E Newsletter CS G Series April2012

User Manual: CS-G series

Open the PDF directly: View PDF ![]() .

.

Page Count: 63

- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

Chairman

Marthi.S.S.

Vice-Chairman

C Dwarakanath

Secretary

Dr.Baiju Ramachandran

Treasurer

Nagendra D Rao

Members

Gopalakrishna Hegde [Ex-Officio]

K. Ramasamy

C. Ramasubramaniam

Dr. B. Ravi

R. Sridharan [Ex-Officio]

C.Sudhir Babu [Ex-Officio]

A.Visweswara Rao

K.Pandian [Co-opted]

Ashok Thakkar [Co-opted]

Chairman cum Editor

Dr. Baiju Ramachandran

Members

M.Alagar

Malathi Mohan (Ms.)

Marthi.S.S.

ICSI-SIRC HOUSE, New No.9, Wheat Crofts Rd, Nungambakkam, Chennai-34

Ph: 044 – 2827 9898 ; 28268685 ; Fax : 2826 8685, Email : siro@icsi.edu

IN PURSUIT OF PROFESSIONAL EXCELLENCE

Statutory body under an Act of Parliament

THE INSTITUTE OF

Company Secretaries of India

April 2012 Issue No.4

www.icsi.edu/siro

SOUTHERN INDIA REGIONAL COUNCIL

NEWS LETTER COMMITTEE

FROM THE CHAIRMAN

T

INTANGIBLE and achieves the IMPOSSIBLE

he Positive Thinker sees the INVISIBLE, feels the

.

Dear Professional Colleagues,

Kudos to Sachin Tendulkar for being the First Sports person to

be nominated to the Rajya Sabha, thus creating another

milestone in the history of our country.

It was indeed a great relief for lot of corporates and the

markets, investors, and citizens of the country due to the roll

back measures announced by the Hon'ble Finance Minister :

i). General Anti Avoidance Rules (GAAR) deferred for

one year.

ii) Long term capital gains tax on private equity cut from

20% to 10%

iii) Withholding tax on foreign borrowing cut to 5%

iv) 1% excise duty on unbranded jewellery to be withdrawn

v) 1% TDS on property transactions withdrawn

th

On 6 April 2012, I had the pleasure of visiting the Bangalore

Chapter to represent the ICSI-SIRC at the Interaction meeting

organized with the President, Vice-President, Secretary &

CEO, The ICSI. The interaction also provided me an

opportunity to meet and share my views on professional

SIRC e-NEWS LETTER April 2012

2

matters with professionals in Bangalore. It was also indeed my pleasure to be present at the ceremony

of signing of the MOU between ICSI and others viz., Direct Taxes Regional Training Institute, Bangalore

Stock Exchange, and Alliance University. Ms Jahanzeb Akhtar, IRS, Commissioner of Income Tax,

Head of the Direct Taxes Regional Training Institute, with her address stole the hearts of all the audience

present there. Her grit, determination, and passion towards the development of the Institute gave all of

us lot of inputs.

The ICSI observed the Capital Market Week from April 23-28, 2012 and organized programmes in

th

different locations in the country.. As part of the celebrations a seminar was organized on 25 April

2012 'Capital Markets – Growth Drivers', in Chennai.. The Seminar was well attended where lot of new

ideas and thought processes had emerged at the various technical sessions. The detailed

proceedings of the Seminar are appearing elsewhere in this eNewsletter.

It was happy to note that several chapters in the Region participated enthusiastically by organizing

series of programmes including Investor Awareness Programmes during the capital market week. I

could participate personally in some of the programmes out of which one was a live programme on

Doordarshan – Saptagiri Channel, where CS G Raghu Babu and me along with a market analyst Mr

Kutumba Rao were interviewed on the issues pertaining to the investors. I am happy to share that it was

a great opportunity to share our views and also speak about our Institute and the profession.

During the month of May, the ICSI-SIRC will be organizing a variety of programmes for Members.

I request the Members to fully utilize the opportunity and attend the programmes for enriching their

knowledge.

The ICSI-SIRC invites suggestions from the Members for organizing programmes on professional

interest and also suggest topics for various programmes and Seminars. I wish to thank the Members for

their continued support and co-operation for every program organized by ICSI-SIRC whether held at

Chennai or other Chapters in SIRC.

Annual Membership fee for the year 2012-2013 is accepted from Members from 1.4.2012 and the last date for

the payment of Membership fee is 30.6.2012. I request the Members to make use of the online facility for

paying the Membership fee.

th

I have pleasure in informing you that the ICSI-SIRC is organizing its 37 Regional Conference for Members.

The dates and venue of the Regional Conference will be intimated to you shortly. Myself and my colleagues on

the Regional Council are deliberating on the theme and the various technical sessions for the Regional

Conference and are also trying to invite eloquent and enlightened speakers for the Regional Conference to

provide an intellectual feast. We are also deliberating on making the Conference arrangements for the

comfortable and professional enlightenment of the delegates for the two days. I invite all of you to attend the

Conference and enjoy the fellowship and the networking of professionals.

I invite Members to enroll under the Corporate Membership Scheme for the year 2012-2013 for attending the

programmes of ICSI-SIRC at a nominal Membership fee of Rs.6000/- and enrich your knowledge and also

secure Programme Credit Hours.

CSBF Life membership subscription is Rs.7,500/- w.e.f.1.4.2012 and the coverage will be Rs.5

lakhs. Kindly enroll yourself as a member of the CSBF at the earliest and oblige. for detailed

information, please see this link

With warm regards,

Yours Sincerely,

CS MARTHI.S.S.

spcspl@gmail.com

http://www.icsi.edu/Member/MemberBenevolentFund.aspx

SIRC e-NEWS LETTER April 2012SIRC e-NEWS LETTER

CONTENTS

Chairman's Message 1

ROC Column 4

Service Tax Updates 6

Article 7

SIRC Activity Report 26

Chapter Activity Report 31

Announcements for Members & 55

Students

3

Registrar of Companies

Chennai, Tamilnadu

ROC’s Column

Shri. Henry Richard

4

SIRC e-NEWS LETTER April 2012

Compliance status of the Indian Corporate

Sector to be improved

The Thrust of enhanced compliance among the companies in the corporate sector has been carried

forward by the Ministry of Corporate Affairs by imposing prohibition on filing of event based returns in the

case of defaulting companies and by bringing in a Scheme known as Fast Track Exit Scheme 2011 as a

remedial measure for easy exit of defunct companies which have not filed returns with ROC for several

years. The multi pronged objective of the Ministry is to improve the compliance status of Corporate Sector

to a level which is comparable to other developed countries. It is common knowledge that the compliance

rate in countries like Singapore, Australia, New Zealand, UK., etc., are much above 90%. Whereas the

compliance rate in Chennai is just about 58%. Even in the case of filing of Financial Statement by large

sized companies, for whom XBRL is mandatory, have not promptly filed Form 23AC (XBRL) and Form

23ACA (XBRL) for the financial year 2010-11. As many as about 900 such companies have defaulted and

Default Notices have been issued to such companies prevailing upon them to comply failing which this

office would have no other option except to initiate prosecution proceedings in the Judicial First Class

Magistrate Court. This deplorable state has been a serious concern for the Ministry. The Ministry has

attempted to tackle this problem in the following manner:-

Firstly, the Ministry has introduced the concept of “Dormant Company”. Any company which has not filed

the Balance Sheets and Annual Returns for a continuous period of three years are placed in a separate

basket designated as Dormant Companies”. Such companies are prohibited from filing any return. The

DIN of the Directors of such companies would also be deactivated. However, such companies can become

active by filing the Form 61 for regularization of the company and thereafter proceed to update the filing of

Annual Returns and Balance Sheets which will bring the company under “Active Company” category.

Secondly, the companies though not declared as dormant but have defaulted in filing one or two returns are

categorized as “Defaulting Companies”. The list of such defaulting companies and their directors are

ROC’s Column

5

SIRC e-NEWS LETTER April 2012

posted on Ministry's website . Such defaulting companies and its directors are also not

permitted to file any return through MCA Portal until the default is made good. Such companies and

directors should take immediate steps to update the filing position and thereafter take steps to get their

names and that of the company removed from the defaulting list.

Thirdly, the Ministry has come out with a special scheme known as “Fast Track Exit Scheme 2011” under

which the defaulting companies or the dormant companies which have no intention to continue their

business can avail this scheme and get the company struck off under Section 560 of the Companies Act,

1956. This special scheme was launched from July 2011 and kept open permanently. The predominant

benefit of this scheme is that the defaulting or dormant companies need not update their filing position. In

other words, the company is not required to file overdue Balance Sheets and Annual Returns but a

Statement of Account has to be made showing the current status of assets and liabilities duly certified by a

Chartered Accountant. Moreover, the directors of such companies need not have DIN or Digital Key for the

purpose of filing the application in the prescribed form. In such cases, the e-application will be filed by the

Professional using his digital key supported by the physical documents executed by the directors such as,

the physical FTE application, Affidavit on stamp paper, and Indemnity Bond on Stamp paper and Statement

of Account duly signed by the directors accompanied by the Board Resolution. If new directors are co-opted

for the purpose of quorum on the Board of Directors, it is not necessary to file Form 32 with ROC but such

appointment of Director shall be certified by the professional. This exist route for dormant or defaulting

companies is truly easy, simple and fast.

The above measures taken by the Ministry to weed out the dormant and defaulting companies or

alternatively persuade them to update the filing position are the best possible measures which the

Regulator could take.

This golden opportunity should be availed by the companies. The Professionals who are advising the

companies must prevail upon such companies not to let go this opportunity so as to achieve the laudable

objective of the Ministry of Corporate Affairs. The detailed list of such defaulting companies are available in

the website of the Ministry of Corporate Affairs for public view so that all the concerned can take appropriate

measures for remedial action. The companies and professional friends must work hand in hand to improve

the compliance status of the Indian Corporate Sector and make it as good as that prevailing in other

developed countries.

www.mca.gov.in

Service Tax Updates

CS.K.K.Rao

K.K.Rao & Associates

Hyderabad

SIRC e-NEWS LETTER April 2012

6

Clarification on the market fee/mandi shulk collected by the Agricultural

Producing Marketing Committee

· Department circular no.157/8 /2012-ST dt. 27.4.2012 clarifies exemption from levy of service tax on

the market fee/mandi shulk collected by the Agricultural Producing Marketing Committee (APMC)

for providing among other things facilities like roads, drinking water, weighing machines, storage

places, street lights, etc. in the market area. The APMC cannot be said to be rendering 'business

support service' to the licensees and 'Market fee' is not in the nature of consideration for such

Business Support Service. The circular classified the services provided by the APMC falling under

the Business Auxiliary Service and since covered under the notification no. 14/2004-ST for being

qualified for exemption, stands exempted and no service tax can be levied thereon.

· Government had constituted a committee to review and suggest to (a) evolve a scientific approach

for the fixation of rates in the schedule of rates for service tax refund; and (b) propose a revised

schedule of rates for service tax refund, taking into account the revision of rate of service tax from

10% to 12% and also movement towards 'Negative List' approach to taxation of services. Public at

large or interested groups or professionals are expected to send their views/suggestions for being

considered by the Committee before 20.6.2012 at the e-mail address: .feedbackonestr@gmail.com

ECB - Liberalisation

CS.M.Alagar

Director

Genicon Business Solutions Pvt Ltd

Mylapore, Chennai

SIRC e-NEWS LETTER April 2012

7

As many of you are aware that the Finance Minister made an announcement in the Union Budget for the Year

2012-13 with regard to liberalization in accessing foreign loan capital by infrastructure and aviation sectors.

In view of the announcements made in the Union Budget for the Year 2012-13, the RBI has liberalized ECB

guidelines especially for infrastructure sector.

Gist of liberalization:

Enhancement of Refinancing limit for Power Sector

Vide APDIR Circular No.25 dated September 23, 2011 the Indian Companies in infrastructure space was

permitted to utilize 25% of fresh ECB raised by the Company for repayment of rupee loan under approval

Route.

Keeping in mind the present situation of power sector, Indian companies in the power sector will be now

allowed to utilise 40 per cent of the fresh ECB raised towards refinancing of the Rupee loan/s availed by

them from the domestic banking system, under the approval route, subject to the condition that at least 60

per cent of the fresh ECB proposed to be raised should be utilised for fresh capital expenditure for

infrastructure project(s).

Source: APDIR Circular No.111 dated April 20, 2012.

ECB for Maintenance and Operation of Toll systems for Roads and Highways

ECBs would also be allowed for capital expenditure under the automatic route for the purpose of

maintenance and operation of toll systems for roads and highways.

Source: APDIR Circular No.111 dated April 20, 2012.

Refinancing / Rescheduling of ECB

As per present ECB policy, existing ECB may be refinanced by raising a fresh ECB subject to the condition

that the fresh ECB is raised at a lower all-in-cost.

ECB - Liberalisation

ECB - Liberalisation

SIRC e-NEWS LETTER April 2012

8

On a review, it has been decided that the borrowers desirous of refinancing an existing ECB can raise fresh

ECB at a higher all-in-cost / reschedule an existing ECB at a higher all-in-cost under the approval route

subject to the condition that the enhanced all-in-cost does not exceed the all-in-cost ceiling

prescribed as per the extant guidelines.

Source: APDIR Circular No.112 dated April 20, 2012.

ECB for working capital - Civil Aviation Sector

As per existing Policy, the Company cannot utilize proceeds of ECB for working capital requirement.

Keeping in view of the announcement made in the Union Budget for the Year 2012-13 and present crisis in

Civil Aviation Sector, it has been decided to allow ECB for working capital as a permissible end-use for the

civil aviation sector, under the approval route, subject to the following conditions:

i. Airline companies registered under the Companies Act, 1956 and possessing scheduled operator

permit license from DGCA for passenger transportation.

ii. ECB will be allowed to the airline companies based on the cash flow, foreign exchange earnings

and its capability to service the debt.

iii. The ECB for working capital should be raised within 12 months from the date of issue of the

circular.

iv. Minimum average maturity period of three years; and

v. The overall ECB ceiling for the entire civil aviation sector would be USD one billion and the

maximum permissible ECB that can be availed by an individual airline company will be USD 300

million. This limit can be utilized for working capital as well as refinancing of the outstanding

working capital Rupee loan(s) availed of from the domestic banking system. Airline companies

desirous of availing of such ECBs for refinancing their working capital Rupee loans may submit the

necessary certification from the domestic lender/s regarding the outstanding Rupee loan/s.

ECB availed for working capital/refinancing of working capital as above will not be allowed to be rolled over.

The application for such ECB should be accompanied by a certificate from a chartered accountant

confirming the requirement of the working capital loan and the projected foreign exchange cash

flows/earnings which would be used for servicing the loan. Authorised Dealer should ensure that the

foreign exchange for repayment of ECB is not accessed from Indian markets and the liability is

extinguished only out of the foreign exchange earnings of the borrowing company.

Source: APDIR Circular No.113 dated April 24, 2012.

CS Dhanapal S

Sr. Partner

S. Dhanapal & Associates

Chennai

SIRC e-NEWS LETTER April 2012

9

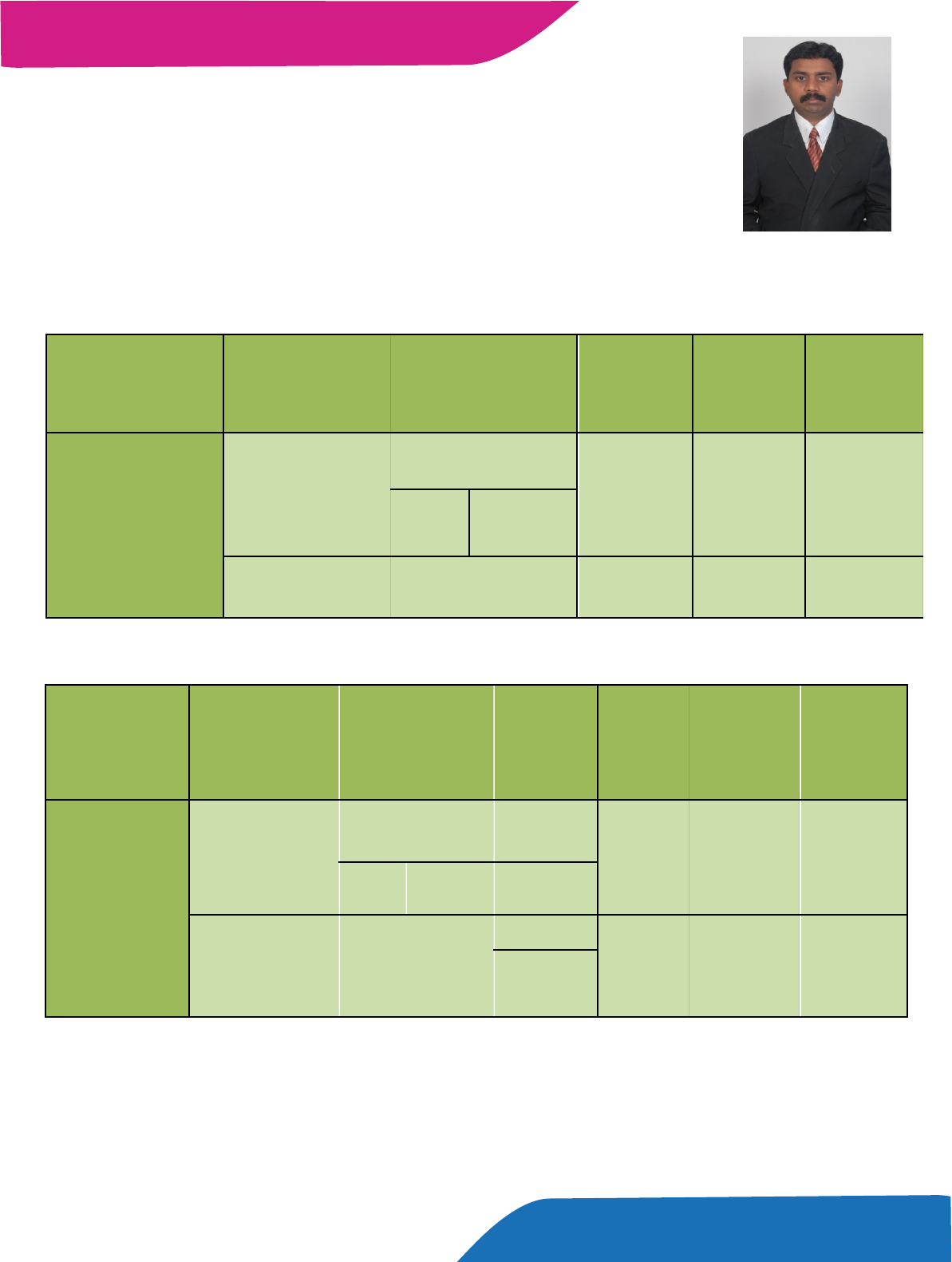

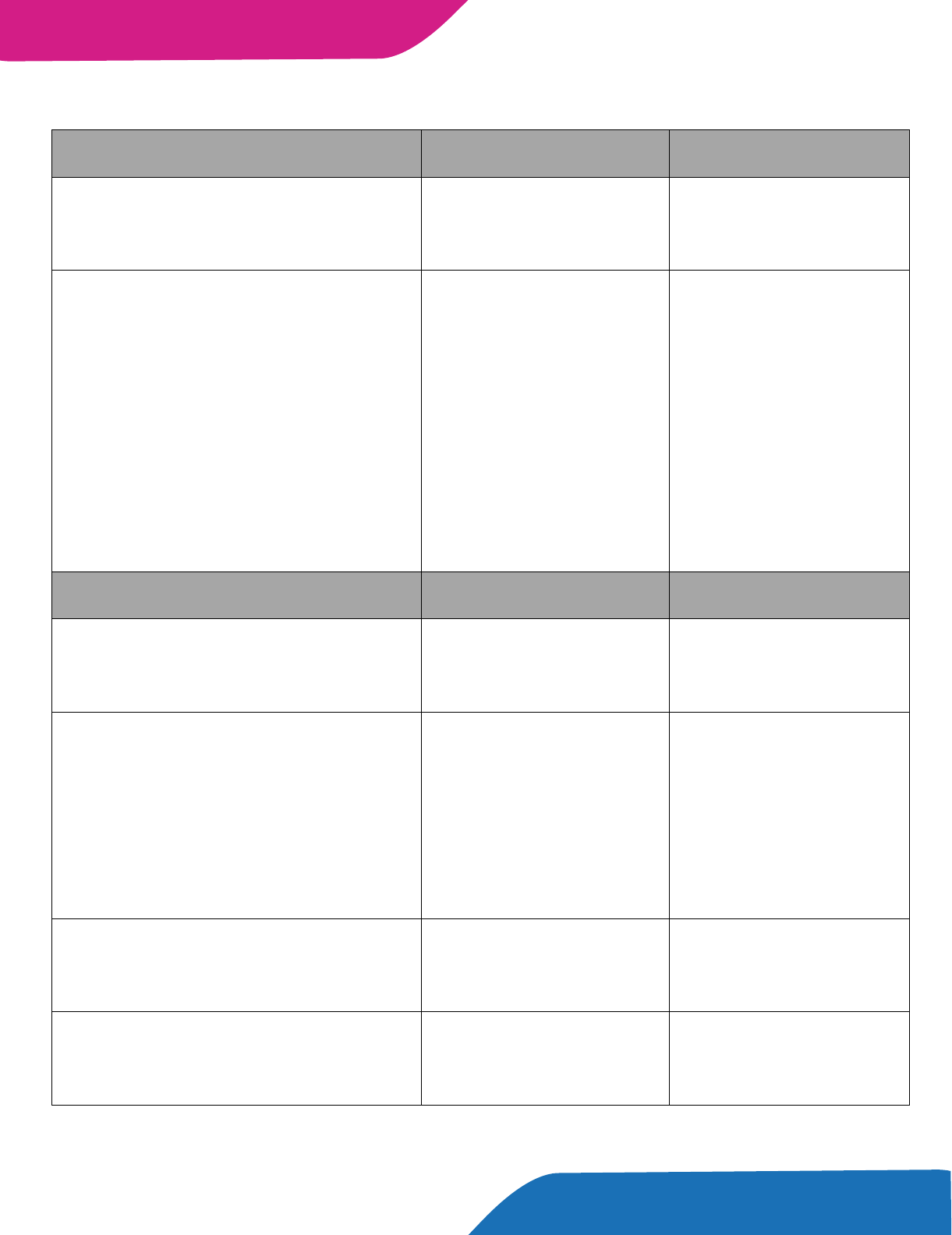

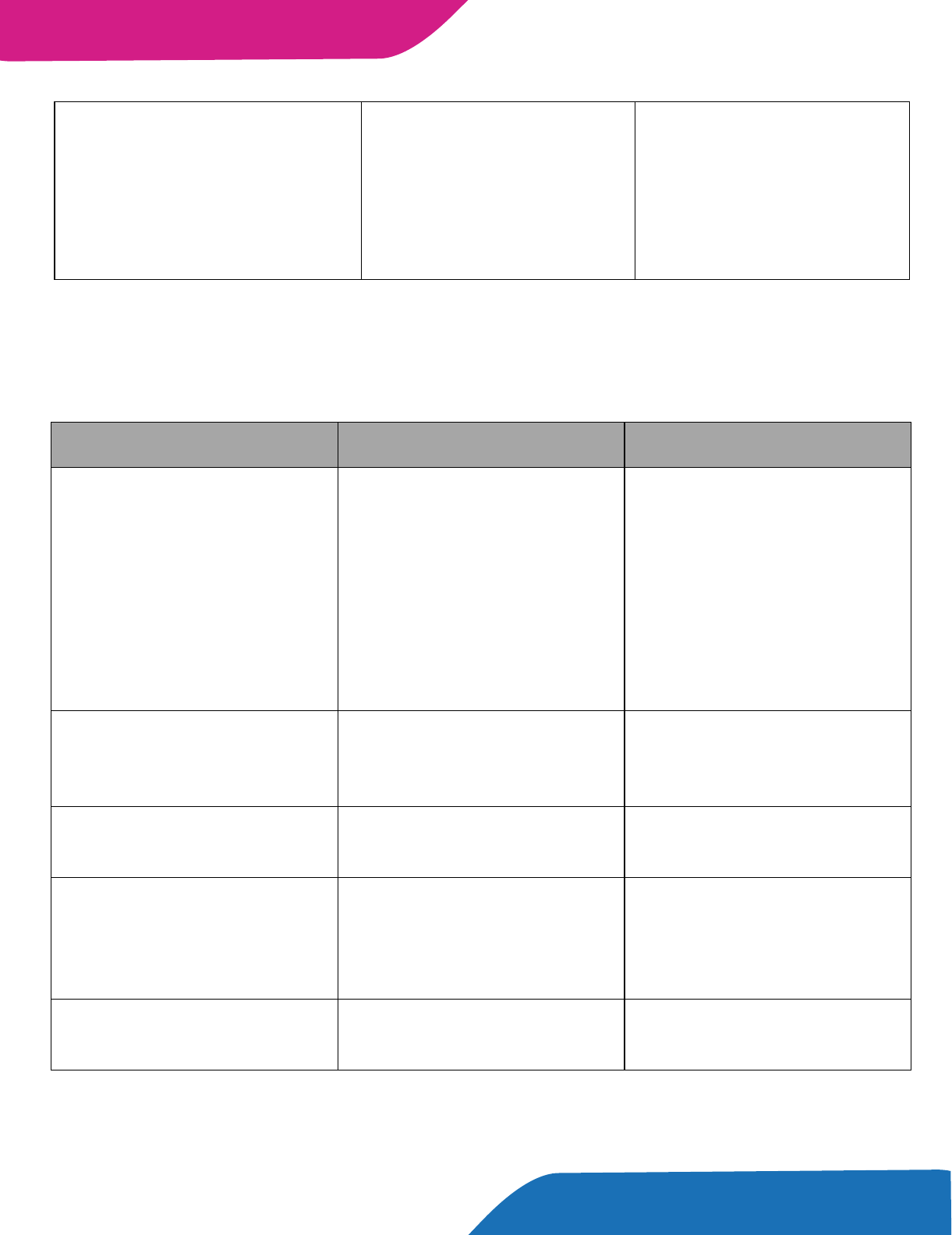

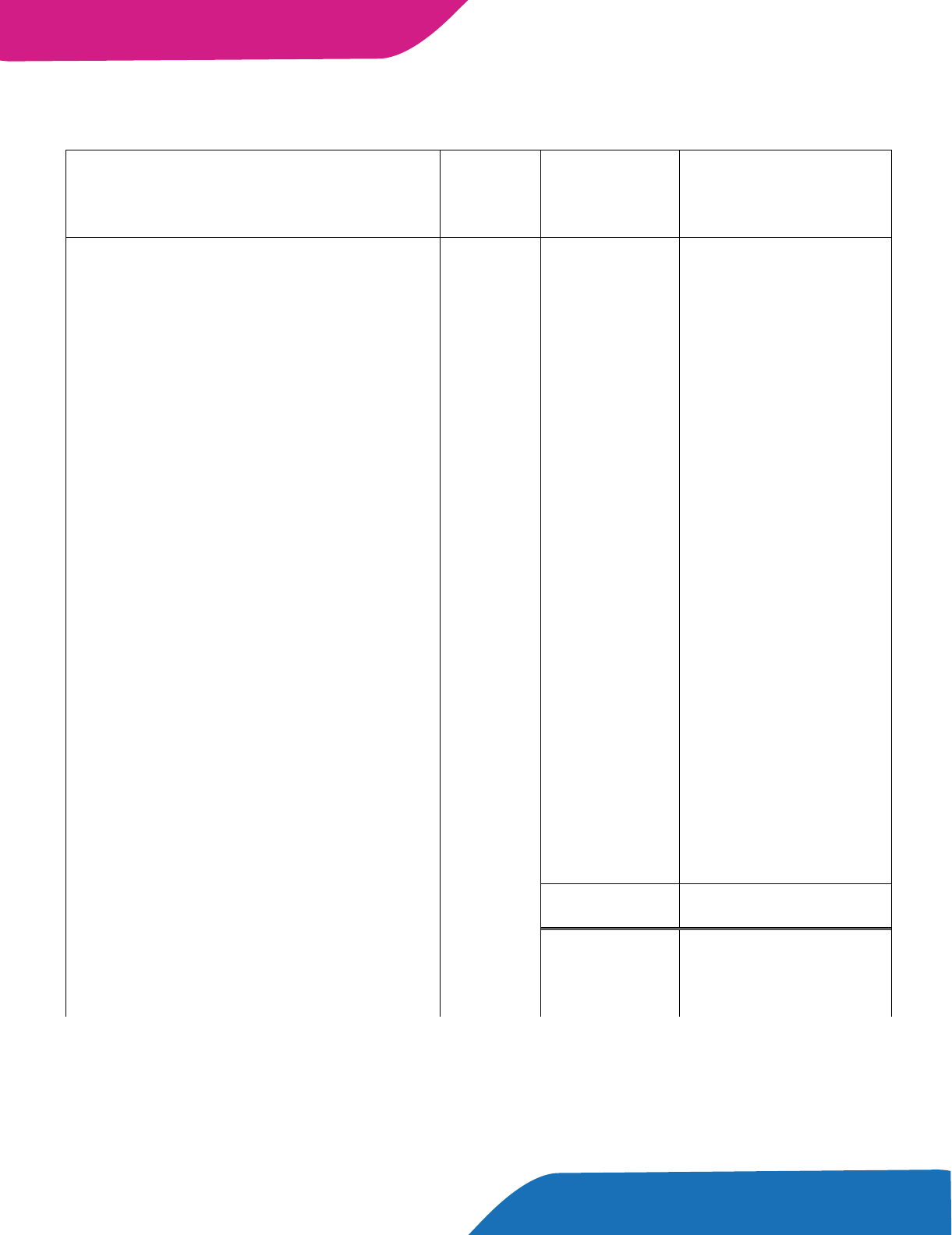

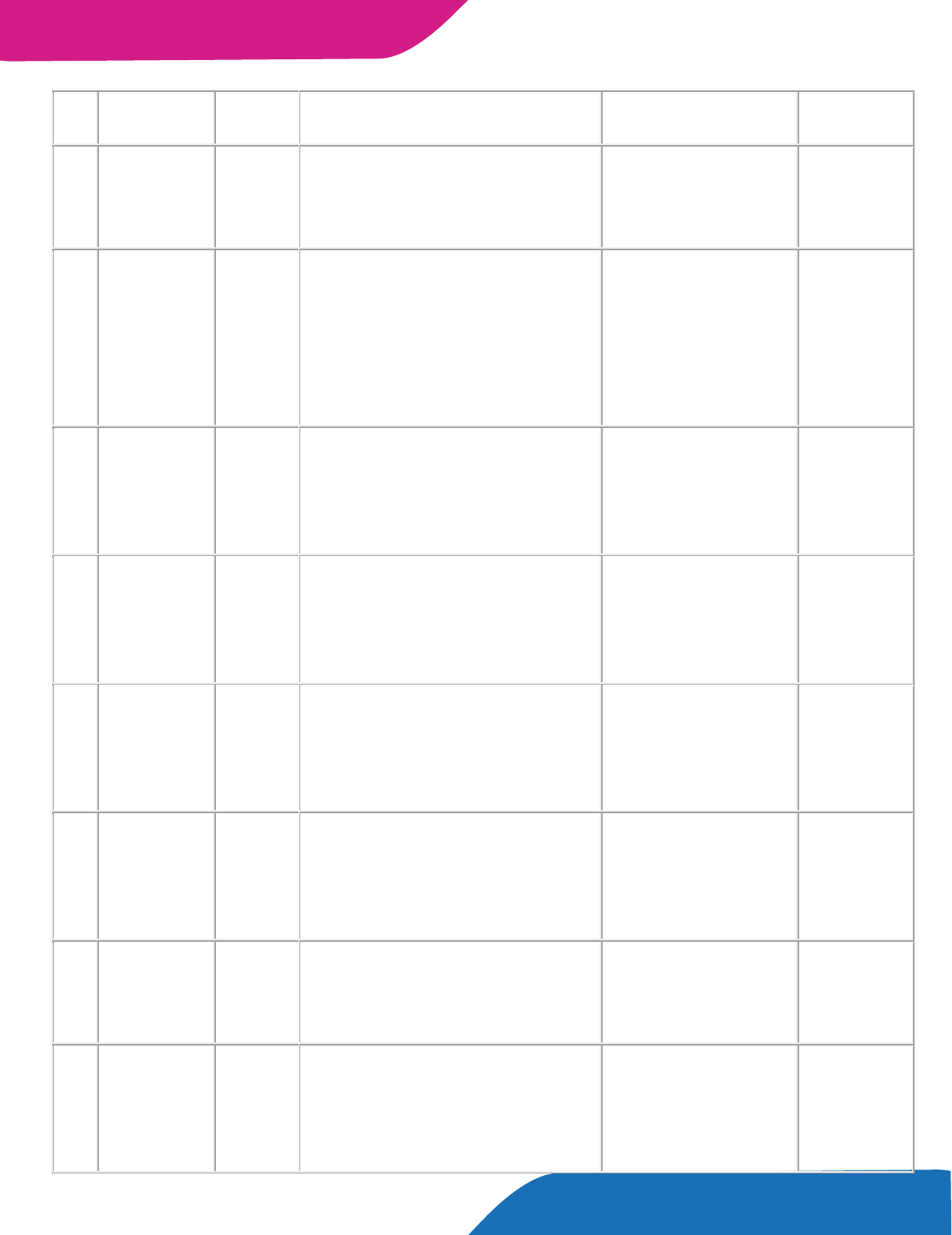

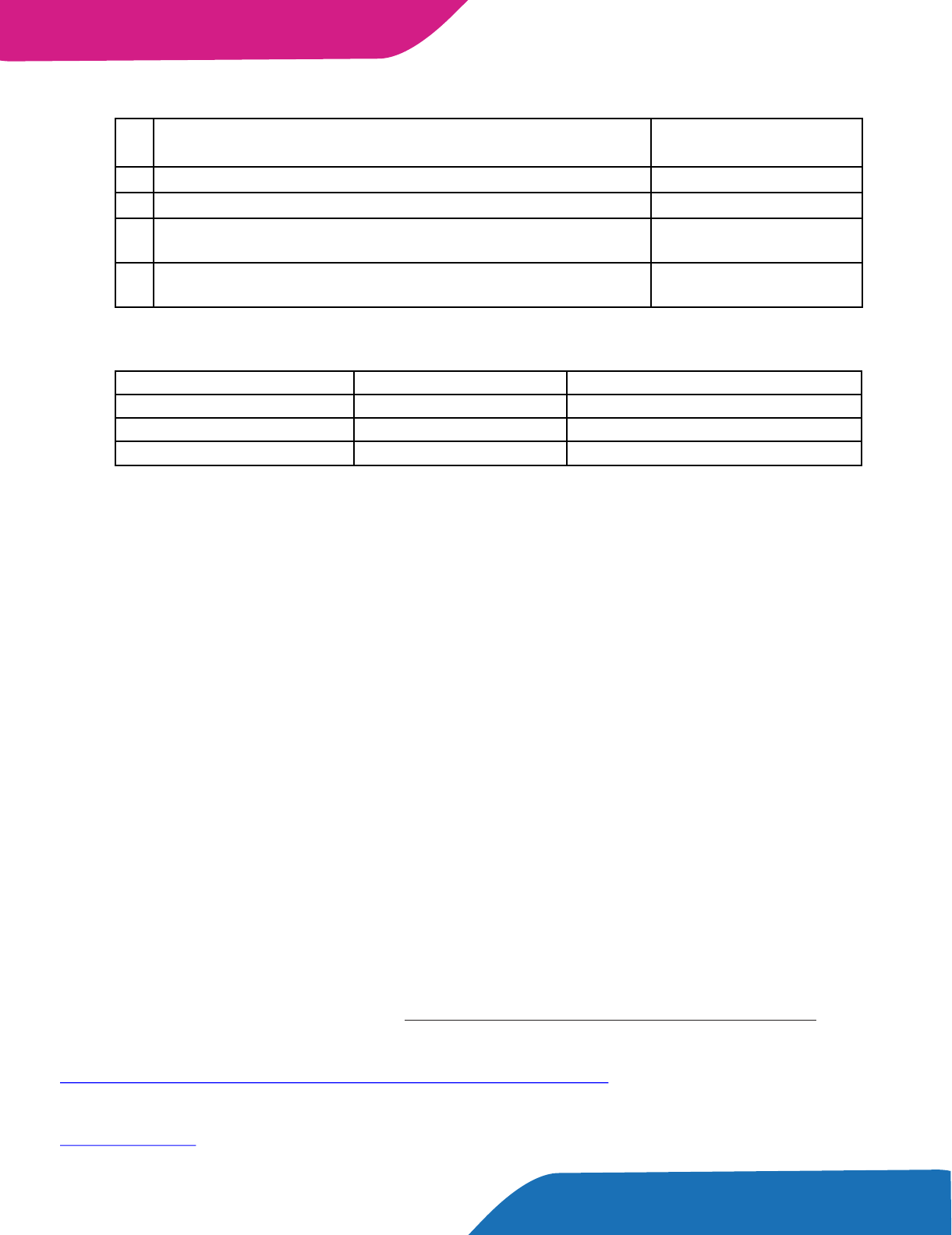

CLASSIFICATION OF COMPANIES UNDER COMPANIES ACT, 1956

BASIS OF

CLASSIFICATION

ON THE BASIS OF

INCORPORATION

ON THE BASIS OF

LIABILITY

ON THE

BASIS OF

NUMBER

OF

MEMBERS

ON THE

BASIS OF

CONTROL

ON THE

BASIS OF

OWNERSHIP

TYPES OF

COMPANIES

Statutory

Companies

Limited Liability

Private

Company

Holding

Company

Government

Limited

by

shares

Limited by

Guarantee

Registered

Companies

Unlimited Liability

Public

Company

Subsidiary

Company

Non

Government

CLASSIFICATION OF COMPANIES UNDER COMPANIES BILL, 2011

BASIS OF

CLASSIFICATION

ON THE BASIS OF

INCORPO RATION

ON THE BASIS

OF LIABILITY

ON THE

BASIS OF

NUMBER

OF

MEMBERS

ON THE

BASIS OF

CONTROL

ON THE

BASIS OF

OWNERSHIP

ON THE

BASIS OF

OPERATION

TYPES OF

COMPANIES

Statutory

Companies

Limited Liability

Private

Company

Holding

Company

Government

Dormant

Company

Limited

by

shares

Limited by

Guarantee

One Person

Company

Registered

Companies

Unlimited Liability

Small

Company

Subsidiary

Company

Non

Government

Inactive

Company

Public

Company

HIGHLIGHTS ON COMPANIES BILL, 2011

SIRC e-NEWS LETTER April 2012

10

BACKGROUND OF COMPANIES BILL, 2011

Comparative Structure Of Companies Act 1956 And Companies Bill 2011

Some New Concepts Under Companies Bill, 2011

rd

·Companies Bill 2008 was introduced on 23 October 2008 in the Lok Sabha to replace existing

companies Act, 1956.

rd

·Companies Bill 2009 was reintroduced on 3 August 2009 with some modifications and the same

was referred to Standing Committee On Finance (SCF) for further process.

st

·On 31 August 2010, Report of SCF on Companies Bill, 2009 was placed in Lok Sabha.

Except One Person Company, private company limits number of members to two hundred.

Can be incorporated only as a private company. Word “One Person Company” should be

mentioned below the name of the company.

It cannot be a public Company; Holding or Subsidiary, Company registered under section 8 or body

corporate governed any special act. Paid-Up capital does not exceed Rs.50,00,000/-

A Company formed and registered under the act for a future project (or) to hold an asset or

intellectual property and has no accounting transaction can be called as “Dormant Company”

When a company does not carry on any business, has not made any accounting transactions and

has not filed returns with the ROC for the last two years will come under the category of “Inactive

Company”

ØPrivate Company [2(68)]

ØOne Person Company [2(62)]

ØSmall Company [2(85)]

ØDormant Company [455]

ØInactive Company

COMPANIES ACT, 1956

COMPANIES BILL 2011

13 Parts

More than 750 sections

15 Schedules

29 Chapters

470 Clauses

7 Schedules

HIGHLIGHTS ON COMPANIES BILL, 2011

11

SIRC e-NEWS LETTER April 2012

Some Important Amendments Made By Companies Bill, 2011

xCommencement of Business - Provision removed under Companies Bill 2011.

üIntroduction of E-governance - Maintenance and inspection of all forms of documents in electronic

form.

üKey Managerial Personnel - CEO or the MD or the manager, Company Secretary, CFO, if the Board of

Directors appoints

üMinimum Period of stay by any one director in India - Minimum stay in India for 182 days in the

previous calendar year.

üDirectors - Mandatory Appointment of Independent Director in listed companies. Nominee director

shall not be deemed to be an independent director. Independent directors shall hold office up to two

consecutive terms. One Term - 5 Consecutive years.

üWoman Director - Mandatory appointment of at least one woman director in the prescribed class or

classes of companies.

üCorporate Social Responsibility - Corporate Social Responsibility Committee board consisting of

three or more directors is mandatory for the company who's Net Worth, Turnover and Net Profit is

more than prescribed limits.

üSecretarial Audit - A Secretarial Audit Report is required to be annexed with the Board's report for

every Listed Company and the company belonging to other class of companies as may be

prescribed by the central government from time to time.

xBuy Back of Shares - No buy-back of share is allowed within the period of one year from the last buy-back

irrespective of whether it is buy back by board approval or shareholders approval.

xDeclaration of Interim Dividend - In the Companies Act, 1956 there was no restriction on declaring

dividend or interim dividend however the Companies bill has laid down various restrictions towards

declaration of dividend such as declaration of dividend out of the surplus amount in the profit and loss

account etc.

üSecretarial Standards - Introduction of Secretarial standards in the Companies' bill 2011 which was not

prevailing in the Companies Act, 1956.

üRegistered Valuers - In Companies Act 1956 there was no provision regarding registered valuers but in

case of companies bill 2011 valuation for any property, stocks, shares, debentures, securities or goodwill

shall be done by a registered valuer.

xWinding up - Certain criteria for winding-up included in the companies act, 1956 was deleted such as

members falling below the minimum number of members, non-commencement of business within one year

and additional ground like conducting the affairs of the business in fraudulent manners etc.

xStatutory Auditors - In case of companies act 1956 there was no restriction on re-appointment of auditor

but in case of Companies bill 2011, no individual can be an auditor for more than one term of five

consecutive years.

üDuplicate Share Certificates - If a company with intent to defraud, issues a duplicate certificate of shares,

the company shall be punishable with fine which shall not be less than five times the face value of the

shares involved in the issue of the duplicate certificate but which may extend to ten times the face value of

such shares or `10 crore whichever is higher. Stringent penalties have also been imposed for defaulting

officers of the company.

12

SIRC e-NEWS LETTER April 20122

xIssue of Shares at a discount - Under Companies bill 2011 a company cannot issue share at a

discount, any share issued by a company at a discounted price shall be void.

xInvestor Protection - Tighter rules are introduced for the purpose of acceptance of deposits and also

provided that the Central Government has the power to prescribe class or classes of companies

which shall not be permitted to allow use of proxies.

üRegistration of Charges - The specific list of cases in which it was necessary to register the charge,

as provided by in the Companies Act 1956, has been dispensed with and now all types of charge

would be required to be registered.

üRegistration Offices - Any document or returns required to be filed under this Bill, if not filed within

prescribed time, has to be filed within period of 270 days on payment of such additional fees as may

be prescribed.

üAnnual Return - Annual return of the company should provide particulars as on the date of closure of

the financial year, the extract of Annual return should form part of the Board's Report and should be

filed within thirty days from the date of AGM.

üEstablishment of SFIO - The Central Government has the power to establish “SERIOUS FRAUD

INVESTIGATION OFFICE” to investigate frauds relating to a Company.

üPunishment in Case of Repeated Default - An offence punishable with fine or imprisonment is

repeated for second or subsequent occasions within a period of 3 years, the company and every

officer in default shall be punishable with twice the amount of fine in addition to imprisonment.

üMaximum Number of members in AOPor Partnerships - Number of persons in any association or

partnership shall not exceed 100; this restriction is not applicable to association or partnership

formed by professionals.

üPenalty for PCS - Fine of Rs.50,000/- to Rs.5,00,000/- shall be imposed on PCS for wrongly certifying

Annual Return.

üChange in Promoters' stake - Every listed company shall file a return in the prescribed form with the

registrar with respect to change in the number of shares held by promoters and top ten

shareholders of the company within 15 days of such change.

üAlteration of Articles - Every alteration in the articles shall be filed within 15 days from the date of

alteration; however there is no stipulated period for the Registrar to register the alteration in the

articles. This provision was introduced mainly to speed up the registration of altered articles much

quicker.

üExemption to certain companies - The central government may by notification from time to time

direct that any of the provisions of the act shall not apply or shall apply with modifications,

exceptions and adaptations as may be specified, to any class or class of companies.

Having introduced the Bill in Parliament in December 2011, the government cannot pull it out unless

it gets leave of the House to withdraw it. The Bill has neither been withdrawn nor pressed for passage.

Wrapping up

13

SIRC e-NEWS LETTER April 2012

PREFACE

Schedule VI to Companies Act, 1956 deals with the Form of Balance sheet, Statement of Profit & Loss

Account and disclosures to be made therein.

th

Ministry of Corporate Affairs [MCA] has issued the revised Schedule VI to companies Act, 1956 on 28

March 2011, which has been developed in the frame work of existing non-converged Indian Accounting

Standards notified under the Companies (Accounting Standards) Rules 2006.

APPLICABILITY

This revised Schedule VI shall apply to all companies uniformly for the financial year commencing on or

st

after 1 April 2011

SALIENT FEATURES OF THE REVISED SCHEDULE VI

a) Horizontal format of balance sheet shall no more exist.

b) All assets and liabilities are classified into current and non-current categories.

c) Comparative information for the preceding accounting period shall be disclosed in Balance Sheet,

Profit and Loss Account and Notes on Accounts [except for the first financial statement]

d) All the additional information shall be provided in Notes to Accounts i.e. Schedules are replaced by

Notes to Accounts and each item on the face of Balance Sheet & Profit and Loss Account shall be

cross referenced to Notes to Accounts.

e) Preference share capital is classified as share capital

f) The new Schedule VI, has eliminated the option of presenting the figures in terms of hundreds or

thousands in case the turnover exceeds Rs. 100 crores

g) In case of issue of shares for consideration other than cash the same can be disclosed only upto 5

financial years and unlike old Schedule VI the same need not be disclosed every year.

h) Share holding morethan 5% shares with the number of shares held needs to be disclosed and also

the share holding of holding/subsidiary/associates of holding company to be disclosed except the

Joint venture.

i) Presenting Debit Balance of P & L account in the Assets side no more in exists and the same should

be presented in the Reserves & Surplus within brackets as a negative figure.

j) Money received against share warrants to be shown as new line item in equity and in case of share

application money pending allotment same shall be classified in between equity and liabilities.

k) Long Term Borrowings:

This should represent only the portion of borrowings which is not due within 12 months after Balance

sheet date and any instalment of the long term borrowing that are scheduled to fall due within 12

months after the Balance sheet date is classified as other current liabilities .

Schedule VI to Companies Act, 1956

CS SRIRAM P

P.Sriram & Associates

Company Secretaries

Chennai

14

SIRC e-NEWS LETTER April 2012

l) Long term & current Provisions:

Provisions for which claim is to be settled beyond 12 months after BS date shall be classified as Non

current provision otherwise it shall be classified as Current liability

m) Short Term Borrowings:

Any borrowing [loans, advances, deposits] repayable within12 months

n) Other current liabilities:

Any long term borrowing having remaining maturity of 12 months or less or portion of such long term

borrowing falling due for payment within12 months after Balance sheet date is classified as other

current liabilities. It also include unpaid dividend, interest accrued but not due on borrowings,

interest accrued and due on borrowings, income received in advance etc.,

o) Introduction of Trade receivables/Payable:

Any amount due on account of goods sold or services rendered are classified as Trade receivables.

Any amount due on account of goods purchased or services received in normal are classified as

Trade payable.

p) Separate line item has been provided with respect to defer payment liabilities and advance income

Advances from customers are classified as trade payables and classified into current and non

current. Such non-current portion is classified as other current liabilities (except defer payment

liability)

q) The tangible and intangible assets needs to be segregated and tangible assets under construction

and intangible assets under development are separate line items. Brand needs to be shown as

Intangible assets

r) Investment Property under the head non-current investments.

s) Cash:

In case of repatriation restriction of foreign currency then the cash and bank balance (depending

upon restriction) shall be shown as current or non current financial assets

t) There is no line item for “Miscellaneous Expenses” therefore accounting for deferred expenses like

share issue expenses debenture discount or debenture issue expenses etc., and presentation

thereof under the existing Indian GAAP creates confusion.

u) Expenses for issue of equity shares shall be adjusted with the issue proceeds (viz., Premium) Apart

from the above:

Schedule VI to Companies Act, 1956

15

SIRC e-NEWS LETTER April 2012

·The Provision 1 of General instruction make it is very clear that where compliance with the

requirement of the Act including Accounting Standards as applicable to companies require any

change in treatment or disclosure the same shall be made and the requirement of Schedule VI

shall stand modified accordingly.

·The disclosure requirements in Part I and Part II of this schedule are in addition to and not in

substitution of the disclosure requirements specified in the Accounting Standards prescribed

under the Companies Act, 1956

·Notes to Accounts shall contain all supplementary information which requires Narrative

descriptions or disaggregation of items recognized and information about items that do not

qualify for recognition in those statements.

Profit & Loss Account:

In the revised Schedule VI, Part II format for the statement of Profit & Loss has been prescribed. This

requires separate presentation of extraordinary items and exceptional items. There needs to be a

separate presentation of P & L accounts that arise out of discontinuing operation.

Any income / expenditure shall attract separate disclosure in case it exceeds either Rs.1.00 lac or 1% of

the revenue from operations whichever is higher.

DISCLOSURES DISPENSED IN THE REVISED SCHEDULE VI

List of items that have been eliminated from disclosure in the Revised Schedule VI

§Information regarding licensed capacity, installed capacity, actual production.

§Disclosure of quantitative details of raw material consumed by Manufacture Company

§ Item wise quantitative details or value of opening stock and closing stock of goods purchased

by Manufacture Company and trading companies. (Accordingly opening and closing stock

value can be presented in aggregate)

§Disclosure of status of WIP

§Disclosure of Brokerage and commission on sales including commission paid to selling

agents.

§Disclosure of special reserve for repayment of capital and loans.

§Disclosure requirement regarding managerial remuneration thereby covered under

Corporate Governance report.

Schedule VI to Companies Act, 1956

16

SIRC e-NEWS LETTER April 2012

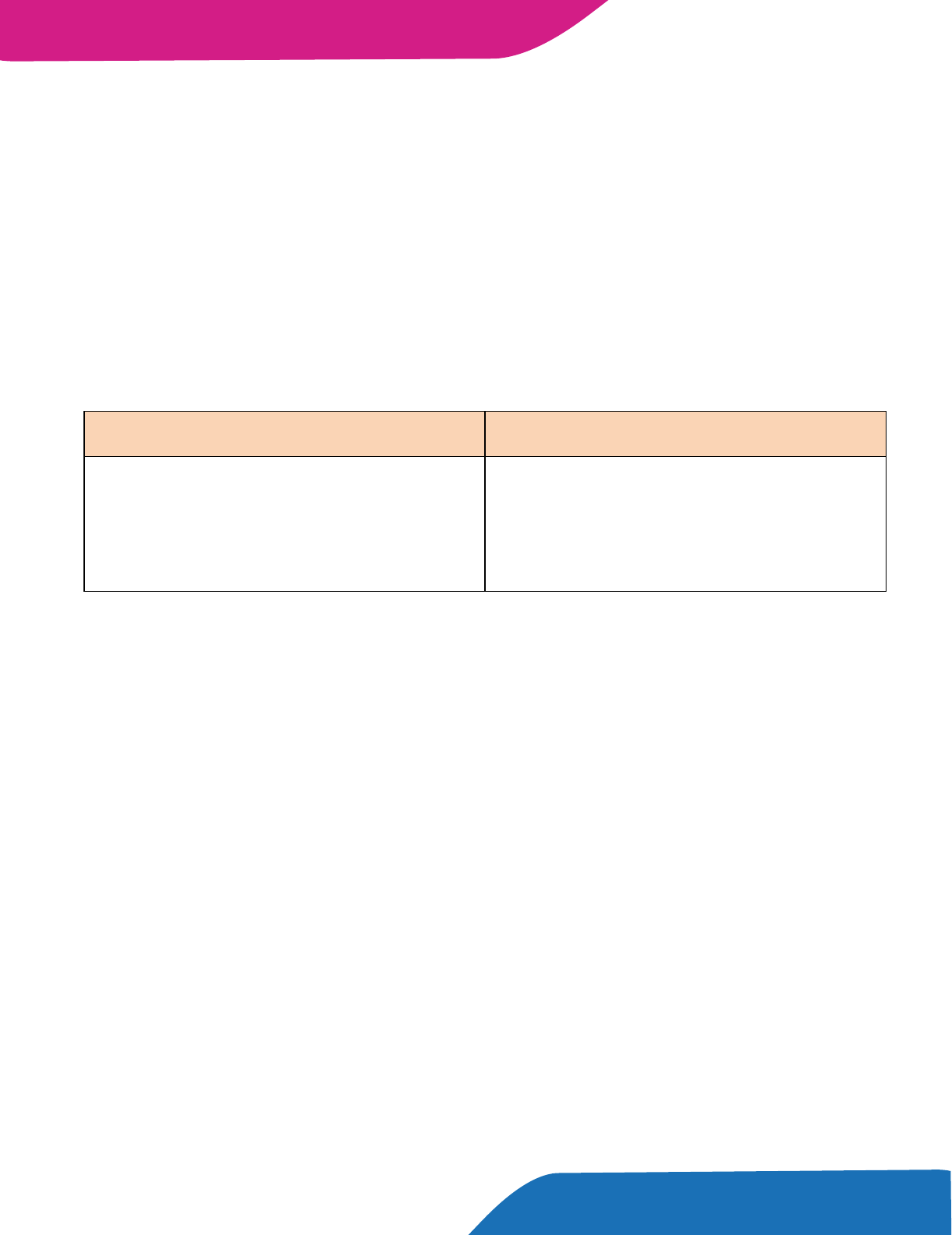

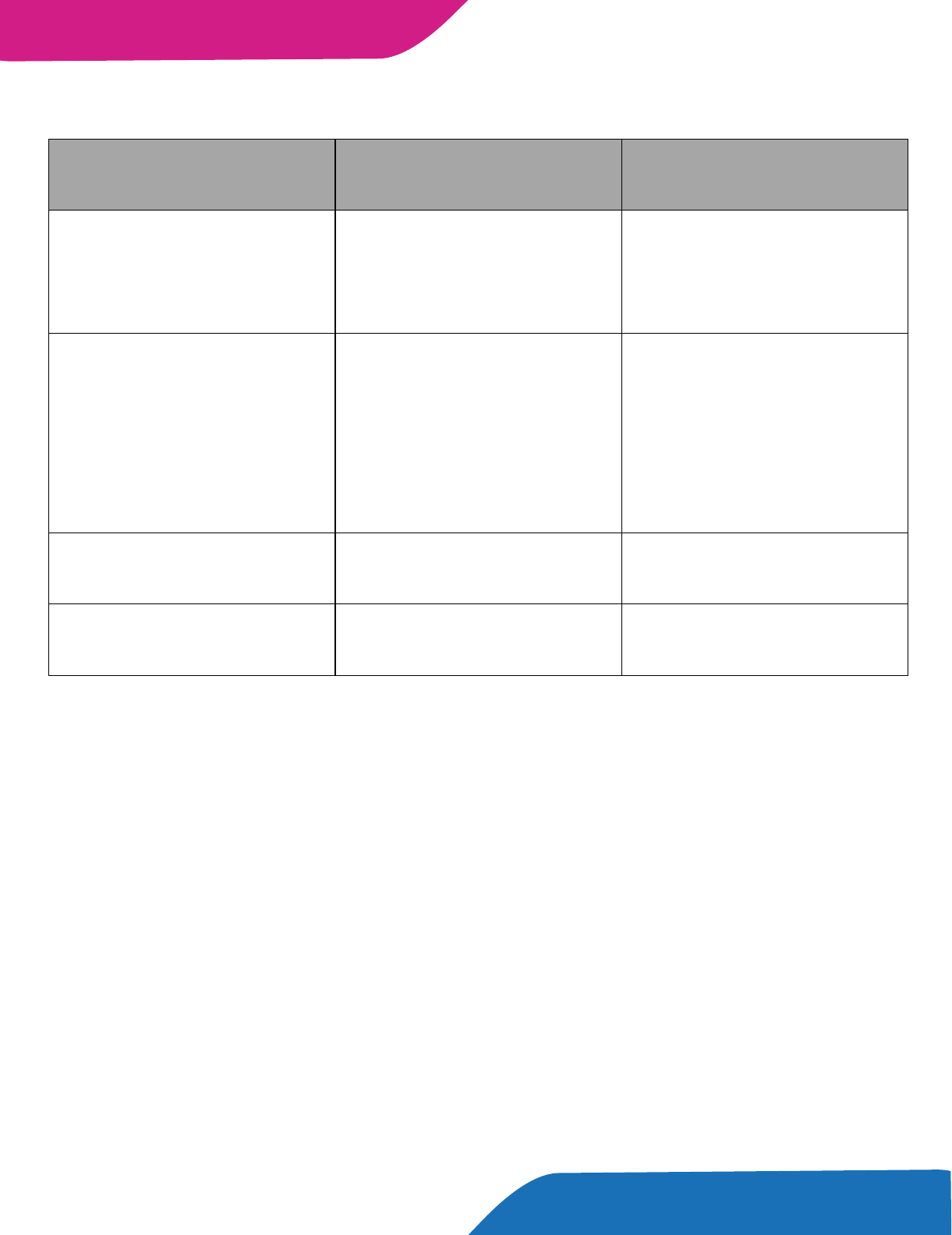

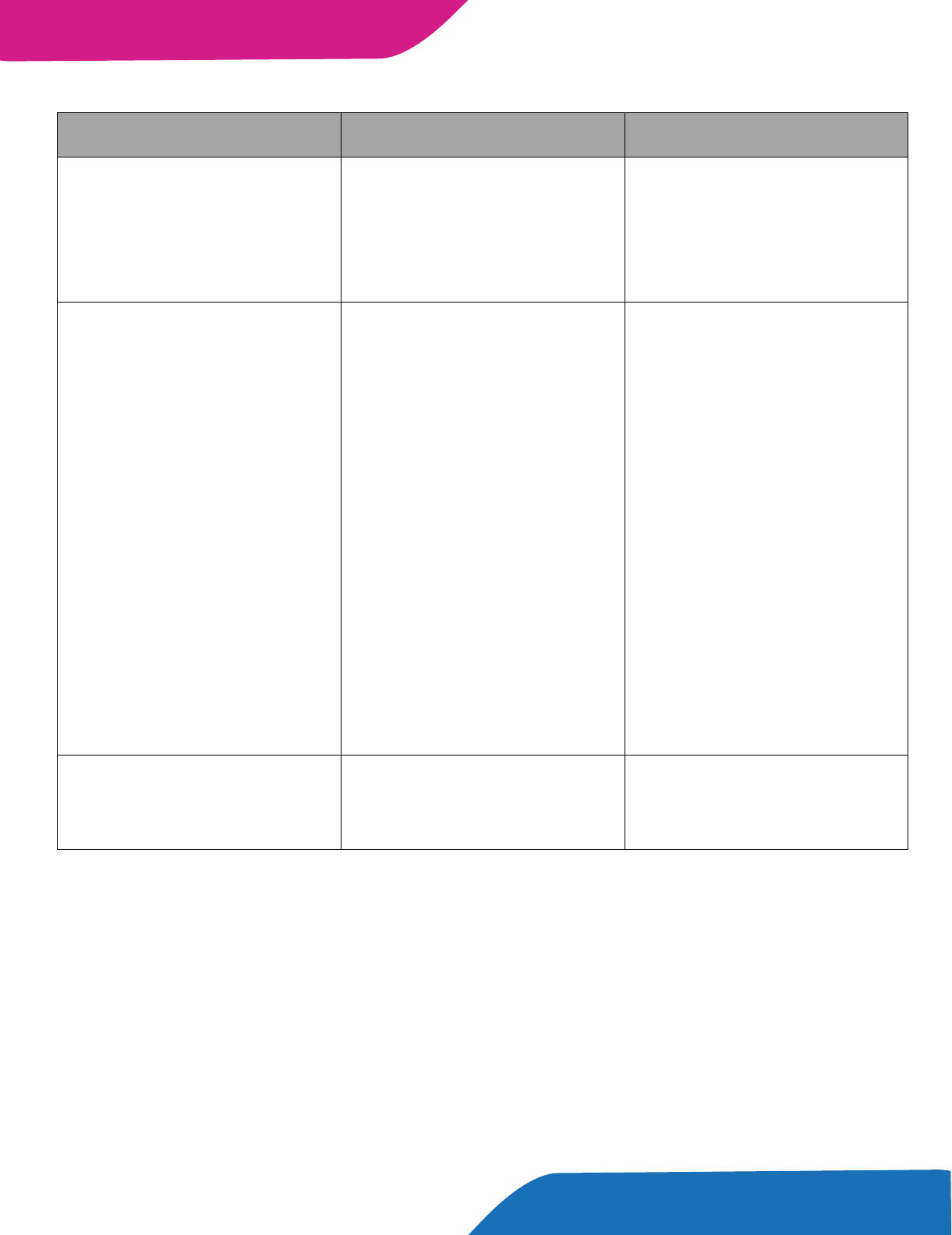

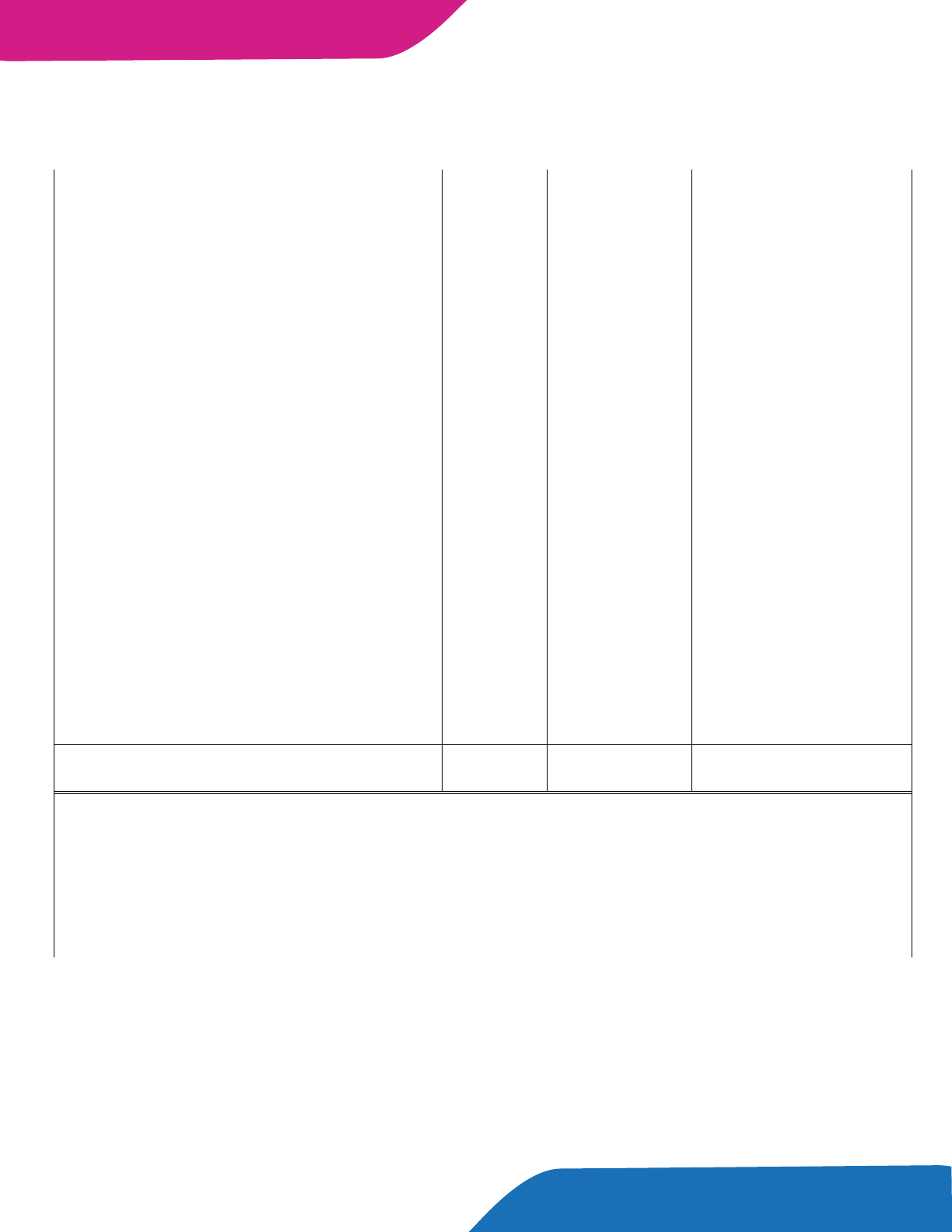

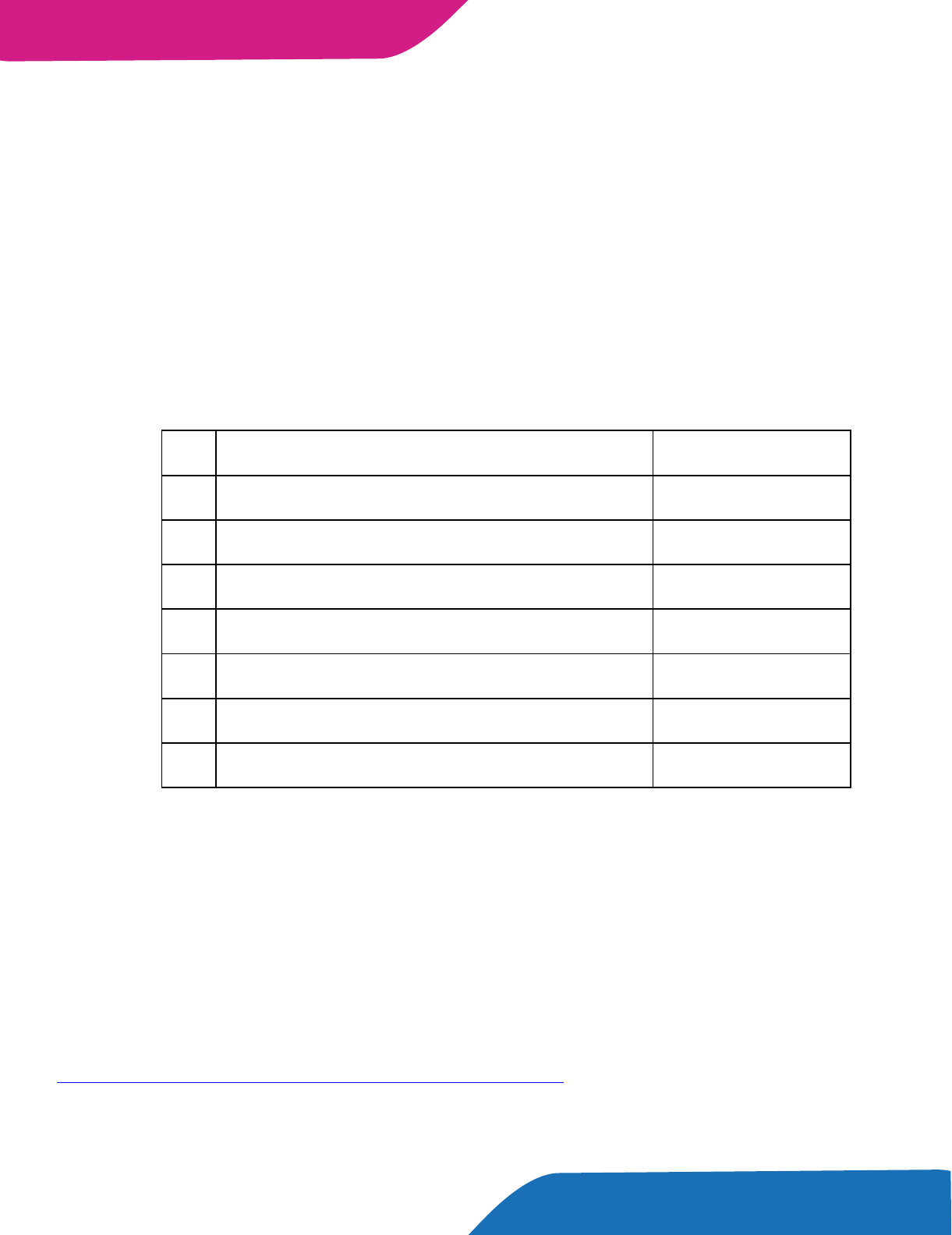

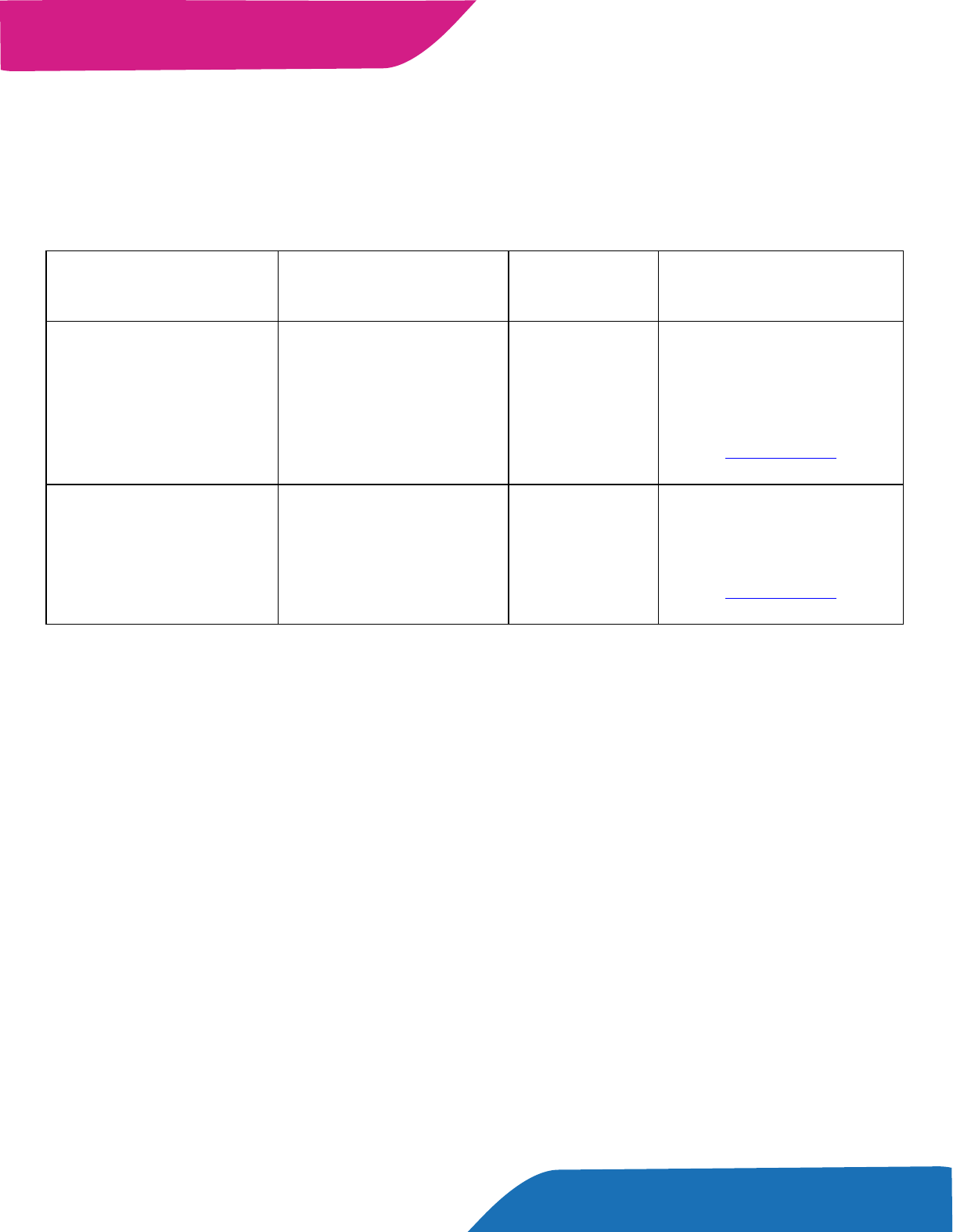

ISSUES

EXISTING SCHEDULE

VI

REVISED SCHEDULE

VI

A reconciliation of the number of

shares outstanding at the beginni ng

and at the end of the reporting

period.

Reconciliation not

required

Reconciliation required

For the period of five years

immediately preceding the date as at

which the Balance sheet is prepared:

-

Aggregate number and class

of shares allotted as fully pa id

up pursuant to contract(s)

without payment being

received in cash.

-

Aggregate number and class

of shares allotted as fully paid

up by way of bonus shares

Requires continued

disclosures

Requires disclosures

of the transactions up

to immediately

preceding 5 years from

the current reporting

date.

ISSUES

EXISTING SCHEDULE

VI

REVISED SCHEDULE

VI

Shares in the company held by each

shareholder holding more than 5%

specifying the number of shares

held.

Disclosure not required

Disclosure required

Other issues:

Treatment of capital profit arising on

reissue of forfeited shares

Transfer to capital

reserve

No specific direction.

Same treatment will

continue. Since there

is no specific treatment

it may be transferred to

securities premium

account.

Share suspense account for pending

share issues against consideration

received

Presently shown as

share suspense

account

To continue as share

suspense account by

creating additional sub-

line item

Share application money pending

allotment of shares

To be presented

between share capital &

Reserves and Surplus

To be presented

between shareholder’s

fund and Long term

Borrowings

COMPARITIVE ANALYSIS OF NEW SCHEDULE VI WITH OLD SCHEDULE VI

Schedule VI to Companies Act, 1956

17

SIRC e-NEWS LETTER April 2012

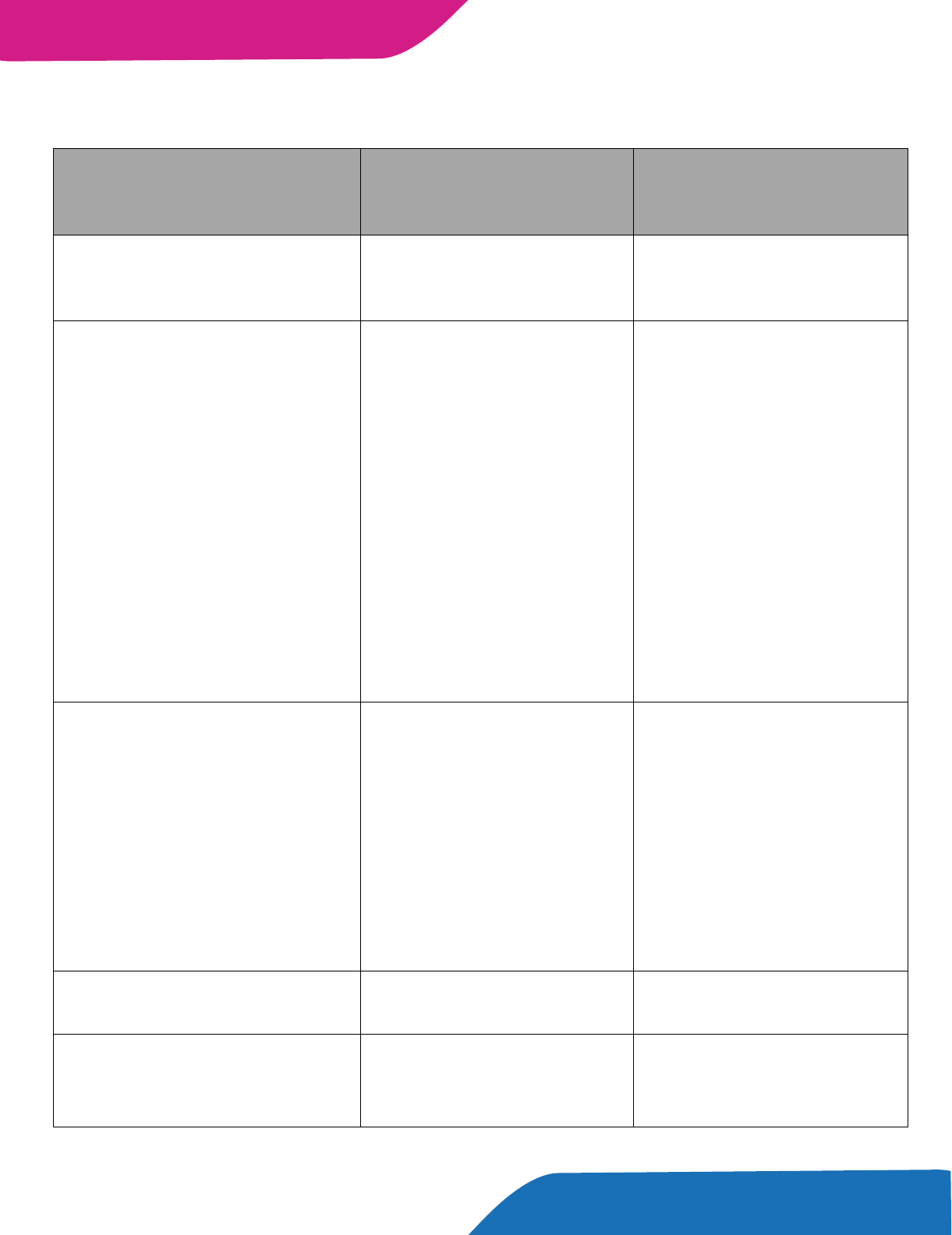

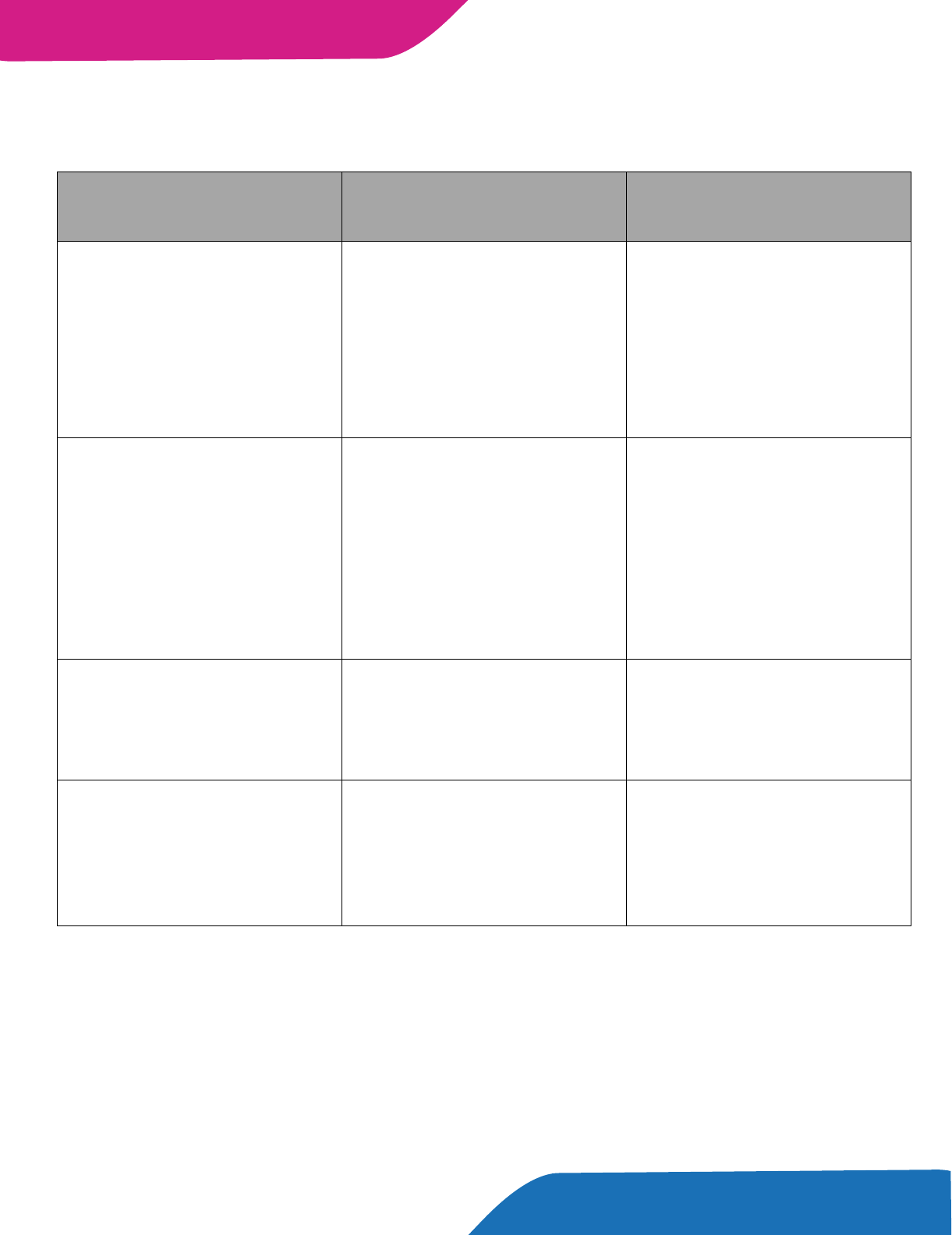

COMPARATIVE DISCLOSURE REQUIREMENTS REGARDING RESERVES AND SURPLUS

DETAILS OF RESERVES

AND SURPLUS

EXISTING SCHEDULE VI

REVISED SCHEDULE VI

Share Premium Account

(now termed as Securities

Premium Reserve)

To include the details of

utilization in accordance

with section 78 of the

Companies Act,

1956

No specific direction to

present utilization

Debenture Redemption

reserve

Earlier there was no

requirement separate

account head has been

created in accordance with

the requirement of section

117C of the Companies

Act, 1956

Specific account head

required

Revaluation Reserve

No requirement

Specific Account head

required

Share option outstanding

Account

No requirement

Separate accounts and

presentation required

Schedule VI to Companies Act, 1956

18

SIRC e-NEWS LETTER April 2012

DETAILS OF CURRENT AND

NON-

CURRENT

LIABILITIES

EXISTING SCHEDULE VI

REVISED SCHEDULE VI

Disclosure of Loan Funds/

long term borrowings

Shown under the head

sources of funds

Shown as Non -

Current

liabilities under the head

Equities and Liabilities

Long ter m and short term

borrowings

short-term as well as long -

term borrowings are

grouped together under

the head Loan funds with

sub-headings as secured

and unsecured

Long term borrowings are

to be showed under non -

current liabilities and

short-term borrowi ngs are

to be shown under current

liabilities with separate

disclosures to secured/

unsecured loans.

>12 months classified as

non-

current liabilities

(long term Borrowings)

<12 months classified as

current Liabilities (short

term borrowings

Deferred Tax

Liabilities/

Assets (Net)

To be disclosed as a

separate head

No specific disclosure

required but break up of

deferred tax assets and

tax liabilities to be

disclosed in notes to

accounts as per AS 22

and shall be included

under the head non -

current assets

and

liabilities as the case may

be.

Lease obligations

Included under the head

current liabilities

Included under the head

Non-

current assets

Default in repayment of loans

Disclosure not required

Defaults in case of

borrowings, in regard to

repayment o f loan or

payment of interest are

COMPARATIVE DISCLOSURE REQUIREMENTS REGARDING

NON- CURRENT AND CURRENT LIABILITIES

Schedule VI to Companies Act, 1956

SIRC e-NEWS LETTER April 2012

19

Details of default in payment

of loans

Disclosure not required

Period and amount of

default in repayment of

dues, providing break -up

of principal and interest

shall be specified

separately in eac h case of

default

Disclosure of current liabilities

Current liabilities and

provisions are reduced

from current assets, Loans

and advances

Disclosure of current

liabilities shown under the

head Equities and

Liabilities

Interest accrued and due

thereon

Interest accrued and due

shown under the head

secured or unsecured

loans

Interest accrued and due

to shown under the head

other current liability

Provisions

Provisions include

Provision for taxation,

proposed dividends,

provisions for

contingencies, for

provident fund schemes,

for insurance and staff

benefit schemes.

Provisions are classified

as current and non -

current provisions

depending upon their

maturity period.

Proposed dividend

Shown under current

liabilities and provisions

Not treated as provision

and not to be disclosed in

the Balance sheet but to

be disclosed in the notes

in contingent liabilities and

commitments. However

AS have an overriding

effect over revised

schedule VI and

accordingly companies

have to disclose for the

same until the revis ion of

AS 4.

Profit and loss account (debit

balance)

Shown under the head

Miscellaneous expenditure

and losses

To be shown as a

negative figure under the

head surplus.

Schedule VI to Companies Act, 1956

SIRC e-NEWS LETTER April 2012

20

Sundry Creditors

To be bifurcated as dues

of Micro and small

enterprises and other th an

micro and small

enterprises.

Sundry creditors renamed

as trade payables under

the head Current liabilities.

Bifurcation for dues of

micro and small

enterprises not required.

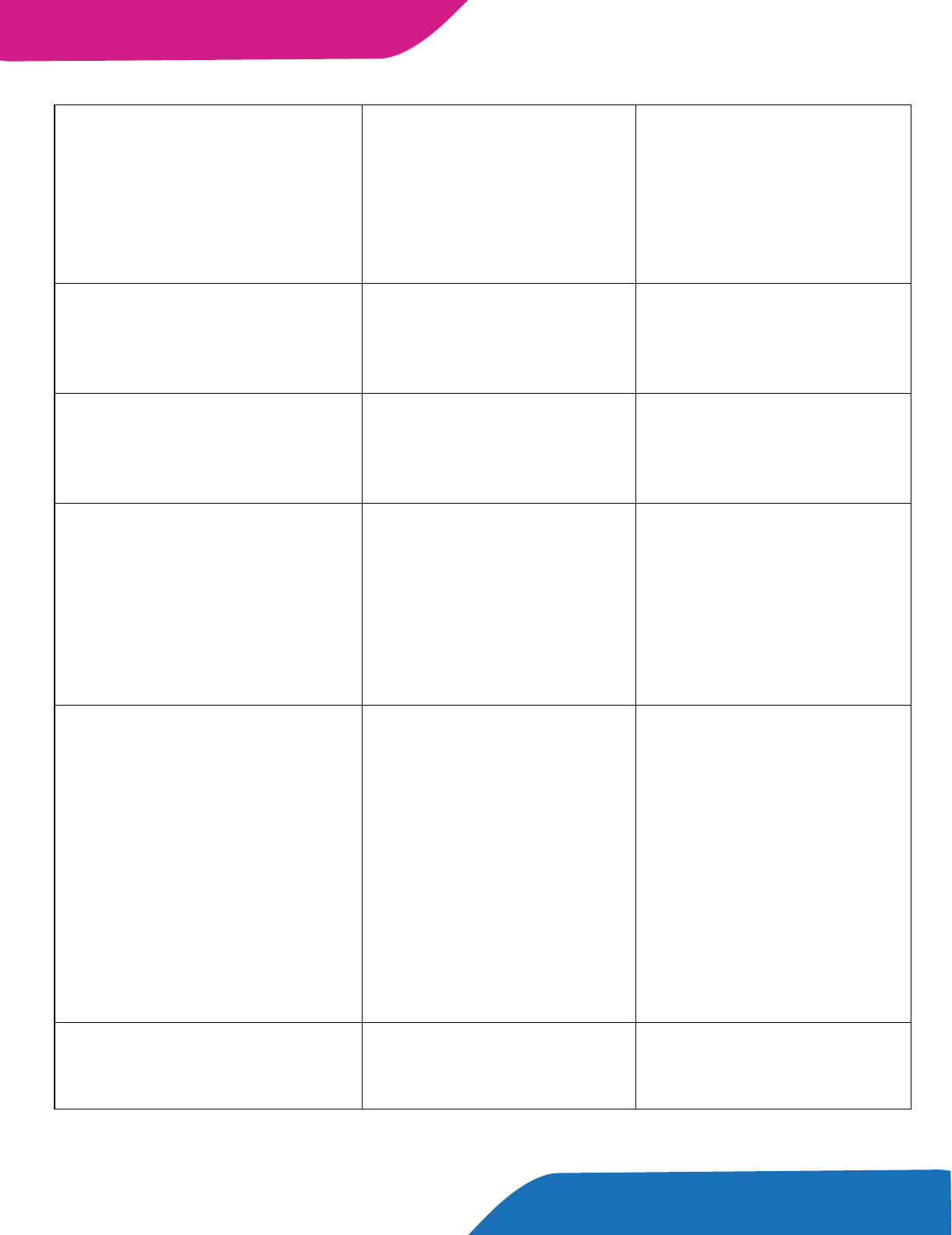

COMPARATIVE DISCLOSURE REQUIREMENTS REGARDING

NON- CURRENT AND CURRENT ASSETS

II. ASSETS – Assets bifurcated under two heads - Non-Current and Current assets

DETAILS OF ASSETS

EXISTING SCHEDULE VI

REVISED SCHEDULE VI

Bifurcation of fixed assets

Bifurcation not required

Bifurcation required.

Fixed assets sub -

divided

as:

Tangibl e assets

Intangible Assets

Capital Work in progress

Intangible assets under

development

Bifurcation of Investments

Bifurcation not required

Bifurcation required as

current and non -

current

investments

Statement of investment

Statement of investment to

be

attached

Not required

Investments at other than

cost

Not required

Investments carried at other

than cost should be

separately stated specifying

the basis for valuation

Sundry Debtors/ Trade

Receivables

In the Balance sheet known

as Sundry Debtors

Sundry

Debtors renamed

as Trade Receivables

Schedule VI to Companies Act, 1956

SIRC e-NEWS LETTER April 2012

21

DETAILS OF ASSETS

EXISTING SCHEDULE VI

REVISED SCHEDULE VI

Loans and advances

Shown along with Current

assets

Bifurcated into short term

and long term loans and

advances under the heads

current and non -current

assets respectively.

Cash and Bank Balances

Bank Balances divided into

two categories Scheduled

Banks and others

Cash Equivalents include

Cheques on hand and Bank

Balances

Restriction on repatriation

of funds with respect to

cash and Bank Balances to

be provided

Bank deposits with more

than 12 months to be

disclosed separately

Unpaid dividend, margin

money, security against

borrowings, guarantees and

commitments to be

disclosed separately

Disclosure of Miscellaneous

expenditure (to the extent

not written off or adjusted)

Disclosure required

No corresponding

disclosure

Schedule VI to Companies Act, 1956

SIRC e-NEWS LETTER April 2012

22

COMPARATIVE DISCLOSURE REQUIREMENTS FOR PROFIT AND LOSS ACCOUNT

DETAILS OF INCOME/

EXPENDITURE

EXISTING SCHEDULE VI

REVISED SCHEDULE VI

Separate line item/

Expenditure criteria

Any item of

income or

expenditure which exceeds

1(one) % of the total

revenue or Rs. 5,000/ -,

whichever is higher was

required to be distinctly

disclosed and not clubbed

Any item of income or

expenditure which exceeds

1 % of the total revenue or

Rs. 100,000/ -, whichever is

higher is required to be

distinctly disclosed and not

clubbed

Disclosure regarding

dividends from subsidiaries

Dividends declared by

subsidiary companies after

the date of the balance

sheet should not be

included unless they are in

respect of the period which

closed on or before the

date of the balance sheet

Treatment of dividend from

subsidiary to be in

accordance with the

applicable Accounting

Standards.

Depreciation

If no provision is made for

depreciation, the fact and

the quantum of arrears i s

required to be disclosed

No such requirement in

respect of depreciation

Gain/ Loss in Foreign

Exchange fluctuation

The net gain/loss on foreign

currency transaction were

to be shown under the head

Finance cost

Net/gain or loss in Foreign

currency trans action shall

be included under the head

finance cost and other

expenses.

Schedule VI to Companies Act, 1956

DISCLOSURES IN NOTES TO ACCOUNTS

Notes to Accounts shall disclose the Details of the following:

i. Share capital

ii. Reserves and surplus

iii. Long term Borrowings

iv. Other long term liabilities

v. Long term provisions

vi. Short term borrowings

vii. Other current liabilities

viii. Short term provisions

ix. Tangible assets

x. Intangible assets

xi. Non- current investments

xii. Other long term loans and advances

xiii. Other non- current assets

xiv. Current investments

xv. Inventories

xvi. Trade receivables

xvii. Cash and cash equivalents

xviii. Short term loans and advances

xix. Other current assets

xx. Contingent liabilities and commitments

CONCLUSION

üThe very main purpose and object of preparation & presentation of financial statement is to

provide information about the financial performance & financial position of an entity which shall

be utilized by various stakeholders and share holders for exercising their financial decisions.

üBy this revised Schedule VI, the objective of providing the exact information on assets,

liabilities, income & expenses (viz., current/non-current) to the investors, shareholders, public,

banks, lenders, Government and its agencies, suppliers be met with. Further the Balance sheet

shall give true and fair view of the statement of affairs of the company

üBy bifurcating as Current & Non Current (Assets/Liabilities) the users of such financial

information shall be able to take informed decision and can never be misled as there is no room

for interpreting the financials at the user end. Moreover it highlights assets that are expected to

be realized within the current operating cycle and liabilities that are due for settlement within the

same period.

üLet's welcome the revised Schedule VI that pave way to best corporate financial reporting.

SIRC e-NEWS LETTER April 2012

23

Schedule VI to Companies Act, 1956

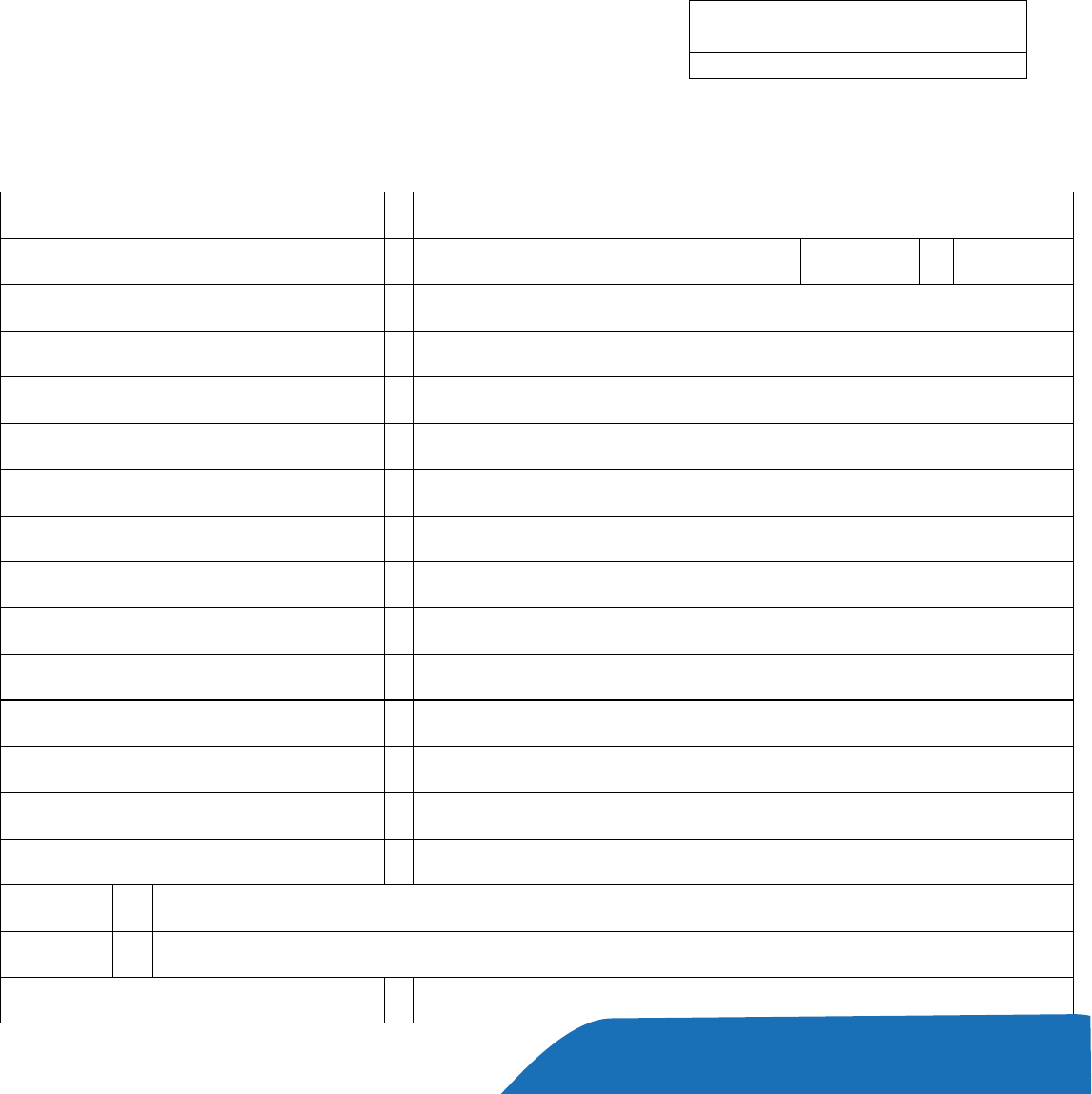

BALANCE SHEET

Balance Sheet as at 31st March, ___________

Particulars Note No

Figures for

the current

reporting

period

Figures for the

previous reporting

period

I. EQUITY AND LIABILITIES

(1) Shareholders' Funds

(a) Share Capital 1

- -

(b) Reserves and Surplus 2

- -

(c) Money received against share

warrants

(2) Share application money pending

allotment

(3) Non-Current Liabilities

(a) Long-term borrowings 3

- -

(b) Deferred tax liabilities (Net)

(c) Other Long term liabilities 4

- -

(d) Long-term provisions 5

- -

(4) Current Liabilities

(a) Short-term borrowings 6

- -

(b) Trade payables

(c) Other current liabilities 7

- -

(d) Short-term provisions 8

- -

Total

- -

II.Assets

(1) Non-current assets

(a) Fixed assets

(i) Tangible assets 9 -

SIRC e-NEWS LETTER April 2012

24

Schedule VI to Companies Act, 1956

(ii) Intangible assets

10

-

-

(iii) Capital work-in-progress

(iv) Intangible assets under

development

(b) Non-current investments

11

-

-

(c) Deferred tax assets (net)

(d) Long term loans and advances

12

-

-

(e) Other non-current assets

13

-

-

(2) Current assets

(a) Current investments

14

-

-

(b) Inventories

15

-

-

(c) Trade receivables

16

-

-

(d) Cash and cash equivalents

17

-

-

(e) Short-term loans and advances

18

-

-

(f) Other current assets

Total

-

-

As per our report of

even date

for and on behalf of M/s

Directors

Dated:

SIRC e-NEWS LETTER April 2012

25

Schedule VI to Companies Act, 1956

26

SIRC Activity Report

SIRC Activity Report

th

Valedictory Session of 11 MSOP

Study Circle Meeting on Guidance notes on Service Tax

One Day Programme on Capital Markets – Growth Drivers

th th

The valedictory session for the 11 Management Skills Orientation Programme [MSOP] was organized on 04 April

2012. Shri Suresh B Menon, Regional Manager, Southern Regional Office, SEBI, Chennai delivered the valedictory

address. Earlier, Ms. Sarah Arokiaswamy, Joint Director, ICSI – SIRO welcomed the Chief Guest and congratulated

the participants on completing the MSOP. She urged the participants to become a member of the CSBF at the

earliest.

CS Marthi S S, Chairman, ICSI – SIRC, in his address highlighted the growing importance of CS in the corporate

world and emerging areas of practice. CS Dr. Ravi B, Member, ICSI – SIRC introduced the Chief Guest to the

participants. 'The more you are updated with the happenings / acts pertaining to the profession, the more you will

glow in the profession as CS' was the message of the CS Dr. Ravi B to the participants. Shri Suresh B Menon, in his

address, highlighted the diversified roles of CS in the modern corporate world through a presentation, which was

well received by the participants. Shri Menon also urged the participants to work on their personality development.

The certificates were distributed to the participants by the dignitaries and the programme concluded with the formal

vote of thanks by CS Ramasubramaniam C, Member, ICSI – SIRC.

CS Babu Sankara Subramanian V, Company Secretary in Practice, Chennai was the speaker for the Study Circle

th

Meeting on guidance notes on service tax on 4 April 2012. CS Marthi S S, Chairman, ICSI – SIRC welcomed the

members and CS Dr. Ravi B, Chairman Professional Development Committee, ICSI – SIRC introduced the speaker

to the members.

Shri Babu elaborated on the Guidance Notes A and B on Service tax. He spoke on the new approach of the

Government to the service tax especially the concept of Service, taxability of services, Negative List, Declared

services, exemptions and further the proposed rules of interpretation and Place of Provision of Services Rules 2012.

He also explored the possible area of scope for practice to the Company Secretary in the Service tax including the

structuring of transaction. His discussion evoked a lively deliberation amongst the members and inspired to pursue

further dimensions of service tax. The Chairman ICSI – SIRC summarized the speech and emphasized the need to

have similar in-depth study and training of members in this area of service tax. The Chairman, ICSI – SIRC proposed

the vote of thanks.

To commemorate the ICSI – Capital Market Week, the ICSI – SIRC organized a one day programme on

th

'Capital Markets – Growth Drivers at Radisson Blu Hotel, Chennai on 25 April 2012.

SIRC e-NEWS LETTER April 2012

27

SIRC Activity Report

SIRC e-NEWS LETTER March 2012

The programme was inaugurated by Shri A D M Chavali, Executive Director, Indian Overseas Bank,

Chennai and Shri V Shankar, Director, Computer Age Management Services Limited, Chennai was the

guest of honour. In the inaugural session, CS Sridharan R, Council Member, The ICSI and the Programme

Director welcomed the dignitaries and delegates. In his address, Shri Sridharan emphasized that the ICSI

has strong interface with the Capital Market and the ICSI is regularly conducting investor awareness

programmes in rural and semi – rural areas in all over India.

In his address, CS Ananthasubramanian S N, Vice President, The ICSI complemented the Capital Markets

Committee for organizing the Capital Markets Week and wished the programme a success. CS Dr. Ravi B,

Chairman, Professional Development Committee, ICSI – SIRC introduced the dignitaries to the delegates.

The guest of honour, Shri V Shankar, in his address, opined that the individual investors are very much

reluctant on investing in Capital Markets. He pointed out that the investment on gold and silver is more by

the individuals. Shri Shankar emphasized that some concrete foundational and structural measures has to

be brought in educating the individuals to invest in capital markets. He observed that the Capital Market in

Indian mainly rely on foreign investors. Shri Shankar opined that it is the duty of the professional bodies and

professionals to educate the citizens on the financial literacy. He suggested that the government should

take efforts to make changes in the curriculum and educate the students from school level, on financial

literacy.

Shri A D M Chavali, Executive Director, Indian Overseas Bank, Chennai, in his inaugural address,

appreciated the ICSI and the SIRC for organizing the series of programmes as a part of the 'Capital Market

Week'. Shri Chavali elaborated the delegates on the treasury market in India. He also spoke on the

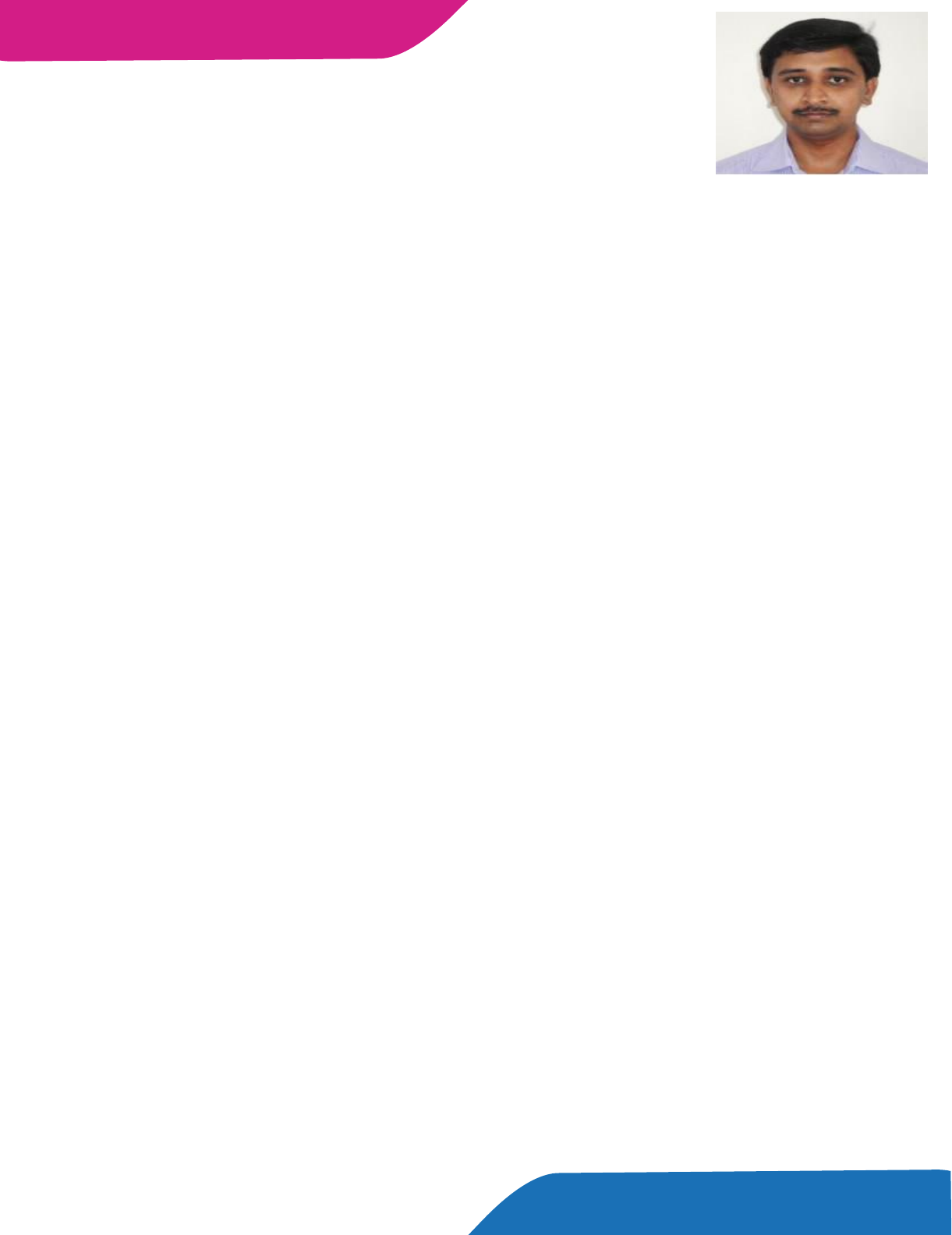

A.D.M.Chavali lighting the lamp.

Others seen are [LtoR]:

V.Shankar;S.N.

Ananthasubramanian, V. Nagappan

and Dr. B .Ravi

S.N. Ananthasubramanian seen

addressing.

Others seen are [LtoR]: Dr. B.Ravi

A.D.M.Chavali;V.Shankar;R.Sridharan

and B. Narasimhan

correlation between the equity and forex markets and observed that the inflow and outflow of FII have great

impact on markets. Shri Chavali observed that during the period between 2002 and 2008, Indian local

markets converted into global markets. Shri Chavali threw light on the roles played by the nationalized

banks in capital markets. He suggested that the professionals should try to educate the individuals on

investing in capital markets. Shri Chavali also requested the ICSI to establish an exclusive capital market

division to educate the investors.

A publication of the ICSI, entitled, 'Referencer on Certification of Securities Transfers - Clause 47(C) of the

Equity Listing Agreement' was released by the dignitaries on the occasion. The inaugural session

concluded with the summing up of the proceedings and vote of thanks by CS Narasimhan B, Council

Member, The ICSI.

Session – I

The first technical session was on the topic 'Capital Markets: Challenges, Opportunities for Innovation'.

The session was addressed by Shri P K Choudhury, Vice Chairman and Group CEO, ICRA Limited and

Shri Keyoor Bakshi, Past President, The ICSI. Earlier CS Ramasubramaniam C, Member, ICSI – SIRC

welcomed the speakers and introduced them to the delegates. Shri Choudhury elaborated members on

the important changes in the global market and Indian capital market. He explained the various

opportunities available for the professionals in financial markets.

In his address, Shri Keyoor Bakshi threw light on the opportunities available for the CS in the financial

markets. He narrated the differences between the market makers and market operators and highlighted

that the market maker may well be an CS. The Past President also opined that the CS has more

opportunities in the areas of M&A, IPR and their advice on the new takeover code to the Board is vital. He

also suggested bringing out an exclusive e-journal on capital markets, to be circulated to members and

students. Shri Keyoor Bakshi also predicted that the Capital Market may increase by three times by the

year 2020. The session concluded with the formal vote of thanks by CS Ramasubramaniam C, Member,

ICSI – SIRC.

Session – II

The second technical session was on the topic 'Recent Regulatory Changes in Capital Markets' and the

speakers were Shri B Madhu Prasad, Vice Chairman, Key Note Corporate Services Limited, Mumbai and

Shri B Narasimhan, Council Member, The ICSI. CS Sridharan R, Council Member, The ICSI introduced the

speakers to the delegates. Shri Madhu Prasad observed that lot of changes has happened in the capital

markets in the period from 1993 to till date. He classified those changes under three heads, viz, the

permission era, the pricing era and the participants. Shri Prasad also made elaborate presentation on the

'Issue of Capital and Disclosure Requirements [ICDR]', which was introduced in August 2009. He

28

SIRC Activity Report

SIRC e-NEWS LETTER April 2012

29

SIRC Activity Report

concluded his speech with a remark that the India has transformed from control pricing regime to free

pricing regime.

Shri B Narasimhan spoke on the recent regulatory updates. Shri Narasimhan focused on Disclosure of

Track Record of the public issues managed by Merchant Bankers, Trade controls in Normal Trading

Session for IPO and other category of scrips, PSU's Disinvestment, etc. While deliberating on the IPP, Shri

Narasimhan explained that the “Institutional placement programme” means a further public offer of eligible

securities by an eligible seller, which the offer, allocation and allotment of such securities is made only to

qualified institutional buyers. He also threw light on the Offer for Sale of Shares by Promotes through the

Stock Exchange Mechanism. Shri Narasimhan made a Comparison of FPO [Follow on Public Offer], IPP &

OFS [Offer for Sale]. The session concluded with the formal vote of thanks by CS Sridharan R. Council

Member, The ICSI.

Session – III

'SME Exchange: Empowering India's SME Sector' was the theme for the second session. CS

Ananthasubramanian S N, Vice President, The ICSI and Shri Vishnu Vardhan M, Regional Head, South,

BSE, Chennai were the speakers for the session. CS Sridharan R, Council Member, The ICSI introduced

the speakers to the delegates. In his speech, the Vice President observed that the SME sector in India is an

unsung sector. He also explained that 94% of the SME's in India is micro industries and out of these, nearly

90% is in proprietary form and hence there is more scope of CS in SME sector. He also quoted that nearly

Rs.5,000 crores has been allotted to the SIDBI in the Union Budget. As the SME's fall under the jurisdiction

of SIDBI, the Vice President sighted a good growth to SME sector in India. He also observed that no efforts

have been taken to list the SME's in Capital Market.

Shri Vishnu Vardhan, Regional Head, South, BSE, Chennai made an elaborate presentation of the SME

sector and its present scenario in India. He also explained in detail the efforts taken by BSE in developing

the SME sector in India. He observed that the BSE – SME Platform provides a great opportunity to the

entrepreneurs to raise the equity capital for the growth and expansion of SMEs. It also provides the

immense opportunity to the investors to identify and invest in the good companies at early stage. Shri

Vishnu Vardhan also opined that the SME's will help unleash the valuation of the company and in the

process create wealth for all the stakeholders including investors, besides considerable long term capital

gains tax benefits and facility to exit at any point of time. He explained that the Micro, Small and Medium

Enterprises (MSMEs) contribute 8% of the country's GDP, 45% of the manufactured output and 40% of

India's exports and concluded by informing that the SME sector provides employment to about 6 crore

people through 2.6 crore enterprises. The session concluded with the formal vote of thanks by CS

Sridharan R. Council Member, The ICSI.

SIRC e-NEWS LETTER April 2012

30

Session – IV

The fourth and final session of the programme was on the topic, 'Indian Capital Market – How to Rebuild

Investor Confidence?'. The speakers were Shri V Nagappan, Director, Madras Stock Exchange, Chennai

and Shri A K Narayan, President, Tamilnadu Investors Association, Chennai. Shri Nagappan explained

that the fact we have less than 2 crores demat account points reveal that the local / retail investor

participation is low. He observed that there is a general opinion among the public that they think the capital

market as a place of gambling and opined that it is the duty of the government, regulators and the

professional bodies to educate the general public about the pros and cons of investing in capital market.

In his simple and illustrative speech, Shri Narayan raised concern over the lack of investor's confidence.

He pointed out that the investment on fixed deposits in banks, gold and real estates by the general public

have increased than that of investing in the capital markets. Shri Narayan asserted that awareness about

Financial Planning, Risk Profiling, Asset Classes etc. should be created and impress the general public

about the need for Equity Investment. He also suggested that the investors should be informed about

Success Stories in Equity Investments and requested that the professional institutes like ICSI has vital role

in educating the investors through investment awareness programmes. The session concluded with the

formal vote of thanks by CS Ramasubramaniam C, Member, ICSI – SIRC.

The programme concluded with the formal vote of thanks by CS Sridharan R, Council Member, The ICSI

and programme director.

The ICSI - SIRC and Andhra Chamber of Commerce, Chennai jointly organized an interactive session on

MCA initiatives and investor awareness on 27th April 2012 at Chennai. Shri D.S. Balachandra Babu,

President, Andhra Chamber of Commerce welcomed the dignitaries and delegates.

Shri Henry Richard, Registrar of Companies, Tamilnadu, Chennai explained the various initiatives of the

MCA. CS Marthi S S, Chairman, ICSI - SIRC spoke on the various measures taken by the government and

the regulators in protecting the interest of investors.

CS Dr. Ravi B, Chairman, Professional Development Committee, ICSI - SIRC, CS Dr. Baiju

Ramachandran, Secretary, ICSI - SIRC and CS Ramasubramaniam C, Member, ICSI - SIRC were also

present during the meeting.

The programme concluded with the formal vote of thanks by Shri G. Ramachandran, ACS, Chairman,

Company Law Sub-Committee of the Andhra Chamber of Commerce.

Interactive Session on MCA initiatives and investor awareness

SIRC e-NEWS LETTER April 2012

SIRC Activity Report

31

Chapters’ Activity Report

Chapters’ Activity Report

BANGALORE CHAPTER

President's Meet with Students' of Bangalore Chapter

One Day Seminar on “Cross Border Transactions – Opportunities and Challenges”

The Bangalore Chapter of the ICSI organised a Students' meeting with CS Nesar Ahmad, President, The

th

ICSI, on 6 APRIL, 2012 at 9:00 AM at The Goldfinch Hotel, Bangalore.

CS S Kannan, Chairman, Bangalore Chapter of The ICSI, welcomed CS Nesar Ahmad, President, The

ICSI; CS S.N Ananthasubramanian, Vice-President, The ICSI; CS Gopalakrishna Hegde, Council Member

The ICSI; CS N.K. Jain, Secretary and CEO, The ICSI; CSS.S. Marthi, Chairman, SIRC of The ICSI; CS

Dwarakanath C, Vice-Chairman, SIRC of The ICSI and CS Nagendra D Rao, Treasurer, SIRC of The ICSI

for the Students Meet.

The President and Vice-President of ICSI addressed the students on the various initiatives of the Institute

for the benefit of students and the profession. The dignitaries also interacted with the 45 students present

wherein the students shared some of their issues and gave suggestions on the course and also to improve

the services being provided by the ICSI.

CS Sharada, Secretary, Bangalore Chapter of the ICSI proposed the vote of thanks

The Bangalore Chapter of the ICSI organised a One Day Seminar on “Cross Border Transactions-

th

Opportunities and Challenges” on 6 April, 2012 at the Goldfinch Hotel, Bangalore.82 delegates

participated in the programme.

CS Nesar Ahmad, President, The ICSI; CS S.N. Ananthasubramanian Vice-President, The ICSI; CSN.K.

Jain, Secretary and CEO, The ICSI were the guests present.

Inaugural Session:

CS S Kannan, Chairman, Bangalore Chapter of the ICSI delivered the welcome address and CS S.S

Marthi, Chairman, SIRC of the ICSI introduced the President and Vice-President.

CS Nesar Ahmad, President, The ICSI inaugurated the programme by lighting of lamp.

Thereafter CS Gopalakrishna Hegde, Member, Central Council, The ICSI facilitated the signing of MOU

between ICSI and the following institution for mutual benefit and growth and exchange of knowledge

resources:

SIRC e-NEWS LETTER April 2012

Chapters’ Activity Report

32

· Direct Taxes Regional Training Institute

· Alliance University

· Bangalore Stock Exchange Limited

· Bangalore Chamber of Industry and Commerce

“Kareebaaogethohumkosamajhpaoge; ye dooriyangalatfahmiyanbadhatihain”(If you come close

you will be able to understand me; these distances increase misunderstandings) were the opening lines by

Ms. JahanzebAkhtar, IRS, Commissioner of Income Tax after signing the MOU with ICSI on behalf of

DTRTI (Direct Taxes Regional Training Institute). It truly reflected the spirit and ethos behind the

collaboration that Bangalore chapter was forging with eminent institutions viz. DTRTI, BSE, Alliance

University,and BCIC.

Thereafter CS N.K Jain, Secretary and CEO; CS Ananthasubramanian, Vice-President, The ICSI

addressed the gathering sharing with them the important role that Company Secretaries can play in Cross

Border Transactions and also shared some of the initiatives taken by the Institute in widening the scope of

functioning of the members in the corporate sector.

CS Nesar Ahmad, President, The ICSI in his inaugural address added to the thoughts shared by Ms.

Jahanzeb Akhtar by stating his perception on how these tie ups with resourceful institutions will lead to the

holistic development and expansion of CS Profession.

CS S.C Sharada, Secretary, Bangalore Chapter of the ICSI proposed the vote of thanks.

First Technical Session on “Overseas Opportunities and Challenges”CS M Manjunatha Reddy,

Vice-Chairman, Bangalore Chapter of the ICSI welcomed and introduced the Speaker for the first

technical session CA and CS P. Chinnaraj, Consultant and Financial Advisor, Bangalore.

CA & CS P. Chinnaraj in his presentation on “Overseas Opportunities and Challenges” focused on the need

for overseas investments and its benefits and how the tax rates influence the investment destinations. He

also shared various case studies to highlight and explain the practical approach required to face and

overcome the challenges while looking for overseas investments.

CS C Dwarakanath, Vice-Chairman, SIRC of the ICSI and Ex-officio Member, Bangalore Chapter of the

ICSI proposed the Vote of Thanks

SIRC e-NEWS LETTER April 2012

Chapters’ Activity Report

Chapters’ Activity Report

33

Technical Session II -EXIM Funding OptionsCS R. Srinivasan, Member, Bangalore Chapter of the ICSI

delivered the welcome address and introduced the speaker Mr. Pranesh B.N, AGM - Regional Head-

Corporate Banking, EXIM Bank of India, Bangalore

Mr .Pranesh B.N in his presentation on EXIM Funding Options emphasized on the range of products and

services offered by EXIM Bank at all stages of Export Business Cycle and various value based

programmes available. He also explained in brief the types of financing programmes available with respect

to Export Credit; Import Credit and loan financing for exports. He also dealt with the Buyers credit option

and role of Commercial banks for the same.

CS Nagendra D Rao, Treasurer, SIRC of the ICSI and Ex-officio, Bangalore Chapter of the ICSI proposed

the Vote of Thanks.

Technical Session - III - FDI recent Regulatory Changes under FEMA

CS S.C. Sharada, Secretary, Bangalore Chapter of the ICSI delivered the welcome address and introduced

the speaker Mr. N. Raja Sujith, Partner, Majmudarand Partners International Lawyers, India.

Mr. N Raja Sujith in his presentation on “FDI recent Regulatory Changes under FEMA” emphasised on the

importance of FDI and the legal framework of certain key andprohibited sectors. He then highlighted the

factors of External Commercial Borrowings in relation to FII and LLP and its process simplifications.

CS G.M. Ganapathi, Immediate Past Chairman and Member, Managing Committee, Bangalore Chapter of

the ICSI proposed the Vote of Thanks.

The Bangalore Chapter of the ICSI organised a Press Meet with CS NesarAhmad, President, The ICSI on

th

6 APRIL, 2012 at The Goldfinch Hotel, Bangalore;

CS S.N .Ananthasubramanian, Vice–President, The ICSI;CS Gopalakrishna Hegde, Council Member, The

ICSI; CS. N.K. Jain, Secretary & CEO, The ICSI; CS S.S. Marthi, Chairman, SIRC; CS S. Kannan

Chairman, Bangalore Chapter of the ICSI and CS S.C. Sharada, Secretary, Bangalore Chapter of the ICSI

were also present

CS S .Kannan, Chairman, Bangalore Chapter of the ICSI welcomed the members of the media and

introduced the dignitaries on dais.

The President and Vice- President briefed the press on the initiatives being taken by the Institute for

members and students, the Vision Plan including extensive career orientation, professional development

programmes, brand building, extensive research projects, re-organization and infrastructure development.

They also shared with the Press that the ICSI had entered into Memorandum of Understanding with various

institutions in Bangalore.

20 press/media persons attended the press meet and interacted with the dignitaries present.

CS S.C Sharada, Secretary, Bangalore Chapter of the ICSI proposed the Vote of thanks.

President's Meet with Press

SIRC e-NEWS LETTER April 2012

Chapters’ Activity Report

34

President's Meet with FKCCI President and Vice-President

President's Meet with Members

Interview at All India Radio

Peer Review Training Programme

CS Nesar Ahmad, President, The ICSI during his visit to Bangalore met Mr. J. R. Bangera President,

FKCCI and Mr. K. Shiva Shanmugam, Vice-President, FKCCI and discussed matters of mutual Interest.

CS S.N.

Ananthasubramanian, Vice-President,

The ICSI; CS Gopalakrishna Hegde, Council Member, The

ICSI; CS. N.K. Jain, Secretary & CEO, The ICSI; and CS S. Kannan, Chairman, Bangalore Chapter of the

ICSI were also present at the meeting.

The Bangalore Chapter of the ICSI organised a Meeting of the Members with the President of the

th

Instituteon6 April, 2012at 5.00 PM at

The Goldfinch Hotel, Bangalore.

CS S. Kannan, Chairman, Bangalore Chapter of The ICSI, delivered the welcome address to all the

dignitaries CS Nesar

Ahmad, President, The ICSI and CS S.N

Ananthasubramanian, Vice-President; The

ICSI; CS Gopalakrishna Hegde, Council Member The ICSI; CS R. Sridharan, Council Member The ICSI;

CS N.K. Jain, Secretary and CEO, The ICSI; CS S.S. Marthi, Chairman, SIRC of The ICSI; CS Nagendra D

Rao, Treasurer, SIRC of

The ICSI for the and all the Members present for the Members meet

The President addressed the Members and shared with them various initiatives taken by the institute for

the benefit of Members.

CS S.N Ananthasubramanian, Vice-President, The ICSI; CS R. Sridharan, Council Member, The ICSI,CS

N.K. Jain, Secretary and CEO, The ICSI; CS S.S. Marthi, Chairman, SIRC of The ICSI also addressed the

members.

34 members attended the meet and shared their views and suggestions on various issues/aspects relating

to the profession.

CS S.C. Sharada, Secretary, Bangalore Chapter of the ICSI proposed the Vote of Thanks.

CS Nesar Ahmad, President, The ICSI, CS Gopalakrishna Hegde, Council Member The ICSI; CS N.K.

Jain, Secretary and CEO,

The ICSI were interviewed live on

All India Radio between 6.00PM to 7.00 PM on

th

6 April, 2012 on “Career as a Company Secretary”. They also answered a number of queries raised by the

listeners.

The programme was aired in most of the regions in Karnataka.

The Institute of Company Secretaries of India organized a Peer Review Training Programme for the

th

Members of Bangalore on 7

April, 2012 At Goldfinch Hotel, Bangalore. The Bangalore Chapter facilitated

the Headquarters in organizing the programme.

CS Nesar Ahmad, President, The ICSI, welcomed all the 21 members for the Peer Review Training

SIRC e-NEWS LETTER April 2012

Chapters’ Activity Report

Chapters’ Activity Report

35

Programme and gave a brief overview on the objective and importance of Peer Review.

CS S.N Ananthasubramanian, Vice-President, The ICSI; CS Gopalakrishna Hegde, Council Member,

The ICSI; CS R. Sridharan, Council Member The ICSI; CS S.S. Marthi, Chairman, SIRC of The ICSI and

CS V. Sreedharan, Member, Peer Review Committee were also present.

CS V Sreedharan, Member, Peer Review Board commenced the training programme with an Overview

on Peer Review and Guidance Notes of ICSI relevant to attestation services.

CS R Sridharan, Council Member, The ICSI and Vice-Chairman, Peer Review Board focused on Office

Administration and Systems in the Office of PCS; Concept of Audit Trail; Audit Diary and significance of

the same

CS S N Ananthasubramanian, Vice-President, The ICSI and Chairman, Peer Review Board, explained

the Compliance Approach and Substantive Approach to be adopted by Peer Reviewers.

CS R Sridharan, Council Member, The ICSI and Vice-Chairman, Peer Review Board then made a

presentation on how to carry out actual attestation assignments of Annual Return Certification, 383A

Compliance Report and Certificate under Clause 47C of Listing Agreement.

CS R Sridharan, Council Member, The ICSI and Vice-Chairman, Peer Review Board addressed this

session and explained in detail the procedure of Conducting of Internal Audit of Depository Participants