28280.Covered Calls And LEAPS A Wealth Option Guide For Generating Extraordinary Monthly Income

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 241 [warning: Documents this large are best viewed by clicking the View PDF Link!]

Covered Calls

and LEAPS—

A Wealth

Option

ffirs.qxd 10/23/06 1:31 PM Page i

Founded in 1807, John Wiley & Sons is the oldest independent publishing

company in the United States. With offices in North America, Europe, Aus-

tralia, and Asia, Wiley is globally committed to developing and marketing

print and electronic products and services for our customers’ professional

and personal knowledge and understanding.

The Wiley Trading series features books by traders who have survived

the market’s ever changing temperament and have prospered—some by

reinventing systems, others by getting back to basics. Whether a novice

trader, professional, or somewhere in-between, these books will provide

the advice and strategies needed to prosper today and well into the future.

For a list of available titles, visit our web site at www.WileyFinance.com.

ffirs.qxd 10/23/06 1:31 PM Page ii

Covered Calls

and LEAPS—

A Wealth

Option

A Guide for Generating

Extraordinary Monthly Income

JOSEPH HOOPER

AARON ZALEWSKI

John Wiley & Sons, Inc.

ffirs.qxd 10/23/06 1:31 PM Page iii

Copyright © 2007 by Compound Stock Earnings Seminars, Inc. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or

transmitted in any form or by any means, electronic, mechanical, photocopying,

recording, scanning, or otherwise, except as permitted under Section 107 or 108 of

the 1976 United States Copyright Act, without either the prior written permission of

the Publisher, or authorization through payment of the appropriate per-copy fee to

the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923,

(978) 750-8400, fax (978)646-8600, or on the web at www.copyright.com. Requests

to the Publisher for permission should be addressed to the Permissions Department,

John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011,

fax (201) 748-6008, or online at http://www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used

their best efforts in preparing this book, they make no representations or warranties

with respect to the accuracy or completeness of the contents of this book and specifi-

cally disclaim any implied warranties of merchantability or fitness for a particular pur-

pose. No warranty may be created or extended by sales representatives or written sales

materials. The advice and strategies contained herein may not be suitable for your situ-

ation. You should consult with a professional where appropriate. Neither the publisher

nor author shall be liable for any loss of profit or any other commercial damages, includ-

ing but not limited to special, incidental, consequential, or other damages.

Designations used by companies to distinguish their products are often claimed as

trademarks. In all instances where John Wiley & Sons, Inc., is aware of a claim, the

product names appear in initial capital or all capital letters. Readers, however, should

contact the appropriate companies for more complete information regarding trade-

marks and registration.

For general information on our other products and services or for technical

support, please contact our Customer Care Department within the United States

at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that

appears in print may not be available in electronic books. For more information

about Wiley products, visit our web site at www.wiley.com.

Library of Congress Cataloging-in-Publication Data:

Hooper, Joseph, 1943–

Covered calls—A wealth option : a guide for generating extraordinary

monthly income / Joseph Hooper And Aaron Zalewski.

p. cm.

Includes bibliographical references and index.

ISBN-13 978-0-470-04470-4 (cloth/dvd : alk. paper)

ISBN-10 0-470-04470-5 (cloth/dvd : alk. paper)

1. Options (Finance) 2. Stock options. I. Zalewski, Aaron, 1980–

II. Title. III. Title: Covered calls.

HG6024.A3H66 2006

332.63'2283—dc22

2006015461

Printed in the United States of America.

10987654321

ffirs.qxd 10/23/06 1:31 PM Page iv

v

Contents

Foreword vii

Preface ix

CHAPTER 1 An Introduction to Options 1

PART I Covered Calls 21

CHAPTER 2 An Introduction to Covered Calls 23

CHAPTER 3 Entering New Covered Call Positions 33

CHAPTER 4 Management Rules 59

CHAPTER 5 Defensive Techniques 75

PART II Calendar LEAPS Spreads 115

CHAPTER 6 An Introduction to Calendar

LEAPS Spreads 117

CHAPTER 7 Entering New LEAPS Positions 123

CHAPTER 8 Management Rules 147

CHAPTER 9 Defensive Techniques 165

ftoc.qxd 10/23/06 1:29 PM Page v

CONCLUSION How to Move Forward 177

APPENDIX A Quick Reference Guide 179

APPENDIX B Foreign Exchange Risk 197

APPENDIX C Brokerages and Order Types 201

APPENDIX D Using ETFs and HOLDRs for

Diversification 205

APPENDIX E Compound Stock Earnings

Support Services 207

Glossary 211

Disclaimer and Legal Information 217

About the DVD 221

Index 223

vi Contents

ftoc.qxd 10/23/06 1:29 PM Page vi

vii

Foreword

Brilliant book. Anyone who has read any of my work knows that I be-

lieve buying, holding, and praying is not an optimal financial strategy.

Joseph Hooper and Aaron Zalewski have done an excellent job mak-

ing a complex subject simple enough for someone like me to understand.

As most of us know, investors invest for two basic things: capital gains

and cash flow. Most people invest for capital gains, which is simply buying

something and hoping the price goes up. Investing for cash flow is invest-

ing for a steady stream of income. Of the two, investing for cash flow re-

quires the most skill. Anyone can deceive themselves by thinking, “The

price will go up in the future.” Or anyone can be suckered into a sales pitch

that goes: “Prices have gone up over the past five years...so you better

buy now.”

The reason I love this book is because the authors have made investing

for cash flow simple. I like the analogy in their Preface of planting trees and

growing a forest to be cut down as an example of investing for capital

gains versus planting fruit trees to harvest and replenish on a regular basis

as the example of investing for cash flow. Obviously, the more savvy in-

vestors invest for both capital gains and cash flow. They want a forest and

the fruit. They want money today and tomorrow.

Regardless, even if you never plan on investing in stocks or covered

calls, this is an excellent book for anyone who wants to look into the mind

of a professional investor. You see, the investment strategy discussed in

this book does not apply only to stocks. This investment strategy works for

real estate as well. Rarely do I buy a stock or piece of real estate without

first knowing that I will receive cash flow and capital gains. In other words,

this book is not about an asset class but more about a class of investor that

likes to win, not gamble.

R

OBERT

K

IYOSAKI

Author of Rich Dad, Poor Dad

fmatter.qxd 10/23/06 1:26 PM Page vii

fmatter.qxd 10/23/06 1:26 PM Page viii

ix

Preface

One can think of the accumulation of a stock portfolio through time as

the cultivation of a forest full of trees. Traditional Street mentality

encourages investors to plant trees throughout their working lives

and rely on appreciating markets to grow the forest over the long term.

Once our working lives are finished and active income ceases, the

Street then encourages investors to begin cutting down the forest to pro-

vide income in retirement. The hope is that the forest has grown large

enough over time to withstand the depletion in retirement. In our experi-

ence, this level of growth is a rarity for the average American.

What the Street has overlooked is that simple and very conservative

cultivation can transform the forest into an orchard of fruit-bearing trees.

Fruit-bearing trees generate cash income on a monthly basis. For investors

who want to grow their assets, rather than eating the fruit each month, the

fruit can be left to fall on fertile soils to grow more trees and thus to com-

pound the growth of the forest through time. For investors who are in re-

tirement, the fruit can be picked each month as cash income for living

expenses—without liquidating stocks in the portfolio and destroying the

forest that they depend on to live.

Correct application of the covered call technique is the vehicle by

which stocks are converted to cash flow generating assets.

OPTIONS ARE NOT JUST A

HIGH RISK/HIGH RETURN INSTRUMENT

Options are without doubt the most misunderstood, misrepresented, and

poorly implemented financial tool in the world. When asked about options,

most people (including those “in the know” like financial planners, stock-

brokers, and accountants) will tell you that “they’re high-risk, high-return

instruments.”

It is astonishing that even those who are financially educated seem un-

aware that options can be used to minimize or even eliminate risk in a

fpref.qxd 10/23/06 1:23 PM Page ix

stock portfolio. In fact, options were originally not devised for use as a

speculative instrument. They were originally used in the agricultural indus-

try to reduce risk by locking in future sales prices before harvest. Regard-

less of this original intent, options maintain the label of “high risk, high

return.”

The high-risk, high-return label derives its origins from the speculative

use of options. Speculators use options to bet on the direction of the mar-

kets for the potential of very high returns. However, with these high returns

come very high risk, and the vast majority of speculators fail over the long

term. If you ever attempt to speculate with options, there is a very high

chance that you, too, will be unsuccessful over the long term.

What evidence do we have that the vast majority of speculators fail over

the long term? Well, if just 10 percent of the world’s speculators were mak-

ing regular 50–100 percent returns per trade over the long term (as is the goal

of a speculator), then the world would be full of multi, multimillionaires who

made overnight fortunes trading options. Clearly, this is not the reality. How-

ever, this get-rich-quick ideal continues to be perpetuated by the endless

hope of investors seeking a quick and easy solution to their financial woes.

Options markets are a zero-sum game. Someone wins only when some-

one else loses. If most speculators lose in the long run, who are the win-

ners? Apart from the market makers and the small portion of speculators

who win over the long term, money flows each and every month into the

hands of option writers. Option writers are the people who are selling op-

tion contracts to the speculators.

What we want to teach you has nothing to do with the risky practice of

speculating with options—this is not high-risk, high-return trading. In fact,

covered calls are almost the complete opposite. In this book we show you

a way to use options to make consistent, steady profits that you can rely on

to pay your mortgage and put food on your table or to compound your in-

vestment capital through time into significant accumulations of wealth.

J

OSEPH

H

OOPER

A

ARON

Z

ALEWSKI

xPreface

fpref.qxd 10/23/06 1:23 PM Page x

1

CHAPTER 1

MARKET BASICS

This section is written specifically for the stock market novice. It is aimed

at those who have never bought a stock before or those who have very lit-

tle understanding of the most basic functions of stock and option markets.

What Is the Stock Market?

From the perspective of a private investor, the stock market provides a

venue for the buying and selling of stock of publicly listed companies. If

you want to buy fruit, you go to the fruit market. If you want to buy stocks,

you buy them through the stock market—it is as simple as that. Other com-

mon terms for the stock market include:

• Share market

• Equity market

• Simply “the market”

From the perspective of a company, listing on the stock market pro-

vides access to a large amount of investment capital that would not other-

wise be available to an unlisted company. The market provides companies

with the ability to seek investment funds from retail investors as well as in-

stitutional investors (fund managers, banks, etc.) who invest on behalf of

others. Access to this public market capital enables a listed company to sig-

nificantly extend its potential funding base upon which it can expand and

grow its business in the future.

An Introduction

to Options

c01.qxd 10/23/06 2:22 PM Page 1

What Is a Share?

A share represents a portion of ownership of a company. Public companies

are very large and, in most instances, are not owned by just one person or

entity. Many thousands of different people or entities own stock in large

listed public companies.

A share literally entitles its owner to a portion of a company’s earnings

(as dividends) and a claim on the company’s assets in the event of bank-

ruptcy (priority given to creditors). Through the election of company di-

rectors, stockowners are also entitled to participate in deciding the future

direction of the company.

Most adults are already stockowners. Some of these stockowners are

active investors who buy and sell stocks based on their own research or on

the advice of their peers or professional advisers such as a stockbroker.

Other stockowners gain exposure to the stock market through mutual

funds where money is pooled and invested by a professional fund manager.

How Are Stocks Bought and Sold

on the Stock Market?

Think of the stock market like a fruit market. Let’s assume you want to buy

10 bananas. You need to go to the fruit market and see who is selling ba-

nanas and at what price. Store owners are entitled to sell their bananas at

whatever price they see fit. Obviously they don’t want to make the price too

high or their fruit won’t sell, or too low because then they are not making

as much money as they could.

You find three different stores selling bananas:

Asking Price, 10 Bananas

Store 1 $1.40

Store 2 $1.47

Store 3 $1.60

You obviously want to buy your bananas as cheaply as possible. If you

think $1.40 is reasonable, you might simply buy them from store 1 at that

price. If you are only prepared to pay $1.35, then you might “bid” to buy them

at $1.35. The manager at store 1 may agree to this price as it’s not far away

from his asking price. If you both agree on a price, the bananas will sell.

Buying stocks on the stock market works exactly the same way! Let’s

assume you want to buy 100 shares of General Electric (GE). You look up

the price at the stock market by calling your stockbroker (or going to your

broker’s online site). You are presented with the market for GE stock. It

looks Table 1.1.

2AN INTRODUCTION TO OPTIONS

c01.qxd 10/23/06 2:22 PM Page 2

If you want to buy 100 shares, you need to buy them by reaching an

agreement on price from someone who wants to sell them. The sellers put

into the market how many shares they want to sell and at what price (the

“ask” price). You obviously want to buy the stock as cheaply as possible, so

the seller asking the lowest price is always at the top of the list. He or she

is offering 5,000 shares for sale at a price of $25.20.

You now have two options:

1. If you think $25.20 is a reasonable price, you can simply put in a bid to

buy 100 shares of GE at $25.20 and your order will be filled.

2. If you think $25.20 is not a reasonable price, you can put in a bid for less.

Let’s assume you think $25.10 is a reasonable price. You enter this bid

price into the market and the market will then look like Table 1.2. Your bid

is now at the top of the column because you are the current highest bidder.

If the seller at $25.20 (or any other seller) thinks that $25.10 is a reasonable

price, he or she may change the order to $25.10 and the stock will trade. Or

a new seller might come into the market enticed by your bid of $25.10 and

your stock may trade.

What Is a Stock Code or Symbol?

All stocks that trade on public markets are represented by an individual

stock code or symbol. No two stocks have the same stock code.

An Introduction to Options 3

TABLE 1.1 The Market for GE Stock

Buyers (Bid) Sellers (Ask)

Number of Shares Bid Price Ask Price Number of Shares

2,000 $25.00 $25.20 5,000

5,000 $24.80 $25.40 400

400 $24.20 $26.00 1,000

TABLE 1.2 Entering a Bid into the Market

Buyers (Bid) Sellers (Ask)

Number of Shares Bid Price Ask Price Number of Shares

100 $25.10 $25.20 5,000

2,000 $25.00 $25.40 400

5,000 $24.80 $26.00 1,000

400 $24.20

c01.qxd 10/23/06 2:22 PM Page 3

While these terms can be used interchangeably, in the United States,

the term symbol is used. U.S. stock symbols consist of one letter to five

letters. For example, Citigroup is represented by the symbol C, Wal-Mart is

represented by the symbol WMT, and Shire Pharmaceuticals is represented

by the symbol SHPGY.

Option contracts in the United States are also represented by symbols/

tickers, which are generally five letters long. As with stocks, no two option

contracts have the same symbol.

What Makes Stock Prices Go Up and Down?

Many factors influence the price at which a company’s stock trades, the

most important factor being a company’s future earnings. Various funda-

mental factors combine to influence a company’s future earnings. You will

become very familiar with fundamental factors as they are of particular

interest to financial analysts and also gain significant exposure in the fi-

nancial press. Common fundamental factors that affect the future earnings

potential of a company include:

• Company-related issues such as increases or decreases in sales, in-

creases or decreases in the cost of doing business, and changes in asset

position, management team, business model, or perceived business risk.

• Industry-related issues such as the financial performance of competi-

tors or introduction of significant legislation.

• Economic-related issues such as the economic growth rate of econo-

mies in which the business operates, currency fluctuations, and inter-

est rate or inflation rate changes.

If a fundamental factor changes and causes the market to think that a com-

pany’s future earnings will be higher (lower) than previously expected, the

stock price will adjust upward (downward) accordingly.

Other influences on stock prices that you should be aware of are techni-

cal factors. Technical analysis is the study of stock price charts through time.

There are many investors and traders in the financial markets who make buy

and sell decisions based solely on technical analysis because they believe

that all fundamental factors are represented in the price charts they analyze.

We discuss both fundamental and technical factors in more depth later

in this book.

What Is a Stockbroker?

Stockbrokers provide access to the stock market by entering buy and sell

orders into the market on behalf of investors. Stockbrokers also hold ac-

counts on behalf of investors where electronic records of stocks, options,

and cash held are kept.

4AN INTRODUCTION TO OPTIONS

c01.qxd 10/23/06 2:22 PM Page 4

A brokerage account is just like a bank account except it holds stocks

and options as well as cash. To set up a brokerage account, contact a bro-

ker (via phone or online), fill out the paperwork, and deposit money into

your account. For the type of investing you are going to be doing, it is best

to use a discount broker with the lowest possible transaction costs and fast

executions.

Do not use a boutique broker (one who provides advice), even if you cur-

rently use one. They are expensive and, from this point on, you will not need

their advice. You will make your own decisions and the returns you will gen-

erate may be many times what the best broker can do for you in the best year!

The brokerage industry is constantly evolving with new online players

entering the market and existing brokerage houses regularly making

changes to trading platforms and commission structures. The current in-

dustry best brokers for using the covered call technique can be found at

www.compoundstockearnings.com/brokers. We strongly advise you to use

one of these recommended brokers because trading platforms and trans-

action costs have a very dramatic effect on profitability.

What Are the Dow Jones Industrial Average,

S&P 500, and NASDAQ?

The Dow Jones Industrial Average (the Dow), S&P 500, and NASDAQ are

stock market indexes. A stock market index is used to represent the per-

formance of a group of stocks rather than just a single stock. Apart from

some exceptions (such as the Dow), indexes are generally constructed on

a market value weighted basis. Consequently, the movements of larger

companies have a greater impact on the performance of the index than do

movements of smaller companies.

Some of the world’s most significant stock market indexes are listed in

Table 1.3.

An Introduction to Options 5

TABLE 1.3 Major Stock Market Indexes

Index Name Market Composition

Dow Jones Industrial U.S.—NYSE 30 stocks on New York Stock Exchange

(Dow) (NYSE)

NASDAQ Composite U.S.—NASDAQ All NASDAQ stocks; heavy in technology

S&P/ASX 200 Australia 200 largest and most liquid companies

Financial Times Stock London 100 largest companies; often called

Exchange (FTSE) “Footsie”

DAX Germany 30 major companies

Hang Seng Hong Kong 33 largest companies

Nikkei Tokyo 225 largest companies

c01.qxd 10/23/06 2:22 PM Page 5

OPTIONS BASICS

What Are Options and How Do They Trade?

An option is a financial instrument and contract. An option gives the holder

the right, but not the obligation, to buy or sell a financial asset at a certain

price up to a certain date. An important distinction is “the right, but not the

obligation.” The holder of the option does not have to exercise the right

under the contract if it is not in his or her favor to do so.

Options (like futures) are known as derivative securities simply be-

cause their value is derived from the value of other more basic variables.

For example, an IBM stock option is a derivative security because its value

depends on the price of IBM stock. The derivative asset is also referred to

as the underlying asset. In this case, the underlying asset is IBM stock.

Options are available on many financial assets including stocks, fu-

tures, and commodities. Most options are exchange traded, meaning they

are traded on public markets, just like stocks are traded on stock exchanges.

There are two basic types of stock options:

1. A call option gives the holder the right, but not the obligation, to buy a

stock at a certain price up to a certain date. Call options are used by

speculators who expect an increase in the price of the underlying

asset.

2. A put option gives the holder the right, but not the obligation, to sell a

stock at a certain price up to a certain date. Put options are used by

speculators who expect a decrease in the price of the underlying asset.

The covered call technique involves the use of call options only.

Options trade exactly the same way that stocks do. There are investors

who want to buy options and there are investors who want to sell, or write,

options. When these two investors reach an agreement on price, the con-

tract trades. This trade happens in exactly the same way as previously de-

scribed in the section on “how stocks are bought and sold on the stock

market.”

All exchange-traded options have certain standard characteristics.

Take this description of a contract as an example:

General Electric September 2005 $30.00 Call Option

Company name All exchange-traded options relate to a specific

publicly listed company (or financial asset). In

this case the contract relates to stock in Gen-

eral Electric (GE).

6AN INTRODUCTION TO OPTIONS

c01.qxd 10/23/06 2:22 PM Page 6

Expiration date All options have an expiration date. In this case

the option expires in September 2005.

Strike or exercise All options have a specific strike or exercise

price price. These two terms are used interchange-

ably. If you own this contract you have the

right to buy GE stock at a price of $30.00.

Type All options are either a call option or a put

option. A call option provides the right to buy

the stock. A put option provides the right to

sell the stock. This contract is a call option.

If you owned the GE September 2005 $30.00 call option, you would have the

right, but not the obligation, to buy GE stock at $30.00 per share up to the

expiration date of September 2005.

Unlike stocks, options are referred to as contracts. In the United States,

a standard contract relates to 100 shares in the underlying stock—this num-

ber changes depending on which country the option is listed in. Thus, if you

buy four GE September 2005 $30 calls, you own four contracts. Each con-

tract relates to 100 shares, so in this instance, you own the right to buy 400

shares.

What Basic Options Terminology Do You

Need to Know?

Long and Short Positions An investor who has an overall buy posi-

tion in a stock or option contract is said to be long. If you currently do not

own GE stock and you purchase 500 GE shares, you are long 500 GE

shares. If you purchase four GE September 2005 $30 calls and have no

existing position in that contract, you are long four GE September 2005

$30 calls.

Conversely, an investor who has an overall sell position in an option

contract is said to be short. If you currently do not own GE stock and you

sell 400 GE shares, you are short 400 shares. If you sell three GE September

2005 $30 calls and have no existing position in that contract, you are said to

be short three September 2005 $30 calls.

Table 1.4 shows each position classified as either long or short. It

assumes that the investor has no existing position in any stock or option

contract.

Opening and Closing Transactions An opening transaction is one

where an option buyer or seller establishes a new position or increases an

existing position as either a buyer or a seller. For example, if John buys one

An Introduction to Options 7

c01.qxd 10/23/06 2:22 PM Page 7

GE September 2005 $30 call, he is said to be “buying to open”—he has

opened a new position. John may also elect to sell one GE September 2005

$30 call. In this case he would be “selling to open” if he was not already long

in the identical contract. The effect of an opening transaction is that the

number of contracts the investor is exposed to is increased.

A closing transaction is one where an option buyer makes an offset-

ting sale of an identical option or an option seller makes an offsetting pur-

chase of an identical option. For example, if John is long one GE September

2005 $30 call and then sells one GE September 2005 $30 call, he would be

“selling to close” because he has now closed out his position in that option

contract and has no further rights or obligations under the contract. The ef-

fect of a closing transaction is that the number of contracts the investor is

exposed to is decreased.

Alternatively, if John holds a short position of one GE September 2005

$30 call and then buys one GE September 2005 $30 call, he would likewise

be “buying to close” because he has now closed out his position in that op-

tion contract and has no further rights or obligations under the contract.

Again, the effect of a closing transaction is that the number of contracts the

investor is exposed to is decreased.

Table 1.5 shows transactions categorized as either an opening or

closing.

The important concept to understand is that an option buyer or seller

can, at any time, close an open position by performing an equal and oppo-

site transaction with the identical contract. Whether the transaction is

closed for a profit or loss depends on the option’s price at the time that the

closing transaction is executed. This action is very similar to closing a tra-

ditional stock investment—the investor can sell the stock and close the po-

sition at any time, but whether the stock can be sold for a profit or loss

depends on the current market price at the time.

8AN INTRODUCTION TO OPTIONS

TABLE 1.4 Comparison of Long and

Short Positions

Position Long Short

Buy 300 GE shares X

Sell 12 WMT calls X

Buy 4 HD calls X

Buy 8 JPM calls X

Sell 1 CD call X

c01.qxd 10/23/06 2:22 PM Page 8

In the Money, Out of the Money, and At the Money Option market

participants have coined the phrases in, out, and at the money to describe

an option’s strike price in relation to the stock price.

An in-the-money option is one that has intrinsic value, where the

owner of the option stands to profit by exercising his or her right under the

contract. For a call option to be in the money, the stock price must be

higher than the strike price. For example, a $15.00 call option is in the

money when the stock price is greater than $15.00.

An out-of-the-money option is one that has no intrinsic value, where

the owner of the option does not stand to profit by exercising his or her

right under the contract. For a call option to be out of the money, the stock

price must be lower than the strike price. For example, a $15.00 call option

is out of the money when the stock price is below $15.00.

An at-the-money option is one where the stock price is trading at or

very close to the exercise price. For example, a $15.00 call option would be

considered at the money if the stock price was $15.00. In practical terms,

market participants also describe an option as at the money when the stock

price is close to the exercise price of the option. So, if an option’s strike

price was $15.00 and the stock price was $14.80 to $15.20, it would be

deemed as being at the money.

Table 1.6 shows options classified as being either in, at, or out of the

money.

Physical Settlement Versus Cash Settlement There are two types

of settlement styles for exchange-traded options: physical settlement and

cash settlement. Physical-settlement options give the owner the right to re-

ceive physical delivery of the underlying asset when the option is exercised.

An Introduction to Options 9

TABLE 1.5 Classification of Transactions

Buy to Buy to Sell to Sell to

Current Position Next Transaction Open Close Open Close

Long 100 GE shares Buy 100 GE shares X

Long 100 GE shares Sell 100 GE shares X

Long 300 GE shares Buy 100 GE shares X

Short 200 GE shares Buy 200 GE shares X

No position Buy 2 GE calls X

No position Sell 2 GE calls X

Short 2 GE calls Buy 2 GE calls X

Long 2 GE calls Sell 2 GE calls X

c01.qxd 10/23/06 2:22 PM Page 9

Cash-settlement options give the owner the right to receive a cash payment

based on the difference between the underlying asset price at the time of the

option’s exercise and the exercise price of the option. The majority of stock

options are physically settled while index options are cash settled.

American Versus European Expiration An American-style option

may be exercised at any time prior to its expiration. A European-style option

may be exercised only on its expiration date. The majority of stock options

traded on U.S. and international options exchanges are American-style

options. Our covered call technique involves the use of American-style op-

tions only.

Option Expiration Dates In the U.S. market, virtually all standardized

option contracts expire on the third Friday of each month; they do not ex-

pire on the last day of the month. For example, if you hold a November op-

tion contract, this contract will expire on the third Friday of November, not

at the end of November.

The Options Clearing Corporation The Options Clearing Corpora-

tion (OCC) guarantees that all market participants fulfill their obligations

under the terms of options contracts. This is a very important function of an

options market, particularly in terms of guaranteeing that options writers

are capable of fulfilling their potentially large exposures.

Apart from keeping a record of all short and long positions, the OCC

ensures that when purchasing an option the buyer must pay for it in full and

the writer of an option must maintain an adequately funded margin account

to cover his or her exposure at all times.

The clearinghouse allows the options market to function. Without it,

the risk of counterparties defaulting on their obligations under an option

contract would stifle the market.

Standardized Options and Option Chain Exchange-traded options

are almost always standardized. Standardized options have set parameters

10 AN INTRODUCTION TO OPTIONS

TABLE 1.6 Classification as In, At, or Out of the Money

Contract Stock Price In At Out

GE Jan 07 $35 Call $35.75 X

WMT Sep 05 $45 Call $48.20 X

C Jan 06 $50 Call $50.02 X

JPM Aug 05 $30 Call $24.10 X

HON Jan 07 $50 Call $40.45 X

ABT Sep 05 $45 Call $44.90 X

c01.qxd 10/23/06 2:22 PM Page 10

in terms of the amount of an underlying asset a contract relates to, the ex-

piration date, the exercise price, the multiplier, and the option style. In-

vestors cannot alter the standardized characteristics of an exchange-traded

option to suit their own needs—they must work within the standardized pa-

rameters provided by the options exchange. The most important function

of standardization is to assist in the formation of liquid secondary markets

where buyers of options can close out positions by selling an identical con-

tract and sellers/writers can close out positions by buying an identical

contract.

An option chain is a list of all standardized options available for a par-

ticular stock or index. Table 1.7 shows an option chain for the U.S.-listed

banking group JP Morgan. Take a moment to study it and note the different

strike prices and expiration dates available.

If you wanted to buy or sell a call option on JP Morgan, you would have

to select an option contract from this option chain. You are not able to se-

lect contract specifications that do not appear in the standardized option

chain. Note that for simplicity only call options appear on this option chain;

the same option chain is also available for put options.

How Do Speculators Use Options

to Trade the Market?

While we don’t use options to speculate on the future direction of a stock

or market, many investors do use options for this purpose. It is essential

that you understand how a speculative trade works in order for you to un-

derstand options markets.

Example of Using a Call Option to Speculate GE stock is cur-

rently trading at $30.00. John thinks GE stock is going to go up in the next

three months. It’s now June, so John decides to buy a September $30.00 call

option (note that he does not have to choose a strike price equal to the cur-

rent stock price). John now has the right, but not the obligation, to buy GE

stock at a price of $30.00 up to September. For this right John pays the pre-

mium of $1.00 per share. The premium is the price the option buyer pays

to the option seller.

So let’s assume John’s hunch is right. It’s now July and GE stock is

$35.00. John has the right to buy GE stock for only $30.00. He can exercise

this right, buy the stock at $30.00, and immediately sell it in the market for

$35.00 (the current stock price). John has paid a premium of $1.00 per share

for this right. His profit appears as follows:

Share sell price – Share buy price – Option price = Profit per share

$35.00 – $30.00 – $1.00 = $4.00

An Introduction to Options 11

c01.qxd 10/23/06 2:22 PM Page 11

12 AN INTRODUCTION TO OPTIONS

TABLE 1.7 JP Morgan Option Chain Example—Stock Price, $39.38

Bid Ask Bid Ask

Strike Symbol Price Price Delta Strike Symbol Price Price Delta

September Mar-05

27.50 JPMIY 11.80 12.00 1.00 27.50 JPMCY 11.90 12.10 0.98

30.00 JPMIF 9.30 9.50 1.00 30.00 JPMCF 9.50 9.70 0.97

32.50 JPMIZ 6.80 7.00 1.00 32.50 JPMCZ 7.20 7.40 0.92

35.00 JPMIG 4.40 4.50 1.00 35.00 JPMCG 5.20 5.30 0.81

37.50 JPMIU 1.95 2.05 0.91 37.50 JPMCU 3.30 3.50 0.63

40.00 JPMIH 0.30 0.35 0.33 40.00 JPMCH 1.90 2.05 0.44

42.50 JPMIV 0.00 0.05 — 42.50 JPMCV 0.90 1.05 0.26

45.00 JPMII 0.00 0.05 — 45.00 JPMCI 0.35 0.45 0.14

47.50 JPMIW 0.00 0.05 — 47.50 JPMCW 0.10 0.20 0.06

50.00 JPMIJ 0.00 0.05 — 50.00 JPMCJ 0.00 0.10 —

October Jan-06

27.50 JPMJY 11.90 12.00 1.00 20.00 WJPAD 19.30 19.50 0.95

30.00 JPMJF 9.40 9.50 1.00 25.00 WJPAE 14.40 14.60 0.94

32.50 JPMJZ 6.90 7.00 1.00 30.00 WJPAF 10.10 10.20 0.87

35.00 JPMJG 4.40 4.60 0.97 35.00 WJPAG 6.30 6.50 0.68

37.50 JPMJU 2.20 2.25 0.79 37.50 WJPAU 4.80 4.90 0.56

40.00 JPMJH 0.55 0.65 0.39 40.00 WJPAH 3.40 3.60 0.44

42.50 JPMJV 0.05 0.10 0.10 42.50 WJPAV 2.40 2.55 0.33

45.00 JPMJI 0.00 0.05 — 45.00 WJPAI 1.55 1.70 0.23

47.50 JPMJW 0.00 0.05 — 47.50 WJPAW 1.00 1.10 0.16

50.00 JPMJJ 0.00 0.05 — 50.00 WJPAJ 0.60 0.70 0.11

December Jan-07

30.00 JPMLF 9.40 9.60 0.99 25.00 VJPAE 14.40 14.90 0.88

32.50 JPMLZ 7.00 7.20 0.97 30.00 VJPAF 10.60 10.80 0.78

35.00 JPMLG 4.80 4.90 0.89 35.00 VJPAG 7.20 7.30 0.61

37.50 JPMLU 2.80 2.95 0.69 40.00 VJPAH 4.60 4.80 0.43

40.00 JPMLH 1.30 1.40 0.42 45.00 VJPAI 2.70 2.90 0.27

42.50 JPMLV 0.50 0.55 0.20 50.00 VJPAJ 1.50 1.60 0.16

45.00 JPMLI 0.10 0.15 0.07

47.50 JPMLW 0.00 0.10 —

Jan-05

25.00 JPMAE 14.30 14.50 0.99

30.00 JPMAF 9.40 9.60 0.98

32.50 JPMAZ 7.10 7.30 0.95

35.00 JPMAG 4.90 5.10 0.85

37.50 JPMAU 3.00 3.20 0.66

40.00 JPMAH 1.55 1.65 0.43

42.50 JPMAV 0.60 0.70 0.23

45.00 JPMAI 0.15 0.25 0.10

47.50 JPMAW 0.05 0.10 0.04

50.00 JPMAJ 0.00 0.05 —

c01.qxd 10/23/06 2:22 PM Page 12

So what would have happened if John’s hunch were wrong and GE

stock actually fell? John has the right, but not the obligation, to buy GE

stock at $30.00. If the stock is less than $30.00, he would not exercise this

right and would just let the option expire. If this were the case, he would

lose the $1.00 premium he paid for the contract. It is important to realize

that this $1.00 is the most John could possibly lose on this trade.

The maximum loss of an option buyer is the premium paid (the cost of

the option).

Example of Using a Put Option to Speculate A put option works

very similarly to a call option; however, investors buy a put option when

they think the price of a stock is going to fall. Let’s look at an example.

It’s now September and GE is trading at $35.00. John thinks that the

price of GE stock is going to fall. So he decides to buy a December $35.00

put option. He now has the right, but not the obligation, to sell GE stock at

a price of $35.00 up to December. For this right John pays, for example,

$1.00 per share.

The price of GE stock then falls to $30.00 per share. John has the right

to sell GE stock at $35.00. He would, therefore, go into the market and buy

GE stock for $30.00 and then exercise his right to sell GE stock at $35.00.

His profit would look like this:

Share sell price – Share buy price – Option price = Profit per share

$35.00 $30.00 $1.00 = $4.00

So what would have happened if John’s hunch were wrong and GE

stock actually rose? John has the right, but not the obligation, to sell GE

stock at $35.00. If the stock is more than $35.00, he would not take up this

right to sell and would just let the option expire. If this were the case, he

would lose the $1.00 he paid for the contract. It is important to realize that

this $1.00 is the most John could possibly lose on this trade.

Again, the maximum loss of an option buyer is the premium paid (the

cost of the option).

Options Trading in the Real World Now you understand the ratio-

nale and logic behind an options trade, but trading in the real world is a lit-

tle different!

In the real world, speculators very rarely exercise their option con-

tracts in order to take profits from a trade. Take the first example where

John has the right to buy GE stock at $30.00 and the stock is trading at

Premium: The price of an option; the amount of money the buyer pays for

the rights and the seller receives for the obligations granted by the contract.

Expressed on a per share basis.

An Introduction to Options 13

c01.qxd 10/23/06 2:22 PM Page 13

$35.00. If John wants to realize a profit on this trade, it is highly unlikely

that he would exercise this option. It is more profitable for John to just sell

his call option to someone else in the market (sell to close).

Remember, John paid $1.00 per share for the right to buy GE stock at

$30.00. If GE stock quickly jumped up to $35.00, he would actually be able

to sell his call option for around $6.00. This $6.00 market value comprises

$5.00 exercisable value and $1.00 of remaining time value. Both exercisable

(intrinsic) value and time value are discussed in detail later in “How Are

Option Prices Determined?”

John’s profit would look like this:

Option sell price – Option buy price = Profit per share

$6.00 – $1.00 = $5.00

So John would make $5.00 per share by selling the call option, compared to

only $4.00 per share if he exercised the call option, because exercising op-

tions results in a loss of time value (discussed in “How Are Option Prices

Determined?”). By exercising the option, John will realize the $5.00 exer-

cisable value in the contract ($35.00 stock price minus $30.00 strike price),

but will forgo the remaining time value in the contract ($1.00).

Due to this loss of time value, option traders very rarely exercise op-

tions in order to take profits from a trade! Options are traded just like

stocks, and profits and losses are made, for the most part, by buying and

selling the option itself, not by exercising it. So, it is important to remember:

Option traders very rarely exercise their options more than two

weeks before expiration. In practicality, the vast, vast majority of op-

tion contracts are exercised on the third Friday of expiration. Exer-

cising options early results in a loss of time value to the option buyer.

Instead, option traders simply buy and sell the option contract just

like buying and selling stocks.

Why Speculate with an Option Instead

of a Stock?

Why speculate with an option instead of a stock? The simple answer is

leverage. Options provide a much greater return potential than investing in

the stock itself (albeit with higher risk). If a stock moves up 5 percent, an

Time Value: The portion of an option’s price that exceeds the exercisable

value.

14 AN INTRODUCTION TO OPTIONS

c01.qxd 10/23/06 2:22 PM Page 14

investor will make more money if he has $10,000 invested in call options

rather than if he has $10,000 invested in stock itself.

Here’s an example. John thinks GE stock is going to rise by $2.00 and

wishes to invest $10,000 on his hunch. He has two alternatives:

1. Buy GE stock.

2. Buy call options on GE stock.

Let’s look at the two scenarios.

Scenario 1 GE stock is currently trading at $30.00. With his $10,000

John can buy 333 shares ($10,000/$30.00 per share). If GE goes up to $32.00

as he expects, John will make $2.00 per share profit, or a total of $666 on his

$10,000 investment. This is a return of 6.7 percent. Not bad.

Scenario 2 GE stock is currently trading at $30.00. With his $10,000

John decides to buy GE call options. He buys the $30.00 call option for

$1.00 per share. In the United States, each contract relates to 100 shares so

he can buy 100 contracts [$10,000/($1.00 per share ×100 shares per con-

tract)]. If GE stock increases by $2.00, his call option contract is likely to be

worth around $1.80 per share. John will make $0.80 per share ×100 shares

per contract ×100 contracts = $8,000. This is a return of 80 percent.

Table 1.8 gives a comparison of the two scenarios.

The preceding example shows that with the same dollar investment in

the same company and the same move in the stock price, John made an

extra 73 percent return on his investment and an extra $7,333 by buying GE

options rather than GE stock. This extra bang for your buck, known as

leverage, attracts speculators to the use of option contracts. Options are

leveraged instruments. But beware! The leverage works both ways. John

could have lost most, if not all, of his money if the stock price went down

$2.00 rather than up!

Leverage is why options are regarded by the vast majority as risky. Op-

tions are, without doubt, very risky when used to speculate. After all, can

An Introduction to Options 15

TABLE 1.8 Comparison of Investing in Stocks Versus Options

Type of Stock Total Number Sell

Scenario Investment Price Invested Price of Units Price Profit

A Shares $30.00 $10,000 $30.00 333 $32.00 $667

or 7%

B Options $30.00 $10,000 $ 1.00 100 $ 1.80 $8,000

or 80%

c01.qxd 10/23/06 2:22 PM Page 15

John, or you, or I see into the future and know which way a stock is going

to go? The answer is obviously no. GE could just as easily have gone down

and John could have lost most, if not all, of his $10,000 investment. We

never use an option for speculative purposes. Covered call writers sell op-

tions, rather than buy them.

How Are Option Prices Determined?

As with determining the price at which a stock sells in the market, it is sup-

ply and demand that influence the price at which an option trades. An in-

vestor attempting to buy an option must do so from an investor wanting to

sell/write an option contract. Option market participants do, however, as-

sess distinct and constantly changing variables in order to determine the

price at which an option trades—its market value.

The liquidity of the options market is a significant contributor to the

consistency of bid and ask prices representing fair market value. In less liq-

uid markets—those with fewer participants, fewer market makers, and a

lower volume of options trades—it is more likely that bid and ask spreads

will be larger and that investors need to take more caution in assessing bid

and ask prices for fair market value. Your covered call activity will likely be

conducted in the options market of the United States, which is the world’s

largest and most liquid options market. As such, the bid and ask prices or

the market for contracts you trade will generally represent a reasonable ap-

proximation of fair market value.

Mathematical formulas such as the Black-Scholes and binomial pricing

models have been developed to calculate an option’s theoretical value. The

shortcomings of these models in terms of encompassing the scope of vari-

ables and uncertain outcomes of financial markets and their resulting de-

tachment from market reality have been well documented. Stock options’

market prices will inconsistently resemble the theoretical value as deter-

mined by models such as the Black-Scholes. As such, option traders and in-

vestors generally do not spend time calculating academic values for

contracts—the market is the primary driver of value determination.

What it all boils down to is this: If you’re investing in the U.S. market

(or a developed overseas market), it is highly likely that the prices at the bid

and ask are reasonable approximations of fair value.

That being said, six independent factors are very important when de-

termining the value of a stock option. It is essential for you to understand

these factors and how they interact and influence the price of an option

Liquidity: Market liquidity refers to the ability to quickly buy or sell a stock

or option without causing a significant movement in the price.

16 AN INTRODUCTION TO OPTIONS

c01.qxd 10/23/06 2:22 PM Page 16

contract. This knowledge will allow you to understand how the price of the

contract will change with changes in the underlying stock price, with lapses

in time, and so on. These six important factors are:

1. The current stock price.

2. The exercise price of the contract.

3. The time to expiration.

4. The volatility of the stock price.

5. Risk-free rate (interest rates).

6. Dividends expected on the stock during the life of the option.

To be successful in the business of writing covered calls, you need to

have a good understanding of factors 1, 2, and 3 and to a lesser extent, fac-

tor 4. Be aware of points 5 and 6; however, an in-depth understanding of

these factors is very academic and not essential to your success as an op-

tion writer.

Factor 1: The Current Stock Price As discussed previously, an in-

vestor who purchases a call option is speculating that the price of the un-

derlying stock is going to increase. The payoff to this investor will be the

difference between the exercise price and the stock price. This difference

is known as intrinsic value, which is simply what the option owner can

make if he or she exercises the option and sells the stock in the market.

That is, if he or she has the right to buy the stock at $35.00, and the stock

price is $40.00, the intrinsic value is $5.00. If the stock price moves up again

to $45.00, the intrinsic value is $10.00. It makes sense that an option con-

tract with $10.00 of intrinsic value should be worth more than a contract

with only $5.00 of intrinsic value.

Thus, call option prices increase as the stock price increases and more

intrinsic value is added to the contract. Put options are the opposite, so put

option prices increase as the stock price decreases. Table 1.9 shows the re-

lationship between option price and intrinsic value.

An Introduction to Options 17

TABLE 1.9 Intrinsic Value

Call Strike $35.00

Stock price $35.00 $40.00 $45.00

Call value $ 1.00 $ 5.60 $10.20

Put Strike $35.00

Stock price $25.00 $30.00 $35.00

Put value $10.20 $ 5.40 $ 1.10

c01.qxd 10/23/06 2:22 PM Page 17

Factor 2: The Exercise Price of the Contract The exercise price

of the contract has an influence on intrinsic value similar to changes in the

stock price. Let’s assume an investor has a $35.00 call option and the stock

price is currently $40.00. We now know that this contract has $5.00 worth

of intrinsic value. Let’s assume the same investor also has a $30.00 call op-

tion on the same stock. The $30.00 call option has $10.00 of intrinsic value

and obviously, then, it has to be worth more!

Thus, call options increase in price the lower the exercise price is. Put

options are the opposite, so they increase in price the higher the exercise

price is. Table 1.10 shows the relationship between option price and exer-

cise price.

Factor 3: The Time to Expiration Up to this point, we have dis-

cussed only intrinsic value. Hopefully, you have been looking at the pricing

examples provided for factors 1 and 2 and wondering why the option price

is greater than the intrinsic value. The option price is greater because the

other portion of value in an option contract is time value.

Intrinsic value + Time value = Option value

The longer an option has to expiration, the greater its time value. John

thinks GE stock is going to rise from the current price of $35.00. He decides

to buy a $35.00 strike call. Remember, John wants GE to increase in price

so that the intrinsic value of his contract will increase. If John has six

months until his contract expires, that gives him a lot of time for GE stock

to increase. However, if John purchases a contract with only one month to

expiration, he does not have much time for GE stock to move in his favor.

Thus, the more time a contract has to expiration, the more it is worth.

Each day that goes by, the price/value of each and every option contract de-

creases because there is less time to expiration. Options are, therefore,

known as decaying assets.

18 AN INTRODUCTION TO OPTIONS

TABLE 1.10 Exercise Price

Stock Price $35.00

Call strike price $35.00 $30.00 $25.00

Call value $ 1.10 $ 6.00 $10.40

Stock Price $35.00

Put strike price $35.00 $40.00 $45.00

Put value $ 1.00 $ 5.70 $10.60

c01.qxd 10/23/06 2:22 PM Page 18

Table 1.11 shows how time affects an option’s price (assume it is early

June).

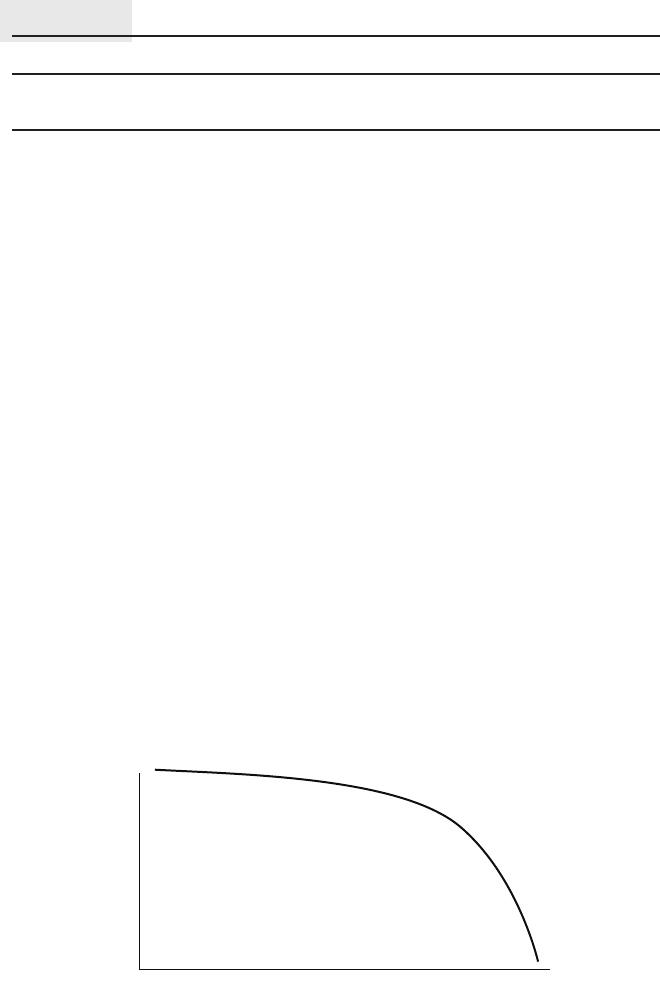

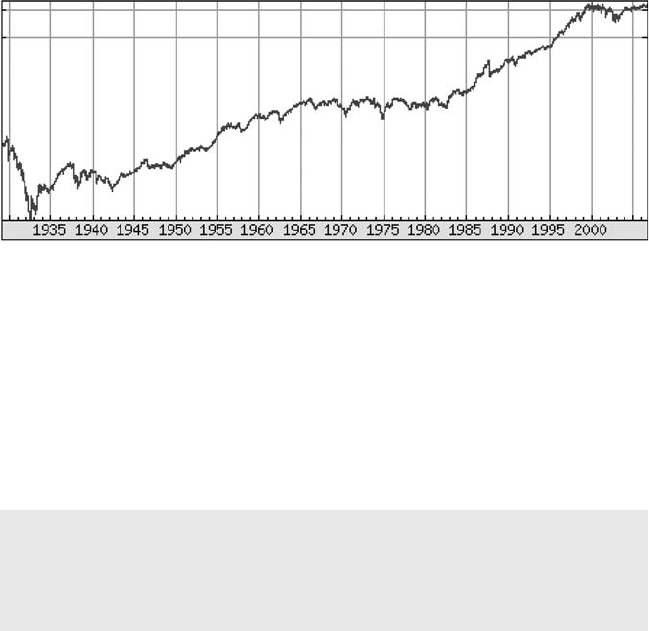

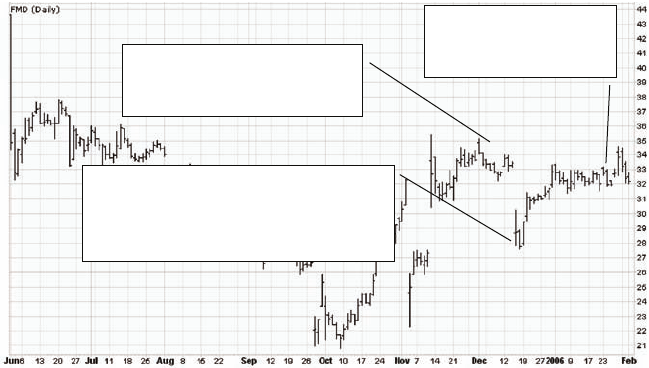

A very important point to understand in options pricing is that time

decay is not linear! (See Figure 1.1.) Contracts that expire in one or two

months have a significantly higher level of time decay than contracts that

expire in one or two years. The majority of an option’s time value is lost

in the weeks leading up to expiration.

The covered-call method of investing actually utilizes the decay in time

value to your advantage. You will make money from the decay in the spec-

ulators’ assets.

Factor 4: The Volatility of the Stock Price Option contracts are

worth more on a stock that is volatile than on a stock that is less volatile.

Volatility is technically defined in terms of standard deviation; however,

for our purposes volatility can be thought of simply as a measure of how un-

certain we are about a stock’s future price movements. As volatility in-

creases, the chance that a stock will make a significant move upward or

downward increases.

If you were the owner of stock in a company, these two extreme out-

comes tend to offset one another. However, if you are the owner of a call or

a put, while your potential loss is limited to the amount invested, your po-

tential profit can be many times over your original investment from signifi-

cant price swings in the appropriate direction.

An Introduction to Options 19

TABLE 1.11 How Time Value Affects Options Price

Strike $35.00

Expiration date June July Sep Dec

Option price $0.50 $1.00 $1.30 $1.50

Price

Time

FIGURE 1.1 Example of the rapid decay of time value toward the end of an

option’s life.

c01.qxd 10/23/06 2:22 PM Page 19

So, all else being equal, a more volatile stock will have higher option

prices (see Table 1.12). Additionally, options prices will adjust upward or

downward to significant changes in a stock’s volatility levels.

Factor 5: Risk-Free Rate (Interest Rates) The effect of interest

rates on option prices is very academic and perhaps only meaningfully no-

ticeable over the longer term where significant interest rate changes occur.

Therefore, this brief discussion of that effect is included for completeness

rather than necessity. Understanding this effect will not have any signifi-

cant influence on your success as an option writer.

As interest rates increase, (1) the present value of future cash flows re-

ceived by the holder of the option decreases and (2) the expected growth

rate of stock prices tend to increase. In the case of calls, effect (1) tends to

decrease option prices and effect (2) tends to increase prices. In the case of

puts, both (1) and (2) have negative effects on prices.

Factor 6: Dividends Expected on the Stock During the Life of

the Option Dividends have the effect of reducing the stock price on the

ex-dividend date (the date the dividend on a stock is paid). The price re-

duction, in turn, decreases the value of call options and increases the value

of put options. A high proportion of companies you are likely to invest in

will pay dividends. Worrying about insignificant pricing influences such as

dividends creates headaches, not better returns. So forget about them, and

leave the squabbling to the academics.

20 AN INTRODUCTION TO OPTIONS

TABLE 1.12 Effect of Volatility on Price

Stock Price Call Strike Expiration Option Price

Stable stock $30.00 $30.00 Mar-06 $1.00

Volatile stock $30.00 $30.00 Mar-06 $1.30

c01.qxd 10/23/06 2:22 PM Page 20

PART I

Covered Calls

c02.qxd 10/23/06 2:21 PM Page 21

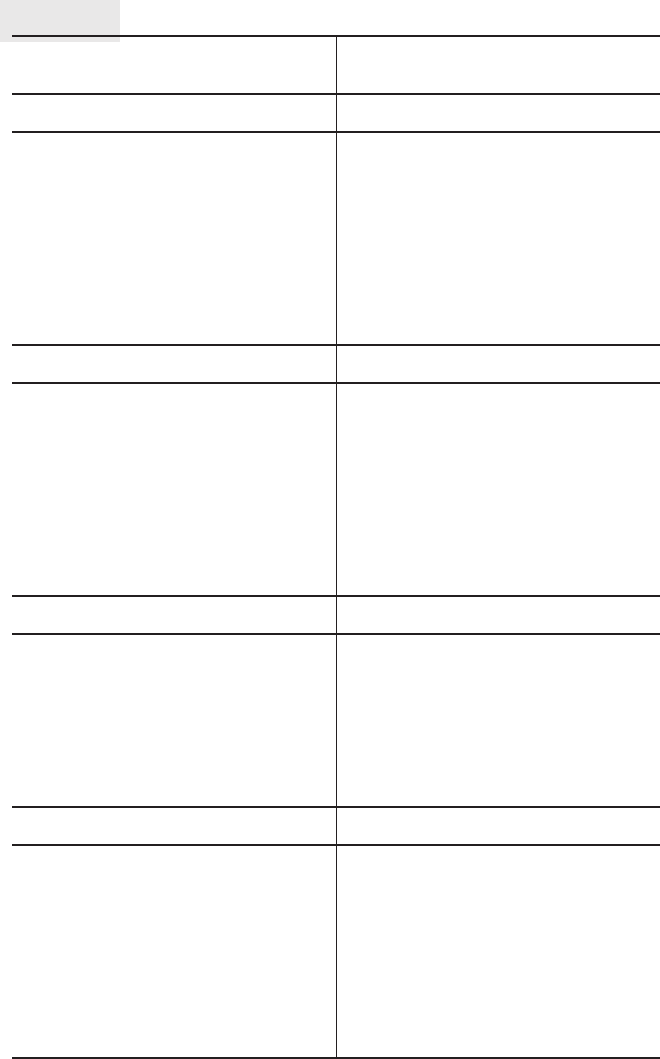

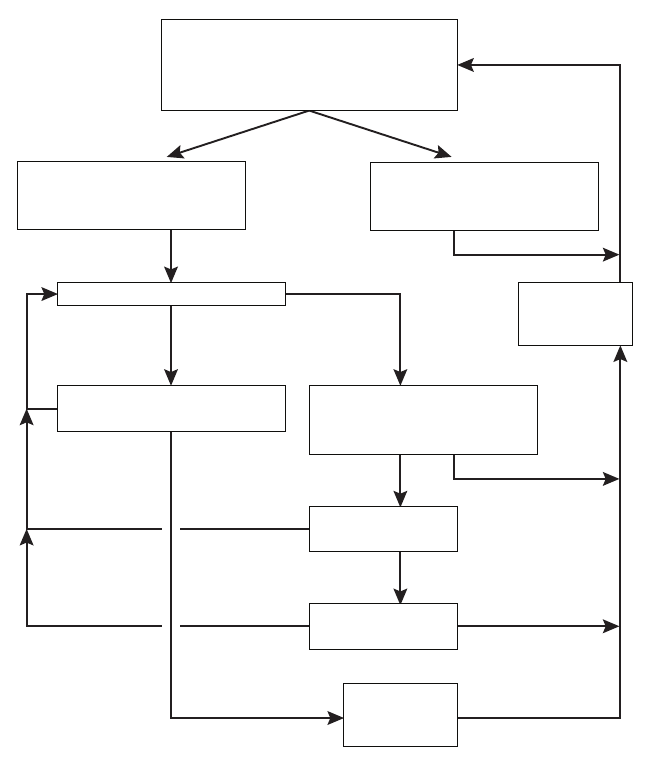

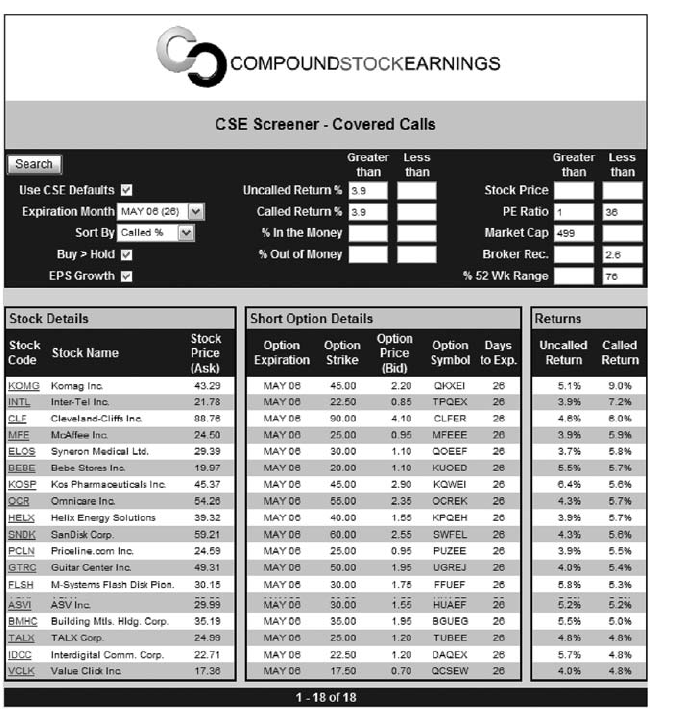

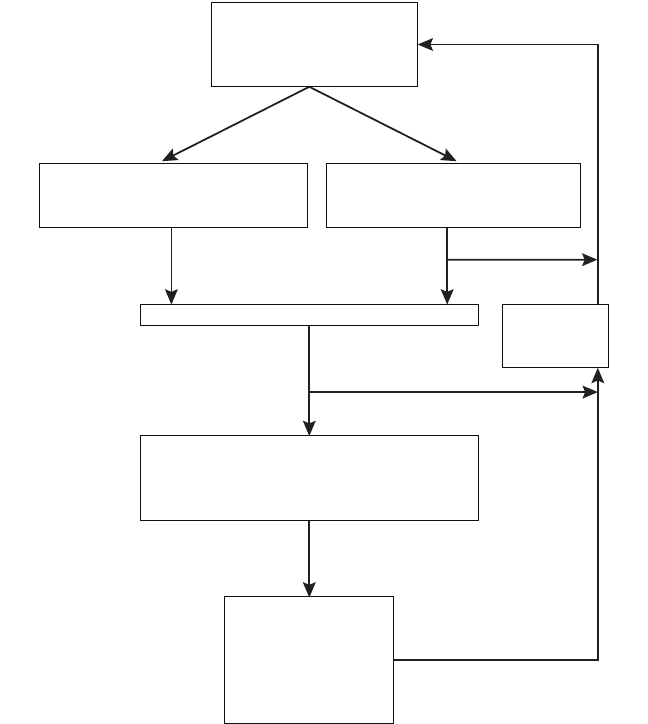

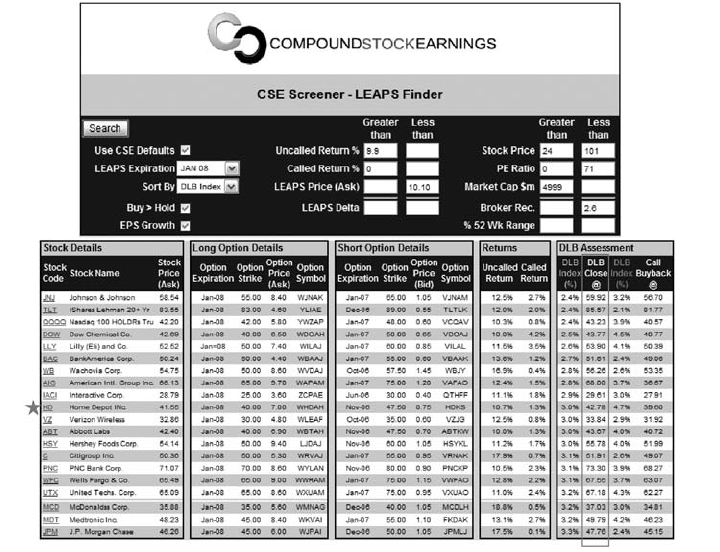

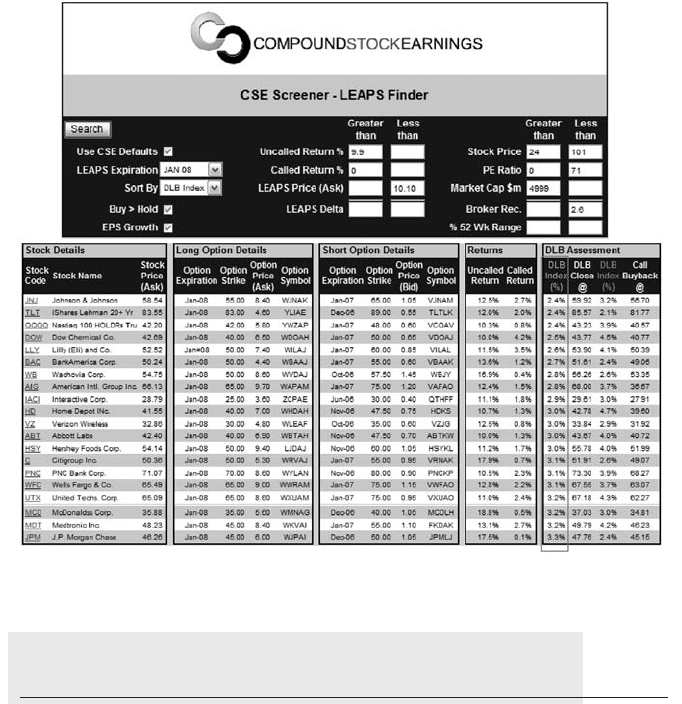

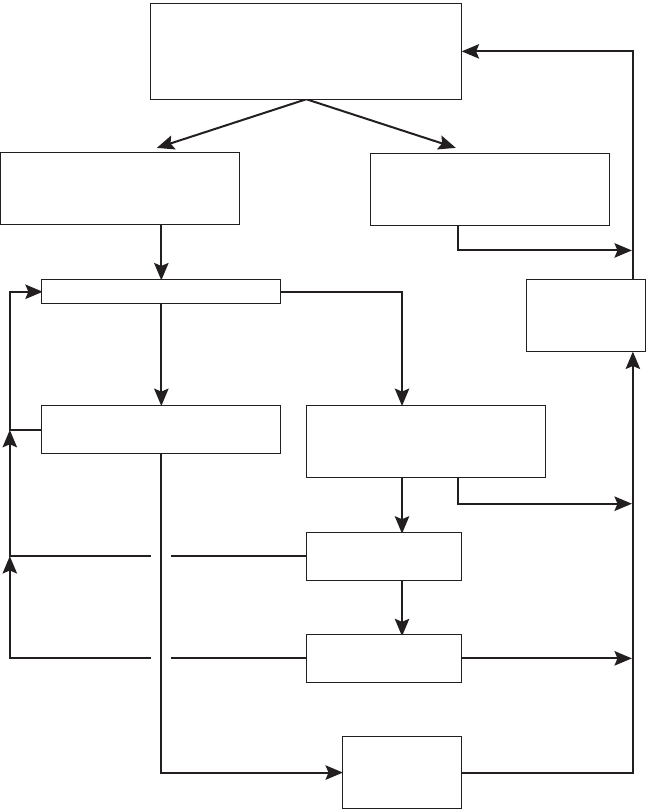

COVERED CALL PROCESS FLOWCHART

Enter New Position

1. Filter with CSE Screener

2. Upward or sideways current cycle

3. Bottom 25% of current cycle

Stock Decreases

1. Mid-month buyback rule or

2. Allow call to expire

Can we favorably CPR?

Wait for expiration of CPR

1. Were we called out?

Profitable buyback

on TSS call?

1. Close on delta or

2. Apply SSR

Reinvest and

compound

proceeds

Reinvest and

compound

proceeds

Stock Increases

1. Close on delta effect or

2. Get called out

Secondary Call Sales Rules

1. Near month call or

2. TSS For income

Yes

Yes

Yes

No Exit

No

No

TSS

No

Exit

Called Out

Near Month

Each step in the covered call investing process is shown in the flowchart

above—from entering new positions, to managing positions for income, to

advanced defensive techniques. Investors familiar with our covered call

method know that there is a specific technique to address every situation

that may occur in the markets. Each situation that can be presented to a

covered call investor can be handled through the use of a specific man-

agement technique. Part I of this book will elaborate, expand on, and

provide an example of each step presented in the covered call process

flowchart. You may wish to revisit the flowchart at the beginning of each

new topic so you can gain an understanding of where a particular rule or

technique is applied in the overall investment process.

c02.qxd 10/23/06 2:21 PM Page 22

23

CHAPTER 2

OPTION SELLERS/WRITERS

In Chapter 1 we discussed only the intentions of speculators who are buy-

ing options to bet on the movement of the market, buyers of calls who are

anticipating an upward move in the stock price, and buyers of puts who are

anticipating a downward move in the stock price. We also stated that for

every buyer of an option contract, there is also a seller/writer of that con-

tract (the terms seller and writer can be used interchangeably). So who are

the sellers of options and what are their objectives?

There are basically three types of sellers of options:

1. Sellers who are closing existing long positions.

2. Sellers who are opening short uncovered positions.

3. Sellers who are opening short covered positions.

Short Position: An overall sell position in a stock or option.

Long Position: An overall buy position in a stock or option.

An Introduction

to Covered Calls

c02.qxd 10/23/06 2:21 PM Page 23

Sellers Who Are Closing Existing Long Positions

Sellers who are closing existing long positions are generally traders who

are speculating in the market. Closing a long position is exactly the same

as someone who has bought stock and is now trying to sell it for a profit

or loss. The seller holds a long position (has bought an option) and is

now hoping to realize a profit or loss on the position by selling the option

to close.

For example, when GE stock was trading at $34.00, a speculator bought

to open a GE $35.00 call option for $1.00 in anticipation of the stock price

rising. Let’s assume the speculator correctly picked the direction of the

market and the stock price is now $36.00. This speculator can sell to close

the GE $35.00 call at $1.50 and realize a $0.50 profit. Alternatively, if the

price of GE stock declined, the speculator could sell this contract for some-

thing less than $1.00 and would realize a loss.

Sellers Who Are Opening Short Uncovered Positions

In most financial markets, you can sell something that you don’t already

own. Such a transaction is possible through short selling. The objective of

short selling is to buy the share or contract back (buy to close) at a lower

price than you sold it for. Let’s look at an example.

John sells a GE $35.00 call option for $1.20. He will immediately get the

$1.20 premium of the contract deposited in his brokerage account by the

option buyer. John wants the stock price to drop so that the call price also

drops and he can buy the contract back (buy to close) and make a profit.

Let’s assume the stock price drops and John buys the contract back (buy to

close) for $1.00. He has made the difference of $0.20.

This transaction is an example of selling an uncovered call. Selling an

uncovered call is simply selling a call option without owning the underlying

stock or another covering option, which prevents a loss if the stock price

increases (we discuss this in the following section, “Sellers Who Are Open-

ing Short Covered Positions”). If you sell a call option without owning the

underlying stock or another covering option you are said to be “uncovered”

or “naked.” Selling naked calls is one of the most risky activities any in-

vestor can do in the markets—the profit and loss potential is simply not

Buying to Close: Closing a short stock or option position.

Selling to Close: Closing a long stock or option position.

24 COVERED CALLS

c02.qxd 10/23/06 2:21 PM Page 24

stacked in the naked seller’s favor. Let’s look at the example of John selling

a GE $35.00 call option for $1.20 and see what his profit and loss potential

looks like.

Profit Remember, John sold this option, so someone has the right, but

not the obligation, to buy GE stock from John for $35.00. When he sold the

contract, John received the premium of $1.20 from the option buyer. The

maximum possible profit that John can make from this trade is restricted to

the price he received for selling the option, which is $1.20. The best out-

come for John is that the stock price plummets, the call is way out of the

money, and the contract expires worthless. In this instance, he would keep

the $1.20 he sold the contract for. However, it is more likely that John will

buy the contract back at some time in the future for something less than he

sold it for. Remember, John has to buy the option back in order to close his

position. Otherwise, if the contract finishes in the money, the buyer will ex-

ercise his option and John may need to deliver GE stock.

Loss We understand now that the most John can make from this trade is

$1.20. But, believe it or not, he has the potential to lose an unlimited

amount of money, because the stock price can theoretically go up to

any value. Let’s assume GE stock goes up to $45.00. There are two scenar-

ios here:

1. The buyer of the option may exercise his or her contract and John will

need to deliver GE stock at $35.00. GE stock is available in the market

at $45.00. So John will have to take the $10.00 loss.

2. John sees the share price soaring and decides to cut his losses. He will

buy to close the contract so that he has no further obligation under the

contract. If the stock is at $45.00, he’ll have to pay around $11.00 to buy

back the call. In this case he would lose $1.20 – $11.00 = $9.80.

Summary In any case, John stands to make a maximum of $1.20 and lose

a potentially unlimited amount on this trade. Business and markets are all

about risk and return. You should now understand that selling naked calls

is a very bad business proposition. Even though people still sell naked calls,

our advice is that you do not ever, under any circumstances, sell naked

calls. Doing so is categorically the quickest and easiest way to lose your

money in the options markets.

Sellers Who Are Opening Short Covered Positions

Sellers who open short covered positions are executing covered calls.

These are the smart sellers and this is the sort of selling that will regularly

An Introduction to Covered Calls 25

c02.qxd 10/23/06 2:21 PM Page 25

put money into your account with very, very low risk. These types of sell-

ers are also selling option positions to open. However, the distinction is that

these sellers also own the underlying stock (or another option contract)

and are thus covered in the event the stock price increases.

Remember in the preceding example where John sold a $35.00 call op-

tion for $1.20? He made money when the stock price declined, as the option

expired worthless and he kept the premium. However, the problem with

this transaction was that, in the event the stock price increased, John stood

to experience a substantial loss. In the event the stock price increased to,

for example, $45.00, the speculator would exercise the call. John would be

forced to buy the stock at the current market price of $45.00, only to im-

mediately deliver the stock to the speculator at a price of $35.00—a $10.00

loss. This problem of suffering a large loss in the event the stock price in-

creases can be easily remedied by owning the underlying stock before sell-

ing the call option.

If John already owned GE stock before selling the call, he would not be

concerned about the stock price rising as he could simply deliver the stock

he already owned. John is therefore covered in the event the stock price

increases after selling the call—he will not be forced to buy the stock at

a higher price in the market and then immediately sell it at a loss to the

speculator.

So if John already owned the stock before selling the call, he would

make money if the stock price goes up, he would also keep the premium if

the stock price goes down. This is an example of selling a covered call,

which is discussed at length later in this book.

Selling or writing covered calls is perhaps the safest and most consis-

tent way to make money in the financial markets and also involves less risk

than owning stock. If you’re not convinced, here’s another example. Let’s

assume it is June and GE stock is trading at $34.50. John decides he’d like

to buy GE stock and sell a covered call against it. Let’s assume he elects to

sell the June $35.00 call and receives a premium of, for example, $0.70

straight into his brokerage account. There are two possible things that can

now happen to John.

1. He gets called out. Remember, John has sold a GE June $35.00 call. So

someone else has the right to buy his GE stock for $35.00 up until the

third Friday of June (remember that the third Friday of the month is the

expiration date for U.S. option contracts). Getting called out means

that the person who bought the GE June $35.00 contract has decided to

exercise the contract and wants to buy John’s stock, because GE stock

has gone up and it is worth more than $35.00. John is contractually ob-

ligated to oblige.

26 COVERED CALLS

c02.qxd 10/23/06 2:21 PM Page 26

So John delivers (or sells) his stock at a price of $35.00 to the op-

tion buyer and this money gets deposited into his account. This trans-

action is good, because John only paid $34.50 for his stock and thus has

made $0.50 per share on the call out. John has also received a premium

of $0.70 from the option buyer, which he also gets to keep. So he’s

made a total of $1.20 per share in just one month! Based on a share

price of $34.50, that’s a monthly return of around 3.5 percent. If he

makes that return each month, he’ll make 41 percent on his money per

year (uncompounded). If he’s really smart and reinvests his earnings

and uses the power of compounding, his 3.5 percent per month turns

into an amazing 51 percent per year!

2. He doesn’t get called out. Again, John’s fate rests in the hands of the in-

vestor who bought the option he sold. If the stock price at the end of

the month is below the $35.00 strike price of the option, then it is not in

the option buyer’s interest to exercise the contract, so John won’t get

called out. In this situation, the contract would simply expire and John

would keep the $0.70 he received for selling the option. That’s a return

of 2.0 percent in a month or 24 percent per year (uncompounded).

John would be left with his GE stock at the end of June and would

simply sell another call for July and start all over again.

You should now be starting to realize the power of covered calls. You

should also be starting to understand that selling covered calls actually de-

creases the risk of stock ownership because you are continually generating

cash flow from your stock investment and effectively lowering your cost in

the stock.

Think of selling covered calls as investing in real estate. You are liter-

ally renting your stock out each month and getting cash flow in return.

Would you buy an investment property and not rent it out while you wait to

sell it? Of course not! You would be leaving thousands of dollars on the

table each month for no reason. Similarly, if you own stocks (which almost

everyone does) and are not selling covered calls against these stocks, you

are also leaving thousands of dollars on the table each month!

COVERED CALLS: THE RIGHT MIND-SET

To be a successful covered call writer, you must recognize from the out-

set what your objectives are and the mind-set you require in order to

achieve them.

An Introduction to Covered Calls 27

c02.qxd 10/23/06 2:21 PM Page 27

Compound Interest

Our objective is to generate consistent monthly cash flow from our assets.

We can then reinvest this cash flow each month to compound our invest-

ment capital and generate extraordinary long-term returns.

Compound interest is the way to accumulate wealth. Whether in busi-

ness, real estate, financial markets, or any other financial pursuit, com-

pounding your assets is the fastest way to make them grow. Don’t take our

word for it. Many years ago Albert Einstein was asked what he thought was

the human race’s greatest invention. His reply was “compound interest.” He

also regarded compounded interest as “the eighth wonder of the world.”

If you are not aware, there are two types of interest: simple and com-

pound. Simple interest allows you to earn money on your principal. Com-

pound interest allows you to earn money on your principal and your

interest. Table 2.1 gives the example of two bank accounts, each with a

starting balance of $10,000 and each earning 5 percent interest per year.

However, one account earns simple interest and the other, compound in-

terest. As you can see, the account that pays compound interest is worth

significantly more at the end of the 10-year period.

Now, in the context of covered calls, compounding is many times more

powerful. Remember, our objective is not to make 5 percent per year; our

objective is to generate monthly returns of 3–6 percent for covered call

transactions. We will then reinvest this return into new positions and com-

pound our returns on a monthly, not a yearly, basis. Let’s look at the

$10,000 bank account again, but this time let’s compound that account at a

28 COVERED CALLS

TABLE 2.1 Simple Versus Compound

Interest at 5 Percent Per Year

Simple Compound

Time Interest Interest

Start $10,000 $10,000

Year 1 10,500 10,500

Year 2 11,000 11,025

Year 3 11,500 11,576

Year 4 12,000 12,155

Year 5 12,500 12,763

Year 6 13,000 13,401

Year 7 13,500 14,071

Year 8 14,000 14,775

Year 9 14,500 15,513

Year 10 15,000 16,289

c02.qxd 10/23/06 2:21 PM Page 28

return of just 4 percent per month and see what it looks like after 10 years.

See Table 2.2

Wow, a $10,000 account has grown to over $1.1 million in 10 years! If

you had started with $50,000, you would have $5.5 million at the end of 10

years. This is the power of covered calls: We are compounding returns that

most investors get in a year on a monthly basis. Now, is this enough moti-

vation for you to gradually take control of your own financial future? We

should hope so!

Cash Flow Focus

We have established that generating monthly cash flow and compounding

this cash flow into much larger sums of money is our objective. To achieve

this objective as a covered call writer we prioritize cash flow over account

market value. To be successful in this technique, you must let go of the tra-

ditional benchmarks for measuring equity portfolio performance—particu-

larly in the short term.

The traditional benchmark that is used by the brokers and fund man-

agers to measure a portfolio’s performance is market value. Brokers and

fund managers report to you the market value of your portfolio on a regu-

lar basis. For instance, you may have started with $100,000, and the broker

bought you stock of this value. Now the combined value of your stocks has

gone up and your portfolio is worth $120,000. So the broker says you have

made $20,000 based on a current market valuation. While this valuation is

fine if you sell today, it is just a paper gain and, if the market turns down,

these gains can be easily lost because they have not been realized as cash.

An Introduction to Covered Calls 29

TABLE 2.2 Compound Interest at

4 Percent Per Month

Time Account Value

Start $ 10,000

Year 1 16,010

Year 2 25,633

Year 3 41,039

Year 4 65,705

Year 5 105,196

Year 6 168,423

Year 7 269,650

Year 8 431,718

Year 9 691,195

Year 10 1,106,626

c02.qxd 10/23/06 2:21 PM Page 29

A covered call writer should only be interested in cash. We do not care

if the stock we purchased for $10.00 is now worth only $8.00 or $5.00 in the

market. We understand and accept that stock prices of good companies go

up and down.

We do not care.

We care only about how much cash (premium income) we are able to

generate from a position. If you purchase a good company with real earn-