1.0 Guide Swish API 170324 Utan ändringsmarkering

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 36

Guide Swish API

Integration Guide

Version 1.6

Datum: 2017/03/24

© Swish 2

Table of content

1 Introduction ....................................................................................................................................... 5

1.1 Terms and definitions ................................................................................................................ 5

1.2 Document purpose .................................................................................................................... 6

1.3 Swish overview ......................................................................................................................... 6

1.4 Payment .................................................................................................................................... 6

1.4.1 Swish e-commerce ............................................................................................................ 6

1.4.2 Swish m-commerce ........................................................................................................... 7

1.5 Refund ....................................................................................................................................... 8

1.6 Security ..................................................................................................................................... 8

2 Use Cases ........................................................................................................................................ 9

2.1 Swish handel application procedure ......................................................................................... 9

2.2 Payment request in the Swish app ......................................................................................... 10

2.2.1 Swish m-commerce ......................................................................................................... 10

2.2.2 Swish e-commerce .......................................................................................................... 11

2.2.3 Reject payment ................................................................................................................ 11

2.3 Refund ..................................................................................................................................... 11

2.4 Termination Swish handel ....................................................................................................... 12

3 Technical Requirements................................................................................................................. 12

4 Merchant Setup Process ................................................................................................................ 12

4.1 Technical Integration ............................................................................................................... 12

4.2 Managing certificates .............................................................................................................. 13

4.3 Revoking a certificate .............................................................................................................. 13

5 Launching Swish app from merchant app ...................................................................................... 14

5.1 Detecting if Swish app is installed on the device .................................................................... 14

5.1.1 iOS (detect) ...................................................................................................................... 14

5.1.2 Android (detect) ............................................................................................................... 14

5.1.3 Windows Phone (call the Swish app) .............................................................................. 15

5.1.4 Detection with mobile web browsers ............................................................................... 15

5.2 Switch to Swish app, and back ............................................................................................... 16

5.2.1 iOS ................................................................................................................................... 16

5.2.2 Android ............................................................................................................................. 17

5.2.3 WinPhone ........................................................................................................................ 18

5.2.4 JavaScript calls and open Swish ..................................................................................... 19

5.2.5 For Chrome version >= 24 ............................................................................................... 19

6 Test Environment ........................................................................................................................... 20

7 Production Environment ................................................................................................................. 20

© Swish 3

8 Guidelines for using the Swish API ................................................................................................ 20

8.1 Consumer in control of payment requests .............................................................................. 20

8.2 Use the call-back for payment requests and refunds ............................................................. 21

8.3 Refund transactions – avoid large batches ............................................................................. 21

8.4 Renewal of Client TLS Certificate ........................................................................................... 21

8.5 Displaying the Swish alias to consumers ................................................................................ 21

9 Versioning the Web Service API .................................................................................................... 21

9.1 Versions .................................................................................................................................. 21

10 Support ....................................................................................................................................... 22

10.1 Deployment support ............................................................................................................ 22

10.2 Operating information .......................................................................................................... 22

11 Swish API Description ................................................................................................................ 23

11.1 Payment Request ................................................................................................................ 23

11.1.1 Swish e-commerce .......................................................................................................... 23

11.1.2 Swish m-commerce ......................................................................................................... 24

11.1.3 Create Payment Request ................................................................................................ 24

11.1.4 Retrieve Payment Request .............................................................................................. 26

11.1.5 Callback ........................................................................................................................... 27

11.2 Payment Refund .................................................................................................................. 28

11.2.1 Create Refund .................................................................................................................. 29

11.2.2 Retrieve Refund ............................................................................................................... 30

11.2.3 Callback ........................................................................................................................... 31

11.3 Objects ................................................................................................................................ 31

11.3.1 Payment Request Object ................................................................................................. 31

11.3.2 Refund Object .................................................................................................................. 34

11.3.3 Error Object ...................................................................................................................... 35

© Swish 4

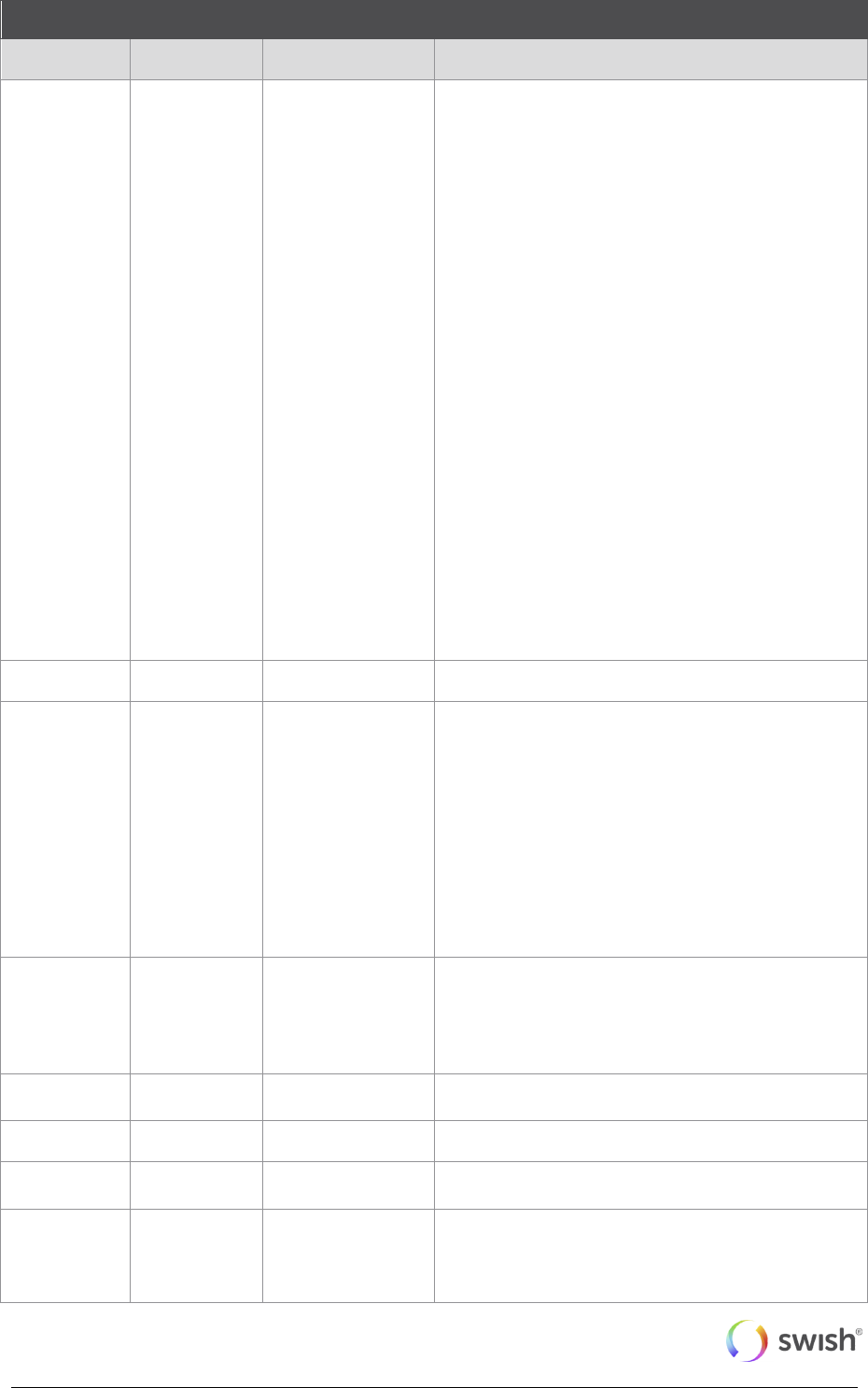

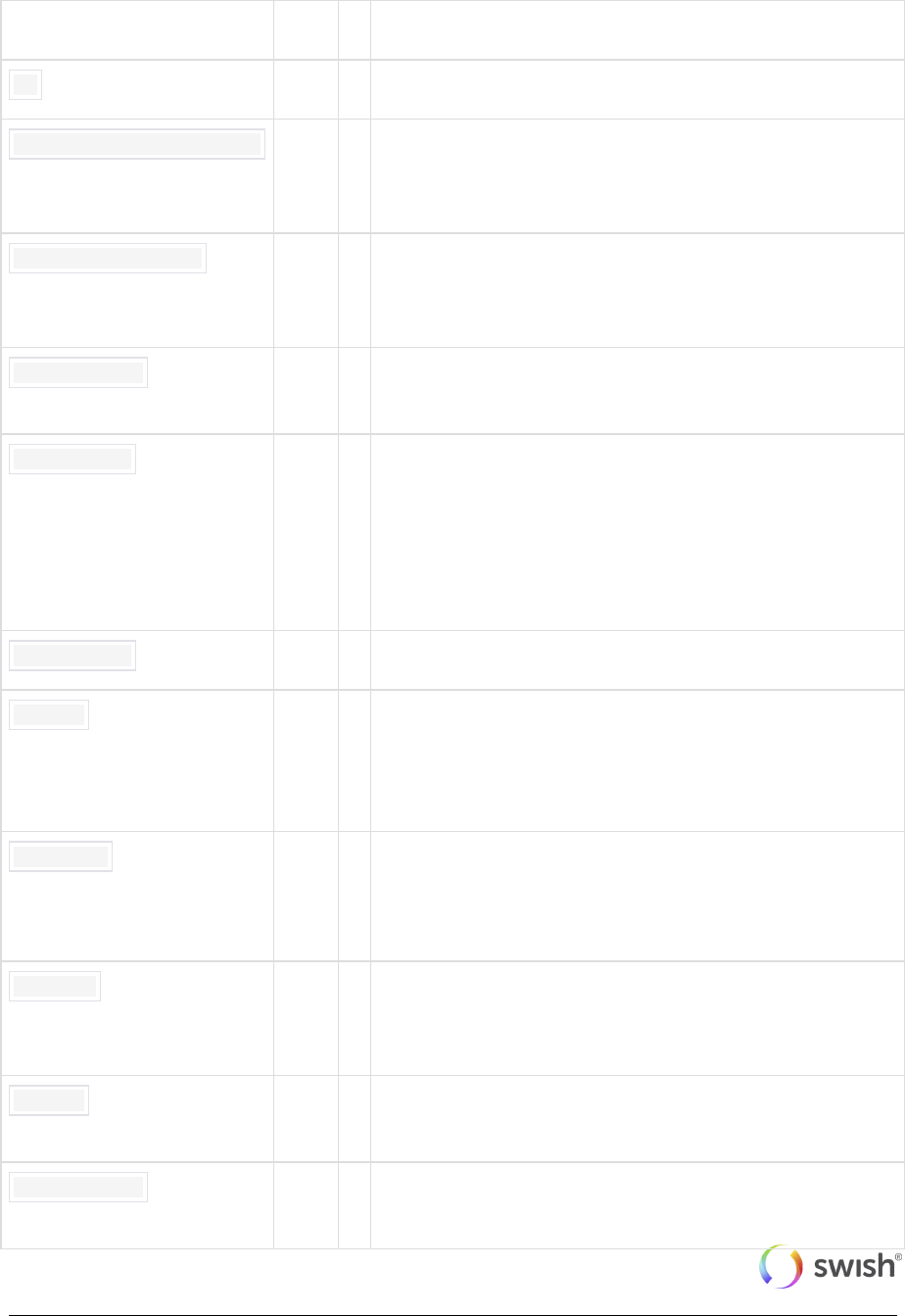

Date

Version

Name

Description

2015-11-13

0.9.8

Version 0.9.8

2015-12-08

0.9.8.1

Claes Scheffer

Changed document name to Guide Swish API.

1.3 Changed some wording.

2.1 Added personal information that needs to be

registered about the CPOC.

3 Added information about port.

4 Added guidelines for handling keys and

certificate.

8.2 Added refund.

11.1.3 Changed url in code examples.

11.1.4 Changed url in code examples.

11.1.5 Added information about time outs.

11.2.1 Deleted error codes AC05, AC06, AC07,

AC15, AM04, AM14, AM21, and DS0K.

Added error code RF07.

Changed url in code examples.

11.3.1 Clarified mandatory, optional and

response parameters.

Deleted error codes AC05, AC06, AC07, AC15,

AM04, AM14, AM21, and DS0K.

Added error code RF07.

11.3.2 Clarified mandatory, optional and

response parameters.

Deleted error codes AC05, AC06, AC07, AC15,

and AM04.

Added error code RF07.

2015-12-10

0.9.8.2

Claes Scheffer

7 Corrected Swish API URL for paymentrequests

2015-12-15

0.9.8.3

Claes Scheffer

3 Complemented information about the

requirement of TLS certificate for callback

endpoint.

11.1.3 Changed payerAlias number format in

example.

11.1.4 Changed payerAlias number format in

example.

11.2.2 Added possible statuses.

Changed payerAlias number format in example.

11.2.3 Added DEBITED.

11.3.2 Changed CREATED to VALIDATED.

2016-01-18

1.0

PJ

1.5.1 Changed text.

1.5.2 Corrected text.

5.1.1 Corrected text and Changed the heading for

Windows phone example.

Created document version 1.0.

2016-02-12

1.1

Sylvain Schüpp

Roland Mattsson

5 Reformatting of code example, App Section

updated.

2016-04-22

1.2

Sylvain Schüpp

11.1.4, change m to e-commerce

2016-10-04

1.3

David Selander

11.2.1 Change payerAlias to 1231181189

11.2.2 Change payerAlias to 1231181189

2016-12-13

1.4

David Selander

11.3.1 Changed text for errorcode RF07

Added error code BANKIDONGOING

11.3.2 Changed text for errorcode RF07

© Swish 5

2017-02-22

1.5

Oscar Jonsson

David Selander

Added 5.2.4 JavaScript calls Swish

Added 5.2.5 For Chrome version >= 24

Changed text 11.1 Payment Request

11.1.5 Cutofftimer changed from 8/5 min to 3 min

11:3:1 Added errorcode BANKIDUNKN

2017-03-24

1.6

David Selander

3. SNI not supported.

1 Introduction

1.1 Terms and definitions

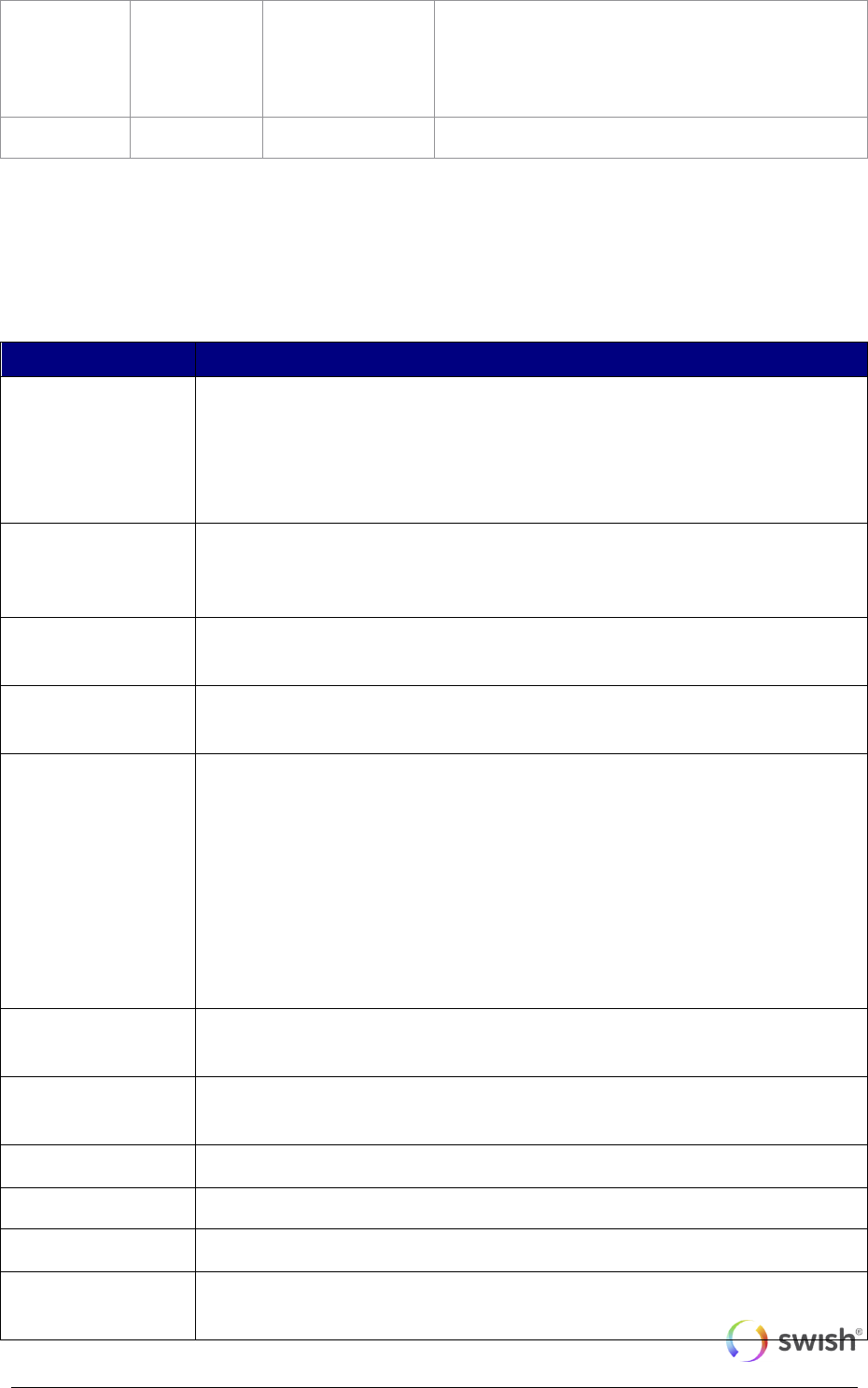

Term

Definition

Partner

A partner is a company, working with technical integrations, app development,

platform development and/or payment services that may help and facilitate

merchant integration and operation for Swish.

Banks have agreements with the merchants who in turn may have an

agreement with a partner.

Merchant

A merchant is a company, association or organisation which receives

payments via Swish.

Merchants sign Swish agreements with their respective bank.

Merchant Swish

Simulator

The Merchant Swish Simulator is a test tool to test the Swish-API.

Consumer

A consumer is a private Swish customer that can use the Swish app on a

mobile device.

Swish handel

Swish handel gives the merchants the possibility to use Swish as a payment

method in m- and e-commerce. The service is aimed primarily for m- and e-

commerce stores, via apps and browsers.

Swish handel consist of two different payment solutions; Swish m-commerce

and Swish e-commerce, a security solution and a function for refunds. All of

them are reachable for the merchants through Swish API.

The service can be offered by the banks under a different product name than

Swish handel.

Swish m-commerce

Swish payments from a mobile device made either through an app or via a

mobile browser on the same mobile device.

Swish e-commerce

Swish payments initiated by the consumer in a browser in equipment other

than the mobile device that hosts the Swish app.

Swish customer

This is any customer to Swish, either a consumer (person) or a merchant.

Payee

This is the Swish customer that receives the payment

Payer

This is the Swish customer that makes the payment

Alias

A unique identifier for a Swish customer. For a consumer it is the mobile

number and for a merchant it is the Swish number.

© Swish 6

Payment request

A payment request is a transaction sent from a merchant to the Swish system

to initiate an e-commerce or m-commerce payment.

Payee Payment

Reference

A payee payment reference is the merchant’s own identifier of the

transaction/order to be paid. It is sent to the Swish system as a parameter to

the payment request and is later returned in confirmation messages.

Refund

A refund is a transaction sent from the merchant to the Swish system to return

the whole amount or part of a payment. The reference to the original payment

must be provided.

1.2 Document purpose

The integration guide is for anyone who wishes to understand and implement Swish handel in their

services and systems. The integration guide explains how to connect to the Swish API and includes

information about the payment and refund options related to the Swish handel service. More

information about the service can be found at https://www.getswish.se/handel.

1.3 Swish overview

By enrolling to the service Swish handel at the merchant’s bank and getting access to the Swish API,

merchants can handle payments in e-commerce and m-commerce scenarios in a way which is very

convenient and familiar to millions of Swedish consumers. The service builds on the ease-of-use of the

person-to-person payment service. Enrolled to the service the merchant can receive payments from all

private persons using Swish.

It is also possible for merchants to make refunds in real time using Swish using the API. Some banks

will also provide the possibility to initiate refunds from the bank’s digital channels.

In brief, a payment involves the following steps:

The merchant creates a payment request using the Swish API that the consumer views and

accepts in the Swish app.

The consumer and the merchant receive payment confirmations instantly when the amount

has been transferred from the consumer’s to the merchant’s account. For security reasons the

payment request is only valid during a limited period time for the consumer in the Swish app.

When enrolling to the service, the merchant obtains a Swish alias to one of the merchant’s bank

accounts. The merchant will also give authorize Certificate Point of Contact persons during enrollment.

These persons will use the Swish Certificate Management System to manage digital certificates, which

is one component of securing the access to the API.

The business transaction when a payment is made using Swish is between the merchant and the

consumer and this transaction implies that the consumer makes an advance payment for purchased

goods or services.

1.4 Payment

It is always the consumer that initiates a payment, and there are two ways to do it; Swish e-commerce

or Swish m-commerce.

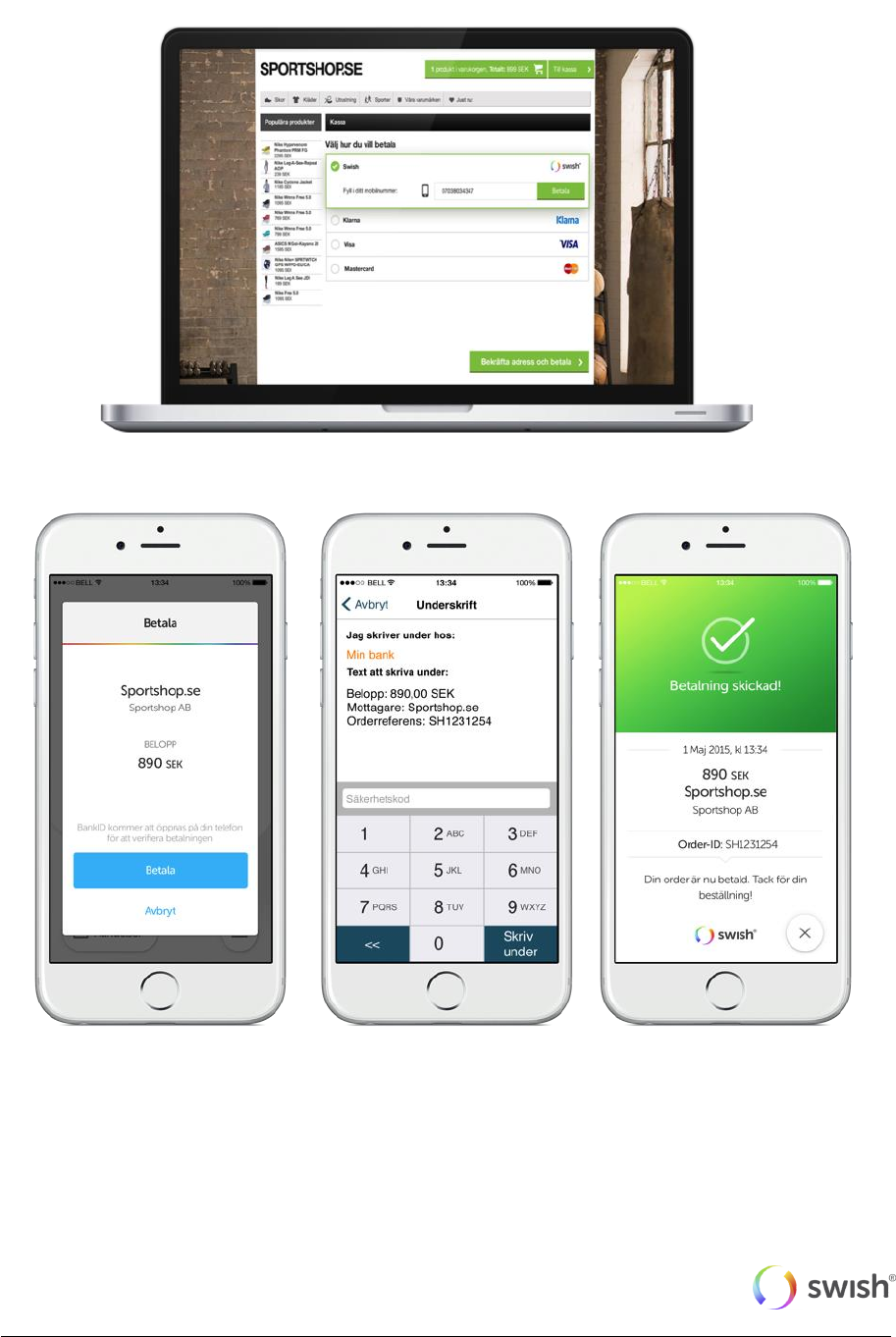

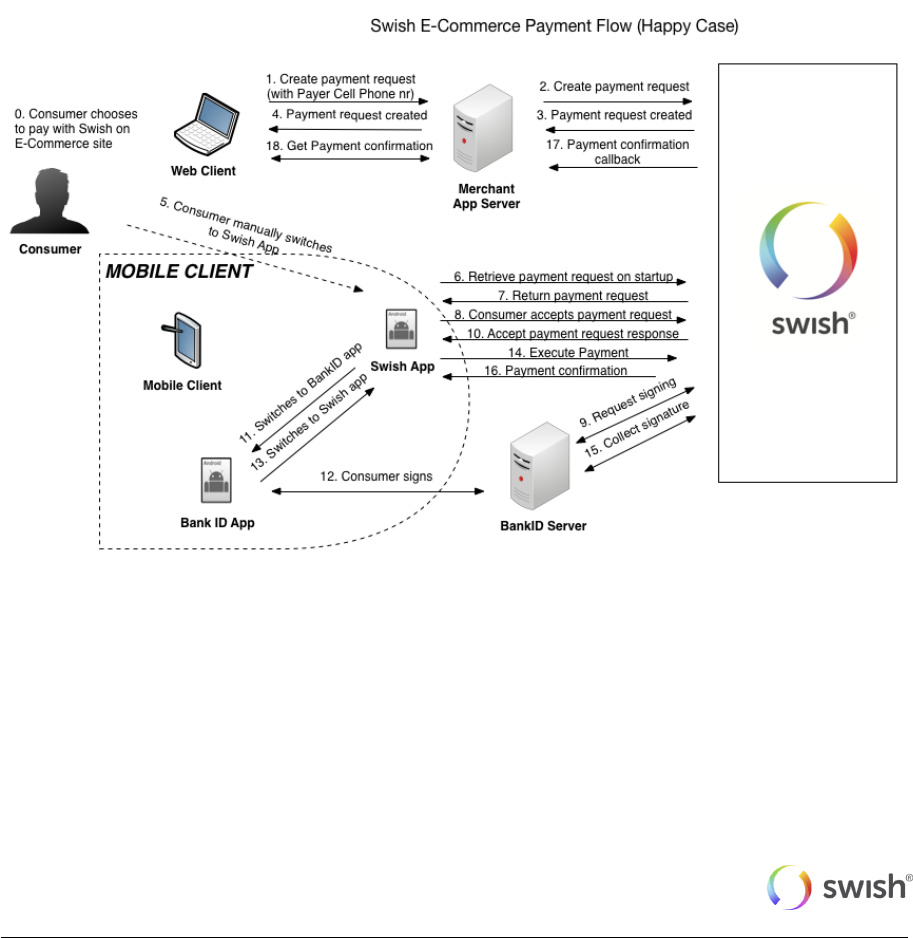

1.4.1 Swish e-commerce

© Swish 7

The consumer initiates the payment on the merchant’s web shop. In this case the consumer needs to

open the Swish-app.

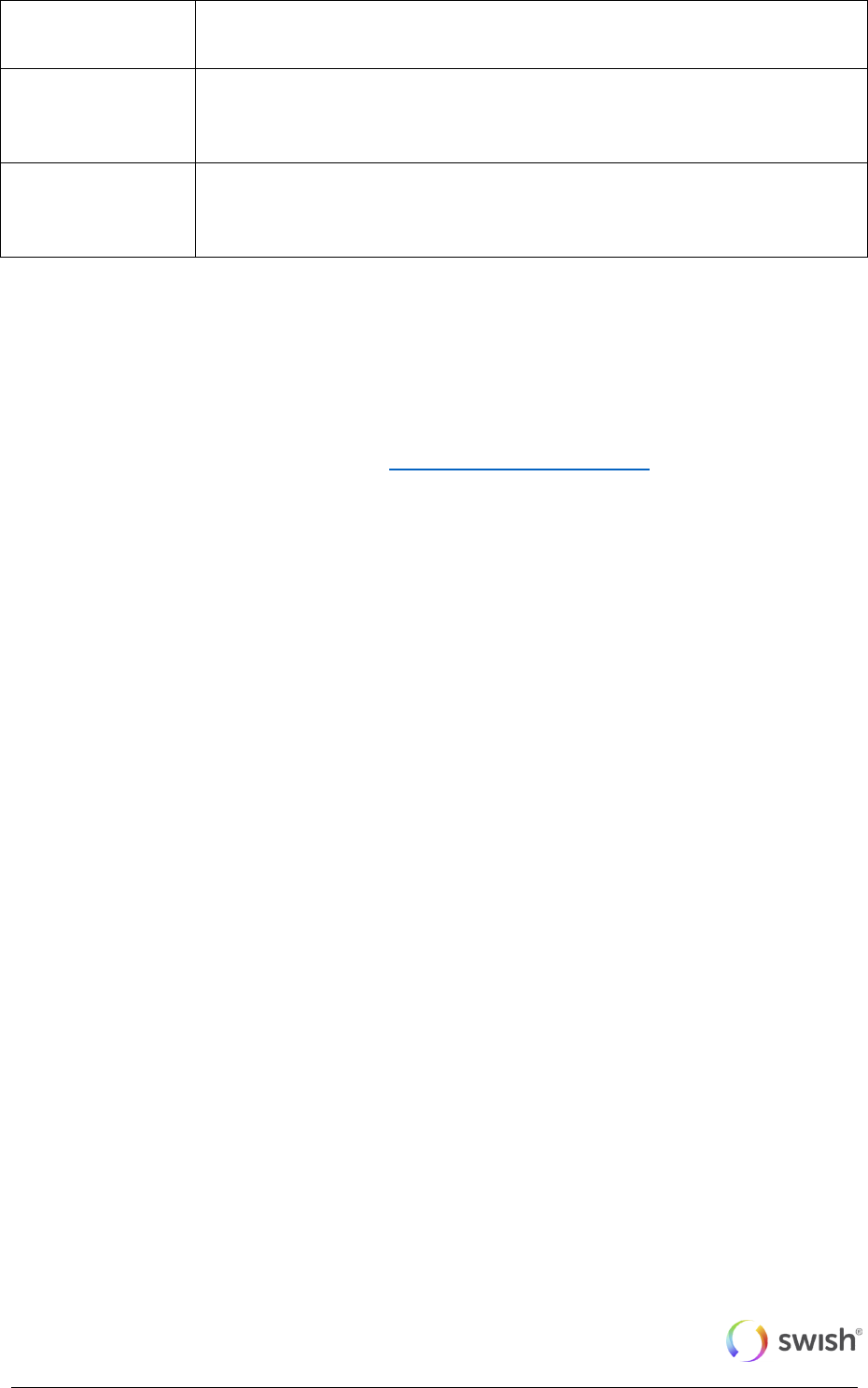

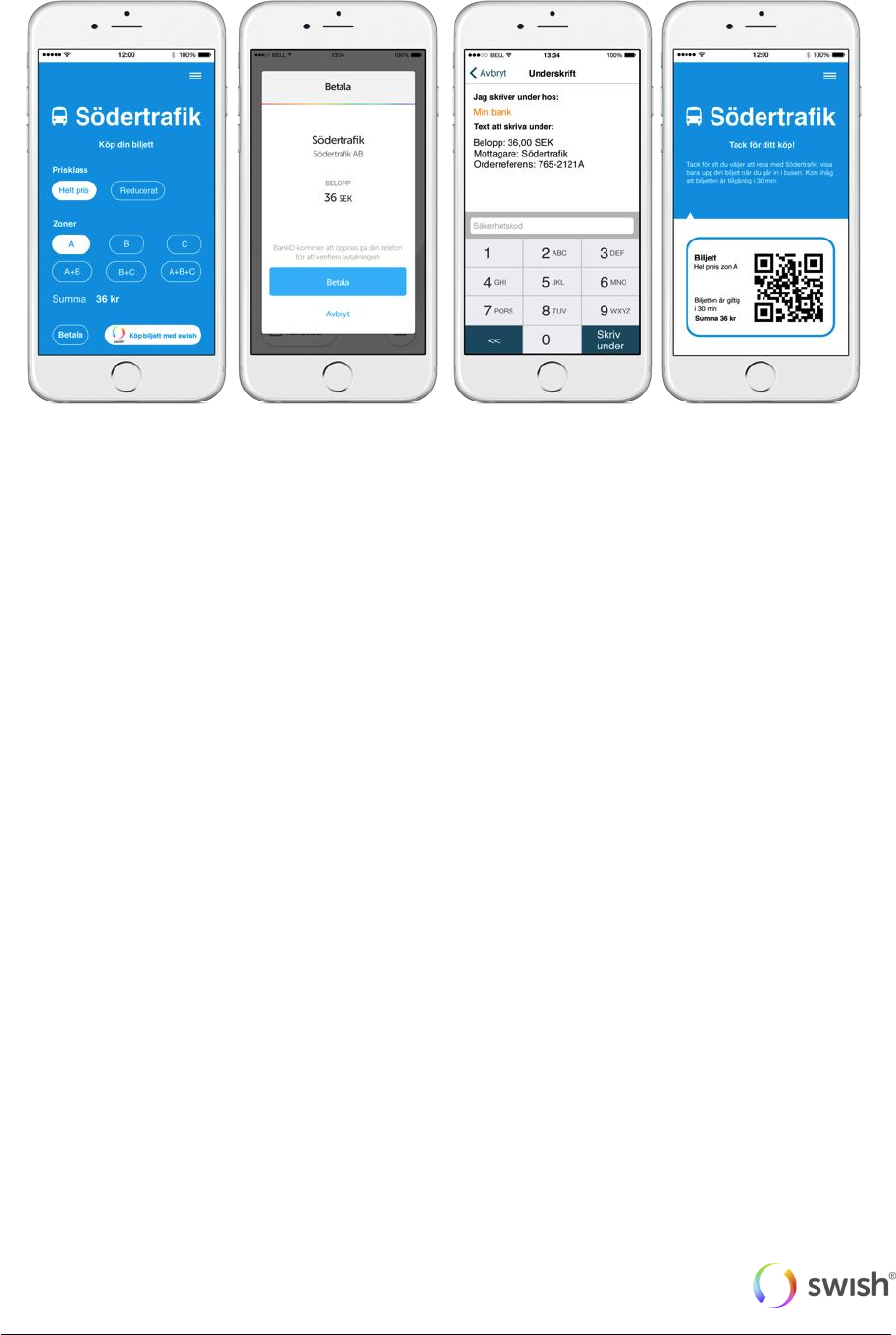

1.4.2 Swish m-commerce

The consumer opens the

Swish app, which is

preloaded with payment

information.

The consumer signs the

payment with Mobile

BankID

A payment confirmation is

shown in the Swish app.

© Swish 8

The consumer initiates the payment on the merchant’s app using a mobile device. In this case the

consumer does not need to open the Swish-app.

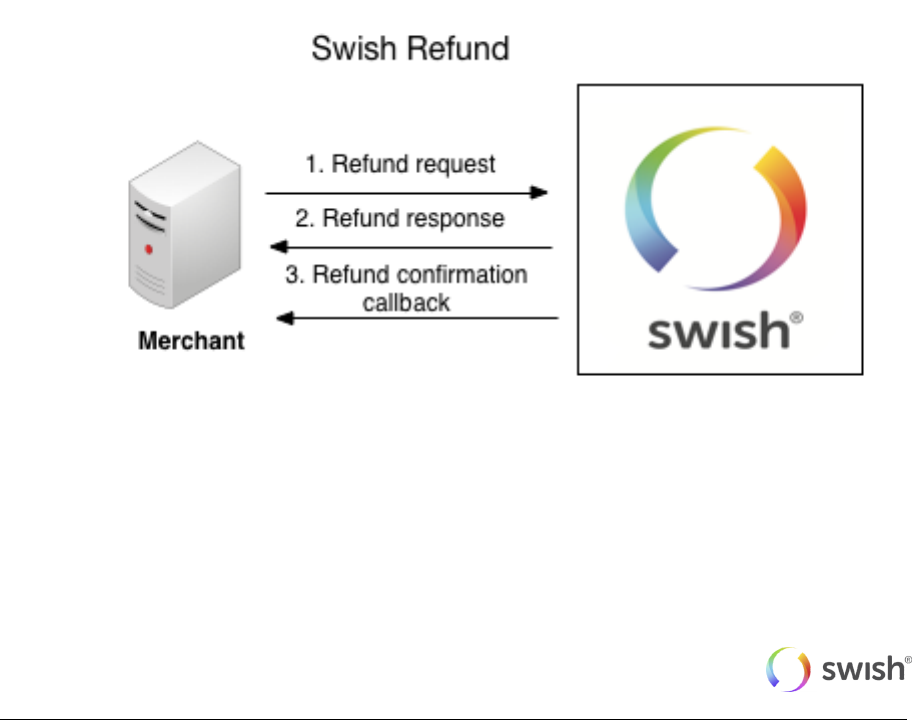

1.5 Refund

A merchant that has received a Swish payment can refund the whole or part of the original transaction

amount to the consumer.

A refund can only be done on an existing payment. The number of refunds on one payment is

unlimited, until the total amount reaches the amount of the original payment. A payer Order payment

reference ID and message to the consumer can be attached to the refund but these are optional. If the

refund is successful, a message will be sent to the payee’s app.

A refund can be made on a payment for 12 months.

1.6 Security

In order to protect the Swish API and to ensure the identity of the parties, the security solution

encrypts the traffic and authenticates the identities of the merchant and Swish server.

The security solution is implemented as PKI based TLS client/server certificates, where the certificates

are issued upon order by the merchant or someone appointed by the merchant. A certificate is valid

for 2 years.

A merchant appoints up to 5 persons via their bank, who will be able to logon to an administrative GUI

connected to the security solution (identified by BankID/BxID on card or Mobile BankID). An appointed

The consumer

chooses to pay

with Swish from the

merchant’s app or

website.

The Swish app is

activated

automatically and

preloaded with

payment

information.

The consumer

signs the payment

with Mobile

BankID.

The consumer gets

the payment

confirmation in the

merchant’s app or

website.

© Swish 9

person can administer their certificates using the GUI. An administration of certificates includes view,

order new/download and revoke.

2 Use Cases

The user stories below act as example to increase the understanding of the service Swish handel on a

high level.

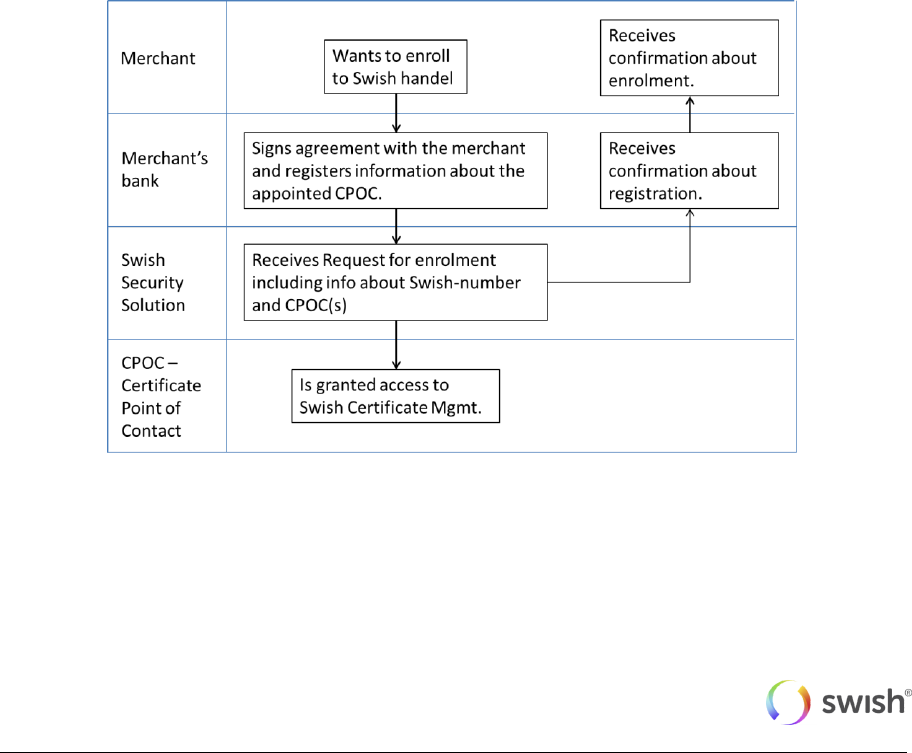

2.1 Swish handel application procedure

This user story describes on a high level how a merchant applies for the service Swish handel.

1. The merchant contacts a Swish connected bank to sign an agreement for the service.

2. The merchant confirms the business terms and signs the agreement with the bank.

a. The bank obtains and registers the necessary merchant information, including info

about the appointed recipients of the API certificate - CPOC (Certificate Point Of

Contact). The following personal information is mandatory about the CPOC: Social

Security Number, Name, Company Registration Number. Optionally, some banks will

also require additional information such as E-mail and phone number.

b. A Swish number is created for the agreement.

c. The bank sends an enrollment request to Swish security solution.

3. The security solution receives and registers info about the CPOC connected to the Swish

number. The CPOC’s are granted access to the certificate management system in the Swish

security solution.

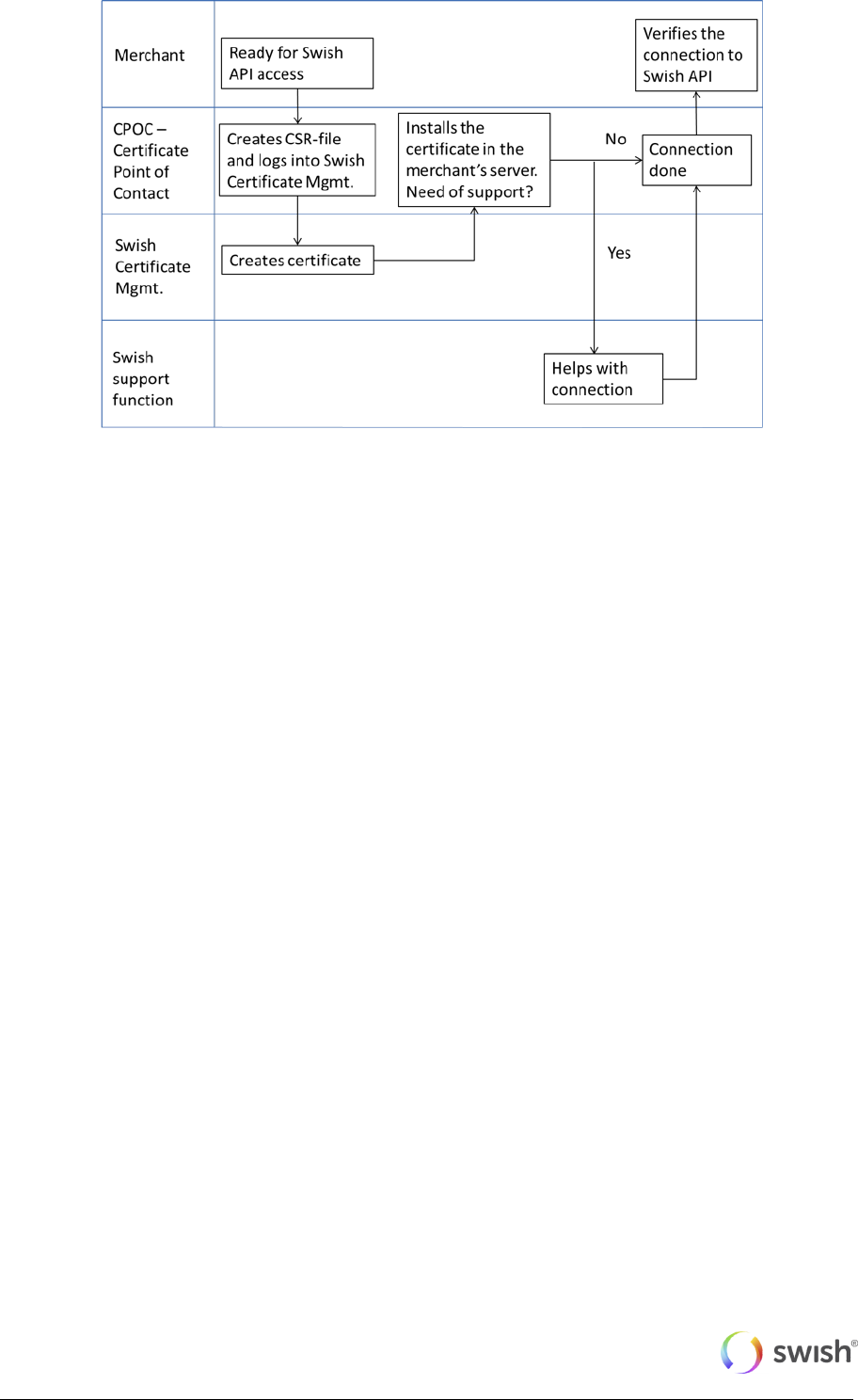

4. The merchant is now ready for Swish API access.

© Swish 10

5. The merchant or the partner needs to generate a csr-file (Certificate Signing Request).

This is normally done by the CPOC.

6. The CPOC logs in to the certificate management system using Mobile BankID, BankID on

card or BxID and creates the certificate.

7. The CPOC installs the certificate in the merchant’s server and connects it to Swish API. If

needed, Swish support function can assist with the connection.

8. The merchant verifies the connection.

2.2 Payment request in the Swish app

2.2.1 Swish m-commerce

The m-commerce flow should be used when the Swish app is on the same device as the merchant’s

mobile site or app – hence a mobile device.

1. Consumer chooses to pay with Swish for a product or a service in the merchant app.

2. The merchant sends a payment request to the Swish system using the API.

a. The transaction contains data such as: amount, receiving Swish-number, merchant

(payee) payment reference and an optional message to the consumer.

3. The merchant receives a Request Token.

4. Consumer’s Swish app is opened automatically by the merchant’s site or app showing the

payment section that is preloaded with payment information.

a. The app is opened with the request token as a parameter.

5. Consumer clicks Pay (”Betala”) and the Mobile BankID app opens automatically for signature of

the payment transaction.

6. Consumer confirms the payment transaction by signing with the Mobil BankID using his/her

password.

7. The amount is transferred in real-time from the consumer’s account to the merchant’s account.

8. Consumer is linked back to the merchant app for payment transaction confirmation.

a. Note: the confirmation screen in Swish-app is not displayed in this flow.

9. The merchant receives a confirmation of successful payment.

10. Consumer can view the payment in the events section “Händelser” as a sent payment in the

Swish app.

© Swish 11

2.2.2 Swish e-commerce

The e-commerce flow should be used when the Swish app is on another device than the merchant’s

site.

1. Consumer chooses to pay with Swish for a product or a service at the merchant website and

enters his/her mobile phone number which is enrolled to Swish.

2. Information on the merchant website should inform the consumer to open the Swish app to

confirm the transaction.

3. The merchant sends a payment request to the Swish system using the API.

a. The transaction contains data such as: amount, receiving Swish-number, consumer’s

mobile phone number, merchant payment reference and an optional message to the

consumer.

4. Consumer opens the Swish app showing the payment section, which is preloaded with the

information in the payment request.

5. Consumer clicks Pay (”Betala”) and the Mobile BankID app opens automatically for signature of

the payment transaction.

6. Consumer confirms the payment transaction by signing with the Mobil BankID using his/her

password.

7. The amount is transferred in real-time from the consumer’s account to the merchant’s account.

8. Consumer receives a payment confirmation in the Swish app.

9. The merchant receives a confirmation of successful payment.

10. Consumer receives a payment confirmation at the merchant website.

11. Consumer can view the payment in the event section “Händelser” as a sent payment in the Swish

app.

2.2.3 Reject payment

Consumer wants to dismiss the payment request in the Swish app and clicks on “Avbryt”. The rejected

payment request is deleted from the Consumer’s Swish app.

2.3 Refund

There are two ways to make a refund: through the bank channel or through the API channel. This

section describes the API channel on a high level.

As a merchant, I have received a Swish payment and wish for some reason to refund the whole or part

of the original amount to the payer.

The merchant chooses which payment that is to be completely or partially refunded. The merchant

specifies the refund amount and sends the refund.

The merchant will also be able to send its own information that will be shown to the payer in the event

section in the Swish app, and also on the payee bank account statement. The information will also be

used by the company for tallying.

The merchant receives a confirmation that the refund has been completed.

As recipient of a refund, the payee receives a payment notification in the Swish app. The payment

notification is marked "Återbetalning" in the event section in the Swish app.

Alternative flow – ”payment notification”:

In cases when the recipient of a refund cannot receive data push notifications at the moment, the

refund will be visible in the Swish app next time the recipient logs in. The refund will also appear in the

recipient´s bank account statement.

© Swish 12

Alternative flow – ”refund receiver not connected to Swish”:

In cases when the recipient of a refund has terminated the Swish agreement since the original

payment occurred, the merchant will receive an error message stating that the refund cannot be

processed. Refund must in this case be done via another channel.

2.4 Termination Swish handel

1. The merchant terminates the agreement with the bank. The service will stop working.

2. The merchant is responsible for termination/revocation of the API certificates.

3. Refunds will not be possible to do on the terminated Swish number.

3 Technical Requirements

The Swish server requires TLS 1.1 or higher.

The merchant must be able to receive the callback HTTPS POST request from the Swish server over

TLS. The callback endpoint has to use HTTPS on port 443 and it is highly recommended to use IP

filtering as well. For the callback Swish will be acting client and the merchant server is acting server.

Swish will validate the merchant callback server TLS certificate against a list of commonly recognized

CAs.

For now that Swish API does not support Server Name Indication (SNI) for the callback functionality.

4 Merchant Setup Process

4.1 Technical Integration

In order to integrate a merchant commerce solution with Swish API the merchant needs to get a client

TLS certificate from Swish Certificate Management and install it on their server. The certificate will be

used for client authentication of TLS communication with Swish API. The following steps need to be

performed:

1. Generate a pair of 2048 bits RSA keys on your server and create a certificate request (CSR)

in a PKCS#10 format.

This step depends on the type of web server solution that is used and differs between different

types of servers. The keys are usually generated to a so-called keystore (e.g. Java keystore,

Microsoft Windows keystore) or file (e.g. openSSL on Apache/Tomcat). For details please

consult your web solution documentation or your supplier.

Note: The following examples are to be considered regarding secure handling of cryptographic

keys and certificates. The Customer’s keys should be installed by the Customer in secure

cryptographic units or should be protected in a similar manner. The keys should only be

installed on units necessary for production and back-up purposes. The keys should be deleted

at all instances when no longer operational. The keys should at all times be stored with strong

encryption and protected using passwords or more secure procedures, e.g. smart-cards.

Passwords used to protect the keys should be handled two jointly and are to be stored in a

secure manner so they cannot be lost or subjected to unauthorized access.

It is highly important to protect the private key from unauthorized access. It is recommended to

protect the keys with a password if your server provides this option. Care should be taken to

protect the passwords as well.

© Swish 13

There are no requirements on the content of the CSR (names or other parameters), except for

the keys that need to be 2048-bit RSA.

It is possible to install the same certificate on several servers (depending on technical server

setup, but no license limitations), or to issue one key pair and certificate per server.

2. Login to Swish Certificate Management at https://getswishcert.bankgirot.se by using mobile

BankID, BankID on card or BxID. Only the person(s) registered by the bank for a specific

merchant will be able to perform this step.

3. Provide the organizational number of the merchant and the Swish number for which a

certificate is to be generated.

4. Choose tab "New certificate" and paste the content of the generated CSR into the text field.

Choose whether the certificate should to be in PKCS#7 or PEM format. Consult your

documentation regarding which format suits your solution.

5. A new certificate is generated and provided on the screen. Copy the text string and save it to a

file. The response (PKCS#7 or PEM) will contain your client certificate and all CA certificates

up to the Swish root.

6. Import the generated certificate and all CA certificates to your server. For details on how to

perform this step consult your web solution documentation or your supplier.

7. The Swish server is set up with a TLS server certificate, which needs to be verified when

initiating TLS from your web server to Swish. Choose to trust Swish Root CA (o=Getswish AB,

ou=Swish Member CA, cn=Swish Root CA v1). The certificate chain for the Swish server TLS

certificate, i.e. the Swish Root CA certificate and the Intermediate CA certificate, are available

via the Certificate Management GUI via the link “Download Swish server TLS certificate”. For

details on how to perform this step consult your web solution documentation or your supplier.

After performing the steps 1 - 7 you should be able to set up TLS with the Swish API.

Note: It is necessary provide the generated certificate together with all CA certificates up to the Swish

Root CA in order to correctly set up a TLS session with the Swish API.

Note: No error messages will be returned before a TLS session is successfully established with the

Swish API. This means that if the wrong certificate has been used, if the validity time of the certificate

has expired, or if the certificate has been revoked, no indication of this is given.

Note: It is recommended to require verification of the Swish API TLS certificate and not to ignore this

verification, in case your server allows you to disable server certificate verification.

4.2 Managing certificates

Login to Swish Certificate Management at https://getswishcert.bankgirot.se by using mobile BankID,

BankID on card or BxID. Only the person(s) registered by the bank for a specific merchant will be able

to perform this step.

Provide the organizational number of the merchant and the Swish number for which a certificate is to

be managed.

After logging in a list is provided with all certificates associated with the specific merchant and Swish

number, and the status of them. By clicking on “Download” it is possible to see further details and to

attain the certificate again.

4.3 Revoking a certificate

© Swish 14

If the integrity of the merchant’s private key has been compromised, if a certificate has been replaced

by a new one, if the service has been terminated, or if the merchant needs to revoke a certificate for

some other reason, this can be done via the Swish Certificate Management.

Login to Swish Certificate Management at https://getswishcert.bankgirot.se by using mobile BankID,

BankID on card or BxID. Only the person(s) registered by the bank for a specific merchant will be able

to perform this step.

Provide the organizational number of the merchant and the Swish number for which a certificate is to

be revoked.

After logging in a list is provided with all certificates associated with the specific merchant and Swish

number, and the status of them. By clicking on the trash can it is possible to revoke a specific

certificate.

Please be aware that the certificate is irreversibly revoked and that revoking a certificate that is in use

may lead to an interruption of the service.

5 Launching Swish app from merchant

app

5.1 Detecting if Swish app is installed on the device

Merchant apps, excluding web browsers, can detect if the Swish app is installed on the device. Below

are code snippets that shows this. Notice that it is not possible from a Windows Phone application to

detect if the Swish app is installed on the device.

5.1.1 iOS (detect)

static inline bool isSwishAppInstalled(void)

{

return [[UIApplication sharedApplication

canOpenURL:[NSURL URLWithString:@"swish://"]];

}

5.1.2 Android (detect)

© Swish 15

//Swish package name is “se.bankgirot.swish”

protected boolean isSwishAppInstalled(Context _context, String

SwishPackageName) {

boolean isSwishInstalled = false;

try {

_context.getPackageManager().getApplicationInfo(SwishPackageName, 0);

isSwishInstalled = true;

} catch(PackageManager.NameNotFoundException e) {

}

return isSwishInstalled;

}

5.1.3 Windows Phone (call the Swish app)

// The URI to launch

string uriToLaunch = @"swish://paymentrequest<parameters>";

// Create a Uri object from a URI string

var uri = new Uri(uriToLaunch);

// Launch the URI

async void DefaultLaunch(){

// Launch the URI

var success = await Windows.System.Launcher.LaunchUriAsync(uri);

if (success) {

// URI launched

}

else

{

// URI launch failed

}

}

5.1.4 Detection with mobile web browsers

The investigation of the abilities to determine if Swish is installed on a device shows that there is an

absence of a standard, documented way to do this from the web browsers. The found workaround is

based on the time during which the return to the browser was performed. The idea of this approach is

that JavaScript code on current page will be frozen right after calling Swish application because the

control flow will be given to the Swish if it started successfully. Control flow will be returned back to

JavaScript when Swish will be finished.

Thus if the JavaScript code continue executing after short time from the moment of the trying to call

Swish - this means that Swish is not installed on the device. The JavaScript code snippet given below:

© Swish 16

//remember the time of start application

timestart = new Date().getTime();

//try to run application (Swish) in the frame by opening custom URL-SCHEME

createIFrame(url+"&browser="+browserName+"&back="+encodeURIComponent(location.toString())+"&us

eragent="+encodeURIComponent(userAgent));

//remember time of returning from application

timeend = new Date().getTime();

//if from the moment of the attempt to run the application to moment when the

//control returns back to this code passed enough much time (more then 3 sec),

//most probably this means that the application was successfully started and

//the user spent the time using the application

if(timeend — timestart > 3000) {

isSwishInstalled = true;

} else {

isSwishInstalled = false;

}

But, as investigations show, this approach does not work for WinPhone and Android Chrome version

25 and newer. Moreover, because Android’s default browser is now based on Chrome core, this is

also true for default browser.

In the 3 variants, WinPhone browser (Internet Explorer), Android default platform browser and Android

Chrome from version 25, they do not immediately return the control to the JavaScript code when the

called application (Swish) is not installed on the device - instead they open a dialog and offer the user

to go to the platform's market to download the required application (Swish).

This means, that in this case the browser will either successfully open Swish or ask the user to go to

the market to download and install Swish.

5.2 Switch to Swish app, and back

The merchant apps, including mobile web browsers, will call the Swish app using the Custom URL

Scheme "swish://paymentrequest".

The merchant app has to send the Swish app the following:

Payment request token

The merchant receives the payment request token from the CPC.

A callback URL

This is a string that Swish will use as parameter to switch back to the merchant app after

payment is finished. The goal of this parameter is to force the application to open a given GUI

view - or for a browser, to open a specific URL.

The callback URL should be passed in in URL-encoded format.

Both parameters are required, so the correct URL to open Swish app is:

swish://paymentrequest?token=<token>&callbackurl=<callbackURL>

When Swish is finished, it (or BankID app) will call the provided callback URL. For the merchant app to

react on this call, the merchant app needs to register for that URL scheme and provide code for

handling the request.

Code snippets describing switch to Swish as well as information about declaring URL scheme and

handling calls to it are provided below for each platform.

Note that the URL Sheme “merchant:\\” is used in the examples below. This is only an example – each

merchant shall use its own unique scheme.

5.2.1 iOS

The following code can be used to switch to Swish from the merchant app

© Swish 17

// character set is used to encode callback URL properly

NSCharacterSet *notAllowedCharactersSet =

[NSCharacterSet characterSetWithCharactersInString:@"!*'();:@&=+$,/?%#[]"];

NSCharacterSet *allowedCharactersSet =

[notAllowedCharactersSet invertedSet];

NSString *callbackURLStr = @"merchant://";

NSString *encodedCallbackURLStr =

[callbackURLStr

stringByAddingPercentEncodingWithAllowedCharacters:allowedCharactersSet];

NSString *swishURLStr = [NSString

stringWithFormat:@"swish://paymentrequest?token=%@&callbackurl=%@", token,

encodedCallbackURLStr];

NSURL *swishURL = [[NSURL alloc] initWithString: swishURLStr];

if ([[UIApplication sharedApplication] canOpenURL:swishURL]) {

if ([[UIApplication sharedApplication] openURL:swishURL]) {

// Success

}

else {

// Error handling

}

}

else {

// Swish app is not installed

// error handling

}

The enable the switch back from Swish, the merchant app needs to register a URL scheme. This is

done by including a CFBundleURLTypes key in the app’s Info.plist.

The merchant app must also implement the following function that will be called when the switch back

happens.

-(BOOL)application:(UIApplication *)application openURL:(NSURL *)url

sourceApplication:(NSString *)sourceApplication annotation:(id)annotation;

5.2.2 Android

© Swish 18

The following code can be used to switch to Swish from the merchant app.

public static boolean startSwish(Activity activity, String token, String

callBackUrl, int requestCode) {

If ( token == null || token.length() == 0 || callBackUrl == null ||

callBackUrl.length() == 0 || activity == null) {

return false;

}

Uri scheme =

Uri.parse("swish://paymentrequest?token="+token+"&callbackurl="+callBackUrl

);

Intent intent = new Intent(Intent.ACTION_VIEW, scheme);

intent.setPackage("se.bankgirot.swish");

boolean started=true;

try {

activity.startActivityForResult(intent, requestCode);

} catch (Exception e){

started=false;

}

return started;

}

The app manifest file is used to register the URL scheme in the merchant app :

<intent-filter>

<action android:name="android.intent.action.VIEW" />

<category android:name="android.intent.category.DEFAULT" />

<category android:name="android.intent.category.BROWSABLE" />

<data android:scheme="merchant" />

</intent-filter>

The merchant app also needs to process then intent in onCreate and onNewIntent methods when

switch back happens.

5.2.3 WinPhone

The following code can be used to switch to Swish from the merchant app.

// Create the URI string

var uriToLaunch =

string.Format("swish://paymentrequest?token={0}&callbackurl={1}",

<INSERT TOKEN HERE>, Uri.EscapeDataString("merchant://"));

// Create the URI to launch from a string.

var uri = new Uri(uriToLaunch);

// Launch the URI.

bool success = await Windows.System.Launcher.LaunchUriAsync(uri);

If the Swish app is not present on the device the operating system presents a dialogue asking to open

Windows Phone store. Merchant app must inform the user.

The merchant app registers an URL scheme in Visual Studio as:

1. Open Package.appxmanifest

2. Open the tab Declarations.

3. Add a "Protocol". Under name enter ”merchant”.

4. Enter a logo and a "Display name".

© Swish 19

Merchant must also implement the following to be successfully re-launched by Swish App. In Visual

Studio add the class AssociationUriMapper:

/// <summary>

/// The association uri mapper.

/// </summary>

internal class AssociationUriMapper : UriMapperBase {

/// <summary>

/// When overridden in a derived class, converts a requested uniform

resource identifier (URI) to a new URI.

/// </summary>

/// <returns>

/// A URI to use for the request instead of the value in the <paramref

name="uri"/> parameter.

/// </returns>

/// <param name="uri">The original URI value to be mapped to a new

URI.</param>

public override Uri MapUri(Uri uri) {

var tempUri = System.Net.HttpUtility.UrlDecode(uri.ToString());

// URI association launch.

if (tempUri.StartsWith("/Protocol")) {

// Here we can redirect to the correct page, but for now we don't

return new Uri("/MainPage.xaml", UriKind.Relative);

}

// Otherwise perform normal launch.

return uri;

}

}

In App.xaml.cs, add AssociationUriMapper as UriMapper by adding the following line to the method

InitializePhoneApplication:

// Assign the URI-mapper class to the application frame.

RootFrame.UriMapper = new AssociationUriMapper();

5.2.4 JavaScript calls and open Swish

For the browser Safari you can use:

swish://paymentrequest?token=value&callbackurl=back_scheme

5.2.5 For Chrome version >= 24

For the browser Chrome you can use this intent-based URI:

obj.href="intent://view/#Intent;<scheme_name>;<package_name>;<payment_reque

st_token>;<browser_name>;<call_back_url>;<user_agent>;end"

The basic syntax for an intent-based URI is as follows:

intent:

HOST/URI-path // Optional host

#Intent;

package=[string];

action=[string];

© Swish 20

category=[string];

component=[string];

scheme=[string];

end;

To check which browser that is used, use the value of userAgent in JavaScript

6 Test Environment

A Merchant Swish Simulator is available for merchants to test their integration with Swish API. The

Merchant Swish Simulator will validate requests and return simulated but correctly formatted

responses. The Merchant Swish Simulator will return a simulated result of the request in the callback

URL. It is also possible to retrieve the payment request status, and to simulate different error

situations.

A user guide for the Merchant Swish Simulator, can be be found at https://www.getswish.se/handel.

7 Production Environment

The Swish server IP address for IP filtering:

194.242.111.220:443

Swish API URL:

https://swicpc.bankgirot.se/swish-cpcapi/api/v1/paymentrequests

https://swicpc.bankgirot.se/swish-cpcapi/api/v1/refunds

Swish server TLS certificate is issued under the following root CA that should to be configured as

trusted:

cn=Swish Root CA v1

ou=Swish Member Banks CA

o=Getswish AB

The complete certificate chain of the Swish server TLS certificate is available through Swish Certificate

Management.

8 Guidelines for using the Swish API

When integrating with Swish API the following guidelines will support stable performance of the

system and a smooth consumer experience.

8.1 Consumer in control of payment requests

© Swish 21

Each payment request transaction sent to the API must be initiated by a physical paying consumer.

The merchant must make sure that the consumer does not receive what he/she perceives as “spam”

or unwanted payment requests.

8.2 Use the call-back for payment requests and refunds

When sending the payment request or refund a call-back is provided to the merchant of the status of

the payment. This is the normal usage scenario, which should be used in most cases.

As a backup there is also a “Retrieve” for Payment Requests and Refunds for reconciliation in the

case that the normal call-back fails for some reason. Note that this is a backup – and not the standard

flow for receiving payment status.

8.3 Refund transactions – avoid large batches

The “create refund” message is intended for real-time one-by-one calls. It is not intended for batching

up a large quantity and then sending the whole batch in a short period of time.

There should be at least 1 second between each refund transaction and if more than 100 transactions

are to be sent in a sequence they should be sent during night time.

8.4 Renewal of Client TLS Certificate

The validity of the client TLS certificate is two years. It is the merchant's responsibility to generate new

keys and certificate in due time, prior to the expiry of the old certificate, in order to ensure

uninterrupted functionality of the commerce site. The merchant could authorise another company (a

partner to the merchant) to manage the certificate renewal process.

8.5 Displaying the Swish alias to consumers

When enrolling to Swish the merchant will receive a Swish alias (123 XXX YYYY) which uniquely

identifies the enrolment and which is used as an alias to the payee’s bank account.

We recommend e-commerce and m-commerce merchants not to expose this to consumers since it

1. Can be used for unprompted payments by entering the Swish alias in the Swish app.

2. Some banks may block unprompted payments to Swish aliases enrolled to “Swish Handel”

The Swish alias for transactions generated by payment requests or refunds will not be displayed by

the Swish app or the bank’s consumer interfaces.

9 Versioning the Web Service API

9.1 Versions

Changes may be made to the API to correct errors or to introduce new functionality. When changed, a

new version of the API will be made available via a new URL. Merchant should always use the latest

version of the API.

The general rule is that old versions of the API will be discontinued two years after the release of the

successor. But if deemed necessary, for example for security reasons, a version of the API may be

© Swish 22

discontinued prematurely. As new functionality is introduced to the system the behaviour of an existing

version of the API may change, e.g. existing faults may also be used in new situations.

10 Support

10.1 Deployment support

Please see the manuals and FAQ available at https://www.getswish.se/handel

If you can’t find the technical information you need, you can contact the deployment support

organisation. The contact details are also published at https://www.getswish.se/handel.

For all commercial questions, please contact your bank.

10.2 Operating information

Operating information is available at https://getswish.se/driftsinformation

© Swish 23

11 Swish API Description

11.1 Payment Request

Payment requests are created/retrieved with the operations listed below. There are two main flows to

this use case, one for Swish m-commerce and one for Swish e-commerce. The main difference is that

in the Swish e-commerce case the consumer is prompted for his/her mobile phone number, and then

the consumer has to manually open the Swish app. But in the Swish m-commerce case the

consumer’s mobile phone number is initially not known to the merchant. So instead, in this case, the

API returns a Payment request token. This token is used to build a so called Swish URL, which the

merchant can use to call the Swish app from their app. The Payment request token is then a

parameter to the Swish URL. Once the paymentrequest reached to final state(either Paid , Timeout or

Error), the Merchant provided Callback URL will be called by Swish. Even though this callback

contains the payment status information, the merchant server should retrieve the result of the payment

request directly from the Swish server (refer to Retrieve Payment Request for further details).These

flows are illustrated in the pictures below.

11.1.1 Swish e-commerce

© Swish 24

11.1.2 Swish m-commerce

11.1.3 Create Payment Request

POST

/api/v1/paymentrequests

The Http request body have to contain a Payment Request Object.

Potential Http status codes returned:

201 Created: Returned when Payment request was successfully created. Will return a

Location header and if it is Swish m-commerce case, it will also return

PaymentRequestToken header.

400 Bad Request: Returned when the Create Payment Request operation was

malformed.

401 Unauthorized: Returned when there are authentication problems with the certificate.

Or the Swish number in the certificate is not enrolled. Will return nothing else.

403 Forbidden: Returned when the payeeAlias in the payment request object is not the

same as merchant’s Swish number.

415 Unsupported Media Type: Returned when Content-Type header is not

"application/json". Will return nothing else.

422 Unprocessable Entity: Returned when there are validation errors. Will return an Array

of Error Objects.

© Swish 25

500 Internal Server Error: Returned if there was some unknown/unforeseen error that

occurred on the server, this should normally not happen. Will return nothing else.

Potential Error codes returned on Error Objects when validation fails (HTTP status code 422 is

returned):

FF08 - PaymentReference is invalid

RP03 - Callback URL is missing or does not use Https

BE18 - Payer alias is invalid

RP01 - Missing Merchant Swish Number

PA02 - Amount value is missing or not a valid number

AM06 - Specified transaction amount is less than agreed minimum

AM02 - Amount value is too large

AM03 - Invalid or missing Currency

RP02 - Wrong formated message

RP06 - A payment request already exist for that payer. Only applicable for Swish e-

commerce.

ACMT03 - Payer not Enrolled

ACMT01 - Counterpart is not activated

ACMT07 - Payee not Enrolled

Create Payment request example (Swish e-commerce):

curl -v --request POST https://swicpc.bankgirot.se/swish-

cpcapi/api/v1/paymentrequests \

--header "Content-Type: application/json" \

--data @- <<!

{

"payeePaymentReference": "0123456789",

"callbackUrl": "https://example.com/api/swishcb/paymentrequests",

"payerAlias": "46701234567",

"payeeAlias": "1234760039",

"amount": "100",

"currency": "SEK",

"message": "Kingston USB Flash Drive 8 GB"

}

!

< HTTP/1.1 201 Created

< Location: https://swicpc.bankgirot.se/swish-

cpcapi/api/v1/paymentrequests/AB23D7406ECE4542A80152D909EF9F6B

© Swish 26

Create Payment request example (Swish m-commerce):

curl -v --request POST https://swicpc.bankgirot.se/swish-

cpcapi/api/v1/paymentrequests \

--header "Content-Type: application/json" \

--data @- <<!

{

"payeePaymentReference": "0123456789",

"callbackUrl": "https://example.com/api/swishcb/paymentrequests",

"payeeAlias": "1234760039",

"amount": "100",

"currency": "SEK",

"message": "Kingston USB Flash Drive 8 GB"

}

!

< HTTP/1.1 201 Created

< Location: https://swicpc.bankgirot.se/swish-

cpcapi/api/v1/paymentrequests/AB23D7406ECE4542A80152D909EF9F6B

< PaymentRequestToken: f34DS34lfd0d03fdDselkfd3ffk21

The PaymentRequestToken is then used to open the swish app, using the Custom URL Scheme

e.g.:

swish://paymentrequest?token=f34DS34lfd0d03fdDselkfd3ffk21

11.1.4 Retrieve Payment Request

GET

/api/v1/paymentrequests/{id}

Potential HTTP status codes returned:

200 OK: Returned when Payment request was found. Will return Payment Request Object.

401 Unauthorized: Returned when there are authentication problems with the certificate.

Or the Swish number in the certificate is not enrolled. Will return nothing else.

404 Not found: Returned when the Payment request was not found or it was not created

by the merchant. Will return nothing else.

500 Internal Server Error: Returned if there was some unknown/unforeseen error that

occurred on the server, this should normally not happen. Will return nothing else.

© Swish 27

Retrieve Payment request example (Swish e-commerce):

curl -v --request GET https://swicpc.bankgirot.se/swish-

cpcapi/api/v1/paymentrequests/AB23D7406ECE4542A80152D909EF9F6B

< HTTP/1.1 200 OK

{

"id": "AB23D7406ECE4542A80152D909EF9F6B",

"payeePaymentReference": "0123456789",

"paymentReference": "6D6CD7406ECE4542A80152D909EF9F6B",

"callbackUrl": "https://example.com/api/swishcb/paymentrequests",

"payerAlias": "46701234567",

"payeeAlias": "1231234567890",

"amount": "100",

"currency", "SEK",

"message": "Kingston USB Flash Drive 8 GB",

"status": "PAID",

"dateCreated": "2015-02-19T22:01:53+01:00",

"datePaid": "2015-02-19T22:03:53+01:00"

}

11.1.5 Callback

Swish will make a callback HTTPS POST request, with the Payment Request Object, to the Callback

URL supplied in the Create Payment Request operation when either of the following events (status)

happens:

PAID - The payment was successful

DECLINED - The payer declined to make the payment

ERROR - Some error occurred, like payment was blocked, payment request timed out etc.

See list of error codes for all potential error conditions.

A payment request has to be accepted or declined by the consumer within three (3) minutes for e-

commerce and three (3) minutes for m-commerce. When the time has elapsed an ERROR status is

returned to the Callback URL. If the consumer accepts the payment request a status is returned to the

Callback URL within 12 seconds.

The callback endpoint has to use HTTPS and we highly recommend IP filtering as well. It is however

up to the merchant to make sure the endpoint is available. Swish will only make the callback request

once, if the merchant has not received a callback response after the timeout, the merchant can choose

to call the Retrieve Payment Request. Swish will always try to make a callback request before the

timeout period, but if it times out, then a timeout callback is sent with status ERROR and the error

code will have value TM01.

© Swish 28

11.2 Payment Refund

Refunds are initiated based on a Payment reference from an earlier payment. To make a refund

create first a Refund, similar to how you create a payment request, and then you will receive a

reference to the refund, but the result of the refund is returned in a Callback, similar to how payment

request works. A refund normally completes much faster than a payment request, but a callback is

used because the actual payment might take a long time, normally it does not, but since it might, the

result is returned asynchronously in the callback. The callback, in the happy case, will return an

intermediate response with status DEBITED. This response is guaranteed to have returned in under

10 s or you will get an ERROR response. The DEBITED response means that the money has been

taken from the merchants (payers) account, but has not been put into the payees account yet.

Normally this should happen very soon afterwards, but this "might" take a long time. Moreover, it is not

guaranteed to succeed, in other words the receiving bank might refuse to put money into the account.

In that case the Commerce customer will receive an ERROR response and the money is put back into

the Commerce customers account. So these are the potential callback scenarios:

1. Happy case: DEBITED, PAID

2. Early error: ERROR

3. Late error: DEBITED, ERROR

So in other words there is a tradeoff here, between speed and accuracy that the merchant needs to

make:

1. Use the early fast guaranteed response of DEBITED to give a quick response that might turn

out to be inaccurate later on.

2. Ignore the DEBITED response and wait for the PAID response that is always accurate but not

always fast.

© Swish 29

11.2.1 Create Refund

POST

/api/v1/refunds

The Http request body have to contain a Refund Object.

Potential Http status codes returned:

201 Created: Returned when Refund was successfully created. Will return a Location header.

400 Bad Request: Returned when Create refund POST operation was malformed.

401 Unauthorized: Returned when there are authentication problems with the certificate. Or

the Swish number in the certificate is not enrolled. Will return nothing else.

403 Forbidden: Returned when the payerAlias in the refund object is not the same as

merchant’s Swish number.

415 Unsupported Media Type: Returned when Content-Type header is not "application/json".

Will return nothing else.

422 Unprocessable Entity: Returned when there are validation errors. Will return an Array of

Error Objects.

500 Internal Server Error: Returned if there was some unknown/unforeseen error that

occurred on the server, this should normally not happen. Will return nothing else.

504 Gateway Timeout: Returned when the Bank validation answers take too long and Swish

times out. This rarely happens.

Potential Error codes returned on Error Objects when validation fails (Http status code 422 is

returned):

FF08 – Payment Reference is invalid

RP03 - Callback URL is missing or does not use Https

PA02 - Amount value is missing or not a valid number

AM06 - Specified transaction amount is less than agreed minimum

RF08 - Amount value is too large or amount exceeds the amount of the original payment

minus any previous refunds. Note: the remaining available amount is put into the additional

information field.

Note: the remaining available amount is put into the additional information field.

AM03 - Invalid or missing Currency

RP01 - Missing merchant Swish Number

RP02 - Wrong formated message

ACMT07 - Payee not Enrolled

ACMT01 - Counterpart is not activated

RF02 - Original Payment not found or original payment is more than than 13 months old

RF03 - Payer alias in the refund does not match the payee alias in the original payment

RF04 - Payer organization number do not match original payment payee organization number.

RF06 - The Payer SSN in the original payment is not the same as the SSN for the current

Payee. Note: Typically this means that the Mobile number has been transferred to another

person.

RF07 - Transaction declined

FF10 - Bank system processing error

BE18 - Payer alias is invalid

© Swish 30

Create Refund example:

curl -v --request POST https://swicpc.bankgirot.se/swish-

cpcapi/api/v1/refunds \

--header "Content-Type: application/json" \

--data @- <<!

{

"payerPaymentReference": "0123456789",

"originalPaymentReference": "6D6CD7406ECE4542A80152D909EF9F6B",

"callbackUrl": "https://example.com/api/swishcb/refunds",

"payerAlias": "1231181189",

"amount": "100",

"currency": "SEK",

"message": "Refund for Kingston USB Flash Drive 8 GB"

}

!

< HTTP/1.1 201 Created

< Location: https://swicpc.bankgirot.se/swish-

cpcapi/api/v1/refunds/ABC2D7406ECE4542A80152D909EF9F6B

11.2.2 Retrieve Refund

GET

/api/v1/refunds/{id}

Potential HTTP status codes returned:

200 OK: Returned when refund was found. Will return Refund Object.

401 Unauthorized: Returned when there are authentication problems with the certificate. Or

the Swish number in the certificate is not enrolled. Will return nothing else.

404 Not found: Returned when no refund was found or it was not created by the merchant.

Will return nothing else.

500 Internal Server Error: Returned if there was some unknown/unforeseen error that

occurred on the server, this should normally not happen. Will return nothing else.

Possible statuses:

VALIDATED - Refund ongoing

DEBITED - Money has been withdrawn from your account

PAID - The payment was successful

ERROR - Some error occurred. See list of error codes for all potential error conditions.

© Swish 31

Retrieve Refund example:

curl -v --request GET https://swicpc.bankgirot.se/swish-

cpcapi/api/v1/refunds/ABC2D7406ECE4542A80152D909EF9F6B

< HTTP/1.1 200 OK

{

"id": "ABC2D7406ECE4542A80152D909EF9F6B",

"payerPaymentReference": "0123456789",

"originalPaymentReference": "6D6CD7406ECE4542A80152D909EF9F6B",

"callbackUrl": "https://example.com/api/swishcb/refunds",

"payerAlias": "1231181189",

"payeeAlias": "46701234567",

"amount": "100",

"currency": "SEK",

"message": "Refund for Kingston USB Flash Drive 8 GB",

"status": "PAID",

"dateCreated": "2015-02-19T22:01:53+01:00",

"datePaid": "2015-02-19T22:03:53+01:00"

}

11.2.3 Callback

Swish will make a callback HTTPS POST request, with the Refund Object, to the Callback URL

supplied in the Create Refund operation when either of the following events (status) happens:

DEBITED – Money has been withdrawn from your account

PAID - The payment was successful

ERROR - Some error occurred. See list of error codes for all potential error conditions.

11.3 Objects

The date fields use the ISO 8601 date format. Since the Swish server creates these date fields, and

the servers are located in Sweden, the timezone used is CET, which is UTC+01:00 or UTC+02:00,

depending on whether it is Central European Summer Time (CEST) or not. See the code examples

for samples.

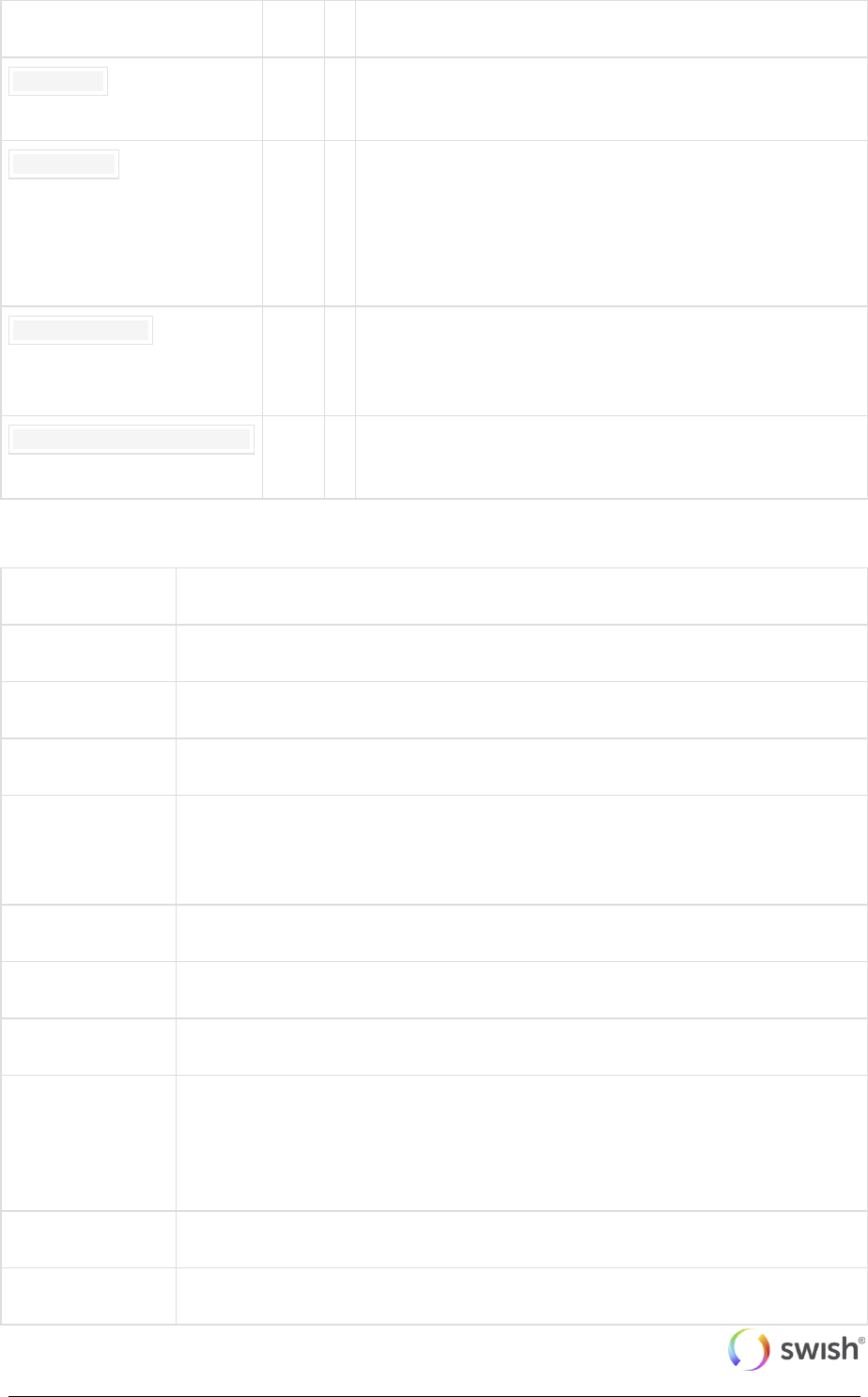

11.3.1 Payment Request Object

The Payment Request Object is used in all 3 Payment Request operations (Create, Retrieve and

Callback). The fields that are mandatory are for the Create operation, but of course those fields will

also be available on the other operations.

© Swish 32

Legend:

M - Mandatory input parameter (for Create operation)

O - Optional input parameter (for Create operation)

R - Response parameter (should not be supplied in Create operation)

Property

Type

Description

id

string

R

Payment request ID

payeePaymentReference

string

O

Payment reference of the payee, which is the merchant that

receives the payment. This reference could be order id or

similar.

paymentReference

string

R

Payment reference, from the bank, of the payment that

occurred based on the Payment request. Only available if

status is PAID.

callbackUrl

string

M

URL that Swish will use to notify caller about the outcome

of the Payment request. The URL has to use HTTPS.

payerAlias

string

O

The registered Cell phone number of the person that makes

the payment. It can only contain numbers and has to be at

least 8 and at most 15 numbers. It also needs to match the

following format in order to be found in Swish: countrycode

+ cell phone number (without leading zero). E.g.:

46712345678

payeeAlias

string

M

The Swish number of the payee

amount

string

M

The amount of money to pay. The amount cannot be less

than 1 SEK and not more than 999999999999.99 SEK.

Valid value have to be all numbers or with 2 digit decimal

seperated with a period.

currency

string

M

The currency to use. Only supported value currently is

SEK.

message

string

O

Merchant supplied message about the payment/order.

Max 50 chars. Allowed characters are the letters a-, A-

Ö, the numbers 0-9 and the special characters :;.,?!()”.

status

string

R

The status of the transaction. Possible values:

CREATED, PAID, DECLINED, ERROR.

dateCreated

string

R

The time and date that the payment request was

created.

© Swish 33

Property

Type

Description

datePaid

string

R

The time and date that the payment request was paid.

Only applicable if status was PAID.

errorCode

string

R

A code indicating what type of error occurred. Only

applicable if status is ERROR.

errorMessage

string

R

A descriptive error message (in English) indicating what

type of error occurred. Only applicable if status is

ERROR

additionalInformation

string

R

Additional information about the error. Only applicable if

status is ERROR.

Potential Error codes values:

Code

Description

ACMT03

Payer not Enrolled

ACMT01

Counterpart is not activated

ACMT07

Payee not Enrolled

RF07

Transaction declined. The payment was unfortunately declined. A reason for the

decline could be that the payer have exceeded their defined Swish limit. Please

advise the payer to check with their bank.

BANKIDCL

Payer cancelled bankid signing

FF10

Bank system processing error

TM01

Swish timed out before the payment was started

DS24

Swish timed out waiting for an answer from the banks after payment was started.

Note: If this happens Swish has no knowledge of whether the payment was

successful or not. The merchant should inform its consumer about this and

recommend them to check with their bank about the status of this payment.

BANKIDONGOING

BankID already in use

BANKIDUNKN

BankID are not able to authorize the payment.

© Swish 34

11.3.2 Refund Object

The Refund Object is used in all 3 Refund operations (Create, Retrieve and Callback). The fields that

are mandatory are for the Create operation, but of course those fields will also be available on the

other operations.

Legend:

M - Mandatory input parameter (for Create operation)

O - Optional input parameter (for Create operation)

R - Response parameter (should not be supplied in Create operation)

Property

Type

Description

id

string

R

Refund ID

payerPaymentReference

string

O

Payment reference supplied by the merchant. This

could be order id or similar.

originalPaymentReference

string

M

Reference of the original payment that this refund is for.

paymentReference

string

R

Reference of the refund payment that occurred based

on the created refund. Only available if status is PAID.

callbackUrl

string

M

URL that Swish will use to notify caller about the

outcome of the Refund. The URL has to use HTTPS.

payerAlias

string

M

The Swish number of the merchant that makes the

refund payment.

payeeAlias

string

R

The Cell phone number of the person that receives the

refund payment.

amount

string

M

The amount of money to refund. The amount cannot be

less than 1 SEK and not more than 999999999999.99

SEK. Moreover, the amount can not exceed the

remaining amount of the original payment that the

refund is for.

currency

string

M

The currency to use. Only supported value currently is

SEK.

message

string

O

Merchant supplied message about the refund. Max 50

chars. Allowed characters are the letters a-, A-Ö, the

numbers 0-9 and the special characters :;.,?!()”.

status

string

R

The status of the refund transaction. Possible

© Swish 35

Property

Type

Description

values:VALIDATED, DEBITED, PAID, ERROR.

dateCreated

string

R

The time and date that the payment refund was

created.

datePaid

string

R

The time and date that the payment refund was paid.

errorCode

string

R

A code indicating what type of error occurred. Only

applicable if status is ERROR.

errorMessage

string

R

A descriptive error message (in English) indicating what

type of error occurred. Only applicable if status is

ERROR

additionalInformation

string

R

Additional information about the error. Only applicable if

status is ERROR.

Potential Error codes values:

Code

Description

ACMT07

Payee not Enrolled

ACMT01

Counterpart is not activated

RF07

Transaction declined. Please contact your bank.

FF10

Bank system processing error

DS24

Swish timed out waiting for an answer from the banks after payment was started. Note: If

this happens Swish has no knowledge of whether the payment was successful or not. The

merchant should inform its consumer about this and recommend them to check with their

bank about the status of this payment.

11.3.3 Error Object

Property

Type

Description

errorCode

string

A code indicating what type of error occurred.

errorMessage

string

A descriptive error message (in English) indicating what type of

error occurred.

© Swish 36

Property

Type

Description

additionalInformation

string

Additional information about the error.

Example: Array of Error objects:

[{

"errorCode": "PA02",

"errorMessage": "Amount value is missing or not a valid number",

"additionalInformation": ""

},{

"errorCode": "AM03",

"errorMessage": "Invalid or missing Currency",

"additionalInformation": ""

},{

"errorCode": "RF08",

"errorMessage": "Amount value is too large or amount exceeds the amount

of the original payment minus any previous refunds",

"additionalInformation": "100.00"

}]