Banking Awareness Guide

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 91

www.BankExamsToday.com

Banking

Awareness Guide

By Ramandeep Singh

sys

[Pick the date]

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 2

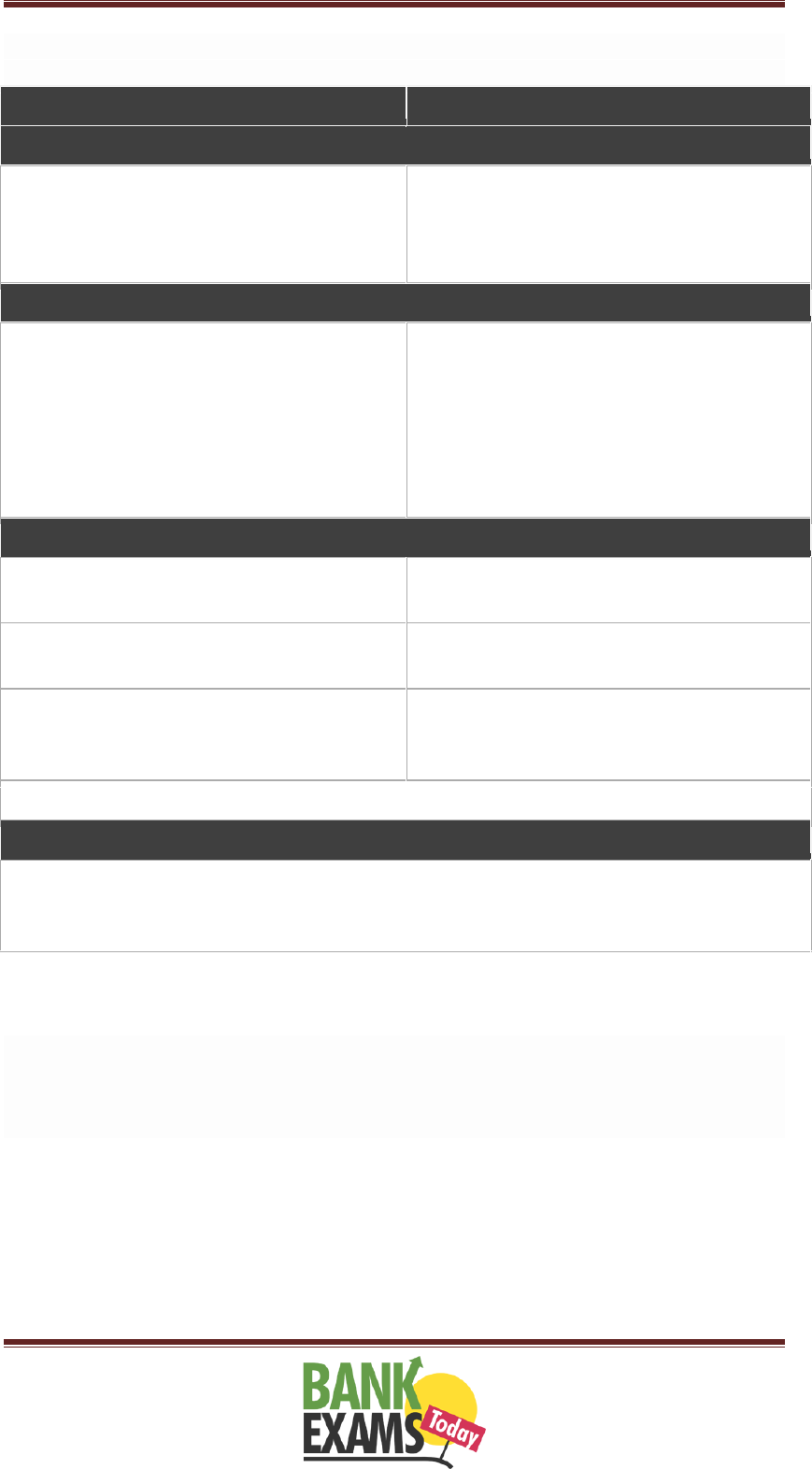

Index

S. NO.

TOPICS

PAGE NO.

1.

FINANCIAL SECTOR REGULATORS IN INDIA

2-4

2.

BASEL NORMS

4-8

3.

STOCK MARKET INDEXES IN THE WORLD

8-11

4.

VARIOUS PAYMENTS SYSTEMS IN BANKS IN INDIA

11-12

5.

TYPES OF ATM’S

12-14

6.

WHAT IS THE REAL VALUE OF US DOLLARS IN

TERMS OF INDIAN RUPEE

14-15

7.

FOREX (MEANING AND INTRODUCTION)

15-17

8.

TYPES OF BANK ACCOUNTS

17-19

9.

DEFINITION OF MICRO, SMALL & MEDIUM

ENTERPRISES

19-20

10.

WHAT IS SENSEX AND HOW IT IS CALCULATED

20-21

11.

30 IMPORTANT BANKING TERMS FOR INTERVIEW

21-24

12.

RECENT BANKING AND FINANCIAL DEVELOPMENTS

IN INDIA

24-25

13.

CORE BANKING SOLUTION

25-26

14.

FUNCTIONS OF RBI

26-29

15.

BANKING OMBUDSMAN

29-31

16.

MONETARY POLICY IN INDIA

31-34

17.

CHEQUE TRUNCATION SYSTEM

34-37

18.

DIFFERENT TYPES OF CHEQUES

37-39

19.

FDI IN INDIA

39-42

20.

NITI AAYOG

42-43

21.

MONEY MARKET AND CAPITAL MARKET

INSTRUMENTS

43-47

22.

NARASIMHAM COMMITTEE

47-49

23.

GST (GOODS AND SERVICE TAX)

49-52

24.

CURRENCY DEVALUATION

52-54

25.

SOVEREIGN GOLD BOND SCHEME VS GOLD

MONETIZATION SCHEME

54-55

26.

WORLD BANK

55-57

27.

BANDHAN BANK

57

28.

PAYMENT BANKS VS SMALL FINANCE BANKS

57-58

29.

CONTACT LESS MULTICURRENCY FOREX CARD

SCHEME

58-59

30.

PRIVATIZATION OF NATIONALIZED BANKS

59-60

31.

SOCIAL SECURITY SCHEMES

60-61

32.

MUDRA BANK

61-62

33.

SERVICE TAX

62-65

34.

FOREIGN EXCHANGE MANAGEMENT ACT

65-68

35.

Banking Basics

68-83

36.

Basic Financial Terms A-Z

83-89

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 3

Current Bank Rates :-

1. Bank Rate - 7.75 %

2. Cash Reserve Ratio (CRR) - 4 %

3. Statutory Liquidity Ratio (SLR) - 21.5 %

4. Repo Rate (RR) - 6.75 %

5. Reverse Repo Rate (RRR) - 5.75 %

6. Marginal Standing Facility (MSF) - 7.75 %

FINANCIAL SECTOR REGULATORS IN INDIA

RBI-Reserve Bank of India

RBI was established on 1 April 1935 with the sole aim to work as banking sector

regulator .RBI was nationalized in 1949.RBI regulate the banking sector (government

and private banks) by banking reglation act 1949 and RBI act 1935 which entrusted

responsibility on the RBI to work foru the enhancement of banking sector in India

.RBI is the sole authority to issue banking licenses to entities who want to open bank

in India , and if any bank want to open new branch it has to be take prior approval

from RBI.

The main aim of RBI is to provide banking services to the last mile of country .To full

this initiative RBI has started financial inclusion program .In this RBI mandated all

banks in India to open at least 25 percent braches in rural areas. RBI also ensure that

adequate credit is provide to rural areas by priority sector lending In this RBI has

mandated all banks including foreign banks working in India to provide 40 percent of

their loans to priority sector like agriculture, student loans etc .If any bank found

violating RBI policy ,it has power to take action against it .

RBI do supervision functions and regular checks to ensure that financial health of

banks is maintained .RBI ensure that all banks follow the government guidelines for

the banking sector. If any bank found indulging in activities against people interest

and violating government polices RBI can fine bank including private banks.

The term of RBI governor is for three years and appointed by GOI.

Present Governor of RBI - Raghuram Rajan

Headquarter - Mumbai

1. RBI bits in detail

IRDA –Insurance Regulatory And Development Authority

IRDA was establishes in 1999 by the IRDA act ,1999 .It is the autonomous body

established by act of parliament .It aim is to ensure growth of insurance sector in

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 4

India.

IRDA was established as sole authority to regulate the insurance industry in India , to

ensure the growth of insurance industry and protect the interest of policy holders.

For any company want to work in insurance sector needs prior approval of IRDA .It

also perform supervision functions to ensure that different insurance companies

including private following rules and regulations or not .It can take action against

erring companies .IRDA works to protect the interest of policy holder and to regulate,

promote and ensure orderly growth of the insurance industry.

The chairman of IRDA is appointed by GOI .The term of IRDA chairman is for five

years.

Present chairman of IRDA - T.S.Vijayan

Headquarter - Hyderabad

SEBI- Securities And Exchange Board Of India

SEBI was enacted on April 12, 1992 in accordance with the provisions of the

Securities and Exchange Board of India Act, 1992. The main aim of SEBI is to

protect the interest of investor in securities .It is sole regulator for all stock exchanges

in India. SEBI regulate the capital markets in India .If any company want to bring IPO

it needs prior approval from SEBI .It is entrusted with responsibility to protect the

interest of investor in stock exchange , ensure the growth of securities market

,regulate and develop a code of conduct for intermediaries such as brokers,

underwriters, etc.

The chairman of SEBI is appointed by GOI .The term of SEBI chairman is for three

years

Present Chairman of SEBI- Upendra kumar Sinha

Headquarter of SEBI - Mumbai

NABARD- National Bank For Agriculture And Rural

Development

NABARD was established on 12 July 1982 by the act of parliament .NABARD is the

apex institution for the development of farm sector , cottage industries and small scale

industries in rural areas. The Banking Regulation Act, 1949, empowers NABARD to

conduct inspection of State Cooperative Banks (SCBs), Central Cooperative Banks

(CCBs) and Regional Rural Banks (RRBs) and protect interest of the present and

future depositor and also provide short and medium term loan to those banks working

in rural areas development .It provides his expertise in rural areas to RBI and GOI in

making policies.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 5

The chairman of NABARD is appointed by GOI .The term of NABARD chairman is

forthree years

Present Chairman of NABARD - Dr. Harsh Kumar Bhanwala

Headquarter - Mumbai

PFRDA- Pension Fund Regulatory And Development Authority

PFRDA is the regulatory body for all the pension funds in India .The Pension Fund

Regulatory & Development Authority Act was passed on 19th September,

2013.PFRDA regulate the pension sector and works for its development, formulate

policies for pension sector.PFRDA is regulating NPS, subscribed by employees of

Govt. of India, State Governments and by employees of private

institutions/organizations & unorganized sectors.

Term of PFRDA chairman is for five years and appointed by GOI.

Present Chairman of PFRDA- Hemant Contractor

Headquarter - New Delhi

BASEL NORMS

In the recent few days we have heard a lot that government is been

infusing lot of money in the public sector banks….. To understand

why??? We have to first understand that what BASEL ACCORD or

BASEL NORMS is all about.

Basel is a city in Switzerland which is also the headquarters of Bureau of

International Settlement (BIS).

BIS fosters co-operation among central banks with a common goal of financial

stability and common standards of banking regulations.

The Bank for International Settlements (BIS) established on 17 May

1930,is the world's oldest international financial organization. There are

two representative offices in the Hong Kong and in Mexico City. In total

BIS has 60 member countries from all over the world and covers approx

95% of the world GDP.

OBJECTIVE-

The set of agreement by the BCBS(BASEL COMMITTEE ON

BANKING SUPERVISION), which mainly focuses on risks to banks and

the financial system are called Basel accord. The purpose of the accord is

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 6

to ensure that financial institutions have enough capital on account to

meet obligations and absorb unexpected losses. India has accepted Basel

accords for the banking system.

Up till now BASEL ACCORD has given us three BASEL NORMS

which are BASEL 1,2 and 3 but before coming to that we have to

understand following terms-

CAR/CRAR- Capital Adequacy Ratio/ Capital to Risk Weighted Asset

Ratio

RWA- Risk Weighted Assets

Formulae for CAR=Total Capital/RWA*100

Now here, Total Capital= Tier1+ Tier2 capital

Tier 1 - The Tier-I Capital is the core capital…….

For example - Paid up Capital, Statutory Reserves, Other disclosed free

reserves, Capital Reserves which represent surplus arising out of the sale

proceeds of the assets, other intangible assets are belongs from the

category of Tier1 capital.

Tier 2 - Tier-II capital can be said to be subordinate capitals.

For example - Undisclosed reserves, Revaluation Reserves, General

Provisions and loss reserves , Hybrid debt capital instruments such as

bonds, Long term unsecured loans, Debt Capital Instruments etc. are

belongs from the category of Tier2 capital.

RISK WEIGHTED ASSETS -

RWA means assets with different risk profiles;it means that we all know

that is much larger risk in personal loans in comparison to the housing

loan, so with different types of loans the risk percentage on these loans

also varies.

BASEL-1

In 1988,The Basel Committee on Banking Supervision (BCBS) introduced

capital measurement system called Basel capital accord, also called as

Basel 1. . It focused almost entirely on credit risk, It defined capital and

structure of risk weights for banks.

The minimum capital requirement was fixed at 8% of risk weighted assets

(RWA).

India adopted Basel 1 guidelines in 1999.

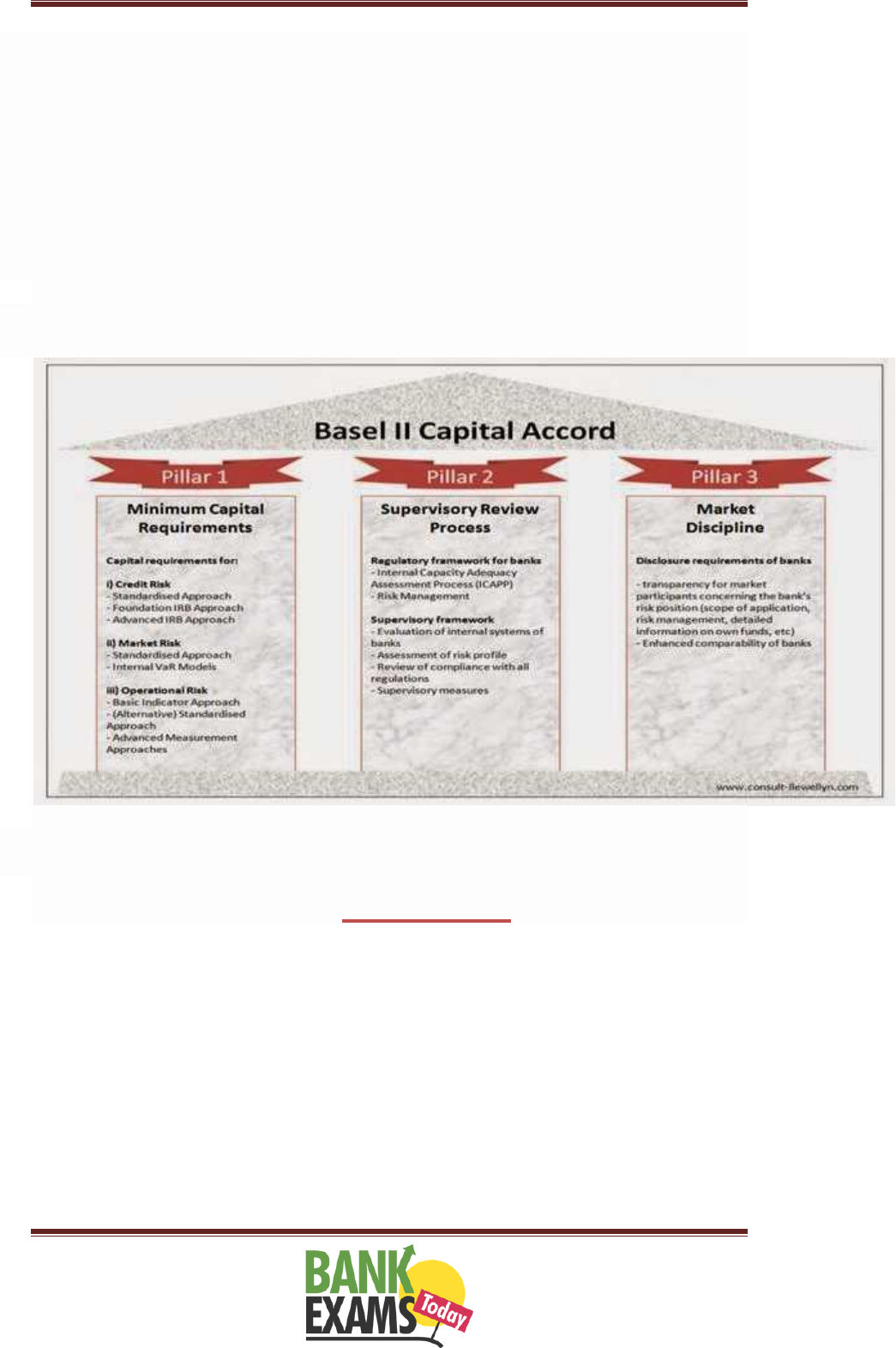

BASEL-2

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 7

In 2004, Basel II guidelines were published by BCBS, which were

considered to be the refined and reformed versions of Basel I accord.

The guidelines were based on three parameters which are as follows-

Banks should maintain a minimum capital adequacy requirement of 8% of risk assets.

Banks were needed to develop and use better risk management techniques in

monitoring and managing all the three types of risks that is credit and increased

disclosure requirements.

The three types of risk are- operational risk, market risk, capital risk.

Banks need to mandatory disclose their risk exposure, etc to the central bank.

Basel II norms in India and overseas are yet to be fully implemented.

The three pillars of BASEL-3 can be understand from the following

figure---

BASEL-3

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 8

In 2010, Basel III guidelines were released. These guidelines were

introduced in response to the financial crisis of 2008.

In 2008, Lehman Brothers collapsed in September 2008, the need for

a fundamental strengthening of the Basel II framework had become

apparent.

Basel III norms aim at making most banking activities such as their trading

book activities more capital-intensive.

The guidelines aim to promote a more resilient banking system by

focusing on four vital banking parameters viz. capital, leverage, funding

and liquidity.

Presently Indian banking system follows basel II norms.

The Reserve Bank of India has extended the timeline for

full implementation of the Basel III capital regulations by a year to March

31, 2019.

Important points regarding to the Implementation of BASEL-3

Government of India is scaling disinvesting their holdings in PSBs to 52 per

cent.

Government will soon infuse Rs 6,990 crore in nine public sector banks

including SBI, Bank of Baroda (BoB), Punjab National Bank (PNB) for

enhancing their capital and meeting global risk norms.

This is the first tranche of capital infusion for which the government had

allocated Rs 11,200 crore in the Budget for 2014-15.

The government has infused Rs 58,600 crore between 2011 to 2014 in the

state-owned banks.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 9

Finance Minister Arun Jaitley in the Budget speech had said that "to be in line

with Basel-III norms there is a requirement to infuse Rs 2,40,000 crore as

equity by 2018 in our banks. To meet this huge capital requirement we need to

raise additional resources to fulfill this obligation.

STOCK MARKET INDEXES IN THE WORLD

‘Sensex loses 556 points, slips below 28K’ screams Economic Times! But what does

it mean? What is Sensex? Why has it lost 556 points? What does it mean that it has

slipped below 28K?

Dear readers, today we attempt to unmystify the world share/ stock market indexes

(indices) – which until now we’d come across while turning pages in the newspaper!

What are stock indexes?

Stock Market, as we all know, is a market (a real/virtual market) where stock or

shares are bought and sold –companies raise money through stock markets. In stock

markets the shares of those companies which are listed with the Stock Exchange are

bought and sold.

Stock markets will have stocks of numerous companies –at various price levels –

activity levels floating around.

Imagine your city’s biggest and most popular vegetable market – where vendors from

all over the city come to sell their produce –so many vendors –so many vegetables –

so many buyers and so many different prices!

Stock Exchange is essentially an organization –which enables the trade in shares by

providing a ‘trading area’, staff, infrastructure and making connections between

buyers and sellers and agents possible. Every stock exchange has its rules and

regulations, which any company which wishes to get listed with it have to comply

with.

Now –when you come back from your veggie shopping trip –and someone at home

asks you how were the prices at the market –were they cheap or not? –How would

you gauge that? Will you, when at market note down the prices of every vegetable –

compare it with prices in other markets –what will you do?!

You will look at the prices of potatoes and onions –because they are the most

important veggies out their –the basic, regularly required veggies –and decide if

they’ve become costlier than before!

Same principle here –some companies are taken as indicators –these companies are

obviously doing well and indicate the overall performance of their industries.

Thus, Stock Index is a numeric/ statistical measurement –an index –a number –

which shows the performance of an economy taking some key companies (a segment

of stock market) as its indicator.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 10

In other words –looking at it from another angle – there is an ‘index’ which includes

some stocks of some companies –the prices of these companies are measured and put

through a formula –to give us the stock market index –the overall picture!

Through these indexes, investors, company owners, economists, traders etc. –who are

known as stakeholders –glean useful information depending on their needs. An

investor will invest if the markets are doing well and keep his money on the company

showing progress –where performance falls –the investors take their monies away

from the markets and that is when the indexes fall!

So more the positive activity –index rises –and vice versa.

How are they calculated?

Indices can differ based on their method of calculation –which is based on certain

specific theory of what elements will give a near perfect indicator of industry average

etc.

Indices may be price-weighted (prices of the stock are considered for calculating the

index), or, capitalization-weighted index which looks at market value of the stocks.

Mostly used method is market capitalization method, where

Market capitalization = market price of shares x number of shares outstanding

(issued by the company)

Another method used is free float market capitalization method, where

Market capitalization = market price of shares x number of share which are

available for trading in the open market

How Sensex is Calculated

Famous indices and trivia:

Some very popular stock indices followed worldwide:

1. Dow Jones Industrial Average, The Global Dow

2. Dow Jones Asia Titans 50

3. S & P –Global 1000/1200 – (S&P = Standard and Poor’s)

4. S & P Asia 50

5. BBC Global 30

6. EURO STOXX 50

7. FTSE indices

8. NASDAQ indices

and, Indian stock indexes are:

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 11

1. Nifty –of NSE

2. Sensex of BSE

3. MCX-SX of MCX Stock Exchange

Famous Stock Exchanges:

(i) NYSE –New York Stock Echange –is the market leader.

(ii) NASDAQ

(iii) Tokyo Stock Exchange

(iv) LSE –London Stock Exchange

(v) Euronext

and, Indian Stock Exchanges are:

(vi) BSE –Bombay Stock Exchange

(vii) NSE –National Stock Echange

(viii) MCX Stock Exchange

Some more indexes for g.k. purpose!

1. Iran’s – Tepix

2. Japan’s – Nikkei 225

3. China’a – SSE, SZCE, CSI 300

4. Hong Kong’s – Hang Seng Index

5. Malaysia’s – Kuala Lumpur Composite Index

6. Nepal’s – Nepal Stock Exchange –NEPSE

7. Pakistan’s – KSE indices

8. Russia’s – Moscow Inter-bank currency exchange –MISEX

9. Sri Lanka’s – All share Price Index –ASPI

10. UK –has all the FTSE indices! So easy to remember

11. USA –has got plenty, am just going to list em –the names are popular enough! -

Dow Jones, NASDAQ, Russell’s, S & P’s, Goldman Sach’s, Amex indices,

Wilshire’s and CPMKTE (capital markets equity index)!

(The numbers after the names of the indices represent the number of companies in the

index.)

and some unique indices:

12. Space Foundation Index (SFI)

13. Palidas Water Index (PWI)

14. Cleantech Index

15. Solactive Indices

Interesting to know – BSE is India’s and Asia’s oldest stock exchange! It happened in

1878! Yep!!

Followed by Tokyo’s stock Exchange in 1878 being the second oldest in Asia.

As far the international scenario is concerned –Amsterdam Stock Exchange is the

oldest, having been established in 1602 by Dutch East India Company!

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 12

Knowing the Indian ones properly!

In Indian scenario –SEBI, the Stock Exchange regulator –recognizes only three stock

exchanges:

SENSEX = Sensitive index, which is the index given by BSE or Bombay

Stock Exchange.

It was founded in 1875 by Premchand Roychand and is the oldest stock

exchange in India –of the three!

It is Head Quartered at the famous Dalal Street in Mumbai.

CEO is Ashish Chauhan.

It uses free float market capitalization method = value of shares which are

available for trading = the value taken into the index.

It consists of 30 major companies listed with the BSE.

Some of them are –SBI, ICICI Bank, Axis Bank, HDFC, Wipro, Infosys,

TCS, ONGC, Airtel, HAL, BHEL, BEL, Coal India, Tata Motor etc.

Sensex is India’s foremost stock market indicator.

Nifty = National Stock Enchange’s 50 major companies

Controlled by India Index Services and Products.

It was founded in 1992 and is head quartered in Mumbai.

NSE’s MD and CEO is Chitra Ramkrishna

It uses free float market capitalization weighted method = value of shares

which are available for trading and calculation done using weights = the value

taken into the index.

The 50 companies include the 30 of sensex and extra 20 companies.

MCX-SX-40

Founded in 2008 –it is the youngest exchange with its Head Quarter in

Mumbai.

CEO is Saurabh Sarkar.

It specializes in using state of the art infrastructure and technology to provide

trading services for a variety of instruments.

VARIOUS PAYMENTS SYSTEMS IN BANKS IN INDIA

In a series of providing useful material for Banking Awareness section of various

banking exams. Today I am explaining various payment systems available in banks in

a very simple language.

1. RTGS: Real Time Gross Settlement

It is a centralized payment system through which inter bank payment

instructions are processed and settled, on GROSS basis, in REAL TIME.

Which simply means, that the transactions are settled as they happen.

Minimum amount is Rs. 2 lacs and there is no limit to maximum amount.

A ‘service charge’ is charged by the banks for outwards transactions (making

an RTGS) and nil for inwards transactions (receiving an RTGS).

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 13

RTGS is used by banks to settle their inter-bank account transactions as well

as customer’s high value transactions.

It uses INFINET (Indian Financial Network) platform to operate.

2. NEFT: National Electronic Funds Transfer

It is a nation-wide funds transfer system which facilitates fund transfer from

any bank’s branch to any other bank’s branch.

The difference between NEFT and RTGS is that NEFT settlements happen in

batches, and on net settlement basis. Where as RTGS is real time and gross

settlement.

Net Settlement means, that transaction pertaining to a particular bank branches

are kept on hold and accumulated and then processed together in a batch with

the ‘net’ amount, which would either be incoming or outgoing transfer.

There is no limit to minimum/maximum transaction value.

NEFT cannot be used for foreign remittances.

3. AEPS: AADHAR Enabled Payment System

It is a payment system which uses Aadhar card number and an individuals

online UIDAI authentication, which are linked to a customers Bank account.

A customer will have to register his/her Aadhar number to their existing bank

account, provided their bank is AEPS enabled.

Through AEPS, customer can withdraw or deposit cash, make balance

enquiry, and transfer funds.

The maximum amount of transaction per account per day is Rs.50,000.

These transactions are normally conducted by Business Correspondents (BCs)

service centres.

4. MTSS: Money Transfer Service Scheme

It is a system of money transfer for transferring personal remittances from

abroad to beneficiaries in India.

Through this only inward remittances into India are permissible. No outward

remittance allowed.

A maximum of Rs.50,000 can be remitted inwards as per the money value.

And a maximum of 30 transactions per calendar year.

5. Nepal Remittance Scheme:

It is a cross-border one-way remittance facility scheme for remittance from

India to Nepal.

Maximum amount remittance is INR 50,000 and beneficiaries will receive in

Nepalese Rupees.

TYPES OF ATM’S

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 14

List of various types of ATMs and their features.

White Label ATM

White Label ATMs are those ATMs which set up, owned and operated by non-bank

entities, which have been incorporated under Companies Act 1956, and after

obtaining RBI’s approval.

Brown Label ATMs

These ATMs are owned and maintained by service provider whereas bank whose

brand is used on ATM takes care of cash management and network connectivity.

Online ATM

Online ATMs: These ATMs are connected to the bank’s database at all times and

provide real time transactions online. The withdrawal limits and account balances are

constantly monitored by the bank. Online ATMs are always watching out for you!

Offline ATM

Offline ATMs: These ATMs are not connected to bank’s database- hence they have a

predefined withdrawal limit fixed and you can withdraw that amount irrespective of

the balance in your account.

So if you did not have balance in your account, and you went to a ‘offline ATM’ and

withdrew money more than the balance – you’ll still get the cash at that time, and

later on will run afoul with your bank balance! Where banks may charge some penalty

for exceeding your balance!

Stand Alone ATM

Stand Alone ATMs are not connected with any ATM network- hence their

transactions are restricted to the ATM’s branch and link branches only.

The opposite of Stand alone ATMs are Networked ATMs, which are connected on the

ATM Network.

Onsite ATM

Onsite ATMs: are the ATMs you find next to your Bank’s branch. They go side-by-

side! Or in proper terms, they are the ATMs installed within a branch’s premises.

Off-site ATM

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 15

Off-site ATMs are the ones which are installed anywhere, but within the branch

premises. That is these are not installed next to branch. So where are they installed?

Shopping Malls, shopping markets, airports, hospitals, business areas etc.!

What is the real value of US Dollars in terms of Indian

Rupee

One of the most common question that arises among people who are planning to

migrate to developed countries that how much can I purchase with salary of US $

5000 or 10,000 a month.

To explain the value of Indian Rupee in terms of US $, I will use Big Mac Index by

The Economist and Purchasing Power Parity by World Bank

PPP factor of India is 0.3 in terms of $US

Monetary value of US$ 1 = INR 63.70 (30 December 2014)

In terms of PPP US$ 1 = 63.70 * 0.3 = INR 19.11

This the product you can purchase of US $ 1 in Newyork city can be purchase for Rs

19.11 in New Delhi.

So if you salary is US $ 5000 in Newyork, it is equivalent (in terms of PPP) of

5000*19.11 = Rs.95,550

1. Forex - All you need to know

2. Foreign currency accounts

Big Mac Index

The Economist, one of the leading economics magazine introduced Big Mac Index to

compare purchasing power of various currencies around the world by comparing price

of a standard Big Mac.

McDonald's is an international fast food chain and it has 35,000 restaurateurs 119

countries around the world.

Indian version of Big Mac is Maharaja Mac

Price of 1 Maharaja Mac in India = Rs 106

Price of 1 Big Mac = $4.8 = 4.8 * 63.7 = Rs 305

In terms of Big Mac US$ 4.8 = Rs 106

Value of US$ 1 = 106 /4.8 = Rs 22.08

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 16

So value of US$ is near about Rs 20 in terms of real purchasing power.

Many of the engineers and migrants from Punjab flaunts about their salaries in US

and UK. Many of my friends are getting $3000 to $4000 a month. By converting US$

4000 into INR 4000*60 (Approx) = Rs 2,40,000, this looks good money. But to know

how much you can actually buy, simply divide it by 3, so it Rs80,000.

So a person making $4000 in USA has an equal standard of living as a person earning

Rs 80,000 in India.

FOREX (MEANING AND DETAILED INTRODUCTION)

Forex stands for ‘Foreign Exchange’. ‘Foreign Exchange’, ‘Forex’ or simply ‘Fx’

refers to the whole nine yards in respect of ‘foreign currency’.

When you say forex, you could mean forex trading or the forex reserves or the forex

rates. All the above deal with foreign currencies but has different meaning and

implications.

Let start with the trading aspect of ‘forex’.

Forex Trading

Forex Trading takes place in ‘Forex Market’.

Forex market operates for 24 hours a day and 5 days a week! Why 24 hours?

Simply because of the time differences in different parts of the world!

Forex market is also known as currency market, as currencies from all over the

world are traded; it is the largest market in the world only because of the sheer

volume of transactions!

Forex market is not a physical market –it is a term used to denote the

worldwide ‘market’ where currencies from all over the world are traded – it is

not limited by geographical constraints.

Any person from any country can trade in the forex market; participants can

be international banks, companies and individuals engaging in hedging or

speculative transactions.

Forex markets operate on ‘Over the Counter’ (OTC) form – just like a medical

store –over the counter –ask for the currency which you want and pay

according to the existing rate of the currency.

Then when you want to sell them – take ‘em back and sell ‘em over the

counter!

The currency rates or forex rates differ every day and sometimes also during a

day and exchange rates for different currencies are different and depend on

various factors.

Investors, traders, hedgers, speculators trading the forex market actually want

to take advantage of the fluctuations of the exchange rates or simply put the

currency’s rate.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 17

Exchange rates depend on various factors such as level of economic activity of

a country, its GDP, its share market activities, political stability or instability

etc., speculators look at all of these factors and make their own predictions

and put their money on particular currency.

Simple example –current dollar rates (forex rate of dollar!) is 1$ = Rs. 63.79; say you

have Rs. 1000 with you and you want to try your luck in the currency market –you go

and buy dollars using Rs. 1000.

How many dollars will you get (remember its all OTC!)? –1000/63.79 = $ 15.67.

So, with Rs. 1000 you are able to buy 15.67 dollars! Dollars is no use to you –its your

commodity –you trade a commodity.

But when will you trade or in this case sell your dollar – you’ll sell only when you see

you can earn a profit obviously! So you wait for the rate to improve …and then when

the rate become 1$ = Rs. 65.85 (it’s increased from Rs. 63.79) you sell your 15.67

dollars and get your rupees back!

15.67 x 65.85 = Rs. 1032! Okay yeah … profit of only Rs. 32 … but we took an

example with easy figure –in real world the figures are huge!

So this is basically how trading objectives are –and when the prices fall, the

traders are dealt with huge losses.

Forex market is highly exciting, highly risky and to be dabbled in when

you’ve become an expert in the free online trading games!

Okay here’s a scenario for consideration – if you are an importer, i.e, you buy goods

from foreign country to be sold in India – you’ve got to pay to the foreign country

seller in say, dollars –today the dollar rate is 1$ = Rs.63.79, so for every dollar you

need 63.79 rupees. Ok.

Suppose when at the time of payment the rate is Rs. 68.85 for every dollar – you’ve

got a loss! Now you will end up paying Rs. 5.06 more for every dollar!

On the flip side –if you are an exporter –you are selling goods to a trader in a foreign

country and you will receive payments in dollars –when the rate becomes Rs. 68.85

from Rs. 63.79 –you end up earning a profit due to exchange rate fluctuation of Rs.

5.06! As when you are paid by in dollars you will get Rs. 68.85 for every dollar!

So you can see what a dynamic world forex is! Ever changing and somewhat

unpredictable!

This brings us to:

Forex Reserves

The term ‘forex reserves’ is used to denote the foreign currency reserve of a

central banks or governments of countries.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 18

So what goes into forex reserves? –Well, you could have foreign currency

notes, deposits from foreign countries, foreign treasury bills other government

securities etc.

So basically forex reserves in a countries ‘reserve’ of money held in foreign

currency or currency equivalent.

Where does all the foreign currency come from? –from Exports, Foreign

Loans, Grants, foreign investments in India –when tourists come to India!

And the reserves are used to pay for imports, repay international loans and

dues, or give international grants –when you go abroad!

A country and its central bank has many international monetary obligations –

forex reserves are used for that –when this reserve runs low the IMF or World

Bank comes to rescue.

Also a country’s strong forex position can impact its exchange rate and

international trade relations!

For India –most of the forex is used to pay for oil imports as you all probably

know –so having a strong forex reserve is extremely important.

Forex reserves are managed by the RBI in India.

Latest though, India is 9th on the list of countries with good forex position; list

headed by China.

And even latest news on the forex reserves front is that, India’s forex reserves rose by

$3.16 billion last week, so the current figure resides at $319.99 billion!

Which is like -$ 3,199,900,000! And the pundits are of the opinion that is it a

comfortable position to be in. Well, who are we to argue!

All we can hope is that with the economic development envisioned for India in the

coming years our forex reserves keep filling up!

TYPES OF BANK ACCOUNTS

This topic is important for bank exams, as generally many questions are asked in bank

exams and interview on bank accounts like what are different types of accounts in

bank ,what is difference between current account and saving account .So

understanding this topic is very important.

VARIOUS TYPES OF BANK ACCOUNTS

1. Saving Account

2. Current Account

3. Recurring deposit Account

4. Fixed deposit Account

5. FCNR Deposit Account

6. NRO Account

7. NRE Account

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 19

Saving Account :

Saving accounts are opened by individuals in banks to save some share of their

earnings .Main aim of saving account is to promote saving habit among individuals.

These saving accounts are opened on the name of individuals only.

On saving account an individual earns some rate of interest, these rate of interest

varies from bank to bank ,earlier this rate of interest in fixed by RBI but now RBI has

given power to banks to decide their own rate of interest on saving account .This rate

of interest is usually 4% but some private banks offering 6% rate of interest too.

When a person open a saving account he is provided with a passbook , ATM card ,

cheque book .

In saving accounts there is restriction a person can deposit or withdrawal money

within month . Minimum deposit a individual has to maintain in account (In PSU

banks) is Rs1000 or less as some bank offering zero balance accounts.

Current Account :

Current account are opened for business transactions , on the name of firm or

company .Banks offered no rate of interest on money held in current account but

provide extra features as compared to current account like there is not limit on deposit

or withdrawal in current account but no passbook is issued for current account holder.

Minimum deposit needed to open current account is Rs5000 or depends on respective

bank. Many facilities are provided to current account holder like overdraft facility,

statement of account.

Recurring Deposit Account or R.D.

In recurring deposit account is a saving feature that bank offers to their customers,

who can save only small amount of money per month. In recurring deposit account a

person deposit a fixed sum of money for fixed period like a person deposit Rs 500 per

month for one year bank pays interest on the deposit money every month after the

completion of fixed period bank pay the deposit money along with interest to his

customer.

Recurring deposit account are generally meant for salary earning people who can save

a fixed sum of money every month.

Fixed Deposit Account or Term Deposit Account

In fixed deposit account , a person deposit a fixed sum of money one time only for the

fixed period bank pays the rate of interest on the fixed deposit account depends on

tenure of deposit account , after the completion of period bank pay the amount along

with rate of interest incurred on the amount .banks also charge penalty is premature

withdrawal is done if person need money before the completion of fixed period .

For NRI to invest in India and earn interest on their hard earn money , as rate of

interest offered by Indian banks is higher than western counterparts so it is

attraction option to deposit money in Indian banks and earn good rate of interest .

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 20

RBI allow three type of account to NRI by which they can deposit their money

in India

FCNR Deposit Account

FCNR stand for Foreign Currency Non -Resident account

This account is opened by NRIs In this account a person invest a fixed sum of money

for a period not less than one year and max five years in any foreign currency in fcnr

account . After the completion of fixed period principal and interest is paid in foreign

currency in which he had deposited .In this way NRI are save from foreign exchange

rate risk

NRO Deposit Account

NRO stand for Non Resident Ordinary saving account

The Non Resident Ordinary Account (NRO Account) is a Savings / Current.

Recurring Deposit / Fixed Deposit bank account held in India, in Indian

Rupees. NRO account is opened by any person resident outside India only who

want to earn attractive rate of interest in India and also have some earnings in India

(such as rent income, dividend, pension, etc).This account is best suited for NRI or

PIO who have some earnings in India as these earnings are deposit in NRO account

.NRO account is only operated in Indian currency only .Average monthly balance in

NRO saving account is Rs1,50,000. NRIs can remit up to 1 million per calendar year .

Banks are free to determine their interest rates on savings deposits under Ordinary

Non-Resident (NRO) Accounts. However, interest rates offered by banks on NRO

deposits cannot be higher than those offered by them on comparable domestic rupee

deposits

NRE Account

NRE stands for Non Resident External Account

The Non Resident External Account (NRE Account) is a Savings / Current. Recurring

Deposit / Fixed Deposit bank account held in India, in Indian Rupees. Such accounts

can be opened only by the NRI. Balances held in NRE account are fully repatriable.

With effect from March 1, 2014, interest rates offered by banks on NRE deposits

cannot be higher than those offered by them on comparable domestic rupee deposits

DEFINITION OF MICRO, SMALL & MEDIUM

ENTERPRISES

In accordance with the provision of Micro, Small & Medium Enterprises

Development (MSMED) Act, 2006 the Micro, Small and Medium Enterprises

(MSME) are classified in two Classes:

1 Manufacturing Enterprises

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 21

The enterprises engaged in the manufacture or production of goods pertaining to any

industry or employing plant and machinery in the process of value addition to the

final product having a distinct name or character or use. The Manufacturing

Enterprise are defined in terms of investment in Plant & Machinery

2. Service Enterprises

The enterprises engaged in providing or rendering of services and are defined in

terms of investment in equipment.

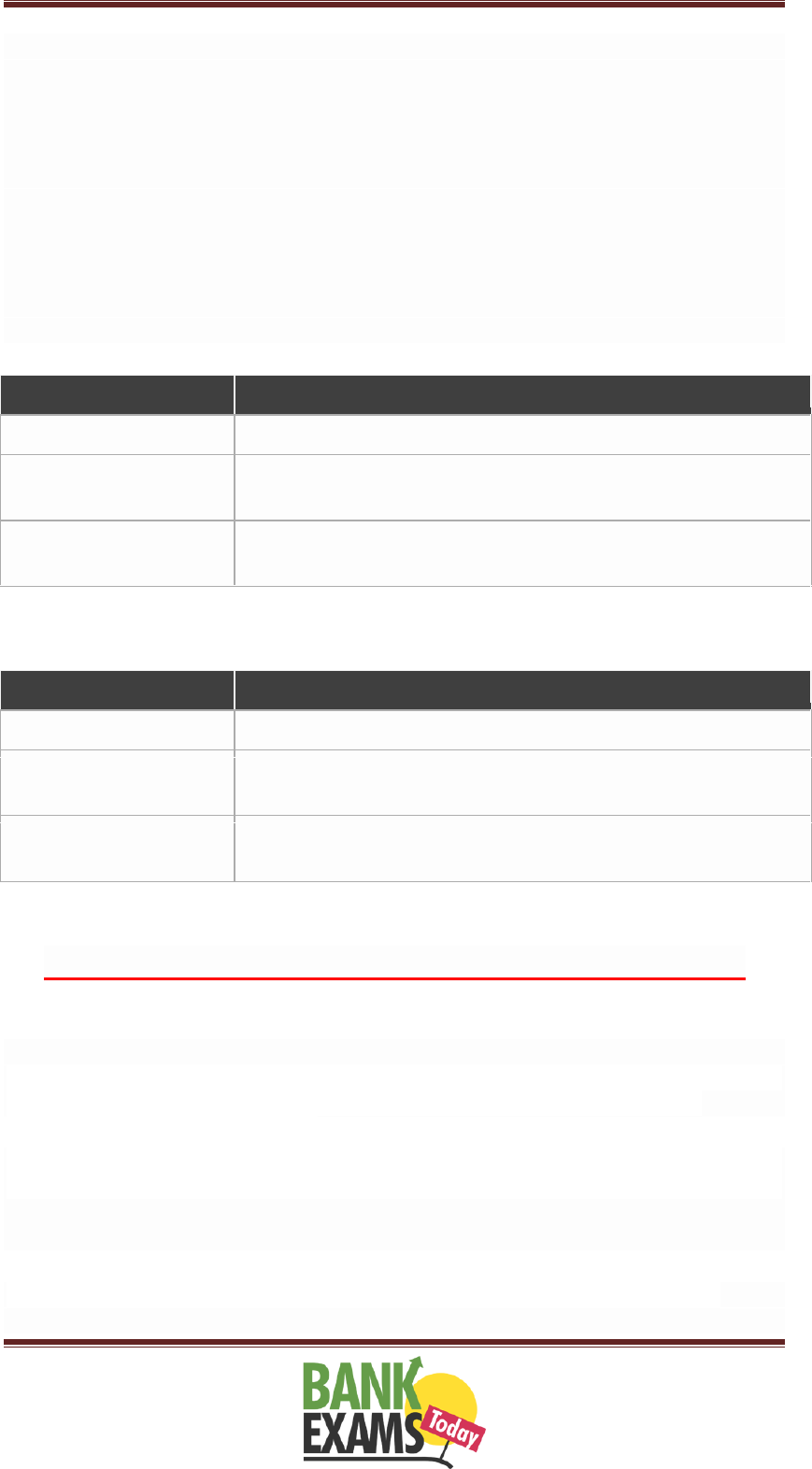

Manufacturing Sector

Enterprises

Investment in plant & machinery

Micro Enterprises

Does not exceed twenty five lakh rupees

Small Enterprises

More than twenty five lakh rupees but does not exceed five

crore rupees

Medium Enterprises

More than five crore rupees but does not exceed ten crore

rupees

Service Sector

Enterprises

Investment in equipments

Micro Enterprises

Does not exceed twenty Ten lakh rupees

Small Enterprises

More than twenty Ten lakh rupees but does not exceed 2 crore

rupees

Medium Enterprises

More than Two crore rupees but does not exceed Five crore

rupees

WHAT IS SENSEX AND HOW IT IS CALCULATED

What is Sensex ?

This is a frequently asked questions in Bank interviews. Everybody know that these

are stock indexes. But interviewers expect you to speak little more about this.

What is Sensex and Nifty ?

Sensex is is an index of top 30 stocks in Bombay stock exchange (BSE) and Nifty is

an index of top 50 stocks in National stock exchange (NSE)

How value of Sensex is calculated

Value of Sensex is calculated using "Free Float Market Capitalization" method.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 22

Sensex is calculated on the basis of Free Float Market Capitalization of top 30

companies included the index.

Free float ratio is number of outstanding shares available for general public to trade

Sensex was started on 1 April 1979. At that time the base value was 100.

For example on 01-04-1979, the free float market capitalization of top 30 shares was

1000 crores. On 2 April 1979, free float market capitalization increased to 1050

crores. So the value increased by 5%. Value of Sensex will also be increased by 5%

and value will become 105.

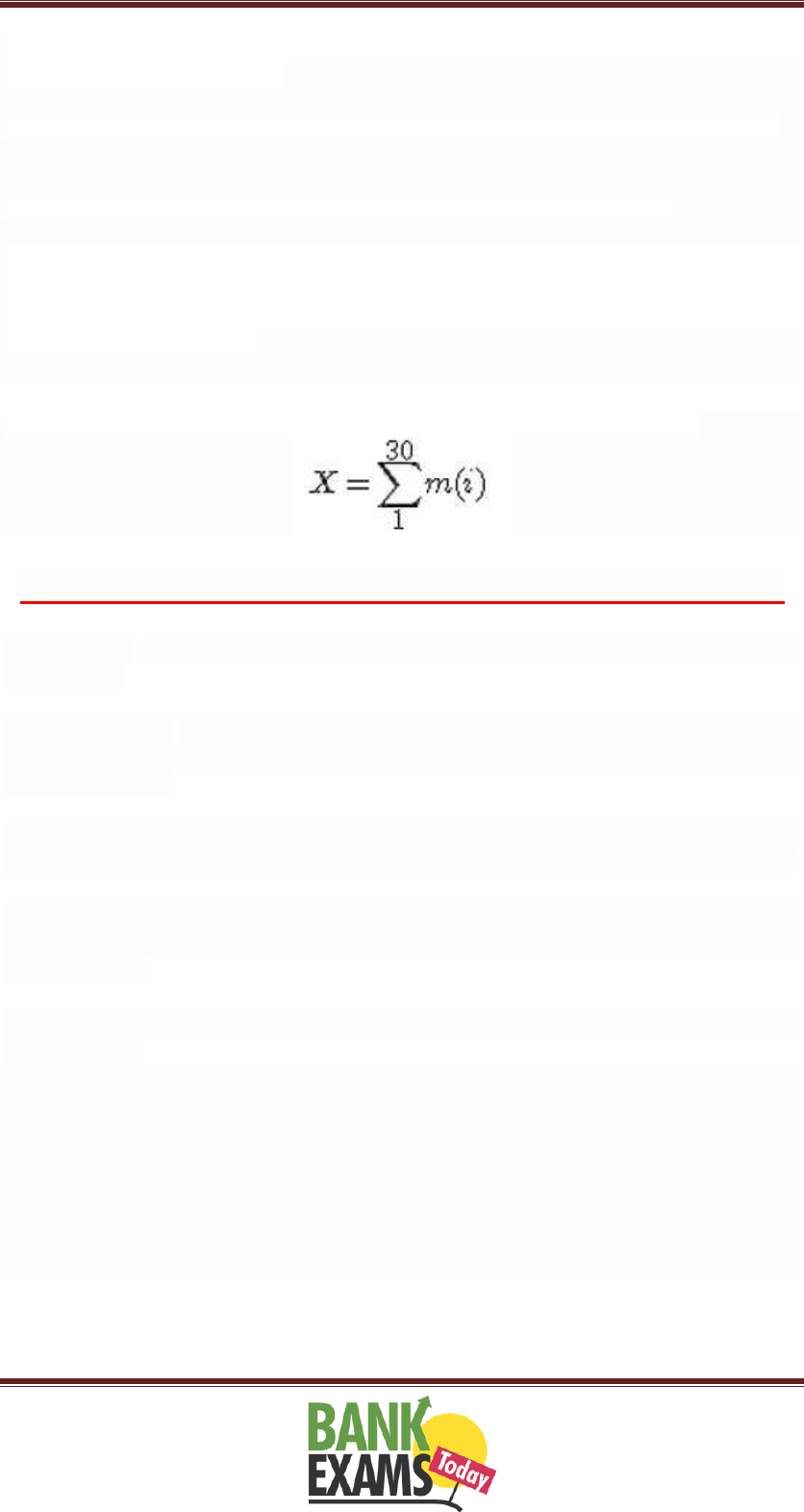

Formula to calculate Sensex

It's nothing but submission of free float market capitalization top 30 stocks.

30 IMPORTANT BANKING TERMS FOR INTERVIEW

Amortization –Adjusting expenses for intangible assets over a long span of time is

amortization.

Balloon Payment - as a balloon looks very little before filling air and seems bigger

after filling with air. same way the payment will be very little at initial stage and later

it will big enough.

Bank Rate - When RBI provides loan to the bank for long term (90 to 365 days).On

that amount of loan RBI takes some interest i.e. called Bank Rate.

According to modern banking definition of BR (Bank Rate): Bank Rate is used by

RBI to provide discount on his securities. So, Bank Rate is known as Discount or

Exchange Rate.

Base Rate - This is the minimum lending rate, below this rate bank cannot provide

loan to anyone.

Call Money - When one bank borrow money from another bank.

a. Valid for only one day

b. It is used to full fill the one day need of bank

CAMEL : CAMEL is the international model of rating the banks

C–Capital Adequacy

A–Assets

M–Management

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 23

E–Earning Profit

L–Liquidity

CRR - (Cash Reserve Ratio):Bank have to maintain or reserve some part of their

deposit in RBI in form of cash.

CRR can be minimum no limit and maximum limit is 20%.Before some time

back CRR was minimum 3% and maximum 15%

CRR is calculated on daily bases

No interest is paid by RBI on CRR

Bank keep their CRR in currency chest

CD- Certificate of Deposit

CD is issued by the bank

Minimum amount of CD is 1 lakh

Valid for minimum –7 days

Valid for maximum –365 days

CP –Commercial Paper

CP is issued by company

Valid for minimum –7 days

Valid for maximum –365 days

Convertible Debenture :

Such type of debenture can be converted into shares, but only in equity shares.

Debenture: Debenture holder is the creditor of company, when company borrows

money from public.

Equity Shares

Equity share holder is the real owner of the company.

Equity share holder has voting rights.

Future Market

Commodity market

In this market dealing is for future.

Commodities & metals are traded in this market

This market is regulated by Forward Market Commission under the Forward

Contract Regulation Act (FCRA).

Gilt Edge market

This is the government security market where government securities are

traded.

This is low profit market but low risk market.

This market is not open for public but on the recommendation of government

or RBI opened for public for some time.

For example:

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 24

Before some time, the RBI issued the Inflation Index Board (IIB) in this market. This

bond had a maturity period of 3 years.

IPO (Initial Public Offer)

When a company issues its share for the first time, it is known as IPO.

This is a part of primary market.

IPO can be the cheapest share of the company.

IPO can be more beneficial than any other shares.

IPO can be issued by unlisted company.

FPO (Follow on Public Offer)

When a company launch the share after IPO, it is known as FPO.

MSF –(Marginal Standing Facility) : The facility in which RBI provide loan to the

bank only for one day

MSF interest Rate is always equal to Bank Rate

By using MSF facility bank can borrow:

Maximum 2% of their total deposit in RBI and 1 crore

NFO (New Fund Offer)

When a group of companies launch the share or when a company launch the

share for a different scheme than its original one, it is known as NFO.

For example, Closed ended funds: these are traded for a specific period of

time.

P- Note (Participatory Note):

P-note is issued by FII (Foreign Institutional Investor) on the recommendation

of SEBI in India.

Without P- Notes, any foreign cannot investor cannot invest.

PLR –(Prime Lending Rate) : On this rate bank provide loan to his prime

customers

Another name of PLR is BPLR i.e. (Benchmark Prime lending rate)

PLR is replaced by Base Rate

Sub PLR : On this rate bank provide loan to unsecured persons

Most PLR : On this rate bank provide loan to his employees

Preferential Shares:

In this type of shares company gives preference in distributing their dividend i.e. part

of profit.

Repo Rate - (Repurchased Option): When RBI provides loan to the bank for 1 to 90

days, RBI takes some interest i.e. called Repo Rate.

Reverse Repo Rate: When bank deposit his excess money in RBI then RBI provides

some interest to that bank. This interest is known as Reverse Repo Rate.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 25

Right issue share: Issues on discount, but only for existing share holder.

Share Market

Long term market or above 1 year market

Governing body of share market is SEBI (securities and exchange Board of

India)

SEBI was established in 1988 with its head office at Mumbai. Its chairman is

Sh. U. K. Sinha.

SLR –(Statutory Liquidity Ratio) : Bank have to maintain some part of their

deposits in itself in the form of cash/foreign exchange, mutual fund.

But in India Government security is the popular form of SLR.

SLR maximum can be 40%

No minimum limit of SLR

Sweat equity Share: Issued on discount, but only for employees.

T-Bill : Treasury Bill. T-Bill is issued by RBI on behalf of Govt.

RECENT BANKING AND FINANCIAL

DEVELOPMENTS IN INDIA

Here are some recent developments in the financial and banking realms.

K.V. Kamath noted banker of India was on 11 May 2015 appointed as the

first President of the $100-billion New Development Bank (NDB) of the

BRICS countries, to be based in China’s financial hub Shanghai.

Lok Sabha on 13 May 2015 passed The Negotiable Instruments

(Amendment) Bill, 2015 by a voice vote. The Bills amends the Negotiable

Instruments Act, 1881 in order to make cheque-bounce filing of cases more

convenient for check payees (person who receives the cheque).

According to the data released by the Reserve Bank of India (RBI), the

number of outstanding credit cards at the end of December was 20.29 million.

Mangaluru-headquartered Corporation Bank recently dropped plans to take

over the assets and liabilities of a Maharashtra-based cooperative bank

namedRupee co-operative bank license was cancelled by the RBI in 2013.

Private-sector Federal Bank on 18 May 2015 ventured into credit card

segment with the launch of a co-branded credit card with SBI.

The new Gold Monetisation Scheme (GMS) was announced in the Union

Budget 2015-16 with the aim of replacing both the present Gold Deposit and

Gold Metal Loan Schemes. The new scheme will allow the depositors of gold

to earn interest in their metal accounts and the jewellers to obtain loans in

their metal account.

The Union Finance Ministry announced that it was able to contain the fiscal

deficit for 2014-15 at 4% of GDP against 4.1% set to be achieved in the

Union Budget.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 26

The revenue deficit was estimated at 2.8% of the as against the revised

estimate of 2.9% of GDP, marking a sharp improvement over 3.2% for 2013-

14.

The Companies (Amendment) Bill, 2014 was passed by the Rajya Sabha on

13 May. The amendments to the Companies Act, 2013, which came into

effect from 1 April 2015, are designed to address some issues raised by

stakeholders.

India’s largest banking entity State Bank of India (SBI) has launched Online

Customer Acquisition Solution (OCAS), an online platform to apply for

loans.

India’s largest private sector lender Industrial Credit and Investment

Corporation of India (ICICI) Bank has launched voice password facility for

users.

India’s largest public sector lender, State Bank of India (SBI) has signed

memorandum of understanding (MoU) with e-commerce giant Amazon. The

MoU seeks to identify and tap the potential areas of collaboration for

payments and commerce solutions between both signatory parties.

ICICI Bank’s first branch in China was inaugurated in Shanghai, a major

global financial hub. It was inaugurated by Prime Minister Narendra Modi in

the presence of ICICI Bank’s MD and CEO Chanda Kochhar. Earlier in 2003,

ICICI Bank had opened a representative office in China.

India’s largest lender, State Bank of India (SBI) has launched contact-less

credit and debit cards sbiINTOUCH. sbiINTOUCH is based upon

latest near-field technology (NFC) that enables customer to transact using the

card by just tapping or waving it against the reader of the POS. SBI is also

proving a fraud liability cover of 1 lakh rupees on these cards.

According to a latest report of the World Bank, 43 % of India’s bank accounts

were lying dormant in 2014.

CORE BANKING SOLUTION

This word is more often used by bankers and now-a-days postal officials are also

using it. CBS is an acronym of Core Banking Solutions. Again one will wonder what

the meaning of core is, core is also an acronym. It stands for "Centralized On-line

Real-time Exchange".

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 27

Definition:-

Core Banking Solution (CBS) is networking of branches, which enables Customers to

operate their accounts, and avail banking services from any branch of the Bank on

CBS network, regardless of where he maintains his account. The customer is no more

the customer of a Branch. He becomes the Bank’s Customer.

Another interesting fact regarding CBS is that all CBS branches are inter-connected

with each other. Therefore, Customers of CBS branches can avail various banking

facilities from any other CBS branch located anywhere in the world.

What it offers to a customer?

It offers invariably all information that a bank's customer would need if he/she visits a

bank branch in person.

These are as herein follows:-

1. To make enquiries about the balance or debit or credit entries in the account.

2. To obtain cash payment out of his account by tendering a cheque.

3. To deposit a cheque for credit into his account.

4. To deposit cash into the account.

5. To deposit cheques / cash into account of some other person who has account in a

CBS branch.

6. To get statement of account.

7. To transfer funds from his account to some other account –his own or of third party,

provided both accounts are in CBS branches.

8. To obtain Demand Drafts or Banker’s Cheques from any branch on CBS – amount

shall be online debited to his account.

9. Customers can continue to use ATMs and other Delivery Channels, which are also

interfaced with CBS platform.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 28

Top CBS Application Software Providers

1-Infosys Technologies Ltd. Finnacle is the universal banking solution from Infosys.

2-I-flex solutions Ltd. since late 2005 it is owned by Oracle

3-TCS FNS (Financial Network Services Limited) is an Australian developer and

supplier of banking application software, operating in world markets. Now owned and

managed by TCS.

Thus, CBS is a step towards enhancing customer convenience through anywhere and

anytime banking.

FUNCTIONS OF RBI

RBI (Reserve Bank of India) is an apex financial institution as we know. RBI is

Central Bank of India. Lets know about its functions.

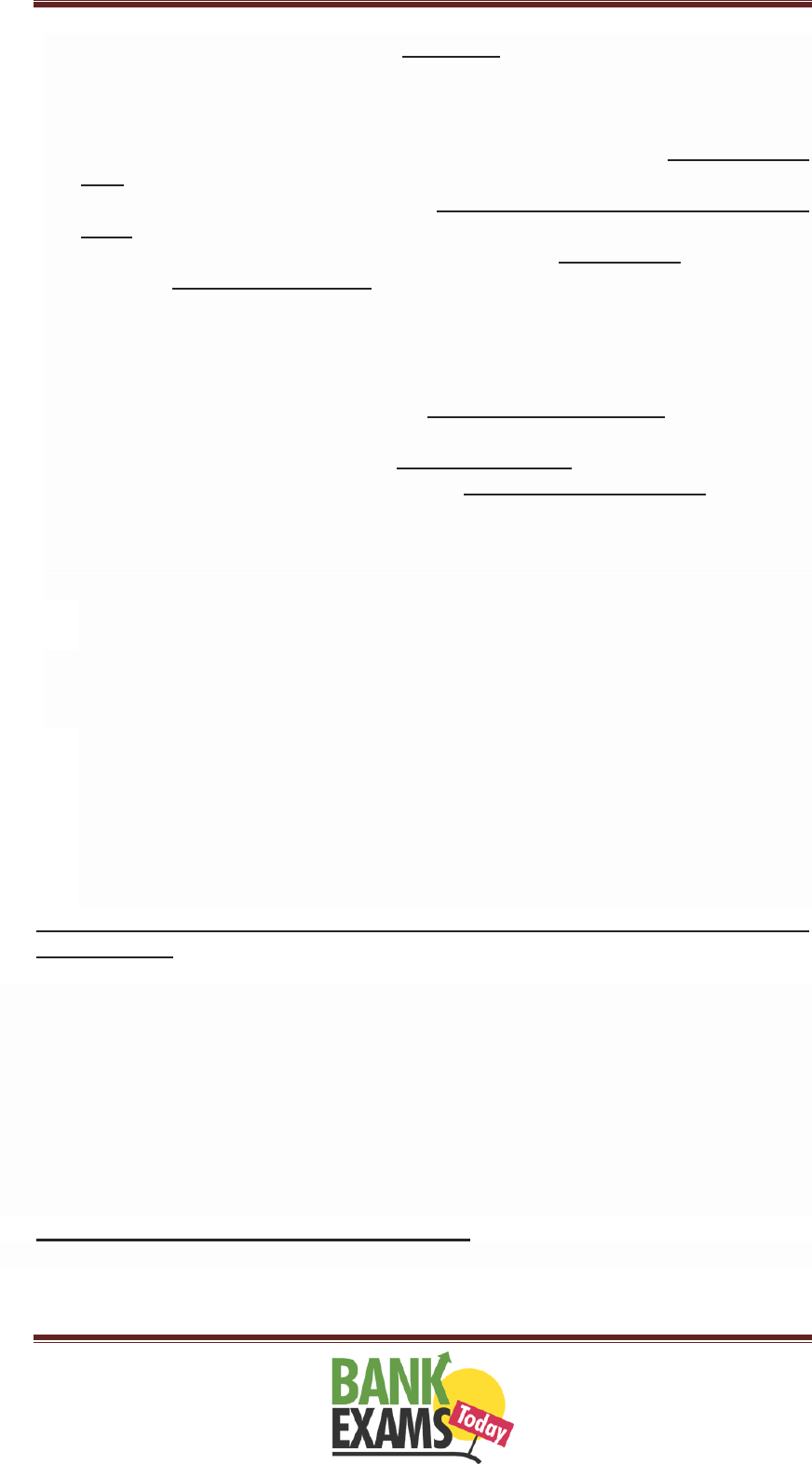

Functions of RBI can be classified into following categories:

a) Traditional functions

b) Development functions

c) Supervisory functions\

(A) Traditional Functions of RBI

1. Issue of Currency Notes

As per the provisions of the Section 22 of the Reserve Bank of India Act 1934 the

RBI has sole right or authority to issue currency notes except one rupee note and

coins of smaller denomination. RBI can exchange these currency notes for other

denominations. RBI issues these currency notes ( 2, 5, 10, 20, 50, 100, 500, 1000)

against the security of gold bullion, foreign securities, rupee coins, exchange bills,

promissory notes and government of India bonds etc.

2. Banker to other Banks

RBI also guide, help and direct other commercial banks in the country.RBI can

control the volume of bank reserves. Every commercial bank has to maintain a part of

their reserves with Its parent (RBI). If bank need fund they approach to RBI for fund,

that is calledLender of the Last Resort.

3. Banter to The Government

RBI works as an agent of the central and state governments. On the behalf of

government it makes payments, taxes and deposits etc. It also represent the

government at international level also. It maintains government accounts and provide

financial advice to the government. It also manages government public debts and

maintains foreign exchange reserves on behalf of the government. RBI also provides

overdraft facility to the government in case of financial shortage.

4. Exchange Rate Management

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 29

For maintenance of the external value of rupee, RBI prepares domestic policies. Also

it need to prepare and implement the foreign exchange rate policy which will help in

attaining the exchange rate stability. For maintenance of exchange rate stability it has

to bring demand and supply of foreign currency (U.S.) dollar close to each other.

5. Credit Control Function

Commercial banks creates credit according to demand in the economy. But if this

credit creation is unchecked or unregulated then it leads the economy into inflationary

cycles. If credit creation is below the required limit then it harms the growth of the

economy. As a central bank of India, RBI has to look for growth with price stability.

Thus it creates the credit creation capacity of commercial banks by using various

credit control tools.

6. Supervisory Function

RBI supervise the banking system in India. RBI has power to issue licence for setting

up new banks, to open new branches, to decide minimum reserves. RBI inspects

functioning of commercial banks in India and abroad. RBI also guide and direct the

commercial banks in India. RBI can conduct audit any of the bank.

(B) DEVELOPMENTAL FUNCTIONS OF RBI

Developmental functions are described as under:

1. Development of the Financial System

The financial systems includes - financial institutions, financial markets and financial

instruments. The sound and efficient financial system is necessary for rapid economic

development of the nation.

RBI encourages the banking and non - banking institution for maintenance of sound

and healthy financial system.

2. Development of Agriculture

As we know, India is an agrarian economy so RBI always give attention to agriculture

sector by assessing credit needs of this sector. Regional Rural Banks (RRB), National

Bank for Agriculture and Rural Development (NABARD) which are only for

agriculture finance comes under the control of the RBI.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 30

3. Industrial Finance

For economic development of country, Industrial development is necessary. As we

know industries includes small industries, middle industries, large scale industries etc

all these industries development is necessary for overall economic development of

country. For this purpose RBI supports the industrial sector also. RBI had played the

vital role for setting up of such industrial finance institutions like ICICI Limited,

IDBI, SIDBI, EXIM etc.

4. Training Provision

RBI always tried to provide essential training to the staff of the banking industry. RBI

has set up banker's training college at several places. The training institute namely

National Institute of Bank Management (NIBM), Bankers Staff College (BSC),

College of Agriculture Banking (CAB) etc.

5. Data Collection

RBI always collects important statistical data on several topics such as interest rates,

inflation, savings, investment, deflation etc. This data is very much useful for policy

makers and researchers.

6. Publication of the Reports

RBI has its separate publication division. This division collect and publish data on

different sector of the economy. The reports and bulletins are regularly published by

the RBI. It includes RBI weekly reports, RBI annual reports, Report on Trend and

Progress of commercial banks. This information is made available to the public also at

cheaper rates.

7. Promotion of Banking Habits

RBI always takes necessary steps to promote the banking habits among people for

economic development of country. RBI has set up many institutions such as Deposit

Insurance Corporation 1962, UTI 1964, IDBI 1964, NABARD 1982, NHB 1988 etc.

These organizations develop and promote the banking habits among the people.

8. Export Promotion

RBI always tries to encourage the facilities for providing finance for foreign trade

especially exports from India. The Export - Import Bank of India (EXIM), and the

Export Credit Guarantee Corporation of India (ECGC) are supported by refinancing

their lending for export purpose.

(C) SUPERVISORY FUNCTIONS

The supervisory functions of RBI are discussed as under:

1. Granting Licence to Banks

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 31

RBI grants licence to banks for carrying its business. RBI also provide licence for

opening extension counters, new branches even to close down existing branches.

2. Bank Inspection

RBI has power to ask for periodical information from banks on various components

of assets and liabilities.

3. Control Over NBFIs

The non - bank financial institutions are not influenced by the working of a monitory

policy. RBI has a right to issue directives to the NBFIs from time to time regarding

their functioning. Through periodic inspection, it can control the NBFIs.

4. Implementation of Deposit Insurance Scheme

The RBI has set up the Deposit Insurance Guarantee Corporation in order to protect

the deposit of small depositors. All bank deposits below Rs. 1 Lakh are insured with

this corporation. The RBI work to implement the Deposit Insurance Scheme in case of

a bank failure.

BANKING OMBUDSMAN

You all are familiar from the term BANKING OMBUDSMAN. Lets know more

about it thoroughly.

The Banking Ombudsman Scheme was introduced under Section 35 A of the

Banking Regulation Act, 1949 by RBI with effect from 1995.

The Banking Ombudsman Scheme was first introduced in India in 1995and

it was revised in 2002.

Current Banking Ombudsman Scheme introduced in 2006.

From 2002 until 2006, around 36,000 complaints have been dealt by the

Banking Ombudsmen.

Banking Ombudsman is appointed by Reserve Bank of India.

Banking Ombudsman is a senior official appointed by RBI. He handle and

redress customer complaints against deficiency in certain banking services.

The offices of Banking Ombudsman is mostly situated at State Capitals.

Around 15 Banking Ombudsmen have been appointed.

All Scheduled Commercial Banks, Regional Rural Banks and Scheduled

Primary Co - operative Banks are covered under the Banking Ombudsman

Scheme.

GROUNDS OF COMPLAINTS

ONE CAN FILE A COMPLAINT ON THE FOLLOWING GROUNDS OF COMPLAINTS:

1. Any excessive delay or non - payment of collection of cheques, drafts, bills

etc.

2. Without any sufficient cause non acceptance of small denomination notes.

3. Charging any commission for acceptance of small denominations notes

4. Any delay in payment of inward remittances or non payment of inward

remittances.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 32

5. If any banking organization refuses to accept taxes or any delaying in

accepting taxes (as required by RBI or Government of India).

6. Any delay in issuing government securities

7. Refusal to issue or redemption of government securities.

8. Without any sufficient reason, forced close the deposit accounts by bankers.

9. If any banker refuse to close the accounts

10. If any banker deliberately delaying in closing the accounts.

11. Non compliance of the provisions of Banking Codes and Standard Board of

India.

12. If any banker commits non - observance of Reserve Bank of India's guidelines

or instructions or any violation of the directives issued by the Reserve Bank in

relation to banking or other services.

13. Without any sufficient cause, non acceptance of coins tendered or charging of

commission in respect thereof.

14. Delay or Failure in issue of drafts, pay orders or banker's cheques.

15. Performance of work is not as per prescribed working hours.

16. Delay or failure in providing any bank facility.

17. Complaints file by Non - resident Indians having accounts in India in relation

to their remittance from abroad, deposits and other bank related matters.

18. Without any reason, refusal to open deposit accounts.

19. Without adequate prior notice to the customer, charges levied by the banker.

20. Any violation of guidelines or instructions of RBI on ATM/Debit Card/Credit

Card operations.

21. Non - disbursement or delay in disbursement of pension.

Other Grounds

A customer can also file a complaint on the following grounds of deficiency in service

with respect to loans and advances:

1. The Banking Ombudsman may also deal with such other matter as may be

specified by the Reserve Bank from time to time.

2. Without any valid reason non - acceptance of application of loans.

3. Any violation of the provisions of the fair practices code for lenders as

adopted by the bank or Code of Bank's Commitment to Customers, as the case

may be.

4. Any type of violation of the instruction, guidelines, recommendations of the

RBI

5. If any non - observance of Reserve Bank Directives on interest rates;

6. Any delays in sanction of loan applications

Reasons, when you can File a Complaint

1. If reply is not received from the bank within a period of one month after

concerned bank has received complaint representation.

2. If bank rejects the complaint.

3. If complainant is not satisfied with bank's reply.

Banking Ombudsman does not charge any fee for filing and resolving

customer's complaints.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 33

If any loss suffered by the complainant then complainant is limited to the

amount arising directly out of the act or omission of the bank or Rs.10

Lakhs whichever is lower.

MONETARY POLICY IN INDIA

Monetary Policy is a Policy made by the central bank(RBI) to control money supply

in the economy and thereby fight both inflation and deflation. It helps maintain price

stability and achieve high economic growth. To Combat Inflation RBI reduces Money

Supply (Tight/Dear Money Policy). To Combat Deflation RBI increases Money

Supply (Easy/Cheap Money Policy).

RBI implements monetary policy using certain tools. These are Quantitative Tools

and Qualitative Tools. Quantitative Tools are Reserve Ratios(CRR,SLR) ,

OMO(Open Market Operations) and Rates(Repo , Reverse Repo , Bank Rate , MSF).

Cash Reserve Ratio

Cash Reserve Ratio is a certain percentage of bank deposits (Net Time and Demand

Liabilities) which banks are required to keep with RBI in the form of reserves or

balances .

Higher the CRR with the RBI lower will be the liquidity in the system and vice-

versa.

It’s a dead Money as Banks don’t receive any Interest from RBI for reserves kept.

RBI can charge Penalty(3% above Bank Rate) for not keeping the reserves. CRR is

defined under Sec 42(1) of RBI Act , 1934.

Its Minimum and Maximum value is the discretion of RBI. It is maintained on

Fortnightly Average Basis. At Present The CRR is 4%. By Increasing CRR the

Money Supply can be Reduced in Market thereby Controlling Inflation(Dear Money

Policy) and by Decreasing it Money Supply can be Increased thereby promoting

Growth(Cheap Money Policy)

Statutory Liquidity Ratio

Every financial institution has to maintain a certain quantity of liquid assets with

themselves at any point of time of their total time and demand liabilities. These assets

can be cash, precious metals, RBI approved securities like bonds, Shares etc. The

ratio of the liquid assets to time and demand liabilities is termed as the Statutory

liquidity ratio.

Some profits are earned through SLR by banks depending upon the asset. It is defined

under Sec 24 of Banking Regulation Act 1949. It is maintained on daily basis by

Banks.

Penalty for Not Maintaining SLR can be 3% above Bank Rate.

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 34

Its Minimum and Maximum value(can be 40%) is the discretion of RBI. It is

maintained on Daily Basis. At Present The SLR is 22%. By Increasing SLR the

Money Supply can be Reduced in Market thereby Controlling Inflation(Dear Money

Policy) and by Decreasing it Money Supply can be Increased thereby promoting

Growth(Cheap Money Policy)

Repo(Repurchase) rate

It is the rate at which RBI lends money to commercial banks against securities in case

commercial banks fall short of funds for Short Term. But Remember The banks

cannot get money by mortgaging SLR quota securities to get money from RBI. It has

to have securities above the SLR quota to Buy Money. This rate is also known as

“Policy Rate”under LAF(Liquidity Adjustment Facility).

There is No Limit on how much the Client can Buy from RBI but Minimum has to Rs

5 crores. Banks use this Facility only when they have less Deposits from Public but

have more Loan Demand. Currently the Repo Rate is 7.75%.

By Increasing Repo Rate the Money Supply can be Reduced in Market as Money

becomes Costly(Dearer) thereby Controlling Inflation(Dear Money Policy) and by

Decreasing it Money Supply can be Increased as Money becomes Cheap thereby

promoting Growth(Cheap Money Policy). Indirectly This helps in GDP growth of

India as less Repo Rates most probably leads to Less Lending Rates by Banks. So

Business can buy More Loans and invest that Money in Production.

Reverse Repo(Repurchase) Rate

Rate at which RBI borrows money from commercial banks. When Banks have

collected More Money from Public but Demand for Loans is Less then Banks mostly

park their Money with RBI and Receives Interest(Reverse Repo Rate). Reverse Repo

Rate is Dependent on Repo Rates as Reverse Repo Rate is set to Repo Rate -1%. RBI

gives Government Securities as Collateral to Banks. Current rate is 6.75%

Officially Repo and Reverse Repo Rates Percentages are in Basis Points. So 1%

means 100 Basis Points.

Marginal Standing Funding

By this mechanism commercial banks can get loans from RBI for their emergency

needs. Under the Marginal Standing Facility (MSF), currently banks avail funds

from the RBI on overnight basis against their excess SLR holdings.

Additionally, they can also avail funds on overnight basis below the stipulated SLR

up to two per cent of their respective Net Demand and Time Liabilities (NDTL)

outstanding at the end of second preceding fortnight.

With a view to enabling banks to meet the liquidity requirements of mutual funds

under the RBI’s Special Repo Window announced on July 17, 2013, it has been

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 35

decided to raise the borrowing limit below the stipulated SLR requirement under the

MSF from 2 per cent of NDTL to 2.5 per cent of NDTL. This Facility is only

Available to Scheduled Commercial Banks. Under This Facility Banks can use

securities from SLR quota. MSF Rate = Repo Rate +1%. Current is 8.75%

Bank rate

It is a rate at which RBI lends money to commercial banks without any security. It is

used for Long Term Borrowing . Bank rate is not the main tool to control money

supply. Repo Rate is the main tool to Control Money Supply. Penal rates are linked

with Bank rate. At present, Penalty rate = Bank rate + 3% (or 5% in some cases)

Impact

When bank rate is increased interest rate also increases which have negative impact

on demand thus prices increases.

QUALITATIVE TOOLS

1. LTV(Loan to Value Ratio) : Suppose I have Land Worth Rs 1 Crore and I

want to get Loan from Bank by Mortgaging that Land. Then I will Not get Rs 1

Crore Loan . If LTV=60% then I can Get Maximum Loan of Rs 60 Lakh.

2. Moral Suasion : Moral Suasion is just as a request by the RBI to the

commercial banks to take so and so action and measures in so and so trend of the

economy. RBI may request commercial banks not to give loans for unproductive

purpose which does not add to economic growth but increases inflation. Rajan

will try to influence those bankers through direct meetings, conference, giving

media statements, giving speeches etc

3. Credit Ceiling: In this operation RBI issues prior information or direction that

loans to the commercial banks will be given up to a certain limit. In this case

commercial bank will be tight in advancing loans to the public. They will

allocate loans to limited sectors. Few example of ceiling are agriculture sector

advances, priority sector lending.

4. Credit Authorization Scheme: Under this instrument of credit regulation

RBI as per the guideline authorizes the banks to advance loans to desired sectors

5. Direct action : Means RBI gives punishment to notorious banks for not

abiding by its guidelines. Punishment can involve: penal interest, refuses to lend

them money and in worst case even cancels their banking license.

CHEQUE TRUNCATION SYSTEM

I’m sure you must have come across the acronym CTS many a times during your

banking studies; today we aim to go further from the acronym and actually understand

what CTS is all about!

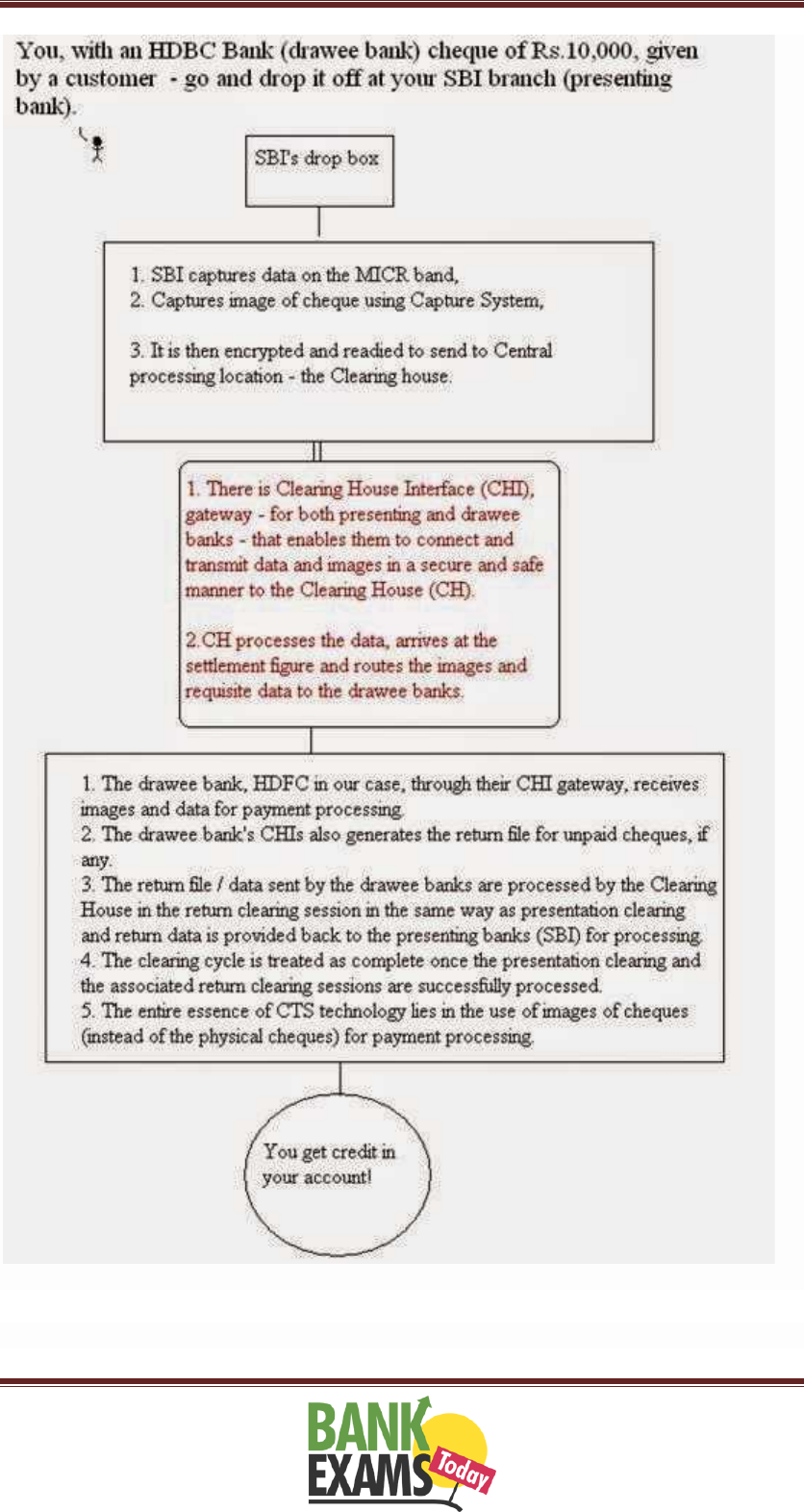

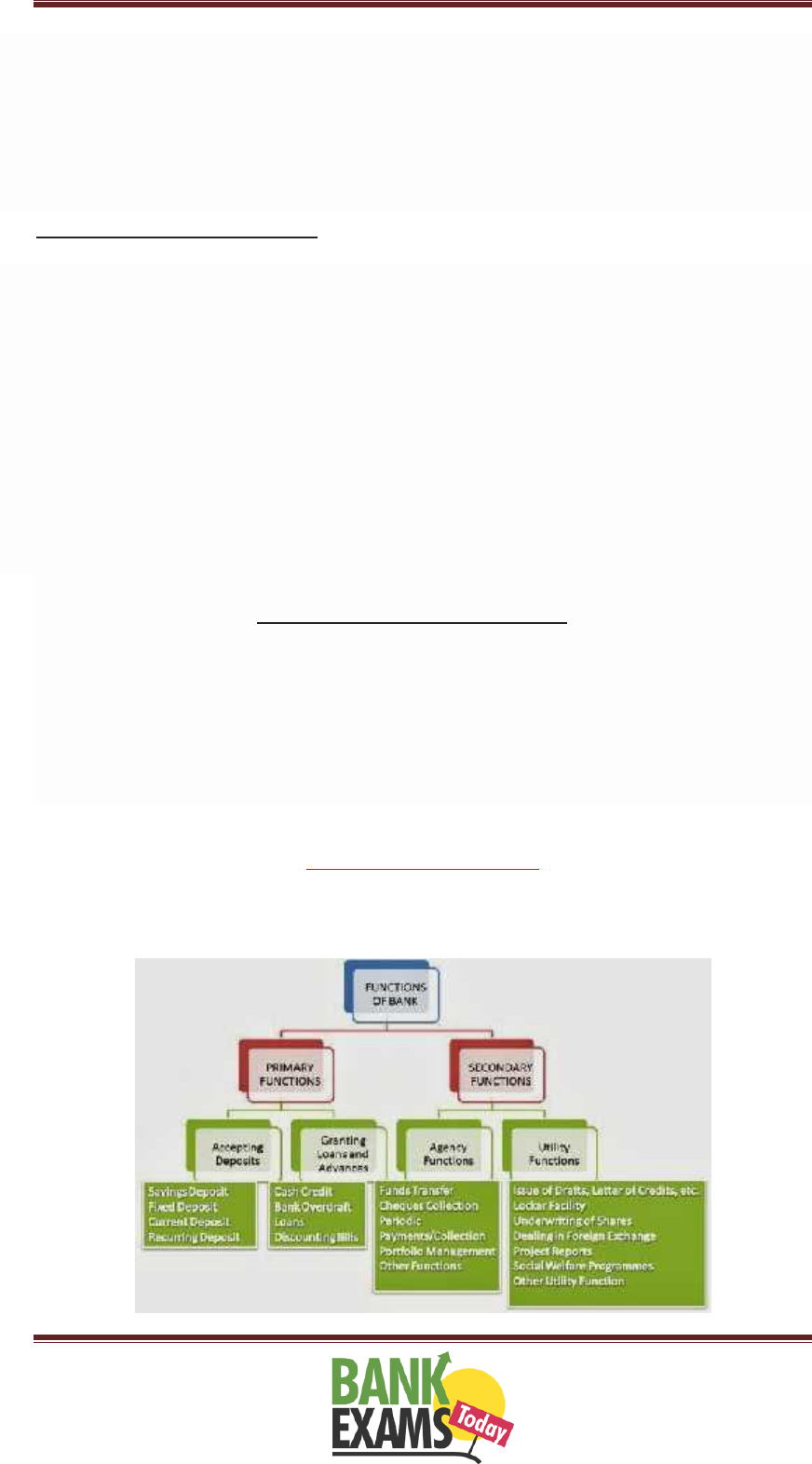

1. What is Cheque Truncation or truncation of cheques?

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 36

Truncation literally means stopping or cutting short. Thus, truncation of cheque

means stopping the flow of the physical cheque by the presenting bank (bank where

the cheque is presented/dropped off!)

en-route to the drawee bank’s (bank on which the cheque is drawn on) branch.

Instead of the physical cheque, an electronic image of the cheque is transmitted to the

drawee branch, along with relevant information like data on the MICR band, date of

presentation, presenting bank, etc.

Cheque truncation, thus, removes the need to move the actual physical cheque from

branch to branch.

2. Process of CTS:

Basically there are three levels, namely, at the Presenting Bank, the Clearing House

and the Drawee Bank. The following should help with understanding the process!

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 37

3. Benefits of CTS:

(i) CTS speeds up the process of collection of cheques,

www.BankExamsToday.com

www.BankExamsToday.com

Banking Awareness Guide

By Ramandeep Singh Page 38

(ii) Reduces the scope for clearing-related frauds or loss of instruments in transit,

(iii) Lowers the cost of collection of cheques,

(iv) Removes reconciliation-related and logistics-related problems,

(v) Reduces the time of clearing cycle –that is faster processing of cheques and

payment in favour of the customer,