CAT L1.2 BUSINESS LAW Study Manual

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 273 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- 2. The Executive branch

- B. The beginning of legal personality: birth of a natural person

- According to Art.15 of Family code (FC), a natural person’s personality begins at birth. However, the potential interests of the unborn child may be protected from his/her conception. Whenever there is a situation which can be to the advantage of a ch...

- C. The end of legal personality: death

- §2. Legal identification of physical persons

- The essential requisites of bill of the exchange are:

- 4- It must be signed by the maker

- The following is an example of a bill of exchange:

- Specimen of promissory note:

- Specimen of cheque

- A promissory note, bill of exchange or cheque may be payable to bearer

- Section 2. Distinct characteristics of negotiable instruments

- §1. Property and Patrimony

- §2. Property and things/ Things and Rights

- §3. Patrimonial and Extra- Patrimonial rights

- A. Introduction and definition

- B. The history of the ownership right

- C. Characteristics of the right of ownership

- E. Prerogatives of the ownership right

- F. Extent of the Right of Ownership

- §2. Dismemberment of the right of ownership

- §2. Land categorization in Rwanda

- A. DEFINITION OF COMPANY

- F. COMPANY AS INSTITUTION

- J. COMPANIES MORAL PERSONALITY

- GENERAL NOTIONS ON MORAL PERSONALITY

- F. RIGHTS AND OBLIGATIONS OF THE SHAREHOLDERS

- RIGHTS OR POWERS OF THE SHAREHOLDERS

- Relevant Rules of General assemblies of shareholders

- A. DORMANT COMPANY

- Chapter 28

- A. REMOVAL FROM REGISTRAR COMPANIES

INSIDE COVER - BLANK

Page 1

© CPA Ireland

All rights reserved.

The text of this publication, or any part thereof, may not be reproduced or transmitted in any

form or by any means, electronic or mechanical, including photocopying, recording, storage in

an information retrieval system, or otherwise, without prior permission of the publisher.

Whilst every effort has been made to ensure that the contents of this book are accurate, no

responsibility for loss occasioned to any person acting or refraining from action as a result of

any material in this publication can be accepted by the publisher or authors. In addition to this,

the authors and publishers accept no legal responsibility or liability for any errors or omissions

in relation to the contents of this book.

INSTITUTE OF

CERTIFIED PUBLIC ACCOUNTANTS

OF

RWANDA

Level 1

L1.2 Business Law

First Edition 2012

This study manual has been fully revised and updated

in accordance with the current syllabus.

It has been developed in consultation with experienced lecturers.

Page 2

BLANK

Page 3

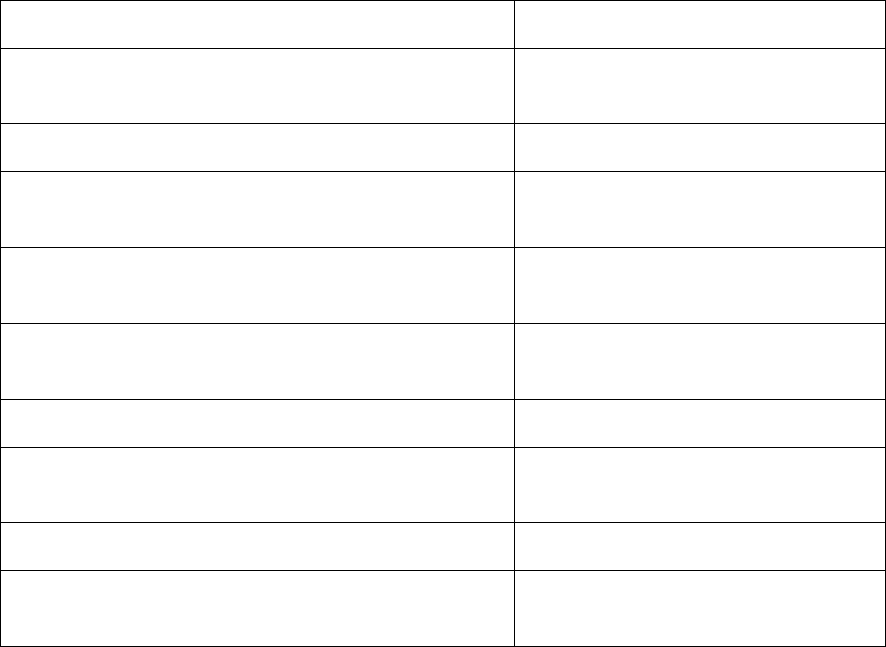

CONTENTS

Study

Unit

Title Page

CHAPTER 1: Introduction to the Course

8

Definition of Law

15

Purpose of Law

15

Law & Morality

16

Law & Ethics

17

Substantive and procedural law

17

Criminal and Civil Law

17

Main divisions of Law

18

Characteristics of a Legal Rule

20

Sanctions of a Legal Rule

22

Major legal systems (families) of the world

22

CHAPTER 2: Sources of Law

24

Material Source of Law

24

Formal Sources

25

Sources of Rwandan Business Law

30

CHAPTER 3: Administrative Law

32

Meaning

32

Separation of Powers

32

CHAPTER 4: The Business Disputes Resolution

39

Review of key constitutional provision regarding the Court System

39

Rwandan Commercial Justice System

39

Arbitration

44

CHAPTER 5: Law of Persons

50

Juridical or legal personality

50

Legal identification of physical persons

52

CHAPTER 6: Law of Tort

58

The liability for personal acts

58

Liability for acts committed by others

60

CHAPTER 7: Law of Contract

64

General overview on Contract

64

Contract formation

67

End of Contractual Obligations

85

CHAPTER 8: Sale of Goods

96

Definition

96

Essentials of contract of sale

96

Distinction between a sale and an agreement for sale

97

CHAPTER 9: Agency

100

Agency: Definition and key features

100

Agent

100

Creation of agency

102

CHAPTER 10: Insurance

104

Definition of the Contract of Insurance and Insurer

104

Common Types Insurance and their Role

104

Categories of Insurance Business

106

Page 4

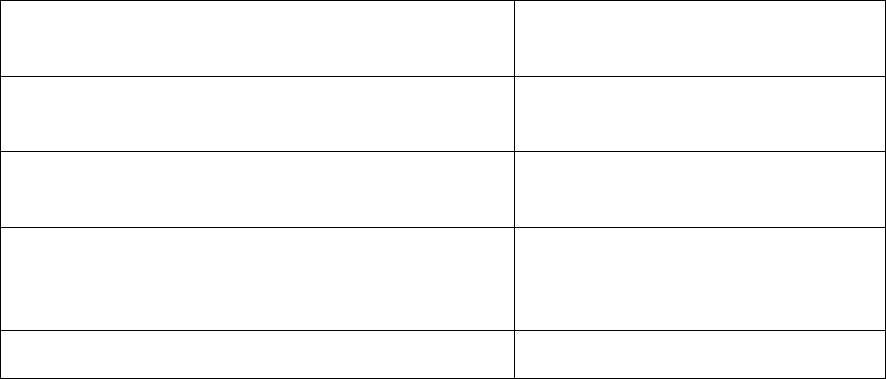

Study

Unit

Title Page

CHAPTER 11: Negotiable Instruments

107

Definition and distinct characteristics of negotiable instruments

107

Different kinds of negotiable instruments

107

CHAPTER 12: The Law of Property

124

Definition of property

124

Real Rights

130

Overview of the 2005 Organic Law on land use and management in Rwanda

140

CHAPTER 13: Nature and Classification of Companies

148

Definition of Company

148

The Company as Contract

149

Shares

150

Vocation to Profits Sharing

151

Affectio Societatis

152

Company as Institution

152

Forms of Business Organisation

153

Distinction between companies and other Business Organisations

154

Legal Status of Companies

155

Companies Moral Personality

166

CHAPTER 14: Registration of Companies

169

Public Limited Company

169

Formation of the Public Limited Company

170

Substantive Requirements

170

Procedural Requirements

171

Office of the Registrar General (ORG)

171

Memorandum and Articles of Association

172

Promoters

174

Legal Consequences of Incorporation

177

Constituent Ordinary Meeting

178

The main differences between a private and a public company

179

CHAPTER 15: Share Capital

180

Subscription of Share Capital

180

Payment of Shares

180

Types of Share Capital

181

Raising Share Capital

185

Variation of Shareholder’s Rights

187

Rights and Obligations of the Shareholders

188

Prospectuses

191

Alteration, maintenance and reduction of Share Capital

192

The Acquisition and Redemption by a Company of its own Shares

194

Financial Assistance by a Company for the Purchase of its own Shares

195

Dividends

195

CHAPTER 16: Debt Capital

196

Debentures

196

Charges

200

Registration of Charges

202

Remedies for Debenture Holders

202

Comparison between a share-holder and a debenture-holder

203

Page 5

Study

Unit

Title Page

CHAPTER 17: Membership of a Company

204

Becoming a Member

204

Register of Members

204

Rights, Obligations and Liabilities of Members

204

Termination of Membership

206

CHAPTER 18: Shares

207

Classes of Shares

207

Issue and Allotment

207

Transfer and Transmission

207

Share Warrant

208

CHAPTER 19: Meetings

209

Classification of Meetings

209

Notice of Meeting

211

Agenda

211

Proxies

211

Quorum

211

Proceedings at the Meeting

212

Resolutions

212

Minutes

213

CHAPTER 20: Directors

214

Management of Companies

214

Appointment of Directors

215

Qualification, Disqualification and Removal of Directors

217

Powers and Duties of Directors

218

Remuneration or Compensation for Loss of Office

219

Loans to Directors

219

Register of Directors

219

Disclosure of Directors’ in Contracts

220

The Turquand’s Rule

221

CHAPTER 21: The Secretary

222

The Company Secretary

222

Qualification, Appointment and Removal

223

Liability of a Secretary

224

Removal of a Secretary

224

Register of Directors and Secretary

224

CHAPTER 22: Auditors

226

Qualification, Appointment and Removal

226

Remuneration

227

Powers and Duties

227

Liability of Auditors

227

Dismissal of Auditors

228

Page 6

Study

Unit

Title Page

CHAPTER 23: Company Accounts, Audit and Inspection

229

Form and Content of Accounts

229

Books of Account

229

Group Accounts

230

Directors’ Report

230

Auditor’s Report

231

Investigation by the Registrar General

231

Appointment and Powers of Inspectors

233

Inspector’s Report

234

CHAPTER 24: Corporate Insolvency

235

The Disappearance of Legal Personality

235

Winding up by the Courts

238

Voluntary Winding Up

239

Liquidators: Appointment and Duties

239

Release of Liquidators

240

CHAPTER 25: Alternatives to Winding Up

242

Reconstruction

242

Amalgamation, Mergers and Take-overs

243

Schemes of Arrangement

243

Rights of Shareholders

244

Rights of Creditors

244

CHAPTER 26: Foreign Companies

245

Definition

245

Registration of Foreign Companies

245

Obligations applicable to foreign companies

246

Cessation of foreign company activities

246

CHAPTER 27: Dormant Company

248

Dormant Company

248

CHAPTER 28: Removal from Register of Companies and Penalties

249

Removal from Register of Companies

249

Solvency and company’s inability to pay

249

Pertinent provisions in relation to the removal from the register of companies

250

Penal Provisions

251

Page 7

Study

Unit

Title Page

CHAPTER 29: Accounting Records and Audit

252

Definition

252

Financial Statement and Annual Report

255

Mandatory Investigation

257

Amalgamation of Companies

259

Alteration of the nature of companies

263

Appendix 1

265

Page 8

Stage: Level 1

Subject Title: L1.2 Business Law

Aim

The aim of this subject is to ensure that students have an understanding of the law relating to the

accountant and the ability to identify problems that require the advice of a legal professional.

Learning Outcomes

On successful completion of this subject students should be able to:

• Distinguish between and describe sources of law

• Interpret, describe and discuss aspects of the law of property

Interpret, describe and discuss aspects of the law of contract and of

sale of goods and supplies of services

• Interpret, describe and discuss aspects of the law relating to negotiable

instruments and insurance

• Recognise if and when more specialist legal knowledge is required

and identify the source of that expertise

• Describe, discuss and explain aspects of company law relating to the

structure of business entities and of their commercial relationships.

Page 9

Syllabus:

1. Nature, Purpose and Classification of Law

Nature and purpose of law

Classification of Law

Law & Morality

Ethics and the Law

2. Sources of Law

The Constitution

Legislation

Statutes of general application

Substance of common law and doctrines of equity

Judicial precedent

3. Administrative Law

Separation of Powers

Natural Justice

Judicial control of the Executive

Administrative Legislation

Arbitration

4. The Court System

Courts and tribunals: composition, jurisdiction

Structure, composition and jurisdiction of courts justice

Subordinate Courts

5. Law of Persons

Legal Personality

Types of persons: natural person, artificial person

Sole proprietorships

Partnerships

Unincorporated Associations

Limited Companies

Page 10

6. Law of Tort

Nature of tortuous liability

General defences in the law of tort

Negligence

Nuisance

Trespass

Vicarious liability

Occupier’s liability

Limitation of action

Defamation

7. Law of Contract

Nature of a contract

Classification of Contracts

Formation of Contracts

Terms of a contract, conditions, warranties and exemption clauses

Vitiating factors: mistake, misrepresentation, duress, undue influence,

illegality, illegal contracts

Discharge of contract

Remedies for breach of contract

Limitation of actions

8. Sale of Goods

Nature of the Contract

Formation of the Contract

Terms of the Contract

Transfer of property in goods

Rights and duties of the parties

International contracts of sale

9. Agency

Nature and creation of agency

Types of Agents

Authority of an agent

Rights and duties of the parties

Termination of agency

Page 11

10. Hire Purchase

Nature of the contract

Formation of the contract

Terms of the contract

Rights and duties of the parties

Termination of the hire purchase contract

11. Negotiable Instruments

Nature and characteristics

Negotiability and transferability

Types: cheques, promissory notes, bills of exchange

Rights & Obligations of the parties

12. Company Law

Nature & Classification of Companies

Forms of business organisations

Distinction between companies and other business organisations

Law relating to other business organisations such as co-operative societies

13. Registration of a Company

Memorandum and Articles of Association

Promoters

Legal consequences of incorporation

14. Share Capital

Types of Share Capital

Raising Share Capital

Variation of shareholders rights

Prospectuses

Alteration, maintenance and reduction of capital

The acquisition and redemption by a company of its own shares

Financial assistance by a company for purchase of its own shares

Dividends

Page 12

15. Debt Capital

Debentures

Charges

Registration of charges

Remedies for debenture holders

Borrowing powers of a company

16. Membership of a company

Ways of becoming a member

Register of members

Rights and liabilities of members

Termination of membership

17. Shares

Classes of shares

Issue and Allotment

Transfer and transmission

Mortgage of Shares

Share Warrant

18. Meetings

Classification of Meetings

Notice of Meetings

Agenda

Proxies

Quorum

Proceedings at the meeting

Resolutions

Minutes

Page 13

19. Directors

Appointment of directors

Qualification, disqualification and removal of directors

Powers and duties of directors

Compensation for loss of office

Loans to directors

Register of directors

Disclosure of directors’ interests in contracts

The Turquand’s rule

Investor Protection

Insider Dealing

20. The Secretary

Qualification, Appointment and removal

Position and duties

Liability of a secretary

Removal of a secretary

Register of directors and secretary

21. Auditors

Qualification, appointment and removal

Remuneration of auditors

Powers and duties

Vacation of office

22. Company Accounts, Audit and Inspection

Form and content of accounts

Books of account

Group Accounts

Directors’ report

Auditor’s report

Investigation by the registrar

Appointment and powers of inspectors

Inspector’s report

Page 14

23. Corporate Insolvency

Winding up by court

Voluntary winding up

Liquidators: Appointment and duties

Release of liquidators

Offences relating to liquidation

24. Alternatives to winding up

Reconstruction

Amalgamation

Mergers and takeover

Schemes of arrangement

Rights of shareholders

Rights of creditors

Page 15

CHAPTER I. GENERAL INTRODUCTION TO LAW

Section 1. MEANING OF THE LAW AND OTHER KEY CONCEPTS

A. Definition of Law

For a better understanding of the course, some key words need to be defined, the first of these

being ‘Law’ itself. The word ‘Law’ can have several meanings depending on one’s point of

view. However, two of them are the most important as far as the definition of Law is

concerned. The rest are complementary and they are useful as well because the word ‘Law’

can be viewed in different ways. Also in Law, there is generally a presumption that where a

clause or rule refers to he or she (similarly, him or her) either refers to the other inclusively.

Law, in its general sense, is a set of rules of conduct prescribed by a controlling authority and

having a binding force. The phrase ‘prescribed by a controlling authority’ means that the

controlling authority declares with authority that something should be done or should not be

done or that a rule should be followed. Law having a binding force means that the law is that

which must be followed by citizens and where the people don’t abide by it, sanctions are

attached. Sanctions mean the penalties or punishments for someone who has done wrong or

who has not respected the law. Having a character of a rule of conduct implies that it

commands what is right and what is wrong.

Law, in its second meaning, is referred to as a scientific subject studying the wide and

heterogeneous body of rules regulating human conduct. In this case, it is also called the

Science of Law.

In another perspective, law is referred to as objective or subjective. Objective law is a set of

rules governing persons’ conduct in a society, enacted and sanctioned by the public authority.

It is in this way that we say that Rwandan law, Belgian law etc., or criminal law, Civil law.

Subjective law refers to the prerogatives or rights bestowed (given) to a person by the objective

law ( above). These are rights or privileges belonging to a particular person or a group because

of their importance or social position. A human being is endowed with a number of rights that

he or she enjoys in his relationship with others; for example, a human being has the right to

property, the right to privacy, freedom of speech etc. Subjective law is what we would call

subjective rights. The reason why we call it a subjective right is because a right cannot exist on

its own. It needs somebody that has the right. It is an issue of who owns what. The one who

owns is the subject and what is being owned is the right.

In another way, law is said to be positive or natural positive law or legal position meaning a

hierarchy of laws made by man, applicable in a given place at a given time. This is manmade

law. Rwandan positive law is the whole body of different rules applicable in Rwanda today.

Natural law is a body of ideal rules of human conduct considered as superior to those of

positive law and compulsory even to the legislator. Natural laws are usually used to justify the

legal rule (positive law) this is because every single law is related to a pure moral law, which is

to say that a legal rule is a result of a moral law. An example is that the legal rule (positive

law) against murder originated from the natural law of ‘don’t kill’ which has been in existence

since time immemorial.

Page 16

Summarizing this development on the definition of the law, one can say that Law might be

understood as a set of rules which are generally obeyed and enforced within a politically

organised society. In other words, law is a body of rules for the guidance of human conduct

which are imposed upon and enforced among the members of a given state. The law is really

necessary in each society.

B. Purpose of the law

The establishment of laws in society is necessary to protect the rights of individuals and to

ensure the good order, functioning and survival of the society. In effect, what the law is trying

to do is to provide answers to the myriad of everyday problems that can arise in society. The

solutions to such problems must accord with objectives that are judged by the community to be

socially desirable. The problems arise in the first place because of the conflicting interests of

individuals and groups within the society and the necessity to ensure the functioning and

survival of the society itself. The more civilized a community becomes, and the greater the

industrial and scientific progress it makes, the more laws it must have to regulate the new

possibilities it is acquiring.

What the law does, in attempting to prevent and resolve conflict in society, is to:

- control social relations and behaviour;

- provide the machinery and procedures for the settlement of disputes;

- preserve the existing legal system;

- protect individuals by maintaining order;

- protect basic freedoms;

- provide for the surveillance and control of official action;

- recognize and protect ownership and enjoyment of the use of property;

- provide for the redress (compensation) of harm;

- reinforce and protect the family;

- facilitate social change.

C. Law and morality

There is a connection between legal laws laid down by a state and certain other norms of

behaviour known as laws of morality. From a legal perspective the essential difference between

these two sets of rules exists in their respective enforcement. Legal rules are enforced in the

courts. Rules of morality depend for their observance upon the good conscience of the

individual and the force of public opinion. In any society it is usual to find the rules of morality

observed by the majority of its members reflected in the legal laws of that society. The contents

of morality, or ethics, and law overlap to a great extent, e g murder, theft and slander; but there

are many rules of morality and ethics which the law does not seek to enforce, such as the

commandment to honour our parents; and many legal rules which are not intrinsically moral,

such as the husband’s general liability to pay tax on his wife’s income.

Page 17

D. Law and Ethics

Ethics (also known as Moral Philosophy) is the science of the rules of moral conduct which

should be followed as being good in themselves. There is a close relationship between law and

ethics, but there are important differences.

First of all, whereas law is enforced by the organs of the state, ethics are not. While the

commands of the law are imposed from without (heteronymous) and enforced by sanctions

primarily exterior, the final decision in moral issues is left to each man’s personal conscience,

and the sanctions lie in one’s own heart (save that, where a rule of ethics coincides with one of

positive morality, public opinion may provide a sanction). Secondly, law concerns itself

primarily with the external behaviour of a person, his overt acts, being interested in the state of

his mind, his intention or his motive as a rule only where it manifests itself in an act. Ethics on

the other hand, concerns itself primarily with the state of a person’s mind, with his thoughts

and desires, and is interested in his acts in the main only in so far as they reveal the state of his

mind.

Thirdly, whereas law imposes its commands in the interests of the community, the laws of

ethics are imposed for their own sake, to achieve virtue. While the Law aims at the doing of

justice and the maintenance of peace and order in the community, the aim of ethical theory is

the perfection of character; institution of law has to do with the regulation of conduct.

To a large extent law and ethics overlap, but they do not coincide.

Section 2. CLASSIFICATION OF LAW

A. Substantive and procedural law

Substantive law sets out the rights and duties governing people as they act in the society and

specifies remedies to back up those rights. Duties tend to take the form of a command. ‘’Do

this’’ or ‘Do that’ or ‘Do not do that’. For example, the Rwanda labour code tells employers

that they must not discriminate amongst people in hiring and employment on the basis of race,

colour, religion, sex, etc. substantive law also establishes rights and privileges, e.g. freedom of

speech, the right to self-defence.

Procedural law establishes the rules by which substantive law is enforced. It does not define

rights or duties, but merely implements them. Rules as to what cases a court can decide how, a

judgment of a court is to be enforced are part of procedural law.

B. Criminal and civil law

Criminal law consists of rules prohibiting anti-social conduct as well as certain deviant

behaviour. It aims to shape people’s conduct along lines which are beneficial to society, by

preventing them from doing what is bad for society. In Rwanda as elsewhere, these

prohibitions are listed in the penal code and a number of subsidiary legislation. Also forming

part of the criminal justice system are courts, which adjudicate questions of criminal liability,

as well as the police force and other enforcement agencies which exist not only to maintain law

and order but also to detect and prosecute violations against the criminal law. It is the society

through Government employees called public prosecutors that bring court action against

Page 18

violators. If a person is found guilty of the crime such as theft, the person will be punished by

imprisonment and or a fine. When a fine is paid, the money goes to the side of the government,

not to victim of the crime.

Civil law lays down rules, principles and standards which create rights and duties and specifies

remedies to back up those rights. The duties are owed by one person (including corporations)

to another. Actions for the breach of civil duty must be brought by the injured party himself or

his representative. Generally, the court does not seek to punish the wrongdoer but rather to

compensate the injured party for the harm he or she has suffered. For instance, if someone

carelessly runs a car into yours that person has committed a civil wrong (tort) of negligence. If

you have suffered damages you will be able to recover to the extent of the damages suffered.

Note that although civil law does not aim to punish, there is an exception. If the behaviour of

someone who commits a tort is outrageous, that person can be made to pay punitive damages

(also called exemplary damages). Unlike a fine paid in a criminal case, punitive damages go to

the injured party.

Sometimes, the same behaviour can violate both the civil law and the criminal law. For

instance, a person whose careless driving causes the death of another may face both a criminal

prosecution by the state and a civil suit for damages by survivors of the deceased. If both suits

are successful, the person would pay back society for the harm done through a fine and or a

sentence, and compensate the survivors through the payment of the money damages.

C. Main divisions of law

Broadly, law can be divided into two broad categories

1. International law

This is sometimes called the law of nations, and consists of rules governing the relations

between states. The basic principles are recognition of the sovereign state, known as pacta sunt

servanda (Latin for "agreements must be kept"). Public international law is the most well-

known branch of International law which regulates legal relations between states and the

manner in which international organizations operate. International law is the set of rules

generally regarded and accepted as binding in relations between states and nations. It serves as

the indispensable framework for the practice of stable and organized international relations.

International law differs from national legal systems in that it only concerns nations rather than

private citizens. National law may become international law when treaties delegate national

jurisdiction to supranational tribunals such as the European Court of Human Rights or the

International Criminal Court. Treaties such as the Geneva Conventions may require national

law to conform.

International law is consent based governance. This means that a state member of the

international community is not obliged to abide by international law unless it has expressly

consented to a particular course of conduct. This is an issue of state sovereignty.

The term "international law" can refer to three distinct legal disciplines:

Page 19

• Public international law, which governs the relationship between provinces and

international entities. It includes these legal fields: treaty law, law of sea, international

criminal law, the laws of war or international humanitarian law and international human

rights law.

• Private international law addresses the questions of (1) which jurisdiction may hear a

case, and (2) the law concerning which jurisdiction applies to the issues in the case.

• Supranational law or the law of supranational organizations, which concerns regional

agreements where the laws of nation states may be held inapplicable when conflicting

with a supranational legal system when that nation has a treaty obligation to a

supranational collective.

The two traditional branches of the field are:

• jus gentium — law of nations

• jus inter gentes — agreements between nations

2. National law

This is the law of a particular country and it is divided into various branches:

a) Public law

Public law is that branch of the law concerned with the organization of the state and state

agencies and corporations as well as their relations with private individuals. Constitutional law,

tax law, public finance, public liberties, administrative law, criminal law is all public law

subjects.

b) Private law

Private law on the other hand, is that branch of the law which governs the relationship of

individuals inter se. There are divisions in this branch of law:

- Law of persons (including family law): This branch of law deals with the legal status

of natural persons, such as minors and insane persons, and involves factors influencing

capacity, such as age, marriage and nationality. Family law deals with the law of

domestic relations and the legal rules for family relationships, such as marriage,

divorce, guardians.

- Law of “things”. This branch is divided into categories:

Law of property: this is a branch of law that is concerned with real rights and

deals with ownership and possession, and various real rights in a thing

belonging to another, such as servitudes, mortgages, pledges and liens.

Law of succession: This deals with what happens to a person’s estate upon

death. In testamentary succession, the deceased leaves a valid will. In intestate

succession, there is no will at all, or part of the estate of the deceased was not

disposed of by will.

Page 20

Law of obligation: This branch of law deals with personal rights, and is divided

into two categories.

Law of contract: a contract is defined as a binding agreement between two or

more persons by which one or more of them agrees to give something, or to do

something, or not to do something. It is therefore an agreement intended to

create or extinguish personal rights between persons.

Civil liability. This is a branch of general duty imposed by law which will

ground an action for damages by any person to whom the duty was owed who

has suffered harm in consequence of the breach. The duty is owed to persons

generally and is imposed independently of the will of the parties.

Business law: There is no simple categorization of laws that fall under business

law, since much of this law also falls into other categories. However, business

law may include laws relating to insurance, labour law, bankruptcy, and agency,

sale of goods, taxation, negotiable instruments, company law, carriage, and law

of banking.

- Procedural law: This branch of law deals with the rules that govern how actions may

be brought under the law. There are two divisions:

a) Civil procedure: This sets out the rules of how persons can bring action against

others in a civil court.

b) Criminal procedure: This sets out procedure on how a criminal court operates,

the powers of judges in criminal matters, and how persons can be brought

before a criminal court.

- Law of evidence: This sets out the rules of how evidence may be introduced and

proved in a civil or criminal court.

- Conflict of laws: This branch of law prescribes rules for settling an issue before a

Rwandan court if the events at issue are so connected to a foreign country that the

foreign country’s system of law has to be considered in resolving the matter.

Section 3. CHARACTERISTICS OF A LEGAL RULE

A legal rule is binding, meaning that it requires you to do something or not to do something.

‘Binding’ also means that it is supposed to be followed by all citizens.

A legal rule is binding in time and space. On the one hand, a legal rule is said to be binding in

space when it is for example applicable to Rwanda and not to Britain. On the other hand, a

legal rule is binding in time, when it exists from a certain date to a certain date. It is possible

that a public (state) authority can vote for a law and it exists for two years and it is then

replaced by a new one.

A legal rule is always general. This means that it applies to persons in general but not to a

particular individual. A legal rule cannot regulate one specific person. A law which regulates

one person is not a legal rule. That law can’t or doesn’t exist.

Page 21

However, a legal rule can apply to a certain class of individuals. Some rules are applied to

some specific categories of people. This is the diversification of rules. An example is when a

law can apply to men and women doing military service, people doing commercial activities or

to employers.

A legal rule is permanent. It means that it is applicable or not interrupted between its inception

and its end. This characteristic of permanency of a legal rule refers to its applicability during its

life (its existence).

A legal rule can be private or public. Private law is a body of legal rules that regulate private

individuals and their relations. Public law is that which regulates relations between private

persons and the public (state) authority.

A legal rule generally regulates human conduct. This is why it is general and abstract (it is

concerned with general ideas or principles rather than specific issues)

A legal rule normally means a general and abstract provision stipulating how beings should

behave. The generalizing and impersonality of a legal rule are an important guarantee against

arbitrariness (unfairness)

A legal rule also distinguishes itself from other rules by the nature of its sanction. The sanction

of a legal rule is exercised by the public (state) authority. The phrase ‘sanction’ here should be

understood as the official permission, approval or acceptance of a legal rule which is the duty

of the state (authority)

On the other hand, an ethical rule (principles about what is right and wrong) bears an internal

sanction. This means that it is the internal conscience which leads someone to decide what is

right (what to do) and what is wrong (what not to do)

An ethical rule can also bear the social sanction but not the one exercised by a public authority.

This means that it is society which accepts and approves the ethical rule. It is clear that the law

cannot rely on such a sanction (of the society) because of its inefficiency to impose respect and

order in the society.

As to religious rules, they are applicable to believers and are sanctioned by church leaders,

which are also different from legal sanctions because they come from a public authority and are

vested with coercive force.

However, it is worthy to mention that, if one of the ethical or religious rules is at the same time

sanctioned by the public authority, it becomes a legal rule even if it is still and ethical or

religious rule. This is why some legal rules are also ethical rules, creating some confusion

between law and ethics.

Page 22

Section 4. SANCTIONS OF A LEGAL RULE

There are three main types of sanctions attached to a legal rule:

• Criminal sanctions

• Civil sanction

• Disciplinary sanctions

A. CRIMINAL SANCTIONS

Criminal sanctions are applied when the legal rule that was violated is concerned with the

public interest (the social order) In this case; the violation is held to be an offence or infraction.

Sanctions or punishment in the case of a criminal conduct (offense) do range from some francs

of fine to the temporary and life imprisonment and the death penalty.

B. CIVIL SANCTIONS

Civil sanctions concern violations of a legal rule protecting private interests. The violation in

this case is concerned to be an attack on individual interests protected by the violated rule.

Civil sanctions aimed at restoring the situation prevailing before the violation. They are also

referred to as damages or reparations.

C. DISCIPLINARY SANCTIONS

Disciplinary sanctions are such as those extended to employees of the civil service, judges and

other magistrates as well as soldiers who do not conform to the duties of their functions. These

sanctions range from the warning, temporary suspension and in extreme cases the exclusion

from service.

Section 5. MAJOR LEGAL SYSTEMS (FAMILIES) OF THE WORLD

Every country in the world has its own laws and sometimes laws co-exist within the same state.

Despite these variations laws can be classed into types under a limited number of general

categories. The following legal systems have been identified in the world-: The Common law

tradition, the Civil law or Romano- Germanic tradition; the Socialist law tradition and Muslim

law tradition.

a) Common law system. The common law family embraces the law of England

and legal systems of the English type. Its wide expansion throughout the world

came as a result of colonization or expansion. Most English-speaking countries

in the world are common law jurisdictions. The essential features of the

common law system are the following. It is basically judge made law. The

common law was formed primarily by judges who had to resolve individual

disputes. Secondly, the legal rule in the common law system is one which seeks

to provide the solution to the case in hand. It does not seek to formulate a

general rule of conduct.

Page 23

b) Civil law system. Originating from continental Europe the civil law system has

spread to the countries of Latin America, Francophone and Lusophone African

countries, the countries of the near East, Japan and Indonesia. Colonization and

voluntary reception contributed for this wide spread. French law stands out as

the prototype of the civil law systems of laws. This is so because the Napoleonic

codes have served as model codes for other countries. The main features of the

civil law system are following. Firstly all civil law jurisdictions adopted the

legal technique of condition. Secondly, the legal rule seeks to formulate a

general rule of conduct as opposed to address the case in hand (cf Common

Law).

c) Socialists legal system. Prior to 25th October 1917 (the October Revolution)

Russian law could be said to belong to civil law family. Since then, law in

Russia has taken a different path based on Marxism-Leninism. So that today, it

is current to speak of socialist legal theory; a socialist law with its own

distinctive structure and system of administering justice. The primary function

of Soviet law is to organize the nation’s economic forces and to transform the

behaviour and attitude to an infringement on the interests of private persons or

an insult to the code of morality. This position is bound to change when states

previously subject to soviet law have adopted European Union market

economic policies (capitalism).

d) Muslim legal system. Muslim law is not an independent branch of knowledge

or leaning. It is only one of the facts of Islamic religion itself; Islam is first of all

a religion, then a state, and finally a culture. The Islamic religion includes,

firstly, theology which established dogma and states exactly what a Muslim

must believe. Secondly It includes the ‘sharia’ (‘the way to follow’) which lays

down rules of behaviour for believers. Since Muslim law is an integral part of

the Islamic religion no authority in the world is qualified to change it.

Page 24

Chapter 2. SOURCES OF LAW

There are two kinds of Sources of law: material and formal sources.

SECTION 1. MATERIAL SOURCE OF LAW

A. Definition.

The material sources are the sources of inspiration of law. In other words, it is what is at the

origin of the legal provision.

There are, for example, historical sources. The ‘right’ keeps the memory of its past, it is

marked by a rather great continuity, a rather great stability. On certain essential questions

(contract law, right of the responsibility, etc.), the applicable rules come to us from the old

right (the canonical right, Roman law, habits). The historical sources are significant.

Concurrently to this core, there is also a very great mobility of the right. The Parliament votes

each year on tens of laws. Jurisprudence evolves/moves also rather quickly. It is not thus

enough to know the history of the right, even if this one is significant.

It is necessary to distinguish two types of sources: material sources and formal sources.

B. Various material sources

1. Social standards

The ‘right’ very often endeavours to re transcribe social rules to transform them into legal

provisions. Example: the question of the homosexual couples and its legal recognition:

gradually society admits the existence of the homosexual couples and more and more reserves

a legal framework for them. , today, the PACS (Civil Pact of Solidarity). Of course, the right is

not always in phase with society, there can sometimes be a rather long time between the

evolution of manners and the evolution of the laws (e.g. 1975 only: lifting of the prohibition of

abortion).

2. The economic theory

More and more economic science takes importance in our society and more and more the right

takes as a starting point the economic theory, p. ex.1 for tax or revenue duty, the environmental

right, etc.

3. Religions

They play a rather weak and indirect role, today in France, primarily through the historical

tradition. It is not the case in other countries of the world (p. ex.: Muslim countries).

1 P ex. Per example or for example and is the same as e.g.

Page 25

C. Value of the material sources

The material sources are, themselves, never obligatory. They inspire the legal provisions, but

they are not themselves legal provisions.

They can be however taken into account to interpret a legal provision and they can clarify the

direction.

SECTION 2. FORMAL SOURCES

We have two main types of formal sources of law. Obligatory and Auxiliary sources

A. OBLIGATORY SOURCES OF LAW

These are the principal sources of law. In a narrow sense, laws are statutes enacted by the

parliament and promulgated by the president of the Republic.

In a broader sense, the Law mean all legal rules of written law formulated in a general way by

means of exercising legislative power or even executive power.

The laws have a general impact, emanating from public power and are obligatory for all

individuals found in a given society.

Here, we have national laws at the country level, and international laws on the international

level.

We will first examine national laws.

1. SOURCES OF NATIONAL LAWS

The laws are ranged, according to their hierarchy, as following:

- The constitution;

- The organic law;

- The ordinary law;

- The Decree law, etc.

1.1. The constitution

At the national level, the constitution comes at the first position. The constitution is a set of

rules which form the fundamental law of a state with which all other laws have to be in

conformity. This means that when there is a conflict between constitutional provisions and any

other law of the country, the former prevails.

For G. Burdeau, the constitution occupies a central place in a system of the rule of law. A

certain philosopher M. Kamto wrote:

“A democracy should not be a government by peoples, but a government by the law”. This is

what is called the rule of law. In this sense, it coincides with a “democratic state” on condition

that “the law really expresses the general will of the public”.

Rwanda has only one constitution, which was adopted through the referendum of 26th May,

2003.

Page 26

1.2. The organic laws

Besides the constitution, there are organic laws, which rank immediately below the

constitution. Within the hierarchy of laws, organic laws come after the constitution.

An organic law is adopted with a view to specifying or completing the constitution and other

laws. There are organic laws in Rwanda. This is the case of the organic law No 08/96 of

30/08/1996 on the organization of prosecutions of crimes constituting the crime of genocide or

crimes against humanity committed between 1st October 1990 and 31/12/1994, the organic law

on the organization and functioning of Gacaca jurisdictions, and so many others.

According to 93(6) of the Rwandan constitution, organic laws shall be passed by a majority

vote of three fifths of the members present in each chamber of Parliament.

Organic laws have a legal force superior to ordinary laws. It is the constitution, which

determines the areas reserved for organic laws. We can cite the:

- Conditions of acquisition, retention, enjoyment and deprivation of Rwandan nationality

(art. 7 const.)

- The organization of education in Rwanda (art. 40 const.)

- The modalities for the establishment of political organizations, their functioning, the

conduct of leaders, the manner in which they shall receive state grants as well as the

organization and functioning of the forum of political organizations (art. 57(2) const.)

- The internal regulations concerning each chamber of parliament (art. 73 const.) i.e. each

chamber of parliament shall adopt an organic law establishing its internal regulations.

- The conditions and the procedures by which parliament controls the actions of the

government.

- The organization and jurisdiction of courts.

1.3. Ordinary laws

Ordinary laws, which are most frequent, are voted by the absolute majority of seating

parliamentarians of each chamber. It is the constitution that determines the relevant areas for

ordinary laws. These areas are many compared to those of organic laws. The quorum required

for each chamber of parliament is at least three fifths of its members (art.66(1) const.).

1.4. Decree Law

In case of the absolute impossibility of parliament holding session, the president of the republic

during such period promulgates decree laws adopted by the cabinet and those decree laws have

the same effect as ordinary laws (art. 63(1) Const.).

These decree-laws become null and void if they are not adopted by parliament at its next

session. This is in conformity with article 63(2) constitution.

Page 27

1.5. Orders of Presidential, prime ministers and other public authorities.

1.5.1. Presidential orders

The president of the republic exercises his functions as the head of the executive Power by way

of Presidential Decrees.

According to article 112 of the constitution, the President of the Republic shall sign

presidential orders approved by the cabinet, and the prime minister, ministers, and ministers of

state and other members of government responsible for their implementation countersign these

orders.

1.5.2. Orders of the Prime minister and others public authorities

The prime minister signs orders of the prime minister relating to the appointment and

termination of senior public servants mentioned by article 118(10) of the constitution.

Ministers, ministers of state and other members of cabinet implement laws relating to matters

for which they are responsible by way of orders (art.120 (i) const)

The prefects of provinces can enact administrative and police regulations (art 21 of the law no

43/2000 concerning the organization and functioning of the province) in the same way, the

District council has the power to enact the regulations of the District in the areas of politics,

security, taxes (art23 of the l aw no 04/2001 of 13/1/2001 concerning the organization and

functioning of the province) in the same way, the District council has the power to enact the

regulations of the District in the areas of politics , security , taxes ( art.23 of the law no.04/2001

of 13/1/2001 concerning the organization and functioning of the District).

2. SOURCES OF INTERNATIONAL LAW

The sources of international law are actually the same as the sources of public international law

which were discussed earlier. Because these sources were elaborated in detail, not much detail

will be provided under this section. Mention can just be made that the classical formulation of

sources of international law is article 38 of the statute of the international court of justice. The

article sets out four sources and these are:

- International conventions, whether general or particular, establishing rules expressly

recognized by contesting states;

- The general principles of law recognized by civilized nations;

- International customs, as evidence of a general practice accepted as law …. Judicial decisions

and the teachings of most highly qualified practioners of law in various nations, as subsidiary

means for the determination of rules of law.

B. AUXILIARY SOURCES OF LAW

The auxiliary sources of law are jurisprudence, doctrine, general principals of law and equity.

Page 28

1. Custom (as a source of law)

A custom is generally defined as a set of a people’s way of doing things which has acquired an

obligatory force in a given social group and which is practiced over a relatively long time

period. Customs are practices or usages of a given society. Customary law is unwritten. It has

to be considered as legally binding on (obligatory by) the people in the society.

A custom is not created as a written law, a unique act, but by a repetition of similar practices

especially with the conception that it has a binding (obligatory) force. The essential elements of

a custom are therefore.

- The usage

- Binding force

- The social consensus

- The time in which it is applicable

But the first two are the ones that are most frequently cited as the ones that form a custom. It is

also important to point out that custom can inspire the legislator when modifying or completing

an existing law or when judges are regulating new cases where the existing laws are not clear

or incomplete. Custom can also help for the comprehension of a legal text. However, it is

important to indicate that custom is applicable in the absence of law; And when they are not

contrary to the constitution, laws, regulations, public order and good morals.

These laws are the principal sources of law. Custom is just a subsidiary source of law, in the

sense that they can inspire the judge and help him in the comprehension of legal texts.

2. General principles of law.

These are principles of law common to the legal systems of the world. In Rwanda, examples of

general principles of law are:

- the principle of double jeopardy

- that law provides for the future and does not have a retroactive effect.

- The principle of permanence and continuity of the state

- It is presumed that no-one is ignorant of the law.

In hierarchy, general principles of law are inferior to the Law. Some of them are already part of

the Rwandan penal code. In general, general principles of law are not as direct a source of law

as the laws they inspire the judge and they are resorted to in the absence of the law.

3. Jurisprudence (Decided case law)

Jurisprudence means the set of decisions rendered by courts and tribunals. In Romano-

Germanic legal systems, jurisprudence doesn’t bind the judge. The decisions of courts and

tribunals don’t have a general field of application. Judges’ decisions are only binding on those

parties involved in the case. If a judge is seized with a new case, he is not obliged to comply

Page 29

with decisions made on similar cases in the past (precedent). This means that in a new case, he

may rule differently from his previous decision.

This led some people to say that jurisprudence is not strictly speaking a source of law.

However, even though the jurisprudence doesn’t have a legal value or a legal binding force, it

exercises an unquestionably factual influence that guides the judge to rule in a given way. We

refer to this influence as defacto authority of jurisprudence .

In a common – law legal system, the situation is different. Jurisprudence does constitute a

binding source of law .we refer to it as Precedent. A common – law precedent has a binding

force on the judge. He cannot easily depart from it.

4. Doctrine

By doctrine, we mean legal scholars’ opinions on critical questions of law. In the wider sense,

doctrine refers to publications of persons deeply involved in the study of law. These are law

professors, senior judges, eminent lawyers, etc.

Doctrine serves to understand the positive law better, which means those rules applicable in a

given society at a precise time. Doctrine serves also to inspire possible law reforms by

proposing rules that should be enacted by the legislator. Although doctrine is not a principal

source of law, it constitutes a subsidiary impact on the law. It exercises an important influence

even though it is not a binding source of law. It guides the judge by promoting reasons for

deciding in a certain way. On the other hand, doctrine guides the legislator when enacting laws.

He can either consult legal works (publications) of scholars or ask them to participate in the

legal process as experts. The authority attached to doctrine relates somehow to the reputation of

the scholar himself. The more reputable he is in his field and publications, the more his

opinion will be of influence.

In conclusion, one can say that although doctrine is not a principle source of law, it plays a

significant role, as the opinion submitted by eminent lawyers on a subject of law can be useful

in case it is put forward and followed in courts, because it can help in the comprehension of a

legal text.

5. Equity

The regulation of 14 May 1886 foresees that in case there is a matter that is not provided by a

legal text, the disputes without solutions in local customs will be solved according to general

principles of law and equity.

Equity, which is based on the general feelings of justice, allows the judge, in case of silence of

law or a legal gap, to make judgements conforming to common sense and feelings of justice.

The notion of equity has a vague character and the judge is not bound by any certain precise

rule but he has the power to decide according to the circumstances but without arbitrariness

(unfairness) . This means that he has to apply equity with fairness. Certain legal provisions give

examples of how equity can be applied ( art 34,142, of the civil code iii , art.82 of the penal

code )

Page 30

Equity is not itself a source of law. It is a means available to the judge when he is supposed to

give a judgement without applying a determined legal rule.

Section 3. SOURCES OF RWANDA BUSINESS LAW

A. International sources

The role of international treaties is unknown in civil law. The implications of international

conventions on commercial law have been compounded by recent developments and increasing

interdependence in international commercial activities. Some might even argue that the result

of these developments might have had led to a uniform (unified) international law. The

implications of international conventions on Rwandan commercial law are both direct and

indirect.

Direct implication happens when a convention or an agreement becomes part of domestic law

or provides the basis for domestic law of similar content (e.g. the decree of December 10th,

1951 which deals with cheques and the decree of July 28th, 1934 which deals with the bill of

exchange the promissory note and protests). The content of both laws are based on the Geneva

Conventions of June 7th, 1930 and of March 19th, 1931, which deal with cheques and bills of

exchange.

Indirect implication of international conventions can be found in the adoption by Rwanda of

the Vienna Convention on the International Sale of Goods ( the United Nations Convention on

Contracts for the International Sale of Goods) of April 1980, which deals primarily with

external trade relations, Convention on the Recognition and Enforcement of Foreign Arbitral

Awards, etc.

.

Below are some examples of international conventions related to international trade.

- 1995- United Nations Convention on Independent Guarantees and Stand-by Letters of Credit;

- 1988- United Nations Convention on International Bills of Exchange and International

Promissory Notes;

- 2001- United Nations Convention on the Assignment of Receivables in International Trade;

1991- United Nations Convention on the Liability of Operators of Transport Terminals in

International Trade;

- 2005- United Nations Convention on the Use of Electronic Communications in International

Contracts.

B. Domestic sources

Currently, there is no commercial law code in Rwanda. However, some disparate laws do exist:

- Decree of 2 August 1913 on traders and proof of commercial engagements;

Page 31

- Decree of 12 January 1920, on pledge of business, discount and the pledge of

commercial bills;

- Decree of 27 July 1934 on bankruptcy and preventive legal settlement to bankruptcy;

- Decree of 10 December 1951 on uniform law on cheques;

- Law n°07/2009 of 27th April 2009 relating to companies, amending the law no 06/1988

of 12th February 1988.

- Law N° 50/2007 Providing for the establishment, organization and functioning of

Cooperative Organizations in Rwanda;

- Law n° 10/2009 of 14/05/2009 on mortgages;

- Law n° 12/2009 of 26/05/2009 relating to commercial recovery and settling of issues

arising from insolvency;

- Law n°40/2008 establishing the organization of Micro Finance activities;

- Law n° 005/2008 of 14/02/2008 on arbitration and conciliation in commercial matters;

- Law n° 35/91 on the organization of internal trade as modified and supplied to date;

- Law n° 11/2009 of 14/05/2009 on security interest in movable property.

- Ministerial order n° 01/MINICOM of 08/05/2009 determining small private limited

company;

- Ministerial order n° 02/09/MINICOM of 08/05/2009 relating to businesses of low

income;

- Ministerial order n° 03/09MINICOM of 08/05/2009 determining fees for registration of

companies’ business activities.

- Law 45/2011 of 25/11/2011 Governing Contracts

It is advisable that the student acquaints himself with the above ministerial orders, laws and

decrees.

Page 32

Chapter 3. ADMINISTRATIVE LAW

Section 1. MEANING

As a scientific subject or discipline, Administrative law is an autonomous branch of public law

comprising the special rules concerning the organisation and functioning of the administration,

the activities of the administration and also litigation should be understood as the processe of

taking claims to court in non-criminal cases.

Private law rules don’t govern controversies (disagreements) within the jurisdiction of

administrative law. The reason of this independence of administrative law is that the

administration, serving a public interest, can’t be subject to the same rules as individuals. This

is why there are special rules different from those applied to private individuals and in some

countries; administrative disputes are adjudicated by special courts called ‘administrative

courts’.

Section 2. SEPARATION OF POWERS

The State is composed of three branches which are the following:

- The Legislature

- The Executive

- The Judiciary

According to article 60(2) of the Constitution of the Republic of Rwanda, these three branches

are separate and independent from one another but are all complementary.

1. The Legislative branch: the Rwandan Parliament

According to article 62 of the constitution, it is stated that legislative power is vested in a

parliament consisting of two chambers:

- The chamber of Deputies, whose members shall have the title of ‘Deputies’

- The Senate, whose members shall have the title of “Senators”.

Parliament deliberates on and passes laws. These may be ordinary laws or organic laws.

Within the hierarchy of laws, an organic law ranks immediately beneath the constitution.

Organic laws are adopted with a view to specifying or completing provisions of the

constitution. Parliament legislates and oversees executive action in accordance with the

procedure determined by the Constitution (art. 62 const.).

Every member of the Parliament represents the whole nation and not just those who elected or

nominated him or her or the political organisation on whose ticket he or she stood for election.

(Art. 64(1)) before taking office, members of parliament shall take oath before the President of

Page 33

the Republic and, in case of his or her absence, before the president of the Supreme Court.

(Article 65(1))

The Bureau of each chamber of parliament is made up of the president and two vice-presidents.

This is in conformity with the constitution (art. 65(5) const.)

The office of a Parliamentarian shall not be compatible with being a member of the

Cabinet.

An organic law determines offices which are incompatible with the office of a

parliamentarian. (article 68(2 & 3) const. but see Art 116 Const. and below) It isalso stipulated

that no one shall at the same time be a member of the chamber of Deputies and of the senate

(Article 68(1) const.). The chamber of Deputies shall be composed of 80 members. The

members of the chamber of Deputies shall be elected for a five year term. Candidates may be

presented by a political organisation or may stand independently.

The Senate shall be composed of twenty six (26) members serving for a term of eight (8) years

and at least 30% (thirty percent) of whom are women. Note should be made that the sittings of

each chamber of parliament are public.

The right to initiate legislation shall be concurrently vested in each Deputy and the Executive

acting through the cabinet (art. 90 const.). The law is sovereign in all matters (art. 93(1))

Organic laws govern all matters reserved for them by the constitution as well as matters that

require related special laws (art 93(2) const.).

An Organic law cannot contradict the constitution neither may an ordinary law or decree law

contradict an organic law nor a Decree contradict an ordinary law. (Article 93(3) const.).

In voting a bill, there must be a separate vote on each article as well as a vote on the entire bill

(article 93(4) const.). A vote on the entire law is conducted by calling each parliamentarian by

name and the parliamentarian votes by replying in a loud voice.

2. The Executive branch

The President of the Republic is the Head of state. He or she is the guardian of the constitution

and guarantees national unity. He or she guarantees the continuity of the state, the

independence and the territorial integrity of the Country and the respect of international treaties

and agreements. (Article 98 const.)

The President of the Republic has the right to address the nation. (Art. 98 const.).

According to article 101 of the constitution, the President of the Republic is elected for a term

of seven years renewable only once. This means that under no circumstances shall a person

hold the office of the president of the Republic for more than two terms. (art 101 (const.) If

the office of the President is vacant before the term expires, elections are organised within a

period not exceeding ninety days (Art . 107(3) const. ).

Page 34

In case the President dies or is permanently unable or otherwise chooses not to assume office,

new elections are held. In that case, the acting president will be the president of the senate, in

the absence of the president of senate, the speaker of the Deputies and in the absence of both,

the duties are assumed by the Prime Minister (art. 105(3) and 107(1) const.)

The office of the President is incompatible with the holding of any other elective public office,

public function or any other civilian or military employment or professional activities (art. 106

cons.)

The President of the Republic is the commander–in–chief of the Rwanda Defence Forces (Art.

110 cons.). He can declare war from his own initiative and he can as well sign agreements

temporarily or permanently to stop the war (Art. 110 const.).

He or she accredits Ambassadors and special envoys to foreign states and the ambassadors

accredited to Rwanda Present their credentials to him or her (Art. 114 const.). He or she shall

make appointments of senior public service and military offices as determined by the

constitution and other laws (Art. 112)

The cabinet shall comprise the Prime Minister, Ministers of state and other members who may

be determined by the President of the Republic (Art. 116(1) Const.).

The Prime Minister shall be nominated, appointed and removed from office by the President of

the Republic (Art. 116(2) const.). Other members of cabinet shall be appointed and removed

from office by the President of the Republic upon proposed by the Prime Minister (Art. 116(3)

const.).

According to Art. 117 const., the cabinet implements national policy agreed upon by the

President of the Republic and the cabinet. It is accountable to the President of the Republic

and to the parliament (Art.117 (2) const.).

3. The Judiciary

A. Introduction

Judicial power is exercised by the Supreme Court and other courts established by the

constitution and other laws. (Art140 (1) const.).

The Judiciary is independent and separate from the legislative and executive branches of

government. (Art. 140 (2)).

Justice is rendered in the name of the people and nobody may be a judge in his or her own

cause. (Art. 140(4) const.).

Judicial decisions are binding on all parties concerned, be they public authorities or individuals.

They shall not be challenged except through ways and procedures determined by law (Art. 140(3)

const.).

Page 35

Every court decision shall indicate the grounds on which it is based. (Art 141(2) const.) Courts

apply orders and regulations only where they are not inconsistent with the constitution and

other laws. (Art. 141(3) const. ).

In the exercise of their function, judges follow the law and only the law (Art. 142(2).

Page 36

B. Judicial organization and competence

B.1. Ordinary courts

a) Lower instance courts

There is established a lower instance court for sector councils. The court is to exercise

jurisdiction within the administrative boundaries of the sector council. In criminal matters

lower instance courts are competent to hear offences whose sentence a term of imprisonment

does not exceed five (5) years. They are not competent to hear offences relating to the violation

of traffic rules.

As regards civil disputes lower instance courts have original jurisdiction to hear and determine:

• Disputes between natural or artificial (legal) persons whose monetary value does not

exceed three million (3,000,000Rwf), except civil actions related to insurance as well as

those seeking damages for loss occasioned by an offence tried by another court:

• Disputes related to land and livestock and their succession:

• Disputes related to civil status and family

• Disputes related to immovable property other than land which does not exceed 3

million Rwf of monetary value and its succession.

• Disputes related to movable property which does not exceed 3million Rwf of monetary

value and its succession.

Note that judgments rendered by lower instance courts in both criminal and civil matter can be

reviewed by the same court or appealed to the higher instance courts. The exception is cases

whose monetary value does not exceed Rwf fifty thousand (50,000). In this case the lower

instance court shall serve as the final court of appeal.

b) Higher instance courts

There is a higher instance court in district councils. Each court has specialized chambers: the

juvenile chamber, the administrative chamber and the labour chamber.

In criminal matters higher instance courts shall have jurisdiction to try offences whose sentence

is a term of imprisonment exceeding five (5) years except where the law reserves the offence to

other courts; they have jurisdiction to try traffic offences and person placed in the first category

accused of crimes of genocide and other crimes against humanity committed between 1st Oct.

1990 and 31st Dec. 1994.

In civil cases, higher instance courts have jurisdiction to hear cases on the first instance that are

not triable by other courts. They shall have competence to hear on first instance case related to

insurance regardless of the value of the claim.

Note that the specialized chambers of higher instance courts shall hear administrative cases

relating inter alia, to actions for damages arising from contractual liability, government

officials and its parastatals.

In its appellate jurisdiction the court can hear appeals against judgment rendered on first

instance by lower instance courts within their respective jurisdiction.

The provincial or city of Kigali court can review its judgment or appeal to the Higher court.

Page 37

c) The Higher court

There is established a higher court whose seat is in the city of Kigali. Its jurisdiction covers the

entire territory of the republic. The higher court shall have four (4) chambers in other parts of

the republic namely: Musanze, Nyanza, Rwamagana and Rusizi. The jurisdiction of the

chamber that operates at Musanze is equal to the jurisdiction of the higher instance court in

Musanze and Rubavu. The jurisdiction of the chamber that operates at Nyanza is equal to the

jurisdiction of the higher instance court Muhanga, Huye and Nyamagabe. The jurisdiction of

the chamber that operates at Rwamangana is equal to the jurisdiction of the higher instance

court of Ngoma and Nyagatare. The jurisdiction of the chambers that operates at Rusizi is

equal to the jurisdiction of the higher instance court of Rusizi and Karongi. Finally cases

originating from the territorial jurisdiction of the higher instance court of Nyarungenge,

Kabuga and Gicumbi shall be tried at the seat of the high court of the republic.

The high court exercises both original appellate jurisdictions. In the exercise of the original

jurisdiction, the high court has competence to hear specific criminal cases, administrative cases

and civil matters; its jurisdiction is limited to the execution or enforcement of authentic deeds

executed by foreign authorities as well as foreign judgments. In the exercise of its appellate

jurisdiction, the higher court has jurisdiction to hear appeals from civil cases heard on first

instance by a higher instance court. It also hears specific appeals on second instance from

higher instance courts. In addition, it hears appeals from decisions taken by arbitration

tribunals.

The high court also hears appeals from criminal cases tried on first instance or appellate level

from higher instance courts.

Note that the high court of the republic has competence to review its own decision. A

dissatisfied party can party can appeal to the Supreme Court.

d) Supreme Court

The Supreme Court is the highest court in the Republic of Rwanda. The Supreme Court directs

and co-ordinates the activities of the lower courts. The court has jurisdiction over the territory

of the Republic of Rwanda. Its decision is not subject to appeal except in terms of a prerogative

of mercy or the revision of a judicial decision.

The Supreme Court exercises ordinary and special jurisdiction. In the exercise of ordinary

jurisdiction the court is the court of last resort for appeal for trials heard by the high court of the

republic in the first degree and in the second degree provided inter alia, the award of damages

equals or exceeds twenty million francs (20,000,000) or the subject matter in disputes equals or

exceeds twenty million francs (20,000,000).

In the exercise of its special jurisdiction the supreme court has, inter alia, exclusive jurisdiction

to try in the first and final degree, the president of the republic, the president of the senate, the

president of the chamber of deputies, the president of the supreme court and the prime minister

for offences committed during their terms of office, whether such offences relate to the

exercise of their public duties or their private matters, regardless of whether they are still or

have ceased to hold office.

Page 38

B.2. Specialized courts

a) Military courts

Military tribunals have competence to try all offences committed by all military personnel

except offences which constitute a threat to national security and murder committed by

soldiers. They also have competence to try all military personnel accused of the crime of

genocide and crimes against humanity committed between October 1st and December 31st 1994

that places them in the first category.

Judgments rendered by a military court may be reviewed by the same court or appealed to the

military high court.

The military high court exercises both original and appellate jurisdiction. In that exercise of its

original jurisdiction, the military high court shall try all offences which constitute a threat to

national security and murder committed by soldiers. However, if, during judgment, the court

finds that the elements of the offences constitute manslaughter instead of murder, it shall

nonetheless hear the case.

In its appellate jurisdiction the court hears appeals from cases tried by the military court. Cases

heard in the first instance by the military high court may be reviewed by the same court or