165, Annual Return For Sales, Use And Withholding Taxes 165 2013 Fillable 442458 7

User Manual: 165

Open the PDF directly: View PDF ![]() .

.

Page Count: 2

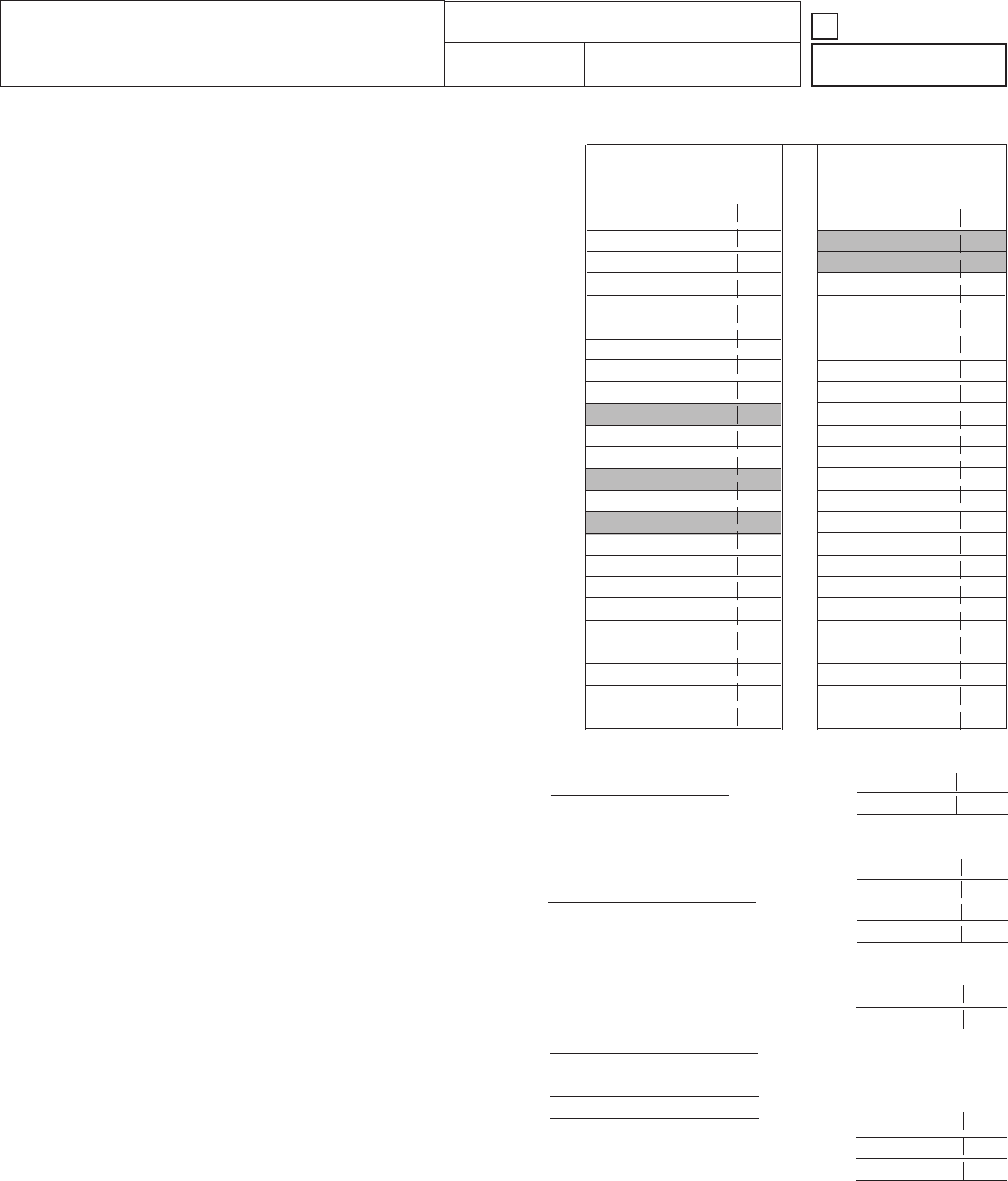

Sales and Use Tax

Use Tax on Items Purchased for Business or Personal Use *

Withholding Tax

Summary

Gross sales (including sales by out-of-state vendors subject to use tax) ......

Rentals of tangible property and accommodations .......................................

Telecommunications services ........................................................................

Add lines 1, 2, and 3 .....................................................................................

Resale ...........................................................................................................

Industrial processing or agricultural producing ..............................................

Interstate commerce ......................................................................................

Exempt services ............................................................................................

Sales on which tax was paid to Secretary of State........................................

Food for human/home consumption ..............................................................

Bad debts ......................................................................................................

Michigan motor fuel or diesel fuel tax ............................................................

Other. Identify: ____________________________ ......................................

Tax included in gross sales (line 1)................................................................

Total allowable deductions. Add lines 5a - 5j .................................................

Taxable balance. Subtract line 5k from line 4 ................................................

Tax Rate ........................................................................................................

Gross tax due. Multiply line 6 by line 7 ..........................................................

Tax collected in excess of line 8 ....................................................................

Add lines 8 and 9 ...........................................................................................

TOTAL discount allowed (see instructions) ..............................................

Total tax due. Subtract line 11 from line 10 ....................................................

Tax payments in current year (after discounts)..............................................

Enter your taxable purchases ........................................................

Tax payments made in the current year .............................................................................................................

Gross Michigan payroll, pension, and other taxable compensation for the year ................................................

Number of W-2, and 1099 forms enclosed .......................................

Total Michigan income tax withheld per W-2 and 1099 forms ............................................................................

Total Michigan income tax withholding paid during current tax year ..................................................................

Total sales, use and withholding taxes due. Add lines 12A, 12B, 14b and 18 ....................................................

Total sales, use and withholding taxes paid. Add lines 13A, 13B, 15 and 19 .....................................................

If line 21 is greater than line 20, enter overpayment ........................

Amount of line 22 to be credited forward on your account.

We will notify you when your credit is veried and available .............

Amount of line 22 to be refunded to you............................................

If line 21 is less than line 20, enter balance due.................................................................................................

If this return is led late, enter penalty and interest. (See instructions.) .............................................................

TOTAL PAYMENT DUE. Add lines 25 and 26. Make check payable to "State of Michigan." ..........................

Michigan Department of Treasury

165 (Rev. 07-13)

Taxpayer's Business Name Account Number

Return Year Date Due

1.

2.

3.

4.

5a.

b.

c.

d.

e.

f.

g.

h.

i.

j.

k.

6.

7.

8.

9.

10.

11.

12.

13.

1.

2.

3.

4.

5a.

b.

c.

d.

e.

f.

g.

h.

i.

j.

k.

6.

7.

8.

9.

10.

11.

12.

13.

A. Use Tax: Sales & Rentals B. Sales Tax

6% 6%

File this return by February 28. Do not use this form to replace a monthly or quarterly return.

Annual Return for Sales, Use and Withholding Taxes

Issued under authority of Public Act 167 of 1933.

x .06 =

x .06 x .06

14a.

.

17.

22.

23.

24.

1.

2.

3.

4.

a.

b.

c.

d.

e.

f.

g.

h.

i.

j.

k.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

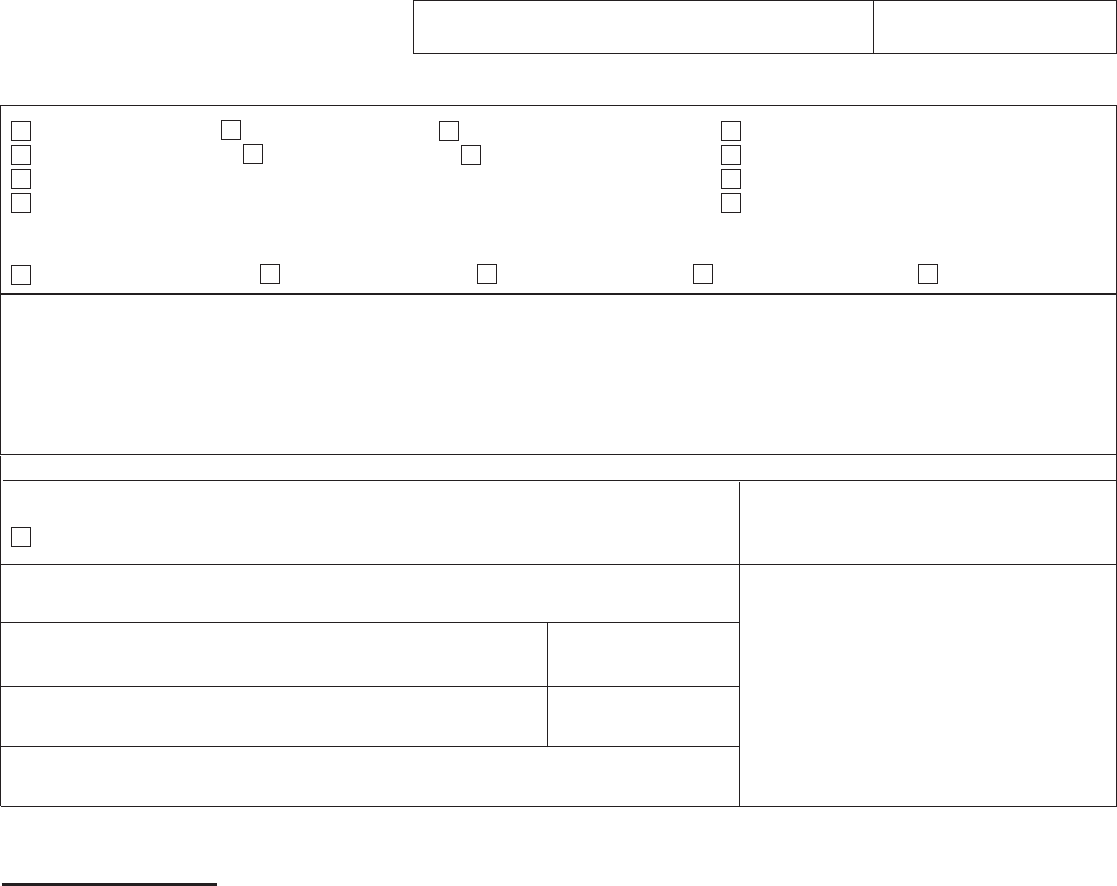

Amended Return

Amendment Date

Check box if this is an

amended return.

* Use Tax on Items Purchased for Business or Personal Use: Use lines 14 and 15 to report purchases made for use in your business or

for items removed from your inventory for personal or business use. Do not repeat the amounts from Column A, lines 1 - 4 here.

5. ALLOWABLE DEDUCTIONS

14b.

15.

16.

18.

19.

20.

21.

25.

26.

27.

Reset Form

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

(i)

Individual

Husband - Wife

General Partnership

Limited Partnership

Type of Business Ownership (check one only)

Non-Michigan Corporation

Subchapter S

Trust or Estate (Fiduciary)

Joint Stock Club or Investment Company

Social Club or Fraternal Organization

Other (Explain)

Mailing Instructions:

If sending an amended annual return, check the amended return box on page 1 of this return, and refer to

page 6 of the SUW Instruction Book (Form 78) for amended return mailing addresses and other instructions.

If enclosing payment with your annual return, mail to:

Michigan Department of Treasury

Department 78172

P.O. Box 78000

Detroit, MI 48278-0172

If requesting a credit to your account (amount on line 23) or a refund (amount on line 24), mail to:

Michigan Department of Treasury

P.O. Box 30779

Lansing, MI 48909

If no payment is enclosed with your annual return, mail to:

Michigan Department of Treasury

Lansing, MI 48930

Signature (you are required to complete all information requested below)

Form 165, Page 2

www.michigan.gov/bustax is a secure Web site designed specically to protect your tax information. Use this Web

site to check the status of your Sales, Use, and Withholding transactions and ask specic questions about your account.

I declare under penalty of perjury that this return is true and complete to the best of my knowledge.

Date

By checking this box, I authorize Treasury to discuss my return with the designated preparer.

I declare under penalty of perjury that this return

is based on all information of which I have any

knowledge.

Signature of Taxpayer's Ofcal Representative (must be an Owner, Ofcer, Member, Manager, or Partner)

Taxpayer's FEIN or Social Security Number

Ofcal Representative's Title (Owner/Ofcer/Member/Manager/Partner) (Required)

Designated Preparer's Signature, Address, Telephone

and ID Number

Telephone Number

Taxpayer's Business Name Account Number

Enter the reason for amending return. Include your account number on each page being submitted. (Required)

Partnership S Corporation

Print Ofcal Representative's Name

C Corporation Disregarded Entity

Individual

Limited Liability Company Taxed As:

Michigan Corporation

Subchapter S