Manage Repayment Instructions

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 7

Manage Repayment Instructions

Overview

The following procedure is used when a customer request is received to create; amend or delete repayment instruction on their loan account.

The Manage Repayment Instructions is used to process a Direct Debit Request for repayments where the repayment amount changes each month ege.g. minimum monthly

repayment amount for Principal and Interest or Interest Only repayments.

The Repayment Instruction is initiated on the loan account to draw funds from an external account only. A Hogan deposit account is considered an external account for Ignite

loans.

Guiding Principles

Pre-Requisites

The following pre-requisites must be completed before commencing this procedure:

Summary Pre-Requisite

Tasks Ensure Customer Search completed and profile viewed in CRM. Confirm Refer to procedure: Search and Prepare

Customer/Party Profile

Customer has been identified and authenticated. Refer to Procedure: Identifying a Customer – Branch & Phone

The Manage Loan Account procedure has been completed

Rules:

The following rules must be understood before completing this procedure:

Summary Rule

Direct Debit Request Form For Store requests, a Direct Debit Request Form must be completed to add, edit or delete repayment instructions

Repayment Accounts Only one repayment account can be set up with 100% appropriation with an External Linked account

Repayment Instructions The Repayment Instruction cannot be added on the day of the loan settlement/disbursement

The Repayment Instruction should not be added on the last day of the loan term as the payment cannot be pulled on the next day

as the loan will not be active anymore

The Repayment Instruction can be added if the Loan is in Hardship

The Repayment Instruction will include any arrears amount due on the repayment due date of the loan

The Repayment Instruction will pull out the outstanding balance of the loan on the maturity date of the loan

Manage Repayment Instructions is used to process a minimum repayment amount and can only be set up as a monthly frequency

Payment Dishonours The dishonour letter will also be auto generated at the same time the dishonour is processed to the loan. If no manual payment is

received form the customer within the 3 day grace period or no funds are available to be pulled from the RPA bucket within the

grace period, then the Arrears Admin Fee or Default Interest rate (Unregulated Loans) will be applicable to the loan

The funds will always be pulled from the Linked account first, irrespective to the status of the RPA. If there are no funds in the

linked account, Ignite will utilise the funds from the RPA balance if available

There are no auto retries to pull the funds from the linked account

Customer Phone Request For Contact Centre requests, a customer can Add, Edit or Delete the Repayment Instruction details via a phone request providing

the Customer Locate and Customer Identification requirements are met and details of the change are recorded in CRM

Cautions

The following cautions must be understood before completing this procedure:

Risk Caution

Customer Experience Failure to follow this procedure correctly could cause delays, result in a breach of privacy and the Code of Banking Practice and

create a poor customer experience

Financial Loss Although the Direct Debit is processed to the loan, the payment can still be dishonoured by the other financial institution e.g.

insufficient funds

Related Items

The following tools, folder locations, websites or documents, are required for this process:

Tools, Folder or Document Location

Ignite Intranet Home Page>Tools>Tools for Banking>Systems/Sites(A-O)>Ignite

Direct Debit Request Form Intranet Home Page>Banking Portal>Info Sites>Home Lending>Forms> Direct Debit Form

Or

Ignite> Manage Loan Account> Generate Documents button>

LM MailTrack Intranet Home Page>Tools>Tools for Banking>Systems / Sites(A-O)>LMMailTrack

Related Tasks

The following procedures are linked as related processes within this procedure:

Procedure Procedure Manual

Generate Ad Hoc Documents Ignite Procedure Manual

Manage Loan Account Ignite Procedure Manual

Search and Prepare Customer/Party Profile Ignite Procedure Manual

Search/Retrieve & Upload Ad Hoc Document Ignite Procedure Manual

Set Up Linked Account/Payee/Beneficiary/Biller Ignite Procedure Manual

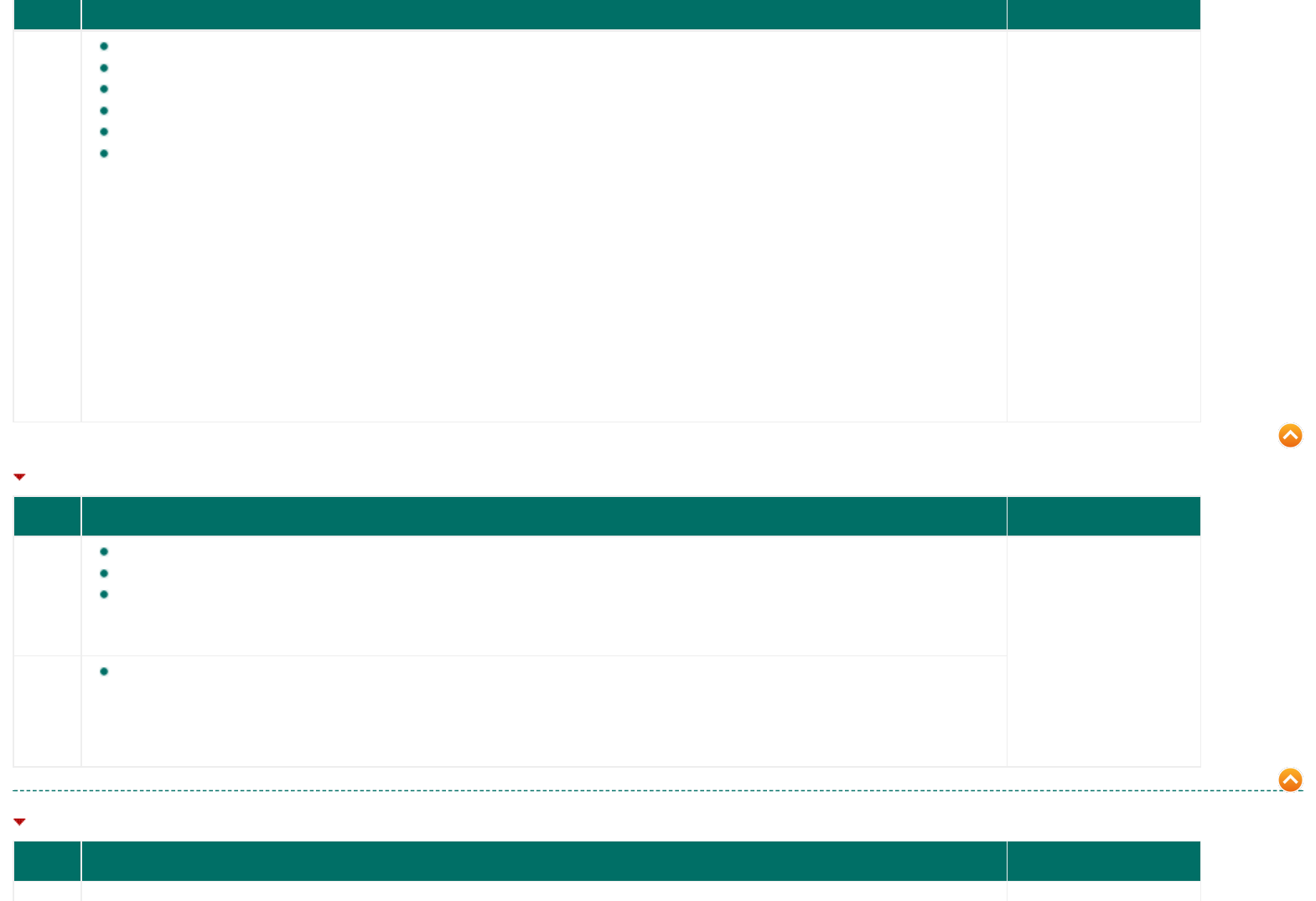

Step 1: Confirm Customer's Request

Step Action Notes

aConfirm Customer's Instructions.

If Then

Creating a new Repayment Instruction No Payment Instructions will appear under the Instructions section.

Proceed to Step 4

Amending an existing Repayment Instruction Payment Instructions will appear under the Instructions section.

Proceed to Step 2

Deleting an existing Repayment Instruction Payment Instructions will appear under the Instructions section.

Proceed to Step 3

Step 2: Amend an Existing Repayment Instruction

Step Action Notes

aClick on the Edit hyperlink to display the Account Payment Instructions section

Click on Retrieve Instructions button

Click on expand arrow

Click on the red cross under the Action column

Click OK on the message box to delete the Repayment instructions

A new repayment instruction will now be required to be created

Proceed to Step 4b

If the Instructions have

been edited on the

Repayment Due Date, the

funds would have been

pulled with the earlier

Instructions.

If the OK (green ticked) is

selected then the

following error message

will display: Settlement

has not been set up for

the following transaction.

At least one settlement

mode must be present.

Click Ok to close the

message box.

Step 3: Deleting an existing Repayment Instruction

Step Action Notes

aClick on the delete hyperlink to delete the Payment Instructions

Message box will appear if Repayment instruction are to be deleted

Click OK to confirm

If the Instruction is deleted

on the Repayment Due

Date, the funds on that

day would have already

been pulled.

Ensure that the Direct

Debit Request Form has

been completed and

signed

bClick OK

Proceed to Step 5

Step 4: Create a new Repayment Instruction

Step Action Notes

aClick on the Edit hyperlink to display the Account Payment Instructions section

Click on Retrieve Instructions button

b Settlement in AUD section

Select the Percentage Radio button

Select Linked Account from the Settlement Through drop list

Do not select Ledger

If Then

There is no Linked Account available Refer to Procedure: Set up Linked Account/ Payee/ Beneficiary/ Biller

Return to Step 4a

There is a Linked Account available Proceed to Step 4c

c Collections section

100% is populated into the Appropriated by field

Click on the Search icon by the Account Number field to display the Search and Result Dialog pop up box.

Select an Account from the list

Click Ok to close the Search and Result Dialog pop up box

The below fields will now be populated. Confirm details displayed are as requested on the Direct Debit Request form or verbally

with the customer

Account Number

Counter Party Name

Institution identification Type

Bank Code

Branch Code

Region Code

Institution Id

Bank Name

Branch Name

Do not alter the following fields:

External Reference number (On the Customers statement this will default to Loan Account number and date of

payment)

Trace Account No (On the Customers statement this will default to Loan Account number)

If The Repayment

instructions are added on

the Repayment due date,

it will pull the funds from

the next due date

onwards as the pull

payment will occur at the

beginning of the day.

dClick on the Save button If Ok is not selected then

the previous account will

The Settlement in AUD section will display the following information

Sr No

Settlement Through

Percent

Details

Action

Click Ok

The Operation completed successfully message box will display

Click OK to close the message box

Payment Instructions will now display under the Instructions section of the LN100 Manage Loan Account screen.

continue to be the linked

account.

eAdvise the Customer the following information:

The Loan repayment will start on the next due date

The repayment amount will be the due amount (Instalment amount arrears if any)

Dishonour fee may be charged by the other financial institution if enough funds are not available

Last Repayment due date will pull the full amount due on the account maturity

Funds in RPA may not be available for Loan Redraw, until the Direct Debit payment has cleared

Proceed to Step 5

A 30 day Notice letter will

be sent out to the

customer informing about

the due amount on the

Maturity date of the loan

If Then

A completed Direct Debit Request Form received Proceed to Step 5

Completed Direct Debit Request Form requires to

be produced from Ignite

Click on the Generate Document button to produce the Direct Debit

Request Form for completion

Refer to Procedure: Generate Ad Hoc Document.

Proceed to Step 5

Step 5: Record details of repayment instructions

Step Action Notes

aIdentify the channel in which the customer request has been received.

If Then

Completed and signed Direct Debit Request Form

received

Proceed to Step 6

Via the phone

Contact Centre /Broker/ other Team

Record Notes in the customer's CRM profile confirming request was

received via phone.

From the customer's profile, locate the Heads Up display bar and

click on the Notes link

Click on New

Subject = DDR

In the Comments field, include the following DDR details:

Start Date

End Date

Frequency

Amount requested

External BSB and Account details (new request)

Reason for Cancellation/Change (close request)

Click on Save

The note will now appear in the Customer's profile.

Step 6: Upload Direct Debit Form into Ignite

Step Action Notes

aUpload the signed Direct Debit Form into Ignite

Refer to procedure: Search/Retrieve & Upload Ad hoc Documents