GEN ELEC 04 G01 Guide For Value Added Tax Via E Filing External

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 39

1 | eFILING USER GUIDE FOR VALUE-ADDED TAX

eFILING USER GUIDE FOR

VALUE-ADDED TAX

2013

2 | eFILING USER GUIDE FOR VALUE-ADDED TAX

CONTENTS

1. INTRODUCTION ............................................................................................................................ 3

2. REGISTERING ON eFILING FOR VAT PURPOSES ................................................................................. 3

3. REQUESTING VAT201 DECLARATION ............................................................................................... 6

4. COMPLETING THE VAT201 DECLARATION ...................................................................................... 10

5. SUBMITTING THE VAT201 DECLARATION FOR A SPECIFIC TAX PERIOD .............................................. 22

6. MAKING PAYMENT ..................................................................................................................... 24

7. REQUEST FOR CORRECTION ........................................................................................................ 29

8. SUBMITTING SUPPORTING DOCUMENTS ....................................................................................... 31

9. VIEWING HISTORIC RETURNS ....................................................................................................... 35

10. REQUESTING STATEMENT OF ACCOUNT (VATSA) ............................................................................. 39

DISCLAIMER

The information contained in this guide is intended as guidance only and is not considered to be a legal reference, nor is it a binding

ruling. The information does not take the place of legislation and readers who are in doubt regarding any aspect of the information

displayed in the guide should refer to the relevant legislation, or seek a formal opinion from a suitably qualified individual.

For more information about the contents of this publication you may:

• Visit the SARS website at www.sars.gov.za

• Visit your nearest SARS branch

• Contact your own tax advisor/tax practitioner

• If calling from within South Africa, contact the SARS Contact Centre on 0800 00 SARS (7277)

• If calling from outside South Africa, contact the SARS Contact Centre on +27 11 602 2093 (only between 8am and 4pm

South African time).

3 | eFILING USER GUIDE FOR VALUE-ADDED TAX

1. INTRODUCTION

Since 2007, the South African Revenue Service (SARS) has been modernising and simplifying tax processes in line with

international best practice. Improvements are being made continuously as we aim to better our service standards and

increase efficiency and compliance.

One of the aspects of compliance that SARS wishes to address is the declaration and payment of Value-Added Tax (VAT).

In 2010 SARS announced that it will be making changes to the VAT Vendor Declaration Form (VAT201 Declaration)

aimed not only at improving its systems, but also at addressing SARS’s efficiency regarding risk assessment and

tax compliance. The following changes apply effective 11 April 2011:

• A new VAT201 Declaration in landscape format has been introduced. It contains the same fields as the previous

VAT201 Declaration but with the following additional fields:

ú Demographic information

ú The declarant’s signature

• A Payment Reference Number (PRN) which will be pre-populated by SARS will replace the previous “reference

number”

This guide is designed to help you complete your VAT201 Declaration accurately and honestly.

Note: The words “declaration” and “return” are used interchangeably in the document but both refer to the

VAT201 Declaration.

2. REGISTERING ON eFILING FOR VAT PURPOSES

A vendor has to be registered as an eFiler to be able to submit VAT201 declarations and make VAT payments via

eFiling.

• This will apply to:

ú Individuals

ú Tax practitioners

ú Organisations (e.g. Companies, Close Corporations, Trusts and Exempt Institutions)

To register on eFiling to submit VAT201 declarations and make VAT payments follow the steps below:

Step 1

Navigate to www.sarsefiling.co.za

4 | eFILING USER GUIDE FOR VALUE-ADDED TAX

Click on LOGIN

Log in with your Login name and Password

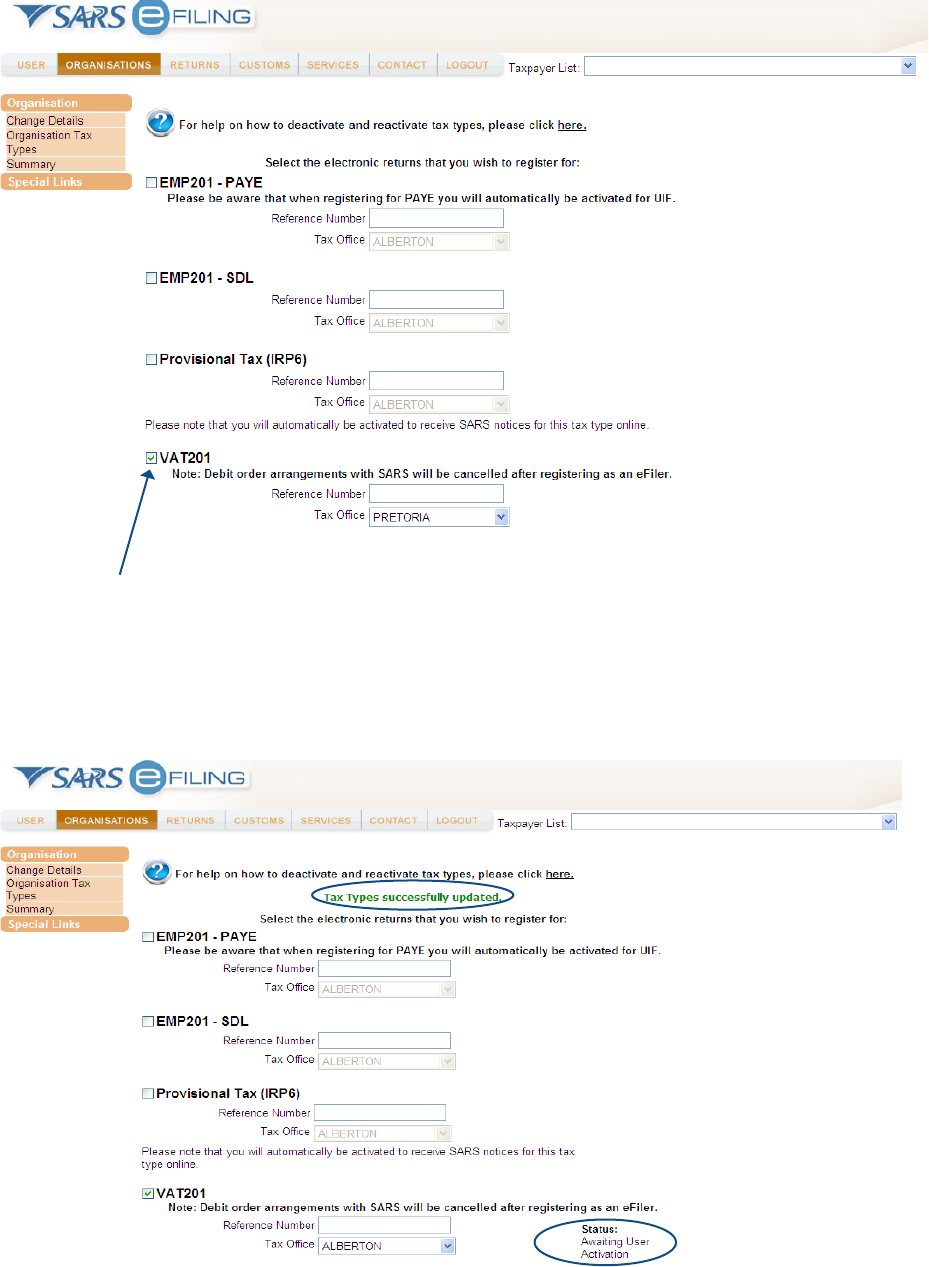

Step 2

Once logged into eFiling, select “Organisation Tax Types” from the side menu options under ORGANISATIONS.

5 | eFILING USER GUIDE FOR VALUE-ADDED TAX

Step 3

Tick the “VAT201” box, and fill in your VAT Reference Number in the space provided and select the applicable

Tax Office from the drop down box.

Step 4

The following messages will appear on the screen: “Tax Types successfully updated” and “Awaiting

User Activation”

6 | eFILING USER GUIDE FOR VALUE-ADDED TAX

Step 5

The information provided will be validated and SARS will activate the user account and the status will be updated to

“Return Successfully Activated”

3. REQUESTING VAT201 DECLARATION

Note: A vendor will be able to request the VAT201 Declaration immediately after the VAT201 tax type has successfully

been activated.

A vendor will be allowed to:

• Request for a VAT201 Declaration for the current tax period plus one future tax period, and

• Request and submit a VAT201 Declaration for a past tax period.

The following steps must be completed in order to request the VAT201 Declaration.

7 | eFILING USER GUIDE FOR VALUE-ADDED TAX

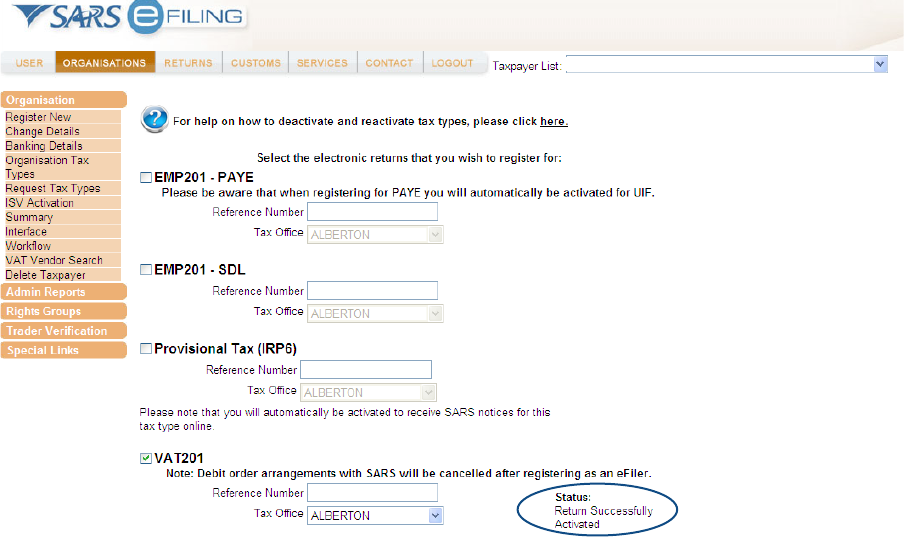

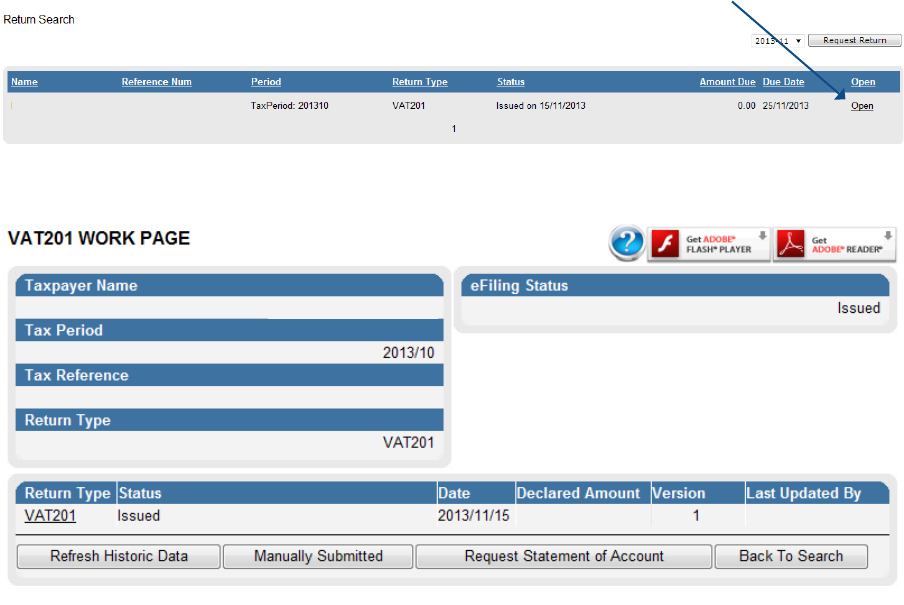

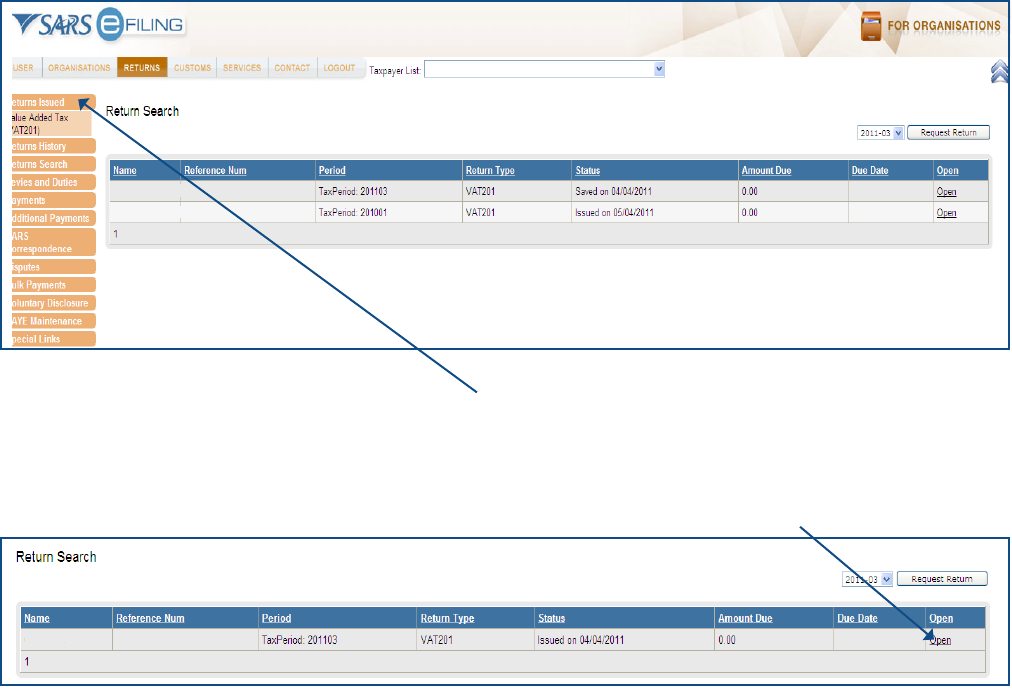

Step 1

Select the relevant VAT201 Declaration under “Returns Issued” from the side menu options under RETURNS.

Click on the relevant VAT201 declaration that must be submitted. VAT201 Declarations will be displayed as follows:

ú Issued

ú Saved

ú In Error

If the following message is displayed: “No records available for your selection”, select the period and click

on the “Request Return” button on the right hand side corner.

8 | eFILING USER GUIDE FOR VALUE-ADDED TAX

Step 2

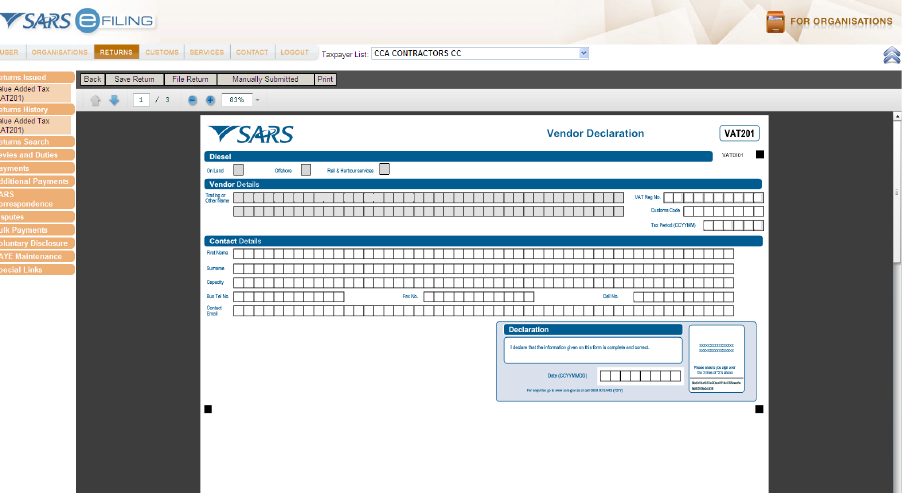

To view any of the issued declarations and to complete the declaration click on “Open”

The following screen will be displayed:

By clicking on the VAT201 link you be will presented with an editable declaration for the selected tax period. To

remove the declaration from the issued/saved list select the “Manually Submitted” option. Declarations that

are listed in the Returns Issued list will also be accessible from the Returns Search menu.

Note: If a timeout occurs while in the process of requesting a VAT201 Declaration, eFiling will display the following

message: “Your return could not be issued at this time, please try again later”

9 | eFILING USER GUIDE FOR VALUE-ADDED TAX

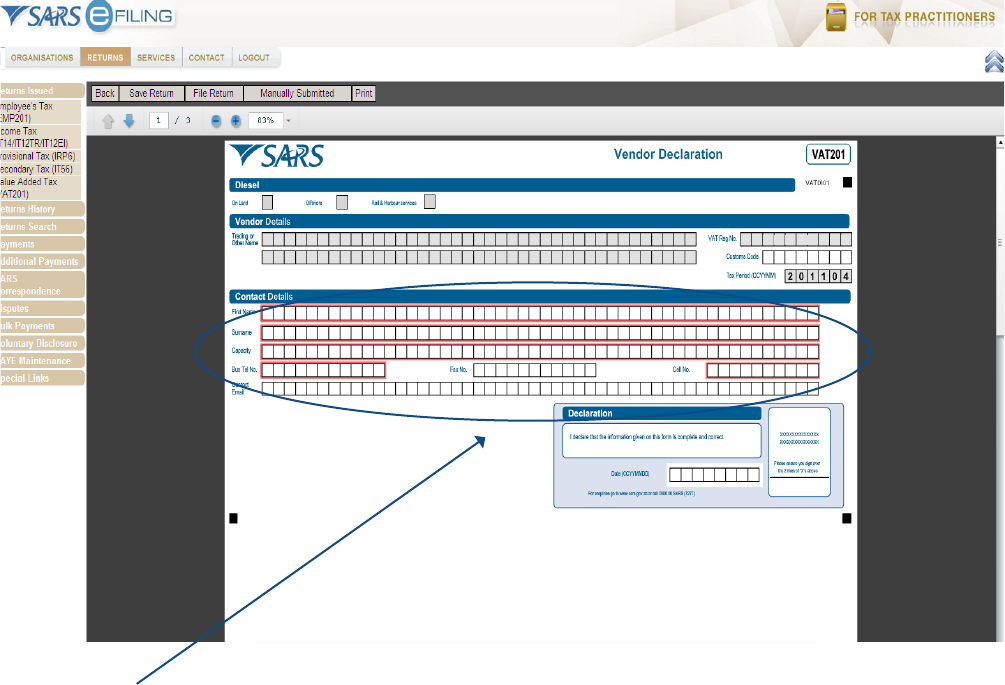

Step 3

The form will already be pre-populated with the following information for first submission:

ú Trading or Other Name

ú VAT Registration Number

ú Tax period for which the declaration is to be made

ú Payment Reference Number (PRN )

ú Diesel Rates to be applied for the applicable year in which the indicated tax period falls and according

to the type of diesel rebate for which the vendor is registered.

The vendor will not be able to edit any of the fields listed above.

The form will already be pre-populated with the following information for revised VAT201 Declarations:

ú Trading or Other Name

ú VAT Registration Number

ú Tax period for which the declaration is to be made

ú The same Payment Reference Number (PRN) as in the original VAT201 Declaration.

ú Diesel Rates to be applied for the applicable year in which the indicated tax period falls and

according to the type of diesel for which the vendor is registered.

ú Financial data from the previous VAT201 Declaration submitted. (For tax periods prior to the

implementation of the new VAT201 Declaration ,the financial data will not be pre-populated)

ú Contact details of the person who completed the first submission of the VAT201 for the tax period

concerned.

10 | eFILING USER GUIDE FOR VALUE-ADDED TAX

• The vendor will not be able to edit any of the fields listed above, except for the contact details of the person

who completed the first submission of the VAT201 Declaration.

• If the revision is for a tax period prior to the last two years, the diesel portion of the VAT201 Declaration will be

generated but greyed out. The fields on the form will still perform all the calculations.

4. COMPLETING THE VAT201 DECLARATION

Note: Before you start completing your VAT201 Declaration, please read the General Rules for Completing a VAT201

Declaration in the “Step by Step Guide for Completion of the Value-Added Tax Vendor Declaration available on the

SARS website.

Complete all the relevant information that is required for the processing of the VAT201 Declaration.

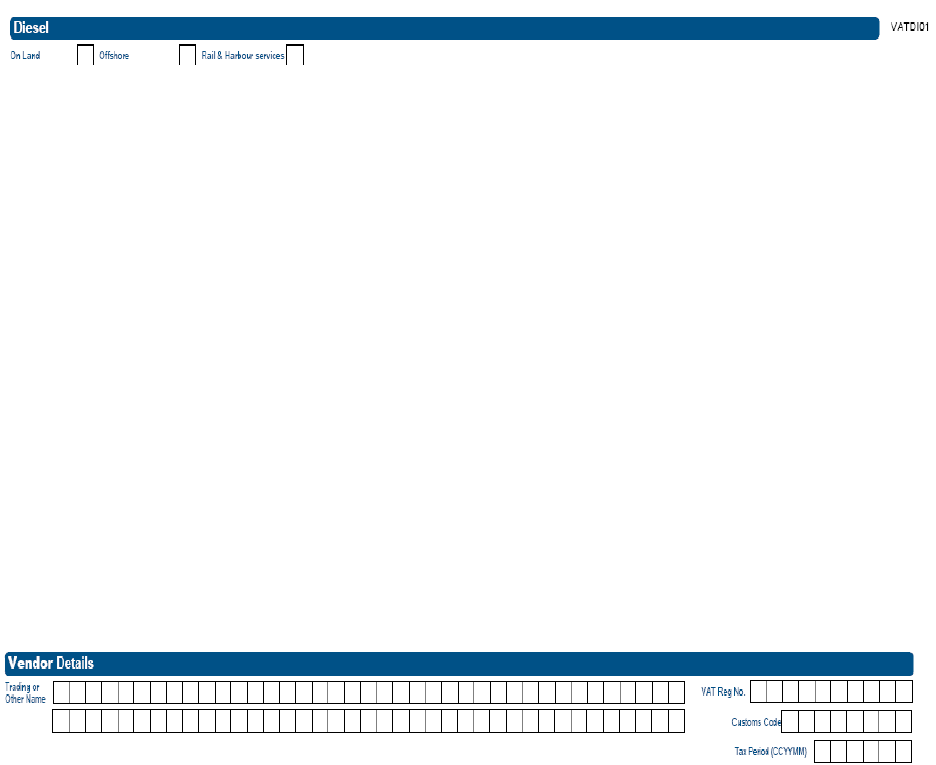

Diesel

Please Note: Selection of the Diesel rebate type can be made if the vendor is registered for a Diesel refund.

• On Land

The farming, forestry and mining industries will qualify for this refund

• Offshore

Commercial fishing, coastal shipping, offshore mining and the National Sea Rescue Institute will qualify for

this refund

• Rail and Harbour Services

Rail freight hauliers and specific harbour service operators will qualify for this refund.

Vendor Details

Note: The vendor’s details must be completed if all the fields have not been pre-populated.

11 | eFILING USER GUIDE FOR VALUE-ADDED TAX

• Trading or Other Name

The trading name is the name under which your business trades. It is also the name known by your suppliers or your

customers and it may be different from your business’ legal name. This field is pre-populated. If the trading name

or other name has changed, you are required to inform SARS in writing.

• VAT Registration Number

The VAT registration number is the 10 digit number allocated by SARS to a registered vendor. This field is

pre-populated.

• Customs Code

The Customs Code is a number allocated to exporters/ importers. The vendor must complete the Customs Code

field if fields 2A, 14A or 15A (or any combination thereof) are completed.

• Tax Period (CCYYMM)

This period is the period for which the VAT201 Declaration must be submitted depending on the declaration and

payment category allocated to the vendor. This field will be pre-populated.

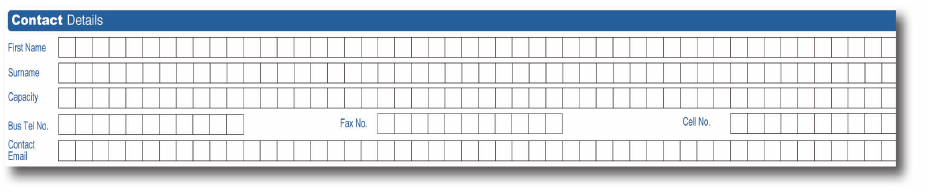

Contact Details

This is a new part of the declaration. The vendor must complete the demographic information of the person responsible

for completing the VAT201 Declaration.

The following fields are mandatory and must be completed:

• First Name

The name of the person responsible for completing the VAT201 Declaration

• Surname

The surname of the person responsible for completing the VAT201 Declaration

• Capacity

The capacity of the person responsible for completing the VAT201 Declaration.

12 | eFILING USER GUIDE FOR VALUE-ADDED TAX

Either the business telephone or cell phone number must be provided. The business telephone number must commence

with the relevant area code. If the business number is not provided, the cell phone number is a mandatory field.

• Business Telephone Number

The business telephone number of the person responsible for completing the VAT201 Declaration

• Fax Number

This is an optional field and may be completed. The fax number of the person responsible for completing the

VAT201 Declaration

• Cell phone Number

The cellular telephone number of the person responsible for completing the VAT201 Declaration

• Contact Email

This is an optional field and may be completed. Provide the email address of the person responsible for completing

the VAT201 Declaration. This field must be completed in BLOCK LETTERS and insert one character per block.

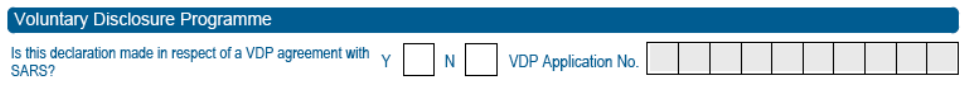

Voluntary Disclosure Programme (VDP)

• What is the purpose of VDP?

ú The VDP seeks to:

o Give applicants an opportunity to come clean by disclosing their tax defaults and/or exchange

control contraventions and obtain relief if successful

o Establish a process within which the application criteria is transparent and relief parameters

clearly prescribed

o Enhance the culture of compliance in both the tax and exchange control environments

• Once the VDP application has been evaluated by the VDP Unit, a written agreement will be concluded between you and

SARS in order to effect the necessary assessments

• Should you require more information, a Comprehensive Guide concerning VDP is available on the SARS website www.

sars.gov.za.

• Where an approved VDP agreement exists between the vendor and SARS, the following information must be completed.

• Is this declaration made in respect of a VDP agreement with SARS?

ú Make sure that an “X” is inserted in the “Y” box.

• VDP application number

ú The VDP application number as found on the VDP agreement must be completed.

ú This is a mandatory field if the “Y” block is selected.

Note: When completing the remainder of the return, do not forget to include all amounts applicable for the tax year for which

VDP was granted, including the previously omitted information.

13 | eFILING USER GUIDE FOR VALUE-ADDED TAX

Declaration

The electronic signature (i.e. the vendor’s log in) associated with an eFiler is deemed to be the signature of the

declarant.

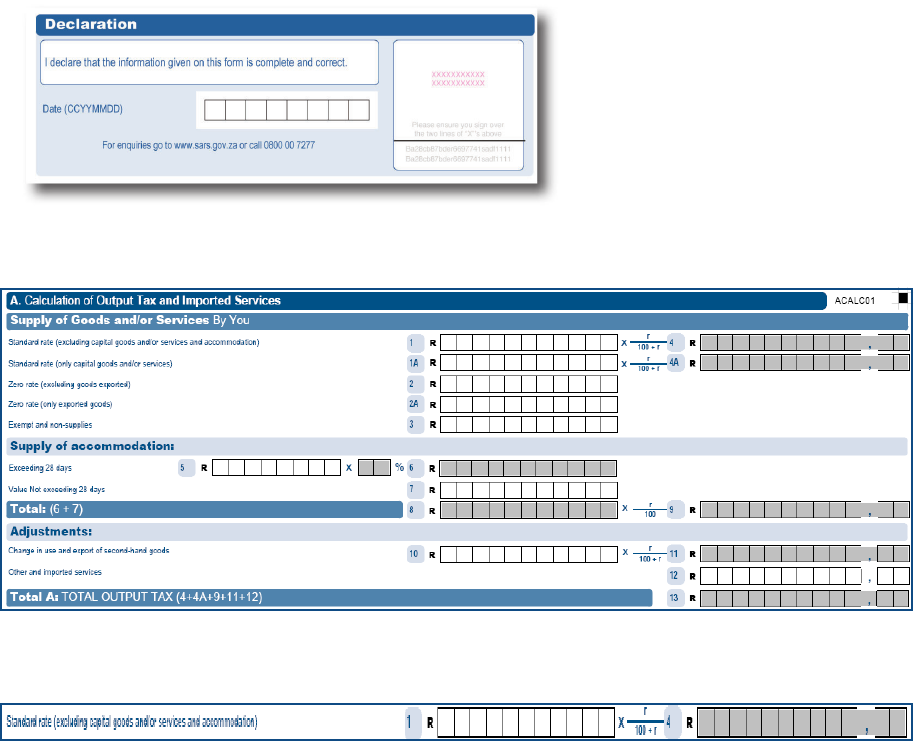

Calculation of Output Tax and Imported Services

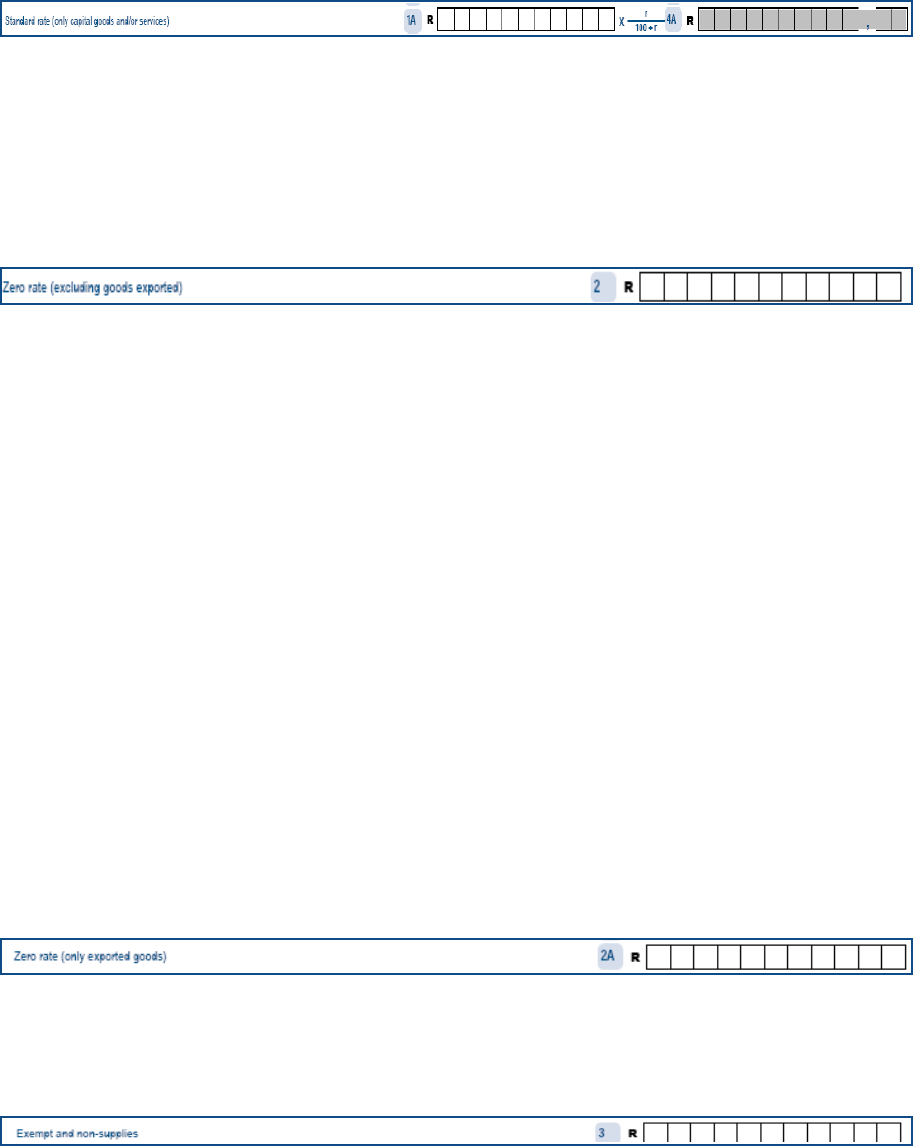

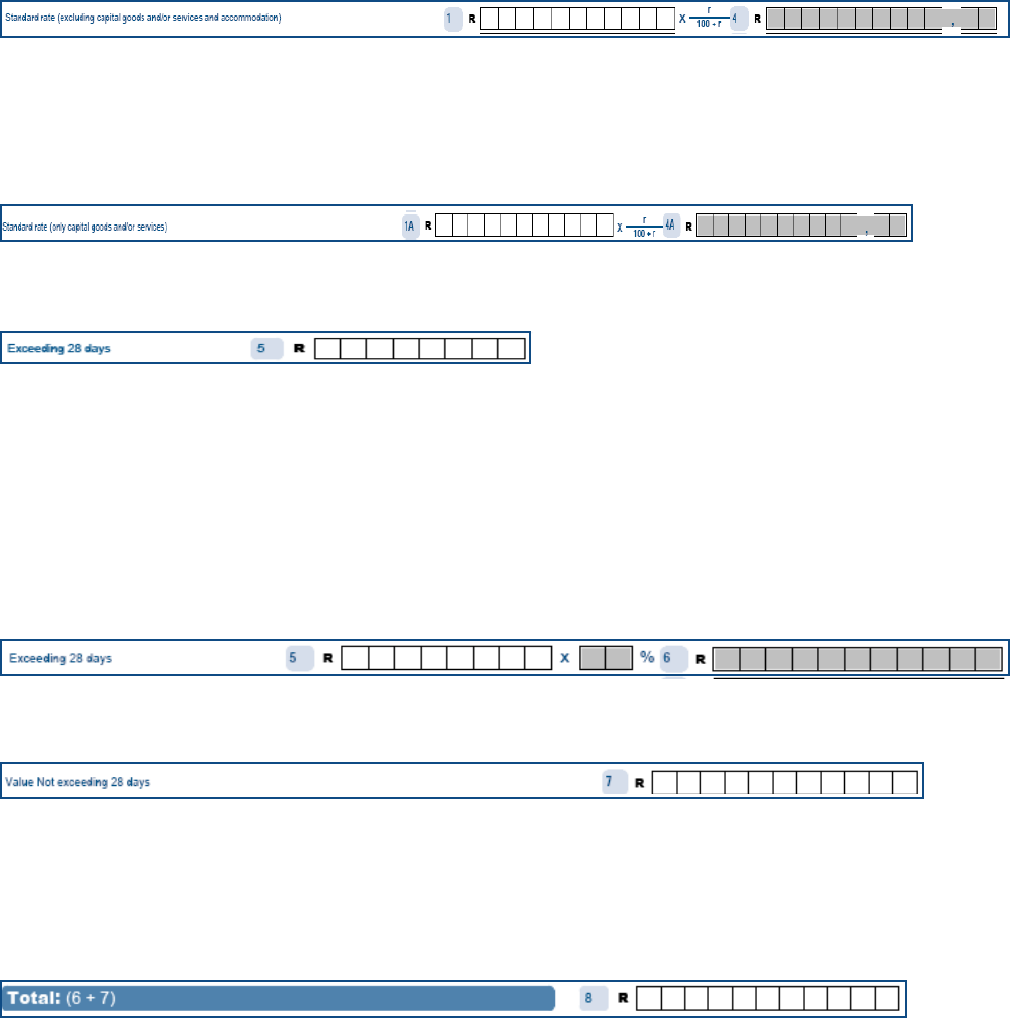

• Field 1 - Standard rate (excluding capital goods and/or services and accommodation)

The VAT inclusive amount of goods and/or services supplied by you (including deemed supplies) at the standard rate,

excluding capital goods and/or services and commercial accommodation must be completed in Field 1. All goods and

services are standard rated (currently 14%) unless specifically zero-rated, exempt or qualify as non-supplies. Examples

of standard rated supplies (sales) are:

o Aircraft fuel

o Building materials and services

o Books and newspapers

o Cigarettes, cold drinks and liquor

o Clothing

o Electricity, water and refuse removal

o Entrance fees to sporting events

o Furniture

o Hotel accommodation

o Lawyer’s services

o Local air travel

o Meat and any food served as a meal

o Medicines

o Medical services (other than by State hospitals)

o Motor repairs

o Motor vehicles and spares

o Paraffin (excluding illuminating kerosene)

o Postage stamps

14 | eFILING USER GUIDE FOR VALUE-ADDED TAX

o Restaurant services

o Telephone services

o Transport of goods

o Washing powder

o White bread.

• Field 1A - Standard rate (only capital goods and/or services)

The VAT inclusive amount of goods and/or services supplied by you at the standard rate, only capital goods and/or

services must be completed in Field 1A. This field must reflect the consideration received (VAT included) in respect of:

o Sale of capital goods and/or services (e.g. Sale of land and buildings, plant and machinery, intellectual

property)

o VAT on assets upon termination of registration.

• Field 2 - Zero rate (excluding goods exported)

The amount of goods and/or services supplied by you at zero rate, excluding exported goods, must be completed in

Field 2. Zero rated supplies are taxable supplies, taxed at a rate of 0%. Examples of zero-rated supplies are:

o Brown bread

o Brown bread flour excluding bran

o Eggs of domesticated chickens

o Edible legumes and pulses of leguminous plants

o Fresh/frozen fruit and vegetables

o Dried beans

o Illuminating kerosene

o Lentils

o Maize meal

o Milk, cultured milk, milk powder and dairy powder blend

o Pilchards/ sardines in tins or cans

o Vegetable oil excluding olive oil

o Fuel levy goods (e.g. petrol and diesel)

o The sale of a business or part of a business as a going concern

o Services supplied in respect of goods temporarily admitted into the RSA from an export country

for the purposes of being repaired or serviced.

o International travel

• Field 2A - Zero rate (only exported goods)

The amount of goods supplied by you at the zero rate which has been exported from the Republic of South Africa

must be completed in Field 2A. The Customs Code field is mandatory, if Field 2A is completed.

• Field 3 - Exempt and non-supplies

The amount of exempt supplies or non-supplies supplied by you must be completed in Field 3. No output tax is levied

in respect of exempt supplies and no input tax relating to the expenditure on these supplies may be deducted. The

following are examples of exempt supplies:

o Financial services

15 | eFILING USER GUIDE FOR VALUE-ADDED TAX

o Donated goods or services by an association not for gain

o Residential accommodation

o The letting of leasehold land

o The sale or letting of land situated outside the Republic

o Transport of fare-paying passengers by road or railway

o The supply of educational services

o Membership contributions to employee organisations, such as trade unions

o The supply of childcare services.

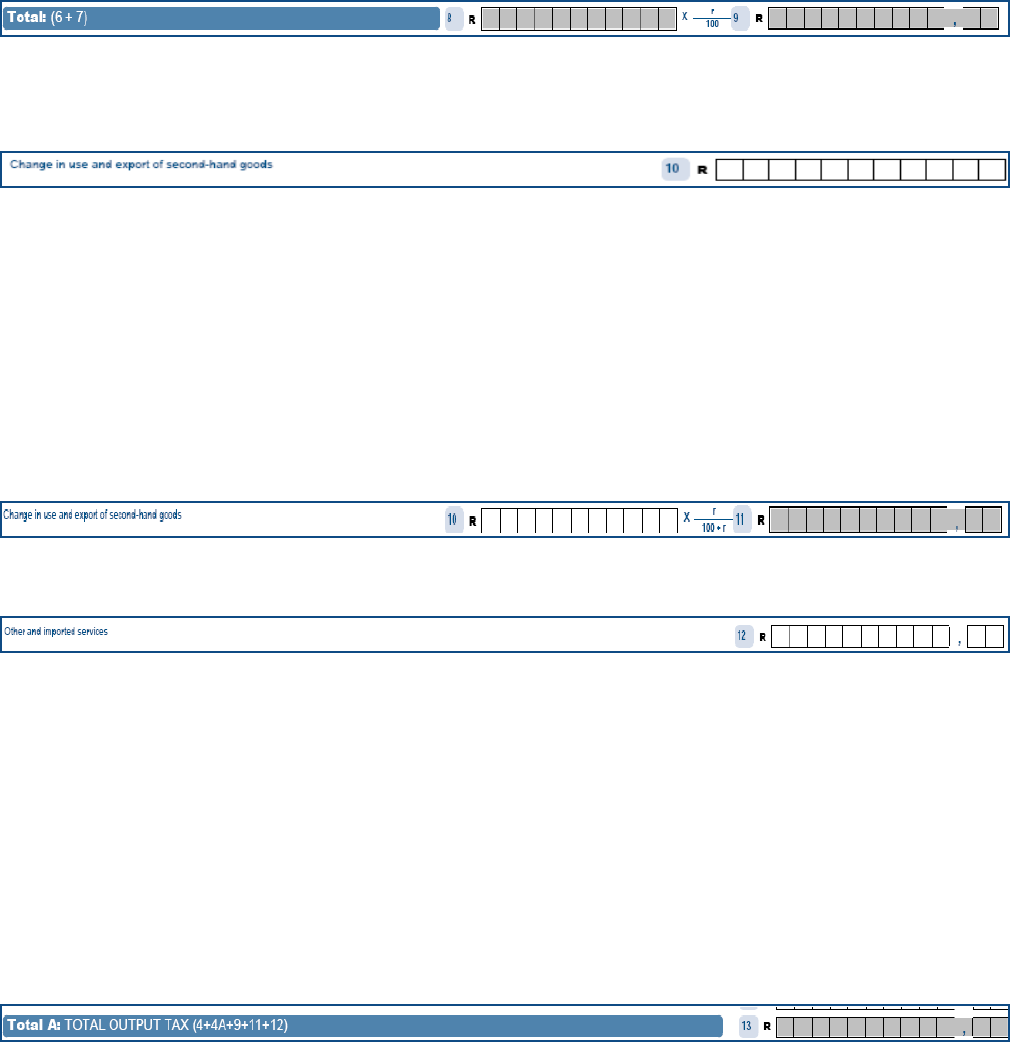

• Field 4 must be equal to Field 1 x (r/(100 + r)), where r is the current VAT rate of 14% This amount is

automatically calculated on the VAT201 declaration, but will be editable if the vendor disagrees

with the automatic calculations. If the edited amount differs considerably from the auto calculated

amount, an error message will prompt the vendor to ensure that the correct value is entered.

Field 4A must be equal to Field 1A x (r/(100 + r)). This amount is automatically calculated on the

VAT201 declaration, but will be editable if the vendor disagrees with the automatic calculations.

If the edited amount differs considerably from the auto calculated amount, an error message will

prompt the vendor to ensure that the correct value is entered.

• Field 5 - Supply of accommodation

The VAT exclusive amount of commercial accommodation supplied exceeding 28 days must be

completed in Field 5. The total value (VAT excluded) in respect of:

o Commercial accommodation provided for a full period of more than 28 days must

be reported in Field 5

o The amount charged must be an all inclusive charge that includes the charge for domestic

goods and services. If the amount is not an all inclusive charge, the amount (inclusive of tax) must

be reflected in Field 1 above.

• Field 6 must be equal to Field 5 x 60%. This amount is automatically calculated on the VAT201 declaration.

• Field 7

The VAT exclusive amount of accommodation supplied not exceeding 28 days must be completed in Field 7. The total

value (VAT excluded) in respect of accommodation supplied for a period equal to or less than 28 days (full period)

must be reported in Field 7

• Field 8 must be equal to the sum of Fields 6 and 7. This amount is automatically calculated on the

VAT201 declaration.

16 | eFILING USER GUIDE FOR VALUE-ADDED TAX

• Field 9 must be equal to Field 8 x (r/100). This amount is automatically calculated on the VAT201 declaration.

Field 9 is calculated by applying the tax rate (i.e. 14%) instead of the tax fraction (14/114) to Field 8.

• Field 10 –Change in use and export of second-hand goods

The amount of change in use and the export of second-hand goods must be completed in Field 10. Consideration

(VAT included) in respect of goods and/or services purchased for taxable supplies, but applied for private use and

exempt supply use.

The purchase price of second-hand goods for which a national input tax was deducted where those goods were

subsequently exported must be completed in Field 10.

• Field 11 must be equal to Field 10 x (r/(100 + r)). This amount is automatically calculated on the

VAT201 declaration, but will be editable if the vendor disagrees with the automatic calculations.

If the edited amount differs considerably from the auto calculated amount, an error message will

prompt the vendor to ensure that the correct value is entered.

• Field 12 – Other and imported services

Only VAT payable in respect of the following may be entered:

o Debit notes issued

o Credit notes received

o Recovery of irrecoverable debts

o Barter transactions

o Services imported by you for purposes of making non taxable supplies

o Adjustments in respect of acquisition of a going concern

o VAT adjustments in respect of change in accounting basis.

Field 13

Total Output Tax must be equal to the sum of Fields 4 +4A+9+11+12. This amount is automatically calculated

on the VAT201 declaration.

17 | eFILING USER GUIDE FOR VALUE-ADDED TAX

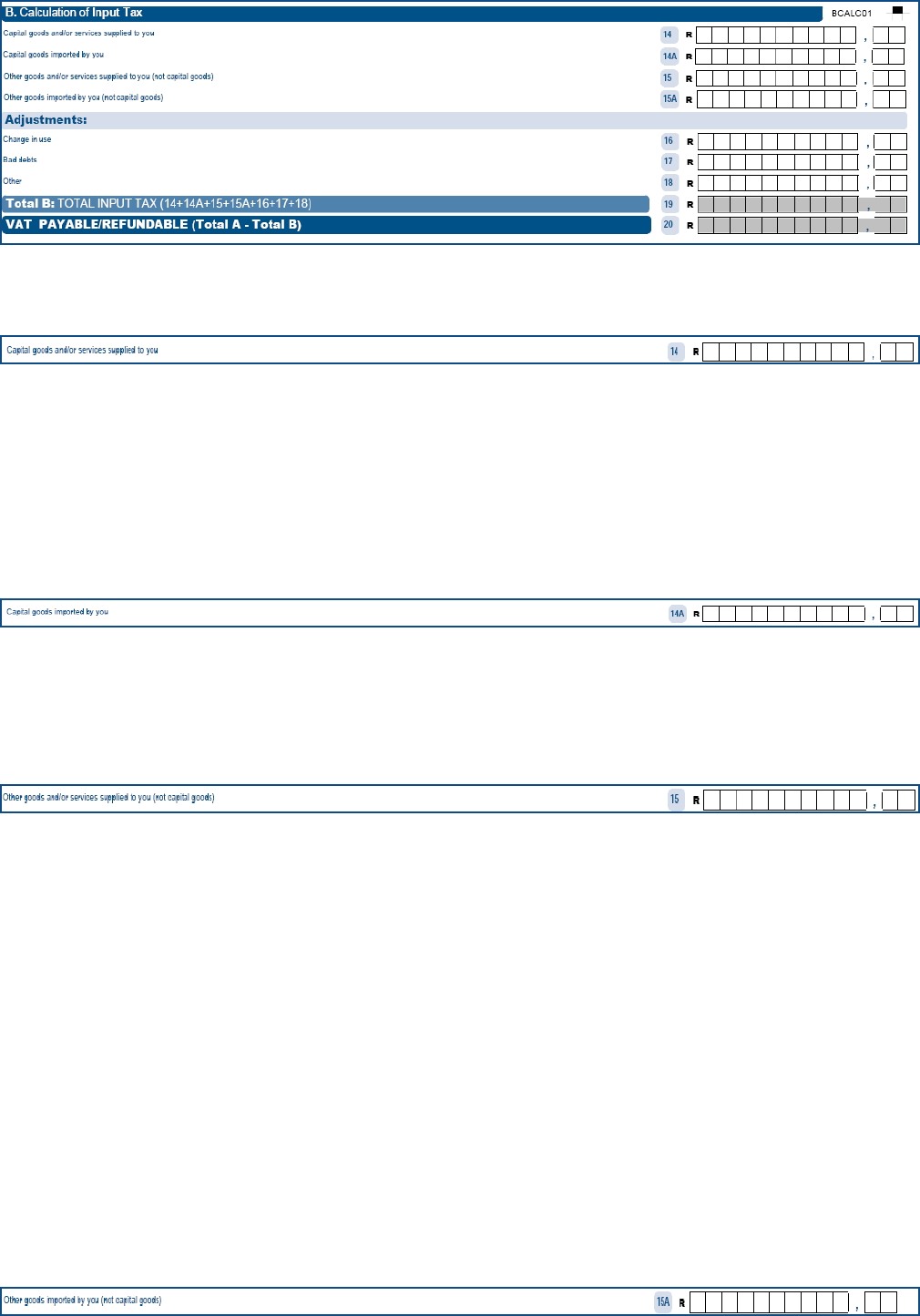

Calculation of Input Tax

• Field 14 - Capital goods and/or services supplied to you

The permissible VAT amount of capital goods and/or services supplied to you must be completed in Field 14. A valid

tax invoice must be held by you. Examples of such acquisitions are:

o Office equipment

o Furniture

o Trucks

o Land and buildings.

• Field 14A - Capital goods imported by you

The permissible VAT amount of capital goods imported by you must be completed in Field 14A. The Customs Code

field is mandatory. This field applies to capital goods imported in respect of which a valid release document issued by

Customs is held.

• Field 15 - Other goods and/or services supplied to you (not capital goods)

The permissible VAT amount of other goods and/or services supplied to you (not capital goods) must be completed in

Field 15. A valid tax invoice must be held by you. Examples of such acquisitions are:

o Accounting fees

o Advertisements

o Commission paid

o Cleaning materials

o Short term insurance premiums

o Membership fees

o Rent

o Repairs

o Second-hand goods (notional input tax)

o Stationery

o Stock purchases

o Telephone

o Water and lights.

• Field 15A - Other goods imported by you (not capital goods)

18 | eFILING USER GUIDE FOR VALUE-ADDED TAX

The permissible VAT amount of other goods imported by you (not capital goods) must be completed in Field 15A.

The Customs Code field is mandatory. This applies to non-capital goods imported in respect of which a valid release

document is issued by Customs is held. An example of such acquisition is the importation of trading stock.

Adjustments

• Field 16 – Change in use

The VAT amount in respect of the change in use must be completed in Field 16. Only the VAT amount in respect of:

o Goods and services previously applied for non taxable purposes and now wholly or partially as

applied for taxable supplies

o An increase in the extent of application of use of goods and / or services for taxable purposes.

Field 17 – Bad debts

The VAT amount in respect of bad debts must be completed in Field 17. Fill in only the VAT amount in respect of

irrecoverable debts on which VAT was levied during the sale. Only applies if registered under the invoice basis of VAT

accounting.

Field 18 - Other

Only the VAT amount in respect of:

o Credit notes issued

o Debit notes received

o VAT adjustments in respect of change in accounting basis

Field 19 must be equal to the sum of Fields 14+14A+15+15A+16+17+18. This amount is automatically

calculated on the VAT201 declaration.

Field 20 must be equal to the difference between Fields 13 and 19. This amount is automatically calculated on the

VAT201 declaration. If the difference between Field 13 and 19 is less than zero, then the minus (-) sign must be added

in the first block before the amount entered in the field. The minus sign (-) will indicate that a refund is due. If Field

20 has no minus sign (-) before the amount, then the amount indicates that payment is due.

19 | eFILING USER GUIDE FOR VALUE-ADDED TAX

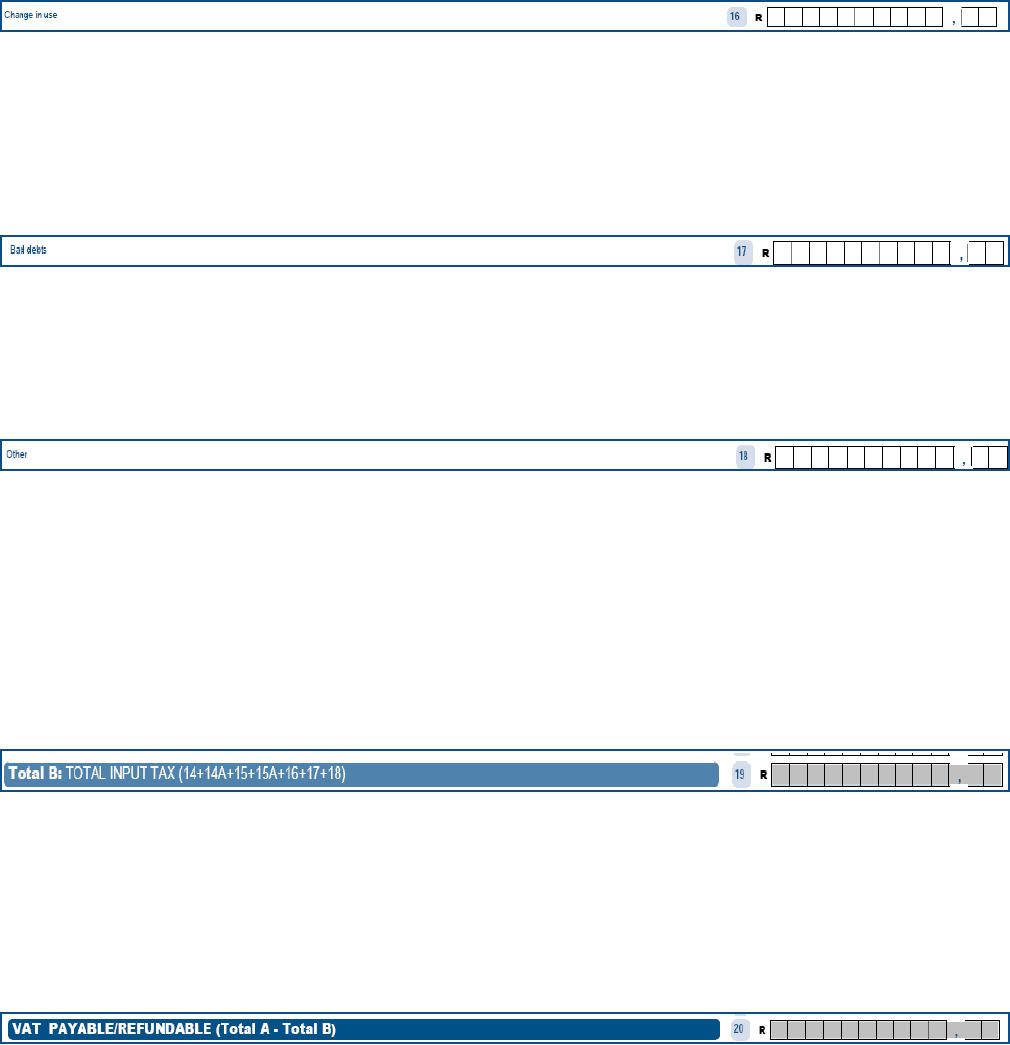

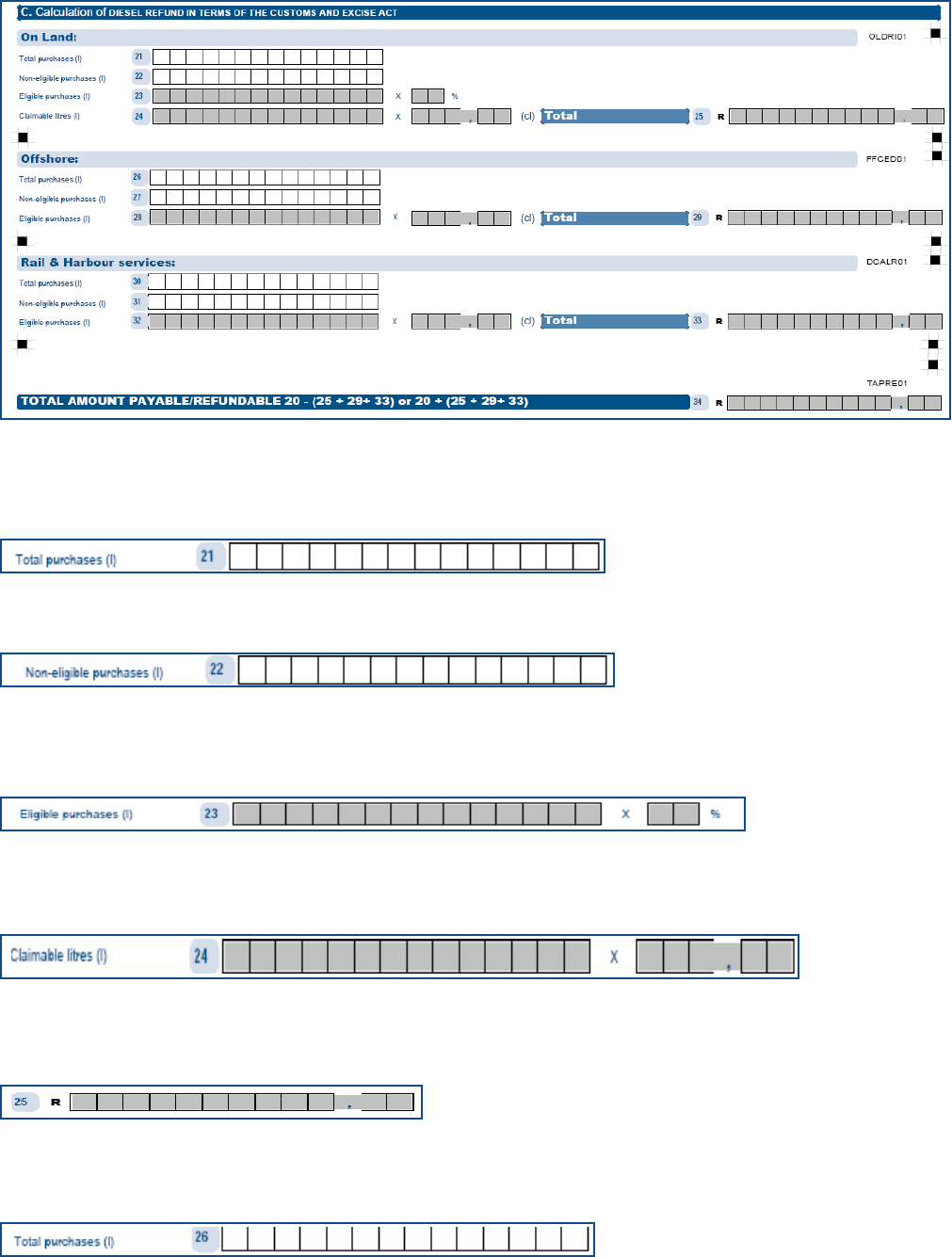

Calculation of DIESEL REFUND IN TERMS OF THE CUSTOMS AND EXCISE ACT

On Land

Field 21 The total amount of diesel purchases in litres in respect of eligible and non-eligible purchases

Field 22 The total amount of non-eligible litres

Field 23 The amount of diesel in respect of eligible purchases (total purchases less non-eligible purchases). This

field is mandatory if field 21 was completed and must be in full litres

Field 24. Eligible litres x 80% (concession percentage). This amount is automatically calculated on the VAT201

declaration.

Field 25. The value of field 24 x (current diesel rate for on land) cents per litre/ 100. This amount is automatically

calculated on the VAT201 declaration.

Offshore

Field 26 The total amount of diesel purchases in litres in respect of eligible and non-eligible purchases

20 | eFILING USER GUIDE FOR VALUE-ADDED TAX

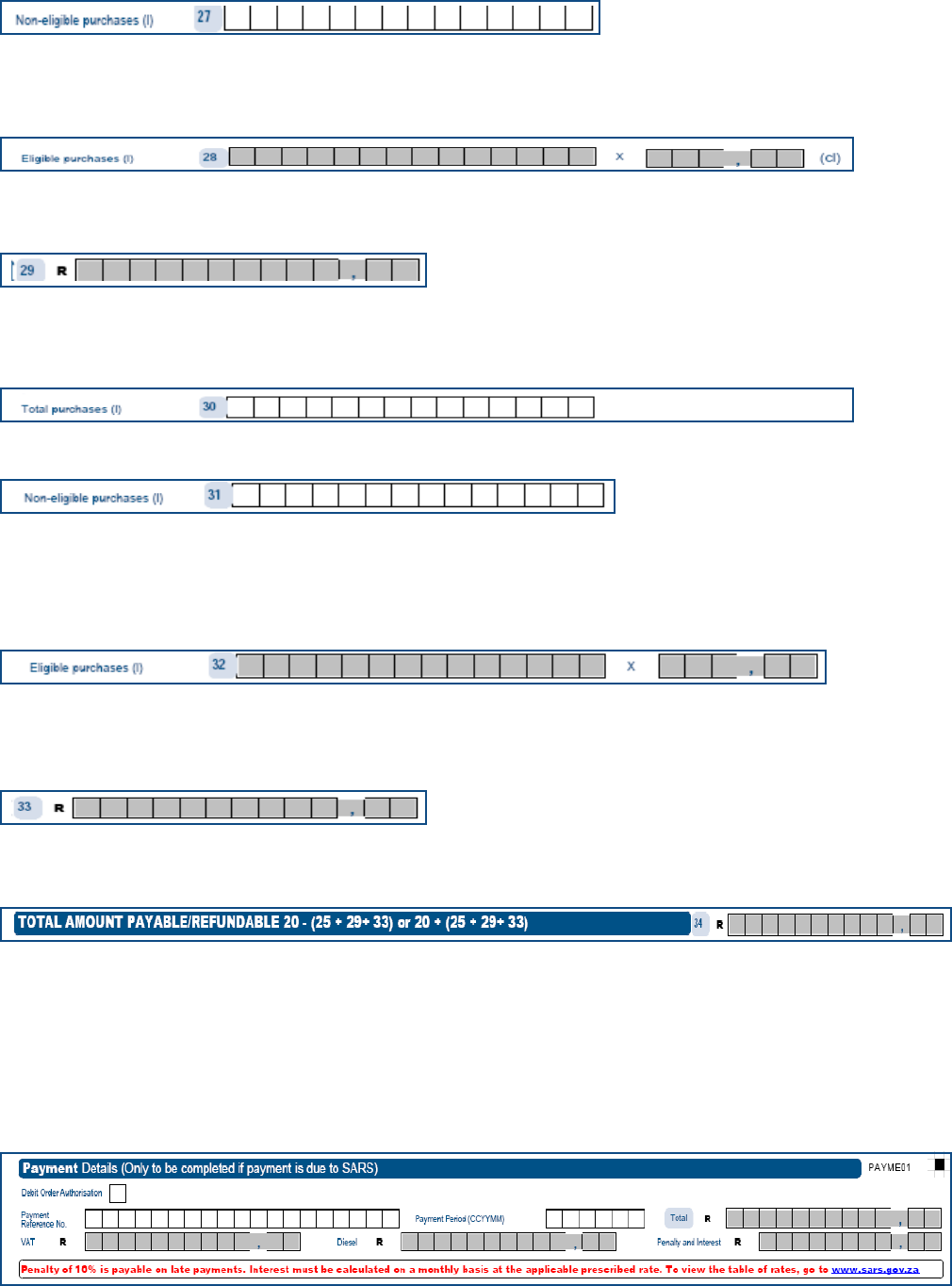

Field 27 The total amount of non-eligible litres

Field 28 The amount of diesel in respect of eligible purchases (total purchases less non-eligible purchases). This

field is mandatory if Field 26 was completed and must be in full litres

Field 29. The total value of field 28 x (current diesel rate for off shore) cents per litre/ 100. This amount is

automatically calculated on the VAT201 declaration.

Rail & Harbour services

Field 30 The total amount of diesel purchases in litres in respect of eligible and non-eligible purchases

Field 31 The total amount of non-eligible litres

Field 32 The amount of diesel in respect of eligible purchases (total purchases less non-eligible purchases). This

field is mandatory if field 30 was completed and must be in full litres

Field 33. The value of field 32 x (current diesel rate for rail) cents per litre/ 100. This amount is automatically

calculated on the VAT201 declaration.

Field 34. This amount is automatically calculated by the form.

o Field 34 = Fields 20 – (25 + 29 + 33)

o If Field 34 is less than zero, then the minus sign (-) must be added in the first block before the

amount is entered in the field. This means a refund is due

o If Field 34 is more than zero, it means a payment is due.

Payment Details

Note: The details of payment made must be completed in this section.

21 | eFILING USER GUIDE FOR VALUE-ADDED TAX

• Debit Order Authorisation

The VAT debit order facility as arranged with SARS, will no longer apply and an “N” will show for all eFilers.

• Payment Reference Number (PRN)

This number will be generated by SARS when the VAT201 Declaration is issued on eFiling.

• Payment Period (CCYYMM)

This field will be automatically pre-populated. The payment period will be exactly the same as the tax period

under the Vendor Details section.

• Total

The total amount of the VAT payment due to SARS is automatically calculated by the VAT201 declaration. If

you are registered for diesel and entered any amounts in the diesel section, then the Total field is calculated as

Fields 20 – (25 + 29 + 33) + Penalties and Interest (where applicable). If you are not registered for diesel, then

the Total field is equal to Field 20 + Penalties and Interest (where applicable).

• VAT

The portion of the total amount of the payment for VAT will be equal to Field 20 and will be automatically

populated on the VAT201 Declaration.

• Diesel

The diesel amount is the sum of Fields 25+29+33. This field will be automatically calculated on the VAT201

Declaration.

• Penalty and Interest

The portion of the payment that must be allocated to a penalty and/or interest for the specific tax period must

be completed in this field. If the vendor wants to pay interest/penalties/outstanding taxes in respect of another

tax period, the PRN for that tax period must be used.

Refund Details

Note: This section must only be completed if a refund is claimed by the vendor. The turnaround time for a refund to

be processed is 21 working days.

• Payment Reference Number (PRN)

This number will be generated by SARS when the VAT201 Declaration is issued on eFiling.

• Payment Period (CCYYMM)

This field will be pre-populated. The payment period will be exactly the same as the tax period under the Vendor

Details section.

• Total

The total amount of the refund claimed is automatically calculated on the VAT201 Declaration. If you are

registered for diesel and entered any amounts in the diesel section, then the Total field is calculated as Fields

20 – (25 + 29 + 33). If you are not registered for diesel then the Total field must be equal to Field 20.

• VAT

The total amount of the VAT refundable (Field 20) will automatically be populated on the VAT201 declaration.

22 | eFILING USER GUIDE FOR VALUE-ADDED TAX

• Diesel

The diesel amount is the sum of Fields 25+29+33. This field will be automatically calculated on the VAT201

Declaration.

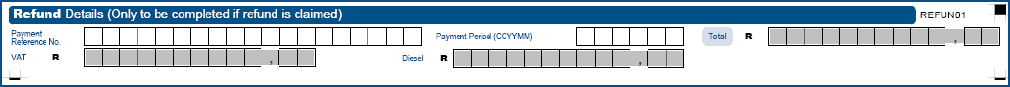

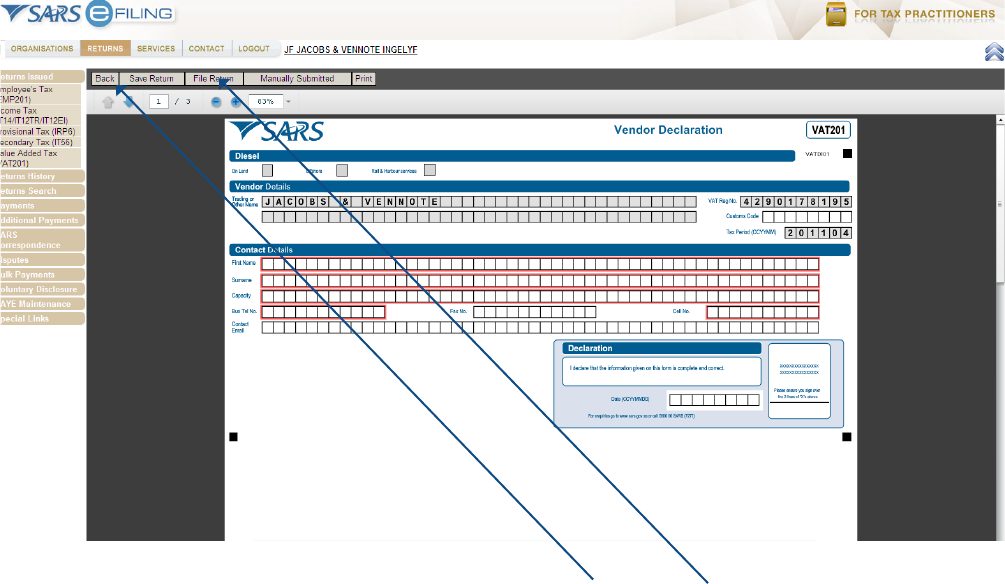

5. SUBMITTING THE VAT201 DECLARATION FOR A SPECIFIC TAX PERIOD

Once all the required fields have been captured, click on the “Save Return /File Return” button to save or file your

VAT201 Declaration.

If the VAT201 Declaration is saved it will be stored on the eFiling system and will still be available for editing before

submitting the VAT201 Declaration to SARS. If the VAT201 Declaration is filed, it will be automatically submitted and

processed by SARS.

If your VAT201 Declaration has been successfully saved on eFiling, the following screen will display:

23 | eFILING USER GUIDE FOR VALUE-ADDED TAX

If your VAT201 Declaration has been successfully filed on eFiling, the following screen will display:

Note: Before the VAT201 Declaration is filed and if the amount declared for this tax period is substantially different

from the amount declared in the previous tax period, the following message will be displayed:

Note: If a vendor was in the process of completing their VAT201 Declaration in the old format and has saved it, the

vendor will not be allowed to submit that VAT201 Declaration. Such VAT201 Declarations will be archived and the

vendor will have to request a VAT201 Declaration, in the new format, to be issued. The vendor will still be able to

view the VAT201 Declaration that was partially completed in the old format. If a vendor wants to complete a VAT201

Declaration for a prior tax period, eFiling will display the VAT201 Declaration in the new Adobe format.

Note: A vendor will only be allowed to submit a VAT201 Declaration on the 1st day of the month following the tax

period for which the declaration must be made.

24 | eFILING USER GUIDE FOR VALUE-ADDED TAX

6. MAKING PAYMENT

You can make the payment immediately after the submission of the VAT201 Declaration or opt to make the payment

at a later stage by selecting the Payments menu on eFiling.

Note:

• Vendors can complete their VAT201 Declaration on eFiling and make the corresponding payment on eFiling

and then submit both the VAT201 Declaration and the payment to SARS

• Vendors can complete their VAT201 Declaration on eFiling and submit to SARS. Thereafter the vendor can

make the corresponding payment at a later time on eFiling via the VAT201 Work Page or another channel (i.e.

Internet Banking, Bank, At a SARS branch). For this payment option, the vendor can effect multiple payments.

• A vendor will not be able to make a payment via eFiling prior to submitting the corresponding VAT201

Declaration via eFiling.

• The following payment method is available on SARS eFiling, namely the credit push.

o Credit push refers to payment transactions that are initiated on the eFiling site and presented

to the banking product as bill presentation, i.e. a payment request. Only once the user has logged

into the banking product and authorised the payment request is this transaction regarded as

an effective payment. Credit push transactions are irrevocable once approved. This option is

supported by ABSA, Capitec Bank, Citibank, FNB, Investec, Nedbank, Standard Bank.

o Debit pull refers to authorised payment transactions that you have requested SARS to collect

on your behalf at a specified date. This payment mechanism involves the initiation of a payment

instruction from SARS’s bank to your bank. The debit pull mechanism may be reversed due to

insufficient funds once the request is processed by the bank. Correct banking details are required

to ensure the payment is successful.

• Please note:

o As of the end of October 2013 Debit Pull transactions are discontinued for ABSA, FNB, Investec,

Nedbank and Standard Bank. For all other banks you will still be allowed to use the Debit Pull

option until phased out. Taxpayers are advised to set-up a Credit Push payment option or use one

of our alternative methods of payment. Refer to www.sars.gov.za for more information on the

credit push set-up and SARS payment rules.

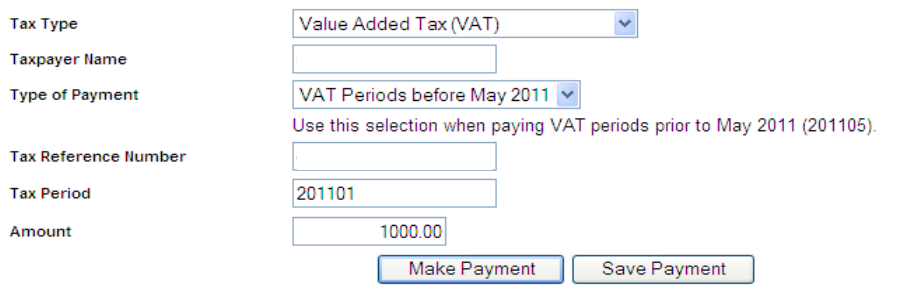

o “Additional Payments” on eFiling for Income Tax, Provisional Tax, Value-Added Tax (VAT) and Pay-

As-You-Earn (PAYE) is not available via the Debit Pull facility. In such cases the Credit Push facility

must be used.

• The date on which the VAT201 Declaration and payment must be received by SARS will be explained in the

table below:

Payment method SARS must receive

return by (or last

preceding business

day)

SARS must receive

payment by (or

last preceding

business day)

SARS eFiling of return only

and payment not using

SARS eFiling

Last business day of the

month

25th

SARS eFiling of return and

payment via SARS eFiling

website

Last business day of the

month

Last business day of the

month

25 | eFILING USER GUIDE FOR VALUE-ADDED TAX

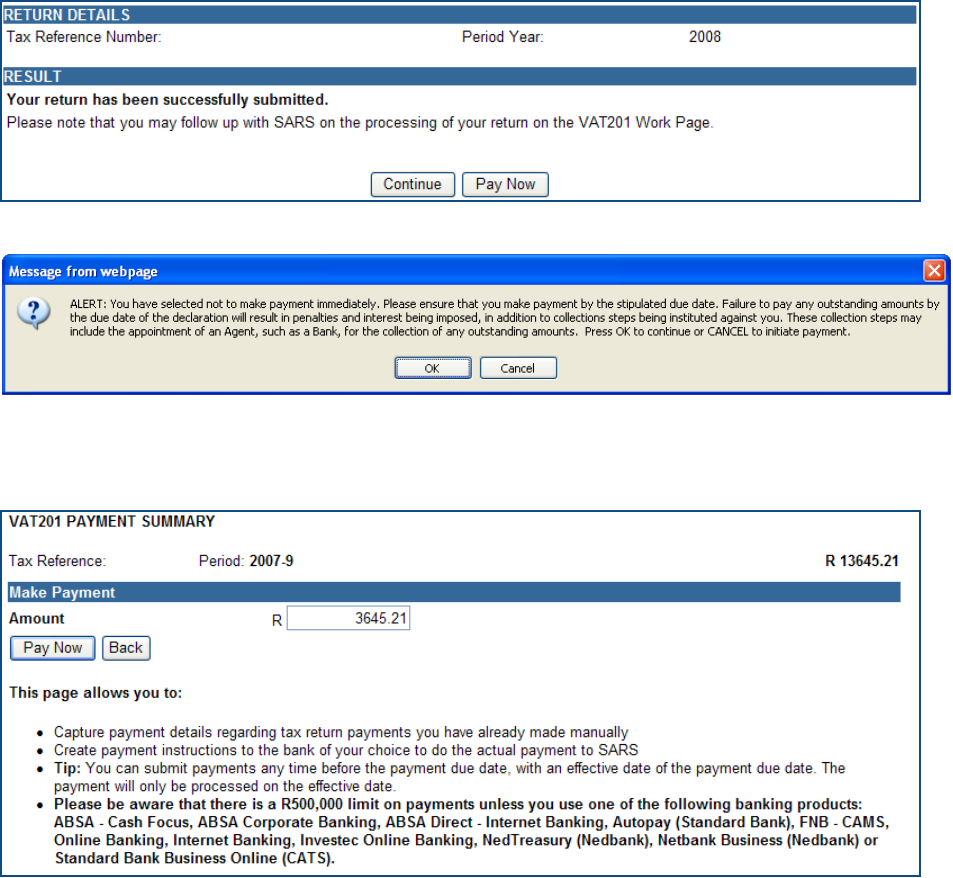

A payment entry will be created and you will be presented with the following screen from which you may choose to

make the payment or postpone it for a later time:

If you click on the “Continue” button the following page will be displayed:

If you click on the “Pay Now” button, the following screen will be displayed and you will be requested to provide

your bank details to initiate the payment process:

• Amount - This field is editable to allow you to enter the amount you would like to pay

• Pay Now – This button will redirect you to the Payment Details page

• Back – This button will take you back to theVAT201 Work Page

26 | eFILING USER GUIDE FOR VALUE-ADDED TAX

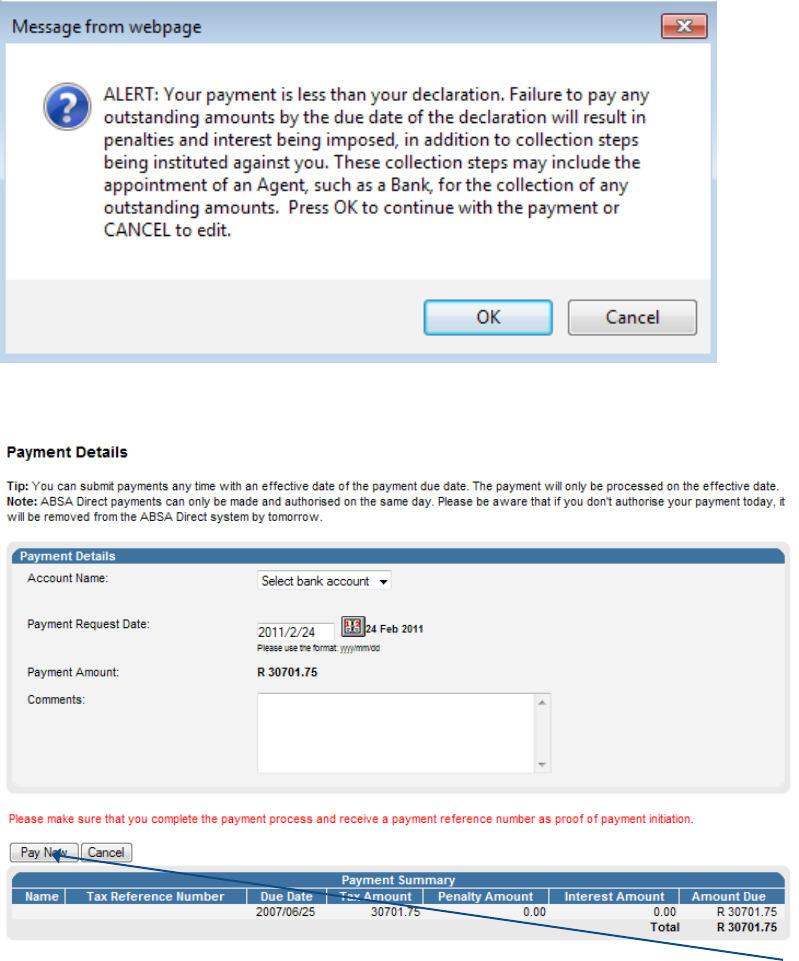

Should you reduce the populated amount to be paid, the following message will be displayed:

If the amount entered is the required amount as populated on the VAT 201 declaration, the following screen will

be displayed:

Once the account name and payment request date has been completed click on the “Pay Now” button to confirm

the payment.

If you click on the “Cancel” button, you will be redirected to the Return Search page.

27 | eFILING USER GUIDE FOR VALUE-ADDED TAX

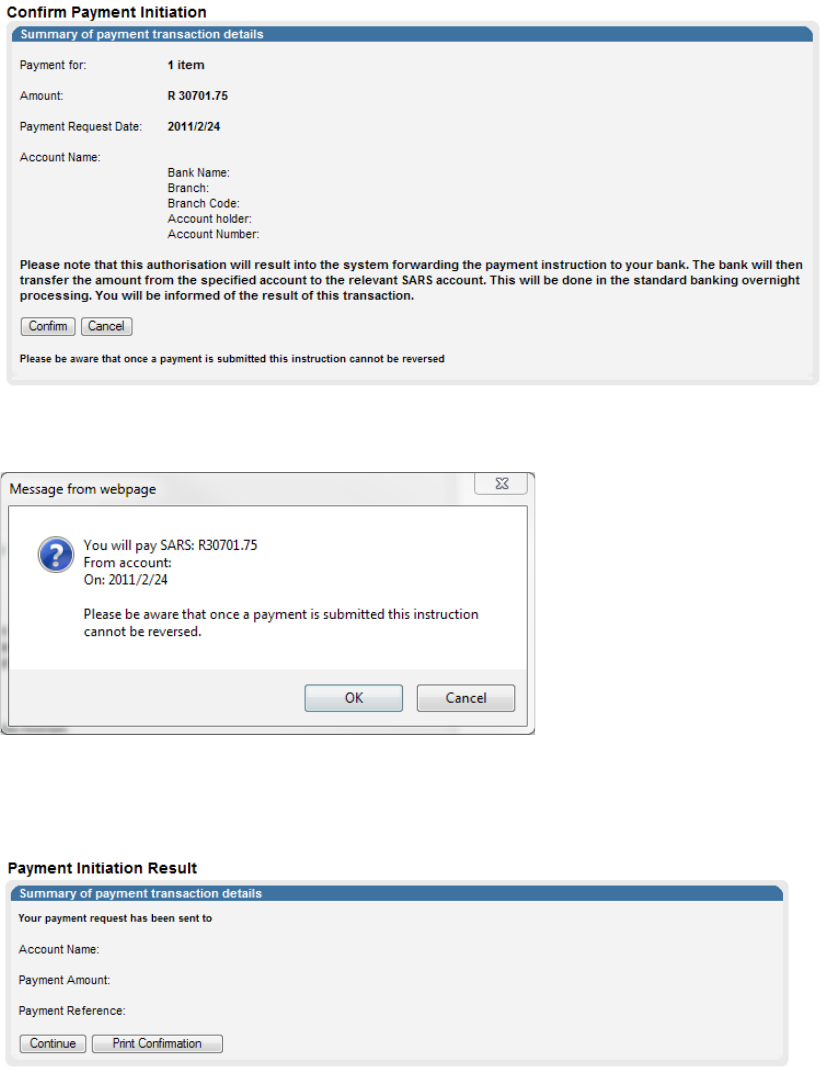

If you click on “Pay Now” the following screen will be displayed:

If you click on the “Confirm” button a payment summary pop-up message will be displayed:

If you click on the “Cancel” button, you will be redirected to the Return Search page.

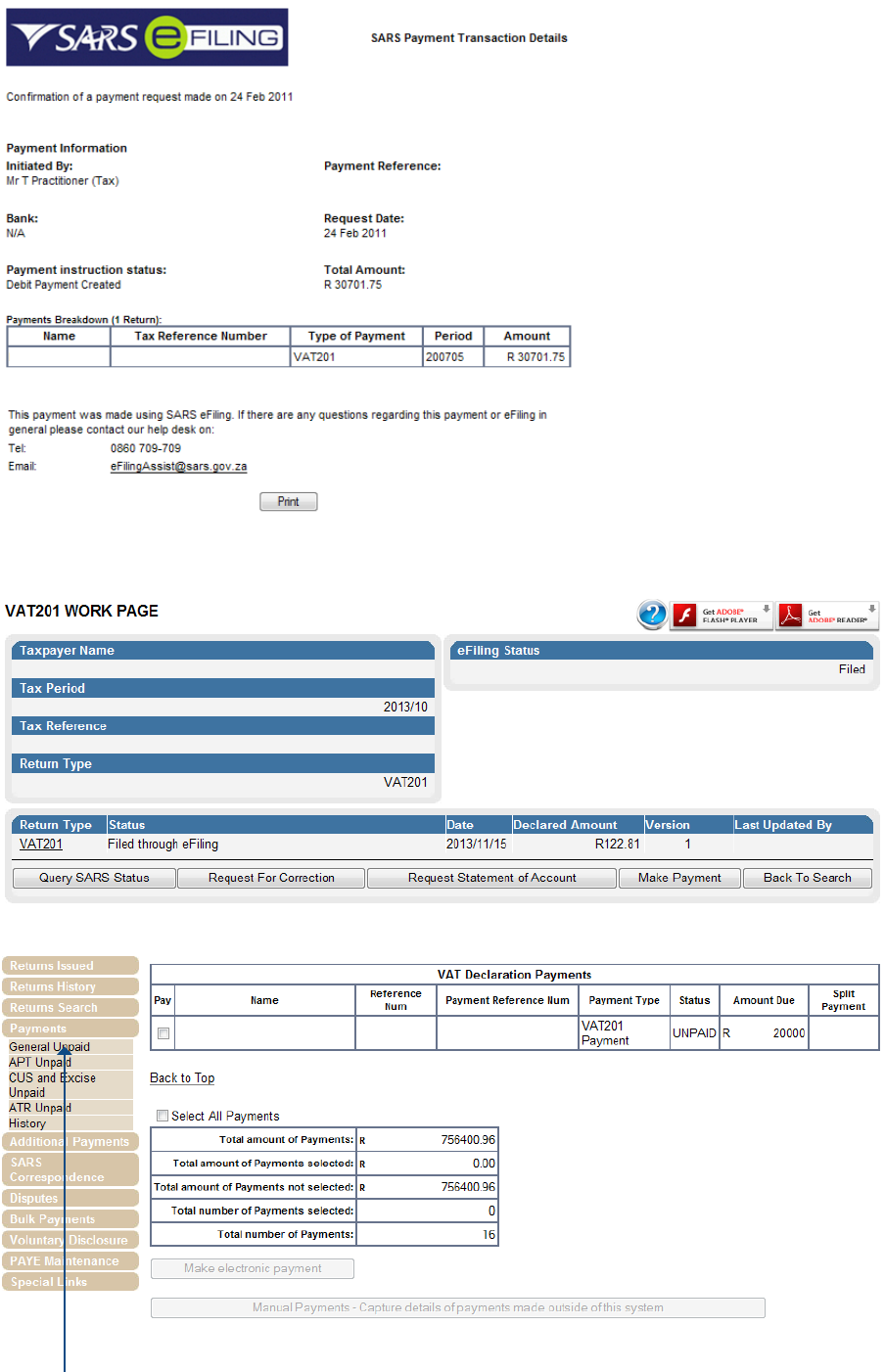

If you click on the “OK” button the confirmation page will be displayed:

If you click on the “Cancel” button, you will be redirected to the Return Search page

To view your payment confirmation, click on the “Print Confirmation” button. The following screen will be displayed:

28 | eFILING USER GUIDE FOR VALUE-ADDED TAX

If you opted to pay later you will find your saved VAT201 Declaration in the VAT201 Work Page. The following screen

will be displayed when you return to the VAT201 Work Page:

If a payment was aborted during the payment process, the payment entry will be created and listed as “General

Unpaid” in the Payments menu. You will be able to confirm the payment by ticking the “Pay” box. Please note that

you will not be able to edit the amount reflected in this section.

29 | eFILING USER GUIDE FOR VALUE-ADDED TAX

7. REQUEST FOR CORRECTION

Vendors have the ability to revise a previously submitted VAT201 Declaration, whether it is for the current tax period

or a prior tax period, by increasing or decreasing the values on a prior VAT201 Declaration to reflect the correct VAT

liability.

Note:

• The vendor will be allowed to do a revision on the VAT portion of the VAT201 Declaration for any tax period

within the last 5 years.

• The vendor will be allowed to do a revision on the diesel portion of the VAT201 Declaration for any tax period

within the last 2 years.

• Revisions on the VAT201 Declarations will only be accepted if submitted in the new format.

• There will be no limit on the number of revisions permitted to the vendors per tax period.

• When a vendor revises a VAT201 Declaration for the second time onwards (version 3), the vendor is required

to submit supporting documents with the submission of the revised VAT201 Declaration to support the change

made to the declaration.

• The vendor will be able to request for a correction on the VAT201 Declaration from any channel and not only

the channel on which the vendor submitted the original assessment for the tax period concerned.

• If an audit case has been finalised or a correction was done by a SARS user, the vendor will not be allowed to

submit a revision of the VAT201 Declaration.

The following two scenarios will be where a vendor can request a correction on the filed VAT201 Declaration:

• Overstated Return: The vendor wants to decrease the declaration for a specific tax period.

• Understated Return: The vendor wants to increase the declaration for a specific tax period.

30 | eFILING USER GUIDE FOR VALUE-ADDED TAX

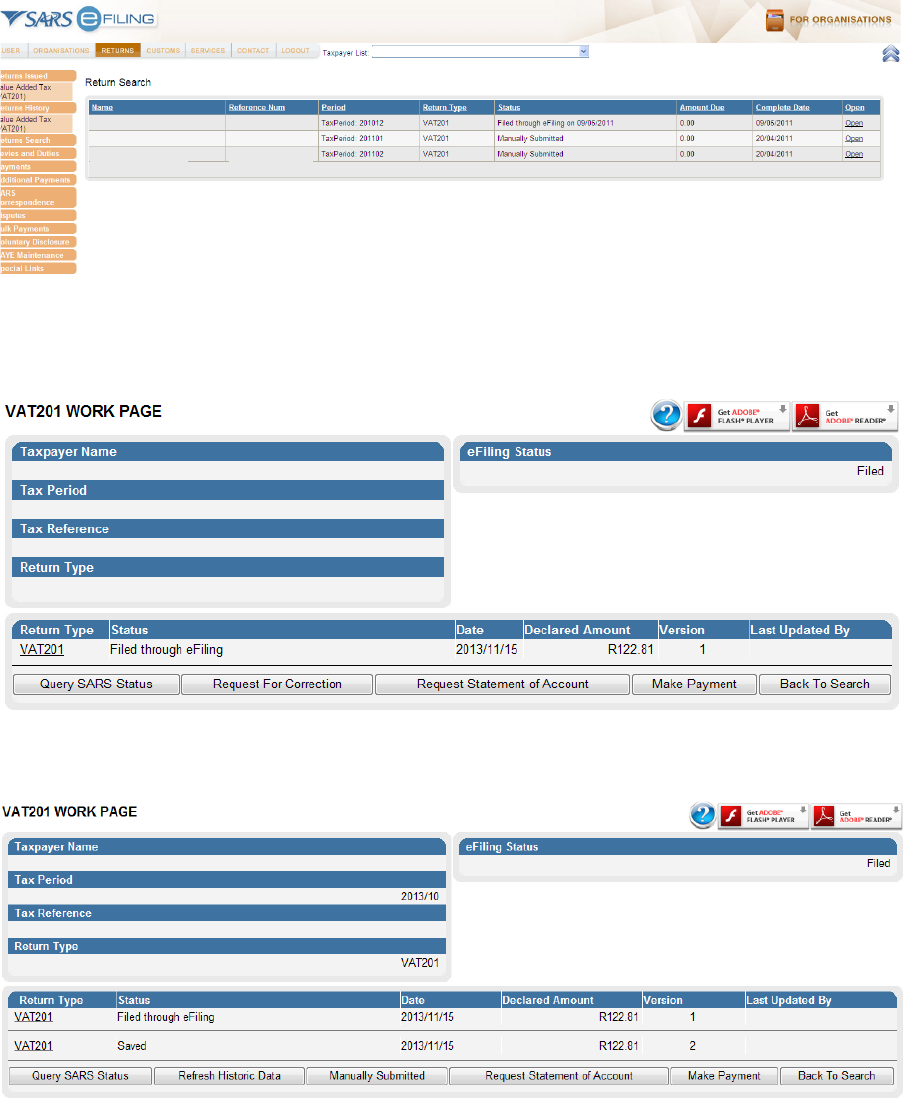

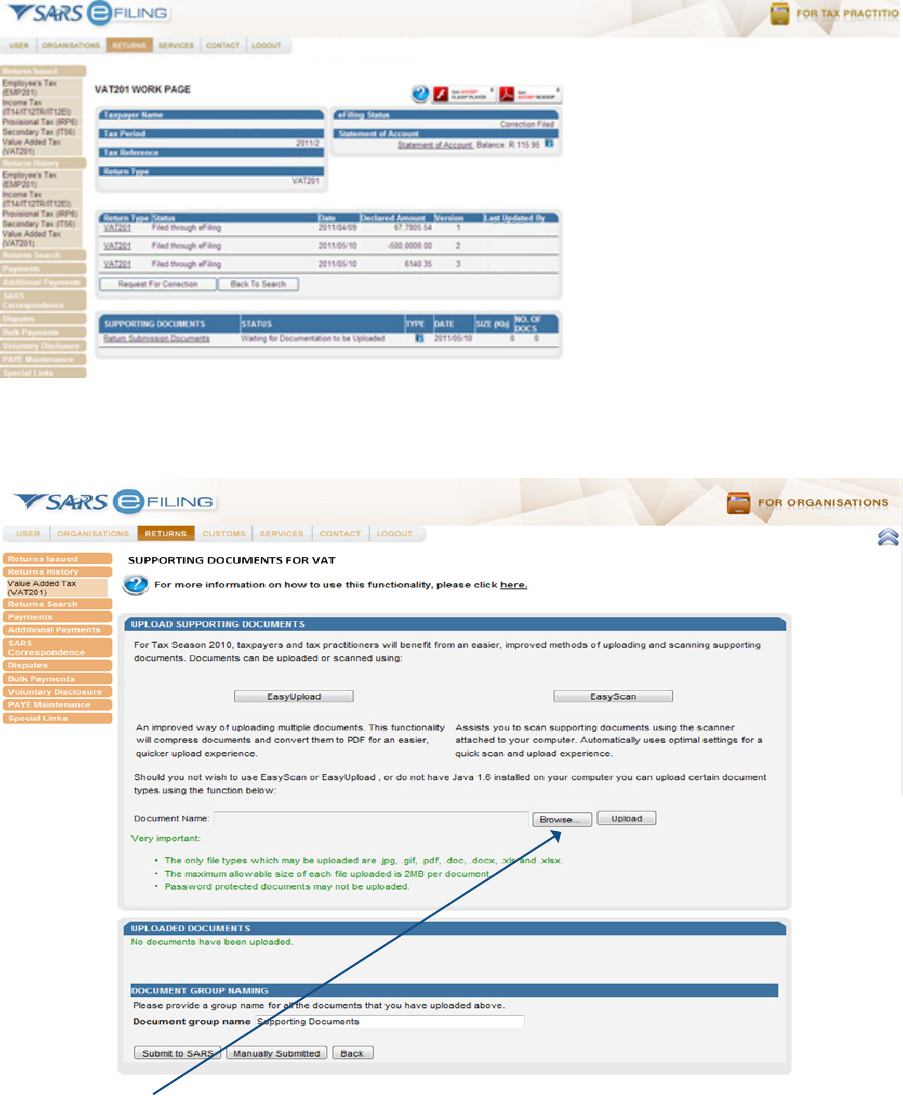

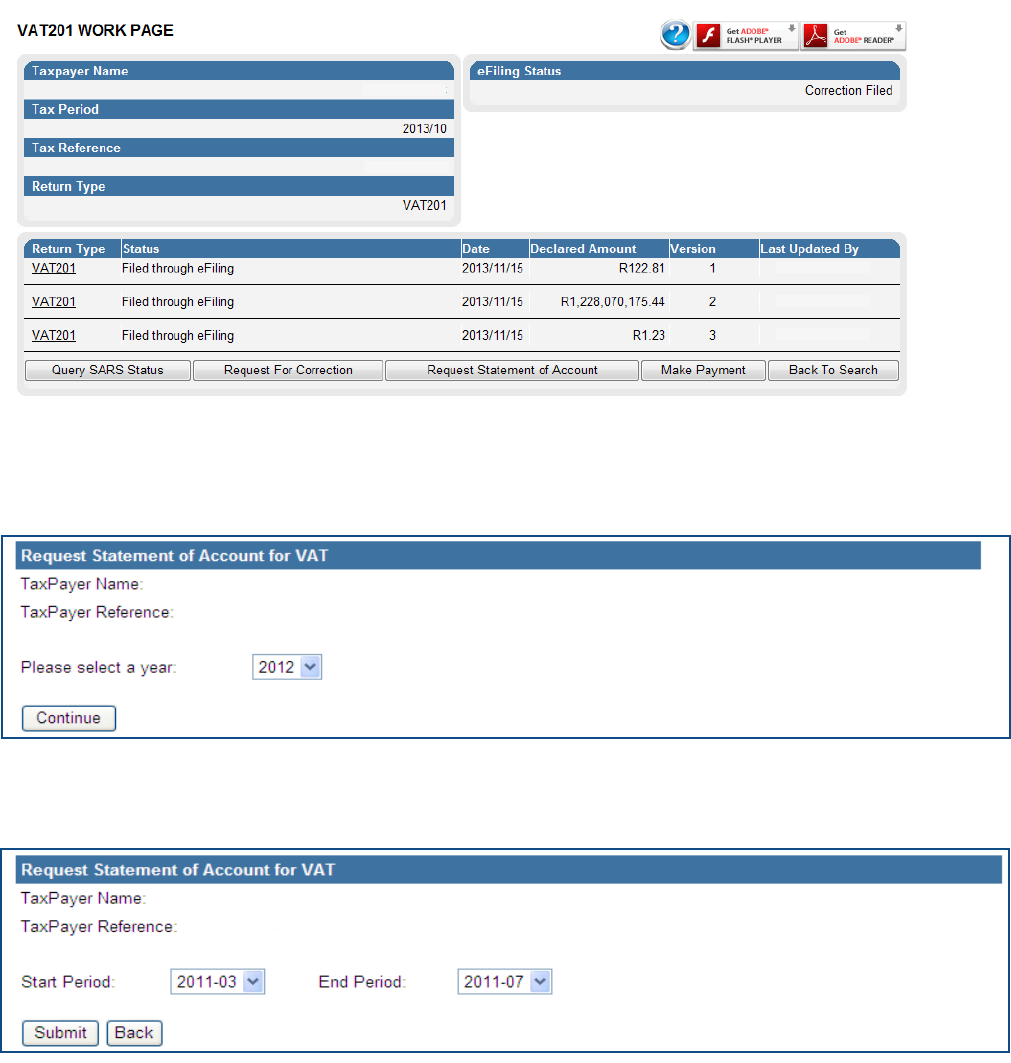

Select the desired declaration where a correction needs to be made on “Returns History” from the side menu

options under Returns.

Select the “Request for Correction” option.

When a vendor requests for a revision, the selected filed return is presented in a SAVED status and is allocated a

new version.

Note: For corrections to previously submitted declarations, vendors will only be allowed to adjust the last version of

each declaration, therefore ensuring that the correct version is always adjusted

The vendor will be able to view the work page of any submitted VAT201 Declarations.

It will contain the following:

o Return type: VAT201 Declaration

o Tax period and Version: indicates the version number of the last submitted VAT201 Declaration

o Status: indicates the current status of the VAT201 Declaration

o Submission date: indicates the date on which that particular version of the VAT201 Declaration

31 | eFILING USER GUIDE FOR VALUE-ADDED TAX

was submitted

o Submission Channel: indicates the channel by which that version was submitted

o Last updated by: indicates the name of the person who last updated the VAT201 Declaration.

A new VAT201 Declaration will be created with the minimal pre-populated fields.

Note:

• The vendor must submit a totally revised VAT201 Declaration and not just the difference on the fields the

vendor wishes to revise.

• The vendor will be able to view the previously submitted declaration when performing the correction.

• The vendor will not be allowed to increase his input tax deduction when doing a revision on a past tax

period. If the vendor wishes to deduct input tax attributable to a past tax period, a deduction can be made

in the next tax period or any future tax period, only if the deduction is made within five years from the date

of first entitlement to such input tax deduction.

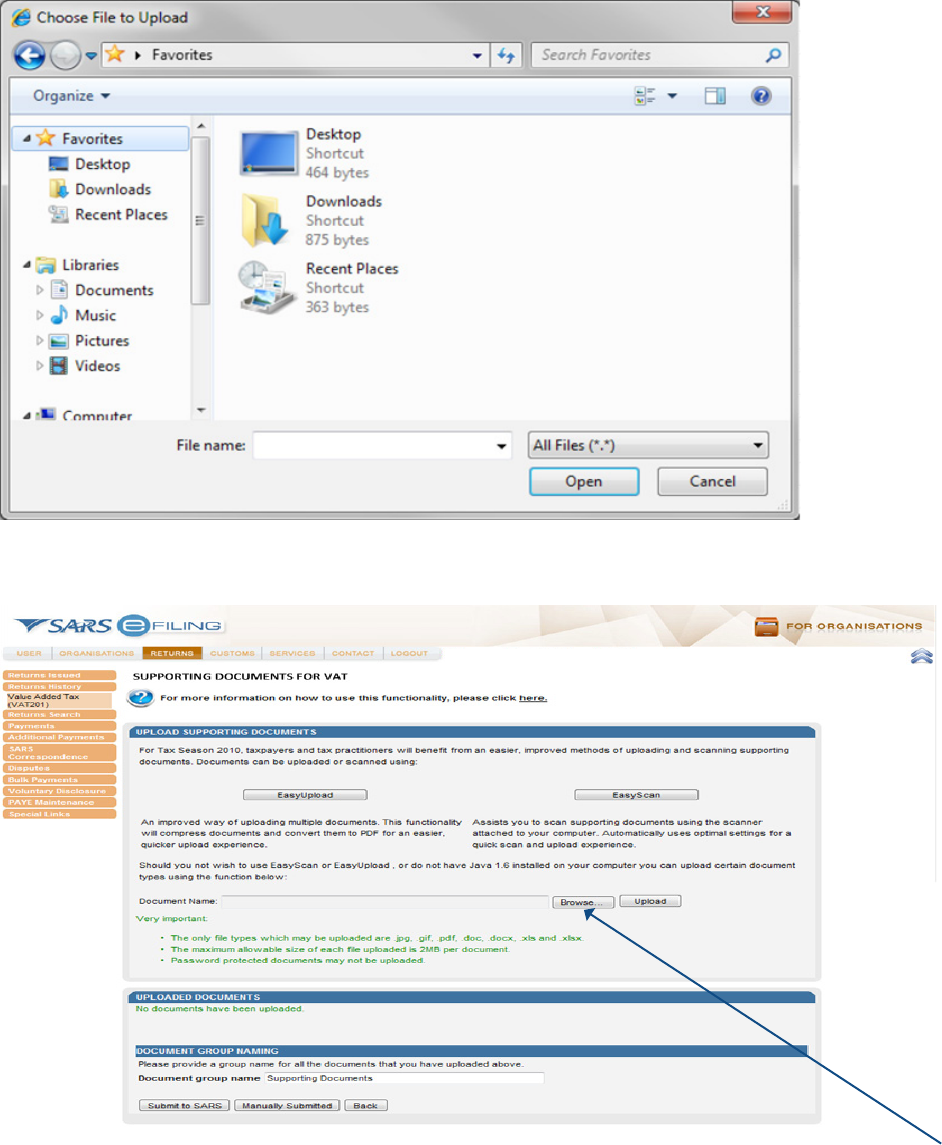

8. SUBMITTING RELEVANT MATERIAL

SARS might request the vendor to upload relevant material, if it deems to be necessary. Relevant material must only

be uploaded if a letter is received from SARS requesting the vendor to submit relevant material. This letter will be

issued via eFiling and can be accessed under “SARS Correspondence” Once the letter is opened, another container

will open on the VAT201 work page under SUPPORTING DOCUMENTS from where the relevant material can now

be uploaded.

32 | eFILING USER GUIDE FOR VALUE-ADDED TAX

Select “Return Submission Documents”

The following screen will be displayed:

Click on the “Browse” button displayed on the submission confirmation message window or on the VAT201 Work

Page.

The following screen will be displayed to allow you to select the document(s) to be uploaded:

33 | eFILING USER GUIDE FOR VALUE-ADDED TAX

This option will allow you to browse for documents saved on the computer, external storage devices and networks.

Once you have selected the document(s) you can upload the supporting document(s) by clicking on the “Upload”

button.

34 | eFILING USER GUIDE FOR VALUE-ADDED TAX

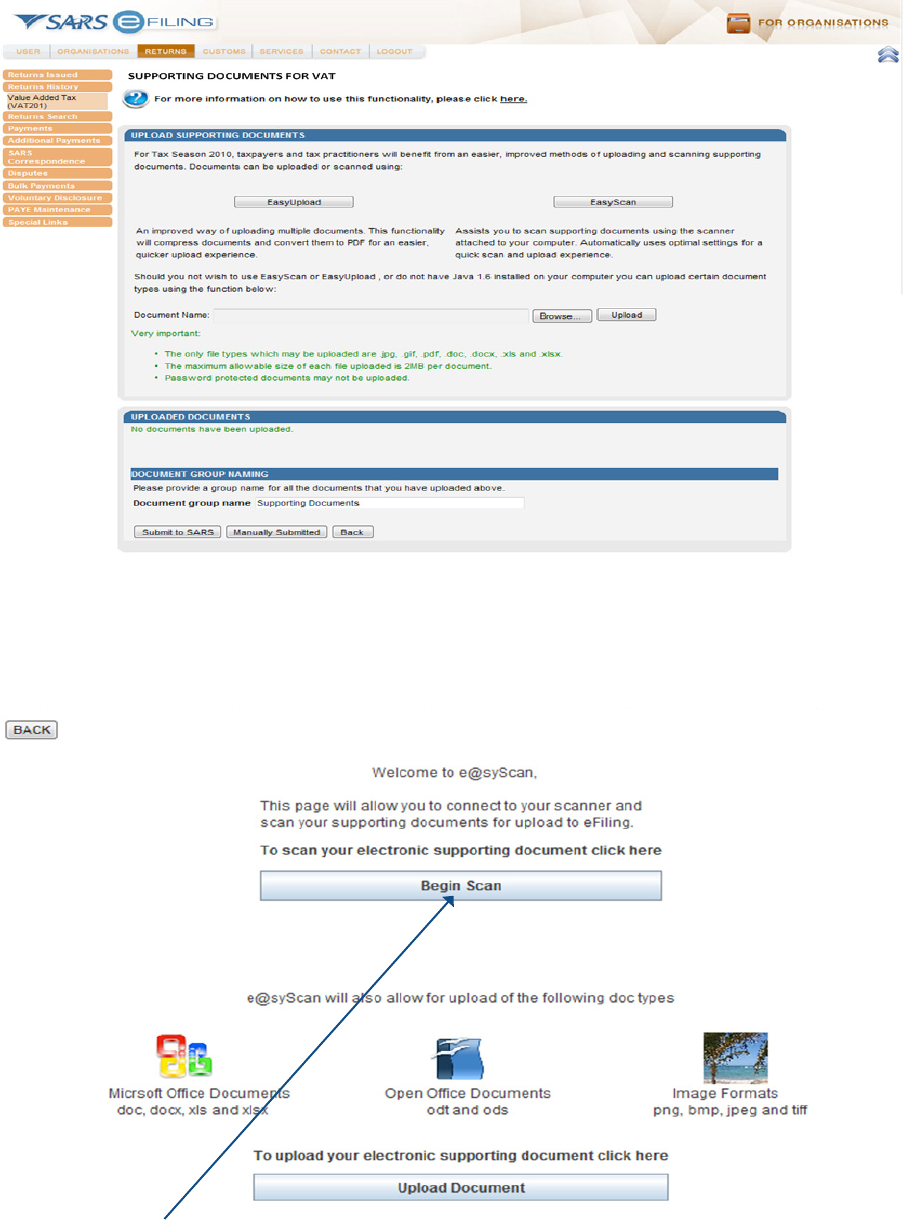

Should you require to scan relevant material that are in hard copy format, click on the “EasyUpload” or

“EasyScan” buttons. EasyUpload will allow you to upload multiple documents.

Once you have clicked on the EasyScan button, the following screen will be displayed:

Click on the “Begin Scan” button to begin scanning the document(s).

• NB: In order to utilise the Easy Scan/Easy Upload function, you must have Java 1.6 installed

on your computer.

After the “Begin Scan” button is clicked, the following screen will be displayed and you will be able to proceed

with the scanning action in order to upload documents.

35 | eFILING USER GUIDE FOR VALUE-ADDED TAX

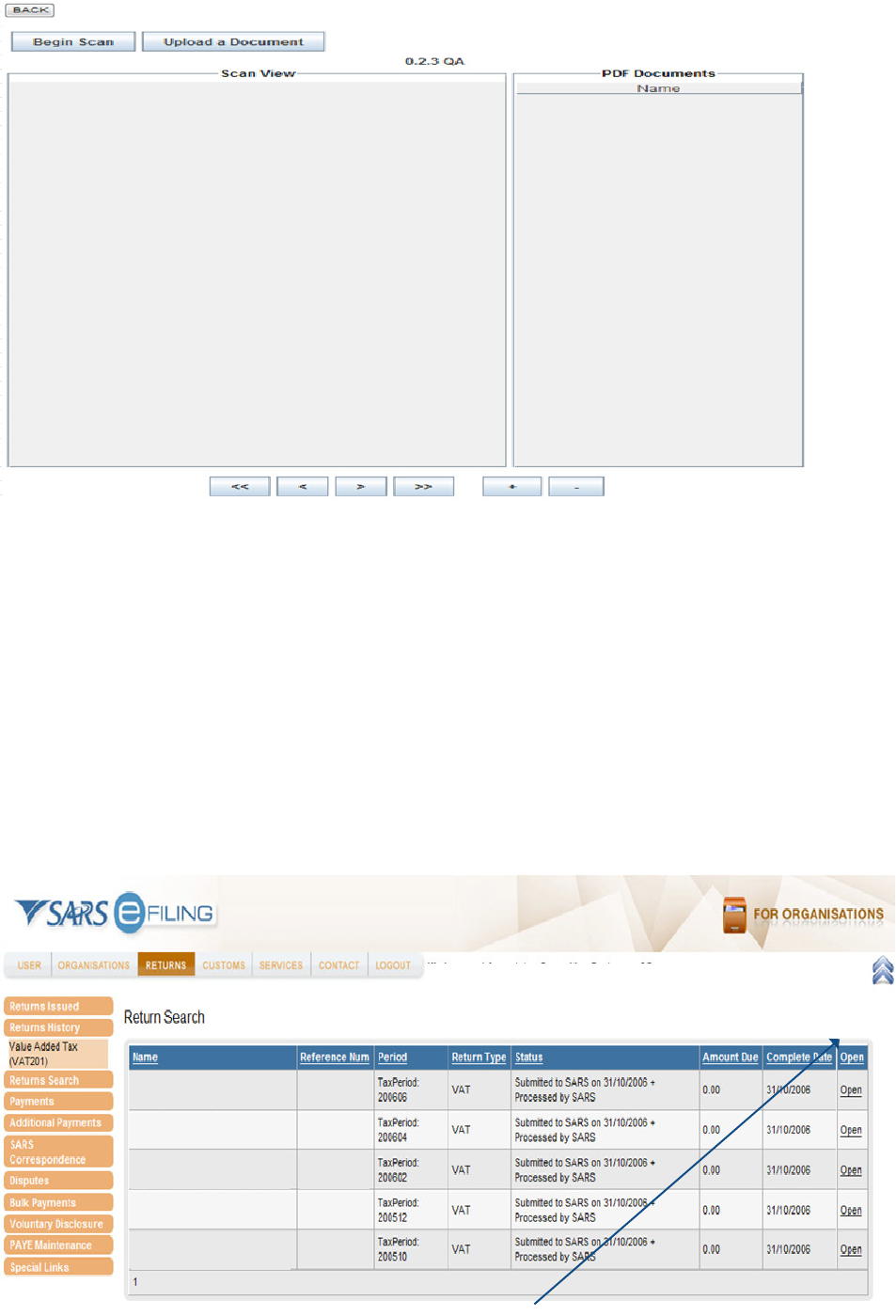

9. VIEWING HISTORIC RETURNS

On eFiling, users will have the ability to search for and view their filed VAT201 Declarations. The VAT201 Declarations

that are listed in the” Returns History” list will be accessible from the Returns Search menu option.

VAT201 Declarations that have the status as set out below will be displayed on this menu:

o Submitted to SARS

o Processed by SARS

o Manually Submitted

o Selected for Audit.

Click on the “Open” button on the grid to be redirected to the VAT201 Work Page.

36 | eFILING USER GUIDE FOR VALUE-ADDED TAX

For a comprehensive understanding of VAT, the VAT404 Guide for Vendors is available on the SARS website at

www.sars.gov.za

10. REQUESTING STATEMENT OF ACCOUNT (VATSA)

This function will allow you to:

• Manage your VAT account by giving you insight into transactions per tax period.

Note:

Step-by-step process:

• To continue to the VAT work page, follow the steps below:

Select the relevant vendor declaration under “Returns Issued” from the side menu. Click on the declaration that

must be submitted. The declarations will be displayed as follows:

To view any of the issued declarations and to proceed to the VAT work page click on “Open”

37 | eFILING USER GUIDE FOR VALUE-ADDED TAX

The following screen will display:

On the VAT Work Page, select the option “Request Statement of Account”

The following screen will be displayed:

The vendor must be able to specify the transactional year (March to Feb) by selecting the appropriate year from a

drop-down list.

Once the vendor has selected the transactional year, the vendor must be able to specify the tax periods within that

year by selecting the “From” and the “To” tax periods from drop-down lists.

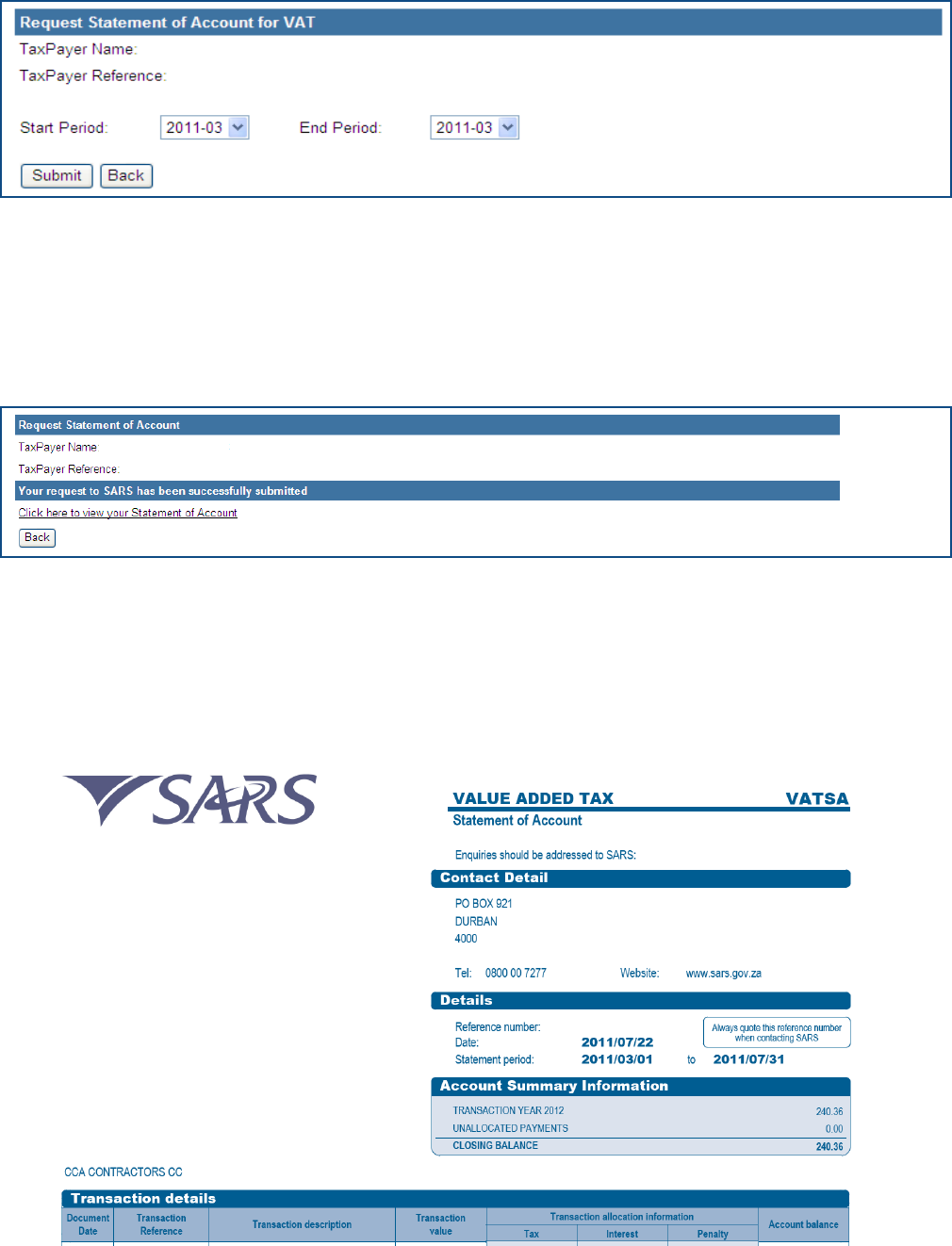

Note: A tax period must be specified in the following format: yyyymm

38 | eFILING USER GUIDE FOR VALUE-ADDED TAX

Where a vendor requires a VATSA for a single tax period, the vendor must be able to select the same tax period

as the “From” and the “To” tax period. This statement will therefore display all the transactions related to this

selected period.

The following screen will be displayed:

The VATSA will always be accompanied by notes to assist the reader on the interpretation of the account.

The notes will provide explanations for tax periods indicated as those for which the vendor was not registered for

VAT and those for which the vendor was registered but on which no transactions were processed.

The statement of account will be presented as follows:

If the vendor was not registered at all for the specified statement period, the following message will be displayed

on the screen: “You were not registered for VAT for the statement period specified by you. Press OK to specify a

39 | eFILING USER GUIDE FOR VALUE-ADDED TAX

different statement period or press Cancel to cancel the request.”

If the statement of account cannot be displayed, the following message will appear on the screen: “Due to a system

problem we are unfortunately unable to issue your statement now. Processing your request can take up to 48

hours. The Statement of Account will be issued to you on eFiling within this period. Press OK”