Funds Control Manual

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 190 [warning: Documents this large are best viewed by clicking the View PDF Link!]

U. S. Environmental Protection

Agency

Office of the Chief Financial Officer Policy

Manual

Funds Control Manual

Administrative Control of Funds

Effective Date: Upon issuance

Supersedes February 2008

Resource Management Directives System 2520

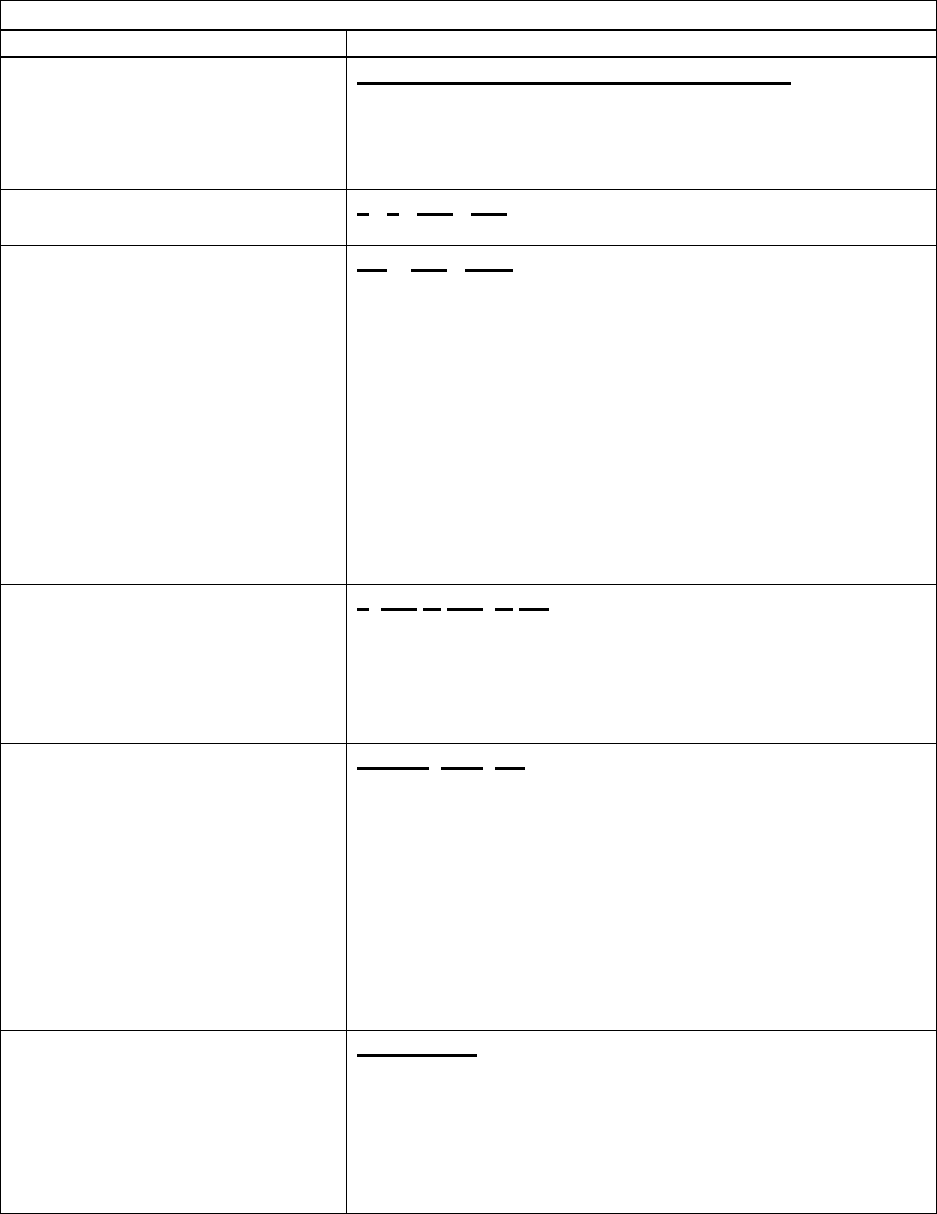

Contents

Introduction.................................................................................................................................. vi

How Organized ......................................................................................................................... vii

Mandatory Review .................................................................................................................... vii

Chapter 1: Federal Entities Influencing the EPA’s Financial Management........................ 1-1

Summary .................................................................................................................................. 1-1

A. Congress ............................................................................................................................ 1-1

B. Department of Commerce, National Institute of Standards and Technology (NIST)....... 1-2

C. General Services Administration (GSA)........................................................................... 1-2

D. Government Accountability Office (GAO) ...................................................................... 1-2

E. Office of Inspector General (OIG) .................................................................................... 1-3

F. Department of Justice (DOJ)............................................................................................. 1-3

G. Office of Management and Budget (OMB) ...................................................................... 1-3

H. Office of Personnel Management (OPM) ......................................................................... 1-4

I. Department of the Treasury .............................................................................................. 1-4

J. Cross-Government Task Forces and Coordinating Groups .............................................. 1-4

K. States, Tribes and Territories ............................................................................................ 1-5

Chapter 2: Federal Laws, Regulations and Guidance............................................................ 2-1

Summary .................................................................................................................................. 2-1

A. Environmental Authorizing Statutes ................................................................................. 2-1

B. Appropriation Statutes ...................................................................................................... 2-9

C. Government-Wide Management and Administrative Statutes ......................................... 2-9

D. Government-Wide Guidance and Regulations................................................................ 2-15

Chapter 3: Federal and EPA Budget and Financial Terms................................................... 3-1

Summary .................................................................................................................................. 3-1

A. Federal Spending Terms ................................................................................................... 3-1

B. EPA Budget Management Terms...................................................................................... 3-2

Additional Information and Training ....................................................................................... 3-4

Chapter 4: The EPA’s Financial and Associated Systems ..................................................... 4-1

Summary .................................................................................................................................. 4-1

A. Automated Standard Application for Payments (ASAP) .................................................. 4-1

B. Budget Automation System (BAS) ................................................................................... 4-1

C. Compass ............................................................................................................................ 4-1

D. Concur ............................................................................................................................... 4-2

E. Contracts Payment System (CPS) ..................................................................................... 4-2

F. Department of Interior, Interior Business Center (IBC) ................................................... 4-2

G. EPA’s Acquisition System (EAS)..................................................................................... 4-2

H. Grant Payment Allocation System (GPAS) ...................................................................... 4-2

I. Integrated Grants Management System (IGMS)............................................................... 4-3

J. Intergovernmental Payment and Collections (IPAC) System........................................... 4-3

K. Office of Management and Budget (OMB) MAX ............................................................ 4-3

L. PeoplePlus ......................................................................................................................... 4-3

M. Superfund Enterprise Management System (SEMS) ........................................................ 4-3

Chapter 5: Sources of Funding for the EPA and Associated Processes................................ 5-1

Summary .................................................................................................................................. 5-1

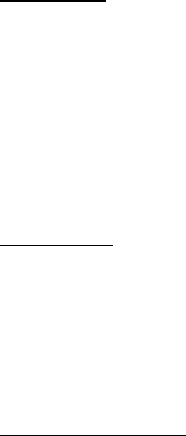

A. Annual Federal Budget Process ........................................................................................ 5-2

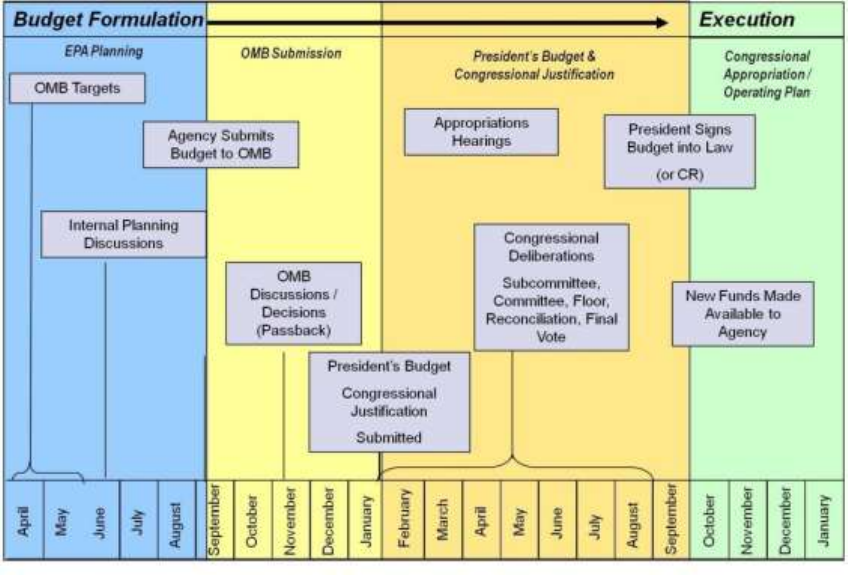

B. Budget Execution Process — Operating Plan Guidance and Allowance Management . 5-11

C. Supplemental Appropriations/Natural Disasters............................................................. 5-21

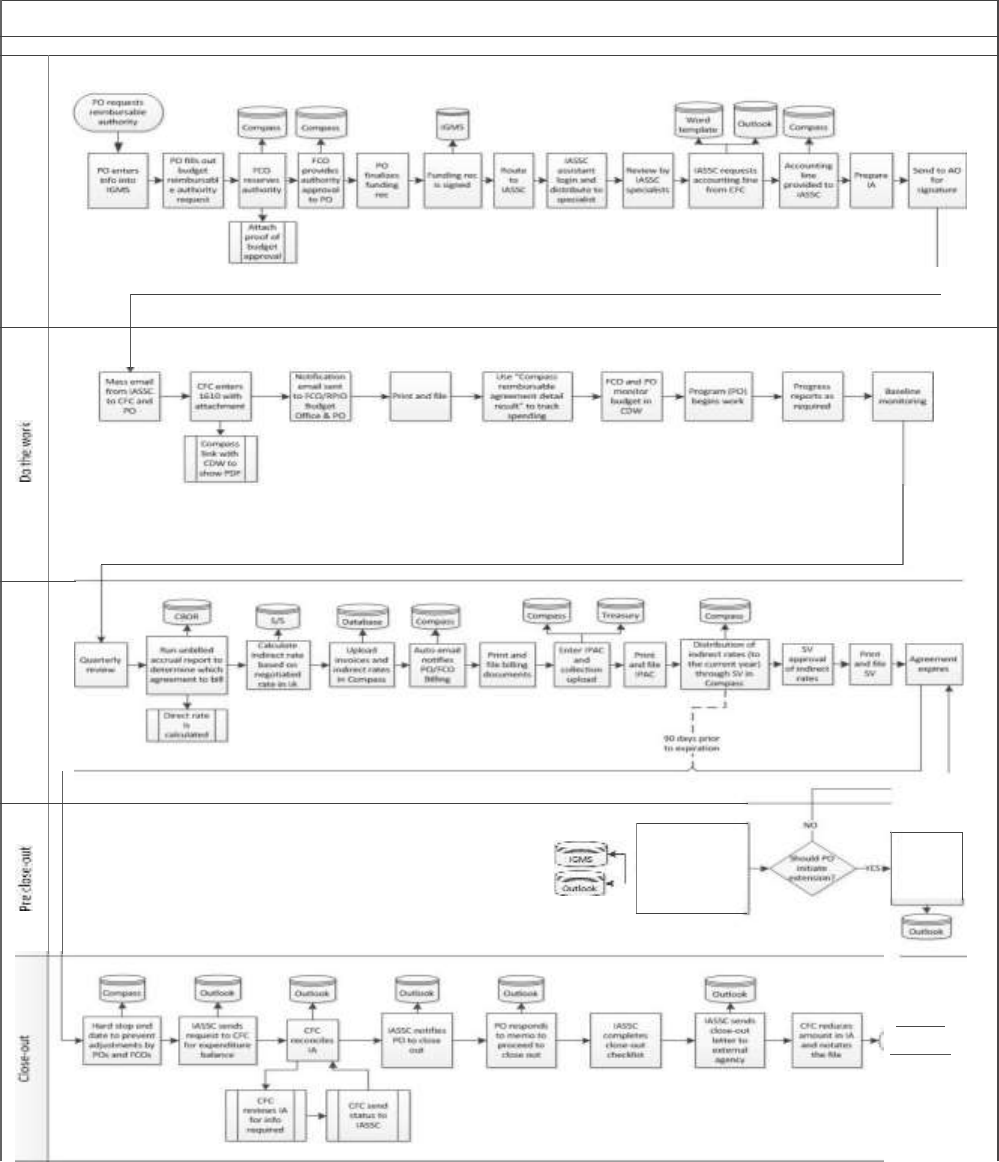

D. Reimbursable Allowances and Interagency Agreements................................................ 5-24

E. Intergovernmental Agreements (Agreements with Other Government Entities) ........... 5-27

F. Fees and Fee Programs.................................................................................................... 5-29

G. Special Accounts ............................................................................................................. 5-30

Additional Information........................................................................................................... 5-32

Chapter 6: EPA’s Budget and Financial Organization and Structure ................................. 6-1

Summary .................................................................................................................................. 6-1

A. Account Code Structure .................................................................................................... 6-2

B. Appropriation Number (Treasury Account Symbol) ...................................................... 6-13

C. Object Classes ................................................................................................................. 6-13

D. EPA Appropriations ........................................................................................................ 6-14

E. EPA Appropriation Accounts ......................................................................................... 6-14

F. Accounting ...................................................................................................................... 6-19

G. Payroll Management and Tracking/PeoplePlus .............................................................. 6-20

Chapter 7: Budget Execution Rules and Guidance ................................................................ 7-1

Summary .................................................................................................................................. 7-1

Overview of Major Spending and Charging Guidelines and Rules ......................................... 7-1

A. Purpose, Time and Amount Explanations: Appropriation Law Concepts ........................ 7-2

B. Tracking and Managing Funds ....................................................................................... 7-13

Chapter 8: Roles and Responsibilities...................................................................................... 8-1

Summary ................................................................................................................................. 8-1

More Detailed Discussion of EPA Responsible Officials Roles and Responsibilities ............ 8-2

A. SROs ................................................................................................................................. 8-2

B. AAs, National Program Managers (NPMs), and Responsible Planning and Implementation

Offices (RPIOs)................................................................................................................. 8-3

C. RAs.................................................................................................................................... 8-4

D. SBOs ................................................................................................................................. 8-4

E. Regional Comptrollers ...................................................................................................... 8-5

F. Regional Budget Officers (RBOs) .................................................................................... 8-6

G. Allowance Holders............................................................................................................ 8-7

H. FCOs ................................................................................................................................. 8-7

I. Originators ........................................................................................................................ 8-8

J. Approving Officials .......................................................................................................... 8-8

K. Obligating Officials........................................................................................................... 8-9

L. Finance Center Directors................................................................................................. 8-10

M. EPA Acquisitions (Contracts) Management ................................................................... 8-11

N. Grants Management: Roles and Responsibilities of EPA Officials................................ 8-13

O. Interagency Agreements: Roles and Responsibilities ..................................................... 8-14

P. Accounts Payable Certifying Officers and Disbursing Officers ..................................... 8-14

Q. OCFO .............................................................................................................................. 8-15

R. Office of General Counsel .............................................................................................. 8-19

Chapter 9: Analysis and Controls ............................................................................................ 9-1

Summary .................................................................................................................................. 9-1

A. Risk Management and Internal and Management Controls/A-123 Reviews .................... 9-1

B. Workload Analysis............................................................................................................ 9-1

Appendix A: Fund Control Relationships at the EPA .......................................................... A-1

Appendix B: Designation of Funds Control Officer Letter .................................................. B-1

Appendix C: A-123 Process Flow ............................................................................................ C-1

Appendix D: List of Key Internal Controls ............................................................................ D-1

Appendix E: Management Integrity Milestones .................................................................... E-1

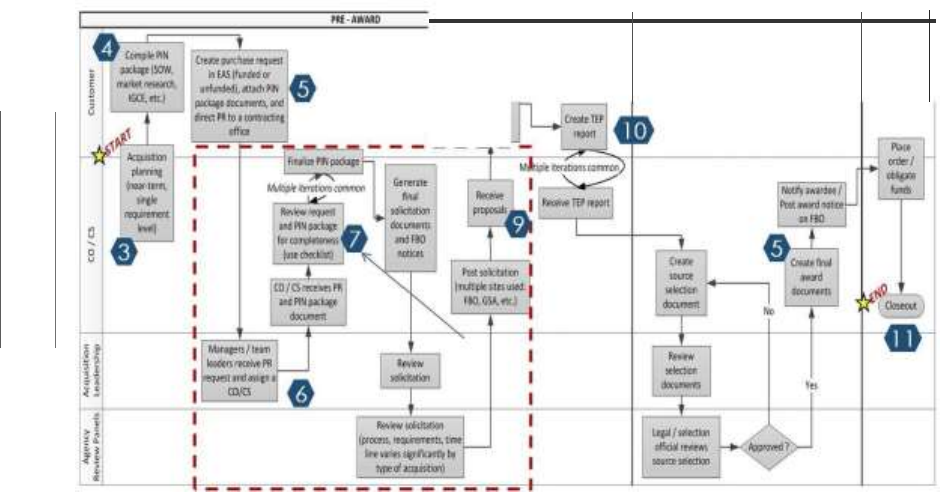

Appendix F: Acquisitions (Procurement) Process ..................................................................F-1

Appendix G: Finance Center Listing ...................................................................................... G-1

Appendix H: Abbreviations and Terms and Definitions ...................................................... H-1

Appendix I: Index of Major Revisions/New Material ............................................................ I-1

Introduction

The U.S. Environmental Protection Agency’s (EPA’s) Funds Control Manual is intended as a

guide on how EPA employees can effectively and efficiently manage funds while following

applicable rules, statutes and regulations. The manual summarizes the EPA’s fund control

principles, policies and procedures and describes their legal basis. These provisions apply to all

of the EPA’s organizations, appropriations and funds.

The control of funds in the federal government is governed by statutes and implemented by

directives from the Office of Management and Budget (OMB), the U.S. Department of Treasury,

and Congress and informed by opinions and accounting standards issued by the Government

Accountability Office (GAO). Although this document is primarily targeted toward the EPA’s

allowance holders and Funds Control Officers, it is a useful reference for all members of the

resource management community. Effective and efficient resource management is everyone's

responsibility.

Per 31 U.S.C. 1514, the head of each agency must prescribe a system for administrative control

of funds. OMB Circular A-11, Part 4, “Instructions on Budget Execution,” provides government-

wide guidance on how to execute the budget and a checklist to use in preparing funds control

regulation for approval by the OMB. This Funds Control Manual explains the policies and

procedures the EPA has in place to ensure that it does not violate legal requirements or OMB

directives. The complexity of the EPA’s mission, the differences between some of its authorizing

statutes and the diversity of its programs means the agency had to carefully design policies and

procedures to track, report on and properly ensure control of the agency’s funds throughout

headquarters offices, regional offices, and laboratories and other offices.

This manual also implements OMB Circular A-123, “Management’s Responsibilities for Internal

Controls,” which provides guidance on using the range of tools at the disposal of agency

managers to achieve desired program results and meet the requirements of the Federal Managers’

Financial Integrity Act of 1982 (FMFIA) which encompasses accounting and administrative

controls; including program, operational, and administrative areas as well as accounting and

financial management.

Management has a fundamental responsibility to develop and maintain effective internal

controls. The proper stewardship of federal resources is an essential responsibility of agency

managers and staff. Federal employees must ensure that federal resources are used efficiently

and effectively to achieve authorized objectives. Programs must operate and resources must be

used consistent with the agency mission; in compliance with laws and regulations; and with

minimal potential for waste, fraud, and mismanagement.

An overview of the FMFIA and OMB Circular A-123, as well as key Office of the Chief

Financial Officer (OCFO) annual guidance memorandums can be found at

http://intranet.epa.gov/ocfo/management_integrity/index.htm.

Congress provides funds for the agency to carry out its mission through specific appropriations,

each one of which is provided for a particular purpose, time and amount. These three

characteristics are regulated through guidelines and restrictions such as the Necessary Expense

Rule (purpose), the Bona Fide Needs Statute (time), and the prohibition on augmentation of

appropriations (amount). The Anti-Deficiency Act (ADA) prohibits (1) spending in excess of an

amount available in an appropriation, (2) authorizing expenditures in advance of an

appropriation, (3) accepting voluntary services without authority, and (4) spending in excess or

in advance of an apportionment. In addition, the EPA also receives funds through other sources

such as Interagency Agreements, fees and special accounts that it also must manage under

similar rules.

This Funds Control Manual:

• Prescribes a system for positive administrative control of funds designed to restrict

obligations and expenditures against each appropriation or fund account to the amount

available therein. Obligations and expenditures from each appropriation or fund account are

limited to the lesser of the amount of apportionments made by OMB or the amount available

for obligation and/or expenditure in the appropriation or fund account.

• Describes procedures to follow in budget execution and specifies basic fund control

principles and concepts. Establishes policy regarding the administrative control of funds.

• Enables the Administrator to determine responsibility for over-obligation and over-

disbursement of appropriations, apportionments, statutory limitations, allotments and other

administrative subdivisions, as well as violations of limitations imposed by agency policy.

• Provides procedures for addressing violations of the ADA as well as violations of limitations

imposed by agency policy.

• Discusses agency administrative control of funds policies that apply to revolving funds,

management funds and trust funds, including those that are not apportioned.

Supplemental guidance regarding the financial management of selected areas, such as travel, and

unique appropriations, such as those derived from the Superfund and Leaking Underground

Storage Tank Trust Funds, can be found in other sections of the RMDS 2500 series. The entire

series, as well as all other OCFO policy documentation, can be accessed online at

http://intranet.epa.gov/ocfo/policies/policies.htm.

How Organized

The Funds Control Manual is divided into chapters, each one of which includes basic information

about a topic area. Each chapter begins with a summary of overall principles in that area,

followed by more detailed explanations on particular topics that include links to additional

information. There is one partial exception: detailed instructions on managing funds at each stage

of the federal funding process are contained in the section on annual appropriations in chapter 5,

since annual appropriations are EPA’s largest source of funds. Please refer to this section for

requirements and processes at each funding stage (such as apportionments).

Mandatory Review

This 2015 version has been updated to reflect the EPA’s Compass financial system

implementation; OMB’s A-11 and A-123; workload review; new conference management

requirements; GAO and Inspector General recommendations; audit findings; and statutory,

process, procedural, and policy changes. This policy will be reviewed and revised as warranted

by new federal laws, regulations, applicable Federal Accounting Standards Advisory Board

requirements or agency policy, with a complete review planned within three years from its date

of issuance.

This document, the EPA’s Funds Control Manual (Resources Management Directives System,

Chapter 2520), is issued as interim guidance until the EPA receives final OMB approval.

Chapter 1: Federal Entities Influencing the EPA’s Financial Management

Summary

Several outside entities play a crucial role in the EPA’s management of funds and in reviewing

the EPA’s requests for funding. Major EPA stakeholders include:

• Congress

• Office of Management and Budget

• Government Accountability Office

• Inspector General

• Department of Justice

• Department of the Treasury

• States and tribes

Provided below are detailed descriptions of these entities and the roles they play.

A. Congress

The EPA may only obligate and spend funds that have been appropriated by Congress. Both the

House and Senate have two major sets of committees and subcommittees that direct the EPA:

1. Congressional Committees

Congress manages its decision-making through many committees and subcommittees.

Congress generally has three types of committees: oversight, authorizing and

appropriating committees. Each fiscal year’s annual budget normally contains specific

direction and requirements from these subcommittees, as do supplemental budgets.

a. Authorizing Committees write the principal statutes or laws that direct government

agencies. Authorizing committees review and propose statutory language.

• Authorizers write the authorizing language for the EPA’s environmental

activities.

b. Appropriating Committees review annual and supplemental budget proposals. Three

main appropriating subcommittees oversee EPA programs: Environment and Public

Works (in the Senate); Energy and Commerce (in the House); and Interior,

Environment, and Related Agencies (in the House).

• Appropriators write specific appropriation bills. The EPA’s budgets are developed

in the Department of Interior (DOI) subcommittee.

http://appropriations.house.gov/ http://www.appropriations.senate.gov/

• Each fiscal year, the EPA generally has hearings with each appropriating

committee and must respond to detailed questions from each committee (called

Questions for the Record).

c. Oversight Committees can be permanent or special temporary committees. They

oversee certain, delineated topic areas, such as government operations. EPA officials

are occasionally required to testify about agency programs.

2. Congressional Budget Office (CBO)

The CBO produces independent analyses of budgetary and economic issues to support

the Congressional budget process. CBO economists and policy analysts conduct analyses

supporting dozens of reports and hundreds of cost estimates each year. The CBO does not

make policy recommendations, and each report and cost estimate discloses an agency’s

assumptions and methodologies. All of the CBO’s products, apart from informal cost

estimates for legislation being developed privately by members of Congress or their

staffs, are available to the Congress and the public on the CBO’s website.

The EPA’s annual budgets are submitted directly to Congressional appropriators as part

of the President’s budget and are not subject to review by the CBO. However, the EPA

policy and budget proposals may be analyzed and scored (through a CBO estimate of

budget implications). Further information can be found at http://www.CBO.gov.

B. Department of Commerce, National Institute of Standards and Technology (NIST)

NIST is one of the nation’s oldest physical science laboratories, where science connects to

real-world applications. With a varied research portfolio, unique facilities, national networks

and international partnerships on standards and technology, NIST works to support U.S.

industry and innovation. From cybersecurity to mammograms and advanced manufacturing,

innumerable technologies, services and products rely upon NIST expertise, measurement and

standards. The EPA must follow NIST direction in cyber-security. NIST has a century-long

tradition of partnering with business, universities, and other government agencies to support

the nation’s vast innovation ecosystem. http://www.commerce.gov/national-institute-

standards-and-technology

C. General Services Administration (GSA)

The GSA oversees the business of the U.S. federal government, travel, buildings and

facilities, procurement, etc. Its acquisition solutions supply federal purchasers with cost-

effective high-quality products and services from commercial vendors. The GSA provides

workplaces for federal employees, and oversees the preservation of historic federal

properties. Its policies covering travel, property and management practices promote efficient

government and consistent operations. http://www.gsa.gov. These policies include the

Federal Acquisitions Regulation, the Federal Management Regulation (successor to the

Federal Property Management Regulation) and the Federal Travel Regulation.

D. Government Accountability Office (GAO)

The GAO audits EPA activities and writes guides for federal agencies on the appropriate use

of funds. The GAO is a congressional agency that investigates how the federal government

spends taxpayer dollars, as well as making recommendations to improve performance and

ensure the accountability of the federal government. The GAO conducts reviews at the

request of congressional committees or subcommittees. Its reviews include:

• Auditing agency operations to determine whether federal funds are being spent efficiently

and effectively.

• Investigating allegations of illegal and improper activities.

• Reporting on how well government programs and policies are meeting their objectives.

• Performing policy analyses and outlining options for Congressional consideration.

• Issuing legal decisions and opinions, such as bid protest rulings and reports on agency

rules.

• Advising Congress and the heads of executive agencies about ways to make government

more efficient, effective, ethical, equitable and responsive.

The GAO issues reports for which the EPA must provide information and responses. The

OCFO’s Office of Budget includes a GAO coordination team that helps the GAO set up its

investigation and find the information it seeks; the team also coordinates the official EPA

responses to GAO recommendations. In addition, each Region and Program Office has a

GAO liaison to coordinate GAO work within it. More information can be found at

http://www.gao.gov/.

E. Office of Inspector General (OIG)

The OIG is an independent office within the EPA that helps the agency protect the

environment more efficiently and cost-effectively. It was created and governed by the

Inspector General Act of 1978, as amended (5 U.S.C. App. 3). The OIG seeks to influence

resolution of the agency’s major management challenges, reduce risk, improve practices and

program operations, and save taxpayer dollars, leading to positive human health and

environmental impacts and attainment of the EPA’s strategic goals. The OIG performs

audits, evaluations and investigations of the EPA, as well as its grantees and contractors, to

promote economy and efficiency, and to prevent and detect fraud, waste and abuse.

http://intranet.epa.gov/oig/

F. Department of Justice (DOJ)

The EPA will occasionally seek advice related to fiscal law from the DOJ’s Office of Legal

Counsel. Where the GAO’s advice differs from the DOJ’s, as an Executive Branch agency,

the EPA follows DOJ’s counsel. More information is at http://www.justice.gov/olc.

• Another part of the DOJ also prosecutes many civil and criminal environmental cases for

the EPA, primarily the Environment and Natural Resources Division.

http://www.justice.gov/enrd/

G. Office of Management and Budget (OMB)

Manages the U.S. federal budget, including budget planning, developing regulations,

management and IT guidance. The OMB implements policies across the Executive Branch. It

carries out its mission through five critical processes that help the President’s planning for

and implementation of priorities across the Executive Branch:

• Budget Development and Execution — the mechanism by which a President implements

decisions, policies, priorities and actions.

• Management — oversight of agency performance, federal procurement, financial

management and information/IT (including paperwork reduction, privacy, and security).

• Coordination and Review of All Significant Federal Regulations by executive agencies,

to reflect Presidential priorities and to ensure that economic and other impacts are

assessed as part of regulatory decision-making, along with review and assessment of

information collection requests.

• Legislative Clearance and Coordination — review and clearance of all agency

communications with Congress, including testimony and draft bills to ensure consistency

of agency legislative views and proposals with Presidential policy.

• Executive Orders and Presidential Memoranda to agency heads and officials, the

mechanisms by which the President directs specific government-wide actions by

Executive Branch officials.

The EPA works extensively with the OMB in all of these areas. The OMB’s website

(http://www.whitehouse.gov/omb) provides further information as well as links to extensive

U.S. government, economic, demographic and other historical data.

H. Office of Personnel Management (OPM)

The OPM works in several broad categories to recruit, retain and honor a world-class

workforce for the American people. It manages federal job announcement postings at

USAJOBS.gov and sets policy on government-wide hiring procedures. The OPM conducts

background investigations for prospective employees and security clearances across

government. It upholds and defends the merit systems in federal civil service, making sure

that the federal workforce uses fair practices in all aspects of personnel management. It

manages pension benefits for retired federal employees and their families while also

administering health and other insurance programs for federal employees and retirees. The

OPM provides training and development programs and other management tools for federal

employees and agencies. It also assumes the lead in developing, testing and implementing

new government-wide policies that relate to personnel issues. http://www.opm.gov

I. Department of the Treasury

Treasury manages government payments systems and sets many government accounting

standards. (Note that “DoT” is normally used for the U.S. Department of Transportation,

“Treasury” for the Department of the Treasury.) http://www.treasury.gov

J. Cross-Government Task Forces and Coordinating Groups

In the last few years, the EPA has also been tasked to coordinate efforts through several

cross-agency Presidential Task Forces, including the Gulf Coast Task Force, the Hurricane

Sandy Task Force and the Recovery Act Transparency Board. These groups have been

established by Presidential Executive Order and require the EPA to work closely with other

government agencies to achieve the Administration’s goals. These groups have also required

the EPA to produce additional financial reports and work with other agencies in designing

and implementing management and control plans.

K. States, Tribes and Territories

Almost all of the EPA’s programs are implemented through or with state, tribal and local

partners. Much of the EPA’s funding also consists of grants to states and tribes. More

information is available on the EPA’s Office of International and Tribal Affairs website at

http://intranet.epa.gov/oiaintra/. The Environmental Council of the States (ECOS) is the

national nonprofit, nonpartisan association of state and territorial environmental agency

leaders. The purpose of ECOS is to improve the capability of state environmental agencies

and their leaders to protect and improve human health and the environment of the United

States of America. http://www.ecos.org/

Chapter 2: Federal Laws, Regulations and Guidance

Summary

The EPA’s fund control practices must comply with the EPA’s authorizing statutes,

appropriations laws, other general management statutes, and rules and regulations issued to all

federal agencies from overall federal government coordinating and oversight offices (such as the

Office of Management and Budget [OMB], Treasury and the General Services Administration

[GSA]). In summary, the EPA must follow the directives in:

• Environmental laws (statutes)

• Appropriations statutes

• Government-wide management laws (statutes)

• Government-wide guidance/regulations

Law Links (http://intranet.epa.gov/ogc/lawlinks.htm) can be used to find full texts of legislation.

Below are summaries of the EPA’s major authorizing legislation and directives, followed by

descriptions of some major statutes directing government-wide management, financial and

administrative requirements and practices.

A. Environmental Authorizing Statutes

Environmental programs are legislated by Acts of Congress in the form of authorizing or

program legislation. Authorizing legislation provides zero funding in itself; it is not an

appropriation of funds. For the EPA, authorizing legislation establishes the agency‘s

environmental mission, which may be undertaken with funds provided by subsequent

appropriations legislation.

Many EPA authorizing statutes — e.g., the CWA, the SWDA, CERCLA or FIFRA (see

Appendix H for a list of abbreviations) — have specific financial authorizations and

requirements.

1. Clean Air Act of 1970

The Clean Air Act (CAA), amended in 1977 and 1990, is intended to foster the protection

and enhancement of the nation’s air quality, and to safeguard public health and welfare

and the productive capacity of the population. The act is divided into six titles:

• Title I includes provisions for setting and achieving ambient air quality standards.

• Title II deals with control of pollution from mobile sources.

• Title III addresses general and administrative matters.

• Title IV deals with requirements to control pollution that leads to acid deposition.

• Title V includes requirements for the issuance of operating permits for certain

stationary sources.

• Title VI deals with pollution that contributes to depletion of the stratospheric ozone.

Motor Vehicle and Engine Compliance Program Fees were authorized by the 1990 CAA

and are administered by the Air and Radiation Program. The fees are set at a level to

cover the cost to the EPA of certifying new engines and vehicles and monitoring

compliance of new and in-use engines and vehicles and are deposited into a special fund

pursuant to section 217 of the CAA. The EPA does not have access to the fees unless

Congress makes appropriations from this special fund.

Fees apply to all manufacturers including makers of heavy-duty, in-use, and non-road

vehicles and engines; large diesel and gas equipment (earthmovers, tractors, forklifts,

compressors, etc.); handheld and non-handheld utility engines (chainsaws, weed-

whackers, leaf-blowers, lawnmowers, tillers, etc.); marine (boat motors, watercraft, jet-

skis); locomotives; aircraft; and recreational vehicles (off-road motorcycles, all-terrain

vehicles, snowmobiles) as well as evaporative requirements for non-road engines. The

EPA may apply new certification fees for additional industry sectors as new programs are

developed.

2. Comprehensive Environmental Response, Compensation and Liability Act of 1980

(CERCLA)

CERCLA, generally referred to as “Superfund” (42 U.S.C. 9601, et seq.), was enacted in

1980 and amended by:

• Superfund Amendments and Reauthorization Act of 1986 (SARA)

• Emergency Planning and Community Right-to-Know Act of 1986 (EPCRA)

• Small Business Liability Relief and Brownfields Revitalization Act of 2002

The CERCLA, as amended by the SARA, makes the agency responsible for providing

emergency response for hazardous substances released into the environment and cleaning

up inactive or abandoned hazardous waste disposal sites. The agency is authorized under

the SARA to respond to releases of hazardous substances, pollutants and contaminants by

either a removal or remedial action or by compelling responsible parties to undertake the

response action. The reauthorized statute significantly broadened Superfund authorities in

key response, enforcement and research areas. The statute established cleanup standards

and mandatory schedules to ensure rapid and permanent solutions in cleaning up sites. It

contained new and stronger enforcement provisions to encourage expeditious settlements

with responsible parties, and to implement a more formal cleanup process for federal

facilities. The law significantly increased Superfund health-related and research and

development authorities, including provisions for an innovative and alternative treatment

demonstration program and health effects research. Overall, the statute expands state and

public participation at all stages of the cleanup process.

a. Emergency Planning and Community Right-to-Know Act (EPCRA) — A subpart of

SARA Title III, the national EPCRA was signed into law on October 17, 1986, as the

key legislation of community safety. Congress enacted this law to help local

communities protect public health, safety and the environment from chemical

hazards. Two of the main goals of EPCRA are to “provide a basis for each

community to develop a chemical emergency preparedness and planning program that

suits its individual needs,” and “provide the public with the identity, quantity,

location, and properties of hazardous substances in the community, as well as data on

annual release of certain chemicals into the environment.”

b. Special Accounts — Under CERCLA 122(b)(3), the EPA is authorized to “retain and

use” funds the agency receives from settlements with potentially responsible parties

and to set up “Special Accounts” to finance work at sites. Special Accounts may pay

for specified activities at particular site(s) and must be used according to the terms of

the individual settlement agreement with the responsible party (or parties).

c. The Small Business Liability Relief and Brownfields Revitalization Act was signed

into law on January 11, 2002. It amends CERCLA to encourage cleanup and reuse of

brownfields and other potentially contaminated or lightly contaminated properties.

The law establishes a statutory brownfields program and clarifies Superfund liability

for certain parties, as well as the state and federal roles in hazardous waste cleanup.

The brownfields program includes grants for assessment; cleanup; capitalizing

cleanup revolving loan funds; state and tribal response programs; and training,

research, and technical assistance.

3. Energy Policy Act of 2005 (EPAct)

The EPAct was signed into law on August 8, 2005, as part of the federal government’s

efforts to stimulate development and use of more efficient and environmentally friendly

domestic energy sources. It was authorized under Title VII (“the Diesel Emissions

Reduction Act”) to fund grants to reduce diesel emissions. The EPAct also required the

agency to develop fuel regulations, revise emission models, and undertake fuel-related

studies and analyses.

4. Federal Insecticide, Fungicide and Rodenticide Act of 1972 (FIFRA)

FIFRA requires that all pesticides, with minor exceptions, must be registered with the

EPA before they can be sold or distributed in the United States. Pesticide products must

be registered if the EPA determines they do not cause unreasonable adverse effects on

humans or the environment. As part of the registration process, scientific data and

proposed label instructions for use and cautionary statements are submitted by registrants

and reviewed by the EPA to ensure that when registered products are used in accordance

with label instructions they will not cause unreasonable adverse effects. FIFRA also

provides that the EPA can designate the more dangerous pesticide products for restricted

use by certified applicators only.

FIFRA fees are as follows:

• The Pesticide Registration Improvement Extension Act of 2012 (PRIA 3, expiring on

September 30, 2017) authorized two fees by amending the FIFRA of 1988.

• Pesticides maintenance fee — Section 4(i) of the FIFRA authorizes the EPA to

charge annual maintenance fees for pesticide registrations.

• Enhanced registration services fee — Section 33 of FIFRA authorizes fees for

services related to registration of pesticides in the United States. This fee-for-service

provision sets deadlines by which the EPA must make decisions on applications.

Congress must authorize the EPA to obligate the PRIA fees it collects in the EPA’s

annual appropriation act.

5. The Clean Water Act (CWA) of 1972

The CWA was based on the Federal Water Pollution Control Act of 1948 (amended 1956

and 1966). It was amended in 1977, reauthorized in 1981, and amended again several

times since. Two major related pieces of legislation are 1) the Water Quality Act of 1987

and 2) the Beaches Environmental Assessment and Coastal Health Act of 2000.

a. The Federal Water Pollution Control Act, 33 U.S.C.7251 et seq., of 1948, was

amended in 1956 and 1966 to authorize a program of grants to municipalities for

construction of sewage treatment plants and institute a program of mandatory water

quality standards for interstate waters, and was substantially revised in 1972 by

amendments referred to as the CWA. The stated objective of the CWA is to restore

and maintain the “chemical, physical, and biological integrity of the Nation’s waters,”

and the stated goals were to achieve “fishable and swimmable” waters by 1983 and

total elimination of pollutant discharges into navigable waters. The CWA spells out

requirements for water quality standards and an implementation system of permits for

technology-based effluent limitations that apply to industrial and municipal

discharges. Congress made certain fine-tuning amendments of the CWA in 1977 and

reauthorized and revised the construction grants program in 1981.

b. The WQA brought major revisions to the CWA. It authorized new water quality

programs; reauthorized existing programs; called for additional water-quality-based

pollution controls; increased requirements pertaining to toxics, sludge, and nonpoint

sources of pollution; and authorized funds for nonpoint source grants, the National

Estuary Program, and the Great Lakes and Chesapeake Bay programs. The WQA also

reauthorized the construction grants program through 1990 and provided for its

phase-out and replacement with a State Revolving Fund program, to be capitalized by

grants to the states.

c. The Beaches Environmental Assessment and Coastal Health Act of 2000 amended the

CWA to improve the quality of coastal recreation waters. This act authorizes a

national grant program to assist state, tribal, and local governments in developing and

implementing monitoring and public notification programs for their coastal recreation

waters. It also requires states to adopt improved water quality standards for pathogens

and pathogen indicators and requires the EPA to conduct studies and develop

improved microbiological water quality criteria guidance.

6. Food Quality Protection Act of 1996 (FQPA)

The EPA regulates the allowable levels of pesticide residues on food under section 408 of

the Federal Food, Drug, and Cosmetic Act (FFDCA). Section 408 was amended in 1996

as part of the FQPA. The FQPA amended the FFDCA by establishing a risk-only

standard for allowable pesticide residues (called tolerances) in raw and processed food.

Under the amended terms of the FFDCA, the EPA can approve a tolerance only if it is

considered safe, and the law defines “safe” as bearing “a reasonable certainty of no

harm.” The FQPA also directed the EPA to give special consideration to children’s health

in establishing or reviewing pesticide tolerances, and directed the EPA to reassess by

2006 all tolerances in existence before 1996 to make sure those tolerances satisfy the new

safety standard.

7. Hazardous Waste Electronic Manifest Establishment Act

On October 5, 2012, the President signed the Hazardous Waste Electronic Manifest

Establishment Act (Public Law 112-195). The act provided for the electronic submission

of hazardous waste manifests to the EPA and established a mechanism for financing the

development and operation of the program through user fees. The EPA’s access to the

fees is subject to annual appropriations. The Resource Conservation and Recovery Act of

1976 (RCRA) requires hazardous waste handlers to document information on the waste’s

generator, destination, quantity and route. The current tracking system relies on paper

manifests. An electronic manifest system will increase transparency and public safety,

making information on hazardous waste movement more accessible to the, states, and the

public. As part of its goal to reduce the burden on regulated entities, where feasible, the

EPA is developing a program to electronically collect manifests to reduce the time and

cost associated with complying with regulations governing the transportation of

hazardous waste. When fully implemented, e-Manifest is estimated to reduce the

reporting burden for firms regulated under RCRA’s hazardous waste provisions by $75

million annually.

8. Leaking Underground Storage Tank (LUST) Trust Fund

The SARA also amends Subtitle I of the Hazardous and Solid Waste Amendments and

authorizes the establishment of a LUST Trust Fund to clean up releases from leaking

underground petroleum storage tanks. The LUST Trust Fund is financed by taxes on

motor fuels. Owners and/or operators are initially responsible for cleanup of their leaking

tanks. At abandoned sites or at sites where owners/operators do not meet their cleanup

responsibilities, the Trust Fund provides the resources for the EPA or states to undertake

or enforce necessary corrective action and to recover costs expended from the fund.

LUST Trust Fund resources are only available through appropriation.

The EPA’s objective is to implement this program primarily through cooperative

agreements with states. To this end, the agency may take corrective action when an

owner/operator or a state fails to respond to a substantial threat to human health and the

environment.

Title XV, Subtitle B, of the Energy Policy Act of 2005 made major changes to the EPA’s

LUST Program to further reduce underground storage tank releases to the environment. It

also authorized the EPA to develop new inspection requirements and provide grants with

LUST Trust Fund money to the states to expand their inspections of leaking underground

storage tanks and undertake compliance assistance and other leak prevention activities.

The EPA was authorized under this new act to enforce fuel standards.

9. Marine Protection, Research, and Sanctuaries Act of 1972 (MPRSA)

The Marine Protection, Research, and Sanctuaries Act generally (unless authorized by

permit) prohibits (1) the transportation of material from the United States for the purpose

of ocean dumping, (2) the transportation of material from any location for the purpose of

ocean dumping by U.S. agencies or U.S.-flagged vessels, and (3) the dumping of material

transported from outside the United States into the U.S. territorial sea (MPRSA § 101).

Permits under the MPRSA may not be issued for the dumping of sewage sludge or

industrial waste (MPRSA § 104B (a)) or radiological, chemical, and biological warfare

agents; high-level radioactive waste; or medical waste (MPRSA § 102(a)). The dumping

at sea of low-level radioactive waste requires a joint resolution of Congress. (MPRSA §

104(i)). Permits may be issued for other materials if the dumping will not unreasonably

degrade or endanger human health, welfare, or the marine environment (MPRSA §

102(a) and 103(a)). The EPA is charged with developing criteria to be used in evaluating

applications for ocean dumping permits (MPRSA § 102(a)). The EPA also is responsible

for designating recommended sites for ocean dumping (MPRSA § 102(c)). The EPA is

the permitting authority for ocean dumping of all materials except dredged material

(MPRSA § 102(a)). The U.S. Army Corps of Engineers is the permitting authority for

dredged material, subject to EPA concurrence and the use of the ocean dumping criteria

developed by the EPA (MPRSA § 103).

10. Oil Pollution Act of 1990 (OIL)

The Oil Pollution Act establishes liability for oil spill response costs and damages, and

imposes significant civil and criminal penalties. Liable parties must pay oil spill response

costs and to compensate parties damaged by them. Additional money for cleanup and

compensation is available through the Oil Spill Liability Trust Fund, managed by the

U.S. Coast Guard. This fund is supported by an oil tax but subject to annual

appropriations. The fund is to be used by the federal government to fund oil spill

response, to perform natural resource damage assessments, and to compensate parties

who have been damaged by the oil spill when the responsible party does not pay for those

costs.

The OPA also requires double hulls on most oil tankers and barges, and contingency

planning on the part of potential dischargers and federal, state and local governments.

The law continues to allow states to impose unlimited liability on shippers and contains

various provisions to ensure navigation safety. The OPA authorizes research on

environmental impacts and response methods of spills. It also amends the CWA to

require the President to direct all public and private response efforts for certain types of

discharge events.

a. 1990 Amendment — Included Responsible Parties’ oil spill and natural resource

damage assessment costs along with annual appropriations for research, prevention,

and preparedness activities; functions; and actions in support of implementation.

11. Pollution Prevention Act of 1990 (PPA)

The PPA requires the EPA to establish an Office of Pollution Prevention to develop and

coordinate a pollution prevention strategy and develop source reduction models. In

addition to authorizing data collection on pollution prevention, the act requires owners

and operators of facilities required to file an annual toxic release form under section 313

of EPCRA to report annually on source reduction and recycling activities.

Enactment of the PPA added a new direction to U.S. environmental protection policy.

From an earlier focus on reducing or repairing environmental damage by controlling

pollutants at the point where they are released to the environment (e.g., at the end of the

pipe or smokestack, at the boundary of a polluter’s private property, in transit over public

highways and waterways, or after disposal), Congress looked to reduce generating

pollutants at their point of origin. This policy change was based on the notion that

traditional approaches to pollution control had achieved progress but should be

supplemented with approaches that control pollution from dispersed or nonpoint sources

of pollution.

12. Radon Abatement Act of 1988

In October 1988 Congress amended the Toxic Substances Control Act (TSCA) by adding

Title III-Indoor Radon Abatement (15 U.S.C. 2661 et seq., P.L. 100-551). The basic

purpose of Title III is to provide financial and technical assistance to the states that

choose to support radon monitoring and control; neither monitoring nor abatement of

radon is required by the Act.

13. Resource Conservation and Recovery Act of 1976 (RCRA)

Congress passed RCRA in 1976 as an amendment to the Solid Waste Disposal Act of

1965. Major amendments and /or related legislation since include:

• Hazardous and Solid Waste Amendments of 1984

• Superfund Amendments and Reauthorization Act of 1986

• Title XV, Subtitle B, of the Energy Policy Act of 2005

• Hazardous Waste Electronic Manifest Act of 2012

14. Safe Drinking Water Act of 1974 (SDWA)

The SDWA, as amended in 1986 and 1996, is the basis for protecting drinking water

systems that serve the public. The act directs the Administrator of the EPA to establish

primary (enforceable) and secondary (advisory) national drinking water regulations based

on maximum contaminant levels of specific pollutants, provides for state enforcement of

the requirements, and establishes a program for protection of underground sources of

drinking water. It also provides for a Drinking Water State Revolving Fund (DW-SRF) to

be established in each state to lend money (sometimes with additional grants as well) to

drinking water systems in carrying out the act.

15. The Solid Waste Disposal Act

As amended by RCRA and the Hazardous and Solid Waste Amendments of 1984, this act

is intended to address the health and environmental dangers arising from the generation,

management and disposal of solid and hazardous wastes. Subtitle C of RCRA provides

for comprehensive cradle-to-grave regulation of hazardous wastes: owners or operators of

hazardous waste treatment, storage or disposal facilities must obtain a permit to operate,

and must meet standards appropriate to the type of unit managing the waste; hazardous

wastes must be treated prior to land disposal; and offsite movements of hazardous wastes

must be accompanied by a document known as a “manifest.”

The requirement for a manifest applies from the waste’s point of generation to its point of

final treatment or disposal, and helps ensure that wastes are not discarded

indiscriminately in the environment by listing precise origin, volume and amounts of

each waste. Although much of RCRA is focused on the current and future management

of hazardous wastes, the statute also includes a significant cleanup program: for example,

owner/operators seeking an operating permit are required to clean up past releases of

hazardous wastes and constituents at their facility in order to obtain a permit. In addition,

RCRA Subtitle D establishes a largely state-administered program for the management of

solid, non-hazardous wastes.

16. Toxic Substances Control Act of 1976 (TSCA)

Congress enacted TSCA to test, regulate and screen all chemicals produced in or

imported into the United States. Many thousands of chemicals and chemical compounds

are developed each year with unknown toxic characteristics. To prevent tragic

consequences should they come in contact with the general public, TSCA requires that

any chemical that reaches the consumer marketplace be tested for possible toxic effects

prior to first commercial manufacture.

Any existing chemical that is determined to pose unreasonable health and environmental

hazards is also regulated under TSCA (example: polychlorinated biphenyls, or PCBs, are

controlled under TSCA). Procedures are also authorized for corrective action under

TSCA in cases of cleanup of toxic materials contamination.

Fees — TSCA authorized two major fees:

a. Premanufacturing Notice (PMN) fee — A PMN fee is collected for the review and

processing of new chemical PMN submitted to the EPA by the chemical industry.

b. Accreditation and Certification Fee — TSCA Title IV, Section 402(a)(3), mandates

the development of a schedule of fees to cover the costs of administering and

enforcing the standards and regulations for persons operating lead training programs

accredited under the 402/404 rule and for lead-based paint contractors certified under

this rule.

Changes to TSCA, including fees, are being proposed in TSCA amendments being

considered by Congress.

17. The National Environmental Policy Act of 1969 (NEPA)

NEPA established a broad national framework for assessing the environmental impacts of

major federal actions that significantly affect the quality of the human environment.

NEPA has two major objectives: to prevent damage to the environment and to ensure that

federal agency decision-makers give appropriate consideration and weight to

environmental factors before taking any major federal action that significantly affects the

quality of the human environment.

NEPA also established the Council of Environmental Quality (CEQ) to advise the

President on environmental matters. The CEQ promulgated regulations implementing

section 102(2) of NEPA. Under NEPA and the CEQ regulations, unless an action is

categorically exempted, agencies conduct an environmental review in the form of an

Environmental Assessment or Environmental Impact Statement, as appropriate. These

reviews analyze the environmental impacts of and alternatives to the proposed action.

Most of the EPA’s actions are not subject to NEPA because either they are statutorily

exempt from NEPA or functionally equivalent to NEPA. EPA actions that are subject to

the NEPA include issuance of the National Pollutant Discharge Elimination System

permits for new sources under the CWA, award of grants for certain projects funded

through the EPA’s annual appropriations acts, research and development activities, and

facilities construction. The EPA has adopted a voluntary NEPA policy under which it

may prepare the NEPA documents voluntarily when it is not legally required to do so if

such documents would be beneficial in addressing agency actions. In addition, in

conjunction with other statutes, the NEPA generally provides authority for the EPA to

conduct international environmental activities.

B. Appropriation Statutes

Congressional appropriations statutes provide discretionary funding for federal government

activities. Congress has a two-step process associated with discretionary spending:

authorization bills and appropriations bills. Authorization bills establish, continue or modify

agencies or programs. Appropriations measures subsequently provide funding for the

agencies and programs authorized (although occasionally Congress will include authorization

in an appropriations bill). Almost all of the EPA’s programs are generally considered to be

discretionary, as opposed to mandatory programs such as Social Security or Medicare.

There are generally two main types of appropriation statutes:

1. Annual Appropriations

Each year Congress passes annual appropriations to fund discretionary programs for a

given fiscal year. These appropriations generally include specific funding levels with

directives and requirements in law and report language.

2. Supplemental Appropriations

Congress also may pass supplemental bills to provide additional funding, usually for

emergency purposes, such as for natural disasters. Examples include the Disaster Relief

Appropriations Act; Hurricane Sandy; Coastal Wetland Planning, Protection and

Restoration Act funds; the Recovery Act; the RESTORE Act, etc. Supplemental

appropriations normally also contain specific tracking reporting and other requirements.

Chapter 5, “EPA Sources of Funding and Associated Processes,” describes the major steps,

processes and major rules governing annual and supplemental appropriations.

C. Government-Wide Management and Administrative Statutes

Below are some of the most important statutes that direct how the federal government must

manage its funds. This is not a comprehensive list, and financial managers should consult

with the Office of General Counsel about whether additional statutes might apply to major

upcoming decisions.

1. Antideficiency Act, 31 U.S.C. 1314,1342 & 1517 (ADA)

The ADA consists of provisions of law passed by Congress (beginning in the nineteenth

century and later codified in Title 31 of the U.S. Code) to prevent departments and

agencies from spending their entire appropriations during the first few months of the

year. (Note – the acronym is also used for American with Disabilities Act)

a. The ADA prohibits:

• Spending in excess of an amount available in an appropriation.

• Authorizing expenditures in advance of an appropriation.

• Accepting voluntary services without authority.

• Spending in excess or in advance of an apportionment.

• Entering into contracts that exceed the enacted appropriations for the year.

• Exceeding budgetary authority, including apportionments

• Purchasing services and merchandise before appropriations are enacted.

b. The ADA:

• Requires that the OMB apportion the appropriations, that is, approve a plan that

spreads out spending over the fiscal period for which the funds were made

available.

• Requires, subject to the OMB’s approval, the head of each executive agency to

prescribe by regulation a system of administrative control of funds (31 U.S.C.

1514(a)).

• Restricts deficiency apportionments to amounts approved by the agency heads

only for “extraordinary emergency or unusual circumstances.”

• Establishes penalties for ADA violations. Violations are obligations or

expenditures in excess of the lower of the amount in the affected account, the

amount apportioned, or administrative subdivision of funds.

2. Budget and Accounting Act and Supplemental Appropriations Act

The Budget and Accounting Act of 1921 and the Supplemental Appropriations Act of

1955 provide the budget and appropriations authority of the President, budget contents

and submissions to Congress, supplemental appropriations, and advances. The specific

requirements for recording obligations, such as documentary evidence, are set forth in 31

U.S.C. 1501.

3. Chief Financial Officers Act of 1990 (CFO Act)

The CFO Act requires 24 federal departments and agencies to prepare and audit financial

statements for trust funds, revolving funds and commercial activities accounts. As one of

the 24 agencies, the EPA follows the OCFO Act structure.

CFOs are designated by each federal department or agency and have the fundamental

responsibility to assure that its use of public funds adheres to the terms of the pertinent

authorization and appropriations acts, as well as any other relevant statutory provisions.

The Assistant Administrator, Office of the Chief Financial Officer, serves as the EPA’s

CFO. Previous to the CFO Act, the EPA relied on a comptroller within the Office of

Administration and Resource Management to coordinate the agency’s financial

operations. Financial Statement Audits are conducted or supervised and issued by the

EPA Office of Inspector General each year by November 15 (unless delayed by approval

of OMB).

4. Congressional Budget Impoundment and Control Act of 1974 (Impoundment Act)

Under this act, an impoundment is defined as an action or inaction by an officer or

employee of the United States that precludes the obligation or expenditure of budget

authority provided by Congress. There are two types of impoundment actions: deferrals

and rescissions.

a. A deferral is a postponement of budget authority in the sense that an agency

temporarily withholds or delays an obligation or expenditure. Deferrals may be

proposed by agencies but must be communicated to Congress by the President in a

special message. Deferred budget authority may not be withheld from obligation

unless Congress passes legislation to approve the deferral and that legislation is

enacted.

b. A rescission involves the cancellation of budget authority previously provided by law

(before that authority would otherwise expire).

If a federal agency fails to obligate appropriated funds, the Comptroller General is

authorized by 2 U.S.C. 682 to bring a civil action against that agency. The expiration of

budget authority, or delays in obligating if resulting from a legitimate programmatic

delay or ineffective or unwise program administration, are not regarded as impoundments

unless the facts establish that the agency intentionally withheld funds.

For short title of Title X of Pub. L. 93–344, found at 2 U.S.C. 681–688, which enacted

this chapter as the ‘‘Impoundment Control Act of 1974,’’ see section 1(a) of Pub. L. 93–

344, as amended, set out as a note under section 621 of this title. The 1974 Congressional

Budget and Impoundment Control Act modified the role of Congress in the federal

budgetary process. It created standing budget committees in both the House and the

Senate, established the Congressional Budget Office, and moved the beginning of the

fiscal year from July 1 to October 1.

5. The Digital Accountability and Transparency Act of 2014 (DATA Act)

The DATA Act aims to make information on federal expenditures more easily accessible

and transparent. The act requires the EPA to work to make detailed information available

on all procurements, grants and interagency agreements.

6. Economy Act of 1932

Federal agencies frequently provide goods or services to other federal agencies. The

Economy Act authorizes agencies to obtain goods or services either directly from other

federal agencies or through contracts awarded by other agencies when it promotes

economy and efficiency for the government. Both agencies must have the authority for

the underlying activities proposed in the agreement. At the EPA, the mechanism to do so

is an interagency agreement between the EPA and the other federal agency.

An Economy Act agreement may not exceed the period of availability of the source

appropriation. In addition, a time-limited appropriation (such as the EPA’s

Environmental Programs and Management appropriation) that is obligated under an

Economy Act agreement must be deobligated at the end of its period of availability to the

extent that the performing agency has not performed or incurred valid obligations under

the agreement. For any appropriation, this rule applies at the end of the source

appropriation’s period of availability.

7. Federal Managers’ Financial Integrity Act of 1982 (FMFIA)

The FMFIA is designed to:

• Protect government resources from fraud, waste, abuse or mismanagement.

• Require systematic self-examination of management controls by program managers.

• Require agency heads to report annually to the President and Congress on the state of

management control systems, identify material management control weaknesses, and

provide corrective action plans and milestones.

The FMFIA requires the establishment of systems of internal accounting and

administrative controls, according to standards prescribed by the Comptroller General,

which provide reasonable assurance that:

• Obligations and costs comply with applicable law.

• Funds, property and other assets are safeguarded against waste, loss, unauthorized use

or misappropriation.

• Agency revenues and expenditures are properly recorded and accounted for to permit

the preparation of accounts and reliable financial and statistical reports, and to

maintain accountability over assets. The agency’s annual report must provide a

separate statement of whether the agency’s accounting system conforms to the

principles, standards and related requirements prescribed by the Comptroller General

under Section 112 of the Accounting and Auditing Act of 1950.

OMB Circular A-123 establishes broad guidelines for agency self-evaluation of

management control systems. The EPA follows A-123 with an annual process of internal

control reviews and A-123 assessments. The OCFO issues annual guidance to the agency

on how each year’s process will be organized and managed.

8. Government Performance and Results Act of 1993 (GPRA) and GPRA

Modernization Act of 2010 (GPRAMA)

Originally, GPRA was enacted to align strategic goals with annual plans, budgets and

serves as a basis for financial and performance accountability reporting. Congress passed

GPRAMA on January 4, 2011. It made substantial changes to the original GPRA law:

• It continues three agency-level products (the EPA Strategic Plan, Annual Plan, and

Budget and Annual Performance Report) from the GPRA 1993, but with changes.

• It establishes new products and processes that focus on goal-setting and performance

measurement in policy areas that cut across agencies (Priority Goals, “unmet goals”

report).

• Brings attention to using goals and measures during policy implementation.

• Increases reporting on the Internet.

• Requires individuals, Goal Leaders (i.e., officials named by the agency head or COO

who will be held accountable for leading implementation efforts to achieve a goal), to

be responsible for some goals and management tasks.

In making these changes, the GPRAMA aligns the timing of many products to coincide

with Presidential terms and budget proposals. The law also includes more central roles

for the OMB, which advances the President’s policy preferences. The GPRAMA also

contains specific requirements for consultations with Congress. By design, many of the

GPRAMA’s products are required to be submitted to Congress for scrutiny and potential

use. The law also provides opportunities for Congress and non-federal stakeholders to

influence how agencies and the OMB set goals and assess performance.

9. Impoundment Control Act of 1974 (please see 4. Congressional Budget

Impoundment and Control Act of 1974.)

10. Independent Offices Appropriations Act (IOAA)

Codified at 31 U.S.C. 9701, the IOAA provides agencies with authority to collect user

fees in certain circumstances. The IOAA does not provide agencies with authority to

“retain and use” the fees, so any monies agencies collect under the IOAA must be

deposited into the Treasury as miscellaneous receipts. The OMB provided implementing

guidance on the IOAA in OMB Circular A-25. Under court decisions sustaining the

OMB’s interpretation of the IOAA, agencies may only charge fees to “identifiable

recipients for a measurable unit or amount of government service or property from which

he derives a special benefit.” Fees may not be imposed under the IOAA “when the

identification of the ultimate beneficiary is obscure and the service can be primarily

considered as benefitting broadly the general public.”

11. Inspector General Act of 1978

This act, amended 1988, requires the Inspector General to conduct and supervise

independent and objective audits, evaluations, investigations and other reviews relating to

the agency programs and operations (including contracts, grants, and acquisition

management; financial transactions; fund control; and financial statements). The

Inspector General also makes recommendations to promote economy, efficiency, and

effectiveness; prevents and detects fraud, waste, and abuse; and keeps agency heads and

Congress fully and currently informed of problems. The EPA Office of the Inspector

General (OIG) conducts and promotes program evaluations of the EPA programs and

activities (including process, outcome, impact and cost-benefit).

The OIG Office of Investigations is a law enforcement entity that conducts criminal, civil

and administrative investigations of possible violations of laws under the criminal code

and alleged misconduct and abuse by agency, contractor or grantee employees. To ensure

objectivity, the Inspector General Act provides the Inspector General with independent

authority to carry out activities such as determining what reviews to perform and

obtaining all necessary information, developing and executing budgets through

independent appropriations, selecting and appointing OIG employees including Senior

Executive Service positions, and entering into contracts. This independence protects the

OIG from interference by agency management and allows it to function as the agency’s

fiscal and operational watchdog.

From the budget formulation process through execution, agency management may not

reduce or reallocate OIG resources if the OIG conforms to OMB and Congressional

guidance. Under the provisions of the IG Reform Act, the OIG may require OMB to

report to Congress if the amount included for the OIG is insufficient for the OIG to carry

out its mission.

12. “M” Account Legislation

The National Defense Authorization Act of 1990 amended controls on the availability of

appropriation accounts and the procedures for closing appropriation accounts (31 U.S.C.

1551–57). The act cancelled all merged or “M account” surplus authority (unobligated

balances in expired appropriations) as of December 5, 1990. The act also requires that,

from 1990 on, unobligated balances and unliquidated obligations will be cancelled five

years after an appropriation has expired, and then that account will be closed out.

The EPA has an exception to the five-year cancellation requirement time period. The

EPA requested and received special statutory authority for the agency’s time-limited

appropriations to remain available to liquidate obligations for seven years after the period

of availability for new obligations expires (Public Law 106-377). This means that the

EPA’s accounts with obligation deadlines (normally called two-year accounts due to the

two-year deadline to obligate funds) have a total of nine years to outlay all funds (2 + 7 =

9). This special authority came into effect in fiscal year 2001.

After an appropriation account has been cancelled or closed out, bills received against

cancelled obligations must be paid from current appropriations available for the same

purpose. The total amount of charges to a current appropriation account may not exceed 1

percent of the total appropriations for that account. OMB Bulletin 91-07, which

implements this legislation, requires federal agencies to have available up to 1 percent of

current-year appropriations to liquidate liabilities that arise from accounts that have been

cancelled. Should a payment be needed that exceeds the 1 percent funding availability,

the agency must go back to Congress and request a supplemental appropriation.

13. Miscellaneous Receipts Act (MRA)

The MRA requires any agency official who receives or is in constructive receipt of funds

(i.e., controls how the funds are used) from an outside source (including other federal

agencies) without explicit authority must deposit the funds into the Treasury’s general

fund.

14. Money and Finance

Public Law 97-258, § 1, September 13, 1982, 96 Statute 877, provides that “Certain

general and permanent laws of the United States, related to money and finance, are

revised, codified, and enacted as title 31, United States Code, ‘Money and Finance’…”:

This includes:

• Sections 1341–1342, 1349–1351, 1511–1519 (part of the Antideficiency Act, as

amended).

• Sections 1101, 1104–1108, 3324 (part of the Budget and Accounting Act, 1921, as

amended).

• Sections 1501–1502 (part of section 1311 of the Supplemental Appropriations Act of

1950).

• Sections 1112, 1531, 3511–3512, 3524 (part of the Budget and Accounting

Procedures Act of 1950).

D. Government-Wide Guidance and Regulations

Federal agencies do not independently determine how they should follow the management

statutes discussed above. Specific federal offices and agencies issue regulations, guidance,

circulars and other direction that agencies must follow. The most prominent guidance

documents, sources and legal opinions upon which government-wide budgeting and

accounting depend are:

• OMB Circulars, particularly:

○ A-11—Preparation, Submission and Execution of the Budget

○ A-123—Management’s Responsibility for Internal Control

○ OMB Circulars at http://www.whitehouse.gov/omb/circulars_default/

• Government Accountability Office (GAO) rulings and opinions—Green Book, Red

Book, etc. http://www.gao.gov/

• Office of Personnel Management (human resources), GSA (space, procurement),