CPA A2.3 ADVANCED TAXATION Study Manual

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 91

- Taxpayer concerned

- Deductible items

- Mechanisms

- Summary of Law(s)

- Taxation of Businesses operated by Individuals who are not employees

- Contents

- Chapter 2

- Income Tax on Companies

- Contents

- Chapter 3

- Value Added Tax

- Contents

- A. CHARACTERISTICS AND MECHANISM

- B. CSUMMARY OF LAW(S)

- Concepts

- Any person who is not required to register for VAT can do so voluntarily. The law here aims at any supplier who does not meet any of the two conditions mentioned above. §2. Consequences of the constraint.

- A person who does not need to register and is not registered will invoice his customers with no VAT added; but he cannot reclaim the VAT which his suppliers invoice to him. The advantage of a lower sales price must be offset against the non-recoverab...

- Taxable operations

- D Exempted and Zero rated businesses

- Deductions and restitutions

- Localization of operations

- Determination of VAT

- Introduction and mechanism

- Constraint

- Responsibilities and Obligations

- Exemptions and Operations which are zero rated

- BLANK

- CHAPTER 4

- DECENTRALIZED TAX - FIXED ASSET TAX

- Contents

- CHAPTER 5

- Contents

- The East African Community Customs Management Act, 2004 incorporating all amendments up to 8th December, 2008

- A good example of a bloc with geographic links is the East African Community (EAC) Common Market. Another good example is the European Union (formerly the European Common Market) – which was formed for historical and geographic reasons.

- Generally speaking such blocs evolve over time. They can start with an agreement to simplify trade administration between two or more countries and to reduce tariffs, customs duties etc on goods and services traded between the countries.

- The ultimate aim of such partnerships is to abolish commercial borders between member states, thus pushing the commercial borders to the periphery of a trading bloc. Thus, goods imported into country A of a trading bloc are deemed to be imported into ...

- So, in the case of the EU, when goods are imported into Belgium, they are also deemed to be imported into France. This means if the goods are subsequently sold from Belgium into France, they are not classified as either a Belgian export or a French im...

- B. Double Taxation Agreements

- International Taxation involves taxation which is cross border. It can arise from an individual having taxable income or assets in two countries, or a business operating in two (or more) countries. Due to increased globalisation, the growing level of ...

- To take a simple example. Joe is a citizen of and lives in Country A. He has a home there, and lives there with his wife and family. Thus, in the normal scheme of things, Joe would be taxed on his income in Country A, in common with all other resident...

- However Joe is slightly unusual. Every Tuesday morning Joe flies to Country B, works there until Thursday afternoon and then flies home again. He gets paid in Country B.

- The dilemma however, is – in what country does the tax liability fall, and how is that

- decided? And a further issue that may arise is that if an individual or a business is taxed in

- Country A and in Country B, then that person or entity has effectively been taxed twice on the same income or transaction. If such a situation were to prevail, it could materially inhibit the development of international trade.

- So, for example, Country A will argue that Joe is a citizen and a resident, he lives with his wife and family there, and every citizen is expected to make their contribution to the various public services they enjoy. Thus, they will argue, Joe should ...

- But Country B will argue that Joe should pay his income tax in their country, because the income originated there, and their rules state that anyone earning an income in their country should be taxed there.

- The dilemma for Joe is that he could end up being taxed in both countries on the same income – which is a bit unfair on Joe. The dilemma for both Countries is that they could end up not taxing Joe in either country. And if it is to be only one – which...

- So a system of double taxation agreements has evolved to deal with this type of situation. The taxpayer does not have to be an individual – it could be a company, or a business operating in both countries.

- There are two principal scenarios to be considered:

- (A) Where there is a double taxation agreement in place

- (B) Where there is not

- Scenario (A)

- In scenario (A) (where there is a tax treaty, on avoidance of double tax and prevention of fiscal evasion), between Country A and Country B, the treaty generally will specify in a clear wording that the right to tax is with state Country B, because th...

- Scenario (B)

- In Scenario (B) (where there is no existing tax treaty on avoidance of double tax and prevention of fiscal evasion) country B will to tax Joe on incomes arising from country B, because that is the source of the incomes. When he goes back to country A,...

- Under Rwanda’s income tax law (Law No.16/2005 OF 18/08/2005, On Direct Taxes on Incomes as modified and complemented to date), this is indicated in article 6, regarding foreign tax credit. Note: foreign tax credit provision exists in almost all tax l...

- It is desirable, and indeed necessary, in the field of international taxation, that there are rules agreed between different countries as to which tax jurisdiction takes what portion of tax, and why a given tax jurisdiction should forego in whole or i...

- Various countries have concluded and ratified tax treaties with other countries. Typically these tend to start with a country’s major trading partners. Rwanda has signed and ratified tax treaties with Mauritius, South Africa and Belgium. The East Afri...

- A typical Double Taxation Agreement (DTA) will address key issues. Each agreement may differ depending on the prevailing circumstances, and the participating countries. However, a typical DTA would be likely to include provisions for some or all of th...

- PERSONS COVERED

- TAXES COVERED

- This provision article sets out the taxes to which the treaty will apply. In some cases this may apply only to taxes on income, (personal and corporate); in other cases it may also apply to Capital taxes.

- It is very important that there is clarity around precisely what taxes are included in the treaty, and which are not included.

- RESIDENT

- This provision sets out the rules for determining whether a person is a resident of of one State or a resident of the other State for the purposes of the treaty. Only residents of the Contracting States can claim the benefits of the treaty. A resident...

- The provision can contain tie-breaker provisions to resolve cases where an individual would be regarded as a resident of both Contracting States.

- A treaty will also normally contain a tie-breaker test for corporate entities. Where the entity is a resident of both States it will normally be deemed to be a resident of the State in which it is effectively managed.

- PERMANENT ESTABLISHMENT

- This provision defines the term “permanent establishment”. The concept of a permanent establishment is important generally but is of primary importance for the purposes of Business Profits. Only when an enterprise of one of the Contracting States carr...

- A “permanent establishment” is defined as a fixed place of business through which the business of an enterprise is wholly or partly carried on.

- INCOME FROM IMMOVABLE PROPERTY

- This provision defines the rules relating to taxation of income from immovable property, including income from agriculture or forestry.

- The term “immovable property” is defined by reference to the domestic law of the Contracting State in which the property is situated.

- Under this provision, each Contracting State agrees to rules for the taxation of Business Profits. The rules tend to revolve around whether an enterprise has a permanent establishment in a State. The provision can also set out the rules by which the p...

- .

- This provision deals with transfer pricing.

- Generally such a provision determines that the profits made by an enterprise from dealings with an associated enterprise in the other Contracting State may be increased to the level they would have been if the enterprises had been independent and deal...

- It may also provide for the adjustment of profits of the associated enterprise in the other State as a consequence of an adjustment in the first State.

- DIVIDENDS

- This provision is concerned with the taxation of dividends paid by a distributing company resident in one Contracting State to a shareholder resident in the other State.

- The term “dividends” will be defined in the article.

- INTEREST

- This provision provides rules for the taxation of interest arising in one Contracting State and paid to a resident of the other State.

- The provision will also include a comprehensive definition of the term “interest”.

- ROYALTIES

- This provision provides rules for the taxation of royalties. It may limit the taxation in the source State of royalties paid to a resident of the other State.

- The term “royalties” is defined and can covers payments in respect of copyright of literary, artistic or scientific work as well as patents and trademarks. Some treaties also cover leasing payments – “payments for the use of, or the right to use, indu...

- .

- INCOME FROM EMPLOYMENT

- This provides for the taxation of income from employment.

- It generally provides that remuneration in respect of an employment derived by an individual who is a resident of a Contracting State may be taxed only in that State unless the employment is exercised in the other Contracting State. In that event, the...

- ARTISTES AND SPORTSPERSONS

- PENSIONS and ANNUITIES

- This provides a general rule for the taxation of pensions and annuities.

- It normally provides that a pension arising in a Contracting State and paid in consideration of past employment to a resident of the other Contracting State will be taxed only in that other State. In some treaties, the source country retains the right...

- ,

- ELIMINATION OF DOUBLE TAXATION

- This provision is relevant where both Contracting States retain taxing rights on items of income or gains. Double taxation is relieved in such cases by the State of residence of the taxpayer either exempting the income or gains from further taxation o...

- .

- EXCHANGE OF INFORMATION

- This provides for the exchange of information that is relevant for the carrying out of the provisions of the treaty or of the domestic laws of the Contracting States concerning taxes covered by the treaty. All information so exchanged is to be treated...

- C. Regional Perspective

- In East Africa, the EAC Partner States commenced implementing the EAC Common Market Protocol in July 2009. This means that Rwanda, Uganda, Kenya, Tanzania and Burundi entered into a single market with free movement of factors of production based on th...

- Some of these rights include free movement of goods, persons and labour.

- The EAC citizens also have the rights of establishment (i.e. a Ugandan citizen can set up a business in Rwanda, and vice versa) as well as rights of residence. There is also provision for free movement of services and capital.

- It is important to note that taxes on international trade will remain as is, except for import duty which will be at 0% on imports from the EAC that comply with the rules of origin criteria.

- If a trader for example imports juice or biscuits that are manufactured in Uganda (an EAC member state) and have a valid certificate of origin, the Rwandan Revenue Authorities (RRA) will not collect import duty (a tax levied on goods imported into th...

- In Rwanda, issuance of certificates of origin has been decentralized to the RRA Gikondo Customs department and at all border posts including, Gatuna (Rwanda-Uganda border) and Rusumo (Rwanda-Tanzania border). It is intended that this service will be i...

- While import duty was abolished for such trade, traders will continue to pay other domestic taxes due on goods including Value Added Tax (VAT) of 18 percent, consumption tax (excise duty) as well as withholding tax of 5 percent.

- However, the withholding tax mentioned above is exempt for people who have a tax clearance certificate (Quitus Fiscale).

- Free movement of goods under the Common Market is provided for under the protocol (Article 39).

- On 1st July, 2009, Rwanda commenced the implementation of the EAC Customs Union and started levying zero percent import duty tariff on goods originating from the Partner States, applying the Common External Tariff and the East African Customs Manageme...

- Implementation of the Customs Union is progressive. For example, the internal tariff elimination on intra regional trade took 5 years.

- Removal of VAT, Consumption tax (excise duty) and Withholding tax will be implemented when a fully fledged customs union is established.

- Such a union will also include the following:

- •Shifting of borders between Partner States to the peripheral

- •Collection of duties and taxes at the point of entry into the Customs Union Territory

- •Agreeing on the revenue sharing mechanism;

- •Establishment of a regional authority to administer the Customs Union

- •Elimination of rules of origin on intra regional trade. In a fully fledged Customs Union, goods from Nairobi to Kigali will not attract any duties and taxes will be considered just as goods coming from Huye, Southern Province or Musanze, Northern Pro...

- Harmonization of tax policies and laws

- The EAC Common Market Protocol provides that the Partner States will progressively harmonize their tax policies and laws to remove tax distortions. This will be done to facilitate the free movement of goods, services and capital and to promote investm...

- It is important to note that the implementation of the EAC Common Market has not changed the existing fiscal regime and the anticipated changes will progressively be realized as Rwanda enters into a fully fledged Customs Union and the harmonization o...

- Harmonization of domestic taxes is being handled under EAC Framework by the Fiscal Affairs Committee(Technical Committee on tax harmonization) and Fiscal Affairs Committee has established Technical Working Groups on Value Added Tax, Excise Tax and Inc...

- It should also be noted that the double taxation and the prevention of fiscal evasion with respect to taxes on income (DTA) was agreed upon by the Partner States and is awaiting legal input from the Attorney Generals Before approval by Council.

- This will all take time to achieve. It may be further complicated by the admission of new member states to the Common Market. And it is possible that there may be a deeper strengthening of trade ties. For example in the EU, the arrangements have moved...

- Countries can also involve themselves in wider, but looser associations for international cooperation. Such an example is COMESA (the Common Market for Eastern and Southern Africa). The benefits of COMESA are:

- 1. A wider, harmonised and more competitive market

- 2. Greater industrial productivity and competitiveness

- 3. Increased agricultural production and food security

- 4. A more rational exploitation of natural resources

- 5. More harmonised monetary, banking and financial policies

- 6. More reliable transport and communications infrastructure

- 19 countries – including Rwanda - are members of COMESA, and the agreed activities cover more than just taxation issues.

- D. Most Favoured Nation

- Most Favoured Nation (MFN) is a status or level of treatment accorded by one state to another in international trade. This means that the country which is the recipient of this treatment must, nominally, receive equal trade advantages as the "most fav...

- Such advantages would include such things as low tariffs or high import quotas. It effectively means that a country that has been accorded MFN status may not be treated less advantageously than any other country with MFN status by the country grantin...

- MFN status is accorded by members of the World Trade Organization (WTO) to each other.

- Preferential treatment of developing countries, regional free trade areas and customs unions is permitted by exception.

- Some of the benefits conferred by MFN status are:

- As a consequence of MFN, smaller countries can participate in the advantages that larger countries often grant to each other. In the absence of an MFN, smaller countries would often not be powerful enough to negotiate such advantages by themselves.

- MFN provides domestic benefits: Administration is simplified. By having one set of tariffs for all countries the rules are simplified and made more transparent. It also lessens the frustrating problem of having to establish rules of origin to determine w<

- MFN restrains domestic special interests from obtaining protectionist measures. For example, butter producers in country A may not be able to lobby for high tariffs on butter to prevent cheap imports from developing country B, because, as the higher tari<

- As MFN clauses promote non-discrimination among countries, they also tend to promote the objective of free trade in general.

- There is, however, a recognition that the MFN rule should be relaxed to accommodate the needs of developing countries.

- The emergence of powerful trade blocs (e.g the EU, or the North American Free trade Agreement (NAFTA) has presented challenges to the MFN concept. In these blocs, tarriffs have been lowered or eliminated among the members while maintaining tariff wall...

- E. Withholding Tax Provisions

- Withholding tax, also called retention tax, is where a government requires the payer of an item of income to withhold or deduct tax from the payment, and pay that tax directly to the government.

- In most jurisdictions, withholding tax applies to employment income. Thus employers deduct the appropriate tax, pay the employee the net amount, and pay the balance (i.e. tax) over to the government.

- Rwanda operates a PAYE (pay as you earn) withholding tax system:

- Rwandan tax law requires that when an employer makes available employment income to an employee the employer must withhold, declare, and pay the PAYE tax to the Rwanda Revenue Authority within 15 days following the end of the month for which the tax w...

- In the case of engaging a casual labourer for less than 30 days during a particular tax year, the employer shall withhold 15% of the taxable employment income of the casual labourer.

- The employer is personally responsible for the correct withholding, declaration and the timely payment to the Rwanda Revenue Authority.

- The employer is personally responsible for keeping proper books of account to prove that the tax has been correctly withheld, paid, and accounted for. Under those circumstances where, the employer is not required to withhold and pay the tax, the emplo...

- Many jurisdictions also require withholding tax on payments of interest or dividends. In most jurisdictions, there are additional withholding tax obligations if the recipient of the income is resident in a different jurisdiction, and in those circumst...

- Withholding Tax on other payments in Rwanda

- A withholding tax of 15% is levied on the following payments made by resident individuals or resident entities including tax-exempt entities:

- Dividends, except those governed by Article 45 of this law; Interest payments; Royalties; Service fees including management and technical service fees; Performance payments made to an artist, a musician or an athlete irrespective of whether paid direc...

- Withholding Tax on Imports and Public Tenders

- A withholding tax of five percent (5%) of the value of goods imported for commercial use shall be paid at custom on the CIF (cost insurance and freight value) value before the goods are released by customs.

- A withholding tax of three percent (3%) on the sum of invoice, excluding the value added tax, is retained on payments Or by public institutions to those who supply goods and services based on public tenders.

- Typically the withholding tax is treated as a payment on account of the recipient's final tax liability. It may be refunded if it is determined, when a tax return is filed, that the recipient's tax liability to the government which received the withho...

- The amount of withholding tax on income payments other than employment income is usually a fixed percentage. In the case of employment income the amount of withholding tax is often based on an estimate of the employee's final tax liability, determined...

- Some governments have written laws which require taxes to be paid before the money can be spent for any other purpose. This ensures the taxes will be paid first, and will be paid on time as the government needs the funding to meet its obligations.

- Most countries require that payers of certain amounts, especially interest, dividends, and royalties, to foreign payees withhold income tax from such payment and pay it to the government. Payments of rent may be subject to withholding tax or may be ta...

- Some countries require withholding by the purchaser of real property.

- Taxes withheld may be eligible for a foreign tax credit in the payee's home country.

- F Transfer Pricing

- Other issues may also arise in international taxation – and a key issue is the issue of transfer pricing.

- Take for example, the case of Business A being headquartered in Country A, and has a subsidiary in Country B. It makes widgets in Country B which it exports back to its parent in Country A. Let us assume that Country A has a corporate tax rate of, s...

- Business B makes 500,000 widgets, at a unit cost of 1 franc. It decides it needs a gross profit of a further 1 franc, and so decides to sell the widgets at 2 francs each back to its own business in Country A.

- Therefore;

- Sales: (To country A) 1,000,000

- Cost of sales 500,000

- Profit 500,000

- Taxed @ 35% 175,000

- The business in Country A sells the widgets locally, for 4f each. They incur distribution costs of 1f each.

- Therefore

- Sales (In Country A) 2,000,000

- Cost of goods sold (1,000,000)

- Distribution costs ( 500,000)

- Profit 500,000

- Taxed @ 15% 75,000

- Therefore total tax

- In country B 175,000

- In country A 75,000

- Total 250,000

- However, to reduce the tax liability, the company could decide to make no profit in Country B, and all the profit in Country A.

- Thus, if the sales are all to their own business in Country A, the company could decide to charge their own company Rwf 1 per unit. The following therefore would be the case:

- Country B

- Sales: (To country A) 500,000

- Cost of sales 500,000

- Profit 0

- Taxed @ 35% 0

- Country A

- Sales 2,000,000

- Cost of goods (500,000)

- Distribution costs (500,000)

- Profit 1,000,000

- Tax @ 15% 150,000

- Therefore we can see that the overall tax liabilities are reduced from 250,000 to 150,000. This has been achieved by the simple mechanism of transferring the original profits from Country B to Country A, where there is a lower tax rate.

- This in turn has been achieved by reducing the price of the goods sold into Country A. Thus no profits are made in Country B, and all the profits are made in Country A. The pricing mechanism used between different parts of the same business is known a...

- Double taxation agreements are increasingly concerned with this issue and seek to mitigate the effects of artificially created pricing structures.

- Transfer pricing refers to:

- the setting,

- analysis,

- documentation,

- and adjustment

- of charges made between related parties for goods, services, or use of property. Transfer prices among components of an enterprise may be used to reflect allocation of resources among such components, or for other purposes.

- OECD Transfer Pricing Guidelines state,

- “Transfer prices are significant for both taxpayers and tax administrations because they determine in large part the income and expenses, and therefore taxable profits, of associated enterprises in different tax jurisdictions.”

- Over 60 governments have adopted transfer pricing rules.

- Transfer pricing rules in most countries are based on what is referred to as the “arm’s length principle” – that is to establish transfer prices based on analysis of pricing in comparable transactions between two or more unrelated parties dealing at a...

- The rules of nearly all countries permit related parties to set prices in any manner, but permit the tax authorities to adjust those prices where the prices charged are outside an arm's length range. Rules are generally provided for determining what c...

- Prices actually charged are compared to prices or measures of profitability for unrelated transactions and parties. The rules generally require that market level, functions, risks, and terms of sale of unrelated party transactions or activities be rea...

- Most tax treaties and many tax systems provide mechanisms for resolving disputes among taxpayers and governments in a manner designed to reduce the potential for double taxation. Many systems also permit advance agreement between taxpayers and one or ...

- Many systems impose penalties where the tax authority has adjusted related party prices. Some tax systems provide that taxpayers may avoid such penalties by preparing documentation in advance regarding prices charged between the taxpayer and related p...

- The OECD system provides that prices may be set by the component members of an enterprise in any manner, but may be adjusted to conform to an arm's length standard. The system provides for several approved methods of testing prices, and allows the gov...

- Most governments have granted authorization to their tax authorities to adjust prices charged between related parties. Some authorizations, (e.g. the United States, United Kingdom, Canada, and Rwanda – Law 16/2005 DTI), allow domestic as well as inter...

- Nearly all systems require that prices be tested using an "arm's length" standard. Under this approach, a price is considered appropriate if it is within a range of prices that would be charged by independent parties dealing at arm's length. This is g...

- There are clear practical difficulties in implementing the arm's length standard. For items other than goods, there are rarely identical items. Terms of sale may vary from transaction to transaction. Market and other conditions may vary geographically...

- In addition, most systems recognize that an arm's length price may not be a particular price point but rather a range of prices.

- The OECD rules require that reliable adjustments must be made for all differences (if any) between related party items and purported comparatives that could materially affect the condition being examined.

- Transactions not undertaken in the ordinary course of business generally are not considered to be comparable to those taken in the ordinary course of business. Among the factors that must be considered in determining comparability are:

- the nature of the property or services provided between the parties,

- functional analysis of the transactions and parties,

- comparison of contractual terms (whether written, verbal, or implied from conduct of the parties),and

- comparison of significant economic conditions that could affect prices, including the effects of different market levels and geographic markets.

- Comparability is best achieved where identical items are compared. However, in some cases it is possible to make reliable adjustments for differences in the particular items, such as differences in features or quality.

- Buyers and sellers may perform different functions related to the exchange and undertake different risks. For example, a seller of a machine may or may not provide a warranty. The price a buyer would pay will be affected by this difference. Among the ...

- Product development

- Manufacturing and assembly

- Marketing and advertising

- Transportation and warehousing

- Credit risk

- Product obsolescence risk

- Market and entrepreneurial risks

- Collection risk

- Financial and currency risks

- Company- or industry-specific items

- Manner and terms of sale may have a material impact on price. For example, buyers will pay more if they can defer payment and buy in smaller quantities. Terms that may impact price include payment timing, warranty, volume discounts, duration of rights...

- Goods, services, or property may be provided to different levels of buyers or users: producer to wholesaler, wholesaler to wholesaler, wholesaler to retailer, or for ultimate consumption. Market conditions, and thus prices, vary greatly at these level...

- Most systems provide variations of the basic rules for characteristics unique to particular types of transactions. The potentially tested transactions include:

- Sale of goods. Identical or nearly identical goods may be available. Product-related differences are often covered by patents.

- Provision of services. Identical services, other than routine services, often do not exist.

- License of intangibles. The basic nature precludes a claim that another product is identical. However, licenses may be granted to independent licensees for the same product in different markets.

- Use of money. Comparable interest rates may be readily available. Some systems provide safe haven rates based on published indices.

- Use of tangible property. Independent comparatives may or may not exist, but reliable data may not be available.

- Tax authorities generally examine prices actually charged between related parties to determine whether adjustments are appropriate. Such examination is by comparison (testing) of such prices to comparable prices charged among unrelated parties. Such t...

- Most systems consider a third party price for identical goods, services, or property under identical conditions, called a comparable uncontrolled price (CUP), to be the most reliable indicator of an arm's length price. All systems permit testing using...

- Among other methods relying on actual transactions (generally between one tested party and third parties) and not indices, aggregates, or market surveys are:

- Cost plus (C+) method: goods or services provided to unrelated parties are consistently priced at actual cost plus a fixed mark-up. Testing is by comparison of the mark-up percentages.

- Resale price method (RPM): goods are regularly offered by a seller or purchased by a retailer to/from unrelated parties at a standard "list" price less a fixed discount. Testing is by comparison of the discount percentages.

- Gross margin method: similar to resale price method, recognised in a few systems.

- Some methods of testing prices do not rely on actual transactions. Use of these methods may be necessary due to the lack of reliable data for transactional methods. In some cases, non-transactional methods may be more reliable than transactional metho...

- Valuable intangible property tends to be unique. Often there are no comparable items. The value added by use of intangibles may be represented in prices of goods or services, or by payment of fees (royalties) for use of the intangible property. Licens...

- Enterprises may engage related or unrelated parties to provide services they need. Where the required services are available within a multinational group, there may be significant advantages to the enterprise as a whole for components of the group to ...

- There may be tax advantages obtained for the group if one member charges another member for services, even where the member bearing the charge derives no benefit. To combat this, the rules of most systems allow the tax authorities to challenge whether...

- Some jurisdictions impose significant penalties relating to transfer pricing adjustments by tax authorities. These penalties may have thresholds for the basic imposition of penalty, and the penalty may be increased at other thresholds. For example, U....

- The rules of many countries require taxpayers to document that prices charged are within the prices permitted under the transfer pricing rules. Where such documentation is not timely prepared, penalties may be imposed, as above. Documentation may be r...

- Results of the tested party or comparable enterprises may require adjustment to achieve comparability. Such adjustments may include effective interest adjustments for customer financing or debt levels, inventory adjustments, etc.

- Tax authorities of most major countries have entered into unilateral or multilateral agreements between taxpayers and other governments regarding the setting or testing of related party prices. These agreements are referred to as advance pricing agree...

- Contents

- A Avoidance and Evasion

- Evasion of paying tax is a simple breaking of the law whether it be a tax law or any other law.

- Avoidance is a means of reducing one’s tax liabilities but within the law. Transfer pricing whether it be done within a country or as a cross-border exercise has been used as a means of reducing a tax liability.

- Off-shore loans and deposits/bonds are also used as a means of reducing tax. Interest paid on a loan is tax deductible.

- A Ltd a resident of R could borrow money from A2 Ltd which is situated in another country, LLY, where the tax laws are more lenient. The Loan from A2 Ltd attracts interest and the income is taxed in LLY. The interest charged to A in R reduces the tax...

- The RRA and the EAC are developing ways and means or reducing avoidance:

- By encouraging tax payers to be good citizens and help pay their dues for the benefit of Rwanda and ultimately themselves.

- By writing and passing laws to make constructive avoidance illegal. This is where an entity takes positive steps to reduce tax liabilities by means of accounting exercises and using “off-shore” entities and transfer pricing as tools.

- See Appendix II which is an extract from the RRA Business Plan 2010-2012 and details aims and targets regarding progress on taxation.

- RRA see Threats to include

- B Transfer pricing

- Transfer prising has been covered within the Cross-border trading section. But the concept is as valid within a group within one country as it is across borders.

- The following example is Z Ltd who makes hide skins for drums. Z sells to Y Ltd a member of the consortium as well as to other drum manufacturers.

- As with all groups, the internal price is different from the external price. But suppose in example 1 the price is the same. At this price Y Ltd makes a loss of Rwf 150m

- Z pays tax on its profits but Y Ltd pays no tax.

- Suppose Z Ltd were to reduce the price charged to Y Ltd to Rwfk 7 per square metre, Y Ltd’s loss would reduce to Rwfk -150 but Z Ltd sales would drop to Rwfk 2,600 and profits to Rwfk 200,000.

- The tax advantage to the “consortium” would be Rwf 300,000,000

- But the RRA would question the sale to Y Ltd at a price at lower than cost.

- An arm’s length price would be considered to be at least cost plus a % markup.

- Even so a tax advantage can be gained:

- Even at a “reasonable” price, there can be a tax advantage to the joint venture and more for the shareholders in the way of dividends which are paid out of profits after tax

- C Online Taxation

- With the increasing use of the internet, tax returns filing and payment are two activities which lend themselves to automation. The use of online filing and payment is at various stages of development around the world.

- There are advantages for both taxpayers and the revenue authorities in this.

- For the taxpayer the key benefits are:

- 1. Convenience - they can do their tax returns at a time, and in a place that suits them.

- 2. Efficiency – they do not have to write out forms, post them, or take them personally to an office.

- 3. Speed – they can complete their transactions quickly.

- 4. Audit trail – there is always an electronic record of what has been submitted without the need to keep paper files etc

- 5. Errors in transcription or electronic reading of forms is reduced

- For the tax authorities the key benefits are:

- 1. Cost of tax collection is reduced. Once the online system is set up, the staff savings can be considerable, as will the savings on paper, postage etc.

- 2. Compliance Monitoring - with a properly functioning online system the authorities can very quickly focus on non-compliant taxpayers, and with the staff resources freed up from administration can focus more on the high risk areas.

- 3. Efficiency – the streamlining of tax returns and payments will lead to a more efficient operation.

- 4. Probable increased compliance – by making it easier for citizens to file and pay returns it is likely that compliance rates will increase.

- The Rwanda Revenue Authority has rolled out an electronic tax filing and payment system that allows taxpayers to file and pay for their taxes online. The self-declaration service is available for VAT, PAYE, withholding (lto), consumption (lto) and iqp...

- With this new e-tax system, taxpayers no longer need to travel to Rwanda Revenue Authority offices or stand in long queues. A call centre has also been established to provide customer care to taxpayers through telephone enquiries, further reducing the...

- As a result, the processing time for VAT returns, Income Tax returns and PAYE returns has been reduced from 23.5 days to just 1 day. Commercial Banks have also seen the value of this system and are now enrolling to provide e-tax payment services, furt...

- The Investment Climate Facility for Africa has worked with the Rwanda Revenue Authority to develop the e-tax system as part of the drive to modernise Rwanda’s tax administration.

- EAST AFRICAN COMMUNITY

- The East African Community Customs Management Act, 2004

- This Edition of the East African Community Customs Management Act, 2004

- incorporates all amendments up to 8th December, 2008 and is printed under the

- authority of Section 12 of the Acts of the East African Community Act, 2004

- Third schedule (ss. 70, 71, and 72) prohibited and restricted exports generally – a table of prohibited and restricted goods is tabled.

- Fourth schedule (ss. 37 and 122.) Determination of value of imported goods liable to Ad valorem import duty

- TRANSACTION VALUE

- TRANSACTION VALUE OF IDENTICAL GOODS

- TRANSACTION VALUE OF SIMILAR GOODS

- DEDUCTIVE VALUE

- COMPUTED VALUE

- FALL BACK VALUE

- ADJUSTMENTS TO VALUE

LOSSARY

LOSSARY

INSIDE COVER – BLANK

LOSSARY

1

© iCPAR

All rights reserved.

The text of this publication, or any part thereof, may not be reproduced or transmitted in any

form or by any means, electronic or mechanical, including photocopying, recording, storage

in an information retrieval system, or otherwise, without prior permission of the publisher.

Whilst every effort has been made to ensure that the contents of this book are accurate, no

responsibility for loss occasioned to any person acting or refraining from action as a result of

any material in this publication can be accepted by the publisher or authors. In addition to

this, the authors and publishers accept no legal responsibility or liability for any errors or

omissions in relation to the contents of this book.

INSTITUTE OF

CERTIFIED PUBLIC ACCOUNTANTS

OF

RWANDA

Advanced 2

A2.3 TAXATION

First Edition 2012

This study manual has been fully revised and updated

in accordance with the current syllabus.

It has been developed in consultation with experienced lecturers.

LOSSARY

2

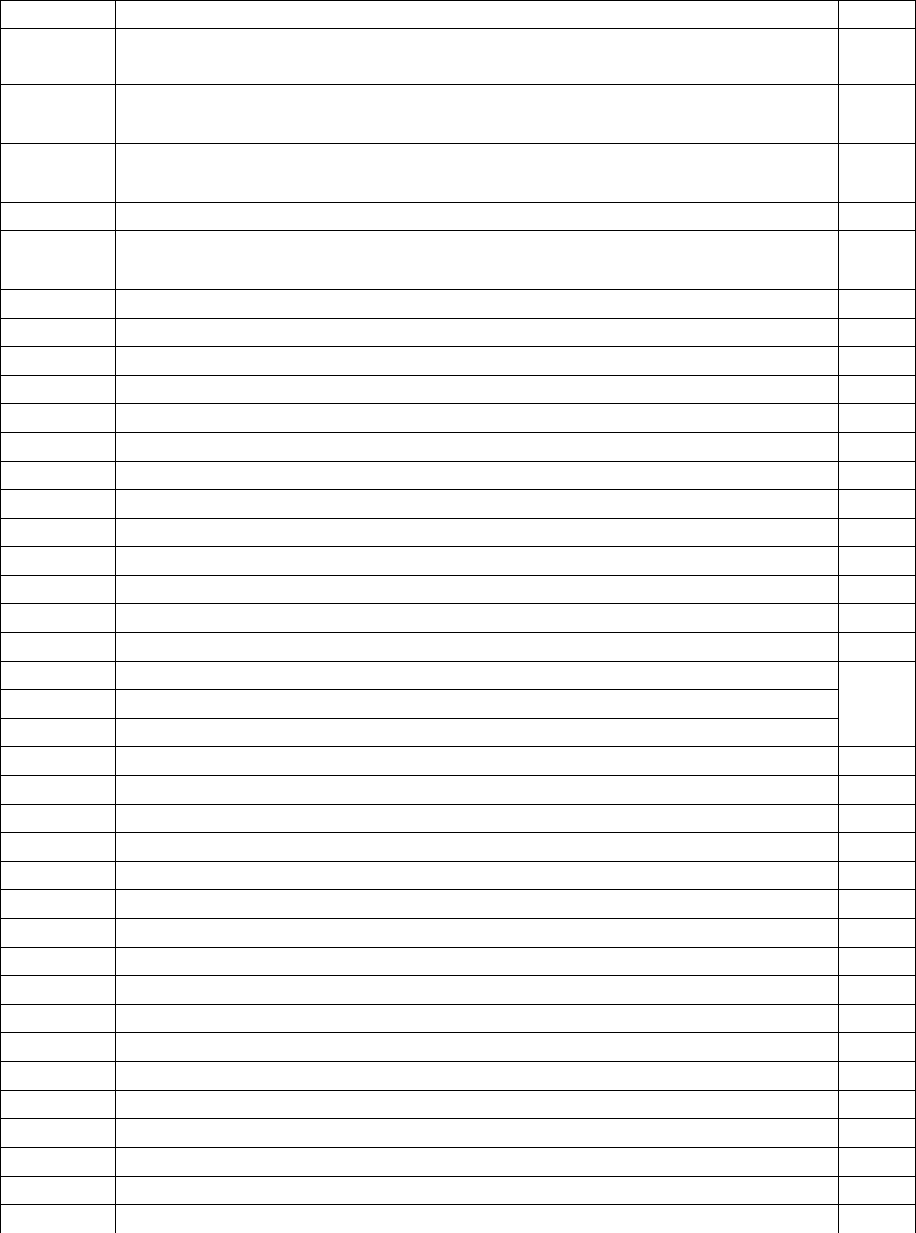

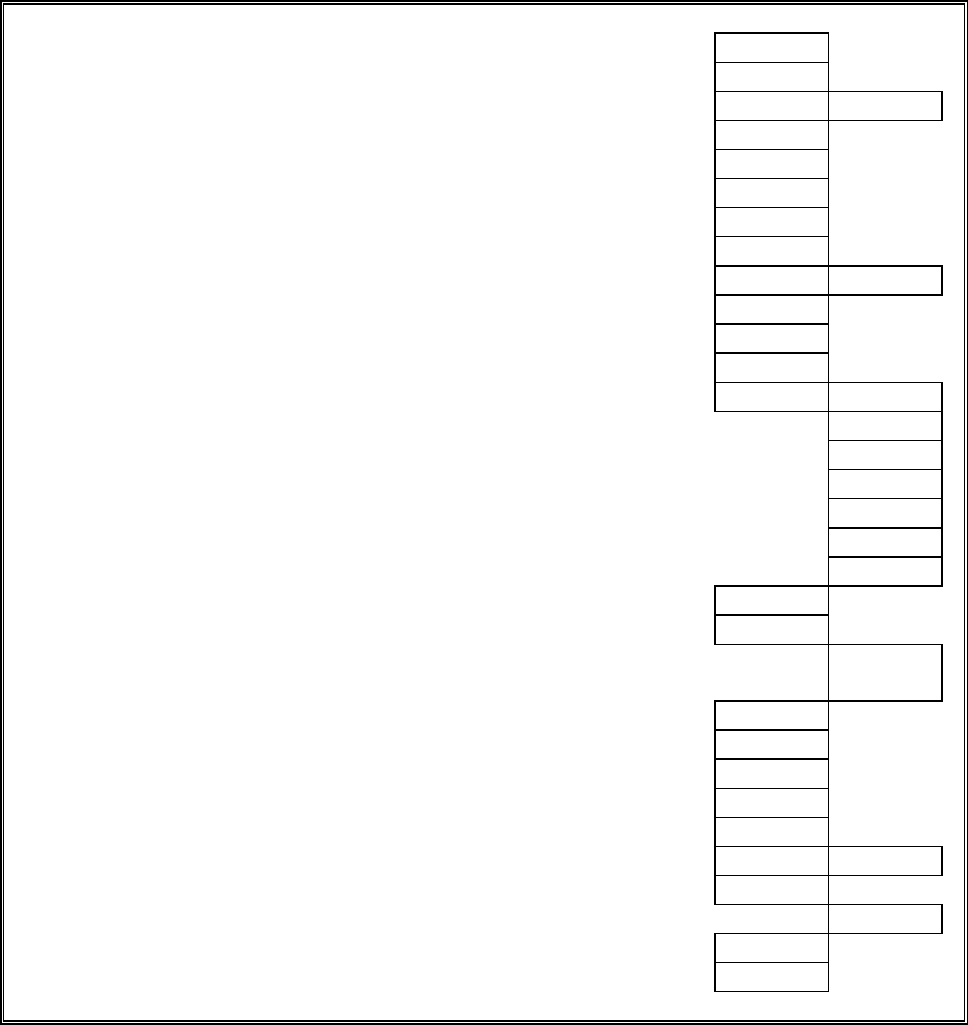

Contents

Chapter

Title

Page

1

TAXATION OF BUSINESSES OPERATED BY INDIVIDUALS

WHO ARE NOT EMPLOYEES

5

Taxpayer concerned 6

Deductible items 6

Assessment of tax

14

Import duties and Withholding tax 16

Tax on Investment income

17

Submissions and Payment of Tax

18

2

INCOME TAX ON COMPANIES

19

Tax payers concerned

20

Tax base

21

Assessment and Allowances

22

3

VALUE ADDED TAX

25

Mechanisms

26

Summary of Law(s)

27

Responsibilities and Obligations

30

Exempted and Zero rated businesses

31

4

DECENTRALIZED TAX – FIXED ASSET TAX

39

5

TAXATION OF CROSS-BORDER ACTIVITIES

49

Distinction between trading in and with a country

50

Double Taxation Agreements

51

Regional perspective

56

“Most Favoured Nation”

58

Withholding Taxes

59

6

EMERGING TRENDS

69

Avoidance and Evasion

70

Transfer pricing

70

Online Taxation

73

7

THE EAST AFFRICAN COMMUNITY

75

Tax and EAC

75

Free movement of goods under the Common Market rules

75

Harmonization of tax policies and laws

76

LOSSARY

3

Appendix I Extract from The East African Community Customs

Management Act, 2004

77

Appendix II

Extract from Rwanda revenue Authority Business Plan

2011-2012

83

Appendix III a– CIT Real Regime Calculator form

88

Appendix III b – PIT Real Regime Calculator form

89

LOSSARY

4

BLANK

LOSSARY

5

Chapter 1

Taxation of Businesses operated by Individuals who are not

employees

Contents

A. Who are the tax payers

B. Deductible Items

C Assessment

D Import duties and withholding tax

E Investment Income

F Submissions and Payment of Tax

LOSSARY

6

A Taxpayers concerned

1) Individuals who are not employees: There are taxpayers required to pay income tax

on business benefits who are physical people and who carry on activities involving financial

remuneration on a purely personal basis. In other words, such taxpayers are not employees

contracted to an employer or a corporate or business entity. These latter situations are

assessed for employment or corporate income tax respectively.

Examples of the former taxpayers would include generally tradesmen or ‘liberal professions’

such as lawyers, doctors and consultants.

Like “employees”, these taxpayers are assessed according to Chapter II of Law 16/2005 of

18/08/2005 on Direct Taxes on Income … (the DTI)

2) Corporate or business entities are covered by Chapter III of the DTI.

But much in Chapter II of DTI also applies to businesses which fall into the categories

covered by Chapter III

Taxes are assessed on the profits made by a business. As covered in the first course, profits

are Income less expenses. But not all items of expenditure can be deducted from profits for

tax purposes.

B Deductible items

a. General

Any expenditure which complies with Art 21 of the DTI may be offset against taxable

income or business profits:

• Such expenditure must be committed for the direct need and the normal requirements

of the company;

• They must be supported by appropriate documentation to confirm that they have been

incurred;

• They must involve a reduction of the net assets of the company;

• They must be included for tax purposes in the expenditure of the period during which

they are committed.

But some types of expense are not “tax-deductible”. These include in particular:

• Cash bonuses, attendance fees and other similar payments allocated to the members of

the Board of directors;

• Declared dividends and participations in profits;

• The surplus of interest paid on loans made out in a foreign currency, compared to the

interbank rate offered in London or "London Inter-Bank Offered Rate " (LIBOR) at

the beginning of the fiscal year increased by one percent (1%); (Law No. 73/2008

Article 2 para 3)

LOSSARY

7

• Contributions to reserves, provisions and other funds with specific purposes, others

than those envisaged by the tax law.

• Fines and other penalties;

• The proportion of any gift (donations in cash or the equivalent value of gifts in kind)

which exceeds one percent (1%) of sales turnover. However if these gifts are granted

by persons or entities carrying on a gainful employment, the gifts will not be entirely

non-deductible;

• Income tax of businesses that is paid abroad and value-added tax (VAT);

Indeed, tax paid abroad is not deductible from the tax base under consideration - it instead

constitutes a foreign tax credit. Also the VAT cannot be deductible expenditure since it is

offset against output VAT. However, all other taxes are deductible from the tax base,

as the law only specifically prohibits the deduction of the two taxes discussed above;

• Personal consumer expenditure and any entertainment expenditure provided that this

expenditure was not already included on income tax of employment (EIT).

Special attention should be given to Art 22 DTI but see also Law No. 73/2008 of 31/12/2008

which modifies the DTI.

Those reserves, provisions and funds which are mentioned by the tax law, and which

consequently are accepted as deductible, include in particular qualifying pension funds

(art.14 4º DTI) and investment provisions (Article 26 DTI);

b. Depreciation

Depreciation is an annual charge against the profits of a company to take account of the

reduction in value resulting from the use of fixed assets belonging to the organisation. It

therefore forms deductible expenditure for the fiscal year under consideration. However,

some assets that are not subject to physical deterioration and associated depreciation in the

same way are not allowable. These include in particular land, works of art and heritage assets

(art 24 paragraph 2 DTI).

The law outlines four (4) categories of acceptable charges relating to depreciation (article 24

para. 3, 4 and 5 DTI) which have their own specific allowable rates as follows:

1. Construction of, or the costs of acquisition of, costs of improvement, restoration or

rebuilding of tangible assets. The annual allowable rate of depreciation is 5% of the

cost price. Examples: of such assets include industrial buildings themselves plus

equipment which forms part of the building such as elevators, light fittings, air-

conditioning and conveyors where these are built into the fabric;

2. Development or costs of acquisition, costs of improvement, restoration or rebuilding of

the intangible assets, which includes goodwill acquired from a third party. Annual rate

of depreciation is 10% of the cost price. The assets thus will be entirely depreciated in

ten (10) years. Example: Goodwill, concessions, patents, licences, etc.;

3. Computers and their accessories, information systems and communication. Annual rate

of depreciation: 50% of the carried forward balance of the asset net of depreciation. An

IT system costing Rwf20m will be valued at 2% of its cost price by year 6

4. Other assets of the company: 25% of the carried forward balance of the asset net of

depreciation. Examples: machine tools, work benches, seed cleaners etc. motor

LOSSARY

8

vehicles, furniture, etc. That is the assets are depreciated on a reducing balance basis;

by year 9 the WDV will be 2.5% of cost – cf IT equipment

Not only is depreciation is calculated in two different ways according to whether the asset

falls into the first two, or the last two, categories described but:

• For the first two categories (depreciation of 5% and 10% of the cost price), depreciation is

calculated individually, asset by asset, and is based on the original cost i.e. straight-line

basis. Additions are simply treated at cost and sales are set against the relevant individual

asset.

• For the second two categories (50% and 25% rates of depreciation), depreciation is not

calculated by individual asset, but by total pool category (article 24 of DTI); And the

depreciation is calculated on the depreciated value at the beginning of the year (NBV –

net book value or WDV – written down value) brought forward i.e. on a Reducing

Balance basis.

• For the “pooled” assets, additions are added to or sales are subtracted from the pool value

at the beginning of the year – Art 25 DTI).

• For all categories, due allowance must be made where due to abnormal occurrences,

assets are damaged or devalued.

However, for the four (4) categories of allowable assets, when a used and depreciated asset

(either completely or partially depreciated) forms part of a business acquired by a taxpayer,

then annual instalments of depreciation are calculated on the price at acquisition (if in the

first two categories) or on the depreciated value (‘net book value’) of the asset at the date of

acquisition if in the last two categories.

It is important to categorise the assets correctly and ensure that the depreciation is correctly

calculated.

It should be noted that if the depreciated value of the assets at the beginning of a year (the

depreciation base) does not exceed 500,000 Rwf, the full amount constitutes a deductible

running cost (art.25 of the DTI).

Finally, if the net book value is negative (as would be the case for example if the selling price

of certain assets of the category are higher than the cost price of all the assets in the category

of costs), this net amount is treated as a gain and is added to profits and the assets base

valuation amount becomes nil (art 25 al.2 DTI).

Example:

Joe starts a business manufacturing chairs. The factory cost Rwf 270 million, the 2 lathes cost

Rwf45 million each and are supported by a Computer Aided Design (CAD) computer which

cost Rwf50,000,000 including cabling and equipment to link the CAD computer to the

Computer Numerically Controlled (CNC) lathes.

The rest of the factory equipment – benches and other tools - cost 45,000,000 and there is a

small admin team and their computers and printer cost 50,000,000 including software and

their office furniture cost 20,000,000.

Total investment cost Rwf 525 m

Company policy is to depreciate an asset over its useful life using the straight-line method:

Factory – 20 years

LOSSARY

9

Lathes – 10 years

Computers and associated equipment - CAD and office – 3 years

Benches and all other tools - 10 years

Office furniture – 10 years

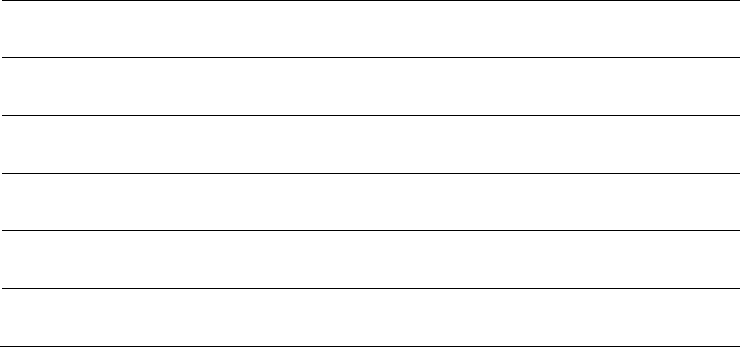

Factory Lathes CAD

Benche

s etc

Office

Computers

Office

furniture

Cost Rwf '000

270,000

90,000

50,000

45,000

50,000

20,000

Life years

20

10

3

10

3

10

Annual Depreciation per company

Straight line basis

13,500 9,000 16,667

4,500

16,667

2,000

Rate % per RRA

0.05

0.25

0.5

0.25

0.5

0.25

Depreciation in first year

13,500

22,500

25,000

11,250

25,000

5,000

Value to which Depreciation is to be applied next year

Per company policy straight-line basis uses

270,000

90,000

50,000

45,000

50,000

20,000

Per RRA Cat 1 Dep'n based on Cost

270,000

Cat 2 - computer equipment WDV

25,000

25,000

Cat 3 all other tools and equipment WDV

81,000

40,500

18,000

Difference RRA minus Company policy

0

13,500

8,333

6,750

8,333

3,000

Adjustment to be deducted from Business Profits 39,917

The total business depreciation in year 1 is Rwf62,333 thousands, whereas the RRA would

calculate taxable profits where depreciation summed to Rwf102,250 thousands. The

adjustment to Line 75 of CIT Real Regime Calculator (see Appendix 1) would be

+39,917,000

For the pooled assets, the RRA method uses the WDV approach and so the life of an asset is

not fixed as the straight-line method is. 10% per year straight-line = 10 years

25% per year of WDV means that pooled assets costing 2,000,000 new are written down to

1,500,000 at the start of year 2 and Rwf1,125,000 at the start of year 3 and so on. In fact in

year 6 the opening valuation is less than Rwf500,000 and so the whole pool would be

expensed to SoCI

c. Investment allowance

Where the business is a registered investor and is able to take advantage of the investment

allowance, the profits in year 1 would be dramatically different. But this is also the year when

start-up costs are expected to be greatest and so the chances of profits slimmer.

According to paragraph 26 of the DTI, an investment allowance of forty percent (40%) of the

amount invested in new or used assets may be depreciated excluding motor vehicles that

carry less than eight (8) persons, except those exclusively used in a tourist business. This

amount is deductible for a registered investor in the first tax period following the purchase

and/or of use of such assets if:

LOSSARY

10

1. the amount of business assets invested is equal to thirty million (30,000,000)

Rwandan francs; and

2. the business assets are retained for at least three (3) tax periods after the tax period in

which the investment allowance was taken into consideration.

The investment allowance becomes fifty per cent (50%) if the registered business is located

outside Kigali or falls within the priority sectors as described by the Investment Code of

Rwanda.

The investment allowance effectively increases the depreciation charge to business profits

and for pooled assets, reduces the value of these assets carried in subsequent years. – next

year’s depreciation for pooled assets is calculated against the written down value as at the 1st

of the period plus the cost of any acquisitions made in the period.

If the business asset that is granted an investment allowance is disposed of before the end of

the period mentioned in the above point 2, the reduction of income tax stemming from the

investment allowance must be paid back to the Tax Administration unless such an asset is

destroyed by natural calamities or other involuntary conversion. The repayment amount is

calculated back to the acquisition date of the relevant asset.

To be eligible for the Investment Allowance, the following conditions must be fulfilled:

• It is necessary to be a recognised and registered investor;

• The acquired asset cannot be a vehicle capable of transporting less than eight (8)

passengers unless it is used solely for tourist business;

• The amount invested must be at least 30 million francs;

• The assets must be held for at least three (3) fiscal years from the time that the

provision for investment was taken into account;

For ease of book-keeping and to make year-end work much easier perhaps the entity should

adopt the RRA depreciation rates and then there would be no need to make adjustments.

But, and this is a big BUT, the business profits for management Account purposes in any one

period could be markedly affected and thus the ratios such as Return on Capital Employed,

RoI, ratios which are most important for the investor, would be affected. Calculations such

as WACC could become invalid and these inaccuracies could in turn lead to incorrect

investment decisions.

When making decisions to select asset lives and how to depreciate assets, the implications

must be carefully assessed before going ahead. Once a specific accounting policy has been

properly adopted, changes in later years can affect the accounts and reports for “prior” years.

d. Expenses for training and research

Art. 27 DTI prescribes that expenses of training and research during a fiscal year are

deductible expenses.

LOSSARY

11

All Training and Research expenses incurred which promote business activities during a tax

period are considered as deductible from taxable profits in accordance with provisions of

Article 21 of this law.

Such expenses, when they are incurred as part of process to purchase of land, buildings and

other immovable properties including renovation or reconstruction as well as exploration

expenses and other assets, are considered as part of the capital cost and will be added to the

cost of the asset.

To understand this concept more clearly, it is necessary to refer to relevant "International

Accounting Standards” (IAS). In IAS 9 regarding "activities of research and development"

(August 1991), the IAS established a distinction between:

• Research: this relates to original research undertaken in order to acquire original

scientific and technical knowledge;

• Development: this relates to the translation of the results of research into a plan of

production of materials, apparatus, products, processes, systems and services new or

substantially new before the commencement of production or commercial

exploitation.

Commentators have opined that, by expenses of research, the law wanted also to include the

expenses of development because the two expenditures are often part of the same aim or

project. See IAS on R&D and the way these costs are treated in the books of accounts

e. Bad debts

The deduction of bad debts is allowed for tax purposes but a bad debt is regarded as

irrecoverable only if the loss has acquired a final and irreversible nature during the fiscal

period. Exactly when a bad debt becomes irrecoverable is an issue of fact and the final

decision lies with the tax department, but the business must have good evidence that the debt

is not recoverable.

To be considered irrecoverable the bad debt must meet certain conditions in order to be

fiscally deductible (article 28DTI):

• This bad debt has been previously included before in the income of the taxpayer;

• The bad debt has then been cancelled for accountancy purposes;

• The taxpayer has taken all reasonable steps to recover the debt and has conclusive

evidence confirming the insolvency of their debtor or other proof of inability to pay.

f. Recoverable losses

As its name indicates, income tax relates to profits earned by a taxpayer. However a taxpayer

may not generate profits during a fiscal year. He/she can also incur losses. In this case, not

only does the taxpayer avoid a tax liability during the fiscal year, he/she also has the right to

carry forward this loss to the next year, so that profits in year 2 can be reduced by the loss

incurred in the year before – up to five years before.

LOSSARY

12

Article 29: Loss Carried Forward

If the determination of business profit results in a loss in a tax period, the loss may be

deducted from the business profit in the next five (5) tax periods, earlier losses being

deducted before later losses.

However: per Article 20 of Law 16/2005 (DTI) “A loss in tax period in which a long-term

contract is completed may be carried back and offset against previously taxed business profit

from that contract to the extent it cannot be absorbed by business profit in the tax period of

completion

However, losses incurred overseas cannot be offset against any profits of Rwandan origin

during the same fiscal year, or against any future or previous profits of Rwandan origin.

Article 29 Para 3 (DTI) If during a tax period, the direct and indirect ownership of the share

capital or the voting rights of a company, whose shares are not traded on a recognized stock

exchange changes more than twenty five per cent (25%) by value or by number, paragraph

one of this Article ceases to apply to losses incurred by that company in the tax period and

previous tax periods.

Article 20: Long-term contract

The timing of inclusion in and deduction from business profit relating to a long-term contract

is accounted for on the basis of the percentage of the contract completed during any tax

period.

The percentage of completion is determined by comparing the total expenses allocated to the

contract and incurred before the end of the tax period with the estimated total contract

expenses including any variations of fluctuations.

a. Long-term contracts

Within the meaning of the law, a long-term contract is a contract for manufacture, installation

or construction, or the provision of services relating to these activities, which is not

completed during the fiscal year in which it began. This excludes any contracts whose

completion was at the outset envisaged to be within twelve (12) months of commencement

(art.20 DTI).

For these contracts, the following rules apply:

• Business profit relating to a long-term contract is accounted for on the basis of the

percentage of the contract completed during any tax period. As per ISA standard

IAS 11, the percentage of profit is calculated from the percentage of completed

and takes into account estimation future costs. Effectively, if the estimated final

cost is expected to be greater than the sale value, then 100% of the loss to date is

taken to the SoCI.

• Para 3 allows that where a long term contract subsequently makes a loss where

previously a profit was anticipated and duly assessed, the realised loss can be

offset against the previously taxed profit of that contract. Where the overall

LOSSARY

13

business profit is insufficient to cover the loss, the loss can be set against the

profits attributed to that contract in previous years.

A is performing a long-term contract which started in Jan 2010 and expected to last until

2012. At the end of 2010, completion so far was calculated as 25% and the final sale at

Rwf1,000,000,000 and expected profit was 10%, Rwf100,000,000. Rwf25,000,000 would

have been assessed at 30% payable to RRA.

At the end of 2011 the valuations were 70% complete and profit was expected to be 7.5% of

the sale value which was now 1,200,000,000.

Profit assessable for tax = 7.5% x 1,200,000,000 x 70% = 63,000,000

at 30% = 18,900,000 less 30% x 25,000,000 charged in 2010.

If in 2012 the contract is completed as forecast in 2011, the tax charge for 2012 would be:

7.5% x 1,200m x 30% = Rwf27m less tax charged in 2010 and 2011

But suppose the contract finally made a loss of Rwf20,000,000 and the remaining business

profits were not sufficient to cover this sum, the profits of the previous years could be

adjusted by readjusting the profit of the long-term contract from Rwf63m to Rwf 43m. In

this way tax due in respect of the previous year could be adjusted downwards and a refund

added to the calculation for the current year.

Readjusted tax for 2011: 30% of Rwf43m = Rwf12.9.

Tax paid in 2011 was Rwf 11.4 m. Tax refund = Rwf1.5m

b. Agricultural and breeding activities

The tax law exempts from tax the income arising from agricultural and breeding activities if

annual turnover does not exceed twelve million (12.000.000 Rwf) Rwandan francs during a

fiscal year (Article 18 DTI).

This measure is intended to take into account the significance of these activities in the

Rwandan economy reality where more than 90% of the population relies on subsistence

agriculture with the sale to local markets of any surplus from their harvests. However, when

the value of such sales exceeds the amount indicated, the law takes the view that the related

agricultural activity is no longer one of subsistence. Therefore, the income of these activities

will be taxed.

If the business profits are less than 20,000,000 francs i.e. the business is “small” (Article 2 of

DTI) then the tax assessed could be a lump sum of 4% of turnover.

The law is not specific regarding produce taken from the farm into the home, but the

wording refers to turnover and so it might be assumed that the turnover is that portion of

output which is sold in a market and not used in the home.

C Assessment of tax

LOSSARY

14

1. Business size = i.e. Turnover

Where a business falls within the category described in Article 2 section 6º DTI) and the

annual turnover is less than 20,000,000 francs business tax can be levied at 4% of turnover

(Article 11 – 2 of DTI). It also applies to other taxpayers who may have elected to adopt this

mode of taxation.

However, these small businesses can choose to be taxed on their actual profits according to a

simplified accounting method determined by Ministerial decree (Article 17 DTI).

Suppose that your turnover is 19,000,000, and you elected not to prepare accounts or

complete a tax return you would declare and pay tax at 4% of Rwf19 million. This would be

Rwf760,000

Grossed up at 30% this would be equivalent to a taxable profit of Rwf2,533,333 or a profits

to sales ratio of 13.3%

If your profits were say 10% it might pay to do the accounting:

Example:

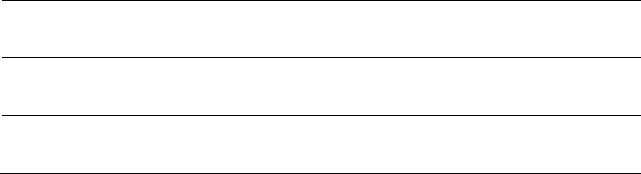

Fred runs a business. He is the sole “employee”:

SoCI

SoCI

SoCI

Rwf

Rwf

Rwf

Sales (T/O)

19,500,000

19,500,000

19,500,000

Cost of sales

17,550,000

16,900,000

15,000,000

Profit assessable to tax

1,950,000

2,600,000

4,500,000

Tax at 30%

585,000

780,000

1,350,000

Profits available for distribution

1,365,000

1,820,000

3,150,000

Profit % sales

10.00

13.33

23.08

Tax at 4% of turnover

780,000

780,000

780,000

Advantage of 4% tax

(195,000)

-

570,000

i.e. + means more to spend

A profit of 13.3% of sales is the point at which the 4% on T/O is the same as 30% on profits.

A return on sales of less than this means that doing the accounts and preparing a proper return

might pay off – how much will be spent doing the accounts?

On the other hand, greater profits would make the 4% turnover tax more attractive.

In the example above, Fred’s business at 4% would attract tax of Rwf780,000 and this is

much lower the 30% tax bill if his assessable profits were Rwf4,500,000

If a business is profitable, and the turnover is less than Rwf20 million per year, it is unlikely

that the 4% tax on turnover would be disadvantageous.

LOSSARY

15

An after tax profit of Rwf780,000 is really not very much for a business and not one to aim

for simply to justify preparing accounts to reduce one’s tax bill.

Also, you have to bear in mind that the business is operated by Fred alone and if he paid

himself a salary of Rwf 8,000,000 (included in the costs above) then PAYE income tax

would be payable:

Rwf

0 – 360,000 Nil

next 840,000 20% 168,000

balance 6,800,000 30% 2,040,000

2,208,000

So in the end, Fred has 8,942,000 to spend in the year assuming PBIT

of Rwf 4,500,000

and he has paid a combined tax bill of 3,556,500 or tax at 18% of turnover.

2. Tax on actual profits

This type of taxation automatically applies to taxpayers whose annual sales turnover is equal

to, or higher than, 20 million Rwandan francs per fiscal year. The taxable amount is not in

this instance the sales turnover but the profit earned.

As is the case for income tax on employment, the assessed income is rounded down to the

nearest thousand RwF (Article 41 DTI). Whilst Article 11 says “rounded to the nearest

thousand”, Article 41 says “rounded down to the nearest thousand”

Declaration and payment of tax

Whilst an annual return must be completed and filed with the tax authorities before the 30th

day of the March after the end of a fiscal period (or the 30th day of the 3rd month where the

fiscal period does not end 31 December) it is also important to remember that a business

either as an individual or company must pay each quarter a 25% portion of what was paid in

tax for the previous year. This will become the prepayment for the current year.

If the taxpayer began his activities during the preceding fiscal year, the quarterly instalment is

equal to twenty five percent (25%) of the amount of the tax due arising in the preceding fiscal

year, adjusted by dividing by the number of months during which the taxpayer undertook his

activities during this preceding period and multiplying by twelve (12).

Suppose Fred’s business is being considered:

He made taxable income from his business of Rwf4,500,000 last year and so his quarterly

payments this year will be ¼ of 30% of Rwf1,350,000 i.e.Rwf337,500.

His salary was Rwf8m and suppose the business pays him the same this year, his monthly

salary will be Rwf666,667 and he will pay by the 15th of the month following the tax due plus

the CSR(RSSB) payments.

LOSSARY

16

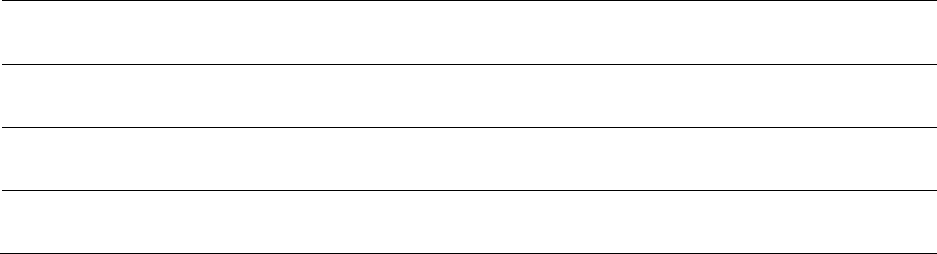

Monthly salary

666,667

PAYE income tax

184,000

CSR - employer's contribution at 5%

33,333

CSR employee's contribution at 3%

20,000

Salary

Tax due

Taxed at nil

30,000

-

Taxed at 20%

70,000

14,000

Taxed at 30% - all above 100,000

566,667

170,000

666,667

184,000

By the 15th day of each month Fred’s business will remit to RRA, Rwf237,333

being the tax due plus both the CSR contributions.

Of course the net monthly salary that Fred actual receives will be after tax and the CSR 3%

deduction namely Rwf462,667. The 5% contribution is an expense to the business.

D. Import Duties and withholding tax

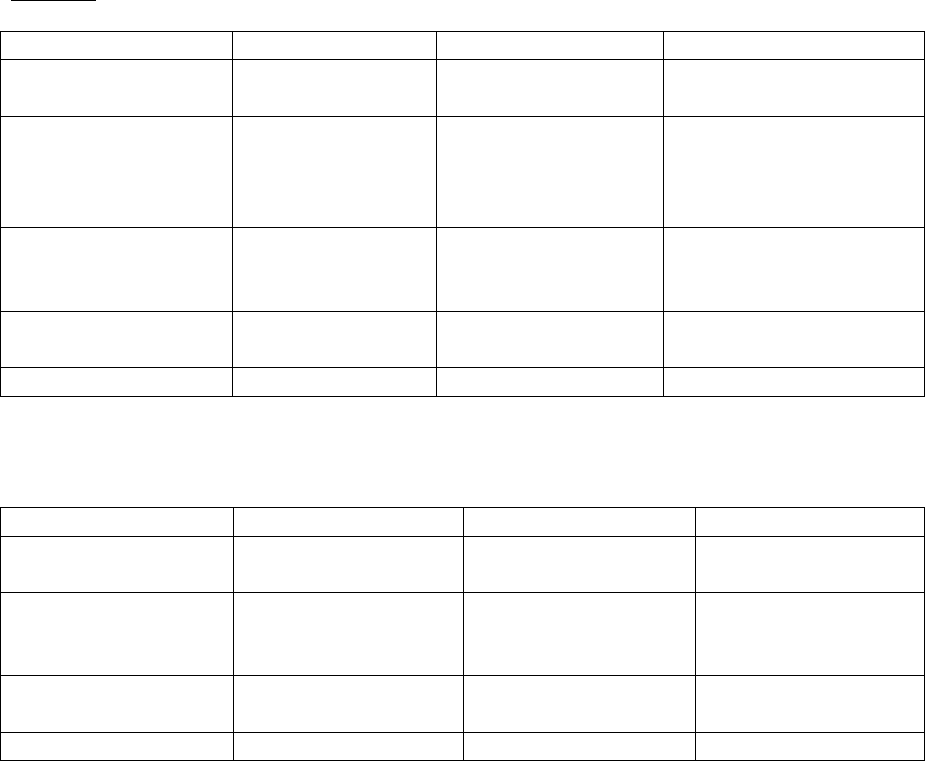

The table from RRA shows:

Product

Rwanda

EAC

Raw Materials

0%

0%

Capital

0%

0%

Intermediate

15%

10%

Finished

30%

25%

The RRA Customs tariff also states that some food product intermediaries are variable at 0%

or 5%. The EAC tariff is not yet finalised. Certain items are subject to

Vehicles are subject to more specific rates depending on engine size, and certain beverages

and other items such as tobacco ready for consumption are subject to consumption tax as

well.

Certain importations require that the importing agent in Rwanda pay to RRA 15% of the

value of the item before it is released to the buyer. In addition to the above, certain operations

are the subject to a deduction at source – withholding tax. These are imports and payments by

public institutions in relation to public tender/service contracts. (Article 52 para. 1 and 2

DTI):

• An advance calculated as five percent (5%) of the cost of the imported goods, including Cost

Insurance and Freight (known as CIF) when regular commercial practices are applied to

transactions involving these goods. A withholding tax of three percent (3%) on the sum

of invoice, excluding value added tax, is retained on payments by public institutions

to the winner of public tenders

.

LOSSARY

17

However such deductions at source do not apply to the taxpayers who are in one of the two

(2) following categories (article 52 para. 3 DTI):

• Taxpayers whose business profits are exempt from taxation;

• The taxpayers who have a tax clearance certificate and this is granted annually by the

Commissioner General of the RRA. This final tax scheme applies only to "good

taxpayers" i.e. those with a good tax track record such as timely submission of tax

declarations, prompt payments of tax liabilities and those who do not have tax arrears.

E Tax on investment incomes

Tax base

As far as investment income is concerned, the tax law aims to tax any payment received in

cash or in kind by an individual in the form of interest, dividends, royalties or rent and which

was not taxed as a business profit (art.32 DTI – Income from Investments). In other words,

any income from investments received by commercial companies will not be subject to

withholding tax if the quarterly tax calculations include this income. (Section 3 Article 31

DTI).

Income in the form of interest includes any income arising from loans, deposits, guarantees

and current accounts. It also includes income from government securities, income from

bonds, and negotiable securities issued by public and private companies and income from

cash bonds

Dividend income, as mentioned in the Law No 16/2005 on Direct Taxes on Income, is

subject to a flat tax of fifteen percent (15%).

If dividend distribution was subjected to withholding tax as stipulated in the law, the taxpayer

does not pay tax on income.

Dividend income includes income from shares and similar income distributed by companies

and other entities.

In the determination of business profits of a resident company, dividends and other profit-

shares received from a resident entity are exempt.

The profits which pay dividends have been taxed at 30% before the dividend is deducted.

One could thus argue that the dividends have already been subjected to tax.

Income in the form of dividends includes income arising from shares and participation in the

profits in any type of company as well as similar incomes distributed by any entity

enumerated by article 38 of the law. Withholding tax is 15%

The term "royalty income’ includes all payments of any kind received as a payment for the

use of, or the right to use, any copyright of literary, craftsmanship or scientific work

including cinematograph films, films, or tapes used for radio or television broadcasting. The

term also includes any payment received from using a trademark, design or model, computer

application secret formula or process. It also includes the price of using, or of the right to use,

industrial, commercial or scientific equipment or for information concerning industrial,

LOSSARY

18

commercial or scientific knowledge. Royalty income also includes payments for natural

resource payments. Again tax is 15% flat rate

Rental income: All revenues derived from rent of machinery and other equipment and land

including livestock in Rwanda, are included in taxable income, reduced by:

a) ten per cent (10%) of gross revenue as deemed expense;

b) interest paid on loans;

c) depreciation expenses as determined according to Article 24of the DTI. Income

derived from the rent of buildings or houses incorporated as assets mentioned in

Article 38 of this law is subject to corporate income tax and is exempted from rental

income tax.

Rental incomes arising from houses and buildings incorporate as assets of qualifying entities

(Art 38) are subject to corporation income tax and are exempted from rental income tax.

(Article 36 DTI).

Finally, it should be noted that some incomes can be compared to investment income as they

are deducted at source using a rate identical to that used on investment income. These

incomes include any profits from the lottery or any another games of chance (art. 51 DTI).

And yet more finally, lottery and gambling winnings are also subject to withholding tax at

15% and this deducted at source.

All withholding tax agents must complete returns and payments within 15 days of the period

end,.

F Payment of tax

The rate of income tax applied to investments is not applied on a progressive basis as is the

case for the majority of income tax payments described above. They are instead applied using

a proportional rate which is fixed at fifteen percent (15%) of the assessed incomes (Article 33

parag.1 DTI).

“A withholding tax of fifteen percent (15%) is levied on the following payments made by

resident individuals or resident entities including tax-exempt entities:

These incomes are any dividends, except those paid between companies, any interest paid on

deposits, royalties, payments for performance by musicians, artist sportsperson and the profits

of lotteries and other games of chance which have a monetary value (Article 51 DTI). The

payments are subject to tax even when paid by or through an entity not resident in Rwanda

For other investment incomes (interest other than that paid on money deposits, or rental

incomes, other than those on houses and buildings and received by physical persons) the