E6913DW1 6913DW 2011Form990

User Manual: 6913DW

Open the PDF directly: View PDF ![]() .

.

Page Count: 48

- Federal

- Custom Letter

- Filing Instructions for 990 and 990PF

- 8879-EO IRS E-File Signature Authorization

- 990 Page 1

- 990 Page 2

- 990 Page 3

- 990 Page 4

- 990 Page 5

- 990 Page 6

- 990 Page 7

- 990 Page 8

- 990 Page 8

- 990 Page 9

- 990 Page 10

- 990 Page 11

- 990 Page 12

- Sch A Page 1

- Sch A Page 2

- Sch A Page 3

- Schedule A Page 4

- Sch B Page 1

- Sch B Page 2

- Sch B Page 3

- Sch B Page 4

- Sch C Page 1

- Sch C Page 2

- Sch C Page 3

- Sch C Page 4

- Sch D Page 1

- Sch D Page 2

- Sch D Page 3

- Sch D Page 4

- Sch D Page 5

- Sch D Page 5

- Sch G Page 1

- Sch G Page 2

- Sch G Page 3

- Sch I Page 1

- Sch I Page 2

- Sch L Page 1

- Sch L Page 2

- Sch M Page 1

- Sch M Page 2

- Schedule O Page 1

- Attachment 1

- Attachment 1 - 2, 2

- Sch R Page 1

- Sch R Page 2

- Sch R Page 3

- Sch R Page 4

- Sch R Page 5

- States

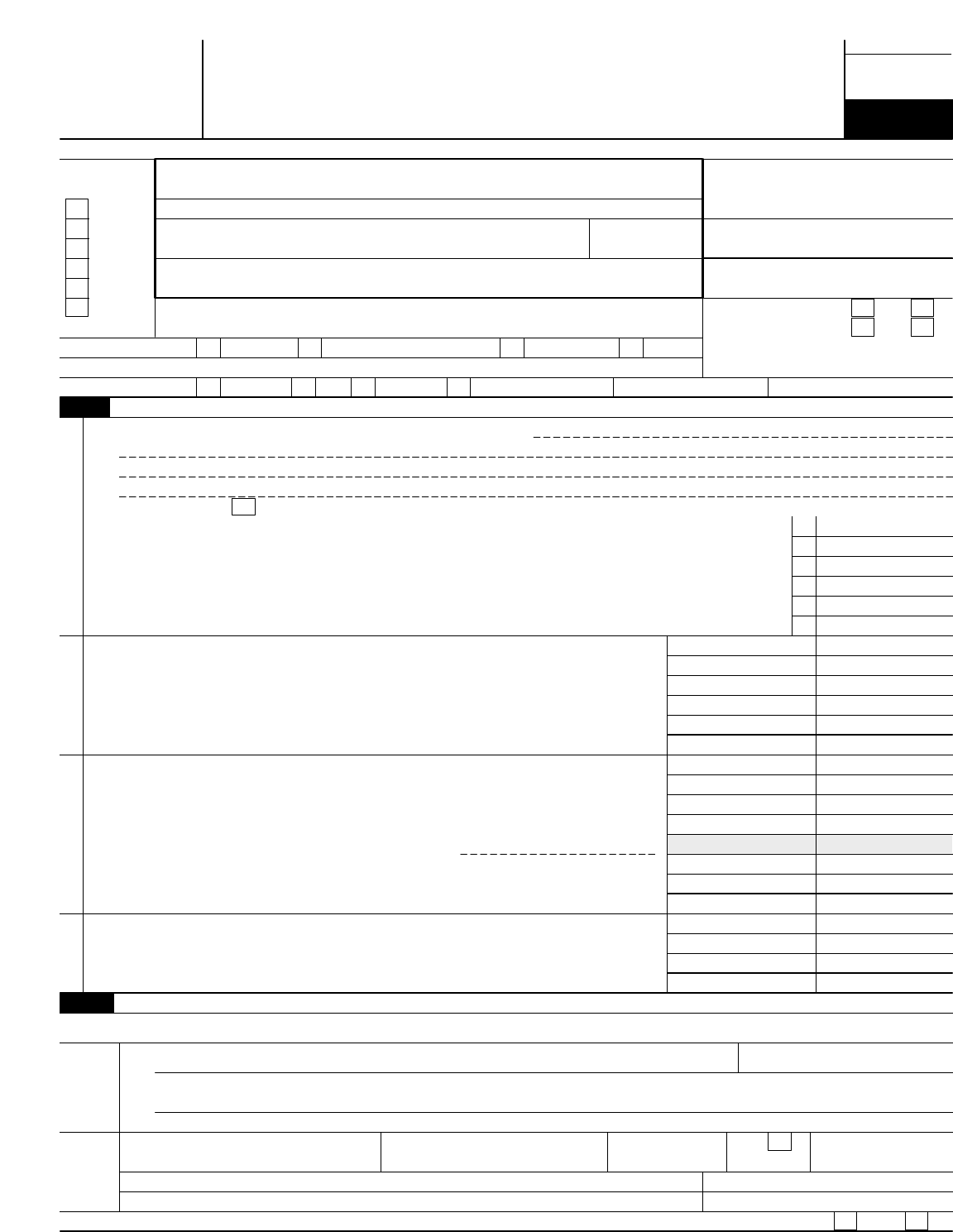

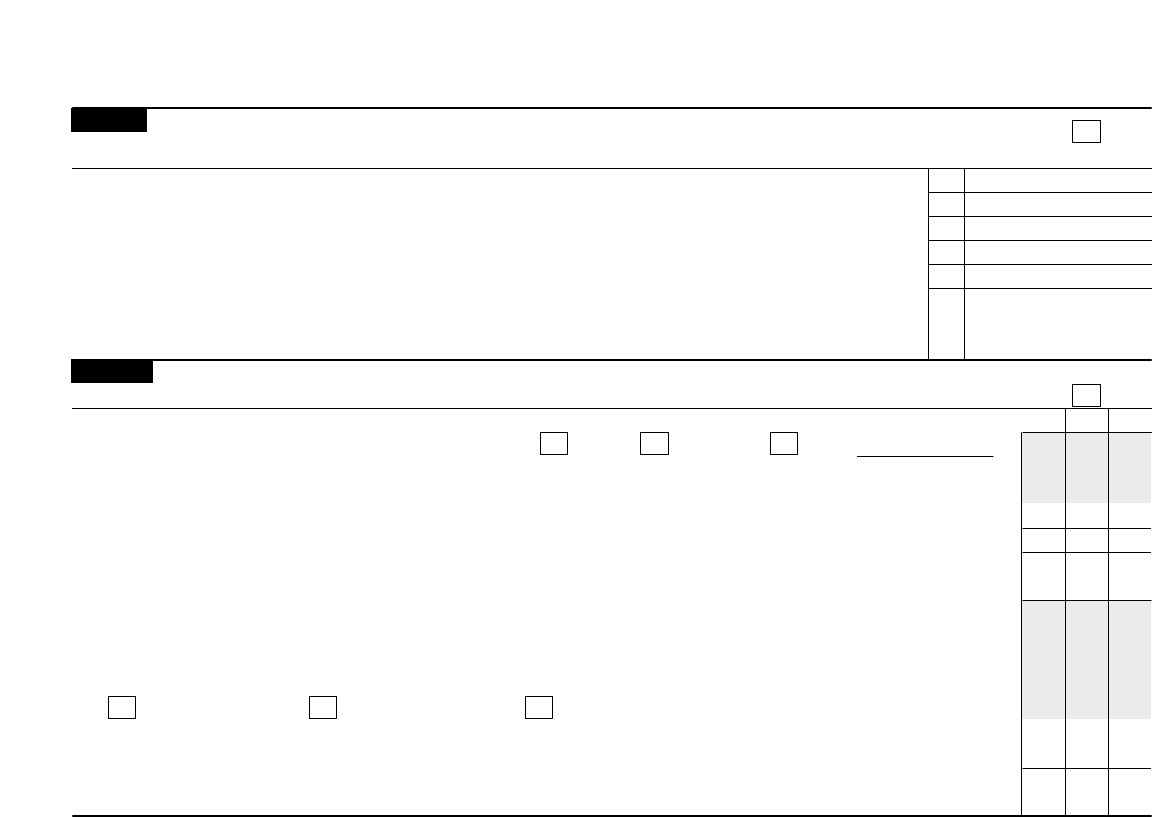

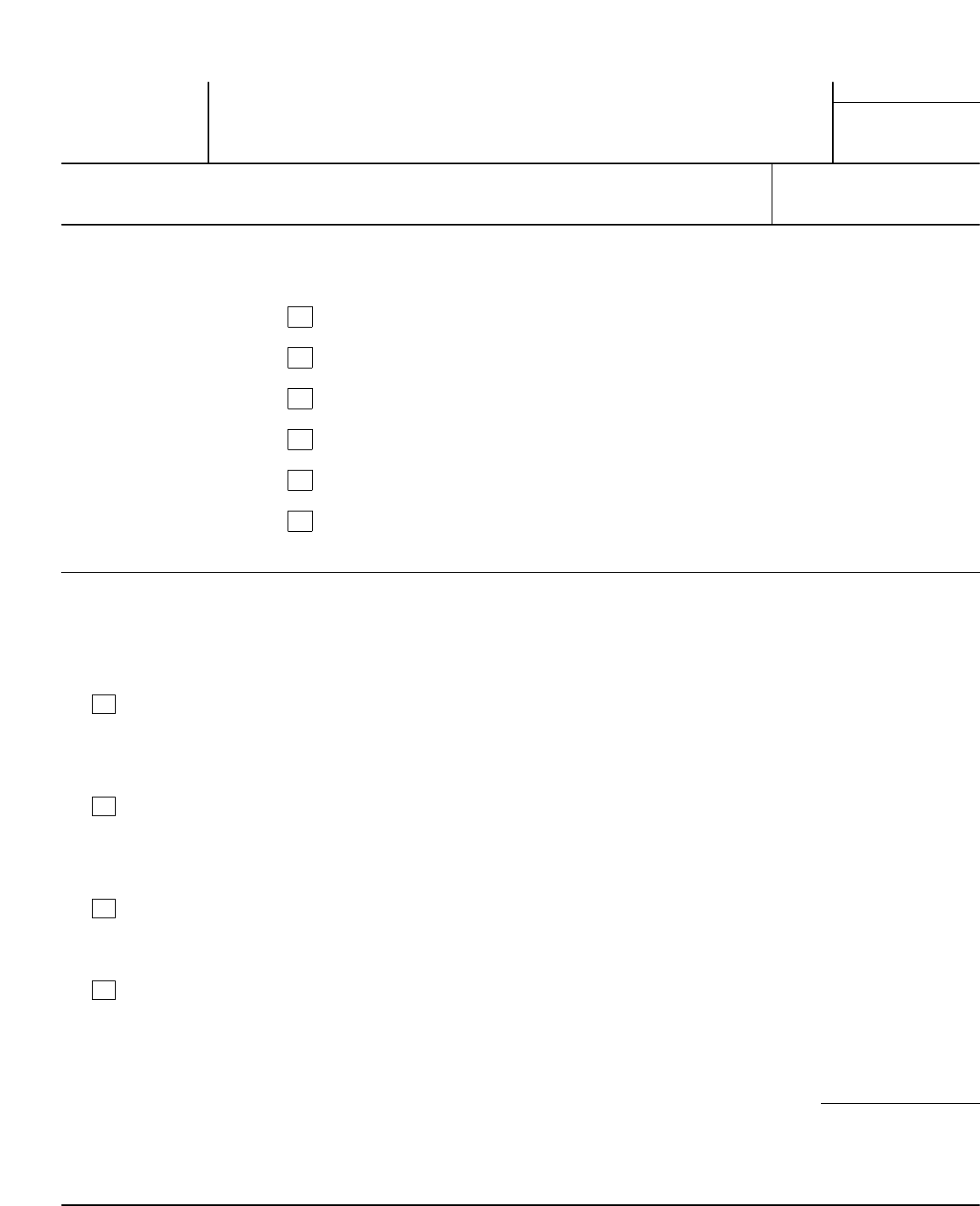

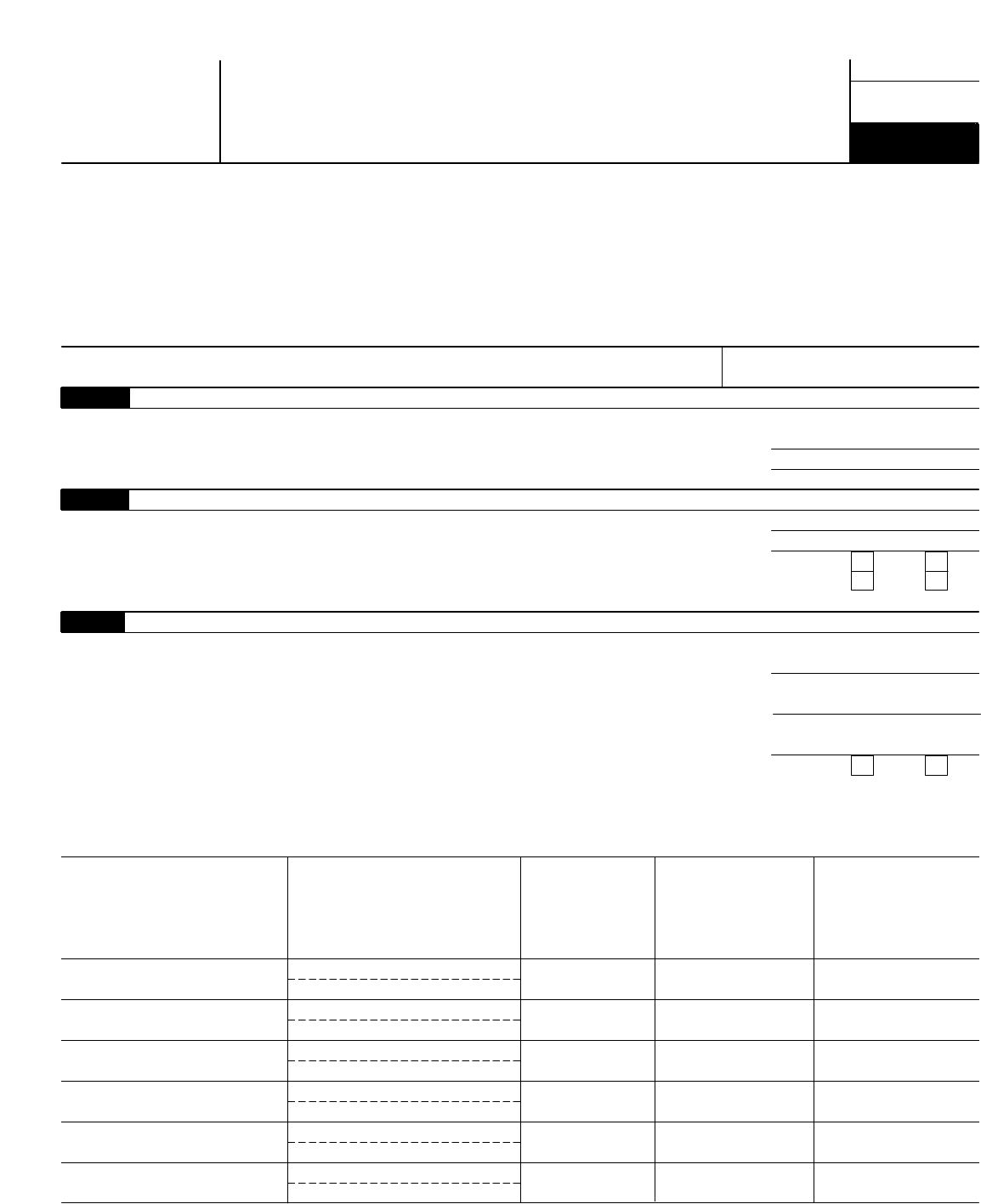

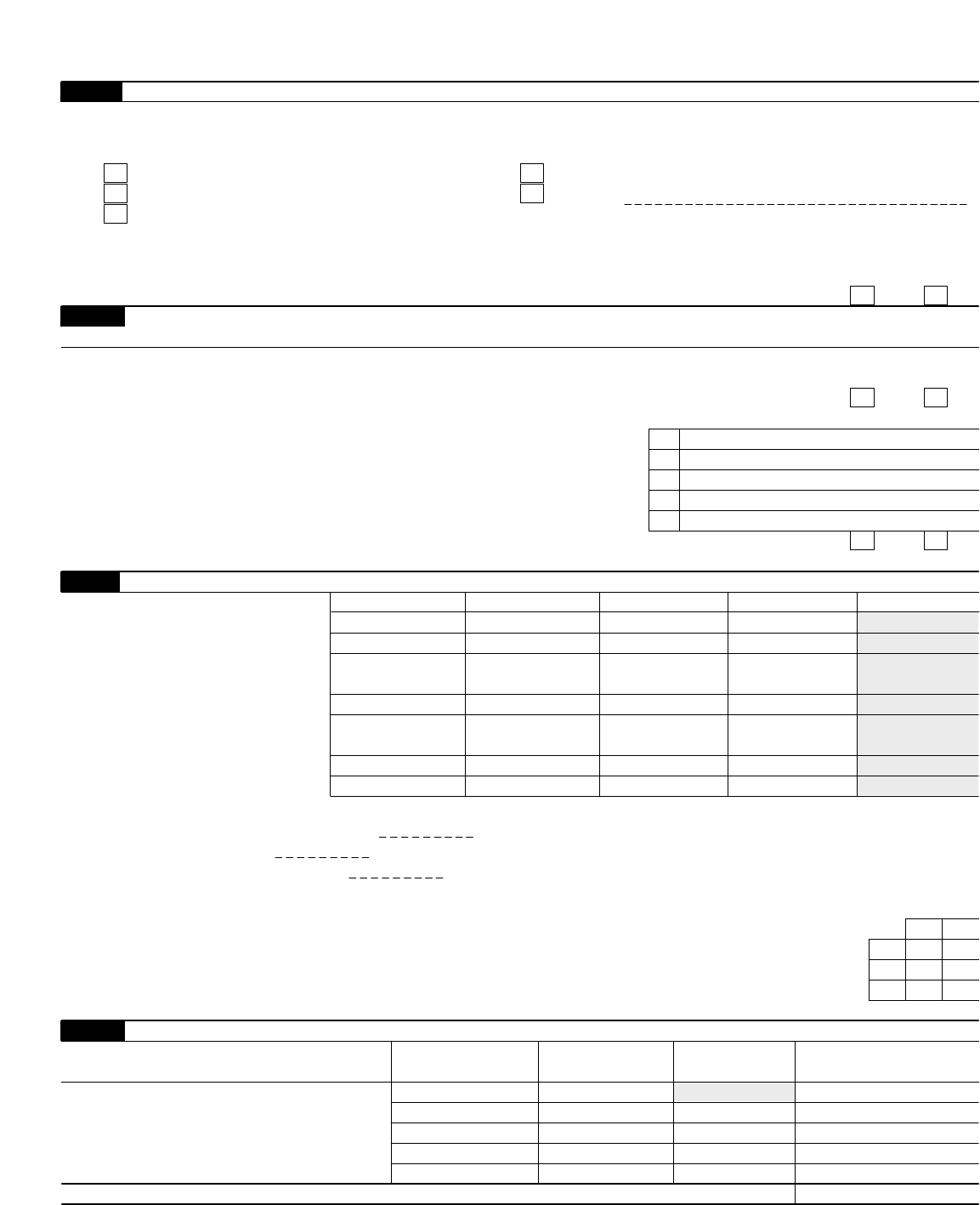

OMB No. 1545-0047

Return of Organization Exempt From Income Tax

Form ½½´ Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung

benefit trust or private foundation)

À¾µµ

Open to Public

Department of the Treasury

Internal Revenue Service IThe organization may have to use a copy of this return to satisfy state reporting requirements.

Inspection

, 2011, and ending , 20

A For the 2011 calendar year, or tax year beginning

D Employer identification number

CName of organization

BCheck if applicable:

Address

change Doing Business As

ETelephone number

Number and street (or P.O. box if mail is not delivered to street address) Room/suite

Name change

Initial return

Terminated City or town, state or country, and ZIP + 4

Amended

return GGross receipts $

Application

pending H(a) Is this a group return for

affiliates?

FName and address of principal officer: Yes No

Are all affiliates included? Yes No

H(b)

If "No," attach a list. (see instructions)

Tax-exempt status:

IJ

501(c) ( ) (insert no.) 4947(a)(1) or 52 7

501(c)(3)

II

Website:

JH(c) Group exemption number

I

KForm of organization: Corporation Trust Association Other LYear of formation: MState of legal domicile:

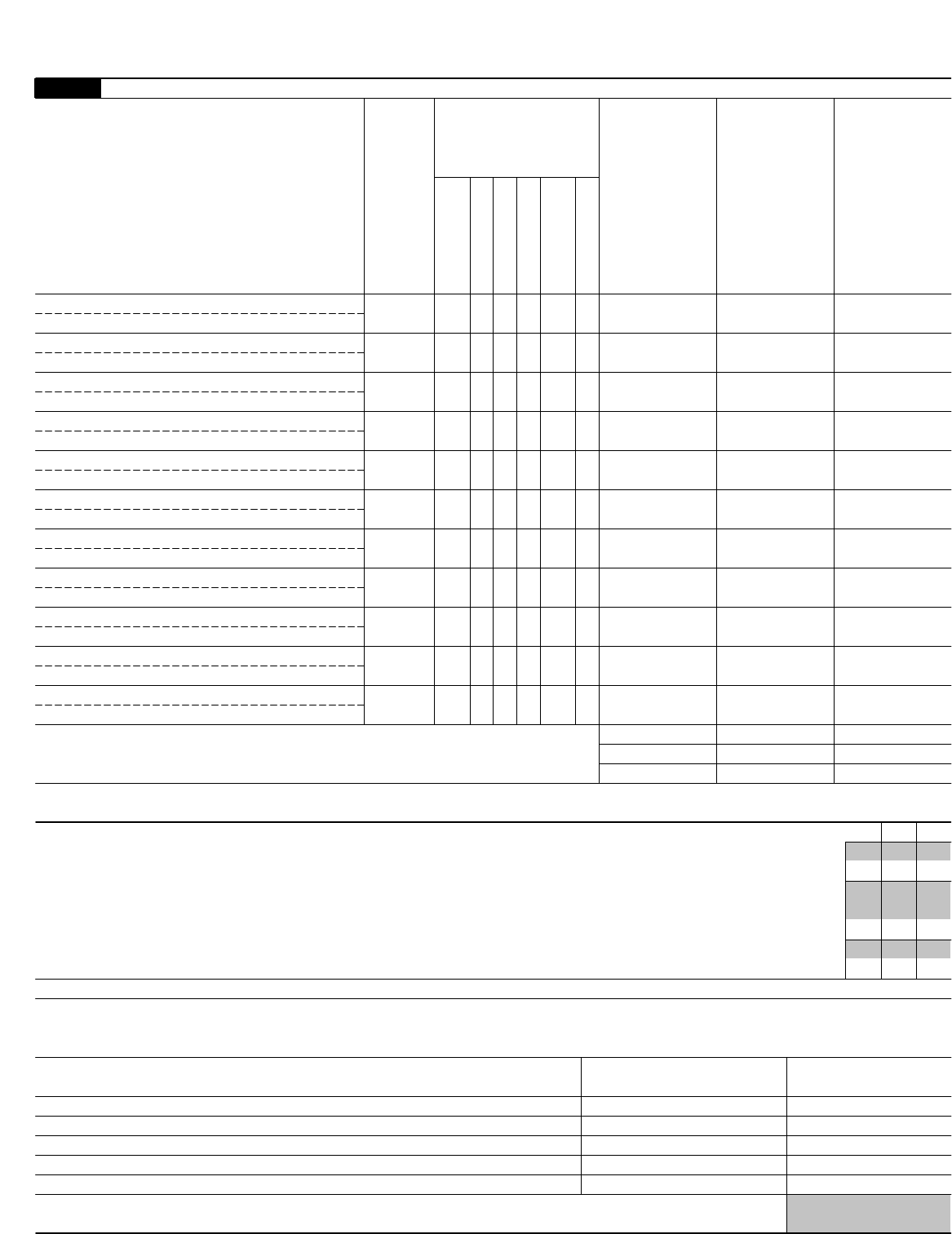

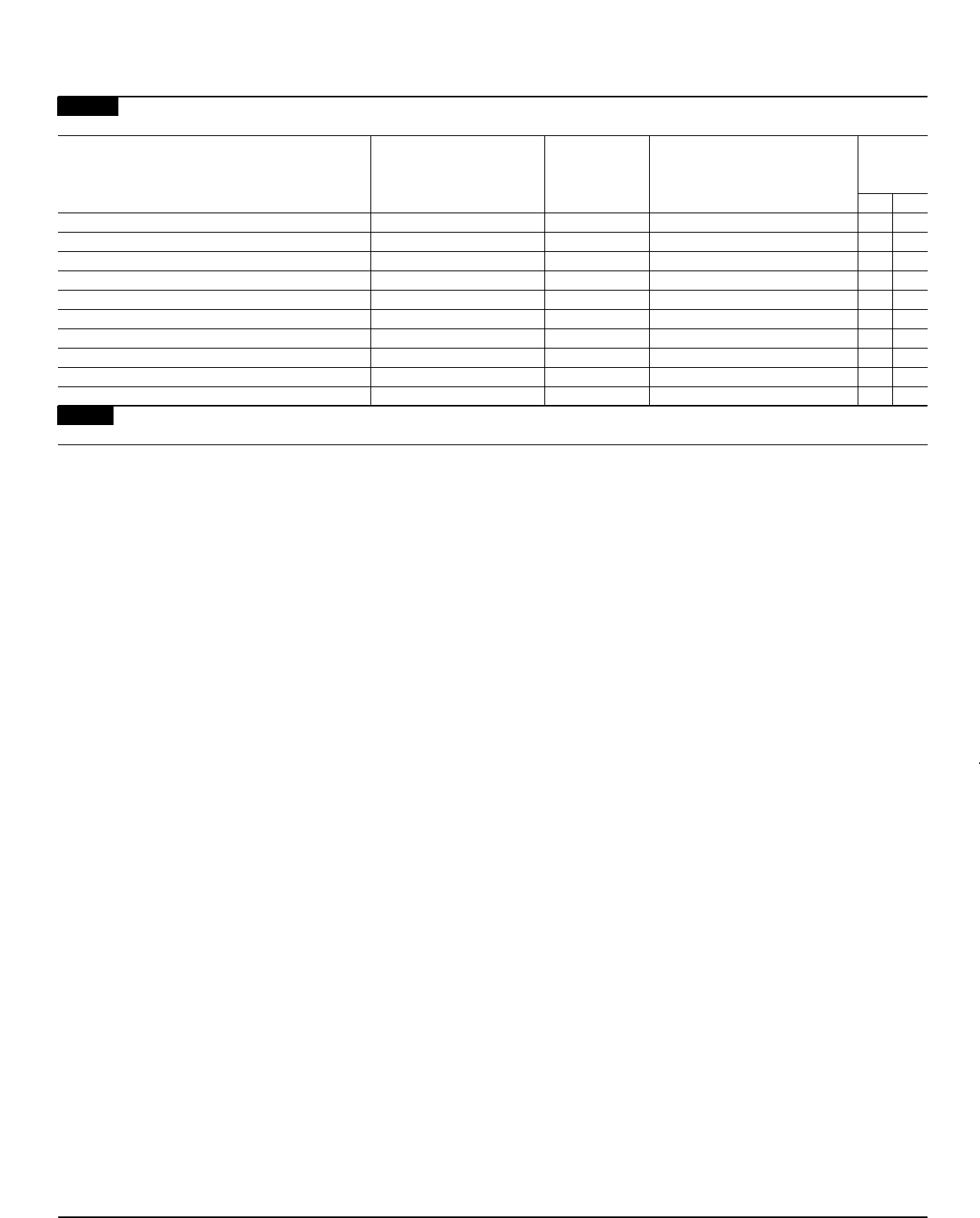

Summary

Part

I

1Briefly describe the organization's mission or most significant activities:

I

2

3

4

5

6

7

Check this box

Number of voting members of the governing body (Part VI, line 1a)

Number of independent voting members of the governing body (Part VI, line 1b)

Total number of individuals employed in calendar year 2011 (Part V, line 2a)

Total number of volunteers (estimate if necessary)

Total unrelated business revenue from Part VIII, column (C), line 12

Net unrelated business taxable income from Form 990-T, line 34

if the organization discontinued its operations or disposed of more than 25% of its net assets.

3

4

5

6

7a

7b

mmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmm

Activities & Governance

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

ammmmmmmmmmmmmmmmmmmmmmmm

bmmmmmmmmmmmmmmmmmmmmmmmmm

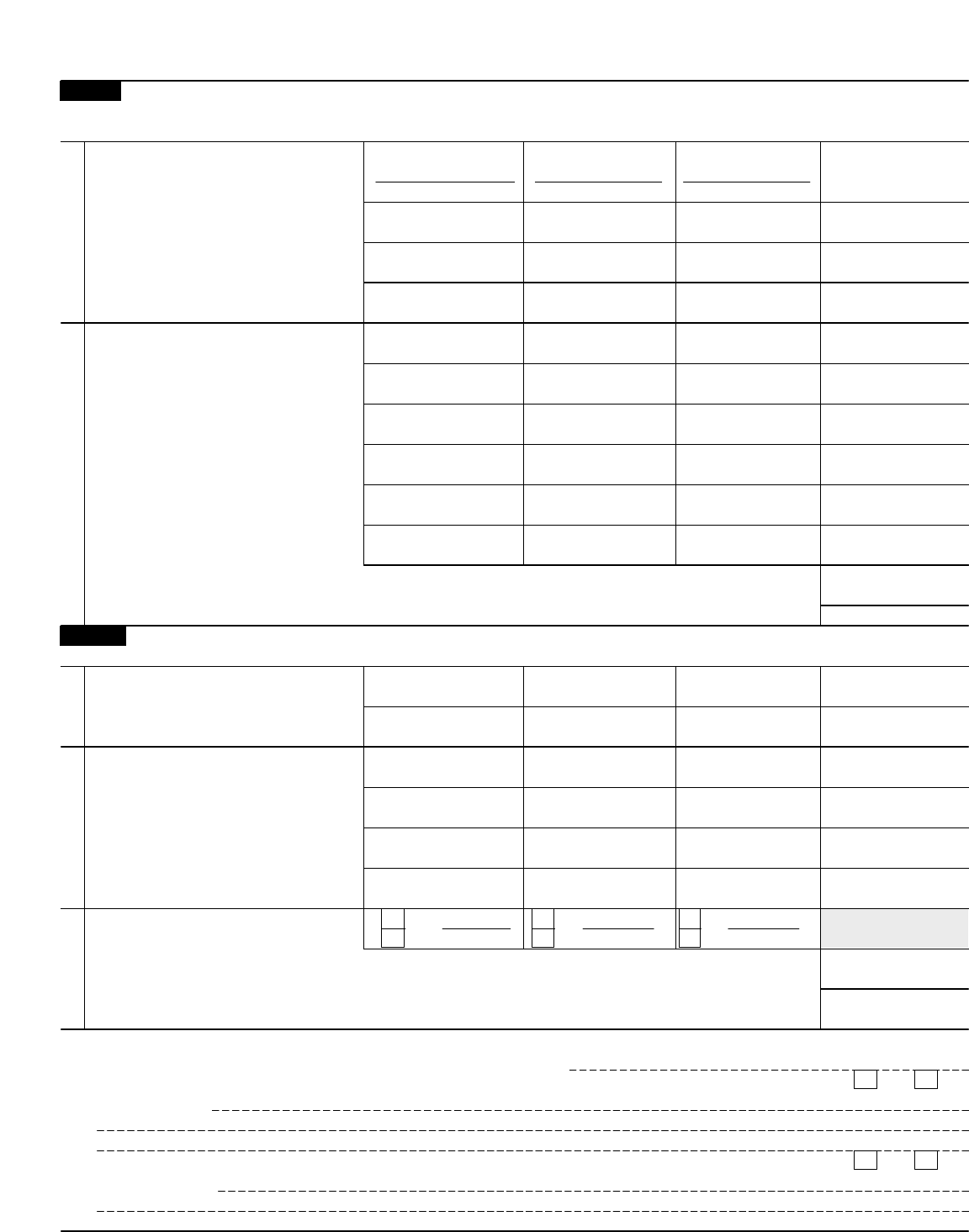

Prior Year Current Year

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

Contributions and grants (Part VIII, line 1h)

Program service revenue (Part VIII, line 2g)

Investment income (Part VIII, column (A), lines 3, 4, and 7d)

Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and 11e)

Total revenue - add lines 8 through 11 (must equal Part VIII, column (A), line 12)

Grants and similar amounts paid (Part IX, column (A), lines 1-3)

Benefits paid to or for members (Part IX, column (A), line 4)

Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10)

Professional fundraising fees (Part IX, column (A), line 11e)

Total fundraising expenses (Part IX, column (D), line 25)

Other expenses (Part IX, column (A), lines 11a-11d, 11f-24e)

Total expenses. Add lines 13-17 (must equal Part IX, column (A), line 25)

Revenue less expenses. Subtract line 18 from line 12

Total assets (Part X, line 16)

Total liabilities (Part X, line 26)

Net assets or fund balances. Subtract line 21 from line 20

mmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmm

Revenue

mmmmmmmmmmmm

mmmmmmm

mmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmm

mmmmmmm

I

ammmmmmmmmmmmmmmmm

b

Expenses

mmmmmmmmmmmmmmmm

mmmmmmmmmm

mmmmmmmmmmmmmmmmmmmm

Beginning of Current Year End of Year

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmm

Net Assets or

Fund Balances

Signature Block

Part

II

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge.

Sign

Here MSignature of officer Date

MType or print name and title

Print/Type preparer's name Preparer's signature Date PTIN

Check if

Paid

Preparer

Use Only

self-employed

I

II

Firm's name

Firm's address

Firm's EIN

Phone no.

May the IRS discuss this return with the preparer shown above? (see instructions) Yes No

mmmmmmmmmmmmmmmmmmmmmmmmm

For Paperwork Reduction Act Notice, see the separate instructions. Form 990 (2011)

JSA

1E1010 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

170 LONGVIEW ROAD (908 ) 234-1225

FAR HILLS, NJ 07931 19,067,247.

X

X

WWW.NJCONSERVATION.ORG

X 1960 NJ

TO PRESERVE LAND AND NATURAL RESOURCES THROUGHOUT NEW JERSEY FOR THE

BENEFIT OF ALL.

25.

25.

37.

250.

0

0

14,802,427. 13,089,533.

0 0

82,790. 123,431.

60,484. 51,914.

14,945,701. 13,264,878.

4,345,923. 1,770,303.

0 0

2,122,730. 2,116,785.

37,429. 0

498,616.

2,316,203. 4,081,502.

8,822,285. 7,968,590.

6,123,416. 5,296,288.

38,004,698. 39,076,748.

1,598,747. 1,912,557.

36,405,951. 37,164,191.

KEITH REED PRESIDENT

P01085545

EISNERAMPER LLP 13-1639826

750 ROUTE 202 SOUTH SUITE 500 BRIDGEWATER, NJ 08807 908-218-5002

X

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 2

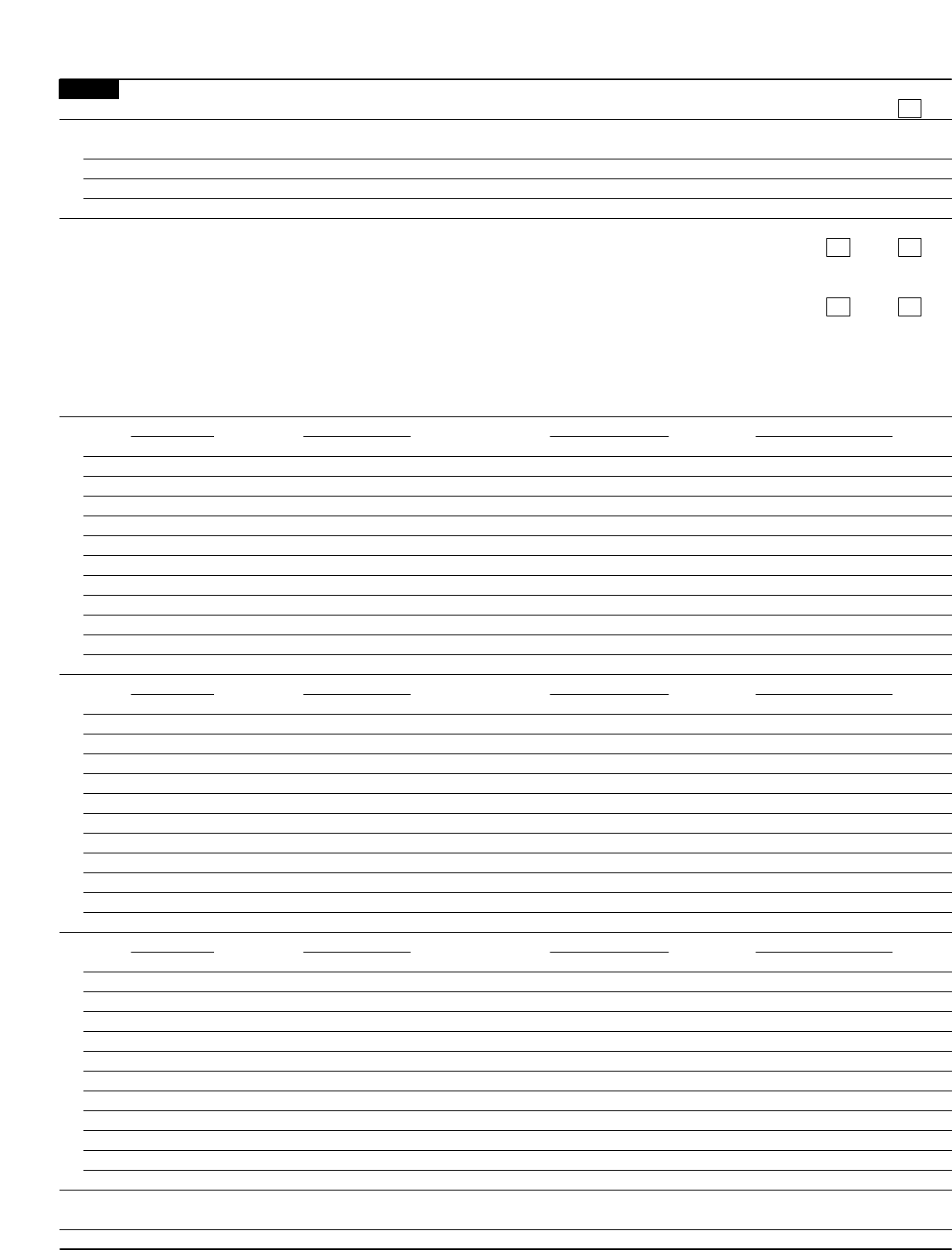

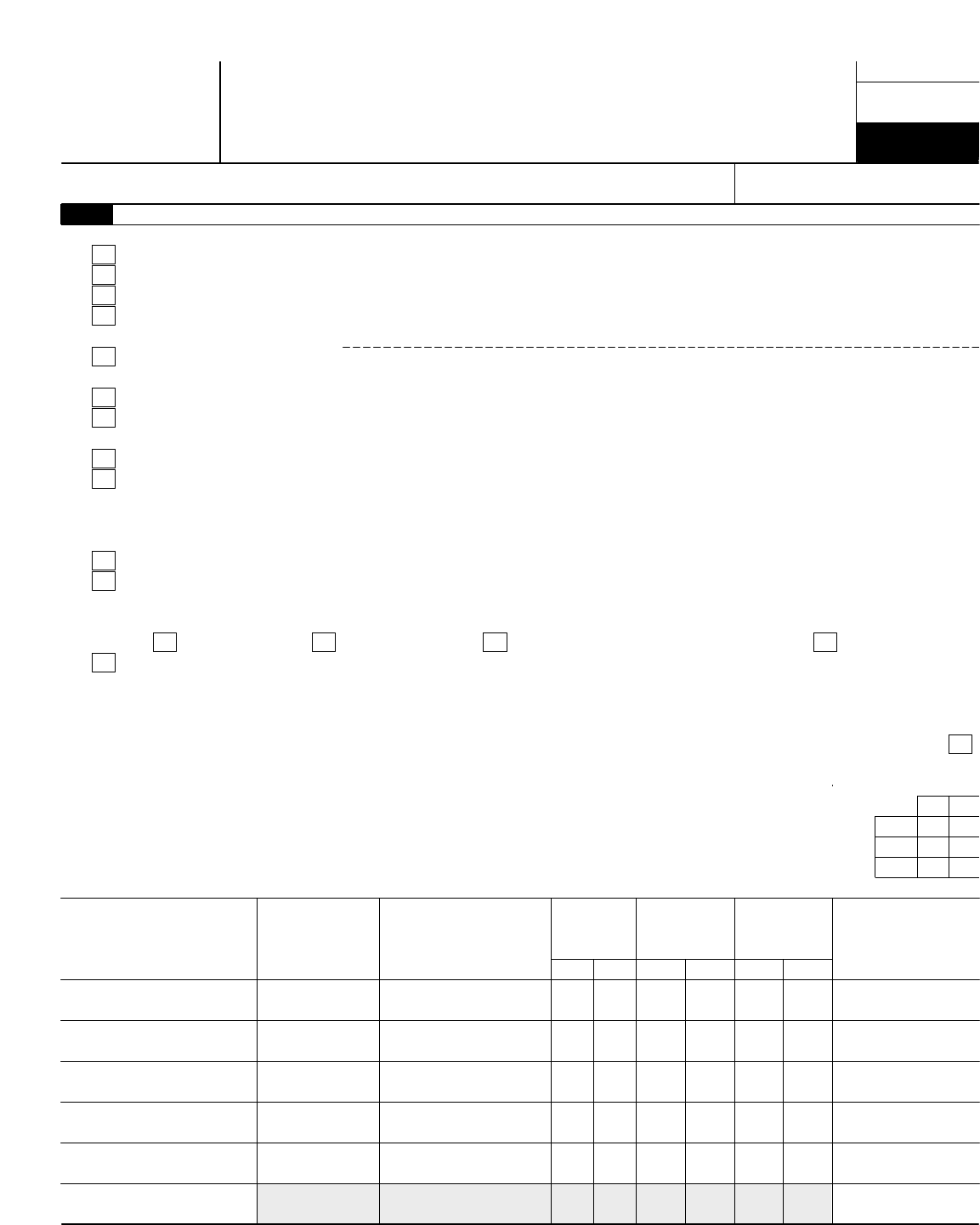

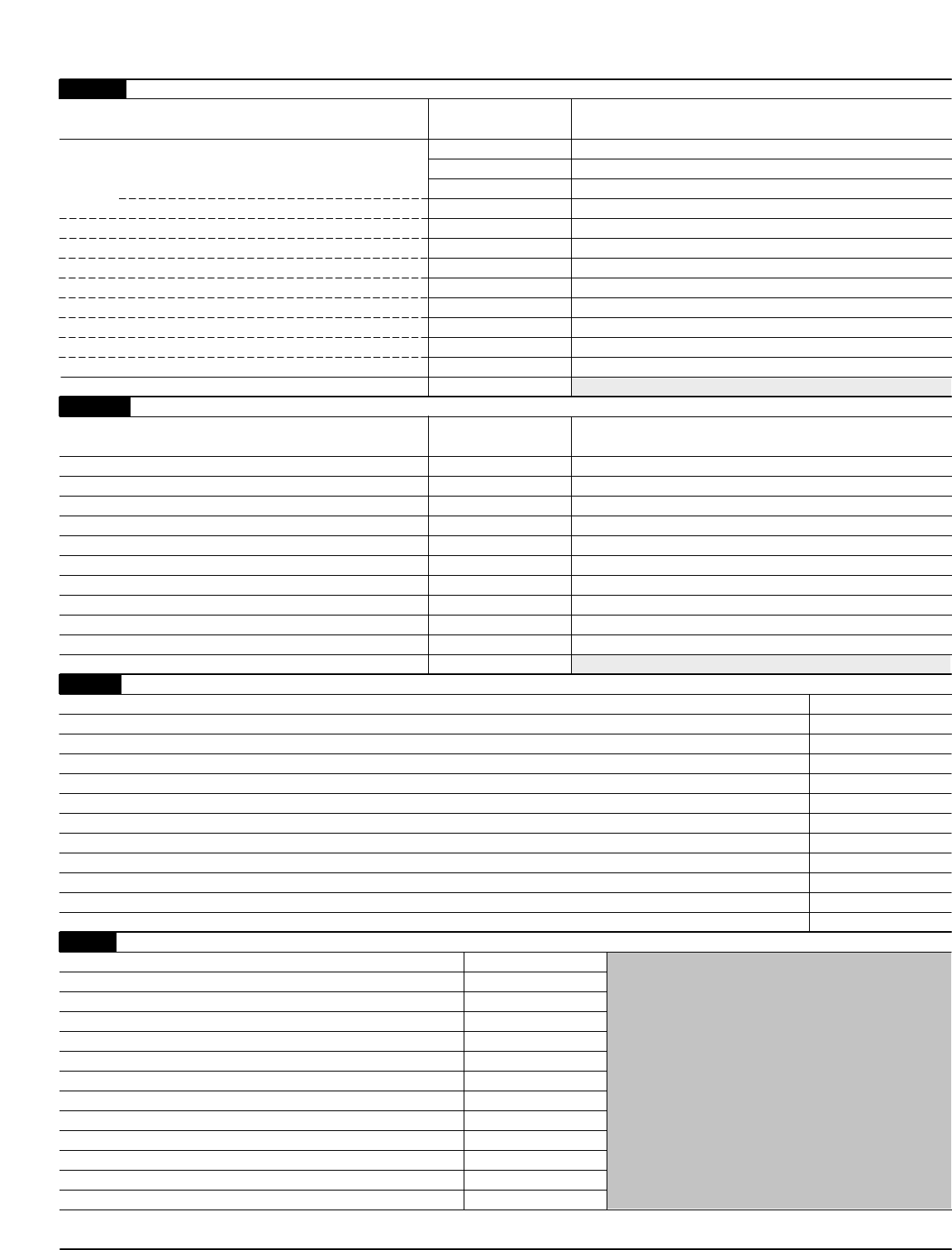

Form 990 (2011) Page 2

Statement of Program Service Accomplishments

Part III

Check if Schedule O contains a response to any question in this Part III mmmmmmmmmmmmmmmmmmmmmmmm

1Briefly describe the organization's mission:

2Did the organization undertake any significant program services during the year which were not listed on the

prior Form 990 or 990-EZ? Yes No

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

If "Yes," describe these new services on Schedule O.

3Did the organization cease conducting, or make significant changes in how it conducts, any program

services? Yes No

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

If "Yes," describe these changes on Schedule O.

4Describe the organization's program service accomplishments for each of its three largest program services, as measured by

expenses. Section 501(c)(3) and 501(c)(4) organizations and section 4947(a)(1) trusts are required to report the amount of

grants and allocations to others, the total expenses, and revenue, if any, for each program service reported.

4a (Code: ) (Expenses $ including grants of $ ) (Revenue $ )

4b (Code: ) (Expenses $ including grants of $ ) (Revenue $ )

4c (Code: ) (Expenses $ including grants of $ ) (Revenue $ )

4d Other program services (Describe in Schedule O.)

(Expenses $ including grants of $ ) (Revenue $ )

I

4e Total program service expenses

JSA Form 990 (2011)

1E1020 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

X

SEE SCHEDULE O.

X

X

7,081,617. 1,770,303.

ATTACHMENT 1

7,081,617.

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 3

Form 990 (2011) Page 3

Checklist of Required Schedules

Part IV

Yes No

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

Is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? If "Yes,"

complete Schedule A 1

2

3

4

5

6

7

8

9

10

11a

11b

11c

11d

11e

11f

12a

12b

13

14a

14b

15

16

17

18

19

20a

20b

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Is the organization required to complete Schedule B, Schedule of Contributors (see instructions)? mmmmmmmmm

Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to

candidates for public office? If "Yes," complete Schedule C, Part I mmmmmmmmmmmmmmmmmmmmmmmmmmm

Section 501(c)(3) organizations. Did the organization engage in lobbying activities, or have a section 501(h)

election in effect during the tax year? If "Yes," complete Schedule C, Part II mmmmmmmmmmmmmmmmmmmmmm

Is the organization a section 501(c)(4), 501(c)(5), or 501(c)(6) organization that receives membership dues,

assessments, or similar amounts as defined in Revenue Procedure 98-19? If "Yes," complete Schedule C,

Part III mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization maintain any donor advised funds or any similar funds or accounts for which donors

have the right to provide advice on the distribution or investment of amounts in such funds or accounts? If

"Yes," complete Schedule D, Part I mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization receive or hold a conservation easement, including easements to preserve open space,

the environment, historic land areas, or historic structures? If "Yes," complete Schedule D, Part II mmmmmmmmmm

Did the organization maintain collections of works of art, historical treasures, or other similar assets? If "Yes,"

complete Schedule D, Part III mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization report an amount in Part X, line 21; serve as a custodian for amounts not listed in Part

X; or provide credit counseling, debt management, credit repair, or debt negotiation services? If "Yes,"

complete Schedule D, Part IV mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization, directly or through a related organization, hold assets in temporarily restricted

endowments, permanent endowments, or quasi-endowments? If "Yes," complete Schedule D, Part V mmmmmmm

If the organization’s answer to any of the following questions is "Yes," then complete Schedule D, Parts VI,

VII, VIII, IX, or X as applicable.

a

b

c

d

e

f

a

Did the organization report an amount for land, buildings, and equipment in Part X, line 10? If "Yes," complete

Schedule D, Part VI mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization report an amount for investments—other securities in Part X, line 12 that is 5% or more

of its total assets reported in Part X, line 16? If "Yes," complete Schedule D, Part VII mmmmmmmmmmmmmmmmm

Did the organization report an amount for investments-program related in Part X, line 13 that is 5% or more

of its total assets reported in Part X, line 16? If "Yes," complete Schedule D, Part VIII mmmmmmmmmmmmmmmmm

Did the organization report an amount for other assets in Part X, line 15 that is 5% or more of its total assets

reported in Part X, line 16? If "Yes," complete Schedule D, Part IX mmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization report an amount for other liabilities in Part X, line 25? If "Yes," complete Schedule D, Part X

Did the organization’s separate or consolidated financial statements for the tax year include a footnote that addresses

the organization's liability for uncertain tax positions under FIN 48 (ASC 740)? If "Yes," complete Schedule D, Part X mmmmmm

Did the organization obtain separate, independent audited financial statements for the tax year? If "Yes,"

complete Schedule D, Parts XI, XII, and XIII mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

b

a

b

a

b

Was the organization included in consolidated, independent audited financial statements for the tax year? If "Yes," and if

the organization answered "No" to line 12a, then completing Schedule D, Parts XI, XII, and XIII is optional mmmmmmmmmmmm

Is the organization a school described in section 170(b)(1)(A)(ii)? If "Yes," complete Schedule E mmmmmmmmmm

Did the organization maintain an office, employees, or agents outside of the United States?mmmmmmmmmmmmm

Did the organization have aggregate revenues or expenses of more than $10,000 from grantmaking,

fundraising, business, investment, and program service activities outside the United States, or aggregate

foreign investments valued at $100,000 or more? If "Yes," complete Schedule F, Parts I and IV mmmmmmmmmmm

Did the organization report on Part IX, column (A), line 3, more than $5,000 of grants or assistance to any

organization or entity located outside the United States? If "Yes," complete Schedule F, Parts II and IV mmmmmmm

Did the organization report on Part IX, column (A), line 3, more than $5,000 of aggregate grants or assistance

to individuals located outside the United States? If "Yes," complete Schedule F, Parts III and IV mmmmmmmmmmm

Did the organization report a total of more than $15,000 of expenses for professional fundraising services

on Part IX, column (A), lines 6 and 11e? If "Yes," complete Schedule G, Part I (see instructions) mmmmmmmmmmm

Did the organization report more than $15,000 total of fundraising event gross income and contributions on

Part VIII, lines 1c and 8a? If "Yes," complete Schedule G, Part II mmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization report more than $15,000 of gross income from gaming activities on Part VIII, line 9a?

If "Yes," complete Schedule G, Part III mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization operate one or more hospital facilities? If "Yes," complete Schedule H

If "Yes" to line 20a, did the organization attach a copy of its audited financial statements to this return?

mmmmmmmmmmmmm

mmmmmm

Form 990 (2011)

JSA

1E1021 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 4

Form 990 (2011) Page 4

Checklist of Required Schedules (continued)

Part IV

Yes No

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

Did the organization report more than $5,000 of grants and other assistance to any government or organization

in the United States on Part IX, column (A), line 1? If "Yes," complete Schedule I, Parts I and II 21

22

23

24a

24b

24c

24d

25a

25b

26

27

28a

28b

28c

29

30

31

32

33

34

35a

35b

36

37

38

mmmmmmmmmmmm

Did the organization report more than $5,000 of grants and other assistance to individuals in the United States

on Part IX, column (A), line 2? If "Yes," complete Schedule I, Parts I and III mmmmmmmmmmmmmmmmmmmmmm

Did the organization answer "Yes" to Part VII, Section A, line 3, 4, or 5 about compensation of the

organization's current and former officers, directors, trustees, key employees, and highest compensated

employees? If "Yes," complete Schedule J mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

a

b

c

d

a

b

a

b

c

Did the organization have a tax-exempt bond issue with an outstanding principal amount of more than

$100,000 as of the last day of the year, that was issued after December 31, 2002? If "Yes," answer lines 24b

through 24d and complete Schedule K. If “No,” go to line 25 mmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization invest any proceeds of tax-exempt bonds beyond a temporary period exception? mmmmmmm

Did the organization maintain an escrow account other than a refunding escrow at any time during the year

to defease any tax-exempt bonds? mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization act as an "on behalf of" issuer for bonds outstanding at any time during the year?mmmmmmm

Section 501(c)(3) and 501(c)(4) organizations. Did the organization engage in an excess benefit transaction

with a disqualified person during the year? If "Yes," complete Schedule L, Part I mmmmmmmmmmmmmmmmmmm

Is the organization aware that it engaged in an excess benefit transaction with a disqualified person in a prior

year, and that the transaction has not been reported on any of the organization's prior Forms 990 or 990-EZ?

If "Yes," complete Schedule L, Part I mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Was a loan to or by a current or former officer, director, trustee, key employee, highly compensated employee, or

disqualified person outstanding as of the end of the organization's tax year? If "Yes," complete Schedule L, Part II m

Did the organization provide a grant or other assistance to an officer, director, trustee, key employee,

substantial contributor or employee thereof, a grant selection committee member, or to a 35% controlled

entity or family member of any of these persons? If "Yes," complete Schedule L, Part III mmmmmmmmmmmmmmm

Was the organization a party to a business transaction with one of the following parties (see Schedule L,

Part IV instructions for applicable filing thresholds, conditions, and exceptions):

A current or former officer, director, trustee, or key employee? If "Yes," complete Schedule L, Part IV mmmmmmmm

A family member of a current or former officer, director, trustee, or key employee? If "Yes," complete

Schedule L, Part IV mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

An entity of which a current or former officer, director, trustee, or key employee (or a family member thereof)

was an officer, director, trustee, or direct or indirect owner? If "Yes," complete Schedule L, Part IV mmmmmmmmm

Did the organization receive more than $25,000 in non-cash contributions? If "Yes," complete Schedule M

Did the organization receive contributions of art, historical treasures, or other similar assets, or qualified

conservation contributions? If "Yes," complete Schedule M mmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization liquidate, terminate, or dissolve and cease operations? If "Yes," complete Schedule N,

Part I mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization sell, exchange, dispose of, or transfer more than 25% of its net assets? If "Yes,"

complete Schedule N, Part II mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization own 100% of an entity disregarded as separate from the organization under Regulations

sections 301.7701-2 and 301.7701-3? If "Yes," complete Schedule R, Part I mmmmmmmmmmmmmmmmmmmmm

Was the organization related to any tax-exempt or taxable entity? If "Yes," complete Schedule R, Parts II, III,

IV, and V, line 1 mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

a

b

Did the organization have a controlled entity within the meaning of section 512(b)(13)? mmmmmmmmmmmmmm

Did the organization receive any payment from or engage in any transaction with a controlled entity within the

meaning of section 512(b)(13)? If "Yes," complete Schedule R, Part V, line 2 mmmmmmmmmmmmmmmmmmmmm

Section 501(c)(3) organizations. Did the organization make any transfers to an exempt non-charitable

related organization? If "Yes," complete Schedule R, Part V, line 2 mmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization conduct more than 5% of its activities through an entity that is not a related organization

and that is treated as a partnership for federal income tax purposes? If "Yes," complete Schedule R,

Part VI mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization complete Schedule O and provide explanations in Schedule O for Part VI, lines 11 and

19? Note. All Form 990 filers are required to complete Schedule O. mmmmmmmmmmmmmmmmmmmmmmmmmForm 990 (2011)

JSA

1E1030 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 5

Form 990 (2011) Page 5

Statements Regarding Other IRS Filings and Tax Compliance

Check if Schedule O contains a response to any question in this Part V

Part V

mmmmmmmmmmmmmmmmmmmmmmm

Yes No

1a

1b

2a

7d

1

2

3

4

5

6

7

8

9

10

11

12

13

14

a

b

c

a

b

a

b

a

b

a

b

c

a

b

a

b

c

d

e

f

g

h

a

b

a

b

a

b

a

b

a

b

c

a

b

Enter the number reported in Box 3 of Form 1096. Enter -0- if not applicable mmmmmmmmmm

Enter the number of Forms W-2G included in line 1a. Enter -0- if not applicable mmmmmmmmm

Did the organization comply with backup withholding rules for reportable payments to vendors and

reportable gaming (gambling) winnings to prize winners? 1c

2b

3a

3b

4a

5a

5b

5c

6a

6b

7a

7b

7c

7e

7f

7g

7h

8

9a

9b

12a

13a

14a

14b

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Enter the number of employees reported on Form W-3, Transmittal of Wage and Tax

Statements, filed for the calendar year ending with or within the year covered by this return m

If at least one is reported on line 2a, did the organization file all required federal employment tax returns?

Note. If the sum of lines 1a and 2a is greater than 250, you may be required to e-file (see instructions) mmmmmmm

Did the organization have unrelated business gross income of $1,000 or more during the year? mmmmmmmmmm

If "Yes," has it filed a Form 990-T for this year? If "No," provide an explanation in Schedule O mmmmmmmmmmmmm

At any time during the calendar year, did the organization have an interest in, or a signature or other authority

over, a financial account in a foreign country (such as a bank account, securities account, or other financial

account)? mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

I

If “Yes,” enter the name of the foreign country:

See instructions for filing requirements for Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts.

Was the organization a party to a prohibited tax shelter transaction at any time during the tax year? mmmmmmmm

Did any taxable party notify the organization that it was or is a party to a prohibited tax shelter transaction?

If "Yes" to line 5a or 5b, did the organization file Form 8886-T? mmmmmmmmmmmmmmmmmmmmmmmmmmmm

Does the organization have annual gross receipts that are normally greater than $100,000, and did the

organization solicit any contributions that were not tax deductible? mmmmmmmmmmmmmmmmmmmmmmmmmm

If "Yes," did the organization include with every solicitation an express statement that such contributions or

gifts were not tax deductible? mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Organizations that may receive deductible contributions under section 170(c).

Did the organization receive a payment in excess of $75 made partly as a contribution and partly for goods

and services provided to the payor? mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

If "Yes," did the organization notify the donor of the value of the goods or services provided? mmmmmmmmmmmm

Did the organization sell, exchange, or otherwise dispose of tangible personal property for which it was

required to file Form 8282? mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

If "Yes," indicate the number of Forms 8282 filed during the year mmmmmmmmmmmmmmmm

Did the organization receive any funds, directly or indirectly, to pay premiums on a personal benefit contract? mmm

Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract?

If the organization received a contribution of qualified intellectual property, did the organization file Form 8899 as required? mmm

If the organization received a contribution of cars, boats, airplanes, or other vehicles, did the organization file a Form 1098-C?

Sponsoring organizations maintaining donor advised funds and section 509(a)(3) supporting

organizations. Did the supporting organization, or a donor advised fund maintained by a sponsoring

organization, have excess business holdings at any time during the year? mmmmmmmmmmmmmmmmmmmmmmm

Sponsoring organizations maintaining donor advised funds.

Did the organization make any taxable distributions under section 4966?

Did the organization make a distribution to a donor, donor advisor, or related person?

Section 501(c)(7) organizations. Enter:

Initiation fees and capital contributions included on Part VIII, line 12

Gross receipts, included on Form 990, Part VIII, line 12, for public use of club facilities

Section 501(c)(12) organizations. Enter:

Gross income from members or shareholders

mmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmm

10a

10b

11a

11b

12b

13b

13c

mmmmmmmmmmmmmm

mmmm

mmmmmmmmmmmmmmmmmmmmmmmmmm

Gross income from other sources (Do not net amounts due or paid to other sources

against amounts due or received from them.) mmmmmmmmmmmmmmmmmmmmmmmmmmm

Section 4947(a)(1) non-exempt charitable trusts. Is the organization filing Form 990 in lieu of Form 1041?

If "Yes," enter the amount of tax-exempt interest received or accrued during the year mmmmm

Section 501(c)(29) qualified nonprofit health insurance issuers.

Is the organization licensed to issue qualified health plans in more than one state? mmmmmmmmmmmmmmmmmm

Note. See the instructions for additional information the organization must report on Schedule O.

Enter the amount of reserves the organization is required to maintain by the states in which

the organization is licensed to issue qualified health plans mmmmmmmmmmmmmmmmmmmm

Enter the amount of reserves on hand mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization receive any payments for indoor tanning services during the tax year? mmmmmmmmmmmmm

If "Yes," has it filed a Form 720 to report these payments? If "No," provide an explanation in Schedule O mmmmmm

JSA Form 990 (2011)

1E1040 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

33

0

X

37

X

X

X

X

X

X

X

X

X

X

X

X

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 6

Form 990 (2011) Page 6

Governance, Management, and Disclosure For each "Yes" response to lines 2 through 7b below, and for a

"No" response to line 8a, 8b, or 10b below, describe the circumstances, processes, or changes in Schedule

O. See instructions.

Part VI

mmmmmmmmmmmmmmmmmmmmmmmmmm

Check if Schedule O contains a response to any question in this Part VI

Section A. Governing Body and Management

Yes No

1a

1b

mmmmmm

1

2

3

4

5

6

7

8

a

b

a

b

a

b

Enter the number of voting members of the governing body at the end of the tax year. If there are

material differences in voting rights among members of the governing body, or if the governing body

delegated broad authority to an executive committee or similar committee, explain in Schedule O.

Enter the number of voting members included in line 1a, above, who are independent mmmmmm

2

3

4

5

6

7a

7b

8a

8b

9

10a

10b

11a

12a

12b

12c

13

14

15a

15b

16a

16b

Did any officer, director, trustee, or key employee have a family relationship or a business relationship with

any other officer, director, trustee, or key employee? mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization delegate control over management duties customarily performed by or under the direct

supervision of officers, directors, or trustees, or key employees to a management company or other person? mmm

Did the organization make any significant changes to its governing documents since the prior Form 990 was filed?

Did the organization become aware during the year of a significant diversion of the organization's assets?

Did the organization have members or stockholders?

mmmmmmm

mmmmm

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization have members, stockholders, or other persons who had the power to elect or appoint

one or more members of the governing body? mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Are any governance decisions of the organization reserved to (or subject to approval by) members,

stockholders, or persons other than the governing body? mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization contemporaneously document the meetings held or written actions undertaken during

the year by the following:

The governing body?

Each committee with authority to act on behalf of the governing body?

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmm

9Is there any officer, director, trustee, or key employee listed in Part VII, Section A, who cannot be reached at

the organization's mailing address? If "Yes," provide the names and addresses in Schedule O mmmmmmmmmmmm

Section B. Policies (This Section B requests information about policies not required by the Internal Revenue Code.)

Yes No

10

11

12

13

14

15

16

a

b

a

b

a

b

c

a

b

a

b

Did the organization have local chapters, branches, or affiliates? mmmmmmmmmmmmmmmmmmmmmmmmmmm

If "Yes," did the organization have written policies and procedures governing the activities of such chapters,

affiliates, and branches to ensure their operations are consistent with the organization's exempt purposes? mmmm

Has the organization provided a complete copy of this Form 990 to all members of its governing body before filing the form? mm

Describe in Schedule O the process, if any, used by the organization to review this Form 990.

Did the organization have a written conflict of interest policy? If "No," go to line 13 mmmmmmmmmmmmmmmmm

Were officers, directors, or trustees, and key employees required to disclose annually interests that could give

rise to conflicts? mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization regularly and consistently monitor and enforce compliance with the policy? If "Yes,"

describe in Schedule O how this was done mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization have a written whistleblower policy?

Did the organization have a written document retention and destruction policy?

Did the process for determining compensation of the following persons include a review and approval by

independent persons, comparability data, and contemporaneous substantiation of the deliberation and decision?

The organization's CEO, Executive Director, or top management official

Other officers or key employees of the organization

If "Yes" to line 15a or 15b, describe the process in Schedule O (see instructions.)

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Did the organization invest in, contribute assets to, or participate in a joint venture or similar arrangement

with a taxable entity during the year? mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

If "Yes," did the organization follow a written policy or procedure requiring the organization to evaluate its

participation in joint venture arrangements under applicable federal tax law, and take steps to safeguard the

organization's exempt status with respect to such arrangements? mmmmmmmmmmmmmmmmmmmmmmmmmm

Section C. Disclosure I

17

18

19

20

List the states with which a copy of this Form 990 is required to be filed

Section 6104 requires an organization to make its Forms 1023 (or 1024 if applicable), 990, and 990-T (Section 501(c)(3)s only)

available for public inspection. Indicate how you made these available. Check all that apply.

Own website Another's website Upon request

Describe in Schedule O whether (and if so, how), the organization made its governing documents, conflict of interest policy,

and financial statements available to the public during the tax year.

State the name, physical address, and telephone number of the person who possesses the books and records of the

I

organization:

JSA Form 990 (2011)

1E1042 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

X

25

25

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

NJ,NY,PA,

X

KAREN RICHARDS, CPA 170 LONGVIEW ROAD FAR HILLS, NJ 07931 908-234-1225

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 7

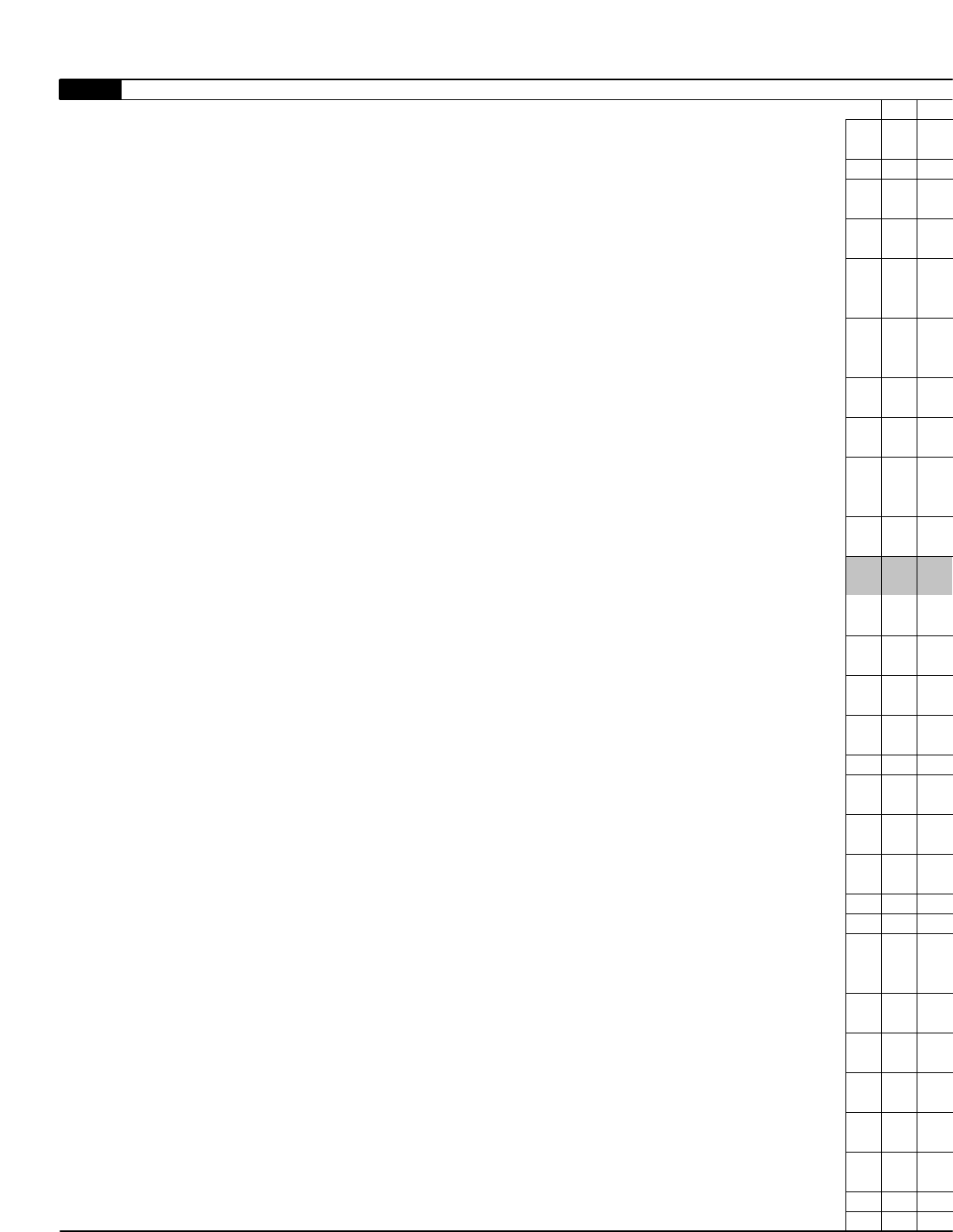

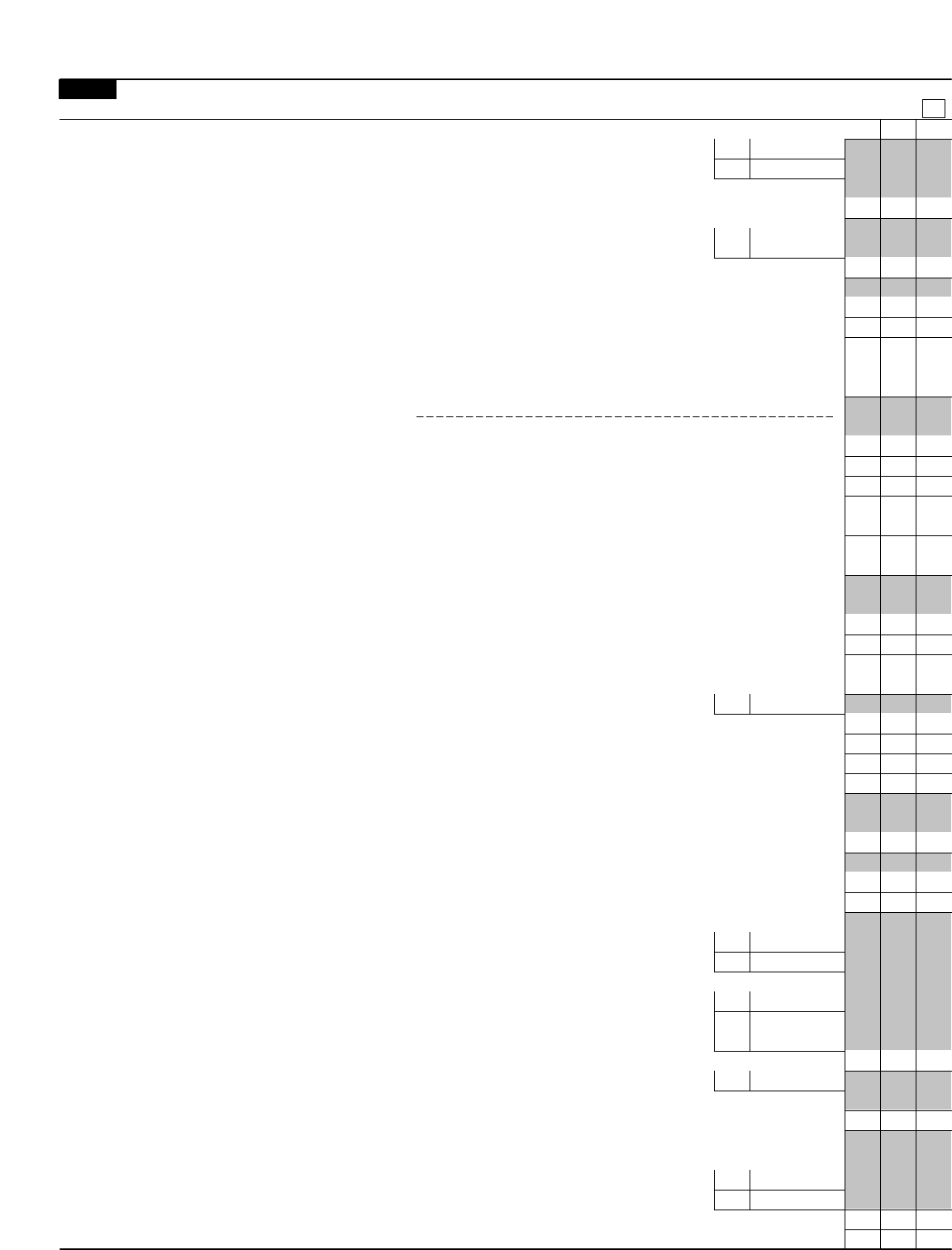

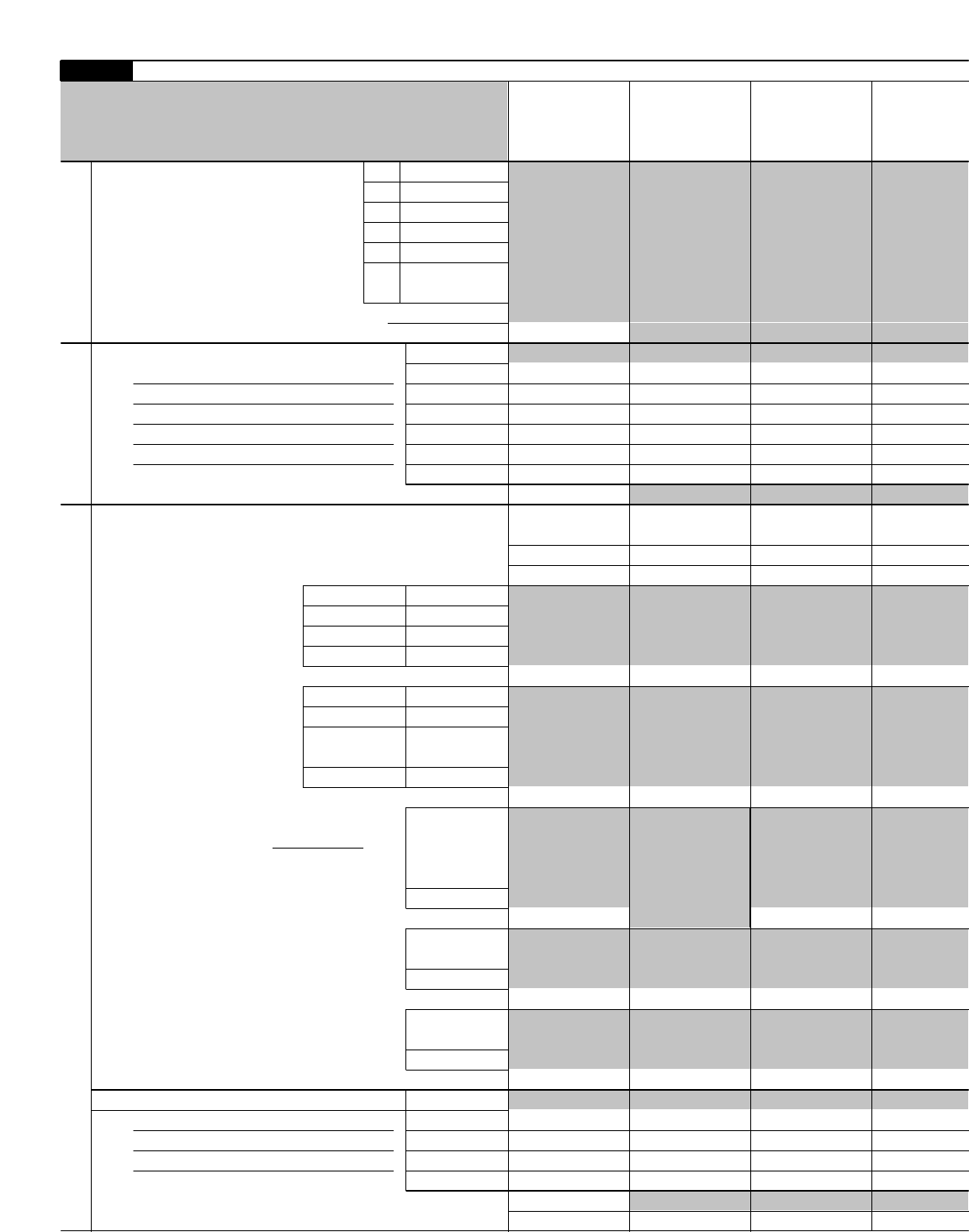

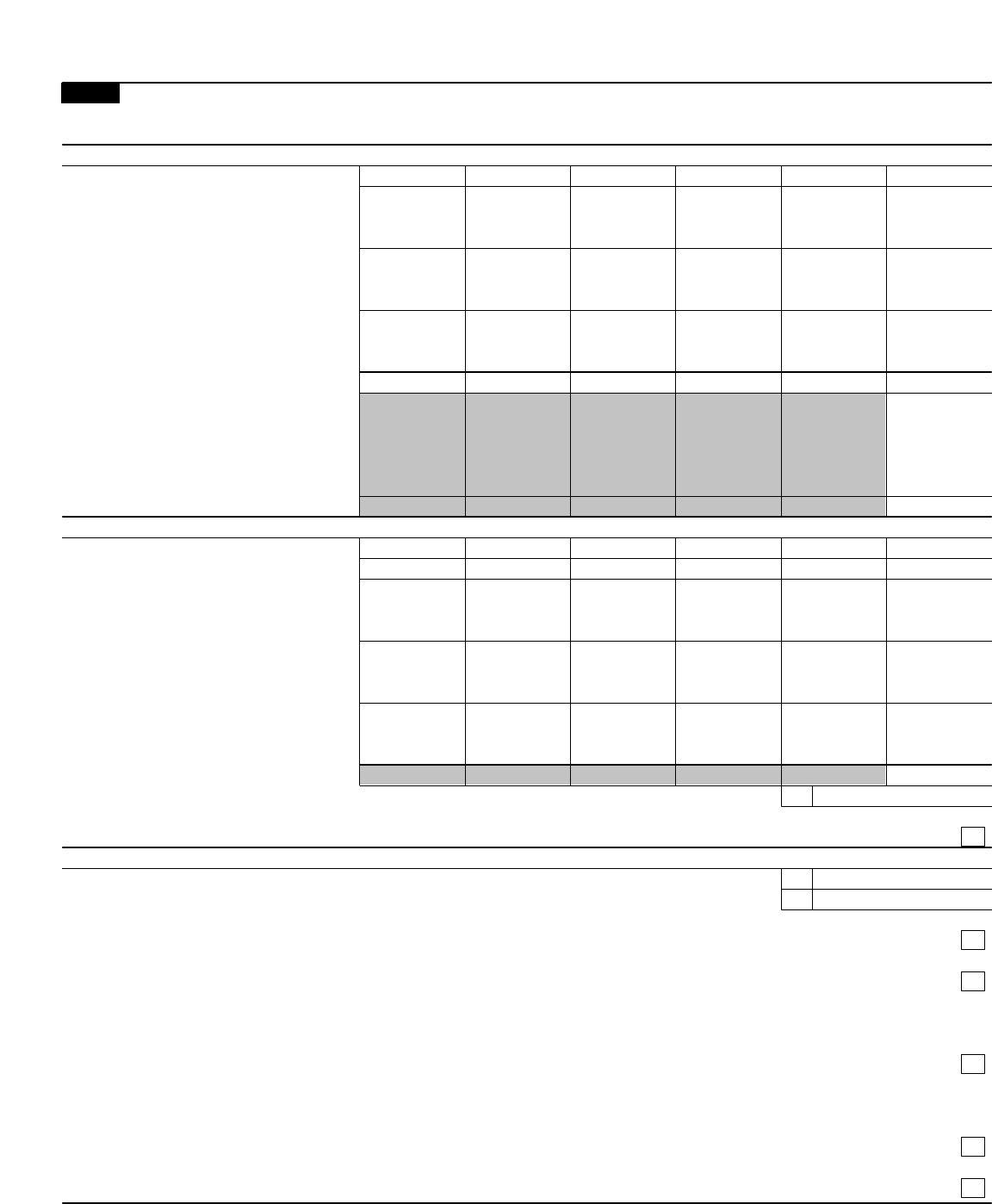

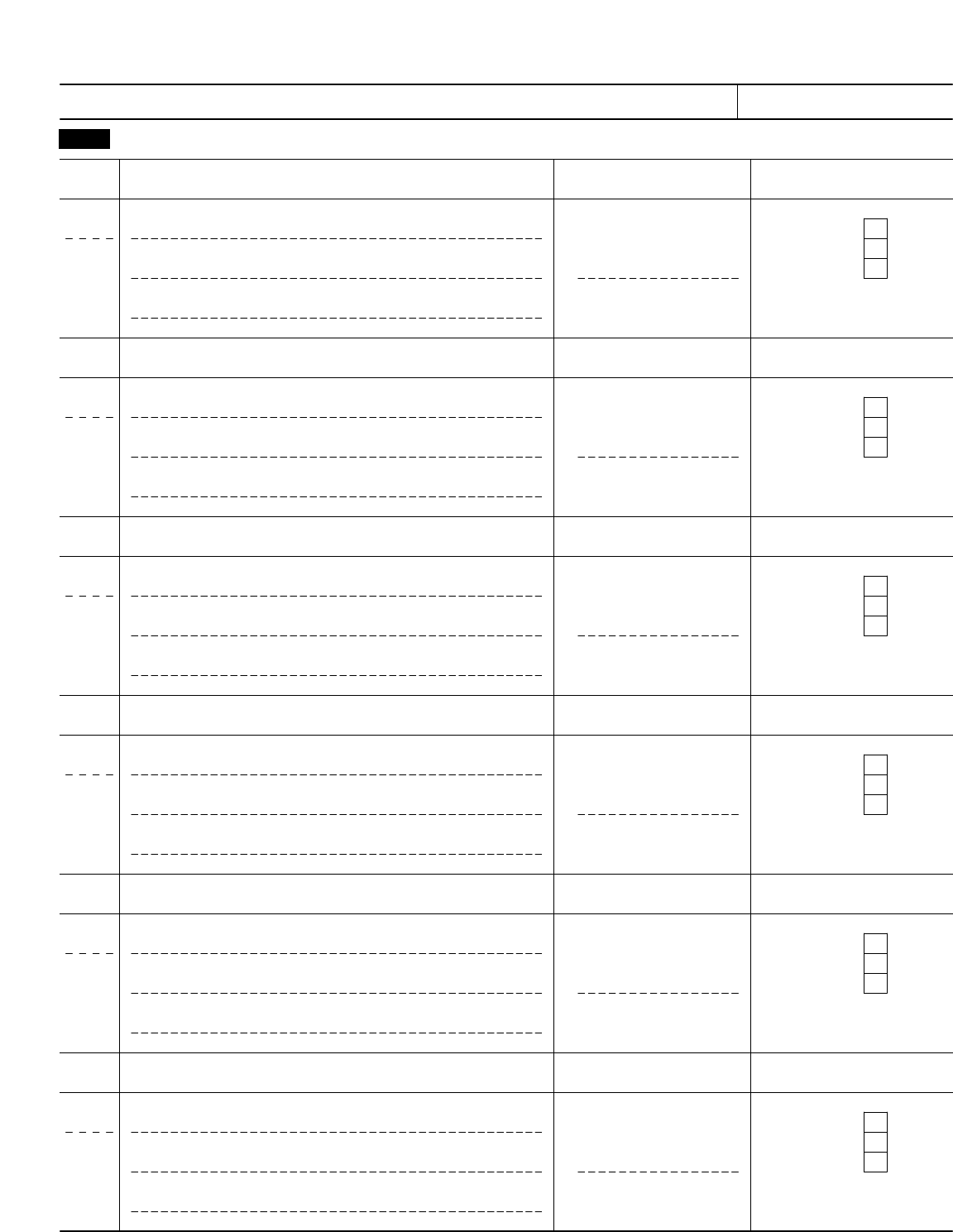

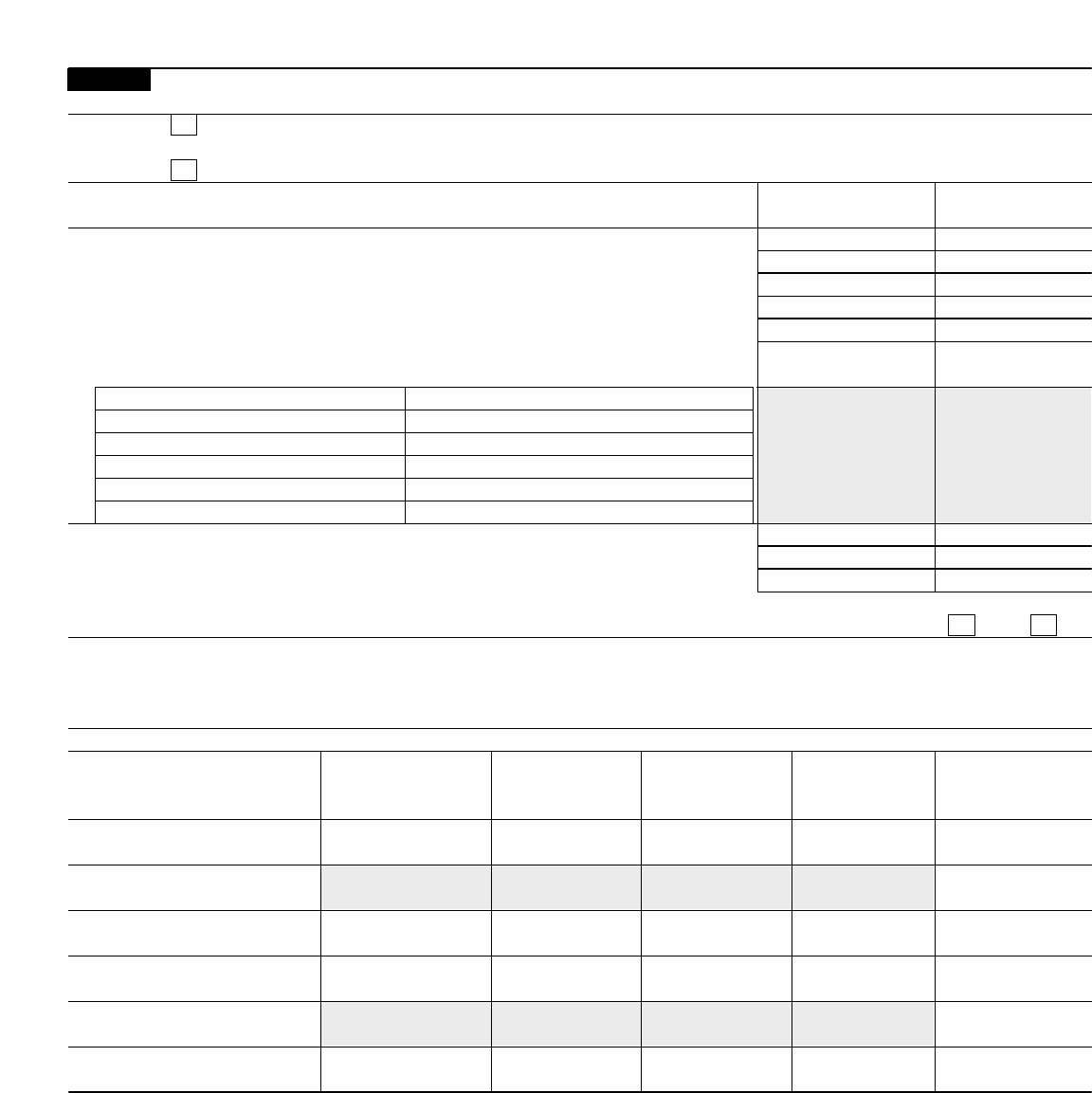

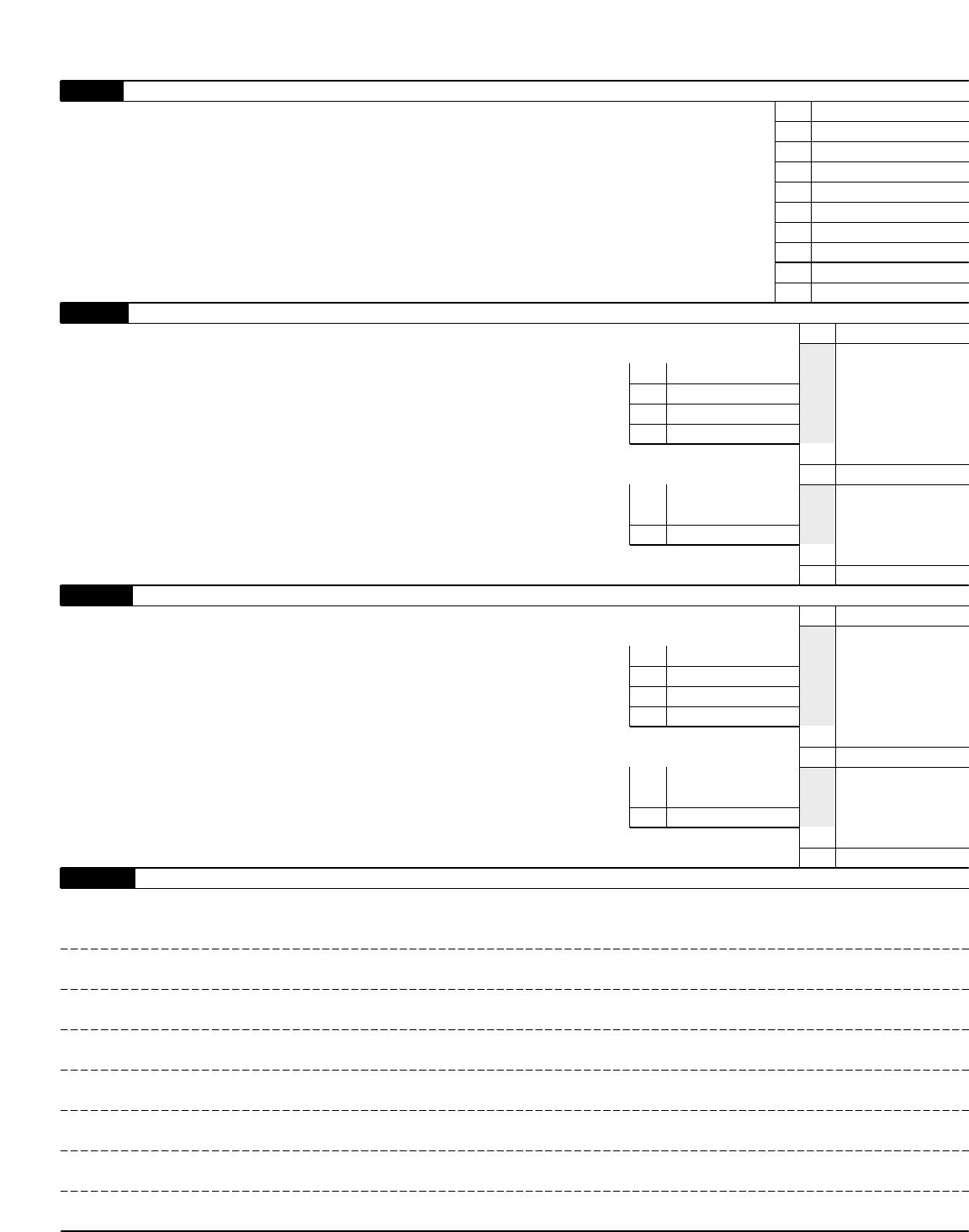

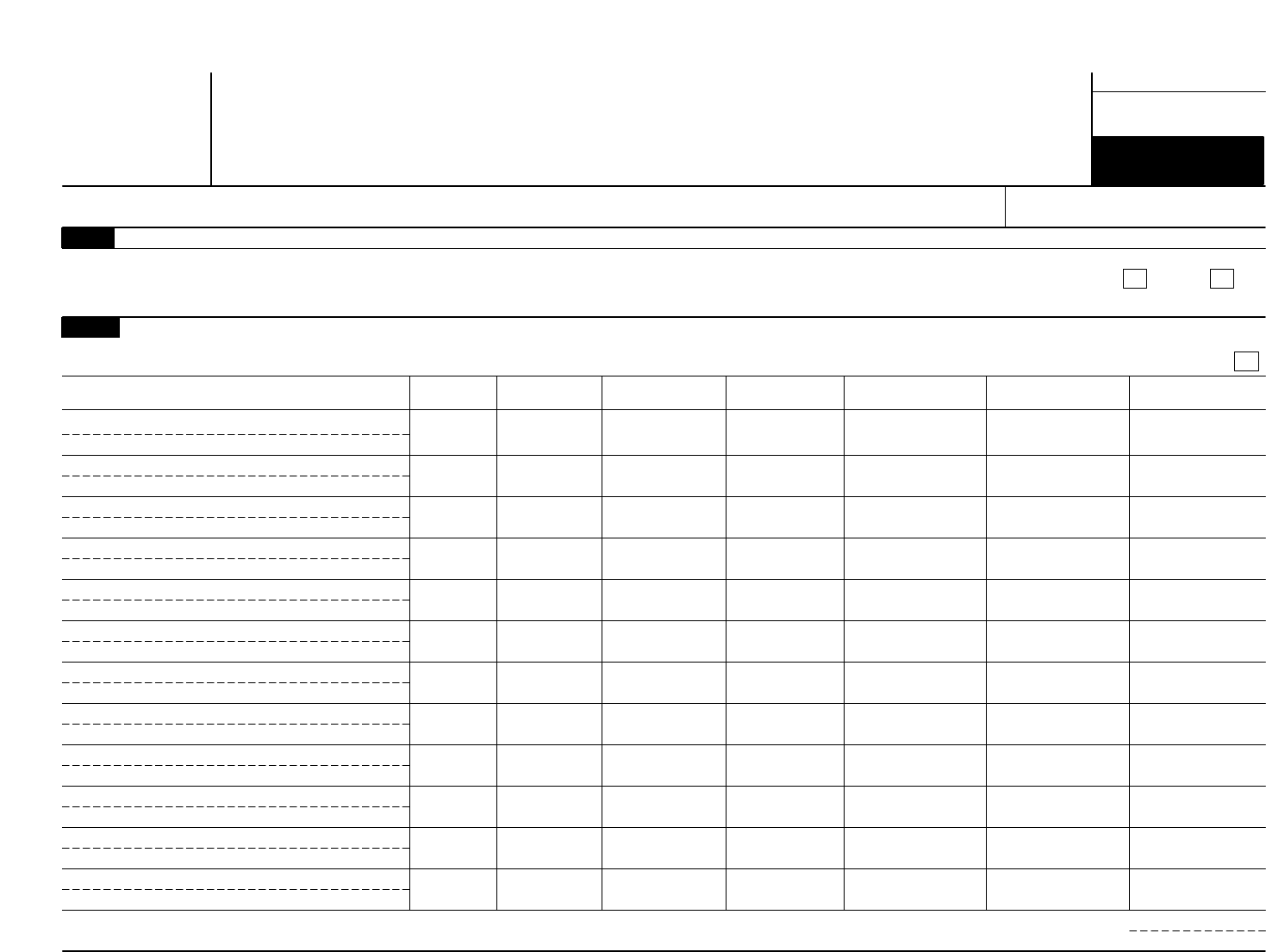

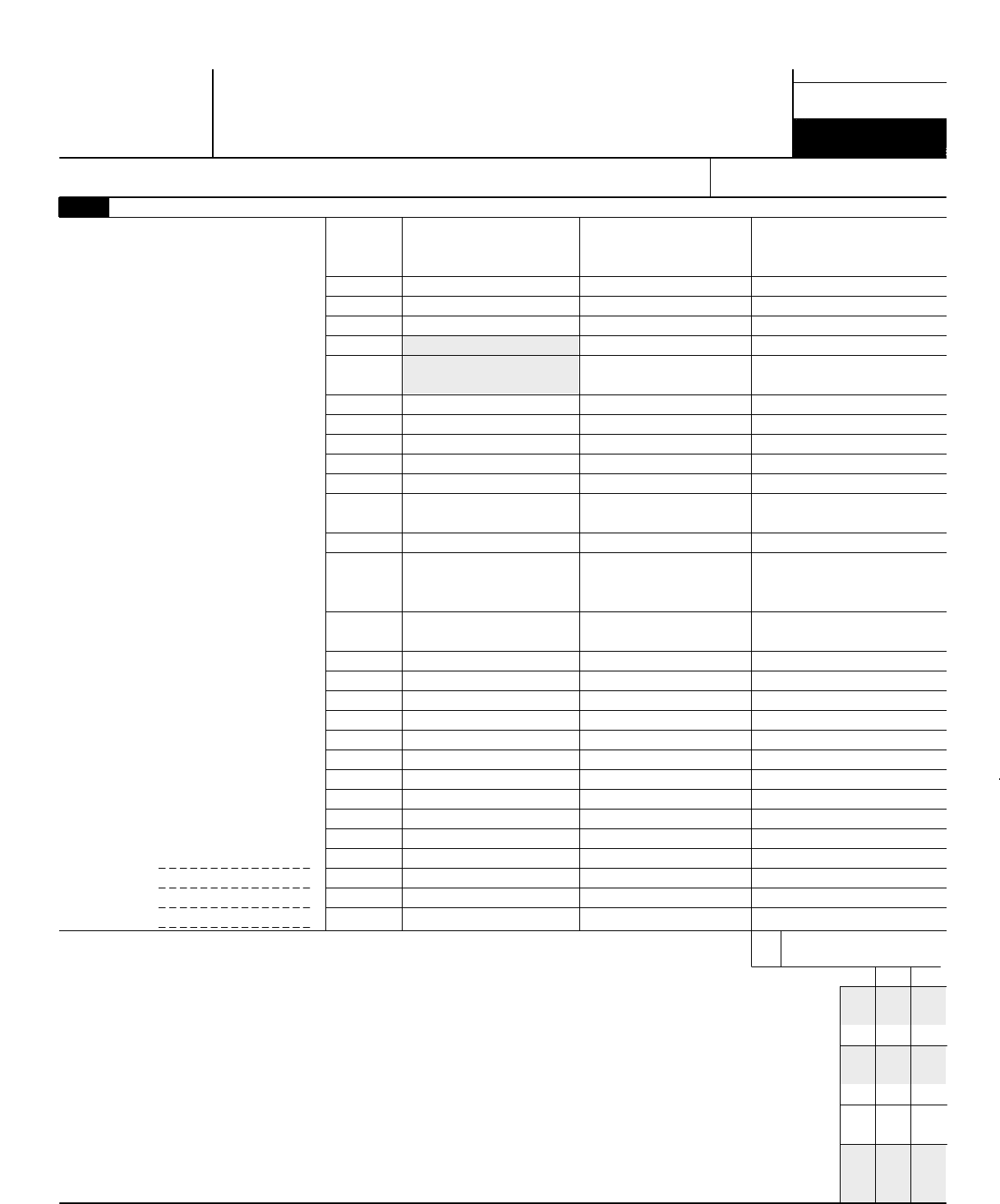

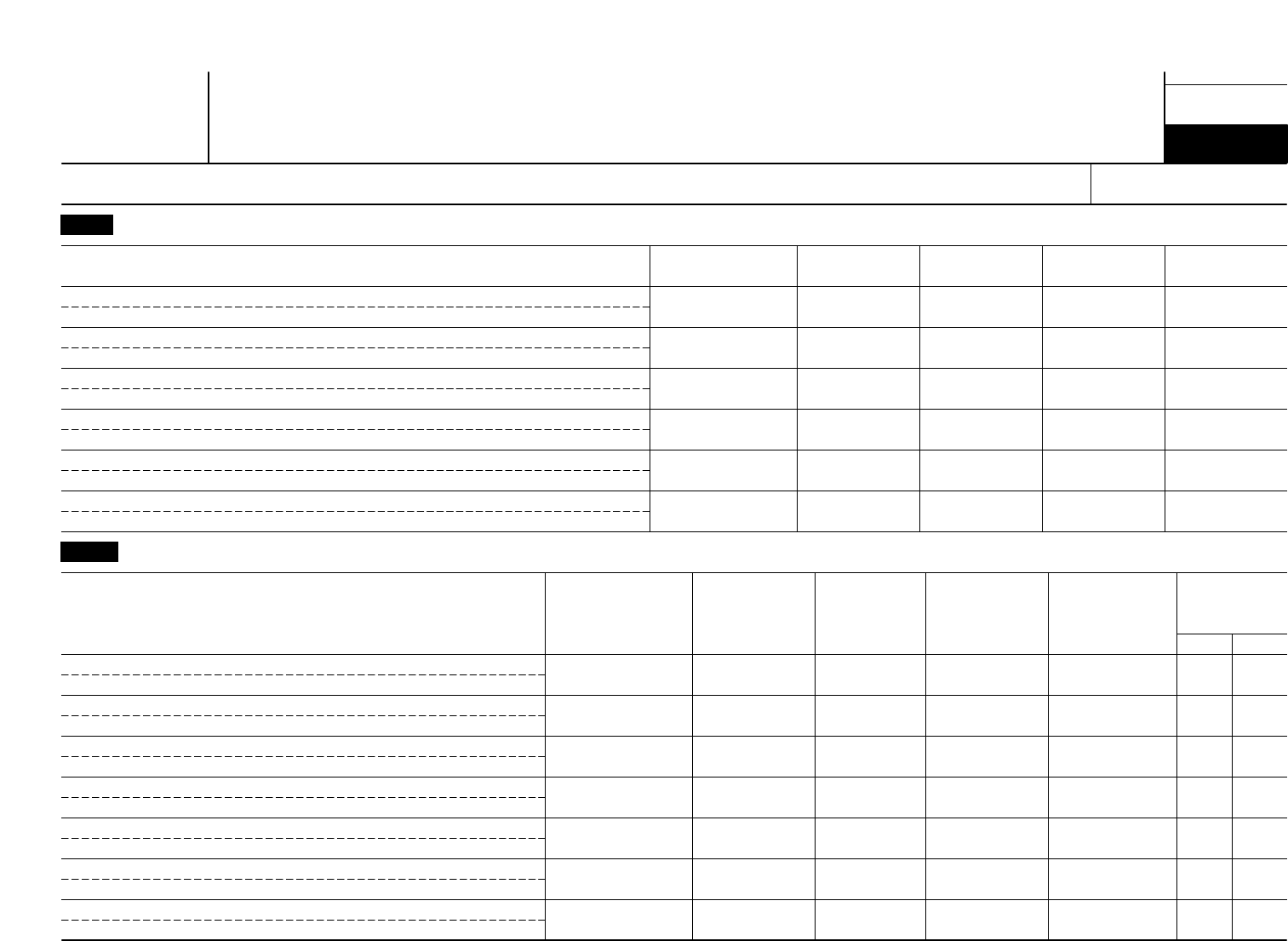

Form 990 (2011) Page 7

Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and

Independent Contractors

Part VII

Check if Schedule O contains a response to any question in this Part VII mmmmmmmmmmmmmmmmmmmm

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

1a Complete this table for all persons required to be listed. Report compensation for the calendar year ending with or within the

organization's tax year.

%

%

%

%

%

List all of the organization's current officers, directors, trustees (whether individuals or organizations), regardless of amount

of compensation. Enter -0- in columns (D), (E), and (F) if no compensation was paid.

List all of the organization's current key employees, if any. See instructions for definition of "key employee."

List the organization's five current highest compensated employees (other than an officer, director, trustee, or key employee)

who received reportable compensation (Box 5 of Form W-2 and/or Box 7 of Form 1099-MISC) of more than $100,000 from the

organization and any related organizations.

List all of the organization's former officers, key employees, and highest compensated employees who received more than

$100,000 of reportable compensation from the organization and any related organizations.

List all of the organization's former directors or trustees that received, in the capacity as a former director or trustee of the

organization, more than $10,000 of reportable compensation from the organization and any related organizations.

List persons in the following order: individual trustees or directors; institutional trustees; officers; key employees; highest

compensated employees; and former such persons.

Check this box if neither the organization nor any related organization compensated any current officer, director, or trustee.

(A) (B) (C) (D) (E) (F)

Name and Title Average

hours per

week

Position

(do not check more than one

box, unless person is both an

officer and a director/trustee)

Reportable

compensation

from

the

organization

(W-2/1099-MISC)

Reportable

compensation from

related

organizations

(W-2/1099-MISC)

Estimated

amount of

other

compensation

from the

organization

and related

organizations

(describe

hours for

related

organizations

in Schedule

O)

Individual trustee

or director

Institutional trustee

Officer

Key employee

Highest compensated

employee

Former

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

(13)

(14)

Form 990 (2011)

JSA

1E1041 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

EDWARD F. BABBOTT

TRUSTEE 5.00 X 0 0 0

MARK W. BIEDRON

TRUSTEE 5.00 X 0 0 0

BRADLEY M. CAMPBELL

TRUSTEE 5.00 X 0 0 0

TIM CARDEN

TRUSTEE 5.00 X 0 0 0

ROSINA DIXON

TRUSTEE 5.00 X 0 0 0

CLEMENT L. FIORI

TRUSTEE 5.00 X 0 0 0

PETER J. FONTAINE

TRUSTEE 5.00 X 0 0 0

KATHRYN A. PORTER

TRUSTEE 5.00 X 0 0 0

LOUISE CURREY WILSON

TRUSTEE 5.00 X 0 0 0

MAUREEN OGDEN

TRUSTEE 5.00 X 0 0 0

BETSY SCHNORR

TRUSTEE 5.00 X 0 0 0

JOHN A. SCULLY

TRUSTEE 5.00 X 0 0 0

LAWRENCE FOX

TRUSTEE 5.00 X 0 0 0

KENNETH KLIPSTEIN II

TRUSTEE 5.00 X 0 0 0

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 8

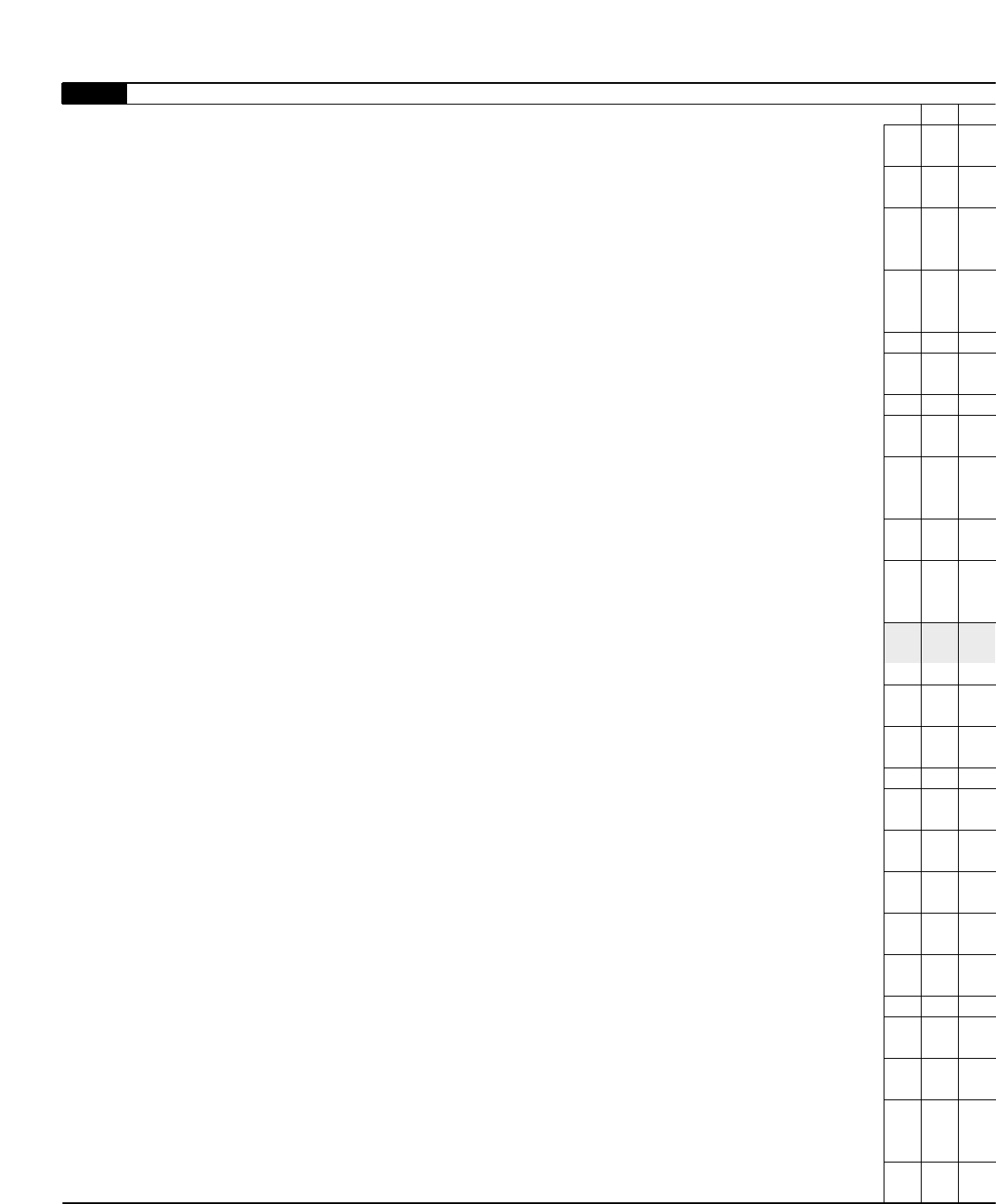

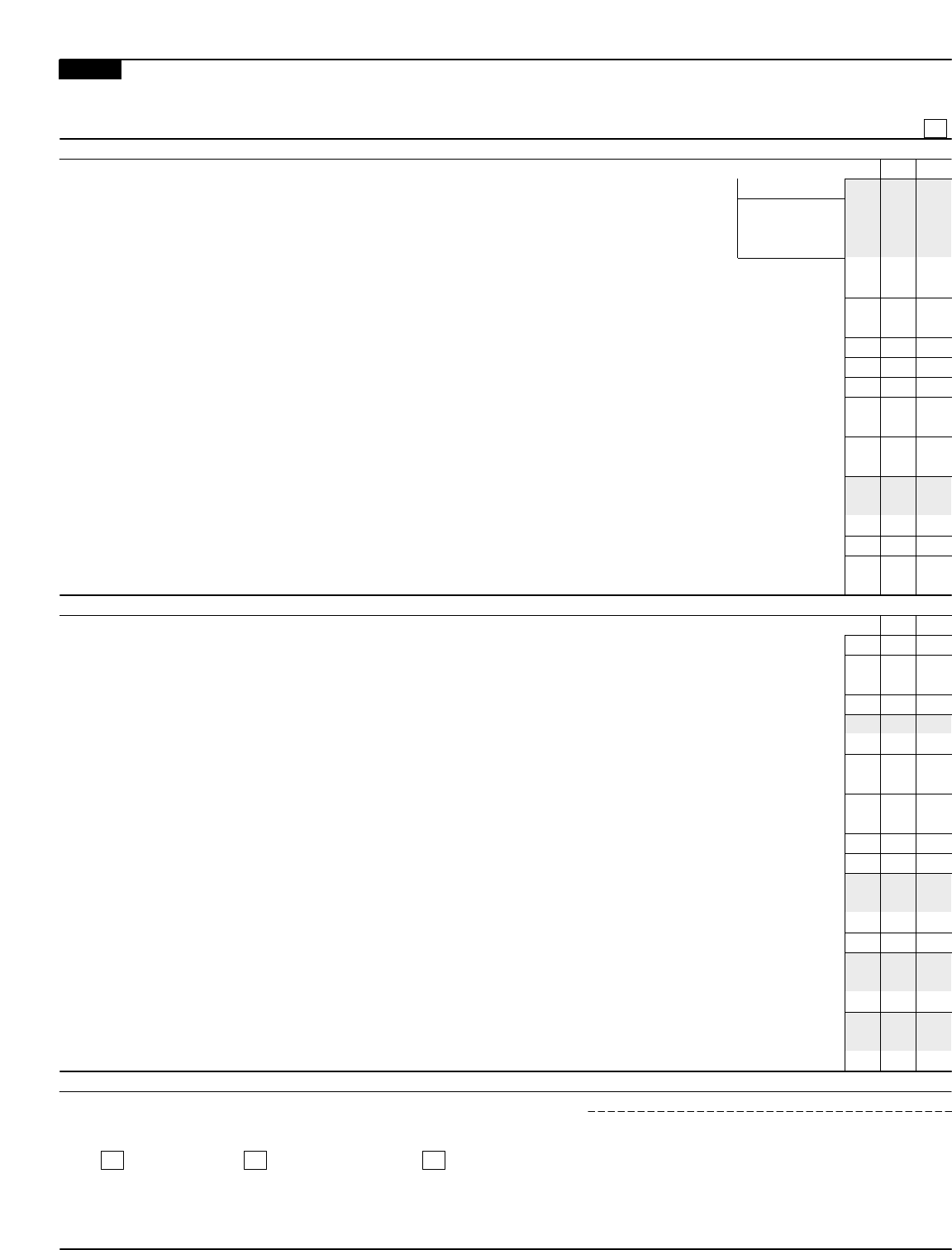

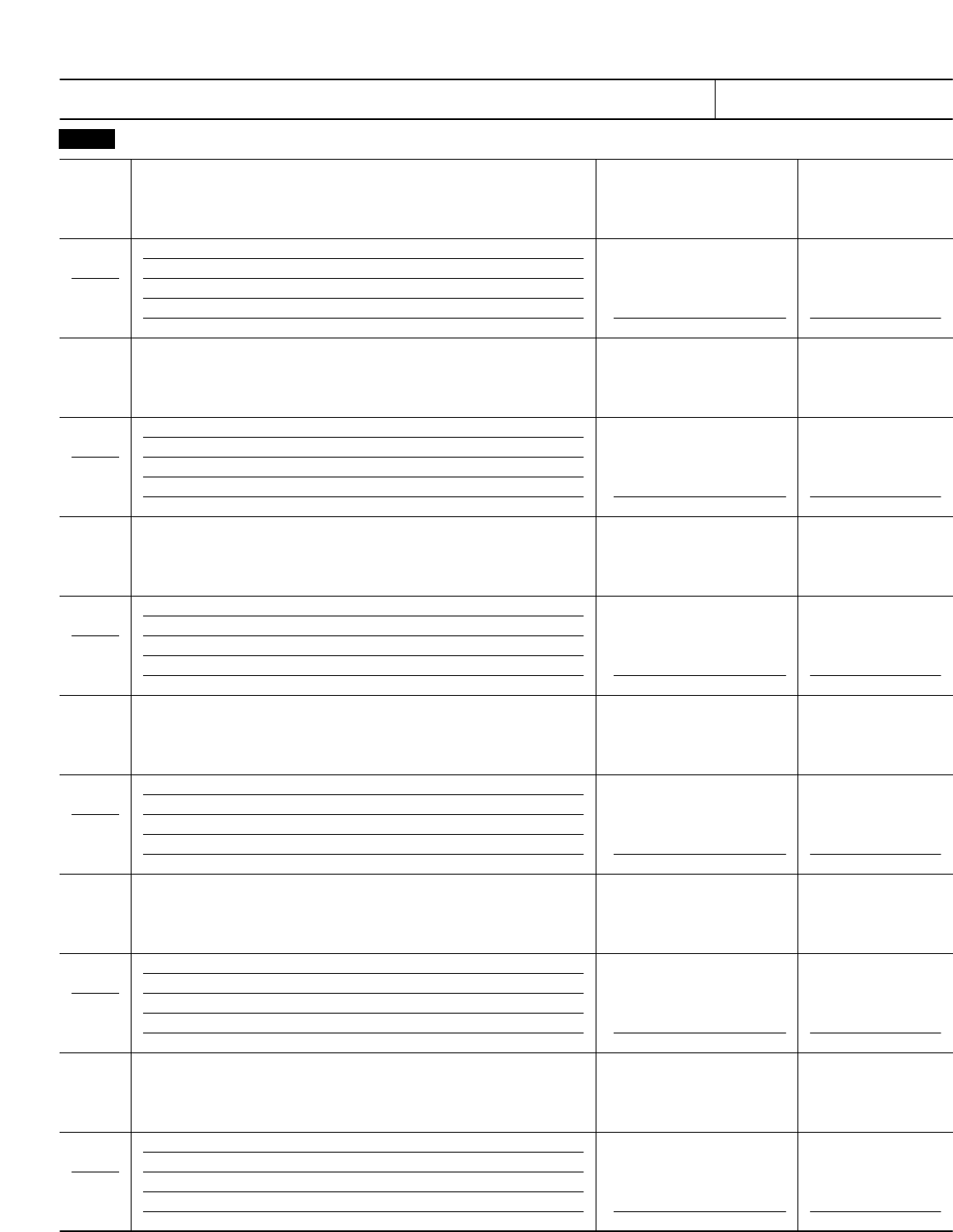

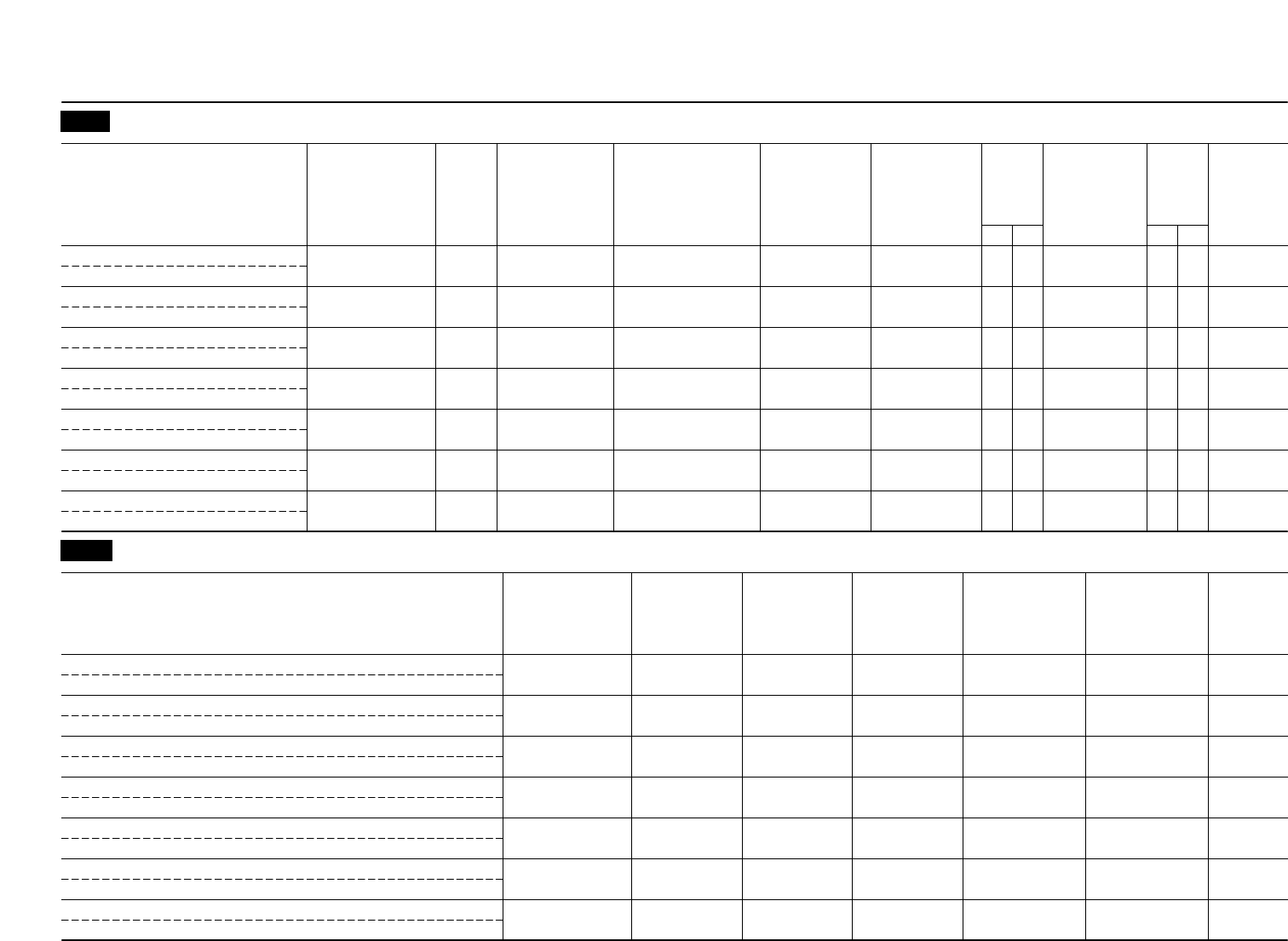

Form 990 (2011) Page 8

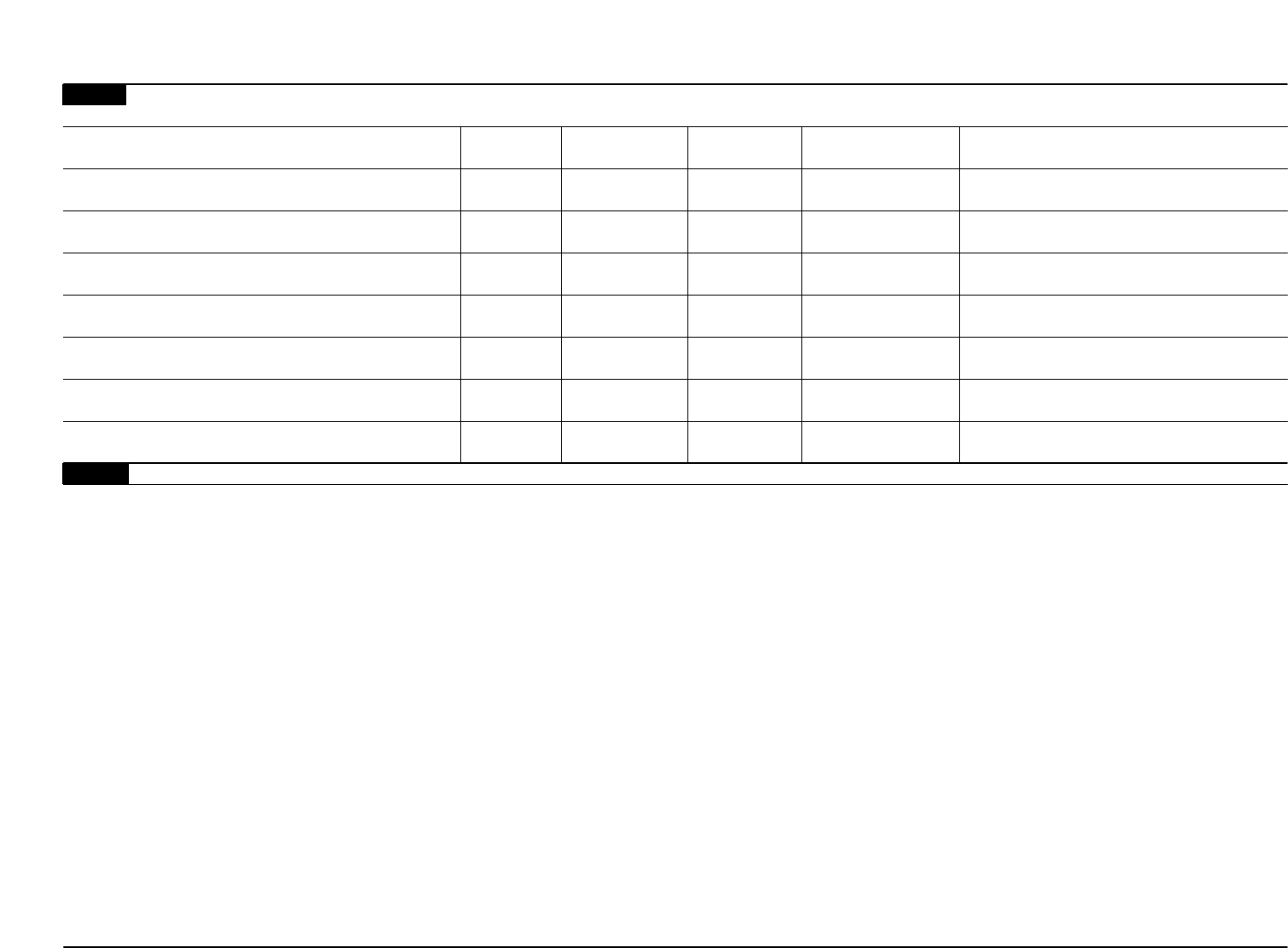

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)

Part VII

(A) (B) (C) (D) (E) (F)

Estimated

amount of

other

compensation

from the

organization

and related

organizations

Name and title Average

hours per

week

(describe

hours for

related

organizations

in Schedule

O)

Position

(do not check more than one

box, unless person is both an

officer and a director/trustee)

Reportable

compensation

from

the

organization

(W-2/1099-MISC)

Reportable

compensation from

related

organizations

(W-2/1099-MISC)

Individual trustee

or director

Institutional trustee

Officer

Key employee

Highest compensated

employee

Former

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmI

1b Sub-total mmmmmmmmmmmmm

I

c Total from continuation sheets to Part VII, Section A

mmmmmmmmmmmmmmmmmmmmmmmmmmmm

I

d Total (add lines 1b and 1c)

2Total number of individuals (including but not limited to those listed above) who received more than $100,000 of

reportable compensation from the organization IYes No

3Did the organization list any former officer, director, or trustee, key employee, or highest compensated

employee on line 1a? If "Yes," complete Schedule J for such individual 3

mmmmmmmmmmmmmmmmmmmmmmmmmm

4For any individual listed on line 1a, is the sum of reportable compensation and other compensation from the

organization and related organizations greater than $150,000? If “Yes,” complete Schedule J for such

individual 4

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

5Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual

for services rendered to the organization? If “Yes,” complete Schedule J for such person 5

mmmmmmmmmmmmmmmm

Section B. Independent Contractors

1Complete this table for your five highest compensated independent contractors that received more than $100,000 of

compensation from the organization. Report compensation for the calendar year ending with or within the organization's tax

year.

(A)

Name and business address (B)

Description of services (C)

Compensation

2Total number of independent contractors (including but not limited to those listed above) who received

more than $100,000 in compensation from the organization I

JSA Form 990 (2011)

1E1055 2.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

( 15) S. BRADLEY MELL

TRUSTEE 5.00 X 0 0 0

( 16) CATHERINE BACON WINSLOW

TRUSTEE 5.00 X 0 0 0

( 17) JACK R. CIMPRICH

TRUSTEE 5.00 X 0 0 0

( 18) ROBERT W. KENT

TRUSTEE 5.00 X 0 0 0

( 19) VIRGINIA K. PIERSON

TRUSTEE 5.00 X 0 0 0

( 20) H. R. HEGENER

SECRETARY 10.00 X 0 0 0

( 21) THOMAS B. HARVEY

TREASURER 10.00 X 0 0 0

( 22) GORDON A. MILLSPAUGH, JR.

ASSISTANT SECRETARY 10.00 X 0 0 0

( 23) JOHN F. PARKER

FIRST VICE PRESIDENT 10.00 X 0 0 0

( 24) WENDY MAGER

SECOND VICE PRESIDENT 10.00 X 0 0 0

( 25) L. KEITH REED

PRESIDENT 10.00 X 0 0 0

0 0 0

202,100. 0 7,436.

202,100. 0 7,436.

1

X

X

X

ATTACHMENT 2

1

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 9

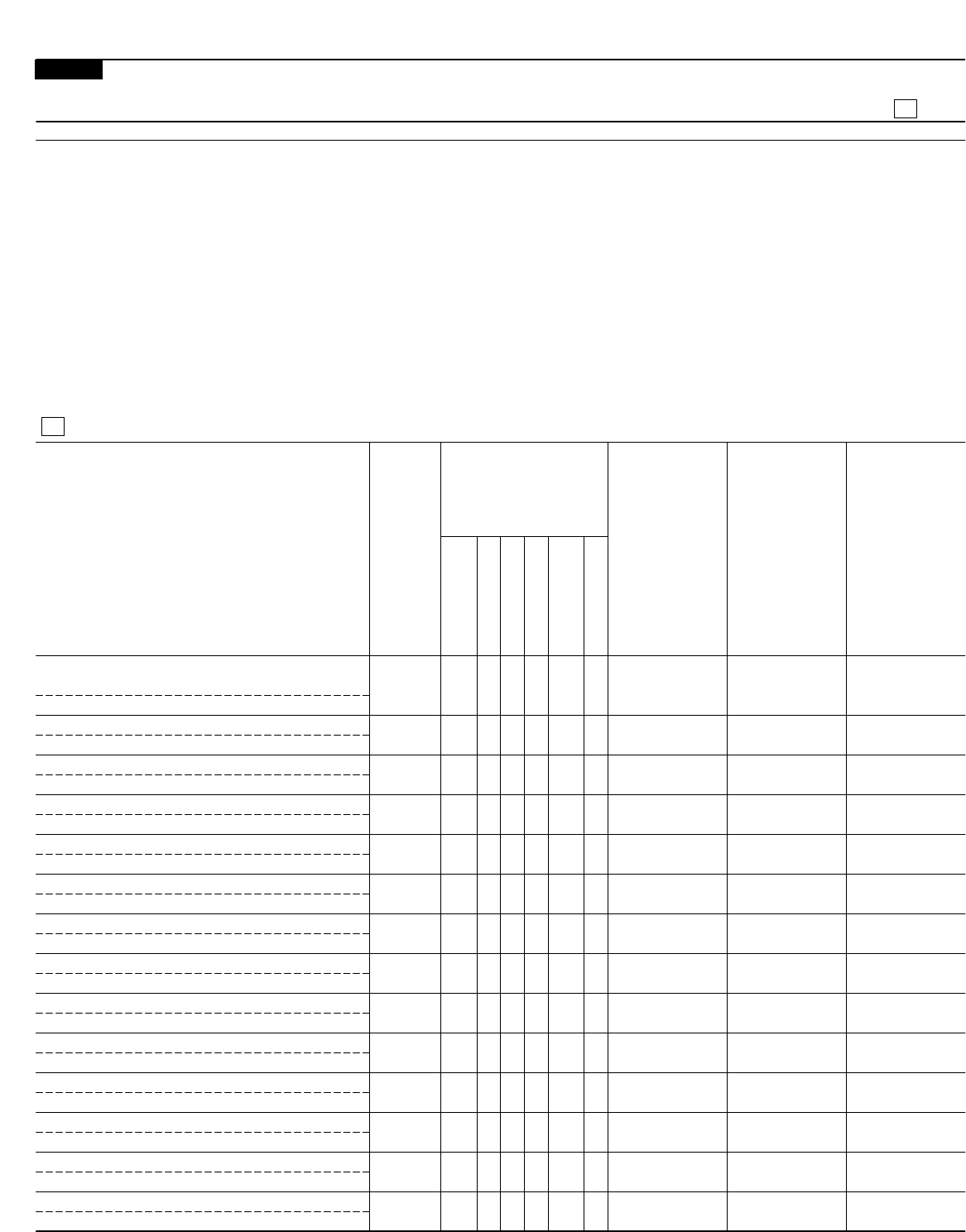

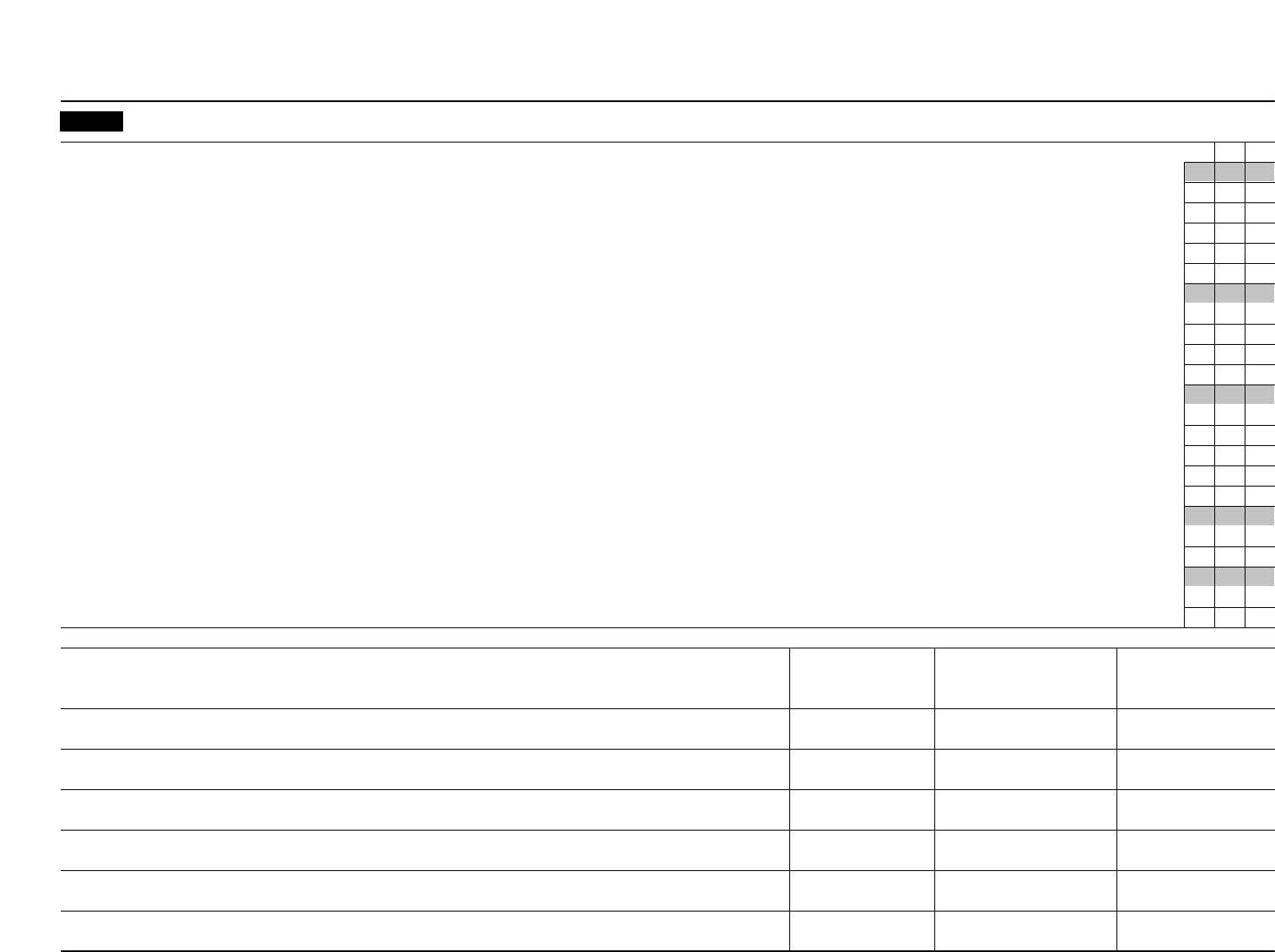

Form 990 (2011) Page 8

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)

Part VII

(A) (B) (C) (D) (E) (F)

Estimated

amount of

other

compensation

from the

organization

and related

organizations

Name and title Average

hours per

week

(describe

hours for

related

organizations

in Schedule

O)

Position

(do not check more than one

box, unless person is both an

officer and a director/trustee)

Reportable

compensation

from

the

organization

(W-2/1099-MISC)

Reportable

compensation from

related

organizations

(W-2/1099-MISC)

Individual trustee

or director

Institutional trustee

Officer

Key employee

Highest compensated

employee

Former

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmI

1b Sub-total mmmmmmmmmmmmm

I

c Total from continuation sheets to Part VII, Section A

mmmmmmmmmmmmmmmmmmmmmmmmmmmm

I

d Total (add lines 1b and 1c)

2Total number of individuals (including but not limited to those listed above) who received more than $100,000 of

reportable compensation from the organization IYes No

3Did the organization list any former officer, director, or trustee, key employee, or highest compensated

employee on line 1a? If "Yes," complete Schedule J for such individual 3

mmmmmmmmmmmmmmmmmmmmmmmmmm

4For any individual listed on line 1a, is the sum of reportable compensation and other compensation from the

organization and related organizations greater than $150,000? If “Yes,” complete Schedule J for such

individual 4

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

5Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual

for services rendered to the organization? If “Yes,” complete Schedule J for such person 5

mmmmmmmmmmmmmmmm

Section B. Independent Contractors

1Complete this table for your five highest compensated independent contractors that received more than $100,000 of

compensation from the organization. Report compensation for the calendar year ending with or within the organization's tax

year.

(A)

Name and business address (B)

Description of services (C)

Compensation

2Total number of independent contractors (including but not limited to those listed above) who received

more than $100,000 in compensation from the organization I

JSA Form 990 (2011)

1E1055 2.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

1

X

X

X

( 26) MICHELE BYERS

EXECUTIVE DIRECTOR 40.00 X 102,100. 0 3,769.

( 27) GREGORY ROMANO

ASSISTANT DIRECTOR 40.00 X 100,000. 0 3,667.

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 10

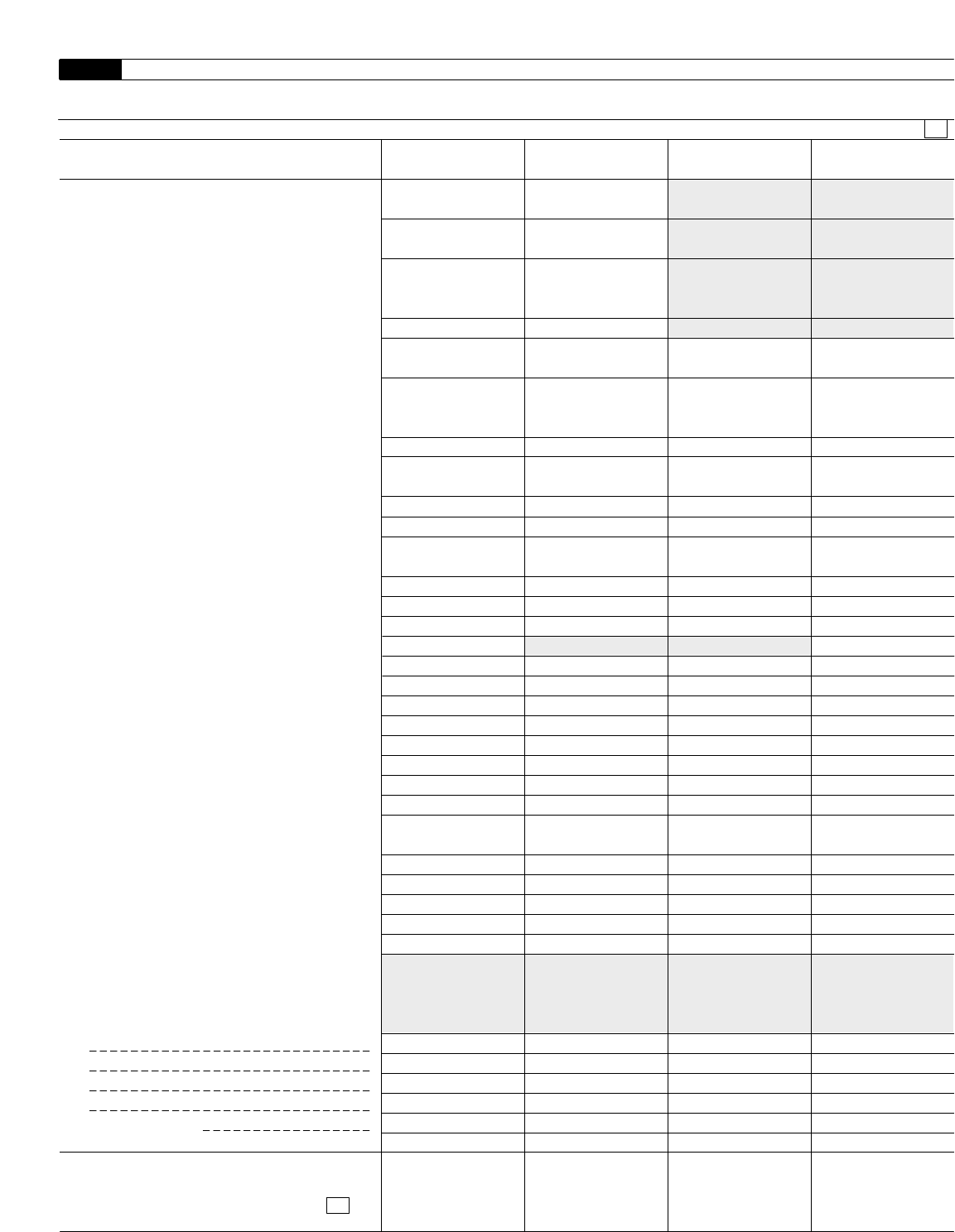

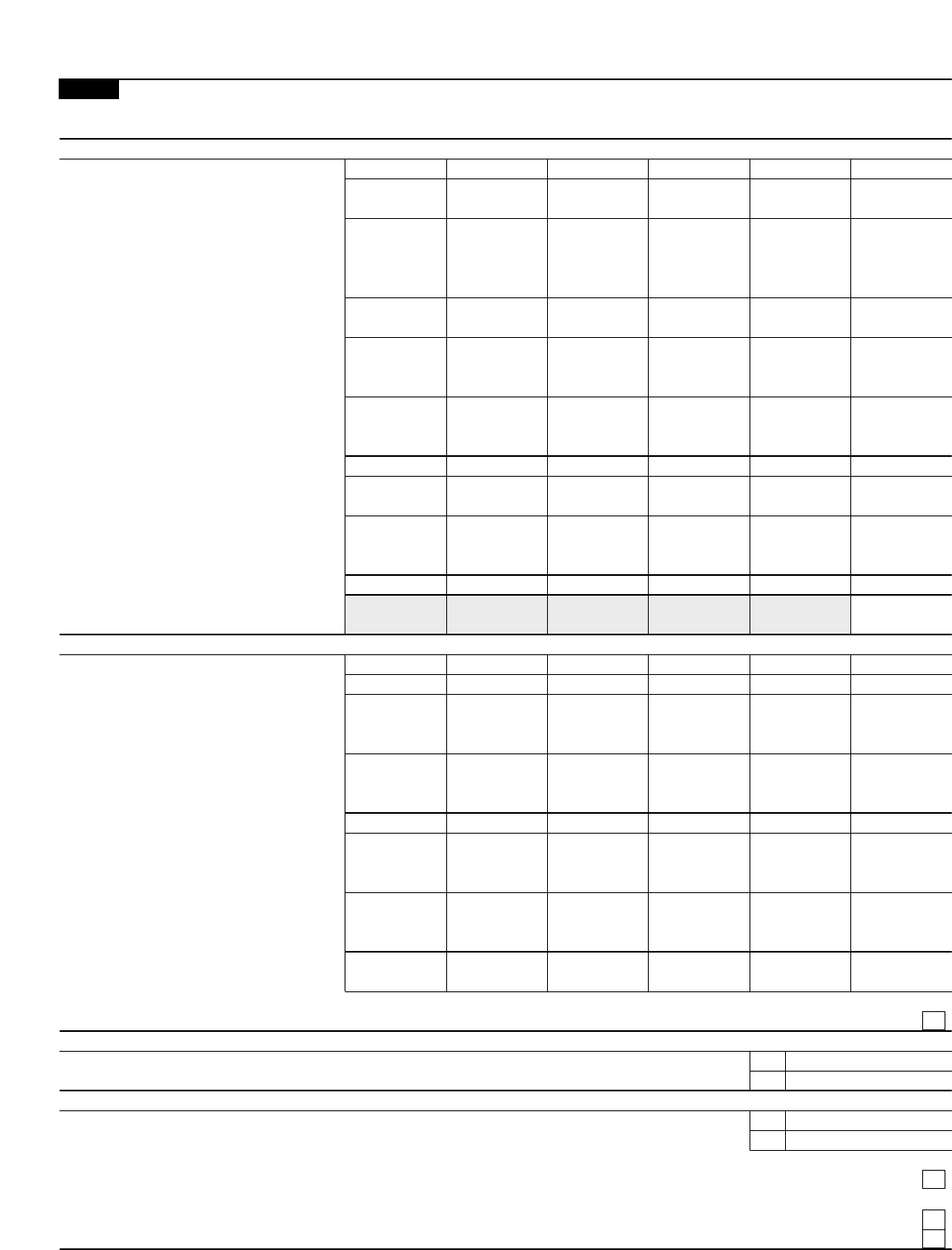

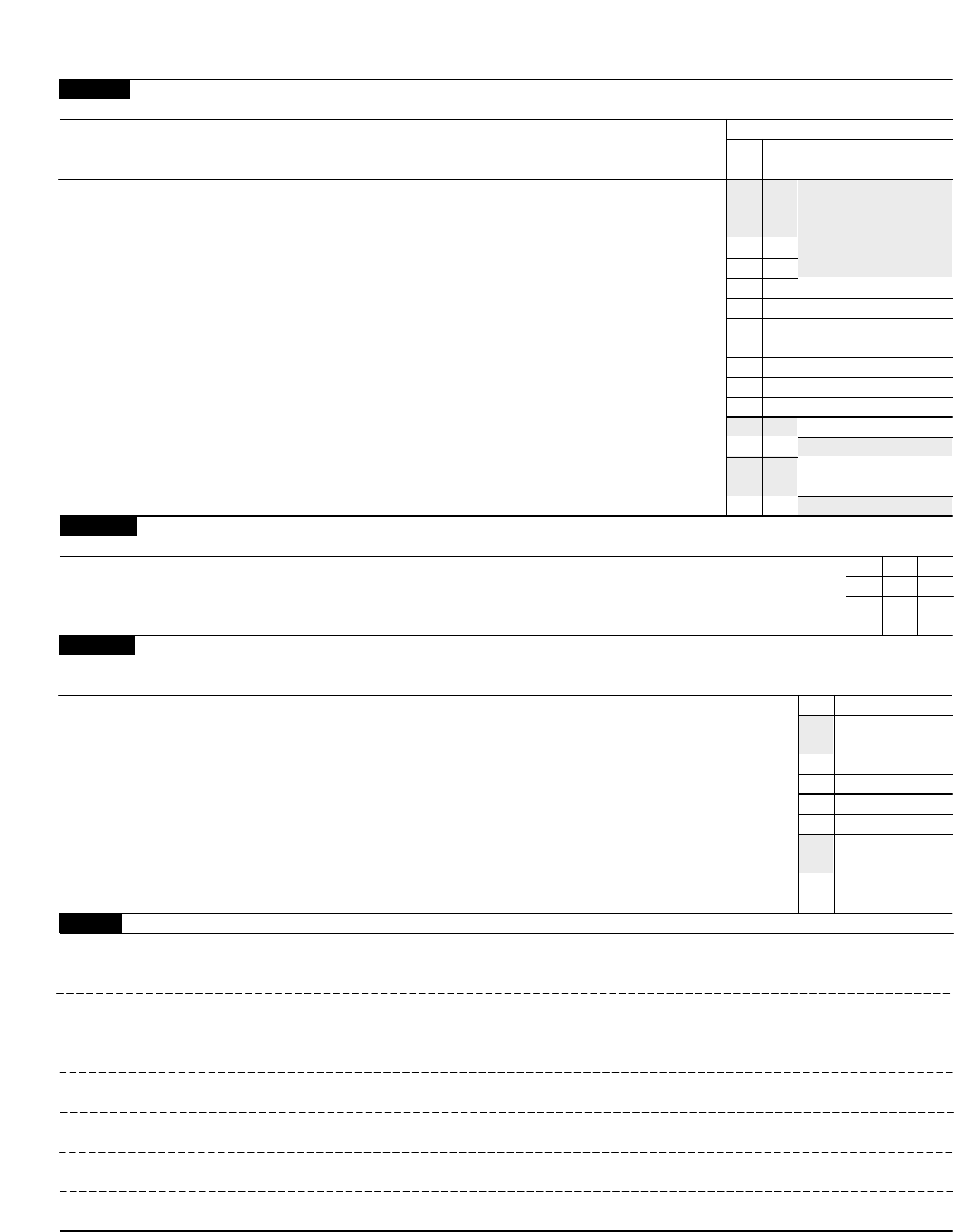

Form 990 (2011) Page 9

Statement of Revenue

(C)

Unrelated

business

revenue

Part VIII

(B)

Related or

exempt

function

revenue

(D)

Revenue

excluded from tax

under sections

512, 513, or 514

(A)

Total revenue

1a

1b

1c

1d

1e

1f

1a

b

c

d

e

f

g

2a

b

c

d

e

f

6a

b

c

b

c

8a

b

9a

b

10a

b

11a

b

c

d

e

Federated campaigns

Membership dues

Fundraising events

Related organizations

Government grants (contributions)

All other contributions, gifts, grants,

and similar amounts not included above

Noncash contributions included in lines 1a-1f:

mmmmmmmm

mmmmmmmmm

mmmmmmmmm

mmmmmmmm

mm

m

$

Contributions, Gifts, Grants

and Other Similar Amounts

I

h Total. Add lines 1a-1f mmmmmmmmmmmmmmmmmmm

Business Code

All other program service revenue mmmmm I

gTotal. Add lines 2a-2f

Program Service Revenue

mmmmmmmmmmmmmmmmmmm

3

4

5

Investment income (including dividends, interest, and

other similar amounts)

Income from investment of tax-exempt bond proceeds

Royalties

I

I

I

I

I

I

I

I

mmmmmmmmmmmmmmmmmmm

mmm

mmmmmmmmmmmmmmmmmmmmmmmmm

(i) Real (ii) Personal

Gross rents

Less: rental expenses

Rental income or (loss)

mmmmmmmm

mmm

mm

dNet rental income or (loss) mmmmmmmmmmmmmmmmm

(i) Securities (ii) Other

7a Gross amount from sales of

assets other than inventory

Less: cost or other basis

and sales expenses

Gain or (loss)

mmmm

mmmmmmm

dNet gain or (loss) mmmmmmmmmmmmmmmmmmmmm

Gross income from fundraising

events (not including $

of contributions reported on line 1c).

See Part IV, line 18

Less: direct expenses

mmmmmmmmmmm

a

b

a

b

a

b

mmmmmmmmmm

cNet income or (loss) from fundraising events mmmmmmmm

Other Revenue

Gross income from gaming activities.

See Part IV, line 19 mmmmmmmmmmm

Less: direct expenses mmmmmmmmmm

cNet income or (loss) from gaming activities mmmmmmmmm

Gross sales of inventory, less

returns and allowances mmmmmmmmm

Less: cost of goods sold mmmmmmmmm

cNet income or (loss) from sales of inventorymmmmmmmmm

Miscellaneous Revenue Business Code

All other revenue

Total. Add lines 11a-11d

mmmmmmmmmmmmm I

mmmmmmmmmmmmmmmmm

I

12 mmmmmmmmmmmmmm

Total revenue. See instructions

Form 990 (2011)

JSA

1E1051 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

40,905.

9,402,202.

3,646,426.

1,575,193.

13,089,533.

0

97,990. 97,990.

0

0

0

5,509,456. 277,250.

5,585,659. 175,606.

-76,203. 101,644.

25,441. 25,441.

40,905.

19,495.

41,104.

-21,609. -21,609.

0

0

MISCELLANEOUS 67,538. 67,538.

SHARED STAFFING FEES 5,985. 5,985.

73,523.

13,264,878. 73,523. 101,822.

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 11

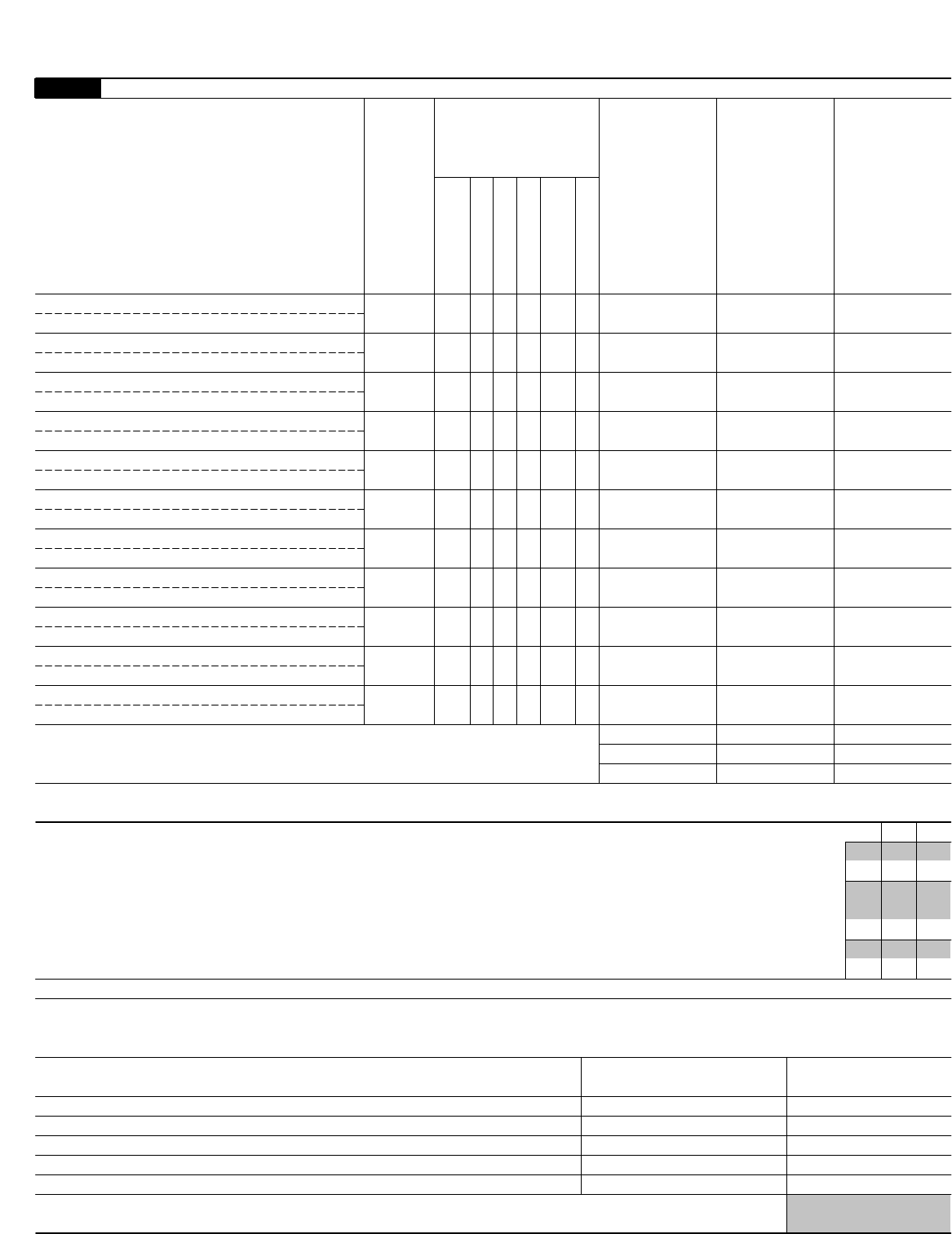

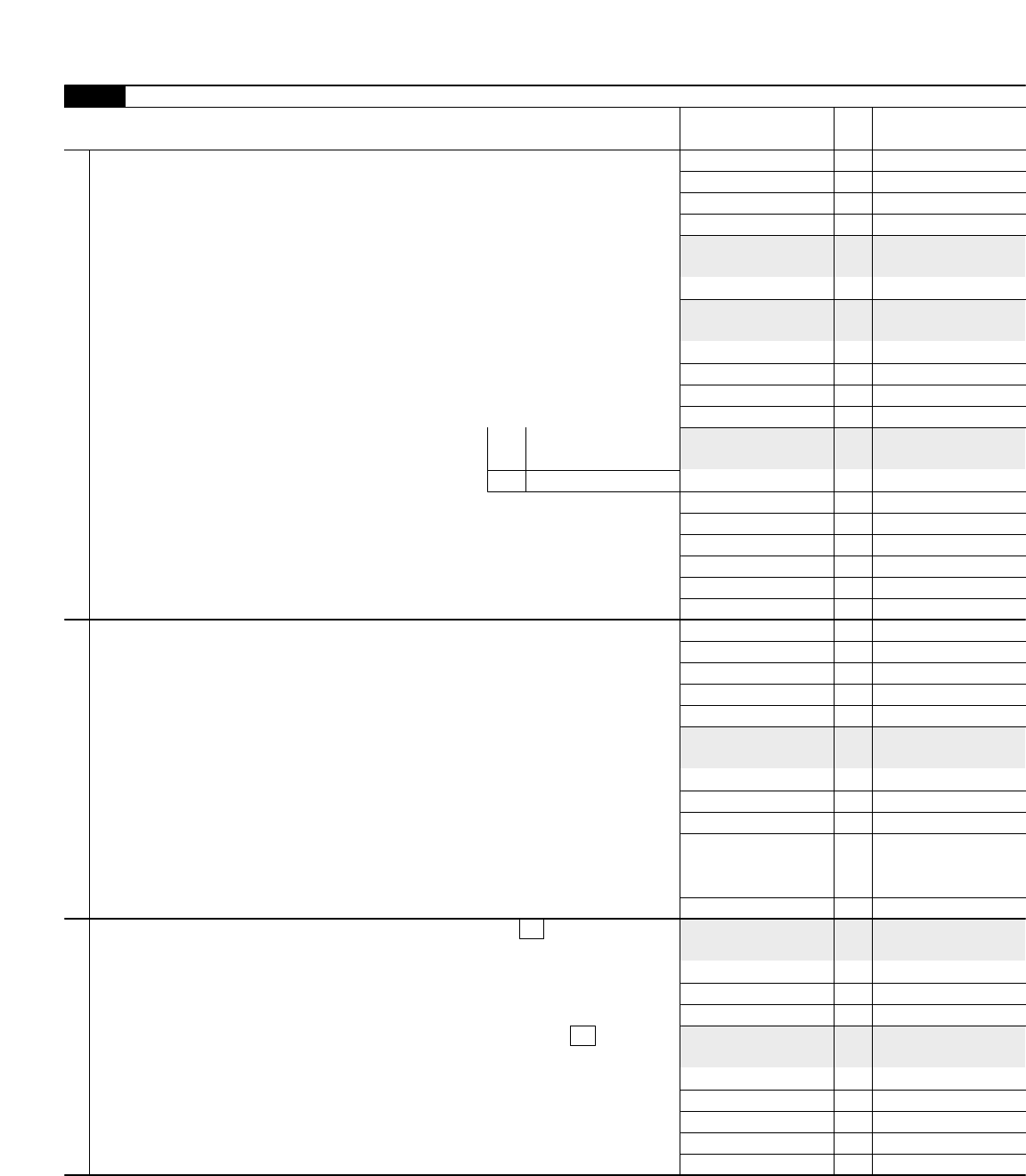

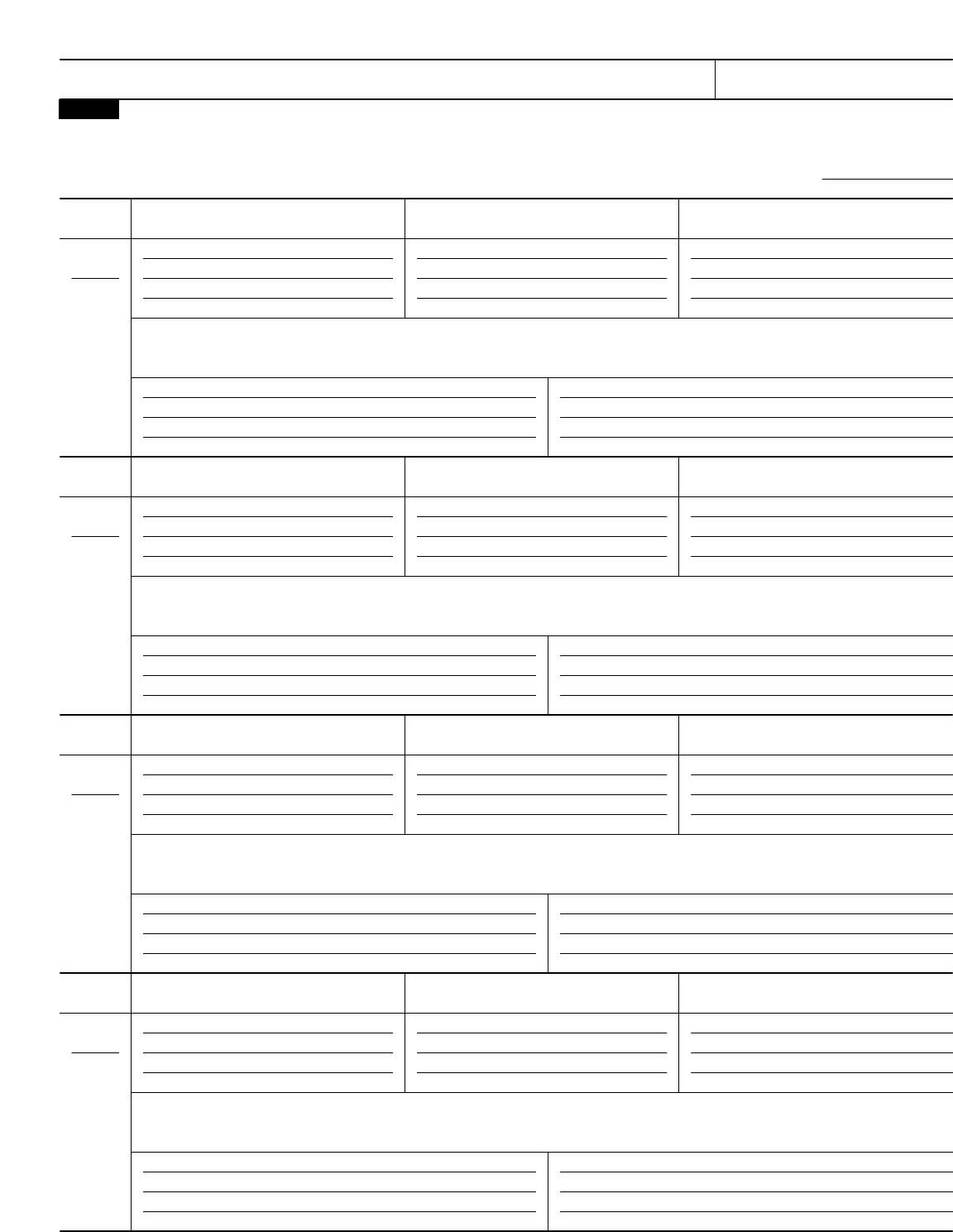

Form 990 (2011) Page 10

Statement of Functional Expenses

Part IX

Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A) but are not

required to complete columns (B), (C), and (D).

Check if Schedule O contains a response to any question in this Part IX mmmmmmmmmmmmmmmmmmmmmmmmmm

(A) (B) (C) (D)

Do not include amounts reported on lines 6b,

7b, 8b, 9b, and 10b of Part VIII. Total expenses Program service

expenses Management and

general expenses Fundraising

expenses

Grants and other assistance to governments and

organizations in the United States. See Part IV, line 2 1

1m

Grants and other assistance to individuals in

the United States. See Part IV, line 22

2mmmmmm

3Grants and other assistance to governments,

organizations, and individuals outside the

United States. See Part IV, lines 15 and 16mmmm

Benefits paid to or for members

4mmmmmmmmm

5Compensation of current officers, directors,

trustees, and key employees mmmmmmmmmm

6Compensation not included above, to disqualified

persons (as defined under section 4958(f)(1)) and

persons described in section 4958(c)(3)(B) mmmmmm

Other salaries and wages

7mmmmmmmmmmmm

8Pension plan accruals and contributions (include section

401(k) and 403(b) employer contributions) mmmmmm

9Other employee benefits

Payroll taxes

Fees for services (non-employees):

Management

Legal

Accounting

Lobbying

mmmmmmmmmmmm

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

mmmmmmmmmmmmmmmmmm

a

b

c

d

e

f

g

mmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmm

Professional fundraising services. See Part IV, line 1 7

Investment management fees mmmmmmmmm

Other

Advertising and promotion

Office expenses

Information technology

mmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmm

mmmmmmmmmmmmmmmm

mmmmmmmmmmmmm

Royalties

Occupancy

Travel

mmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmm

Payments of travel or entertainment expenses

for any federal, state, or local public officials

Conferences, conventions, and meetings

Interest

Payments to affiliates

Depreciation, depletion, and amortization

Insurance

mmmm

mmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmm

mmmm

mmmmmmmmmmmmmmmmmmm

Other expenses. Itemize expenses not covered

above (List miscellaneous expenses in line 24e. If

line 24e amount exceeds 10% of line 25, column

(A) amount, list line 24e expenses on Schedule O.)

a

b

c

d

eAll other expenses

25 Total functional expenses. Add lines 1 through 24e

26 Joint costs. Complete this line only if the

organization reported in column (B) joint costs

from a combined educational campaign and

I

fundraising solicitation. Check here if

following SOP 98-2 (ASC 958-720) mmmmmmm

JSA Form 990 (2011)

1E1052 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

1,770,303. 1,770,303.

0

0

0

184,422. 129,095. 23,975. 31,352.

0

1,522,389. 1,065,673. 197,910. 258,806.

52,413. 36,689. 6,814. 8,910.

218,194. 152,736. 28,365. 37,093.

139,367. 97,557. 18,118. 23,692.

0

10,757. 9,237. 764. 756.

36,050. 30,957. 2,559. 2,534.

0

0

0

557,836. 479,032. 39,597. 39,207.

860. 430. 430.

96,713. 47,306. 3,593. 45,814.

0

0

115,354. 92,656. 9,836. 12,862.

44,039. 41,794. 134. 2,111.

0

33,144. 21,698. 7,771. 3,675.

0

0

11,269. 7,888. 1,465. 1,916.

59,959. 41,971. 7,795. 10,193.

PURCHASE OF EASEMENTS 2,793,585. 2,793,585.

PROPERTY MANAGEMENT 158,682. 158,682.

INVESTMENT 78,586. 43,402. 35,184.

DUES 4,893. 3,575. 571. 747.

79,775. 57,351. 3,906. 18,518.

7,968,590. 7,081,617. 388,357. 498,616.

0

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 12

Form 990 (2011) Page 11

Balance Sheet

Part

X

(A)

Beginning of year (B)

End of year

Cash - non-interest-bearing

Savings and temporary cash investments

Pledges and grants receivable, net

Accounts receivable, net

1

2

3

4

5

1

2

3

4

5

6

7

8

9

10c

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

mmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmmmmmm

Receivables from current and former officers, directors, trustees, key

employees, and highest compensated employees. Complete Part II of

Schedule L mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Receivables from other disqualified persons (as defined under section

4958(f)(1)), persons described in section 4958(c)(3)(B), and contributing

employers and sponsoring organizations of section 501(c)(9) voluntary

employees' beneficiary organizations (see instructions)

6mmmmmmmmmmmm

Notes and loans receivable, net

Inventories for sale or use

Prepaid expenses and deferred charges

7

8

9

mmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmm

mmmmmmmmmm

10a

10b

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

aLand, buildings, and equipment: cost or

other basis. Complete Part VI of Schedule D

Less: accumulated depreciation

b

Investments - publicly traded securities

Investments - other securities. See Part IV, line 11

Investments - program-related. See Part IV, line 11

Intangible assets

Other assets. See Part IV, line 11

Total assets. Add lines 1 through 15 (must equal line 34)

mmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmm

mmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmm

Assets

Accounts payable and accrued expenses

Grants payable

Deferred revenue

Tax-exempt bond liabilities

mmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmmmmm

Escrow or custodial account liability. Complete Part IV of Schedule D

Payables to current and former officers, directors, trustees, key

employees, highest compensated employees, and disqualified persons.

Complete Part II of Schedule L

Liabilities

mmmmmmmmmmmmmmmmmmmmmmmmm

Secured mortgages and notes payable to unrelated third parties

Unsecured notes and loans payable to unrelated third parties mmmmmmm

mmmmmmmmm

Other liabilities (including federal income tax, payables to related third

parties, and other liabilities not included on lines 17-24). Complete Part X

of Schedule D mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

I

Total liabilities. Add lines 17 through 25 mmmmmmmmmmmmmmmmmmmm

and completeOrganizations that follow SFAS 117, check here

lines 27 through 29, and lines 33 and 34.

27

28

29

30

31

32

33

34

Unrestricted net assets

Temporarily restricted net assets

Permanently restricted net assets

Capital stock or trust principal, or current funds

Paid-in or capital surplus, or land, building, or equipment fund

Retained earnings, endowment, accumulated income, or other funds

Total net assets or fund balances

Total liabilities and net assets/fund balances

27

28

29

30

31

32

33

34

mmmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmmm

I

mmmmmmmmmmmmmmmmmmmmmmmm

and

Organizations that do not follow SFAS 117, check here

complete lines 30 through 34. mmmmmmmmmmmmmmmm

mmmmmmmm

mmmm

Net Assets or Fund Balances

mmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmm

Form 990 (2011)

JSA

1E1053 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

0 0

3,182,859. 3,632,520.

2,734,648. 205,976.

0 0

0 0

0 0

0 0

0 0

57,009. 55,801.

27,399,490.

191,157. 26,167,067. 27,208,333.

0 0

5,696,270. 7,298,909.

0 0

0 0

166,845. 675,209.

38,004,698. 39,076,748.

196,064. 172,151.

0 0

1,232,370. 790,760.

0 0

0 0

0 0

0 0

170,313. 949,646.

0 0

1,598,747. 1,912,557.

X

31,661,865. 32,258,341.

4,644,212. 4,805,726.

99,874. 100,124.

36,405,951. 37,164,191.

38,004,698. 39,076,748.

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 13

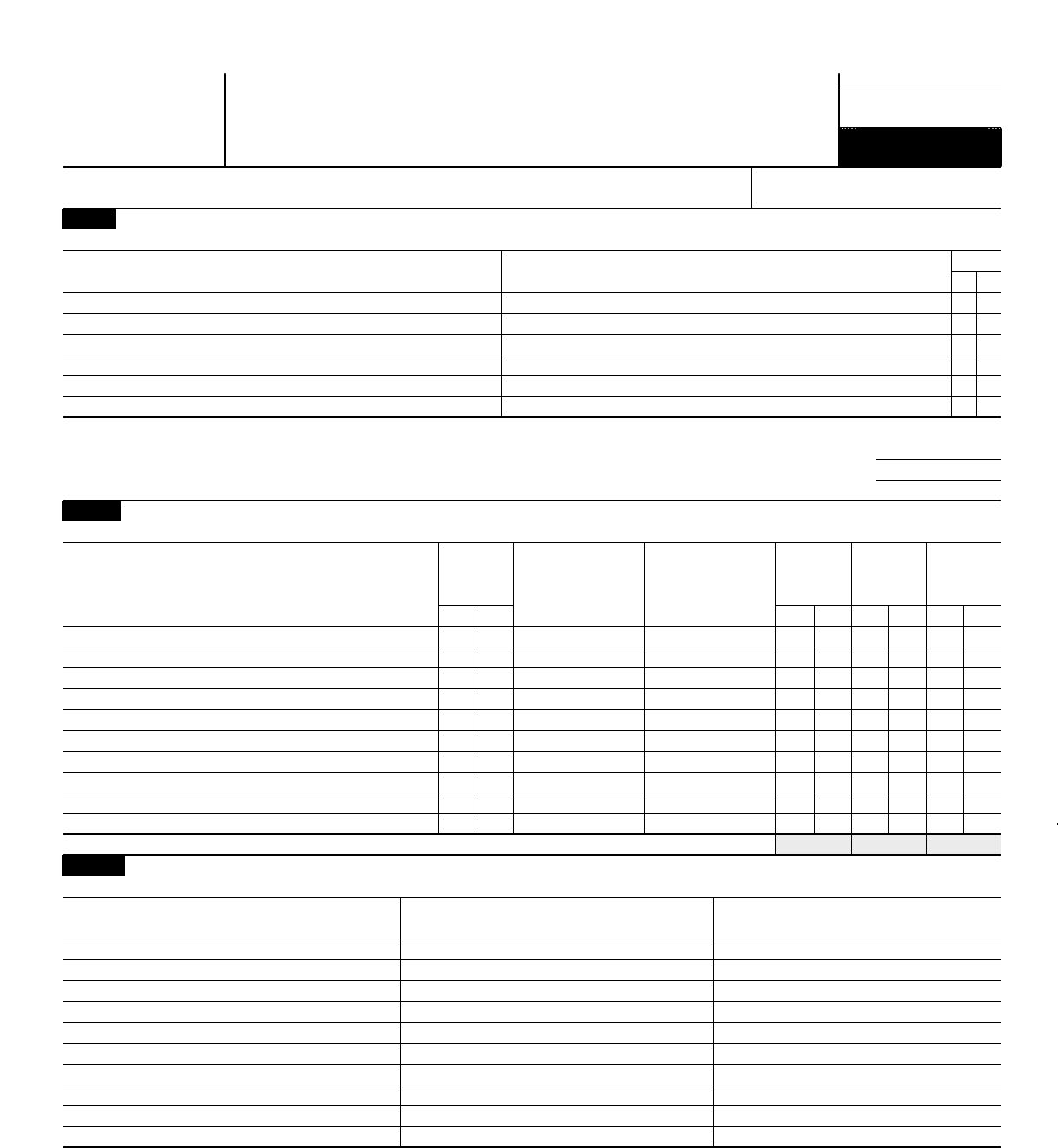

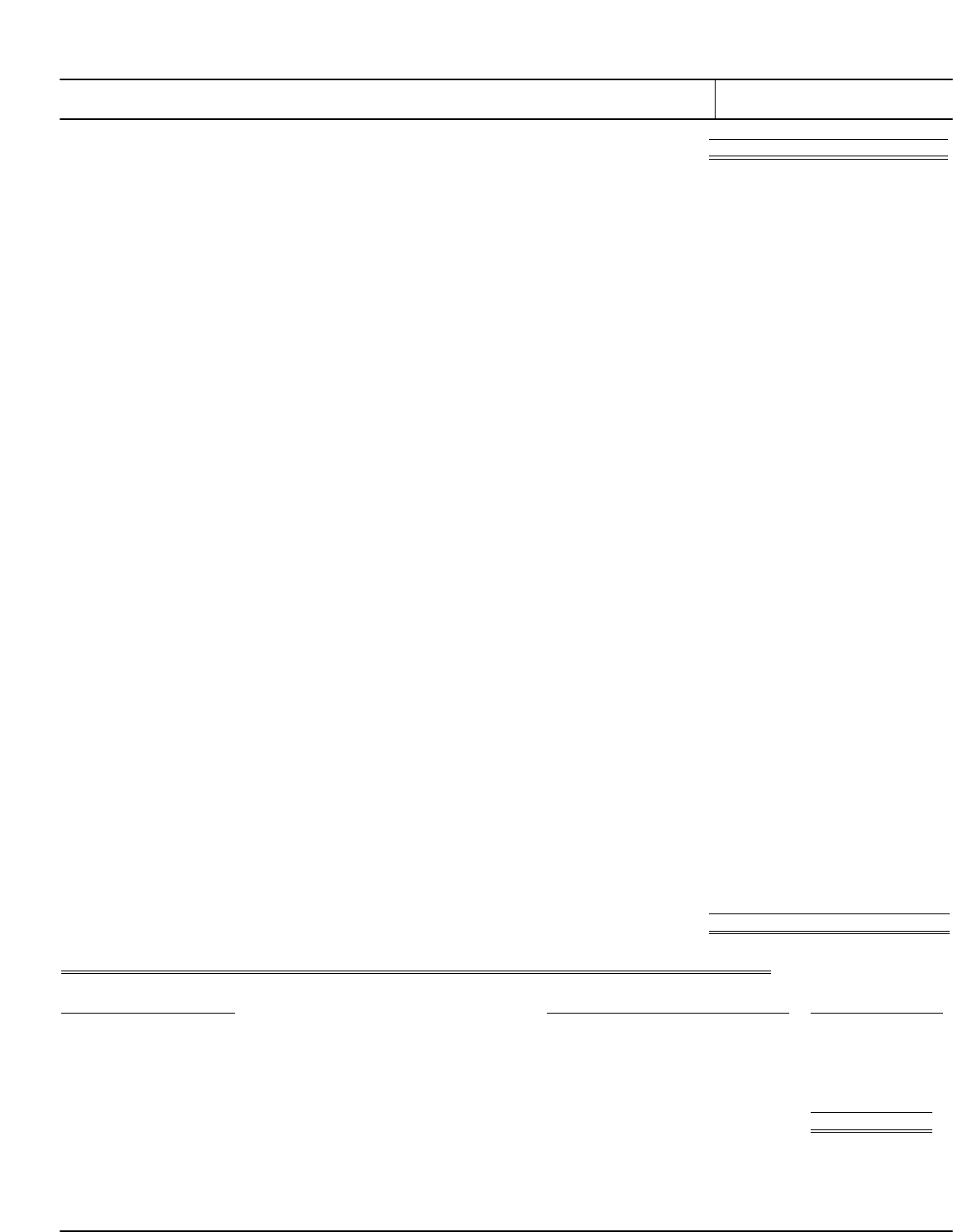

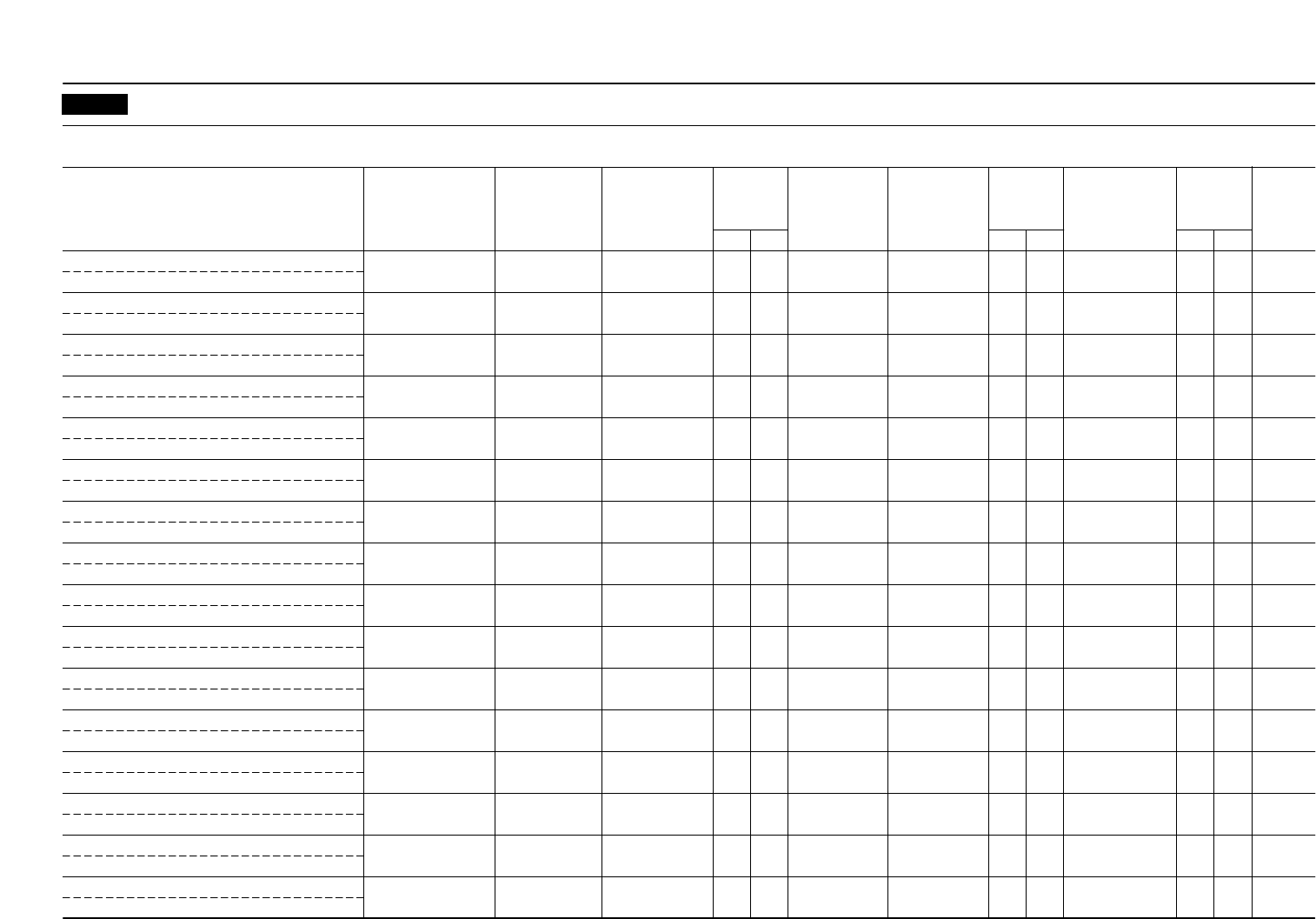

Form 990 (2011) Page 12

Reconciliation of Net Assets

Part XI

Check if Schedule O contains a response to any question in this Part XI mmmmmmmmmmmmmmmmmmmmmmm

1

2

3

4

5

1

2

3

4

5

6

Total revenue (must equal Part VIII, column (A), line 12) mmmmmmmmmmmmmmmmmmmmmmmmmm

Total expenses (must equal Part IX, column (A), line 25) mmmmmmmmmmmmmmmmmmmmmmmmmm

Revenue less expenses. Subtract line 2 from line 1 mmmmmmmmmmmmmmmmmmmmmmmmmmmm

Net assets or fund balances at beginning of year (must equal Part X, line 33, column (A)) mmmmmmmm

Other changes in net assets or fund balances (explain in Schedule O) mmmmmmmmmmmmmmmmmm

Net assets or fund balances at end of year. Combine lines 3, 4, and 5 (must equal Part X, line 33,

column (B)) mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm6

Financial Statements and Reporting

Part XII

Check if Schedule O contains a response to any question in this Part XII mmmmmmmmmmmmmmmmmmmmmm

Yes No

1

2

3

Accounting method used to prepare the Form 990: Cash Accrual Other

If the organization changed its method of accounting from a prior year or checked "Other," explain in

Schedule O. mmmmmmmm

mmmmmmmmmmmmmmmm

mmmm

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

2a

2b

2c

3a

3b

a

b

c

d

a

b

Were the organization's financial statements compiled or reviewed by an independent accountant?

Were the organization's financial statements audited by an independent accountant?

If "Yes" to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight

of the audit, review, or compilation of its financial statements and selection of an independent accountant?

If the organization changed either its oversight process or selection process during the tax year, explain in

Schedule O.

If "Yes" to line 2a or 2b, check a box below to indicate whether the financial statements for the year were

issued on a separate basis, consolidated basis, or both: Both consolidated and separate basis

Separate basis Consolidated basis

As a result of a federal award, was the organization required to undergo an audit or audits as set forth in

the Single Audit Act and OMB Circular A-133?

If "Yes," did the organization undergo the required audit or audits? If the organization did not undergo the

required audit or audits, explain why in Schedule O and describe any steps taken to undergo such audits

Form 990 (2011)

JSA

1E1054 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

X

13,264,878.

7,968,590.

5,296,288.

36,405,951.

-4,538,048.

37,164,191.

X

X

X

X

X

X

X

X

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 14

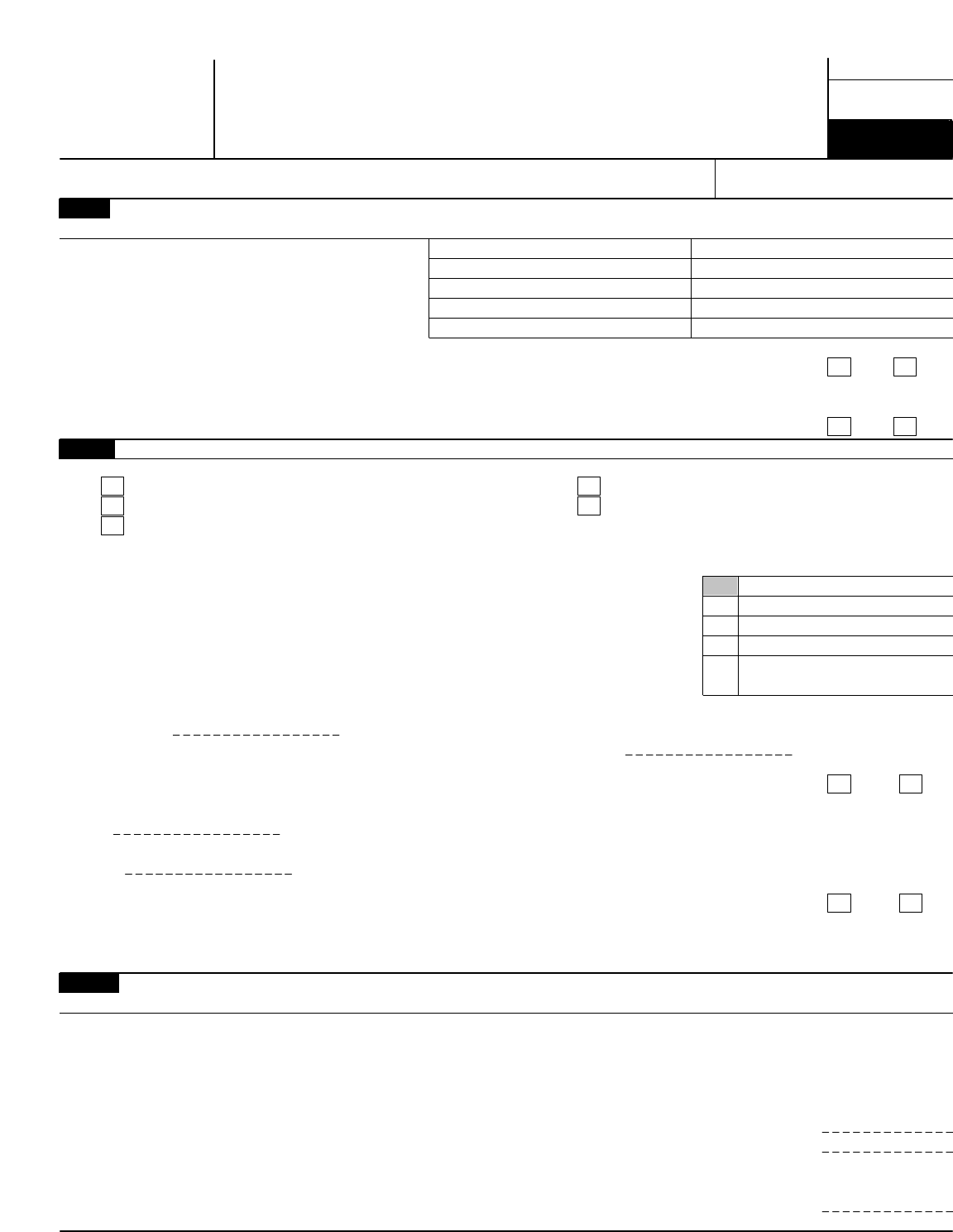

OMB No. 1545-0047

SCHEDULE A Public Charity Status and Public Support

(Form 990 or 990-EZ)

Complete if the organization is a section 501(c)(3) organization or a section

4947(a)(1) nonexempt charitable trust. À¾µµ

Department of the Treasury

Open to Public

Inspection

I I

Attach to Form 990 or Form 990-EZ. See separate instructions.

Internal Revenue Service

Name of the organization Employer identification number

Reason for Public Charity Status (All organizations must complete this part.) See instructions.

Part I

The organization is not a private foundation because it is: (For lines 1 through 11, check only one box.)

1

2

3

4

5

6

7

8

9

10

11

A church, convention of churches, or association of churches described in section 170(b)(1)(A)(i).

A school described in section 170(b)(1)(A)(ii). (Attach Schedule E.)

A hospital or a cooperative hospital service organization described in section 170(b)(1)(A)(iii).

A medical research organization operated in conjunction with a hospital described in section 170(b)(1)(A)(iii). Enter the

hospital's name, city, and state:

An organization operated for the benefit of a college or university owned or operated by a governmental unit described in

section 170(b)(1)(A)(iv). (Complete Part II.)

A federal, state, or local government or governmental unit described in section 170(b)(1)(A)(v).

An organization that normally receives a substantial part of its support from a governmental unit or from the general public

described in section 170(b)(1)(A)(vi). (Complete Part II.)

A community trust described in section 170(b)(1)(A)(vi). (Complete Part II.)

An organization that normally receives: (1) more than 331 /3 % of its support from contributions, membership fees, and gross

receipts from activities related to its exempt functions - subject to certain exceptions, and (2) no more than 331/3% of its

support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses

acquired by the organization after June 30, 1975. See section 509(a)(2). (Complete Part III.)

An organization organized and operated exclusively to test for public safety. See section 509(a)(4).

An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the

purposes of one or more publicly supported organizations described in section 509(a)(1) or section 509(a)(2). See section

509(a)(3). Check the box that describes the type of supporting organization and complete lines 11e through 11h.

aType I bType II cType III - Functionally integrated dType III - Other

e

f

g

h

By checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified

persons other than foundation managers and other than one or more publicly supported organizations described in section

509(a)(1) or section 509(a)(2).

If the organization received a written determination from the IRS that it is a Type I, Type II, or Type III supporting

organization, check this box mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Since August 17, 2006, has the organization accepted any gift or contribution from any of the

following persons?

Yes No

(i)

(ii)

(iii)

A person who directly or indirectly controls, either alone or together with persons described in (ii)

and (iii) below, the governing body of the supported organization? 11g(i)

11g(ii)

11g(iii)

mmmmmmmmmmmmmmmmmmmmm

A family member of a person described in (i) above?

A 35% controlled entity of a person described in (i) or (ii) above?

mmmmmmmmmmmmmmmmmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmm

Provide the following information about the supported organization(s).

(i) Name of supported

organization (ii) EIN (iii) Type of organization

(described on lines 1-9

above or IRC section

(see instructions))

(iv) Is the

organization in

col. (i) listed in

your governing

document?

(v) Did you notify

the organization

in col. (i) of

your support?

(vi) Is the

organization in

col. (i) organized

in the U.S.?

(vii) Amount of

support

Yes No Yes No Yes No

(A)

(B)

(C)

(D)

(E)

Total

For Paperwork Reduction Act Notice, see the Instructions for

Form 990 or 990-EZ. Schedule A (Form 990 or 990-EZ) 2011

JSA

1E1210 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

X

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 15

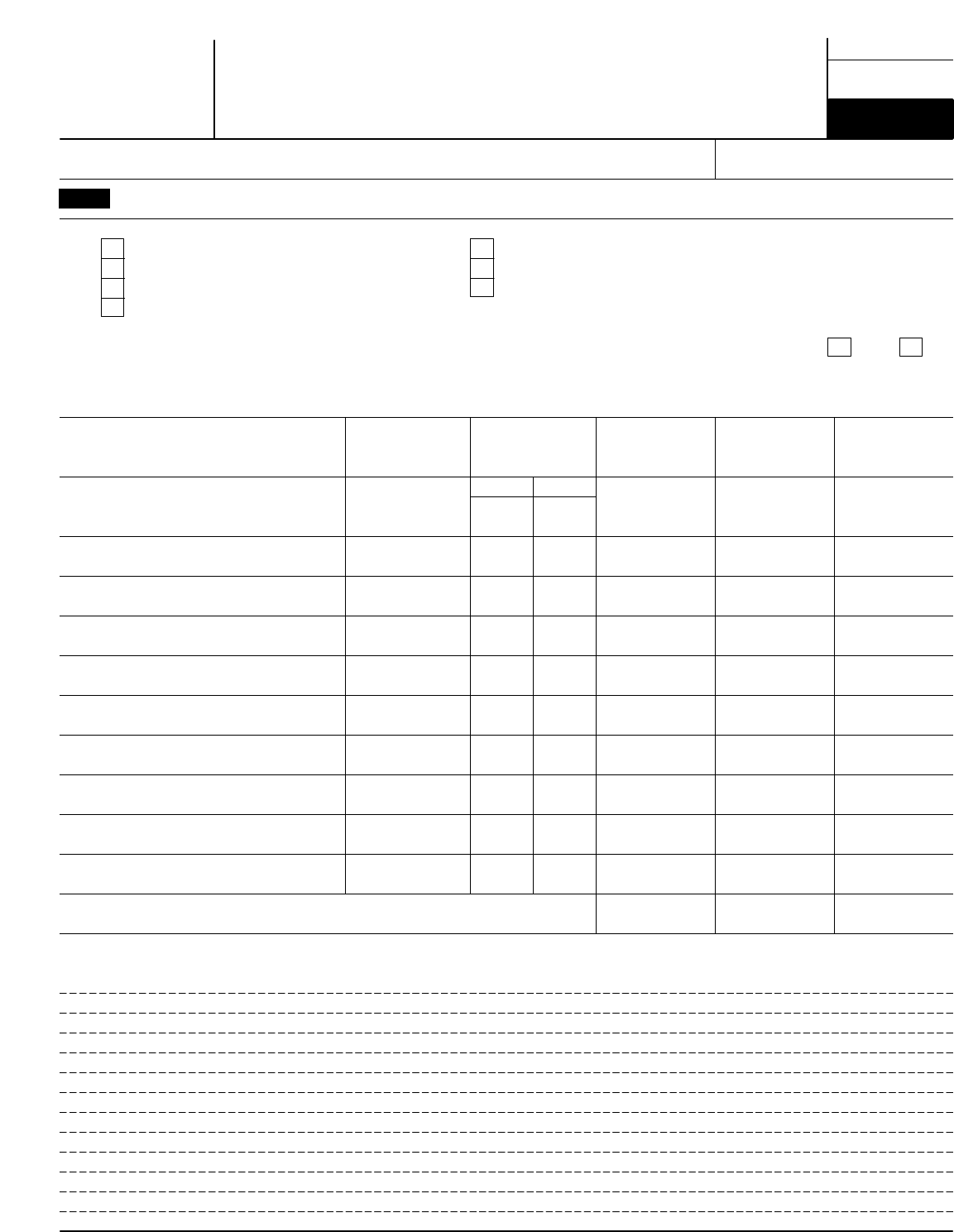

Schedule A (Form 990 or 990-EZ) 2011 Page 2

Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi)

(Complete only if you checked the box on line 5, 7, or 8 of Part I or if the organization failed to qualify under

Part III. If the organization fails to qualify under the tests listed below, please complete Part III.)

Part II

Section A. Public Support

(a) 2007 (b) 2008 (c) 2009 (d) 2010 (e) 2011 (f) Total

I

Calendar year (or fiscal year beginning in)

1Gifts, grants, contributions, and

membership fees received. (Do not

include any "unusual grants.") mmmmmm

2Tax revenues levied for the

organization's benefit and either paid

to or expended on its behalf mmmmmmm

3The value of services or facilities

furnished by a governmental unit to the

organization without charge mmmmmmm

4Total. Add lines 1 through 3 mmmmmmm

5The portion of total contributions by

each person (other than a

governmental unit or publicly

supported organization) included on

line 1 that exceeds 2% of the amount

shown on line 11, column (f)mmmmmmm

6Public support. Subtract line 5 from line 4.

Section B. Total Support

(a) 2007 (b) 2008 (c) 2009 (d) 2010 (e) 2011 (f) Total

I

Calendar year (or fiscal year beginning in)

7Amounts from line 4 mmmmmmmmmm

8Gross income from interest, dividends,

payments received on securities loans,

rents, royalties and income from similar

sources mmmmmmmmmmmmmmmmm

9Net income from unrelated business

activities, whether or not the business

is regularly carried on mmmmmmmmmm

10 Other income. Do not include gain or

loss from the sale of capital assets

(Explain in Part IV.) mmmmmmmmmmm

11 Total support. Add lines 7 through 10

Gross receipts from related activities, etc. (see instructions)

mm 12

14

15

12 mmmmmmmmmmmmmmmmmmmmmmmmmm

13 First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501(c)(3)

I

I

I

I

I

I

organization, check this box and stop here mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Section C. Computation of Public Support Percentage

%

%

14 Public support percentage for 2011 (line 6, column (f) divided by line 11, column (f))

Public support percentage from 2010 Schedule A, Part II, line 14 mmmmmmmm

15 mmmmmmmmmmmmmmmmmmm

16a 331/3 % support test - 2011. If the organization did not check the box on line 13, and line 14 is 331/3 % or more, check

this box and stop here. The organization qualifies as a publicly supported organization mmmmmmmmmmmmmmmmmmmm

b 331/3 % support test - 2010. If the organization did not check a box on line 13 or 16a, and line 15 is 3 31/3 % or more,

check this box and stop here. The organization qualifies as a publicly supported organization mmmmmmmmmmmmmmmmm

17a 10%-facts-and-circumstances test - 2011. If the organization did not check a box on line 13, 16a, or 16b, and line 14 is

10% or more, and if the organization meets the "facts-and-circumstances" test, check this box and stop here. Explain in

Part IV how the organization meets the "facts-and-circumstances” test. The organization qualifies as a publicly supported

organization mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

b 10%-facts-and-circumstances test - 2010. If the organization did not check a box on line 13, 16a, 16b, or 17a, and line

15 is 10% or more, and if the organization meets the "facts-and-circumstances" test, check this box and stop here.

Explain in Part IV how the organzation meets the "facts-and-circumstances" test. The organization qualifies as a publicly

supported organization mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

18 Private foundation. If the organization did not check a box on line 13, 16a, 16b, 17a, or 17b, check this box and see

instructions mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Schedule A (Form 990 or 990-EZ) 2011

JSA

1E1220 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

6,906,168. 6,928,792. 15,261,519. 14,802,427. 13,089,533. 56,988,439.

6,906,168. 6,928,792. 15,261,519. 14,802,427. 13,089,533. 56,988,439.

56,988,439.

6,906,168. 6,928,792. 15,261,519. 14,802,427. 13,089,533. 56,988,439.

500,569. 476,299. 142,722. 215,771. 97,990. 1,433,351.

58,421,790.

97.55

91.83

X

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 16

Schedule A (Form 990 or 990-EZ) 2011 Page 3

Support Schedule for Organizations Described in Section 509(a)(2)

(Complete only if you checked the box on line 9 of Part I or if the organization failed to qualify under Part II.

If the organization fails to qualify under the tests listed below, please complete Part II.)

Part III

Section A. Public Support

(a) 2007 (b) 2008 (c) 2009 (d) 2010 (e) 2011 (f) Total

I

Calendar year (or fiscal year beginning in)

1Gifts, grants, contributions, and membership fees

received. (Do not include any "unusual grants.")

2Gross receipts from admissions, merchandise

sold or services performed, or facilities

furnished in any activity that is related to the

organization's tax-exempt purpose mmmmmm

3Gross receipts from activities that are not an

unrelated trade or business under section 513 m

4Tax revenues levied for the

organization's benefit and either paid

to or expended on its behalf mmmmmmm

5The value of services or facilities

furnished by a governmental unit to the

organization without charge mmmmmmm

6 Total. Add lines 1 through 5 mmmmmmm

7a Amounts included on lines 1, 2, and 3

received from disqualified persons mmmm

bAmounts included on lines 2 and 3

received from other than disqualified

persons that exceed the greater of $5,000

or 1% of the amount on line 13 for the year

cAdd lines 7a and 7b mmmmmmmmmmm

8 Public support (Subtract line 7c from

line 6.) mmmmmmmmmmmmmmmmm

Section B. Total Support

(a) 2007 (b) 2008 (c) 2009 (d) 2010 (e) 2011 (f) Total

I

Calendar year (or fiscal year beginning in)

9Amounts from line 6mmmmmmmmmmm

10a Gross income from interest, dividends,

payments received on securities loans,

rents, royalties and income from similar

sources mmmmmmmmmmmmmmmmm

bUnrelated business taxable income (less

section 511 taxes) from businesses

acquired after June 30, 1975 mmmmmm

cAdd lines 10a and 10b mmmmmmmmm

11 Net income from unrelated business

activities not included in line 10b,

whether or not the business is regularly

carried on mmmmmmmmmmmmmmm

12 Other income. Do not include gain or

loss from the sale of capital assets

(Explain in Part IV.) mmmmmmmmmmm

13 Total support. (Add lines 9, 10c, 11,

and 12.) mmmmmmmmmmmmmmmm

14 First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501(c)(3)

organization, check this box and stop here I

mmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmmm

Section C. Computation of Public Support Percentage

15

16

Public support percentage for 2011 (line 8, column (f) divided by line 13, column (f))

Public support percentage from 2010 Schedule A, Part III, line 15

15

16

17

18

%

%

%

%

mmmmmmmmmmmmmm

mmmmmmmmmmmmmmmmmmmmmmm

Section D. Computation of Investment Income Percentage

17

18

19

20

Investment income percentage for 2011 (line 10c, column (f) divided by line 13, column (f))

Investment income percentage from 2010 Schedule A, Part III, line 17 mmmmmmmmmm

mmmmmmmmmmmmmmmmmmmm

a

b

331/3 % support tests - 2011. If the organization did not check the box on line 14, and line 15 is more than 331/3 %, and lineI

17 is not more than 331/3 %, check this box and stop here. The organization qualifies as a publicly supported organization

331/3 % support tests - 2010. If the organization did not check a box on line 14 or line 19a, and line 16 is more than 331/3 %, andI

line 18 is not more than 331/3 %, check this box and stop here. The organization qualifies as a publicly supported organization I

Private foundation. If the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions

JSA Schedule A (Form 990 or 990-EZ) 2011

1E1221 1.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 17

Schedule A (Form 990 or 990-EZ) 2011 Page 4

Supplemental Information. Complete this part to provide the explanations required by Part II, line 10;

Part II, line 17a or 17b; and Part III, line 12. Also complete this part for any additional information. (See

instructions).

Part IV

Schedule A (Form 990 or 990-EZ) 2011

JSA

1E1225 2.000

NEW JERSEY CONSERVATION FOUNDATION 22-6065456

6913DW B94H 10/16/2012 4:01:40 PM V 11-6 0285351.1 PAGE 18

OMB No. 1545-0047

Schedule B Schedule of Contributors À¾µµ

(Form 990, 990-EZ,

or 990-PF) I

Department of the Treasury

Internal Revenue Service

Attach to Form 990, Form 990-EZ, or Form 990-PF.

Name of the organization Employer identification number

Organization type (check one):

Filers of:

Form 990 or 990-EZ

Section:

501(c)( ) (enter number) organization

4947(a)(1) nonexempt charitable trust not treated as a private foundation

527 political organization

501(c)(3) exempt private foundation

4947(a)(1) nonexempt charitable trust treated as a private foundation

501(c)(3) taxable private foundation

Form 990-PF

Check if your organization is covered by the General Rule or a Special Rule.

Note. Only a section 501(c)(7), (8), or (10) organization can check boxes for both the General Rule and a Special Rule. See

instructions.

General Rule

For an organization filing Form 990, 990-EZ, or 990-PF that received, during the year, $5,000 or more (in money or

property) from any one contributor. Complete Parts I and II.

Special Rules

For a section 501(c)(3) organization filing Form 990 or 990-EZ that met the 33 1/3 % support test of the regulations

under sections 509(a)(1) and 170(b)(1)(A)(vi) and received from any one contributor, during the year, a contribution of