Ledger SMB Manual

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 75

- I LedgerSMB and Business Processes

- Introduction to LedgerSMB

- Installing LedgerSMB

- User Account and Database Administration Basics

- Contact Management

- Chart of Accounts

- Administration

- Goods and Services

- Transaction Approval

- AP

- AR

- Projects

- Quotations and Order Management

- Fixed Assets

- HR

- POS

- General Ledger

- Recurring Transactions

- Financial Statements and Reports

- The Template System

- An Introduction to the CLI for Old Code

- II Technical Overview

- III Appendix

LedgerSMB Manual v. 1.3

The LedgerSMB Core Team

June 8, 2012

Except for the included scripts (which are licensed under the GPL v2 or later), the following per-

missive license governs this work.

Copyright 2005-2012 The LedgerSMB Project.

Redistribution and use in source (L

A

T

EX) and ’compiled’ forms (SGML, HTML, PDF, PostScript,

RTF and so forth) with or without modification, are permitted provided that the following conditions

are met:

1. Redistributions of source code (L

A

T

EX) must retain the above copyright notice, this list of condi-

tions and the following disclaimer as the first lines of this file unmodified.

2. Redistributions in compiled form (converted to PDF, PostScript, RTF and other formats) must

reproduce the above copyright notice, this list of conditions and the following disclaimer in the

documentation and/or other materials provided with the distribution.

THIS DOCUMENTATION IS PROVIDED BY THE LEDGERSMB PROJECT "AS IS" AND ANY EX-

PRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WAR-

RANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE ARE DISCLAIMED.

IN NO EVENT SHALL THE LEDGERSMB PROJECT BE LIABLE FOR ANY DIRECT, INDIRECT, IN-

CIDENTAL, SPECIAL, EXEMPLARY, OR CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT

LIMITED TO, PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES; LOSS OF USE, DATA, OR

PROFITS; OR BUSINESS INTERRUPTION) HOWEVER CAUSED AND ON ANY THEORY OF LI-

ABILITY, WHETHER IN CONTRACT, STRICT LIABILITY, OR TORT (INCLUDING NEGLIGENCE

OR OTHERWISE) ARISING IN ANY WAY OUT OF THE USE OF THIS DOCUMENTATION, EVEN

IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGE.

Contents

I LedgerSMB and Business Processes 8

1 Introduction to LedgerSMB 8

1.1 WhatisLedgerSMB........................................ 8

1.2 WhyLedgerSMB ......................................... 8

1.2.1 Advantages of LedgerSMB . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

1.2.2 KeyFeatures ....................................... 8

1.3 LimitationsofLedgerSMB.................................... 10

1.4 System Requirements of LedgerSMB . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

2 Installing LedgerSMB 11

1

3 User Account and Database Administration Basics 12

3.1 CompaniesandDatasets..................................... 12

3.2 HowtoCreateaUser....................................... 12

3.3 Permissions ............................................ 13

3.3.1 ListofRoles........................................ 13

3.4 CreatingCustomGroups..................................... 19

3.4.1 NamingConventions .................................. 19

3.4.2 Example.......................................... 19

4 Contact Management 19

4.1 Addresses ............................................. 20

4.2 ContactInfo ............................................ 20

4.3 BankAccounts........................................... 20

4.4 Notes................................................ 20

5 Chart of Accounts 20

5.1 Introduction to Double Entry Bookkeeping . . . . . . . . . . . . . . . . . . . . . . . . . . 21

5.1.1 BusinessEntity ...................................... 21

5.1.2 DoubleEntry ....................................... 21

5.1.3 Accounts.......................................... 21

5.1.4 DebitsandCredits .................................... 22

5.1.5 Accrual........................................... 22

5.1.6 SeparationofDuties ................................... 23

5.1.7 References......................................... 23

5.2 General Guidelines on Numbering Accounts . . . . . . . . . . . . . . . . . . . . . . . . . 24

5.3 Adding/ModifyingAccounts.................................. 24

5.4 Listing Account Balances and Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . 24

6 Administration 24

6.1 Taxes, Defaults, and Preferences . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

6.1.1 Adding A Sales Tax Account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

6.1.2 Setting a Sales Tax Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

6.1.3 DefaultAccountSetup.................................. 25

6.1.4 CurrencySetup...................................... 25

6.1.5 SequenceSettings..................................... 25

6.2 AuditControl ........................................... 26

6.2.1 Explaining transaction reversal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

6.2.2 Closebooksoption.................................... 26

6.2.3 AuditTrails ........................................ 26

6.3 Departments............................................ 26

6.3.1 CostvProfitCenters.................................... 27

6.4 Warehouses ............................................ 27

6.5 Languages ............................................. 27

6.6 TypesofBusinesses........................................ 27

6.7 Misc. ................................................ 27

6.7.1 GIFI............................................. 27

6.7.2 SIC ............................................. 27

6.7.3 Overview of Template Editing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

6.7.4 Year-end.......................................... 28

6.8 Options in the ledger-smb.conf . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

2

7 Goods and Services 29

7.1 BasicTerms ............................................ 29

7.2 ThePriceMatrix.......................................... 29

7.3 Pricegroups ............................................ 29

7.4 Groups ............................................... 29

7.5 Labor/Overhead ......................................... 29

7.6 Services............................................... 29

7.6.1 Shipping and Handling as a Service . . . . . . . . . . . . . . . . . . . . . . . . . . 29

7.7 Parts ................................................ 29

7.8 Assemblies and Manufacturing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

7.8.1 StockingAssemblies ................................... 30

7.9 Reporting.............................................. 30

7.9.1 All Items and Parts Reports . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

7.9.2 Requirements....................................... 30

7.9.3 ServicesandLabor.................................... 30

7.9.4 Assemblies ........................................ 30

7.9.5 GroupsandPricegroups................................. 31

7.10Translations ............................................ 31

7.11 How Cost of Goods Sold is tracked . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

8 Transaction Approval 31

8.1 BatchesandVouchers....................................... 31

8.2 Drafts................................................ 31

9 AP 32

9.1 BasicAPConcepts ........................................ 32

9.2 Vendors............................................... 32

9.3 APTransactions.......................................... 32

9.4 APInvoices ............................................ 32

9.4.1 Correcting an AP Invoice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

9.5 Cash payment And Check Printing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

9.5.1 Batch Payment Entry Screen . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

9.6 Transaction/Invoice Reporting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

9.6.1 TransactionsReport ................................... 33

9.6.2 OutstandingReport ................................... 33

9.6.3 APAgingReport..................................... 33

9.6.4 Tax Paid and Non-taxable Report . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

9.7 VendorReporting......................................... 34

9.7.1 VendorSearch....................................... 34

9.7.2 VendorHistory ...................................... 34

10 AR 34

10.1Customers ............................................. 34

10.1.1 CustomerPriceMatrix.................................. 34

10.2ARTransactions.......................................... 34

10.3ARInvoices ............................................ 35

10.4CashReceipt............................................ 35

10.4.1 Cash Receipts for multiple customers . . . . . . . . . . . . . . . . . . . . . . . . . 35

10.5ARTransactionReporting .................................... 35

10.5.1 ARTransactionsReport ................................. 35

10.5.2 ARAgingReport..................................... 35

10.6CustomerReporting ....................................... 35

3

11 Projects 35

11.1ProjectBasics ........................................... 35

11.2Timecards ............................................. 36

11.3ProjectsandInvoices ....................................... 36

11.4Reporting.............................................. 36

11.4.1 TimecardReporting ................................... 36

11.4.2 Project Transaction Reporting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

11.4.3 ListofProjects....................................... 36

11.5 Possibilities for Using Projects . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

12 Quotations and Order Management 36

12.1SalesOrders ............................................ 36

12.2Quotations............................................. 37

12.3Shipping .............................................. 37

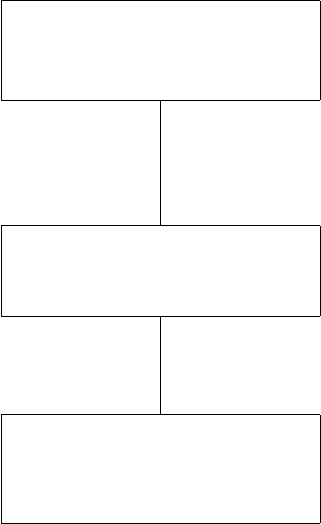

12.4ARWorkFlow........................................... 37

12.4.1 ServiceExample ..................................... 37

12.4.2 Single Warehouse Example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

12.4.3 Multiple Warehouse Example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

12.5 Requests for Quotation (RFQ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

12.6PurchaseOrders.......................................... 40

12.7Receiving.............................................. 40

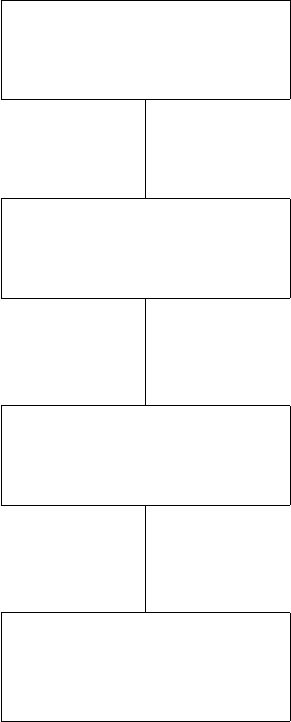

12.8APWorkFlow........................................... 40

12.8.1 Bookkeeper entering the received items, order completed in full . . . . . . . . . . 40

12.8.2 Bookkeeper entering received items, order completed in part . . . . . . . . . . . 41

12.8.3 Receiving staff entering items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

12.9 Generation and Consolidation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

12.9.1 Generation......................................... 43

12.9.2 Consolidation....................................... 43

12.10Reporting.............................................. 43

12.11Shipping Module: Transferring Inventory between Warehouses . . . . . . . . . . . . . . 43

13 Fixed Assets 43

13.1ConceptsandWorkflows..................................... 43

13.1.1 Fixed Assets and Capital Expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

13.1.2 AssetClasses ....................................... 44

13.1.3 Depreciation........................................ 44

13.1.4 Disposal .......................................... 44

13.1.5 NetBookValue...................................... 44

13.1.6 Supported Depreciation Methods . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

14 HR 45

15 POS 45

15.1SalesScreen ............................................ 45

15.2PossibilitiesforDataEntry.................................... 45

15.3HardwareSupport ........................................ 45

15.4Reports............................................... 46

15.4.1 OpenInvoices....................................... 46

15.4.2 Receipts .......................................... 46

4

16 General Ledger 46

16.1GLBasics.............................................. 46

16.1.1 Paper-based accounting systems and the GL . . . . . . . . . . . . . . . . . . . . . 46

16.1.2 Double Entry Examples on Paper . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

16.1.3 TheGLinLedgerSMB.................................. 47

16.2CashTransfer ........................................... 47

16.3GLTransactions.......................................... 48

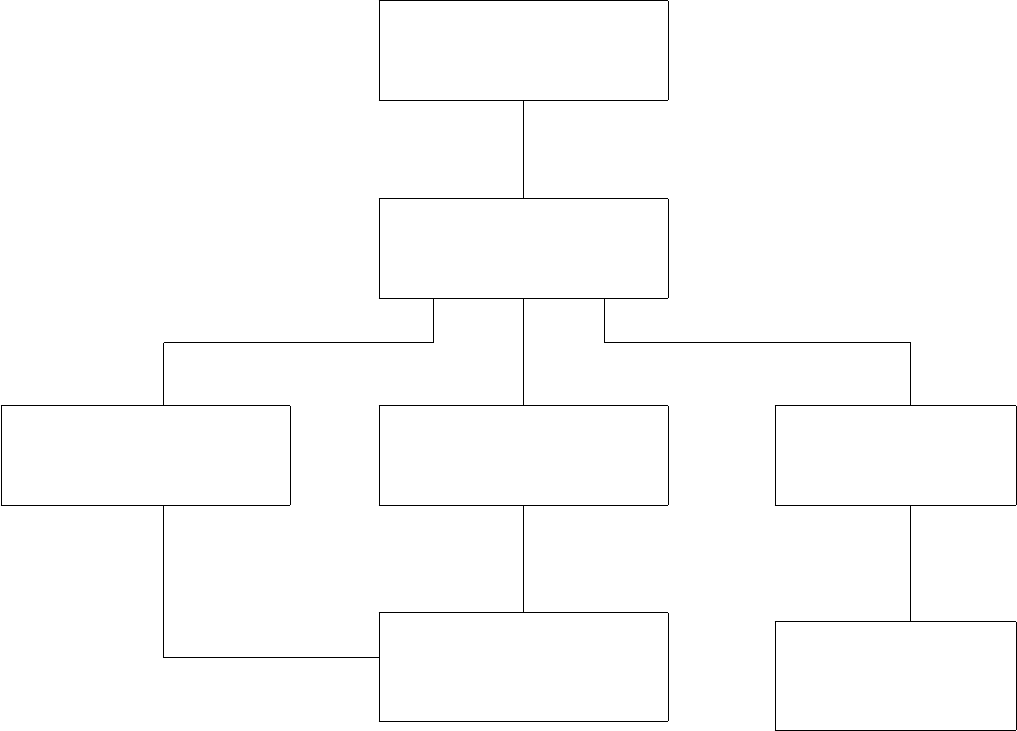

16.4PayrollasaGLtransaction.................................... 48

16.5Reconciliation ........................................... 48

16.5.1 FileImportFeature.................................... 49

16.6Reports............................................... 49

16.6.1 GL as access to almost everything else . . . . . . . . . . . . . . . . . . . . . . . . . 49

17 Recurring Transactions 49

18 Financial Statements and Reports 50

18.1Cashv.AccrualBasis....................................... 50

18.2 Viewing the Chart of Accounts and Transactions . . . . . . . . . . . . . . . . . . . . . . . 50

18.3TrialBalance............................................ 50

18.3.1 The Paper-based function of a Trial Balance . . . . . . . . . . . . . . . . . . . . . . 50

18.3.2 Running the Trial Balance Report . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

18.3.3 What if the Trial Balance doesn’t Balance? . . . . . . . . . . . . . . . . . . . . . . . 51

18.3.4 Trial Balance as a Summary of Account Activity . . . . . . . . . . . . . . . . . . . 51

18.3.5 Trial Balance as a Budget Planning Tool . . . . . . . . . . . . . . . . . . . . . . . . 51

18.4IncomeStatement......................................... 51

18.4.1 Uses of an Income Statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

18.5BalanceSheet ........................................... 52

18.6 What if the Balance Sheet doesn’t balance? . . . . . . . . . . . . . . . . . . . . . . . . . . 52

18.7 No Statement of Owner Equity? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

19 The Template System 53

19.0.1 What is L

A

T

EX? ...................................... 53

19.0.2 Using L

YX to Edit L

A

T

EXTemplates ........................... 53

19.1CustomizingLogos........................................ 53

19.2 How are They Stored in the Filesystem? . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

19.3UpgradeIssues .......................................... 54

20 An Introduction to the CLI for Old Code 54

20.1Conventions............................................ 55

20.2Preliminaries............................................ 55

20.3 First Script: lsmb01-cli-example.sh . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

20.3.1 Script1(Bash)....................................... 56

20.4 Second Script: lsmb02-cli-example.pl . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

20.4.1 Script2(Perl) ....................................... 57

II Technical Overview 61

5

21 Basic Architecture 61

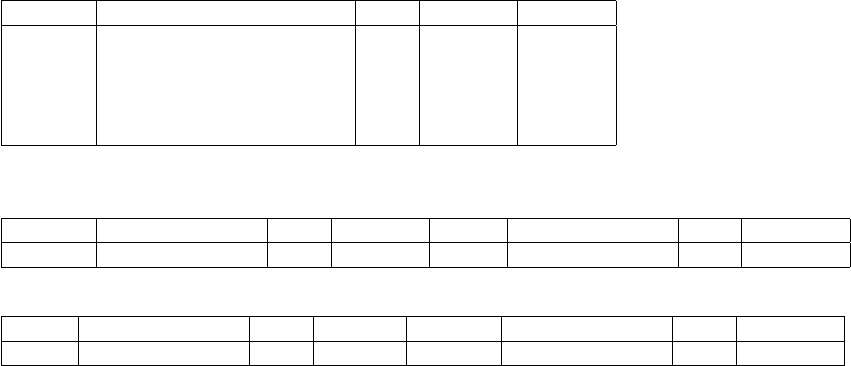

21.1TheSoftwareStack ........................................ 61

21.2CapacityPlanning......................................... 62

21.2.1 ScalabilityStrategies ................................... 62

21.2.2 DatabaseMaintenance.................................. 62

21.2.3 Knownissues....................................... 63

22 Customization Possibilities 63

22.1 Brief Guide to the Source Code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

22.2DataEntryScreens ........................................ 64

22.2.1 Examples ......................................... 64

22.3Extensions ............................................. 64

22.3.1 Examples ......................................... 64

22.4Templates ............................................. 64

22.4.1 Examples ......................................... 64

22.5Reports............................................... 64

22.5.1 Essential Parts of a Report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

22.5.2 FilterScreen........................................ 65

22.5.3 TheStoredProcedure .................................. 65

22.5.4 ReportModule ...................................... 68

22.5.5 WorkflowHooks ..................................... 68

23 Integration Possibilities 69

23.1ReportingTools .......................................... 69

23.1.1 Examples ......................................... 69

23.2 Line of Business Tools on PostgreSQL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

23.2.1 Strategies ......................................... 69

23.2.2 Examples ......................................... 69

23.3 Line of Business Tools on other RDBMS’s . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

23.3.1 Strategies ......................................... 70

23.3.2 Integration Products and Open Source Projects . . . . . . . . . . . . . . . . . . . . 70

24 Customization Guide 70

24.1GeneralInformation ....................................... 70

24.2CustomizingTemplates ..................................... 70

24.2.1 Template Control Structures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

24.3CustomizingForms........................................ 71

24.4CustomizingModules ...................................... 71

24.4.1 DatabaseAccess ..................................... 71

III Appendix 72

A Where to Go for More Information 72

B Quick Tips 72

B.1 Understanding Shipping Addresses and Carriers . . . . . . . . . . . . . . . . . . . . . . . 72

B.2 Handlingbaddebts........................................ 72

C Step by Steps for Vertical Markets 72

C.1 CommonInstallationErrors................................... 72

C.2 Retail With Light Manufacturing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

6

D Glossary 74

List of Figures

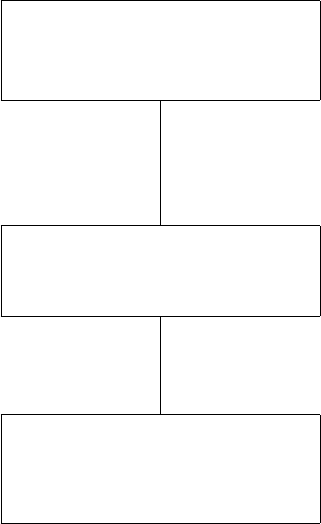

1 Simple AR Service Invoice Workflow Example . . . . . . . . . . . . . . . . . . . . . . . . 37

2 ARWorkflowwithShipping................................... 38

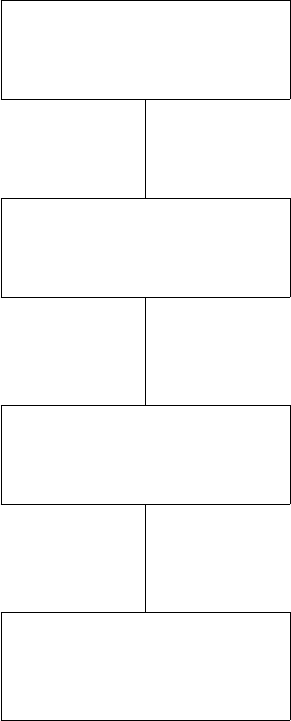

3 Complex AR Workflow with Shipping . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

4 SimpleAPWorkflow....................................... 40

5 APWorkflowwithReceiving .................................. 41

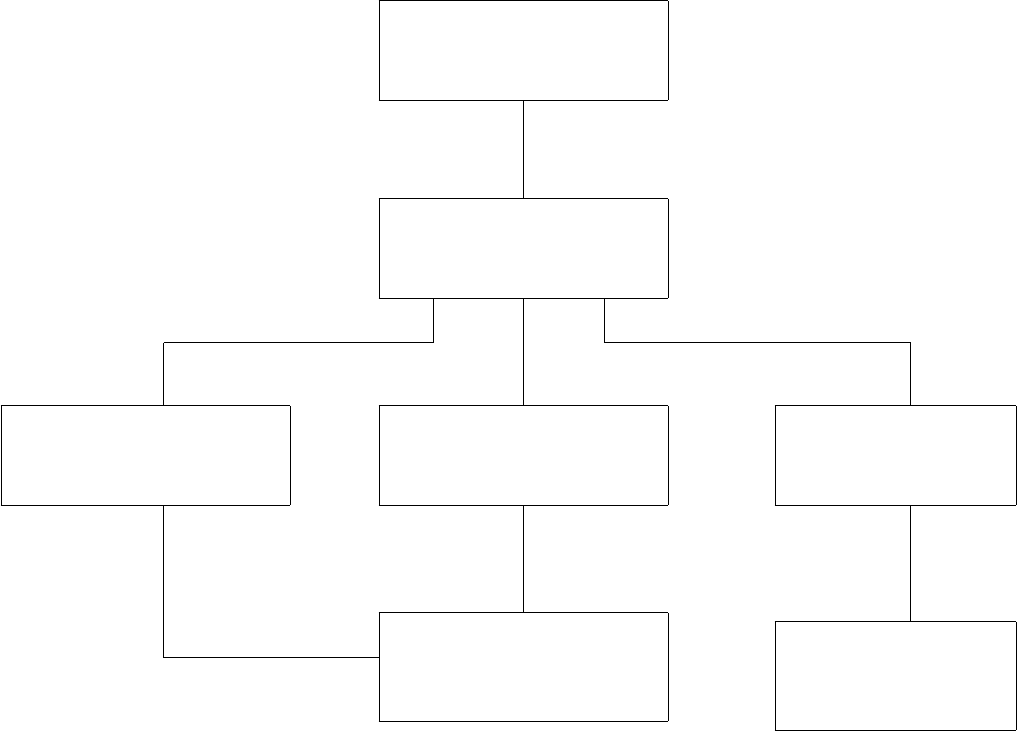

6 ComplexAPWorkflow...................................... 42

7 Payroll as a GL Transaction (Purely fictitious numbers) . . . . . . . . . . . . . . . . . . . 48

8 The LedgerSMB software stack in a Typical Implementation . . . . . . . . . . . . . . . . 61

7

Part I

LedgerSMB and Business Processes

1 Introduction to LedgerSMB

1.1 What is LedgerSMB

LedgerSMB is an open source financial accounting software program which is rapidly developing

additional business management features. Our goal is to provide a robust financial management

suite for small to midsize busiensses.

1.2 Why LedgerSMB

1.2.1 Advantages of LedgerSMB

•Flexibility and Central Management

•Accessibility over the Internet (for some users)

•Relatively open data format

•Integration with other tools

•Excellent accounting options for Linux users

•Open Source

•Flexible, open framework that can be extended or modified to fit your business.

•Security-conscious development community.

1.2.2 Key Features

•Accounts Receivable

–Track sales by customer

–Issue Invoices, Statements, Receipts, and more

–Do job costing and time entry for customer projects

–Manage sales orders and quotations

–Ship items from sales orders

•Accounts Payable

–Track purchases and debts by vendor

–Issue RFQ’s Purchase Orders, etc.

–Track items received from purchase orders

•Budgeting

–Track expenditures and income across multiple departments

–Track all transactions across departments

8

•Check Printing

–Customize template for any check form

•General Ledger

•Inventory Management

–Track sales and orders of parts

–Track cost of goods sold using First In/First Out method

–List all parts below reorder point

–Track ordering requirements

–Track, ship, receive, and transfer parts to and from multiple warehouses

•Localization

–Provide Localized Translations for Part Descriptions

–Provide Localized Templates for Invoices, Orders, Checks, and more

–Select language per customer, invoice, order, etc.

•Manufacturing

–Track cost of goods sold for manufactured goods (assemblies)

–Create assemblies and stock assemblies, tracking materials on hand

•Multi-company/Multiuser

–One isolated database per company

–Users can have localized systems independent of company data set

–Depending on configuration, users may be granted permission to different companies sep-

arately.

•Point of Sale

–Run multiple cash registers against main LedgerSMB installation

–Suitable for retail stores and more

–Credit card processing via TrustCommerce

–Supports some POS hardware out of the box including:

∗Logic Controls PD3000 pole displays (serial or parallel)

∗Basic text-based receipt printers

∗Keyboard wedge barcode scanners

∗Keyboard wedge magnetic card readers

∗Printer-attached cash drawers

•Price Matrix

–Track different prices for vendors and customers across the board

–Provide discounts to groups of customers per item or across the board

–Store vendors’ prices independent of the other last cost in the parts record

9

•Reporting

–Supports all basic financial statements

–Easily display customer history, sales data, and additional information

–Open framework allows for ODBC connections to be used to generate reports using third

party reporting tools.

•Tax

–Supports Retail Sales Tax and Value Added Tax type systems

–Flexible framework allows one to customize reports to change the tax reporting framework

to meet any local requirement.

–Group customers and vendors by tax form for easy reporting (1099, EU VAT reporting, and

similar)

•Fixed Assets

–Group fixed assets for easy depreciation and disposal

–Straight-line depreciation supported out of the box

–Framework allows for easy development of production-based and time-based depreciation

methods

–Track full or partial disposal of assets

1.3 Limitations of LedgerSMB

•No payroll module (Payroll must be done manually)

•Some integration limitations

•Further development/maintenance requires a knowledge of a relatively broad range of tech-

nologies

1.4 System Requirements of LedgerSMB

•PostgreSQL 8.3 or higher

•A CGI-enabled Web Server (for example, Apache)

•Perl 5.8.x or higher

•An operating system which supports the above software (usually Linux, though Windows, Ma-

cOS X, etc. do work)

•L

A

T

EX (optional) is required to create PDF or Postscript invoices

•The following CPAN modules:

–Data::Dumper

–Log::Log4perl

–Locale::Maketext

–DateTime

–Locale::Maketext::Lexicon

10

–DBI

–MIME::Base64

–Digest::MD5

–HTML::Entities

–DBD::Pg

–Math::BigFloat

–IO::File

–Encode

–Locale::Country

–Locale::Language

–Time::Local

–Cwd

–Config::Std

–MIME::Lite

–Template

–Error

–CGI::Simple

–File::MimeInfo

and these optional ones:

–Net::TCLink

–Parse::RecDescent

–Template::Plugin::Latex

–XML::Twig

–Excel::Template::Plus

2 Installing LedgerSMB

The process of installing LedgerSMB is described in detail in the INSTALL file which comes with the

distribution archive. In the process is:

1. Install the base software: Web Server (Apache), Database server (PostgreSQL) and Perl from

your distribution and package manager or source. Read the INSTALL file for details

2. Installing Perl module dependencies from your distribution and package manager or CPAN.

Read the INSTALL file for details

3. Give the web server access to the ledgersmb directory

4. Edit ./ledgersmb/ledgersmb.conf to be able to access the database and locate the relevant Post-

greSQL contrib scripts

5. Initializing a company database; database setup and upgrade script at http://localhost/ledgersmb/setup.pl

6. Login with your name (database username), password (database user password), Company

(databasename)

11

3 User Account and Database Administration Basics

LedgerSMB 1.3 offers a variety of tools for setting up new databases, and most functionality (aside

from creating new databases) is now offered dirctly within the main applications. LedgerSMB 1.2

users will note that the admin.pl script is no longer included.

3.1 Companies and Datasets

LedgerSMB 1.3 stores data for each company in a separate "database". A database is a PostgreSQL

concept for grouping tables, indexes, etc.

To create a database you will need to know a PostgreSQL superuser name and password. If you

do not know this information you can set authentication to "trust," then set the password, then set

back to a more reasonable setting after this process. Plese see the PostgreSQL documentation for

details.

Each company database must be named. This name is essentially the system identifier within

PostgreSQL for the company’s dataset. The name for the company database can only contain let-

ters, digits and underscores. Additionally, it must start with a letter. Company database names are

case insensitive, meaning you can’t create two separate company databases called ’Ledgersmb’ and

’ledgersmb’.

One way you can create databases fairly easily is by directing your web browser to the setup.pl

script at your installed ledgersmb directory. So if the base URL is http://localhost/ledgersmb/, you

can access the database setup and upgrade script at http://localhost/ledgersmb/setup.pl. This is

very different from the approaches taken by LedgerSMB 1.2.x and earlier and SQL-Ledger, but rather

forms a wizard to walk you through the process.

An alternative method is the ’prepare-company-database.sh’ script contributed by Erik Huels-

mann. This script can be useful in creating and populating databases from the command line and it

offers a reference implementation written in BASH for how this process is done.

The ’prepare-company-database.sh’ script in the tools/ directory will set up databases to be used

for LedgerSMB. The script should be run as ’root’ because it wants to ’su’ to the postgres user. Al-

ternatively, if you know the password of the postgres user, you can run the script as any other user.

You’ll be prompted for the password. Additionally, the script creates a superuser to assign owner-

ship of the created company database to. By default this user is called ’ledgersmb’. The reason for

this choice is that when removing the ledgersmb user, you’ll be told about any unremoved parts of

the database, because the owner of an existing database can’t be removed until that database is itself

removed.

The following invocation of the script sets up your first test company, when invoked as the root

user and from the root directory of the LedgerSMB sources:

$ ./tools/prepare-company-database.sh –company testinc

The script assumes your PostgreSQL server runs on ’localhost’ with PostgreSQL’s default port

(5432).

Upon completion, it’ll have created a company database with the name ’testinc’, a user called

’ledgersmb’ (password: ’LEDGERSMBINITIALPASSWORD’), a single user called ’admin’ (password:

’admin’) and the roles required to manage authorizations.

Additionally, it’ll have loaded a minimal list of languages required to succesfully navigate the

various screens.

All these can be adjusted using arguments provided to the setup script. See the output generated

by the –help option for a full list of options.

3.2 How to Create a User

In the database setup workflow, a simple application user will be created. This user, by default, only

has user management capabilities. Ideally actual work should be done with accounts which have

12

fewer permissions.

To set up a user, log in with you administrative credentials (created when initializing the database)

and then go to System/Admin Users/Add User. From here you can create a user and add appropriate

permissions.

3.3 Permissions

Permissions in LedgerSMB 1.3 are enforced using database roles. These are functional categories and

represent permissions levels needed to do basic tasks. They are assigned when adding/editing users.

The roles follow a naming convention which allows several LSMB databases to exist on the same

PostgreSQL instance. Each role is named lsmb_[dbname]__ followed by the role name. Note that two

underscores separate the database and role names. If these are followed then the interface will pick

up on defined groups and display them along with other permissions.

3.3.1 List of Roles

Roles here are listed minus their prefix (lsmb_[database name]__, note the double underscore at the

end of the prefix).

•Contact Management: Customers and Vendors

contact_read Allows the user to read contact information

contact_create Allows the user to enter new contact information

contact_edit Allows the user to update the contact information

contact_all provides permission for all of the above. Member of:

–contact_read

–contact_create

–contact_edit

•Batch Creation and Approval

batch_create Allows the user to create batches

batch_post Allows the user to take existing batches and post them to the books

batch_list Allows the user to list batches and vouchers within a batch. This role also grants

access to listing draft tansactions (i.e. non-approved transactions not a part of a batch).

Member of:

–ar_transaction_list

–ap_transaction_list

•AR: Accounts Receivable

ar_transaction_create Allows user to create transctions. Member of:

–contact_read

ar_transaction_create_voucher . Allows a user to create AR transaction vouchers. Member of:

–contact_read

–batch_create

ar_invoice_create Allows user to create sales invoices. Member of:

–ar_transaction_create

ar_transaction_list Allows user to view transactions. Member Of:

13

–contact_read

ar_transaction_all , all non-voucher permissions above, member of:

–ar_transaction_create

–ar_transaction_list

sales_order_create Allows user to create sales order. Member of:

–contact_read

sales_quotation_create Allows user to create sales quotations. Member of:

–contact_read

sales_order_list Allows user to list sales orders. Member of:

–contact_read

sales_quotation_list Allows a user to list sales quotations. Member of:

–contact_read

ar_all : All AR permissions, member of:

–ar_voucher_all

–ar_transaction_all

–sales_order_create

–sales_quotation_create

–sales_order_list

–sales_quotation_list

•AP: Accounts Payable

ap_transaction_create Allows user to create transctions. Member of:

–contact_read

ap_transaction_create_voucher . Allows a user to create AP transaction vouchers. Member of:

–contact_read

–batch_create

ap_invoice_create Allows user to create vendor invoices. Member of:

–ap_transaction_create

ap_transaction_list Allows user to view transactions. Member Of:

–contact_read

ap_transaction_all , all non-voucher permissions above, member of:

–ap_transaction_create

–ap_transaction_list

purchase_order_create Allows user to create purchase orders, Member of:

–contact_read

rfq_create Allows user to create requests for quotations. Member of:

–contact_read

purchase_order_list Allows user to list purchase orders. Member of:

–contact_read

rfq_list Allows a user to list requests for quotations. Member of:

–contact_read

14

ap_all : All AP permissions, member of:

–ap_voucher_all

–ap_transaction_all

–purchase_order_create

–rfq_create

–purchase_order_list

–rfq_list

•Point of Sale

pos_enter Allows user to enter point of sale transactions Member of:

–contact_read

close_till Allows a user to close his/her till

list_all_open Allows the user to enter all open transactions

pos_cashier Standard Cashier Permissions. Member of:

–pos_enter

–close_till

pos_all Full POS permissions. Member of:

–pos_enter

–close_till

–list_all_open

•Cash Handling

reconciliation_enter Allows the user to enter reconciliation reports.

reconciliation_approve Allows the user to approve/commit reconciliation reports to the books.

reconciliation_all Allows a user to enter and approve reconciliation reports. Don’t use if sepa-

ration of duties is required. Member of:

–reconciliation_enter

–reconciliation_approve

payment_process Allows a user to enter payments. Member of:

–ap_transaction_list

receipt_process Allows a user to enter receipts. Member of:

–ar_transaction_list

cash_all All above cash roles. Member of:

–reconciliation_all

–payment_process

–receipt_process

•Inventory Control

part_create Allows user to create new parts.

part_edit Allows user to edit parts

inventory_reports Allows user to run inventory reports

pricegroup_create Allows user to create pricegroups. Member of:

–contact_read

15

pricegroup_edit Allows user to edit pricegroups Member of:

–contact_read

assembly_stock Allows user to stock assemblies

inventory_ship Allows user to ship inventory. Member of:

–sales_order_list

inventory_receive Allows user to receive inventory. Member of:

–purchase_order_list

inventory_transfer Allows user to transfer inventory between warehouses.

warehouse_create Allows user to create warehouses.

warehouse_edit Allows user to edit warehouses.

inventory_all All permissions groups in this section. Member of:

–part_create

–part_edit

–inventory_reports

–pricegroup_create

–pricegroup_edit

–assembly_stock

–inventory_ship

–inventory_transfer

–warehouse_create

–warehouse_edit

•GL: General Ledger and General Journal

gl_transaction_create Allows a user to create journal entries or drafts.

gl_voucher_create Allows a user to create GL vouchers and batches.

gl_reports Allows a user to run GL reports, listing all financial transactions in the database.

Member of:

–ar_list_transactions

–ap_list_transactions

yearend_run Allows a user to run the year-end processes

gl_all All GL permissions. Member of:

–gl_transaction_create

–gl_voucher_create

–gl_reports

–yearend_run

•Project Accounting

project_create Allows a user to create project entries. User must have contact_read permission

to assing them to customers however.

project_edit Allows a user to edit a project. User must have contact_read permission to assing

them to customers however.

project_timecard_add Allows user to add time card. Member of:

–contact_read

16

project_timecard_list Allows a user to list timecards. Necessary for order generation. Member

of:

–contact_read

project_order_generate Allows a user to generate orders from time cards. Member of:

–project_timecard_list

–orders_generate

•Order Generation, Consolidation, and Management

orders_generate Allows a user to generate orders. Member of:

–contact_read

orders_sales_to_purchase Allows creation of purchase orders from sales orders. Member of:

–orders_generate

orders_purchase_consolidate Allows the user to consolidate purchase orders. Member of:

–orders_generate

orders_sales_consolidate Allows user to consolidate sales orders. Member of:

–orders_generate

orders_manage Allows full management of orders. Member of:

–project_order_generate

–orders_sales_to_purchase

–orders_purchase_consolidate

–orders_sales_consolidate

•Financial Reports

financial_reports Allows a user to run financial reports. Member of:

–gl_reports

•Batch Printing

print_jobs_list Allows the user to list print jobs.

print_jobs Allows user to print the jobs Member of:

–print_jobs_list

•System Administration

system_settings_list Allows the user to list system settings.

system_settings_change Allows user to change system settings. Member of:

–system_settings_list

taxes_set Allows setting of tax rates and order.

account_create Allows creation of accounts.

account_edit Allows one to edit accounts.

auditor Allows one to access audit trails.

audit_trail_maintenance Allows one to truncate audit trails.

gifi_create Allows one to add GIFI entries.

gifi_edit Allows one to edit GIFI entries.

17

account_all A general group for accounts management. Member of:

–account_create

–account_edit

–taxes_set

–gifi_create

–gifi_edit

department_create Allow the user to create departments.

department_edit Allows user to edit departments.

department_all Create/Edit departments. Member of:

–department_create

–department_edit

business_type_create Allow the user to create business types.

business_type_edit Allows user to edit business types.

business_type_all Create/Edit business types. Member of:

–business_type_create

–business_type_edit

sic_create Allow the user to create SIC entries.

sic_edit Allows user to edit business types.

sic_all Create/Edit business types. Member of:

–sic_create

–sic_edit

tax_form_save Allow the user to save the tax form entries.

template_edit Allow the user to save new templates. This requires sufficient file system per-

missions.

users_manage Allows an admin to create, edit, or remove users. Member of:

–contact_create

–contact_edit

system_admin General role for accounting system administrators. Member of:

–system_setting_change

–account_all

–department_all

–business_type_all

–sic_all

–tax_form_save

–template_edit

–users_manage

•Manual Translation

language_create Allow user to create languages

language_edit Allow user to update language entries

part_translation_create Allow user to create translations of parts to other languages.

project_translation_create Allow user to create translations of project descriptions.

18

manual_translation_all Full management of manual translations. Member of:

–language_create

–language_edit

–part_translation_create

–project_translation_create

3.4 Creating Custom Groups

Because LedgerSMB uses database roles and naming conventions to manage permissions it is possible

to create additional roles and use them to manage groups. There is not currently a way of doing this

from the front-end, but as long as you follow the conventions, roles you create can be assigned to

users through the front-end. One can also create super-groups that the front-end cannot see but can

assign permissions to broups of users on multiple databases. This section will cover both of these

approaches.

3.4.1 Naming Conventions

In PostgreSQL, roles are global to the instance of the server. This means that a single role can exist

and be granted permissions on multiple databases. We therefore have to be careful to avoid naming

collisions which could have the effect of granting permissions unintentionally to individuals who are

not intended to be application users.

The overall role consists of a prefix and a name. The prefix starts with lsmb_ to identify the role as

one created by this application, and then typically the name of the database. This convention can be

overridden by setting this in the defaults table (the setting is named ’role_prefix’) but this is typically

done only when renaming databases. After the prefix follow two underscores.

So by default a role for LedgerSMB in a company named mtech_test would start with lsmb_mtech_test__.

To create a role for LedgerSMB all we have to do is create one in the database with these conventions.

3.4.2 Example

Suppose mtech_test is a database for a financial services company and most users must have appro-

priate permissions to enter batches etc, but not approve them A role could be created like:

CREATE ROLE lsmb_mtech_test__user;

GRANT lsmb_mtech_test__all_ap,

lsmb_mtech_test__create_batch,

lsmb_mtech_test__read_contact,

lsmb_mtech_test__list_batches,

lsmb_mtech_test__create_contact,

lsmb_mtech_test__all_gl,

lsmb_mtech_test__process_payment

TO lsmb_mtech_test__user;

Then when going to the user interface to add roles, you will see an entry that says "user" and this

can be granted to the user.

4 Contact Management

Every business does business with other persons, corporate or natural. They may sell goods and

services to these persons or they may purchase goods and services from these persons. With a few

exceptions those who are being sold goods and services are tracked as customers, and those from

19

whom goods and services are being purchased from are vendors. The actual formal distinction is

that vendors are entities that the business pays while customers pay the business. Here are some key

terms:

Credit Account An agreement between your business and another person or business and your busi-

ness about the payment for the delivery of goods and services on an ongoing basis. These credit

accounts define customer and vendor relationships.

Customer Another person or business who pays your business money

Vendor Another person or business you pay money to.

Prior versions of LedgerSMB required that customers and vendors be entirely separate. In 1.3,

however, a given entity can have multiple agreements with the business, some being as a customer,

and some being as a vendor.

All customers and vendors are currently tracked as companies, while employees are tracked as

natural persons but this will be changing in future versions so that natural persons can be tracked as

customers and vendors too.

Each contact must be attached to a country for tax reporting purposes. Credit accounts can then

be attached to a tax form for that country (for 1099 reporting in the US or EU VAT reporting).

4.1 Addresses

Each contact, whether an employee, customer, or vendor, can have one or more addresses attached,

but only one can be a billing address.

4.2 Contact Info

Each contact can have any number of contact info records attached. These convey phone, email,

instant messenger, etc. info for the individual. New types of records can be generated easily by

adding them to the contact_class table.

4.3 Bank Accounts

Each contact can have any number of bank accounts attached, but only one can be the primary ac-

count for a given credit account. There are only two fields here. The first (BIC, or Banking Institution

Code) represents the bank’s identifier, such as an ABA routing number, or a SWIFT code, while the

second (IBAN) represents the individual’s account number.

4.4 Notes

In 1.3, any number of read-only notes can be attached either to an entity (in which case they show up

for all credit accounts for that entity), or a credit account, in which case they show up only when the

relevant credit account is selected.

5 Chart of Accounts

The Chart of Accounts provides a basic overview of the logical structure of the accounting program.

One can customize this chart to allow for tracking of different sorts of information.

20

5.1 Introduction to Double Entry Bookkeeping

In order to set up your chart of accounts in LedgerSMB you will need to understand a bit about

double entry bookkeeping. This section provides a brief overview of the essential concepts. There is

a list of references for further reading at the end.

5.1.1 Business Entity

You always want to keep your personal expenses and income separate from that of the business or

you will not be able to tell how much money it is making (if any). For the same reason you will want

to keep track of how much money you put into and take out of the business so you will want to set

up a completely seperate set of records for it and treat it almost as if it had a life of its own.

5.1.2 Double Entry

Examples:

•When you buy you pay money and receive goods.

•When you sell you get money and give goods.

•When you borrow you get money and give a promise to pay it back.

•When you lend you give money and get a promise to pay it back.

•When you sell on credit you give goods and get a promise to pay.

•When you buy on credit you give a promise to pay and get goods.

You need to record both sides of each transaction: thus double entry. Furthermore, you want to

organize your entries, recording those having to do with money in one place, value of goods bought

and sold in another, money owed in yet another, etc. Hence you create accounts, and record each

half of each transaction in an appropriate account. Of course, you won’t have to actually record the

amount in more than one place yourself: the program takes care of that.

5.1.3 Accounts

Assets Money and anything that can be converted into money without reducing the net equity of the

business. Assets include money owed, money held, goods available for sale, property, and the

like.

Liabilities Debts owned by the business such as bank loans and unpaid bills.

Equity or Capital What would be left for the owner if all the assets were converted to money and

all the liabilities paid off ("Share Capital" on the LedgerSMB default chart of accounts: not to be

confused with "Capital Assets".)

Revenue Income from business activity: increases Equity

Expense The light bill, the cost of goods sold, etc: decreases Equity

All other accounts are subdivisions of these. The relationship between the top-level accounts is

often stated in the form of the Accounting Equation (don’t worry: you won’t have to solve it):

Assets = Liabilities + Equity + (Revenue - Expense)

You won’t actually use this equation while doing your bookkeeping, but it’s a useful tool for

understanding how the system works.

21

5.1.4 Debits and Credits

The words "Debit" and "Credit" come from Latin roots. Debit is related to our word "debt" while

credit can indicate a loan or something which edifies an individual or business. The same applies

to double entry accounting as it involves equity accounts. Debts debit equity, moneys owed to the

business credit the business. Credits to equity accounts make the business more valuable while debits

make it less. Thus when you invest money in your business you are crediting that business (in terms

of equity), and when you draw money, perhaps to pay yourself, you are debiting that business.

Double entry accounting systems grew out of single entry ones. The goal was to create a sys-

tem which had inherent checks against human error. Consequently accounts and transactions are

arranged such that debits across all accounts always equal credit accounts.

If you invest money in your business that credits an equity account, but the other side of the

transaction must thus be a debit. Because the other side of the transaction is an asset account (for

example a bank account) it is debited.

Similarly as liability accounts increase, the equity of the business decreases. Consequently, lia-

bilities increase with credits. Income and expense accounts are often the flip sides of transactions

involving assets and liailities and represent changes in equity. Therefore they follow the same rules

as equity accounts.

•Debits increase assets

•Debits increase expense

•Credits increase liabilities

•Credits increase capital

•Credits increase revenue

Examples:

You go to the bank and make a deposit. The teller tells you that he is going to credit your account.

This is correct: your account is money the bank owes you and so is a liability from their point of

view. Your deposit increased this liability and so they will credit it. They will make an equal debit

to their cash account. When you return you will debit your bank deposits account because you have

increased that asset and credit cash on hand because you have decreased that one.

5.1.5 Accrual

Early accounting systems were usually run on a cash basis. One generally did not consider money

owed to affect the financial health of a company, so expenses posted when paid as did income.

The problem with this approach is that it becomes very difficult or impossible to truly understand

the exact nature of the financial health of a business. One cannot get the full picture of the financial

health of a business because outstanding debts are not considered. Futhermore, this does not allow

for revenue to be tied to cost effectively, so it becomes difficult to assess how profitable a given activity

truly is.

To solve this problem, accrual-based systems were designed. The basic principle is that income

and expense should be posted as they are incurred, or accrued. This allows one to track income

relative to expense for specific projects or operations, and make better decisions about which activities

will help one maximize profitability.

To show how these systems differ, imagine that you bill a customer for time and materials for a

project you have just completed. The customer pays the bill after 30 days. In a cash based system, you

would post the income at the time when the customer pays, while in an accrual system, the income is

posted at the time when the project is completed.

22

5.1.6 Separation of Duties

There are two important reasons not to trust accounting staff too much regarding the quality of data

that is entered into the system. Human error does occur, and a second set of eyes can help reduce that

error considerably.

A second important reason to avoid trusting accounting staff too much is that those with access to

financial data are in a position to steal money from the business. All too often, this actually happens.

Separation of duties is the standard solution to this problem.

Separation of duties then refers to the process of separating parts of the workflow such that one

person’s work must be reviewed and approved by someone else. For example, a book keeper might

enter transactions and these might later be reviewed by a company accountant or executive. This

thus cuts down both on errors (the transaction is not on the books until it is approved), and on the

possibility of embezzlement.

Typically, the way duties are likely to be separated will depend on the specific concerns of the

company. If fraud is the primary concern, all transactions will be required to go through approval

and nobody will ever be allowed to approve their own transactions. If fraud is not a concern, then

typically transactions will be entered, stored, and later reviewed/approved by someone different, but

allowances may be made allowing someone to review/approve the transactions he/she entered. This

latter example doesn’t strictly enforce separation of duties, but encourages them nonetheless.

By default, LedgerSMB is set up not to strictly enforce the separation of duties. This can be

changed by adding a database constraint to ensure that batches and drafts cannot be approved by

the same user that enters them.

In the age of computers, separation of duties finds one more important application: it allows

review and approval by a human being of automatically entered transactions. This allows the ac-

counting department to double-check numbers before they are posted to the books and thus avoid

posting incorrect numbers (for example, due to a software bug in custom code).

Unapproved transactions may be deleted as they are not full-fledged transactions yet. Approved

transactions should be reversed rather than deleted.

Separation of duties is not available yet for sales/vendor invoice documents, but something sim-

ilar can be handled by feeding them through the order entry workflow (see 12).

5.1.7 References

http://www.accounting-and-bookkeeping-tips.com/learning-accounting/accounting-basics-credit.

htm

Discussion of debits and credits as well as links to other accounting subjects.

http://www.computer-consulting.com/accttips.htm

Discussion of double entry bookkeeping.

http://www.minnesota.com/~tom/sql-ledger/howtos/

A short glossary, some links, and a FAQ (which makes the "credit=negative number" error). The FAQ

focuses on SQL-Ledger, LedgerSMB’s ancestor.

http://bitscafe.com/pub2/etp/sql-ledger-notes#expenses

Some notes on using SQL-Ledger (LedgerSMB’s ancestor).

http://en.wikipedia.org/wiki/List_of_accounting_topics

Wikipedia articles on accounting.

http://www.bized.ac.uk/learn/accounting/financial/index.htm

Basic accounting tutorial.

23

http://www.asset-analysis.com/glossary/glo_index.html

Financial dictionary and glossary.

http://www.geocities.com/chapleaucree/educational/FinanceHandbook.html

Financial glossary.

http://www.quickmba.com/accounting/fin/

Explanation of fundamentals of accounting, including good discussions of debits and credits and of

double-entry.

5.2 General Guidelines on Numbering Accounts

In general, most drop-down boxes in LedgerSMB order the accounts by account number. Therefore

by setting appropriate account numbers, one can affect the default values.

A second consideration is to try to keep things under each heading appropriate to that heading.

Thus setting an account number for a bank loan account in the assets category is not generally advis-

able.

If in doubt, review a number of bundled chart of accounts templates to see what sorts of number-

ing schemes are used.

5.3 Adding/Modifying Accounts

These features are listed under System->Chart of Accounts. One can list the accounts and click on the

account number to modify them or click on the "add account" option to create new accounts.

•Headings are just broad categories and do not store values themselves, while accounts are used

to store the transactional information.

•One cannot have an account that is a summary account (like AR) and also has another function.

•GIFI is mostly of interest to Canadian customers but it can be used to create reports of account

hierarchies.

5.4 Listing Account Balances and Transactions

One can list the account balances via the Reports->Chart of Accounts report. Clicking on the account

number will provide a ledger for that account.

6 Administration

This section covers other (non-Chart of Accounts) aspects to the setup of the LedgerSMB accounting

package. These are generally accessed in the System submenu.

6.1 Taxes, Defaults, and Preferences

Since LedgerSMB 1.2, sales tax has been modular, allowing for different tax accounts to be goverend

by different rules for calculating taxes (although only one such module is supplied with LedgerSMB

to date). This allows one to install different tax modules and then select which taxes are applied by

which programming modules. The sales tax module has access to everything on the submitted form

so it is able to make complex determinations on what is taxable based on arbitrary criteria.

24

The tax rules drop-down box allows one to select any installed tax module (LedgerSMB 1.3 ships

only with the simple module), while the ordering is an integer which allows one to specify a tax run

which occurs on the form after any rules with lower entries in this box. This allows for compounding

of sales tax (for example, when PST applies to the total and GST as well).

As in 1.3.16, new API’s have been added to allow one to pass info to tax modules as to minimum

and maximum taxable values. These values are used by the Simple tax module as applying to the

subtotal of the invoice.

6.1.1 Adding A Sales Tax Account

Sales Tax is collected on behalf of a state or national government by the individual store. Thus a sales

tax account is a liability– it represents money owed by the business to the government.

To add a sales tax account, create an account in the Chart of Accounts as a liability account, check

all of the “tax” checkboxes.

Once this account is created, one can set the tax amount.

6.1.2 Setting a Sales Tax Amount

Go to System->Defaults and the tax account will be listed near the bottom of the page. The rate can

be set there.

6.1.3 Default Account Setup

These accounts are the default accounts for part creation and foreign exchange tracking.

6.1.4 Currency Setup

The US accounts list this as USD:CAD:EUR. One can add other currencies in here, such as IDR (In-

donesian Rupiah), etc. Currencies are separated by colons.

6.1.5 Sequence Settings

These sequences are used to generate user identifiers for quotations, invoices, and the like. If an

identifier is not added, the next number will be used.

A common application is to set invoices, etc. to start at 1000 in order to hide the number of issued

invoices from a customer.

Leading zeros are preserved. Other special values which can be embedded using <?lsmb ?>tags

include:

DATE expands to the current date

YYMMDD expands to a six-digit version of the date. The components of this date can be re-arranged

in any order, so MMDDYY, DDMMYY, or even just MMYY are all options.

NAME expands to the name of the customer or vendor

BUSINESS expands to the type of business assigned to the customer or ventor.

DESCRIPTION expands to the description of the part. Valid only for parts.

ITEM expands to the item field. Valid only for parts.

PERISCOPE expands to the partsgroup. Valid only for parts.

PHONE expands to the telephone number for customers and vendors.

25

6.2 Audit Control

Auditability is a core concern of the architects of any accounting system. Such ensures that any

modification to the accounting information leaves a trail which can be followed to determine the

nature of the change. Audits can help ensure that the data in the accounting system is meaningful

and accurate, and that no foul play (such as embezzlement) is occurring.

6.2.1 Explaining transaction reversal

In paper accounting systems, it was necessary to have a means to authoritatively track corrections of

mistakes. The means by which this was done was known as “transaction reversal.”

When a mistake would be made, one would then reverse the transaction and then enter it in

correctly. For example, let us say that an office was renting space for $300 per month. Let us say that

they inadvertently entered it in as a $200 expense.

The original transaction would be:

Account Debit Credit

5760 Rent $200

2100 Accounts Payable $200

The reversal would be:

Account Debit Credit

5760 Rent $200

2100 Accounts Payable $200

This would be followed by re-entering the rent data with the correct numbers. This was meant to

ensure that one did not erase data from the accounting books (and as such that erasing data would

be a sign of foul play).

LedgerSMB has a capability to require such reversals if the business deems this to be necessary.

When this option is enabled, existing transactions cannot be modified and one will need to post

reversing transactions to void existing transactions before posting corrected ones.

Most accountants prefer this means to other audit trails because it is well proven and understood

by them.

6.2.2 Close books option

You cannot alter a transaction that was entered before the closing date.

6.2.3 Audit Trails

This option stores additional information in the database to help auditors trace individual transac-

tions. The information stored, however, is limited and it is intended to be supplemental to other

auditing facilities.

The information added includes which table stored the record, which employee entered the infor-

mation, which form was used, and what the action was. No direct financial information is included.

6.3 Departments

Departments are logical divisions of a business. They allow for budgets to be prepared for the indi-

vidual department as well as the business as a whole. This allows larger businesses to use LedgerSMB

to meet their needs.

26

6.3.1 Cost v Profit Centers.

In general business units are divided into cost and profit centers. Cost centers are generally regarded

as business units where the business expects to lose money and profit centers are where they expect

to gain money. For example, the legal department in most companies is a cost center.

One of the serious misunderstandings people run up against is that LedgerSMB tends to more

narrowly define cost and profit centers than most businesses do. In LedgerSMB a cost center is any

department of the business that does not issue AR transactions. Although many businesses may

have cost centers (like technical support) where customer fees may subsidize the cost of providing

the service, in LedgerSMB, these are profit centers.

LedgerSMB will not allow cost centers to be associated with AR transactions. So if you want this

functionality, you must create the department as a profit center.

6.4 Warehouses

LedgerSMB has the ability to track inventory by warehouse. Inventory items can be moved between

warehouses, and shipped from any warehouse where the item is in stock. We will explore this concept

more later.

6.5 Languages

Languages allow for goods and services to be translated so that one can maintain offices in different

countries and allow for different goods and service descriptions to be translated to different languages

for localization purposes.

6.6 Types of Businesses

One can create types of businesses and then give them discounts across the board. For example, one

might give a firm that uses one’s services as a subcontractor a 10% discount or more.

6.7 Misc.

6.7.1 GIFI

GIFI is a requirement for Canadian customers. This feature allows one to link accounts with Canadian

tax codes to simplify the reporting process. Some European countries now use a similar system.

People that don’t otherwise have a use for GIFI can use it to create reports which agregate accounts

together.

6.7.2 SIC

Standard Industrial Classification is a way of tracking the type of business that a vendor or customer

is in. For example, an accountant would have an SIC of 8721 while a graphic design firm would have

an SIC of 7336. The classification is hierarchical so one could use this field for custom reporting and

marketing purposes.

6.7.3 Overview of Template Editing

The templates for invoices, orders, and the like can be edited from within LedgerSMB. The submenus

within the System submenu such as HTML Templates, Text Templates and L

A

T

EX templates provide

access to this functionality.

27

6.7.4 Year-end

Although the Year-end functionality in LedgerSMB is very useful, it does not entirely make the pro-

cess simple and painless. One must still manually enter adjustments prior to closing the books. The

extent to which these adjustments are necessary for any given business is a matter best discussed

with an accountant.

The standard way books are normally closed at the end of the year is by moving all adjusted1

income and expenses to an equity account usually called ‘Retained Earnings.’ Assets and liabilities

are not moved. Equity drawing/dividend accounts are also moved, but the investment accounts are

not. The reasoning behind this process is that one wants a permanent record of the amount invested

in a business, but any dividends ought not to count against their recipients when new investors are

brought on board.

LedgerSMB automatically moves all income and expense into the specified year-end/retained

earnings account. It does not move the drawing account, and this must be done manually, nor does

it automate the process of making adjustments.

Contrary to its name, this function can close the books at any time, though this would likely be of

limited use.

Once the books are closed, no transactions can be entered into the closed period. Additionally the

year end routines cannot be run if there are unapproved transactions in a period to be closed.

6.8 Options in the ledger-smb.conf

The ledger-smb.conf configures the software by assigning site-wide variables. Most of these should

be left alone unless one knows what one is doing. However, on some systems some options might

need to be changed, so all options are presented here for reference:

auth is the form of authenticaiton used. If in doubt use ‘DB’ auth.

decimal_places Number of decimal places for money.

templates is the directory where the templates are stored.

sendmail is the command to use to send a message. It must read the email from standard input.

language allows one to set the language for the login screen and admin page.

latex tells LedgerSMB whether L

A

T

EX is installed. L

A

T

EX is required for generating Postscript and PDF

invoices and the like.

Environmental variables can be set here too. One can add paths for searching for L

A

T

EX, etc.

Printers section can be used to set a hash table of printers for the software. The primary example is

[printers]

Default = lpr

Color = lpr -PEpson

However, this can use any program that can accept print documents (in Postscript) from stan-

dard input, so there are many more possibilities.

database provides connection parameters for the database, typically the host and port, but also the

location of the contrib scripts (needed for the setup.pl), and the default namespace.

1Adjustments would be entered via the General Ledger. The exact process is beyond the scope of this document, however.

28

7 Goods and Services

The Goods and Services module will focus on the definition of goods and services and the related

accounting concepts.

7.1 Basic Terms

COGS is Cost of Goods Sold. When an item is sold, then the expense of its purchase is accrued as

attached to the income of the sale.

List Price is the recommended retail price.

Markup is the percentage increase that is applied to the last cost to get the sell price.

ROP is re-order point. Items with fewer in stock than this will show up on short reports.

Sell Price is the price at which the item is sold.

7.2 The Price Matrix

It is possible to set different prices for different groups of customers, or for different customers indi-

vidually. Similarly, one can track different prices from different vendors along with the required lead

time for an order.

7.3 Pricegroups

Pricegroups are used to help determine the discount a given customer may have.

7.4 Groups

Groups represent a way of categorizing POS items for a touchscreen environment. It is not fully

functional yet, but is sufficient that with some stylesheet changes, it could be made to work.

7.5 Labor/Overhead

Labor/overhead is usually used for tracking manufacturing expenses. It is not directly billed to a

customer. It is associated with an expense/Cost of Goods Sold (COGS) account.

7.6 Services

Services include any labor that is billed directly to the customer. It is associated with an expense/COGS

account and an income account. Services can be associated with sales tax.

7.6.1 Shipping and Handling as a Service

One approach to dealing with shipping and handling is to add it as a service. Create a service called

“Shipping and Handling,” with a sell price $1 per unit, and a 0% markup. Bill it as $1 per unit. This

allows one to add the exact amount of shipping and handling as necessary.

7.7 Parts

A part is any single item you might purchase and either might resell or use in manufacturing an

assembly. It is linked to an expense/COGS account, an income account, and an inventory account.

Parts can be associated with sales tax.

29

7.8 Assemblies and Manufacturing

Manufacturers order parts but they sell the products of their efforts. LedgerSMB supports manufac-

turing using the concept of assemblies. An assembly is any product which is manufactured on site. It

consists of a selection of parts, services, and/or labor and overhead. Assemblies are treated as parts

in most other regards.

However, one cannot order assemblies from vendors. One must instead order the components

and stock them once they are manufactured.

7.8.1 Stocking Assemblies

One stocks assemblies in the Stock Assembly entry on the Goods and Services submenu. When an

assembly is stocked the inventory is adjusted properly.

The Check Inventory option will cause LedgerSMB to refuse to stock an assembly if the inventory

required to produce the assembly would drop the part below the reorder point.

7.9 Reporting

7.9.1 All Items and Parts Reports

The All Items report provides a unified view of assemblies, parts, services, and labor for the company,

while the Parts report confines it to parts.

Types of reports are:

Active lists all items not marked as obsolete.

On Hand lists current inventory .

Short Lists all items which are stocked below their ROP.

Obsolete Lists all items which are marked as obsolete.

Orphaned Lists all items which have never had a transaction associated with them.

One can also list these goods by invoice, order, or quotation.

For best results, it is a good idea to enter some AR and AP data before running these reports.

7.9.2 Requirements

This report is designed to assist managers determine the quantities of goods to order and/or stock.

It compares the quantity on hand with the activity in a given time frame and provides a list of goods

which need to be ordered and the relevant quantity.

7.9.3 Services and Labor

This is similar to the Parts and All Items menu but only supports Active, Obsolete, and Orphaned

reports.

7.9.4 Assemblies

This is similar to the Parts and All Items reports but it also provides an ability to list individual items

in the assemblies as well.

AP Invoices, Purchase Orders, and RFQ’s are not available on this report.

30

7.9.5 Groups and Pricegroups

These reports provide a simple interface for locating groups and pricegroups. The report types are

similar to what they are for services.

7.10 Translations

One can add translations so that they show up in the customer’s native language in the issued invoice.

To issue translations, one must have languages defined. One can then add translations to descrip-

tions and part groups.

7.11 How Cost of Goods Sold is tracked

Cost of Goods Sold is tracked on a First-In, First-out (FIFO) basis. When a part is purchased, its cost

is recorded in the database. The cost of the item is then added to the inventory asset account. When

the good is sold, the cost of the item is moved to the cost of goods sold account.

This means that one must actually provide invoices for all goods entered at their actual cost. If

one enters in $0 for the cost, the cost of goods sold will also be $0 when the item is sold. We will cover

this entire process in more depth after we cover the AP and AR units below.

8 Transaction Approval

With the exception of Sales/Vendor Invoices (with inventory control), any financial transaction en-

tered by default must be approved before it shows up in financial reports. Because there are two ways

these can be set up, there are two possibly relevant workflows.

For sales/vendor invoices where goods and services are tracked (as distinct from AR/AP transac-

tions which only track amounts), the separation of duties interface is not complete. Here, you should

use orders for initial entry, and convert these to invoices.

8.1 Batches and Vouchers

Often larger businesses may need to enter batches of transactions which may need to be approved or

rolled back as a batch. Batches are thus a generic "container" for vouchers. A given batch can have

AR, AP, payment, receipt, and GL vouchers in it together. That same batch, however, will be classified

by its main purpose.

For example, one may have a batch for processing payments. That batch may include payment

transactions, but also related ar/ap transactions (relating to specific charges relating to payment or

receipt). The batch would still be classified as a payment batch however.

In the “Transaction Approval/Batches” screen, one can enter search criteria for batches.

The next screen shows a list of batches including control codes, amounts covered in the batch, and

descriptions. Clicking on the control code leads you to a details screen where specific vouchers can

be dropped from the batch.

When the batch is approved, all transactions in it are approved with it.

8.2 Drafts

Drafts are single transactions which have not yet been approved. For example, a journal entry or AR

Transaction would become a “draft” that would need to be approved after entry.

As with batches, one searches for drafts on the first screen and then can approve either on the

summary screen or the details screen (by clicking through).

31

9 AP

9.1 Basic AP Concepts

The Accounts Payable module tracks all financial commitments that the company makes to other

businesses. This includes rent, utilities, etc. as well as orders of goods and services.

9.2 Vendors

A vendor is any business that the company agrees to pay money to.

One can enter vendor information under AP->Vendors->Add Vendor. The vendor list can be

searched under AP->Vendors->Reports->Search.

Please see the Contact Management section above for more on manageing vendors.

9.3 AP Transactions

AP Transactions are generally used for items other than goods and services. Utilities, rent, travel

expenses, etc. could be entered in as an AP transaction.

If the item is paid partially or in full when the transaction is entered, one can add payments to the

payment section.

All other payments can and should be entered under cash payment (below).

The PO Number and Order Number fields are generally used to track associations with purchase

orders sent to vendors, etc. These fields can be helpful for adding misc. expenses to orders for

reporting purposes.

The department drop-down box appears when one has created one or more departments. A trans-