Hanson_Ch14 243677 0170186288

User Manual: 243677

Open the PDF directly: View PDF ![]() .

.

Page Count: 204 [warning: Documents this large are best viewed by clicking the View PDF Link!]

Case studies

Introduction A summary of the case

analysis process C-2

Preparing an effective

case analysis – the full

story C-5

Case 1 Hearing with the aid of

implanted technology: The

case of Cochlear™, an

Australian high-technology

leader C-19

Case 2 The Australian retail wars:

Coles Myer and Woolworths

battle for brand value C-26

Case 3 eBay.com: Profitably

managing growth from

start-up to 2000 C-32

Case 4 Gillette and the men’s

wet-shaving market C-50

Case 5 Gunns and the greens:

Governance issues in

Tasmania C-70

Case 6 Growth at Hubbard’s

Foods? C-79

Case 7 Incat Tasmania’s race for

international success:

Blue-riband strategies C-89

Case 8 The Golden Arches in

India: A case of strategic

adaptation C-95

Case 9 Monsanto: Better

living through genetic

engineering? C-106

Case 10 Nucor Corporation and the

US steel industry C-121

Case 11 Philip Condit and the

Boeing 777: From design and

development to production

and sales C-152

Case 12 Resene Paints C-168

Case 13 Sony Corporation: The vision

of tomorrow C-184

C-2

Introduction

A summary of the case

analysis process

Dallas Hanson

University of Tasmania

Case analysis is an essential part of a strategic man-

agement course and is also perhaps the most enter-

taining part of such a course. The ‘full story’ that

follows this summary gives you considerable detail

about how to go about a case analysis, but for now

here is a brief account.

Before we start, a word about attitude: make it a

real exercise; you have a set of historical facts and use

a rigorous system to work out what strategies should

be followed. All the cases are about real companies,

and one of the entertaining bits of the analysis pro-

cess is to compare what you have said they should do

with what they really have done. So, it is best not to

check the Net to see current strategies until you have

completed your analysis.

What follows is one analytical system, a fairly

tight one that you may want to adapt according to

how much time you have and the style of the case.

External analysis

Step 1 What industry is it?

You must decide on this early. This is an important

step, because it changes the analysis – for example,

your industry analysis will yield different conclusions

depending on what industry you determine.

Step 2 General environment analysis

Analyse the six generic elements – economic, socio-

cultural, global, technological, political/legal and

demographic – and work out what the important

facts are. There may be many issues and facts in each

element, but you put down only the important ones.

It is also important to avoid the common error of over-

emphasis on the firm in question. So, assuming the

firm operates in the Australian ice-cream industry,

the demographic analysis may have this comment: ‘A

large baby boomer generation is now becoming more

health-conscious. This presents opportunities in health

foods and healthy alternatives for conventional foods.

It also presents opportunities for low-fat ice creams.’

Or, in analysing the demographics of the Cochlear™

firm, you may conclude that there is a global market of

1.8 million profoundly deaf people and that this pro-

vides a huge undeveloped market for the implantable

hearing devices industry.

Step 3 The industry environment

Analyse the five forces (that is, supplier power, buyer

power, potential entrants, substitute products and

rivalry among competitors) and explain briefly what

is significant for each. For example, what are the

issues involved in new entrants into the industry? For

Introduction • A summary of the case analysis process C-3

the implantable hearing devices industry, these may

include the need for understanding of intricate new

technology, possession of a reputation in the global

deaf community for safe and effective product devel-

opment, and links to research institutions. This makes

the industry hard to enter. Each force needs a brief dis-

cussion followed by a short conclusion.

One extra consideration before you pull the anal-

ysis together and work out if this is an attractive

industry (the main conclusion) is: Is there a key force

or forces in your industry? Porter argues that there is

a key force in any industry, one that exerts more influ-

ence than the other forces.

Now, is it an attractive industry? You need to

explain, briefly, why or why not. Bear in mind that

it is often not a clear decision because the forces are

mixed – for example, there may be little concern about

new entrants, suppliers or substitutes, but buyers may

be fickle and rivalry high. In such cases, the key force

analysis is very important

Remember: it is the industry you analyse, not the

firm.

Step 4 Competitive environment

Is there a strategic group that you need to take account

of? What is the rivalry like in this group? What capa-

bilities do the relevant firms have? What strategies do

they follow? What threats do they represent?

Step 5 You now have material about

opportunities and threats

It is easy to pull this together from the four steps you

have now completed.

Internal analysis

Step 6 The firm’s resources, tangible and

intangible

List all relevant resources. It is useful to distinguish

between tangible and intangible resources. Remem-

ber: firms have many resources.

At this point, if you have the skills and time, you

can analyse the financial information that almost all

cases provide. This provides material for a financial

resources paragraph.

Step 7 Capabilities identification

Here you make a list of capabilities. Capabilities tell

you what the firm can do.

Remember: each firm may have a dozen or more

capabilities, so include some that are very unlikely to

be core competencies. This is a difficult step, because

you must explain the capabilities carefully to indicate

what the firm really does. For example, Cochlear has

a capability for research in cochlear-related technol-

ogy. It does not have a generic research capability.

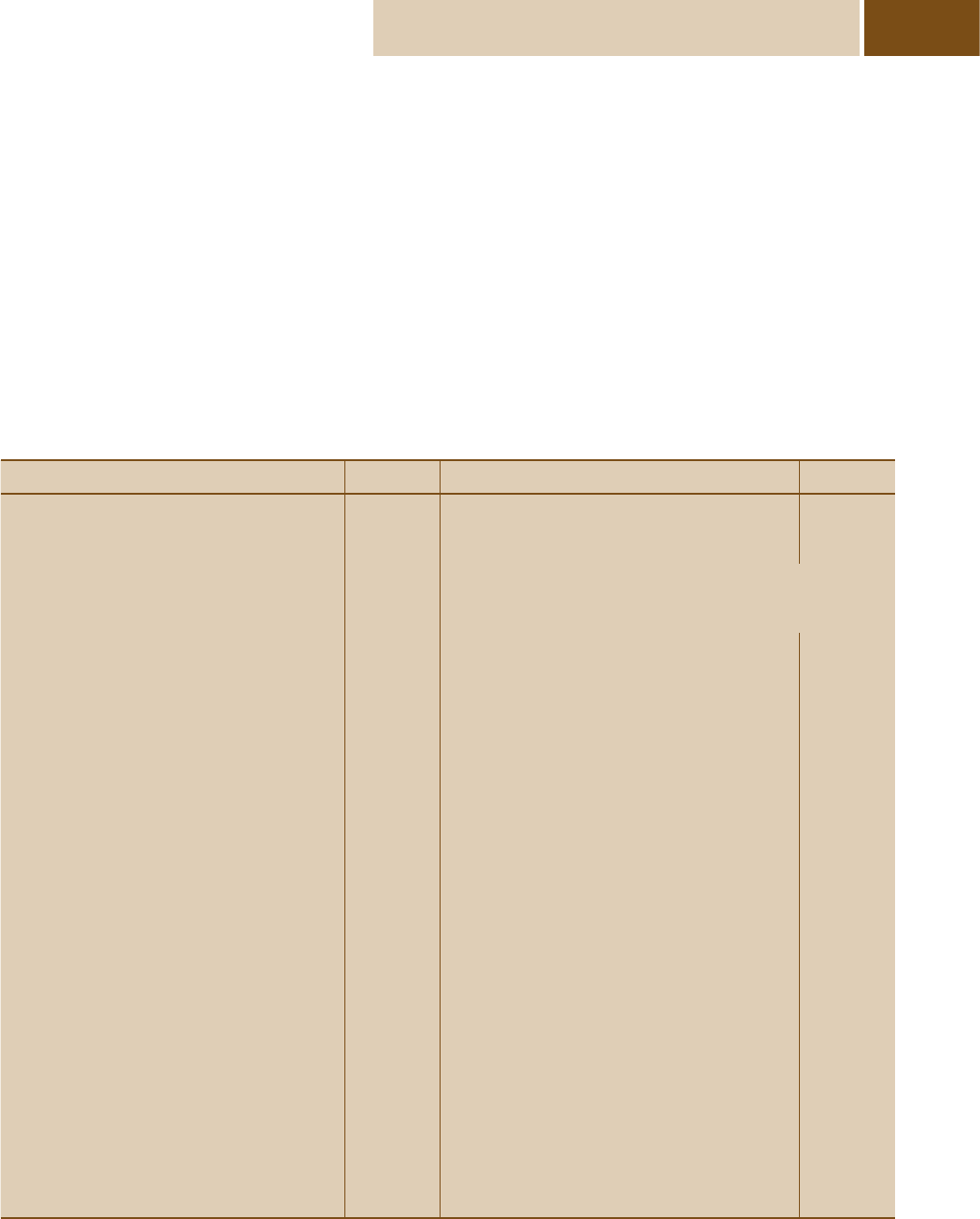

Step 8 Core competency analysis

For each capability, indicate which of the four tests

for a core competency it meets. An easy way to do this

is through use of a table. For example:

Rare? Valuable?

Costly to

imitate?

Non-

substitutable

Logistics

management

in cochlear

technologies Yes Y

es No No

Research

knowledge and

skill in cochlear-

related areas Yes Yes Yes Yes

Etc.

This is an important step, because the core compe-

tencies are fundamental in the strategies you suggest

– firms use their core competencies.

Step 9 Weaknesses

What major weaknesses does the firm have – for

example, old technology, very limited finance and poor

cash flow, no succession planning?

Step 10 Pulling it together

You now have all the material for an excellent

SWOT (strengths/weaknesses, opportunities/threats)

analysis. Pull together the earlier identification of

opportunities and threats (step 5) with the internal

analysis you have done. This resources-based, theory-

oriented system gives you a powerful vocabulary

to describe what simpler systems call ‘strengths’,

and the other elements of the system allow you to

systematically identify other significant factors in

the mix.

C-4 Introduction • A summary of the case analysis process

Step 11 Current strategies

Work out the firm’s current strategies.

Step 12 Strategies

Here you take advantage of opportunities and handle

threats. You should be able to make use of core com-

petencies to do this.

You may need strategies at the business level, cor-

porate level and international level (but it depends on

the industry and on whether all are required). Also,

bear in mind that you may need to specify functional-

level strategies to fit the generic strategies at the

business level. For example, if your ice-cream compa-

ny adopts a differentiation strategy, you must specify

how it is differentiated (on what grounds – low fat?)

and there must be associated innovation and market-

ing strategies (or, in the corporate-level strategy, a

supporting acquisition strategy may be used to handle

the innovation issue).

Make a list of alternative possibilities and use

the external and internal analyses that you have con-

ducted to assess them. Choose one set of alternatives.

How do these differ from current strategies?

Make sure the strategies chosen fit in with your

earlier analysis. Use all the conclusions in the earlier

analysis. For example (and bear in mind that this is

simplified to make the idea clearer), if you are in a

rivalrous industry which has good growth prospects

because of useful demographic change and you have

good financial resources, you may argue for expan-

sion into the new segment using available resources.

If the finances were not there, this strategy would be

difficult to support.

Using the Cochlear™ case

as a training case

This case analysis process is easy to use once you have

learned it, and the best way to learn is to try it out. The

Cochlear™ case in this book is designed as a training

case to help you do this. Don’t be concerned if you get

a slightly different analysis to other people: one of the

glories of case analysis is that they are never ‘right’;

some are, however, more plausible than others.

C-5

Preparing an effective case

analysis – the full story

In most strategic management courses, cases are used

extensively as a teaching tool.1 A key reason is that

cases provide active learners with opportunities to

use the strategic management process to identify and

solve organisational problems. Thus, by analysing

situations that are described in cases and presenting

the results, active learners (that is, students) become

skilled at effectively using the tools, techniques and

concepts that combine to form the strategic manage-

ment process.

The cases that follow are concerned with actual

companies. Presented within the cases are problems

and situations that managers and those with whom

they work must analyse and resolve. As you will see,

a strategic management case can focus on an entire

industry, a single organisation, or a business unit of

a large, diversified firm. The strategic management

issues facing not-for-profit organisations also can be

examined using the case analysis method.

Basically, the case analysis method calls for a care-

ful diagnosis of an organisation’s current conditions

(as manifested by its external and internal environ-

ments) so that appropriate strategic actions can be

recommended in light of the firm’s strategic intent and

strategic mission. Strategic actions are taken to devel-

op and then use a firm’s core competencies to select

and implement different strategies, including business-

level, corporate-level, acquisition and restructuring,

international and cooperative strategies. Thus, appro-

priate strategic actions help the firm to survive in the

long run as it creates and uses competitive advantages

as the foundation for achieving strategic competitive-

ness and earning above-average returns. The case

method that we are recommending to you has a rich

heritage as a pedagogical approach to the study and

understanding of managerial effectiveness.2

As an active learner, your preparation is critical

to successful use of the case analysis method. With-

out careful study and analysis, active learners lack the

insights required to participate fully in the discussion

of a firm’s situation and the strategic actions that are

appropriate.

Instructors adopt different approaches in their

application of the case analysis method. Some require

active learners/students to use a specific analytical

procedure to examine an organisation; others pro-

vide less structure, expecting students to learn by

developing their own unique analytical method. Still

other instructors believe that a moderately structured

framework should be used to analyse a firm’s situa-

tion and make appropriate recommendations. Your

lecturer or tutor will determine the specific approach

you take. The approach we are presenting to you is a

moderately structured framework.

We divide our discussion of a moderately struc-

tured case analysis method framework into four

sections. First, we describe the importance of under-

standing the skills active learners can acquire through

effective use of the case analysis method. In the sec-

ond section, we provide you with a process-oriented

framework. This framework can be of value in your

efforts to analyse cases and then present the results of

your work. Using this framework in a classroom set-

ting yields valuable experiences that can, in turn, help

you to successfully complete assignments that you

will receive from your employer. The third section

C-6

is where we describe briefly what you can expect to

occur during in-class case discussions. As this descrip-

tion shows, the relationship and interactions between

instructors and active learners/students during case

discussions are different than they are during lectures.

In the final section, we present a moderately struc-

tured framework that we believe can help you to pre-

pare effective oral and written presentations. Written

and oral communication skills also are valued highly

in many organisational settings; hence, their develop-

ment today can serve you well in the future.

Skills gained through use of

the case analysis method

The case analysis method is based on a philosophy

that combines knowledge acquisition with significant

involvement from students as active learners. In the

words of Alfred North Whitehead, this philosophy

‘rejects the doctrine that students had first learned

passively, and then, having learned should apply

knowledge’.3 In contrast to this philosophy, the case

analysis method is based on principles that were elab-

orated upon by John Dewey:

Only by wrestling with the conditions of this

problem at hand, seeking and finding his own way

out, does [the student] think ... If he cannot devise

his own solution (not, of course, in isolation, but

in correspondence with the teacher and other

pupils) and find his own way out he will not learn,

not even if he can recite some correct answer with

a hundred percent accuracy.4

The case analysis method brings reality into the

classroom. When developed and presented effectively,

with rich and interesting detail, cases keep conceptu-

al discussions grounded in reality. Experience shows

that simple fictional accounts of situations and collec-

tions of actual organisational data and articles from

public sources are not as effective for learning as fully

developed cases. A comprehensive case presents you

with a partial clinical study of a real-life situation that

faced managers as well as other stakeholders, includ-

ing employees. A case presented in narrative form

provides motivation for involvement with and analy-

sis of a specific situation. By framing alternative stra-

tegic actions and by confronting the complexity and

ambiguity of the practical world, case analysis pro-

vides extraordinary power for your involvement with

a personal learning experience. Some of the poten-

tial consequences of using the case method are sum-

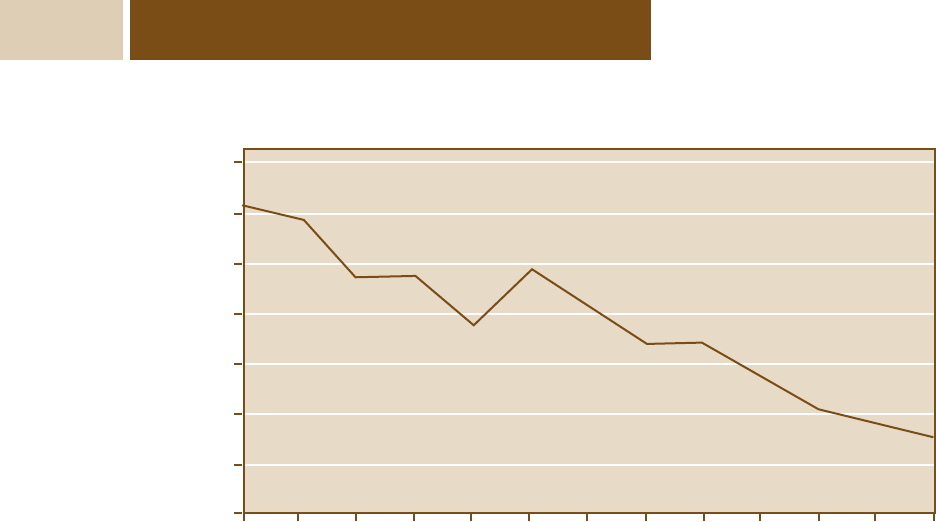

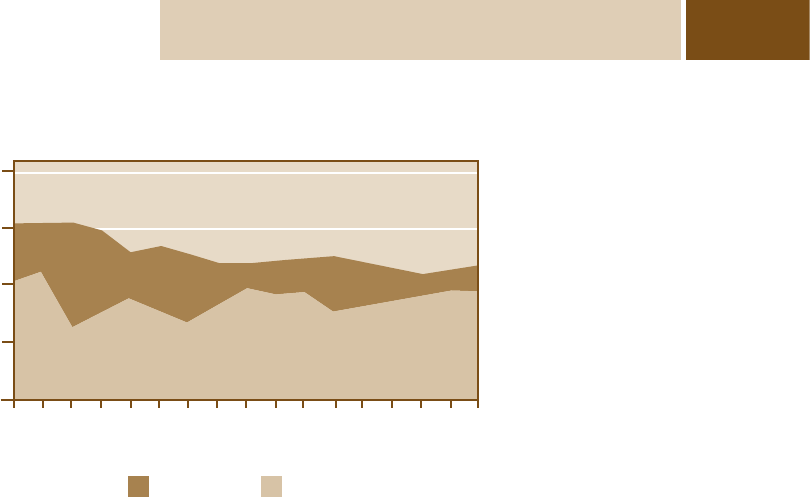

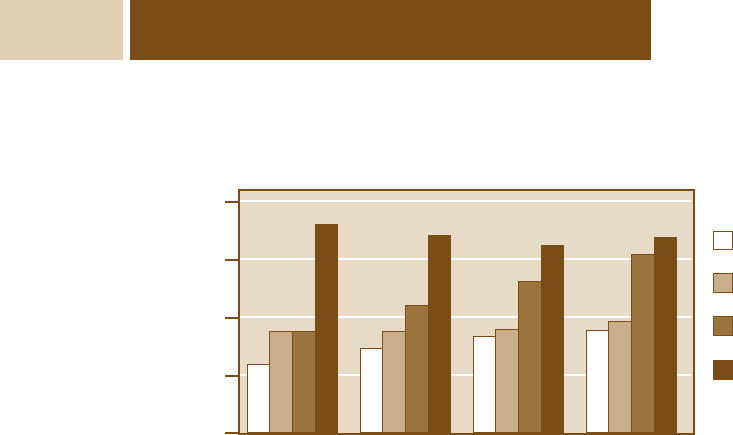

marised in Exhibit 1.

As Exhibit 1 suggests, the case analysis meth-

od can assist active learners in the development of

their analytical and judgement skills. Case analy-

sis also helps students to learn how to ask the right

questions. By this we mean questions that focus on

the core strategic issues that are included in a case.

Active learners/students with managerial aspirations

can improve their ability to identify underlying prob-

lems rather than focusing on superficial symptoms as

they develop skills at asking probing, yet appropriate,

questions.

The collection of cases your instructor chooses to

assign can expose you to a wide variety of organisa-

tions and decision situations. This approach vicari-

ously broadens your experience base and provides

insights into many types of managerial situations,

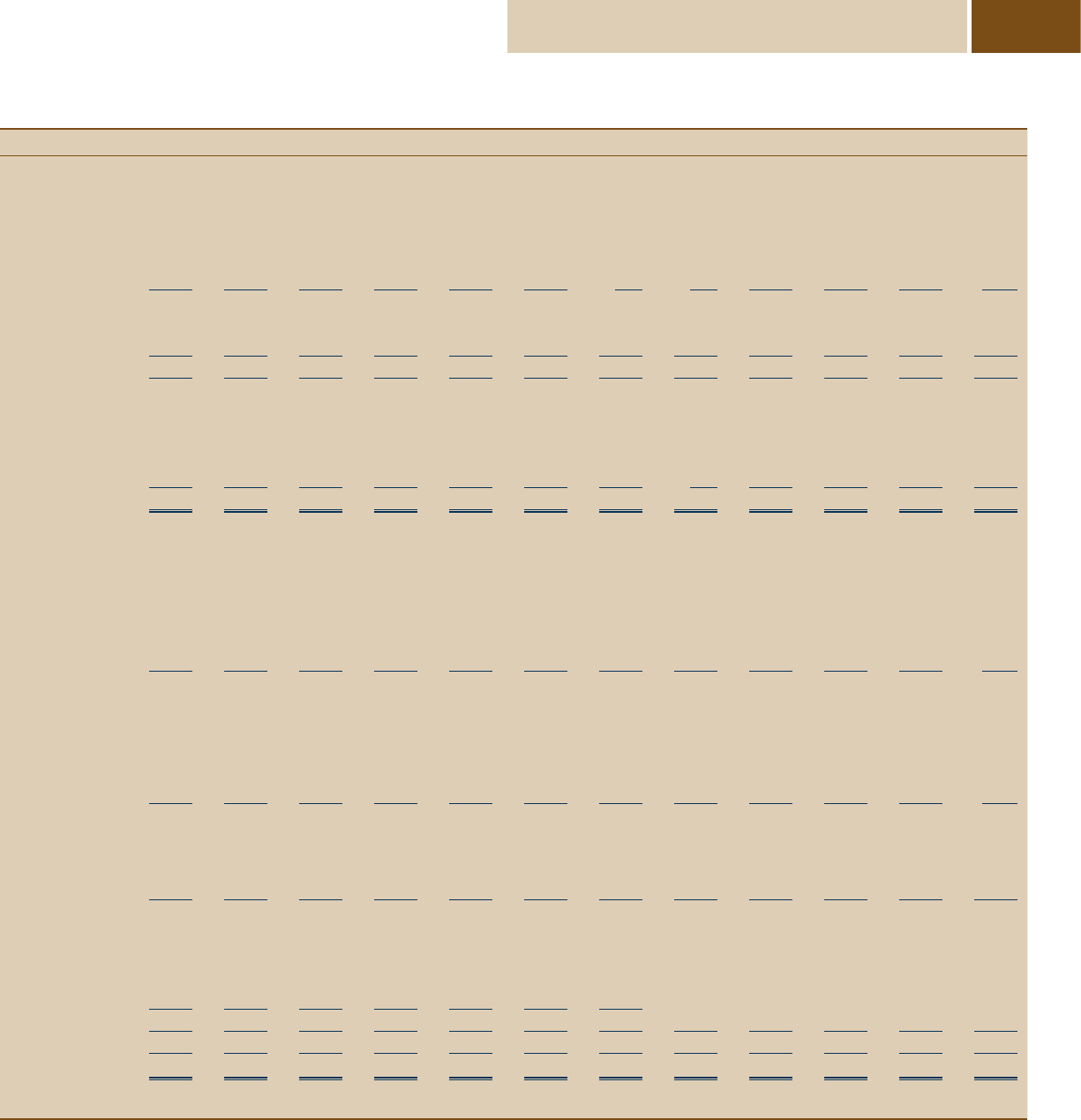

Exhibit 1

1 Case analysis requires students to practise important managerial skills – diagnosing, making decisions, observing, listening and

persuading – while preparing for a case discussion.

2 Cases require students to relate analysis and action, to develop realistic and concrete actions despite the complexity and

partial knowledge characterising the situation being studied.

3 Students must confront the intractability of reality – complete with absence of needed information, an imbalance between

needs and available resources, and conflicts among competing objectives.

4 Students develop a general managerial point of view – where responsibility is sensitive to action in a diverse environmental

context.

Source: C.C. Lundberg and C. Enz, 1993, ‘A framework for student case preparation’, Case Research Journal, 13 (summer), p. 134.

Introduction • Preparing an effective case analysis

C-7

tasks and responsibilities. Such indirect experience

can help you to make a more informed career deci-

sion about the industry and managerial situation

you believe will prove to be challenging and satisfy-

ing. Finally, experience in analysing cases definitely

enhances your problem-solving skills, and research

indicates that the case method for this subject is better

than the lecture method.5

Furthermore, when your instructor requires oral

and written presentations, your communication skills

will be honed through use of the case method. Of

course, these added skills depend on your prepara-

tion as well as your instructor’s facilitation of learn-

ing. However, the primary responsibility for learning

is yours. The quality of case discussion is generally

acknowledged to require, at a minimum, a thorough

mastery of case facts and some independent analysis

of them. The case method therefore first requires that

you read and think carefully about each case. Addi-

tional comments about the preparation you should

complete to successfully discuss a case appear in the

next section.

Student preparation for

case discussion

If you are inexperienced with the case method,

you may need to alter your study habits. A lecture-

oriented course may not require you to do intensive

preparation for each class period. In such a course,

you have the latitude to work through assigned read-

ings and review lecture notes according to your own

schedule. However, an assigned case requires signifi-

cant and conscientious preparation before class. With-

out it, you will be unable to contribute meaningfully

to in-class discussion. Therefore, careful reading and

thinking about case facts, as well as reasoned anal-

yses and the development of alternative solutions to

case problems, are essential. Recommended alterna-

tives should flow logically from core problems iden-

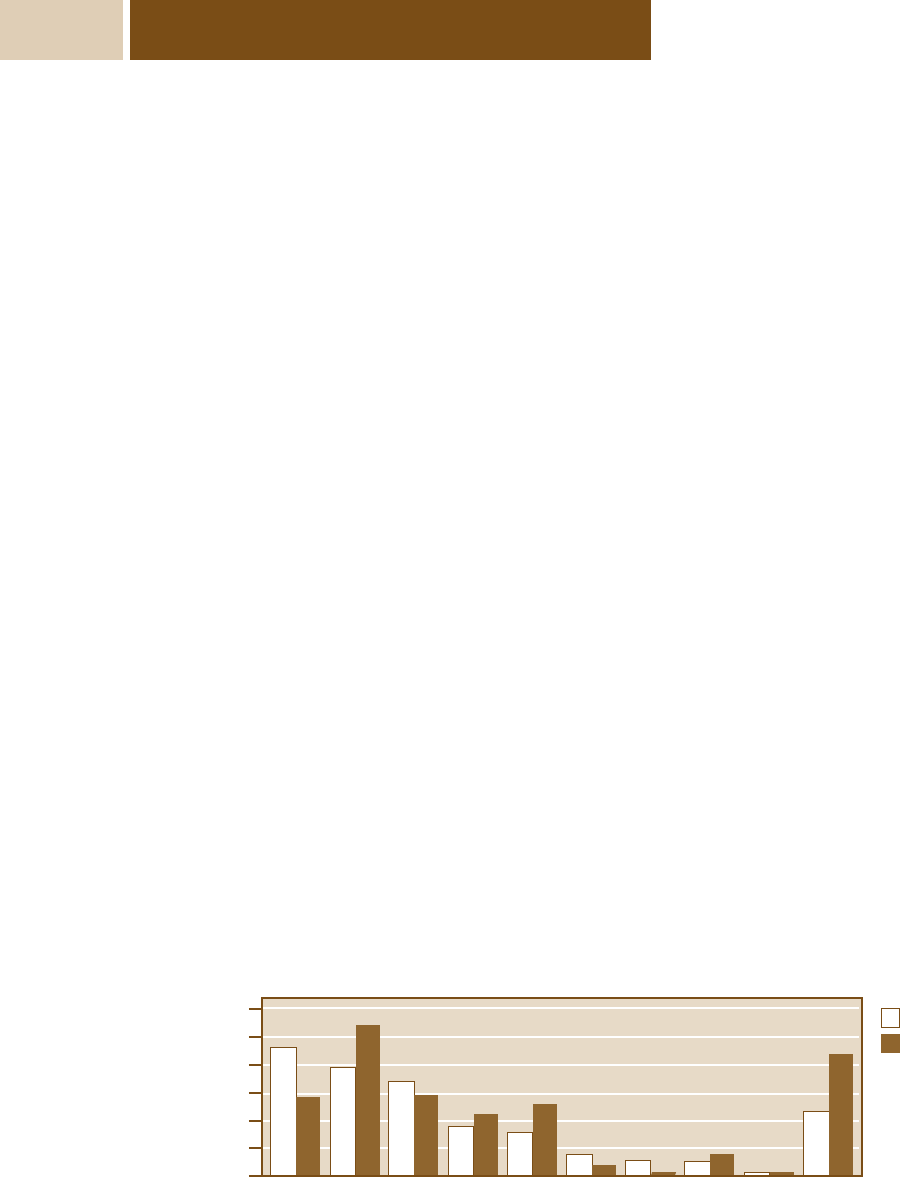

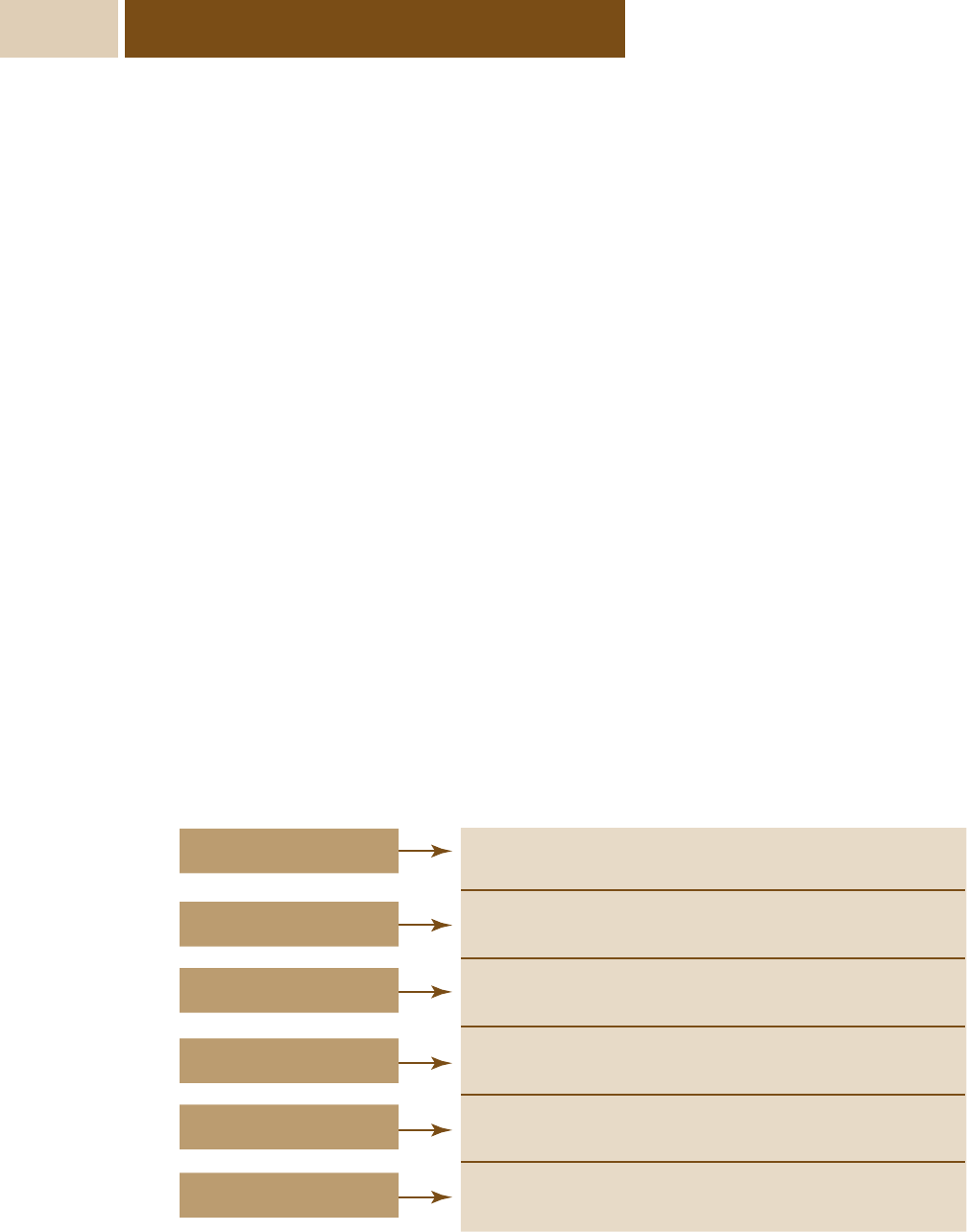

tified through study of the case. Exhibit 2 shows a

set of steps that can help you to familiarise yourself

with a case, identify problems and propose strategic

actions that increase the probability that a firm will

achieve strategic competitiveness and earn above-

average returns.

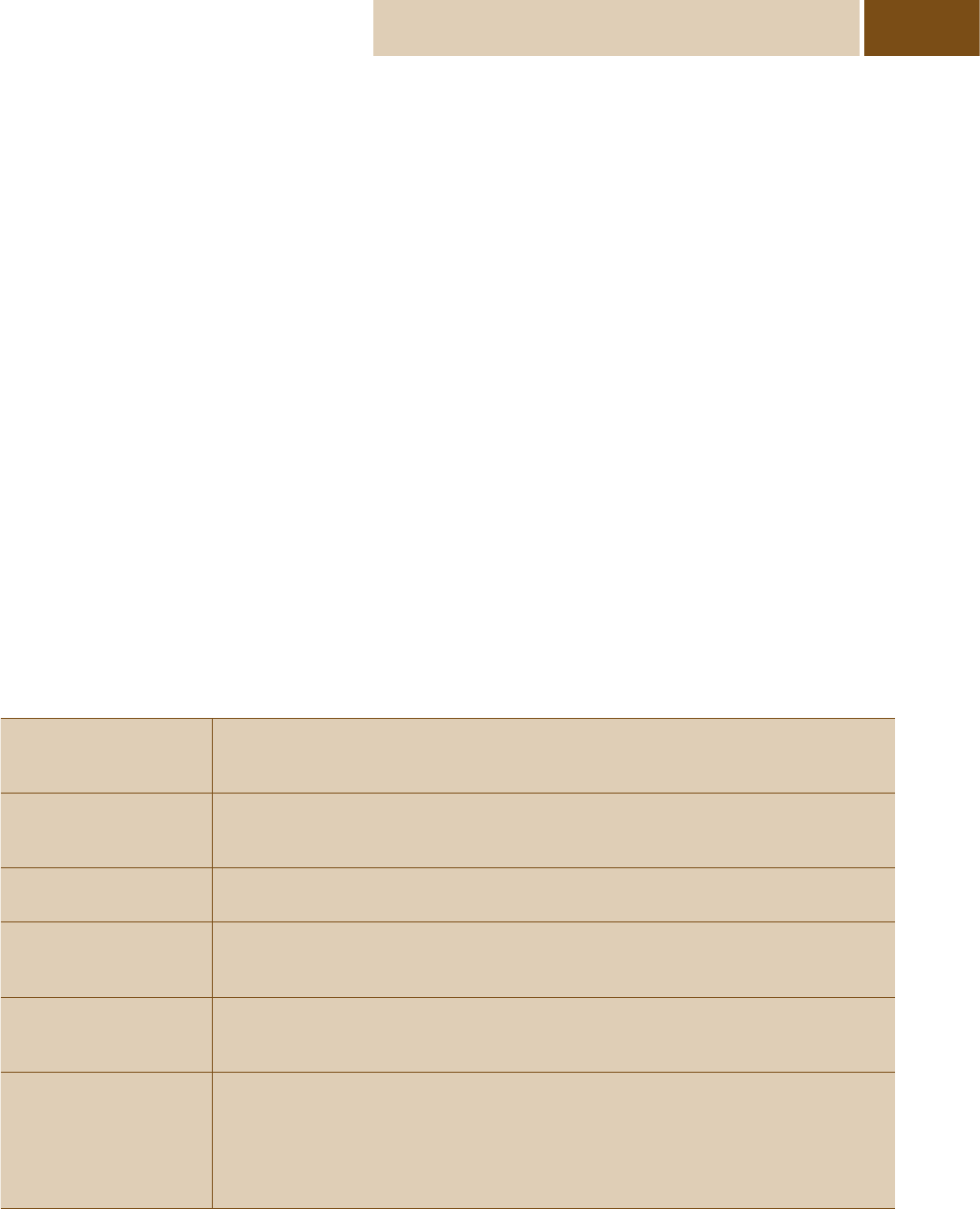

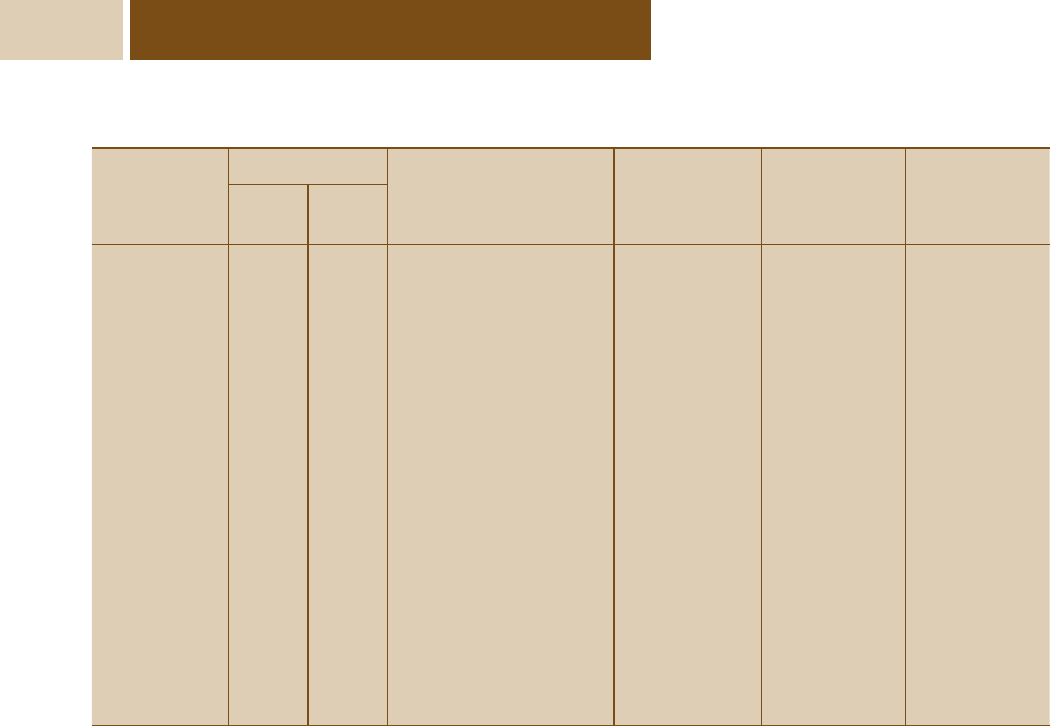

Exhibit 2

Step 1:

Gaining familiarity

a In general – determine who, what, how, where and when (the critical facts of the case).

b In detail – identify the places, persons, activities and contexts of the situation.

c Recognise the degree of certainty/uncertainty of acquired information.

Step 2:

Recognising symptoms

a List all indicators (including stated ‘problems’) that something is not as expected or as desired.

b Ensure that symptoms are not assumed to be the problem. (Symptoms should lead to

identification of the problem.)

Step 3:

Identifying goals

a Identify critical statements by major parties (e.g. people, groups, the work unit, etc.).

b List all goals of the major parties that exist or can be reasonably inferred.

Step 4:

Conducting the analysis

a Decide which ideas, models and theories seem useful.

b Apply these conceptual tools to the situation.

c As new information is revealed, cycle back to sub-steps (a) and (b).

Step 5:

Making the diagnosis

a Identify predicaments (goal inconsistencies).

b Identify problems (discrepancies between goals and performance).

c Prioritise predicaments/problems regarding timing, importance, etc.

Step 6:

Doing the action planning

a Specify and prioritise the criteria used to choose action alternatives.

b Discover or invent feasible action alternatives.

c Examine the probable consequences of action alternatives.

d Select a course of action.

e Design an implementation plan/schedule.

f Create a plan for assessing the action to be implemented.

Source: C. C. Lundberg and C. Enz, 1993, ‘A framework for student case preparation’, Case Research Journal, 13 (summer), p. 144.

Introduction • Preparing an effective case analysis

C-8

Gaining familiarity

The first step of an effective case analysis process calls

for you to become familiar with the facts featured in

the case and the focal firm’s situation. Initially, you

should become familiar with the focal firm’s general

situation (for example, who, what, how, where and

when). Thorough familiarisation demands apprecia-

tion of the nuances, as well as the major issues, in

the case.

Gaining familiarity with a situation requires you to

study several situational levels, including interactions

between and among individuals within groups, busi-

ness units, the corporate office, the local communi-

ty and the society at large. Recognising relationships

within and among levels facilitates a more thorough

understanding of the specific case situation.

It is also important that you evaluate information

on a continuum of certainty. Information that is

verifiable by several sources and judged along similar

dimensions can be classified as a fact. Information

representing someone’s perceptual judgement of a par-

ticular situation is referred to as an inference. Infor-

mation gleaned from a situation that is not verifiable

is classified as speculation. Finally, information that is

independent of verifiable sources and arises through

individual or group discussion is an assumption.

Obviously, case analysts and organisational decision

makers prefer having access to facts over inferences,

speculations and assumptions.

Personal feelings, judgements and opinions evolve

when you are analysing a case. It is important to be

aware of your own feelings about the case and to

evaluate the accuracy of perceived ‘facts’ to ensure

that the objectivity of your work is maximised.

Recognising symptoms

Recognition of symptoms is the second step of an

effective case analysis process. A symptom is an indi-

cation that something is not as you or someone else

thinks it should be. You may be tempted to correct the

symptoms instead of searching for true problems. True

problems are the conditions or situations requiring

solution before the performance of an organisation,

business unit or individual can improve. Identifying

and listing symptoms early in the case analysis process

tends to reduce the temptation to label symptoms as

problems. The focus of your analysis should be on the

actual causes of a problem, rather than on its symptoms.

Thus, it is important to remember that symptoms are

indicators of problems; subsequent work facilitates

discovery of critical causes of problems that your case

recommendations must address.

Identifying goals

The third step of effective case analysis calls for

you to identify the goals of the major organisations,

business units and/or individuals in a case. As appro-

priate, you should also identify each firm’s strategic

intent and strategic mission. Typically, these direc-

tion-setting statements (goals, strategic intents and

strategic missions) are derived from comments made

by central characters in the organisation, business

unit or top management team as described in the

case and/or from public documents (for example, an

annual report).

Completing this step successfully can sometimes be

difficult. Nonetheless, the outcomes you attain from

this step are essential to an effective case analysis

because identifying goals, intent and mission helps

you to clarify the main problems featured in a case

and to evaluate alternative solutions to those problems.

Direction-setting statements are not always stated

publicly or prepared in written format. When this

occurs, you must infer goals from other available fac-

tual data and information.

Conducting the analysis

The fourth step of effective case analysis is concerned

with acquiring a systematic understanding of a situ-

ation. Occasionally, cases are analysed in a less-than-

thorough manner. Such analyses may be a product of

a busy schedule or of the difficulty and complexity of

the issues described in a particular case. Sometimes

you will face pressures on your limited amounts of

time and may believe that you can understand the sit-

uation described in a case without systematic analy-

sis of all the facts. However, experience shows that

familiarity with a case’s facts is a necessary, but insuf-

ficient, step in the development of effective solutions

– solutions that can enhance a firm’s strategic com-

petitiveness. In fact, a less-than-thorough analysis

typically results in an emphasis on symptoms, rather

than on problems and their causes. To analyse a case

Introduction • Preparing an effective case analysis

C-9

effectively, you should be sceptical of quick or easy

approaches and answers.

A systematic analysis helps you to understand

a situation and determine what can work and prob-

ably what will not work. Key linkages and under-

lying causal networks based on the history of the firm

become apparent. In this way, you can separate causal

networks from symptoms.

Also, because the quality of a case analysis depends

on applying appropriate tools, it is important that you

use the ideas, models and theories that seem to be use-

ful for evaluating and solving individual and unique

situations. As you consider facts and symptoms, a

useful theory may become apparent. Of course, hav-

ing familiarity with conceptual models may be impor-

tant in the effective analysis of a situation. Successful

students and successful organisational strategists add

to their intellectual tool kits on a continual basis.

Making the diagnosis

The fifth step of effective case analysis – diagnosis – is

the process of identifying and clarifying the roots of

the problems by comparing goals with facts. In this

step, it is useful to search for predicaments. Predica-

ments are situations in which goals do not fit with

known facts. When you evaluate the actual perfor-

mance of an organisation, business unit or individual,

you may identify over- or under-achievement (relative

to established goals). Of course, single-problem situa-

tions are rare. Accordingly, you should recognise that

the case situations you study probably will be com-

plex in nature.

Effective diagnosis requires you to determine

the problems affecting longer-term performance and

those requiring immediate handling. Understanding

these issues will aid your efforts to prioritise prob-

lems and predicaments, given available resources and

existing constraints.

Doing the action planning

The final step of an effective case analysis process is

called action planning. Action planning is the process

of identifying appropriate alternative actions. In the

action planning step, you select the criteria you will

use to evaluate the identified alternatives. You may

derive these criteria from the analyses; typically, they

are related to key strategic situations facing the focal

organisation. Furthermore, it is important that you

prioritise these criteria to ensure a rational and effec-

tive evaluation of alternative courses of action.

Typically, managers ‘satisfice’ when selecting

courses of action; that is, they find acceptable courses

of action that meet most of the chosen evaluation

criteria. A rule of thumb that has proved valuable to

strategic decision makers is to select an alternative

that leaves other plausible alternatives available if the

one selected fails.

Once you have selected the best alternative, you

must specify an implementation plan. Developing an

implementation plan serves as a reality check on the

feasibility of your alternatives. Thus, it is important

that you give thoughtful consideration to all issues

associated with the implementation of the selected

alternatives.

What to expect from

in-class case discussions

Classroom discussions of cases differ significantly

from lectures. The case method calls for instructors to

guide the discussion, encourage student participation

and solicit alternative views. When alternative views

are not forthcoming, instructors typically adopt one

view so that students can be challenged to respond

to it thoughtfully. Often students’ work is evaluated

in terms of both the quantity and the quality of their

contributions to in-class case discussions. Students

benefit by having their views judged against those of

their peers and by responding to challenges by other

class members and/or the instructor.

During case discussions, instructors listen, ques-

tion and probe to extend the analysis of case issues.

In the course of these actions, peers or the instructor

may challenge an individual’s views and the validity

of alternative perspectives that have been expressed.

These challenges are offered in a constructive man-

ner; their intent is to help students develop their ana-

lytical and communication skills. Instructors should

encourage students to be innovative and original in

the development and presentation of their ideas. Over

the course of an individual discussion, students can

develop a more complex view of the case, benefiting

from the diverse inputs of their peers and instructor.

Introduction • Preparing an effective case analysis

C-10

Among other benefits, experience with multiple-case

discussions should help students to increase their

knowledge of the advantages and disadvantages of

group decision-making processes.

Student peers as well as the instructor value com-

ments that contribute to the discussion. To offer

relevant contributions, you are encouraged to use

independent thought and, through discussions with

your peers outside of class, to refine your thinking. We

also encourage you to avoid using ‘I think’, ‘I believe’

and ‘I feel’ to discuss your inputs to a case analysis

process. Instead, consider using a less emotion-laden

phrase, such as ‘My analysis shows’. This highlights

the logical nature of the approach you have taken to

complete the six steps of an effective case analysis

process.

When preparing for an in-class case discussion,

you should plan to use the case data to explain your

assessment of the situation. Assume that your peers

and instructor know the case facts. In addition, it is

good practice to prepare notes before class discus-

sions and use them as you explain your view. Effective

notes signal to classmates and the instructor that you

are prepared to engage in a thorough discussion of a

case. Moreover, thorough notes eliminate the need for

you to memorise the facts and figures needed to dis-

cuss a case successfully.

The case analysis process just described can help

you prepare to effectively discuss a case during class

meetings. Adherence to this process results in consid-

eration of the issues required to identify a focal firm’s

problems and to propose strategic actions through

which the firm can increase the probability that it will

achieve strategic competitiveness.

In some instances, your instructor may ask

you to prepare either an oral or a written analysis

of a particular case. Typically, such an assignment

demands even more thorough study and analysis of

the case contents. At your instructor’s discretion, oral

and written analyses may be completed by individuals

or by groups of two or more people. The informat-

ion and insights gained through completing the six

steps shown in Exhibit 2 are often of value in the

development of an oral or written analysis. However,

when preparing an oral or written presentation, you

must consider the overall framework in which your

information and inputs will be presented. Such a

framework is the focus of the next section.

Preparing an oral/written

case strategic plan

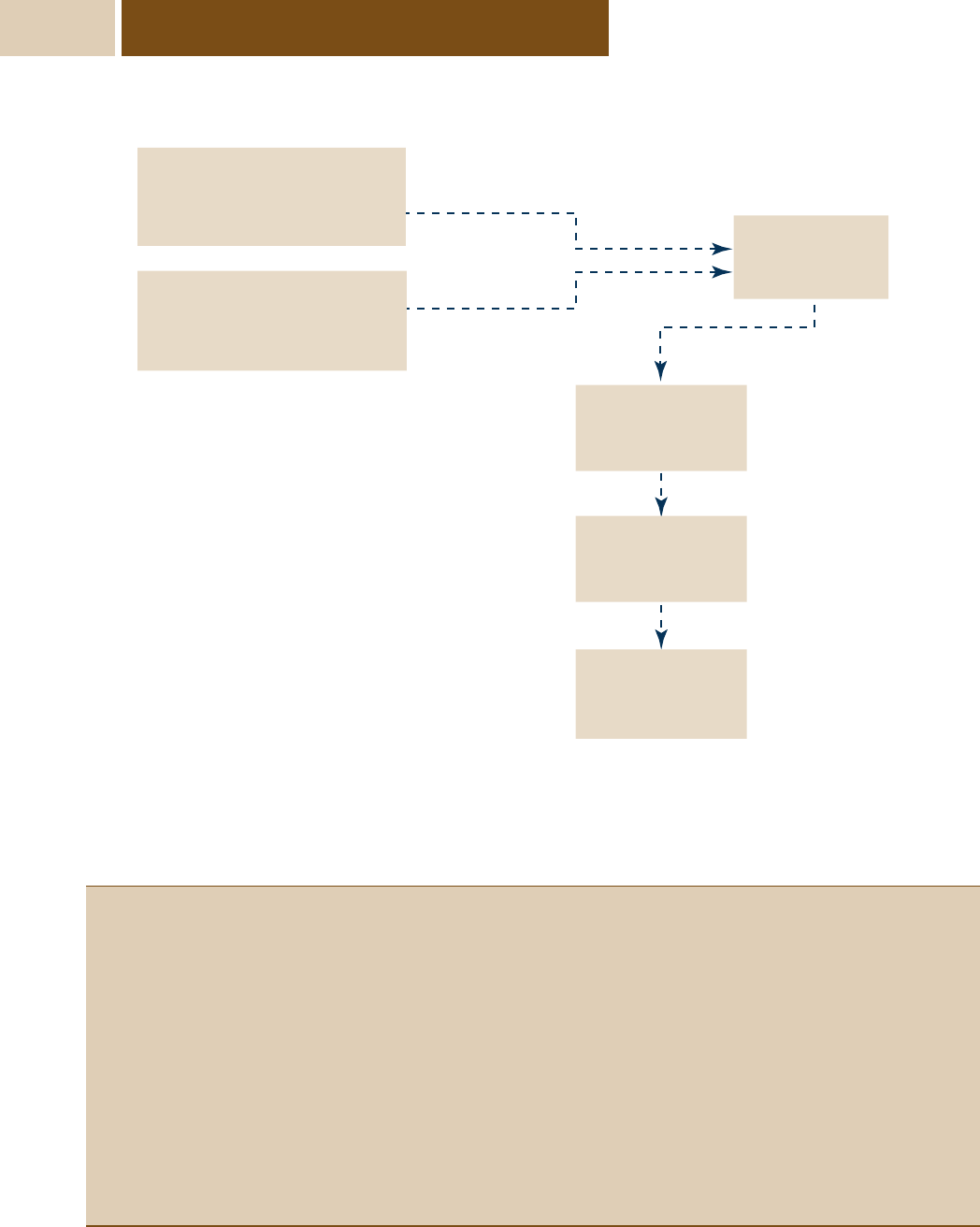

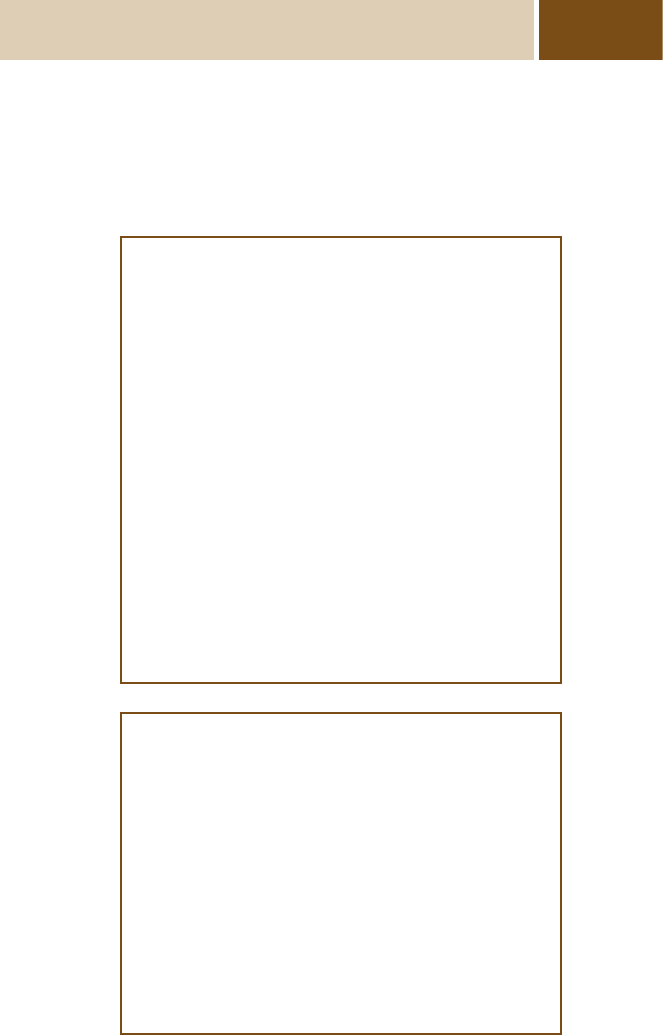

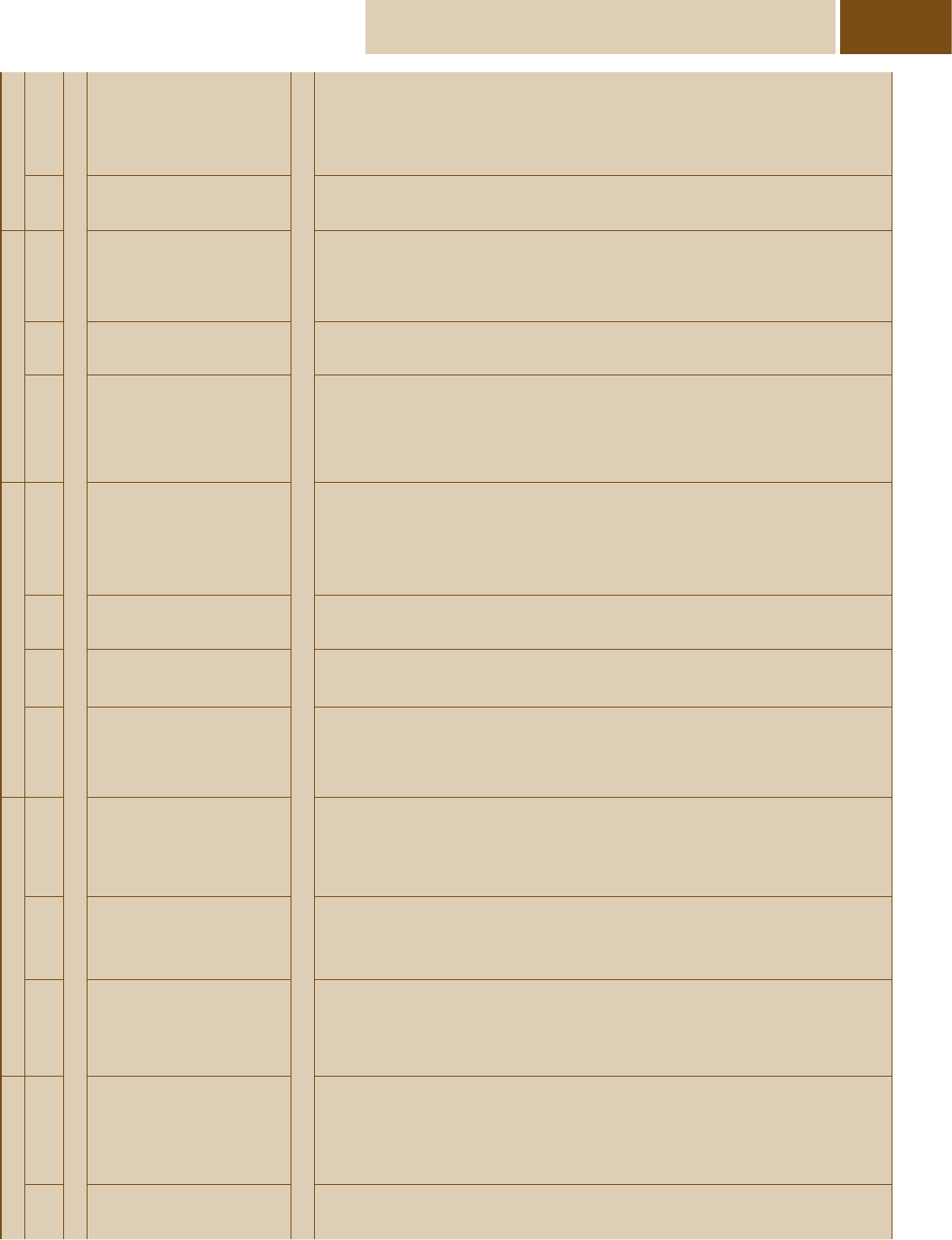

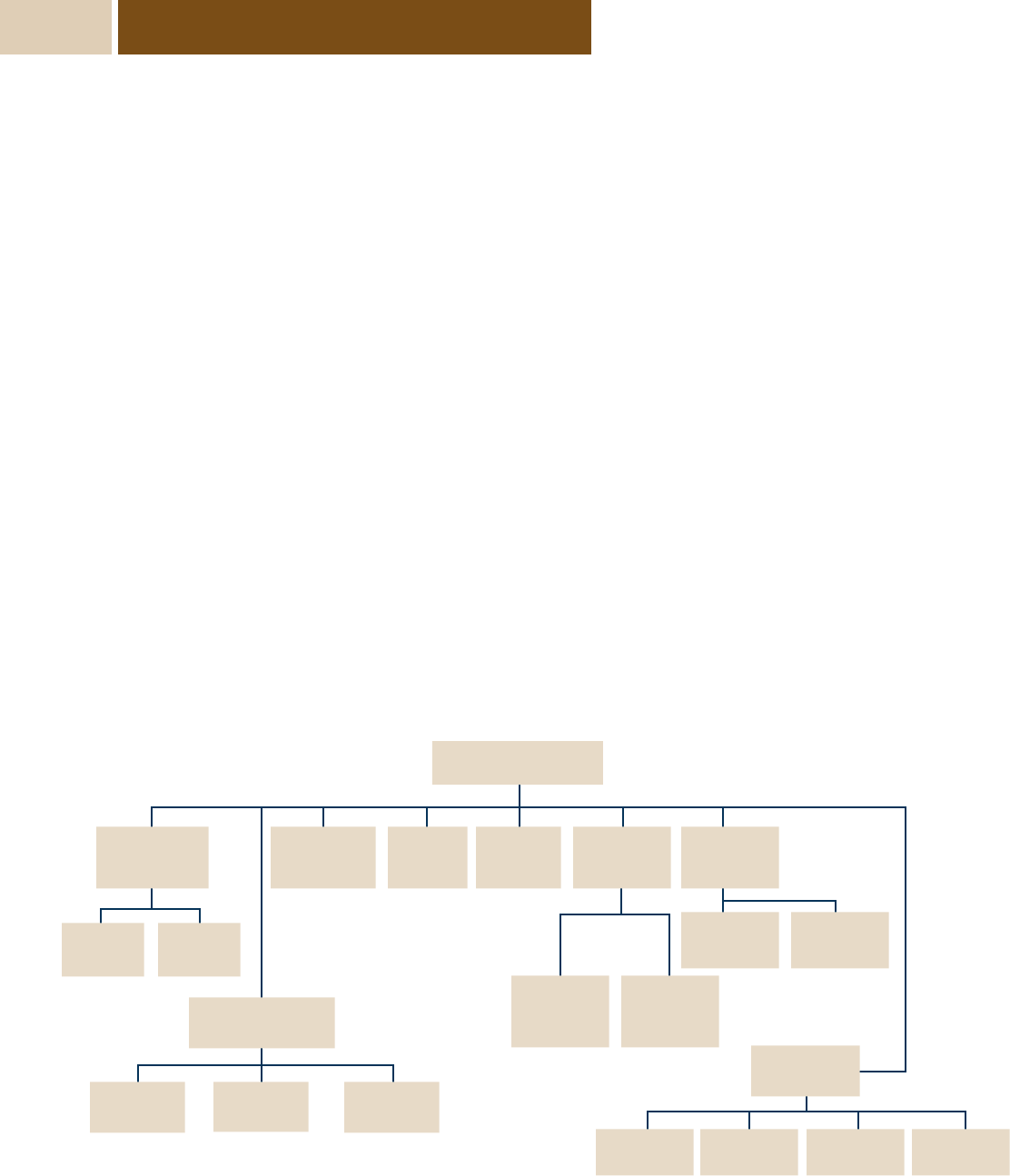

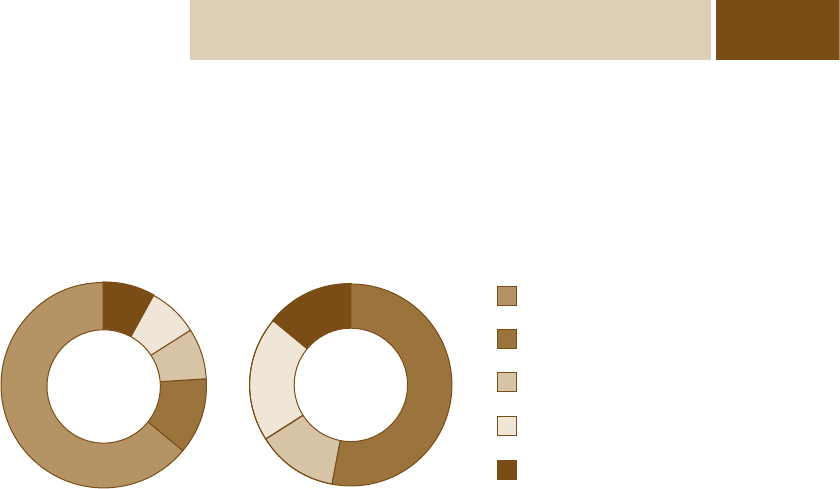

Experience shows that two types of thinking are nec-

essary in order to develop an effective oral or written

presentation (see Exhibit 3). The upper part of the

model in Exhibit 3 outlines the analysis stage of case

preparation.

In the analysis stage, you should first analyse the

general external environmental issues affecting the

firm. Next, your environmental analysis should focus

on the particular industry (or industries, in the case

of a diversified company) in which a firm operates.

Finally, you should examine the competitive environ-

ment of the focal firm. Through study of the three

levels of the external environment, you will be able to

identify a firm’s opportunities and threats. Following

the external environmental analysis is the analysis of

the firm’s internal environment, which results in the

identification of the firm’s strengths and weaknesses.

As noted in Exhibit 3, you must then change the

focus from analysis to synthesis. Specifically, you

must synthesise information gained from your analy-

sis of the firm’s internal and external environments.

Synthesising information allows you to generate alter-

natives that can resolve the significant problems or

challenges facing the focal firm. Once you identify a

best alternative, from an evaluation based on prede-

termined criteria and goals, you must explore imple-

mentation actions.

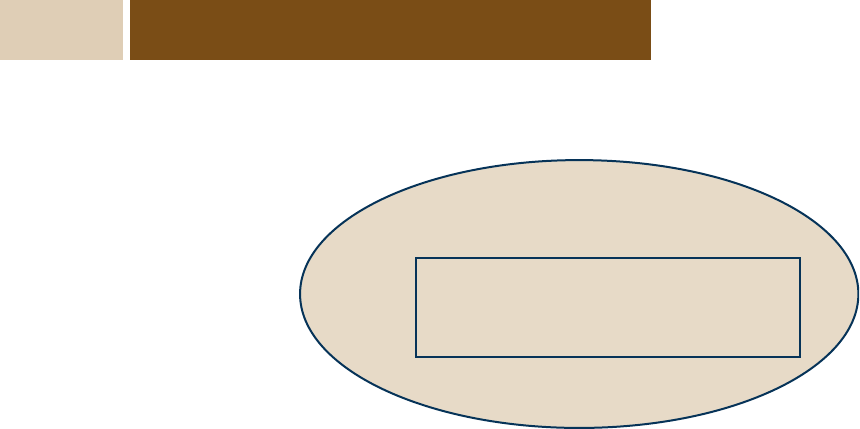

Exhibits 4 and 5 outline the sections that should

be included in either an oral or a written strategic

plan presentation: introduction (strategic intent and

mission), situation analysis, statements of strengths/

weaknesses and opportunities/threats, strategy for-

mulation and implementation plan. These sections,

which can be completed only through use of the two

types of thinking featured in Exhibit 3, are described

in the following discussion. Familiarity with the con-

tents of your textbook’s 13 chapters is helpful because

the general outline for an oral or a written strategic

plan shown in Exhibit 5 is based on an understand-

ing of the strategic management process detailed in

those chapters.

Introduction • Preparing an effective case analysis

C-11

External environment analysis

As shown in Exhibit 5, a general starting place for

completing a situation analysis is the external envi-

ronment. The external environment is composed of

outside conditions that affect a firm’s performance.

Your analysis of the environment should consider the

effects of the general environment on the focal firm.

Following that evaluation, you should analyse the

industry and competitor environmental trends.

These trends or conditions in the external environ-

ment shape the firm’s strategic intent and mission.

The external environment analysis essentially indi-

cates what a firm might choose to do. Often called an

environmental scan, an analysis of the external envi-

ronment allows a firm to identify key conditions that

are beyond its direct control. The purpose of studying

the external environment is to identify a firm’s oppor-

tunities and threats. Opportunities are conditions in

the external environment that appear to have the

potential to contribute to a firm’s success. In essence,

opportunities represent possibilities. Threats are

conditions in the external environment that appear

to have the potential to prevent a firm’s success. In

essence, threats represent potential constraints.

When studying the external environment, the

focus is on trying to predict the future (in terms of

local, regional, and international trends and issues)

and to predict the expected effects on a firm’s oper-

ations. The external environment features conditions

in the broader society and in the industry (area of

competition) that influence the firm’s possibilities

and constraints. Areas to be considered (to identify

opportunities and threats) when studying the general

environment are listed in Exhibit 6. Many of these

issues are explained more fully in Chapter 2.

Once you analyse the general environmental

trends, you should study their effect on the focal indus-

try. Often the same environmental trend may have a

significantly different impact on separate industries,

or it may affect firms within the same industry differ-

ently. For instance, with deregulation of the airline

industry in the United States, older, established air-

lines had a significant decrease in profitability, while

many smaller airlines, such as Southwest Airlines,

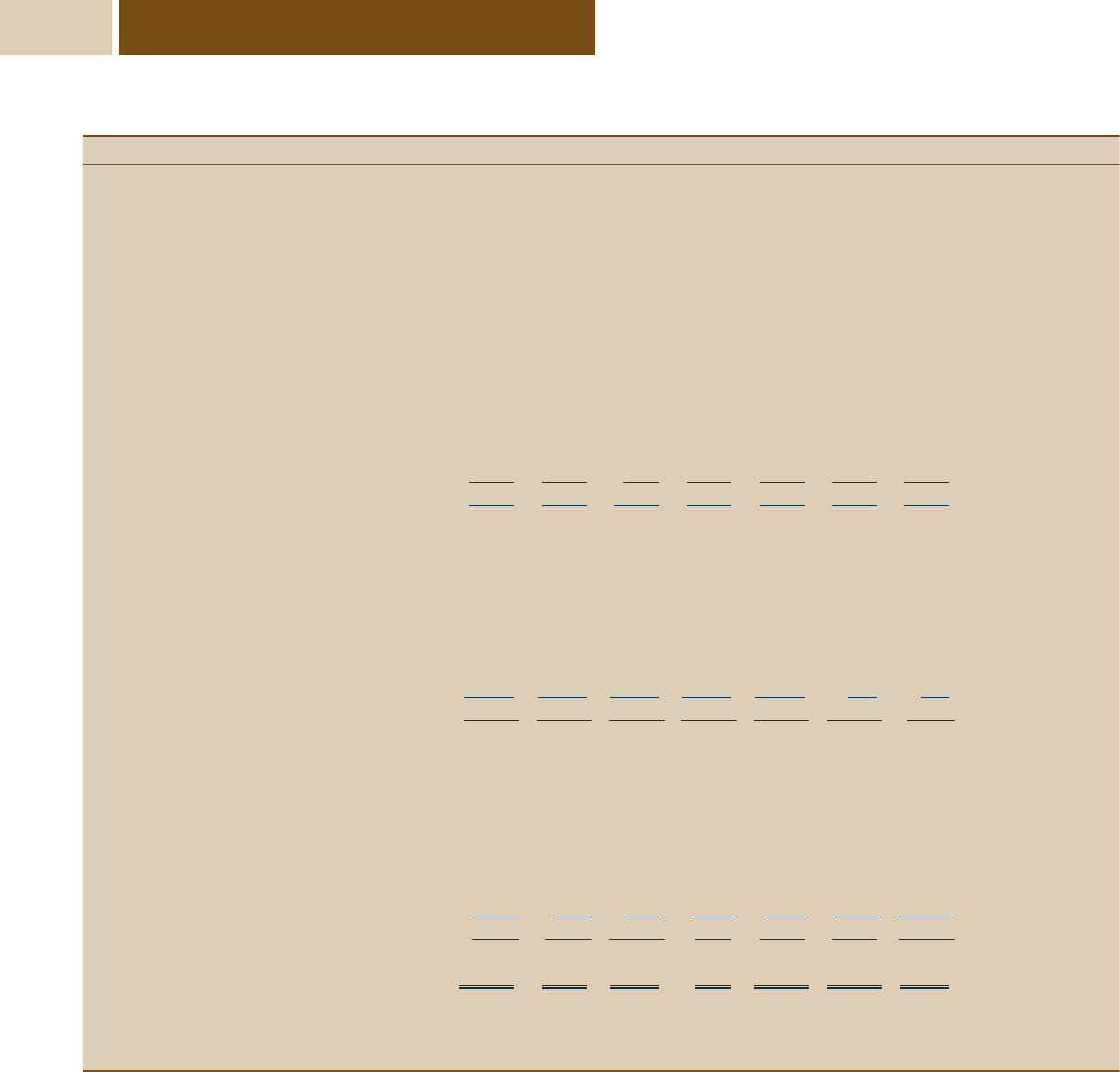

Exhibit 3 Types of thinking in case preparation: Analysis and synthesis

ANALYSIS

External environment

General environment

Industry environment

Competitor environment

Internal environment

Statements of

strengths,

weaknesses,

opportunities

and threats

Alternatives

Evaluations of alternatives

Implementation

SYNTHESIS

Introduction • Preparing an effective case analysis

C-12

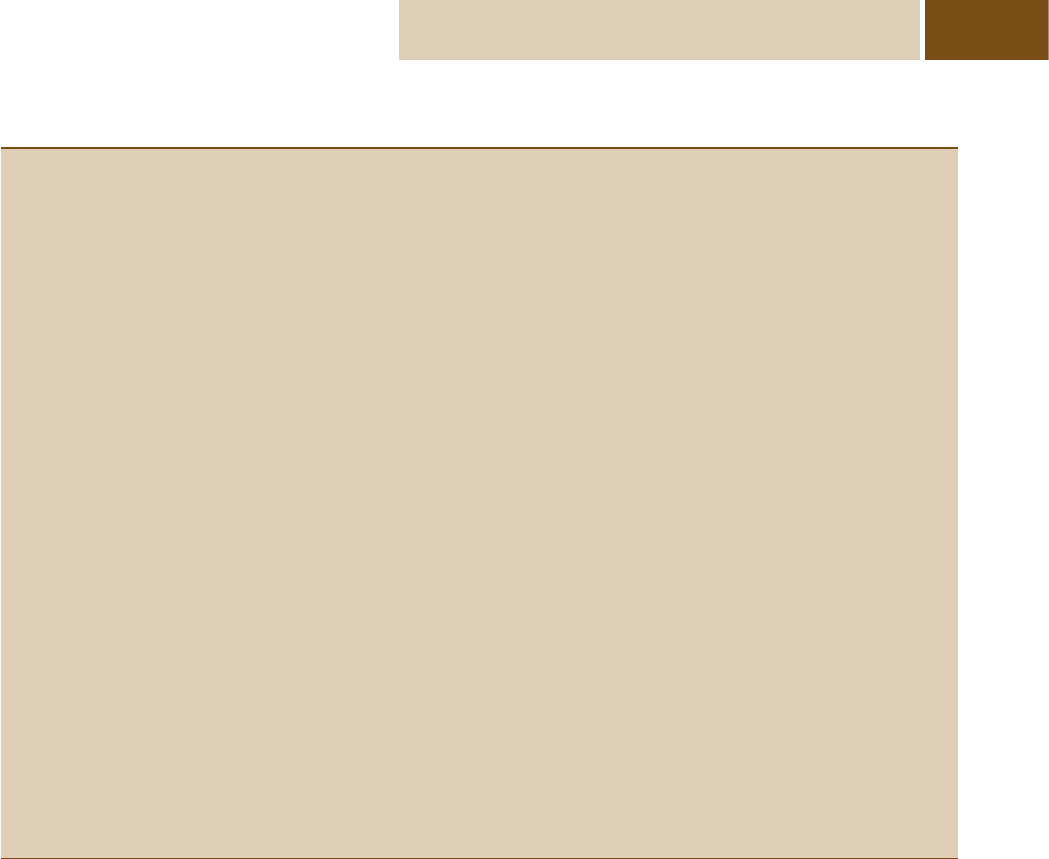

Exhibit 5 Strategic planning and its parts

• Strategic planning is a process through which a firm determines what it seeks to accomplish and the actions required to

achieve desired outcomes

✓ Strategic planning, then, is a process that we use to determine what (outcomes to be reached) and how (actions to be taken

to reach outcomes)

• The effective strategic plan for a firm would include statements and details about the following:

✓ Opportunities (possibilities) and threats (constraints)

✓ Strengths (what we do especially well) and weaknesses (deficiencies)

✓ Strategic intent (an indication of a firm’s ideal state)

✓ Strategic mission (purpose and scope of a firm’s operations in product and market terms)

✓ Key result areas (KRAs) (categories of activities where efforts must take place to reach the mission and intent)

✓ Strategies (actions for each KRA to be completed within one to five years)

✓ Objectives (specific statements detailing actions for each strategy that are to be completed in one year or less)

✓ Cost linkages (relationships between actions and financial resources)

Exhibit 4 Strategic planning process

Strategic intent

Strategic mission

Strategies

• 1 to 5 years

• Cost linkages

Objectives

• 1 year or less

• Cost linkages

Key result areas

• Required efforts

• Cost linkages

External environment

• Opportunities (possibilities)

• Threats (constraints)

Internal environment

• Strengths

• Weaknesses

Introduction • Preparing an effective case analysis

C-13

with lower cost structures and greater flexibility, were

able to aggressively enter new markets.

Porter’s five forces model is a useful tool for ana-

lysing the specific industry (see Chapter 2). Careful

study of how the five competitive forces (that is, sup-

plier power, buyer power, potential entrants, substi-

tute products and rivalry among competitors) affect

a firm’s strategy is important. These forces may cre-

ate threats or opportunities relative to the specific

business-level strategies (that is, differentiation, cost

leadership, focus) being implemented. Often a stra-

tegic group’s analysis reveals how different environ-

mental trends are affecting industry competitors.

Strategic group analysis is useful for understanding

the industry’s competitive structures and firm con-

straints and possibilities within those structures.

Firms also need to analyse each of their primary

competitors. This analysis should identify their com-

petitors’ current strategies, strategic intent, strategic

mission, capabilities, core competencies and compet-

itive response profile. This information is useful to

the focal firm in formulating an appropriate strategic

intent and mission.

Internal environment analysis

The internal environment is composed of strengths

and weaknesses internal to a firm that influence its

strategic competitiveness. The purpose of completing

an analysis of a firm’s internal environment is to iden-

tify its strengths and weaknesses. The strengths and

weaknesses in a firm’s internal environment shape

the strategic intent and strategic mission. The inter-

nal environment essentially indicates what a firm

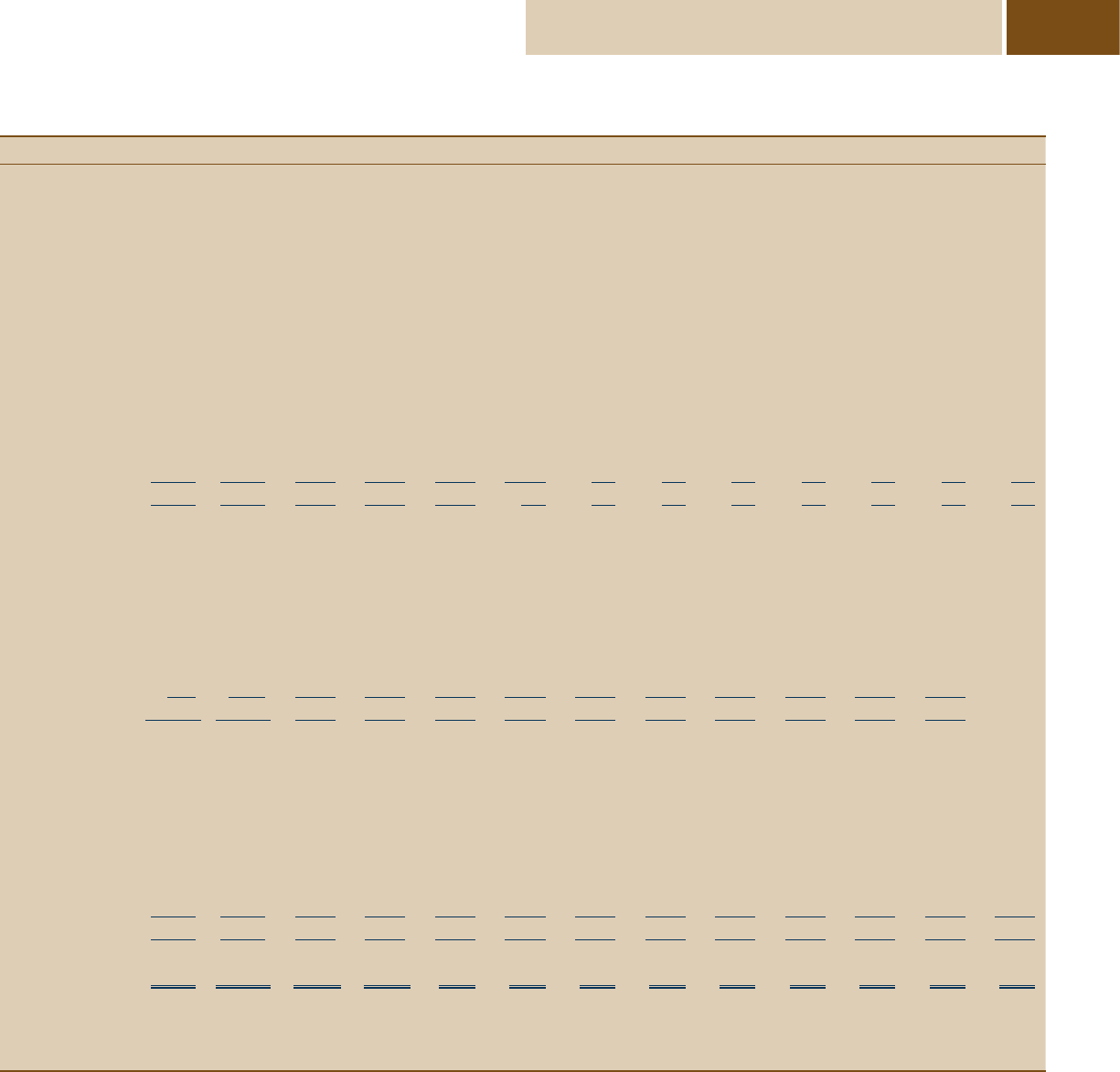

Exhibit 6 Sample general environmental categories

Technology • Information technology continues to become cheaper and have more practical

applications

• Database technology allows organisation of complex data and distribution of information

• Telecommunications technology and networks increasingly provide fast transmission of all

sources of data, including voice, written communications and video information

Demographic trends • Computerised design and manufacturing technologies continue to facilitate quality and

flexibility

• Regional changes in population due to migration

• Changing ethnic composition of the population

• Ageing of the population

• Ageing of the baby boomer generation

Economic trends • Interest rates

• Inflation rates

• Savings rates

• Trade deficits

• Budget deficits

• Exchange rates

Political/legal environment • Antitrust enforcement

• Tax policy changes

• Environmental protection laws

• Extent of regulation/deregulation

• Developing countries privatising state monopolies

• State-owned industries

Socio-cultural environment • Increasing proportion of women in the workforce

• Awareness of health and fitness issues

• Concern for the environment

• Concern for customers

Global environment • Currency exchange rates

• Free trade agreements

• Trade deficits

• New or developing markets

Introduction • Preparing an effective case analysis

C-14

can do. Capabilities or skills that allow a firm to do

something that others cannot do or that allow a firm

to do something better than others do it are called

strengths. Strengths can be categorised as something

that a firm does especially well. Strengths help a firm

to take advantage of external opportunities or over-

come external threats. Capabilities or skill deficien-

cies that prevent a firm from completing an important

activity as well as others do it are called weaknesses.

Weaknesses have the potential to prevent a firm from

taking advantage of external opportunities or suc-

ceeding in efforts to overcome external threats. Thus,

weaknesses can be thought of as something the firm

needs to improve.

Analysis of the primary and support activities of

the value chain provides opportunities to understand

how external environmental trends affect the spe-

cific activities of a firm. Such analysis helps to high-

light strengths and weaknesses. (See Chapter 3 for an

explanation of the value chain.) For the purposes of

preparing an oral or written presentation, it is impor-

tant to note that strengths are internal resources and

capabilities that have the potential to be core com-

petencies. Weaknesses, on the other hand, have the

potential to place a firm at a competitive disadvantage

in relation to its rivals.

When evaluating the internal characteristics of

the firm, your analysis of the functional activities

emphasised is critical. For example, if the strategy of

the firm is primarily technology-driven, it is important

to evaluate the firm’s R&D activities. If the strategy

is market-driven, marketing functional activities are

of paramount importance. If a firm has financial diffi-

culties, critical financial ratios would require careful

evaluation. In fact, because of the importance of

financial health, most cases require financial analysis.

The appendix lists and operationally defines several

common financial ratios. Included are exhibits des-

cribing profitability, liquidity, leverage, activity and

shareholders’ return ratios. Other firm characteristics

that should be examined to study the internal environ-

ment effectively include leadership, organisational

culture, structure and control systems.

Identification of strategic intent

and mission

Strategic intent is associated with a mind-set that

managers seek to imbue within the company. Essen-

tially, a mind-set captures how we view the world

and our intended role in it. Strategic intent reflects

or identifies a firm’s ideal state. Strategic intent flows

from a firm’s opportunities, threats, strengths and

weaknesses. However, the main influence on strate-

gic intent is a firm’s strengths. Strategic intent should

reflect a firm’s intended character and a commitment

to ‘stretch’ available resources and strengths in order

to reach strategies and objectives. Examples of strate-

gic intent include:

• The relentless pursuit of perfection (Lexus).

• To be the top performer in everything that we do

(Phillips Petroleum).

• We are dedicated to being the world’s best at

bringing people together (AT&T).

The strategic mission flows from a firm’s strate-

gic intent; it is a statement used to describe a firm’s

unique intent and the scope of its operations in prod-

uct and market terms. In its most basic form, the stra-

tegic mission indicates to stakeholders what a firm

seeks to accomplish. An effective strategic mission

reflects a firm’s individuality and reveals its leader-

ship’s predisposition(s). The useful strategic mission

shows how a firm differs from others and defines

boundaries within which the firm intends to operate.

For example:

• Cochlear’s mission is to have ‘clinical teams and

recipients embrace Cochlear as their partner in

hearing for life’.

• Coca-Cola Amatil’s mission is to have market

leadership in every territory.

Hints for presenting an

effective strategic plan

There may be a temptation to spend most of your

oral or written case analysis on the results from the

analysis. It is important, however, that the analysis

of a case should not be over-emphasised relative to

Introduction • Preparing an effective case analysis

C-15

the synthesis of results gained from your analytical

efforts – what does the analysis mean for the organi-

sation (see Exhibit 3)?

Strategy formulation: Choosing key

result areas

Once you have identified strengths and weaknesses,

determined the firm’s core competencies (if any), and

formulated a strategic intent and mission, you have a

picture of what the firm is and what challenges and

threats it faces.

You can now determine alternative key result

areas (KRAs). Each of these is a category of activi-

ties that helps to accomplish the strategic intent of the

firm. For example, KRAs for Cochlear may include

to remain a leader in hearing implant technology and

to build links with hearing clinicians in Southeast

Asia. Each alternative should be feasible (that is, it

should match the firm’s strengths, capabilities and,

especially, core competencies), and feasibility should

be demonstrated. In addition, you should show how

each alternative takes advantage of the environmental

opportunity or avoids/buffers against environmental

threats. Developing carefully thought-out alternatives

requires synthesis of your analyses and creates greater

credibility in oral and written case presentations.

Once you develop a strong set of alternative

KRAs, you must evaluate the set to choose the best

ones. Your choice should be defensible and provide

benefits over the other alternatives. Thus, it is impor-

tant that both the alternative development and evalu-

ation of alternatives be thorough. The choice of the

best alternative should be explained and defended.

For the two Cochlear KRAs presented earlier, the

strategies are clear and in both cases they take advan-

tage of competencies within the company and oppor-

tunities in the external environment.

Key result area implementation

After selecting the most appropriate KRAs (that is,

those with the highest probability of enhancing a

firm’s strategic competitiveness), you must consider

effective implementation. Effective synthesis is impor-

tant to ensure that you have considered and evaluated

all critical implementation issues. Issues you might

consider include the structural changes necessary to

implement the new strategies and objectives associ-

ated with each KRA. In addition, leadership changes

and new controls or incentives may be necessary to

implement these strategic actions. The implementa-

tion actions you recommend should be explicit and

thoroughly explained. Occasionally, careful evalua-

tion of implementation actions may show the strat-

egy to be less favourable than you originally thought.

(You may find that the capabilities required to imple-

ment the strategy are absent and unobtainable.) A

strategy is only as good as the firm’s ability to imple-

ment it effectively. Therefore, expending the effort to

determine effective implementation is important.

Process issues

You should ensure that your presentation (either oral

or written) has logical consistency throughout. For

example, if your presentation identifies one purpose,

but your analysis focuses on issues that differ from

the stated purpose, the logical inconsistency will be

apparent. Likewise, your alternatives should flow

from the configuration of strengths, weaknesses,

opportunities and threats you identified through the

internal and external analyses.

Thoroughness and clarity also are critical to an

effective presentation. Thoroughness is represented

by the comprehensiveness of the analysis and alterna-

tive generation. Furthermore, clarity in the results of

the analyses, selection of the best alternative KRAs

and strategies, and design of implementation actions

are important. For example, your statement of the

strengths and weaknesses should flow clearly and

logically from the internal analyses presented, and

these should be reflected in KRAs and strategies.

Presentations (oral or written) that show logi-

cal consistency, thoroughness and clarity of purpose,

effective analyses, and feasible recommendations are

more effective and will receive more positive evalua-

tions. Being able to withstand tough questions from

peers after your presentation will build credibility for

your strategic plan presentation. Furthermore, devel-

oping the skills necessary to make such presentations

will enhance your future job performance and career

success.

Introduction • Preparing an effective case analysis

C-16

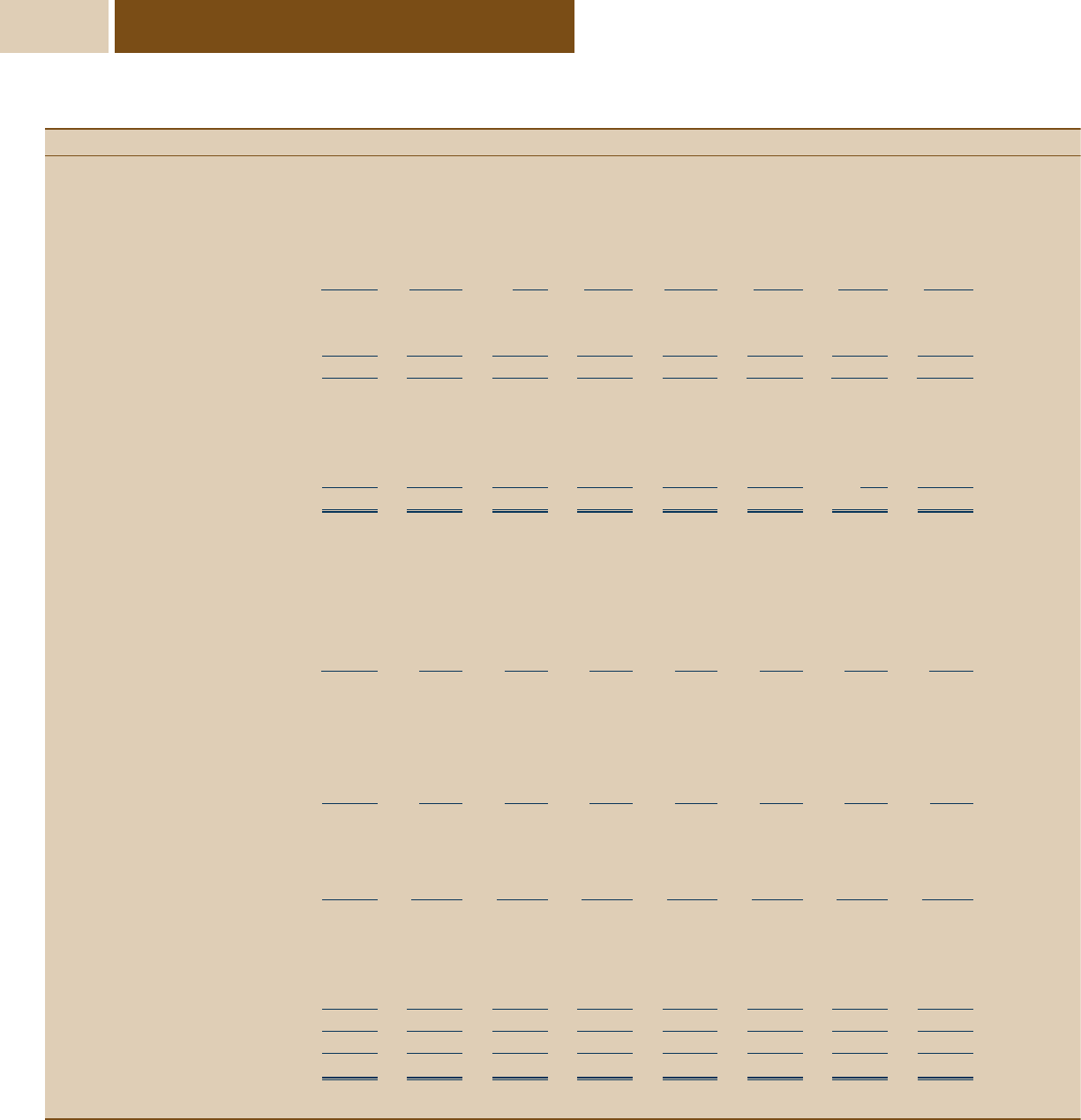

Appendix: Financial analysis in case studies

Exhibit A-1 Profitability ratios

Ratio Formula What it shows

1 Return on total assets Profits after taxes

Total assets

The net return on total investment

of the firm

or or

Profits after taxes + interest

Total assets

The return on both creditors’ and

shareholders’ investments

2 Return on shareholders’ equity

(or return on net worth)

Profits after taxes

Total shareholders’ equity

How effectively the company is

utilising shareholders’ funds

3 Return on ordinary equity Profit after taxes – preference share dividends

Total shareholders’ equity – par value of

preference shares

The net return to ordinary

shareholders

4 Operating profit margin

(or return on sales)

Profits before taxes and before interest

Sales

The firm’s profitability from

regular operations

5 Net profit margin

(or net return on sales)

Profits after taxes

Sales

The firm’s net profit as a

percentage of total sales

Exhibit A-2 Liquidity ratios

Ratio Formula What it shows

1 Current ratio Current assets

Current liabilities

The firm’s ability to meet its current financial

liabilities

2 Quick ratio (or acid-test ratio) Current assets – inventory

Current liabilities

The firm’s ability to pay off short-term

obligations without relying on sales of

inventory

3 Inventory to net working capital Inventory

Current assets – current liabilities

The extent to which the firm’s working capital

is tied up in inventory

Introduction • Preparing an effective case analysis

C-17

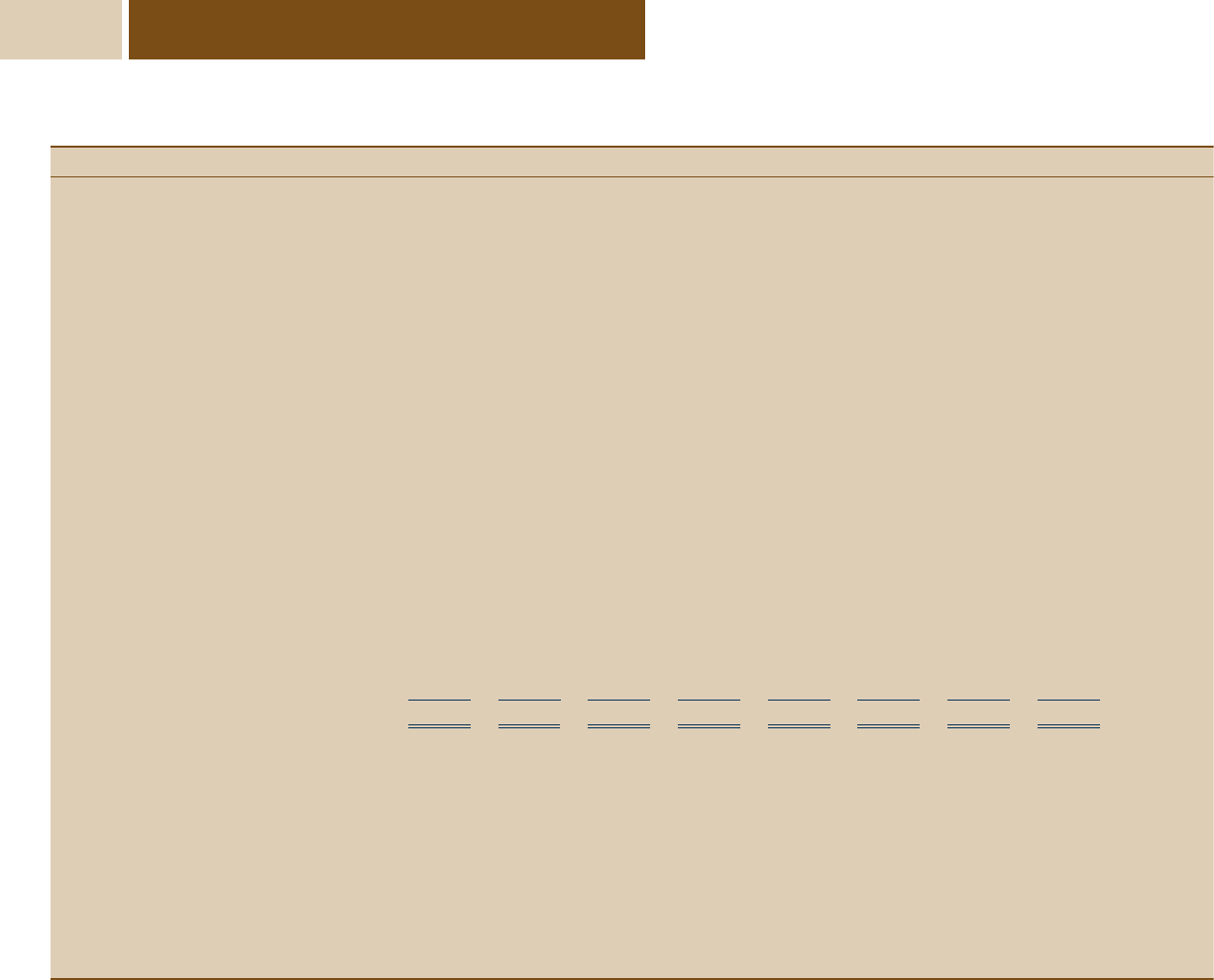

Exhibit A-3 Leverage ratios

Ratio Formula What it shows

1 Debt-to-assets Total debt

Total assets

Total borrowed funds as a percentage of total

assets

2 Debt-to-equity Total debt

Total shareholders’ equity

Borrowed funds versus the funds provided by

shareholders

3 Long-term debt-to-equity Long-term debt

Total shareholders’ equity

Leverage used by the firm

4 Times-interest-earned

(or coverage ratio)

Profits before interest and taxes

Total interest charges

The firm’s ability to meet all interest payments

5 Fixed charge coverage Profits before taxes and interest

+ lease obligations

Total interest charges

+ lease obligations

The firm’s ability to meet all fixed-charge

obligations, including lease payments

Exhibit A-4 Activity ratios

Ratio Formula What it shows

1 Inventory turnover Sales

Inventory of finished goods

The effectiveness of the firm in employing

inventory

2 Fixed assets turnover Sales

Fixed assets

The effectiveness of the firm in utilising plant

and equipment

3 Total assets turnover Sales

Total assets

The effectiveness of the firm in utilising total

assets

4 Accounts receivable turnover Annual credit sales

Accounts receivable

How many times the total receivables have

been collected during the accounting period

5 Average collection period Accounts receivable

Average daily sales

The average length of time the firm waits to

collect payments after sales

Introduction • Preparing an effective case analysis

C-18

Exhibit A-5 Shareholders’ return ratios

Ratio Formula What it shows

1 Dividend yield on ordinary

shares

Annual dividends per share

Current market price per share

A measure of return to ordinary shareholders

in the form of dividends

2 Price–earnings ratio Current market price per share

After-tax earnings per share

An indication of market perception of the firm.

Usually, the faster-growing or less risky firms

tend to have higher PE ratios than the slower-

growing or more risky firms

3 Dividend payout ratio Annual dividends per share

After-tax earnings per share

An indication of dividends paid out as a

percentage of profits

4 Cash flow per share After-tax profits + depreciation

Number of ordinary shares outstanding

A measure of total cash per share available for

use by the firm

Notes

1 M. A. Lundberg, B. B. Levin and H. I. Harrington, 2000, Who

Learns What from Cases and How? The Research Base for Teaching

and Learning with Cases (Englewood Cliffs, NJ: Lawrence Erlbaum

Associates).

2 L. B. Barnes, A. J. Nelson and C. R. Christensen, 1994, Teaching

and the Case Method: Text, Cases and Readings (Boston: Harvard

Business School Press); C. C. Lundberg, 1993, ‘Introduction to

the case method’, in C. M. Vance (ed.), Mastering Management

Education (Newbury Park, Calif.: Sage); C. Christensen, 1989,

Teaching and the Case Method (Boston: Harvard Business School

Publishing Division).

3 C. C. Lundberg and E. Enz, 1993, ‘A framework for student

case preparation’, Case Research Journal, 13 (summer), p. 133.

4 J. Solitis, 1971, ‘John Dewey’, in L. E. Deighton (ed.), Encyclopedia

of Education (New York: Macmillan and The Free Press).

5 F. Bocker, 1987, ‘Is case teaching more effective than lecture

teaching in business administration? An exploratory analysis’,

Interfaces, 17(5), pp. 64–71.

Introduction • Preparing an effective case analysis

C-19

Case 1

Hearing with the aid of

implanted technology:

The case of Cochlear™, an Australian

high-technology leader

Dallas Hanson Mark Wickham

University of Tasmania University of Tasmania

The Cochlear company of

Australia: The situation

Cochlear™ is a leading Australian company specialis-

ing in cochlear devices – that is, implantable hearing

devices. It is the world leader in this market and a pro-

minent innovator in the high-technology niche within

which it operates. Cochlear originated in Australia

but now sells globally in an increasingly competitive

market.

There are several problems currently facing the

company. Within the global deaf community there is

a serious debate about the use of technology to aid

hearing in the profoundly deaf, and this obviously

threatens the market. Second, and more significantly,

in 2002 there was a major issue when the US Food

and Drug Administration (FDA) issued a notification

that it had received news of possible associations

between cochlear implants and meningitis. In late

2003 a new CEO, Chris Roberts, took over. What are

his options?

The Cochlear implant technology

A cochlear implant is a small electronic device that

helps a profoundly (completely) deaf person to have

a sense of sound. It is different from a hearing aid

because it helps to compensate for damaged or non-

functional parts of the ear, while a hearing aid ampli-

fies sound. The implant has four parts:

• a tiny but sensitive microphone that picks up

sound

• a speech processor that selects and arranges

useful sounds

• a transmitter and receiver that turns these

sounds into electrical impulses

• a series of electrodes that are surgically

implanted in the inner ear, which pick up the

receiver’s impulses and transmit them to the

brain. (This process is analogous to how hearing

people hear sounds.)

The cochlear implant technology is getting more

sophisticated all the time. It is a fast-moving technol-

ogy, and changes are further enhancing the capacity

C-20 Case 1 • Hearing with the aid of implanted technology: Cochlear

of the devices as well as making them smaller and

therefore more socially acceptable.

Implanting the devices is a surgical procedure that

has some risks. It is also expensive because it requires

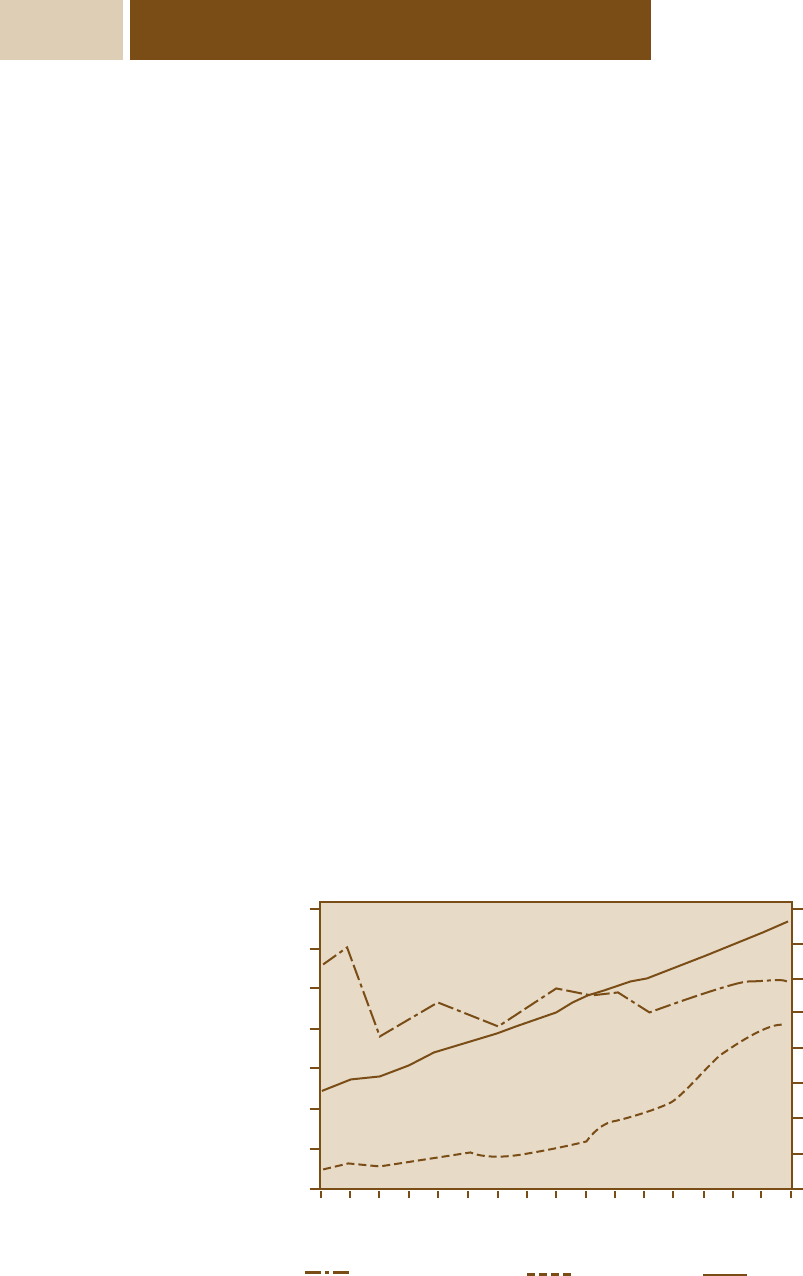

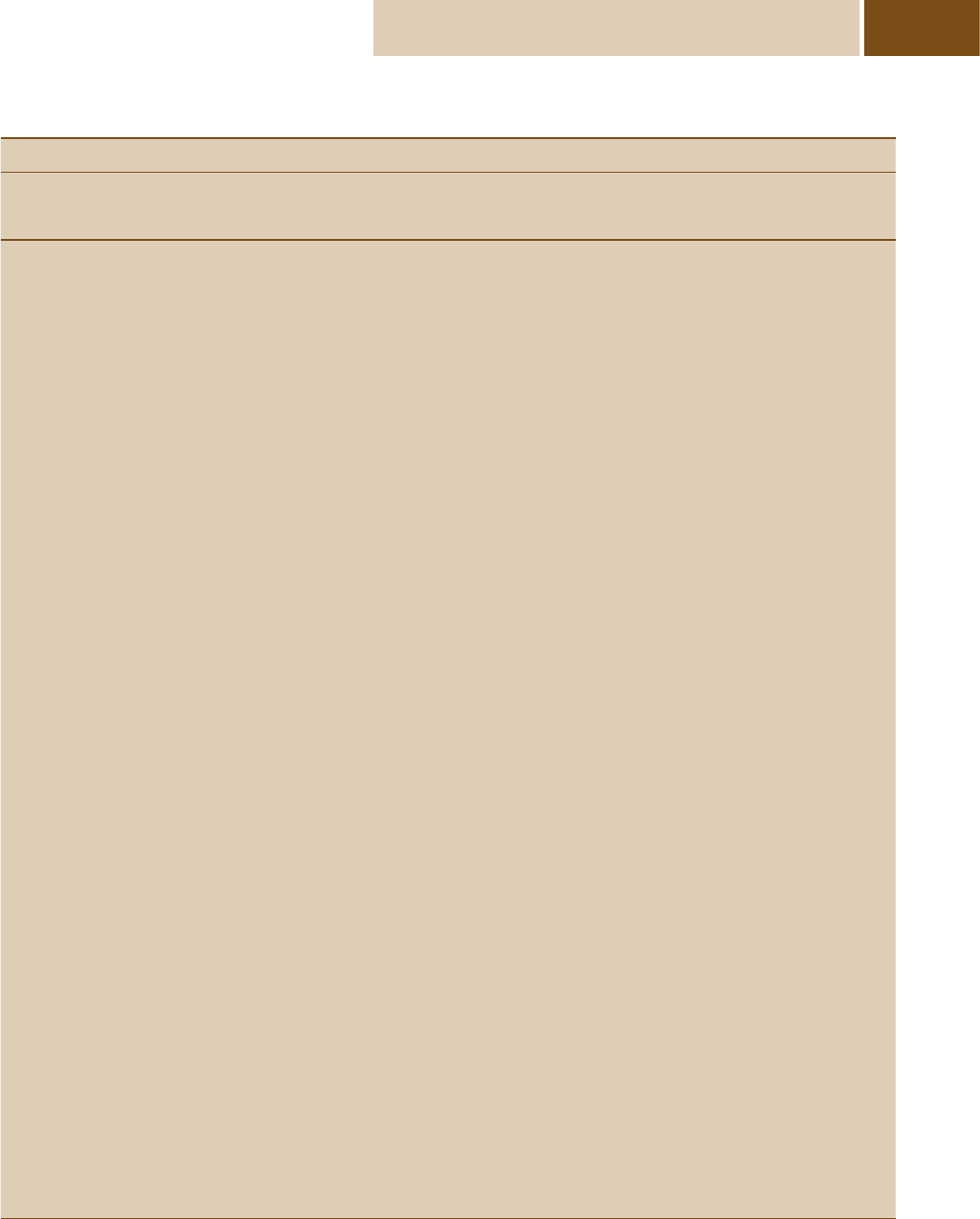

an experienced surgeon. Exhibit 1 is a diagrammatic

representation of the device.

A recent Cochlear company annual report out-

lines the details of this technology and indicates its

intricacy:

Introduction to the Nucleus® 3 system

The unique features of the Nucleus® 3 system

include:

Longest battery life on the market: The ESPrit™

3G speech processor is the only processor on the

market with a battery life that lasts up to three

days. Few interruptions and clear sound means

better hearing.

Unique Whisper setting provides more sound:

The ESPrit 3G is the only speech processor on the

market that features a special Whisper setting

designed to make soft sounds more audible –

like rain falling or a person calling from another

room.

Wireless FM and in-built telecoil: An in-built

telecoil allows you to use the telephone with no

additional attachments. The wireless FM provides

access to sound in a variety of settings including

cinemas, museums, meetings, classrooms, and

wherever an FM system is in place for hearing-

impaired participants. No additional cables are

necessary.

The only pre-curved (contoured) electrode

array on the market: The Nucleus® 24 Contour™

implant is the first implant choice for surgeons.

It features a pre-curved electrode array, which

has two important benefits: 1) The curve of the

array puts the electrodes as close as possible to

the hearing fibers in the cochlea to allow for the

distinct sound. 2) The pre-curved shape of the

array matches the shape of the cochlea, which

helps to protect its delicate structure.

Titanium implant casing for best reliability:

Nucleus® implants are durable and reliable and

are made from Titanium. The Nucleus 24 Contour

has never fractured on impact. Nucleus is built for

a lifetime of use.

Removable magnet for safe MRI: Nucleus is the

first implant to feature the removable magnet for

MRI. This allows recipients to have a full-strength

MRI if they require one.1

Exhibit 1 How the Nucleus® 3 system works

1 A directional microphone picks up sound.

2 Sound is sent from the microphone to the speech processor.

3 The speech processor analyses and digitises the sound into coded

signals.

4 Coded signals are sent to the transmitter via radio frequency.

5 The transmitter sends the code across the skin to the internal

implant.

6 The internal implant converts the code to electrical signals.

7 The signals are sent to the electrodes to stimulate the remaining

nerve fibres.

8 The signals are recognised as sounds by the brain, producing a

hearing sensation.

Case 1 • Hearing with the aid of implanted technology: Cochlear C-21

Cochlear, the company

The history of Cochlear’s Nucleus® device goes back to

1967, when Graeme Clark started research on multi-

channel cochlear implants. In 1978, Professor Clark

implanted Rodney Saunders with a multi-channel

cochlear device, and by 1982 a 22-channel device

was implanted in Graham Carrick. (The more chan-

nels, basically, the better the hearing.) In 1985 the

22-channel Nucleus device was approved by the FDA

for use in adults, and in 1990 for use in children. By

1998, 10 000 children had been implanted, and by

2001 more than 36 000 adults and children had been

implanted.2

Cochlear’s technology has kept improving, and

each component improvement improves the overall

system. In 2003 the company announced a further

significant improvement to its basic product: the

Nucleus® 24 Contour Advance™ was designed to

minimise trauma to the delicate cochlear structures

during implant surgery. It also developed a new Micro-

Link Adaptor for use with the speech processor and

receiver. (This was a product of the alliance Cochlear

has with European technology firm Phonok AG.) In

recent years the company has continually enhanced

the capacity, and further minimised the size, of its

Nucleus devices. Cochlear has won many awards for

innovation – for example, the Medical Design Excel-

lence Award in 2001 (an internationally prestigious

achievement).

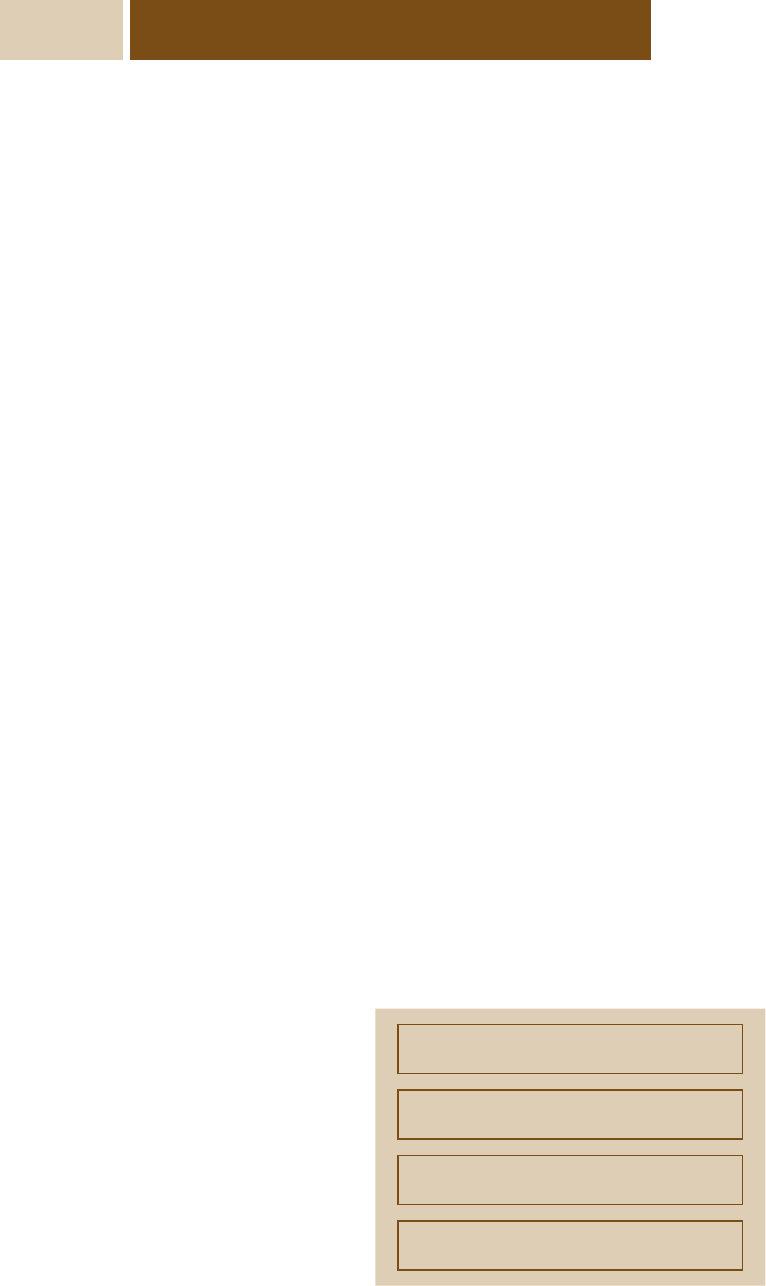

The 2002/03 financial year also included a record

result financially. Profit after tax increased by 45 per

cent to A$58.2 million and earnings per share were

up 44 per cent. There were also record unit sales, up

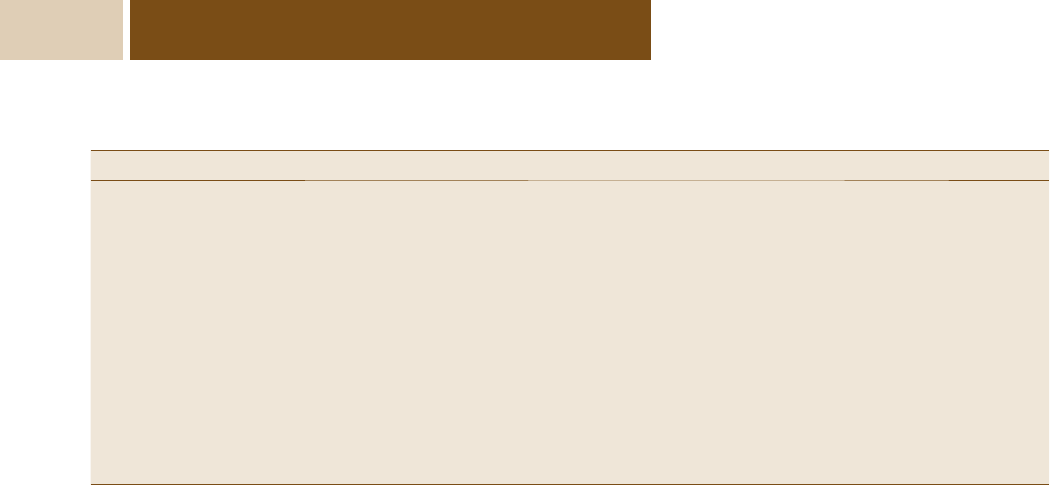

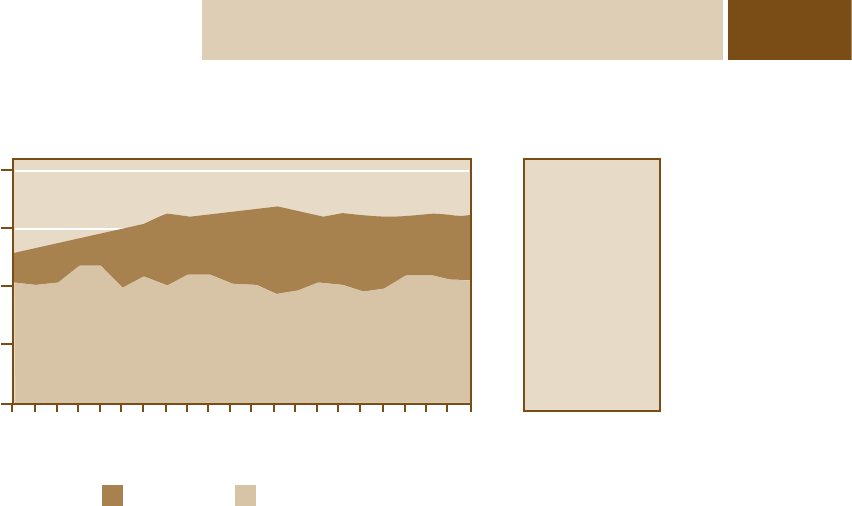

Exhibit 2 Statement of financial performance

Cochlear Limited and its controlled entities for the year ended 30 June 2003

Consolidated Company

2003

$000

2002

$000

2003

$000

2002

$000

Revenue from ordinary activities 290 045 256 201 205 044 187 752

Expenses 209 239 204 021 131 110 136 448

Borrowing costs 796 1 150 153 195

Profit from ordinary activities before related income tax expense 80 010 51 030 73 781 51 109

Income tax expense relating to ordinary activities 21 797 10 920 19 892 11 952

Net profit attributable to members of the parent entity 58 213 40 110 53 889 39 157

Non-owner transaction changes in equity

T

ranslation adjustment in general reserve (8) 3 – –

Net (decrease)/increase in retained profits on the initial adoption of:

Revised AASB 1028, ‘Employee Benefits’ (116) – (90) –

AASB 1044, ‘Provisions, Contingent Liabilities and Contingent Assets’ 311 – 2 411 –

Net exchange difference relating to self-sustaining foreign operations (4 737) 2 507 – –

Total changes in equity from non-owner related transactions

attributable to the members of the parent entity 53 663 42 620 56 210 39 157

Basic earnings per share (cents)

Ordinary shares 110.0 76.6

Diluted earnings per share (cents)

Ordinary shares 110.0 76.6

C-22 Case 1 • Hearing with the aid of implanted technology: Cochlear

19 per cent on the previous year. Sales in the United

States were strong; in Europe they were steady; and

in Asia there was strong growth before the SARS out-

break of 2002 affected the market. Some 9328 devices

were sold during the financial year, and at A$50 000

for lifetime care this indicated a very good year. It

took Cochlear 20 years to sell 30 000 systems, but in

the last couple of years it has sold another 20 000.3

Exhibit 2 shows the statement of financial perfor-

mance for the 2002/03 financial year.

Cochlear’s manufacturing facilities are world class

and have had repeated upgrades in order to maintain

this status.

The firm is very focused on R&D and devotes

15 per cent of total revenue to research. As well as

220 research staff, it has major long-term research

links with the CRC (Co-operative Research Centre)

for Cochlear Implant and Hearing Aid Innovation in

Melbourne, as well as with the University of Melb-

ourne itself. In addition, Cochlear has collaborative

research arrangements with 90 other partners in 35

countries.4

The organisation is very determined to maintain

excellent links with implant recipients and the sur-

geons and audiologists that work with them. In 2002,

70 surgeons attended the Sydney facility through

Cochlear’s ongoing visiting surgeon program.

Cochlear has 630 staff in 70 countries. It has an

excellent training system for new staff. For exam-

ple, in 2002, 43 new staff attended the Sydney head-

quarters for intensive training in the technology of

implants and all aspects of the implantation process,

including surgery. Cochlear is proud of the ethnic

diversity of its staff – the Sydney office includes staff

from 60 nations.

The board is made up of eight independent non-

executive directors, the CEO, and one other execu-

tive director. Cochlear has a great committee system

and all meetings are well documented. In September

2002, Cochlear was named in the top three Australian

companies for best corporate governance by Investor

Relations Magazine.

The external world for the

industry

Hearing impairment

Hearing impairment ranges from mild to profound,

and some people can hear some frequencies but not

others. Mild hearing loss means that people can hear

in quiet, one-to-one, situations but have problems in

noisy environments such as cafés and bars. At the

moderate level of loss, people find difficulty in hear-

ing normal speech at any distance over a metre and

are unlikely to hear well in crowded social situations.

Profound hearing loss means that a person cannot

hear a normal speaking voice or normal sounds. They

may be helped by hearing aids, but tend to rely heav-

ily on speech reading or sign language. Those with

high-frequency loss (often caused by exposure to loud

noises) can hear the person speaking but have diffi-

culty hearing all the sounds. For example, the higher-

pitched consonants such as P, S, F and CH may be

confused, so ‘sun’ may be heard as ‘fun’ or ‘pat’ heard

as ‘sat’.5

The market for cochlear devices is the pro-

foundly deaf. The number of such people is diffi-

cult to determine. The UK National Deaf Children’s

Society (NDCS) suggests that one in 1000 children

are born with severe/profound hearing problems.6

The (Australian) Bionic Ear Institute estimates the

potential market in the West plus Japan as 3 million

devices. In China, there are possibly 35 000 people

born each year who would benefit from the device.7

Even when discounted for unwillingness to risk the

operation or lack of money, the numbers are huge.

The companies competing in the industry concen-

trate on the United States and European markets and

have barely penetrated the wider global market.

The political/legal environment

The cochlear industry is part of the general medical

technology industry. Regulation is therefore signifi-

cant and the US Food and Drug Administration is

Case 1 • Hearing with the aid of implanted technology: Cochlear C-23

the most significant regulator because its findings

have weight worldwide. The FDA must approve new

devices before they can be sold in the United States.

The FDA was also the initiator of the 2002 meningitis

scare, which affected the whole industry.

The global aspect

The cochlear market has gradually expanded beyond

Australia, the United States and Europe. Cochlear

itself established its European offices in 1987 and

an office in Japan and Hong Kong in the 1990s,

while China was a major target in 2001. Cochlear

devices are now sold in more than 60 nations. Given

that profound deafness is a problem globally, it can

be expected that the global market will continue to

expand.

Economics and cochlear devices

Cochlear devices cost around A$50 000 for a life-

time service.8 Demand worldwide therefore comes

from relatively affluent individuals, medical insur-

ance companies and government organisations. It is

possibly limited in poorer nations. However, within

the OECD the middle to upper income groups are

increasingly prosperous and these people are a poten-

tial market without government help. On the other

hand, medical and insurance systems are gradually

coming under increasing pressure as government tax

incomes struggle to cope with competing demands for

health, education and welfare services.9

In 2003 the global economy was expected to take

an upturn, while Australia continued a phase of con-

tinued prosperity and Europe and the United States

were basically stable in economic terms.

The meningitis crisis in the

Cochlear implant industry

On 24 July 2002 the FDA issued a notification that it

had reports of a link between cochlear implants and

bacterial meningitis (a potentially fatal infection of

the lining of the surface of the brain). There were 43

such cases and 11 people died. There were reports that

implants had been withdrawn from sale in Germany,

France and Spain. On 25 July the FDA updated its

warning and said it had now learned of 118 cases.10

Cochlear responded to the crisis quickly. Graeme

Clark claimed that the infection was related to a

design change by their competitor, Advanced Bionics,

that created ‘dead space’ within the ear, thus provid-

ing a home for bacteria. Professor Clark commented

that, ‘It is a very great problem of engineers per se

designing something without due recourse to biolo-

gists and medical people.’11 Advanced Bionics tempo-

rarily withdrew its product from sale.

The neuro-technology industry (the generic

industry for implantable devices) bulletin commented

on this scare: ‘One side benefit of the relative lack

of media exposure that the neural prosthesis industry

receives is that this crisis has not gained the inten-

sive public scrutiny that has greeted other industries

when confronted with unflattering data or allega-

tions.’12 The scare nevertheless received significant

media attention and Cochlear’s share price dropped

sharply. Advanced Bionics advanced a reputation for

crisis management with its suspension from sales and

detailed explanations of problems to its stakeholders.

The meningitis scare has had a long-term ripple

effect on the industry, and doubt remains despite a

climb in share prices to those similar to levels prior

to the scare. The deaf community and the medical

profession have an ongoing debate about cochlear

implants. For example, Blake Papsin, the director of

the Cochlear implant program in Toronto, Canada,

in early 2003, said:

In coming to terms with the relation between

cochlear implants and meningitis, we should not

lose sight of the benefit of this technology. For

many children, the cochlear implant is a marvel

that has allowed them to attain or regain hearing

and speech. The growing number of candidates

for cochlear implants, at least in Canada centres,

reflects a conservative application of this technology