Insperity Hr Outsourcing A Step By Guide To Professional Employer Organizations

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 11

NEXT

Overview Get the expertise and help you need to focus entirely on

running and growing your business. This guide walks you through the

process of hiring a PEO and helps you determine if it’s right for you.

HR Outsourcing: A Step-by-Step Guide to

2 / 11

Table of Contents

Introduction

The Power of PEOs

How a PEO Can Benefit Your Business

How PEOs Work

Common Misconceptions

Finding the Right Fit

3 / 11

Introduction

Companies of all sizes struggle with growth. But as a small business, to stay competitive, you’re constantly forced

to do more with less.

Not only do small businesses have fewer resources to deal with daily HR responsibilities, they also face greater

regulatory burdens than their larger competitors.

The good news is, despite your size, you can still come out ahead of the pack. Outsourcing even a portion of your

HR tasks can afford you the freedom to focus on core activities that will help you grow your business.

HR outsourcing vs. PEO

HR outsourcing can take many forms, from basic payroll processing and timekeeping to complex regulatory

compliance and benefits administration. The most comprehensive solution is a Professional Employer

Organization (PEO), which offers a full slate of HR services to its clients.

A PEO provides your company with access to these key resources:

• Beer health, retirement and workers’ compensation benefits

• Professionals well-versed in all aspects of employee recruitment, retention and management

• Reduced accounting and payroll costs

• Comprehensive employer liability management that lessens employment-related risk

• Relief from administrative duties that drain your valuable time and aention

What you’ll get in this guide

Discover how partnering with a PEO can help your business gain a competitive edge despite its size. In this

guide, you’ll learn how to gauge your needs, vet service providers and quantify results.

Did You Know?

Small businesses

that use a PEO

have an employment growth rate that

is nearly 10 percent higher than small

businesses that don’t.

National Association of Professional Employer

Organizations (NAPEO)

4 / 11

The Power of PEOs

Unlike other types of HR outsourcing companies that provide only one or two specific services, PEOs can handle

the bulk of your business’s HR tasks. As a PEO client, you won’t have to devote your valuable time to tracking

payroll or negotiating rates with benefits providers, nor will you have to hire additional staff to manage these

responsibilities for you.

How a PEO Can Benet Your Business

Outsourcing all or even a portion of your HR duties can provide the following:

1. Access to comprehensive and affordable benefits

A PEO typically provides benefits under a sponsored plan and can offer a wider range of services to your staff

at a much beer price, including health and retirement 401(k) benefits.

2. Relief from general HR tasks

Outsourcing administrative duties to a group that specializes in HR ensures that important issues will be

handled correctly, including:

• Payroll administration

• Government compliance

• Employee benefits

• Employer liability management

3. Reduced payroll and administration burdens

By contracting with a PEO, you stand to benefit from a decrease in the costs associated with payroll

processing and maintaining wage records. You’ll also receive reliable assistance with tasks such as:

• Payroll processing

• Tax reporting and deposits

• Paycheck/paystub preparation and delivery

• Garnishments

The National Association of Professional

Employer Organizations (NAPEO) estimates that

about 700 PEOs are in operation today in the

U.S., covering 2-3 million American workers.

700

5 / 11

4. Assistance with federal and state employment laws and regulations

A PEO should be able to:

• Administer payroll in accordance with federal and state laws, and

properly report federal, state and local tax

• Administer unemployment claims

• Respond to employment verifications

• Comply with federal laws affecting PEO-sponsored

benefits (e.g., COBRA, HIPAA and ERISA)

• Provide guidance with OSHA

• Assist with health care reform compliance

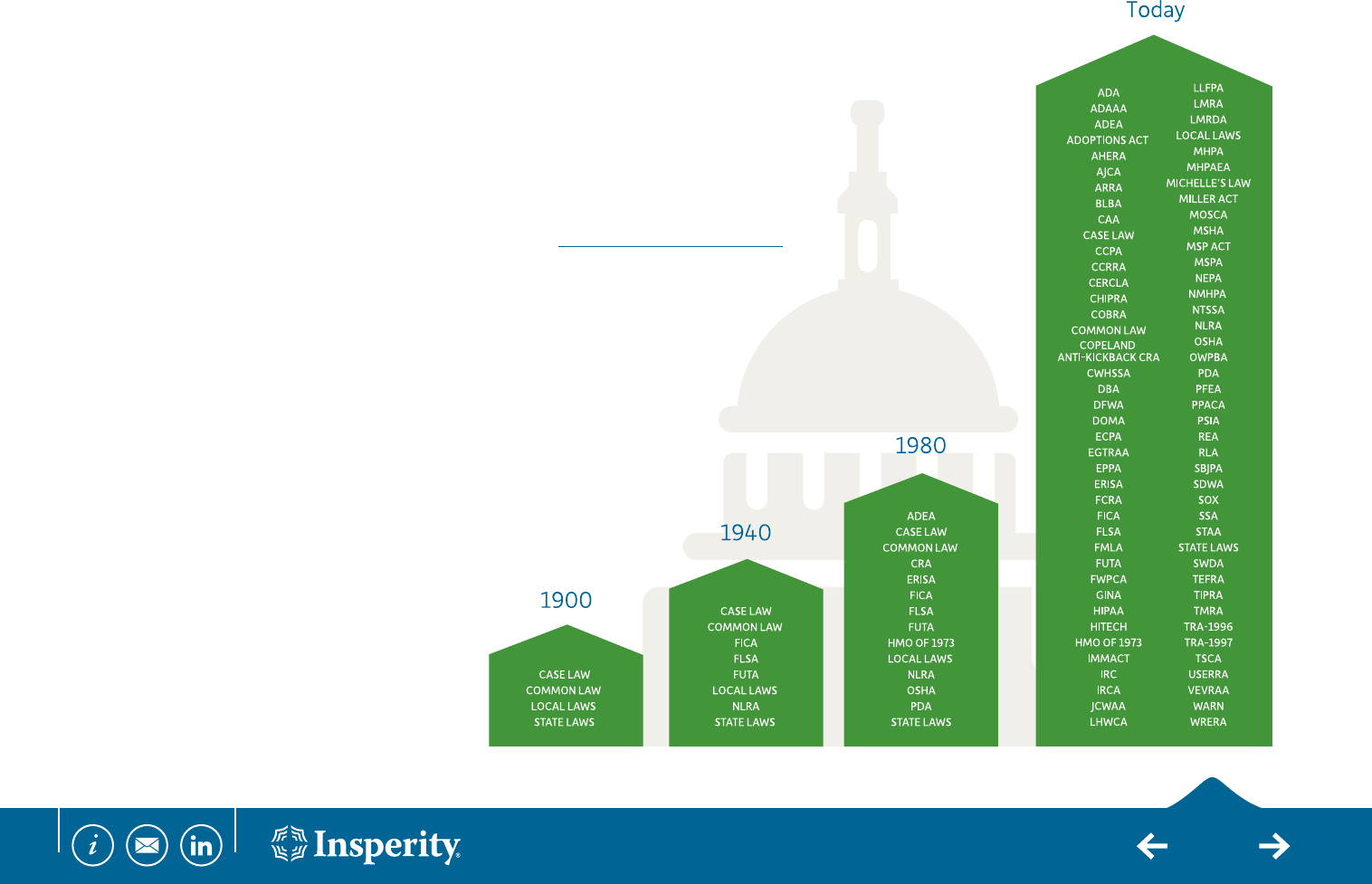

The number of government

statutes and regulations has

grown signicantly since 1980.

New Government Statutes and Regulations

6 / 11

5. Reduced liability

PEOs have a vested interest in keeping your business compliant and will

assist you with related tasks, including:

• Employee handbooks

• Workers’ compensation claims

• Agency interface

6. Access to seasoned HR professionals

PEOs comprise knowledgeable professionals who specialize

in HR and can be trusted to handle issues in a timely and thorough manner, including:

• Employee relations support

• Employee liability awareness training

• EEOC claim investigation, reporting and mediation

7. Freedom to focus on core business issues

Your time is valuable and beer spent aending to tasks related to growth and profitability.

Did You Know?

250,000 businesses

use PEOs

National Association of Professional

Employer Organizations (NAPEO)

7 / 11

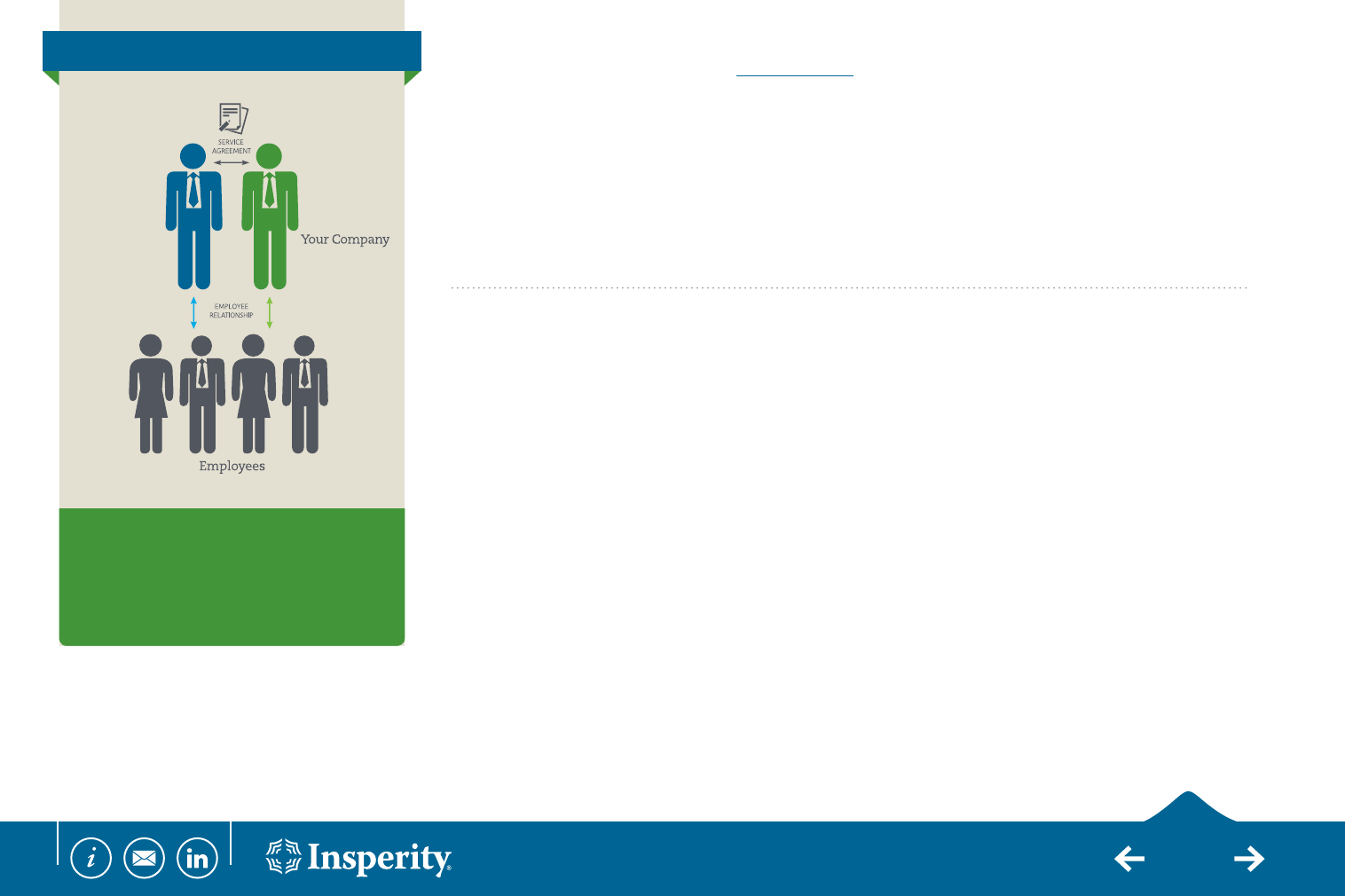

How PEOs Work

PEOs exist through a relationship called co-employment. Simply put, your employees work for both your

company and the PEO. You maintain control of all business decisions and operations while the PEO manages all

personnel-related functions (payroll, benefits, HR, workers’ compensation, etc.).

The client employer maintains control of all business decisions and operations while the co-employer manages

all employee-related aspects of business operation (wage and benefits administration, I-9s, W-2s, etc.).

Above all, it is important to note that PEOs do not supply a workforce; they supply HR

services and benets to your company and its existing workforce.

Common Misconceptions

Although the PEO industry is more than 30 years old, some common misconceptions persist.

Loss of control

PEOs provide access to seasoned HR professionals, whose guidance and advice you can solicit when you need

assistance. They manage the employee-related aspects of your company, but you maintain control of all

business and operational decisions.

Worry that employees may not embrace the relationship

There is minimal, if any, disruption to employees when you work with a PEO. They will see that they are being

paid by the PEO and not your company, but will likely appreciate the greater depth and breadth of benefits

offered as a result.

Worry that existing HR staff will be terminated

PEOs oen align with your company’s existing HR department to provide much-needed expertise. External

resources can prove invaluable when you are faced with high-risk HR situations.

How Co-Employment Works

The client employer maintains control of all

business decisions and operations while the

co-employer manages all employee-related

aspects of business operation (wage and

benefits administration, I-9s, W-2s, etc.).

PEO

8 / 11

Finding the Right Fit

If you’ve decided to partner with a PEO, here are some points to consider before making your selection:

1. The financial strength and security of the candidate company

Verify that each company’s financial statements are independently audited

by a CPA; their risk management practices have been independently

certified; and their operational, financial and ethical practices have been

independently accredited.

2. Their commitment to customer service

Meet the people who will be serving you. Some companies charge extra to

speak with a live representative, while others use call centers and expect

you to speak with a different person each time you need help. A dedicated

service team can be priceless.

3. The breadth of their benefits plan options

A PEO whose health plan centers around a state-specific provider won’t

work if you have employees in other states or plan to expand your business.

4. Their service and cost structure

Many variables affect the cost of partnering with a PEO. Your company’s

size, overall workers’ compensation risk and the benefits package you

would like to offer will all play a part. Most PEOs bill based on a percentage

of gross payroll or total number of employees and are able to offer

considerable savings because of economies of scale.

1986

Year Established

Clients/Employees

2013 Revenues

Honors/Recognition

Insperity has been publicly traded on the

New York Stock Exchange since 1997.

Serves more than 100,000 businesses with

over 2 million employees.

Consistently named one of the Best Places to

Work in America. Named 2013 Mid-Market

Company of the Year by CEO Connection.

Insperity operates in 57 offices throughout

the United States.

$2.3 BILLION

About Insperity

9 / 11

Finding the Right Fit (Continued)

5. Their client and professional references

Ask for referrals from other businesses in your industry and/or geographic location.

6. The company’s administrative and management expertise and competence

What experience and depth does their internal staff have? Are they familiar with the laws governing your state?

7. How employee benefits are tailored

Determine if they fit the needs of your employees. Will you have input into HR policies?

8. The fine print

Are the respective parties’ responsibilities and liabilities clearly laid out? What provisions permit you or the PEO to

cancel the terms of the contract? Does the company carry professional liability insurance? What coverage (if any)

will you gain?

Your company can buy in and compete in today’s marketplace with the help of HR

outsourcing. A PEO can shoulder the bulk of your administrative burdens so you can focus

on what maers most — growing your business.

See page 10 to learn more about our comprehensive PEO service, Insperity® Workforce Optimization®.

Did You Know?

For about the same amount of money you’ll

spend on small-group coverage alone, here’s

what you can get with our PEO service,

Insperity® Workforce Optimization®:

• Beer health insurance

• Employee benefits management

• Payroll (processing, compliance,

record management)

• Employer liability management

(including workers’ comp)

• Recruiting and outplacement support

• Performance management support

• Training and development

• A dedicated service team

• Additional business services

10 / 11

Here’s How Insperity’s PEO Service Can Give Your Business a Boost

As a small business, the more time you spend managing daily HR to-dos, the less time you have to focus on

profitable projects.

With Insperity® Workforce Optimization® you’ll get administrative relief, access to beer benefits, reduced

liabilities and dedicated HR support from our experienced service team so you can spend more time doing what

you love – growing your business.

As a Workforce Optimization client, you’ll receive:

Affordable employee health insurance and benefits

Give your employees access to Fortune 100-level benefits. Choose from a range of benefits packages from a

variety of insurance carriers, including our national medical insurance carrier, UnitedHealthcare®.

Stress-free payroll and HR administration

Ensure your payroll is always complete, accurate and on time. We’ll also handle all your payroll-related taxes and

employment verification, benefits administration, employee-related paperwork and other HR tasks.

Complete government compliance

Limit employer-related liability by allowing us to handle your government reporting, agency interface,

unemployment claims management, and wage claims and audits.

Ongoing health care reform support

Ever since health care reform was enacted in early 2010, we’ve been reviewing and analyzing the law. We’re ready

to take on the increased compliance and complexity, shielding you from costly penalties.

A dedicated HR service team

Get a team of professional HR specialists who can lend a helping hand with day-to-day HR duties as well as

employee recruitment, retention and management.

Contact us today to learn how our unmatched HR services and support can help your

business forge ahead.

See what our clients are saying.

Thelab is a media arts firm headquartered in

New York. Before signing on with Insperity

in 2007, they lacked the resources to handle

day-to-day HR duties, including benefits

administration, government compliance and

payroll processing. Thelab solved this problem

with a tailored set of business performance

solutions from Insperity.

“ Choosing Insperity is probably one of the best

business decisions I’ve ever made.”

Tom Conti, EVP and COO thelab

Watch video

hp://goo.gl/RIwJ05

Play

11 / 11

To learn more, call 800-465-3800 or visit Insperity.com

About Insperity

Insperity®, a trusted advisor to America’s best businesses for more than 28 years, provides an array of human

resources and business solutions designed to help improve business performance. Insperity® Business

Performance Advisors offer the most comprehensive suite of products and services available in the

marketplace. Insperity delivers administrative relief, beer benefits, reduced liabilities and a systematic way

to improve productivity through its premier Workforce Optimization® solution. Additional company offerings

include Human Capital Management, Payroll Services, Time and Aendance, Performance Management,

Organizational Planning, Recruiting Services, Employment Screening, Financial Services, Expense

Management, Retirement Services and Insurance Services. Insperity business performance solutions support

more than 100,000 businesses with over 2 million employees. With 2013 revenues of $2.3 billion, Insperity

operates in 57 offices throughout the United States. For more information, visit Insperity.com.

Email this guide

Click here to pass along a copy of this guide to others.

Visit our blog

Learn about our latest guides. Sign up for our free newsleer.

insperity.com/blog.

®