AUDIT PRACTICE CPA A1.2 & ASSURANCE SERVICES Study Manual

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 236 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- CONTENTS

- Professional Appointments

- Acceptance

- Professional Responsibility and Liability

- Fraud

- Audit Evaluation and Review

- Going Concern

- Acceptance

- Fraud

- Selecting Items for Testing to Gather Audit Evidence

- Statistical Versus Non-statistical Sampling Approaches

- Sample Size

- Selecting the Sample

- Acknowledgment by Management of its Responsibility for the Financial Statements

- Representations by Management as Audit Evidence

- Documentation of Representations by Management

- Action if Management Refuses to Provide Representations

- Determining the Need to Use the Work of an Expert

- Competence and Objectivity of the Expert

- Scope of the Expert's Work

- Evaluating the Work of the Expert

- Reference to an Expert in the Auditor's Report

- Going Concern

- Audit Conclusions and Reporting

- If adequate disclosure is made in the financial statements, the auditor should express an unqualified opinion but modify the auditor's report by adding an ‘emphasis of matter’ paragraph that highlights the existence of a material uncertainty and draws...

- Segment reporting

- Earnings per share

- Discontinued operations

- Accepting appointment

- Carrying out procedure

- Reporting

- Elements of an assurance engagement

- Assurance given

- Accepting and continuing appointment

- Agreeing terms

- Planning and performing the engagement

- Materiality and engagement risk

- Reporting

- Need for assurance

- Possible assurance criteria

- Responsibility for risk assessment

- Assessing risk

- Responses to risk

- Value for money audits

- Engaging in e-commerce

- Business risks

- Internal controls issues

- Security

Page 0

Twinning Arrangement to develop Capacity Building for ICPAR

CPA

Certified Public Accountant Examination

Stage: Advanced Level 1 A1.2

Subject Title: Audit Practice and Assurance

Services

Study Manual

INSIDE COVER - BLANK

Page 1

s

INTRODUCTION

© CPA Ireland

All rights reserved.

The text of this publication, or any part thereof, may not be reproduced or transmitted in any

form or by any means, electronic or mechanical, including photocopying, recording, storage

in an information retrieval system, or otherwise, without prior permission of the publisher.

Whilst every effort has been made to ensure that the contents of this book are accurate, no

responsibility for loss occasioned to any person acting or refraining from action as a result of

any material in this publication can be accepted by the publisher or authors. In addition to

this, the authors and publishers accept no legal responsibility or liability for any errors or

omissions in relation to the contents of this book.

INSTITUTE OF

CERTIFIED PUBLIC ACCOUNTANTS

OF

RWANDA

ADVANCED Level 1

A1.2 AUDIT PRACTICE &

ASSURANCE SERVICES

First Edition 2012

This study manual has been fully revised and updated

in accordance with the current syllabus.

It has been developed in consultation with experienced lecturers.

Page 2

CONTENTS

BLANK

Page 3

s

CONTENTS

CONTENTS

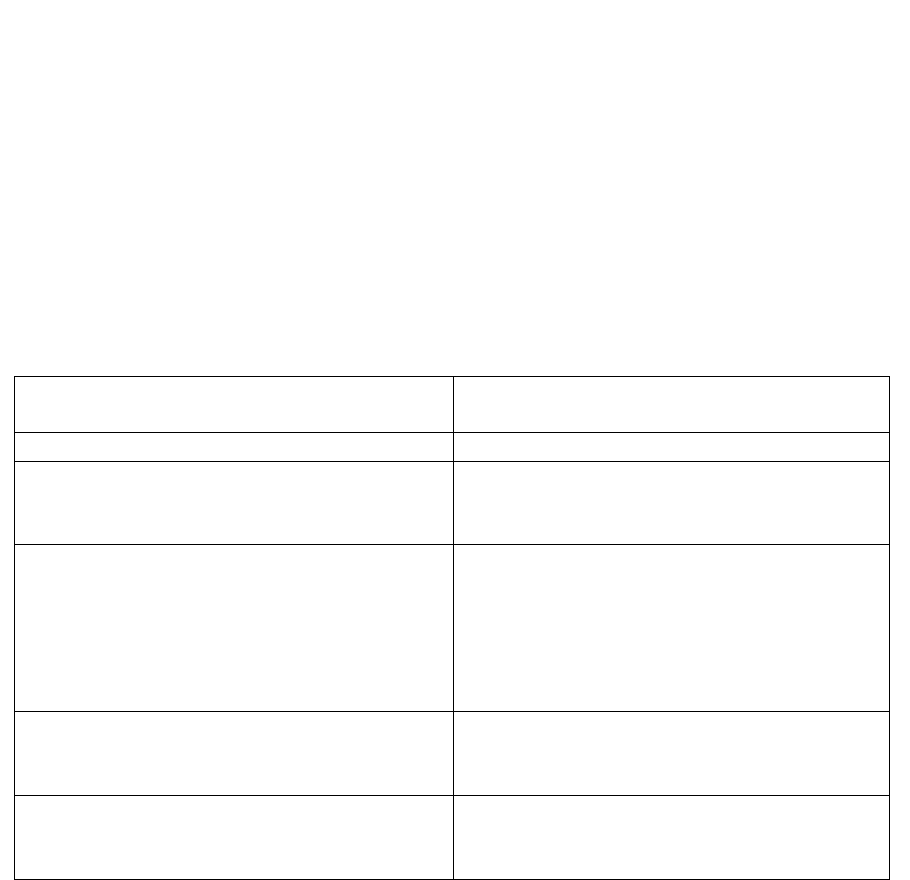

Study

Unit

Title

Page

Introduction to the Course

7

1

Assurance and the Audit Function

13

Introduction

14

Assurance

14

Need for Regulation

16

The Audit Function

16

Small Entities

18

Methodology of an Audit

19

Sample Questions

20

2

Professional Conduct

21

Fundamental principles and guidance

22

Independence

23

Confidentiality

25

Areas of Controversy

26

Sample Questions

27

3

Professional Appointments

29

Advertising

30

Tendering

30

Acceptance

32

Agreeing the Terms

34

Books and Documents

35

Change in Auditors

36

Sample Questions

37

4

Professional Responsibility and Liability

39

Fraud

40

Professional Liability

45

Misconduct

48

Professional Indemnity Insurance

48

Sample Questions

49

5

Practice Management & Regulatory Environment

51

Risks to which firms are exposed

52

Quality Control

53

What are the Current Trends?

59

Corporate Governance

60

Law and Regulation

65

Sample Questions

70

Page 4

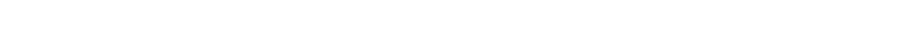

s

CONTENTS

Study

Unit

Title

Page

6

Audit Planning and Strategy

73

Audit Planning

74

Materiality

82

Risk

83

The Risk Approach

85

Systems and Controls

87

Cycles and Transactions

87

Balance Sheet Approach

87

Directional Testing

88

Analytical Procedures

88

Sample Questions

90

7

Audit Evidence

93

Audit Evidence Introduction

94

Related Parties

99

Management Representations

103

Using the Work of Others

105

Documentation

109

Sample Questions

109

8

Audit Evaluation and Review

111

Review Procedures

112

Opening Balances

113

Comparatives

115

Other Information

118

Subsequent Events

121

Going Concern

123

Compliance with International Financial Reporting Standards

127

Sample Questions

128

9

Audit Reports

131

Forming and Audit Opinion

132

The Problem of Communication

133

Electronic Reporting

134

Special Purpose Reports

135

Reporting to Management

136

Sample Questions

137

Page 5

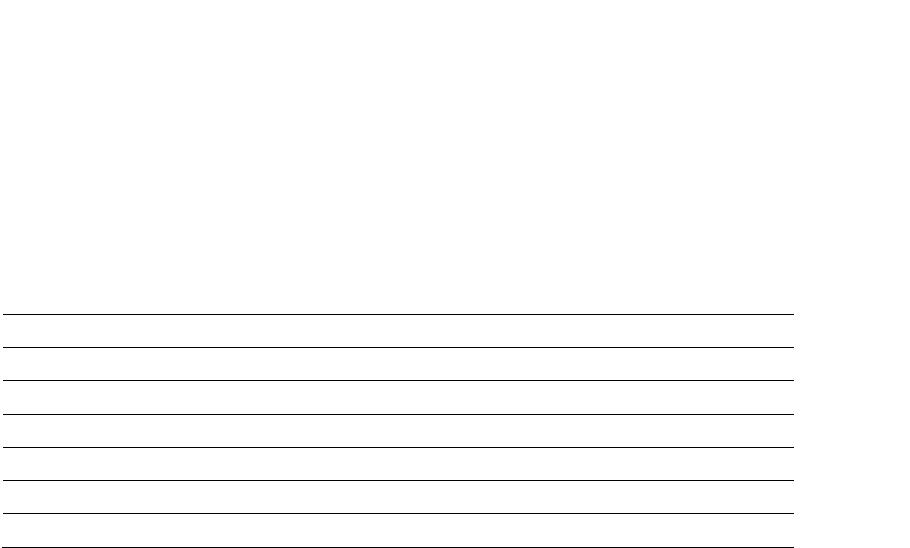

s

CONTENTS

Study

Unit

Title

Page

10

Audit of Financial Statements

139

Introduction

140

Construction Contracts

140

Liabilities

147

Income

151

Expenses

153

Disclosures

154

Sample Questions

156

11

Audit Related and Assurance Services

159

Audit Related Services

160

Assurance Engagements

162

Risk Assessments

163

Performance Management

164

Systems Reliability

165

Electronic Commerce

168

Forensic Audits

169

Whistleblowing

170

Sample Questions

170

12

Internal Audit and Outsourcing

171

Internal Audit

172

Outsourcing

174

Impact of Outsourcing on an Audit

176

Sample Questions

177

13

Prospective Financial Information

179

Reporting on Prospective Financial Information

180

Accepting an Engagement

180

Procedures

180

Expressing an Opinion

181

Sample Question

182

14

Social and Environmental Audits

183

Implications for the Company

184

Implications for the Management

184

Measuring Social and Environmental Performance

185

Implications for the Statutory Audit

186

Implications of Assurance Services

187

Sample Question

188

Page 6

s

CONTENTS

Study

Unit

Title

Page

15

Group Audits

189

Group Accounting and the Holding Company Auditors

190

Principal Auditors and Other Auditors

190

The Consolidation Process

194

Joint Audits

195

Auditing Foreign Subsidiaries

196

Recent Developments

196

Sample Question

197

16

Solutions

199

Solution 1.1

199

Solution 1.2

199

Solution 2.1

200

Solution 2.2

201

Solution 2.3

202

Solution 3.1

203

Solution 3.2

204

Solution 3.3

204

Solution 4.1

204

Solution 4.2

206

Solution 4.3

206

Solution 5.1

207

Solution 5.2

207

Solution 5.3

207

Solution 5.4

208

Solution 6.1

209

Solution 6.2

212

Solution 7.1

214

Solution 7.2

217

Solution 8.1

218

Solution 8.2

220

Solution 8.3

220

Solution 9.1

220

Solution 9.2

221

Solution 9.3

221

Solution 9.4

222

Solution 10.1

223

Solution 10.2

224

Solution 11.1

227

Solution 11.2

227

Solution 12.1

228

Solution 13.1

229

Solution 14.1

231

Solution 15.1

232

Page 7

INTRODUCTION TO THE COURSE

Stage: Advanced Level 1

Subject Title: A1.2 Audit Practice & Assurance Services

Aim

The aim of this subject is to ensure that students can demonstrate the knowledge, skills and

competencies necessary to carry out the audit of an entity and undertake assurance

engagements, having due regard to the Institute’s and profession’s ethical standards in a

changing and complex business environment.

Audit Practice and Assurance Services as an Integral Part of the Syllabus

In carrying out the audit of an entity’s financial statements it is essential to fully understand

the application of the relevant International Standards in Auditing (ISAs), International

Accounting Standards (IASs) and International Financial Reporting Standards (IFRSs). Many

issues that face auditors frequently arise from the accounting treatment of certain financial

transactions in the financial statements of the entity.

The study of the subject Auditing at Advanced 1 Stage is an essential foundation for the study

of Audit Practice and Assurance Services at Advanced 2 Stage. Financial Accounting and

Information Systems (at Foundation 2 Stage) and Financial reporting and Company Law (at

Advanced 1 Stage) are also essential prerequisites for the study of Audit Practice and

Assurance Services.

Learning Outcomes

Upon successful completion of this subject students should be able to:

• Explain, interpret and apply the legal, regulatory and ethical framework to the

role of the auditor.

• Identify audit risks, and describe the procedures undertaken at the planning stage

to meet the objectives of the audit.

• Design, evaluate and report on internal control and financial reporting systems

and identify and communicate control risks, applying these skills to practical

situations in both manual and computerised environments.

• Describe the application of Computer Assisted Auditing Techniques.

• Design, plan and apply audit testing techniques and procedures in the practical

application of International Standards on Auditing (ISAs), International Standards

on Quality Control (ISQCs) and other technical pronouncements to auditing and

assurance situations.

Page 8

s

CONTENTS

• Evaluate the role of internal audit, including a comparison with the role of the

external auditor.

• Draw conclusions, having applied appropriate professional skill, scepticism and

judgement.

• Report to shareholders, management and other relevant parties in the course of

providing audit and assurance services.

• Plan and perform the necessary work and report on other assurance engagements

in the context of agreed terms of reference and the legal, regulatory and ethical

framework.

• Undertake audit and assurance engagements with reference to the best practices

and developments in Corporate Governance and their application to clients’

processes.

• Evaluate, explain and discuss issues and developments relating to auditing,

including audit expectations and developments in the regulation of audits.

• Demonstrate an ability to work within a professional and ethical framework.

Page 9

s

CONTENTS

Syllabus:

1. Legal and Regulatory Environment

• An in-depth knowledge of the Companies Acts / Orders and other company

law legislation affecting the auditor.

• Responsibilities imposed on auditors of Rwandan Stock Exchange listed

companies and legal responsibilities to shareholders.

• An in-depth knowledge of standards and other technical pronouncements

issued by the IASB and IAASB.

• A detailed appreciation of case law decisions and their implications for the

auditing process.

• An in-depth knowledge of other legal liabilities affecting auditors and

accountants in providing audit and assurance services.

2. Ethics

• Application of the ICPAR Code of Ethics.

• The fundamental principles of professional ethics.

• Threats and safeguards.

• Responsibilities to clients and colleagues.

• Other responsibilities and practices including:

– Changes in professional appointments.

– Use of lien in fee disputes.

– Advertising and publicity.

– Use of professional designations.

• Conflicts of interests.

• Code of confidentiality.

• Professional liability and indemnity.

• Misconduct and negligence.

3. Internal Controls and Financial Systems

• The definition of the control environment and control procedures.

• Effective internal controls.

• The limitations on the effectiveness of internal controls.

• Ascertaining and understanding internal control systems: narrative notes,

flowcharts, checklists, internal control questionnaires, walk through tests.

• Evaluations and assessment of accounting systems and internal control

systems and its subsequent impact on audit work.

• Reliance on internal controls and internal audit.

• The principles and control procedures in a computer environment including

system analysis and design considerations.

• The use of Computer Assisted Audit Techniques.

Page 10

s

CONTENTS

4. Risk Assessment & Audit Process

• New engagements.

• The strategic design and planning of an audit and knowledge of the client’s

business.

• The review of financial statements to include analysis and critical assessment.

• Quality control and recording of the audit.

• The evaluation and testing of control procedures and audit evidence.

• The design and carrying out of tests of substance on specific audit areas.

• Consideration of materiality, audit risk, reliance on other specialists, events

after the reporting period, contingencies, related parties.

• Use of experts.

• Characteristics of fraud and the responsibility of auditors for detecting

material misstatement due to fraud.

5. Reporting

• Reporting on Audited Financial Statements.

• Key concepts: opinion, true and fair view, materiality, statutory requirements.

• Basic elements of the Auditor’s Report.

• Modified Reports, differentiating between

– Matters that do not affect the auditor’s opinion, and

– Matters that do affect the auditor’s opinion.

• Circumstances giving rise to Modified Reports.

– Limitations on Scope.

– Disagreements with management.

• Auditor’s responsibility before and after the date of the Auditor’s Report.

• Auditor’s responsibility for other information in documents (e.g. Annual

Report) containing audited financial statements.

6. Special Audits and Other Assurance Engagements

• Relevant audit planning, execution (including internal control implications),

reporting and professional practice considerations concerning:

• Group audits, small business audits (including small business exemption), not-for-

profit audits, first time audits.

• Prospectuses and other offering documents (investment circulars): historical year-

end financial statements, interim financial statements, and future oriented

information.

• Other types of historical financial assurance engagements: financial statements

review engagement (Accountant’s Report), financial statements compilation

engagements (Compilation Report), audit or review of specific financial

information (e.g. sales figures for retail park leases), compliance with agreements

(e.g. loan covenants), agreed upon procedures.

• Assurance on internal controls in service organisations.

• Other types of audits: value for money/operational, social and environmental,

health and safety, whistleblowing, forensic (fraud identification, analysis and

assessment).

Page 11

s

CONTENTS

7. Corporate Governance

• Best Practice

• Audit Committees – structures, roles, benefits and drawbacks.

• Roles and effectiveness of Non-Executive Directors.

• Anti-Money Laundering Procedures.

8. Current Issues

• The current issues and developments relating to auditing, including audit

expectations and developments in the regulation of audits.

Page 12

BLANK

Page 13

s

Study Unit 1

Assurance and the Audit Function

Contents

A.

Introduction

B.

Assurance

C.

Need for Regulation

D.

The Audit Function

E.

Small Entities

F.

Methodology of an Audit

G.

Sample Questions

Page 14

s

ASSURANCE AND THE AUDIT FUNCTION

A. INTRODUCTION

There has been a huge growth in information that is available today in all aspects of business.

The use of the internet has made access easy and more and more information is been required

in all areas, not just financial.

This growth in information has led to a need for assurance as to the quality and reliability of

that information so that users can make informed decisions based on the information that is

available to them.

Audit and assurance services play a vital role in maintaining confidence and therefore

stability in the world economy. The markets need confidence and in order to get this

confidence they seek to reduce their exposure to risk. To reduce risk they need assurance

in the market.

B. ASSURANCE

The International Standards on Auditing (ISA) glossary of terms gives a definition of an

assurance engagement as “one in which a practitioner expresses a conclusion designed to

enhance the degree of confidence of the intended users other than the responsible party about

the outcome of the evaluation or measurement of a subject matter against criteria.”

In practice, this could be an auditor expressing an opinion to the shareholders of a company

on a set of financial statements prepared by management as to whether they have been

prepared in a true and fair manner in accordance with accounting standards and relevant

company law.

Any assurance engagement must have the following five elements:

• A three party relationship such as the Auditor reporting to a shareholder about the

actions of management.

• Some subject matter such as a set of financial statements.

• Suitable criteria such as the accounting standards and/or law.

• Sufficient appropriate evidence, in a form that is sufficient, reliable and relevant.

• A written report in an appropriate form.

Levels of Assurance

Various levels of assurance may be given but this depends very much on (1) the individual

engagement, (2) the criteria applied and (3) the subject matter. The glossary of terms refers

to two types:

• Reasonable level of assurance – subject matter materially conforms to criteria i.e.

accounts give a true and fair view having regard to the accounting standards and law.

• Limited level of assurance – no reason to believe that subject matter does not

conform to criteria. Essentially, a negative form of expression.

Page 15

s

Absolute assurance can never be given. There are inherent limitations of an audit that affect

the auditor’s ability to detect material misstatements in a set of financial statements.

The Limitations of an audit

• Every item is not checked. In fact, only test checks are carried out by auditors. It

would be impractical to examine all items within a class of transactions or account

balance. Hence, it is not really possible to give absolute assurance.

• Auditors depend on representations from management and staff. Collusion can

mitigate some good controls such as division of duties. There is always the

possibility of collusion or misrepresentation for fraudulent purposes.

• Evidence gathered is persuasive rather than conclusive. It often indicates what is

probable rather than what is certain.

• Auditing is not purely an objective exercise. Judgements have to be made in a

number of areas. The view in financial statements is itself based on a combination of

fact and judgement.

• The timing of an audit.

• An unqualified audit opinion is not a guarantee of a company’s future viability, the

effectiveness and efficiency of management, nor that fraud has not occurred in the

company.

So are there any benefits of an audit? Yes, there are.

• The shareholders of a company are given an independent opinion as to the true and

fair view of the accounts that have been prepared by management.

• The use made by third parties such as suppliers and banks of the accounts adds

confidence in the performance of a company.

• Auditors themselves can use the knowledge accumulated during the course of the

audit to provide additional services to the company such as the provision of

consultancy services or a management letter showing weaknesses in the business and

recommendations to alleviate such weaknesses in the future.

• While not responsible for detecting fraud, the very fact that an audit is carried out and

may uncover evidence of fraud, can help to mitigate against such risks.

Types of engagements

The type of assurance engagement will depend very much on the subject matter, whether it be

a set of accounts or an internal control system.

In order that an assurance engagement can be carried out, the subject matter must be:

• Identifiable

• Capable of consistent evaluation and measurement and

• Capable of being subject to procedures and evidence gathering.

Page 16

s

Types of assurance engagements include

• Audits and reviews (different levels of assurance)

• Reports on systems and controls as part of corporate governance framework

• Reports for lenders and other investors

• Reports on prospective financial information

• Risk assessments

• Business performance measurement

• Social and environmental issues and

• Value for money studies

Implications of assurance services

• Members of professions will need to have a good broad skills base to deal with the

various types of engagements and not just the standard audit.

• More types of engagements increase the potential liability of accountants. Clear

identification of what is extended liability is vital.

• There is the potential for increasing the expectations gap. Auditors’ view versus the

public’s view. The auditor is not responsible for preparation of accounts or the

detection of fraud.

C. THE NEED FOR REGULATION

Where there is reduced confidence in the markets and this leads to business failure, this in

turn leads to instability. As a result there is increased demand for regulation.

There has been regulation in the markets since the introduction of the concept of limited

liability. The requirement for audited financial statements is a way to protect the owners of a

business from unscrupulous management and also prevent the abuse of the limited liability

status.

D. THE AUDIT FUNCTION

What is an audit?

An audit is an exercise, of which the objective is, to enable an independent auditor to express

an opinion on whether a set of financial statements is prepared in a true and fair manner in

accordance with an identified financial reporting framework.

The same objective applies to the audit of financial or other information prepared in

accordance with appropriate criteria.

Page 17

s

Overview of Syllabus and audit

ISA (International standards on auditing) 200: Objective and general principles

governing an audit of financial statements sets out what audits are all about.

• The auditor should comply with the code of ethics for professional accountants issued

by the International Federation of Accountants (IFAC), ethical standards and the ethical

pronouncements issued by the auditor’s relevant professional body.

• The auditor should conduct an audit in accordance with International Standards of

Auditing and should plan and perform an audit with an attitude of professional

scepticism.

• ISA 200 also makes a very important point in that while the auditor is responsible for

forming and expressing an opinion on the financial statements, the responsibility for

preparing and presenting those financial statements lies with the management.

• Furthermore, the auditor does not have any responsibility with regard to the prevention

and detection of fraud. Again, that lies with the management. These points often form

the basis for the expectation gap mentioned above.

Types of audits

• Statutory audits as required by companies’ legislation.

• Non-statutory audits preferred by interested parties rather than been required by law.

For example, charities, societies, public interest companies etc.

• Small entity audits.

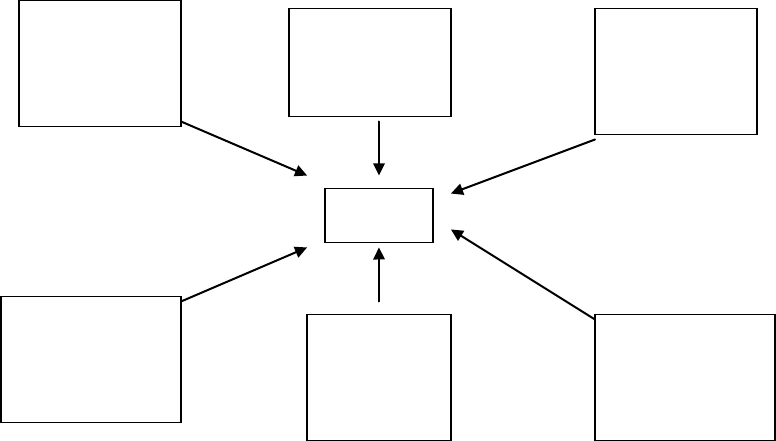

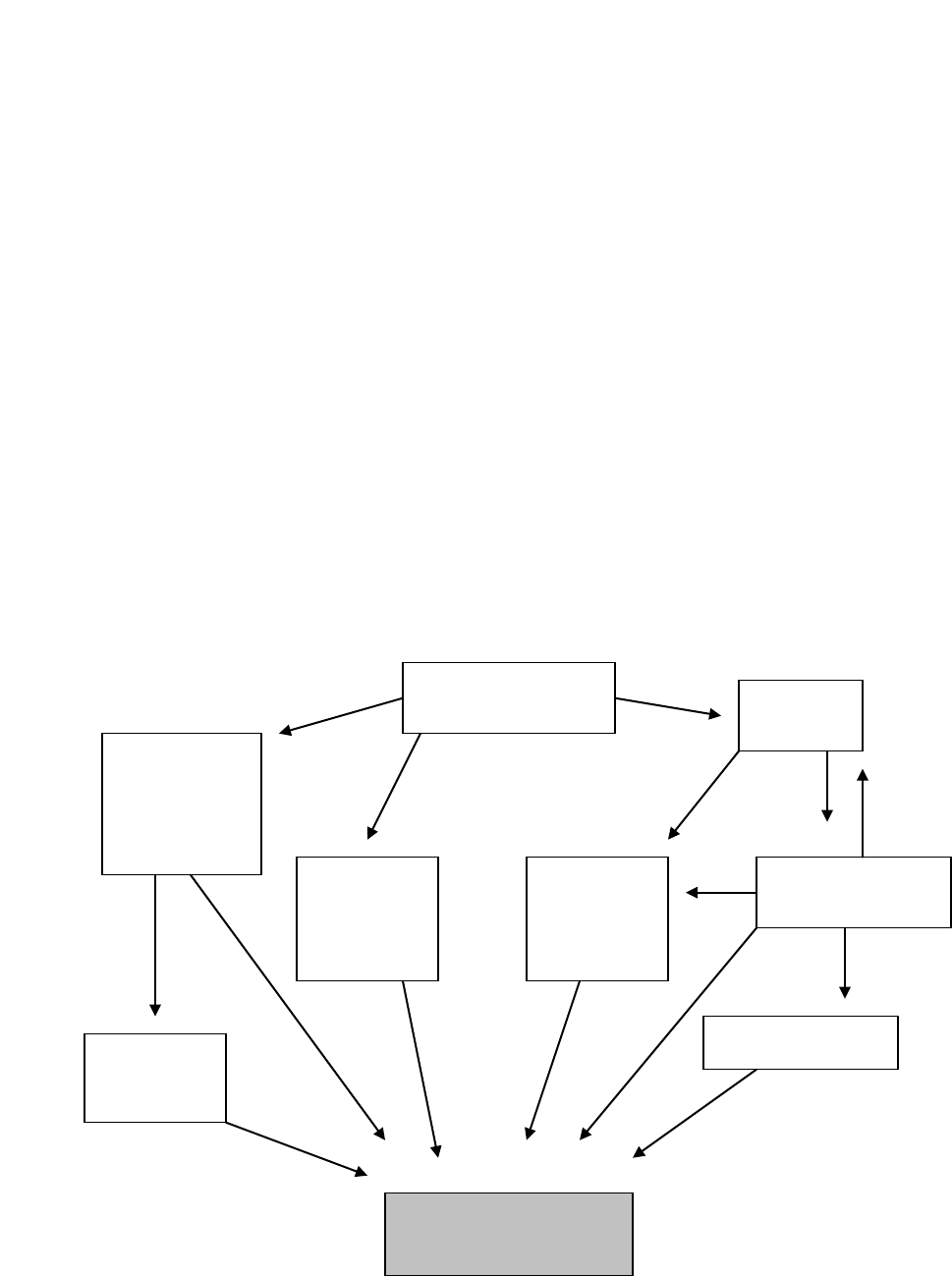

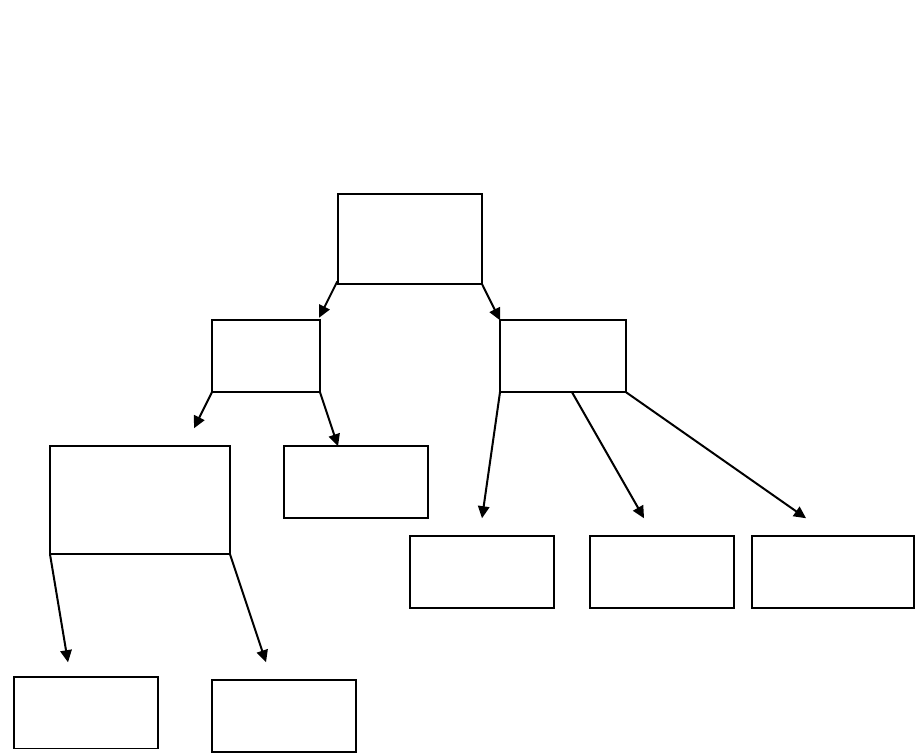

Legal &

Regulatory

environment

Risk

Assessment &

Audit process

Reporting

AUDIT

Ethics

Internal

controls &

financial

statements

Corporate

Governance &

current issues

Page 18

s

E. SMALL ENTITIES

Elements of a small entity would include:

• Small number of individuals re ownership and management.

• Basic record keeping.

• Limited internal controls with huge potential for management override of such

controls.

There are arguments for and against small company audits. Each of the stakeholders,

shareholders, management, employees, banks, suppliers and revenue commissioners has their

pros and cons.

• Reassurance given by audited accounts for shareholders not involved in management.

• On the contrary, where shareholders are part of management, the whole audit exercise

may not appear to be value for money.

• Audited accounts provide a good indication of a fair valuation for shares particularly

unquoted shares.

• An audit provides management with an independent check on the accuracy of their

financial statements. Also, some auditors do provide decent management letters.

• In reality, a more focused systems review or similar consultancy report would be of

more benefit to management.

• Employees can gain comfort from audited accounts as to their job security and for

wage negotiations. In reality, I don’t think this actually happens.

• Bank managers often rely on audited accounts when reviewing security in the event of

granting a loan.

• More importantly though, a bank manager may want to see a good credit history in a

company’s transactions with the bank.

• Suppliers can gain assurance from audited accounts when giving credit to customers.

• On the contrary, the accounts might be out of date and the customer could be

experiencing difficulties. Might be more appropriate to get relevant credit references.

• Rwandan Revenue Authority can rely on audited accounts to back up tax returns.

• In reality, revenue authorities generally accept sets of accounts prepared by

independent accountants.

Small company audits and potential problems

• Small companies create difficulties for auditors in that the auditor has to direct more of

his work in the verification of items by physical inspection and the vouching of third

party evidence, as he would otherwise probably do with larger company audits. The

general principles applied in an audit are the same for large and small companies. But

the specific testing may vary considerably.

• Due to the nature of small companies as noted above, problems can arise with the

reliability of internal control systems. In fact Control Risk is considered high. (ISA

200 defines control risk)

Page 19

s

• Lack of controls coupled with the risk of management override may lead to

difficulties such as the incompleteness of income or the recording of inappropriate

expenditure. In a larger company the system of internal control and a suitable staff

structure would provide a check against a persons work. In smaller companies, some

internal controls will be useful as a management check on staff, but will provide no

checking mechanism on management itself. Where there are limitations in the

effectiveness of internal controls, it has little value to the auditor in helping him form

an opinion on a set of financial statements. As a result he will need to increase his

substantive testing. Examples would be physically verifying additional assets

purchased throughout the year and obtaining third party confirmation from a bank as to

the small companies’ bank balances at the year-end.

• Another problem associated with small company audits is that the lack of an

appropriate internal control system coupled with the auditor’s inability to design or

carry out procedures to obtain sufficient, reliable and relevant evidence as to the

completeness and accuracy of the accounting records can create a limitation on the

scope of the auditor’s work. This can affect the type of audit report that is issued. For

example, you can have a qualified audit report where the scope limitation does not

prevent the auditor from expressing an opinion, or you can have a report where the

scope limitation is so significant that the auditor is unable to express an opinion.

F. METHODOLOGY OF AN AUDIT

• Determine the scope and the audit approach.

Legislation and the auditing standards lay down the scope for statutory audits. An

auditor should prepare a plan for his audit.

• Ascertain the system and controls.

Discuss the accounting system and the flow of documents with all the relevant

personnel in the company. Document all your notes. Some auditors do flow charts,

narrative notes and/or internal control questionnaires.

Get to know the client’s business.

Confirm that you have recorded the system accurately by carrying out walkthrough

tests.

• Assess the system and internal controls.

Evaluate the system as it is to weigh up its reliability and draw up a plan to test its

effectiveness. At this stage you could draw up a letter to management recommending

any improvements you consider from your findings. In addition, what you have

learned here may influence the type of further audit testing you may carry out later on.

• Test the system and internal controls.

Above, you evaluated the controls that are in place. You need also to test if they were

effective. Compliance tests will cover many more transactions than the walkthrough

tests. You need to carry out a representative sample through the accounting period.

If you can establish that the controls are indeed effective, you can reduce the amount

of detailed testing later on. However, if the controls turn out to be ineffective, then

more substantive tests will need to be carried out.

Page 20

s

• Test the financial statements.

This section covers the substantive testing which has been described earlier. You are

effectively trying to stand over the figures in the financial statements. Substantive

tests are audit procedures performed to detect material misstatements. Remember, if

you think that any error you might find in a class of transactions will not be

significant, then there is no point carrying out the substantive test.

• Review the financial statements.

After all the testing has been done and the evidence gathered, you should review the

accounts as to their overall reliability making a critical analysis of the content and

presentation.

• Express an opinion.

You need to evaluate all the evidence you have gathered and express an opinion on a

set of accounts by way of a written audit report.

You may in addition, write a management letter which can set out improvements you

recommend or to place on record specific points in connection with the audit.

Question 1.1

What are the limitations of an audit?

Question 1.2

You have been preparing accounts for Mr J. Butera for the last number of years which he

submits to the Revenue Authorities. His current turnover is RWF1million. Mr. Butera is

considering forming a company and has asked for your advice on a number of issues.

1. Are there any advantages to having a company audit.

2. Would the audit carried out on his company be similar to that of say Bank of Kigali

(BOK).

3. Is there anything other than an audit that would give him a degree of assurance.

Page 21

Study Unit 2

Professional Conduct

Contents

A.

Fundamental principles and guidance

B.

Independence

C.

Confidentiality

D.

Areas of Controversy

E.

Sample Questions

Page 22

s

A. FUNDAMENTAL PRINCIPLES AND GUIDANCE

ISA 200 sets out the general principles of an audit. The auditor should comply with the code

of ethics for professional accountants issued by the International Federation of Accountants.

Accountants require ethics because people rely on them for their expertise in specific areas.

Both the International Federation of Accountants (IFAC) and the Institute of Certified Public

Accountants of Rwanda (ICPAR) have issued a code of ethics of which the fundamental

principles of both associations are very similar.

The ICPAR ethical framework states principles and encourages the auditor to make their own

judgements. On the other hand the ethics as laid down by the IFAC provides more guidance

by way of examples of potential issues and safeguards to mitigate against those threats.

The ICPAR code of ethics lays out the fundamental principles as follows:

• Integrity. A member should be straightforward and honest in all professional and

business relationships.

• Objectivity. A member should not allow bias, conflict of interest or undue influence

of others to override professional or business judgements.

• Professional competence and due care. A member has a continuing duty to

maintain professional knowledge and skill at the level required to ensure that a client

or employer receives competent professional service.

• Confidentiality. A member should respect the confidentiality of information

acquired as a result of professional and business relationships and should not disclose

any such information to third parties without proper and specific authority unless

there is a legal or professional right or duty to disclose. Any information acquired

should not be used for the personal advantage of the member or third parties.

• Professional behaviour. A member should comply with relevant laws and

regulations and should avoid any action that discredits the profession.

The circumstances in which members operate may give rise to specific threats to compliance

with the fundamental principles. However, it is impossible to define every situation that

creates such threats and to specify the appropriate mitigating action. In addition, the nature

of engagements and work assignments may differ.

The ICPAR conceptual framework requires each member to identify, evaluate and address

threats to compliance, rather than merely complying with a set of specific rules such as those

laid down by the IFAC.

If the threats are significant, then you need to identify and apply safeguards to eliminate the

risk or to reduce it to an acceptable manner. If no appropriate safeguards are available,

then you need to eliminate the activities causing the threat or decline the engagement or

discontinue it as the case may be.

Page 23

s

Advantages of a framework over a system of rules

• A framework forces you to consider the threats for every given situation and to act

accordingly.

• A framework prevents you from interpreting technical issues.

• Rules don’t always cover all situations.

• Rules need to be constantly amended to live in a rapidly changing environment.

B. INDEPENDENCE

An auditor needs to be and seen to be independent. He must have independence of mind

and independence in appearance.

Independence is a state of mind that permits the provision of an opinion without being

affected by influences that compromise professional judgement, allows an individual to act

with integrity and exercise objectivity and professional judgement.

An auditor needs to avoid facts and circumstances that are so significant that a reasonable and

informed third party would reasonably conclude an auditor’s integrity, objectivity or

professional scepticism had been compromised.

Public confidence in the operation of capital markets and in the conduct of public interest

entities depends upon the credibility of the opinions and reports issued by auditors.

What are the threats to independence?

ES 1 Integrity, objectivity and independence sets out the principal types of threats.

• Self interest:

A financial interest in a client, undue dependence on fees, close business relationship,

concern over losing a client, potential employment with client or loans from client.

• Self review:

Reporting on the operation of financial systems after you were involved in their

design and preparing the accounts now under audit.

• Management threat:

Making judgements and taking decisions which are the responsibility of management.

• Advocacy:

Acting as a legal advocate for client in litigation or promoting shares in the company.

• Familiarity:

Having close personal relationships developed with client personnel through long

association or a family relationship. Auditor may not be sufficiently questioning the

client’s point of view. Acceptance of gifts of significant value.

• Intimidation:

Threat of replacement due to disagreement.

Page 24

s

Review the Institute of Certified Public Accountants of Rwanda code of ethics together with

the IFAC code of ethics with regard to areas such as financial interests, loans and guarantees,

close business relationships, family and personal relationships, employments connections

with the client, long association with client personnel, provision of non-assurance services,

fees, gifts and hospitality and actual or threatened litigation.

Safeguards to independence

Safeguards that may eliminate or reduce threats to an acceptable level fall into two general

categories:

• Safeguards created by the profession, legislation or regulation and

• Safeguards in the work environment whether within the auditor’s own systems and

procedures or within the client company.

The first category includes:

• Educational, training and experience requirements for entry into the profession.

• Continuing professional development requirements.

• Corporate governance regulations.

• Professional standards.

• Professional or regulatory monitoring and disciplinary procedures.

• External review by a legally empowered third party of the reports, returns,

communications or information produced by a member.

The second category includes:

Firm wide safeguards

• Such as firms stressing the importance of compliance with the fundamental principles.

• The expectation that members will act in the public interest.

• Documented policies and procedures to implement and monitor quality control of

engagements.

• Documented policies regarding identification of threats, their evaluation and

application of safeguards.

• Documented independence policies.

• Policies and procedures to enable identification of interests and relationships between

auditor and client.

• Monitoring the fee income received.

• Timely communication of a firm’s policies and procedures to all staff and appropriate

training thereof.

• Implementing a quality control system and appointing a member of senior

management.

• Advising all staff of the clients from whom they must be independent.

• A suitable disciplinary mechanism to promote compliance with policies.

Page 25

s

Engagement specific safeguards

• Involving an additional professional accountant to review the work done.

• Consulting independent third parties.

• Disclosing the nature of services provided and extent of fees charged to those charged

with client governance.

• Rotating senior audit team personnel.

Safeguards within client systems and procedures

• Persons other than management ratify auditor appointment.

• Client has competent employees with experience to make decisions.

• The client has a corporate governance structure that provides appropriate oversight

and communications regarding the firm’s service.

Specific safeguards in relation to independence are mentioned in the ICPAR and IFAC

guidance and cover such areas are financial interest, loans, close business relationships, fees

and litigation.

International standard on quality control sets out the standards and provides guidance

regarding a firm’s responsibilities for its system of quality control for audits.

• The firm should establish a system of quality control designed to provide it with

reasonable assurance that the firm and its personnel comply with professional

standards and regulatory and legal requirements.

• The firm’s system of quality control should include policies and procedures

addressing elements such as leadership responsibilities, ethical requirements,

acceptance of engagements, human resources, engagement performance and

monitoring.

The quality control policies and procedures should be documented and communicated

to the firm’s personnel.

C. CONFIDENTIALITY

There is a duty of confidence to the client but there are several exceptions noted.

The principle is twofold. One, you should refrain from disclosing any information acquired

without proper authority to do so unless there exists a legal or professional right or duty to

disclose.

Secondly, you should refrain from using any information acquired for your own personal

advantage or that of a third party.

A member should maintain confidentiality even in a social environment and even needs to

comply with the principle even after the end of the professional relationship. The member

can only use prior experience.

Page 26

s

Exceptions when member may be required to disclose:

• Disclosure permitted by law and authorised by client.

• Disclosure by law e.g. production of documents during course of legal proceedings or

disclosure to appropriate public authorities of infringements of law that have come to

light.

Money Laundering

Theft and Fraud Offences Duty to report where books of account are not been kept.

• Professional duty or right to disclose when not prohibited by law, such as to comply

with quality assurance reviews, to respond to an inquiry by an institute, to protect the

professional interests of a member in legal proceedings or to comply with technical

standards and ethical requirements.

Having decided that there should be some disclosure, the auditor must consider-

• Whether the interests of any parties could be harmed by such disclosure and whether

the auditor will incur legal liability as a result of the disclosure.

• Whether all relevant facts are known and substantiated.

• The type of communication that is expected and to whom it should be addressed.

Under ISA 250 consideration of laws and regulations in an audit of financial statements,

if auditors become aware of a suspected or actual occurrence of non-compliance with law and

regulation which give rise to a statutory right or duty to report, they should report it to the

proper authority immediately.

In all cases of disclosure where there is a duty of confidentiality, you should seek legal

advice.

D. AREAS OF CONTROVERSY

Independence

• Multiple services

Many audit firms are moving away from their traditional roles and are offering a

wider variety of work to their clients. Audit is sometimes even seen as a loss leader

in gaining other lucrative work.

Having more legislation in this area, could restrict clients in whom they could choose

to give them business and any synergies found in the auditor also providing additional

services would be lost.

Note, in the USA, SEC guidance suggests that an auditor is not independent in

relation to a listed company if they provide certain non-audit services, such as

bookkeeping, internal audit, management or human resources functions.

• Specialist services

Services such as valuation of intangible assets, property or unquoted investments

where carried by a firm who are also a company’s auditors can lead to a self review

threat. A firm should not therefore audit a client’s accounts which include specialist

work carried out by themselves.

Page 27

s

• Second opinions

Second opinions are acceptable but not if the current auditors are pressurised to accept

the second opinion. In order to avoid this, there should be constant communication

between the two auditors.

The second firm has a duty to seek permission from the client to approach the current

auditors. Without such communication, the second opinion may be formed

negligently, as the second opinion may not be based on the same set of facts or is

based on inadequate evidence.

Confidentiality

• Conflicts of interest

Conflicts of interest can arise when a firm has two or more audit clients, and the

clients are in direct competition with each other e.g. major banks.

An audit firm can argue that different audit teams are involved and this can maintain

independence and confidentiality. However, clients may not perceive it this way and

could well move the audit to another firm.

Takeovers also need special consideration. You could be the auditor to both

companies in a takeover. In these cases, the auditor should not be the principal

advisors to either and should not issue any assessment reports on either party other

than the actual audit reports.

• Insider dealing

Auditors can be seen as insiders as they often have access to very sensitive

information. Auditors should see the duty not to deal as an insider as an extension of

their duty of confidentiality to their clients. Again, it is not just in relation to third

parties but also to their own personal gain.

Question 2.1

You are a partner in an audit firm. A number of issues have emerged in relation to some of

your clients. You are asked to document your considerations on each of the issues, noting the

threat arising, the significance of that threat and any factors you have taken into account, and,

if relevant, any safeguards you could apply to eliminate or mitigate against that threat.

1. JNS Ltd

2. John is the most junior member of your audit team of eight. He has just invested in a

personal pension plan that invests in all listed companies.

3. White LTD

4. You are the partner leading up a high powered team carrying out due diligence work

on Black LTD, a company, your client, White LTD, is considering taking over. Paul,

your deputy has mentioned that he met the daughter of the MD of Black LTD during

the initial phases of the work and is going to ask her out.

Page 28

s

5. Take it Easy LTD

6. You have been associated with this audit for ten years, four as audit engagement

partner. You are just back from a six week cruise with the MD on his yacht.

Question 2.2

Here is an example of a press report which appeared in recent years which dealt with issues

of objectivity and independence within a firm of multinational firm of accountants.

“..a partner in the firm was told by the regulatory body that he must resign because he was in

breach of the body’s independence rules, as his brother in law was the financial controller of

an audit client. He was told that the alternative was that he could move his home and place of

work at least 400 miles from the offices of the client, even though he was not the reporting

partner. This made his job untenable. The regulatory body was seen as taking its rules to

absurd lengths by the accounting firm. Shortly after this comment, the multinational firm

announced proposals to split the firm into three areas between audit, tax and business

advisory services; management consultancy; and investment advisory.”

Discuss the above events and the impact they may have on the public perception of integrity,

objectivity and independence.

Question 2.5

Where auditors are perceived not to be independent is a real cause for concern. Where

auditors provide non audit services to their clients, their objectivity may well be impaired by

undue dependence on those clients. In addition, further concerns may arise in the situation

where audit clients hire staff who were previously employed by their auditors. In this case

the objectivity of future audits may be at risk.

1. Describe the problems that may arise if an audit client hires, as finance director, a

former audit partner.

2. Are there any advantages to a client of their auditor becoming an executive in their

company?

3. How does current ethical guidance attempt to deal with these potential problems

surrounding an auditor becoming an executive and what additional safeguards if any

may help the situation?

Page 29

Study Unit 3

Professional Appointments

Contents

A.

Advertising

B.

Tendering

C.

Acceptance

D.

Agreeing the Terms

E.

Books and Documents

F.

Change in Auditors

G.

Sample Questions

Page 30

s

PROFESSIONAL APPOINTMENTS

A. ADVERTISING

ISA 200 sets out the ethical principles governing the auditor’s professional responsibilities.

One of them is professional behaviour. A member is expected to comply with relevant laws

and regulations and should avoid any action that discredits the profession.

Now, auditors are like anyone else in business and in business it is necessary to advertise.

But this advertising should be aimed at informing the public in an objective manner and

should be in good taste.

The Institute of Certified Public Accountants of Rwanda have stated they will use the IFAC

code of ethics as their basis and thus imply that in promoting themselves and their work,

members should be honest and truthful and should not make any exaggerated claims for

the services they are able to offer, the qualifications they possess or the experience they have

gained. In addition, they should not make any disparaging references or unsubstantiated

comparisons to the work of others.

Use of logos

Persons can only use the designated letters of a profession after their name such as in

advertisements when they are members of the said profession.

A firm must have a practicing/auditing certificate to describe themselves as registered

auditors.

Fees

If reference is made in promotional material to fees, the basis on which the fees are

calculated should be stated. The greatest care should be taken to ensure that any reference

does not mislead as to the precise range of services and time commitment that the reference is

intended to cover.

The danger of giving a misleading impression is great when there are constraints in respect of

space limits for advertisements. It is for this reason that it is generally inappropriate to

advertise fees. It is probably better to advertise free consultations to discuss fee issues.

B. TENDERING

Client companies can change auditors. In this regard a firm may be approached to submit a

tender for an audit. When approached to tender, an audit firm must consider whether they

want to do the work and they must have regard for the ethical considerations, such as

independence and professional competence. In addition, they need to consider fees and some

other practical issues.

Fees

A member may quote whatever fee is deemed to be appropriate. The fact that one may

quote a lower fee than another auditor is not in itself unethical. However, it does raise the

Page 31

s

risk of a threat to the principles of professional competence and due care in that the fee

quoted may be so low as to make it appear to be difficult to perform the audit to the expected

standards.

Therefore, it is wise to set out the basis of the calculation of the fee. The following factors

should be considered when setting out a fee:

• What does the job involve. Is it audit and/or tax or is there some other complicated

work involved.

• Which staff will need to be involved, numbers and quality. How long will they be

required. Is the nature of the business complex.

• What charge out rates are to be applied.

The practice of undercutting fees has been called lowballing and can be seen in action

generally where large audits are concerned. We have seen that having a lower fee may

seem to have a negative impact on an auditor’s perceived independence but there are other

factors to be considered:

• Auditors operate in a market like any other business where supply and demand very

often dictate the price.

• Fees may be lower due to reasons such as better internal audit functions and

simplified group structures within client companies.

• Auditing firms have increased productivity, whether through the use of more

sophisticated IT or experience gained through understanding the client’s business.

Practical issues

It is important that the auditor also considers a number of other issues:

• Can the audit assignment be fitted in to the audit firms current work plan.

• Is their suitable audit staff available.

• Will any specialist skills be required. What are the future plans for the company.

• Is there any training required for current staff and what will be the cost of that

training.

• What work does the client actually want. Audit and/or tax.

• Is this the first time the company has been audited.

• Whether the client is seeking to change its auditors and if so what is the reason behind

it.

Submitting an audit proposal

There is no set format. In fact, the client may dictate the format whether it be a written

submission or a presentation to the board of directors.

Whatever the form of the tender submission, the following matters should be included in the

proposal:

• The audit fee and the basis for its calculation

• An assessment of the needs of the client

Page 32

s

• How the firm means to meet the needs of the client

• Any assumptions made to support the proposal

• The audit approach to be adopted by the firm

• A brief outline of the firm

• Details and background of the key audit staff on the proposed engagement.

Evaluating the tender

Different clients will have different ways of evaluating a tender. Some of the more general

points are listed below. It is important to bear these in mind when preparing a proposal:

• Fee. This can be the most vital point. Some clients go straight to this figure and don’t

even bother with the rest of the document.

• Professionalism. Auditors are expected to be professional. Remember, the audit team

and the tender documents are often the first factors on which a prospective client forms

an impression.

• Proposed audit approach. Clients are always looking for the least amount of

disruption to their already busy schedules, so the shortest number of days on-site may

be the key to winning a tender.

• Personal service. Fostering relationships is vital. Client should always feel he is

getting value for money.

C. ACCEPTANCE

You have submitted a tender. You have been successful and the client has offered you the

audit. Before you accept and commence the audit you should carry out a number of

procedures in order to comply with the provisions in ISQC1 quality control (section 26 to

28).

Before accepting the assignment

• Make sure there are no ethical issues which would prevent you from accepting this

assignment.

• Make sure that you are professionally qualified to carry out the work requested and

that your firm has the resources available in terms of staff, expertise and time.

• Check out references for the directors of the client firm especially if they are unknown

to the audit firm.

• Consult previous auditors as a matter of professional courtesy and establish from them

whether there is anything that you ought to know about this vacancy.

After accepting the assignment

• Make sure the resignation of the previous auditors has been properly carried out and

that the new appointment is valid. A resolution by shareholders of the company is

required.

• Submit a letter of engagement to the directors of the client company and ensure it is

accepted and signed before any audit work is carried out.

Page 33

s

ISQC1 states that a firm should establish policies and procedures for the acceptance and

continuance of client relationships and specific engagements, designed to provide it with

reasonable assurance that it will only undertake or continue relationships and engagements

where it:

• Has considered the integrity of the client and does not have any information that would

lead it to conclude that the client lacks integrity,

• Is competent to perform the engagement and has the capabilities, time and resources to

do so and

• Can comply with the ethical requirements.

The firm should obtain such information as it considers necessary in the circumstances before

accepting an engagement with a new client, when deciding whether to continue an existing

engagement and when considering acceptance of a new engagement with an existing client.

Where issues have been identified and the firm decides to accept or continue the relationship

or a specific engagement, it should document how the issues were resolved.

In short, a firm must:

• Obtain relevant information

• Identify relevant issues

• Resolve issues that are identified, and document that resolution.

Integrity of client

Matters to be considered:

• Identity and business reputation of owners, key management and those charged with

governance.

• Nature of the client’s operations and its business practices.

• Attitude of the owners, key management and those charged with governance towards

matters such as aggressive interpretation of accounting standards and the internal

control environment.

• Client’s attitude to fees.

• Indications of inappropriate limitation in the scope of work.

• Indications that client may be involved in money laundering or other criminal

activities.

• Reasons given for non-reappointment of previous auditors.

Information can be gathered through communications with previous auditors or other

professionals who may have provided services and through other third parties such as

bankers, legal counsel and industry peers. There are also a multitude of relevant databases

where one can do some background research.

Competence of the firm

Matters to be considered:

• Has the firm got sufficient knowledge of the relevant industry and the relevant

regulatory environment.

• Are there sufficient personnel within the firm having the necessary capabilities and

competence and are experts/specialists available when needed.

Page 34

s

• Are competent individuals available to perform engagement quality control reviews.

• Will the firm be able to complete the engagement within the reporting deadline.

Other issues

• Where a potential conflict of interest is identified, the firm should consider whether it

is appropriate to accept the engagement.

• Need to consider any significant matters that may have arisen during the current or

previous engagements of whatever description.

ISQC1 goes on to state that where the firm obtains information that would have caused it to

decline an engagement if that information had been available earlier, policies and procedures

(on the continuance of the engagement and the client relationship) should include

consideration of:

• The professional and legal responsibilities that apply to the circumstances, including

whether there is a requirement for the firm to report to the person or persons who made

the appointment or, in some cases, to regulatory authorities, and

• The possibility of withdrawing from the engagement or from both the engagement and

the client relationship.

Some suggested procedures would include discussing with appropriate client management the

appropriate action that the firm might make based on the relevant facts and circumstances.

Also, the firm should document the significant issues, consultations, conclusions and the

basis for those conclusions.

D. AGREEING THE TERMS

Once an engagement has been accepted it is important to agree the terms. It is essential that

both parties fully understand what the agreed services are. Any misunderstanding could lead

to a breakdown in the relationship and could result in legal action.

ISA 210: terms of audit engagements establishes standards and provides guidance on:

• Agreeing the terms of an engagement with the client and

• The auditor’s response to a request by a client to change those terms to one that

provides a lower level of assurance.

It states that the auditor and the client should agree on the terms of the engagement. The

agreed terms would need to be recorded in an audit engagement letter or other suitable form

of contract. The terms should be recorded in writing.

The objective and scope of an audit and the auditor’s obligations may be established by law,

but the auditor may still find that an audit engagement letter will be informative for their

clients.

The main points to be clarified in the letter of engagement would include:

• Confirmation of the auditor’s acceptance of the appointment.

• The auditor is responsible for reporting on the accounts to the shareholders

Page 35

s

• The directors of the company have a statutory duty to maintain the books of the

company and are responsible for the preparation of the financial statements.

• The directors are responsible for the prevention and detection of fraud.

• The fact that because of the test nature and other inherent limitations of an audit, there

is the unavoidable risk that some material misstatements may remain undiscovered.

• The scope of the audit including reference to appropriate legislation and standards.

• There should be unrestricted access to whatever books and records the auditor needs

in the performance of his duties.

Other points to be included:

• Arrangements regarding the planning and performance of the audit.

• The expectation of receiving from management written confirmation regarding

representations made in connection with the audit.

• Request for the client to confirm in writing the terms of the letter.

• The fee to be charged and the credit terms.

• The form of any reports or other communication of results of the engagement.

Other issues

• On recurring audits, the auditor should consider whether circumstances require the

terms of the engagement to be revised and whether there is a need to remind the client

of the existing terms of the engagement.

• An auditor who, before the completion of the engagement, is requested to change the

engagement to one which provides a lower level of assurance, should consider the

appropriateness of doing so. Where the terms are changed, both parties should agree on

the new terms. Note, the auditor should not agree to a change of engagement where

there is no reasonable justification for doing so.

E. BOOKS AND DOCUMENTS

ISQC1 states that the firm should establish policies and procedures for the retention of

engagement documentation for a period sufficient to meet the needs of the firm or as required

by law or regulation.

Unless otherwise specified by law or regulation, engagement documentation is the property

of the audit firm. The firm may, at its discretion, make portions of, or extracts from,

engagement documentation available to clients, provided such disclosure does not undermine

the validity of the work performed, or, in the case of assurance engagements, the

independence of the firm or its personnel.

Audit working papers belong to the auditor and cannot be taken over by another set of

auditors taking over the audit assignment. In practice, the previous auditors provide the new

auditors with enough carry over information such as the lead schedules behind the make up

of the financial statements.

The auditor owes a duty of confidentiality to the client, so documents about the client should

not be given to third parties unless:

Page 36

s

• The client agrees to the disclosure

• The disclosure is required by law or court order

• Disclosure is otherwise in accordance with the rules of professional conduct.

The previous auditors should ensure that all the books and documents belonging to the client

are returned promptly. In some cases, the previous auditors are allowed to keep the books

where they are exercising a lien. This is a suppliers right to retain possession of a customer’s

property until the customer pays up what is owed.

There are strict conditions when this can be enforced:

• The books and documents must actually belong to the client

• The auditor must have got them by proper means

• The actual work must have been done and a fee note raised and given to the client

• The fee must relate to the held documents.

Financial statements and tax compliance work belong to the client, even if the

auditor/accountant has prepared them.

F. CHANGE IN AUDITORS

Companies do actually change their auditors. It is important that auditors understand why a

company may seek to change their auditor in a bid to prevent this from happening to them.

The following sets out the reasons why this can happen:

Audit fee

Many companies perceive that an audit has very little value. In turn this makes the audit fee

a very sensitive issue.

• The fee may be perceived to be too high. Remember, a lot of the audit work may be

done off site and the hours charged at the firms office will belong to the managers and

partners, so the client might not understand why the fee is so high.

• It may not be seen as good value for money. For example, a client may have important

tax work carried out for him. The fee charged may be way lower than that of the audit,

probably due to the time involved, yet the client might see the value of this work far

greater than that of the audit.

• The current fee might not appear to be very competitive. Other similar firms may be

getting audit services for less.

• The client may put the audit out to tender to see whether the price is actually

negotiable, even though he may have no intention of changing his auditor.

• The audit fee may breach the recommended level of overall practice fees as laid down

by ethics and auditor may have no other alternative but to resign.

Audit firm may not seek re-election

• The auditor may choose not to stand for ethical reasons, such as he doubts the integrity

of management

• Conflicts of interest may have arisen such as competition between clients or maybe he

has been offered some lucrative work by the client and he may have to resign the audit

Page 37

s

• The auditor may have a disagreement with the client such as in the formulation of

accounting policies

• The auditor may simply not want to reduce his audit fee.

Size of the company

• The company may be growing at such a rate that the audit firm no longer has the

necessary resources, staff, time, and expertise, to allow it to retain the audit.

Remember the principle of professional competence and due care.

• Alternatively, the company may be constricting and it now finds that it can avail of the

audit exemption specified under relevant jurisdiction regulations.

• There is very little that the auditor can do in each of these cases.

Other reasons

• With small companies, the audit is almost a personal service. If the relationship

breaks down, there may be no where to go except discontinue the relationship. Within

a big firm with big audit clients, you could simply change the engagement partner.

• As part of the safeguards against the threats to independence, audit rotation was put

forward. This is where the audit moves to another firm although in the previous point,

rotating to another engagement partner within the same firm will mean the same thing.

Question 3.1

A B Ltd, a large quoted company, was founded and controlled by Mr. Narang. The principle

business of the company was to develop undeveloped land in city centres into apartment

blocks. In 2010, the Revenue Authorities became suspicious of the nature of the operations

been carried out by the company and instigated an investigation.

The investigation highlighted weak organisational internal controls and non-existence in

many cases. Payments to unknown persons and fictitious consultancy firms were found. In

addition Mr Narang maintained a secret expense account that was used to disburse funds to

himself. The board of directors did not know of the existence of the account which was

maintained by the audit engagement partner. The auditors were heavily criticised in the

report.

Winalot & Co the firm of auditors had an aggressive marketing campaign and had increased

its audit fees substantially over a number of years. They had accepted the audit appointment

in 2008 after the previous auditor had been dismissed. The audit report for 2007 had been

heavily qualified on the ground of poor internal control and lack of audit evidence. Mr

Narang had approached several firms of auditors in order to ascertain whether they would

qualify the audit report given the present system of internal controls. Winalot said it was

unlikely that they would qualify the report. They realised that Mr Narang was opinion

shopping but were prepared to give an opinion in order to attract the client to their firm.

The PLC subsequently filed for insolvency and the auditors were sued for negligence by a

creditor.

Page 38

s

You are required to:

1. Describe the procedures that an audit firm should carry out before accepting a new

client with a potentially high audit risk.

2. Detail the ethical problems raised by the maintenance of the secret expense by the

audit partner.

3. Suggest measures to try and minimise the practice of opinion shopping by

prospective audit clients.

4. Explain how audit firms can reduce the risk of litigation and its effects upon the

audit practice.

Question 3.2

Why would an auditor not seek re-election and what practical issues should an auditor

consider when submitting a tender.

Question 3.3

Discuss accountants and the advertising of fees.

Page 39

Study Unit 4

Professional Responsibility and Liability

Contents

A.

Fraud

B.

Professional Liability

C.

Misconduct

D.

Professional Indemnity Insurance

E.

Sample Questions

Page 40

s

PROFESSIONAL RESPONSIBILITY AND LIABILITY

A. FRAUD

An auditor’s main concern in an audit is the risk of a material misstatement in the financial

statements. These material misstatements can arise from fraud or error.

An error is an unintentional misstatement in the financial statements, whether an omission

of an amount or a disclosure. It can be a mistake in gathering or processing data for the

accounts, an incorrect accounting estimate or a mistake in the application of accounting

principles.

Fraud is an intentional act by one or more individuals among management, employees or

third parties, involving the use of deception to obtain an unjust or illegal advantage.

Auditors do not make legal determination of whether fraud has actually occurred, the

auditor is concerned with fraud that causes a material misstatement in the financial

statements.

Responsibility

ISA 240: the auditor’s responsibility to consider fraud in an audit of financial

statements, states quite clearly in paragraph 240.13 that the primary responsibility for the

prevention and detection of fraud rests with the management and those charged with

governance of the entity. It is their responsibility to establish a control environment to assist

in achieving the orderly and efficient conduct of the entities operations. It is up to them to

put a strong emphasis within the entity on fraud prevention.

The auditor does not have a specific responsibility to prevent or detect fraud, but he must

consider whether it has caused a material misstatement in the financial statements.

Types of fraud

There are two types of intentional misstatement:

• Fraudulent financial reporting

• Misappropriation of assets

Fraudulent financial reporting

This may be accomplished by the following:

• Manipulation, falsification, or alteration of accounting records or supporting

documentation from which the accounts are prepared

• Misrepresentation in or intentional omission from the accounts of events, transactions

or other significant information

Page 41

s

• Intentional misapplication of accounting principles relating to amounts, classification,

manner of presentation or disclosure.

Specifically fraud can be committed by management overriding controls using techniques

such as:

• recording fictitious journal entries

• inappropriately adjusting assumptions

• omitting, advancing or delaying recognition of events or transactions in the correct

accounting period

• Concealing or not disclosing facts that could affect amounts recorded in the financial

statements

• Engaging in complex transactions that are structured to misrepresent the financial

position

• Altering records and terms related to significant and unusual transactions.

Misappropriation of assets

This involves the theft of a company’s assets. While management are in a position to be able

to disguise or conceal misappropriations in ways that are difficult to detect, small and

immaterial amounts misappropriated are often perpetrated by employees.