TY 2017 500

User Manual: 500

Open the PDF directly: View PDF ![]() .

.

Page Count: 5

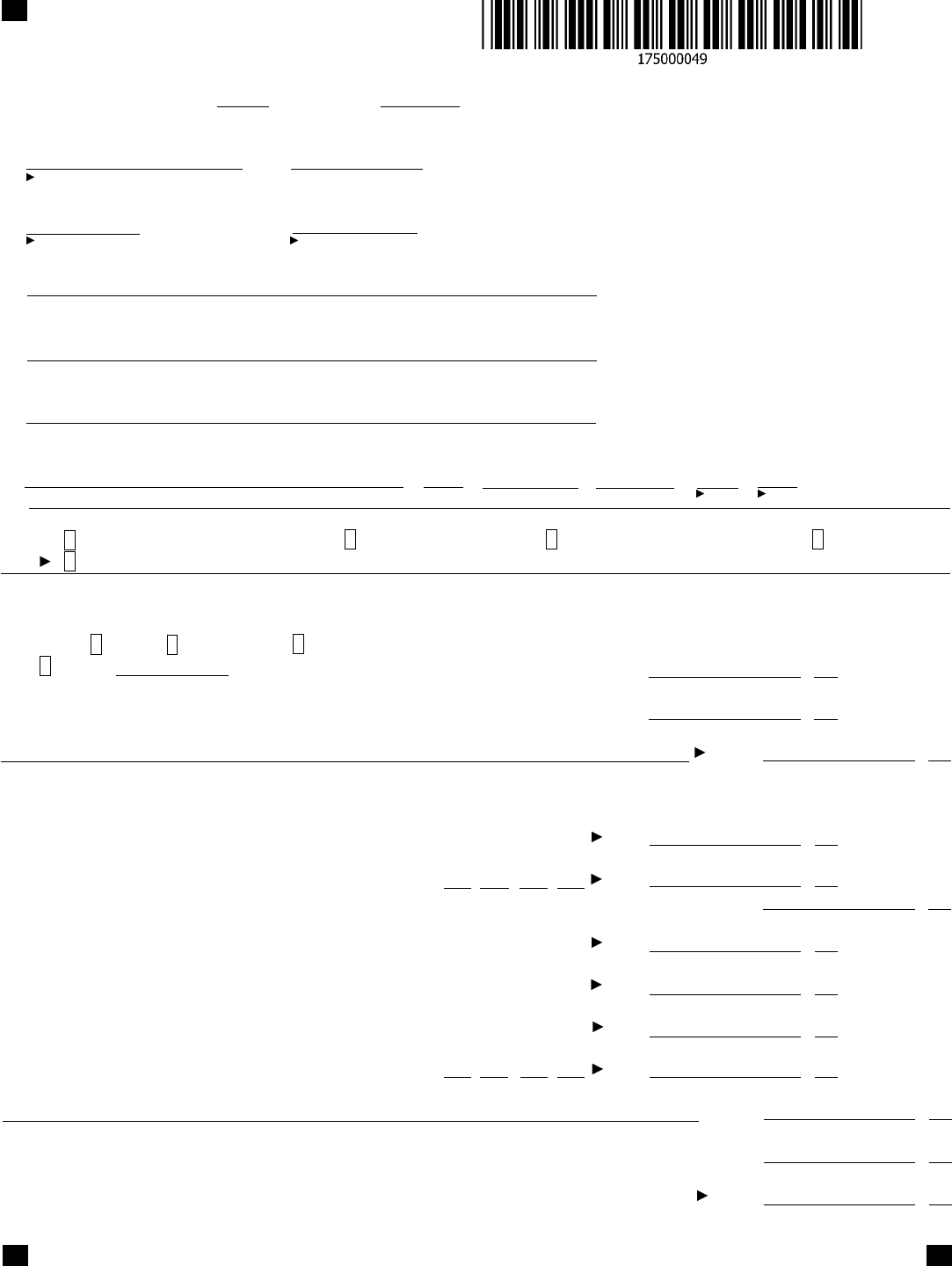

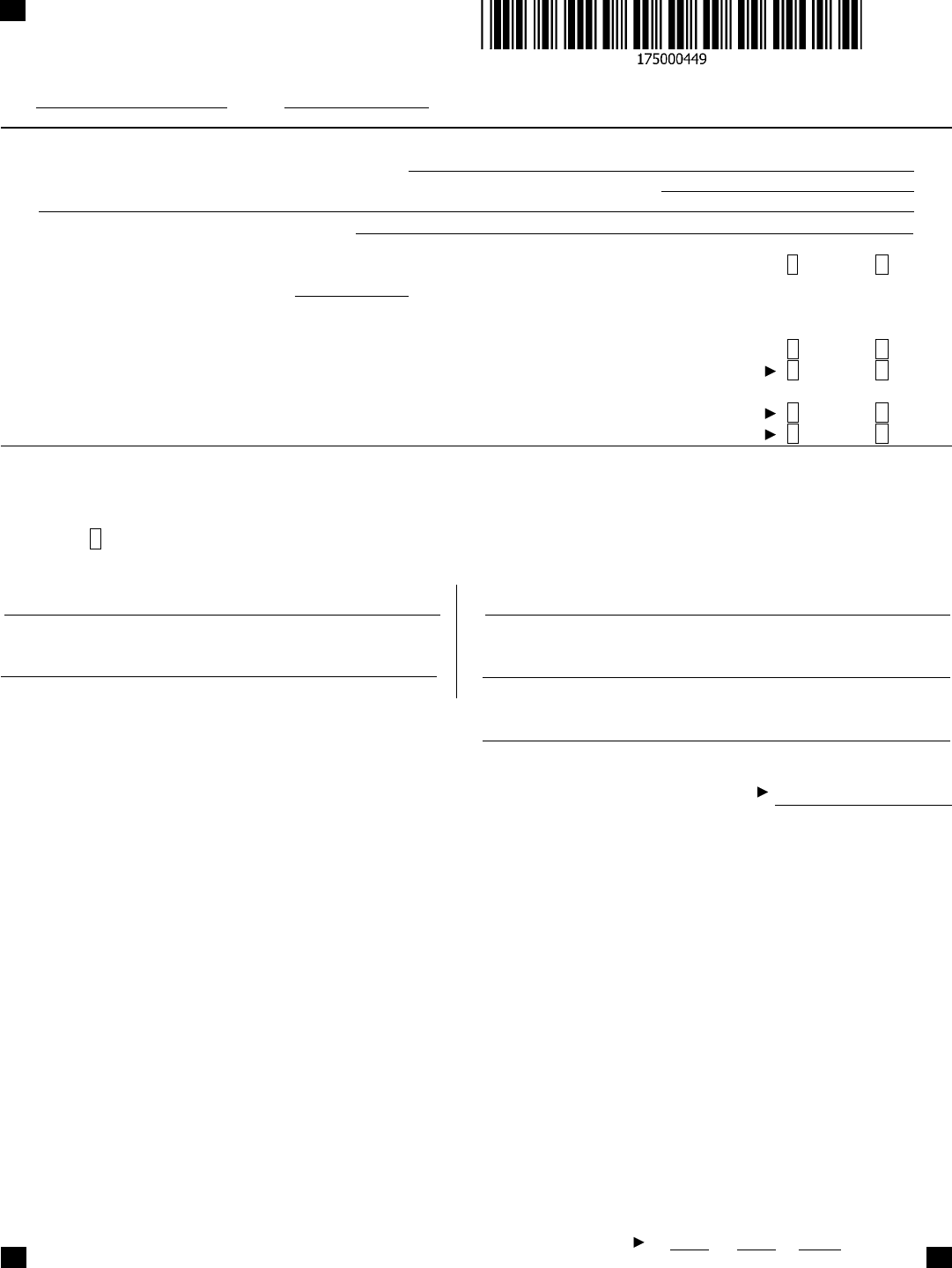

MARYLAND

FORM

500

CORPORATION INCOME

TAX RETURN

COM/RAD-001

OR FISCAL YEAR BEGINNING 2017, ENDING

Print Using Blue or Black Ink Only

STAPLE CHECK

HERE

2017

$

Federal Employer Identication Number (9 digits) FEIN Applied for Date (MMDDYY)

Date of Organization or Incorporation (MMDDYY) Business Activity Code No. (6 digits)

Name

Current Mailing Address Line 1 (Street No. and Street Name or PO Box)

Current Mailing Address Line 2 (Apt No., Suite No., Floor No.)

City or town State ZIP Code +4 ME YE

CHECK HERE IF:

Name or address has changed Inactive corporation First filing of the corporation Final Return

This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation.

SEE CORPORATION INSTRUCTIONS. ATTACH A COPY OF THE FEDERAL INCOME TAX RETURN THROUGH SCHEDULE M2.

1a. Federal Taxable Income (Enter amount from Federal Form 1120 line 28 or Form 1120-C

line 25.) See Instructions. Check applicable box:

1120 1120-REIT 990T

Other: IF 1120S, FILE ON FORM 510 ................1a.

1b. Special Deductions (Federal Form 1120 line 29b or

Form 1120-C line 26b.) ........................................1b.

1c. Federal Taxable Income before net operating loss deduction

(Subtract line 1b from 1a) ............................................. 1c.

MARYLAND ADJUSTMENTS TO FEDERAL TAXABLE INCOME

(All entries must be positive amounts.)

ADDITION ADUSTMENTS

2a. Section 10-306.1 related party transactions ....................... 2a.

2b. Decoupling Modification Addition adjustment

(Enter code letter(s) from instructions.) ............ 2b.

2c. Total Maryland Addition Adjustments to Federal Taxable Income (Add lines 2a and 2b) ..... 2c.

SUBTRACTION ADJUSTMENTS

3a. Section 10-306.1 related party transactions ....................... 3a.

3b. Dividends for domestic corporation claiming foreign tax credits

(Federal form 1120/1120C Schedule C line 15) ..................... 3b.

3c. Dividends from related foreign corporations

(Federal form 1120/1120C Schedule C line 13 and 14) ............... 3c.

3d. Decoupling Modification Subtraction adjustment

(Enter code letter(s) from instructions.) ............ 3d.

3e. Total Maryland Subtraction Adjustments to Federal Taxable Income

(Add lines 3a through 3d.) ............................................... 3e.

4. Maryland Adjusted Federal Taxable Income before NOL deduction is applied

(Add lines 1c and 2c, and subtract line 3e.) ................................... 4.

5. Enter Adjusted Federal NOL Carry-forward available from previous tax years (including

FDSC Carry-forward) on a separate company basis (Enter NOL as a positive amount.) .... 5.

.

.

.

.

.

.

.

.

.

.

.

.

.

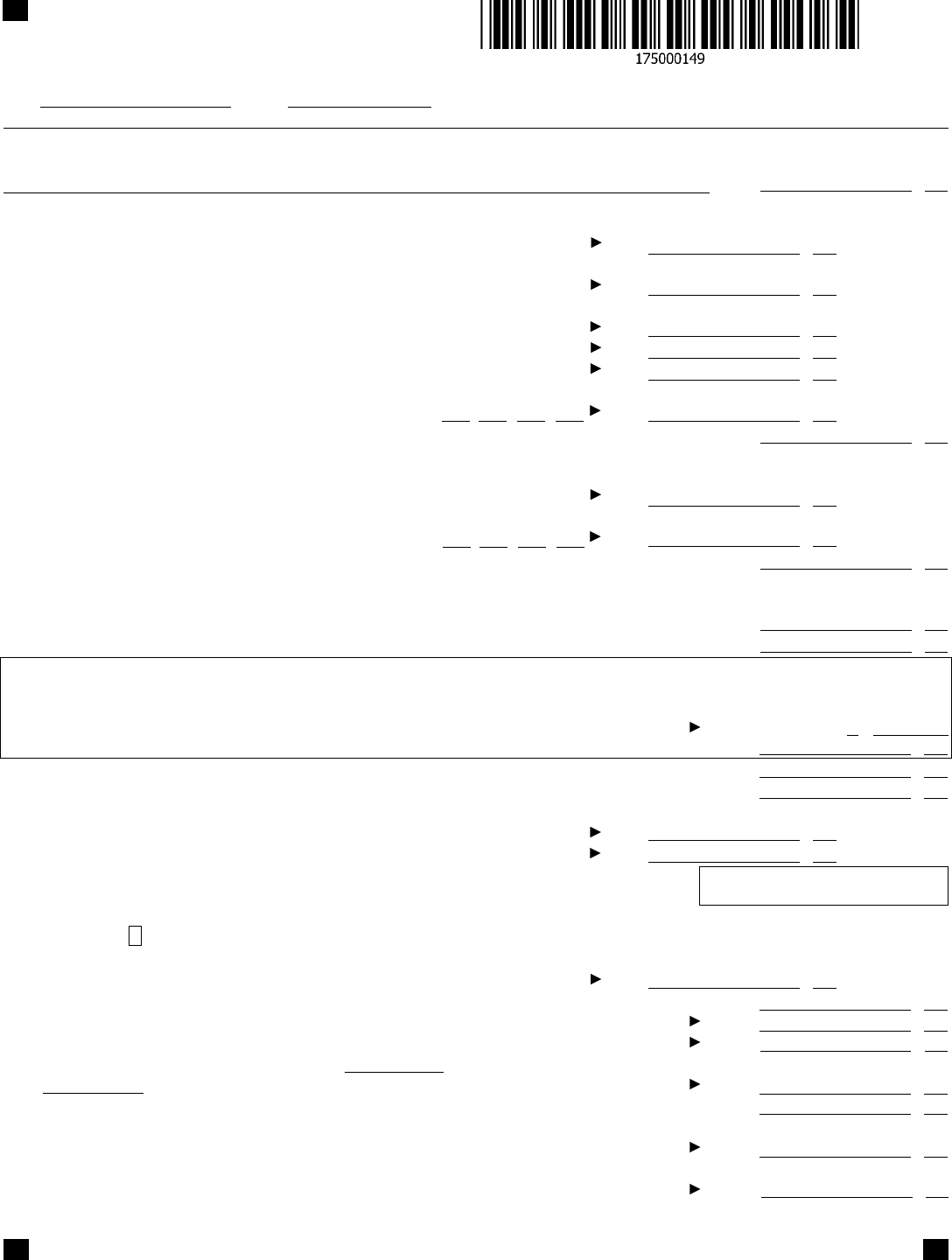

MARYLAND

FORM

500

CORPORATION INCOME

TAX RETURN

COM/RAD-001

NAME FEIN

2017

page 2

6. Maryland Adjusted Federal Taxable Income (If line 4 is less than or equal to zero,

enter amount from line 4.) (If line 4 is greater than zero, subtract line 5 from line 4 and

enter result. If result is less than zero, enter zero.) ............................... 6.

MARYLAND ADDITION MODIFICATIONS

(All entries must be positive amounts.)

7a. State and local income tax ................................... 7a.

7b. Dividends and interest from another state, local or federal tax

exempt obligation ......................................... 7b.

7c. Net operating loss modification recapture (Do not enter NOL carryover.

See instructions.) ......................................... 7c.

7d. Domestic Production Activities Deduction ......................... 7d.

7e. Deduction for Dividends paid by captive REIT ...................... 7e.

7f. Other additions (Enter code letter(s) from

instructions and attach schedule) ............... 7f.

7g. Total Addition Modifications (Add lines 7a through 7f.) ......................... 7g.

MARYLAND SUBTRACTION MODIFICATIONS

(All entries must be positive amounts.)

8a. Income from US Obligations .................................. 8a.

8b. Other subtractions (Enter code letter(s) from

instructions and attach schedule) ............... 8b.

8c. Total Subtraction Modifications (Add lines 8a and 8b.) .......................... 8c.

NET MARYLAND MODIFICATIONS

9. Total Maryland Modifications (Subtract line 8c from 7g. If less than zero,

enter negative amount.) .............................................. 9.

10. Maryland Modified Income (Add lines 6 and 9.) ............................... 10.

APPORTIONMENT OF INCOME

(To be completed by multistate corporations whose apportionment factor is less than 1, otherwise skip to line 13.)

11. Maryland apportionment factor (from page 4 of this form)

(If factor is zero, enter .000001.) ........................................ 11.

12. Maryland apportionment income (Multiply line 10 by line 11.) .................... 12.

13. Maryland taxable income (from line 10 or line 12, whichever is applicable.) ........... 13.

14. Tax (Multiply line 13 by 8.25%.) ......................................... 14.

15a. Estimated tax paid with Form 500D, Form MW506NRS and/or credited

from 2016 overpayment .................................... 15a.

15b. Tax paid with an extension request (Form 500E) ................... 15b.

15c. Nonrefundable business income tax credits from Part BB. (See instructions for Form 500CR.)

15d. Refundable business income tax credits from Part EE. (See instructions for Form 500CR.)

15e. The Heritage Structure Rehabilitation Tax Credit is claimed on line 1 of Part EE on Form 500CR.

Check here if you are a non-prot corporation.

15f. Nonresident tax paid on behalf of the corporation by pass-through entities

(Attach Maryland Schedule K-1.) ............................... 15f.

15g. Total payments and credits (Add lines 15a through 15f.) ........................ 15g.

16. Balance of tax due (If line 14 exceeds line 15g, enter the difference.) ............... 16.

17. Overpayment (If line 15g exceeds line 14, enter the difference.) .................. 17.

18. Interest and/or penalty from Form 500UP or late payment interest

..............................................TOTAL . 18.

19. Total balance due (Add lines 16 and 18, or if line 18 exceeds line 17 enter the difference.) 19.

20. Amount of overpayment to be applied to estimated tax for 2018

(not to exceed the net of line 17 less line 18) ................................ 20.

21. Amount of overpayment TO BE REFUNDED

(Add lines 18 and 20, and subtract the total from line 17.) ...................... 21.

You must le this form electronically to claim

business tax credits from Form 500CR.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

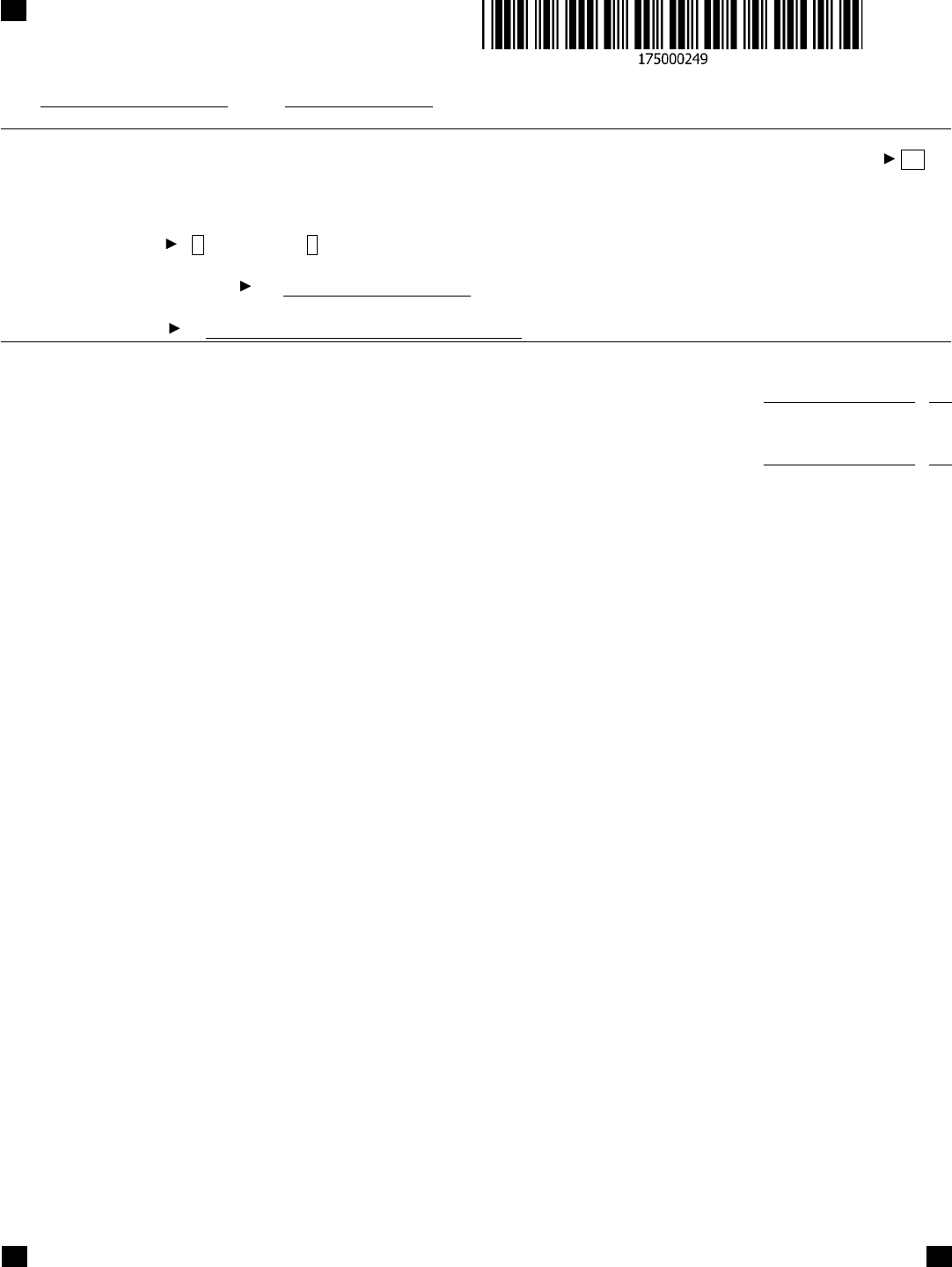

MARYLAND

FORM

500

CORPORATION INCOME

TAX RETURN

COM/RAD-001

NAME FEIN

2017

page 3

DIRECT DEPOSIT OF REFUND (See Instructions.) Be sure the account information is correct.

If this refund will go to an account outside of the United States, then to comply with banking rules, place a "Y" in this box

and see Instructions.

For the direct deposit option, complete the following information clearly and legibly.

22a. Type of account: Checking Savings

22b. Routing Number (9-digits):

22c. Account number:

INFORMATIONAL PURPOSES ONLY (LINES 23 & 24)

23. NOL generated in Current Year - Carryforward 20 years and back 2 years

(If line 6 is less than zero, enter on line 23.) ................................ 23.

24. NAM generated in Current Year - Carried Forward/Back with Loss on Line 23 per

Section 10-205(e) (If line 6 is less than zero AND line 9 is greater than zero, enter the

amount from line 9 on line 24.) ......................................... 24.

.

.

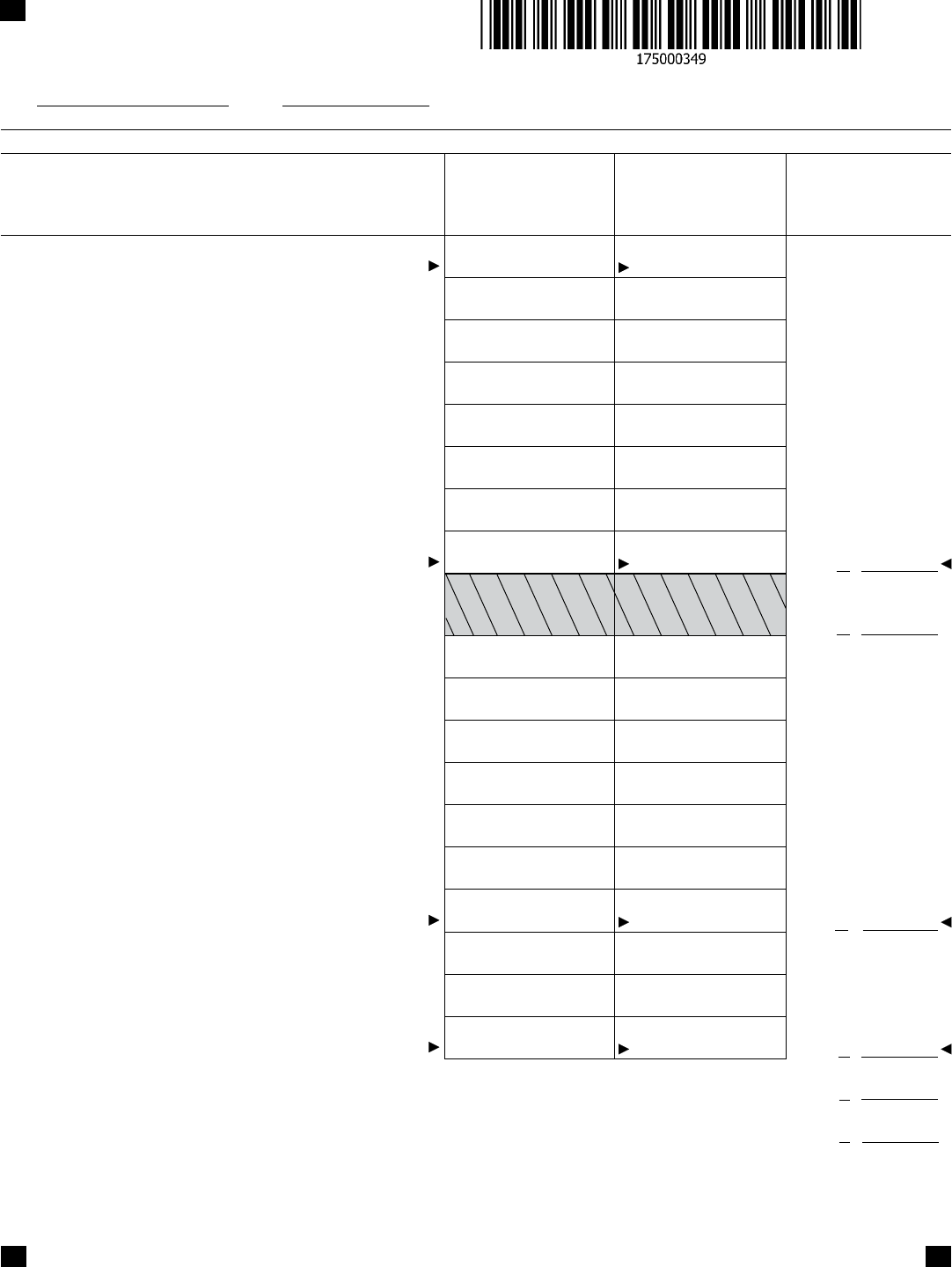

MARYLAND

FORM

500

CORPORATION INCOME

TAX RETURN

COM/RAD-001

NAME FEIN

2017

page 4

Schedule A - COMPUTATION OF APPORTIONMENT FACTOR (Applies only to multistate corporations. See instructions.)

NOTE: Special apportionment formulas are required for rental/

leasing, nancial institutions, transportation and

manufacturing companies.

Column 1

TOTALS WITHIN

MARYLAND

Column 2

TOTALS WITHIN

AND WITHOUT

MARYLAND

Column 3

DECIMAL FACTOR

(Column 1 ÷ Column 2

rounded to six places)

1A. Receipts a. Gross receipts or sales less returns and

allowances .....................

b. Dividends ......................

c. Interest ........................

d. Gross rents ......................

e. Gross royalties ...................

f. Capital gain net income .............

g. Other income (Attach schedule.) .......

h. Total receipts (Add lines 1A(a) through

1A(g), for Columns 1 and 2.) .........

1B. Receipts Enter the same factor shown on line 1A,

Column 3. Disregard this line if special

apportionment formula is used

2. Property a. Inventory .......................

b. Machinery and equipment ...........

c. Buildings .......................

d. Land ..........................

e. Other tangible assets (Attach schedule.) .

f. Rent expense capitalized

(multiply by eight) .................

g. Total property (Add lines 2a through 2f,

for Columns 1 and 2) ..............

3. Payroll a. Compensation of ofcers ............

b. Other salaries and wages ............

c. Total payroll (Add lines 3a and 3b, for

Columns 1 and 2.) ................

4. Total of factors (Add entries in Column 3.) ............................................

5. Maryland apportionment factor Divide line 4 by four for three-factor formula, or by the number of

factors used if special apportionment formula required. (If factor is zero, enter .000001 on line 11 page 2.)

.

.

.

.

.

.

MARYLAND

FORM

500

CORPORATION INCOME

TAX RETURN

COM/RAD-001

NAME FEIN

2017

page 5

SCHEDULE B - ADDITIONAL INFORMATION REQUIRED (Attach a separate schedule if more space is necessary.)

1. Telephone number of corporation tax department:

2. Address of principal place of business in Maryland (if other than indicated on page 1):

3. Brief description of operations in Maryland:

4. Has the Internal Revenue Service made adjustments (for a tax year in which a Maryland return

was required) that were not previously reported to the Maryland Revenue Administration Division? .... Yes No

If "yes", indicate tax year(s) here: and submit an amended return(s) together with a copy of the IRS

adjustment report(s) under separate cover.

5. Did the corporation file employer withholding tax returns/forms with the Maryland Revenue

Administration Division for the last calendar year? . .................................. Yes No

6. Is this entitiy part of the federal consolidated filing? ................................... Yes No

If a multistate operation, provide the following:

7. Is this entity a multistate corporation that is a member of a unitary group? ................... Yes No

8. Is this entity a multistate manufacturer with more than 25 employees? ...................... Yes No

SIGNATURE AND VERIFICATION

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements and to

the best of my knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer, the declaration is

based on all information of which the preparer has any knowledge.

Check here if you authorize your preparer to discuss this return with us.

Officer's Signature Date Preparer's Signature

Officer's Name and Title Preparer's name, address and telephone number

Make checks payable to and mail to:

Comptroller Of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, Maryland 21411-0001

(Write Your FEIN On Check Using Blue Or Black Ink.)

Preparer’s PTIN (required by law)

CODE NUMBERS (3 digits per line)

INCLUDE ALL REQUIRED PAGES OF FORM 500