104 Self Employed Rev 1 3 18

User Manual: 104 Self-employed rev 1-3-18

Open the PDF directly: View PDF ![]() .

.

Page Count: 23

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 1

REVISED JANUARY 2018

104.1 Purpose

This section describes the special policies that apply to households that have self-

employment income.

104.2 General Information

I. FSP applicants and recipients may have income from self employment. Self-

employed people can include: child or adult care providers; taxicab/Uber/Lyft drivers;

hairdressers, barbers or beauticians; handymen, odd jobs, landscapers or lawn care

providers; newspaper delivery people; small business owners; farmers; fishermen or

watermen; and, craft, art, or jewelry sales people. In general, people who have

earnings from working for themselves are considered self employed. They may work

under a contract for another person or business or they may own their own

business.

Here are some ways to identify self-employment:

A. If an employer reports a person’s wages on an IRS form 1099-MISC rather than

a W-2 form, the person is almost always self employed. See Section 104.91.

If the person is employed by a company or organization as a contractor, they

should have an IRS form 1099-MISC provided by the employer showing their

“nonemployee compensation.”

The self-employed person should also file a Schedule C with their 1040,

showing their gross income from self employment in Part 1, Line 1 (or Part II,

Line 1 on the Schedule C-EZ). Schedule C is the first place you should look

for self employment income. See Section 104.92.

B. The IRS form 1099-MISC can also be used to report royalties (in box 2), which

are considered unearned income for FSP purposes.

Musicians or writers may have royalties from album or book sales.

C. If an employer does not withhold taxes and social security (FICA), the person is

considered self employed.

Some people, such as day care providers or handymen, work directly for

people who do not provide an IRS form 1099-MISC at the end of the tax year.

Often people in these jobs are paid in cash.

D. A self-employed person may file Schedule E to report income from rental real

estate, partnerships, S corporations, and also unearned income from estates,

trusts and royalties.

In a partnership, each partner must file Schedule K-1 (form 1065) to report

their income from the partnership.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 2

REVISED JANUARY 2018

An S corporation must also file a Schedule K-1 (form 1120S) to report on

each shareholder’s share of income. The shareholders use the information

on the K-1 to report on their individual return Schedule E.

Trusts and estates use Schedule K-1 (form 1041) to report income to their

beneficiaries which is considered unearned income for FSP purposes.

E. The Code of Federal Regulations requires that earned income includes all wages

and salaries of an employee and the gross income from a self employment

enterprise.

Ownership of a rental property is considered self employment unless the

owner spends an average of 20 or more hours a week managing the

property, then it is considered earned income.

Payments from a roomer or boarder are also considered income from self

employment.

F. Self employed individuals may incorporate their businesses in several different

ways, among them are:

Limited Liability Company (LLC) – the least complex business structure that

protects personal assets and passes through taxes on profit (or loss) to the

owners, who report it on their individual income tax returns.

S Corporation – also protects personal assets and passes through taxes to

the owners who report their share of profit (or loss) on their individual income

tax returns.

Partnership – incorporated partnerships also protect personal assets and

pass through taxes to the partners who report their share of profit (or loss) on

their individual income tax returns.

II. To calculate self-employment income, allow a deduction of 50% from the gross

income as the cost for producing the income before applying the 20% earned

income deduction. Self-employed farmers may deduct actual losses from their gross

income rather than the 50% if the cost to produce exceeds the income from the

farm. To be considered a self-employed farmer, the farmer must have gross income

of $1,000 or more from the farm.

III. All the policies and procedures described in the general sections of this manual

apply to households with self-employed members. However, the following four

specific areas require special consideration:

A. Work Registration

B. Resources

C. Income

D. Certification Periods

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 3

REVISED JANUARY 2018

104.3 Work Registration

Receiving income from self-employment does not automatically exempt a household

member from the work registration requirement. All the statutory exemptions listed in

FSP Manual Section 130.5 Work Requirements apply to self employed individuals. In

order to be exempt due to employment, a self-employed member must be:

A. Working a minimum of 30 hours weekly, or

B. Receiving earnings which, on a weekly basis, are equal to the federal minimum

wage multiplied by 30 hours (see Section 130)

C. Self employed at least 20 hours per week, averaged monthly, to meet the

ABAWD requirement.

EXAMPLE 1: A cash crop farmer who performs actual farming activity 8 months out

of the year is exempt from work registration during the other 4 months if his annual

income from farming equals the federal minimum wage multiplied by 30 hours when

considered on a weekly basis. In other words, annual income divided by 52 must be

at least equal to 30 times the minimum hourly wage.

EXAMPLE 2: A franchise operator hires other people to perform the actual day-to-

day operation of the business. He does not actually work at least 30 hours weekly

on the business. He does not earn enough annually to equal weekly earnings of 30

times the minimum wage. This FSP participant must register for work unless he is

otherwise exempt.

EXAMPLE 3: A tourist shop owner operates the business at least 30 hours per week

during the tourist season. The shop is closed during the off season and the owner

does not work at the business during that time. The owner is exempt from work

registration during the tourist season. However, she must be registered for work

during the off season unless:

The income earned during the tourist season is intended to provide annual

support and it equals an annual weekly amount of 30 times the federal

minimum wage; or

She qualifies for some other work registration exemption.

104.4 Resources

Exempt as a resource any monies that have been prorated as income. For example, a

cash crop farmer receives his income when he sells his crop. This income is prorated

over the year and therefore cannot be counted as a resource. Remember, resources

are not counted for categorically eligible households.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 4

REVISED JANUARY 2018

104.5 Special Income Considerations

Capital Gains

Count the full amount of proceeds from the sale of capital goods or equipment as self-

employment income, even if only 50% of the proceeds from the sale is taxed for federal

income tax purposes. Add the proceeds from the sale of capital goods or equipment to

any other self-employment income and compute the total self-employment income as

described in Section 104.6.

104.6 Income Computation

Consider the following special factors when determining the gross monthly income for

self-employed households:

A. Annualizing

1. Prorate over a 12-month period self-employment income that represents a

household’s annual support, even if the income is received in only a short

period of time. For example, the self-employment income of a crop farmer

must be prorated over a 12-month period, if the income is intended to support

the farmer on an annual basis.

2. Annualize self-employment income even if the household receives income

from other sources in addition to the self-employment.

B. Averaging

1. Average over a 12-month period self-employment income received on a

regular basis (weekly, monthly, etc) that does not fluctuate greatly in amount

but which represents a household’s annual support. For example, a dairy

farmer whose annual income is derived from his business receives income

from the sale of milk on a regular basis. Convert this income to a yearly

amount and average over a 12-month period. See Section 104.891 for types

of verification.

2. Average self-employment income that is intended to meet the household’s

needs for only part of the year, over the period of time the income is intended

to cover. For example, self-employed vendors who work at this business only

in the summer and supplement their income from other sources during the

balance of the year must have their self-employment income averaged over

the summer months rather than a 12-month period.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 5

REVISED JANUARY 2018

104.6 Income Computation (continued)

3. Average self-employment income over the period of time a business has

operated, if it has been in business for less than a year. Project this monthly

amount for the coming year.

4. Verify the income used for averaging using the types of verifications in section

104.891 of this manual.

C. Anticipating

Anticipate rather than average self-employment income under the following

circumstances:

1. The average amount does not accurately reflect the household’s actual

monthly circumstances because there has been a substantial increase or

decrease in business; or

2. The nature of the business is such that the receipt and amount of income

varies greatly; or

3. A business has been in operation such a short time that there is not enough

information to average earnings and project them over a yearly period.

104.7 Self Employment Earned Income Deduction

The self-employment earned income deduction is 50% of the gross receipts. Take

gross receipts from IRS form 1040 Schedule C line 1. This 50% allowance is

considered the cost to produce. The gross income test is applied after the 50%

deduction. The 20% earned income deduction is then applied to the remainder.

Example: Ms. B provides child care in her home. She provided a tax Form 1040

Schedule C (Part 1 line 1 shows annual income of $10,000). The allowable

deduction for cost-to-produce is $5,000. The countable annual income is $5,000. Ms.

B also receives a 20% earned income deduction of $1,000 for net annual income

from self-employment of $4,000.

CARES applies the 50% cost to produce and the 20% earned income deduction. If

the customer does not provide IRS 1040 Schedule C or K or IRS Form 1099 to show

business earnings, the customer must provide receipts, business ledger or statement

showing actual earnings.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 6

REVISED JANUARY 2018

104.8 Self-Employed Business People

104.81 Definition of a Self-Employed Farmer

NOTE: The 50% cost-to-produce deduction does not apply to the self-

employment income of farmers, fishermen and watermen who verify a cost-to-

produce in excess of the 50% deduction. See section 104.7.

If the cost of producing self-employment farm income exceeds the gross farm

income, the losses are offset against other countable income. To qualify for this

offset, the person must receive or anticipate receiving annual gross proceeds of

$1,000 or more from the farming enterprise.

A. The case manager must first determine if the person is a self-employed farmer.

B. To be considered a self-employed farmer, the person must:

1. Earn at least $1,000 a year from the farm,

2. Be engaged in farming activity for the purpose of producing income, and

3. Have direct involvement in farming activity.

For example, a person who rents his land to another individual to raise a crop is

not a self-employed farmer if he is not directly involved in the growing or

harvesting of the crop.

C. The case manager must use his or her best judgment on a case-by-case basis to

determine if a person is a self-employed farmer or a farm employee.

D. COMAR 07.03.17.39C allows self-employed farmers to offset farm losses against

gross earnings and does not restrict them to the 50% cost to produce deduction.

104.82 Definition of a Self-Employed Business Person

A. Sole Proprietorship.

1. Self-employment income generally consists of earnings derived by an

individual as the sole proprietor of her business.

2. A sole proprietorship is an unincorporated business that has no existence

apart from the owner.

3. The business liabilities are the personal liabilities of the single owner.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 7

REVISED JANUARY 2018

B. Partnership.

1. There may also be some self-employment income situations that involve a

partnership.

2. There should be an oral or written agreement. Generally, a partner's share of

income, gain, loss, deductions or credits is determined by the partnership

agreement. In any matter not addressed by a written agreement, the

provisions of local law are considered to be part of the agreement.

C. Independent Contractors.

1. Other self-employment situations for FSP purposes include independent

contractors who pay expenses and persons who do not have a direct

employer/employee relationship.

2. In determining if the person is an independent contractor, the case manager

should determine if a household operates a separate (perhaps more

specialized) business than the proprietor of the main business.

3. In determining if there is an employer and employee relationship, the case

manager may consider such things as whether the person has an established

work schedule and specified wages, whether the employer withholds social

security and income taxes from earnings.

A sharecropper who pays the costs of doing business and receives a portion

of the net farm income in exchange for her labor is a self-employed farmer. A

sharecropper who does not pay the costs of doing business is not a self-

employed farmer.

D. Corporations.

1. If the household has shares in an S Corporation, the S Corporation income

reported on the household's Form 1040 must be counted as self-employment

income and annualized over a 12-month period.

2. An owner or employee of another corporation is not a self-employed

person. If the person receives a salary from the corporation, she is

considered an employee of the corporation. Shareholders who only receive

dividends are entitled to neither the costs of producing self-employment

income nor the earned income deduction. The dividends are counted as

unearned income. Corporations are separate legal entities, and the

corporation is responsible for its debts and obligations.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 8

REVISED JANUARY 2018

104.83 BASIC STANDARDS

104.831 Basic Standards for Farmers

A. Self-employed farm households are subject to the same basic processing,

eligibility and allotment standards as other households. However, self-employed

farmers’ monthly net income is computed differently, changes in their farm

income are treated differently, and there is a special resource provision.

B. Non self-employed farmers are treated the same as other households that do not

have farm income, e.g., wages of a farm laborer are counted as earned income,

income from renting a farm is treated like other rental income.

C. Some farm workers are given crops at harvest time in addition to salary. If the

farm worker plans to sell the crop during the certification period in which it is

received, the money received from the sale is counted as self-employment

income. If the farm worker does not plan to sell the crop during the certification

period in which it is received, the value of the crop is counted as a resource

beginning the month in which it is received. If the household later sells a crop

that was counted as a resource, the payments received are not counted as

income. Resources are counted only for non-categorically eligible households.

D. There is a special expedited service provision for migrants and seasonal farm

worker households. (See Section 122)

E. Gross self-employment income used in the income calculation is excluded from

resources during the period of time that the income is counted.

Example: A household earned $10,000 gross self-employment income last year and

expects to earn the same amount this year. Six thousand dollars of expenses were

excluded from income to cover the costs of doing business. Four thousand dollars were

annualized and prorated as income for calendar year 2001. The household has

$11,000 in a bank account. Only $1,000 is counted as a resource during 2001 for a

non-categorically eligible household unless there are other changes. Resources are not

counted for categorically eligible households.

Prorated Income Not a Resource

Gross Farm Income in 2000 $10,000

Allowable costs -6,000

Prorated for 2001 $4,000 (no changes were anticipated)

Bank Account $11,000

Gross Farm Income - 10,000

Count as a Resource $1,000

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 9

REVISED JANUARY 2018

104.832 Basic Standards for Businesses

A. The treatment of resources of a corporation varies based on the type of

corporation.

1. Profits of an S Corporation are not considered a resource essential to the

employment of a household member even if they are used to purchase more

stock in the corporation.

2. Resources of other corporations are not counted as the resources of an

individual’s household. Bank accounts that a corporation owns must be in the

corporation's name.

3. Ownership of Stock in a Corporation.

(a) If a person owns stock in a corporation, the stock is considered a resource

for a non-categorically eligible household unless it is essential to his or her

employment.

(b) If a person is employed by and owns stock in a corporation, the case

manager must determine if the stock is essential to the non-categorically

eligible person's employment.

(c) To the extent that an employee of a corporation must hold stock in the

corporation as a condition of employment, the stock is essential to the

employment of that person and not considered a resource.

(d) If ownership of the stock is not essential, the stock is considered a

resource for non-categorical households.

Example: if a farmer has incorporated his farm, he is the sole worker and all

of the corporation's assets are related to the farming operation, the farmer's

stock in the corporation is essential to his employment and excluded from

being considered a resource.

(e) Sometimes the value of shares in a corporation with only one shareholder

or just a few shareholders is not readily available. In such instances, the

case manager may subtract corporate liabilities from assets and prorate

the difference among the various shareholders based on the percentage

of shares held.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 10

REVISED JANUARY 2018

(f) 104.832 Basic Standards for Businesses (continued)

B. Loans.

1. All loans, except deferred educational loans, are excluded as income.

2. Loans, other than deferred repayment educational loans, are considered a

resource for non-categorical households in the month received even if the

household anticipates spending some or all of it in the same month.

3. For an ongoing (certified) household, excess resources any time during the

month makes a non-categorically eligible household ineligible. Any amount

remaining after the month of receipt continues to be counted as a resource

until the money is spent. This includes business loans as well as personal

loans. NOTE: Almost all FSP household are categorically eligible under

expanded categorical eligibility rules.

4. Sometimes a farmer may obtain a loan, but funds can only be released by

signature of both the lender and the farmer. In such cases where the farmer

has a "line-of-credit," only the portion that is actually borrowed and held in an

account is considered a resource.

C. Payment-In-Kind (PIK) payments.

Some farm households receive Payment-In-Kind (PIK) payments. Normally

these are annualized as income. However, if the farmer indicates that he intends

to retain PIK payments for longer than a year, the payments should not be

annualized as income but considered a resource for a non-categorical household

to the extent that they will be kept longer than a year.

D. Bankruptcy.

Some farmers or businesses declare bankruptcy. If so, the case manager must

determine what resources are accessible to the non-categorically eligible

household and, if they are accessible, whether the resources can be excluded

under another provision such as being essential to self-employment if the person

is still self-employed.

E. Non-liquid assets against which a lien has been placed as a result of taking out a

business loan are excluded if the household is prohibited by the security or lien

agreement from selling the asset. Verify using loan agreement.

.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 11

REVISED JANUARY 2018

104.84 Computing Income and Farm Expenses

A. Annualized With Certain Exceptions:

1. Normally self-employment income and expenses are averaged over a 12-

month period. Regardless of whether the household receives the income

monthly or less often than monthly, annualizing is done when the self-

employment represents a household's annual income. Self-employment is

annualized even if the household receives income from other sources. For

example, a man is a self-employed grain farmer. His wife is a part-time nurse

in a doctor’s office. In this case the self-employment income would be

annualized and the wife’s nursing income would be considered earned

income.

2. Normally self-employment income and expenses from the past year are

counted for the current year. However, anticipated changes, such as a

change in the type of farm operation or the amount of land farmed, crop

failure, a substantial change in market prices, etc. which would affect the net

income must be taken into account. In anticipating income, it may be helpful

to review a cash flow plan prepared by a lender such as the Farmer’s Home

Administration (FmHA), a bank, or a Federal loan bank. These plans

anticipate income and expenses. The income and expenses must be

prorated evenly over a 12-month period to determine eligibility.

For example, last year a farmer earned $10,000 and had $5,000 in expenses.

This year he inherited additional land and he expects to gross $22,000 and

have $11,000 in allowable FSP expenses. The case manager must

annualize the anticipated income of $22,000 and the anticipated expenses of

$11,000.

B. Capital Gains.

1. For FSP purposes, proceeds from the sale of capital goods or equipment are

calculated in the same manner as a capital gain for Federal income tax

purposes.

2. For Federal income tax purposes, capital gains are generally computed by

comparing the sales price to the "cost or other basis." If the sales price is

greater, there is a gain. If the costs are greater, there is a loss. The "cost or

other basis" in general is the cost of the property, purchase commissions,

improvements and sales expenses such as broker's fees and commissions

minus depreciation, amortization and depletion.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 12

REVISED JANUARY 2018

3. The full amount of the capital gain, if any, is counted as income for FSP

purposes.

4. 104.84 Computing Income and Farm Expenses (continued)

5. If the self-employment was anticipated rather than averaged, any capital

gains that the household anticipates in the 12-month period starting with the

date of application must be divided by 12 and the average monthly amount

added to the anticipated monthly self-employment income. The average

monthly capital gain amount must be counted in each of the 12 months even

if more than one certification period is involved. However, a new average

must be calculated and used if the anticipated amount of capital gains

changes.

C. Allowable Expenses.

1. When a farmer verifies expenses in excess of the 50 percent deduction you

may exclude allowable costs of doing business from self-employment income

such as those listed in 3 below.

2. Self-employment income for FSP purposes is not computed the same way as

it is for Internal Revenue Service (IRS) purposes. The IRS forms may only be

used for verification purposes.

3. Allowable farming costs for FSP purposes include costs such as identifiable

costs of:

(a) Labor such as wages and salaries paid to employees. However, an

exclusion cannot be allowed for wages paid to the farmer himself or other

household members;

(b) Stock;

(c) Raw material and supplies;

(d) Seed and plants;

(e) Fertilizer and lime;

(f) The interest portion of (i) payments on business or operating loans and

(ii) payments on income-producing real estate and capital assets such as

equipment, machinery and other durable goods;

(g) Insurance premiums;

(h) Taxes paid on income-producing property;

(i) Privilege taxes such as licensing fees and gross receipts and general

excise taxes that must be paid in order to earn self-employment income;

(j) Business transportation costs such as costs of carrying grain to an

elevator, trips to obtain needed supplies, etc.;

(k) Rental payments on income-producing equipment. If a farmer is renting

equipment with an option to buy, the rent payments are allowed until the

purchase is made;

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 13

REVISED JANUARY 2018

(l) Costs of repairs and maintenance of equipment; and

(m) Storage and warehousing charges.

104.84 Computing Income and Farm Expenses (continued)

4. Costs are allowed when they are billed or otherwise become due. When the

income is annualized, only expenses billed or otherwise due in the current 12-

month period are allowed. Costs that were billed or otherwise became due in

a prior year which are not expected to recur in the current year may not be

brought forward to the current year regardless of when they are paid.

D. There are some costs that specifically are NOT ALLOWABLE. They are:

1. Payments on the principal of the purchase price of income-producing real

estate and capital assets such as equipment, machinery and other durable

goods;

2. Expenses and net losses from previous periods;

3. Federal, State and local income taxes, money set aside for retirement and

other work-related personal expenses such as transportation to and from

work. These expenses are allowed for by the 20 percent earned income

deduction;

4. Depreciation. To allow such costs would result in an exclusion for amounts

which are not actual costs to the household and would, in effect, constitute an

exclusion for the costs of income-producing property and assets which

otherwise are not allowed;

5. Repayment of the principal of a bank loan. The loan was never counted as

income, and the repayments as such are not excluded as an expense.

However, the household is given an exclusion for allowable expenses (see

104.83C) when purchases are made even if they are paid for with a business,

operating or personal loan;

6. Penalties and fines. For example, an IRS penalty imposed on a farmer for

failure to pay an employee's social security taxes is not an allowable cost of

doing business. Likewise, penalties imposed by the U. S. Department of

Agriculture for failure to comply with planting and marketing programs are not

allowable costs;

7. Blue jeans and work boots are not specific to any one job, and their costs are

not allowable exclusions. However, if a self-employed fisherman needs hip

boots or a bee keeper needs protective head gear, the costs would be

allowable exclusions; and

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 14

REVISED JANUARY 2018

8. Charitable contributions.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 15

REVISED JANUARY 2018

104.85 Shelter Portion of a Farm

A. Shelter Costs Other Than Utilities

1. If a household's home is on property connected to property used for farming,

the case manager must determine if the shelter costs (e.g. rent or mortgage)

and the self-employment costs can be separately identified.

2. Proration may be used to separately identify costs based on information from

a mortgage lender, real estate tax records, Farmers Home Administration

documents, insurance premiums, etc., and the home ratio may be applied to

taxes and insurance costs if better information is not readily available.

3. If the costs of rent or mortgage, insurance, taxes, and interest cannot be

separated, no self-employment exclusion for insurance, taxes or interest on

the mortgage payment may be allowed, and no portion of the mortgage

payment, taxes or interest may be allowed as shelter costs.

4. If the farmer uses a room or a separate apartment in his or her house or

residence solely for the farm operation, the case manager may on a case-by-

case basis:

(a) Include all costs (such as rent, mortgage, taxes, and insurance) that the

household is required to pay to live there as household shelter costs; or

(b) Exclude part of the costs as self-employment costs and part as shelter

costs, provided that no costs are allowed as both self-employment costs

and shelter costs. The self-employment costs may be separately identified

based on the number of rooms, square feet, etc. If separately identified,

only the portion attributed to the household's living space can be included

in shelter costs. No portion of the principal attributed to the self-

employment enterprise under this option is allowed.

B. Utilities:

1. If a farmer's home is on property connected to property used for farming, the

case manager must determine if the shelter costs and self-employment costs

can be separately identified. Utility costs for a barn are often metered

separately from the home, and the cost of a telephone is the same as for

other households.

2. If utilities are measured and billed separately, the household is entitled to the

Standard Utility Allowance (SUA) or actual utility costs for its residence and to

the separately billed self-employment costs as a cost of doing business.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 16

REVISED JANUARY 2018

104.85 Shelter Portion of Farm (continued)

3. If the utility costs cannot be separately identified, the household may not

claim actual utility costs. As part of its shelter costs, the household is

entitled to SUA if it incurs out-of-pocket heating and cooling costs for the

home separately from the rent or mortgage or it receives a Low Income

Home Energy Assistance Act (MEAP) payment.

4. If the farmer uses part of his house, such as a separate room or a

separate apartment solely for the farm enterprise and there is a central

meter, the case manager on a case-by-case basis must:

(a) Allow the household either the SUA or the total actual utility costs for

the house as shelter costs, but no self-employment exclusion; or

(b) Allow the household to claim actual utility costs prorated between

shelter costs and self-employment costs. The SUA cannot be used

under this option.

104.86 Garnishments and Bankruptcy for Farmers

A. Garnishments have no effect on the treatment of self-employment income, i.e.

the total gross amount is counted in the income computation. The amount

garnished is not an income exclusion.

B. The self-employment income of farmers who have declared bankruptcy is

computed the same as the self-employment income of other farmers. There are

different types of bankruptcies.

Some allow people to continue to do the same kind of business and others

do not. If the person continues to earn self-

employment income, the gross amount minus allowable expenses is counted.

Sometimes the total amount of income goes to a trustee, and from this

amount he pays the bills and gives the farmer a living allowance. This living

allowance is not counted as income because it would result in double

counting. No exclusion is allowed for the fees of a trustee or conservator for

his services.

In other situations all of the money goes to the farmer, but he must pay a set

amount to a court appointed person for back debts. This amount is not

allowed as exclusion. An exclusion is allowed only for certain costs in the

year in which they are billed or otherwise become due. The household is not

entitled to a double exclusion.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 17

REVISED JANUARY 2018

C. Paying off a loan

If a farmer sells equipment and uses the proceeds to pay off a loan, the

money is income to the farmer.

If he or she sells equipment and the proceeds are diverted to a bank to

repay a loan, the money is counted as income to the farmer.

If he or she voluntarily turns over collateral to a bank, and the bank sells

the collateral to pay off a loan, the proceeds of the sale are not counted as

income to the farmer. Once the collateral is turned over to the bank, it

becomes the legal property of the bank.

If a farmer holds the title to property and sells the property, any proceeds

from the sale are counted as income to him/her.

If the farmer gives the title to the bank or if the property is repossessed

prior to sale and the bank sells the property, the proceeds are not counted

as income to the household.

If a lender is unable to collect on a farm loan, the lender may write all or

part of it off or "forgive" the outstanding balance. The forgiven portion is

not counted as income to the household.

104.87 Farm Losses Offset Against Other Income

A. If the costs of producing self-employment farm income exceed the gross farm

income, such losses are offset against other countable income.

B. To qualify for this offset, the person must receive or anticipate receiving annual

gross proceeds of $1,000 or more from the farming enterprise.

C. Monthly net farm self-employment income is computed in the normal manner

by taking gross income, subtracting allowable exclusions and prorating the

result over the period the income is intended to cover (usually 12 months). If

there is a monthly net farm loss, the offset is made in two phases.

Phase I. The monthly farm loss is offset against the total amount of other net

self-employment income computed for that month.

Phase II. If other net self-employment income is not enough to cover the farm

loss, the remainder of the farm loss is offset against the total other earned and

unearned income for that month. If there is still a net loss, the household is

certified based on zero net income. The monthly excess loss is not carried

forward to subsequent months.

D. A fisherman is equivalent to a self-employed farmer for purposes of the offset

provision if the fisherman is self-employed, rather than an employee, and the

fisherman receives or anticipates receiving annual gross proceeds of $1,000 or

more from fishing. This applies even if the fisherman is only involved in

catching or harvesting the fish. This applies to watermen as well as to other

fishermen.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 18

REVISED JANUARY 2018

104.88 Specific Types of Payments

Following is guidance for the treatment of specific types of payments:

A. A Federal gasoline tax credit is excluded from income. (It is a credit against tax

liability.)

B. A State gasoline tax refund is excluded from income on the basis that it is a

nonrecurring lump-sum payment. The Federal gasoline tax credit and the State

gasoline tax refund may be combined on the same line of the tax form.

C. Patronage dividends are reported on tax forms. They are paid by cooperatives in

cash or shares of stock. These dividends are similar to rebates paid based on

the amount of goods bought or services used for the self-employment enterprise.

Cash dividends are counted as self-employment income. Dividends in the form

of stock are considered a resource for non-categorically eligible households.

D. Payments received as royalties are counted as unearned income.

E. Income from rental property is self-employment income.

F. Disaster assistance payments made as the result of a Presidentially declared

major disaster or Presidentially declared emergency are excluded from income

and resources. This applies to Federal assistance provided to persons directly

affected and to comparable disaster assistance provided by States, local

governments, and disaster assistance organizations.

104.89 Earned Income Deduction

A. If a household has a monthly net self-employment income gain after the 50%

cost-to-produce deduction or a farm loss offset, if, the household is entitled to

a 20% earned income deduction from the net self-employment amount. If

there is a net self-employment income loss, the household is not entitled to an

earned income deduction from self-employment income.

B. If a household has earned income that is not from self-employment, the

earned income deduction from that income is computed based on the

amount before the 50% cost to produce deduction or farm loss offset, is

made.

104.891 Verification

The farmer's or business owner’s most recent income tax forms and schedules are

normally good sources of verification for self-employment income and expenses.

However, other sources may be used. If the tax form is questionable or not

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 19

REVISED JANUARY 2018

104.891 Verification (continued)

available, the case manager must ask to see other documents that support the

income and expenses that the household has reported.

Other sources of verification may include, but are not limited to, ledgers, charge

account statements, sales slips, canceled checks, invoices, purchase orders and

cash receipts. In documenting this verification, the case manager should record the

date, identify the other party or company, describe the expense or income, and

record the amount, taxes and discounts, if any.

In some instances, such as anticipated changes or a new business, it may be

necessary to obtain information from collateral contacts.

If a bankruptcy action has been initiated, the case manager may get a statement

from the bankruptcy trustee regarding the debt reorganization plan concerning the

accessibility of assets and the anticipated gross income and expenses.

104.892 Making Changes

When income has been annualized and changes are reported during the 12-month

period, the State agency must make adjustments. The following are some examples.

A. This household filed its income tax return in February and applied for FSP

benefits in February. It is subject to simplified reporting. The household did not

choose to have the income prorated in uneven amounts.

Original Certification:

$16,000 crop income

- 8,000 50% self-employment deduction (actual farm expenses were $4000)

$ 8,000 divided by 12 months = $667 net per month for February through January

of the following year.

Due to a drought, the household reported on July 20 that it expected to only get

$10,000 from the sale of crops for the year. The case manager must re-annualize

the income over the same 12-month period that was used at the time of certification

or recertification using the new income amount.

1st Change:

$10,000 crop income

- 5,000 farm expenses (50% self-employment deduction)

$ 5,000 divided by 12 months = $417 net per month for August through January of

the following year.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 20

REVISED JANUARY 2018

104.892 Making Changes (continued)

The household came in on August 1 and reported a second change. It reported that

it expected to receive an additional $2,400 payment in September from the sale of

crops on land that it recently purchased. The case manager must re-annualize

again over the same 12-month period that was used at the time of certification or

recertification based on the most recent information available.

2nd Change:

$10,000 crop income

+ 2,400 additional crop income

12,400 total gross income

- 6,200 expenses

$ 6,200 divided by 12 months = $517 net per month for September through

January in lieu of all previously computed amounts. A Notice of Adverse

Action must be sent in August.

The end result is that this household will be certified with net monthly farm income

of $667 for February - July, $417 for August, and $517 for September - January.

B. If her income and expenses were annualized and a person leaves the hairdressing

salon where she rents a chair during the 12-month period, the case manager should

stop counting the self-employment income when the last income is received from

that source. For example, the hair dresser reported the first of September that she

planned to leave the salon in October and take a job the first of November as an

employee in another salon. Her hairdressing self-employment income had already

been included in the averaged amount. The averaged amount of income would

continue to be counted for October. No self-employment income would be counted

for November, but her earned income from the new salon would be counted.

C. If a household is expected to receive residual income after the person stops being

actively engaged in a business enterprise and the amount of income is expected to

be substantially more or less than that previously averaged, the case manager must

calculate the residual income based on the anticipated monthly amounts. For

example, the annualized self-employment income resulted in an average monthly

amount of $400. On June 5, the person reported that he would not be actively

engaged in farming after June and would not receive any additional income from that

source except that a person who bought some hay owes him $100 in July and $200

in August. The person does not anticipate any future expenses. In this case, the

case manager would stop counting the $400 monthly amount after June’s issuance

and calculate future self- employment income based on the amount anticipated to be

received each month. The case manager could count $100 as self-employment

income for July and $200 self-employment income for August, or the anticipated

fluctuating income could be averaged over the remainder of the certification period.

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 21

REVISED JANUARY 2018

104.9 IRS Forms

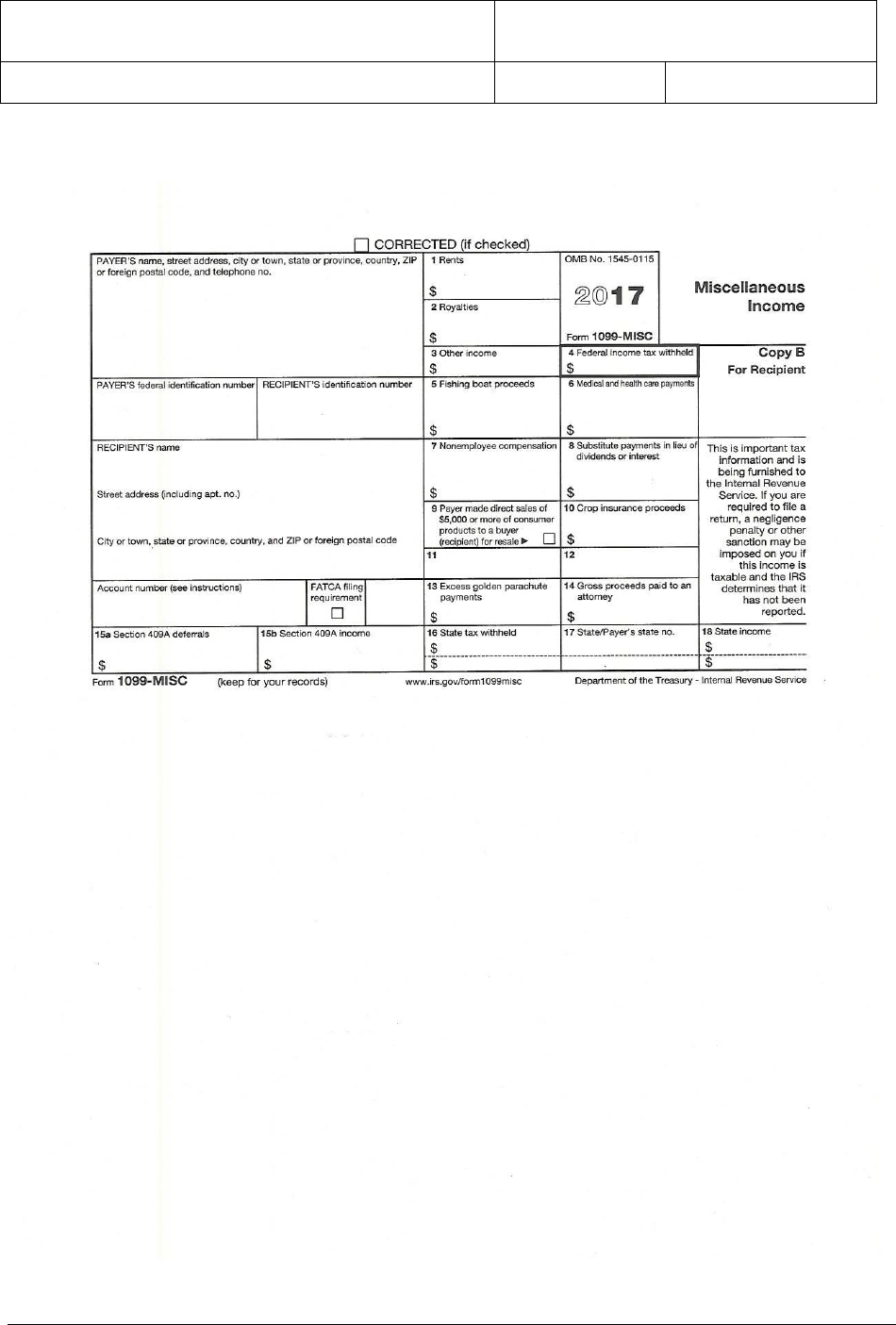

104.91 1099 MISC

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 22

REVISED JANUARY 2018

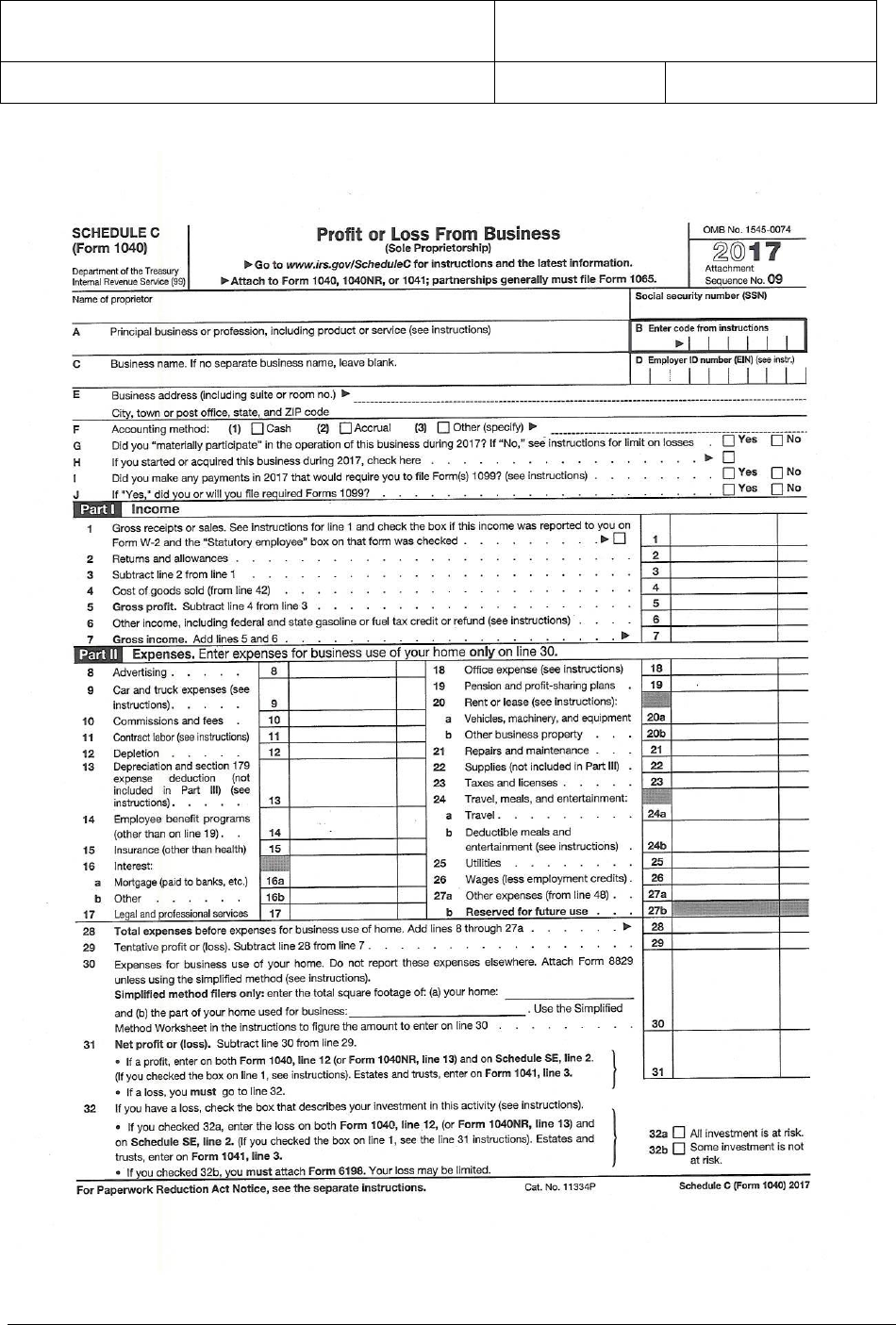

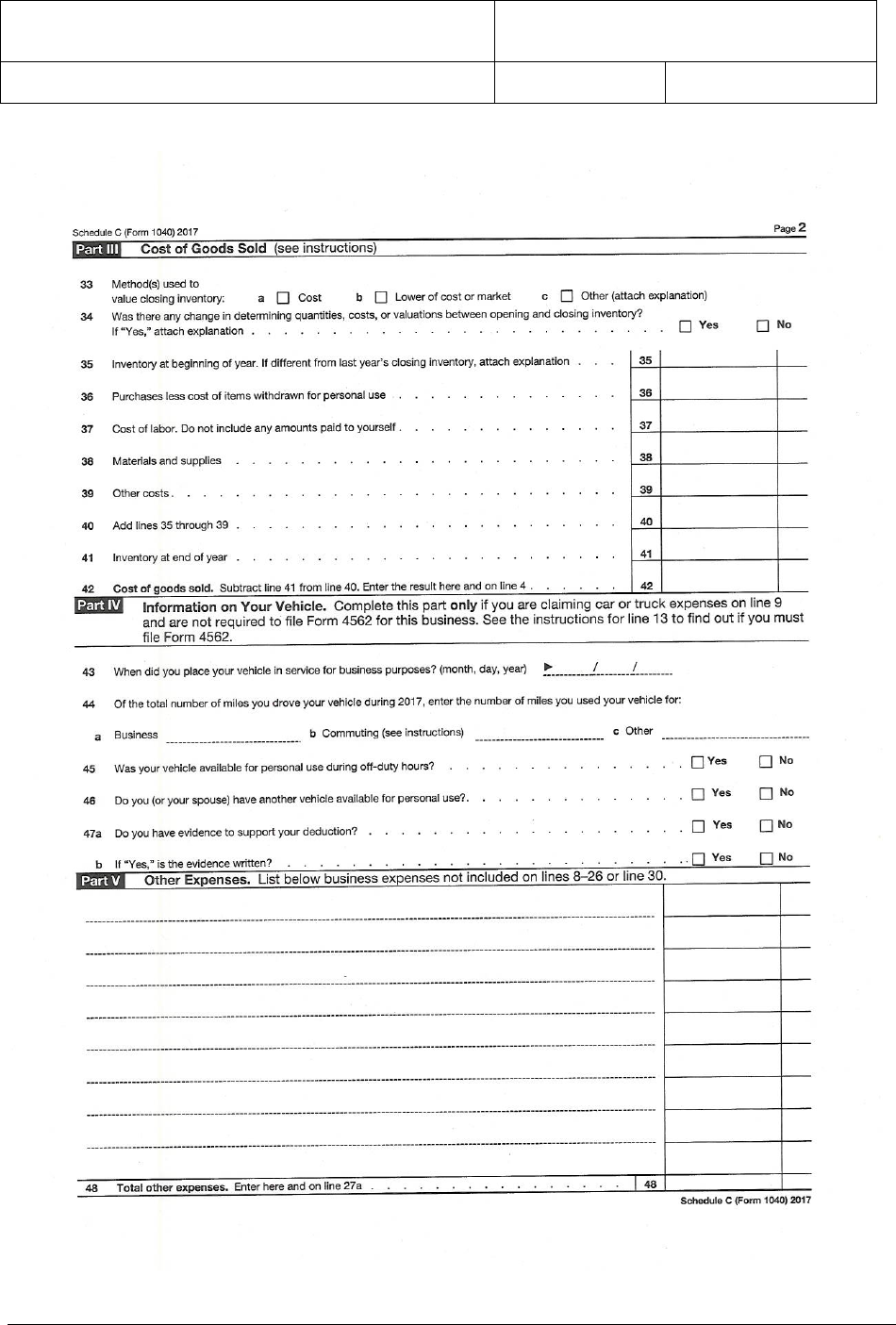

104.92 Schedule C

DEPARTMENT OF HUMAN RESOURCES

FAMILY INVESTMENT ADMINISTRATION

FOOD SUPPLEMENT

PROGRAM MANUAL

SELF-EMPLOYED HOUSEHOLDS

Section 104

Page 23

REVISED JANUARY 2018