Institutional User Manual

Institutional_User_Manual

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 59

1 | P a g e

SBIMF ONLINE INVESTMENT PLATFORM

FOR NON INDIVIDUALS

USER MANUAL

2 | P a g e

Contents

Page

3 Chapter 1: Online Investment Platform at a Glance

3 Availability of the platform

3 Features and transaction facilities

3 Registration requirements

5 Chapter 2: Registration Process

5 Get started

11 Creation of user ids

14 Group creation

15 User to Group mapping

16 Creation of transaction amount range

18 Creation of approval level(s) and rule(s)

20 Submission of registration

22 Edit/Complete registration details in incomplete or unapproved request

23 Initiate and submit change in existing successful registration

27 Chapter 3: Transaction Process

27 Login

28 Purchase

28 Initiation of purchase request

33 Approval of purchase request

37 Fund transfer for purchase request

43 Redemption

43 Initiation of redemption request

46 Approval of redemption request

48 Final confirmation of redemption request

49 Switch

49 Initiation of switch request

52 Approval of switch request

54 Final confirmation of switch request

55 Chapter 4: Other Services

55 Generate account statement

56 Manage account

57 Track transactions

58 Write to us

3 | P a g e

Online Investment Platform at a Glance 1

Availability of the platform

SBIMF Online Investment Platform for Non Individuals is available for all existing KYC

compliant Non Individual investors i.e. Company, Partnership Firms, Trusts, Government

Bodies, Banks and Financial Institutions etc.

Features

Platform is available for non-individual investors for their convenience, to help them gain

access to their portfolio of investments in SBI Mutual Fund schemes, managing and

transacting the same effectively and efficiently, using a unique user-id and password

issued to the Specified Authorized Signatories of the institution.

After successful registration investors would be able to:

Perform purchase and additional purchase transactions to various schemes of SBI

Mutual Fund, including any new Schemes launched by SBI Mutual Fund from time

to time

Switch units from one scheme to another scheme of SBI Mutual Fund

Redeem clear units from existing investment

View portfolio and transaction history

Download account statement

Registration requirements

The entity should mention all the necessary information for registration in the website

and download the registration form and submit the completed registration form of SBIMF

Online Investment Platform for Non-Individuals, duly signed by all the authorized

signatories along with the necessary corporate documents (like Board Resolution /

Partnership Deed / Trust Deed, Specimen signatures of authorized signatories etc.).

On receipt of the registration form and documents and subject to necessary verification /

validation processes / procedures as may be prescribed by SBIMF from time to time,

SBIMF shall issue a separate unique user-id and password for each Specified Authorized

Signatory of the entity.

4 | P a g e

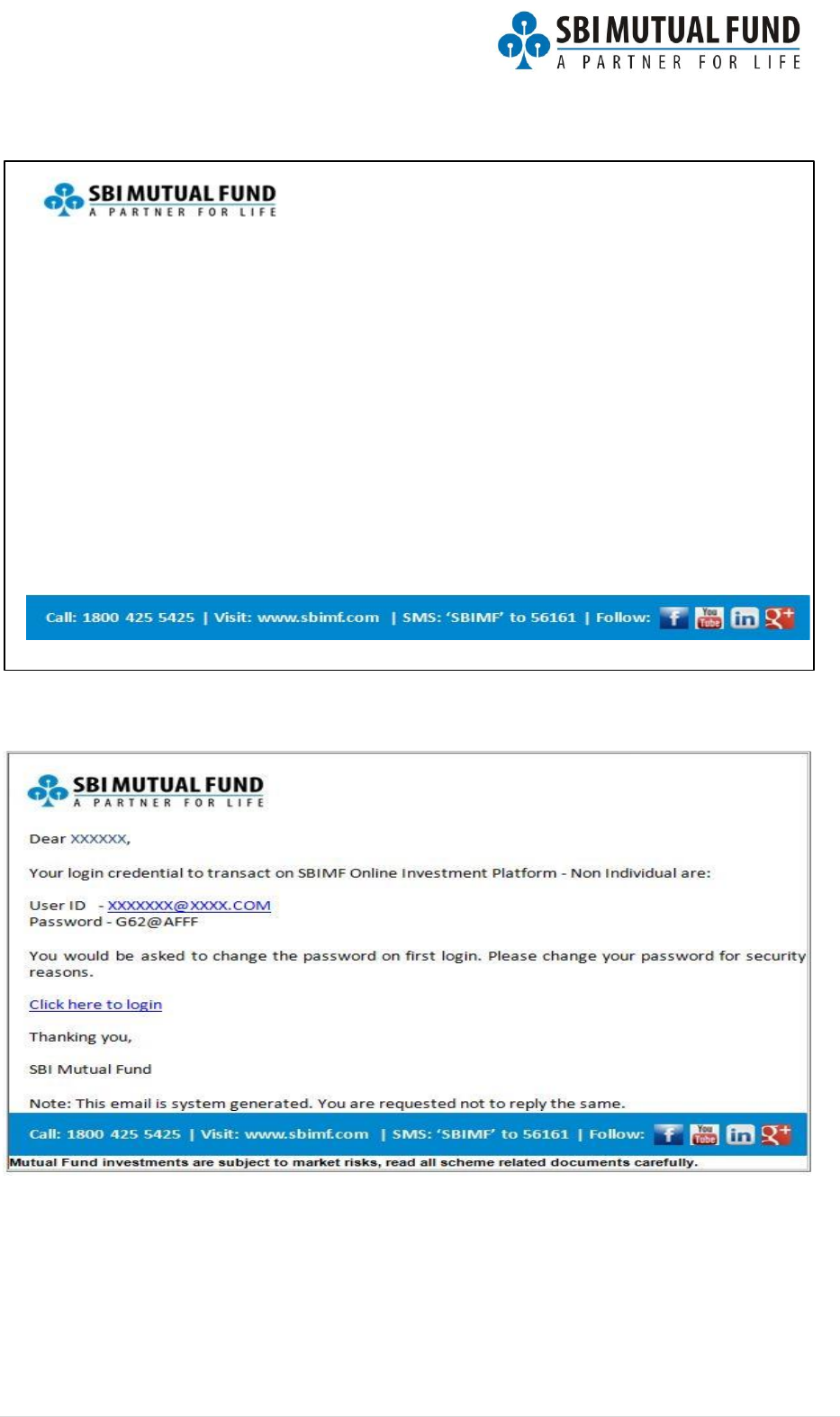

SBIMF will dispatch the user-id and password to each Specified Authorised Signatory,

through email on the registered email id.

Upon receipt of the user-id and the password from SBIMF, the Specified Authorised

Signatories shall have an option to change the password allotted by SBIMF as per his own

choice.

5 | P a g e

Registration Process 2

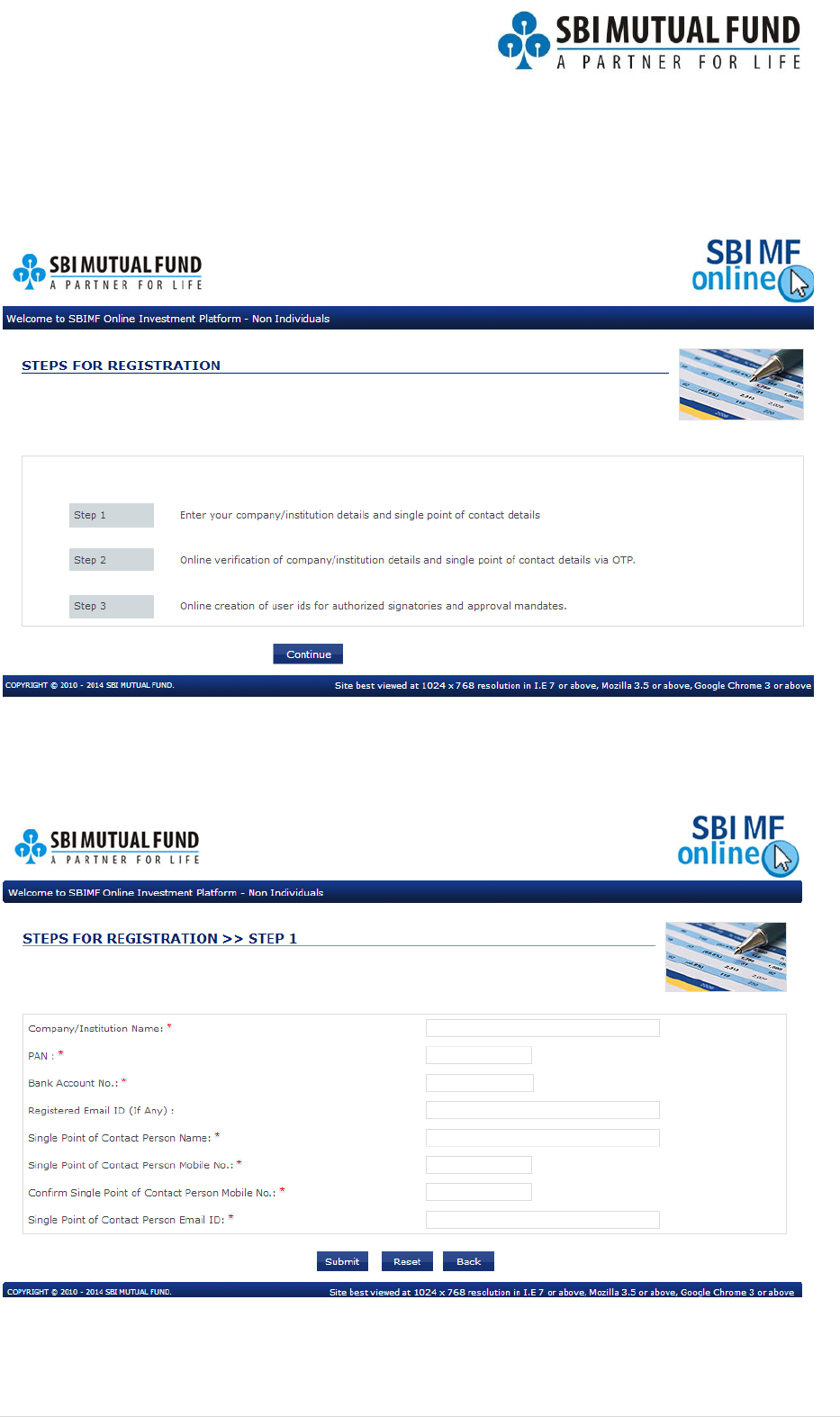

Registration process is divided into 3 steps:

1. Submission of company/institution details and single point of contact person

details

2. Online verification of submitted company/institution details and initiation of

registration process by single point of contact person after verification via One

Time Password (OTP)

3. Online creation of user ids for authorized signatories and approval mandates

Get started

Logon to www.sbimf.com or www.onlinesbimf.com

www.sbimf.com

7 | P a g e

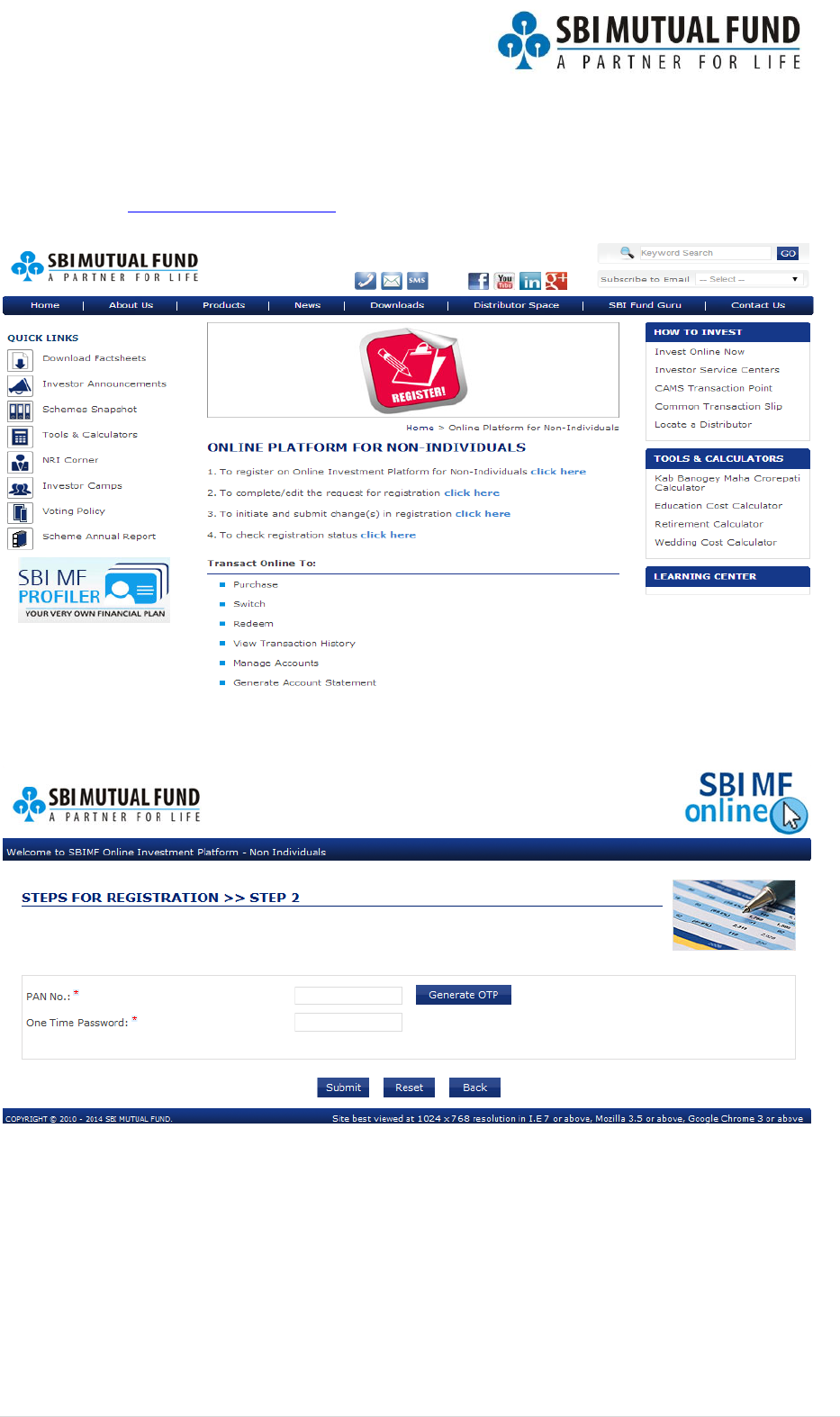

For first time registration choose option 1 – “To register on Online Investment

Platform for Non-Individuals”

On click following screen would be loaded

Click on Continue button to proceed. Following screen would be loaded on the click.

8 | P a g e

Please submit the required information and click on Submit button

Company/Institution Name – Enter the organization’s full name.

PAN – Enter PAN of the organization

Bank Account No. – Enter bank account number registered against a folio in the name of

the organisation, if you have multiple folios and multiple banks registered with SBI Mutual

Fund, you may enter any one registered bank account number.

Registered Email ID – If an email id is registered in the folio, enter the same email id, this

is not a mandatory field, if you do not have any registered email id registered you may

leave this field blank.

Single Point of Contact Person (SPOC) Name – Single point of contact person can be

anyone, it is not mandatory that SPOC needs to be an authorized signatory as per Board

Resolution / Trust Deed / Partnership Deed etc. This person would be responsible for

completing the registration process and would also act as SPOC for communications

between organization and SBI Mutual Fund if required. SPOC can be an authorized

signatory also.

Single Point of Contact Person Mobile No.– Enter a valid 10 digit mobile number, SBI

Mutual Fund would use this number to send One Time Password (OTP) for verification for

further registration process and would also be used for verification for any modification in

registration details.

Confirm Single Point of Contact Person Mobile No.- Enter the same 10 digit mobile

number as entered in the above field.

Single Point of Contact Person Email ID – Enter a valid email id for SPOC, SBI Mutual

Fund would send OTP to the entered email id also apart from the mobile number entered.

Note: SPOC has no role in authorization of any transaction nor he/she would be provided

any login id or password, SPOC would only be authorized to perform registration process.

If SPOC is an authorized signatory then he/she would need to be registered as per the

process depicted in the document.

9 | P a g e

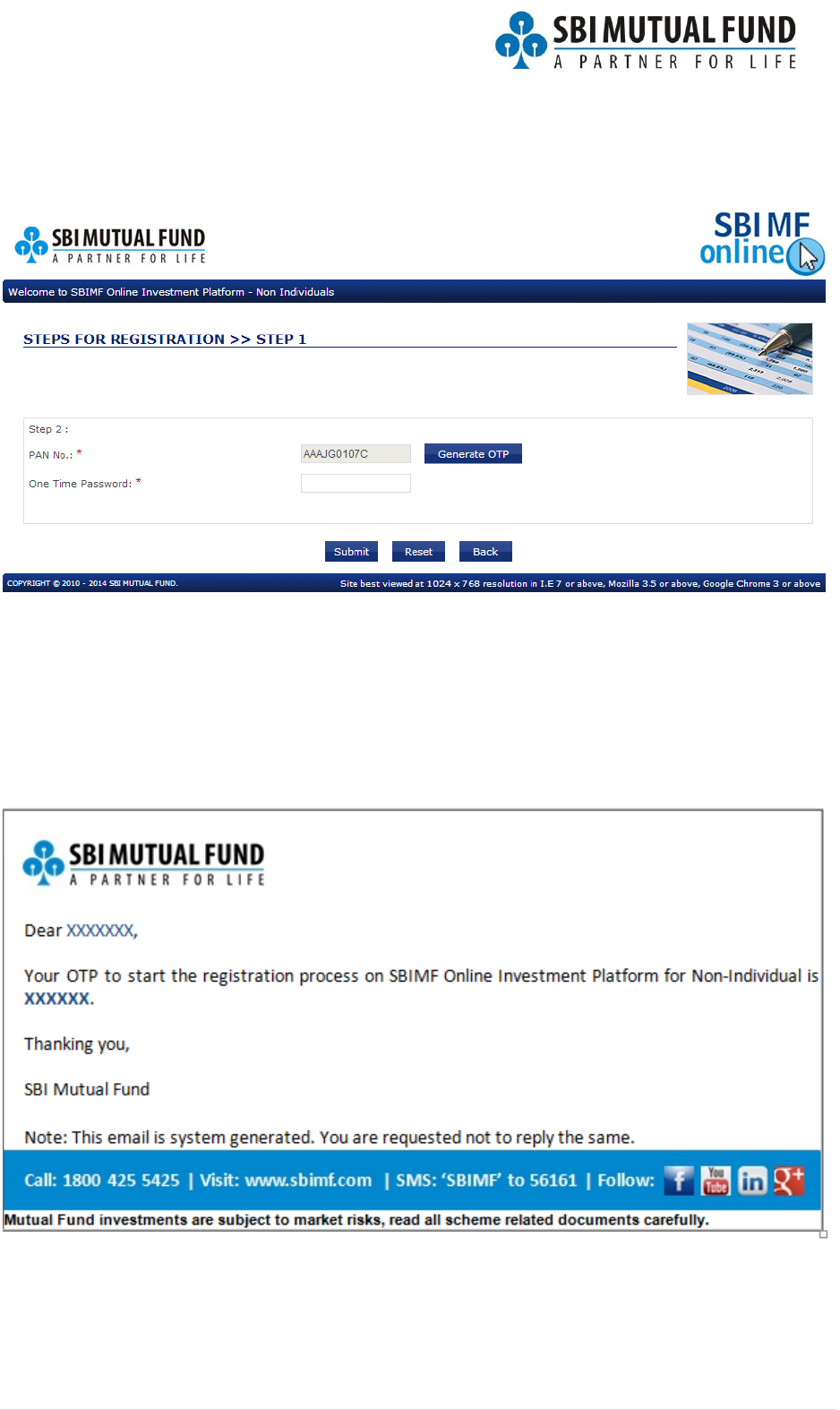

On submission of the above information following screen would be loaded:

This screen would verify the SPOC mobile number and would allow him/her to proceed

for registration. SPOC would need to generate an OTP by clicking on GENERATE OTP

button and enter the same. The OTP would be sent on the SPOC’s submitted mobile

number and email id.

Email Template for OTP

10 | P a g e

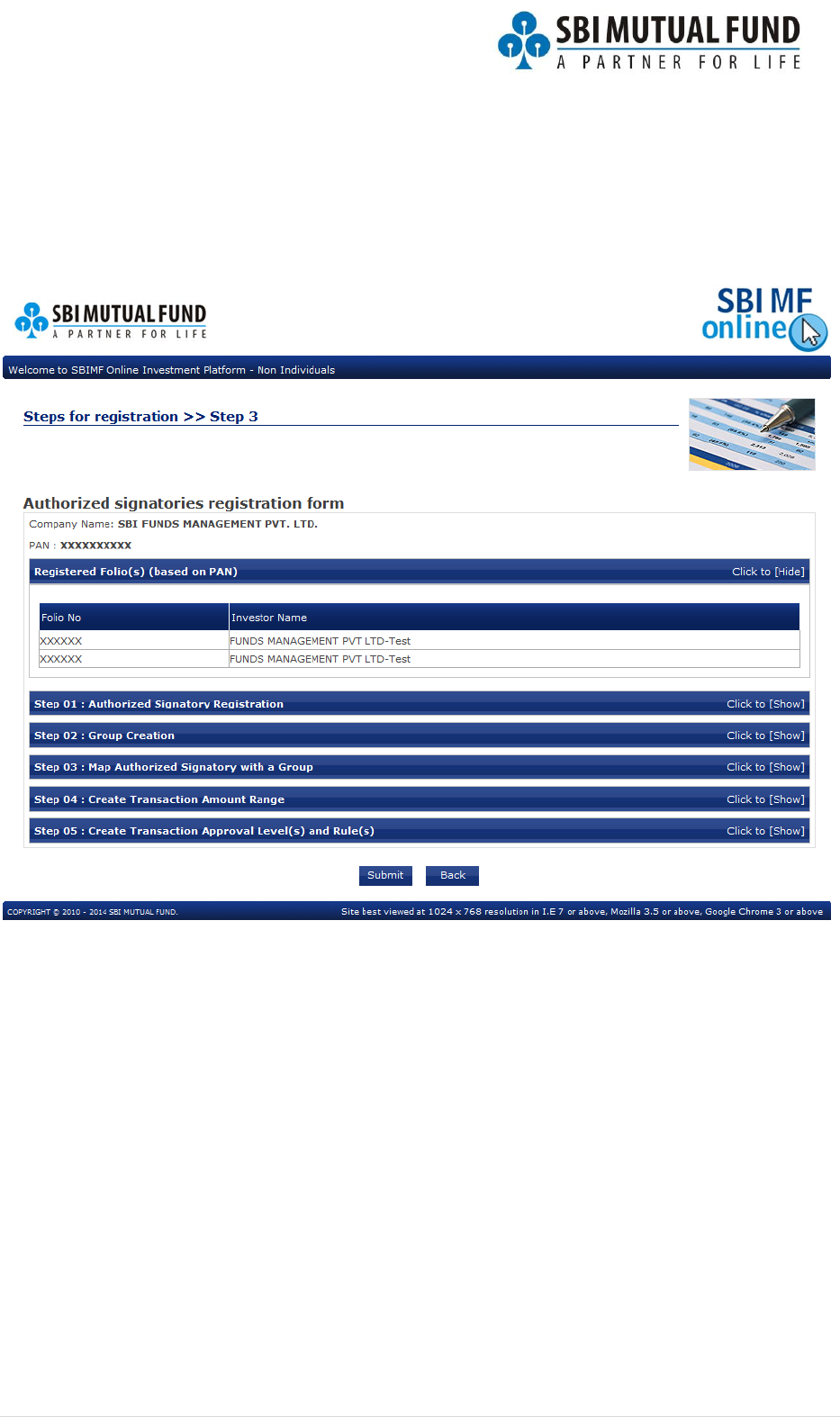

On submission of OTP and online verification of registered information provided by SPOC,

registration step “3” screen will be loaded.

First section of registration form will provide the registered folio(s) based on the PAN

submitted by SPOC.

This information is retrieved online from the registrar database.

To proceed for registration go to Step 01 on this form – Authorized Signatory Registration

11 | P a g e

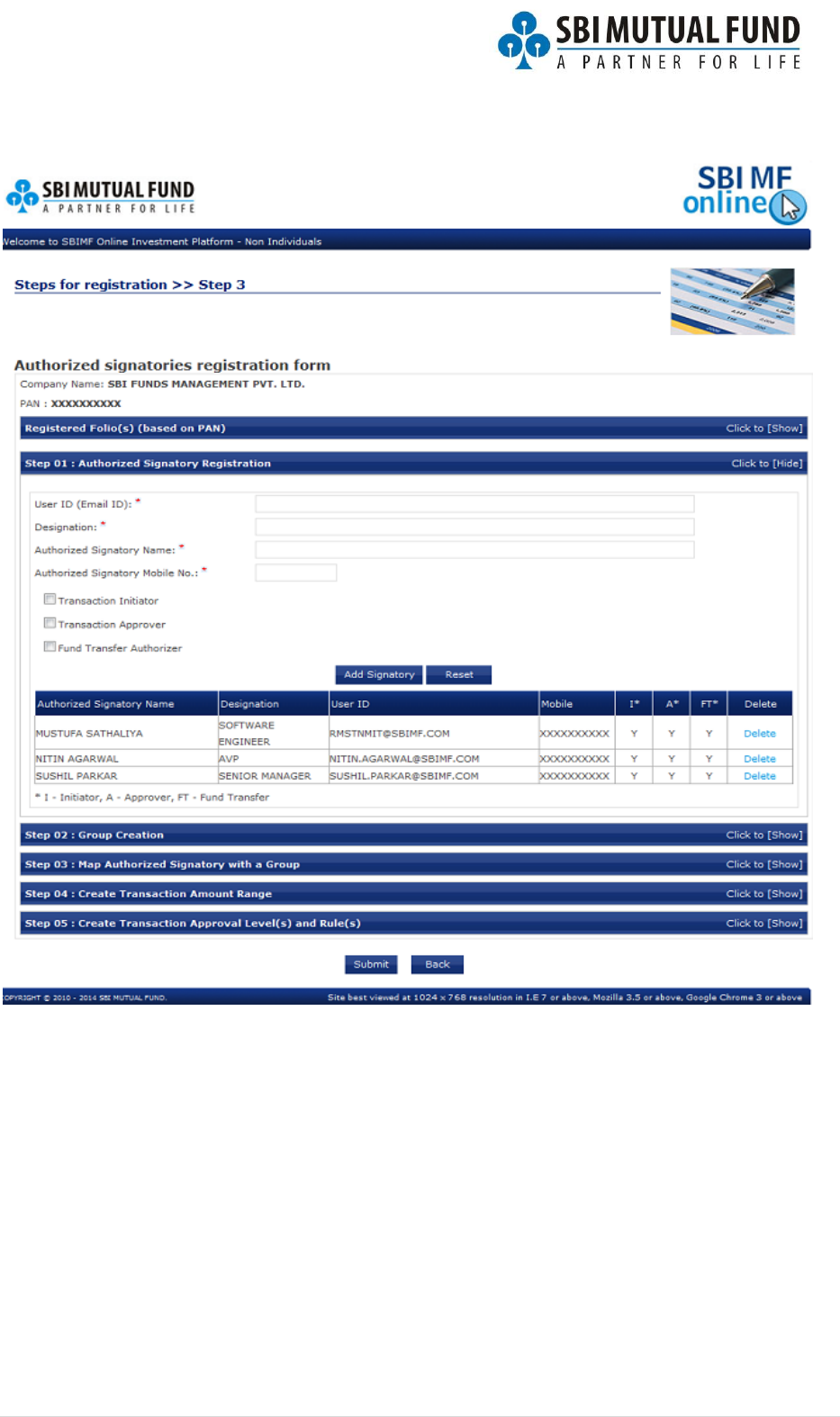

Creation of user ids (Step 01 – Authorized Signatory Registration)

User ID (Email ID) – provide a unique email id of an authorized signatory, this would also

be his/her login id to logon to the platform. Same email id cannot be registered with two

or more users. SBI Mutual Fund suggests SPOC to provide an official email id for

registration for every authorized signatory.

Designation – provide the designation of the user.

Authorized Signatory Name – provide the name of authorized signatory.

12 | P a g e

Authorized Signatory Mobile No. – provide a 10 digit mobile number of authorized

signatory.

Choose the roles and rights for the authorized signatory from the check boxes:

Transaction Initiator: This role and right will allow the user to initiate any

purchase / redemption / switch transactions.

Transaction Approver: This role and right will allow the user to approve initiated

transactions of purchase/redemption/switch.

Fund Transfer Authorizer: This role and right will allow the user to perform

Online Fund Transfer / Update UTR No. and submit purchase request to SBIMF in

case of RTGS / Update bank details and submit purchase request to SBIMF in case

of Offline Fund Transfer.

After providing all mandatory details of the user and assigning role and rights click on

ADD SIGNATORY button. Repeat the process as described again to add users.

To delete any user click on DELETE link in grid of added users. To modify details of a user

first delete the user and add again with modified details.

Note:

1. There are no restrictions on number of user which an entity can register.

2. Transaction Approver role and rights can only be assigned Authorized Signatories

mentioned in Board Resolution / Trust Deed / Partnership Deed or any other specific

document required for identifying the authorized signatory allowed to perform

transaction on behalf of the entity.

3. If any user with Approver Role is registered using the above form does not figure in

Board Resolution / Trust Deed / Partnership Deed or any other specific document

required for identifying the authorized signatory the registration request will be

rejected by SBI Mutual Fund.

4. All users can be assigned all roles and rights as per Board Resolution / Trust Deed /

Partnership Deed or any other specific document required for identifying the

authorized signatory.

13 | P a g e

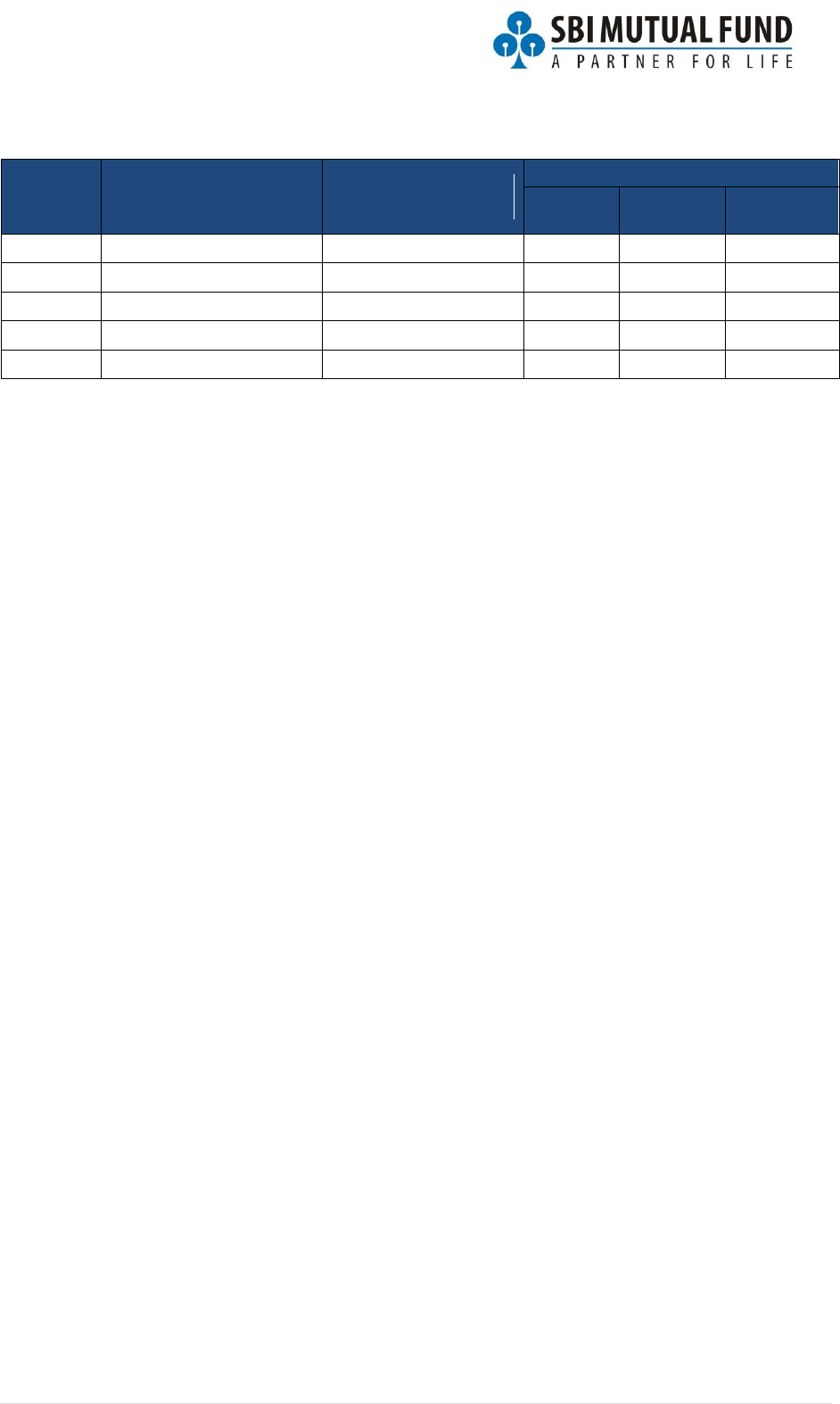

An Example:

User

Name

Authorized Signatory

as per mandatory

document

Role in

organization

Allowed Role & Rights

Initiator

Approver

Fund

Transfer

A

Yes

Authorized Signatory

Y

Y

Y

B

Yes

Authorized Signatory

Y

Y

Y

C

Yes

Authorized Signatory

Y

Y

Y

D

No

Staff

Y

N

Y

E

No

Finance Department

Y

N

Y

14 | P a g e

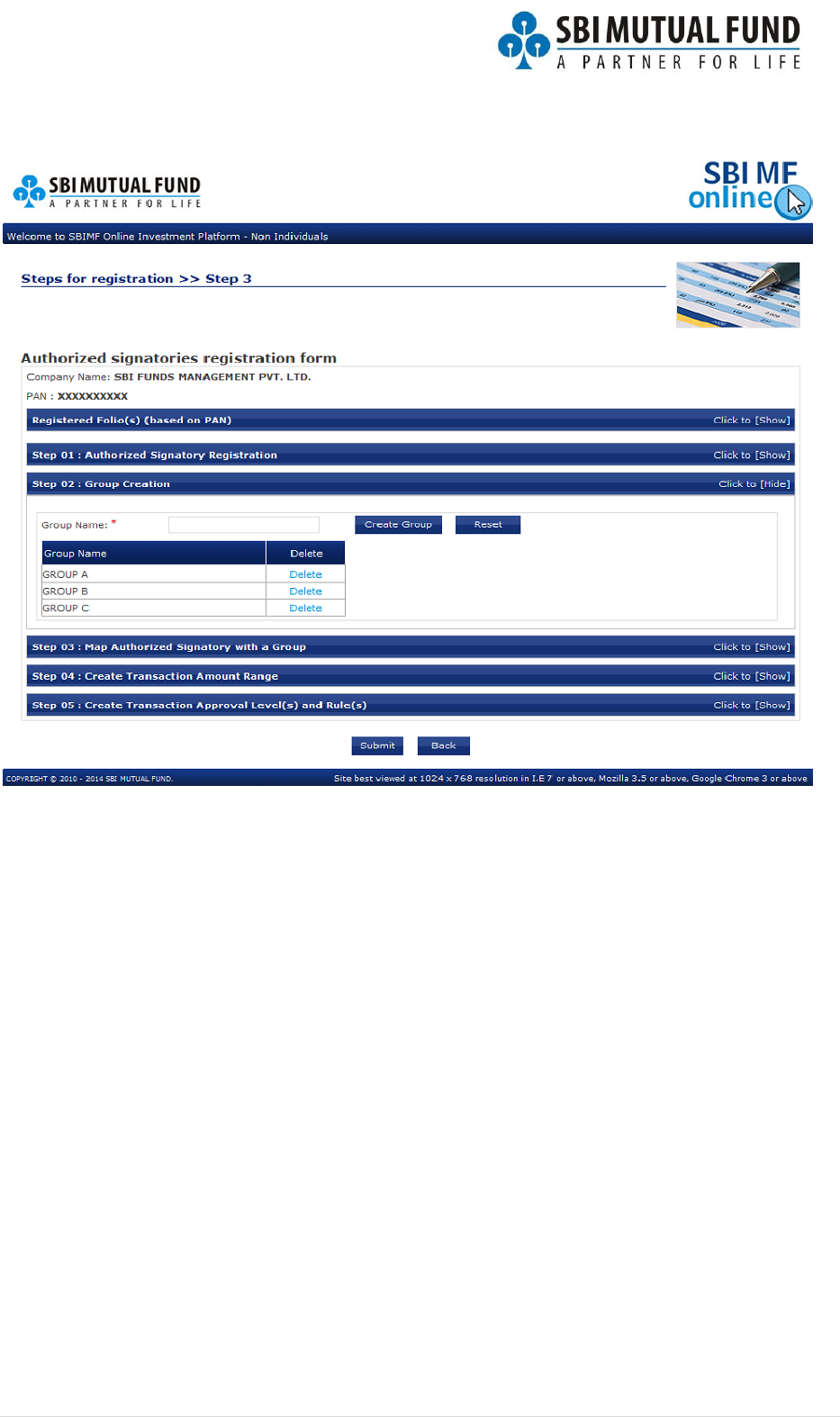

Creation of Group(s) (Step 02 – Group Creation)

Group Name: Provide a group name and click on CREATE GROUP button.

To delete a group click on DELETE link in grid of created groups.

Note:

1. Every user with Transaction Approval role and right has to be assigned a Group.

2. Although there is no restriction on group name but SBI Mutual Fund suggest that

group name should be based on designation or levels of approvals required or if

there is any defined group in the organization same nomenclature can be used.

15 | P a g e

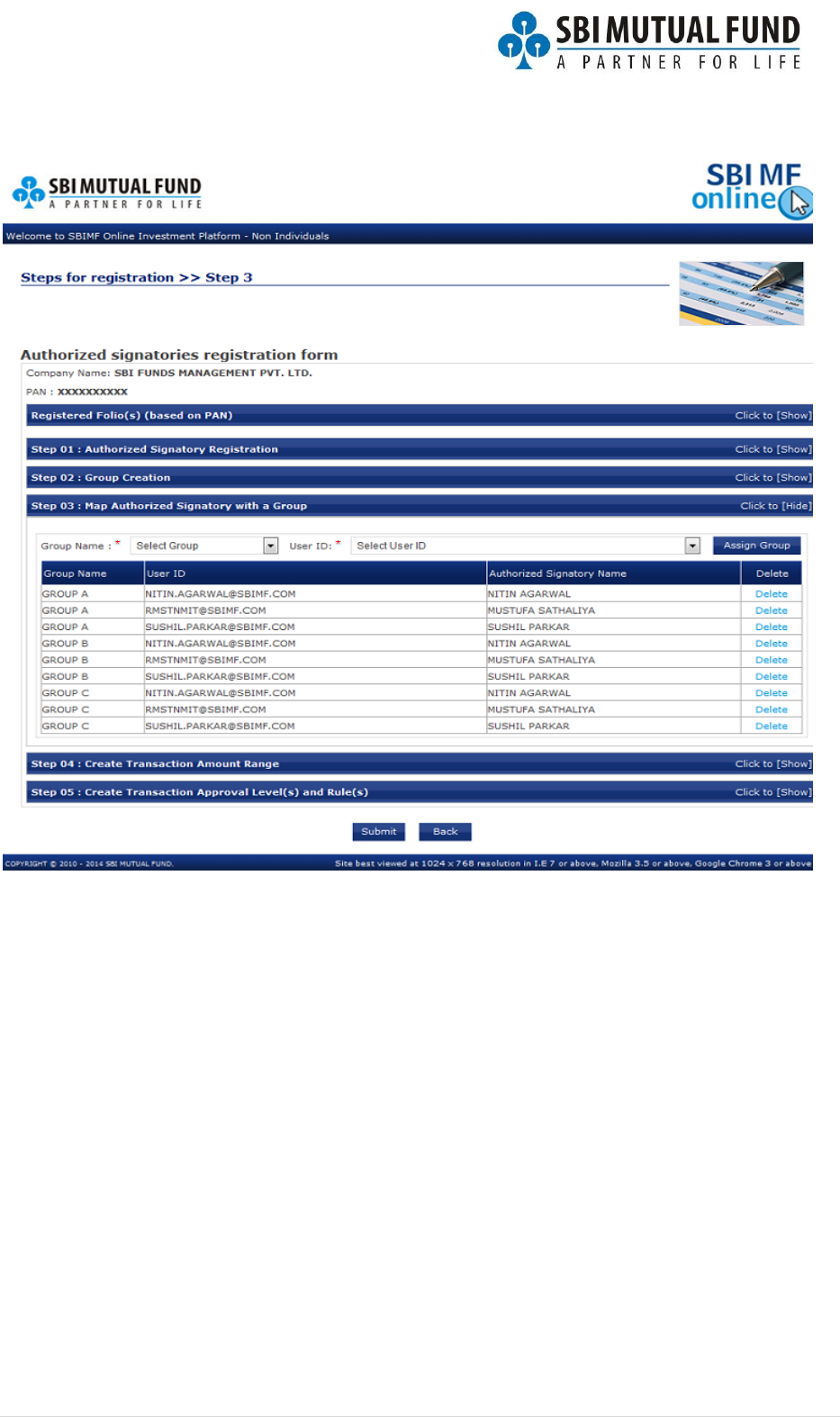

User to Group Mapping (Step 03 – Map Authorized Signatories with a Group)

Group Name: Select a group created from drop down list.

User ID: Select user id of an added authorized signatory from drop down list.

Click on ASSIGN GROUP button to map an authorized signatory to a group.

To delete user group mapping for any authorized signatory click on DELETE link in the

grid.

Note:

1. One or more authorized signatory can be mapped to multiple groups.

2. Only users with Transaction Approval roles and rights should be mapped to a

group.

3. If any other user is mapped to a group the request for registration would be

rejected by SBI Mutual Fund.

16 | P a g e

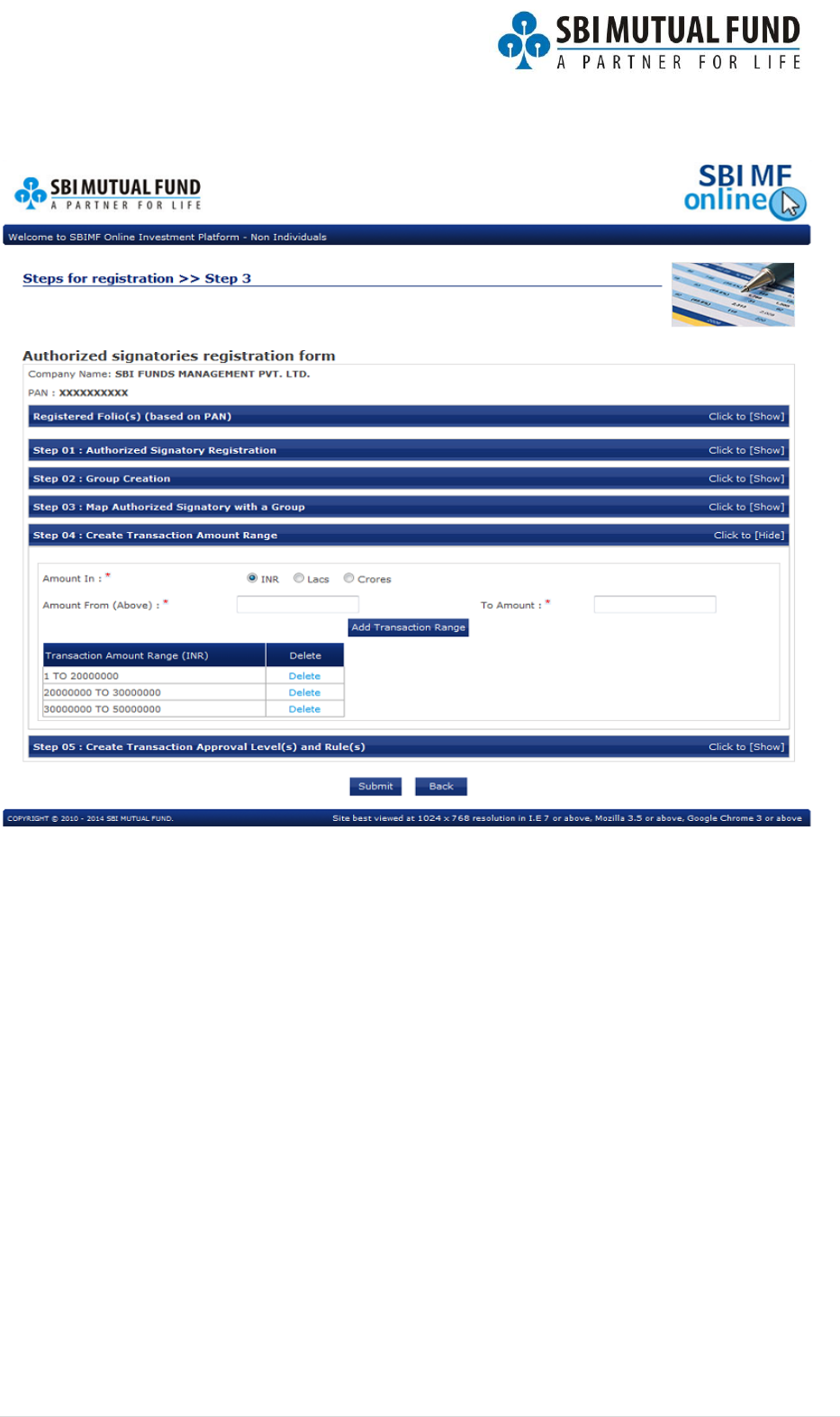

Creation of Transaction Amount Range (Step 04 – Create Transaction Amount Range)

Amount In - select the denomination in which you want to create a transaction amount

range.

Amount From (Above) – enter the minimum amount of the range.

To Amount – enter the maximum amount of the range.

Click on ADD TRANSACTION RANGE button to create a range.

Example: if transaction amount range is Re. 1 to Rs. 10 Lacs then enter Re. 1 in “Amount

From (Above)” and Rs 10 Lacs in “To Amount”.

To delete any transaction range click on DELETE link in the grid.

17 | P a g e

Note:

1. Transaction range cannot be defined in decimals.

2. There is no restriction on number of transaction range which can be created.

3. User cannot define a range as a mid-range, i.e. if there is a transaction range of Re. 1

to Rs. 10 Lacs the next range would be from Rs. 10 Lacs and above to any amount

as desired. In this case the range cannot be created from Rs. 5 Lacs to Rs. 20 Lacs or

any amount as Rs. 5 Lacs would be covered under the range of Re. 1 to Rs. 10 Lacs

already created.

18 | P a g e

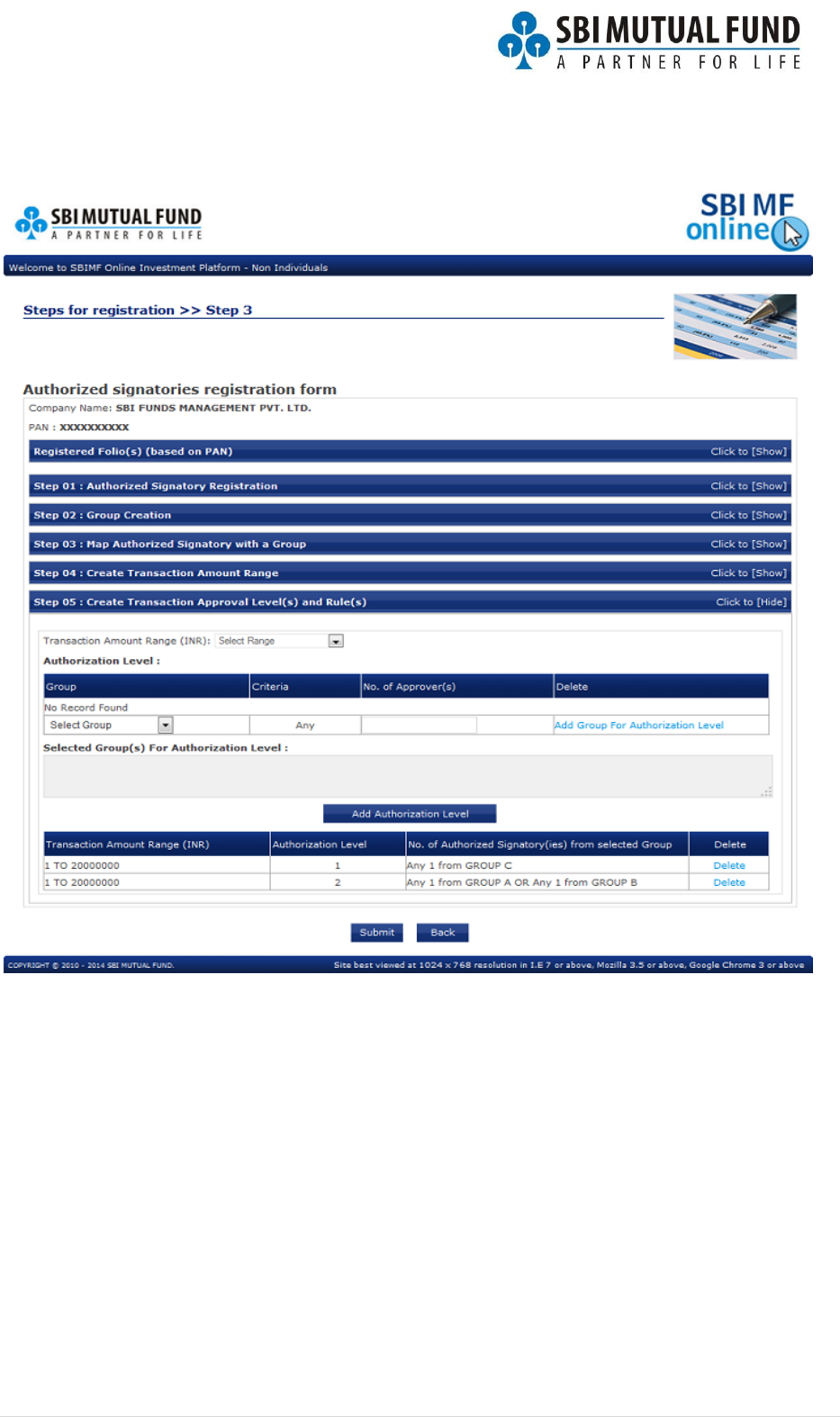

Creation of Approval Level(s) and Rule(s) (Step 05 – Create Transaction Approval Level(s)

and Rule(s))

Steps to create transaction approval level(s) and rule(s):

1. Select the transaction amount range from drop down list.

2. Select a group from drop down list

3. Enter the number of mandatory approvals required from the selected group.

Example, if there are 3 authorized signatories in the group selected and you need

minimum 2 out of 3 then enter 2 in the No. of Approver(s) text box.

4. Click on ADD GROUP FOR AUTHORIZATION LEVEL link, your selected group with

number of mandatory approvers will appear in the grey box. To add more

approvers from different groups for same authorization level repeat the process.

19 | P a g e

5. Once all groups and number of approvers are selected for first level approval click

on ADD AUTHORIZATION LEVEL, this will freeze the authorization level with

authorized signatories for a defined transaction amount range.

6. To add next level of authorization repeat the process as explained above.

Note:

1. There is no restriction in adding a group at multiple levels, but no authorized

signatory can approve the transaction more than once. To seek multiple approvals

from a particular group there should be multiple authorized signatories mapped to

the group.

2. There is no restriction on number of approval levels. Entity can create as many

levels of approvals as required.

3. If any user with Approver Role is registered using the above form does not figure in

Board Resolution / Trust Deed / Partnership Deed or any other specific document

required for identifying the authorized signatory the registration request will be

rejected by SBI Mutual Fund.

To submit the registration request click on SUBMIT button.

20 | P a g e

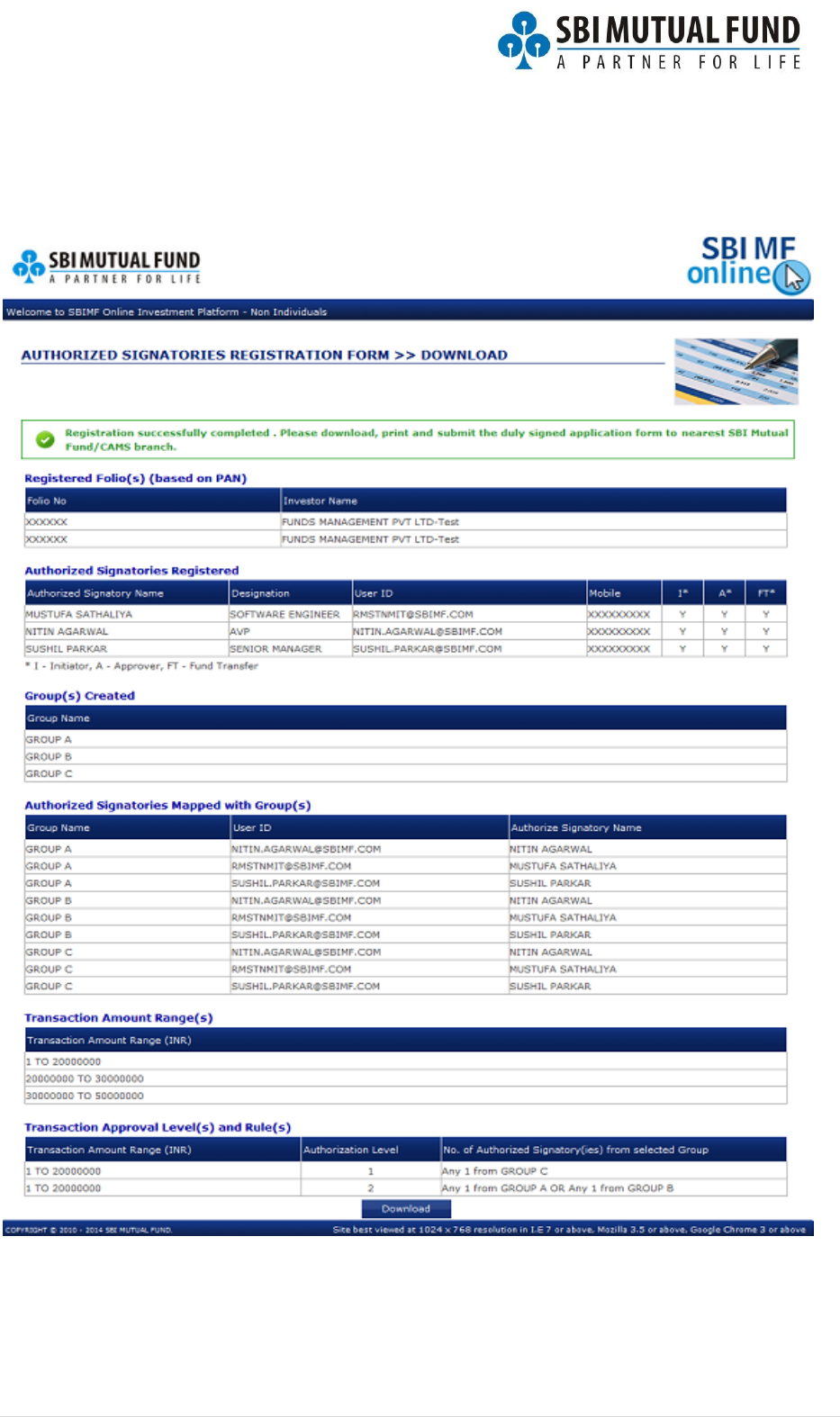

Submission of Registration Form

On submit following form will be available for download, click on DOWNLOAD to print and

submit the duly signed form to SBI Mutual Fund.

21 | P a g e

Email Template on Online Submission of Registration Form

Email Template to All Authorized Signatories on Successful

Registration and Approval by SBI Mutual Fund

Dear InvestorName,

Please find attached registration form with details as entered by you on behalf of your organization.

You are requested to kindly submit the attached registration form duly signed by Authorized Signatory

with mandatory documents as mentioned in the registration form with any SBI Mutual Fund branch.

Once your request for registration is verified and approved all authorized signatories mentioned in the

registration form will receive login credentials via email on the registered email id.

Your Request ID is #RequestID, please mention your request id for any further communication with

SBI Mutual Fund.

The approval process will be completed shortly and we would respond in 5 working days after receipt

of duly signed registration form.

Thanking you,

SBI Mutual Fund

Note: This email is system generated. You are requested not to reply the same.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

22 | P a g e

Edit/Complete registration details in incomplete or unapproved registration request

To initiate editing or completing the registration details for unapproved registration

request go to www.onlinesbimf.com and click on REGISTER WITH SBI MUTUAL FUND.

Use the link on “2. To complete/edit the request for registration”

Enter the PAN of the entity and generate an OTP. OTP will be sent on the registered mobile

number and registered email id of SPOC. To proceed click on SUBMIT button.

On submit the existing registration details will be available for editing. SPOC need to

proceed for registration as explained Registration Process section of user manual.

23 | P a g e

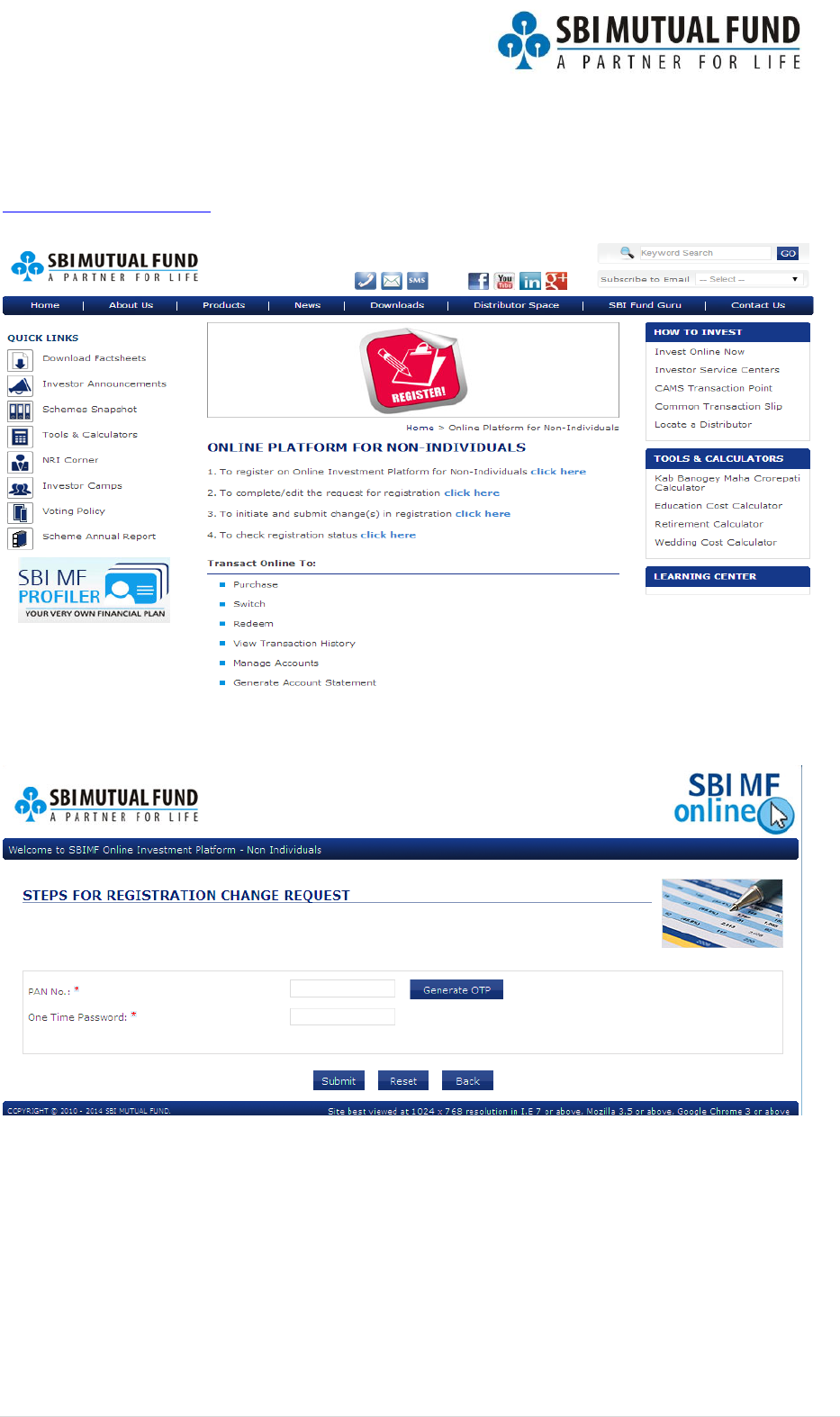

Initiate and Submit Change in Existing Successful Registration

To initiate and submit change in existing successful registration request go to

www.onlinesbimf.com and click on REGISTER WITH SBI MUTUAL FUND.

Use the link on “3. To initiate and submit change(s) in registration”

Enter the PAN of the entity and generate an OTP. OTP will be sent on the registered mobile

number and registered email id of SPOC. To proceed click on SUBMIT button.

24 | P a g e

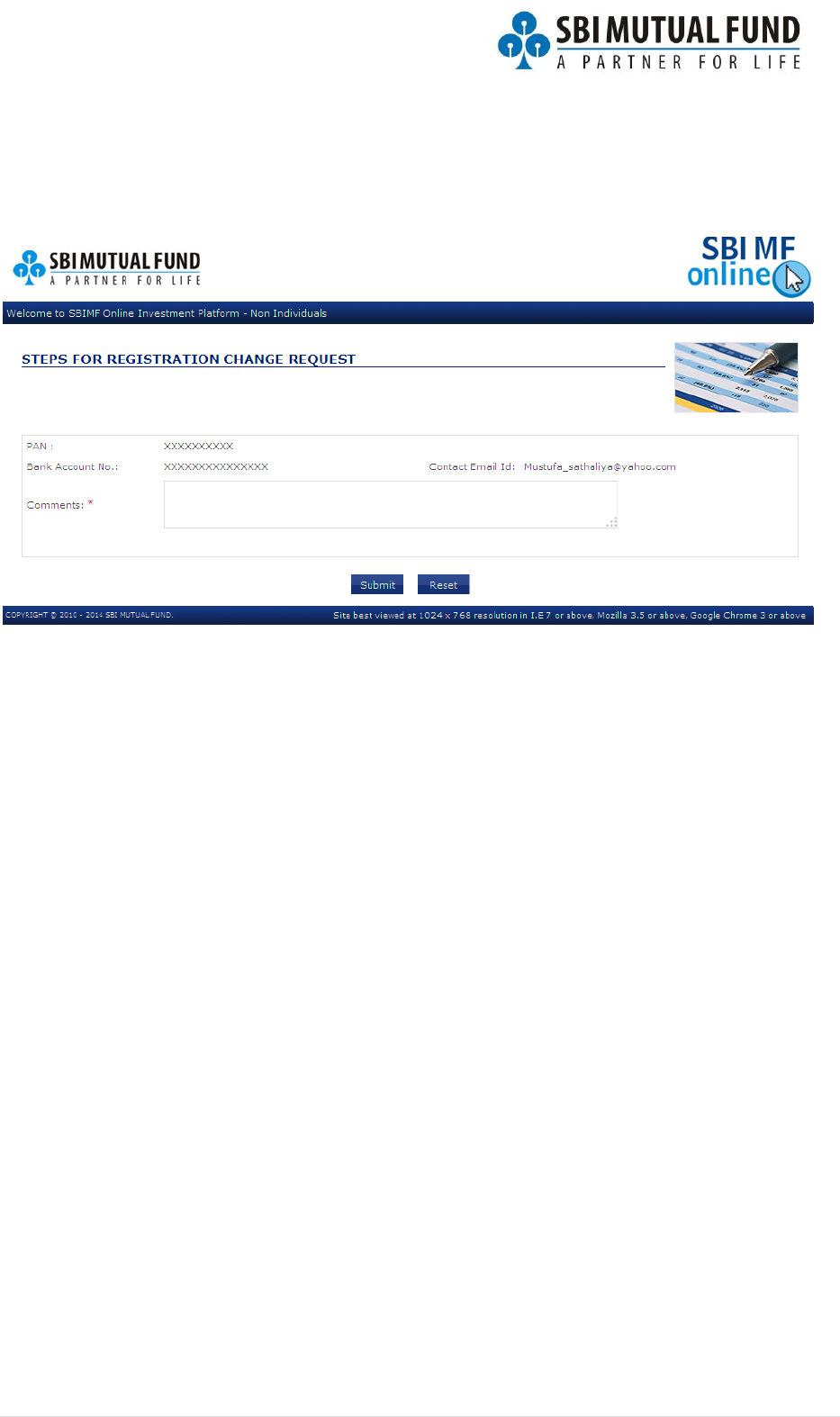

On submission of PAN and OTP by SPOC, following screen would be loaded where SPOC

would need to enter comments as to why he/she needs to make changes in registration.

Note:

1. Once the request for change in successful registration is received by SBI Mutual

Fund, SBI Mutual Fund would block the PAN and all Folios for Online Transactions.

2. Investor would be allowed to transact offline in the folios till the time change in

registration is completed successfully and approved by SBI Mutual Fund.

3. SBI Mutual Fund would verify that there are no pending transactions for

approvals/payments in any Folio mapped to the PAN for which change in

registration has been requested.

4. If there are any transactions pending investor would need to either approve/reject

and submit the same else change request would not be processed.

5. Once the change request is approved SPOC would be able to view and edit the

existing registration details and submit the same as per the process explained in

Registration Process section of user manual.

25 | P a g e

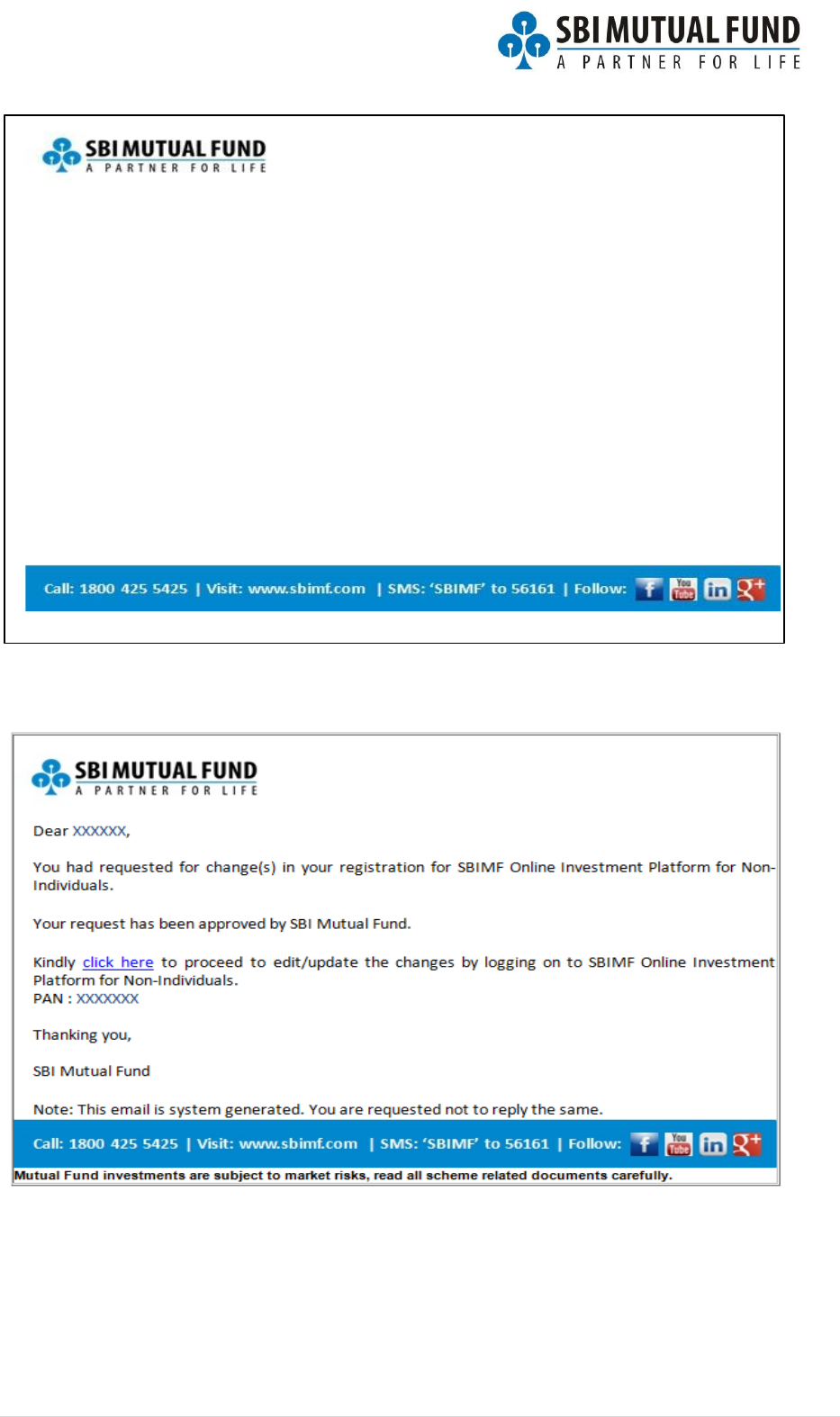

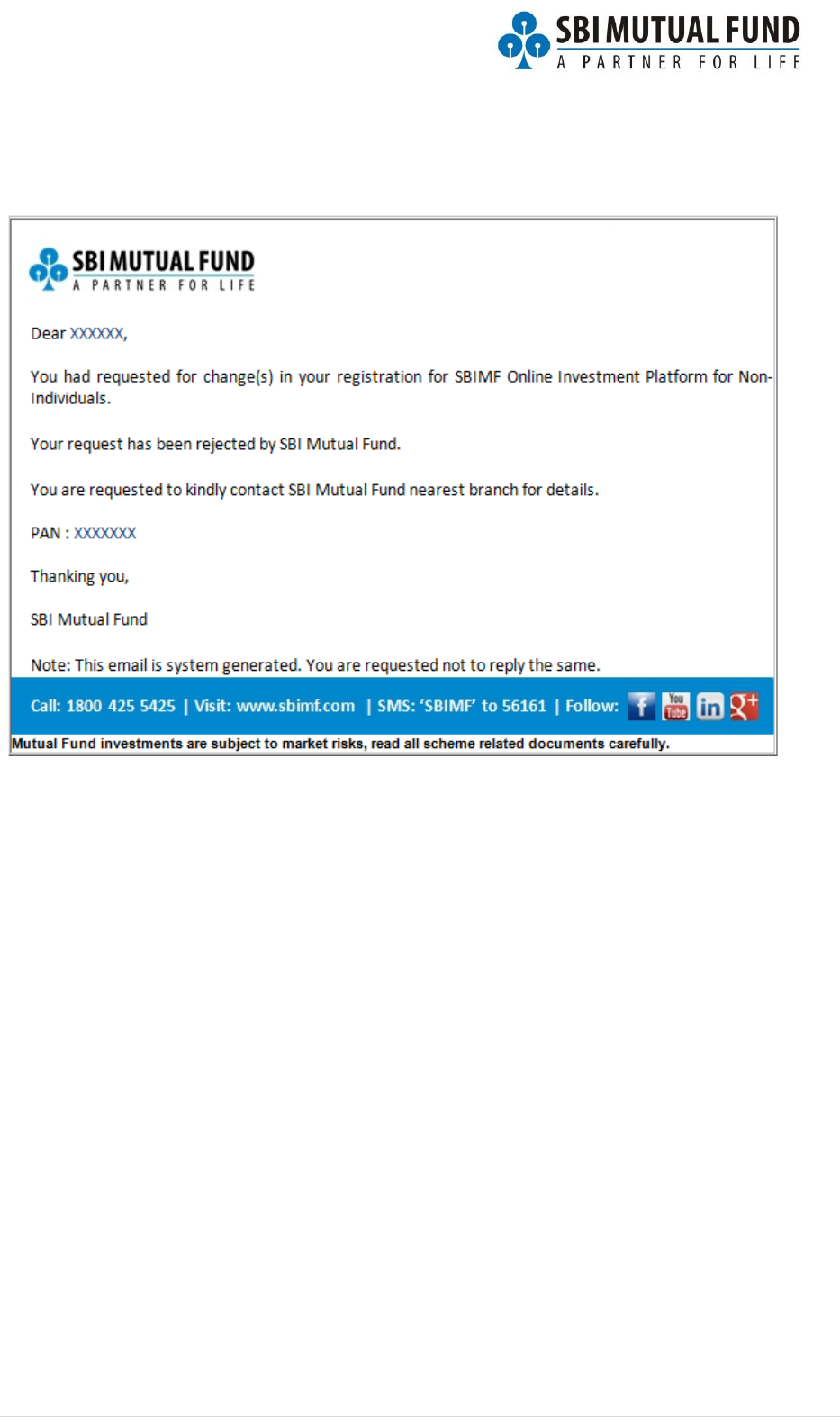

Email Template for Initiated Change Request

Email Template for Approved Change Request

Dear All,

We have received your request for change(s) in your registration for SBIMF Online Investment

Platform for Non-Individuals.

Your request would be attended shortly and we would respond within next 5 working days.

Please note:

All user ids associated with your online registration will be disabled till the time change(s) in

registration are authorized and accepted by SBI Mutual Fund.

In meantime if you need to transact in SBI Mutual Fund schemes please use offline mode.

PAN : #PAN

Thanking you,

SBI Mutual Fund

Note: This email is system generated. You are requested not to reply the same.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

26 | P a g e

Email Template for Rejected Change Request

27 | P a g e

Transaction Process 3

Login

Enter your User ID (Email ID) provided in the registration form.

Enter PAN of your organization.

For first time login – enter the system generated password sent to you by SBI

Mutual Fund on your registered email id (User ID) else enter the password chosen

by you.

28 | P a g e

Purchase

Initiation of Purchase Request

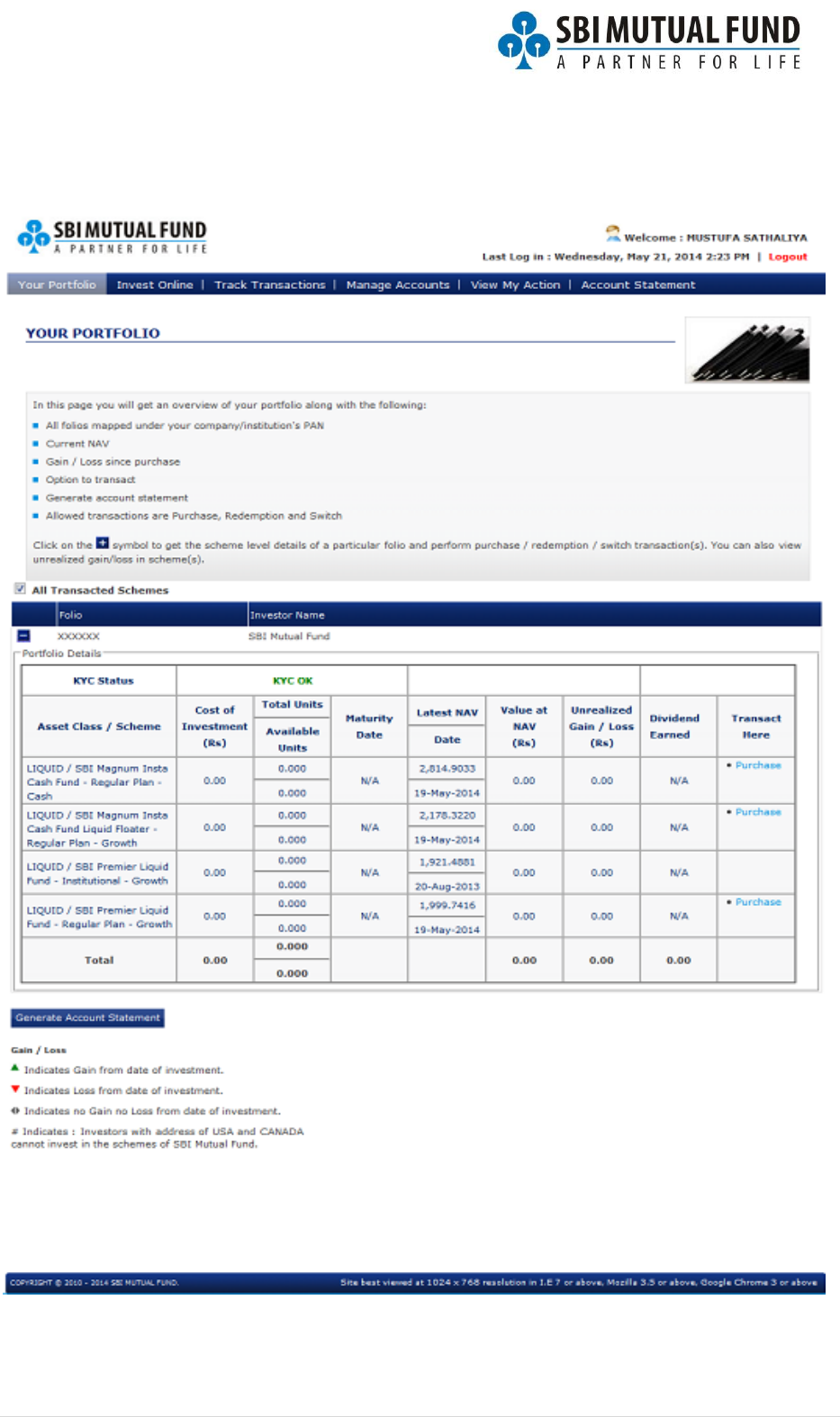

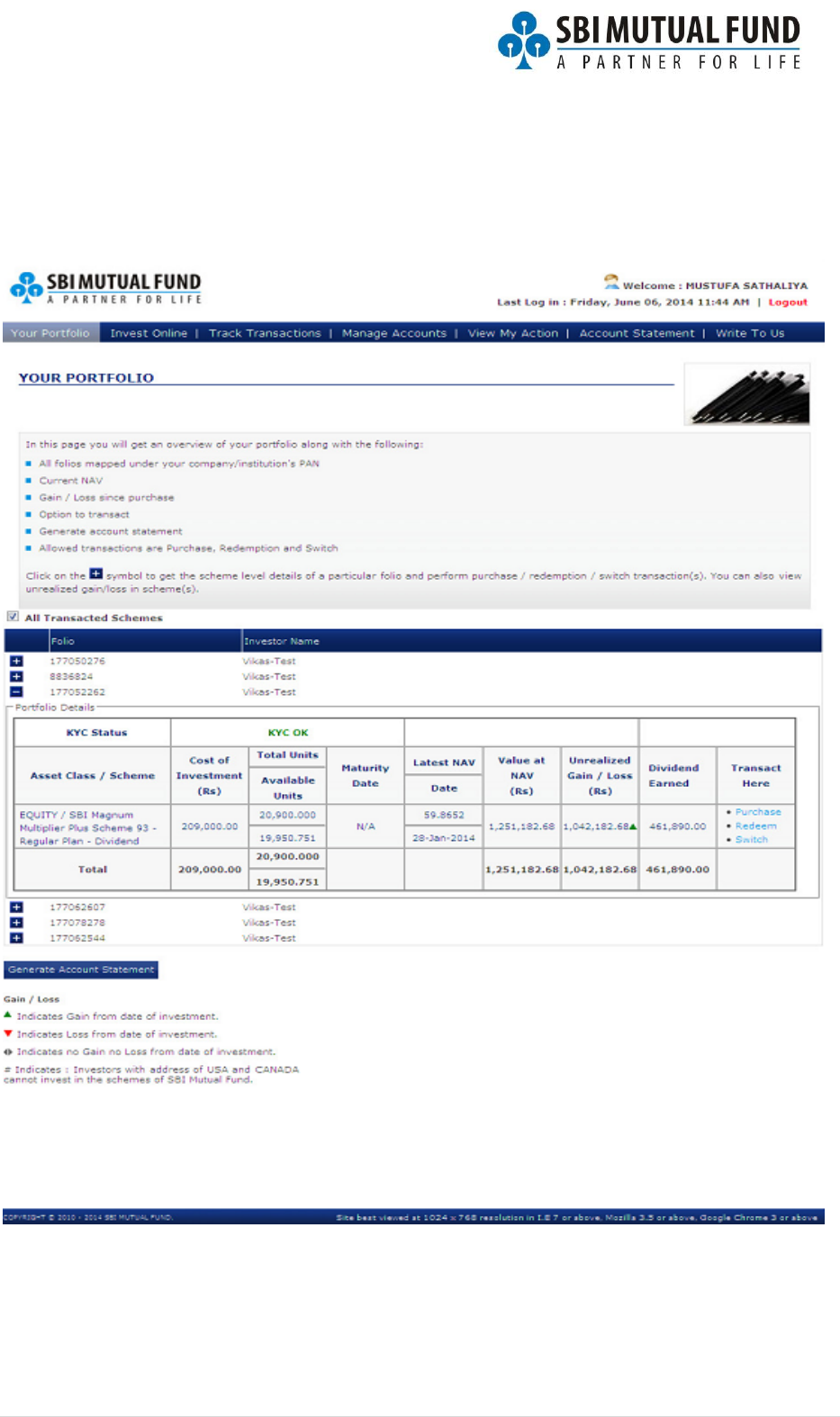

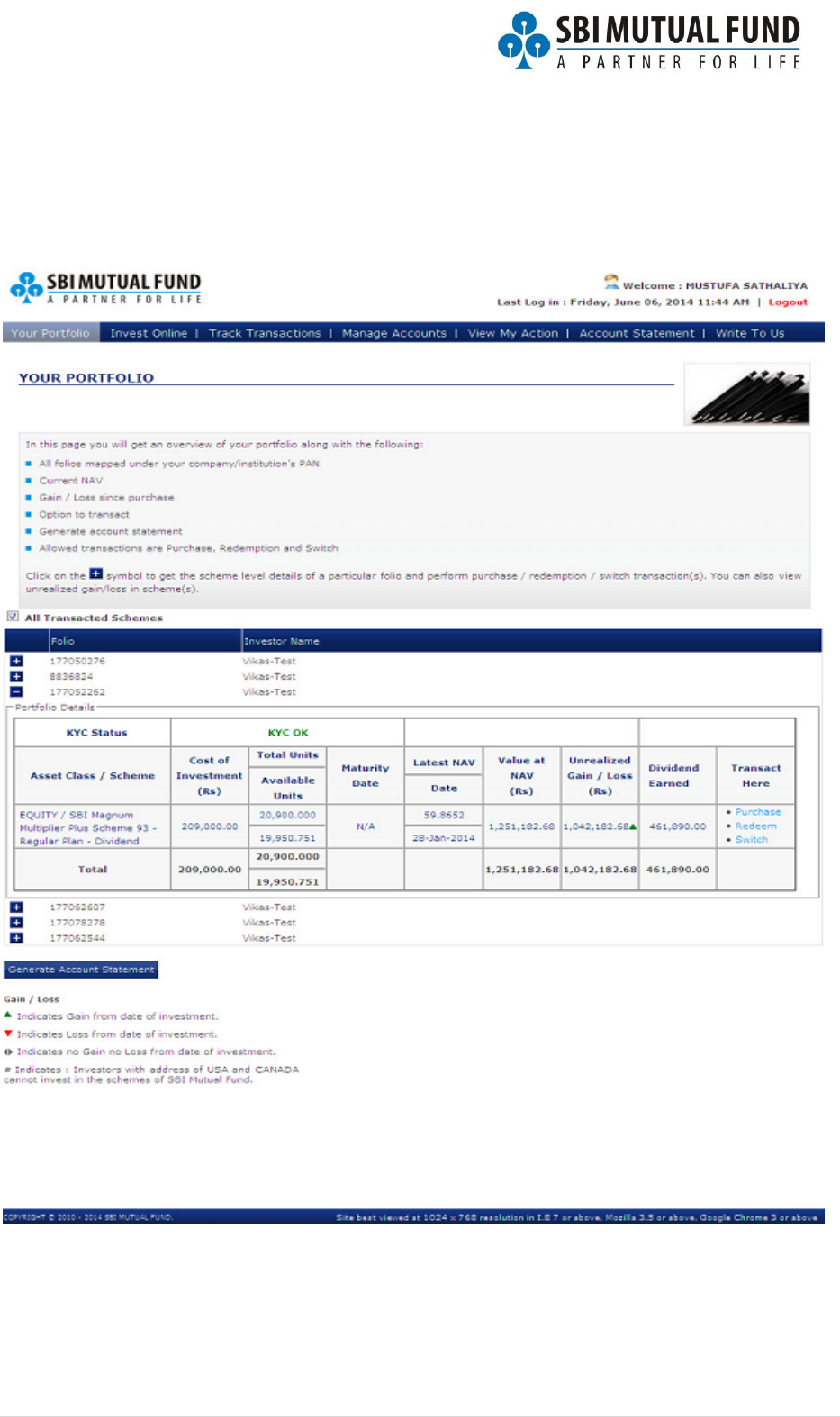

Purchase transaction can be performed through two screens 1. Your Portfolio 2. Invest

Online Tab.

Your Portfolio

Click on “+” sign against the folio to expand the list the of schemes available in the folio.

29 | P a g e

Expanded view of folio

30 | P a g e

Click on Purchase link in Transact Here column of the expanded view to initiate purchase

request.

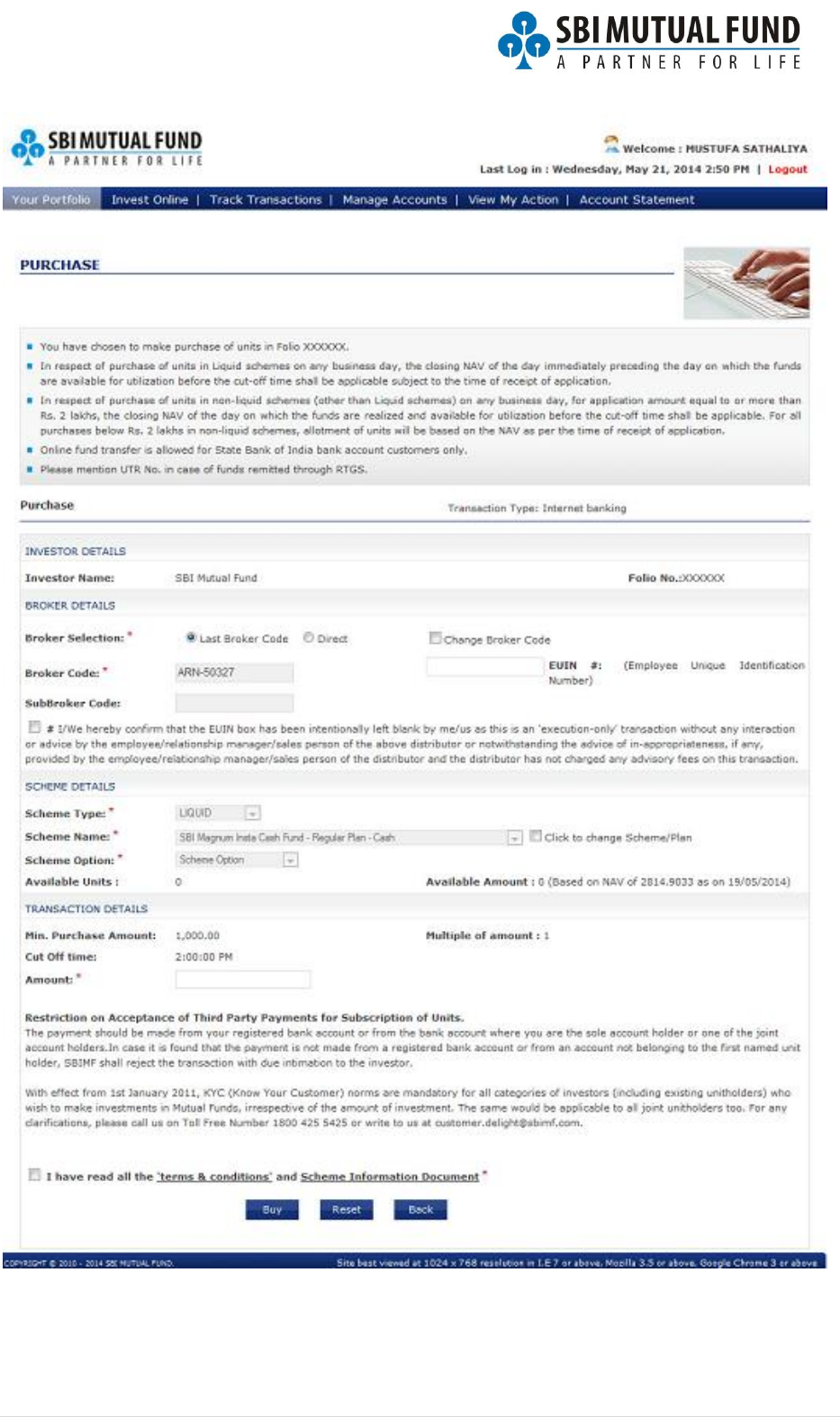

After clicking on Purchase link following screen would be displayed

31 | P a g e

32 | P a g e

By default the last broker code through which a transaction has been processed will be

populated in the broker code field.

If you want to change the broker code then activate the change broker code check box, else

you can continue to use the last broker code for purchase.

If you want to invest without any broker then choose Direct as Broker Selection.

Enter details in following fields:

1. Broker Code - This is pre populated as per last transaction, to change this please

follow the steps as explained above.

2. EUIN – Enter EUIN of the broker if available.

3. Scheme details will be populated as per the Purchase Link of the Scheme of the

portfolio.

4. If you want to change the scheme in which you need to invest you need to activate

the change scheme check box.

5. Scheme Option is dependent of the Scheme Plan – Dividend/Growth.

6. Amount – Enter Amount you want to invest.

7. Activate the terms and conditions check box.

Once all details are entered click on Buy.

On Click on Buy button following screen would be loaded.

33 | P a g e

Click on Confirm Button to complete the initiation of Purchase Transaction.

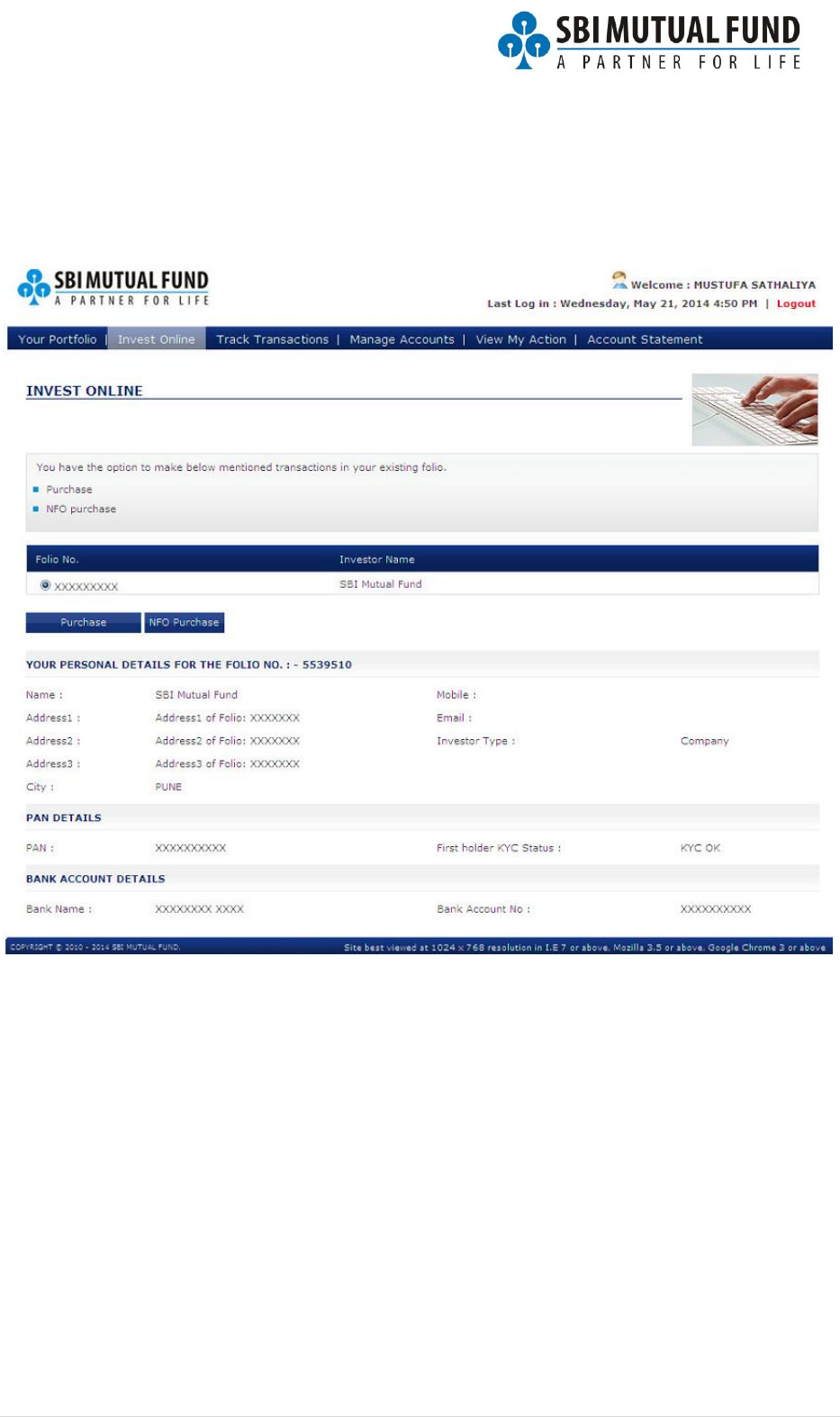

Invest Online

Click on Invest Online Tab

Choose the folio in which you want to make a purchase transaction.

Click on Purchase Button.

When you click on Purchase button the same process and screen would be loaded as

explained above under Your Portfolio section of Purchase Initiation.

34 | P a g e

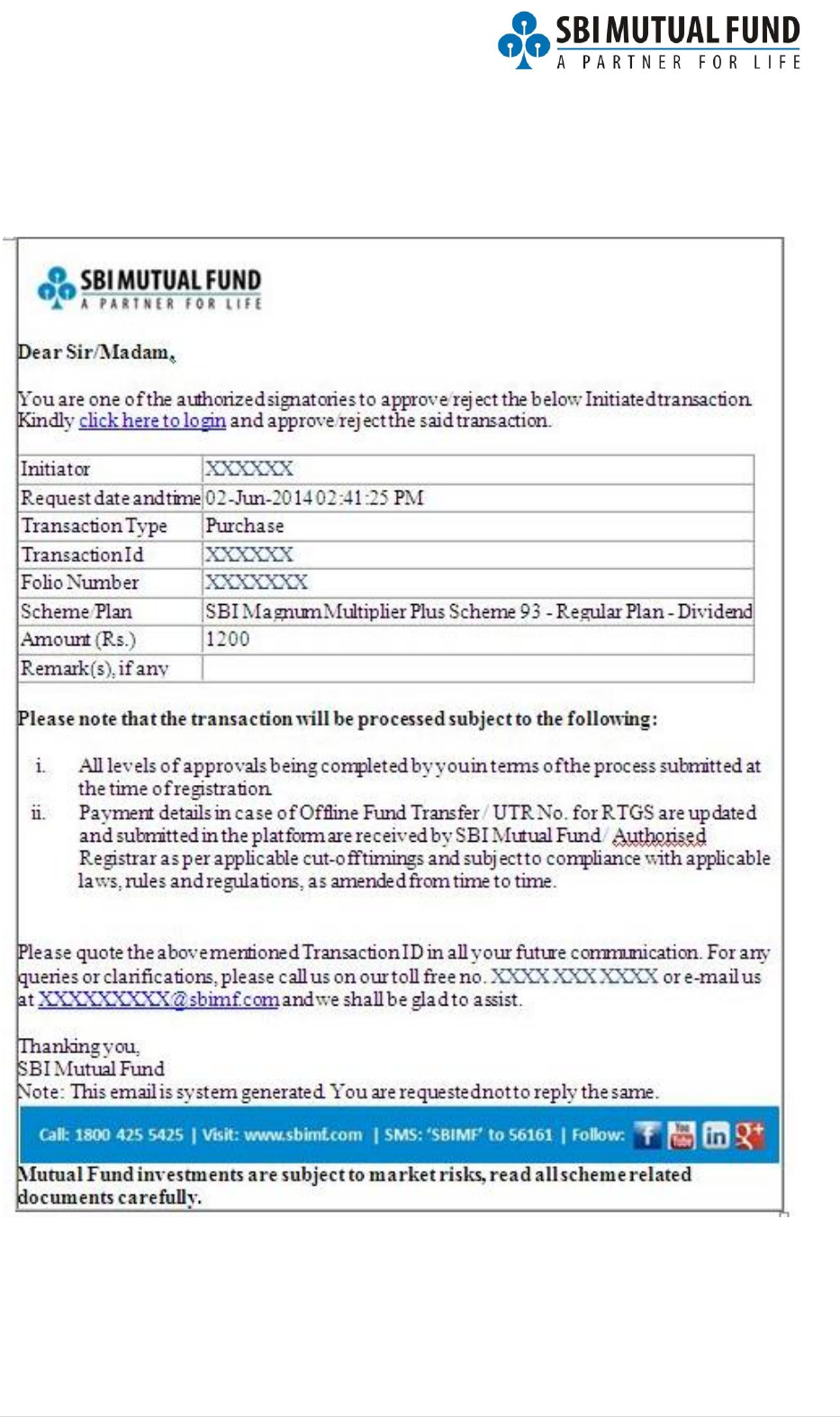

Approval of Purchase Request

Once a Purchase request is initiated following email would be sent to all Authorized

Signatories as per the Registration Mandate for approval(s).

Authorized signatory would need to logon to the system to approve the initiated

transaction.

35 | P a g e

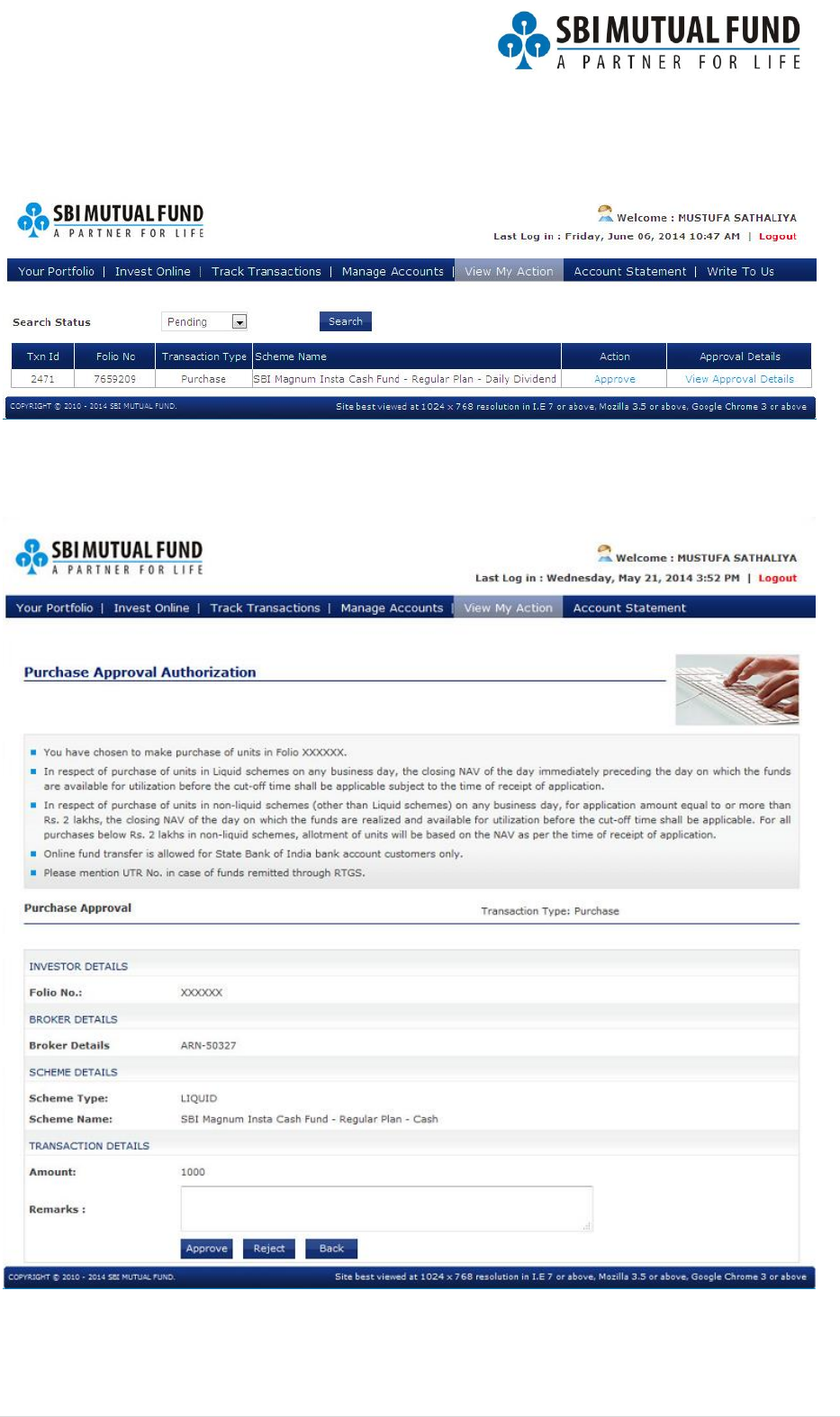

Once the authorized signatory logs on to the system following screen would be available

for approving the initiated transaction.

Authorized signatory would need to click on Approve under Action column to approve or

reject the transaction.

Click on Approve/Reject button to approve/reject the transaction.

36 | P a g e

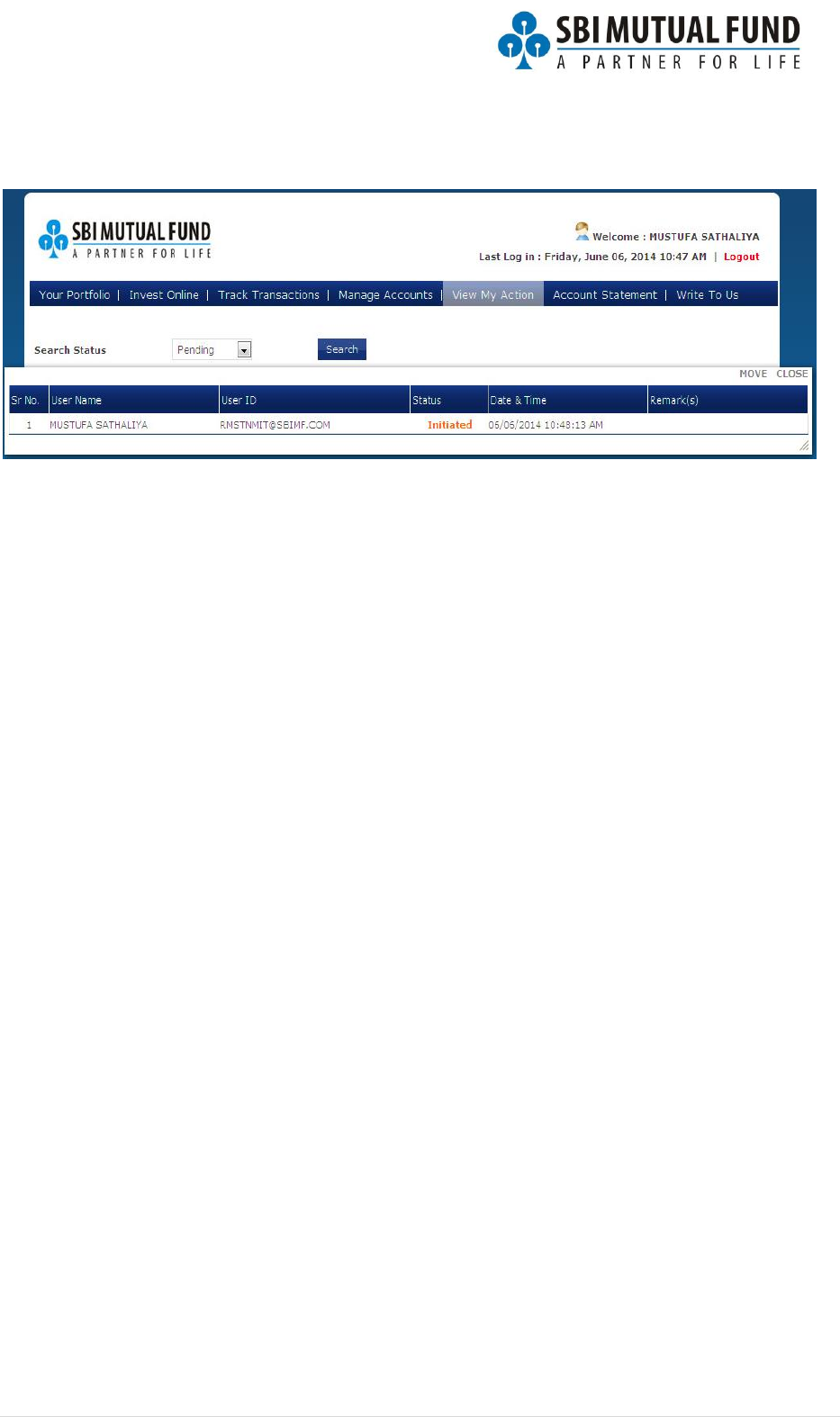

Authorized Signatory can also view approval details by clicking on View Approval Details

under Approval Details column.

Once the transaction is approved by all Authorized Signatories the transaction will be as

pending for payment for all users with Fund Transfer authority as per registration

mandate

The user with Fund Transfer authority would need to logon to the system and submit the

Fund Transfer details for final processing of the transaction.

37 | P a g e

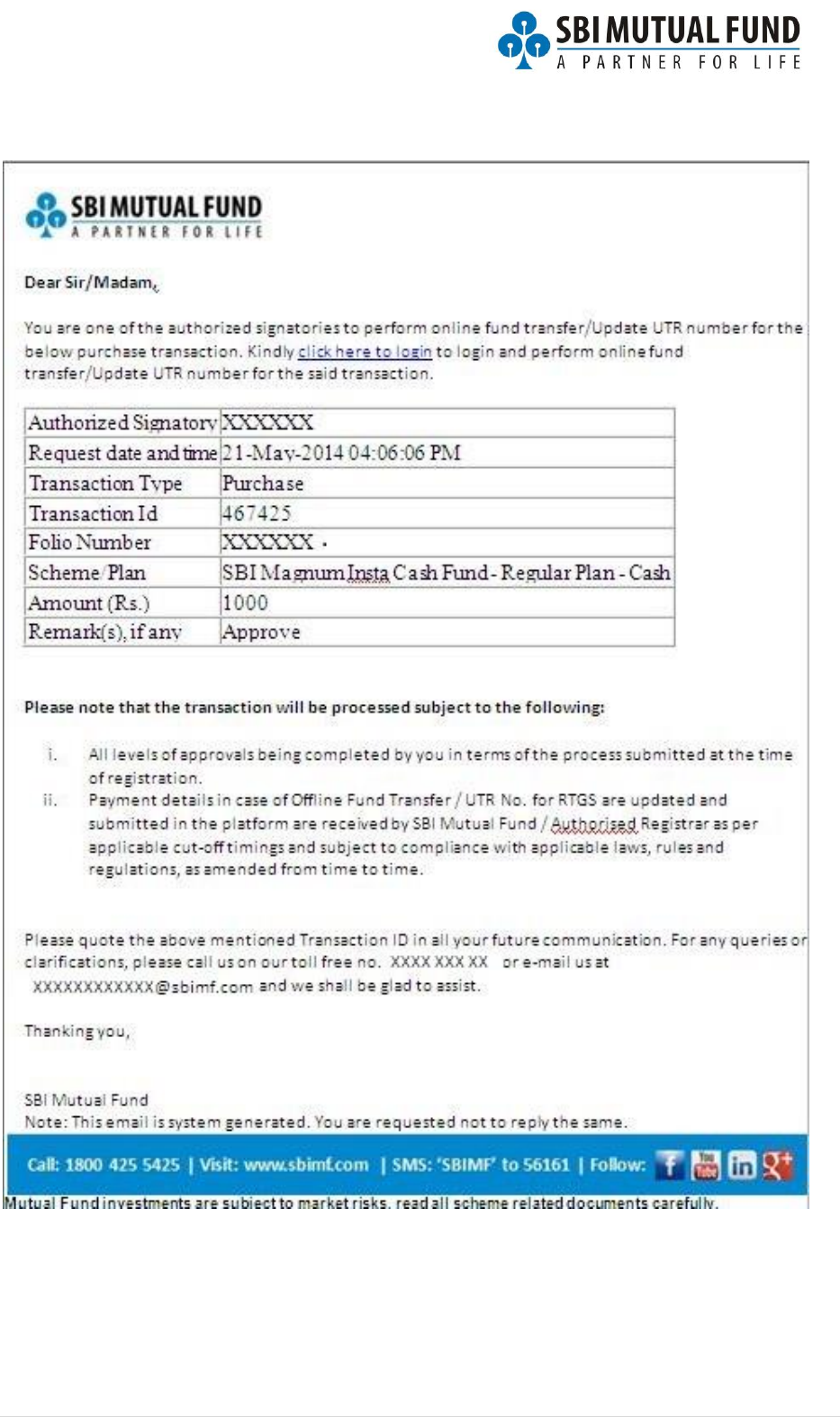

Following email would be sent to all users with Fund Transfer authority.

38 | P a g e

Fund Transfer for Purchase Request

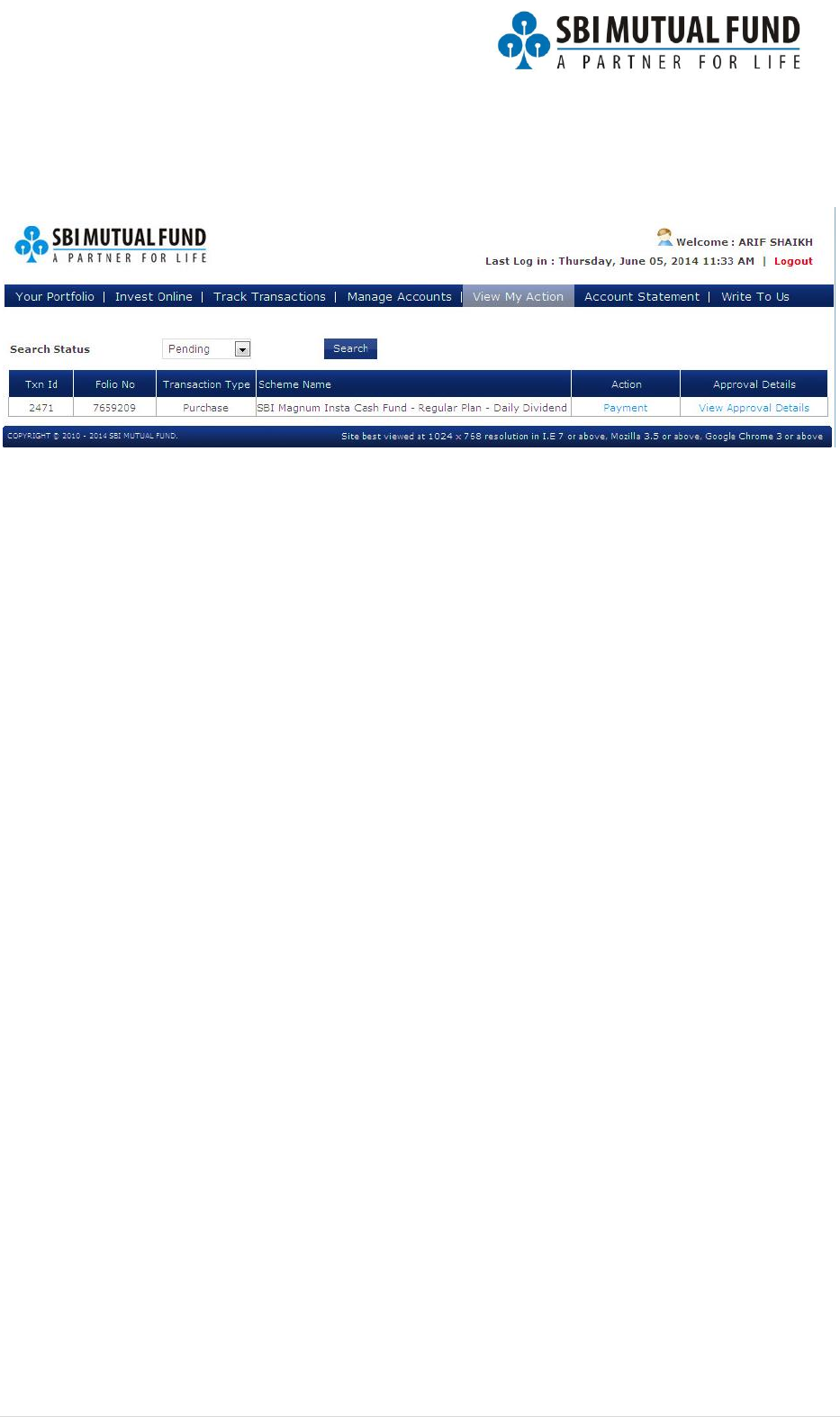

Payment pending screen under view my action for users with Fund Transfer authority.

User need to click on Payment link under Action column.

39 | P a g e

Note:

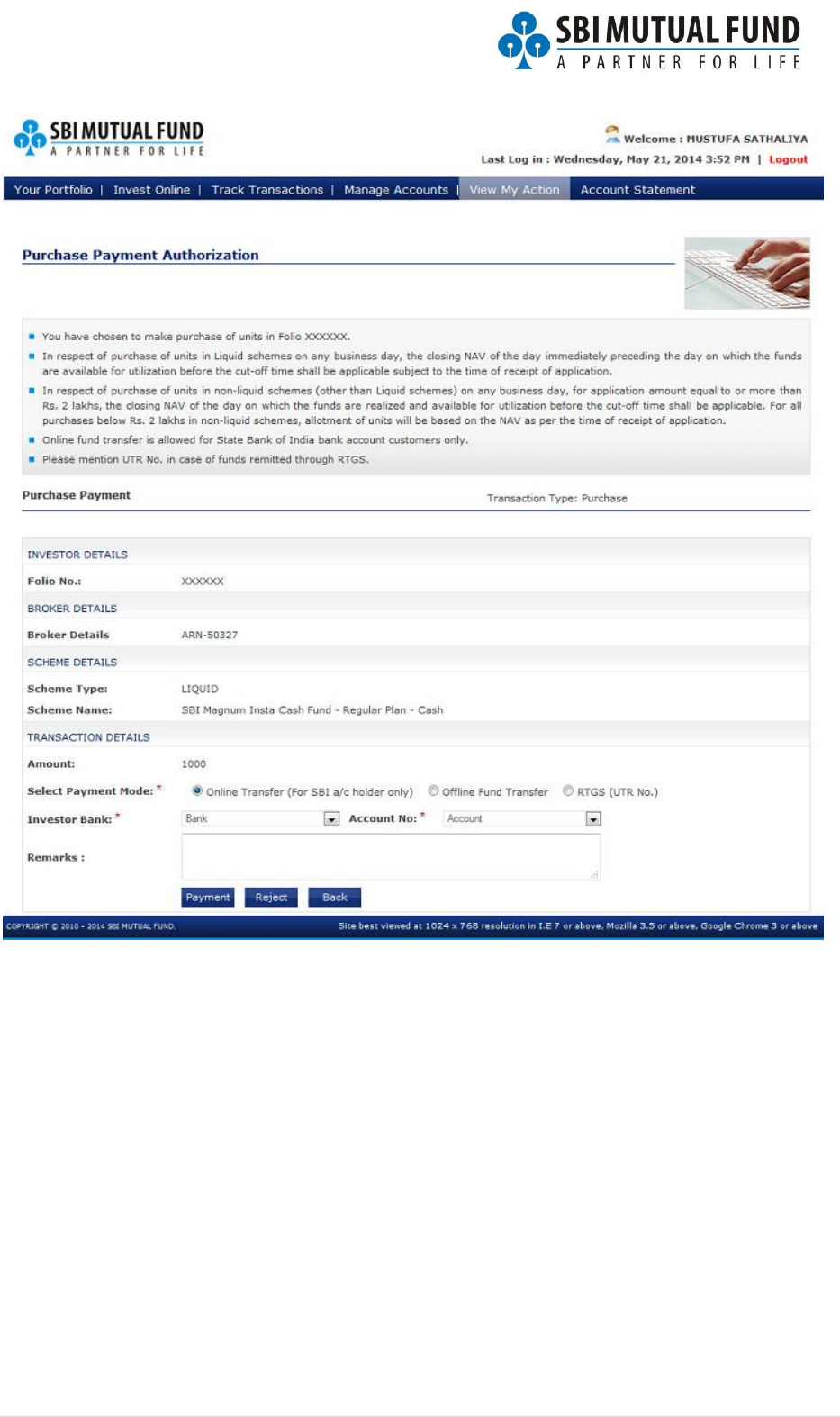

1. Investor needs to choose the registered bank and account number from the drop

down list from which payment needs to be processed.

2. Online transfer is available only for State Bank of India bank accounts.

3. For any other bank accounts you need to use Offline Fund Transfer or RTGS.

40 | P a g e

Online Fund Transfer:

If investor has a State Bank of India account registered in the folio then an online fund

transfer can be performed.

To proceed for online fund transfer click on Payment button. On click investor would be

redirected to OnlineSBI website where investor would need to proceed as per bank

mandates.

Once the payment is initiated by investor at banking site he would redirected to SBI

Mutual Fund site and would be get the payment status as pending for confirmation. Only

on final approval at banking site the payment status would be updated as successful.

Investor is not required to logon to SBI Mutual Fund site again for initiated or approving

further banking approvals. This can be performed directly on SBI net banking site and

status would be updated at SBI Mutual Fund site automatically.

41 | P a g e

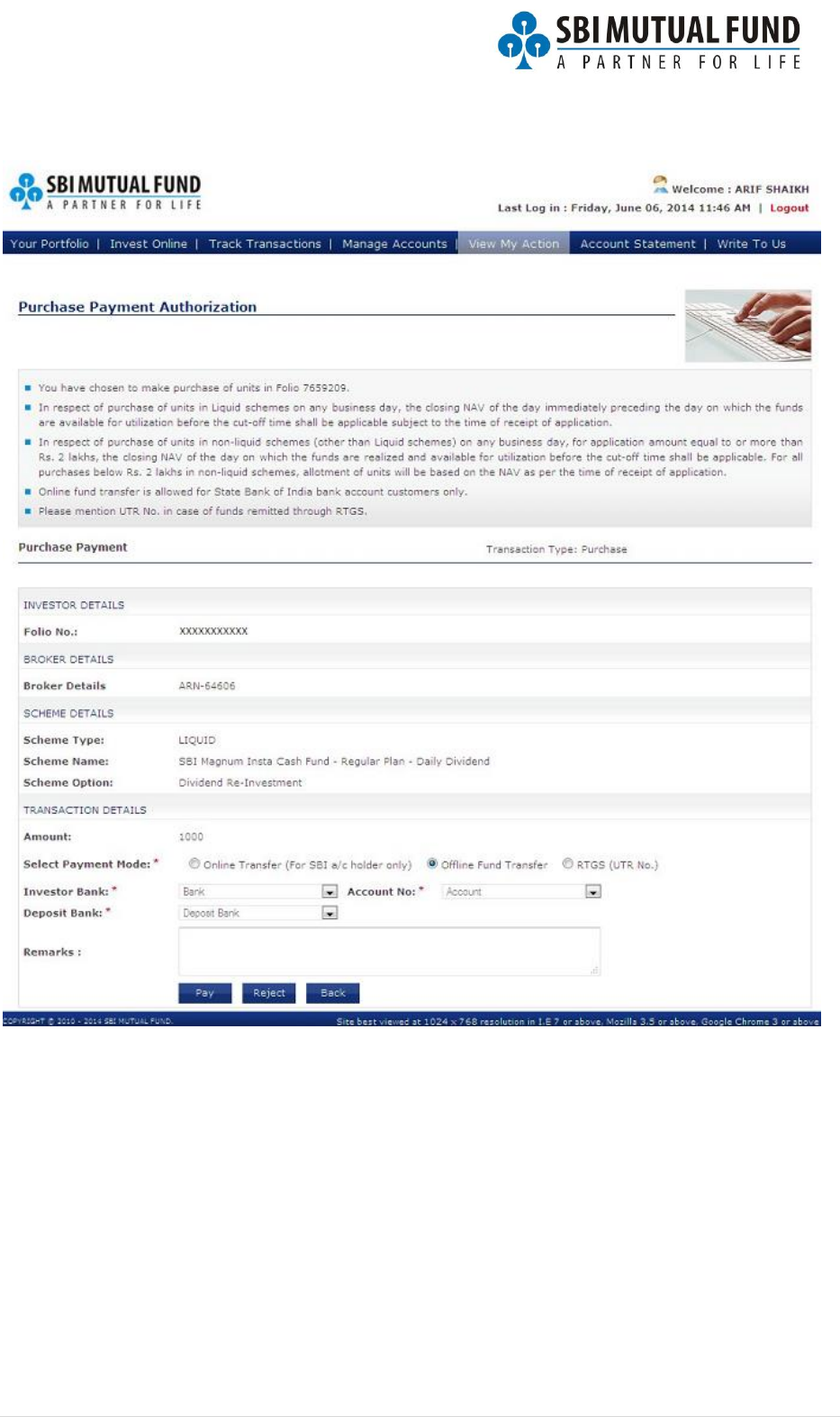

Offline Fund Transfer

Choose the Bank details and click on Pay button to submit the transaction.

42 | P a g e

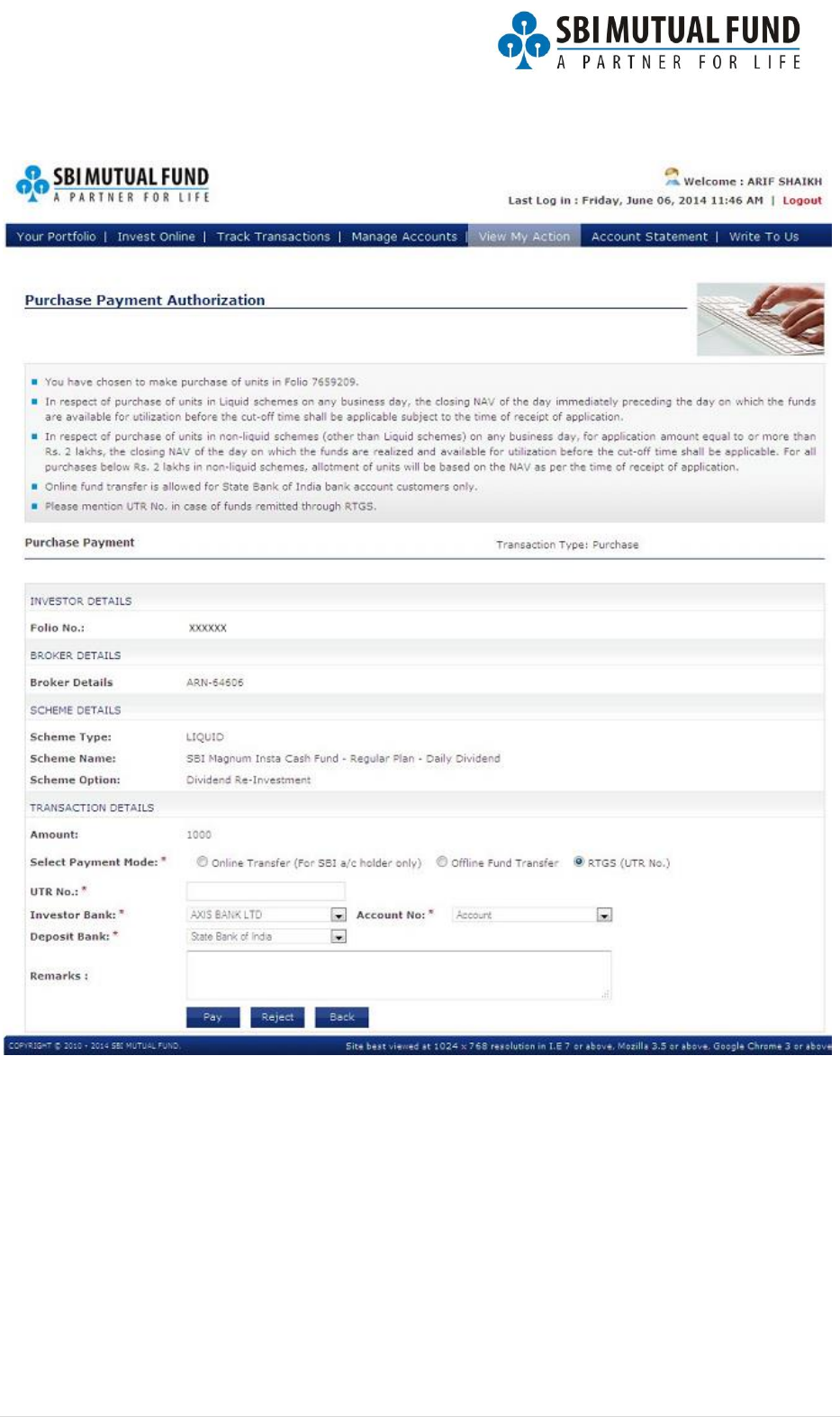

RTGS (Real Time Gross Settlement)

Choose bank details, update the UTR No. and click on Pay button to submit the application.

43 | P a g e

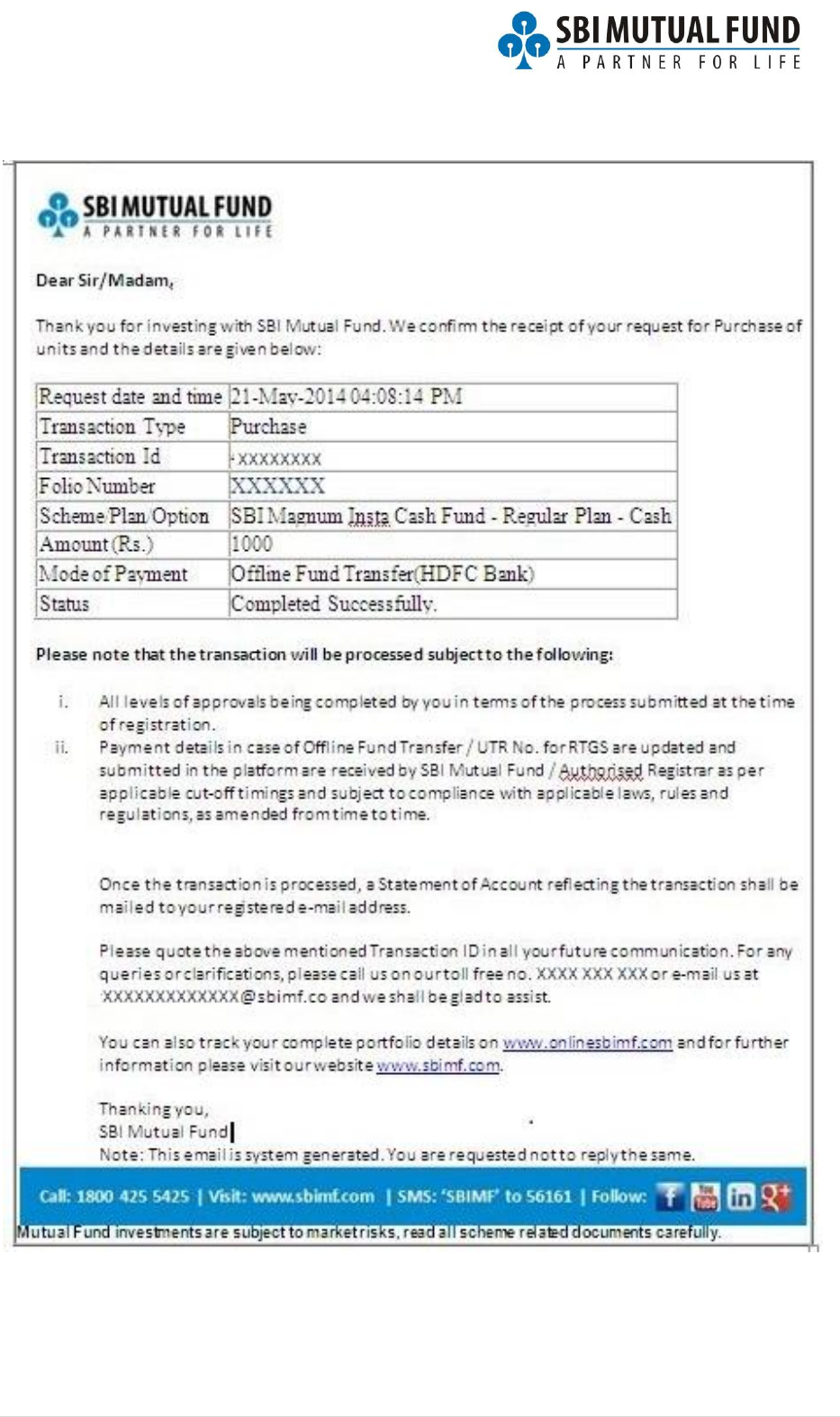

Final confirmation email on successful payment and submission of application

44 | P a g e

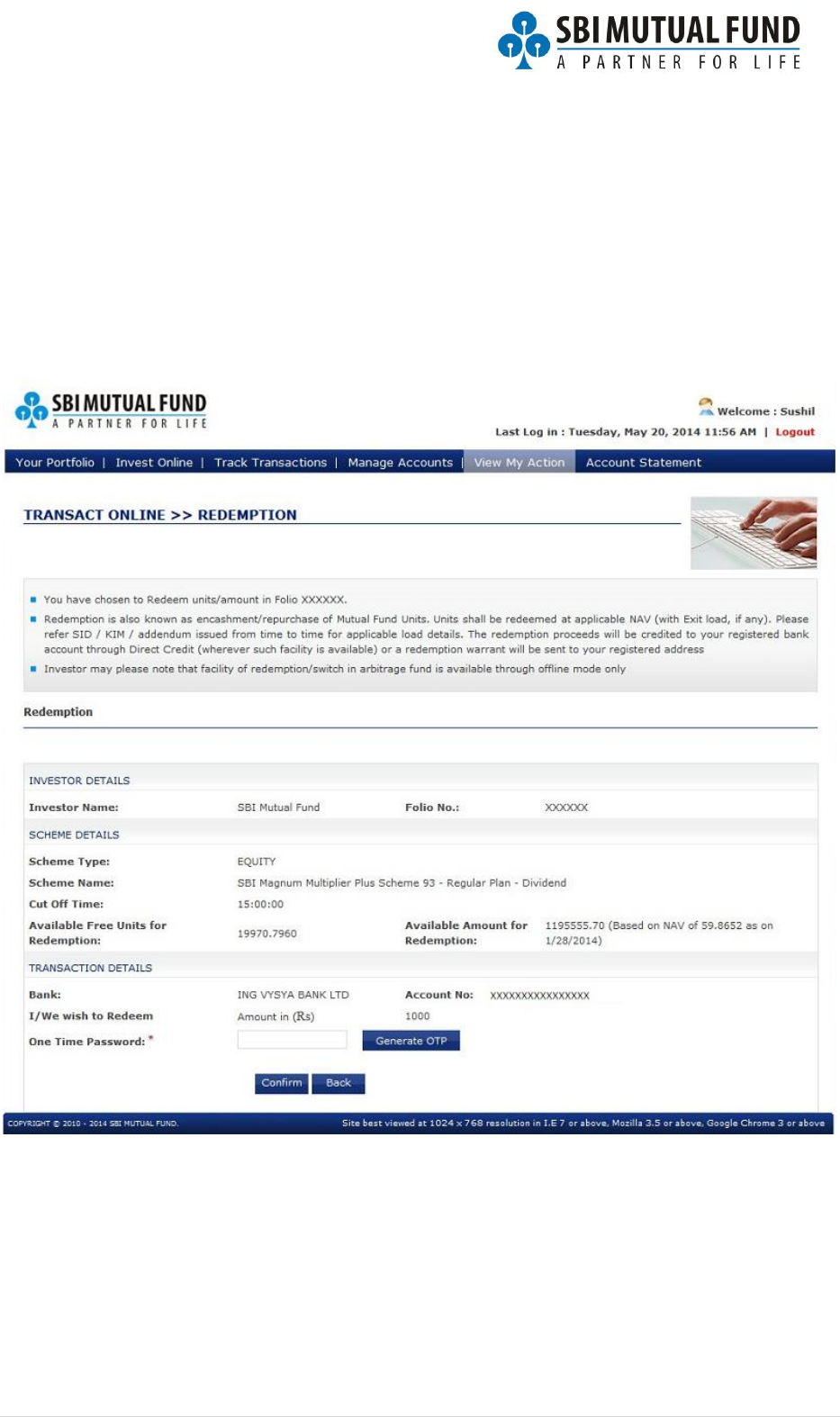

Redemption

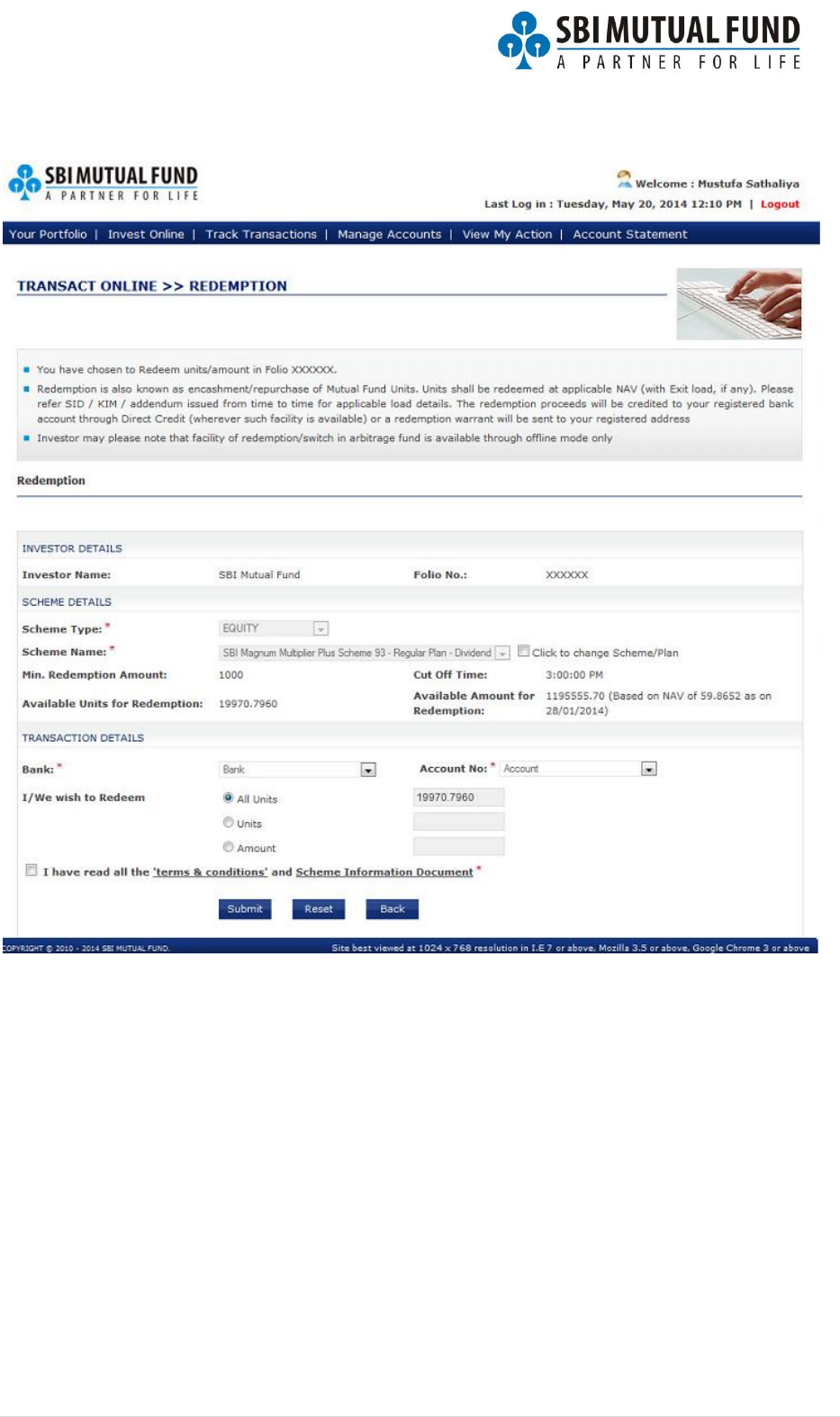

Initiation of Redemption Request

Redemption transaction can be performed through Your Portfolio

Click on Redeem link in Transact Here column against the scheme to initiate redemption

transaction.

45 | P a g e

Screen for initiating redemption transaction

Choose Bank and Account No. in which redemption proceeds are required.

You may choose to redeem under options of All Units/Units/Amount.

Activate the terms and conditions check box.

Click on Submit button.

46 | P a g e

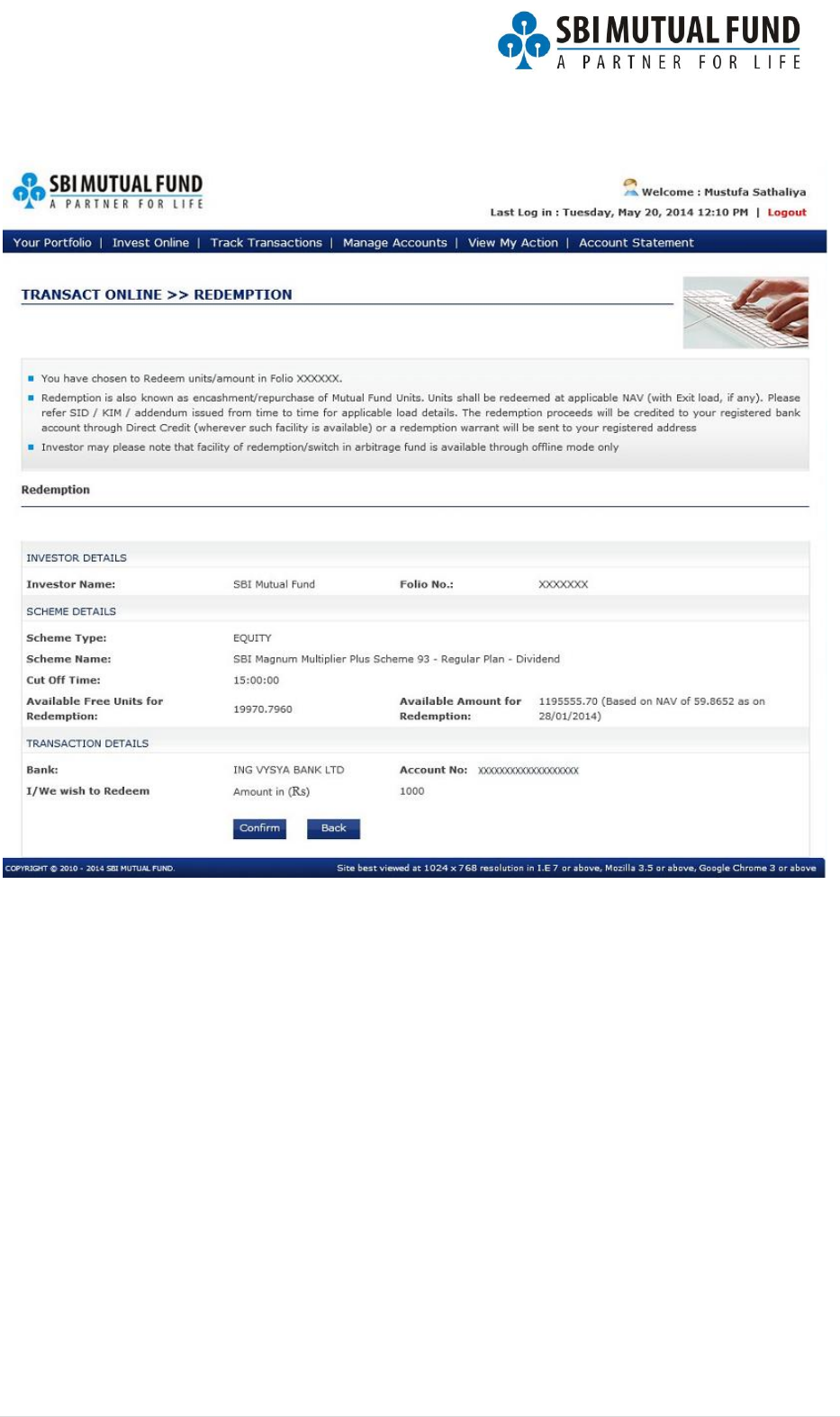

Confirmation of redemption request initiation screen

Click on Confirm button to submit the transaction for approval from Authorized

Signatories.

47 | P a g e

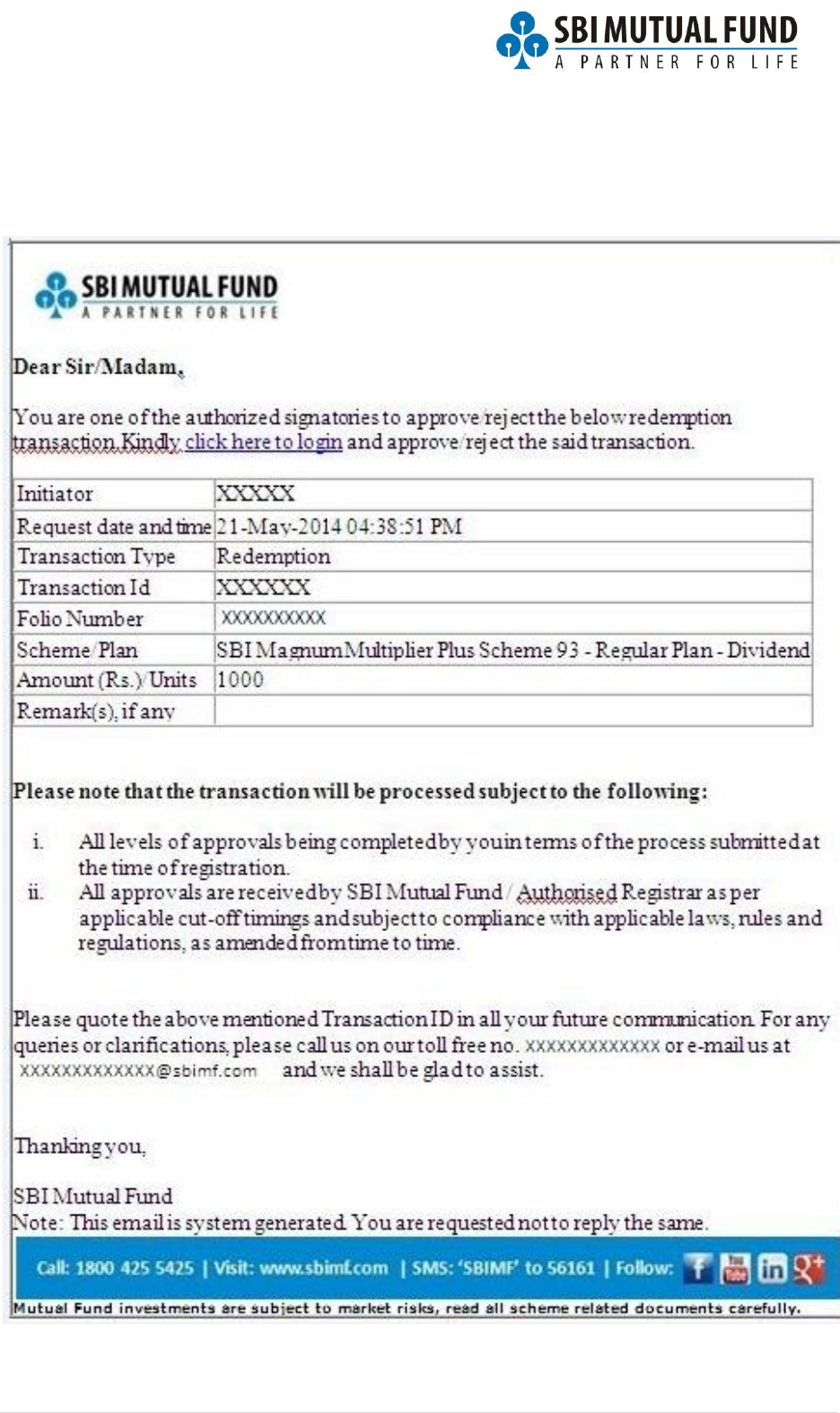

Approval of Redemption Request

Once a Redemption request is initiated following email would be sent to all Authorized

Signatories as per the Registration Mandate for approval(s).

48 | P a g e

Note:

The approval process for redemption is same as for purchase approval.

In redemption approval only the final approver would need to enter an OTP for final

submission of the transaction.

Final approval for redemption request

49 | P a g e

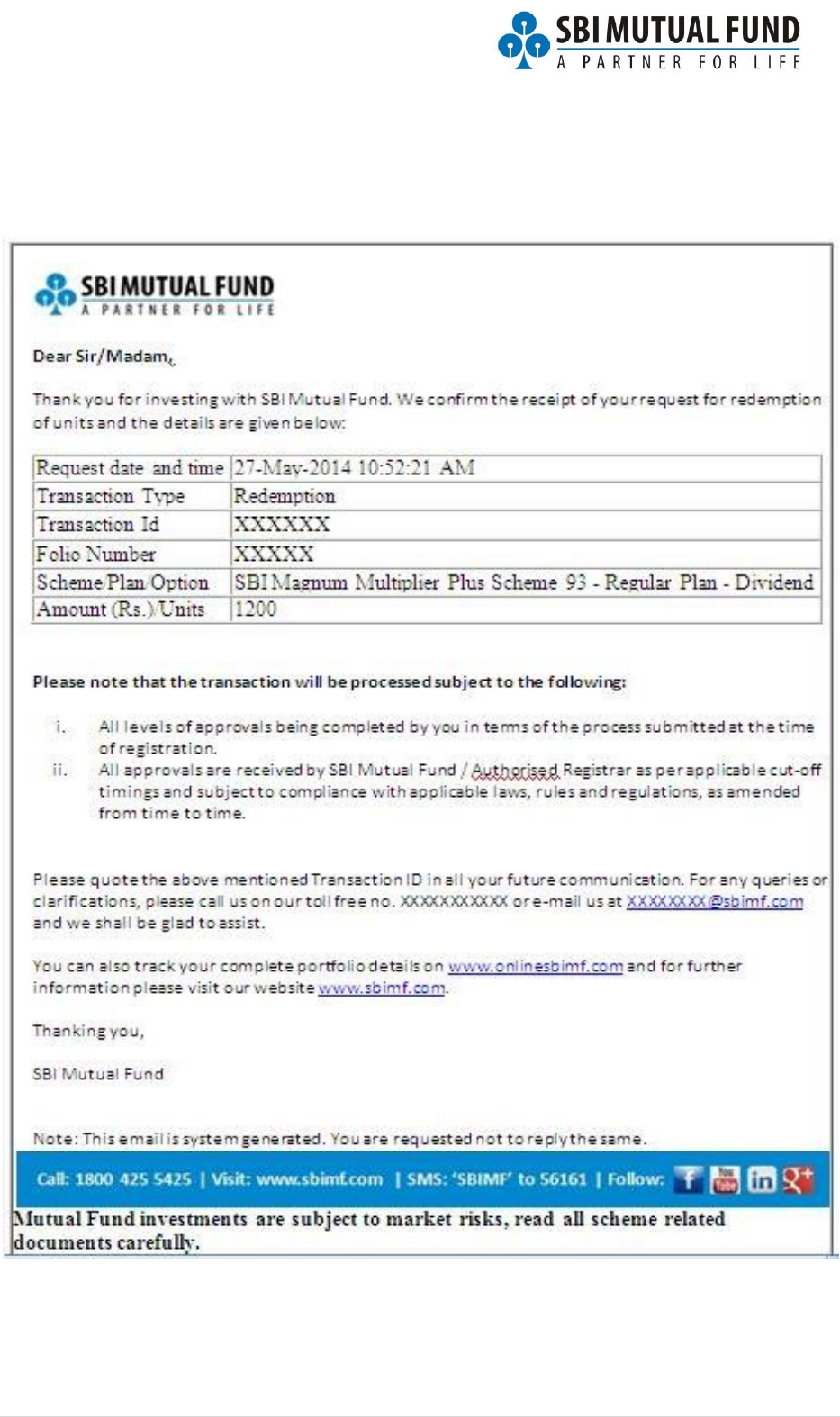

Final confirmation of redemption request

On submission of redemption request following email would be sent to all concerned

authorized signatories.

50 | P a g e

Switch

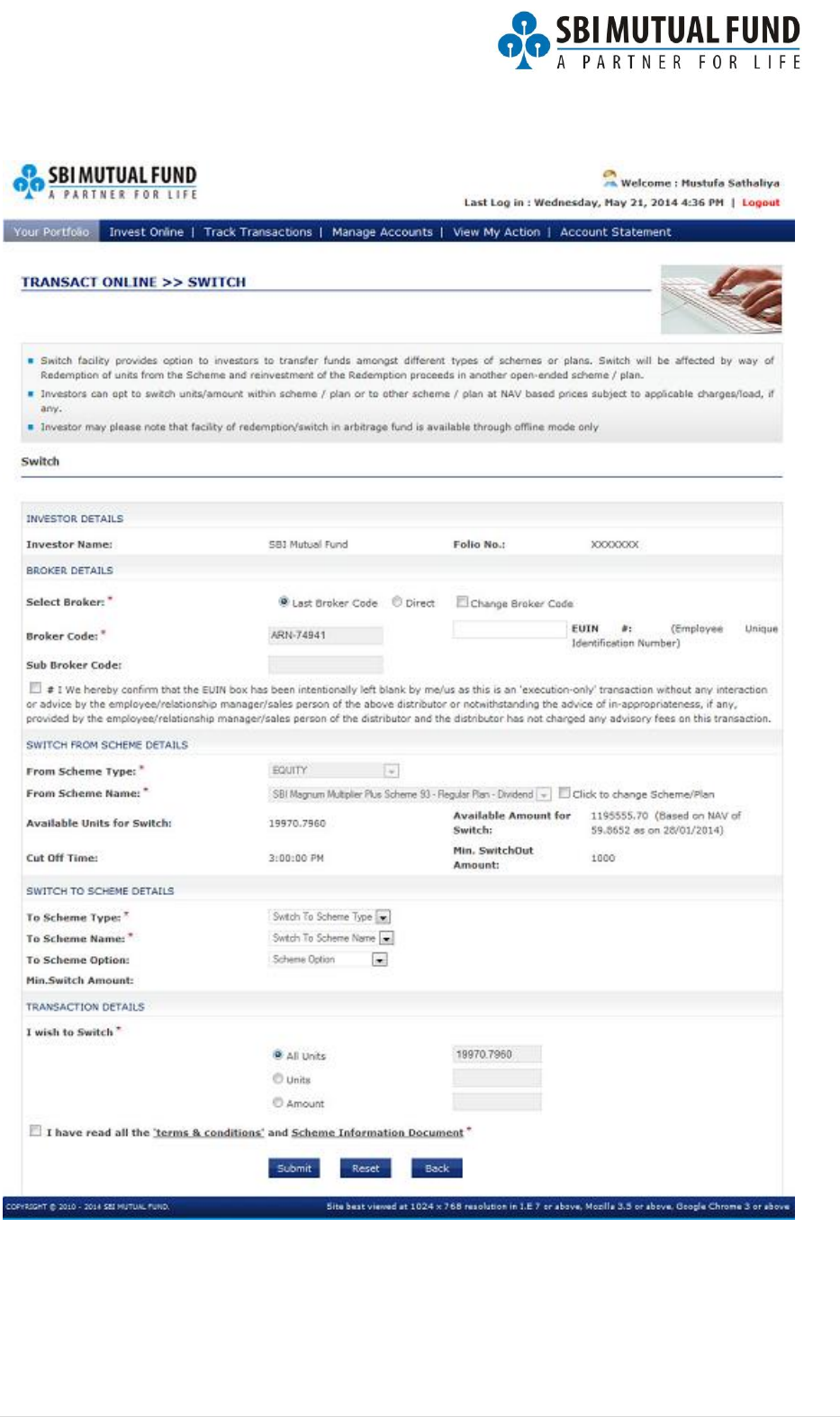

Initiation of Switch Request

Switch transaction can be performed through Your Portfolio

Click on Switch link in Transact Here column against the scheme to initiate Switch

transaction.

51 | P a g e

Screen for initiating Switch transaction

Choose Switch To Scheme Details

You may choose to switch under options of All Units/Units/Amount.

52 | P a g e

Activate the terms and conditions check box.

Click on Submit button.

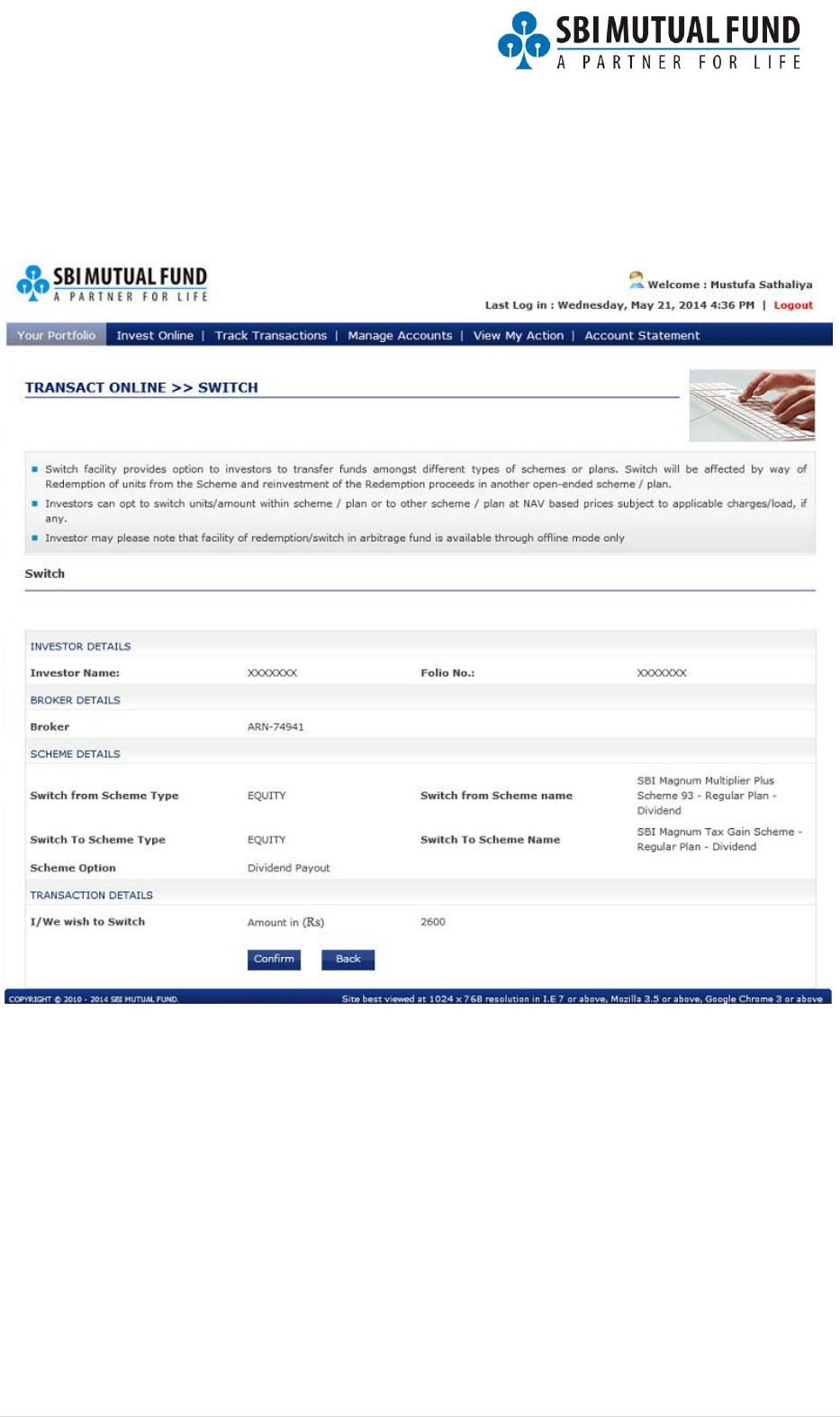

Confirmation of switch request initiation screen

Click on Confirm button to submit the transaction for approval from Authorized

Signatories.

53 | P a g e

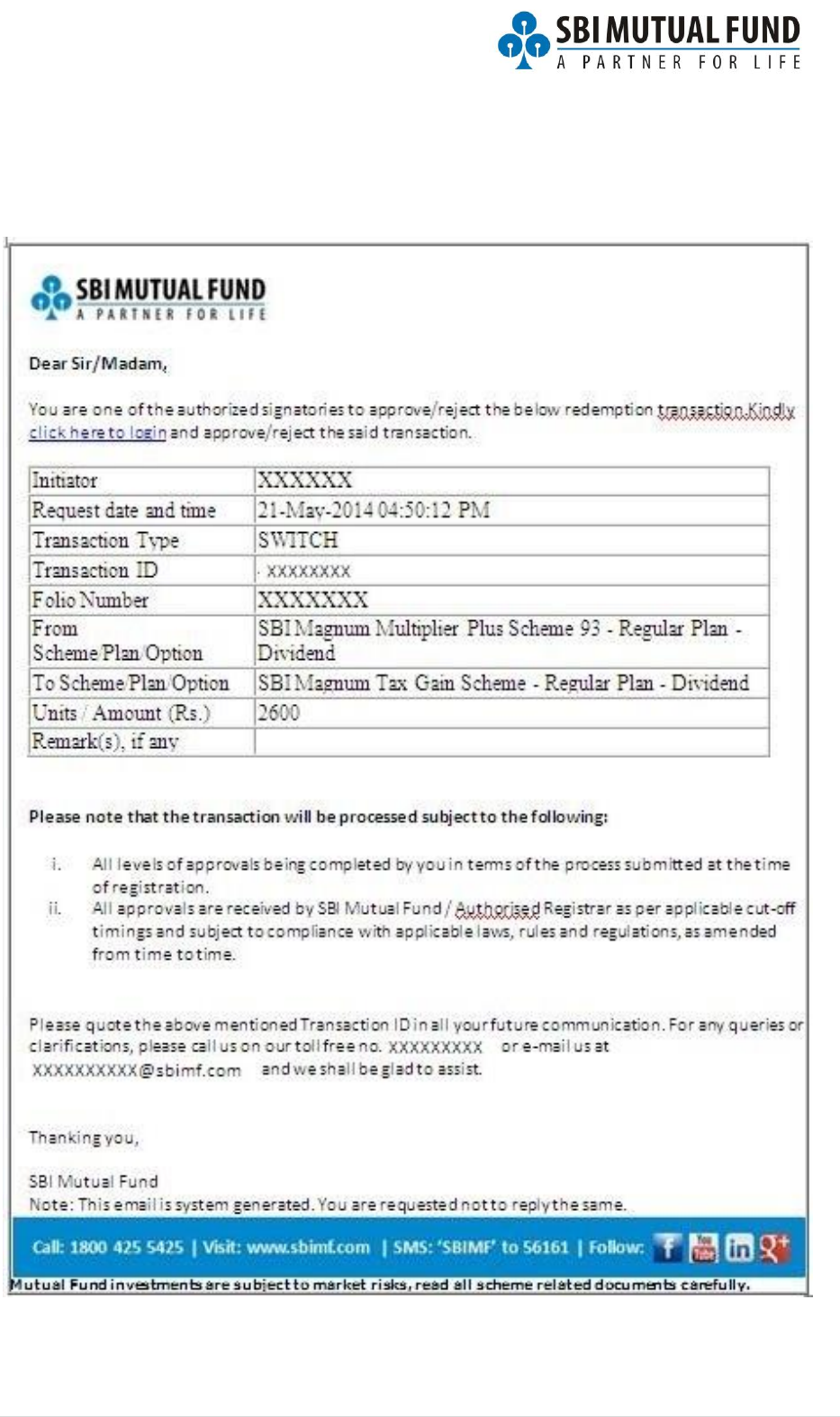

Approval of Switch Request

Once a Switch request is initiated following email would be sent to all Authorized

Signatories as per the Registration Mandate for approval(s).

54 | P a g e

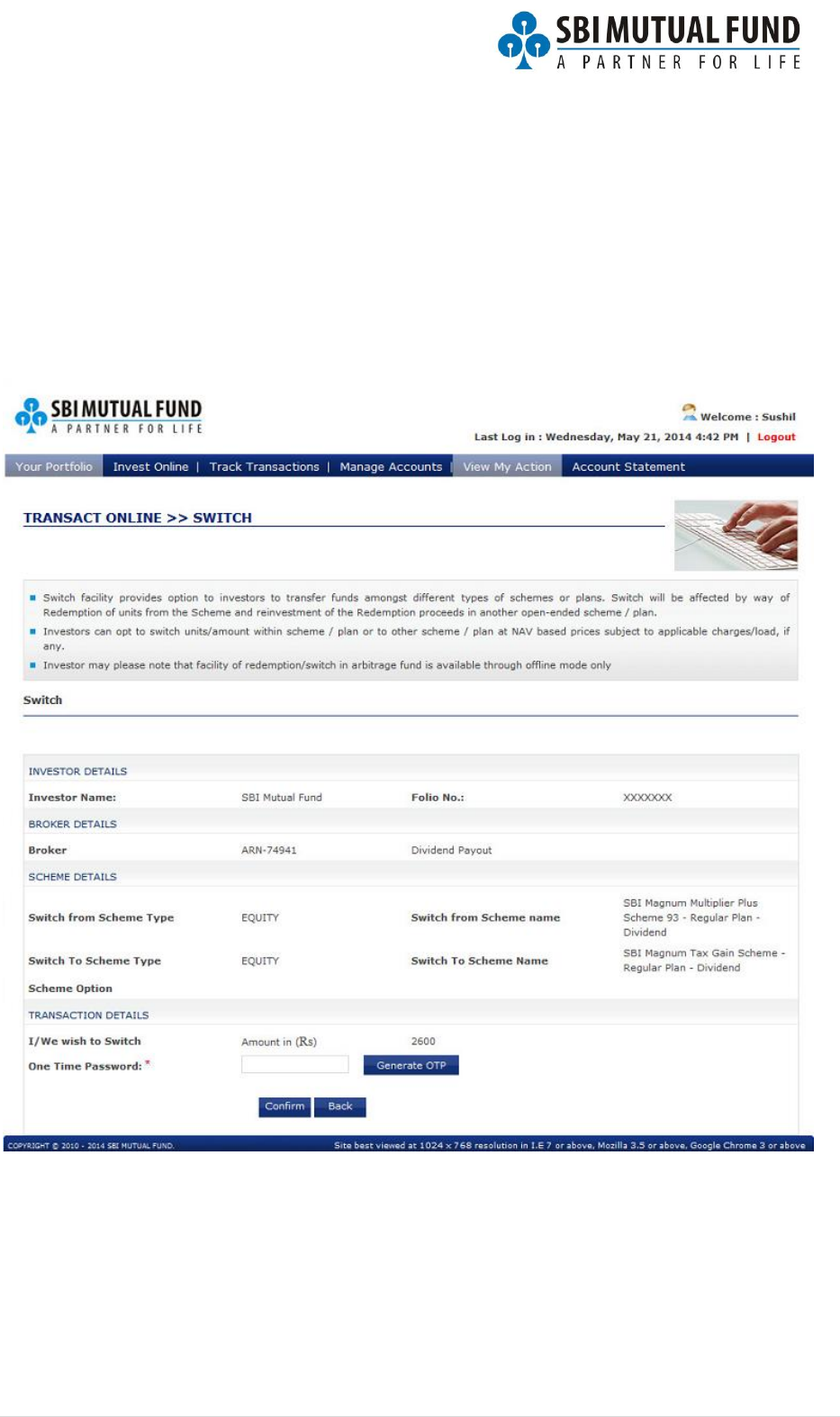

Note:

The approval process for switch is same as for purchase/redemption approval.

In switch approval only the final approver would need to enter an OTP for final

submission of the transaction.

Final approval for switch request

55 | P a g e

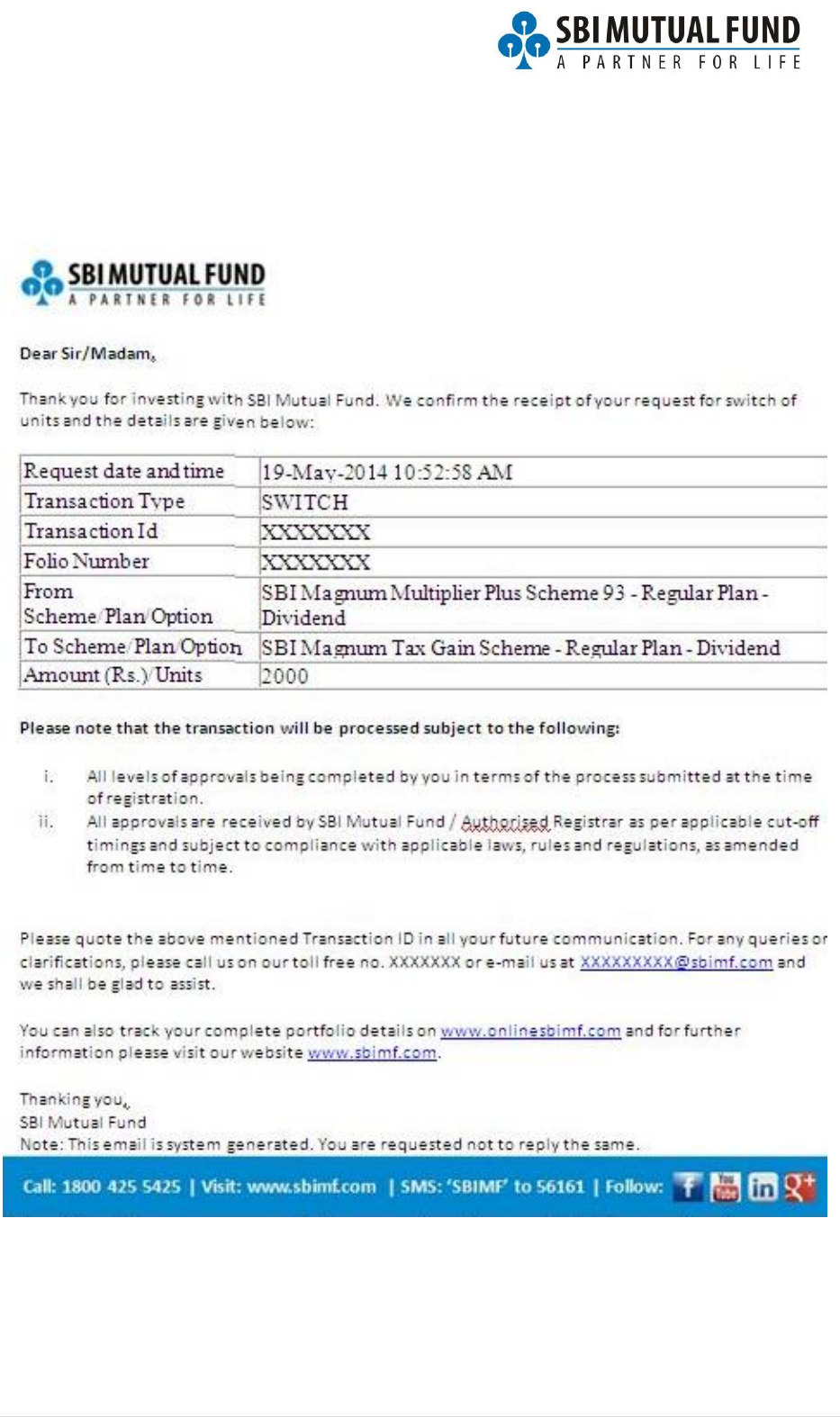

Final confirmation of switch request

On submission of switch request following email would be sent to all concerned

authorized signatories.

56 | P a g e

Other services 4

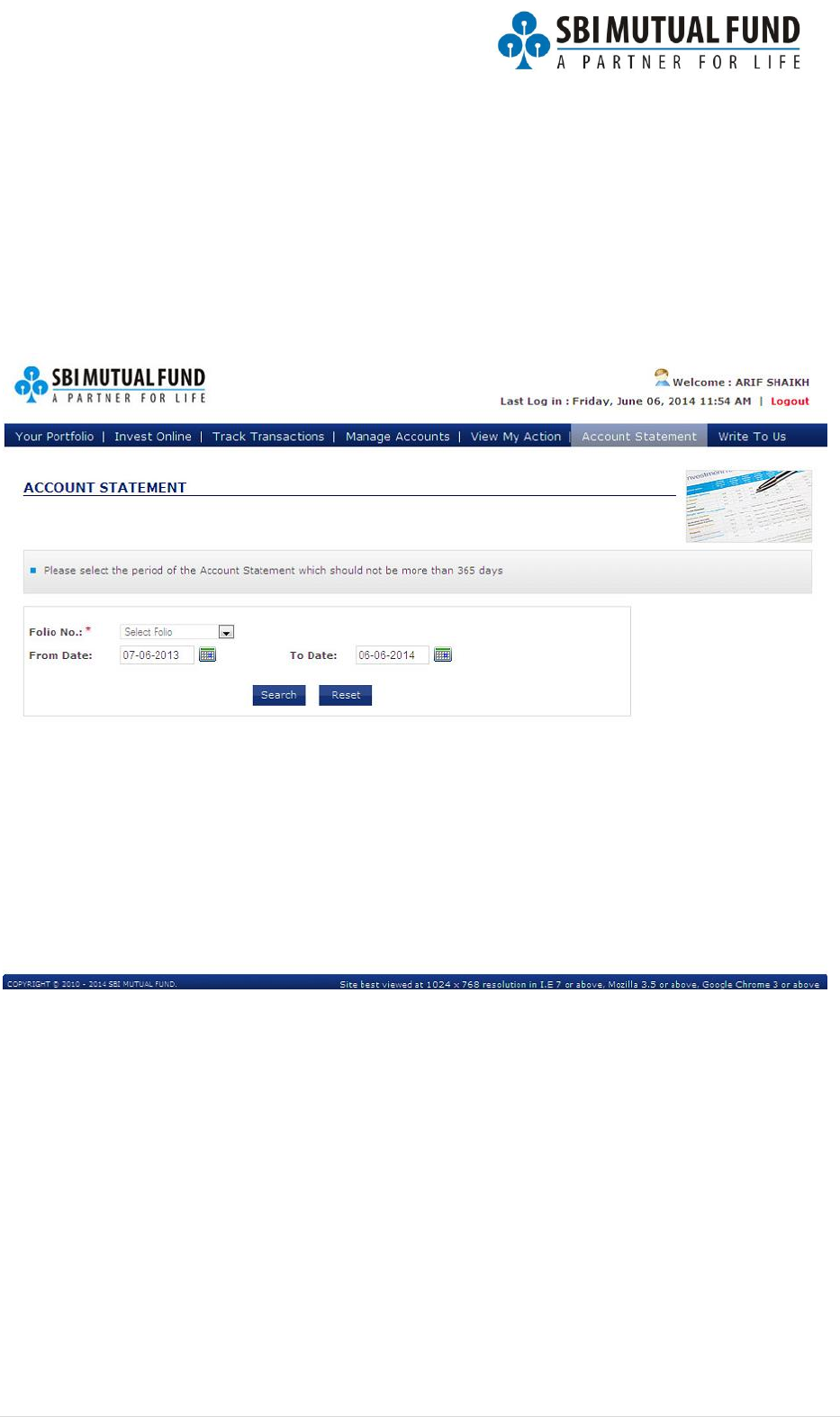

Generate account statement

Investor can generate an account statement for any 365 days with a given date range.

57 | P a g e

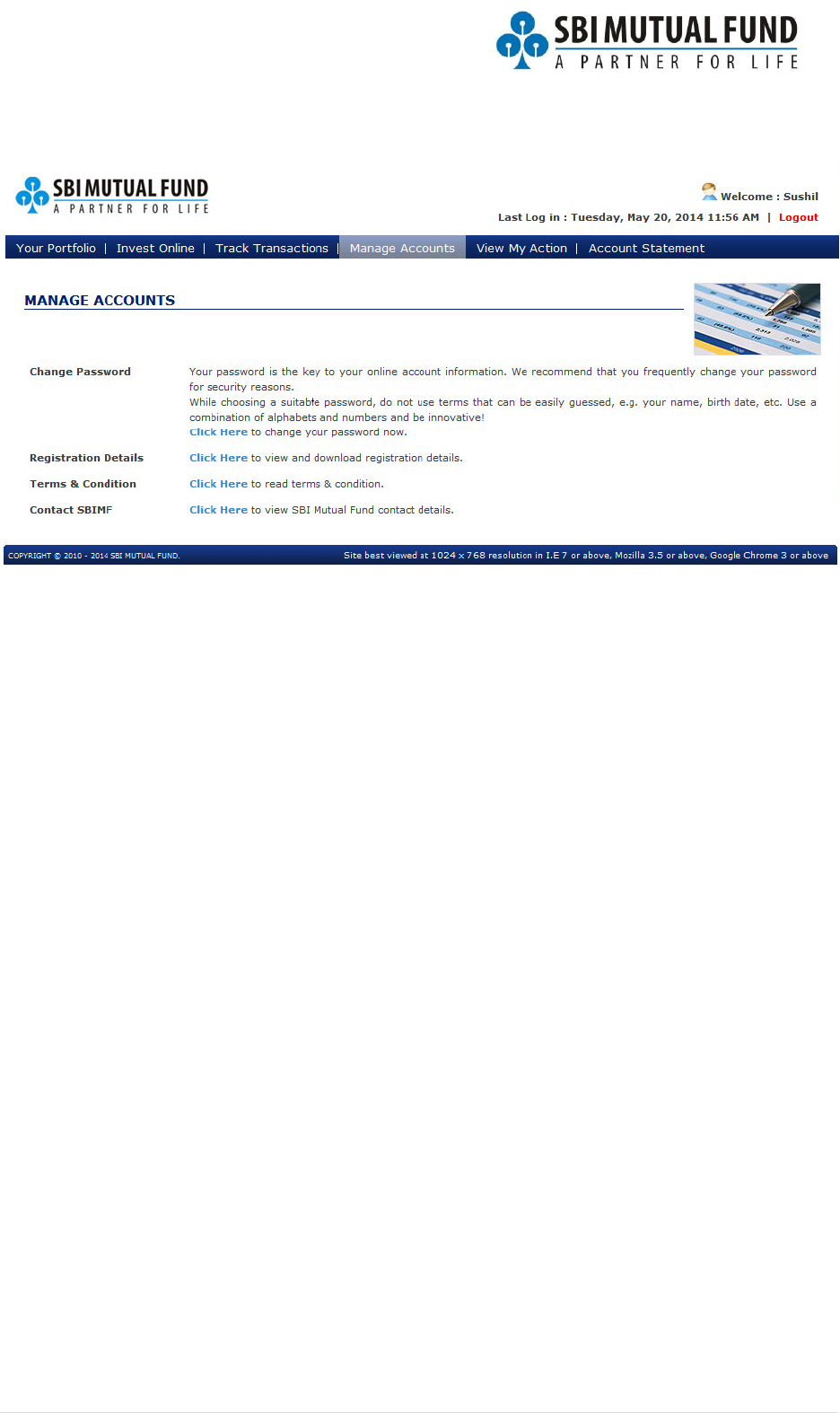

Manage accounts

Investors can use this section to:

1. Change password.

2. Download registration mandate submitted and approved.

3. View terms and conditions for using this platform

4. Contact details of SBI Mutual Fund

58 | P a g e

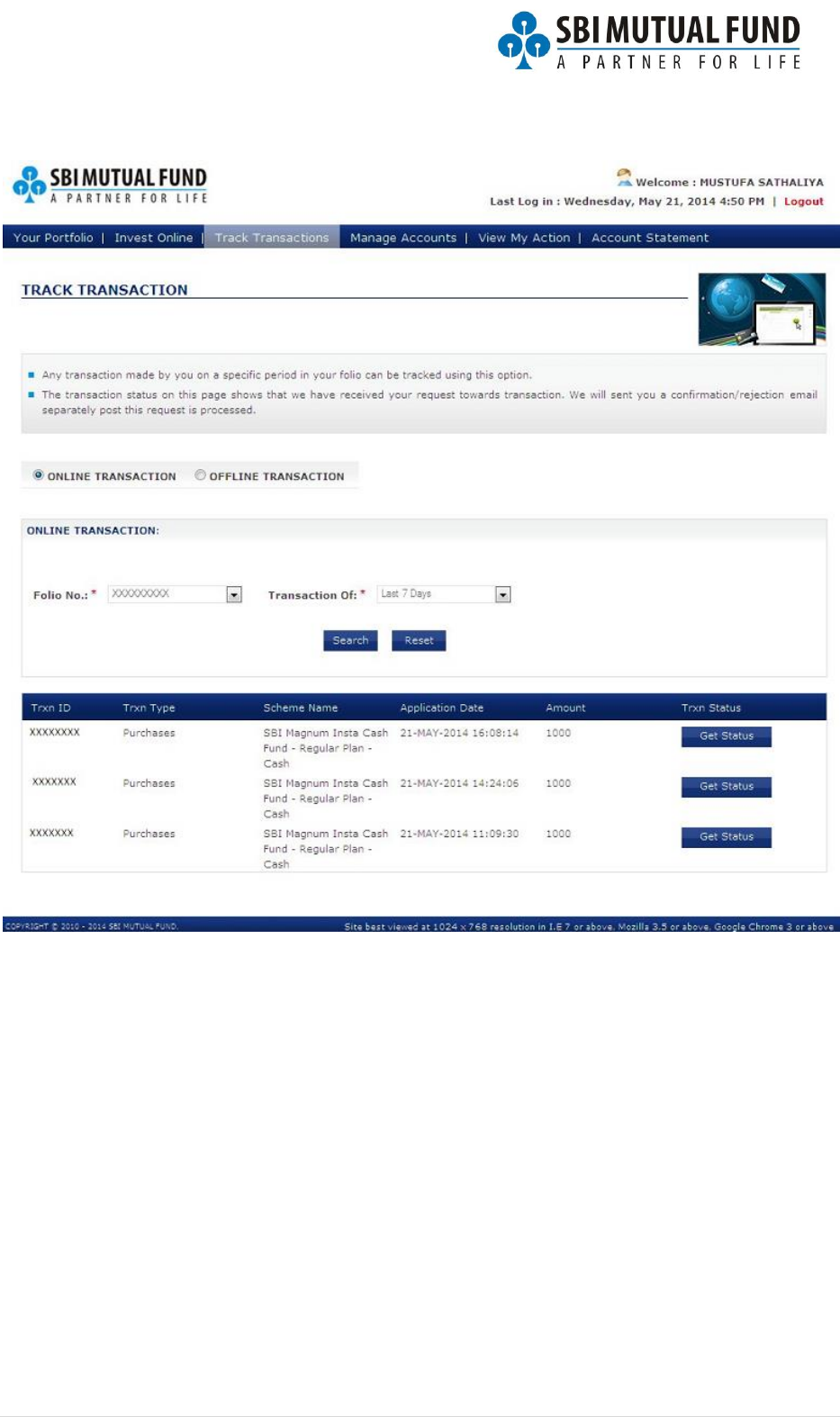

Track transactions

Investor can track the status of transactions performed – Online/Offline

59 | P a g e

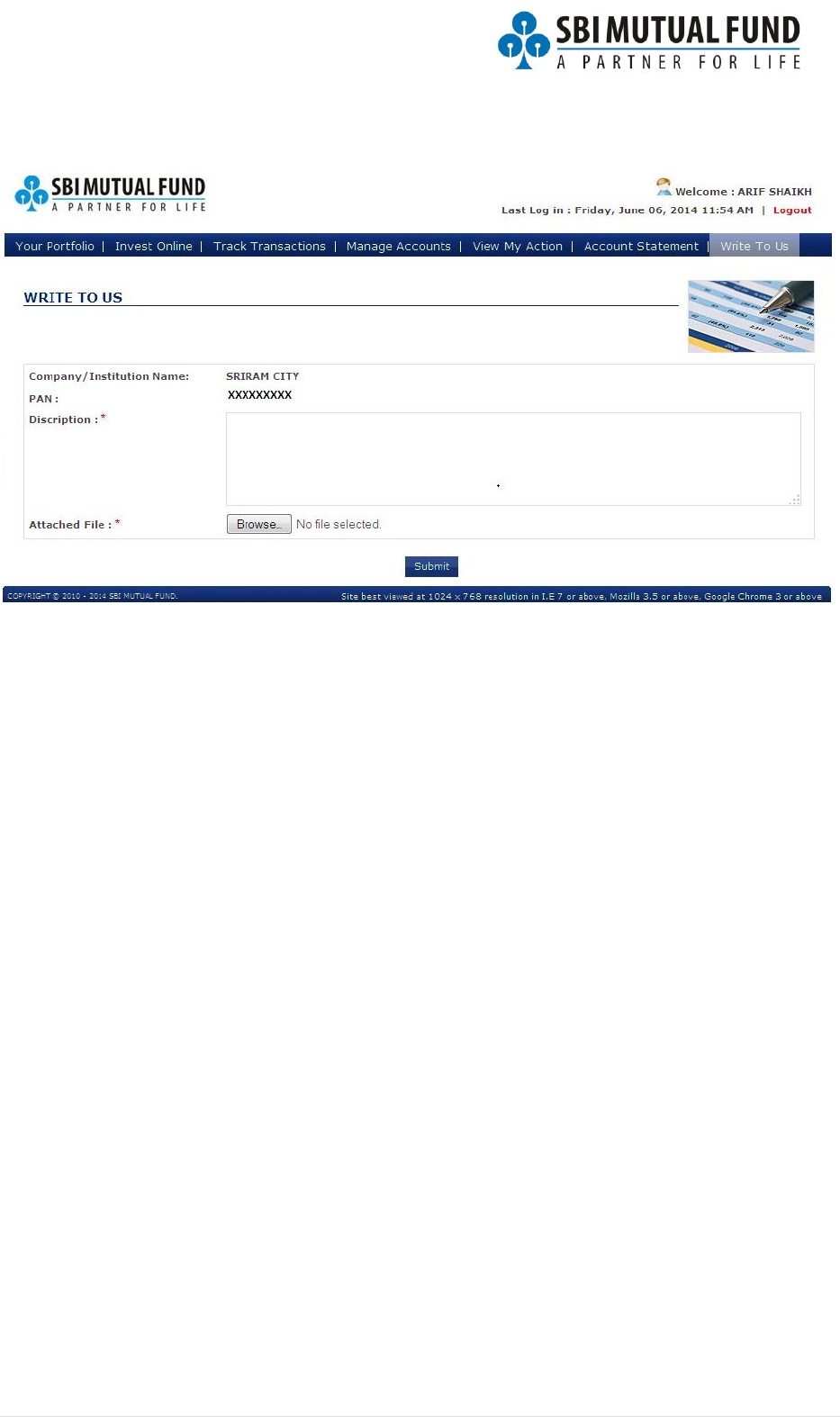

Write to us

In case of any error or help required investor can write to us with screen shots of errors or

any other information using this service.