 46 43 43

99 81 281 74 71 69 66 229 64 61 59 56

122 99 299 87 84 81 244 78 75 68

144 119 318 99 96 259 92 89 81

166 136 336 115 111 274 107 103 93

SOUTH DAKOTA

4% 5% 5.5% 6%

0 0 0 190 0

1 1 1 210 1

111 1

12 10 10 9

37 30 28 26

46 43

64 60

82 76

100 92

118 109

136

154

172

P R S

T

Part-4

43

E

Tax Tables

TEXAS

HOUSTON

(Harris

DALLAS

County)

4% 4% 4.125%

4.625%

5%

5.125%

5.25%

5.375%

5.5% 5.625% 6% 6% 6%

6.125%

6.25%

0 0 0 181 424

4.625

0

5.125

0 142

5.375

0 137

0

133

0 0 0 6.125 0 119

1 1 1 206 5002 1 5002 1 161 5002 1 155 1 151 1 1 1 5002 1

1 1 1 230 1 12 180 1 173 1 168 1 1 1 1

12 12 12 254 9 9 199 9 191 8 8 9 8 7

37 37 36 278 29 28 209 27 209 26 24 25 24 23

62 60 303 49 47 45 44 41 42 41 39

87 84 327 69 66 63 62 58 59 58 55

109 351 85 81 79 74 71

133 375 104 99 97 91 87

157 399 123 118 115 108 103

TEXAS

6.25% 6.75%

7%

7.25%

7.5% 7.75% 8%

8.25%

6.25 6.75 0 107 7.25 0 0 96 0 8.25

5002 5002 1 5002 1 1 109 1 5002

1 1 5 122 1

7 6 6 135 6

21 19 19 148 18

35 33 32 161 31

49 46 45 174

64 59 58 187

78 73 70

92 86 83

UTAH

7.25%

7.25

5002

VERMONT

3% 4% 5% 6% 8%

00060

1 1 1 5002 1

4 2 2100

13 10 10 10 18

33

25 20

16

31