74922_002_Spansion_bmk.ps 2050 XXK Annual Report Placeholder

User Manual: 2050 XXK

Open the PDF directly: View PDF ![]() .

.

Page Count: 204 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- TABLE OF CONTENTS

- QUESTIONS AND ANSWERS

- ITEM 1ELECTION OF DIRECTORS

- CORPORATE GOVERNANCE

- COMMITTEES AND MEETINGS OF THE BOARD OF DIRECTORS

- DIRECTOR COMPENSATION

- SECURITY OWNERSHIP

- SECTION 16 a BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

- EXECUTIVE OFFICERS

- EXECUTIVE COMPENSATION

- EQUITY COMPENSATION PLAN INFORMATION

- ITEM 2RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

- CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

- AUDIT COMMITTEE REPORT

- OTHER MATTERS

- ANNUAL REPORT AND FINANCIAL STATEMENTS

- INDEX

- PART I

- PART II

- ITEM 5 MARKET FOR REGISTRANT'S COMMON EQUITY RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

- ITEM 6 SELECTED FINANCIAL DATA

- ITEM 7 MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

- ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

- ITEM 8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

- ITEM 9 CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

- ITEM 9A CONTROLS AND PROCEDURES

- ITEM 9B OTHER INFORMATION

- PART III

- ITEM 10 DIRECTORS EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

- ITEM 11 EXECUTIVE COMPENSATION

- ITEM 12 SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

- ITEM 13 CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

- ITEM 14 PRINCIPAL ACCOUNTANT FEES AND SERVICES

- PART IV

Spansion Inc.

2008 Proxy Statement

and

2007 Annual Report on Form 10-K

April 9, 2008

Dear Stockholder:

On behalf of the Board of Directors, you are cordially invited to attend the 2008 Annual Meeting of

Stockholders of Spansion Inc. to be held at the Four Seasons Hotel, 2050 University Avenue, East Palo Alto,

California, on Tuesday, May 27, 2008 at 11:00 a.m., local time. The formal notice of the Annual Meeting appears

on the following page. The attached Notice of Annual Meeting and Proxy Statement describe the matters that we

expect to be acted upon at the Annual Meeting and provide additional information for stockholders.

During the Annual Meeting, stockholders will hear a presentation by Spansion and have the opportunity to

ask questions. Whether or not you plan to attend the Annual Meeting, it is important that your shares be

represented. Please vote as soon as possible. You may vote via the Internet, by telephone or by mailing a

completed proxy card as an alternative to voting in person at the Annual Meeting. Voting by any of these

methods will ensure your representation at the Annual Meeting.

We encourage you to sign up for electronic delivery of future proxy materials in order to conserve natural

resources and help us reduce printing costs and postage fees. For more information, please see “Questions and

Answers” in the Proxy Statement.

We urge you to carefully review the proxy materials and to vote FOR the director nominees and FOR the

ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for

the current fiscal year.

We look forward to seeing you at the Annual Meeting.

/s/ Dr. Bertrand F. Cambou

Dr. Bertrand F. Cambou

President and Chief Executive Officer

SPANSION INC.

915 DeGUIGNE DRIVE

P.O. BOX 3453

SUNNYVALE, CALIFORNIA 94088

NOTICE OF 2008 ANNUAL MEETING OF STOCKHOLDERS

We will hold the 2008 Annual Meeting of Stockholders of Spansion Inc. at the Four Seasons Hotel, 2050

University Avenue, East Palo Alto, California, on Tuesday, May 27, 2008. The meeting will start at 11:00 a.m.

local time. At the Annual Meeting, our stockholders will be asked to:

1. Elect two Class A directors to serve for a three-year term expiring at the 2011 annual meeting of

stockholders;

2. Elect one Class C director to serve for a three-year term expiring at the 2011 annual meeting of

stockholders;

3. Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for

the current fiscal year; and

4. Transact any other business that properly comes before the meeting and any postponement or

adjournment of the Annual Meeting.

Only record holders of Common Stock at the close of business on March 31, 2008, the record date for the

Annual Meeting, are entitled to receive notice of and to vote on all matters submitted to a vote of stockholders at

the Annual Meeting. Only record holders of the Class A Common Stock are entitled to vote on the election of the

Class A directors, and only record holders of Class C Common Stock are entitled to vote on the election of the

Class C director. Record holders of all classes of Common Stock are entitled to vote as a single class on all other

matters submitted to a vote of the stockholders. Stockholders are urged to read the attached proxy statement

carefully for additional information concerning the matters to be considered at the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. Stockholders who plan to

attend in person are nevertheless requested to vote online, by telephone, or by signing and returning their proxy

cards to make certain that their vote will be represented at the Annual Meeting should they unexpectedly be

unable to attend.

By Order of the Board of Directors,

/s/ Robert C. Melendres

ROBERT C. MELENDRES

Corporate Secretary

This proxy statement and accompanying proxy card are first being distributed on or about April 9, 2008.

YOUR VOTE IS IMPORTANT.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, WE URGE YOU TO VOTE

ONLINE AT PROXYVOTE.COM, BY TELEPHONE, OR COMPLETE, SIGN AND DATE THE

ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENVELOPE PROVIDED.

VOTING ONLINE, BY TELEPHONE, OR BY RETURNING YOUR PROXY CARD WILL ENSURE

THAT YOUR VOTE IS COUNTED IF YOU LATER DECIDE NOT TO ATTEND THE MEETING.

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ............................................................. 1

ITEM 1—ELECTION OF DIRECTORS ...................................................... 5

CORPORATE GOVERNANCE ............................................................. 8

COMMITTEES AND MEETINGS OF THE BOARD OF DIRECTORS ............................. 13

DIRECTORCOMPENSATION............................................................. 16

SECURITY OWNERSHIP ................................................................. 19

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE ........................ 22

EXECUTIVE OFFICERS .................................................................. 22

EXECUTIVECOMPENSATION ........................................................... 24

EQUITY COMPENSATION PLAN INFORMATION ........................................... 46

ITEM 2—RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ........ 47

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS ................................ 49

AUDIT COMMITTEE REPORT ............................................................ 59

OTHER MATTERS ...................................................................... 59

ANNUAL REPORT AND FINANCIAL STATEMENTS ......................................... 59

SPANSION INC.

PROXY STATEMENT

2008 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS

1. Q: WHO IS SOLICITING MY VOTE?

A: This proxy solicitation is being made by the Board of Directors of Spansion Inc. All expenses of

soliciting proxies, including clerical work, printing and postage, will be paid by us. Our directors,

officers and other employees may solicit proxies in person, by mail, by telephone, by facsimile,

through the Internet or by other means of communication, but such persons will not be specifically

compensated for such services.

2. Q: WHEN WAS THIS PROXY STATEMENT MAILED TO STOCKHOLDERS?

A: This proxy statement was first mailed to stockholders on or about April 9, 2008.

3. Q: WHAT MAY I VOTE ON?

A: Spansion stockholders may vote as follows:

• Holders of Class A Common Stock may vote on the election of two director nominees, Dr. Bertrand

F. Cambou and Mr. David E. Roberson, to serve as Class A Directors on our Board of Directors;

• The holder of Class C Common Stock may vote on the election of one director nominee, Mr. Gilles

Delfassy, to serve as Class C Director on our Board of Directors; and

• Holders of Class A Common Stock and Class C Common Stock, voting together as a single class,

may vote on the ratification of the appointment of Ernst & Young LLP as our independent

registered public accounting firm for the current fiscal year.

4. Q: HOW DOES THE BOARD OF DIRECTORS RECOMMEND I VOTE ON THE PROPOSALS?

A: The Board recommends that you vote:

• FOR each of the director nominees; and

• FOR ratification of the appointment of Ernst & Young LLP as our independent registered public

accounting firm for the current fiscal year.

5. Q: WHO IS ENTITLED TO VOTE?

A: Stockholders as of the close of business on March 31, 2008, the Record Date, are entitled to vote on all

items properly presented at the Annual Meeting for which they are eligible to vote. On the Record

Date, 158,323,770 shares of our Class A Common Stock and one share of our Class C Common Stock

were outstanding. Our Class B Common Stock and Class D Common Stock have been retired and no

shares are outstanding. Consequently, the only stockholders entitled to vote are record holders of

shares of Class A Common Stock and Class C Common Stock (together, the “Common Stock”). Every

stockholder is entitled to one vote for each share of Common Stock held. A list of these stockholders

will be available during ordinary business hours at the principal place of business of Spansion, located

at 915 DeGuigne Drive, Sunnyvale, California 94085-3836, at least ten days before the Annual

Meeting. The list of stockholders will also be available at the time and place of the Annual Meeting.

1

6. Q: HOW DO I VOTE BY MAIL?

A: If you complete and properly sign each proxy card you receive and return it to us in the prepaid

envelope, it will be voted by one of the individuals indicated on the card (your “proxy”) as you direct.

If you return your signed proxy card but do not mark the boxes showing how you wish to vote, your

shares will be voted FOR the election of the director nominees and FOR the ratification of the

appointment of our auditors. If your shares are held by your broker, see question 12 below.

7. Q: CAN I VOTE BY TELEPHONE OR ELECTRONICALLY?

A: If you live in the United States or Canada, you may submit your proxy by following the Vote by

Telephone instructions on the proxy card. If you have Internet access, you may submit your proxy

from any location in the world by following the Vote by Internet instructions on the proxy card.

8. Q: WHO CAN ATTEND THE ANNUAL MEETING?

A: Only stockholders as of the Record Date, holders of proxies for those stockholders and other persons

invited by us can attend. If your shares are held by your broker in “street name,” you must bring a

letter from your broker or a copy of your proxy card to the meeting showing that you were the direct

or indirect beneficial owner of the shares on the Record Date to attend the meeting.

9. Q: CAN I VOTE AT THE MEETING?

A: Yes. If you attend the meeting and plan to vote in person, we will provide you with a ballot at the

meeting. If your shares are registered directly in your name, you are considered the stockholder of

record and have the right to vote in person at the meeting. If your shares are held by your broker in

“street name,” you are considered the beneficial owner of the shares held in street name. As a

beneficial owner, if you wish to vote at the meeting, you must bring to the meeting a legal proxy from

your broker showing that you were the beneficial owner of the shares on the Record Date and are

authorized to vote those shares.

10. Q: CAN I CHANGE MY VOTE AFTER I RETURN MY PROXY CARD OR AFTER I HAVE

VOTED BY TELEPHONE OR ELECTRONICALLY?

A: Yes. You may change your vote at any time before the voting concludes at the Annual Meeting by:

• Sending in another proxy with a later date by mail, telephone or over the Internet;

• Notifying our Corporate Secretary in writing before the Annual Meeting that you wish to revoke

your proxy; or

• Voting in person at the Annual Meeting.

11. Q: HOW DO I VOTE MY SHARES IF THEY ARE HELD IN STREET NAME?

A: If your shares are held by your broker in “street name,” you will receive a form from your broker

seeking instruction as to how your shares should be voted. We urge you to complete this form and

instruct your broker how to vote on your behalf. You can also vote in person at the Annual Meeting,

but you must bring a legal proxy from the broker showing that you were the beneficial owner of your

shares on the Record Date and are authorized to vote the shares.

12. Q: WHAT IS BROKER “DISCRETIONARY” VOTING?

A: If you hold your shares through a broker, your broker is permitted to vote your shares on routine

“discretionary” items, such as the election of directors and ratification of our independent registered

public accounting firm, if it has transmitted the proxy materials to you and has not received voting

instructions from you on how to vote your shares before the deadline set by your broker.

2

13. Q: WHAT IS A “QUORUM?”

A: A “quorum” is a majority of the outstanding shares of Common Stock. They may be present at the

Annual Meeting or represented by proxy. There must be a quorum for the Annual Meeting to be held.

If you submit a properly executed proxy card, even if you abstain from voting, you will be considered

part of the quorum. Broker “non-votes” are also considered a part of the quorum. Broker non-votes

occur when a broker holding shares for a beneficial owner does not vote on a particular matter

because the broker does not have discretionary voting power with respect to that item and has not

received voting instructions from the beneficial owner.

14. Q: HOW ARE MATTERS PASSED OR DEFEATED?

A: The director nominees receiving the highest number of affirmative votes from holders of our Class A

Common Stock and the affirmative vote of the holder of our Class C Common Stock will be elected

as Class A directors and a Class C director, respectively. A properly executed proxy marked

“WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted

with respect to the director or directors indicated, although it will be counted for purposes of

determining whether there is a quorum.

Ratification of the appointment of our independent registered public accounting firm must receive

affirmative votes from more than 50 percent of the shares of Common Stock that are present in

person or represented by a proxy and entitled to vote on that proposal at the Annual Meeting. In

tabulating the voting results for any particular proposal, shares that constitute broker non-votes are

not considered entitled to vote on that proposal. However, abstentions and broker non-votes will be

treated as shares present for the purpose of determining the presence of a quorum for the transaction

of business. As a result, abstentions will have the same effect as negative votes and broker non-votes

are not counted for purposes of determining whether stockholder approval of the matter has been

obtained.

15. Q: WHO WILL COUNT THE VOTES?

A: Votes will be tabulated by Computershare Trust Company, N.A.

16. Q: HOW WILL VOTING ON ANY BUSINESS NOT DESCRIBED IN THE NOTICE OF

ANNUAL MEETING BE CONDUCTED?

A: We do not know of any business to be considered at the Annual Meeting other than the proposals

described in this proxy statement. If any other business is presented at the Annual Meeting, your

signed proxy card gives authority to Dr. Bertrand F. Cambou, our President and Chief Executive

Officer, and Mr. Robert C. Melendres, our Executive Vice President, Business Development, Chief

Legal Officer and Corporate Secretary, to vote on such matters at their discretion.

17. Q: HOW CAN I OBTAIN ELECTRONIC COPIES OF THE PROXY MATERIALS FOR THE

2008 ANNUAL MEETING?

A: This proxy statement and Spansion’s Annual Report on Form 10-K for Fiscal 2007 are available

electronically at the Investor Relations page of our website at investor.spansion.com/

2008_Proxy_Statement.

18. Q: HOW CAN I ELECT TO RECEIVE FUTURE PROXY MATERIALS ELECTRONICALLY?

A: We strongly encourage you to elect to receive future proxy materials electronically in order to

conserve natural resources and to help us reduce printing costs and postage fees. With electronic

delivery, you will be notified via e-mail as soon as the proxy materials are available on the Internet,

and you can submit your votes online. To sign up for electronic delivery:

• Go to our website at investor.spansion.com/2008_Proxy_Statement;

3

• Click on “Electronic Proxy Statement;” and

• Follow the directions provided to complete your enrollment.

Once you enroll for electronic delivery, you will receive proxy materials electronically as long as

your account remains active or until you cancel your enrollment.

19. Q: WHEN ARE THE STOCKHOLDER PROPOSALS FOR THE 2009 ANNUAL MEETING

DUE?

A: In accordance with the rules of the Securities and Exchange Commission, in order for stockholder

proposals to be considered for inclusion in the proxy statement for the 2009 Annual Meeting, they

must be submitted in writing to our Corporate Secretary, Spansion Inc., 915 DeGuigne Drive, P.O.

Box 3453, Sunnyvale, California 94088 on or before December 10, 2008. In addition, our bylaws

provide that for directors to be nominated or other proposals to be properly presented at a

stockholders meeting, an additional notice of any nomination or proposal must be received by us

between February 26, 2009 and March 28, 2009. However, if our 2009 Annual Meeting is not within

30 days of May 27, 2009, to be timely, the notice by the stockholder must be received by our

Corporate Secretary not later than the close of business on the tenth day following the day on which

the first public announcement of the date of the Annual Meeting was made or the notice of the

meeting was mailed, whichever occurs first. More information on our bylaws and a description of the

information that must be included in the stockholder notice is included in this proxy statement

beginning on page 8 under the heading “Consideration of Stockholder Nominees for Director.”

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

2008 ANNUAL STOCKHOLDERS MEETING TO BE HELD ON MAY 27, 2008.

The proxy statement to security holders is available at investor.spansion.com/2008_Proxy_Statement.

4

ITEM 1—ELECTION OF DIRECTORS

General

Our Board of Directors currently consists of nine directors. Our Certificate of Incorporation provides that

the Board of Directors consists of three classes of directors, each serving staggered three-year terms. At each

annual meeting of stockholders, directors will be elected for a term of three years to succeed those directors

whose terms are expiring.

Our Certificate of Incorporation also provides that, subject to each holder’s aggregate ownership interest in

Spansion, the holders of Class C Common Stock, voting together as a separate class, are entitled to vote for one

director to the Board (the “Class C Director”). As the sole holder of our Class C Common Stock, Fujitsu

Microelectronics Limited, a wholly owned subsidiary of Fujitsu Limited, has the right to elect the Class C

Director. The holders of Class A Common Stock, voting together as a separate class, are entitled to vote for all

other directors to the Board (the “Class A Directors”).

Classified Board

Our Board of Directors is currently composed of the following classes of directors:

Class Expiration Member

Class I 2009 David K. Chao (Class A Director)

Robert L. Edwards (Class A Director)

Donald L. Lucas (Class A Director)

Class II 2010 Boaz Eitan (Class A Director)

Patti S. Hart (Class A Director)

John M. Stich (Class A Director)

Class III 2008 Bertrand F. Cambou (Class A Director)

Gilles Delfassy (Class C Director)

David E. Roberson (Class A Director)

Election of Class III Directors

At the Annual Meeting, three directors will be elected for a three-year term, which expires at our 2011

Annual Meeting of Stockholders, until their successors are duly elected and qualified in accordance with our

bylaws. Two of the nominees, Dr. Cambou and Mr. Roberson, are presently member of our Board of Directors

and serve as Class A Directors. Mr. Delfassy, who is also a nominee and presently a member of our Board of

Directors, serves as a Class C Director. Upon the recommendation of the Nominating and Corporate Governance

Committee, the Board of Directors has nominated Dr. Cambou, Mr. Delfassy and Mr. Roberson for re-election as

Class III directors. See “Nominees” below. If Dr. Cambou, Mr. Delfassy or Mr. Roberson should be unable or

decline to serve at the time of the Annual Meeting, the persons named as proxies on the proxy card will vote for

such substitute nominee(s) as our Board of Directors recommends, or vote to allow the vacancy created thereby

to remain open until filled by our Board of Directors. The Board of Directors has no reason to believe that the

nominees will be unable or decline to serve as directors if elected.

The Board of Directors recommends that the holders of Class A Common Stock vote in favor of the election

of Dr. Cambou and Mr. Roberson as Class A Directors and that the holder of Class C Common Stock vote in

favor of the election of Mr. Delfassy as a Class C Director. Proxies received will be voted “FOR” the nominees

named below, unless marked to the contrary.

Nominees

The following director nominees are standing for election by the holders of our Class A Common Stock:

Bertrand F. Cambou, age 52, has served as our President and Chief Executive Officer since July 2003. From

July 2003 until November 2005, he served as a member of Spansion LLC’s Board of Managers. Since November

5

2005, he has served as a Class A Director. Beginning in January 2002 until December 2005, he served as a vice

president of Advanced Micro Devices, Inc. (AMD), first as group vice president of AMD’s Memory Group, and

later as an executive vice president. Dr. Cambou was chief operating officer and co-president of Gemplus

International S.A. from June 1999 to January 2002. Also during this time, he was a board member of Gemplus

International S.A. and of Ingenico Ltd. Dr. Cambou’s career includes a 15-year tenure at Motorola Inc., where he

held various management positions including senior vice president and general manager of the Networking and

Computing System Group as well as chief technical officer of the Semiconductor Sector. Dr. Cambou received

his engineering degree from Supelec, Paris, and his doctorate in electrical engineering from Paris XI University.

He is the author of 15 U.S. patents.

David E. Roberson, age 53, has served as a Class A Director since the consummation of our initial public

offering in December 2005. Since May 2007, Mr. Roberson has served as senior vice president and general

manager of the StorageWorks Division of Hewlett-Packard Company. Prior to that, he served as president and

chief executive officer and as a member of the board of directors of Hitachi Data Systems from April 2006 until

May 2007. From April 2004 until April 2006, Mr. Roberson served as president and chief operating officer of

Hitachi Data Systems, and from April 2000 until April 2004 he served as its chief operating officer.

Mr. Roberson received a bachelor’s degree in Social Ecology from the University of California, Irvine and a law

degree from Golden Gate University School of Law in San Francisco, California. Mr. Roberson also studied

financial management at Harvard Business School.

The following director nominee is standing for election by the holder of our Class C Common Stock:

Gilles Delfassy, age 52, has served as a Class C Director since September 2007. Until his retirement in

January 2007, Mr. Delfassy served in various senior management positions at Texas Instruments Incorporated,

which he joined in 1978, most recently as a senior vice president. Mr. Delfassy is also a member of the Board of

Directors of Anadigics, Inc. Mr. Delfassy received an Engineering Diploma (equivalent to master’s of science in

electrical engineering) at Ecole Nationale Superieure d’Electronique et d’ Automatique de Toulouse. He also

graduated in Business Administration from Institute d’Administration des Entreprises de Paris.

Other Directors

The following six directors whose terms of office do not expire in 2008 will continue to serve after the

Annual Meeting until such time as their respective terms of office expire and their respective successors are duly

elected and qualified:

David K. Chao, age 41, has served as a Class A Director since the consummation of our initial public

offering in December 2005. Mr. Chao is a co-founder of DCM (formerly known as Doll Capital Management), a

venture capital firm based in the Silicon Valley, and has been a general partner of DCM since 1996. Prior to

founding DCM, Mr. Chao was a co-founder and member of the board of directors of Japan Communications, Inc.

He also worked as a management consultant at McKinsey & Company and as a marketing manager at Apple

Computer. Prior to these positions, he was an account executive for Recruit, a Japanese human resources,

advertising and services company. Mr. Chao serves on the boards of numerous DCM portfolio companies,

including 51job, Inc., where he has served since 2000. He is a management board member of the Stanford

Graduate School of Business board of trustees and a member of The Thacher School board of trustees. Mr. Chao

received a bachelor’s degree in economics and East Asian studies from Brown University and a master’s degree

in business administration from Stanford University.

Robert L. Edwards, age 52, has served as a Class A Director since December 2006. Since March 2004,

Mr. Edwards has served as executive vice president and chief financial officer of Safeway, Inc. Prior to that, he

served as executive vice president and chief financial officer of Maxtor Corporation from September 2003 until

March 2004. Prior to joining Maxtor, Mr. Edwards was senior vice president, chief financial officer and chief

administrative officer at Imation Corporation, where he was employed from 1998 to August 2003. He is also a

6

director of Casa Ley, in which Safeway has a 49% ownership interest. Mr. Edwards holds a bachelor’s degree in

accounting and a master’s degree in business administration from Brigham Young University.

Boaz Eitan, age 59, has served as a Class A Director and Executive Vice President and Chief Executive

Officer, Saifun since March 2008. Dr. Eitan founded Saifun Semiconductors Ltd. (Saifun) in 1996 and served as

its Chief Executive Officer and Chairman of the Board of Directors from 1996 to 2008, when Spansion acquired

Saifun. From 1992 to 1997, Dr. Eitan managed the Israeli design center of WaferScale Integration Inc., which he

established in 1992. From 1983 to 1992, Dr. Eitan held various positions at WaferScale Integration Inc.,

including manager of the Device Physics group, director of memory products and Vice President of Product and

Technology Development. From 1981 to 1983, Dr. Eitan served as a physicist at Intel Corporation’s research and

development center in Santa Clara, California. Dr. Eitan holds a Ph.D. and an M.Sc. in Applied Physics and a

B.Sc. in Mathematics and Physics from the Hebrew University, Jerusalem. He is the inventor of Saifun’s NROM

technology. Dr. Eitan is named as the inventor of over 85 issued U.S. patents, over 45 pending U.S. patent

applications and a number of issued non-U.S. patents and pending non-U.S. patent applications.

Patti S. Hart, age 52, has served as a Class A Director since the consummation of our initial public offering

in December 2005. Ms. Hart most recently served as chairman and chief executive officer of Pinnacle Systems

from March 2004 until August 2005. Prior to joining Pinnacle Systems in 2004, Ms. Hart was chairman and chief

executive officer of Excite@Home from April 2001 until March 2002. Prior to joining Excite@Home in 2001,

Ms. Hart served as chairman, president and chief executive officer of Telocity and as a member of Telocity’s

board of directors from July 1999 through its sale to DirecTV in March 2001. From 1986 to 1999, Ms. Hart

worked at Sprint Corporation, most recently as president and chief operations officer of Sprint’s Long Distance

Division. Ms. Hart is also a member of the board of directors for Korn Ferry International, International Game

Technology and LIN TV Corp., and is a former board member of Plantronics Inc., Vantive Corporation,

EarthLink, Inc. and Premisys Corporation. Ms. Hart holds a bachelor’s degree in marketing and economics from

Illinois State University.

Donald L. Lucas, age 77, has served as Chairman of the Board of Directors and as a Class A Director since

September 2007. Since 1967, Mr. Lucas has been actively engaged in venture capital activities as a private

individual. He has been a director of Oracle Corporation since 1980 and serves as chairman of their executive

committee. Mr. Lucas also currently serves as chairman of the board of directors of DexCom, Inc. and 51job,

Inc., and as a director of Cadence Design Systems, Inc. and Vimicro Corp. Mr. Lucas received a bachelor’s

degree from Stanford University and a master’s degree from the Stanford Graduate School of Business.

John M. Stich, age 66, has served as a Class A Director since December 2006. He is the Honorary Consul

General of Japan at Dallas. Previously, he spent 35 years at Texas Instruments, with his most recent position as

chief marketing officer in Japan. He lived and worked for Texas Instruments in Asia for a total of 24 years where

he held various additional management positions such as vice president of semiconductors for Texas Instruments

Asia Ltd., managing director of Texas Instruments Hong Kong Ltd., and marketing director of Texas Instruments

Taiwan Limited. Mr. Stich has been active in leading various industry associations, including serving as:

governor of the American Chambers of Commerce in Japan and Hong Kong, and chairman of the Semiconductor

Industry Association (Japan Chapter). Currently, he is a director of Stonestreet One, Inc. and Diodes Inc. In

addition, Mr. Stich is a member of the Dallas/Taipei and Dallas/Sendai Sister City Committees, a member of the

Advisory Council for Southern Methodist University’s Asian Studies Program, a director of the Japan America

Society of Dallas/Fort Worth, Vice-Dean of the Consular Corps of Dallas/Fort Worth, and a member of the

Pastoral Council of Prince of Peace church. Mr. Stich holds a bachelor’s degree in electrical engineering from

Marquette University.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE

PROPOSED DIRECTOR NOMINEES LISTED ABOVE.

7

CORPORATE GOVERNANCE

Principles of Corporate Governance

The Board of Directors has adopted Principles of Corporate Governance to address significant corporate

governance issues. The Principles of Corporate Governance provide a framework for our corporate governance

matters and include topics such as Board and Board Committee composition, the role and functions of the Board,

the responsibilities of various Board committees and Board evaluations. The Nominating and Corporate

Governance Committee is responsible for reviewing and recommending any changes on the Principles of

Corporate Governance to the Board.

Director Independence

The Board of Directors affirmatively determines the independence of each director and nominee for election

as a director in accordance with the elements of independence set forth in the NASDAQ Stock Market listing

standards. On March 12, 2008, the Board conducted a review of director independence. During this review, the

Board considered transactions and relationships between each director or any member of his or her immediate

family and Spansion and our subsidiaries and affiliates, including those reported under “Certain Relationships

and Related Transactions” on page 49. The Board also considered whether there were any transactions or

relationships between directors or any member of their immediate families (or any entity on which a director or

an immediate family member is an executive officer, general partner or significant equity holder) and members

of Spansion’s executive team or their affiliates. The purpose of this review was to determine whether any

transactions or relationships exist that are inconsistent with a determination of director independence.

As part of this review, the Board of Directors considered: (i) the ownership interest that Mr. Chao’s firm,

DCM, has in Vendavo, Inc., which provides software we purchased through an agreement with SAP Inc.;

(ii) Mr. Delfassy’s service on the board of directors of Discretix Inc., which licenses software to us;

(iii) Mr. Lucas’ service on the board of directors of Cadence Design Systems, Inc., which provides equipment

and services to us; and (iv) Mr. Roberson’s employment with Hewlett-Packard Company, which is one of our

customers. The Board determined that none of these relationships violate the elements of independence set forth

in the NASDAQ Stock Market listing standards and, therefore, seven of the nine members of Spansion’s Board

of Directors are independent directors. More specifically, the Board of Directors affirmatively determined that

each of the following non-employee directors is independent and has no relationship with Spansion, except as a

director and stockholder of Spansion:

• David K. Chao • Patti S. Hart • David E. Roberson

• Gilles Delfassy • Donald L. Lucas • John M. Stich

• Robert L. Edwards

In addition, the Board affirmatively determined that Dr. Cambou is not independent because he is the

President and Chief Executive Officer of Spansion and that Dr. Eitan is not independent because he is Executive

Vice President and Chief Executive Officer, Saifun. Dr. Eitan joined Spansion in March 2008, when we acquired

Saifun Semiconductors Limited, which is a wholly owned subsidiary of Spansion.

Nominations for Directors

Process for Evaluating and Selecting Potential Director Candidates

Our Nominating and Corporate Governance Committee is responsible for annually identifying and

recommending to the Board of Directors the nominees to be selected by the Board for each annual meeting of

stockholders (or special meeting of stockholders at which directors are to be elected) and recommending

candidates to fill any vacancies on the Board (whether through the resignation of any director or through the

increase in the number of directors by the Board). The Nominating and Corporate Governance Committee is also

8

responsible for periodically assessing and developing the appropriate criteria to be utilized in evaluating potential

director nominees, and communicating such criteria to the Board.

Minimum Qualifications for Director Nominees

The Nominating and Corporate Governance Committee has established the following minimum criteria for

evaluating prospective candidates to be selected by the Board:

• Reputation for integrity, strong moral character and adherence to high ethical standards;

• Holds or has held a generally recognized position of leadership in community or chosen field of

endeavor, and has demonstrated high levels of accomplishment;

• Demonstrated business acumen and experience, and ability to exercise sound business judgment and

common sense in matters that relate to the current and long-term objectives of Spansion;

• Ability to read and understand basic financial statements and other financial information pertaining to

Spansion;.

• Commitment to understand our business, industry and strategic objectives;

• Commitment and ability to regularly attend and participate in meetings of the Board of Directors, Board

committees and stockholders (taking into account the number of other company boards on which the

candidate serves), and ability to generally fulfill all responsibilities as a director;

• Willingness to represent and act in the interests of all stockholders of Spansion rather than the interests

of a particular group;

• Good health, and ability to serve;

• For prospective non-employee directors, independence under Securities and Exchange Commission

rules and the NASDAQ Stock Market listing standards, and the absence of any conflict of interest

(whether due to a business or personal relationship) or legal impediment to, or restriction on, the

nominee serving as a director; and

• Willingness to accept the nomination to serve as a director of Spansion.

Other Factors for Potential Consideration

The Nominating and Corporate Governance Committee will also consider the following factors in

connection with its evaluation of each prospective director nominee:

• Whether the prospective director nominee will foster a diversity of skills and experiences;

• Whether the prospective director nominee possesses the requisite education, training and experience to

qualify as “financially literate” or as an “audit committee financial expert” under applicable Securities

and Exchange Commission rules and the NASDAQ Stock Market listing standards;

• For incumbent directors standing for re-election, the director’s performance during his or her term,

including the number of meetings attended, level of participation, and overall contribution to Spansion;

• The number of other company Boards on which the prospective director nominee serves; and

• Whether the prospective director nominee will add to or complement the Board’s existing strengths.

Process for Identifying, Evaluating and Recommending Director Nominees

• The Nominating and Corporate Governance Committee initiates the process for identifying, evaluating

and recommending prospective director nominees by preparing a list of potential candidates who, based

on their biographical information and other information available to the Nominating and Corporate

9

Governance Committee, appear to meet the criteria specified above and who have specific qualities,

skills or experience being sought (based on input from the Board).

Outside Advisors. The Nominating and Corporate Governance Committee may engage a third-party

search firm or other advisors to assist in identifying prospective director nominees.

Stockholder Suggestions for Potential Nominees. The Nominating and Corporate Governance

Committee will consider suggestions of prospective director nominees from stockholders. Stockholders

may recommend individuals for consideration in accordance with the procedures set forth below in

“Consideration of Stockholder Nominees for Director.” The Nominating and Corporate Governance

Committee will evaluate a prospective director nominee suggested by any stockholder in the same

manner and against the same criteria as any other prospective director nominee identified by the

Nominating and Corporate Governance Committee from any other source.

Nomination of Incumbent Directors. The re-nomination of existing directors should not be viewed as

automatic, but should be based on continuing qualification under the criteria set forth above. For

incumbent directors standing for re-election, the Nominating and Corporate Governance Committee will

assess the incumbent director’s performance during his or her term, including the number of meetings

attended; level of participation, and overall contribution to Spansion; composition of the Board at that

time; and any changed circumstances affecting the individual director which may bear on his or her

ability to continue to serve on the Board.

Management Directors. The number of officers or employees of Spansion serving at any time on the

Board should be limited such that at all times a majority of the directors is “independent” under

applicable Securities and Exchange Commission rules and the NASDAQ Stock Market listing

standards.

• After reviewing appropriate biographical information and qualifications, first-time candidates will be

interviewed by at least one member of the Nominating and Corporate Governance Committee and by

the Chief Executive Officer.

• Upon completion of the above procedures, the Nominating and Corporate Governance Committee shall

determine the list of potential candidates to be recommended to the Board for nomination at the annual

meeting.

The Board of Directors will select the slate of nominees only from candidates identified, screened and

approved by the Nominating and Corporate Governance Committee.

Consideration of Stockholder Nominees for Director

The policy of the Nominating and Corporate Governance Committee is to consider properly submitted

stockholder nominations for candidates to serve on our Board. Pursuant to our bylaws, stockholders who wish to

nominate persons for election to the Board of Directors at the 2009 annual meeting must be stockholders of

record when they give us notice of such nomination, must be entitled to vote at the meeting and must comply

with the notice provisions in our bylaws. A stockholder’s notice must be delivered to our Corporate Secretary or

the Chair of the Nominating and Corporate Governance Committee not less than 60 nor more than 90 days before

the anniversary date of the immediately preceding annual meeting. For our 2009 annual meeting, the notice must

be delivered between February 26, 2009 and March 28, 2009. However, if our 2009 annual meeting is not within

30 days of May 27, 2009, the notice must be delivered no later than the close of business on the tenth day

following the earlier of the day on which the first public announcement of the date of the Annual Meeting was

made or the day the notice of the meeting is mailed. The stockholder’s notice must include the following

information for the person proposed to be nominated:

• Name, age, nationality, business and residence addresses;

• Principal occupation and employment;

10

• The class and number of shares of stock owned beneficially and of record by the proposed nominee;

• Any other information required to be disclosed in a proxy statement with respect to the proposed

nominee; and

• The proposed nominee’s written consent to being a nominee and to serving as a director if elected.

The stockholder’s notice must also include the following information for the stockholder giving the notice

and the beneficial owner, if any, on whose behalf the nomination or proposal is made:

• Names and addresses;

• The number of shares of stock owned beneficially and of record by them;

• A description of any arrangements or understandings between them and each proposed nominee and any

other persons (including their names) pursuant to which the nominations are to be made;

• A representation that they intend to appear in person or by proxy at the Annual Meeting to nominate the

person named in the notice;

• A representation as to whether they are part of a group that intends to deliver a proxy statement or solicit

proxies in support of the nomination; and

• Any other information that would be required to be included in a proxy statement.

The Chair of the Annual Meeting will announce whether the procedures in the bylaws have been followed,

and if not, declare that the nomination be disregarded. If the nomination is made in accordance with the

procedures in our bylaws, the Nominating and Corporate Governance Committee will apply the same criteria in

evaluating the nominee as it would any other director nominee candidate and will recommend to the Board

whether or not the stockholder nominee should be nominated by the Board and included in our proxy statement.

These criteria are described below in the description of the Nominating and Corporate Governance Committee on

page 15. The nominee and nominating stockholder must be willing to provide any information reasonably

requested by the Nominating and Corporate Governance Committee in connection with its evaluation.

Communications with the Board or Non-Management Directors

Stockholders who wish to communicate with Spansion’s Board of Directors or with non-management

directors may send their communications in writing to our Corporate Secretary, Spansion Inc., 915 DeGuigne

Drive, P.O. Box 3453, Sunnyvale, California 94088 or send an email to Corporate.Secretary@spansion.com.

Spansion’s Corporate Secretary will forward these communications to our independent directors except for spam,

junk mail, mass mailings, product complaints or inquiries, job inquiries, surveys, business solicitations or

advertisements, or patently offensive or otherwise inappropriate material. Communications will not be forwarded

to the independent directors unless the stockholder submitting the communication identifies himself or herself by

name and sets out the number of shares of stock he or she owns beneficially or of record.

Codes of Business Conduct and Ethics

The Board of Directors has adopted a code of conduct, entitled “Code of Business Conduct,” which applies

to all directors and employees and which was designed to help directors and employees resolve ethical and

compliance issues encountered in the business environment. The Code of Business Conduct governs matters such

as conflicts of interest, compliance with laws, confidentiality of company information, encouraging the reporting

of any illegal or unethical behavior, fair dealing and use of company assets. The Board of Directors has also

adopted a Code of Ethics for the Chief Executive Officer, the Chief Financial Officer, the Corporate Controller

and All Other Senior Finance Executives. The Code of Ethics governs matters such as financial reporting,

conflicts of interest and compliance with laws, rules, regulations and Spansion’s policies.

11

You can access Spansion’s Principles of Corporate Governance, Code of Business Conduct and Code of

Ethics at the Investor Relations page of our website at www.spansion.com or by writing to us at Corporate

Secretary, Spansion Inc., 915 DeGuigne Drive, P.O. Box 3453, Sunnyvale, California 94088, or emailing us at

Corporate.Secretary@spansion.com. We will provide you with this information free of charge. Please note that

information contained on our website is not incorporated by reference in, or considered to be a part of, this

document. We will post on our website any amendment to the Code of Ethics, as well as any waivers of the Code

of Ethics, that are required to be disclosed by the rules of the Securities and Exchange Commission or the

NASDAQ Stock Market.

12

COMMITTEES AND MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors

The Board of Directors has Audit, Compensation, Finance and Nominating and Corporate Governance

Committees. The Strategy Committee was created in March 2007 and dissolved in March 2008. The members of

these committees and their chairs are recommended by the Nominating and Corporate Governance Committee

and then appointed by the Board. During the 2007 fiscal year, the Board of Directors held nine regularly

scheduled and special meetings, the Audit Committee held thirteen regularly scheduled and special meetings, the

Compensation Committee held five regularly scheduled and special meetings, the Finance Committee held three

regularly scheduled and special meetings, the Nominating and Corporate Governance Committee held six

regularly scheduled and special meetings, and the Strategy Committee held five regularly scheduled and special

meetings. All directors attended at least 75 percent of the meetings of the Board of Directors and Board

committees during the periods that he or she served in fiscal 2007, except for Dr. Hector de J. Ruiz, who resigned

as Chairman of the Board on September 20, 2007. The independent directors hold regularly scheduled sessions

without any members of Spansion’s management present. Four such sessions of the independent directors were

held in fiscal 2007. Spansion’s directors are strongly encouraged to attend the Annual Meeting of Stockholders.

All seven members of our Board of Directors attended the 2007 Annual Meeting of Stockholders.

On March 16, 2007, the Board established the position of Lead Independent Director and, upon the

recommendation of our Nominating and Corporate Governance Committee, designated Mr. David E. Roberson

as Lead Independent Director. The general authority and responsibilities of the Lead Independent Director are

established by the Board, and include presiding at all meetings of the Board when the Chairman is not present;

serving as a liaison between the independent directors and the Chairman of the Board; evaluating and approving

the information, agenda and meeting schedules sent to the Board; calling and chairing meetings of the

independent directors; recommending to the Nominating and Corporate Governance Committee the membership

of the Board committees and selection of committee chairpersons; recommending the retention of advisors and

consultants who report directly to the Board; assisting in ensuring compliance with and implementation of the

Board’s corporate governance principles; and being available for consultation and communication with

stockholders. On September 20, 2007, upon the appointment of an independent Chairman of the Board of

Directors, Mr. Roberson resigned from his position as Lead Independent Director.

Audit Committee

The Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Securities

Exchange Act of 1934, as amended, currently consists of Mr. Robert L. Edwards, as Chair, Mr. John M. Stich

and Mr. Roberson, each of whom was determined by the Board of Directors to be financially literate and

“independent” as such term is defined for Audit Committee members by the NASDAQ Stock Market listing

standards. Mr. Roberson served as Chair of the Audit Committee until Mr. Edwards was appointed as Chair on

March 16, 2007, Mr. David K. Chao served as a member of the Audit Committee until September 20, 2007 and

Ms. Patti S. Hart served as a member of the Audit Committee until March 12, 2008. The Board of Directors has

determined that Messrs. Edwards and Roberson are each an “audit committee financial expert” as defined under

the rules of the Securities and Exchange Commission.

The Audit Committee assists the Board with its oversight responsibilities regarding our accounting and

financial reporting processes, the audit of our financial statements, the integrity of our financial statements, our

internal accounting and financial controls, our compliance with legal and regulatory requirements, the

independent registered public accounting firm’s qualifications and independence and the performance of our

internal audit function and the independent registered public accounting firm. The Audit Committee is also

directly responsible for the appointment, compensation, retention and oversight of the work of the independent

registered public accounting firm, which reports directly to the Audit Committee. The Audit Committee meets

alone with our financial and legal personnel, our internal auditor and with our independent registered public

13

accounting firm, who have free access to the Audit Committee at any time. The director of our Internal Audit

Department reports directly to the Chair of the Audit Committee, confers regularly with our Chief Financial

Officer and serves a staff function for the Audit Committee.

Compensation Committee

The Compensation Committee consists of Ms. Hart, as Chair, and Mr. Gilles Delfassy and Mr. Roberson,

each of whom was determined by the Board to be “independent.” Mr. Roberson served as a member of the

Compensation Committee until March 16, 2007 and then was reappointed to the Compensation Committee on

December 20, 2007. Messrs. Chao, Edwards and John M. Stich each served on the Compensation Committee

until September 20, 2007.

The Compensation Committee assists the Board with its oversight responsibilities regarding our

compensation plans, policies and benefit programs. The Compensation Committee also assists the Board in

discharging its responsibilities regarding oversight of the compensation of executive officers and directors,

including by designing (in consultation with management or the Board), recommending to the Board for approval

and evaluating our compensation plans, policies and programs for executive officers and directors. The

Compensation Committee shall ensure that compensation programs are designed to encourage high performance,

promote accountability and assure that employee interests are aligned with the interests of the Company’s

stockholders. In fulfilling its responsibilities, the Compensation Committee may delegate any or all of its

responsibilities to a subcommittee of the Compensation Committee, except for the adoption and approval of

cash- and equity-based compensation plans, matters that involve executive compensation or matters where the

Compensation Committee has determined such compensation is intended to comply with Section 162(m) of the

Internal Revenue Code or is intended to be exempt from Section 16(b) under the Securities Exchange Act of

1934, as amended, pursuant to Rule 16b-3.

The Compensation Committee approves all equity awards granted to executive officers and the annual

equity awards granted to employees following Spansion’s annual performance evaluation process. The

Compensation Committee has delegated to our Grant Committee, which consists of our Chief Executive Officer,

Chief Financial Officer and Chief Operating Officer, authority to approve stock option and restricted stock unit

awards to non-executive officers, subject to established guidelines. The purpose of this delegation is to provide

administrative flexibility to recognize new hires and promotions or achievements for employees below the level

of executive officer. The Compensation Committee approves all equity awards granted to non-executive officers

that are not within the guidelines established for the Grant Committee. The Compensation Committee also

reviews all equity awards approved by the Grant Committee.

The agendas for meetings of the Compensation Committee are determined by the Chair with the assistance

of members of our Human Resources and Legal Departments. Compensation Committee meetings are attended

by the Chief Executive Officer, the Chief Legal Officer, the Corporate Vice President, Human Resources and

other members of management in the Human Resources and Legal Departments. The Compensation Committee

also meets in executive sessions without any members of management present. The Chair reports the

Compensation Committee’s decisions and recommendations on executive compensation to the Board of

Directors.

Finance Committee

The Finance Committee consists of Mr. Donald L. Lucas, as Chair, and Messrs. Chao, Delfassy and

Edwards. The Finance Committee assists the Board with its oversight responsibilities regarding financial matters,

including by reviewing our corporate capital structure, material transactions and investments to assess their

impact on our strategic plans and business operations. The Finance Committee also assists the Board in

discharging its responsibilities regarding oversight of the development and implementation of Spansion’s

business strategies.

14

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of Mr. Roberson, as Chair, Ms. Hart and

Mr. Stich, each of whom was determined by the Board of Directors to be “independent.” Mr. Chao and Ms. Hart

each served on the Nominating and Corporate Governance Committee until September 20, 2007, Mr. Chao

served as Chair until Mr. Roberson was appointed as Chair on March 16, 2007 and Ms. Hart was reappointed on

March 20, 2008. The Nominating and Corporate Governance Committee assists the Board with its oversight

responsibilities regarding the identification of qualified candidates to become Board members, the selection of

nominees for election as directors at the next Annual Meeting of Stockholders (or special meeting of

stockholders at which directors are to be elected), the selection of candidates to fill any vacancies on the Board,

the selection of Board members for each committee of the Board, the development and recommendation to the

Board of a set of applicable corporate governance guidelines and principles and oversight of the evaluation of the

Board. In seeking candidates to determine if they are qualified to become Board members, the Nominating and

Corporate Governance Committee looks for the following attributes, which, among others, the Nominating and

Corporate Governance Committee deems appropriate: personal and professional integrity, ethics and values;

experience in corporate management, such as serving as an officer or former officer of a publicly held company;

experience serving as a director of a privately or publicly held company; experience in our industry and with

relevant social policy concerns; ability to make independent analytical inquiries; academic expertise in an area of

our operations; and practical and mature business judgment. For a detailed description of the process for

nomination of director candidates by stockholders, please see information under the heading “Consideration of

Stockholder Nominees for Director” on page 10. The Nominating and Corporate Governance Committee will use

the same standards to evaluate all director candidates, whether or not the candidates are proposed by

stockholders.

Strategy Committee

The Strategy Committee, which had authority to monitor and review material strategic transactions,

including any potential mergers, acquisitions, consolidations, joint ventures or similar transactions, and to make

recommendations to the Board regarding such transactions, was established in March 2007 and dissolved in

March 2008.

Bylaws and Committee Charters

You can access Spansion’s bylaws and the charters of our Audit, Compensation, Finance and Nominating

and Corporate Governance Committees at the Investor Relations page of our website at www.spansion.com or by

writing to us at Corporate Secretary, Spansion Inc., 915 DeGuigne Drive, P.O. Box 3453, Sunnyvale, California

94088, or emailing us at Corporate.Secretary@spansion.com. We will provide you with this information free of

charge. Please note that information contained on our website is not incorporated by reference in, or considered

to be a part of, this document.

Compensation Committee Interlocks and Insider Participation

The individuals who served as members of the Compensation Committee during fiscal 2007 were Ms. Hart

and Messrs. Chao, Delfassy, Edwards, Roberson and Stich. No member of the Compensation Committee was at

any time during fiscal 2007 or at any other time an officer or employee of Spansion, and no member had any

relationship with Spansion requiring disclosure under Item 404 of Regulation S-K. None of our executive

officers has served on the board of directors or compensation committee of any other entity that has or has had

one or more executive officers who served as a member of the Board of Directors or the Compensation

Committee during fiscal 2007.

15

DIRECTOR COMPENSATION

Spansion uses a combination of cash and equity-based incentive compensation to attract and retain qualified

candidates to serve on the Board of Directors. Our independent director compensation is determined by the Board

of Directors acting upon the recommendation of the Compensation Committee. In setting director compensation,

our Board of Directors considers, among other things, the significant amount of time that directors spend in

fulfilling their duties, the skill-level required by directors and competitive market data provided by Hewitt

Associates, an independent compensation consultant. Directors who are also employees of Spansion, or who are

otherwise determined to not be independent, receive no additional compensation for service as a director. We

may reimburse any of our directors and, in some circumstances, spouses who accompany directors, for travel,

lodging and related expenses they incur in attending Board of Directors and Board committee meetings.

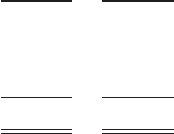

Cash Compensation

During fiscal 2007, our independent directors received fees for their services as set forth in the table below.

Board retainer and meeting fees have not changed for fiscal 2008. All annual cash compensation is paid in

quarterly installments, in advance.

Annual Retainer (1) ................................................................. $ 60,000

Additional Annual Retainers

Chairperson ................................................................... $100,000

Audit Committee Chair .......................................................... $ 15,000

Compensation Committee Chair ................................................... $ 7,500

Finance Committee Chair ......................................................... $ 7,500

Nominating and Corporate Governance Committee Chair ............................... $ 7,500

Strategy Committee Chair ........................................................ $ 7,500

Lead Independent Director ........................................................ $ 30,000

Fees Per Board Meeting in Excess of Eight Board Meetings (2) .............................. $ 2,000

Fees Per Committee Meeting in Excess of Twelve Committee Meetings (2) ..................... $ 2,000

(1) All independent directors, including directors serving as Chairperson, receive this annual retainer.

(2) If in any calendar year an independent director is required to and does attend (i) more than eight meetings of

our Board of Directors, such director will receive $2,000 for each Board meeting attended in excess of eight,

or (ii) more than twelve meetings of a specific Board committee on which he or she serves, such director

will receive $2,000 per such Board committee meeting in excess of twelve.

Equity-Based Incentive Compensation

Each independent director received an initial stock option award exercisable for 20,000 shares of our

Class A Common Stock and an initial restricted stock unit award of 20,000 units that convert upon vesting into

20,000 shares of our Class A Common Stock. These awards were made at the time of our initial public offering

of our Class A Common Stock in December 2005 or, if later, upon the director’s appointment to our Board of

Directors. In addition, an independent director who serves as Chairperson of the Board receives an additional

initial restricted stock unit award of 10,000 units that convert upon vesting into 10,000 shares of our Class A

Common Stock.

For each year of continued service, independent directors receive an annual stock option award exercisable

for 10,000 shares of our Class A Common Stock and an annual restricted stock unit award of 10,000 units that

convert upon vesting into 10,000 shares of our Class A Common Stock. In addition, for each year of continued

service, an independent director serving as the Chairperson of the Board shall receive an additional annual stock

option award exercisable for 5,000 shares of our Class A Common Stock and an additional annual restricted

16

stock unit award of 5,000 units that convert upon vesting into 5,000 shares of our Class A Common Stock. All

annual equity-based compensation is awarded to independent directors on the date of the annual stockholders

meeting. At the annual stockholders meeting, each independent director who (i) joined our Board of Directors at

or prior to the last annual stockholders meeting, or (ii) joined our Board of Directors after the last annual

stockholders meeting but attended at least three meetings of the full Board of Directors, is entitled to receive an

annual equity award at that annual stockholders meeting.

All stock option and restricted stock unit awards granted to our independent directors vest 25% on the

anniversary of the grant date and the remainder vests in equal installments quarterly over the remaining 36

months, except for the stock option and restricted stock unit awards granted to our independent directors in

December 2005 at the time of the initial public offering of our Class A Common Stock. Those awards vested

25% on January 28, 2007 and the remainder vests in equal installments quarterly over the remaining 36 months

beginning January 28, 2007.

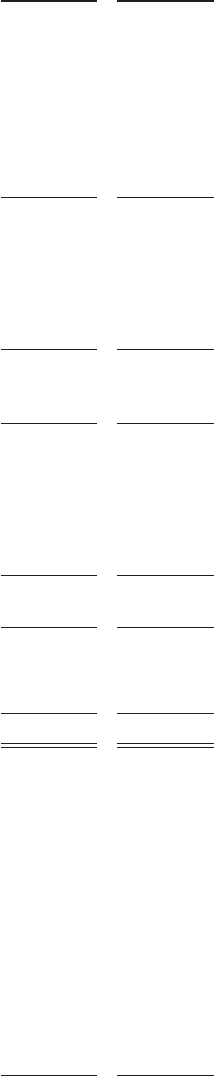

Director Summary Compensation Table for Fiscal 2007

The following table provides information concerning compensation expense paid to or earned by each of our

independent directors for fiscal 2007. Dr. Cambou, our President and Chief Executive Officer, does not receive

additional compensation for his services as a director.

Name (1)

Fees Earned or

Paid in Cash (6)

($)

Stock

Awards (7)(8)(9)

($)

Option

Awards (7)(8)(9)

($)

Total

($)

David K. Chao ............................... 61,875 75,137 41,258 178,270

Gilles Delfassy (2) ........................... 15,000 11,342 4,904 31,246

Robert L. Edwards ........................... 71,250 72,108 36,539 179,897

Patti S. Hart ................................. 67,500 75,137 41,258 183,895

Donald L. Lucas (2) .......................... 41,875 17,013 4,904 63,792

David E. Roberson ........................... 84,375 75,137 41,258 200,770

John M. Stich ............................... 65,625 72,509 36,742 174,876

Toshihiko Ono (3) (4) ......................... — — — —

Hector de J. Ruiz (3) (5) ....................... — — — —

(1) Bertrand F. Cambou, Spansion’s President and Chief Executive Officer, is not included in this table as he is

an employee of Spansion and thus receives no compensation for his services as director. The compensation

received by Dr. Cambou as an employee of Spansion is shown in the Fiscal 2007 Summary Compensation

Table on page 33.

(2) Messrs. Delfassy and Lucas were elected to Spansion’s Board of Directors on September 20, 2007.

(3) Mr. Ono and Dr. Ruiz were non-independent directors and consequently received no compensation for their

services as a director.

(4) Mr. Ono resigned from the Board of Directors on March 16, 2007.

(5) Dr. Ruiz resigned from the Board of Directors on September 20, 2007.

(6) Mr. Lucas earned $1,875 for his service as Chair of the Finance Committee during the fourth quarter of

fiscal 2007 but did not receive payment until February 2008.

(7) On May 29, 2007, Messrs. Chao and Roberson and Ms. Hart received their annual stock option award

exercisable for 10,000 shares of our Class A Common Stock and a restricted stock unit award of 10,000

units that convert upon vesting into 10,000 shares of our Class A Common Stock. The grant date fair value

computed in accordance with FAS 123(R) of the fiscal 2007 annual stock option awards and restricted stock

unit awards was $49,817 and $107,300, respectively.

17

(8) As of December 30, 2007, the aggregate number of shares of Class A Common Stock underlying stock

option and restricted stock unit awards for each of our independent directors was:

Name (1)

Aggregate Number of Shares

Underlying Stock Options

Aggregate Number of Shares

Underlying Restricted Stock Units

David K. Chao ............................... 30,000 21,250

Gilles Delfassy ............................... 20,000 20,000

Robert L. Edwards ............................ 20,000 15,000

Patti S. Hart .................................. 30,000 21,250

Donald L. Lucas .............................. 20,000 30,000

David E. Roberson ............................ 30,000 21,250

John M. Stich ................................ 20,000 15,000

Toshihiko Ono ............................... — —

Hector de J. Ruiz .............................. — —

(9) Reflects the grant date fair value of each stock option and restricted stock unit award computed in

accordance with FAS 123(R). The assumption used in valuation of these awards are set forth in the notes to

our consolidated financial statements, which are included in our Annual Report on Form 10-K for the fiscal

year ended December 30, 2007, filed with the Securities Exchange Commission on February 28, 2007.

These amounts do not correspond to the actual value that will be recognized by the Named Executive

Officers.

18

SECURITY OWNERSHIP

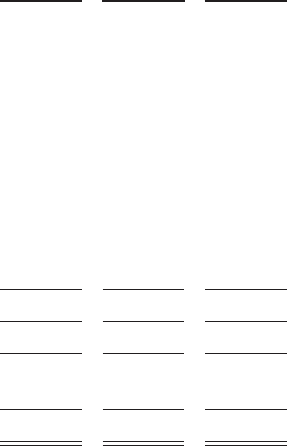

Security Ownership of Certain Beneficial Owners

The following table sets forth the beneficial owners of more than five percent of the outstanding shares of

Spansion Common Stock as of March 31, 2008. This information is based upon our records and other

information available from outside sources. We are not aware of any other beneficial owner of more than five

percent of any class of Spansion Common Stock. Except as otherwise indicated, to our knowledge, each person

has sole investment and voting power with respect to the shares shown as beneficially owned.

Name and Address of Beneficial Owner Title of Class

Number of

Shares Beneficially

Owned

Percent of

Class Beneficially

Owned (1)

Fujitsu Microelectronics Limited (2) .....................

Shinjuku Daiichi Seimei Building, 2-7-1 Nishi-Shinjuku,

Shinjuku-ku

Tokyo 163-0701, Japan

Class A

Class C

18,352,934

1

11.59%

100%

Prudential Financial, Inc. (3) (4) .........................

751 Broad Street

Newark, NJ 07102-3777

Class A 15,311,456 9.67%

Ameriprise Financial, Inc. (5) (6) ........................

145 Ameriprise Financial Center

Minneapolis, MN 55474

Class A 15,262,314 9.63%

FMRLLC(7)(8).....................................

82 Devonshire Street

Boston, MA 02109

Class A 14,135,029 8.92%

AMD Investments, Inc. (9) .............................

One AMD Place

Sunnyvale, CA 94088

Class A 14,039,910 8.86%

Donald Smith & Co., Inc. (10) ..........................

152 West 57th Street

New York, NY 10019

Class A 13,507,800 8.53%

Janus Capital Management LLC (11) (12) (13) .............

151 Detroit Street

Denver, CO 80206

Class A 7,948,434 5.02%

(1) Based on 158,323,770 shares of Class A Common Stock and one share of Class C Common Stock

outstanding as of March 31, 2008. Calculated in accordance with the rules of the Securities Exchange Act of

1934, as amended.

(2) The Class A Common Stock information is based on information set forth in a Schedule 13D/A filed with

the Securities and Exchange Commission on March 24, 2008. Fujitsu Microelectronics Limited is the holder

of the single outstanding share of Class C Common Stock, and therefore holds 100 percent of the Class C

Common Stock.

(3) Based on information set forth in a Schedule 13G/A filed with the Securities and Exchange Commission on

February 6, 2008. According to the Schedule 13G/A, Prudential Financial, Inc. has sole voting power with

respect to 2,950,600 shares, shared voting power with respect to 11,941,573 shares, sole dispositive power

with respect to 2,950,600 shares and shared dispositive power with respect to 12,360,856 shares.

(4) Prudential Financial, Inc. has the power to direct the voting and disposition of the securities held by

Jennison Associates LLC.

(5) Based on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on

February 13, 2008. According to the Schedule 13G, Ameriprise Financial, Inc. has shared voting power with

respect to 140,470 shares and shared dispositive power with respect to 15,262,314 shares.

19

(6) Ameriprise Financial, Inc. has the power to direct the voting and disposition of the securities held by

RiverSource Funds and RiverSource Investments LLC.

(7) Based on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on

March 10, 2008.

(8) Edward C. Johnson 3d and FMR LLC, have the power to direct the disposition of the securities held by

Fidelity Management & Research Company.

(9) Based on information set forth in a Schedule 13D/A filed with the Securities and Exchange Commission on

November 28, 2006 and in Forms 4 filed with the Securities and Exchange Commission on February 22,

2007, February 26, 2007 and February 28, 2007. AMD Investments, Inc. is a wholly owned subsidiary of

AMD (U.S.) Holdings, Inc., which is a wholly owned subsidiary of Advanced Micro Devices, Inc. (AMD).

AMD (U.S.) Holdings, Inc. and AMD are indirect beneficial owners of the reported securities.

(10) Based on information set forth in a Schedule 13G/A filed with the Securities and Exchange Commission on

February 8, 2008. According to the Schedule 13G/A, Donald Smith & Co., Inc. has sole voting power with

respect to 10,144,000 shares and sole dispositive power with respect to 13,507,800 shares.

(11) Based on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on

February 14, 2008. According to the Schedule 13G, Janus Capital Management LLC has sole voting power

with respect to 7,948,434 shares and sole dispositive power with respect to 7,948,434 shares.

(12) Janus Capital Management LLC (“Janus Capital”) is the investment adviser of Janus Growth and Income

Fund (“Janus Growth”) and consequently has voting control and investment discretion over securities held

by Janus Growth. Janus Capital therefore may be deemed to be the beneficial owner with sole voting power

and sole dispositive power with respect to such securities.

(13) Janus Capital indirectly owns Enhanced Investment Technologies LLC (“INTEC”) and Perkins, Wolf,

McDonnell and Company, LLC (“Perkins Wolf”). Due to this ownership structure, holdings for Janus

Capital, Perkins Wolf and INTECH are aggregated for the purposes of the Schedule 13G filed on

February 14, 2008. Janus Capital therefore may be deemed to be the beneficial owner with sole voting

power and sole dispositive power with respect to such securities.

20

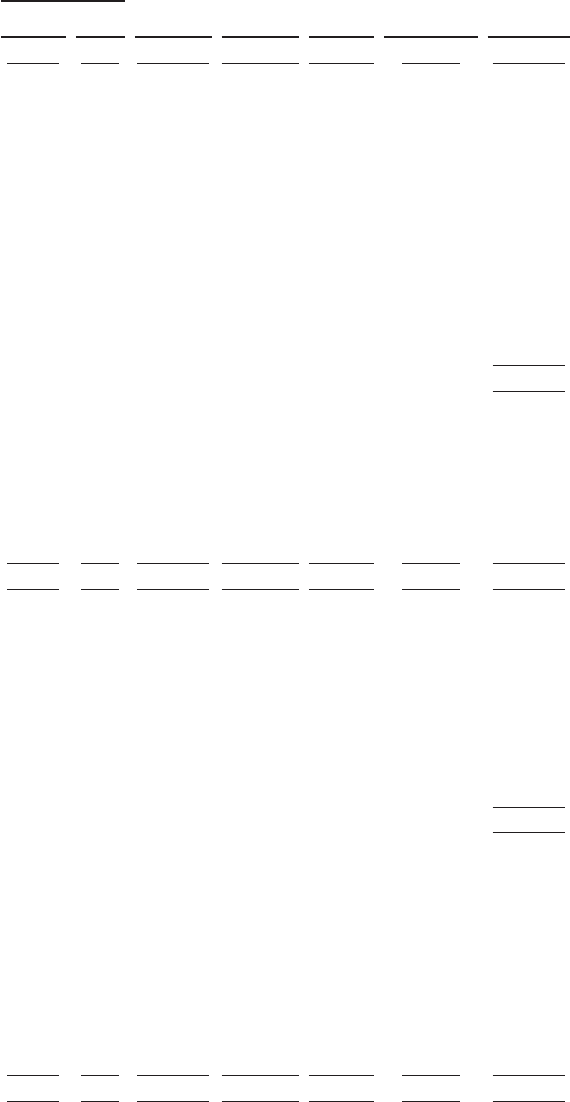

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information known to us with respect to beneficial ownership of Spansion

Class A Common Stock, as of March 31, 2008, for our current directors and the nominees for election as

directors, each of our executive officers listed in the Fiscal 2007 Summary Compensation Table on page 33, and

all of our directors and executive officers as a group. This ownership information is based upon information

provided by the individuals.

Name (1) Shares Currently Owned

Shares Acquirable Currently

or Within 60 Days

Aggregate

Shares Beneficially

Owned (2)

Percent of Class

Beneficially

Owned (2)(3)

Bertrand F. Cambou ..... 121,608 199,331 320,939 *