FR500 FR 500 042214

User Manual: FR500

Open the PDF directly: View PDF ![]() .

.

Page Count: 16

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF THE CHIEF FINANCIAL OFFICER

OFFICE OF TAX AND REVENUE

• List of Principal Business Activity Codes (NAICS)

• Instructions

• Form FR-500

• General Information (Part I)

• Franchise Tax Registration (Part II)

• Employer’s DC Withholding Tax Registration (Part III)

• Sales and Use Tax Registration (Part IV)

• Personal Property Tax Registration (Part V, Section 1)

• Ballpark Fee Registration (Part V, Section 2)

• Nursing Facility Registration (Part V, Section 3)

• Tobacco Products Excise Tax Registration (Part V, Section 4)

• Intermediate Care Facility for Persons with Intellectual or Developmental Disabilities (ICF-IDD)

Tax Registration (Part V, Section 5)

• Hospital Revenue Assessment (Part V, Section 6)

• Hospital Provider Fee (Part V, Section 7)

• Miscellaneous Tax (Part V, Section 8)

• Unemployment Compensation Tax Registration (Part VI)

NOTE:

Effective immediately, demographic information (Part 1, Line 13) is MANDATORY.

Failure to complete this form in full may result in your denial for an application for a license or permit with

other DC Government agencies.

Corporations must provide Articles of Incorporation or Articles of Organization with the completed FR-500.

Trade names must be first registered with the Department of Consumer and Regulatory Affairs (DCRA).

FR-500

OFFICE OF TAX AND REVENUE (OTR)

CUSTOMER SERVICE ADMINISTRATION

1101 4TH STREET, SW

Washington DC 20024

Telephone No. (202) 727-4TAX (4829)

(Rev. 03/14)

COMBINED REGISTRATION APPLICATION FOR BUSINESS DC TAXES/FEES/ASSESSMENTS

Agriculture, Forestry, Fishing

and Hunting

Code

Crop Production

111100 Oilseed & Grain Farming

111210 Vegetable & Melon Farming

(including potatoes & yams)

111300 Fruit & Tree Nut Farming

111400 Greenhouse Nursery, &

Floriculture Production

111900 Other Crop Farming (including

tobacco, cotton, sugarcane, hay,

peanut, sugar beet & all other

crop farming)

Animal Production

112111 Beef Cattle Ranching &

Farming

112112 Cattle Feedlots

112120 Dairy Cattle & Milk Production

112210 Hog & Pig Farming

112300 Poultry & Egg Production

112400 Sheep & Goat Farming

112510 Animal Aquaculture (including

shellfish & finfish farms &

hatcheries)

112900 Other Animal Production

Forestry and Logging

113110 Timber Tract Operations

113210 Forest Nurseries & Gathering

of Forest Products

113310 Logging

Fishing, Hunting and Trapping

114110 Fishing

114210 Hunting & Trapping

Support Activities for Agriculture and

Forestry

115110 Support Activities for Crop

Production (including cotton

ginning, soil preparation,

planting & cultivating)

115210 Support Activities for Animal

Production

115310 Support Activities for Forestry

Mining

211110 Oil & Gas Extraction

212110 Coal Mining

212200 Metal Ore Mining

212310 Stone Mining & Quarrying

212320 Sand, Gravel, Clay, & Ceramic

& Refractory Minerals Mining

& Quarrying

212390 Other Nonmetallic Mineral

Mining & Quarrying

213110 Support Activities for Mining

Utilities

221100 Electric Power Generation,

Transmission & Distribution

221210 Natural Gas Distribution

221300 Water, Sewage & Other

Systems

Construction

Building, Developing, and General

Contracting

233110 Land Subdivision & Land

Development

Code

233200 Residential Building

Construction

233300 Nonresidential Building

Construction

Heavy Construction

234100 Highway, Street, Bridge, &

Tunnel Construction

234900 Other Heavy Construction

Special Trade Contractors

235110 Plumbing, Heating, &

Air-Conditioning Contractors

235210 Painting & Wall Covering

Contractors

235310 Electrical Contractors

235400 Masonry, Drywall, Insulation, &

Tile Contractors

235500 Carpentry & Floor Contractors

235610 Roofing, Siding, & Sheet Metal

Contractors

235710 Concrete Contractors

235810 Water Well Drilling Contractors

235900 Other Special Trade Contractors

Manufacturing

Food Manufacturing

311110 Animal Food Mfg

311200 Grain & Oilseed Milling

311300 Sugar & Confectionery Product

Mfg

311400 Fruit & Vegetable Preserving &

Specialty Food Mfg

311500 Dairy Product Mfg

311610 Animal Slaughtering and

Processing

311710 Seafood Product Preparation &

Packaging

311800 Bakeries & Tortilla Mfg

311900 Other Food Mfg (including

coffee, tea, flavorings &

seasonings)

Beverage and Tobacco Product

Manufacturing

312110 Soft Drink & Ice Mfg

312120 Breweries

312130 Wineries

312140 Distilleries

312200 Tobacco Manufacturing

Textile Mills and Textile Product Mills

313000 Textile Mills

314000 Textile Product Mills

Apparel Manufacturing

315100 Apparel Knitting Mills

315210 Cut & Sew Apparel Contractors

315220 Men’s & Boys’ Cut & Sew

Apparel Mfg

315230 Women’s & Girls’ Cut & Sew

Apparel Mfg

315290 Other Cut & Sew Apparel mfg

315990 Apparel Accessories & Other

Apparel Mfg

Leather and Allied Product

Manufacturing

316110 Leather & Hide Tanning &

Finishing

316210 Footwear Mfg (including rubber

& plastics)

316990 Other Leather & Allied Product

Mfg

Code

Wood Product Manufacturing

321110 Sawmills & Wood Preservation

321210 Veneer, Plywood, &

Engineered Wood Product Mfg

321900 Other Wood Product Mfg

Paper Manufacturing

322100 Pulp, Paper & Paperboard Mills

322200 Converted Paper Product Mfg

Printing and Related Support

Activities

323100 Printing & Related Support

Activities

Petroleum and Coal Products

Manufacturing

324100 Petroleum Refineries

(including integrated)

324120 Asphalt Paving, Roofing, &

Saturated Materials Mfg

324190 Other Petroleum & Coal

Products Mfg

Chemical Manufacturing

325100 Basic Chemical Mfg

325200 Resin, Synthetic Rubber &

Artificial & Synthetic Fibers &

Filaments Mfg

325300 Pesticide, Fertilizer, & Other

Agricultural Chemical Mfg

325410 Pharmaceutical & Medicine Mfg

325500 Paint Coating, & Adhesive Mfg

325600 Soap, Cleaning Compound, &

Toilet Preparation Mfg

325900 Other Chemical Product &

Preparation Mfg

Plastics and Rubber Products

Manufacturing

326100 Plastics Product Mfg

326200 Rubber Product Mfg

Nonmetallic Mineral Product

Manufacturing

327100 Clay Product & Refractory Mfg

327210 Glass & Glass Product Mfg

327300 Cement & Concrete Product

Mfg

327400 Lime & Gypsum Product Mfg

327900 Other Nonmetallic Mineral

Product Mfg

Primary Metal Manufacturing

331110 Iron & Steel Mills & Ferroalloy

Mfg

331200 Steel Product Mfg from

Purchased Steel

331310 Alumina & Aluminum Production

& Processing

331400 Nonferrous Metal (except

Aluminum) Production &

Processing

331500 Foundries

Fabricated Metal Product

Manufacturing

332110 Forging & Stamping

332210 Cutlery & Handtool Mfg

332300 Architectural & Structural Metals

Mfg

332400 Boiler, Tank, & Shipping

Container Mfg

332510 Hardware Mfg

332610 Spring & Wire Product Mfg

332700 Machine Shops; Turned

Product; & Screw, Nut, & Bolt

Mfg

332810 Coating, Engraving, Heat

Treating, & Allied Activities

332900 Other Fabricated Metal Product

Mfg

Machinery Manufacturing

333100 Agriculture, Construction, &

Mining Machinery Mfg

333200 Industrial Machinery Mfg

333310 Commercial & Service Industry

Machinery Mfg

333410 Ventilation, Heating, Air-

Conditioning, & Commercial

Refrigeration Equipment Mfg

333510 Metalworking Machinery Mfg

333610 Engine, Turbine & Power

Transmission Equipment Mfg

Code

333900 Other General Purpose

Machinery Mfg

Computer and Electronic Product

Manufacturing

334110 Computer & Peripheral

Equipment Mfg

334200 Communications Equipment

Mfg

334310 Audio & Video Equipment Mfg

334410 Semiconductor & Other

Electronic Component Mfg

334500 Navigational, Measuring,

Electromedical, & Control

Instruments Mfg

334610 Manufacturing & Reproducing

Magnetic & Optical Media

Electrical Equipment, Appliance, and

Component Manufacturing

335100 Electric Lighting Equipment Mfg

335200 Household Appliance Mfg

335310 Electrical Equipment Mfg

335900 Other Electrical Equipment &

Component Mfg

Transportation Equipment

Manufacturing

336100 Motor Vehicle Mfg

336210 Motor Vehicle Body & Trailer

Mfg

336300 Motor Vehicle Parts Mfg

336410 Aerospace Product & Parts Mfg

336510 Railroad Rolling Stock Mfg

336610 Ship & Boat Building

336990 Other Transportation Equipment

Mfg

Furniture and Related Product

Manufacturing

337000 Furniture & Related Product

Manufacturing

Miscellaneous Manufacturing

339110 Medical Equipment & Supplies

Mfg

339900 Other Miscellaneous

Manufacturing

Wholesale Trade

Wholesale Trade, Durable Goods

421100 Motor Vehicle & Motor Vehicle

Parts & Supplies Wholesalers

421200 Furniture & Home Furnishing

Wholesalers

421300 Lumber & Other Construction

Materials Wholesalers

421400 Professional & Commercial

Equipment & Supplies

Wholesalers

421500 Metal & Mineral (except

Petroleum) Wholesalers

421600 Electrical Goods Wholesalers

421700 Hardware, & Plumbing

& Heating Equipment &

Supplies Wholesalers

421800 Machinery, Equipment, &

Supplies Wholesalers

421910 Sporting & Recreational Goods

& Supplies Wholesalers

421920 Toy & Hobby Goods & Supplies

Wholesalers

421930 Recyclable Material

Wholesalers

421940 Jewelry, Watch, Precious Stone,

& Precious Metal Wholesalers

421990 Other Miscellaneous Durable

Goods Wholesalers

422100 Paper & Paper Product

Wholesalers

422210 Drugs & Druggists’ Sundries

Wholesalers

422300 Apparel, Piece Goods, &

Notions Wholesalers

422400 Grocery & Related Product

Wholesalers

422500 Farm Products Raw Material

Wholesalers

422600 Chemical & Allied Products

Wholesalers

Codes for Principal Business Activity

This list of principal business activities and their associated codes is

designed to classify an enterprise by the type of activity in which it is

engaged. These principal business activity codes are based on the North

American Industry Classification System.

If a company purchases raw materials and supplies them to a subcontrac-

tor to produce the finished product, but retains title to the product, the com-

pany is considered a manufacturer and must use one of the manufacturing

codes (311110-339900).

1

Code

Wholesale Trade, Durable Goods

422700 Petroleum & Petroleum

Products Wholesalers

422800 Beer, Wine, & Distilled Alcoholic

Beverage Wholesalers

422910 Farm Supplies Wholesalers

422920 Books, Periodical, & Newspaper

Wholesalers

422930 Flower, Nursery Stock &

Florists’ Supplies Wholesalers

422940 Tobacco & Tobacco Product

Wholesalers

422950 Paint, Varnish, & Supplies

Wholesalers

422990 Other Miscellaneous

Nondurable Goods Wholesalers

Retail Trade

Motor Vehicle and Parts Dealers

441110 New Car Dealers

441120 Used Car Dealers

441210 Recreational Vehicle Dealers

441221 Motorcycle Dealers

441222 Boat Dealers

441229 All Other Motor Vehicle Dealers

441300 Automotive Parts, Accessories,

& Tire Stores

Furniture and Home Furnishings

Stores

442110 Furniture Stores

442210 Floor Covering Stores

442291 Window Treatment Stores

442299 All Other Home Furnishings

Stores

Electronics and Appliance Stores

443111 Household Appliance Stores

443112 Radio, Television, & Other

Electronics Stores

443120 Computer & Software Stores

443130 Camera & Photographic

Supplies Stores

Building Material and Garden

Equipment and Supplies Dealers

444110 Home Centers

444120 Paint & Wallpaper Stores

444130 Hardware Stores

444190 Other Building Material Dealers

444200 Lawn & Garden Equipment &

Supplies Stores

Food and Beverage Stores

445110 Supermarkets and Other

Grocery (except Convenience)

Stores

445120 Convenience Stores

445210 Meat Markets

445220 Fish & Seafood Markets

445230 Fruit & Vegetable Markets

445291 Baked Goods Stores

445292 Confectionery & Nut Stores

445299 All Other Specialty Food Stores

445310 Beer, Wine, & Liquor Stores

Health and Personal Care Stores

446110 Pharmacies & Drug Stores

446120 Cosmetics, Beauty Supplies,

& Perfume Stores

446130 Optical Goods Stores

446190 Other Health & Personal Care

Stores

Gasoline Stations

447100 Gasoline Stations (including

convenience stores with gas)

Clothing and Clothing Accessories

Stores

448110 Men’s Clothing Stores

448120 Women’s Clothing Stores

448130 Children’s & Infants’ Clothing

Stores

448140 Family Clothing Stores

448150 Clothing Accessories Stores

448190 Other Clothing Stores

448219 Shoe Stores

448310 Jewelry Stores

448320 Luggage & Leather Goods

Stores

Code

Sporting Goods, Hobby, Book, and

Music Stores

451110 Sporting Goods Stores

451120 Hobby, Toy, & Game Stores

451130 Sewing, Needlework, & Piece

Goods Stores

451140 Musical Instrument & Supplies

Stores

451211 Book Stores

451212 News Dealers & Newsstands

451220 Prerecorded Tape, Compact

Disc, & Record Stores

General Merchandise Stores

452110 Department Stores

452900 Other General Merchandise

Stores

Miscellaneous Store Retailers

453110 Florists

453210 Office Supplies & Stationery

Stores

453220 Gift, Novelty, & Souvenir Stores

453310 Used Merchandise Stores

453910 Pet & Pet Supplies Stores

453920 Art Dealers

453930 Manufactured (Mobile) Home

Dealers

453990 All Other Miscellaneous Store

Retailers (including tobacco,

candle, & trophy shops)

Nonstore Retailers

454110 Electronic Shopping & Mail-

Order Houses

454210 Vending Machine Operators

454311 Heating Oil Dealers

454312 Liquefied Petroleum Gas

(Bottled Gas) Dealers

454319 Other Fuel Dealers

454390 Other Direct Selling

Establishments (including door-

to-door retailing, frozen food

plan providers, party plan

merchandisers, & coffee-break

service providers)

Transportation and Warehousing

Air, Rail, and Water Transportation

481000 Air Transportation

482110 Rail Transportation

483000 Water Transportation

Truck Transportation

484110 General Freight Trucking, Local

484120 General Freight Trucking, Long-

distance

484200 Specialized Freight Trucking

Transit and Ground Passenger

Transportation

485110 Urban Transit Systems

485210 Interurban & Rural Bus

Transportation

485310 Taxi Service

485320 Limousine Service

485410 School & Employee Bus

Transportation

485510 Charter Bus Industry

485990 Other Transit & Ground

Passenger Transportation

Pipeline Transportation

486000 Pipeline Transportation

Scenic & Sightseeing Transportation

487000 Scenic & Sightseeing

Transportation

Support Activities for Transportation

488100 Support Activities for Air

Transportation

488210 Support Activities for Rail

Transportation

488300 Support Activities for Water

Transportation

488410 Motor Vehicle Towing

488490 Other Support Activities for

Road Transportation

488510 Freight Transportation

Arrangement

Code

488990 Other Support Activities for

Transportation

Couriers and Messengers

492110 Couriers

492210 Local Messengers & Local

Delivery

Warehousing And Storage

493100 Warehousing & Storage (except

lessors of miniwarehouses &

self-storage units)

Information

Publishing Industries

511110 Newspaper Publishers

511120 Periodical Publishers

511130 Book Publishers

511140 Database & Directory

Publishers

511190 Other Publishers

511210 Software Publishers

Motion Picture and Sound Recording

Industries

512100 Motion Picture & Video

Industries (except video rental)

512200 Sound Recording Industries

Broadcasting and

Telecommunications

513100 Radio & Television Broadcasting

513200 Cable Networks & Program

Distribution

513300 Telecommunications (including

paging, cellular, satellite, & other

telecommunications)

Information Services and Data

Processing Services

514100 Information Services (including

news syndicates, libraries, &

on-line information services)

514210 Data Processing Services

Finance and Insurance

Depository Credit Intermediation

522110 Commercial Banking

522120 Savings Institutions

522130 Credit Unions

522190 Other Depository Credit

Intermediation

Nondepository Credit Intermediation

522210 Credit Card Issuing

522220 Sales Financing

522291 Consumer Lending

522292 Real Estate Credit (including

mortgage bankers & originators)

522293 International Trade Financing

522294 Secondary Market Financing

522298 All Other Nondepository Credit

Intermediation

Activities Related to Credit

Intermediation

522300 Activities Related to Credit

Intermediation (including loan

brokers)

Securities, Commodity Contracts, and

Other Financial Investments and

Related Activities

523110 Investment Banking & Securities

Dealing

523120 Securities Brokerage

523130 Commodity Contracts Dealing

523140 Commodity Contracts

Brokerage

523210 Securities & Commodity

Exchanges

523900 Other Financial Investment

Activities (including portfolio

management & investment

advice)

Code

Insurance Carriers and Related

Activities

524140 Direct Life, Health, & Medical

Insurance & Reinsurance

Carriers

524150 Direct Insurance & Reinsurance

(except Life, Health & Medical)

Carriers

524210 Insurance Agencies &

Brokerages

524290 Other Insurance Related

Activities

Funds, Trusts, and Other Financial

Vehicles

525100 Insurance & Employee Benefit

Funds

525910 Open-end Investment Funds

525920 Trusts, Estates, & Agency

Accounts

525930 Real Estate Investment Trusts

525990 Other Financial

Vehicles

“Offices of Bank Holding Companies”

and “Offices of Other Holding

Companies,” are located under

Management of Companies (Holding

Companies)

Real Estate and Rental and

Leasing

Real Estate

531110 Lessors of Residential Buildings

& Dwellings

531114 Cooperative Housing

531120 Lessors of Miniwarehouses &

Self-Storage Units

531190 Lessors of Other Real Estate

Property

531210 Offices of Real Estate Agents &

Brokers

531310 Real Estate Property Managers

531320 Offices of Real Estate

Appraisers

531390 Other Activities Related to Real

Estate

Rental and Leasing Services

532100 Automotive Equipment Rental &

Leasing

532210 Consumer Electronics &

Appliances Rental

532220 Formal Wear & Costume Rental

532230 Video Tape & Disc Rental

532290 Other Consumer Goods Rental

532310 General Rental Centers

532400 Commercial & Industrial

Machinery & Equipment Rental

& Leasing

Lessors of Nonfinancial Intangible

Assets (except copyrighted works)

533110 Lessors of Nonfinancial

Intangible Assets (except

copyrighted works)

Professional, Scientific, and

Technical Services

Legal Services

541110 Offices of Lawyers

541190 Other Legal Services

Accounting, Tax Preparation,

Bookkeeping, and Payroll Services

541211 Offices of Certified Public

Accountants

541213 Tax Preparation Services

541214 Payroll Services

541219 Other Accounting Services

Architectural, Engineering, and

Related Services

541310 Architectural Services

541320 Landscape Architecture

Services

541330 Engineering Services

541340 Drafting Services

2

Code

Architectural Engineering, and

Related Services

541350 Building Inspection Services

541360 Geophysical Surveying &

Mapping Services

541370 Surveying & Mapping (except

Geophysical) Services

541380 Testing Laboratories

Specialized Design Services

541400 Specialized Design Services

(including interior, industrial,

graphic, & fashion design)

Computer Systems Design and

Related Services

541511 Custom Computer

Programming Services

541512 Computer Systems Design

Services

541513 Computer Facilities

Management Services

541519 Other Computer Related

Services

Other Professional, Scientific, and

Technical Services

541600 Management, Scientific, &

Technical Consulting Services

541700 Scientific Research &

Development Services

541800 Advertising & Related Services

541910 Marketing Research & Public

Opinion Polling

541920 Photographic Services

541930 Translation & Interpretation

Services

541940 Veterinary Services

541990 All Other Professional,

Scientific, & Technical Services

Management of Companies

(Holding Companies)

551111 Offices of Bank Holding

Companies

551112 Offices of Other Holding

Companies

Administrative and Support and

Waste Management and

Remediation Services

Administrative and Support Services

561110 Office Administrative Services

561210 Facilities Support Services

561300 Employment Services

561410 Document Preparation Services

561420 Telephone Call Centers

561430 Business Service Centers

(including private mail centers &

copy shops)

561440 Collection Agencies

561450 Credit Bureaus

561490 Other Business Support

Services (including reposses-

sion services, court reporting, &

stenotype services)

Code

561500 Travel Arrangement &

Reservation Services

561600 Investigation & Security

Services

561710 Exterminating & Pest Control

Services

561720 Janitorial Services

561730 Landscaping Services

561740 Carpet & Upholstery Cleaning

Services

561790 Other Services to Buildings &

Dwellings

561900 Other Support Services (includ-

ing packaging & labeling servic-

es, & convention & trade show

organizers)

Waste Management and Remediation

Services

562000 Waste Management &

Remediation Services

Educational Services

611000 Educational Services

(including schools, colleges, &

universities)

Health Care and Social

Assistance

Offices of Physicians and Dentists

621111 Offices of Physicians (except

mental health specialists)

621112 Offices of Physicians, mental

Health Specialists

621210 Office of Dentists

Offices of Other Health Practitioners

621310 Offices of Chiropractors

621320 Offices of Optometrists

621330 Offices of Mental Health

Practitioners (except

Physicians)

621340 Offices of Physical,

Occupational & Speech

Therapists, & Audiologists

621391 Offices of Podiatrists

621399 Offices of All Other

Miscellaneous Health

Practitioners

Outpatient Care Centers

621410 Family Planning Centers

621420 Outpatient Mental Health &

Substance Abuse Centers

621491 HMO Medical Centers

621492 Kidney Dialysis Centers

621493 Freestanding Ambulatory

Surgical & Emergency Centers

621498 All Other Outpatient Care

Centers

Medical and Diagnostic Laboratories

621510 Medical & Diagnostic

Laboratories

Home Health Care Services

621610 Home Health Care Services

Code

Other Ambulatory Health Care

Services

621900 Other Ambulatory Health Care

Services (including ambulance

services & blood & organ

banks)

Hospitals

622000 Hospitals

Nursing and Residential Care

Facilities

623000 Nursing & Residential Care

Facilities

Social Assistance

624100 Individual & Family Services

624200 Community Food & Housing, &

Emergency & Other Relief

Services

624310 Vocational Rehabilitation

Services

624410 Child Day Care Services

Arts, Entertainment, and

Recreation

Performing Arts, Spectator Sports,

and Related Industries

711100 Performing Arts Companies

711210 Spectator Sports (including

sports clubs & racetracks)

711300 Promoters of Performing Arts,

Sports, & Similar Events

711410 Agents & Managers for Artists,

Athletes, Entertainers & Other

Public Figures

711510 Independent Artists, Writers, &

Performers

Museums, Historical Sites, and

Similar Institutions

712100 Museums, Historical Sites &

Similar Institutions

Amusement, Gambling, and

Recreation Industries

713100 Amusement Parks & Arcades

713200 Gambling Industries

713900 Other Amusement & Recreation

Industries (including golf

courses, skiing facilities,

marinas, fitness centers, &

bowling centers)

Accommodations and Food

Services

Accommodations

721110 Hotels (except casino hotels)

& Motels

721120 Casino Hotels

721191 Bed & Breakfast Inns

721199 All Other Traveler

Accommodation

721210 RV (Recreational Vehicle) Parks

& Recreational Camps

721310 Rooming & Boarding Houses

Code

Food Services and Drinking Places

722110 Full-Service Restaurants

722210 Limited-Service Eating Places

722300 Special Food Services (includ-

ing food service contractors &

caterers)

722330 Mobile Food Vendors Including

Trucks and Hot Dog Carts

722410 Drinking Places (Alcoholic

Beverages)

Other Services

Repair and Maintenance

811110 Automotive Mechanical &

Electrical Repair & Maintenance

811120 Automotive Body, Paint, Interior,

& Glass Repair

811190 Other Automotive Repair

& Maintenance (including oil

change & lubrication shops &

car washes)

811210 Electronic & Precision

Equipment Repair &

Maintenance

811310 Commercial & Industrial

Machinery & Equipment (except

Automotive & Electronic) Repair

& Maintenance

811410 Home & Garden Equipment &

Appliance Repair &

Maintenance

811420 Reupholstery & Furniture

Repair

811430 Footwear & Leather Goods

Repair

811490 Other Personal & Household

Goods Repair & Maintenance

Personal and Laundry Services

812111 Barber Shops

812112 Beauty Salons

812113 Nail Salons

812190 Other Personal Care Services

(including diet & weight reduc-

ing centers)

812210 Funeral Homes & Funeral

Services

812220 Cemeteries & Crematories

812310 Coin-Operated Laundries &

Drycleaners

812320 Drycleaning & Laundry

Services (except Coin-

Operated)

812330 Linen & Uniform Supply

812910 Pet Care (except Veterinary)

Services

812920 Photofinishing

812930 Parking Lots & Garages

812990 All Other Personal Services

Religious, Grantmaking, Civic,

Professional, and Similar

Organizations

813000 Religious, Grantmaking, Civic,

Professional, & Similar

Organizations (including

condominium and homeowners

associations)

Additional codes can be found at

http://www.census.gov/eos/www/naics/

3

4

INSTRUCTIONS

The Combined Registration Application For Business DC

Taxes/Fees/Assessments (Form FR-500) is to be completed by

a business or consumer registering with the Government of the

District of Columbia (DC), Office of Tax and Revenue (OTR) and

the Department of Employment Services (DOES) for the follow-

ing taxes or payment:

• Corporation Franchise Tax Return (Form D-20)

• Unincorporated Business Franchise Tax Return (Form D-30)

• Employer Withholding Tax Return (Form FR-900 series)

• Sales and Use Tax Return (Form FR-800 series)

• Personal Property Tax Return (Form FP-31)

• Ballpark Fee

• Tobacco Products Excise Tax

• Department of Health Care Finance Assessments/Fees

(DHCF)

• Miscellaneous Tax

• Unemployment Compensation Tax (Registered by DOES)

GENERAL INSTRUCTIONS

The following general instructions will assist you in completing

Form FR-500.

• Furnish all information requested in Parts I through VI. If

not applicable, write “N/A” in the answer block.

• Effective immediately, demographic information (Part I, Line

13) is mandatory.

• Although there is some duplication of information requested

in Part I and Part VI, both parts must be completed. Part VI

is processed separately from Parts I through V-1 and V-2.

• Answer all questions requesting a date with the month, day

and year.

• Sign the application at the end of Parts V-7 and VI.

• Return only the signed, original, completed application

form, DO NOT SEND COPIES.

PART I

• Enter your Federal Employer Identification Number.

• Enter your Social Security Number.

• Enter the correct Business Activity Code from the list of

codes pro vided.

The identification number(s) entered on the Form FR-500 will

be used only for tax administration purposes.

PART II

DC TAX REQUIREMENTS

Corporation Franchise Tax

Unincorporated Business Franchise Tax

Corporation Franchise Tax — Every corporation engaging in or

carrying on a trade or business in DC and/or receiving income

from sources within DC must file a Corporation Franchise Tax

Return (Form D-20). The return must be filed by March 15th or

the 15th day of the third month following the close of the cor-

poration’s taxable year. If the amount of DC Gross Receipts

owed is less than the $250 minimum required payment, $250

must be paid.

Unincorporated Business Franchise Tax — An Unincorporated

Business Franchise Tax Return (Form D-30) is required of every

unincorporated business (sole proprietor, joint venture, etc.)

engaging in or carrying on a trade or business in DC, deriving

rental income, and/or receiving other income from sources

within DC, whose gross receipts exceed $12,000. A Form D-30

must be filed by April 15th or the 15th day of the fourth month

following the close of the business taxable year.

The minimum tax is $1,000 for corporate and unincorporated

filers with District gross receipts greater than $1 million.

5

Partnership Return of Income (D-65) — Partnerships not required to

file a Form D-30 (for whatever reason) must file a Form D-65.

Non-profi t Organizations — Organizations subject to tax on unrelated

business income, as defi ned in IRC §512, must fi le a Form D-20, Cor-

poration Franchise Tax return. The due date for this fi ling is the 15th

day of the fi fth month after the close of the organization’s tax year.

PART III

Employer Withholding Tax

Employer Withholding Tax — Every employer who pays wages to

a DC resident or payor of lump-sum distributions who withholds

DC income tax must fi le a DC withholding tax return. This includes

individual employers who have household employee(s). Lump-sum

distributions do not include:

(a) any portion of a lump-sum payment that was previously subject

to tax;

(b) an eligible rollover distribution that is effected as a direct trustee

to trustee transfer; and

(c) a rollover from an individual retirement account to a traditional or

Roth individual retirement account that is affected as a direct trustee

to trustee transfer.

An employer or payor who fails to withhold or pay withholding taxes

to DC is personally liable for the tax. If your withholding tax liability is

less than or equal to $200 per period, fi le an annual return, FR-900A.

The FR-900A is due on or before the 20th day of January following

the year being reported. If your withholding tax liability is greater than

or equal to $201 and less than or equal to $1200 per period, fi le a

quarter return, FR-900Q. The FR-900Q is due on or before the 20th

day of the month following the quarter being reported. If your with-

holding tax liability is greater than or equal to $1201 per period, fi le a

monthly return, FR-900M. The FR-900M is due on or before the 20th

day of the month following the month being reported.

The District requires withholding at the highest DC income tax rate

(8.95%) for DC residents on lump-sum distributions from retirement

accounts and plans.

Note: If your withholding tax liability is $5,000 or greater per

period, you shall fi le and pay electronically.

Visit www.taxpayerservicecenter.com

PART IV

Sales and Use Tax

Sales Tax — Every sales vendor, mobile food services vendor and

Business Benefi cial License Holder (BBLH) who has made any sale at

retail taxable under the provisions of District of Columbia (DC) Offi cial

Code §47-2001 et seq., shall fi le a return with the OTR. Such returns

shall show the total gross proceeds of the vendor's business for the

month, quarter or year for which the return is fi led; the gross receipts of

the business of the vendor upon which the tax is computed; the amount

of tax for which the vendor is liable and such other information that is

deemed necessary for the computation and collection of the tax. If your

sales and use liability is less than or equal to $200 per period, fi le an

annual return, FR-800A. The FR-800A is due on or before October

20th. If your sales and use tax liability is greater than or equal to $201

and less than or equal to $1200 per period, fi le a quarterly return,

FR-800Q. The FR-800Q is due on or before the 20th day of the month

following the quarter being reported. If your sales and use tax liability

is greater than or equal to $1201 per period, fi le a monthly return,

FR-800M. The FR-800M is due on or before the 20th day of the month

following the month being reported.

The promoter of a Special Event must provide a list of the par-

ticipants (the individuals who must collect DC sales tax from the

purchasers of any goods sold at the event). The list should contain

the name, address and telephone number of each participant, the

name and date(s) of the event. Please refer to the Special Event

Registration Application (Form FR-500B) for additional informa-

tion.

The Sales and Use Tax Special Event Return, Form FR-800SE, is

used to report and pay any sales and use tax liability arising from a

special event. It is due by the 20th of the month following the last

day of the special event.

A $.05 fee is imposed on each disposable carryout bag provided

by retail establishments - grocery stores, drug stores, liquor stores,

restaurants and food vendors (including street vendors) - to their

customers.

Street and Mobile Food Services Vendor Minimum Sales Tax (FR-800V)

Vendor Sales Tax Collection and Remittance Act of 2012 requires a

minimum sales tax that a street or mobile food services vendor (a

person licensed to vend from a sidewalk, roadway, or other public

space) must fi le and pay in lieu of the previous “payment in lieu of

collecting and remitting sales tax”. Street and mobile food services

vendors are required to collect sales tax and fi le and pay a street

vendor minimum sales tax (MST) quarterly tax return and remit the

greater of the taxes collected (5.75% or 10%) or the minimum sales

tax of $375 on a quarterly basis.

Use Tax — The use tax is imposed at the same rate as the

corresponding sales tax on the purchase or rental of tangible

personal property for the use, storage or consumption in DC by a

buyer who did not pay a sales tax to DC or any other tax jurisdiction

at the time of the purchase or rental of the property.

Employer Use Tax Return Act of 2012

Any employer required to fi le a DC withholding tax return, which is

not otherwise required to collect and remit sales tax, shall fi le an

annual use tax return on or before October 20th of each year, remit-

ting with such return the use taxes which are due.

Note: If your sales tax liability is $5,000 or greater, you shall fi le

and pay electronically. Visit www.taxpayerservicecenter.com

PART V, Section 1

Personal Property Tax

Personal Property Tax — A Personal Property Tax Return (Form

FP-31) must be filed by every business owning or holding in trust

any tangible personal property (furniture, computers, fixtures, books,

etc.) located in or having a taxable situs in DC. The tax applies to

property used or available for use in a trade, business or office held

for business purposes, including property kept in storage or held for

rent or which is leased to third parties, including governmental agen-

cies, under a “lease-purchase agreement.” A Form FP-31 must be

filed and the tax paid on or before July 31st of each year based upon

the remaining cost (current value) of all tangible personal property

owned as of July 1st.

Railroad companies operating rolling stock, parlor cars and sleeping

cars in DC over any railroad line, must file Form FP-32 (Railroad

Tangible Property Return) by July 31st of each year, on property

If you have any questions regarding these tax requirements, contact the Office of Tax and Revenue, Customer Service Administration,

1101 4th Street, SW, Washington, DC 20024; or call (202) 727-4TAX (4829). First time applicants must mail the original

application to: Office of Tax and Revenue, Customer Service Administration, PO Box 470, Washington, DC 20044-0470.

6

owned on July 1st. Also, every railroad company whose lines run

through DC, must report by July 31st of each year, on Form FP-33

(Railroad Company Report), and any other company whose cars run

on their DC tracks, must file Form FP-34 (Rolling Stock Tax Return)

together with full payment of the tax owed.

Note: If your personal property tax liability is $5,000 or greater, you

shall file and pay electronically.

Visit www.taxpayerservicecenter.com

PART V, Section 2

Ballpark Fee

Except as provided below, any person that derived at least $5 million

in annual District gross receipts and who was subject to any of the

following at any given point during that person’s most recent calen-

dar or fiscal year ending on or before June 15th, each year, shall file

and pay the Ballpark Fee online:

• DC Corporation Franchise Tax;

• DC Unincorporated Business Franchise Tax; or

• The DC Unemployment Compensation Act, except employers who

employ persons to provide personal or domestic services in a private

home unless the employment is in relation to the employer’s trade,

occupation, profession, enterprise or vocation.

PART V, Section 3

Nursing Facility Assessment

The nursing facility assessment liability is set annually on a fiscal

year basis, ending September 30th. Every nursing care provider

operating in the District must pay the nursing facility assessment.

Nursing care providers operated by the federal government are

exempt. The assessment can only be filed and paid online.

PART V, Section 4

Tobacco Products Excise Tax

Business must pay the tobacco products excise tax every quarter to

report ‘little cigars’ and other tobacco products sold in the District

during the reporting period using Form FR-1000Q.

PART V, Section 5

Intermediate Care Facility for Persons with Intellectual

or Developmental Disabilities (ICF-IDD)

Every ICF-IDD facility operating in the District must pay the ICF-IDD

assessment in quarterly installments. The assessment can only be

filed and paid online.

PART V, Section 6

Hospital Revenue Assessment

Annually, by September 1, each hospital operating in the District

must pay the assessment. The assessment can only be filed and paid

online.

PART V, Section 7

Hospital Provider Fee

Each hospital operating in the District must pay the hospital pro-

vider fee quarterly, due the 15th day of the District's fiscal year

quarter (Dec., Mar., June and Sept.) The fee can only be filed and

paid online.

7

Part V, Section 8

Miscellaneous Tax

Gross Receipts Tax — Utilities, telecommunication companies providing

long distance service, companies providing cable television, satellite

relay or distribution of video or radio transmission to subscribers and

paying customers, heating oil delivery companies, commercial mobile

service providers and non-public utility sellers of natural or artificial gas

are subject to a Gross Receipts Tax.

Companies subject to the Gross Receipts Tax must submit a monthly

report of their gross receipts from DC sources. Gross receipts are

reported by filing:

Form FP-27 for utilities;

Form FP-27T for toll telecommunication companies;

Form FP-27C for cable television, satellite relay, or distribution of

video and radio transmission companies;

Form FP-27NAG for non-public utility sellers of natural or artificial

gas;

Form FP-27M for commercial mobile service providers; or

Form FP-27H for heating oil delivery companies.

Companies must file the proper form by the 20th of the month following

the month being reported.

If you have any questions regarding these tax requirements, contact the Office of Tax and Revenue,

Customer Service Administration, 1101 4th Street, SW, Washington, DC 20024; or call (202) 727-4TAX (4829).

First time applicants must mail the original application to: Office of Tax and Revenue,

Customer Service Administration, PO Box 470, Washington, DC 20044-0470

8

Unemployment Compensation Tax — Employers who hire one or

more persons to perform services in DC must register for

Unemployment Compensation Taxes. Domestic/ house hold employ-

ers who pay cash remuneration of $500 or more in any calendar

quarter also must register and file reports. A non-profit organization

granted an exemption from the payment of FUTA taxes under

IRC §501(c)(3) may elect to reimburse the DC Office of

Unemployment Compensation instead of paying taxes.

ITEM 16 OF PART VI SHOULD ONLY BE COMPLETED BY NON-

PROFIT ORGANIZATIONS. If the organization is exempt from fed-

eral unemployment taxes, check the appropriate box and include a

copy of the Internal Revenue Service exemption letter.

A non-profit organization has two options for financing Unemployment

Insurance Coverage:

1. Paying contributions at the rate assigned by the DC Department

of Employment Services. The rate is applied to the taxable wages

earned by each employee during a calendar year. Contributions

are paid on a calendar quarter basis.

2. Reimburse the trust fund. At the end of each calendar quarter, the

employer is billed for unemployment benefits paid by DC to its

former employees during the quarter.

All items marked "REQUIRED" must be completed. Failure to com-

plete the required items will delay the processing of the registration.

PERCENTAGE OF ASSETS ACQUIRED. Enter the appropriate infor-

mation in Item 15 of Part VI of the form. List any prior DC ID num-

ber issued to you or to the business.

If you are a new employer acquiring your business from a predeces-

sor, answer the appropriate questions or state whether this is a

change in the entity doing business under individual ownership,

partnership or corporation. This information is necessary to deter-

mine your experience rate. If changing the trade name, include the

former trade name.

Questions concerning liability or financing options for

Unemployment Compensation Taxes should be directed to the DC

Department of Employment Services, Office of Unemployment

Compensation, Tax Division, 4058 Minnesota Ave., NE, 4th FL,

Washington, DC 20019 or telephone (202) 698-7550. The fac-

simile number is (202) 698-5706.

PART VI

UNEMPLOYMENT COMPENSATION TAX REGISTRATION

COMPLETE PART VI ONLY IF YOU HAVE EMPLOYEES WHO WORK IN THE DISTRICT OF COLUMBIA.

Although some information has already been requested in Part 1, this form must be completed in its entirely by all employers

who have employees working in the District of Columbia. PART VI will be processed separately from Parts I through V.

If you have any questions or need additional information regarding PART VI, please call the DC Department of

Employment Services Office of Unemployment Compensation-Tax Division at 202-698-7550

Please note that entities completing this form as a requirement for submitting contract proposals with the Government of the

District of Columbia MUST complete this form even if they do not have employees who work in the District of Columbia.

COMBINED REGISTRATION APPLICATION FOR

BUSINESS DC TAXES/FEES/ASSESSMENTS

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF TAX AND REVENUE

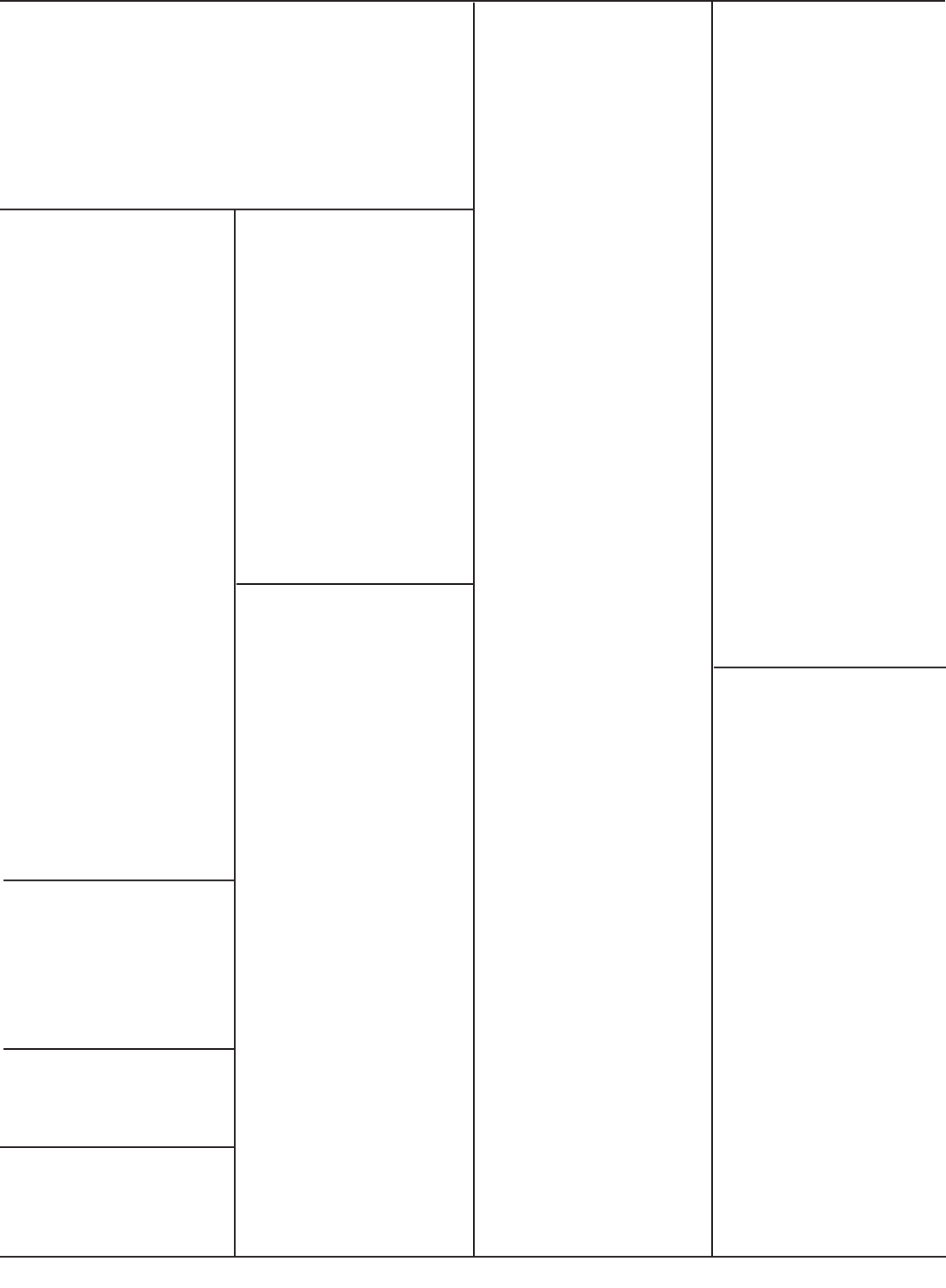

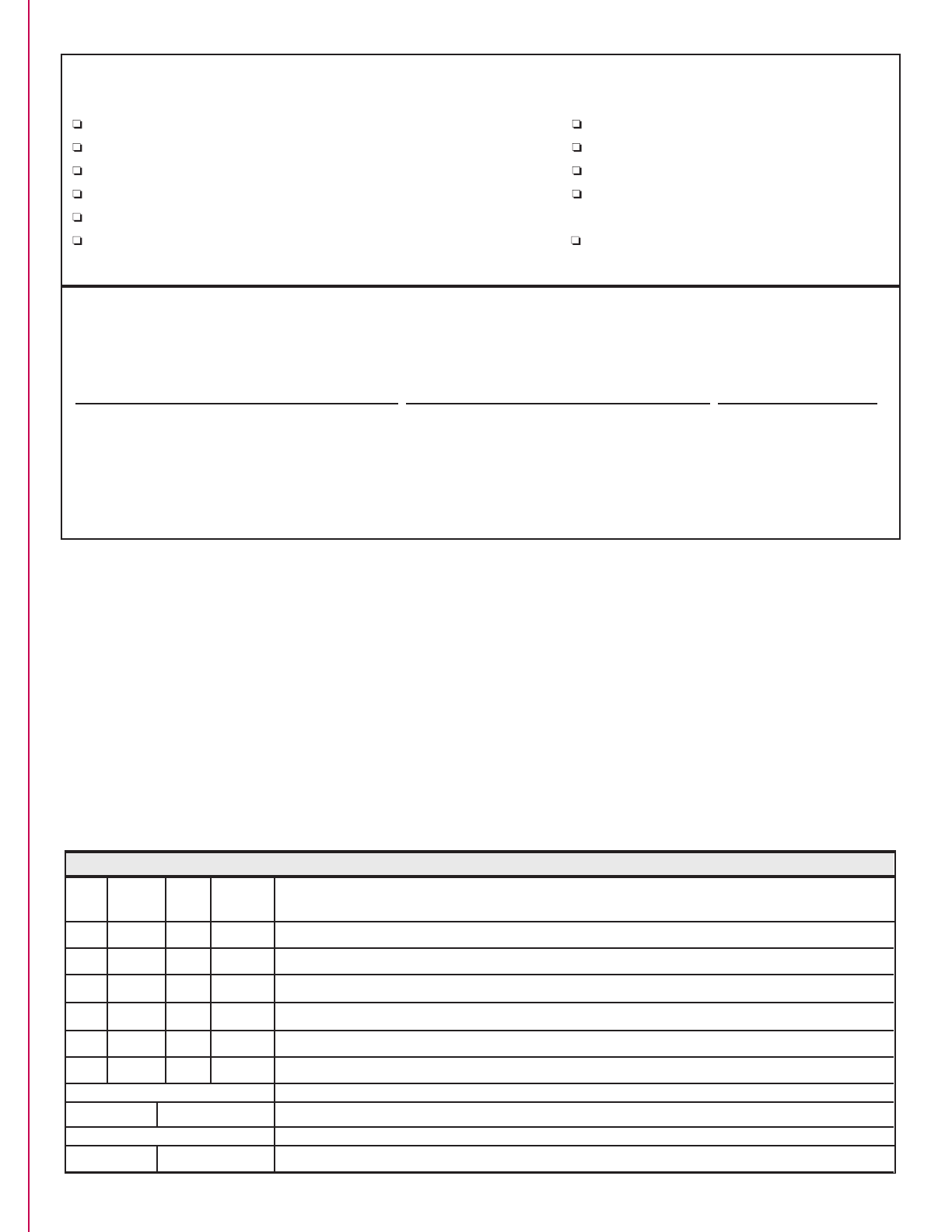

PART I — General Information

1(a). Federal Employer Identification Number

■■

■■–

■■■■■■

■■■■■■

■

■

2. NAICS Business Code

■■■■■■

■■■■■■

1(b). Social Security Number

■■■

■■■–

■■

■■–

■■■■

■■■■

3. Reason for application: (please check) 4. Legal form of business (please check):

❏ New business ❏ Employment of household/domestic help ❏ Sole Proprietor ❏ Limited partnership

❏ Additional location ❏ Address change ❏ Limited Liability Company ❏ Government

❏ Purchased existing business ❏ Merger (attach merger agreement) ❏ General partnership ❏ Joint Venture

❏ Name change ❏ Other (describe on an attachment) ❏ Limited Liability Partnership ❏ Other (specify)

(if a corporation, attach corporation amendment) ❏ Heating oil company ❏ Corporation

❏ Legal form change ❏ Utility company

❏ Street and Mobile Food Services Vendor

5. Business Name (Individual, Partnership, Corporation)

6. Trade Name (if different from Line 5)

7. Business Address (PO Box is not acceptable unless located in a Rural Area)

8. Mailing Address

9. Local Business Phone No. 10. Main Office Phone No. 10(a). Fax No. 11. Date present business began or is

expected to begin in DC

( ) ( ) ( ) Mo. ________ Day ________ Year ________

12. If previously registered with the DC, please provide:

Former Entity Name __________________________________________ Business Tax Registration Number ___________________________________

Former Trade Name ___________________________________________ Name of Former Owner(s) _________________________________________

13. NAME, TITLE, HOME ADDRESS, SOCIAL SECURITY NUMBER OF PROPRIETOR, PARTNERS OR PRINCIPAL OFFICERS

Name and Title Home Address Zip Code Social Security Number

Name and Title Home Address Zip Code Social Security Number

Name and Title Home Address Zip Code Social Security Number

PART II — Franchise Tax Registration

14. Indicate your profession, principal business activity or service (for example, retail grocery, wholesale auto parts, barber shop, doctor, contractor, etc.)

15. Do you or will you have an office, warehouse, or other place of business in DC, or a representative

with a DC location? ❏ Yes ❏ No

16. Do you or will you have merchandise stored in a public or private warehouse in DC? ❏ Yes ❏ No

17. Do you or will you perform in DC personal services (medical, accounting, consulting); or other services such as

electrical, heating, construction, etc., or installations or repairs of any type? ❏ Yes ❏ No

18. Do you or will you generate any business related income from DC sources? ❏ Yes ❏ No

19. Do you or will you have rental property in DC? ❏ Yes ❏ No 20. Date converted or expected to be converted to rental property ____/____/____

21. Date on which your taxable year ends: Month ________ Day ________ Year ________ (❏ Calendar or ❏ Fiscal)

22. Describe fully ALL your current or expected business activities and/or major type of services performed within DC.

(Attach separate sheet if necessary.)

— INCOMPLETE APPLICATIONS WILL NOT BE PROCESSED AND WILL BE RETURNED —

Mandatory: If incorporated, enter state and date of incorporation.

State _________________ Mo. _____ Day _____ Yr _____otherwise go to Line 5.

E-mail Address

E-mail Address

E-mail Address

(Rev. 03/14 )

FR-500

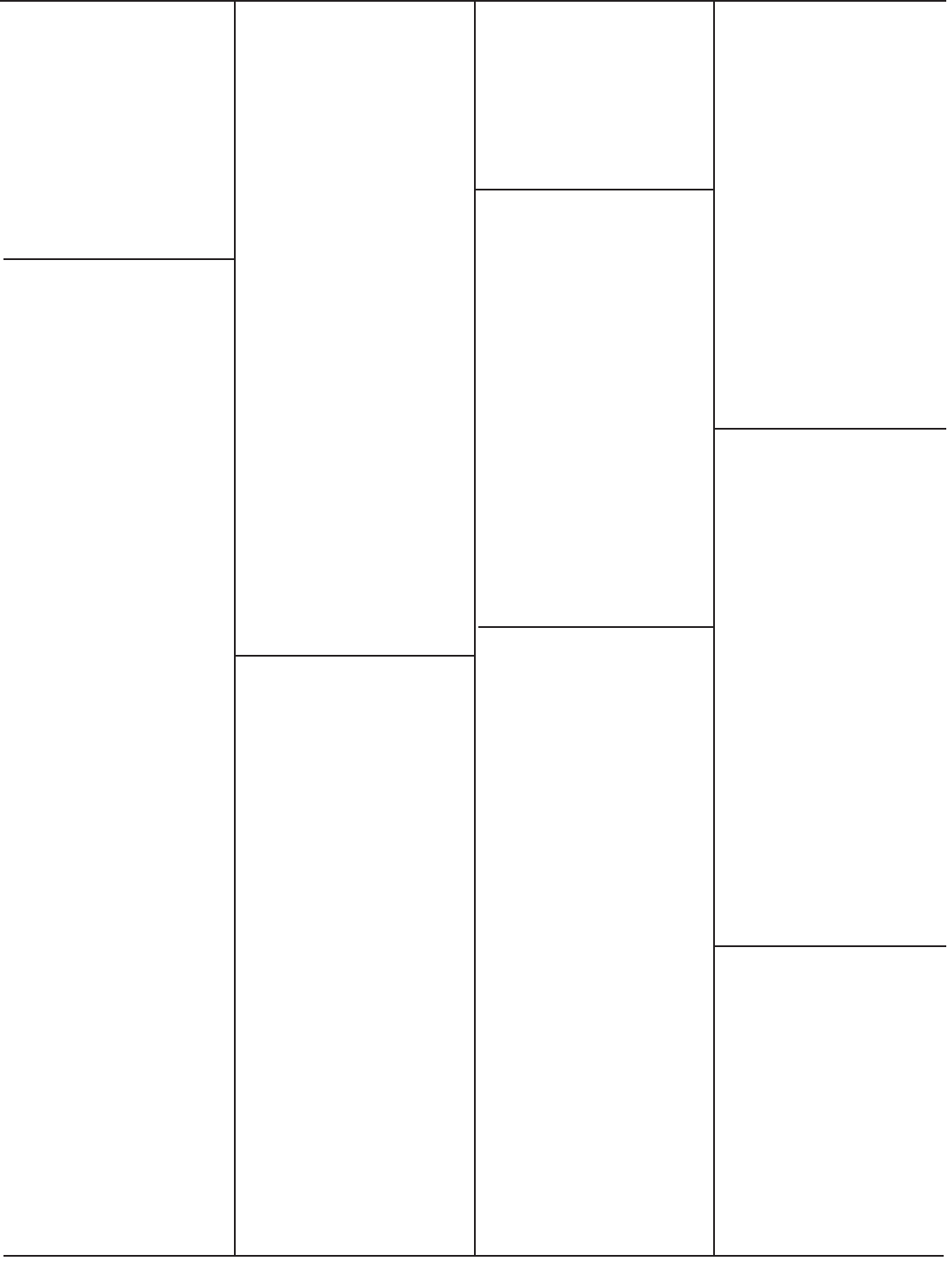

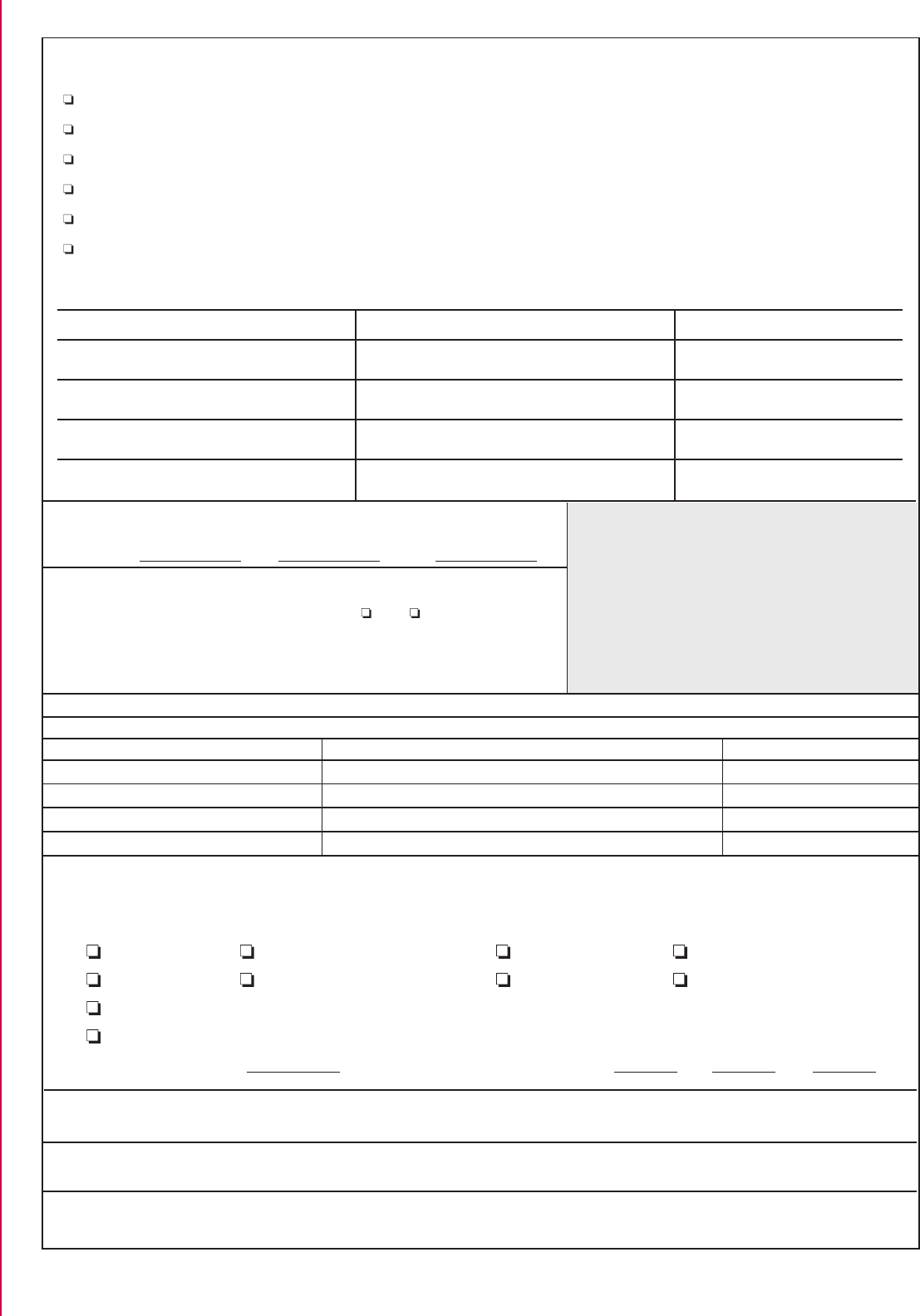

PART III — Employer’s DC Withholding Tax Registration

PART IV — Sales and Use Tax Registration

23. Estimated total number of employees __________ 24. Number of DC resident employees subject to DC

Withholding Tax: _______________

25a. Date when you began to employ DC resident(s) ____-____-____ 26. Estimate of amount of DC tax to be withheld monthly from

mo. day yr. DC resident employees:

25b. Date when you began or when you expect to begin

to withhold DC tax from resident employees ____-____-____ 27. Will you have employee(s) working in DC?

28. Withholding from retirement accounts or plans

29. Check applicable box(es) below

Reporting Sales Tax on retail sales or rentals.

Reporting Use Tax on items purchased tax free inside/outside DC

Purchasing in DC items for resale outside DC (Attach photocopy of state/county sales tax registration.)

Purchasing in DC cigarettes for resale outside DC (Attach photocopy of state/county cigarette/tobacco license.)

Making no taxable sales and tax is paid to vendors on all taxable purchases.

Making exempt sales where a Certificate of Resale is issued.

30. Date when sales/use began in DC (mo./day/yr.) ______/______/______ or date expected to begin.

31. If you have more than one place of business where you collect taxes on sales

in DC, do you wish to file a Combined Sales Tax Return for all locations? Yes No

Please attach a statement listing the additional places of business.

PART V, Section 1 — Personal Property Tax Registration

Describe the type of Personal Property at each location (ex. furniture, fixtures, machinery equipment and supplies), used for business purposes.

PART V, Section 2 — Ballpark Fee Registration

Are annual gross receipts greater than $5 million? Yes No

PART V, Section 3 — Nursing Facility/Registration

Yes No Begin date (MMDDYYYY) ____/____/________ End date (MMDDYYYY) ____/____/________

PART V, Section 4 — Tobacco Products Excise Tax Registration

Yes No Begin date (MMDDYYYY) ____/____/________ End date (MMDDYYYY) ____/____/________

PART V, Section 5 —

Intermediate Care Facility for Persons with Intellectual or Developmental Disabilities (ICF-IDD) Tax Registration

Yes No Begin date (MMDDYYYY) ____/____/________ End date (MMDDYYYY) ____/____/________

PART V, Section 6 — Hospital Revenue Assessment

Yes No Begin date (MMDDYYYY) ____/____/________ End date (MMDDYYYY) ____/____/________

PART V, Section 7 — Hospital Provider Fee

Yes No Begin date (MMDDYYYY) ____/____/________ End date (MMDDYYYY) ____/____/________

Begin date (MMDDYYYY) __ /___/____ End date (MMDDYYYY) ___/___/____

Street and Mobile Food Services Vendor.

Yes No

PART V, Section 8 — Miscellaneous Tax Registration

CERTIFICATION

I declare under penalties as provided by law that this application (including any accompanying schedules and statements) has been examined

by me and, to the best of my knowledge, it is correct.

etaDeltiTerutangiS

APPLICATIONS WHEN COMPLETED MUST BE SIGNED BY EITHER THE OWNER, PARTNER OR PRINCIPAL OFFICER

OF THE CORPORATION. (Agents or Representatives signing must attach a

Power of Attorney

.)

Check applicable block(s) below and the appropriate payment booklets/returns will be sent to you or available on the website.

Alcoholic Beverage Wholesaler Gross Receipts Tax on Heating Oil

Cable Television, Satellite Relay or Distribution of Video or Radio Transmission only Interstate Bus

Cigarette Wholesaler Motor Vehicle Fuel Tax

Commercial Mobile Service Tax Gross Receipts Tax on Natural or Artificial Gas by

nosreP ytilitU cilbuP-noNytilitU cilbuP stpieceR ssorG

Gross Receipts Tax on Toll Telecommunication Service

If you have questions please contact the Customer Service Administration at (202) 727-4TAX (4829).

OFFICIAL USE ONLY

Type Date Lia.

Tax began Cycle Method Remarks

H

J

W

S

P

MISC

Reviewer/Date

Date Data Entered/Initials

Medical Marijuana

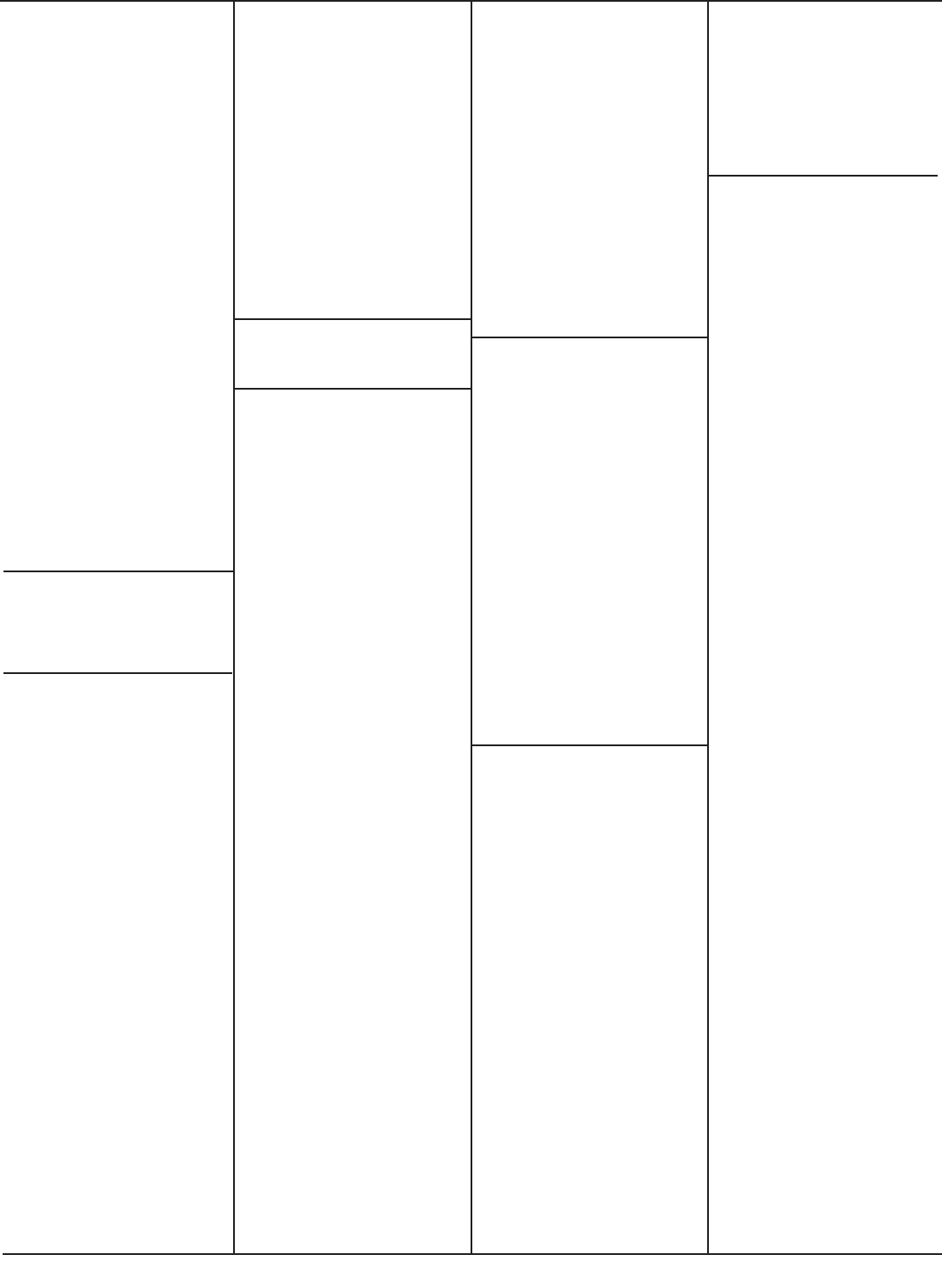

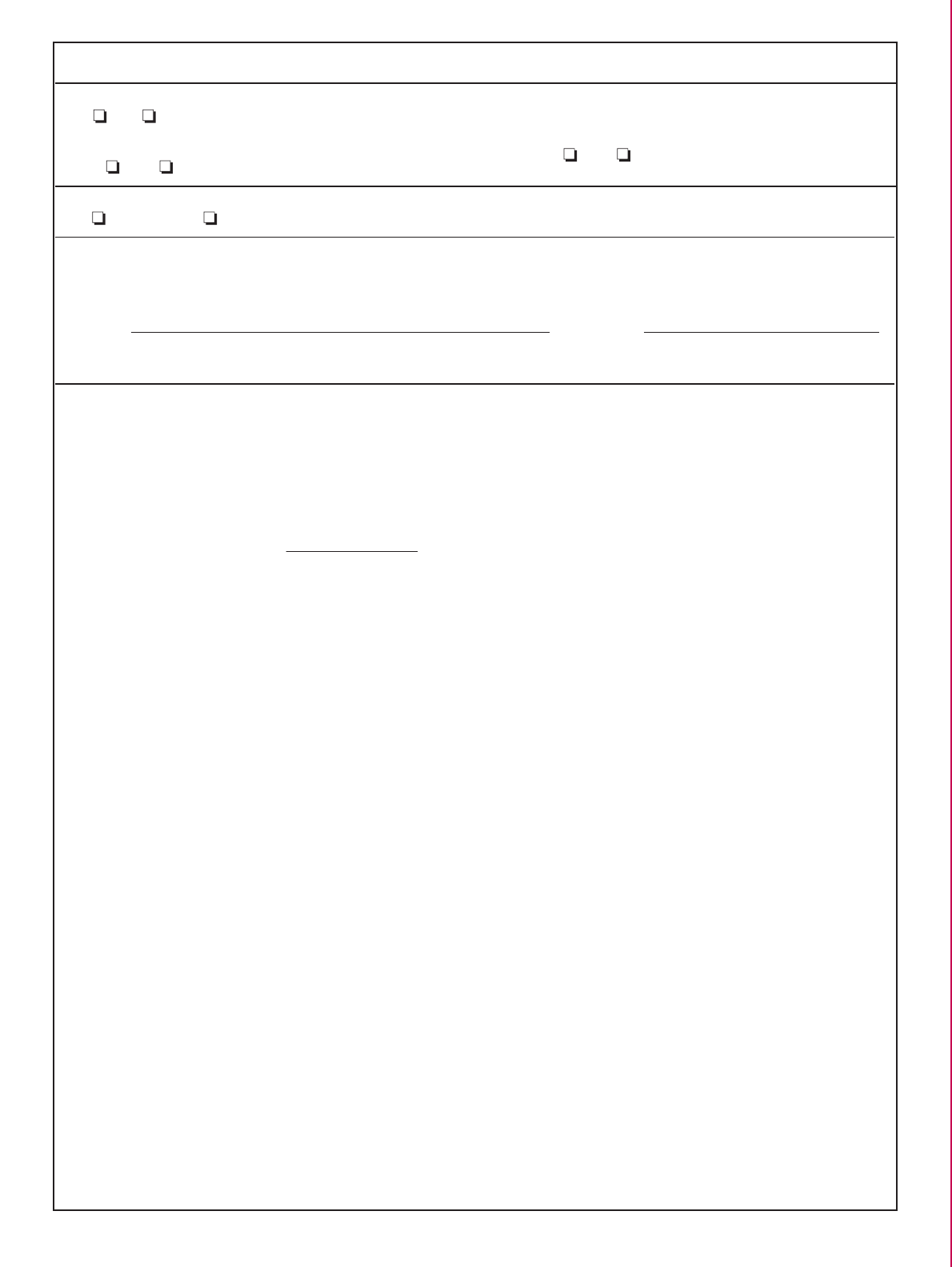

PART VI — Unemployment Compensation Tax Registration

1. Federal Employer

Identification Number –

3. Type of ownership

(check one)

Sole Proprietor Household/domestic

Partnership Limited Liability Company

Joint Venture Limited Liability Partnership

Corporation Other (specify)

___________________________

If incorporated, enter:

State __________________ Date ___________________

MM / DD / YYYY

4. Describe in detail your business activity and/or major source of sales that generate sales and use tax; specify the product manufactured

and/or sold, or the type of service performed. (Omission of this information may delay the determination of your status.)

5. Legal entity name 6. Trade name (if different from line 5)

7. Street address of DC business, worksite or employee’s home 8a. Mailing address for Tax Correspondence

Mailing address for Benefits Correspondence

address if working from home. Application will NOT be processed

without a DC address. (PO Box is not acceptable)

2. Previously assigned unemployment

insurance number

(if applicable)

–

Reason for applying:

New Business Additional location

Merger (attach merger Purchased existing

agreement) business

Household/domestic Other (specify)

Change of Entity ________________________

Reorganization

Name Change

(if a corporation attach corporation amendment)

Although some information has already been requested in Part 1, this form must be completed in its entirety by all employers who

have employees working in the District of Columbia. PART VI will be processed separately from Parts I through V.

If you have any questions or need additional information regarding PART VI, please call the DC Department of Employment

Services Office of Unemployment Compensation-Tax Division at 202-698-7550 for assistance or email doesregistration@dc.gov

— COMPLETE REVERSE SIDE —

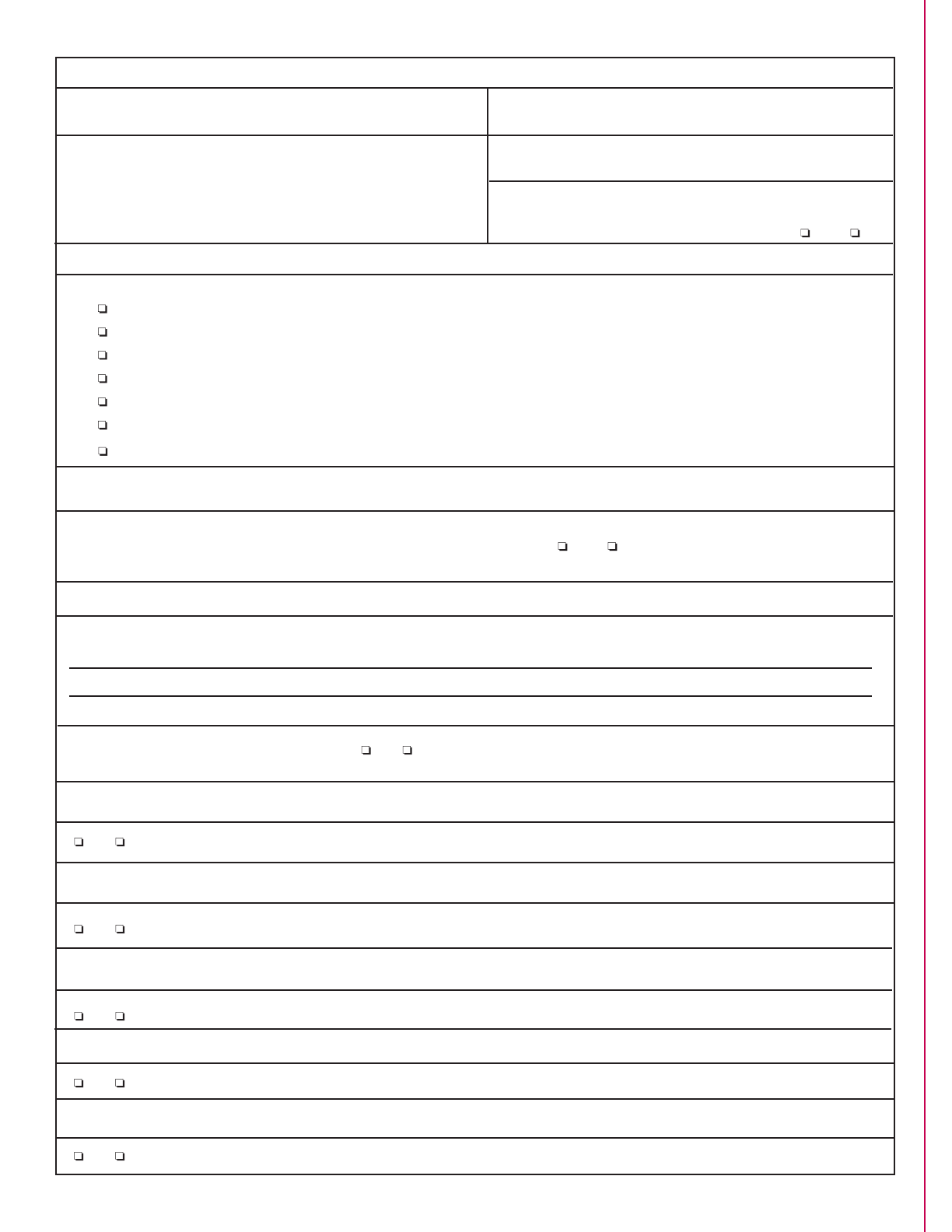

8b.

COMPLETE PART VI TO DETERMINE UNEMPLOYMENT INSURANCE LIABILITY

Please note that entities completing this form as a requirement for submitting contract proposals with the Government of the District

of Columbia MUST complete this form even if they do not have employees who work in the District of Columbia.

12a. Date wages were first paid to employees performing services in DC

(write N/A if there were no services performed in DC.)

Month: Day: Year:

12b. For household employers only. Do you have an individual in your private DC

residence performing personal, rather than business, services to whom you

pay $500 or more in one calendar quarter? Yes No

If yes: indicate the earliest quarter and calendar year when you paid $500 or

more : Quarter: _______ Year: _______

Check your preference for filing Contribution and Wage Reports:

Quarterly _____ Annually ______

13. Number of workers employed in DC (including officers).

14. List all places of business in DC

EDOC PIZSSERDDA NOITACOLEMAN SSENISUB

15. If the reason for registering is due to the purchase of an existing business, merger, reorganization, or change of legal entity, or the

acquisition, assumption or transfer of the workplace of another entity or entities, provide the following information including the

percentage of assets and/or workforce acquired (if needed, attach an additional explanation of transactions).

Nature of transfer (check appropriate box):

Purchase Merger or consolidation Foreclosure Receivership

Lease Corporate Reorganization Bankruptcy Assignment

Partnership reorganization (admission or withdrawal of one or more partners).

Other (specify in detail): ____________________________________________________________________________________________

Percent of assets acquired: % Date of aquisition transfer: Month: Day: Year:

rebmuN

tnuoccA

s’rossecederPe (Legal Entity Name)maN

s’rossecederP

Address

Trade name (D/B/A) under which transferred business or business that formerly employed your acquired workforce was operated.

This space for official use only.

Account Number ______________________________

Date _________________________________________

Signature _____________________________________

11. List proprietor, partners, or principal officers ALL FIELDS MUST BE COMPLETED:

r (REQUIRED)ebmuN ytiruceS laicoSs (REQUIRED)serddAe (REQUIRED)ltiT dna emaN

9. Electronic Means of Communication (REQUIRED)

(Leave blank if not applicable)

Local Voice Number ______________________________

Local Fax Number ______________________________

Main Office Voice Number ______________________________

Main Office Fax Number ______________________________

Tax E-mail Address ______________________________

Website Address ______________________________

10. Owner, officer, or agent responsible for reporting and remitting

unemployment taxes:

Name __________________________________________________

Title ___________________________________________________

Voice No. ______________________________________________

Fax No. ________________________________________________

16. COMPLETE THIS PART ONLY IF THIS IS A NON-PROFIT ORGANIZATION

16a.Is the organization covered by the Federal Unemployment Tax Act? 16b.Is the organization exempt from Federal income taxes under

Yes No

Unemployment Tax Act? Yes No

Yes No (If yes, please attach a copy of the §501(c)(3) exemption letter.)

16c.Choose an option to finance unemployment insurance coverage

(see instructions)

Contributions Reimbursement of trust fund

CERTIFICATION.

I declare under penalties as provided by law that Part VI (including any accompanying schedules and statements) has been

examined by me and, to the best of my knowledge, it is correct.

rebmuN

enohpeleTetaDeltiTerutangiS

THE COMPLETED PART VI MUST BE SIGNED BY THE OWNER, PARTNER OR PRINCIPAL OFFICER OF THE

BUSINESS, OR BY AN AGENT (Power of Attorney must be attached if signed by an agent.)

Return completed forms to: Department of Employment Services

4058 Minnesota Ave. NE 4th FL

Office of Unemployment Compensation - Tax Division

Washington, DC 20019

or email to: doesregistration@dc.gov

Please note that wage information and other confidential unemployment compensation information may be requested and used for other

government purposes, including determination or verification of an individual eligibility for other government programs, This notice is required

by 20 CFR

§

603.11(b).

§501(c)(3) of the IRS code for religious, educational, or

charitable purposes?

IMPORTANT NOTICE

PLEASE NOTE THAT FAILURE TO COMPLETE ALL ITEMS MARKED “REQUIRED” OR

OTHERWISE INDICATED AS REQUIRED WILL EITHER DELAY THE PROCESSING OF

THE APPLICATION OR CAUSE THE INCOMPLETE APPLICATION TO BE RETURNED

FOR ADDITIONAL INFORMATION.

Print Name Email Address

If NO, is it exempt under

§3306(c)(8) of the Federal