E20 0043_Mortgage_Loan_Accounting 0043 Mortgage Loan Accounting

E20-0043_Mortgage_Loan_Accounting E20-0043_Mortgage_Loan_Accounting

User Manual: E20-0043_Mortgage_Loan_Accounting

Open the PDF directly: View PDF ![]() .

.

Page Count: 14

MORTGAGE LOAN ACCOUNTING

Progressive

commercial

banks,

savings

banks,

savings

and

loan

associations,

mortgage

servicing

companies

and

insurance

companies

long have

recognized

the

advantages of

utilizing

IBM

Data

Processing

Systems

for

Mortgage

Loan

Accounting.

The flexibility of

the

IBM Method

permits

the

design

of

procedures

to

meet

individual

needs.

For

instance:

A

number

of

customers

are

using

the

IBM 557

Interpreter

with Selective Line

Printing

to

automatically

print

their

Ledger

Cards.

Other

customers

use

the

IBM Balance

Cards

as

their

Ledger

Records

and

periodically

use

them

to

list

an

Historical

Record

of

transactions

and

balances

by

mortgagor.

A copy of

this

listing,

showing prinCipal,

interest,

escrow

payments

and

escrow

disburse-

ments,

mailed

to

the

mortgagor

at

year

end,

eliminates

inquiries

for

data

to

support

income

tax

returns.

The

customer

whose

procedure

is

described

in

this

book

prepares

his

Ledger

Cards

on

the

IBM 954

Facsimile

Posting

Machine.

On

mortgage

billing,

the

IBM Method

is

sufficiently

flexible

to

be

efficient

whether

a

bill,

a

passbook,

a coupon book

or

a

receipt

plan

is

utilized.

The

IBM

prepared

bill,

on

paper

or

an

IBM

card,

is

an

extra

dividend

achieved

through

use

of

the

IBM

Data

Processing

Machines.

In addition

to

the

regular

accounting functions,

the

use

of IBM

machines

makes

possible

the

preparation

of

special

analyses

for

audit

and

management

purposes.

These

analyses

may

take

the

follOwing

suggested

forms:

mortgage

property

analysis

by

type

of

property,

by

location

and

type

of

mortgage,

and

by

type

of

mortgage

and

amortization

status.

Installations

of IBM

Data

Processing

Systems

are

currently

serving

customers-

whose

portfolios

vary

from

less

than

2000

to

over

100, 000

mortgages.

1

2

PROCEDURE

The following

is

a

brief

description

of

the

way

in

which one

customer

has

met

and

solved

his

accounting

requirements.

NEW

LOANS

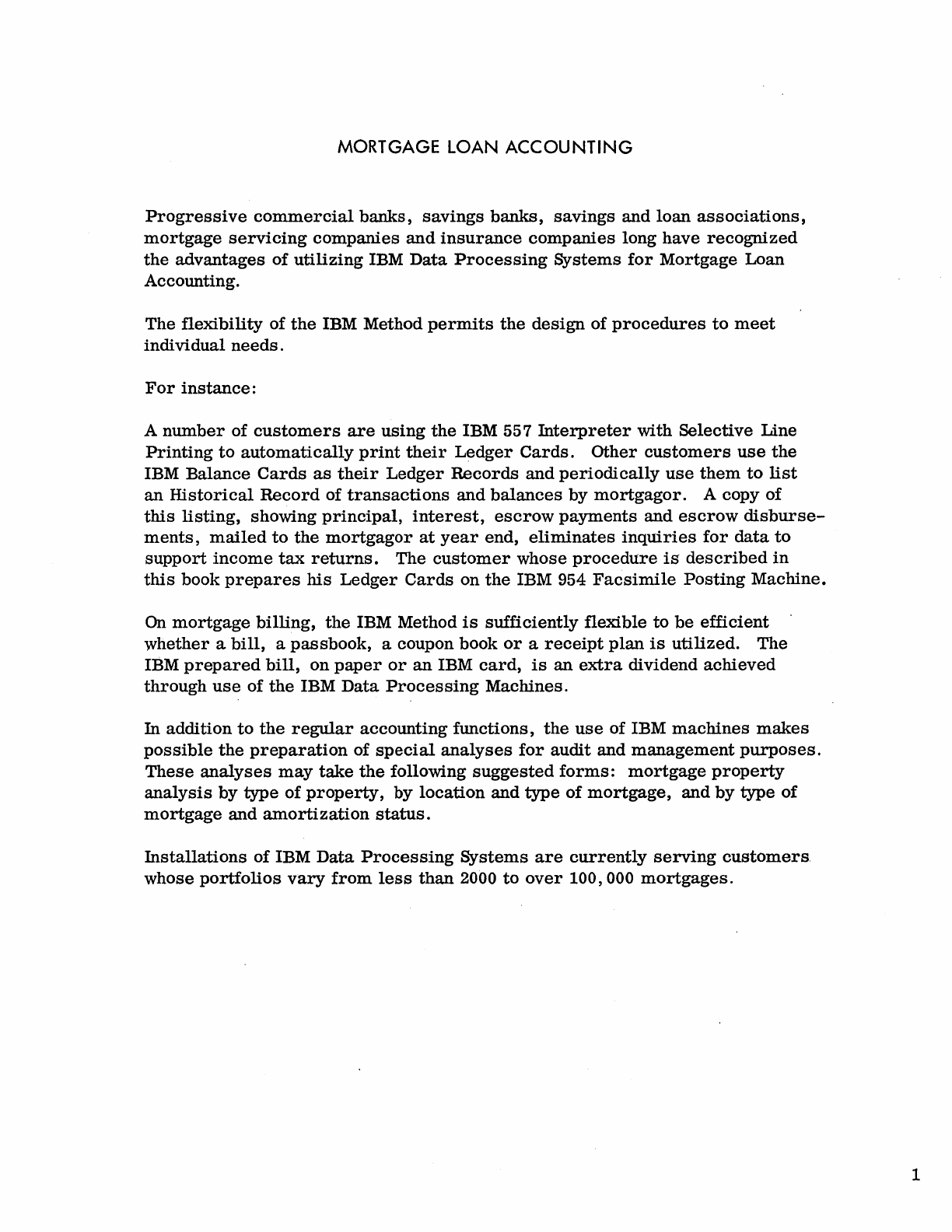

1. Name

and

Address

Cards.

They

are

used

in

the

printing

of

the

mortgagor's

name

and

address

and

the

location

of

the

property

on

the

mortgage

bills.

These

cards

are

filed

in

account

number

sequence

for

each

day,

period,

and

kind of

mortgage,

and

are

used

repetitively

in

each

billing

period

during

the

term

of

mortgage.

C

BlN

NUMBER

K

RATE

P

DAY

NAME

.R

.~ESS

•• AGEN'

too,

013520811

451

II

10

III

846

MONTCLAIR

ROAD 1

CAR~

BUNUNBER

K'

RATE

SP

DUE

DATE

•••

• •

••

ME

OR

ADDRESS A iENT

100010

ODD

00

10

DO

000000001000000000000

00000000

00000000000000000000

00000000000000

00

1 2 3 4 5 •

119

1011

213 415

'O""~~~~N~anna»~~~~~s

313131404142

4344

~.u.a~~U~~"~~~9~~uaM

&5111111191011n1l141511n1l

1910

'"

BaM

I~:/E

g!

oj

I NAME

OR

IoDRESS

1 AGENT

5

NUMBER

<.>

222122

222

22 22 22

222222222222222222222

22222222

2222222222f222222222

22222222222222

22

313333

333

33 33 33

33333333111333333

3333333333333333

33333333333333

33

444444

414

44 44 44

44144144444444444

I

4444444444444444

44444444444444

44

551555

551

55555551555555555

MORTGAGE

NAME

OR

ADDRESS

55 55 55

5555555555555555

55555555555555

55

666666

666

6 6 66 66

666166166666666616666

66666666

66666666666666666666

66666666666666

66

777777

777

77 77 77

7777777

7 7

777 777

7 7 77 77

77777777

77777777777777777777

77777777777777

77

888881

888

88 88 88

81888888888888888a888

88888888

88888888888888888888

88888888888888

88

99999999999999999999999999911919999999999999999999999

9 9 9 9 9 9 9

99999999999999999.999

1 2 3 4 5 • 1 1 •

10

11

12

13 14 15

1&

11

II

19

~

21

~ ~

24 25

a

21

n a »

31

l2

~ ~

l5 S

31 31

31

jO

41

42

43

44

~

•

41

•

41

50

51

U

~

~

"

~

51

~

11110

11

U a M

&5

66&1

II

19

10

11

12 13

14

15

?,

n

11

11.

IBM

7B499~

2. Mortgage

Transaction

Cards.

These

cards

are

used

for

the

calculation

of

interest

charges,

principal

and

escrow

payments,

principal

and

escrow

balances,

the

preparation

of

bills,

and

the

establishment

of accounting

controls.

/

Ci

III

IUlm

!K

RITE!

s!

P I

DAY!t~

•.

A!YI]UAIS

I!TERESIT !

ESC~OI

IIlllCE

!

P~INCIP1L

BAL~NCE

I

loill

P1!1EIIl

I

m'Rol

P1I:EIT ! FRllcl'm

PIU'EIT

!

BiRO'

8ll:~CE

!

P~INCIP1L

BAL~NCE

3520811101105

1

~

15,051,62,,21

4,014,041

15,531

,

13

1

421,

77,651

41

000,62

BaM

NUMBER

Kip

I

DAY

I

MO.

lUIS.

A INTEREST

ESCROW

BALANCE

I PRINCIPAL BALANCE I

ESCROI

pmm

I PRINCIPAL

PAYMENT

I

ESCROW

BALANCE

I PRINCIPAL BALANCE

~

: : : I I ; : I

'I

I:

~

: I I I

000010000

101010000011:100:1011:100:001:110:10

OliO

11:10 0:1111:10

0:0

0

11110

0:0

0

1110

0:0

0 1:110:111:0 0

] 4 I 9

117

I] I

I!

II II

~B

71:"

'l

24k5

26

21

I I , I • • I I I I I

16~

5566:616869:10

1112:13

14

15b6

7118:19

80

:i!

B6M

I

~

:;j'd~

~

~

INT l T ESCRO.....

PRINCIIL

TOTAL

OR

EStOW

PRINCIAL

ESCROW

PRINCIPAL

~

NUMBER

i<

~

:l;

P

DAyi%

~ ~

~

E S BALANCE BALANCE

~~~~Tt~;

PAYMENT PAYMENT BALANCE BALANCE

1,2

2

.2

2 2 2 2 2

212

212

21212

2

212

2i2

2

2i2

1. 1.

1.:1.

1.

I;:

11.:1.

1.

1.:1.

1.

m

11.

2:2 2

2:

2

212

2 2:2

22

2

2i2

2

2i2

12

2:2

2

2i2

2

2:2

2

2:2

2

2:2

I

I I I :

::

: I I : I I I

31333

3 3 3 3 3

333

3 3 3 3 3 3 3

3:3

3

3:3

3 3

3:3

3

3:3

333:3 3 3:313 3

3:3

3

1:3

3 3

3:3

3

3:3

3

3:3

3

3:33

3:3

3

: 1 I : I I

::

: I : : :

444444414444444444444:44

4!4

4 4

4:4

44:4

MORIAGEIRtiSACTlcil

444:444:44444:444:1444:444:444:441:444:44

• I I I I i I I I • • : •

551555551555551555555:551:5155:555:5

ill:J;:J:J

:Ji:J:J

:J1:1:1:1

:11:1:1

:I!:I 5 5

515

51115 5 5

5:5

5

5:5

5 5

5:5

5 5:515:5 5 51

5 5

5:5

5

I : I I : : i : :

::

::

: I : : :

666666666666666666666:666:6666:616:666:666:666:666

6'6

6

6,6

6 6

616

6

6:6

6 6 6

6:6

6

6'6

6 6

6'6

6

6:16

6:6

6

6:6

661

16

• : : : • I • : :

::

I:

: I : I :

7777

7 7 7 77 7 7 7 77 7 7 7 77 7

7:77

7:7

77

7:7

7 m 7 m 77:77

7:7

77 7:77 7:77 7 m 7

717

7 77 71

7 7 717

777'71.777'777:777:77

1 : I : : : : I I

I:

::

: I : I I

888881888888888888888:888:8888:888:888:888:8881888

818

8

8:8

8 8

818

8

818

8 8 8

8:8

8

8:8

8 8 81

8 8 818 8 81888:8881

88

1 I : : I : : : :

::

I I : : : : :

999999999

9 9 9 9

99999999:999:9999:999:99

9:9

9

9:9

9

9:9

9 9

9:9

9

9:9

9 9

919

9

9:9

9 9 9

9:9

9

9:9

9 9

9:9

9

9:9

9

9:9

9

9:9

9

919

9

1 2 3 4 5 & 1 1 9

10

II

12

13 14

15

1&

1111

19

20

21122

23

24125

21

2121129303113233

41353631.31394014142

3441454641.4149505115253541555&

15151

59160

6162163

6465

6616168

6911011121131415116111811980

I

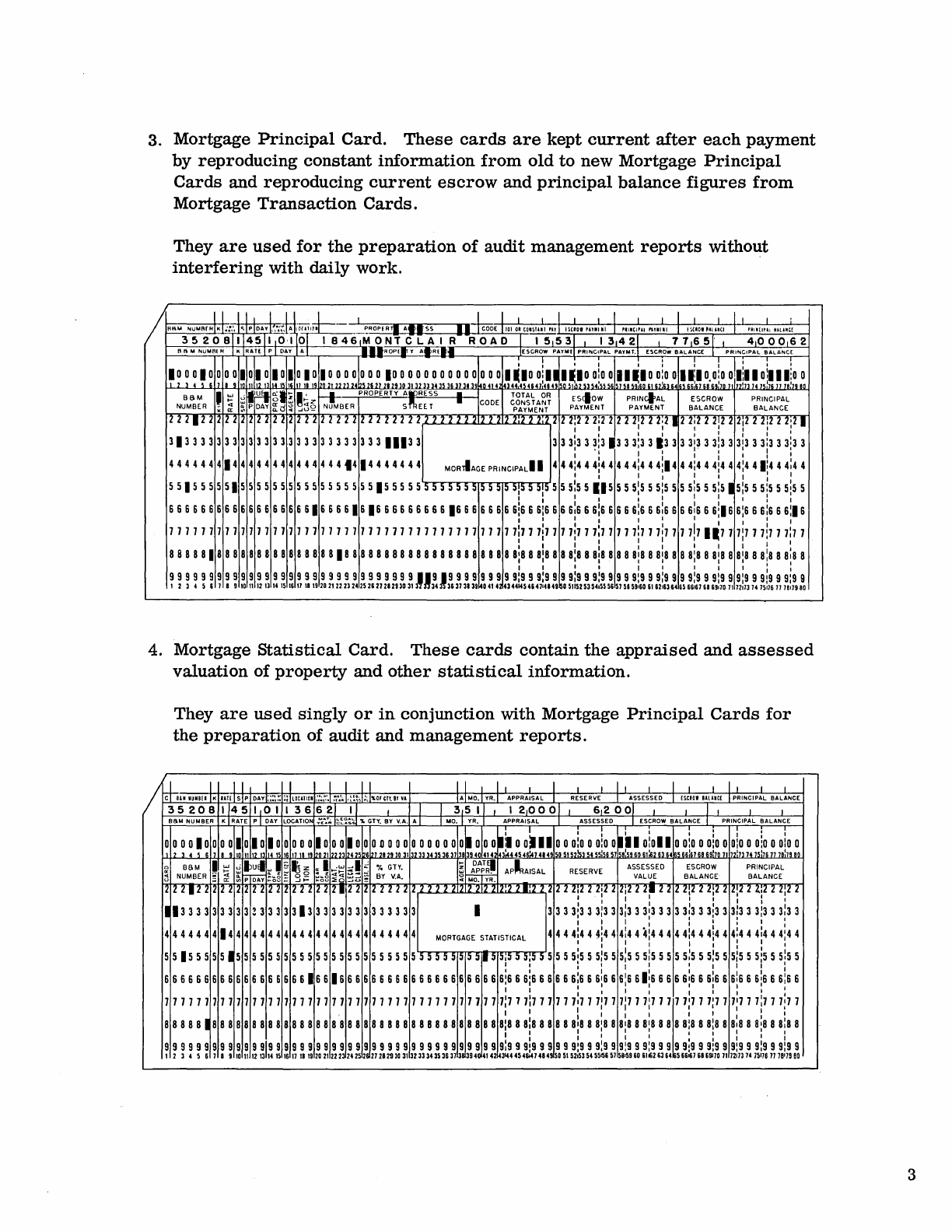

3. Mortgage

Principal

Card.

These

cards

are

kept

current

after

each

payment

by

reproducing

constant

information

from

old

to

new Mortgage

Principal

Cards

and

reproducing

current

escrow

and

principal

balance

figures

from

Mortgage

Transaction

Cards.

They

are

used

for

the

preparation

of audit

management

reports

without

interfering

with daily work.

/

H""

NU"RrH1KL:...I~lpIDA.!.'

..

;:.M,-m,I~·

,

PROPIR'II

A

••

55

I I I , I , , I I I I ~ I

11

I

••

1

CODE

10101

COIIIIII

'"

1

IlelOI

"""I

1

'IIIe,""

"1IIl(

ISelOUAIntl

I

PlII.(I~l:

UU"Cf

35208114511,010118461MONTCLAIR

ROAD

1 I

5,531

,

13,421

,

77,651·

I

4,000,62

R"

"

Nu"BI

H

~

K

RAllJ

P

~

DA'

AI

".RDPII"

A.RIM

IESCROW

PA'''TI

PRINCIPAL

PA'''T.I

ESCROw BALANCE I

PRINCIPAL

BALANC[

, i

1.1

00;00

11.1

00;00

I :

Iii

I o:lllio 0

100010

o 0 0

10

10

10

1010

10000000

100000000000

00 0

1.100ili

11:10,0:00

.LZ..l4~6

119

10;11

:,21l

114

,~

1611l1,q

I,n"

"""

12&

2121293031

4 I

169:1011

112!13

141~:I&

II

18:19

10

B8M

I

~

~~

~

~!

E

~~z

• PROPERTY

AWl_RESS

•

TOTAL

OR

[stow

PRINciAL

ESCROW PRINCIPAL

N~MBER

S~EE

T •

CODE

CONSTANT

NUMBER

"

~

~

.....

jg

PAYMENT

PAYMENT

PAYMENT

BALANCE

BALANCE

1222122

l

122

1212

122

12

2

1212

2 2 2 2 2 2 2

12

2 l 2 2 2 2

2,"}

"} "} "}

12

Z

2:222:

12

2i2

2

2:2

2 2 2

2:2

2

2;2112

2:2

2

212

212i2

2

2i2

2 2;21

313333

I I I I I I I I I

3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3

33311133

3 3

3:3

3

~:3

13 3

3:3

313

3 3

313

3

313

3

313

3

3:3

3 * 3

I I

I'

I ' I I I

4 4 4 4 4 4

414

4 4 4 4 4 4 4 4 4 4 4 4 4

1414

4 4 44 4 4 MORriAGE

PRINCIPALII

4 4

4:4

4

4:4

4 4 4

4:4

4 4:14 4

4:4

4

4:4

4

4:4

41:4 4

4:4

4

I,

I I I I I : I

55155555155555555555555555155555

:i:i

5

555515551551555:5555:55115555:555:5555:555:515:555:5

5

5:5

5

I I I I I I , , I : I

6666666666666666661

6

666161666666666

166666666:66616666:666:66666:666:66661666:166:666:6

6 6:16

I : : I

I:

I I I : I

7 7 1 7 7 11 7 7 7 7 7

111

7 11 7 11 7 7 11 7 7 1 71 77 7 7 7 77 1 7 7 7 1 7 7:77

717

7 1

117

11:111111111111111111111'1

7

1111

7:11

I ' I I

,I

I

"I

I ,

'I

I I I I , I

88888188888888888888818888888888888888888888188

8:a

a a

a:a

a

al8

a 8 8

8'8

8

8'8

888:888'888'88

a:8

a

a:8

a

: I

I:

::

I : : : :

999999999999999999999999999999

91~919

9 9 9 9 9 9 9

9:9

9

9:9

9 9

9:9

9

9:9

9 9 9

9:9

9

9:9

999:999:999:999:999:99

1 2 3 4

~

6 1 8 9

10

11

12 13 14

I~

16

11

18

19

20

2122

23 24

2~

26

21

2129

3031

34

36313139140414

43

441454641'414950

~1152

5354.~5

56 51 51

591606162163

64

6B6.61

68

69.10

11

1211314

15116

1118.1980

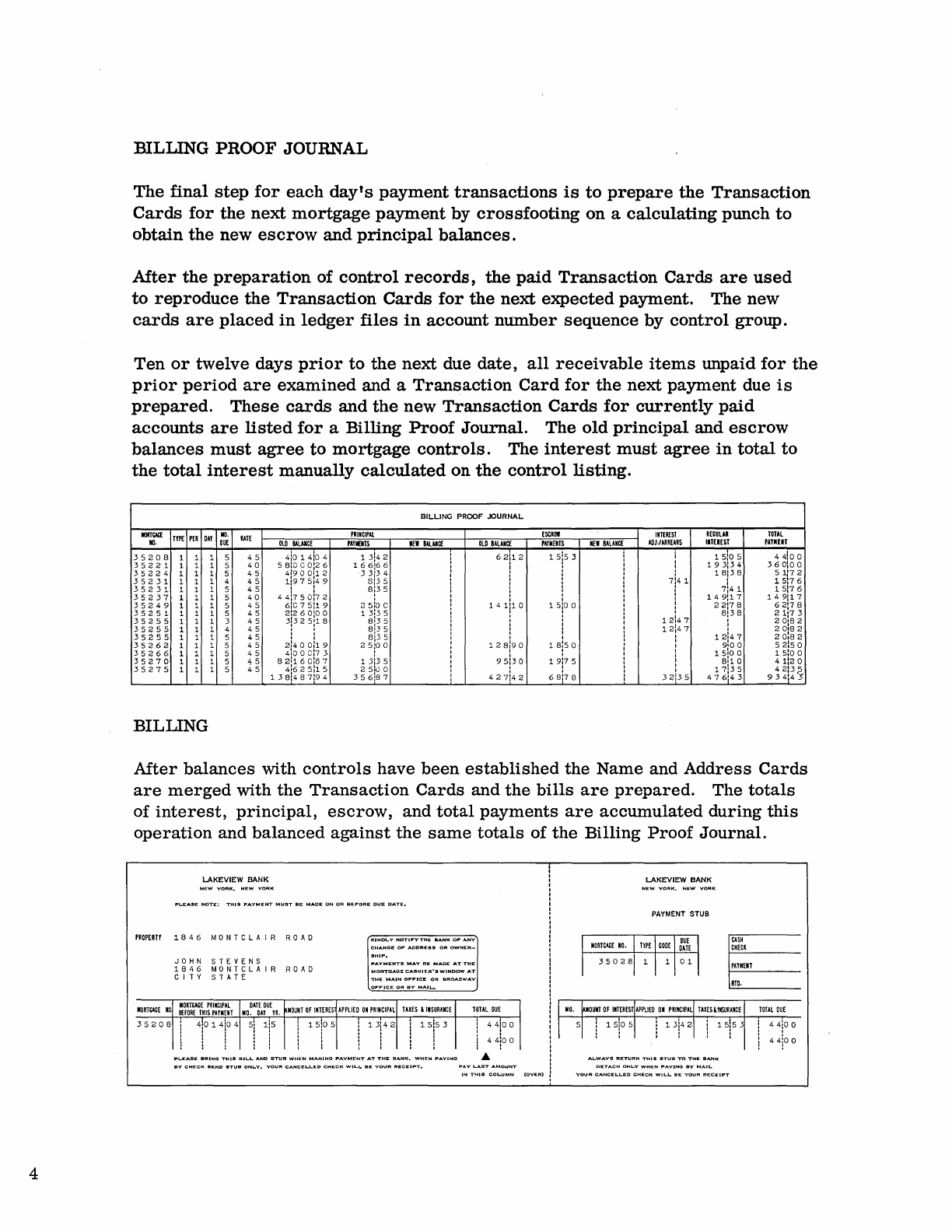

4. Mortgage

Statistical

Card.

These

cards

contain

the

appraised

and

assessed

valuation of

property

and

other

statistical

information.

/

They

are

used

singly

or

in

conjunction with Mortgage

Principal

Cards

for

the

preparation

of audit and

management

reports.

I I I I I I I I I I

II

II

, I , I

I,

I I I I

II

I I

C

8U

nU[I

K

ut(

SiP

OA!l~~:~::

~HlOC1TJO.

c·:~lo.:J:("

..

'~lr~~~;;~

,,"crenal

VA

A

"0.

'R.I

APPRAISAL RESERVE I ASSESSED I

ESCROI

ULilCE 1 PRINCIPAL BALANCE

35

208

1145

110 I 1

36

6

21

II I I

3,5

I I

12,0001

I

6,2001

, , I , , ,

BS"

NU"BER

K I

RATE

P I

DAY

LOCATION

y .... t

..

T

'"

I~~~~'&I

%

GTY.

BY

V.A.

AI

I

"0.

I YR. APPRAISAL I ASSESSED I ESCROW BALANCE. 1 PRINCIPAL BALANCE

0.0

• I , :

••

101011

o

0:0

0

oio

0 : : .

000010

000

10 10

10

o

000

10

00

10

0011000

000000

00

••

00111

o

O,~b~

00:00 0:00 0:00

oio

0

lil2

3456

11119

lioll1

li213

1415

161111819

20"

".

I

..

21293031

38139401

414

143~44546:"141

49

15051

1545515651

8:596061~26J64

6566:6768691101

J21J3H1SI1611J8:J980

0 B8M I w

~tu.

~,

~,z

~~,

.w

§!

~

%

GTY.

§

~~:,

AP~AISAL

RESERVE ASSESSED

ESCROW

PRINC'PAL

~

~

!;i~

..

NUMBER

e;

P'oAv

~:;8

~

g~

::'0

~

BY

V.A.

~IMO.IYR.

VALUE

BALANCE BALANCE

12122

12

2!ZIZ

ZI2121Z

Z Z Z

21Z

Z Z l

liZ.

Z 2121222222222221212212212:221:222122

2i2

2

2i2

212:2

2

2[12

2 2

212

2

2:2

2

2!2

21.;222:22

I :

':

I.::.

'1133333333

3

~

33333133333333333333

I

3333:333:333:333

1

33333:333:333:333:333:33

I ,

':

: I : I :

44444441444444444444444444444444

MORTGAGE

STATISTICAL

4444:444;444:444:44444:444:444:444:444:44

: I : I : I : : I

55155555155555555555555555555555

!!

5 5 5

51!!1:J

51

:JI:J;:J:J

5;5

5 5 5 5

515

5

sIs

5

515

5

5:5

5 5 5

5.5

5

5:5

5

5:5

5

5:5

5

5:5

5

::

::':

::

I : :

6666

666

6 6 6 6 6 6 6 6 6 6

616 616

6 6 6 6 6 6 6 6 6 6 6 6 6 6 6 6 6 6 6

6:6

6

6:6

6 6 6 6

6:6

6

616

6

6:6

611

6 6 6 6

616

6

616

6

6:6

6

6:6

6

6:6

6

I I

::

I:

:::

I :

1111111111111111111111111111111111111111111:111:111111'111:111:111:llll:III:II1'111:111'11

,

,I

: I

,I

I I : : :

88888188

a 8 a a 8 8 8 a 8 8 a a a 8 8 8 a 8 8 8 8 8 8 8 8 8 a 8 a 8 8 8 8 a

8:a

8

8:8

a a a 8

818

a

8:a

8

al8

8 818 a a a

a:8

8

a:8

a

81a

8

8'8

a

8:8

8

':

: I

::

:::::

99

9 9 9 9 9 9 9 9 9 9 9 99 9 9 9 9 9 9

999

9 9 9 9 9 9 9 9

99999999999:999:999999:999:999:999:999

99:9 9

9:9

9

9:9

9

9:9

9

9:9

9

1 2 3 4 5 6 1 8 9

10

11

12

,31,4

15 16

11

18 19

20

21

22232425262128293031

3233343536313839404142

314445460414849505152.535455156515815960611626364

566161686911011

12113141511611

78'19

80

3

4

BILLING

PROOF

JOURNAL

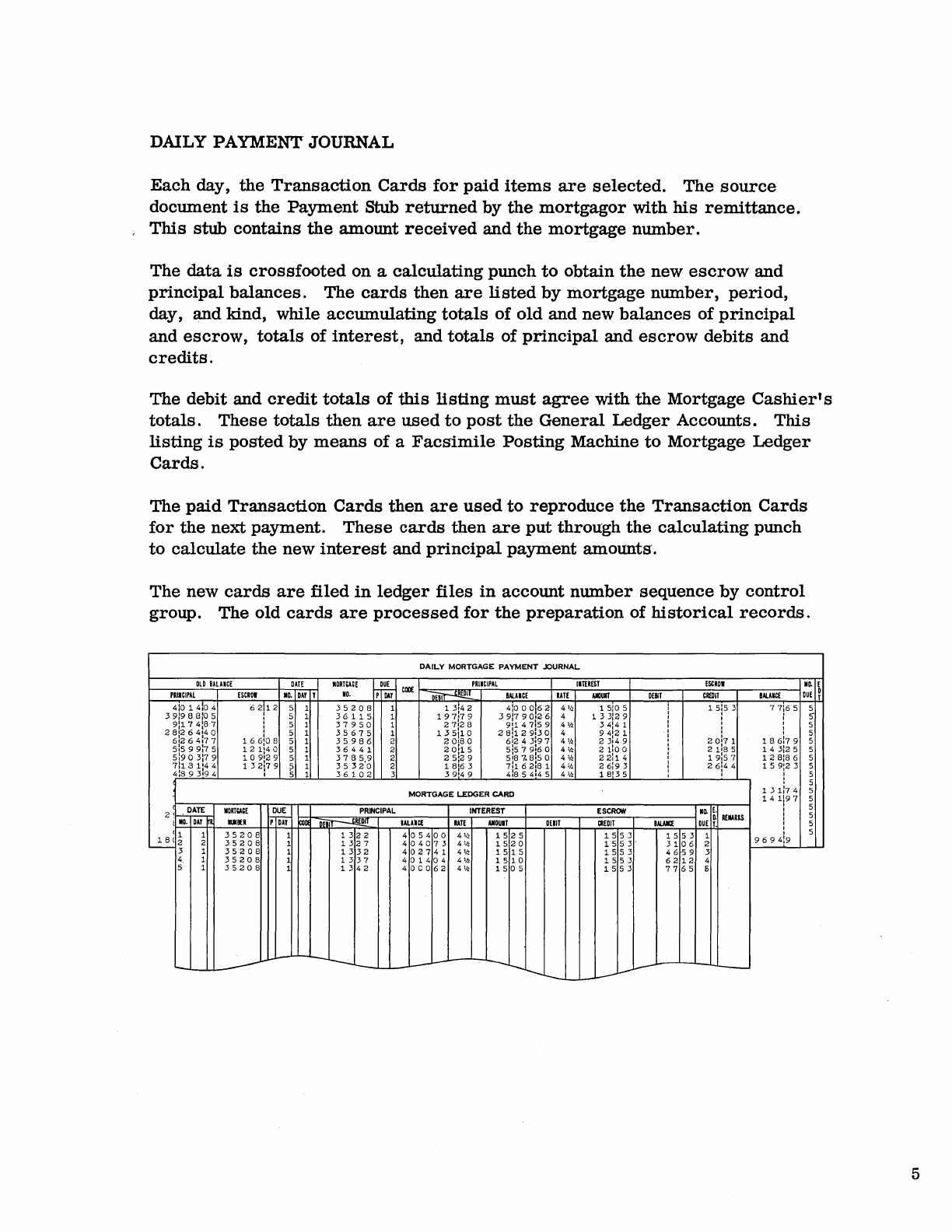

The

final

step

for

each

day's

payment

transactions

is

to

prepare

the

Transaction

Cards

for

the

next

mortgage

payment

by

crossfooting

on

a

calculating

punch

to

obtain

the

new

escrow

and

principal

balances.

Mter

the

preparation

of

control

records,

the

paid

Transaction

Cards

are

used

to

reproduce

the

Transaction

Cards

for

the

next

expected

payment.

The

new

cards

are

placed

in

ledger

files

in

account

number

sequence

by

control

group.

Ten

or

twelve

days

prior

to

the

next

due

date,

all

receivable

items

unpaid

for

the

prior

period

are

examined

and

a

Transaction

Card

for

the

next

payment

due

is

prepared.

These

cards

and

the

new

Transaction

Cards

for

currently

paid

accounts

are

listed

for

a Billing

Proof

Journal.

The

old

principal

and

escrow

balances

must

agree

to

mortgage

controls.

The

interest

must

agree

in

total

to

the

total

interest

manually

calculated

on

the

control

listing.

BILLING

PROOF JOURNAL

MORTGACf

TYPE

PER

DAY

110.

RATE

PRIICIPAl

ESCRDI

IITEREST

mULAR

TOTAL

110.

OUE

OLD

BALAICE

PAYIOTS

~EI

BAlUCE

OLDBALAICE

PAYMEITS

lEI

BALANCE

ADJ.lARREARS

IITEREST

PAlun

35208

1 1 1 5

45

410

1

4io

4 1

*2

62!12

1

sis

3 !

15\05

44100

35221

1 1 1 5

40

5810

C

0:2

6

166:66

19313

4

36

0:0

a

35224

1 1 1 5

45

41900112

3313

4 l :

18

1

38

51\72

35231

1 1 1 4

45

li975:49

8135

1

7\41

15\76

35231

1 1 1 5

45

I I 81

35

!

7\41

15:76

35237

1 1 1 5

40

4

4!7

5

0:7

2 !

14

9\17

1

49

117

35249

1 1 1 5

45

61C75119

2510

C

"'I"

1510

a

221

78

62:78

35251

1 1 1 5

45

2126

0:0

0

13135

81

38

21

1

73

35255

1 1 1 3

45

3!325i18

81

35

12:47

20

1

82

35255

1 1 1 4

45

8:35

!

12147

20182

35255

1 1 1 5

45

813

5 :

12:47

20:82

35262

1 1 1 5

45

2:400\19

2 5iO a

12

8i9

0

18

1

50

!

9'00

52150

35266

1 1 1 5

45

41000173

15100

15:0

0

35270

1 1 1 5

45

82116

C:8 7

13:35

95:30

1 9!7 5 !

8:10

41\20

35275

1 1 1 5

45

1 3

~i~

~ ~i~ ~

2

51c

0

17:35

42:3.5

356:87

427142

68178

32:35

476'43

934:45

BILLING

After

balances

with

controls

have

been

established

the

Name and

Address

Cards

are

merged

with

the

Transaction

Cards

and

the

bills

are

prepared.

The

totals

of

interest,

principal,

escrow,

and

total

payments

are

accumulated

during

this

operation

and

balanced

against

the

same

totals

of

the

Billing

Proof

Journal.

PROPERTY

MORTGAGE

NO

35208

LAKEVIEW

BANK

1846

MONTCLAIR

R 0 A 0

KINDt.,V

NOTIP'V

THE

BANK

OF

ANY

CHANGE

OF

ADDRESS

OR

OWNER_

J 0 H N

STEVENS

PAVMENTS

MAY

BE

MADE

AT

THE

1846

MONTCLAIR

R 0 A 0

MORTGAGE

CASHIER'SWINDOW

AT

CIT

Y

STATE

THE

MAIN

OFFICE

OR

BROADWAY

OI"'FICE

OR

BY

MAIJ-

MORTGAGE

PRINCIPAL

om

DUE

MOUNTOFINTERES

APPLIED

ON

PRINCIPAL

TAXESllISURANCE

TOTAL

DUE

BEFORE

THIS

PAYMENT

MO.

DAY

YR.

41

0

14104

51

liS

I 1 5iO 5

13

1

42

I 1 S!5 3 1

4410

0

! ! I I ! ! i 4

410

0

: : I i I : I

PL.EASE

BRING

THIS

BIL.L.

AND

STUB

WHEN

MAKING

PAYMENT

AT

THE

BANK.

WHEN

PAYING

BY

CHECK

SEND

STUB

ONL.Y.

YOUR

CANCEL.L.ED

CHECK

WILL

BE

YOUR

RECEIPT.

PAY

LAST

AMOlJNT

IN

THIS

COLUMN

LAKEVIEW

BANK

PAYMENT STUB

ALWAYS

RETURN

THIS

STUB

TO

THE

BANK

DETACH

ONLY

WHEN

PAYING

BY

MAIL

YOUR

CANCELLED

CHECK

WIL.L

BE

YOUR

RECEIPT

CASH

CHECK

PAYMEIT

RTD.

TOTAL

DUE

4 4!0 0

441

00

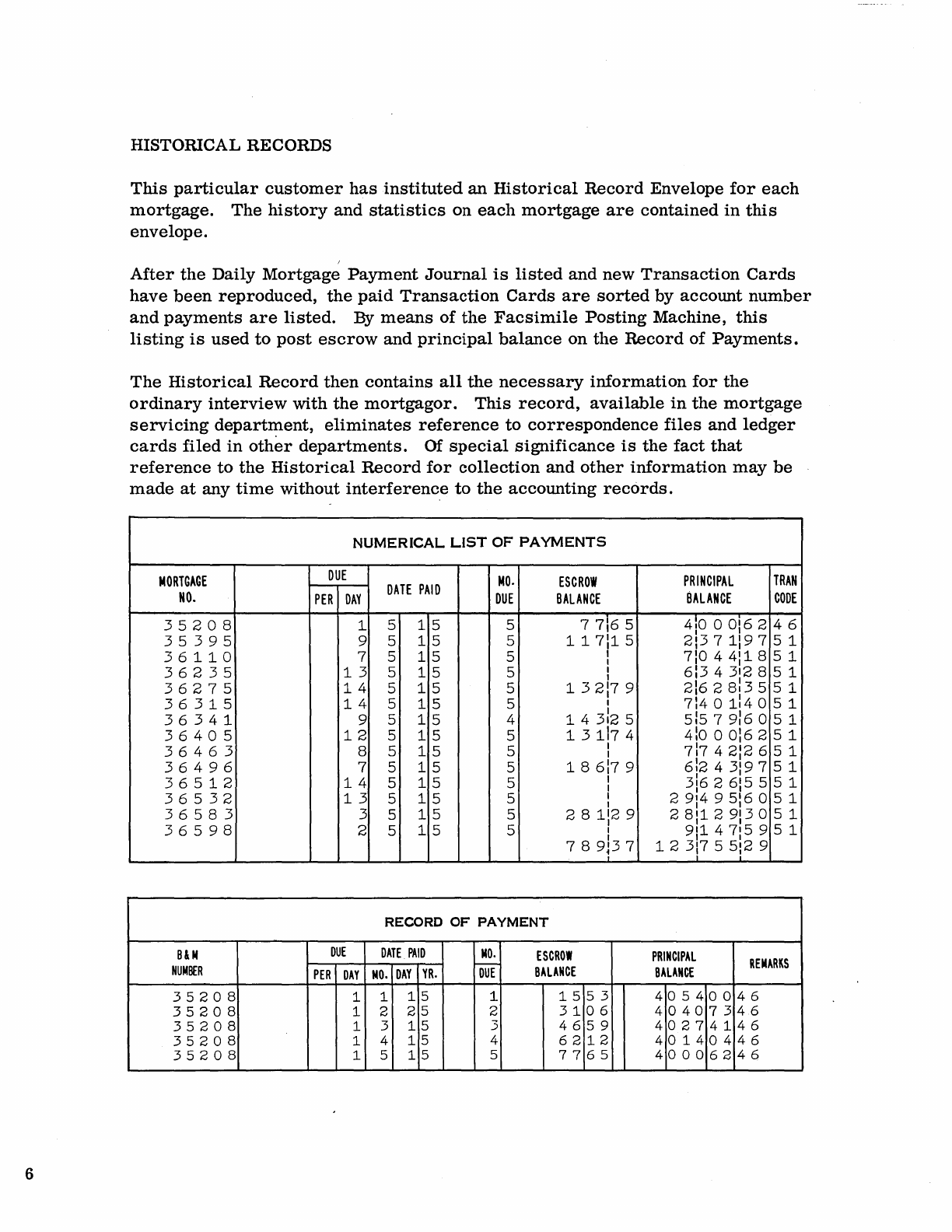

DMLYPAYMENTJOURNAL

Each

day,

the

Transaction

Cards

for

paid

items

are

selected.

The

source

document

is

the

Payment

Stub

returned

by

the

mortgagor

with

his

remittance.

This

stub

contains

the

amount

received

and

the

mortgage

number.

The

data

is

crossfooted

on a

calculating

punch

to

obtain

the

new

escrow

and

principal

balances.

The

cards

then

are

listed

by

mortgage

number,

period,

day, and kind, while

accumulating

totals

of

old

and new

balances

of

principal

and

escrow,

totals

of

interest,

and

totals

of

principal

and

escrow

debits

and

credits.

The

debit

and

credit

totals

of

this

listing

must

agree

with

the

Mortgage

Cashier's

totals.

These

totals

then

are

used

to

post

the

General

Ledger

Accounts.

This

listing

is

posted

by

means

of a

Facsimile

Posting

Machine

to

Mortgage

Ledger

Cards.

The

paid

Transaction

Cards

then

are

used

to

reproduce

the

Transaction

Cards

for

the

next

payment.

These

cards

then

are

put

through

the

calculating

punch

to

calculate

the

new

interest

and

principal

payment

amounts.

The

new

cards

are

filed

in

ledger

files

in

account

number

sequence

by

control

group.

The

old

cards

are

processed

for

the

preparation

of

historical

records.

OLD

SALAICE

PRI.CIPAL

410

1410

4

39:988:05

91174:87

28'264'40

6:264:77

5:5

9

9:7

5

5:903:79

7113

1:4

4

418 9

3'94

DATE

ESCROI

.0.

DAY

Y

6T2

I

~

166:08

5 1

12

1140

5 1

i

~

~!~

~

~

i

• 5 1

.0RTmE

.0.

35208

36115

37950

35675

35986

36441

3785.9

35320

36102

DAILY

MORTGAGE

PAYMENT

JOURNAL

P

D-ir

COIlE

.......",~=--......,..rrP:.::;:RI

•

.:.:.:.CIP;.:.:.AL-B-AlA-.C-E

-+-m--E

.,.:.:1.=TER=:.:....uIIT--+--DE-BlT-..,-----=C:.:....~::..:..I--,---BAl-AICE--lD·U~

If

1

1

1

1

2

2

2

2

3

MORTGAGE LEDGER CARD

2 ( .

DATE

ir.Q.DAY

.ORT~~E

UBER

DUE

PRINCIPAL

INTEREST

ESCROW

.0.

E.

(1

1

18

(2

2

'-----

3 1

4.

1

5 1

35208

35208

35208

35208

35208

PDAY

COli

0Ei~

1

1322

1

1327

1

1332

1

1337

1

1342

IALUCE

lATE

AIIOU.T

405400

4'12

1525

4040734

1

k

1520

402741

41k

1515

4014044

1

k

1510

40C062

41k

1505

DEBIT

CREDIT

1553

1553

1553

1553

1553

------

---

....

--.l...-I_~

0.

REMARlS

BAlAIICf

DUET.

1553

1

3106

2

46·59

3

6212

4

7765

6

-

5

6

HISTORICAL RECORDS

This particular

customer

has instituted an

Historical

Record Envelope

for

each

mortgage. The

history

and

statistics

on each mortgage

are

contained in

this

envelope.

/

After the Daily Mortgage Payment Journal

is

listed

and new Transaction Cards

have been reproduced, the paid Transaction Cards

are

sorted

by account number

and payments

are

listed.

By

means of the

Facsimile

Posting Machine,

this

listing

is

used

to

post

escrow

and principal balance on the Record of Payments.

The Historical Record then contains

all

the

necessary

information for the

ordinary interview with the mortgagor. This

record,

available

in

the mortgage

servicing

department,

eliminates

reference

to correspondence

files

and

ledger

cards

filed in other departments. Of

special

significance

is

the fact that

reference

to the Historical Record for collection and other information may

be

made at any

time

without interferenc.e to the accounting

records.

NUMERICAL

LIST

OF

PAYMENTS

MORTGAGE

DUE

MO.

ESCROW

PRINCIPAL

TRAN

NO.

PER

DAY

DATE

PAID

DUE

BALANCE

BALANCE

CODE

35208

1 5

15

5 7 716 5

41000162

46

I 1

35395

9 5

15

5

11

7\1

5 213 7

1197

51

36110

7 5

15

5 I 710 4 411 8 5 1

1

36235

13

5 1 5 5 1 613 4 312 8 5 1

1

36275

14

5

15

5 1

3217

9

21628135

5 1

36315

14

5

15

5 1

7140

114 0

51

36341

9 5

15

4 1 4

3:2

5 515 7 916 0 5 1

36405

12

5

15

5 1 3 117 4

4~0

0 016 2

51

36463

8 5

15

5 1 717

42\2

6 5 1

1

36496

7 5

15

5 1 8 617 9 612 4

3197

5 1

36512

14

5

15

5 I 316 2 615 5 5 1

1

36532

13

5

15

5 1 2 914 9

5/6

0

51

1

36583

3 5

15

5 2 8 112 9 2

8112

9130

5 1

36598

2 5

15

5 1 911 4 715 9 5 1

7 8

9:3

7 1 2

3\7

5

5!2

9

i

RECORD

OF

PAYMENT

BlM

DUE

DATE

PAID

MO.

ESCROW

PRINCIPAL

NUMBER

f----

BALANCE

REMARKS

PER

DAY

MO.

DAY

YR.

DUE

BALANCE

35208

1 1

15

1

15

5 3

4054

00

46

35208

1 2

25

2

31

06

4040

7 3

46

35208

1 3

15

3

46

5 9

4027

41 46

35208

1 4

15

4

62

12

4014

04

46

35208

1 5

15

5

77

65

4000

62

46

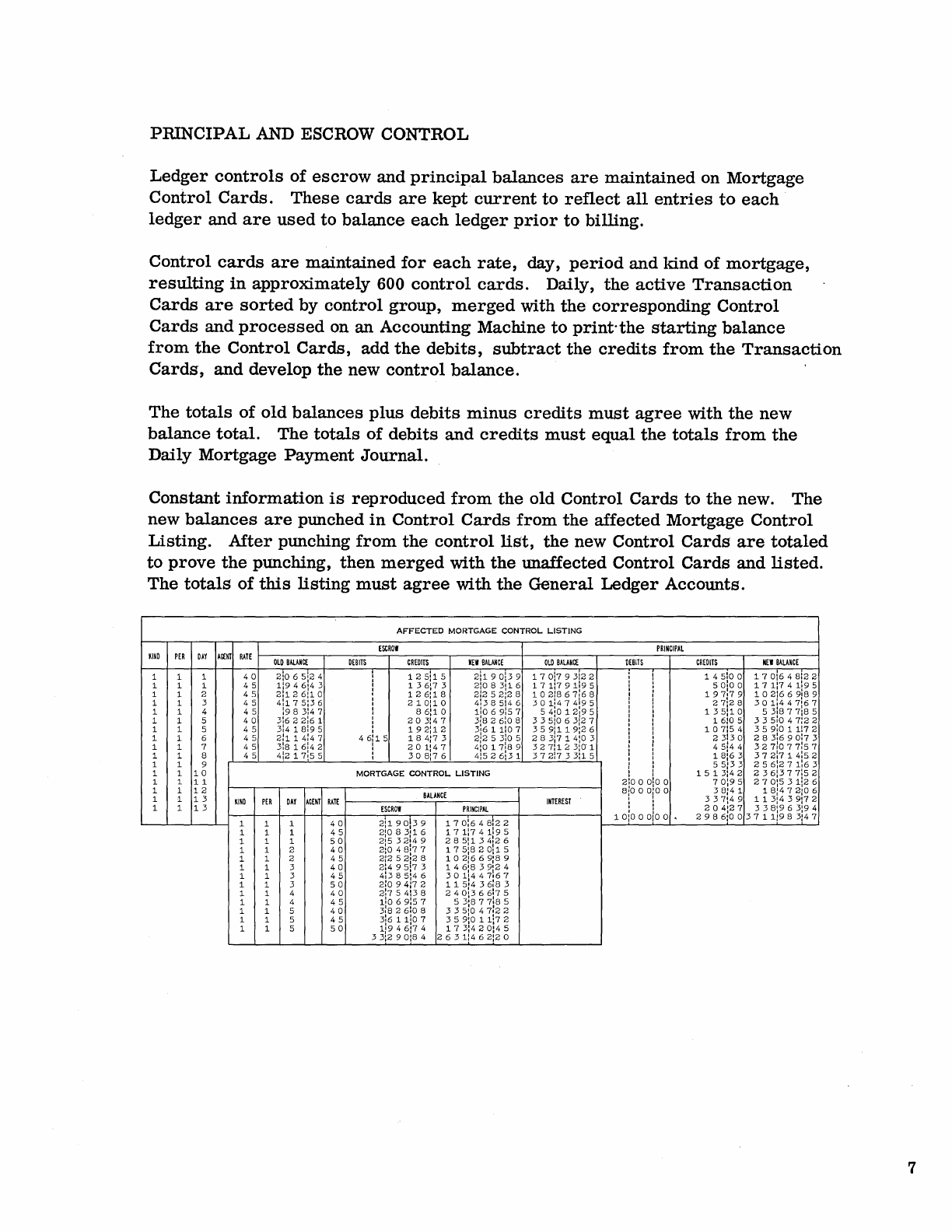

PRINCIPAL AND ESCROW CONTROL

Ledger

controls

of

escrow

and principal balances

are

maintained on Mortgage

Control Cards.

These

cards

are

kept current

to

reflect

all

entries

to

each

ledger

and

are

used

to balance

each

ledger

prior

to billing.

Control

cards

are

maintained for

each

rate,

day,

period

and ldnd

of

mortgage,

resulting

in

approximately 600 control

cards.

Daily, the active Transaction

Cards

are

sorted

by control group,

merged

with the corresponding Control

Cards and

processed

on

an

Accounting Machine to print-the starting balance

from

the Control Cards, add the debits, subtract the

credits

from the Transaction

Cards, and develop the new control balance.

The totals

of

old balances

plus

debits minus

credits

must

agree

with the new

balance total. The totals

of

debits and

credits

must equal the totals from the

Daily Mortgage Payment Journal.

Constant information

is

reproduced from the old Control Cards to the new. The

new

balances

are

punched

in

Control Cards from the affected Mortgage Control

Listing. After punching from the

control

list,

the new Control Cards

are

totaled

to prove the punching, then

merged

with the unaffected Control Cards and

listed.

The totalS

of

this

listing

must

agree

with the General Ledger Accounts.

AFFECTED

MORTGAGE

CONTROL

LISTING

ESCROW

PRINCIPAL

KIND

PER

DAY

AGEtIT

RATE

OLD

BALANCE

DEBITS

CREDITS

NEW

BALANCE

OLD

BALANCE

DEBITS

CREDITS

NEW

BALANCE

1 1 1

40

2:065:24

,

125:15

2:190:39

17

0!7

9 312 2

145100

1701648122

,

1

~

~!~

g

171:741:95

1 1 1

45

1:9

4 614 3 , 1

36:7

3

2:08

3116

1711791195

,

1021867168

1021669189

1 1 2

45

21126110

,

126:18

21252:28

1 1 3

45

4:175:36

,

210:10

4:385146

3

~

zi6

I

~!~

~

27:28

301:447:67

,

1 1 4

45

:983147

,

86110

11069:57

135:10

53:877:85

,

1 1 5

40

31622:61

,

203147

5!~

i

~!g ~

335:063:27

16105

335:047:22

,

1 1 5

45

3:4

18195

,

192:12

3591119:26

107154

359:011172

1 1 6

45

211 1

4:4

7

46:15

184:73

2:253:05

2831714103

23130

2831690:73

1 1 7

45

31816:42

201147

4:017189

3271123:0"1

45:44

3271077157

1 1 8

45

41217:55

308:76

41526:31

3721733:15

18:63

37

217 1

4:5.2

1 1 9

5513

3

2561271:63

1 1

10

MORTGAGE

CONTROL

LISTING

1513142

2361377152

1 1

11

2 0

,00

70:95

270:531:26

1 1

12

BALANCE

81

000

,00

38:41

18:472106

1 1

13

KIND

PER

DAY

AGENT

RATE

INTEREST

: I

337149

113:439172

1 1

13

ESCROW

PRINCIPAL

204127

338:963:94

1

40

2:190139

170:648122

10:00

oio

0 •

2986:00

3 7

1119

8

314

7

1 1

1 1 1

45

2'083'16

171:741195

1 1 1

50

2:5

32:49

285:134126

1 1 2

40

21048:77

175:820!15

1 1 2

45

~i2

~

~i~

~

1021669:89

1 1 3

40

~;

~!~

g!~

*

1 1 3

45

4:385:46

1 1 3

50

2:094172

115:436:83

1 1 4

40

21754138

2401366175

1 1 4

45

11069157

53:877:85

1 1 5

40

31826:08

335:047:22

1 1 5

45

31611107

35910

11172

1 1 5

50

1:946:74

173:

420

145

33:29

oi8

4

26311462:20

7

8

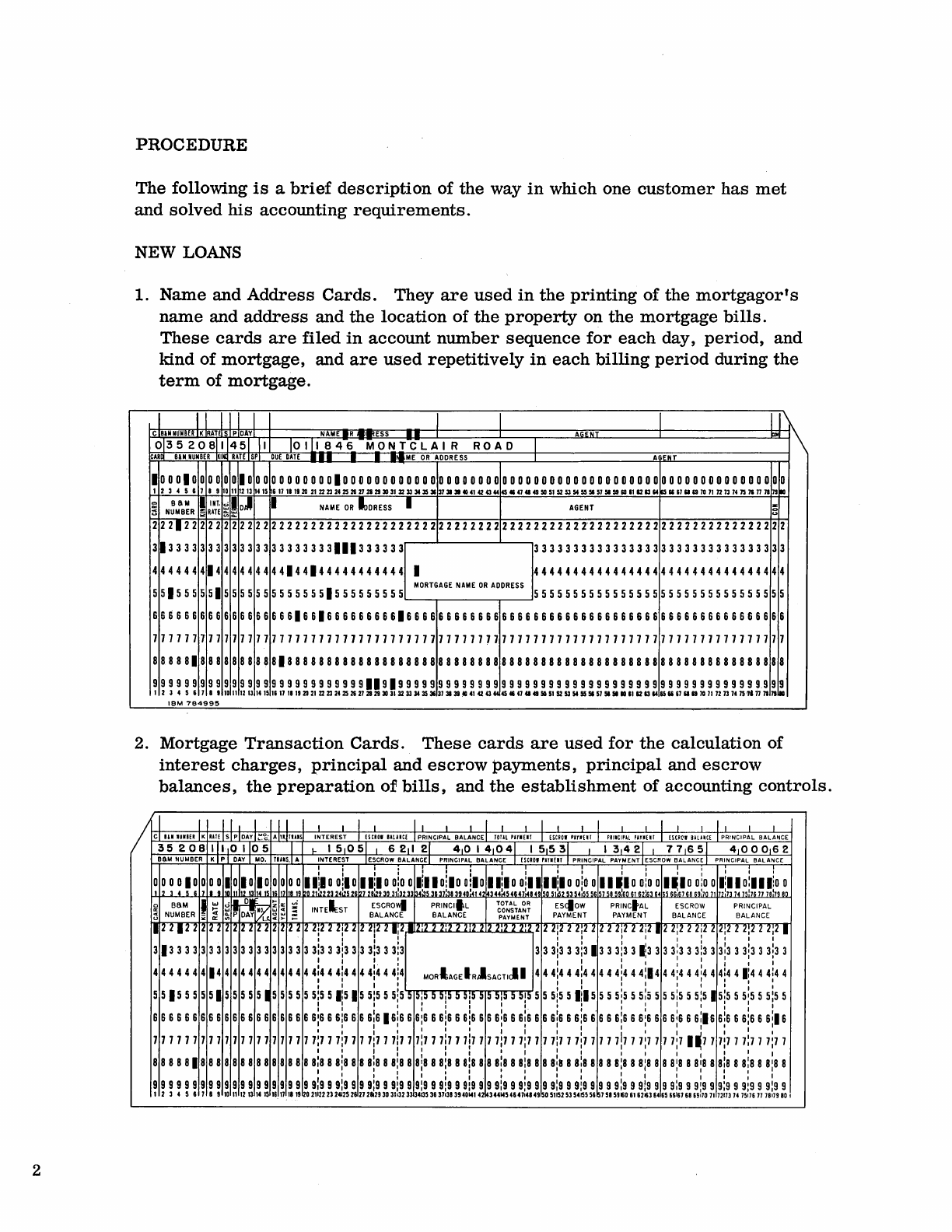

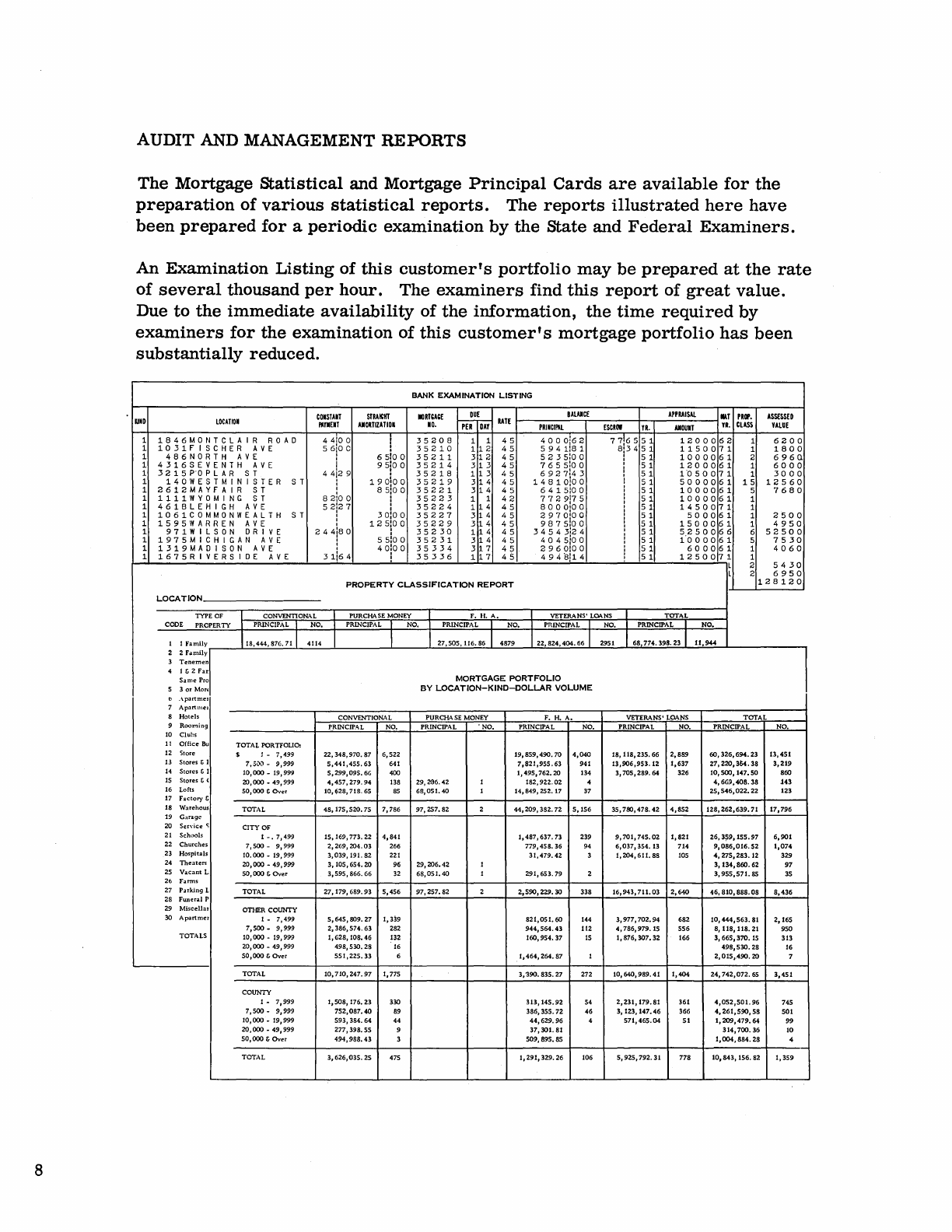

AUDIT

AND

MANAGEMENT REPORTS

The

Mortgage

Statistical

and Mortgage

Principal

Cards

are

available

for

the

preparation

of

various

statistical

reports.

The

reports

illustrated

here

have

been

prepared

for

a

periodic

examination

by

the

State and

Federal

Examiners.

An

Examination

Listing

of

this

customer's

portfolio

may

be

prepared

at

the

rate

of

several

thousand

per

hour.

The

examiners

find

this

report

of

great

value.

Due

to

the

immediate

availability

of

the

information,

the

time

required

by

examiners

for

the

examination

of

this

customer's

mortgage

portfolio

has

been

substantially

reduced.

BANK

EXAMINATION LISTING

CONSTANT

STRAIGHT

IMlmm

DUE

BALANCE

APPRAISAl

!!AT

PRII'.

ASSESSED

liND

LOCATION

~Y.EIT

AMORTIZATIOI

NO.

t-m'Dif

RATE

PRINCI~L

ESCRIlI

YR.

CLASS

VAlUE

YR.

AMOUIT

1

1846MONTCLAIR

R 0 A 0

44100

!

35208

1 1

45

~

g

~

~l~

~

7

7!6

5

51

12000

62

1

6200

1

1031FISCHER

A V E

56

1

00

35210

112

45

8'34

51

11500

71

1

1800

1

486NORTH

A V E 6

5io

0

35211

312

45

5235:00

51

10000

61

2

6960.

1

4316SEVENTH

A V E I 9

5iO

0

35214

313

45

7655:00

51

12000

61

1

6000

1

32

15

P'O

P L A R S T 4

4!2

9

19

oio

0

35218

113

45

6927\43

51

1'0500

71

1

3000

1

140WESTMINISTER

S T

35219

314

45

14810:00

51

50000

61

15

12560

1

2612MAYFAIR

S T 8 5

i

O 0

35221

314

45

6415:00

51

10000

61

5

7680

1

llllWYOMING

S T

82100

35223

1 1

42

772

9!7

5

51

10000

61

1

1

4618LEHIGH

A V E 5

2i2

7

35224

114

45

8000:00

51

14500

71

1

1

1061COMMONWEALTH

S T

30:00

35227

314

45

~

§

~

~ig

g

51

5000

61

1

2500

1

1595WARREN

A V E

24

4!8

0

12

5iO

0

35229

314

45

51

15000

61

1

4950

1

971WILSON

DR I V E

35230

114

45

3454

3i2

4

51

52500

66

6

52500

1

1975MICHIGAN

A V E

55:00

35231

314

45

40451

00

51

1'0000

61

5

7530

1

1319MADISON

A V E 4 0iO 0

35334

317

45

2960:00

51

6000

61

1

4060

1

1675RIVERSIDE

A V E

31164

35336

117

45

494811

4

51

12500

71

1

L 2

5430

L 2

6950

PROPERTY

CLASSIFICATION

REPORT

128120

LOCATION

TYPE OF I CONVENTIONAL I PURCHASE MONEY I

F.

H.

A.

I VETERANS' LOANS I

TOTAL

CODE PROPERTY I PRINCIPAL I NO. I PRINCIPAL I NO.

~

PRINCIPAL

NO.

PRINCIPAL NO. T PRINCIPAL T

NO.

I 1

Family

118.444,876.71

I 4114 1 1 1

27,505,

116.86

4879

1

22,824,404.66

1 2951 1

68

774.398.23

1

11,944

2 2

Family

3

Tenernen

4 I & 2 Fa<

Same

Pro

MORTGAGE

PORTFOLIO

5 3

or

Mor(

BY

LOCATION-KIND-DOLLAR

VOLUME

"

.\partmer

7 Ap:u1.mel

8

Hotels

CONVENTIONAL PURCHASE MONEY F. H.

A.

VETERANS' LOANS

TOTAL

9

Rooming

PRINCIPAL NO. PRINCIPAL . NO. PRINCIPAL NO. PRINCIPAL NO. PRINCIPAL

NO.

10

Clubs

11

Office

8u TOTAL PORTFOLIO:

12 Store $

1-

7,499

22,348,970.87

6,522

19,859,490.70

4,040

18,

118,235.

66

2,889

60,326,694.23

13,451

13

Stores

& J 7t

5L\.1

-

9,999

5,441,455.63

641

7,821,955.63

941

13,906,953.12

1,637

27,220,3&4.38

3,219

14

Stores

& I

10,000

-

19,999

5,299,095.66

400

1,495,762.20

134

3,705,289.

64 326 tO,5OO,

147.50

860

15

Stores & (

20,000

-

49,999

4,457,279.94

138

29,206.42

I

182,922.02

4

4,669,408.38

.143

16 Lofts

50,000

COver

10,6

2

8,718,65

85

68,051.40

1

14,849,252.

17 37

25,546,022.22

123

17

Factory

&

18 Warehous TOTAL

48,175,520.75

7,786

97,257.82

2

44,209,382.72

5,156

35,780,478.42

4,852

128,262,639.71

17,796

19

Garage-

20

Ser\'ice

<;

CITY

OF

21

Schools

1-.7,499

15,169,773.22

4,841

1,487,637.73

239

9,701,745.02

1,821

26,

3~9,

155.97

6,901

22

Churches

7,

500

-

9,999

2,269,204.03

266

779,458.36

94

6,037,354.

13

714

9,086,016.52

1,074

23

Hospitals

10.000

-

19,999

3,039,191.

82 221

31,479.42

3

1,204,611.88

105

4,275,283.12

329

24

Theaters

20,000

-

49,999

3,

105,654.20

96

29,206.42

I

3,

134,860.

62

97

25

VacantL

SO,

IX)() &

Over

3,595,866.66

32

68,051.40

I

291,653.79

2

3,955,571.85

3S

26

Farms

27

Parking

L

TOTAL

27,179,689.93

5,456

97,257.82

2

2,590,229.30

338

16,943,711.03

2,640

46,810,888.08

8,436

28

Funeral

P

29

Miscellar

OTHER COUNTY

30

Apartmer

1-

7,499

5,645,809.27

1,339

821,051.60

144

3,977,702.94

682

10,444,563.81

2,165

7,500

-

9,999

2,386,574,63

282

944,564.43

112

4,786,979.

15

556

8,

118, 118.

21

950

TOTALS

10,000

-

19,999

1,628,

108.46

132

160,954.37

15

1,876,307.32

166

3,665,370.

15

313

20,000

-

49,999

498,530.28

16

498,530.28

16

50,000

&

Over

551,225.33

6

1,464,264.87

I

2,015,.490.20

7

TOTAL

10,710,247.97

1,775

3,390.835.27

272

10,640,989.41

1,404

24,742,072.65

3,451

COUNTY

1-

7,999

1,508,176.23

330

313,145.92

54

2,231,179.81

361

4,052,501.96

745

7,500

-

9,999

752,087.40

89

386,355.72

46

3,123,147.46

366

4,261,590,58

501

10,000

-

19,999

593,384.64

44

44,629.96

4

571,465.04

51

1,209,479.64

99

20,000

-

49,999

277,398.55

9

37,301.

81

314,700.36

10

so,

IX)() &

Over

494,988.43

3

509,895.85

1,004,884.28

4

TOTAL

3,626,035.25

475

1,291,329.26

106

5,925,792.31

778

10,843,

156.

82

1,359

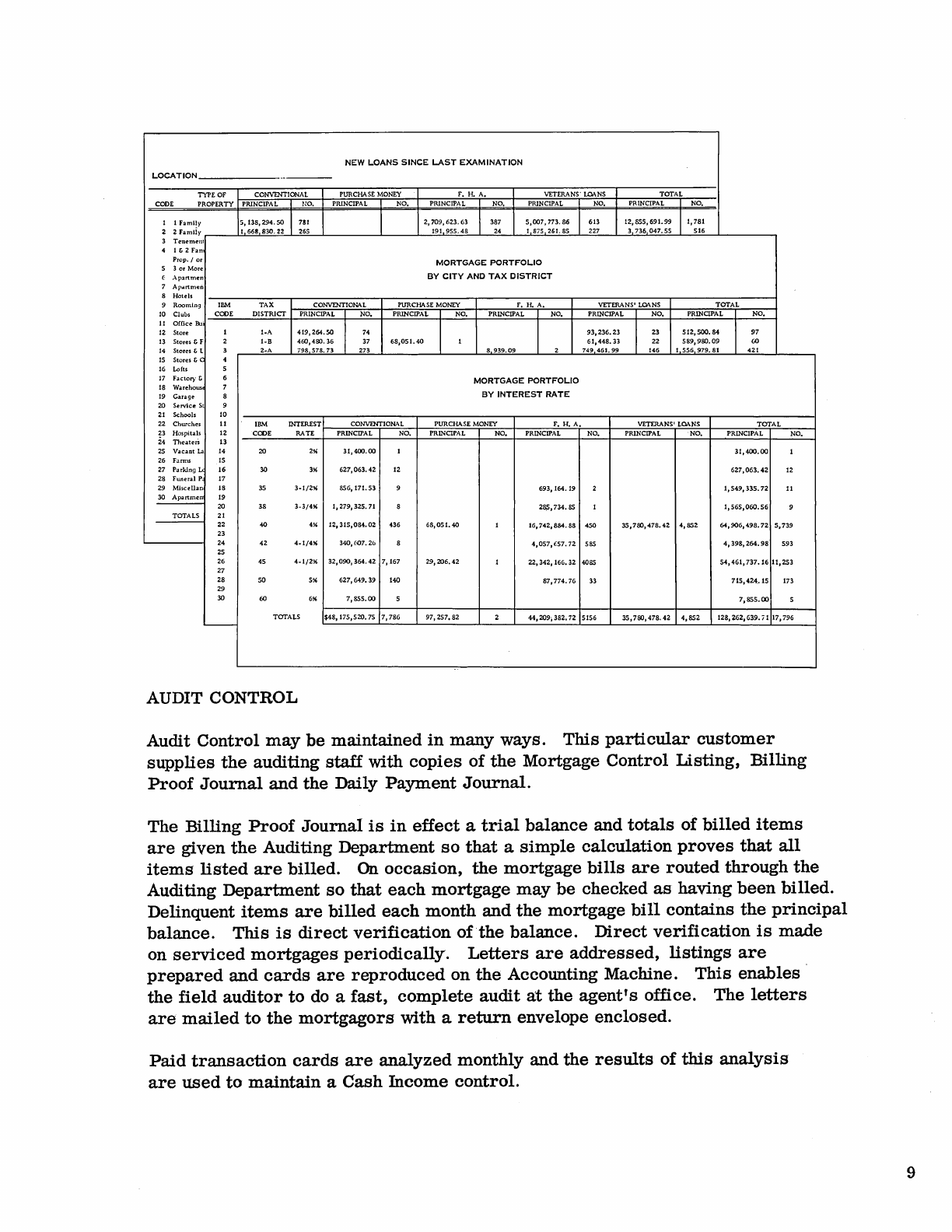

LOCATION

_________

_

TYPE OF CONVENTIONAL

CODE PROPERTY PRINCIPAL

liO.

NEW

LOANS

SINCE

LAST

EXAMINATION

PURCHASE MONEY F. H. A.

PRINCIPAL

NO.

PRINCIPAL NO.

VETERANS' LOANS

PRINCIPAL I NO.

TOTAL

PRINCIPAL I NO.

1

Family

5,138,294.50

781

2,709,623.63

387

5,007,773.86

613 12, SS5,

691.

99

11,781

3

~::::~~1Ir--~1CL.!:6:::.::68:...::8~3O::.!:.

2~2

~2~65___'_

___

___L

__

l__!::.19!.LI

9::=;55!:..:.

4~8___L~24!-..1__!.1L2.87~5

L!!26:!.!.:1.~85~__!2~27~..L_3~7~36~O~47~-

5e.

5

--L.-=5:!!:16~L-

__

---.

4

1&

2

Fan

Prop. I

or

5 3

or

More

(:

Apartmen

7

Ap.utmen

8 Hotels

9

Rooming

IBM TAX CONVENTIONAL

MORTGAGE

PORTFOLIO

BY

CITY

AND

TAX

DISTRICT

PURCHASE MONEY F.

H.

A.

VETERANS' LOANS

TOTAL

:~

~~~~s.

IklI--=C.:::OD:::.E-..=..:::.=:.:.t~=~+_~=_+......:..::~!.!!!:..+--!::~f___!~~:....-j___:~+_~~~_+~~---.;~!::!!::!=---~~~

DISTRICT

PRINCIPAL I NO. PRINCIPAL I NO. PRINCIPAL NO. PRINCIPAL

NO.

PRINCIPAL

NO.

I I

12

Store

I-A

419,264.50

74

93,236.23

23

512,500.84

97

13

Stores & F

I-B

460,480_ 36 37

68,051.40

61,448.33

22

589,980.09

60

14 Stores & t 2-A 798

578.73

273 8

939.09

749

461.

99

146 I

556

979.81

421

15

Stores t c

16 Lofts

17 Factory t

MORTGAGE

PORTFOLIO

18 Warehous

19 Garage

BY

INTEREST

RATE

20 Service S

21

Schools 10

22 Churches

11

IBM INTEREST CONVENTIONAL PURCHASE MONEY F.

H.

A.

VETERANS' LOANS

TOTAL

23

Hospitals

12

24

Theaten

13

CODE RATE PRINCIPAL NO. PRINCIPAL

NO.

PRINCIPAL NO. PRINCIPAL

NO.

PRINCIPAL

NO.

25

Vacant

La 14

20

2"

31,400.00

31,400.00

26 Farnu 15

27 Parking

1.<

16

30

3"

627,063.42

12

627,063.42

12

28

Funeral P 17

29

Miscellan

18 35

3-1/2"

SS6,I71.

53

693,164.19

1,549,335.72

11

30

Apartmerr

19

20

38

3-3/4"

1,279,325.71

21\5,734.

SS

1,565,060.56

TOTALS 21

22

40

4"

12,315,084.02

436

68,051.40

16,742,884.88

450

3S,

780,

478.

42

4,852

64,906,498.72

5,739

23

24

42

4-1/4"

34O,W7.26

4,057,!i57.72

5SS

4,398,264.98

593

25

26

45

4-1/2"

32,090,364_

42

7,167

29,206.42

22,342,

166.

32 40SS

54,461,737.16

11,253

27

28

50

5"

627,649.39

140

87,774.76

33

715,424

.•

15 173

29

30 60

6"

7,SS5.OO

7,

SSS.

00

TOTALS

$48,175,520.75

7,786

97,257.82

44,209,382.72

5156

35,780,478.42

4,SS2

128,262,639.

i 1

17,796

AUDIT CONTROL

Audit Control

may

be maintained

in

many ways. This particular

customer

supplies the auditing staff with

copies

of

the Mortgage Control Listing, Billing

Proof Journal and the Daily Payment Journal.

The Billing

Proof

Journal

is

in

effect

a

trial

balance and

totals

of

billed

items

are

given the Auditing Department

so

that a

simple

calculation

proves

that

all

items

listed

are

billed.

On

occasion,

the mortgage

bills

are

routed through the

Auditing Department

so

that each mortgage may be checked

as

having been billed.

Delinquent

items

are

billed each month and the mortgage

bill

contains the principal

balance. This

is

direct verification of

the

balance.

Direct

verification

is

made

on

serviced

mortgages

periodically.

Letters

are

addressed,

listings

are

prepared and

cards

are

reproduced on the Accounting Machine. This

enables'

the field auditor to

do

a fast, complete audit at the agent's office. The

letters

are

mailed

to the mortgagors with a return envelope enclosed.

Paid transaction cards

are

analyzed monthly and the

results

of

this

analysis

are

used

to

maintain a Cash Income control.

9

10

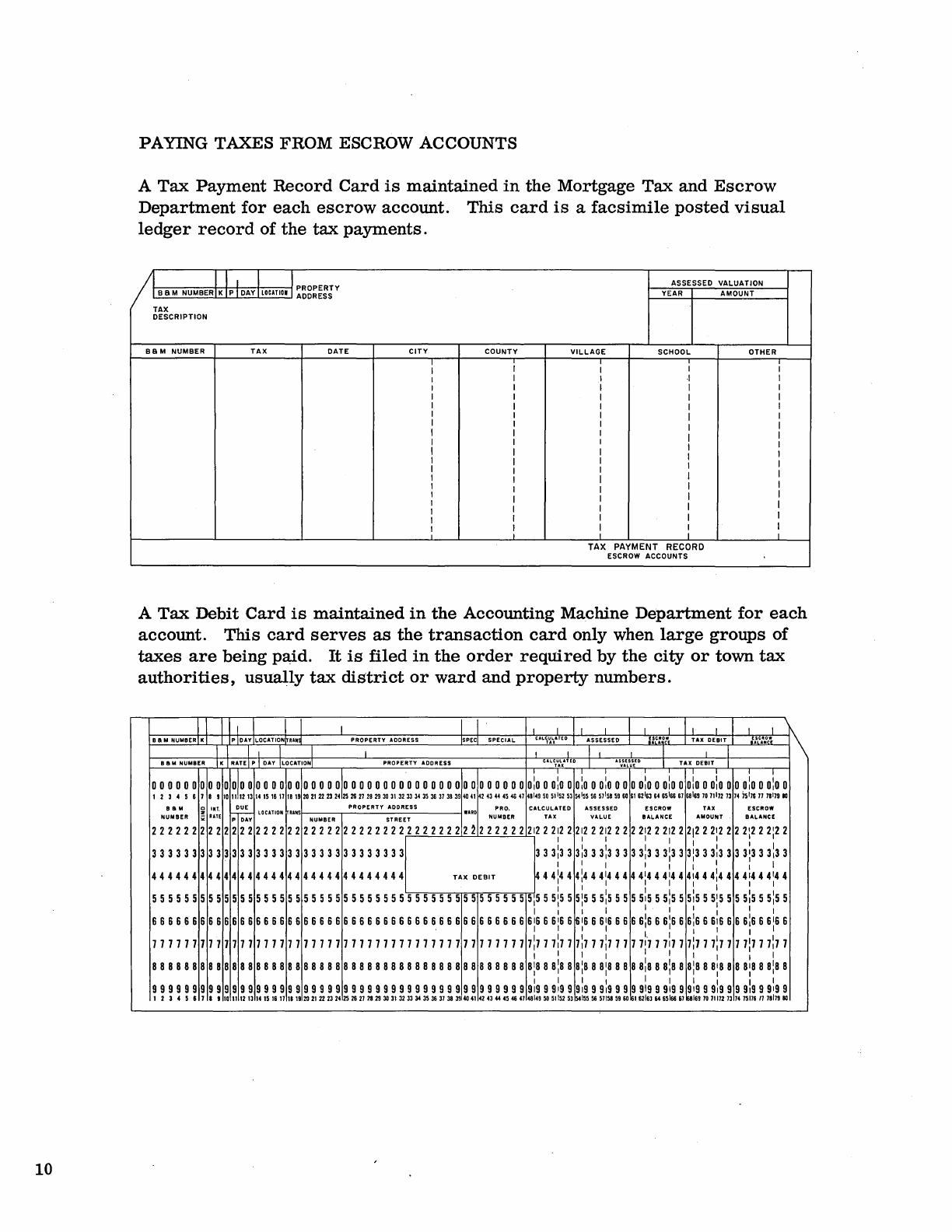

PAYING TAXES

FROM

ESCROW

ACCOUNTS

A Tax Payment Record Card

is

maintained

in

the Mortgage Tax and

Escrow

Department for each

escrow

account. This

card

is

a

facsimile

posted

visual

ledger

record

of the tax payments.

I,

I I ASSESSED VALUATION

I

BaM

NUMBER

Kip

I

DAY

I

LOCATIO'

I

~~g=~;iY

YEAR AMOUNT

TAX

DESCRIPTION

Ba

M NUMBER

TAX

DATE

CITY

COUNTY

VILLAGE

SCHOOL

OTHER

I I

I

,

I

I

I

I

I

I I I I

TAX

PAYMENT

RECORD

ESCROW ACCOUNTS

A

Tax

Debit Card

is

maintained

in

the Accounting Machine Department for each

account. This card

serves

as

the transaction card only when

large

groups

of

taxes

are

being paid. It

is

filed

in

the

order

required by the

city

or

town tax

authorities, usually tax

district

or

ward and property numbers.

I I I I I I I I I I I I

B8M

NUMBERI_I I plDAY

"OCATION~RAN~

PROPERTY

ADDRESS

ISPECI

SPECIAC

CA'\~~ATED

I ASSESSED

::c:~~.

TAX

DEBIT I ::,":.DC"

I I I I I I

II

I I I I I

~

II

:I~

I I I I I ! I I

000000000000000000000000000000000000000000000000:0

0

0:0

0

0:0

0

0:0

0 0 0

0:0

0

0:0

0

0:0

0

0:0

0 0

0:0

0

0:0

0

1234

5

61191011121314151611181920212223242526212829303132333435363138394041424344454841481495051

1

5253541

5556511

58596061621

6364651

66616816910111121314i51

16111111910

N~:B~R

~

~:;E

pD~

LOCATION

RAMS

NUMBER

PROPERTY

SATD:ERE~SS

.ARO

N::~~R

CALC:A":TED

A::ELSUSEED

BEASL~RNOC~

A;:~NT

BE:LCAR:C~

22222222222222222222222222222222

22222222222222221222122212221222221222122212221222

2:222:22

I I I I I I I

33333333333333333333333333333333

333:333:333:33333:333:333:333:3333:333:33

I I I I I I I I I

44444444444444

4 4 4 4 4

44

4 4 4 4

44

4 4 4 4 4

TAX

DEBIT

444:444:444

1

444

44

1

4 4

414

4

4144

4:4

4 4

4144

41

4 4

I I I I I I I I

55555555555555555555555555555555

5555555555555555:555:555:555:55555:555:555:555:555

5:5

5

5:5

5

I I I I I I I I I I

66666666666666666666666666666666666666666666666616

6 61

6

6~16

6

616

6 6 6

6:6

6

6:6

6

6:66616666:666

1

66

, I I I I I I I I

777777

7 7 7

77

7 7 7 7 7 7 7 7 77 77 7 7 7 7 7 7 77 77 77 7 7 7 77 7 7 7 7 7 7 7

7:7

7

7:7

7 7:77 7:77 7 77:'77

7:7

7 7:77 7:77 7 7:77

7:7

7

I I I I I I I I I I

888888888888888888888888888888888888888888888888:8

8

8:8

8

8:8

8

8:8

8 8 8

8:8

8

8:8

8

8:8

8

8:8

8 8

8:8

8

8i8

8

I I I I I I I I I I

99999999999999999999999999999999999999999999999919

9

919

9

919

9

919

9 9 9

919

9

919

9

919

9

919

9 9

919

9

919

9

1 2 3 4 5 6 1 a

910111213141516111119202122

23

24

25 26

2128

29

30

3132

33 34

35

36

3138 39404142

43

44

45

48

4148149

50

51152

53

54155

5&

5115159

6O~162163

6465166

616816910

1117213

14

75116117117910

Upon

request

of

the

Mortgage

Tax

and

Escrow

Department,

the

Accounting

Machine

Department

lists

all

the

Tax

Debit

Cards

filed

under

requested

tax

districts

or

sections.

Listed

is

the

mortgage

number,

ldnd,

period

and

day

due,

property

address

and

information

pertaining

to

the

tax

district

or

ward

and

property

number.

The

list

is

sent

to

the

Mortgage

Tax

and

Escrow

Department

and

in

turn

to

the

tax

authorities

of that

district.

They

pull

the

tax

bills

from

the

listing

and

return

the

listing

with

the

tax

bills.

The Mortgage

Tax

and

Escrow

Department

examines

the

bills

for

accuracy

and

runs

the

tax

amoWlt on

an

adding

machine

for

a document

control

tape.

The

bills

and a

total

are

forwarded

to

the

Accounting

Machine

Department.

The

AccoWlting Machine

Department

punches

the

amount of

the

tax

into

the

Tax

Debit

Card.

The

cards

are

total

printed

for

proof

to

the

adding

machine

total.

After

proof

the

cards

are

consecutively

numbered

on

the

602A.

They

are

then

sorted

into

the

same

order

as

the

Mortgage

Principal

Cards

which contain

the

escrow

balance.

The

Principal

Card

is

matched

with

the

Tax

Debit

Card

and

then

the

escrow

balance

is

reproduced

into

the

Tax

Debit

Card.

The

Tax

Debit

Card

is

crossfooted

for

the

new

escrow

balance

and

listed

for

facsimile

posting

to

the

Mortgage

Ledger

Card

which

contains

the

mortgage

payments.

While

this

crossfooting

and

listing

is

in

process

the

Principal

Cards

are

used

to

pull

the

Mortgage

Transaction

Card.

Both

the

Principal

and

Transaction

Cards

are

reproduced

and

the

new

escrow

balance

from

the

Tax

Debit

Card

is

reproduced

into

this

new

PrinCipal

and

Transaction

Card.

The

Tax

Debit

Cards

are

sorted

into

mortgage

number

order

and

listed

for

facsimile

posting

to

the

llistorical

Record

Card.

Then

the

cards

are

sorted

to

the

consecutively

punched

number

bringing

them

back

into

the

original

order.

At

this

time

they

are

listed

for

facsimile

posting

to

the

Tax

Payment

Record

Cards

and

reproduced

for

the

next

tax

payment.

The

tax

bills

and

a

total

of

the

taxes

paid

are

returned

to

the

Mortgage

Tax

and

Escrow

Department

and

one

check

is

drawn

to

pay

all

taxes.

Totals

of

the

tax

debit

by

kind of

mortgage

are

consolidated

with

the

regular

day's

work

for

entry

on

the

General

Ledger

ACCOWltS.

11

12

ADVANTAGES

The

use

of IBM

Data

Processing

equipment

for

Mortgage

Loan Accounting

brings

these

advantages:

1.

Cards

are

punched only when

mortgage

is

originated;

thereafter

they

are

reproduced

automatically.

2.

Interest

is

calculated

and

proved

automatically.

3.

Trial

balances

are

available

instantly.

4.

Regular

and

delinquent

billing

is

available

as

a

by-product.

5.

Increased

business

can

be

handled

with

little

or

no

increase

in

equipment

or

personnel.

6.

Portfolios

may

be

analyzed

as

extensively

and

as

frequently

as

desired.

7.

Records

of

transactions,

accounts,

and

statements

are

available

without

interfering

with

ledger

files.

8.

Banks

and

associations

with a high

volume

of window

payments

find

that.by

relieving

tellers

of bookkeeping functions

they

can

handle

transactions

more

rapidly,

thereby

reducing

window congestion.

9.

Mail

payments

can

be

encouraged

because

they

are

handled

in

a highly

mechanized

manner.

10. Automatic

analysis

of

escrow

accounts

can

be

made

at

any

time.

11.

The

IBM

Data

Processing

System

is

sufficiently

flexible

to

allow

tailoring

to

meet

and

solve

any

bank's

or

association's

accoWlting

requirements.