Mi6861 5453o 2005 7 6

User Manual: mi6861

Open the PDF directly: View PDF ![]() .

.

Page Count: 60

,46230 +1/-. 7251

988:

WV][_ Oeb\`d^h Ri\

<Pd[egfegYi]\ `d L]gcj\Y l`i_ b`c`i]\ b`YZ`b`in=

CDg\ Nbeeg>VY` T`d^ Pd\jhig`Yb M]dig]> Lbe[a B

EG V`d^ Qea UeY\>VY` Te> S]l V]gg`ieg`]h> Oed^ Qed^

V]bI <HEC= CFHA BAAA NYmI <HEC= CFHA BDAA

_iifI@@lll?ki][_?[ec

]cY`bI `dk]hiegXg]bYi`edhJki][_?[ec

KddjYb U]fegiKddjYb U]fegi

VTech’s mission is to be the most cost

effective designer and manufacturer of

innovative, high quality consumer

electronics products and to distribute

them to markets worldwide in the most

efficient manner.

Mission

technology

cost effective

communicate

>> enjoy life

Corporate Profile

VTech is one of the world’s largest suppliers of corded and

cordless telephones and a leading supplier of electronic

learning products. It also provides highly sought-after contract

manufacturing services. Founded in 1976, the Group’s mission is

to be the most cost effective designer and manufacturer of

innovative, high quality consumer electronics products

and to distribute them to markets worldwide in the most

efficient manner.

With headquarters in the Hong Kong Special Administrative

Region and state-of-the-art manufacturing facilities in mainland

China, VTech currently has a presence in 10 countries and

approximately 22,700 employees, including around 880 R&D

professionals in R&D centres in Canada, Hong Kong SAR and

mainland China. This network allows VTech to stay abreast of

the latest technology and market trends throughout the world,

while maintaining a highly competitive cost structure.

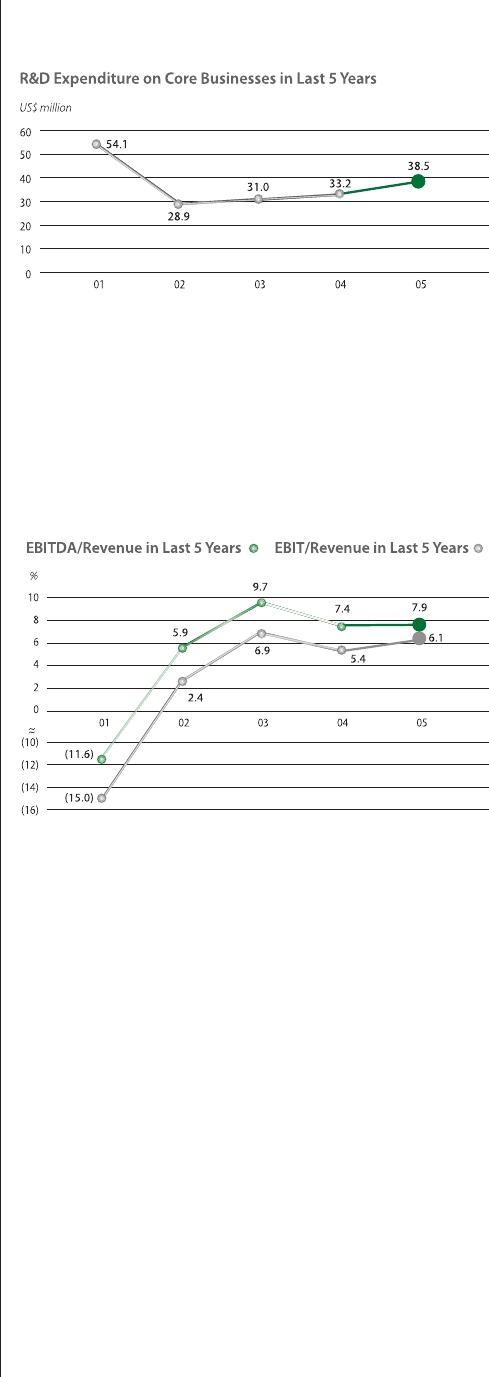

The Group invested US$38.5 million in R&D in the financial year

2005 and launches numerous new products each year. VTech

sells its products via a strong brand platform supported by an

extensive distribution network of leading retailers in North

America, Europe and Asia. Apart from the well-known VTech

brand, the Group has the rights to use the AT&T brand in

connection with the manufacture and sale of its wireline

telephones and accessories.

In addition, VTech has license agreements with Disney,

Warner Brothers, Marvel, Nickelodeon, Sesame Street, HIT

Entertainment and Joester Loria - American Greetings that allow

it to use well-known children’s characters in the cartridges for its

popular V.Smile product range.

Shares of VTech Holdings Limited are listed on both the Hong

Kong and London stock exchanges (SEHK: 303; London SE: VTH).

Ordinary shares are also available in the form of American

Depository Receipts (ADRs) through the Bank of New York

(ADR: VTKHY).

Contents

01

02

06

07

10

18

20

22

24

28

32

33

34

54

55

56

Message from

Deputy Chairman

Corporate Profile

Letter to Shareholders

VTech Holdings Ltd Annual Report 2005 01

Review of Operations

Corporate Affairs

Year in Review

Directors and Senior

Management

Consolidated

Financial Statements

Report of the

Independent Auditors

Notes to the

Financial Statements

VTech in the

Last Five Years

Corporate Information

Corporate Governance

Management Discussion

and Analysis

Report of the Directors

Information for

Shareholders

Letter to Shareholders

I am pleased to report that the full year results for

the financial year 2005 were better than we

expected when we announced our half year results

in November 2004.

>>

>>

Dear Shareholders,

I am pleased to report that the full year

results for the financial year 2005 were

better than we expected when we

announced our half year results in

November 2004. The Group's Electronic

Learning Products (ELP) and Contract

Manufacturing Services (CMS) businesses

achieved better than expected growth for

the full year, helping to offset an

unsatisfactory performance from our

telecommunication products business in

the United States. Through management

efforts, the difficult situation of the

telecommunication products business in

the United States was brought under

control and, following a series of

rationalisation measures, its US operations

are becoming more effective and efficient.

Results

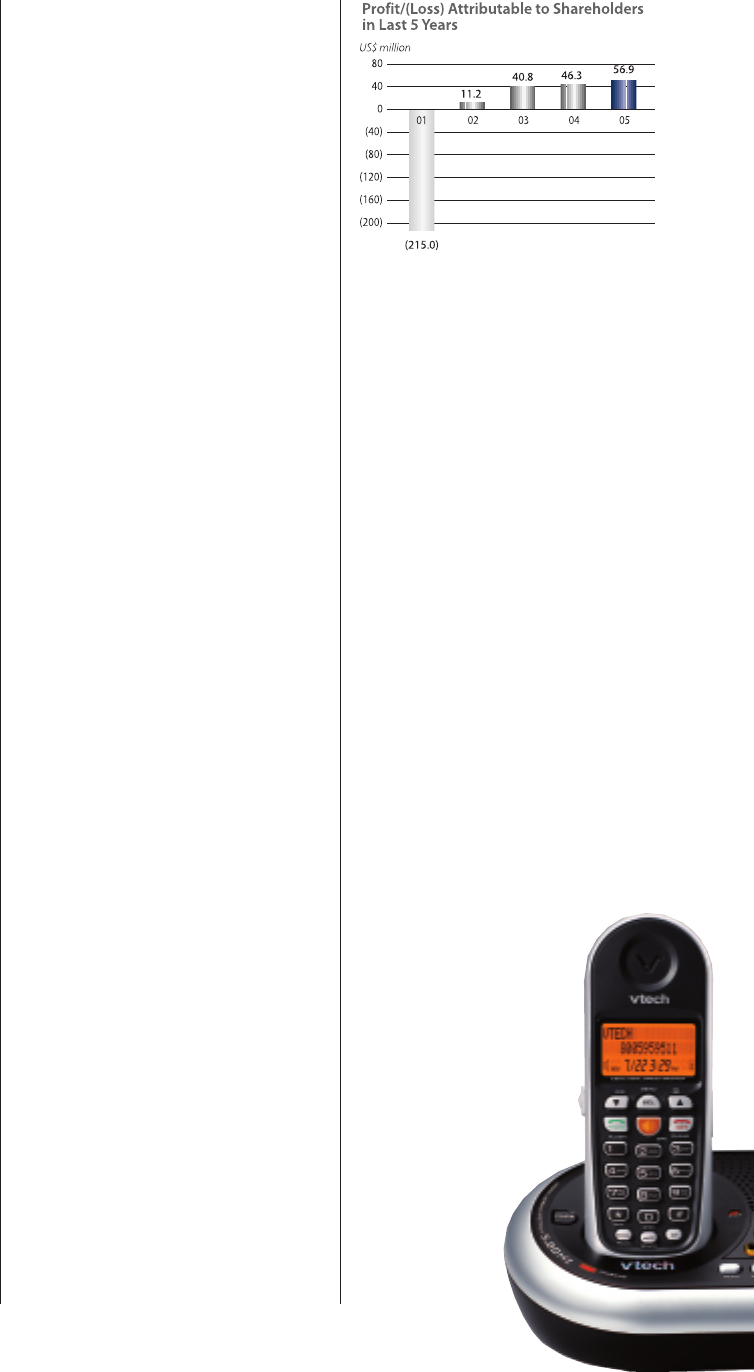

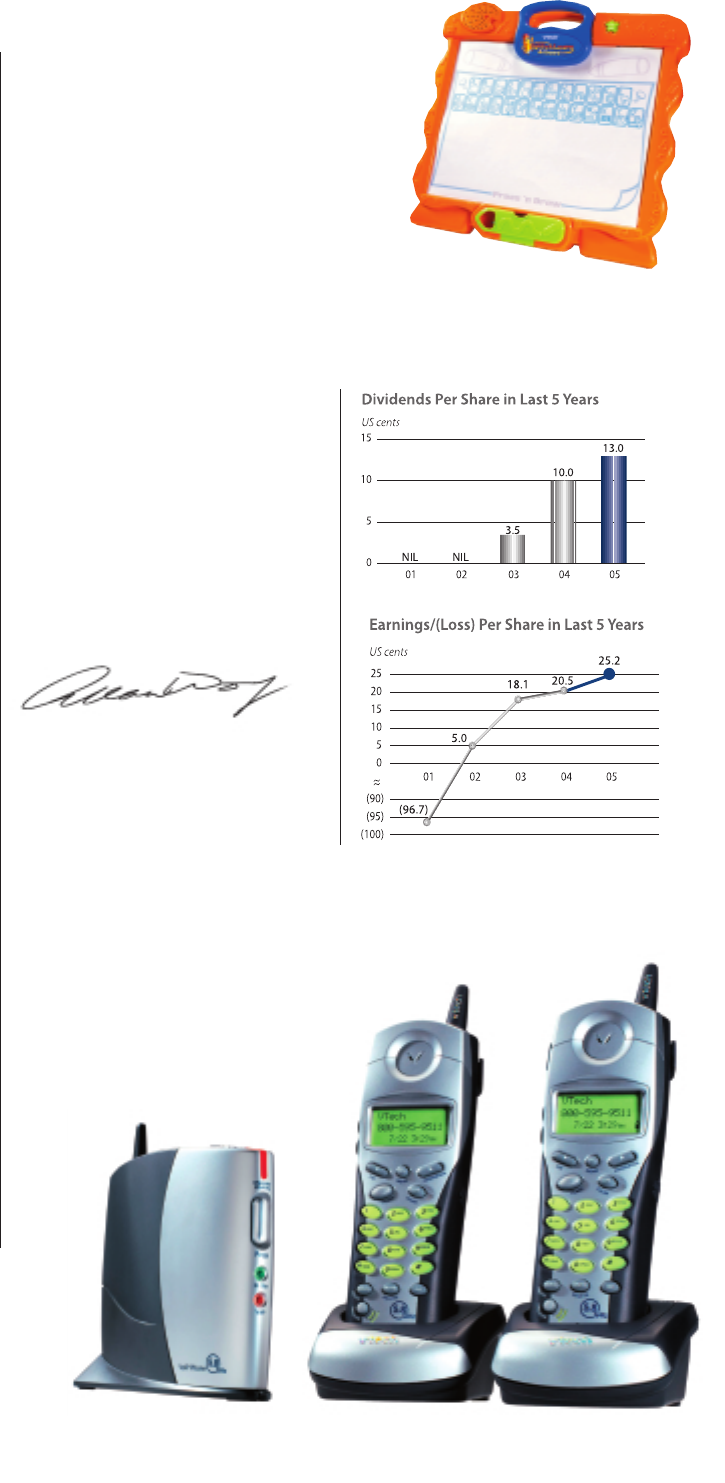

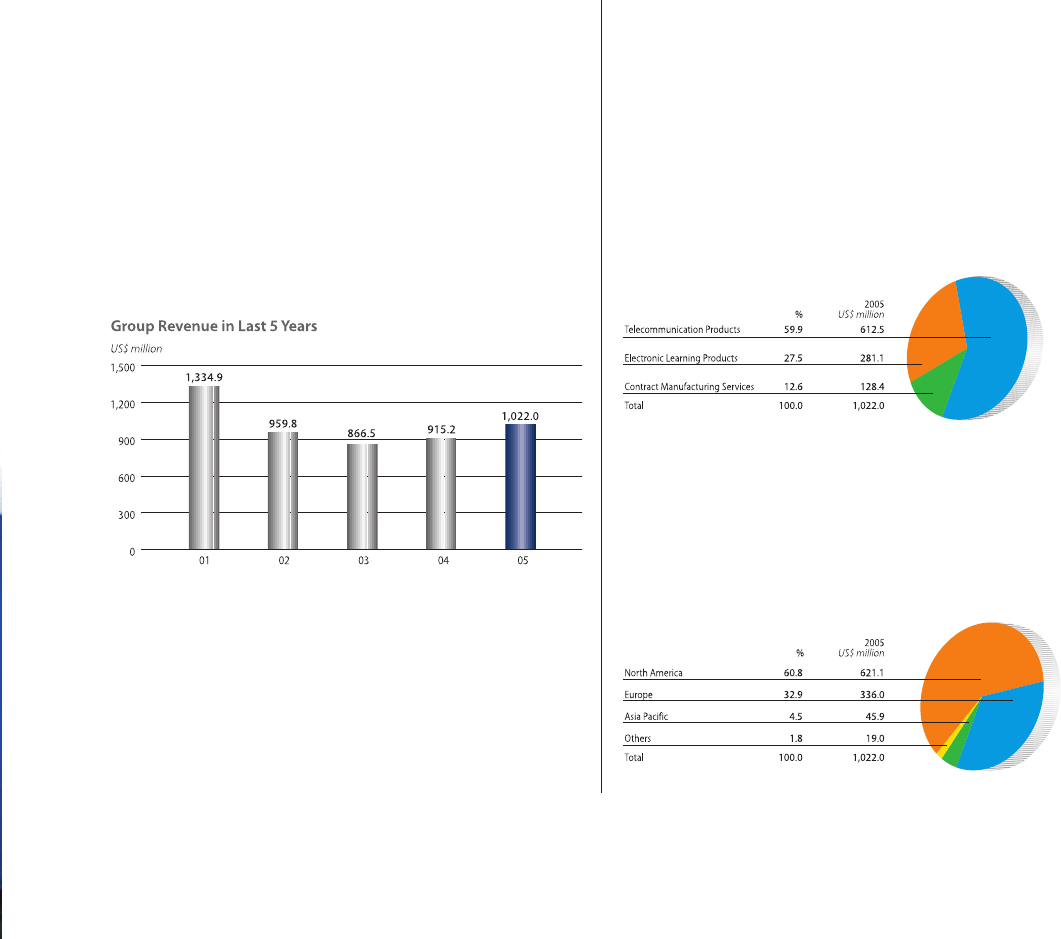

Revenue for the Group increased by 11.7%

over the financial year 2004 to US$1,022.0

million and profit attributable to

shareholders, including US$6.7 million

non-recurring income arising from

settlement of an indemnification claim,

increased by 22.9% to US$56.9 million.

Earnings per share rose 22.9% to US25.2

Allan WONG Chi Yun

Chairman

02 VTech Holdings Ltd Annual Report 2005

Letter to Shareholders

VTech Holdings Ltd Annual Report 2005 03

mi6861 5.8GHz cordless phone

cents. This has allowed the Board of

Directors to propose a higher final

dividend of US12.0 cents, giving a total

dividend for the year of US13.0 cents per

ordinary share, compared to US10.0 cents

for the financial year 2004, representing an

increase of 30.0%.

Operations

The financial year 2005 was challenging for

our telecommunication products business,

as our products were not as competitive as

other major players in the US market on

both product design and price, which

resulted in lower sales that undermined a

strong performance in Europe. Over-

optimistic sales projections for the US

market led to higher overheads and

operating costs, resulting in operational

inefficiency, which further impacted

profitability of the business.

To rectify the problem in the United States,

management of the business was changed

while operations began the process of

streamlining and rationalisation. Greater

emphasis has been put on understanding

retailer expectations to ensure product

design and features correspond to

consumer preferences. Through our

efforts, the situation at the US operations

was successfully brought under control in

the second half of the financial year 2005.

In January 2005, the Group took an

industry lead in responding to

technological developments in the US

cordless phone market by launching its

first Voice over Internet Protocol (VoIP)

5.8GHz cordless phone with Vonage, and

its first VoIP 2.4GHz cordless phone with

Skype. The Group is now developing an

entirely new range of more cost effective

products that meet retailer expectations

and consumer requirements, which will be

introduced in early 2006.

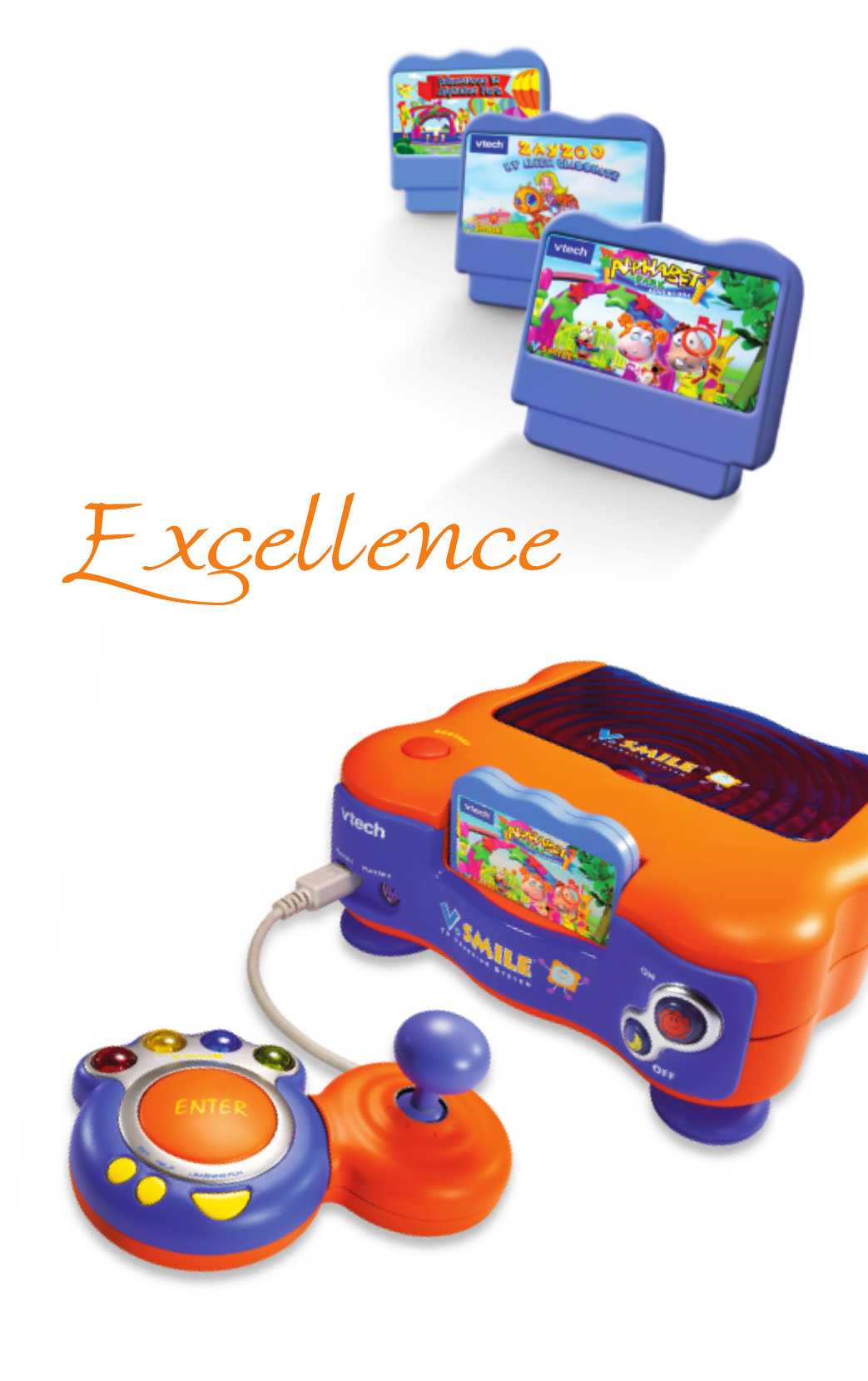

In contrast with the telecommunication

products business, the ELP business has

proven its successful turnaround with a

strong rebound in both revenue and

profitability. The V.Smile TV Learning

System was enthusiastically received by

retailers and consumers, garnering

numerous top awards, and is enabling us

to strengthen further our position in

Europe while rebuilding sales in the

United States.

The attraction of this new product

platform, which in February 2005 was

joined by the handheld model V.Smile

Pocket, is greatly enhanced by highly

interactive software using licensed

children's characters, which now comprise

a library of 27 titles. In support of V.Smile,

VTech has also committed more

promotional dollars than in the past,

making this product fully competitive from

a marketing perspective.

Despite the importance of V.Smile, which

we see as a key growth platform, our

traditional product lines also performed

well during the financial year 2005. The

Group is committed to maintaining a

broad ELP range, focusing on the growing

infant and pre-school segments.

The CMS business remains a steady

contributor to the Group revenue and

profit. In the financial year 2005, the

business achieved record revenue and

higher profit, and its revenue growth was

much stronger than the global Electronic

Manufacturing Services (EMS) industry.

This outperformance testifies not only to

our ability to deliver quality products,

flexible and reliable service, but also to our

success in maintaining margins while

passing on savings to customers. The

investment in R&D has paid off, with R&D

related services increasingly driving sales,

while the business has seen success in

gaining a new customer in the industrial

printing sector. The business is also

moving towards compliance with the

Restriction of the use of certain Hazardous

Substances in electrical and electronic

equipment (RoHS), a European Union

environmental directive that takes effect in

July 2006.

Management Changes

During the financial year 2005, I assumed

the role of CEO of the telecommunication

products business following the departure

of Mr. James C. Kralik. In December 2004,

Mr. Edwin Ying, former CEO of the ELP

business, made the decision to resign and

subsequently Mr. Albert Lee, our Deputy

Chairman took up the role.

Letter to Shareholders

VTech Holdings Ltd Annual Report 2005

04

Touch TabletTM

New Manufacturing Facilities

Manufacturing facilities in mainland China

have been increasingly migrating inland to

be closer to untapped labour pools, which

ultimately reduces operational costs.

During the financial year 2005, the

Group decided to establish its third

manufacturing plant in Qingyuan city in

the northern part of Guangdong province.

The new 49,000 square metre facility will

initially be used for supplying the plastics

needs of our telecommunication products

business. The plant is expected to start

operations in the fourth quarter of the

calendar year 2005.

Although VTech has currently not been

affected by the tight supply of labour and

electric power in the Pearl River Delta,

where its manufacturing facilities are

located, the Qingyuan facility offers the

ability to relocate some processes to an

area of lower cost if required.

Outlook - Cautiously Optimistic

VTech's mission is to be the most cost

effective designer and manufacturer of

innovative, high quality consumer

electronics products and to distribute

them to markets worldwide in the most

efficient manner. We remain optimistic

about the outlook of the financial year

2006, but this is tempered with caution in

view of a number of factors.

The US economy appears to be on a

reasonably firm footing, but rising short

term interest rates and stubbornly high oil

prices may at some point dampen

consumer spending. The Group also faces

potential challenges from rising resin

prices and from RoHS compliance, which

will increase the cost of manufacturing for

products shipping to Europe and Japan.

In addition, a potential upward revaluation

of the RMB would increase our operating

costs, while a weakening of the Euro

and Sterling may also affect our

results, although forward foreign

exchange contracts are used to hedge

certain exposures.

Nonetheless, the Group's three core

businesses are well placed for the future,

albeit with fundamentally different

challenges and opportunities. The

telecommunication products business is

now on much more stable footing, with a

lower cost structure and a pipeline of more

competitive products under development.

We will continue to leverage our dual

brand strategy, using both the AT&T and

VTech brands to develop products for

different market segments.

Following the re-engineering measures,

we expect the profitability of the

VTech's mission is to be

the most cost effective

designer and

manufacturer of

innovative, high quality

consumer electronics

products and to

distribute them to

markets worldwide in the

most efficient manner.

We remain optimistic

about the outlook of the

financial year 2006, but

this is tempered with

caution in view of a

number of factors.

Letter to Shareholders

Write & Learn ArtboardTM

telecommunication products business to

be improved in the financial year 2006.

Revenue, however, is expected to suffer in

the short term and will not return to a

growth path until the financial year 2007,

when the revamped products hit the

shelves in the US market in early 2006. This

is despite further expansion in Europe,

which will support sales.

We expect the strong momentum for the

ELP business to continue in the financial

year 2006. We will develop and expand the

V.Smile product range, which provides a

good platform for future growth. Although

competing products are beginning to

appear, we believe we have a head start in

product awareness and that V.Smile offers

the superior interactivity and software

choice which will allow it to remain the

market leader. We will invest further in

R&D to increase the number and variety of

Smartridges, and continue to negotiate

license agreements to expand our

portfolio of children's characters. We will

also continue to invest in our traditional

product lines and to support all our

products with the promotional dollars

required to make them compelling from a

marketing perspective.

The global EMS industry is still in an

uptrend and is expected to deliver further

growth in the financial year 2006. VTech's

CMS business is well positioned to take

advantage of this favourable situation to

deliver top and bottom line growth, given

its stable customer base and efficient

operations. The programme to meet RoHS

requirements will continue to be a major

focus and new market segments will be

developed. Input costs are forecast to

remain stable, although manufacturing

costs will rise as a result of RoHS. The CMS

business will work to maintain margins

through strict cost control and working

closely with material suppliers.

Finally, I would like to thank my fellow

directors and senior management, as well

as all VTech employees for their

commitment to ensuring continued

improvement for the Group. My

appreciation also goes out to our

shareholders, bankers and business

partners for their invaluable support.

Looking ahead, I believe VTech has an

improved cost structure, enhanced

product ranges and the right management

to allow the Group to capitalise on its core

competencies to achieve continued

progress, and bring solid long-term returns

to shareholders.

Allan WONG Chi Yun

Chairman

Hong Kong, 22nd June 2005

VTech Holdings Ltd Annual Report 2005 05

VoIP 5.8GHz cordless phone

Message from Deputy Chairman

The financial year 2005 was a remarkable year for our ELP business.

V.Smile has had a successful first year, demonstrating VTech’s ability

to spot a gap in the market and create a product to meet a

consumer need that others had failed to identify.

VTech saw that television was one of the most influential media in

children’s lives, with almost 80 percent watching at least one hour

of TV a day, according to Media Awareness Network 2003. So VTech

set out to design a product that could tap into that time and

provide a smart alternative through engaging educational game-

play with popular characters — turning game time into brain time!

The result was V.Smile.

This was conceived not just as a piece of hardware, but a platform

for an increasing range of software. V.Smile “Smartridges” are

specifically designed for children aged 3 and up and promote

learning concepts key to their educational development. V.Smile

offers popular titles to keep kids engaged without the violence that

other video games portray.

Following the TV based version, VTech turned to capture the

opportunities in handheld version - and in February 2005

announced the launch of V.Smile Pocket. So VTech now has a

portable educational game system for children aged 5 and older

that delivers videogaming fun on the go or at home. Its high

resolution (320 x 240) colour LCD screen gives kids a sharp, crystal-

clear interface anytime, anywhere. At home, V.Smile Pocket can

even be connected to a television for videogaming on the

big screen.

But VTech is not just about V.Smile. The Group continues to

introduce new electronic learning products in infant, pre-school

and electronic learning aid categories. Write and Learn Series is one

of the new product lines that launched in February 2005. It

leverages VTech’s unique writing recognition technology,

providing children with fun toys to encourage fundamental

handwriting skills.

VTech will continue to develop innovative, age-appropriate

electronic learning products for children from birth through to

the pre-teens. The calendar year 2004 product line is proof of this

innovation and adaptability to market trends. VTech aims to

expand licensed product lines, innovate in new categories, and find

new ways to provide meaningful learning products to children

in entertaining formats.

06 VTech Holdings Ltd Annual Report 2005

Albert LEE Wai Kuen

Deputy Chairman

Management Discussion and Analysis

>>

>>

>>

>>

>>

>>

VTech Holdings Ltd Annual Report 2005 07

Highlights

Group revenue increased by 11.7% to US$1,022.0 million

Profit attributable to shareholders* increased by 22.9% to US$56.9 million

Final dividend of US12.0 cents per ordinary share, total dividend for the year up 30.0%

Strong rebound in electronic learning products business

Outperformance by contract manufacturing services business

Unsatisfactory results of telecommunication products business in the

United States

Rationalisation of the telecommunication products business contributing to

more efficient operations

* including US$6.7 million non-recurring income arising from settlement of an indemnification claim

>>

Revenue

For the year ended 31st March 2005, the Group reported a revenue

of US$1,022.0 million, representing a growth of US$106.8 million or

11.7% over the previous financial year. In contrast to the severe

challenges faced by the telecommunication products business in

the US market, the ELP business recorded substantial growth with

a 115.1% year on year increase in revenue to US$281.1 million. The

growth was attributable to the success of its revamped product

lines, in particular the exceptionally strong demand for the new

V.Smile TV Learning System.

strong demand from existing customers and its ability to offer

comprehensive R&D services to customers. The rise in revenue was

mainly driven by the power supply and professional audio

equipment segments.

The Group's revenue continues to derive from the three core

businesses as follows: 59.9% from telecommunication products,

27.5% from ELP and 12.6% from CMS.

North America continues to be the largest market for the Group.

Revenue from this market accounted for 60.8% of the Group

revenue for the financial year 2005. Europe and Asia Pacific

accounted for 32.9% and 4.5% respectively.

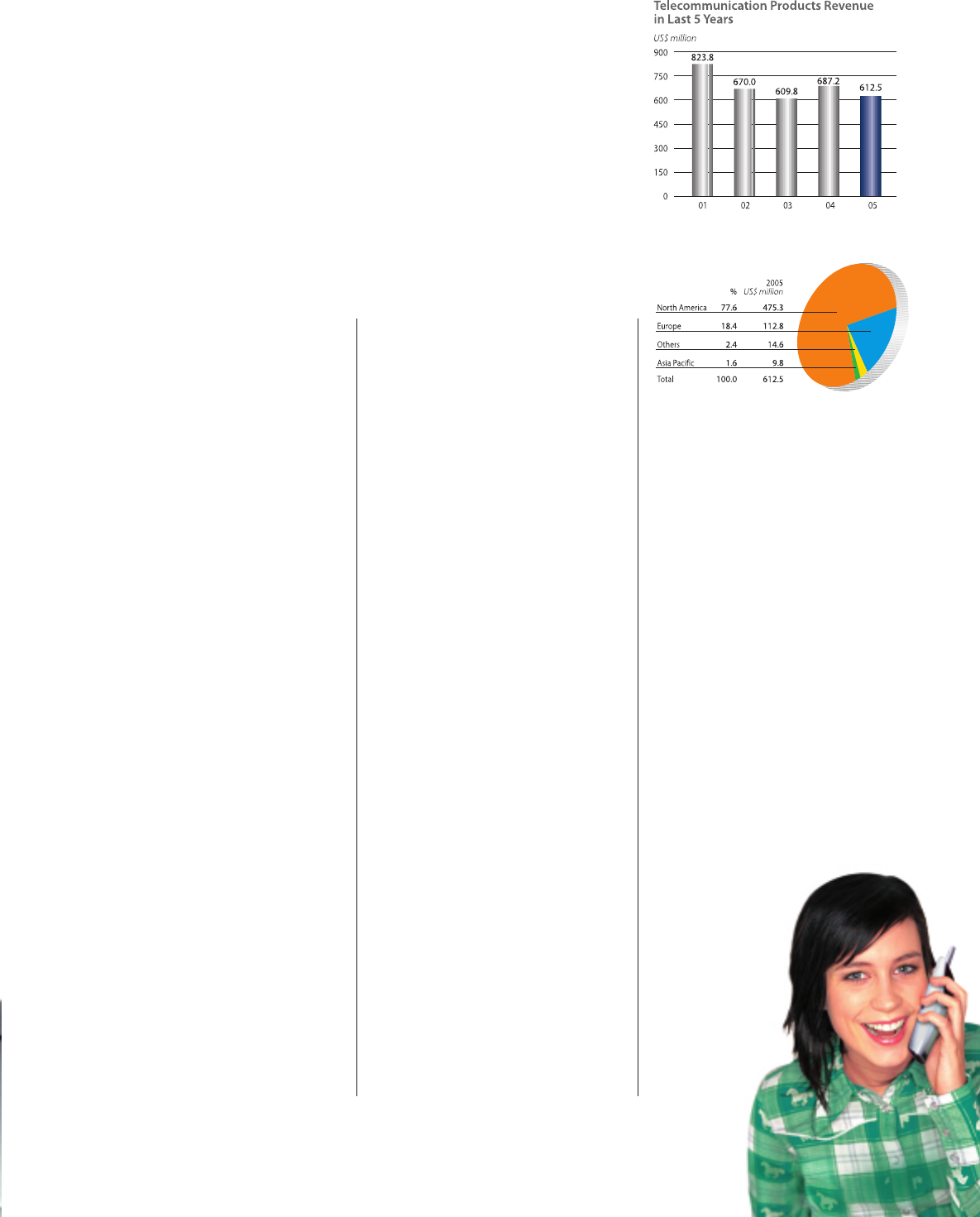

The revenue from the telecommunication products business

declined by 10.9% to US$612.5 million due to underperformance

in the US market, although the situation was partly alleviated by

further progress in its development of the European market, where

sales increased by 102.2% over the previous financial year.

For the CMS business, revenue increased by 32.0% over the

previous financial year, reaching US$128.4 million as a result of

Group Revenue by Product Line

Group Revenue by Region

Management Discussion and Analysis

VTech Holdings Ltd Annual Report 2005

08

Gross Profit/Margin

The gross profit for the financial year 2005 was US$328.8 million, an

increase of US$47.5 million compared to the US$281.3 million

gross profit recorded in the previous financial year. Gross margin

for the year improved from 30.7% to 32.2%. The increase in gross

margin was due to the change in sales mix, the success of the

V. Smile TV Learning System and management effort in

controlling overheads.

Operating Profit

The operating profit for the year ended 31st March 2005 was

US$62.7 million, an increase of US$13.2 million over the previous

financial year. Current year's operating profit included non-

recurring income arising from settlement of an indemnification

claim amounted to US$6.7 million. Excluding such income, the

operating profit increased by US$6.5 million, or 13.1%. This

improvement mainly came from improved gross profit and

gross margin.

Selling and distribution costs increased by 21.2% from US$150.7

million in the previous financial year to US$182.6 million in the

financial year 2005, owing to increased spending on advertising

and promotional activities to foster sales of new products, as well

as an increase in royalty payments to licensors for the use of

popular cartoon characters for certain ELPs and V. Smile

Smartridges. Distribution costs also increased in response to the

increased volume of products sold. Administrative and other

operating expenses increased from US$47.9 million in the previous

financial year to US$51.7 million in the financial year 2005,

representing an increase of 7.9%. These expenses included

additional expenditure related to the implementation of a new

global enterprise resources planning system to enhance supply

chain and management processes. Nevertheless, the amount of

administrative and other operating expenses as percentage of

Group revenue slightly decreased from 5.2% in the previous

financial year to 5.1% in the financial year 2005.

During the financial year 2005, the appreciation of the Euro,

Sterling, Canadian dollar and other currencies against the US dollar

gave rise to a net exchange gain of US$3.3 million, compared to a

net exchange gain of US$5.0 million in the previous financial year.

In the first half of the financial year 2005, the Group disposed of its

Mexican factory and entities that were acquired in 2000, as part of

Lucent's Wired Consumer Phones Business. The Group realised a

gain of US$1.8 million from these transactions.

Research and development activities are vital for the long-term

development of the Group. During the financial year 2005, the

Group spent US$38.5 million on research and development

activities, which represented around 3.8% of total Group revenue.

Basic earnings per share for the year ended 31st March 2005 was

US25.2 cents as compared to US20.5 cents in the previous financial

year. During the year, the Group declared and paid an interim

dividend of US1.0 cent per share, which aggregated to US$2.3

million. The Board of Directors has proposed a final dividend of

US12.0 cents per share, which will aggregate to US$27.3 million.

Total dividend for the year amounts to US13.0 cents per share,

representing an increase of US3.0 cents per share or 30.0% from

the previous year.

Liquidity and Financial Resources

The shareholders' funds as at 31st March 2005 were US$203.3

million, a 25.0% increase from US$162.6 million reported for the

financial year 2004. The net assets per share increased by 25.0%

from US72.1 cents to US90.1 cents.

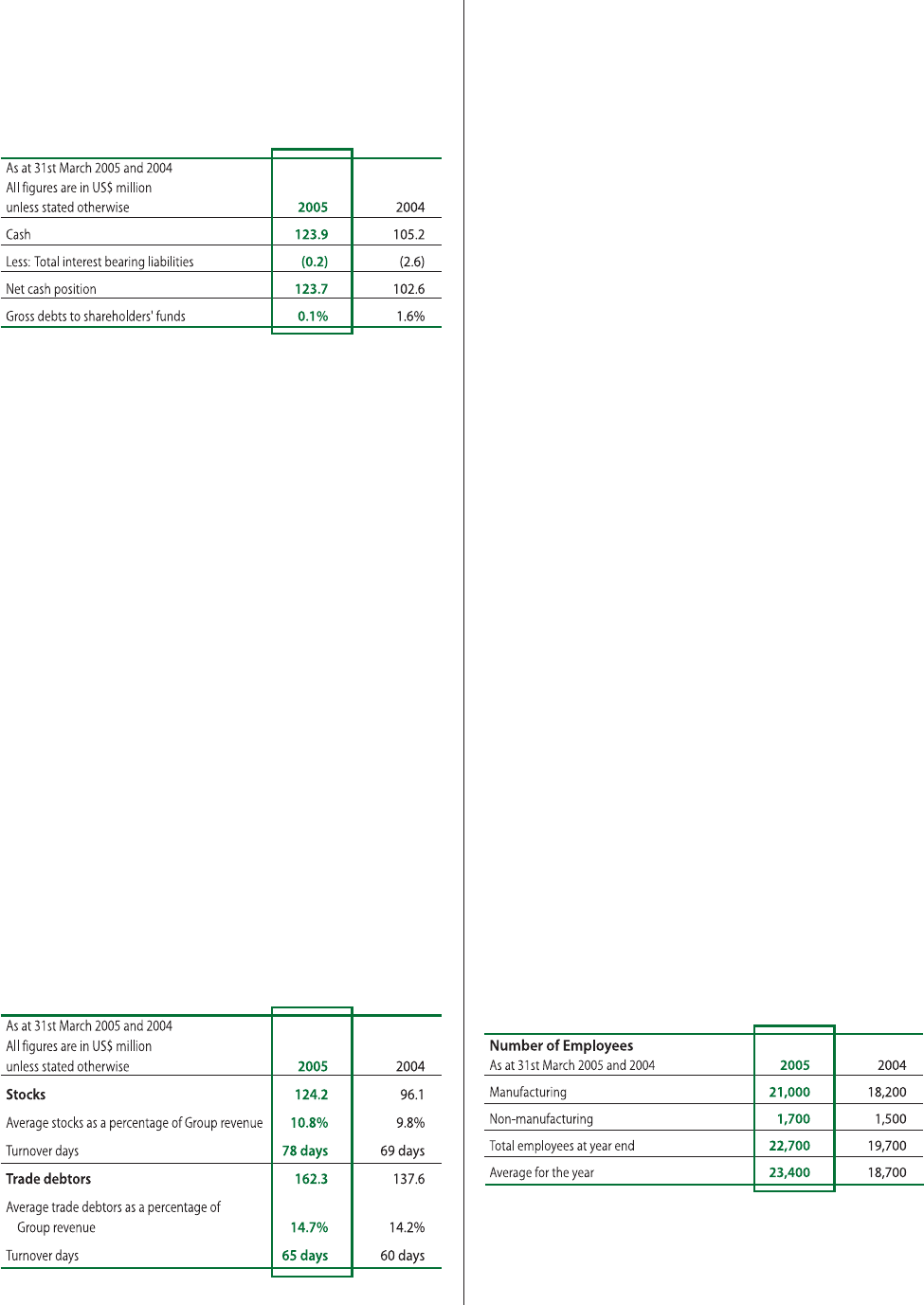

As at 31st March 2005, the net cash increased to US$123.7 million,

up 20.6% from US$102.6 million at the previous year-end. The

Group is substantively debt-free, except for certain interest bearing

liabilities amounting to US$0.2 million, of which US$0.1 million is

Net Profit and Dividends

The profit attributable to shareholders for the year ended

31st March 2005 was US$56.9 million, an increase of US$10.6

million as compared to the previous financial year. There were non-

recurring receipts of US$6.7 million arising from settlement of an

indemnification claim during the financial year 2005. The ratio of

EBIT and EBITDA to revenue was 6.1% and 7.9% respectively.

Management Discussion and Analysis

VTech Holdings Ltd Annual Report 2005 09

repayable within one year and US$0.1 million is repayable within

five years. The Group's borrowings are denominated in Euro and

United States dollar and are on a fixed-rate basis. An amount of

US$0.1 million of the total gross interest bearing liabilities is

secured against equipment.

Capital Expenditure

For the year ended 31st March 2005, the Group invested US$21.5

million in plant, machinery, equipment, computer systems and

other tangible assets. All of these capital expenditures were

financed from internal resources.

Capital Commitments and Contingencies

In the previous financial year, the Group had committed to the

implementation of a new global enterprise resources planning

system to enhance the supply chain management. Most of the

investment was incurred during the financial year 2005 and was

financed from internal resources.

The Group expects to invest approximately US$48 million on capital

expenditure in the financial year 2006. During the financial year 2005,

the Group decided to establish a new manufacturing plant in

Qingyuan city in the northern part of Guangdong province. The plant

is expected to start operation in the fourth quarter of the calendar

year 2005 and the capital investment for the new plant in the

financial year 2006 is estimated at approximately US$22 million. It

will be financed from internal resources.

As of the financial year end date, the Group had no material

contingencies.

Employees

As at 31st March 2005, the Group had approximately 22,700

employees, an increase of 15.2% from 19,700 in the previous

financial year. Employee costs for the year ended 31st March 2005

were approximately US$107 million, as compared to US$99 million

in the financial year 2004. The increase in the number of employees

was mainly in response to the sales increase at the ELP and

CMS businesses.

The Group has established an incentive bonus scheme and a share

option scheme for its employees, in which the benefits are

determined based on the performance of the Group and

individual employees.

Treasury Policies

The objective of the Group's treasury policies is to manage its

exposure to fluctuation in foreign currency exchange rates arising

from the Group's global operations. It is our policy not to engage in

speculative activities. Forward foreign exchange contracts are used

to hedge certain exposures.

Working Capital

The stock balance as at 31st March 2005 increased by 29.2% over

the balance at 31st March 2004 to US$124.2 million. The turnover

days increased from 69 days to 78 days. The increase in stock level

was primarily to cater for the increased demand for ELPs and

V. Smile in the first quarter of the financial year 2006. The stock

balance in relation to other businesses remained at a similar level

to the previous financial year. The trade debtors balance as at

31st March 2005 was US$162.3 million, an increase of 18.0% as

compared to that reported for the previous financial year. The

turnover days increased from 60 days in the previous financial year

to 65 days in the financial year 2005. The increase in trade debtors

was mainly due to an increase in sales at the ELP business in the

fourth quarter of the financial year 2005 compared to the same

period of the previous financial year, despite a decrease in sales at

the telecommunication products business for the same period.

Review of Operations

Telecommunication Products

VTech continued to make progress in

developing the European markets, where

revenue rose strongly by 102.2% over the

financial year 2004 to US$112.8 million.

A Year of

>>

VTech Holdings Ltd Annual Report 2005

10

Outperformance

E

Rationalisation

xcellence

Review of Operations

The financial year 2005 was a challenging year for the

telecommunication products business. Revenue fell by

10.9% to US$612.5 million due to the unsatisfactory

performance in the US market, which outstanding

results in the European market were unable to offset.

Profitability of the business was substantially affected

by the underperformance in the United States. In the

financial year 2005, the business accounted for 59.9%

of Group revenue, compared to 75.1% in the financial

year 2004.

11

Unsatisfactory Results in the

United States

In North America, revenue declined by

23.6% to US$475.3 million, accounting for

77.6% of the total telecommunication

products revenue, compared to 90.5% in

the financial year 2004. The decrease in

revenue was mainly the result of lower

sales in the United States, as our phones

failed to compete on both product design

and price. Over-optimistic sales projections

also led to higher overheads and operating

costs, resulting in operational inefficiency

which further impacted profitability.

Comprehensive Measures to

Rectify the Problems

Management moved swiftly to identify

and address the problems, so that the

situation was successfully brought under

control in the second half of the financial

year 2005. In November 2004, Mr. Allan

Wong, Chairman and Group CEO assumed

the role of CEO of the telecommunication

products business, following the departure

of the former CEO, Mr. James C. Kralik.

A comprehensive and broad-based

improvement programme was put in place

to re-engineer all processes worldwide,

with the aim of managing the brands

better, strengthening channel marketing,

forecasting demand more accurately,

rationalising product design and

development and raising productivity.

The business also moved to streamline

operations and tighten cost control

globally.

More specifically, overheads were reduced

to bring them in line with the level of sales.

Product management, marketing

communications and channel marketing

functions in the US sales offices began a

process of integration to strengthen

communication, thereby improving

product offerings and marketing. Product

design and development began to be

consolidated to Hong Kong to shorten the

product development cycle. Greater

emphasis has been put on understanding

retailer expectations to ensure product

design and features correspond to

consumer preferences. A revamped

product line is being developed and will

be introduced in early 2006.

Strong Performance in Europe

Despite the challenges in the United

States, VTech continued to make progress

in developing the European markets,

where revenue rose strongly by 102.2%

over the financial year 2004 to US$112.8

million. Europe, in the financial year 2005,

accounted for 18.4% of the total

telecommunication products revenue,

compared to 8.1% in the financial

year 2004.

VTech is supplying products to the leading

fixed-line telephone operators on an

Original Design Manufacturing (ODM)

basis. The European business is benefiting

from the increasing opening of the

markets. VTech will adopt the same

strategy to pursue opportunities in

markets outside Europe and

North America.

VoIP Products - Tapping Longer

Term Potential

In addition to geographical diversification,

the business has been developing a range

of products for the VoIP market, which is

beginning to grow rapidly. In January

2005, VTech announced the launch of the

first VoIP 5.8GHz cordless phone with

Vonage, North America's leading

broadband phone service provider and the

first VoIP 2.4GHz cordless phone with

Skype, the leading free Internet telephony

service provider worldwide. We expect

these products to start

delivering a meaningful

contribution to the

business in the

financial

year 2007.

VTech Holdings Ltd Annual Report 2005

Telecommunication Products

Revenue by Region

Review of Operations

Electronic

Learning Products

A Year of

The V.Smile TV Learning System is a dynamic

video game platform for children aged 3-7.

The response to V.Smile from both the trade

and consumers has been overwhelmingly

positive, making it a "star" in the ELP market

worldwide.

>>

VTech Holdings Ltd Annual Report 2005

12

Review of Operations

The ELP business recorded a strong performance in

the financial year 2005. Revenue rose significantly by

approximately 1.2 times or 115.1% to US$281.1

million following the well-executed roll out of the

award-winning V.Smile TV Learning System. Supported

by effective and efficient operations, profitability

rebounded sharply. During the financial year 2005, the

ELP business accounted for 27.5% of Group revenue,

compared to 14.3% in the financial year 2004.

VTech Holdings Ltd Annual Report 2005 13

V.Smile won top industry awards in FY2005

United States

• Best Overall Toy of the Year

• Best Educational Toy

of the Year

Germany

• Toy Innovations Award

2005 - Learning Category

United Kingdom

• Electronic Learning

Toy of the Year

Successfully Rebuilding

US Sales

The successful launch of V.Smile has

allowed the business to rebuild sales and

regain lost shelf space gradually in the US

market, while further strengthening its

leadership position in Europe. In the

financial year 2005, revenue from the

North American market rebounded sharply

by more than 3 times or 328.1% to

US$108.3 million, accounting for 38.5% of

total ELP revenue, compared to 19.4% of

total ELP revenue in the financial year

2004. Revenue from the European market

also showed a robust increase of 60.3% to

US$160.0 million, accounting for 56.9% of

total ELP revenue.

Successful Start for V.Smile

The V.Smile TV Learning System is a

dynamic video game platform for children

aged 3-7, comprising a console that plugs

into a television together with

interchangeable software cartridges. The

product hit the shelves in August 2004

with a total of 10 "Smartridges", including

popular children's characters from four

licensors: Disney, Marvel, Joester Loria

Group - American Greetings and

Warner Brothers.

The response to V.Smile from both the

trade and consumers has been

overwhelmingly positive, making it a "star"

in the ELP market worldwide. Not only

have the consoles sold in greater volumes

than our initial forecasts, but the ratio

of Smartridges to consoles has also

been higher.

V.Smile won more than 20 awards globally

during the financial year 2005, including

the "Best Educational Toy of the Year" and

the "Best Overall Toy of the Year" from the

US Toy Industry Association; as well as the

"Toy Innovations Award 2005 - Learning

Category" at the Nuremberg International

Toy Fair. These are recognised as the top

industry awards worldwide.

The success of V.Smile reflects its well

thought-through product design and

attractive software, which is educational,

fun, highly interactive and animated.

The system provides the same fun

videogaming experience for pre-school

children as that enjoyed by older children,

while parents are assured of content that

is neither violent nor inappropriate in

other ways.

ELP Revenue by Region

Alongside the stunning success of

V.Smile, the traditional product

lines recorded respectable growth

in revenue in both North America

and Europe.

Review of Operations

V.Smile Pocket, the handheld version of V.Smile

VTech Holdings Ltd Annual Report 2005

14

Review of Operations

VTech Holdings Ltd Annual Report 2005 15

Master Minds

- Ages 6 to 7 or 8

2004 Titles

Learnin’ Wheels

Mickey Mouse

2005 Titles

Aladdin

Batman

Cinderella

Spider-Man II

SpongeBob Squarepants

Zayzoo

Early Learners

- Ages 3 to 5

2004 Titles

Alphabet Park

Care Bears

The Lion King

Winnie the Pooh

2005 Titles

Barney

Bob the Builder

Blue’s Clues

Elmo’s World

The Wiggles

Thomas & Friends

Junior Thinkers

- Ages 4 to 6

2004 Titles

Little Red Riding Hood

Scooby-Doo

Spider-Man & Friends

The Little Mermaid

2005 Titles

Dora the Explorer

Finding Nemo

Sesame Street

Toy Story 2

Art Studio

V.Smile Smartridge Library

Well-executed television, public relations

and point-of-sale campaigns were also key

factors in the success as they effectively

conveyed the excitement, learning

benefits and features to children, parents,

other potential purchasers and influencers.

Trade confidence in VTech was enhanced,

providing a good foundation for future

growth. Support from the licensors in both

software development and marketing was

also crucial to the outperformance.

In February 2005, the business announced

the launch of the handheld version,

V.Smile Pocket, using the same

Smartridges. VTech also introduced 17

new Smartridges that included popular

children's characters from existing and

new licensors, namely HIT Entertainment,

Nickelodeon and Sesame Street, adding

further avenues of growth to this

product platform.

Growth in Traditional Product

Lines

Alongside the stunning success of V.Smile,

the traditional product lines recorded

respectable growth in revenue in both

North America and Europe. In the financial

year 2005, the Group continued to invest

in strengthening the traditional product

lines with a focus on the growing infant

and pre-school categories. VTech remains

committed to providing a broad portfolio

of ELPs to consumers that combine

learning and fun in new and exciting ways.

Effective Cost Control

In addition to the sales increase, effective

cost control contributed to the substantial

rise in profitability for the ELP business. In

particular, the Group faced the pressure

of higher resin prices, which was

mitigated by the adoption of multiple

cavity moulding that enhanced

operational efficiency.

Development of New Markets

During the financial year 2005, progress

was made in developing new markets

such as Scandinavia, where initial sales

were small but encouraging. The China

market remains under development and

progress has been relatively slow due to its

fragmented nature, different cultural

attitudes towards education and

comparatively low average income levels.

Review of Operations

A Year of

VTech's investment in offering a

comprehensive R&D service to customers

also began to show results, helping to

drive the outperformance of the CMS

business.

Contract Manufacturing

Services

>>

VTech Holdings Ltd Annual Report 2005

16

Outperformance

E

Rationalisation

xcellence

Review of Operations

VTech Holdings Ltd Annual Report 2005 17

The business received two

customer awards in the financial

year 2005 in recognition of its

quality service.

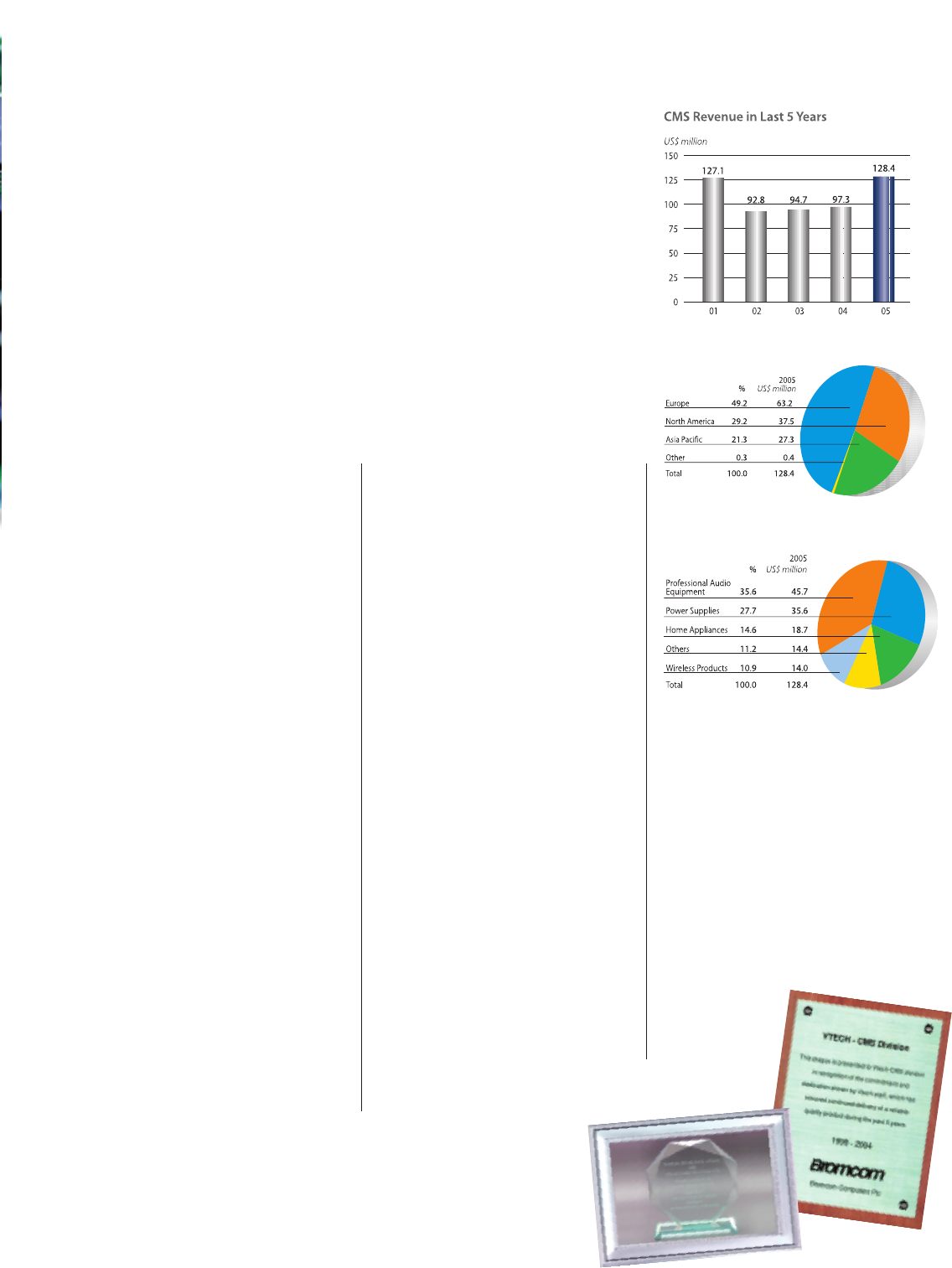

The CMS business delivered encouraging results in the

financial year 2005, achieving record revenue and

higher profit. Revenue increased by 32.0% over the

financial year 2004 to US$128.4 million, accounting for

12.6% of Group revenue, compared to 10.6% in the

financial year 2004. The percentage increase in

revenue was markedly higher than the growth of the

global EMS industry. This performance reflects VTech's

success in delivering exceptional service to its core

focus of small and medium sized customers.

Strong Demand from Existing

Customers

The rise in revenue was driven by strong

demand from existing customers, led by

the well established power supply and

professional audio equipment segments,

which together accounted for over 60% of

the total CMS revenue. A new customer

in the industrial printing sector also

contributed to the revenue growth.

Encouraging Results from R&D

Investment

VTech's investment in offering a

comprehensive R&D service to customers

also began to show results, helping to

drive the outperformance of the CMS

business. In the financial year 2005, the

R&D centre in Shenzhen came into full

operation. As a result, the business not

only helps customers improve product

design from a cost and quality perceptive,

but also takes initial concepts from first

design through to full production. During

the financial year 2005, approximately 15%

of CMS revenue was derived from business

having an R&D element.

Geographically, Europe continued to be

the largest market of the CMS business,

accounting for 49.2% of the total CMS

revenue, followed by the United States at

27.7% and Japan at 17.2%.

Good Overheads Control

During the financial year 2005, the

business was able to achieve a higher

profit, despite a slight decline in gross

margins due to changes in product mix

and pricing pressure from customers. This

was mainly because of the success in

controlling fixed overheads in spite of

higher volumes. Raw materials costs

during the period were little changed over

the previous financial year.

RoHS Compliance

VTech is committed to supporting

environmental initiatives. To comply with

the Directive 2002/95/EC on RoHS, which

will become mandatory in the European

Union in July 2006, the CMS business had

started as early as 2003 to improve its

manufacturing process. In mid-2004,

teams were established to work with

major customers on component selection,

to enable the business to speed up the

process of compliance.

Currently, the business is working with

four of the top five customers and it

targets to achieve full compliance in the

first quarter of the calendar year 2006,

ahead of the industry.

CMS Revenue by Region

CMS Revenue by Product Line

Corporate Affairs

Investor Relations

The Group is committed to a proactive

investor relations and communications

programme, and makes every effort to

ensure fair disclosure, non-selective

dissemination of material information and

clear, comprehensive reporting of

performance and business activities in a

timely manner.

Investor Briefings

During the financial year 2005, VTech

held over 30 one-on-one meetings with

investors to keep them abreast of the

latest company developments. In addition,

the Group organised site visits to its

advanced manufacturing facilities in

mainland China.

Quarterly Newsletter

The Group’s quarterly newsletter continues

to keep investors informed of the latest

developments at VTech.

Through the intranet, the global on-line

quarterly newsletter keeps staff informed

of key developments within the Group.

The Suggestion Box, which provides

another channel for feedback and

information, was widely used.

e-Corporate Culture Building

Programme

To help foster a strong and consistent

culture within the Group, in August 2004

VTech launched its annual worldwide

e-Corporate Culture Building programme.

The theme of “making a difference”

highlighted the benefits that can be found

in going beyond set ways of doing things

to achieve results. In all, more than 200

employees participated by logging on to

the special web page.

Training

As a global organisation with a worldwide

market reach, multiple language skills are

increasingly important to the workings of

the Group and during the financial year we

arranged courses in both English and

Putonghua to address this need. Computer

software and presentation skills training

were also welcomed by employees

seeking to upgrade their skills.

Staff in training class

Visit to VTech's manufacturing facilities in

Dougguan

VTech Holdings Ltd Annual Report 2005

18

Results Announcement Webcast

VTech webcasts its key financial

announcements, allowing investors

not able to be present to watch the

event, accompanied by the detailed

slide presentations.

Investor Relations Website

For both institutional and retail investors,

the corporate website www.vtech.com

provides up-to-date information on

the Group’s financial and business

developments, including press releases,

stock exchange announcements,

slide presentations and annual and

interim reports.

Employee Relations

VTech benefits from the loyalty and

enthusiasm of its employees and takes

care to maintain a motivated workforce.

Open Communications

Open communications are critical to

sound employee relations and VTech has

sought to use the latest technology to

expand the scope of its dialogue with

employees at all levels.

VTech’s intranet enables efficient

communication between the worldwide

offices, offering information on Group

developments, guidelines and policy.

Corporate Affairs

Employment Policy

VTech’s policy is to employ, retain,

promote, terminate and treat all

employees on the basis of merit,

qualifications and competence. The Group

creates a favourable work environment in

which all employees can enjoy equal

opportunities at work and avoid

discrimination on the grounds of age, sex,

status, disability or any other non-job

related factor.

Fun at Work

Fun social events designed to build team

spirit and stimulate creative thinking also

enhanced employee motivation. During

the financial year 2005, the Group

organised a number of tours, including a

one-day boat trip in Hong Kong and a

three-day tour to Macau and mainland

China over the Easter holiday. Overseas

offices also held a variety of events,

including Christmas parties and family

picnics, while the plant in mainland China

staged anniversary parties, as well as

soccer and bridge competitions.

Code of Conduct

VTech has adopted a Code of Conduct

applicable to all employees, with the aim

of promoting integrity in the conduct of

the Group’s business since October 2002.

The Code sets out VTech’s business ethics

and principles, covering issues such as

conflict of interest, occupational health

and safety, and environmental protection.

All employees are required to sign

statements confirming compliance with

the Code.

VTech and the Community

VTech creates prosperity through the

employment it provides to approximately

23,000 people from all walks of life in the

United States, Europe and Asia. VTech also

supports community initiatives in the

markets where it operates that enhance

people’s lives such as improved access to

education and lend support for individuals

in genuine need.

Summer Internships in Hong Kong

and the United States

VTech has provided summer internships

for students at universities and colleges of

education in Hong Kong, giving them the

opportunity to gain real-life experience of

the world of work. During the financial

year 2005, the internship programme

was carried out in Hong Kong and the

United States.

Hospital Donations in France

In June 2004, VTech ran a tremendously

successful email community relations

campaign in France. Emails were sent to

our contact database encouraging

consumers to visit www.vtechfrance.com

and donate 1 Euro worth of toys to

children in hospitals for each click.

Consumers participated enthusiastically

and the Group reached its target of

100,000 Euros within three weeks. VTech

donated the 100,000 Euros worth of

products and point-of-sale materials to

various public hospitals in France.

Tsunami Relief in Hong Kong

VTech organised a variety of fund-raising

activities following the tsunami that

devastated parts of South East Asia in late

2004. During the financial year 2005, the

Group made donations to the Red Cross,

while staff members made donations to

the Red Cross, UNICEF and World Vision.

VTech staff joined the football tournament

organised by KPMG

VTech donated 100,000 Euros worth of

products and point-of-sale materials to

various public hospitals in France

VTech Holdings Ltd Annual Report 2005 19

Summer internship programme was carried

out in Hong Kong and the United States

Year in Review

Electronic Learning Products

V.Smile received the “Seal of Approval”

from the National Parenting Centre in

the United States.

Me-Mo-Mo was given the

“Gold” award in technology

and innovation at the 16th

Guangzhou International

Toys and Gifts Fair in

mainland China.

Electronic Learning Products

VTech announced a partnership with Beijing

San Chen Blue Cat Toy Co., Ltd to co-develop

the Chinese electronic learning products

market under the “Blue Cat • VTech” brand.

Electronic Learning Products

V.Smile was given the “Grand Prix du Jouet”

(Toy of the Year) award in the electronic toys

category in France and the “Comenius

Medal” from the Association for Education

and Information in Germany.

Telecommunication Products

VTech Telecommunications Canada Ltd

received “The Most Improved Supplier of

the Year” award from the Basics Convey

Office Products in recognition of its

outstanding customer support.

VTech Communications, Inc won the “2003

LIMA International Licensing Excellence

Award for Best Corporate Brand Licensee of

the Year” for its AT&T branded telephone

product line. This award was presented by

the International Licensing Industry

Merchandisers’ Association (LIMA).

Telecommunication Products

VTech Telecommunication Ltd was awarded a

plaque of recognition by Deutsche Telekom for

surpassing the “one

million mark” in

supplying the company

with DECT phones.

Electronic Learning Products

The V.Smile launch campaign was

successfully held in New York,

Dallas and Chicago, laying the

foundation for strong reception

of the product.

Electronic Learning Products

Time magazine released its “coolest

inventions” guide for 2004, and V.Smile

was one of the only five toys featured in

the “Tech Buyer’s Guide”.

Contract Manufacturing Services

The business launched a programme called

“Implementation of Restriction of Hazardous

Substances directive in VTech”, with the

target to convert all customer products

compliant with the RoHS directive by the

first quarter of the calendar year 2006.

The business designed and launched a new

product called “Aged Care Phone System” for

a European customer.

Electronic Learning Products

V.Smile was named the “Ultimate Toy”

in the Educational and Learning category

by the Toy Wishes magazine in the

United States.

VTech Holdings Ltd Annual Report 2005

20

Year in Review

Contract Manufacturing Services

VTech Communications Ltd was

recognised by Bromcom Computer Plc for

the continued delivery of reliable and

quality products over the past five years.

The business also received a Supplier

Excellence Award 2003 from Soundcraft.

Electronic Learning Products

V.Smile received the

2004 National Parenting

Publications Award (NAPPA)

in the United States.

Electronic Learning Products

Play and Learn Fun Fair was awarded

“Toy of the Year” in the September issue

of American Baby magazine.

Corporate

VTech Chairman and

Group CEO, Mr. Allan

Wong, was presented

the prestigious

“Industrialist of the Year

Award 2004” by the Federation of Hong

Kong Industries to recognise his significant

contributions to the industry and

the community.

Electronic Learning Products

V.Smile was the winner in the Dutch Toy of

the Year Election 2004.

V.Smile was named one of the 2004 “Hot

Dozen” Hottest Holiday Products by the

Toy Wishes magazine in the United States.

VTech (China) Trading Ltd was given the

“Outstanding Toy Enterprise in China”

award by the China Toy Association in

recognition of its achievements and

contributions to the toy industry.

Electronic Learning Products

V.Smile was awarded the “Electronic

Learning Toy of the Year” by The Toy

Retailers Association at the London Toy Fair.

Telecommunication Products

VTech participated in the 2005 Consumer

Electronics Show (CES) in

Las Vegas, introducing 23

new cordless phones to

customers, including

the first-ever fully

integrated VoIP

broadband phones.

Electronic Learning Products

V.Smile and V.Smile Pocket were presented

the “Toy Innovations Award 2005 - Learning

Category” at the Nuremberg International

Toy Fair in Germany.

V.Smile was awarded the “Best Overall Toy

of the Year” and the “Best Educational Toy of

the Year” by the

US

Toy Industry Association

(TIA), bringing the total

US

V.Smile awards

to 21.

V.Smile Pocket, a

handheld educational

video game system,

was unveiled at

international toy fairs in

Germany and the

United States.

Contract Manufacturing Services

The business designed and launched a

bluetooth communication product for a

Japanese customer.

Electronic Learning Products

VTech was given “2004 Vendor of the Year

Award” by Toys “R” Us.

Telecommunication Products

VTech Telecommunication Ltd received the

“2004 Outstanding Quality Manufacturer

of the Year” award

from RadioShack.

VTech Holdings Ltd Annual Report 2005 21

Corporate Governance

22 VTech Holdings Ltd Annual Report 2005

VTech is committed to maintaining a strong system of corporate

governance so that all business activities and decision-making

can be properly regulated. The Stock Exchange of Hong Kong

Limited (the “Hong Kong Stock Exchange”) has promulgated a

new Code on Corporate Governance Practices (the “Code”)

which came into effect in January 2005. The Company has

already put in place corporate governance practices to meet all

the provisions of the Code except for the combined role of

Chairman and Chief Executive Officer. The Company has also

complied with, to a certain extent, the recommended best

practices in the Code. Throughout the year ended 31st March

2005, the Company complied with the Code of Best Practice as

set out in Appendix 14 of The Rules Governing the Listing of

Securities on the Hong Kong Stock Exchange (the “Listing

Rules") except for the appointment of non-executive directors

for a specific term despite the one-third rotational provision

(other than the Chairman) under the existing Company’s Bye-

laws. At the forthcoming annual general meeting, the directors

proposed a special resolution to amend the existing Bye-laws of

the Company so that every director is subject to retirement by

rotation at least once every three years in compliance with the

provisions of the Code.

Board of Directors For the year ended 31st March 2005,

the Board of Directors (the “Board”) comprised two executive

directors and four independent non-executive directors. The

independent non-executive directors are high calibre executives

with diversified industry expertise and bring a wide range of

skills and experience to the Group. They bring independent

judgement on issues of strategy, performance, risk and people

through their contribution at board meetings. The Board

considers that four non-executive directors, more than one third

of the Board, are independent in character and judgement and

they also meet the independence criteria set out in Rule 3.13 of

the Listing Rules. All non-executive directors are required to

submit themselves for re-election at least every three years.

Biographical details of all directors are set out on page 24.

Each of the independent non-executive directors has made an

annual confirmation of independence pursuant to Rule 3.13 of

the Listing Rules.

The Board’s focus is on the formulation of business strategy and

policy, and on control. Matters reserved for the Board are those

affecting the Company’s overall strategic policies, finances and

shareholders. These include: financial statements, dividend

policy, the annual operating budgets, major investments and

board memberships.

Four board meetings at approximately quarterly interval are

scheduled for 2005/2006 with other meetings as necessary. All

Directors have access to the advice and services of the Company

Secretary and independent professional advice may be taken by

the Directors as required.

The Directors acknowledge their responsibility for preparing the

financial statements of the Group that give a true and fair view

of the state of affairs of the Group and of the results and cash

flow for the period. In preparing the financial statements for the

year ended 31st March 2005, the Directors have:

• Selected suitable accounting policies and applied them

consistently;

• Made judgements and estimates that are prudent and

reasonable; and have prepared the accounts on a going

concern basis.

The Directors are responsible for keeping proper accounting

records, for safeguarding the assets of the Group and for taking

reasonable steps for the prevention and detection of fraud and

other irregularities.

The following paragraphs describe the key governance

structures operating in the Group under the overall direction of

the Board.

Corporate Governance

23

VTech Holdings Ltd Annual Report 2005

Board of Management For the year ended 31st March

2005, the Board of Management has been delegated the

authority by the Board of Directors to be responsible for the

management of all business activities of the Group. Its members

are appointed by the Board from time to time and comprises

executive directors and senior management executives.

Model Codes for Securities Transactions The

Company has adopted the Model Codes as set out in Appendix

10 of the Listing Rules and Appendix to Chapter 16 of the

Listing Rules of the Financial Services Authority in the United

Kingdom (the “UK Listing Rules”) regarding securities

transactions by directors and senior management in relation to

the accounting period covered by the Annual Report. After

specific enquiry, all directors of the Company confirmed that

they have complied with the required standard of dealings set

out therein.

Audit Committee The Audit Committee comprising three

independent non-executive directors, has been established to

assist the Board in fulfilling its oversight responsibilities for

financial reporting, risk management and evaluation of internal

controls and auditing processes. It also ensures that the Group

complies with all applicable laws and regulations. Terms of

reference of the Audit Committee which have been adopted by

the Audit Committee are posted on the Company’s website.

Mr. Raymond CH’IEN Kuo Fung, being a member of the Audit

Committee, has the appropriate financial management

expertise. The Audit Committee meets at least twice a year to

receive reports from external auditors, reviews the interim and

annual financial statements, and receives regular reports from

the internal audit functions. The meetings deal with the matters

of significance arising from the work conducted since the

previous meeting and are attended by the Chairman, Chief

Compliance Officer, Group Chief Financial Officer and external

auditors.

Risk Management Committee The Board has the

overall responsibility for internal control, including risk

management, and sets appropriate policies having regard to the

objectives of the Group. Executive directors and management

has the responsibility for the identification, evaluation and

management of financial and non-financial risks and for the

implementation and maintenance of control systems across the

Group in accordance with Group policies. The Risk Management

Committee, comprising the executive directors, assists the Audit

Committee in reviewing and assessing the number and

seriousness of findings raised by the Internal Audit

Department and also the corrective actions taken by the

relevant departments.

The Group maintains controls to safeguard the Group’s assets

and ensure that transactions are executed in accordance with

management’s authorisation. The information systems in place

are designed to ensure that the financial report is reliable.

Remuneration Committee The Remuneration

Committee comprises three independent non-executive

directors. It is responsible for reviewing and recommending all

elements of the executive directors and senior management

remuneration. The remuneration for the non-executive directors

is determined by the Board. Terms of reference of the

Remuneration Committee which have been adopted by the

Remuneration Committee are posted on the Company’s

website.

Bye-laws of the Company At the annual general

meeting held on 13th August 2004, the shareholders had

passed a special resolution to amend the Company’s Bye-laws

to reflect the amendments to Appendix 3 to the Listing Rules

which came into effect on 31st March 2004. The Company has

instituted changes to implement the retirement by rotation for

all Directors at least once every three years (including those

appointed for a specific term) by proposing to amend its Bye-

laws in the forthcoming annual general meeting in accordance

with the Code.

Directors and Senior Management

24 VTech Holdings Ltd Annual Report 2005

Profile of Directors

Allan WONG Chi Yun, JP, aged 54,

Chairman and Group Chief Executive

Officer, co-founded the Group in 1976.

Dr. WONG holds a Bachelor of Science

degree in Electrical Engineering from the

University of Hong Kong, a Master of

Science degree in Electrical and

Computer Engineering from the

University of Wisconsin and an

honourary degree of Doctor of

Technology from the Hong Kong

Polytechnic University. Dr. WONG is the

Chairman of the Hong Kong Applied

Science and Technology Research

Institute and an ex-officio member of

the Steering Committee on Innovation

and Technology. He is also a council

member of the University of Hong Kong,

an independent non-executive director

of the Bank of East Asia Limited, China-

Hongkong Photo Products Holdings

Limited and Li & Fung Limited.

Albert LEE Wai Kuen, aged 54, Deputy

Chairman, joined the Group in 1984 and

became a director in the same year.

Before joining the Group, he ran his own

electronics manufacturing service

company for two years and was a

manager of a computer chess game

manufacturing company for three years.

Mr. LEE holds a Bachelor of Science

degree in Electrical Engineering from the

University of Calgary.

Raymond CH’IEN Kuo Fung, GBS,

CBE, JP, aged 53, is Independent Non-

executive Director since November 2001.

Dr. CH’IEN is the Executive Chairman and

CEO of CDC Corporation as well as

Chairman of its subsidiary, China.com Inc.

He is also the Chairman of MTR

Corporation Limited. Dr. CH’IEN serves on

the boards of HSBC Holdings plc, the

Hongkong and Shanghai Banking

Corporation Limited, Inchcape plc,

Convenience Retail Asia Limited and The

Wharf (Holdings) Limited. In public

service, Dr. CH’IEN is the Chairman of the

Advisory Committee on Corruption of

the Independent Commission Against

Corruption and the Chairman of the

Hong Kong/European Union Business

Cooperation Committee and is a Hong

Kong member of the APEC Business

Advisory Council. He received a doctoral

degree in Economics from the University

of Pennsylvania, USA in 1978. He was

appointed a Justice of the Peace in 1993

and a Commander in the Most Excellent

Order of the British Empire in 1994 and

awarded the Gold Bauhinia Star Medal in

1999.

William FUNG Kwok Lun, OBE, JP,

aged 56, is Independent Non-executive

Director since November 2001. Dr. FUNG

is the Group Managing Director of Li &

Fung Limited and has held key positions

in major trade associations. He is past

Chairman of the Hong Kong General

Chamber of Commerce, the Hong Kong

Exporters’ Association and the Hong

Kong Committee for the Pacific

Economic Cooperation Council. He

currently serves as a member of the

Economic and Employment Council of

the Hong Kong SAR. Dr. FUNG holds a

Bachelor of Science in Engineering from

Princeton University, and an MBA degree

from the Harvard Graduate School of

Business. He has been awarded an

Honourary Doctorate degree of Business

Administration by the Hong Kong

University of Science and Technology.

Dr. FUNG is also a non-executive director

of Convenience Retail Asia Limited,

Integrated Distribution Services Group

Limited, HSBC Holdings plc, CDC

Corporation and CLP Group

Holdings Limited.

Michael TIEN Puk Sun, BBS, JP, aged

54, is Independent Non-executive

Director since November 2001. Mr. TIEN is

the Chairman and founder of the G2000

Group which starts its business back in

1979. Before starting up G2000, he

worked with Macy’s Department Store in

New York, USA. Mr. TIEN is an active

member in Hong Kong community

affairs, holding posts like the Chairman

of the Standing Committee on Language

Education and Research; the Chairman of

the Employee Retraining Board and a

member of the Education Commission.

Mr. TIEN was appointed as the Chairman

of Kowloon-Canton Railway Corporation

in December 2001.

Patrick WANG Shui Chung, JP, aged

54, is Independent Non-executive

Director since November 2001. Dr. WANG

received an Honourary Doctorate of

Engineering from Purdue University in

Indiana, USA in May 2004. He earned

both his BSc and MSc degrees in

Electrical Engineering from Purdue

University in 1972. Dr. WANG is a

member of the Exchange Fund Advisory

Committee of the Hong Kong Monetary

Authority. He is currently the Chairman

and Chief Executive Officer of Johnson

Electric Holdings Limited and also a non-

executive director of The Hongkong and

Shanghai Banking Corporation Limited

and Tristate Holdings Limited.

Profile of Senior Management

Telecommunication Products

Kent WONG Wah Shun, aged 42,

Chief Operating Officer of

Telecommunication Products Business,

is responsible for overall business

operations including manufacturing

operations, product management and

Directors and Senior Management

25

VTech Holdings Ltd Annual Report 2005

development. Mr. WONG joined VTech in

1989 and over the years has held

management positions in a number of

areas including business development,

engineering, operations and quality

assurance. Mr. WONG holds a Master

degree in Engineering, a Master degree

in Engineering Management and an

MBA degree. Mr. WONG is a Chartered

Engineer, holding a Membership of

Institute of Electrical Engineer, and

Fellowship of Chartered Management

Institute, UK.

Nicholas P. DELANY, aged 53, Senior

Vice President, is responsible for the

Telecommunication Products Business in

US specifically sales, customer support,

business intelligence processes, supply

chain, logistics and IT. Prior to joining

VTech in 2000, Mr. DELANY had over 20

years sales and management experience

in the industrial, retail, construction and

mining industries in Asia, Europe and

South Africa. He also has seven years of

experience in developing supply chain

systems with leading corporations in

North America including The Stanley

Works, Inc. Mr. DELANY holds a Bachelor

degree in Marketing and Financial

Management from the University of

South Africa & Damlein College.

Gary TAM Wai Keung, aged 41, Vice

President and General Manager of

International Sales and Market

Development, is responsible for the

development of the Telecommunication

Products Business sales and marketing

activities in Europe, South America and

other international markets outside of

North America. He is also responsible for

ODM (Original Design Manufacturing)

business activities worldwide. Mr. TAM

joined VTech in 1986 and he held

management positions in a number of

areas including operations, and sales and

marketing. He holds a Bachelor degree in

Electronics from Chinese University of

Hong Kong and an MBA degree from

Strathclyde Business School, UK.

Gordon CHOW, aged 49, President of

VTech Telecommunications Canada

Limited, is responsible for the

Telecommunication Products Business in

Canada. He established the Canadian

operations in 1986. Mr. CHOW holds a

Bachelor of Commerce degree from the

University of British Columbia and is a

member of the Institute of Chartered

Accountants of British Columbia. He is a

member of the Board of Governors of

Crofton House School in Vancouver.

Mr. CHOW has served as a member of

the President’s Advancement Council of

British Columbia Institute of Technology

and a director of the BCIT Foundation.

He was also a member of the Royal

Roads University — MBA Advisory

Board and a director of the Canadian

Toy Association.

Gary ROGALSKI, aged 42, Vice

President of Engineering, is responsible

for the Telecommunication Products

Business research and development

activities in Vancouver, Canada. He leads

a team based in Vancouver that develop

5.8GHz digital telephony products as

well as other voice and data

transmission technologies. Mr. ROGALSKI

joined VTech in 1988 and has 20 years of

engineering research and development

experience in the telecommunications

industry. He holds a Diploma in

Telecommunications from British

Columbia Institute of Technology.

Stanley M. HARTSTEIN, aged 48, Vice

President of Business Development, is

responsible for the development of new

business activities including the

establishment of strategic relationships

with leading VoIP service providers and

identification of innovative VoIP hardware

solutions. He further coordinates the

Telecommunication Products Business

day to day relationship with AT&T Corp.

and manages VTech’s US legal activity and

Be Connected subsidiary. Mr. HARTSTEIN

has over 23 years experience in the

consumer electronics industry. Prior to

joining VTech in 2000, he held a number

of management positions at Sony Corp.,

AT&T Corp. and Lucent Technologies Inc.

Mr. HARTSTEIN holds a Bachelor degree in

Accounting from the State University of

New York.

Paulina AU King Lun, aged 35,

Divisional Financial Controller, is

responsible for financial and accounting

control of the Telecommunication

Products Business. Ms. AU has over 11

years of experience in professional

accounting and finance and prior to

joining VTech in 2000, she worked with

PricewaterhouseCoopers as an audit

manager. Ms. AU holds a Bachelor degree

in Accountancy from City University of

Hong Kong and a Master degree in

Applied Finance from Macquarie

University, Australia. She is a Fellow

Member of Association of Chartered

Certified Accountants and an Associate

Member of Hong Kong Institute of

Certified Public Accountants.

Electronic Learning Products

William TO, aged 49, President of VTech

Electronics North America, L.L.C., joined

the Group in 1983. Mr. TO is responsible

for the Group’s Electronic Learning

Products Business in the United States of

America and Canada. He holds a Master

degree in Business Administration from

the University of Chicago.

Directors and Senior Management

26 VTech Holdings Ltd Annual Report 2005

Andrew DICKSON, aged 44, Chief

Executive Officer of Northern Europe

operation of Electronic Learning Products

Business, joined the Group in November

2001. Mr. DICKSON is responsible for the

Group’s electronic learning products

business in the United Kingdom and

Scandinavia. With over 16 years of

experience in sales and marketing of

consumer durable products and

operational management experience in

marketing, finance and logistical

functions, he had been the United

Kingdom Managing Director of IDTUK

(Oregon Scientific UK Limited) previous to

that was Sales Director with Texas

Instruments Incorporated. Mr. DICKSON

graduated from Royal College of Music

and attended Insead International School

of Management.

Gilles SAUTIER, aged 49, Chief Executive

Officer of operations in Southern Europe,

Luxembourg and Netherlands of

Electronic Learning Products Business,

joined the Group in November 2000 and

is responsible for the Group’s electronic

learning products business in France,