1475 11

User Manual: 1475

Open the PDF directly: View PDF ![]() .

.

Page Count: 9

Non-Confidential

DTCC is now offering enhanced access to all important notices via a new, Web-based subscription service. The new notification system

leverages RSS Newsfeeds, providing significant benefits including real-time updates and customizable delivery. To learn more and to set up

your own DTCC RSS alerts, visit http://www.dtcc.com/subscription_form.php.

1

#: 1475-11

Date: September 22, 2011

To: All Participants

Category: Dividends

From: International Services

Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers

Subject: Tax Relief – Country: Japan

Eisai Co., Ltd. CUSIP: 282579309

Record Date: 09/29/11 Payable Date: TBA

EDS Cut-Off: 10/06/11 Documentation Cut-Off: 10/06/11 8PM

Participants can use DTC’s Elective Dividend System (EDS) function over the Participant Terminal

System (PTS) or TaxRelief option on the Participant Browser System (PBS) web site to certify all or a

portion of their position entitled to the applicable withholding tax rate.

Questions regarding this Important Notice may be directed to Globe Tax. 212-747-9100

Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy,

timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part

on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained

in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. In providing

this communication, DTC shall not be liable for (1) any loss resulting directly or indirectly from mistakes, errors, omissions, interruptions,

delays or defects in such communication, unless caused directly by gross negligence or willful misconduct on the part of DTC, and (2) any

special, consequential, exemplary, incidental or punitive damages.

To ensure compliance with Internal Revenue Service Circular 230, you are hereby notified that: (a) any discussion of federal tax issues

contained or referred to herein is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties that may be

imposed under the Internal Revenue Code; and (b) as a matter of policy, DTC does not provide tax, legal or accounting advice and

accordingly, you should consult your own tax, legal and accounting advisor before engaging in any transaction.

EISAI CO., LTD. has announced a cash

dividend. JPMorgan Chase Bank acts as

the Depositary for the company’s

American Depositary Receipt (“ADR”)

program.

Participants can use DTC’s Elective

Dividend System (EDS) function over the

Participant Terminal System (PTS) or

Tax Relief option on the Participant

Browser System (PBS) web site to certify

all or a portion of their position entitled to

the applicable withholding tax rate. Use

of EDS will permit entitlement amounts to

be paid through DTC.

On ADR Pay Date, all non-Japanese

resident holders will receive this dividend

net of Japanese withholding tax of 7%

with the possibility to reclaim as outlined

in the Eligibility Matrix below.

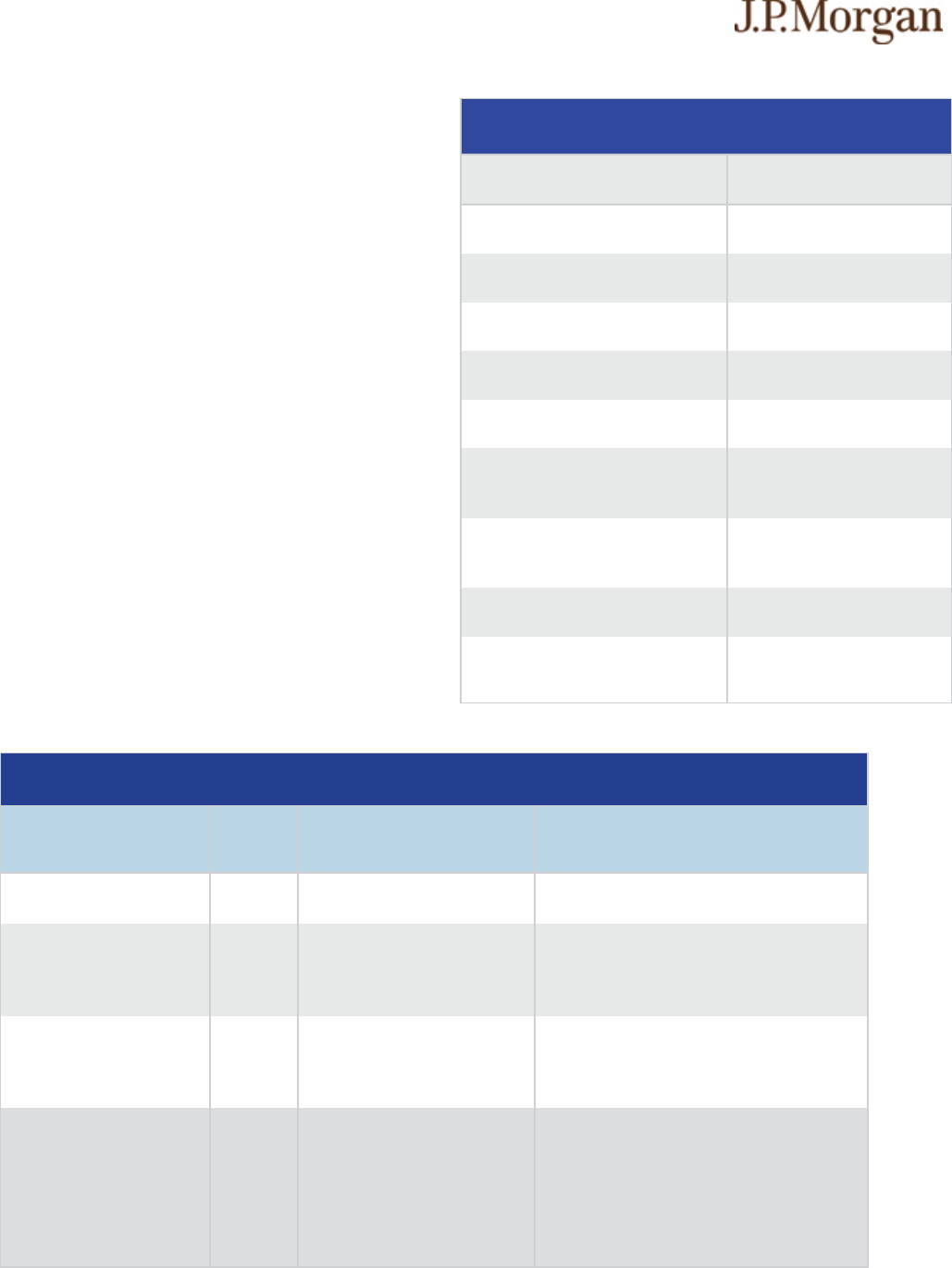

ELIGIBILITY MATRIX

RATE DESCRIPTION RECLAIM

RATE ELIGIBLE RESIDENTS DOCUMENTATION REQUIRED

10% 0% JAPANESE INDIVIDUAL

RESIDENTS 1. APPENDIX A

FAVORABLE - 7% 0% ALL BENEFICIARIES EXCEPT

JAPANESE INDIVIDUAL

RESIDENTS AND TREATY

ELIGIBLE PENSIONS

NO DOCUMENTATION REQUIRED

EXEMPT - 0% 7% TREATY ELIGIBLE NON-

JAPANESE RESIDENT

PENSIONS

(PLEASE SEE EXHIBIT 1)

1. FORM 6166

2. APPENDIX A

3. POWER-OF-ATTORNEY (APPENDIX B)

20% 0% LARGE SHAREHOLDERS

THAT HOLD 3% OR MORE

OF THE OUTSTANDING

SHARES EXCLUDING

FOREIGN/(JAPANESE)

DOMESTIC CORPORATE

LARGE SHAREHOLDERS

FOR DIVIDEND INCOME

2. APPENDIX A

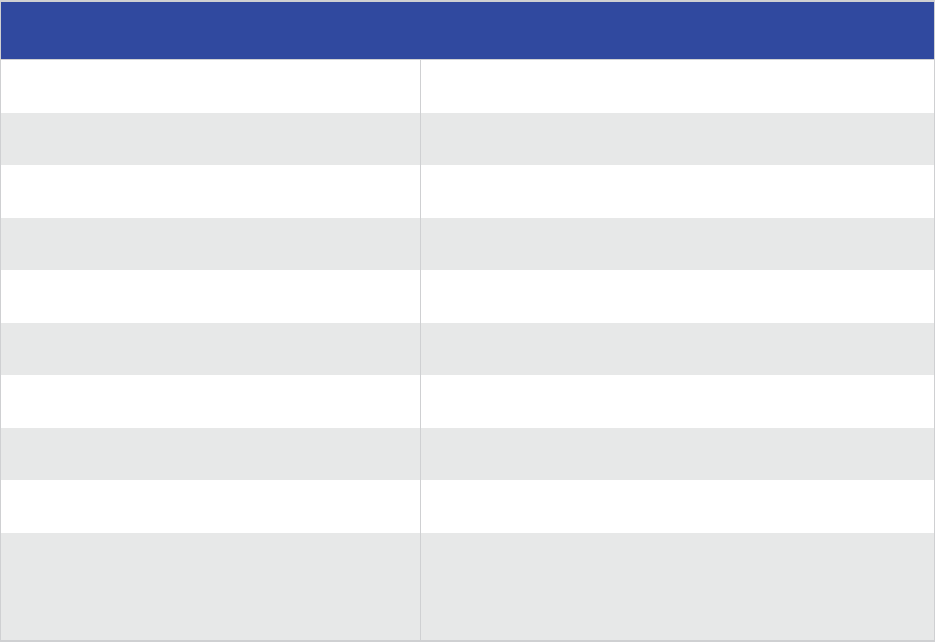

DIVIDEND EVENT DETAILS

COUNTRY OF ISSUANCE JAPAN

ISSUE EISAI CO., LTD.

CUSIP# 282579309

DEPOSITARY J.P. Morgan Chase Bank

ADR RECORD DATE September 29, 2011

ADR PAY DATE TBA

ADR GROSS DIVIDEND RATE

ON PAY DATE TBA

ORD GROSS DIVIDEND RATE

ON PAY DATE TBA

RATIO TBA

RATE OF TAX WITHHOLDING 7% (3% additional local

tax for Japanese individual

residents only)

CHARGES & DEADLINES

FILING METHOD BATCH PAYMENT

METHOD

DEPOSITARY

SERVICE

CHARGE

MINIMUM SERVICE

CHARGE PER

BENEFICIAL OWNER

FINAL

SUBMISSION

DEADLINE

(ALL TIMES

EST)

RELIEF AT

SOURCE PAYMENT ON PAY

DATE EDS UP TO $0.0035

per ADR $0 October 6,

2011; 8:00 P.M.

LONG-FORM POST-EDS PROCESS;

ONGOING CHECK UP TO $0.005

per ADR UP TO $400

UP TO 5

YEARS FROM

ADR RECORD

DATE

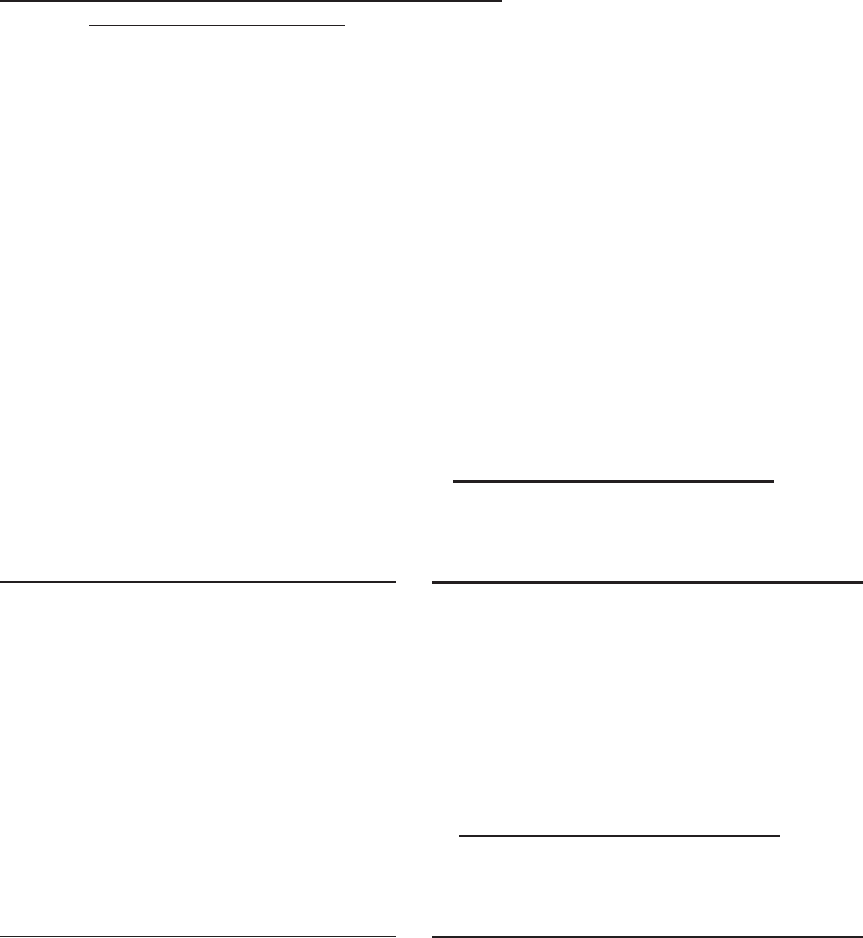

DESCRIPTION OF VARIOUS DOCUMENTATION

DOCUMENT NAME DESCRIPTION ORIGINAL / COPY SIGNATURE

REQUIREMENT

IRS FORM 6166 ISSUED BY THE INTERNAL REVENUE

SERVICE, STATING THE NAME AND TAX

PAYER IDENTIFICATION NUMBER OF THE

BENEFICIAL OWNER. IT MUST BE DATED

WITHIN 9 MONTHS OF SUBMISSION. CANNOT

BE CERTIFIED FOR ANY OTHER COUNTRY.

MUST HAVE IRS CODES 401(A) AND 501 (A)

ORIGINAL IRS

REPRESENTATIVE

APPENDIX

A

(COVER LETTER)

LISTING OF BENEFICIAL OWNERS AND/OR

JAPANESE INDIVIDUAL RESIDENTS ORIGINAL DTC PARTICIPANT

APPENDIX B

(POWER OF

ATTORNEY)

SIGNED BY BENEFICIAL OWNER APPOINTING

DEPOSITARY ON BENEFICIAL OWNER’S

LETTERHEAD

ORIGINAL BENEFICIAL OWNER

LIMITED POWER

OF ATTORNEY IF THE POA IS SIGNED BY THE BROKER,

TRUST AGREEMENT OR LIMITED POA MUST

ALSO BE SUBMITTED

COPY DTC PARTICIPANT

APPENDIX C CERTIFICATE OF RESIDENCE FOR UK

PENSIONS ORIGINAL UK TAX AUTHORITY

WITHHOLDING TAX UPDATE REGARDING “LARGE SHAREHOLDERS”

Individual (non-Corporate) "large shareholders" who hold 3% or more of the number of outstanding shares for

dividend income from listed shares, now fall under the "large shareholder" category. These "large shareholders" will

no longer be eligible for the preferential tax rates and thus be applied the 20% tax rate for dividends paid after

September 30, 2011. Participants are required to disclose the name and address of these "large shareholders" to the

Depositary by the deadline stated within this notice. Corporate entities (both Japanese and non-Japanese) who hold

3% or more of the number of outstanding shares for dividend income from listed shares are still entitled to the

preferential withholding rates and are eligible to receive the income with a 7% withholding rate applied or more if

eligible based on the treaty between the investors country of residence and Japan. Dividend income for unlisted

shares will continue to be withheld at the 20% Japanese National Tax Rate.

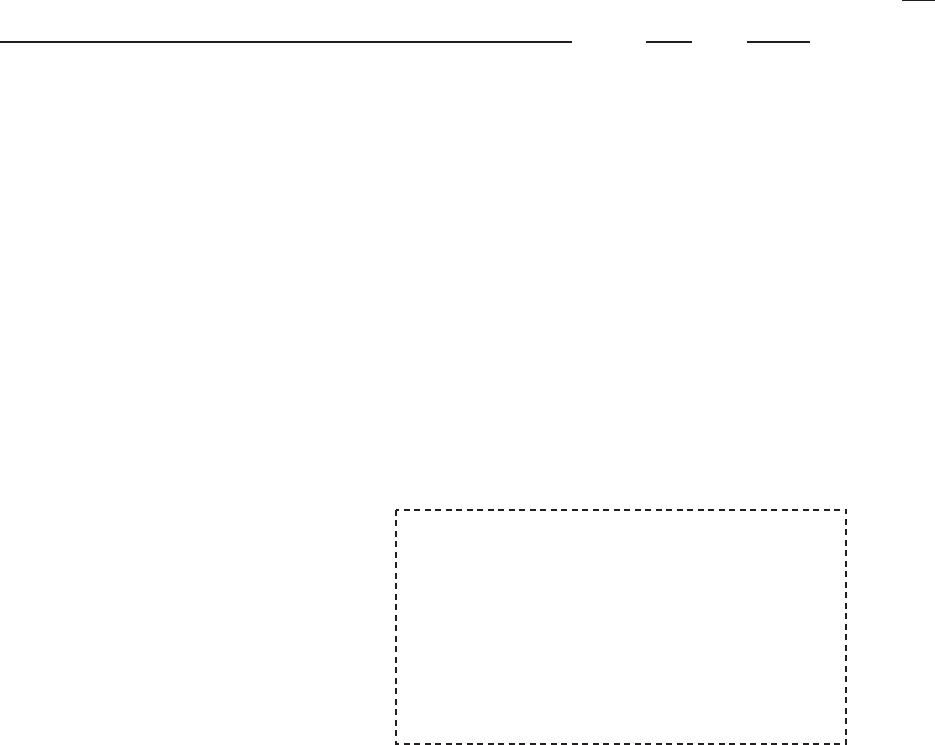

FREQUENTLY ASKED QUESTIONS (FAQs)

QUESTION ANSWER

CAN I SUBMIT A TRUST AGREEMENT IN LIEU OF A

POA SIGNED BY THE BENEFICIAL OWNER?

YES, BUT A LIMITED POA SIGNED BY THE

PARTICIPANT MUST BE ACCOMPANIED BY THE

TRUST AGREEMENT

ARE FORM 6166S WITH IRS CODE RULING 81-100

ACCEPTED? YES, WITH A TAX DETERMINATION LETTER

DOES THE BENEFICIARIES NAME ON THE FORM

6166 NEED TO MATCH THE POA? YES, THE BENEFICIARIES NAME ON BOTH

DOCUMENTS SHOULD BE IDENTICAL.

HOW LONG DOES IT TAKE FOR LONG-FORM

CLAIMS TO BE PAID? WE ESTIMATE IT TAKES UP TO 1 YEAR FOR LONG

FORM CLAIMS TO BE PAID

DOES THE LONG-FORM PROCESS HAVE A

MINIMUM POSITION REQUIRMENT PER

BENEFICIAL OWNER? YES, PLEASE CALL FOR MORE DETAILS.

DO POAS NEED TO BE NOTARIZED FOR SHORT

FORM CLAIMS? NO, ONLY POAS SUBMITTED FOR LONG FORM

CLAIMS NEED TO BE NOTARIZED.

WHAT IS THE STATUTE OF LIMITATIONS FOR

FILING JAPANESE RECLAIMS?

IT IS 5 YEARS FROM ORDINARY PAY DATE. CLAIMS

RECEIVED AFTER OUR SUBMISSION DEADLINE

WILL BE FILED ON A BEST EFFORT BASIS.

WHAT IF THE BENEFICIAL OWER NAME AND/OR

ADDRESS IS NOT CONSISTANT WITH THE OTHER

DOCUMENTS?

SEND A LETTER ON PARTICIPANT LETTERHEAD

EXPLAINING THE DISCREPANCY. BE SURE TO

INCLUDE THE TAX ID NUMBER.

J.P. Morgan Chase Bank, now offers ESP powered by GlobeTax, an electronic withholding tax

submission system. This system allows for the secure and simplified transfer of beneficial owner

level data from the Participant to J.P. Morgan Chase Bank and creates applicable documentation

on the Participants behalf.

Submit the data online through the web site below, print out the document on letterhead, sign, and

mail to J.P. Morgan Chase Bank / GlobeTax along with the additional documentation (necessary

for U.S. Pensions, U.K. Pensions, Japanese Residents and Large Shareholders).

These claims should be submitted through the following web site. (Requires a one-time registration)

https://www.globetaxesp.com

Please contact Jonathan Staake at 212-747-9100 if you have any questions about this process.

CONTACT DETAILS

PRIMARY CONTACT RITA PATEL

DOMESTIC PHONE (U.S.) 1-800-929-5484

DOMESTIC FAX (U.S.) 1-800-929-9986

INTERNATIONAL PHONE 1-212-747-9100

INTERNATIONAL FAX 1-212-747-0029

EMAIL ADDRESS RITA_PATEL@GLOBETAX.COM

COMPANY JPMORGAN CHASE BANK/ GLOBETAX

STREET ADDRESS 90 BROAD STREET, 16

TH

FLOOR

CITY/STATE/ZIP NEW YORK, NY 10004

ADDITIONAL CONTACTS SARAH MARTIN

JONATHAN STAAKE

APPENDIX A – COVER LETTER

(DTC Participant’s Letterhead)

To: JPMorgan Chase Bank / GlobeTax

90 Broad Street, 16th Floor

New York, New York 10004-2205

Phone: 1-800-929-5484 Fax: 1-800-929-9986

Re: Withholding Certification for EISAI CO., LTD. ; CUSIP# 282579309

I / We the undersigned (Contact Name) authorized representative of (DTC Participant Name)______

holding shares at Cede & Co. under DTC# (DTC PTS Number) of EISAI CO., LTD. ; CUSIP# 282579309, request that

the upcoming cash dividend payable to holders as of September 29, 2011 , receive their entitled tax reclaim.

Name of Beneficiary Complete Address Country of

Residence Tax ID Number # ADRs

Law of

Establishment

(ERISA, State Law

of <State>, etc.)

*** IF THERE ARE MORE THAN 7 BENEFICIAL HOLDERS, PLEASE CALL THE NUMBER ABOVE AND WE WILL SEND YOU A PRE-

FORMATTED DISK. PLEASE RETURN THE DISK AND THE HARD COPY WITH THE REQUIRED AUTHORIZED SIGNATURES TO THE

ADDRESS ABOVE.

I / We certify that to the best of my knowledge the above beneficial owners are eligible for the preferential rates as stated herein and I declare that I have performed

all the necessary due diligence to satisfy myself as to the accuracy of the information submitted to me by these beneficial owners.

JPMorgan Chase Bank is not liable for failure to secure the refund and any funds erroneously received shall be immediately returned to JPMorgan Chase Bank,

including any interest, additions to tax or penalties thereon. This is not tax advice. Please consult your tax advisor.

Incorrect claims and/or elections could result in fines and/or penalties.

TEL : _________________________________________

Print Name of Signatory

FAX: _________________________________________

Position of Signatory

PLEASE INCLUDE YOUR PHONE AND FAX NUMBER SO THAT WE CAN CONTACT YOU

WITH ANY QUESTIONS THAT WE MIGHT HAVE.

APPENDIX B – POWER OF ATTORNEY

(Pension Fund’s Letterhead)

Power of Attorney

(Name of Pension Fund/IRA = the Undersigned), with address in (City, State, Country) hereby

appoints JPMorgan Chase (“Bank”) and/or the Bank’s designated standing proxy(ies) as its true and

lawful attorney with full Power of Attorney to do all or any of the following acts with respect to the

American Depository Receipts representing shares in EISAI CO., LTD. (“Securities”) that the Bank

holds in its safe custody on behalf of the Undersigned through a Participant in the Depository Trust

Company .

i) To sign and file required forms with competent tax authorities in order to secure any tax

privileges and benefits such as tax reduction or tax-exemption at source.

ii) To receive on behalf of the Undersigned tax repayments made by competent tax authorities

as a result of lodging reclaim forms.

iii) To perform any other act as may be necessary to execute the acts mentioned herein.

The Undersigned also authorizes the Bank and/or the Bank’s designated standing

proxy(ies) to submit this power of attorney or a photocopy of it to competent tax

authorities.

(Name of the Pension Fund/IRA)

_ <Place and Date>__________ _ _<Signature of Officer of Beneficiary>____

Place and Date Authorized Signature(s)/Title(s)

In addition, the authorized representative:

Confirms that more than 50% of the beneficiaries, members or participants of the eligible pension

fund were individual residents of the ________ or Japan as of the prior taxable period.

(Name of the Pension Fund/IRA)

_ <Place and Date>__________ _ _<Signature of Officer of Beneficiary>____

Place and Date Authorized Signature(s)/Title(s)

APPENDIX C

ᒃఫ⪅ド᫂᭩

Certificate of Residence

⚾ࡣࠊᒆฟ⪅ ________________________________________________________

ࡀࠊ᪥ᮏᅜ_________________________________________________________

ࡢ㛫ࡢ ⛒⛯᮲⣙➨_____᮲➨___㡯____つᐃࡍࡿᒃఫ⪅࡛࠶ࡿࡇࢆド᫂ࡋࡲࡍࠋ

I hereby certify that (the applicant:)____________________________________

is a resident under the provisions of the Income Tax Convention between Japan and the

United Kingdom of Great Britain and Northern Ireland, Article 22, para. 2 (e) .

ᖺ᭶᪥ ____________________________

Date _______/_________/___________

⨫ྡ ____________________________________

Signature _____________________________________

ᐁ ༳

Official Stamp

EXHIBIT 1

TREATY ELIGIBLE PENSIONS

COUNTRY OF

PENSION FUND DESCRIPTION QUALIFYING PLANS

UNITED STATES

APPLIES TO A BENEFICIAL OWNER OF THE

ADRS THAT:

1) IS NOT ENGAGED IN A TRADE OR

BUSINESS IN JAPAN THROUGH A PERMANENT

ESTABLISHMENT SITUATED IN JAPAN, WITHIN

THE MEANING OF THE U.S. DOUBLE TAXATION

TREATY WITH JAPAN

2) IS A QUALIFYING “PENSION FUND” AS

DEFINED ON PAGE 11 OF THE TECHNICAL

EXPLANATION OF THE NEW TAX TREATY

BETWEEN THE U.S. AND JAPAN, PUBLISHED

BY THE U.S. DEPARTMENT OF TREASURY

3) IS ABLE TO CERTIFY THAT MORE THAN

50 % OF THE BENEFICIARIES, MEMBERS OR

PARTICIPANTS OF THE ELIGIBLE PENSION

FUND WERE INDIVIDUAL RESIDENTS OF THE

U.S. OR JAPAN AS OF THE PRIOR TAXABLE

PERIOD.

- QUALIFIED PLANS UNDER SECTION 401(A)

- INDIVIDUAL RETIREMENT PLANS (INCLUDING

THOSE THAT ARE A PART OF A SIMPLIFIED

EMPLOYEE PENSION PLAN THAT SATISFIES 408(K))

- INDIVIDUAL RETIREMENT ACCOUNTS, INDIVIDUAL

RETIREMENT ANNUITIES, SECTION 408(P)

ACCOUNTS

- ROTH IRAS UNDER SECTION 408 A

- SECTION 457 GOVERNMENTAL PLANS

- SECTION 403(A) QUALIFIED ANNUITY PLANS

- SECTION 403(B) PLANS

- SECTION 401(K) PLANS QUALIFY AS PENSION

FUNDS BECAUSE A 401(K) PLAN IS A TYPE OF

401(A) PLAN.

- ANY OTHER FUND IDENTICAL OR SUBSTANTIALLY

SIMILAR TO THE FOREGOING SCHEMES THAT ARE

ESTABLISHED PURSUANT TO LEGISLATION

INTRODUCED AFTER THE DATE OF SIGNATURE OF

THE CONVENTION.

UNITED KINGDOM

APPLIES TO A BENEFICIAL OWNER OF THE

ADRS THAT:

1) IS NOT ENGAGED IN A TRADE OR BUSINESS

IN JAPAN THROUGH A PERMANENT

ESTABLISHMENT SITUATED IN JAPAN, WITHIN

THE MEANING OF THE U.K. DOUBLE TAXATION

TREATY WITH JAPAN,

2) IS A QUALIFYING “PENSION FUND” AS

DEFINED BY ARTICLE 22, PARAGRAPH 2(E) OF

THE INCOME TAX CONVENTION BETWEEN

JAPAN AND THE UNITED KINGDOM OF GREAT

BRITAIN AND NORTHERN IRELAND,

PUBLISHED BY THE MINISTRY OF FINANCE

JAPAN

3) IS ABLE TO CERTIFY THAT MORE THAN

50 % OF THE BENEFICIARIES, MEMBERS OR

PARTICIPANTS OF THE ELIGIBLE PENSION

FUND WERE INDIVIDUAL RESIDENTS OF THE

U.K. OR JAPAN AS OF THE PRIOR TAXABLE

PERIOD.