Employee Guide RSVP & Lay DC Plan Pension Your To Getting Started 1

Lay_Pension_Your_Guide_to_Getting_Started

Lay_Pension_Your_Guide_to_Getting_Started

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 36

employee guide

Start Investing in Yourself with Help from

The Episcopal Church Retirement

Savings Plan (RSVP) or

The Episcopal Church Lay Employees’

Defined Contribution Retirement Plan

(Lay DC Plan)

Dear Friend,

Welcome to your retirement plan. Depending upon your eligibility and the plan your employer has

adopted, you are now enrolled in either:

•TheEpiscopalChurchRetirementSavingsPlan(RSVP)or

•TheEpiscopalChurchLayEmployees’DefinedContributionRetirementPlan(LayDCPlan).

Wearedelightedthatyouareparticipatinginthisimportantsavingsvehicleforyourretirement.

Now that you enrolled in a plan, here’s what you need to do next:

•Goonlinetowww.cpg.org/myaccount to set up your Web account.

•Chooseyourcontributionamountandinvestmentelections.*

•DesignateyourbeneficiariesbyloggingontoFidelityNetBenefits® at www.cpg.org/myaccount and

clicking Beneficiaries in the About YousectionofYour Profile.

Pleasenotethatwherevertheword“Plan”or“Plans”isusedintheEmployeeGuide,thattermwillrefertoone

orbothoftheRSVPandtheLayDCPlan.IfanythingintheEmployeeGuideappliesonlytoonePlan,specific

referencewillbemadetotheRSVPortotheLayDCPlan,asapplicable.Accordingly,therulesandprovisions

describedintheEmployeeGuideareapplicabletobothPlansunlessspecifiedotherwise.

TheEmployeeGuidecontainsadescriptionofthematerialtermsofthePlans.Belowareafewhighlights.

Pretax contributions:YourcontributionstothePlansaredeductedfromyourpaybeforefederalincome

taxesaretakenout.Thisisreferredtoasa“pretaxcontribution”andcanlowertheamountofincometaxes

you currently pay.

Tax-deferred growth:BecauseeachPlaniswhat’sknownasa“qualifiedplan,”youwillpaynotaxesonany

earningsinyourPlanaccountuntilyoureceiveadistributionfromthePlan,soyourmoneycangrowfaster.

When you retire and start making withdrawals, you will be taxed on the money you take out, but you may

well be in a lower tax bracket at that time.

Employer contributions:**UndertheRSVP,youremployermayormaynotmakebaseand/ormatching

contributions in its discretion.

UndertherulesoftheLayDCPlan,youremployertypicallycontributesabaseof5%ofyourannual

compensation,andalsotypicallymatchesyourcontributionsupto4%ofyourcompensation.Thatmeansthat

youremployerwillcontributethebasewhetherornotyoucontributeanything.Buttogetemployermatching

money,youmustcontributetotheLayDCPlan.Themoreyoucontribute,themoreemployermatchingmoney

youwillget—upto4%ofyourannualcompensation.Ifyouareunabletocommittothe4%contributionatthis

time,youcancontributeatalowerrateandstillbuildyourretirementsavings.

If you’re a cleric, there may be additional tax advantages:Atretirement,youmaybeabletoapplyyour

RSVPwithdrawalstowardyourhousingallowance,soyoumightnothavetopayincometaxesonyourtotal

withdrawal.Makesuretoconsultyourtaxadvisoraboutthis.

Contributing the maximum amount allowed by the IRS:Eachyear,theIRSsetsthemaximumallowable

pretaxcontributionyoucanmaketothePlans.Ifyoucan,itmakesgoodsensetocontributethemaximum

allowabletoyourretirementaccountbecauseitwillgrowtax-deferred.

Wewishyouafulfillingcareerandacomfortableretirement.

Sincerely,

FredBeaver

SeniorVicePresident,PensionServices

19East34thStreet

NewYork,NY10016

(866)802-6333

(877)208-0092

Fax:(212)592-9487

*ParticipantsaredefaultedtoaFidelityFreedomK®Fundoptionatthepointofenrollment.

**Contributionsvary,sopleaseobtainfurtherinformationregardingemployercontributionsdirectlyfromyouremployer.

Countonustosupportyou

everystepoftheway.

Investing in yourself is easy with the Plans. We’ll show you how to get started, step by step.

When you’re ready to enroll, call (877) 208-0092 or go to www.cpg.org/rsvp, for

the RSVP, or to www.cpg.org/laydc, for the Lay DC Plan.

Decidehowmuchtoinvest.

Step

1

Step

2

Step

3

Determineinvestmentsthatarerightforyou.

Completeyourenrollment.

First: Let’s see why it’s important to start today.

Getstartedtoday.

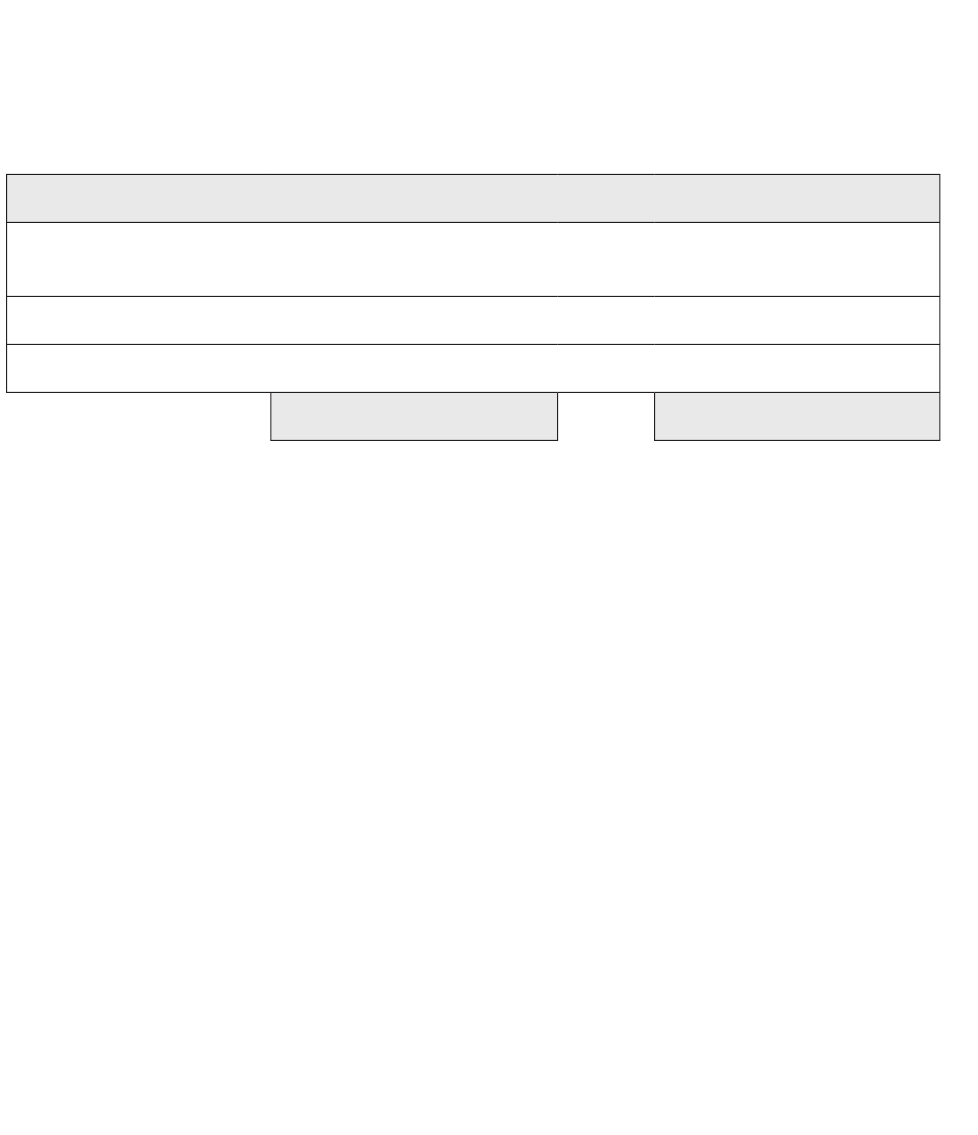

Starting now can have an impact on your account.

Your decision to start today could give you quite a bit more savings at retirement than starting five

years from now.

Hypothetical example:

Potential growth if you contribute $100 of your paycheck monthly

Potential account value

in 10 years (2024)

Potential account value

in 20 years (2034)

Start today $16,580* $49,195*

Wait five years to start $6,901 $30,155

$9,679 difference $19,040 difference

* Increase your contribution to $200 a month, and your potential account value could be even

more — $33,159 in 10 years and $98,389 in 20 years.

This hypothetical illustration is based on the following assumptions: (1) Hypothetical participant remains employed and contributes

$100 ($200 in the second example) at the beginning of each month throughout the periods shown, (2) a hypothetical effective

annual rate of return of 7%, (3) reinvestment of all earnings, (4) no withdrawals or loans throughout the indicated periods, and

(5) participant is 100% vested. Income taxes, inflation, fees, and expenses are not taken into account. If they were, values would be

lower. Earnings, pretax contributions, and employer contributions in a tax-deferred plan are subject to income taxes when withdrawn,

and if distributions are taken before age 59½ may also be subject to a 10% penalty. Individual results will vary. Systematic investing

does not ensure a profit and does not protect against loss in a declining market. This example is for illustrative purposes only and

does not represent the performance of any investment. Contributions are subject to Plan and IRS limits, and such limits are indexed

and adjusted for cost of living increases. Plan limits may be less than IRS limits. For highly compensated employees, additional limits

may apply.

This hypothetical illustration is for educational purposes. Actual benefits are provided solely according to the terms of the Plan.

A participant’s actual account balance at any point in the future will be determined by the contributions that have been made, any

Plan or account activity, and any investment gains or losses that may occur. The illustrations of future balances should in no way be

construed to imply any guarantee of future employment.

2

Step1 For more information, visit www.cpg.org or call (877) 208-0092.

3

Decide how much

toinvest.

1

Step

More than any other factor, the amount you put away will help determine

how much your savings may grow. How much should you invest? For

starters, if your employer makes matching contributions, you should con-

tribute at least enough to be credited with all of the matching contributions

your employer is offering.

Herearesomesuggestionsfor

setting your contribution amount:

• Try for 10%.Fidelityconsiders10%–15%per

paycheckaverygoodstart.Thisamountcan

take you a long way toward reaching your

financialgoals.

•Do what you can afford—you can change

your contribution amount later if needed.

Startwithanamountthatfeelscomfortableto

you.Theimportantthingistoinvestwhatyou

canaffordandstartrightaway.

• Invest more in the Plan, pay less in taxes.

Yourpretaxcontributionscomeoutofyour

paybeforeincometaxesaretakenout.You

can actually lower your current taxes by

investinginthePlantoday.Takealookatthe

chart to see how it works.

Take-home pretax pay calculations

If your pay-period

contribution is:

Your take-home pay

is estimated to be

reduced by only:

$100 $72

$200 $144

Estimatedannualafter-taxcostassumesasingletaxpayer

inthe28%federaltaxbracketandnostatetaxesincurred.

Youractualtaxsavingsmaybemoreorlessthantheestimate

showndependingonyourtaxablefederalandstateincome,

exemptions,andfilingstatus.Potentialchangestofederal

and/orstatetaxratesmayaffecttaxsavingsinfutureyears.

Find out more:

TheFidelity Take-Home Pay Calculator

showshowaffordableitcanbetoinvest

inthePlan,thankstopretaxcontributions.

You’llfinditintheTools & Learningsectionof

the Fidelity Web site that you can access at

www.cpg.org/myaccount.

Step2

4

Determineinvestments

thatarerightforyou.

2

Step

What kind of investor are you? The answer to this question will determine

which Plan investments may be right for you. The Plan offers a range of

investments, so you can build your portfolio your way.

Option A:

Are you a hands-on investor?

•Doyouwanttomakeyourowninvestmentdecisions?

•Doyouhavethetimetoactivelymanageyourinvestments?

•Areyoucomfortablebuildingyourownportfolio?

If you answered yes to any of these questions, the following steps will help you

build your portfolio.

First,startbyfindingyourapproach.

Areyouaconservativeinvestor?Anaggressive

investor?Somewhereinbetween?Theansweris

afunctionofthreethings.Thefirstisthelength

oftimeyouhavetoinvest—inthiscase,the

numberofyearsuntilyouexpecttoretire.The

secondisyourcomfortwithrisk.Thethirdis

yourfinancialsituation.

Ifyourtimehorizonislong,yourrisktolerance

ishigh,andyourfinancialsituationstable,

youmaybeanaggressiveinvestor.Onthe

otherhand,ifyou’llneedyourmoneysoon,

areuncomfortablewithrisk,andyourfinancial

situation is somewhat uncertain, you may need

amoreconservativeapproach.Manyinvestors

may be somewhere in between, taking a growth

or balanced approach.

Tohelpdetermineyourpossibleinvestment

approach,considerthesefactors:

•Theageyouwanttoretire

•Yourcomfortlevelwiththestockmarket’s

ups and downs

•Whetheryoupreferstabilityorthepotential

forbiggerreturns,whichentailsgreaterrisk

•Yourshort-andlong-termfinancialneeds

*Hypothetical, for illustrative purposes only.

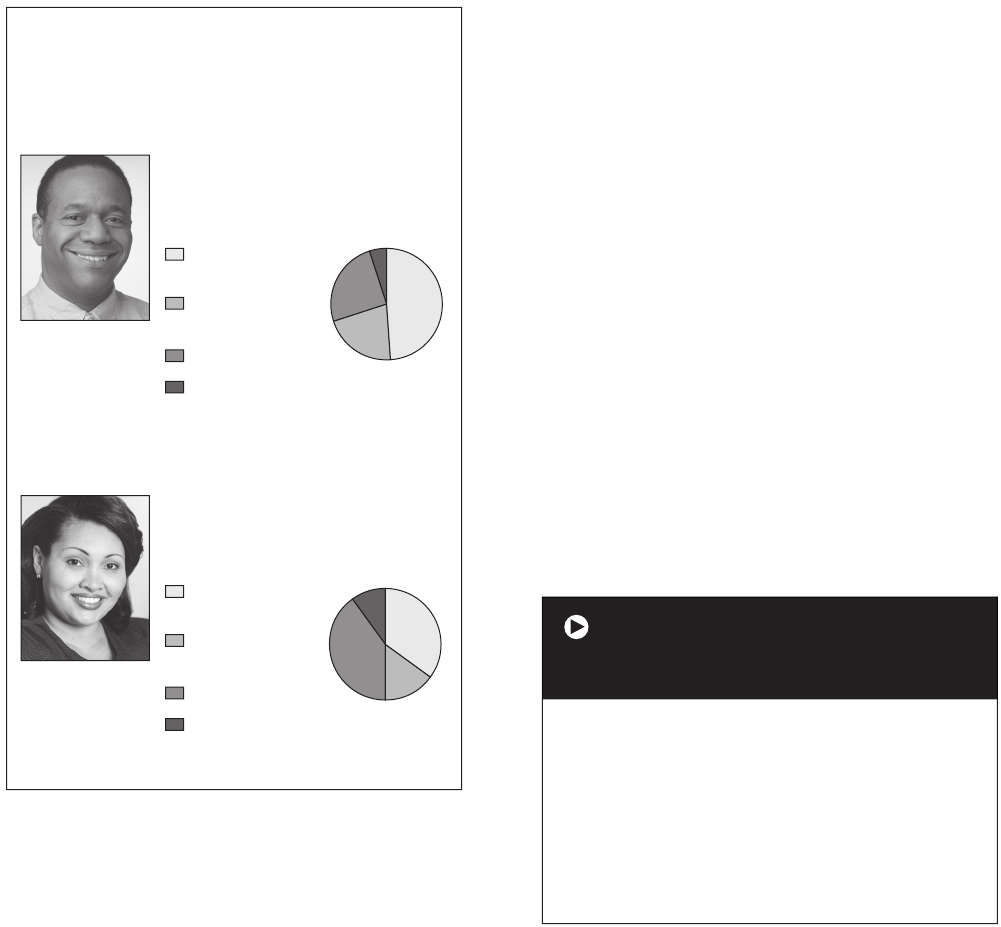

Here are the approaches two

others have taken.*

This is Larry. Age:42

Hehasabout23yearsuntilheretires.

Hecantoleratesignificantup-and-

downmovementinthemarket.

Hehasapreferenceforgrowthand

doesn’tmindsubstantialmovement

inhisportfolio’svalue.

Hisfinancialsituationissecure.

Based on these factors, Larry considers

himself a fairly aggressive investor.

This is Nancy. Age:47

Shehasabout18yearsuntil

she retires.

Shecantoleratesomeup-and-down

movementinthemarket.

Sheislookingforsomeopportunityfor

growth and can tolerate some up-and-

downmovementinherportfolio’svalue.

Herfinancialsituationissomewhatsecure.

Based on these factors, Nancy considers

herself a fairly conservative investor.

CONSERVATIVE AGGRESSIVE

14% domestic stocks

6% international/global

50% bonds

30% short-term

investments

May be appropriate

if you prefer steadier

performance over time,

with some opportunity

for growth.

35% domestic stocks

15% international/global

40% bonds

10% short-term

investments

May be appropriate if

you want some opportunity

for growth, and can

tolerate some up-and-

down movement in your

portfolio’s value.

49% domestic stocks

21% international/global

25% bonds

5% short-term

investments

May be appropriate if

you have a preference

for growth, and can

tolerate significant up-

and-down movement in

your portfolio’s value.

60% domestic stocks

25% international/global

15% bonds

May be appropriate if you

have a strong preference

for growth, and can tolerate

wide, and sometimes sudden,

up-and-down movement

in your portfolio’s value.

Conservative Mix Balanced Mix Growth Mix Aggressive Growth Mix

14% domestic

stocks

6% international

stocks

50% bonds

30% short-term

investments

C

onservative

Mix

Ba

l

a

n

ced

Mix

35

%

do

m

est

i

c

stocks

15%

in

te

rn

at

i

o

n

al

stocks

40

%

bo

n

ds

10

%

sho

r

t

-

te

r

m

i

nv

est

m

e

n

ts

G

r

o

w

th

Mix

49%

do

m

est

i

c

stocks

21%

in

te

rn

at

i

o

n

al

stocks

25%

bo

n

ds

5%

sho

r

t

-

te

r

m

i

nv

e

s

t

m

e

n

t

s

60% domestic

stocks

25% international

stocks

15% bonds

Aggressive

Growth Mix

q q q q

Step2 For more information, visit www.cpg.org or call (877) 208-0092.

5

Thepurposeofthesampleinvestmentmixesistoshowhowmixesmaybecreatedwithdifferentriskandreturncharacteristicstohelp

meetaparticipant’sgoals.Youshouldchooseyourowninvestmentsbasedonyourparticularobjectivesandsituation.Remember,you

maychangehowyouraccountisinvested.Besuretoreviewyourdecisionsperiodicallytomakesuretheyarestillconsistentwithyour

goals.YoushouldalsoconsideranyinvestmentsyouhaveoutsidethePlanwhenmakingyourinvestmentchoices.

TheinvestmentoptionsofferedthroughthePlanwerechosenbyTheChurchPensionFund.Thesamplemixesillustratesomeofthe

manycombinationsthatcouldbecreatedandshouldnotbeconsideredinvestmentadvice.

Next, learn about the different

kinds of investments.

There are four basic investment types — short-

term investments, stable value investments,

bonds, and stocks. And they, like investors, fall

along a range from conservative to aggressive.

Short-term investments are the most

conservative. Short-term investments, like

money market funds, are also known as “cash”

investments. They involve the least amount of

risk, but also provide the lowest potential return.

Bonds and stable value investments are in

the middle. Bonds are generally less risky than

stocks. These investment types typically offer

moderate returns compared with stocks. Stable

value investments seek to preserve principal and

provide income by means of a stable rate of

interest.

Stocks are the most aggressive. Although

past investment results do not guarantee future

results, this investment type has historically

provided the highest long-term returns and the

greatest risk. Stock investments include large

(large cap), medium-sized (mid-cap), and small

(small cap) U.S. companies, as well as foreign

companies. However, each of these types of

stock investments has its own level of risk — for

example, small cap tends to be more risky than

large cap.

Then, select the right mix of

investment types for your situation.

Once you know how conservative or aggressive

your approach is as an investor, and you

understand the difference between investment

types, you can figure out what mix of investment

types matches your approach.

This chart shows how four hypothetical investment mixes align with different approaches

to investing, from relatively conservative to relatively aggressive.

Step2

6

Finally, pick your

investmentoptions.

ThePlanoffersinvestmentoptionsacrossthree

investmenttypes.Fordescriptions,turntothe

“InvestmentOptions”sectionoftheEmployee

Guide.Youcanalsogotowww.cpg.org/myaccount

togetup-to-dateperformanceinformation,other

investmentspecifics,andeducationalmaterial.

*Hypothetical, for illustrative purposes only.

Growth Mix

G

r

o

w

th

Mix

49%

do

m

est

i

c

stocks

21%

in

te

rn

at

i

o

n

al

stocks

25%

bo

n

ds

5%

sho

r

t

-

te

r

m

i

nv

e

s

t

m

e

n

t

s

49% domestic

stocks

21% international/

global

25% bonds

5% short-term/

stable value

investments

This is Larry. Age:42

As a fairly aggressive investor,

Larry selected a growth mix of

investments.

This is Nancy. Age:47

As a fairly conservative investor, Nancy

chose a balanced mix of investments.

Balanced Mix

Larry and Nancy revisited: a look

at their investment mixes.*

35% domestic

stocks

15% international/

global

40% bonds

10% short-term/

stable value

investments

Ba

l

a

n

ced

Mix

35

%

do

m

est

i

c

stocks

15%

in

te

rn

at

i

o

n

al

stocks

40

%

bo

n

ds

10

%

sho

r

t

-

te

r

m

i

nv

est

m

e

n

ts

For help finding your

investment mix:

e-Learning:OnlineFidelitye-Learning®

workshopscanteachyouthefundamentals

ofsavingforretirement,includingEvaluating

InvestmentOptions.You’llfinditintheTools

&LearningsectiononFidelityNetBenefits®

atwww.cpg.org/myaccountorcallthe

RetirementBenefitsLineat(877)208-0092.

Step2

7

Option B:

Are you a hands-off investor?

•Areyouuncertainabouthowtobuildyourretirementportfolio?

•Areyouunabletospendasmuchtimeasyou’dlikemanagingyourinvestments?

•Wouldyoupreferaneasier,lessinvolvedapproachtoinvesting?

If you answered yes to any of these questions, you may want to consider the following:

Fidelity Freedom K® Funds offer a single-

fund approach to investing. Lifecycle funds

are designed for investors expecting to retire

around the year indicated in each fund’s

name. The investment risk of each lifecycle

fund changes over time as each fund’s asset

allocation changes. The funds are subject to

the volatility of the financial markets, including

that of equity and fixed income investments

in the U.S. and abroad, and may be subject

to risks associated with investing in high-yield,

small-cap, commodity-linked, and foreign

securities. Principal invested is not guaranteed

at any time, including at or after the fund’s

applicable target date.

For more information, visit www.cpg.org or call (877) 208-0092.

3

Step Completeyour

enrollment.

It’seasytojointhePlanandmakethatnextgreatinvestmentinyourself.Here’show:

• Ifyouhavenotalreadydoneso,completeanEmployeeApplicationforMembershipform

(availablefromyouremployer)

• Access Your Account

oGotoFidelityNetBenefits®atwww.cpg.org/myaccountorcalltheRetirementBenefitsLineat

(877)208-0092,8:30a.m.to8:30p.m.Easterntime,MondaythroughFriday.

oSetupyourpassword.IfyouarealreadyaFidelitycustomer,youcanuseyourexistingpassword.

•Select Your Salary Contribution Amount

oIfyoudidnotindicateasalarydeferralamountatthetimeofenrollmentorwishtochangewhat

youindicatedatthattime,chooseyoursalarycontribution(deferralamount)indollarsor

1%increments.

•Select Your Investment Options

oYouhaveanumberofinvestmentoptionstochoosefrom,plustheFidelityFreedomK®

Funds.

oIfyoudonotselectspecificinvestmentoptionsinthePlan,yourcontributionswillbeinvestedin

theFidelityFreedomK®

Fund with the target retirement date closest to the year you might retire,

basedonyourcurrentageandassumingaretirementageof65,atthedirectionofTheChurch

PensionFund.

•Designate Your Beneficiary

oSimplylogontoFidelityNetBenefits®atwww.cpg.org/myaccountandclickBeneficiaries in the

About YousectionofYour Profile.IfyoudonothaveaccesstotheInternetorprefertocomplete

yourbeneficiaryinformationbyusingapaperform,pleasecontacttheRetirementBenefitsLine

at(877)208-0092.

Please note:ItisimportanttoselectyourbeneficiarieswhenyoufirstenrollinthePlan.Also,

pleasekeepinmindthatifyouhaveexperiencedalife-changingevent,suchasamarriage,

divorce,birthofachild,oradeathinthefamily,it’stimetoreconsideryourbeneficiary

designation(s).

Please see the following pages for important details about the Plan, including FAQs and

descriptions of your investment options.

Remember, we’re here to help.

Ifyouneedanyhelpalongtheway,visitFidelity

NetBenefits®atwww.cpg.org/myaccountorcallthe

RetirementBenefitsLineat(877)208-0092.

8

Step3

FAQs For more information, visit www.cpg.org or call (877) 208-0092.

9

The Episcopal Church Retirement Savings Plan (RSVP) isadefinedcontributionretirementplan

designedtosatisfySection403(b)(9)oftheInternalRevenueCode(Code).

The Episcopal Church Lay Employees’ Defined Contribution Retirement Plan (Lay DC Plan)

isdividedintotwodistinctdefinedcontributionretirementplans:oneofwhichisdesignedtosatisfy

Section401(a)oftheCode,andthesecondofwhichisdesignedtosatisfySection403(b)(9)oftheCode.

INTRODUCTORY FAQS

What are the purposes of the Plans?

ThePlanswereestablishedforemployeesof

participatingemployersoftheEpiscopalChurch

tosavefortheirretirementonatax-deferred

basis.Theyfunctionsimilarlytoa401(k)plan,

whichisofferedbymanyfor-profitcompanies.

TheRSVPismeantprimarilytosupplementthe

retirementsavingsofclergyandlayemployees

whoareenrolledinadefinedbenefitpension

plan.TheLayDCPlanismeanttoserveas

theprimaryretirementsavingsvehiclefor

layemployeeswhoseemployersareoffering

adefinedcontributionretirementplanin

accordancewithResolutionA138,76thGeneral

Convention,2009.(Formoreinformationabout

ResolutionA138,seetheFAQ“Whatarethe

employercontributionrequirementsfortheLay

DCPlan?”onpage11.)

Can I actively participate in the RSVP and

Lay DC Plan at the same time?

No,youmayonlyactivelyparticipateinthe

Planthatyouremployerhasadoptedandin

whichyouhavebeenenrolled.Checkwithyour

employertodeterminethePlanyouremployer

offersandtheeligibilityrequirements,if

applicable.

How is my retirement benefit determined?

Theamountavailableatretirementisbasedon

your account balance, which depends on the

amountinvestedandtheperformanceofthe

investment(s)overtime.Eachparticipanthashis

or her own account and directs how the money

isinvestedbychoosingamongarangeof

investmentoptions.

ENROLLMENT AND ELIGIBILITY

What does my employer have to do to allow

employees to enroll in the Plan?

Inordertobeacceptedformembershipinthe

Plan,youremployermustadoptthePlan.The

adoptionprocessconsistsofcompletingand

returningtothePlanAdministrationDepartment

atTheChurchPensionFundtheapplicable

EmployerAdoptionAgreement.“Participating

employers”areemployersthathavebeen

acceptedformembershipinthePlanbythe

Planadministrator.

When am I eligible to participate in the Plan?

Asaneworexistingemployee,onceyour

employeradoptsthePlan,youareeligible

tomakesalarydeferralsonthefirstdayof

themonthfollowingyourdateofhireand

submissionoftheEmployeeApplicationfor

Membershipform.However,youarenoteligible

foremployercontributions,ifapplicable,

untilyoumeettheeligibilityrequirements

selectedbyyouremployerinitsEmployer

AdoptionAgreement.Themaximumeligibility

requirementisworkingatleast1,000hours

duringtheyear.Participatingemployersmay

adoptaneligibilityrequirementthatisless

stringentthanthemaximumrequirement,

but not more stringent than the established

maximum.Scheduledtimeoffforvacation,sick

leave,ortemporarydisability(nottoexceedone

year)countstowardtheeligibilityrequirement

adoptedbyyouremployer.Checkwithyour

employer to determine the applicable eligibility

requirement.

FrequentlyaskedquestionsaboutthePlans.

*

*Pleasenotethatwherevertheword“Plan”or“Plans”isusedintheseFAQs,thattermwillrefertooneorbothoftheRSVPandthe

LayDCPlan.IfanythingintheseFAQsappliesonlytoonePlan,specicreferencewillbemadetotheRSVPortotheLayDCPlan,as

applicable.Accordingly,therulesandprovisionsdescribedintheseFAQsareapplicabletobothPlansunlessspeciedotherwise.

10

FAQs

How do I enroll in the Plan?

Enrollingiseasy.Followthesefivesimplesteps

to set up your account.

1.CompletetheEmployeeApplicationfor

MembershipForm.Onceyouhavecompleted

theform,youwillbeenrolledinthePlan.Ifyou

havenotcompletedthisapplication,youwill

needtoobtaintheEmployeeApplicationfor

MembershipFormfromyouremployer.

2.Determineyourcontributionamount.Please

indicate the contribution amount you would like

deductedfromyourcompensation.Ifyoudo

not complete the employee contribution section

oftheapplication,youwillbeautomatically

enrolledata4%pretaxpayrolldeduction.

Youmaychangethepercentagelevelofyour

contributionatanytime.Anycontributionsthat

are automatically deducted are not allowed to

berefundedduetoIRSregulations.

3.Chooseyourinvestments.Onceyouenroll,

allcontributionswillbeinvestedintheFidelity

FreedomK® Fund that correlates with your

birthdateasdirectedbythePlansponsor,

accordingtothechartonpage18ofthe

EmployeeGuide.However,youcanelectto

choosedifferentinvestmentoption(s)atany

time.Seethe“InvestmentOptions”sectionin

theEmployeeGuideformoreinformationabout

yourinvestmentchoices.

4.SetupyouronlineFidelityaccount.

TosetupyourFidelityaccount,goto

www.cpg.org/myaccount.Ifyouneedassistance,

pleasecontactaFidelityRetirementBenefits

Representativeat(877)208-0092.Tosetup

your account:

• EnteryourSocialSecuritynumberandsetup

a username and a password.

• Reviewandmakeyourinvestmentelection(s),

by simply clicking Change Investments on the

leftsideoftheWebpage.ClickInvestment

ElectiontoselectanyoftheavailablePlan

investmentoptions.

• Reviewyourcontributionamountbyclicking

Contribution Amountlocatedontheleftside

oftheWebpage.

5.Designateyourbeneficiary.Yourfinalstepwill

betodesignateyourbeneficiary.Youmaygo

onlinetodesignateyourbeneficiarybylogging

ontoFidelityNetBenefits®atwww.cpg.org/

myaccountoryoumaycall(877)208-0092to

requestapaperform.

CONTRIBUTIONS

How are the Plans funded?

ThePlansarefundedbyyourindividual

contributions(onapretaxorafter-taxbasis)

and/oremployercontributions.Makingpretax

contributions will reduce your current taxable

income.

IfyouareenrolledintheRSVP,someemployers

maymakeemployercontributionstotheRSVP

asahousingequityallowance(clergyonly)or

otherdeferredcompensationarrangement(lay

employeeorclergy).

IfyouareenrolledintheLayDCPlan,your

employerisrequiredtomakeanemployer

contributionbasedonapercentageof

your annual compensation and match your

contributions up to a certain limit, as mandated

bytheEpiscopalChurch.(Formoreinformation,

seetheFAQ“Whataretheemployer

contributionrequirementsfortheLayDCPlan?”

onpage11.)

How much can I contribute to the Plan?

Youmaycontributein1%incrementsoraset

dollaramountofyourbasesalaryonapretax

orafter-taxbasis,uptotheIRSlimits.Ifyoudo

not elect a set percentage or dollar amount

ontheEmployeeApplicationforMembership

form,youwillbeautomaticallyenrolledinthe

Planatapretaxcontributionrateof4%ofyour

compensation,untilyousubsequentlyelect

otherwise.

What are the IRS contribution limits?

TheIRSannuallimitonpretaxsalarydeferral

contributionsis$17,500for2014.Ifyouwillattain

age50orolderduringthecalendaryearand

contributeuptotheIRSpretaxcontribution

limit, you are eligible to make an additional

pretaxcatch-upcontributionof$5,500in2014.In

addition,thereisacombinedannuallimitfortotal

Plancontributions(employeepretaxandafter-

taxcontributionsandemployercontributions),

whichis100%ofyourFormW-2compensationor

$52,000($57,500includingcatch-upcontributions)

for2014,whicheverisless.

Can I change or suspend my contributions?

Yes, you can change or suspend your pretax

salarydeferralcontribution(orafter-taxcontribution)

electionatanytimeforfuturecontributions.However,

ifyouchangeyourcontributionsandyouremployer

makes matching contributions, the matching

contribution may also change.

FAQs For more information, visit www.cpg.org or call (877) 208-0092.

11

How do I change or suspend my contributions?

Ifyouchoosetogoonlinetochangeyour

contribution rate or suspend your contributions,

you will need to:

• LogontoFidelityNetBenefits® at www.cpg

.org/myaccountandenteryourusernameand

password.

• Electthecontributionamountyouwish

to contribute to your account by clicking

Contribution Amountlocatedontheleftside

ofthewebpage.

Alternatively,youmaychangeorsuspendyour

contributionsbycallingFidelityat(877)208-0092.

What are the employer contribution

requirements for the Lay DC Plan?

Resolutiond165(a),70thGeneralConvention,

1991, establishes minimum contribution

requirementsasfollows:“IfthePlanisadefined

contribution plan, the employer shall contribute

notlessthanfivepercentandagreetomatch

employeecontributionsuptoanotherfour

percent.”

ResolutionA138,76thGeneralConvention,

2009,reaffirmedtheseminimumcontribution

requirementsforemployersthatelectto

provideadefinedcontributionplanfortheir

employees.Iftheemployerisaschool,a

differentcontributionrateschedulemayapply,

assetforthinResolutionC042,77thGeneral

Convention,2012.Formoreinformationabout

theseresolutions,pleasevisitwww.cpg.org/

laypensions.

How are employer contributions calculated

under the Plans?

IfyouareenrolledintheRSVP,youremployer

may,butisnotrequiredto,makeemployer

contributionsonyourbehalf.Ifyouareenrolled

intheLayDCPlan,youremployerisrequiredto

makeemployercontributionsonyourbehalfas

explainedintheimmediatelyprecedingFAQ.In

eithercase,thetypesofemployercontributions

thatcanbemadetothePlansarethesameand

are described below.

Anemployer base contribution is a percentage

ofyourtotalwagesthatisreportedorwould

bereportableintheboxtitled“Medicare

WagesandTips”ofFormW-2,plusanypretax

contributionstoacafeteriaplan.Inaddition,all

overtime,bonuses,commissions,andseverance

pay generally will be included in compensation

forpurposesofdeterminingtheamountof

theemployerbasecontribution.Ifyoureceive

church-providedhousing,youremployeralso

mustincludeanamountequivalenttothevalue

ofmaintenancefurnishedtoyou(includingutility

and room and board expenses and the rental

valueofhousing).

Anemployer matching contribution is a

percentageoftheamountthatyouactually

contributetothePlan.Bothpretaxandafter-tax

salarydeferralsarematchedonadollarfordollar

basis.Tomaximizeyouremployermatch,you

shouldtrytocontributethesamepercentageof

your compensation that your employer matches.

Forexample,ifyouremployermatchesupto

4%ofanemployee’scompensation,youshould

contribute4%ofyourcompensationonapretax

and/orafter-taxbasis.Ifyoureceivechurch-

providedhousing,however,youmustcontribute

more than the employer match percent in order

tofullymaximizetheemployermatch.Thisis

because,underIRSregulations,youcannotmake

salarydeferralsoncompensationthatyoudonot

actuallyreceive.

Please see the following example:

Cashcompensation=$40,000

Valueofhousing=$10,000

Employerbasecontribution=5%

Employermatchingcontribution=upto4%

Employeeelectivepretaxsalarydeferral=4%

Theemployeewillreceiveanemployerbase

contributionequalto$2,500(i.e.5%x($40,000

+$10,000)).Themaximumemployermatching

contributionis$2,000,whichis4%ofthe

employee’stotalcompensationof$50,000(i.e.

$40,000+$10,000).Basedontheemployee’s

electionofa4%pretaxsalarydeferral,the

employer matching contribution that the

employeewillactuallyreceiveis$1,600(i.e.4%

x$40,000)becausetheemployeecannotmake

asalarydeferralonthevalueofhousing.To

maximizetheemployermatch,theemployee

wouldhavetocontributeanadditional$400to

thePlan,whichamountisequivalentto1%ofthe

employee’scashcompensationof$40,000(i.e.

$400/$40,000=1%).Thus,theemployeeneeds

toelecta5%pretaxsalarydeferralinorderto

maximizetheemployermatch.Allcontributions

aresubjecttotheIRSlimitsdescribedabove.

FAQs

12

Can I move money from another retirement

plan into my account in the Plan?

Youarepermittedtorollovereligiblepretax

contributionsfromanother401(k)plan,401(a)plan,

403(b)planoragovernmental457(b)retirement

plan account, or eligible pretax contributions

fromanIRA.CalltheRetirementBenefitsLine

at(877)208-0092fordetails.Youshouldconsult

yourtaxadvisorandcarefullyconsidertheimpact

ofmakingarollovercontributiontoyourPlan

accountbecauseitcouldaffectyoureligibility

forfuturespecialtaxtreatment.

VESTING

What is vesting?

Vestingdefineswhenaparticipatingemployee

receivescompleteownershipofcontributions

made into his or her account, including the

earningsonthosecontributions.Onceyouare

vested,youareentitledtoallamountsinyour

accountevenifyouterminateemploymentwith

your employer.

When am I vested?

Employeeandemployercontributions

(ifapplicable)andtheearningsonthose

contributionsarealways100%vestedunder

thePlan.Anyrollovercontributionsyoumake

and the earnings on those contributions are

alsoalways100%vested.

INVESTMENTS

What are my available investment options?

TheinvestmentoptionsavailableunderthePlan

includeavarietyofselectionssuchasastable

valueinvestmentoptionofferingafixedrateof

return, which is reset periodically, and mutual

fundsrangingfromamoneymarketfundto

growth-focusedstockfunds.

ThePlanalsoofferstheFidelityFreedomK® Funds,

whichprovideablendofstocks,bonds,andshort-

terminvestmentswithinasinglefund.EachFidelity

FreedomK®Fund’sassetallocationisbased

onthenumberofyearsuntilthefund’starget

retirementdate.TheFidelityFreedomK® Funds

aredesignedforinvestorswhowantasimple

approachtoinvestingforretirement.Lifecycle

fundsaredesignedforinvestorsexpectingtoretire

aroundtheyearindicatedineachfund’sname.The

investmentriskofeachlifecyclefundchangesover

timeaseachfund’sassetallocationchanges.The

fundsaresubjecttothevolatilityofthefinancial

markets,includingthatofequityandfixedincome

investmentsintheU.S.andabroad,andmaybe

subjecttorisksassociatedwithinvestinginhigh-

yield,small-cap,commodity-linked,andforeign

securities.Principalinvestedisnotguaranteed

atanytime,includingatorafterthefunds’

target dates.

Youcaninvestyouraccountbalanceinoneor

moreoftheseinvestmentoptions.Weencourage

youtotakeanactiveroleinthePlanandchoose

investmentoptionsthatbestsuityourgoals,

timehorizon,andrisktolerance.Toassistyou

inmakinginvestmentdecisions,acomplete

descriptionofthePlan’sinvestmentoptionsand

theirhistoricalperformance,aswellasplanning

tools to help you choose an appropriate mix, are

availableonlineatwww.cpg.org/myaccount.You

will need to enter your username and password.

Pleasealsorefertothe“InvestmentOptions”

sectionintheEmployeeGuideformoredetails.

Can I allocate my contributions among

different investment options?

Yes,youcanallocatesomeorallofyour

contributionsamongavarietyofinvestment

options,includingastablevalueinvestment

optionandmutualfundsrangingfromamoney

marketfundtogrowth-focusedstockfunds.

Youmayalsoallocatesomeorallofyour

contributionstoFidelityFreedomK® Funds.

What is the Stable Value Option?

TheStableValueOption(SVO)isaninvestment

optioninthePlanthatoffersstable,tax-deferred

growthataninterestratebasedonfinancial

conditions.Itisfundedbyanunallocated

groupannuitycontractissuedbytheChurch

LifeInsuranceCorporationtoTheChurch

PensionFund.*

*Guaranteesandobligationsunderthegroupannuitycontractare

solelythoseofChurchLifeInsuranceCorporation(ChurchLife)

andaresubjecttotheclaims-payingabilityofChurchLife.The

ChurchPensionFunddoesnotguaranteethenancialperfor-

manceofChurchLifeoranyprincipalorinterestinvestedinthe

StableValueOption.Tolearnmoreaboutthenancialcondition

ofChurchLife,reviewthesummaryofChurchLife’snancial

conditiondescribedintheChurchPensionGroupAnnualReport

locatedatwww.cpg.orgorcall(866)802-6333foradditional

informationrelatingtothenancialconditionofChurchLife,fora

copyoftheChurchPensionGroupAnnualReportorforacopyof

ChurchLife’sstatutorynancialstatements.

InformationabouttheStableValueOptionwasprovidedbyThe

ChurchPensionFund.

May I invest in the CLIC TSA?

TheCLICTSAisavailableundertheRSVPonlyand

wasfrozentonewinvestorseffectiveJanuary1,2005.

FAQs For more information, visit www.cpg.org or call (877) 208-0092.

13

May I transfer money in my account between

investment options and, if so, how often?

Youcanrequestatransferofyourfullaccount

balanceoranyportionthereofbetween

investmentoptionsonadailybasis.Ifyouwant

totransferfundsfromtheStableValueOption

(SVO)toanotheroption,youmaymakepenalty-

freetransfersofupto20%ofyourSVOaccount

balanceeachyearasofJanuary1(plusany

transfersorcontributionsmadetoyourSVO

account in the same calendar year, less any

transfersoutthatyoumayhavepreviouslymade

inthesamecalendaryear).Ifyoutransfermore

than20%intotal,youwillincura5%feeon

theamounttransferredinexcessof20%.Upon

attainingage59½,thisfeenolongerapplies.

Theremayalsobetaxconsequencestoa

withdrawal.Youshouldconsultyourtaxadvisor

beforemakingawithdrawal.

How do I change my investment elections?

Tochangeyourinvestmentelections,simply

logontoFidelityNetBenefits® at www.cpg

.org/myaccount.Youwillneedtoenteryour

usernameandpassword.Onceyouhave

logged on to your account, you will need to

click Change Investments. You will be able to

updateyourinvestmentelectionstoanyofthe

investmentoptionsavailableunderthePlan.

What if I don’t make an investment election?

Weencourageyoutotakeanactiveroleinthe

Planandchooseinvestmentoptionsthatbest

suityourgoals,timehorizon,andrisktolerance.

Ifyoudonotselectspecificinvestmentoptions,

yourcontributionswillbeinvestedintheFidelity

FreedomK® Fund with the target retirement

date closest to the year you might retire, based

on your current age and assuming a retirement

ageof65,atthedirectionofTheChurch

PensionFund.Pleaserefertothe“Investment

Options”sectionintheEmployeeGuidefor

more details.

Ifnodateofbirthoraninvaliddateofbirthison

fileatFidelity,yourcontributionsmaybeinvested

intheFidelityFreedomK®IncomeFund.

How do I obtain additional investment option

information?

YouremployerhasappointedFidelitytoprovide

additionalinformationontheinvestment

optionsavailableunderthePlan.Contacta

FidelityRetirementBenefitsRepresentativeat

(877)208-0092orlogontoFidelityNetBenefits®

atwww.cpg.org/myaccount.

What are my rights with respect to mutual

fund pass-through voting?

AsaPlanparticipant,youhavetheabilityto

exercisevoting,tender,andothersimilarrights

formutualfundsinwhichyouareinvestedunder

thePlan.Materialsrelatedtotheexerciseof

theserightswillbesentatthetimeofanyproxy

meeting,tenderoffer,orwhenothersimilar

rightsrelatingtotheparticularmutualfunds

held in your account can be exercised.

Descriptions of the investment options available

under the Plans begin on page 19 of the

Employee Guide.

LOANS, WITHDRAWALS, AND OTHER

DISTRIBUTIONS

Can I take a loan from my account?

ThePlanallowsanactiveparticipanttotakea

loansubjecttoIRSlimitations.Youmayborrow

uptofiftypercent(50%)ofthebalanceofyour

accounttoamaximumof$50,000.Theminimum

principalamountofanyloanis$500.00.Any

outstandingloanbalancesovertheprevious

12monthsmayreducetheamountyouhave

availabletoborrow.Amaximumoftwoloans

may be outstanding at any one time.

Theminimumloanrepaymentperiodis

12months.Themaximumloanrepayment

periodisfiveyears,unlessthepurposeofthe

loanistoacquireaprincipalresidence,inwhich

casearepaymentperiodofupto15years

ispermitted(notincludingrefinancingofa

previousloan).Loansmaybeprepaidinfullor

in part at any time without penalty.

Allloanswillbechargedaone-time$35

applicationfeeanda$3.75quarterly

recordkeepingfee.Theloanapplication

andquarterlyloanrecordkeepingfeeswill

bededucteddirectlyfromyourindividual

Planaccount.LoansarerepaidbyAutomatic

ClearingHouse(ACH)debitsthroughyour

bank account.

Ifyoufailtorepayyourloan(basedonthe

originaltermsoftheloan),itwillbeconsidered

in“default”andtreatedasadistribution,

makingitsubjecttoincometaxandpossibly

toa10%earlywithdrawalpenalty.Defaulted

loansmayalsoimpactyoureligibilitytorequest

additional loans.

FAQs

14

Tolearnmoreabout,ortorequestaloan,call

theRetirementBenefitsLineat(877)208-0092.

BesureyouunderstandthePlanguidelinesand

impactoftakingaloanbeforeyouinitiatealoan

fromyourPlanaccount.

Can I make withdrawals from my account?

WithdrawalsfromthePlanarepermittedwhen

youhaveadistributableevent.Theseevents

includeterminationofemployment,retirement,

attainingage59½,becomingdisabled,financial

hardship,ordeath.Thetaxableportionofyour

withdrawalthatiseligibleforrolloverintoan

individualretirementaccount(IRA)oranother

employer’sretirementplanissubjectto20%

mandatoryfederalincometaxwithholding,

unlessitisdirectlyrolledovertoanIRAor

anotheremployerplan.(Youmayowemore

orlesswhenyoufileyourincometaxes.)If

youareunderage59½,thetaxableportion

ofyourwithdrawalisalsosubjecttoa10%

earlywithdrawalpenalty,unlessyouqualifyfor

anexceptiontothisrule(e.g.,adistribution

followingterminationofemploymentafter

age55).ThePlandocumentsandcurrent

taxlawsandregulationswillgovernincase

ofadiscrepancy.Besureyouunderstand

thetaxconsequencesandthePlanrulesfor

distributionsbeforeyouinitiateadistribution.

Youmaywanttoconsultyourtaxadvisorabout

your situation.

YoucanwithdrawfundsfromtheStableValue

Optionwithoutasurrenderchargeifyou

experienceadistributableeventifyouwishto

beginreceivingpaymentsunderthePlan.

Do I have to take a distribution of my

entire retirement account if I terminate my

employment?

No,youdonothavetotakeadistributionof

yourentireretirementaccountifyouterminate

employment.Youhaveseveraloptions.You

canmaintainyourretirementsavingsinthe

PlanuntilyouretireoruntilApril1following

theyearinwhichyouattainage70½,whenyou

mayneedtosatisfyIRSminimumdistribution

requirements.Youcanalsotakepartialorfull

withdrawalsfromyouraccount,annuitizeallora

portionofyouraccount,orrollovermoneyinto

anIRAoranotheremployer’sretirementplan.

How can I access my Plan money in

retirement?

ThePlanoffersseveraloptionstoselect

from.Theseoptionsarecalled“distribution

options”andincludeguaranteedlifetime

incomethatoffersyouthestabilityofequal

monthlypayments,aspecifiedpayment,partial

withdrawal, or a lump sum payment. When you

arereadytodiscussyouroptions,callustollfree

at(877)208-0092andrequestaconsultationwith

aChurchPensionFundplanningrepresentative.

Pleasenotethatifyouareaclericandwishto

designatealloraportionofyourdistribution

asahousingallowance,youmustidentify

yourselfasaclergymembertotheFidelity

representative.

What happens to the money in my account

when I die?

Thebalanceispayabletoyourdesignated

beneficiary.Ifyoudidnotdesignatea

beneficiary,youraccountbalanceispayableto

yourspouse(ifany);otherwise,youraccount

balance is payable to your estate.

BENEFICIARIES, FEES, AND STATEMENTS

When should I designate my beneficiary?

Itisimportanttoselectyourbeneficiarieswhen

youfirstenrollinthePlan.Also,pleasekeep

inmindthatifyouhaveexperiencedalife-

changingevent,suchasamarriage,divorce,

birthofachild,oradeathinthefamily,it’stime

toreconsideryourbeneficiarydesignation(s).

Tomakeyourdesignations,simplylogonto

FidelityNetBenefits®atwww.cpg.org/myaccount

and click Beneficiaries in the About You section

ofYour Profile.Ifyoudonothaveaccesstothe

Internetorprefertocompleteyourbeneficiary

informationbypaperform,pleasecallthe

RetirementBenefitsLineat(877)208-0092.

Pleasenotethatifyouhavedesignatedyour

currentspouseasyourbeneficiary,thenheor

shewillremainyourbeneficiaryevenifyou

subsequentlydivorceorlegallyseparate,unless

youaffirmativelydesignateanewbeneficiaryor

remarryandreportyourremarriagetothePlan

administrator.

FAQs For more information, visit www.cpg.org or call (877) 208-0092.

15

What fees may be charged against my

account balance?

• Administrativefeesarecurrentlyfixedat

0.075%perquarterandarechargedatthe

beginningofeachquarterbasedonthe

marketvalueofthemutualfundaccount

balancesattheendofthepreviousquarter.

• Aswithallmutualfundinvestments,thereare

someunderlyingfeesandexpenses,which

willvarybyfund.

• Therearenomanagementoradministrative

feeschargedontheStableValueOption

(SVO).

• Thereisnofeefortransferringmonies

betweenmutualfunds(exceptwhenfund

short-termtradingfeesareapplicable).You

canmakepenalty-freetransfersofupto20%

ofyourSVOaccountbalanceeachyearasof

January1(plusanycontributionsortransfers

madetotheSVOinthesamecalendaryear,

lessanytransfersoutthatyoumayhave

previouslymadeinthesamecalendaryear).

Ifyoutransfermorethan20%intotal,you

willincura5%feeontheamounttransferred

inexcessof20%.Atage59½,thisfeeno

longer applies.

• Takinganewloanincursa$35.00processing

feeanda$3.75quarterlyrecordkeepingfee

foreachoutstandingloan.

• Thereisnofeeforprocessingadistribution

fromanaccount.

How often will I receive account statements

and in what format will they be delivered?

Youwillreceiveaccountstatementsona

quarterlybasis.Alinktoyourstatementwillbe

senttoyouviae-mail.Toreceiveyourstatement

viaprint,pleaseregisteronlineatwww.cpg

.org/myaccount.Onceregistered,youwill

be prompted to choose whether to keep the

electronicdeliveryofstatementsortoreceive

printedstatementsinthemail.Regardlessof

howyoureceiveyourquarterlystatements,you

canviewyouraccountanytimebyloggingon

towww.cpg.org/myaccount.

CLAIMS AND APPEALS PROCESS

How do I file a claim if I have been denied a

benefit under the Plan?

Ifaparticipant,beneficiary,oranyotherperson

(a“claimant”)believesthatheorshehasbeen

deniedbenefitsthatheorsheisdueunder

thePlan,theclaimantmayfileaclaimwithThe

ChurchPensionFund(CPF).(Seetheaddress

below.)Theclaim:

• mustbeinwriting,

• maybesubmittedeitherbytheclaimantorby

hisorherauthorizedrepresentative,and

• mustprovidedetailedreasons(including

anysupportingevidence)regardingwhythe

claimantbelievesCPF’sinitialdecisionwas

incorrect.

Theclaimwillbesubjecttoafullandfair

review.Theclaimantgenerallywillreceivea

writtenresponsetohisorherclaimwithin60

daysaftertheclaimisreceivedbyCPF.IfCPF

needsadditionaltime(upto60days)toreview

theclaim,theclaimantwillbenotifiedofthe

reason(s)forthedelayandtheanticipated

responsedate,whichmaynotexceedatotalof

120daysfromthedateCPFreceivedtheclaim.

IfCPFdeniestheclaim,inwholeorinpart,

CPF’swrittenresponsetotheclaimantwill

include:

• thespecificreason(s)forthedenial,

• specificreferencetothePlanprovision(s)on

which the denial is based, and

• adescriptionofthePlan’sappealprocedures

and the time limits applicable to such

procedures.

Wheretofileaninitialbenefitclaim:

SeniorVicePresident

PensionServicesDepartment

TheChurchPensionFund

19East34thStreet

NewYork,NY10016

Appeal Procedure

Within60daysafterthedatetheclaimant

receivesCPF’sdenialletter,theclaimant(orhis

orherauthorizedrepresentative)maysubmit

awrittenappeallettertoCPFattheaddress

FAQs

16

below.(CPFmay,initssolediscretion,extend

the60-dayperiodtofileanappeal.)Theappeal

lettershouldgiveadetailedexplanationofwhy

theclaimantbelievestheclaimshouldnothave

been denied and include any other documents

orsupportinginformationthatmayhavebearing

ontheclaim.Theclaimantwillbeaffordedafull

andfairreviewoftheclaimthatdoesnotgive

deferencetotheinitialdetermination.

Theclaimantgenerallywillreceiveawritten

responsetohisorherappealwithin90days

aftertheappealisreceivedbyCPF.IfCPF

needsadditionaltime(upto90days)toreview

theclaim,theclaimantwillbenotifiedofthe

reason(s)forthedelayandtheanticipated

responsedate,whichmaynotexceedatotalof

180daysfromthedateCPFreceivedtheappeal.

If,uponappeal,thedenialoftheclaimisupheld,

CPF’swrittenresponsewillagaingivethespecific

reason(s)forthedenialandtheplanprovision(s)

on which the denial is based.

Wheretofileanappeal:

BenefitAppealsCommittee

c/oLegalDepartment

TheChurchPensionFund

19East34thStreet

NewYork,NY10016

How do I file a claim if my application for

disability status is rejected?

Ifaclaimrelatestowhetheraparticipantis

disabled or not, the same procedures outlined

abovewillapply,exceptthat:

•TheclaimmustbesubmittedtoCPF’sMedical

Boardwithin180daysaftertheparticipant’s

receiptoftheMedicalBoard’sdetermination

thattheparticipantisnotdisabled.(Seethe

addressbelow.)CPFmay,initssolediscretion,

extendthe180-dayperiodtofileaclaim.

•CPF’sMedicalBoardgenerallywillrespond

inwritingtotheclaimwithin90daysafterits

receiptoftheclaimbutmaytakeuptoan

additional90daystoreviewtheclaim(fora

totalof180days).

•Inrenderingitsdecision,CPF’sMedicalBoard

may, in its sole discretion, consult with an

independentmedicalreviewboardselectedby

CPFfromtimetotime.

PleasenotethatifCPF’sMedicalBoardconsults

withanindependentmedicalreviewboard

inmakingitsdecision,CPF’sMedicalBoard’s

determinationwillbefinal,andnofurtherappeal

underthePlanwillbepermitted.

Disability Appeal Procedure

TotheextentthatCPF’sMedicalBoarddoes

notconsultwithanindependentmedicalreview

boardaspartofitsreviewoftheclaim,the

claimant may submit a written appeal letter to

CPF’sMedicalBoardrequestinganindependent

evaluation,within180daysaftertheclaimant’s

receiptofthedenialletter.(CPFmay,initssole

discretion,extendthe180-dayperiodtofilean

appeal.)Thesameappealproceduresoutlined

abovewillapply,exceptthat:

•theappealwillbeforwardedtoan

independentmedicalreviewboardofCPF’s

choosing, and

•CPF’sMedicalBoardgenerallywillsendafinal

determinationinwritingbasedonthatreview

board’srecommendationwithin90daysofits

receiptoftheappealbutmaytakeuptoan

additional90daystoreviewtheappeal(fora

totalof180days).

Wheretofileadisabilityclaimandappeal:

TheMedicalBoardofTheChurchPensionFund

DisabilityReviewProgram

19East34thStreet

NewYork,NY10016

What are my options after I exhaust the

Plan’s claims procedures?

IfaclaimantisnotsatisfiedwithCPF’sfinal

determinationandhasexhaustedthePlan’s

administrativereviewprocessoutlinedabovein

theprevioustwoquestions,theclaimantmay

fileacivilsuit.Thecivilsuitmustbefiledwithin

180daysaftertheclaimantreceivesCPF’sfinal

determination.Asaparticipantorbeneficiary

inthePlan,theclaimanthasconsentedtothe

venueandexclusivejurisdictionofthecourts

locatedinNewYorkCity.Therefore,anycivil

actionmustbefiledinNewYorkCity.

For more information, visit www.cpg.org or call (877) 208-0092.

17

Spectrums

The Episcopal Church Retirement Savings Plan

and

The Episcopal Church Lay Employees’ Defined Contribution

Retirement Plan

InvestmentOptions

CONSERVATIVE AGGRESSIVE

Investment options to the left have potentially

more inflation risk and less investment risk

Investment options to the right have potentially

less inflation risk and more investment risk

Short Term Stable Value Bond Domestic

Equity

International/

Global Equity

Fidelity® Money

MarketTrust

RetirementMoney

MarketPortfolio

CLICTSA*

StableValue

Option

Diversified

Dodge&Cox

IncomeFund

Spartan®U.S.

Bond

IndexFund—

Fidelity

Advantage

Class

Inflation-Protected

AmericanCentury

Investments

InflationAdjusted

BondFund

InstitutionalClass

Large Value

Dodge&Cox

StockFund

Large Blend

DominiSocial

EquityFund

ClassR

Fidelity®Dividend

GrowthFund—

ClassK

Spartan®500Index

FundAdvantage

Class

Mid Blend

Spartan®Extended

MarketIndex

Fund—Fidelity

AdvantageClass

Small Blend

Fidelity®SmallCap

DiscoveryFund

Large Growth

Fidelity®

Contrafund®—

ClassK

Mid Growth

NeubergerBerman

GenesisFund

ClassR6

Diversified

AmericanFunds

EuroPacificGrowth

FundClassR-6

Spartan®

InternationalIndex

Fund—Fidelity

AdvantageClass

*PleasenotethattheCLICTSAisavailableundertheRSVPonlyandwasfrozentonewinvestorseffectiveJanuary1,2005.

Thisspectrum,withtheexceptionoftheDomesticEquitycategory,isbasedonFidelity’sanalysisofthecharacteristicsofthegeneral

investmentcategoriesandnotontheactualinvestmentoptionsandtheirholdings,whichcanchangefrequently.Investment

optionsintheDomesticEquitycategoryarebasedontheoptions’Morningstarcategoriesasof8/31/2013.Morningstarcategories

arebasedonafund’sstyleasmeasuredbyitsunderlyingportfolioholdingsoverthepastthreeyearsandmaychangeatanytime.

Thesestylecalculationsdonotrepresenttheinvestmentoptions’objectivesanddonotpredicttheinvestmentoptions’futurestyles.

Investmentoptionsarelistedinalphabeticalorderwithineachinvestmentcategory.Riskassociatedwiththeinvestmentoptionscan

varysignificantlywithineachparticularinvestmentcategoryandtherelativeriskofcategoriesmaychangeundercertaineconomic

conditions.Foramorecompletediscussionofriskassociatedwiththemutualfundoptions,pleasereadtheprospectusesbefore

makingyourinvestmentdecisions.Thespectrumdoesnotrepresentactualorimpliedperformance.

Spectrums

18

The Episcopal Church Retirement Savings Plan

and

The Episcopal Church Lay Employees’ Defined Contribution

Retirement Plan

InvestmentOptions

Lifecycle Funds

Placement of investment options within each risk spectrum is only in relation to the investment options

within that specific spectrum. Placement does not reflect risk relative to the investment options shown in

the other risk spectrums.

For each risk spectrum below, investment options to the left

have potentially more inflation risk and less investment risk

For each risk spectrum below, investment options to the right

have potentially less inflation risk and more investment risk

Risk Spectrum for Lifecycle

FidelityFreedomK®IncomeFund

FidelityFreedomK®2010Fund

FidelityFreedomK®2015Fund

FidelityFreedomK®2020Fund

FidelityFreedomK®2025Fund

FidelityFreedomK®2030Fund

FidelityFreedomK®2035Fund

FidelityFreedomK®2040Fund

FidelityFreedomK®2045Fund

FidelityFreedomK®2050Fund

FidelityFreedomK®2055Fund

Targetdateinvestmentsarerepresentedonaseparatespectrumbecausetheyaregenerallydesignedforinvestorsexpectingto

retirearoundtheyearindicatedineachinvestment’sname.Theinvestmentsaremanagedtograduallybecomemoreconservative

overtime.Theinvestmentriskofeachtargetdateinvestmentchangesovertimeasitsassetallocationchanges.Theinvestments

aresubjecttothevolatilityofthefinancialmarkets,includingthatofequityandfixedincomeinvestmentsintheU.S.andabroad,

andmaybesubjecttorisksassociatedwithinvestinginhigh-yield,small-cap,andforeignsecurities.Principalinvestedisnot

guaranteedatanytime,includingatoraftertheinvestments’targetdates.

ThechartbelowillustratesthePlan-assignedfundthatthePlansponsorbelieveswillbestfityourdiversificationneedsshould

younotselectaninvestmentoption.

Your Birth Date* Fund Name Target Retirement Years

December31,1942,orbefore

January1,1943–December31,1947

January1,1948–December31,1952

January1,1953–December31,1957

January1,1958–December31,1962

January1,1963–December31,1967

January1,1968–December31,1972

January1,1973–December31,1977

January1,1978–December31,1982

January1,1983–December31,1987

January1,1988,orafter

FidelityFreedomK®IncomeFund

FidelityFreedomK®2010Fund

FidelityFreedomK®2015Fund

FidelityFreedomK®2020Fund

FidelityFreedomK®2025Fund

FidelityFreedomK®2030Fund

FidelityFreedomK®2035Fund

FidelityFreedomK®2040Fund

FidelityFreedomK®2045Fund

FidelityFreedomK®2050Fund

FidelityFreedomK®2055Fund

Retired1997orbefore

2008–2012

2013–2017

2018–2022

2023–2027

2028–2032

2033–2037

2038–2042

2043–2047

2048–2052

2053orlater

*DatesselectedbyPlansponsor.

For more information, visit www.cpg.org or call (877) 208-0092.

19

InvestmentOptions

InvestmentOptions

Before investing in any investment option, consider the investment objectives, risks, charges,

and expenses. Contact Fidelity for a mutual fund or variable annuity prospectus or, if available,

a summary prospectus. For information on fixed annuities, contact Fidelity to request a fact

sheet. Read them carefully.

American Century Investments Inflation Adjusted Bond Fund Institutional Class

FPRS Code: OKLX

Ticker: AIANX

Objective: The investment seeks total return and inflation protection consistent with investment in inflation-

indexed securities.

Strategy: Under normal market conditions, the fund invests at least 80% of its assets in inflation-adjusted debt securities.

It may invest up to 20% of its assets in traditional U.S. Treasury, U.S. government agency or other non-U.S. government

securities that are not inflation-indexed.

Risk: The interest payments of TIPS are variable; they generally rise with inflation and fall with deflation. In general the

bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually

fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry

inflation risk and credit and default risks for both issuers and counterparties. Unlike individual bonds, most bond funds

do not have a maturity date, so avoiding losses caused by price volatility by holding them until maturity is not possible.

Additional risk information for this product may be found in the prospectus or other product materials, if available.

Short-term Redemption Fee Note: None

Who may want to invest:

• Someone who is seeking potential returns primarily in the form of interest dividends and who can tolerate more

frequent changes in the size of dividend distributions than those usually found with more conservative bond funds.

• Someone who is seeking to supplement his or her core fixed-income holdings with a bond investment that is tied to

changes in inflation.

A mutual fund registered under American Century Government Income Trust, and managed by American Century Inv

Mgt, Inc. This description is only intended to provide a brief overview of the fund. Read the fund’s prospectus for more

detailed information about the fund.

American Funds EuroPacific Growth Fund Class R-6

FPRS Code: OUBE

Ticker: RERGX

Objective: The investment seeks long-term growth of capital.

Strategy: The fund invests primarily in common stocks of issuers in Europe and the Pacific Basin that the investment

adviser believes have the potential for growth. Growth stocks are stocks that the investment adviser believes have the

potential for above-average capital appreciation. It normally invests at least 80% of net assets in securities of issuers

in Europe and the Pacific Basin. The fund may invest a portion of its assets in common stocks and other securities of

companies in countries with developing economies and/or markets.

Risk: Foreign securities are subject to interest-rate, currency-exchange-rate, economic, and political risks, all of which

may be magnified in emerging markets. Value and growth stocks can perform differently from other types of stocks.

Growth stocks can be more volatile. Value stocks can continue to be undervalued by the market for long periods of

time. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market,

economic or other developments. Additional risk information for this product may be found in the prospectus or other

product materials, if available.

Short-term Redemption Fee Note: None

Who may want to invest:

• Someone who is seeking to complement a portfolio of domestic investments with international investments, which can

behave differently.

• Someone who is willing to accept the higher degree of risk associated with investing overseas.

A mutual fund registered under EuroPacific Growth Fund, and managed by Capital Research and Management Company.

This description is only intended to provide a brief overview of the fund. Read the fund’s prospectus for more detailed

information about the fund.

20

InvestmentOptions

CLIC TSA

FPRS Code: OBYF

Ticker: N/A

Objective: Seeks to provide the highest possible yield while offering a guarantee of principal and interest, thus provid-

ing greater stability than a traditional income (bond) fund.

Strategy: Invests primarily in high-quality investment-grade securities including, but not limited to, U.S. Treasury, agency

and mortgage-backed securities, and publicly traded corporate bonds.

Risk: The fund is backed by a diversified portfolio of fixed-income assets held in the general account of the issuer.

Guarantees are subject to the claims-paying ability of the issuer. The Contracts provide for the payment of certain

withdrawals and exchanges at book value during the terms of the Contracts.

Short-term Redemption Fee Note: None

Who may want to invest:

• Someone seeking to safeguard their principal value or to balance out a more aggressive portfolio.

• The investor may be nearing retirement and looking to earn a predictable rate of return or looking for a fund that offers

guaranteed lifetime income options in retirement.

The investment option is an annuity. The fund is managed by Church Life Insurance Corporation. This description is only

intended to provide a brief overview of the fund. Investment elections and exchanges into the CLIC TSA are only allowed

if you have a balance in this investment option.

The Church Life Insurance Corporation Tax Sheltered Annuity is not a mutual fund and is underwritten and offered by

Church Life Insurance Corporation, which guarantees your principal and interest. Information furnished on the Church

Life Insurance Corporation Tax Sheltered Annuity was provided by Church Life. Fidelity Investments Institutional Service

Company, Inc. and Church Life Insurance Corporation are not affiliated.

This investment option is not a mutual fund.

Dodge & Cox Income Fund

FPRS Code: OFDZ

Ticker: DODIX

Objective: The investment seeks a high and stable rate of current income, consistent with long-term preservation

of capital.

Strategy: The fund invests in a diversified portfolio of high-quality bonds and other debt securities. Normally, the fund

will invest at least 80% of its total assets in the following categories: debt obligations issued or guaranteed by the U.S.

government, its agencies or GSEs; investment-grade debt securities; unrated securities if deemed to be of investment-

grade quality by Dodge & Cox; and bankers’ acceptances, bank certificates of deposit, repurchase agreements, and

commercial paper.

Risk: In general the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise,

bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income

securities also carry inflation risk and credit and default risks for both issuers and counterparties. Unlike individual bonds,

most bond funds do not have a maturity date, so avoiding losses caused by price volatility by holding them until maturity

is not possible. Additional risk information for this product may be found in the prospectus or other product materials,

if available.

Short-term Redemption Fee Note: None

Who may want to invest:

• Someone who is seeking potential returns primarily in the form of interest dividends rather than through an increase in

share price.

• Someone who is seeking to diversify an equity portfolio with a more conservative investment option.

A mutual fund registered under Dodge & Cox Funds, and managed by Dodge & Cox. This description is only intended to

provide a brief overview of the fund. Read the fund’s prospectus for more detailed information about the fund.

21

InvestmentOptions For more information, visit www.cpg.org or call (877) 208-0092.

Dodge & Cox Stock Fund

FPRS Code: OMAW

Ticker: DODGX

Objective: The investment seeks long-term growth of principal and income; a secondary objective is to achieve a

reasonable current income.

Strategy: The fund invests primarily in a diversified portfolio of common stocks. It will invest at least 80% of its total

assets in common stocks, including depositary receipts evidencing ownership of common stocks. The fund may also

purchase other types of securities, for example, preferred stocks, and debt securities which are convertible into common

stock. It may invest up to 20% of its total assets in U.S. dollar-denominated securities of non-U.S. issuers traded in the

United States that are not in the S&P 500.

Risk: Value stocks can perform differently than other types of stocks and can continue to be undervalued by the market

for long periods of time. Stock markets are volatile and can decline significantly in response to adverse issuer, political,

regulatory, market, economic or other developments. These risks may be magnified in foreign markets. Additional risk

information for this product may be found in the prospectus or other product materials, if available.

Short-term Redemption Fee Note: None

Who may want to invest:

• Someone who is seeking the potential for long-term share-price appreciation and, secondarily, dividend income.

• Someone who is comfortable with the volatility of large-cap stocks and value-style investments.

A mutual fund registered under Dodge & Cox Funds, and managed by Dodge & Cox. This description is only intended to

provide a brief overview of the fund. Read the fund’s prospectus for more detailed information about the fund.

The S&P 500® Index is a registered service mark of The McGraw-Hill Companies, Inc., and has been licensed for use by

Fidelity Distributors Corporation and its affiliates. It is an unmanaged index of the common stock prices of 500 widely

held U.S. stocks that includes the reinvestment of dividends.

Domini Social Equity Fund Class R

FPRS Code: OSAE

Ticker: DSFRX

Objective: The investment seeks to provide its shareholders with long-term total return.

Strategy: The fund primarily invests in the equity securities of mid- and large-capitalization U.S. companies. Under

normal circumstances, at least 80% of the fund’s assets will be invested in equity securities and related investments with

similar economic characteristics. It may also invest in companies organized or traded outside the U.S. (or in equivalent

shares such as ADRs). Domini evaluates the fund’s potential investments against its social and environmental standards

based on the businesses in which they engage, as well as on the quality of their relations with key stakeholders.

Risk: Value and growth stocks can perform differently from other types of stocks. Growth stocks can be more volatile.

Value stocks can continue to be undervalued by the market for long periods of time. Stock markets are volatile and can

decline significantly in response to adverse issuer, political, regulatory, market, economic or other developments. These

risks may be magnified in foreign markets. Additional risk information for this product may be found in the prospectus or

other product materials, if available.

Short-term Redemption Fee Note: This fund has a Short-term Redemption Fee of 2.00% for shares held less than

30 days.

Who may want to invest:

• Someone who is seeking the potential for long-term share-price appreciation and, secondarily, dividend income.

• Someone who is seeking both growth- and value-style investments and who is willing to accept the volatility associated

with investing in the stock market.

A mutual fund registered under Domini Social Investment Trust, and managed by Domini Social Investments LLC. This

description is only intended to provide a brief overview of the fund. Read the fund’s prospectus for more detailed

information about the fund.

22

InvestmentOptions

Fidelity Freedom K® 2010 Fund

FPRS Code: 2174

Ticker: FFKCX

Objective: Seeks high total return until its target retirement date. Thereafter, the fund’s objective will be to seek high

current income and, as a secondary objective, capital appreciation.

Strategy: Investing in a combination of underlying Fidelity domestic equity funds, international equity funds, bond funds,

and short-term funds. Allocating assets among underlying Fidelity funds according to an asset allocation strategy that

becomes increasingly conservative until it reaches approximately 17% in domestic equity funds, 7% in international equity

funds, 46% in bond funds, and 30% in short-term funds (approximately 10 to 19 years after the year 2010). Ultimately,

the fund will merge with Fidelity Freedom K Income Fund. Strategic Advisers may continue to seek high total return for

several years beyond the fund’s target retirement date in an effort to achieve the fund’s overall investment objective.

Risk: The investment risk of each Fidelity Freedom K Fund changes over time as its asset allocation changes. The funds

are subject to the volatility of the financial markets, including that of equity and fixed income investments in the U.S. and

abroad, and may be subject to risks associated with investing in high-yield, small-cap, commodity-linked, and foreign

securities. Principal invested is not guaranteed at any time, including at or after the funds’ target dates.

Short-term Redemption Fee Note: None

Who may want to invest:

•Someone who is seeking an investment option intended for people in or very near retirement and who is willing to

accept the volatility of diversified investments in the market.

•Someone who is seeking a diversified mix of stocks, bonds, and short-term investments in one investment option or

who does not feel comfortable making asset allocation choices over time.

AmutualfundregisteredunderFidelityAberdeenStreetTrust,andmanagedbyStrategicAdvisers,Inc.Thisdescription

isonlyintendedtoprovideabriefoverviewofthefund.Readthefund’sprospectusformoredetailedinformationabout

thefund.

Fidelity Freedom K® 2015 Fund

FPRS Code: 2175

Ticker: FKVFX

Objective: Seeks high total return until its target retirement date. Thereafter, the fund’s objective will be to seek high

current income and, as a secondary objective, capital appreciation.

Strategy: Investing in a combination of underlying Fidelity domestic equity funds, international equity funds, bond funds,

and short-term funds. Allocating assets among underlying Fidelity funds according to an asset allocation strategy that

becomes increasingly conservative until it reaches approximately 17% in domestic equity funds, 7% in international equity

funds, 46% in bond funds, and 30% in short-term funds (approximately 10 to 19 years after the year 2015). Ultimately,

the fund will merge with Fidelity Freedom K Income Fund. Strategic Advisers may continue to seek high total return for

several years beyond the fund’s target retirement date in an effort to achieve the fund’s overall investment objective.

Risk: The investment risk of each Fidelity Freedom K Fund changes over time as its asset allocation changes. The funds

are subject to the volatility of the financial markets, including that of equity and fixed income investments in the U.S. and

abroad, and may be subject to risks associated with investing in high-yield, small-cap, commodity-linked, and foreign

securities. Principal invested is not guaranteed at any time, including at or after the funds’ target dates.

Short-term Redemption Fee Note: None

Who may want to invest:

•Someonewhoisseekinganinvestmentoptionintendedforpeopleinorverynearretirementandwhoiswillingto

accept the volatility of diversified investments in the market.

•Someonewhoisseekingadiversifiedmixofstocks,bonds,andshort-terminvestmentsinoneinvestmentoptionor

who does not feel comfortable making asset allocation choices over time.

AmutualfundregisteredunderFidelityAberdeenStreetTrust,andmanagedbyStrategicAdvisers,Inc.Thisdescription

isonlyintendedtoprovideabriefoverviewofthefund.Readthefund’sprospectusformoredetailedinformationabout

thefund.

23

InvestmentOptions For more information, visit www.cpg.org or call (877) 208-0092.

Fidelity Freedom K® 2020 Fund

FPRS Code: 2176

Ticker: FFKDX

Objective: Seeks high total return until its target retirement date. Thereafter, the fund’s objective will be to seek high

current income and, as a secondary objective, capital appreciation.

Strategy: Investing in a combination of underlying Fidelity domestic equity funds, international equity funds, bond funds,

and short-term funds. Allocating assets among underlying Fidelity funds according to an asset allocation strategy that

becomes increasingly conservative until it reaches approximately 17% in domestic equity funds, 7% in international equity

funds, 46% in bond funds, and 30% in short-term funds (approximately 10 to 19 years after the year 2020). Ultimately,

the fund will merge with Fidelity Freedom K Income Fund. Strategic Advisers may continue to seek high total return for