Truth In Lending Disclosure Statement SC910 1678785227truth Agreement

User Manual: SC910

Open the PDF directly: View PDF ![]() .

.

Page Count: 2

REV 02/01/2010

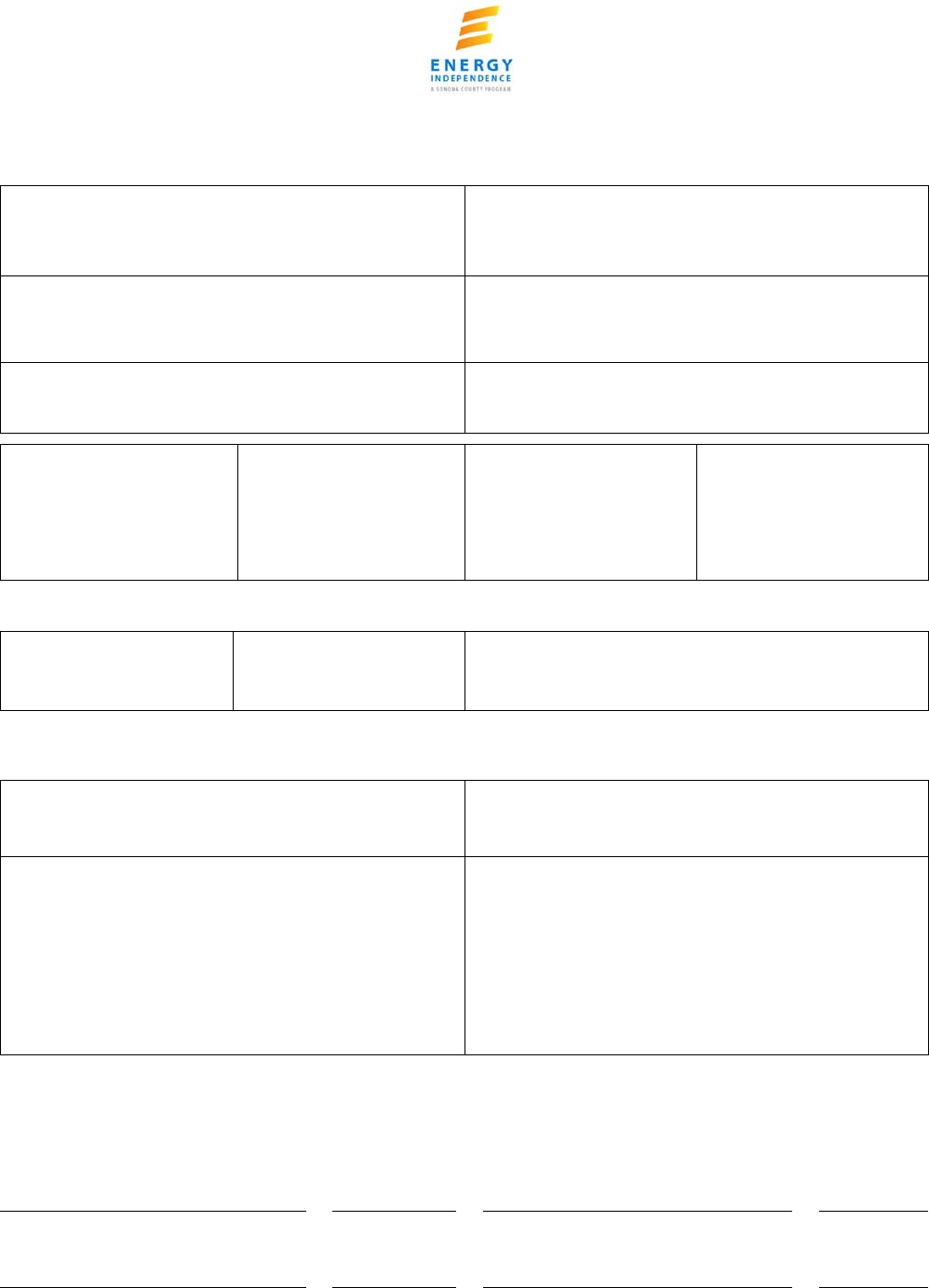

TRUTH IN LENDING DISCLOSURE STATEMENT

See reverse of form for definitions

APPLICANT NAME

PROGRAM NAME

Sonoma County Energy Independence Program

PROPERTY ADDRESS

PROGRAM ADDRESS

404 Aviation Boulevard

Santa Rosa, CA 95403

SCEIP FILE NO SIMPLE INTEREST RATE

7.00%

ANNUAL PERCENTAGE RATE FINANCE CHARGE AMOUNT FINANCED TOTAL OF PAYMENTS

The cost of your credit as a

yearly rate. The dollar amount the credit

will cost you over the entire

term of your assessment.

The amount of credit provided

to you on your behalf. The amount you will have paid

after you have made all

payments as scheduled.

E* % E$ E$ E$

*E is defined as Estimate

Your payment schedule will be:

NUMBER OF PAYMENTS AMOUNT OF PAYMENTS* WHEN PAYMENTS ARE DUE

$ Payments are due in the same manner and in the same

installments as the general taxes of the County on real property.

*All amounts and payments are estimated based on the maximum Assessment amount. After the final disbursement of Assessment

proceeds a statement will be provided showing principal and payment amounts.

SECURITY

APPLICABLE FEES

The County will put a lien against the property entered into the

property address field above. See Reverse

LATE CHARGES

PREPAYMENT

Your payments will be collected in the same manner as your

property taxes and will be subject to the same penalties,

procedure, sale and lien priority in case of delinquency as

applicable for property taxes.

If you prepay this assessment in full you:

a. will not have to pay a premium while the SCEIP investment

bond is held by the County Treasury. Thereafter, you may

have to pay a premium of up to 3 percent under current market

conditions.

b. will not be entitled to a refund of any part of the finance charge

owed through the payoff date. Available payoff dates are

March 2nd and September 2nd of each year.

See your contract documents for any additional information regarding non-payment, default, required repayment in full before

scheduled date, and prepayment refunds and penalties. Written itemization of the Amount Financed and interest charges will

be provided upon request.

I/We hereby acknowledge reading and receiving a complete copy of this disclosure. I/We understand there is no commitment for the

Program to provide this financing and there is no obligation for me/us to accept this financing upon delivery or signing of this disclosure.

Applicant’s Signature

Date

Applicant’s Signature

Date

Applicant’s Signature

Date

Applicant’s Signature

Date

REV 02/01/2010

Sonoma County Energy Independence Program

Truth In Lending Disclosure Statement Definitions

Amount Financed Amount of the assessment actually made available to a borrower, repayable according to terms of the assessment

contract. It is equal to the Assessment Amount less any prepaid fees,

Amount of Payments All amounts and payments are estimated based on the maximum assessment amount. After the final

disbursement of assessment proceeds, a repayment schedule will be provided.

Annual Percentage Rate Effective cost of credit in consumer loans and real estate loans expressed as a percentage interest rate. The

annual percentage rate is the interest rate the borrower actually pays, including fees required in order to

participate in the program.

Applicant Name Property Owner requesting the contractual assessment.

Additional Fees Annual Assessment Fee1$40.00

Multiple Disbursement Fee Per Interim Disbursement $150.00

No Permit Required SCEIP Inspection Fee (varies by jurisdiction) $67.00 - $150.00

Recording Fee2$66.00

Title Costs – Initial

Financing requests less than $5,000 $50.00

Financing requests $5,000 to $499,999 $125.00

Financing requests $500,000 and above require title search and insurance.

Contact SCEIP for estimate.

TBD

Title Costs – Second project within 180 days $30.00

All projects subject to local jurisdiction building permit fees TBD

Finance Charge The Assessee’s total cost of assessment, including interest, fees, and prepaid interest. Under the Truth in Lending

Act, the finance charge must be disclosed as the total dollar cost of credit. Contrast with ANNUAL PERCENTAGE RATE,

which states the cost of credit as an annualized rate. This is the amount the Assessee will pay over the entire term

of the assessment. This amount will change if the assessment is paid off early or the initial amount of the

assessment is less than the amount listed in item #6, Amount Financed.

The finance charge does not include late payment fees or annual fees.

Itemization This is a line item breakdown of the amount of your assessment.

Late Charges Your payments will be collected in the same manner as your property taxes and will be subject to the same

penalties, procedure, sale, and lien priority in case of delinquency as applicable for property taxes.

Number of Payments This is the number of installment payments requested by the applicant.

Prepayment This assessment may be prepaid in full within one year with no penalty. In the future, it is possible that bond

investors may impose up to a 3% premium in order to prepay this assessment in full. Available payoff dates are

March 2nd or September 2nd. Please call for a correct payoff quote prior to sending any payment. Partial

prepayments are not permitted except at the discretion of the County in the case multiple disbursement

contracts, and only from remaining unspent assessment proceeds.

Program Name Entity that coordinates with the Applicant and Sonoma County Tax Collector to assign the assessment to the

property.

SCEIP File No Sonoma County Energy Independence Program File number assigned to the application.

Security The real property that will be pledged as collateral for the assessment.

Simple Interest Rate Interest rate calculation based on the original principal amount.

Total of Payments The Total of Payments is the amount you will have paid after making all payments as scheduled.

When Payments are Due Payments are payable in the same manner and in the same installments as the general taxes of the County on real

property payable.

1 The Annual Administrative Assessment shall not exceed $40.00 in fiscal year 2009-2010 of the assessment, and shall thereafter be adjusted annually for

cost of living based on the U.S. Department of Labor, Bureau of Labor Statistics, Consumer Price Index for all urban consumers for the Northern California

Counties. The Annual Assessment charge is calculated in the Annual Percentage Rate (APR).

2 The Recording Fee for the Assessment Lien documents and Assessment Contract is set by State law and the County Recorders Office and is updated

annually.