HPS Integrator's Guide V 17.2 Nov 2017

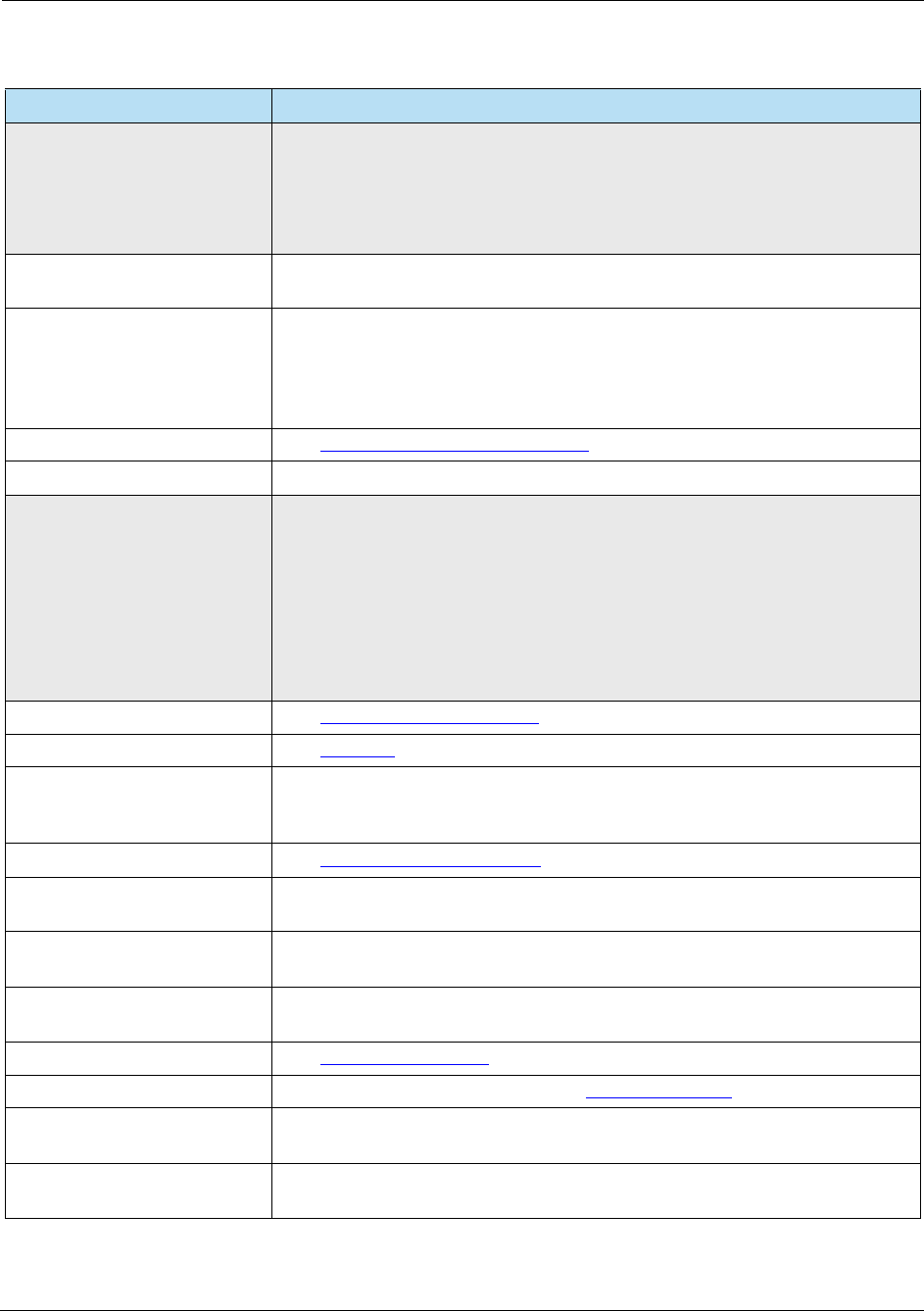

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 316 [warning: Documents this large are best viewed by clicking the View PDF Link!]

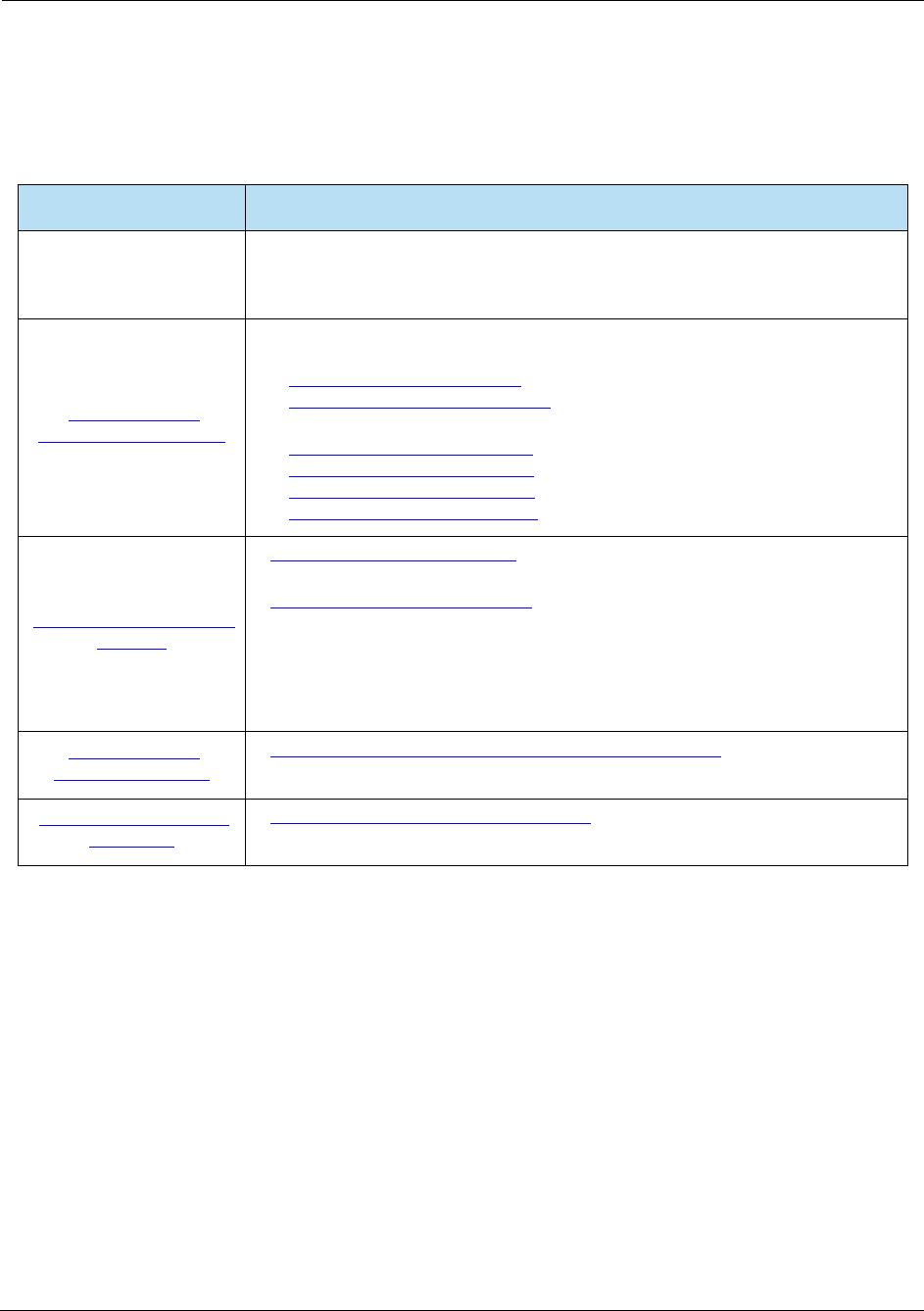

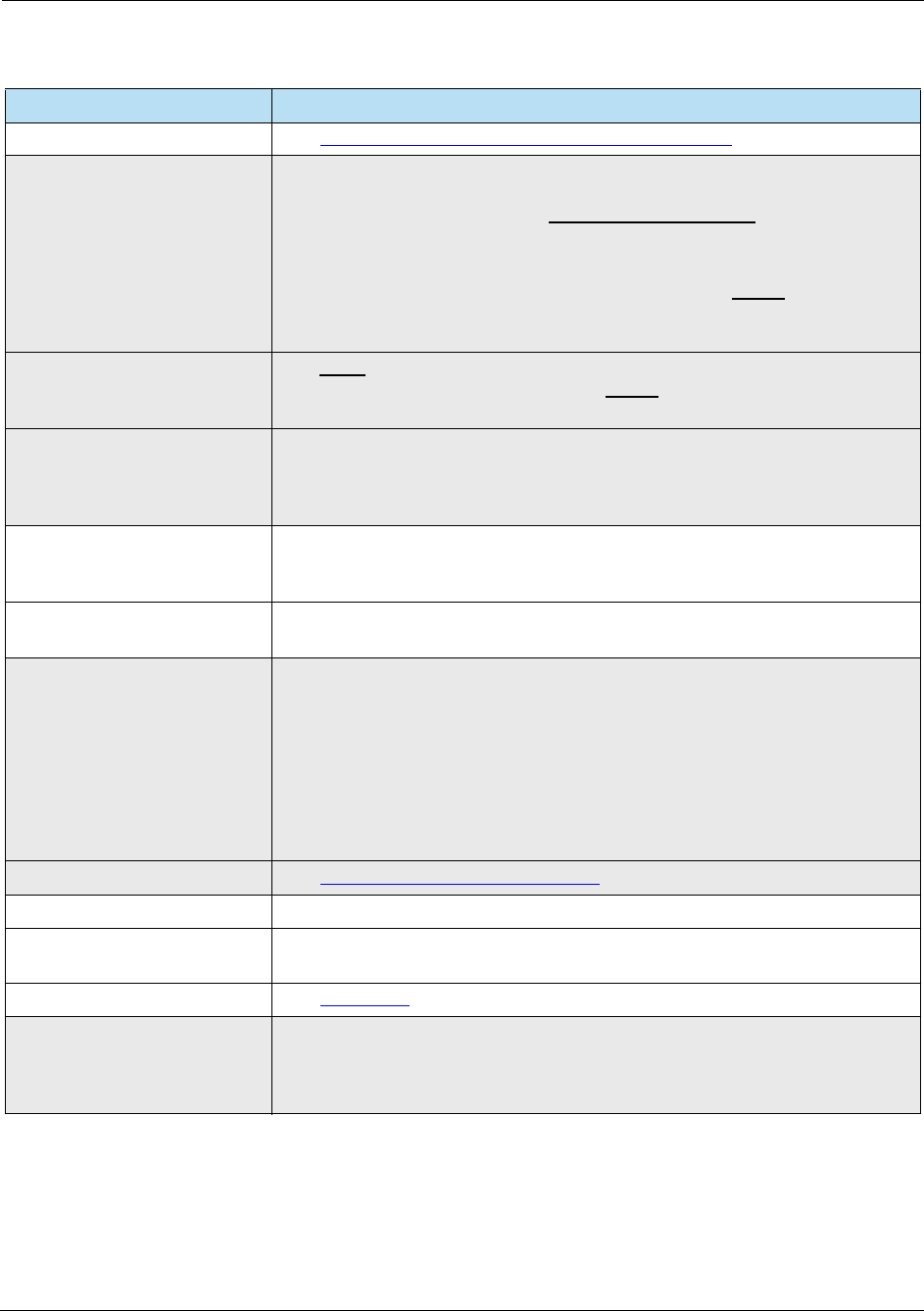

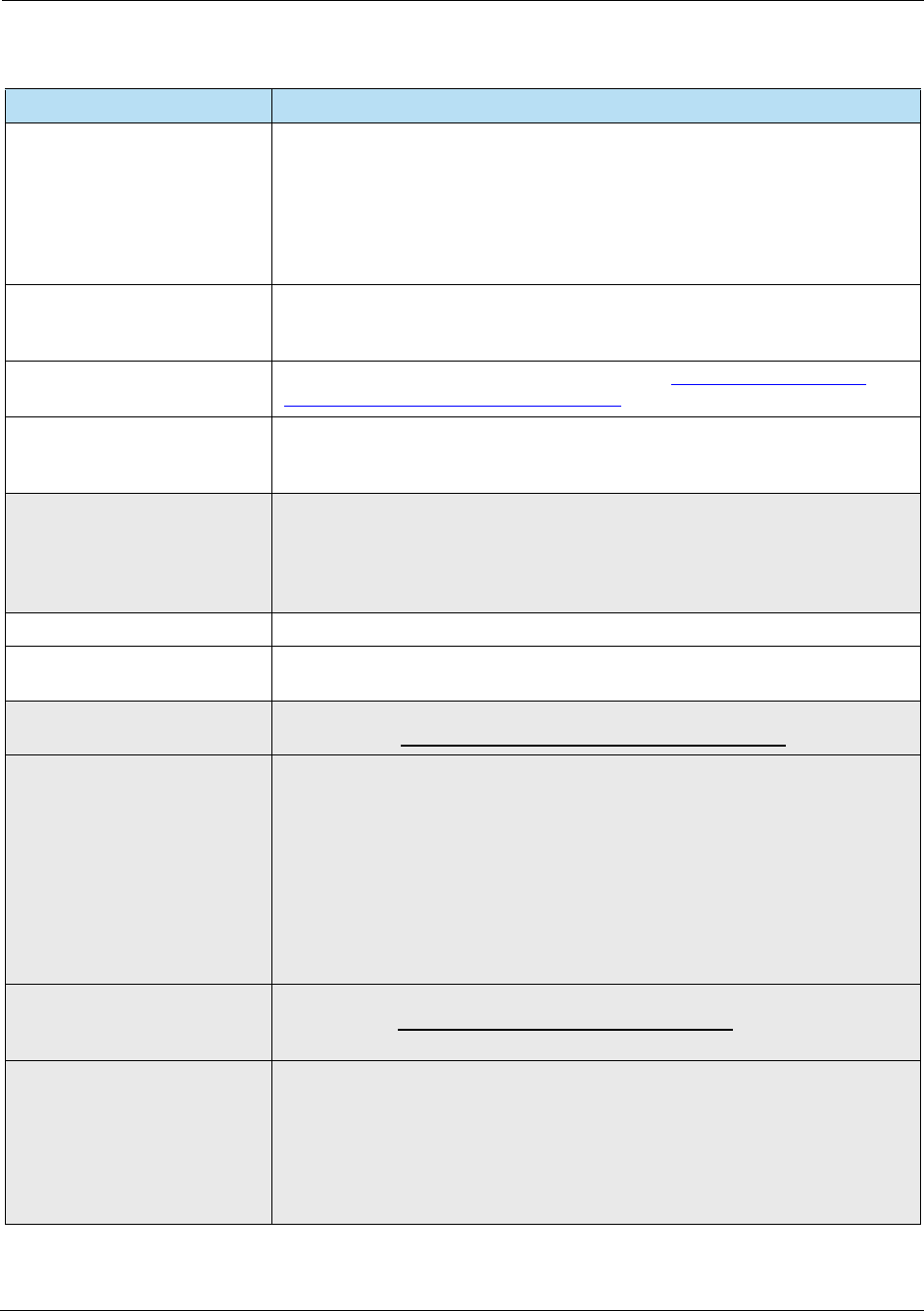

- Heartland Integrator’s Guide

- Release Notes

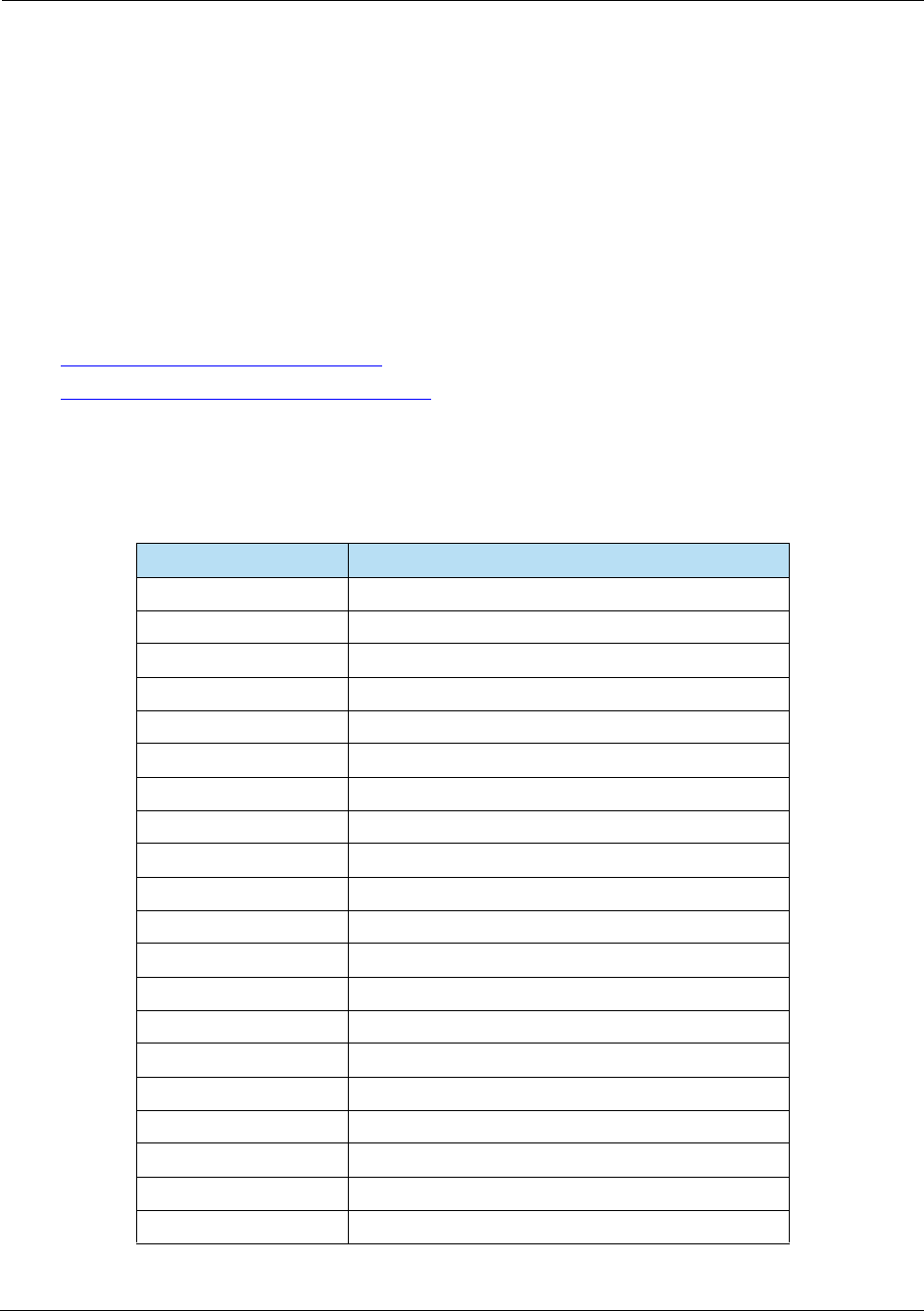

- Table of Contents

- List of Tables

- List of Figures

- Chapter 1: Overview

- Chapter 2: General POS Requirements

- Chapter 3: Card Brand Information

- 3.1 Introduction

- 3.2 American Express

- 3.3 AVcard

- 3.4 Centego Prepaid Card

- 3.5 Discover Card

- 3.6 Diner’s Club International Card

- 3.7 Drop Tank Card

- 3.8 Heartland Gift Card

- 3.9 EBT Card

- 3.10 Fleet One Card

- 3.11 FleetCor Card

- 3.12 JCB Card

- 3.13 Mastercard

- 3.14 Mastercard Fleet Card Type

- 3.15 Mastercard Purchasing Card

- 3.16 Multi Service Track Data

- 3.17 PayPal Card

- 3.18 Stored Value Solutions (SVS)

- 3.19 UnionPay Card

- 3.20 ValueLink Card

- 3.21 Visa Card

- 3.22 Visa Corporate or Business

- 3.23 Visa Purchasing

- 3.24 Visa Fleet Card Type

- 3.25 Voyager Fleet Card

- 3.26 WEX Fleet Card

- Chapter 4: E3 Processing Overview

- Chapter 5: EMV Processing Overview

- Chapter 6: EMV Development Overview

- Chapter 7: EMV Terminal Interface

- 7.1 EMV Terminal to Card Communication

- 7.2 EMV Data Elements

- 7.3 Contact Transaction Flow

- 7.3.1 Tender Processing

- 7.3.2 Card Acquisition

- 7.3.3 Application Selection

- 7.3.4 Initiate Application Processing

- 7.3.5 Read Application Data

- 7.3.6 Offline Data Authentication

- 7.3.7 Processing Restrictions

- 7.3.8 Cardholder Verification

- 7.3.9 Terminal Risk Management

- 7.3.10 Terminal Action Analysis

- 7.3.11 Card Action Analysis

- 7.3.12 Online Processing

- 7.3.13 Issuer Authentication

- 7.3.14 Issuer-to-Card Script Processing

- 7.3.15 Completion

- 7.3.16 Card Removal

- 7.4 Contactless Transaction Flow

- 7.4.1 Pre-Processing

- 7.4.2 Discovery Processing

- 7.4.3 Application Selection

- 7.4.4 Initiate Application Processing

- 7.4.5 Read Application Data

- 7.4.6 Card Read Complete

- 7.4.7 Processing Restrictions

- 7.4.8 Offline Data Authentication

- 7.4.9 Cardholder Verification

- 7.4.10 Online Processing

- 7.4.11 Completion

- 7.4.12 Issuer Update Processing

- 7.5 EMV Receipts

- Chapter 8: EMV Parameter Interface

- Chapter 9: EMV Quick Chip Processing Overview

- 9.1 Introduction

- 9.2 Quick Chip Processing Definition

- 9.3 Impact to Existing EMV Kernel and Host Software

- 9.4 Comparison of Standard EMV and Quick Chip Processes

- 9.5 Online Processing Overview

- 9.6 Quick Chip Processing Flow

- 9.7 Floor Limit

- 9.8 Amounts – Final or Pre-Determined

- 9.9 Cashback Processing

- 9.10 CVM List

- 9.11 No Signature Required Processing

- Appendices

- Appendix A: Industry Codes

- Appendix B: Receipt Requirements

- Appendix C: State Codes / Region Codes

- Appendix D: EMV Field Definitions

- D.1 Additional Terminal Capabilities

- D.2 Amount, Authorised (Numeric)

- D.3 Amount, Other (Numeric)

- D.4 Application Cryptogram

- D.5 Application Dedicated File (ADF) Name

- D.6 Application Identifier (AID) – Terminal

- D.7 Application Interchange Profile

- D.8 Application Label

- D.9 Application Preferred Name

- D.10 Application Primary Account Number (PAN) Sequence Number

- D.11 Application Transaction Counter (ATC)

- D.12 Application Usage Control

- D.13 Application Version Number (ICC)

- D.14 Application Version Number (Terminal)

- D.15 Authorisation Response Code

- D.16 Cardholder Verification Method (CVM) Results

- D.17 Cryptogram Information Data (CID)

- D.18 Customer Exclusive Data

- D.19 Dedicated File Name

- D.20 Form Factor Indicator (FFI)

- D.21 ICC Dynamic Number

- D.22 Interface Device (IFD) Serial Number

- D.23 Issuer Action Code – Default

- D.24 Issuer Action Code – Denial

- D.25 Issuer Action Code – Online

- D.26 Issuer Application Data

- D.27 Issuer Authentication Data

- D.28 Issuer Country Code

- D.29 Issuer Script Results

- D.30 Issuer Script Template 1 & 2

- D.31 POS Entry Mode

- D.32 Terminal Action Code – Default

- D.33 Terminal Action Code – Denial

- D.34 Terminal Action Code – Online

- D.35 Terminal Capabilities

- D.36 Terminal Country Code

- D.37 Terminal Type

- D.38 Terminal Verification Results (TVR)

- D.39 Third Party Data

- D.40 Transaction Currency Code

- D.41 Transaction Date

- D.42 Transaction Sequence Counter

- D.43 Transaction Status Information

- D.44 Transaction Time

- D.45 Transaction Type

- D.46 Unpredictable Number

- Appendix E: EMV PDL Data Examples

- Appendix F: Glossary

POS Message Interface

Heartland Integrator’s Guide

Version 17.2

November 2017

For Internal Use Only

Notice HPS Integrator’s Guide V 17.2

22017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive

Notice

THE INFORMATION CONTAINED HEREIN IS PROVIDED TO RECIPIENT “AS IS” WITHOUT

WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO, THE IMPLIED

WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE, OR

WARRANTY OF TITLE OR NON-INFRINGEMENT. HEARTLAND PAYMENT SYSTEMS, LLC

(“HEARTLAND”) MAKES NO WARRANTIES OR REPRESENTATIONS THAT THE MATERIALS,

INFORMATION, AND CONTENTS HEREIN ARE OR WILL BE ERROR FREE, SECURE, OR MEET

RECIPIENT’S NEEDS. ALL SUCH WARRANTIES ARE EXPRESSLY DISCLAIMED.

RECIPIENT’S USE OF ANY INFORMATION CONTAINED HEREIN IS AT RECIPIENT’S SOLE AND

EXCLUSIVE RISK. IN NO EVENT SHALL HEARTLAND BE LIABLE FOR ANY DIRECT, INDIRECT,

SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES RESULTING FROM THE USE OF ANY

INFORMATION CONTAINED HEREIN, WHETHER RESULTING FROM BREACH OF CONTRACT,

BREACH OF WARRANTY, NEGLIGENCE, OR OTHERWISE, EVEN IF HEARTLAND HAS BEEN

ADVISED OF THE POSSIBILITY OF SUCH DAMAGES. HEARTLAND RESERVES THE RIGHT TO

MAKE CHANGES TO THE INFORMATION CONTAINED HEREIN AT ANY TIME WITHOUT NOTICE.

THIS DOCUMENT AND ALL INFORMATION CONTAINED HEREIN IS PROPRIETARY TO HEARTLAND,

RECIPIENT SHALL NOT DISCLOSE THIS DOCUMENT OR THE SYSTEM DESCRIBED HEREIN TO

ANY THIRD PARTY UNDER ANY CIRCUMSTANCES WITHOUT PRIOR WRITTEN CONSENT OF A

DULY AUTHORIZED REPRESENTATIVE OF HEARTLAND. IN ORDER TO PROTECT THE

CONFIDENTIAL NATURE OF THIS PROPRIETARY INFORMATION, RECIPIENT AGREES:

(A) TO IMPOSE IN WRITING SIMILAR OBLIGATIONS OF CONFIDENTIALITY AND

NONDISCLOSURE AS CONTAINED HEREIN ON RECIPIENT’S EMPLOYEES AND

AUTHORIZED THIRD PARTIES TO WHOM RECIPIENT DISCLOSES THIS INFORMATION

(SUCH DISCLOSURE TO BE MADE ON A STRICTLY NEED-TO-KNOW BASIS) PRIOR TO

SHARING THIS DOCUMENT AND

(B) TO BE RESPONSIBLE FOR ANY BREACH OF CONFIDENTIALITY BY THOSE EMPLOYEES

AND THIRD PARTIES TO WHOM RECIPIENT DISCLOSES THIS INFORMATION.

RECIPIENT ACKNOWLEDGES AND AGREES THAT USE OF THE INFORMATION CONTAINED

HEREIN SIGNIFIES ACKNOWLEDGMENT AND ACCEPTANCE OF THESE TERMS. ANY SUCH USE IS

CONDITIONED UPON THE TERMS, CONDITIONS AND OBLIGATIONS CONTAINED WITHIN THIS

NOTICE.

THE TRADEMARKS AND SERVICE MARKS RELATING TO HEARTLAND’S PRODUCTS OR

SERVICES OR THOSE OF THIRD PARTIES ARE OWNED BY HEARTLAND OR THE RESPECTIVE

THIRD PARTY OWNERS OF THOSE MARKS, AS THE CASE MAY BE, AND NO LICENSE WITH

RESPECT TO ANY SUCH MARK IS EITHER GRANTED OR IMPLIED.

To verify existing content or to obtain additional information, please call or email your assigned Heartland

contact.

For Internal Use Only

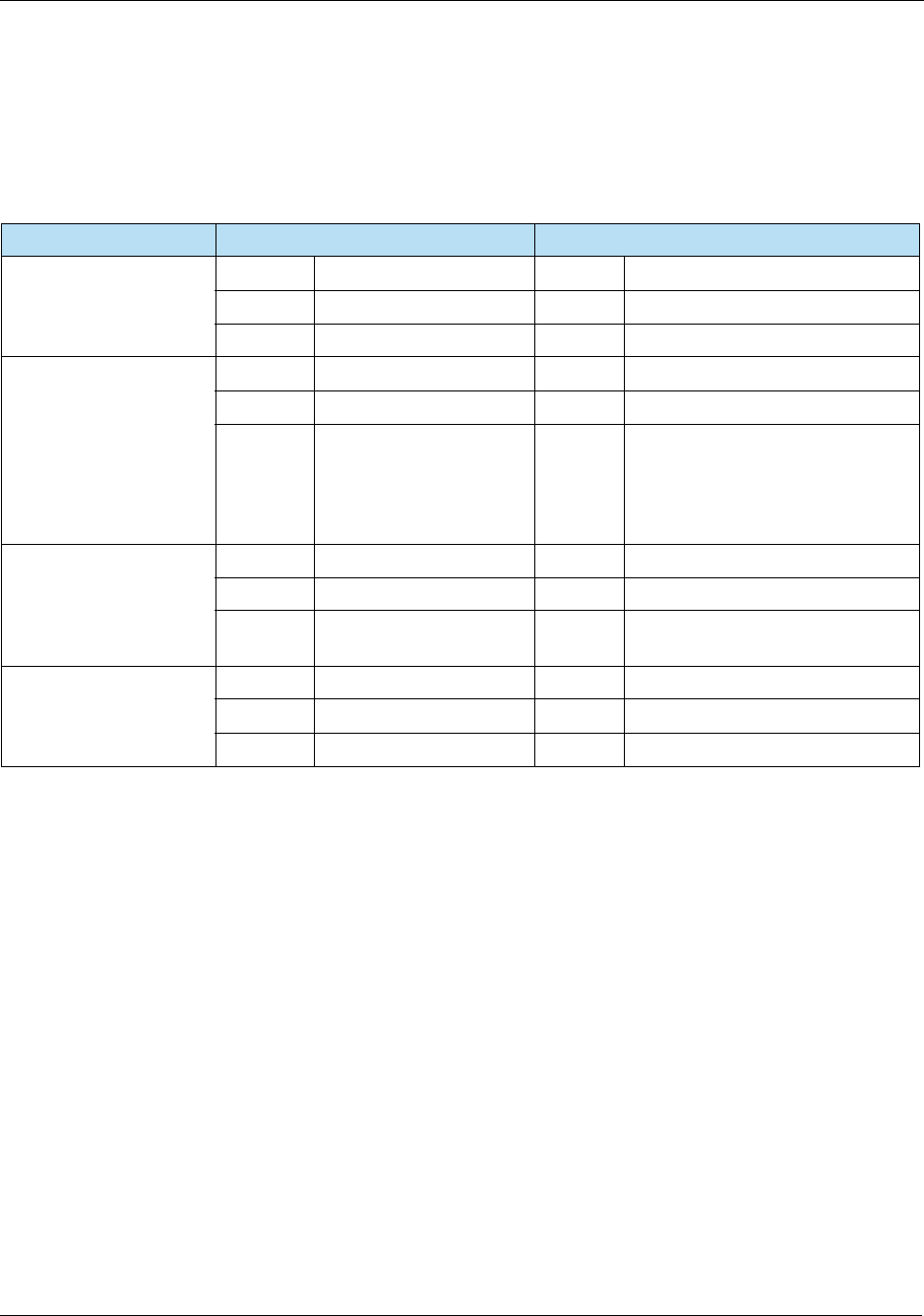

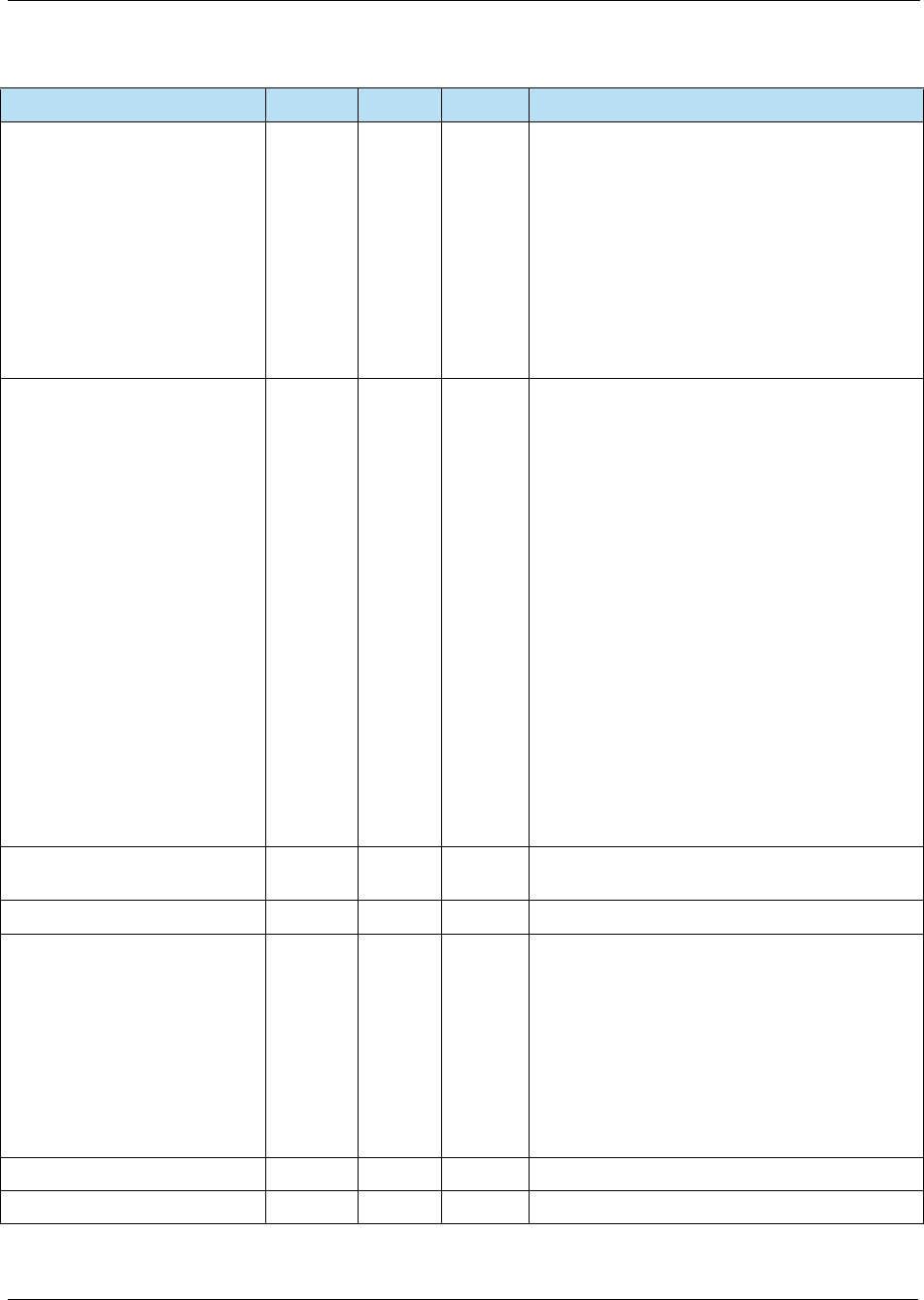

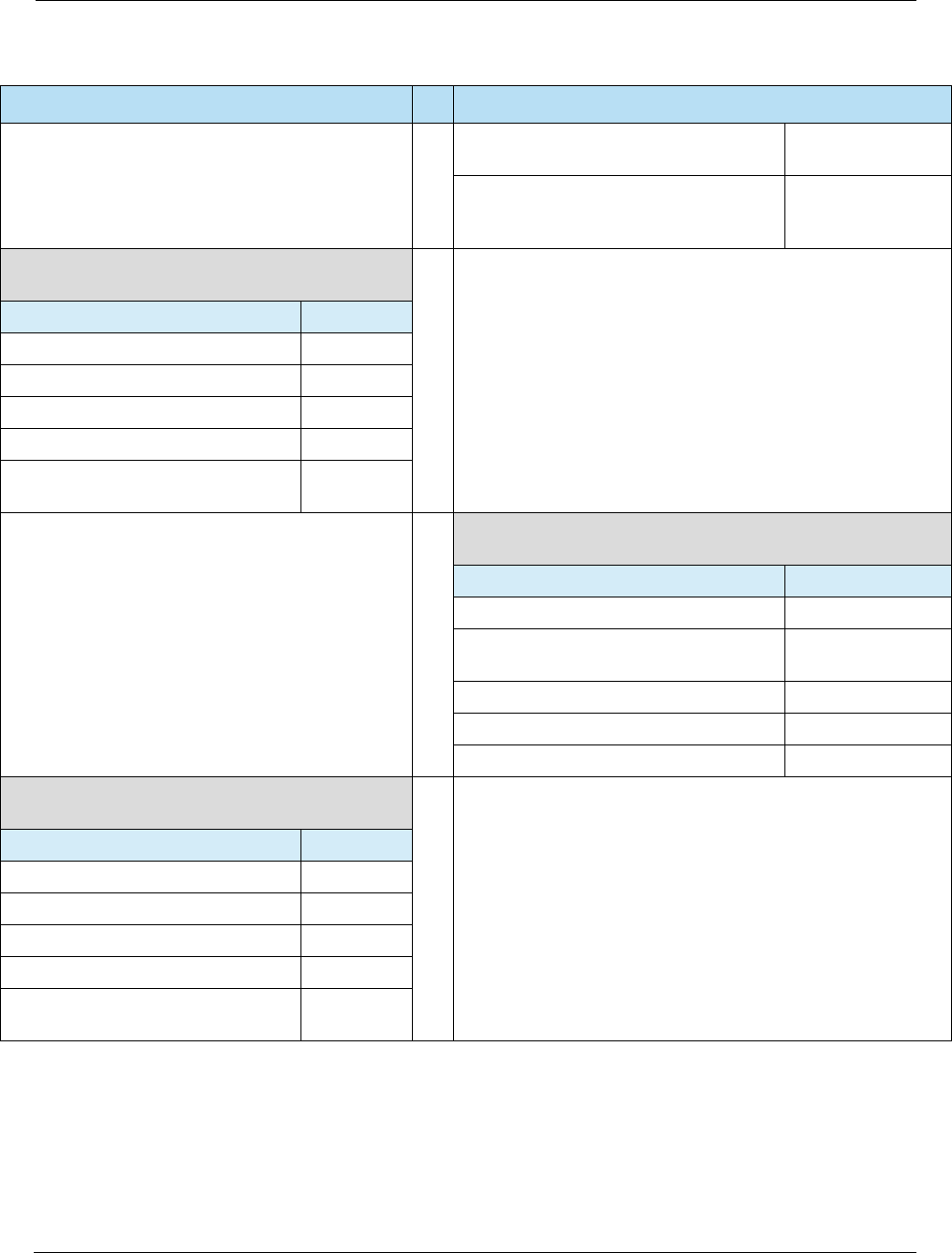

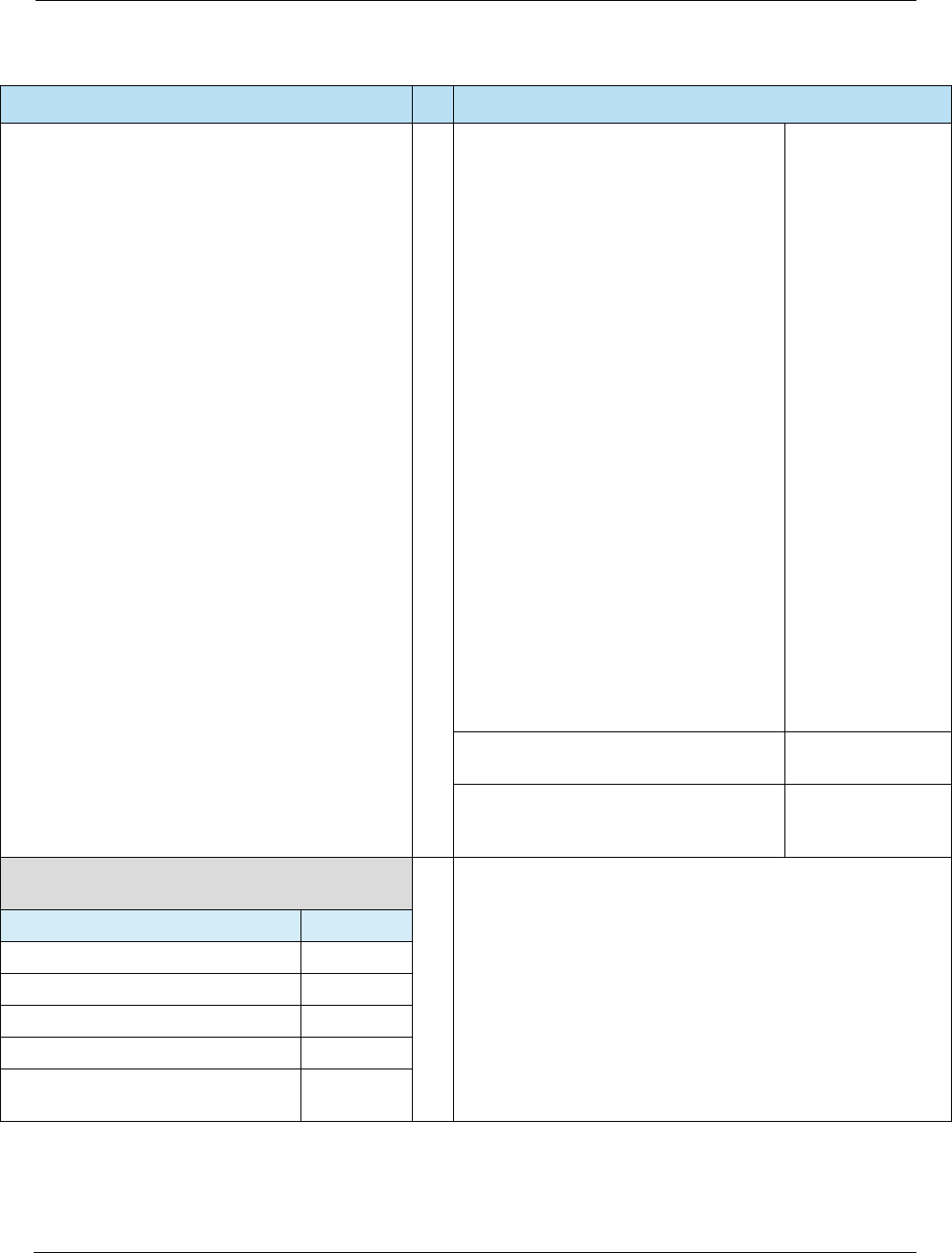

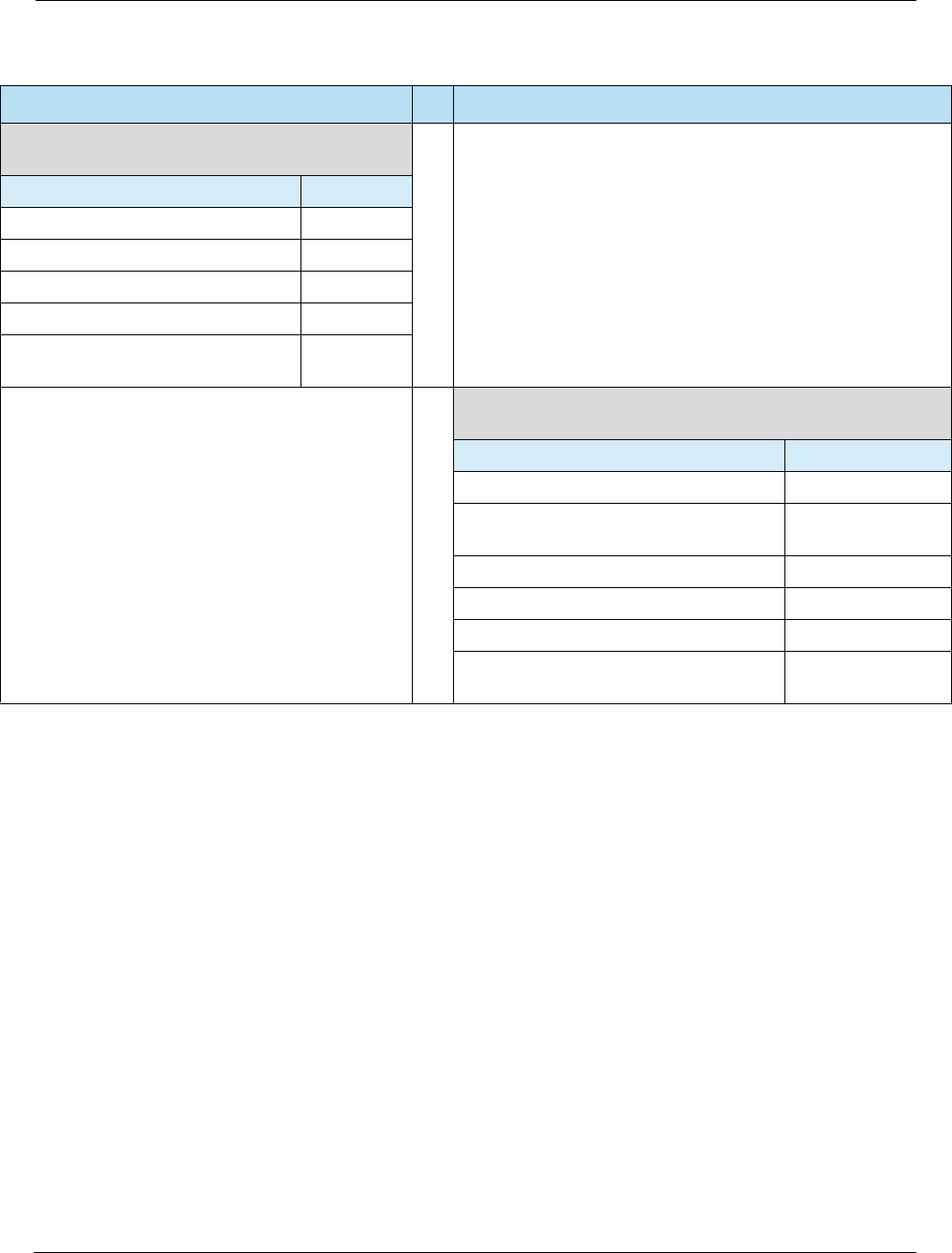

HPS Integrator’s Guide V 17.2 Release Notes

2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive 3

Release Notes

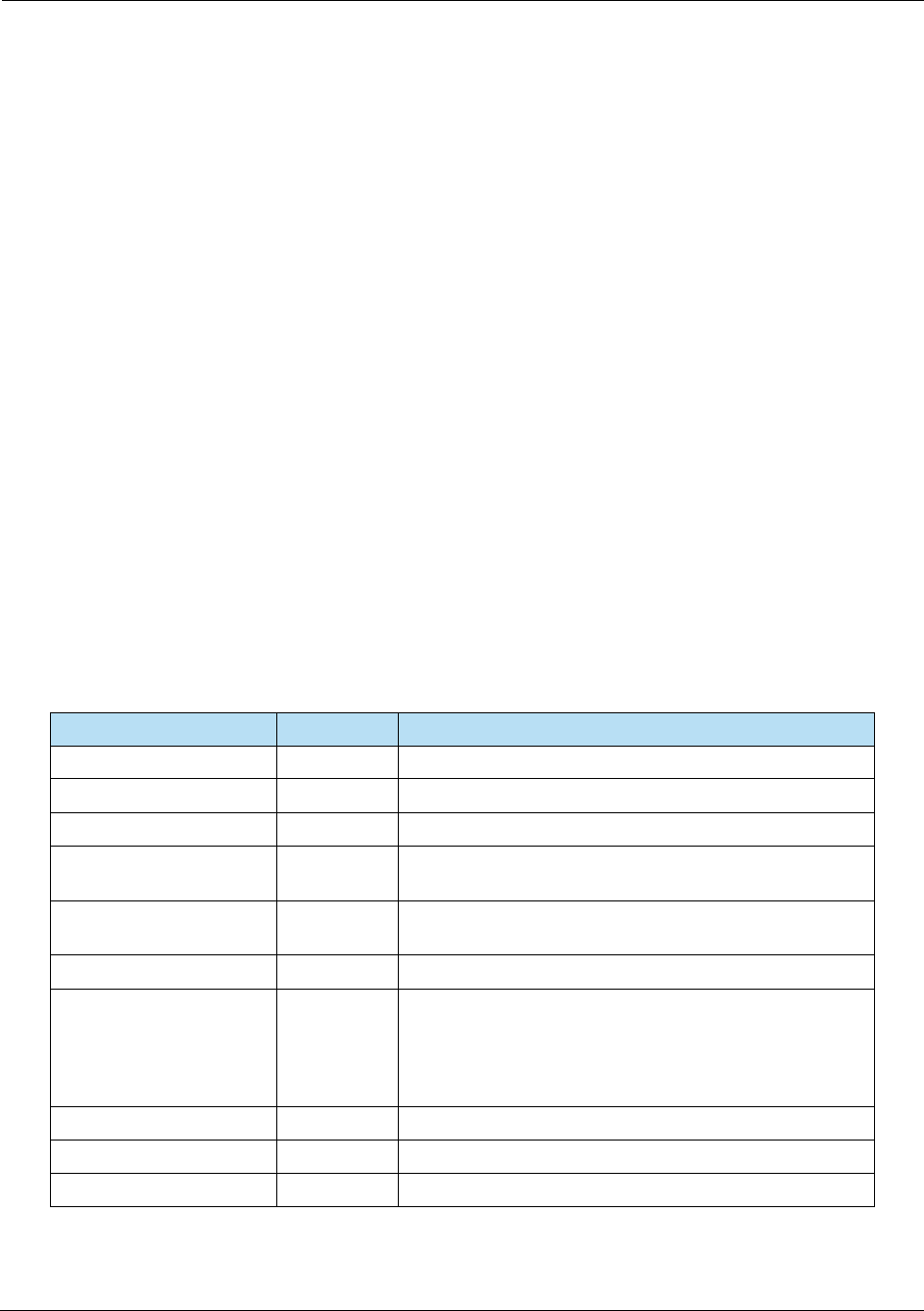

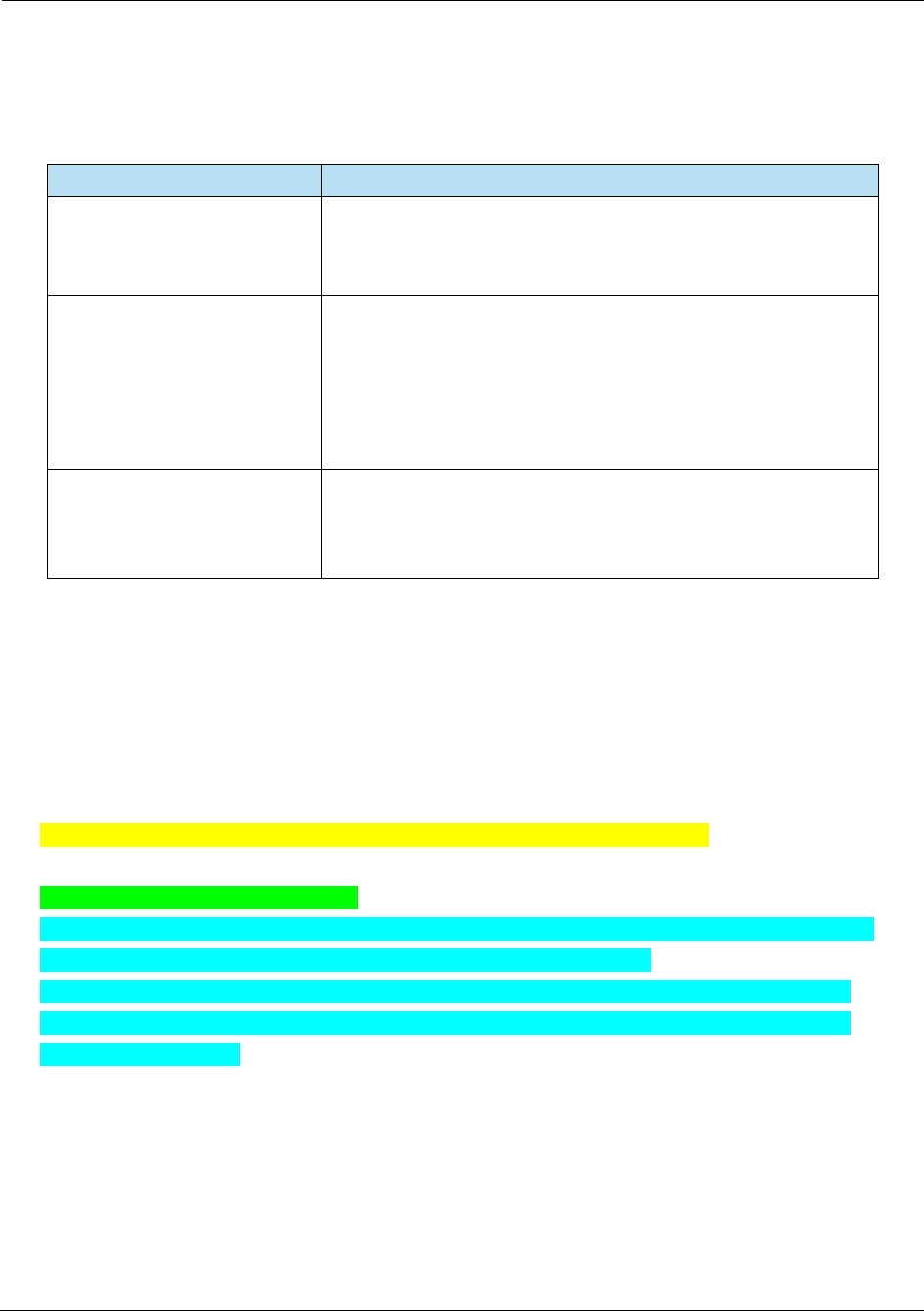

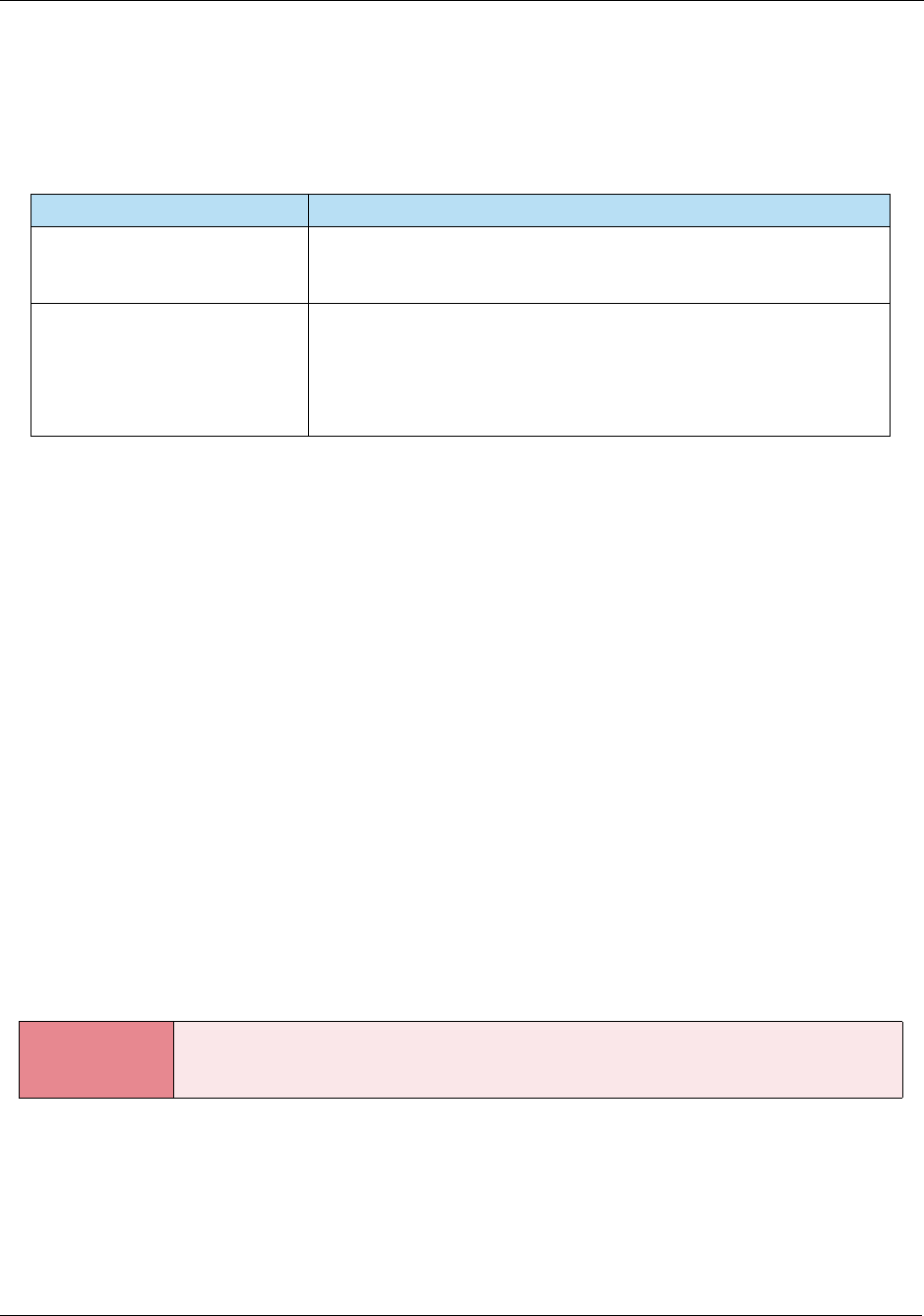

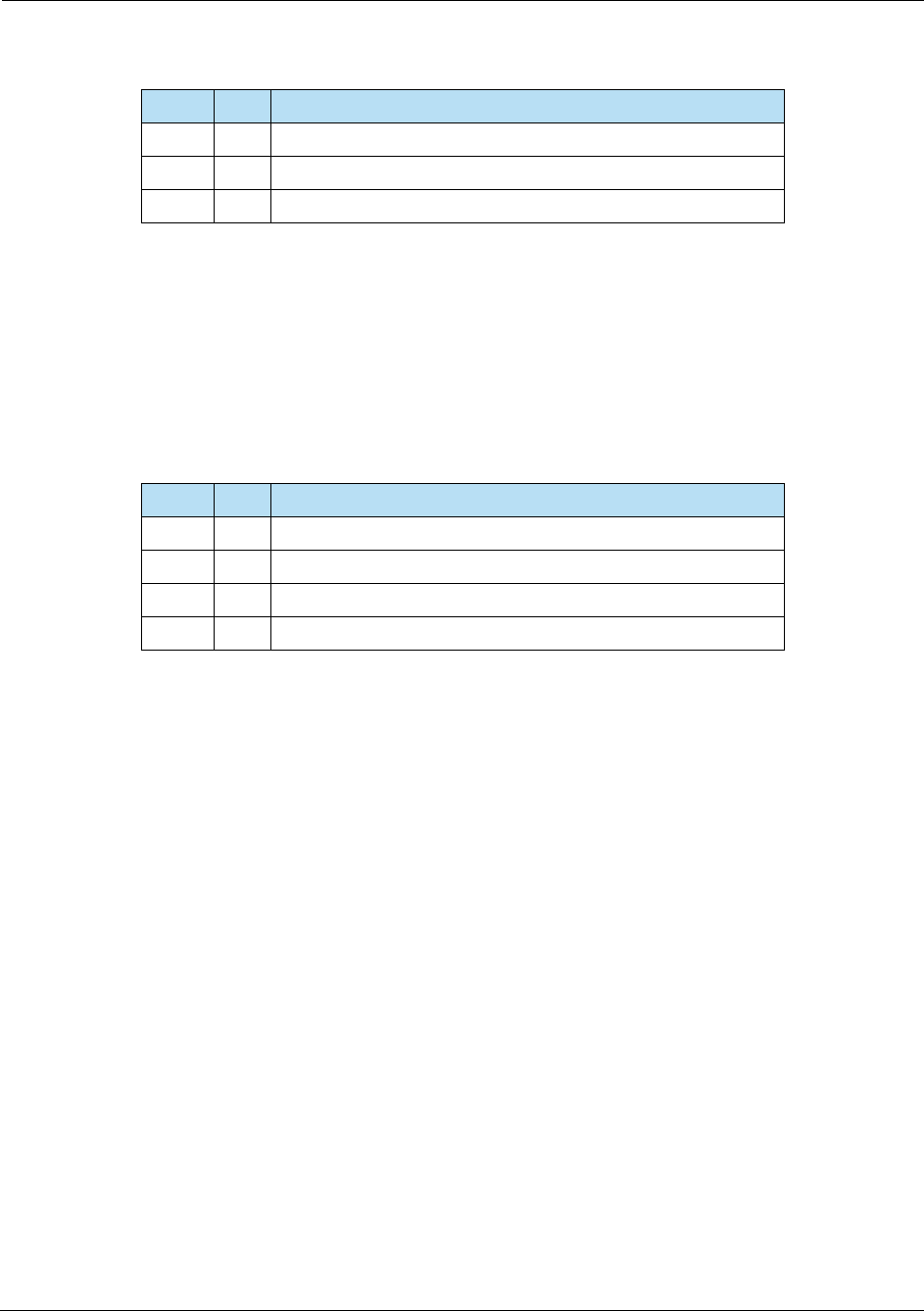

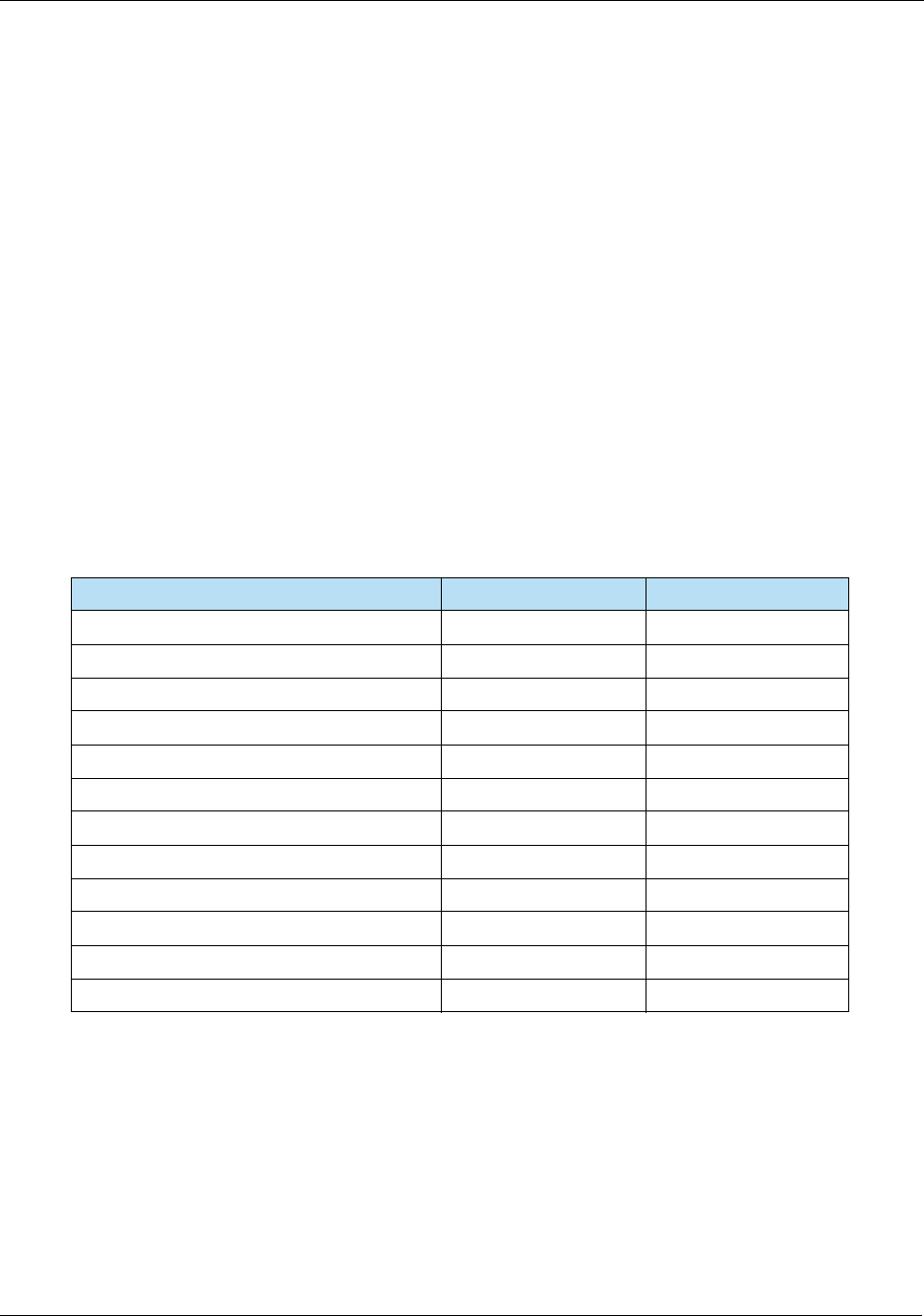

Version 17.2 Release Notes

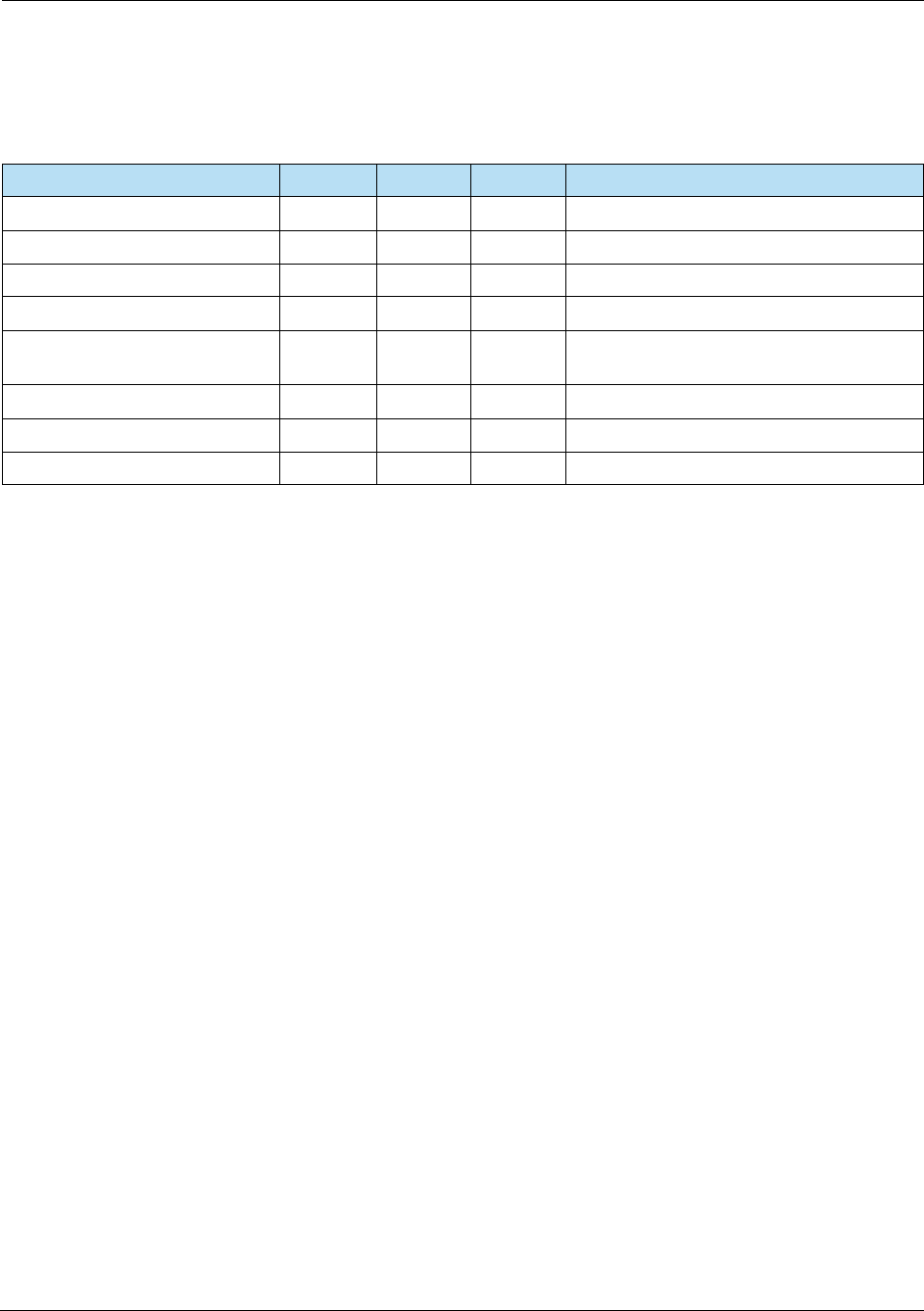

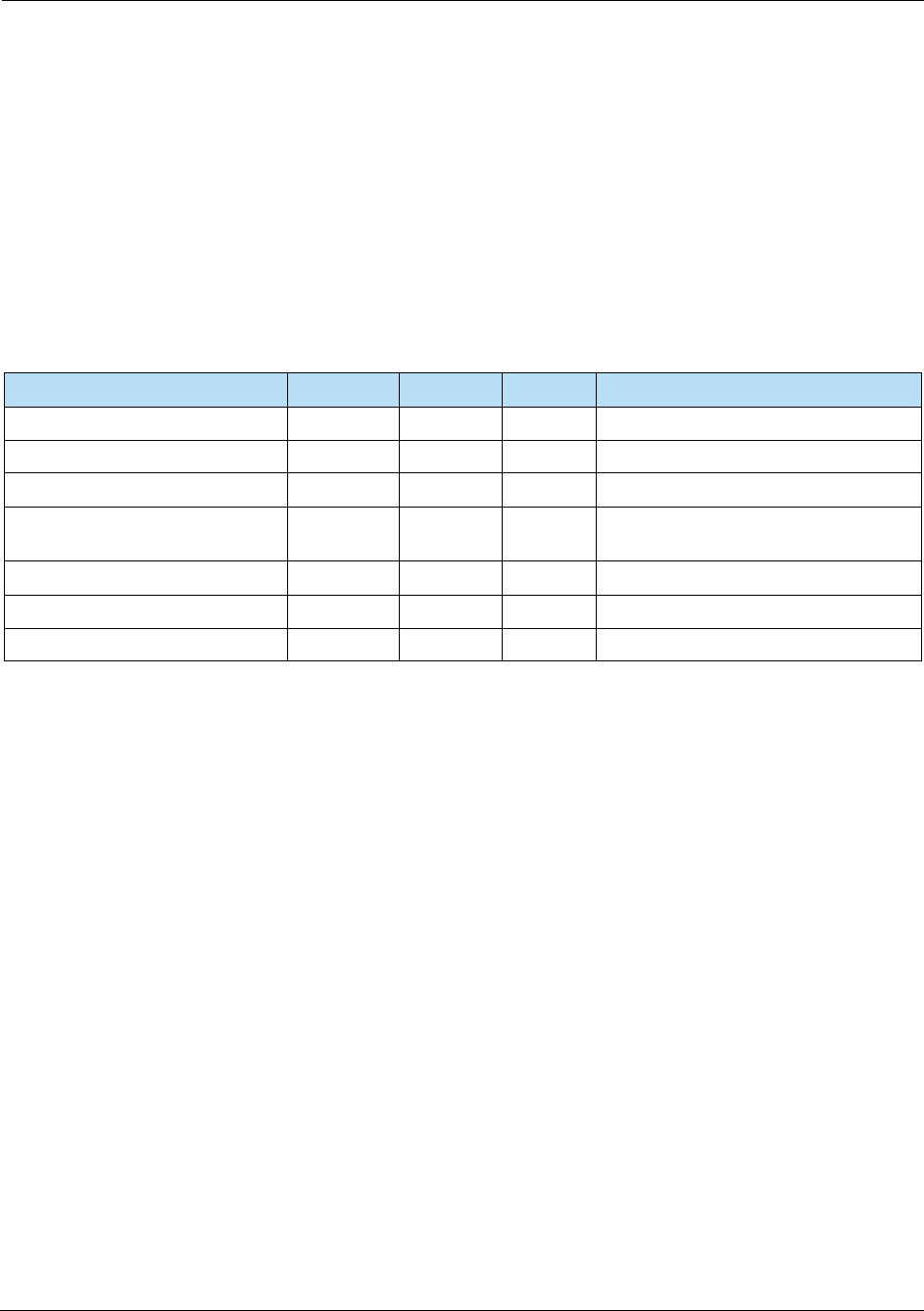

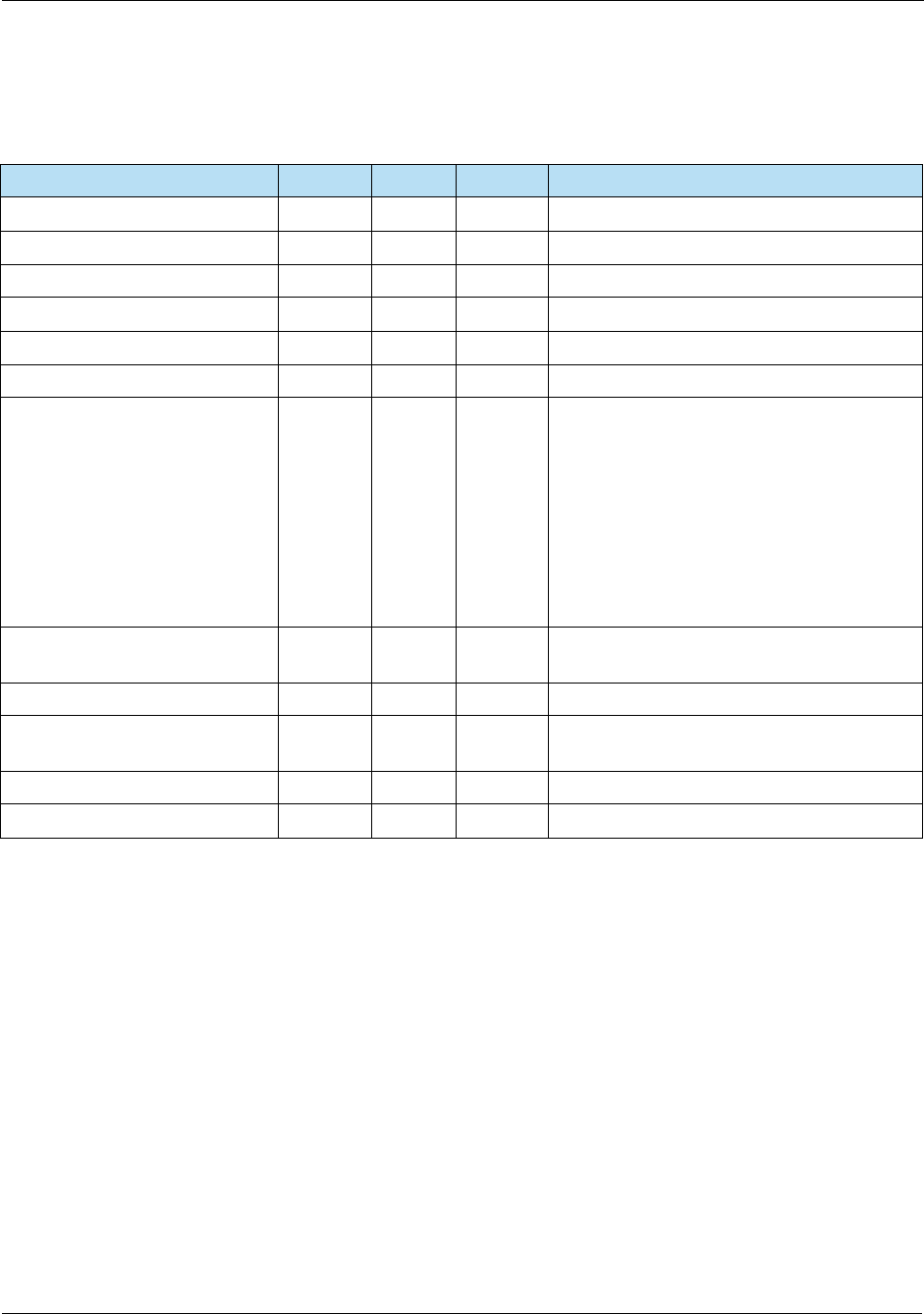

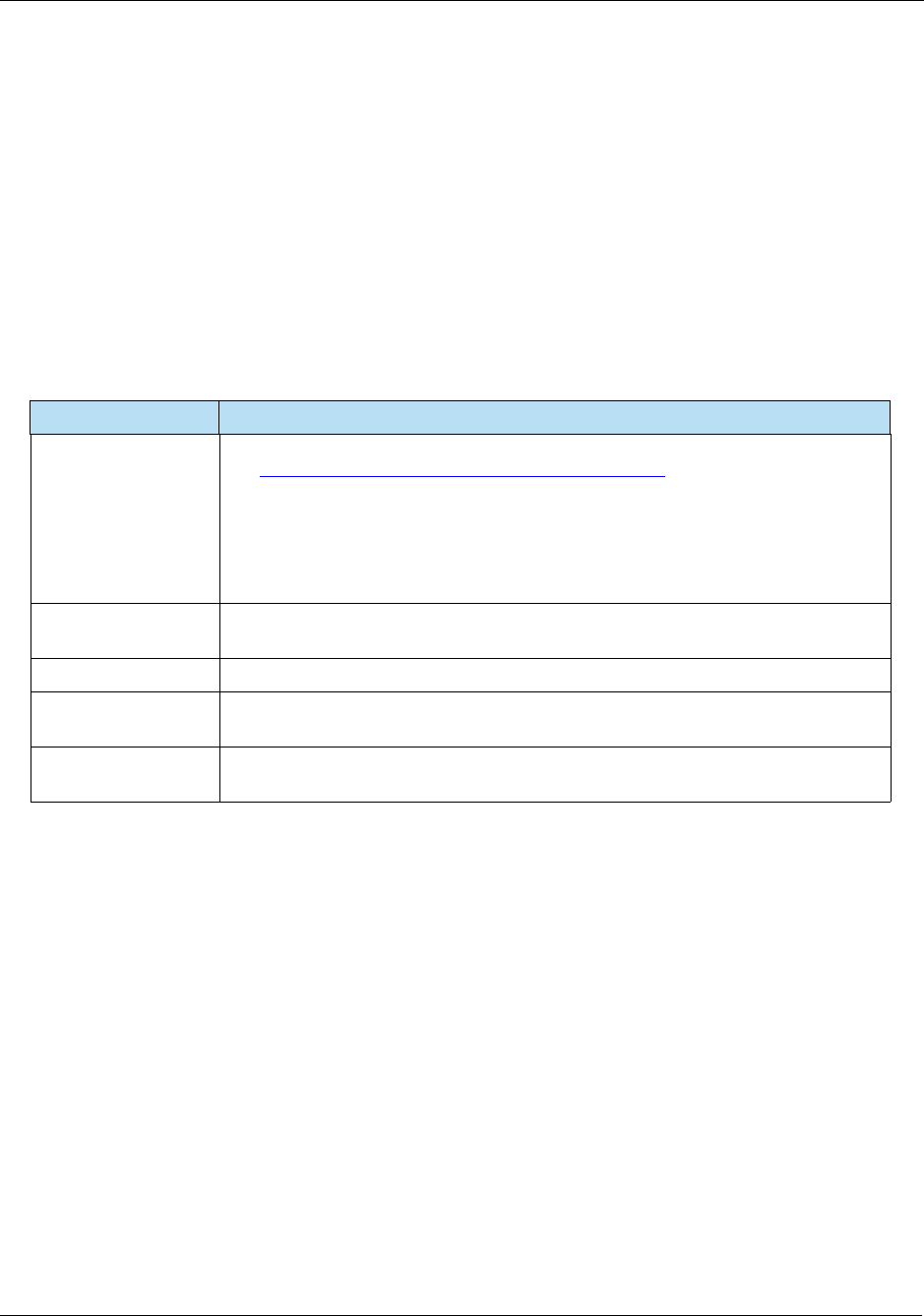

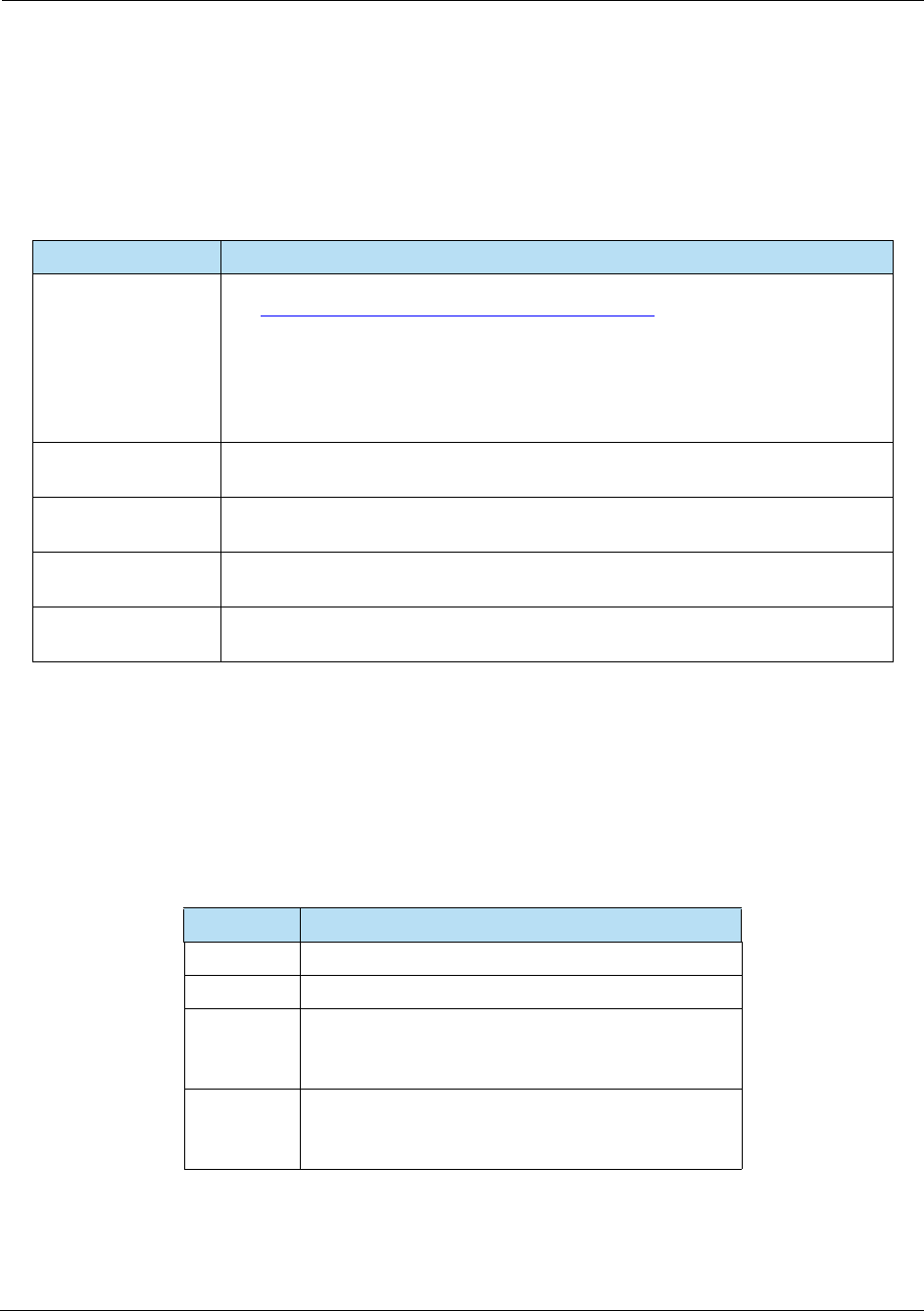

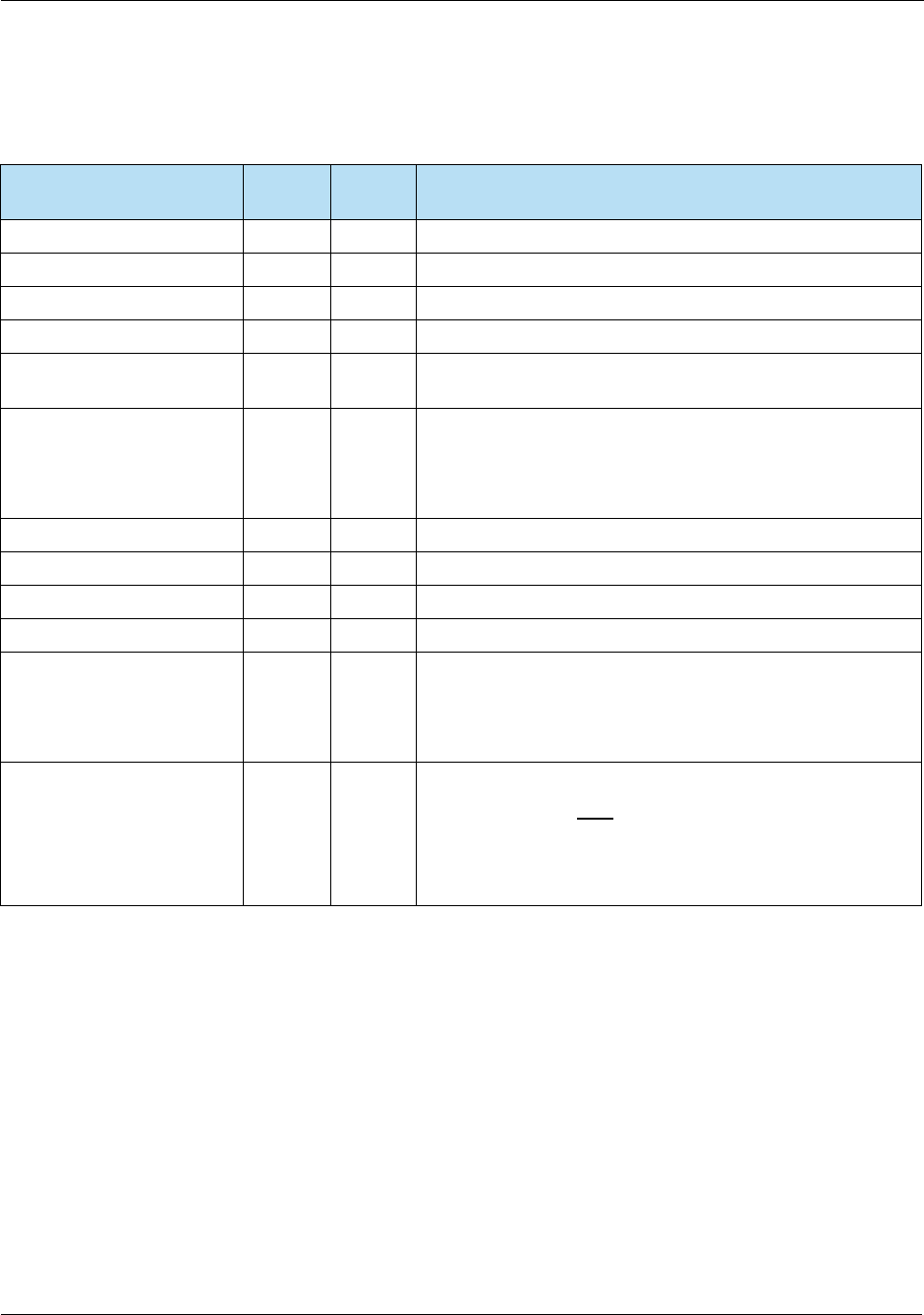

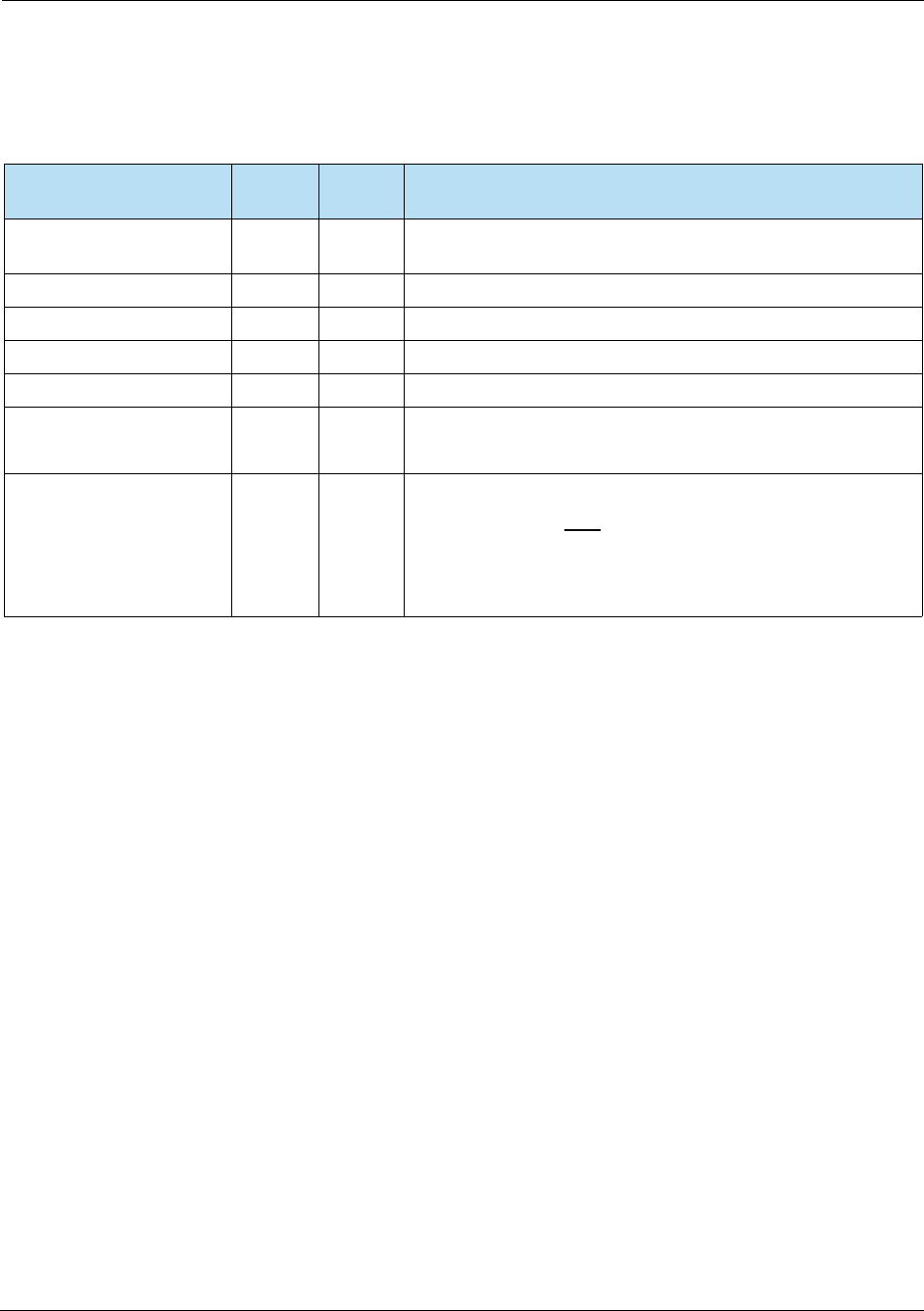

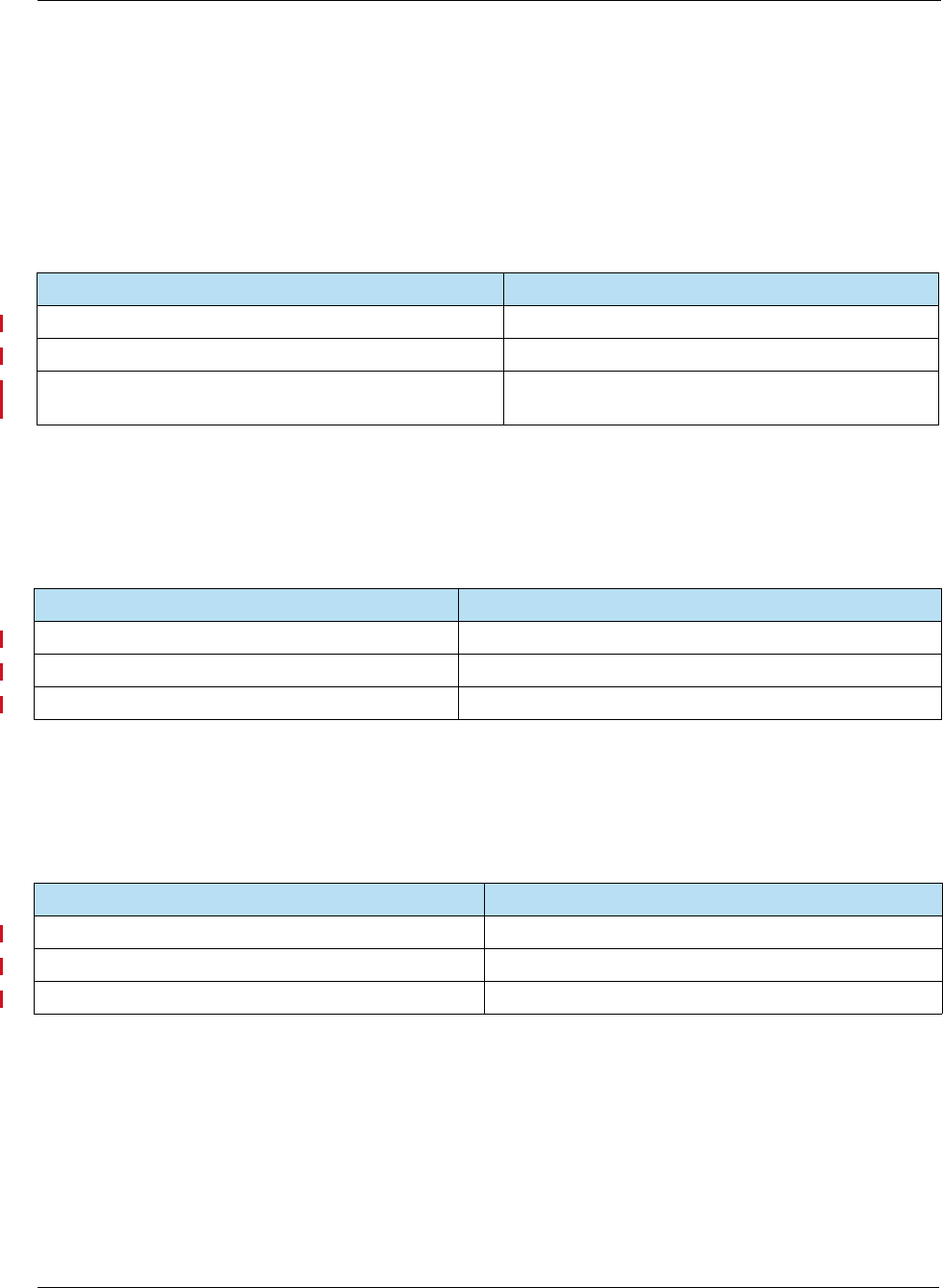

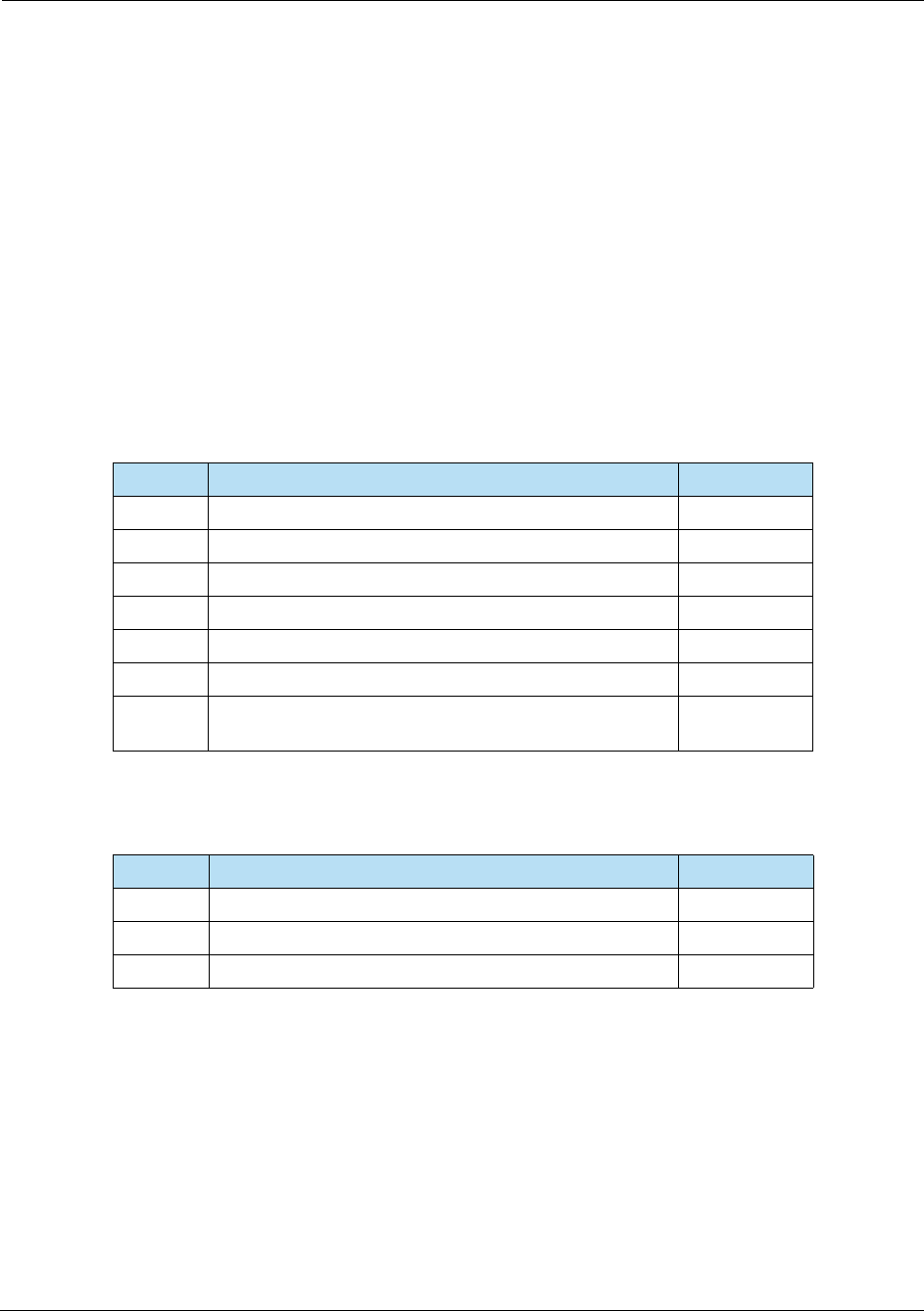

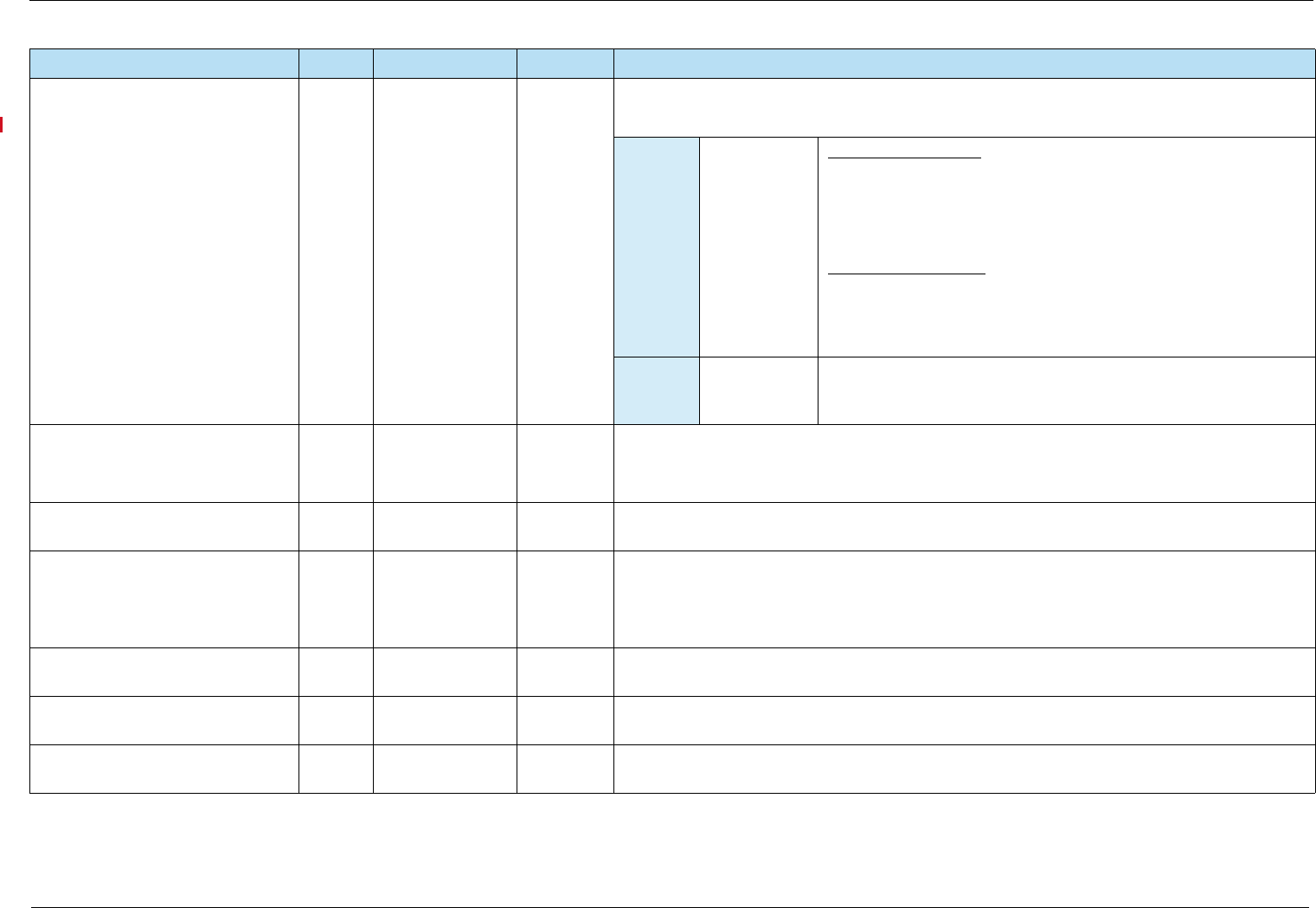

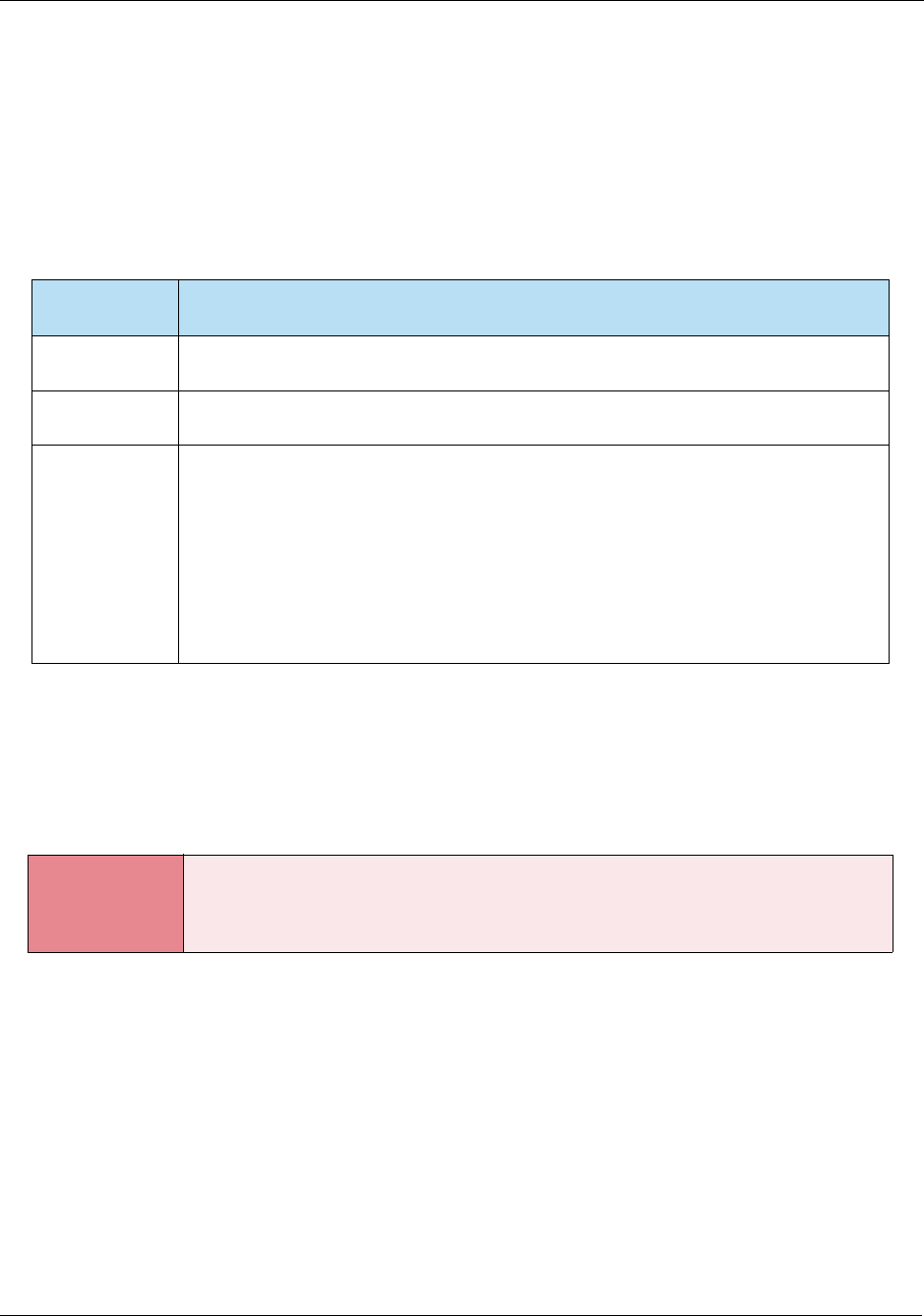

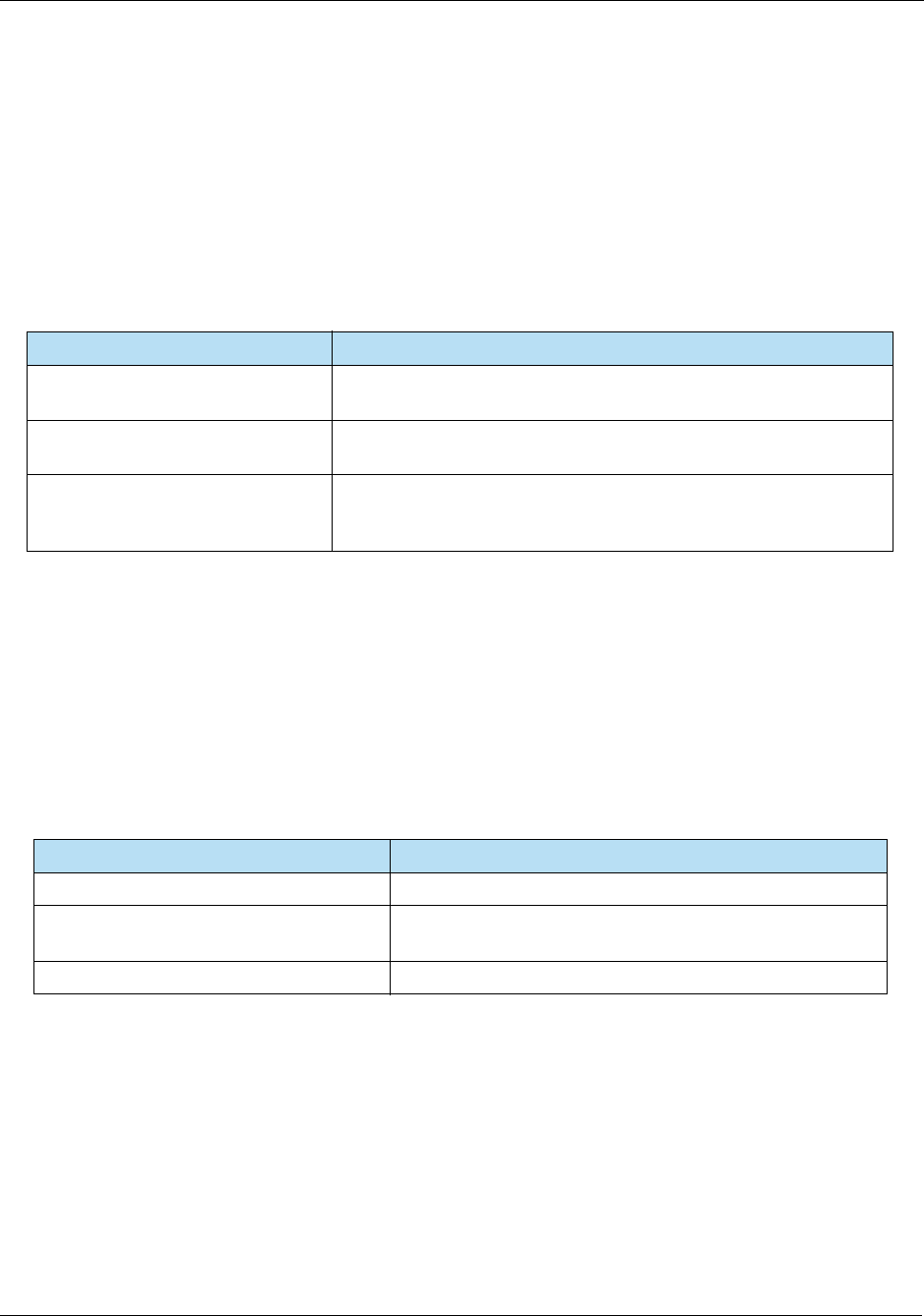

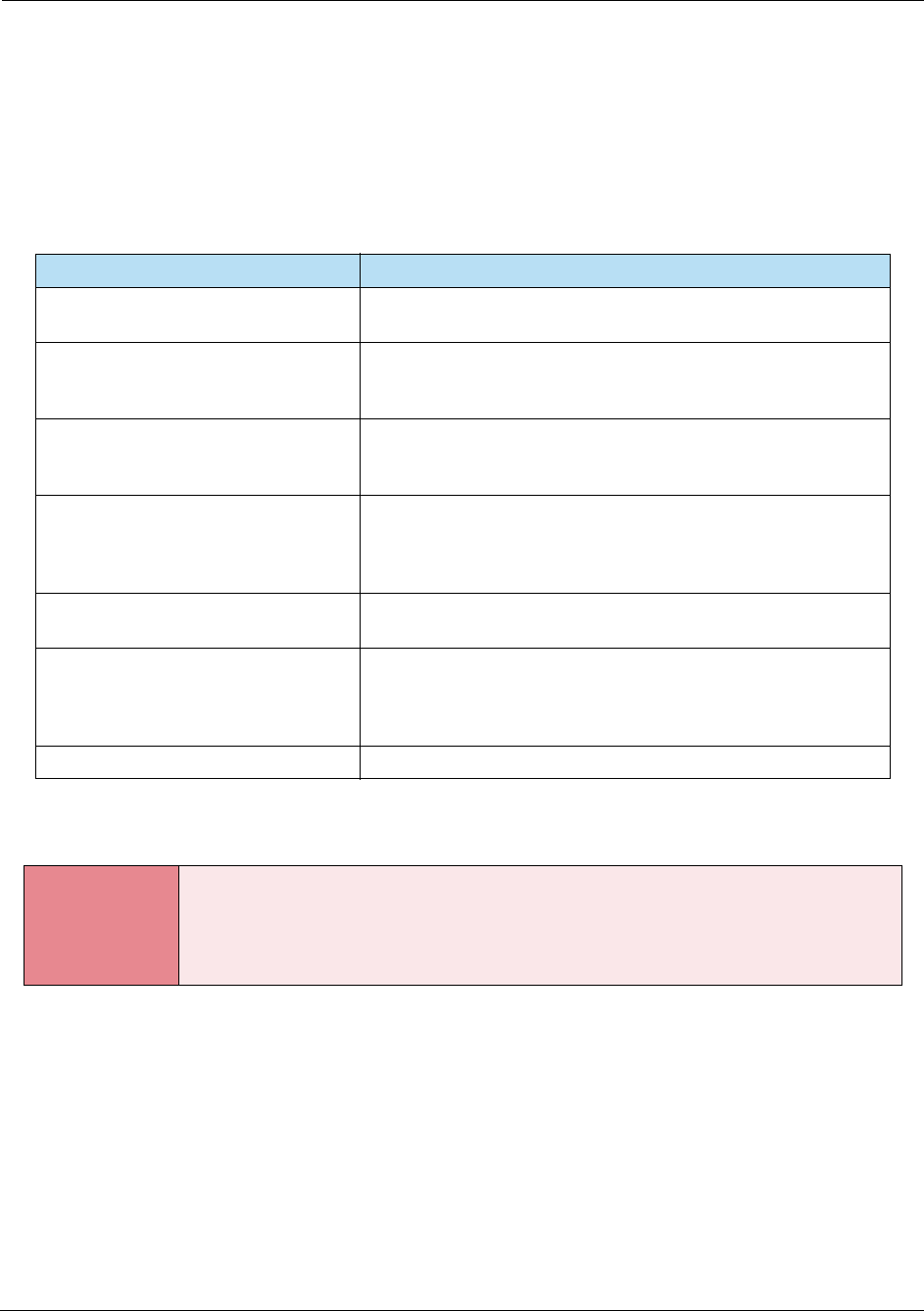

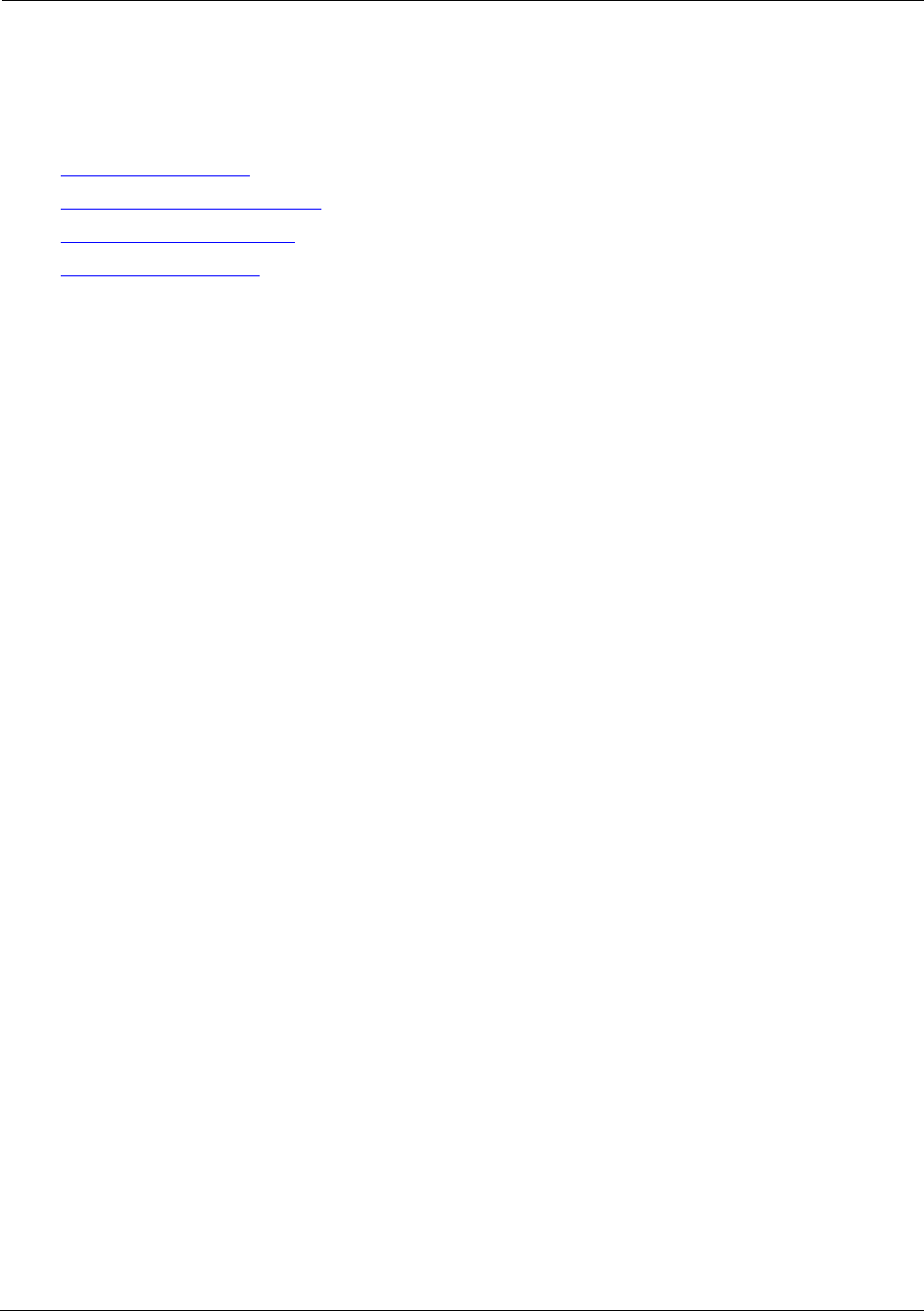

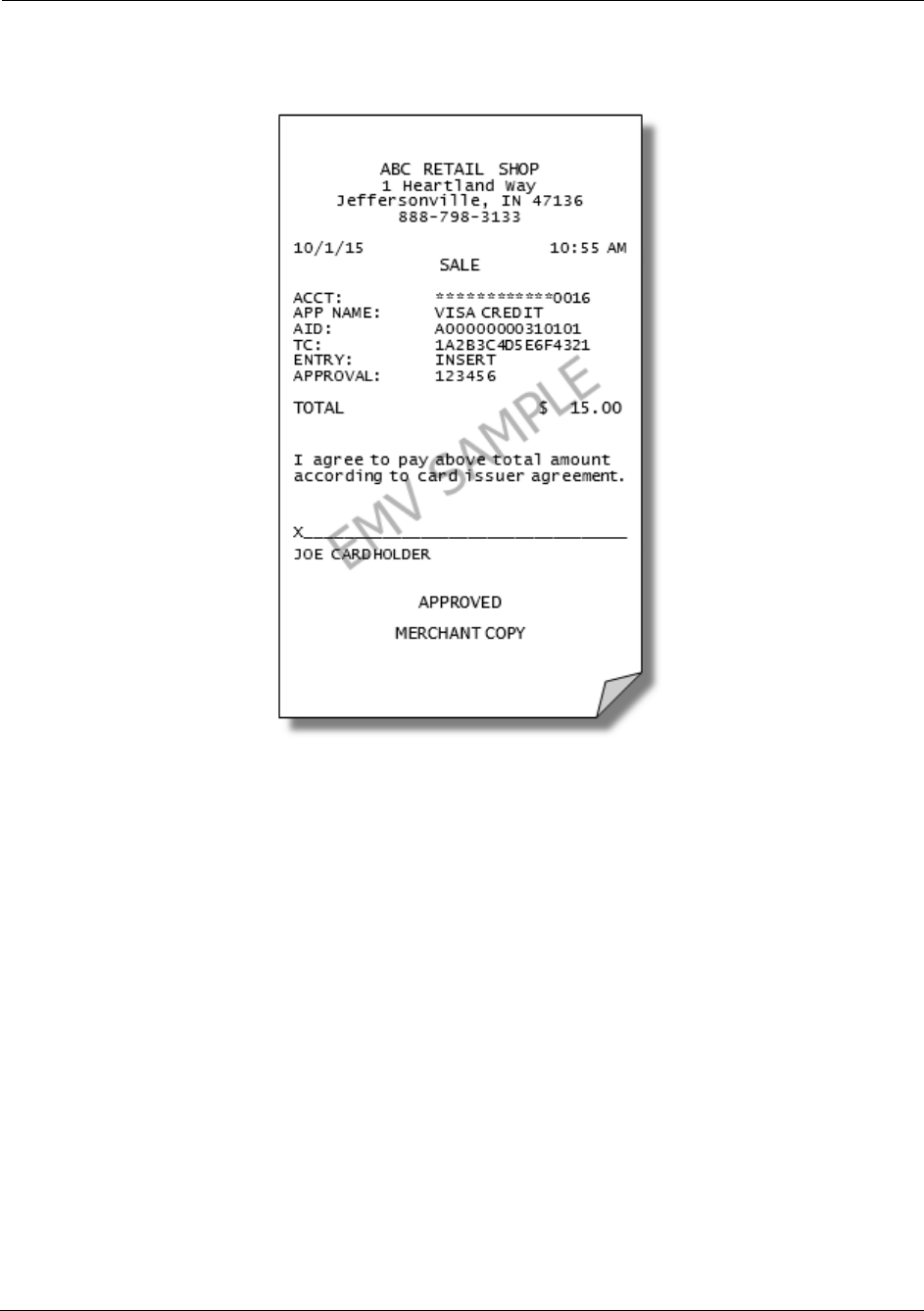

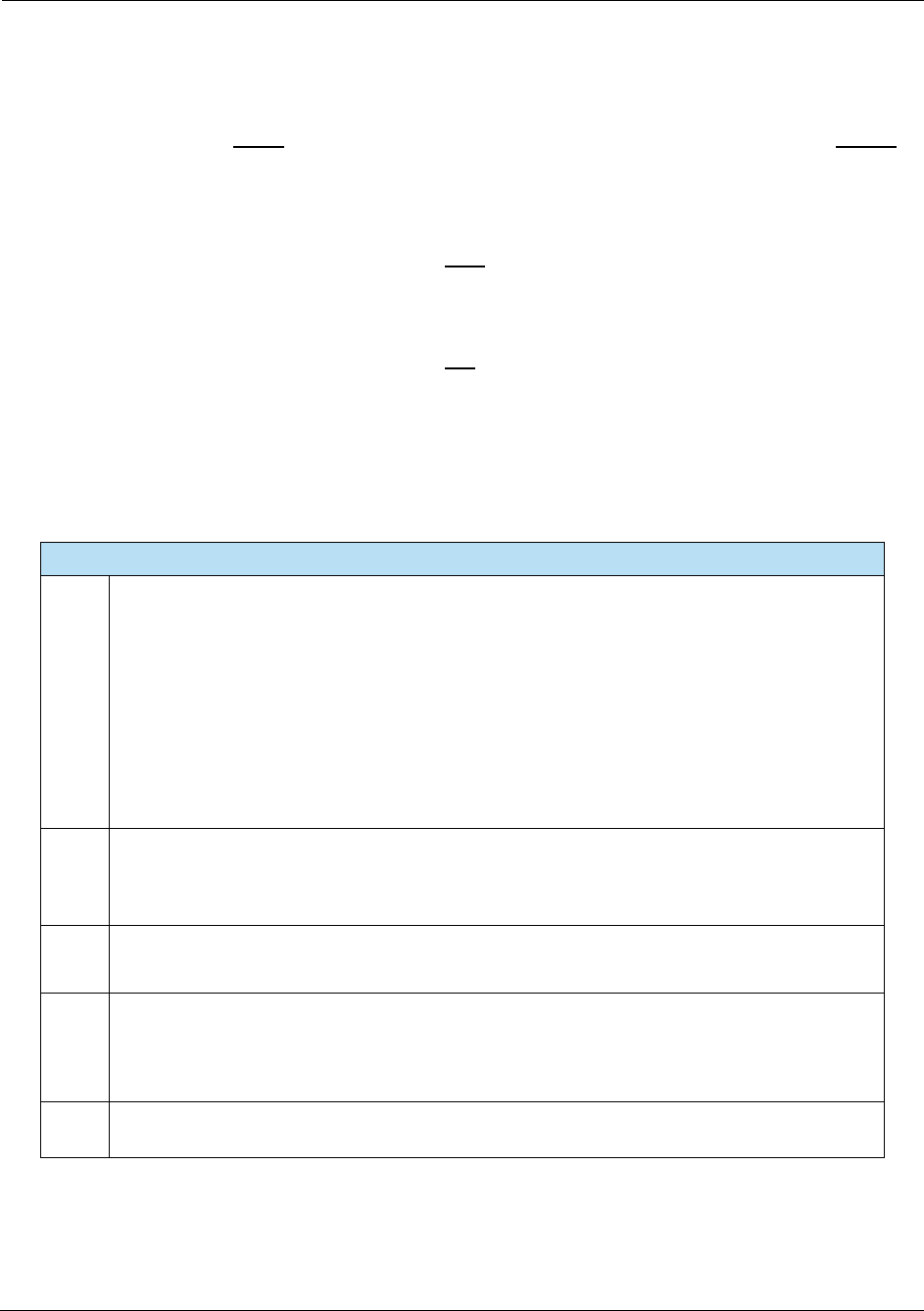

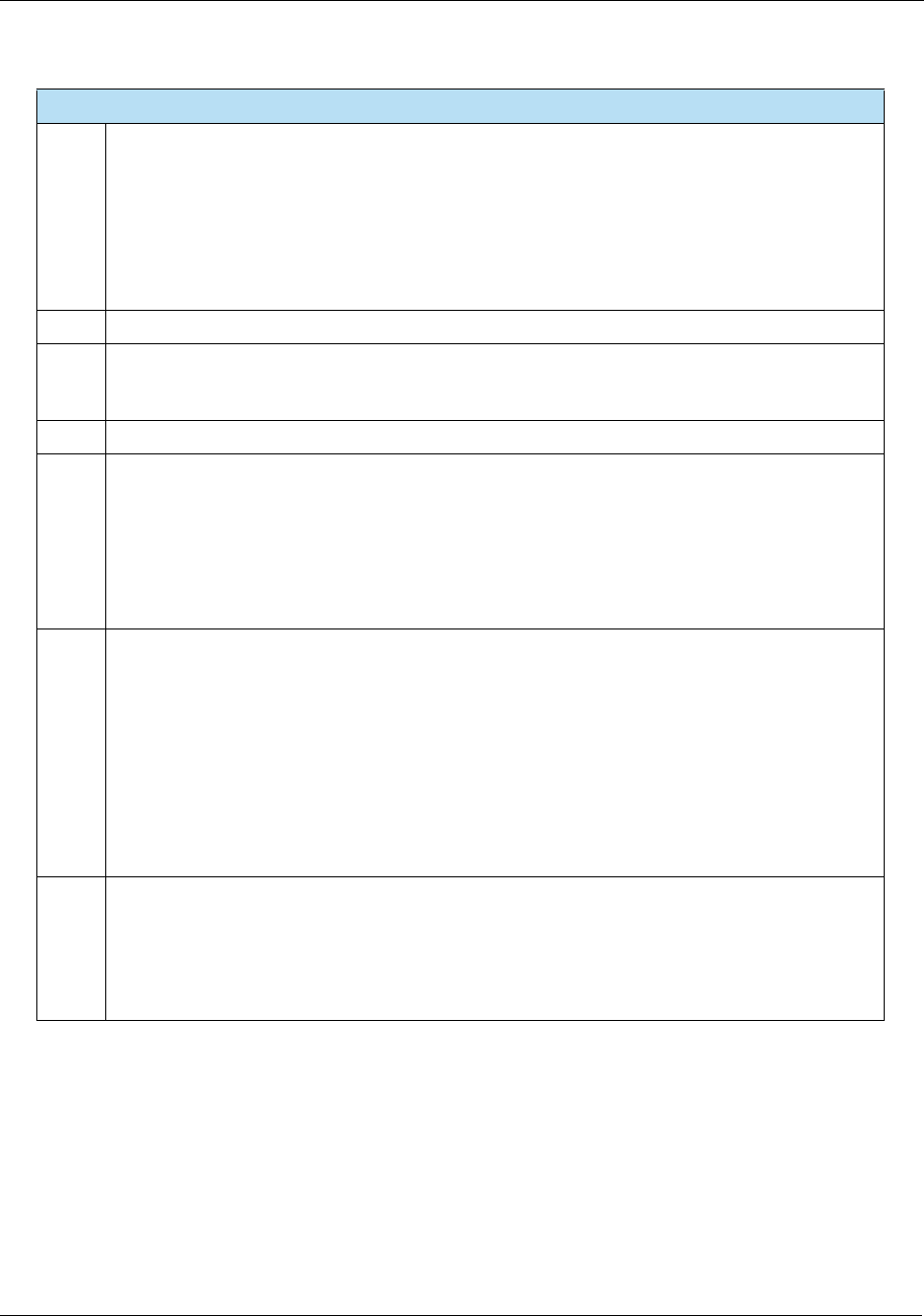

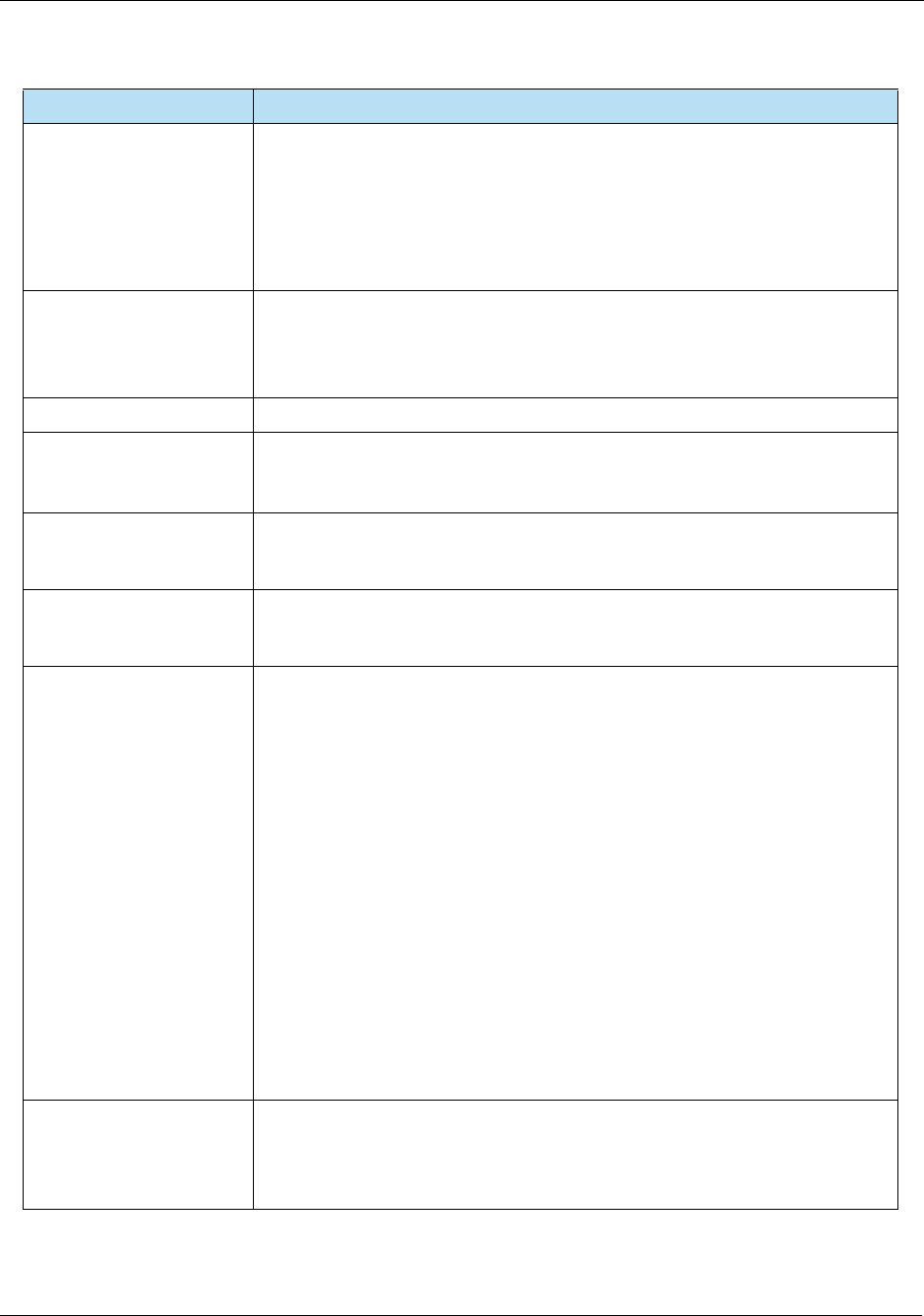

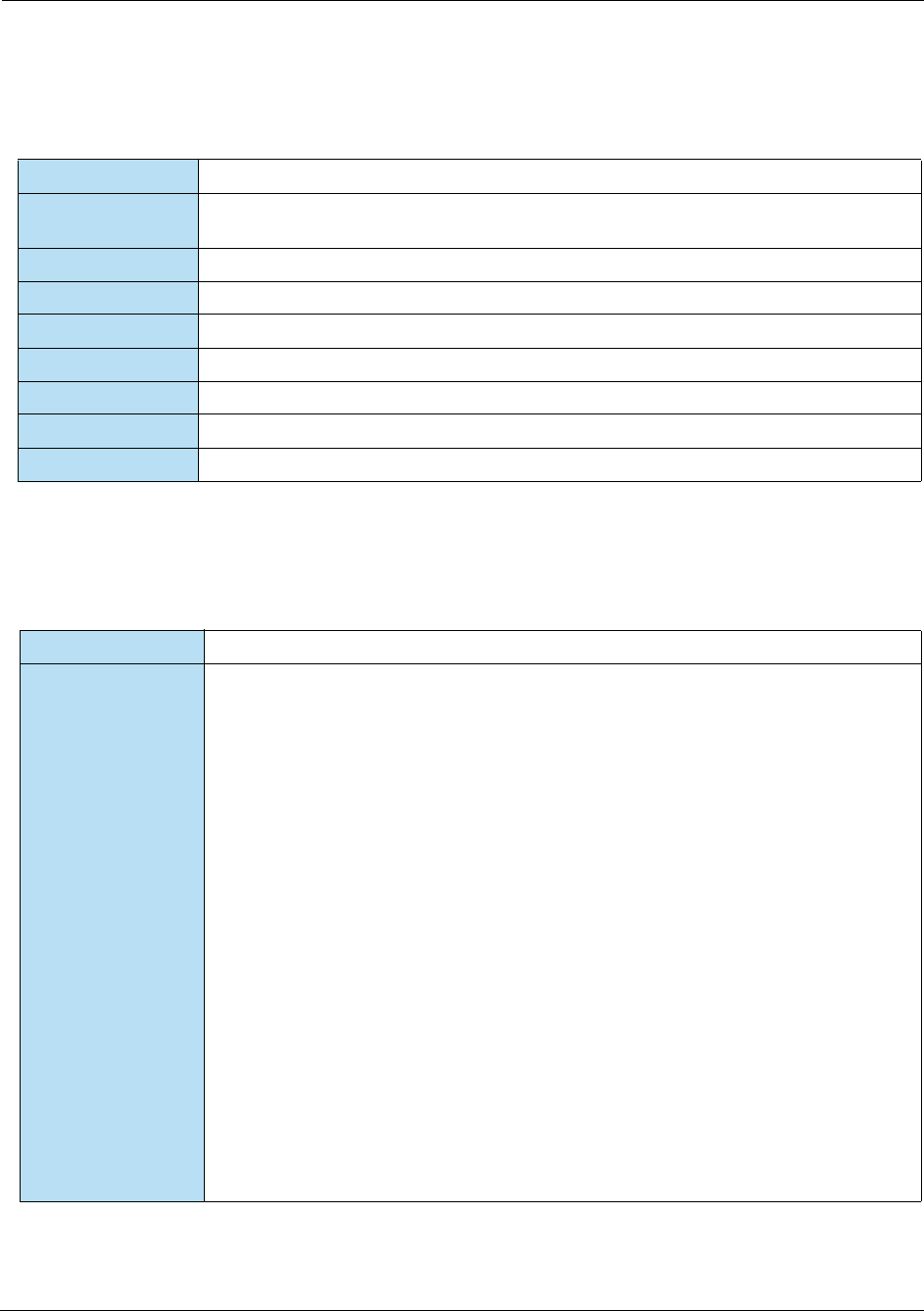

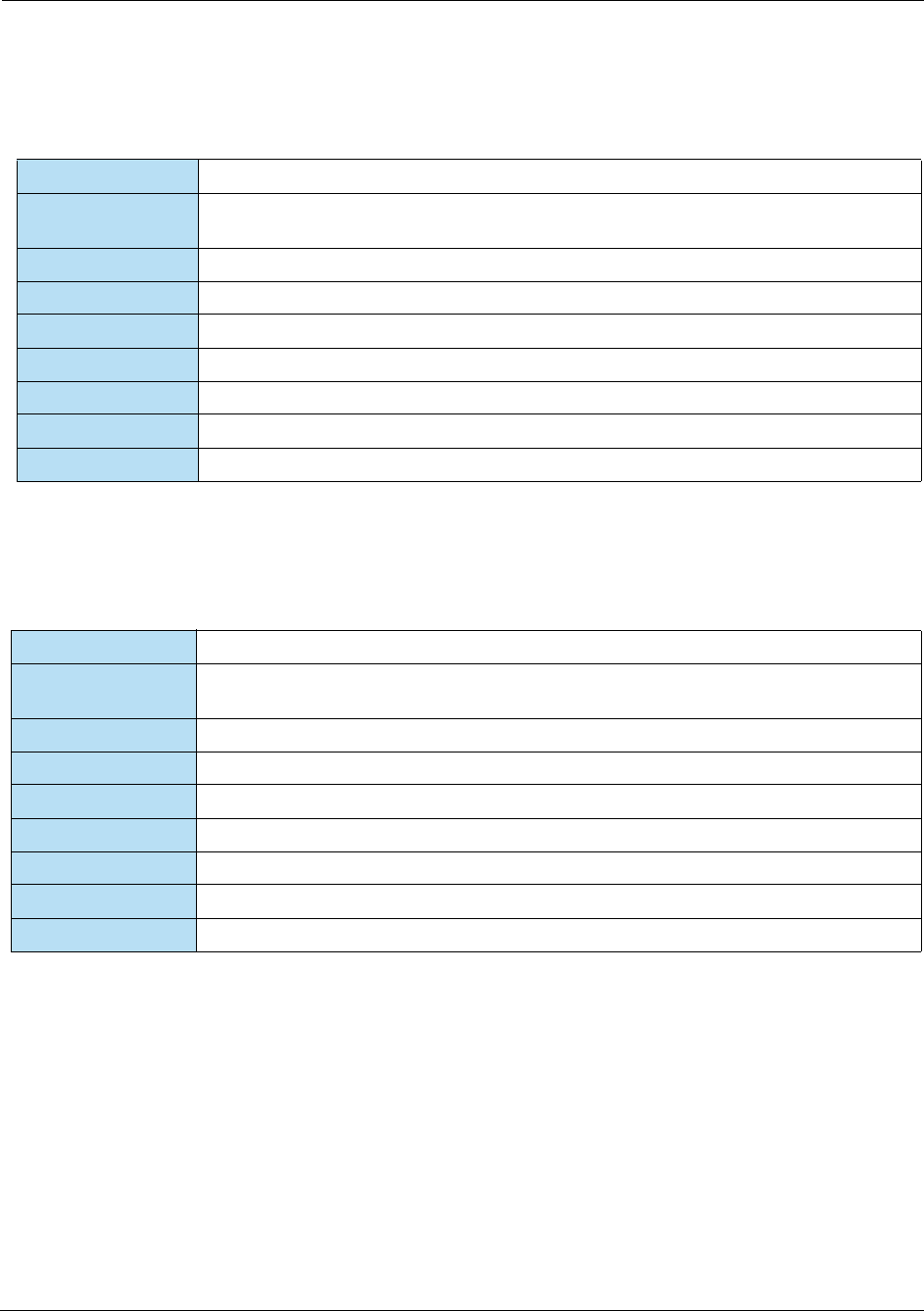

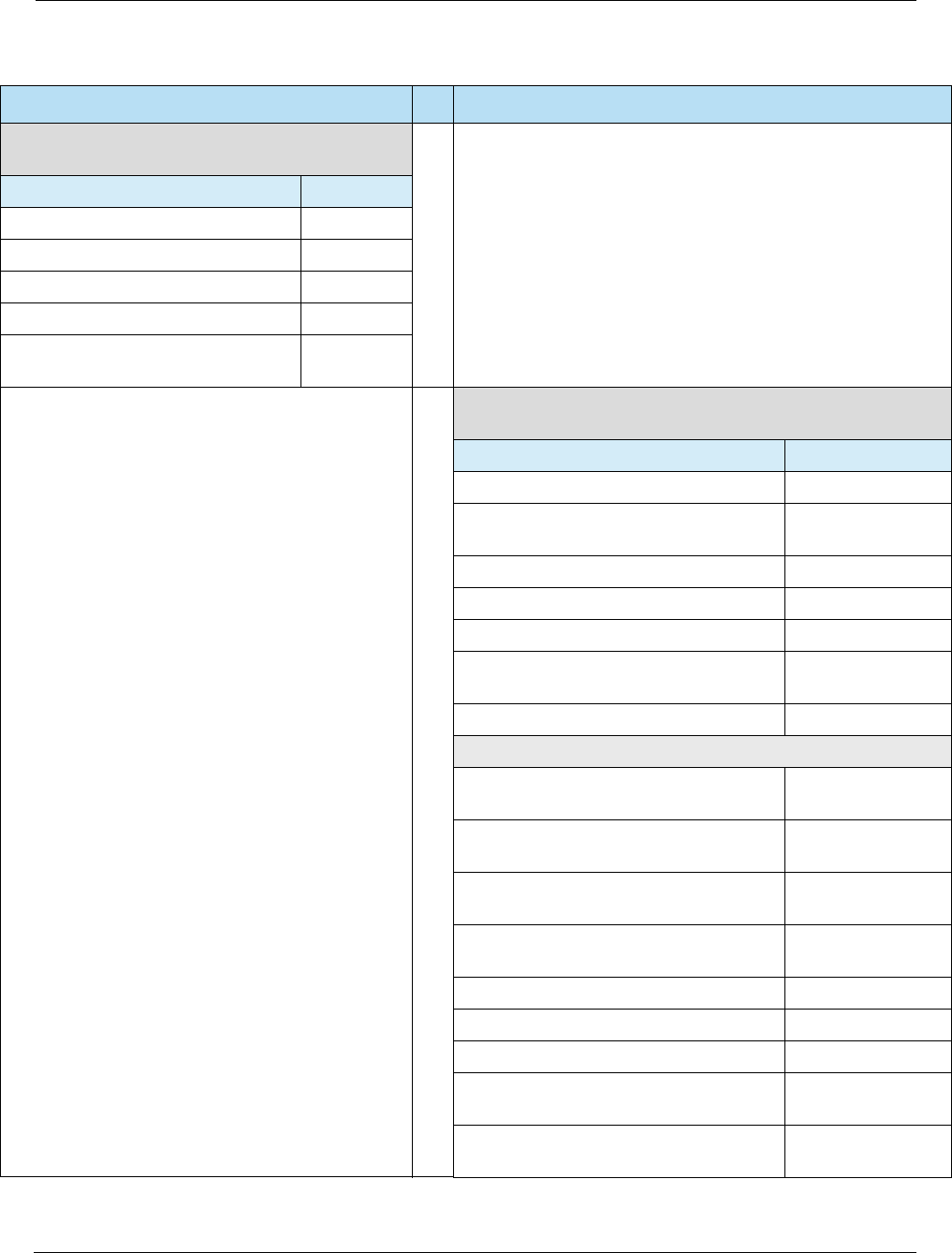

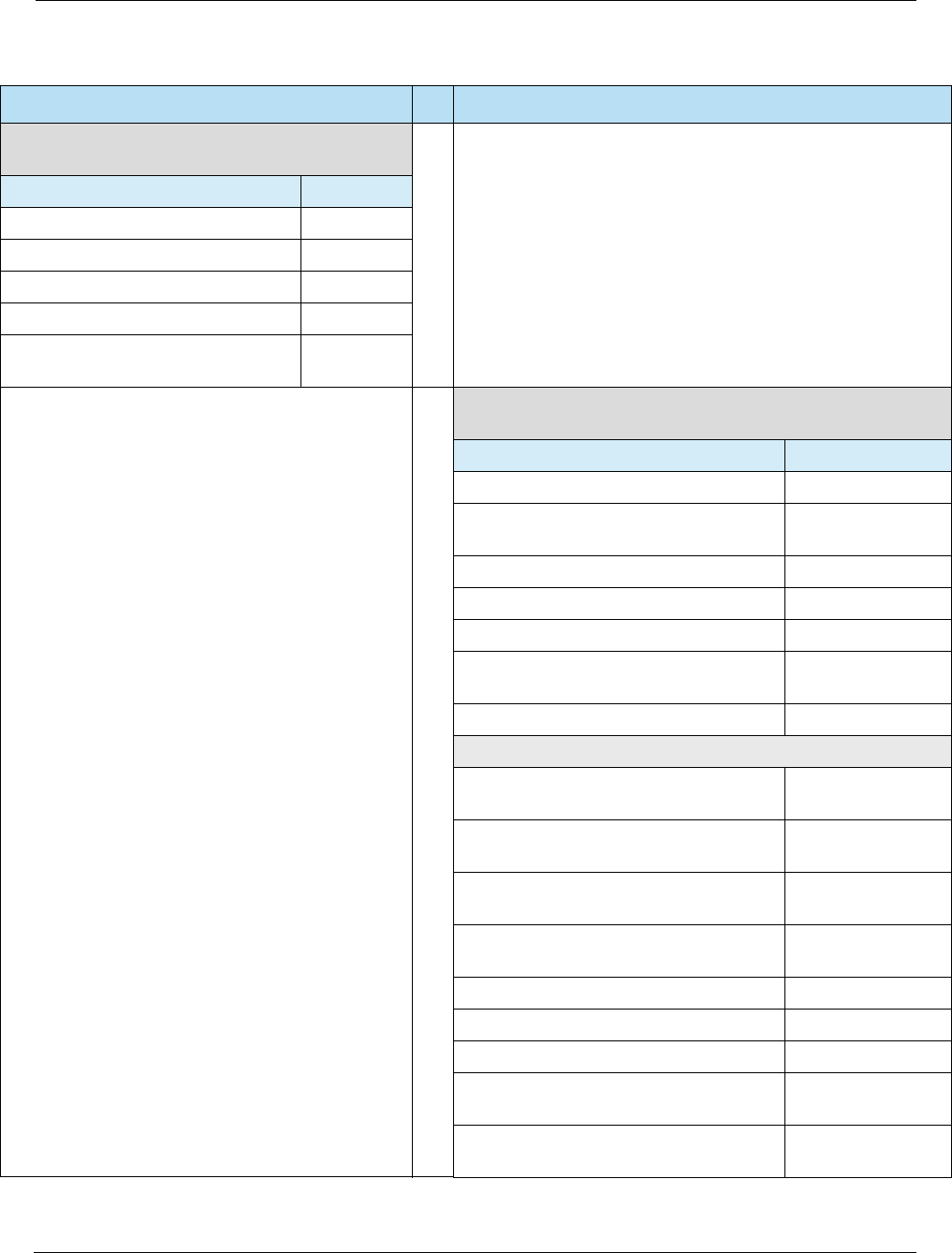

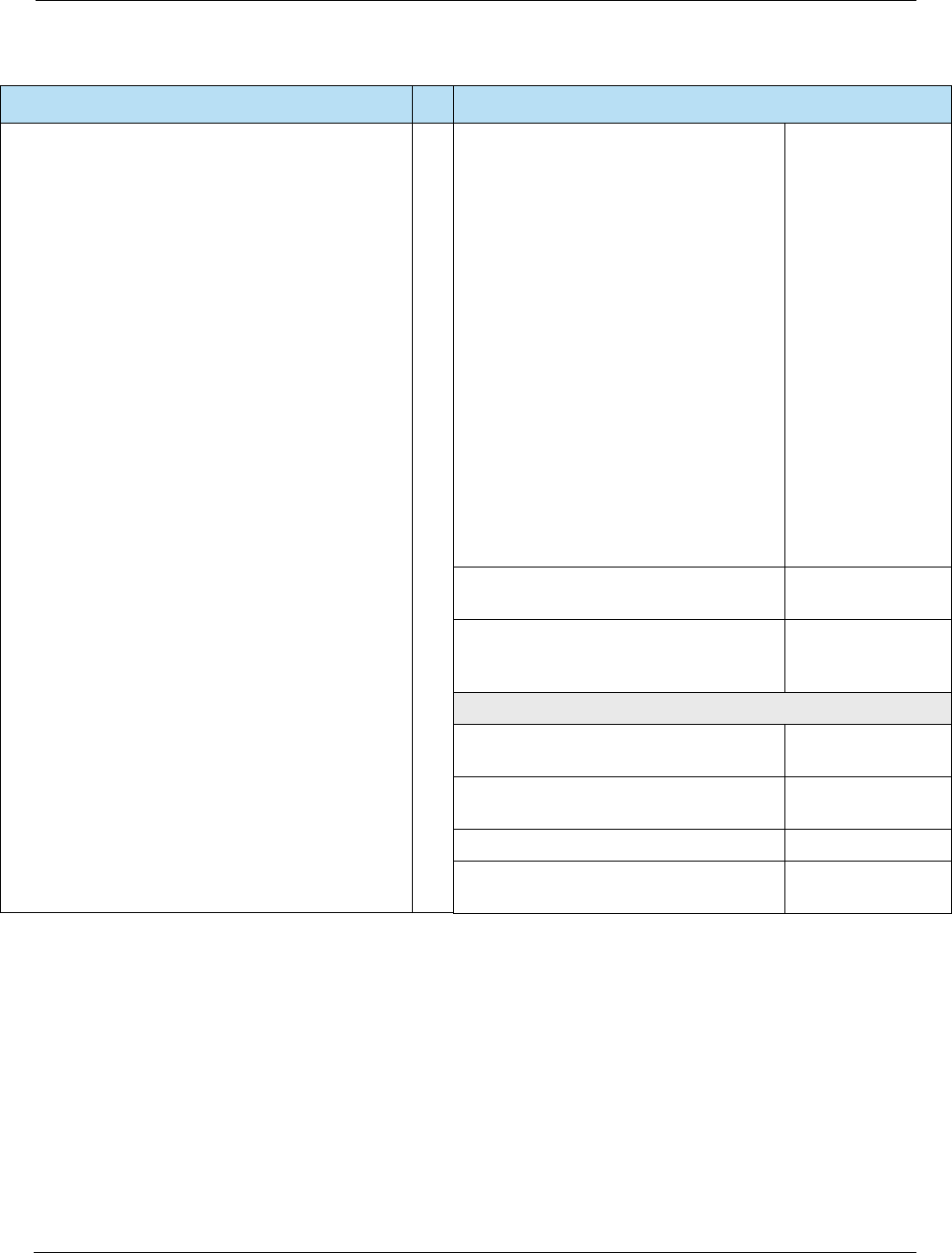

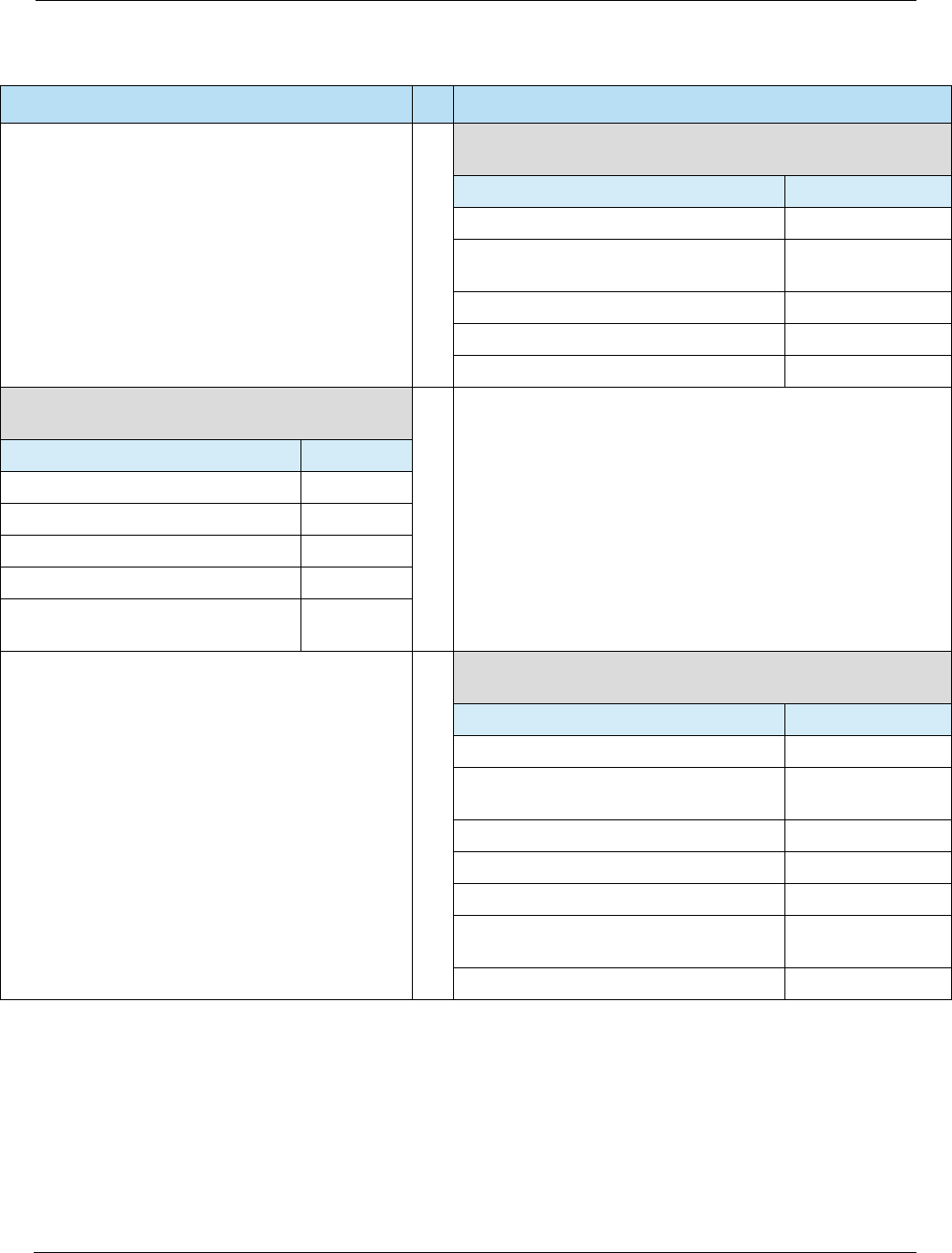

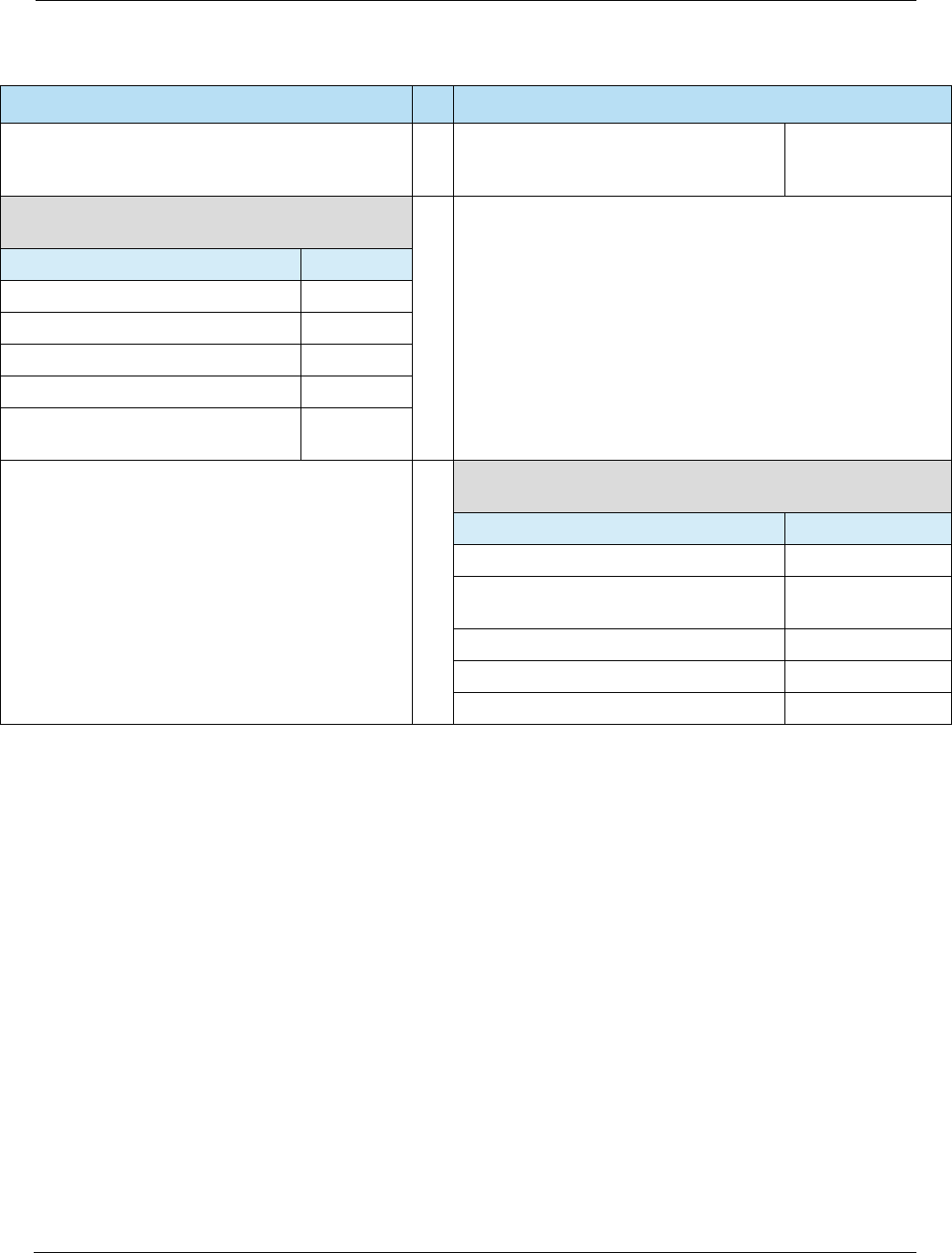

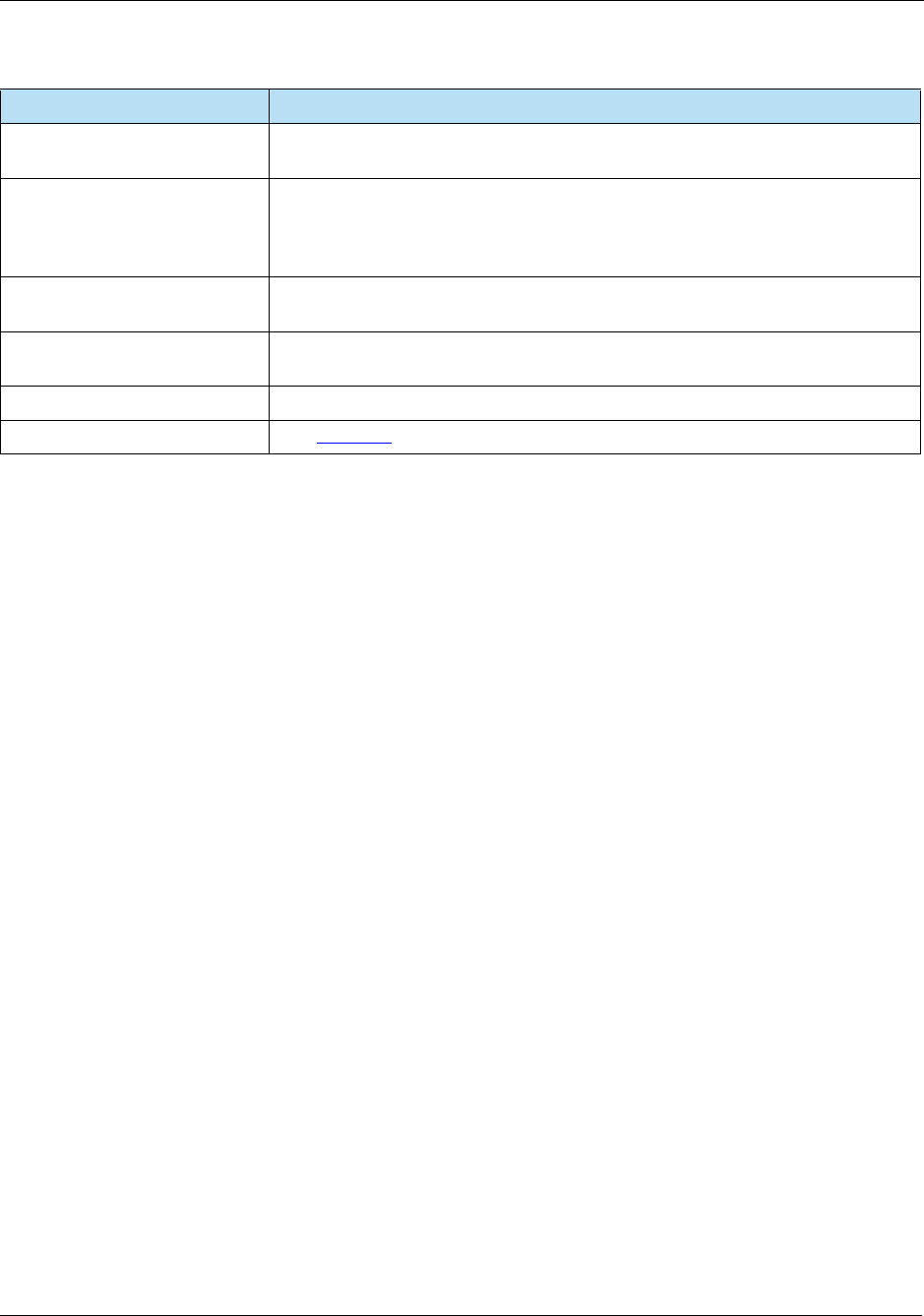

Chapter/Appendix Revisions

General Format and

Global Changes

• Red change bars added on clarification and project updates.

• For clarification purposes only: Some content modified and reformatted (with

no change bar), with no impact to development.

Chapter 6: EMV

Development Overview

• Removed out of date Version 2.x for approved PED or EPP devices from the

following sections:

– 6.1.1 Contact Devices, p. 105

– 6.1.2 Contactless Devices, p. 105

• Removed version numbers from the following test plan tables:

– Table 6-2 VSDC Testing, p. 108

– Table 6-3 M-TIP Testing, p. 108

– Table 6-4 AEIPS Testing, p. 108

– Table 6-5 D-PAS Testing, p. 109

Chapter 7: EMV Terminal

Interface

• Table 7-4 Terminal Data, p. 116: Added clarification to ISSUER SCRIPT

RESULTS from EMVCo document that Bytes 1-5 are repeated.

• Table 7-11 Available AIDs, p. 141:

– Added Note stating that standard credit AIDs for Mastercard and Visa support

their fleet, business, corporate, consumer cards, etc.

– For Discover U.S. Common Debit AID, removed the note that stated it was not

supported for PIN Debit. It is now supported.

– CUP: Added Union Pay AIDs.

Chapter 8: EMV

Parameter Interface

• Table 8-2 Platform Identifiers to EMV PDL System, p. 163: Added a row for the

8583 platform field identifiers for EMV PDL (DE41, DE42, DE62).

Appendix D: EMV Field

Definitions

• Table D-22 Form Factor Indicator, p. 234: Correction, 9F6E is mandatory for

MasterCard contactless.

For Internal Use Only

Release Notes HPS Integrator’s Guide V 17.2

42017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive

This page intentionally left blank for duplex printing.

For Internal Use Only

HPS Integrator’s Guide V 17.2 Table of Contents

2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive 5

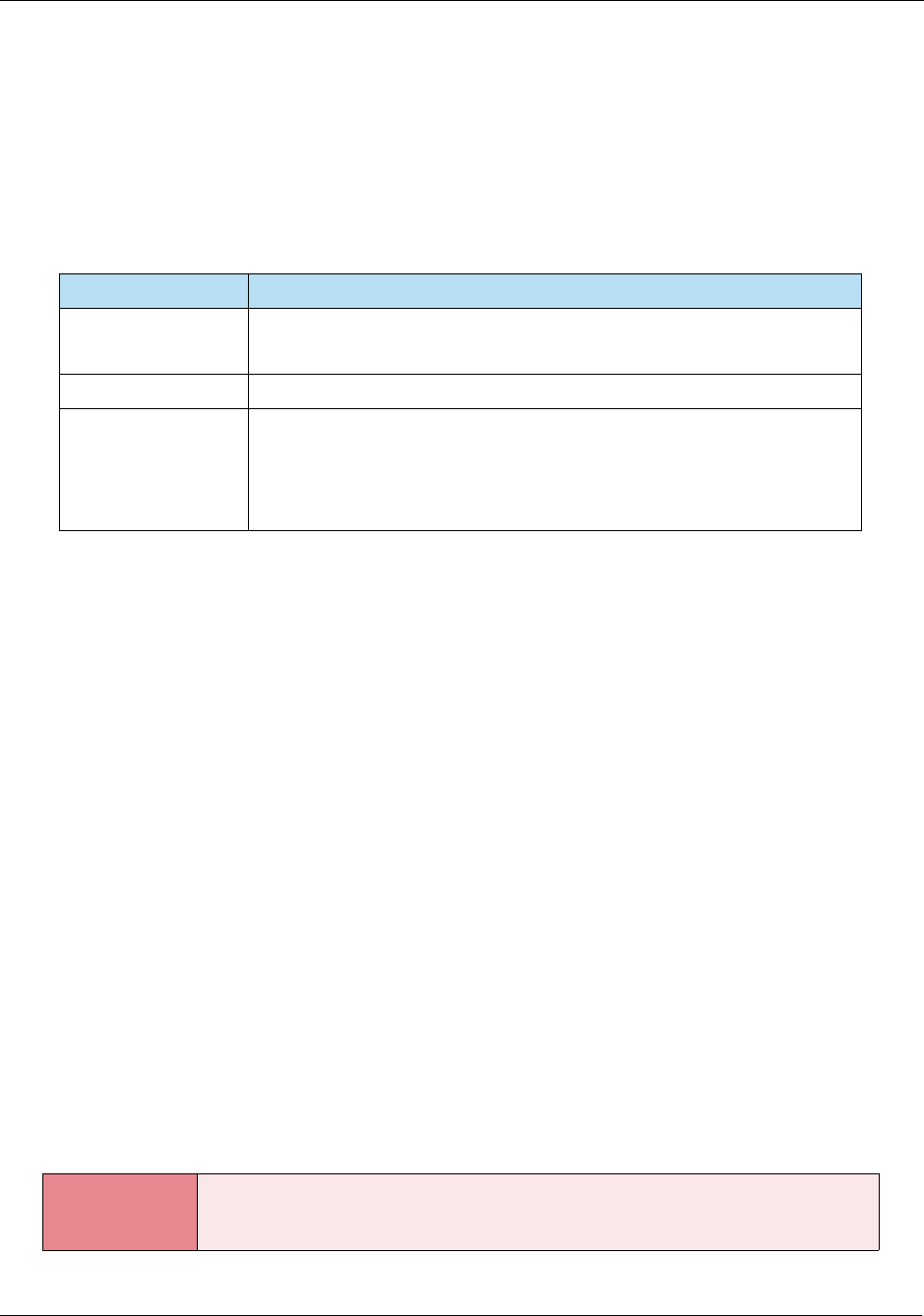

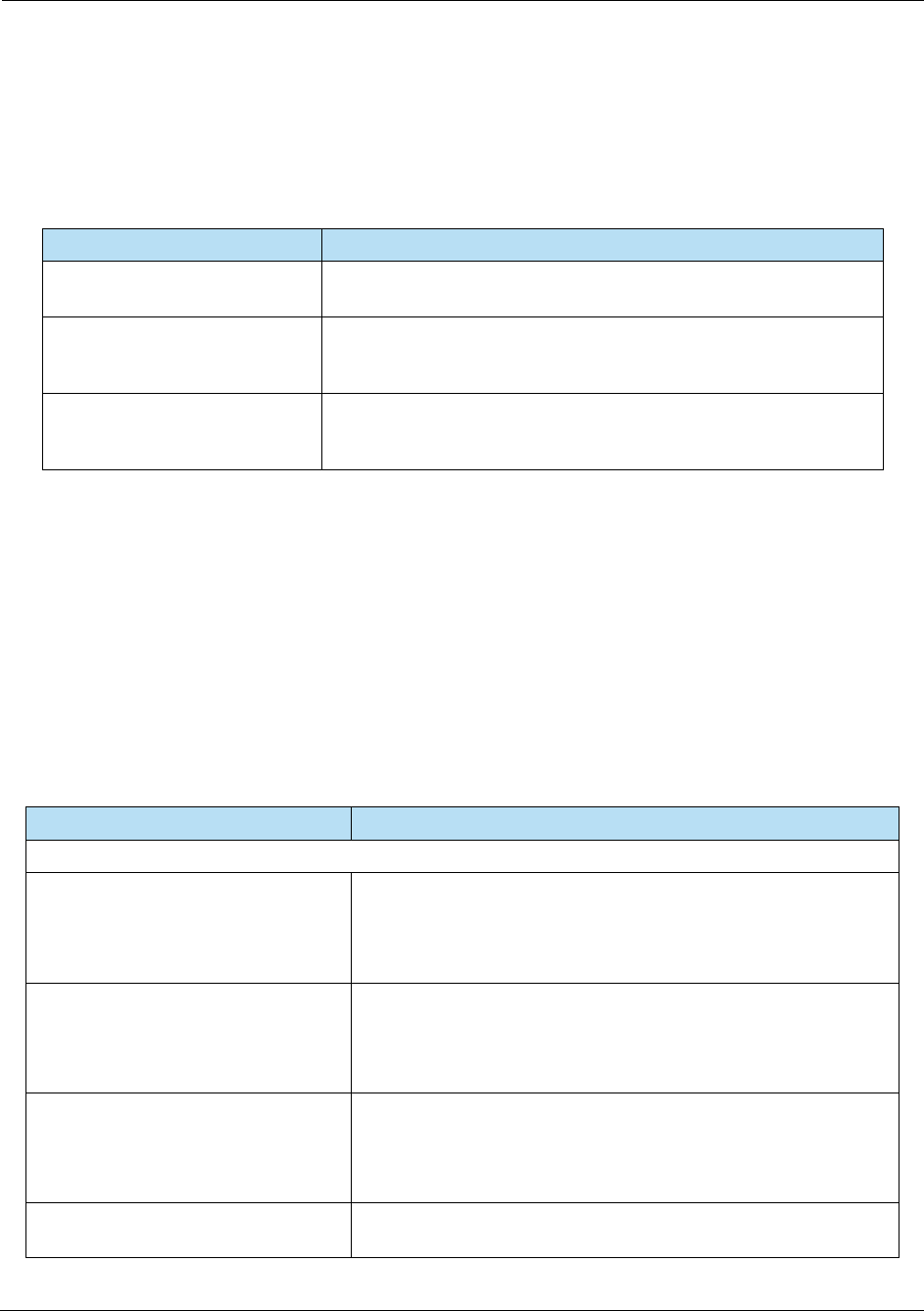

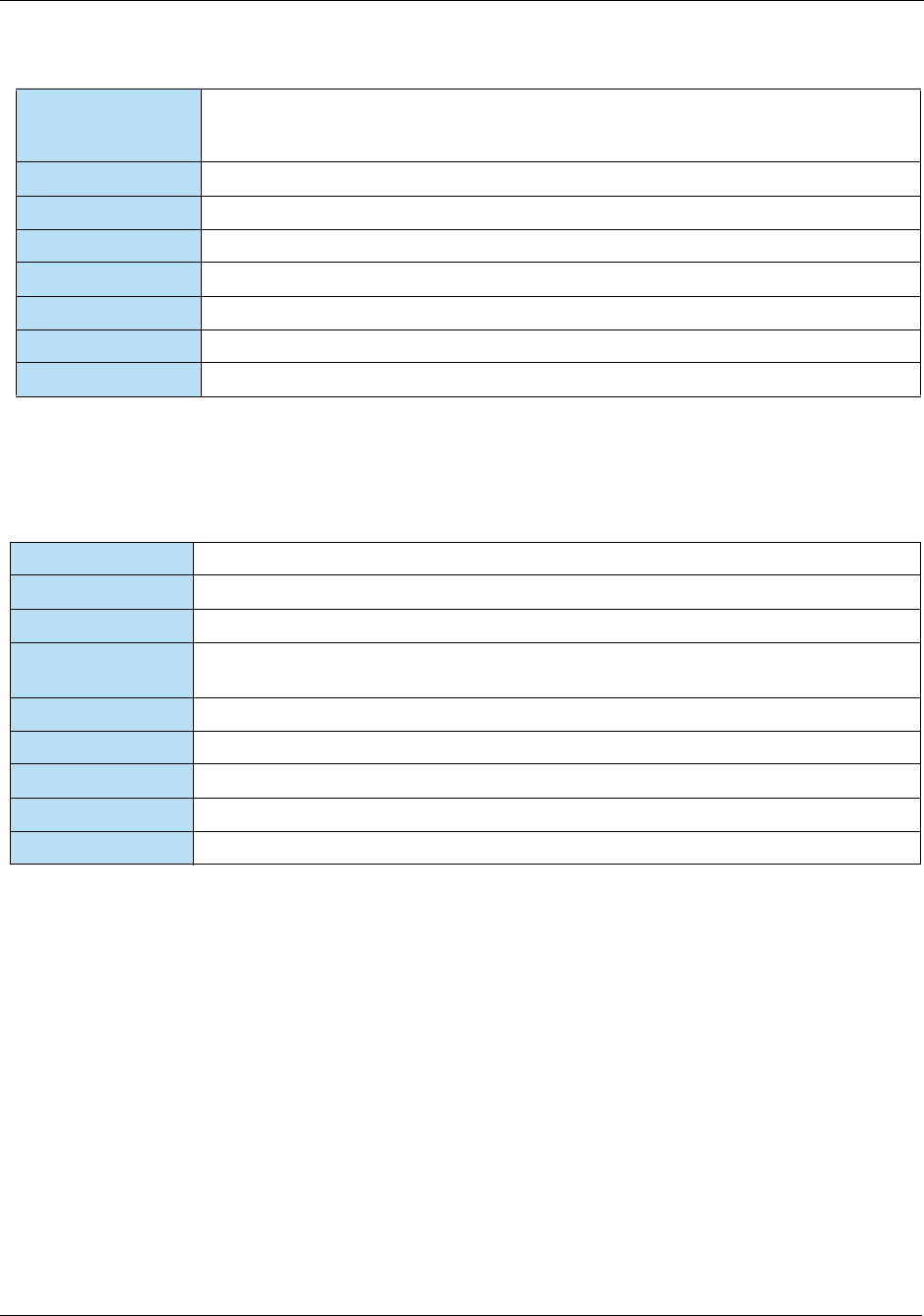

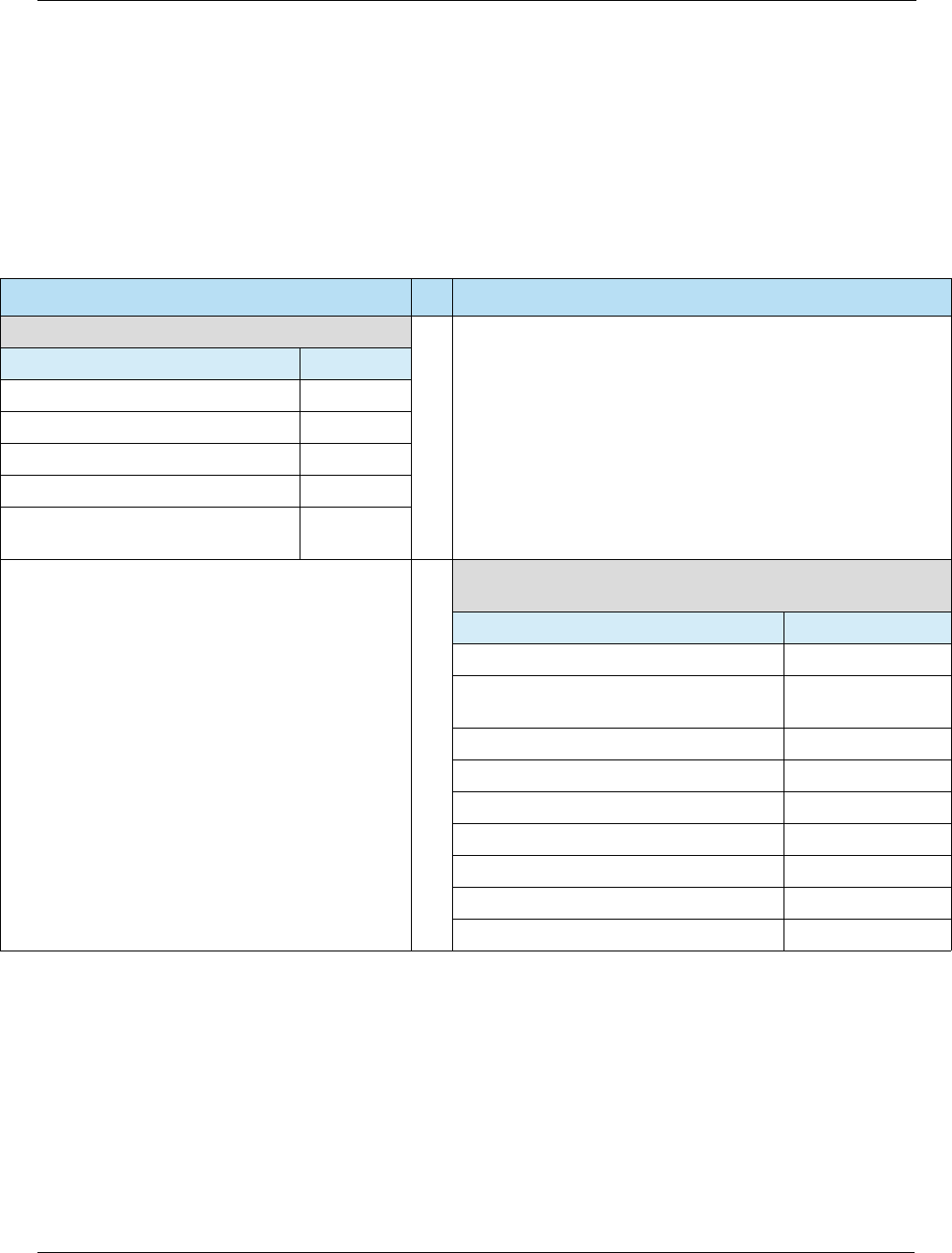

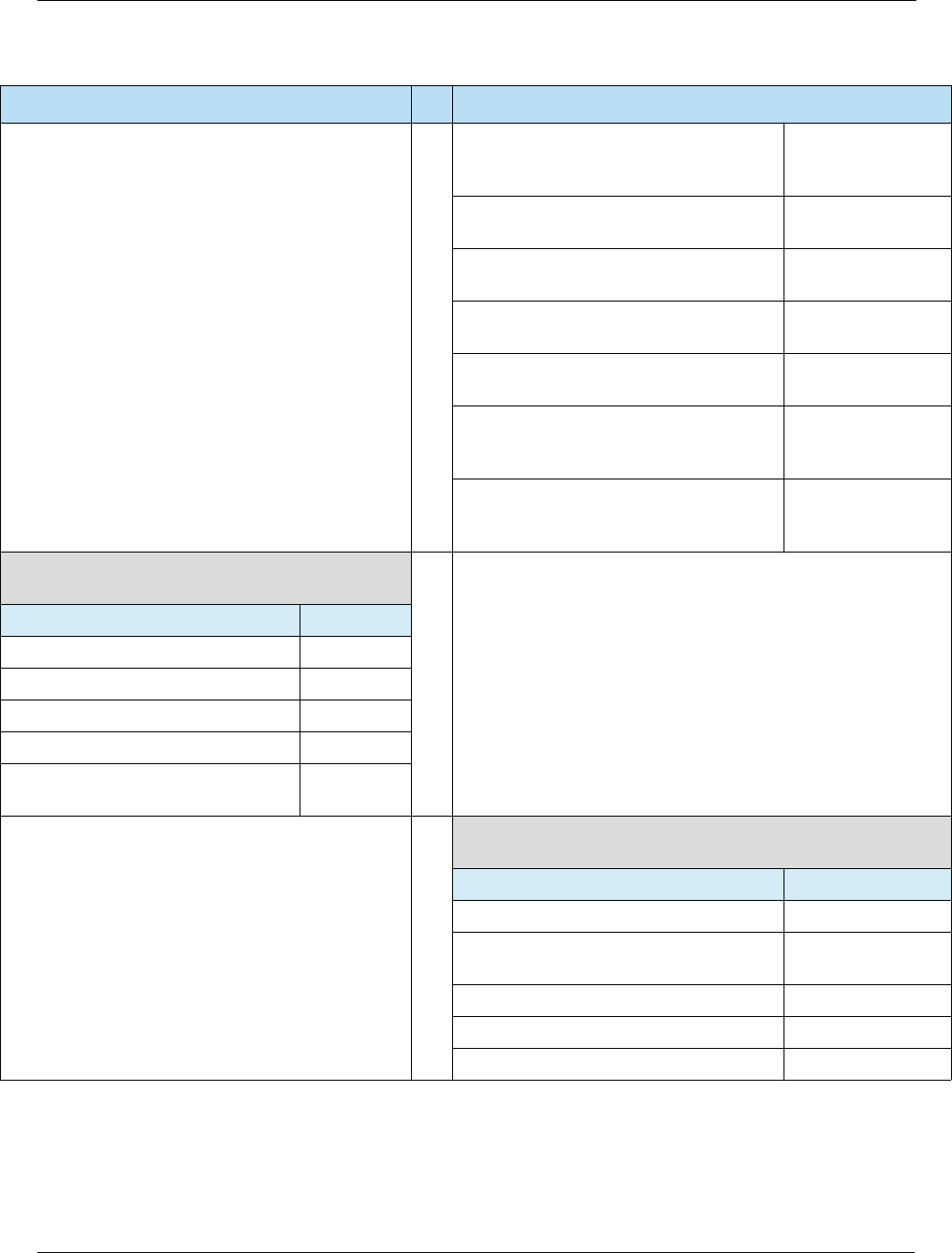

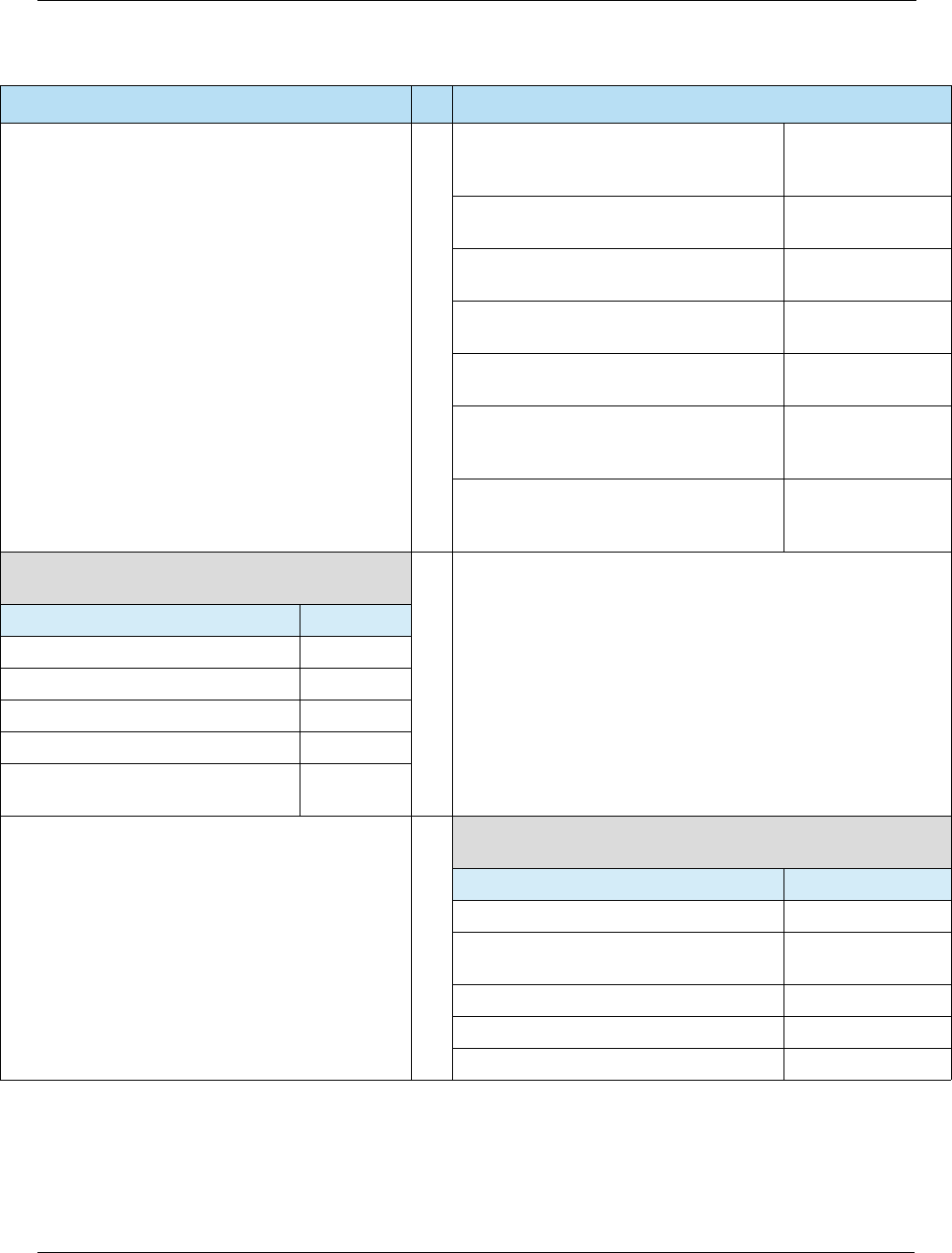

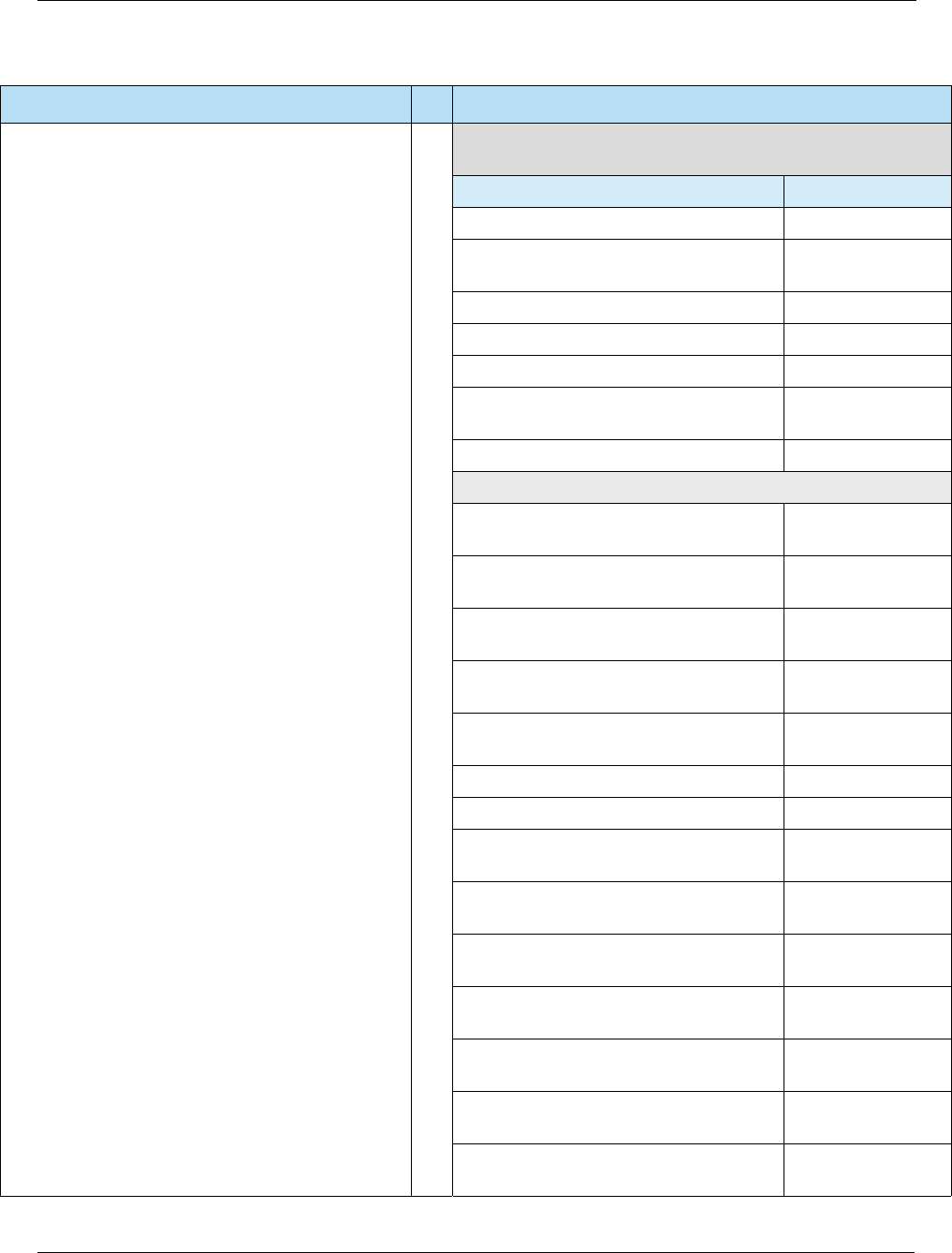

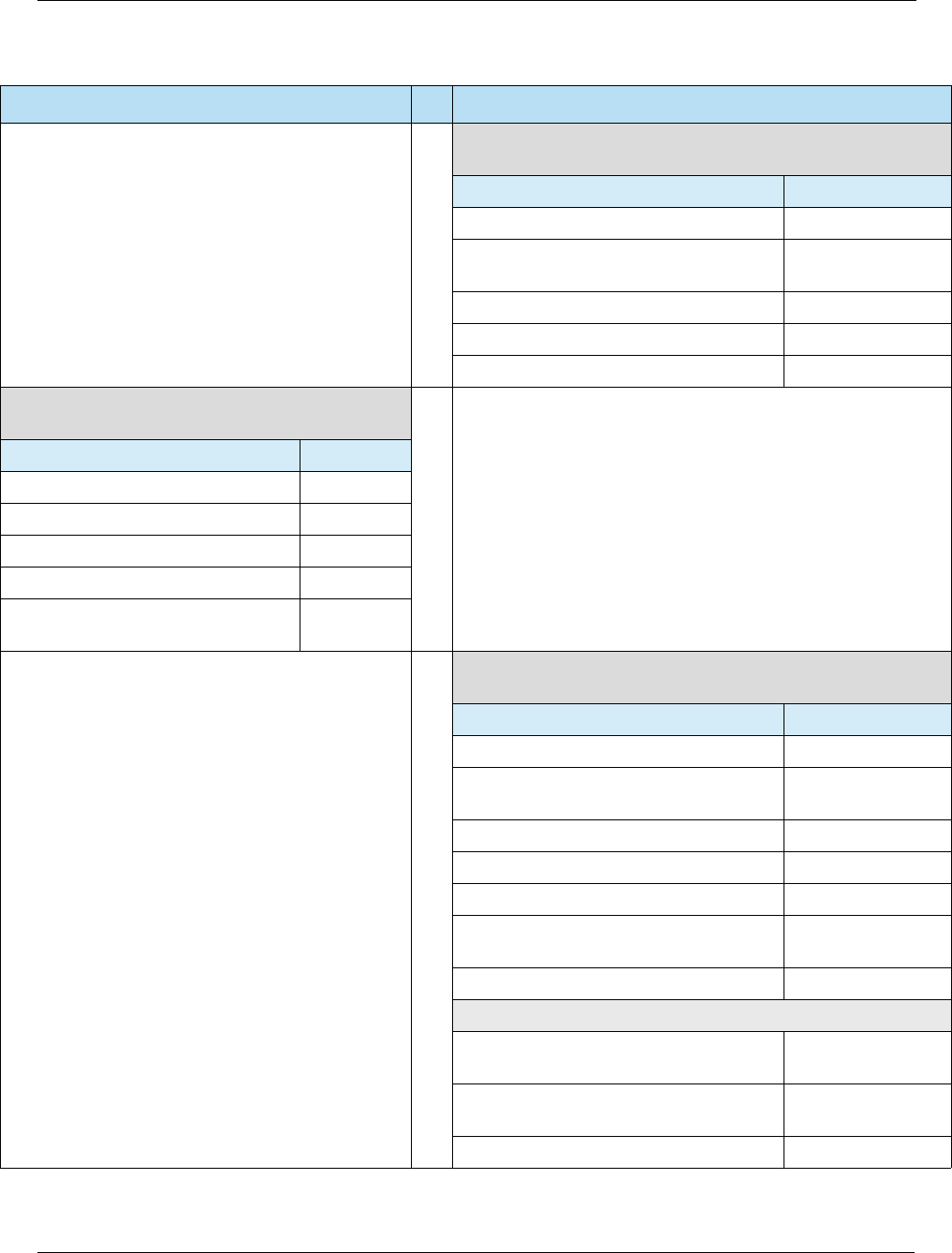

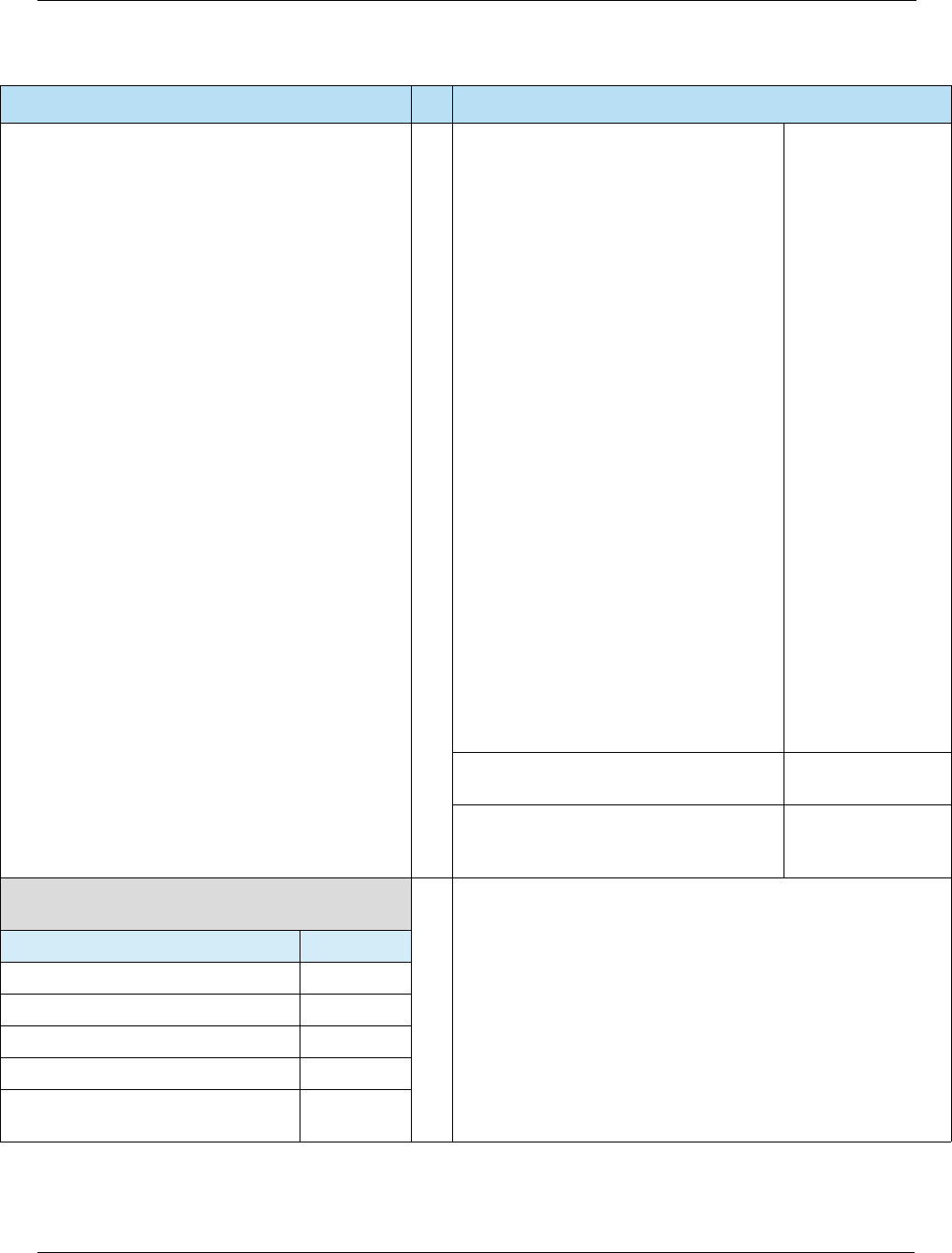

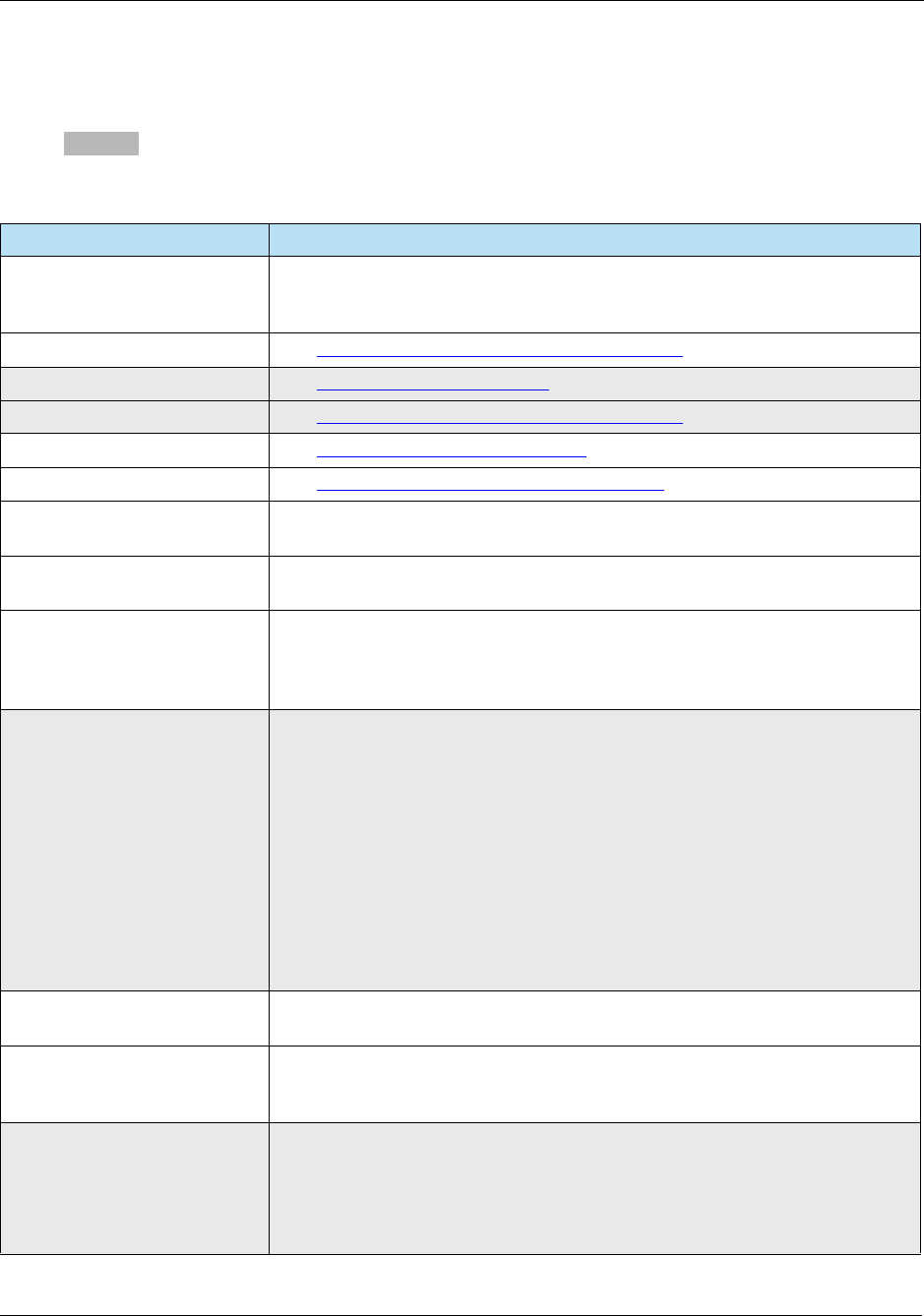

Table of Contents

Chapter 1: Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

1.1 Introduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

1.2 Document Purpose. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

1.3 Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

1.4 Payment Application Data Security Standards (PA-DSS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Chapter 2: General POS Requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

2.1 Address Verification Service. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

2.1.1 AVS Data Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

2.1.2 AVS Result Code Guidelines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

2.2 Chargeback Protected Limits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

2.3 No Signature Required. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

2.4 Binary to ASCII Hex Conversion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Chapter 3: Card Brand Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

3.1 Introduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

3.2 American Express . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

3.2.1 American Express Track 1 Format X4.16 Standard . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

3.2.2 American Express Track 1 Format ISO 7813 Standard . . . . . . . . . . . . . . . . . . . . . . . . 31

3.2.3 American Express Track 2 Format X4.16 Standard . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

3.2.4 American Express Track 2 Format ISO 7813 Standard . . . . . . . . . . . . . . . . . . . . . . . . 33

3.3 AVcard . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

3.3.1 AVcard Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

3.3.2 AVcard Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

3.4 Centego Prepaid Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

3.4.1 Centego Prepaid Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

3.4.2 Centego Prepaid Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

3.5 Discover Card. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

3.5.1 Discover Track 1 Format. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

3.5.2 Discover Track 2 Format. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

3.6 Diner’s Club International Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

3.6.1 Diner’s Club International Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

3.6.2 Diner’s Club International Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

3.7 Drop Tank Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

3.7.1 Drop Tank Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

3.7.2 Drop Tank Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

3.8 Heartland Gift Card. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

3.8.1 Heartland Gift Card Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

For Internal Use Only

Table of Contents HPS Integrator’s Guide V 17.2

62017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive

3.9 EBT Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

3.9.1 EBT Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

3.10 Fleet One Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

3.10.1 Fleet One Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

3.11 FleetCor Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

3.11.1 FleetCor Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

3.12 JCB Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

3.12.1 JCB IIN Ranges on Discover Network . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

3.13 Mastercard . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

3.13.1 Mastercard Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

3.13.2 Mastercard Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

3.14 Mastercard Fleet Card Type . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

3.14.1 Mastercard Fleet Card Example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

3.14.2 Account Number Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

3.14.3 Mastercard Fleet Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

3.14.4 Mastercard Fleet Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

3.15 Mastercard Purchasing Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

3.15.1 Mastercard Purchasing Card Example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

3.15.2 Mastercard Purchasing Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

3.15.3 Mastercard Purchasing Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

3.15.4 Mills Fleet Farm PLCC Track 1 Format. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

3.15.5 Mills Fleet Farm PLCC Track 2 Format. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

3.16 Multi Service Track Data. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

3.16.1 Multi Service Swiped Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

3.17 PayPal Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

3.18 Stored Value Solutions (SVS). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

3.18.1 SVS Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

3.18.2 SVS Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

3.19 UnionPay Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

3.20 ValueLink Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

3.20.1 ValueLink Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

3.20.2 ValueLink Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60

3.21 Visa Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61

3.21.1 Visa Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61

3.21.2 Visa Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

3.22 Visa Corporate or Business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

3.23 Visa Purchasing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

3.24 Visa Fleet Card Type . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

3.24.1 Visa Fleet Card Example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

3.24.2 Visa Fleet Track 1 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

3.24.3 Visa Fleet Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

3.25 Voyager Fleet Card. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

For Internal Use Only

HPS Integrator’s Guide V 17.2 Table of Contents

2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive 7

3.25.1 Voyager Account Number Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

3.25.2 Voyager Fleet Track 1 Format. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68

3.25.3 Voyager Fleet Track 2 Format. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

3.26 WEX Fleet Card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70

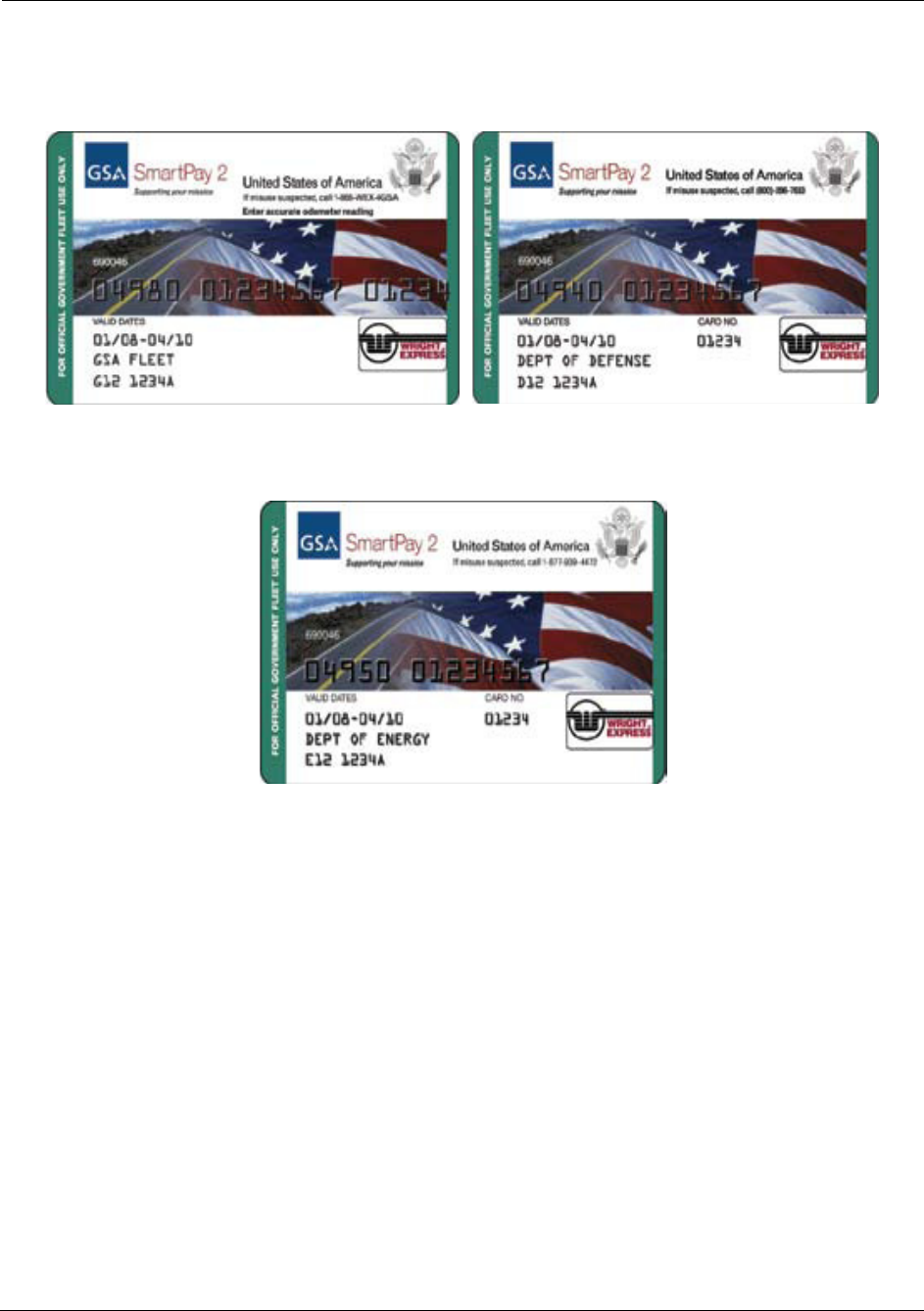

3.26.1 WEX Fleet Card Example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70

3.26.2 WEX GSA Fleet Cards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70

3.26.3 WEX Fleet Track 2 Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

3.26.4 WEX MOD 10 Calculation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

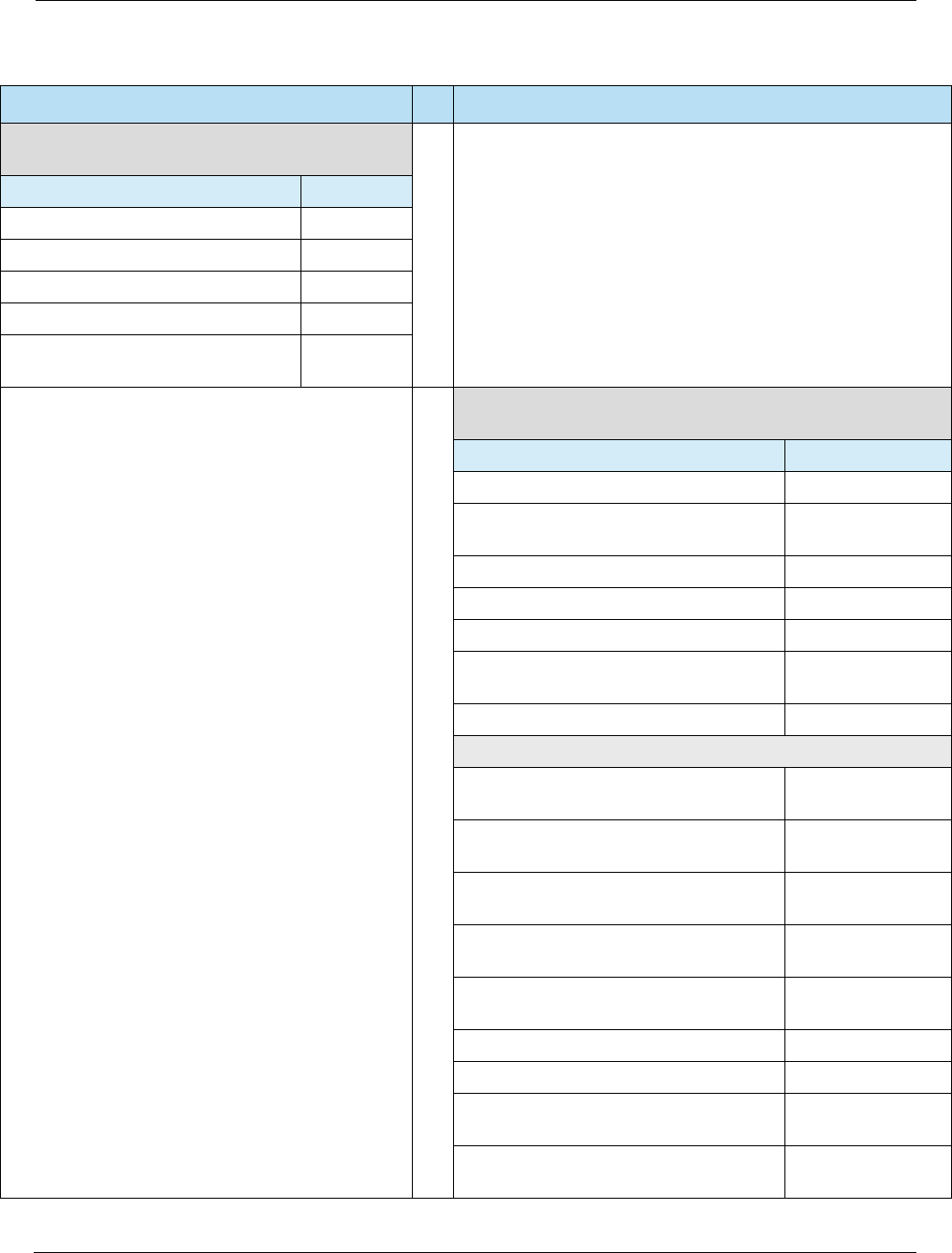

Chapter 4: E3 Processing Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

4.1 Introduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

4.2 The E3® Solution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

4.3 Encryption Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

4.3.1 Encrypted Track and PAN Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

4.3.2 Encrypted Card Security Code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

4.3.3 Encryption Transmission Block . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

4.4 E3 Specific Requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

4.4.1 Heartland Exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

4.4.1.1 Unique Transaction ID (UID). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

4.4.1.2 Merchant ID Number (MID) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

4.4.1.3 Account Data Source . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

4.4.1.4 Customer Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

4.4.1.5 Retrieval Reference Number (RRN) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

4.4.1.6 Transaction Identifier . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

4.4.1.7 Authorization Example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

4.4.1.8 Void/Incremental Example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

4.4.2 Settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

4.4.2.1 Header Record Field Requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

4.4.2.2 Detail Record Fields Requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

4.4.2.3 Settlement Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

4.4.3 POS 8583 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83

4.4.4 NTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84

4.4.5 Z01 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86

4.5 E3 Hardware Devices. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88

4.5.1 E3 MSR Wedge (HPS-E3-M1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88

4.5.2 E3 MSR Wedge Device Interface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89

4.5.3 E3 MSR Wedge Example Output . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89

4.6 E3 PIN Pad (HPS-E3-P1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

4.6.1 E3 PIN Pad Device Interface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92

4.6.1.1 E3 PIN Pad Requests. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92

4.6.1.2 E3 PIN Pad Responses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92

4.6.2 Ingenico iPP300 and iSC Touch Series PIN Pads . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

4.6.3 Equinox L4000 and L5000 Series PIN Pads. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

For Internal Use Only

Table of Contents HPS Integrator’s Guide V 17.2

82017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive

Chapter 5: EMV Processing Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95

5.1 Introduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95

5.2 EMV Migration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96

5.2.1 Enhanced Security . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96

5.2.2 Card Brand Mandates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96

5.2.3 Fraud Liability Shifts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97

5.2.4 PCI Audit Waivers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97

5.3 EMV Specifications. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

5.3.1 Contact Specifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

5.3.2 Contactless Specifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

5.3.3 Heartland Host Specifications. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

5.4 EMV Online vs. Offline . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100

5.4.1 Card Authentication. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100

5.4.2 Cardholder Verification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100

5.4.3 Authorization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100

5.5 Full vs. Partial EMV Transactions and Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101

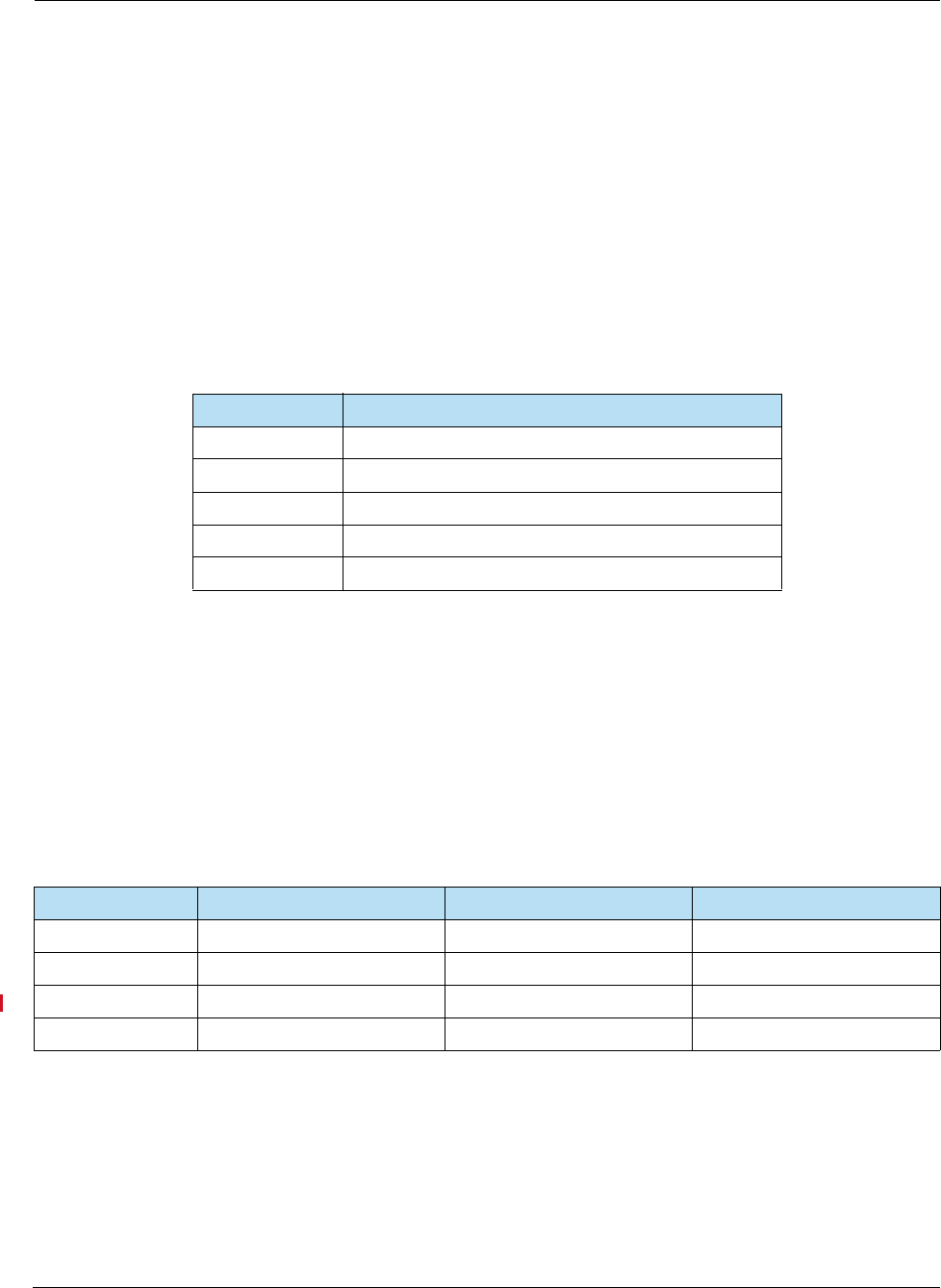

5.5.1 Full vs. Partial Transaction Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101

5.5.2 Full vs. Partial Credit Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 102

5.5.3 Full vs. Partial Debit Transactions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103

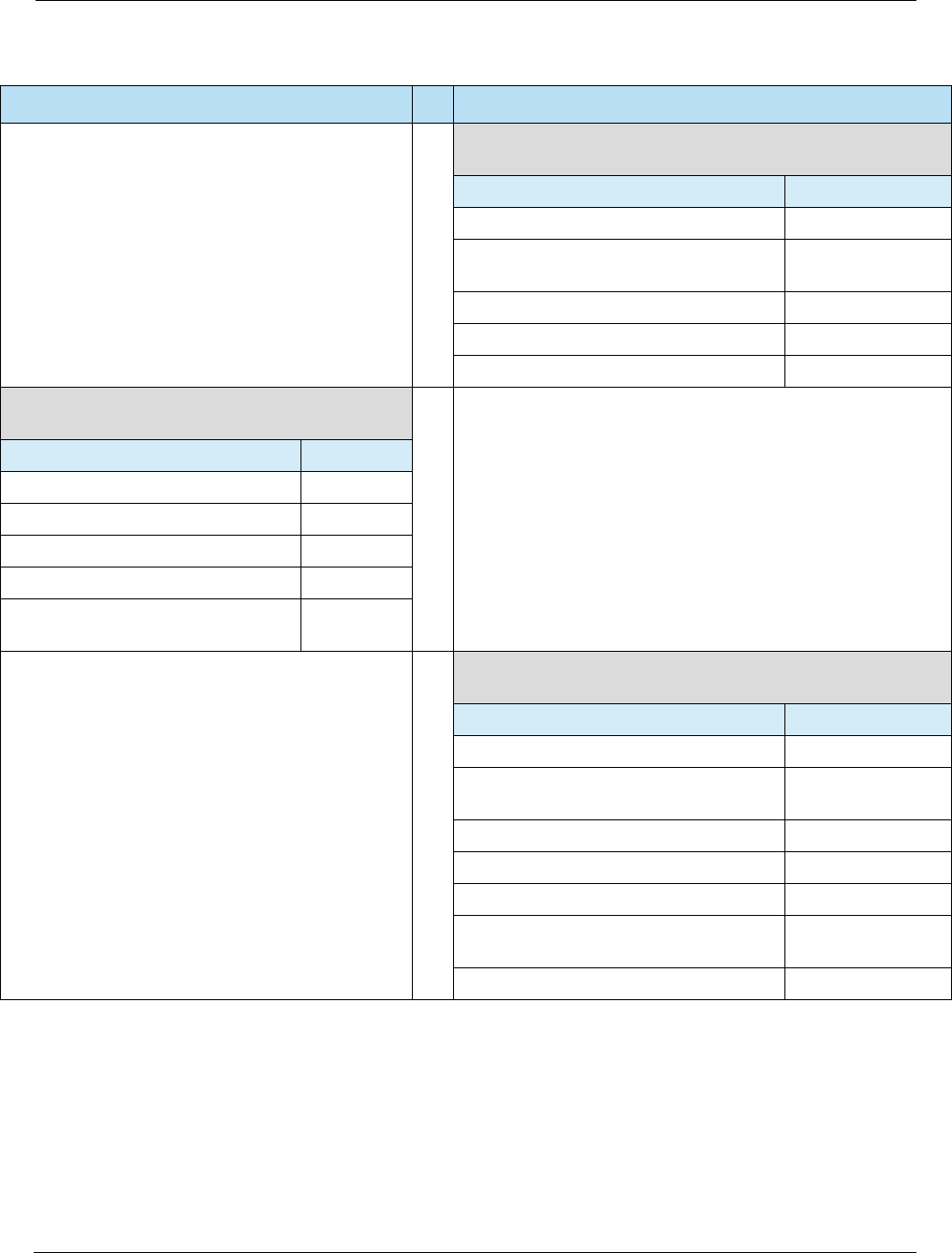

Chapter 6: EMV Development Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105

6.1 EMV Terminals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105

6.1.1 Contact Devices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105

6.1.2 Contactless Devices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105

6.1.3 Letters of Approval . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106

6.2 EMV Solutions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106

6.2.1 Integrated . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106

6.2.2 Standalone . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106

6.3 EMV Certifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 107

6.3.1 Test Requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 107

6.3.2 Test Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 108

6.3.2.1 Visa Smart Debit/Credit (VSDC) Testing. . . . . . . . . . . . . . . . . . . . . . . . . . 108

6.3.2.2 Mastercard Terminal Integration Process (M-TIP) Testing . . . . . . . . . . . . 108

6.3.2.3 AMEX Integrated Circuit Card Payment Specification (AEIPS) Testing . . 108

6.3.2.4 Discover D-Payment Application Specification (D-PAS) Testing. . . . . . . . 109

6.3.3 Test Tools . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 109

6.3.4 Test Environments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 110

6.3.5 Test Process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 110

6.4 EMV Support . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111

Chapter 7: EMV Terminal Interface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 113

7.1 EMV Terminal to Card Communication. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 113

For Internal Use Only

HPS Integrator’s Guide V 17.2 Table of Contents

2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive 9

7.1.1 Application Protocol Data Units (APDUs) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 113

7.1.2 Tag, Length, Value (TLV) Data Objects. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 114

7.1.3 Kernel Application Programming Interface (API) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 114

7.2 EMV Data Elements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 115

7.2.1 Data Conventions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 115

7.2.2 Terminal Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 116

7.2.3 Card Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 127

7.2.4 Issuer Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 134

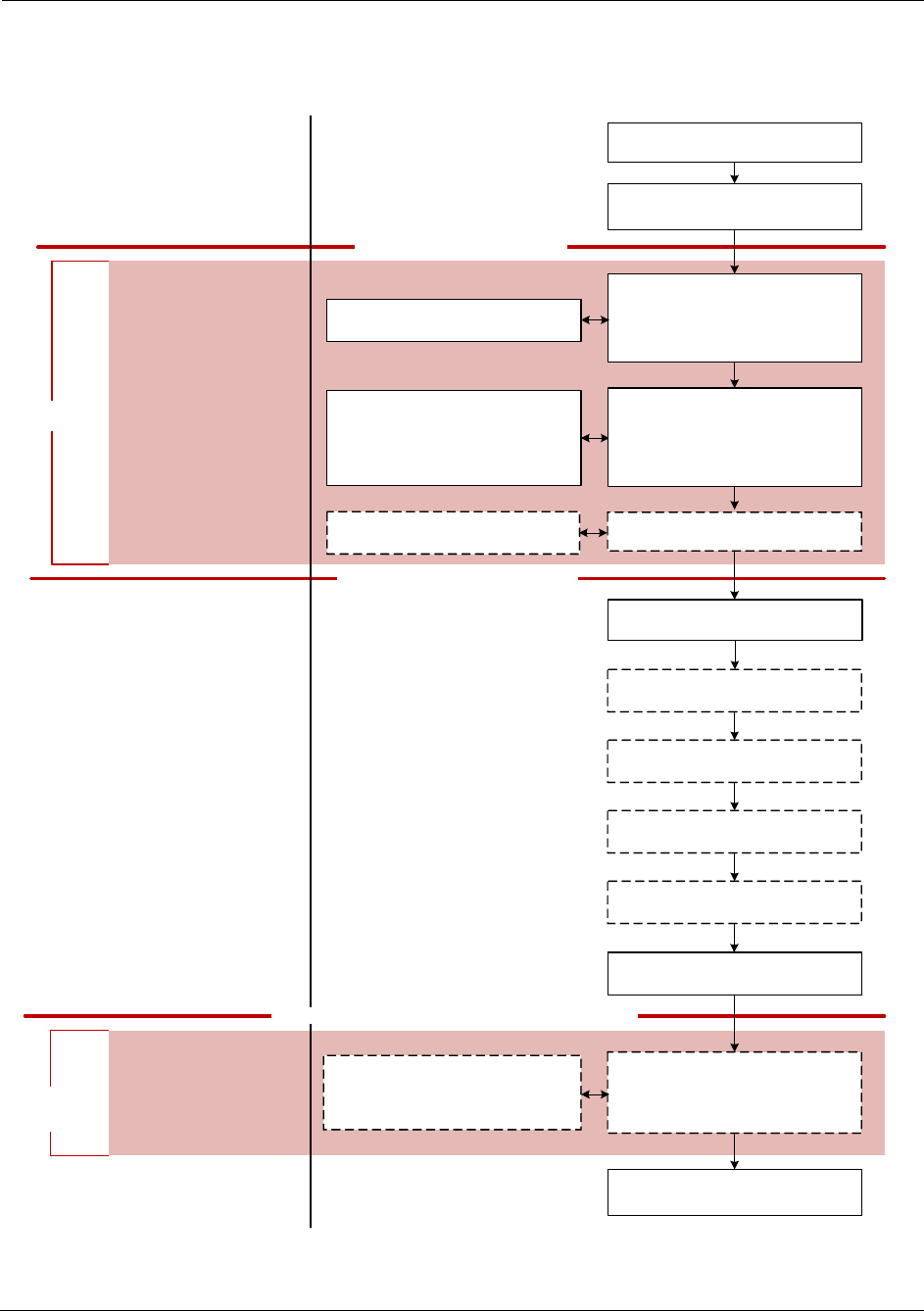

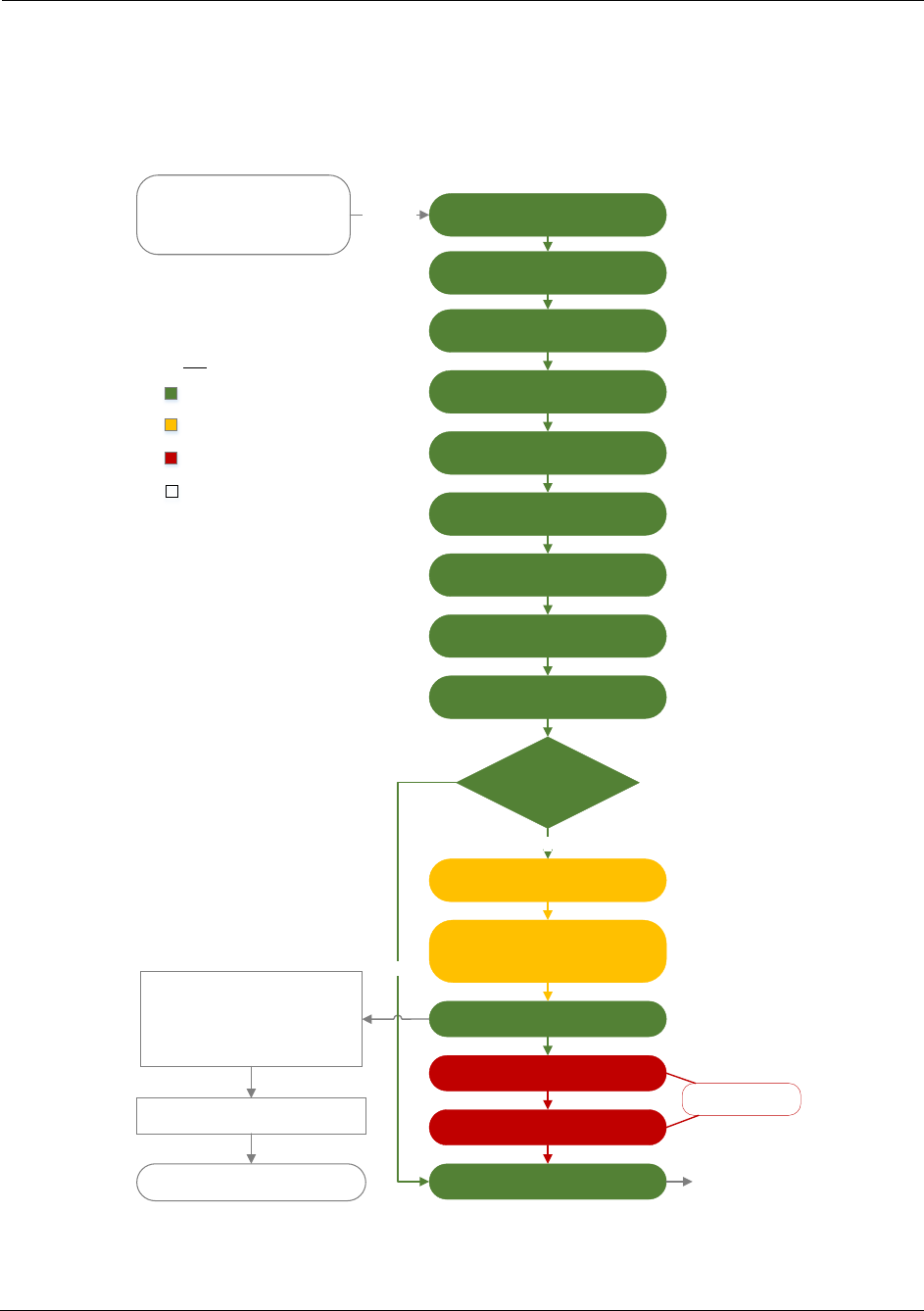

7.3 Contact Transaction Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 134

7.3.1 Tender Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 136

7.3.2 Card Acquisition . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 137

7.3.2.1 Card Swipe . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 137

7.3.2.2 Fallback Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 138

7.3.3 Application Selection. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 139

7.3.3.1 Available AIDs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 141

7.3.3.2 Debit AIDs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 142

7.3.4 Initiate Application Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 143

7.3.5 Read Application Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 143

7.3.6 Offline Data Authentication . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 144

7.3.7 Processing Restrictions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 144

7.3.8 Cardholder Verification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 145

7.3.8.1 PIN Support . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 146

7.3.9 Terminal Risk Management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 147

7.3.10 Terminal Action Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 147

7.3.11 Card Action Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 148

7.3.12 Online Processing. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 148

7.3.12.1 Offline Authorization (Optional, Not Used in U.S.) . . . . . . . . . . . . . . . . . . 149

7.3.12.2 Deferred Authorization (Store-and-Forward) . . . . . . . . . . . . . . . . . . . . . . 149

7.3.12.3 Forced Acceptance (Stand-In) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 150

7.3.13 Issuer Authentication. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 151

7.3.14 Issuer-to-Card Script Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 152

7.3.15 Completion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 152

7.3.16 Card Removal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 154

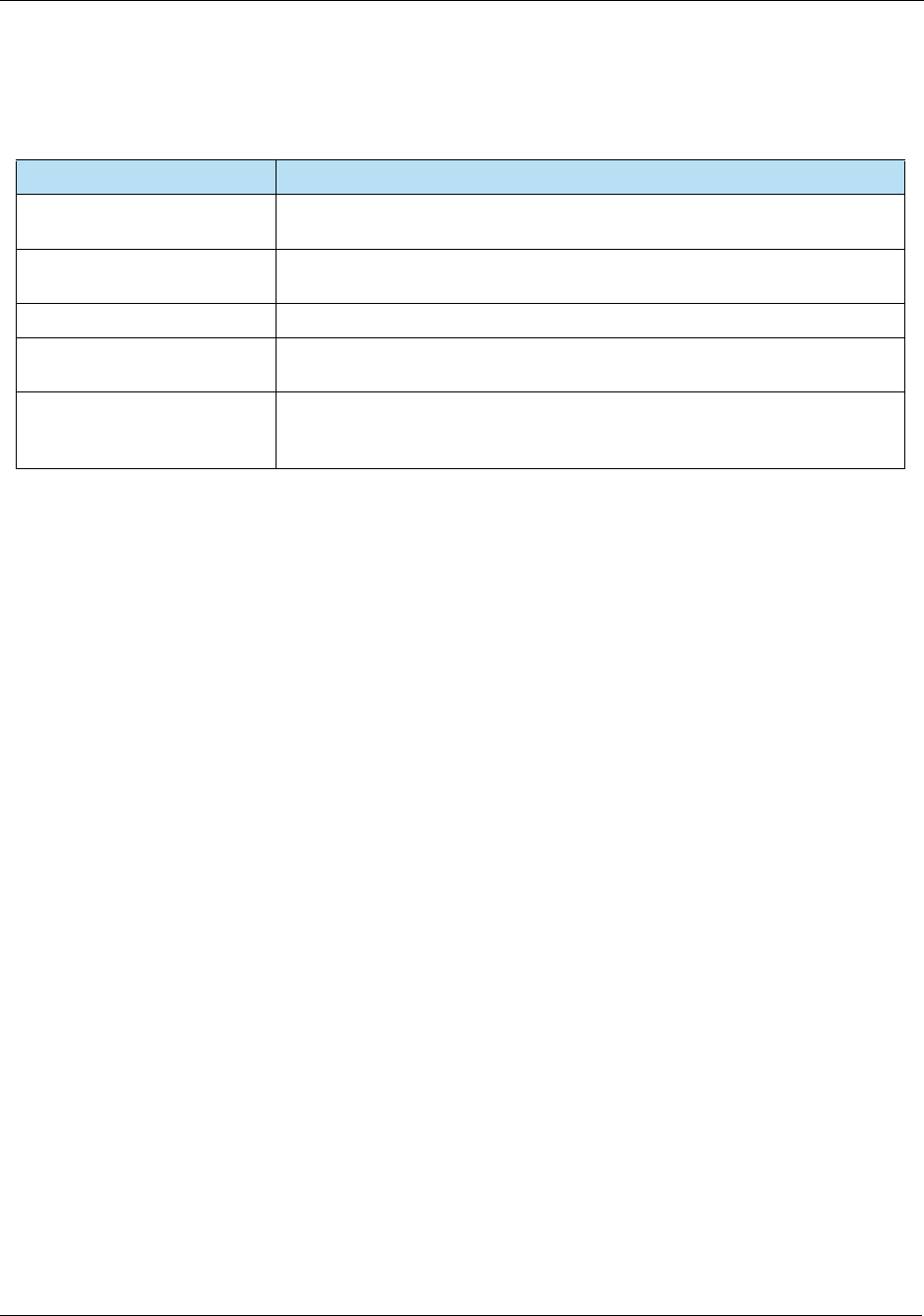

7.4 Contactless Transaction Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 154

7.4.1 Pre-Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 156

7.4.2 Discovery Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 156

7.4.3 Application Selection. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 156

7.4.4 Initiate Application Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 157

7.4.4.1 Path Determination . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 157

7.4.4.2 Terminal Risk Management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 157

7.4.4.3 Terminal Action Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 157

7.4.4.4 Card Action Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 157

7.4.5 Read Application Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 158

7.4.6 Card Read Complete . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 158

For Internal Use Only

Table of Contents HPS Integrator’s Guide V 17.2

10 2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive

7.4.7 Processing Restrictions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 158

7.4.8 Offline Data Authentication . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 158

7.4.9 Cardholder Verification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 158

7.4.10 Online Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 159

7.4.11 Completion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 159

7.4.12 Issuer Update Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 159

7.5 EMV Receipts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160

7.5.1 Approval Receipts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160

7.5.2 Decline Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 161

Chapter 8: EMV Parameter Interface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163

8.1 Introduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163

8.2 Exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 165

8.3 POS 8583 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 166

8.4 NTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 166

8.5 Z01 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 167

8.6 Portico . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 167

8.7 SpiDr. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 168

Chapter 9: EMV Quick Chip Processing Overview . . . . . . . . . . . . . . . . . . . . . . . . . 169

9.1 Introduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 169

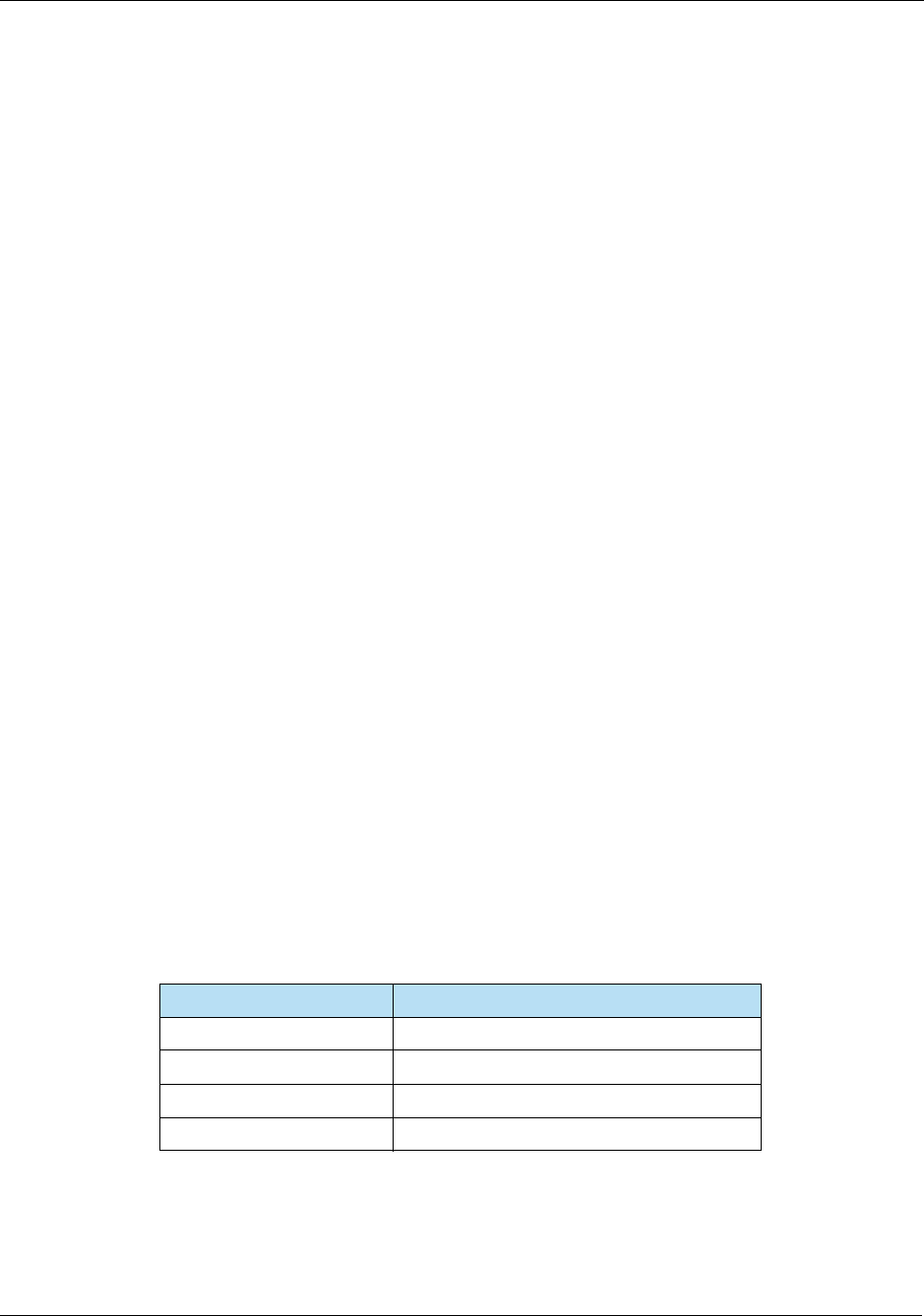

9.2 Quick Chip Processing Definition . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 169

9.3 Impact to Existing EMV Kernel and Host Software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 170

9.4 Comparison of Standard EMV and Quick Chip Processes . . . . . . . . . . . . . . . . . . . . . . . . . . . . 170

9.5 Online Processing Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 171

9.6 Quick Chip Processing Flow. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 173

9.7 Floor Limit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 174

9.8 Amounts – Final or Pre-Determined . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 174

9.9 Cashback Processing. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 174

9.10 CVM List . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 175

9.11 No Signature Required Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 175

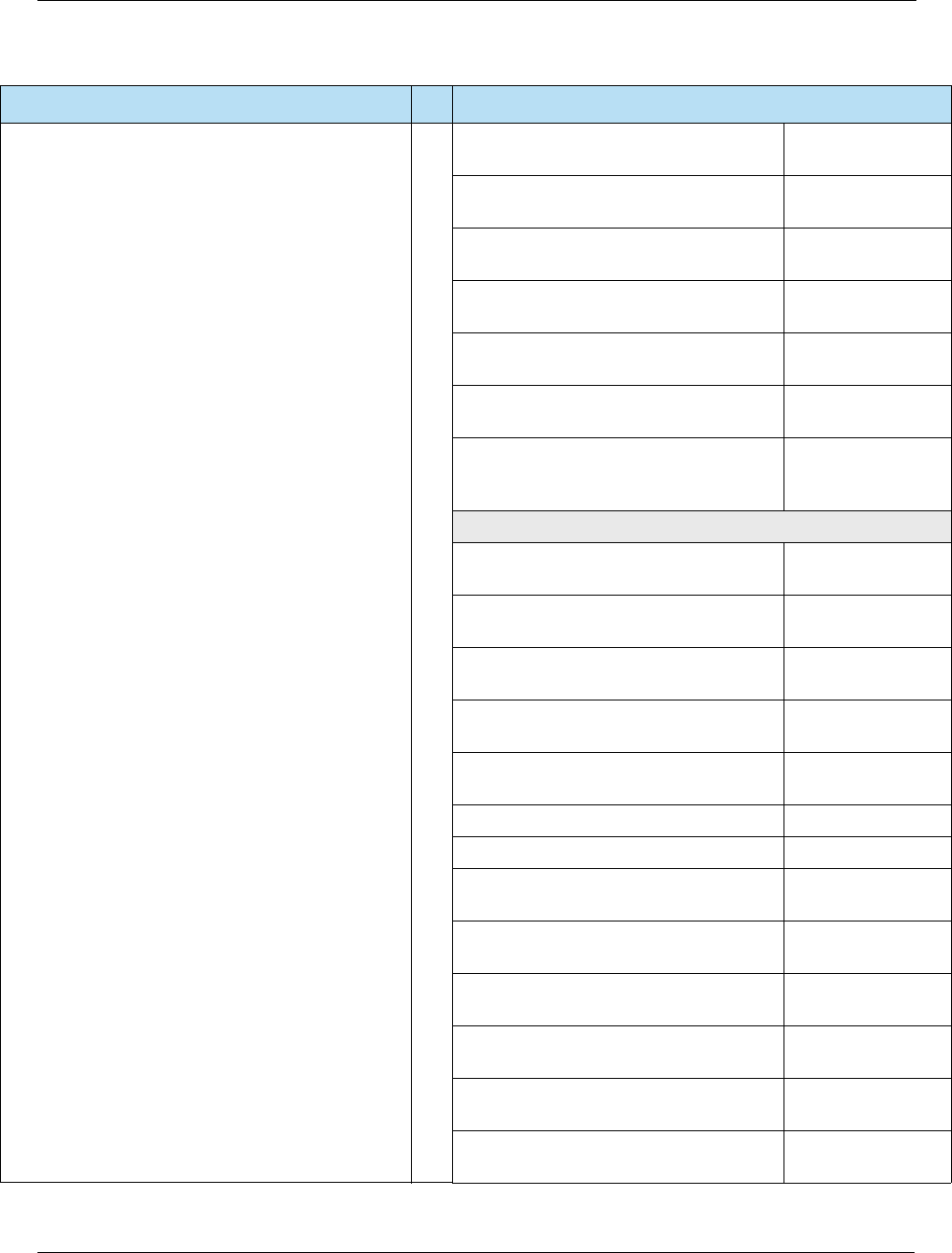

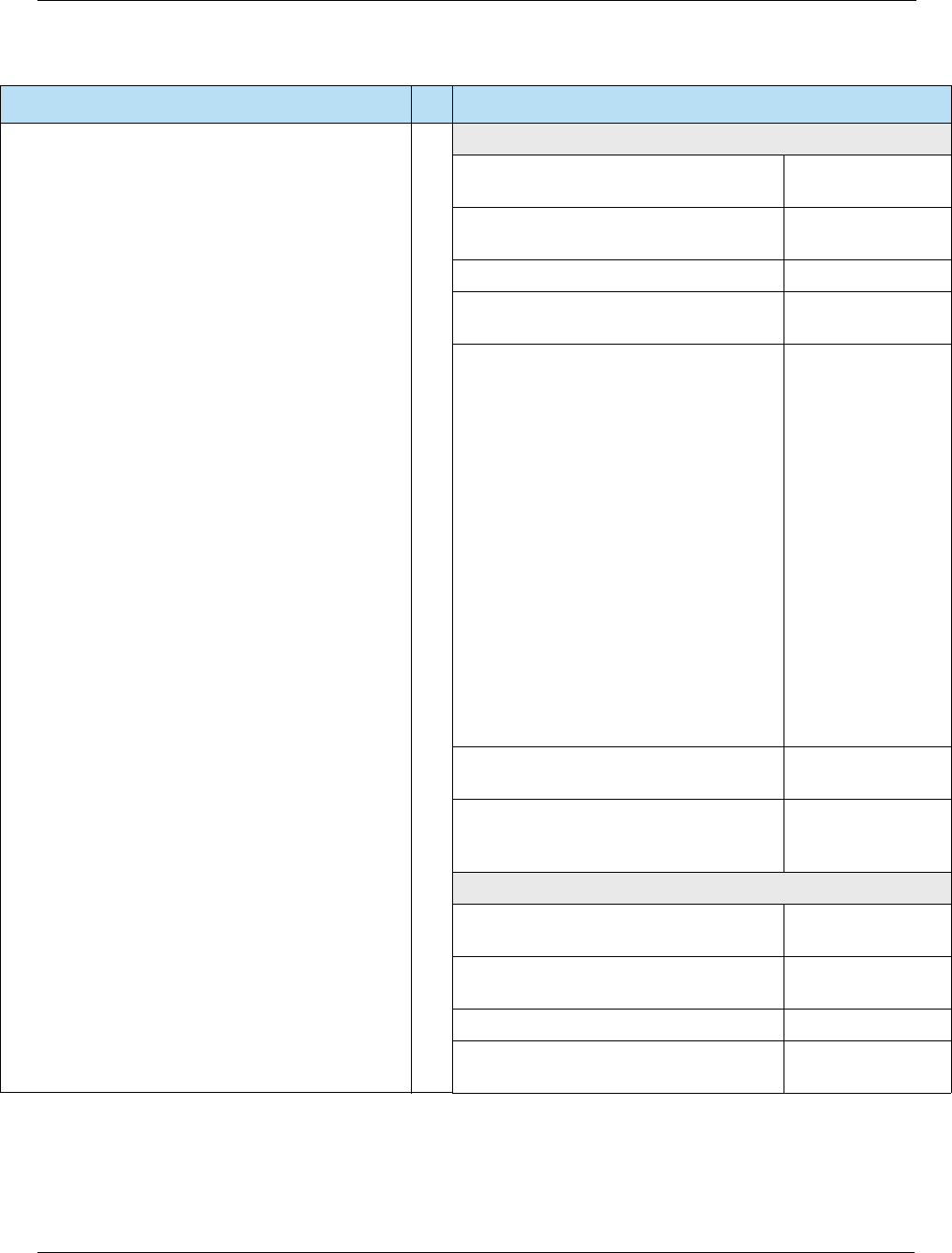

Appendices. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 177

A: Industry Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 177

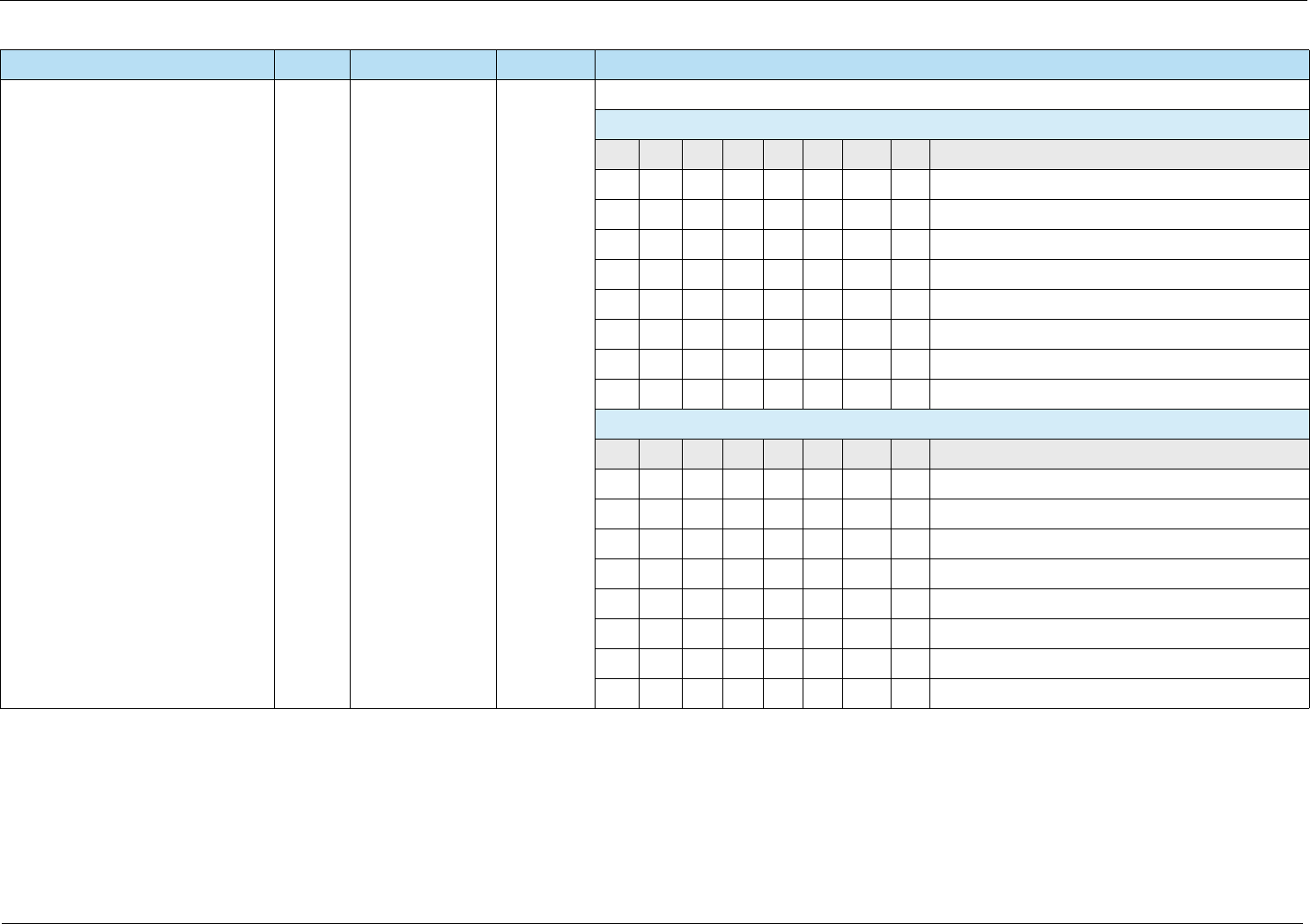

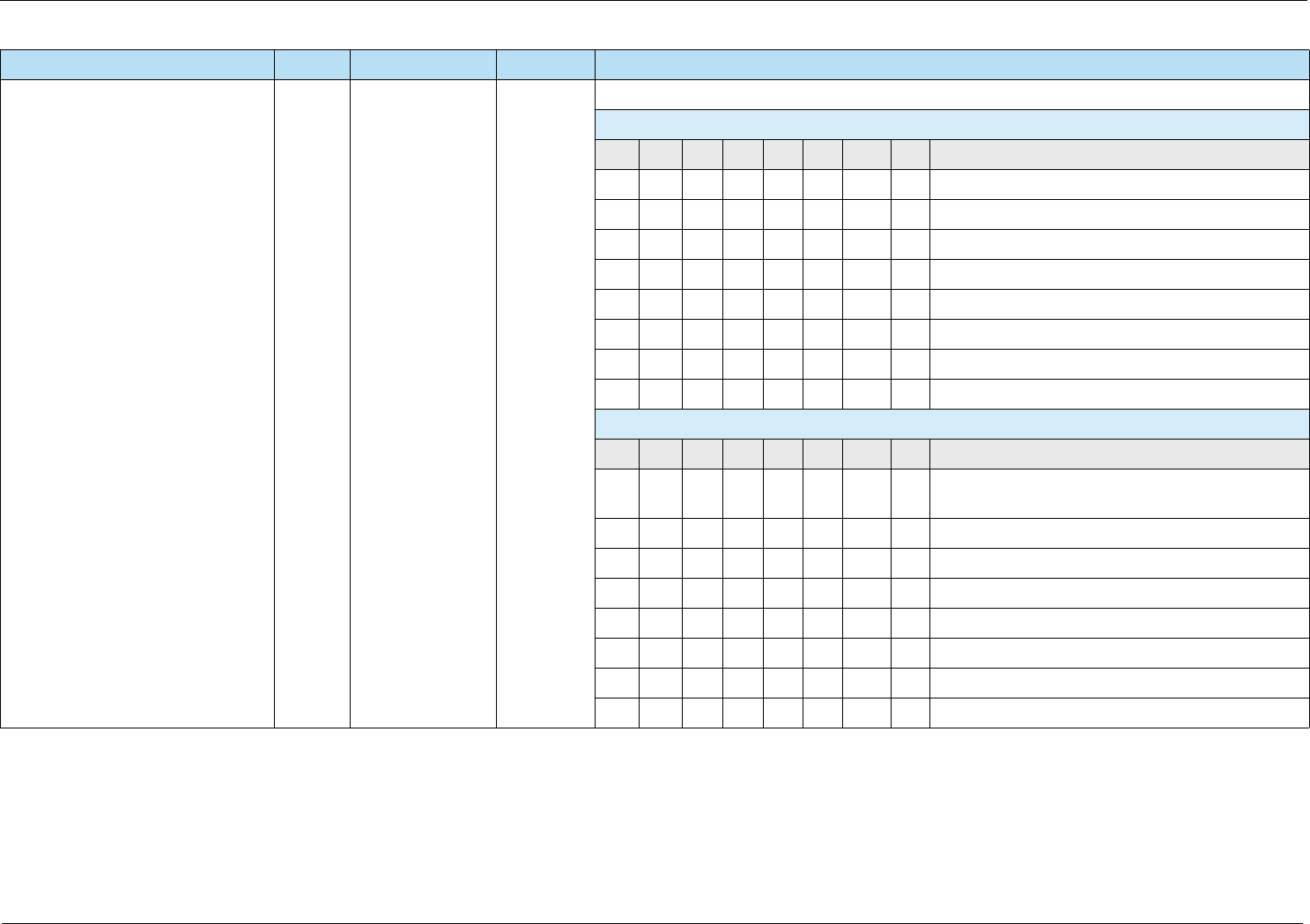

A.1 Conexxus Product Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 178

A.2 Mastercard Purchasing Product Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 191

A.2.1 Mastercard Purchasing Fuel Product Codes . . . . . . . . . . . . . . . . . . . . . . 191

A.2.2 Mastercard Purchasing Non-Fuel Product Codes . . . . . . . . . . . . . . . . . . 193

A.3 Mastercard Fleet Product Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 195

A.3.1 Mastercard Fleet Fuel Product Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . 195

A.3.2 Mastercard Fleet Non-Fuel Product Codes . . . . . . . . . . . . . . . . . . . . . . . 196

For Internal Use Only

HPS Integrator’s Guide V 17.2 Table of Contents

2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive 11

A.4 Heartland Product Codes for Visa Fleet Processing. . . . . . . . . . . . . . . . . . . . . . . . . . 197

A.4.1 Fuel Product Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 197

A.4.2 Non-Fuel Product Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 199

A.5 Voyager Product Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 200

A.5.1 Voyager Fuel Product Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 200

A.5.2 Voyager Non-Fuel Product Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 201

A.6 WEX Supported Conexxus Product Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 207

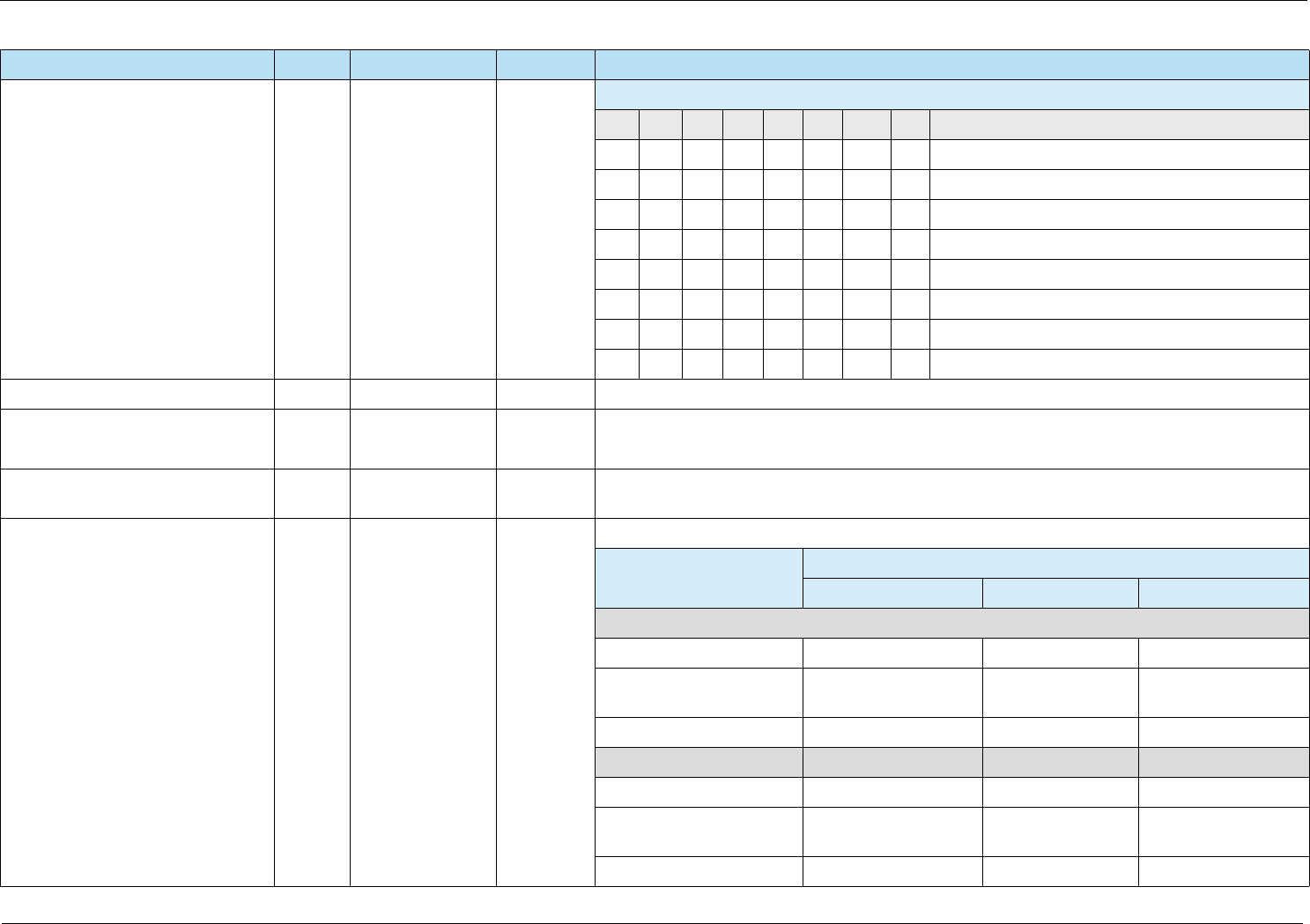

B: Receipt Requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 216

B.1 General Receipt Requirements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 216

B.2 Additional Receipt Requirements by Card Types . . . . . . . . . . . . . . . . . . . . . . . . . . . . 217

C: State Codes / Region Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 220

D: EMV Field Definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 223

D.1 Additional Terminal Capabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 224

D.2 Amount, Authorised (Numeric) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 224

D.3 Amount, Other (Numeric) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 225

D.4 Application Cryptogram. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 225

D.5 Application Dedicated File (ADF) Name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 226

D.6 Application Identifier (AID) – Terminal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 227

D.7 Application Interchange Profile . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 227

D.8 Application Label. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 228

D.9 Application Preferred Name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 228

D.10 Application Primary Account Number (PAN) Sequence Number . . . . . . . . . . . . . . . . 229

D.11 Application Transaction Counter (ATC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 229

D.12 Application Usage Control . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 230

D.13 Application Version Number (ICC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 230

D.14 Application Version Number (Terminal) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 231

D.15 Authorisation Response Code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 231

D.16 Cardholder Verification Method (CVM) Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 232

D.17 Cryptogram Information Data (CID) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 233

D.18 Customer Exclusive Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 233

D.19 Dedicated File Name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 234

D.20 Form Factor Indicator (FFI). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 234

D.21 ICC Dynamic Number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 235

D.22 Interface Device (IFD) Serial Number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 235

D.23 Issuer Action Code – Default . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 236

D.24 Issuer Action Code – Denial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 236

D.25 Issuer Action Code – Online . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 237

D.26 Issuer Application Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 237

D.27 Issuer Authentication Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 238

D.28 Issuer Country Code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 238

D.29 Issuer Script Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 239

D.30 Issuer Script Template 1 & 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 239

D.31 POS Entry Mode . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 240

For Internal Use Only

Table of Contents HPS Integrator’s Guide V 17.2

12 2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive

D.32 Terminal Action Code – Default . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 240

D.33 Terminal Action Code – Denial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 241

D.34 Terminal Action Code – Online . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 241

D.35 Terminal Capabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 242

D.36 Terminal Country Code. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 242

D.37 Terminal Type . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 243

D.38 Terminal Verification Results (TVR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 243

D.39 Third Party Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 244

D.40 Transaction Currency Code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 244

D.41 Transaction Date. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 245

D.42 Transaction Sequence Counter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 245

D.43 Transaction Status Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 246

D.44 Transaction Time . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 246

D.45 Transaction Type . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 247

D.46 Unpredictable Number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 247

E: EMV PDL Data Examples . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 248

F: Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 292

For Internal Use Only

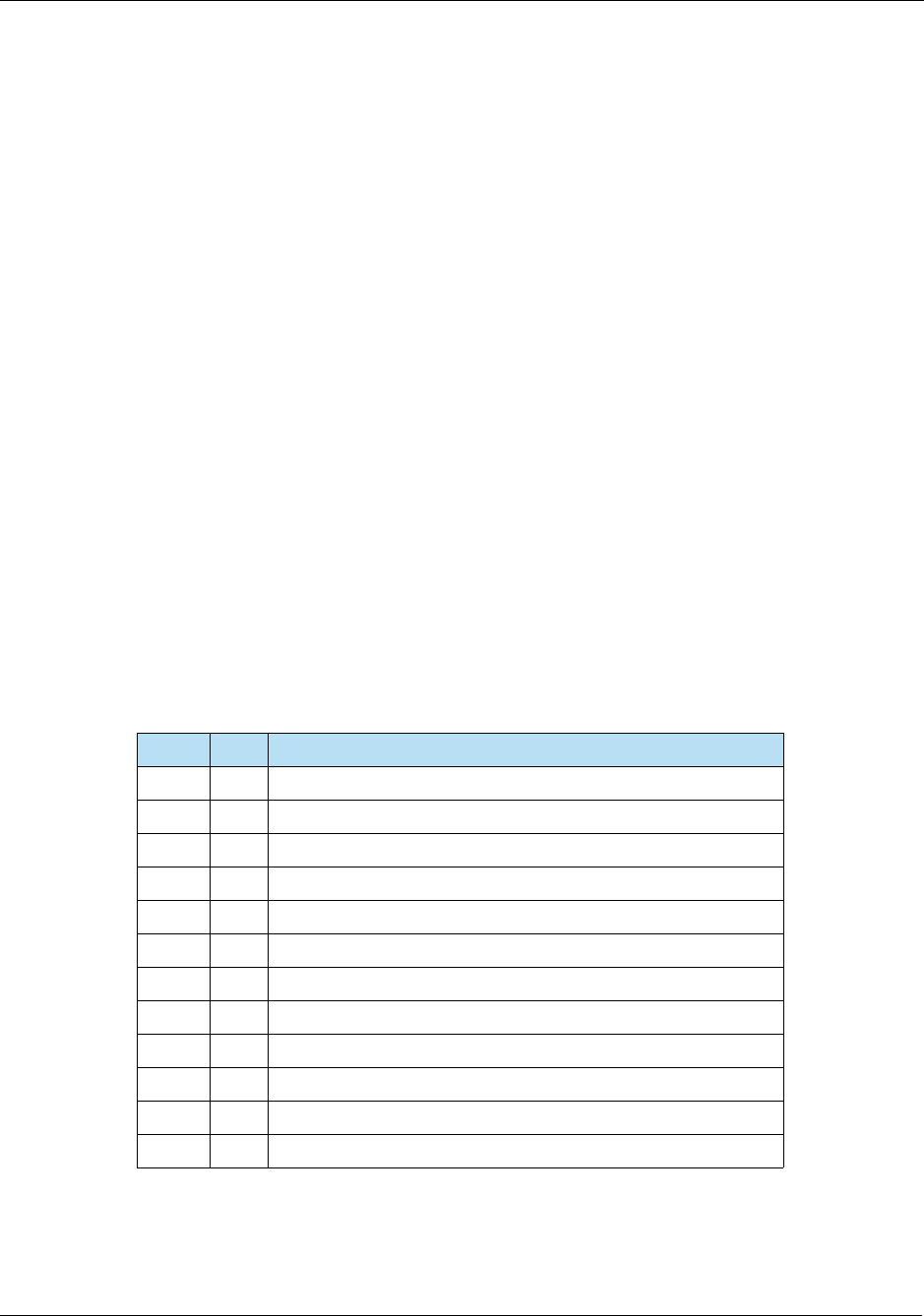

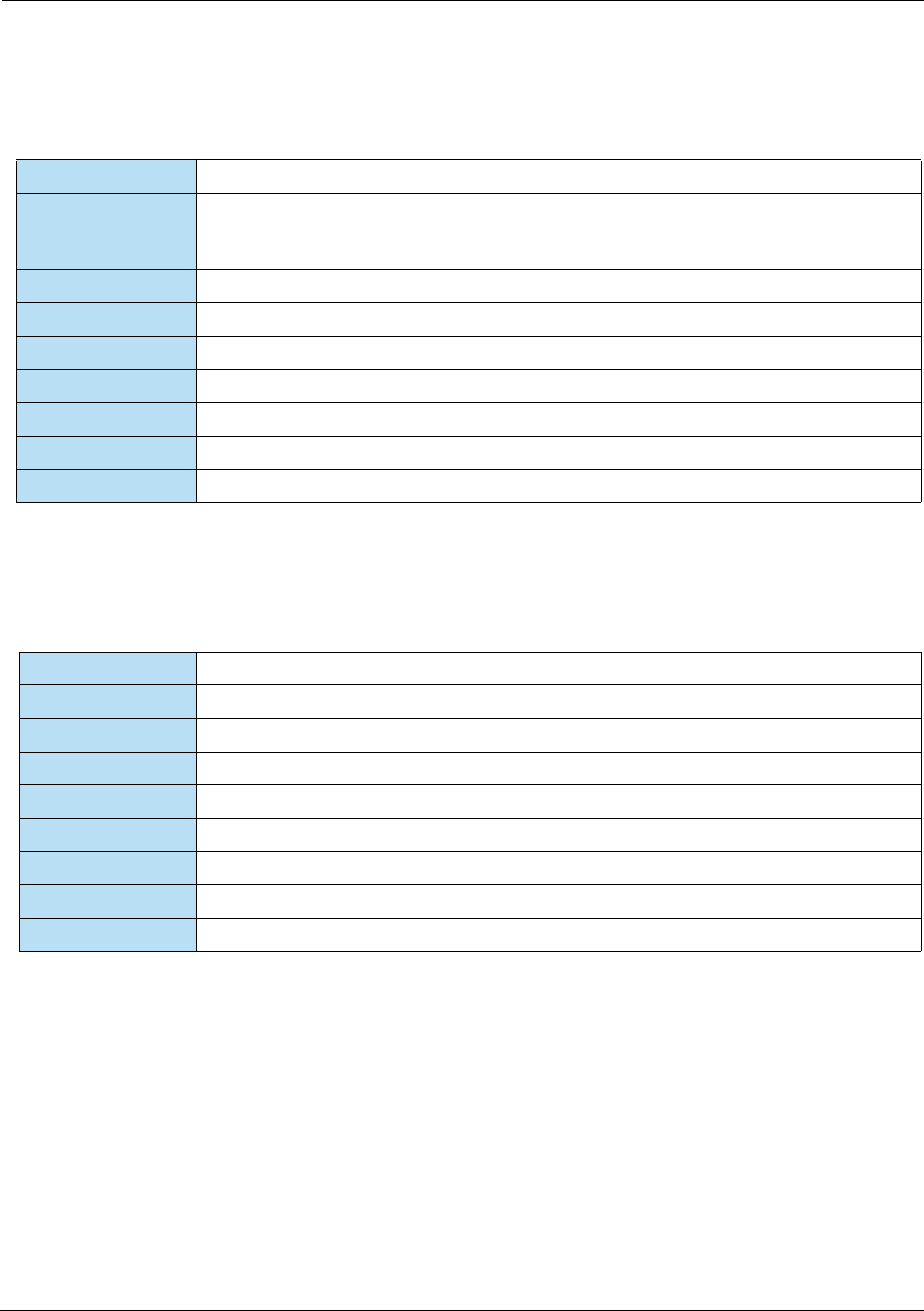

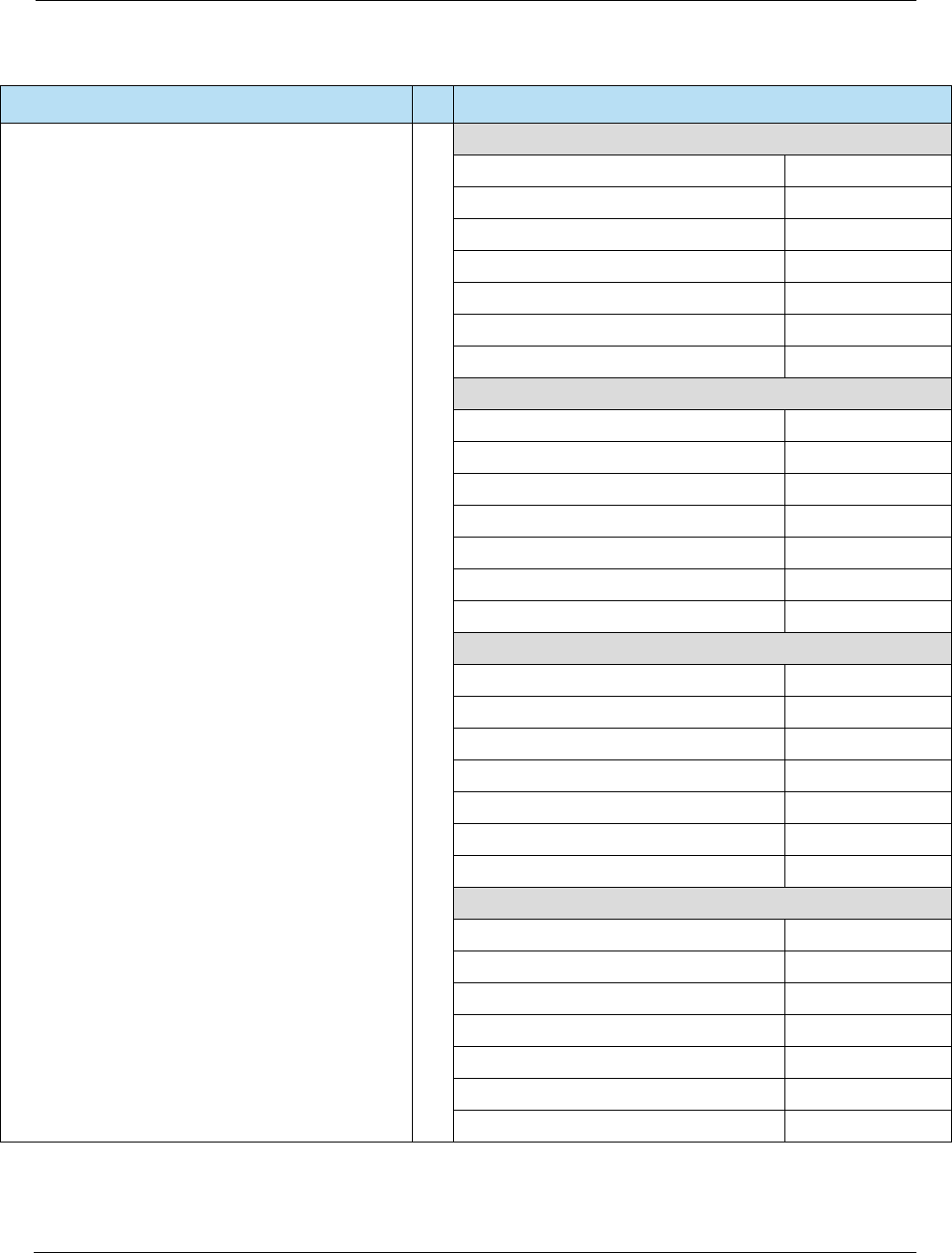

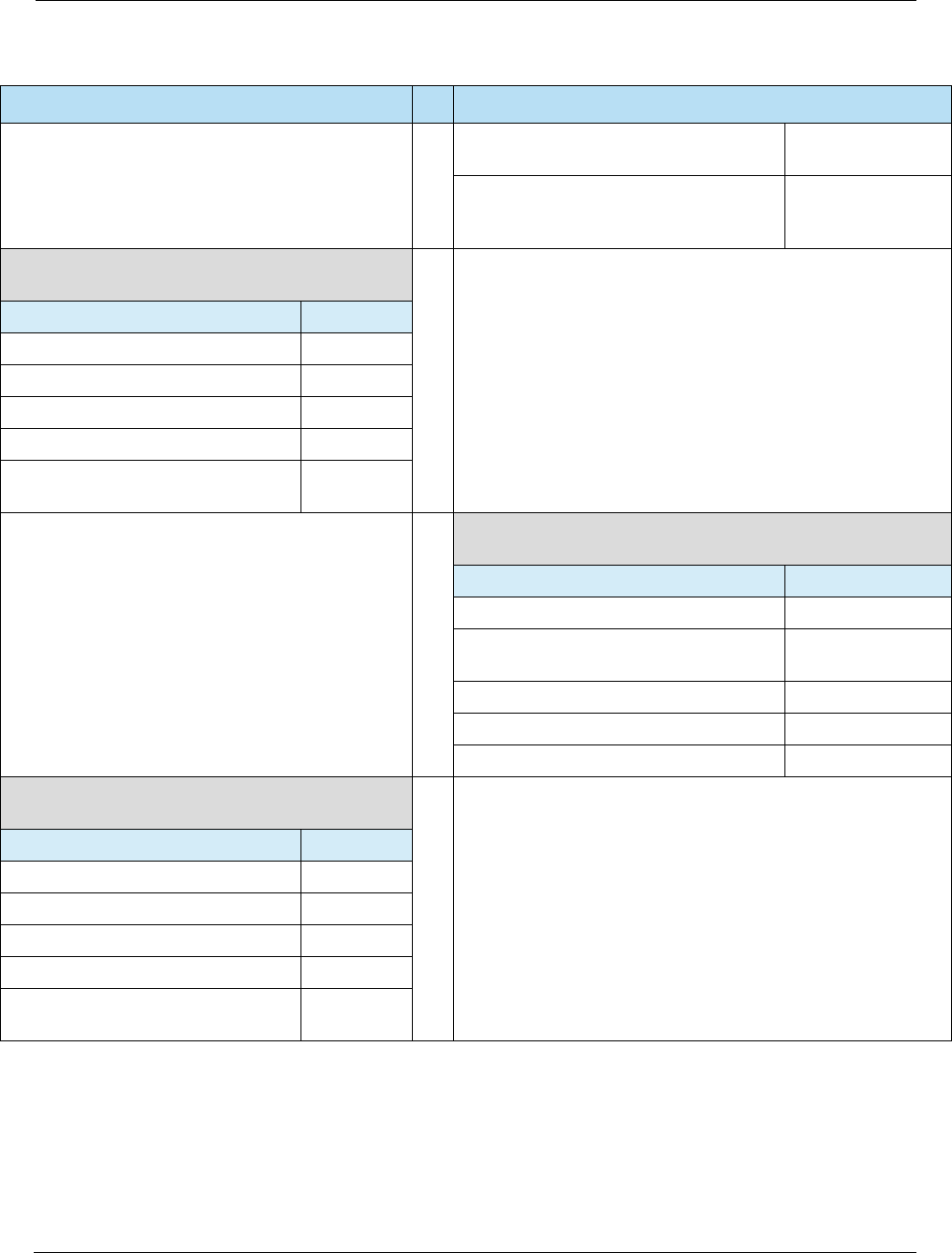

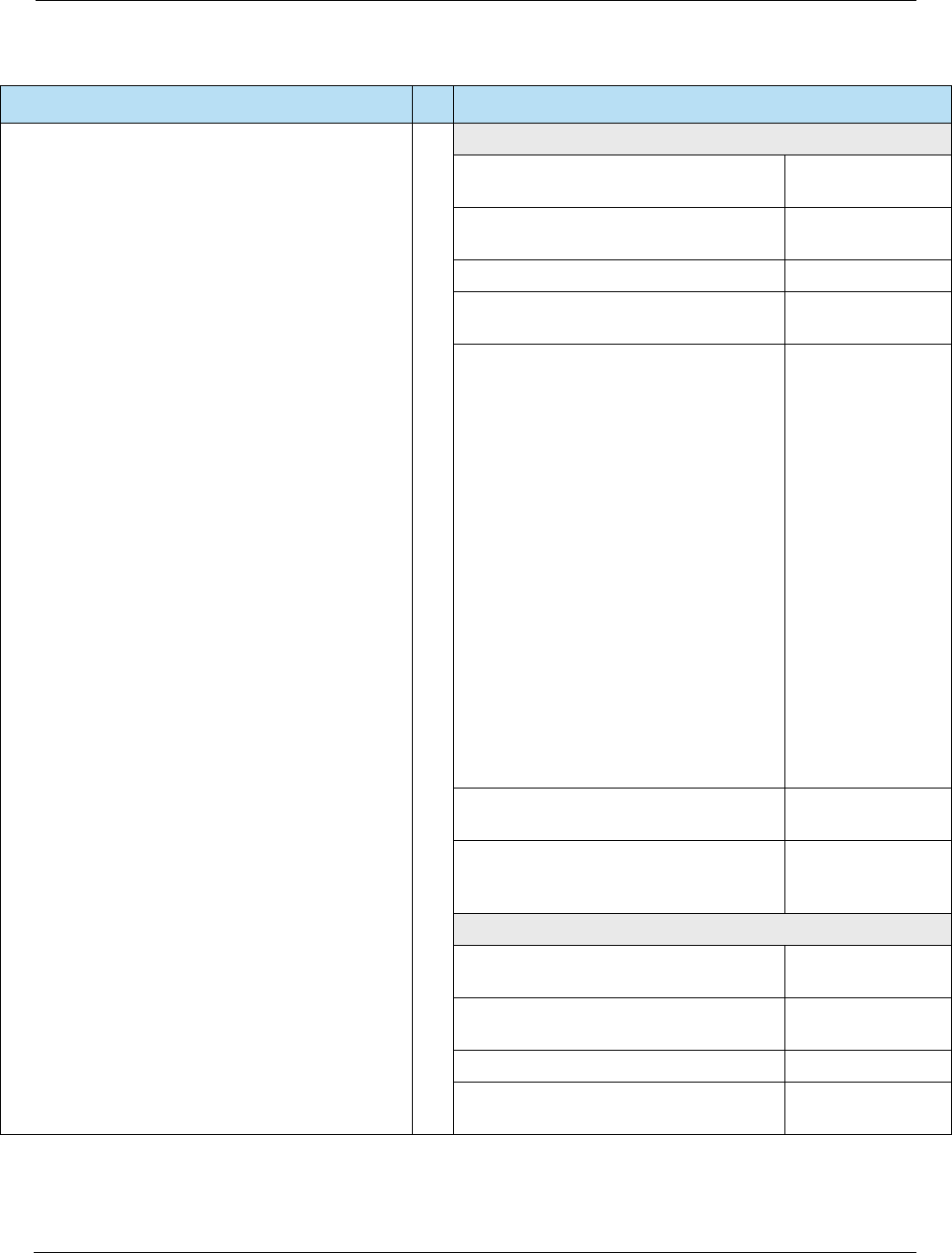

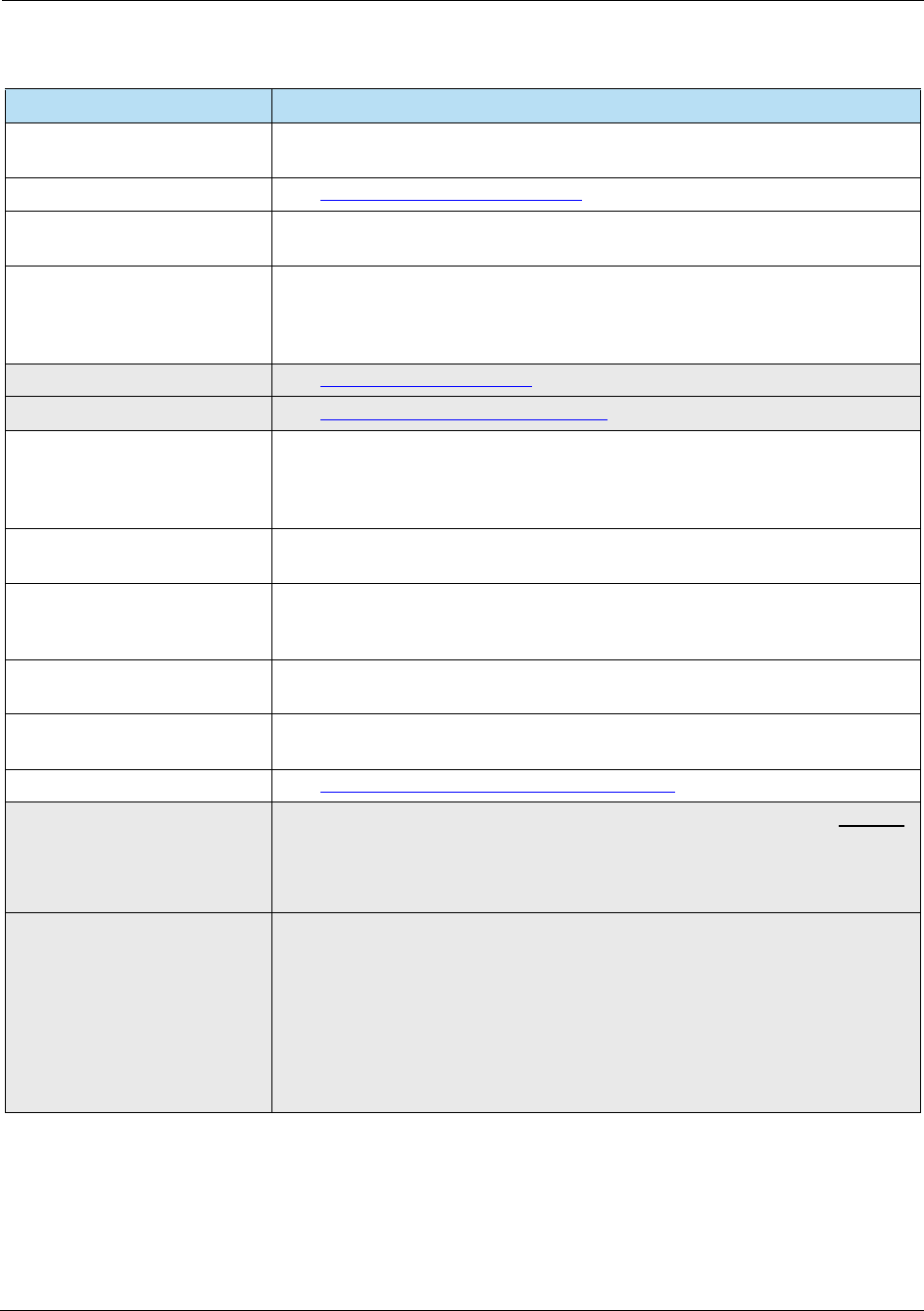

HPS Integrator’s Guide V 17.2 List of Tables

2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive 13

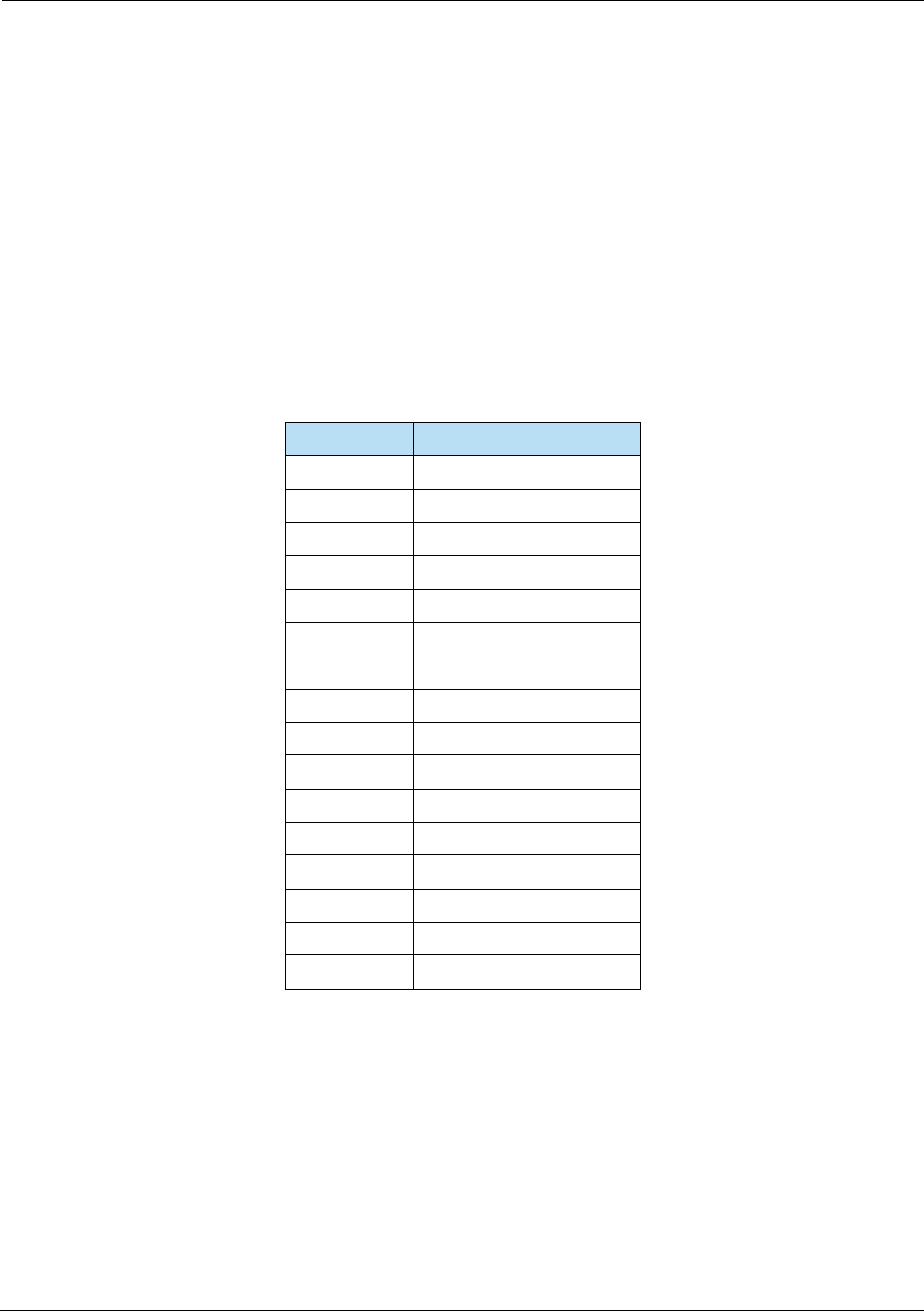

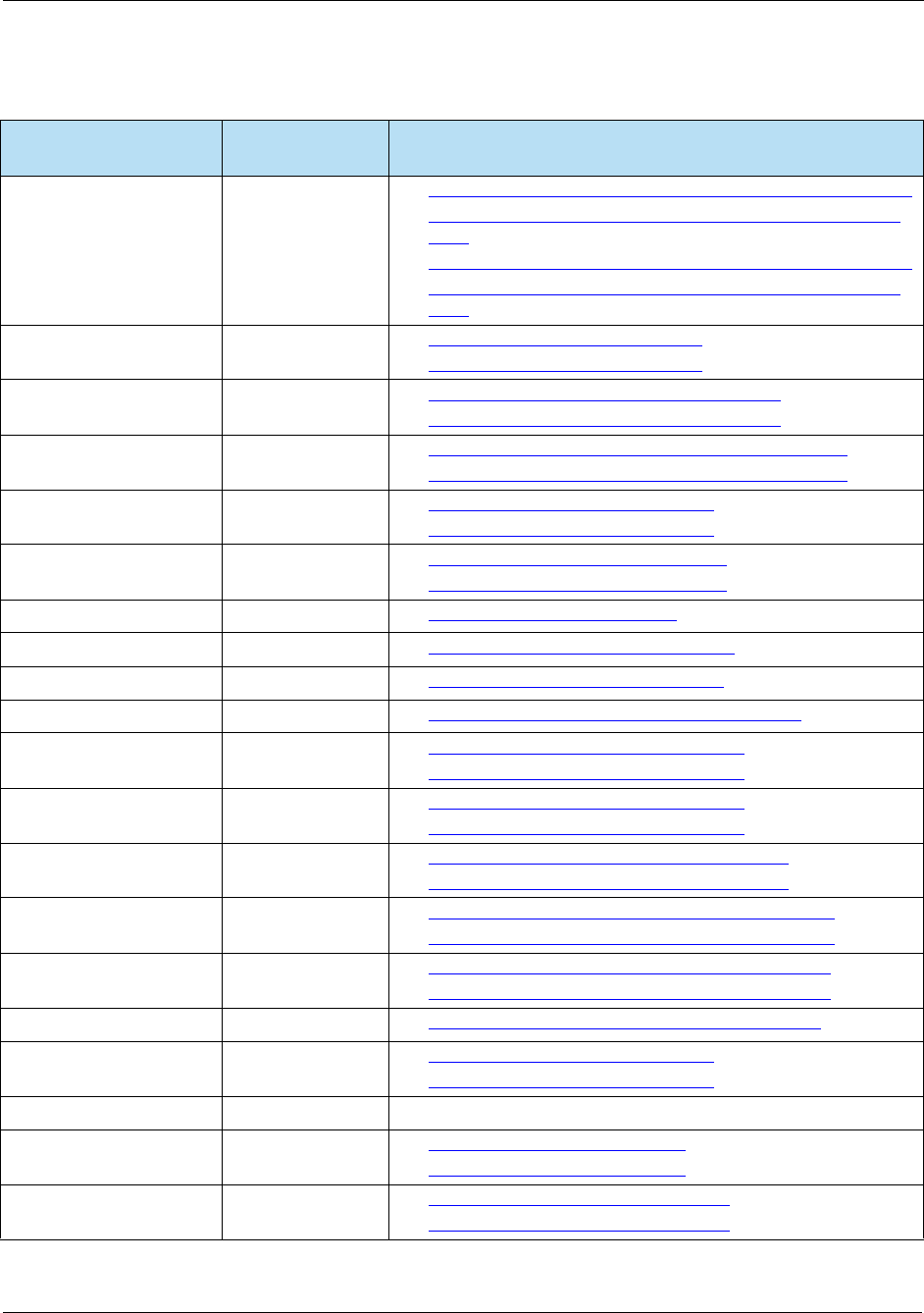

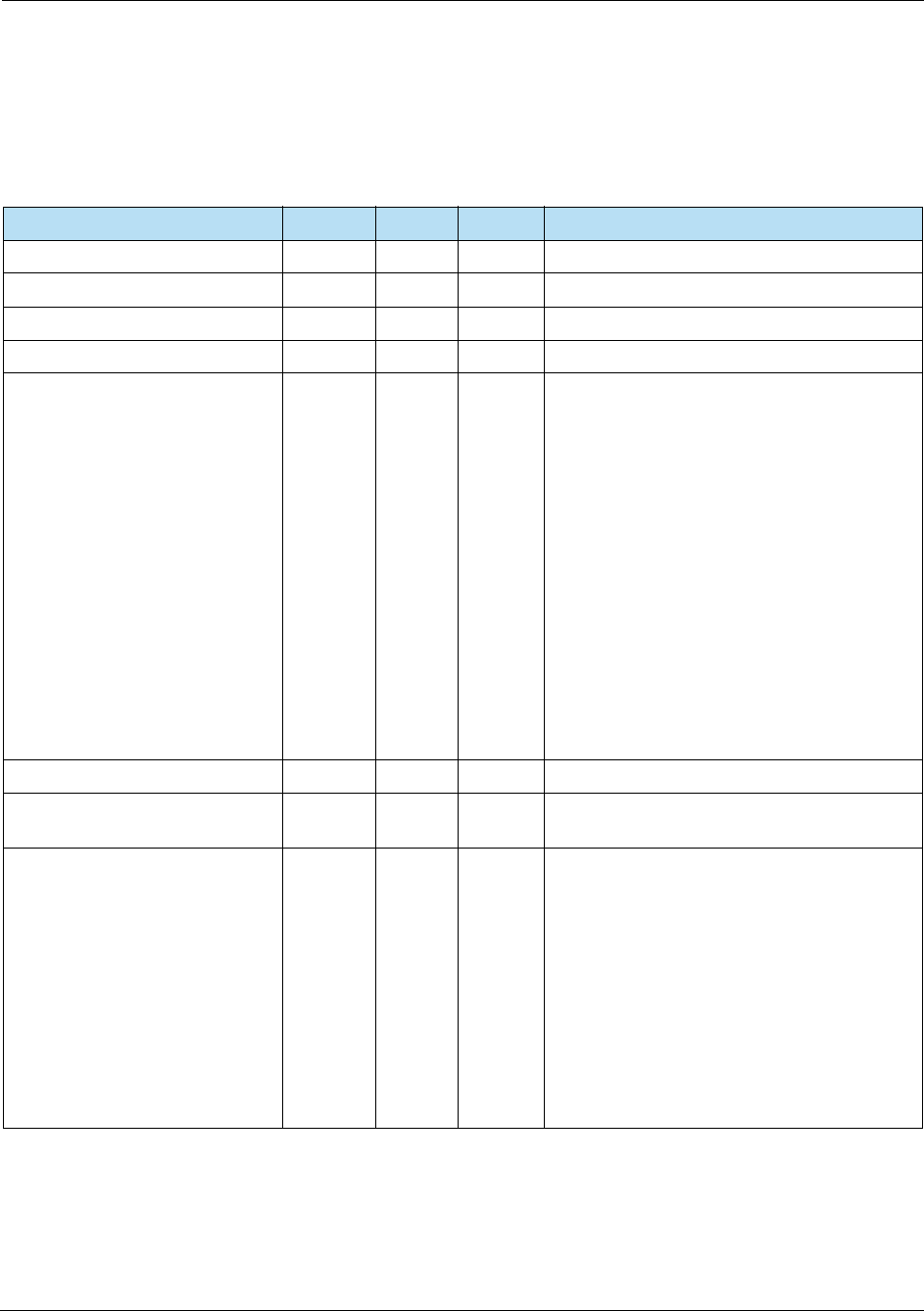

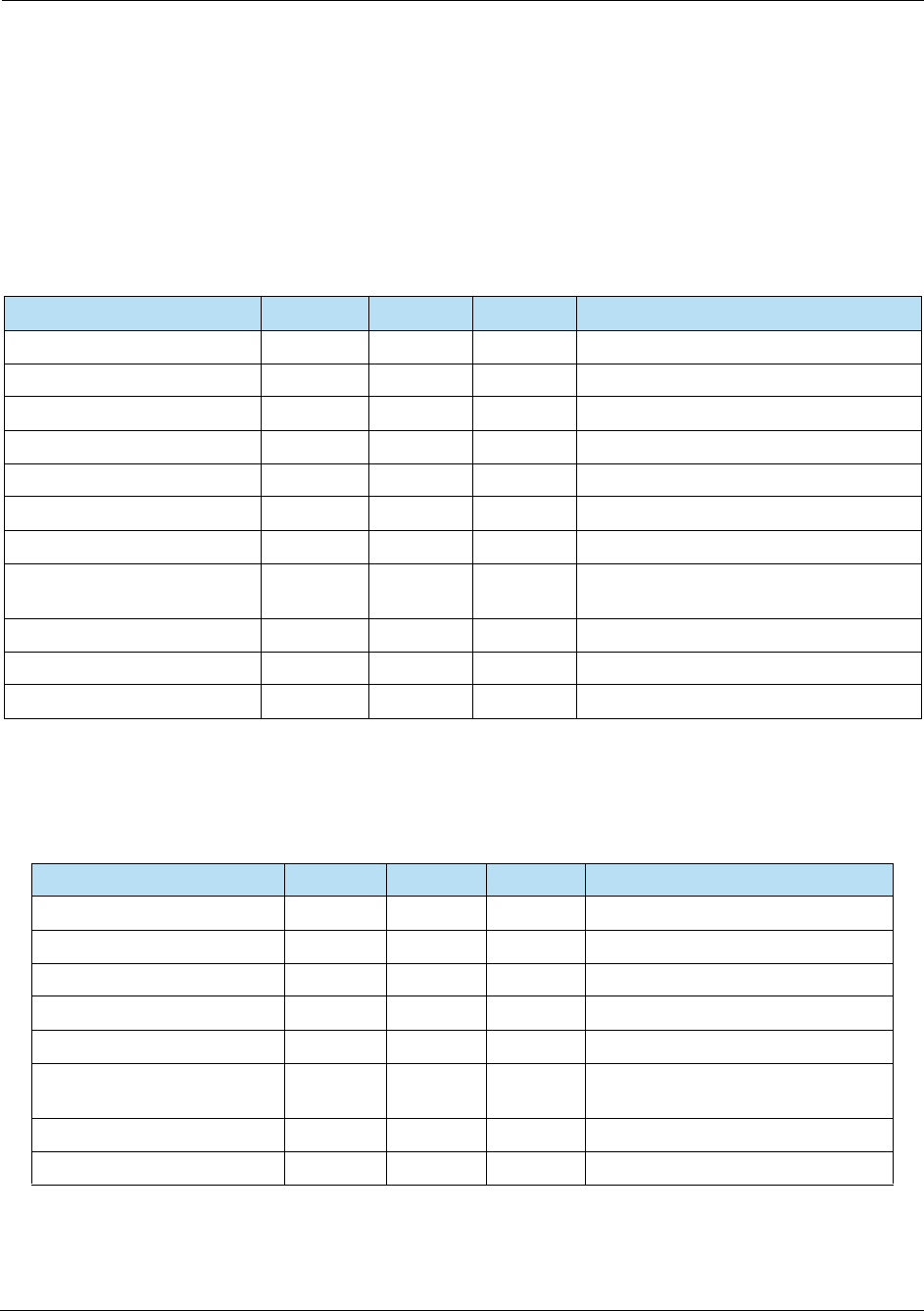

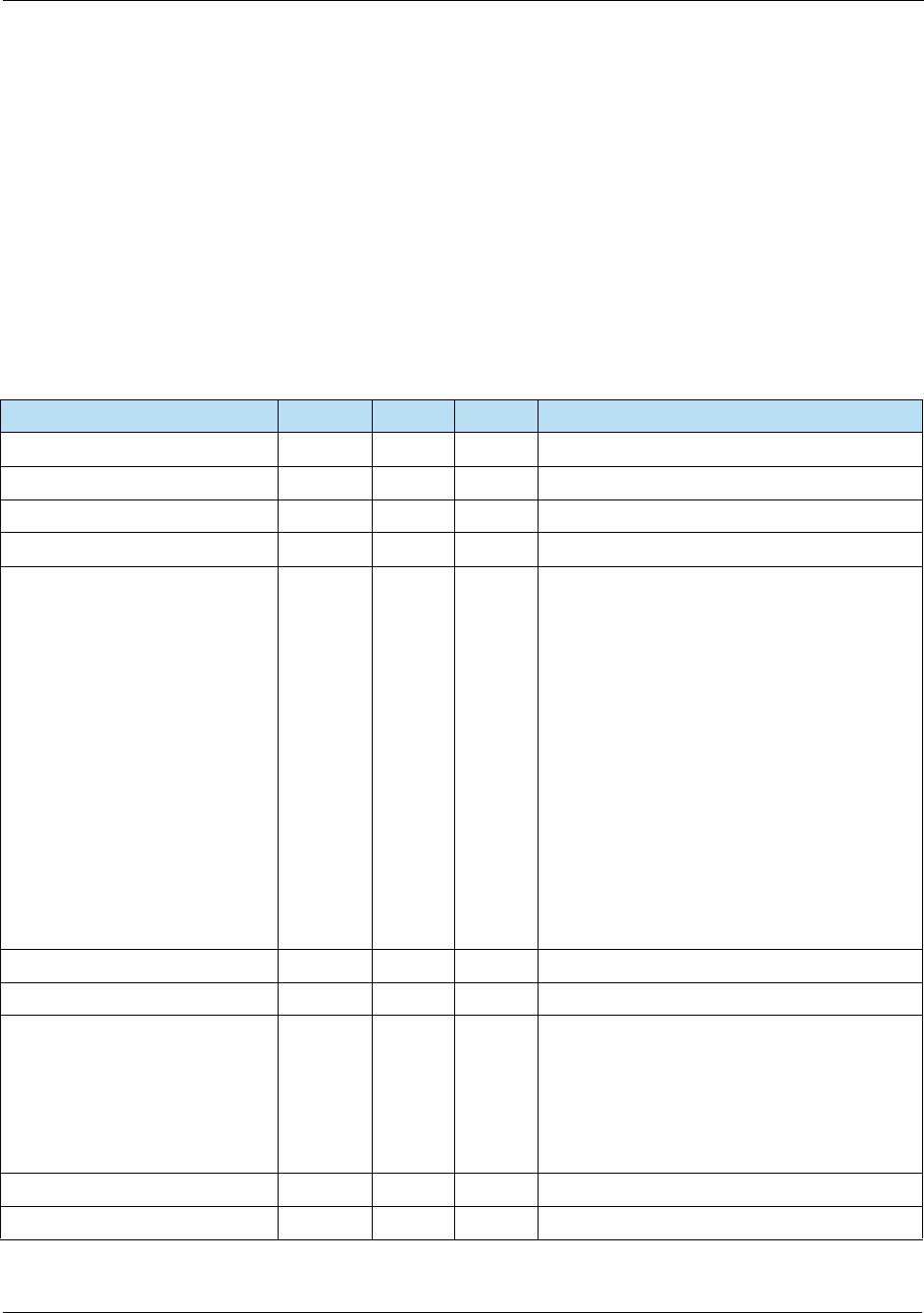

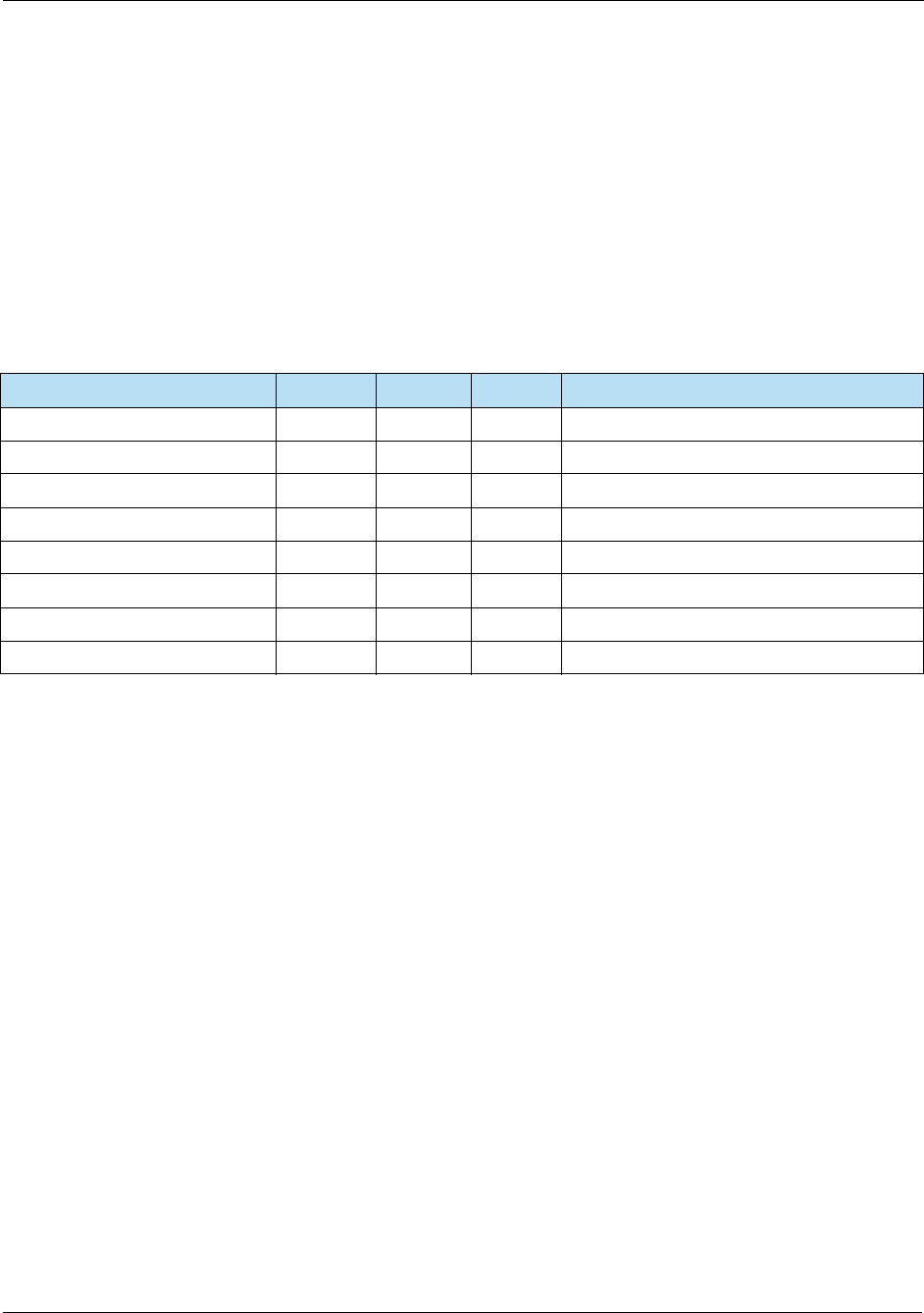

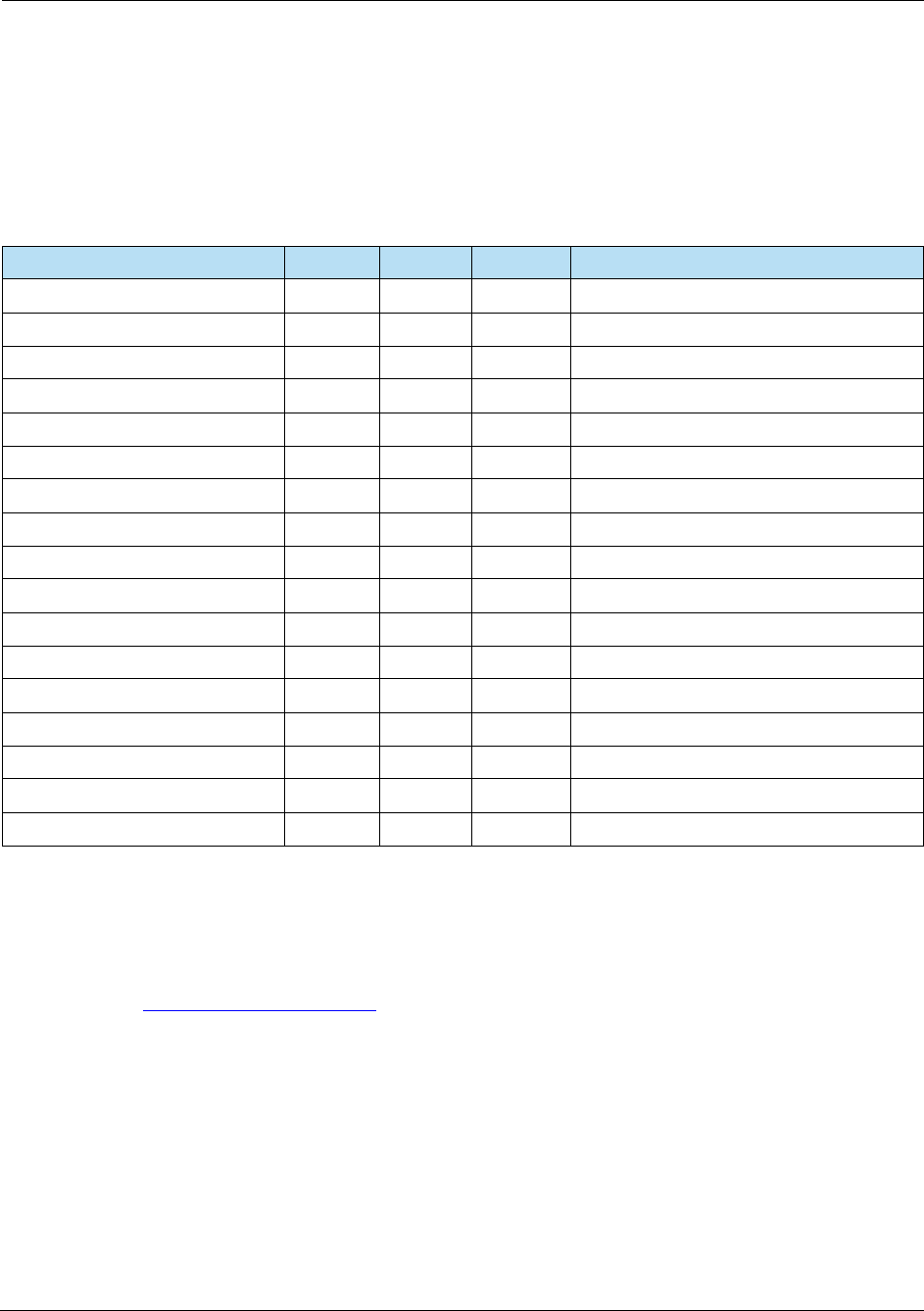

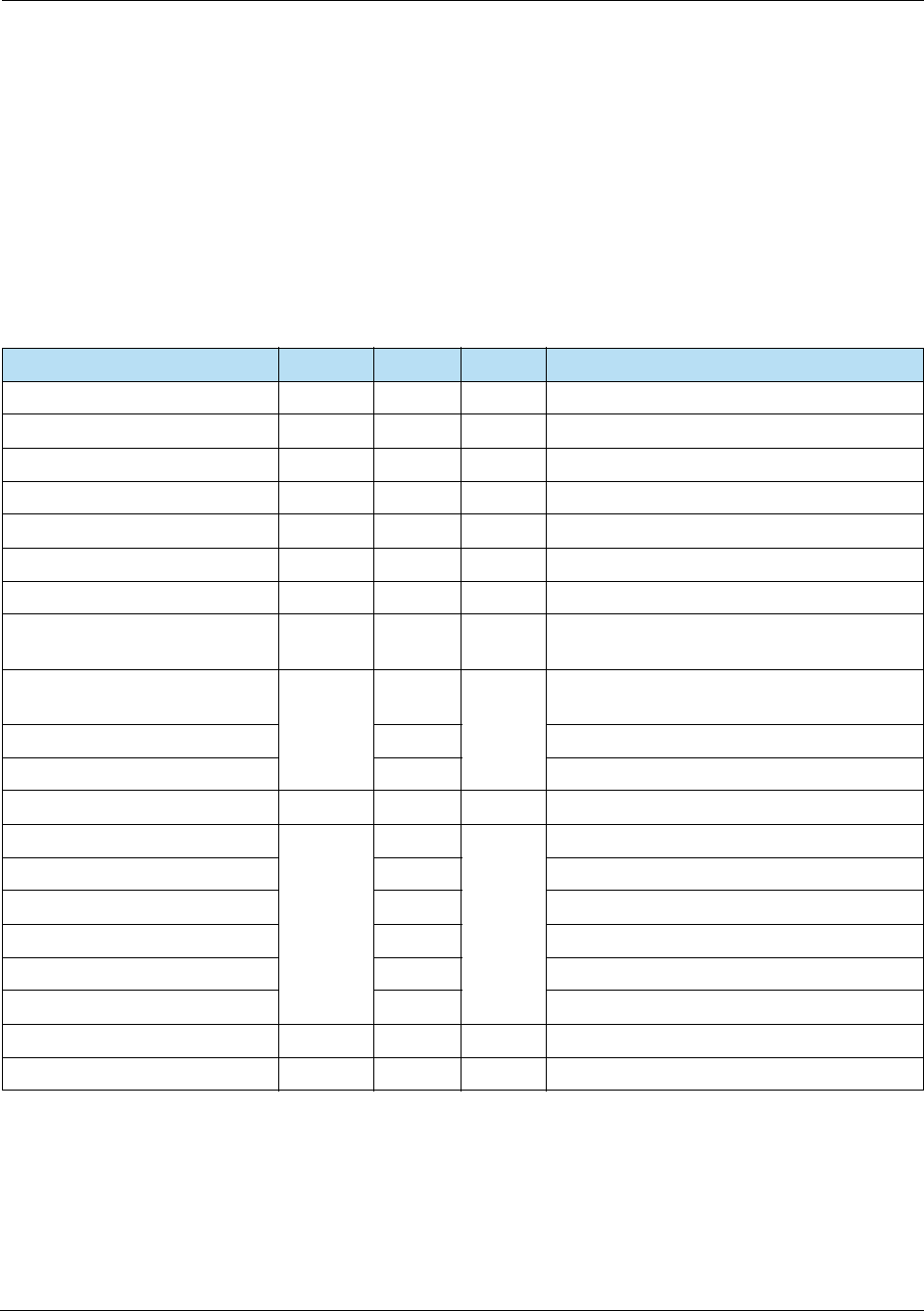

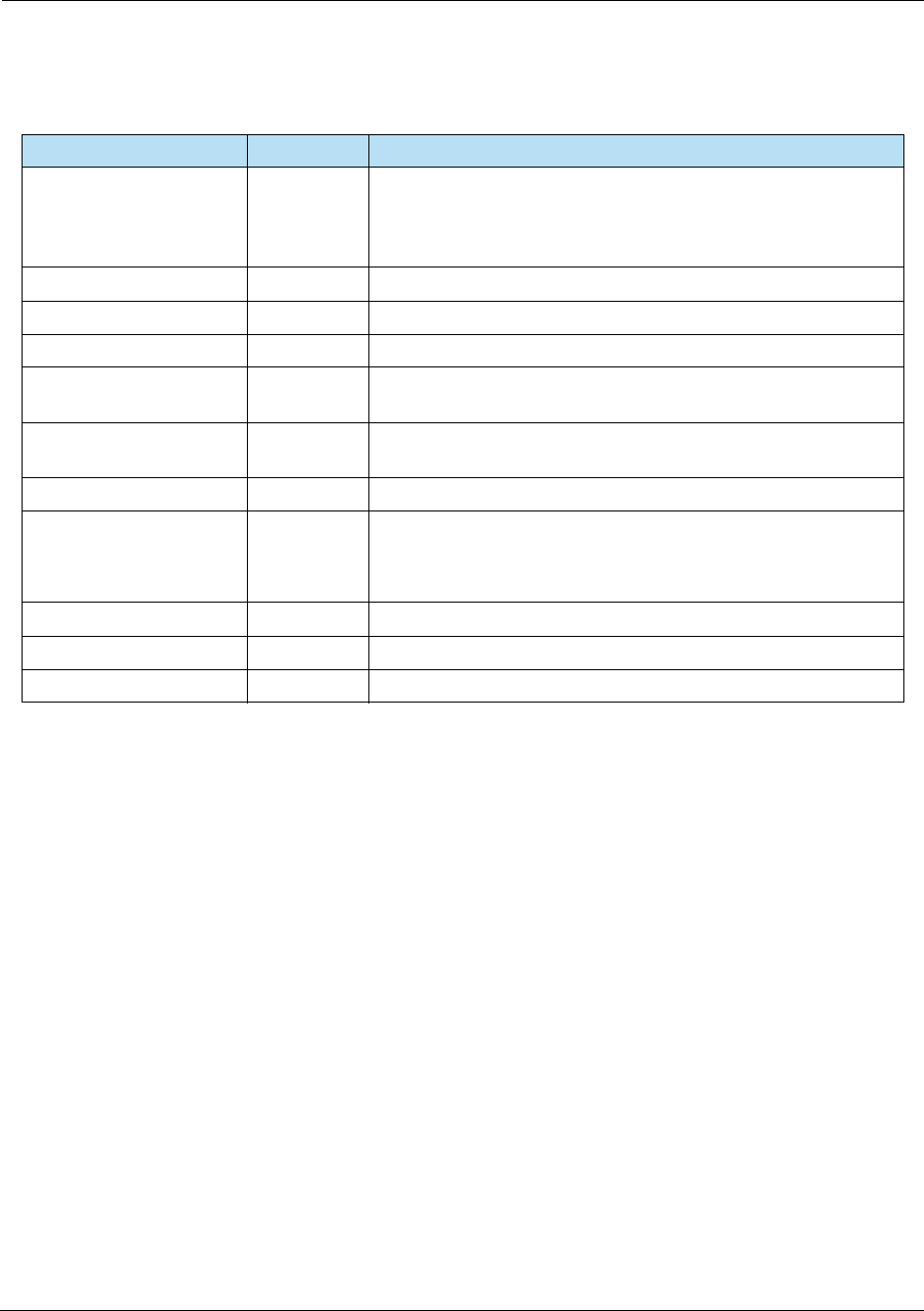

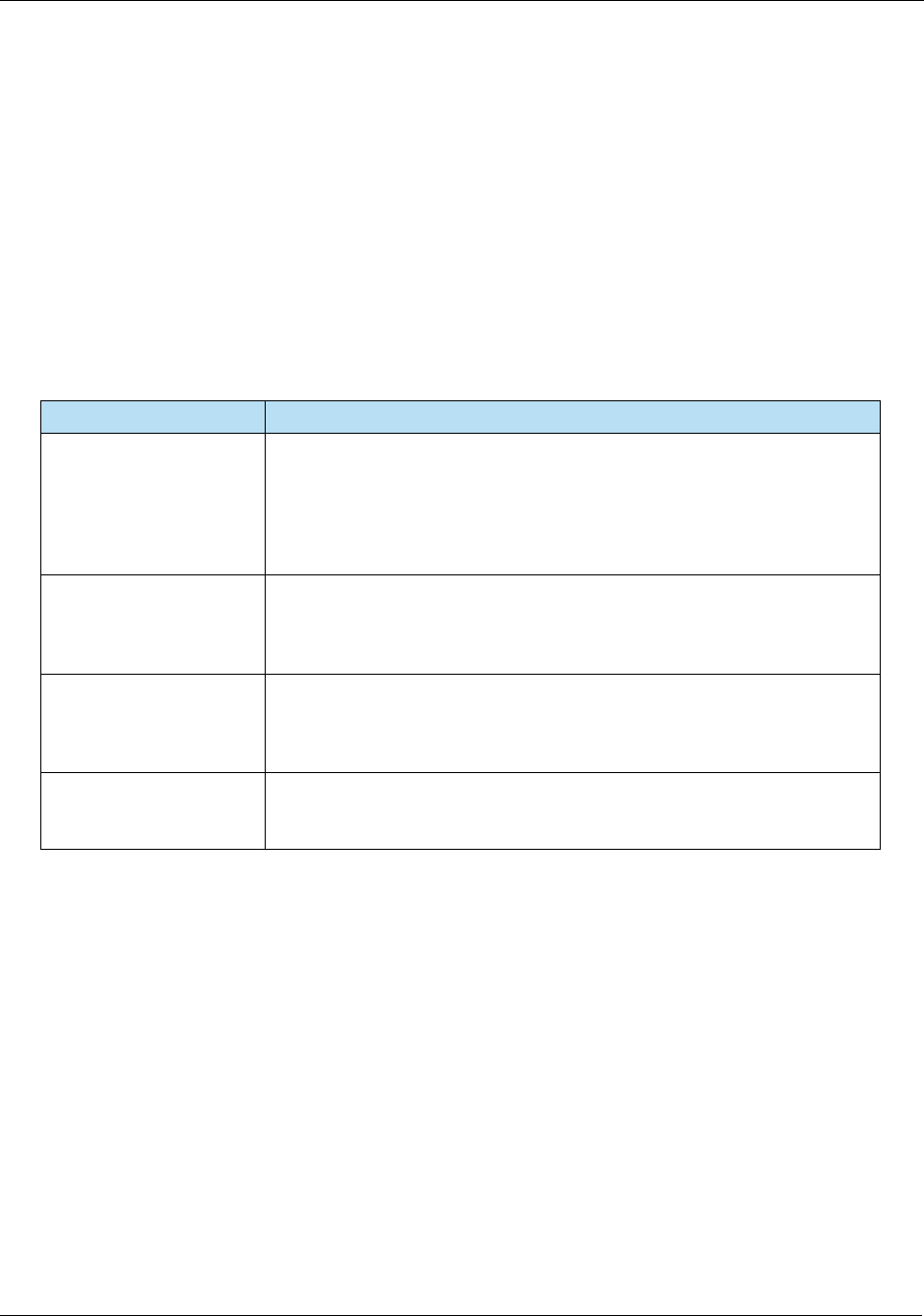

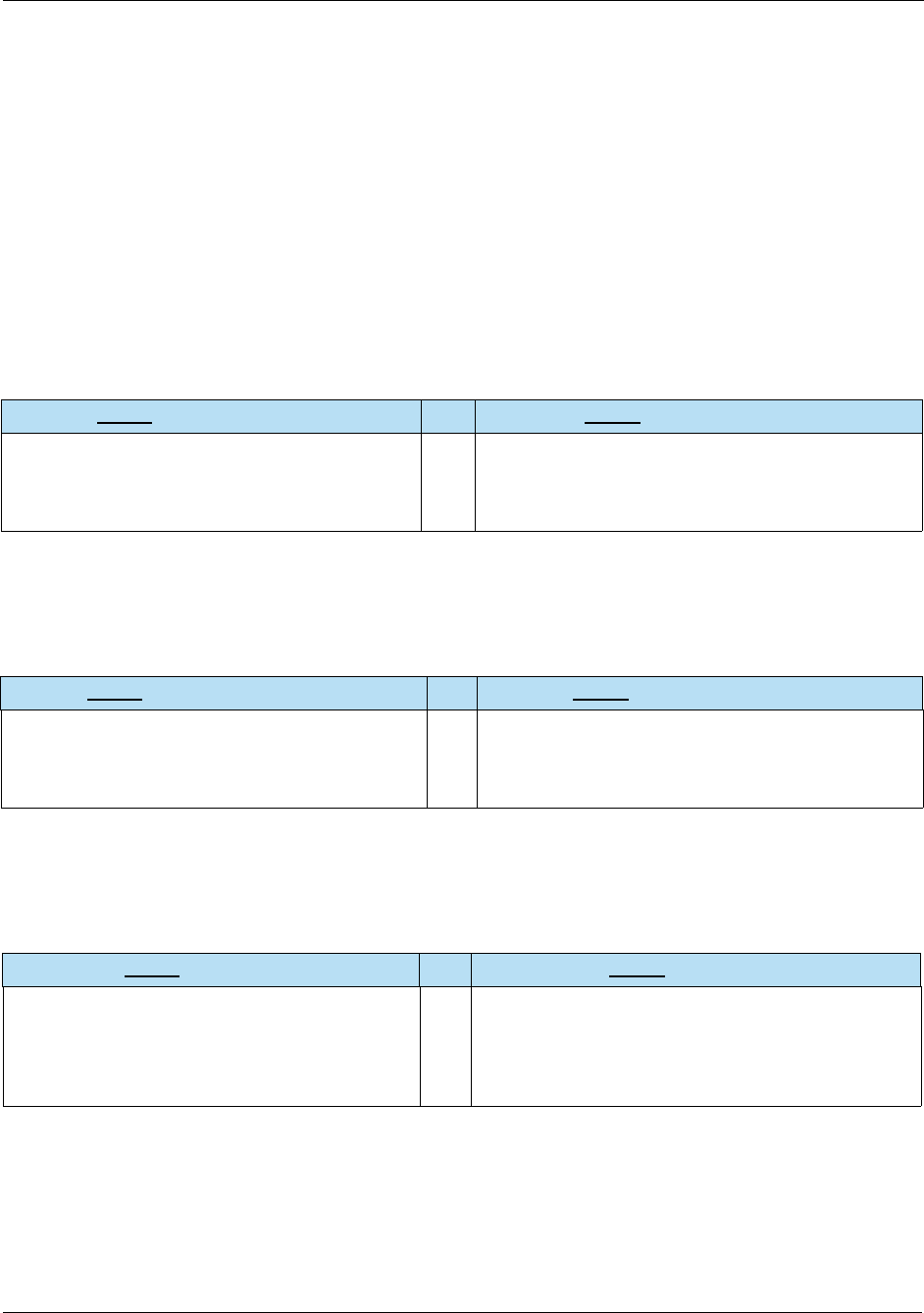

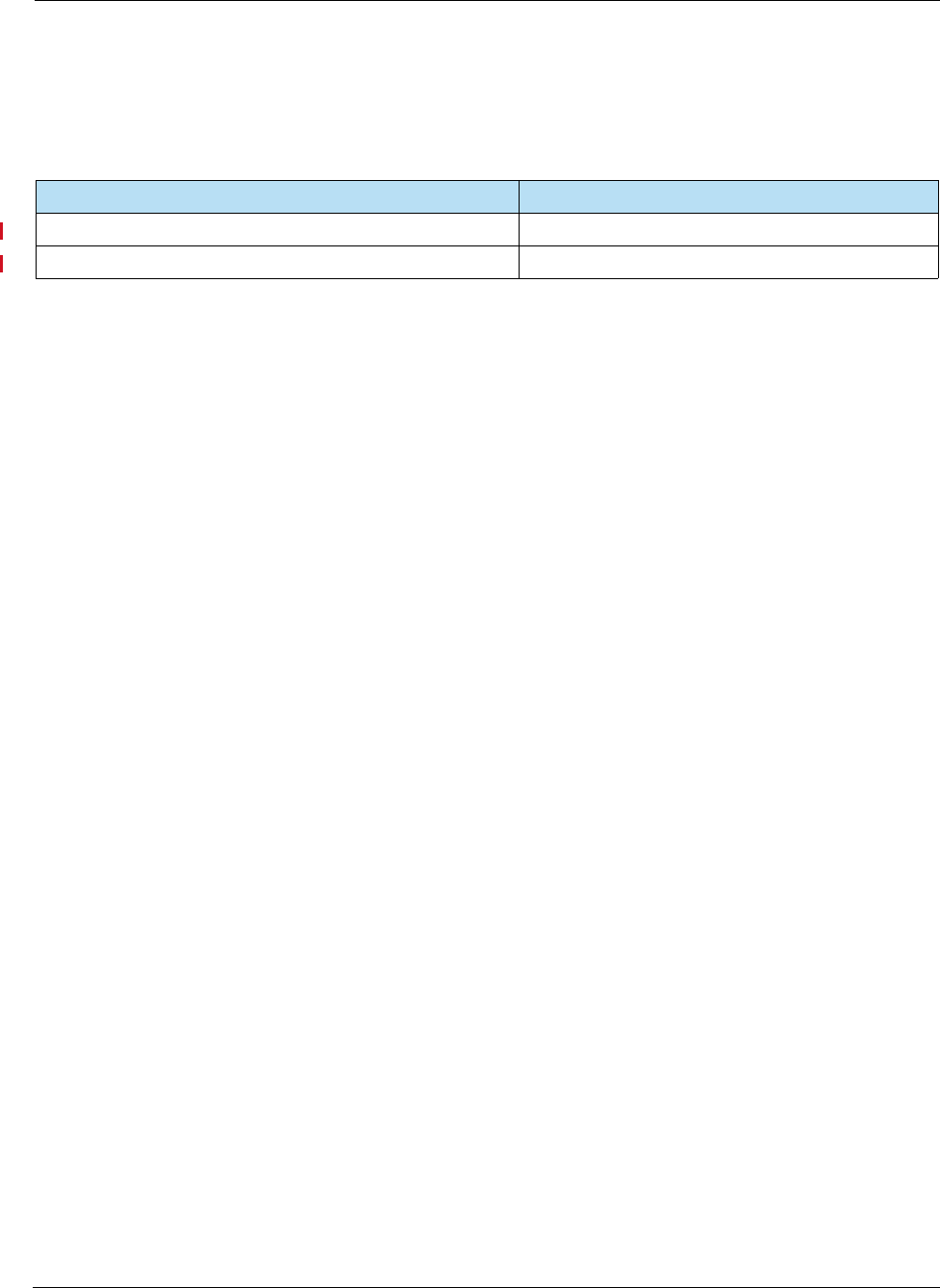

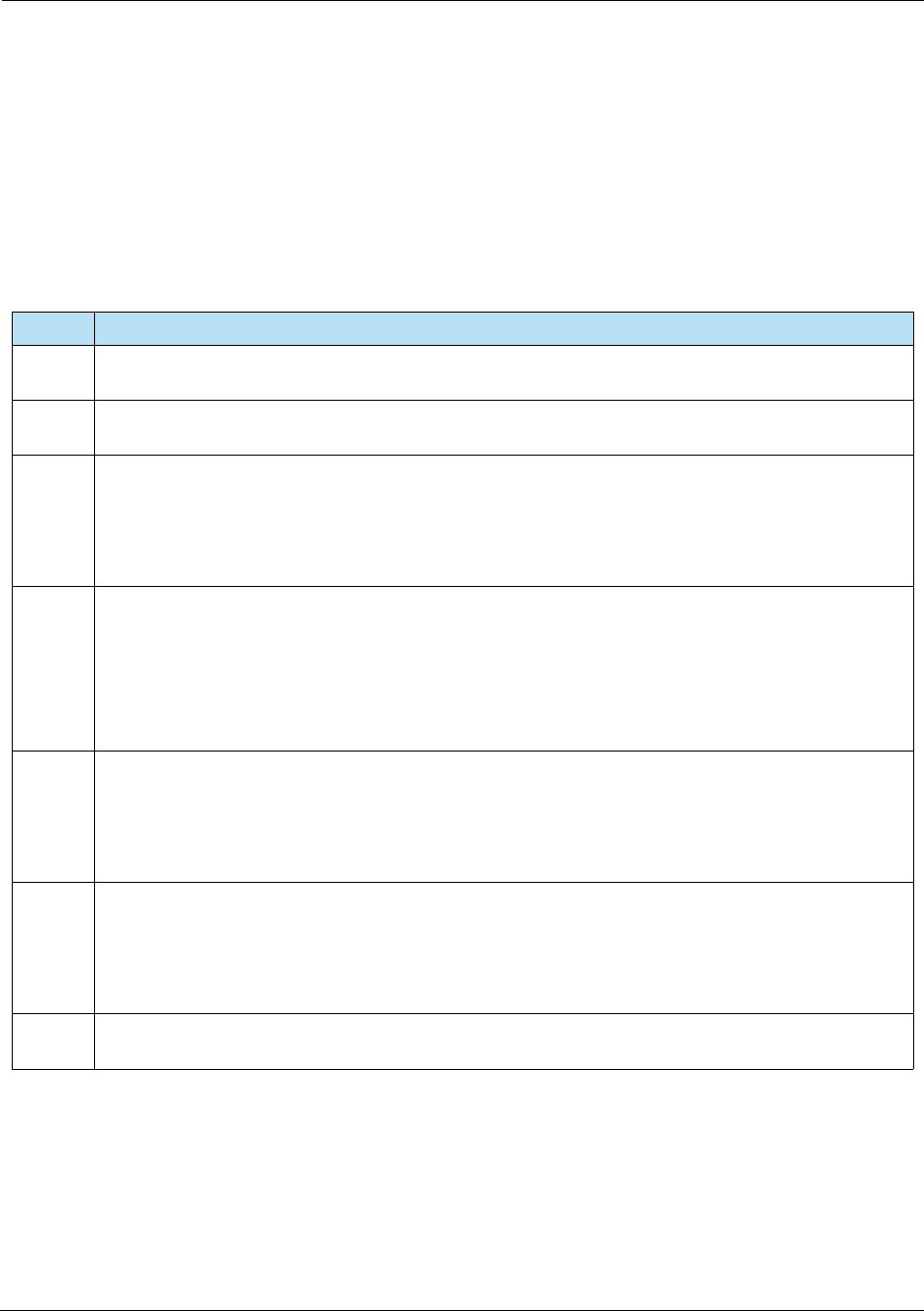

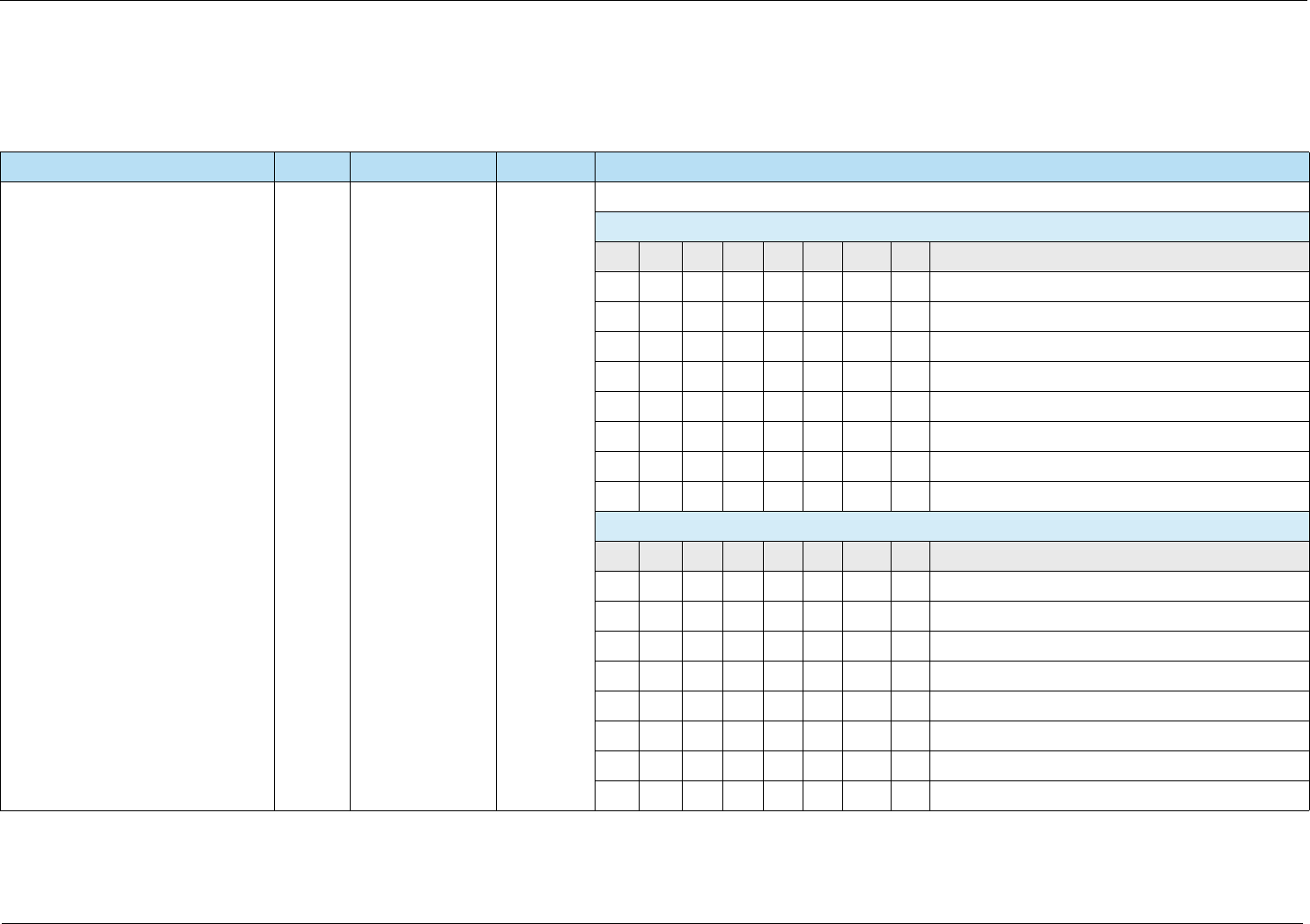

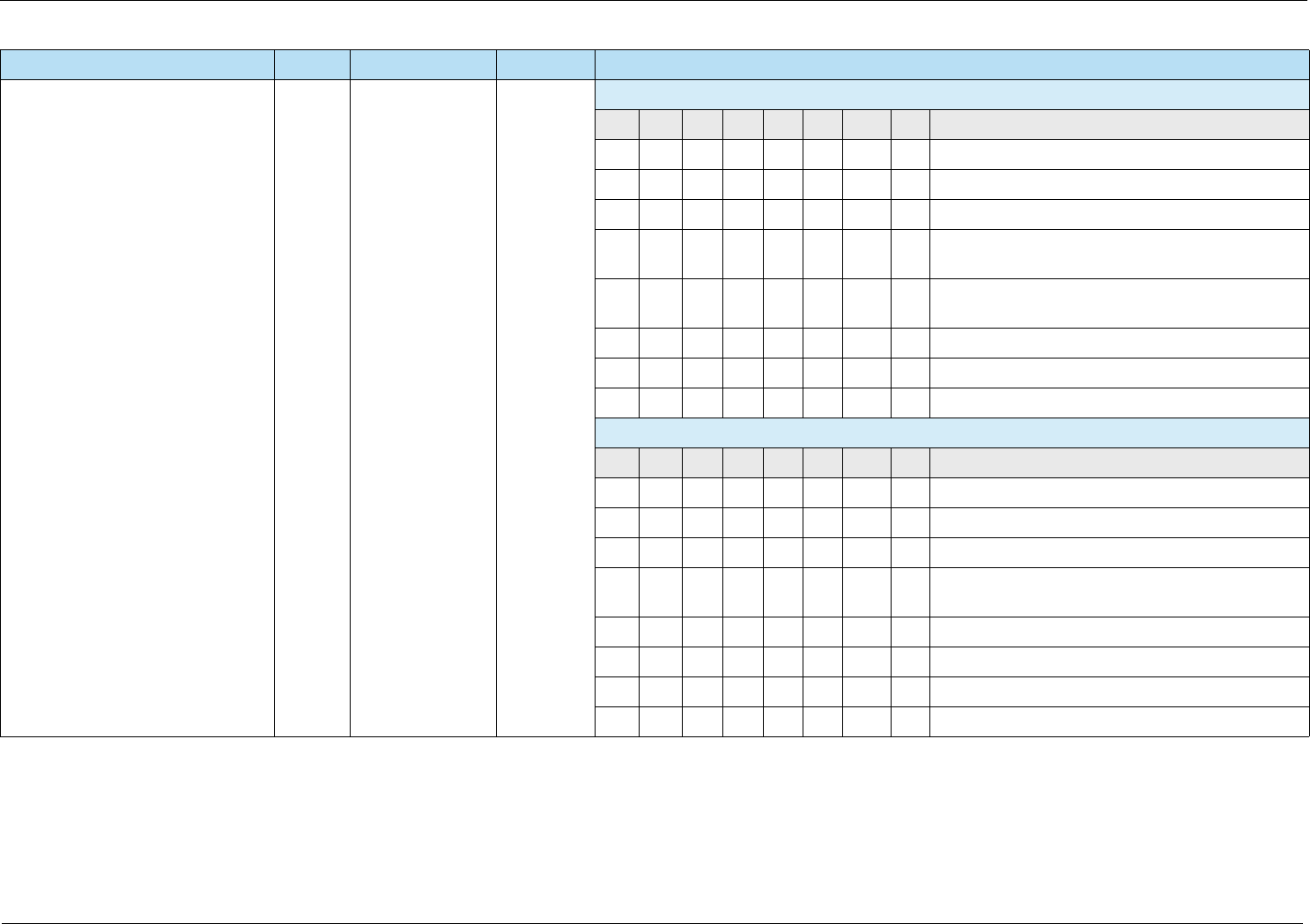

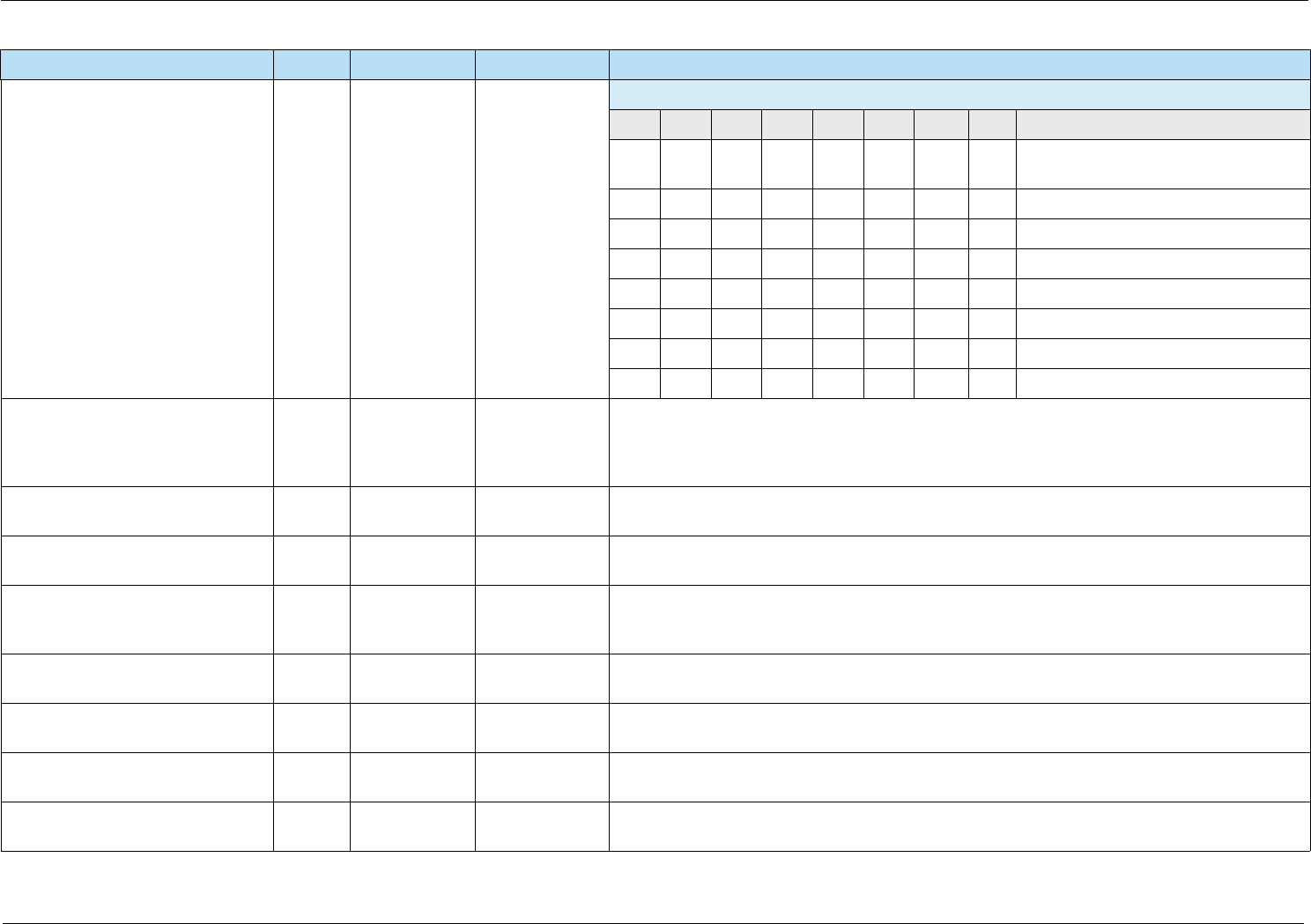

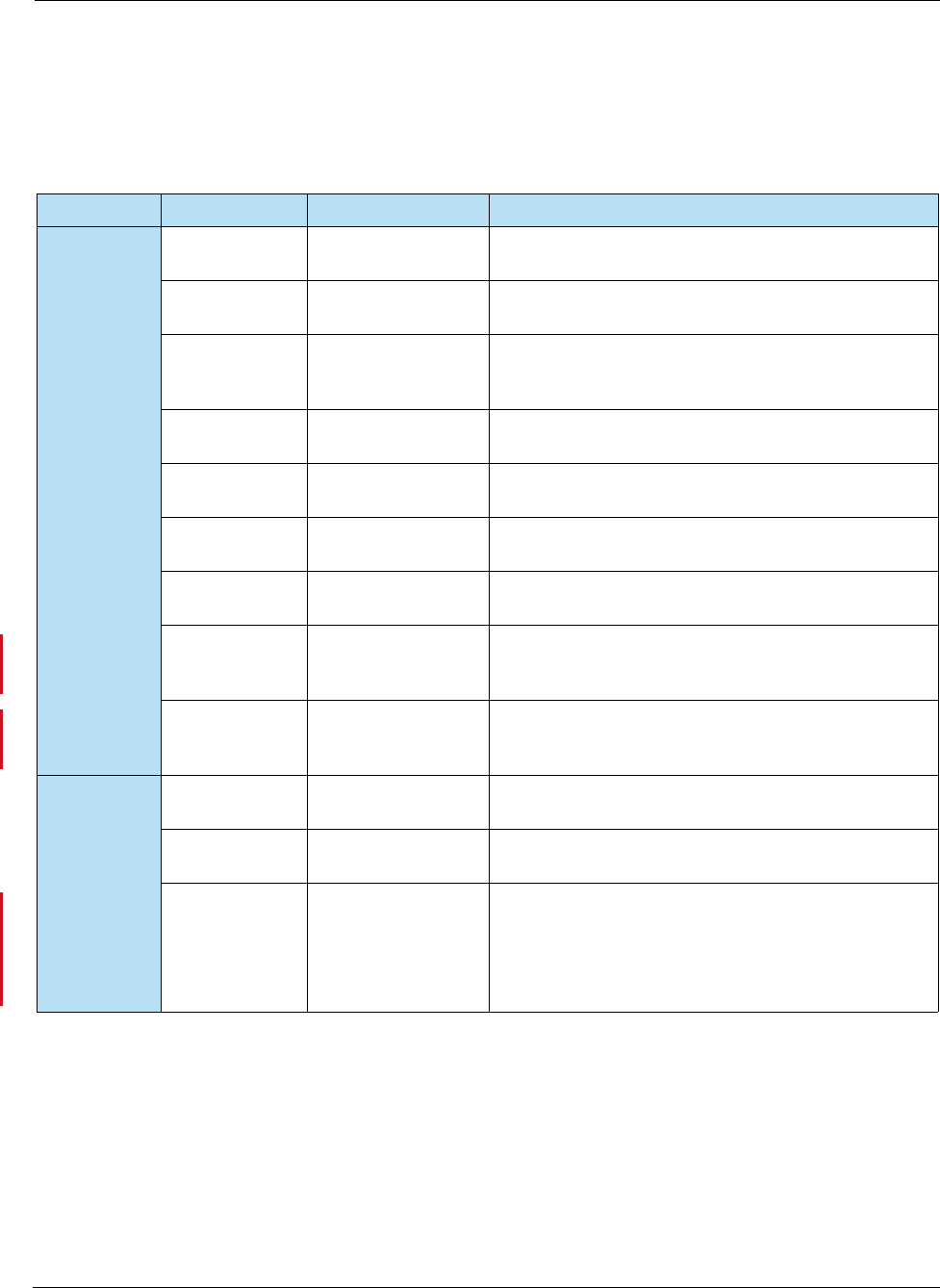

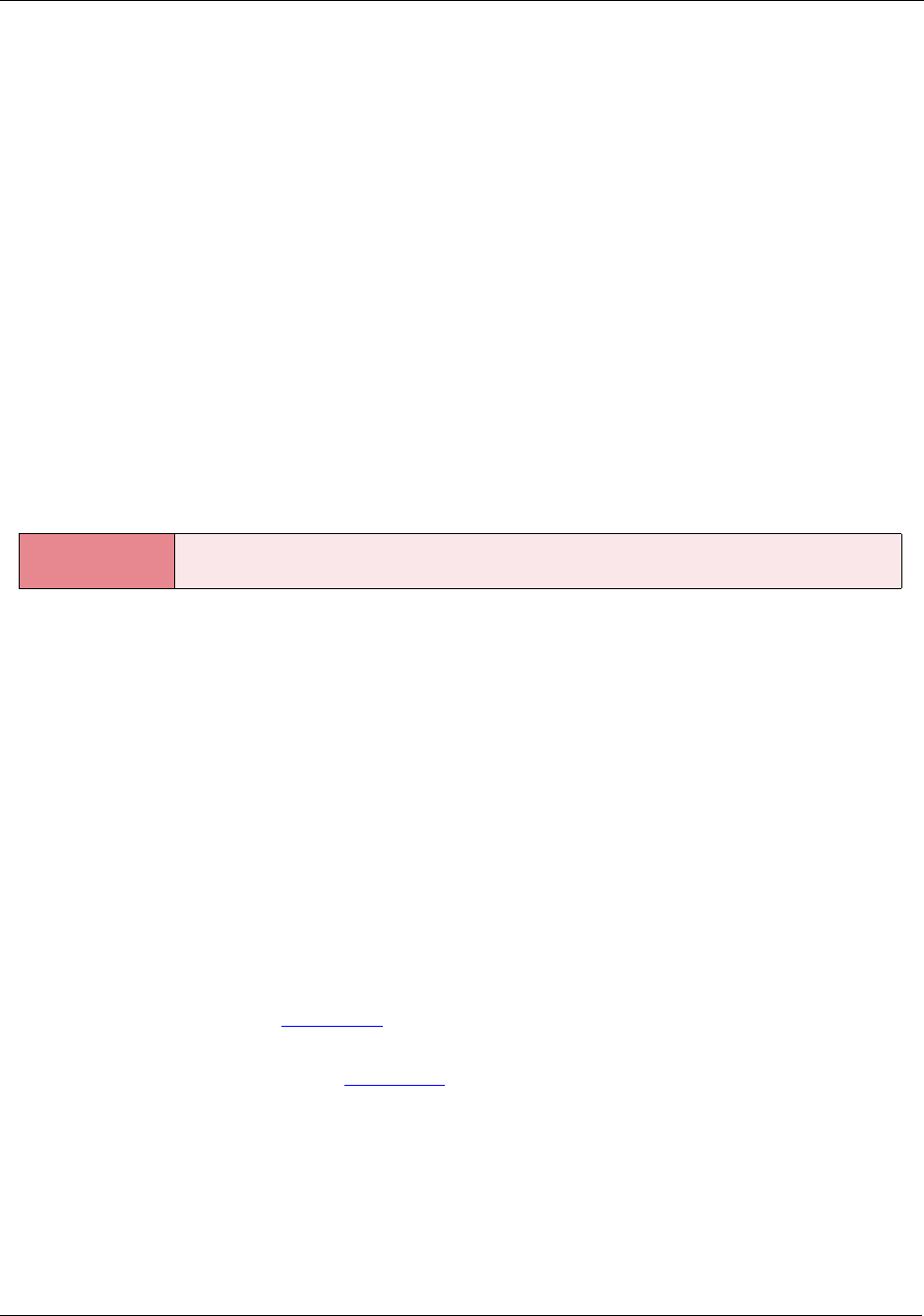

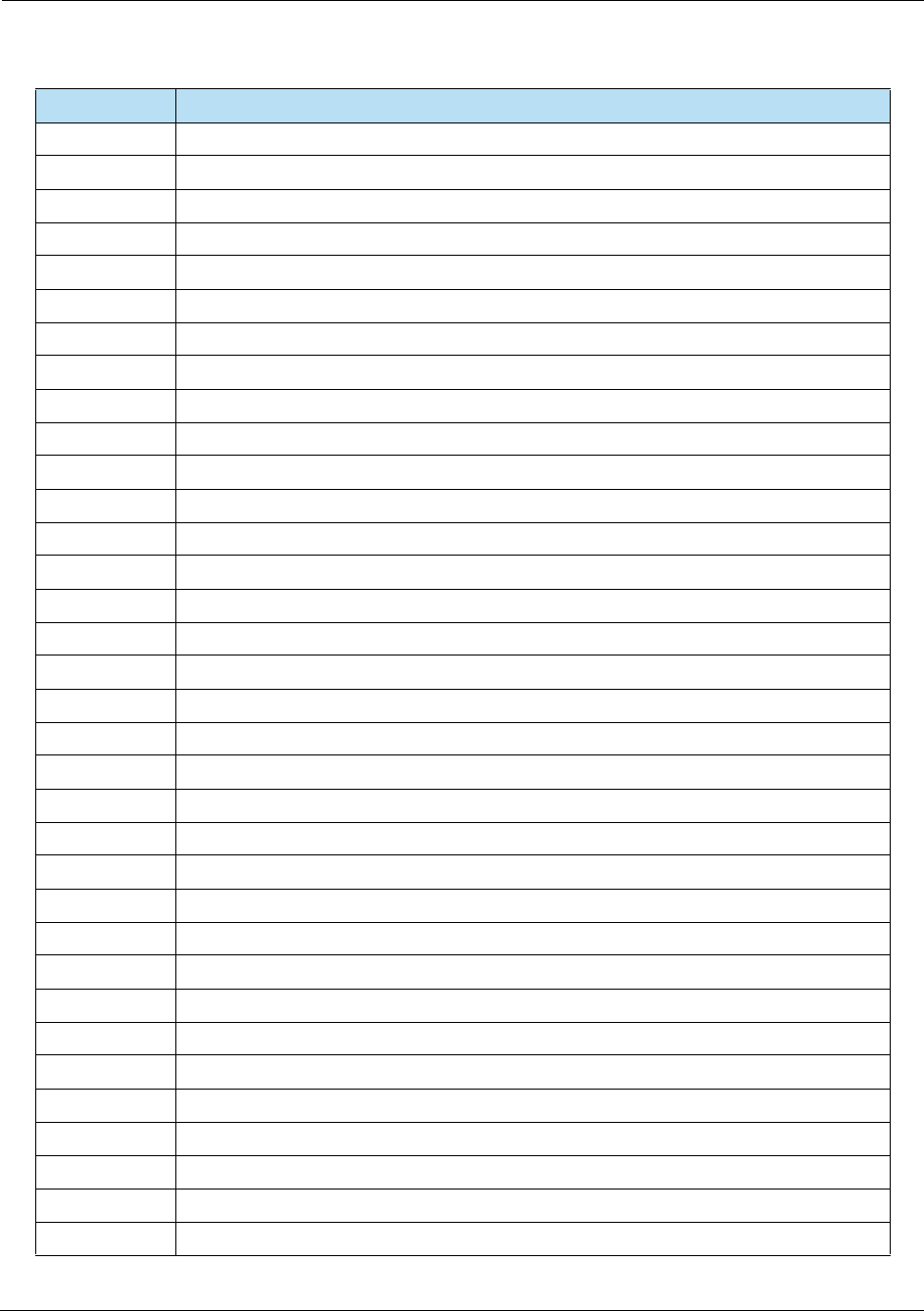

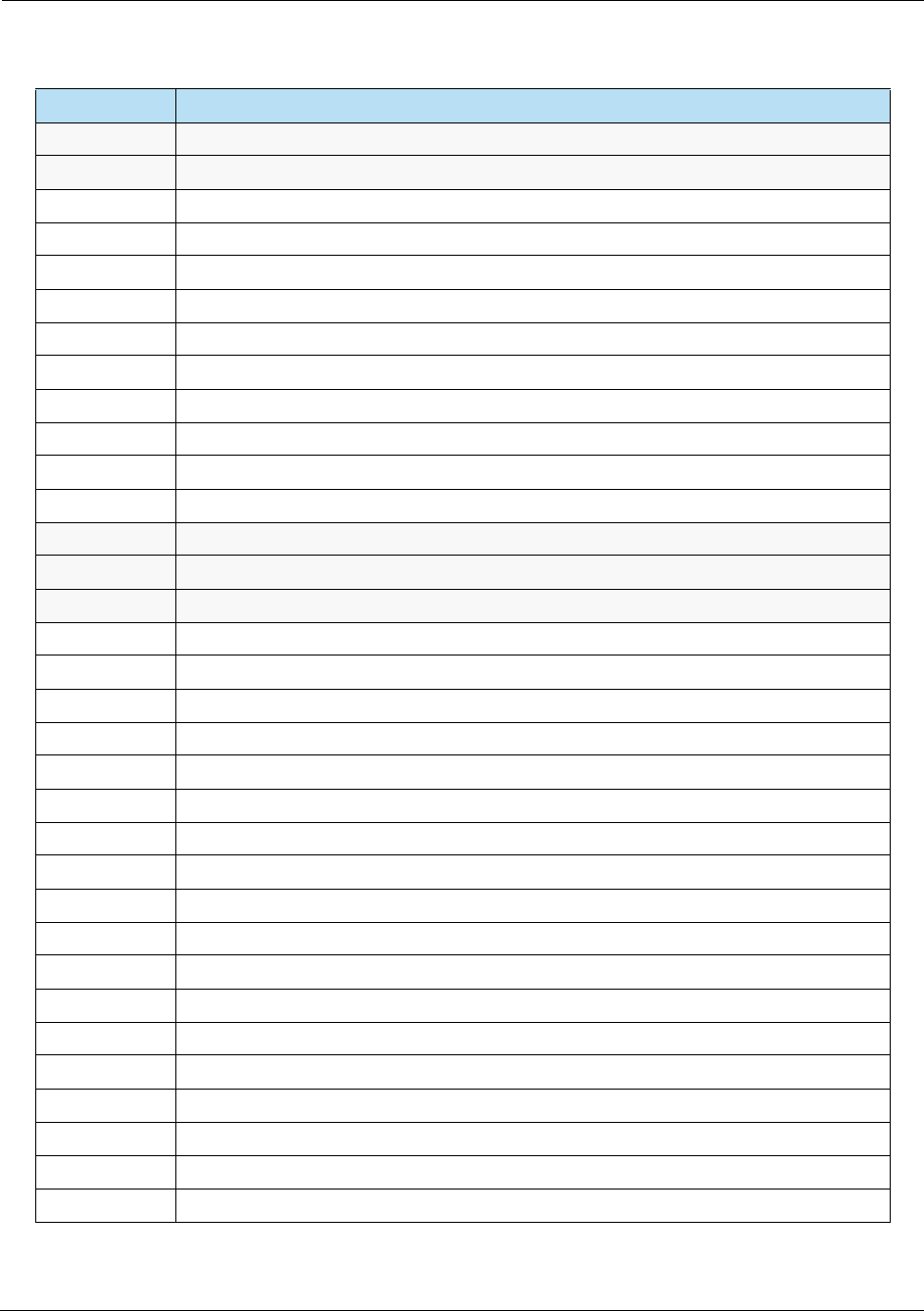

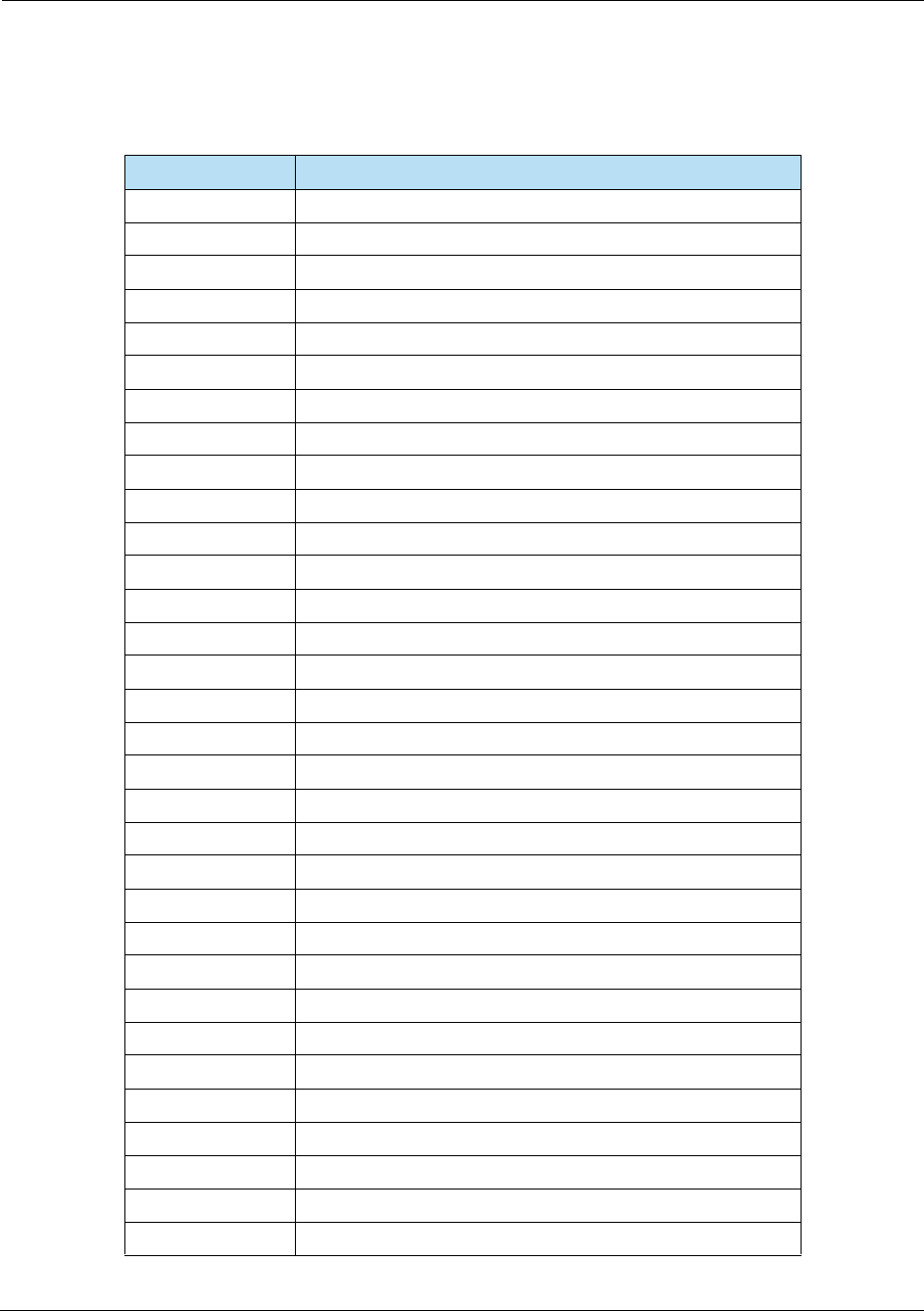

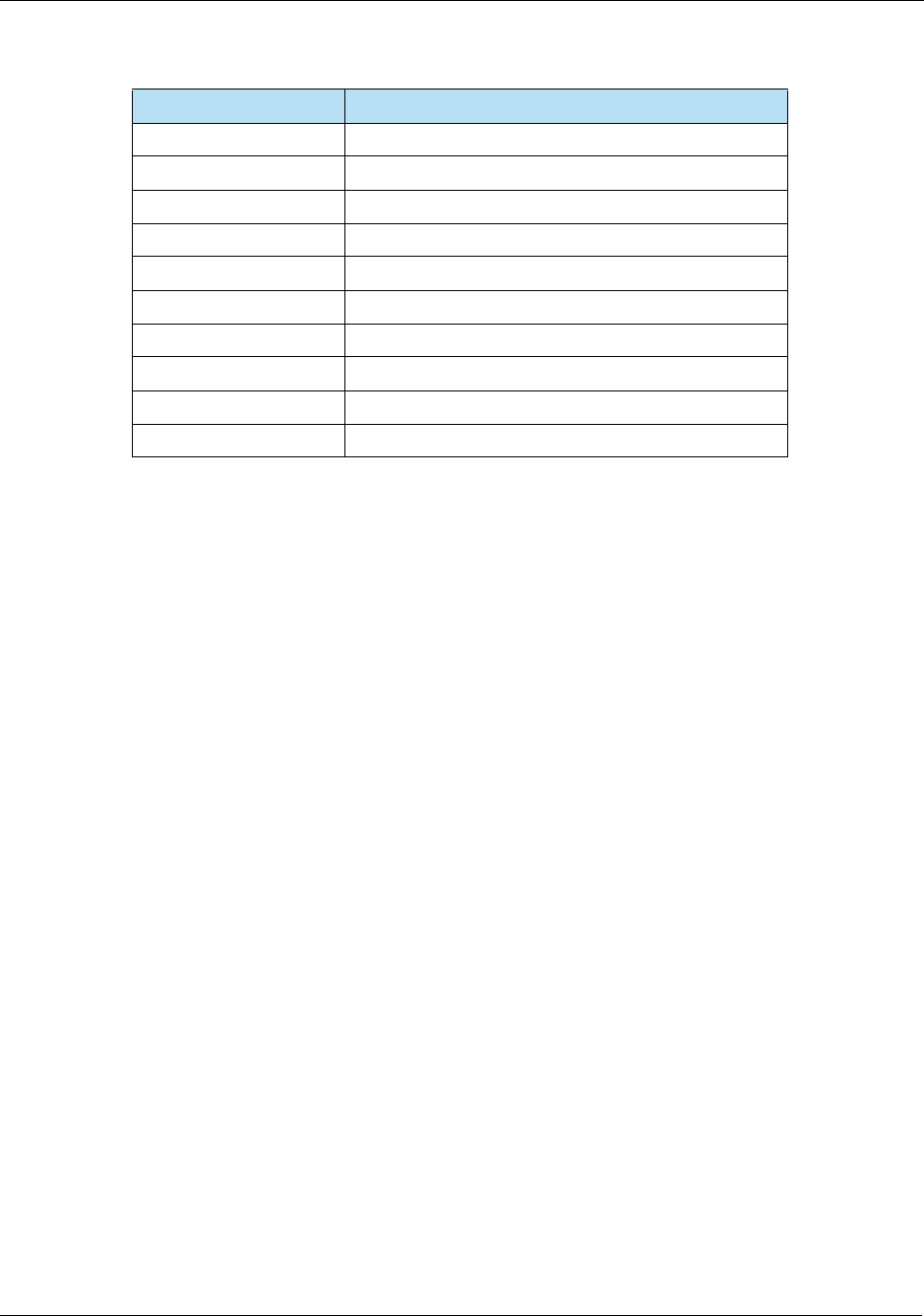

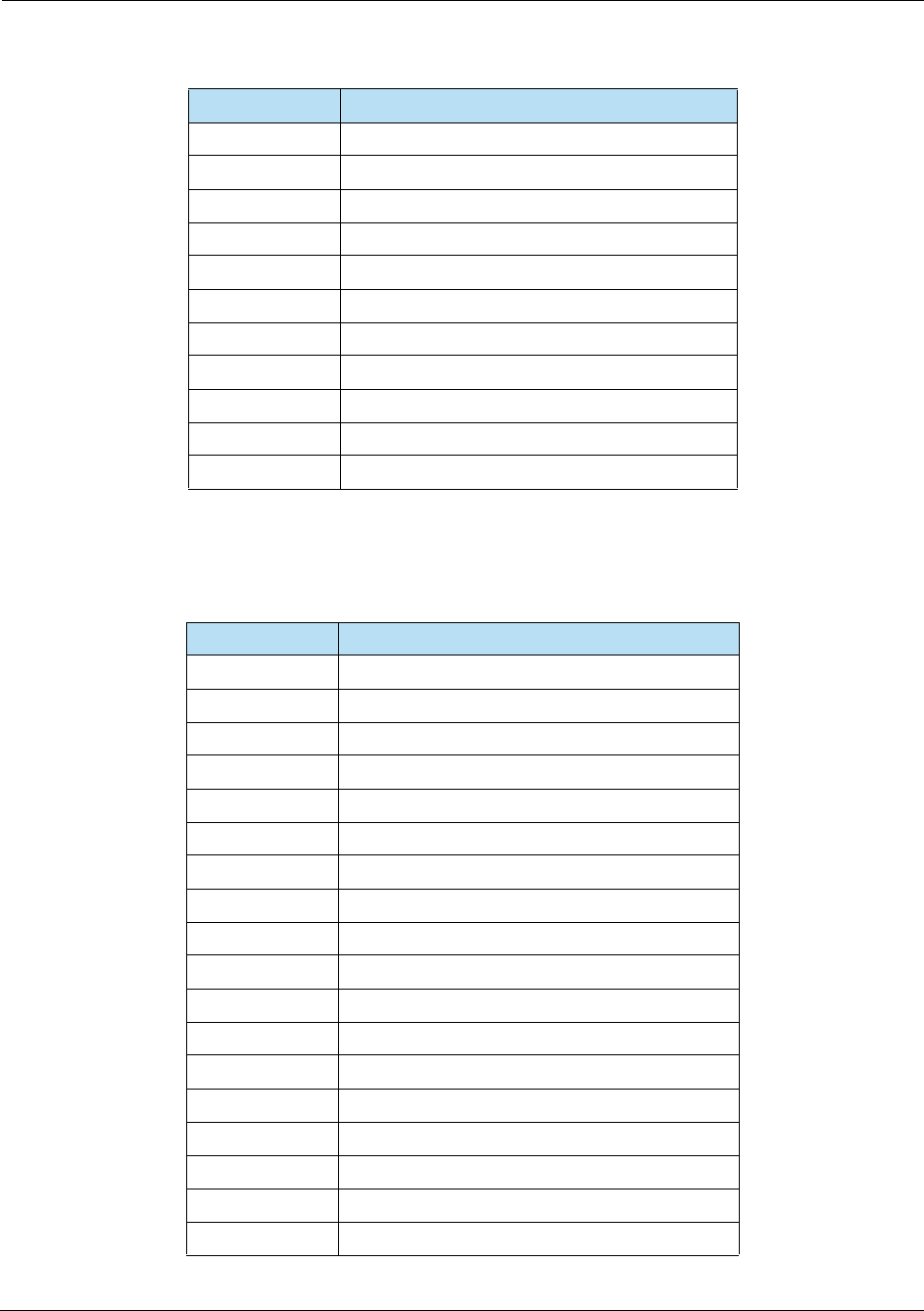

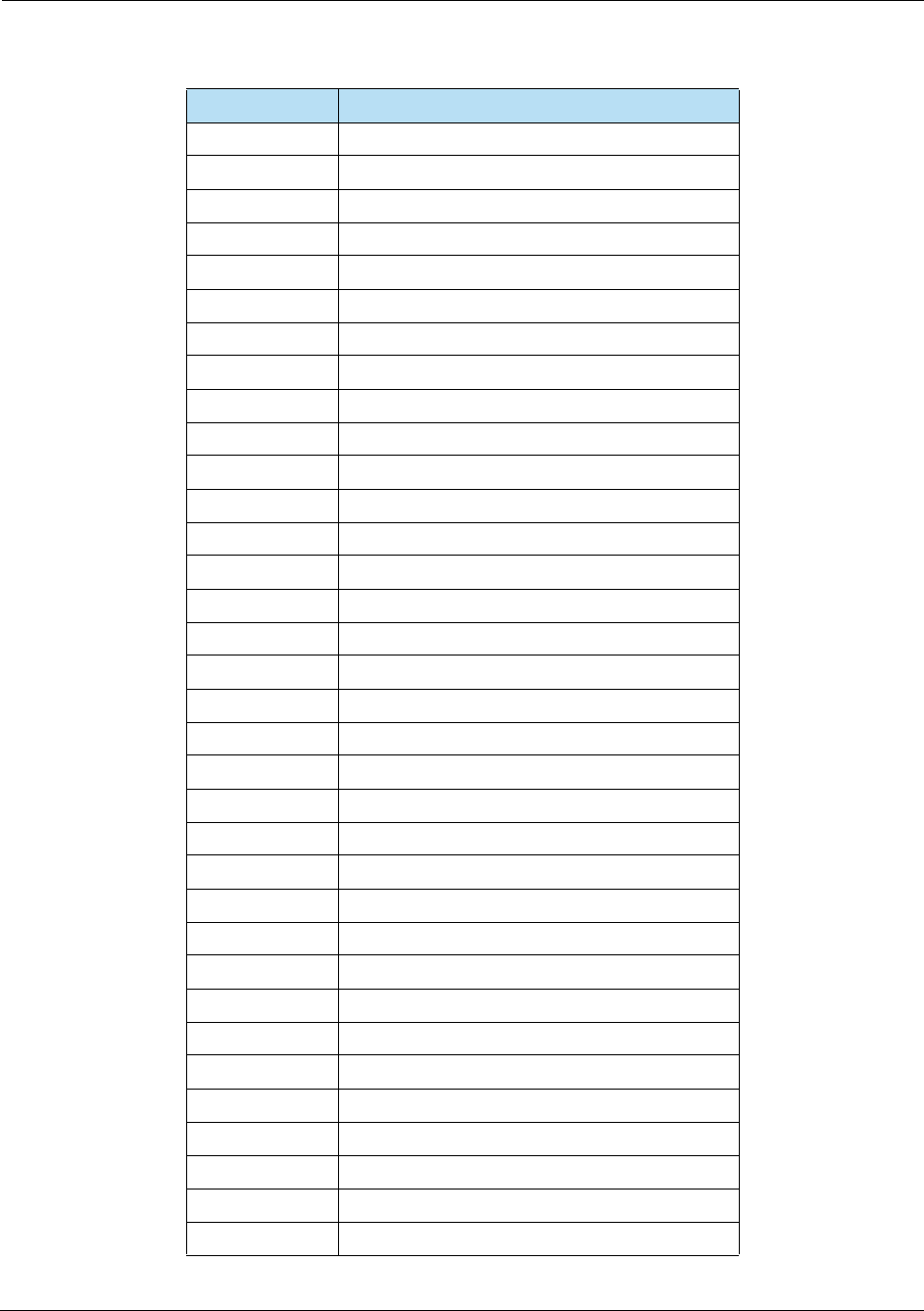

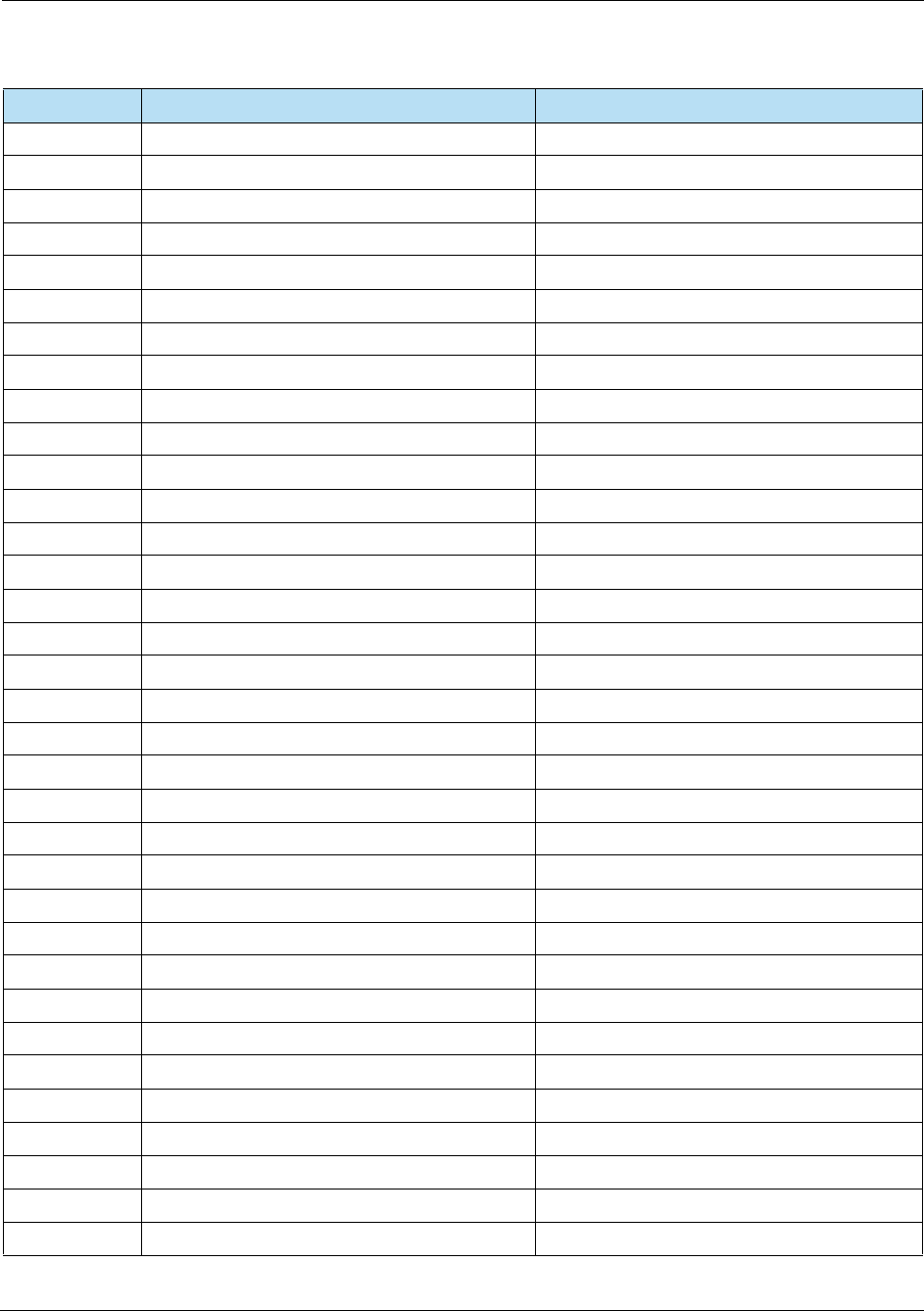

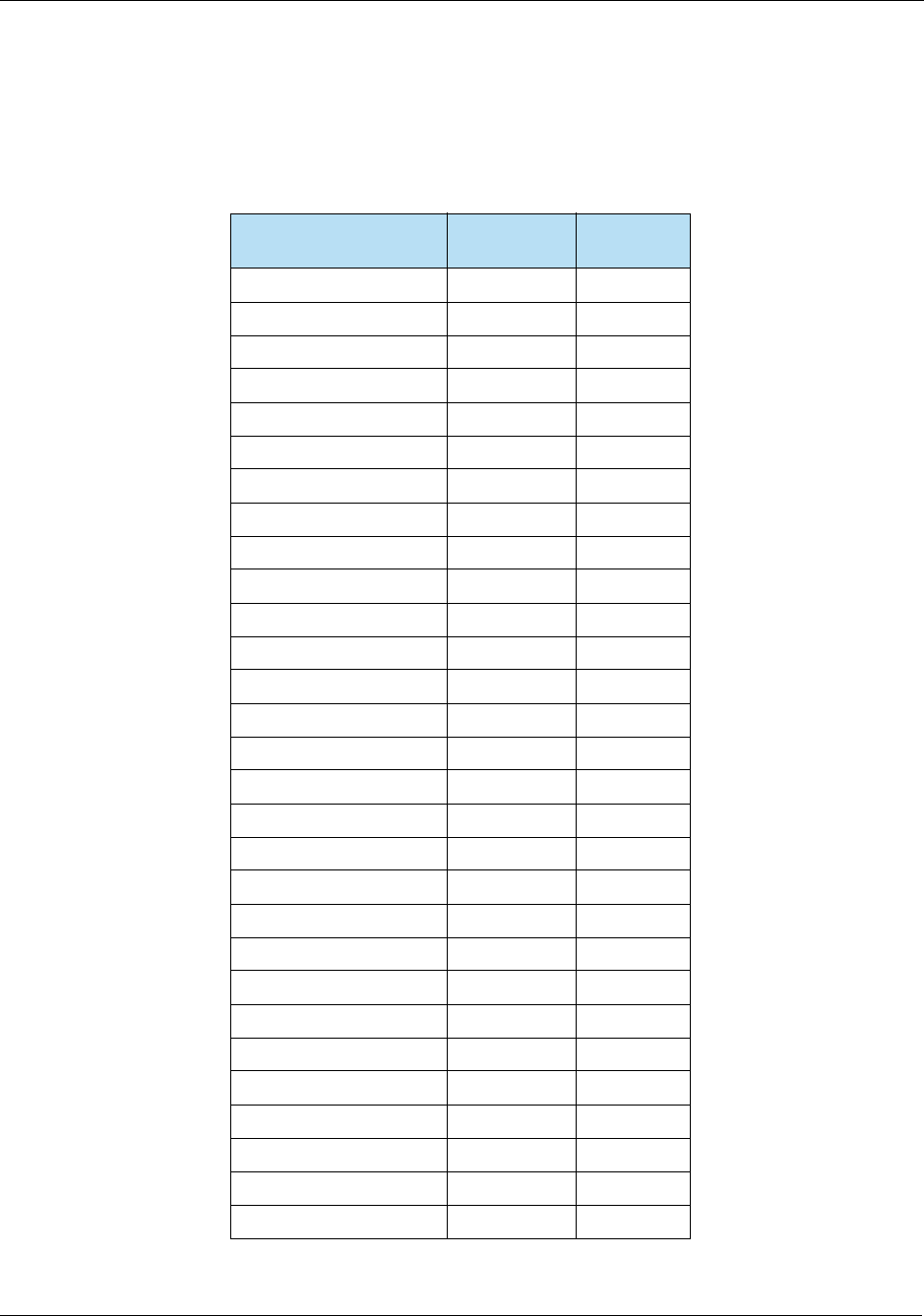

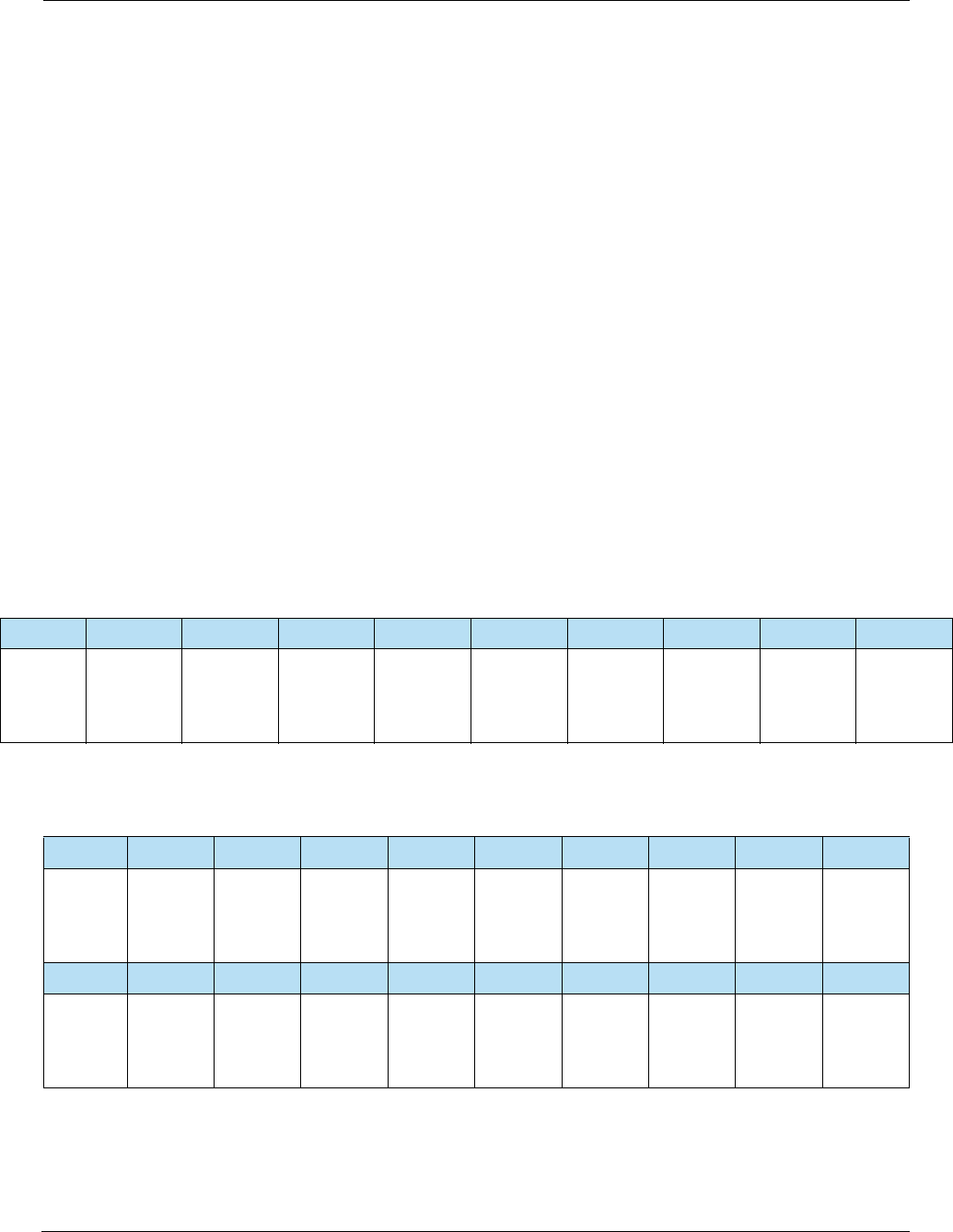

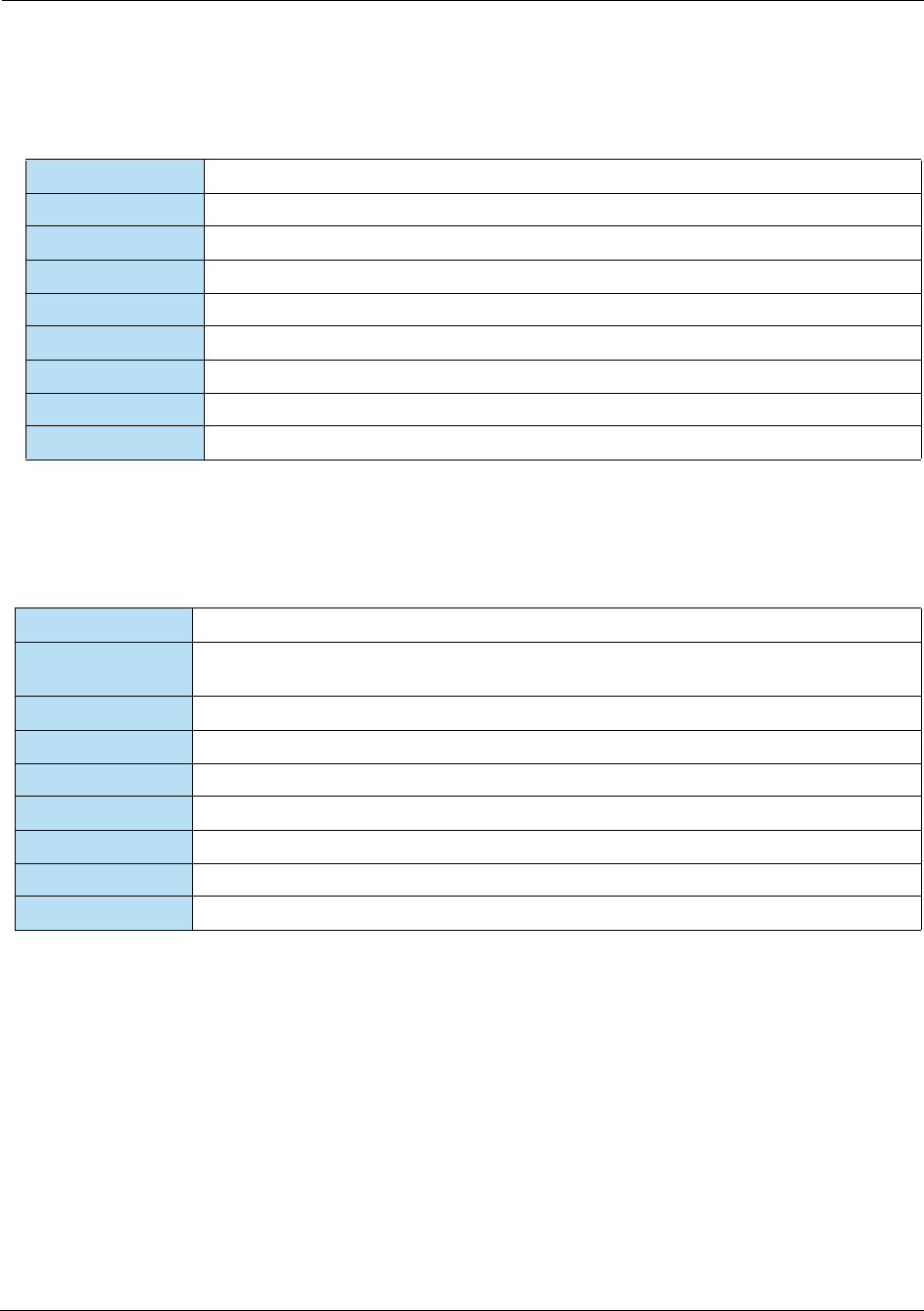

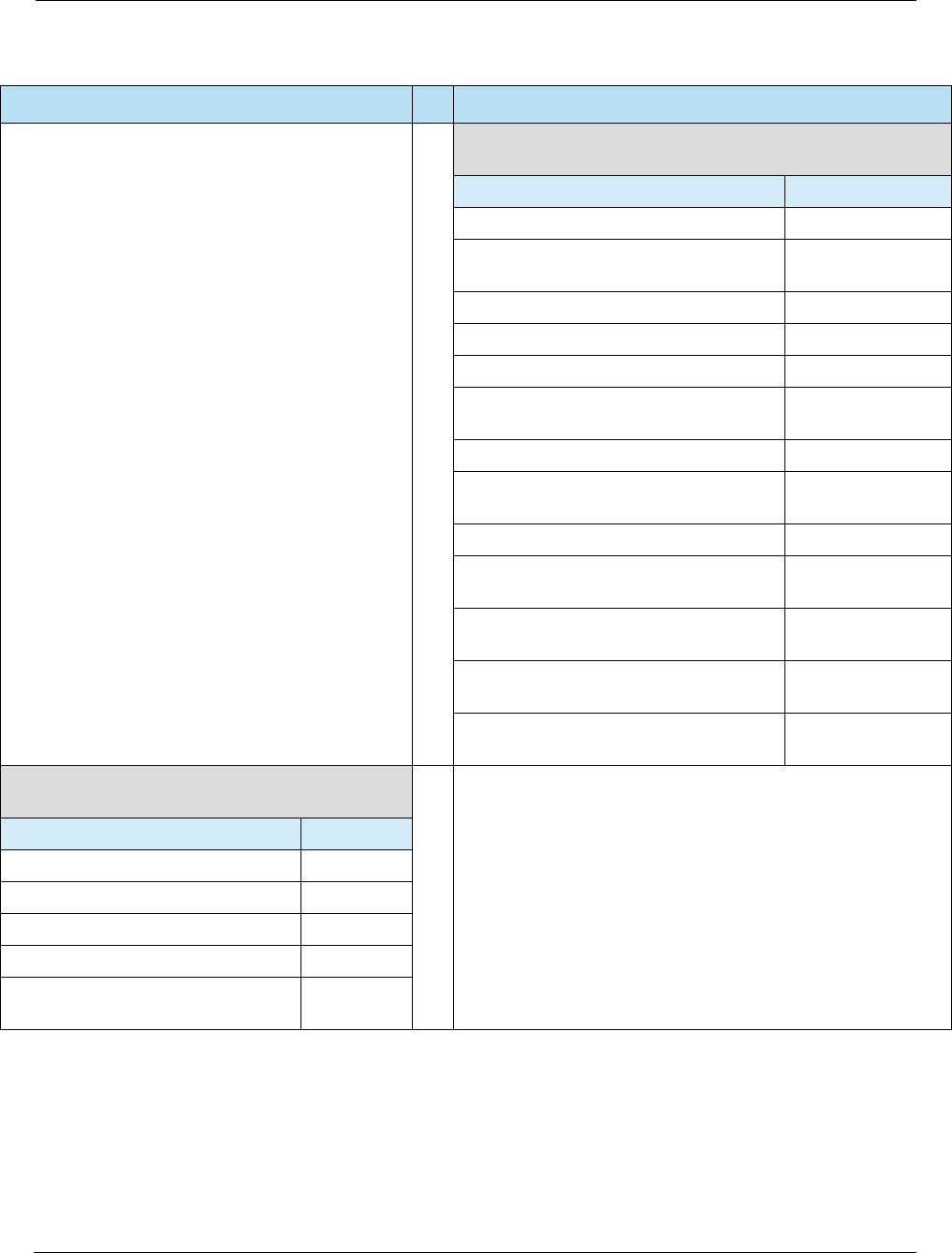

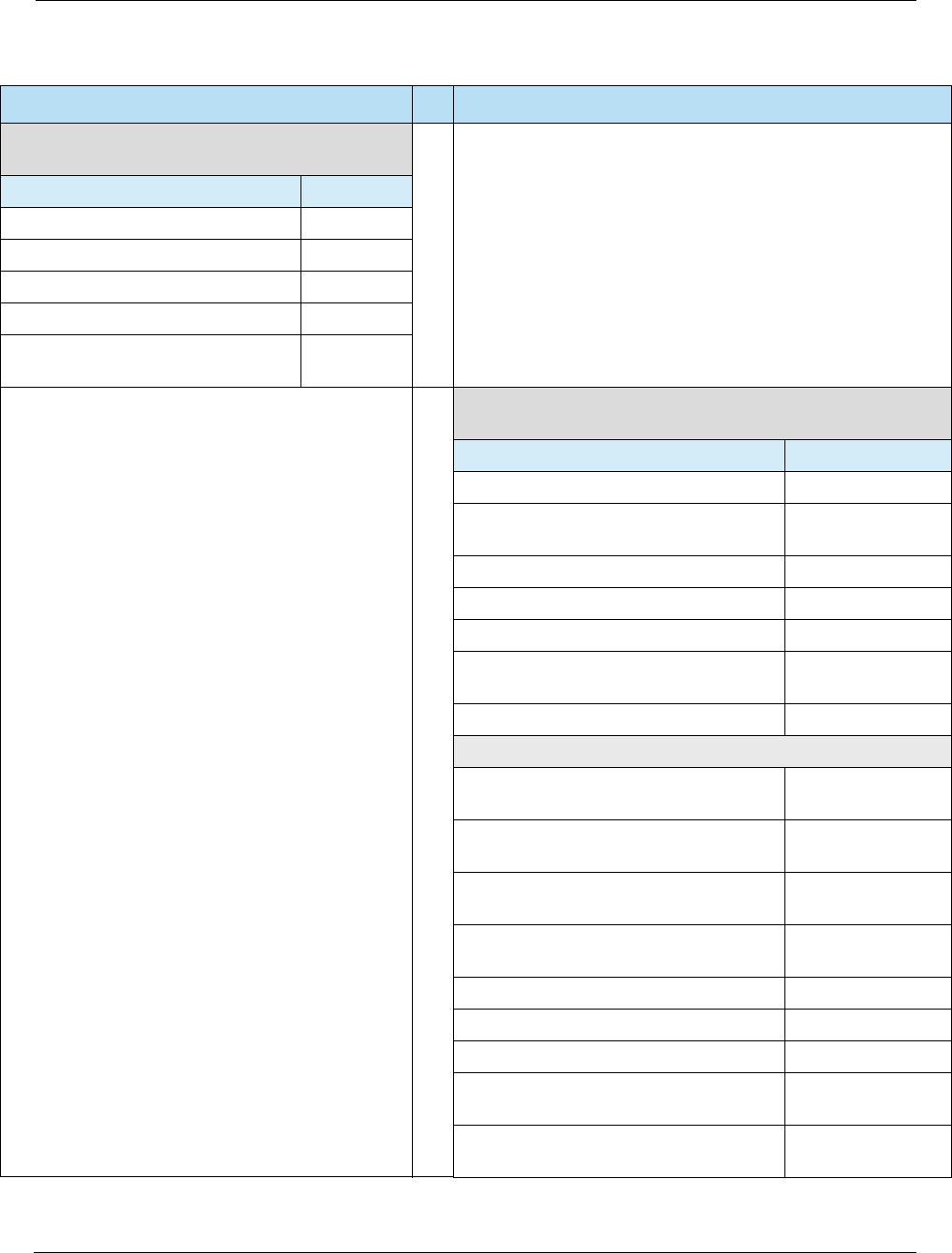

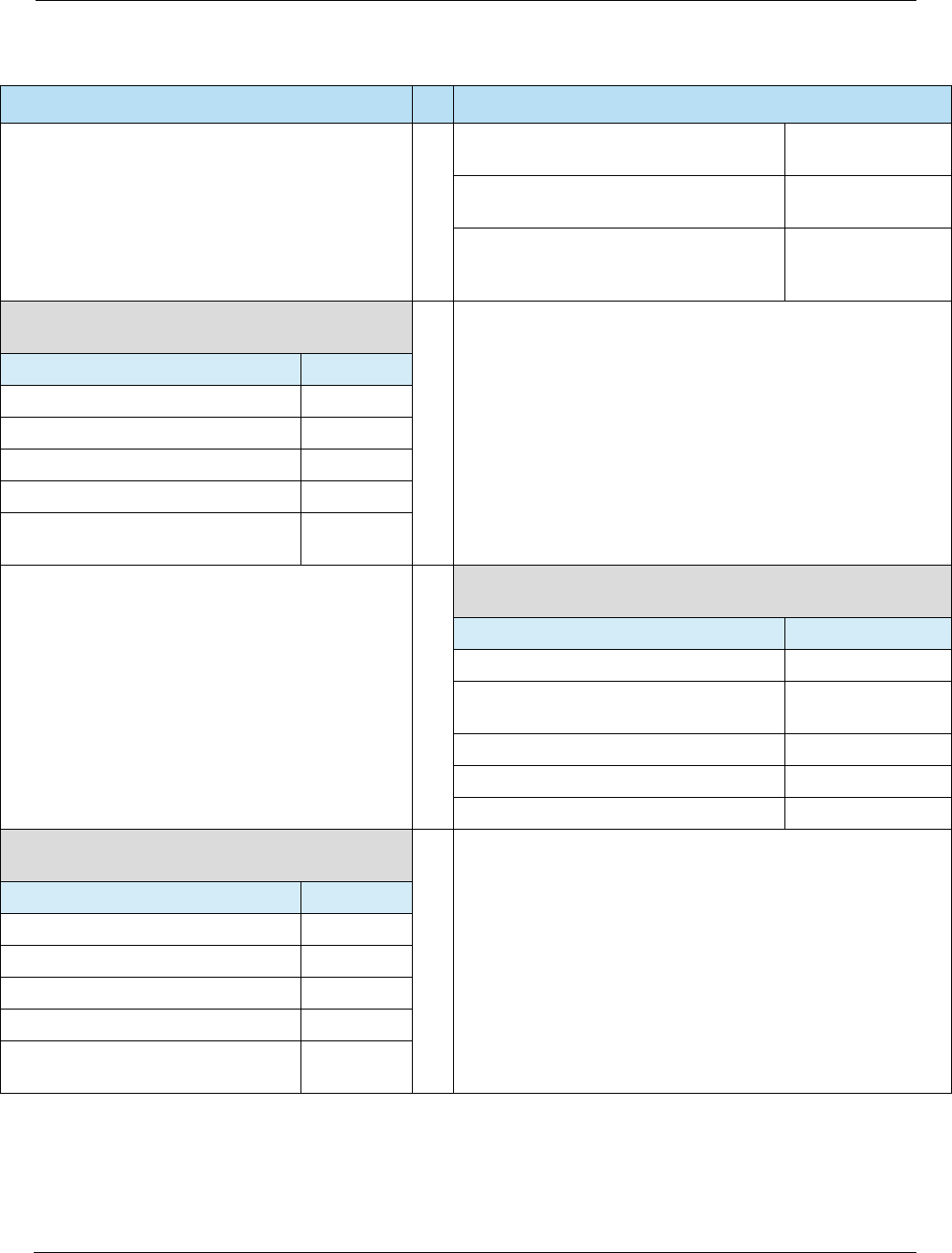

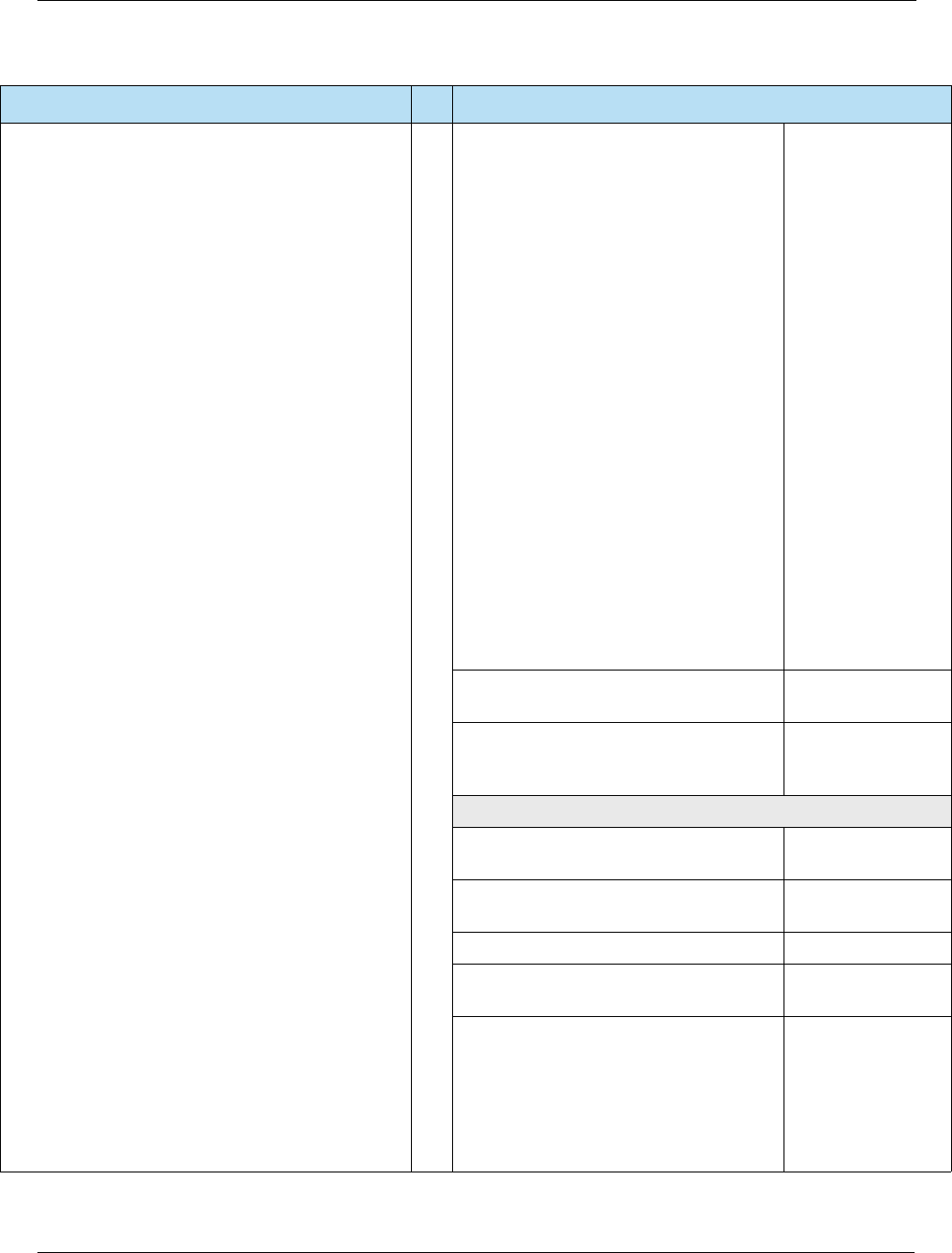

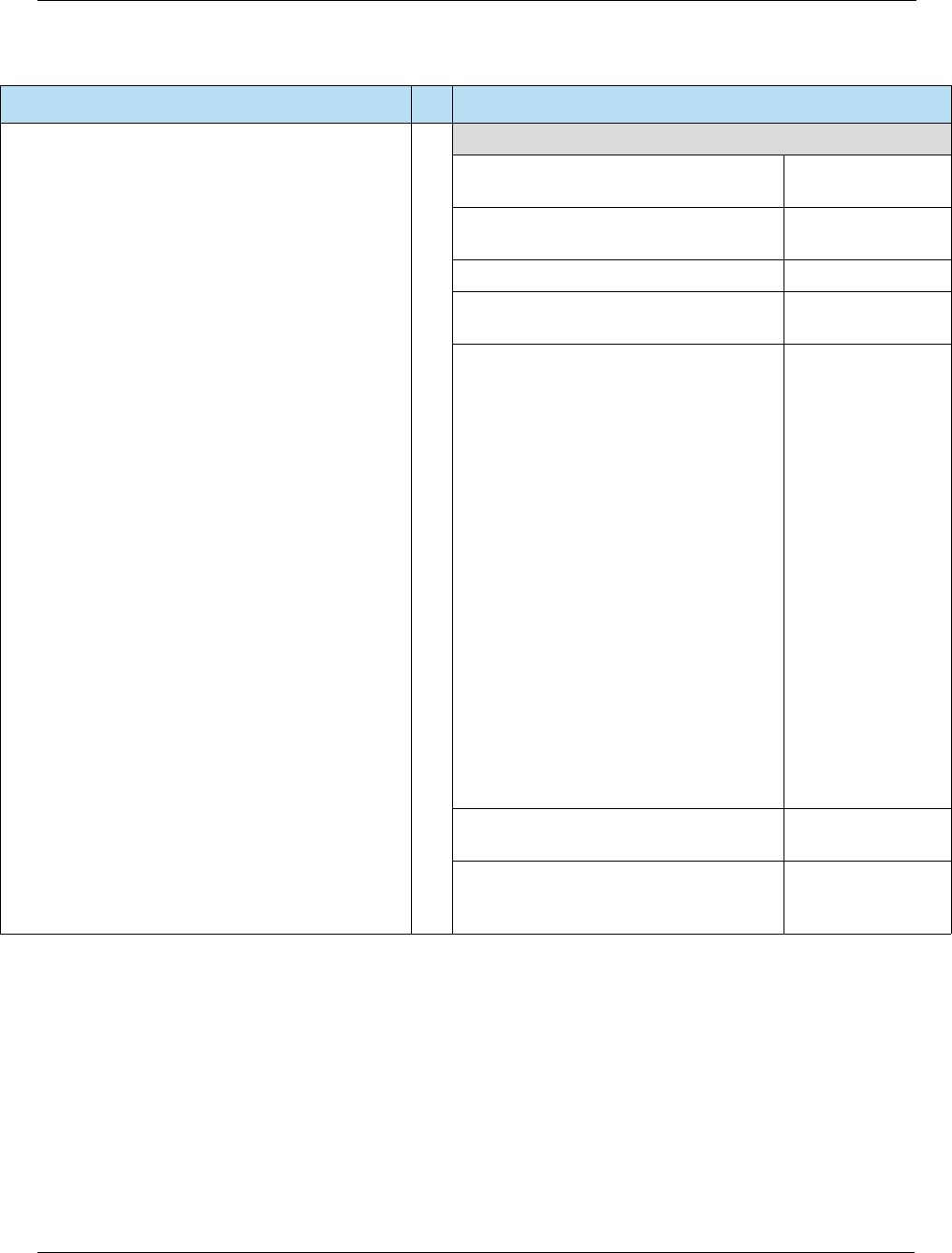

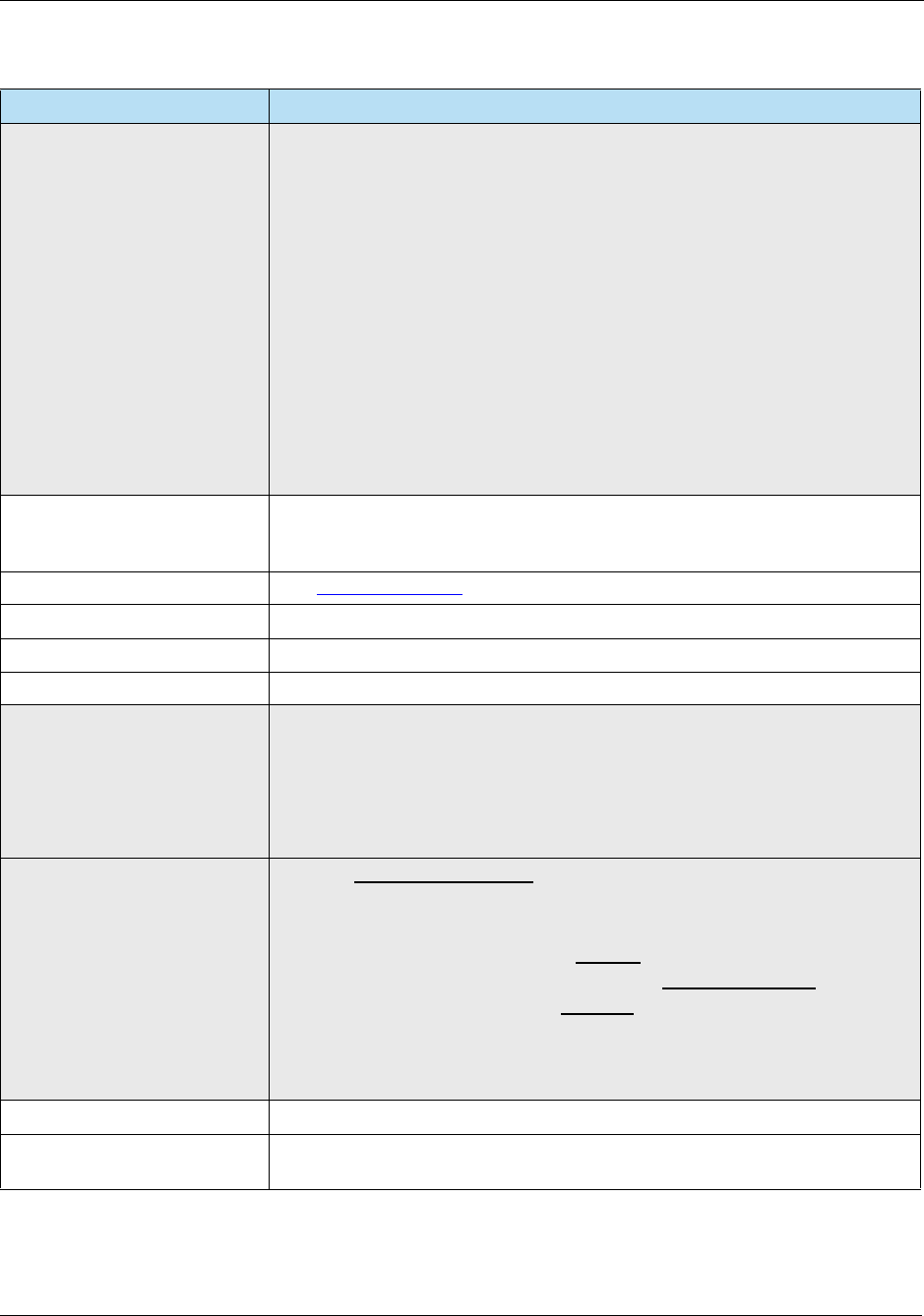

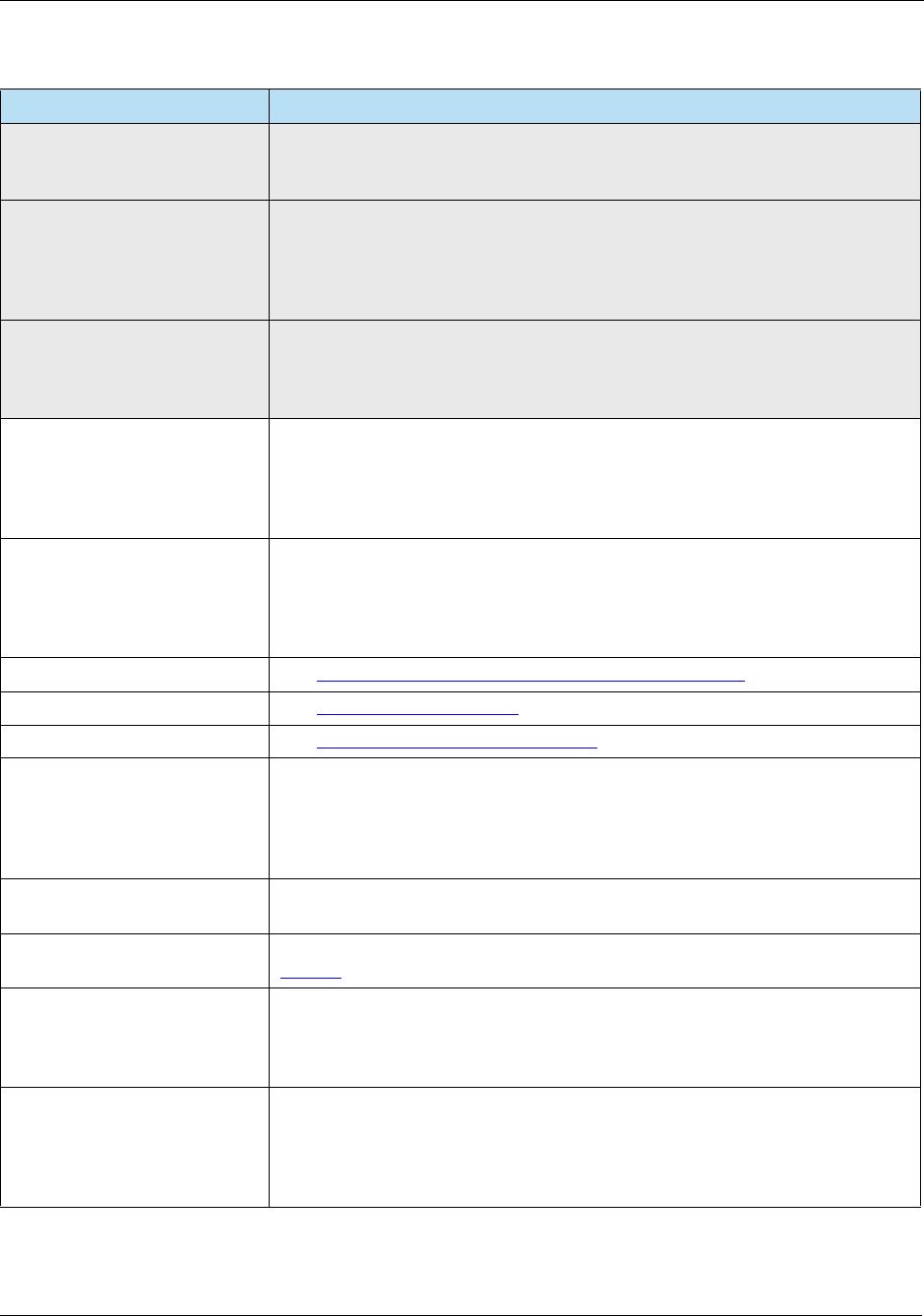

List of Tables

2-1 Address Verification Service .......................................................................................................21

2-2 Chargeback Protected Limits......................................................................................................23

2-3 Binary to ASCII Hex Conversion.................................................................................................25

2-4 Binary ASCII Hex Conversion Example......................................................................................26

3-1 Card Brand References to Track Data........................................................................................28

3-2 American Express Track 1 Format X4.16 Standard ...................................................................30

3-3 American Express Track 1 Format ISO 7813 Standard..............................................................31

3-4 American Express Track 2 Format X4.16 Standard ...................................................................33

3-5 American Express Track 2 Format ISO 7813 Standard..............................................................33

3-6 AVcard Track 1 Format...............................................................................................................35

3-7 AVcard Track 2 Format...............................................................................................................35

3-8 Centego Prepaid Track 1 Format................................................................................................36

3-9 Centego Prepaid Track 2 Format................................................................................................37

3-10 Discover Track 1 Format.............................................................................................................38

3-11 Discover Track 2 Format.............................................................................................................39

3-12 Diner’s Club International Track 1 Format ..................................................................................40

3-13 Diner’s Club International Track 2 Format ..................................................................................41

3-14 Drop Tank Track 1 Format..........................................................................................................42

3-15 Drop Tank Track 2 Format..........................................................................................................42

3-16 Heartland Gift Card Track 2 Format............................................................................................43

3-17 EBT Track 2 Format....................................................................................................................44

3-18 Fleet One Track 2 Format...........................................................................................................45

3-19 FleetCor Track 2 Format.............................................................................................................46

3-20 Mastercard Track 1 Format.........................................................................................................48

3-21 Mastercard Track 2 Format.........................................................................................................48

3-22 Mastercard Fleet Account Number Information Method .............................................................50

3-23 Mastercard Fleet Track 1 Format................................................................................................51

3-24 Mastercard Fleet Track 2 Format................................................................................................52

3-25 Mastercard Purchasing Track 1 Format......................................................................................53

3-26 Mastercard Purchasing Track 2 Format......................................................................................54

3-27 Mills Fleet Farm PLCC Track 1 Format ......................................................................................55

3-28 Mills Fleet Farm PLCC Track 2 Format ......................................................................................56

3-29 Multi Service Swiped Track 2 Format .........................................................................................57

3-30 SVS Track 1 Format ...................................................................................................................58

3-31 SVS Track 2 Format ...................................................................................................................58

3-32 ValueLink Track 1 Format...........................................................................................................59

3-33 ValueLink Track 2 Format...........................................................................................................60

3-34 Visa Track 1 Format....................................................................................................................61

3-35 Visa Track 2 Format....................................................................................................................62

3-36 Visa Fleet Track 1 Format...........................................................................................................64

3-37 Visa Fleet Track 2 Format...........................................................................................................65

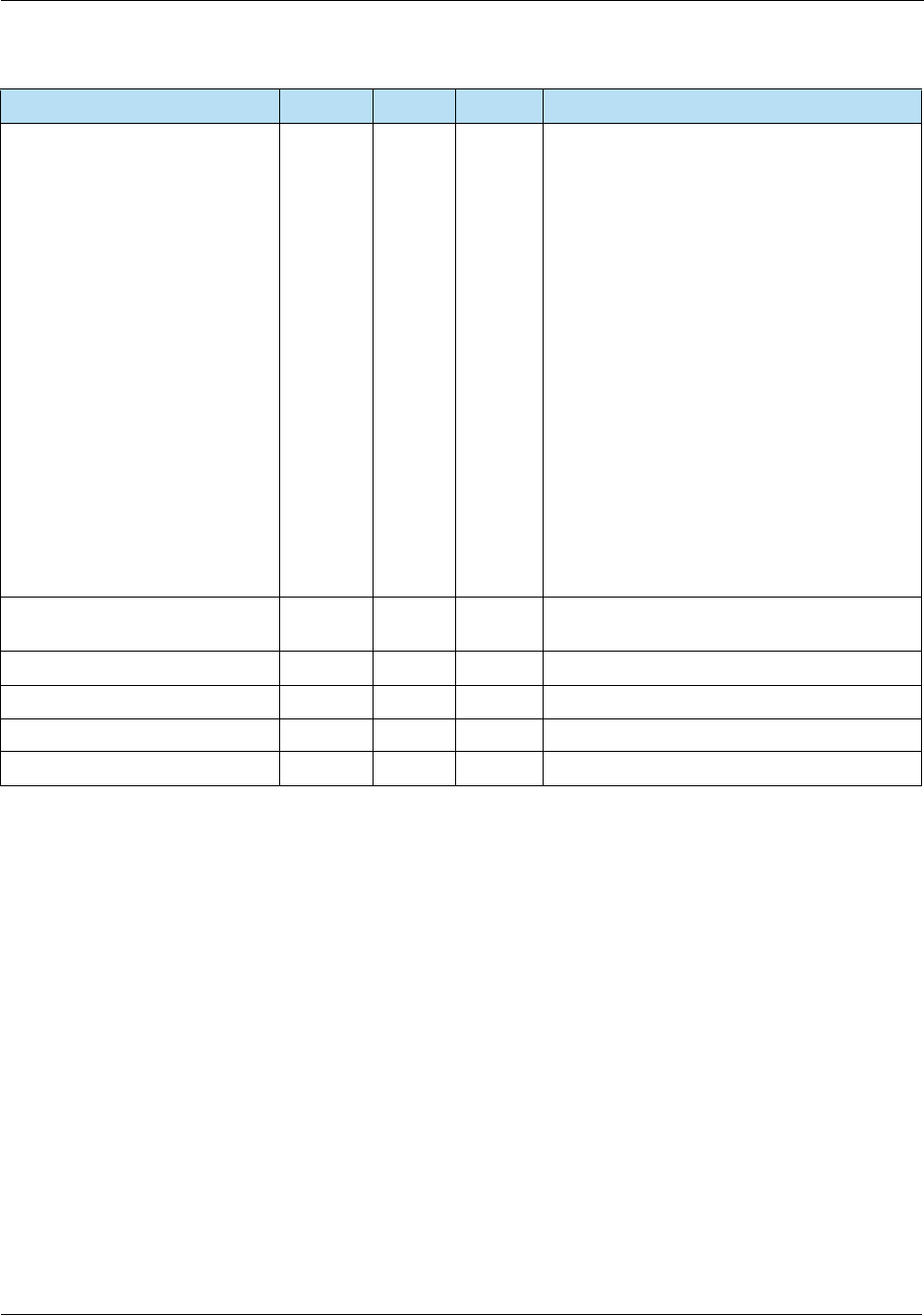

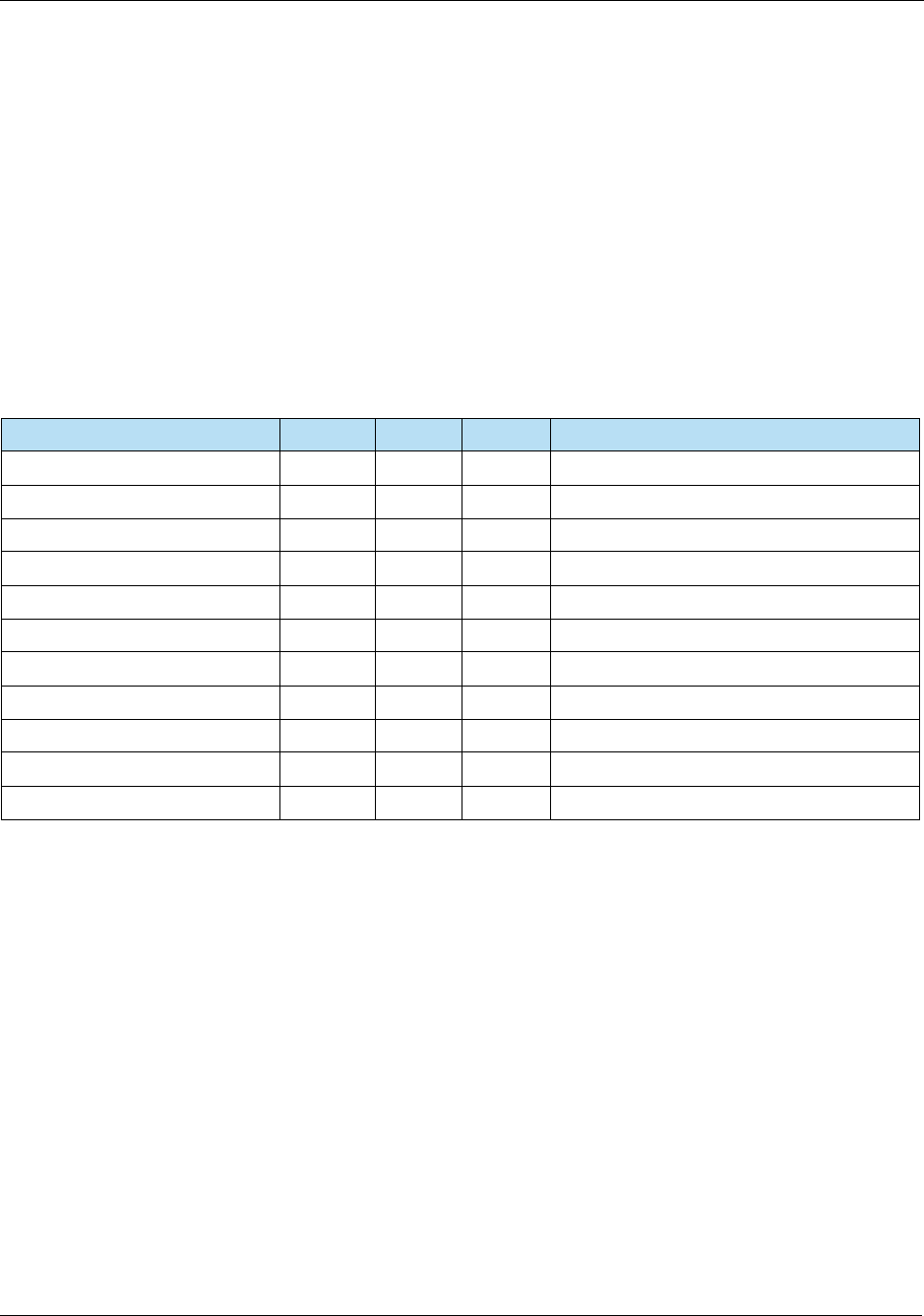

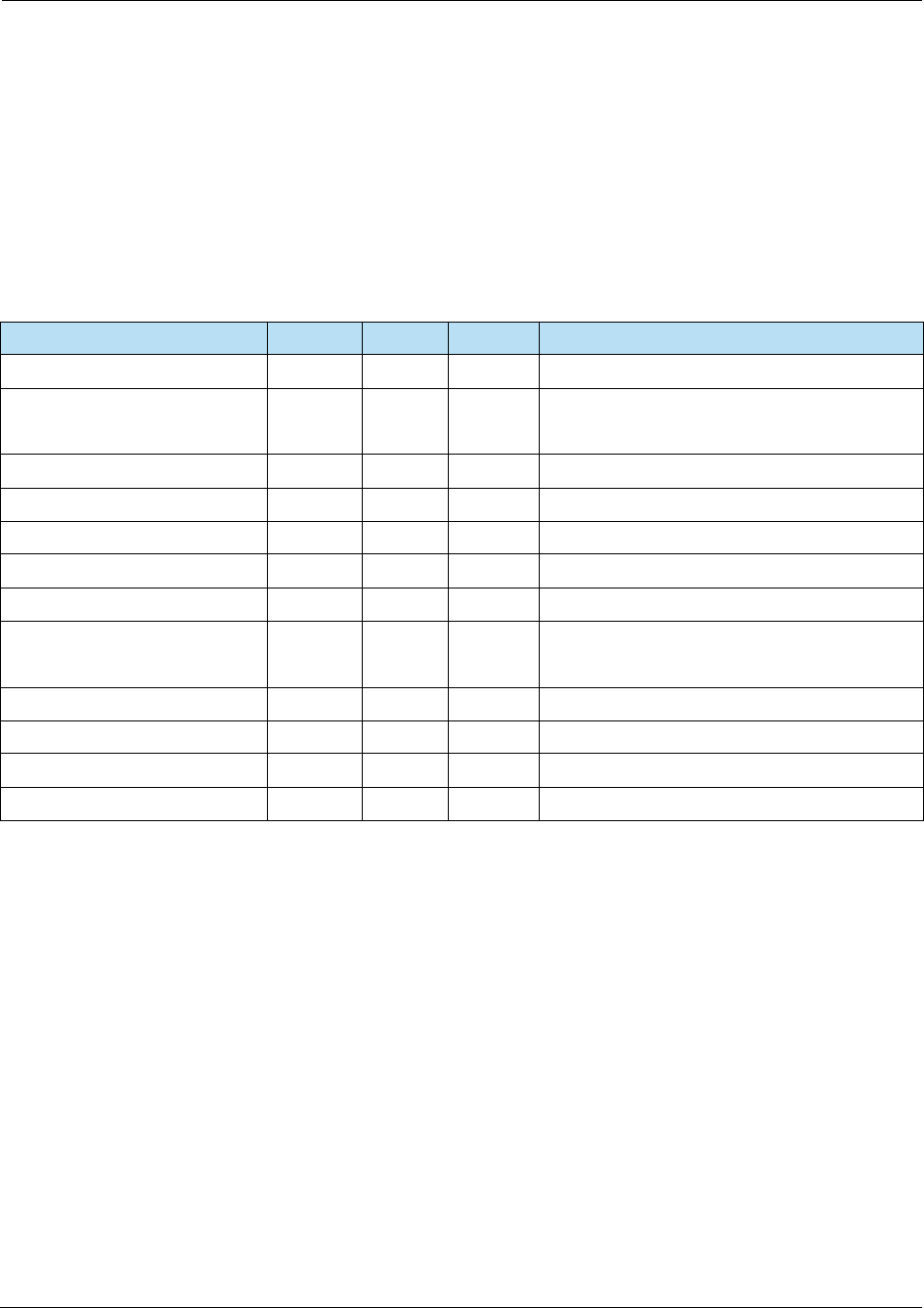

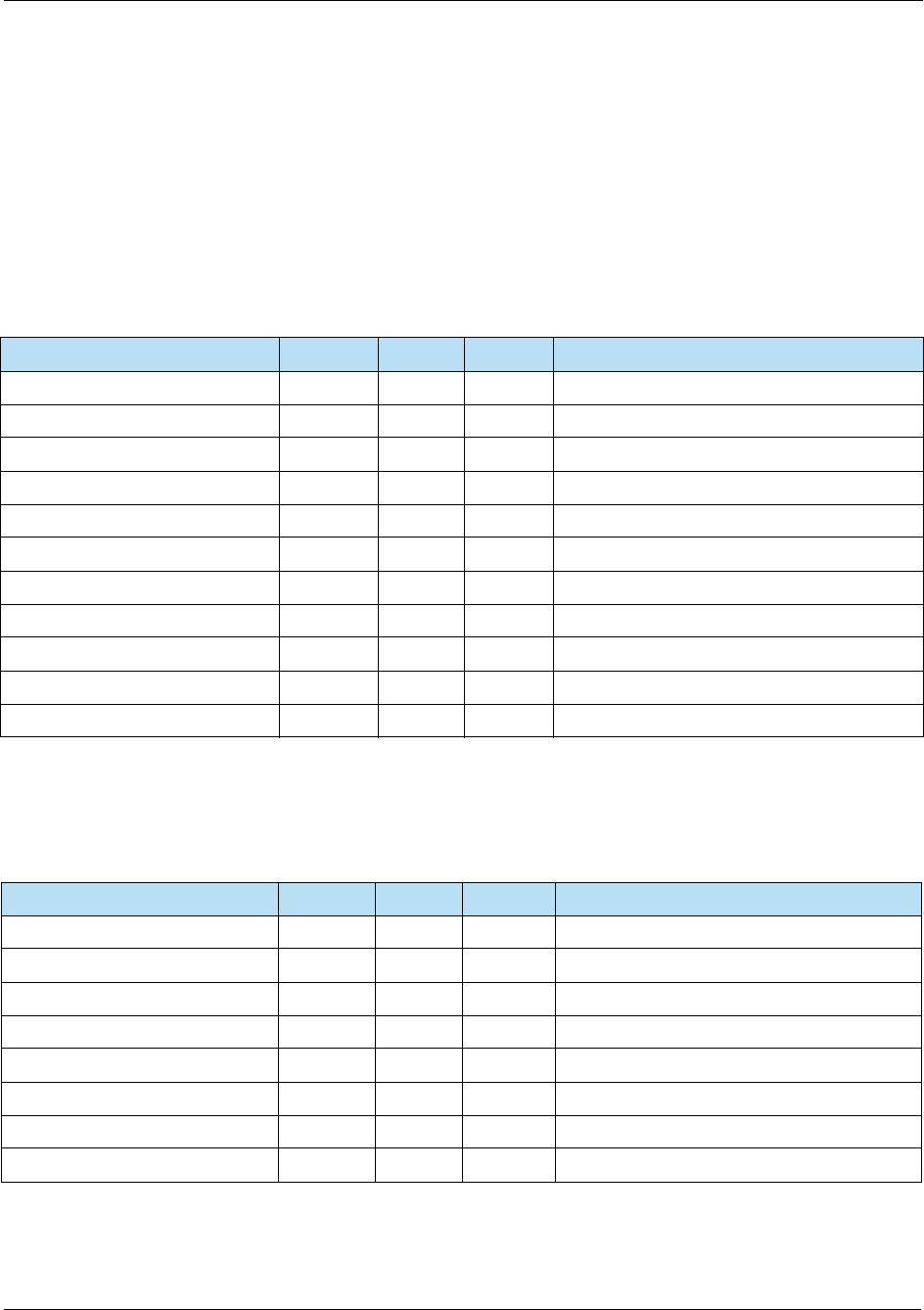

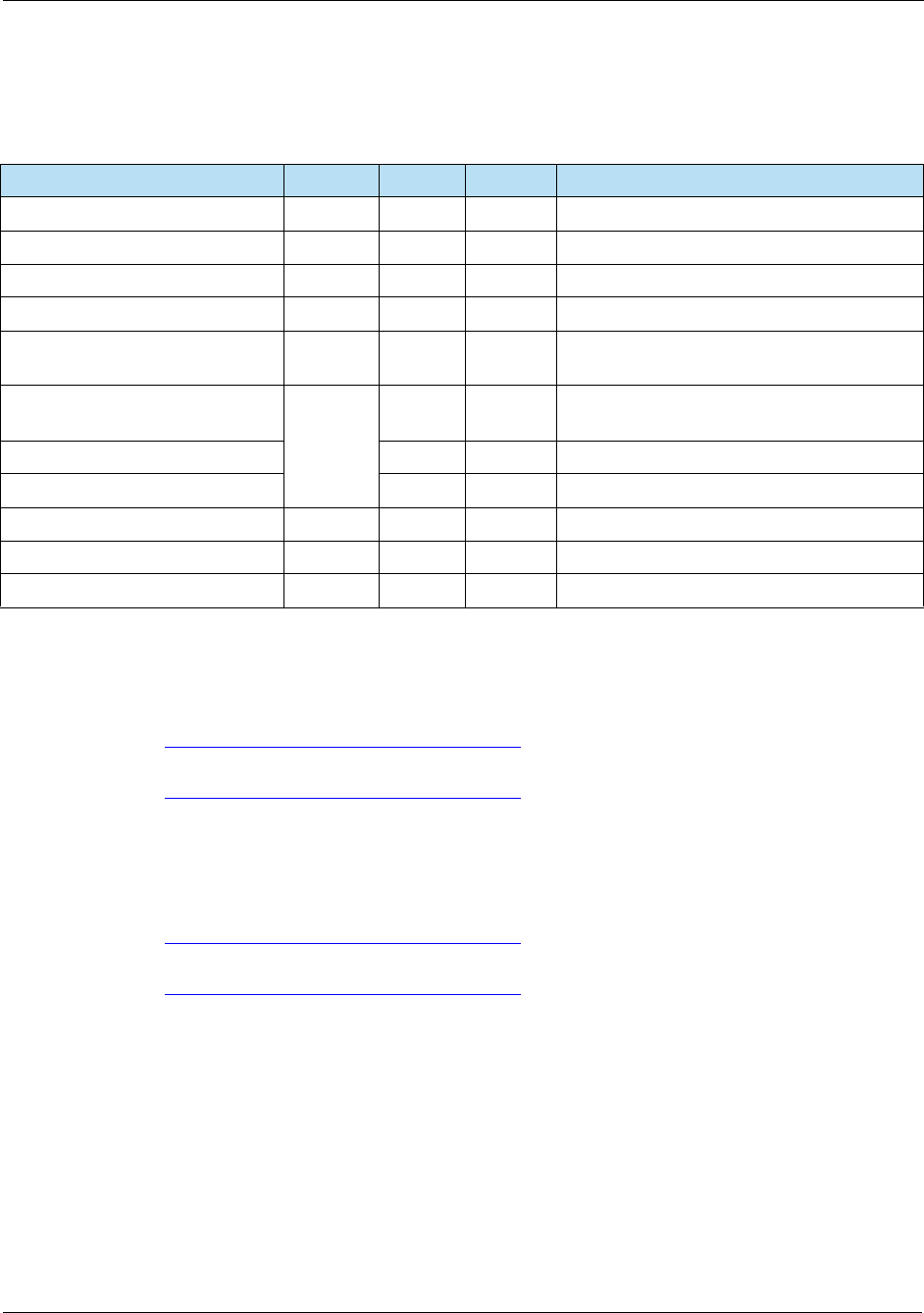

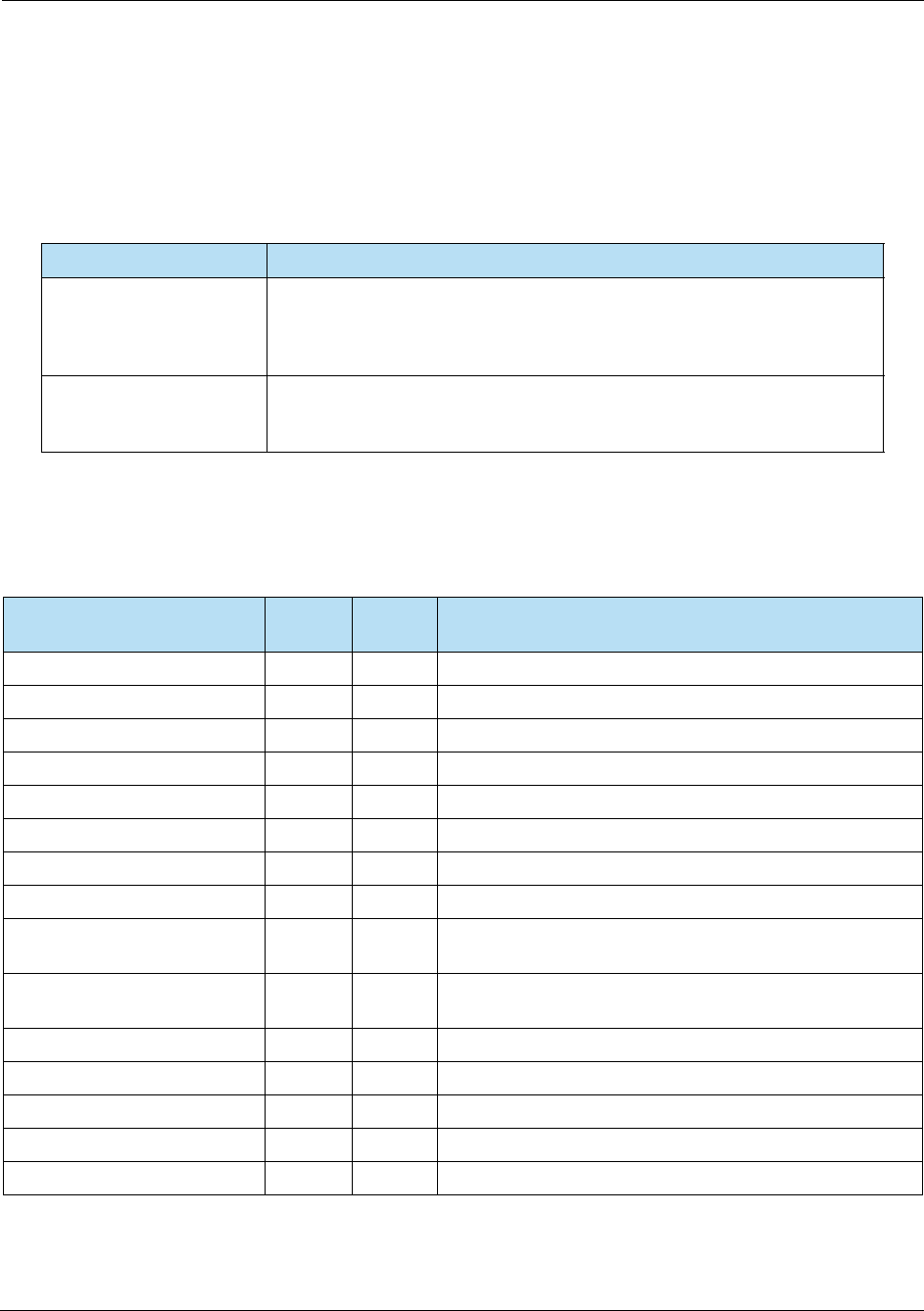

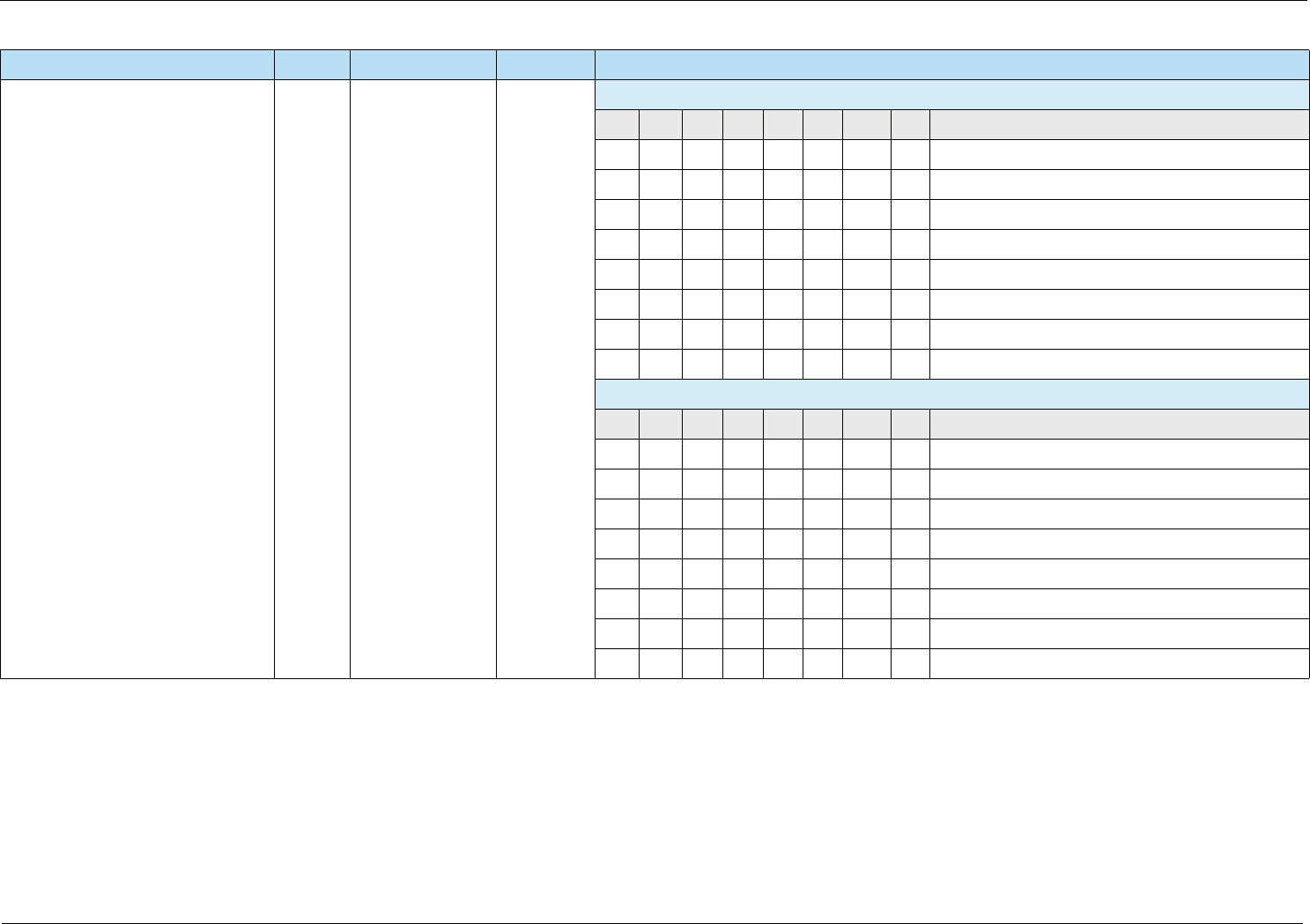

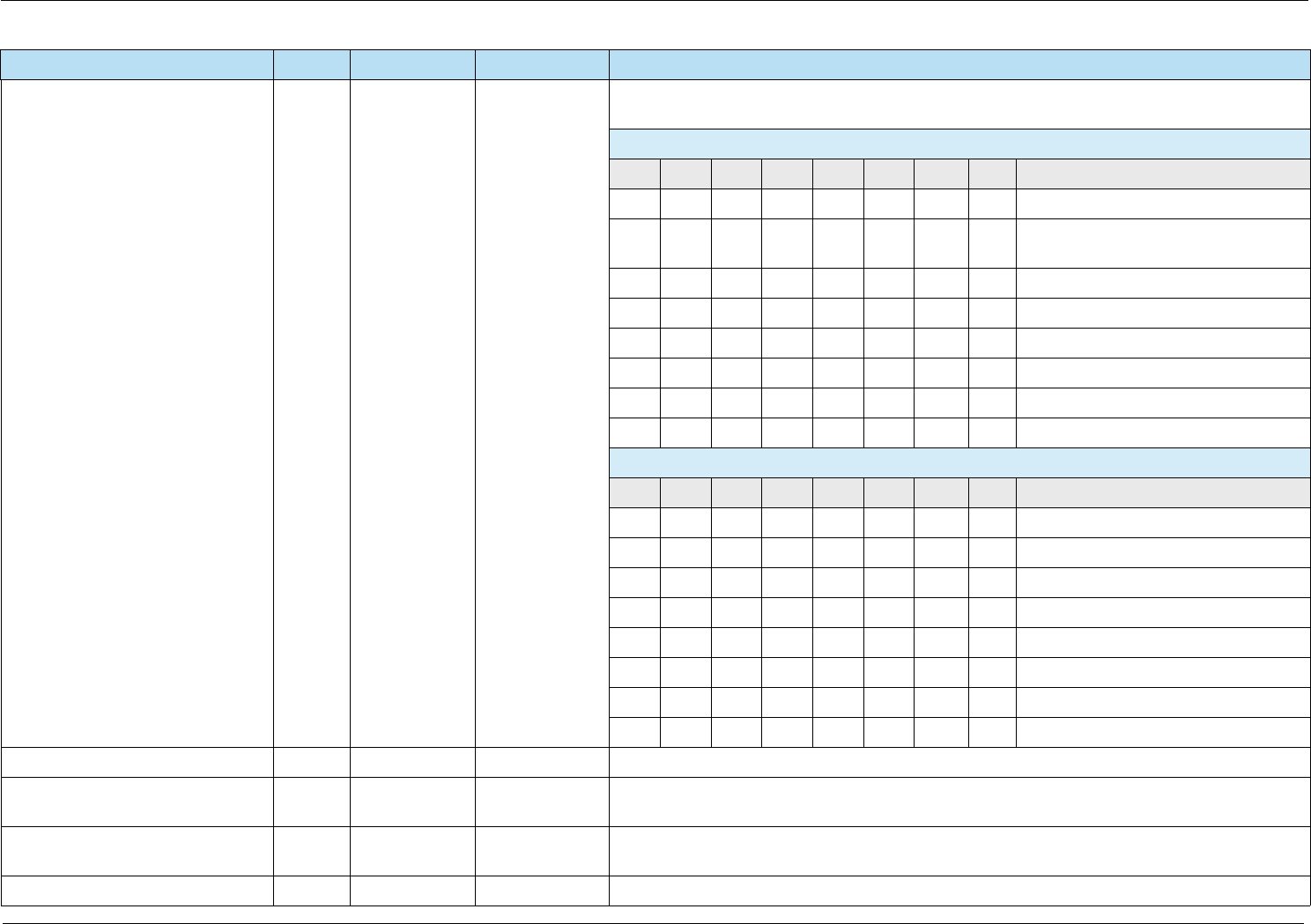

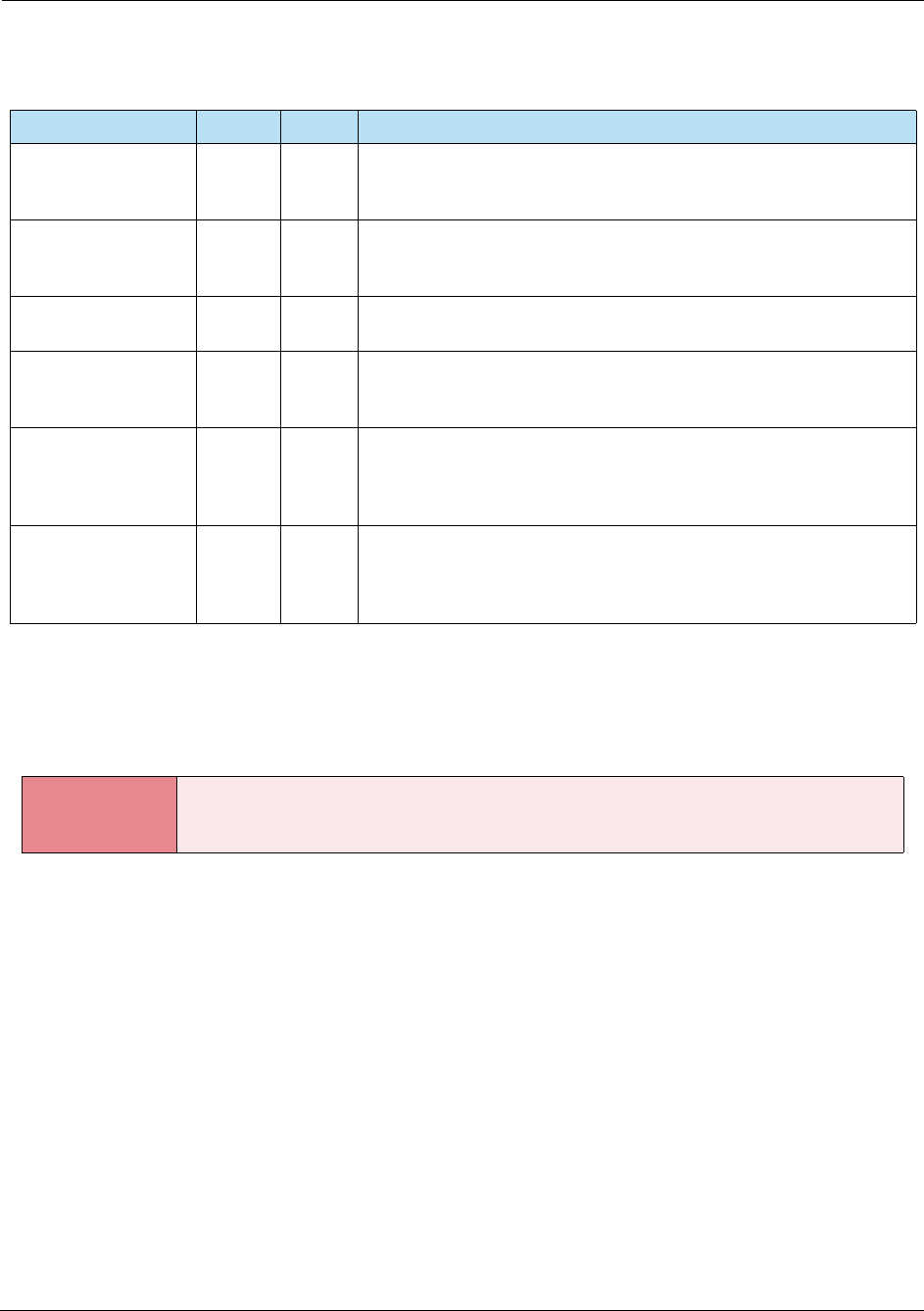

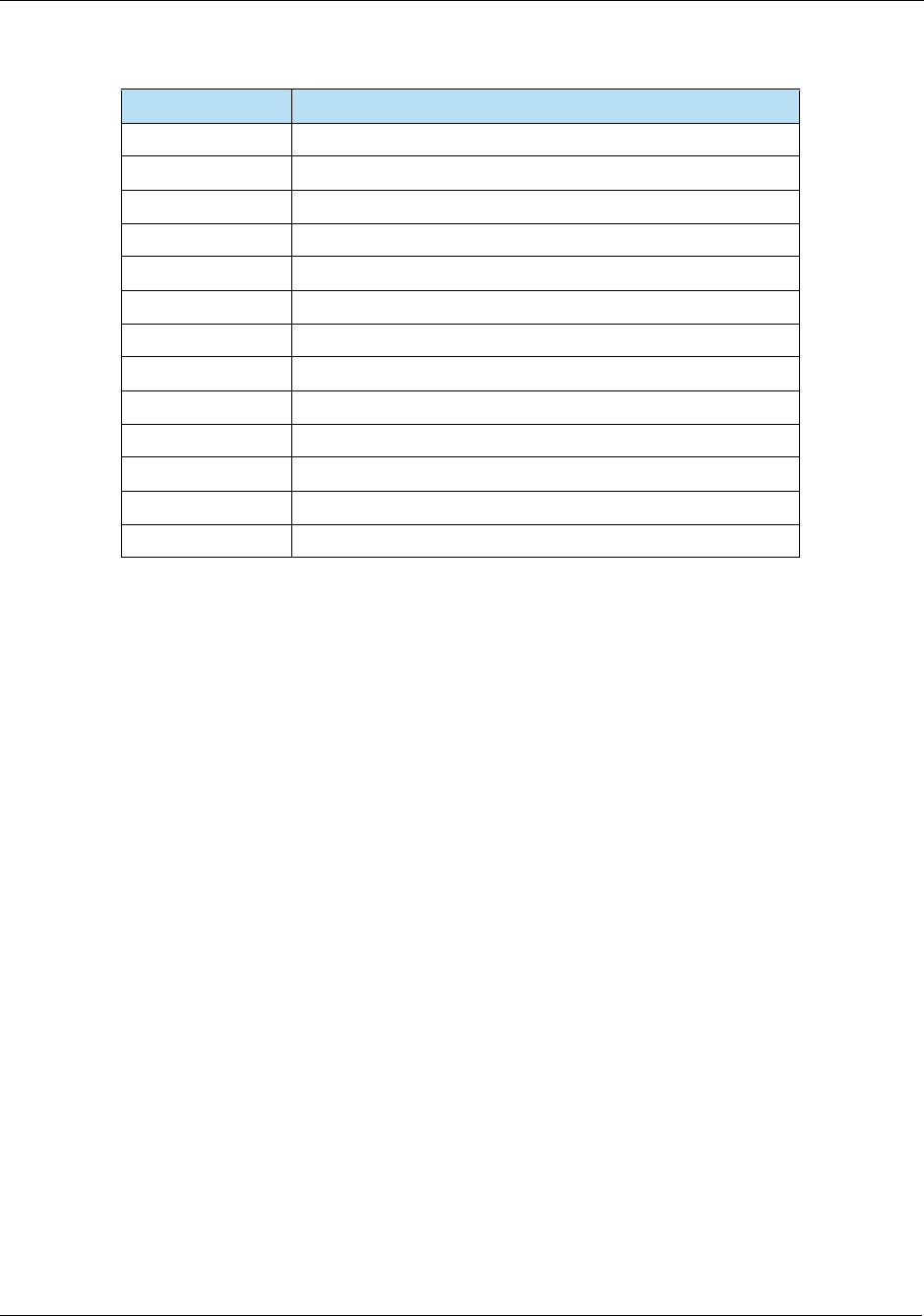

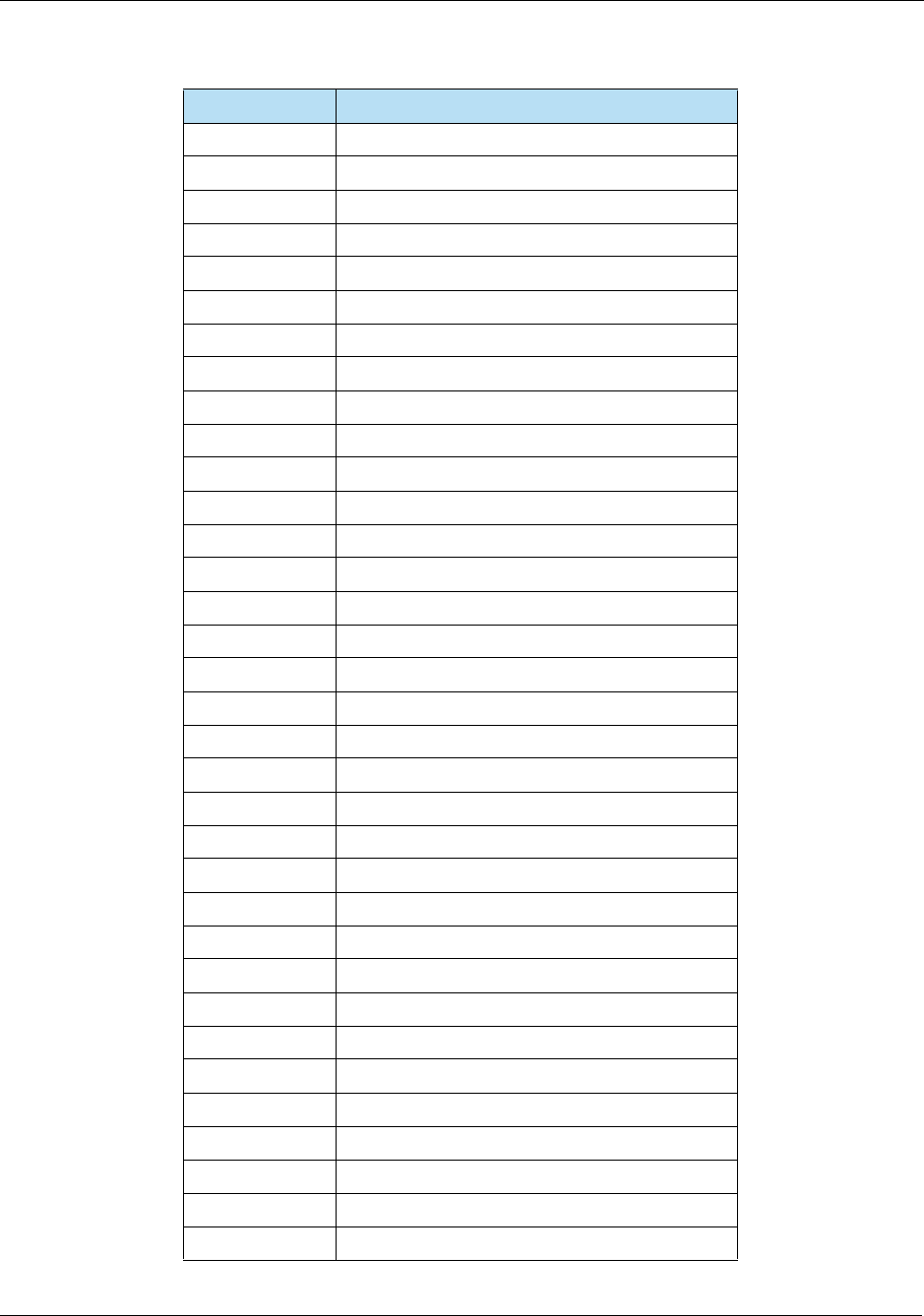

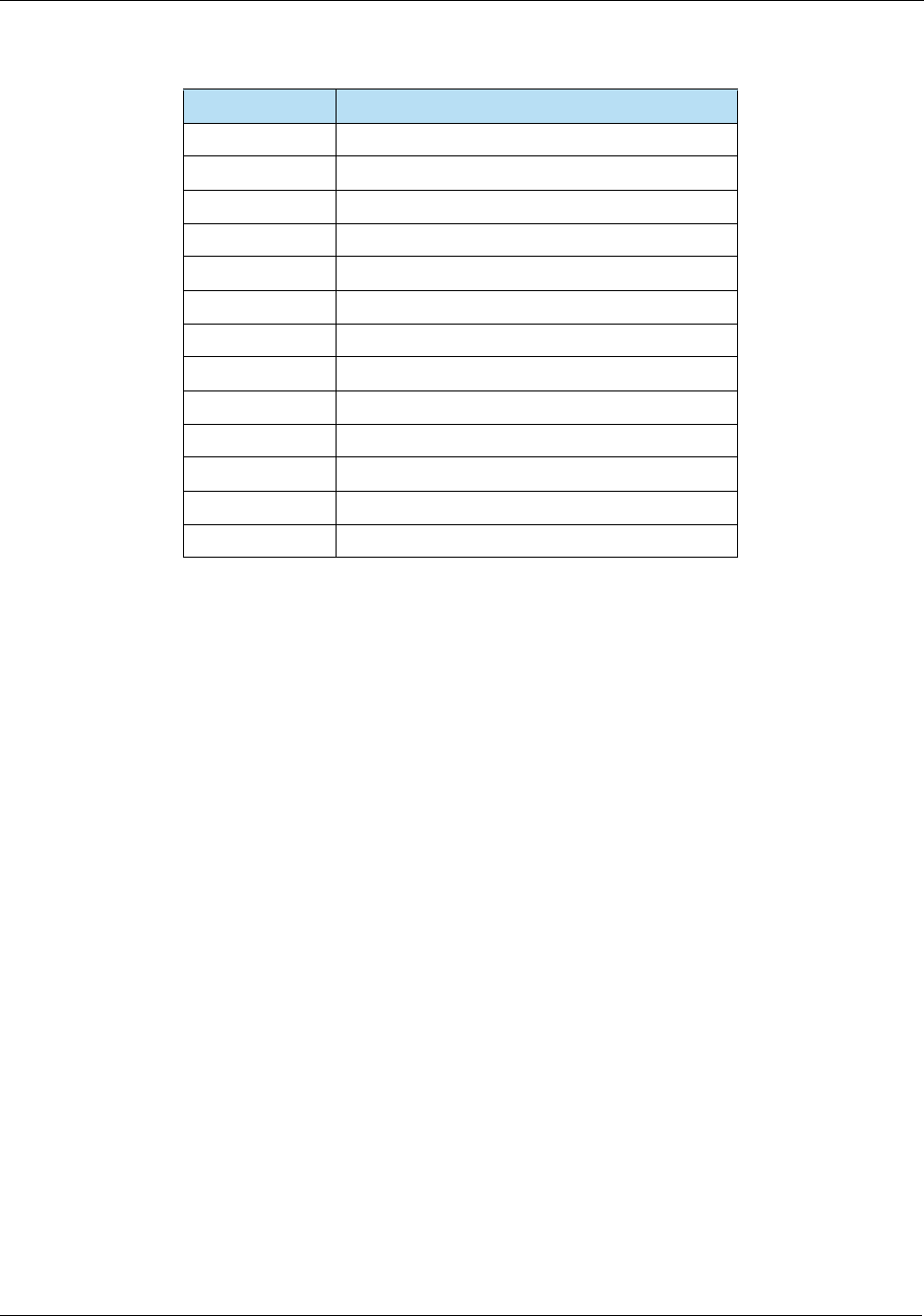

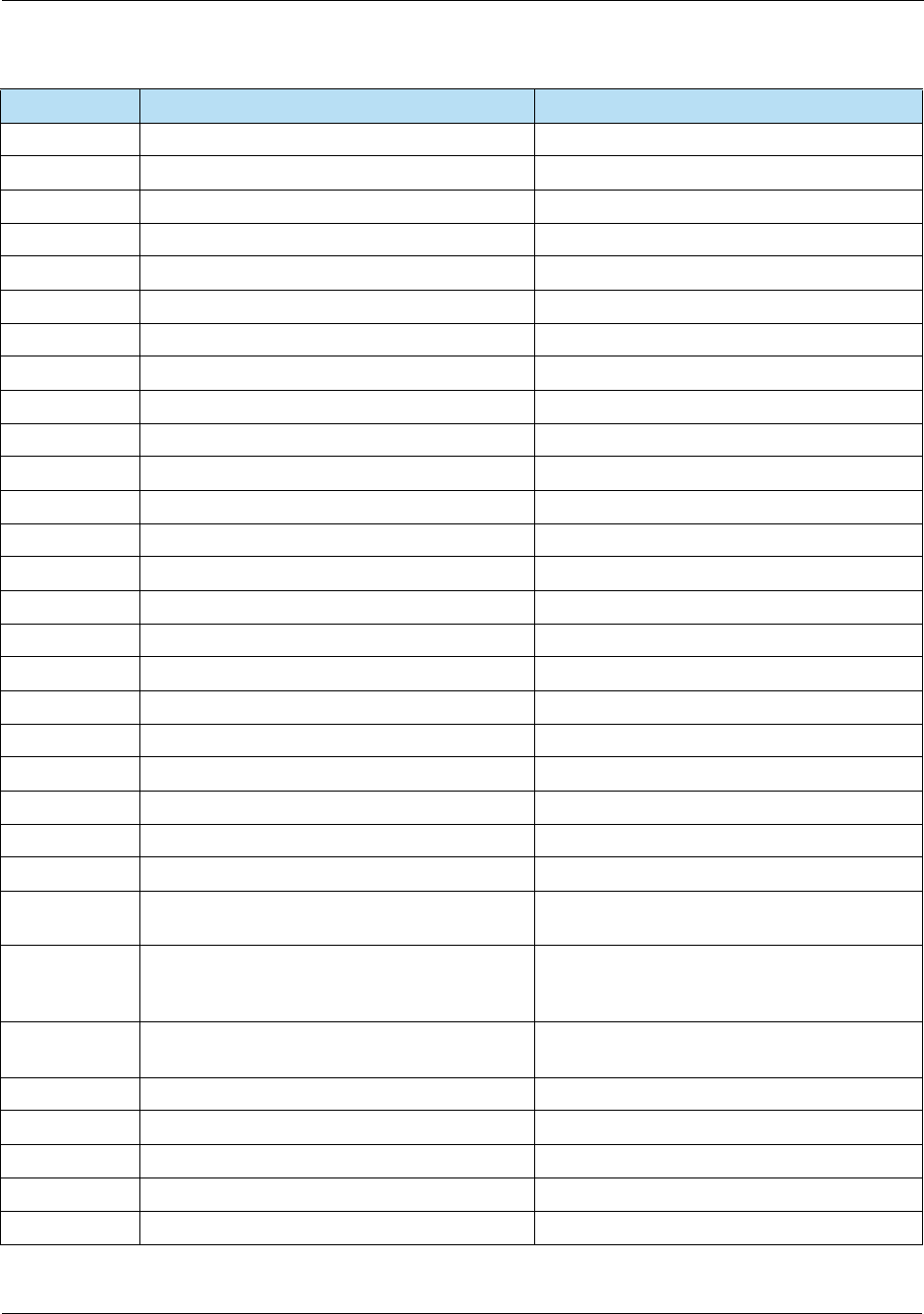

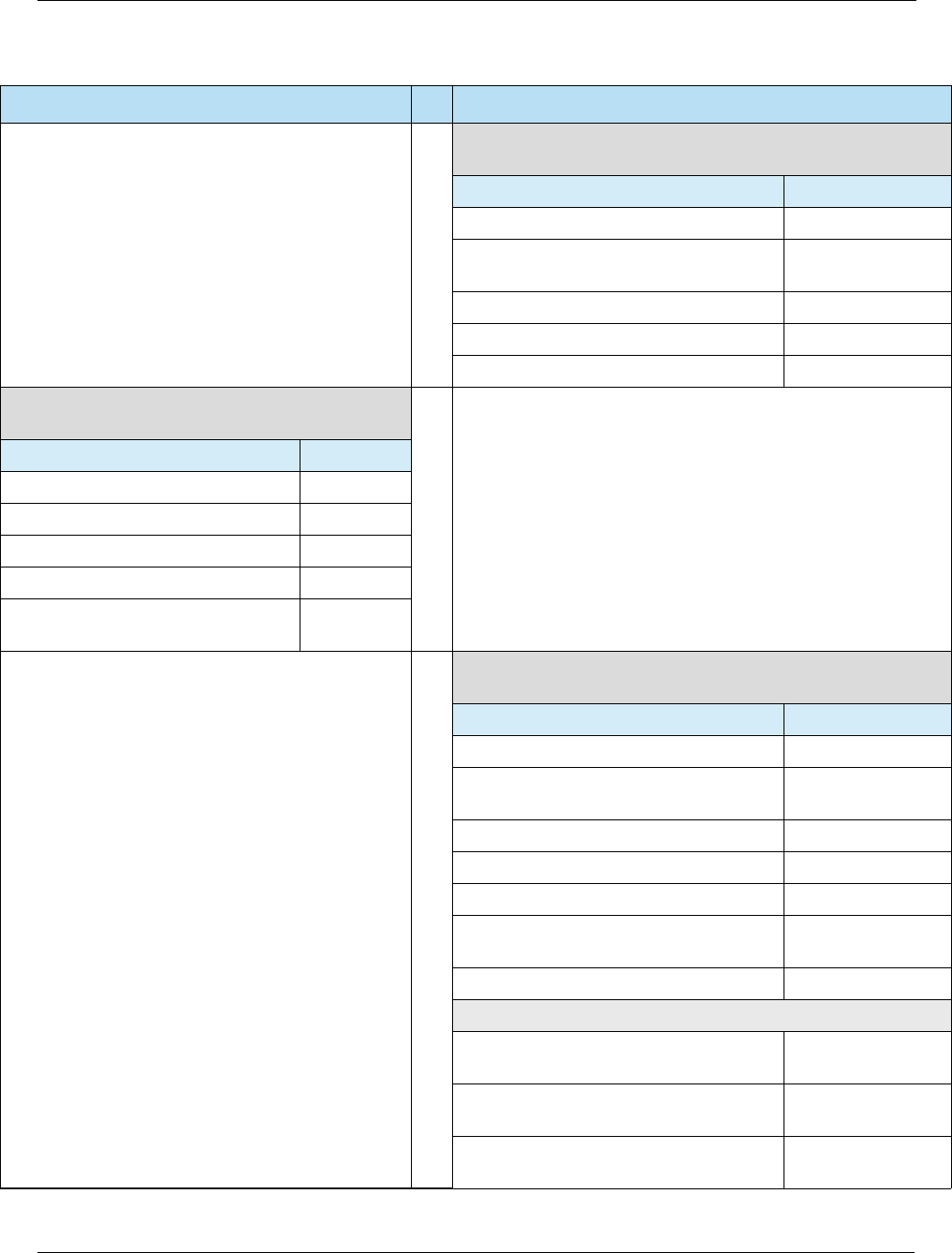

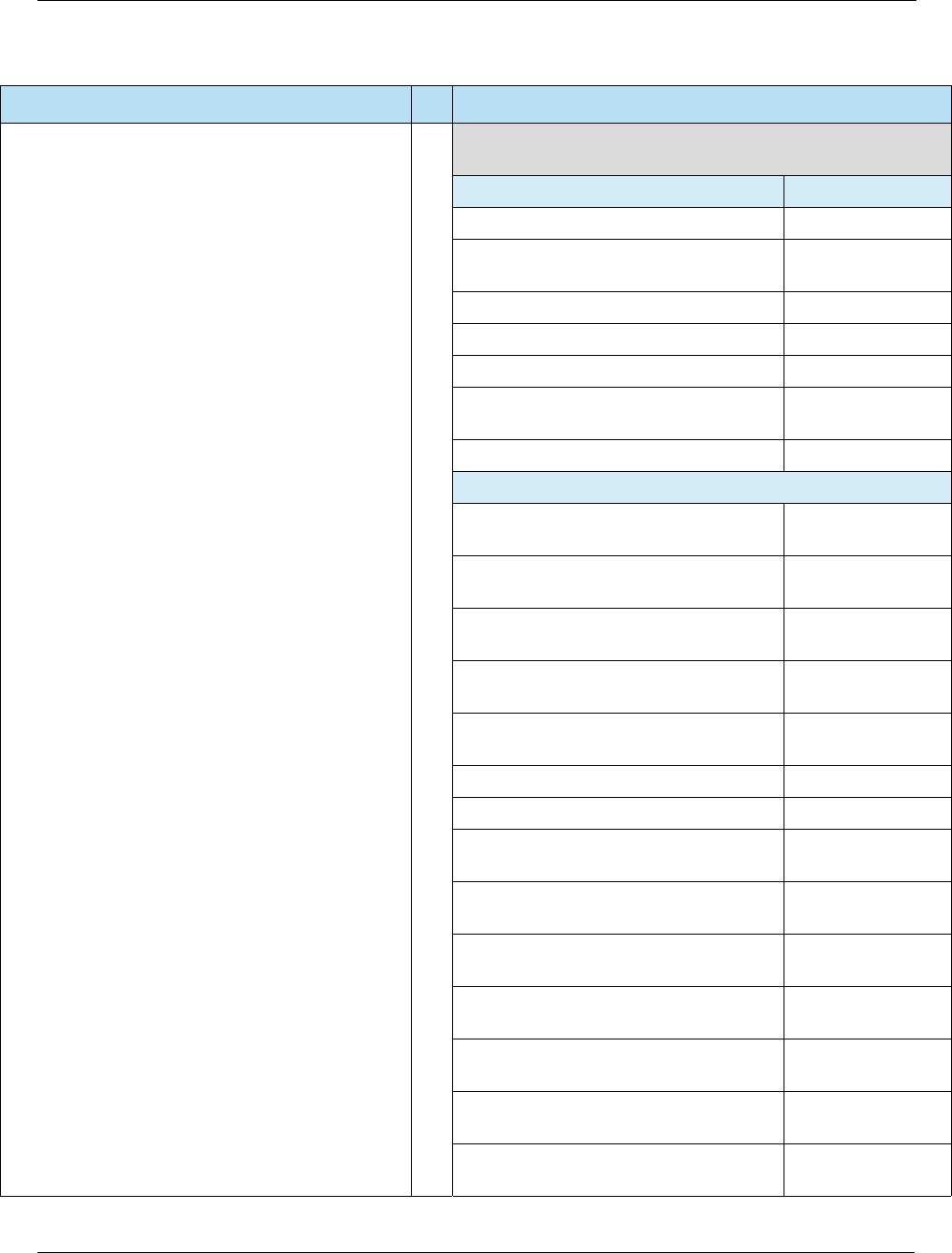

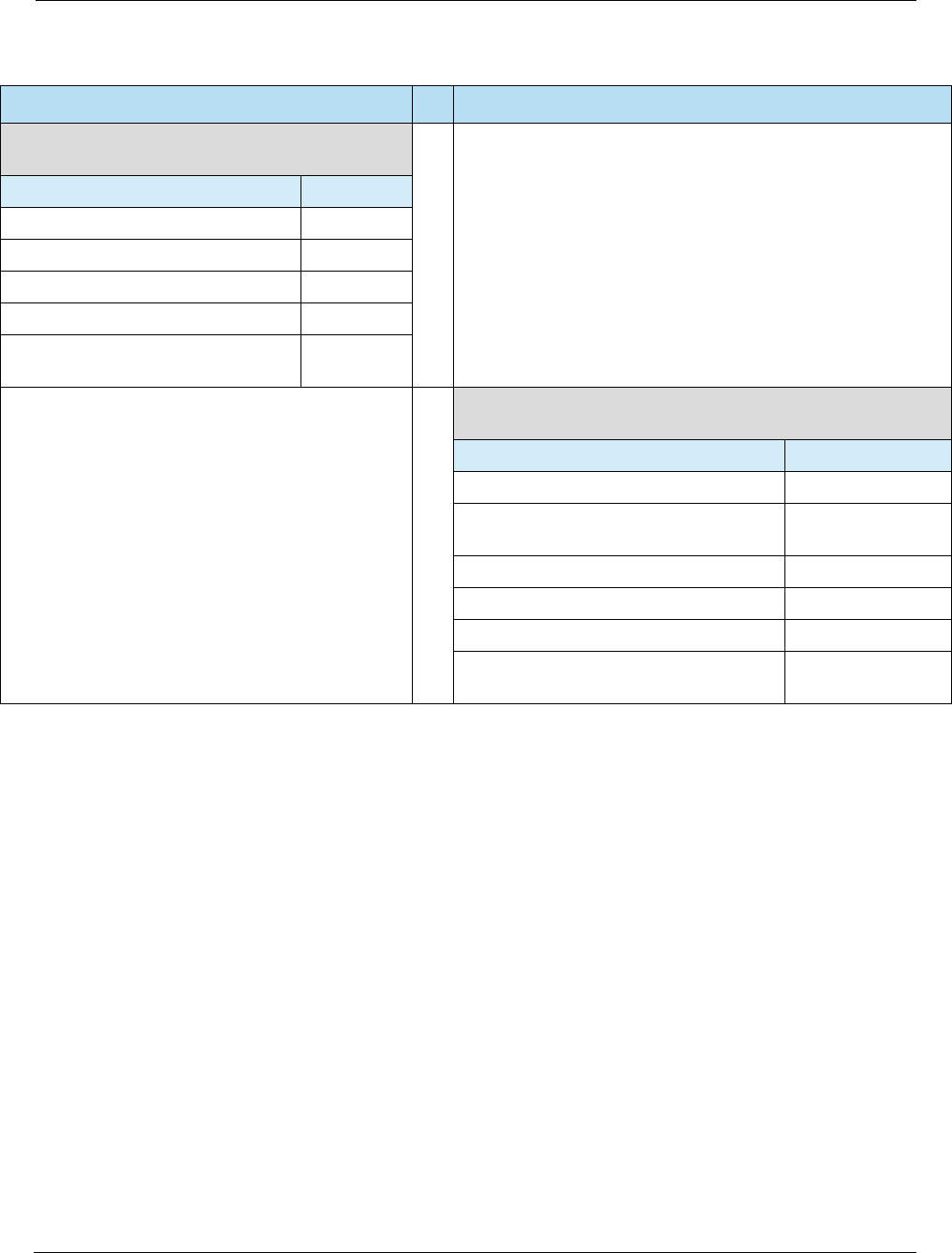

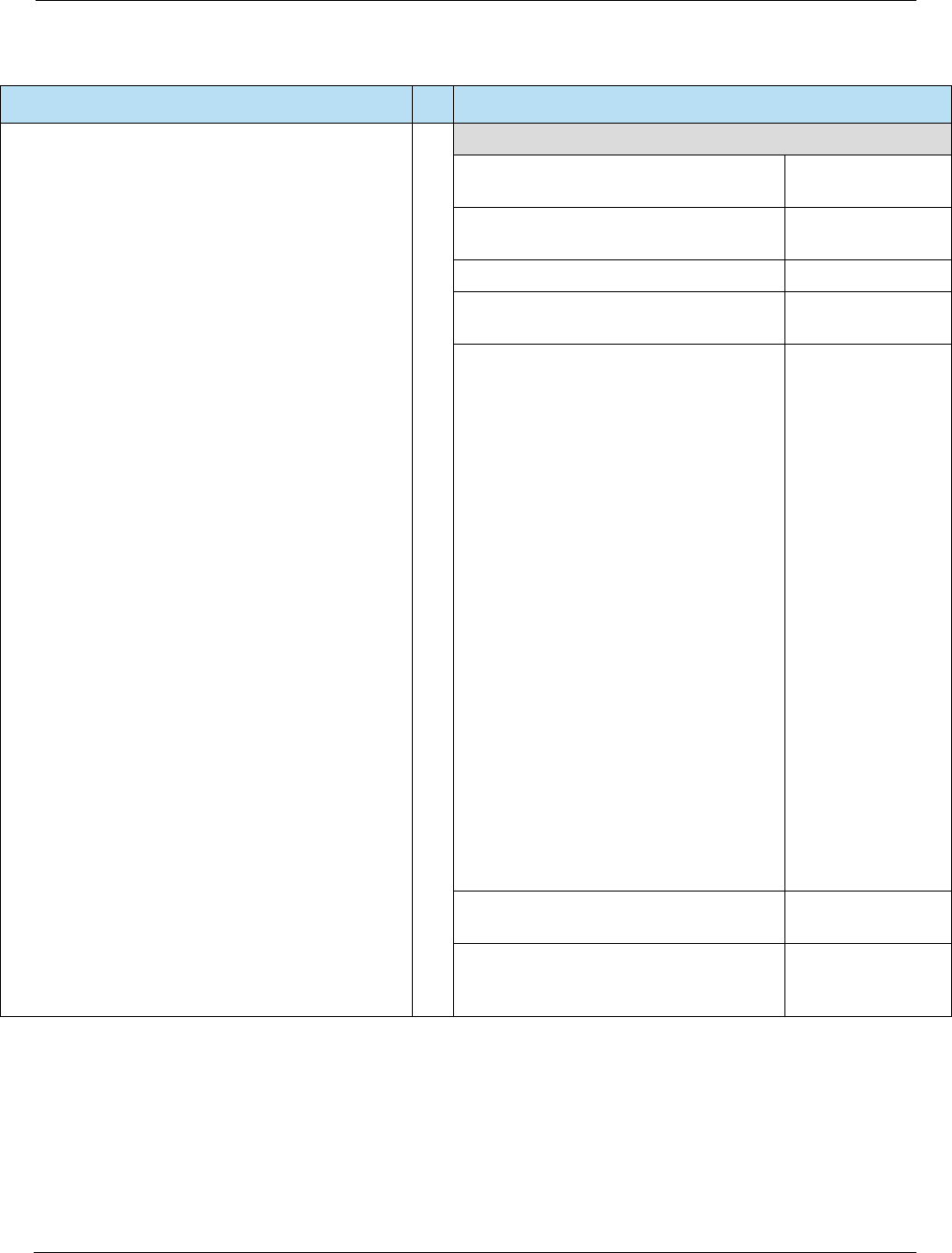

For Internal Use Only

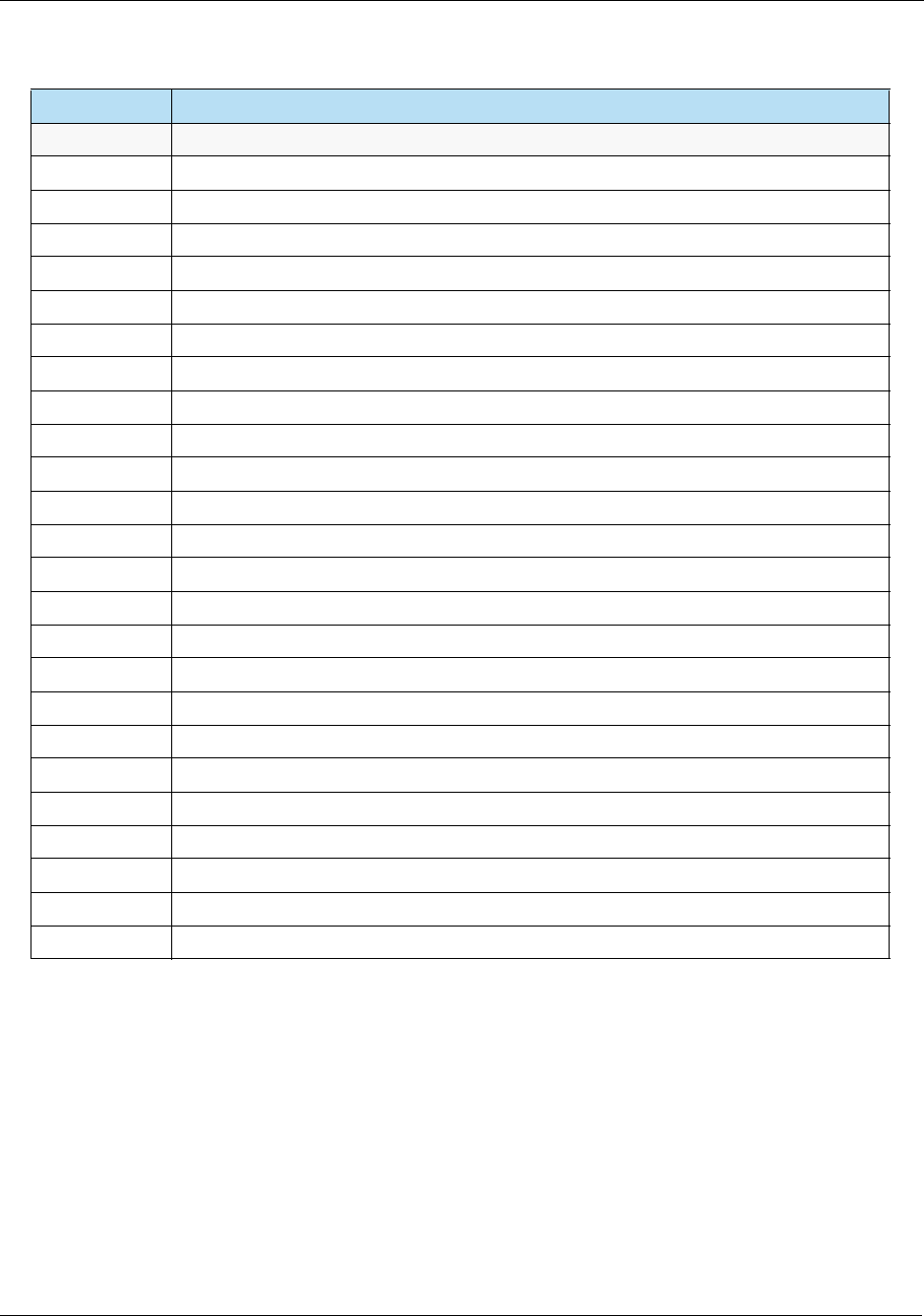

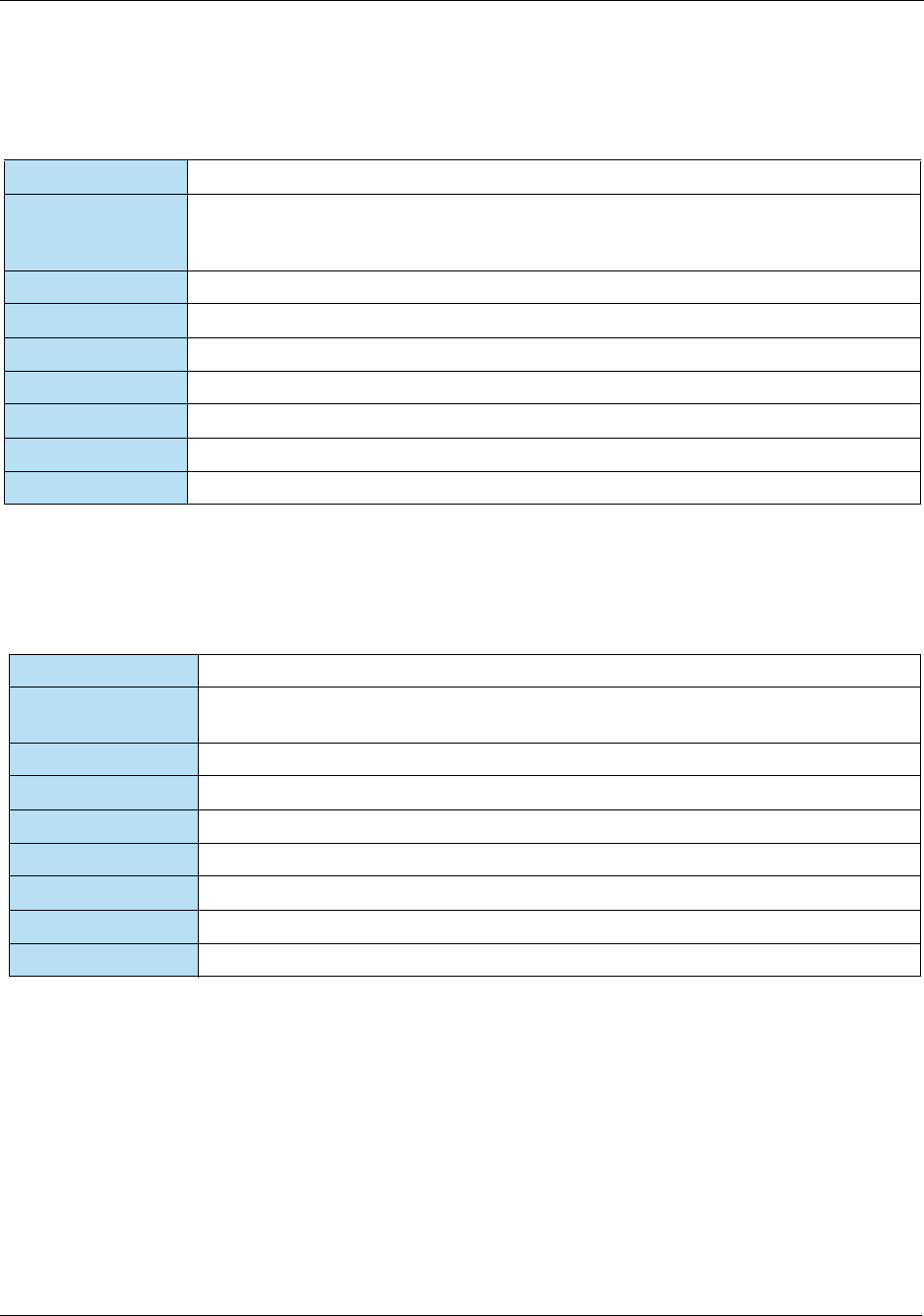

List of Tables HPS Integrator’s Guide V 17.2

14 2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive

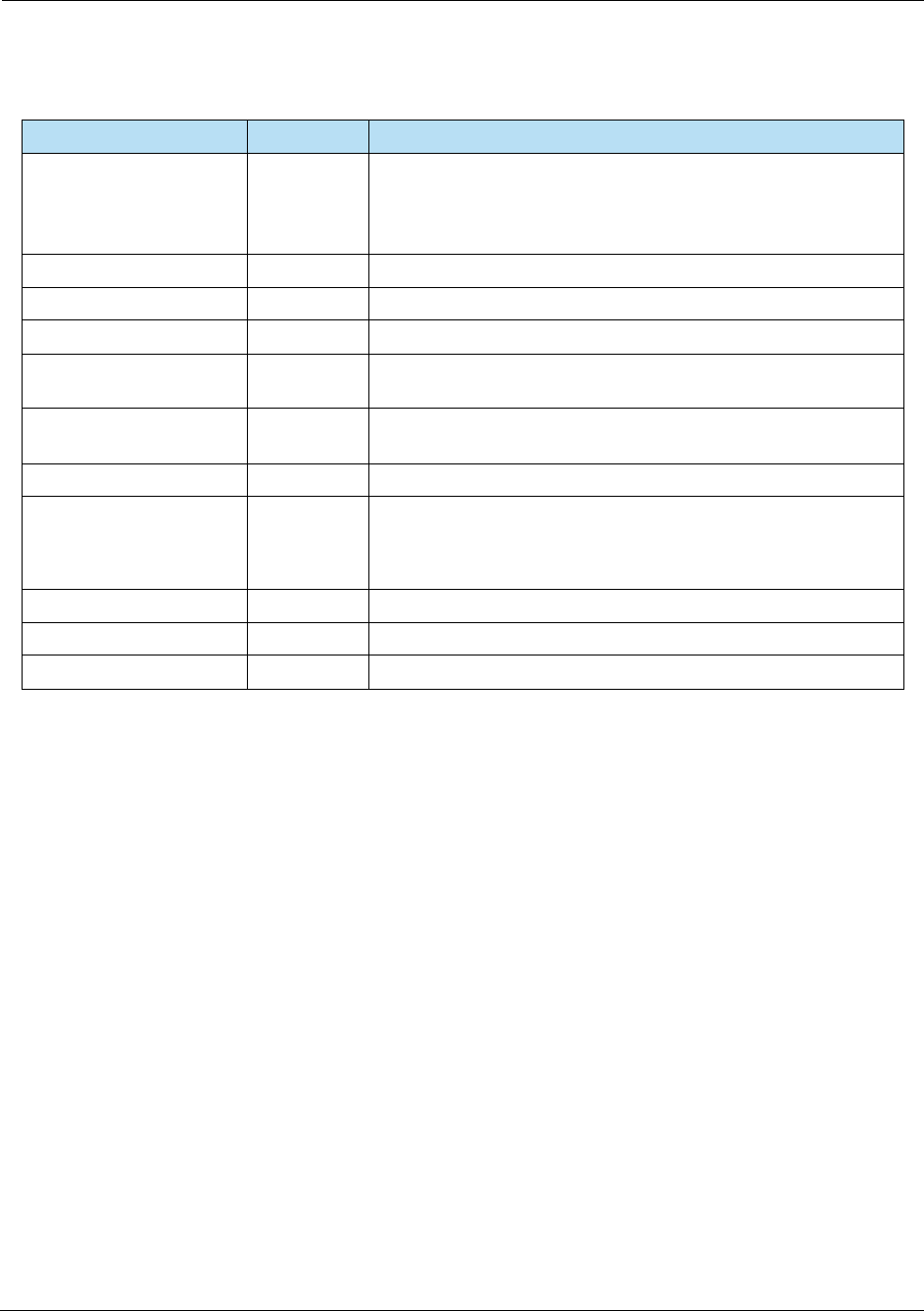

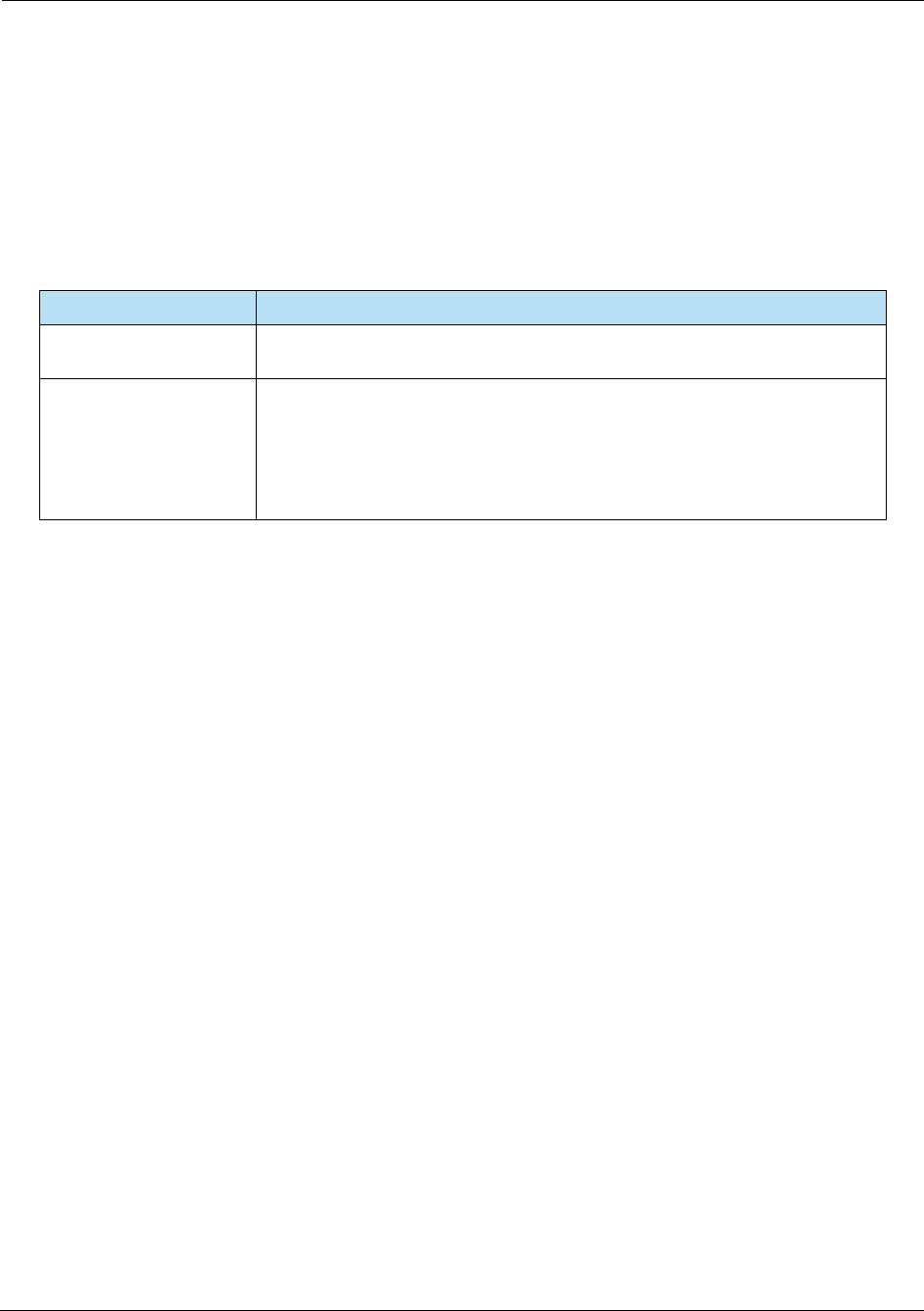

3-38 Voyager Fleet Account Number Information Method ..................................................................67

3-39 Voyager Fleet Track 1 Format ....................................................................................................68

3-40 Voyager Fleet Track 2 Format ....................................................................................................69

3-41 WEX Fleet Track 2 Format .........................................................................................................72

4-1 PAN Encryption...........................................................................................................................76

4-2 Track 1 Encryption ......................................................................................................................76

4-3 Track 2 Encryption ......................................................................................................................76

4-4 Encrypted CSC Steps .................................................................................................................77

4-5 Authorization Examples ..............................................................................................................79

4-6 POS 8583 Data Fields ................................................................................................................83

4-7 NTS Data Fields..........................................................................................................................85

4-8 Z01 Data Fields...........................................................................................................................87

4-9 E3 MSR Wedge Operation Modes..............................................................................................89

4-10 E3 MSR Wedge Operation Modes..............................................................................................91

5-1 Key Security Features.................................................................................................................96

5-2 Liability Shifts ..............................................................................................................................97

5-3 Contact Specifications ................................................................................................................98

5-4 Contactless Specifications ..........................................................................................................99

5-5 Heartland Host Specifications.....................................................................................................99

5-6 Card Authentication ..................................................................................................................100

5-7 Cardholder Verification .............................................................................................................100

5-8 Authorization .............................................................................................................................100

5-9 Full vs. Partial EMV Transactions and Flow .............................................................................101

5-10 Full vs. Partial Transaction Flow ...............................................................................................101

5-11 Full vs. Partial Credit Transactions ...........................................................................................102

5-12 Full vs. Partial Debit Transactions ............................................................................................103

6-1 Integrated Solutions ..................................................................................................................106

6-2 VSDC Testing ...........................................................................................................................108

6-3 M-TIP Testing ...........................................................................................................................108

6-4 AEIPS Testing...........................................................................................................................108

6-5 D-PAS Testing ..........................................................................................................................109

6-6 Test Environments ....................................................................................................................110

6-7 Test Process .............................................................................................................................110

7-1 Command APDU Format ..........................................................................................................113

7-2 Response APDU Format ..........................................................................................................113

7-3 Data Conventions .....................................................................................................................115

7-4 Terminal Data ...........................................................................................................................116

7-5 Card Data..................................................................................................................................127

7-6 Issuer Data................................................................................................................................134

7-7 Tender Processing....................................................................................................................136

7-8 Fallback Processing..................................................................................................................138

7-9 Application Selection.................................................................................................................139

7-10 Supported Application Methods ................................................................................................140

7-11 Available AIDs...........................................................................................................................141

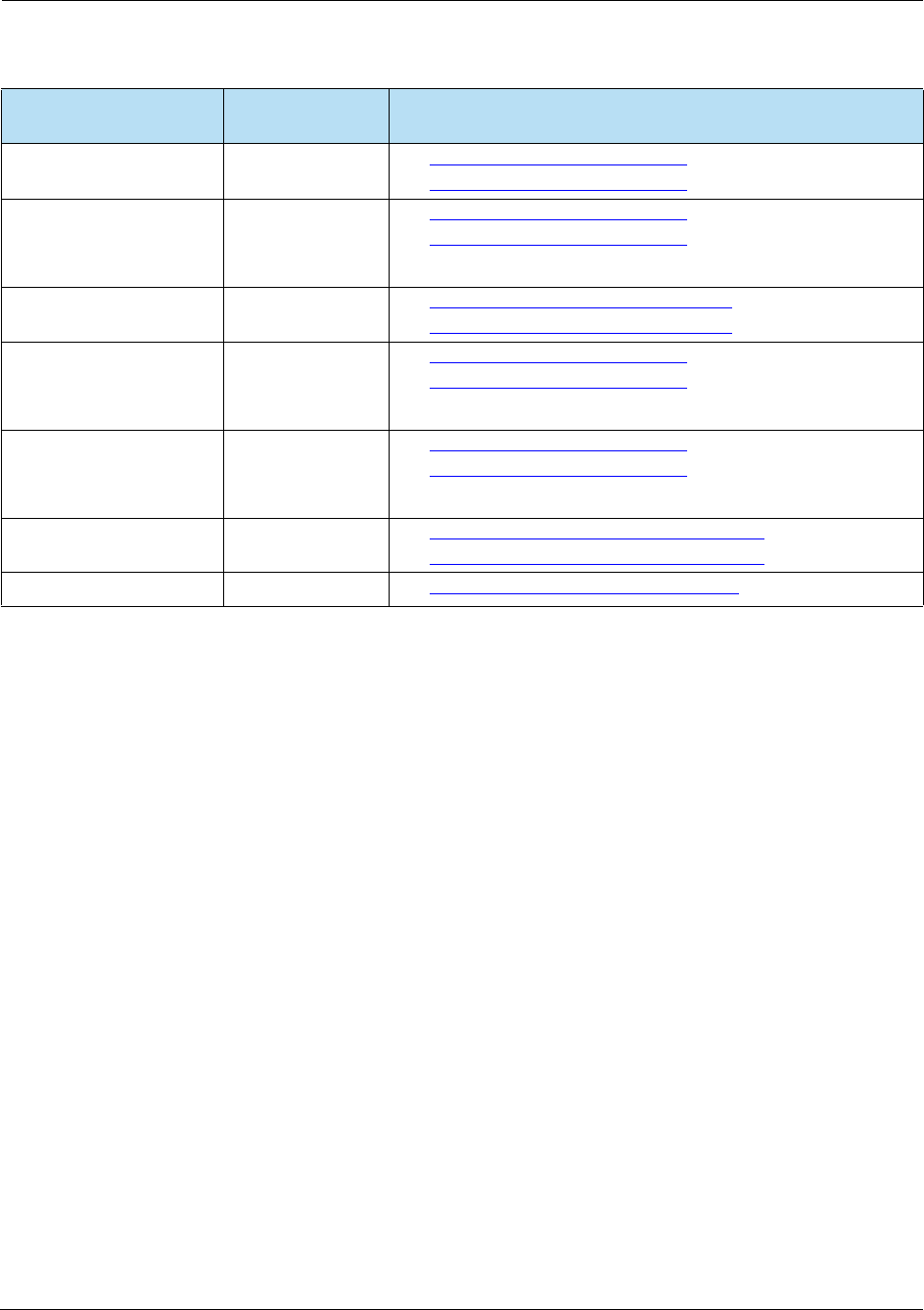

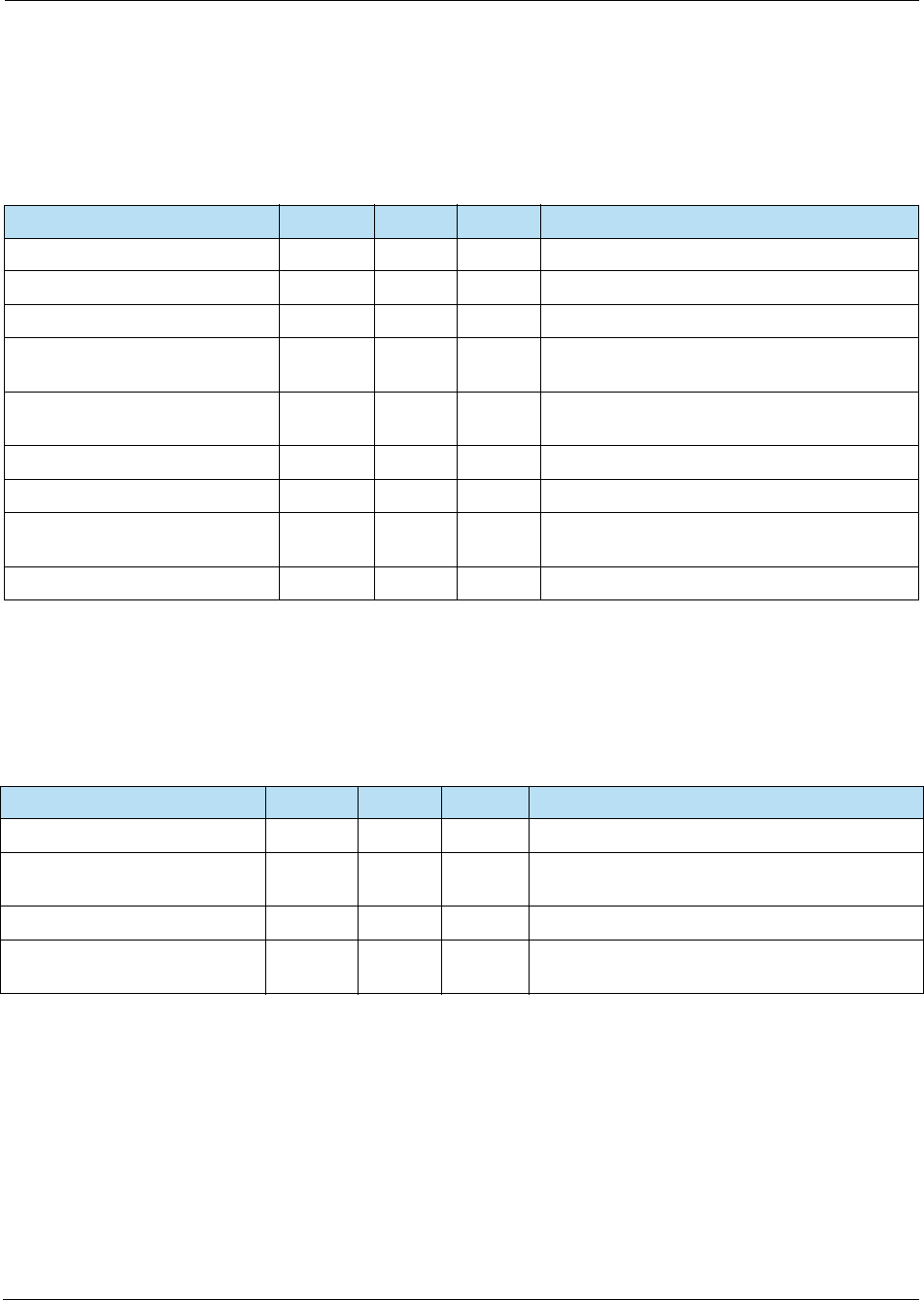

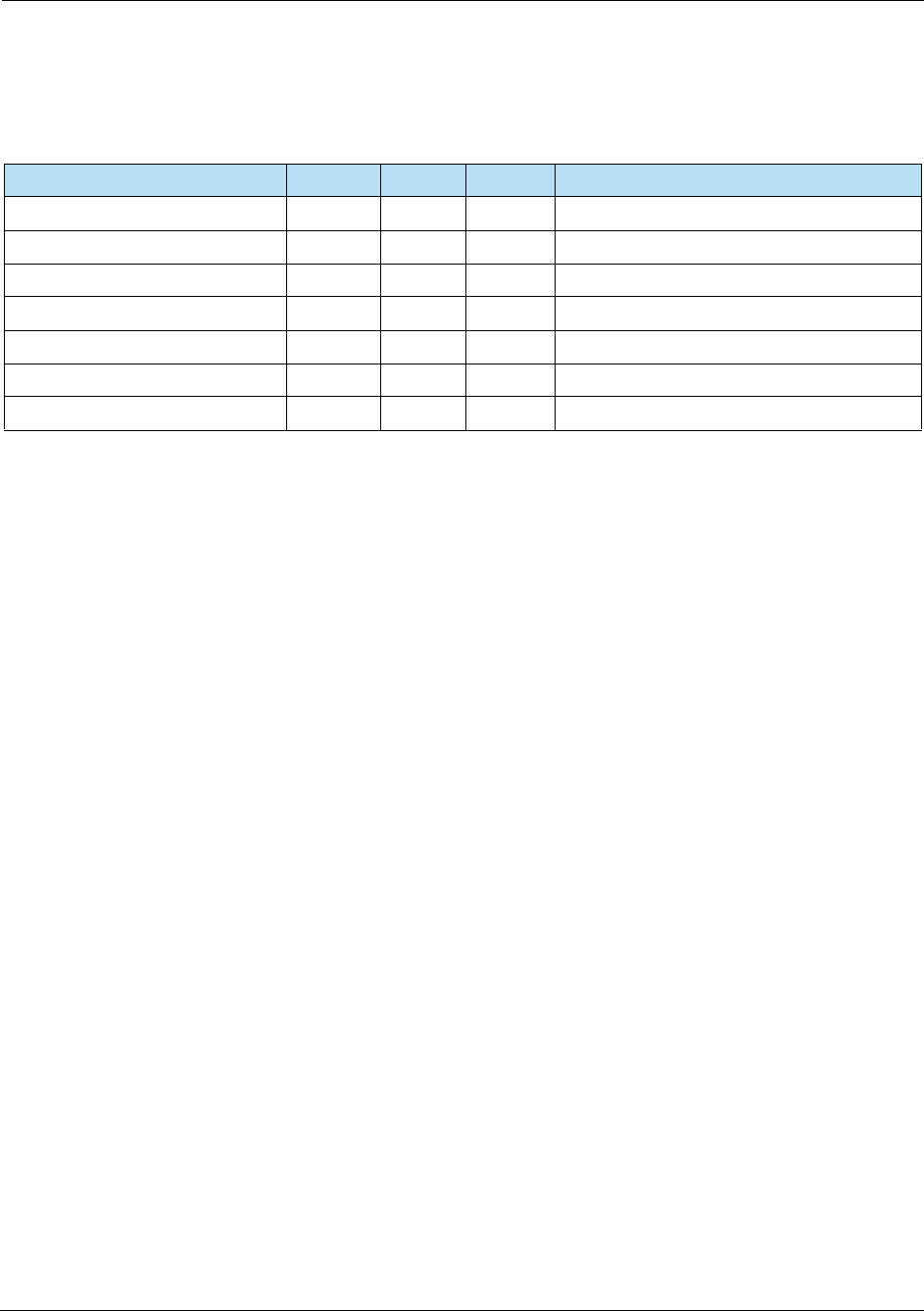

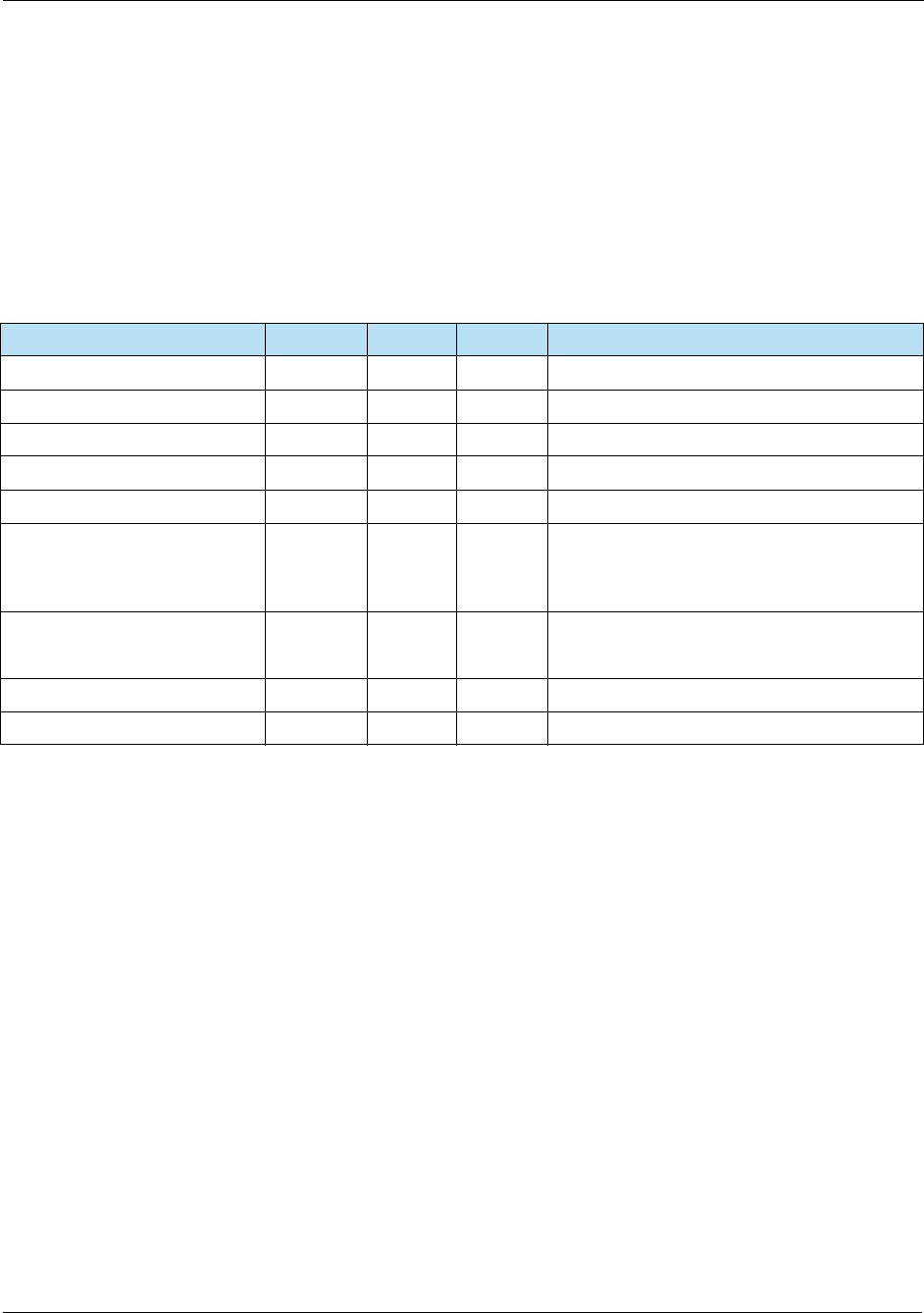

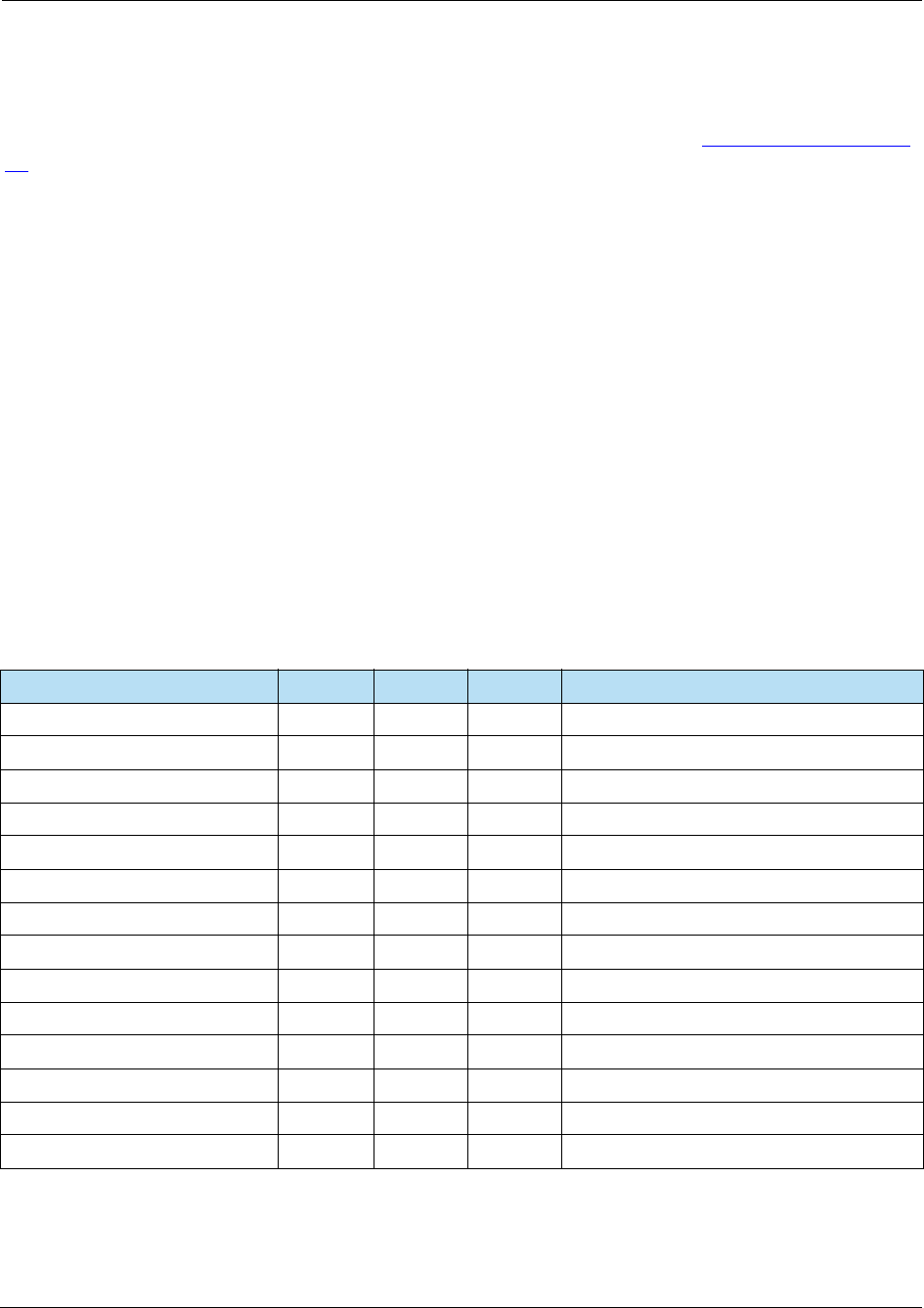

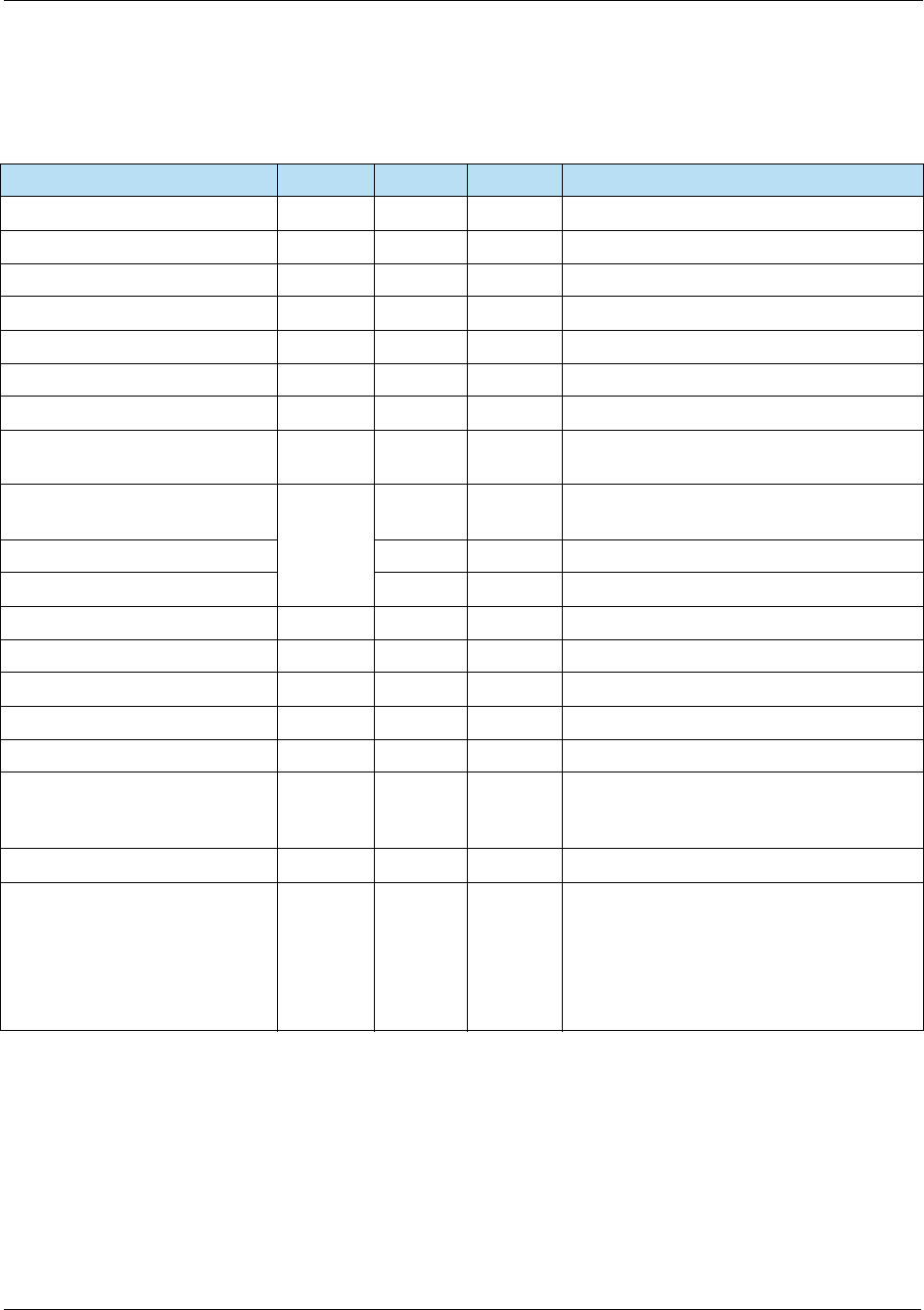

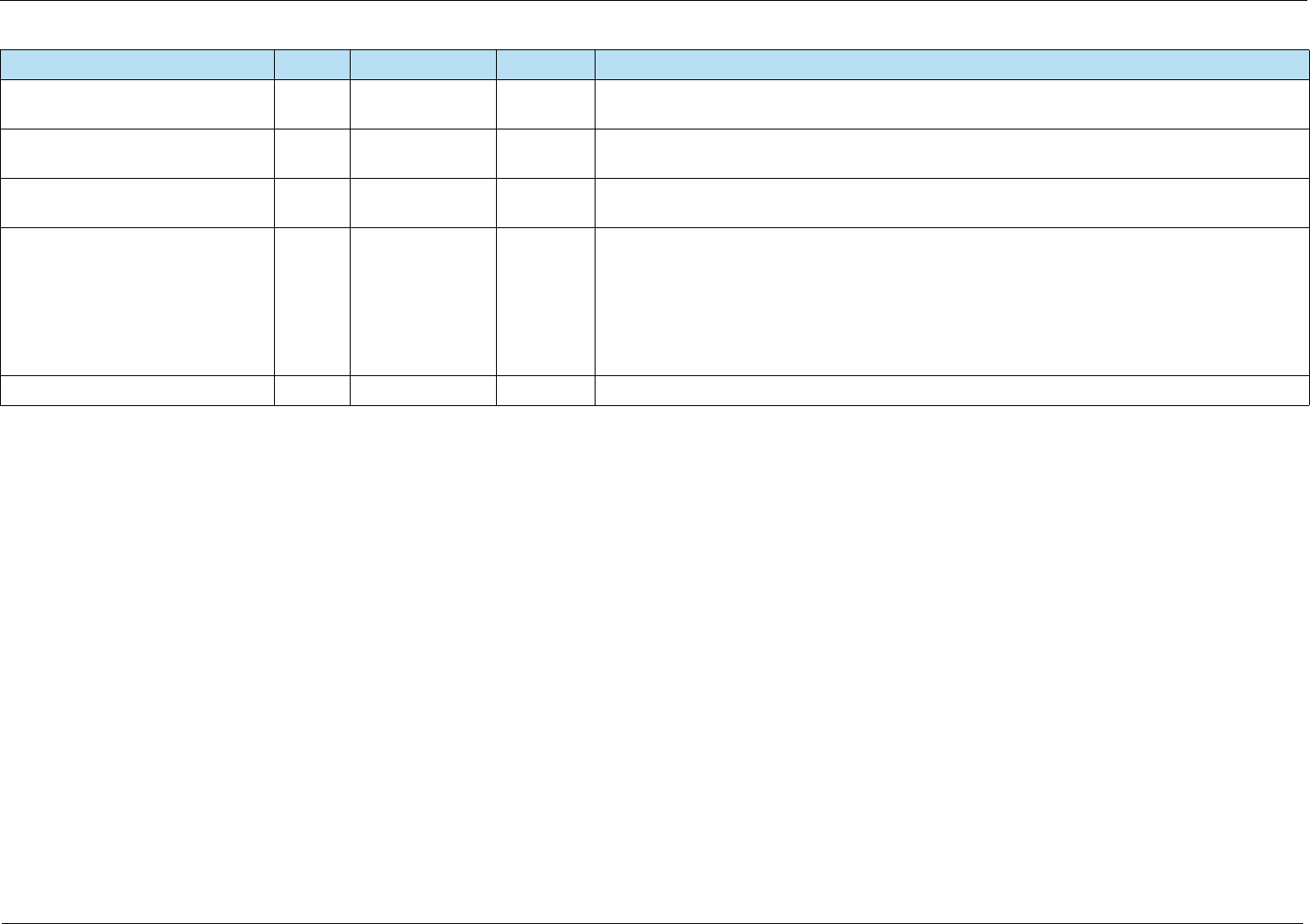

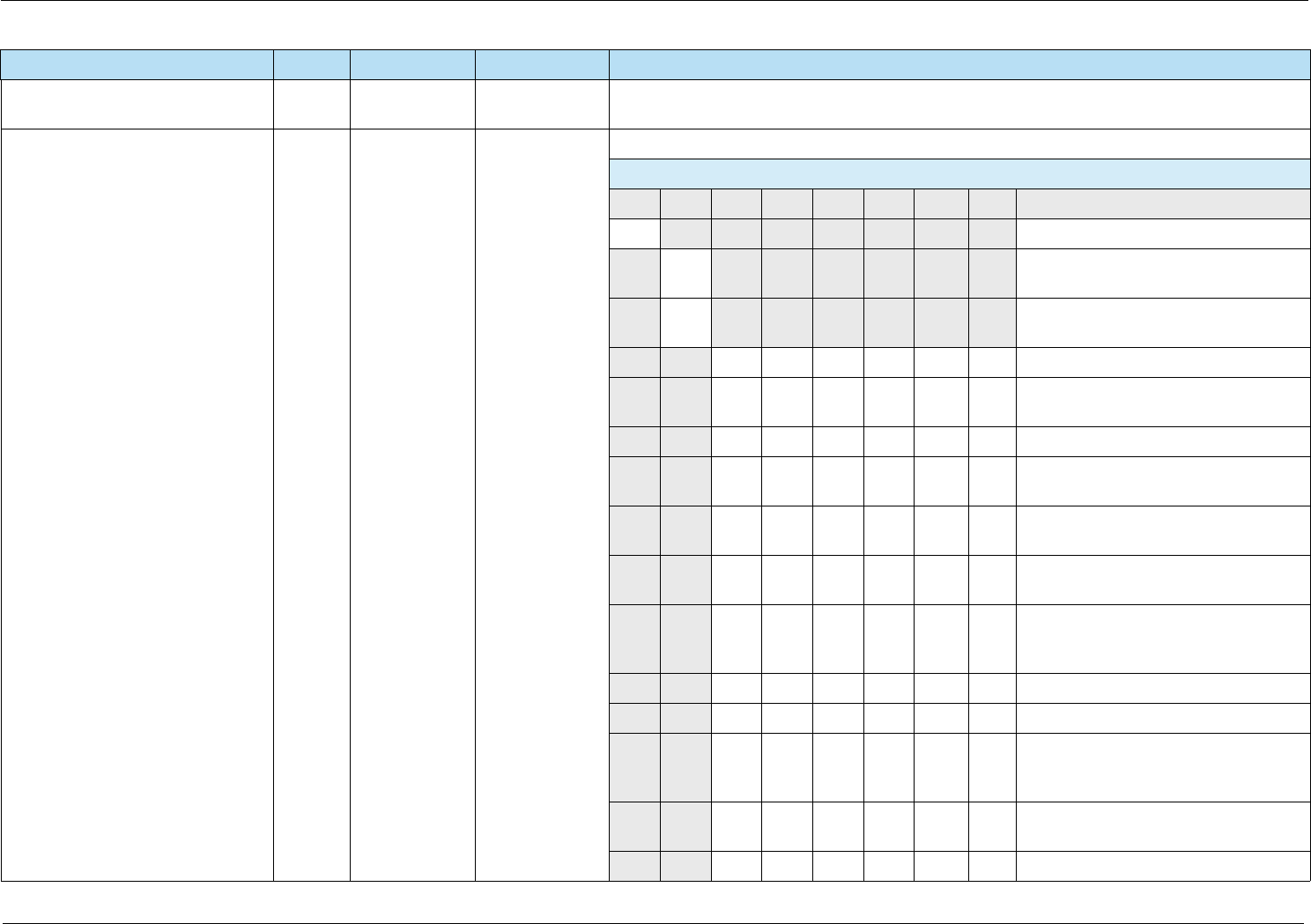

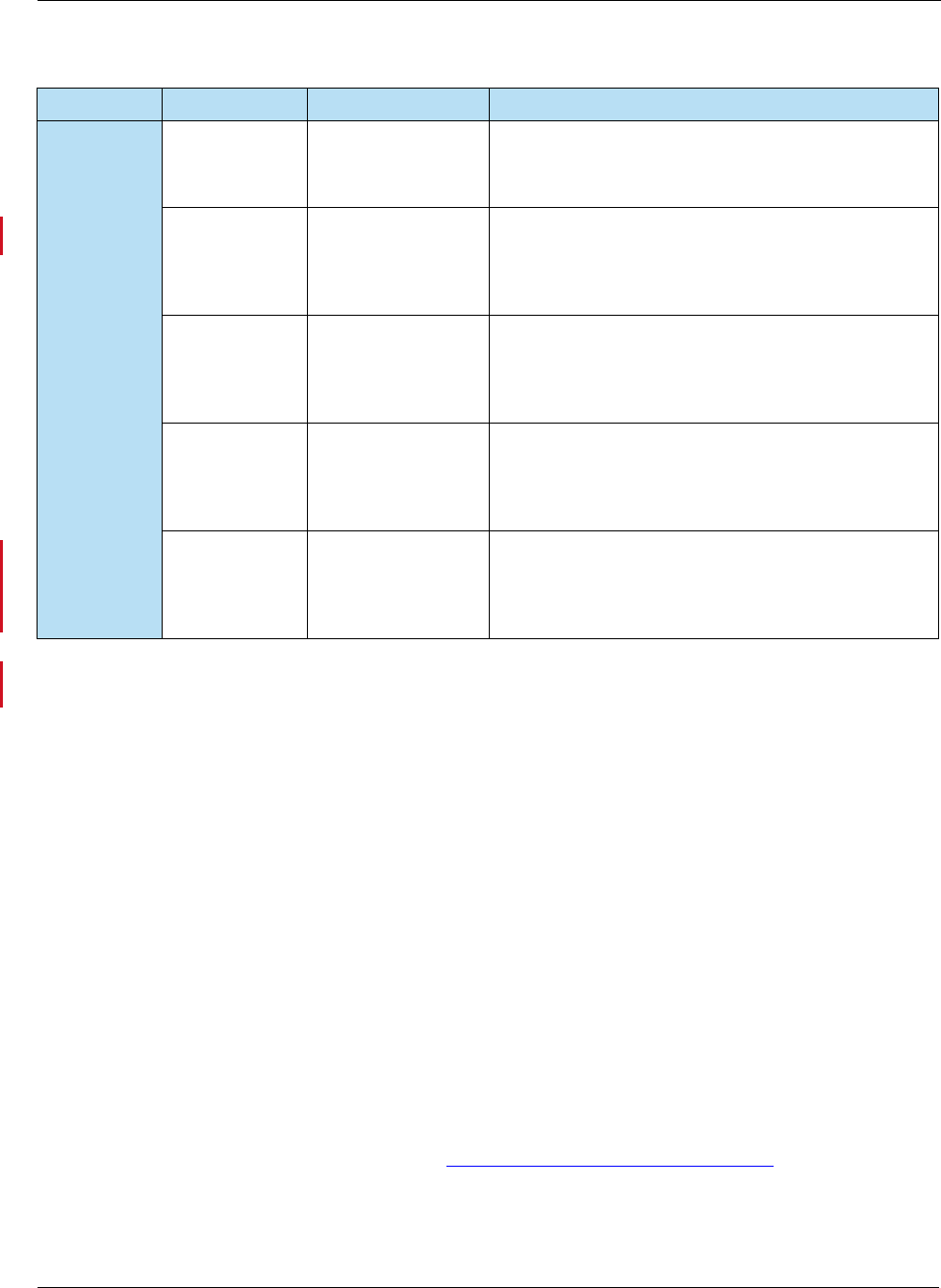

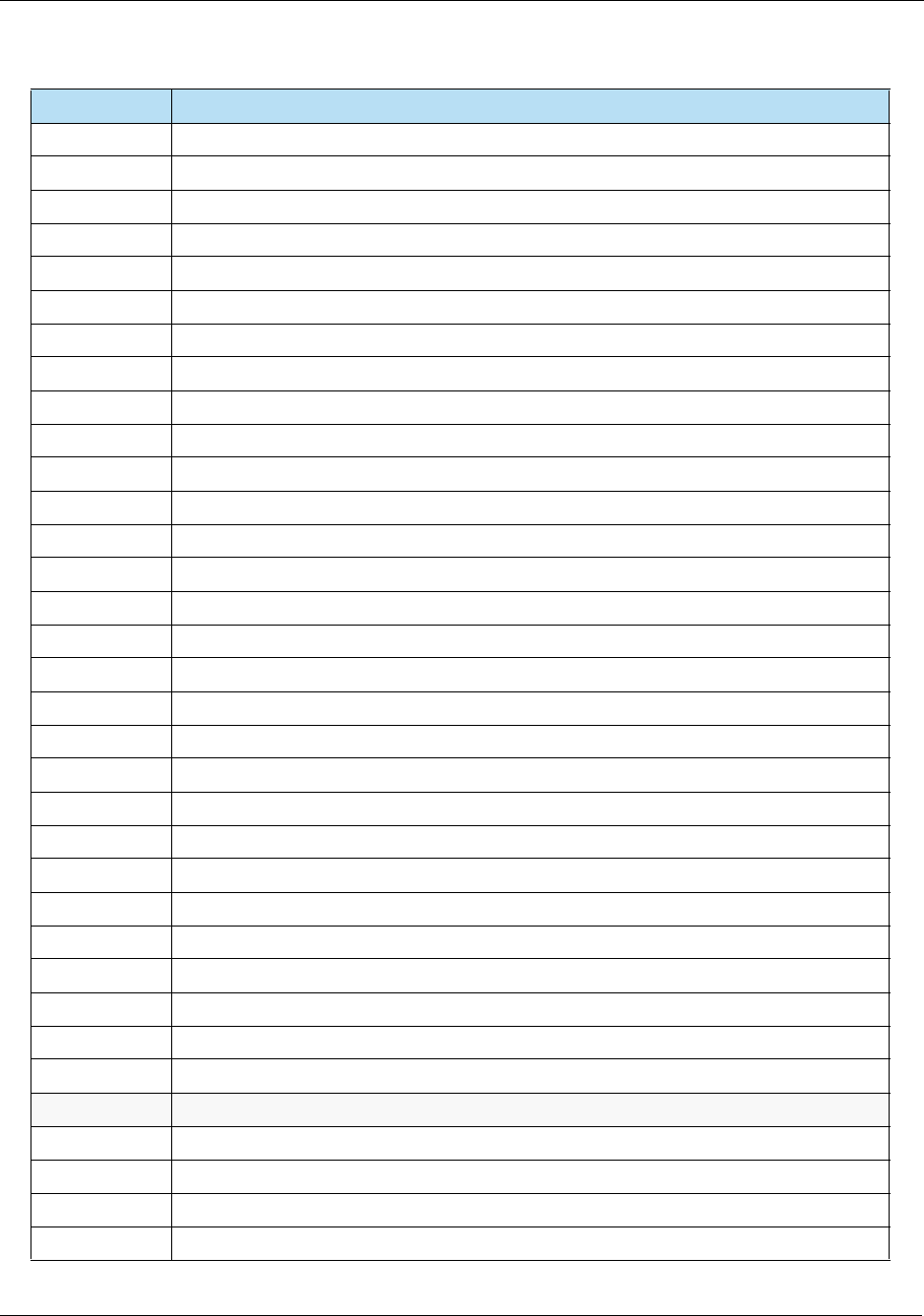

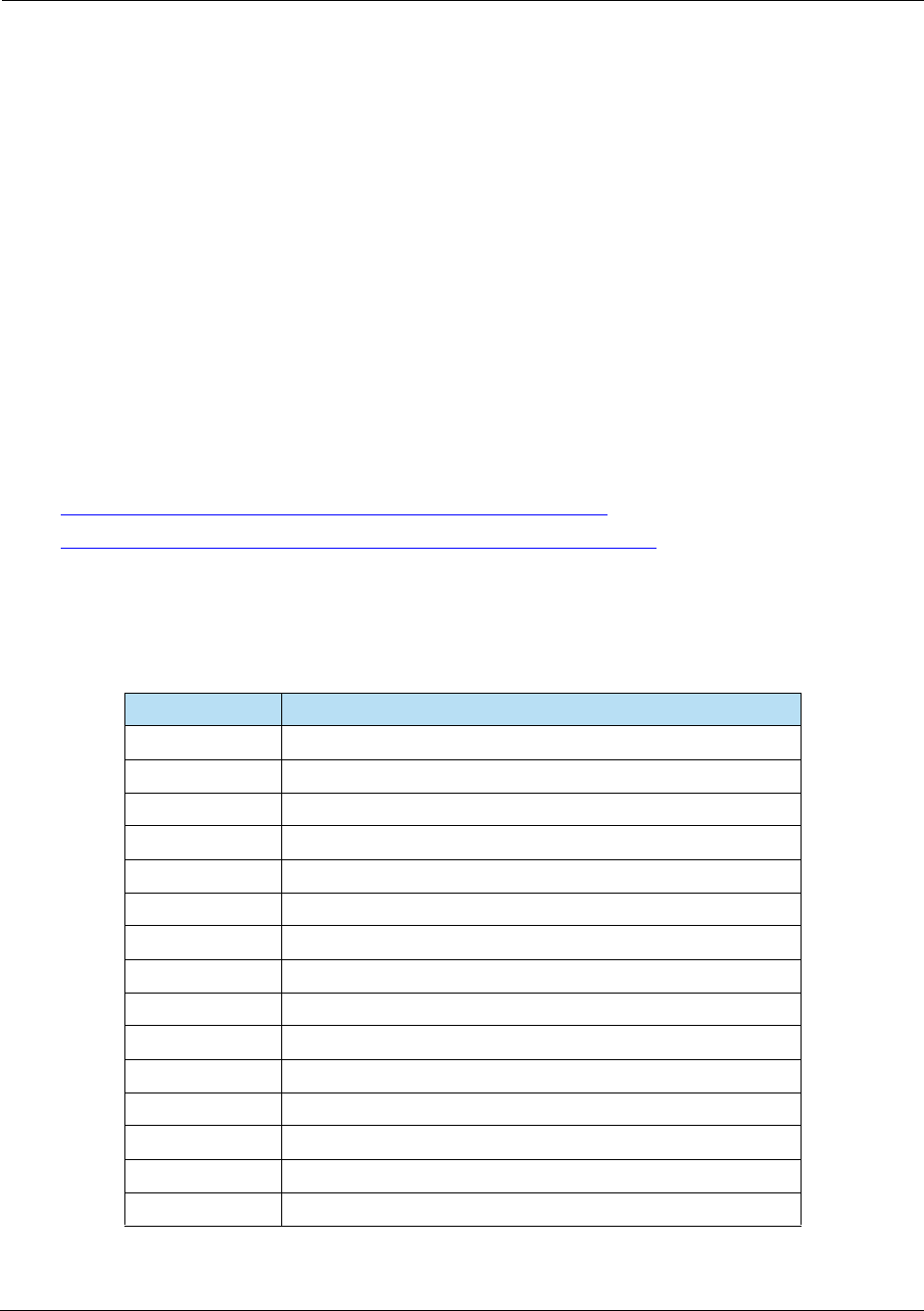

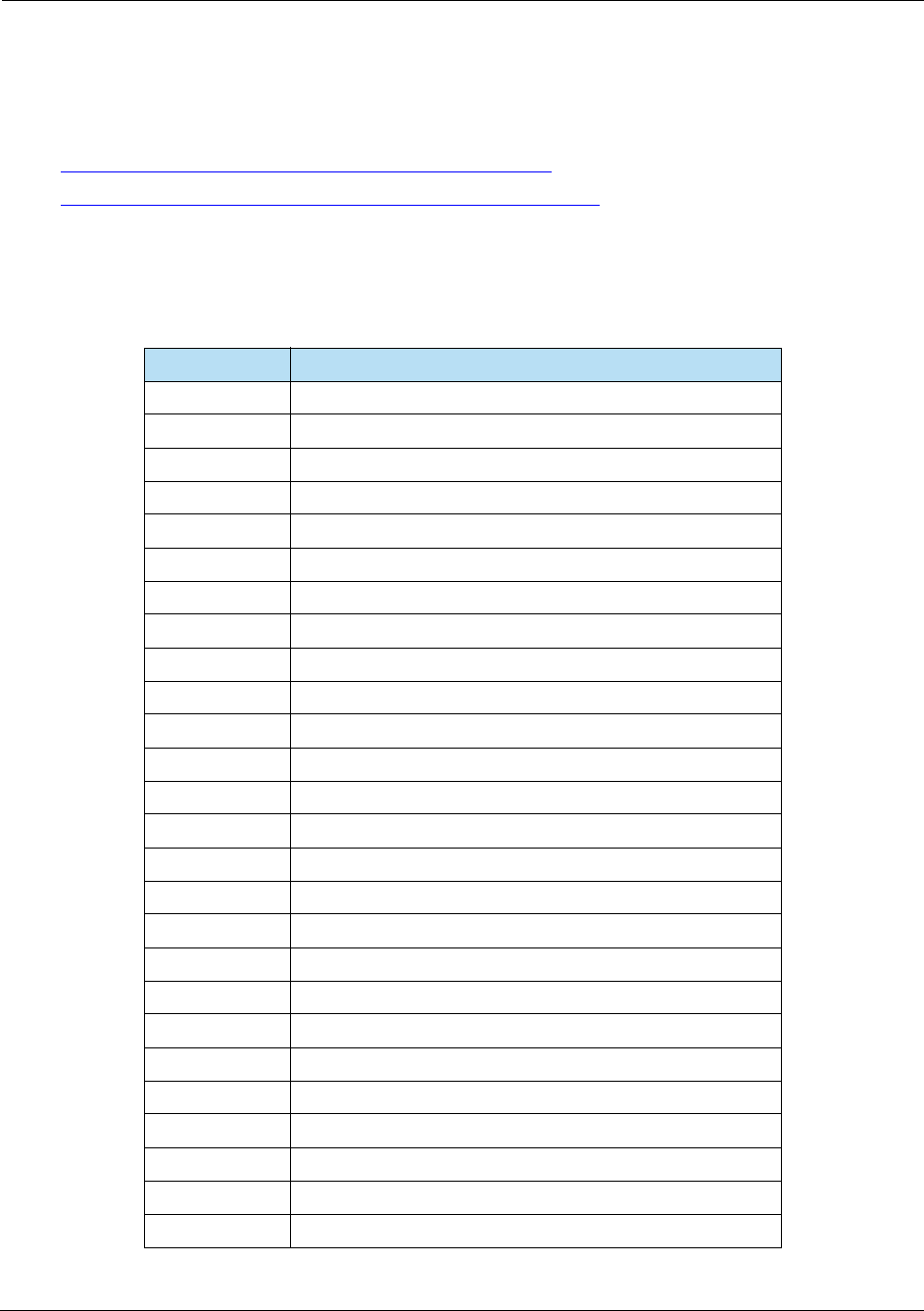

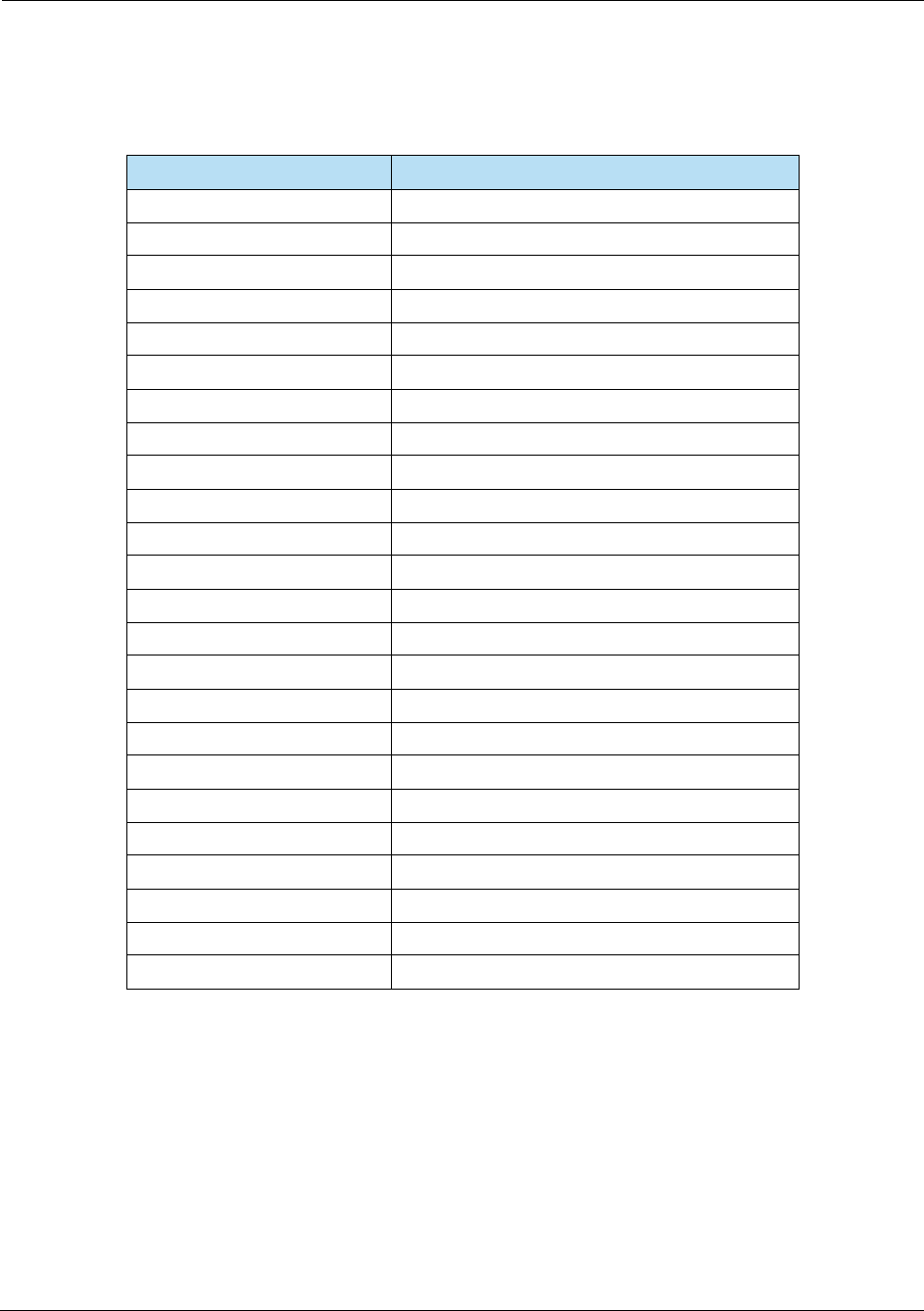

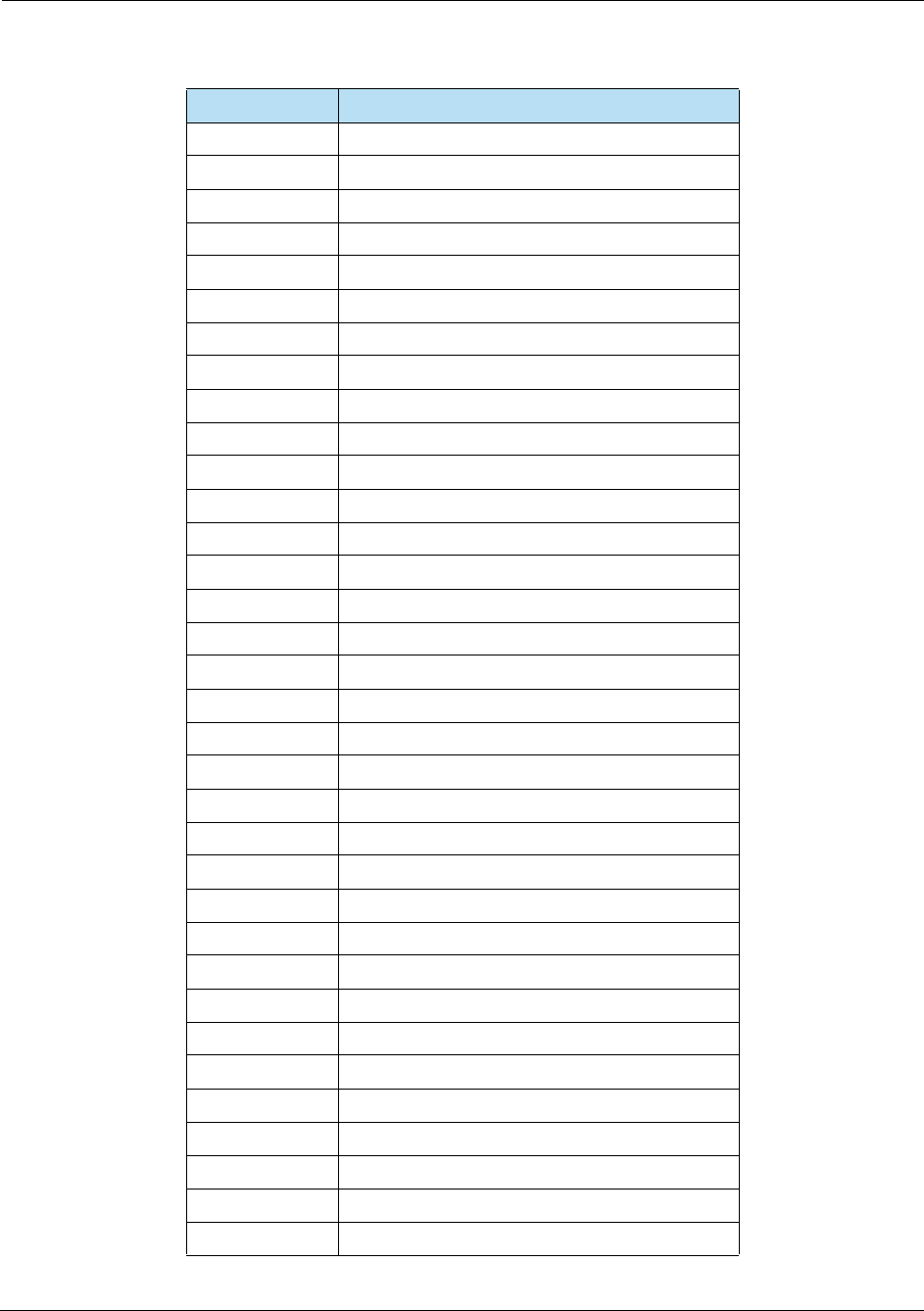

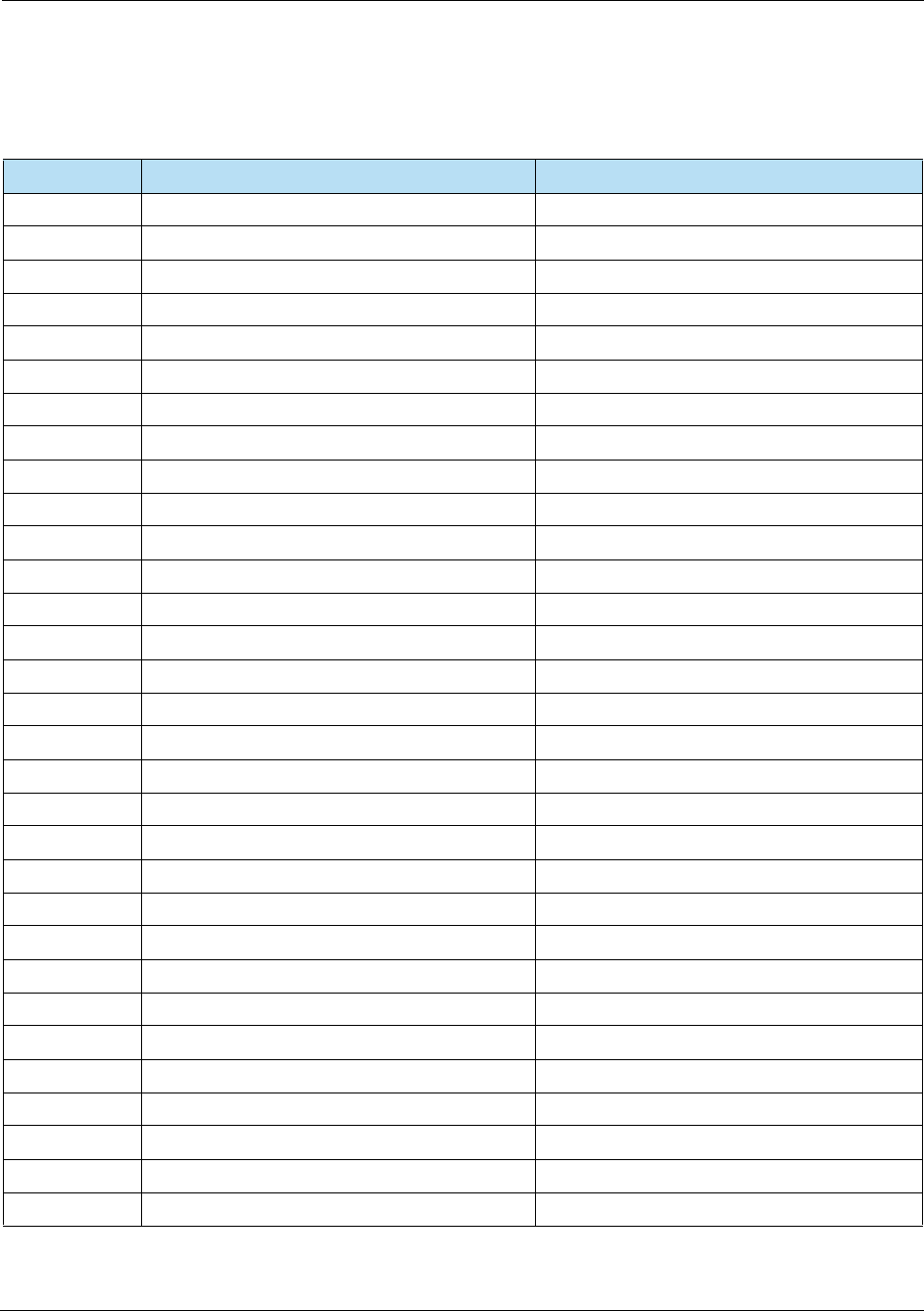

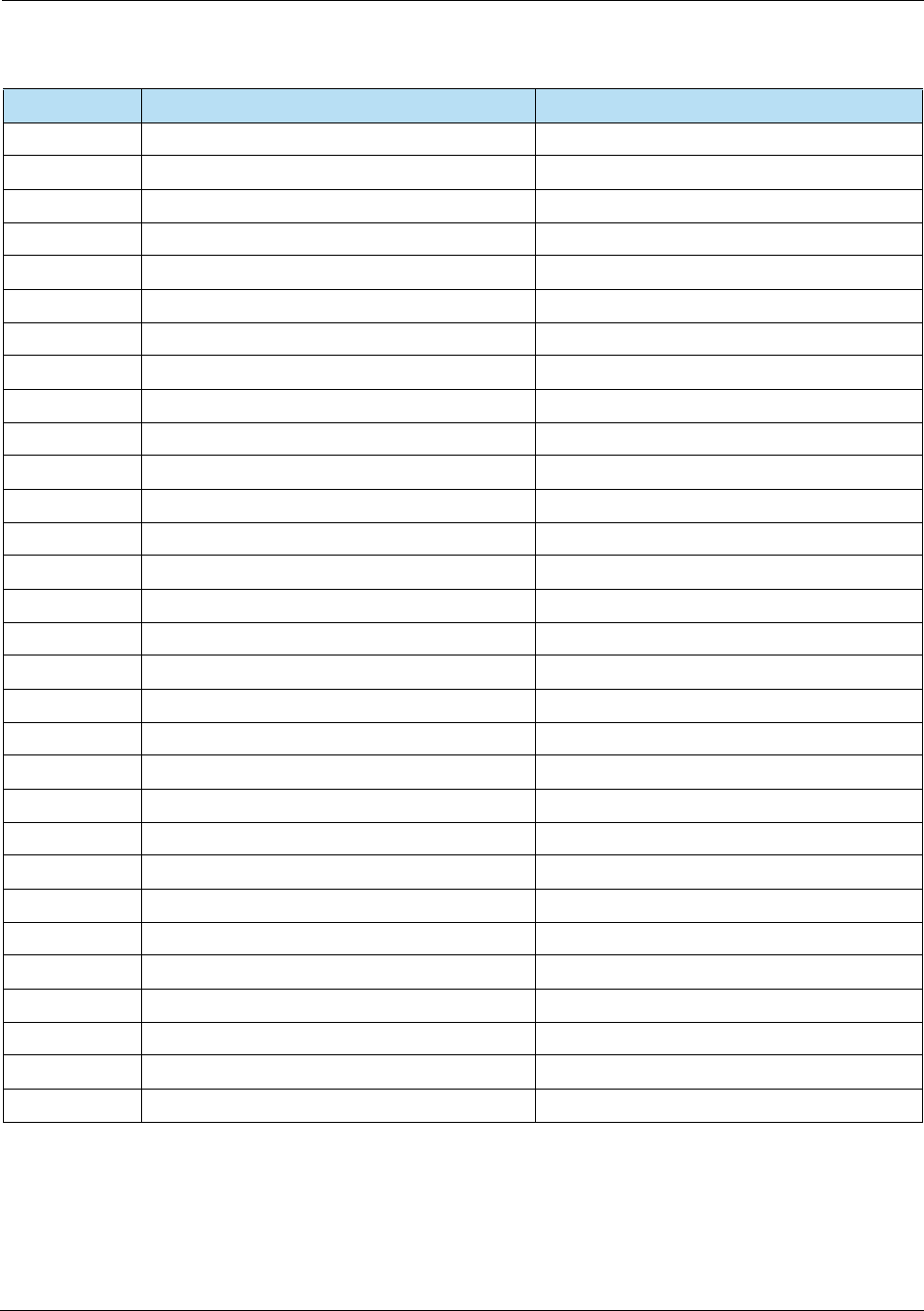

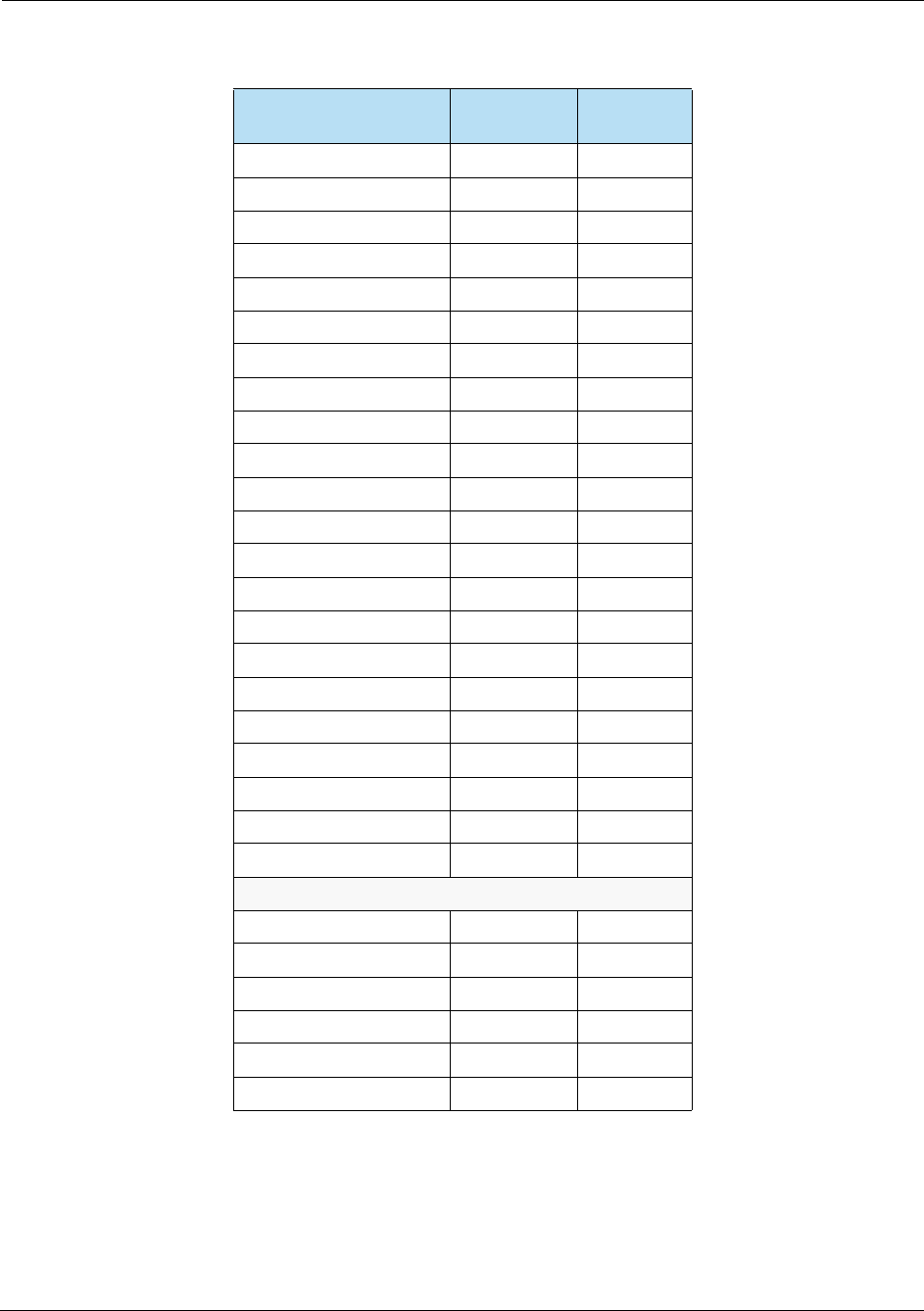

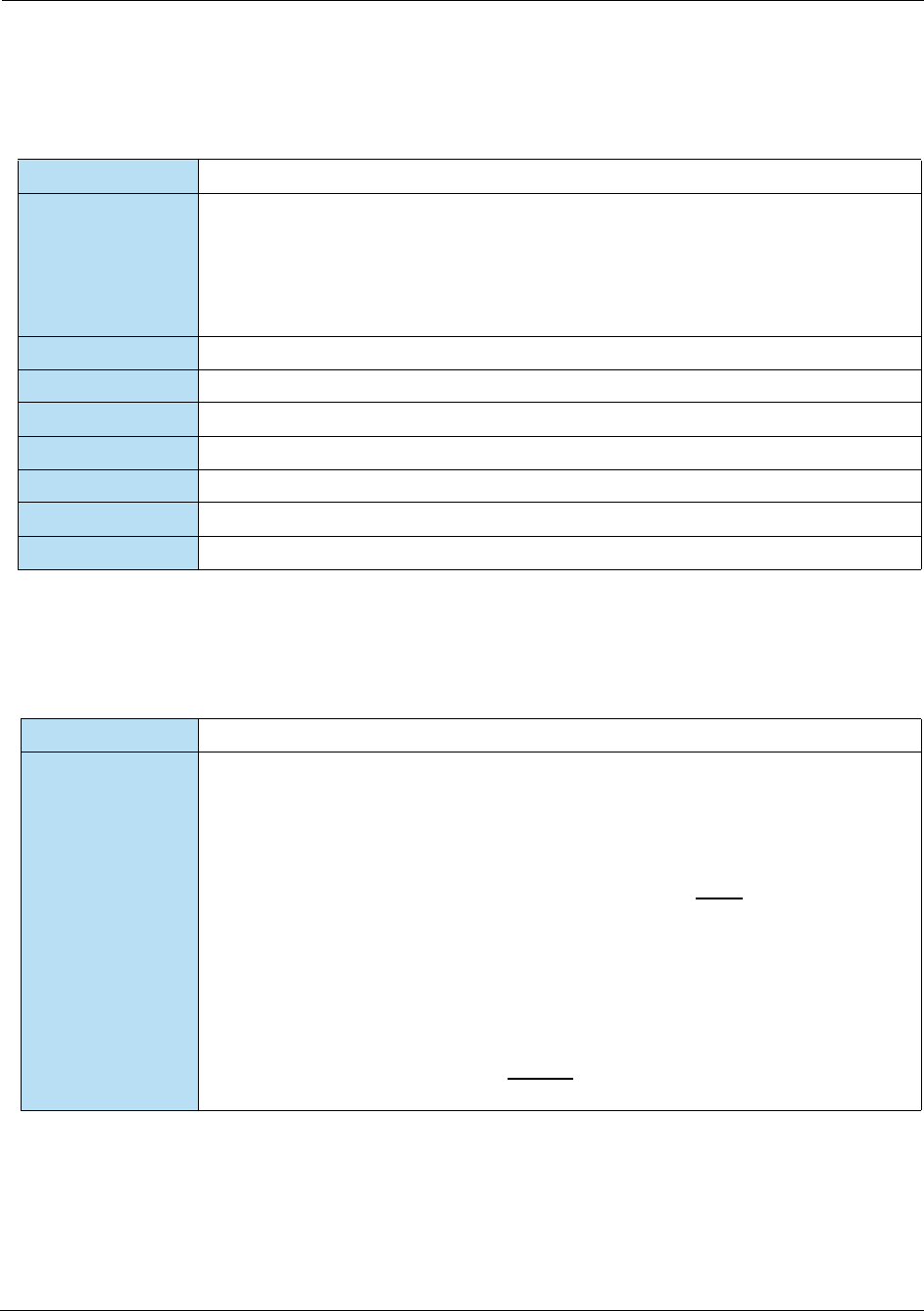

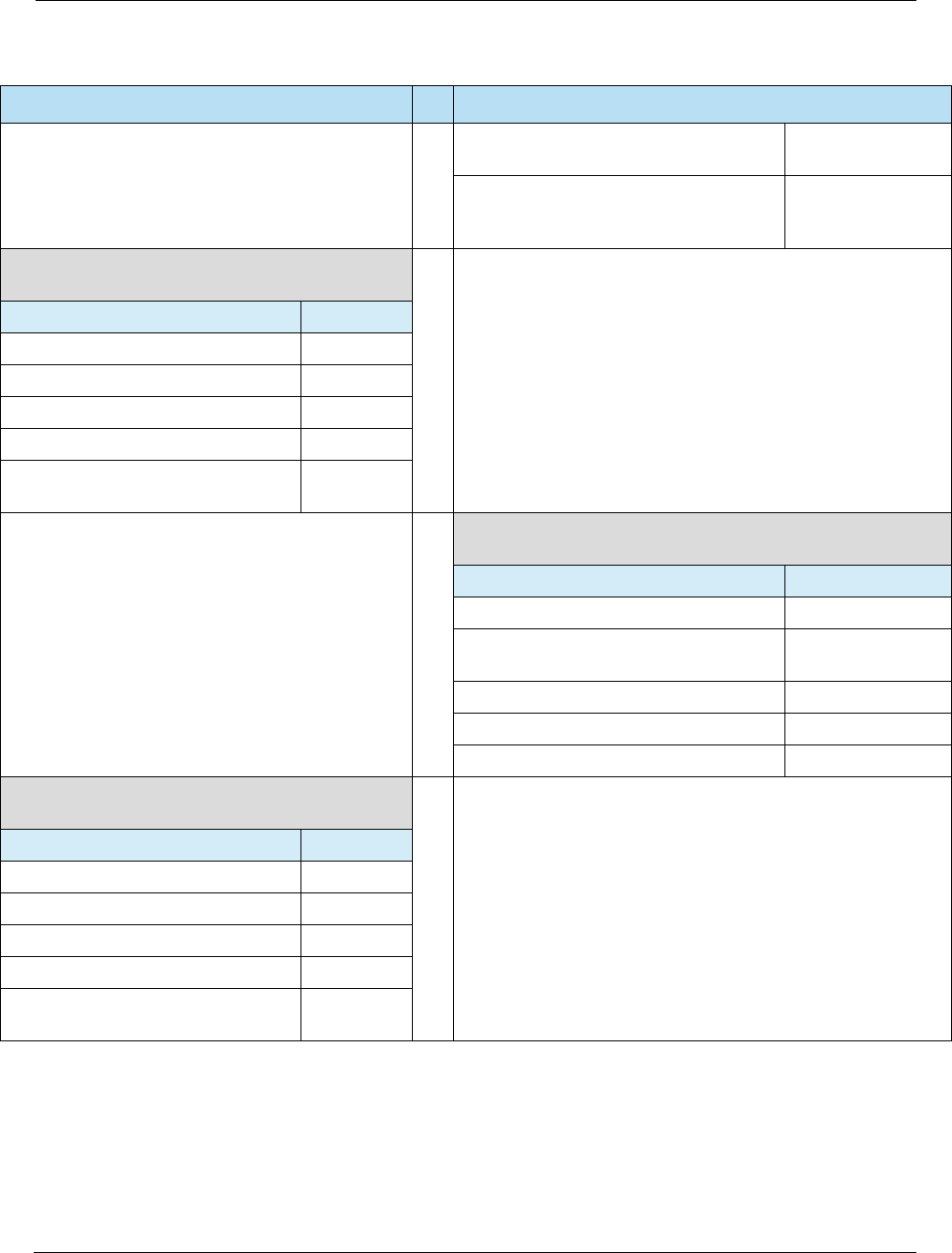

For Internal Use Only

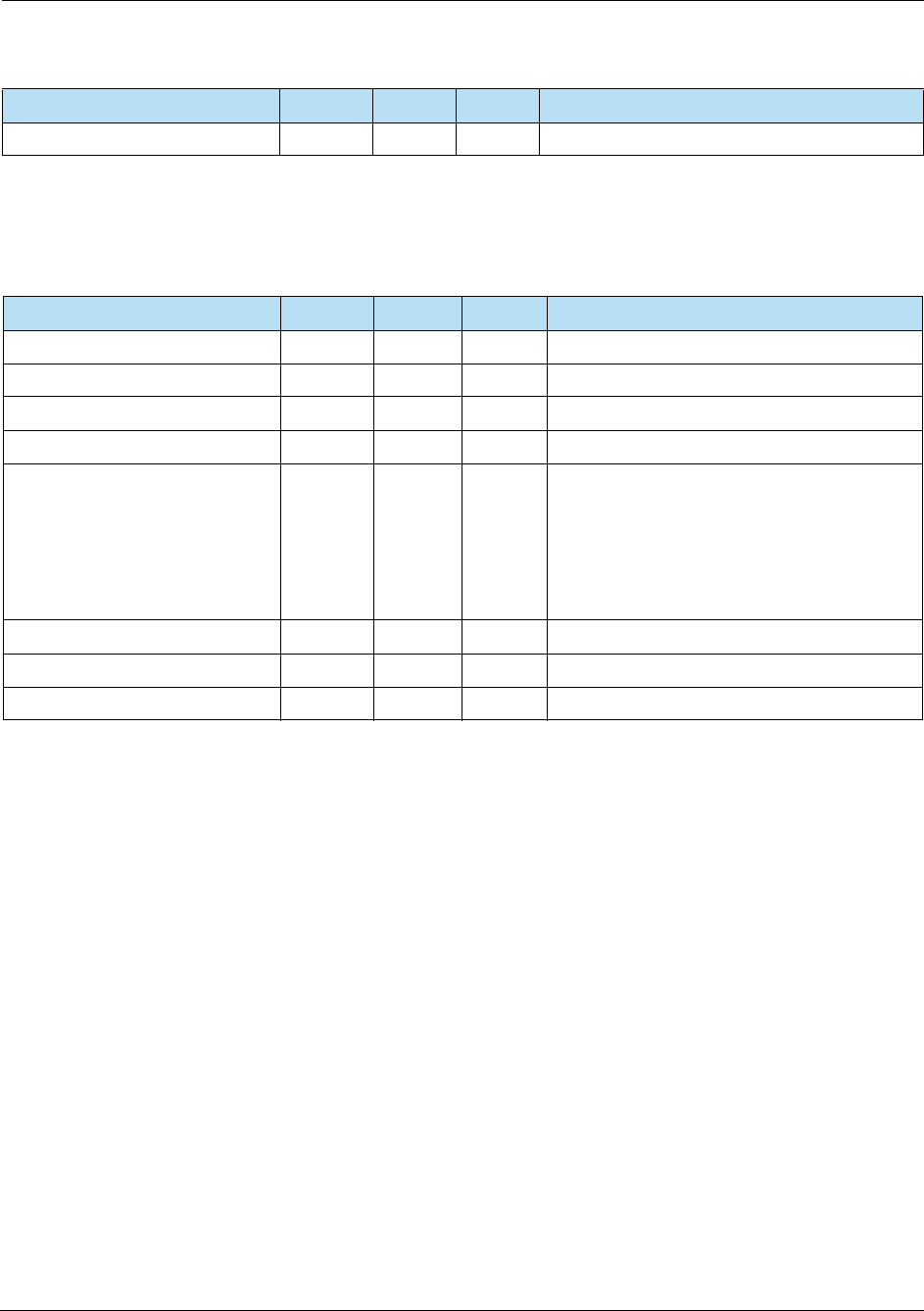

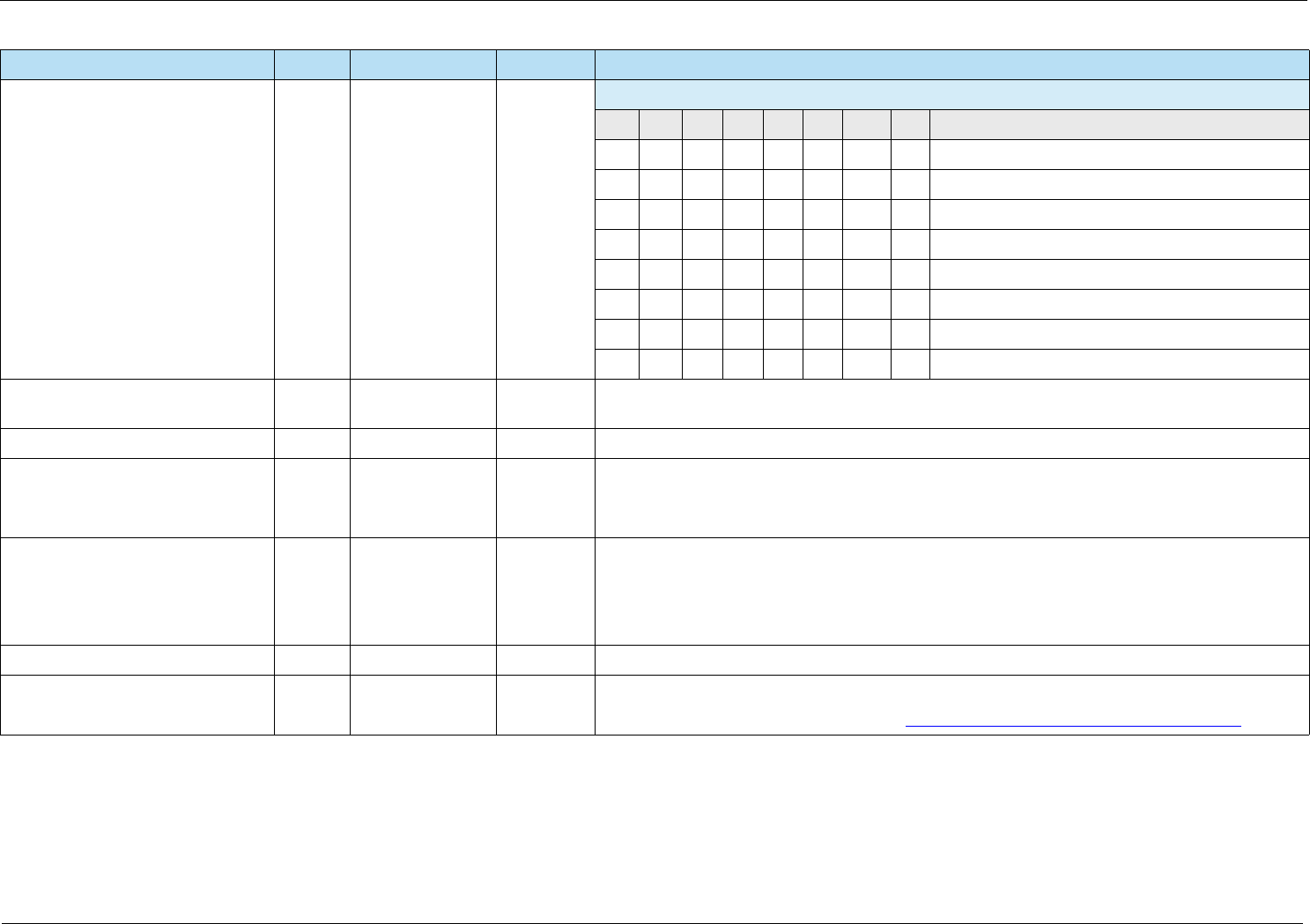

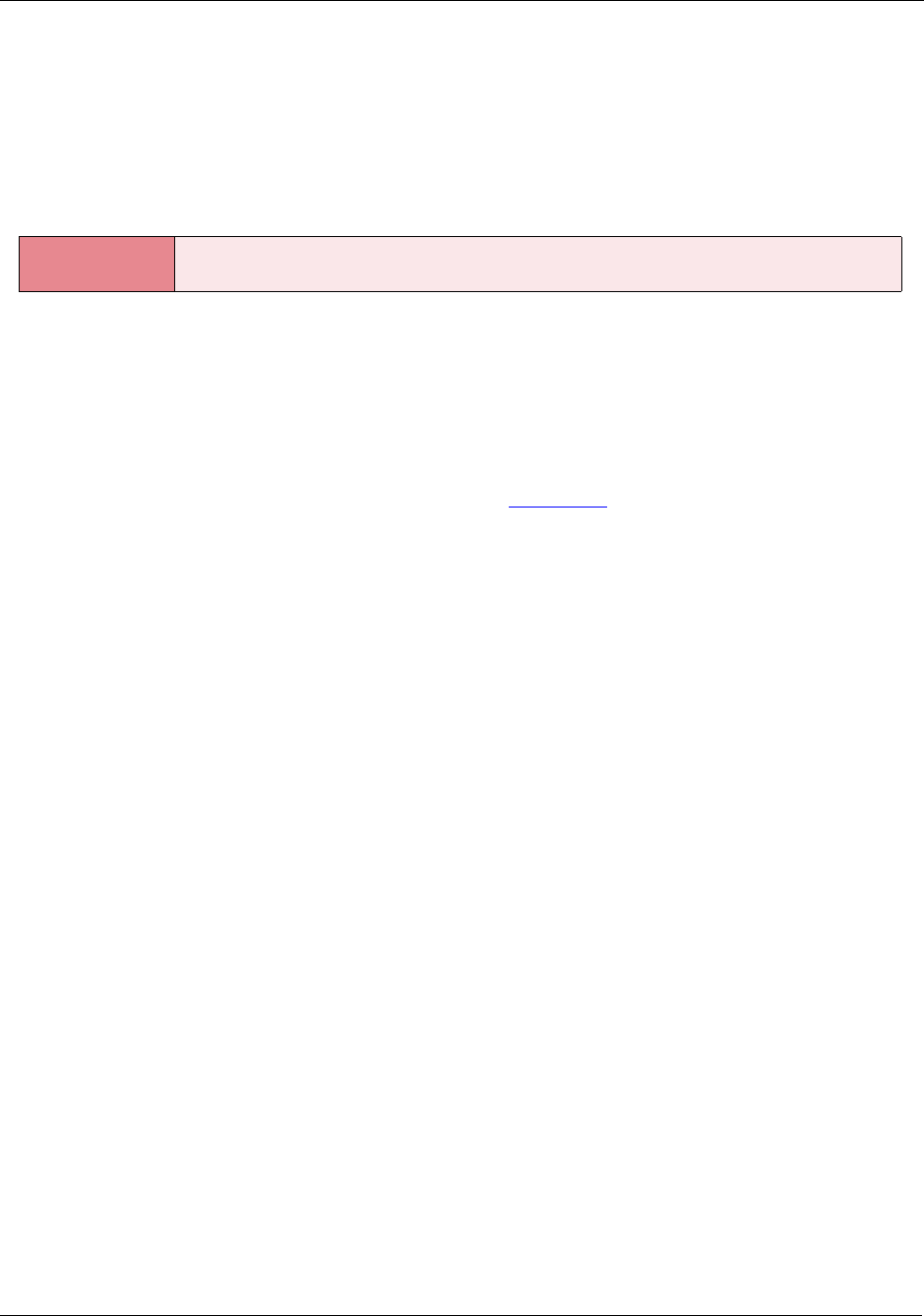

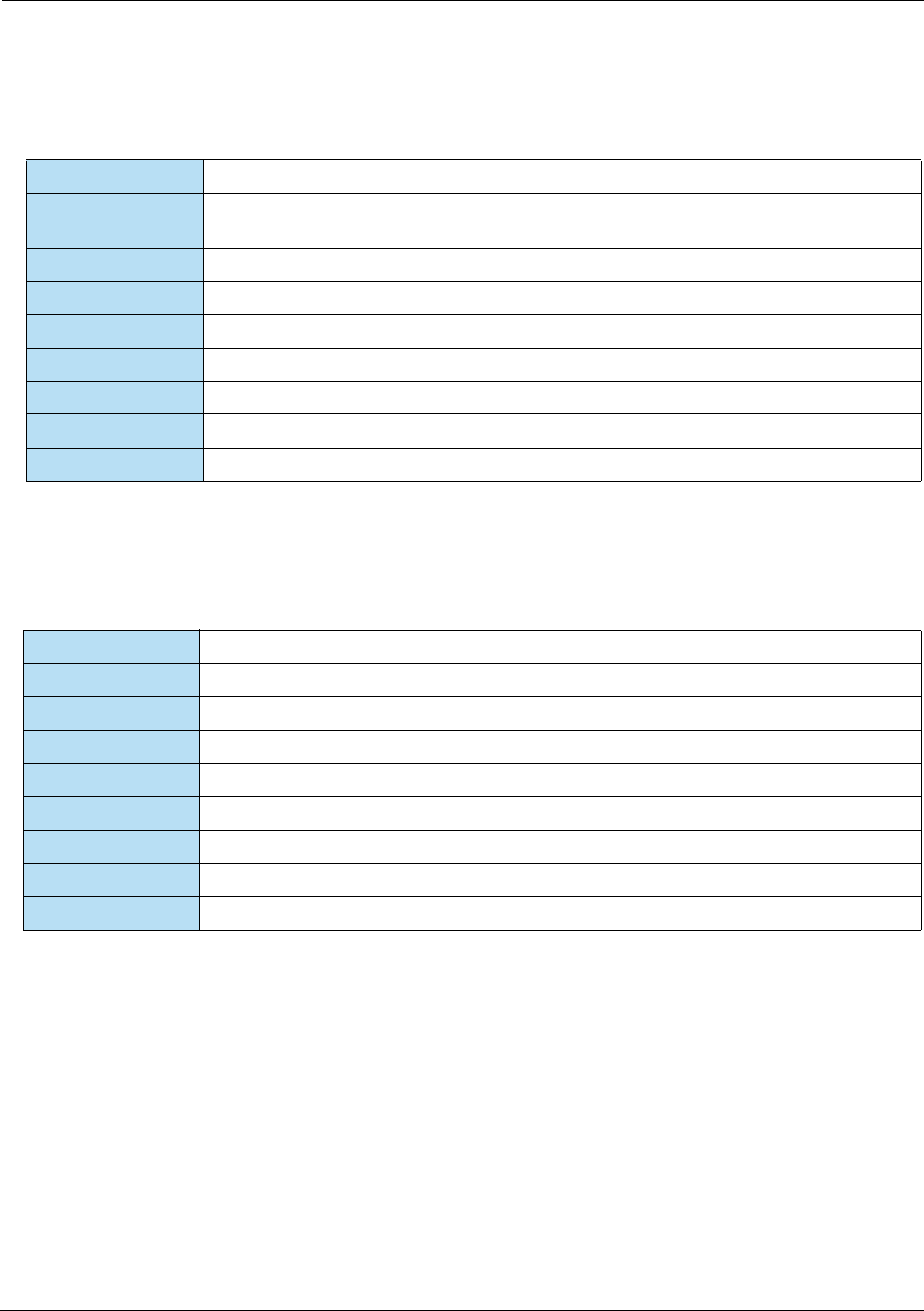

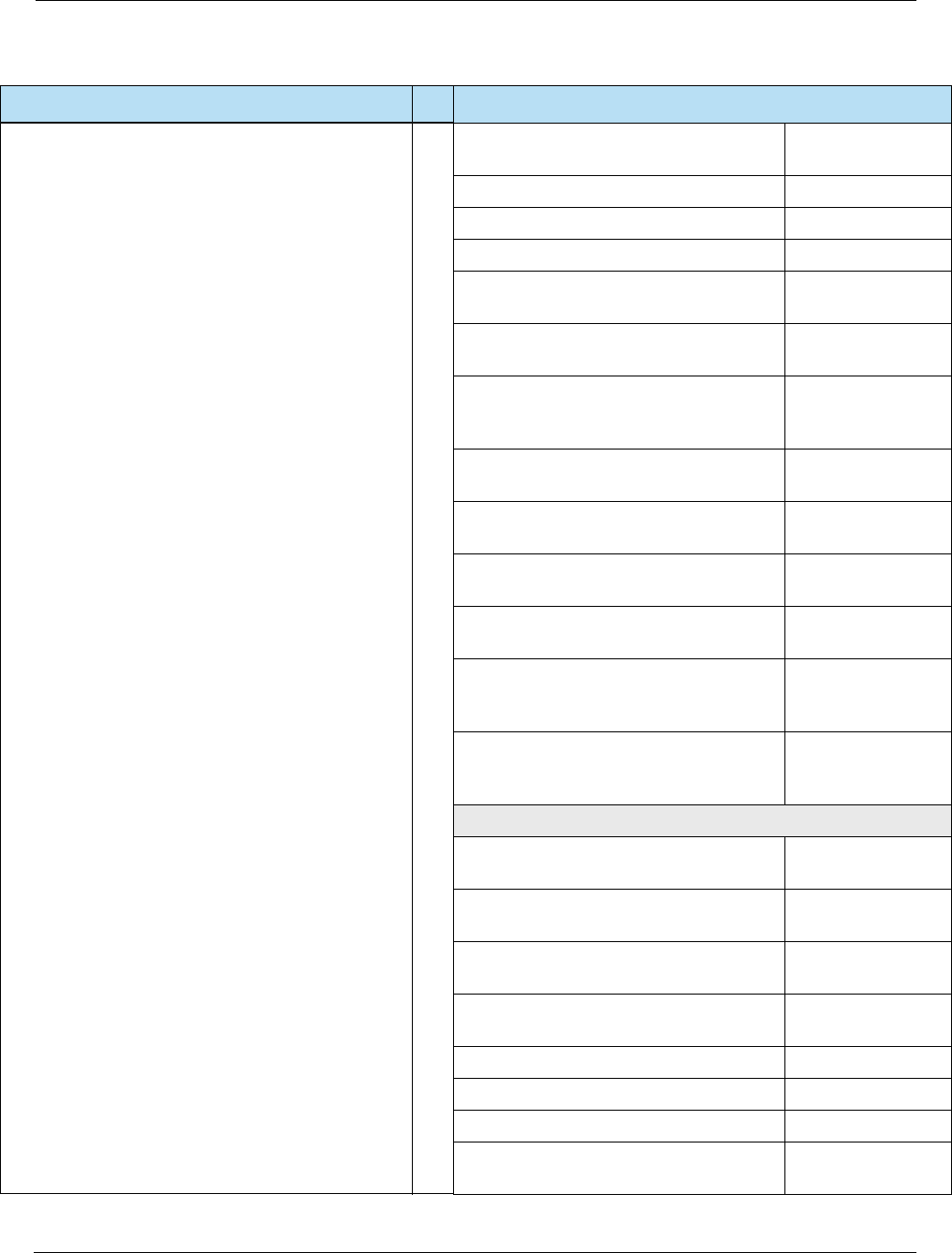

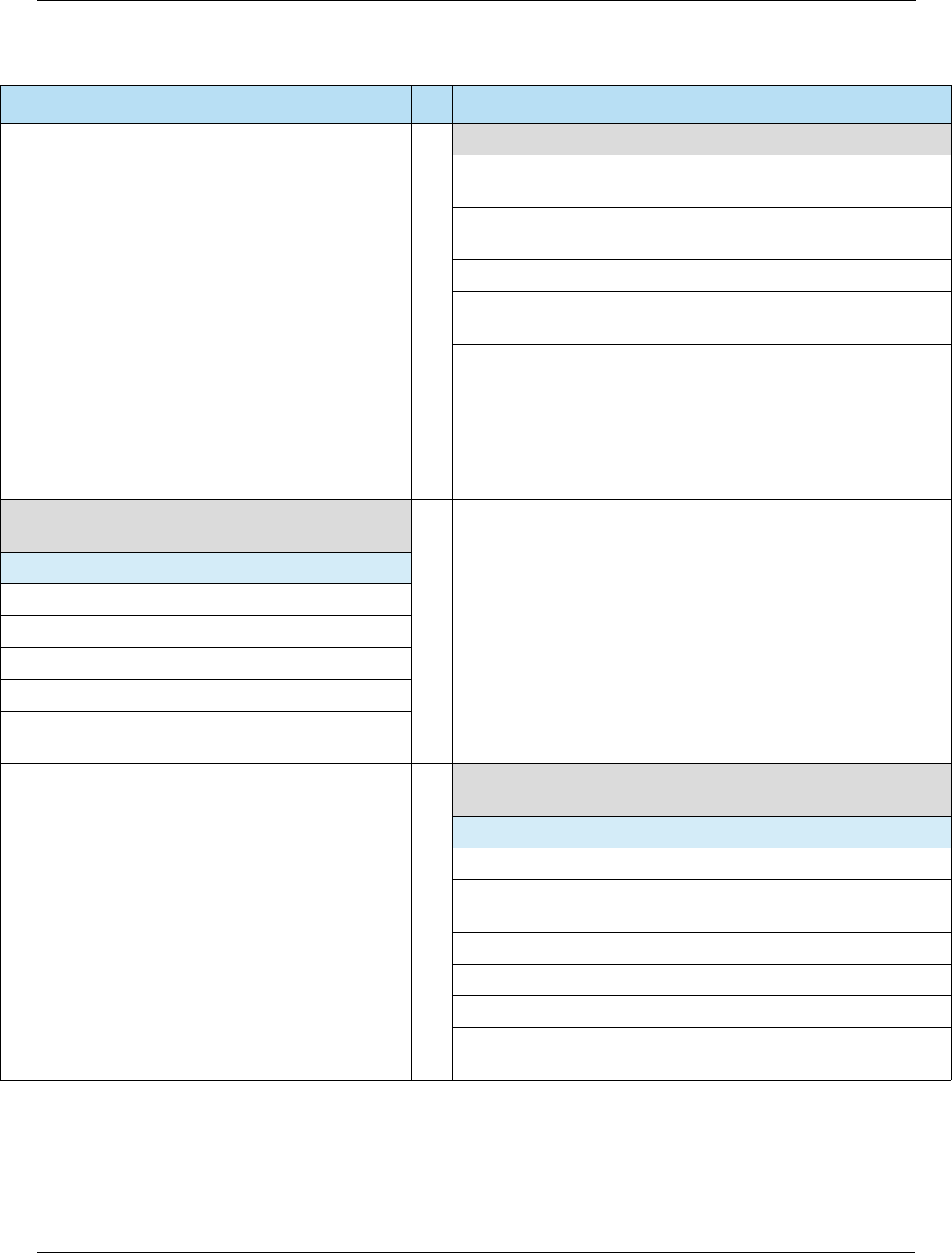

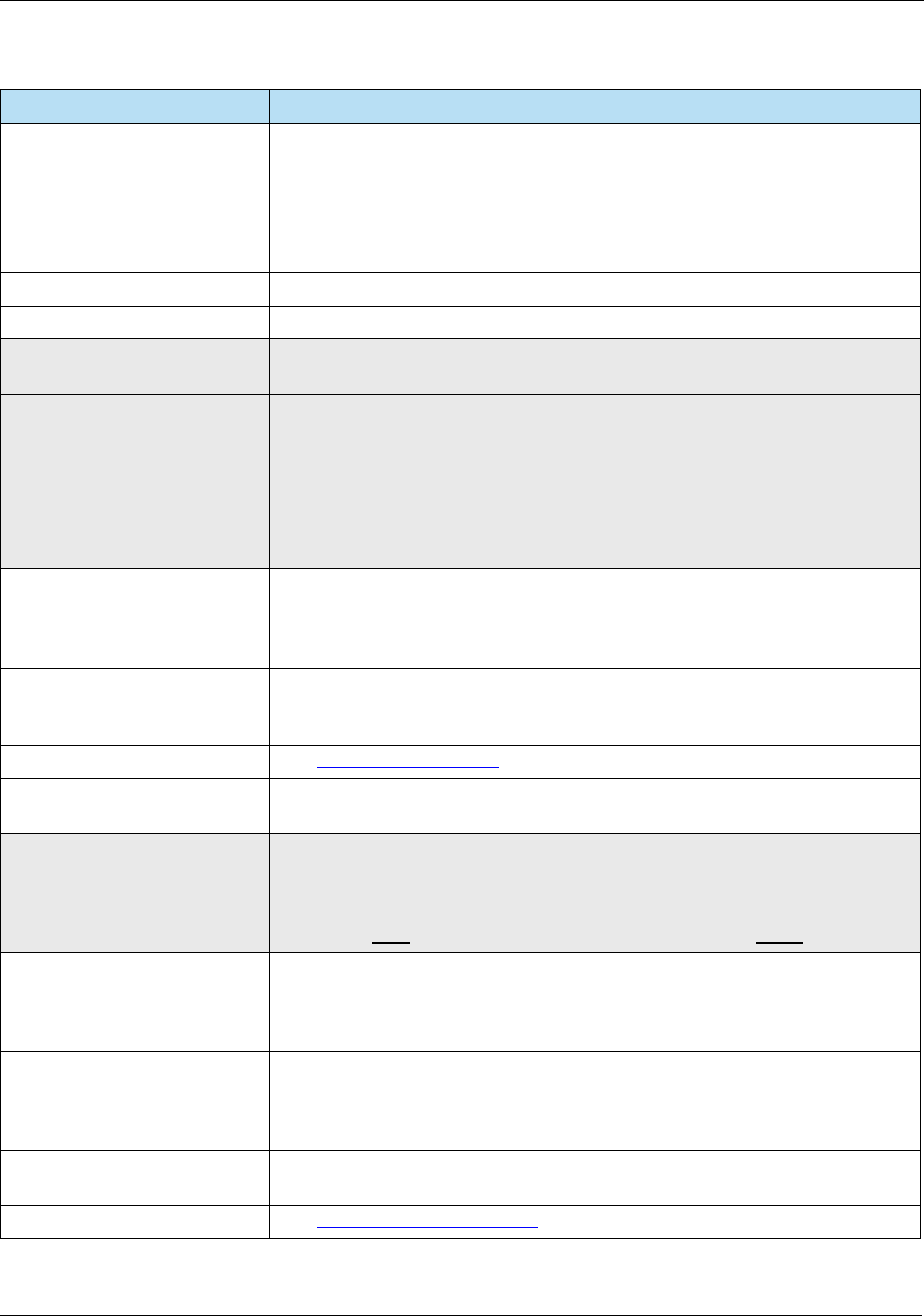

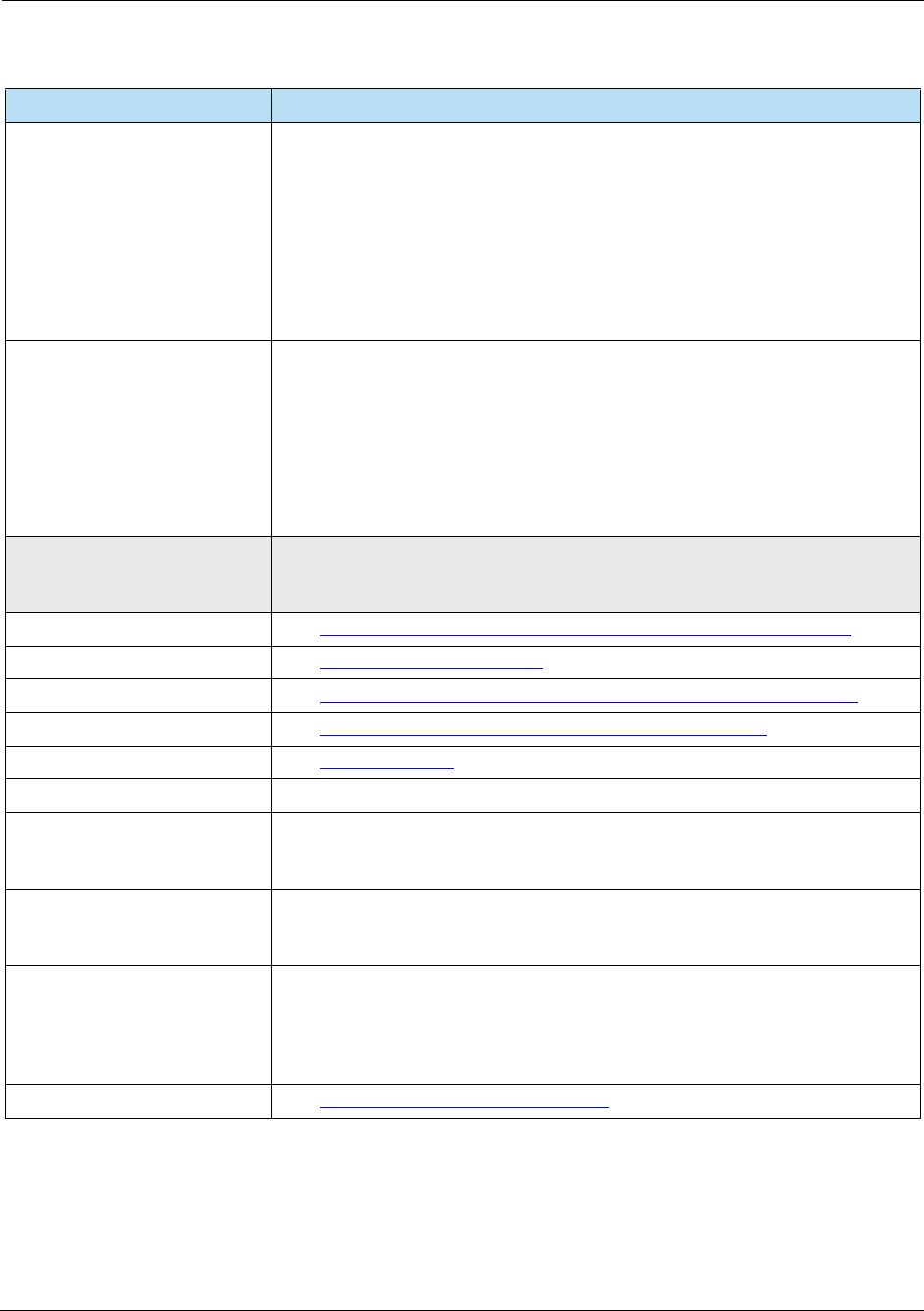

HPS Integrator’s Guide V 17.2 List of Tables

2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive 15

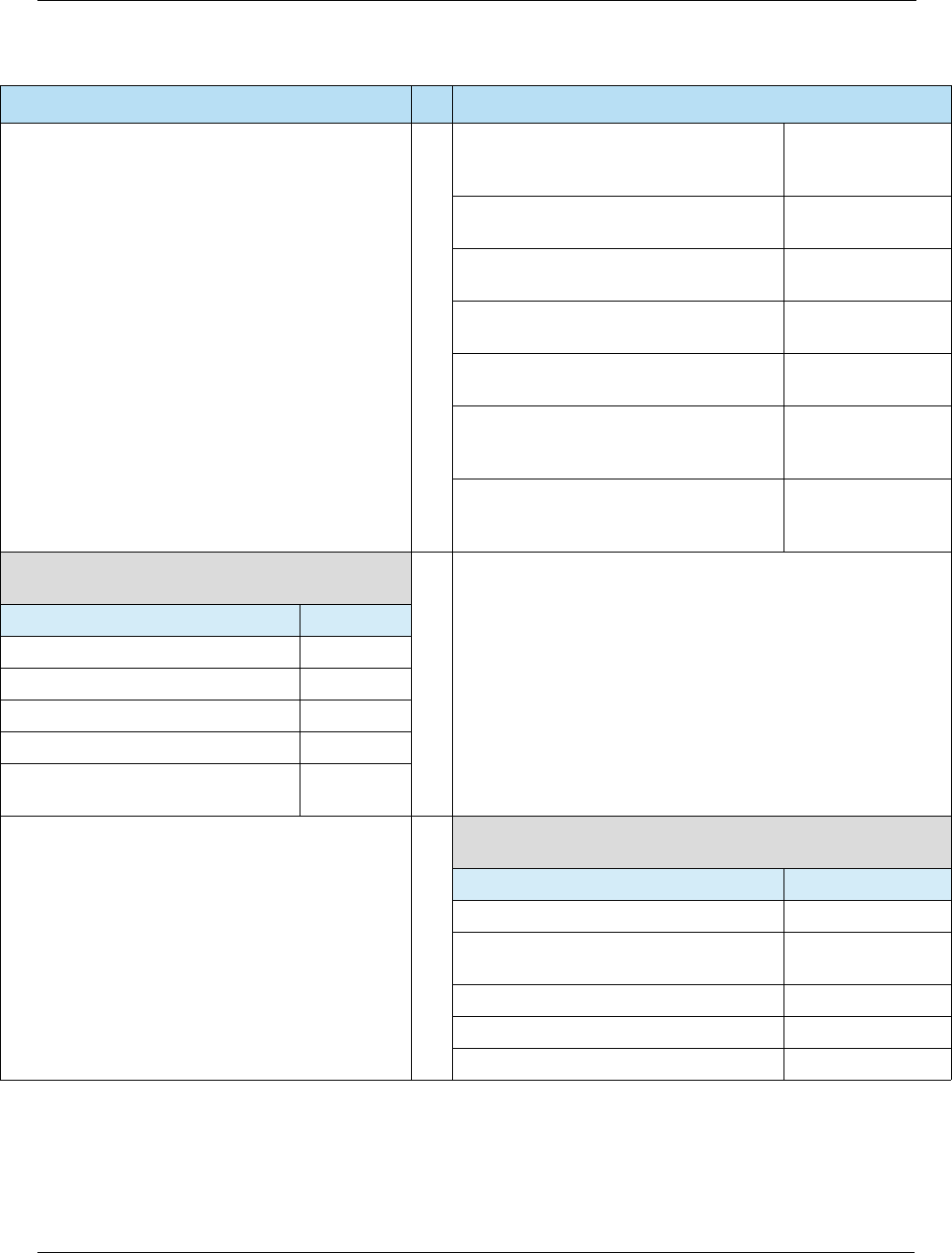

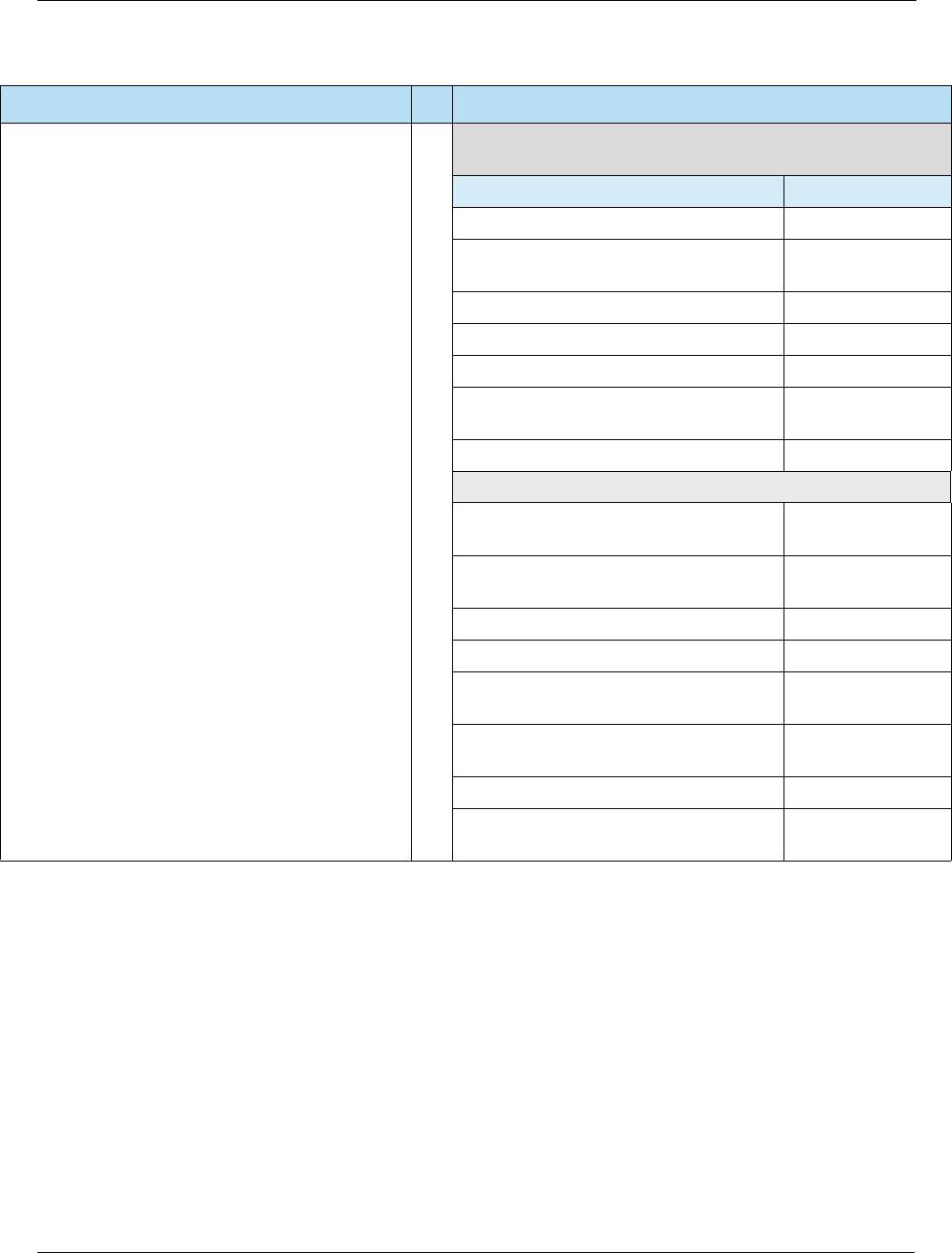

7-12 Offline Data Authentication .......................................................................................................144

7-13 Processing Restrictions ............................................................................................................144

7-14 Cardholder Verification .............................................................................................................145

7-15 PIN Support ..............................................................................................................................146

7-16 Terminal Risk Management ......................................................................................................147

7-17 Terminal Action Analysis...........................................................................................................147

7-18 Terminal Verification Results ....................................................................................................150

7-19 Transaction Status Indicator .....................................................................................................151

7-20 Online or Offline Disposition .....................................................................................................153

7-21 Contact EMV Flow Differences .................................................................................................156

7-22 Card Verification .......................................................................................................................158

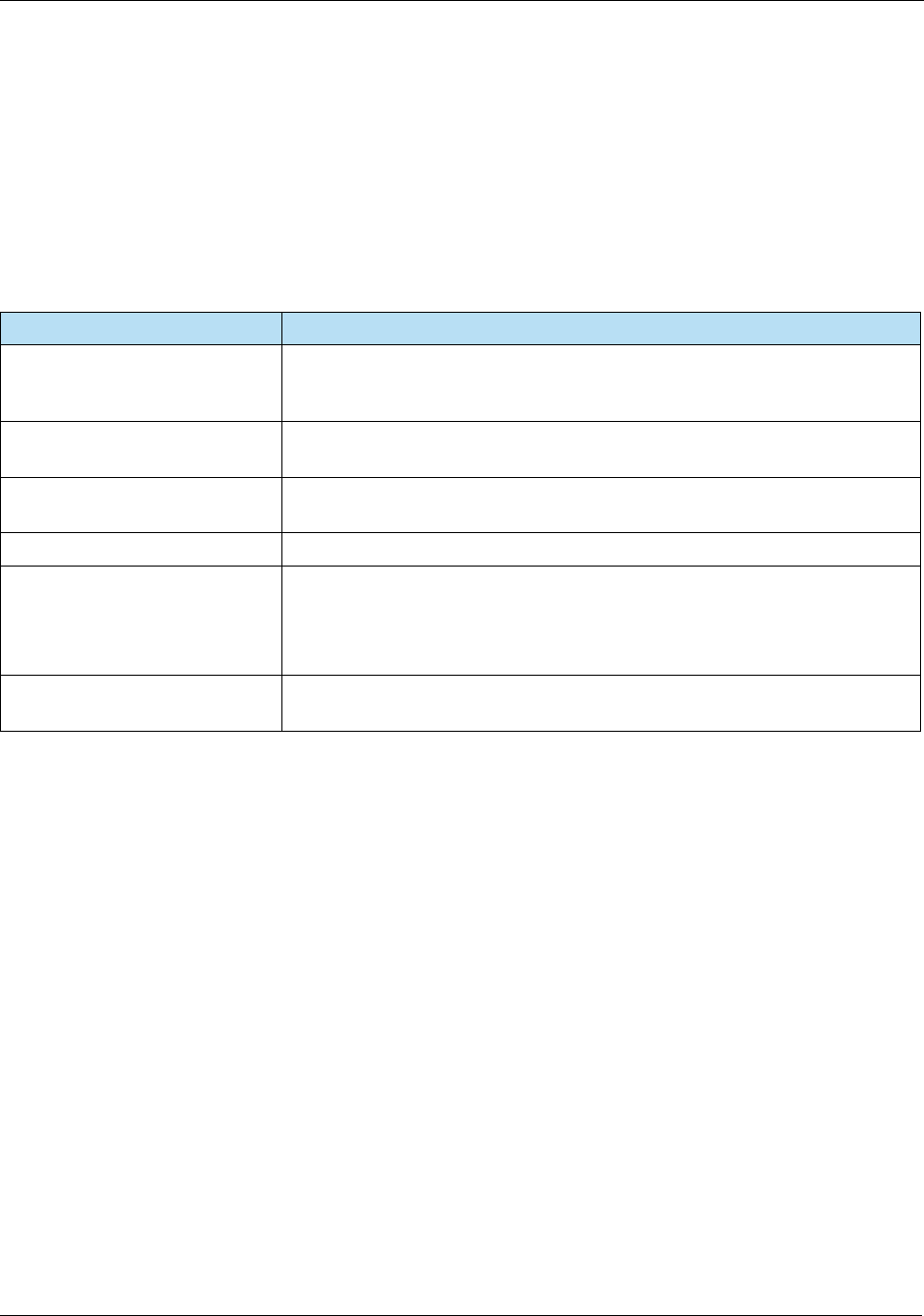

7-23 Receipt Requirements ..............................................................................................................160

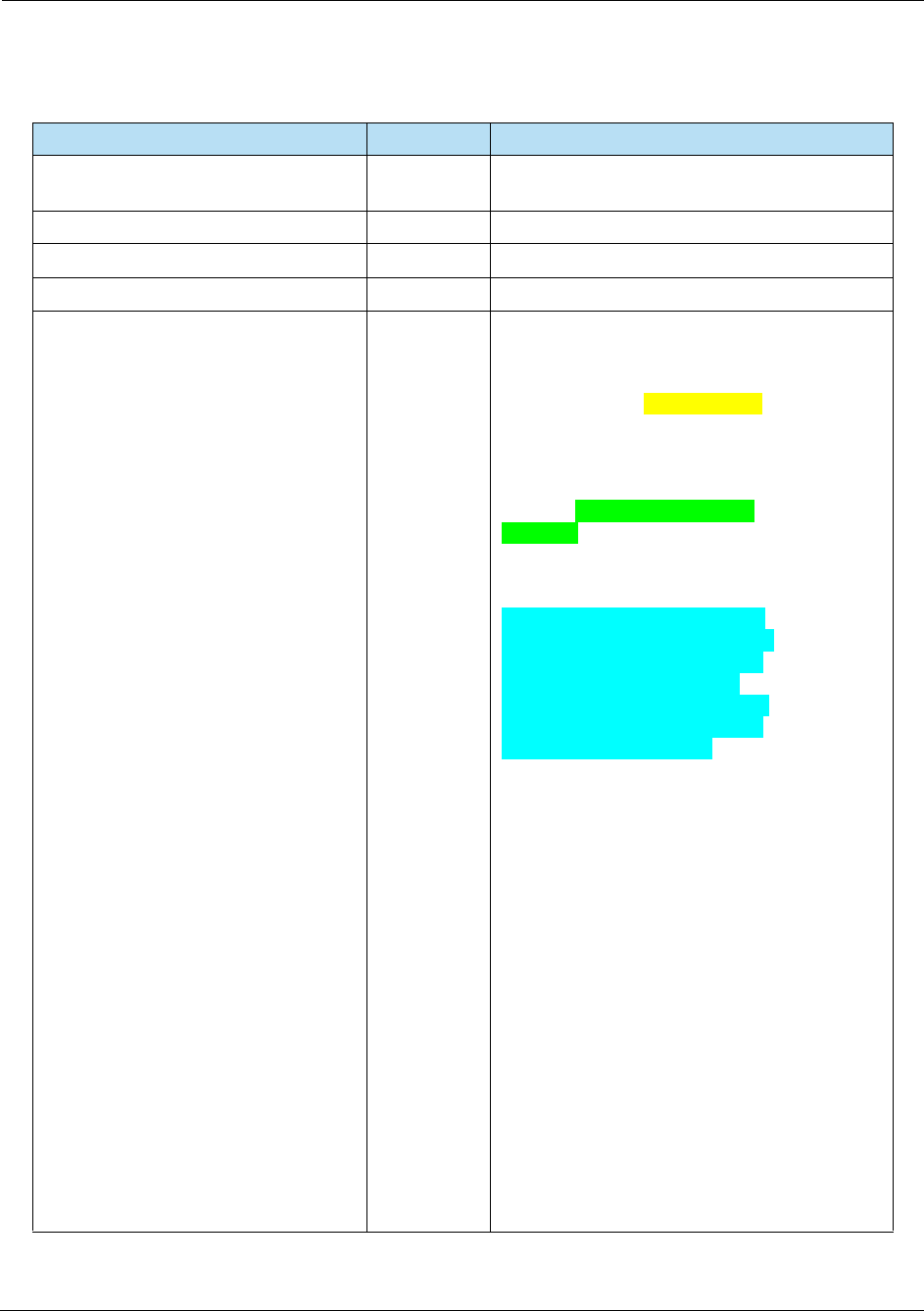

8-1 EMV PDL Tables ......................................................................................................................163

8-2 Platform Identifiers to EMV PDL System ..................................................................................163

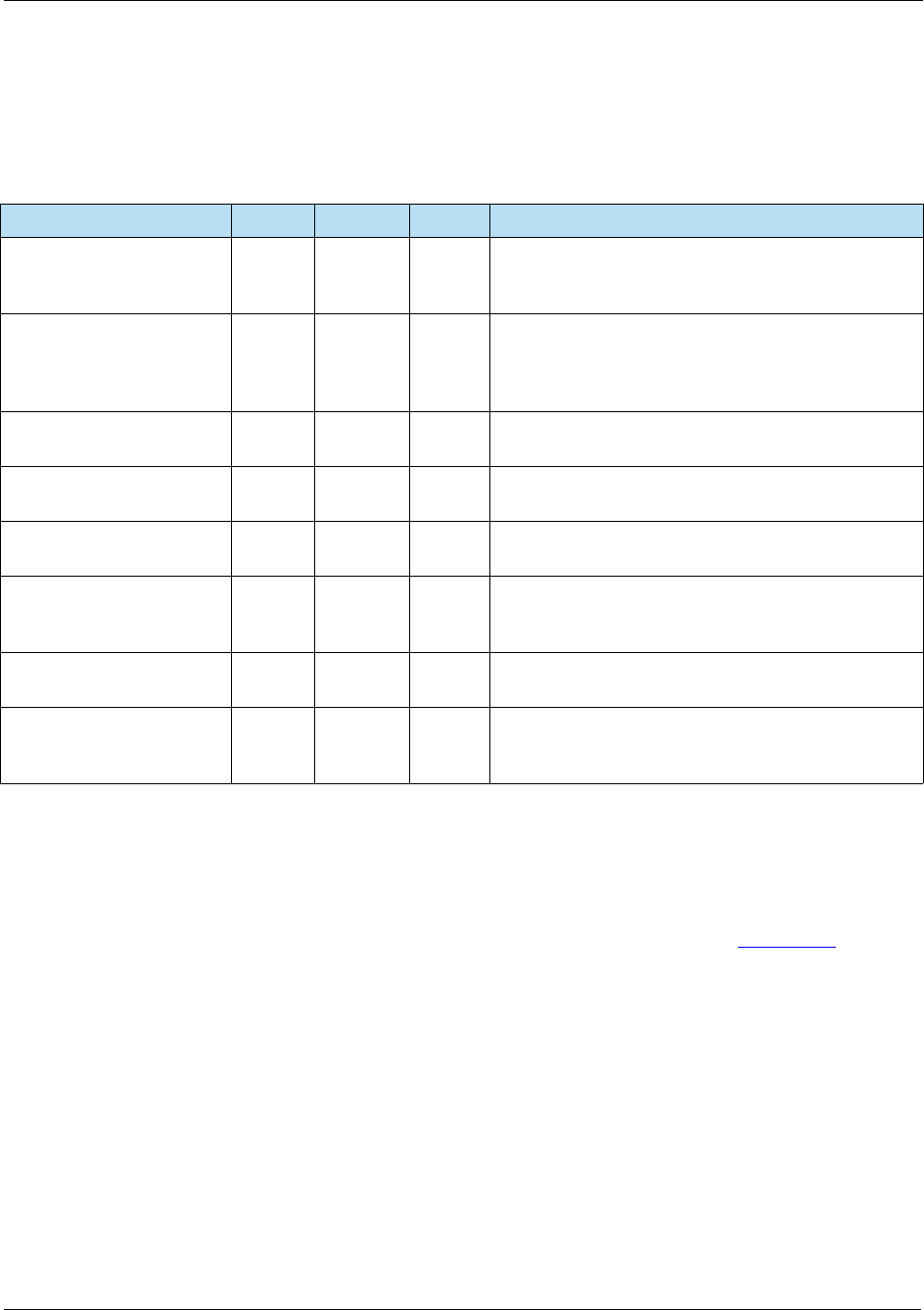

9-1 Comparison of Standard EMV and Quick Chip Processes.......................................................170

9-2 Online Processing.....................................................................................................................171

A-1 Conexxus Product Codes .........................................................................................................178

A-2 Mastercard Purchasing Fuel Product Codes ............................................................................191

A-3 Mastercard Purchasing Non-Fuel Product Codes ....................................................................193

A-4 Mastercard Fleet Fuel Product Codes ......................................................................................195

A-5 Mastercard Fleet Non-Fuel Product Codes ..............................................................................196

A-6 Fuel Product Codes ..................................................................................................................197

A-7 Non-Fuel Product Codes ..........................................................................................................199

A-8 Voyager Fuel Product Codes....................................................................................................200

A-9 Voyager Non-Fuel Product Codes ............................................................................................201

A-10 WEX Supported Conexxus Product Codes ..............................................................................207

B-1 Additional Receipt Requirements by Card Types .....................................................................217

C-1 State Codes ..............................................................................................................................220

C-2 Region Codes: Canada (Province Codes)................................................................................222

D-1 POS 8583: Binary Example ......................................................................................................223

D-2 Exchange, Portico, NTS, Z01, SpiDr: ASCII Hex Example.......................................................223

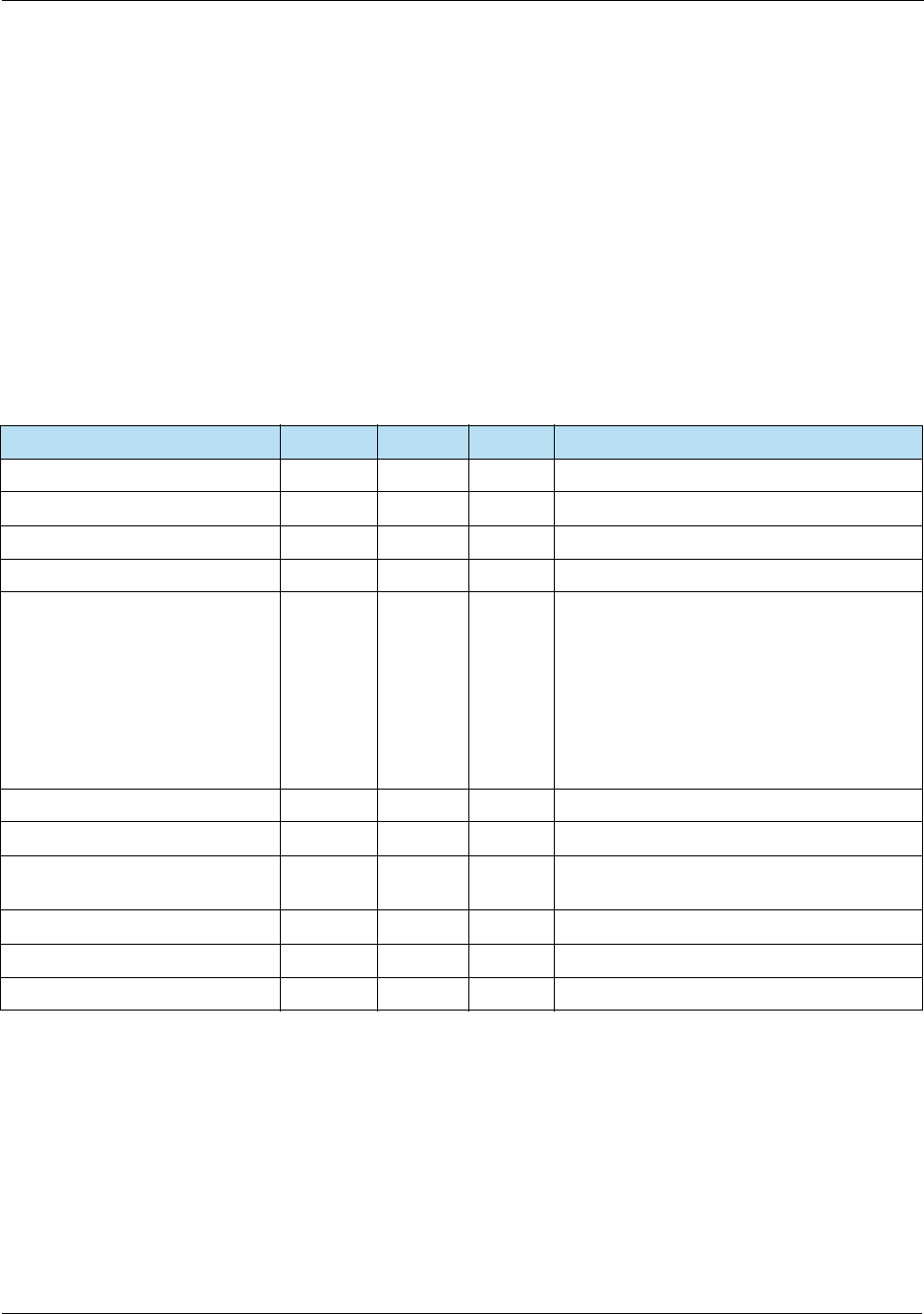

D-3 Additional Terminal Capabilities................................................................................................224

D-4 Amount, Authorised (Numeric)..................................................................................................224

D-5 Amount, Other (Numeric)..........................................................................................................225

D-6 Application Cryptogram.............................................................................................................225

D-7 Application Dedicated File (ADF) Name ...................................................................................226

D-8 Application Identifier (AID) – Terminal ......................................................................................227

D-9 Application Interchange Profile .................................................................................................227

D-10 Application Label.......................................................................................................................228

D-11 Application Preferred Name......................................................................................................228

D-12 Application Primary Account Number Sequence Number ........................................................229

D-13 Application Transaction Counter (ATC) ....................................................................................229

D-14 Application Usage Control ........................................................................................................230

D-15 Application Version Number (ICC)............................................................................................230

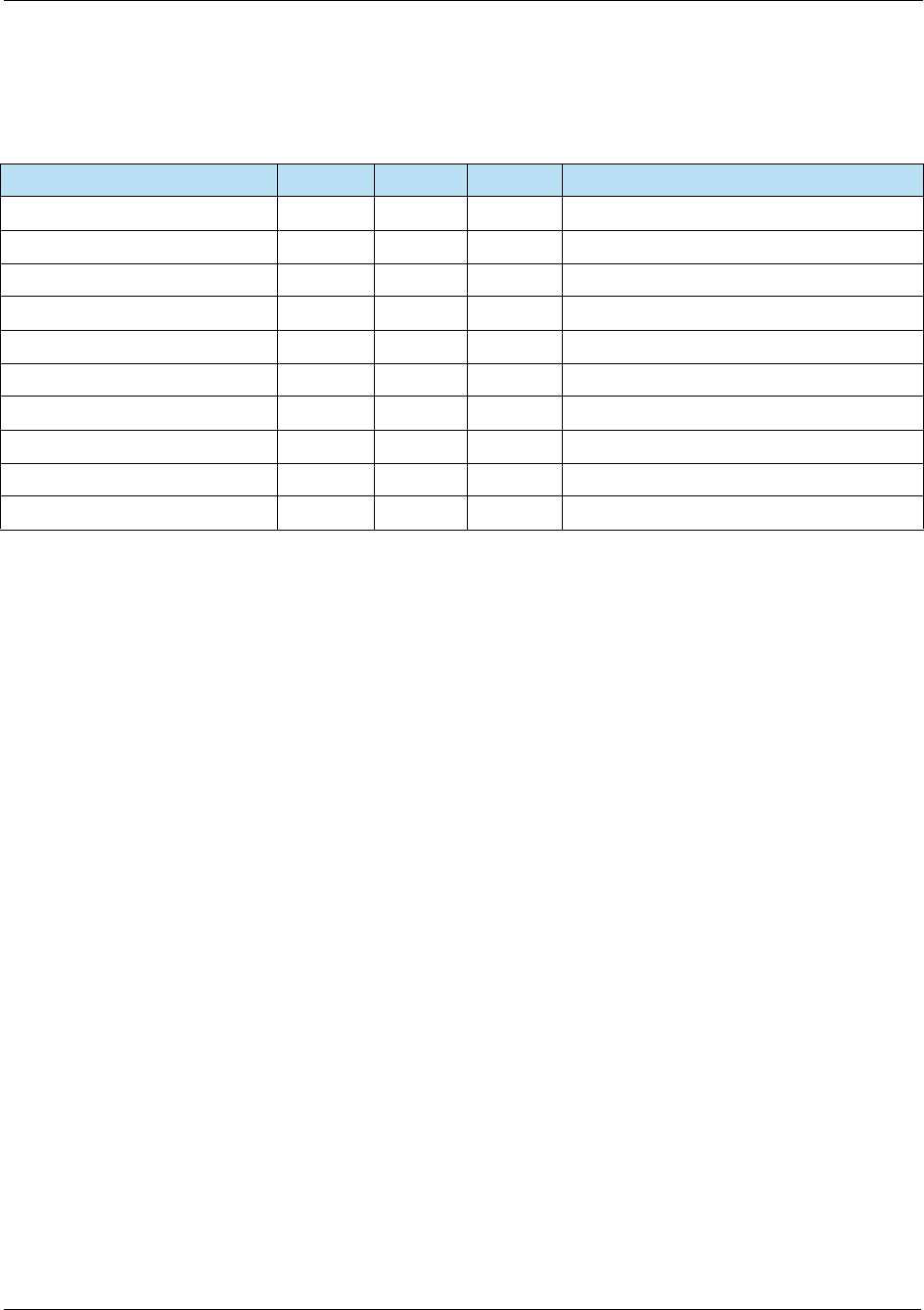

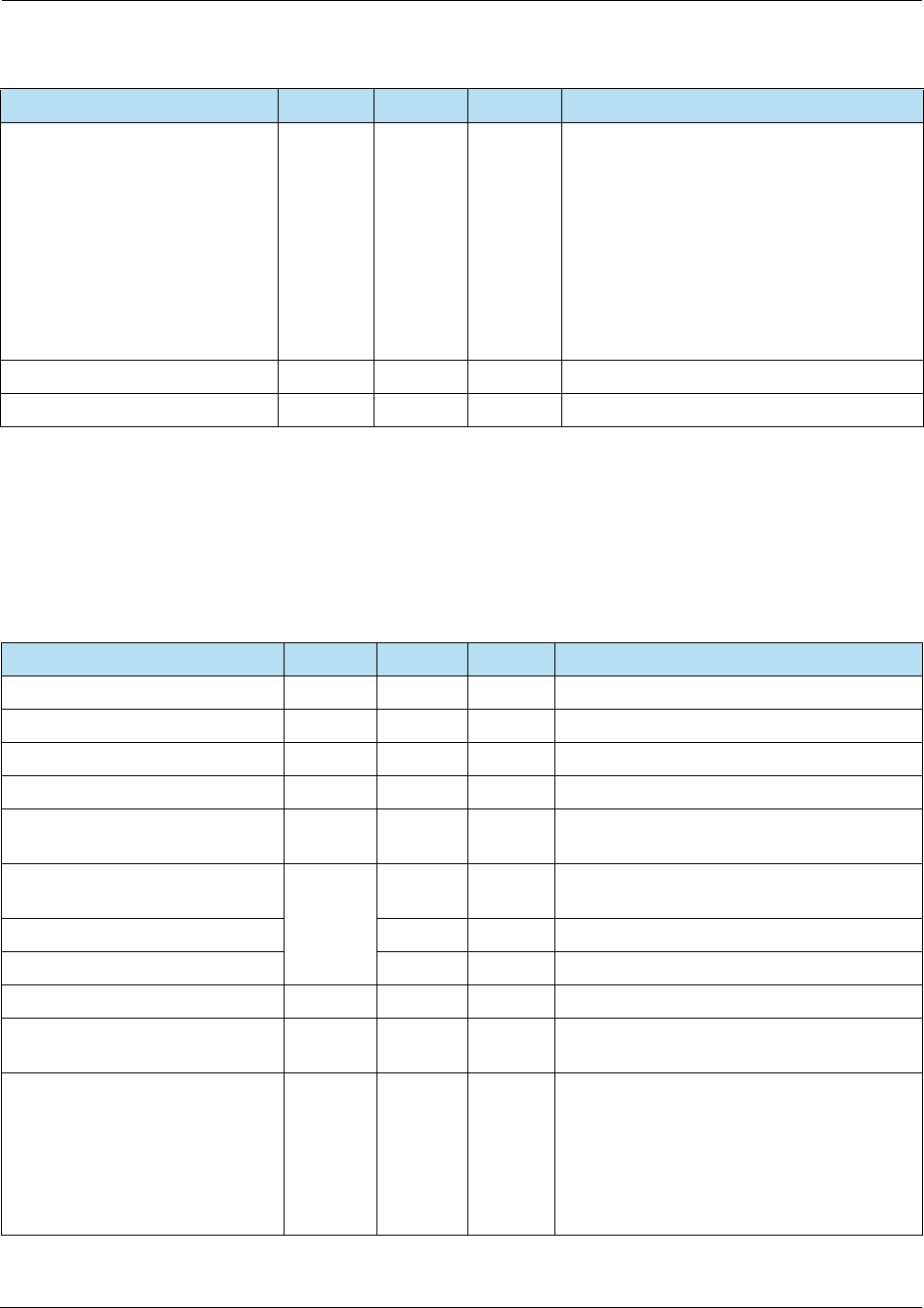

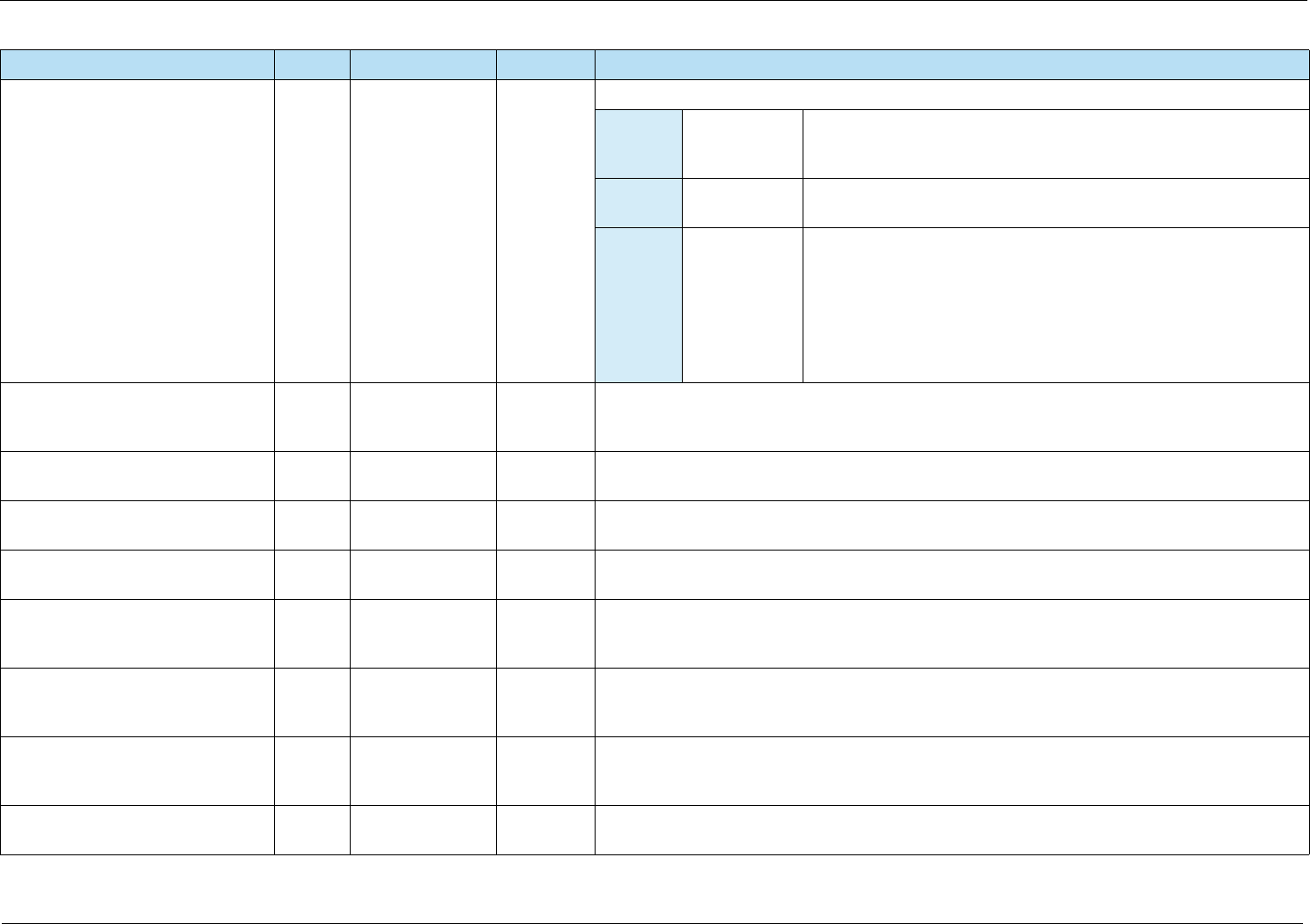

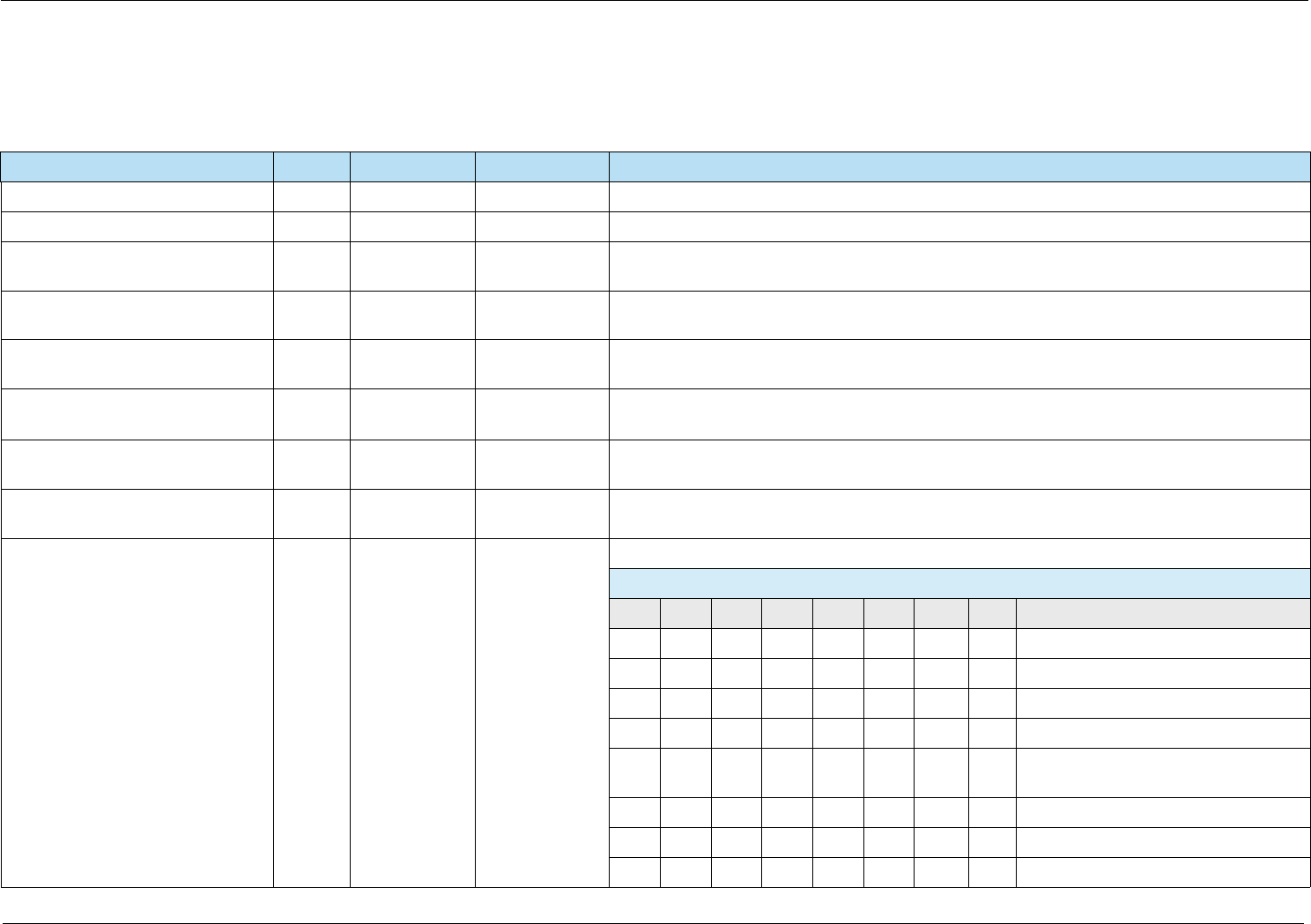

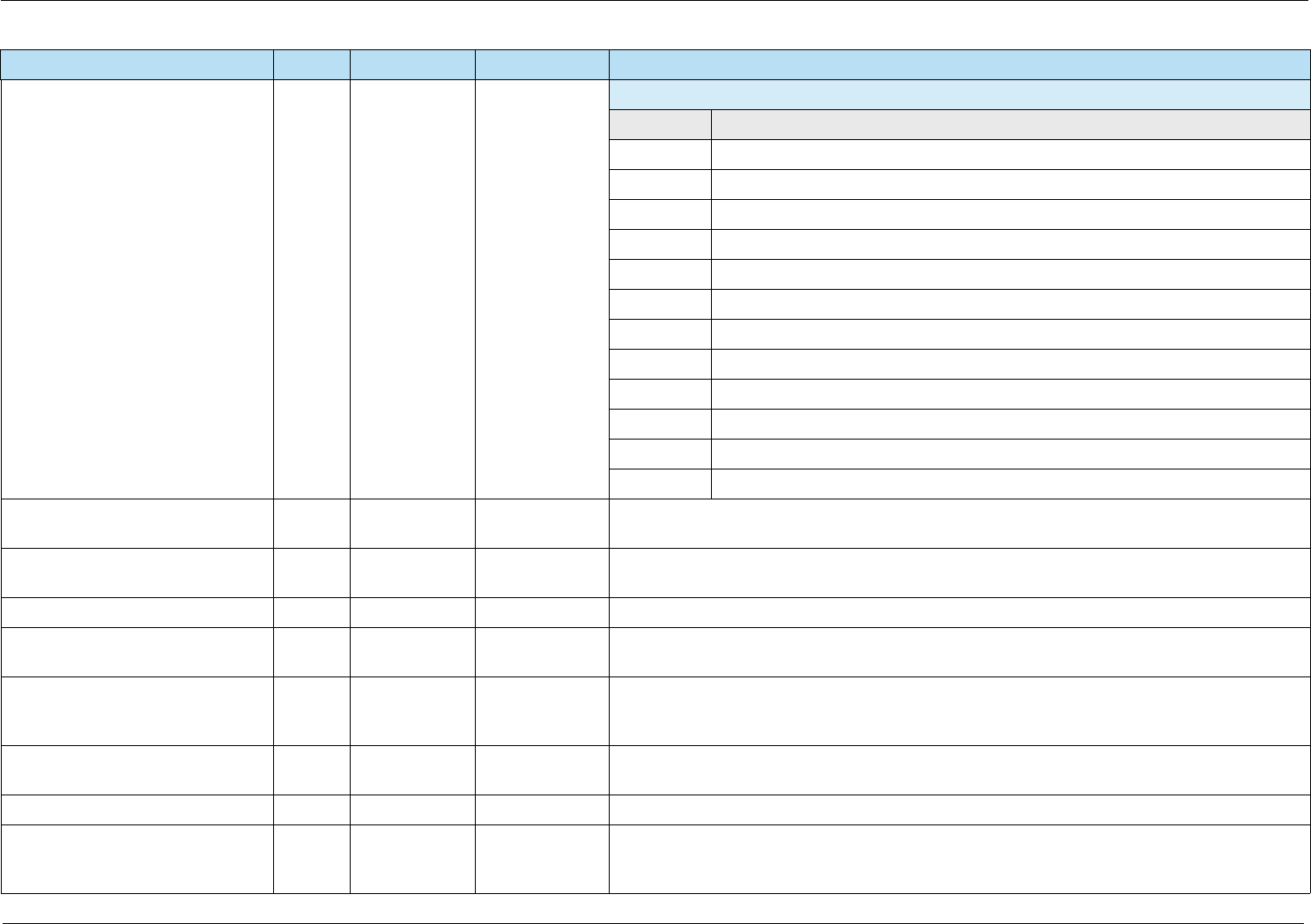

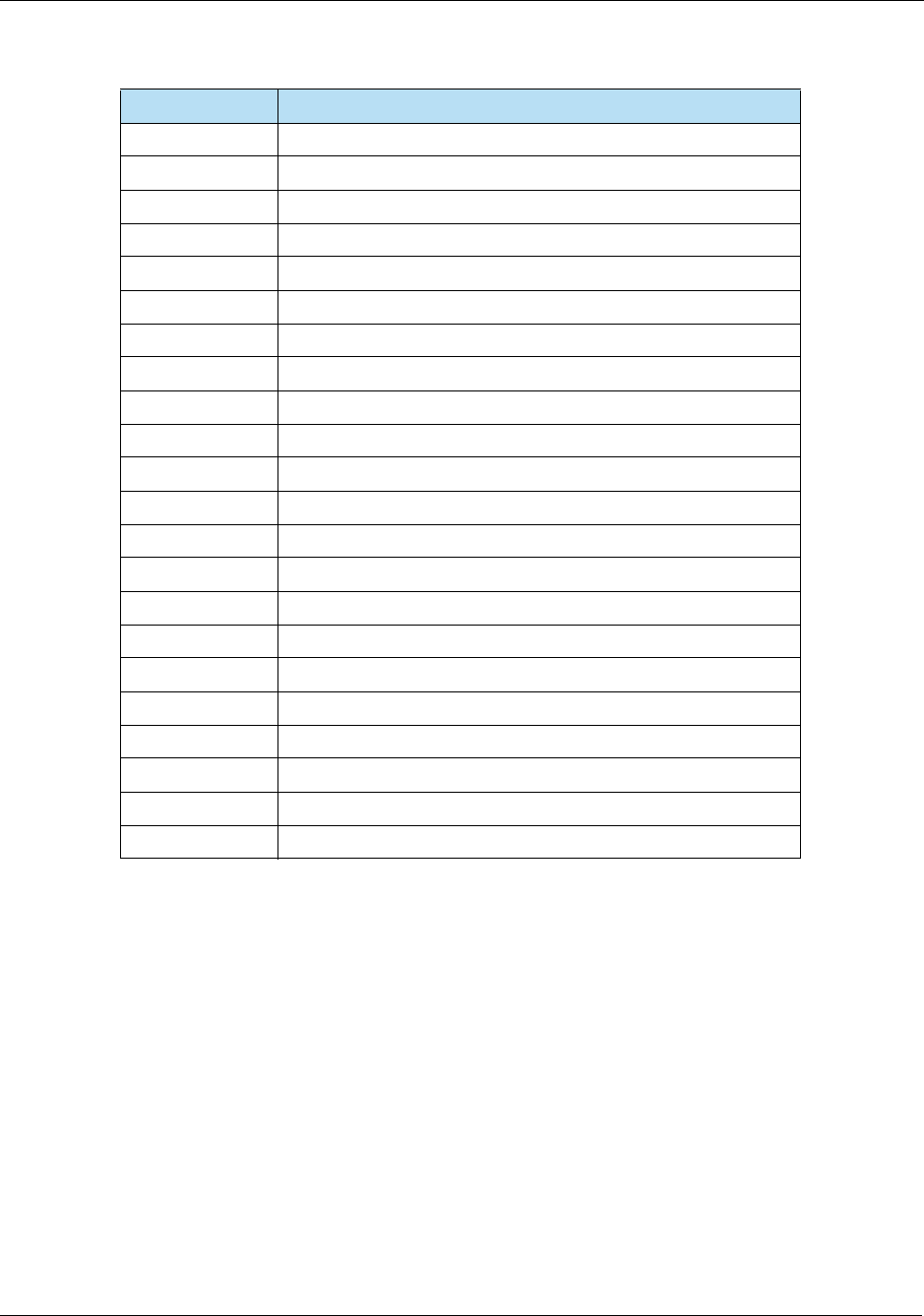

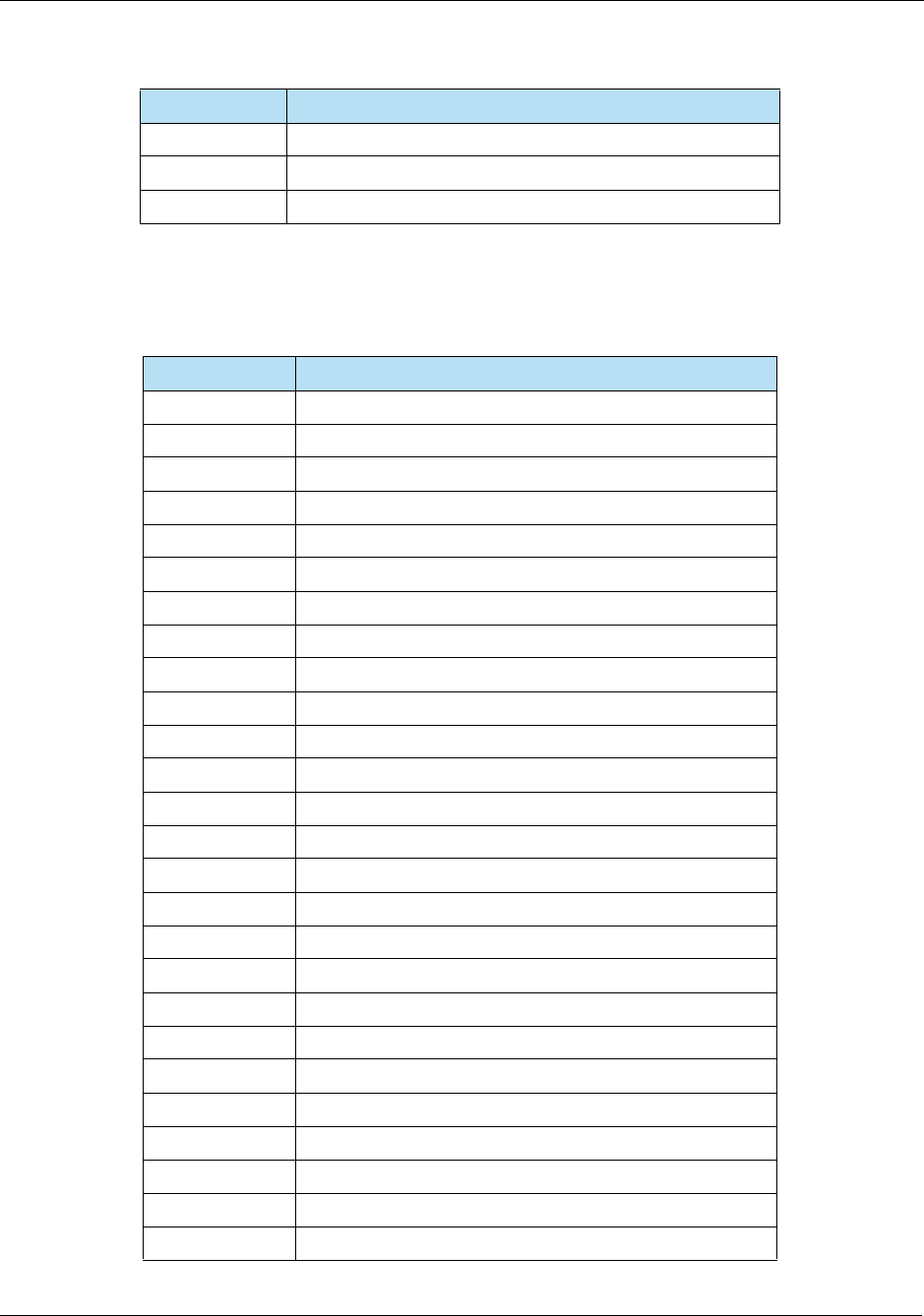

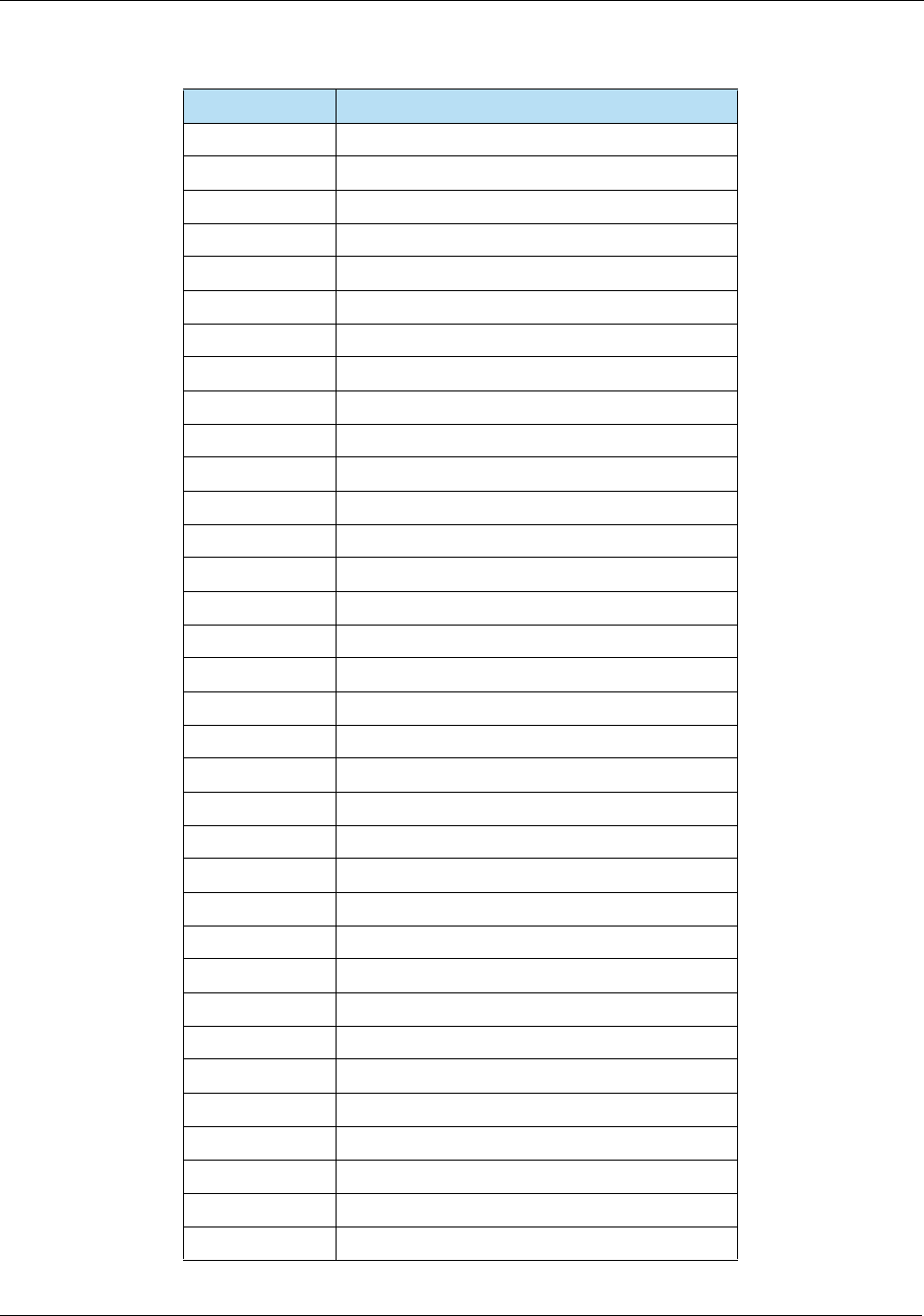

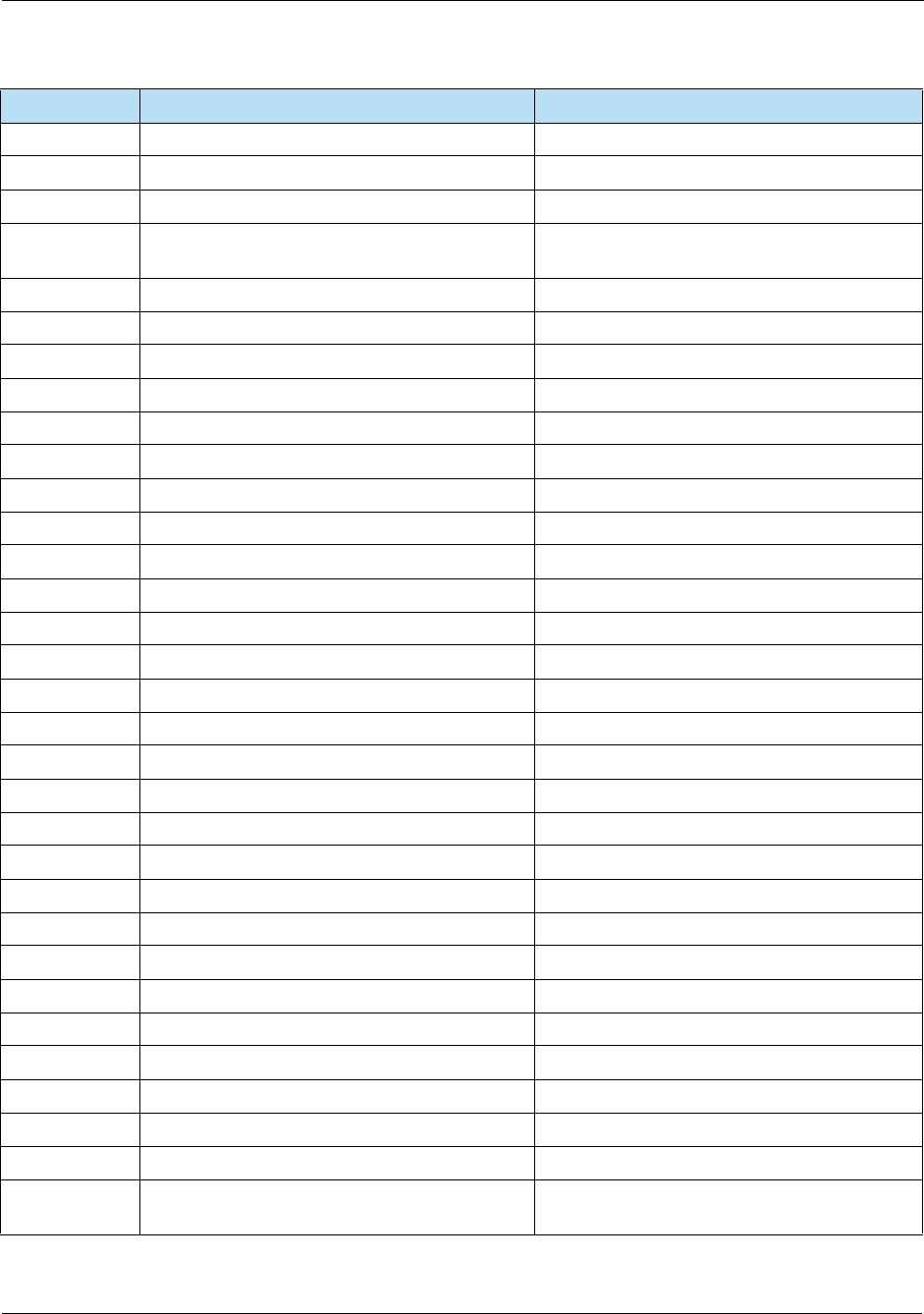

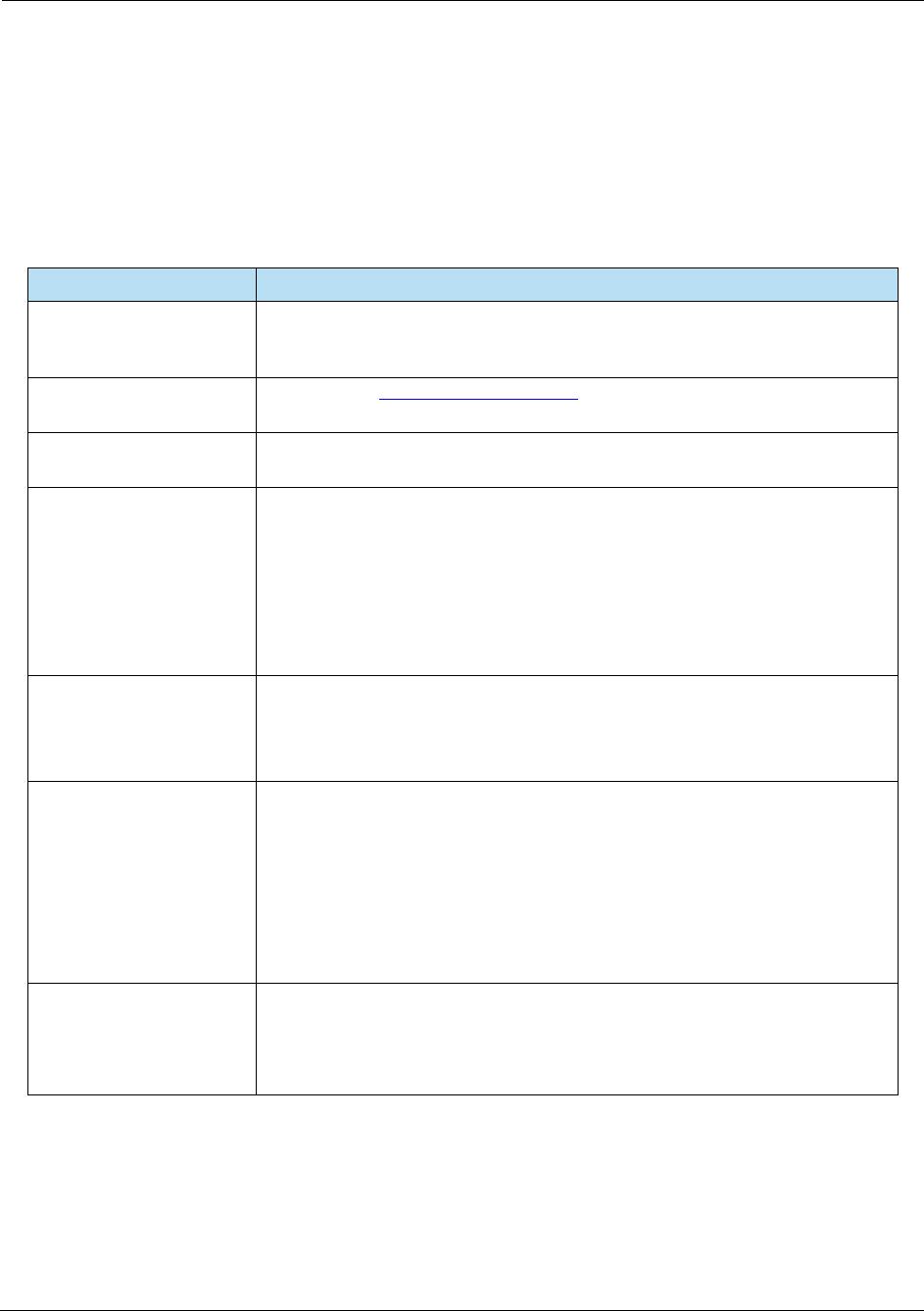

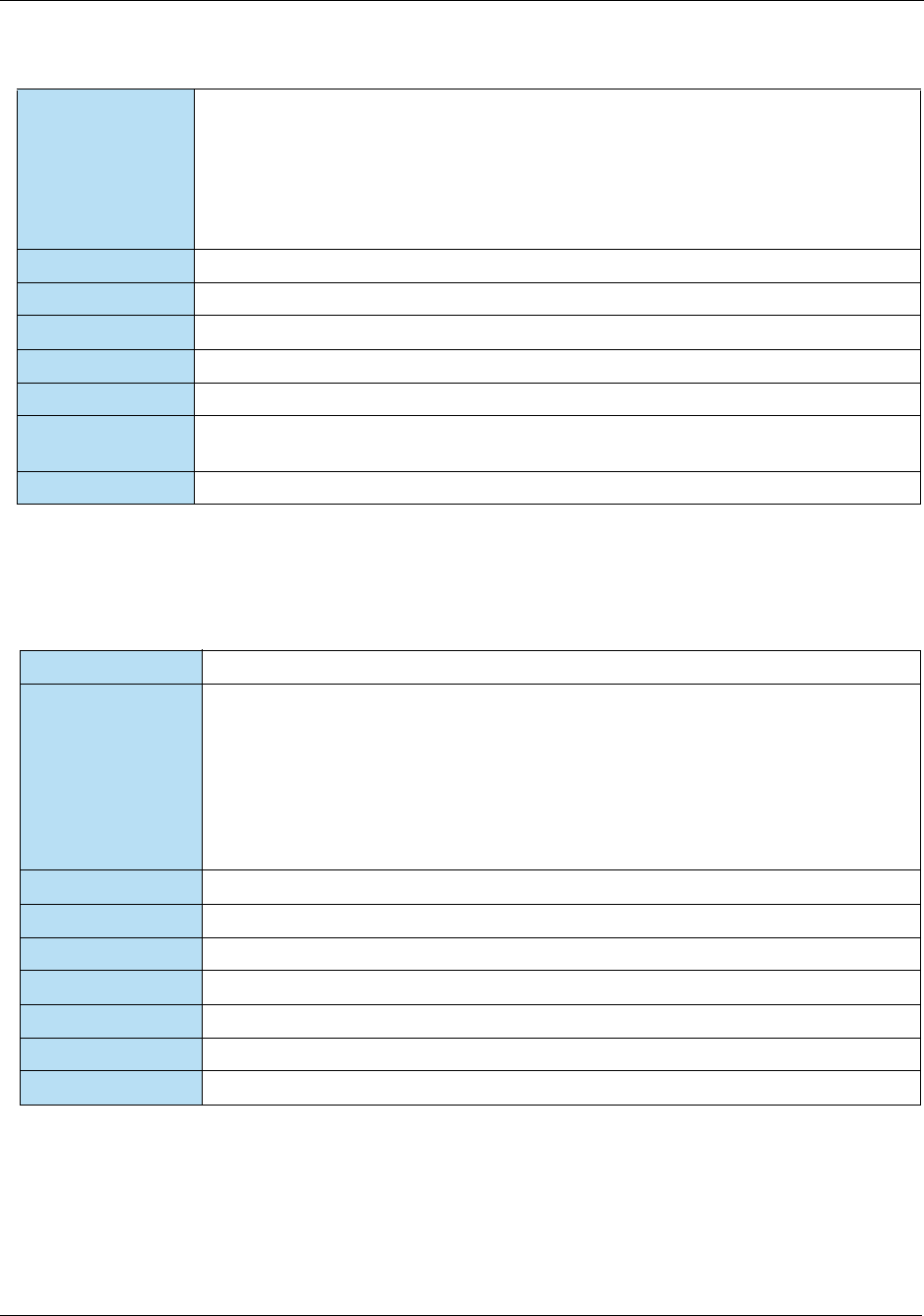

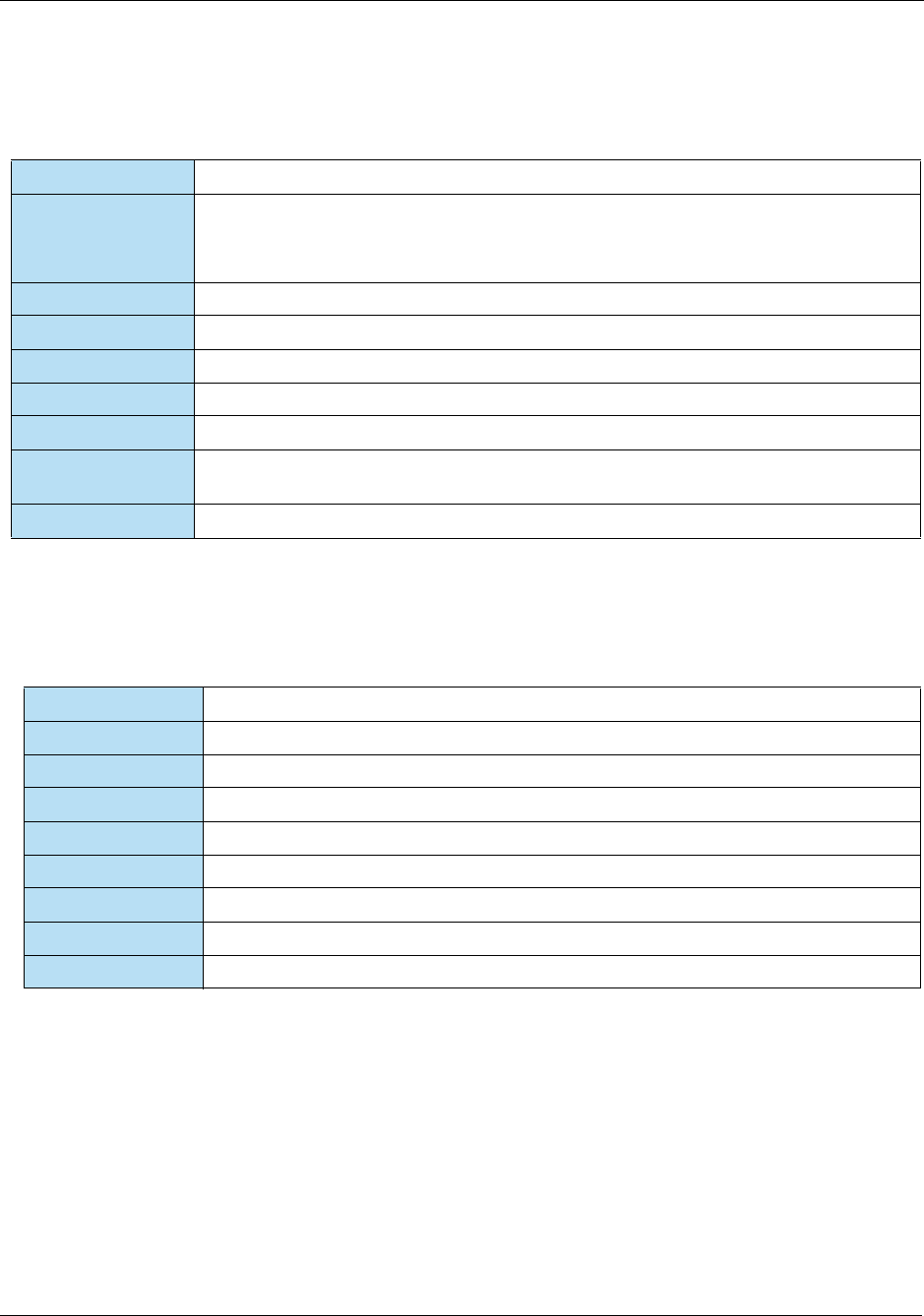

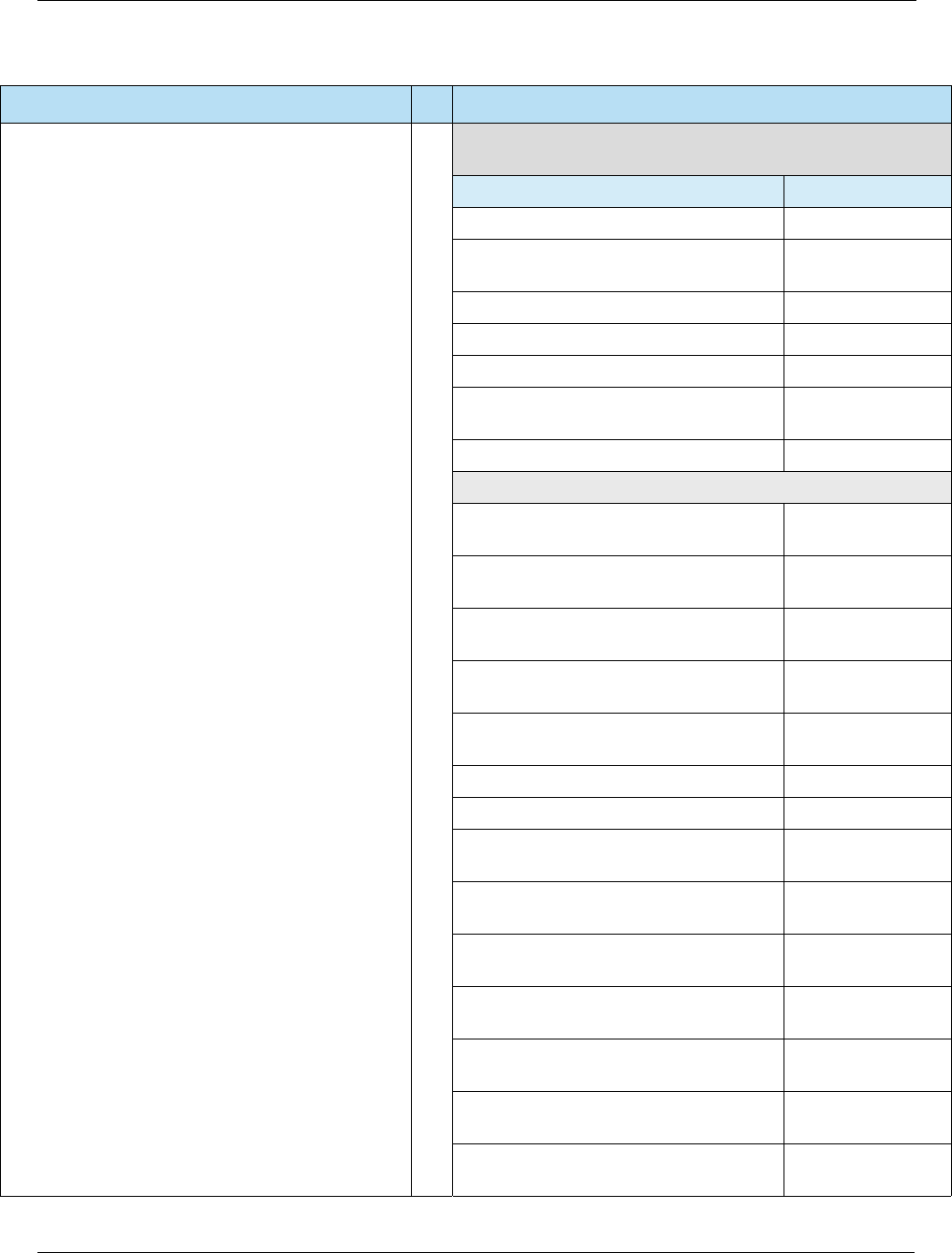

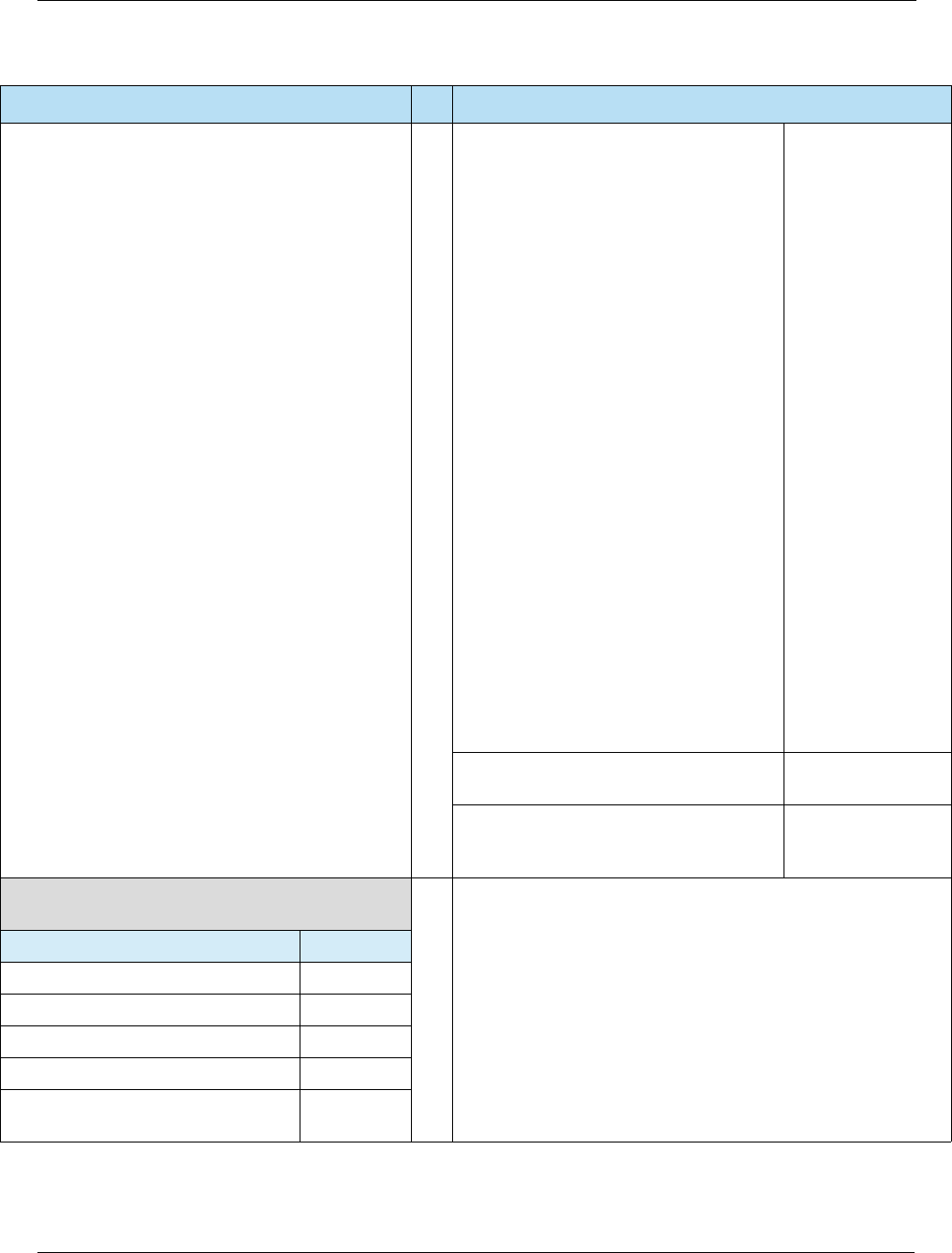

For Internal Use Only

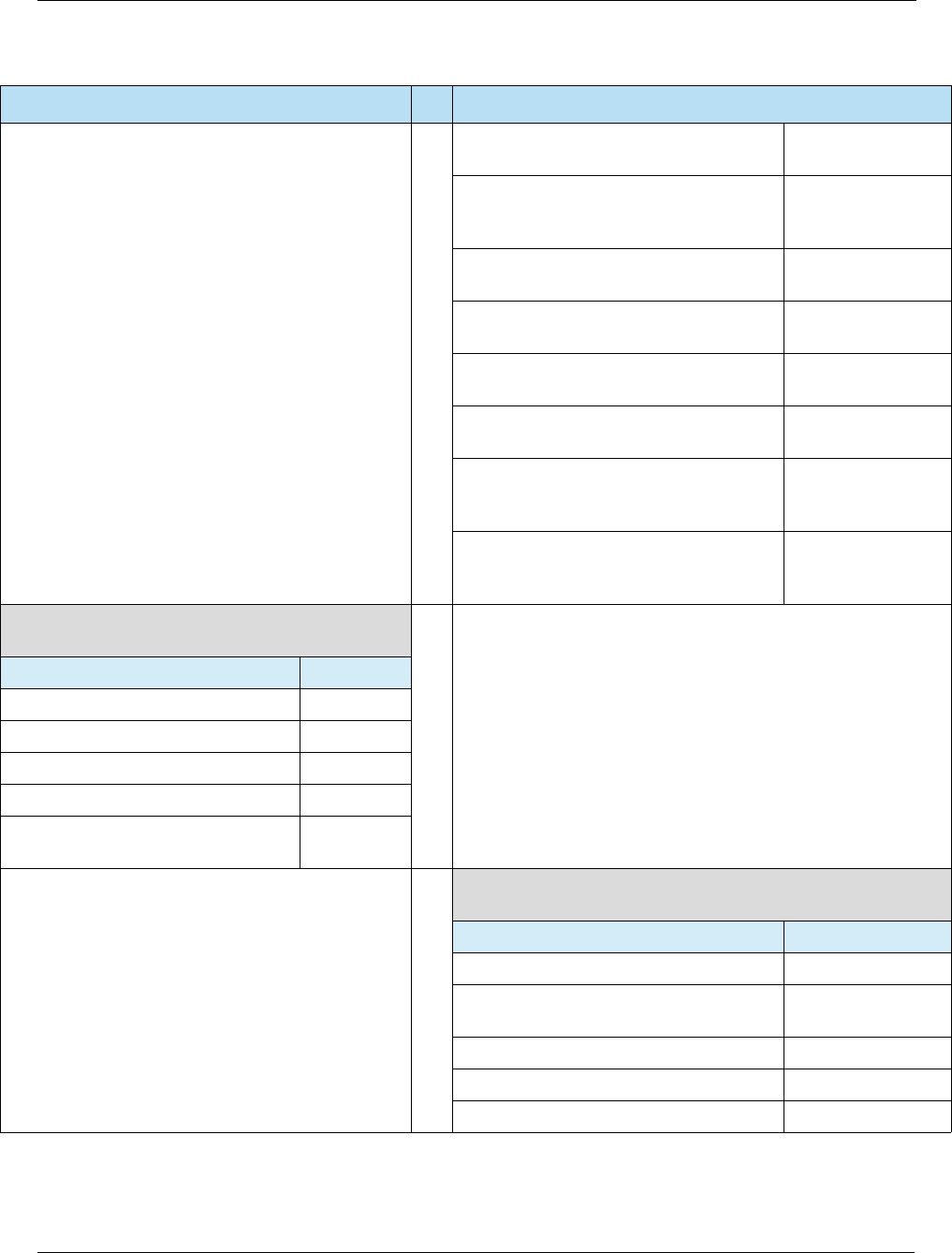

List of Tables HPS Integrator’s Guide V 17.2

16 2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive

D-16 Application Version Number (Terminal) ....................................................................................231

D-17 Authorisation Response Code ..................................................................................................231

D-18 Cardholder Verification Method (CVM) Results ........................................................................232

D-19 Cryptogram Information Data (CID) ..........................................................................................233

D-20 Customer Exclusive Data..........................................................................................................233

D-21 Dedicated File Name ................................................................................................................234

D-22 Form Factor Indicator................................................................................................................234

D-23 ICC Dynamic Number ...............................................................................................................235

D-24 Interface Device (IFD) Serial Number .......................................................................................235

D-25 Issuer Action Code – Default ....................................................................................................236

D-26 Issuer Action Code – Denial .....................................................................................................236

D-27 Issuer Action Code – Online .....................................................................................................237

D-28 Issuer Application Data .............................................................................................................237

D-29 Issuer Authentication Data........................................................................................................238

D-30 Issuer Country Code .................................................................................................................238

D-31 Issuer Script Results .................................................................................................................239

D-32 Issuer Script Template 1 & 2.....................................................................................................239

D-33 POS Entry Mode .......................................................................................................................240

D-34 Terminal Action Code – Default ................................................................................................240

D-35 Terminal Action Code – Denial .................................................................................................241

D-36 Terminal Action Code – Online .................................................................................................241

D-37 Terminal Capabilities ................................................................................................................242

D-38 Terminal Country Code.............................................................................................................242

D-39 Terminal Type ...........................................................................................................................243

D-40 Terminal Verification Results (TVR)..........................................................................................243

D-41 Third Party Data........................................................................................................................244

D-42 Transaction Currency Code ......................................................................................................244

D-43 Transaction Data.......................................................................................................................245

D-44 Transaction Sequence Counter ................................................................................................245

D-45 Transaction Status Information .................................................................................................246

D-46 Transaction Time ......................................................................................................................246

D-47 Transaction Type ......................................................................................................................247

D-48 Unpredictable Number ..............................................................................................................247

E-1 EMV PDL Data Examples.........................................................................................................248

F-1 Glossary....................................................................................................................................292

For Internal Use Only

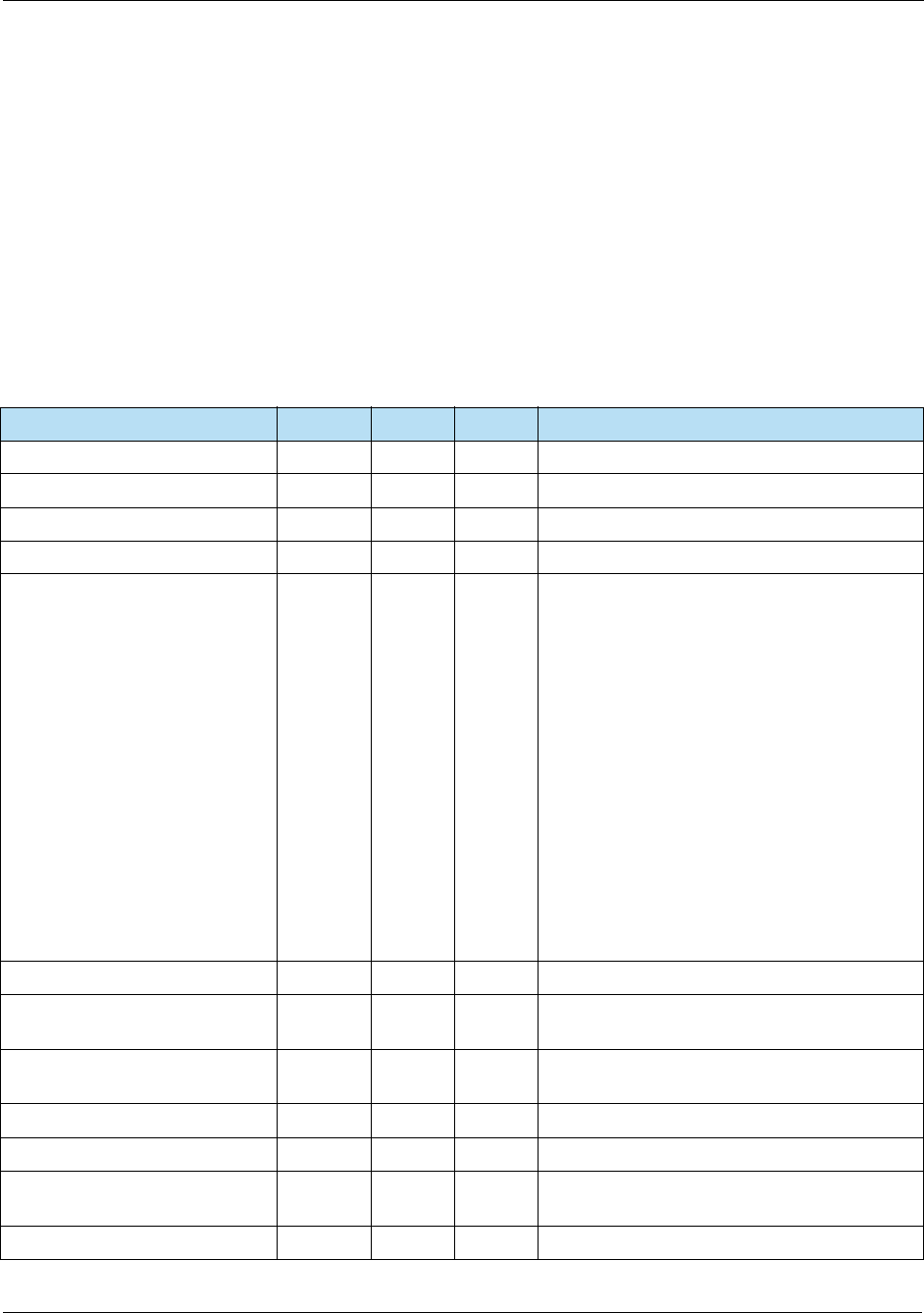

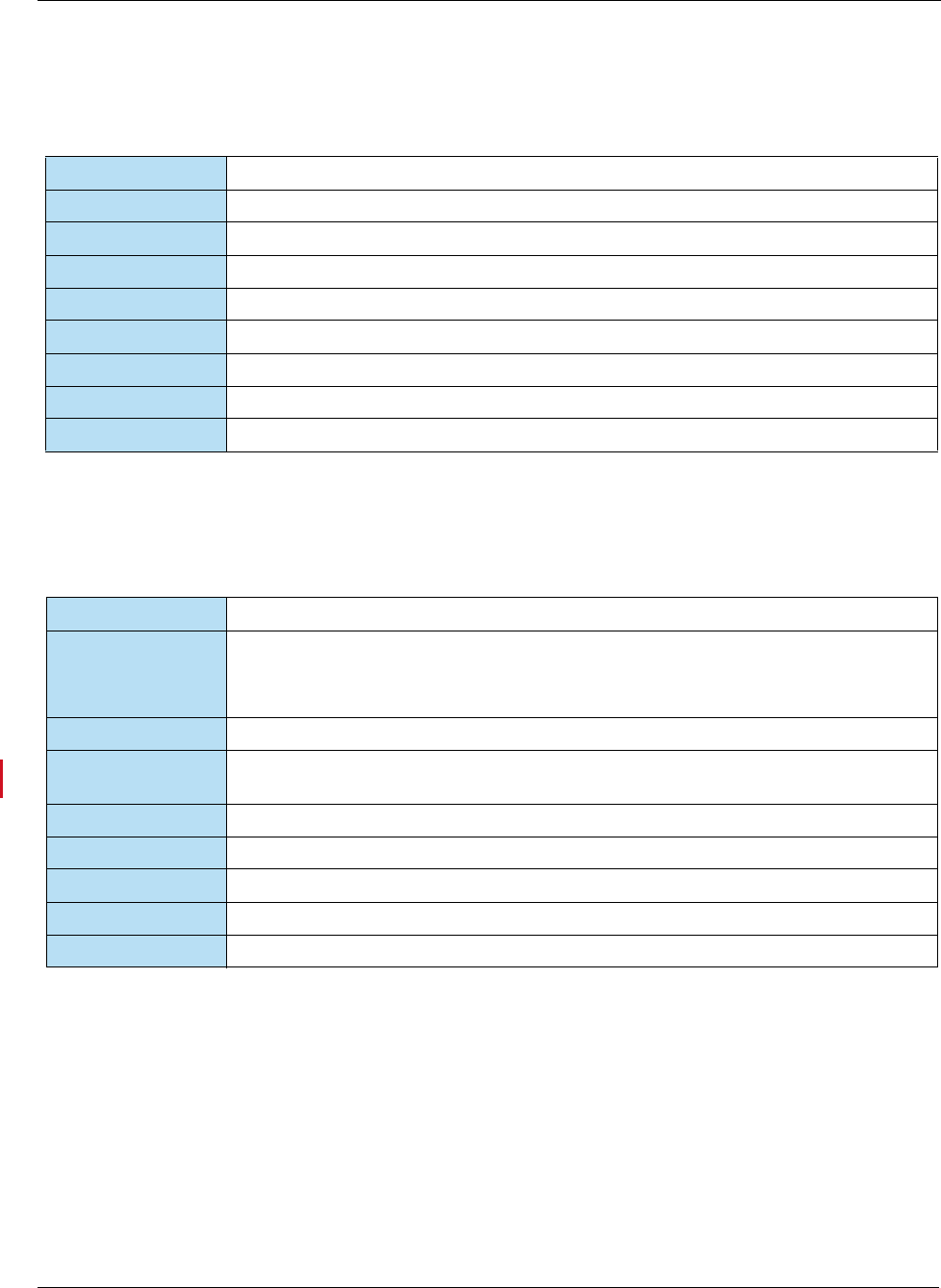

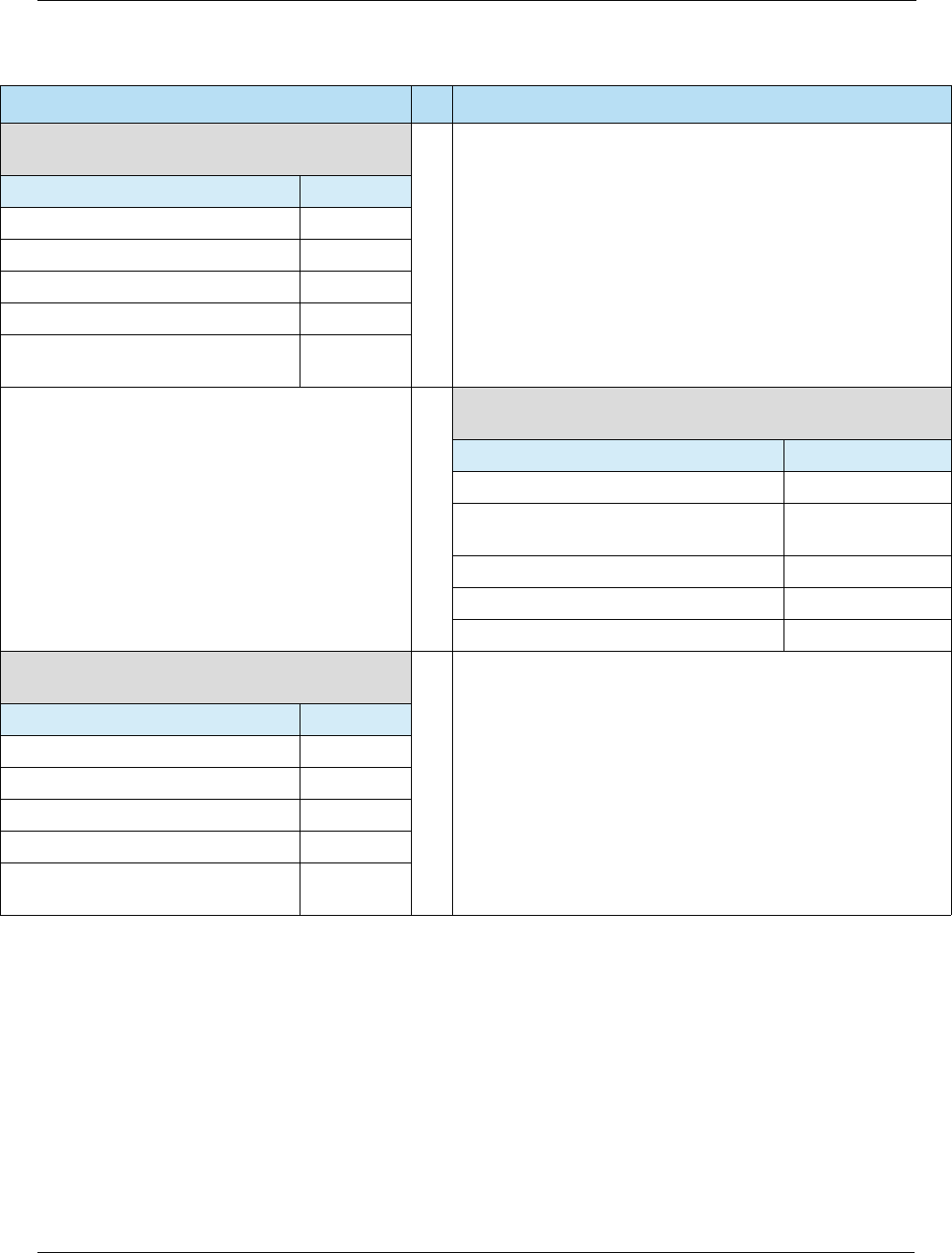

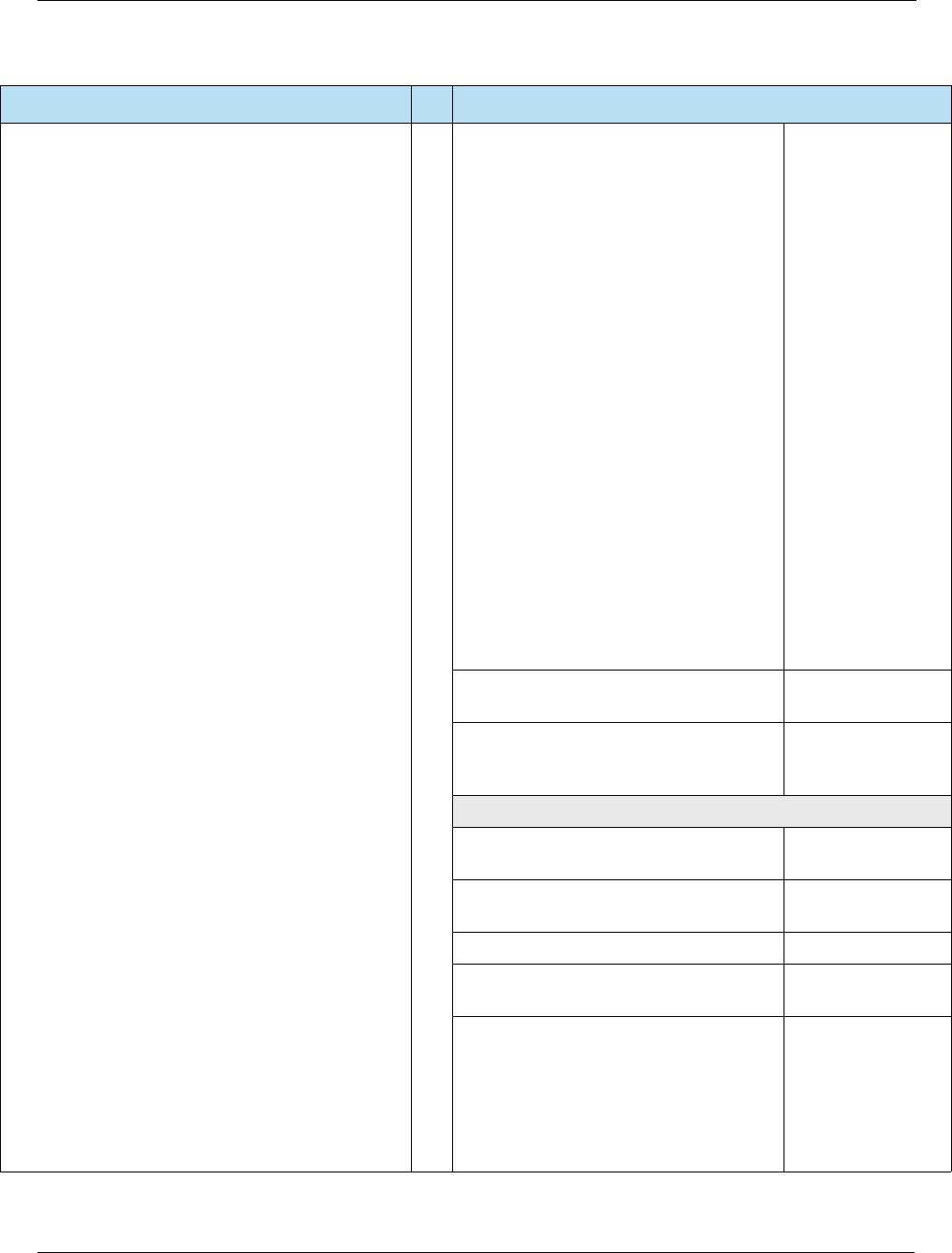

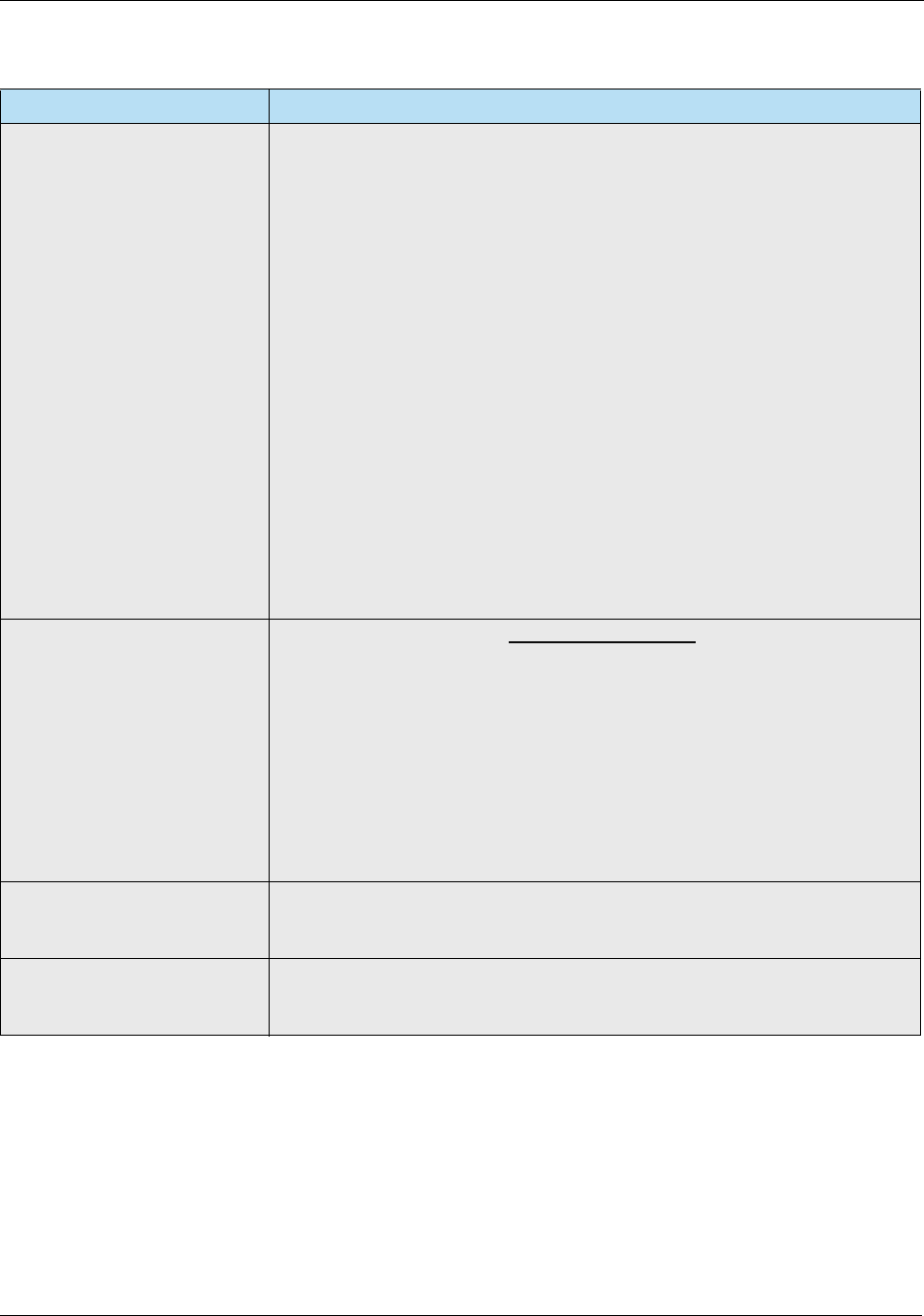

HPS Integrator’s Guide V 17.2 List of Figures

2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive 17

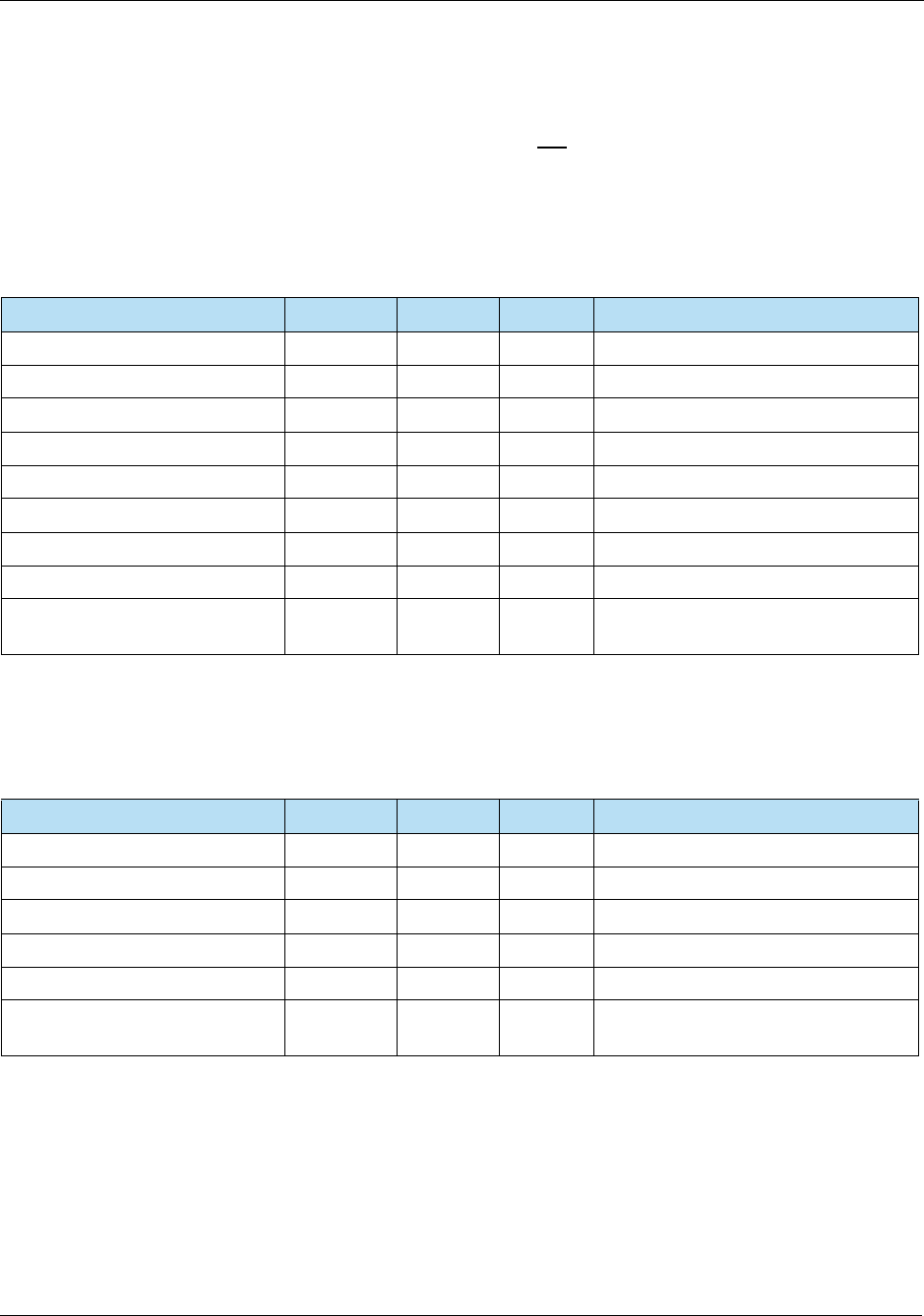

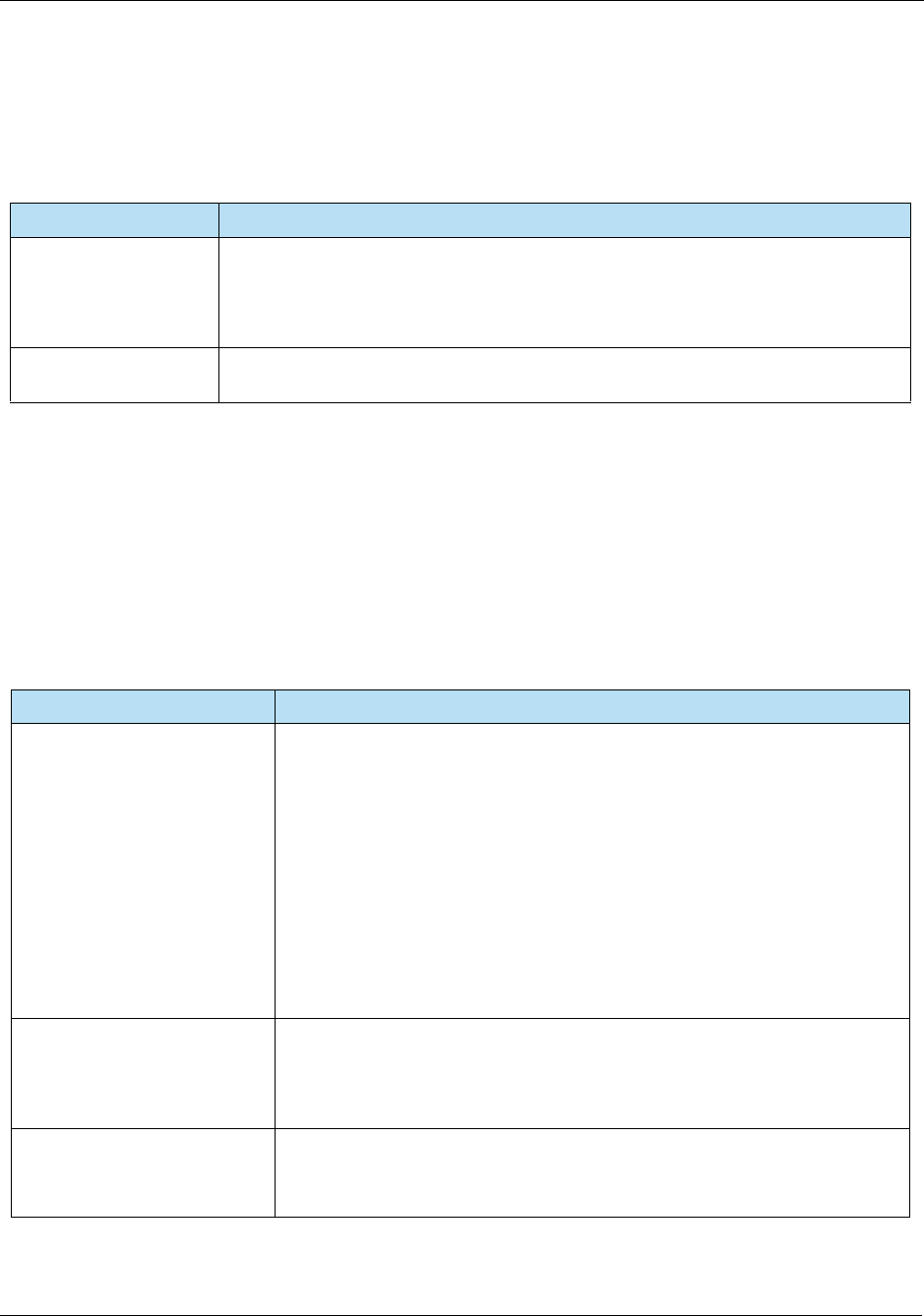

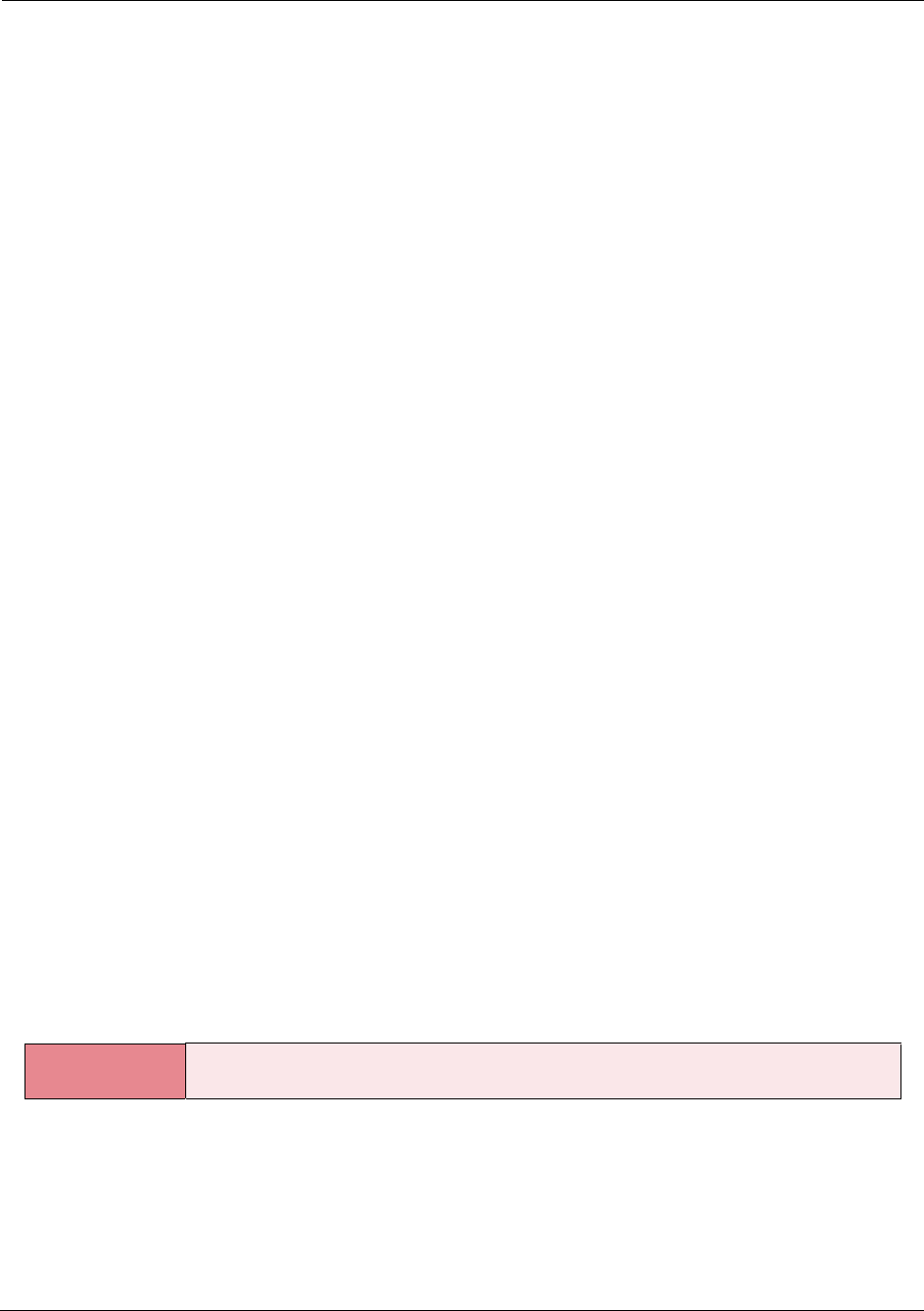

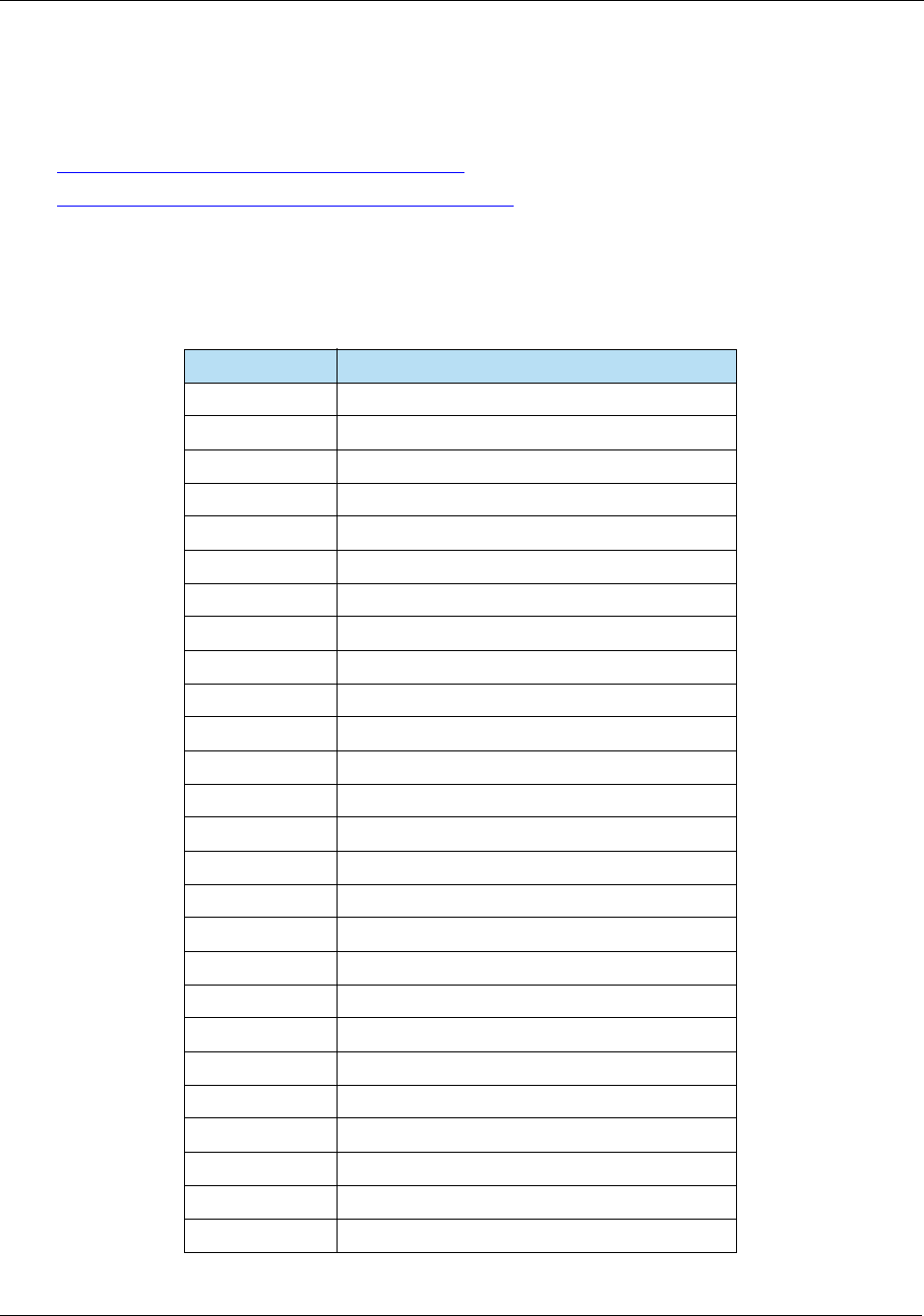

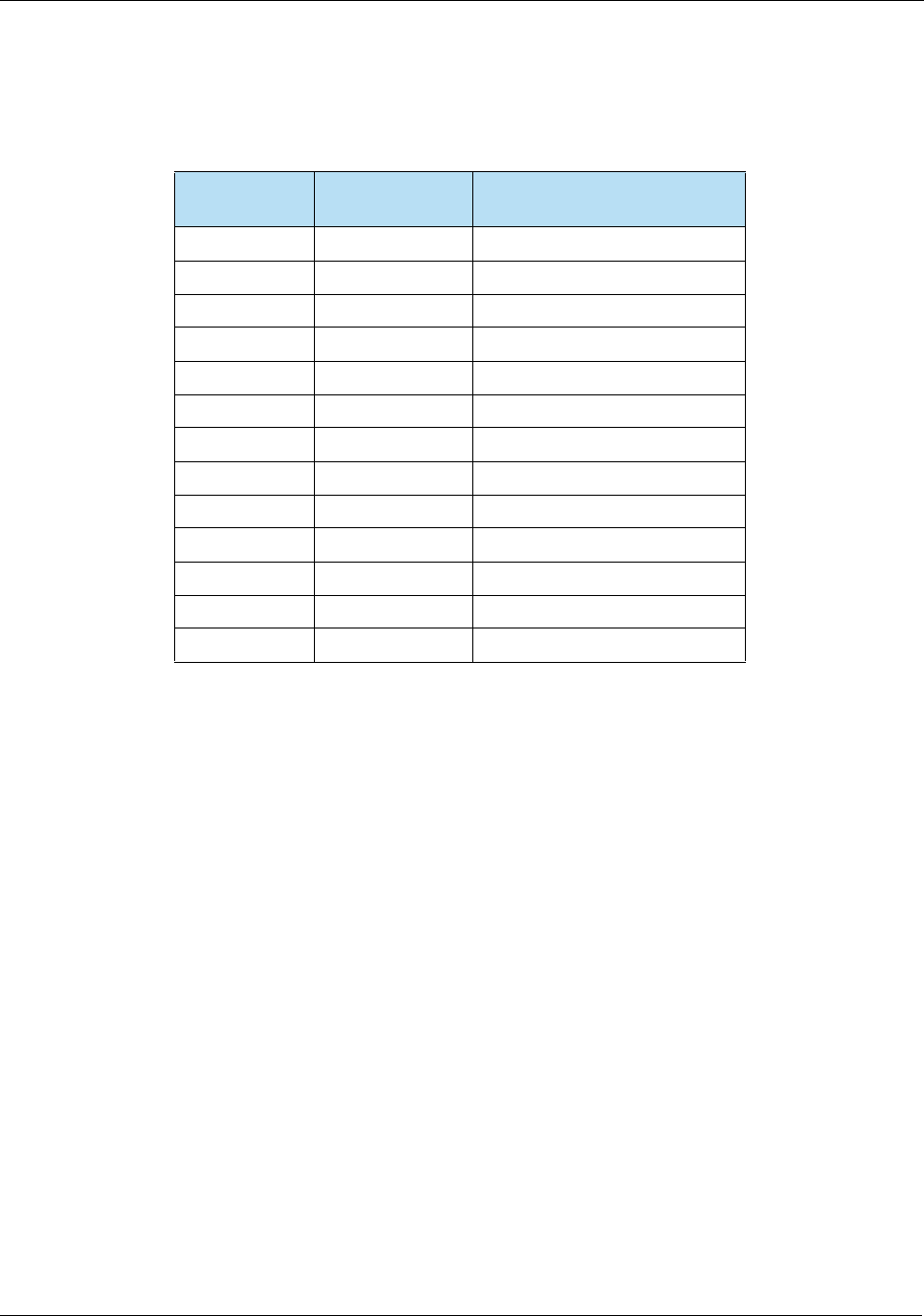

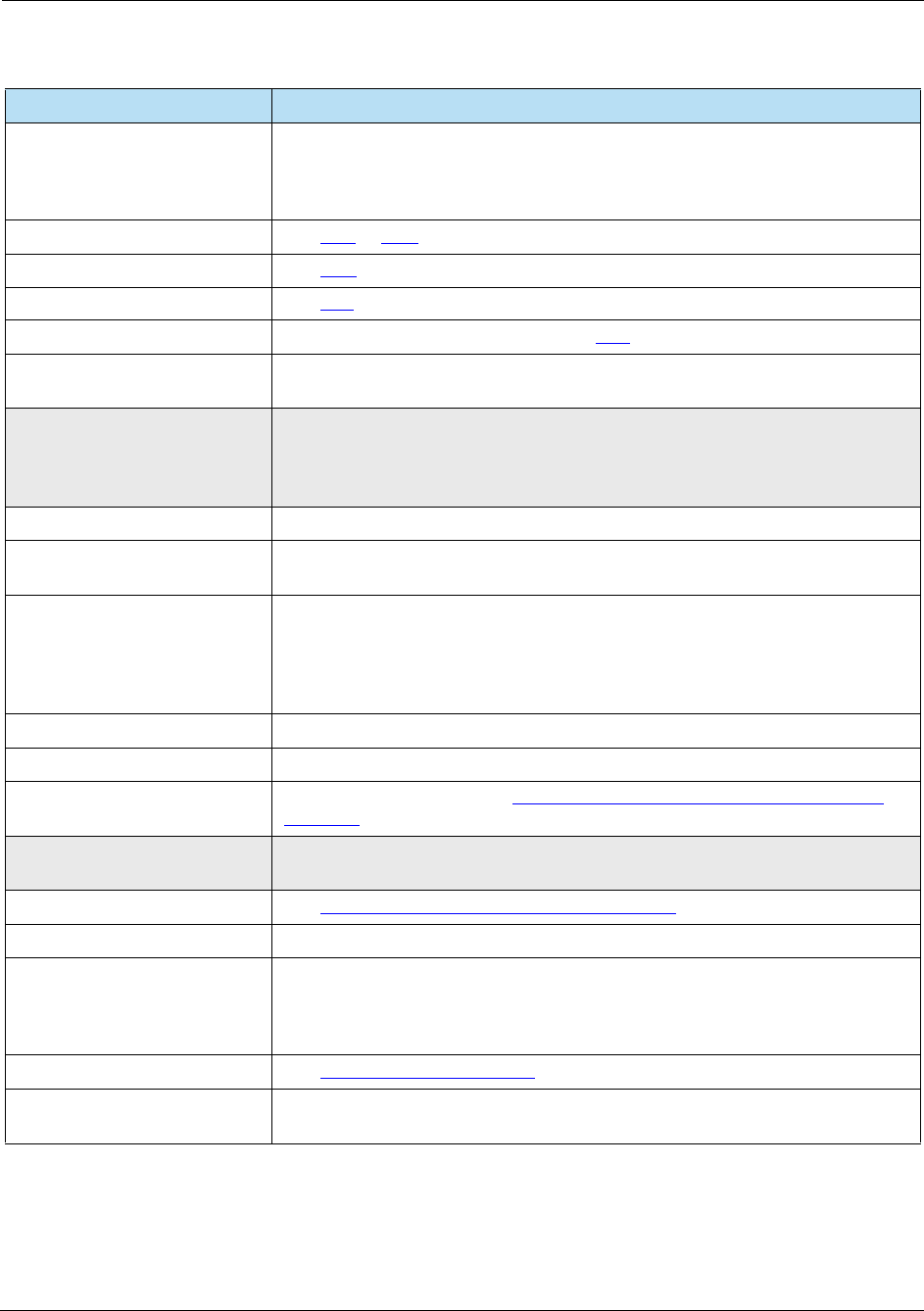

List of Figures

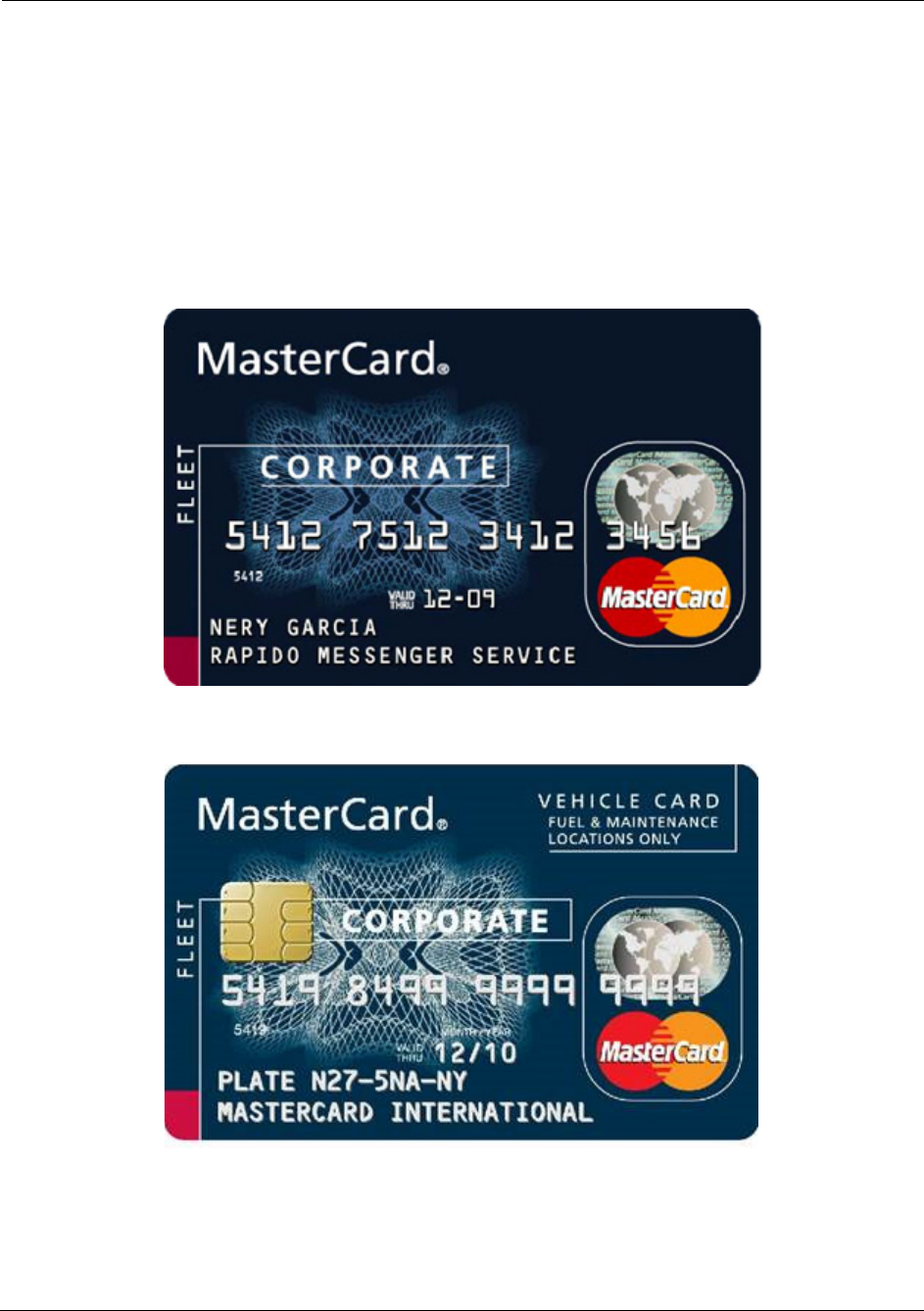

3-1 Mastercard Fleet Card: Driver Assigned Example......................................................................49

3-2 Mastercard Fleet Card: Vehicle Assigned Example....................................................................49

3-3 Visa Fleet Card: Driver Assigned Example.................................................................................63

3-4 Visa Fleet Card: Vehicle Assigned Example...............................................................................63

3-5 WEX Fleet Card Example ...........................................................................................................70

3-6 WEX GSA Fleet ..........................................................................................................................71

3-7 WEX Dept. of Defense Fleet.......................................................................................................71

3-8 WEX Dept. of Energy Fleet.........................................................................................................71

4-1 E3 MSR Wedge ..........................................................................................................................88

4-2 E3 PIN Pad .................................................................................................................................90

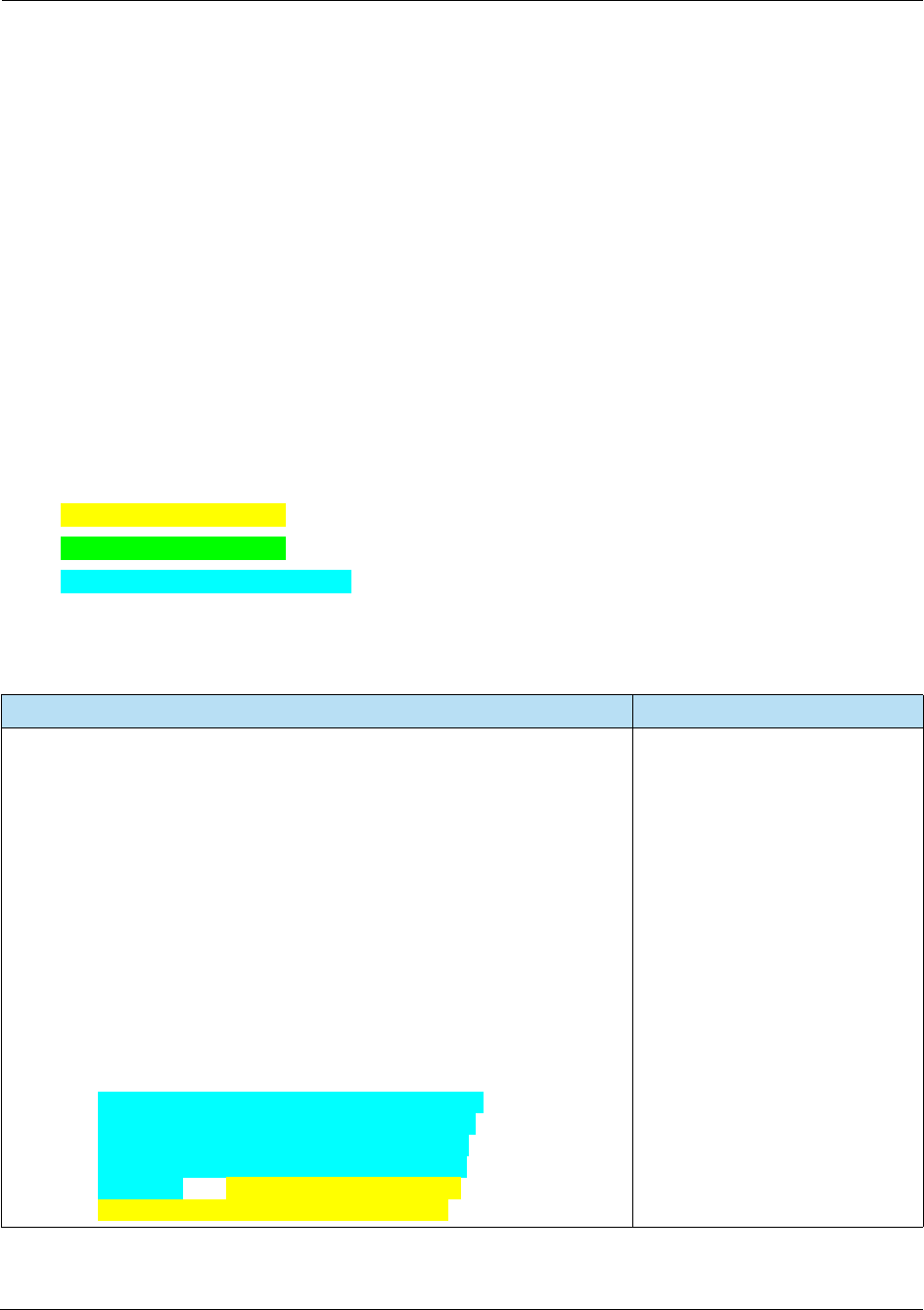

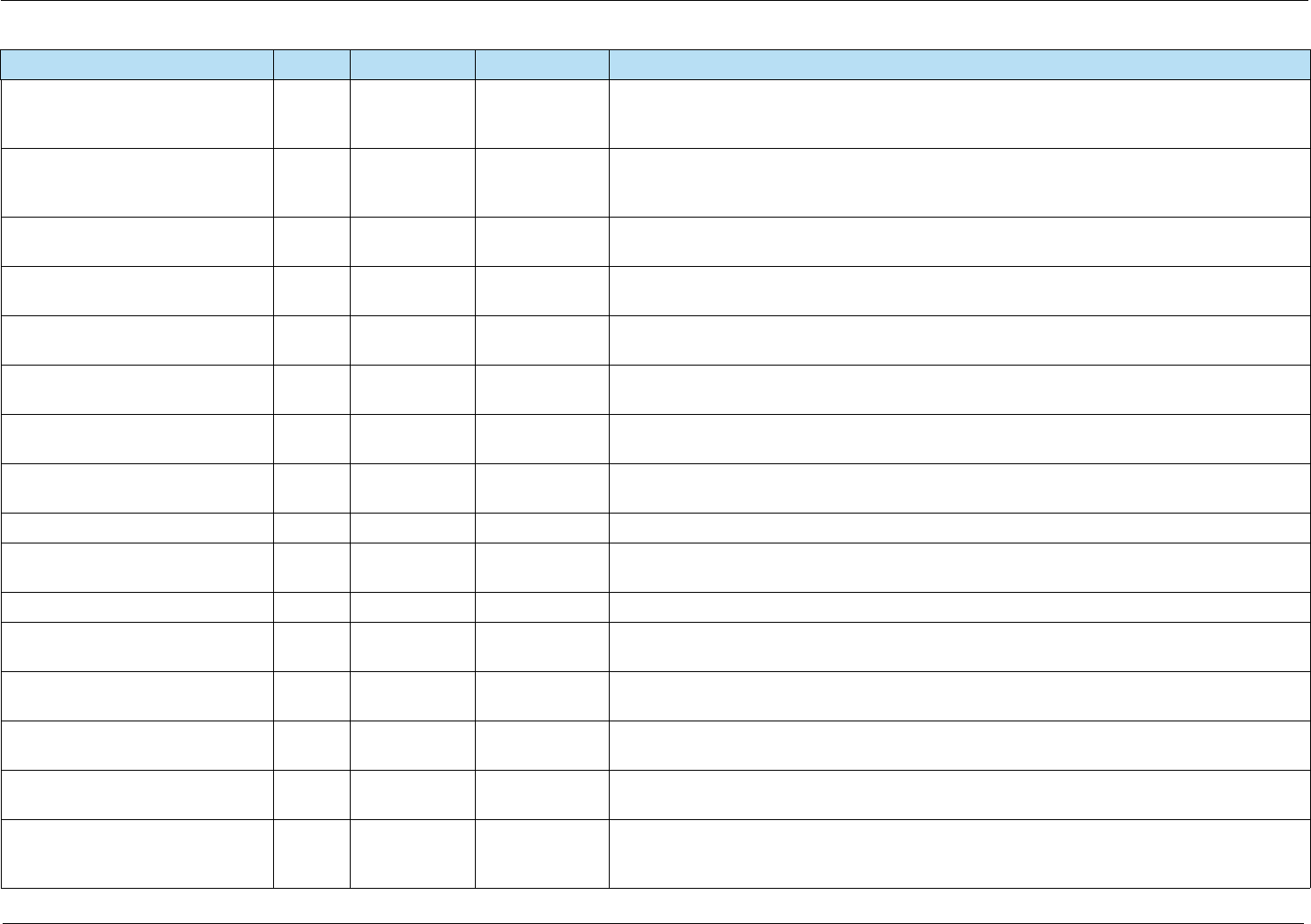

7-1 Contact Transaction Flow .........................................................................................................135

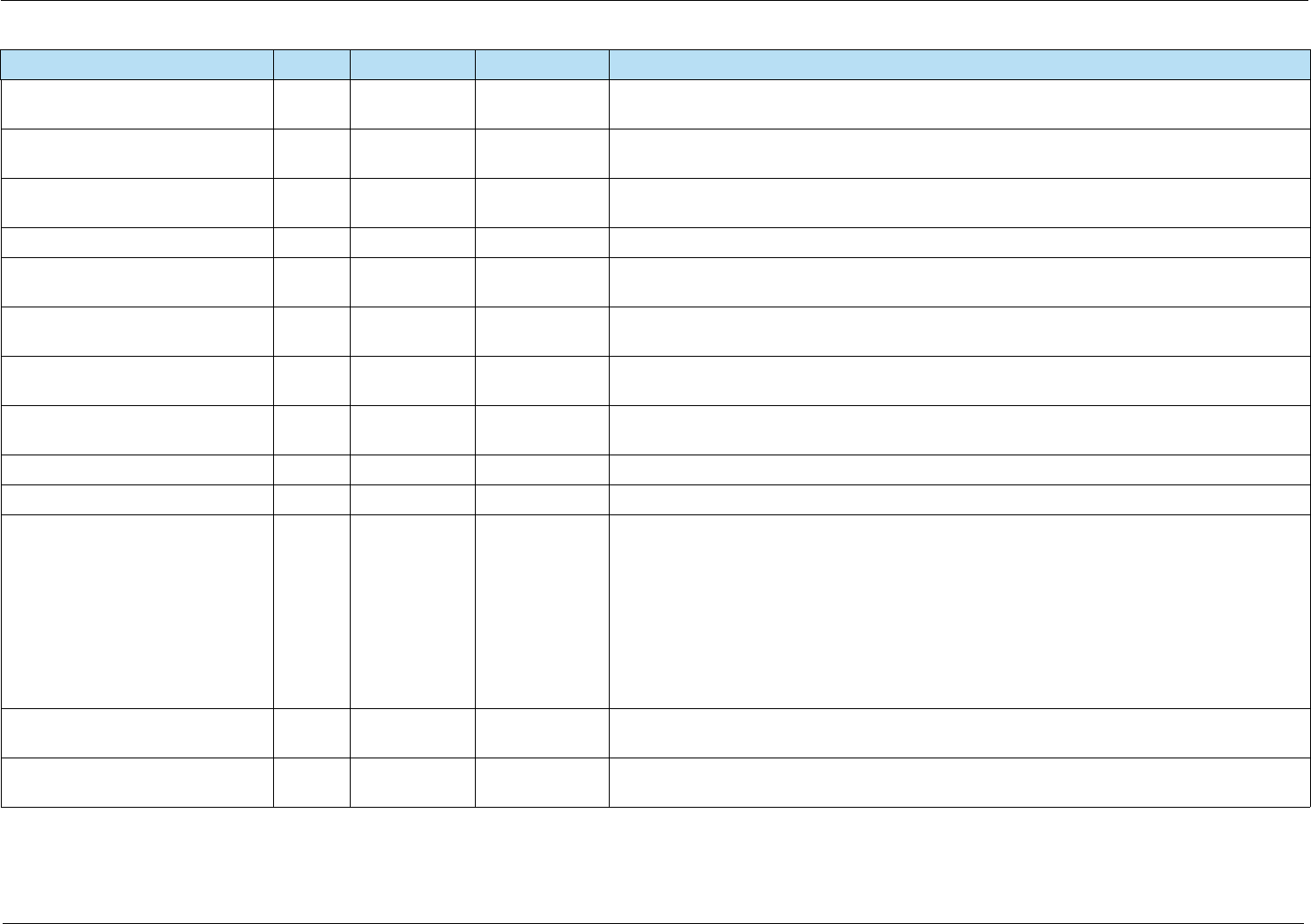

7-2 Contactless Transaction Flow...................................................................................................155

7-3 EMV Receipt Example ..............................................................................................................161

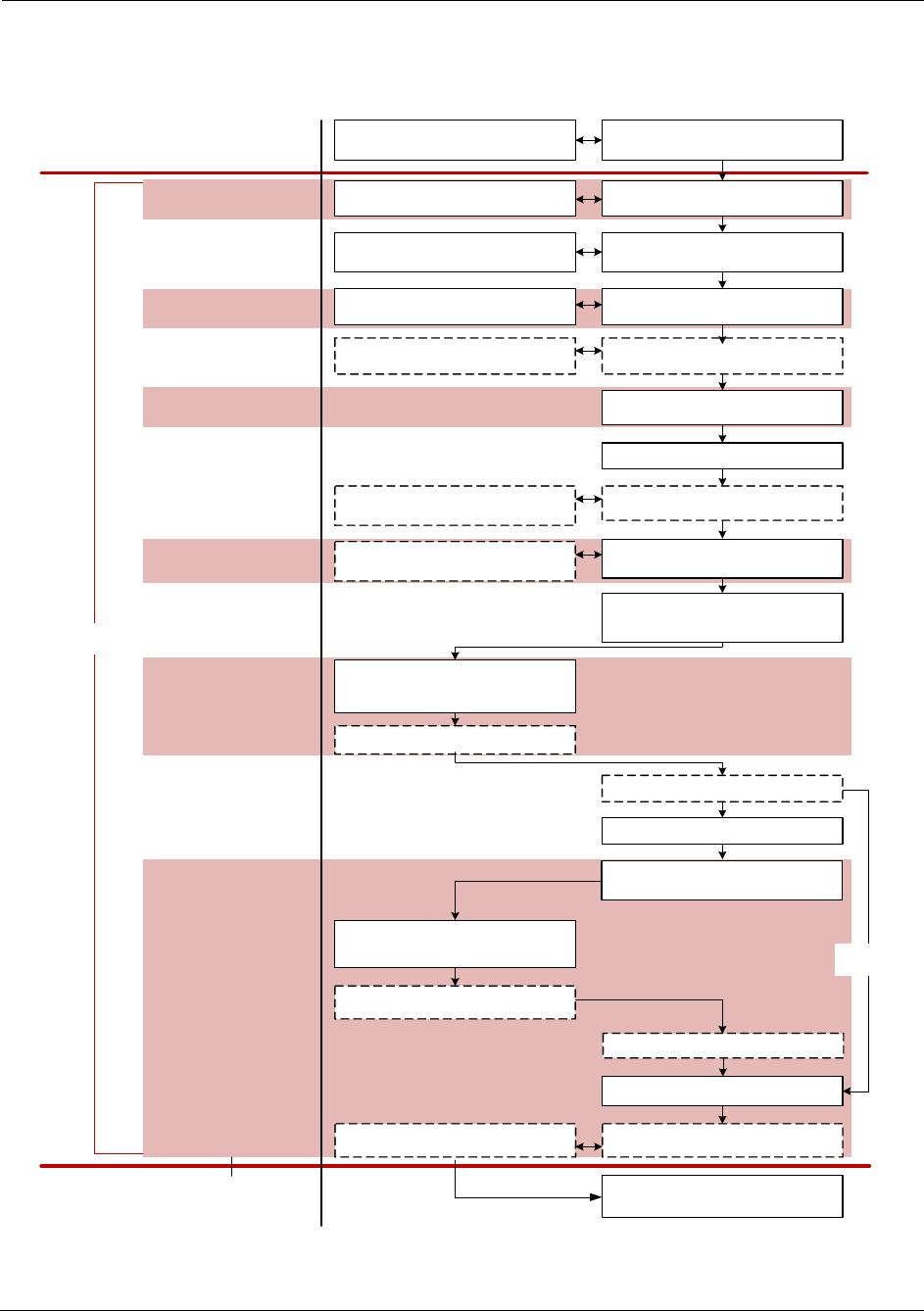

9-1 Quick Chip Processing Flow .....................................................................................................173

For Internal Use Only

List of Figures HPS Integrator’s Guide V 17.2

18 2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive

For Internal Use Only

HPS Integrator’s Guide V 17.2 1: Overview

2017 Heartland Payment Systems, LLC, All Rights Reserved–HPS Confidential: Sensitive 19

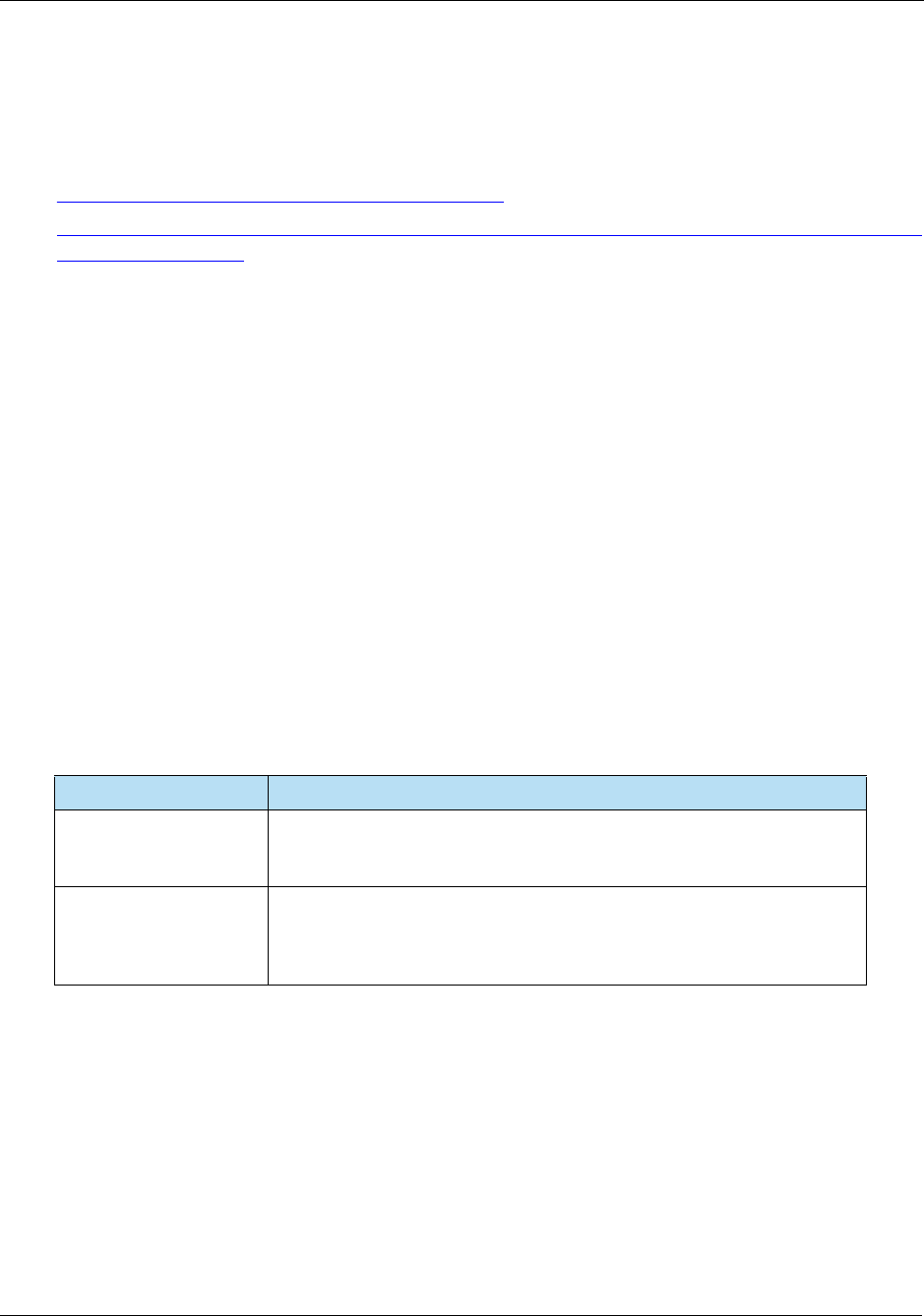

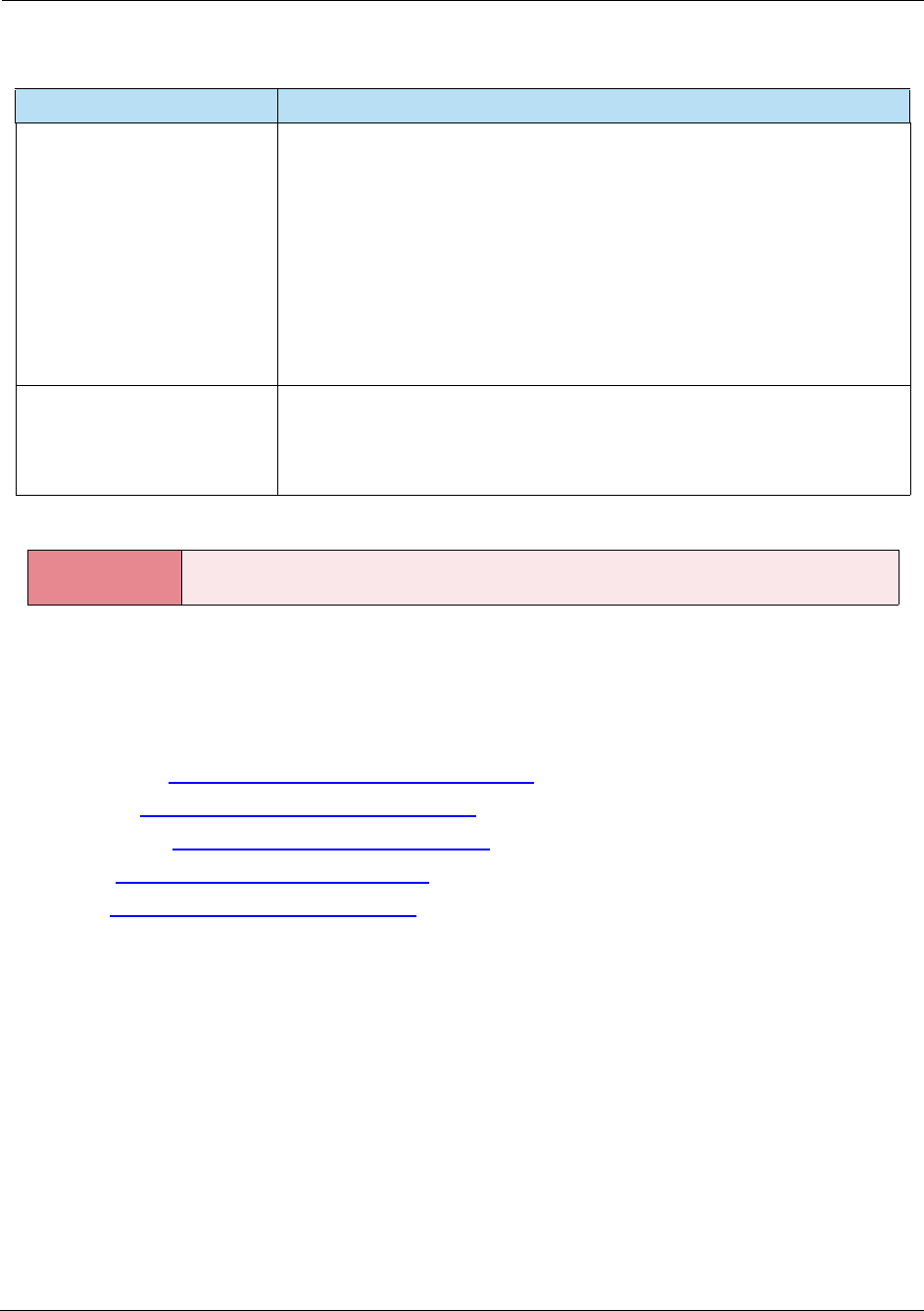

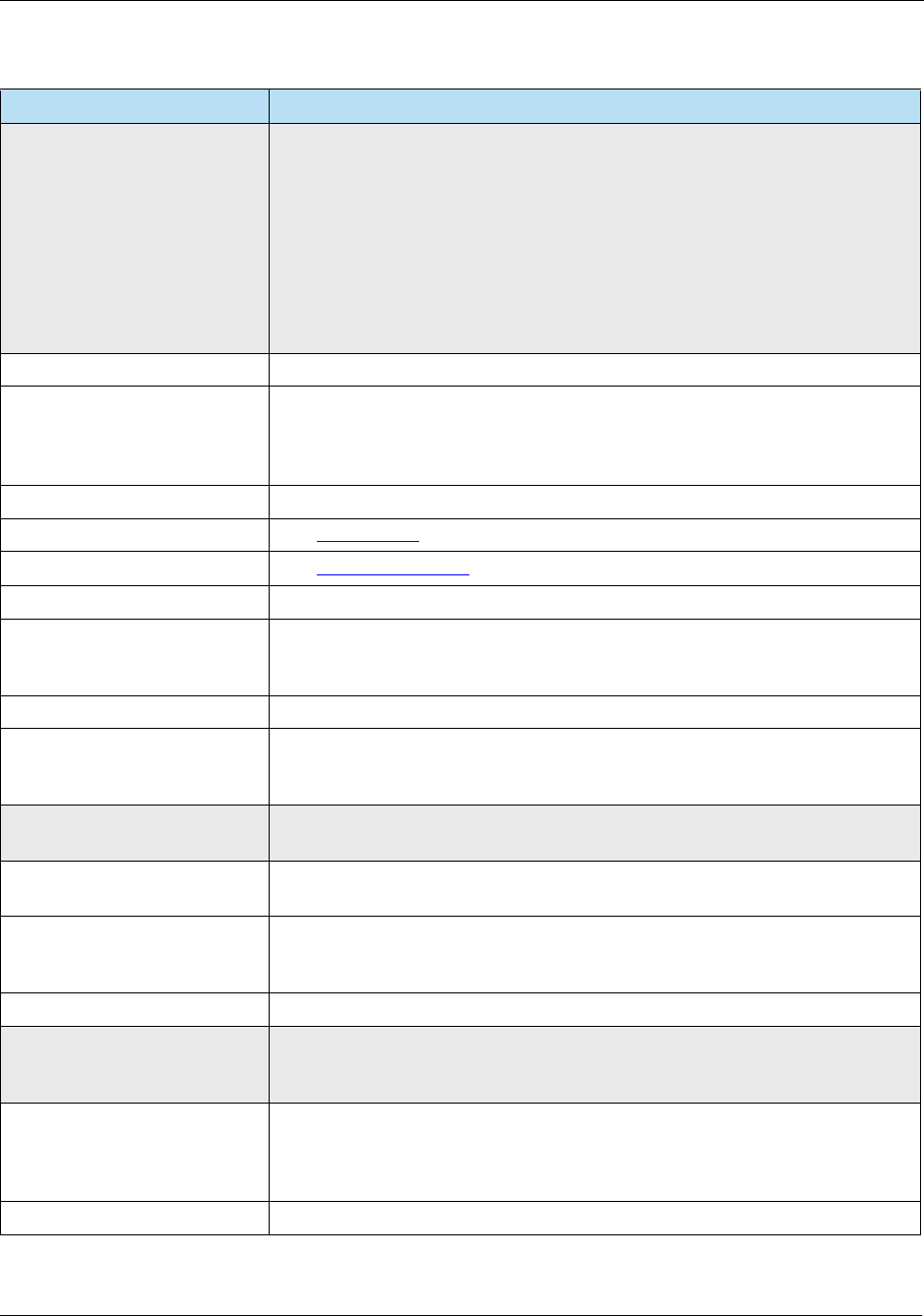

Chapter 1: Overview

1.1 Introduction

Heartland Payment Systems, LLC (Heartland) is a leading third-party provider of payment card

transaction processing, providing the following services:

• Host Network transaction services

• Bankcard, Fleet, Debit and Private Label card processing

• Mobile and e-commerce solutions

• Settlement processing

1.2 Document Purpose

The purpose of this document is to provide information in order to integrate a POS system to

Heartland. Topics include:

1.3 Audience

The primary audience for this document consists of third-party vendors responsible for

developing POS payment systems to interface with the Heartland network. The secondary

audience consists of Heartland internal staff responsible for certifying or supporting POS

payment applications. All users of this document are assumed to have a basic understanding of

POS applications.

•General POS Requirements •Industry Codes

•Card Brand Information •Receipt Requirements

•E3 Processing Overview •State Codes / Region Codes

•EMV Processing Overview •EMV Field Definitions

•EMV Development Overview •EMV PDL Data Examples