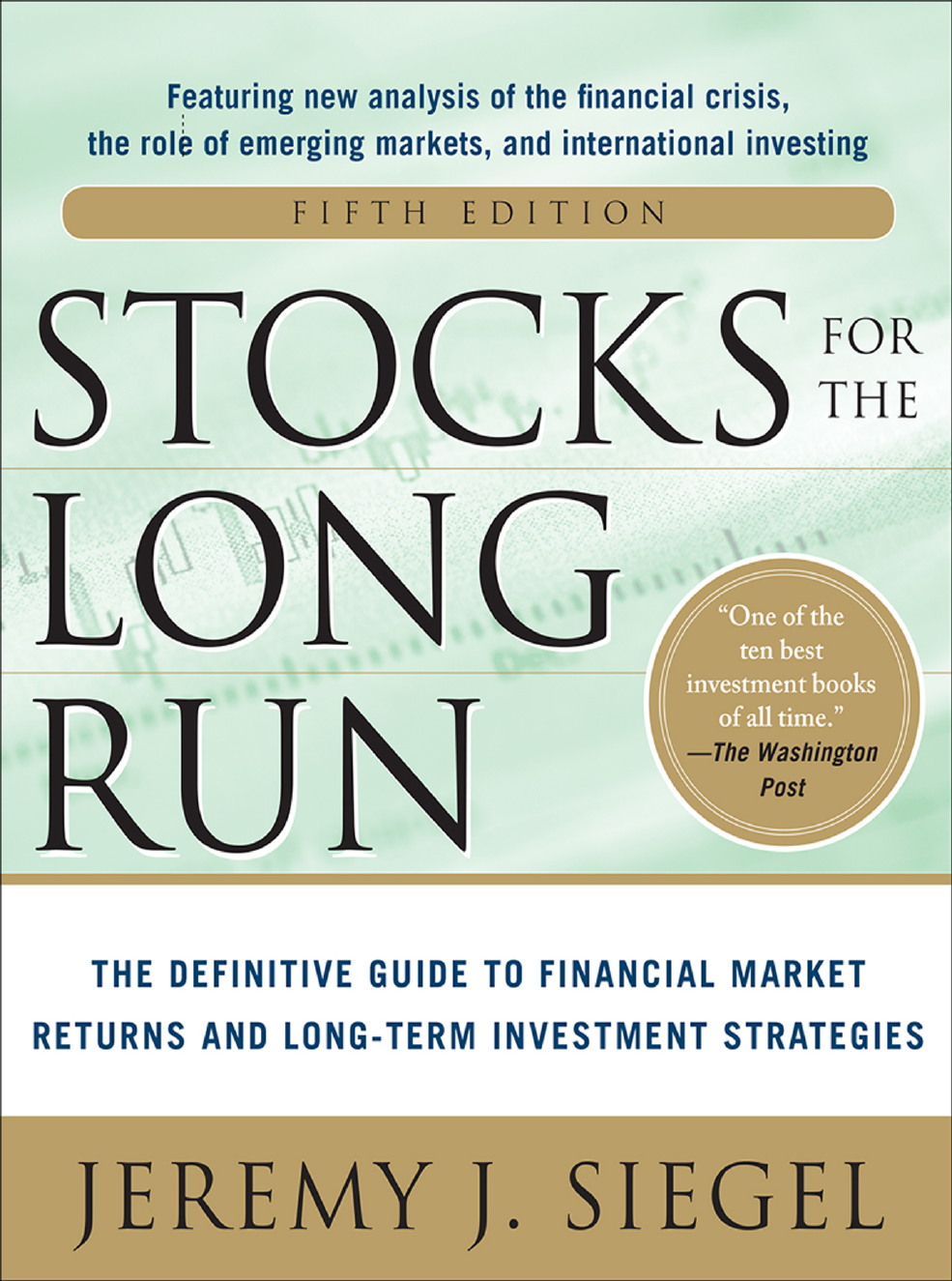

Stocks For The Long Run 5/E Jeremy J. Siegel Definitive Guide To Financial Market Returns &

Jeremy%20J.%20Siegel-Stocks%20for%20the%20Long%20Run_%20%20The%20Definitive%20Guide%20to%20Financial%20Market%20Returns%20%26%20

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 448 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- Cover

- Title Page

- Copyright Page

- Contents

- Foreword

- Preface

- Acknowledgments

- Part I: Stock Returns: Past, Present, and Future

- Chapter 1 The Case for Equity: Historical Facts and Media Fiction

- Chapter 2 The Great Financial Crisis of 2008: Its Origins, Impact, and Legacy

- Chapter 3 The Markets, the Economy, and Government Policy in the Wake of the Crisis

- Chapter 4 The Entitlement Crisis: Will the Age Wave Drown the Stock Market?

- Part II: The Verdict of History

- Chapter 5 Stock and Bond Returns Since 1802

- Financial Market Data from 1802 to the Present

- Total Asset Returns

- The Long-Term Performance of Bonds

- Gold, the Dollar, and Inflation

- Total Real Returns

- Real Returns on Fixed-Income Assets

- The Continuing Decline in Fixed-Income Returns

- The Equity Premium

- Worldwide Equity and Bond Returns

- Conclusion: Stocks for the Long Run

- Appendix 1: Stocks from 1802 to 1870

- Chapter 6 Risk, Return, and Portfolio Allocation: Why Stocks Are Less Risky Than Bonds in the Long Run

- Chapter 7 Stock Indexes: Proxies for the Market

- Chapter 8 The S&P 500 Index: More Than a Half Century of U.S. Corporate History

- Chapter 9 The Impact of Taxes on Stock and Bond Returns: Stocks Have the Edge

- Chapter 10 Sources of Shareholder Value: Earnings and Dividends

- Chapter 11 Yardsticks to Value the Stock Market

- Chapter 12 Outperforming the Market: The Importance of Size, Dividend Yields, and Price/Earnings Ratios

- Stocks That Outperform the Market

- Small- and Large-Cap Stocks

- Valuation: “Value” Stocks Offer Higher Returns Than “Growth” Stocks

- Dividend Yields

- Price/Earnings Ratios

- Price/Book Ratios

- Combining Size and Valuation Criteria

- Initial Public Offerings: The Disappointing Overall Returns on New Small-Cap Growth Companies

- The Nature of Growth and Value Stocks

- Explanations of Size and Valuation Effects

- Conclusion

- Chapter 13 Global Investing

- Chapter 5 Stock and Bond Returns Since 1802

- Part III: How The Economic Environment Impacts Stocks

- Chapter 14 Gold, Monetary Policy, and inflation

- Money and Prices

- The Gold Standard

- The Establishment of the Federal Reserve

- The Fall of the Gold Standard

- Postdevaluation Monetary Policy

- Postgold Monetary Policy

- The Federal Reserve and Money Creation

- How the Fed’s Actions Affect Interest Rates

- Stock Prices and Central Bank Policy

- Stocks as Hedges Against Inflation

- Why Stocks Fail as a Short-Term Inflation Hedge

- Conclusion

- Chapter 15 Stocks and the Business Cycle

- Chapter 16 When World Events impact Financial Markets

- Chapter 17 Stocks, Bonds, and the Flow of Economic data

- Chapter 14 Gold, Monetary Policy, and inflation

- Part IV: Stock Fluctuations in The Short Run

- Chapter 18 Exchange-Traded Funds, Stock Index Futures, and Options

- Exchange-Traded Funds

- Stock Index Futures

- Basics of the Futures Markets

- Index Arbitrage

- Predicting the New York Open with Globex Trading

- Double and Triple Witching

- Margin and Leverage

- Tax Advantages of ETFS and Futures

- Where to Put Your Indexed Investments: ETFS, Futures, or Index Mutual Funds?

- Index Options

- The Importance of Indexed Products

- Chapter 19 Market Volatility

- The Stock Market Crash of October 1987

- The Causes of the October 1987 Crash

- Circuit Breakers

- Flash Crash—May 6, 2010

- The Nature of Market Volatility

- Historical Trends of Stock Volatility

- The Volatility Index

- The Distribution of Large Daily Changes

- The Economics of Market Volatility

- The Significance of Market Volatility

- Chapter 20 Technical Analysis and Investing with the Trend

- Chapter 21 Calendar Anomalies

- Chapter 22 Behavioral Finance and the Psychology of Investing

- Chapter 18 Exchange-Traded Funds, Stock Index Futures, and Options

- Part V: Building Wealth Through Stocks

- Chapter 23 Fund Performance, indexing, and Beating the Market

- The Performance of Equity Mutual Funds

- Finding Skilled Money Managers

- Reasons for Underperformance of Managed Money

- A Little Learning is a Dangerous Thing

- Profiting from Informed Trading

- How Costs Affect Returns

- The Increased Popularity of Passive Investing

- The Pitfalls of Capitalization-Weighted Indexing

- Fundamentally Weighted Versus Capitalization-Weighted Indexation

- The History of Fundamentally Weighted Indexation

- Conclusion

- Chapter 24 Structuring a Portfolio for Long-Term Growth

- Chapter 23 Fund Performance, indexing, and Beating the Market

- Notes

- Index

STOCKS

for the

LONG

RUN

This page intentionally left blank

FIFTH EDITION

STOCKS

for the

LONG

RUN

THE DEFINITIVE GUIDE TO FINANCIAL MARKET

RETURNS & LONG-TERM INVESTMENT STRATEGIES

JEREMY J. SIEGEL

Russell E. Palmer Professor of Finance

The Wharton School

University of Pennsylvania

New York Chicago San Francisco

Athens London Madrid Mexico City

Milan New Delhi Singapore Sydney Toronto

Copyright © 2014, 2008, 2002, 1998, 1994 by Jeremy J. Siegel. All rights reserved. Except as permited under the United States

Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a

database or retrieval system, without the prior written permission of the publisher.

ISBN: 978-0-07-180052-5

MHID: 0-07-180052-2

The material in this eBook also appears in the print version of this title: ISBN: 978-0-07-180051-8,

MHID: 0-07-180051-4.

eBook conversion by codeMantra

Version 1.0

All trademarks are trademarks of their respective owners. Rather than put a trademark symbol after every occurrence of a

trademarked name, we use names in an editorial fashion only, and to the benet of the trademark owner, with no intention of infringe-

ment of the trademark. Where such designations appear in this book, they have been printed with initial caps.

McGraw-Hill Education eBooks are available at special quantity discounts to use as premiums and sales promotions or for use in

corporate training programs. To contact a representative, please visit the Contact Us page at www.mhprofessional.com.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold

with the understanding that neither the author nor the publisher is engaged in rendering legal, accounting, futures/securities trading,

or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person

should be sought.

—From a Declaration of Principles jointly adopted by a Committee

of the American Bar Association and a Committee of Publishers

TERMS OF USE

This is a copyrighted work and McGraw-Hill Education and its licensors reserve all rights in and to the work. Use of this work is

subject to these terms. Except as permitted under the Copyright Act of 1976 and the right to store and retrieve one copy of the work,

you may not decompile, disassemble, reverse engineer, reproduce, modify, create derivative works based upon, transmit, distribute,

disseminate, sell, publish or sublicense the work or any part of it without McGraw-Hill Education’s prior consent. You may use the

work for your own noncommercial and personal use; any other use of the work is strictly prohibited. Your right to use the work may

be terminated if you fail to comply with these terms.

THE WORK IS PROVIDED “AS IS.” McGRAW-HILL EDUCATION AND ITS LICENSORS MAKE NO GUARANTEES OR

WARRANTIES AS TO THE ACCURACY, ADEQUACY OR COMPLETENESS OF OR RESULTS TO BE OBTAINED FROM

USING THE WORK, INCLUDING ANY INFORMATION THAT CAN BE ACCESSED THROUGH THE WORK VIA

HYPERLINK OR OTHERWISE, AND EXPRESSLY DISCLAIM ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING

BUT NOT LIMITED TO IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE.

McGraw-Hill Education and its licensors do not warrant or guarantee that the functions contained in the work will meet your

requirements or that its operation will be uninterrupted or error free. Neither McGraw-Hill Education nor its licensors shall be liable

to you or anyone else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages resulting therefrom.

McGraw-Hill Education has no responsibility for the content of any information accessed through the work. Under no circumstances

shall McGraw-Hill Education and/or its licensors be liable for any indirect, incidental, special, punitive, consequential or similar

damages that result from the use of or inability to use the work, even if any of them has been advised of the possibility of such

damages. This limitation of liability shall apply to any claim or cause whatsoever whether such claim or cause arises in contract,

tort or otherwise.

Foreword xvii

Preface xix

Acknowledgments xxiii

PART I

STOCK RETURNS: PAST, PRESENT, AND FUTURE

Chapter 1

The Case for Equity

Historical Facts and Media Fiction 3

“Everybody Ought to Be Rich” 3

Asset Returns Since 1802 5

Historical Perspectives on Stocks as Investments 7

The Influence of Smith’s Work 8

Common Stock Theory of Investment 8

The Market Peak 9

Irving Fisher’s “Permanently High Plateau” 9

A Radical Shift in Sentiment 10

The Postcrash View of Stock Returns 11

The Great Bull Market of 1982–2000 12

Warnings of Overvaluation 14

The Late Stage of the Great Bull Market, 1997–2000 15

The Top of the Market 16

The Tech Bubble Bursts 16

v

CONTENTS

Rumblings of the Financial Crisis 17

Beginning of the End for Lehman Brothers 18

Chapter 2

The Great Financial Crisis of 2008

Its Origins, Impact, and Legacy 21

The Week That Rocked World Markets 21

Could the Great Depression Happen Again? 22

The Cause of the Financial Crisis 23

The Great Moderation 23

Subprime Mortgages 24

The Crucial Rating Mistake 25

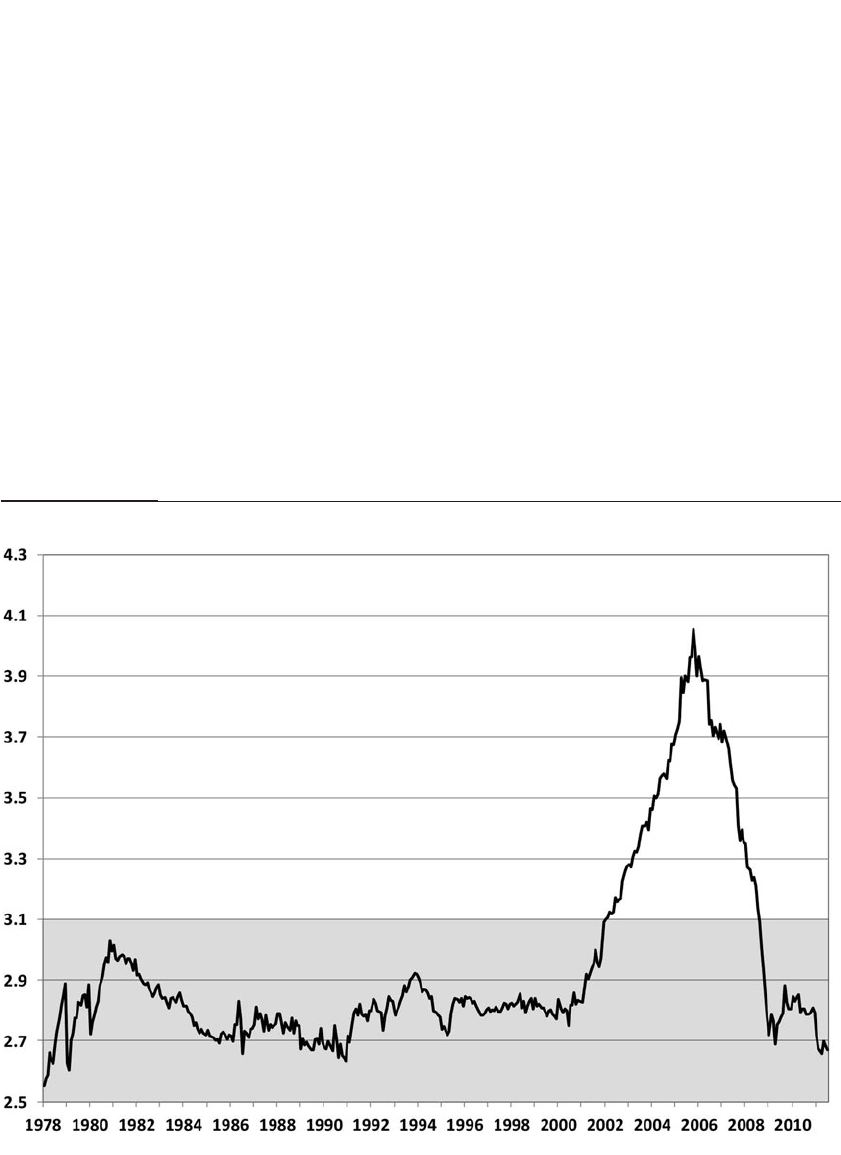

The Real Estate Bubble 28

Regulatory Failure 30

Overleverage by Financial Institutions in Risky Assets 31

The Role of the Federal Reserve in Mitigating the Crisis 32

The Lender of Last Resort Springs to Action 32

Should Lehman Brothers Have Been Saved? 34

Reflections on the Crisis 36

Chapter 3

The Markets, the Economy, and Government Policy

in the Wake of the Crisis 39

Avoiding Deflation 41

Reaction of the Financial Markets to the Financial Crisis 41

Stocks 41

Real Estate 45

Treasury Bond Markets 45

The LIBOR Market 46

Commodity Markets 47

Foreign Currency Markets 48

Impact of the Financial Crisis on Asset Returns and Correlations 48

Decreased Correlations 50

Legislative Fallout from the Financial Crisis 52

Concluding Comments 55

vi CONTENTS

Chapter 4

The Entitlement Crisis

Will the Age Wave Drown the Stock Market? 57

The Realities We Face 58

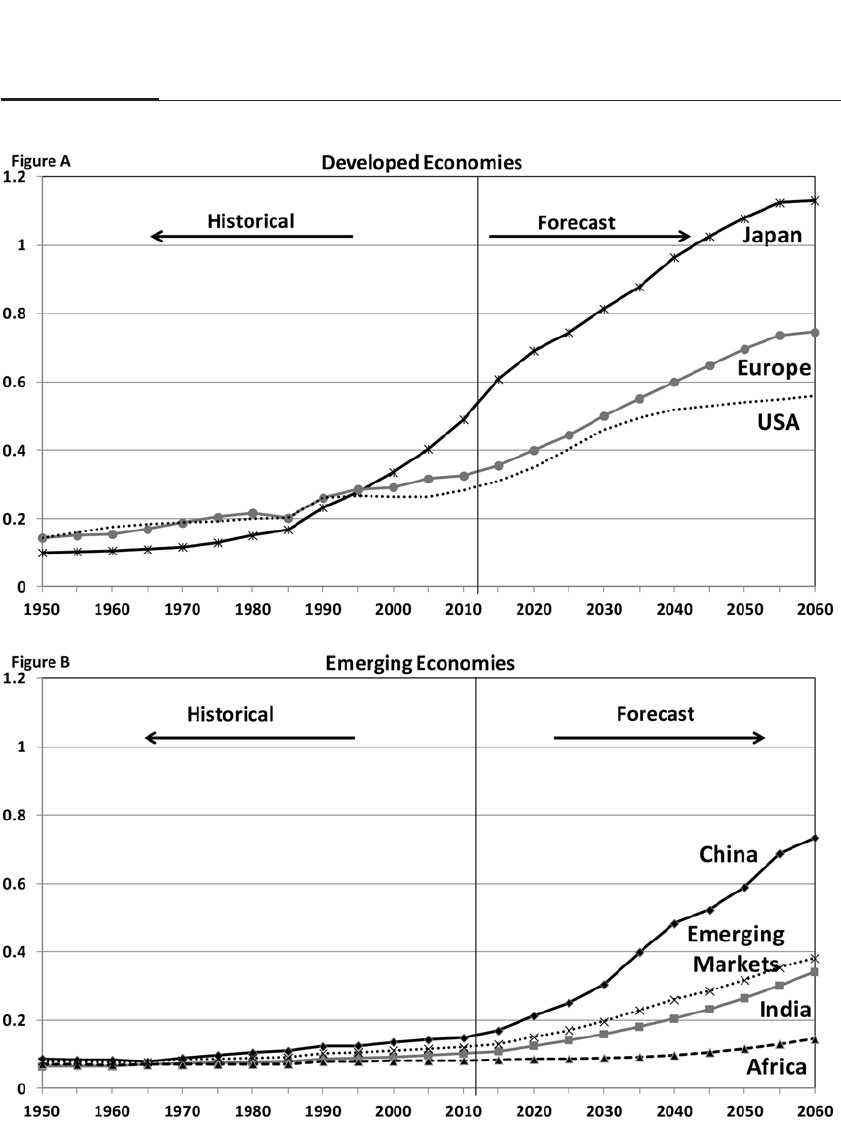

The Age Wave 58

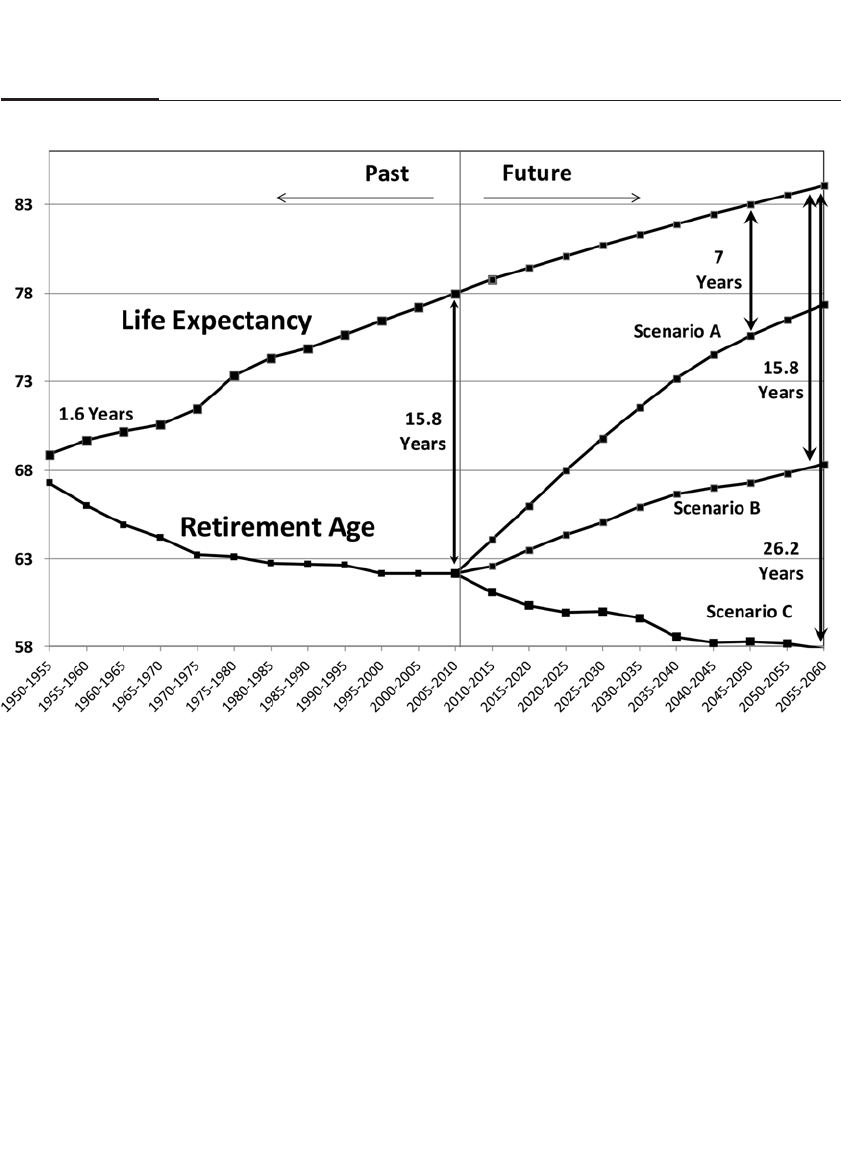

Rising Life Expectancy 59

Falling Retirement Age 59

The Retirement Age Must Rise 60

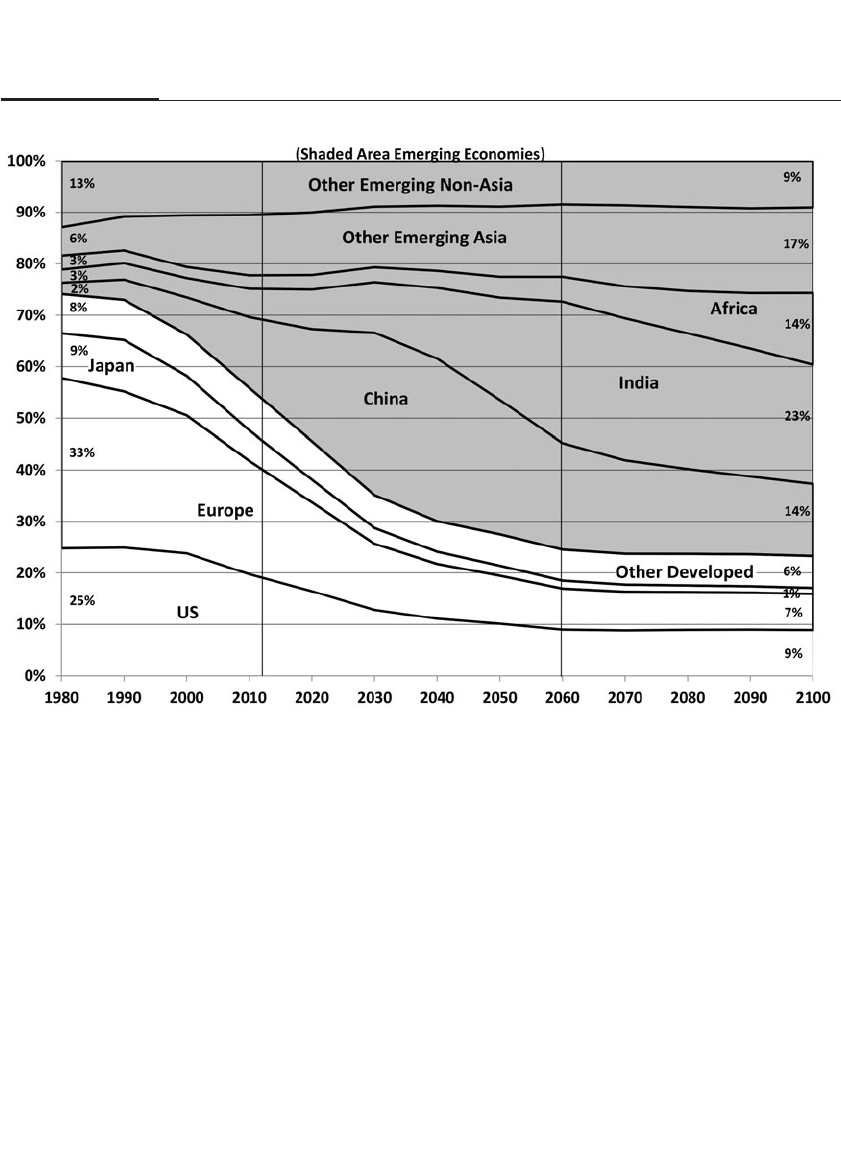

World Demographics and the Age Wave 62

Fundamental Question 64

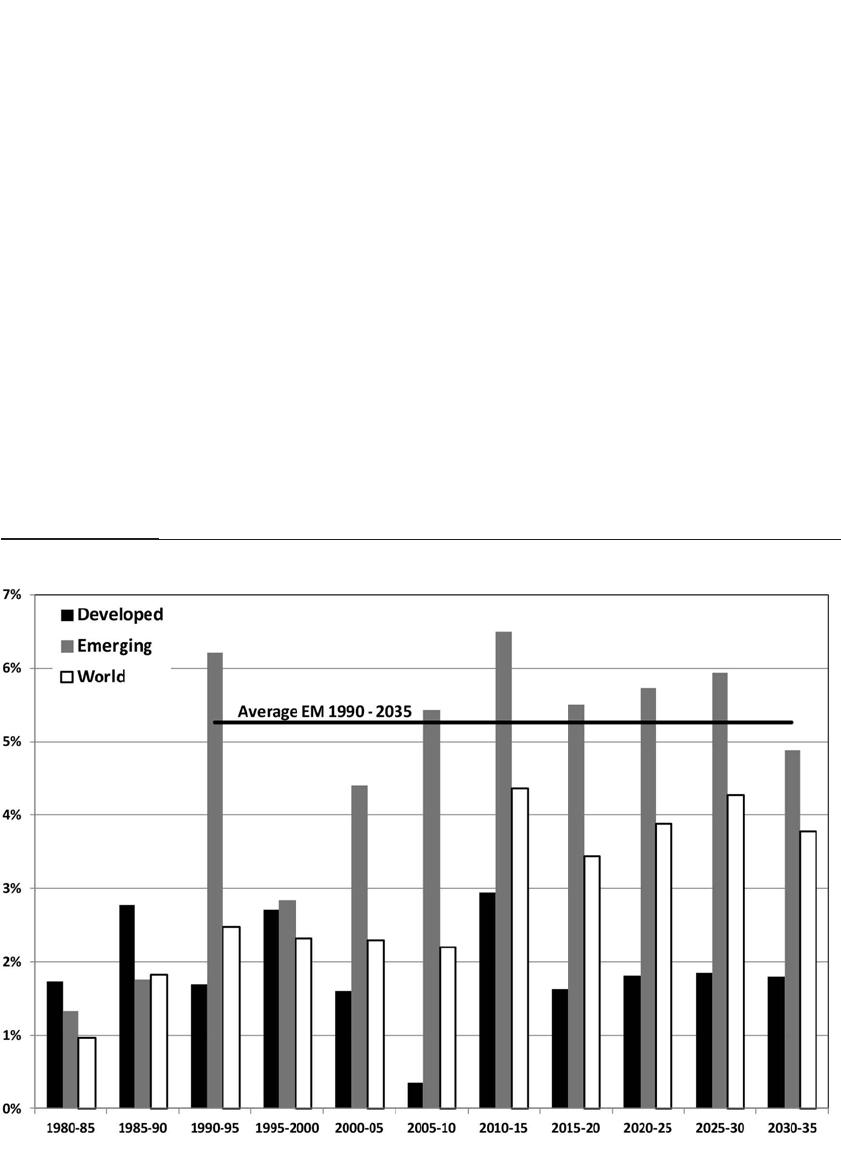

Emerging Economies Can Fill the Gap 68

Can Productivity Growth Keep Pace? 69

Conclusion 71

PART II

THE VERDICT OF HISTORY

Chapter 5

Stock and Bond Returns Since 1802 75

Financial Market Data from 1802 to the Present 75

Total Asset Returns 76

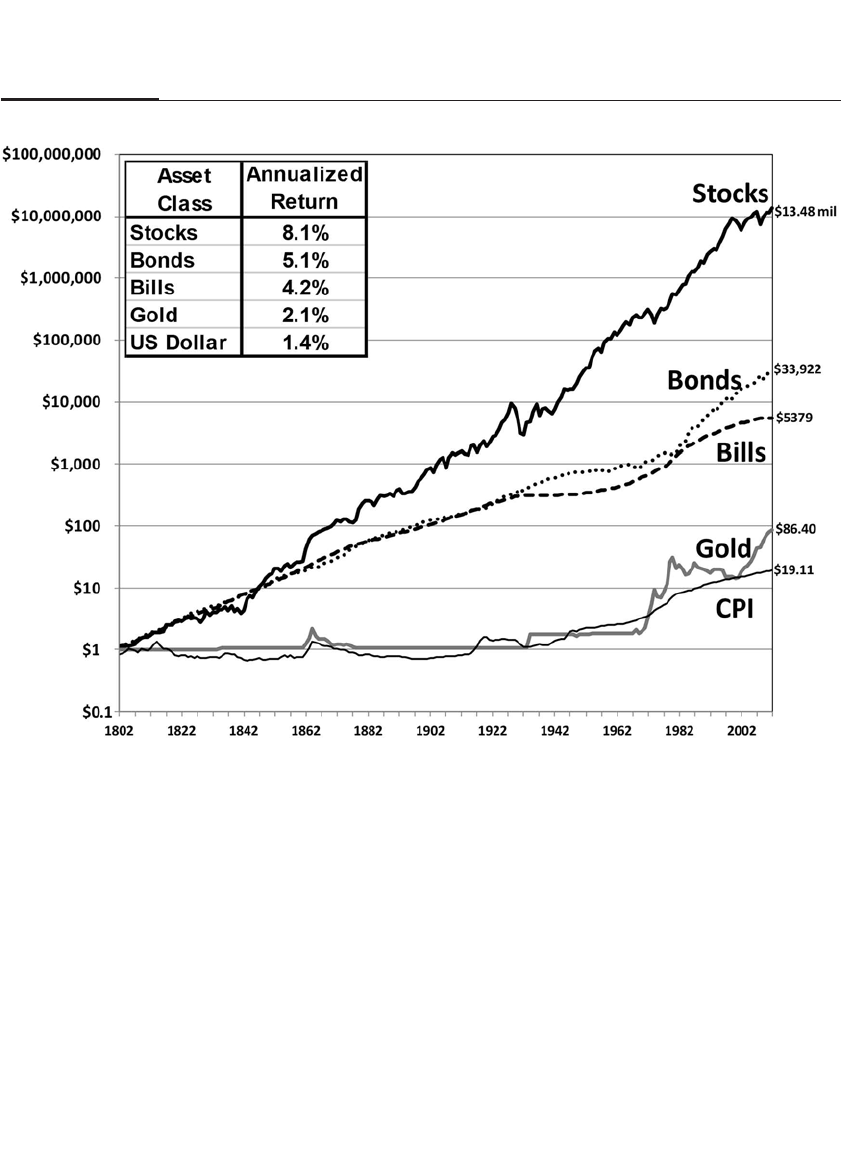

The Long-Term Performance of Bonds 78

Gold, the Dollar, and Inflation 79

Total Real Returns 81

Real Returns on Fixed-Income Assets 84

The Continuing Decline in Fixed-Income Returns 86

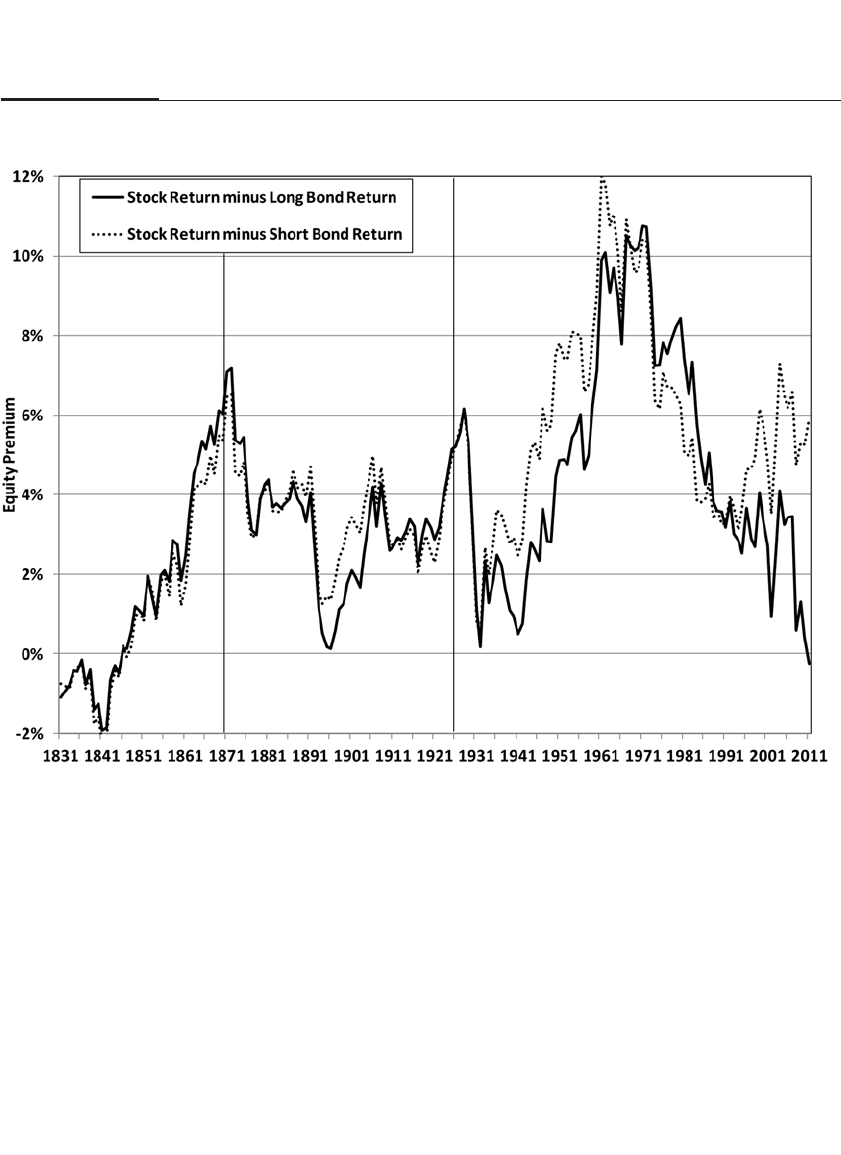

The Equity Premium 87

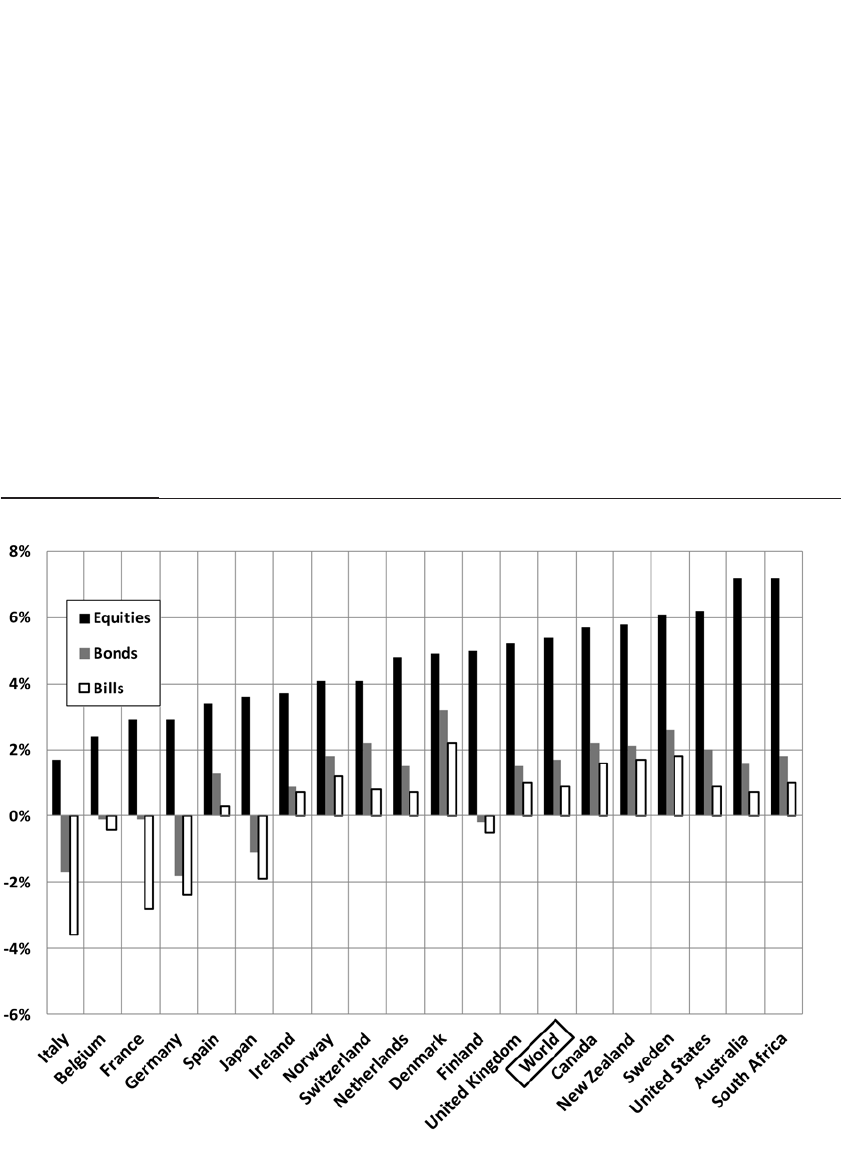

Worldwide Equity and Bond Returns 88

Conclusion: Stocks for the Long Run 90

Appendix 1: Stocks from 1802 to 1870 91

Chapter 6

Risk, Return, and Portfolio Allocation

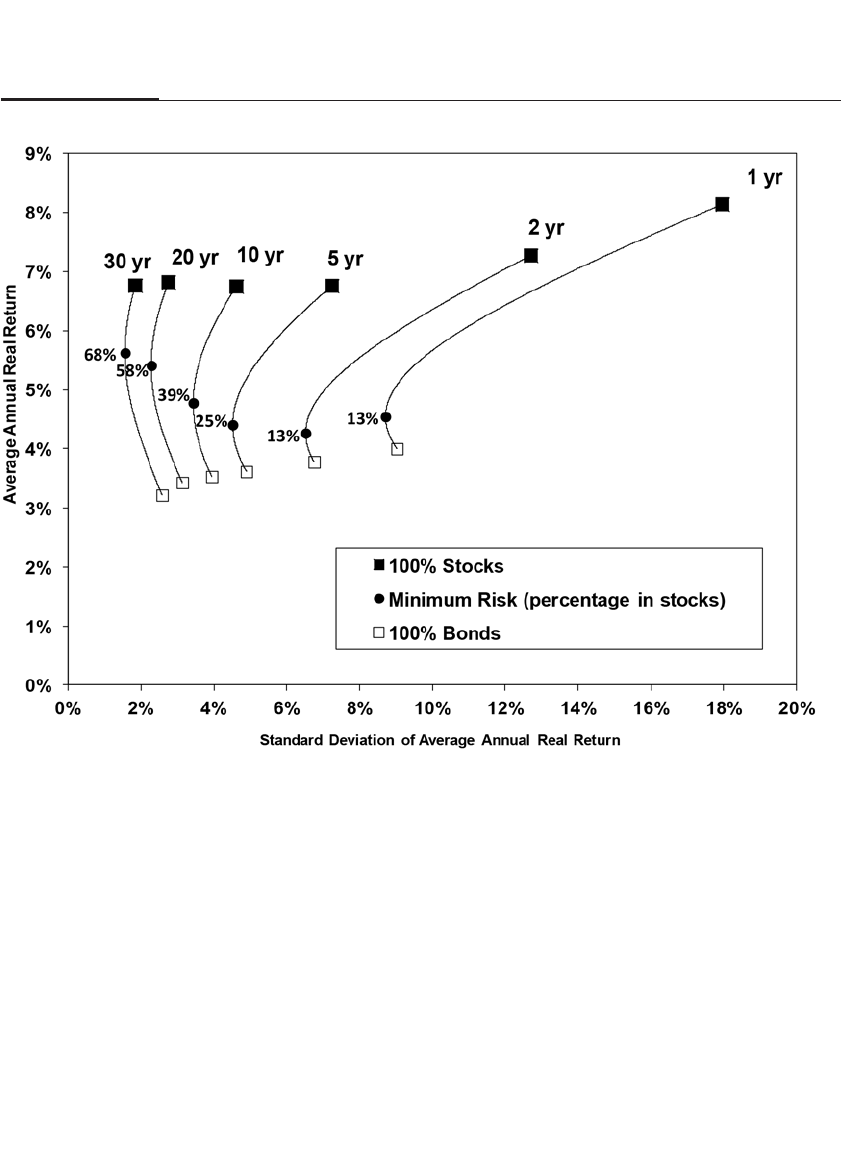

Why Stocks Are Less Risky Than Bonds in the Long Run 93

Measuring Risk and Return 93

CONTENTS vii

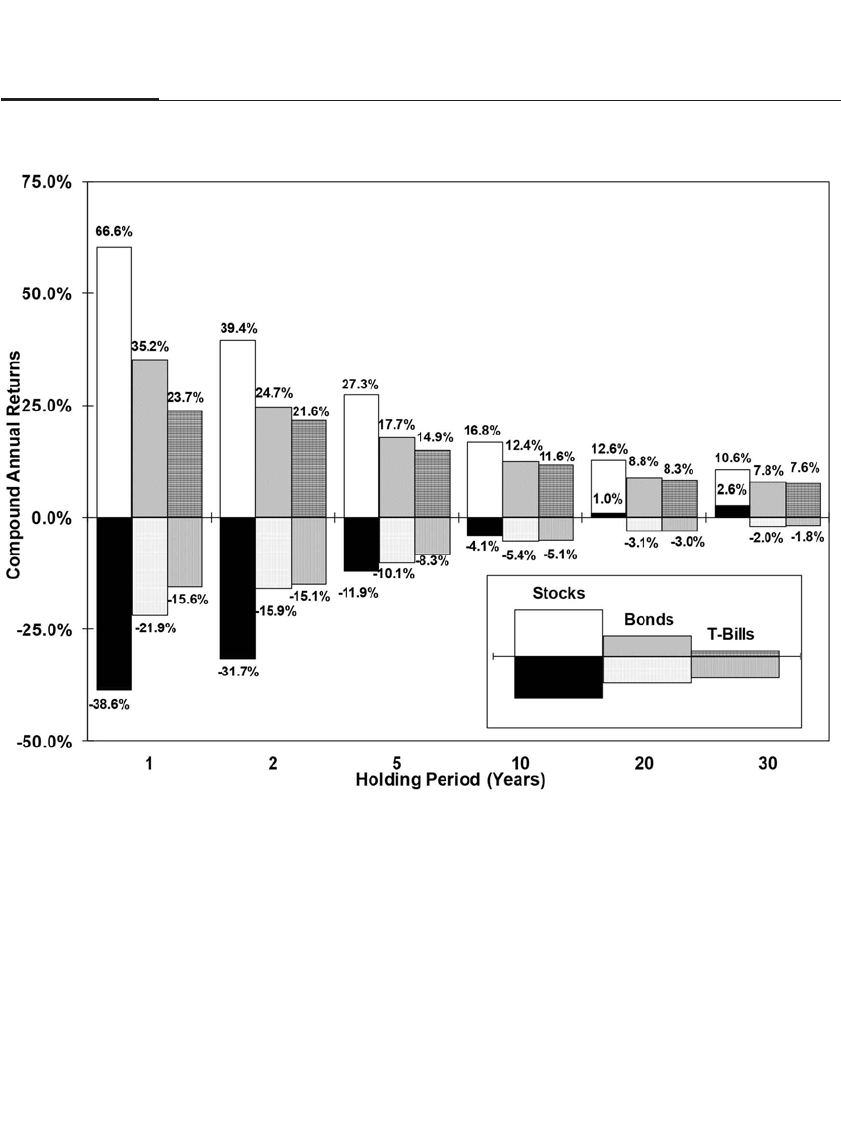

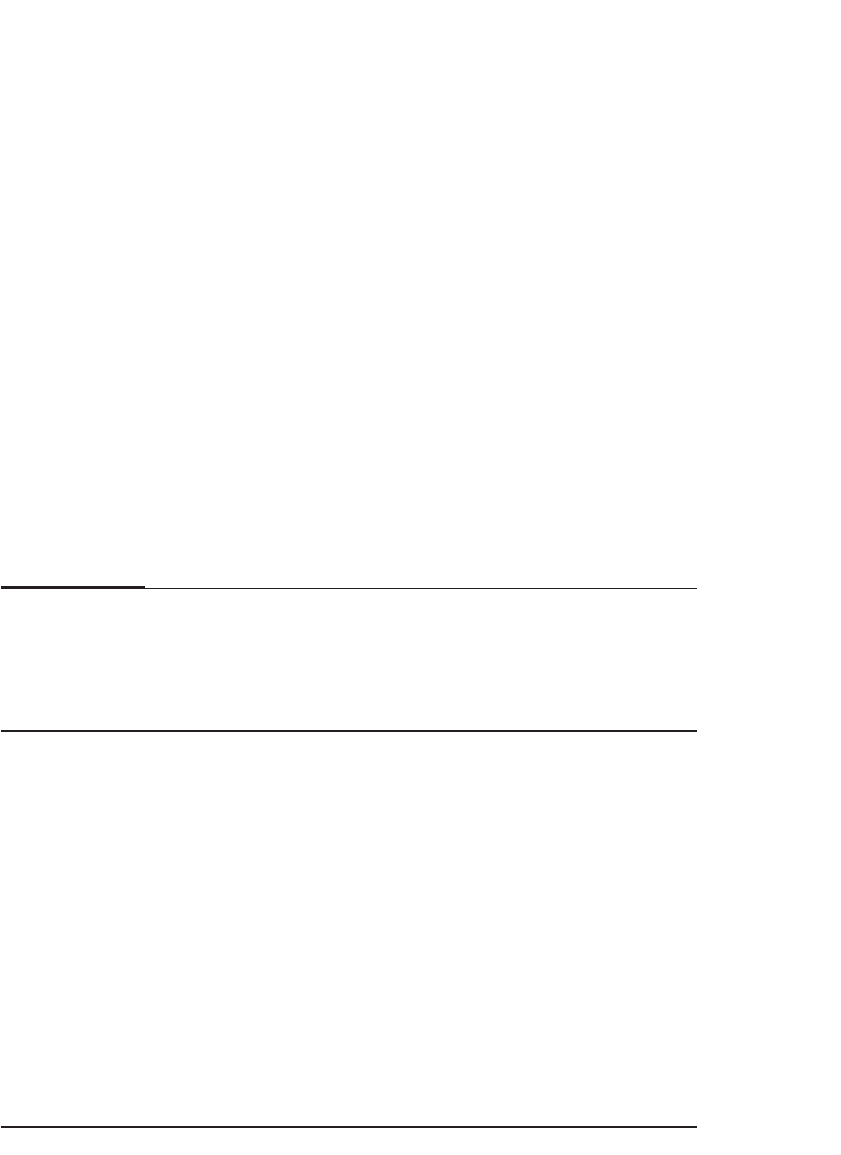

Risk and Holding Period 94

Standard Measures of Risk 97

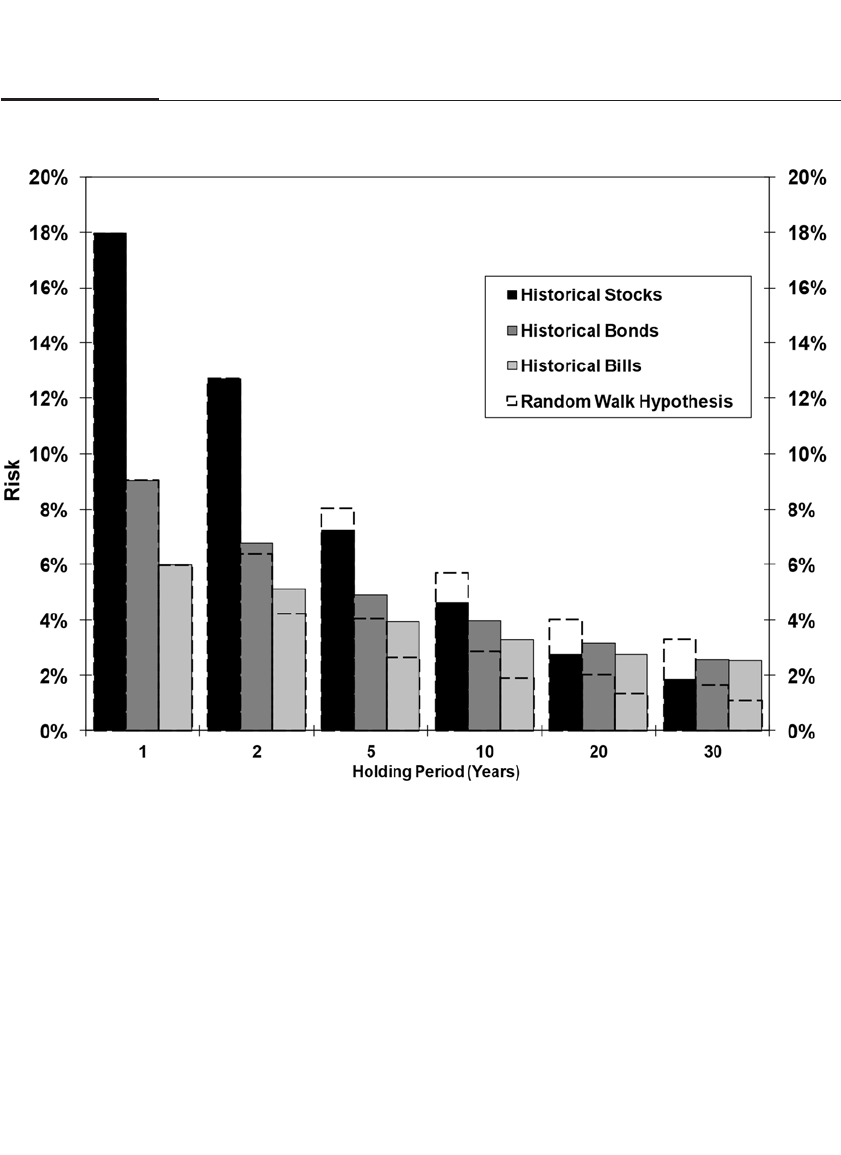

Varying Correlation Between Stock and Bond Returns 99

Efficient Frontiers 101

Conclusion 102

Chapter 7

Stock Indexes

Proxies for the Market 105

Market Averages 105

The Dow Jones Averages 106

Computation of the Dow Index 108

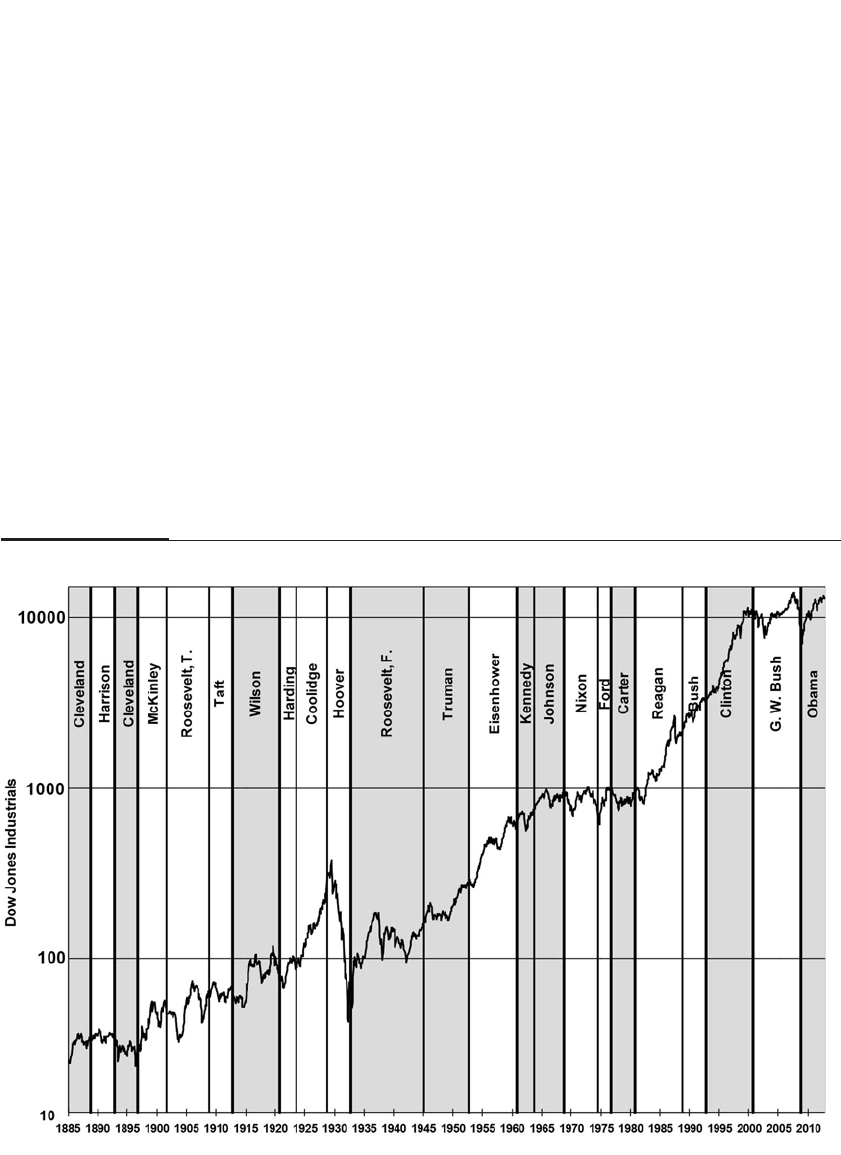

Long-Term Trends in the Dow Jones Industrial Average 108

Beware the Use of Trendlines to Predict Future Returns 109

Value-Weighted Indexes 110

Standard & Poor’s Index 110

Nasdaq Index 111

Other Stock Indexes: The Center for Research in Security Prices 113

Return Biases in Stock Indexes 113

Appendix: What Happened to the Original 12 Dow Industrials? 115

Chapter 8

The S&P 500 Index

More Than a Half Century of U.S. Corporate History 119

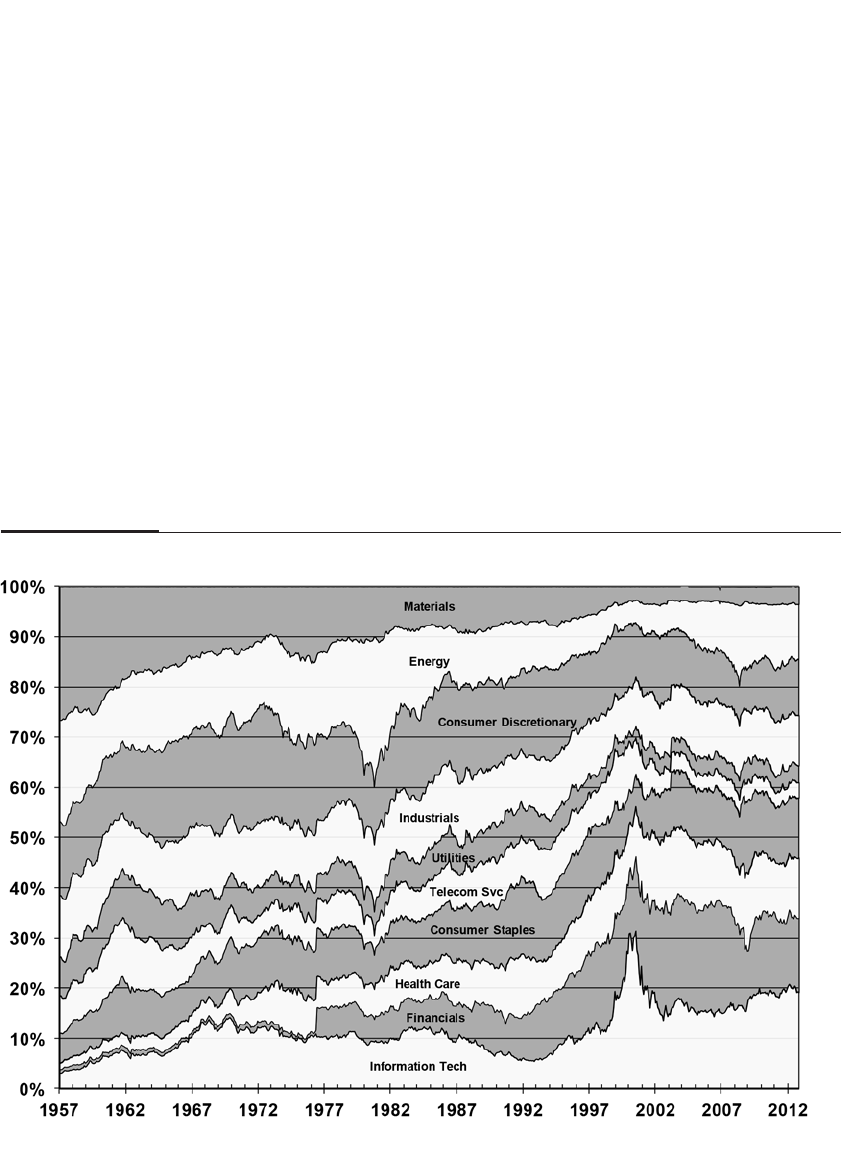

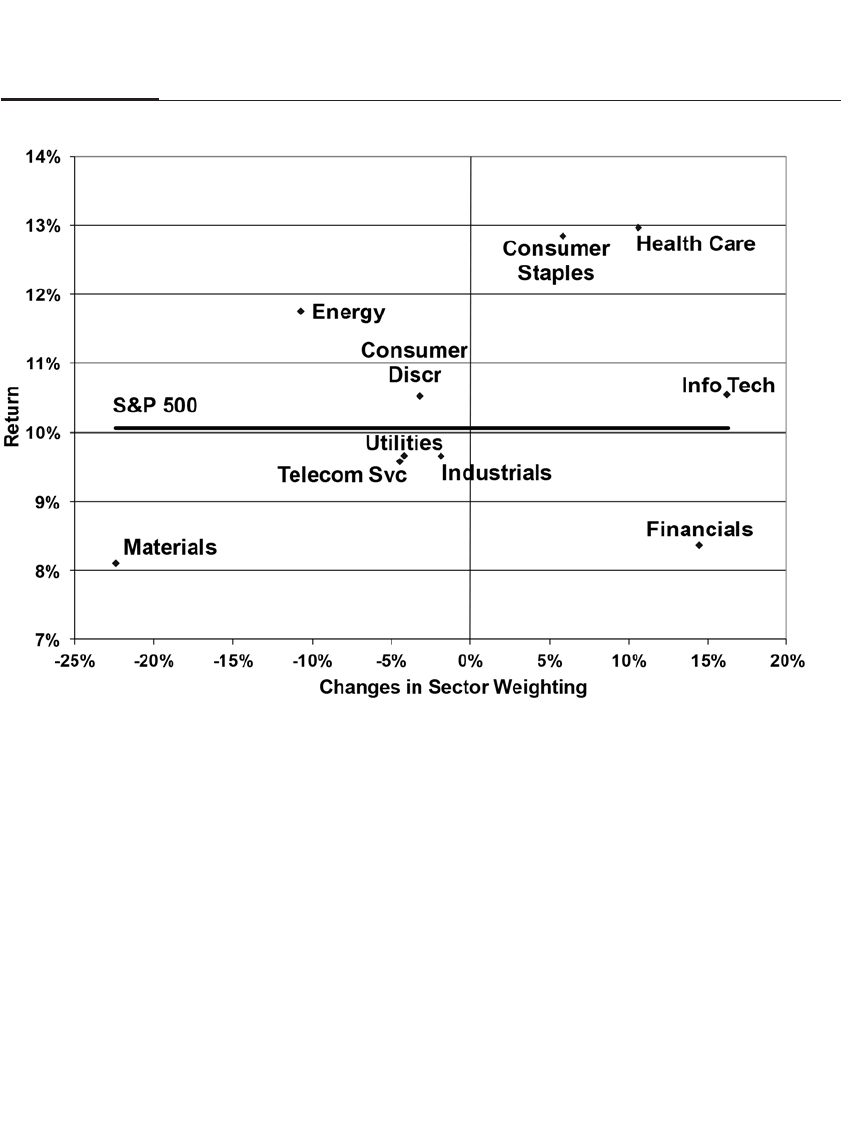

Sector Rotation in the S&P 500 Index 120

Top-Performing Firms 126

How Bad News for the Firm Becomes Good News for Investors 128

Top-Performing Survivor Firms 128

Other Firms That Turned Golden 129

Outperformance of Original S&P 500 Firms 130

Conclusion 131

Chapter 9

The Impact of Taxes on Stock and Bond Returns

Stocks Have the Edge 133

Historical Taxes on Income and Capital Gains 133

viii CONTENTS

Before- and After-Tax Rates of Return 135

The Benefits of Deferring Capital Gains Taxes 135

Inflation and the Capital Gains Tax 137

Increasingly Favorable Tax Factors for Equities 139

Stocks or Bonds in Tax-Deferred Accounts? 140

Conclusion 141

Appendix: History of the Tax Code 141

Chapter 10

Sources of Shareholder Value

Earnings and Dividends 143

Discounted Cash Flows 143

Sources of Shareholder Value 144

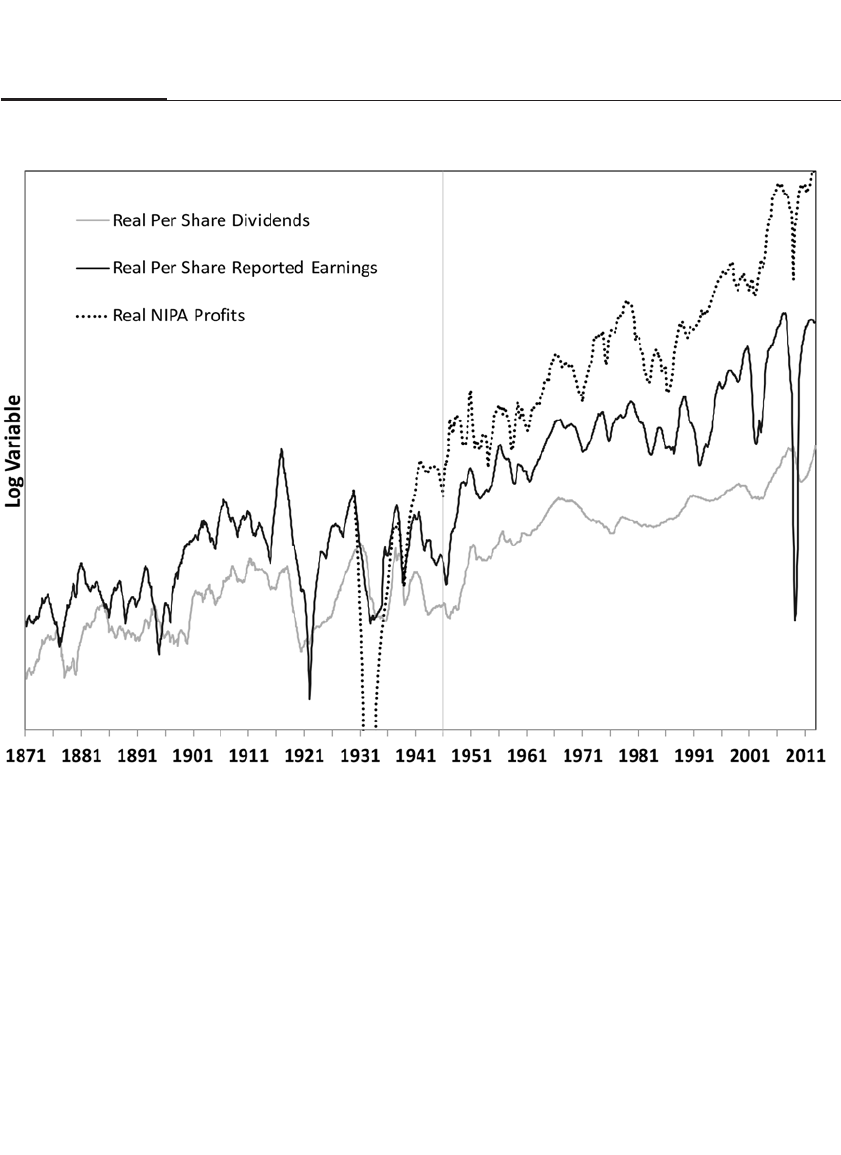

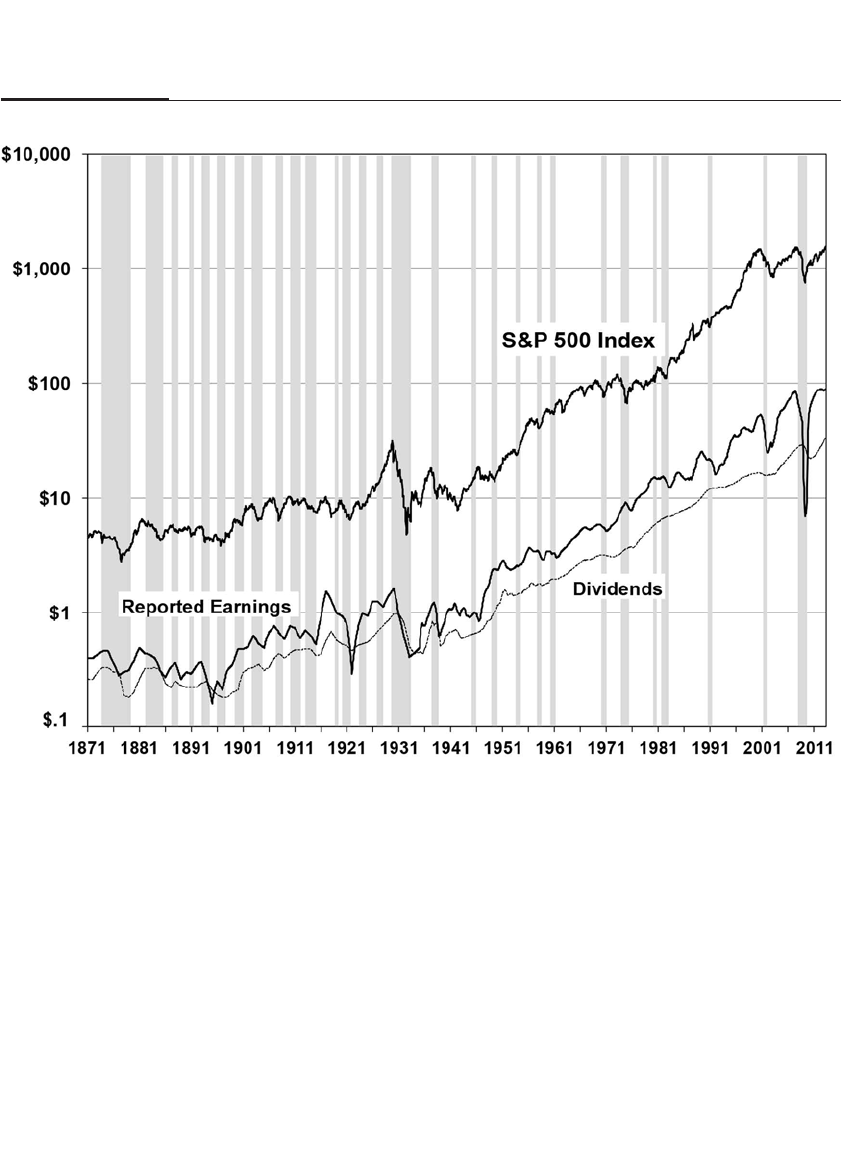

Historical Data on Dividends and Earnings Growth 145

The Gordon Dividend Growth Model of Stock Valuation 147

Discount Dividends, Not Earnings 149

Earnings Concepts 149

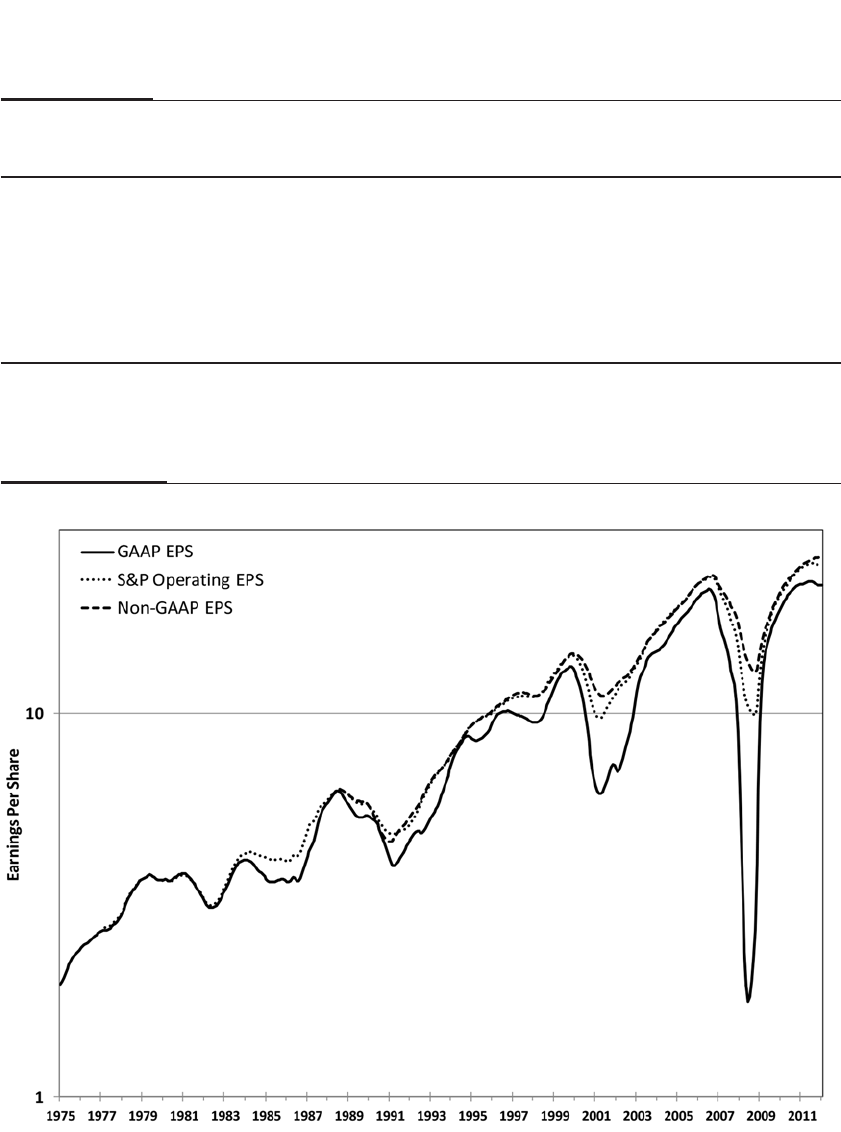

Earnings Reporting Methods 150

Operating Earnings and NIPA Profits 152

The Quarterly Earnings Report 154

Conclusion 155

Chapter 11

Yardsticks to Value the Stock Market 157

An Evil Omen Returns 157

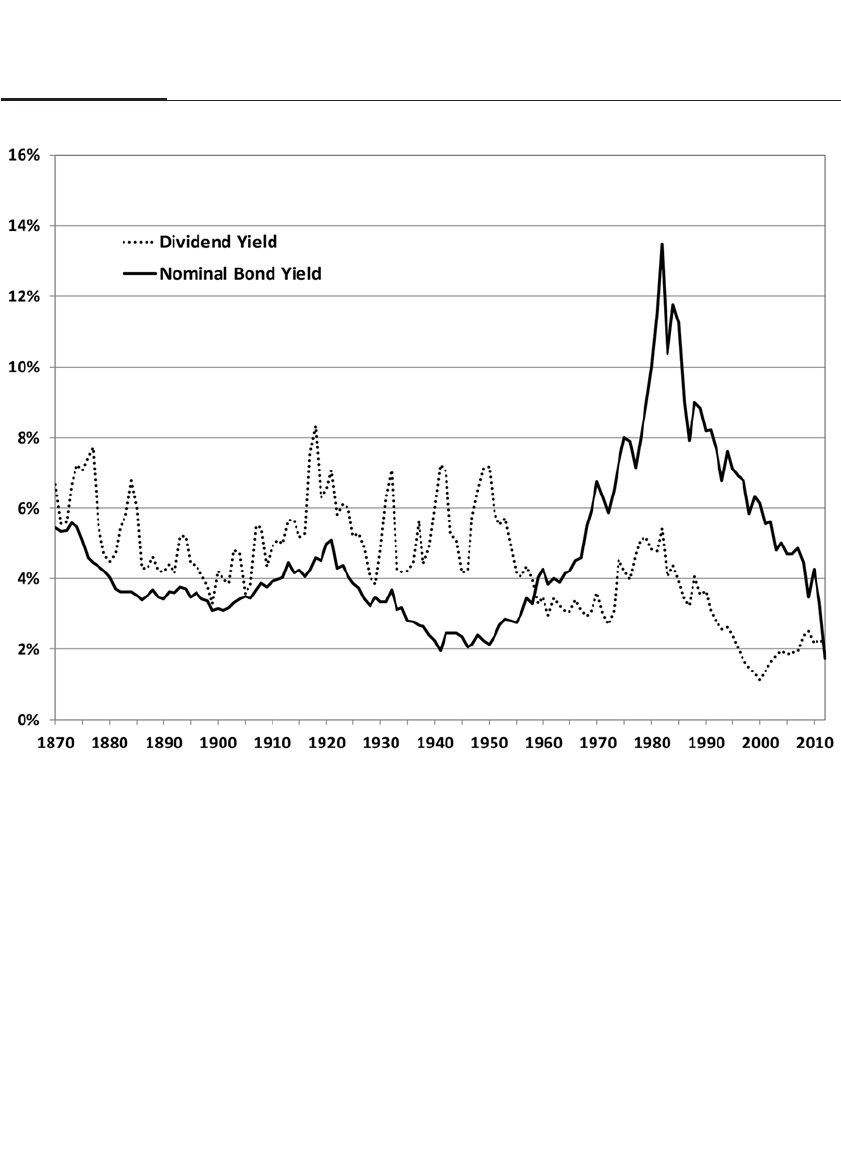

Historical Yardsticks for Valuing the Market 159

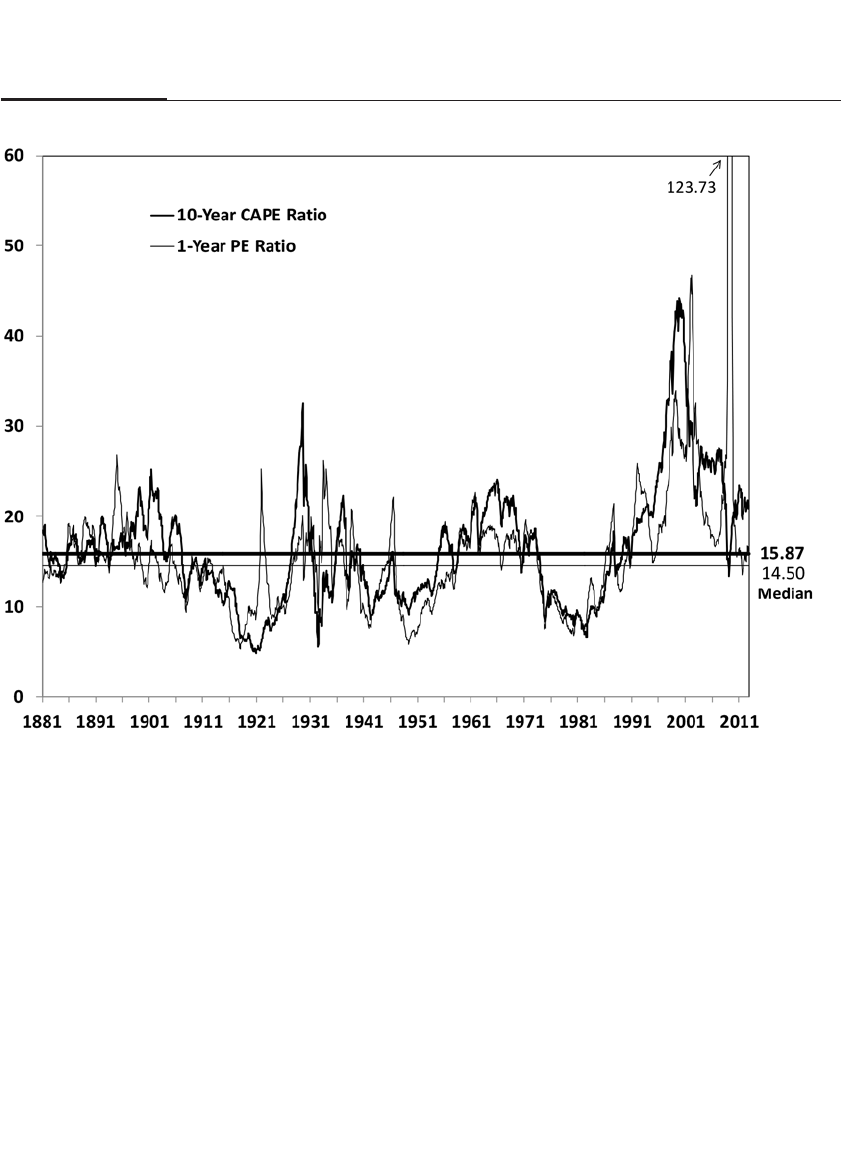

Price/Earnings Ratio and the Earnings Yield 159

The Aggregation Bias 161

The Earnings Yield 161

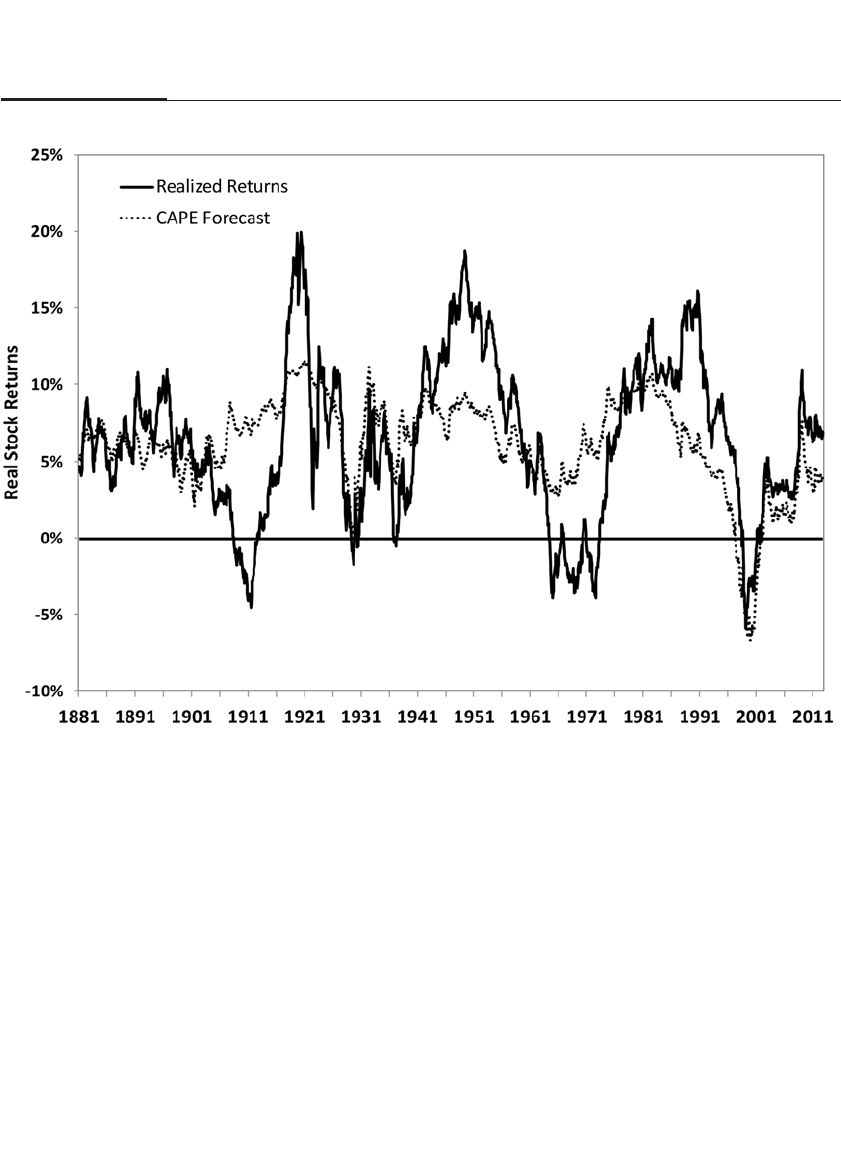

The CAPE Ratio 162

The Fed Model, Earnings Yields, and Bond Yields 164

Corporate Profits and GDP 166

Book Value, Market Value, and Tobin’s Q 166

Profit Margins 168

Factors That May Raise Future Valuation Ratios 169

A Fall in Transaction Costs 170

Lower Real Returns on Fixed-Income Assets 170

CONTENTS ix

The Equity Risk Premium 171

Conclusion 172

Chapter 12

Outperforming the Market

The Importance of Size, Dividend Yields,

and Price/Earnings Ratios 173

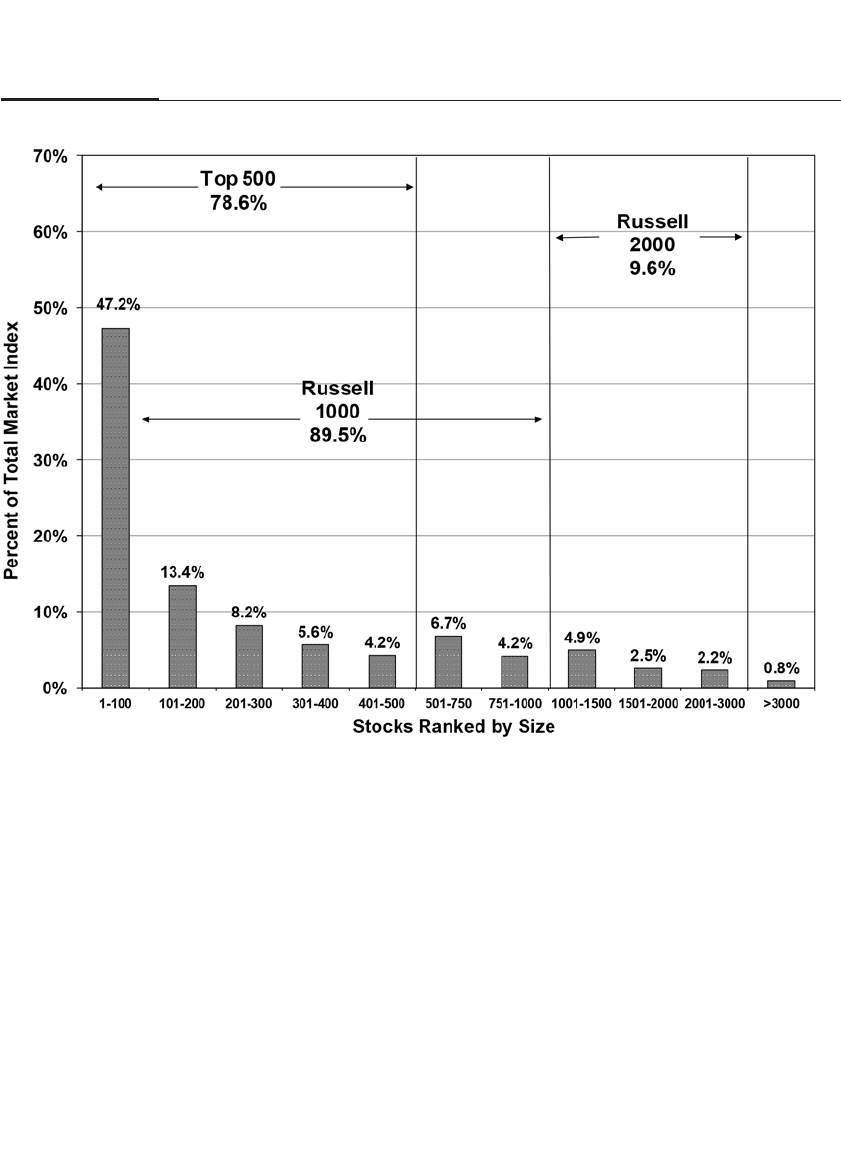

Stocks That Outperform the Market 173

What Determines a Stock’s Return? 175

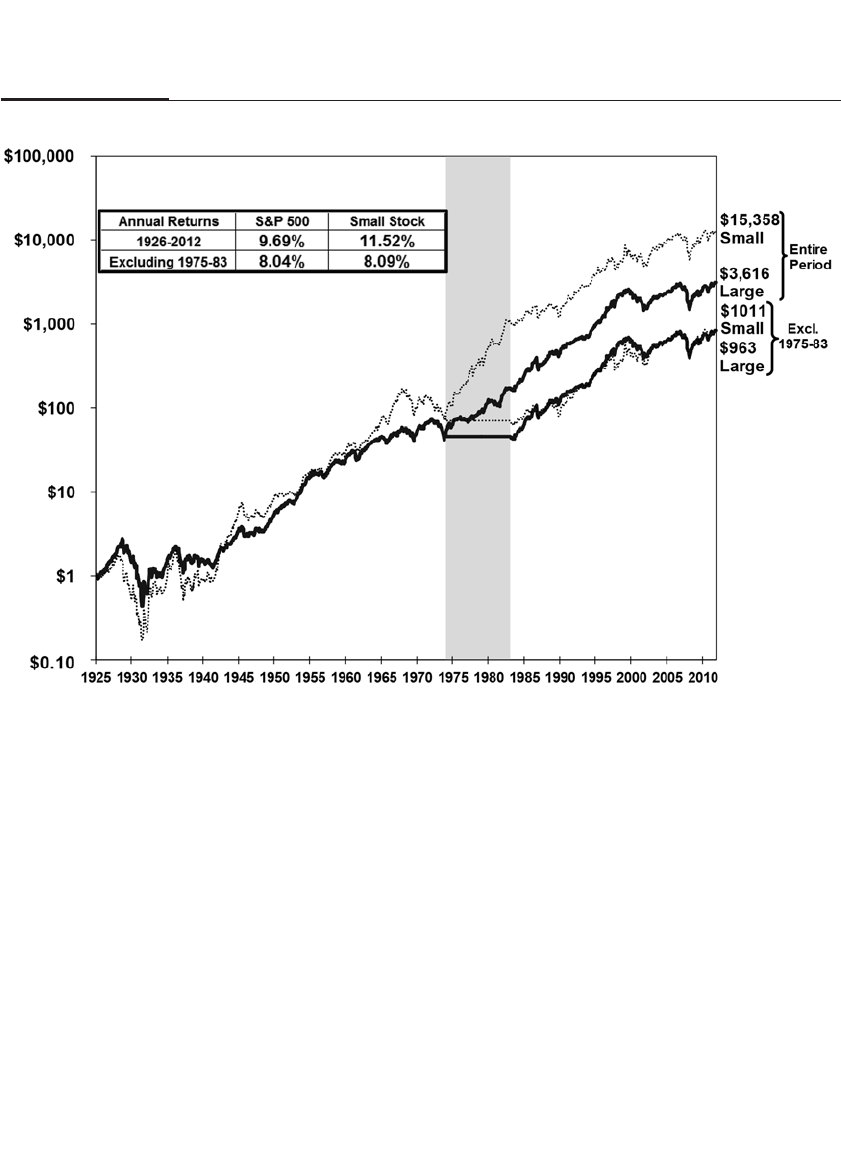

Small- and Large-Cap Stocks 176

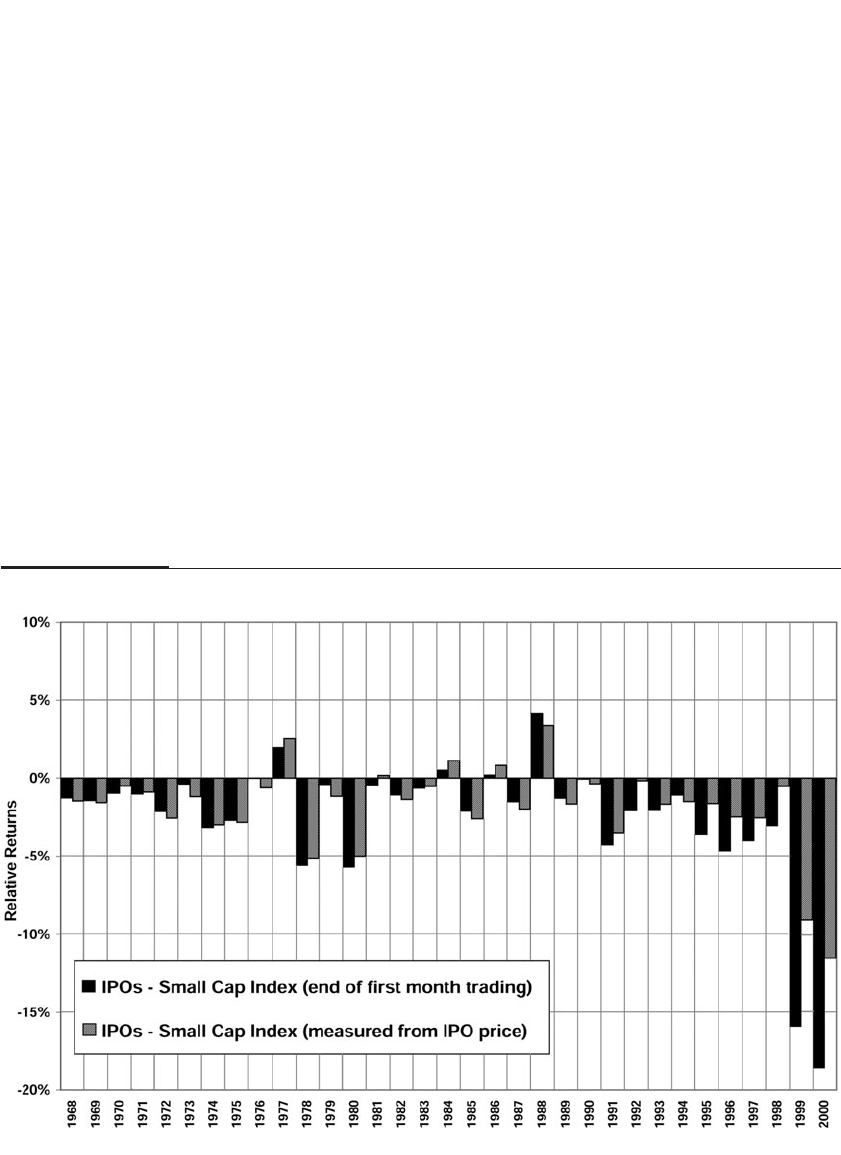

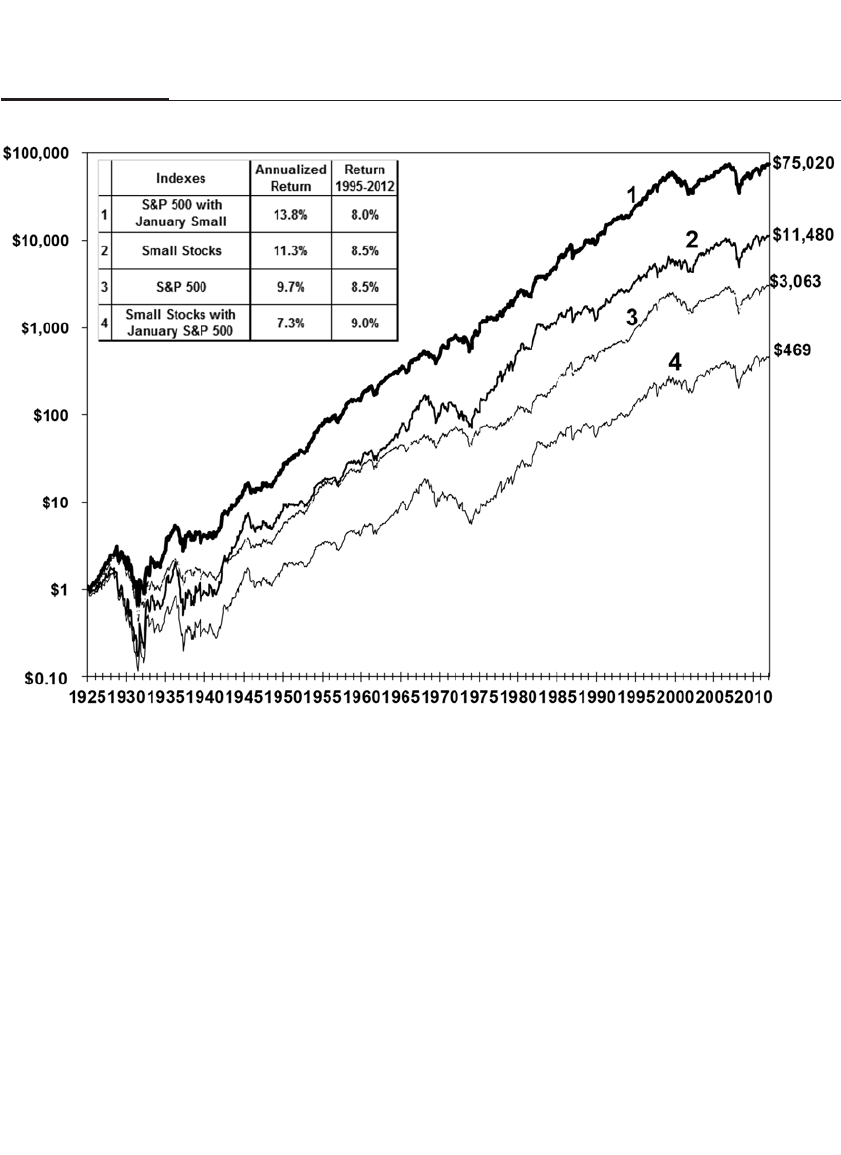

Trends in Small-Cap Stock Returns 177

Valuation: “Value” Stocks Offer Higher Returns Than “Growth” Stocks 179

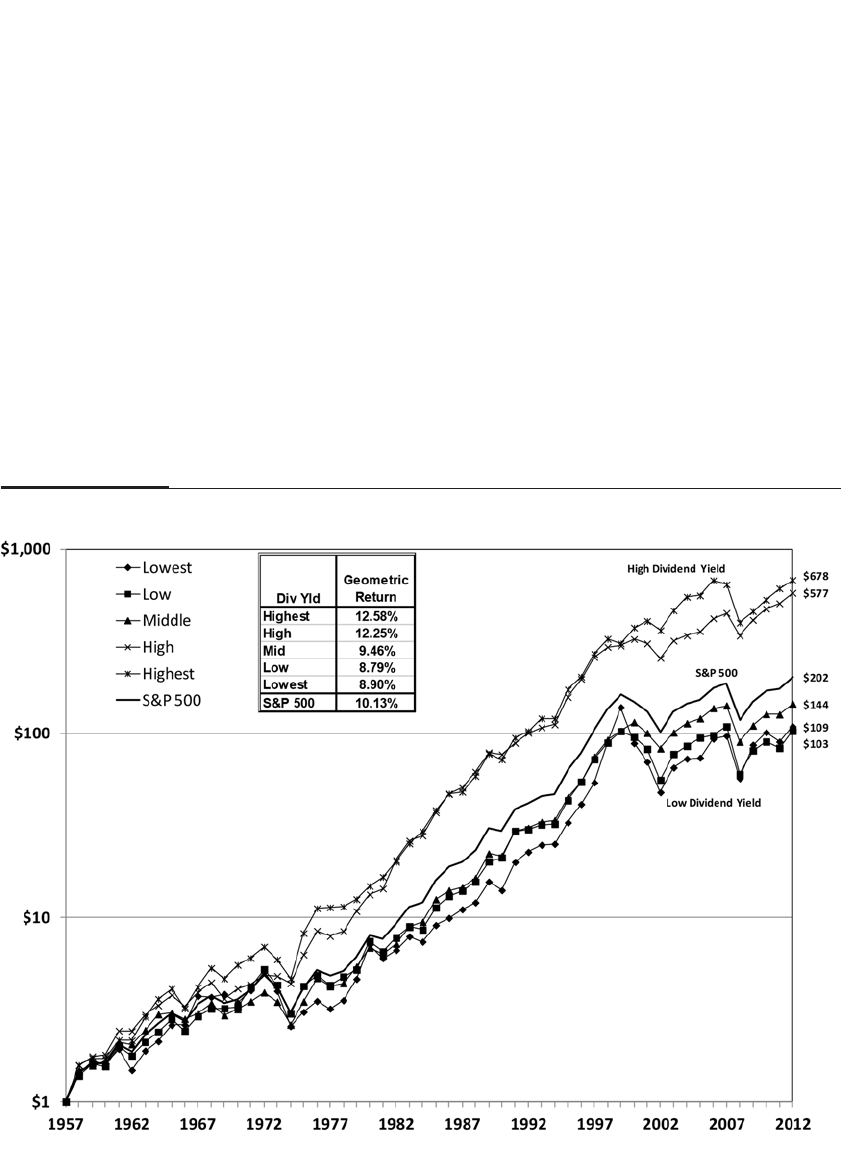

Dividend Yields 179

Other Dividend-Yield Strategies 181

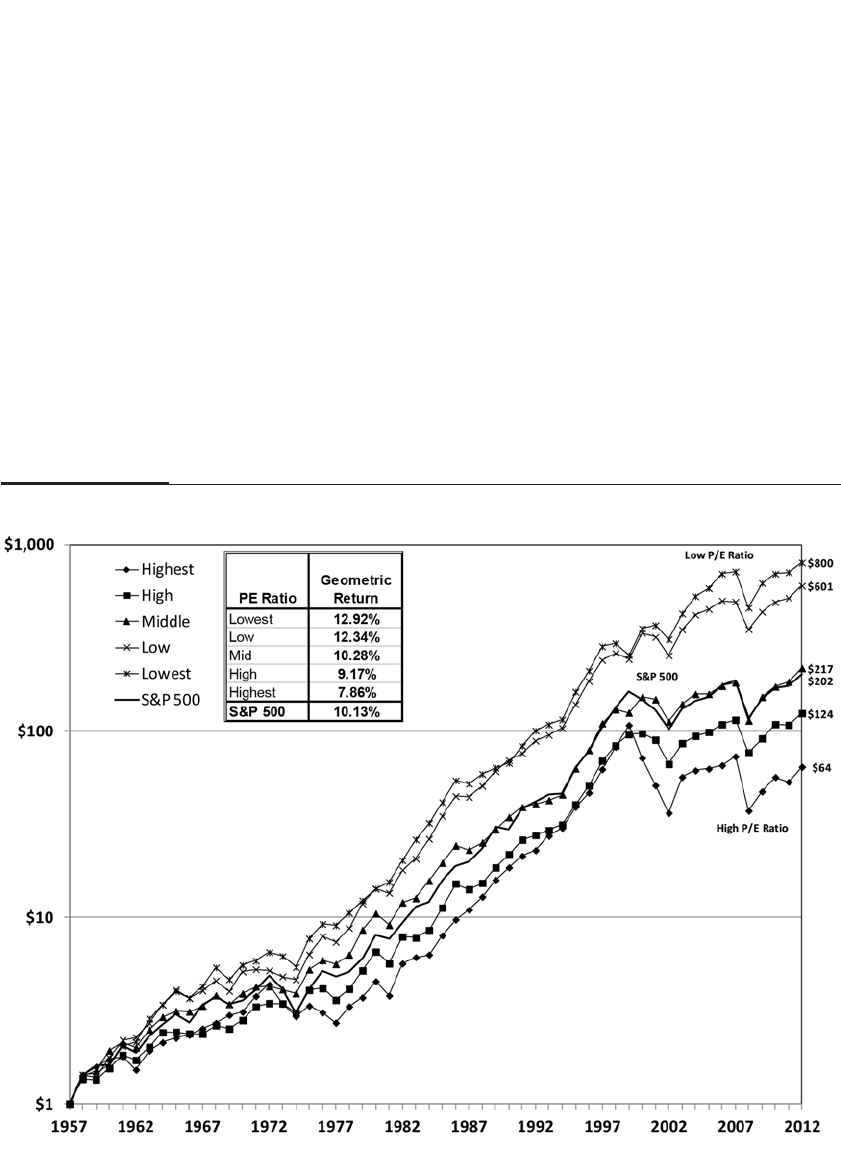

Price/Earnings Ratios 183

Price/Book Ratios 185

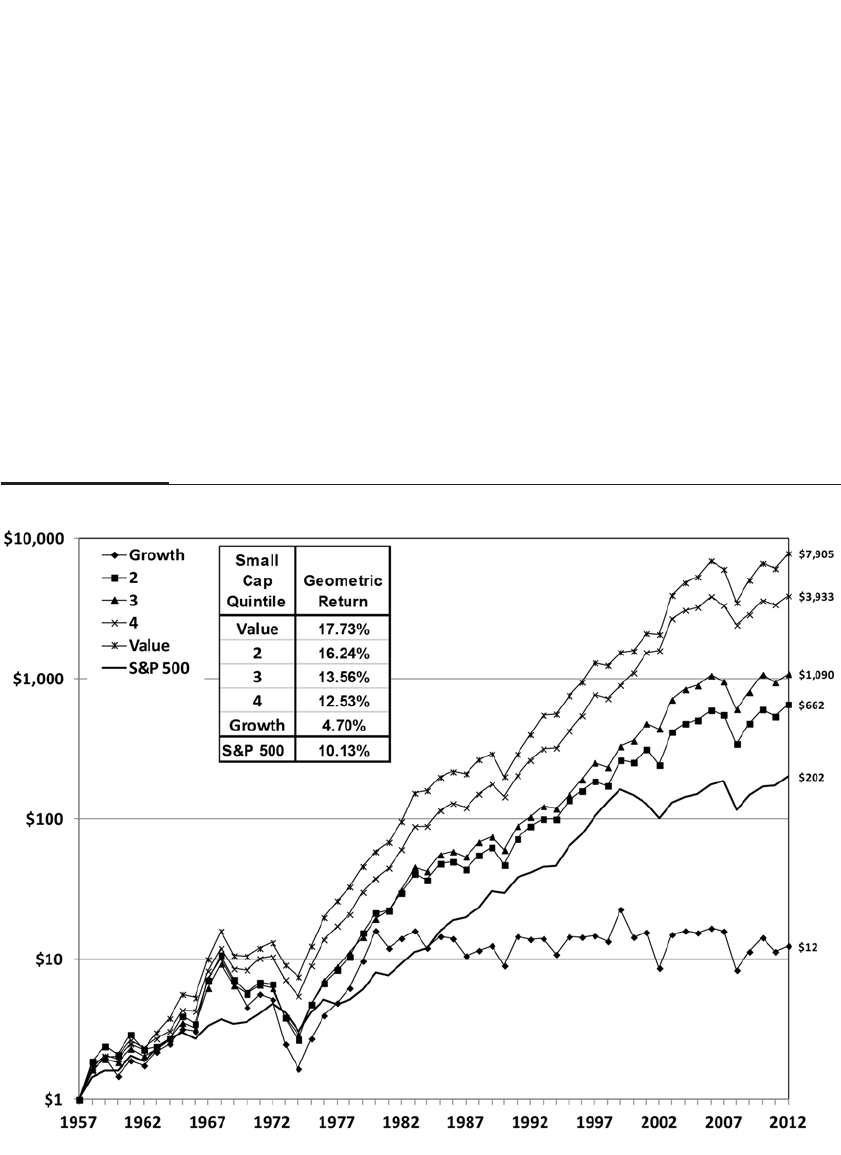

Combining Size and Valuation Criteria 186

Initial Public Offerings: The Disappointing Overall

Returns on New Small-Cap Growth Companies 188

The Nature of Growth and Value Stocks 190

Explanations of Size and Valuation Effects 191

The Noisy Market Hypothesis 191

Liquidity Investing 192

Conclusion 193

Chapter 13

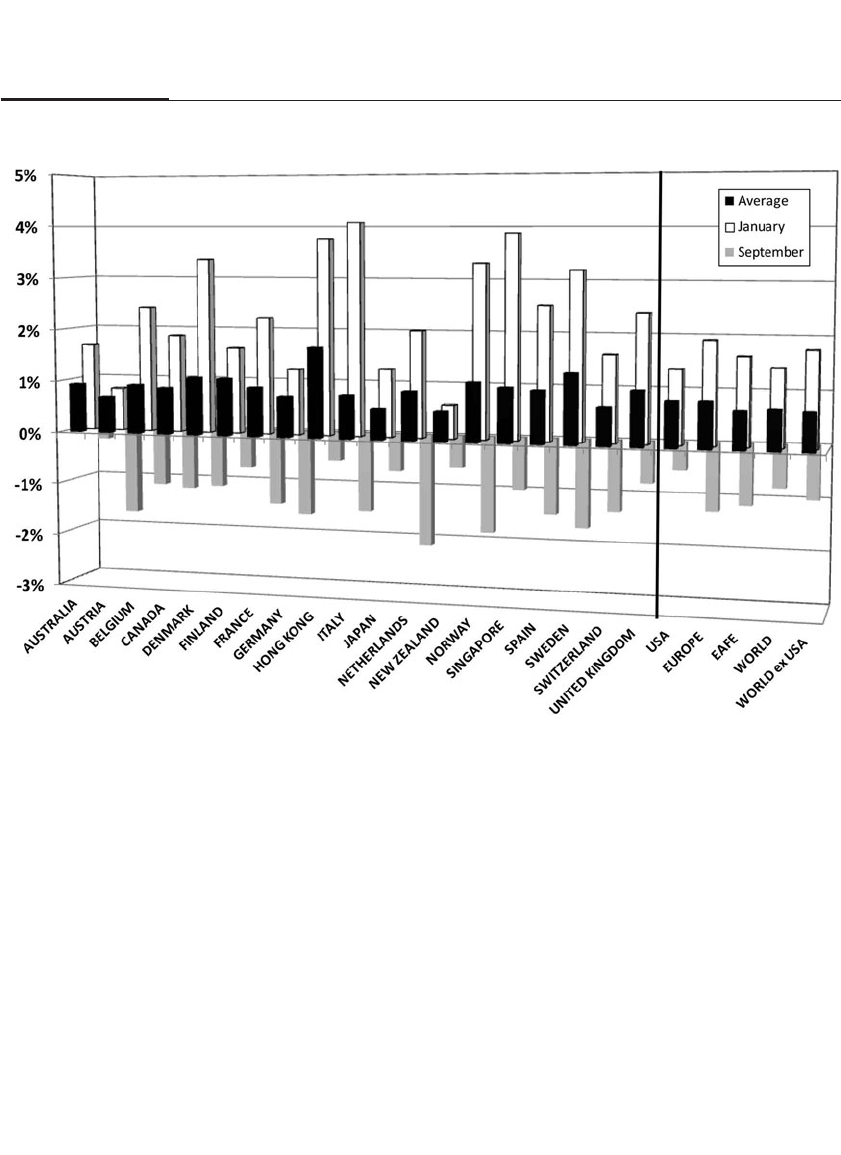

Global Investing 195

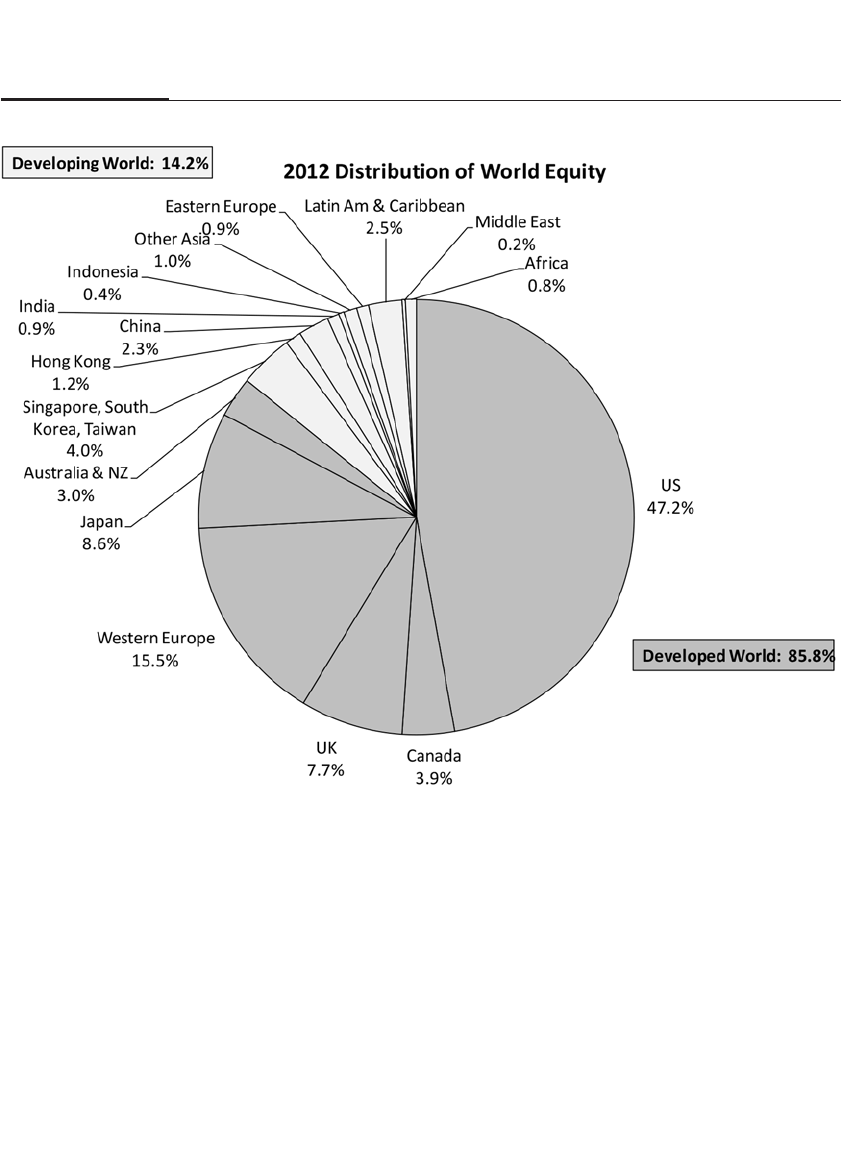

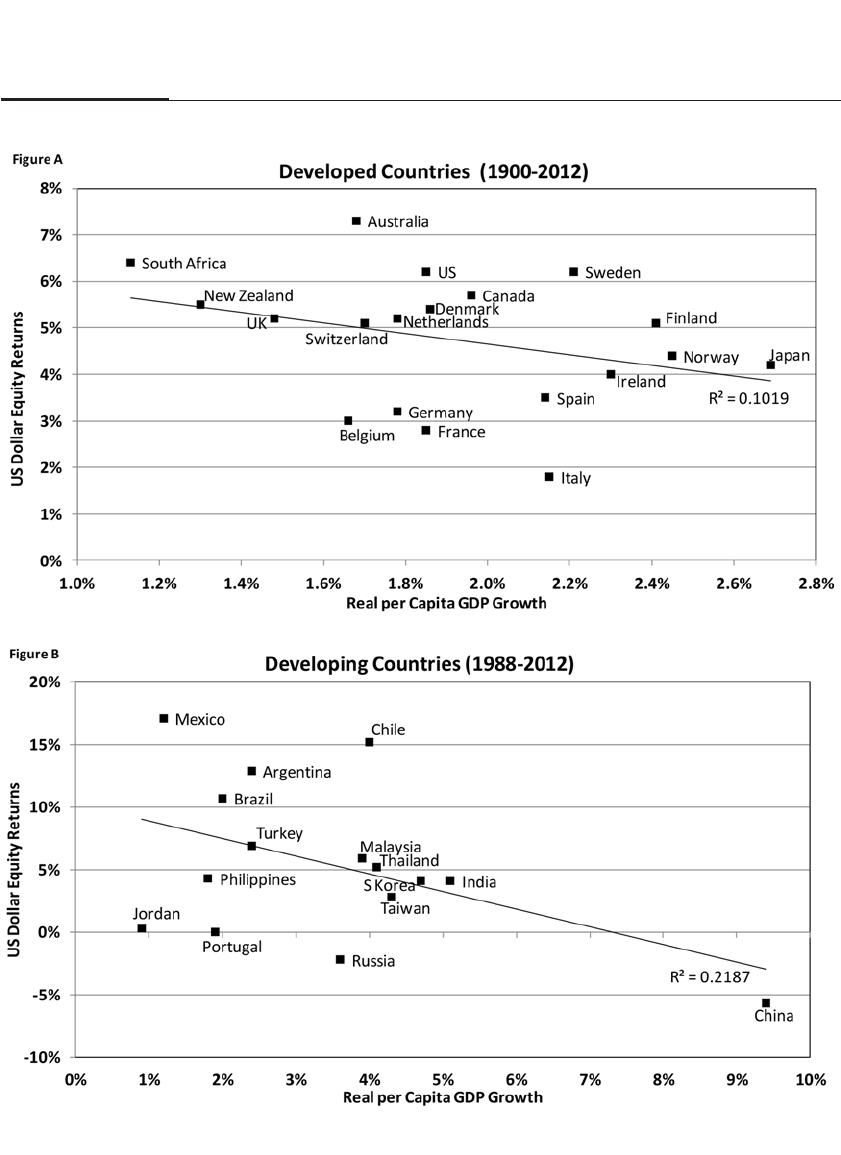

Foreign Investing and Economic Growth 196

Diversification in World Markets 198

International Stock Returns 199

The Japanese Market Bubble 199

Stock Risks 201

Should You Hedge Foreign Exchange Risk? 201

Diversification: Sector or Country? 202

Sector Allocation Around the World 203

Private and Public Capital 206

Conclusion 206

x CONTENTS

PART III

HOW THE ECONOMIC ENVIRONMENT IMPACTS STOCKS

Chapter 14

Gold, Monetary Policy, and Inflation 209

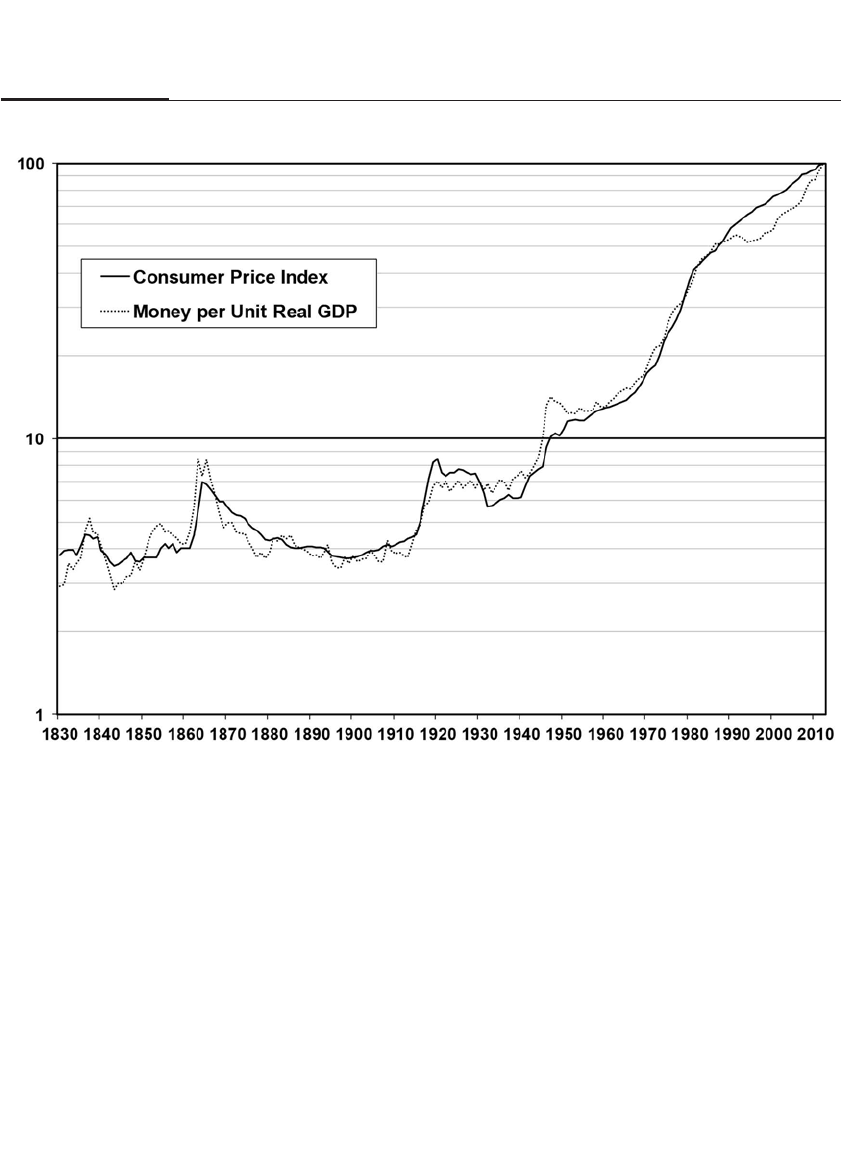

Money and Prices 210

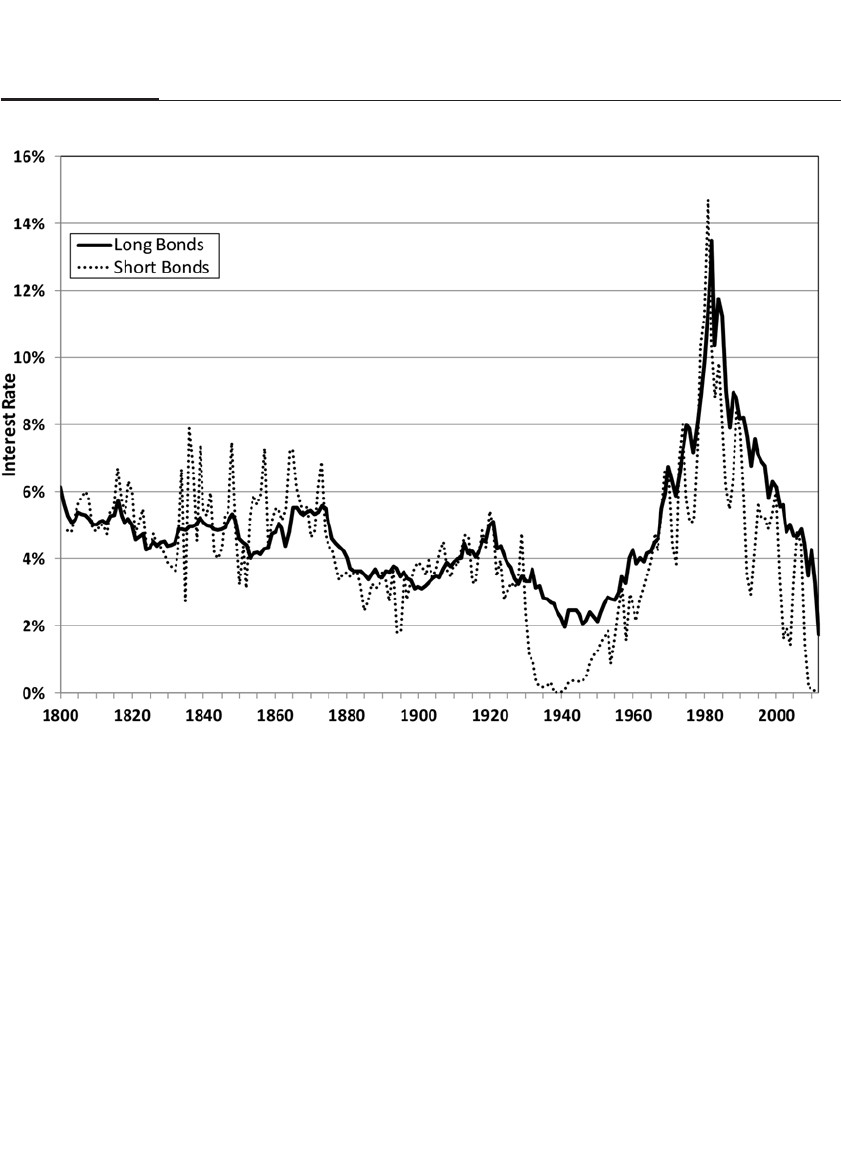

The Gold Standard 213

The Establishment of the Federal Reserve 213

The Fall of the Gold Standard 214

Postdevaluation Monetary Policy 215

Postgold Monetary Policy 216

The Federal Reserve and Money Creation 217

How the Fed’s Actions Affect Interest Rates 218

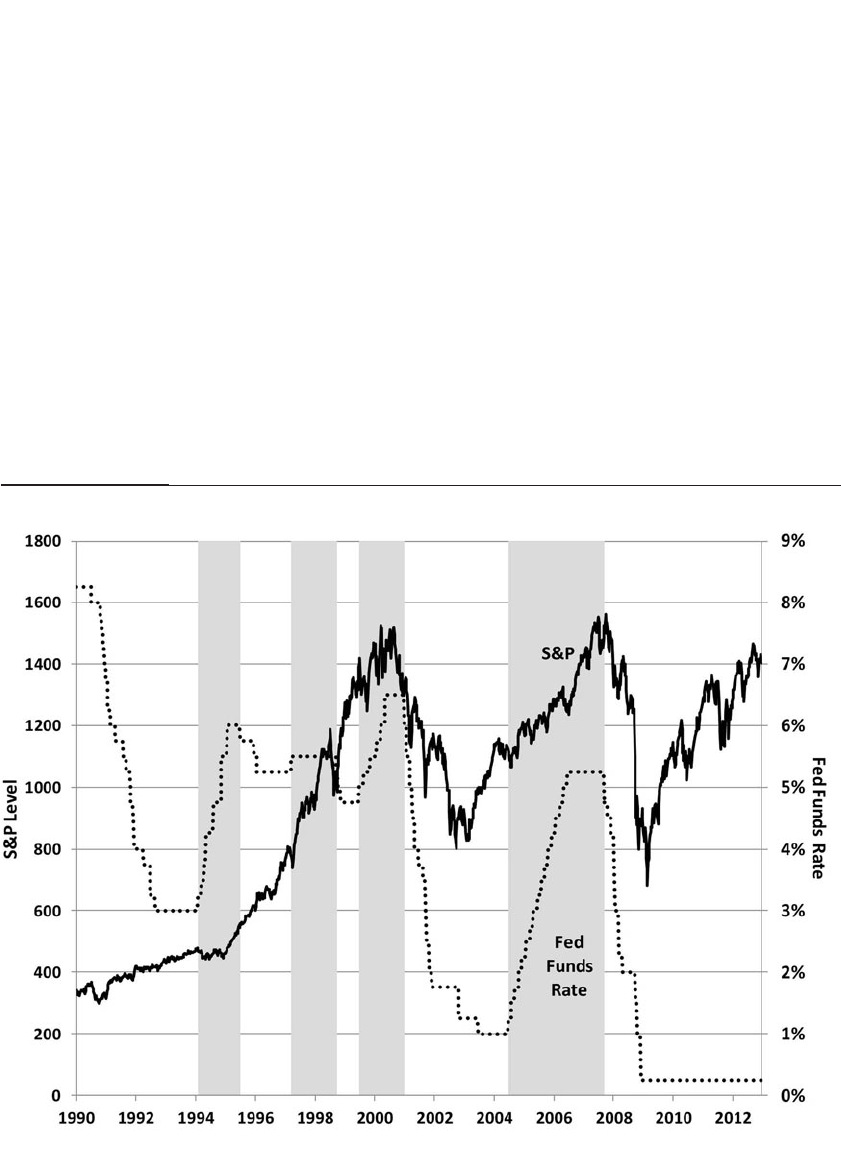

Stock Prices and Central Bank Policy 218

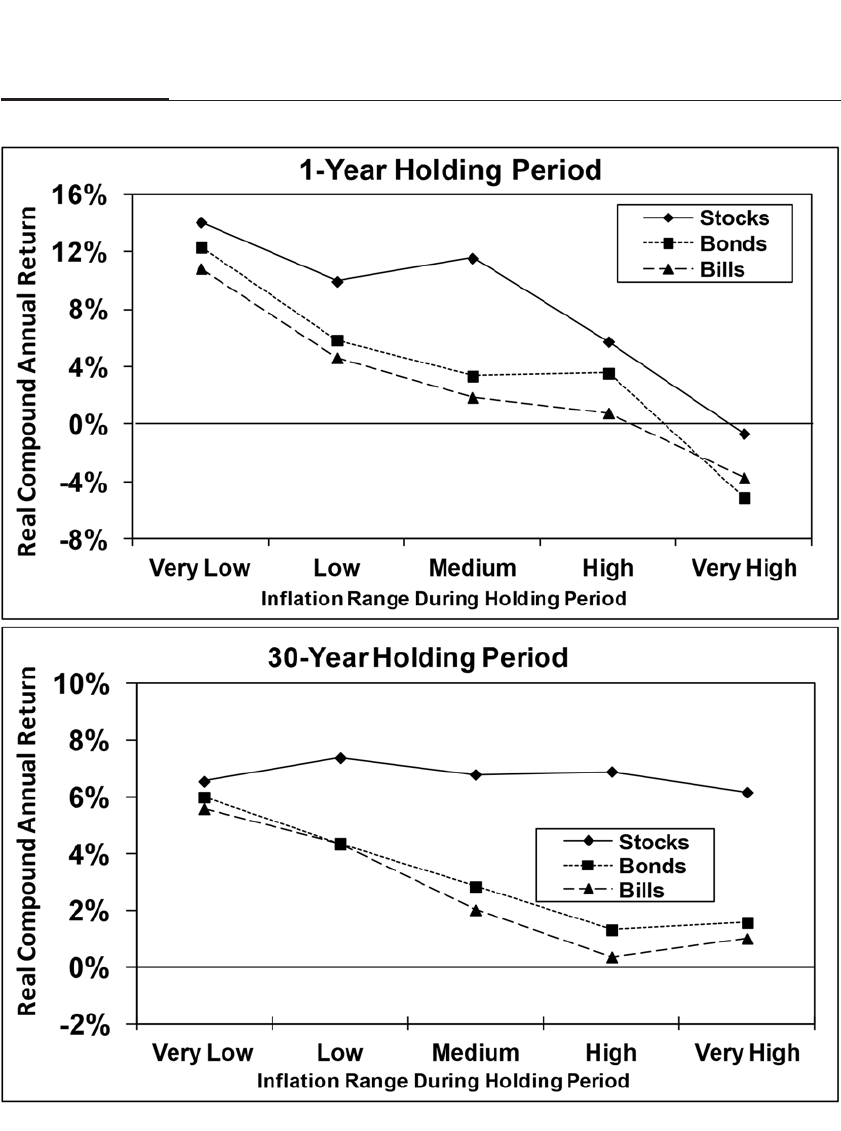

Stocks as Hedges Against Inflation 220

Why Stocks Fail as a Short-Term Inflation Hedge 223

Higher Interest Rates 223

Nonneutral Inflation: Supply-Side Effects 223

Taxes on Corporate Earnings 224

Inflationary Biases in Interest Costs 225

Capital Gains Taxes 226

Conclusion 226

Chapter 15

Stocks and the Business Cycle 229

Who Calls the Business Cycle? 230

Stock Returns Around Business Cycle Turning Points 233

Gains Through Timing the Business Cycle 235

How Hard Is It to Predict the Business Cycle? 236

Conclusion 238

Chapter 16

When World Events Impact Financial Markets 241

What Moves the Market? 243

Uncertainty and the Market 246

Democrats and Republicans 247

CONTENTS xi

Stocks and War 250

Markets During the World Wars 252

Post-1945 Conflicts 253

Conclusion 255

Chapter 17

Stocks, Bonds, and the Flow of Economic Data 257

Economic Data and the Market 258

Principles of Market Reaction 258

Information Content of Data Releases 259

Economic Growth and Stock Prices 260

The Employment Report 261

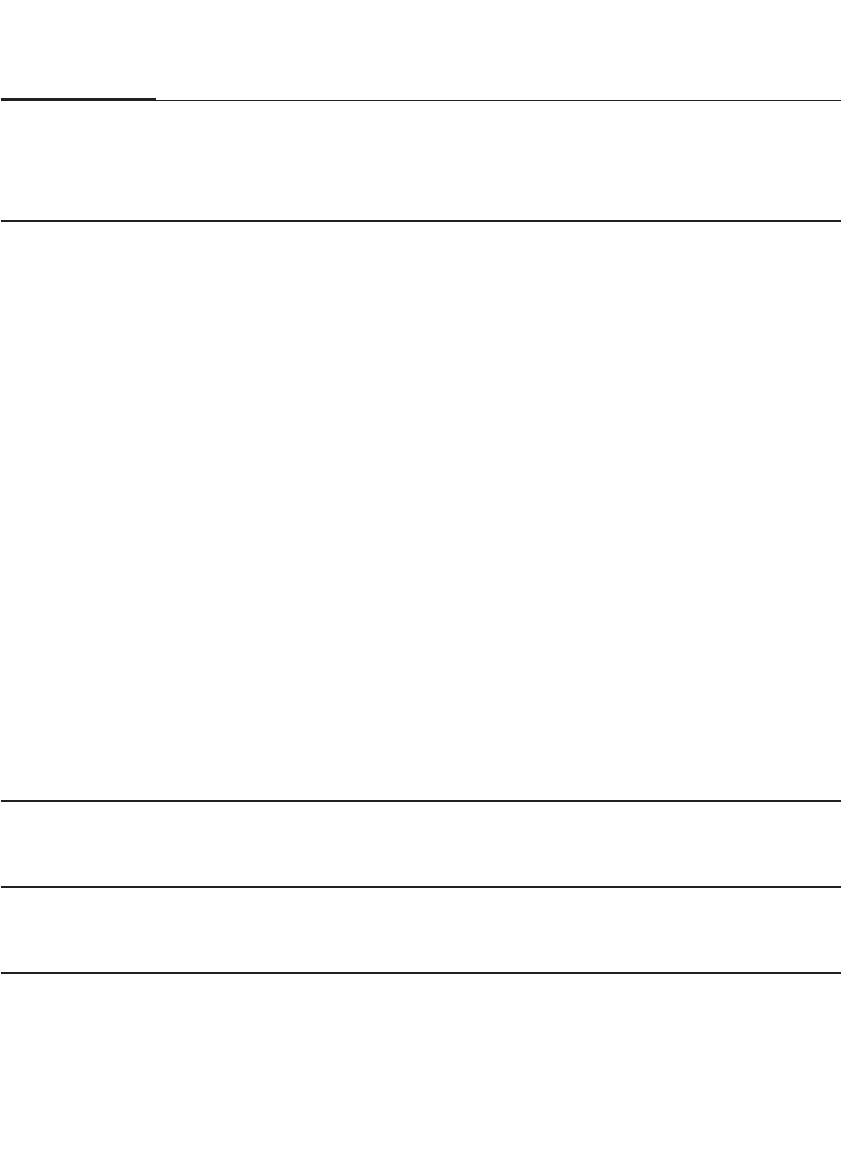

The Cycle of Announcements 262

Inflation Reports 264

Core Inflation 265

Employment Costs 266

Impact on Financial Markets 266

Central Bank Policy 267

Conclusion 268

PART IV

STOCK FLUCTUATIONS IN THE SHORT RUN

Chapter 18

Exchange-Traded Funds, Stock Index Futures, and Options 271

Exchange-Traded Funds 272

Stock Index Futures 273

Basics of the Futures Markets 276

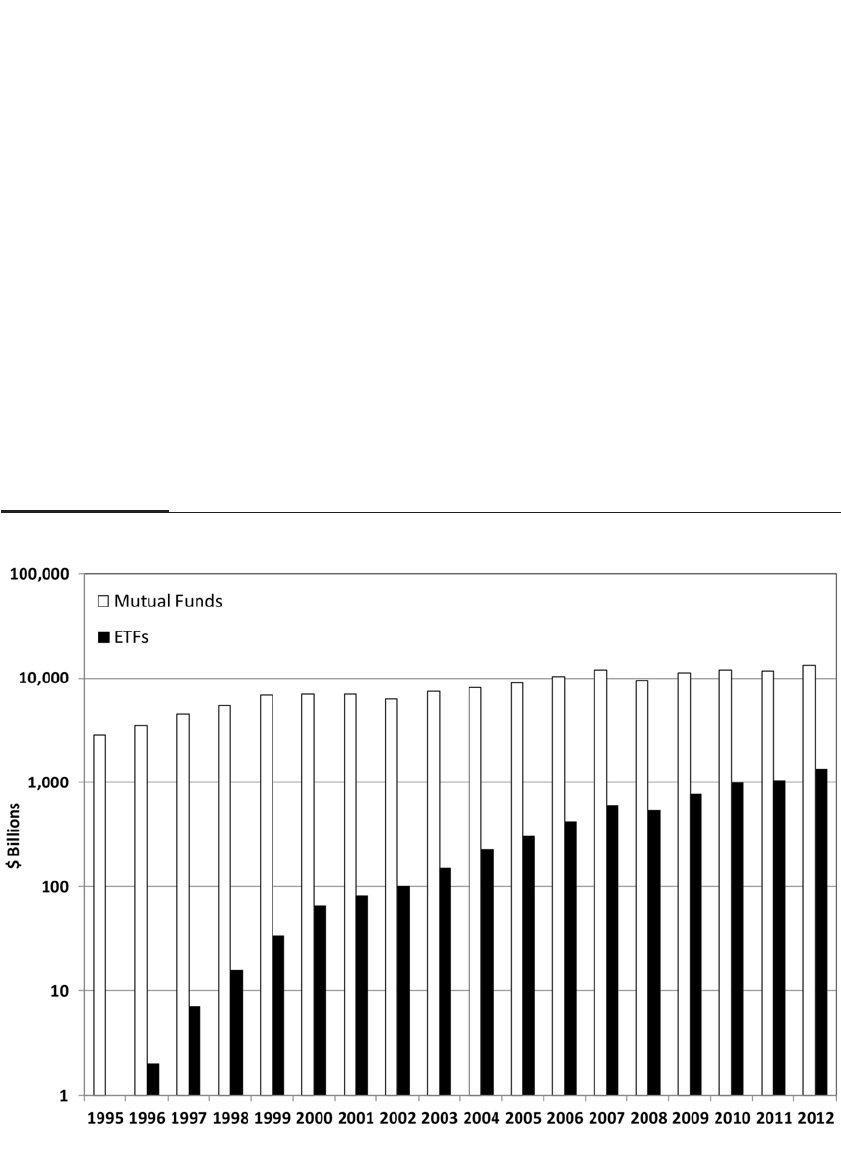

Index Arbitrage 278

Predicting the New York Open with Globex Trading 279

Double and Triple Witching 280

Margin and Leverage 281

Tax Advantages of ETFS and Futures 282

Where to Put Your Indexed Investments: ETFS, Futures, or Index Mutual

Funds? 282

Index Options 284

xii CONTENTS

Buying Index Options 286

Selling Index Options 286

The Importance of Indexed Products 287

Chapter 19

Market Volatility 289

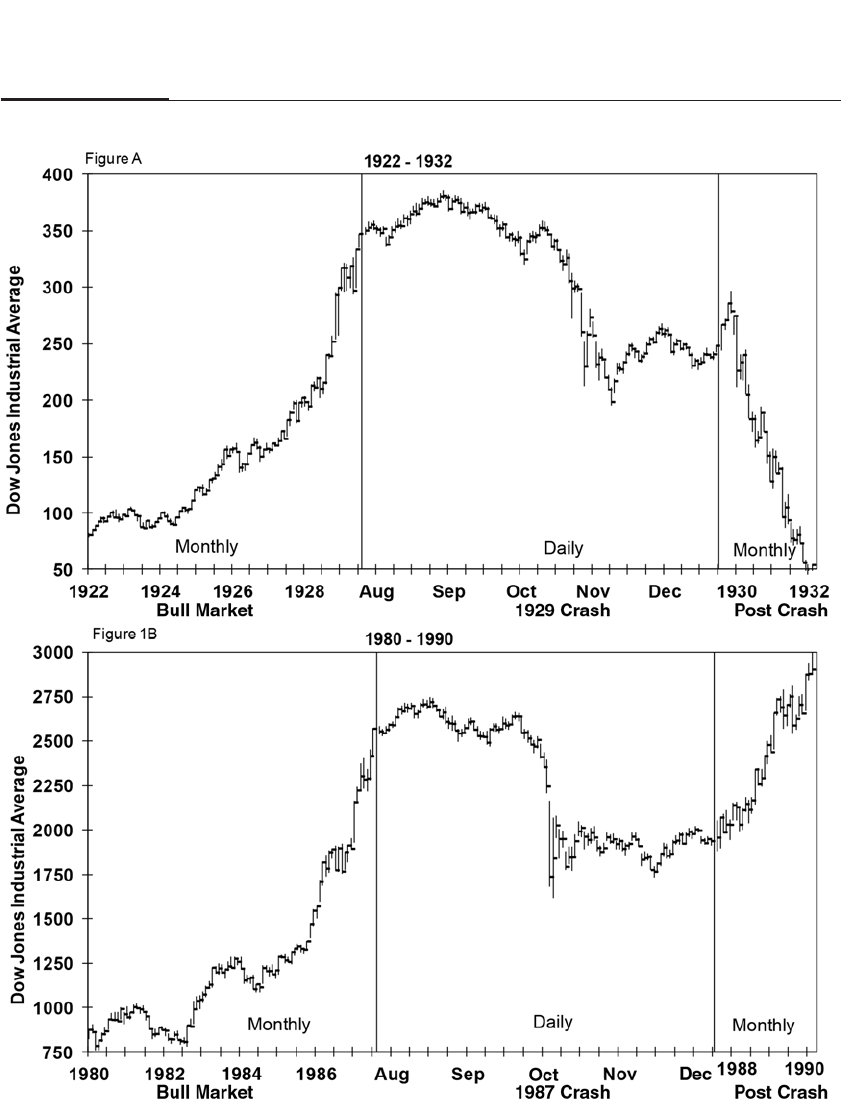

The Stock Market Crash of October 1987 291

The Causes of the October 1987 Crash 293

Exchange Rate Policies 293

The Futures Market 294

Circuit Breakers 296

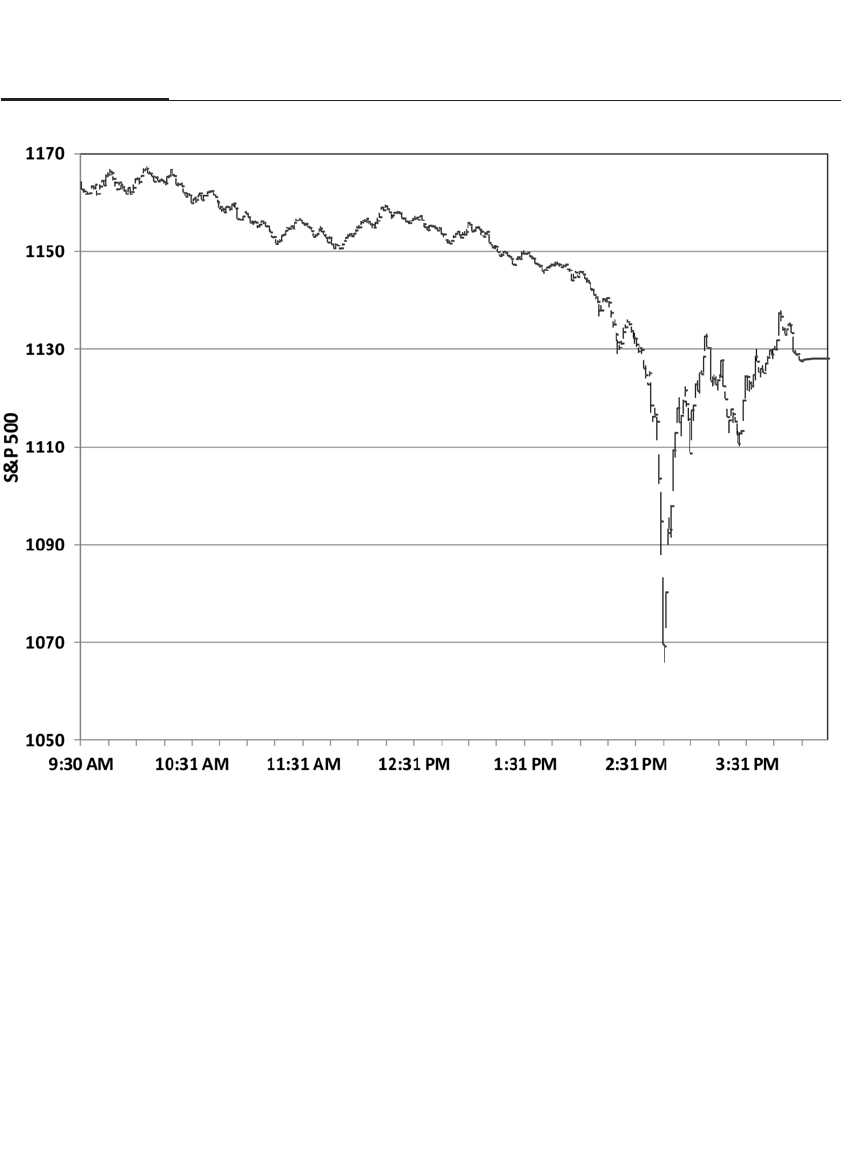

Flash Crash—May 6, 2010 297

The Nature of Market Volatility 300

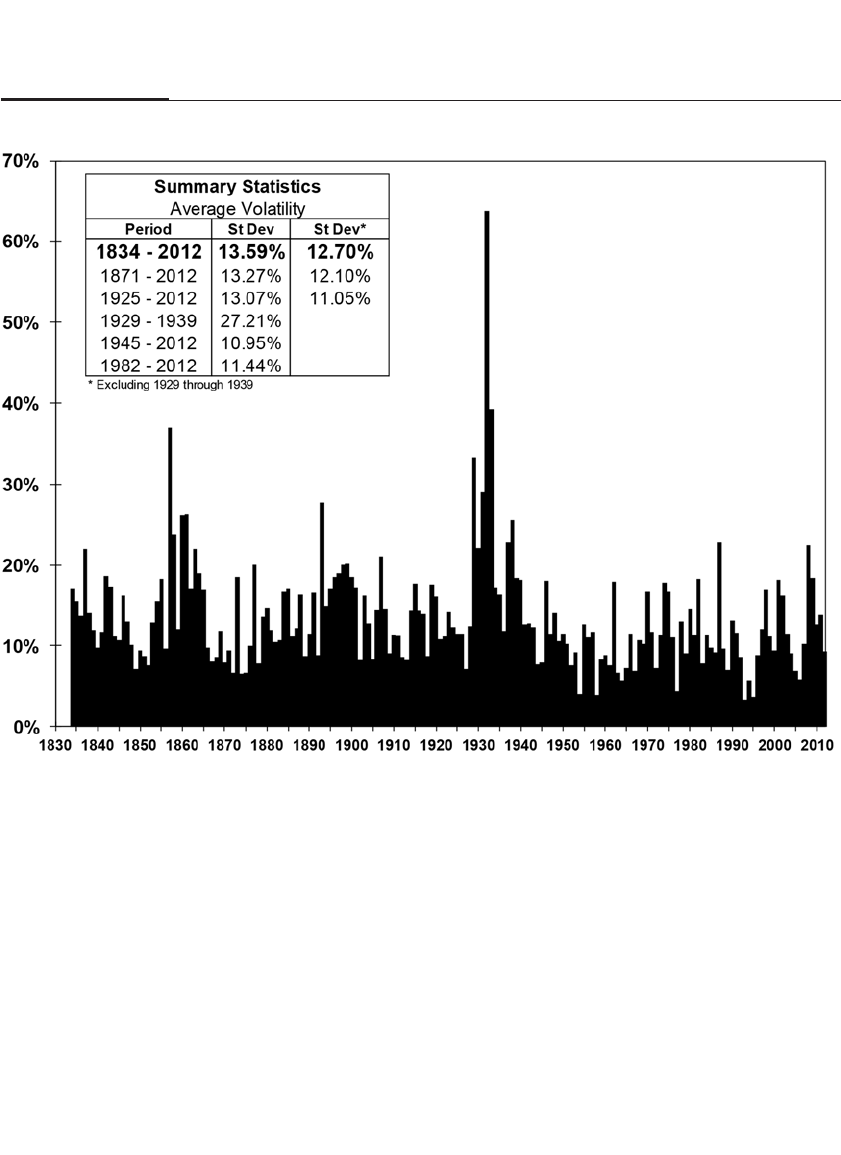

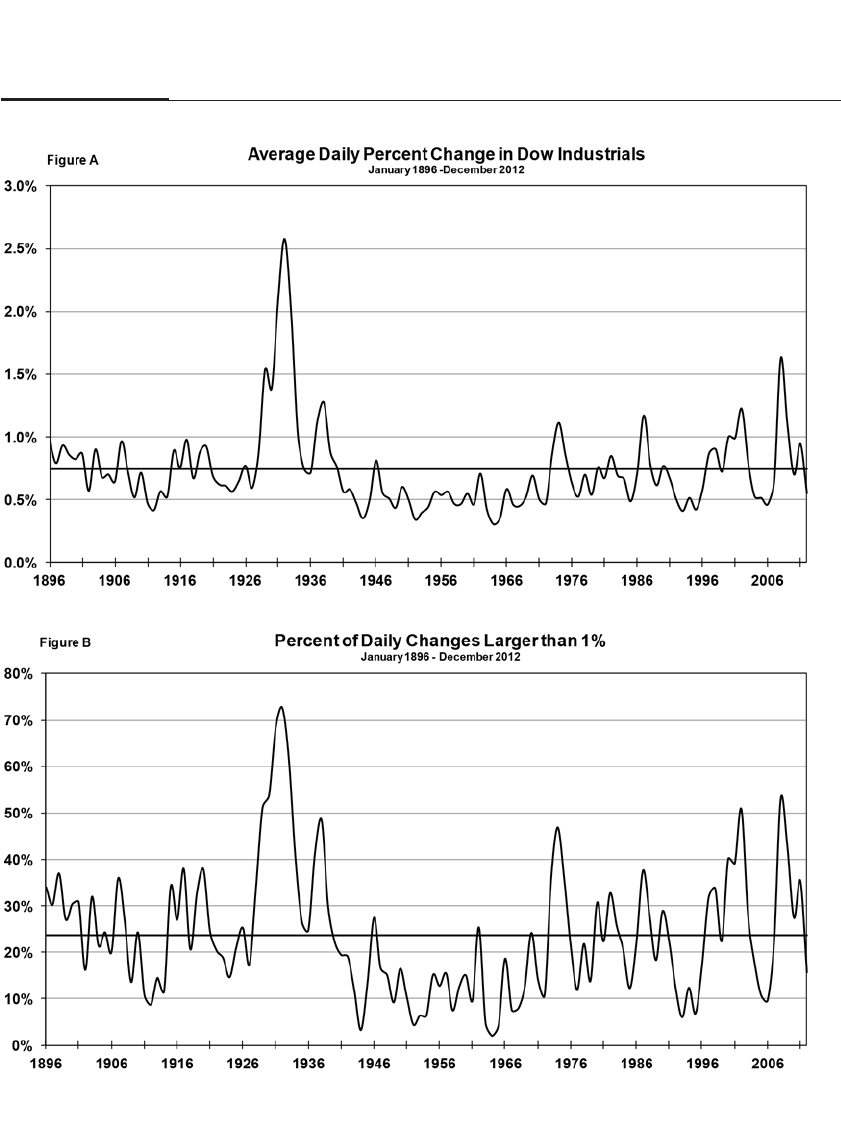

Historical Trends of Stock Volatility 300

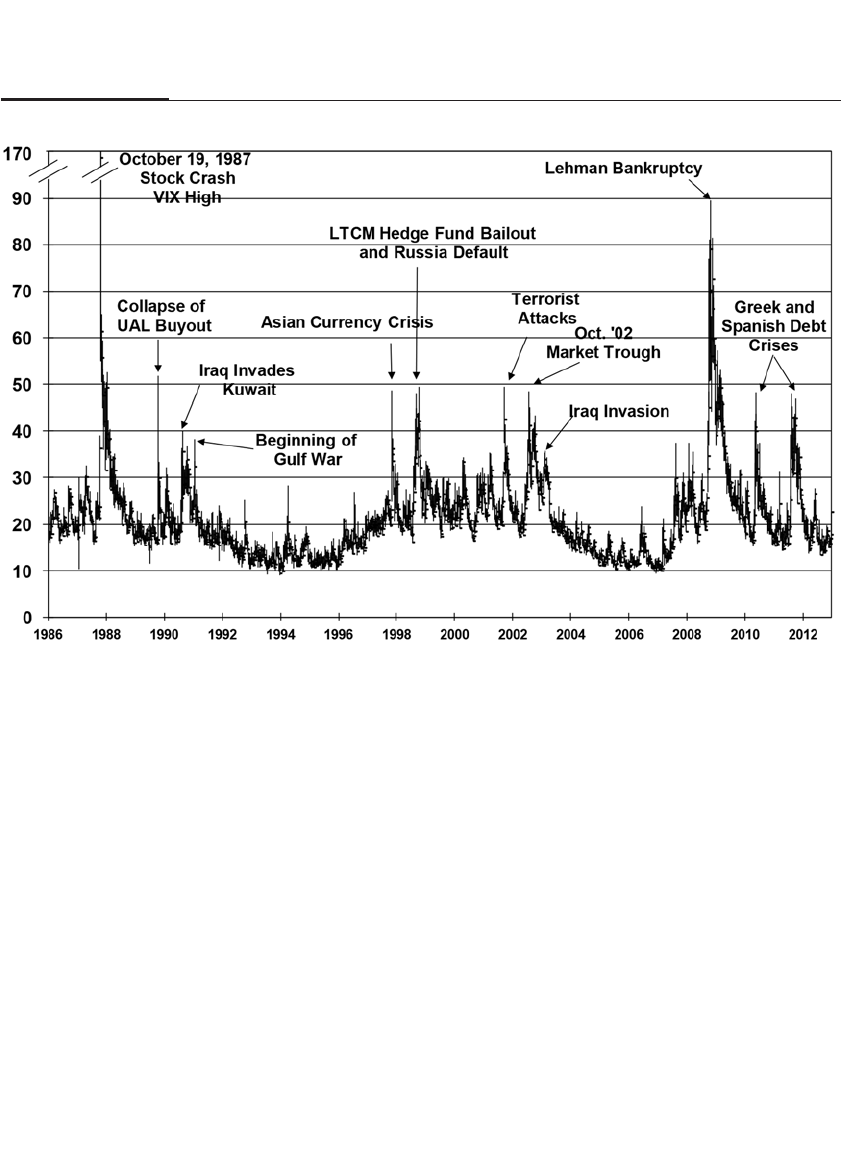

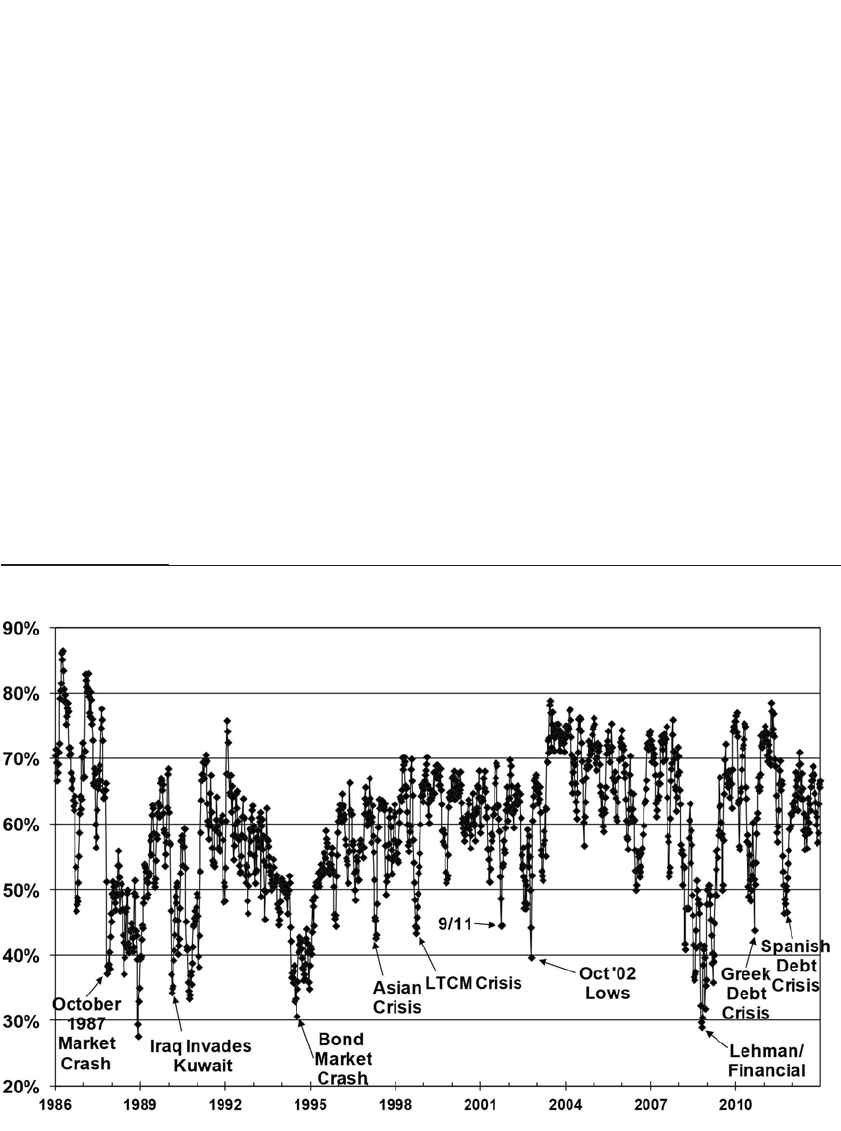

The Volatility Index 303

The Distribution of Large Daily Changes 305

The Economics of Market Volatility 307

The Significance of Market Volatility 308

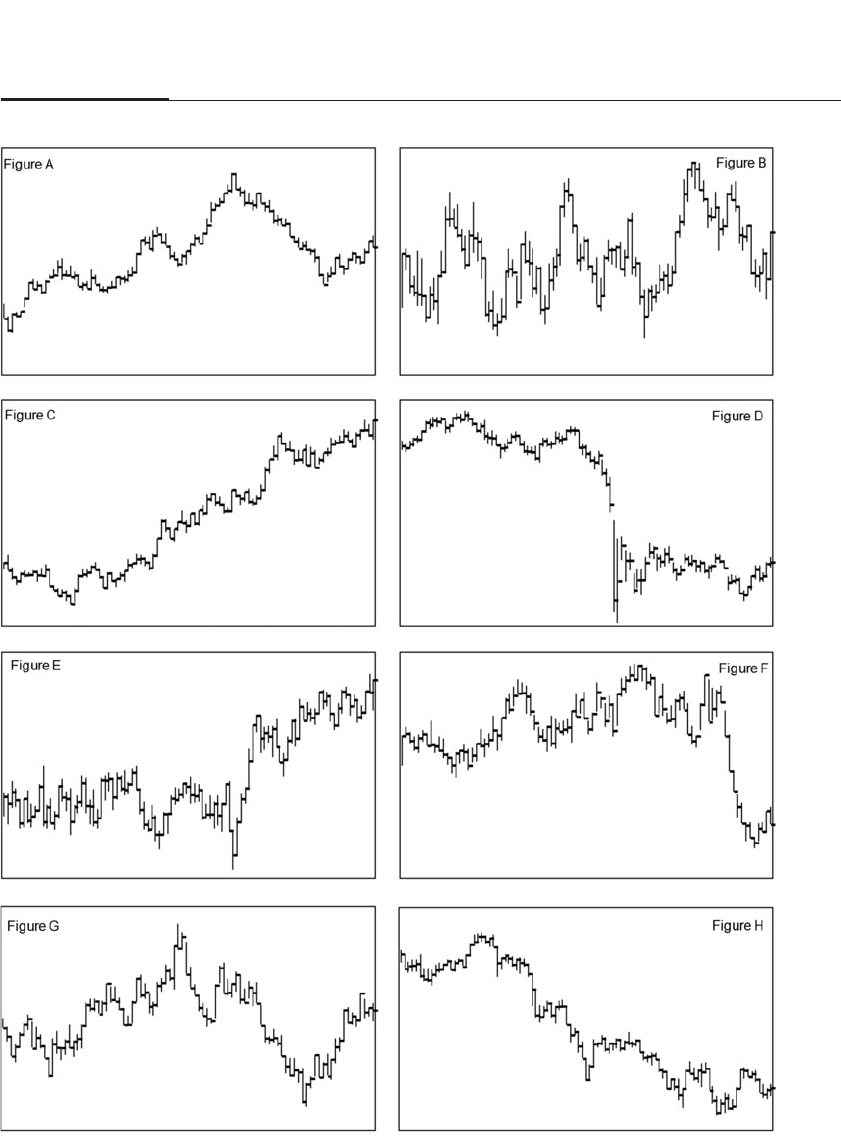

Chapter 20

Technical Analysis and Investing with the Trend 311

The Nature of Technical Analysis 311

Charles Dow, Technical Analyst 312

The Randomness of Stock Prices 312

Simulations of Random Stock Prices 314

Trending Markets and Price Reversals 314

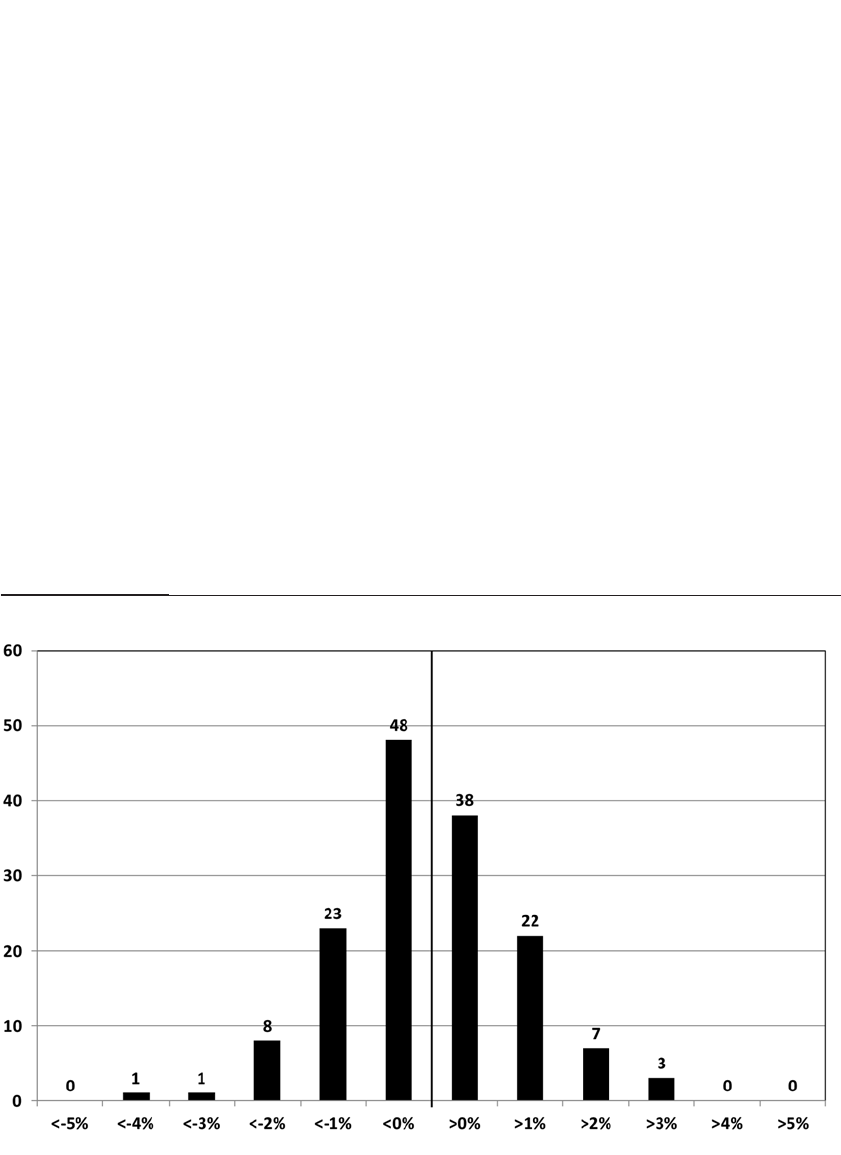

Moving Averages 316

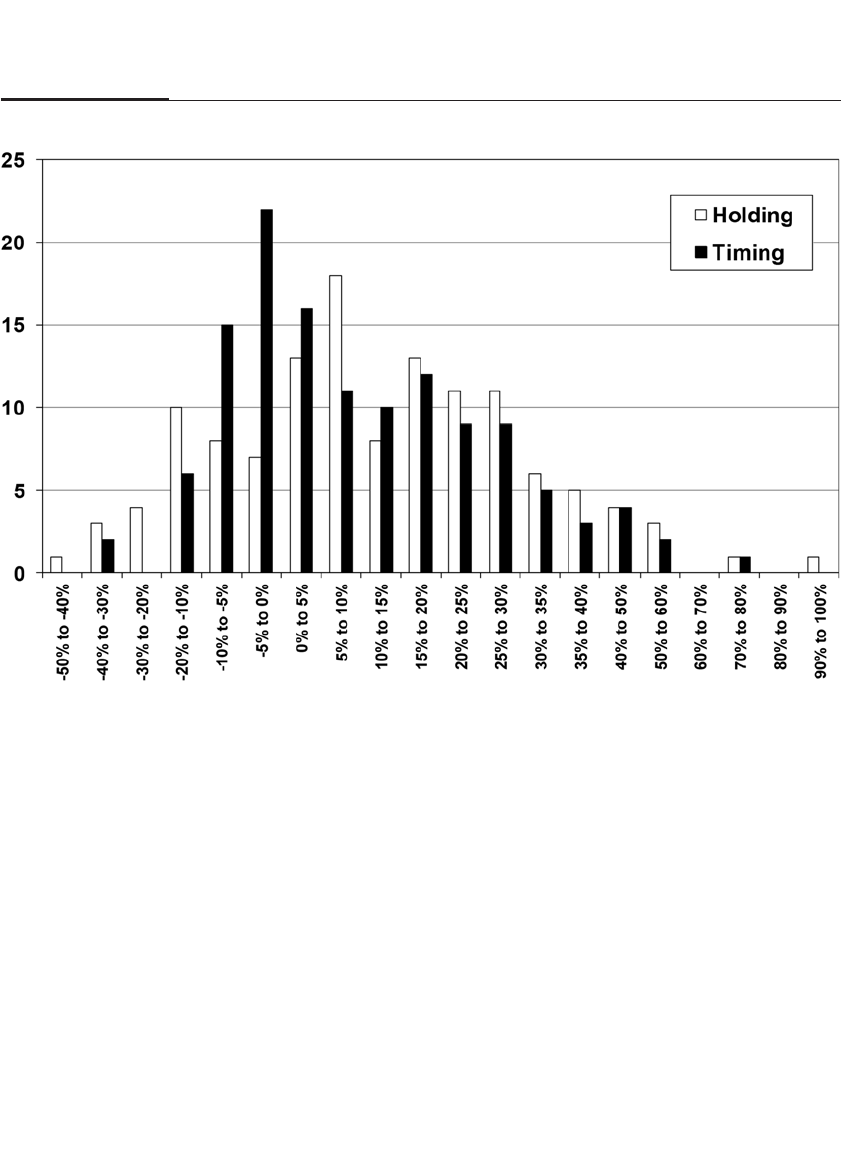

Testing the Dow Jones Moving-Average Strategy 317

Back-Testing the 200-Day Moving Average 318

Avoiding Major Bear Markets 320

Distribution of Gains and Losses 321

Momentum Investing 322

Conclusion 323

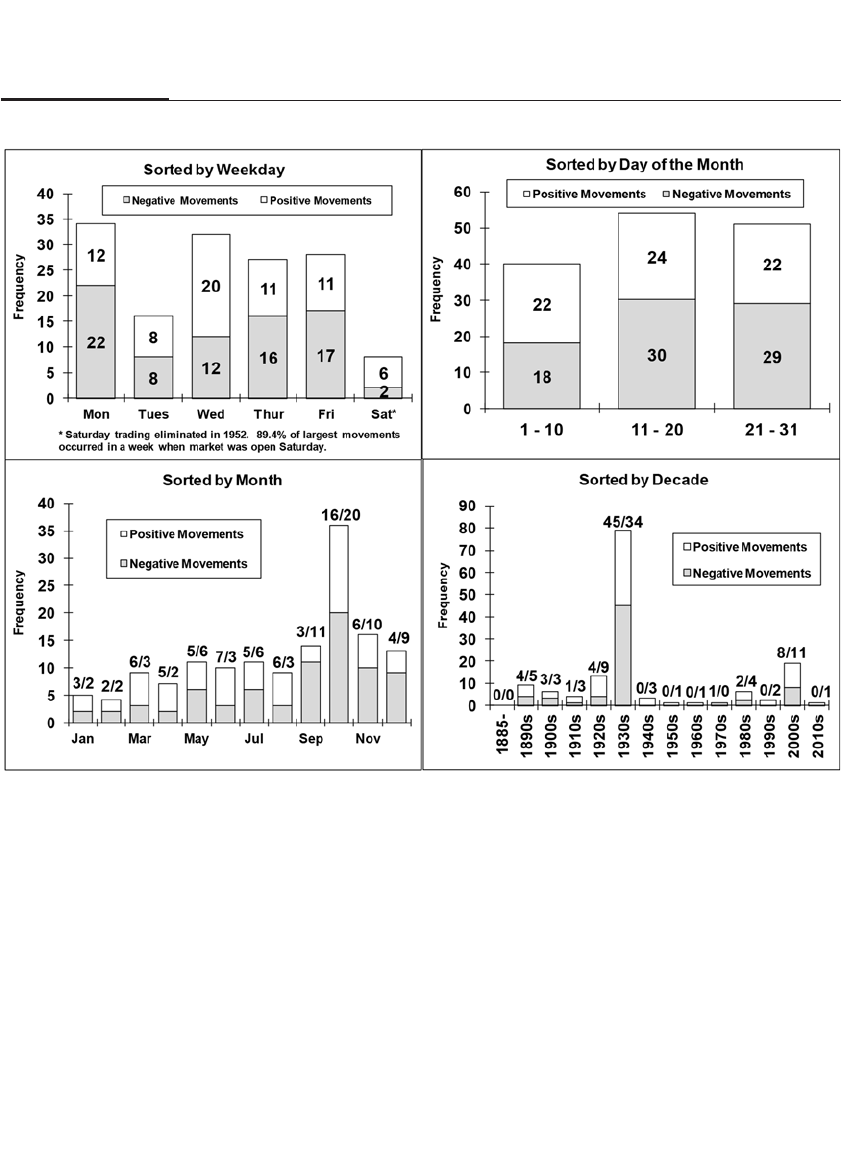

Chapter 21

Calendar Anomalies 325

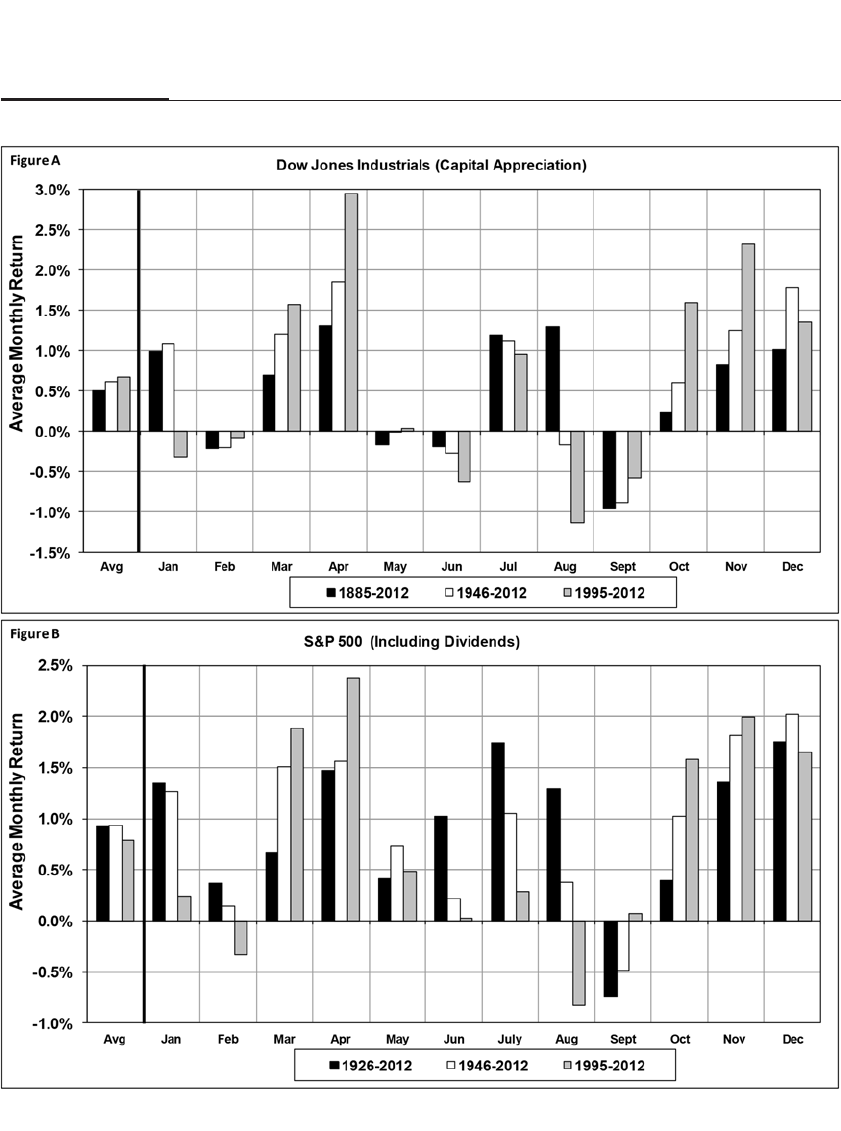

Seasonal Anomalies 326

CONTENTS xiii

The January Effect 326

Causes of the January Effect 328

The January Effect Weakened in Recent Years 329

Large Stock Monthly Returns 330

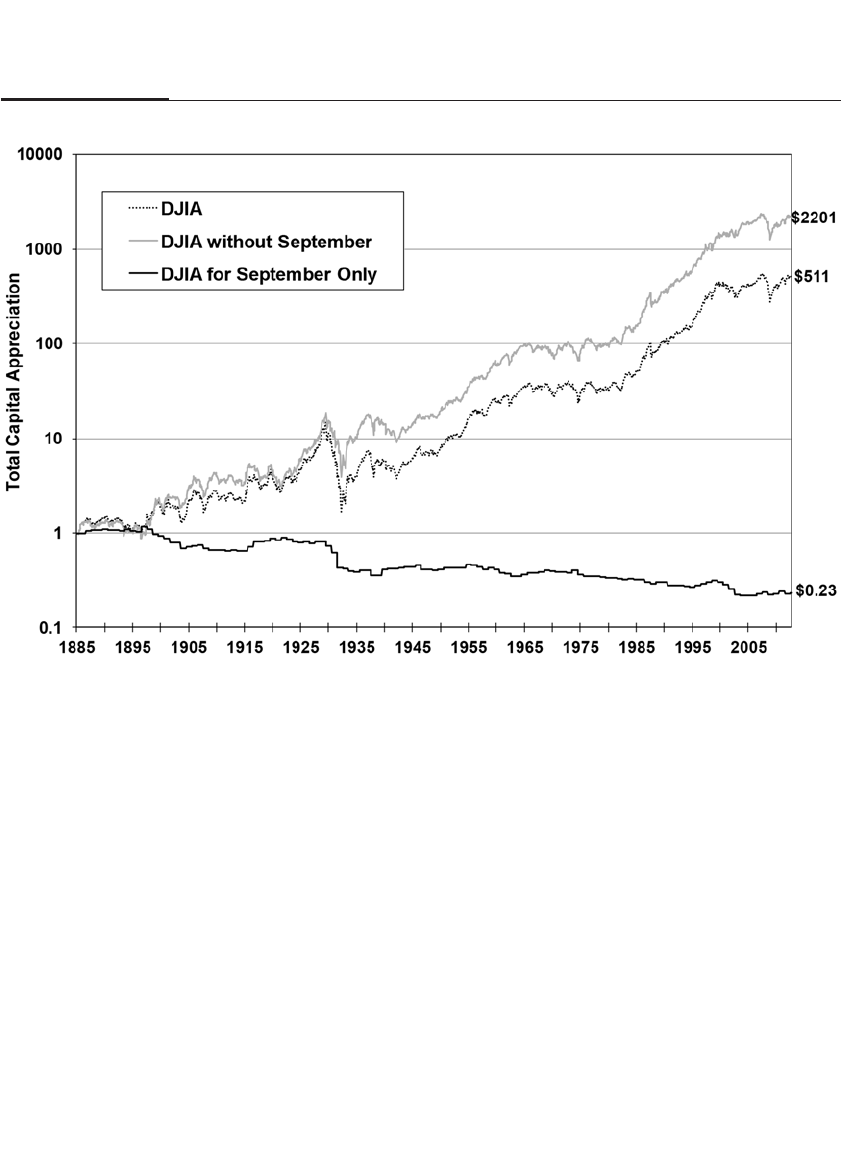

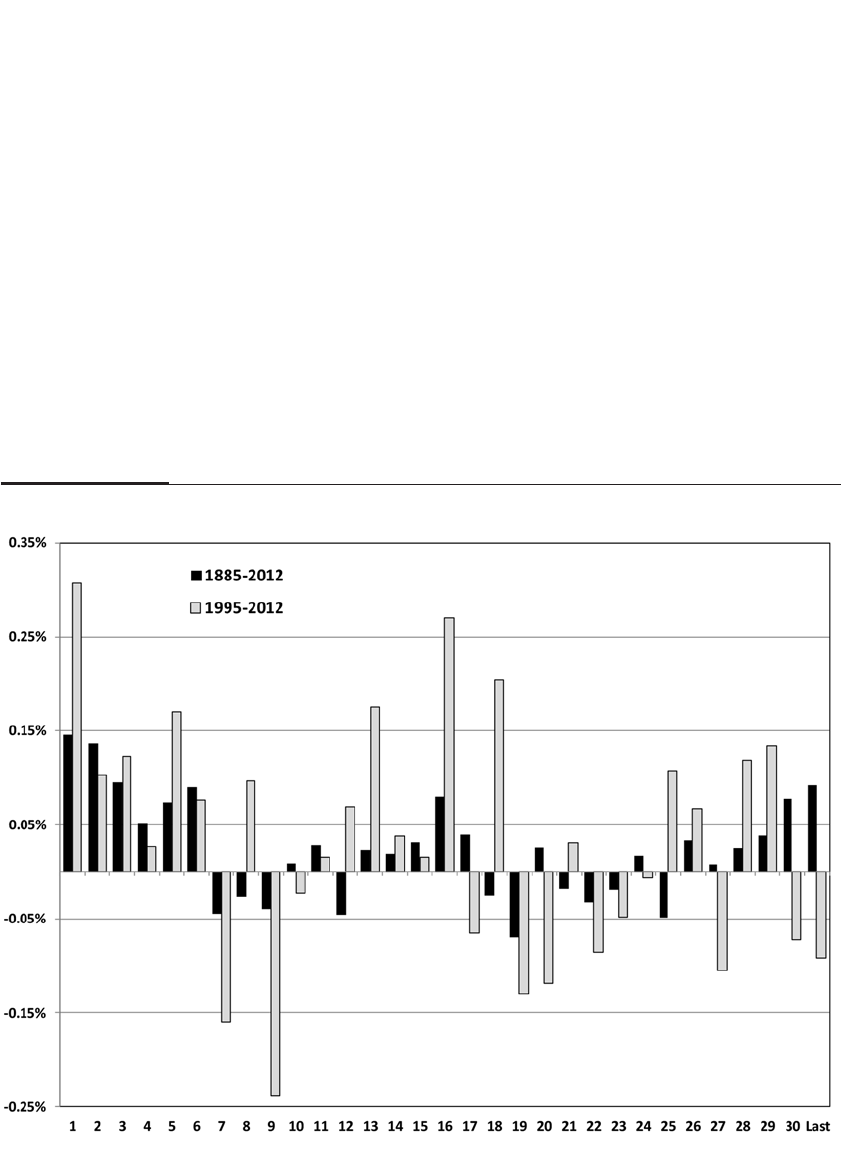

The September Effect 330

Other Seasonal Returns 334

Day-of-the-Week Effects 336

What’s an Investor to Do? 337

Chapter 22

Behavioral Finance and the Psychology of Investing 339

The Technology Bubble, 1999 to 2001 340

Behavioral Finance 342

Fads, Social Dynamics, and Stock Bubbles 343

Excessive Trading, Overconfidence, and the Representative Bias 345

Prospect Theory, Loss Aversion, and the Decision

to Hold on to Losing Trades 347

Rules for Avoiding Behavioral Traps 350

Myopic Loss Aversion, Portfolio Monitoring,

and the Equity Risk Premium 350

Contrarian Investing and Investor Sentiment:

Strategies to Enhance Portfolio Returns 352

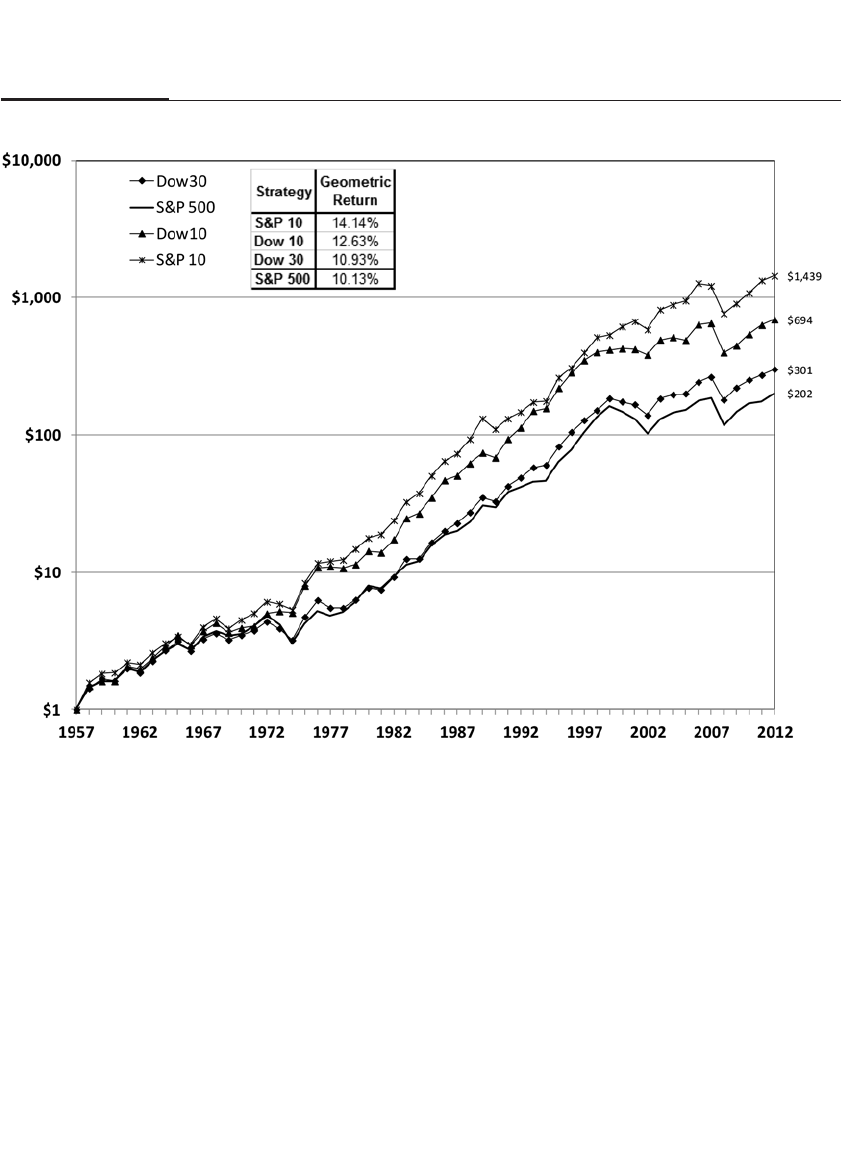

Out-of-Favor Stocks and the Dow 10 Strategy 354

PART V

BUILDING WEALTH THROUGH STOCKS

Chapter 23

Fund Performance, Indexing, and Beating the Market 357

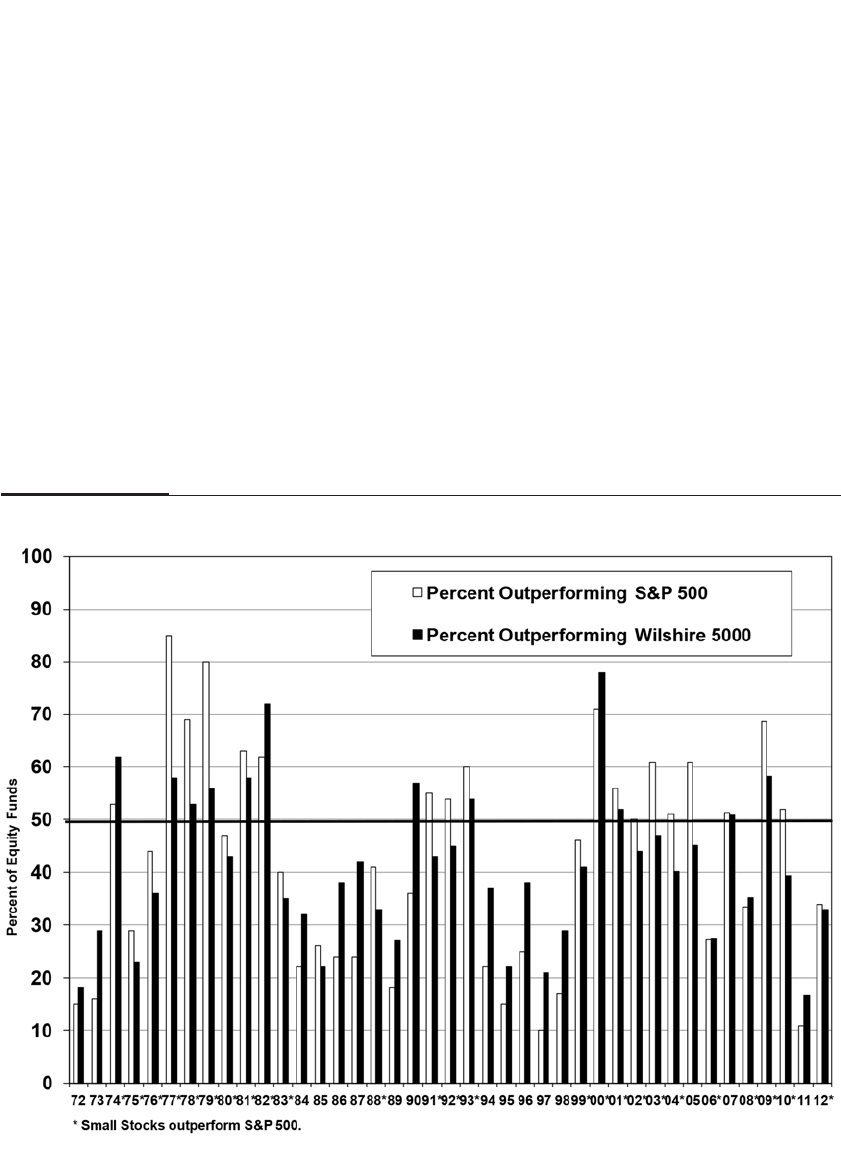

The Performance of Equity Mutual Funds 358

Finding Skilled Money Managers 363

Persistence of Superior Returns 364

Reasons for Underperformance of Managed Money 365

A Little Learning Is a Dangerous Thing 365

Profiting from Informed Trading 366

How Costs Affect Returns 367

xiv CONTENTS

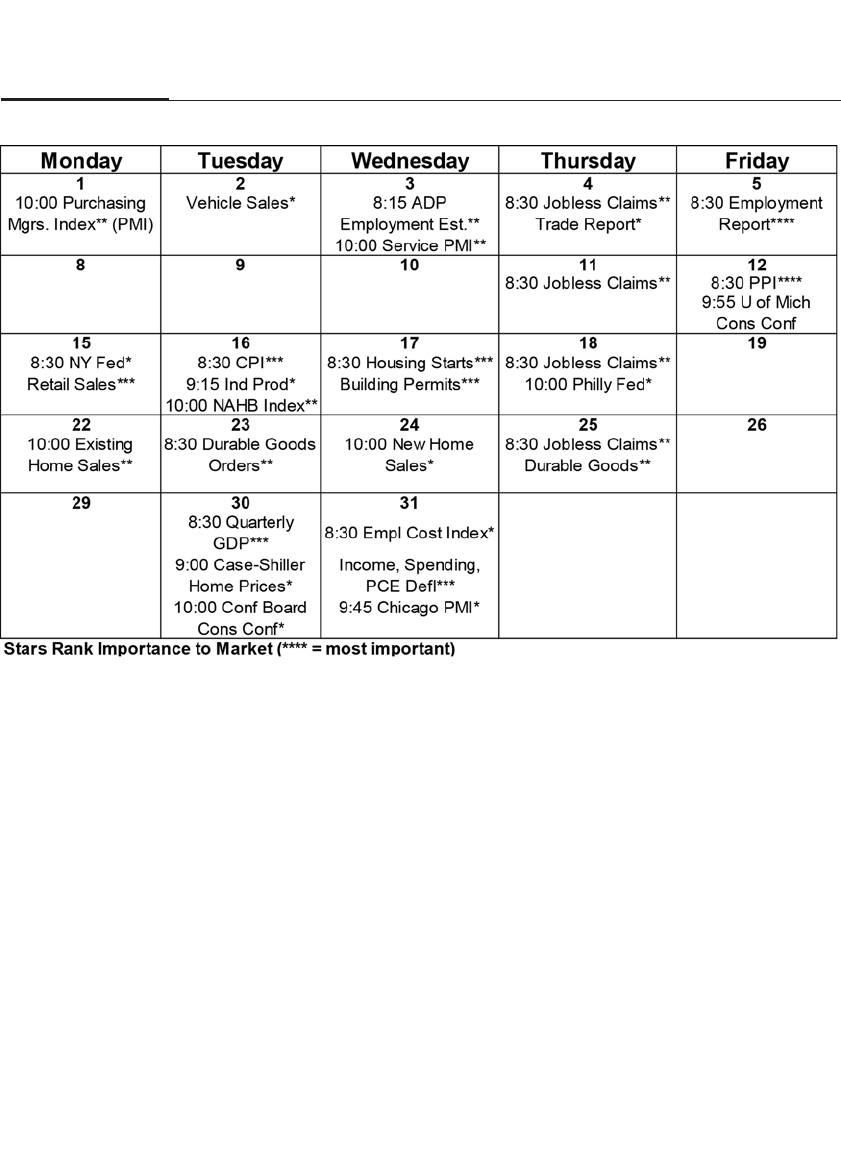

The Increased Popularity of Passive Investing 367

The Pitfalls of Capitalization-Weighted Indexing 368

Fundamentally Weighted Versus Capitalization-Weighted Indexation 369

The History of Fundamentally Weighted Indexation 371

Conclusion 372

Chapter 24

Structuring a Portfolio for Long-Term Growth 373

Practical Aspects of Investing 373

Guides to Successful Investing 374

Implementing the Plan and the Role of an Investment Advisor 377

Concluding Comment 378

Notes 379

Index 405

CONTENTS

xv

This page intentionally left blank

In July 1997 I called Peter Bernstein and said I was going to be in New

York and would love to lunch with him. I had an ulterior motive. I

greatly enjoyed his book Capital Ideas: The Improbable Origins of Modern

Wall Street and the Journal of Portfolio Management, which he founded

and edited. I hoped there might be a slim chance he would consent to

write the preface to the second edition of Stocks for the Long Run.

His secretary set up a date at one of his favorite restaurants, Circus

on the Upper East Side. He arrived with his wife Barbara and a copy of

the first edition of my book tucked under his arm. As he approached, he

asked if I would sign it. I said “of course” and responded that I would be

honored if he wrote a foreword to the second edition. He smiled; “Of

course!” he exclaimed. The next hour was filled with a most fascinating

conversation about publishing, academic and professional trends in

finance, and even what we liked best about Philly and New York.

I thought back to our lunch when I learned, in June 2009, that he had

passed away at the age of 90. In the 12 years since our first meeting, Peter

had been more productive than ever, writing three more books, including

his most popular, The Remarkable Story of Risk. Despite the incredible pace

he maintained, he always found time to update the preface of my book

through the next two editions. As I read through his words in the fourth

edition, I found that his insights into the frustrations and rewards of

being a long-term investor are as relevant today as they were when he

first penned them nearly two decades ago. I can think of no better way to

honor Peter than to repeat his wisdom here.

Some people find the process of assembling data to be a deadly bore.

Others view it as a challenge. Jeremy Siegel has turned it into an art form.

You can only admire the scope, lucidity, and sheer delight with which

Professor Siegel serves up the evidence to support his case for investing in

stocks for the long run.

But this book is far more than its title suggests. You will learn a lot of

economic theory along the way, garnished with a fascinating history of

both the capital markets and the U.S. economy. By using history to maxi-

mum effect, Professor Siegel gives the numbers a life and meaning they

would never enjoy in a less compelling setting. Moreover, he boldly does

battle with all historical episodes that could contradict his thesis and

emerges victorious—and this includes the crazy years of the 1990s.

xvii

FOREWORD

With this fourth edition, Jeremy Siegel has continued on his merry

and remarkable way in producing works of great value about how best to

invest in the stock market. His additions on behavioral finance, globaliza-

tion, and exchange-traded funds have enriched the original material with

fresh insights into important issues. Revisions throughout the book have

added valuable factual material and powerful new arguments to make his

case for stocks for the long run. Whether you are a beginner at investing or

an old pro, you will learn a lot from reading this book.

Jeremy Siegel is never shy, and his arguments in this new edition

demonstrate he is as bold as ever. The most interesting feature of the whole

book is his twin conclusions of good news and bad news. First, today’s

globalized world warrants higher average price/earnings ratios than in the

past. But higher P/Es are a mixed blessing, for they would mean average

returns in the future are going to be lower than they were in the past.

I am not going to take issue with the forecast embodied in this view-

point. But similar cases could have been made in other environments of

the past, tragic environments as well as happy ones. One of the great les-

sons of history proclaims that no economic environment survives the long

run. We have no sense at all of what kinds of problems or victories lie in

the distant future, say, 20 years or more from now, and what influence

those forces will have on appropriate price/earnings ratios.

That’s all right. Professor Siegel’s most important observation about

the future goes beyond his controversial forecast of higher average P/Es

and lower realized returns. “Although these returns may be diminished

from the past,” he writes, “there is overwhelming reason to believe stocks

will remain the best investment for all those seeking steady, long-term

gains.

“[O]verwhelming reason” is an understatement. The risk premium

earned by equities over the long run must remain intact if the system is

going to survive. In the capitalist system, bonds cannot and should not out-

perform equities over the long run. Bonds are contracts enforceable in

courts of law. Equities promise their owners nothing—stocks are risky

investments, involving a high degree of faith in the future. Thus, equities

are not inherently “better” than bonds, but we demand a higher return

from equities to compensate for their greater risk. If the long-run expected

return on bonds were to be higher than the long-run expected return on

stocks, assets would be priced so that risk would earn no reward. That is an

unsustainable condition. Stocks must remain “the best investment for all

those seeking steady, long- term gains” or our system will come to an end,

and with a bang, not a whimper.

—Peter Bernstein

xviii FOREWORD

The fourth edition of Stocks for the Long Run was written in 2007. During

the last several years, as many of my colleagues my age had slowed the

pace of their research, I was often asked why I was working so hard on yet

another edition of this book. With a serious face I responded, “I believe

that a few events of significance have occurred over the past six years.”

A few events indeed! The years 2008 and 2009 witnessed the deep-

est economic recession and market collapse since the Great Depression

of the 1930s. The disruptions were so extensive that I put off writing this

edition until I gained better perspective on the causes and consequences

of the financial crisis from which we still have not completely recovered.

As a result, this edition is more thoroughly rewritten than any of

the previous editions were. This is not because the conclusions of the

earlier editions needed to be changed. Indeed the rise of U.S. equity mar-

kets to new all-time highs in 2013 only reinforces the central tenet of this

book: that stocks are indeed the best long-term investment for those who

learn to weather their short-term volatility. In fact, the long-term real

return on a diversified portfolio of common stocks has remained virtu-

ally identical to the 6.7 percent reported in the first edition of Stocks for

the Long Run, which examined returns through 1992.

CONFRONTING THE FINANCIAL CRISIS

Because of the severe impact of the crisis, I felt that what transpired

over the last several years had to be addressed front and center in this

edition. As a result I added two chapters that described the causes and

consequences of the financial meltdown. Chapter 1 now previews the

major conclusions of my research on stocks and bonds and traces how

investors, money managers, and academics regarded stocks over the

past century.

Chapter 2 describes the financial crisis, laying blame where blame

is due on the CEOs of the giant investment banks, the regulators, and

Congress. I lay out the series of fatal missteps that led Standard and

Poor’s, the world’s largest rating agency, to give its coveted AAA rating

to subprime mortgages, foolishly declaring them as safe as U.S. Treasury

bonds.

xix

PREFACE

Chapter 3 analyzes the extraordinary impact of the financial crisis

on the financial markets: the unprecedented surge of the “libor spread”

that measured cost of capital to the banks, the collapse of stock prices

that wiped out two-thirds of their value, and, for the time since the dark

days of the 1930s, Treasury bill yields falling to zero and even below.

Most economists believed that our system of deposit insurance,

margin requirements, and financial regulations rendered the above

events virtually impossible. The confluence of forces that led to the crisis

were remarkably similar to what happened following the 1929 stock

market crash, with mortgage-back securities replacing equities as the

main culprit.

Although the Fed failed miserably at predicting the crisis,

Chairman Ben Bernanke took unprecedented measures to keep financial

markets open by flooding the financial markets with liquidity and guar-

anteeing trillions of dollars of loans and short-term deposits. These

actions ballooned the Fed’s balance sheet to nearly $4 trillion, 5 times its

precrisis level, and raised many questions about how the Fed would

unwind this unprecedented stimulus.

The crisis also changed the correlation between asset classes. World

equity markets became much more correlated, reducing the diversifying

gains from global investing, while U.S. Treasury bonds and the dollar

became “safe haven” assets, spurring unprecedented demand for feder-

ally guaranteed debt. All commodities, including gold, suffered during

the worst stages of the economic downturn, but precious metals

rebounded on fear that the central bank’s expansionary policies would

generate high inflation.

Chapter 4 addresses longer-run issues impacting our economic well-

being. The economic downturn saw the U.S. budget deficit soar to $1.3

trillion, the highest level relative to GDP since World War II. The slow-

down in productivity growth generated fears that increase in living stan-

dards will slow markedly or even grind to a halt. This raises the question

of whether our children will be the first generation whose standard of liv-

ing will fall below that of their parents.

This chapter updates and extends the results of earlier editions by

using new data provided by the U.N. Population Commission and pro-

ductivity forecasts provided by the World Bank and the IMF. I now cal-

culate the distribution of world output of the major countries and

regions of the world to the end of the twenty-first century. This analysis

strongly suggests that although the developed world must increase the

age at which social security and medical benefits are offered by the gov-

xx PREFACE

ernment, such increases will be moderate if productivity growth in the

emerging economies remains strong.

OTHER NEW MATERIAL IN THE FIFTH EDITION

Although the financial crisis and its aftermath are front and center in this

fifth edition, I have made other significant changes as well. Not only

have all the charts and tables been updated through 2012, but the chap-

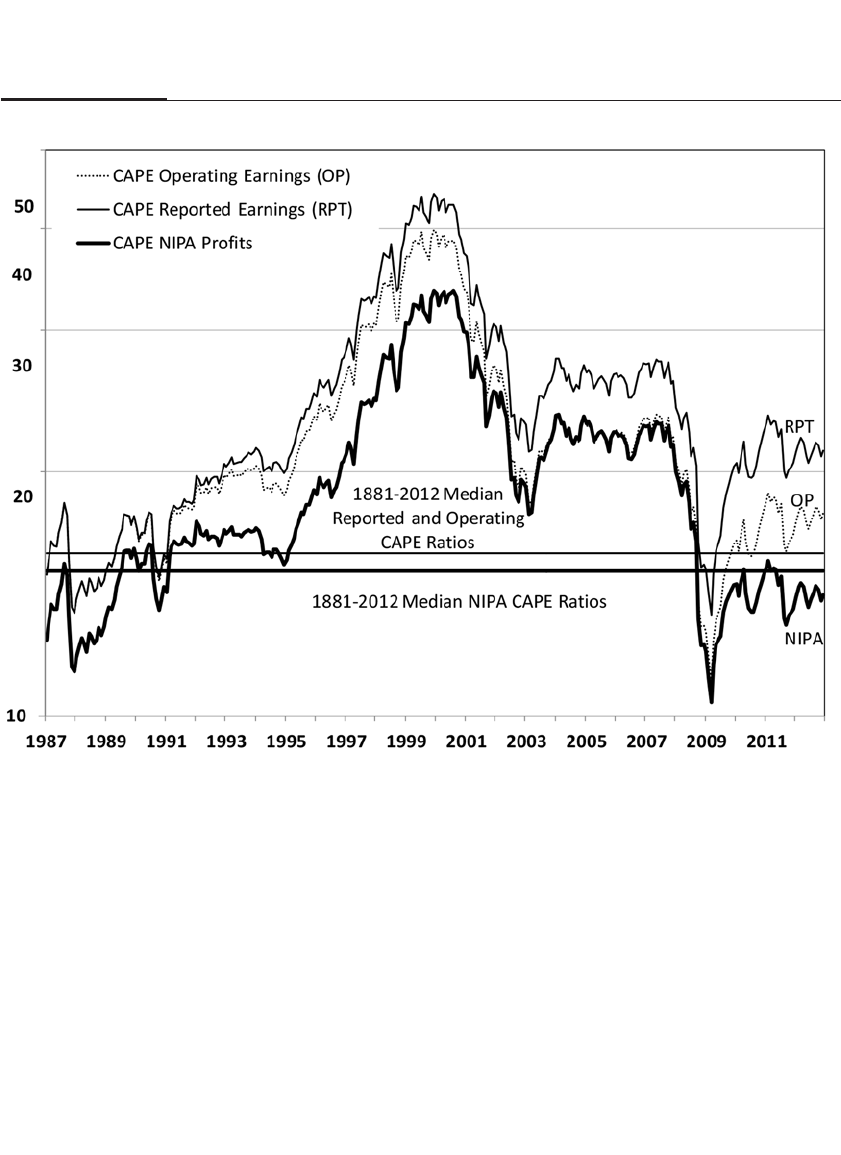

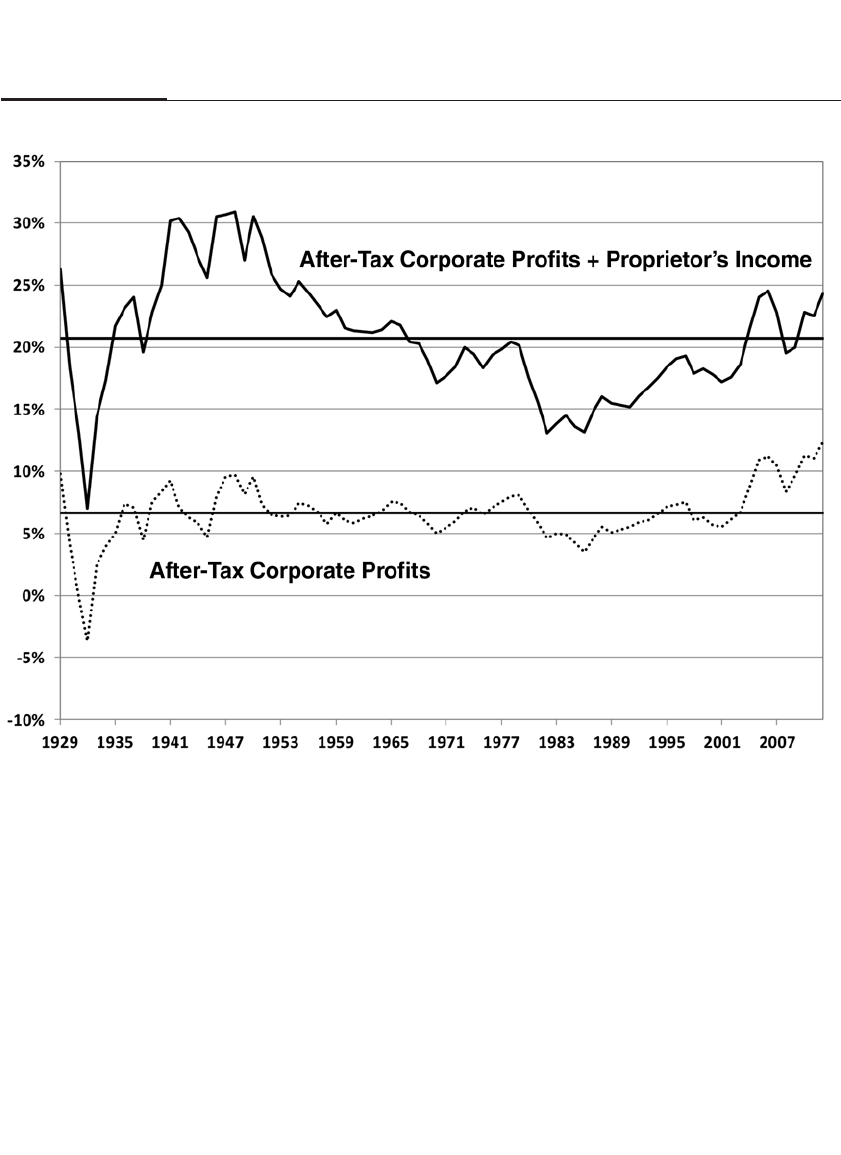

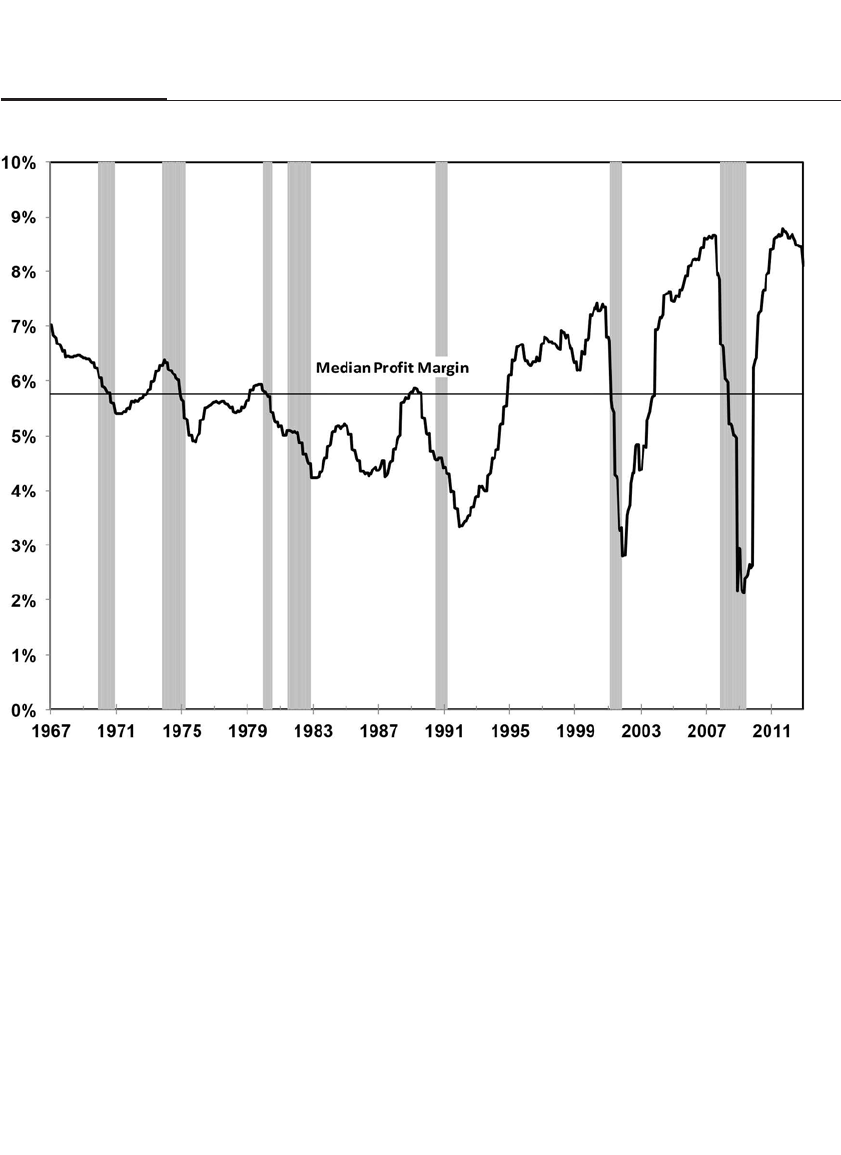

ter on the valuation of equities has been expanded to analyze such

important new forecasting models such as the CAPE ratio and the sig-

nificance of profit margins as a determinant of future equity returns.

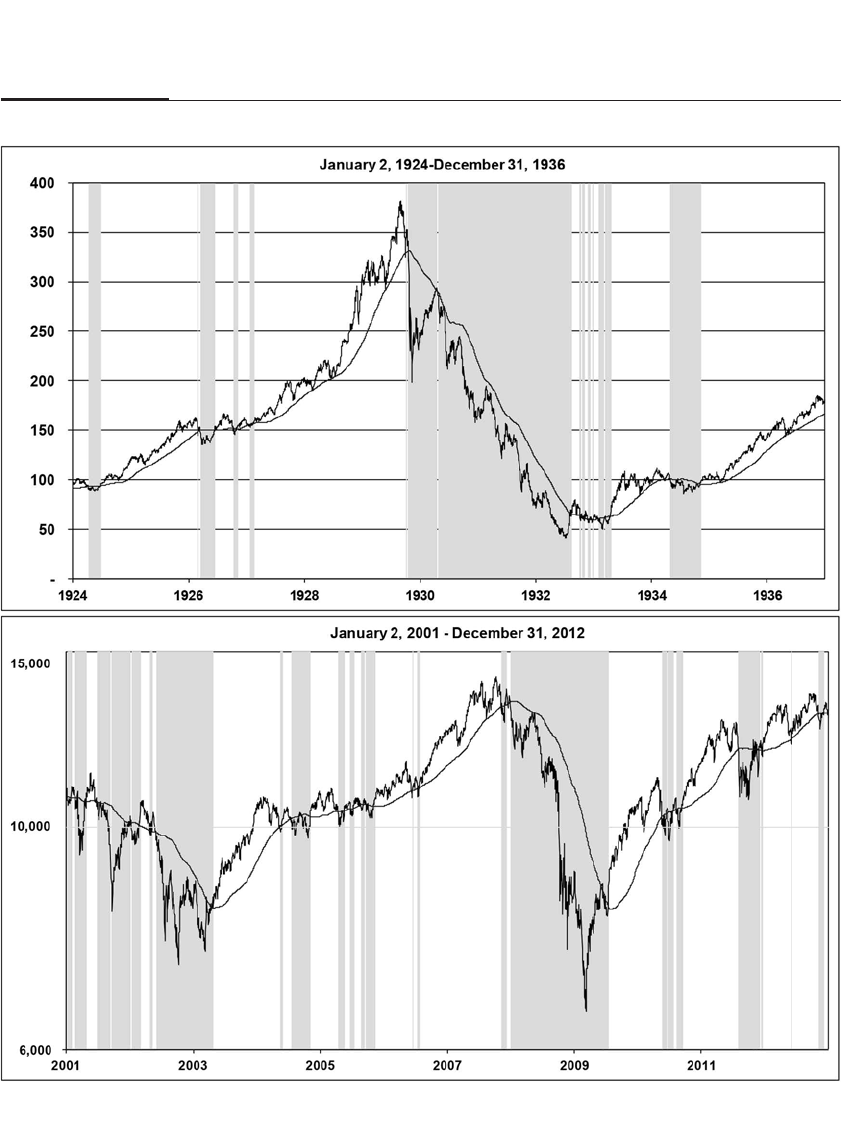

Chapter 19, “Market Volatility,” analyzes the “Flash Crash” of

May 2010 and documents how the volatility associated with the finan-

cial crisis compares with the banking crisis of the 1930s. Chapter 20

shows that, once again, following a simple technical rule such as the

200-day moving average would have avoided the worst part of the

recent bear market.

This edition also addresses whether the well-known calendar anom-

alies, such as the “January effect, the “small stock effect,” and the

“September effect,” have survived over the two decades since they were

described in the first edition of this book. I also include for the first time a

description of “liquidity investing” and explain how it might supplement

the “size” and “value” effects that have been found by researchers to be

important determinants of individual stocks’ return.

CONCLUDING REMARKS

I am both honored and flattered by the tremendous reception that Stocks

for the Long Run has received. Since the publication of the first edition

nearly 20 years ago, I have given hundreds of lectures on the markets

and the economy around the world. I have listened closely to the ques-

tions that audiences pose, and I have contemplated the many letters,

phone calls, and e-mails from readers.

To be sure, there have been some extraordinary events in the capi-

tal markets in recent years. Even those who still believed in the long-

term superiority of equities were put to severe test during the financial

crisis. In 1937 John Maynard Keynes stated in The General Theory of

Employment, Interest and Money, “Investment based on genuine long-

term expectation is so difficult today as to be scarcely practicable.” It is

no easier 75 years later.

PREFACE xxi

But those who have persisted with equities have always been

rewarded. No one has made money in the long run from betting against

stocks or the future growth of our economy. It is the hope that this latest

edition will fortify those who will inevitably waver when pessimism

once again grips economists and investors. History convincingly

demonstrates that stocks have been and will remain the best investment

for all those seeking long-term gains.

Jeremy J. Siegel

November 2013

xxii

PREFACE

It is never possible to list all the individuals and organizations that have

praised Stocks for the Long Run and encouraged me to update and

expand past editions. Many who provided me with data for the first four

editions of Stocks for the Long Run willingly contributed their data again

for this fifth edition. David Bianco, Chief U.S. Equity Strategist at

Deutsche Bank, whose historical work on S&P 500 earnings and profit

margins was invaluable for my chapter on stock market valuation, and

Walter Lenhard, senior investment strategist at Vanguard, once again

obtained historical data on mutual fund performance for Chapter 23. My

new Wharton colleague, Jeremy Tobacman, helped me update the mate-

rial on behavioral finance.

This edition would not have been possible without the hard work

of Shaun Smith, who also did the research and data analysis for the first

edition of Stocks for the Long Run in the early 1990s. Jeremy Schwartz,

who was my principal researcher for The Future for Investors, also pro-

vided invaluable assistance for this edition.

A special thanks goes to the thousands of financial advisors from

dozens of financial firms, such as Merrill Lynch, Morgan Stanley, UBS,

Wells Fargo, and many others who have provided me with critical feed-

back in seminars and open forums on earlier editions of Stocks for the

Long Run.

As before, the support of my family was critical in my being able to

write this edition. Now that my sons are grown and out of the house, it

was my wife Ellen who had to pay the whole price of the long hours

spent revising this book. I set a deadline of September 1 to get my mate-

rial to McGraw-Hill so we could go on a well-deserved cruise from

Venice down the Adriatic. Although I couldn’t promise her that this

would be the last edition, I know that completing this project has freed

some very welcome time for both of us.

xxiii

ACKNOWLEDGMENTS

This page intentionally left blank

PART

STOCK RETURNS

Past, Present, and Future

I

This page intentionally left blank

The Case for Equity

Historical Facts and Media Fiction

The “new-era” doctrine—that “good” stocks (or “blue chips”) were

sound investments regardless of how high the price paid for them—

was at the bottom only a means of rationalizing under the title of

“investment” the well-nigh universal capitulation to the gambling

fever.

—BENJAMIN GRAHAM AND DAVID DODD,

SECURITY ANALYSIS1

Investing in stocks has become a national hobby and a national obses-

sion. To update Marx, it is the religion of the masses.

—ROGER LOWENSTEIN, “A COMMON MARKET:

THE PUBLIC’SZEAL TO INVEST”2

Stocks for the Long Run by Siegel? Yeah, all it’s good for now is a

doorstop.

—INVESTOR CALLING INTO CNBC, MARCH, 20093

“EVERYBODY OUGHT TO BE RICH”

In the summer of 1929, a journalist named Samuel Crowther inter-

viewed John J. Raskob, a senior financial executive at General Motors,

about how the typical individual could build wealth by investing in

stocks. In August of that year, Crowther published Raskob’s ideas in a

3

1

Ladies’ Home Journal article with the audacious title “Everybody Ought

to Be Rich.”

In the interview, Raskob claimed that America was on the verge of

a tremendous industrial expansion. He maintained that by putting just

$15 per month into good common stocks, investors could expect their

wealth to grow steadily to $80,000 over the next 20 years. Such a

return—24 percent per year—was unprecedented, but the prospect of

effortlessly amassing a great fortune seemed plausible in the atmos-

phere of the 1920s bull market. Stocks excited investors, and millions put

their savings into the market, seeking quick profit.

On September 3, 1929, a few days after Raskob’s plan appeared, the

Dow Jones Industrial Average hit a historic high of 381.17. Seven weeks

later, stocks crashed. The next 34 months saw the most devastating

decline in share values in U.S. history.

On July 8, 1932, when the carnage was finally over, the Dow

Industrials stood at 41.22. The market value of the world’s greatest cor-

porations had declined an incredible 89 percent. Millions of investors’

life savings were wiped out, and thousands of investors who had bor-

rowed money to buy stocks were forced into bankruptcy. America was

mired in the deepest economic depression in its history.

Raskob’s advice was ridiculed and denounced for years to come. It

was said to represent the insanity of those who believed that the market

could rise forever and the foolishness of those who ignored the tremen-

dous risks in stocks. Senator Arthur Robinson of Indiana publicly held

Raskob responsible for the stock crash by urging common people to buy

stock at the market peak.4In 1992, 63 years later, Forbes magazine

warned investors of the overvaluation of stocks in its issue headlined

“Popular Delusions and the Madness of Crowds.” In a review of the his-

tory of market cycles, Forbes fingered Raskob as the “worst offender” of

those who viewed the stock market as a guaranteed engine of wealth.5

Conventional wisdom holds that Raskob’s foolhardy advice epito-

mizes the mania that periodically overruns Wall Street. But is that ver-

dict fair? The answer is decidedly no. Investing over time in stocks has

been a winning strategy whether one starts such an investment plan at a

market top or not. If you calculate the value of the portfolio of an

investor who followed Raskob’s advice in 1929, patiently putting $15 a

month into the market, you find that his accumulation exceeded that of

someone who placed the same money in Treasury bills after less than 4

years. By 1949 his stock portfolio would have accumulated almost

$9,000, a return of 7.86 percent, more than double the annual return in

bonds. After 30 years the portfolio would have grown to over $60,000,

4 PART I Stock Returns: Past, Present, and Future

with an annual return rising to 12.72 percent. Although these returns

were not as high as Raskob had projected, the total return of the stock

portfolio over 30 years was more than eight times the accumulation in

bonds and more than nine times that in Treasury bills. Those who never

bought stock, citing the Great Crash as the vindication of their caution,

eventually found themselves far behind investors who had patiently

accumulated equity.6

The story of John Raskob’s infamous prediction illustrates an impor-

tant theme in the history of Wall Street. Bull markets and bear markets

lead to sensational stories of incredible gains and devastating losses. Yet

patient stock investors who can see past the scary headlines have always

outperformed those who flee to bonds or other assets. Even such calami-

tous events as the Great 1929 Stock Crash or the financial crisis of 2008 do

not negate the superiority of stocks as long-term investments.

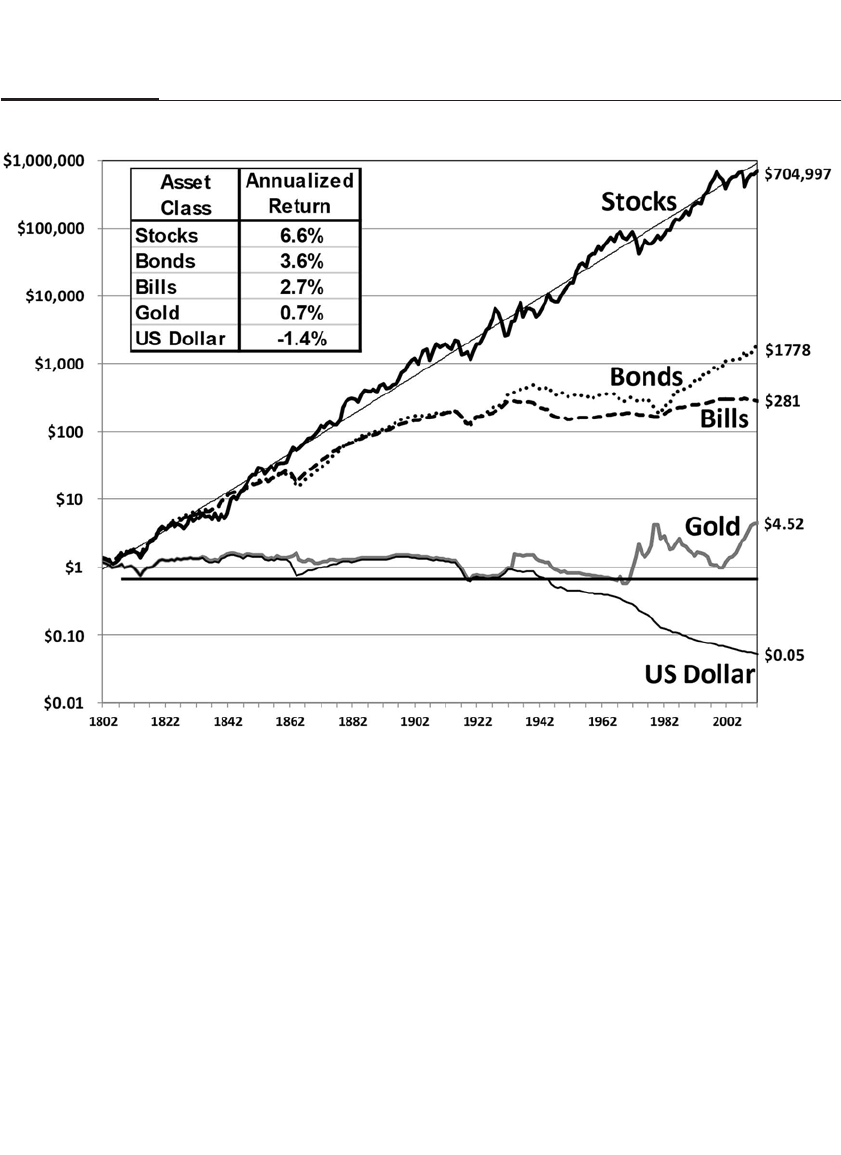

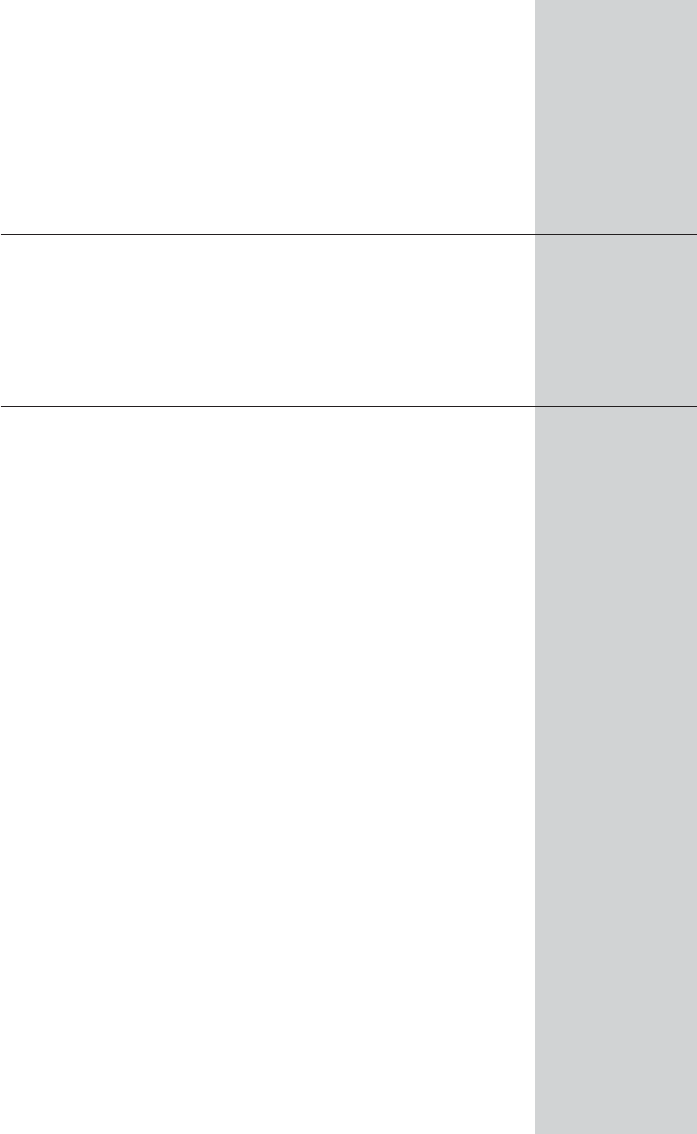

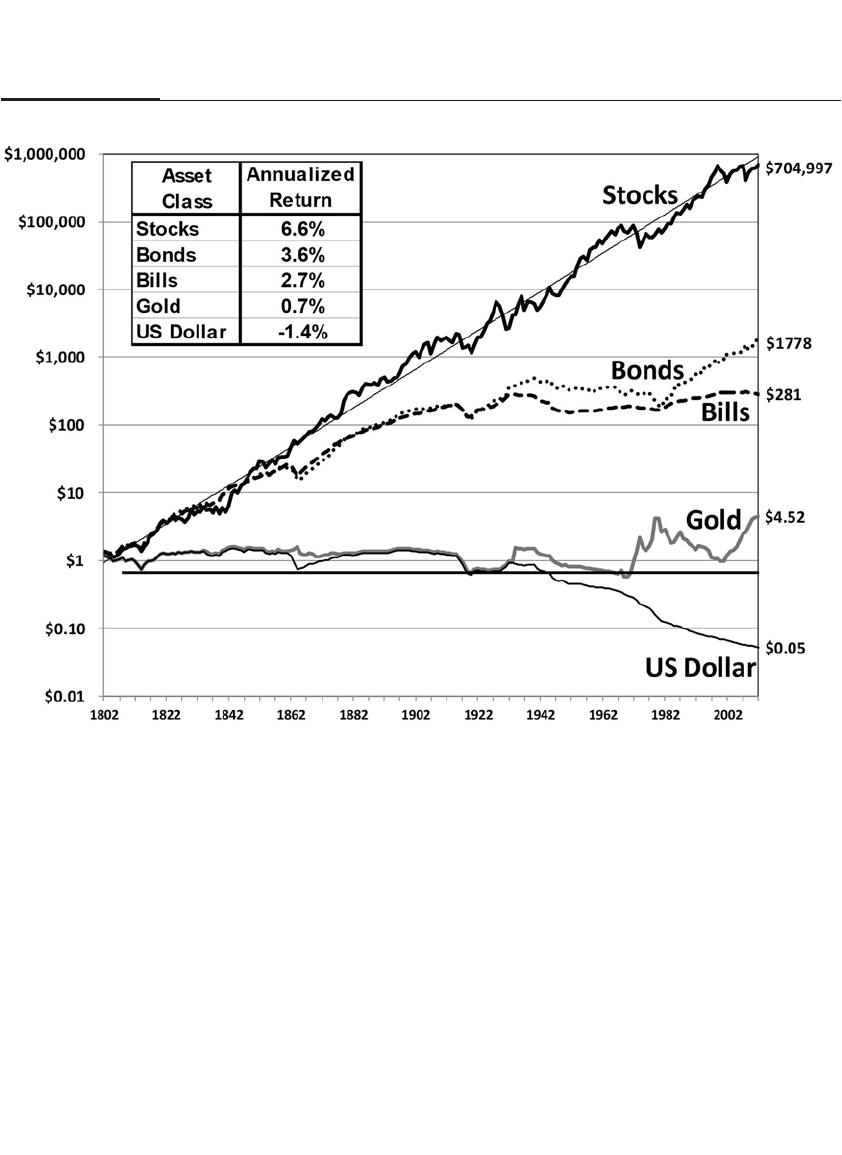

Asset Returns Since 1802

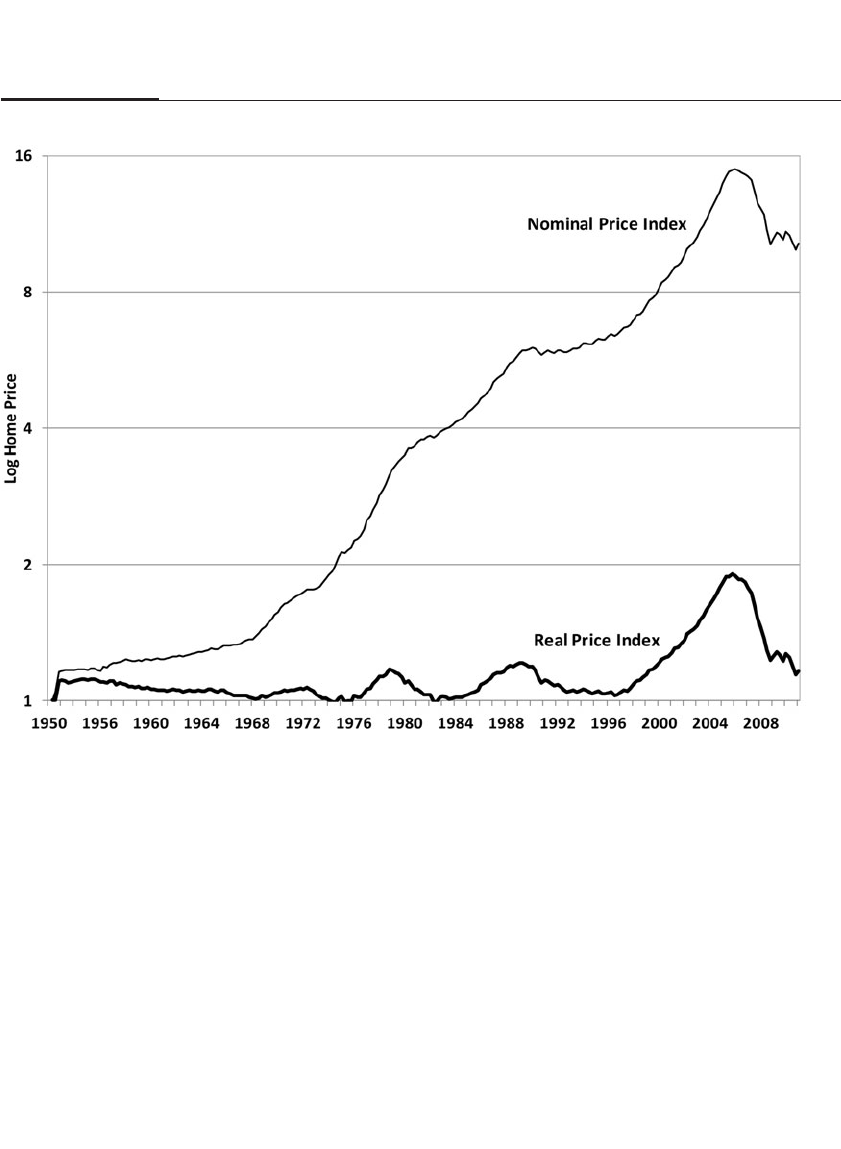

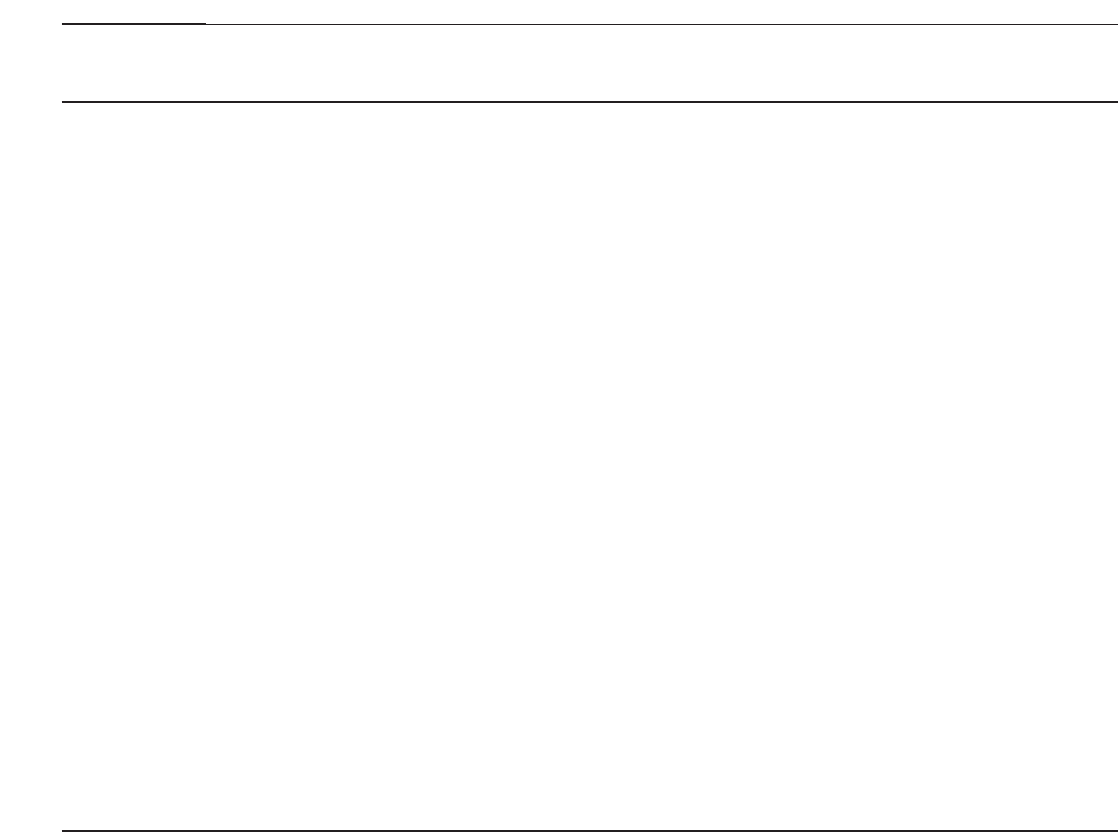

Figure 1-1 is the most important chart in this book. It traces year by year

how real (after-inflation) wealth has accumulated for a hypothetical

investor who put a dollar in (1) stocks, (2) long-term government bonds,

(3) U.S. Treasury bills, (4) gold, and (5) U.S. currency over the last two

centuries. These returns are called total real returns and include income

distributed from the investment (if any) plus capital gains or losses, all

measured in constant purchasing power.

These returns are graphed on a ratio, or logarithmic scale. Economists

use this scale to depict long-term data since the same vertical distance

anywhere on the chart represents the same percentage change. On a log-

arithmic scale the slope of a trendline represents a constant after-inflation

rate of return.

The compound annual real returns for these asset classes are also

listed in the figure. Over the 210 years I have examined stock returns, the

real return on a broadly diversified portfolio of stocks has averaged 6.6

percent per year. This means that, on average, a diversified stock portfo-

lio, such as an index fund, has nearly doubled in purchasing power every

decade over the past two centuries. The real return on fixed-income

investments has averaged far less; on long-term government bonds the

average real return has been 3.6 percent per year and on short-term

bonds only 2.7 percent per year.

The average real return on gold has been only 0.7 percent per year.

In the long run, gold prices have remained just ahead of the inflation

rate, but little more. The dollar has lost, on average, 1.4 percent per year

CHAPTER 1 The Case for Equity 5

of purchasing power since 1802, but it has depreciated at a significantly

faster rate since World War II. In Chapter 5 we examine the details of

these return series and see how they are constructed.

I have fitted the best statistical trendline to the real stock returns in

Figure 1-1. The stability of real returns is striking; real stock returns in

the nineteenth century do not differ appreciably from the real returns in

the twentieth century. Note that stocks fluctuate both below and above

the trendline but eventually return to the trend. Economists call this

behavior mean reversion, a property that indicates that periods of above-

average returns tend to be followed by periods of below-average returns

and vice versa. No other asset class—bonds, commodities, or the dol-

lar—displays the stability of long-term real returns as do stocks.

In the short run, however, stock returns are very volatile, driven by

changes in earnings, interest rates, risk, and uncertainty, as well as psy-

6 PART I Stock Returns: Past, Present, and Future

FIGURE 1–1

Total Real Returns on U.S. Stocks, Bonds, Bills, Gold, and the Dollar, 1802–2012

chological factors, such as optimism and pessimism as well as fear and

greed. Yet these short-term swings in the market, which so preoccupy

investors and the financial press, are insignificant compared with the

broad upward movement in stock returns.

In the remainder of this chapter, I examine how economists and

investors have viewed the investment value of stocks over the course of

history and how the great bull and bear markets impact both the media

and the opinions of investment professionals.

HISTORICAL PERSPECTIVES ON STOCKS AS INVESTMENTS

Throughout the nineteenth century, stocks were deemed the province of

speculators and insiders but certainly not conservative investors. It was

not until the early twentieth century that researchers came to realize that

equities might be suitable investments under certain economic condi-

tions for investors outside those traditional channels.

In the first half of the twentieth century, the great U.S. economist

Irving Fisher, a professor at Yale University and an extremely successful

investor, believed that stocks were superior to bonds during inflationary

times but that common shares would likely underperform bonds during

periods of deflation, a view that became the conventional wisdom dur-

ing that time.7

Edgar Lawrence Smith, a financial analyst and investment manager

of the 1920s, researched historical stock prices and demolished this con-

ventional wisdom. Smith was the first to demonstrate that accumula-

tions in a diversified portfolio of common stocks outperformed bonds

not only when commodity prices were rising but also when prices were

falling. Smith published his studies in 1925 in a book entitled Common

Stocks as Long-Term Investments. In the introduction he stated:

These studies are a record of a failure—the failure of facts to sustain a pre-

conceived theory, . . . [the theory being] that high-grade bonds had proved

to be better investments during periods of [falling commodity prices].8

Smith maintained that stocks should be an essential part of an

investor’s portfolio. By examining stock returns back to the Civil War,

Smith discovered that there was a very small chance that an investor

would have to wait a long time (which he put at 6 to, at most, 15 years)

before being able to sell his stocks at a profit. Smith concluded:

We have found that there is a force at work in our common stock holdings

which tends ever toward increasing their principal value. . . . [U]nless we

CHAPTER 1 The Case for Equity 7

have had the extreme misfortune to invest at the very peak of a noteworthy

rise, those periods in which the average market value of our holding remains

less than the amount we paid for them are of comparatively short duration.

Our hazard even in such extreme cases appears to be that of time alone.9

Smith’s conclusion was right not only historically but also prospec-

tively. It took just over 15 years to recover the money invested at the 1929

peak, following a crash far worse than Smith had ever examined. And

since World War II, the recovery period for stocks has been even better.

Even including the recent financial crisis, which saw the worst bear mar-

ket since the 1930s, the longest it has ever taken an investor to recover an

original investment in the stock market (including reinvested divi-

dends) was the five-year, eight-month period from August 2000 through

April 2006.

The Influence of Smith’s Work

Smith wrote his book in the 1920s, at the outset of one of the greatest bull

markets in our history. Its conclusions caused a sensation in both aca-

demic and investing circles. The prestigious weekly The Economist

stated, “Every intelligent investor and stockbroker should study Mr.

Smith’s most interesting little book, and examine the tests individually

and their very surprising results.”10

Smith’s ideas quickly crossed the Atlantic and were the subject of

much discussion in Great Britain. John Maynard Keynes, the great

British economist and originator of the business cycle theory that

became the paradigm for future generations of economists, reviewed

Smith’s book with much excitement. Keynes stated:

The results are striking. Mr. Smith finds in almost every case, not only

when prices were rising, but also when they were falling, that common

stocks have turned out best in the long-run, indeed, markedly so. . . . This

actual experience in the United States over the past fifty years affords

prima facie evidence that the prejudice of investors and investing institu-

tions in favor of bonds as being “safe” and against common stocks as hav-

ing, even the best of them, a “speculative” flavor, has led to a relative

over-valuation of bonds and under-valuation of common stocks.11

Common Stock Theory of Investment

Smith’s writings gained academic credibility when they were published

in such prestigious journals as the Review of Economic Statistics and the

8 PART I Stock Returns: Past, Present, and Future

Journal of the American Statistical Association.12 Smith acquired an interna-

tional following when Siegfried Stern published an extensive study of

returns in common stock in 13 European countries from the onset of

World War I through 1928. Stern’s study showed that the advantage of

investing in common stocks over bonds and other financial investments

extended far beyond America’s financial markets.13 Research demon-

strating the superiority of stocks became known as the common stock the-

ory of investment.14

The Market Peak

Smith’s research also changed the mind of the renowned Yale economist

Irving Fisher, who saw Smith’s study as a confirmation of his own long-

held belief that bonds were overrated as safe investments in a world

with uncertain inflation. In 1925 Fisher summarized Smith’s findings

with these prescient observations of investors’ behavior:

It seems, then, that the market overrates the safety of “safe” securities and

pays too much for them, that it overrates the risk of risky securities and

pays too little for them, that it pays too much for immediate and too little

for remote returns, and finally, that it mistakes the steadiness of money

income from a bond for a steadiness of real income which it does not pos-

sess. In steadiness of real income, or purchasing power, a list of diversified

common stocks surpasses bonds.15

Irving Fisher’s “Permanently High Plateau”

Professor Fisher, cited by many as the greatest U.S. economist and the

father of capital theory, was no mere academic. He actively analyzed

and forecast financial market conditions, wrote dozens of newsletters on

topics ranging from health to investments, and created a highly success-

ful card-indexing firm based on one of his own patented inventions.

Although he hailed from a modest background, his personal wealth in

the summer of 1929 exceeded $10 million, which is over $100 million in

today’s dollars.16

Irving Fisher, as well as many other economists in the 1920s,

believed that the establishment of the Federal Reserve System in 1913

was critical to reducing the severity of economic fluctuations. Indeed

the 1920s were a period of remarkably stable growth, as the instability

in such economic variables as industrial production and producer

prices was greatly reduced, a factor that boosted the prices of risky

CHAPTER 1 The Case for Equity 9

assets such as stocks. As we shall see in the next chapter, there was a

remarkable similarity between the stability of the 1920s and the decade

that preceded the recent 2008 financial crisis. In both periods not only

had the business cycle moderated, but there was great confidence—

later shattered—that the Federal Reserve would be able to mitigate, if

not eliminate, the business cycle.

The 1920s bull market drew millions of Americans into stocks, and

Fisher’s own financial success and reputation as a market seer gained him

a large following among investors and analysts. The market turbulence in

early October 1929 greatly increased interest in his pronouncements.

Market followers were not surprised that on the evening of October

14, 1929, when Irving Fisher arrived at the Builders’ Exchange Club in

New York City to address the monthly meeting of the Purchasing

Agents Association, a large number of people, including news reporters,

pressed into the meeting hall. Investors’ anxiety had been rising since

early September when Roger Babson, businessman and market seer,

predicted a “terrific” crash in stock prices.17 Fisher had dismissed

Babson’s pessimism, noting that Babson had been bearish for some time.

But the public sought to be reassured by the great man who had cham-

pioned stocks for so long.

The audience was not disappointed. After a few introductory

remarks, Fisher uttered a sentence that, much to his regret, became

one of the most-quoted phrases in stock market history: “Stock

prices,” he proclaimed, “have reached what looks like a permanently

high plateau.”18

On October 29, two weeks to the day after Fisher’s speech, stocks

crashed. His “high plateau” turned into a bottomless abyss. The next

three years witnessed the most devastating market collapse in history.

Despite all of Irving Fisher’s many accomplishments, his reputation—

and the thesis that stocks were a sound way to accumulate wealth—was

shattered.

A RADICAL SHIFT IN SENTIMENT

The collapse of both the economy and the stock market in the 1930s left an

indelible mark on the psyches of investors. The common stock theory of

investment was attacked from all angles, and many summarily dismissed

the idea that stocks were fundamentally sound investments. Lawrence

Chamberlain, an author and well-known investment banker, stated,

“Common stocks, as such, are not superior to bonds as long-term investments,

because primarily they are not investments at all. They are speculations.”19

10 PART I Stock Returns: Past, Present, and Future

In 1934, Benjamin Graham, an investment fund manager, and

David Dodd, a finance professor at Columbia University, wrote Security

Analysis, which became the bible of the value-oriented approach to ana-

lyzing stocks and bonds. Through its many editions, the book has had a

lasting impact on students and market professionals alike.

Graham and Dodd clearly blamed Smith’s book for feeding the bull

market mania of the 1920s by proposing plausible-sounding but falla-

cious theories to justify the purchase of stocks.

They wrote:

The self-deception of the mass speculator must, however, have its element

of justification. . . . In the new-era bull market, the “rational” basis was the

record of long-term improvement shown by diversified common-stock

holdings. [There is] a small and rather sketchy volume from which the

new-era theory may be said to have sprung. The book is entitled Common

Stocks as Long-Term Investments by Edgar Lawrence Smith, published in

1924.20

THE POSTCRASH VIEW OF STOCK RETURNS

Following the Great Crash, both the media and analysts trashed both the

stock market and those who advocated stocks as investments.

Nevertheless, research on indexes of stock market returns received a big

boost in the 1930s when Alfred Cowles III, founder of the Cowles

Commission for Economic Research, constructed capitalization-

weighted stock indexes back to 1871 of all stocks traded on the New

York Stock Exchange. His total-return indexes included reinvested divi-

dends and are virtually identical to the methodology that is used today

to compute stock returns. Cowles confirmed the findings that Smith

reached before the stock crash and concluded that most of the time

stocks were undervalued and enabled investors to reap superior returns

by investing in them.21

After World War II, two professors from the University of

Michigan, Wilford J. Eiteman and Frank P. Smith, published a study of

the investment returns of actively traded industrial companies and

found that by regularly purchasing these 92 stocks without any regard

to the stock market cycle (a strategy called dollar cost averaging), stock

investors earned returns of 12.2 percent per year, far exceeding those in

fixed-income investments. Twelve years later they repeated the study,

using the same stocks they had used in their previous study. This time

the returns were even higher despite the fact that they made no adjust-

CHAPTER 1 The Case for Equity 11

ment for any of the new firms or new industries that had surfaced in the

interim. They wrote:

If a portfolio of common stocks selected by such obviously foolish meth-

ods as were employed in this study will show an annual compound rate

of return as high as 14.2 percent, then a small investor with limited knowl-

edge of market conditions can place his savings in a diversified list of

common stocks with some assurance that, given time, his holding will

provide him with safety of principal and an adequate annual yield.22

Many dismissed the Eiteman and Smith study because the period

studied did not include the Great Crash of 1929 to 1932. But in 1964, two

professors from the University of Chicago, Lawrence Fisher and James

H. Lorie, examined stock returns through the stock crash of 1929, the

Great Depression, and World War II.23 Fisher and Lorie concluded that

stocks offered significantly higher returns (which they reported at 9.0

percent per year) than any other investment media during the entire 35-

year period, 1926 through 1960. They even factored taxes and transac-

tion costs into their return calculations and concluded:

It will perhaps be surprising to many that the returns have consistently

been so high. . . . The fact that many persons choose investments with a

substantially lower average rate of return than that available on common

stocks suggests the essentially conservative nature of those investors and

the extent of their concern about the risk of loss inherent in common

stocks.24

Ten years later, in 1974, Roger Ibbotson and Rex Sinquefield pub-

lished an even more extensive review of returns in an article entitled

“Stocks, Bonds, Bills, and Inflation: Year-by-Year Historical Returns

(1926–74).”25 They acknowledged their indebtedness to the Lorie and

Fisher study and confirmed the superiority of stocks as long-term

investments. Their summary statistics, which are published annually in

yearbooks, are frequently quoted and have often served as the return

benchmarks for the securities industry.26

THE GREAT BULL MARKET OF 1982–2000

The 1970s were not good years for either stocks or the economy. Surging

inflation and sharply higher oil prices led to negative real stock returns

for the 15-year period from the end of 1966 through the summer of 1982.

But as the Fed’s tight money policy quashed inflation, interest rates fell

sharply and the stock market entered its greatest bull market ever, a

12 PART I Stock Returns: Past, Present, and Future

market that would eventually see stock prices appreciate by more than

tenfold. From a low of 790 in August 1982, stocks rose sharply, and the

Dow Industrial Average surged past 1,000 to a new record by the end of

1982, finally surpassing the 1973 highs it had reached nearly a decade

earlier.

Although many analysts expressed skepticism that the rise could

continue, a few were very bullish. Robert Foman, president and chair-

man of E.F. Hutton, proclaimed in October 1983 that we are “in the

dawning of a new age of equities” and boldly predicted the Dow Jones

average could hit 2,000 or more by the end of the decade.

But even Foman was too pessimistic, as the Dow Industrials broke

2,000 in January 1987 and surpassed 3,000 just before Saddam Hussein

invaded Kuwait in August 1990. The Gulf War and a real estate recession

precipitated a bear market, but this one, like the stock crash of October

1987, was short lived.

Iraq’s defeat in the Gulf War ushered in one of the most fabulous

decades in stock market history. The world witnessed the collapse of

communism and the diminished threat of global conflict. The transfer

of resources from military expenditures to domestic consumption

enabled the United States to increase economic growth while keeping

inflation low.

As stocks moved upward, few thought the bull market would last.

In 1992, Forbes warned investors in a cover story “The Crazy Things

People Say to Rationalize Stock Prices” that stocks were in the “midst of

a speculative buying panic” and cited Raskob’s foolish advice to invest

at the market peak in 1929.27

But such caution was ill advised. After a successful battle against

inflation in 1994, the Fed eased interest rates, and the Dow subsequently

moved above 4,000 in early 1995. Shortly thereafter, BusinessWeek

defended the durability of the bull market in an article on May 15, 1995,

entitled “Dow 5000? Don’t Laugh.” The Dow quickly crossed that bar-

rier by November and then reached 6,000 eleven months later.

By late 1995, the persistent rise in stock prices caused many more

analysts to sound the alarm. Michael Metz of Oppenheimer, Charles

Clough of Merrill Lynch, and Byron Wien of Morgan Stanley expressed

strong doubts about the underpinnings of the rally. In September 1995,

David Shulman, chief equity strategist for Salomon Brothers, wrote an

article entitled “Fear and Greed,” which compared the current market

climate with that of similar stock market peaks in 1929 and 1961.

Shulman claimed intellectual support was an important ingredient in

sustaining bull markets, noting Edgar Smith’s and Irving Fisher’s work

CHAPTER 1 The Case for Equity 13

in the 1920s, the Fisher-Lorie studies in the 1960s, and my Stocks for the

Long Run, published in 1994.28 But these bears had little impact as stocks

continued upward.

Warnings of Overvaluation

By 1996, price/earnings ratios on the S&P 500 Index reached 20, consid-

erably above its average postwar level. More warnings were issued.

Roger Lowenstein, a well-known author and financial writer, asserted in

the Wall Street Journal:

Investing in stocks has become a national hobby and a national obsession.

People may denigrate their government, their schools, their spoiled sports

stars. But belief in the market is almost universal. To update Marx, it is the

religion of the masses.29

Floyd Norris, lead financial writer for the New York Times, echoed

Lowenstein’s comments by penning an article in January 1997, “In the

Market We Trust.”30 Henry Kaufman, the Salomon Brothers guru whose

pronouncements on the fixed-income market had frequently rocked

bonds in the 1980s, declared that “the exaggerated financial euphoria is

increasingly conspicuous,” and he cited assurances offered by optimists

equivalent to Irving Fisher’s utterance that stocks had reached a perma-

nently high plateau.31

Warnings of the end of the bull market did not emanate just from

the media and Wall Street. Academicians were increasingly investigat-

ing this unprecedented rise in stock values. Robert Shiller of Yale

University and John Campbell of Harvard wrote a scholarly paper

showing that the market was significantly overvalued and presented

this research to the Board of Governors of the Federal Reserve System in

early December 1996.32

With the Dow surging past 6,400, Alan Greenspan, chairman of the

Federal Reserve, issued a warning in a speech before the annual dinner

for the American Enterprise Institute in Washington on December 5,

1996. He asked, “How do we know when irrational exuberance has

unduly escalated asset values, which then become subject to unexpected

and prolonged contractions as they have in Japan over the past decade?

And how do we factor that assessment into monetary policy?”

His words had an electrifying effect, and the term irrational exuber-

ance became the most celebrated utterance of Greenspan’s tenure as Fed

chairman. Asian and European markets fell dramatically as his words

14 PART I Stock Returns: Past, Present, and Future

were flashed across computer monitors, and the next morning Wall

Street opened dramatically lower. But investors quickly regained their

optimism, and stocks closed in New York with only moderate losses.

The Late Stage of the Great Bull Market, 1997–2000

From there it was onward and upward, with the Dow breaking 7,000 in

February 1997 and 8,000 in July. Even Newsweek’s cautious cover story

“Married to the Market,” depicting a Wall Street wedding between

America and a bull, did nothing to quell investor optimism.33

The market became an ever-increasing preoccupation of middle-

and upper-income Americans. Business books and magazines prolifer-

ated, and the all-business cable news stations, particularly CNBC, drew

huge audiences. Electronic tickers and all-business TV stations were

broadcast in lunchrooms, bars, and even lounges of the major business

schools throughout the country. Air travelers flying 35,000 feet above the

sea could view up-to-the-minute Dow and Nasdaq averages as they

were flashed from monitors on phones anchored to the backs of the seats

facing the travelers.

Adding impetus to the already surging market was the explosion of

communications technology. The Internet allowed investors to stay in

touch with markets and with their portfolios from anywhere in the

world. Whether it was from Internet chat rooms, financial websites, or e-

mail newsletters, investors found access to a plethora of information at

their fingertips. CNBC became so popular that major investment houses

made sure that all their brokers watched the station on television or their

desktop computers so that they could be one step ahead of clients call-

ing in with breaking business news.

The bull market psychology appeared impervious to financial and

economic shocks. The first wave of the Asian crisis sent the market down

a record 554 points on October 27, 1997, and closed trading temporarily.

But this did little to dent investors’ enthusiasm for stocks.

The following year, the Russian government defaulted on its

bonds, and Long-Term Capital Management, considered the world’s

premier hedge fund, found itself entangled in speculative positions

measured in the trillions of dollars that it could not trade. These events

sent the Dow Industrials down almost 2,000 points, or 20%, but three

quick Fed rate cuts sent the market soaring again. On March 29, 1999, the

Dow closed above 10,000, and it then went on to a record close of

11,722.98 on January 14, 2000.

CHAPTER 1 The Case for Equity 15

The Top of the Market

As has happened so many times, at the peak of the bull market the dis-

credited bears retreat while the bulls, whose egos have been reinforced

by the continued upward movement of stock prices, become even

bolder. In 1999, two economists, James Glassman and Kevin Hassett,

published a book entitled Dow 36,000. They claimed that the Dow Jones

Industrial Average, despite its meteoric rise, was still grossly underval-

ued, and its true valuation was three times higher at 36,000. Much to my

surprise, they asserted that the theoretical underpinning for their analy-

sis came from my book Stocks for the Long Run! They claimed that since I

showed that bonds were as risky as stocks over long horizons, then stock

prices must rise threefold to reduce their returns to those of bonds,

ignoring that the real comparison should be with the Treasury inflation-

protected bonds, whose yield was much higher at that time.34

Despite the upward march of the Dow Industrials, the real action in

the market was in the technology stocks that were listed on the Nasdaq,

which included such shares as Cisco, Sun Microsystems, Oracle, JDS

Uniphase, and other companies as well as the rising group of Internet

stocks. From November 1997 to March 2000, the Dow Industrials rose 40

percent, but the Nasdaq index rose 185 percent, and the dot-com index

of 24 online firms soared nearly tenfold from 142 to 1,350.

The Tech Bubble Bursts

The date March 10, 2000, marked the peak not only of the Nasdaq but

also of many Internet and technology stock indexes. Even I, a longtime

bull, wrote that the technology stocks were selling at ridiculous prices

that presaged a collapse.35

When technology spending unexpectedly slowed, the bubble burst,

and a severe bear market began. Stock values plunged by a record

$9 trillion, and the S&P 500 Index declined by 49.15 percent, eclipsing

the 48.2 percent decline in the 1972 to 1974 bear market and the worst

since the Great Depression. The Nasdaq fell 78 percent and the dot-com

index by more than 95 percent.

Just as the bull market spawned the irrational optimists, the col-

lapsing stock prices brought back the bears in droves. In September

2002, with the Dow hovering around 7,500 and just a few weeks before

the bear market low of 7,286, Bill Gross, the legendary head of the

PIMCO, home of the world’s largest mutual fund, came out with a piece

entitled “Dow 5,000” in which he stated that despite the market’s awful

16 PART I Stock Returns: Past, Present, and Future

decline, stocks were still nowhere near as low as they should be on the

basis of economic fundamentals. It was startling that within a period of

two years, one well-regarded forecaster claimed the right value for the

Dow was as high as 36,000, while another claimed it should fall to 5,000!

The bear market squelched the public’s fascination with stocks.

Televisions in public venues were no longer tuned to CNBC but instead

switched on sports and Hollywood gossip. As one bar owner colorfully

put it, “People are licking their wounds and they don’t want to talk

about stocks anymore. It’s back to sports, women, and who won the

game.”36

The declining market left many professionals deeply skeptical of

stocks, and yet bonds did not seem an attractive alternative, as their

yields had declined below 4 percent. Investors wondered whether there

might be attractive investments beyond the world of stocks and bonds.

David Swenson, chief investment officer at Yale University since

1985, seemed to provide that answer. At the peak of the bull market, he

wrote a book, Pioneering Portfolio Management: An Unconventional

Approach to Institutional Investment, that espoused the qualities of “non-

traditional” (and often illiquid) assets, such as private equity, venture

capital, real estate, timber, and hedge funds. As a result, hedge funds,

pools of investment money that can be invested in any way the fund

managers see fit, enjoyed a boom.37 From a mere $100 billion in 1990,

assets of hedge funds grew to over $1.5 trillion by 2007.

But the surge of assets into hedge funds drove the prices of many

unconventional assets to levels never before seen. Jeremy Grantham, a

successful money manager at GMO and a onetime big booster of uncon-

ventional investing, stated in April 2007, “After these moves, most

diversifying and exotic assets are badly overpriced.”38

RUMBLINGS OF THE FINANCIAL CRISIS

From the ashes of the technology bust of 2000–2002, the stock market

almost doubled from its low of 7,286 on October 9, 2002, to an all-time

high of 14,165 exactly five years later on October 9, 2007. In contrast to

the peak of the technology boom, when the S&P 500 was selling for 30

times earnings, there was no general overvaluation at the 2007 market

peak; stocks were selling for a much more modest 16 times earnings.

But there were signs that all was not well. The financial sector,

which in the bull market had become the largest sector of the S&P 500

Index, peaked in May 2007, and the price of many large banks, such as

Citi and BankAmerica, had been falling all year.

CHAPTER 1 The Case for Equity 17

More ominous developments came from the real estate market.

Real estate prices, after having nearly tripled in the previous decade,

peaked in the summer of 2006 and were heading downward. All of a

sudden, subprime mortgages experienced large delinquencies. In April

2007 New Century Financial, a leading subprime lender, filed for bank-

ruptcy, and in June Bear Stearns informed investors that it was suspend-

ing redemptions from its High-Grade Structured Credit Strategies

Enhanced Leverage Fund, a fund whose name is as complex as the secu-

rities that it held.

At first the market ignored these developments, but on August 9,

2007, BNP Paribas, when France’s largest bank, halted redemptions in its

mortgage funds, world equity markets sold off sharply. Stocks recovered

when the Fed lowered the Fed funds rate 50 basis points in an emer-

gency meeting in August and another 50 basis points at its regular

September meeting.

Yet 2008 brought no relief from subprime troubles. Bear Stearns,

which had to take an increasing volume of subprime mortgages back on

its own balance sheets, began to experience funding problems, and the

price of its shares plummeted. On March 17, 2008, the Federal Reserve,

in an effort to shield Bear from imminent bankruptcy, arranged an emer-

gency sale of all of Bear Stearns’s assets to JPMorgan at a price of $2

(later raised to $10) a share, almost 99 percent below its high of $172.61

reached in January of the prior year.

Beginning of the End for Lehman Brothers

But Bear Stearns was only the appetizer for this bear market, and the

main dish was not far behind. Lehman Brothers, founded in the 1850s,

had a storied history that included bringing such great companies as