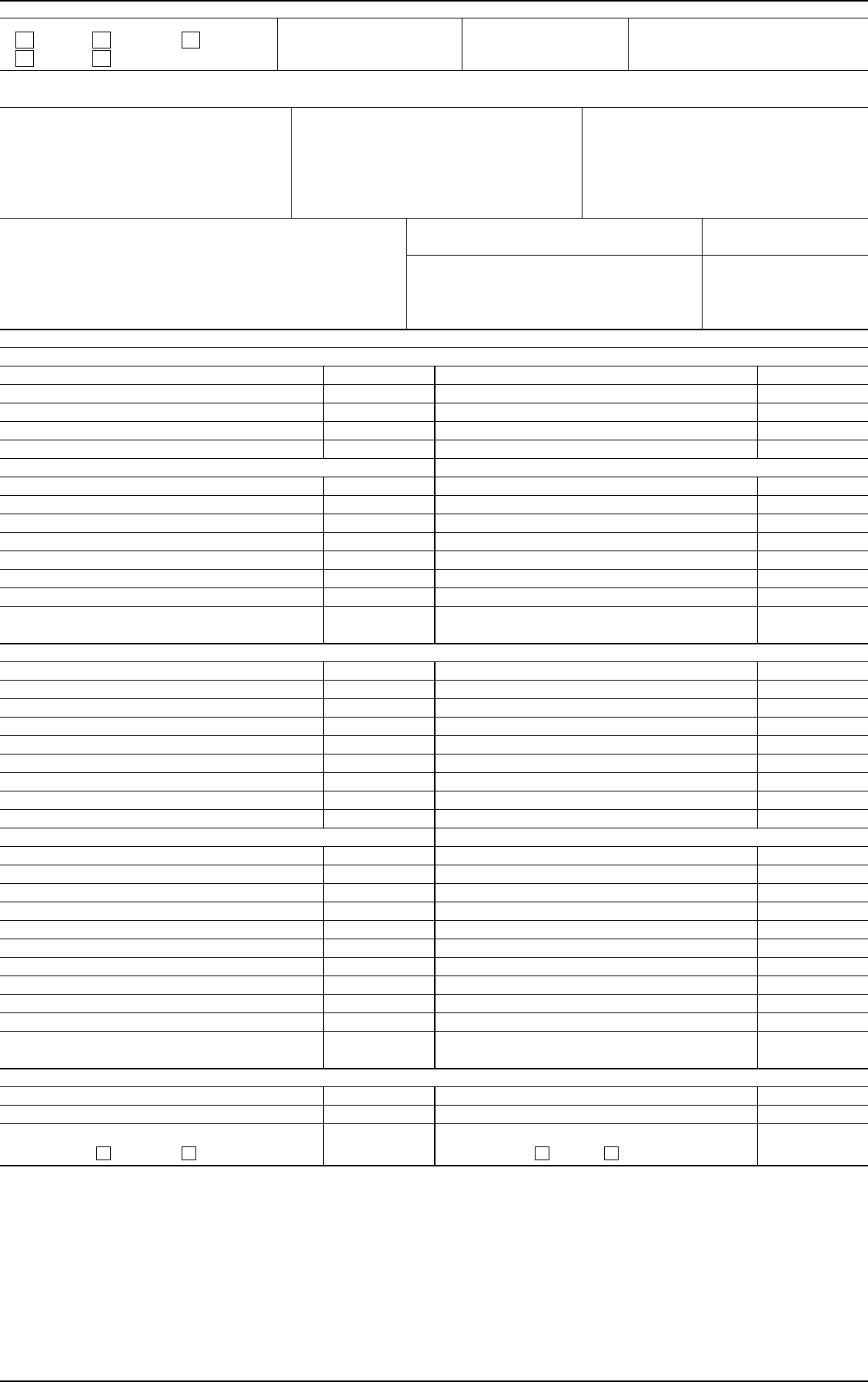

1p1 HUD 1 Settlement Statement

User Manual: HUD-1 Settlement Statement

Open the PDF directly: View PDF ![]() .

.

Page Count: 3

Previous editions are obsolete form HUD-1 (3/86)

ref Handbook 4305.2

Page 1 of 2

U.S. Department of Housing

and Urban Development

A. Settlement Statement OMB Approval No. 2502-0265

C. Note: This form is furnished to give you a statement of actual settlement costs. Amounts paid to and by the settlement agent are shown. Items marked “(p.o.c.)”

were paid outside the closing; they are shown here for informational purposes and are not included in the totals.

D. Name & Address of Borrower: E. Name & Address of Seller: F. Name & Address of Lender:

G. Property Location: H. Settlement Agent:

Place of Settlement: I. Settlement Date:

J. Summary of Borrower's Transaction K. Summary of Seller's Transaction

100. Gross Amount Due From Borrower 400. Gross Amount Due To Seller

101. Contract sales price 401. Contract sales price

102. Personal property 402. Personal property

103. Settlement charges to borrower (line 1400) 403.

104. 404.

105. 405.

Adjustments for items paid by seller in advance Adjustments for items paid by seller in advance

106. City/town taxes to 406. City/town taxes to

107. County taxes to 407. County taxes to

108. Assessments to 408. Assessments to

109. 409.

110. 410.

111. 411.

112. 412.

120. Gross Amount Due From Borrower 420. Gross Amount Due To Seller

200. Amounts Paid By Or In Behalf Of Borrower 500. Reductions In Amount Due To Seller

201. Deposit or earnest money 501. Excess deposit (see instructions)

202. Principal amount of new loan(s) 502. Settlement charges to seller (line 1400)

203. Existing loan(s) taken subject to 503. Existing loan(s) taken subject to

204. 504. Payoff of first mortgage loan

205. 505. Payoff of second mortgage loan

206. 506.

207. 507.

208. 508.

209. 509.

Adjustments for items unpaid by seller Adjustments for items unpaid by seller

210. City/town taxes to 510. City/town taxes to

211. County taxes to 511. County taxes to

212. Assessments to 512. Assessments to

213. 513.

214. 514.

215. 515.

216. 516.

217. 517.

218. 518.

219. 519.

220. Total Paid By/For Borrower 520. Total Reduction Amount Due Seller

300. Cash At Settlement From/To Borrower 600. Cash At Settlement To/From Seller

301. Gross Amount due from borrower (line 120) 601. Gross amount due to seller (line 420)

302. Less amounts paid by/for borrower (line 220) ( ) 602. Less reductions in amt. due seller (line 520) ( )

303. Cash From To Borrower 603. Cash To From Seller

6. File Number: 7. Loan Number: 8. Mortgage Insurance Case Number:

1. FHA 2. FmHA 3. Conv. Unins.

4. VA 5. Conv. Ins.

B. Type of Loan

Section 4(a) of RESPA mandates that HUD develop and prescribe this

standard form to be used at the time of loan settlement to provide full disclosure

of all charges imposed upon the borrower and seller. These are third party

disclosures that are designed to provide the borrower with pertinent informa-

tion during the settlement process in order to be a better shopper.

The Public Reporting Burden for this collection of information is estimated to

average one hour per response, including the time for reviewing instructions,

searching existing data sources, gathering and maintaining the data needed,

and completing and reviewing the collection of information.

This agency may not collect this information, and you are not required to

complete this form, unless it displays a currently valid OMB control number.

The information requested does not lend itself to confidentiality.

Section 5 of the Real Estate Settlement Procedures Act (RESPA) requires the

following: • HUD must develop a Special Information Booklet to help persons

borrowing money to finance the purchase of residential real estate to better

understand the nature and costs of real estate settlement services; • Each

lender must provide the booklet to all applicants from whom it receives or for

whom it prepares a written application to borrow money to finance the

purchase of residential real estate; • Lenders must prepare and distribute with

the Booklet a Good Faith Estimate of the settlement costs that the borrower is

likely to incur in connection with the settlement. These disclosures are

manadatory.

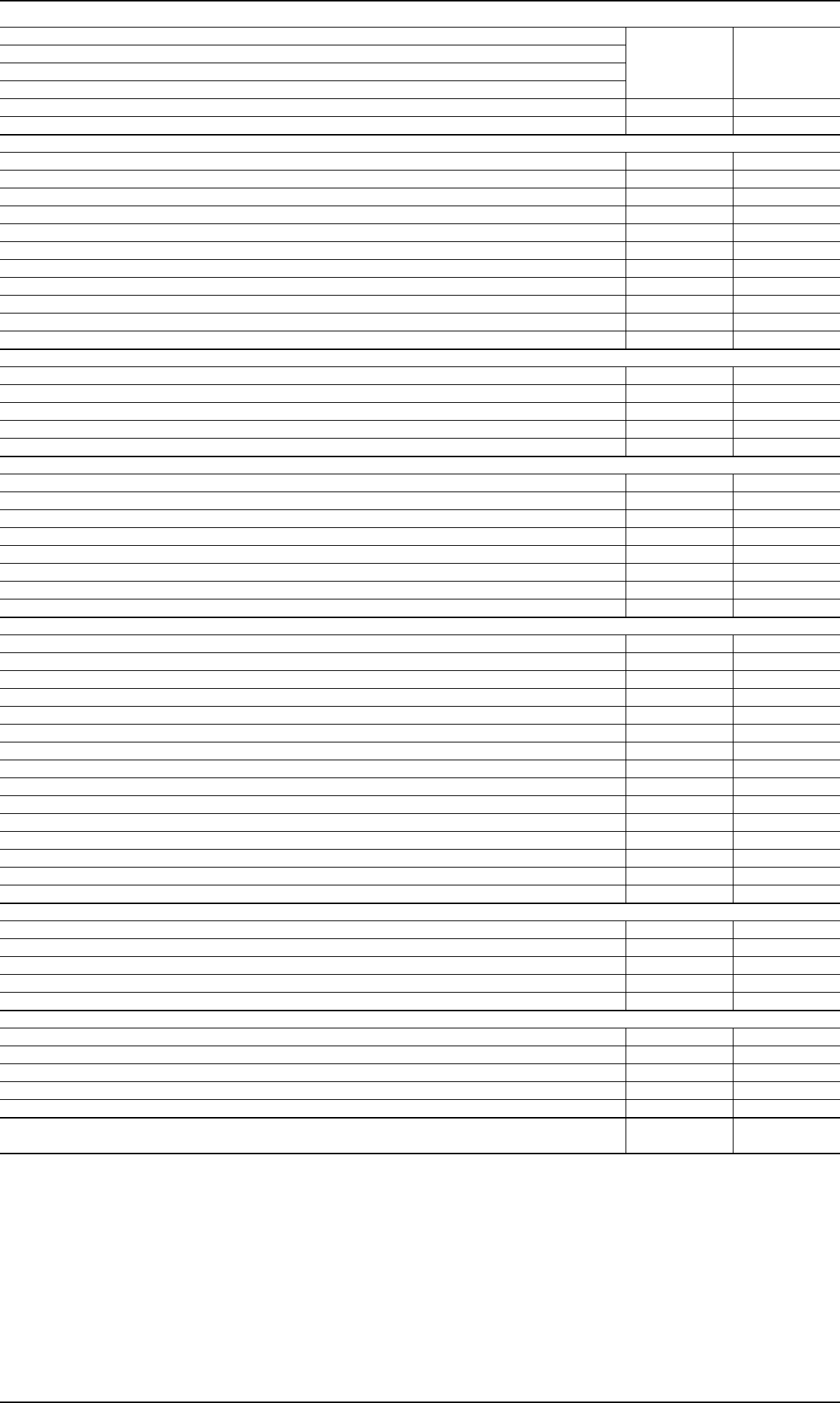

Previous editions are obsolete form HUD-1 (3/86)

ref Handbook 4305.2

Page 2 of 2

L.Settlement Charges

Paid From

Seller's

Funds at

Settlement

Paid From

Borrowers

Funds at

Settlement

700.Total Sales/Broker's Commission based on price $ @ % =

Division of Commission (line 700) as follows:

701.$ to

702.$ to

703.Commission paid at Settlement

704.

800.Items Payable In Connection With Loan

801.Loan Origination Fee %

802.Loan Discount %

803.Appraisal Fee to

804.Credit Report to

805.Lender's Inspection Fee

806.Mortgage Insurance Application Fee to

807.Assumption Fee

808.

809.

810.

811.

900.Items Required By Lender To Be Paid In Advance

901.Interest from to @$ /day

902.Mortgage Insurance Premium for months to

903.Hazard Insurance Premium for years to

904. years to

905.

1000.Reserves Deposited With Lender

1001.Hazard insurance months@$ per month

1002.Mortgage insurance months@$ per month

1003.City property taxes months@$ per month

1004.County property taxes months@$ per month

1005.Annual assessments months@$ per month

1006. months@$ per month

1007. months@$ per month

1008. months@$ per month

1100.Title Charges

1101.Settlement or closing fee to

1102.Abstract or title search to

1103.Title examination to

1104.Title insurance binder to

1105.Document preparation to

1106.Notary fees to

1107.Attorney's fees to

(includes above items numbers: )

1108.Title insurance to

(includes above items numbers: )

1109.Lender's coverage $

1110.Owner's coverage $

1111.

1112.

1113.

1200.Government Recording and Transfer Charges

1201.Recording fees: Deed $ ; Mortgage $ ; Releases $

1202.City/county tax/stamps: Deed $ ;Mortgage $

1203.State tax/stamps: Deed $ ;Mortgage $

1204.

1205.

1300.Additional Settlement Charges

1301.Survey to

1302.Pest inspectionto

1303.

1304.

1305.

1400.Total Settlement Charges (enter on lines 103, Section J and 502, Section K)

William Bronchick’s

Powerful Training

Library Will Show You

Real-Life Formulas for

Creating Wealth!

VOLUME 1: FLIPPING PROPERTIES - $395.00

Are you just getting started in real estate investing? Need more cash flow? Do you want to make CASH PROFIT now? This course is for

anyone who wants to learn how to make IMMEDIATE CASH PROFIT in real estate. Even if you are a rank beginner, you can learn how to

make money immediately in today's real estate market by flipping properties. Step-by-step details for analyzing deals, marketing to find

motivated sellers and drafting purchase offers are laid out in an easy-to-understand format. Includes 214-page course book four video

tapes, and six audio cassettes recorded at a live seminar, plus legal forms CD-ROM.

VOLUME II: BIGH PROFITS WITH LEASE/OPTIONS - $395.00

This all-day videotaped workshop walks you step-by-step through the mechanics of the lucrative world of lease/options. You will learn,

step-by-step, the secrets of how to create instant monthly cash flow with little or no money invested, 7 creative strategies for profiting using

leases & options, 10 tested ways to find lease/option properties (includes sample ads & flyers), the "sure-fire" telephone script that literally

"weeds out" the unmotivated sellers, and the air-tight legal forms and strategies you need to protect yourself from disaster (including the

“performance mortgage”). Updated 2002!

VOLUME III: ALTERNATIVE REAL ESTATE FINANCING - $395.00

This course gives you all of the advanced cutting-edge techniques for acquiring real estate in today’s market with little or no cash, credit or

personal liability. Covers the details of “subject to” transfers (including the “land trust assignment”), buying and selling on land contract,

wraparounds, profiting from over-financed properties, discounting liens, subordination & substitution of collateral, foreclosure tricks and

strategies, creative tax strategies for maximizing your profit, and much, much more! Includes CD-ROM with all of the latest forms, plus

special bonus mortgage calculators in MS-Excel format.

VOLUME IV: SECRETS OF A REAL ESTATE LAWYER - $395.00

Are you drowning in the sea of paperwork involved in real estate transactions? Are you sick of sending your hard-earned cash on a one-

way trip to your lawyer’s office? Are you ready to start filling in the gaps and important legal issues that so-called “gurus” leave out of their

courses? Are you interested in saving a fortune by doing some of the simple legal paperwork that real estate attorneys have had a

monopoly on? If you answered “yes” to any of these questions, then you MUST have this course! “Secrets of a Real Estate Lawyer” will

open your eyes to money-making possibilities you never imagined. Whether you are just getting started or are a 30-year real estate

veteran, you’ll acquire a wealth of information! Includes 4 video tapes, six audios and CD-ROM with state-specific real estate forms!

**Make Sure to Ask for Special Discounts for the Entire Library**

Customer Order Form

Name_____________________________________________________________________________

E-mail ________________________________ Daytime Phone _____________________________

Shipping Address ___________________________________________________________________

City _____________________________________________ ST _____________ Zip ____________

Enclosed is my check payable to “Legalwiz Publications”

Please bill my MC/VISA _______________________________________________ Ex ________

Telephone Orders:

Toll Free 1-800-655-3632

Fax Orders:

Toll Free 1-888-665-3742

Internet Orders:

www.legalwiz.com/books.htm

Mail Orders: Legalwiz Publications

2620 S. Parker Rd #272

Aurora, CO 80014