The Deutsche Bank Guide To Exchange Rate Determination FX Broker DB

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 160 [warning: Documents this large are best viewed by clicking the View PDF Link!]

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 1

Deutsche Bank@

May 2002

FX Research

Global Markets Research

Michael R. Rosenberg

Head of Global FX Research

David Folkerts-Landau

Managing Director, Head of

Global Markets Research

Exchange-Rate Determination

in the Short, Medium, & Long Run

The Deutsche Bank

Guide to

Exchange-Rate

Determination

A Survey of

Exchange-Rate

Forecasting Models and

Strategies

Bandwagon Effect/

Trend-Following Behavior

Real

Interest-Rate

Differentials

Purchasing Power Parity

Capital

Flows

Fiscal

Policy Portfolio-Balance

Considerations

Current

Account

Trends

Relative

Economic

Growth

Monetary

Policy

Investor Positioning

FX Options Market

Positioning

Risk Appetite

Investor Sentiment

Net Foreign Assets

Productivity Trends

Savings/Investment

Balance Trends

Persistent Trend in

Terms-of-Trade

Exchange Rate

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

2Deutsche Bank Foreign Exchange Research

Introduction .................................................................................................... 4

Exchange Rate Determination in the Short Run ........................................ 7

Currency Forecasting Using Technical Analysis .........................................11

Sentiment and Positioning Indicators ....................................................... 21

Currency Options Market ......................................................................... 22

Order Flow and the Determination of Exchange Rates ........................... 24

Investor Positioning and the Trend in Exchange Rates ............................. 27

Risk Appetite Shifts and Currency Trends................................................. 28

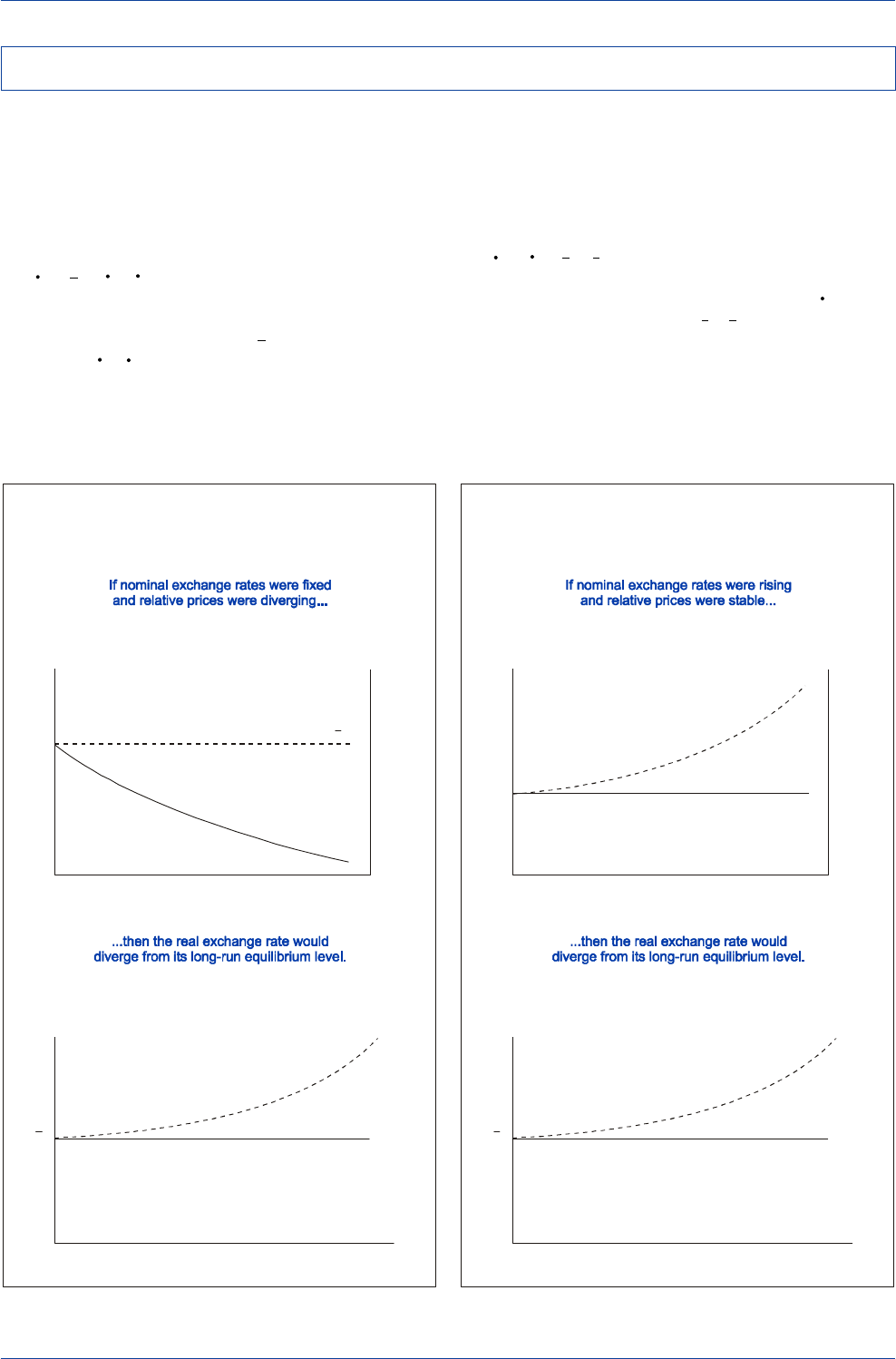

Exchange Rate Determination in the Long Run ....................................... 31

Purchasing Power Parity ........................................................................... 33

The Macroeconomic-Balance Approach to Long-Run

Exchange-Rate Determination ............................................................ 42

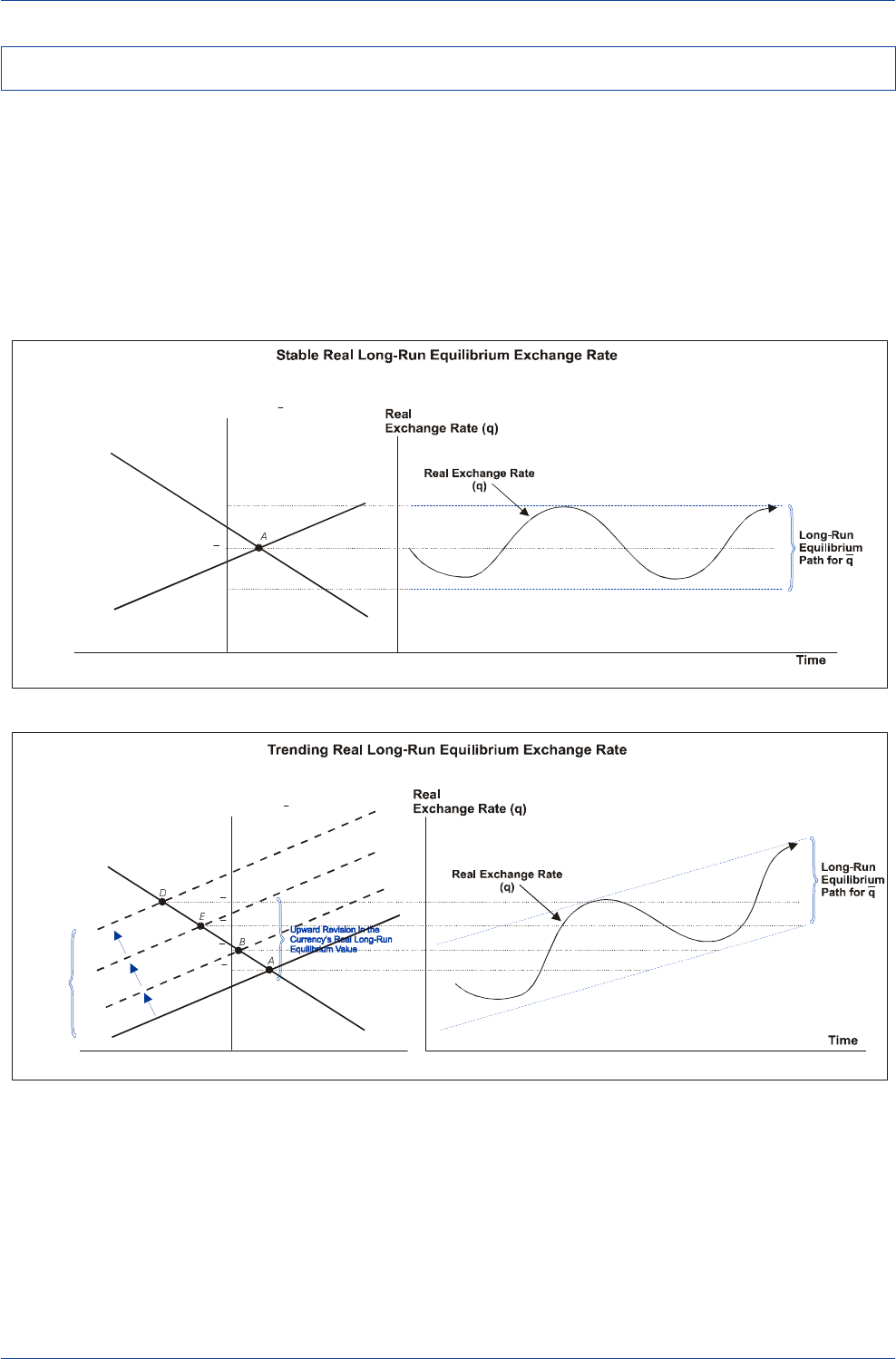

The Real Long-Run Equilibrium Exchange Rate ....................................... 43

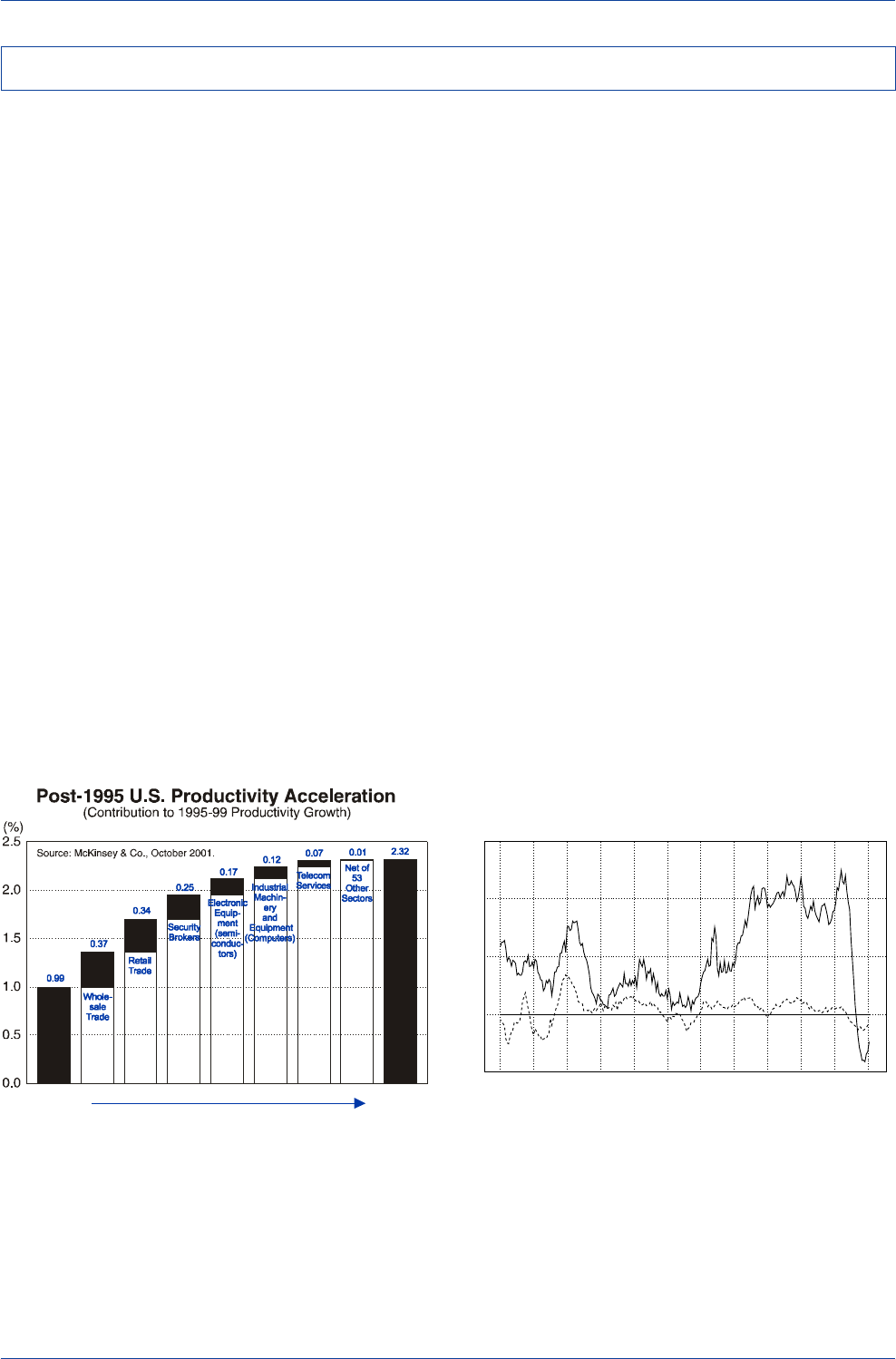

Productivity Trends and Exchange Rates .................................................. 46

Terms of Trade and Exchange Rates......................................................... 50

Net International Investment and the Equilibrium Exchange Rate........... 51

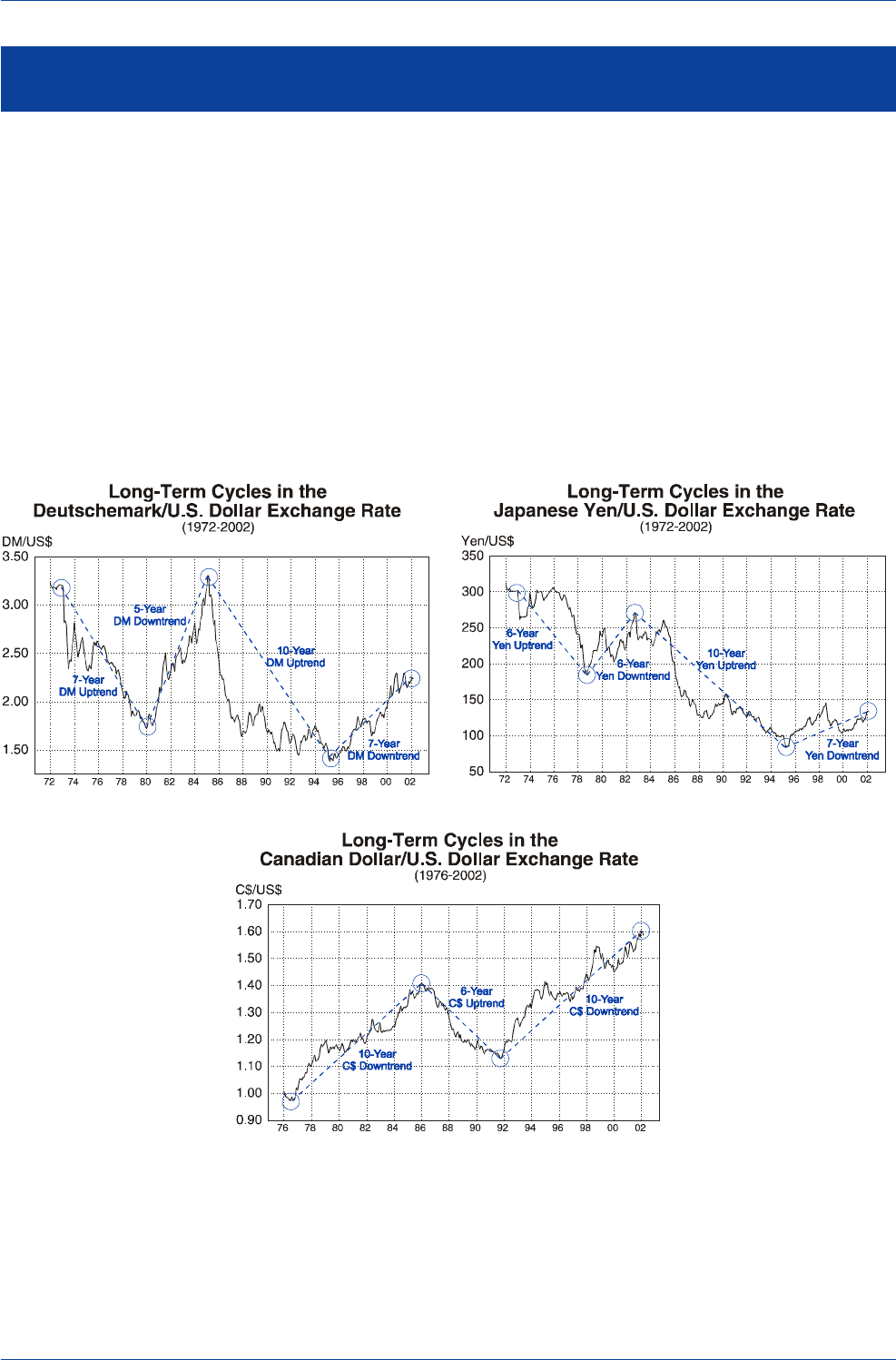

Long-Term Cycles in Exchange Rates....................................................... 53

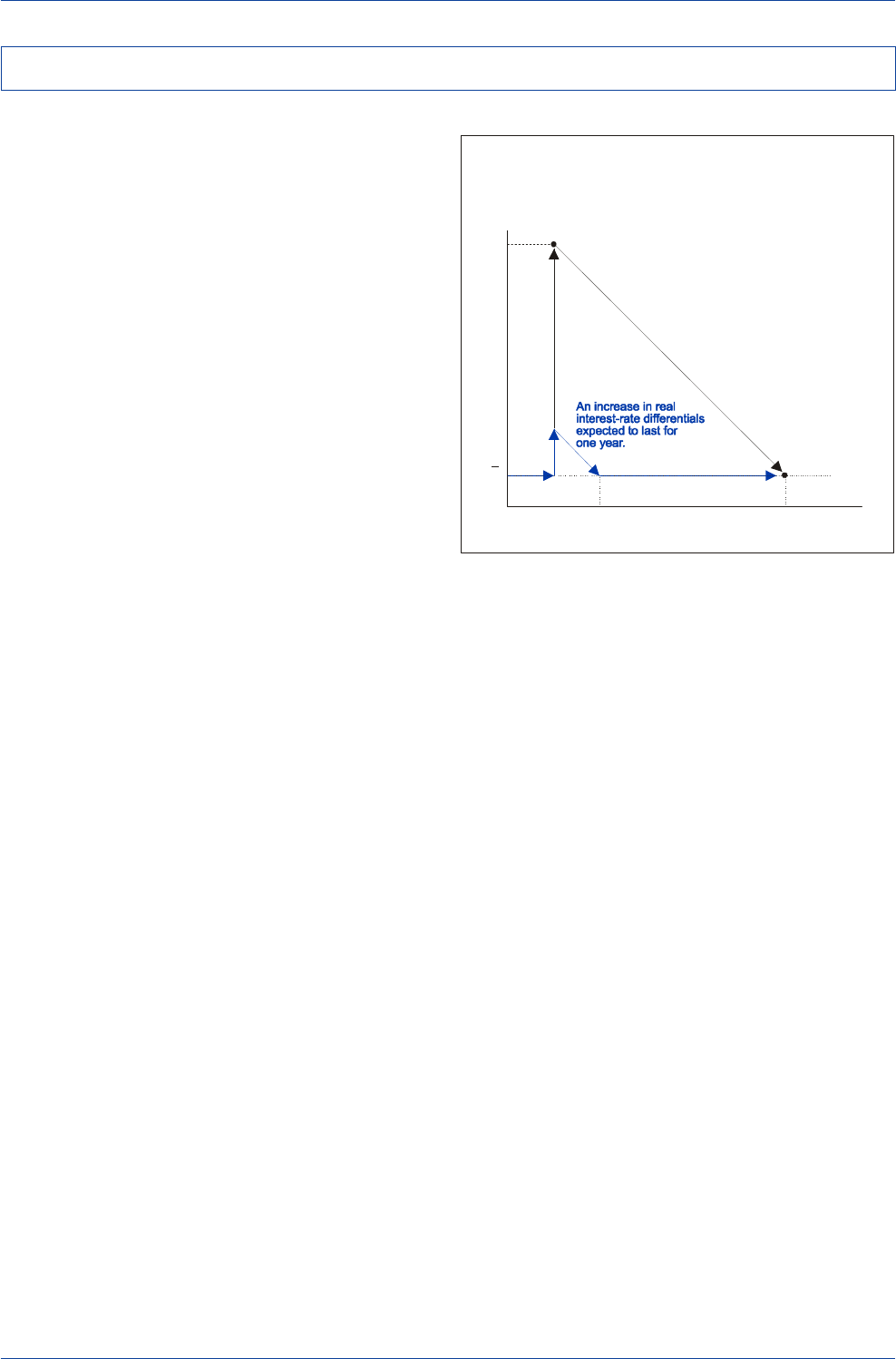

Overshooting Exchange Rates ................................................................. 60

Exchange Rate Determination in the Medium Run.................................. 63

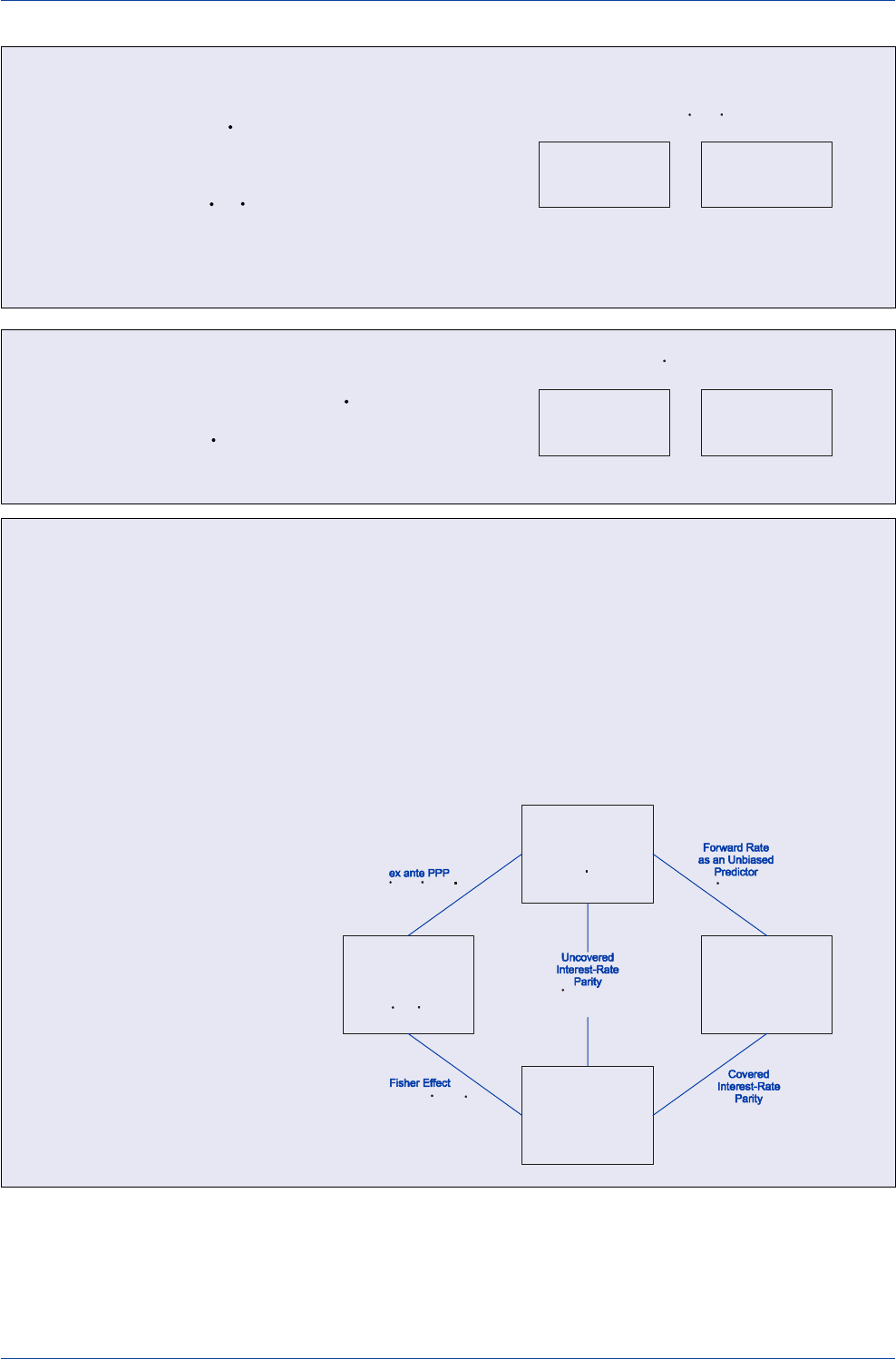

International Parity Conditions.................................................................. 65

Real Interest-Rate Differential Model ....................................................... 67

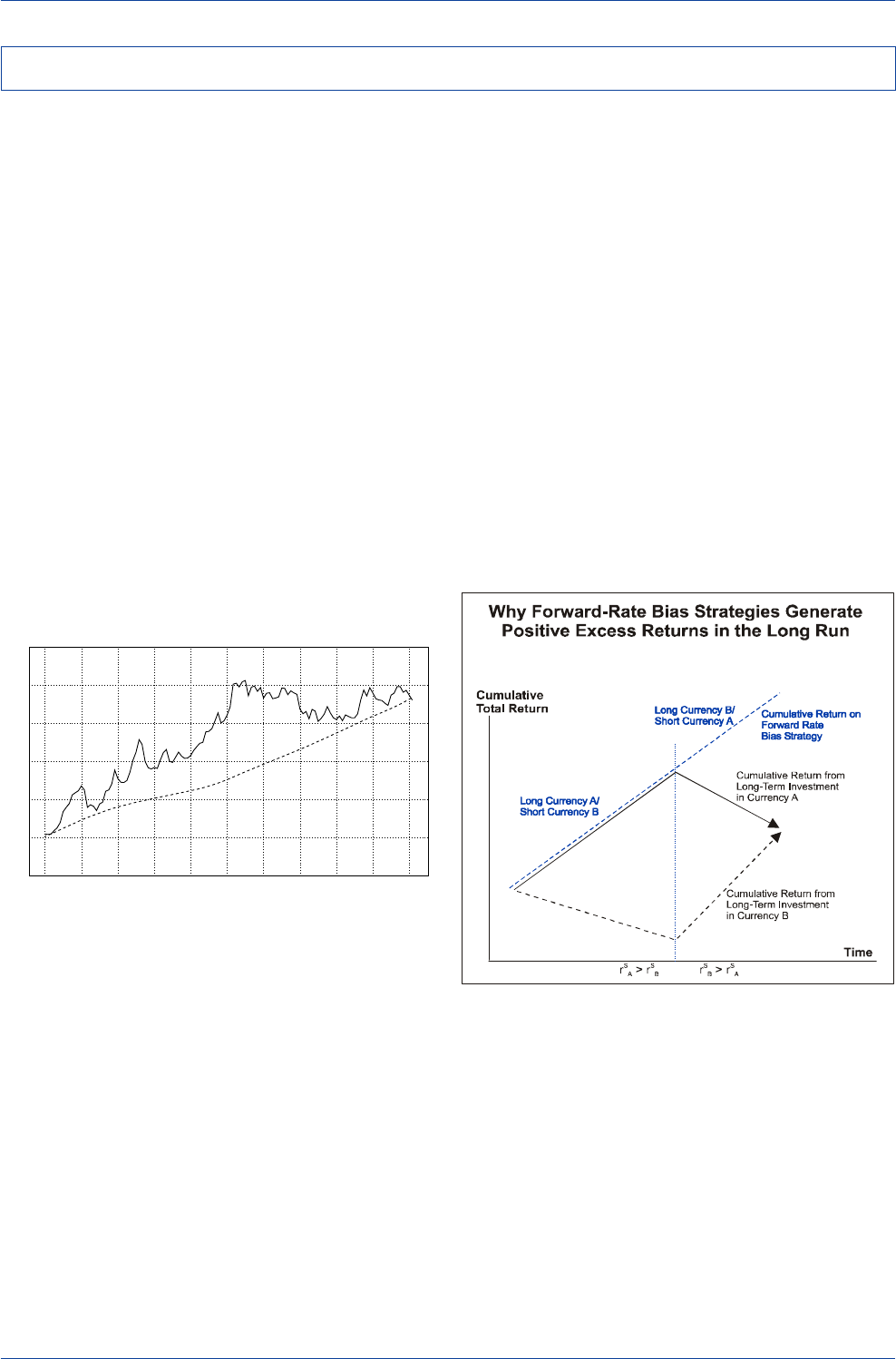

Forward-Rate Bias Strategy...................................................................... 72

Current-Account Imbalances and the Determination of

Exchange Rates................................................................................... 77

Capital Flows and Exchange Rates........................................................... 86

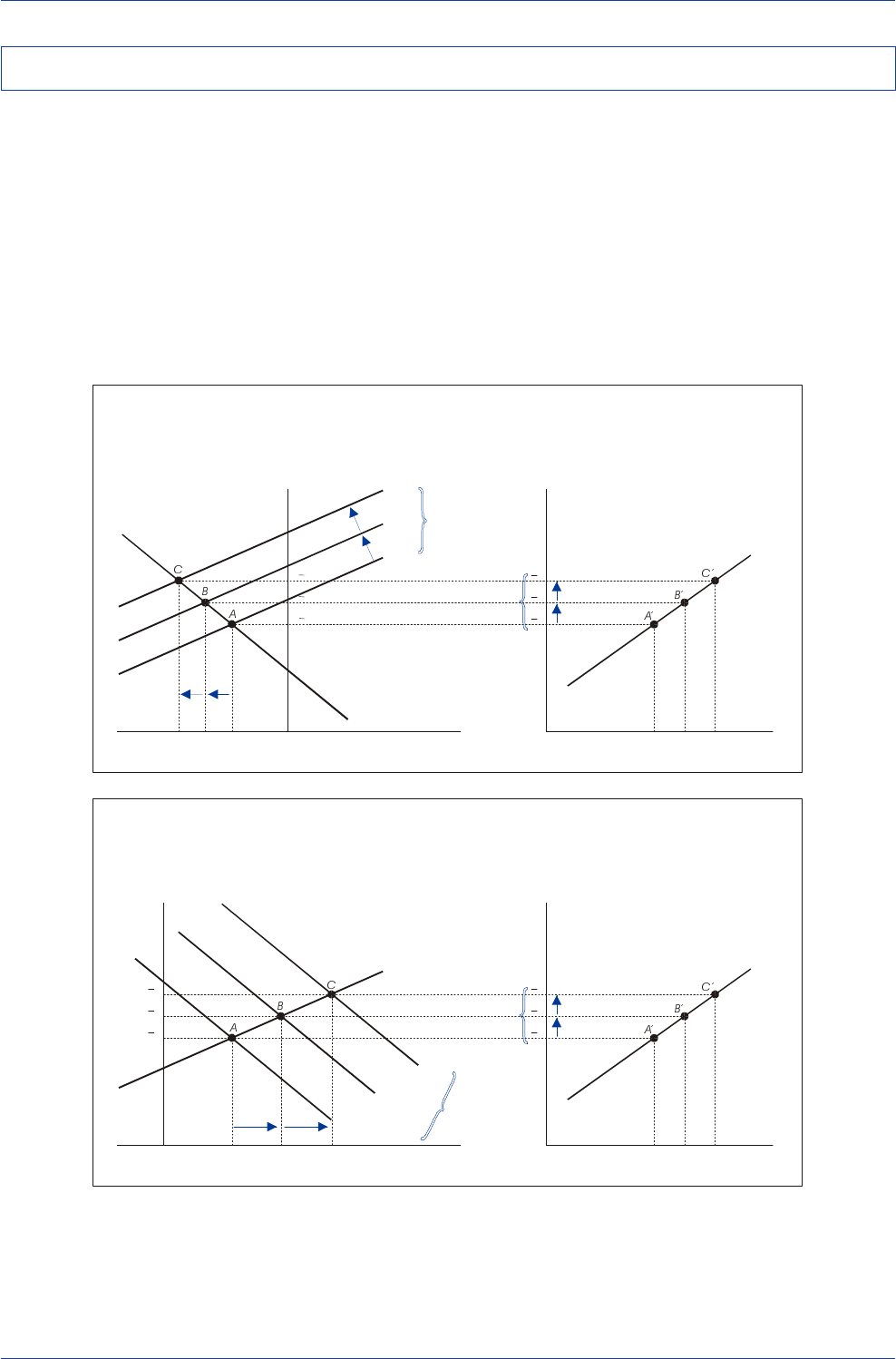

Mundell-Fleming Model ........................................................................... 96

Monetary Approach ................................................................................ 104

Portfolio-Balance Approach ..................................................................... 108

Fiscal Policy .............................................................................................115

Economic Growth....................................................................................119

Central-Bank Intervention ....................................................................... 124

Anticipating Currency Crises in Emerging Markets ............................... 129

References................................................................................................... 155

Table of Contents

Datastream International, Inc. is the source of the majority of data

used in the charts and tables in this publication. Other sources are

noted individually.

Market sentiment data is by permission of Consensus, Inc.,

Con-

sensus, National Futures and Financial Weekly,

(1) (800) 383-1441 or (1) (816) 373-3700

www.consensus-inc.com

Sources:

May 5, 2002

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 3

"If you think writing about the fortunes of the stock

market is tricky, try getting your arms around cur-

rencies."

Bill Gross

PIMCO

Investment Outlook, January 2002

"Having endeavored to forecast exchange rates

for more than half a century, I have understand-

ably developed significant humility about my abil-

ity in this area...."

Alan Greenspan

Remarks Before the Euro 50 Roundtable

Washington D.C., November 30, 2001

Deutsche Bank Guide to Exchange-Rate Determination

"Explaining the yen, dollar and euro exchange rates

is still a very difficult task, even ex-post."

Kenneth Rogoff

Economic Counselor and Director of Research,

International Monetary Fund

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

4Deutsche Bank Foreign Exchange Research

Getting the exchange rate right is a critical objective of all

international investors. Unfortunately, getting the exchange

rate right on a reasonably consistent basis is far from easy.

As anyone involved in the business of currency forecast-

ing can attest, it can be a humbling experience.

Currency forecasts can go awry for a variety of reasons.

For instance, if one's expectation of the direction in which

fundamental-based forces are heading is flawed, so will

be one's forecast of a currency's future path. Even if one's

interpretation of the underlying fundamental forces were

correct, currency forecasts might still go awry if short-term

technical forces carried exchange rates far from their fun-

damental equilibrium path.

Scores of empirical studies have found that fundamental-

based models tend to perform poorly in terms of explain-

ing exchange-rate trends, particularly over short-term peri-

ods. However, fundamental-based models tend to work

better over medium and especially longer-run horizons.

Unfortunately, most fund managers, whose performances

are evaluated over relatively short time spans these days,

are often not willing to risk significant sums of capital on

the basis of longer-term, fundamental-based projections.

That is why many market participants have recently turned

their attention away from longer-run fundamental-based

forecasting approaches in favor of shorter-term forecast-

ing tools such as technical-based trend-following trading

rules. In addition, there has recently been significant inter-

est in flow, sentiment, and positioning indicators to deter-

mine the exposure of market participants to the individual

currencies. Such indicators are often used as contrarian

indicators to determine whether a currency is significantly

overbought or oversold, and thus ripe for a correction.

Given the wide variety of forecasting approaches, we

thought it would be useful to put together a guidebook

that summarized each of those approaches in an easy-to-

read format. Our intention was to create a user-friendly

format where the written text was purposely kept to a

minimum and where the charts and tables—about 400 in

all—would tell the story.

This guidebook recognizes that the tools required for short-

term investors differ significantly from those needed for

medium and long-term currency managers. Hence, the

guidebook devotes separate chapters to the determina-

tion of exchange rates over short, medium, and long-term

horizons.

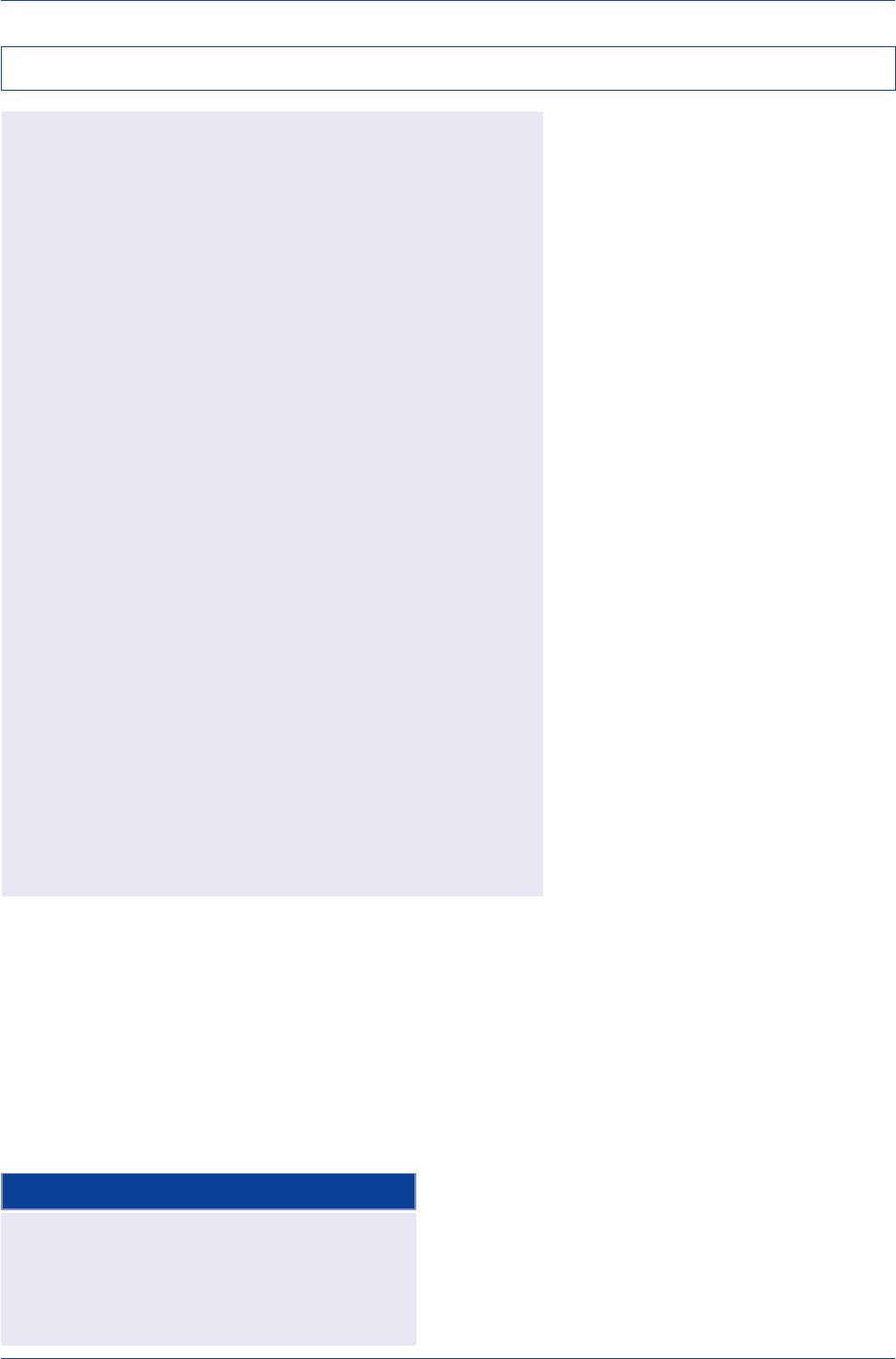

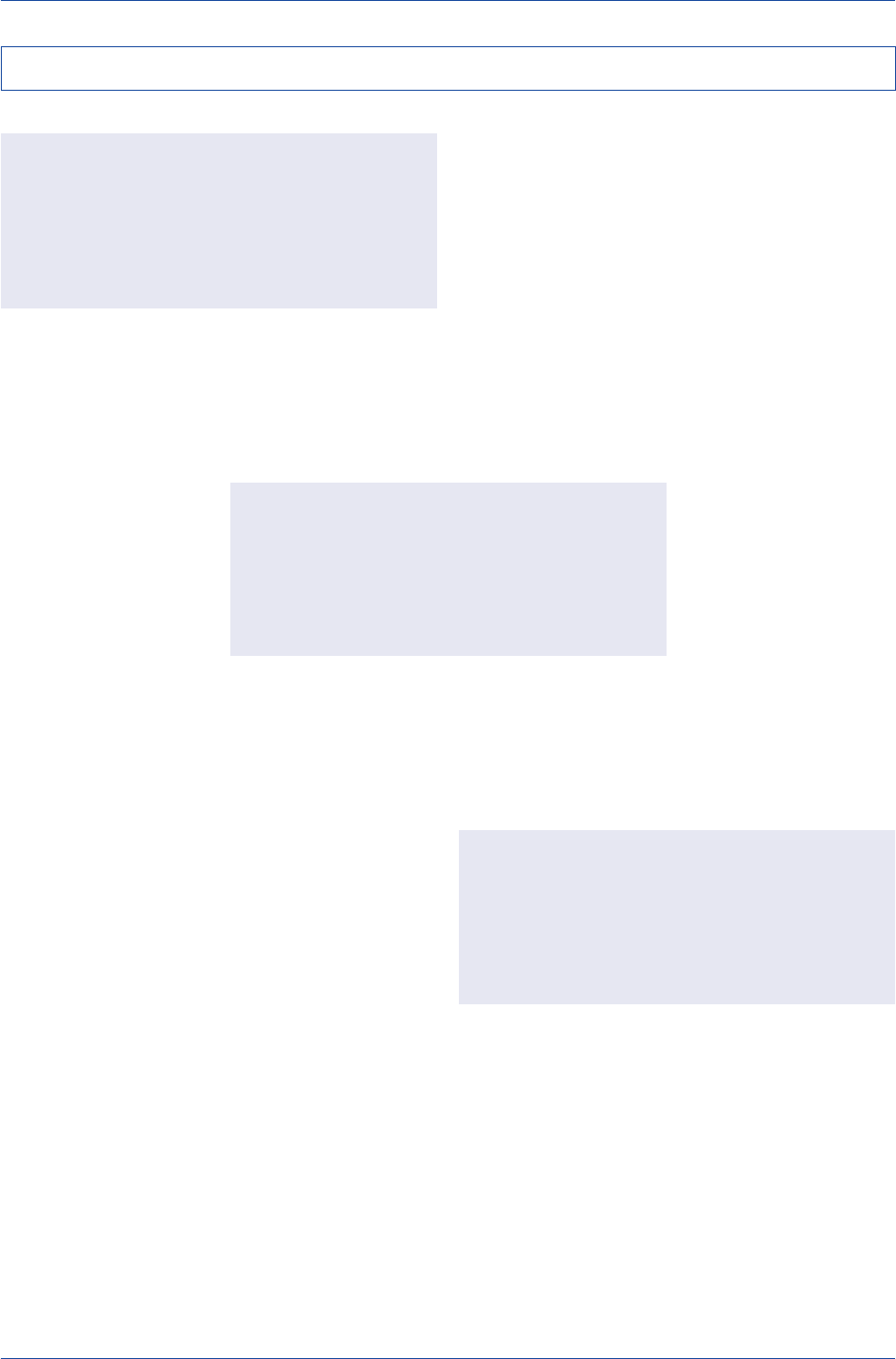

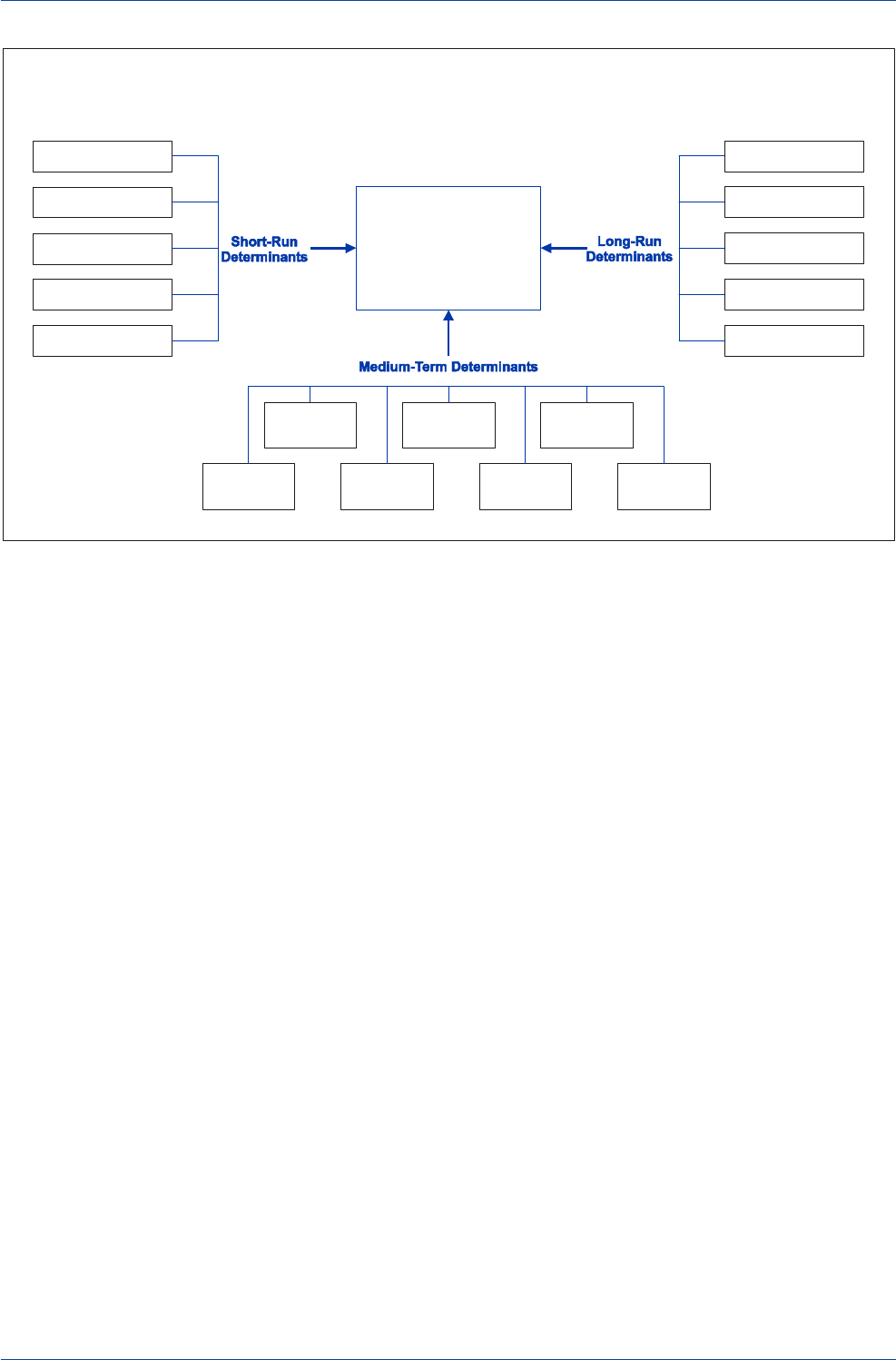

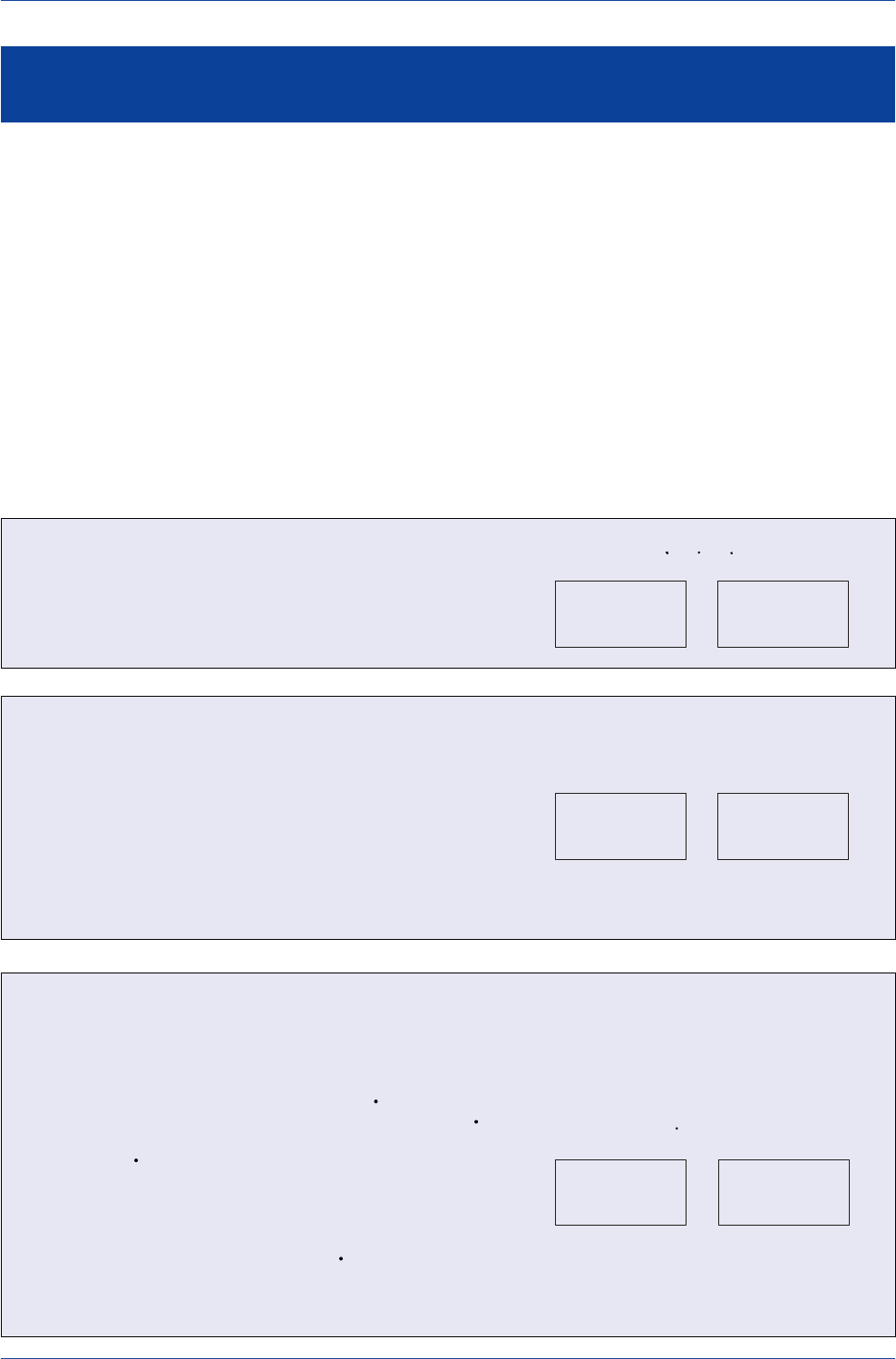

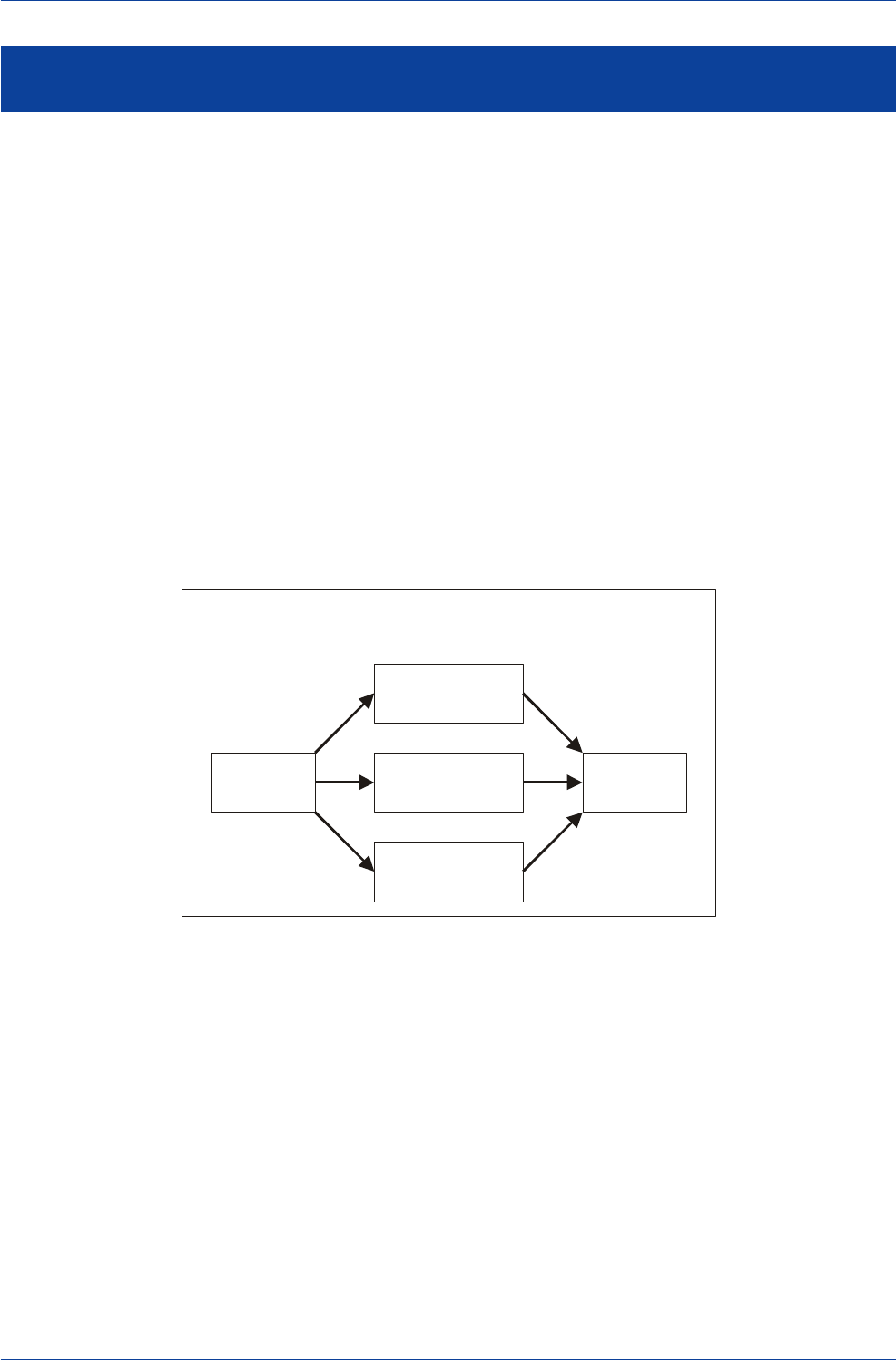

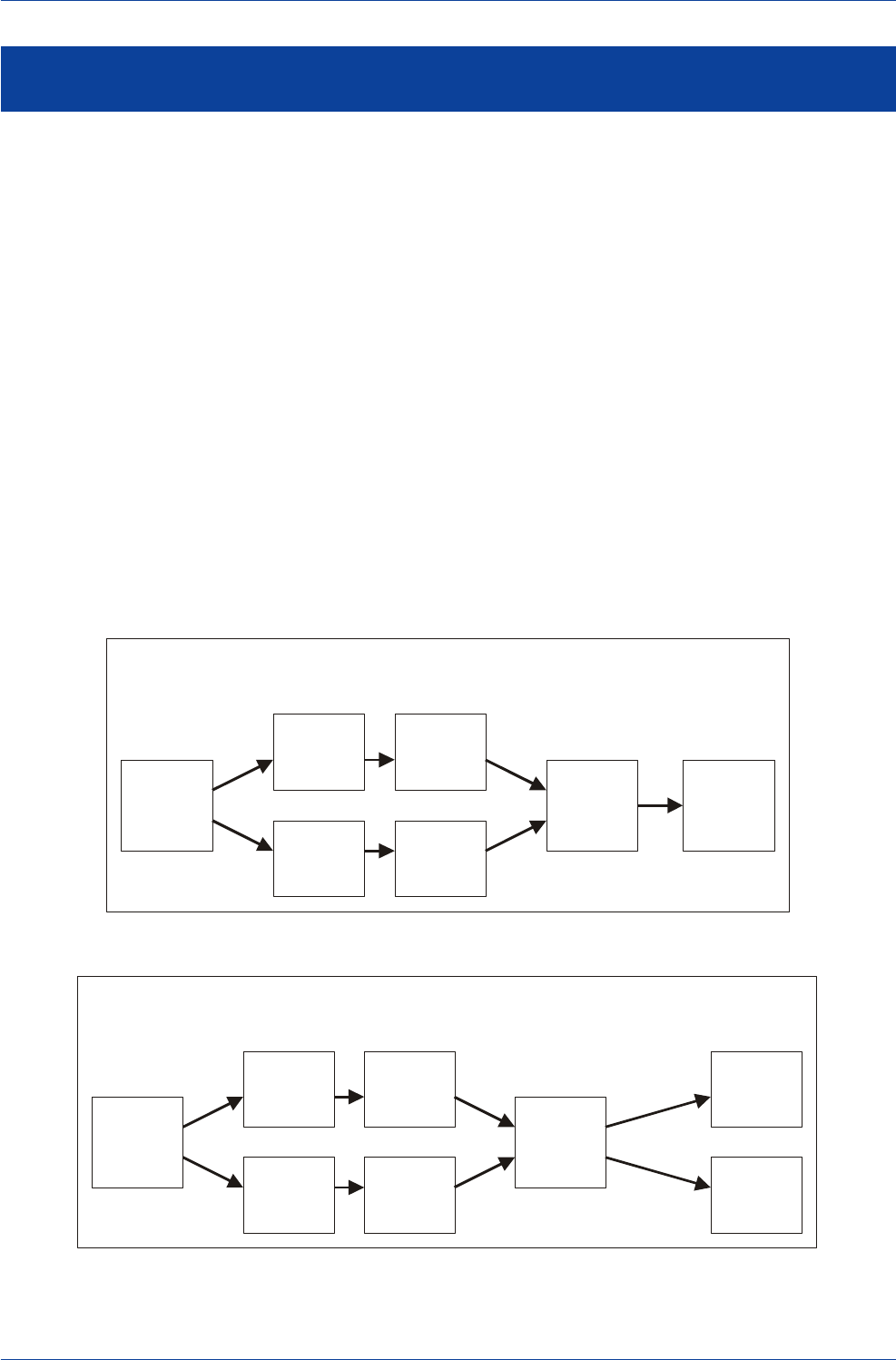

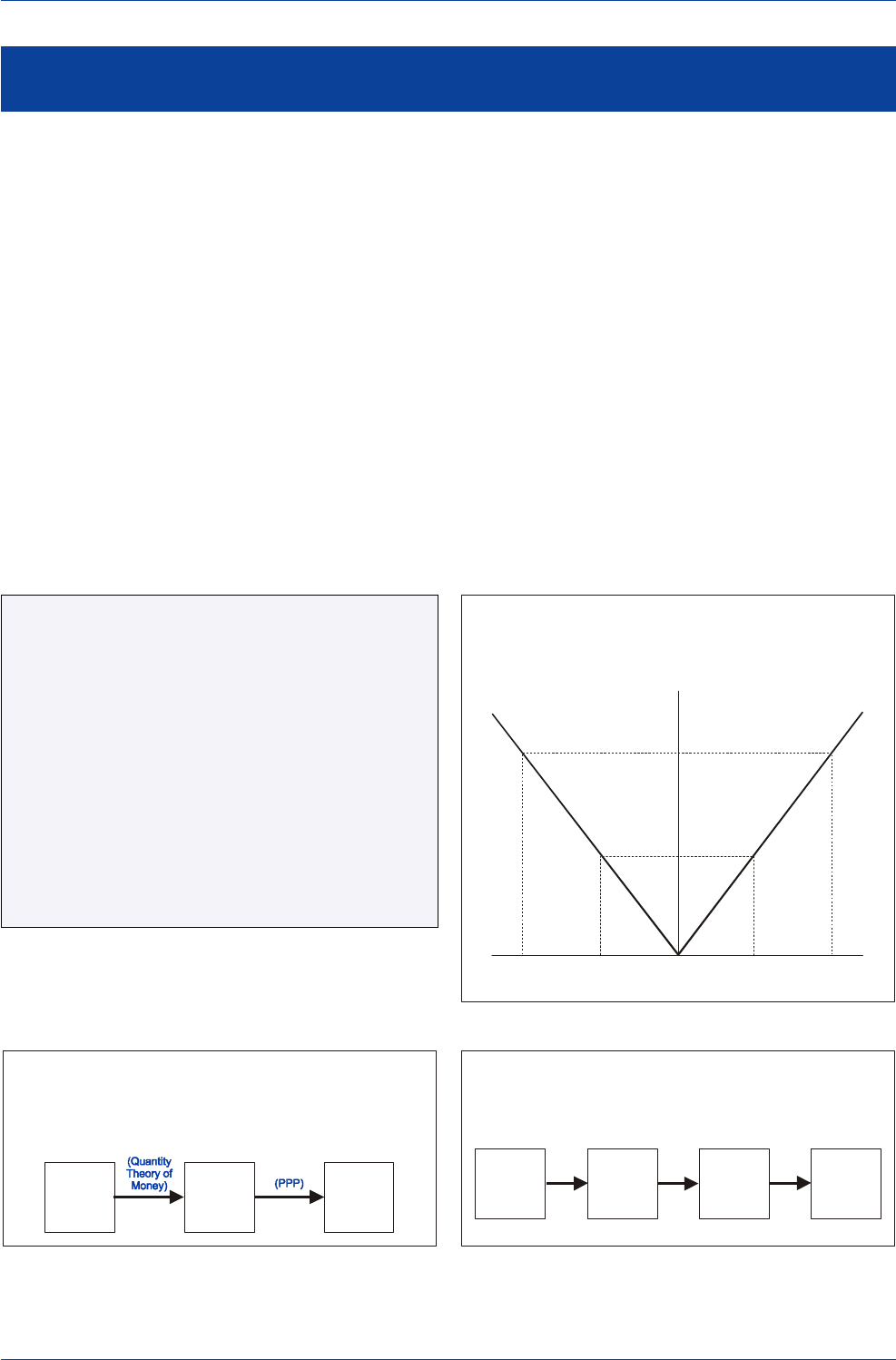

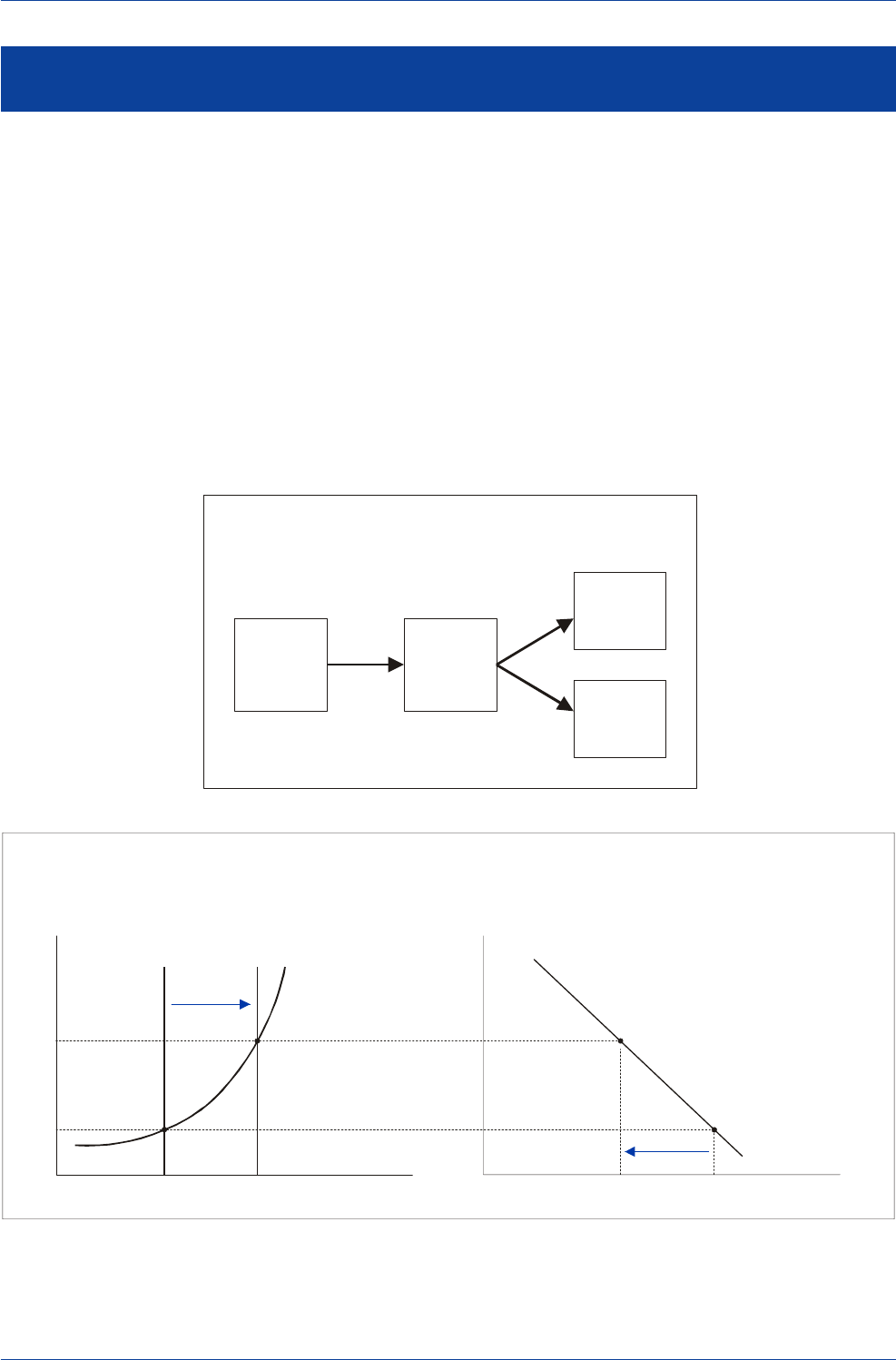

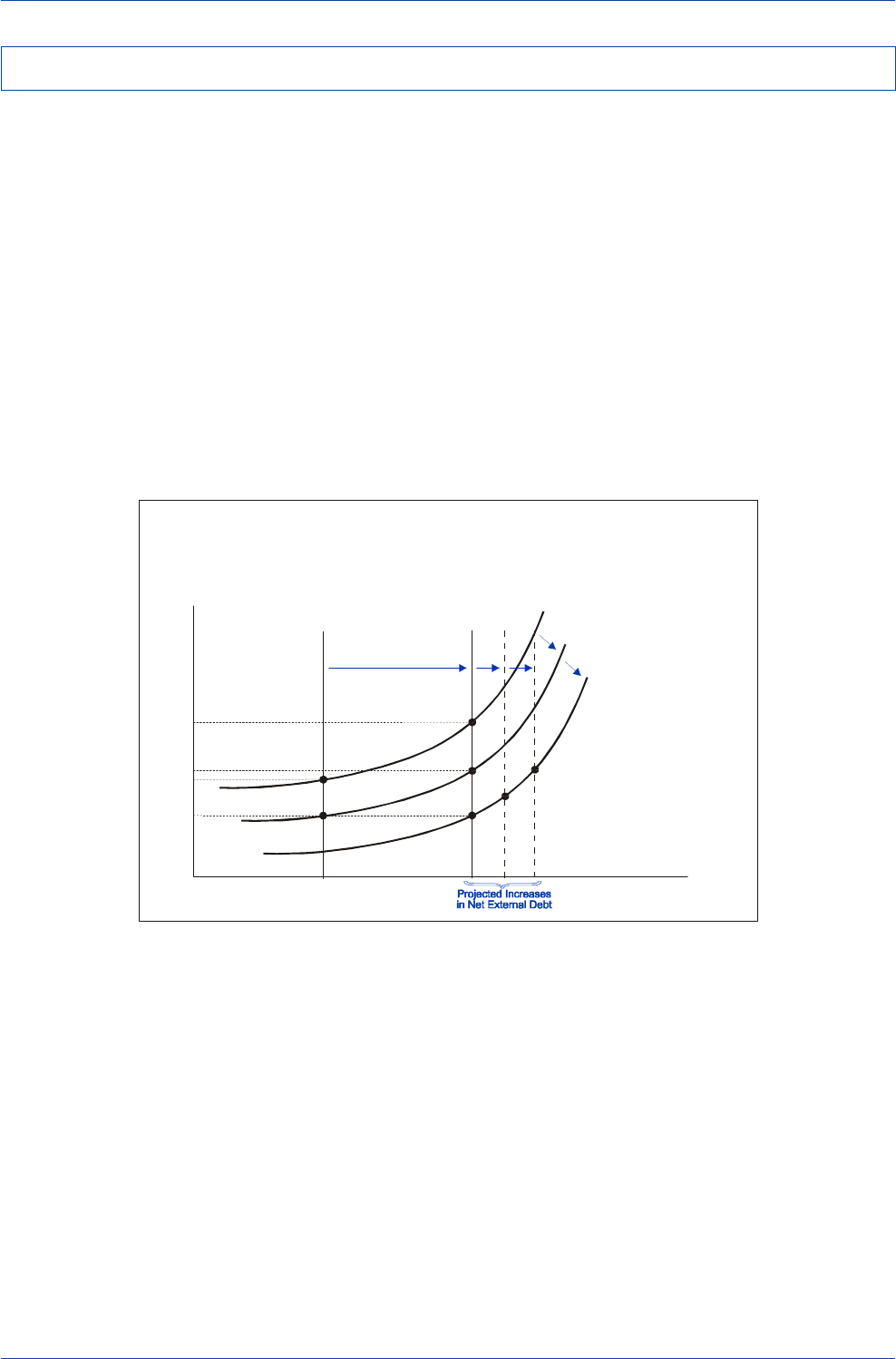

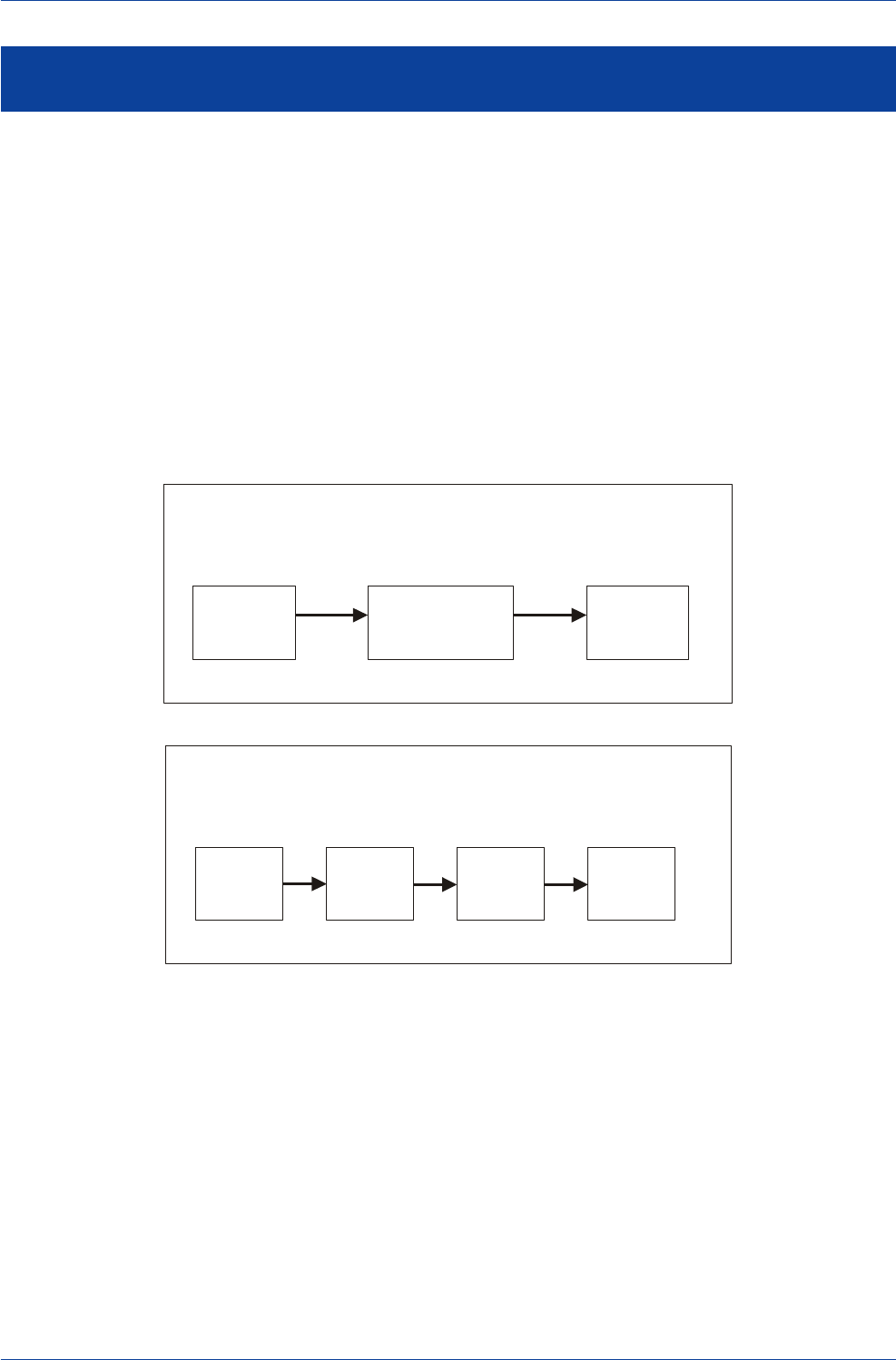

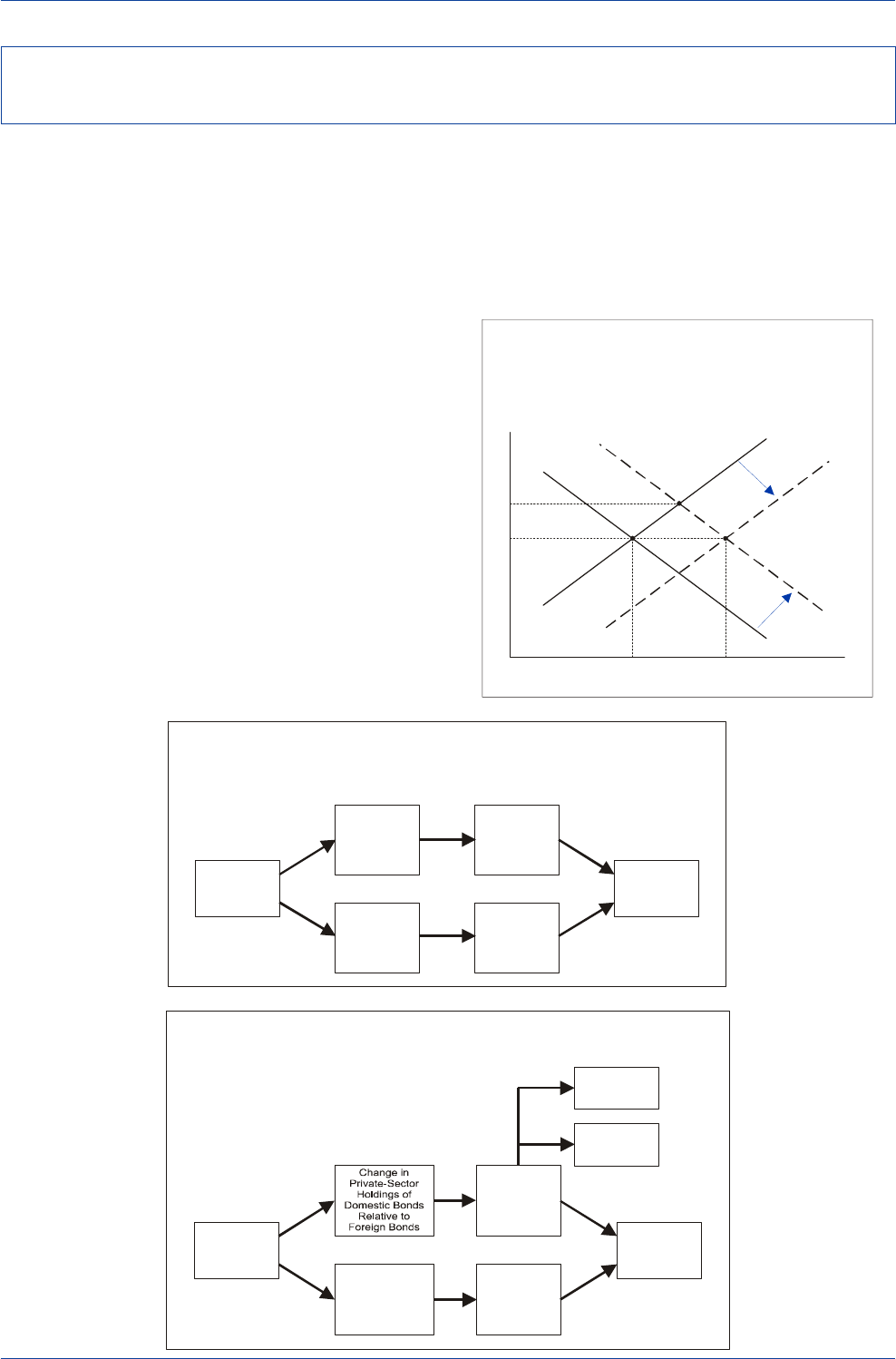

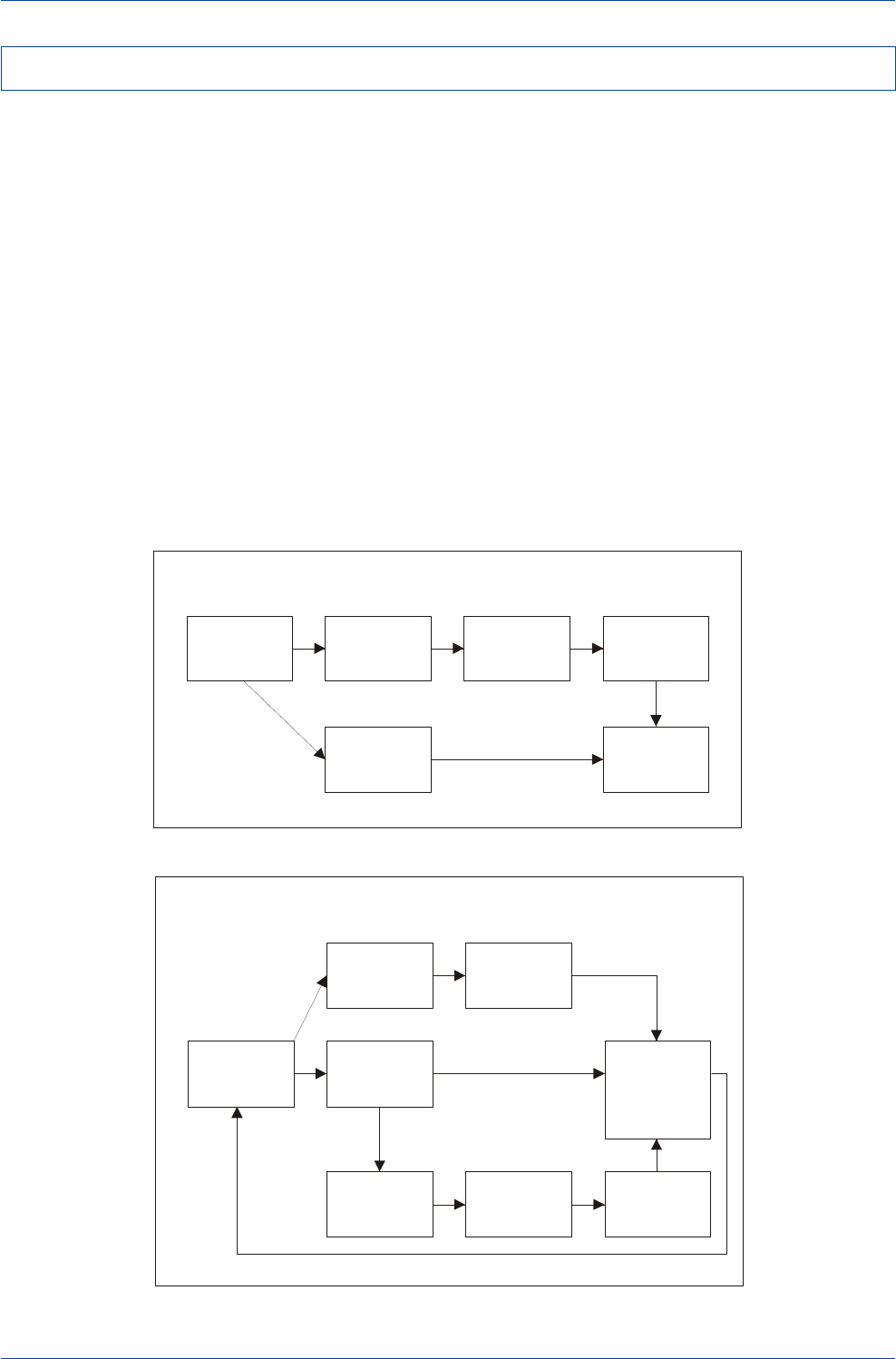

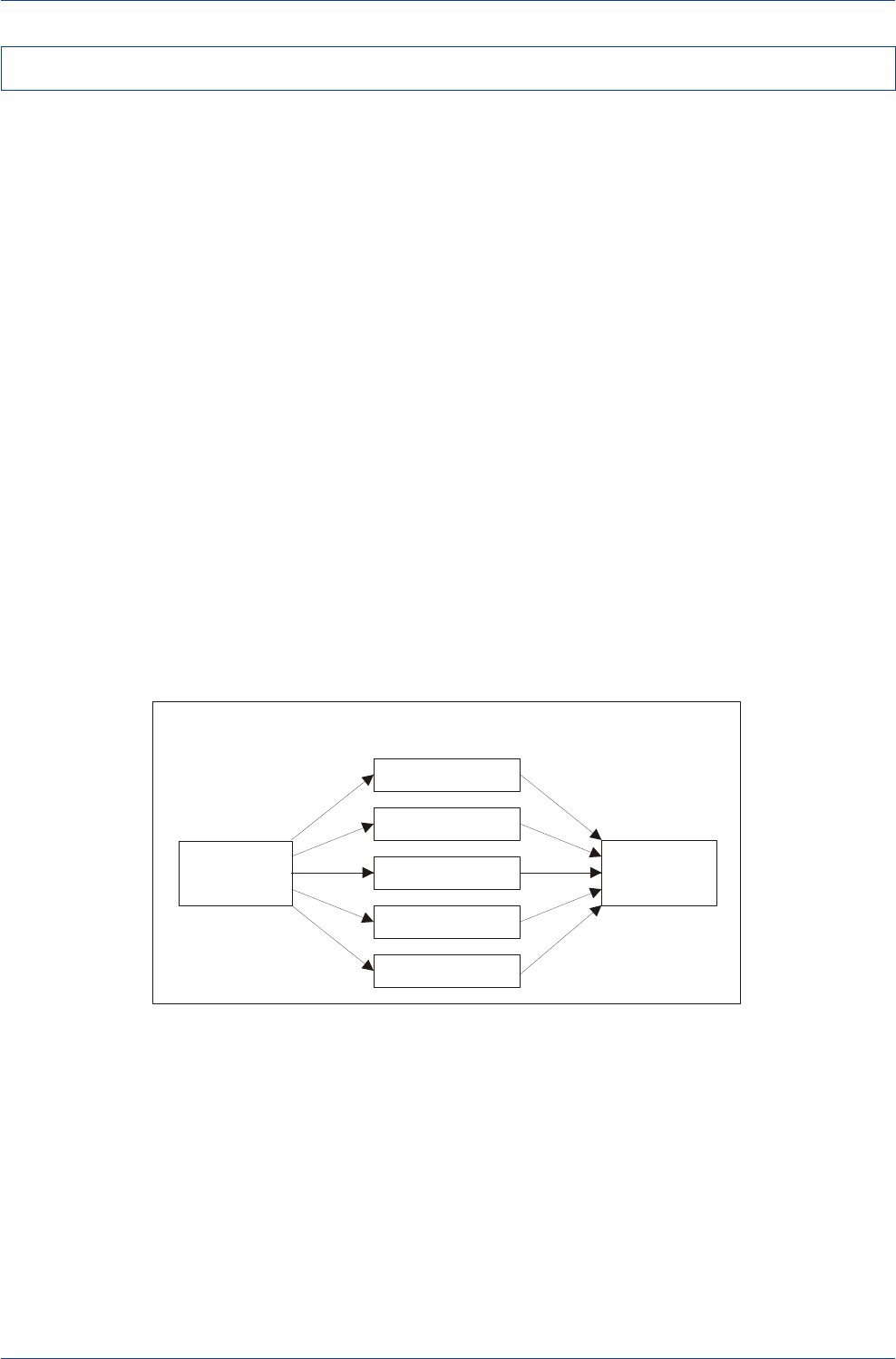

The adjacent schematic diagram provides a convenient il-

lustration of the layout of this guidebook and highlights

the myriad of channels through which fundamental and

technical forces jointly affect exchange rates. Some of those

channels will tend to exert a more profound impact on ex-

change rates in the short run, while others will tend have a

more profound impact in the medium or long run. We ex-

plore each of those channels in the chapters that follow.

In the chapter entitled "Exchange Rate Determination in

the Short Run," we investigate the potential risks and re-

wards of using a variety of short-run forecasting tools in

formulating short-term FX strategies. These include mov-

ing-average trend-following trading rules, sentiment and

positioning surveys, FX dealer customer-flow data, infor-

mation embedded in currency option prices, and risk ap-

petite indices.

We find that moving-average trading rules would have gen-

erated significant risk-adjusted excess returns over rela-

tively long periods for most major currency pairs, although

losing trades tend to occur far more frequently than win-

ning trades, in many cases by a factor of 3 to 1. The high

frequency of losing trades suggests that moving-average

trading rules can be risky over short periods and that an

investor would need considerable risk capital on hand to

absorb such losses to stay in the game until exchange rates

eventually become more highly trended.

The evidence on flow, sentiment, and positioning surveys

suggests that these indicators should be viewed more as

contemporaneous rather than as leading indicators of ex-

change-rate movements. We argue that such indicators can

be useful as confirmation indicators in conjunction with

traditional trend-following trading rules in formulating short-

term FX strategies.

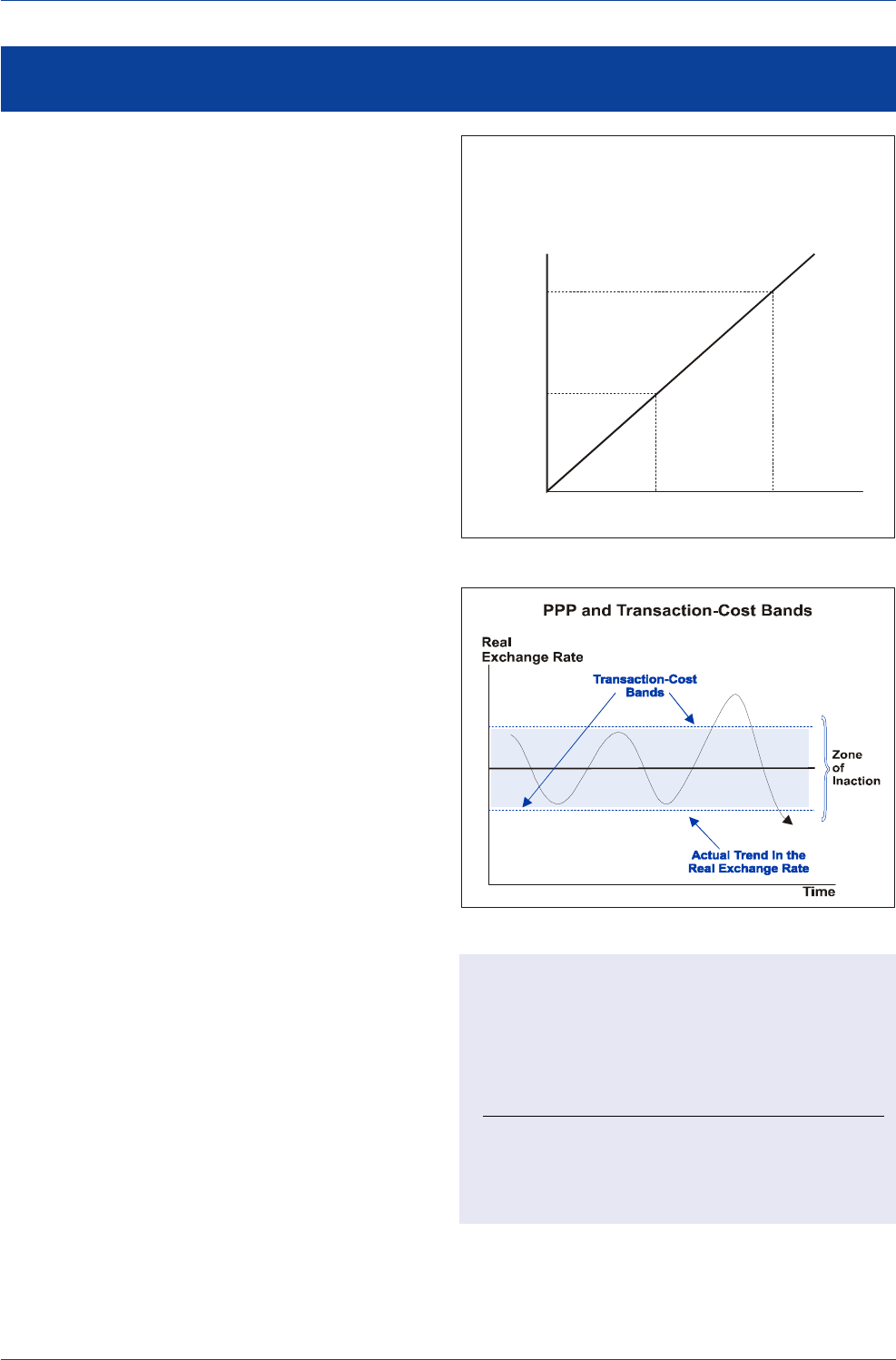

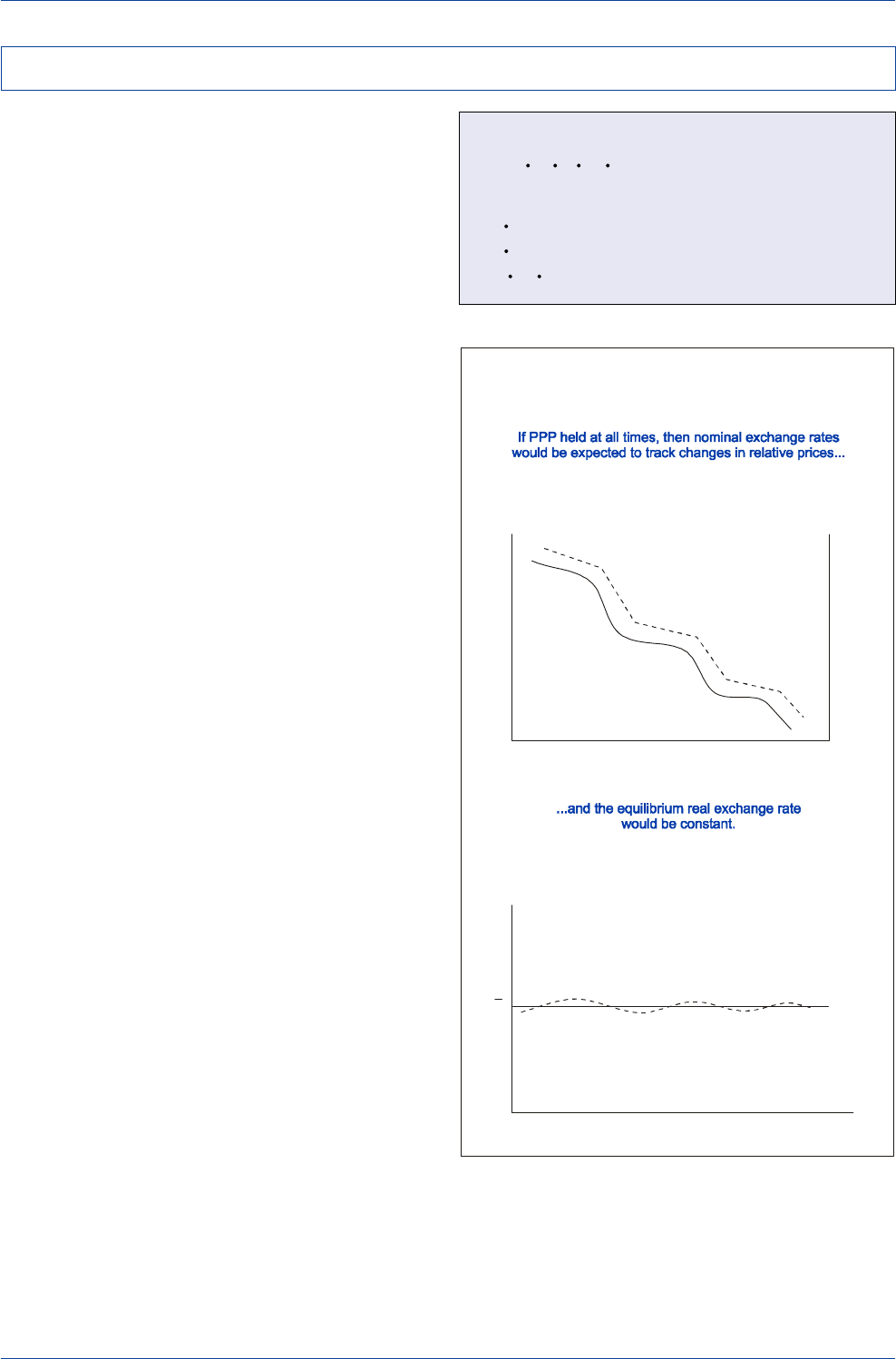

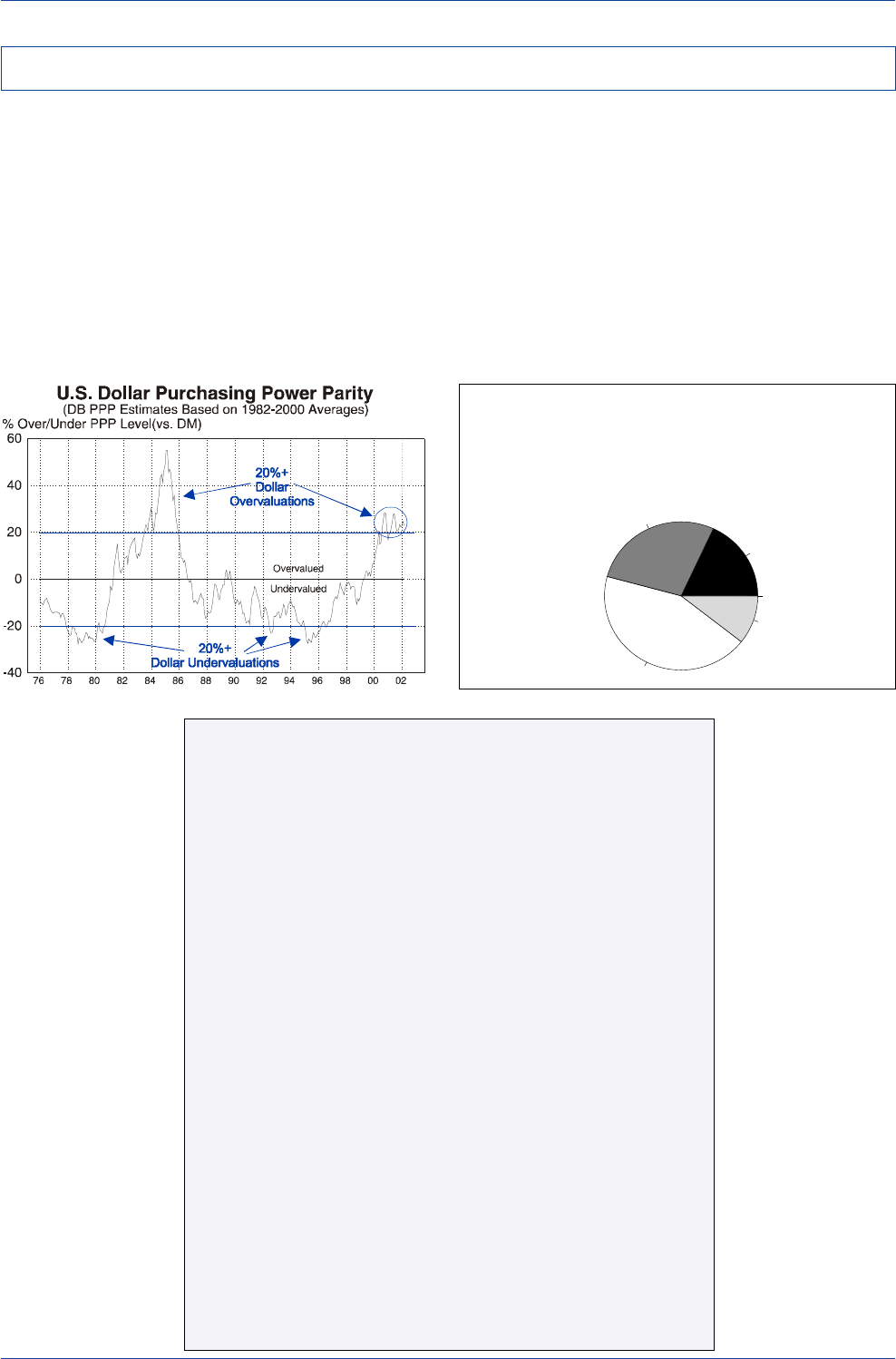

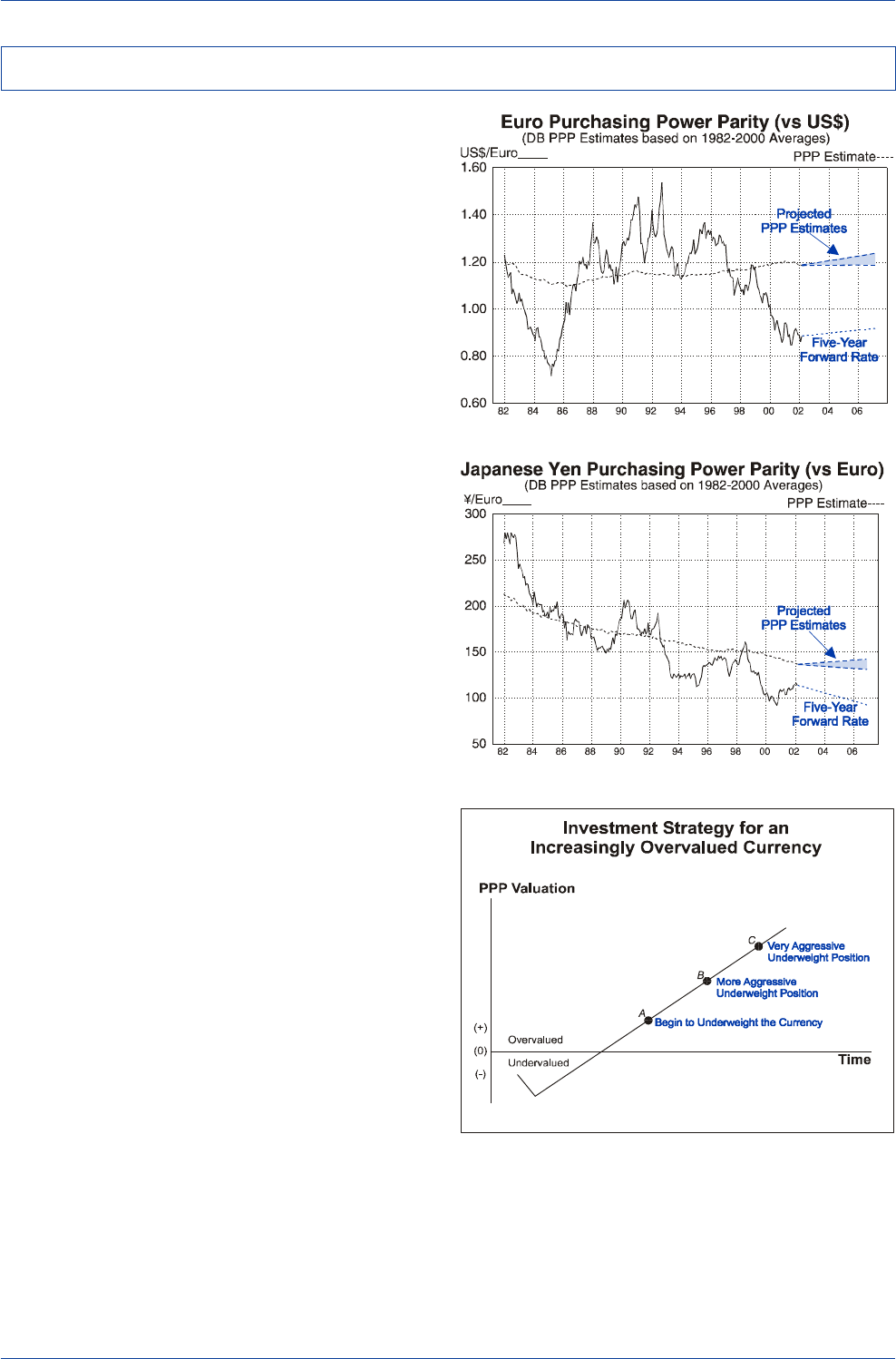

In the chapter entitled "Exchange Rate Determination in

the Long Run," we explore the fundamental forces that

give rise to long-term cycles in exchange rates. The chap-

ter begins by noting that deviations from estimated PPP

values have tended to be large and persistent, suggesting

that fundamental forces other than relative national infla-

tion rates have played a key role in driving the long-term

path that exchange rates have taken. We investigate a va-

riety of fundamental variables that have had some suc-

cess in explaining the long-term path that currencies have

taken, including relative productivity growth, persistent

trends in a country's terms of trade, long-term trends in

net foreign asset and liability positions, and long-term

trends in national savings and investment.

Introduction

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 5

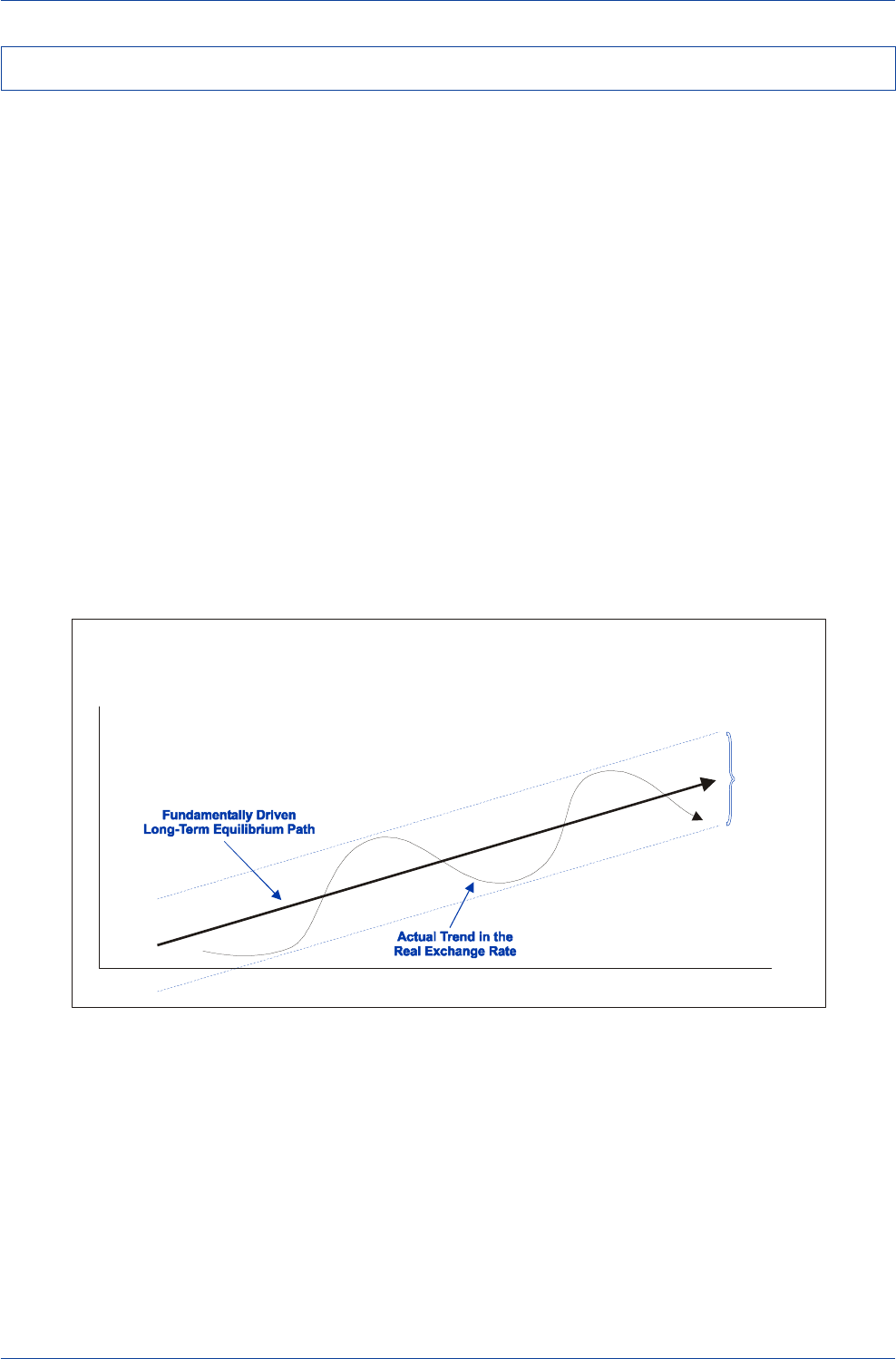

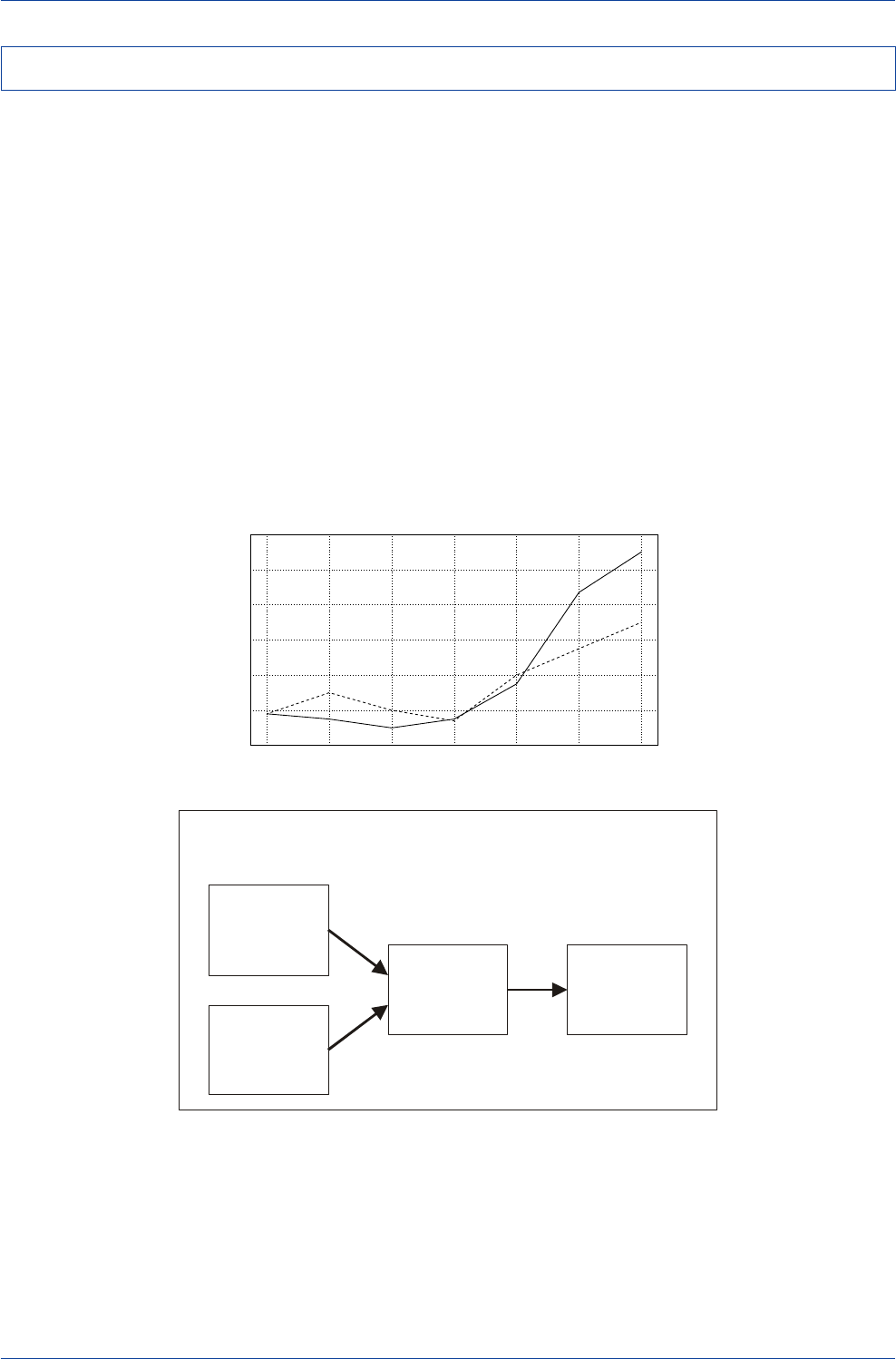

In the chapter entitled "Exchange Rate Determination in

the Medium Run," we investigate a wide range of cyclical

forces that have caused currencies either to rise or fall on

a medium-term basis relative to their long-run equilibrium

path. In many cases, these medium-term deviations from

the long-run equilibrium path have been quite sizeable and

persistent. We find that medium-term trends are influenced

by a variety of macroeconomic indicators such as the trend

in real interest-rate differentials, current and capital-account

balances, relative monetary and fiscal policies, relative eco-

nomic growth, and portfolio-balance considerations.

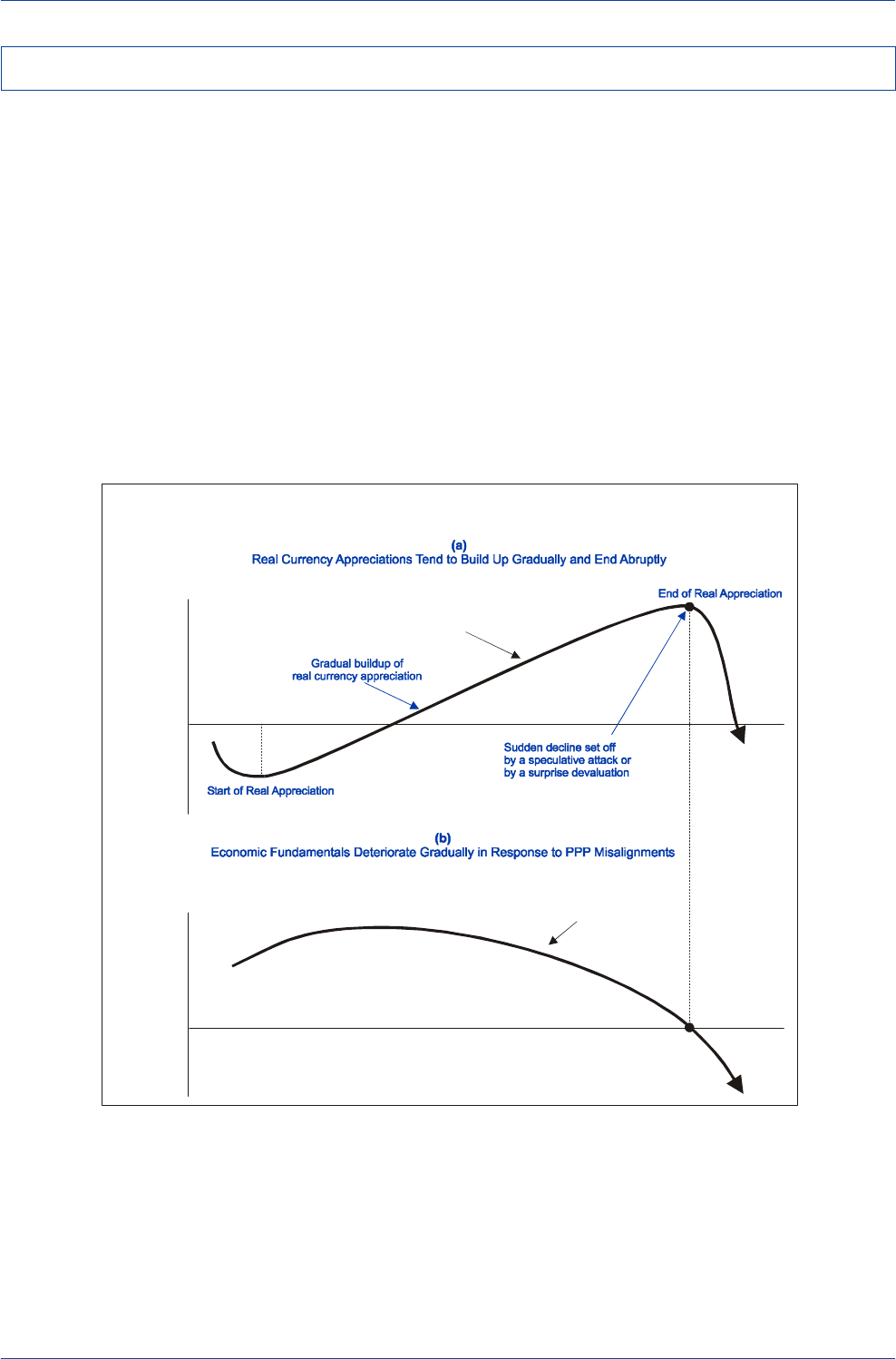

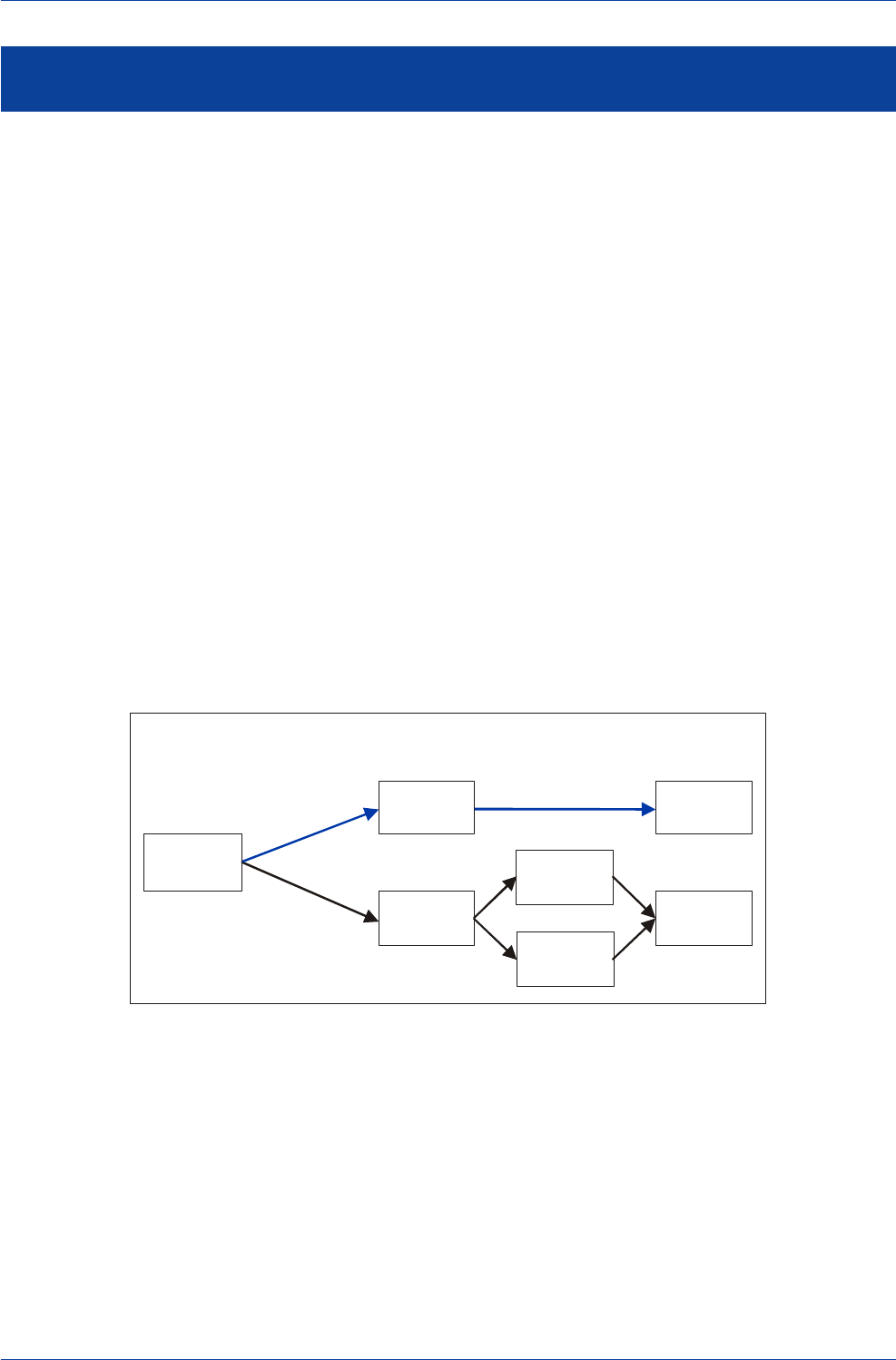

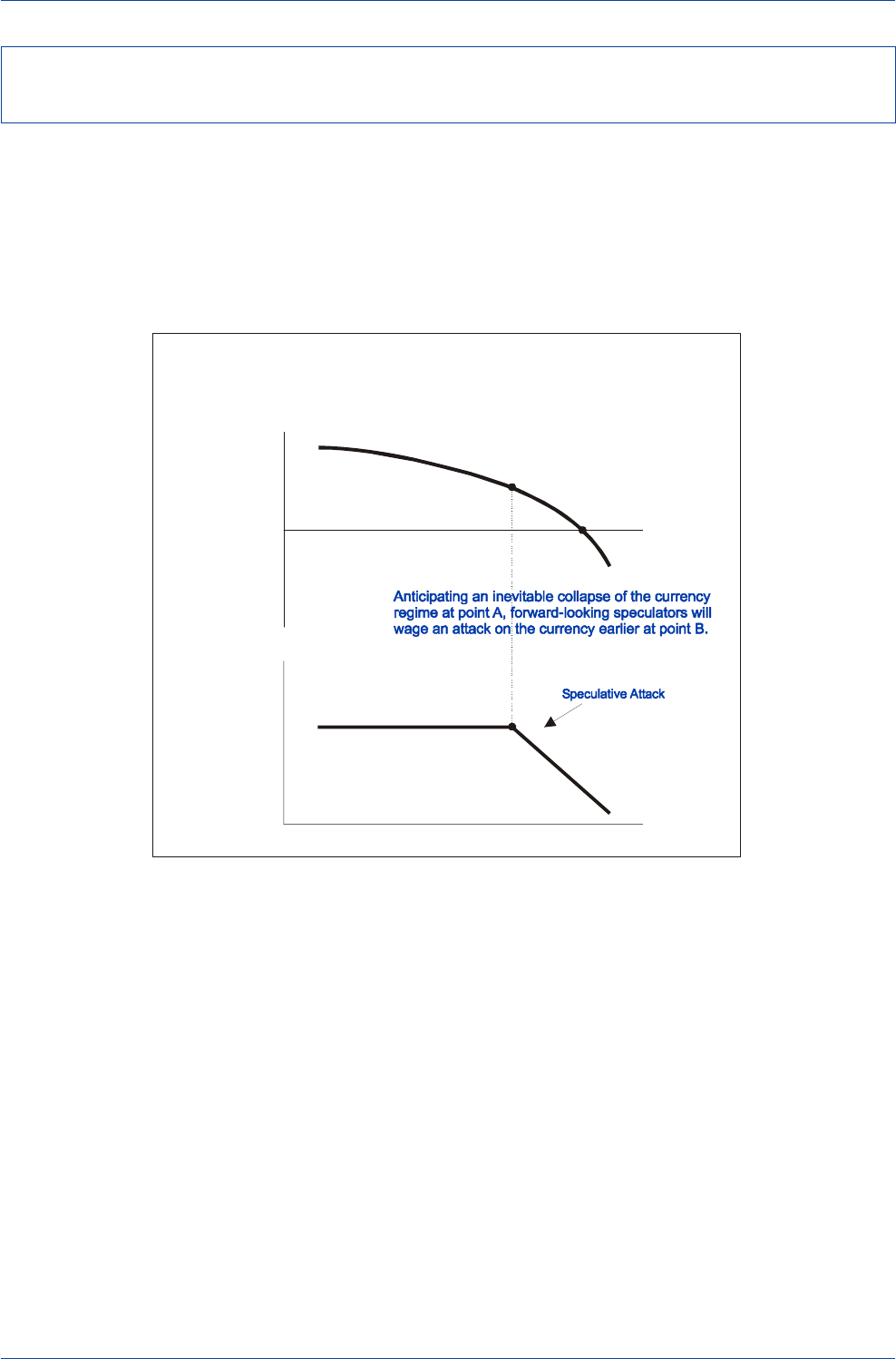

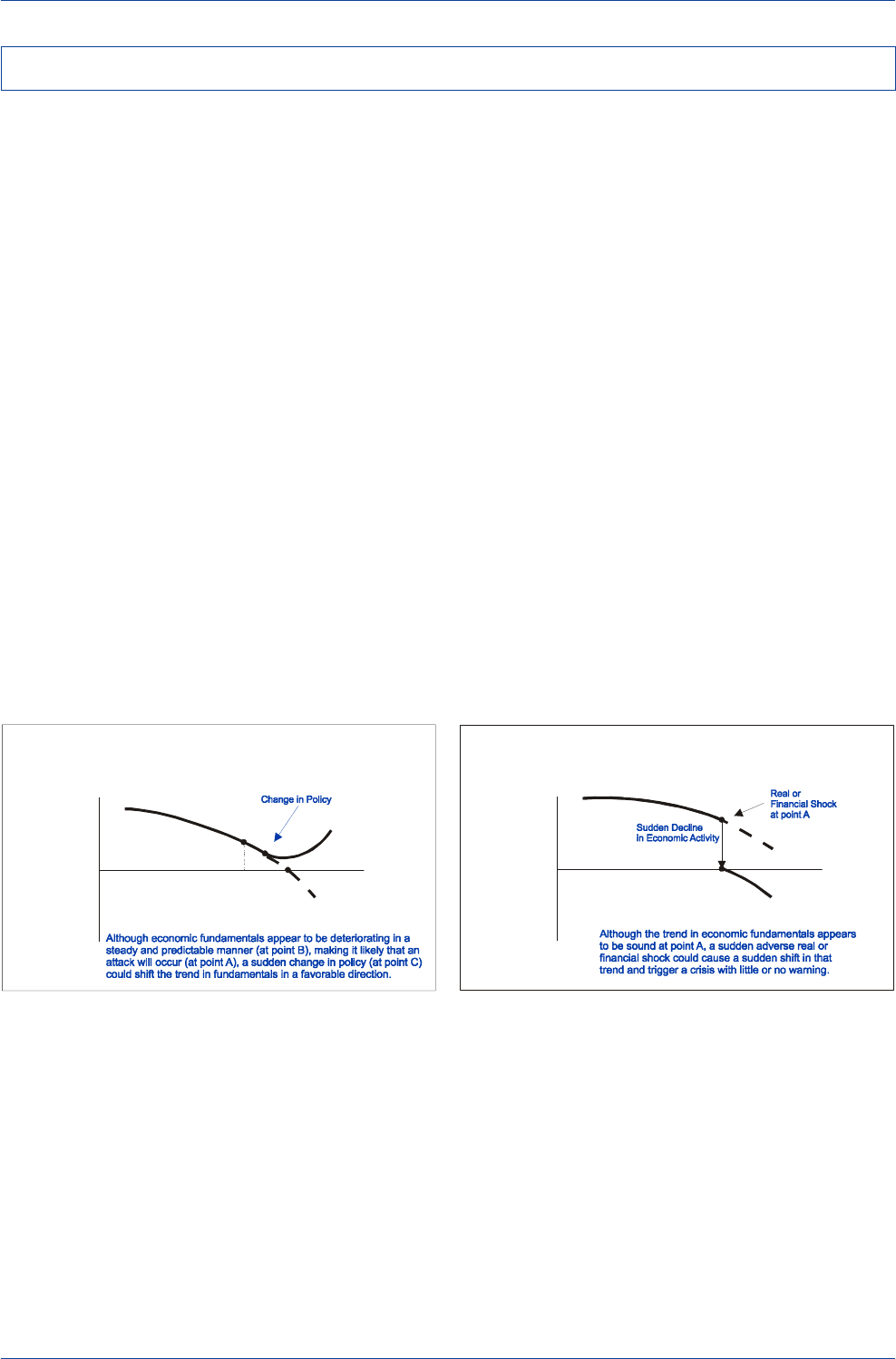

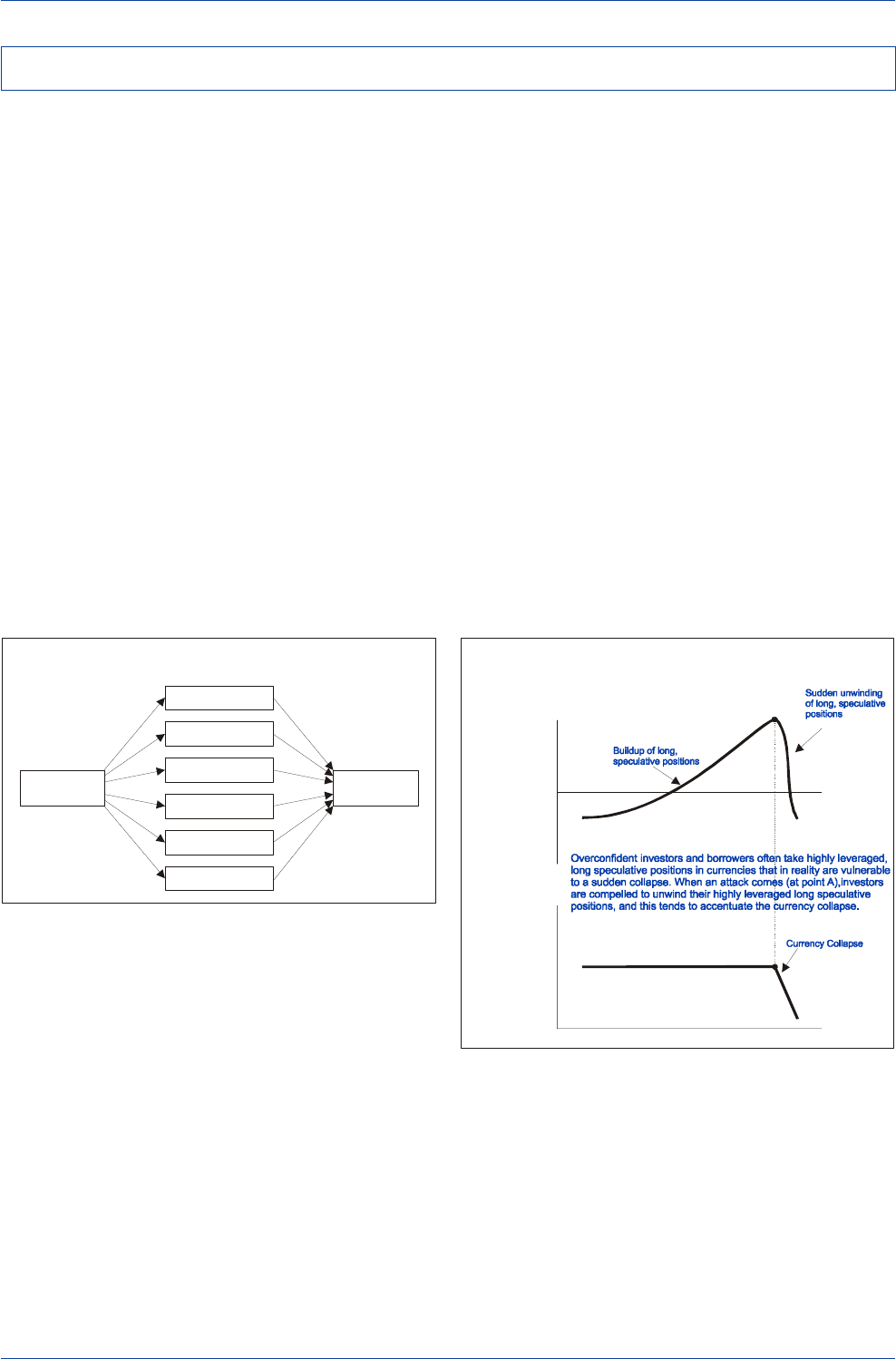

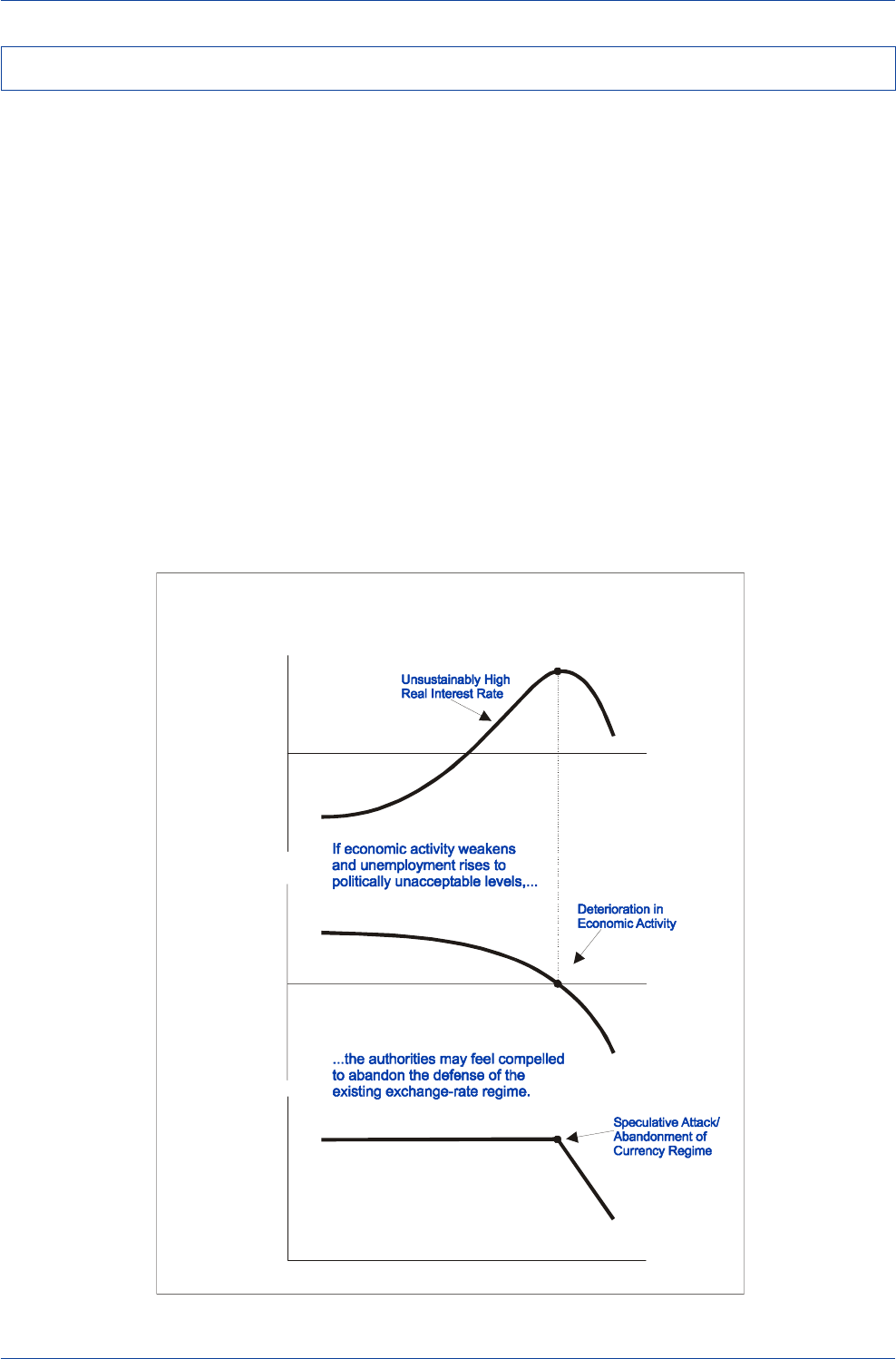

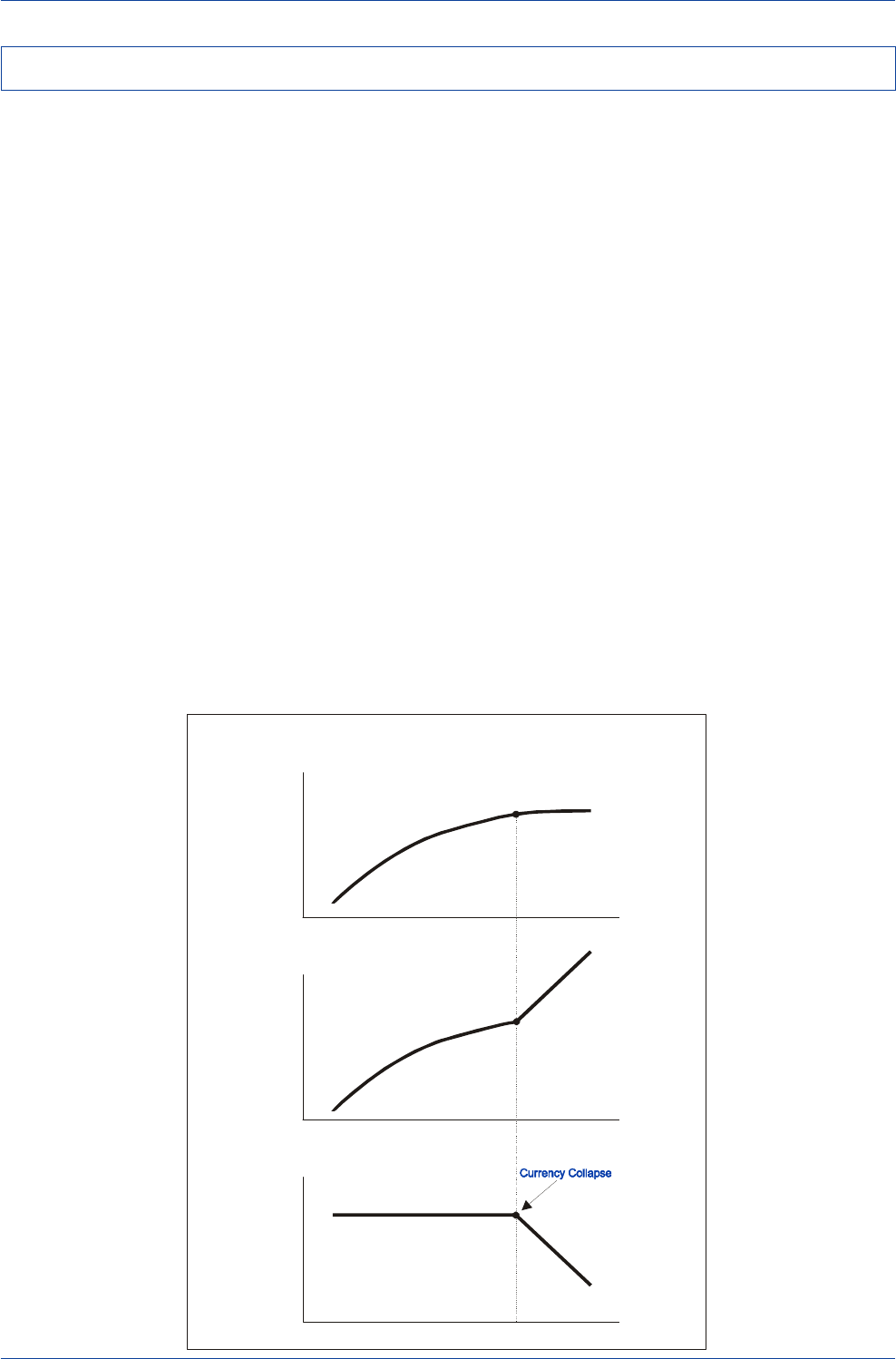

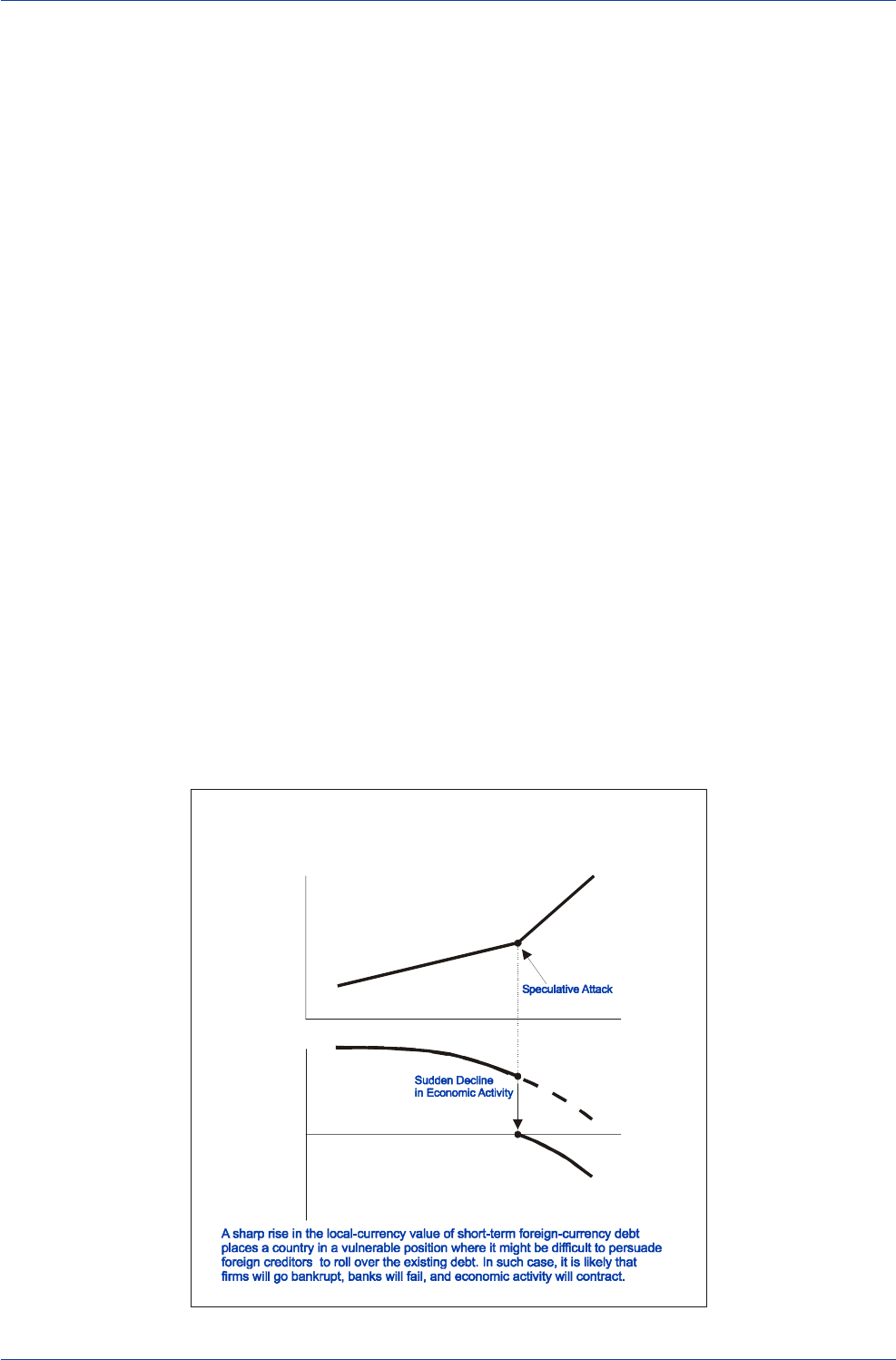

Finally, in the chapter entitled "Anticipating Currency Cri-

ses in Emerging Markets," we set out to identify those

economic and financial variables that have had success in

correctly predicting whether an emerging-market currency

might be vulnerable to a speculative attack, and whether it

is possible to construct an early-warning system that can

successfully pinpoint when a speculative attack might oc-

cur. Empirical research finds that crises-prone currencies

typically display a number of classic symptoms that warn

of an impending attack. Those symptoms include exces-

sive real appreciation of the emerging-market currency,

weak domestic economic growth, rising unemployment,

an adverse terms of trade shock, deteriorating current-ac-

count balances, excessive domestic credit expansion, bank-

ing-system difficulties, unsustainably large government

budget deficits, overly expansionary monetary policies, a

high ratio of M2 money supply to reserves, foreign-ex-

change reserve losses, falling asset prices, and/or a huge

build-up in short-term liabilities by either the private or public

sector.

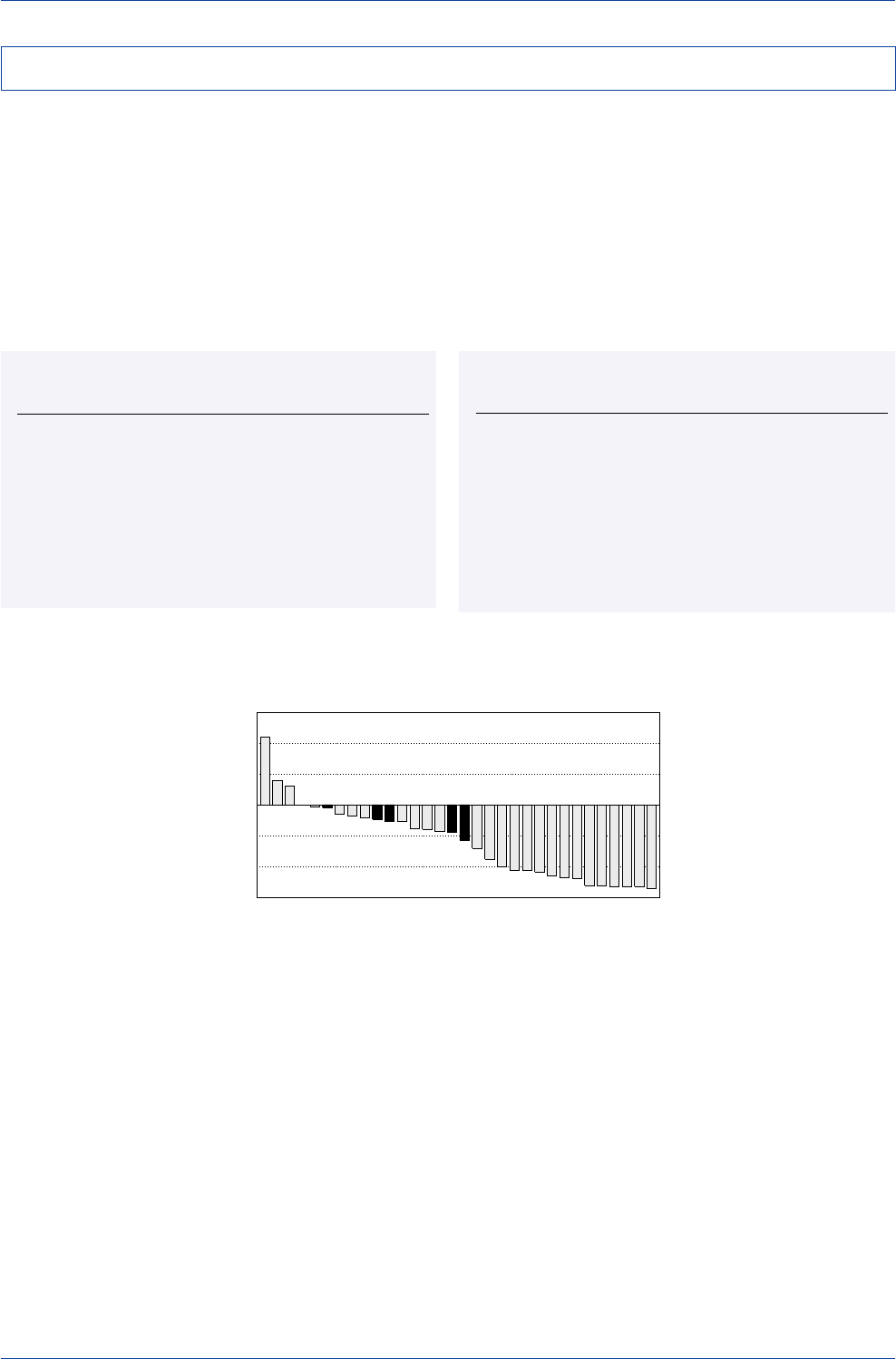

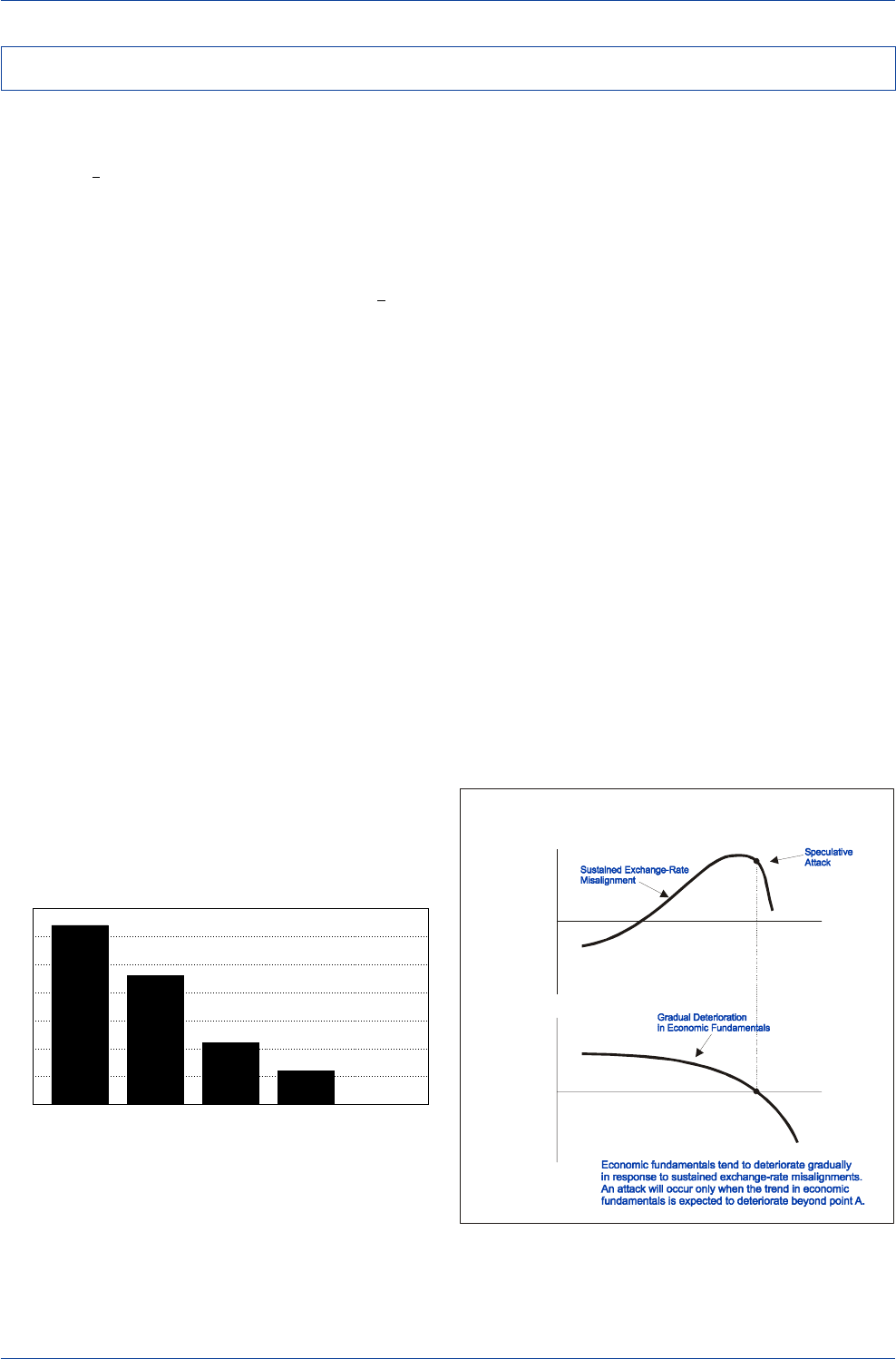

The overall conclusion one draws from a variety of empiri-

cal studies is that the success of early-warning systems in

terms of generating correct out-of-sample projections is

mixed. While most early-warning models can point to a

significant number of correctly predicted crises, those

same models also have a tendency to generate a sizable

number of false alarms and missed crises.

Perhaps all that one can say after reviewing all the differ-

ent approaches to exchange-rate determination is that no

single approach has a monopoly on being right all of the

time. Some strategy systems such as moving-average trad-

ing rules and forward-rate bias strategies appear to have a

long-run track record of success, but one needs to be mind-

ful that there were a number of periods in the past when

significant losses were incurred from following these strat-

egies. Likewise, some key fundamental variables may have

closely tracked the trend in exchange rates in the past, but

there is no guarantee that they will continue to do so in

the future. If divergent trends begin to set in, fund manag-

ers must decide whether to disregard the trend in those

key fundamental variables or not.

Although many fund managers might prefer to follow a

rigid rule or trading system for formulating FX strategies,

one should not sell short a judgment-based approach to

currency investment management. In the end, successful

FX management is based as much on "art" as it is on "sci-

ence."

Bandwagon Effect/

Trend-Following Behavior

Real

Interest-Rate

Differentials

Purchasing Power Parity

Capital

Flows

Fiscal

Policy Portfolio-Balance

Considerations

Current

Account

Trends

Relative

Economic

Growth

Monetary

Policy

Investor Positioning

FX Options Market

Positioning

Risk Appetite

Investor Sentiment

Net Foreign Assets

Productivity Trends

Savings/Investment

Balance Trends

Exchange-Rate Determination

in the Short, Medium, and Long Run

Persistent Trend in

Terms-of-Trade

Exchange Rate

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

6Deutsche Bank Foreign Exchange Research

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 7

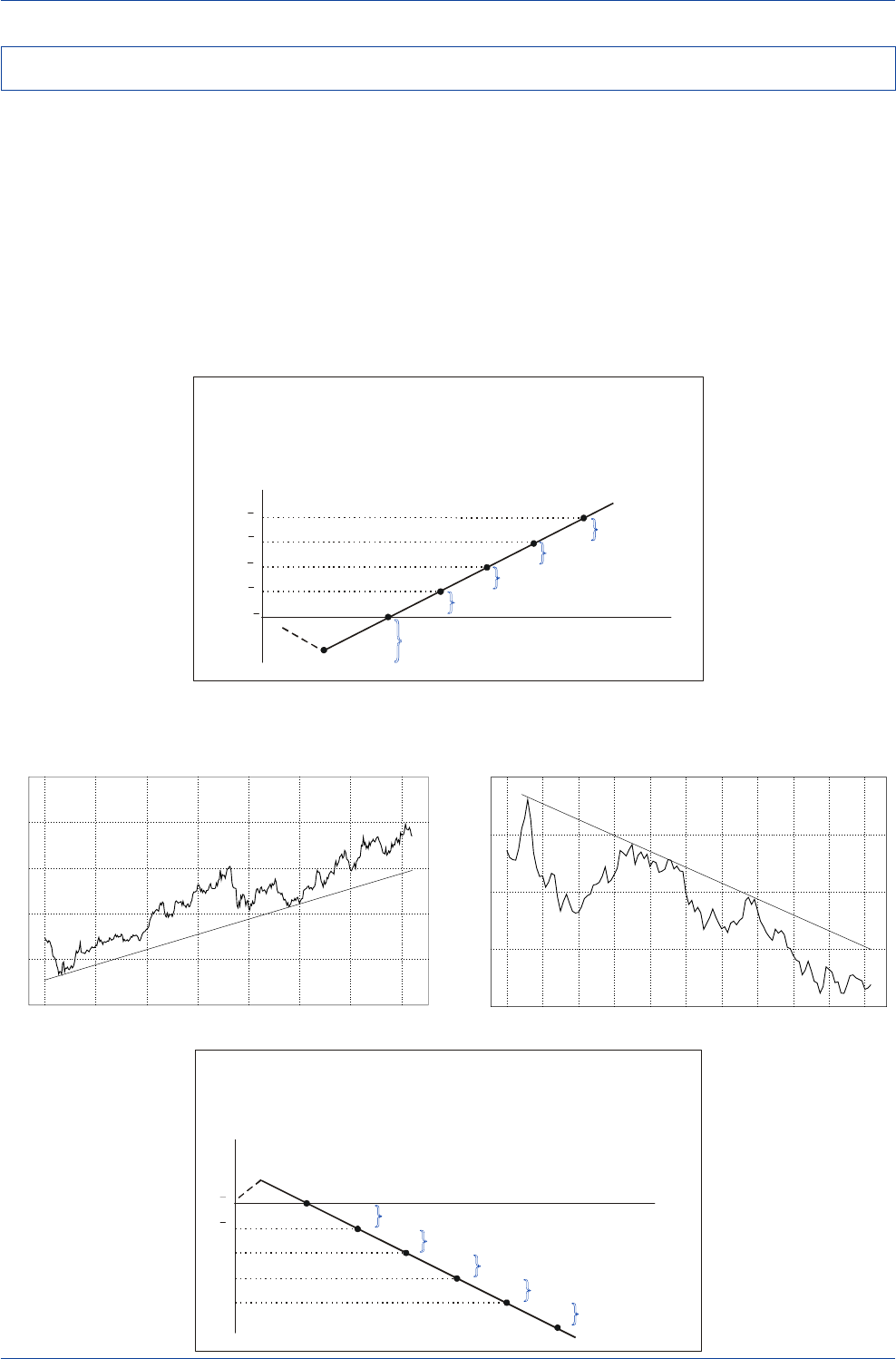

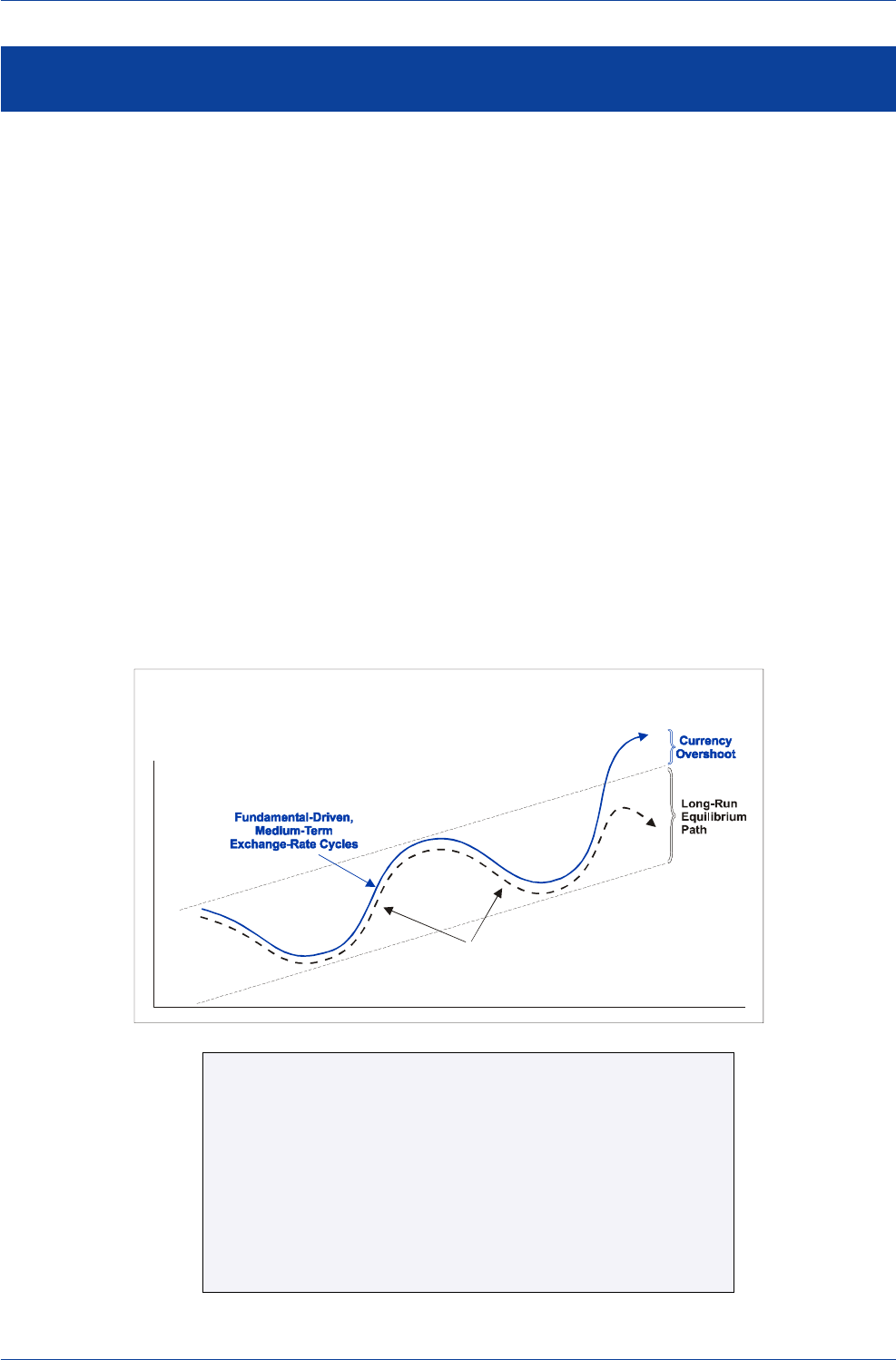

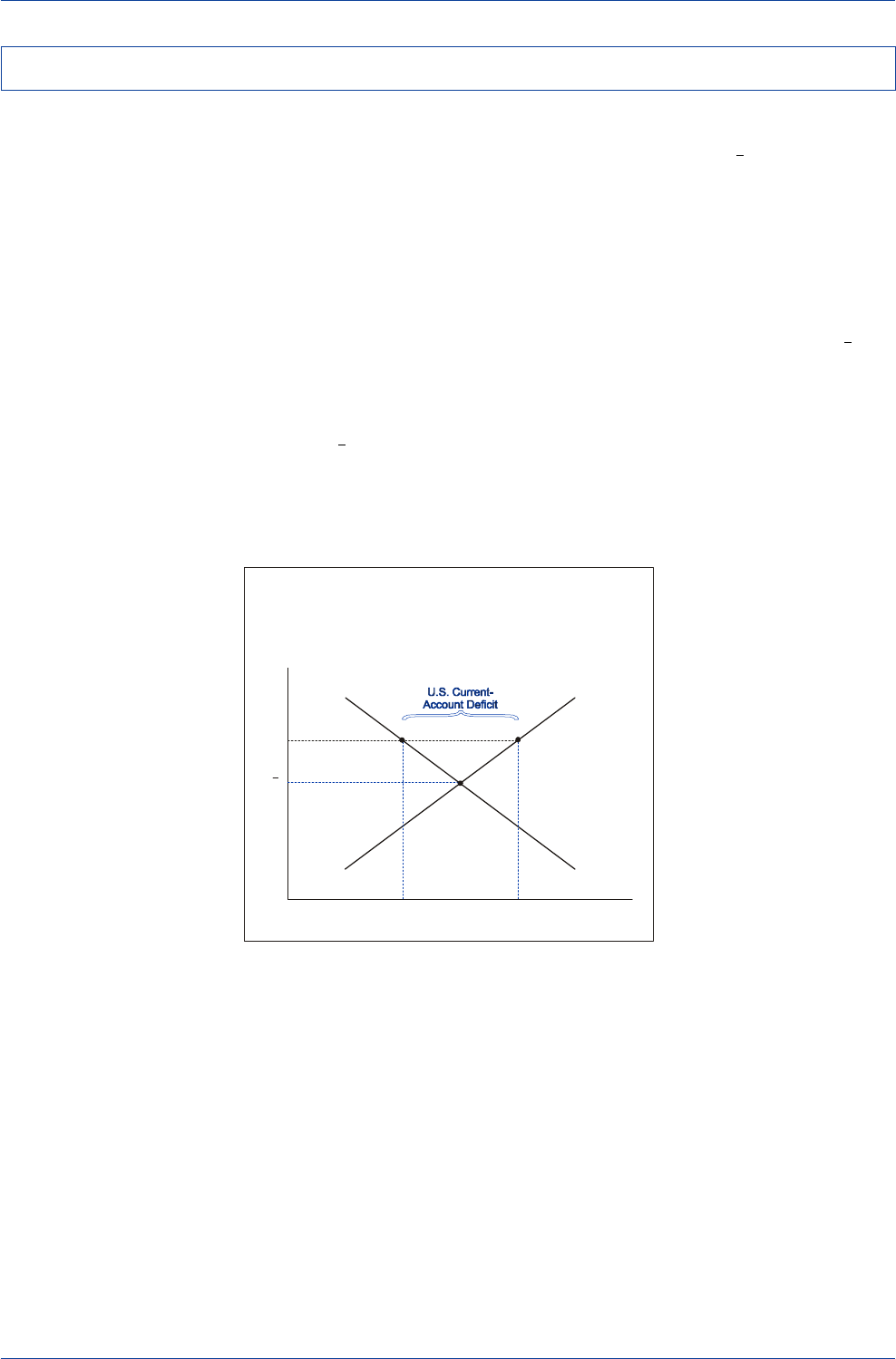

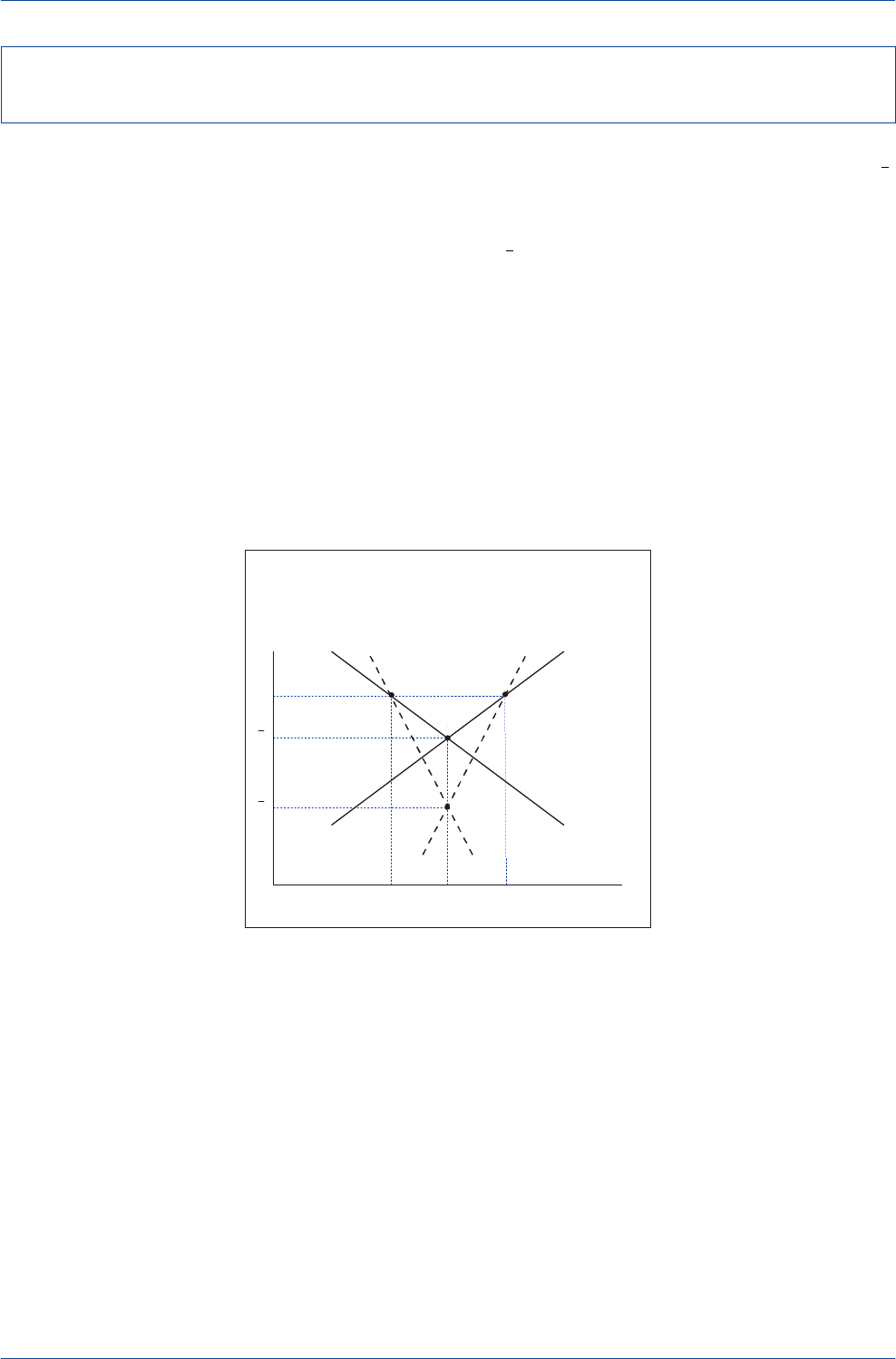

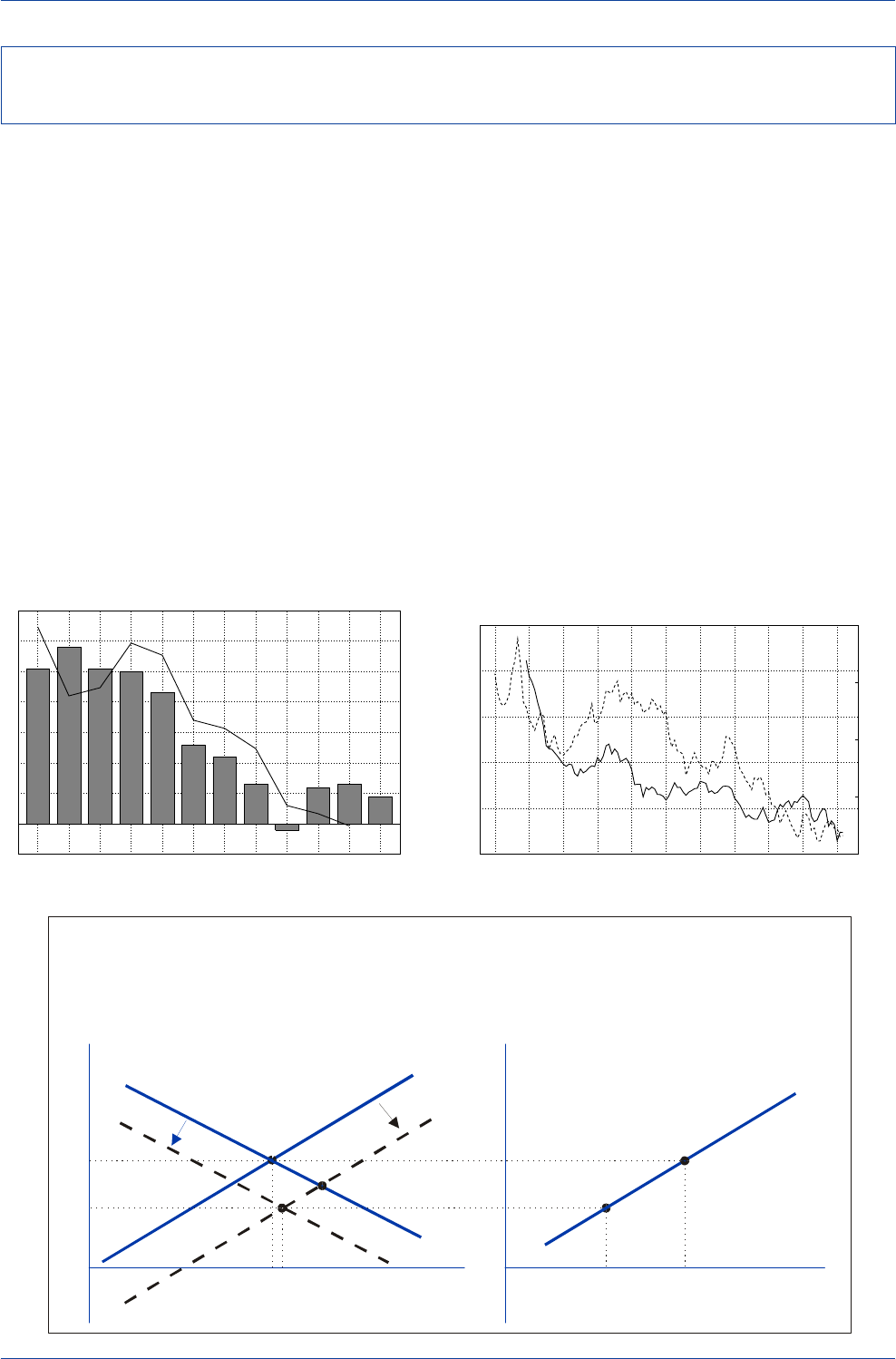

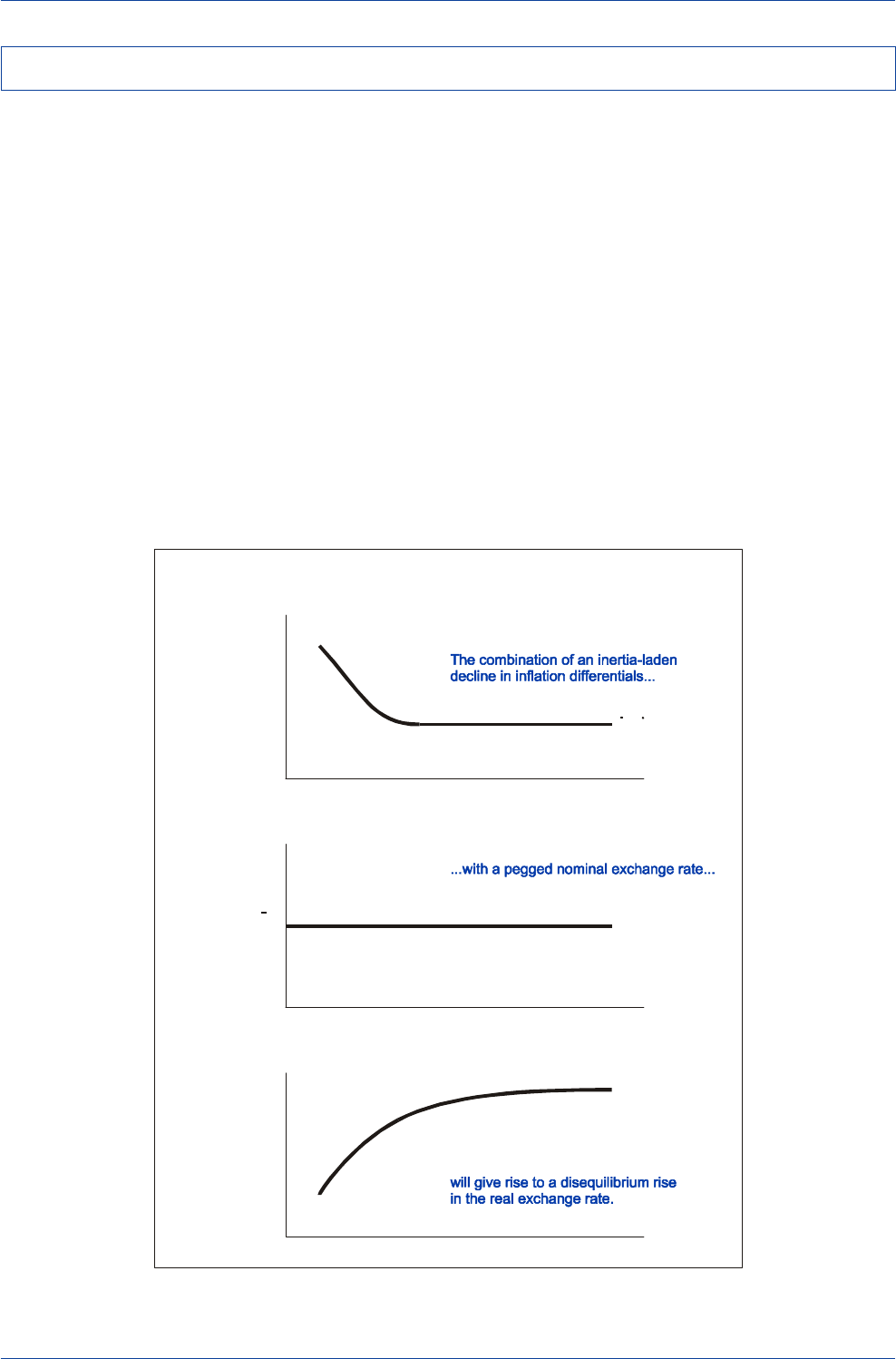

A Stylized Model of Exchange-Rate Overshooting

at the End of a Long-Term Uptrend

Currency’s

Value

Time

Economic Fundamentals

Exchange-Rate Determination

in the Short Run

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

8Deutsche Bank Foreign Exchange Research

Economists have come up with a wide range of theories

to explain how exchange rates are determined. The over-

whelming body of evidence from scores of empirical stud-

ies indicates that fundamental-based models, while use-

ful in explaining long-term trends, have not met much suc-

cess in explaining short-term exchange-rate trends. Indeed,

the evidence suggests that for short-term horizons, a ran-

dom walk characterizes exchange-rate movements better

than most conventional fundamental-based exchange rate

models.

One of the reasons why researchers have not been able

to unearth any significant relationship between changes

in macroeconomic variables and changes in exchange rates

over short periods is that exchange rates often exhibit much

greater variability than do macroeconomic time series in

the short run. The often chaotic behavior of exchange rates

is capable of generating so much noise that it may ob-

scure any discernable relationship between macroeco-

nomic time series and the short-term movement of ex-

change rates.

Bandwagon effects are also capable of causing exchange

rates to wander away from fundamental equilibrium val-

ues in the short run. Survey studies find that FX market

participants tend to have extrapolative expectations over

short-term horizons and mean-reverting or regressive ex-

pectations over longer horizons. If investors have extrapo-

lative expectations over short horizons, they may tend to

accentuate and perpetuate exchange-rate movements in

the short run far beyond the path justified by fundamen-

tals alone. Indeed, if a significant number of investors en-

gaged in extrapolative/trend-following trading strategies,

exchange rates might tend to overshoot on both the up-

side and downside, which could further obscure the rela-

tionship between macroeconomic fundamentals and the

short-term movement of exchange rates.

Because exchange rates can and often do deviate signifi-

cantly from any semblance of fair value in the short run,

investors have looked for alternative forecasting tools to

help them formulate currency investment strategies over

short-term horizons. Short-run forecasting tools that have

attracted interest in recent years include technical-based

trend-following trading rules, sentiment and positioning sur-

veys, FX dealers' customer order flow data, information

embedded in currency option prices, and risk appetite in-

dices.

Investors who concentrate their energies on such tools

presume that the market exhibits a tendency to tip its hand

ahead of time as to which direction it intends to take ex-

change rates in the future. While technical models have

been found to be profitable in the past, most of the other

short-term indicators are relatively new to the FX arena

and thus only a limited time series is available to test their

predictive power. What evidence we do have, however,

suggests that in most cases, these indicators are more

useful as contemporaneous rather than as leading indica-

tors of exchange-rate movements. Nevertheless, they may

prove useful as confirmation indicators that can be used in

conjunction with traditional technical-based trend-follow-

ing trading rules in formulating short-term investment strat-

egies.

Short-Run Forecasting Tools

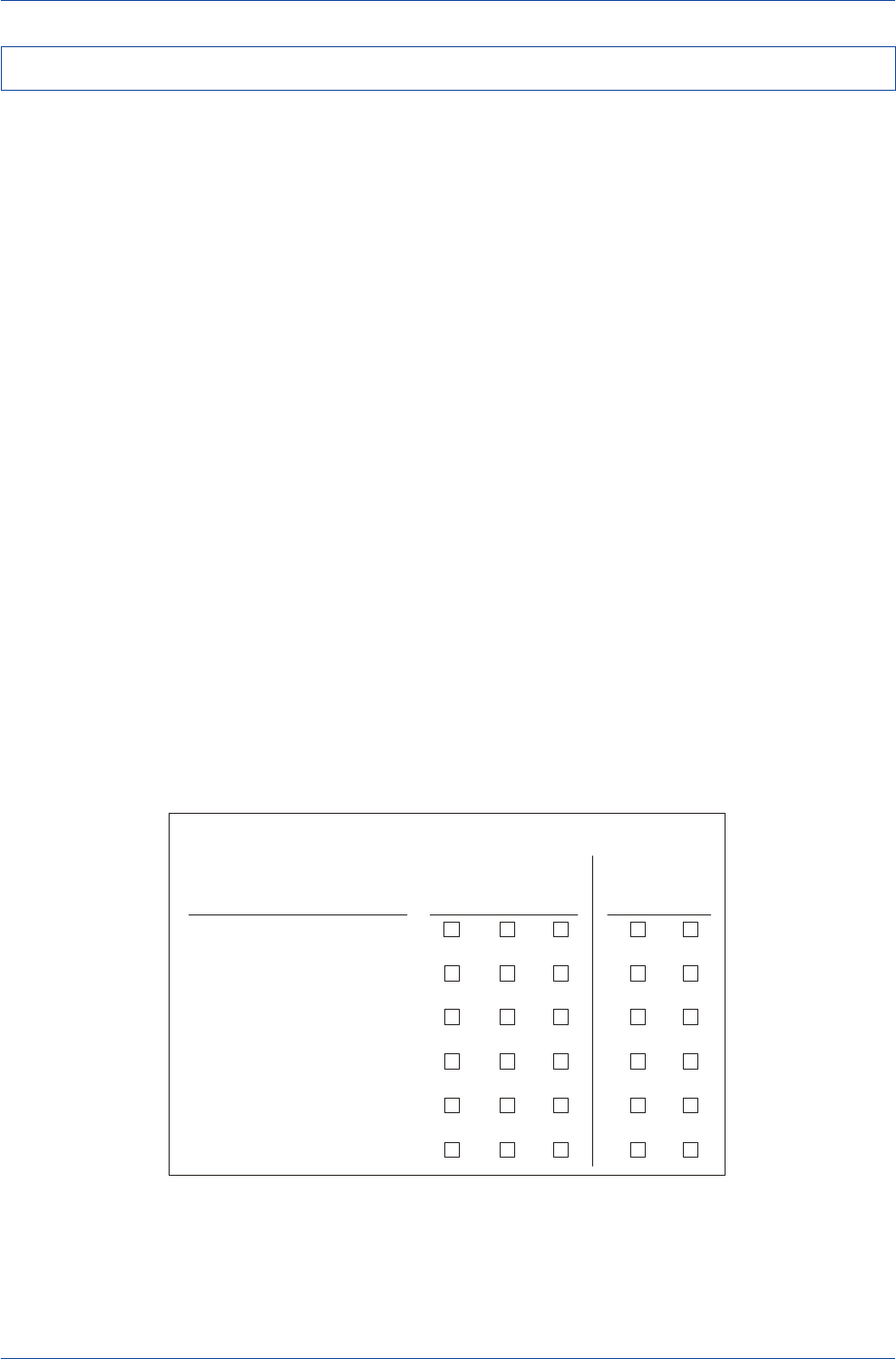

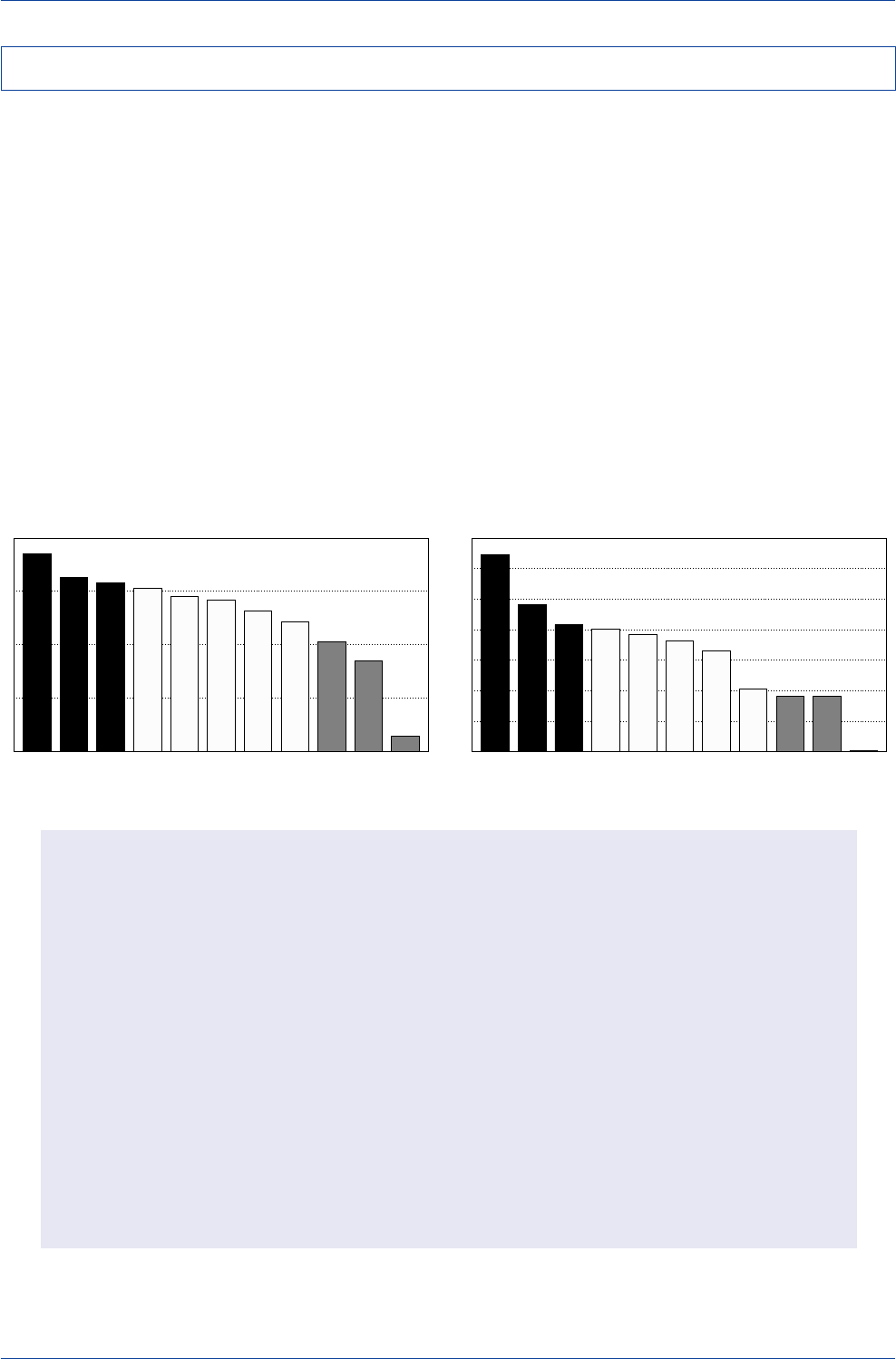

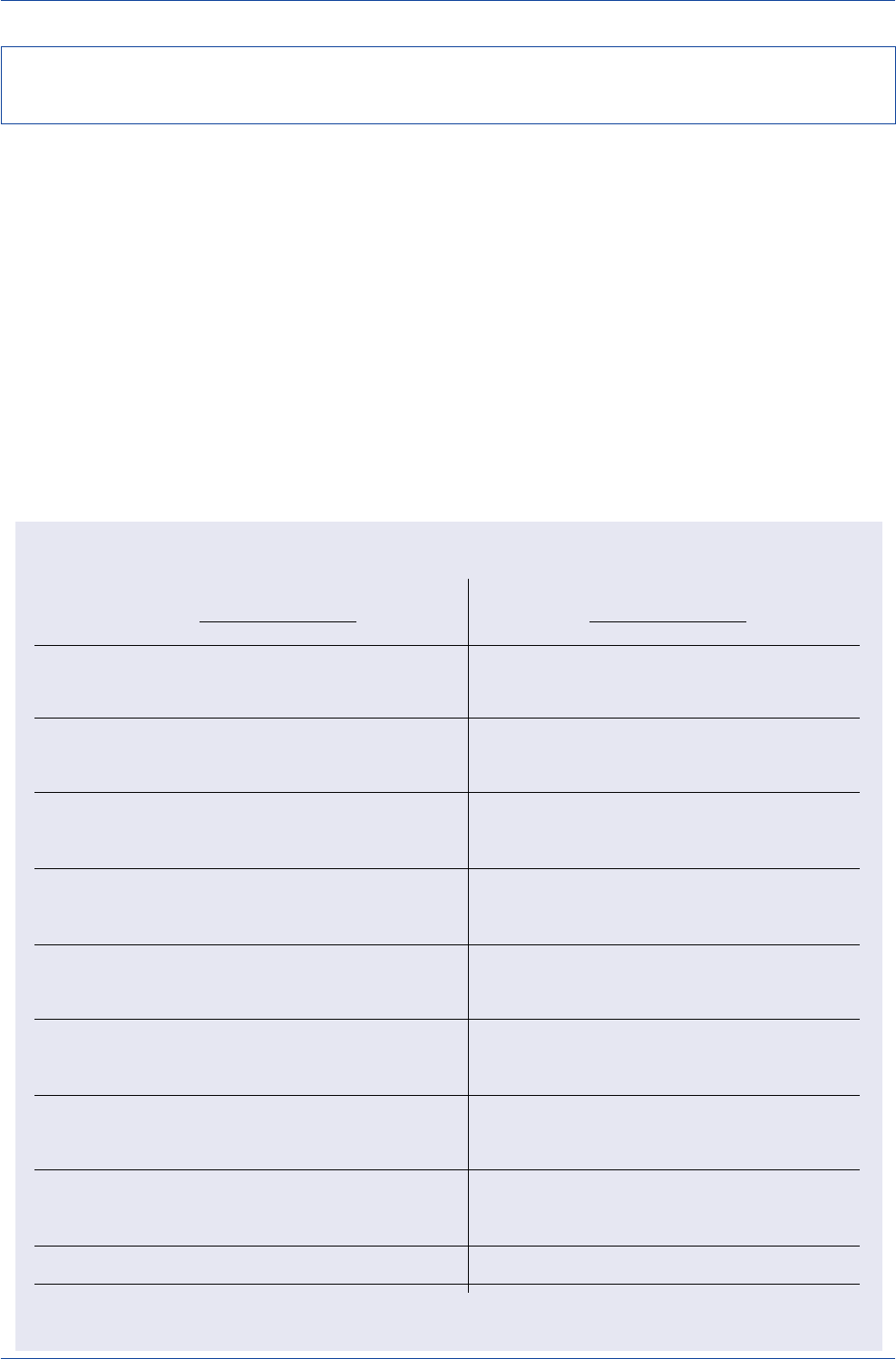

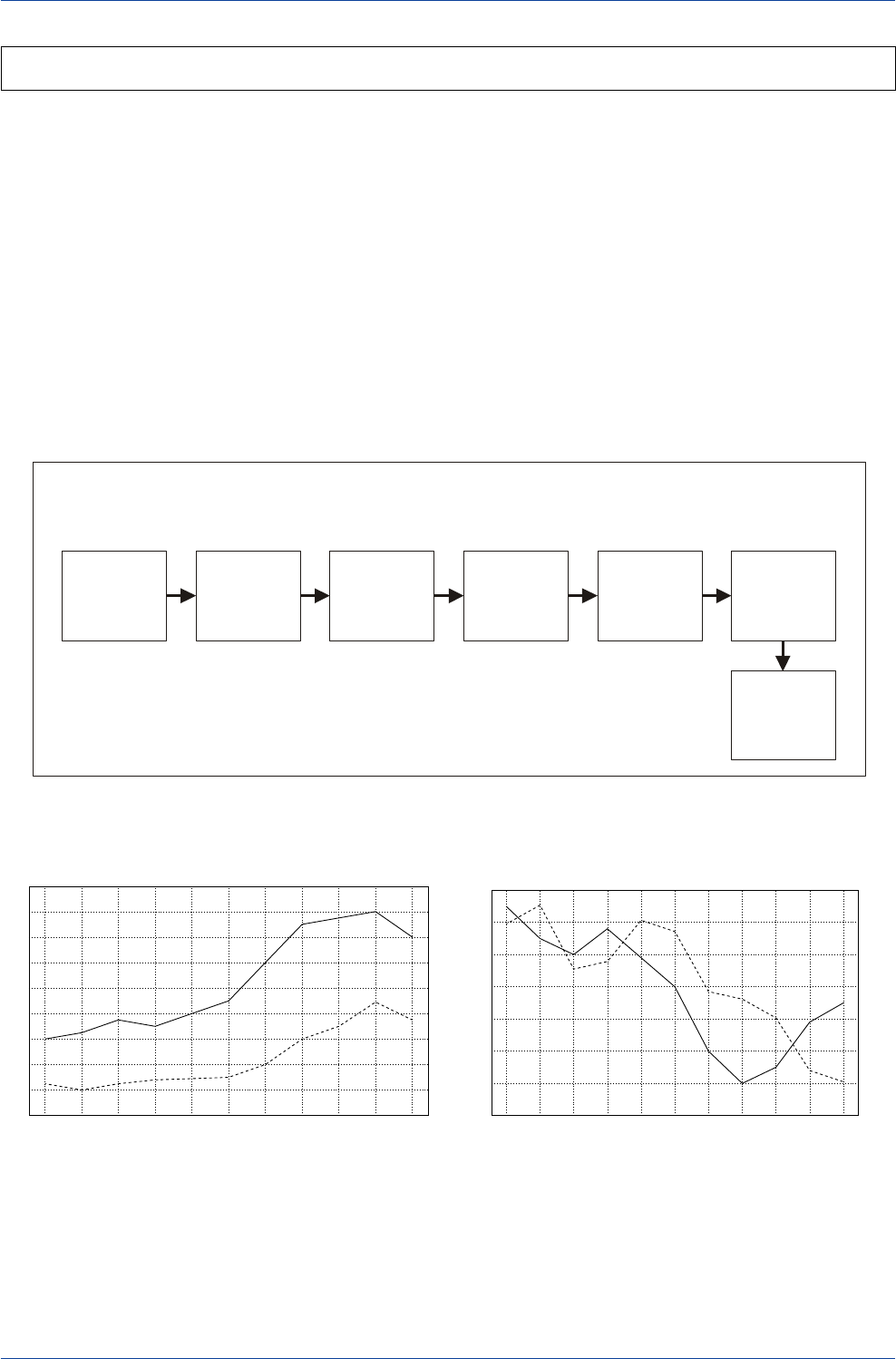

Short-Run Forecasting Tools: A Checklist

Up

Short-Term Trend

Down

Moving-Average Crossover Trading Rule

Market Sentiment

Speculative Positioning

Order Flow

Option Market Sentiment

Risk Appetite Indices

Neutral Over-

sold

Over-

bought

Momentum

(Consensus Inc. Index of Bullish Opinion)

(Net IMM Contracts)

(DB Customer Order Flow Database)

(Risk Reversals)

Forecasting Tool

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 9

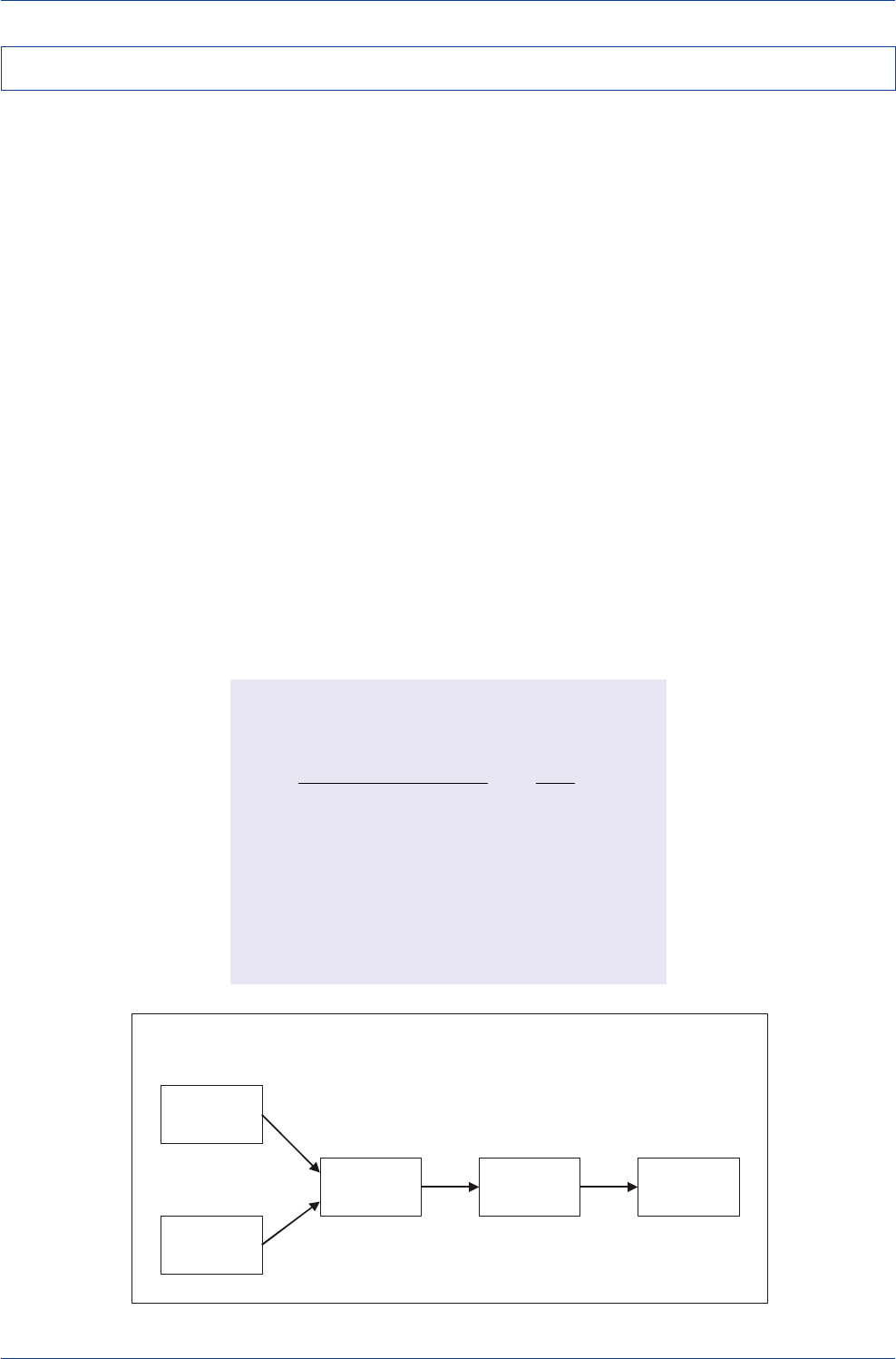

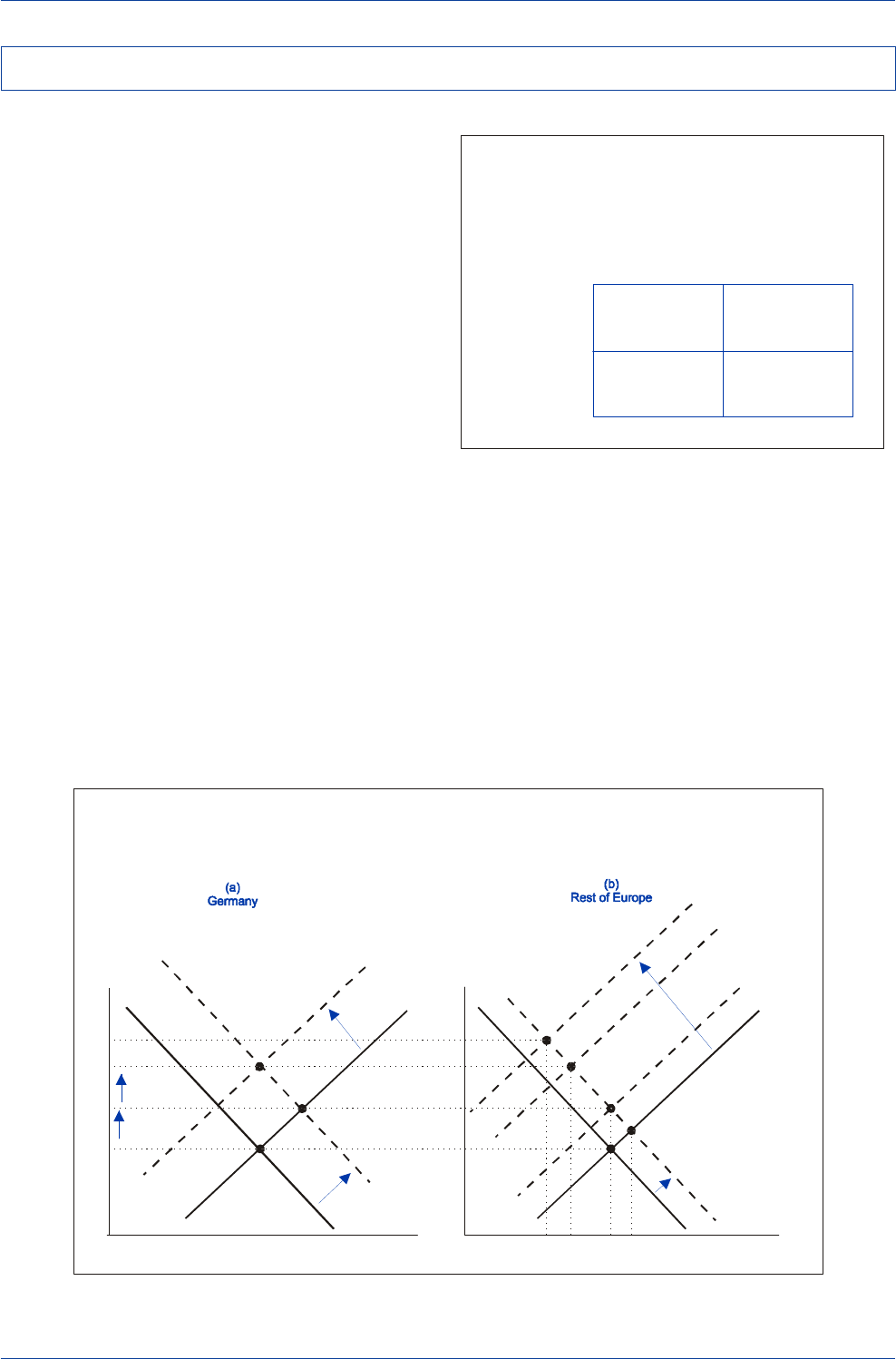

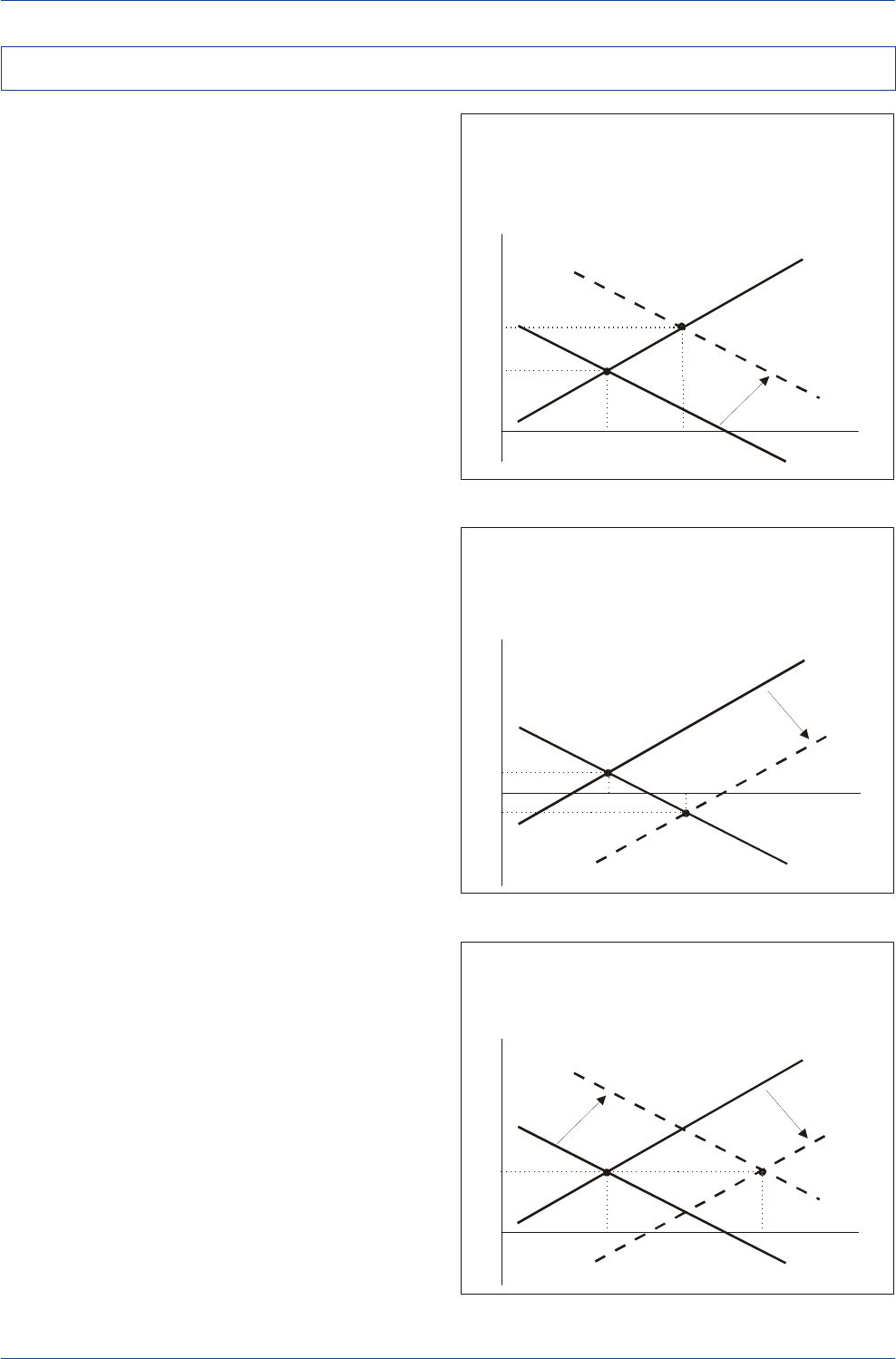

FX market participants typically fall into one of two camps:

(1) Shorter-run technically oriented traders or

(2) Longer-run fundamental-based investors.

Shorter-run technically oriented traders do not base their

investment decisions on fundamental considerations.

Rather, they rely on trend-following trading rules to deter-

mine their position taking: they buy when the currency is

rising, and they sell when the currency is falling. In con-

trast, longer-run fundamental-based investors base their

investment decisions largely on valuation considerations.

If a currency is believed to be mispriced relative to its fair

value, fundamental-based investors would buy those cur-

rencies that are believed to be undervalued and would

sell those currencies that are believed to be overvalued.

Knowing precisely what exchange-rate level represents a

currency's true equilibrium or fair value is not an easy task.

Different exchange-rate models can and often do yield quite

different estimates of a currency's long-run equilibrium

value. In most cases, the marketplace will have only a rough

idea of where a currency's long-run equilibrium value lies.

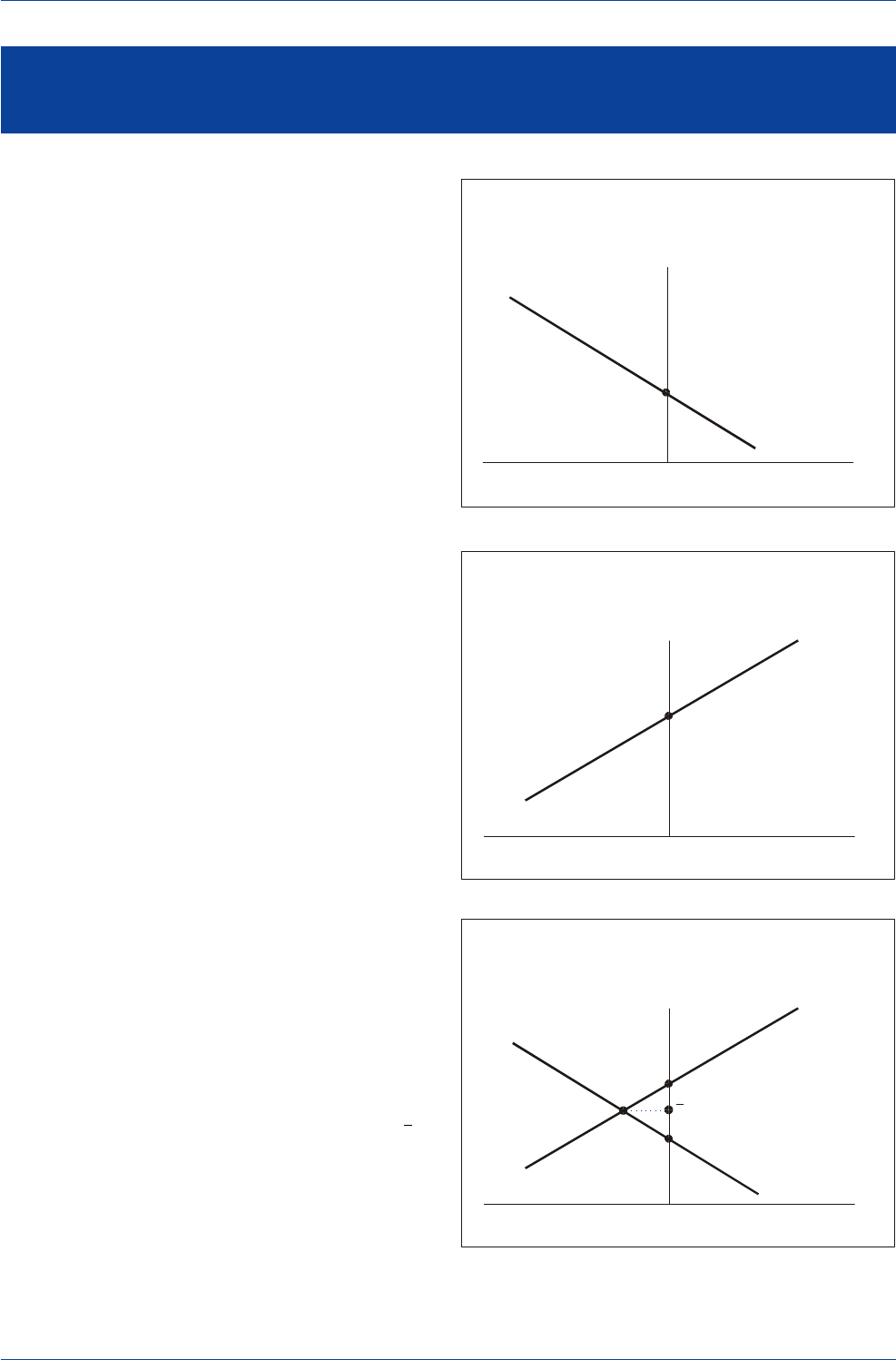

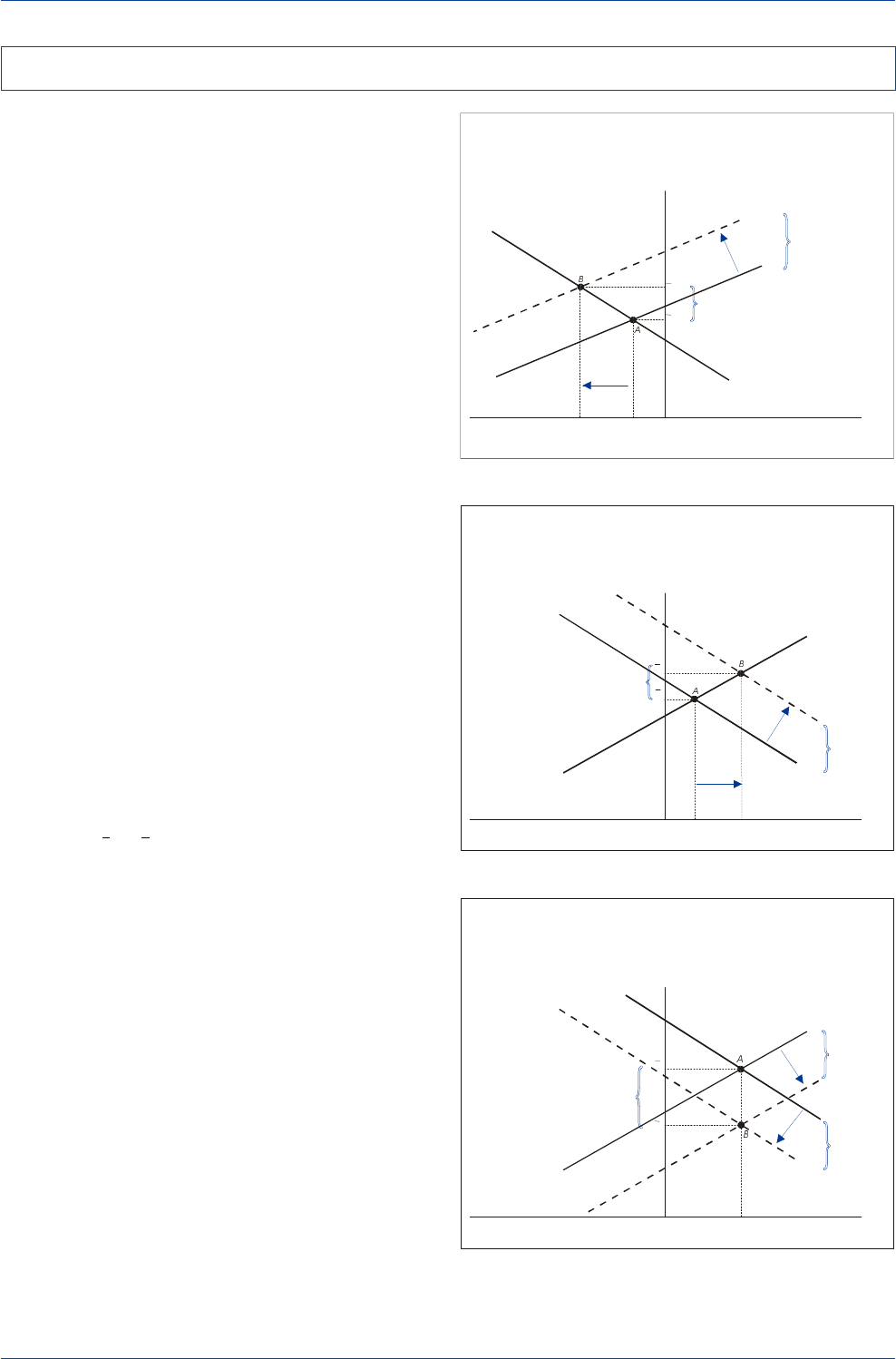

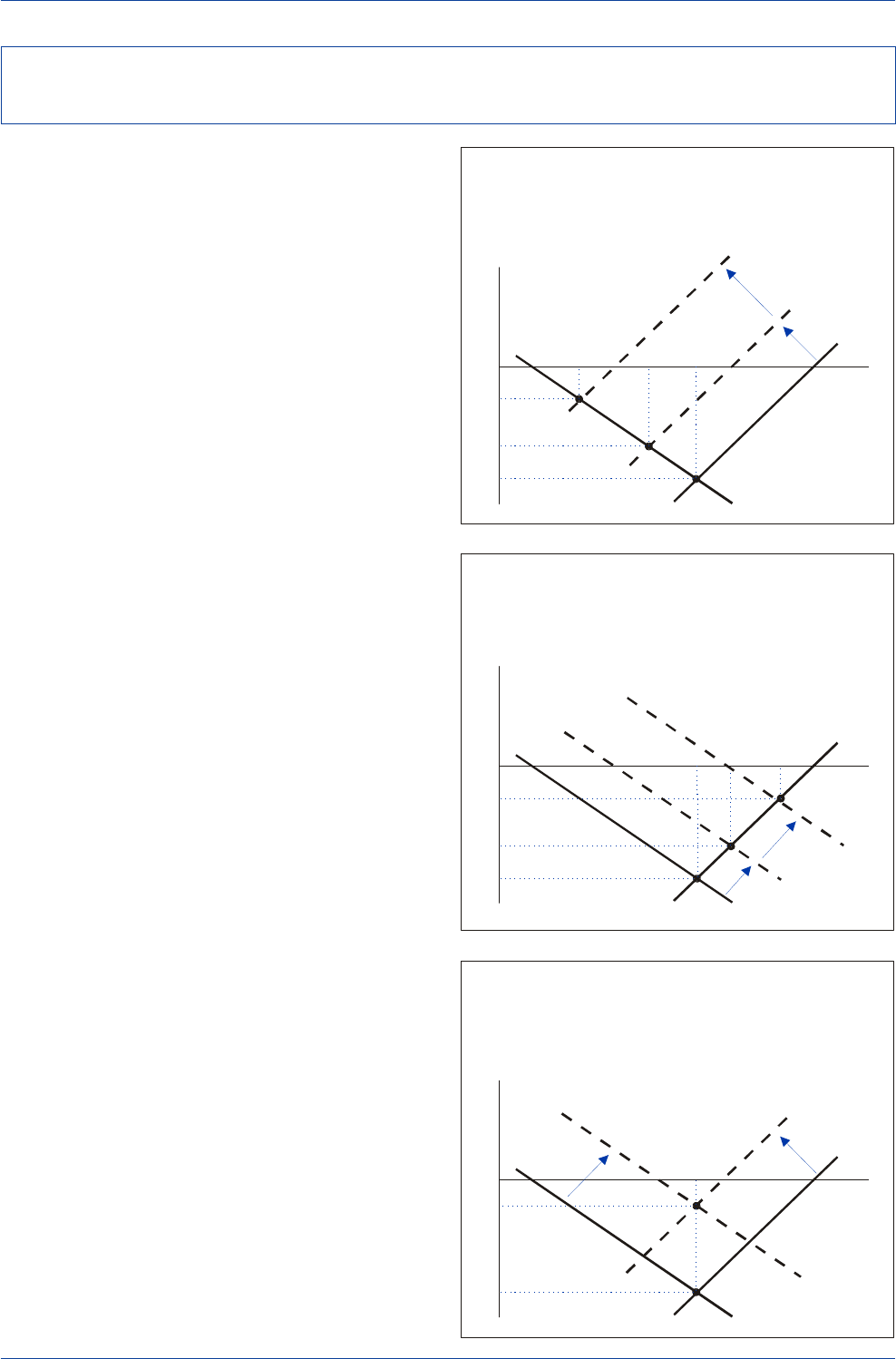

Because of this, fundamental-based investors will not set

their sights on an imprecise point estimate of fair value,

but rather on an equilibrium range or band. Within this

equilibrium range or band, fundamental-based investors

will presume that the true but unknown equilibrium ex-

change rate, q, lies somewhere between an upper bound,

qU, and a lower bound, qL.

The qU-qL band has been referred to as the "band of agnos-

ticism" in academic writings (see DeGrauwe, 1996). When

exchange rates trade inside the qU-qL band, fundamental-

based investors tend to be agnostic in terms of their cur-

rency positioning, accepting the fact that the actual ex-

change rate is probably trading close to its fair value. Ex-

change-rate movements within the qU-qL band are viewed

as noise and therefore not worthy of serious investment

consideration. Fundamental-based investors would thus

not feel compelled to take on either aggressive long or

short currency positions when exchange rates are trading

inside the band. Instead, they would more likely adopt a

neutral stance toward currency positioning.

When exchange rates fluctuate inside the band of agnosti-

cism, trading tends to be dominated by short-term techni-

cally oriented traders since fundamental-based investors

will refrain from joining the fray until the actual exchange

rate moves outside of the band. When the actual exchange

rate moves outside the qU-qL equilibrium range, fundamen-

tal-based investors will tend to shed their agnosticism and

become more willing to take on aggressive long positions

if the actual exchange rate falls below qL and aggressive

short positions if the actual exchange rate rises above qU.

In times of greater market uncertainty, however, the band

of agnosticism is likely to widen since investor confidence

regarding estimates of fair value is likely to be less strongly

held than in tranquil environments. In such cases, techni-

cally oriented traders would tend to dominate trading ac-

tivity over even wider ranges (q'U-qL'>qU- qL). That, in turn,

would likely lead to even greater FX volatility in the short

run.

One of the key problems for fundamental-based investors

is that even if the exchange rate moved outside of the

band of agnosticism, there is no guarantee that it would

move back inside the band anytime soon. Indeed, funda-

mental-based investors run the risk that an overvalued

currency might get even more overvalued if the exchange

rate moved deeper into overvalued territory, and vice versa.

Since large financial resources are likely to be needed for

investors to position themselves against an overshooting

exchange rate, one has to wonder how many fund manag-

ers would be willing to risk their clients' capital on the

basis of long-run valuation considerations, particularly if

clients evaluate their fund manager’s investment perfor-

mance over a relatively short time span. If fund managers

view it as simply too risky to take on long or short cur-

rency positions on the basis of long-run valuation consid-

erations, then there might be several occasions when ex-

change rates could wander far from any semblance of fair

value, and yet very few investors would be willing to risk

their clients' capital to bring the exchange rate back into

line with fair value.

Why FX Market Participants Focus Their Energies on Short-Run Rather

Than Long-Run Strategies

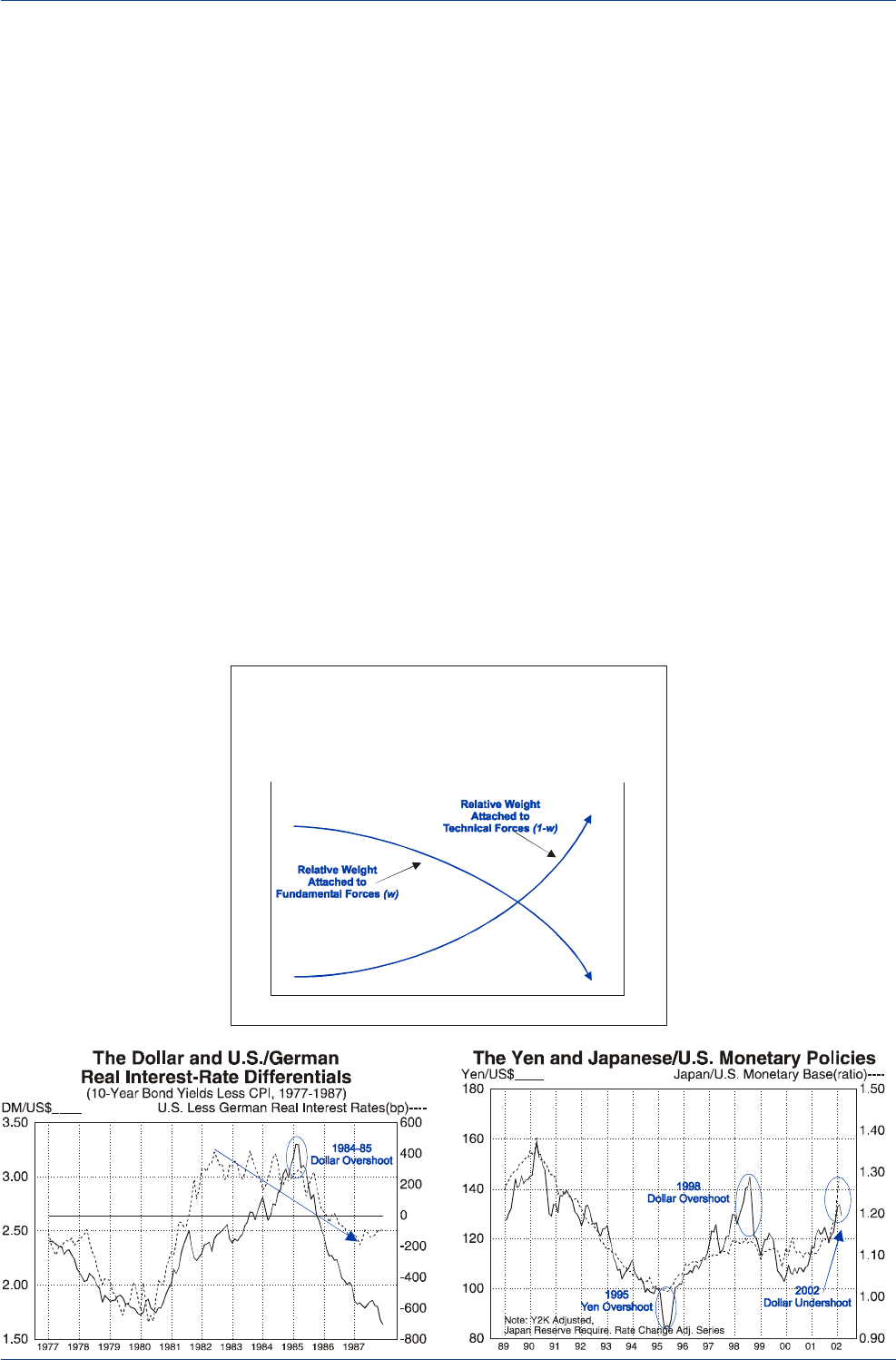

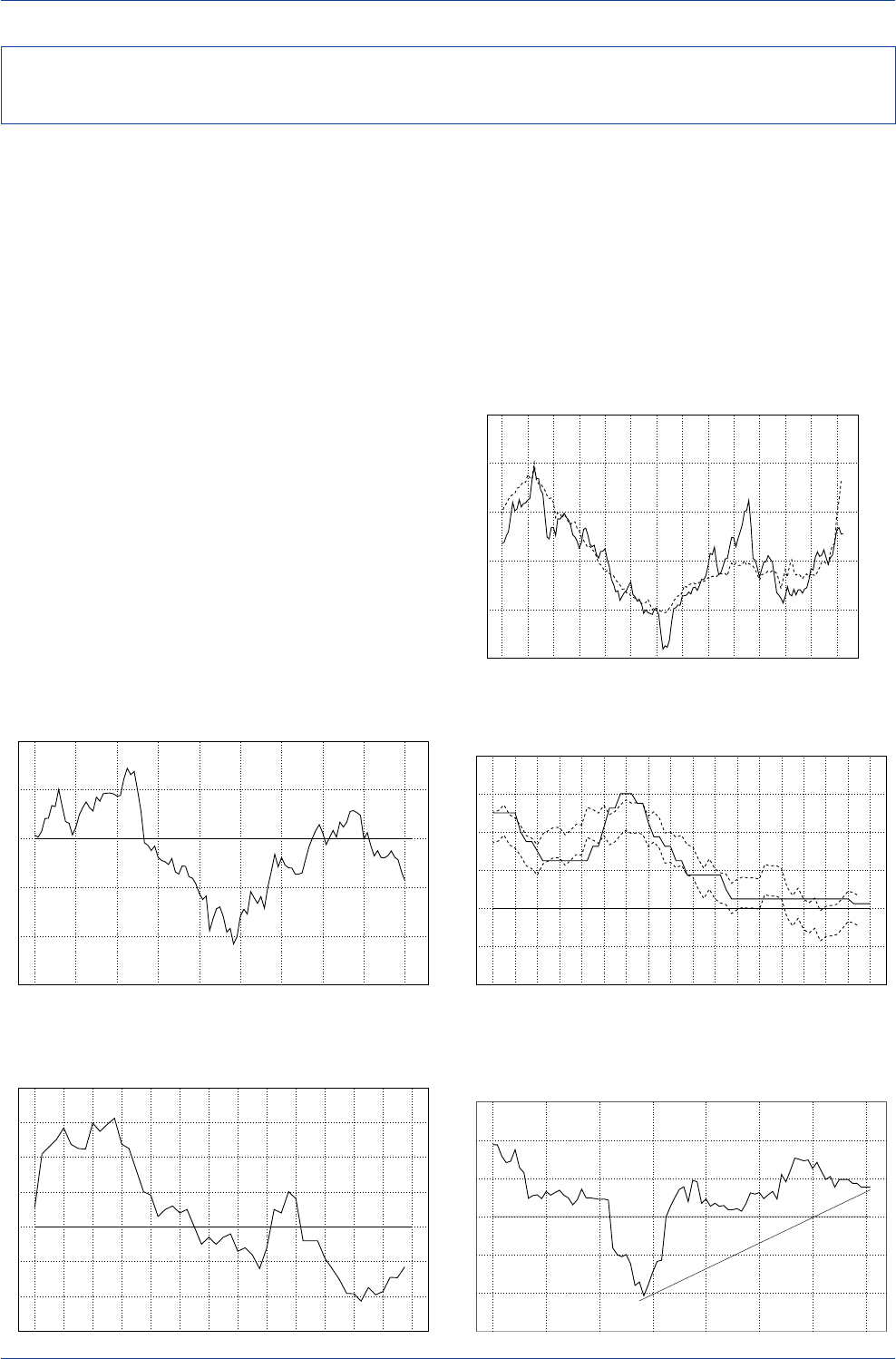

The "Band of Agnosticism"

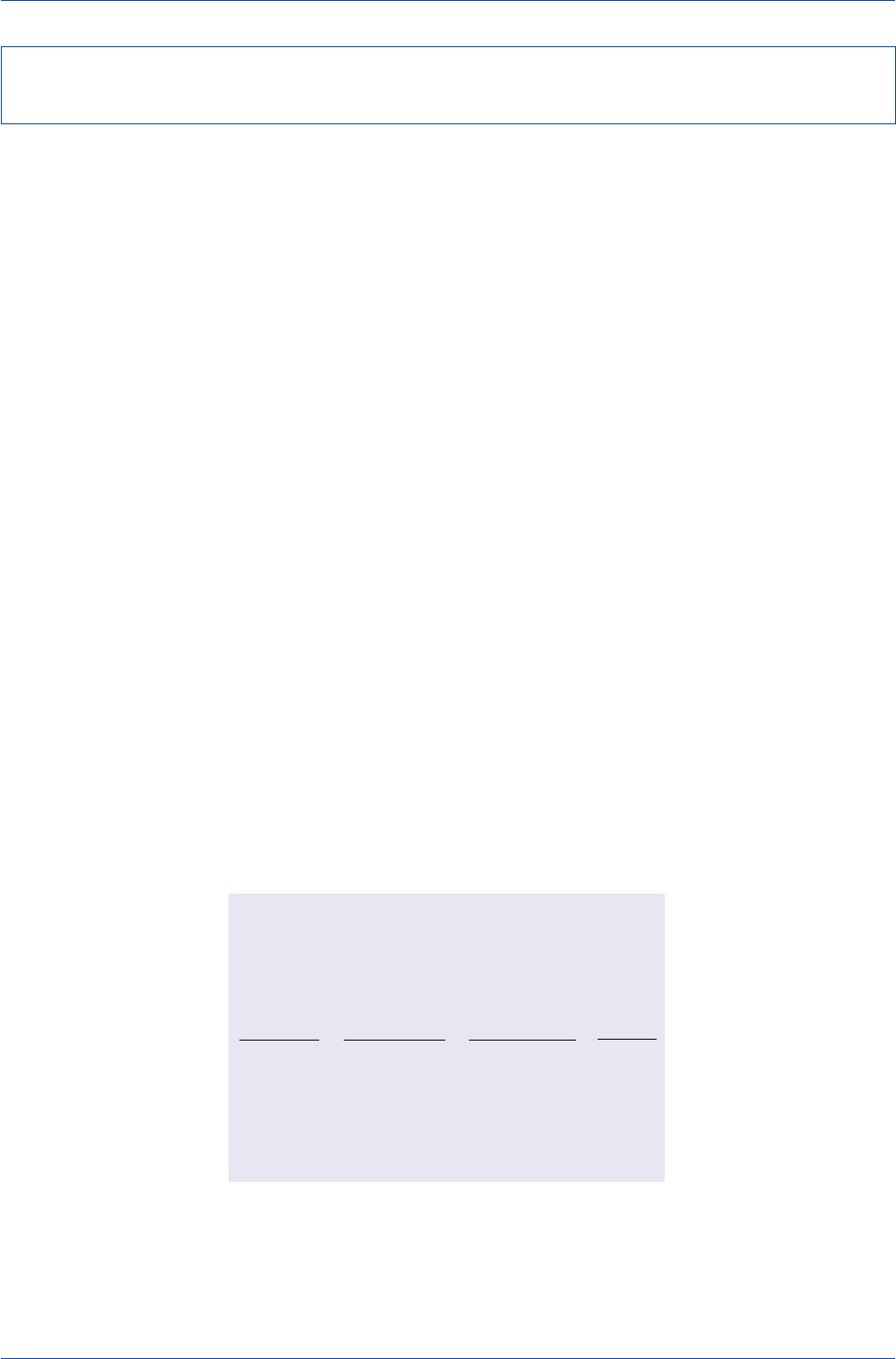

Index of Investor Willingness to

Make Currency Bets Based on

"Fundamentals"

Real Exchange Rate

q’

L

q

L

Analyzing the Behavior of Fundamental-Based Investors When

Expectations of Real Long-Run Equilibrium Exchange Rates Are Loosely Held

q

U

q’

U

Source: Adapted from DeGrauwe (1996)

q

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

10 Deutsche Bank Foreign Exchange Research

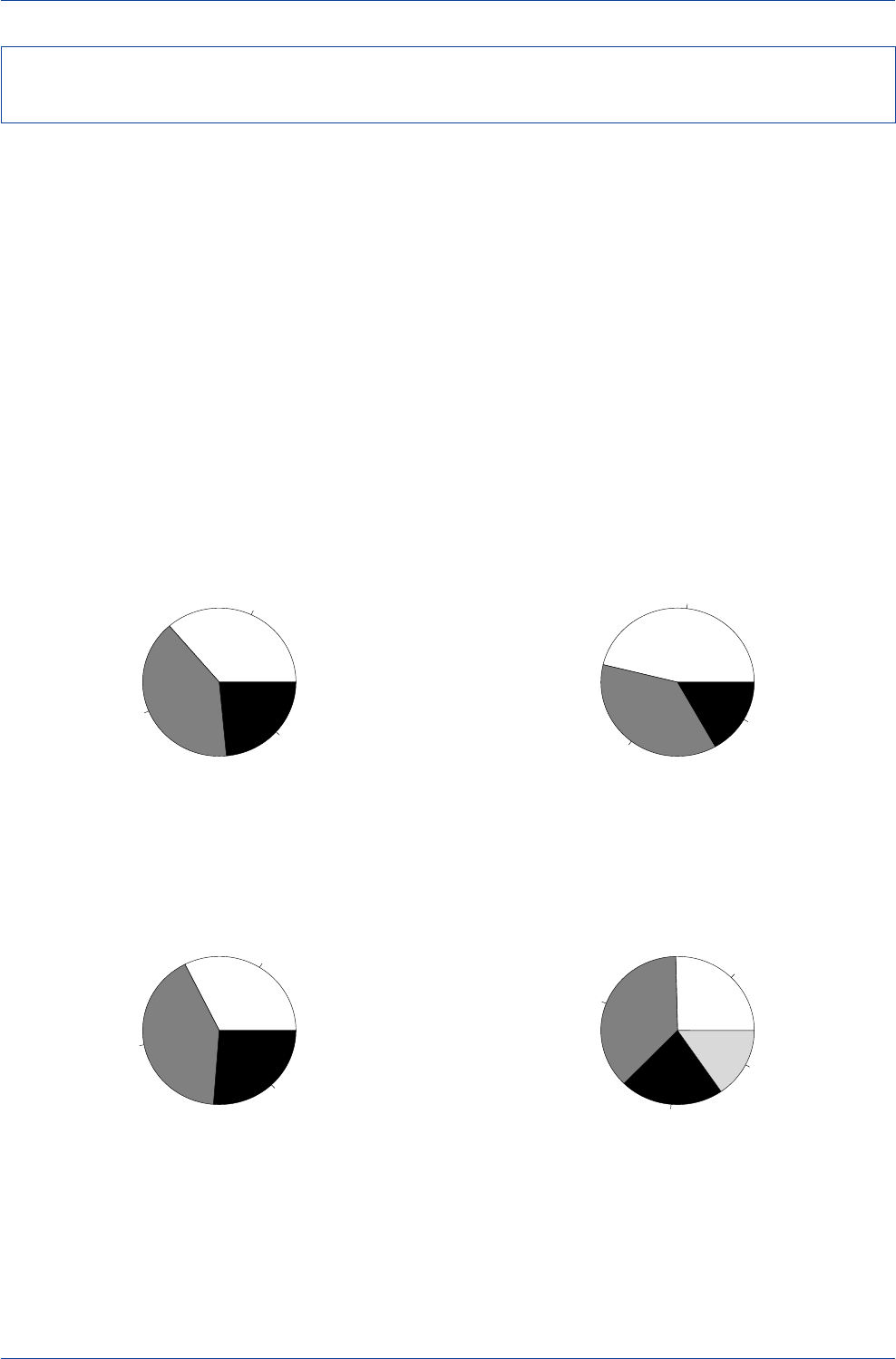

When FX dealers were asked recently what role funda-

mental factors played in the determination of exchange

rates, 97% of the respondents felt that fundamentals

played no role on an intra-day basis. However, over me-

dium and longer-term horizons, FX dealers felt that funda-

mental forces did play an important role, with 57.4% of

the respondents believing that exchange rates reflect fun-

damental value on a medium-term (within six months)

basis, and 87% believing exchange rates reflect fundamen-

tal value on a long-term (over six months) basis.

When asked to rank the most important determinants of

exchange rates on an intra-day basis, FX dealers indicated

that bandwagon effects, speculative forces, and over-re-

action to news were the principal driving forces in the very

short run. On a medium-term basis, economic fundamen-

tals and technical trading increase in importance from the

dealer community's perspective, but FX dealers also con-

tinued to assign importance to speculative forces as a key

determinant of medium-term trends in exchange rates. For

longer horizons, FX dealers believed that economic funda-

mentals were the dominant factor driving exchange rates.

However, a not insignificant number (11.3%) believed that

technical trading was important even in the long run.

The FX dealer survey also asked dealers whether they

thought that exchange rates were more predictable on an

intra-day basis or on a medium-term (up to six months) or

long-term (beyond six months) basis. FX dealers were

asked to assign a rating of 1 if there was no predictability,

a rating of 5 if there was a high predictability and a rating

of 2, 3, or 4 if there was low, medium, or better than aver-

age predictability, respectively. Since FX dealers tend to

trade on an intra-day basis, one might have thought that

they would assign a high rating to exchange-rate predict-

ability on an intra-day basis. This was not the case. Indeed,

62% of the dealer respondents gave ratings of 1 or 2, to

the predictability of exchange rates in the short run, while

only 11% gave ratings of 4 or 5.

For medium and longer time horizons, the confidence in

exchange-rate predictability increases, with 30.4% of deal-

ers assigning a ranking of 4 or 5 on a medium-term basis

and 35.1% assigning a ranking of 4 or 5 on a longer-term

basis. The question that we need to ask ourselves is: if FX

dealers are more confident in predicting exchange rates

on a medium/long-term basis rather than on an intra-day

basis, why then do traders concentrate their energies on

very short-run trading? The answer might be that traders

are in a better position to evaluate and manage FX risk on

a short-term basis, which overrides their greater confidence

in medium/long-term exchange-rate predictability.

FX Dealers’ Perception of the Role of Fundamentals

in Explaining Exchange-Rate Movements

FX Dealer Survey Question—Do You Believe Exchange-Rate

Movements Reflect Changes in Fundamental Value on an:

Intraday Medium-Run Long-Run

Basis Basis Basis

(up to 6 months) (beyond 6 months)

Yes 3% 57.8% 87%

No 97% 42.2% 12%

No Opinion 0% 0.0% 1%

Source: Yin-Wong Cheung, Menzie D. Chinn, and Ian W. Marsh,

“How Do UK-Based Foreign Exchange Dealers Think Their Market Operates?”,

NBER Working Paper 7524, February 2000.

FX Dealers’ Perception of the Most Important Factor

That Explains Exchange-Rate Movements

FX Dealer Survey Question—Select the Single Most Important

Factor that Determines Exchange Rate Movements on an:

Intraday Medium-Run Long-Run

Basis Basis Basis

(up to 6 months) (beyond 6 months)

Bandwagon Effects 29.3% 9.5% 1.0%

Over-reaction to News 32.8% 0.7% 0.0%

Speculative Forces 25.3% 30.7% 3.1%

Economic Fundamentals 0.6% 31.4% 82.5%

Technical Trading 10.3% 26.3% 11.3%

Other 1.7% 1.5% 2.1%

Source: Yin-Wong Cheung, Menzie D. Chinn, and Ian W. Marsh,

“How Do UK-Based Foreign Exchange Dealers Think Their Market Operates?”,

NBER Working Paper 7524, February 2000.

FX Dealers’ Perception of the Predictability of

Exchange-Rate Movements

FX Dealer Survey Question—On a Scale of 1 to 5, Indicate If You

Believe the Market Trend Is Predictable on an:

Intraday Medium-Run Long-Run

Basis Basis Basis

(up to 6 months) (beyond 6 months)

1 (Least Predictable) 21.6% 5.9% 17.2%

2 40.3% 20.7% 16.4%

3 26.9% 43.0% 30.6%

4 9.0% 18.5% 20.9%

5 (Most Predictable) 2.2% 11.9% 14.2%

Source: Yin-Wong Cheung, Menzie D. Chinn, and Ian W. Marsh,

“How Do UK-Based Foreign Exchange Dealers Think Their Market Operates?”,

NBER Working Paper 7524, February 2000.

How FX Dealers View the Determination of Exchange Rates in the Short Run

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 11

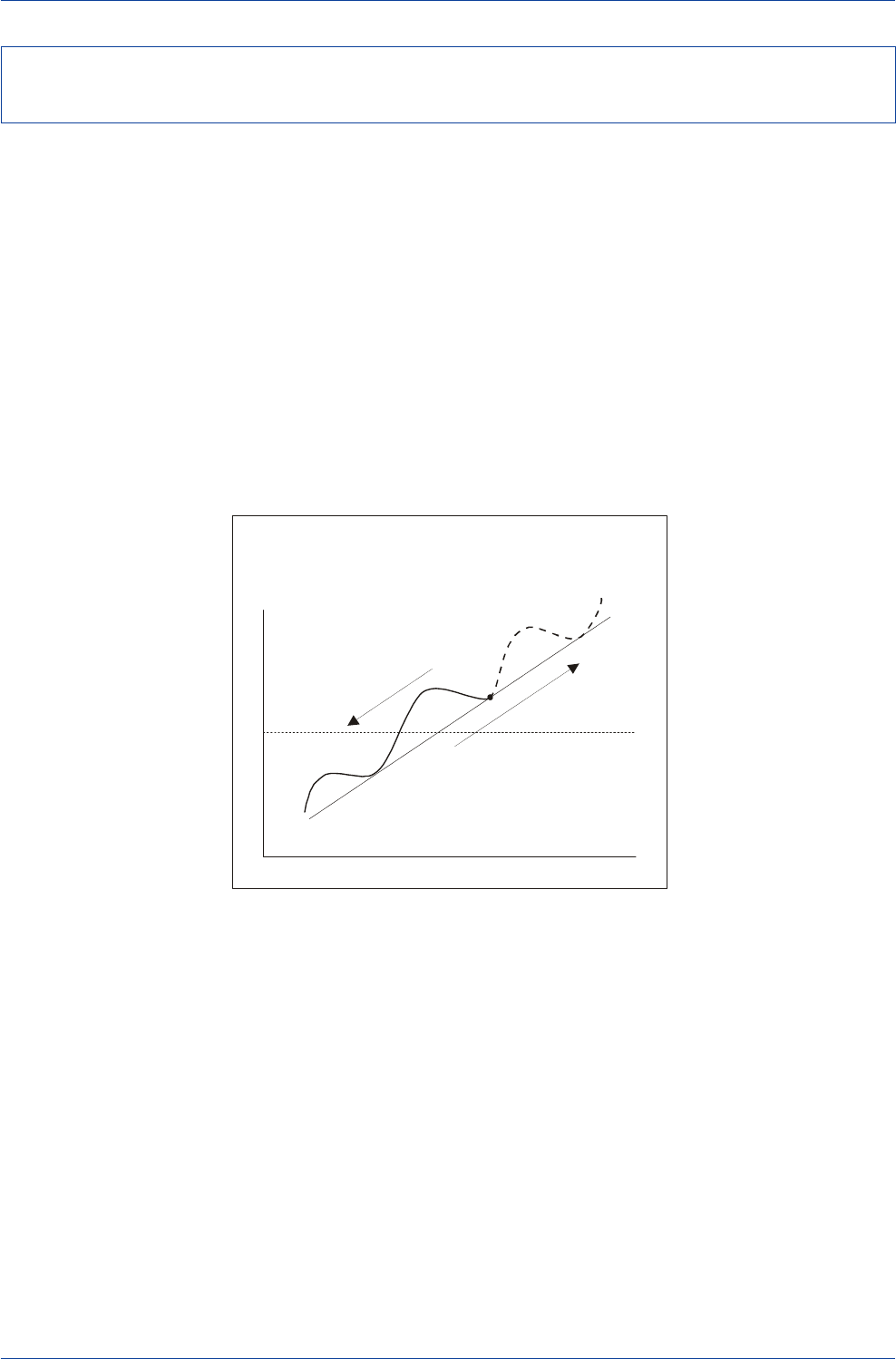

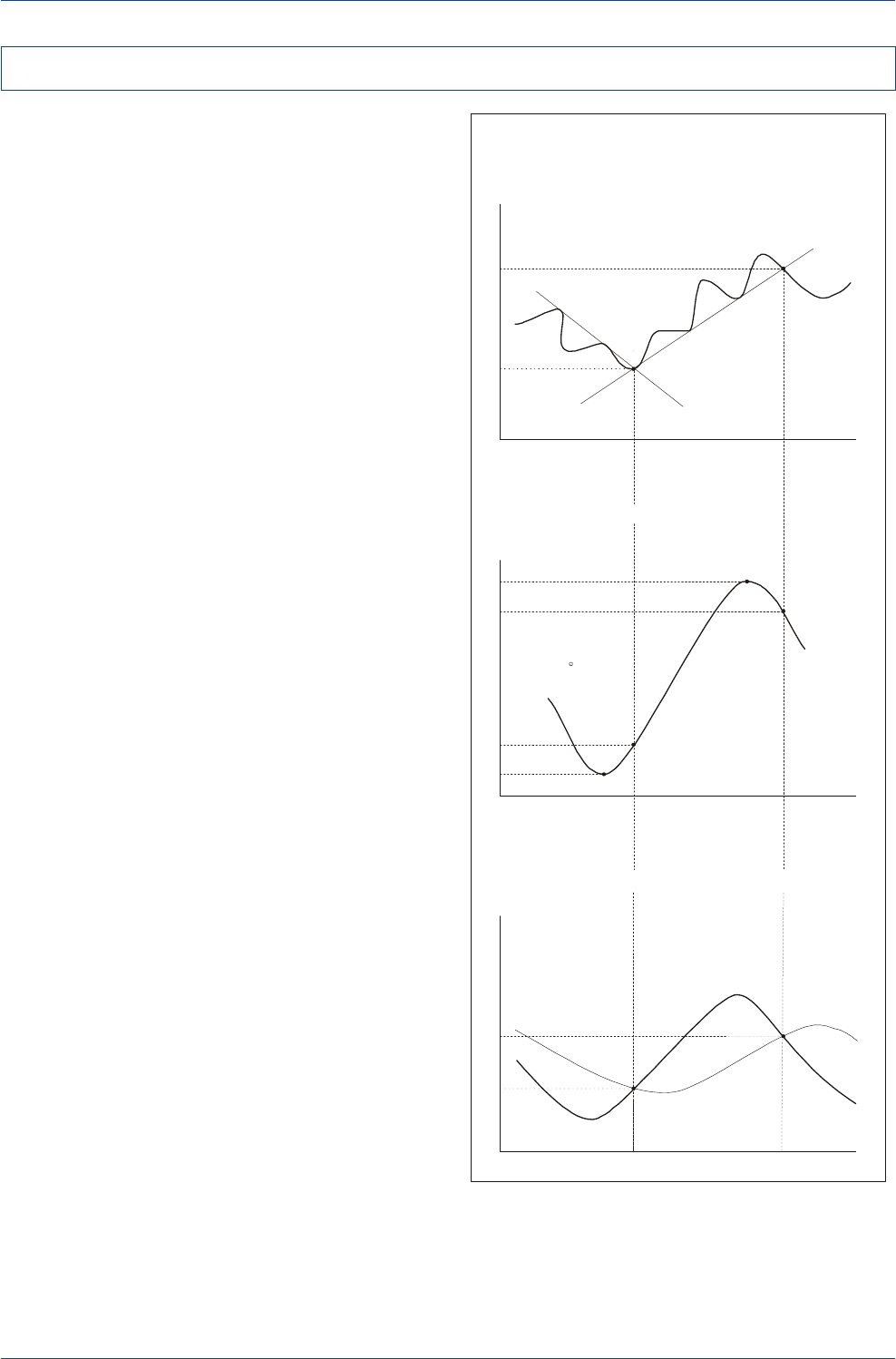

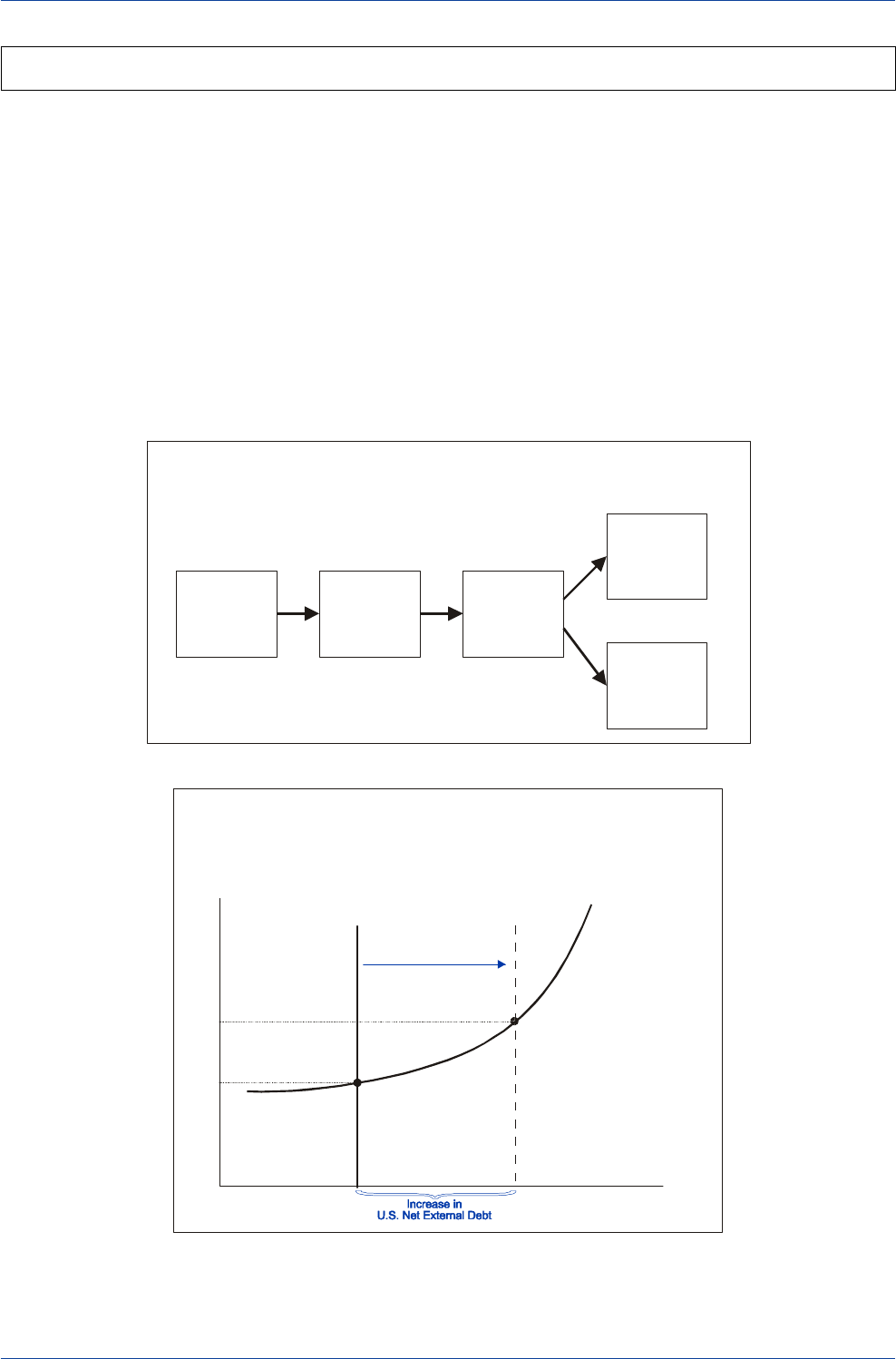

Technical models generate exchange-rate forecasts by

extrapolating past sequences of exchange-rate movements

into the future. For example, if a currency begins to edge

higher and rises above some critical value, a technical

model will typically issue a recommendation to go long

that currency, the presumption being that the newly formed

trend will continue to carry the currency higher in the fu-

ture. Similarly, a sell signal would be issued if the currency

began to edge lower and fell below some critical value.

Trend-following trading rules will be profitable as long as

the ensuing trend does indeed move in the same direc-

tion as the preceding trend, which would be the case if

exchange rates moved in broad, well-defined cycles. But

that is not to say that exchange rates must always move in

large swings for trend-following trading rules to be profit-

Technical Analysis:

The Advantage of Trading

With and Not Against the Trend

Exchange Rate

Time

Long-Run Equilibrium

Exchange Rate

Technical Analysis:

Even though a currency overshoots its

long-run equilibrium level, a technician

will recommend maintaining long positions

as long as the trend in the exchange

rate is up.

Fundamental Analysis:

May prematurely recommend

selling a currency that has

overshot its long-run

equilibrium level.

Trendline

Market Price

Today’s

Spot

Rate

able. What matters for long-term profitability is that large

exchange-rate upswings and downswings must occur on

a frequent enough basis to overcome those occasions

when currency movements are not highly trended.

Fundamental-based models tend to focus on whether a

currency lies above or below its long-run equilibrium or

"fair" value. Technical models, on the other hand, are not

interested in whether a currency lies above or below its

fair value. Rather, technical models are only interested in

whether the trend in the exchange rate is upward or down-

ward. As long as a confirmed uptrend (or downtrend) is in

place, a recommended long (short) position will be main-

tained even if the prevailing trend carries the exchange

rate well above (below) its long-run fair value.

Currency Forecasting Using Technical Analysis—

The Advantage of Trading with and Not Against the Trend

Source: Rosenberg (1996)

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

12 Deutsche Bank Foreign Exchange Research

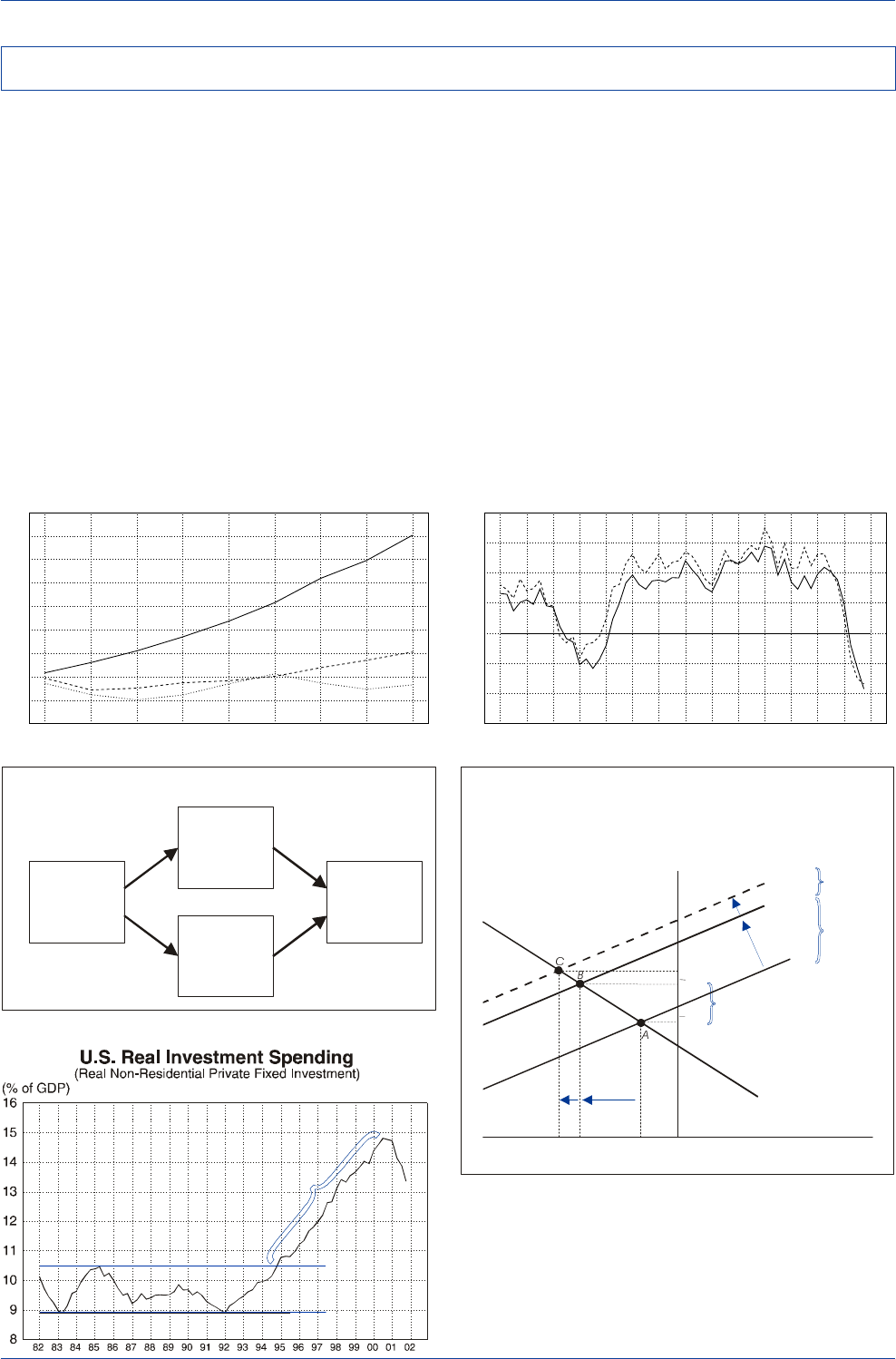

Identification and Confirmation of a Valid Uptrend/Downtrend

Exchange Rate

Time

Trendline

Market Price

Peak

2

Exchange Rate

Time

Peak

1

Peak

3

Trough

2

Trough

1

Trough

3

Trendline

Peak

2

Peak

3

Trough

2

Trough

1

Trough

3

Peak

1

Market Price

Identification and Confirmation

of a Market Reversal

Exchange Rate

Time

Trendline

Market Price

Head-and-Shoulders Reversal Pattern

Exchange Rate

Time

Neckline

Market Price

Head

Left Shoulder

Right Shoulder

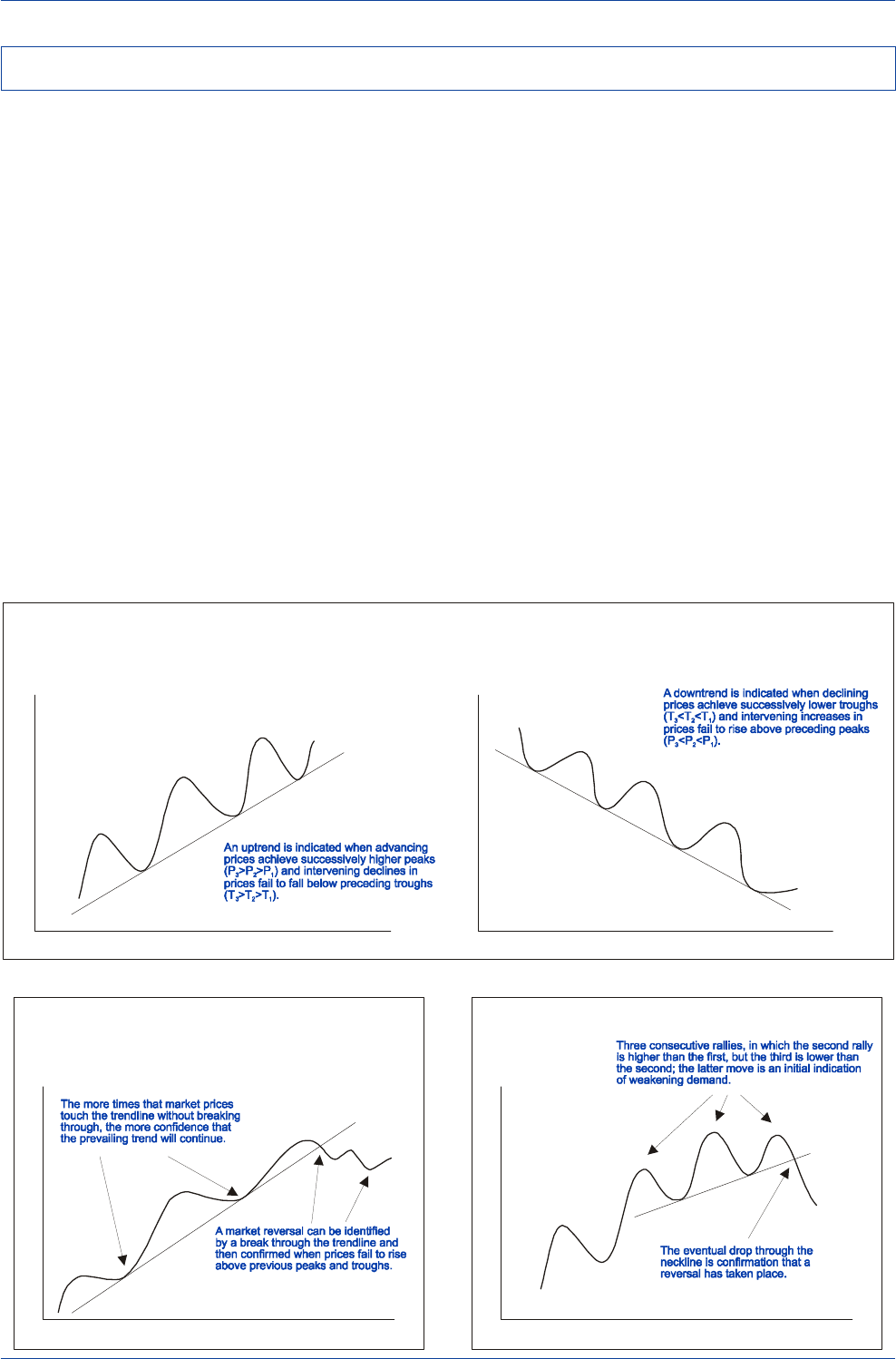

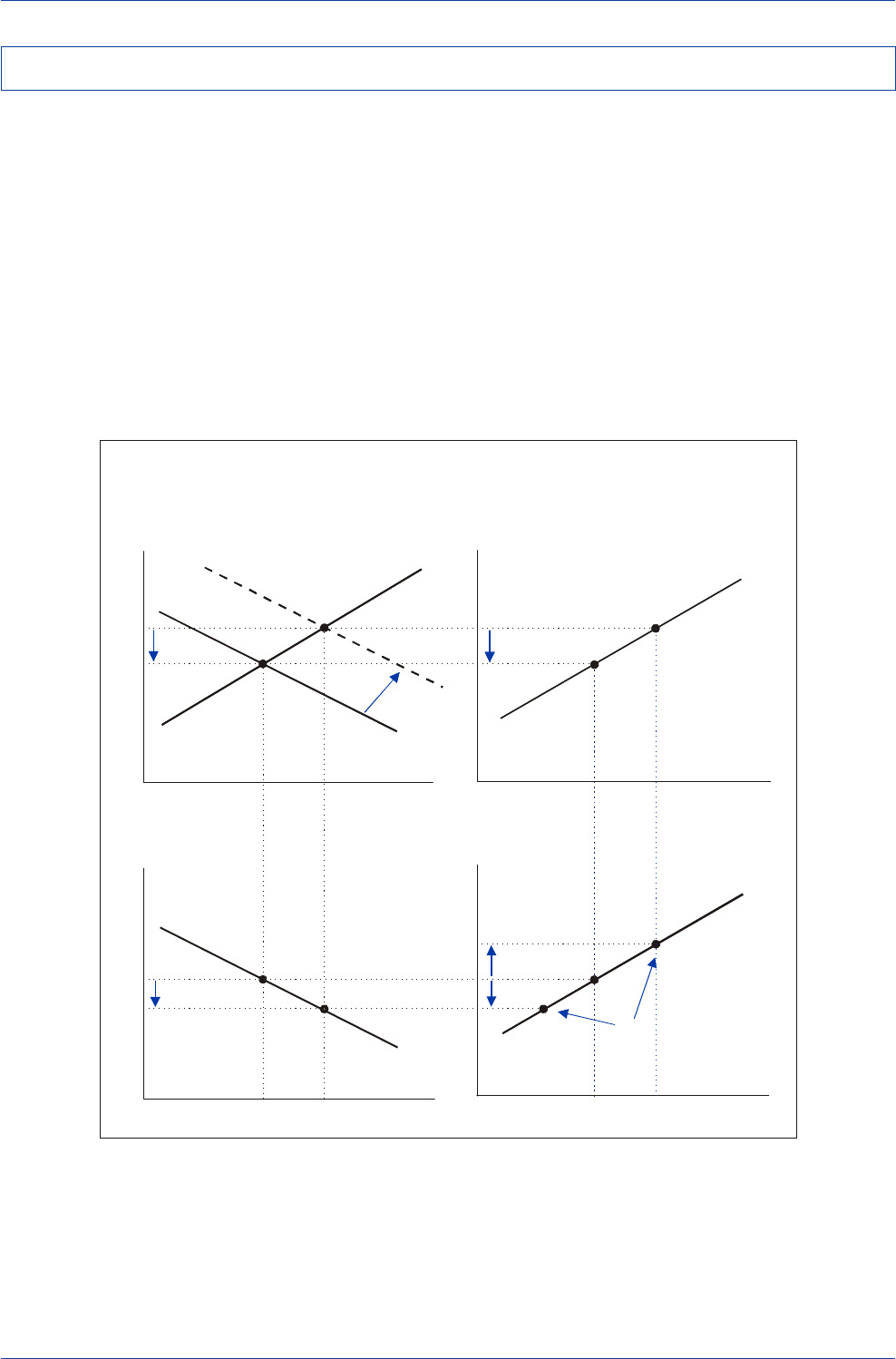

Trend-following trading rules come in many forms. But what

all trend-following trading rules have in common is that

they seek to identify the direction in which the

broad

trend

in exchange rates is heading. One can visualize the trend

in exchange rates as a series of primary and secondary

waves. The primary wave refers to the large, broad moves

in exchange rates that carry the underlying trend in cur-

rency values either upward or downward. The secondary

waves refer to the temporary corrections or partial

retracements of the primary trend that typically take place

over the course of longer-run exchange-rate cycles. What

trend-following trading rules attempt to do is to identify

the direction in which the primary waves are heading.

In a rising market, each rally and partial retracement will

be higher than its predecessor. As long as advancing prices

achieve successively higher peaks and troughs, they indi-

cate that buying pressure is overcoming selling pressure.

In such a case, the uptrend will be presumed to be intact,

until a reversal is signaled. The opposite would be the case

in a declining market.

Markets reverse in many different ways, but all reversals

have one thing in common—all reversals of valid uptrends

(downtrends) must be preceded by the failure of market

prices to achieve successively higher peaks and troughs

(lower troughs and peaks). In the case of a reversal of a

previous valid uptrend, when the wavelike series of rising

peaks and troughs is broken, it indicates that selling pres-

sure is finally beginning to overcome buying pressure.

One of the most recognizable reversal patterns is the head-

and-shoulders pattern. A head-and-shoulders pattern is

essentially a series of three successive rallies with the

second stronger than the first, and the third weaker than

the second. Because the third rally fails to carry as far as

the second, the string of successively higher peaks is bro-

ken. This is an initial indication of weak demand, and the

eventual drop in market prices to levels below the preced-

ing trough (or neckline) is confirmation that a reversal is

taking place. A recent Federal Reserve Bank of New York

study (Osler and Chang, 1995) found that head-and-shoul-

ders patterns have been successful in anticipating rever-

sals in trend for the yen and Deutschemark.

The Identification of FX Market Trends and Reversals

Source: Rosenberg (1996)

Source: Rosenberg (1996) Source: Rosenberg (1996)

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 13

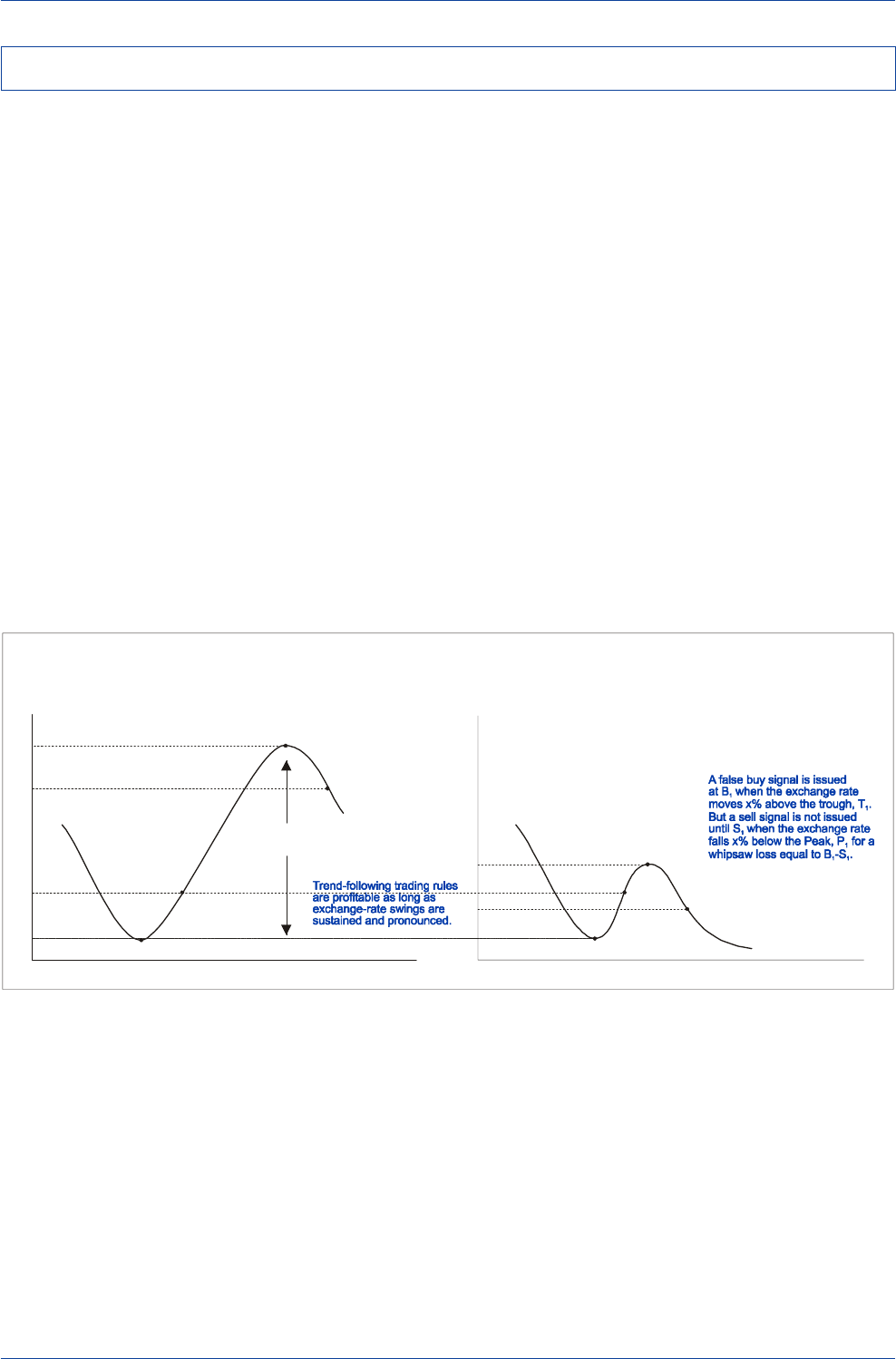

A wide variety of trend-following trading rules abounds,

but by and large they all share the basic property of ex-

trapolation. A chartist who monitors the behavior of mar-

ket prices on a bar chart with a ruler and pencil will as-

sume that an uptrend is intact as long as advancing prices

achieve successively higher peaks and intervening declines

fail to fall below preceding troughs.

More sophisticated extrapolation techniques can be de-

signed with the assistance of a computer. One popular

computer-based technical model is the filter rule, which

issues a buy recommendation if an exchange rate rises by

x%

above its most recent trough, and issues a sell recom-

mendation if the exchange rate falls by

x%

below its most

recent peak. Another popular computer-based technical

model is the moving-average crossover model. By con-

structing longer-run moving averages of daily exchange-

rate movements, one can more easily isolate the primary

trend from short-run noise. If the short-run moving aver-

age of the exchange rate rises above its long-run moving

average, it is an indication that buying pressure is over-

coming selling pressure, and vice versa.

In each case, predictions of the likely future path that ex-

change rates might take are being generated by the ex-

trapolation of the prevailing trend in exchange rates into

the future. Essentially, it really doesn't matter which trend-

following rule you use. Since a trend is a trend, all trend-

following trading rules should roughly generate the same

directional forecast.

Because all of these models generate forecasts by extrapo-

lating the recent past trend of exchange rates into the fu-

ture, buy or sell signals will be issued only after a currency

has already started rising or falling. Although this means

that trend-following trading rules will not capture the very

top and bottom of market moves, they may nevertheless

be profitable if the ensuing exchange-rate movements per-

sist long enough and carry far enough to generate signifi-

cant excess returns.

Filter-Rule Strategy

DM/US$

Time

B

S

P

T

x%

x%

Moving-Average Crossover Strategy

DM/US$

Time

B

S

SRMA

LRMA

All Trend-Following Trading Rules Share

the Same Property: Extrapolation

DM/US$

Time

B

S

Down Trendline

Up Trendline

Trendline Penetration

Trend-Following Trading Rules and the Principle of Extrapolation

Source: Rosenberg (1996)

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

14 Deutsche Bank Foreign Exchange Research

Investors Who Follow a Trend-Following Trading Rule

May Be Vulnerable to Whipsaws Caused by False Signals

DM/US$

Time

B

S

P

T

x%

x%

DM/US$

B

1

S

1

P

1

T

1

An Example of a False Signal

and a Whipsaw Loss

Time

1

Market-Swing

Requirement

Market-Swing Requirement

of Profitable Trend-Following Trading Rules

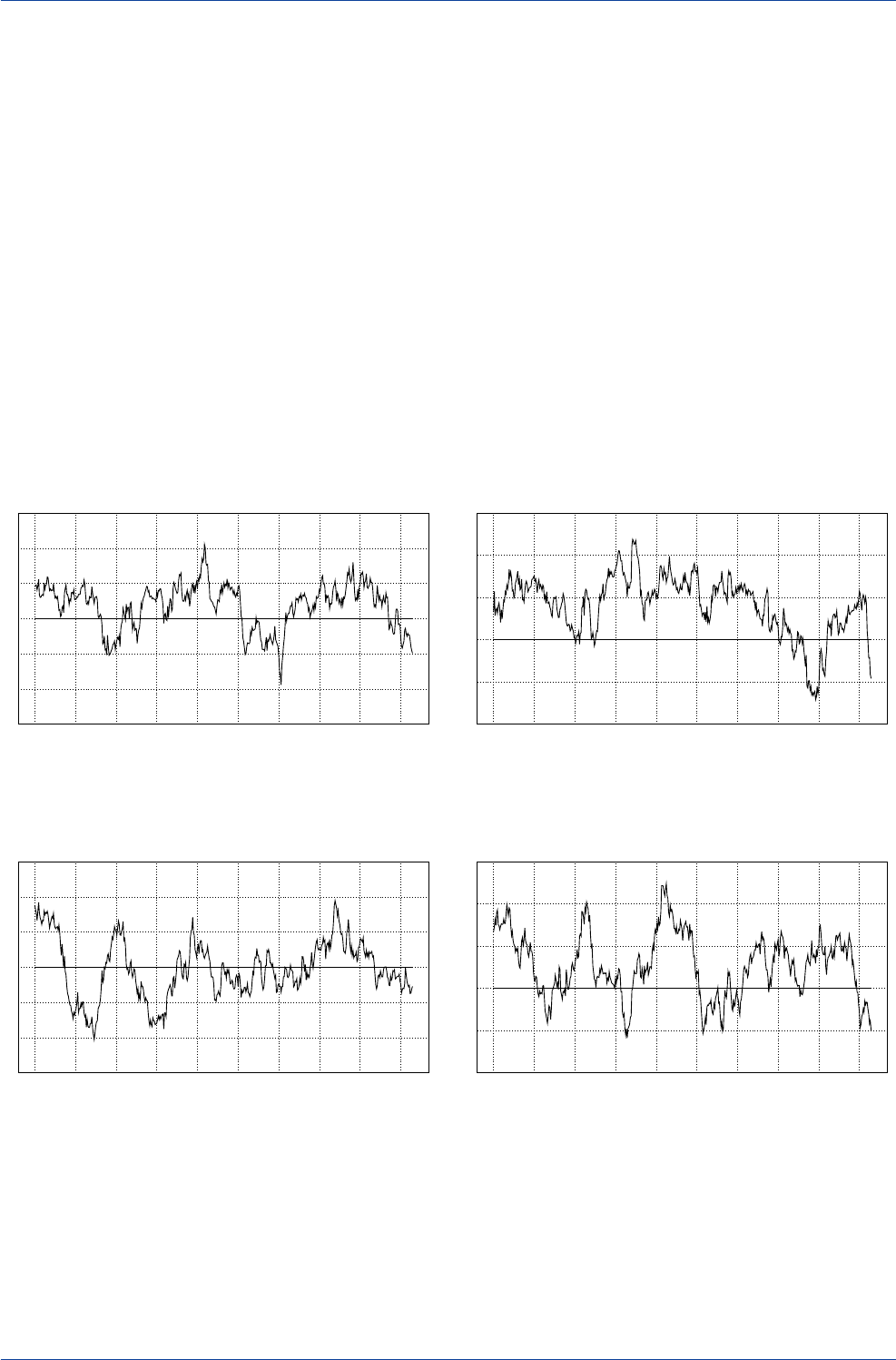

When exchange-rate swings are sustained and pro-

nounced, the profitability of most technical trading rules

will not be seriously undermined if the trading rule tends

to be a bit late in drawing attention to a shift in market

direction. Unfortunately, this market-swing requirement

could prove in many cases to be a tall order. In markets

that exhibit little overall price variation or are not highly

trended, an investor who adheres to a trend-following trad-

ing rule will find his portfolio vulnerable to potential whip-

saw losses caused by frequent false signals.

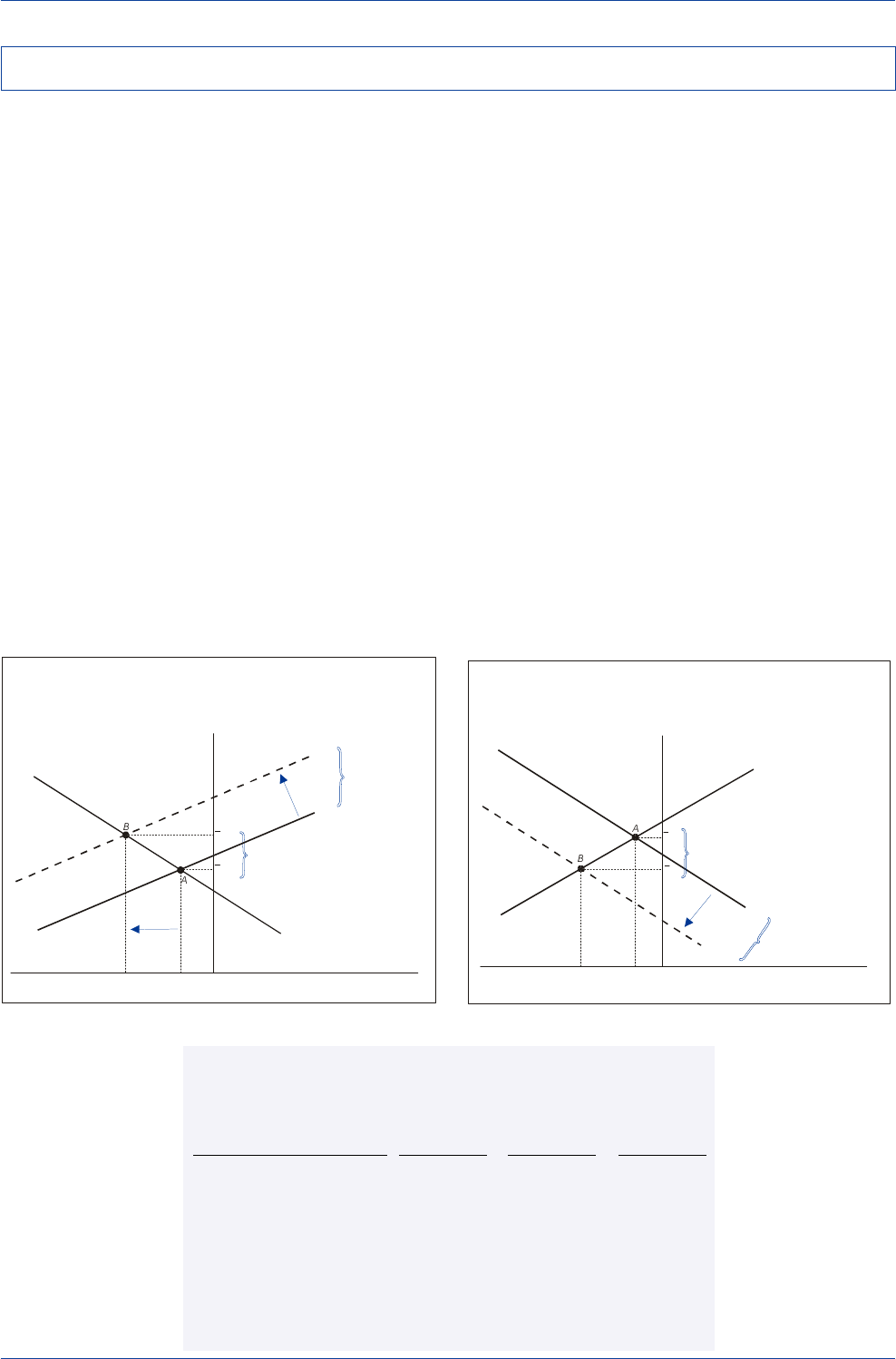

Consider the two exchange rate series depicted below.

The series on the left illustrates the working of a profitable

x%

filter rule trading strategy. A recommendation to buy

dollars is issued at point

B

when the DM/US$ exchange

rate rises

x%

from its recent trough at point

T

. The ensuing

market action then carries the DM/US$ exchange rate to a

peak at point

P

, but a recommendation to sell dollars is

issued only at point

S

, when the exchange rate has fallen

x%

from its peak level. An investor who rigidly adhered to

this

x%

filter rule trading strategy would have bought dol-

lars at

B

and sold dollars at

S

, with the spread between

S

and

B

representing the profit margin per dollar invested.

The series on the right illustrates how losses can be in-

curred using a filter rule trading strategy. The series on the

right behaves in a similar fashion as the series on the left,

except for the fact that the dollar's upswing is less pro-

nounced following the recommendation to buy dollars at

point

B

1. That is, the swing in the DM/US$ exchange rate

from

B

1 to

P

1 falls short of the swing from

B

to

P

in the

chart on the left. At

P

1, the dollar's upward momentum is

shown to lose steam far earlier than was the case in the

series on the left. Indeed, the DM/US$ actually begins to

lose ground soon after its initial rise and a sell signal is

eventually issued at point

S

1. Since the selling price (

S

1)

lies below the purchase price (

B

1), a loss is incurred with

the spread between

S

1 and

B

1 representing the margin of

loss per dollar invested. Hence, the buy recommendation

at

B

1 proved to be a false buy signal, with the investor

whipsawed in the process.

Potential Pitfalls from Following Technical Trading Rules

Source: Rosenberg (1996)

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 15

Studies on the long-run profitability of technical-based trad-

ing rules often find that simple moving-average rules would

have generated significant excess returns over relatively

long periods for most major currency pairs. We simulated

more than 2500 sets of moving-average crossover trading

rules for seven currencies versus the U.S. dollar—the Deut-

schemark, Japanese yen, Swiss franc, British pound, and

the dollar-bloc currencies—over the 1986-2002 period, and

unearthed the optimal moving-average trading rules listed

in the table below. The criterion used to choose the opti-

mal trading rule in each case was to identify the rule that

yielded the highest Sharpe ratio (after adjusting for trans-

action costs) for the entire 16-year period.

For each exchange rate, there were a number of moving-

average crossover trading rules that yielded similar attrac-

tive Sharpe ratios, and we list the top 10 trading rules for

each exchange rate. In each case, there was always one

rule that eked out the highest Sharpe ratio and those are

shown in the column on the left. (For example, the best

performing trading rule for the Deutschemark/U.S. dollar

exchange rate was a 1-day/32-day moving-average cross-

over trading rule, which yielded an average annual total

return of 5.01% with a Sharpe ratio of 0.45.) The moving-

average crossover trading rules are ranked for each ex-

change rate and are listed from left to right in the table

below.

The 10 Best Moving-Average Crossover Trading Rules for 1986-2002

(Average Annual Total Returns and Sharpe Ratios for January 1986-April 2002 )

US$ Exchange Rate #1 #2 #3 #4 #5 #6 #7 #8 #9 #10

DEM Mov. Avg. Days 1/32 1/33 1/31 1/28 1/30 1/29 1/34 1/20 1/35 1/19

Total Return (%) 5.01 4.89 4.38 4.20 3.96 3.88 3.98 3.58 3.43 3.13

Std. Dev. (%) 11.06 11.06 11.06 11.06 11.06 11.06 11.06 11.06 11.06 11.06

Sharpe Ratio 0.45 0.44 0.40 0.38 0.36 0.35 0.36 0.32 0.31 0.28

JPY Mov. Avg. Days 8/59 8/60 7/61 8/61 7/60 9/60 9/62 9/61 8/62 8/63

Total Return (%) 9.19 9.16 8.83 8.86 8.76 8.79 8.63 8.63 8.53 8.49

Std. Dev. (%) 11.75 11.75 11.75 11.75 11.75 11.75 11.75 11.75 11.75 11.75

Sharpe Ratio 0.78 0.78 0.75 0.75 0.75 0.75 0.73 0.73 0.73 0.72

GBP Mov. Avg. Days 1/19 1/18 1/20 1/21 1/22 1/16 1/24 1/15 1/17 1/23

Total Return (%) 5.80 5.45 5.36 5.32 5.28 5.20 4.91 4.82 4.80 4.49

Std. Dev. (%) 9.46 9.47 9.46 9.46 9.46 9.47 9.45 9.47 9.47 9.45

Sharpe Ratio 0.61 0.58 0.57 0.56 0.56 0.55 0.52 0.51 0.51 0.48

CHF Mov. Avg. Days 1/57 1/59 1/58 1/56 1/60 1/55 1/69 1/54 1/61 1/65

Total Return (%) 8.63 8.44 8.40 8.40 7.87 7.79 7.50 7.24 7.21 6.84

Std. Dev. (%) 11.65 11.64 11.66 11.65 11.63 11.66 11.63 11.66 11.63 11.64

Sharpe Ratio 0.74 0.72 0.72 0.72 0.68 0.67 0.65 0.62 0.62 0.59

CAD Mov. Avg. Days 14/199 14/200 14/197 13/197 14/198 13/198 15/195 15/193 15/194 14/196

Total Return (%) 1.88 1.88 1.86 1.83 1.82 1.81 1.75 1.66 1.64 1.59

Std. Dev. (%) 4.81 4.81 4.81 4.81 4.81 4.81 4.81 4.81 4.81 4.81

Sharpe Ratio 0.39 0.39 0.39 0.38 0.38 0.38 0.36 0.34 0.34 0.33

AUD Mov. Avg. Days 13/39 13/38 13/40 1/16 13/42 13/41 14/43 13/37 13/43 13/45

Total Return (%) 3.53 3.44 3.41 2.99 2.73 2.54 2.45 2.44 2.37 2.34

Std. Dev. (%) 10.30 10.31 10.28 10.29 10.28 10.28 10.28 10.31 10.28 10.28

Sharpe Ratio 0.34 0.33 0.33 0.29 0.27 0.25 0.24 0.24 0.23 0.23

NZD Mov. Avg. Days 10/17 11/15 10/18 10/15 11/17 14/196 10/16 11/20 11/16 11/14

Total Return (%) 5.20 4.99 5.10 4.76 4.67 4.28 4.28 4.41 3.85 3.38

Std. Dev. (%) 10.79 10.80 10.78 10.80 10.79 10.14 10.80 10.78 10.80 10.81

Sharpe Ratio 0.48 0.46 0.47 0.44 0.43 0.42 0.40 0.41 0.36 0.31

Note: A Sharpe Ratio measures the amount of return on an investment (less the return of a risk-free asset) per unit of risk, which is proxied by its standard deviation.

Datastream is the source of the underlying exchange-rate data.

Empirical Evidence on the Profitability of Moving-Average Trading Rules

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

16 Deutsche Bank Foreign Exchange Research

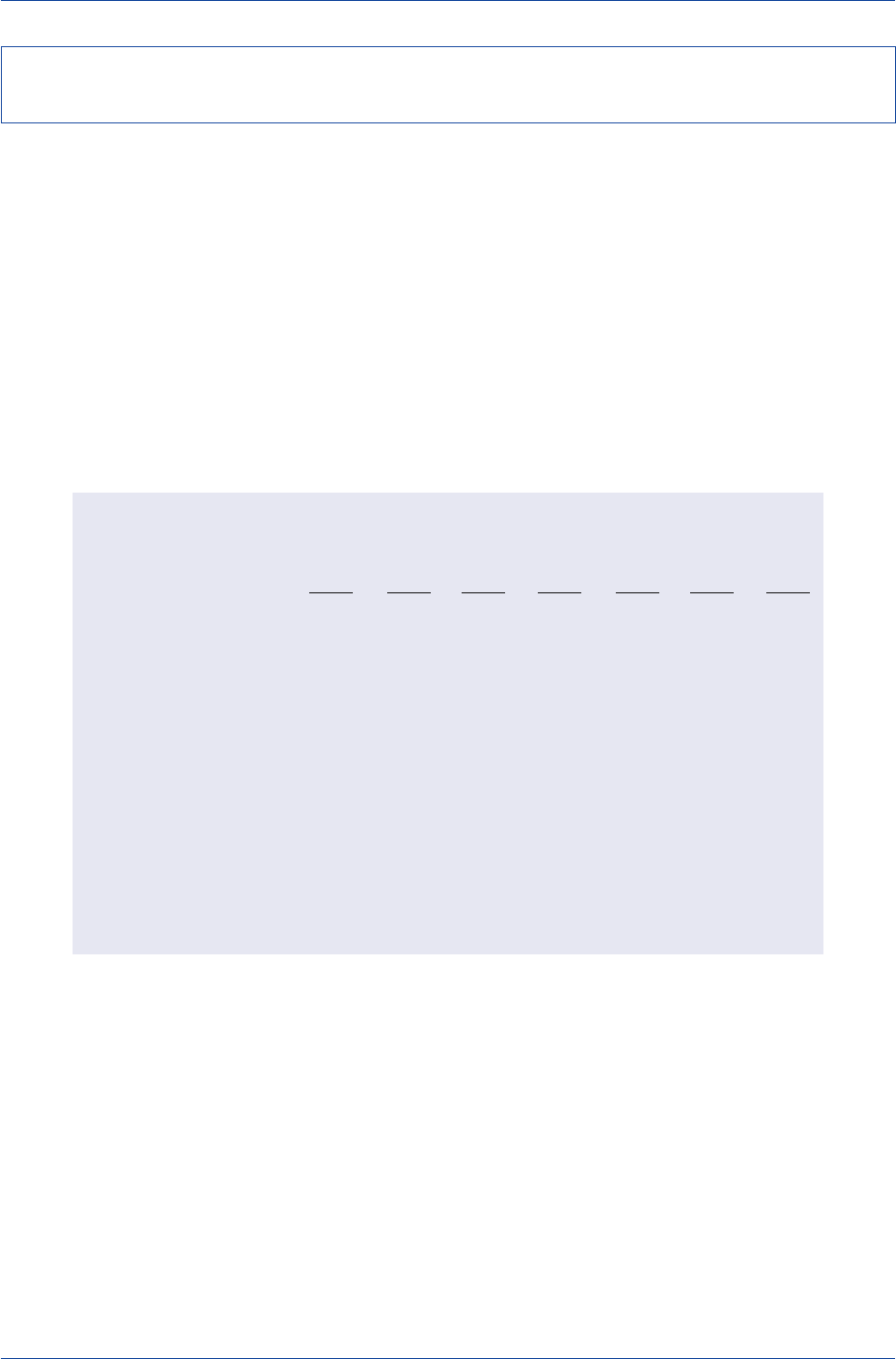

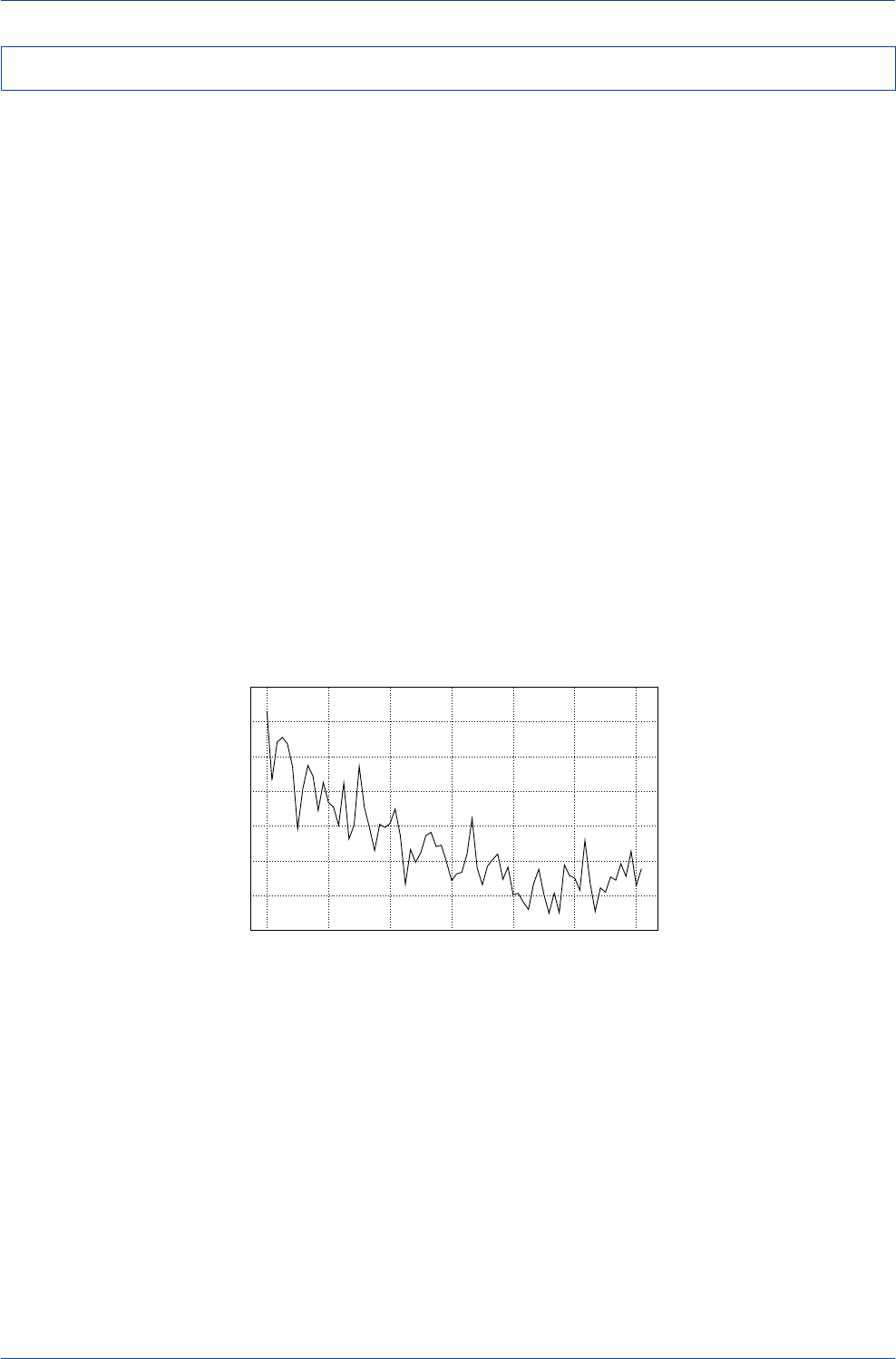

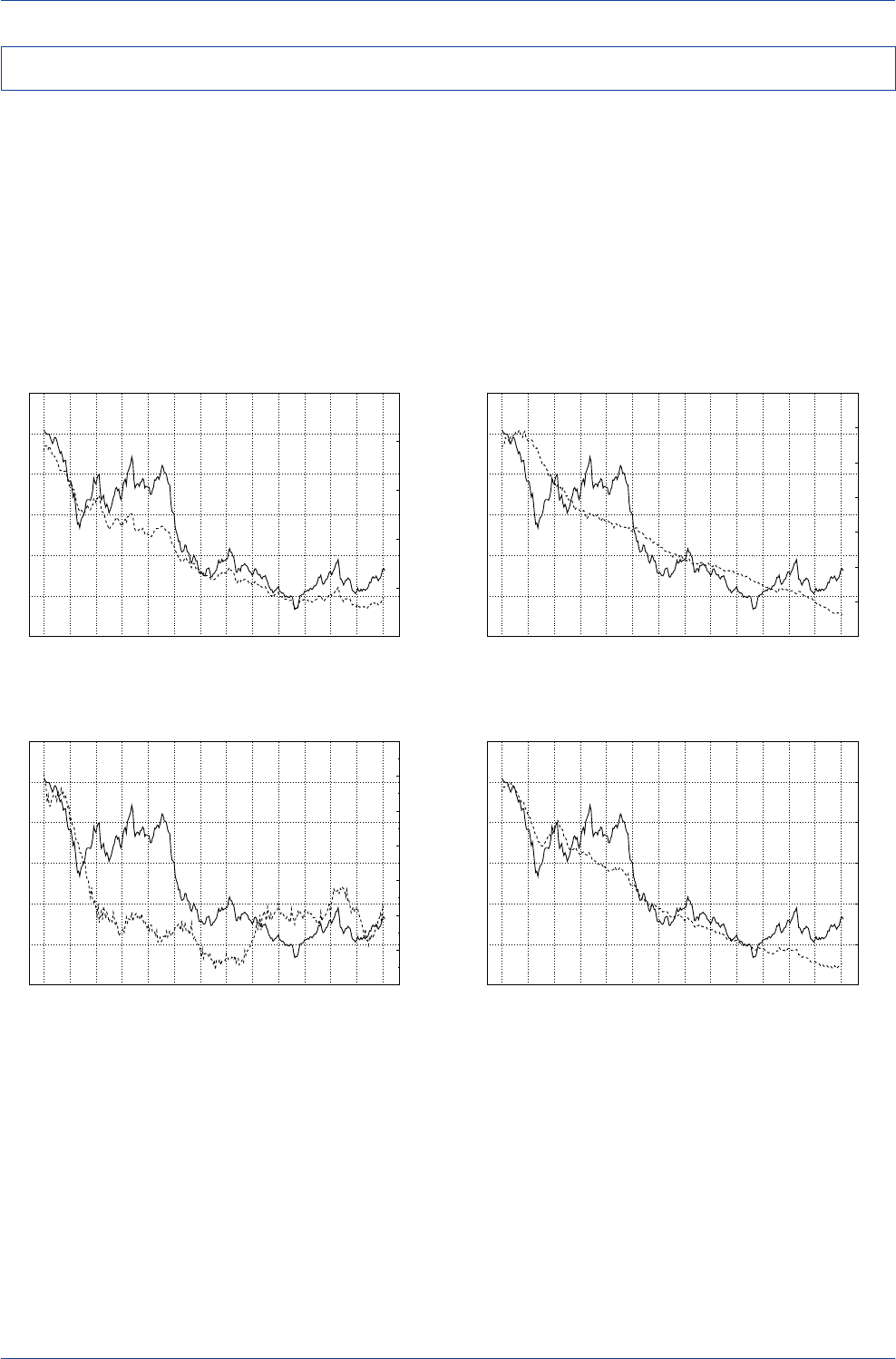

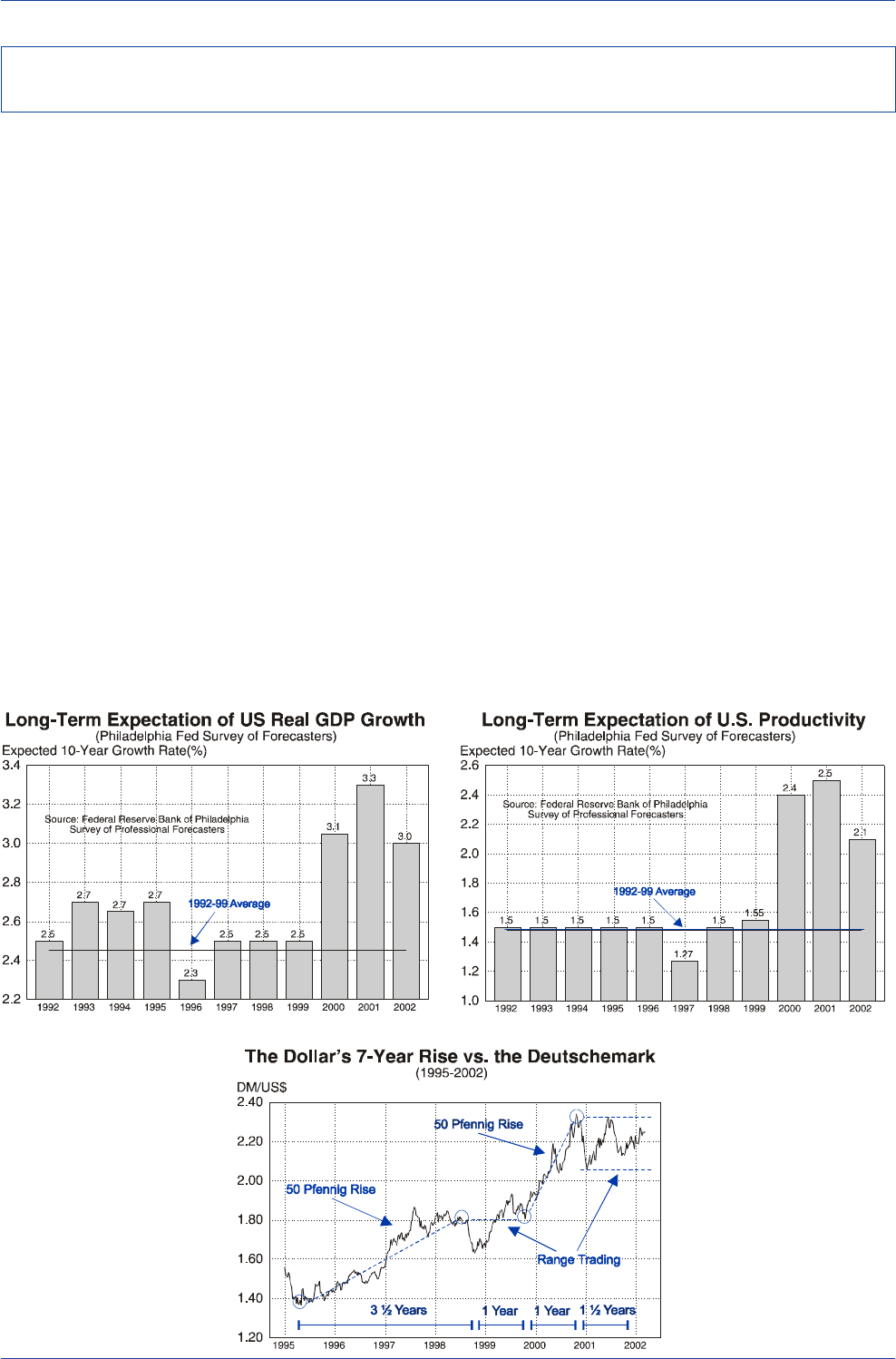

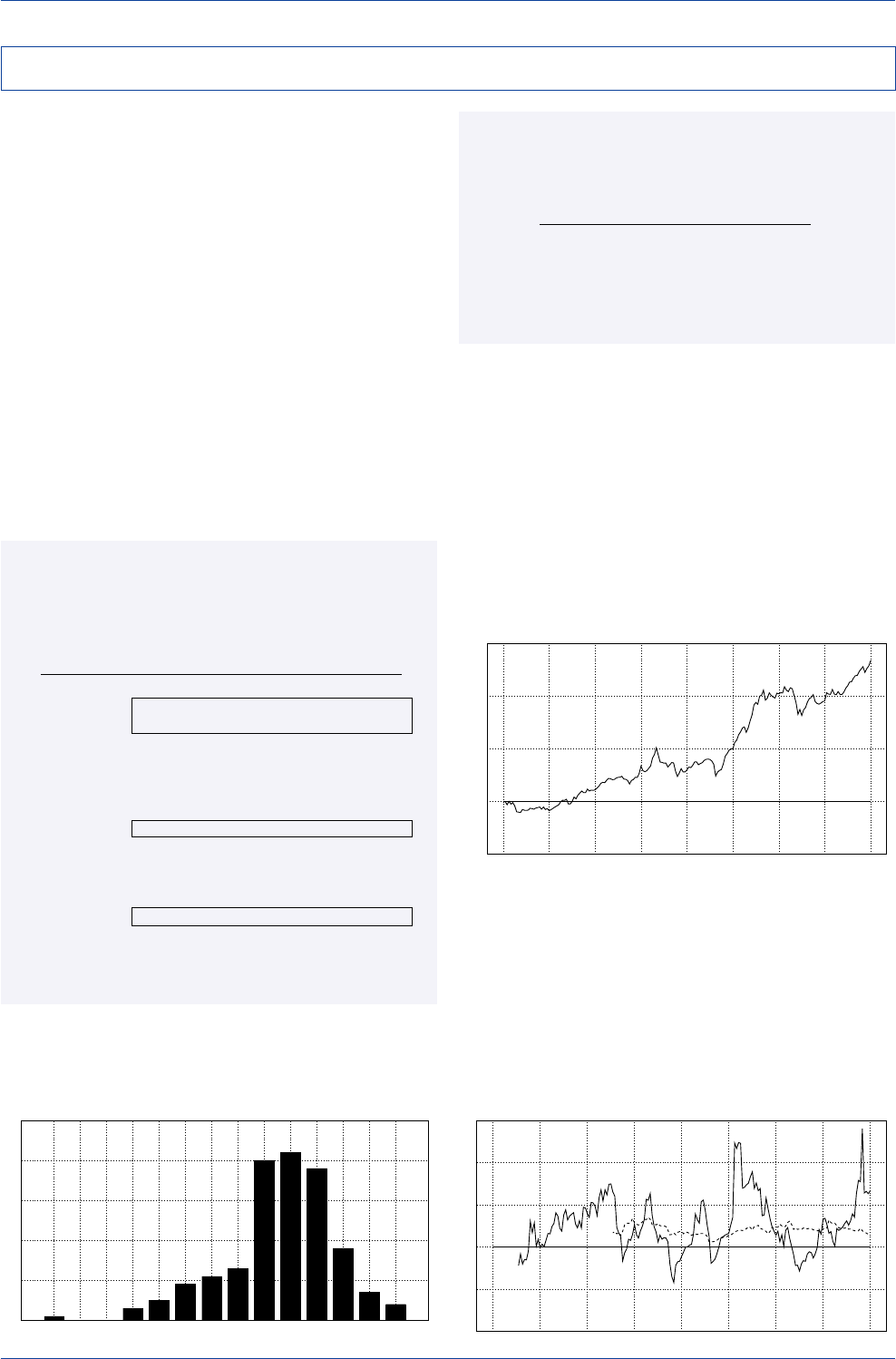

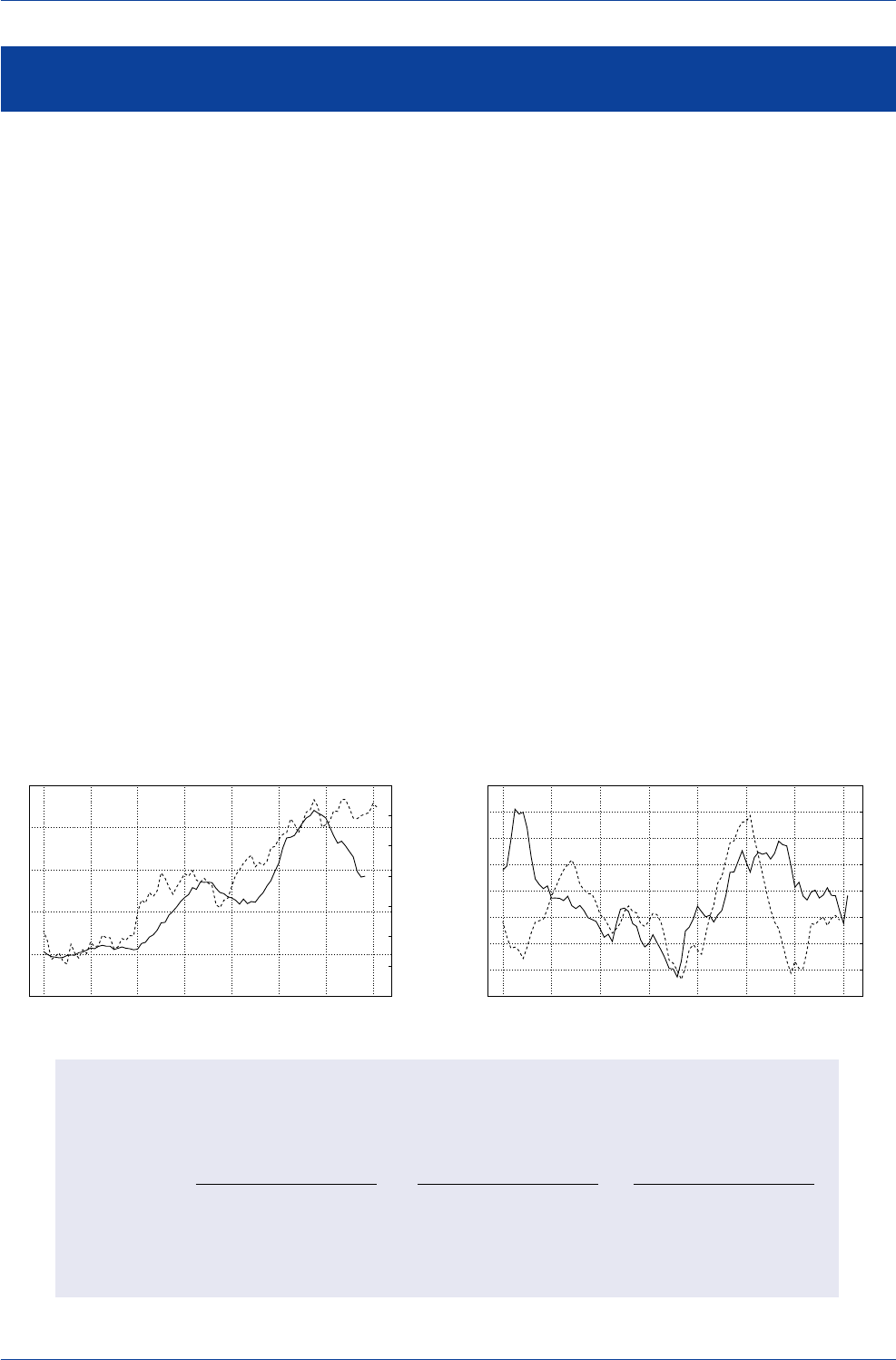

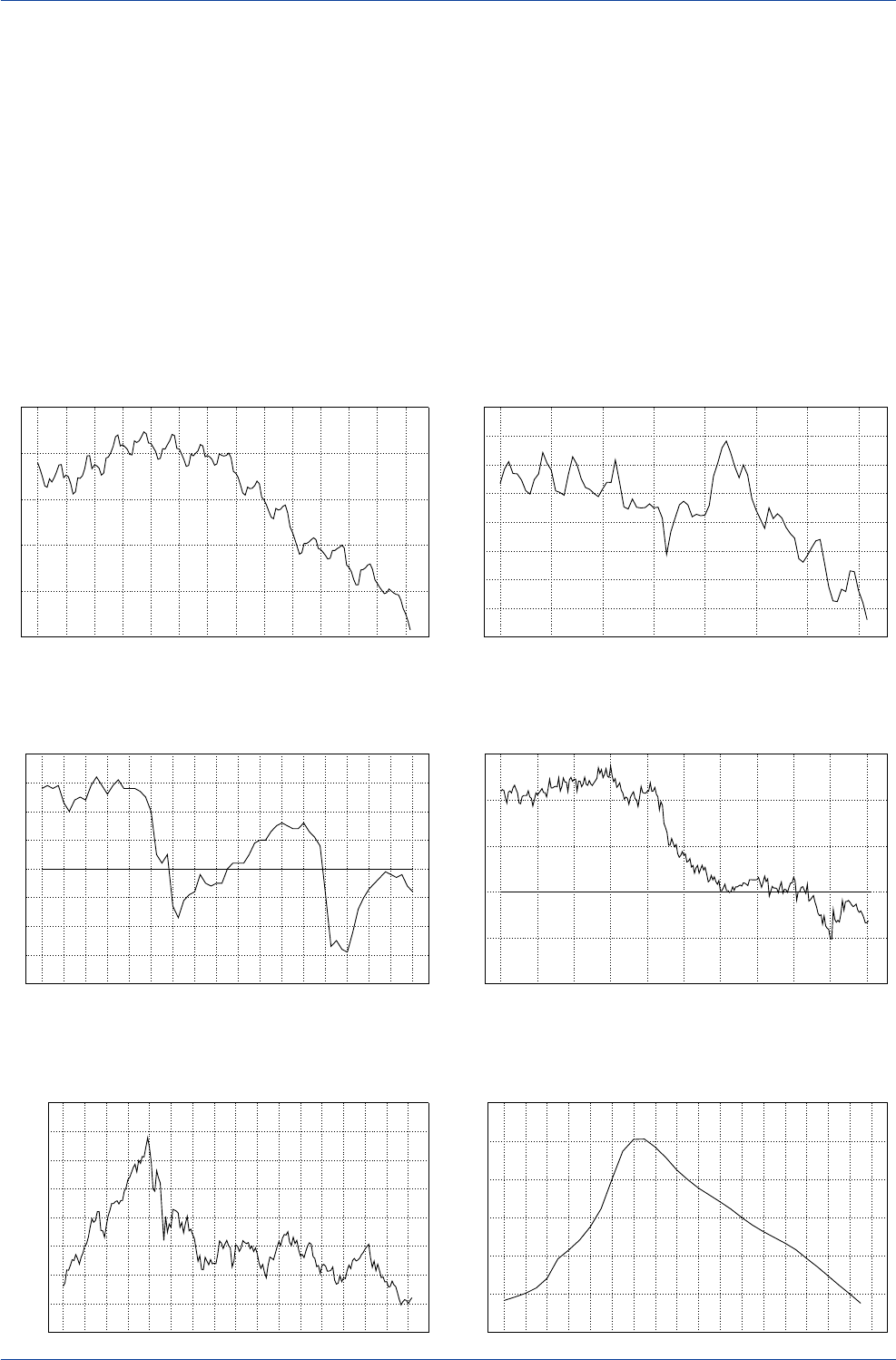

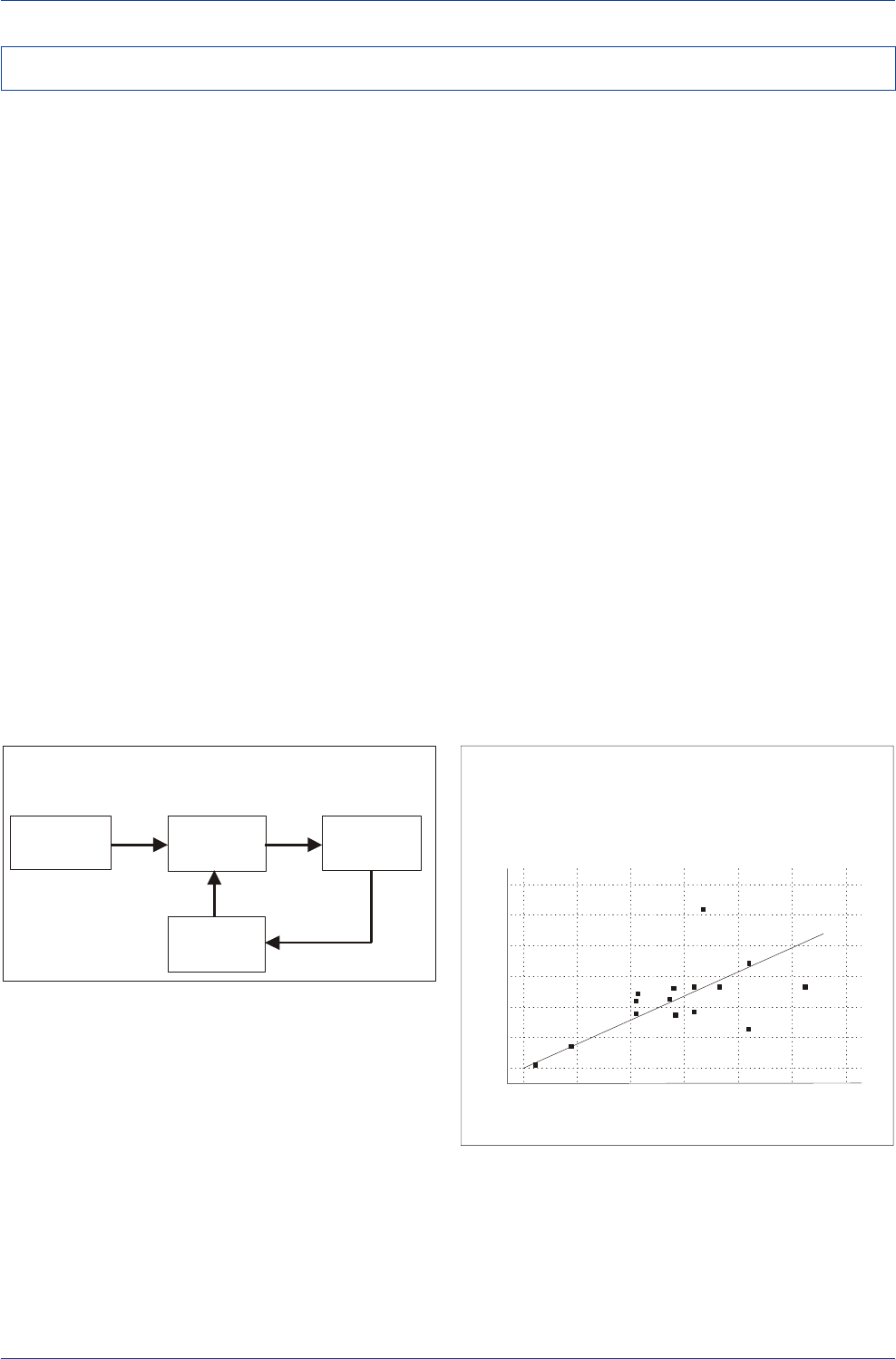

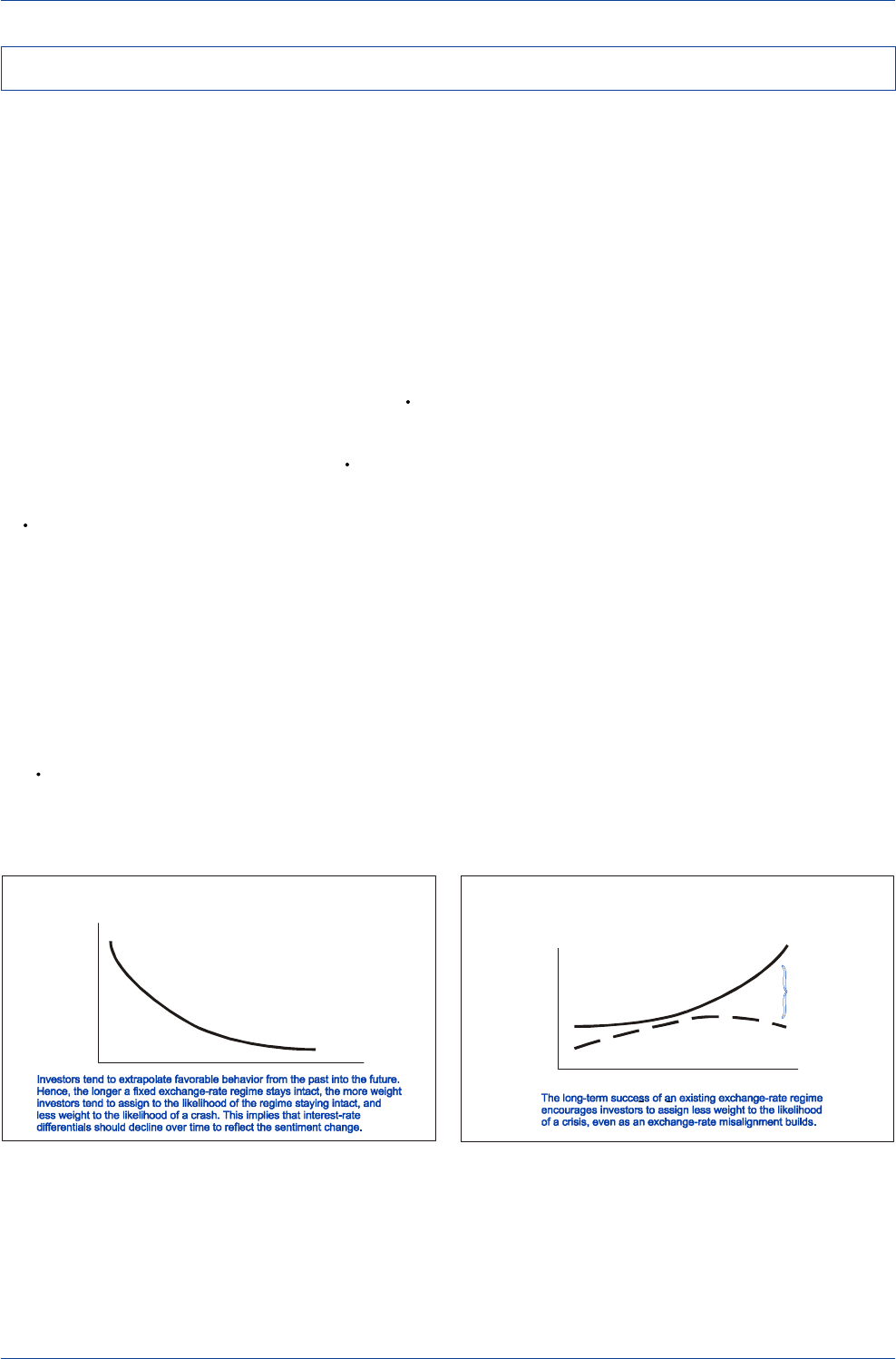

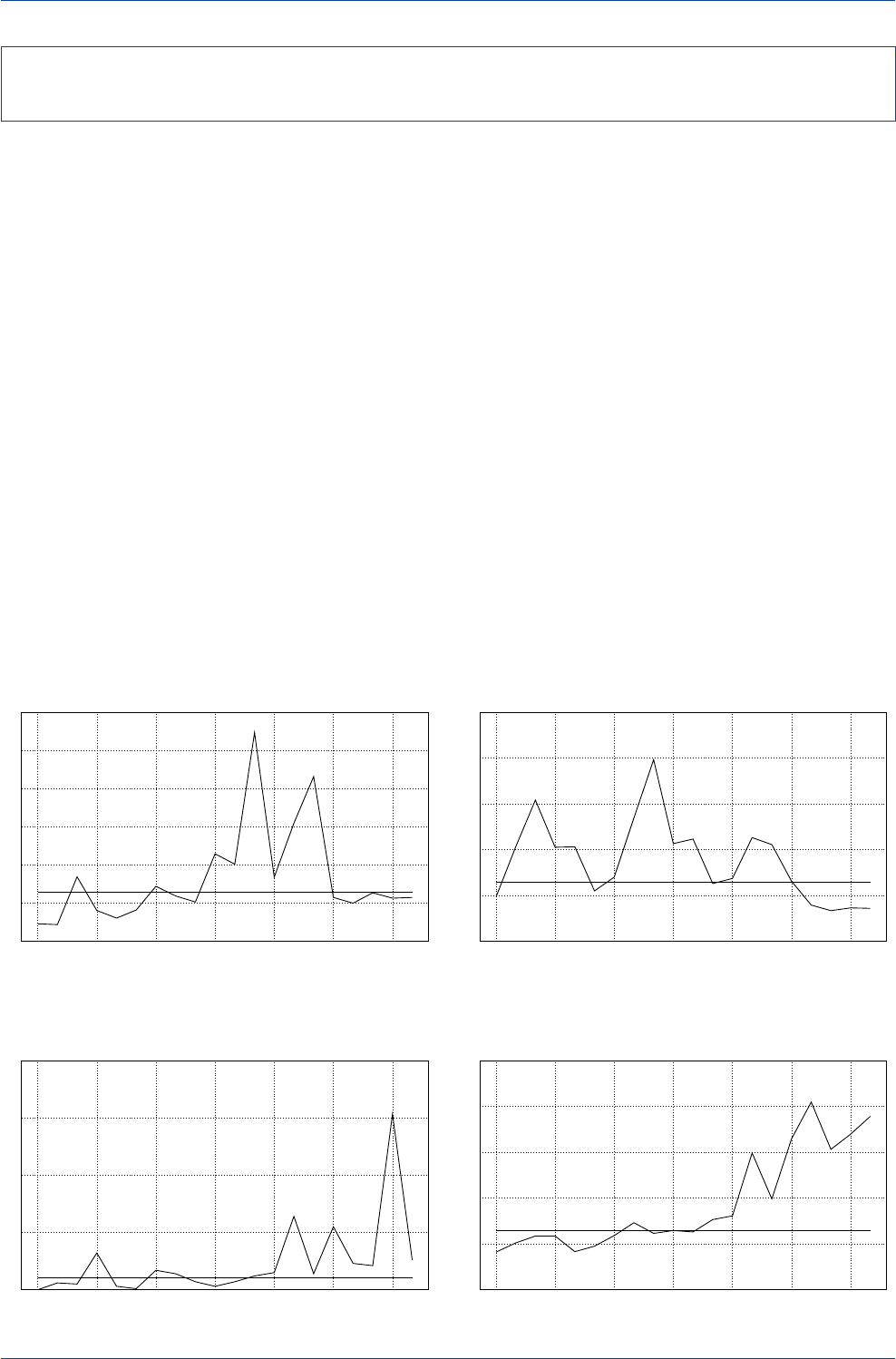

Given the Sharpe ratios shown in the table on the preced-

ing page, one might wonder why more investors do not

rely on trend-following trading rules more regularly. One

reason is that investors might have a fairly high Sharpe

ratio threshold for committing capital to any particular trad-

ing strategy. For instance, many investors might not em-

brace a trading strategy rule unless it generated a Sharpe

ratio of at least 0.50. And in some cases, an even higher

Sharpe ratio might be required for an investor to add sig-

nificant risk capital to a particular trading rule. If that were

the case, only the yen and Swiss franc would qualify as

currencies worthy of trading from a technical perspective.

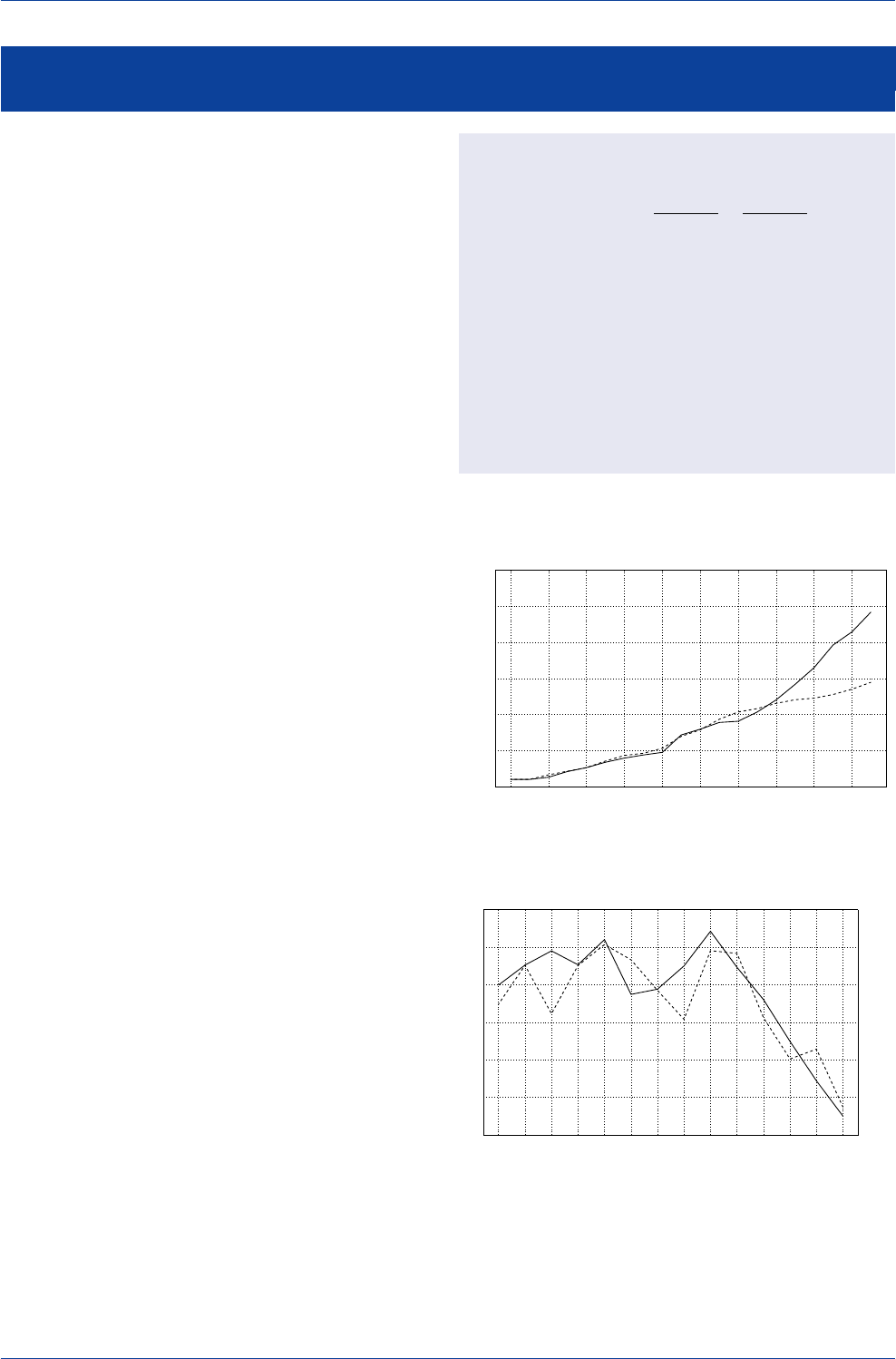

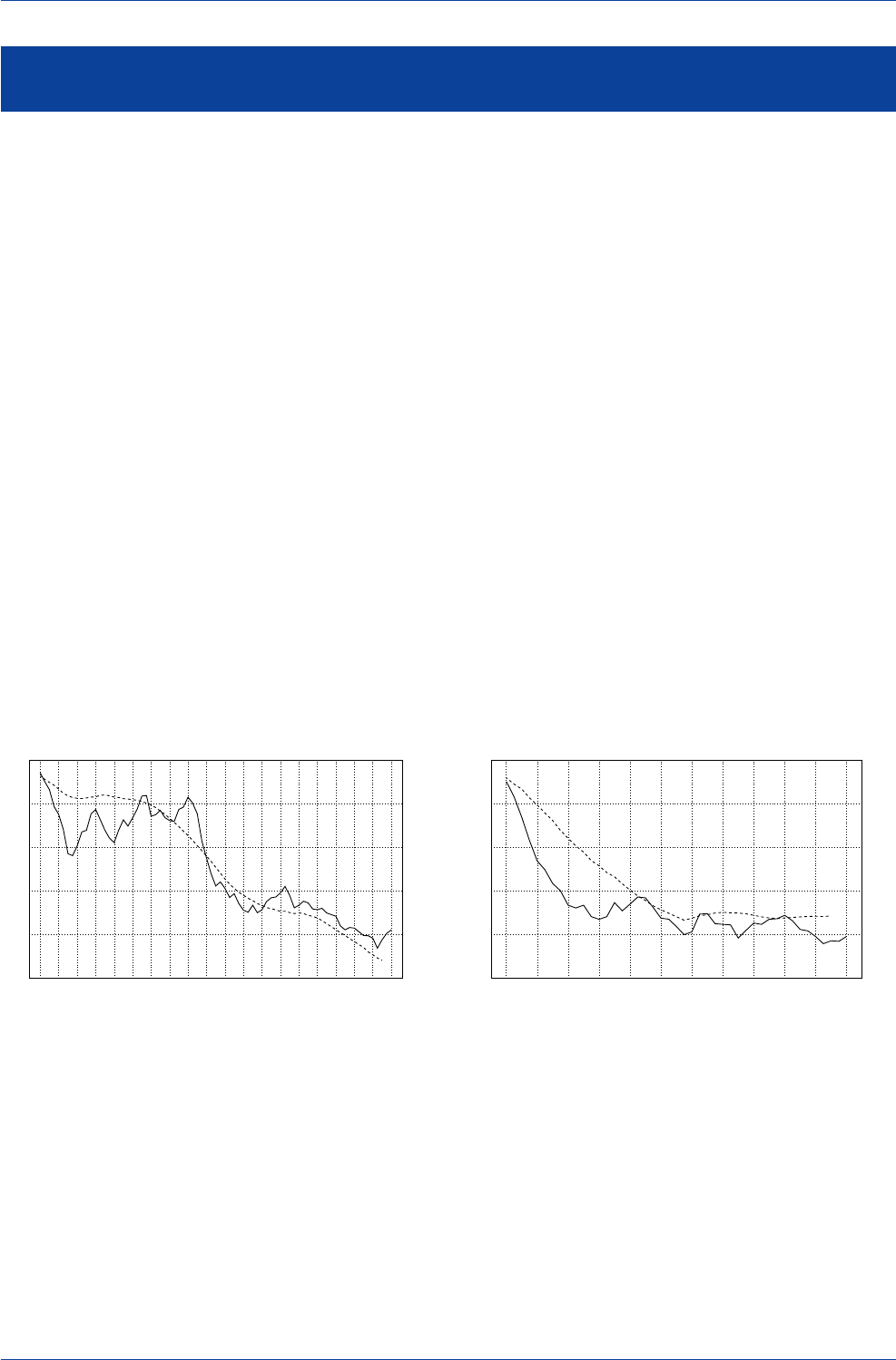

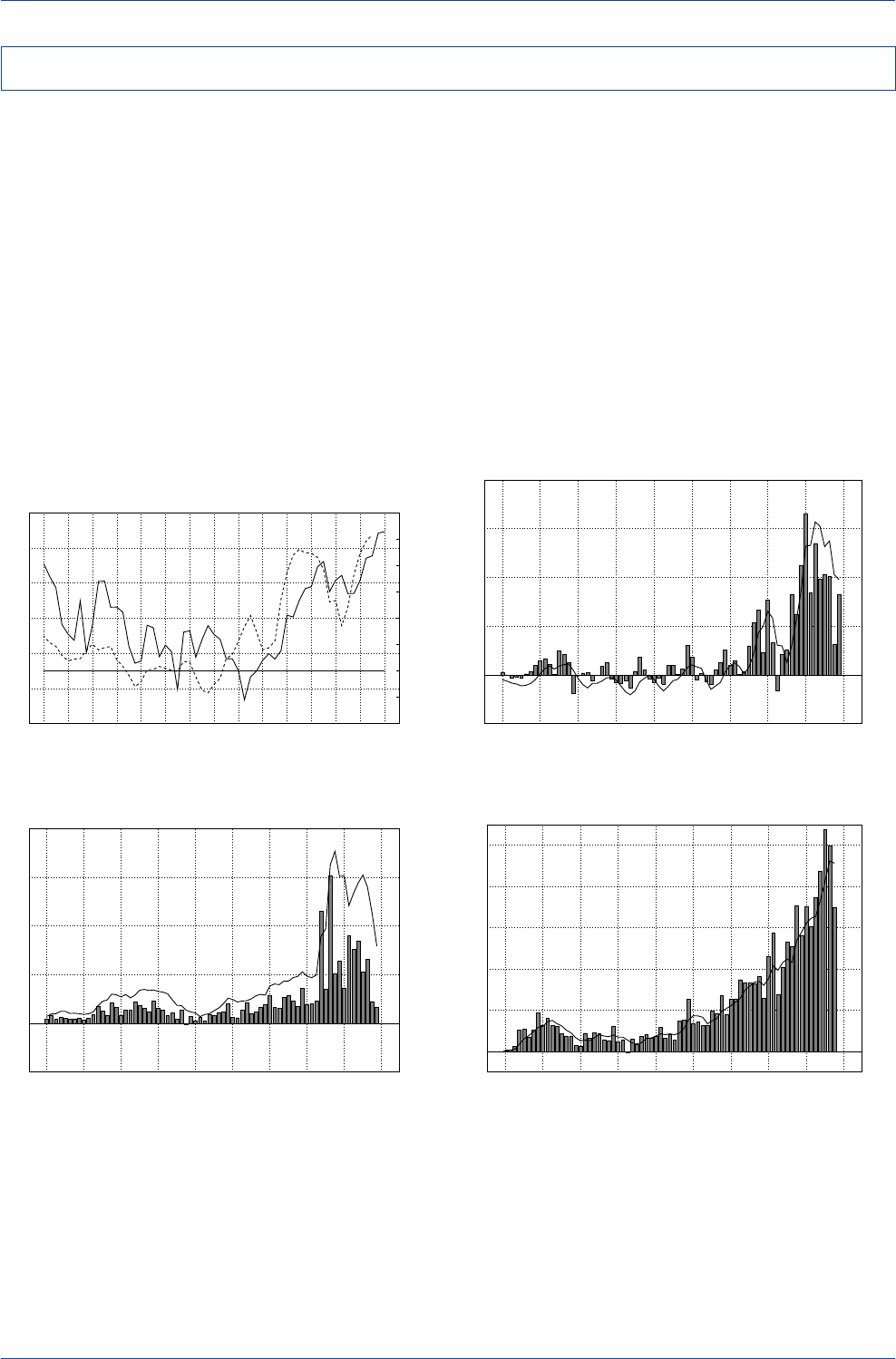

While the estimated Sharpe ratios may have been high on

average for the 1986-2002 period, one should note that

the Sharpe ratios were highly volatile when viewed on a

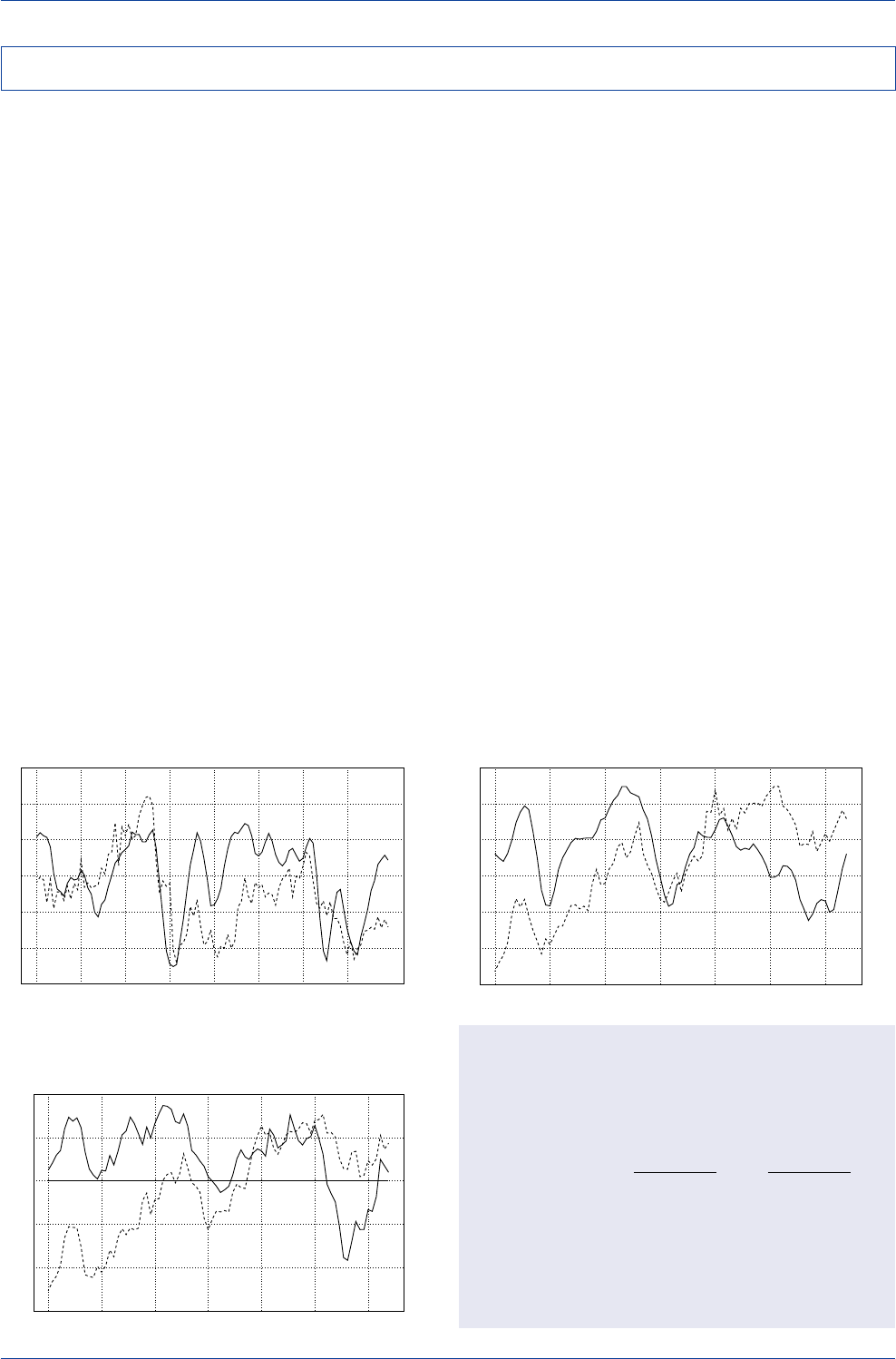

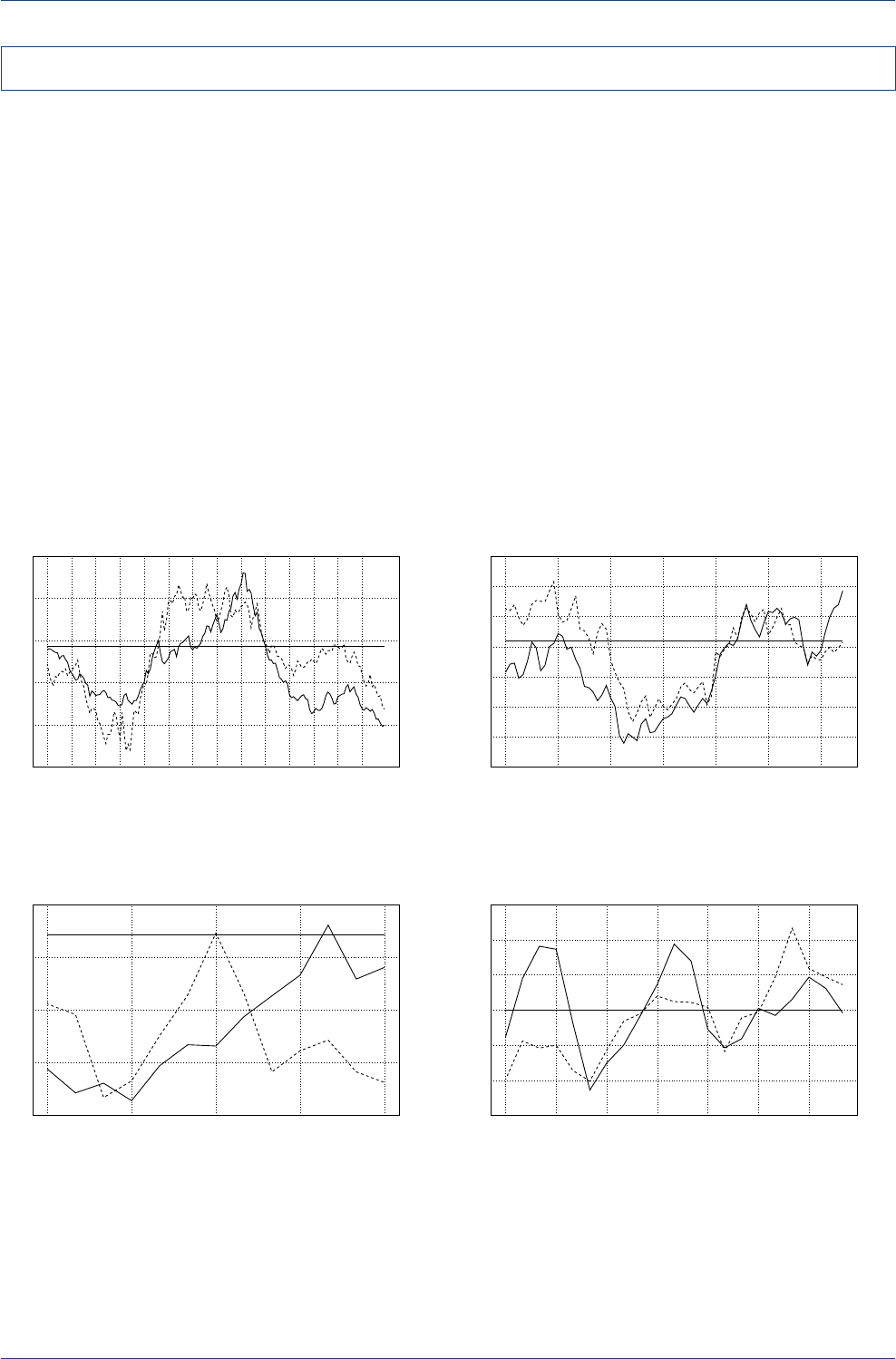

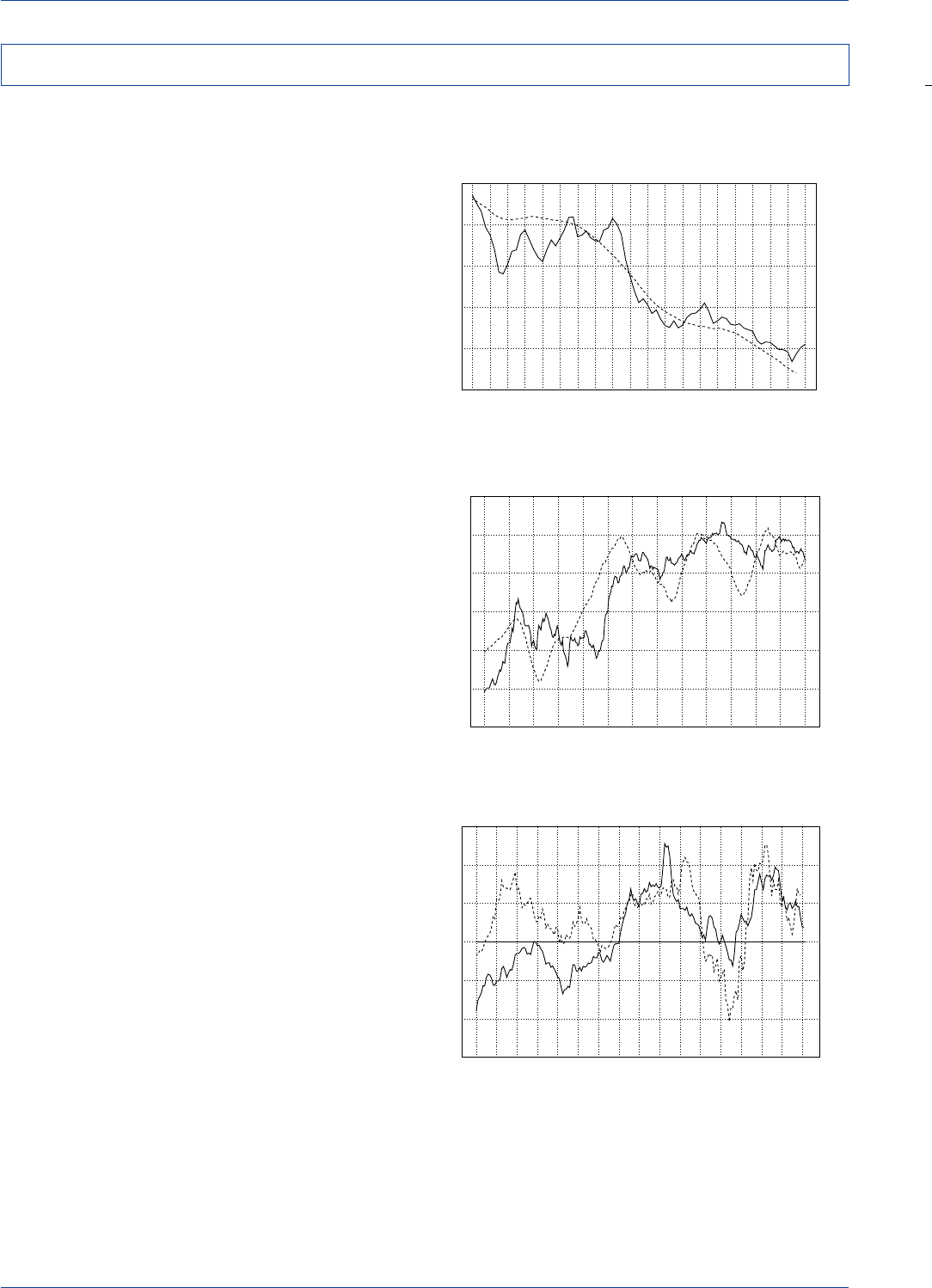

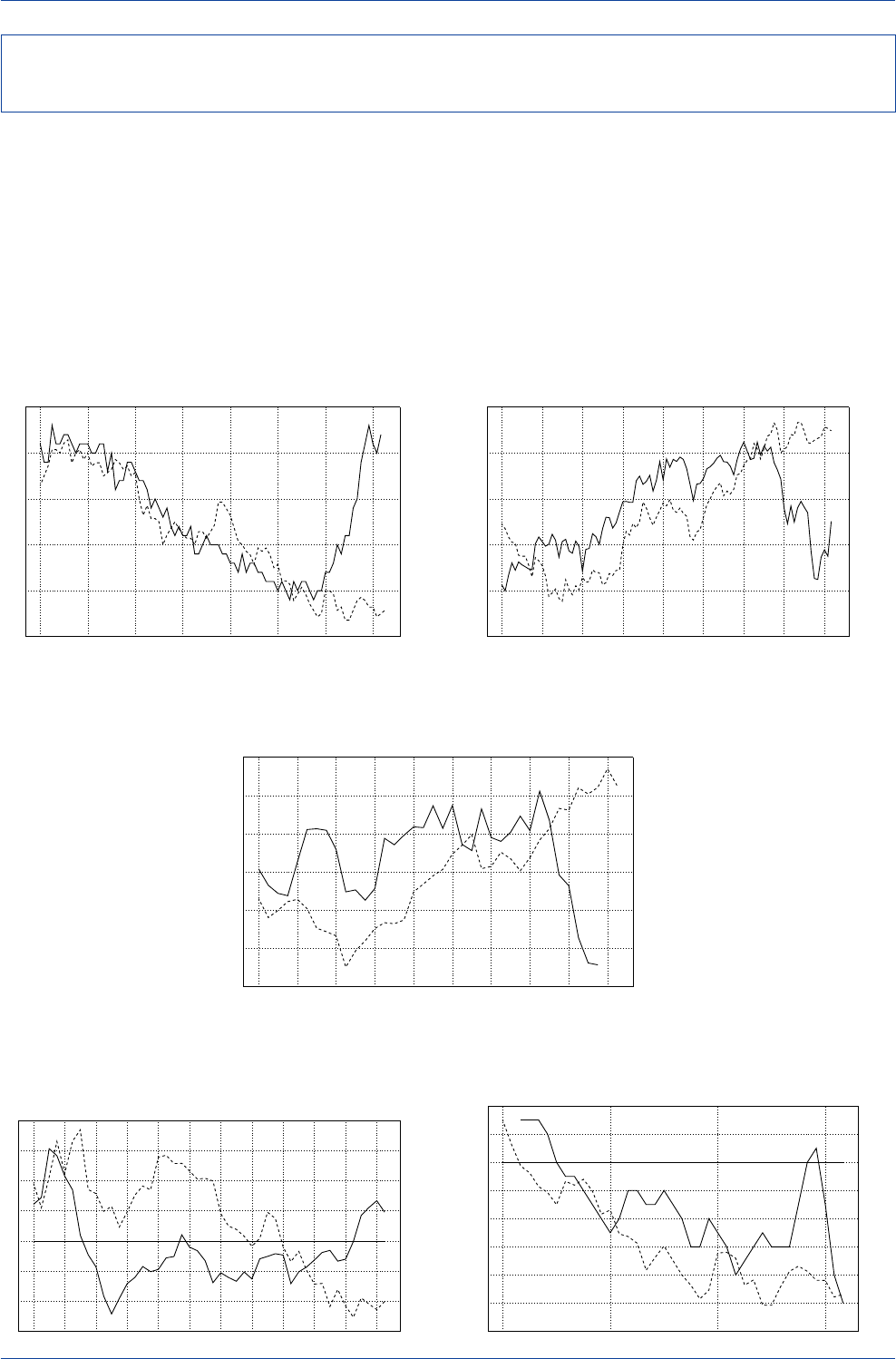

one-year rolling basis. As the charts below show, there

were periods when risk-adjusted return performances were

high and other periods when risk-adjusted return perfor-

mances were downright poor. This was clearly the case

for several key exchange rates in 2001, with one-year roll-

ing Sharpe ratios falling into negative territory for the Deut-

schemark, British pound, and Swiss franc.

Except for the yen and the dollar-bloc currencies, total re-

turn performances were not that impressive in 2001. In

most cases, currencies were largely range-bound versus

the U.S. dollar in 2001 and therefore generated a consider-

able number of false signals that yielded small but fre-

quent losses. On the other hand, the yen’s downtrend—

particularly in late 2001—was clearly evident and exploit-

able by following a moving-average crossover trading rule.

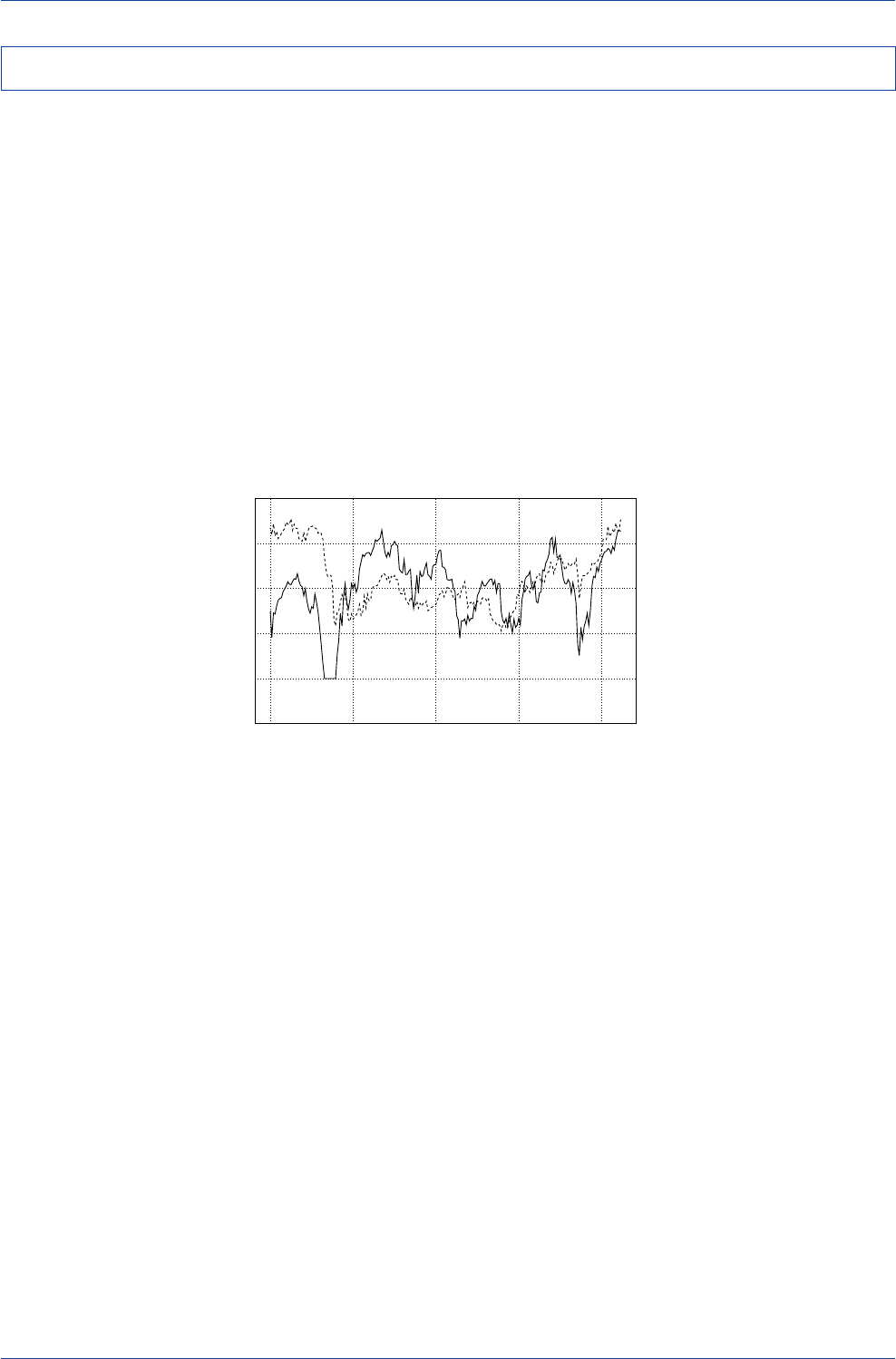

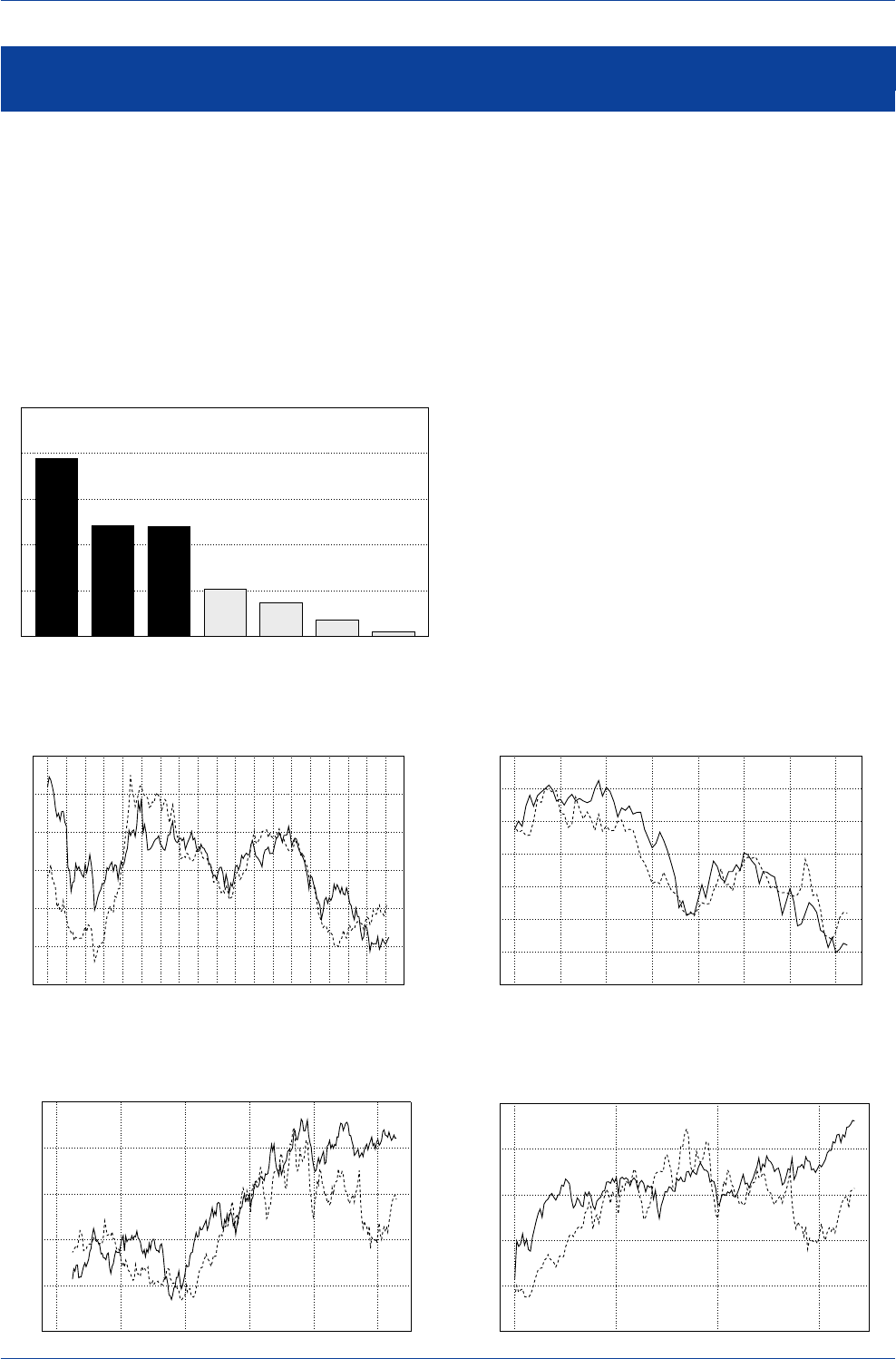

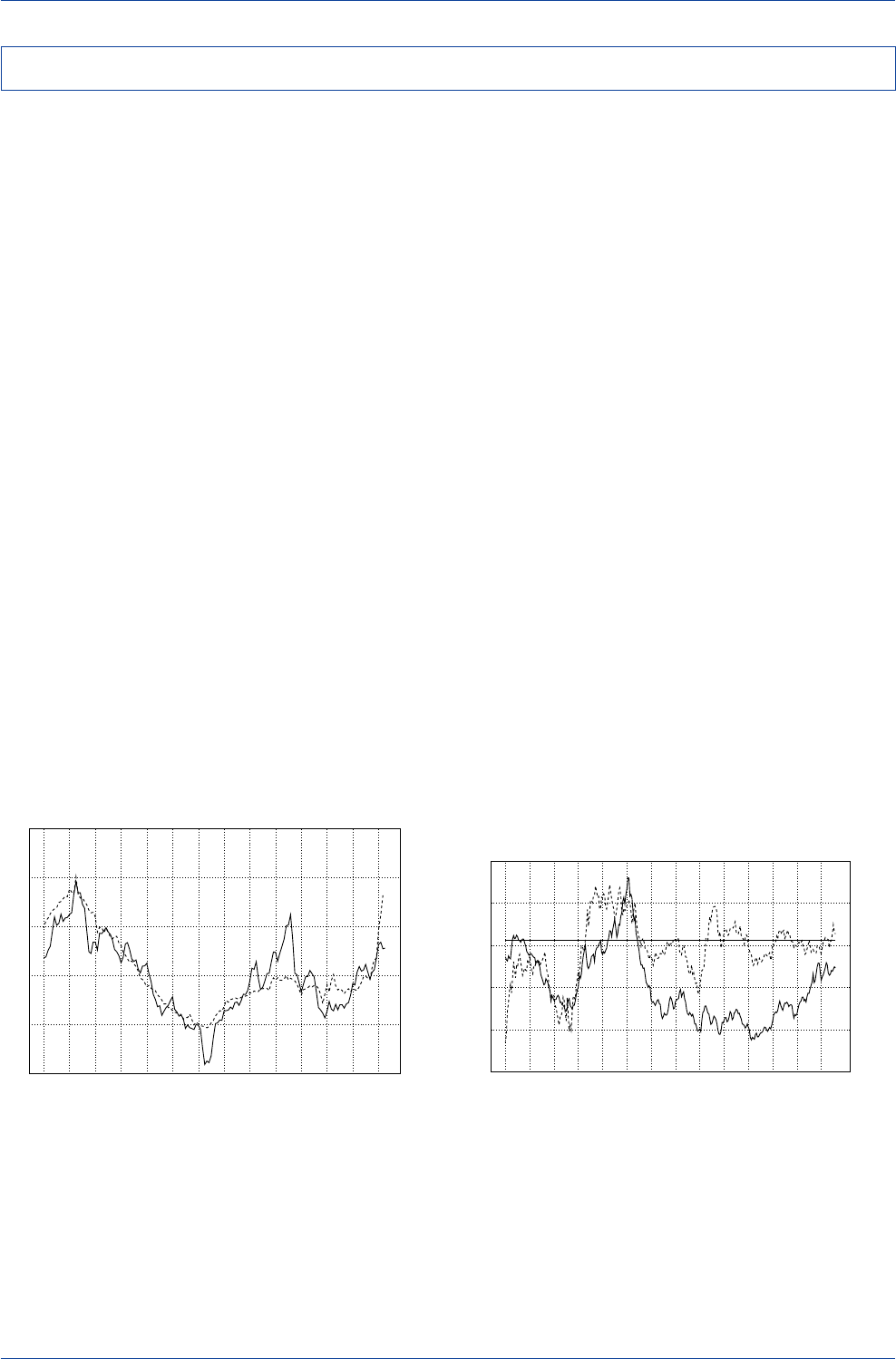

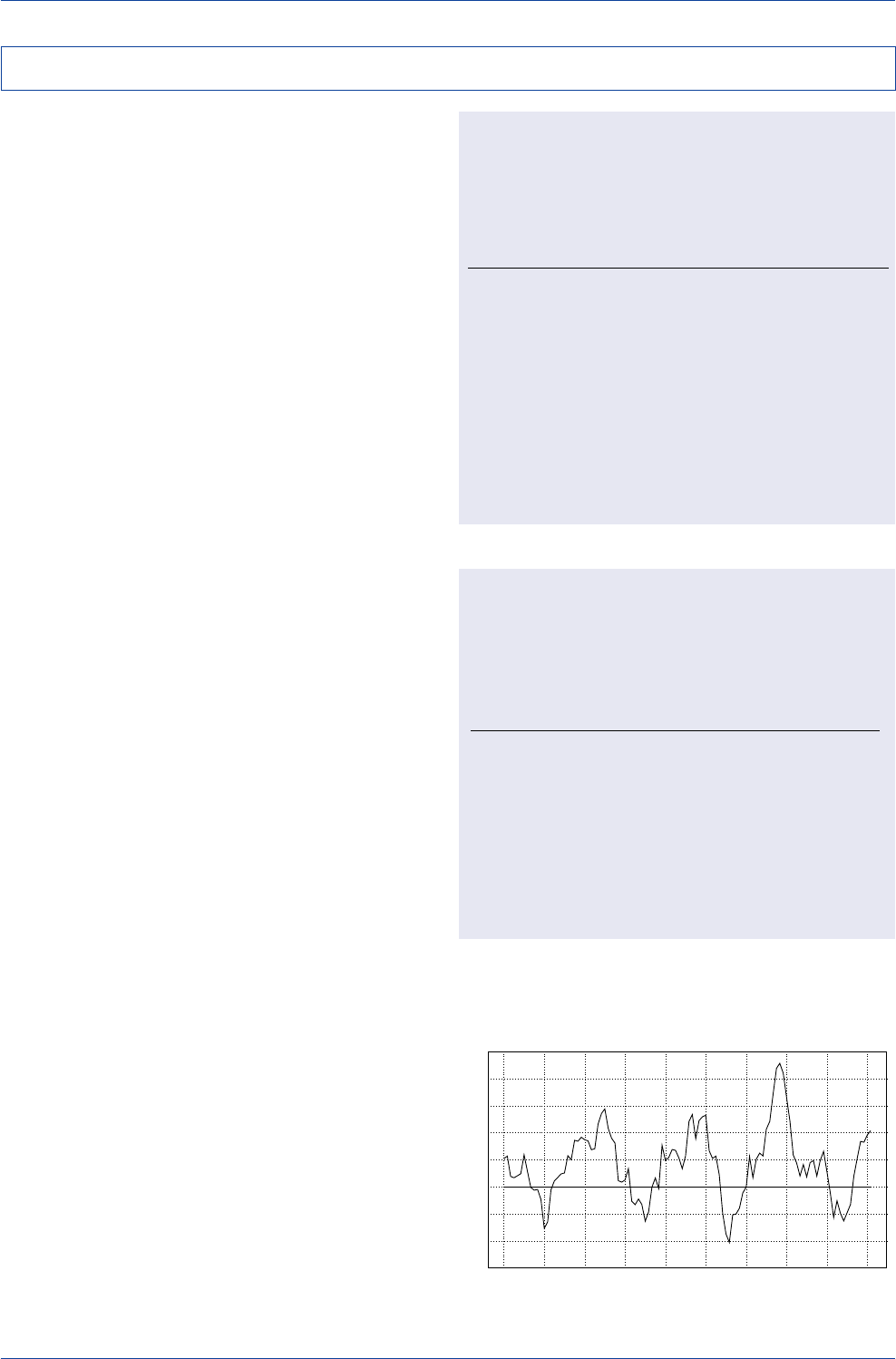

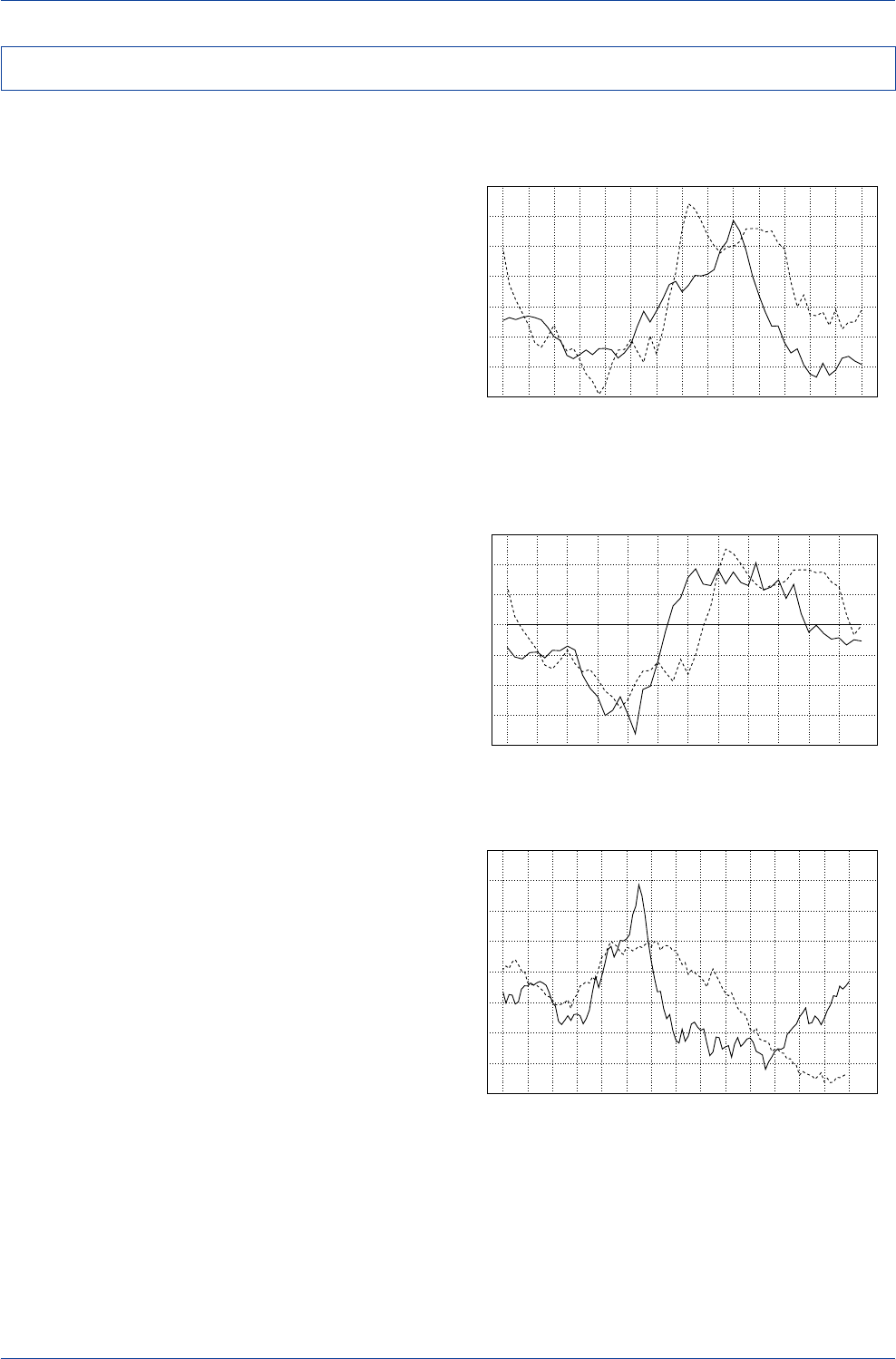

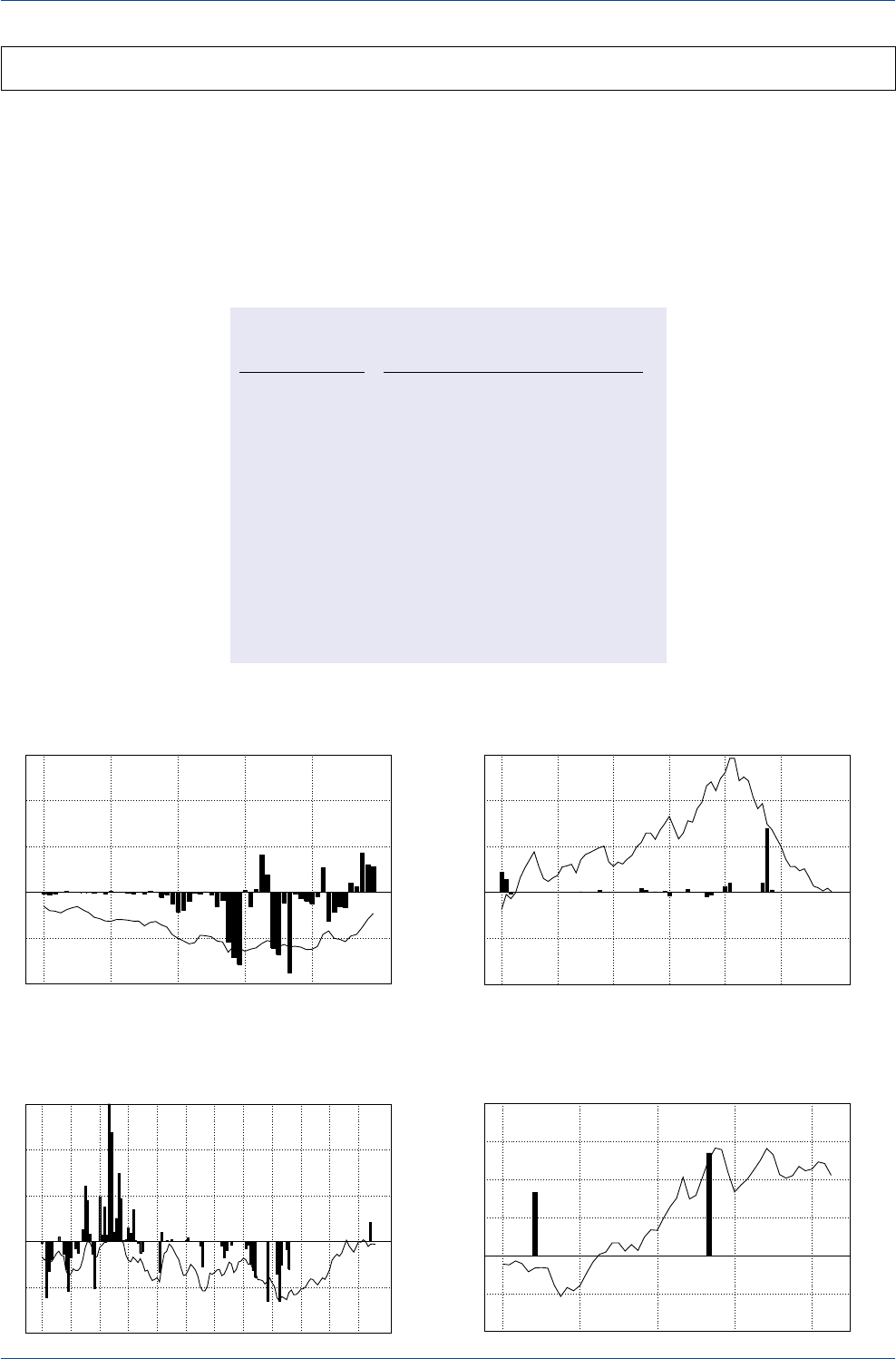

Deutschemark Moving-Average Crossover

Trading Rule Risk-Adjusted Performance

(1993-2002)

-3

-2

-1

0

1

2

3

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

(One-Year Rolling Sharpe Ratio)

Japanese Yen Moving-Average Crossover

Trading Rule Risk-Adjusted Performance

(1993-2002)

-2

-1

0

1

2

3

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

(One-Year Rolling Sharpe Ratio)

British Pound Moving-Average Crossover

Trading Rule Risk-Adjusted Performance

(1993-2002)

-3

-2

-1

0

1

2

3

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

(One-Year Rolling Sharpe Ratio)

Swiss Franc Moving-Average Crossover

Trading Rule Risk-Adjusted Performance

(1993-2002)

-2

-1

0

1

2

3

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

(One-Year Rolling Sharpe Ratio)

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 17

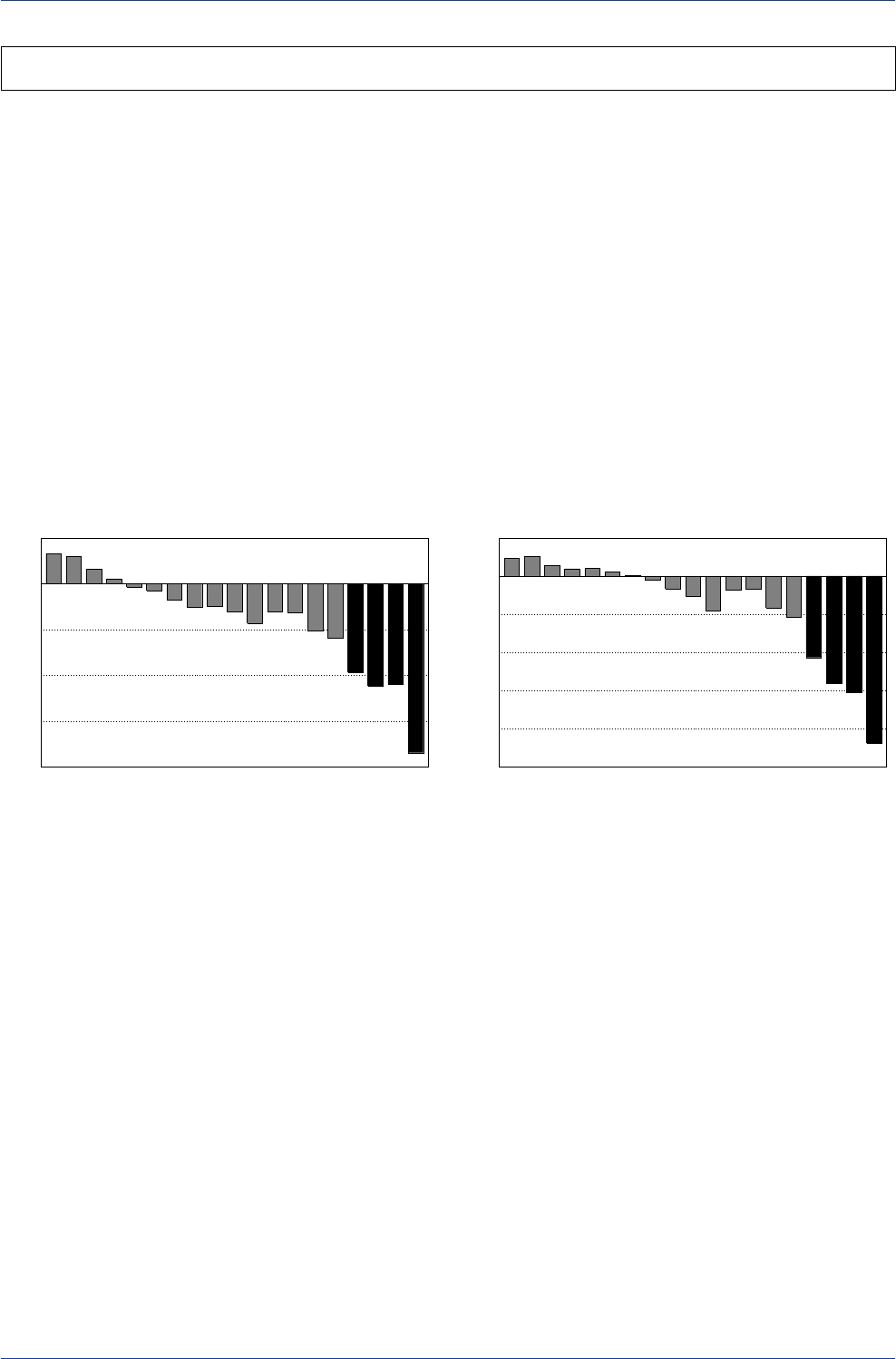

Most academic studies as well as our own work docu-

ment the fact that moving-average trading rules have

tended to generate attractive risk-adjusted returns over the

long run. What is not often pointed out in these studies is

the frequency with which winning and losing positions tend

to occur. As the table below illustrates, moving-average

trading rules have tended to generate far more losing than

winning trades on average. For example, in the case of

the Deutschemark, Swiss franc, cable, and the A$, roughly

75% of the recommended trades generated by optimized

moving-average trading rules end up as losing trades. Only

25% of the trades proved to be winning ones. In the case

of the C$ and NZ$, roughly two-thirds of the recommended

trades resulted in losses. Only in the case of the yen was

the win/loss ratio close to 50%.

From a longer-run perspective, having a trading rule that

generates such frequent losing trades does not pose a

serious problem if the losing positions are cut quickly—so

only a small loss is taken—and profits are allowed to ride

on the less frequent correctly predicted winning trades.

Indeed, this is often what is found to be the case. As shown

in the table below, the average profit on the less frequent

winning trades has tended to exceed the average loss on

the more frequent losing trades by a fairly hefty margin.

This margin of difference has been sufficient to allow mov-

ing-average trading rules to be profitable in the long run.

Frequency of Winning and Losing Trades Generated by Moving-Average

Trading Rules

Profit and Losses from Optimal Moving-Average Trading Rules

(Risk-Return Analysis & Winning versus Losing Trades of Selected Currencies versus the U.S. Dollar)

(January 1986-April 2002)

DEM JPY GBP CAD AUD NZD CHF

Optimal Moving-Average Trading Rule

Number of Days (SRMA/LRMA) 1/32 8/59 1/19 14/199 1/16 10/17 1/57

Average Annual Return 5.0% 9.2% 5.8% 1.9% 3.5% 5.2% 8.6%

Standard Deviation of Returns 11.1% 11.8% 9.5% 4.8% 10.3% 10.8% 11.7%

Sharpe Ratio 0.45 0.78 0.61 0.40 0.34 0.48 0.74

Total Recommended Trades 342 81 452 35 218 165 217

Winning Trades 91 37 126 13 61 58 57

Winning Trade Percentage 27% 46% 28% 37% 28% 35% 26%

Losing Trades 251 44 326 22 157 107 160

Losing Trade Percentage 73% 54% 72% 63% 72% 65% 74%

Average Profit on Winning Trades 2.97% 5.92% 2.27% 3.69% 2.03% 2.11% 4.63%

Average Profit on Losing Trades -0.77% -1.72% -0.62% -1.03% -0.63% -0.84% -0.84%

Ratio of Profits/Losses 3.86 3.44 3.66 3.58 3.22 2.51 5.51

Note: A Sharpe Ratio measures the amount of return on an investment (less the return of a risk-free asset) per unit of risk,

which is proxied by its standard deviation.

Datastream is the source of the underlying exchange-rate data.

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

18 Deutsche Bank Foreign Exchange Research

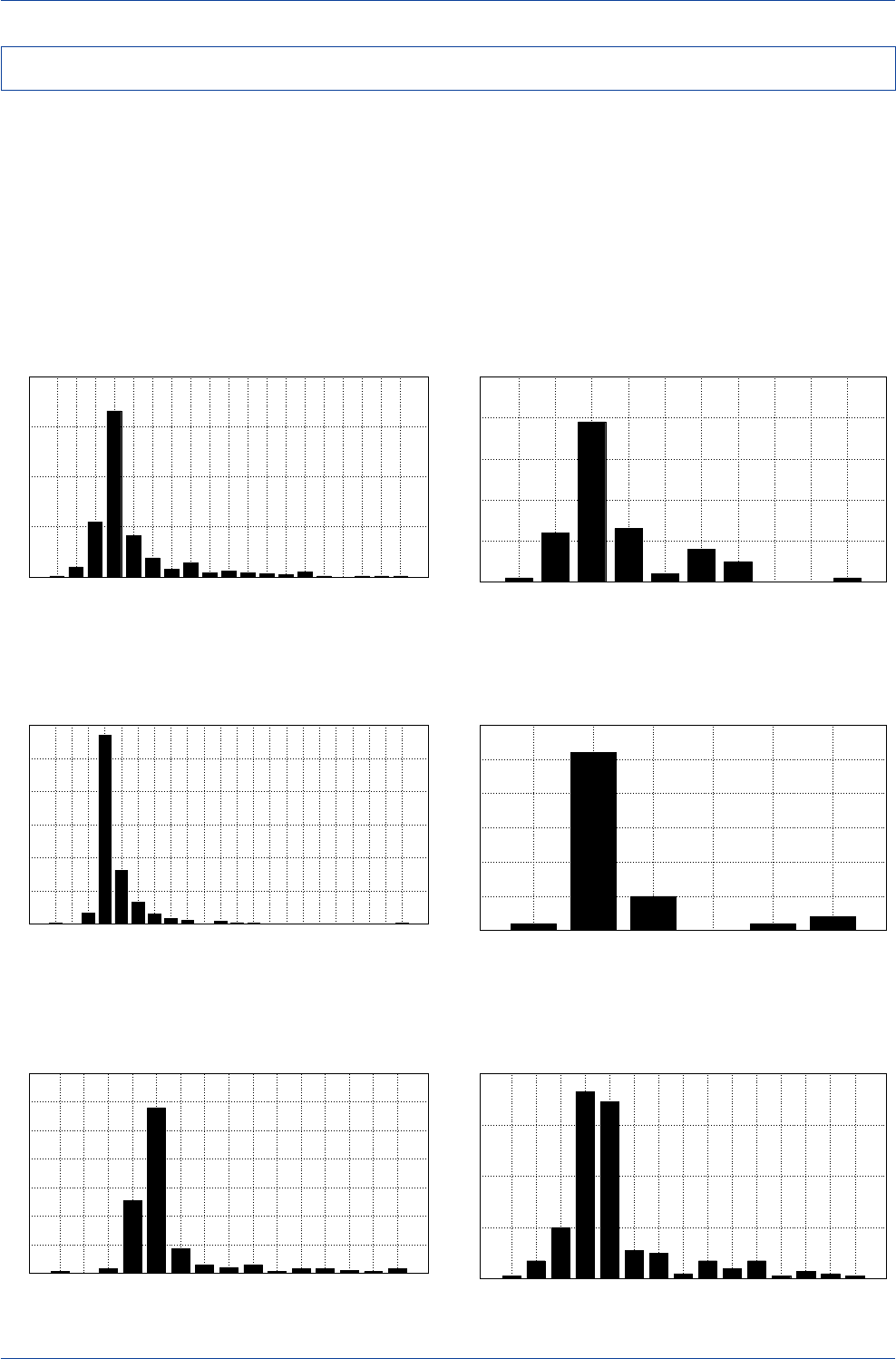

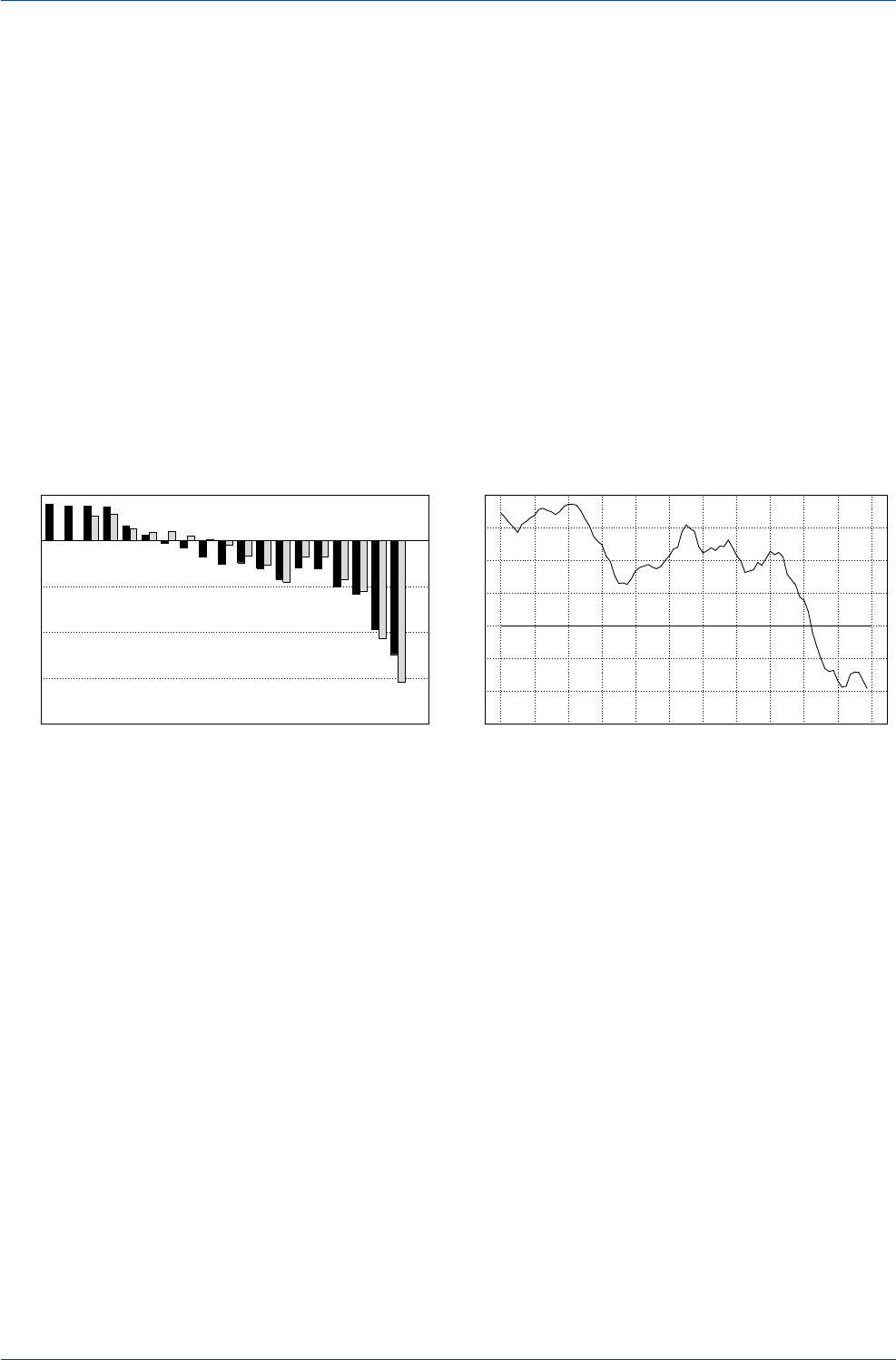

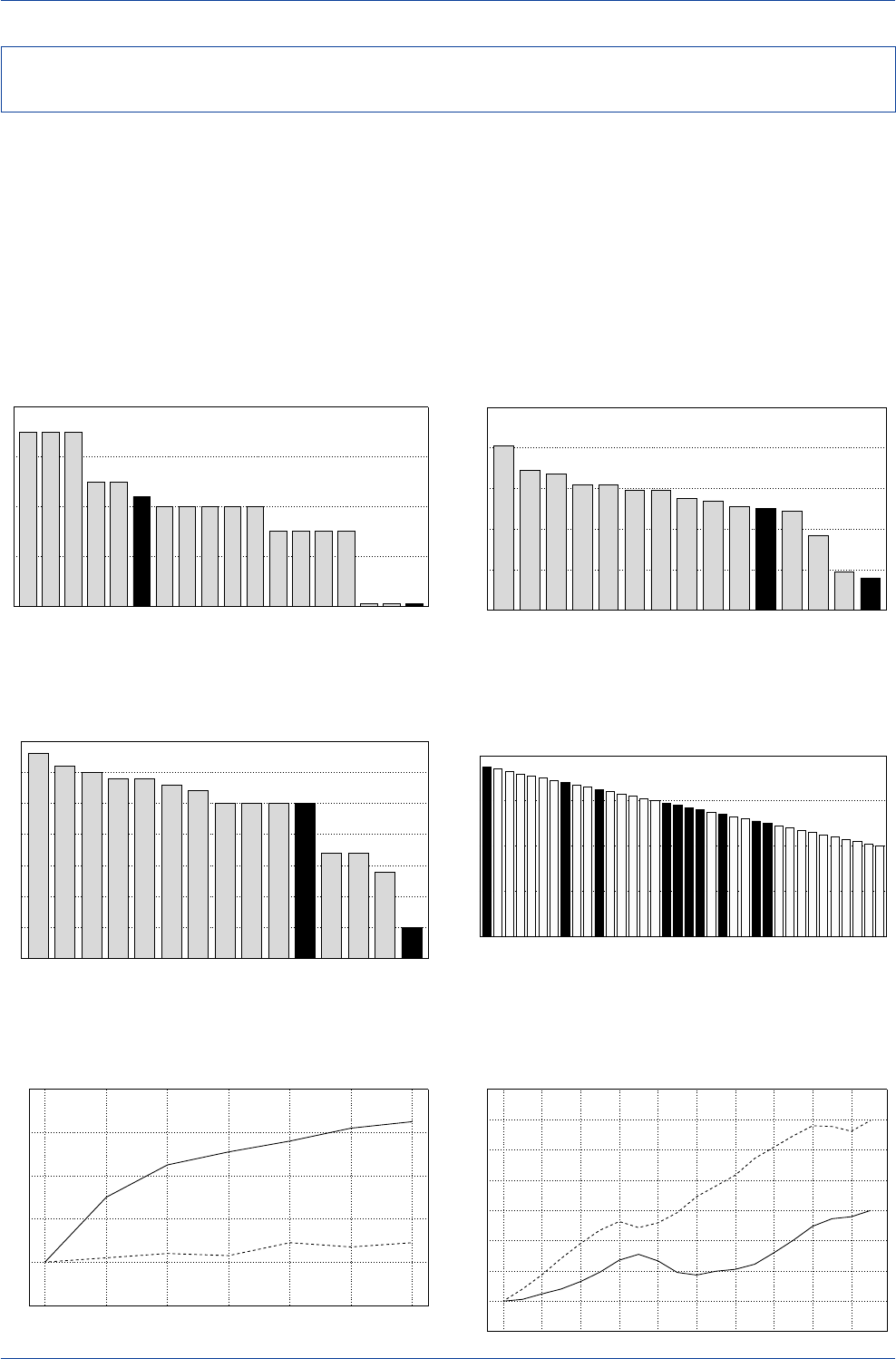

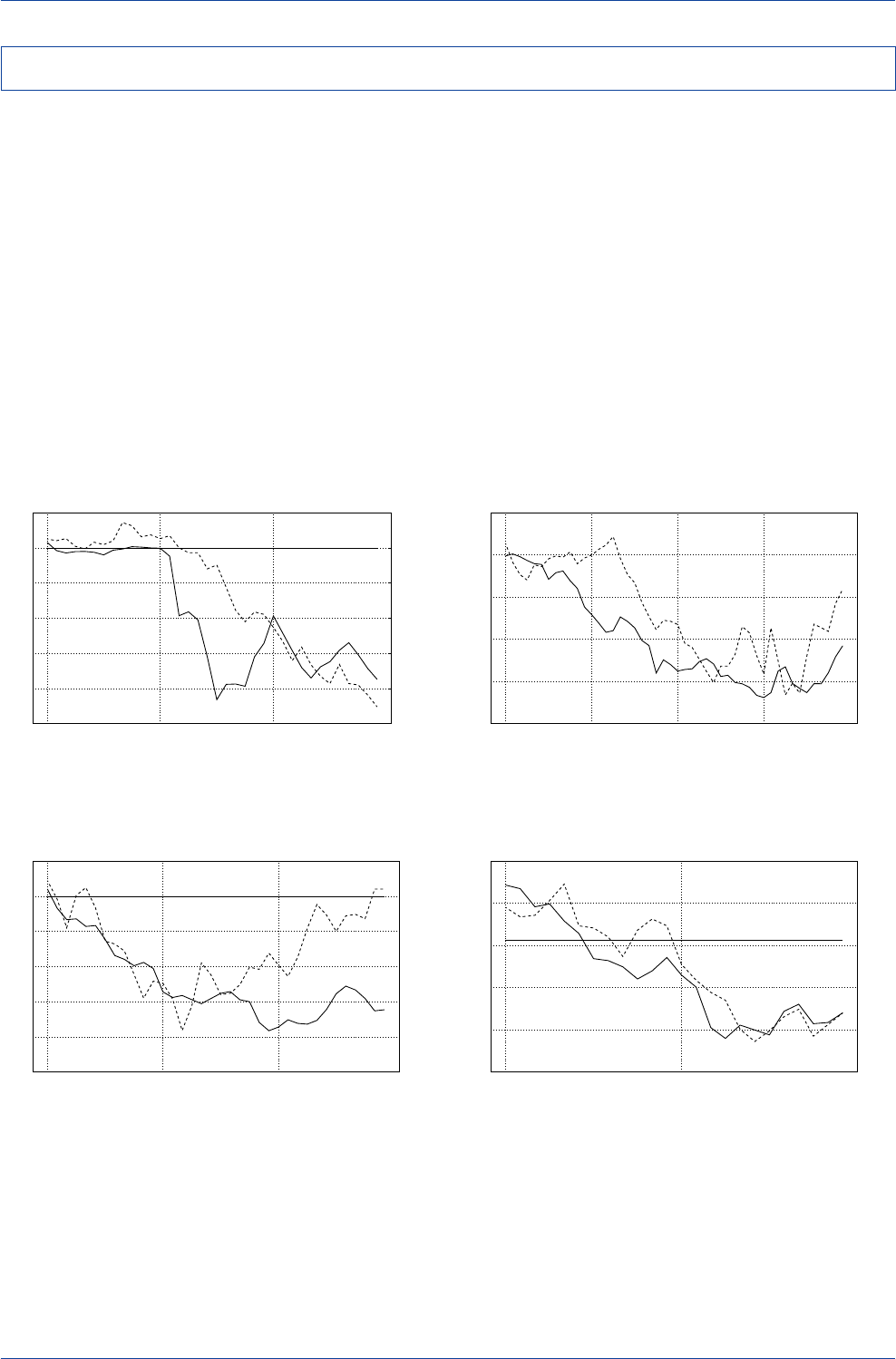

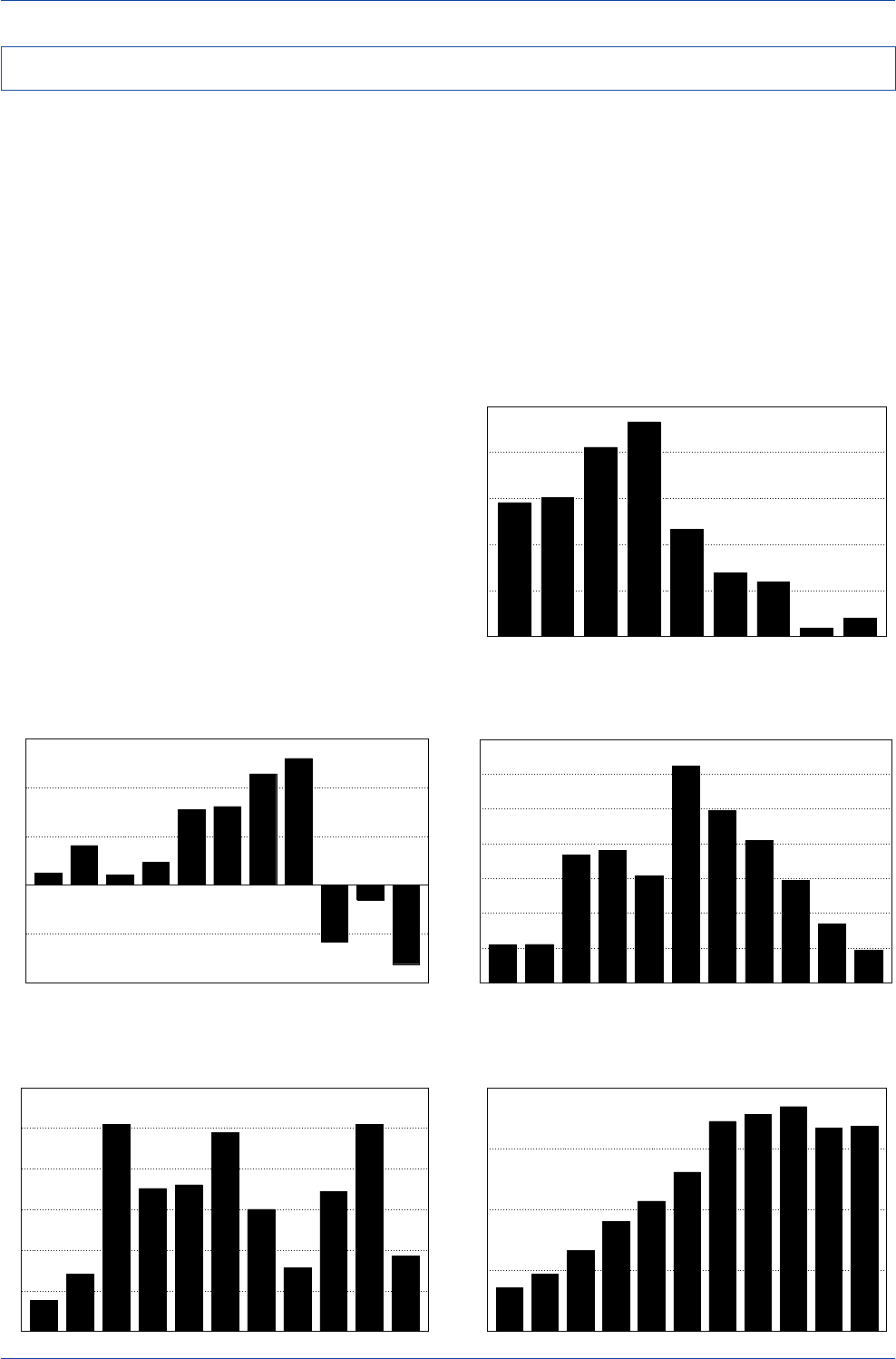

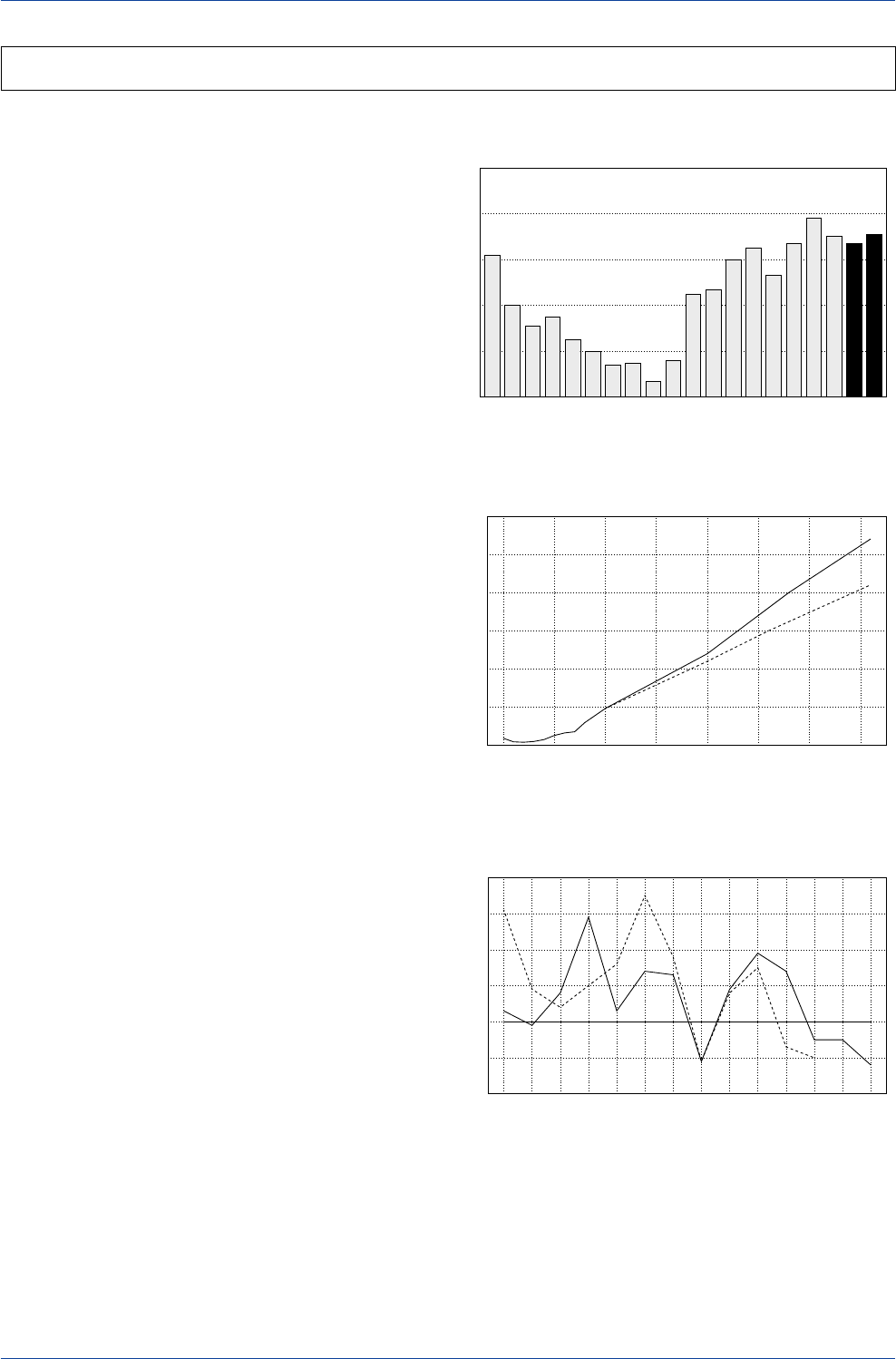

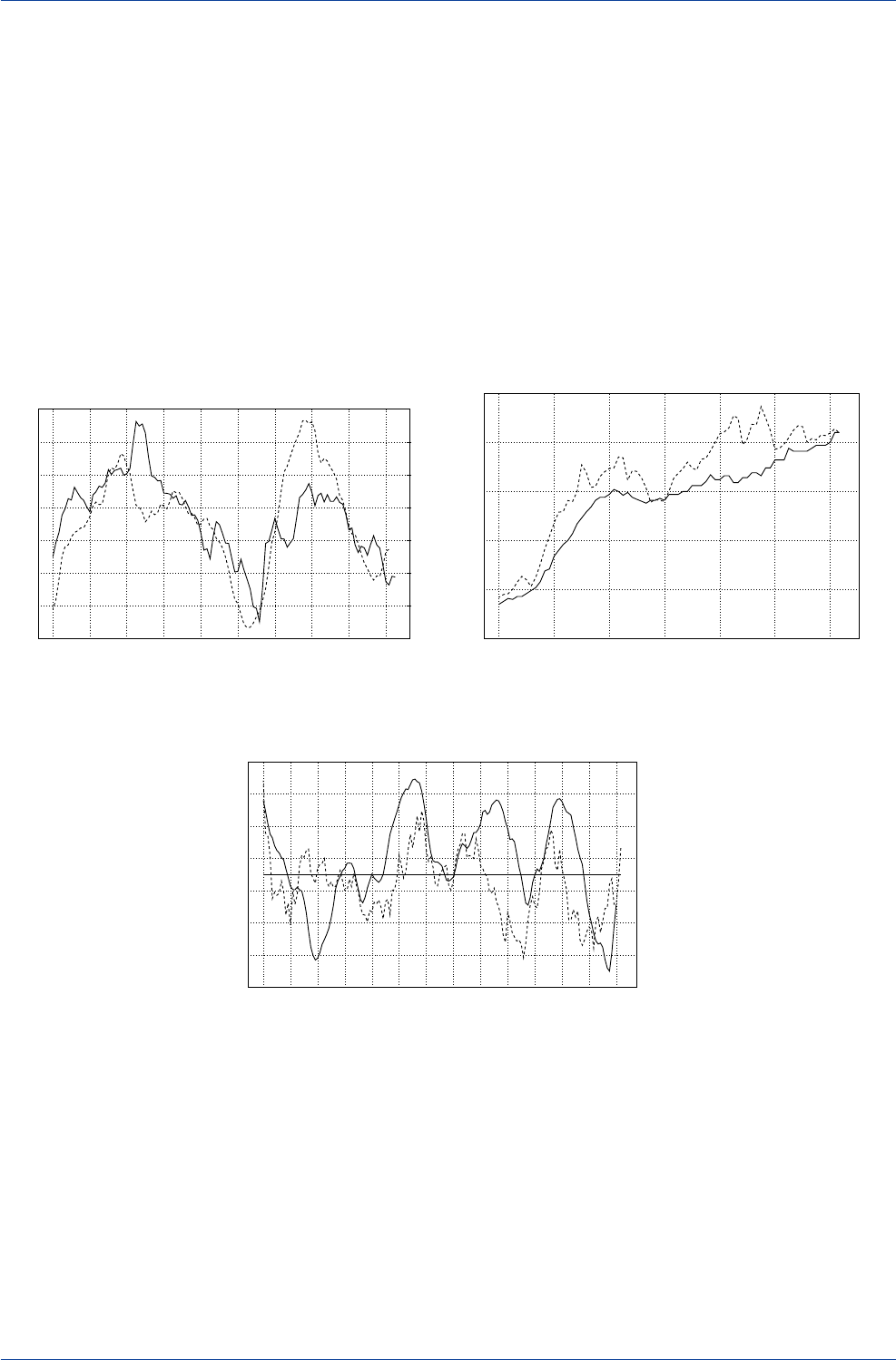

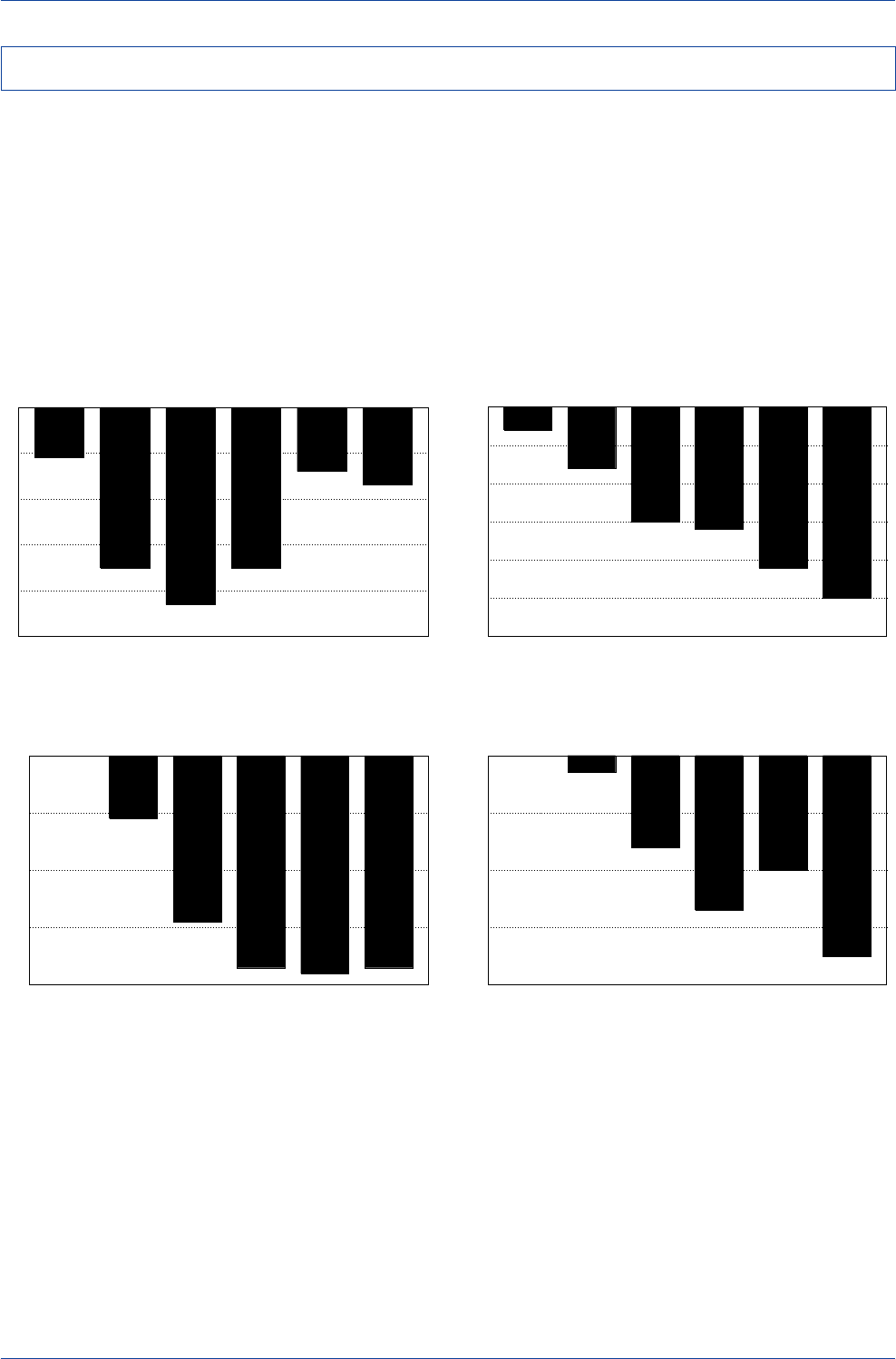

The charts below reveal the distribution of returns that each

of our optimal moving-average crossover trading rules has

generated over the past 16 years. As shown, the over-

whelming majority of recommended trades resulted in ei-

ther small gains or small losses. However, note that the

distribution of returns is skewed heavily to the right in most

cases. This indicates that large positive returns do occur

from time to time; it is just that the frequency of big win-

ning trades tends to be quite low. These highly skewed

return distributions raise the question whether conventional

measures of risk such as standard deviation, Sharpe ra-

tios, and information ratios accurately convey the asym-

metric risks facing technically oriented investors, particu-

larly over short horizons.

Distribution of Returns from Moving-Average Trading Rules

Distribution of Returns of DEM Trades

(Generated by Moving-Average Crossover Strategy)

(1986-2002)

0

50

100

150

200

-2.9

-2.0

-1.1

-0.20.71.6 2.5 3.4 4.35.26.1 7.0 7.9 8.89.7

10.6

11.5

12.4

13.1

Frequency

Return(%)

Distribution of Returns of JPY Trades

(Generated by Moving-Average Crossover Strategy)

(1986-2002)

0

10

20

30

40

50

-5.4 -2.1 1.3 4.6 8.0 11.4 14.7 18.1 21.4 24.5

Frequency

Return(%)

Distribution of Returns of GBP Trades

(Generated by Moving-Average Crossover Strategy)

(1986-2002)

0

50

100

150

200

250

300

-4.1

-2.8

-1.4

-0.1

1.2

2.5

3.8

5.2

6.5

7.8

9.1

10.4

11.8

13.1

14.4

15.7

17.0

18.3

19.7

21.0

22.3

23.6

Frequency

Return(%)

Distribution of Returns of CAD Trades

(Generated by Moving-Average Crossover Strategy)

(1986-2002)

0

5

10

15

20

25

30

-2.46 0.81 4.07 7.34 10.6 13.6

Frequency

Return(%)

Distribution of Returns of AUD Trades

(Generated by Moving-Average Crossover Strategy)

(1986-2002)

0

20

40

60

80

-2.4 -1.7 -1.0 -0.4 0.3 1.0 1.7 2.3 3.0 3.7 4.4 5.1 5.7 6.4 6.8

Frequency

Return(%)

Distribution of Returns of CHF Trades

(Generated by Moving-Average Crossover Strategy)

(1986-2002)

0

20

40

60

80

100

120

140

-5.73

-4.13

-2.52

-0.91 0.69 2.3 3.9 5.51 7.12 8.72

10.33

11.93

13.54

15.15 16.2

Frequency

Return(%)

Source: Datastream

Source: Datastream

Source: Datastream

Source: Datastream

Source: Datastream

Source: Datastream

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 19

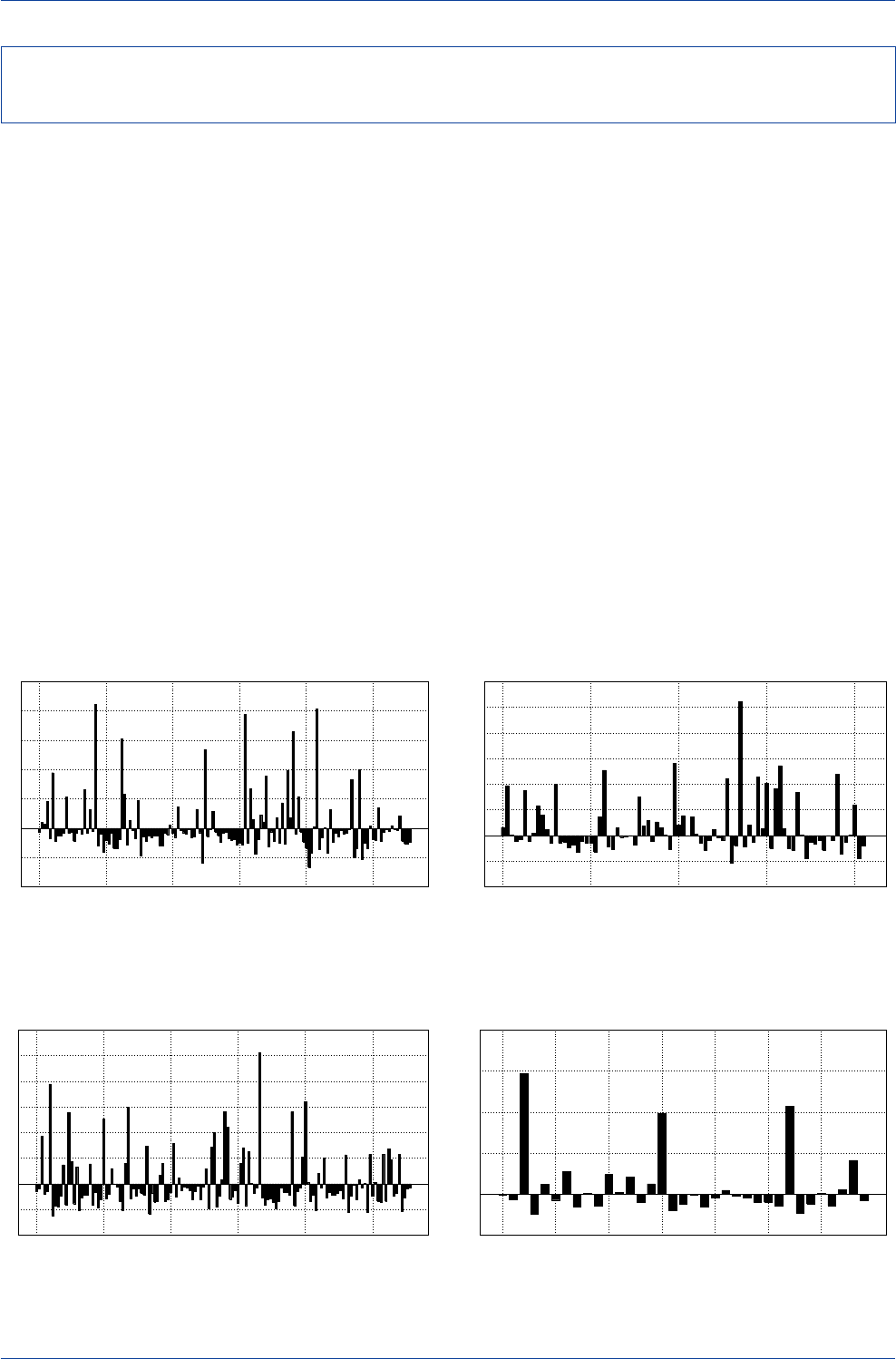

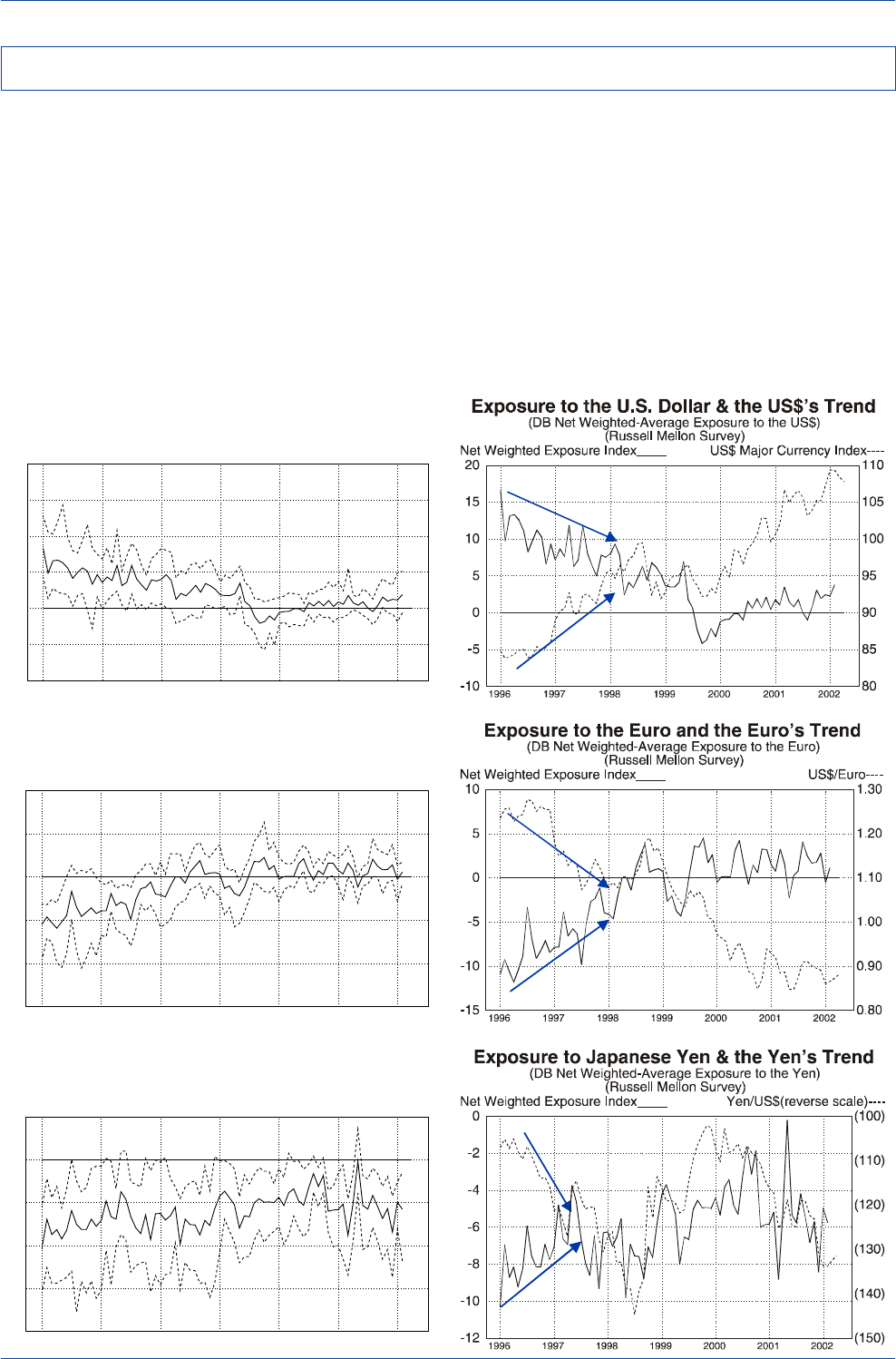

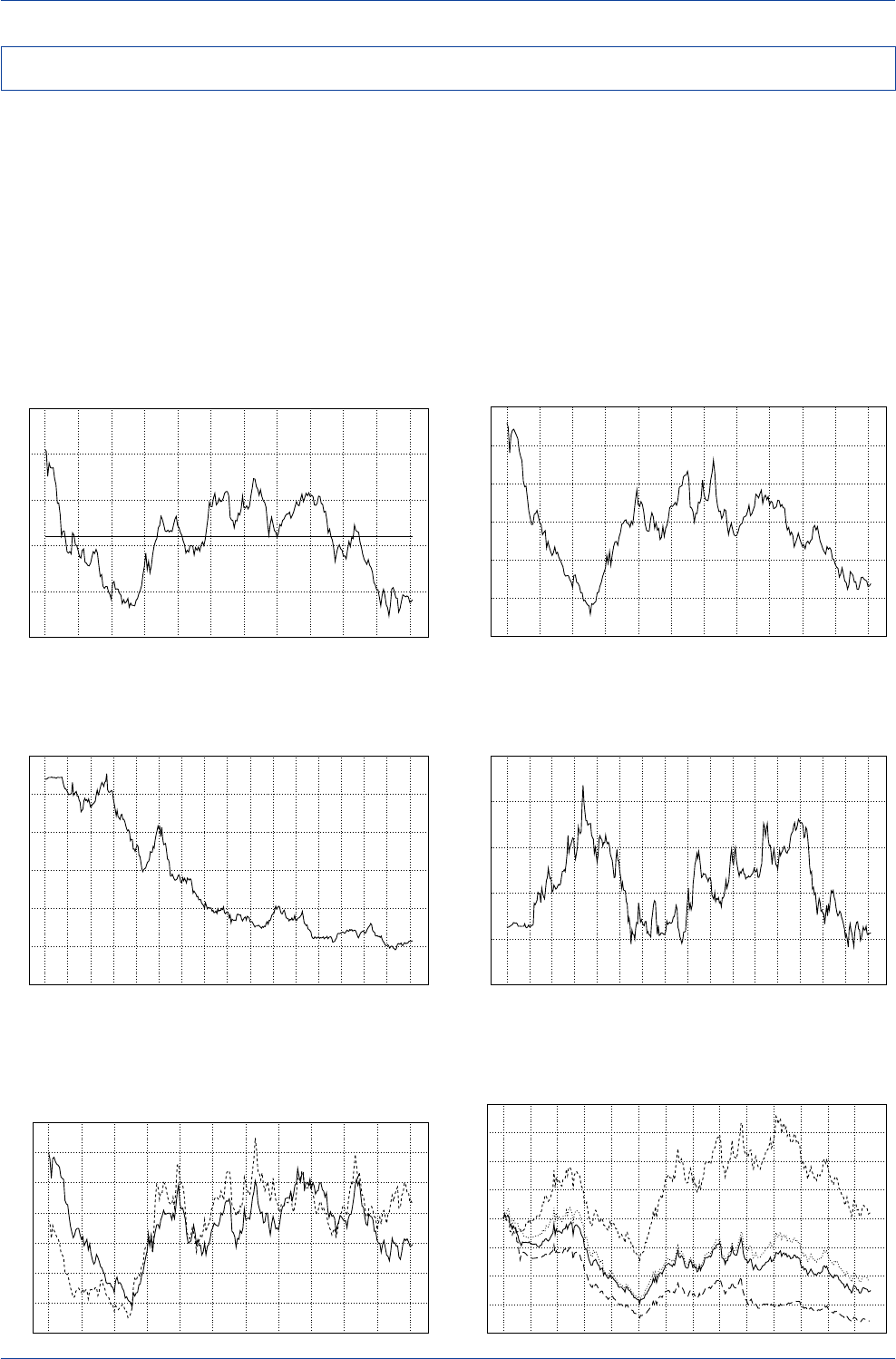

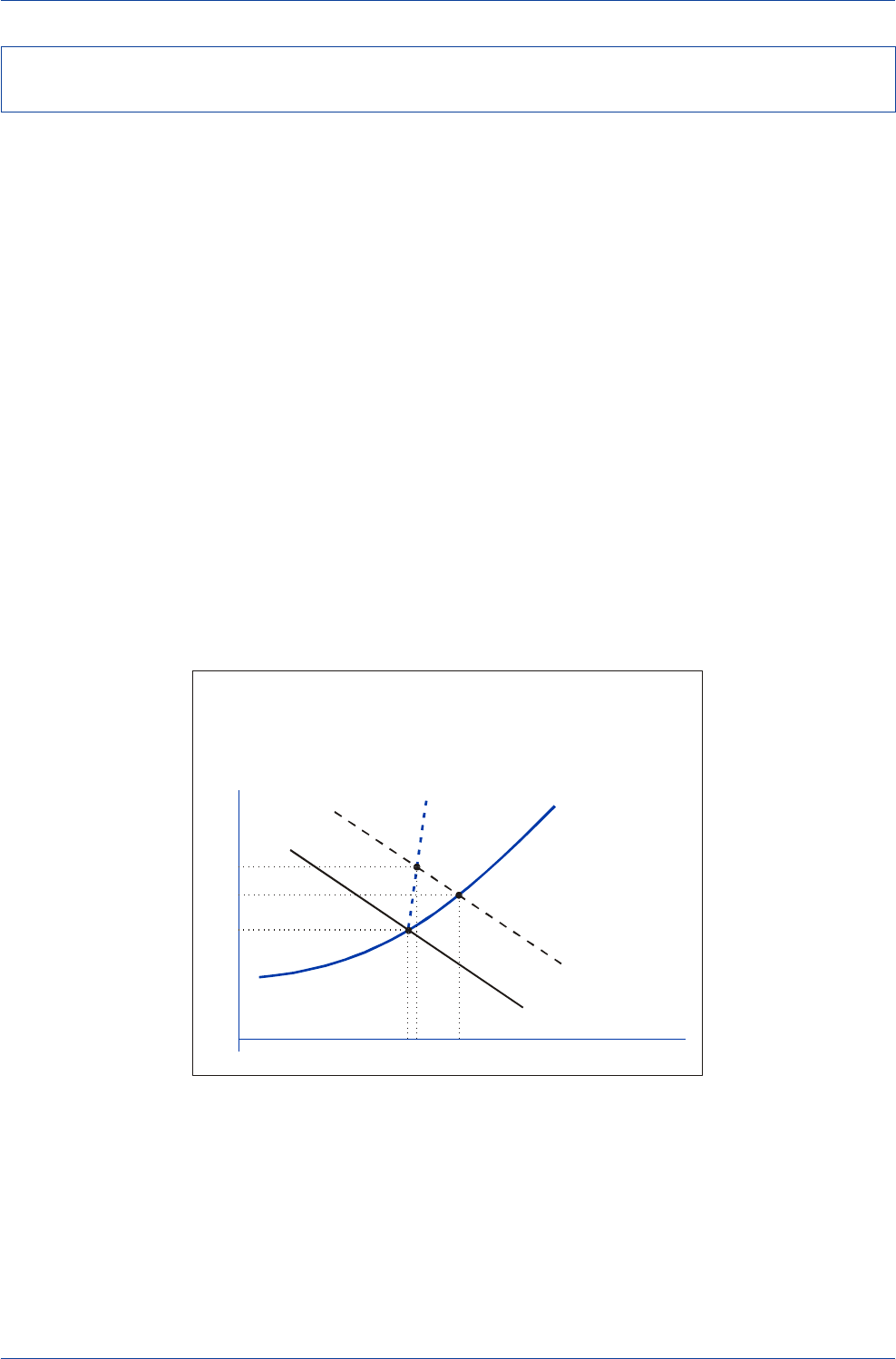

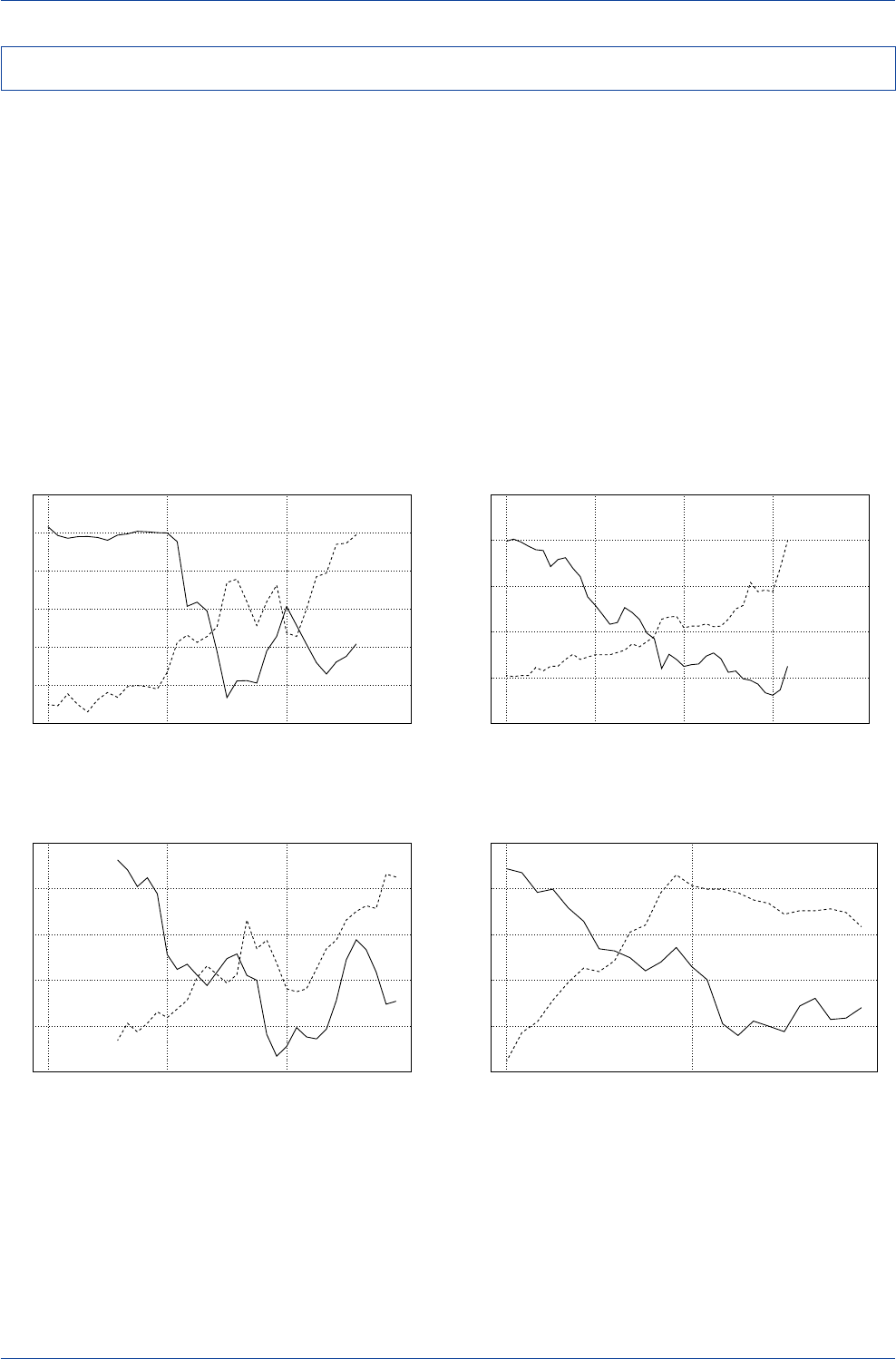

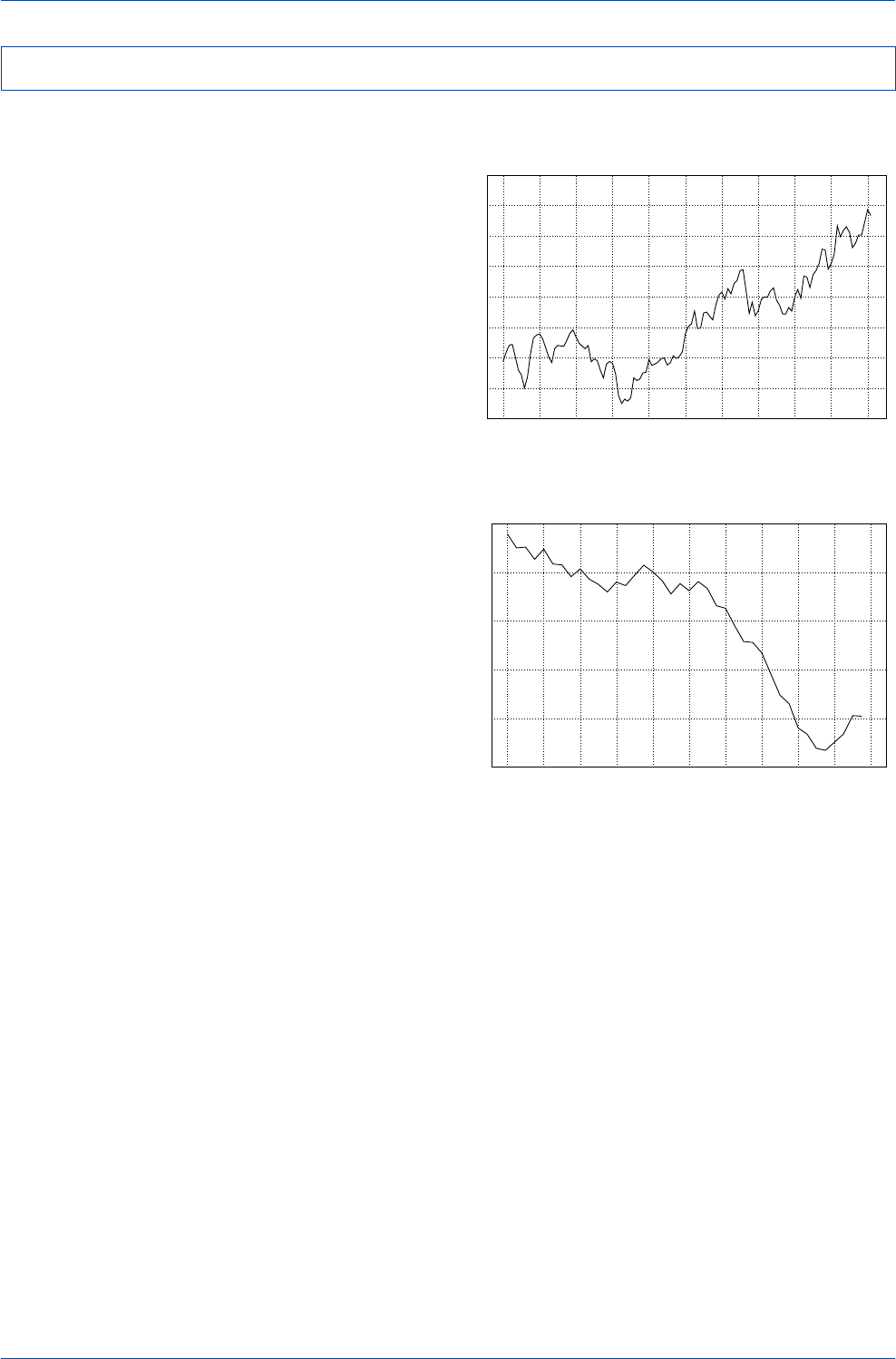

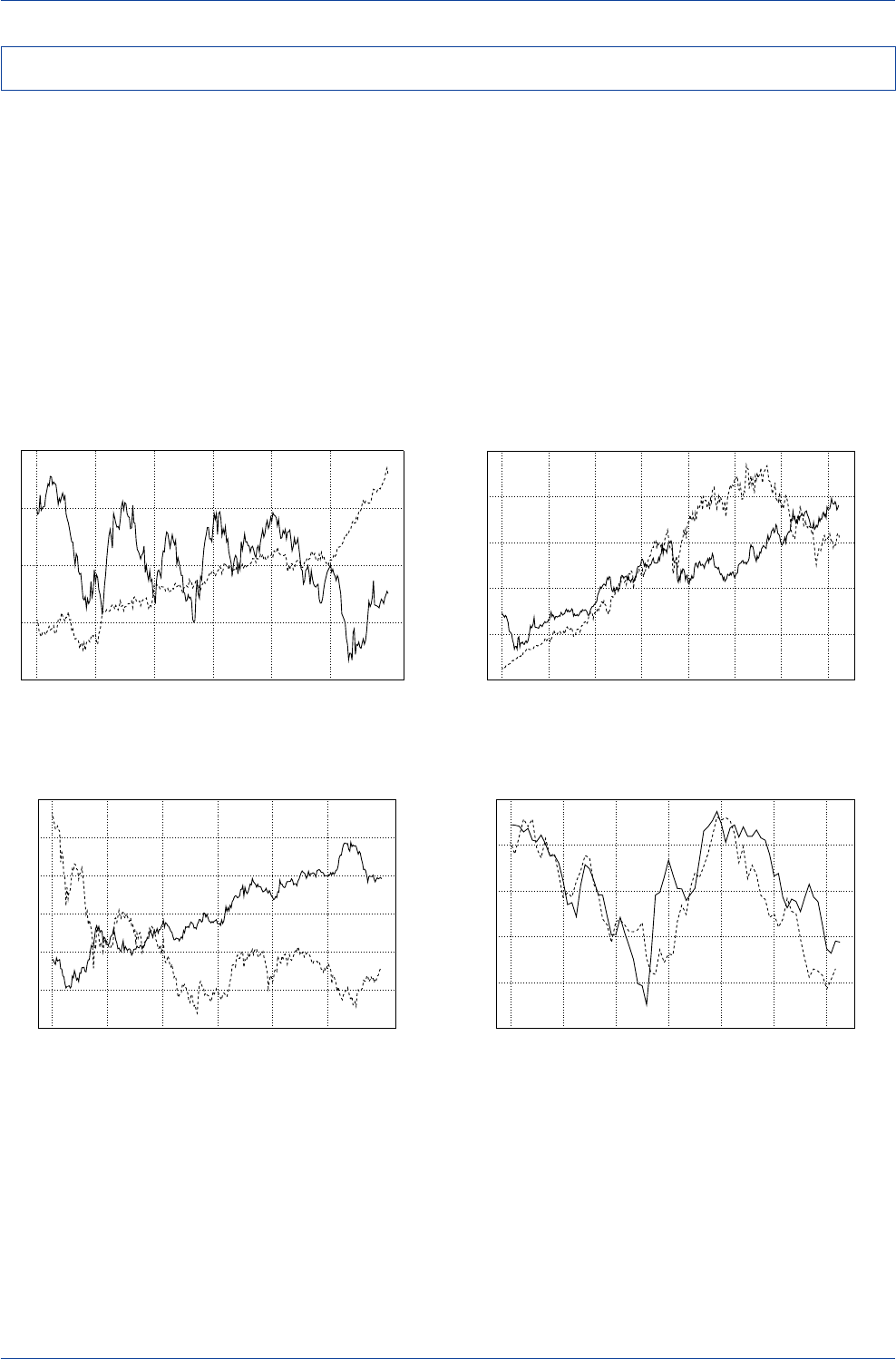

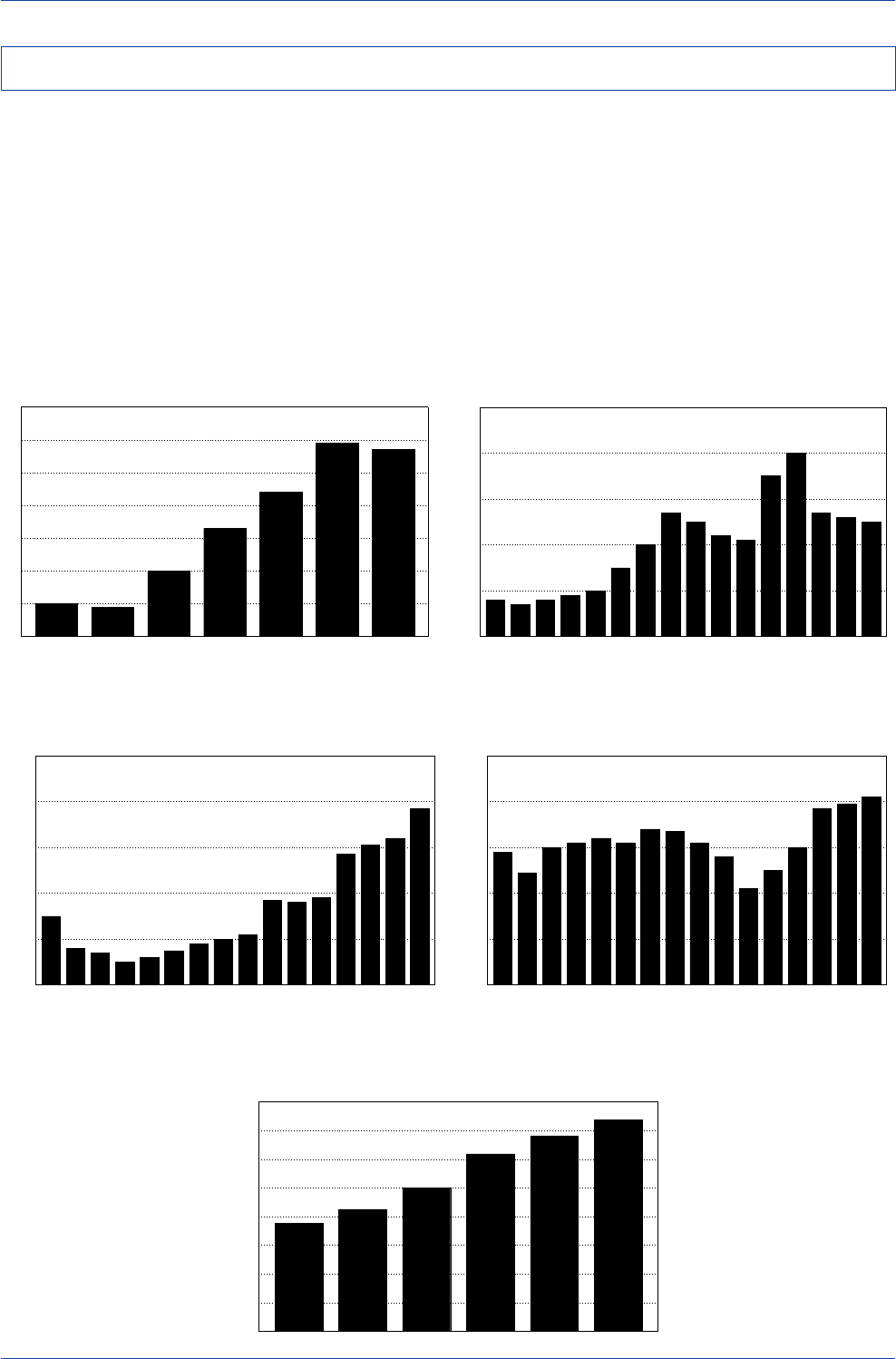

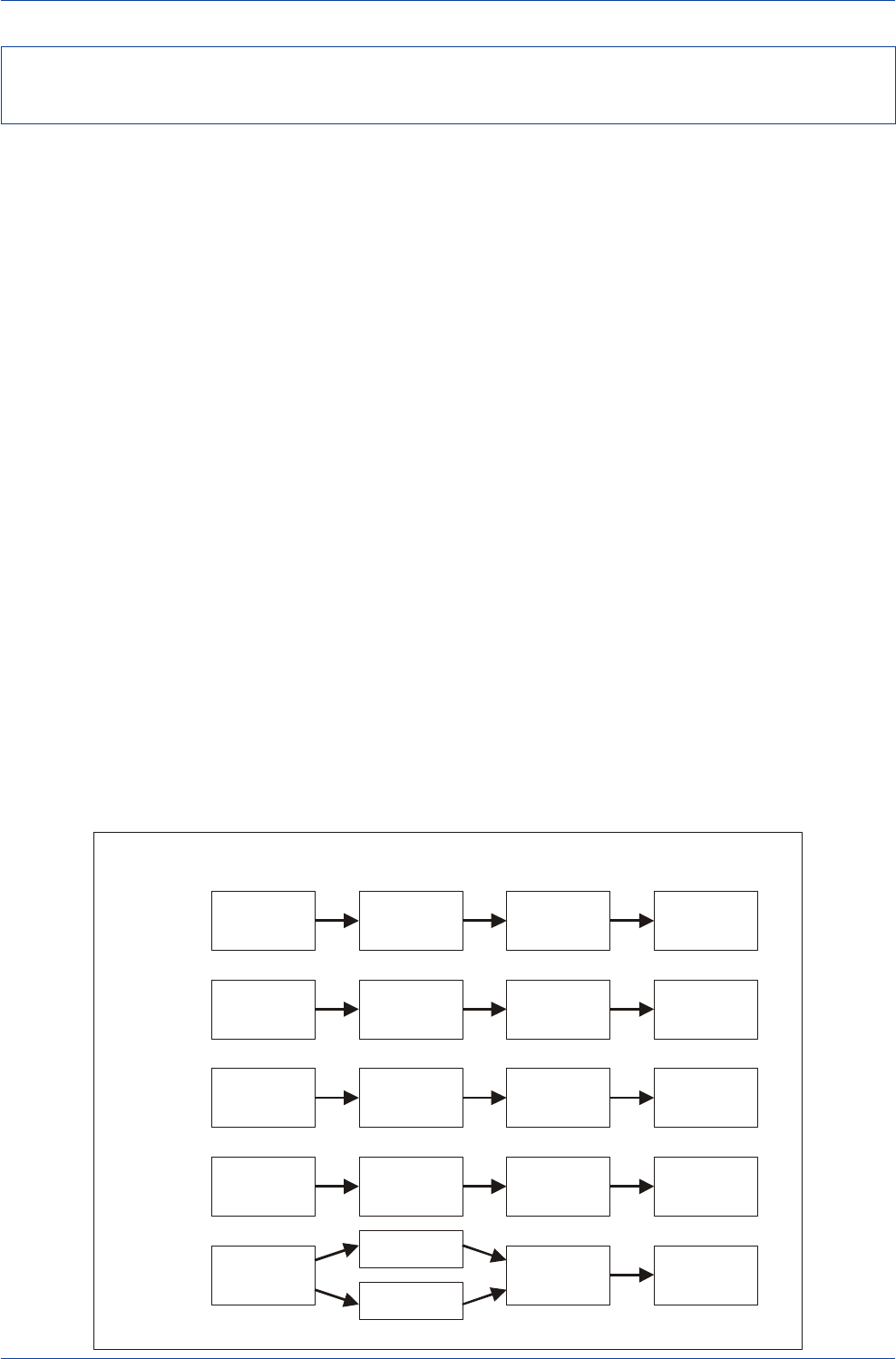

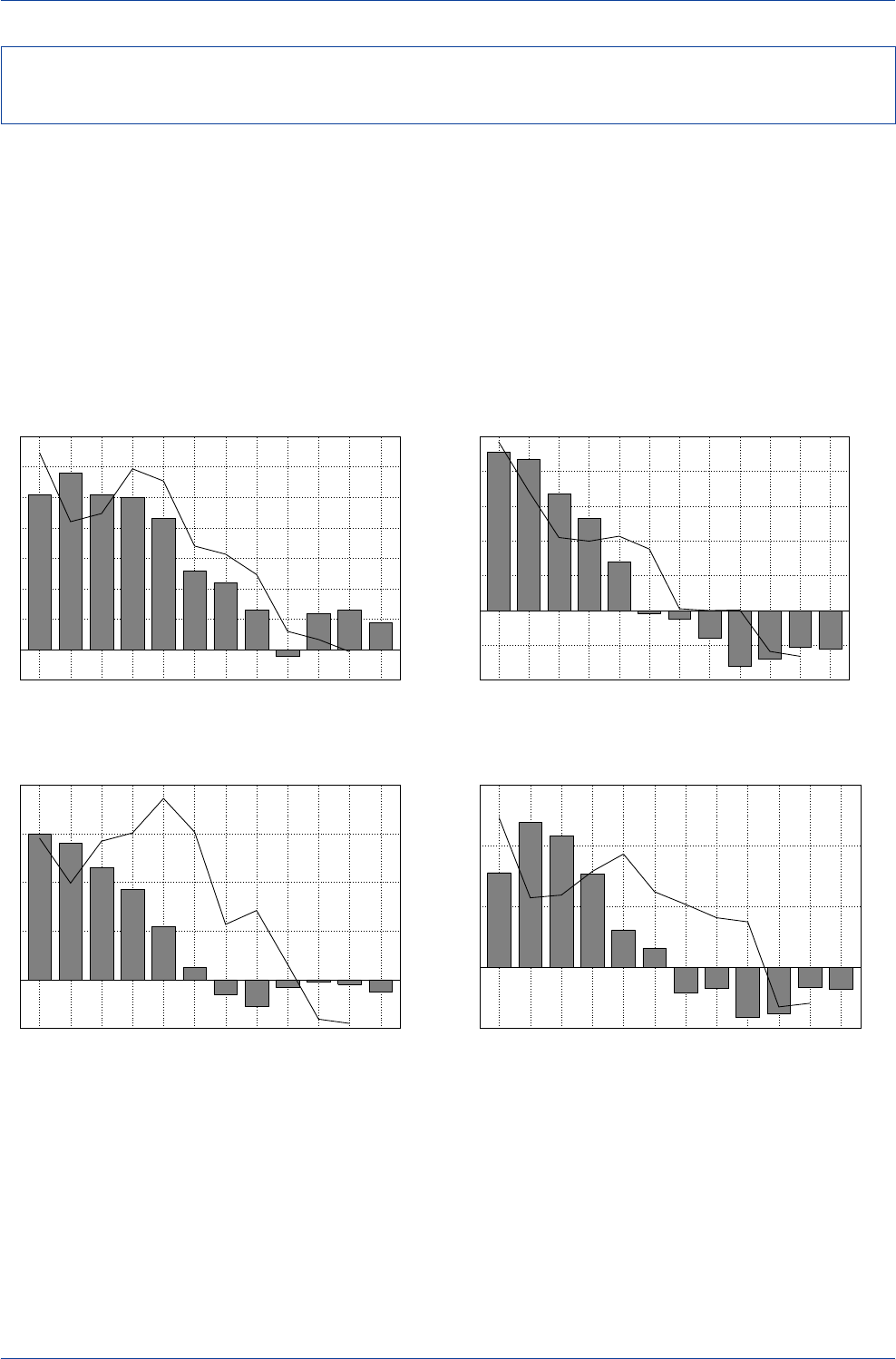

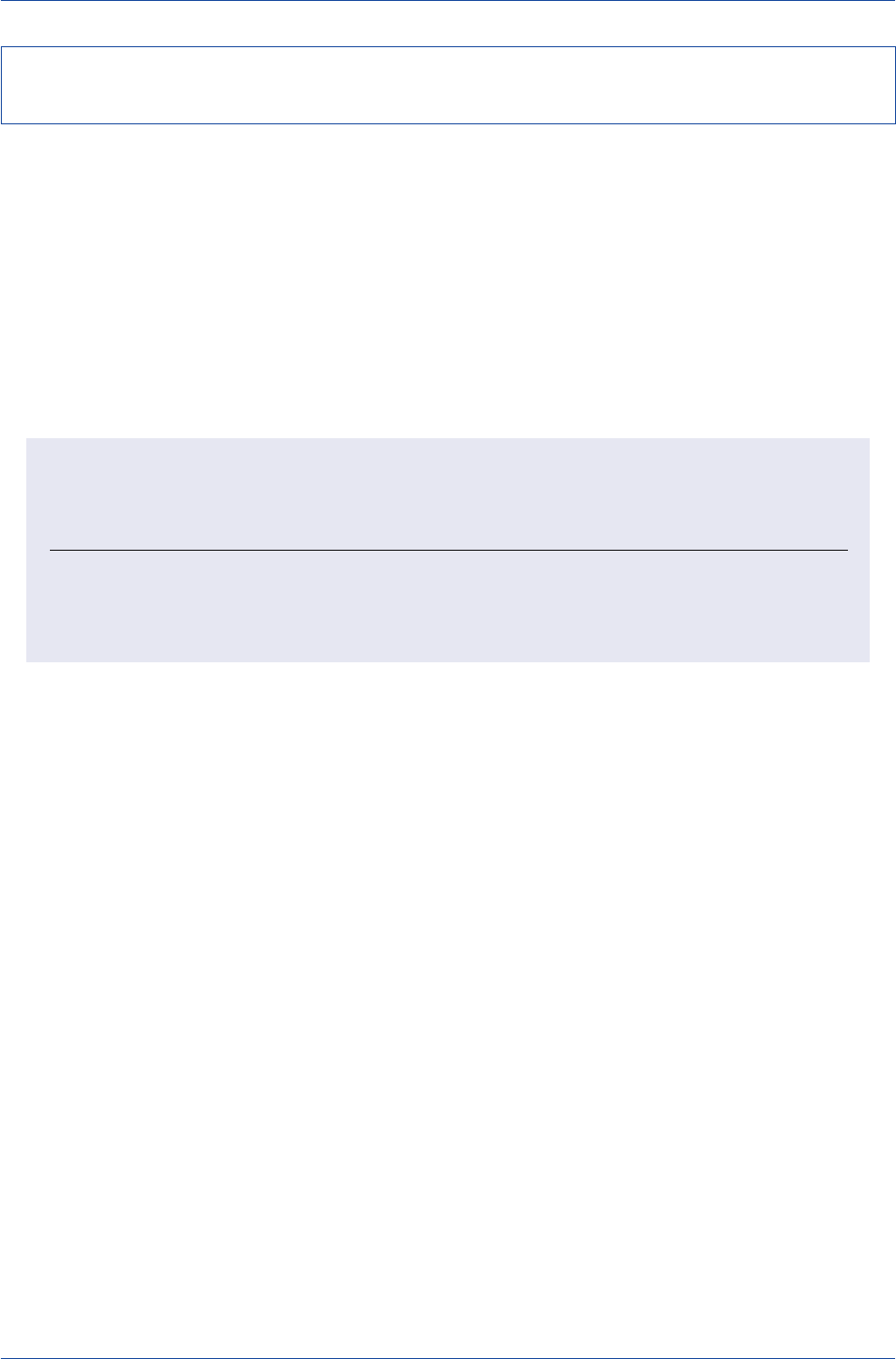

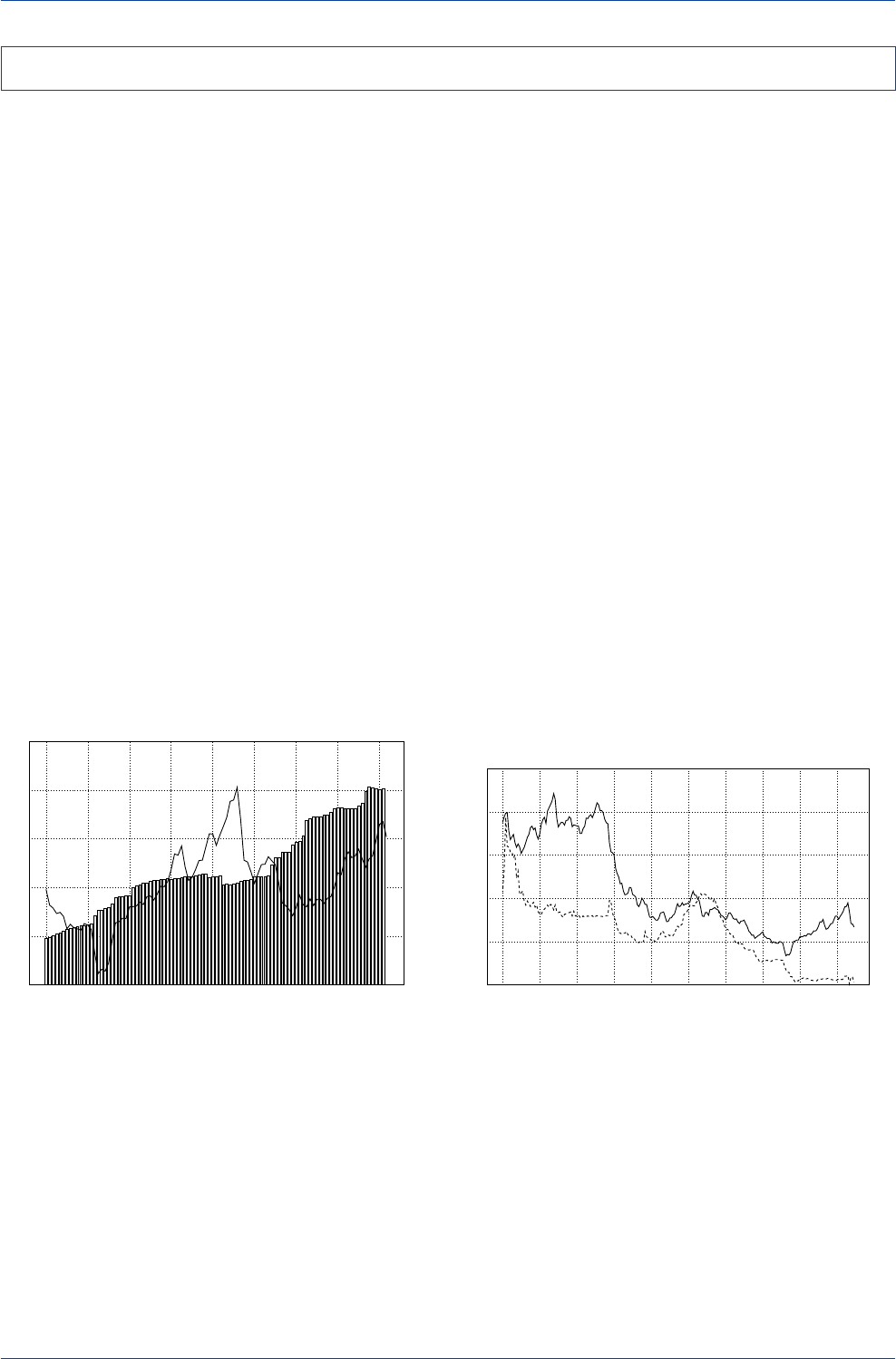

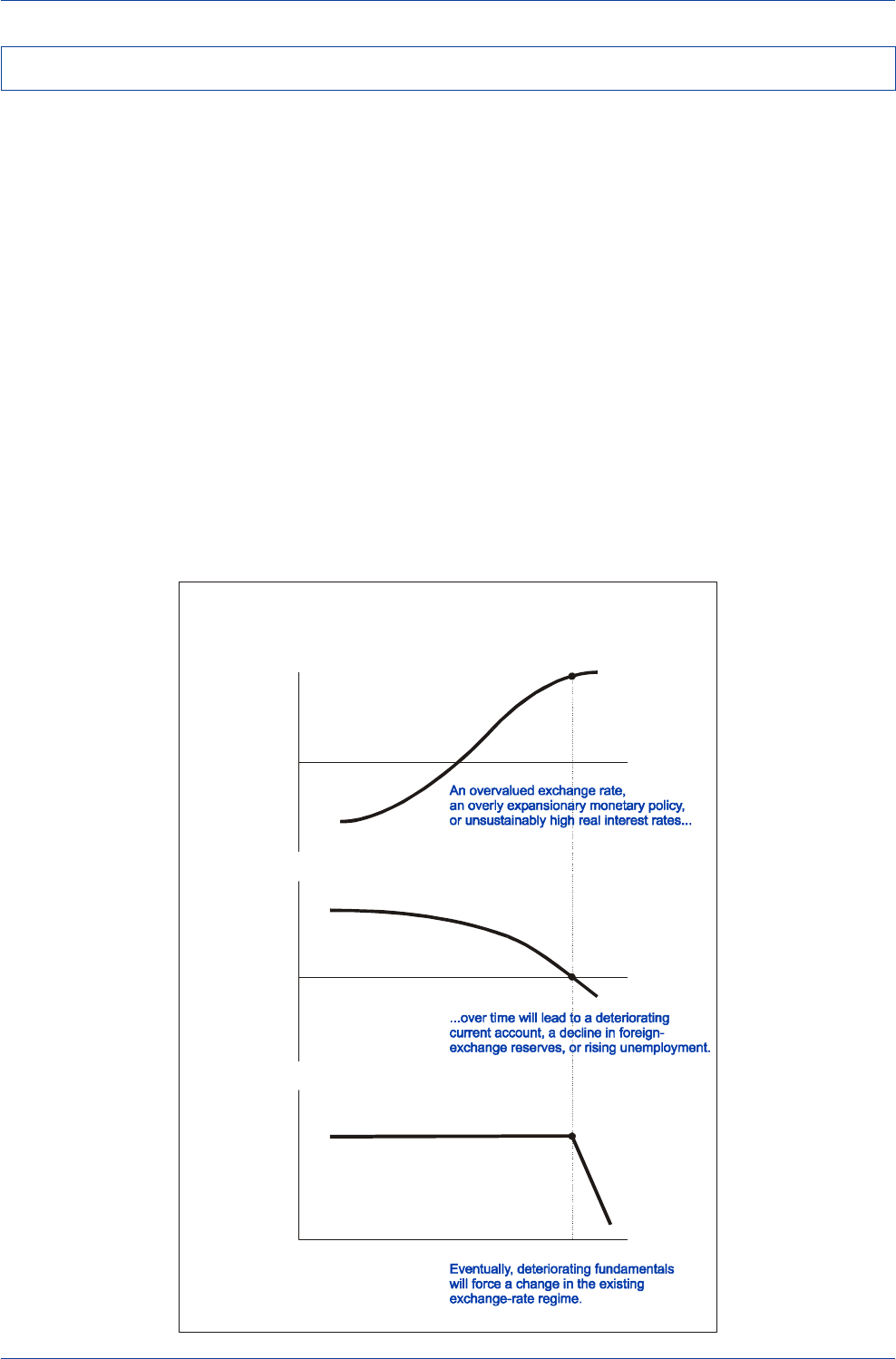

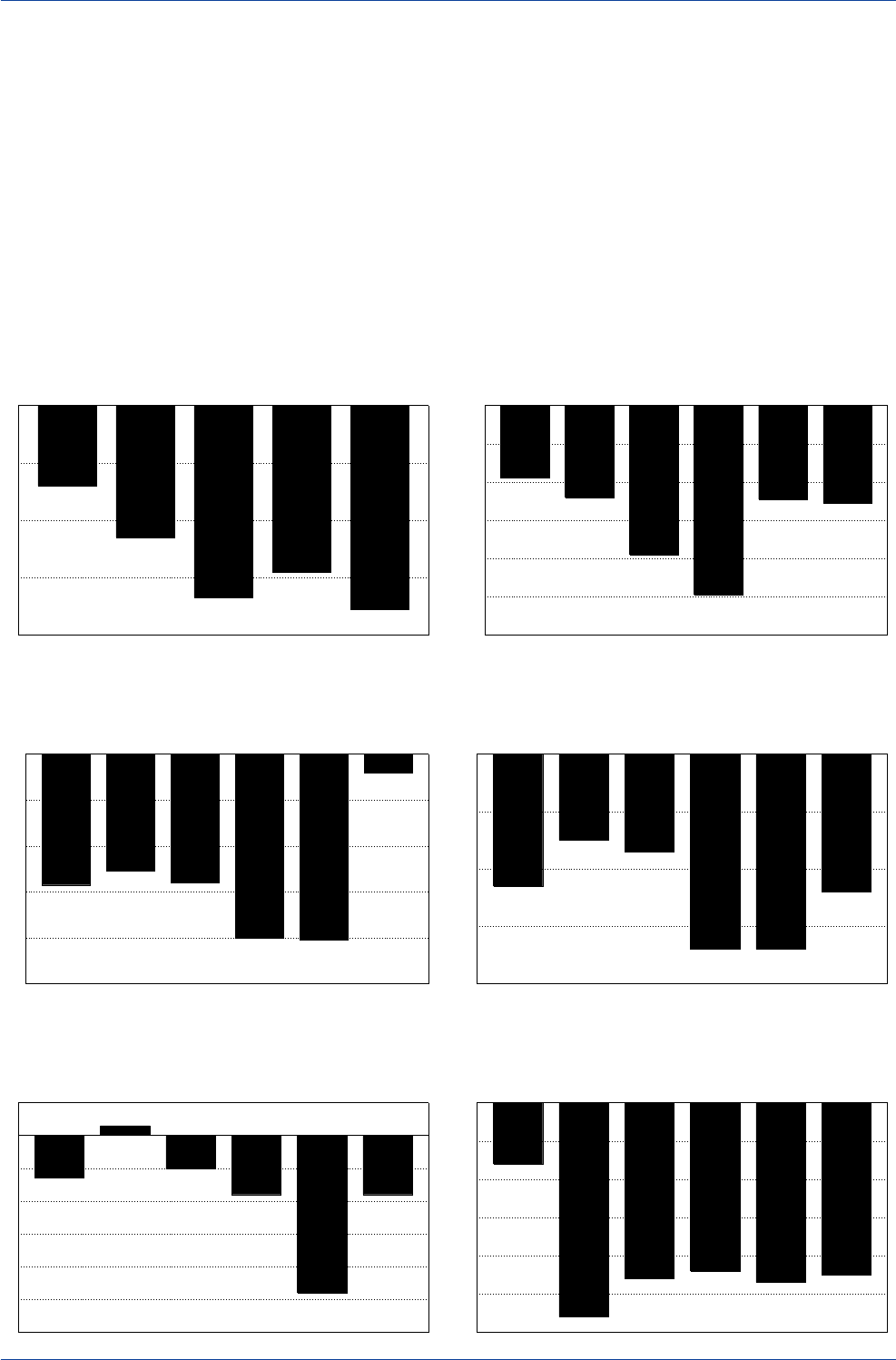

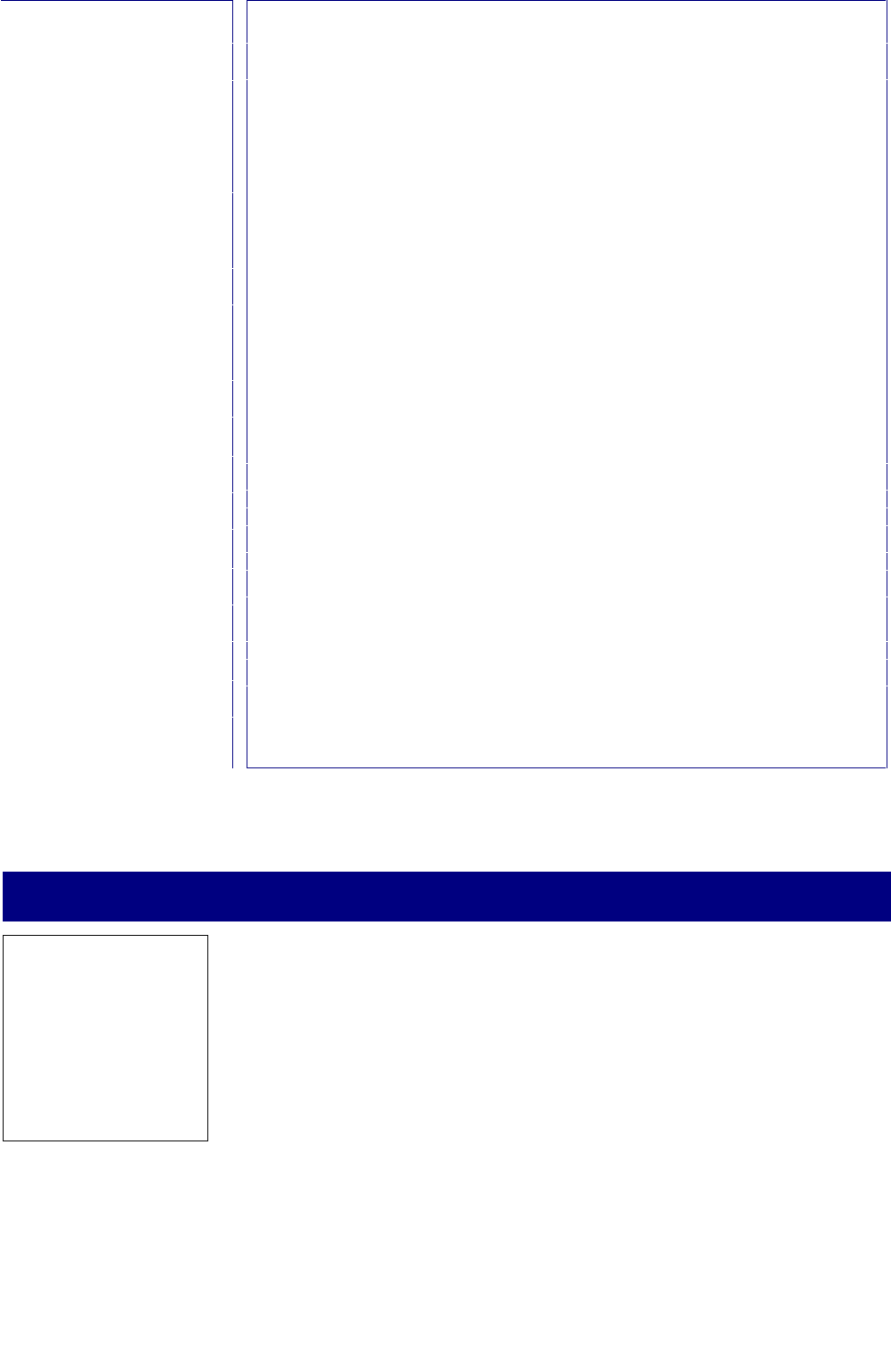

The charts below provide a different way of looking at the

short-term risks facing technically oriented investors in the

FX arena. These charts show the actual gains and losses

on the recommended trades that our optimal moving-av-

erage trading rules have generated in recent years. What

these charts reveal is that there were often frequent runs

of successive losing trades that had to be absorbed be-

fore a sizeable winning trade was generated. While posi-

tive returns were generated in most cases for the entire

sample period, clearly there were uncomfortably lengthy

intervals when frequent losses were incurred.

Our analysis raises several interesting issues. First, should

technical-based moving-average trading rules be viewed

as short-term forecasting tools or instead would it be bet-

ter to view such trading rules as long-term forecasting

tools? The results here suggest that technical-based mov-

ing-average trading rules work best in the long run, not in

the short run. Indeed, the odds that a moving-average trad-

ing rule recommendation will generate a profit appear to

be no better than 25%-35% in most cases in the short

run. Second, it is possible that since the frequency of los-

ing trades is so large, this might actually dissuade inves-

tors from using technical models in formulating currency

investment strategies. If investors shy away from using

technical models because of the high frequency of short-

term losses, this might explain why excess returns in the

long run from technical-based models are not completely

arbitraged away.

In order to successfully trade currencies using a technical-

based moving-average trading rule, an investor needs to

have staying power—considerable risk capital on hand to

absorb possible frequent short-term trading losses—and

patience. There might be other technical tools that could

be used to cut down on the number of frequent losses on

short-term trading positions, but one needs to be mindful

of the fact that attempts to add "filters" or other types of

technical bells and whistles to limit the frequency of false

signals might hinder the upside potential of correctly pre-

dicted winning trades.

Should Moving-Average Trading Rules Be Viewed as Short or Long-Run

Forecasting Tools?

Profit and Losses on Individual DEM Trades

(Generated by Moving-Average Crossover Strategy)

(Most Recent 140 Trades)

-4

-2

0

2

4

6

8

10

12-27-95 04-21-97 03-27-98 01-14-99 11-08-2000 10-02-2001

Returns(%)

Trade Dates

Profit and Losses on Individual JPY Trades

(Generated by Moving-Average Crossover Strategy)

(1986-2002)

-10

-5

0

5

10

15

20

25

30

01-01-87 12-27-89 02-02-94 01-23-98 03-07-2002

Returns(%)

Trade Dates

Profit and Losses on Individual GBP Trades

(Generated by Moving-Average Crossover Strategy)

(Most Recent 140 Trades)

-2

-1

0

1

2

3

4

5

6

06-12-97 06-01-98 01-27-99 01-03-2000 01-12-2001 09-24-2001

Returns(%)

Trade Dates

Profit and Losses on Individual CAD Trades

(Generaged by Moving-Average Crossover Strategy)

(1986-2002)

-5

0

5

10

15

20

11-03-86 06-23-89 11-02-90 09-16-94 04-25-96 01-14-97 08-06-99

Returns(%)

Trade Dates

Datastream is the source of the

underlying exchange-rate data.

Datastream is the source of the

underlying exchange-rate data.

Datastream is the source of the

underlying exchange-rate data.

Datastream is the source of the

underlying exchange-rate data.

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

20 Deutsche Bank Foreign Exchange Research

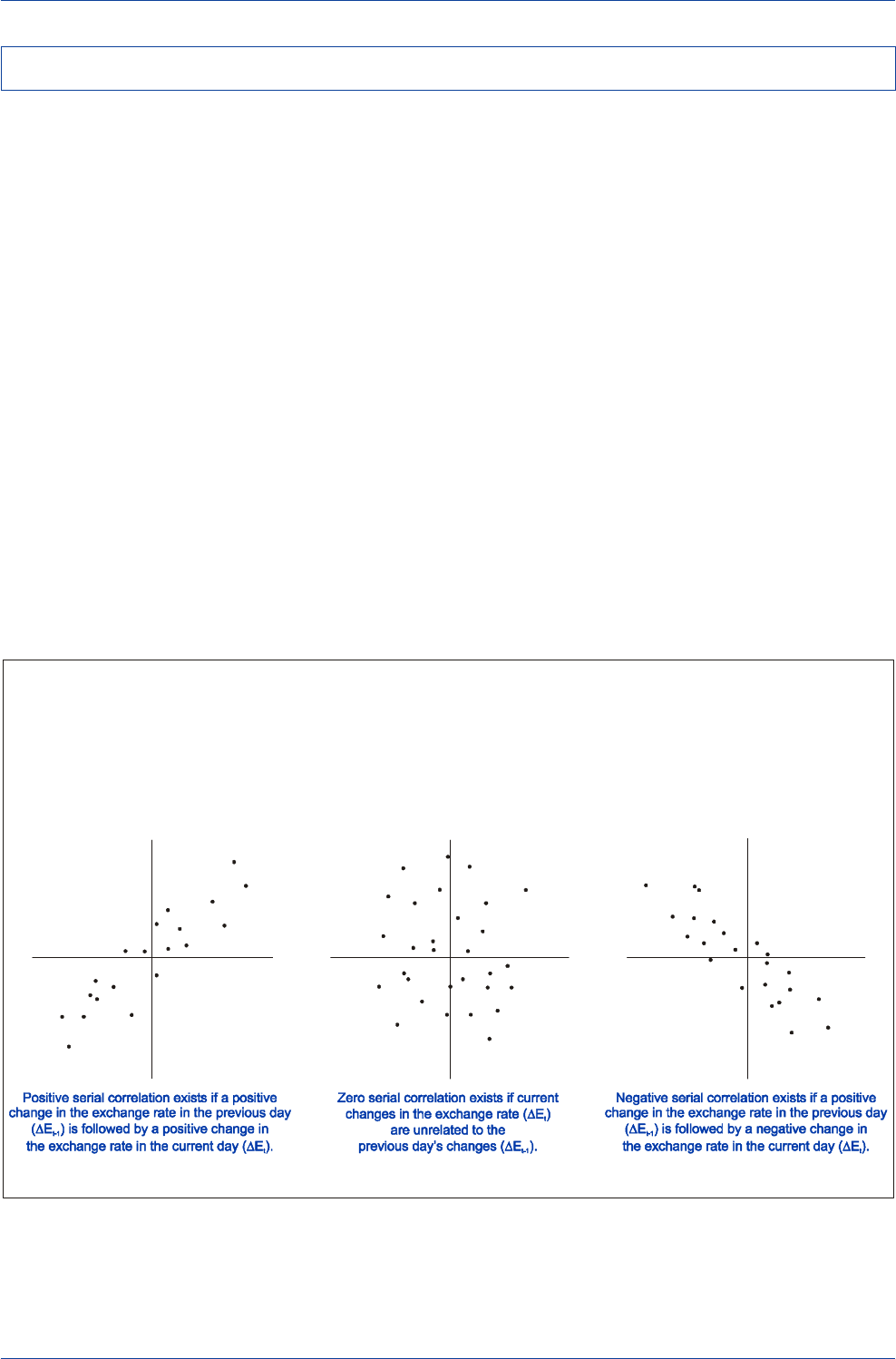

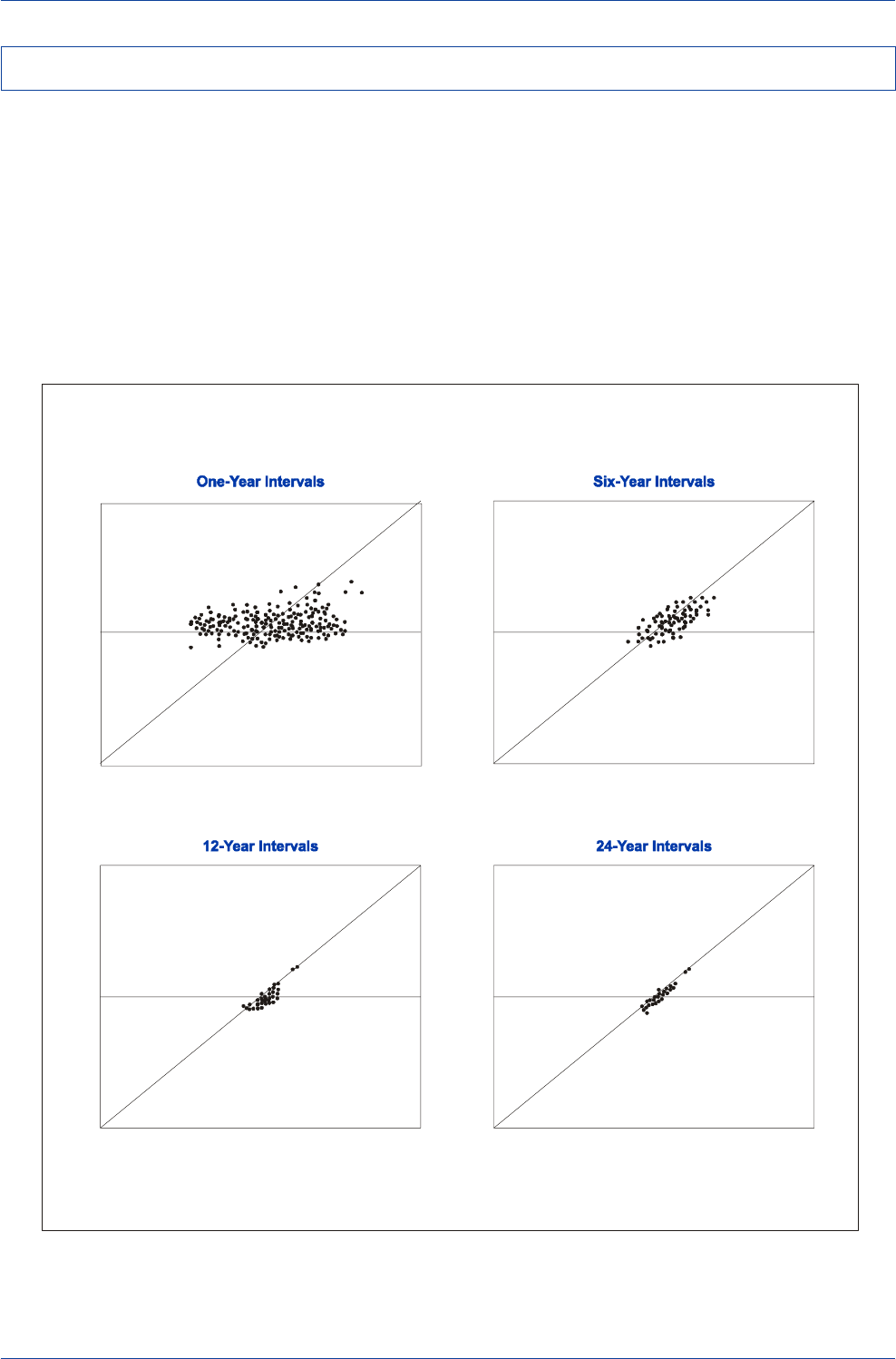

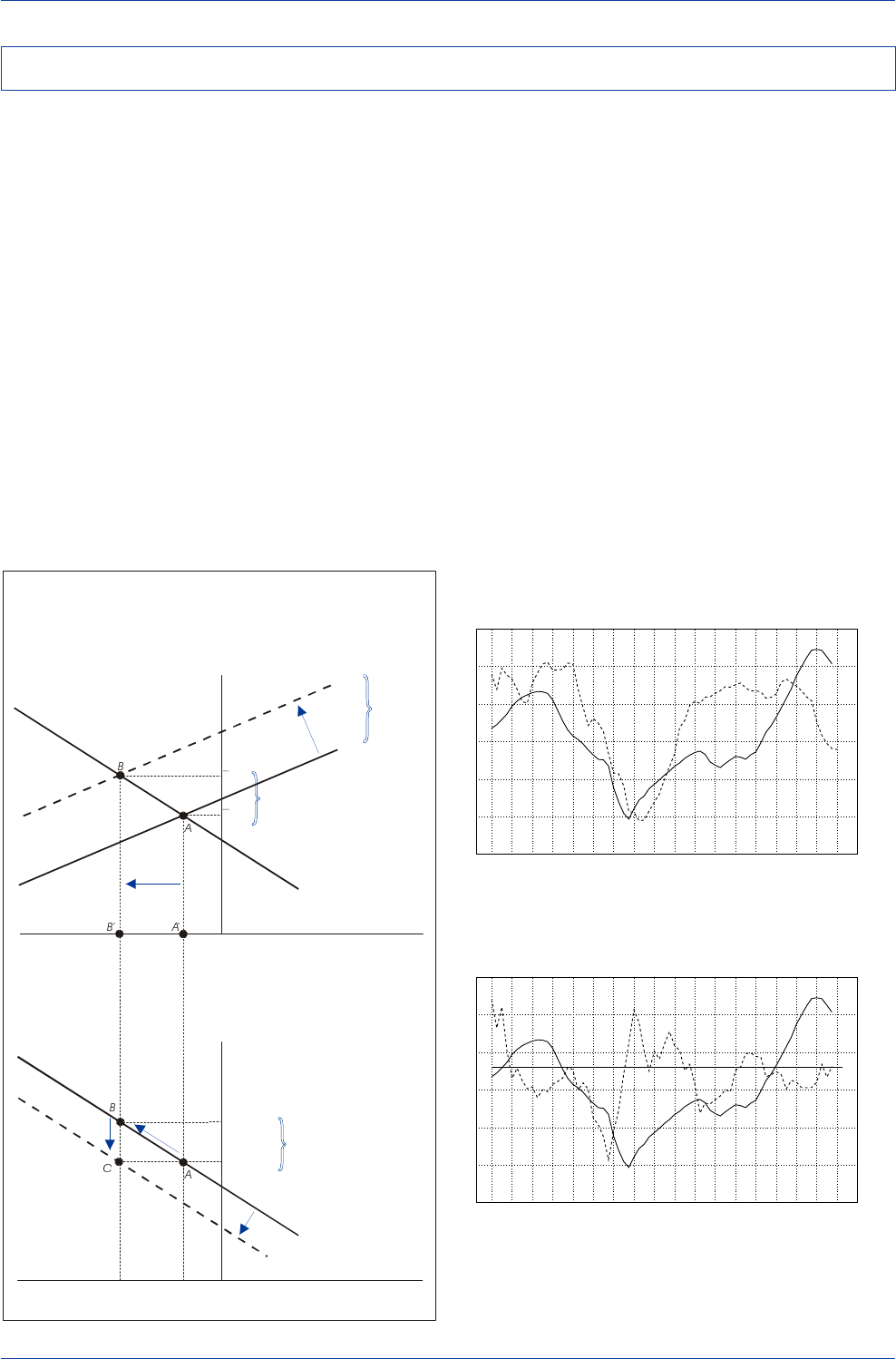

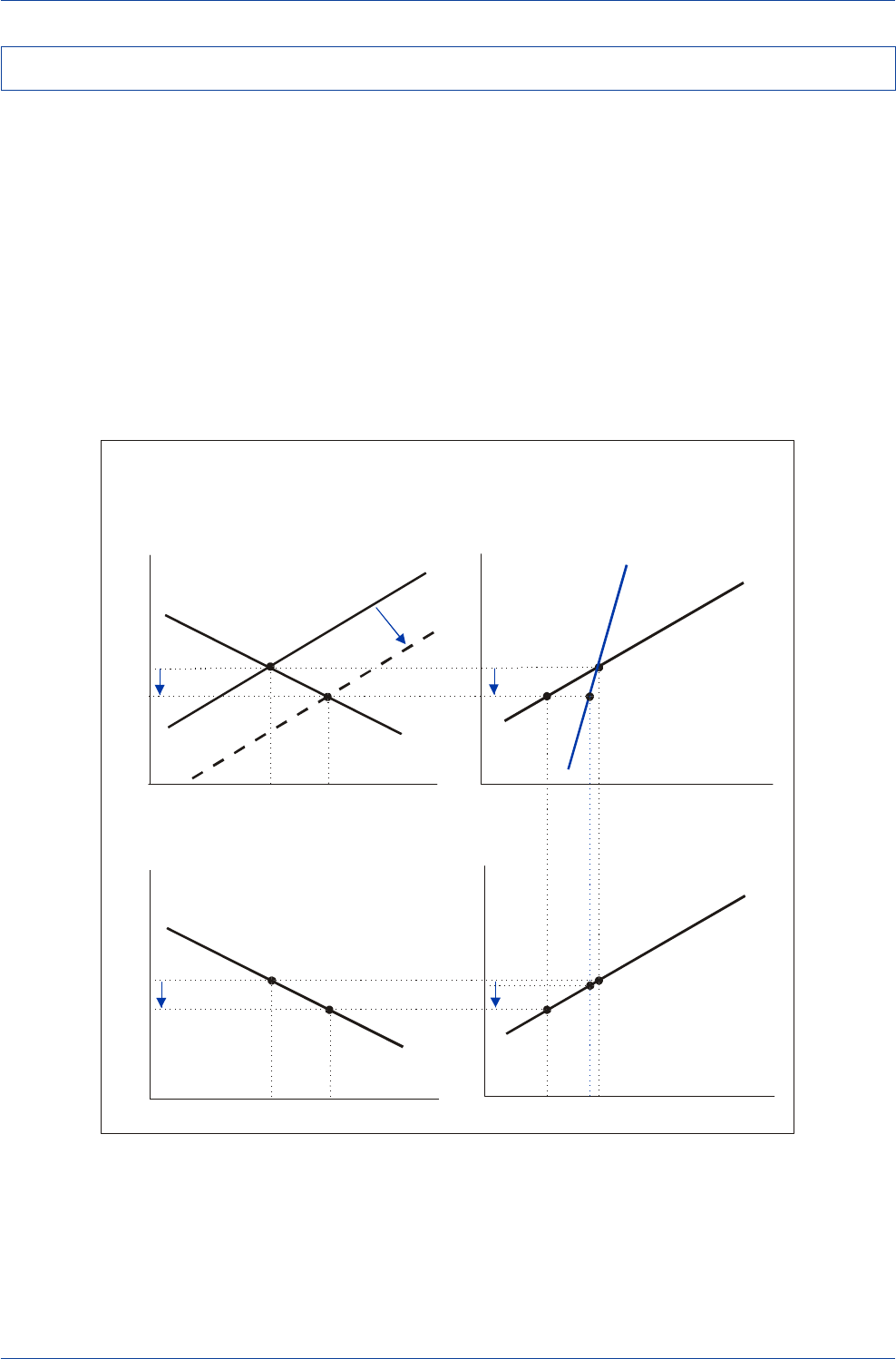

Most academic studies have concluded that exchange-rate

movements closely approximate a random walk process.

A random walk (serial correlation) test seeks to investi-

gate whether there exists a positive, negative, or zero lin-

ear relationship between today’s change in the exchange

rate and yesterday’s change in the exchange rate. Evidence

of a positive linear relationship would indicate the exist-

ence of trend persistence since a positive change in a

currency's value yesterday would tend to be followed by a

positive change today.

Estimated serial correlation coefficients could vary between

+1, 0, and -1 depending on whether there exists a strong

positive relationship, no relationship, or a strong negative

relationship between successive exchange-rate changes.

The weight of evidence generally supports the view that

for most currencies, the estimated serial correlation coef-

ficients are often quite small and in many cases statisti-

cally insignificant from zero.

Although researchers often find support for the view that

exchange-rate movements tend to fluctuate randomly on

a daily basis, they also find evidence that exchange-rate

changes are positively serially correlated when viewed on

a monthly basis. Thus, although exchange rates may fluc-

tuate randomly over very short time spans (i.e., daily), they

tend to rise and fall on a trend basis on a medium/long-

term (i.e., monthly) basis. If so, this would imply that trend-

following trading rules could be devised to profit from these

medium/long-term trends that exchange rates follow.

One of the problems with serial correlation tests is that

they seek only to determine whether a stable "linear" rela-

tionship exists between successive exchange-rate move-

ments. Although it might be the case that successive ex-

change-rate changes are linearly independent, they might

nevertheless exhibit significant positive nonlinear depen-

dence, which traditional serial correlation tests would not

detect. This might explain why researchers have found that

exchange rates follow a random walk, yet at the same time

have found that trend-following technical trading rules have

been profitable. It may be the case that there does exist

some form of serial dependency in successive exchange-

rate movements; it's just that this serial dependence is

not linear. If there exists some form of nonlinear depen-

dence in successive exchange-rate movements, it would

appear that trend-following trading rules are capturing this

form of serial dependence.

Random Walk Tests and the Profitability of Technical Trading Rules

(a)

Positive Serial Correlation

Serial Correlation Tests:

Examining Whether a Stable Linear Relationship Exists between

Current and Previous Changes in an Exchange Rate

(b)

Zero Serial Correlation (c)

Negative Serial Correlation

∆

E

t

∆

E

t

∆

E

t

∆

E

t-1

∆

E

t-1

∆

E

t-1

Source: Adapted from Fogler (1978)

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 21

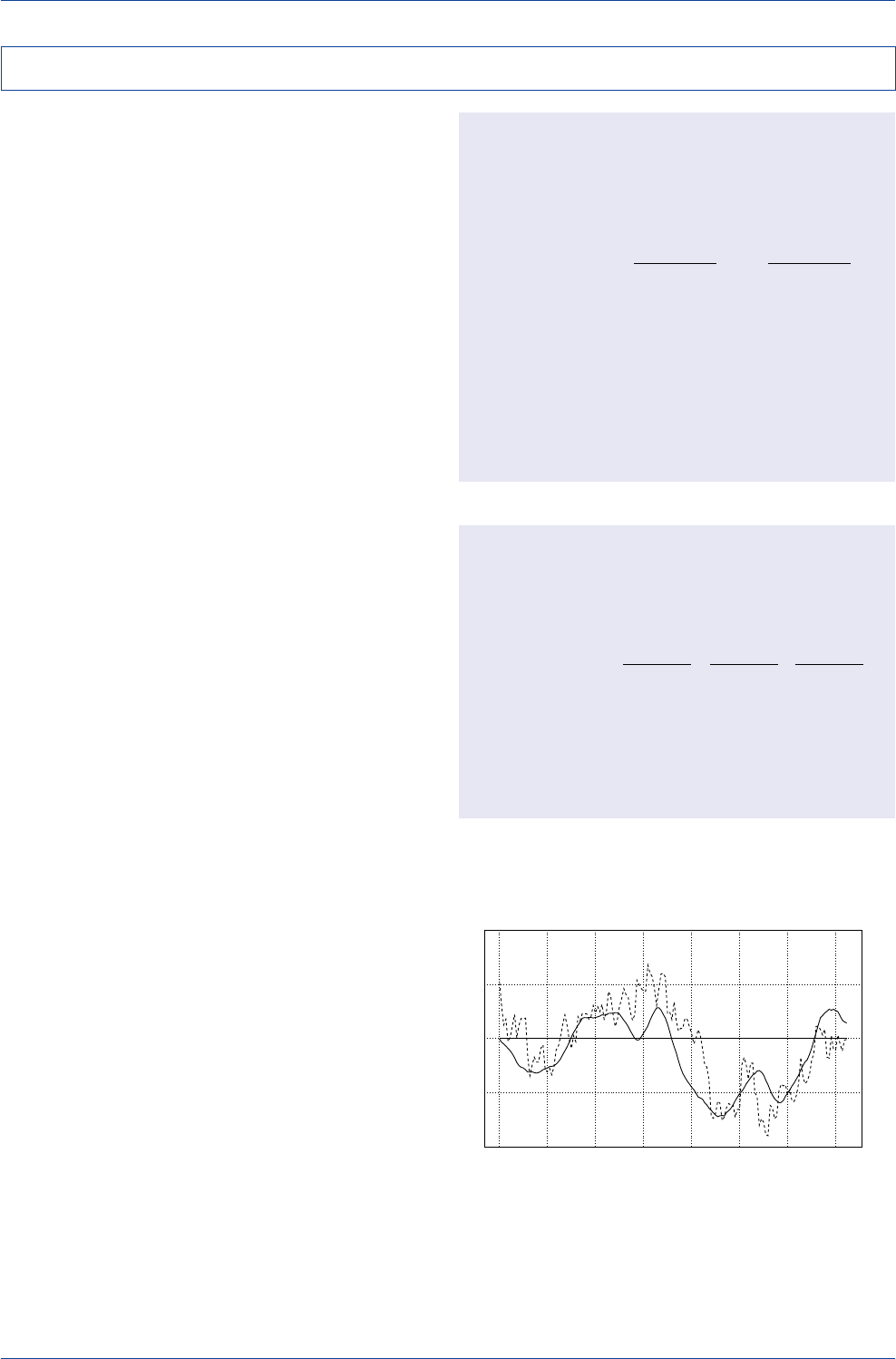

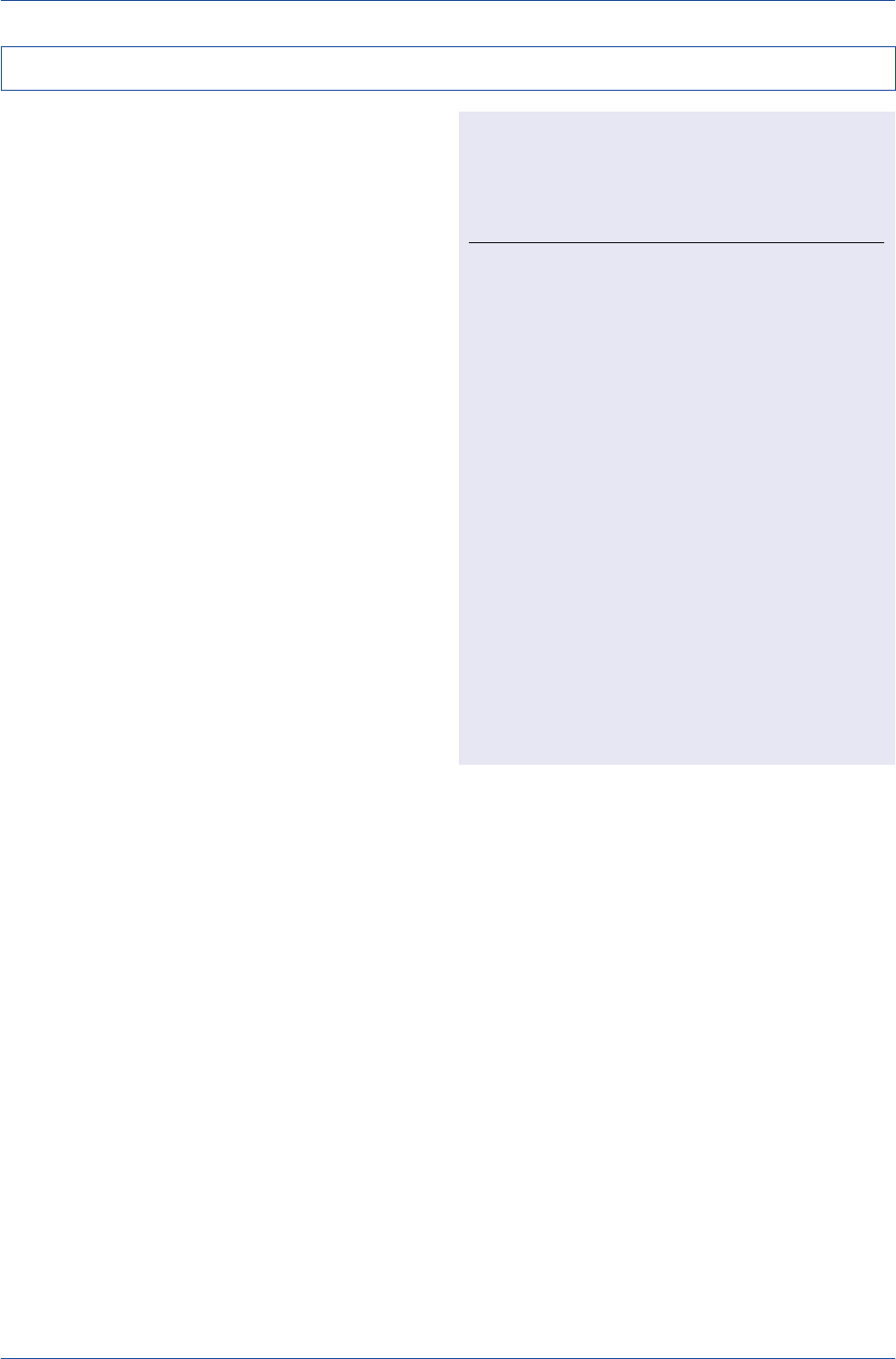

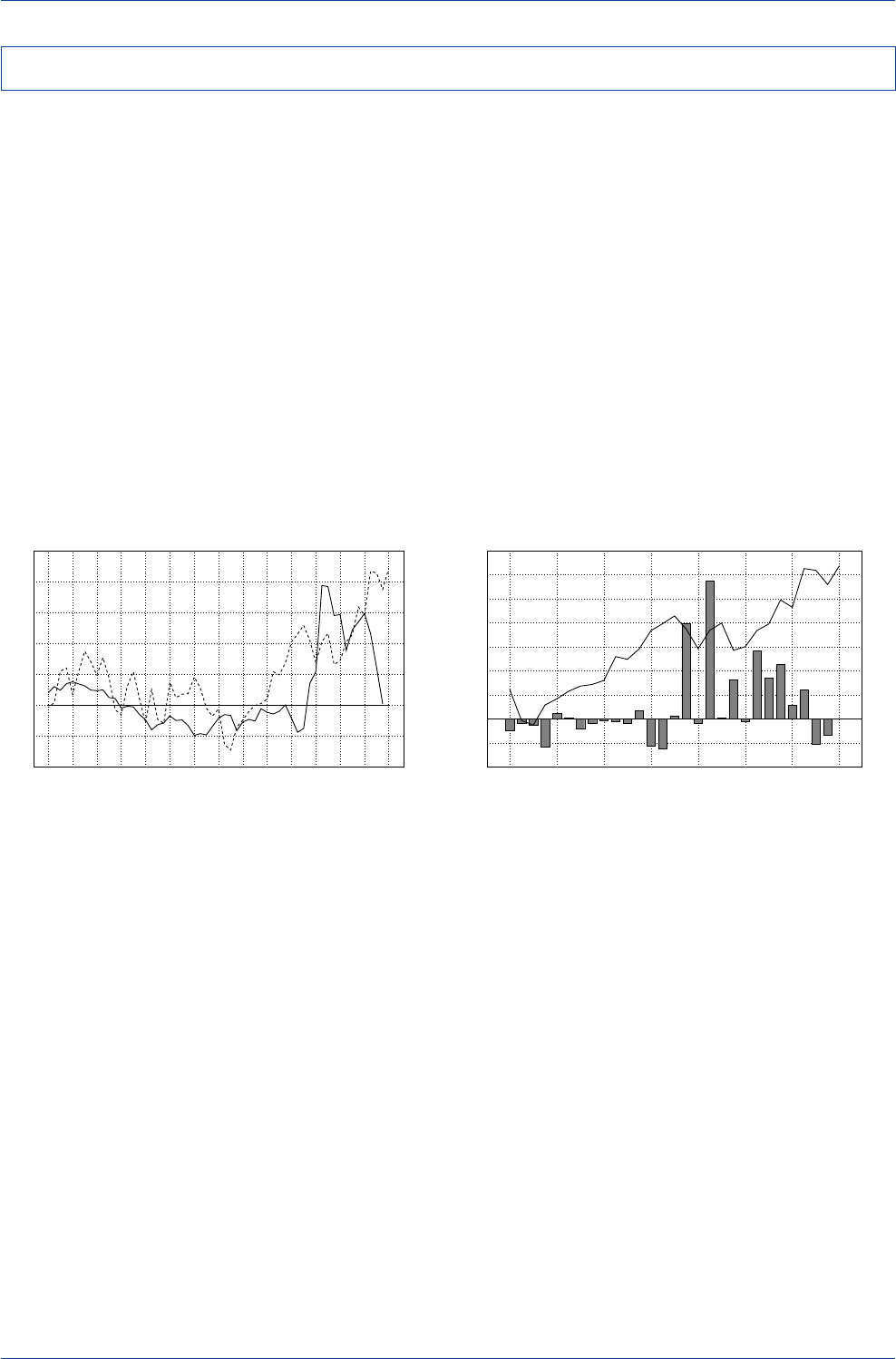

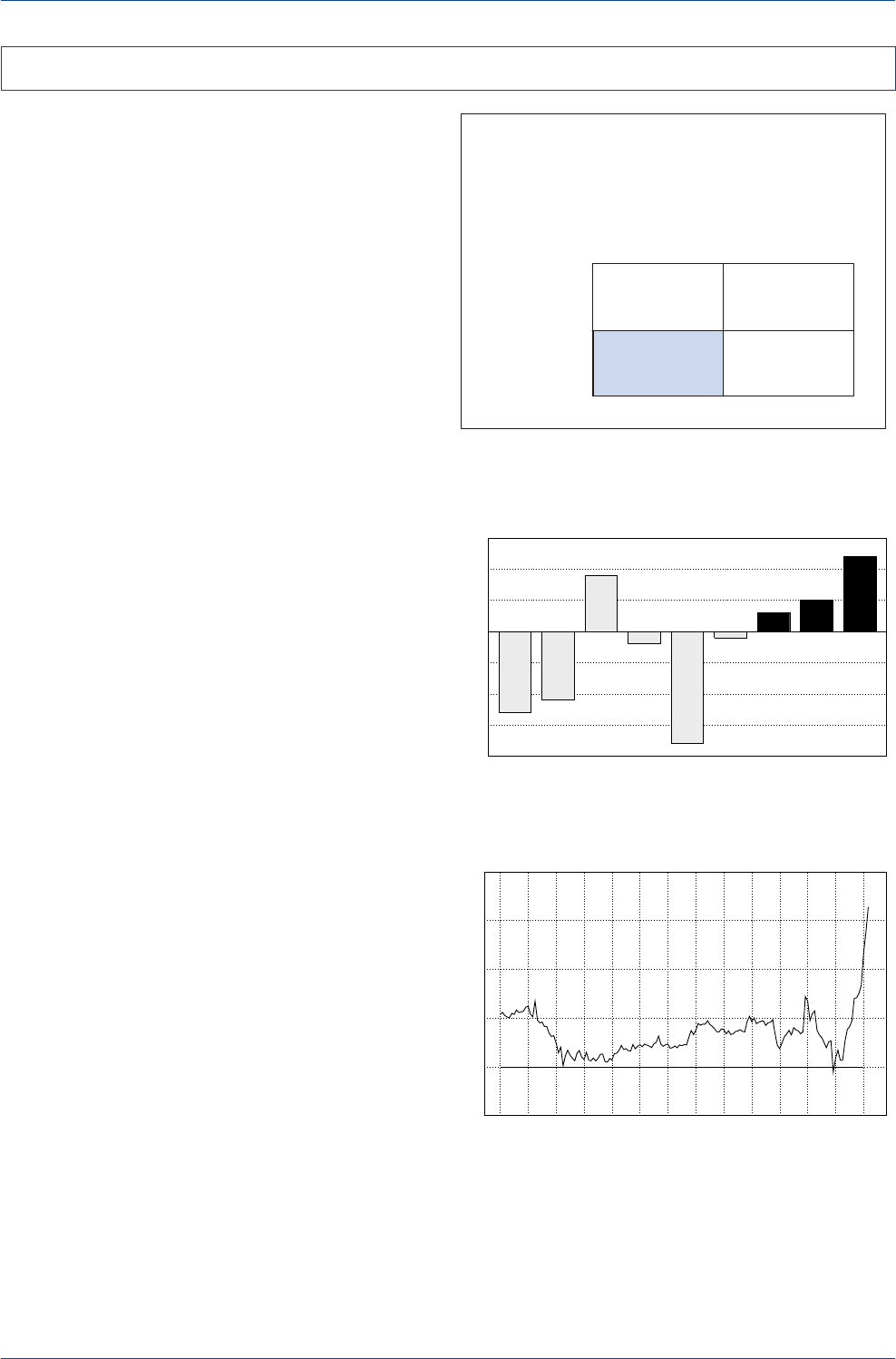

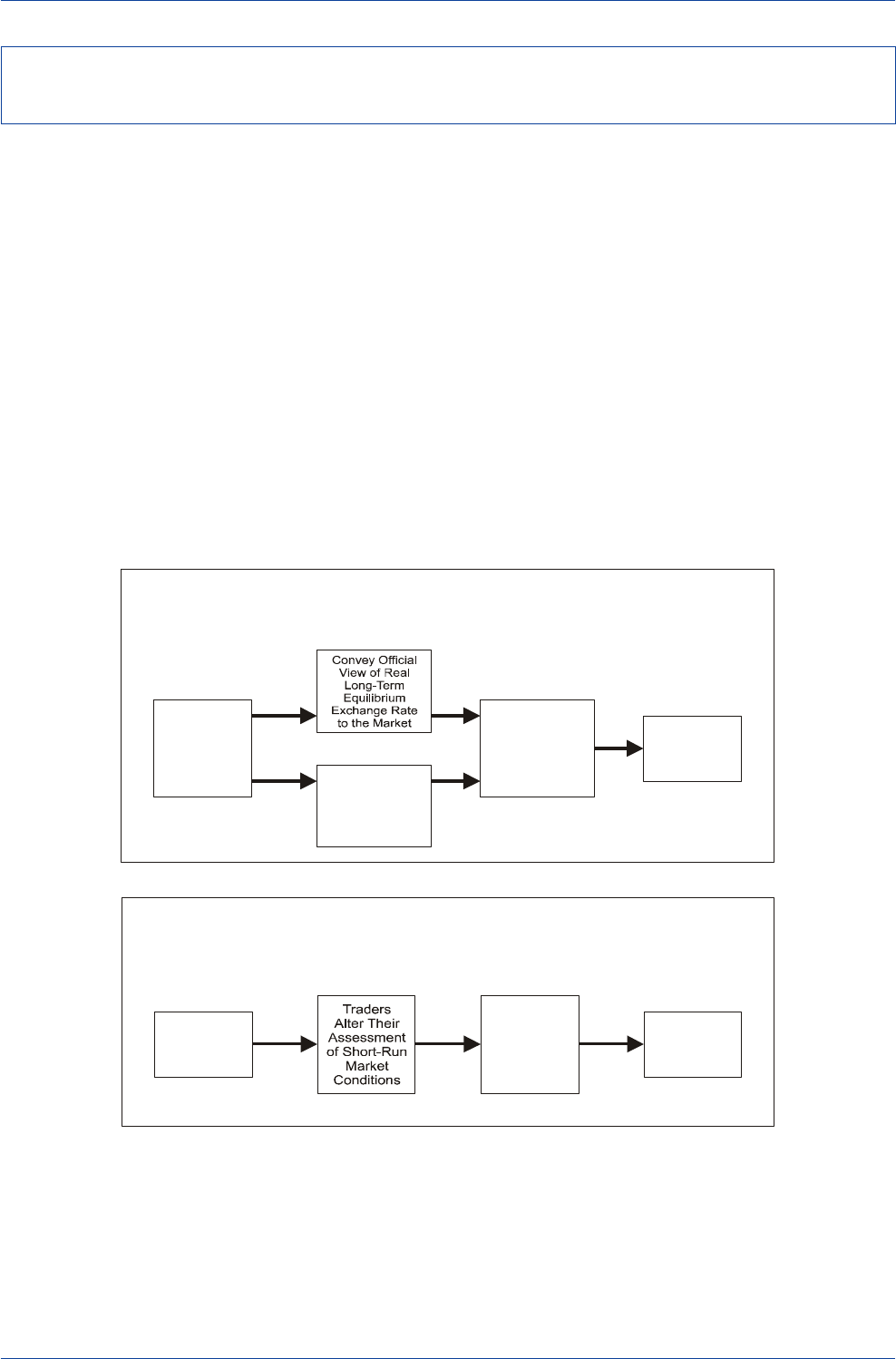

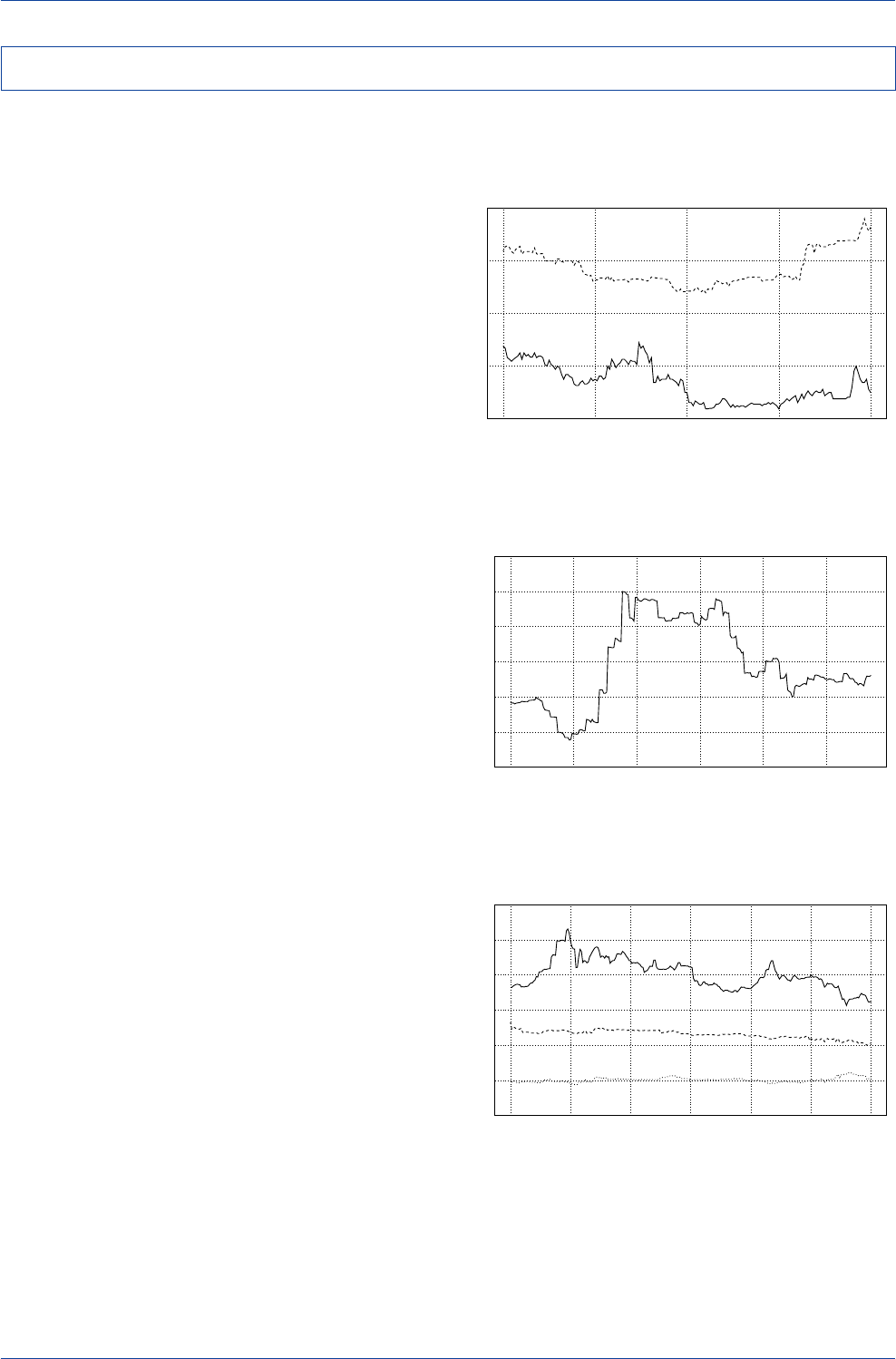

Fund managers have turned to sentiment and positioning

surveys in recent years as forecasting tools. In most cases,

exchange rates move in the same direction that sentiment

and positioning surveys are moving in the short run. For

example, when sentiment toward the dollar becomes in-

creasingly bullish—as reported in the weekly Consensus

Inc. Survey of Bullish Market Opinion—the dollar tends to

rise. Similarly, when long U.S. dollar speculative positions

are undertaken on the IMM (money-market futures ex-

change), the dollar tends to rise as well.

What does the empirical evidence say about the success

of sentiment/positioning surveys in predicting exchange-

rate movements? Our analysis, listed in the table below,

finds that changes in sentiment and positioning surveys

are statistically significant, for the most part, in explaining

contemporaneous changes in exchange rates, but that

lagged values of sentiment and positioning survey data

are statistically insignificant in predicting current changes

in exchange rates. This suggests that sentiment/position-

ing survey data cannot be relied upon as forecasting tools.

What does the empirical evidence say about the useful-

ness of sentiment/positioning survey data as contrarian

indicators? The trends in market sentiment and specula-

tive positioning could be viewed as potential overbought

or oversold indicators if the rise or fall in each of those

series appeared stretched relative to historical norms.

Unfortunately, the empirical evidence suggests that there

is no statistically significant relationship between over-

stretched sentiment and positioning surveys and subse-

quent changes in exchange rates. Based on these find-

ings, it could prove risky to adopt a contrarian position sim-

ply because investors' FX exposures appeared to be at

extreme levels. History is replete with examples where

over-stretched markets have stayed over-stretched for a

considerable time. Perhaps all that one can say is that if

one or more of those indicators moved into significantly

overbought or oversold territory, then the

odds

of a rever-

sal would have increased, but that it would not be pos-

sible to issue a definitive signal that an imminent reversal

was at hand.

Although trends in sentiment and positioning surveys may

not help us in forecasting future movements in exchange

rates, they may nevertheless be useful as trend confirma-

tion indicators. Because of the strong positive contempo-

raneous correlation between the sentiment and position-

ing data, on the one hand, and the trend in exchange rates

on the other, sentiment and positioning data could be used

in conjunction with a moving-average model to confirm

whether an exchange-rate uptrend or downtrend is intact.

Market Sentiment and the U.S. Dollar

(Consensus Inc. Index of Bullish Opinion)

(1998-1999)

90

92

94

96

98

100

102

30

40

50

60

70

80

90

Jan-98 Apr-98 Jul-98 Oct-98 Jan-99 Apr-99 Jul-99 Oct-99

US$ Index----

A

nalysts Bullish on the US$(4-Week Avg.)(%)____

Sources: Datastream;

Based on Consenus Inc. Index of Bullish Market Opinion

Market Sentiment and the U.S. Dollar

(Consensus Inc. Index of Bullish Opinion)

(April 2000-November 2001)

94

96

98

100

102

104

106

108

30

40

50

60

70

80

90

Apr-00 Jul-00 Oct-00 Jan-01 Apr-01 Jul-01 Oct-01

US$ Index----

A

nalysts Bullish on the US$(4-Week Avg.)(%)____

Based on Consenus Inc. Index of Bullish Market Opinion

By permission of Consensus, Inc., (1) (816) 373-3700,

Consensus, National Futures and Financial Weekly,

www.consensus-inc.com

Speculative Positioning and the U.S. Dollar

(IMM Derived Net Non-Commercial FX Positions)

(April 2000-November 2001)

94

96

98

100

102

104

106

108

-150

-100

-50

0

50

100

Apr-00 Jul-00 Oct-00 Jan-01 Apr-01 Jul-01 Oct-01

US$ Index----

S

um of Net Contracts vs. USD(000s)____

Assessing the Statistical Significance of

Sentiment/Positioning/Flow Variables as

Explanatory Variables of Exchange-Rate Movements

(January 15, 1999-November 2, 2001 Weekly Data)

Lagged

Contemporaneous One Period

Consensus Inc. Bullish Market Opinion (US$)

Regression Coefficient 0.12 0.09

(t-Statistic) (3.90) * (1.15)

IMM Net Non-Commercial FX Positions (US$)

Regression Coefficient 0.23 0.01

(t-Statistic) (5.65) * (0.24)

*Indicates a statistically significant value at the 95% confidence level.

By permission of Consensus Inc.

Are Sentiment and Positioning Indicators Useful in Predicting FX Movements?

Source: IMM, Datastream

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

22 Deutsche Bank Foreign Exchange Research

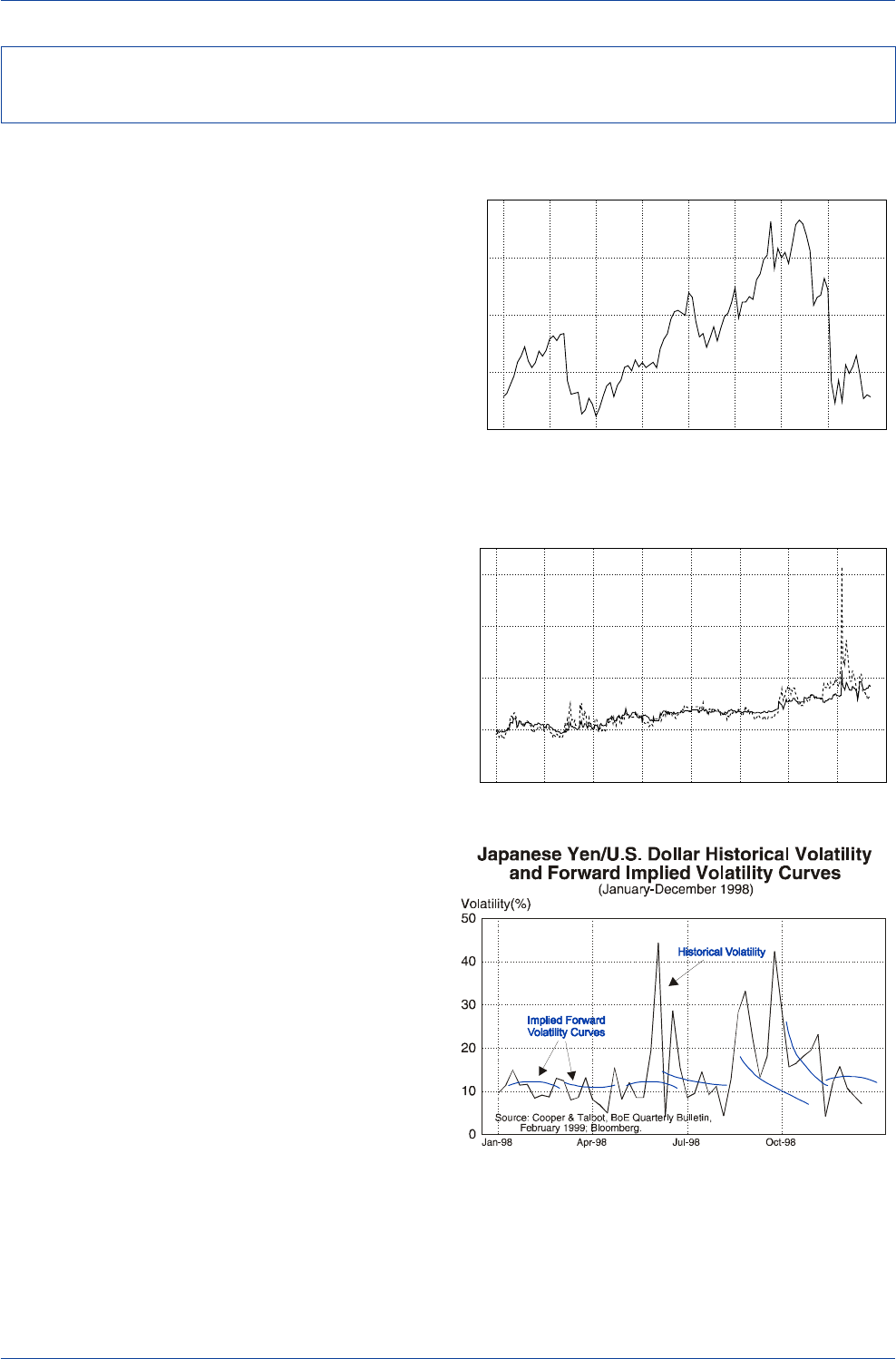

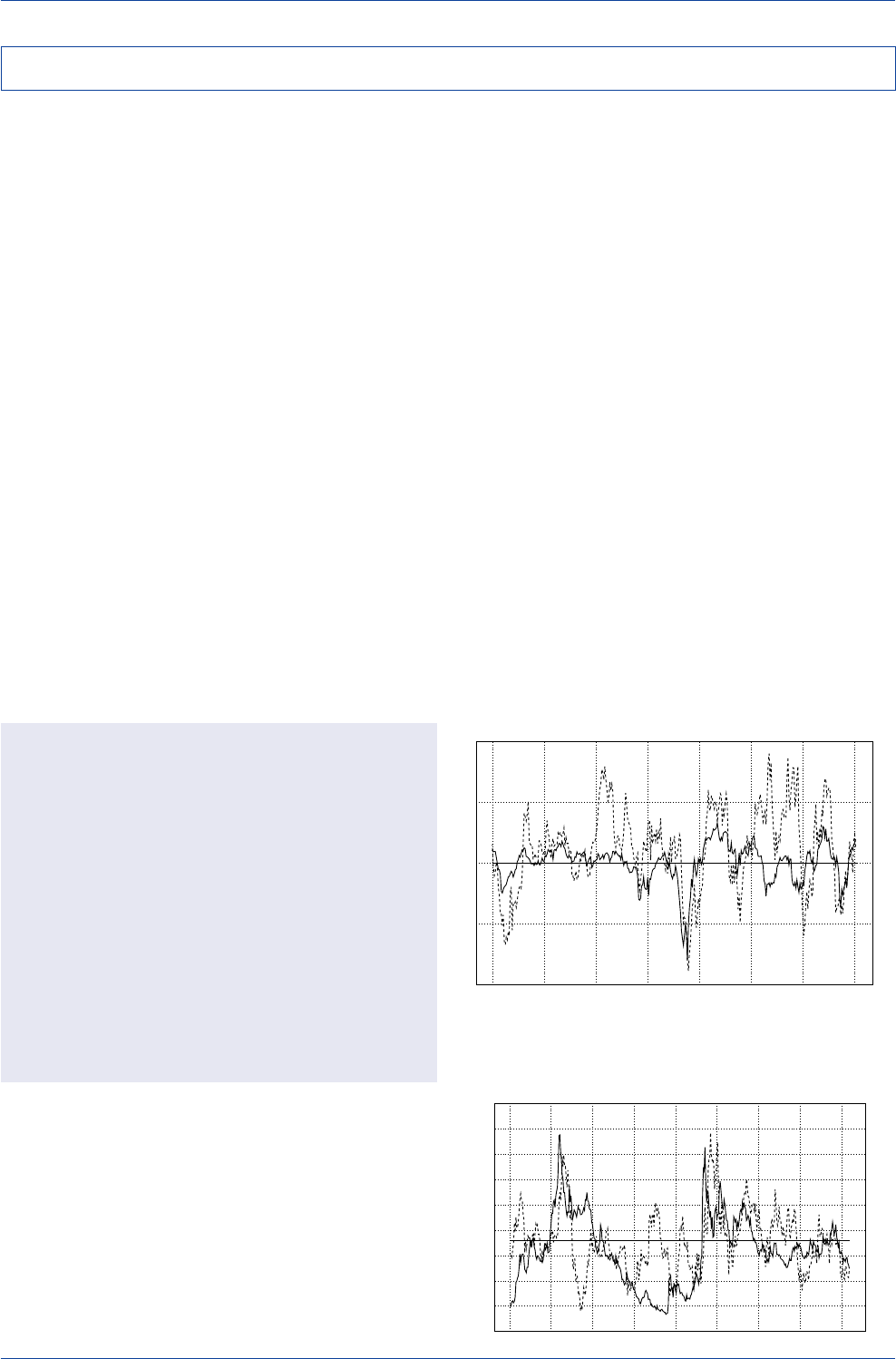

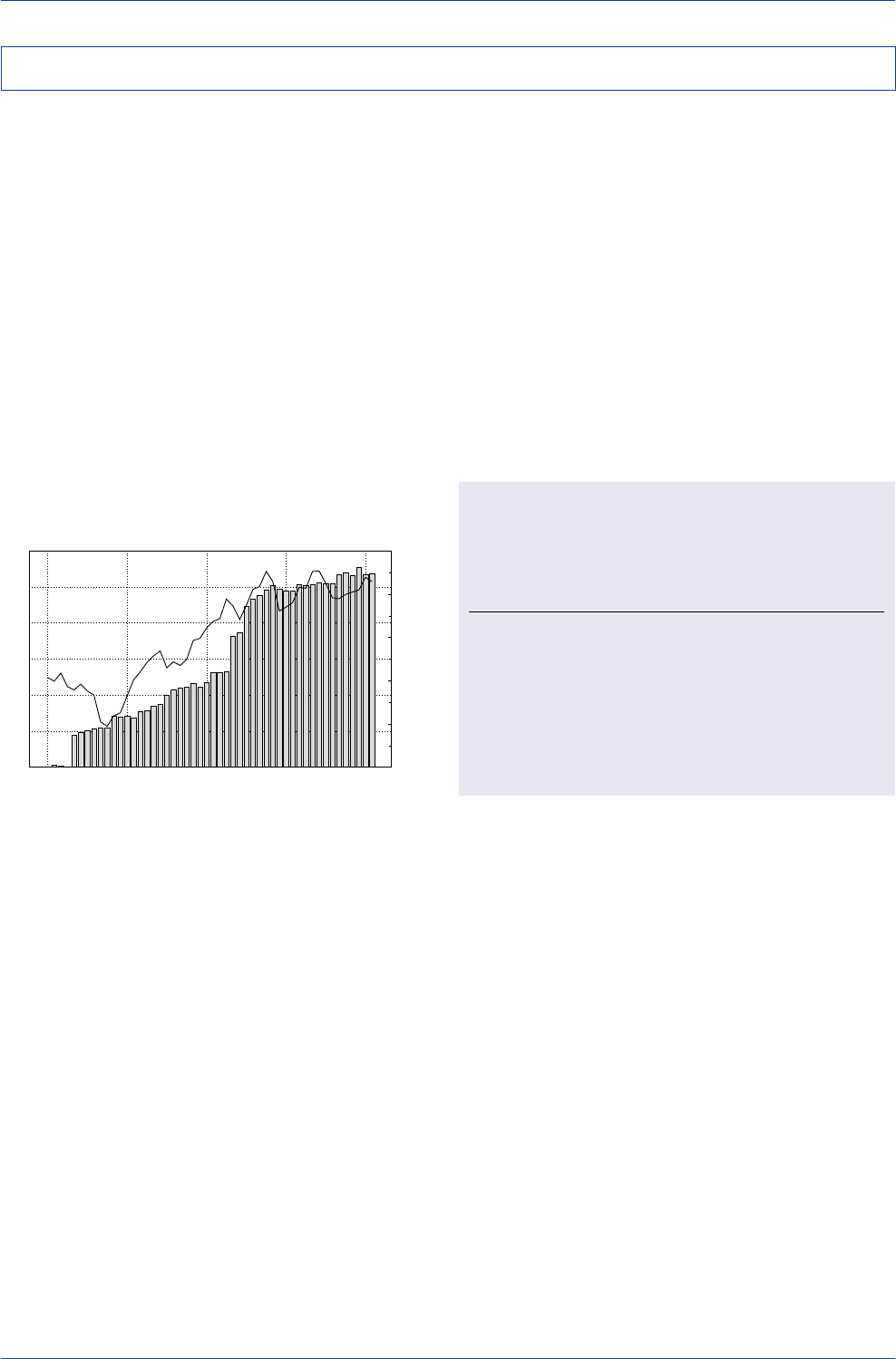

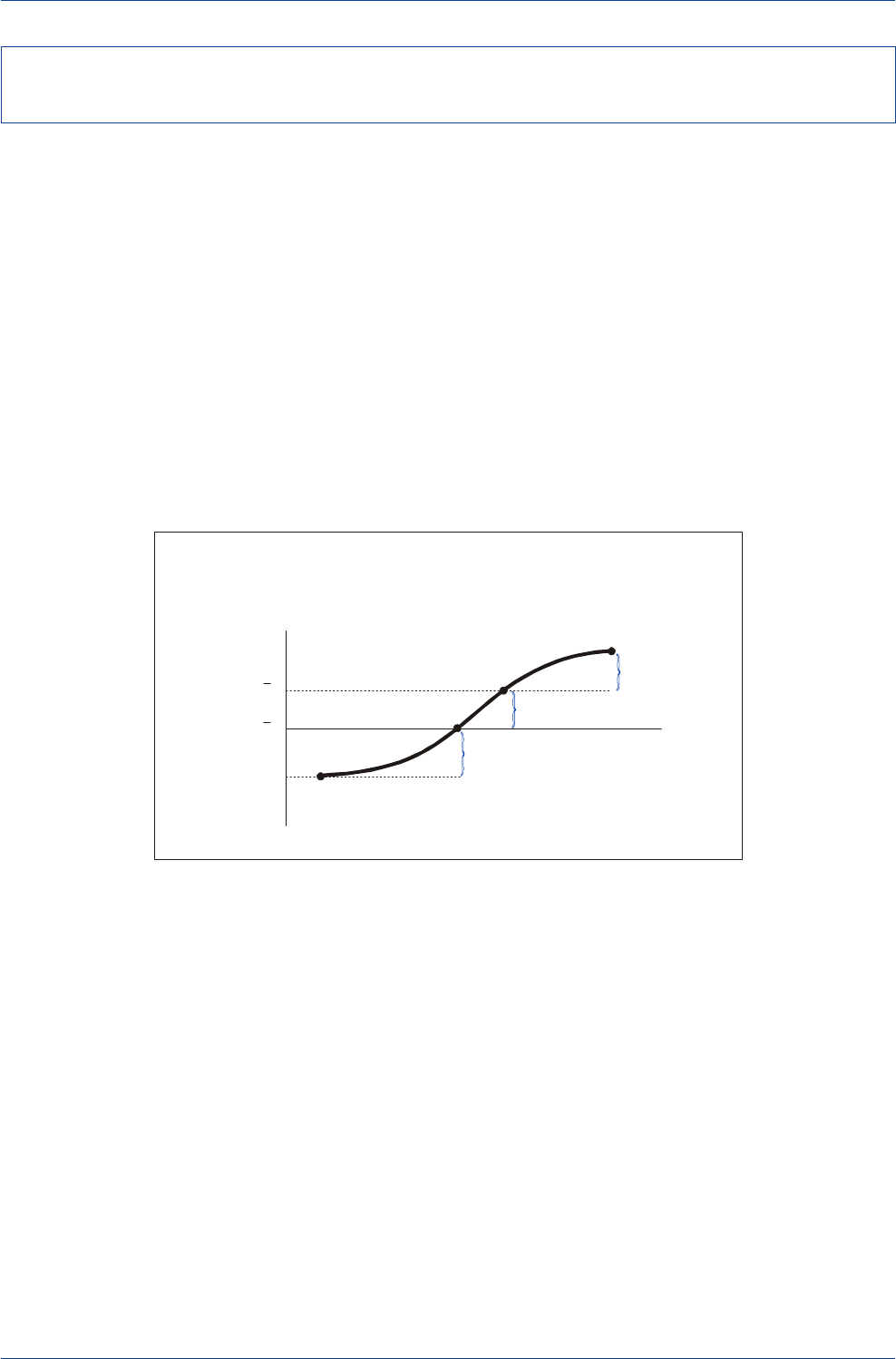

Investors often try to infer the market's expectation of fu-

ture interest-rate movements by examining interest-rate

futures contracts for various maturities or by examining

the implied future path in interest rates embedded in yield-

curve slopes. Similarly, investors often try to infer the

market's expectation of future exchange-rate movements

by examining the level of domestic/foreign interest-rate

spreads, or the implied path of long-dated forward ex-

change rates.

Information on future interest-rate and exchange-rate move-

ments can also be gleaned from the options market.

Whereas interest-rate futures, yield-curve slopes, and yield

spreads provide point estimates regarding expected fu-

ture values, the options market provides a different piece

of information—the market's expectation of the probabil-

ity distribution of future interest rates and exchange rates.

For example, in the FX market, data on implied volatility

for a range of maturities and strike prices are readily avail-

able. Implied volatility provides us with a measure of the

marketplace's uncertainty regarding future exchange-rate

movements. If implied volatility is rising, it "implies" greater

uncertainty about future exchange-rate movements, and

vice versa.

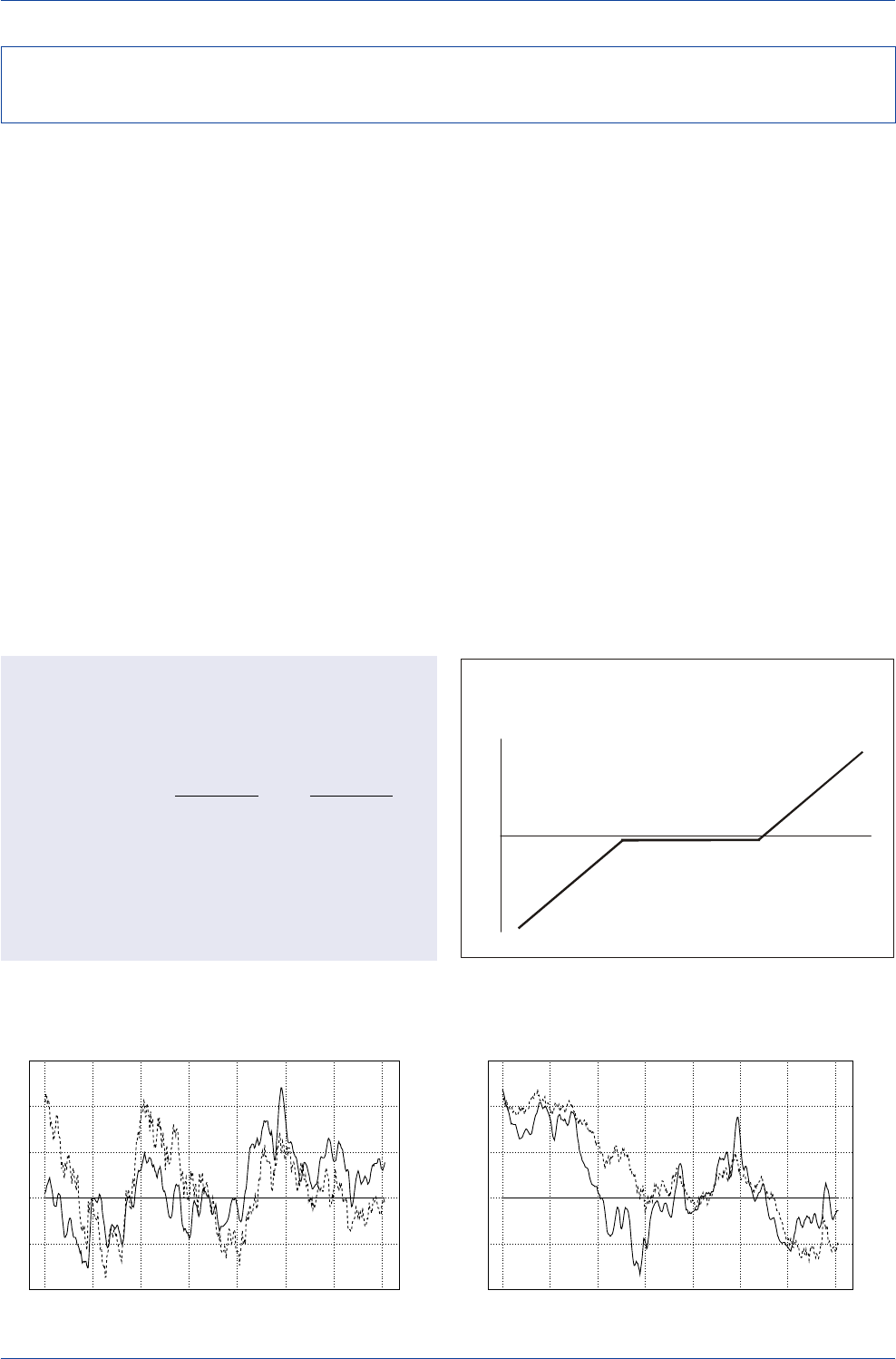

One could construct a forward implied volatility curve to

glean expected future volatility movements by stringing

together implied volatilities for a range of maturities with

the same strike price. If the forward implied volatility curve

were steeply upward sloping, the market would be pricing

in the expectation of a future jump in currency volatility. If

the forward implied volatility curve were flat, the market-

place would be pricing in no change in the level of cur-

rency volatility in the future.

Does the forward implied volatility curve accurately antici-

pate future jumps in exchange-rate volatility? Because vola-

tility jumps often occur suddenly and without warning, it

is highly unlikely that the forward implied volatility curve

would be able to consistently forecast future jumps in the

exchange rate. Indeed, the Bank of England examined

whether implied forward volatility curves anticipated the

unwinding of the infamous yen carry (long dollar/short yen)

trade in October 1998, and concluded that "Forward vola-

tility curves…. did not expect the increase in volatilities

(that occurred) in October 1998. Although (historical) vola-

tility had increased throughout the summer, the forward

volatility curve suggested that it would fall back towards

previous levels." Indeed, in mid-September 1998, histori-

cal volatility was running around 22%-26% and forward

volatility curves were expecting implied volatilities to ease

toward 14% in the October-November 1998 period. Instead,

historical volatility soared to over 40% in early October

when the yen carry trade was suddenly unwound.

Can One Extract Information from the Currency Options Market

to Predict Future Exchange-Rate Movements?

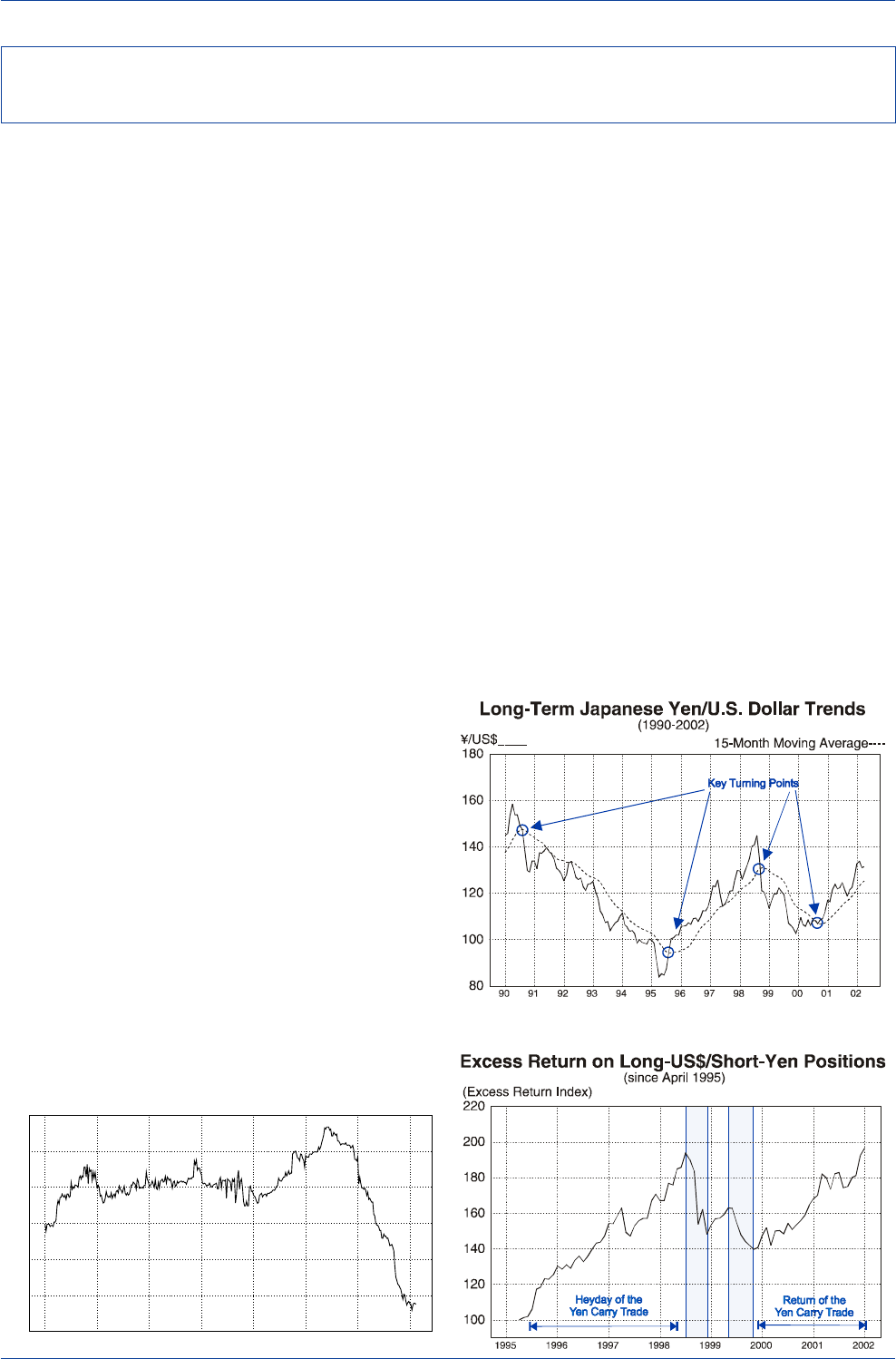

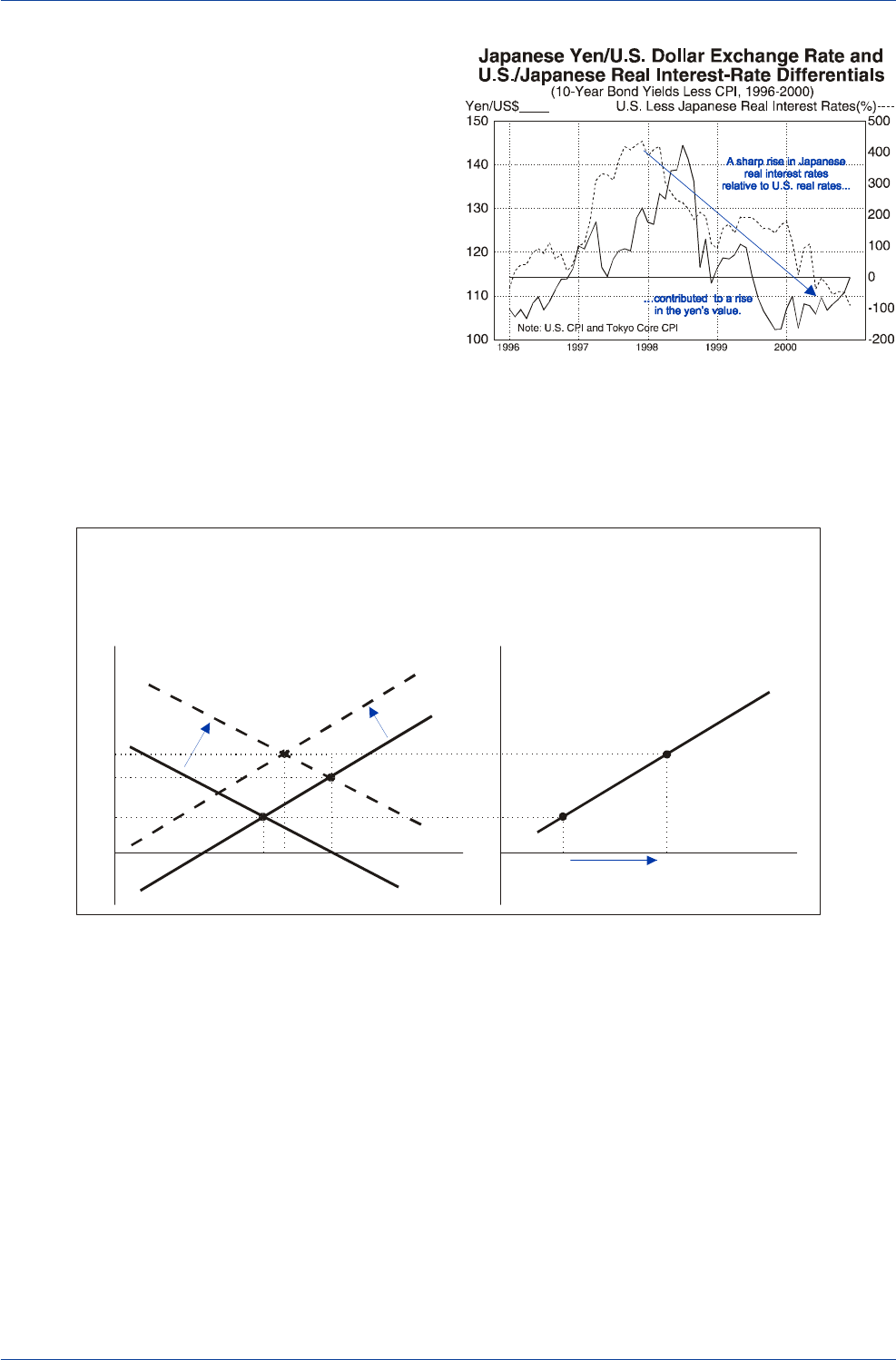

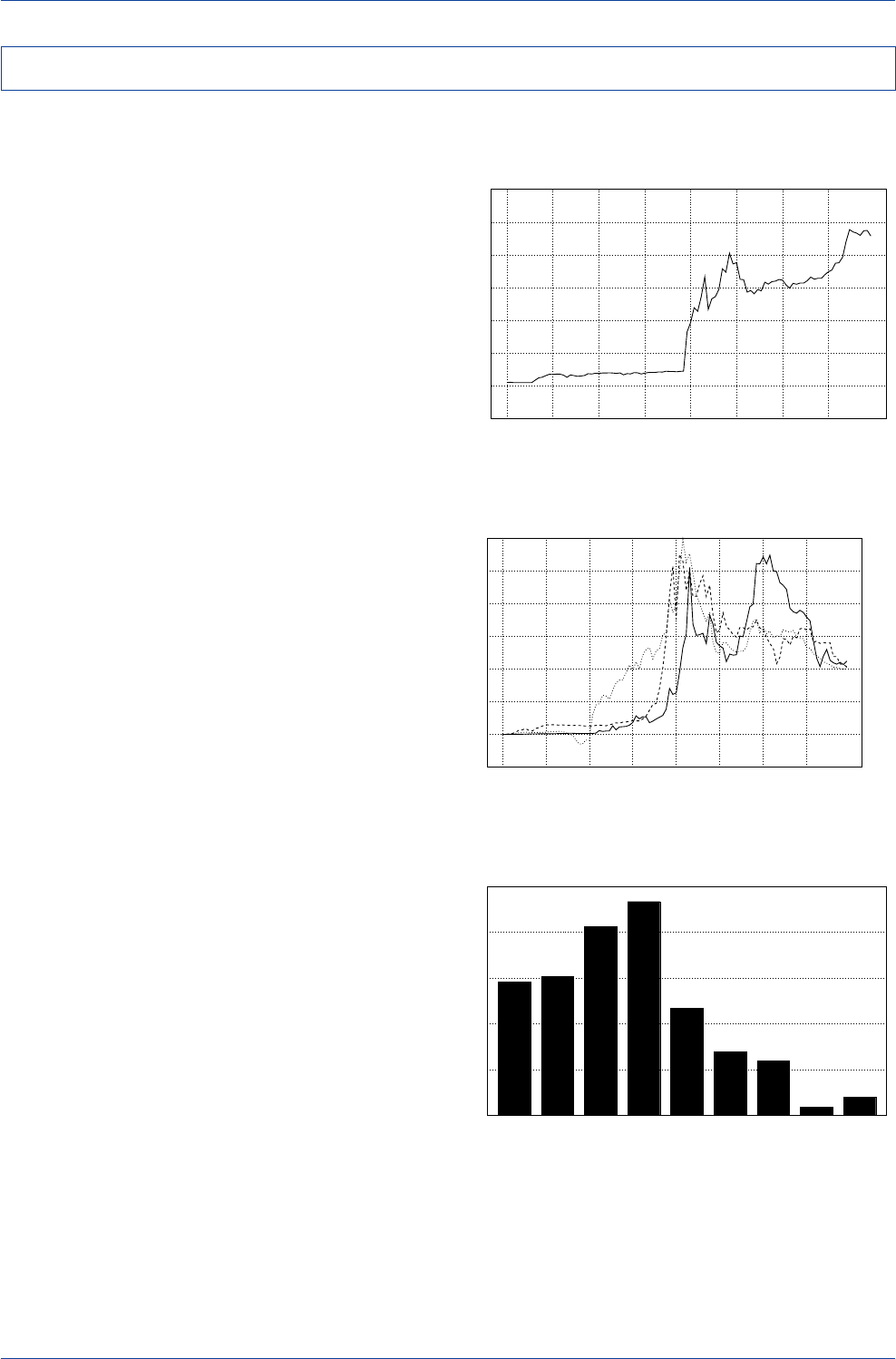

Japanese Yen/U.S. Dollar Exchange Rate

(1997-1998)

110

120

130

140

150

Jan-97 Apr-97 Jul-97 Oct-97 Jan-98 Apr-98 Jul-98 Oct-98

Yen/US$

Japanese Yen/U.S. Dollar Implied Volatility

(1997-1998)

0

10

20

30

40

Jan-97 Apr-97 Jul-97 Oct-97 Jan-98 Apr-98 Jul-98 Oct-98

1-Month Volatility----(%) 12-Month Volatility____

Source: Datastream

Source: DRI

DB Guide to Exchange-Rate Determination

May 2002 Deutsche Bank @

Deutsche Bank Foreign Exchange Research 23

Assessing the Statistical Significance of

Sentiment/Positioning/Flow Variables as

Explanatory Variables of Exchange-Rate Movements

(January 15, 1999-November 2, 2001 Weekly Data)

Lagged

Contemporaneous One Period

Option Market Sentiment (Euro Risk Reversals)

Regression Coefficient -0.02 0.03

(t-Statistic) (-0.90) (1.23)

Option Market Sentiment (Yen Risk Reversals)

Regression Coefficient 0.11 0.04

(t-Statistic) (3.06) * (1.19)

*Indicates a statistically significant value at the 95% confidence level.

Source: Datastream; DB

Euro Risk Reversals & US$/Euro Exchange Rate

Euro Calls(+)/Puts(-) Trading at Premium vs. USD

0.82

0.84

0.86

0.88

0.90

0.92

0.94

0.96

0.98

-1.0

-0.5

0.0

0.5

1.0

1.5

Jul-00 Oct-00 Jan-01 Apr-01 Jul-01 Oct-01 Jan-02 Apr-02

US$/Euro----

C

alls(+)/Puts(-) Trading at Premium____

Yen Risk Reversals & Yen/US$ Exchange Rate

Yen Calls(+)/Puts(-) Trading at Premium vs. USD

(140)

(135)

(130)

(125)

(120)

(115)

(110)

(105)

(100)

-2.0

-1.0

0.0

1.0

2.0

3.0

Jul-00 Oct-00 Jan-01 Apr-01 Jul-01 Oct-01 Jan-02 Apr-02

Yen/US$(reverse scale)----

C

alls(+)/Puts(-) Trading at Premium____

FX traders often use risk reversals to glean information on

whether the market might be attaching a higher probabil-

ity to a large currency appreciation than to a large currency

depreciation, or vice versa. A risk reversal is a currency

option position that consists of the purchase of an out-of-

the-money (25

delta

) call and the simultaneous sale of an

out-of-the-money (25

delta

) put, both in equal amounts and

both with the same expiration date. Risk reversals are

quoted in terms of the implied volatility spread between

the 25

delta

call and 25

delta

put. For example, if the im-

plied volatility on the call were 2% larger than the implied

volatility on the put, the risk reversal would be quoted at

+2.0%. If the implied volatility on the put were 2% greater

than the implied volatility on the call, the risk reversal would

be quoted at -2%.

A risk reversal quoted at +2% would indicate that the

market was attaching a higher probability to a large cur-

rency appreciation than to a large currency depreciation.

This would indicate that the market was willing to pay more

to insure against the risk that the currency will rise sharply

than it was willing to pay to insure against the risk that the

currency will fall sharply.

The key issue for traders and investors is whether the level

or trend in currency risk reversals can be used to correctly

anticipate future exchange-rate movements. The evidence

indicates a high contemporaneous correlation between the

trend in risk reversals and the trend in exchange rates, but

no statistically significant relationship exists between

lagged risk reversal data and future exchange-rate move-

ments. Therefore, risk reversals are capable of confirming

an exchange rate’s trend, but not predicting it.

Nor is there evidence that overly stretched risk reversal

measures can function as a consistently reliable contrary

indicator. Indeed, the Bank of England's study on the un-

winding of the yen carry trade in the fall of 1998 found that

dollar/yen risk reversals failed to provide an early warning

of the dramatic unwinding of long dollar/short yen posi-

tions that was about to occur.

Inferring Information about Future Exchange-Rate Movements

from Currency Risk Reversals

Yen/US$

Profit

Payoff Schedule of 25 Delta

Risk Reversal at Maturity

(-)

(+)

0

Source: Datastream; DB Source: Datastream; DB

DB Guide to Exchange-Rate Determination May 2002

Deutsche Bank @

24 Deutsche Bank Foreign Exchange Research