07032006_spa 4602 Morning Glance 07 03 2006

User Manual: 4602

Open the PDF directly: View PDF ![]() .

.

Page Count: 3

d

SPA Morning Glance

Research 07 Mar, 2006

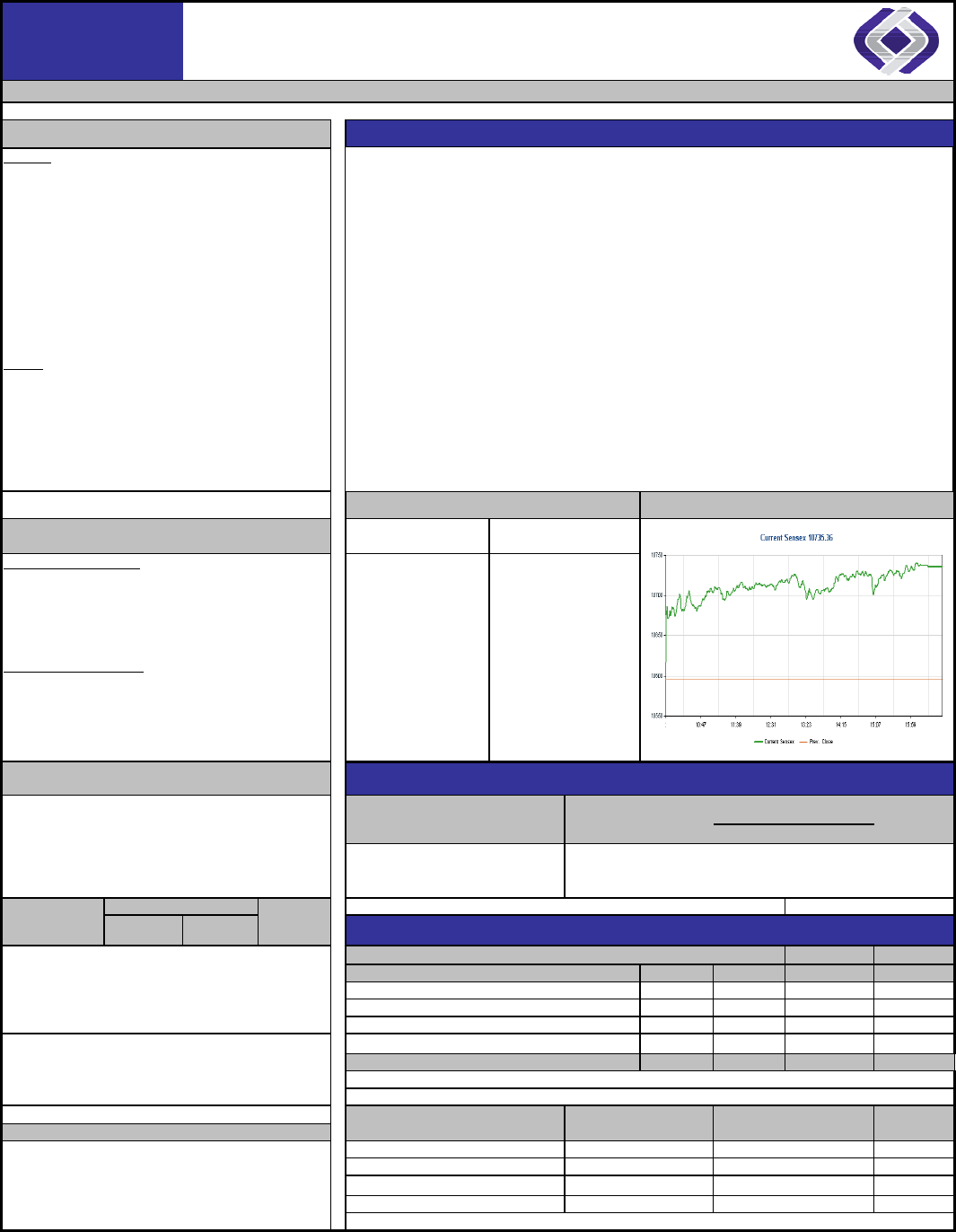

Indices 6-Mar Chg (%) Pts Market Summary

Indian

Sensex 10735.36 1.32 139.93

Nifty 3190.40 1.37 43.05

BSE Bankex 5268.83 0.33 17.27

BSE IT 3787.63 1.11 41.45

BSE Health 3668.47 1.51 54.53

BSE FMCG 2026.48 1.31 26.22

BSE PSU 5821.27 1.61 92.48

CNX Midcap 4602.30 1.13 51.55

World

Nasdaq 2286.03 -0.72 -16.57

Dow Jones 10958.59 -0.57 -63.00

Hang Seng * 15646.35 -1.05 -165.48

Nikkei * 15763.48 -0.87 -137.68

KOSPI Index * 1327.71 -1.27 -17.05

* At 9.00 AM today Board Meeting (07th Mar, 2006) BSE Intraday (6th Mar, 2006)

Delivery

Statistics Trade

Volume Delivery

Volume %Company Purpose

Nifty Most Delivered Abbott India Ltd. Dividend & Accounts

(

Revised

)

SCI 490972 341594 69.58 Bharat Heavy Electricals Ltd. Special Interim Dividend

DRREDDY 136227 92041 67.56 Col

g

ate-Palmolive

(

India

)

Lt Third interim Dividend

HDFC 280087 186831 66.7 Thermax Ltd. Subdivision of Equity Shares

HEROHONDA 569740 341772 59.99

M&M 1150442 660335 57.4

Nifty Least Delivered

VSNL 1912245 212773 11.13

ACC 1781557 262863 14.75

SBIN 1611692 243375 15.1

SCI 414782 64415 15.53

ABB 147796 27664 18.72

Trade

Statistics BSE NSE F & O Derivatives Segment (NSE)

Turnove

r

(

Rs cr

)

4967.87 8428.79 27306.00 Future

Statistics Ex-Date Open Int Options

Statistics Strike

Price Open Int. (In lac.) Put/Call

Ratio

Advance (No) 1451 511 Call Put

Declines (No) 1085 352 Nifty-Mar 30-Mar 29399200 Nifty-Mar ALL 61.42 107.93 1.76

Unchanged 73 26 Nifty-Apr 27-Apr 720500 Nifty-Mar 3100 13.92 15.35 1.10

Total 2609 889 Nifty-May 25-May 233500 Nifty-Mar 3050 11.89 23.82 2.00

Inst. Activity Cash F&O

2006

Source : NSE

3-Mar Mar 2006 FII's Derivatives Statistics

FIIs (Rs cr) Particulars Trade Date 3-Mar

Buy 1699.90 8177.70 855.42 Details Buy* Sell* OI (Nos.) OI (Crs.)

Sell 1310.10 6364.30 865.48 Index Future 493.82 535.61 273571 8,595.78

Net 389.80 1813.40 -10.06 Index Options 182.38 3.11 94928 2,987.72

Open Interest (Rs. Cr) 25,709.59 Stock Futures 174.80 319.90 388268 14,068.57

MFs (Rs cr) Stock Options 4.42 6.86 1456 57.52

Buy 384.02 2291.04 Total 855.42 865.48 758,223.00 25,709.59

Sell 409.23 1976.63 Source : NSE * Rs. In Crores (BSE+NSE)

Net -25.21 314.41

Futures Indices 6-Mar % Change Pts

Indicators Closing Change (%)

Call Money 6.6 1.54 Index 3190.40 1.37 43.05

10yr Gilt 7.4473 0.32 Mar06 Future 3186.00 1.54 48.40

Nymex Crude 63.3 -0.58 Apr06 Future 3180.50 1.55 48.60

May06 Future 3172.00 1.54 48

The BSE Sensex ended at a new all time closing high, as buying continued throughout the

day's trading session. There was a strong demand for heavyweight counters across the board.

The BSE Sensex ended the day at 10,735.36, a gain of 139.93 points (1.32%). Sensex

oscillated 125 points for the day between a low of 10,616.99 and a high of 10,741.59.

The NSE Nifty ended higher by 43 points (1.37%) to 3190.40 points.

The BSE Mid-Cap index was up 1.39% while the BSE Small-Cap index was up 1.23%.

Hindalco was the biggest gainer from the Sensex pack (up 5.30% to Rs 166.75), followed by

Tata Power (up 5.20% to Rs 575.25) and Tata Steel (up 4.32% to Rs 474)

SPA Morning Glance

Research

07 Mar, 2006

Junior Nifty Delivery Statistics for 6th Mar, 2006* CORPORATE NEWS

Junior Nifty Traded Delivery

Scrip Qty Qty %

CADILAHC 79426 77170 97.16

ASIANPAINT 28734 26590 92.54

APOLLOTYRE 24235 22245 91.79

IBP 39252 35585 90.66

CONCOR 3120 2705 86.70

INGVYSYABK 559285 473594 84.68

PFIZER 17842 13998 78.46

NIRMA 8926 6737 75.48

MOSERBAER 26576 19921 74.96

AVENTIS 3240 2399 74.04

PUNJABTRAC 20974 15354 73.20

LICHSGFIN 203579 141282 69.40

LUPIN 24367 15461 63.45

UTIBANK 493645 313131 63.43

RAYMOND 75658 47716 63.07

PATNI 65061 40736 62.61

BIOCON 28187 16774 59.51

TVSMOTOR 281570 154479 54.86

INGERRAND 179191 96994 54.13

STER 215230 109929 51.08

CHENNPETRO 67794 34589 51.02

IDBI 2055361 1046204 50.90

BONGAIREFN 220359 111818 50.74

IOB 1015528 470096 46.29

KOTAKBANK 267422 123412 46.15

ANDHRABANK 1183607 546036 46.13 INDUSTRY AND ECONOMY NEWS

SYNDIBANK 3287174 1482303 45.09

NICOLASPIR 330140 146838 44.48

I-FLEX 168276 69012 41.01

AUROPHARMA 322505 131090 40.65

MPHASISBFL 392391 159487 40.64

TTML 3726191 1497686 40.19

IFCI 5801319 2293094 39.53

JPASSOCIAT 1073738 413963 38.55

CORPBANK 296468 105242 35.50

CUMMINSIND 904392 313914 34.71

UNIONBANK 1029502 344402 33.45

COCHINREFN 43049 13405 31.14

BHARATFORG 692624 211707 30.57

GESHIPPING 367166 110787 30.17

BANKBARODA 798985 240858 30.15

VIJAYABANK 700133 182137 26.01

ASHOKLEY 7080245 1770699 25.01

BANKINDIA 2960055 702954 23.75

WOCKPHARMA 153493 35773 23.31

BEL 271575 62453 23.00

SIEMENS 251215 44753 17.81

CANBK 950626 132254 13.91

RELCAPITAL 1863191 242901 13.04

POLARIS 775050 94033 12.13

* Source : NSE

BCCL picks up stake in Access Atlantech & Easy Bill

Bennet Coleman & Co (BCCL) has picked up stakes in Access Atlantech

Tech (I) (AAT), the company which brought SAE Technology College to

India. The private treaties arm of BCCL signed the deal with AAT

promoter Rathish Babu Unnikrishnan. (ET)

Reliance Natural stakes 40% claim to RIL’s gas finds

Reliance Natural Resources (RNRL), the recently listed Anil Ambani

group gas company, has staked its claim to 40% of all future gas found

by Reliance Industries (RIL). RIL has interests in about 35 oil and gas

properties and the oil and gas should be available to the shareholders,

the ADAG group chief Anil Ambani said today. He said RNRL was

negotiating with RIL for the gas.

LIC revs it up, raises stake in BAL

Leading insurer and financial investor LIC has increased its stake in

Bajaj Auto (BAL), India’s second-largest two-wheeler company, to cash

in on the growth opportunities in the local two-wheeler market.

FMCG majors get a tax break

The FMCG industry has, for long, complained about the discrimination

between branded and unbranded products. Their grouse stems from

unbranded products getting a host of benefits in the form of excise and

sales tax exemptions, making them more competitive. (ET)

Banks rush for big numbers in small push

India’s leading private sector and foreign banks have taken to collateral

free, unsecured lending to target the small and medium enterprise

(SME) segment. In the fray are ICICI Bank, HDFC Bank and Citigroup,

which provide small entrepreneurs with unsecured loans up to Rs 25

lakh, at a rate of interest higher than that of retail or corporate loans.

(ET)

SBI sees stable rates and tight liquidity

Domestic interest rates are looking comparatively stable but liquidity

pressures are seen continuing as credit offtake rises in a growing

economy. India is expected to grow 8.1% in the year to March ’06.

Booming growth has led to rising lending by banks. (ET)

Price control on drugs hangs fire

The government has decided to go slow on National Pharmaceutical

Pricing Authority’s (NPPA) request to price control a few medicines

which it said, has, become costlier by more than one-fifth their market

prices in a year. (ET)

SPA Morning Glance

Research

07 Mar, 2006

Major BSE Bulk Deals Source-BSE

Date Scrip

Code Scrip

Name Client

Name Deal

Type * Qty Price

06-Mar-06 513309 ALUM IND EX DEUTSCHE SECURITIES MAURI B 435000 50.5

06-Mar-06 530323 ERA CONSTR I ING VYSYA MF LION FUND B 160000 290.41

06-Mar-06 530323 ERA CONSTR I ING VYSYA MF MIDCAP FUND B 67000 290.41

06-Mar-06 532692 RADHA MADHAV TAIB BANK AC TSML B 100000 39.75

06-Mar-06 514412 SARUP TANNER ICICI BANK LTD INVESTMENT S 47500 25.02

06-Mar-06 511074 WEIZMANN FIN LOTUS GLOBAL INVESTMENTS B 3000 52.8

Major NSE Bulk Deals Source-NSE

Date Scrip

Name Client

Name Deal

Type * Qty Price

06-Mar-06 BALLARPUR INDUSTRIES LTD T. ROWE PRICE INTERNATIONAL INC. A/C T ROWE

P

BUY 973054 127

06-Mar-06 BALLARPUR INDUSTRIES LTD T ROWE PRICE INTERNATIONAL INC SELL 973054 127

06-Mar-06 HOTEL LEELA VENTURES LTD DWS INVESTMENT CMBH BUY 400000 355

06-Mar-06 HOTEL LEELA VENTURES LTD MORGAN STANLEY INVESTMENT MGMT INC BUY 1900000 355

06-Mar-06 HOTEL LEELA VENTURES LTD NOMURA ASSET MANAGEMENT CO LTD BUY 1000000 355

06-Mar-06 NIIT LIMITED MACQUARIE BANK LIMITED BUY 155000 250.09

06-Mar-06 AMAR REMEDIES LTD. LOTUS GLOBAL INVESTMENT LTD SELL 500000 90.15

06-Mar-06 KPIT CUMMINS INFOSYSTEMS ICICI PRUDENTIAL LIFE INSURANCE CO LTD BUY 76500 371.45

06-Mar-06 HOTEL LEELA VENTURES LTD CAPITAL INTERNATIONAL BUY 2381300 355

06-Mar-06 HOTEL LEELA VENTURES LTD IDFC TRUSTEESHIP SERVICES LTD A/C IDFC INFRA

S

SELL 6000000 355

Research Team

Ravi Gupta +91 98192 67510 ravikant.

g

upta@spasecurities.com

Sandeep Biyani +91 98670 30316 sandeep.biyani@spasecurities.com

Sankhe Rupesh +91 98670 30329 sankhe.rupesh@spacapital.com

Somendra A

g

arwal +91 93227 01170 somendra.kumar@spasecurities.com

This Morning Glance is also available on `MoneylineTelerate' Newsletter.

SPA SECURITIES LIMITED Member NSE-Capital Market, F&O and Wholesale Debt Markets, SEBI Regn. No. INB231178238/INF231178238

SPA CAPITAL SERVICES LIMITED Investment Advisory services, AMFI Reg. No. ARN-0007

SPA MERCHANT BANKERS LTD. SEBI registered Category-1 Merchant Bankers SEBI Regn. No. INM000010825

SPA INSURANCE SERVICES LTD. Direct Broker for Life and General Insurance broking IRDA Lic. Code No. DB053/03

MUMBAI

10A, 10th Floor, Chandermukhi, Nariman Point, Mumbai 400021. Tel: (022) 22801240-49 Fax: (022) 22846318

NEW DELHI

25, C-Block Community Centre, Janak Puri, New Delhi - 110 058 Tel: (011) 25517371, 25515086, Fax: (011) 25532644

KOLKATA

4/1, Red Cross Place, Kolkata - 700001. Tel: (033) 22100818-19 Fax: (033) 22100819

BANGALORE

S-309, Manipal Centre, South Block, 47 Dickenson Road, Bangalore - 560 042 Tel: (080) 25092206-07 Fax: 25092208

JAIPUR

UL-15, Amber Tower, Sansar Chand Road, Jaipur - 302001. Tel: (0141) 5107044/5107144 Fax: 5107144

AHMEDABAD

407,Anand Mangal Complex1, c.g road, Navrangpura, Ahmedabad Tel:(079)-30998056

CHENNAI

3H, 3rd Floor, East Coast Chambers, 92/34, G. N. Chetty Road, T. Nagar Chennai - 600017 Tel: (044)-52071380/81/82 Fax: 044-52071379

Disclaimer:The information contained in this report is obtained from reliable sources and is directed at institutional investors. In no circumstances should it be considered as an offer to

sell/buy or, a solicitation of any offer to, buy or sell the securities or commodities mentioned in this report. No representation is made that the transactions undertaken based on the information

contained in this report will be profitable, or that they will not result in losses. SPA and/or its representatives will not be liable for the recipients’ investment decision based on this report.