OECD Manual Measuring The Digital Economy

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 161 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- 1ere

- Final Combined

- 001

- 002

- DSTI 2014 (eng)--BaT241014--eBook

- Foreword

- Acknowledgements

- Table of Contents

- Reader’s Guide

- Executive Summary

- A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY

- Chapter 1 THE DIGITAL ECONOMY TODAY

- Figure 1. Internet usage trends in the OECD and differences by country (top panel) and by age group

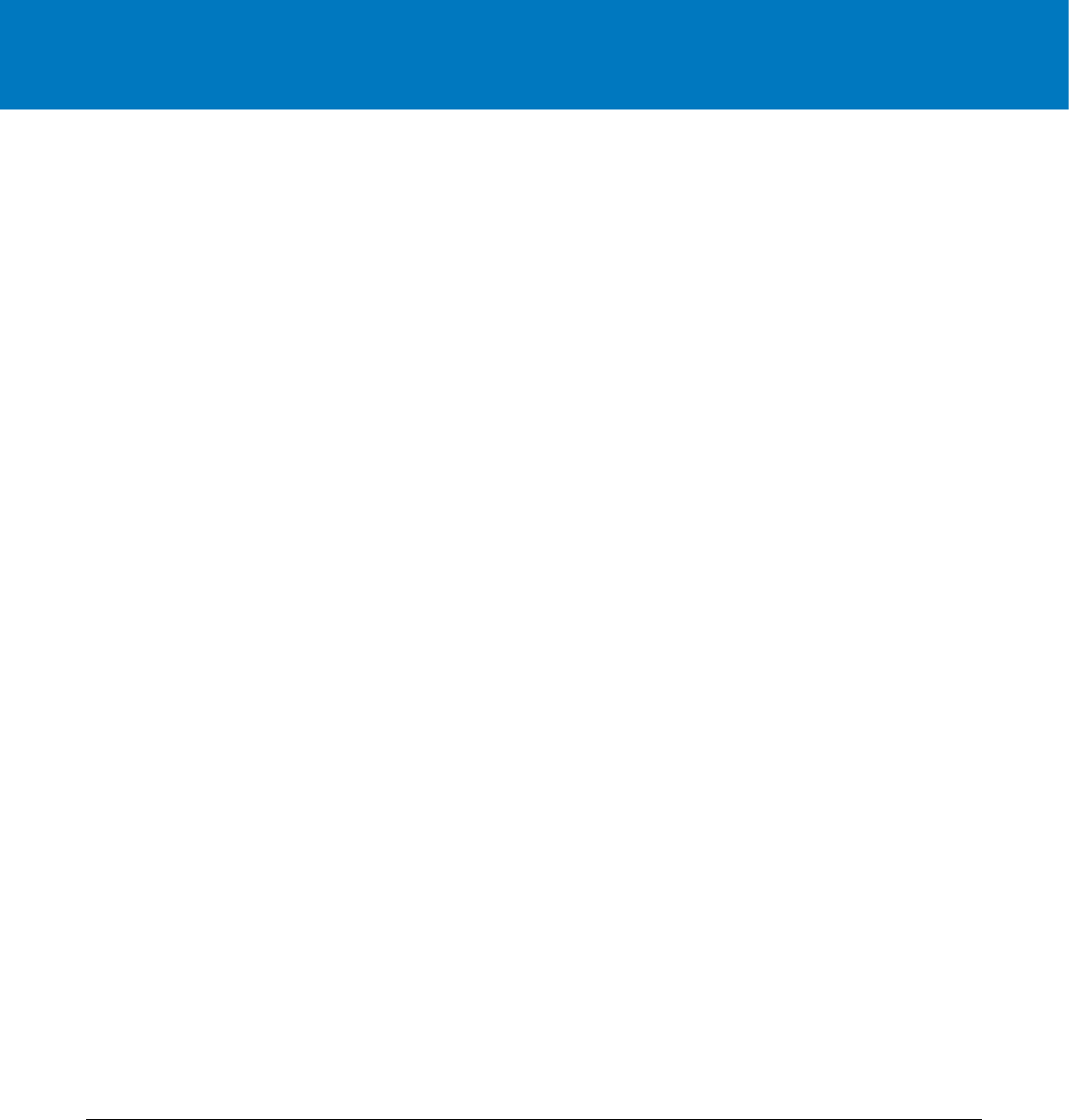

- Figure 2. Trends in broadband speed across the OECD, Q4 2009-13

- Figure 3. Wikipedia monthly page views on mobile platforms, by language, 2010-13

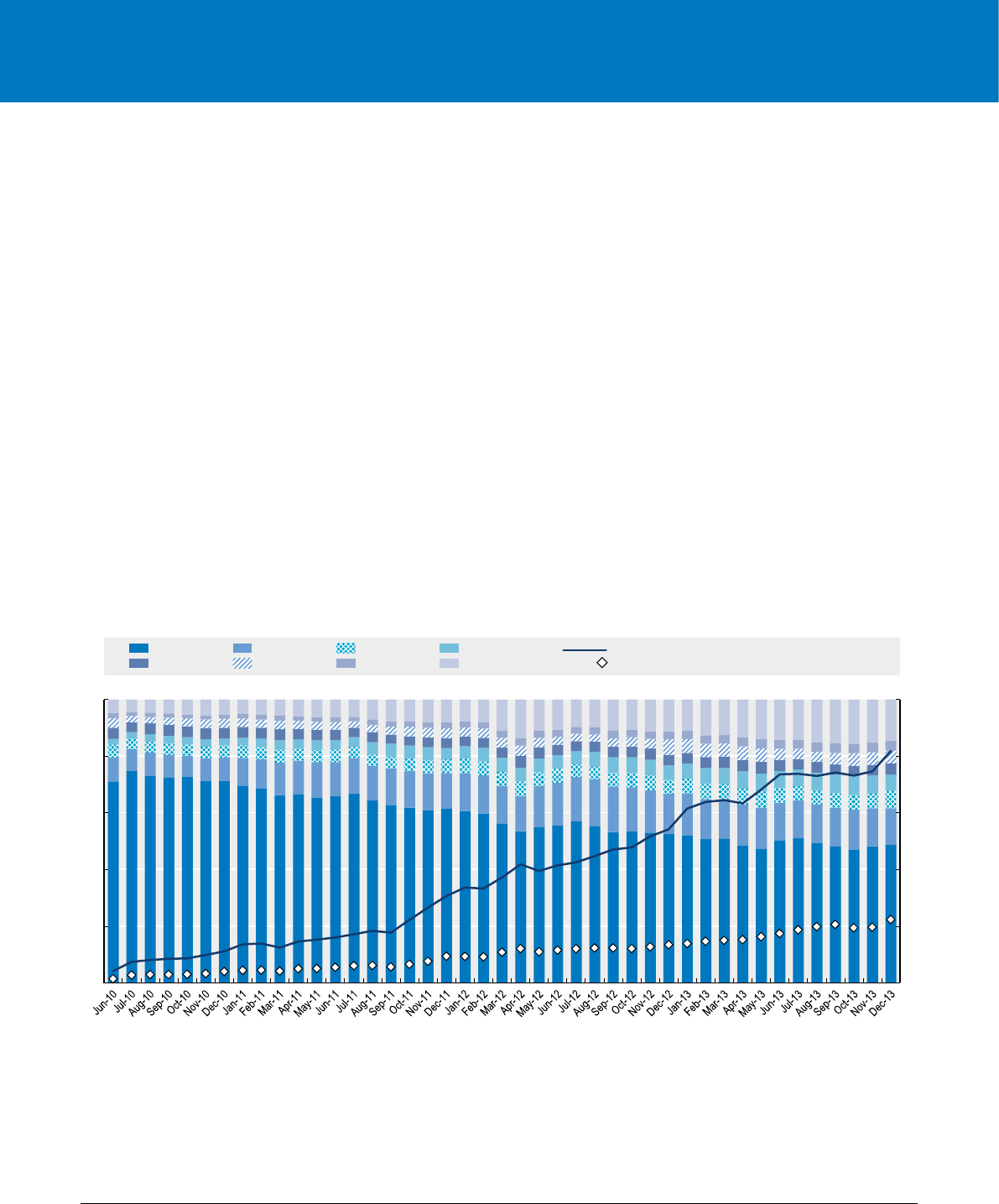

- Figure 4. The progress of smartphones, 2010-13

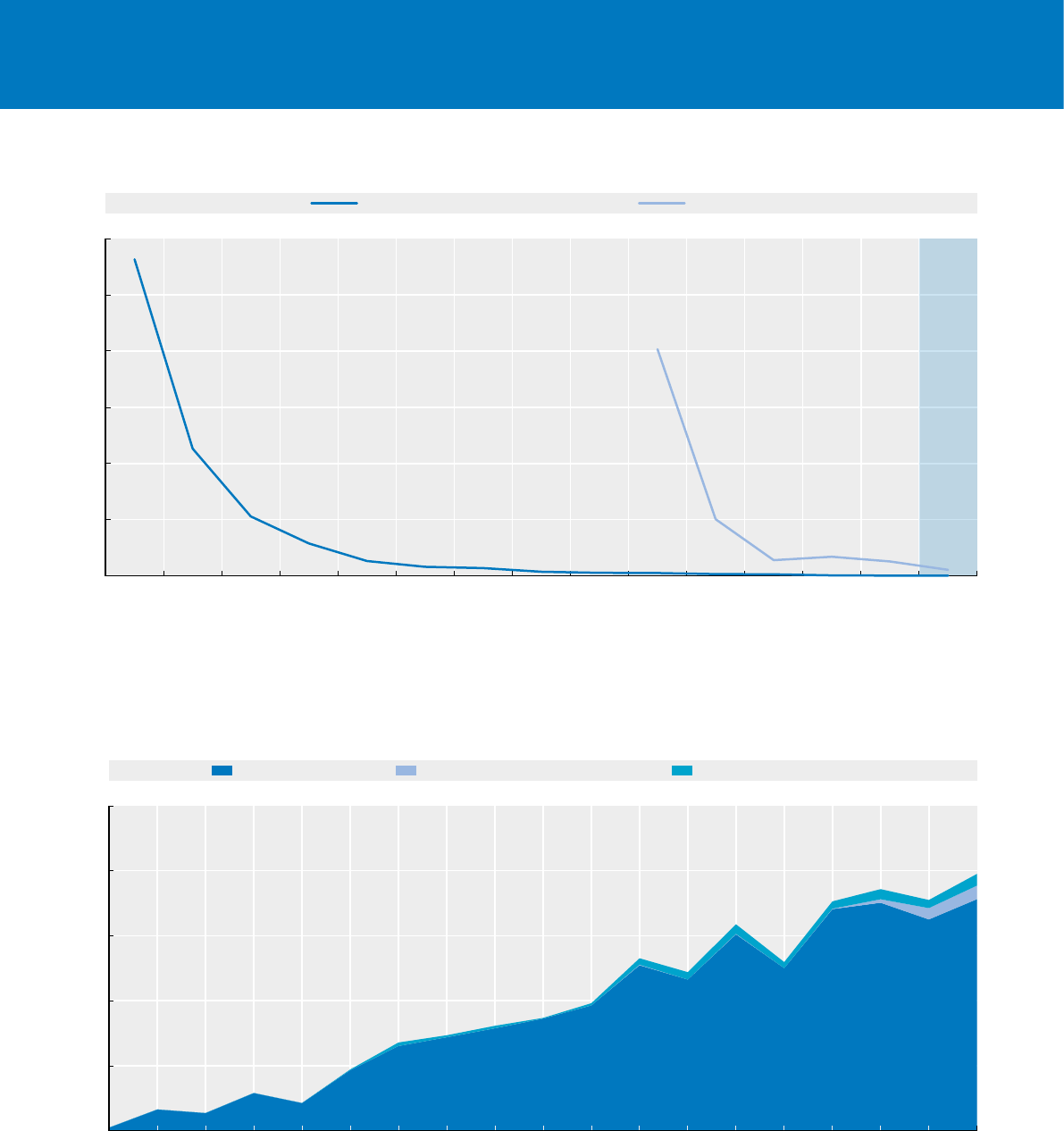

- Figure 5. Average data storage cost for consumers, 1998-2012

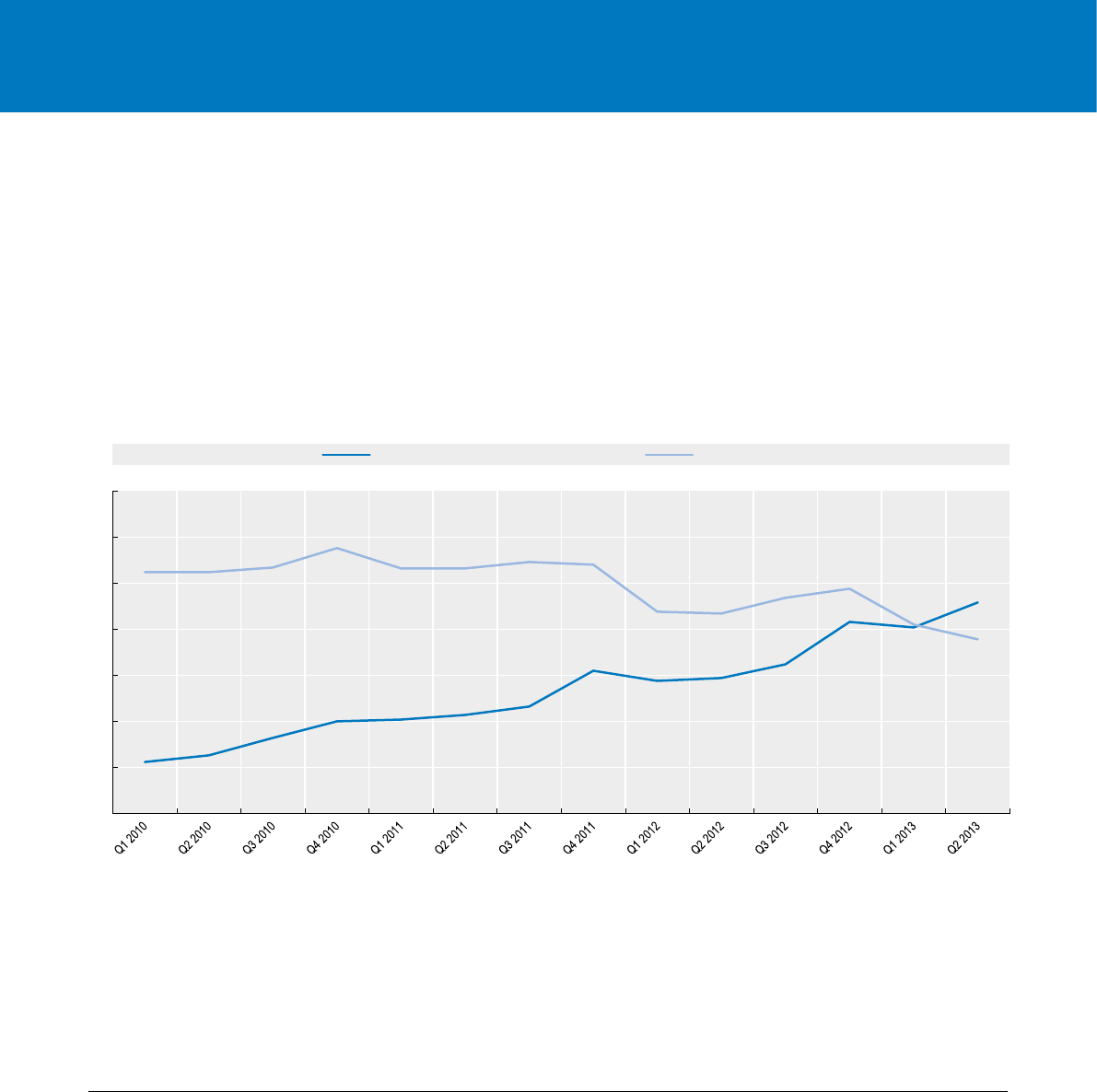

- Figure 6. Data mining-related scientific articles, 1995-2014

- Figure 7. R&D intensity and contribution to total BERD by industry in the OECD, 2011

- Figure 8. Methods to stimulate creativity across 22 European countries in information industries vs

- Figure 9. ICT uptake among process and organisational innovators and non-innovators in 13 European c

- Figure 10. Patents on M2M, data analytics and 3D printing technologies, 2004-14

- Figure 11. Cost of genome sequencing, 2001-14

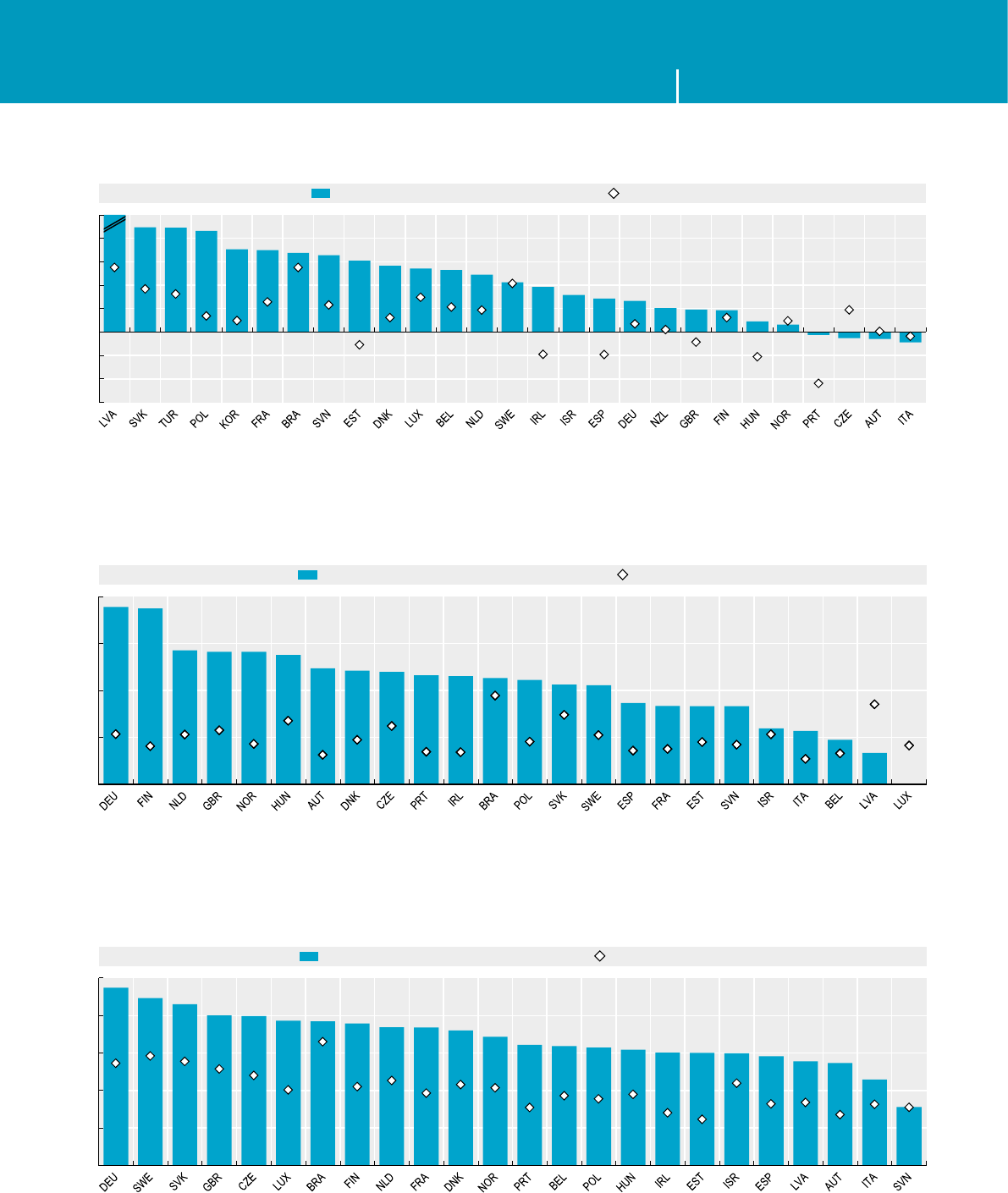

- Figure 12. The relative size of information industries in the OECD, 2000 and 2012

- Figure 13. Apparent labour productivity levels, information industries vs. total economy, 2012

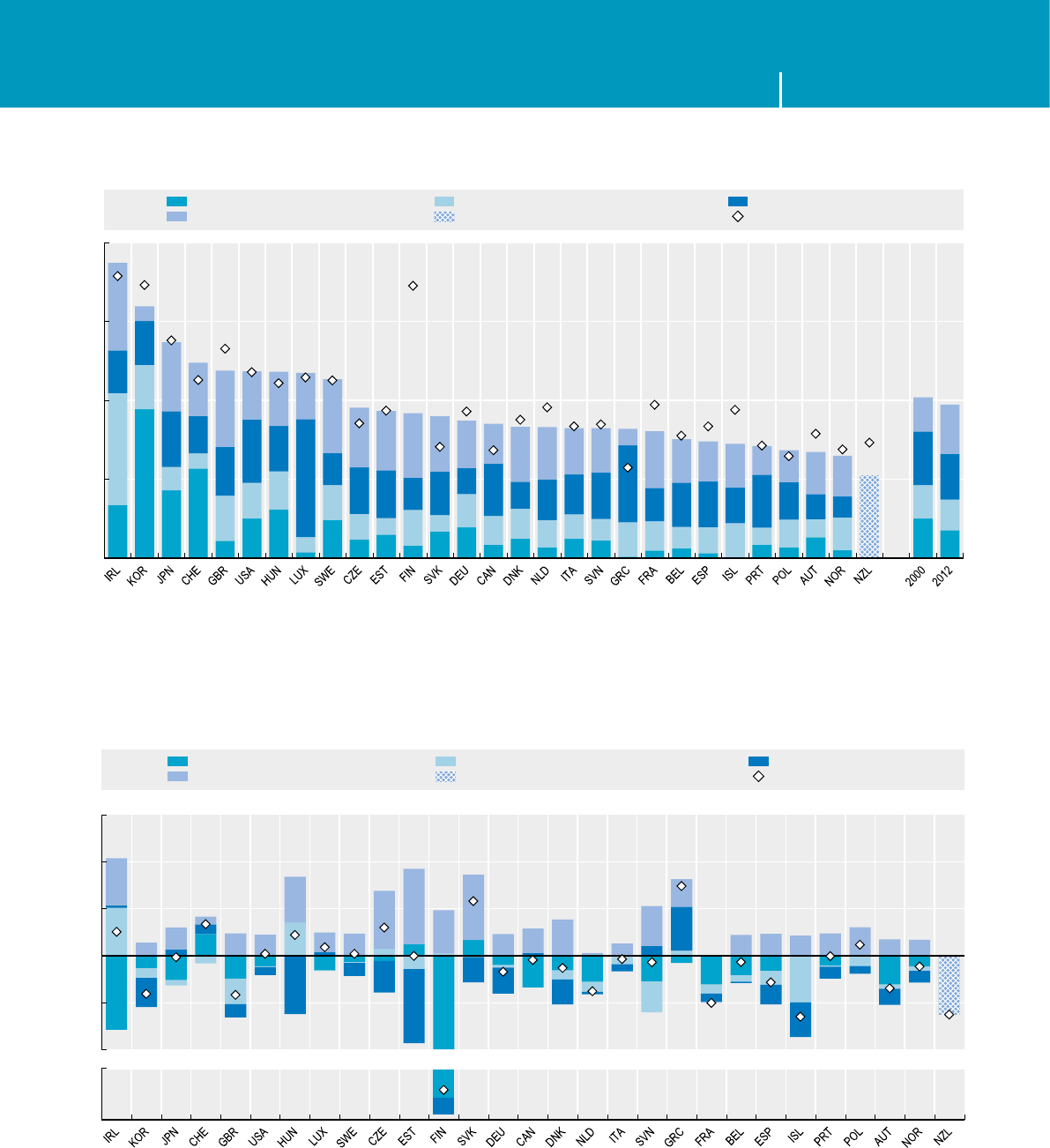

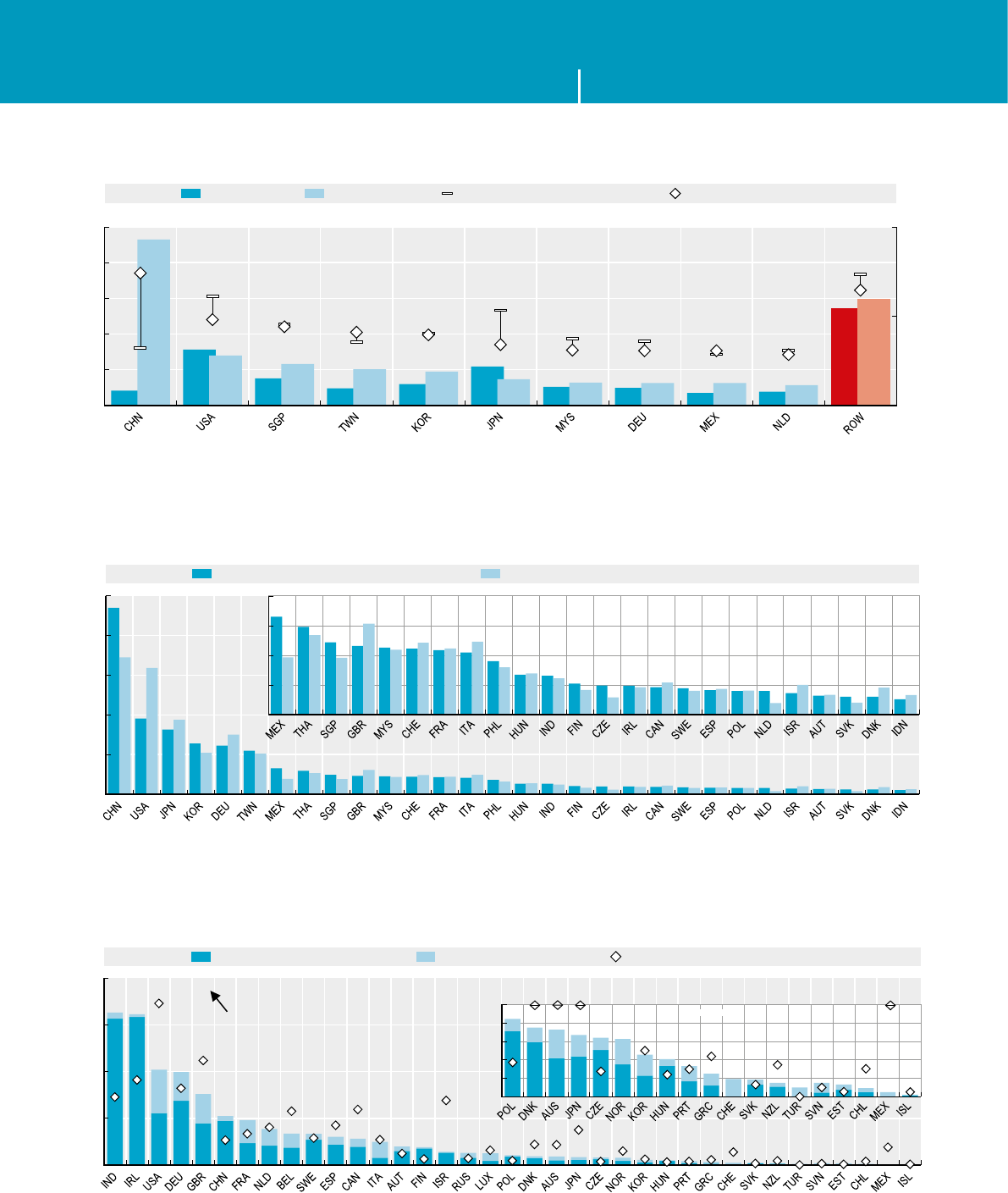

- Figure 14. OECD shares in global exports of ICT goods and in underlying value added, 2000 and 2009

- Figure 15. Performance trends of top 250 ICT firms, 2000-13

- Figure 16. Venture capital investment in the United States, by industry, 1995-2012

- Figure 17. The dynamics of ICT sector employment in the OECD, 1995-2012

- Figure 18. The dynamics of ICT-related occupations in OECD countries, 2003-13

- Figure 19. Computer use at work in OECD countries, by level of sophistication, 2012

- Figure 20. Participation in e-commerce by individuals and enterprises, 2007-08 and 2012-13

- Notes

- References

- Chapter 2 INVESTING IN SMART INFRASTRUCTURE

- 2.1 Broadband penetration

- 2.2 Mobile data communication

- 2.3 The growth of the Internet

- 2.4 Toward higher speed

- 2.5 Prices for connectivity

- 2.6 ICT devices and applications

- 2.7 E-commerce across borders

- 2.8 Security

- Use of security methods for authentication/identification and the protection of data by enterprises,

- Businesses having encountered IT security problems, attacks resulting in denial-of-service, by size,

- Distributed denial-of-service attacks originating from or targeting each geographical area, April 20

- 2.9 Perceiving security and privacy threats

- 2.10 Improving the evidence base for online security and privacy

- Notes

- References

- Chapter 3 EMPOWERING SOCIETY

- Chapter 4 UNLEASHING INNOVATION

- Chapter 5 DELIVERING GROWTH AND JOBS

- Data sources

- List of Figures

- 999

- 4eme

Consult this publication on line at http://dx.doi.org/10.1787/9789264221796-en.

This work is published on the OECD iLibrary, which gathers all OECD books, periodicals and statistical databases.

Visit www.oecd-ilibrary.org for more information.

Measuring the Digital Economy

A NEW PERSPECTIVE

The growing role of the digital economy in daily life has heightened demand for new data and measurement

tools. Internationally comparable and timely statistics combined with robust cross-country analyses are crucial

to strengthen the evidence base for digital economy policy making, particularly in a context of rapid change.

Measuring the Digital Economy: A New Perspective presents indicators traditionally used to monitor the

information society and complements them with experimental indicators that provide insight into areas of

policy interest. The key objectives of this publication are to highlight measurement gaps and propose actions

to advance the measurement agenda.

Contents

• A measurement agenda for the digital economy

• The digital economy today

• Investing in smart infrastructure

• Empowering society

• Unleashing creativity and innovation

• Delivering growth and jobs

For more information about the OECD’s work on measurement and analysis of the digital economy,

see www.oecd.org/sti/measuring-the-digital-economy.htm.

Measuring the Digital Economy A NEW PERSPECTIVE

Measuring the

Digital Economy

A NEW PERSPECTIVE

ISBN 978-92-64-21130-8

93 2014 02 1 P 9HSTCQE*cbbdai+

932014021Cov.indd 1 29-Sep-2014 11:28:11 AM

Measuring the

Digital Economy

A NEW PERSPECTIVE

This work is published under the responsibility of the Secretary-General of the OECD. The

opinions expressed and arguments employed herein do not necessarily reflect the official

views of OECD member countries.

This document and any map included herein are without prejudice to the status of or

sovereignty over any territory, to the delimitation of international frontiers and boundaries

and to the name of any territory, city or area.

ISBN 978-92-64-21130-8 (print)

ISBN 978-92-64-22179-6 (PDF)

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use

of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli

settlements in the West Bank under the terms of international law.

Photo credits: Cover © echo3005/Shutterstock.com.

Corrigenda to OECD publications may be found on line at: www.oecd.org/about/publishing/corrigenda.htm.

© OECD 2014

You can copy, download or print OECD content for your own use, and you can include excerpts from OECD publications, databases and

multimedia products in your own documents, presentations, blogs, websites and teaching materials, provided that suitable

acknowledgment of the source and copyright owner is given. All requests for public or commercial use and translation rights should be

submitted to rights@oecd.org. Requests for permission to photocopy portions of this material for public or commercial use shall be

addressed directly to the Copyright Clearance Center (CCC) at info@copyright.com or the Centre français d’exploitation du droit de copie

(CFC) at contact@cfcopies.com.

Please cite this publication as:

OECD (2014), Measuring the Digital Economy: A New Perspective, OECD Publishing.

http://dx.doi.org/10.1787/9789264221796-en

FOREWORD FOREWORD

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 3

Foreword

Sound measurement is crucial for policy making. It helps policy makers to evaluate the

efciency of their actions and to reinforce the accountability of public interventions.

Thedemand for new data and measurement tools is particularly high in the case of the

digital economy, because of its growing role in everyday life and the fast pace of change.

Measuring the Digital Economy: A New Perspective selects indicators traditionally used to

monitor the information society and complements them with experimental indicators that

provide insight into areas of policy interest. Key objectives of the report are to highlight

measurement gaps and propose actions to advance the measurement agenda.

Objectives and scope

Measuring the Digital Economy addresses the use of ICTs and the Internet at work in relation

to the economy and society. It is designed to be a point of reference with respect to

currently available statistics, and to mark progress towards the development of relevant

new indicators on a broad range of issues. The aim is to:

• Review the current set of internationally comparable ICT indicators in light of OECD

policy priorities in the area of the digital economy, as formulated in the 2008 Seoul

Ministerial Declaration and the 2011 High-Level Meeting on the Internet Economy;

• Exploit the potential of existing ofcial statistics and experiment with new metrics;

• Identify data gaps and foreground the measurement agenda; and

• Discuss the data infrastructure needed to measure ICT diffusion and impacts, including

tools for the analysis of large datasets.

Structure

A Measurement Agenda For The Digital Economy

Based on the OECD’s expertise in the development of ICT indicators, this section summarises

the main weaknesses of the current measurement framework and identies a number of key

areas for action with a view to establishing a forward-looking international measurement

agenda. The target audience of this section encompasses policy makers in search of sound

evidence to support decisions, the broader research community in the area of ICTs, and

statisticians involved in production of ICT data. This section of the publication builds on

the following parts but it is placed at the beginning to bring discussion of a long-term

strategy for measurement of the digital economy closer to the heart of policy making.

The Digital Economy Today (C 1)

Chapter 1 sets the stage by pinpointing the evolving features of the digital economy and

society. The target audience includes experts as well as the more general public (i.e. any

person interested in obtaining a broader picture and key trends). The chapter highlights

features such as the rise of mobile broadband access and applications; the increased offer

of cloud computing services; the development of “smart” applications and associated

sensor-based networks and machine-to-machine (M2M) communications; the rise of big

data analytics; the role of ICT in innovation and the performance of ICT industries during

the recent economic crisis.

Thematic Chapters (C 2, 3, 4, 5)

The second section of the publication consists of four thematic chapters, which aim to

reect priorities for government action in the ICT area. They cover topics ranging from

infrastructure availability to openness and participation in the Internet economy, cyber

FOREWORD

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 20144

security and privacy, protection and empowerment of consumers and citizens, and

innovation and sustainability. These thematic chapters map existing indicators against

current digital economy policy issues as reected in the OECD Internet Policy Principles, as

well as in the overarching objective to foster the role of ICT in promoting growth and jobs:

Chapter 2: Investing in smart infrastructure

Chapter 3: Empowering society

Chapter 4: Unleashing creativity and innovation

Chapter 5: Delivering growth and jobs

The target audience for the thematic chapters includes policy analysts with a certain level

of sophistication in the use of indicators, as well as those engaged in producing indicators

for policy making. The chapters also include a few “Gap Pages” that make a case for the

development of new statistics in areas that lack high-quality, internationally comparable

indicators. The “Gap Pages” discuss user needs, highlight the measurement challenges and

propose ways forward:

• Improving the evidence base for online security and privacy (in chapter 2);

• Children online (in chapter 3);

• ICT and health (in chapter 3);

• Unleashing the potential of micro-data (in chapter 4); and

• Measuring quality in communication services (in chapter 5).

ACKNOWLEDGEMENTS ACKNOWLEDGEMENTS

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 5

Acknowledgements

Measuring the Digital Economy: A New Perspective was prepared under the overall guidance

of Alessandra Colecchia by Andrea de Panizza, Elif Köksal-Oudot, Vincenzo Spiezia, Pierre

Montagnier, Pedro Herrera-Gimenez (Economic Analysis and Statistics Division, EAS),

Cristina Serra-Vallejo and Frédéric Bourassa (Digital Economy Policy Division, DEP) of the

OECD Directorate for Science, Technology and Innovation (DSTI).

Several colleagues made available their respective areas of expertise: Brigitte Acoca,

Peter Avery, Rudolf van der Berg, Laurent Bernat, Anne Carblanc, Augustín Díaz-Pinés,

Michael Donohue, Aaron Martin, Hajime Oiso, Sam Paltridge, Taewon Park, Elettra Ronchi

and Christian Reimsbach-Kounatze of the Digital Economy Policy Division (DEP), as well

as other colleagues in DSTI and different OECD Directorates, namely Nadim Ahmad,

Laudeline Auriol, Francesco Avvisati, Francesca Borgonovi, Agnès Cimper, Hélène Dernis,

Fernando Galindo-Rueda, Corinne Heckmann, Mariarosa Lunati, Valentine Millot, Dirk Pilat,

Gueram Sargsyan, Mariagrazia Squicciarini, David Valenciano, Fabien Verger, Colin Webb,

Andrew Wyckoff and Belen Zinni.

The time and help granted by delegates of the Working Party on Measurement and Analysis

of the Digital Economy (WPMADE) and their colleagues at the Committee on the Digital

Economy Policy (CDEP) have been instrumental in the development of this publication.

This collaborative effort would not have been possible without the help and dedication of

all. We hope to build on this experiment and on the longer-term measurement agenda to

further improve the evidence base for digital economy policy.

TABLE OF CONTENTS TABLE OF CONTENTS

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 7

Table of Contents

Foreword ....................................................................................................................................................................................................... 3

Acknowledgements ........................................................................................................................................................................... 5

Reader’s Guide ........................................................................................................................................................................................ 9

Executive Summary ........................................................................................................................................................................... 13

A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY ....................................................................... 17

References ...................................................................................................................................................................................... 23

Chapter 1 THE DIGITAL ECONOMY TODAY .............................................................................................................. 25

Notes.................................................................................................................................................................................................... 44

References ...................................................................................................................................................................................... 47

Chapter 2 INVESTING IN SMART INFRASTRUCTURE .................................................................................... 49

2.1 Broadband penetration ......................................................................................................................................... 50

2.2 Mobile data communication ............................................................................................................................ 52

2.3 The growth of the Internet ................................................................................................................................ 54

2.4 Toward higher speed ............................................................................................................................................... 56

2.5 Prices for connectivity ........................................................................................................................................... 58

2.6 ICT devices and applications .......................................................................................................................... 60

2.7 E-commerce across borders ............................................................................................................................. 62

2.8 Security ................................................................................................................................................................................ 64

2.9 Perceiving security and privacy threats ................................................................................................ 66

2.10 Improving the evidence base for online security and privacy ........................................ 68

Notes.................................................................................................................................................................................................... 70

References ...................................................................................................................................................................................... 73

Chapter 3 EMPOWERING SOCIETY ................................................................................................................................... 75

3.1 Internet users ................................................................................................................................................................. 76

3.2 Online activities ........................................................................................................................................................... 78

3.3 User sophistication ................................................................................................................................................... 80

3.4 Digital natives ................................................................................................................................................................ 82

3.5 Children online ............................................................................................................................................................. 84

3.6 ICTs in education ........................................................................................................................................................ 86

3.7 ICT skills in the workplace ................................................................................................................................ 88

3.8 E-consumers .................................................................................................................................................................... 90

3.9 Content without borders ..................................................................................................................................... 92

3.10 E-government use ...................................................................................................................................................... 94

3.11 ICT and health ............................................................................................................................................................... 96

Notes.................................................................................................................................................................................................... 98

References ...................................................................................................................................................................................... 103

Chapter 4 UNLEASHING INNOVATION ......................................................................................................................... 105

4.1 ICT and R&D .................................................................................................................................................................... 106

4.2 Innovation in ICT industries ............................................................................................................................ 108

4.3 E-business .......................................................................................................................................................................... 110

4.4 Unleashing the potential of micro-data ............................................................................................... 112

4.5 ICT patents ....................................................................................................................................................................... 114

4.6 ICT designs ....................................................................................................................................................................... 116

TABLE OF CONTENTS

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 20148

4.7 ICT trademarks ............................................................................................................................................................. 118

4.8 Knowledge diffusion ............................................................................................................................................... 120

Notes.................................................................................................................................................................................................... 122

References ...................................................................................................................................................................................... 125

Chapter 5 DELIVERING GROWTH AND JOBS ........................................................................................................... 127

5.1 ICT investment ............................................................................................................................................................. 128

5.2 ICT business dynamics ......................................................................................................................................... 130

5.3 ICT value added ........................................................................................................................................................... 132

5.4 Labour productivity in information industries .............................................................................. 134

5.5 Measuring quality in communication services ............................................................................. 136

5.6 E-commerce ..................................................................................................................................................................... 138

5.7 Human capital in ICT.............................................................................................................................................. 140

5.8 ICT jobs and jobs in the ICT sector ............................................................................................................ 142

5.9 Trade competitiveness and GVCs ............................................................................................................... 144

Notes.................................................................................................................................................................................................... 146

References ...................................................................................................................................................................................... 149

Data sources .............................................................................................................................................................................................. 151

List of Figures ........................................................................................................................................................................................... 153

Look for the StatLinks2at the bottom of the tables or graphs in this book.

To download the matching Excel® spreadsheet, just type the link into your

Internet browser, starting with the http://dx.doi.org prex, or click on the link from

the e-book edition.

Follow OECD Publications on:

This book has...

StatLinks2

A service that delivers Excel

®

les from the printed page!

http://twitter.com/OECD_Pubs

http://www.facebook.com/OECDPublications

http://www.linkedin.com/groups/OECD-Publications-4645871

http://www.youtube.com/oecdilibrary

http://www.oecd.org/oecddirect/

OECD

Alerts

READER’S GUIDE READER’S GUIDE

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 9

Reader’s Guide

Acronyms

ADE Automated data exchange

ANACOM National Communication Authority of Portugal

(Autoridade Nacional de Comunicações)

AS Autonomous system

ASN Autonomous system number

BERD Business enterprise expenditure on research and development

BLS Bureau of Labor Statistics

B2B Business-to-business

B2C Business-to-consumer

B2G Business-to-government

ccTLD Country code top-level domain

CDN Content distribution network

CDSS Clinical decision support system

CERT Computer emergency response team

CIS Community Innovation Survey

CSIRT Computer security incident response team

C2C Consumer-to-consumer

DDOS Distributed denial-of-service

DNS Domain name system

DOS Denial-of-service

DSL Digital subscriber line

EDI Electronic data interchange

EHR Electronic health record

ERP Enterprise resource planning

ESS European Statistical System

EU European Union

FCC Federal Communications Commission

FTE Full-time equivalent

FTTH Fibre to the home

GDP Gross domestic product

Gbit Gigabyte

gTLD Generic top-level domain

HDD Hard disk drive

HTTP Hypertext Transfer Protocol

ICT Information and communication technology

IDS Intrusion detection system

GFCF Gross xed capital formation

GPS Global positioning system

IaaS Infrastructure as a service

IC3 Internet Crime Complaint Center

ICIO Inter-Country Input-Output

IP Internet Protocol

IPC International Patent Classication

IPv4 Internet Protocol version 4

READER’S GUIDE

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 201410

ISC Internet Systems Consortium

ISCED International Standard Classication of Education

ISCO International Standard Classication of Occupations

ISIC International Standard Industrial Classication

ISP Internet service provider

IT Information technology

ITU International Telecommunication Union

JST Japan Science and Technology Agency

KISA Korean Internet & Security Agency

LAN Local area network

LTE Long term evolution

Mbit Megabyte

MHGE Medium and high-growth enterprise

MNE Multinational enterprise

MOOC Massive open online course

M2M Machine-to-machine

NAT Network address translation

NFC Near eld communication

NIC Network information centre

NSF National Science Foundation

NSO National statistical ofce

OFCOM Ofce of Communications

OHIM Ofce for Harmonization in the Internal Market

PaaS Platform as a service

PCT Patent Cooperation Treaty

PPP Purchasing power parity

R&D Research and development

RCA Revealed comparative advantage

RCD Registered Community Design

RFID Radio frequency identication

RIR Regional Internet registry

SaaS Software as a service

SCM Supply chain management

SIM Subscriber identity module

S&T Science and technology

SME Small and medium-sized enterprise

SMS Short message service

SNA System of National Accounts

SSD Solid-state drive

USD United States dollar

USPTO United States Patent and Trademark Ofce

VC Venture capital

VoIP Voice over Internet Protocol

Wi-Fi Wireless delity

WIPO World Intellectual Property Organization

READER’S GUIDE READER’S GUIDE

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 11

Abbreviations

For most of the charts, this publication uses ISO codes for countries or economies.

AUS Australia

AUT Austria

BEL Belgium

BRA Brazil

CAN Canada

CHE Switzerland

CHL Chile

CHN People’s Republic of China

COL Colombia

CRI Costa Rica

CZE Czech Republic

DEU Germany

DNK Denmark

ESP Spain

EST Estonia

FIN Finland

FRA France

GBR United Kingdom

GRC Greece

HKG Hong Kong, China

HRV Croatia

HUN Hungary

IDN Indonesia

IND India

IRL Ireland

ISL Iceland

ISR Israel

ITA Italy

JPN Japan

KOR Korea

LUX Luxembourg

LVA Latvia

MEX Mexico

MYS Malaysia

NLD Netherlands

NOR Norway

NZL New Zealand

PAN Panama

PHL Philippines

POL Poland

PRT Portugal

ROU Romania

RUS Russian Federation

SAU Saudi Arabia

SGP Singapore

SVK Slovak Republic

SVN Slovenia

SWE Sweden

THA Thailand

TUR Turkey

TWN Chinese Taipei

UKR Ukraine

USA United States

VGB Virgin Islands (British)

ZAF South Africa

Country groupings

BRIICS Brazil, the Russian Federation, India, Indonesia, China and South Africa.

EU28 European Union

OECD Australia, Austria, Belgium, Canada, Chile, the Czech Republic, Denmark,

Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel,

Italy, Japan, Korea, Luxembourg, Mexico, the Netherlands, New Zealand,

Norway, Poland, Portugal, the Slovak Republic, Slovenia, Spain, Sweden,

Switzerland, Turkey, the United Kingdom and the United States.

ROW Rest of the world

WLD World

EXECUTIVE SUMMARY EXECUTIVE SUMMARY

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 13

Executive Summary

With lacklustre growth across much of the globe, monitoring and understanding the role

of ICTs and the Internet in the broader economy is a priority. Measuring the Digital Economy

maps existing indicators against digital economy policy issues, identies gaps in the

measurement framework, assesses progress, and proposes a forward-looking international

measurement agenda.

ICTs have triggered deep changes in economies and societies

The number of Internet users in OECD countries increased from fewer than 60% of adults

in 2005 to about 80% in 2013, reaching 95% among young people, with large differences

across and within countries. In 2013, more than 90% of individuals accessed the Internet

in Luxembourg, the Netherlands, the Nordic countries, and Switzerland against 60% or less

inGreece, Italy, Mexico and Turkey. The gap between Internet uptake among the elderly

and the younger population generally remained high in the lagging countries compared to

the leaders.

Fifteen-year-olds in the OECD spend about 3hours on the Internet on a typical weekday

and more than 70% use the Internet at school. In OECD countries, 62% of Internet users

participate in social networks and 35% use e-government services. About half of individuals

in OECD countries purchase goods and services online, and almost 20%inDenmark, Korea,

Sweden and the UnitedKingdom use a mobile device to do so.

In 2012-13, 77% of enterprises in the OECD area had a website or home page and 21% sold

their products electronically. Over 80% of enterprises used e-government services.

Technological developments are feeding further penetration

Higher speed Internet, lower unit prices and smart devices have favoured new and more

data-intensive applications. Wireless broadband subscriptions in the OECD area increased

over twofold in just four years: by December 2013, almost 3 out of 4 individuals in the OECD

area had a mobile wireless broadband subscription.

Mobile broadband is also widely available in many emerging and less developed countries.

In sub-Saharan Africa, for example, subscriptions grew from 14million in 2010 to 117million

in 2013.

In less than two years, the number of pages viewed from mobile devices and tablets is

estimated to have risen from 15% to over 30% of total. In 2013, over 75% of active Facebook

users connected via a mobile device.

International differences in speed and prices remain signicant, however, even among

OECD countries. In December 2013, the share of high-speed broadband subscribers (above

10Mbit/s) ranged from over 70% to under 2% across OECD countries. Depending on country,

smartphone users in the OECD may pay up to seven times more for a comparable basket

of mobile services.

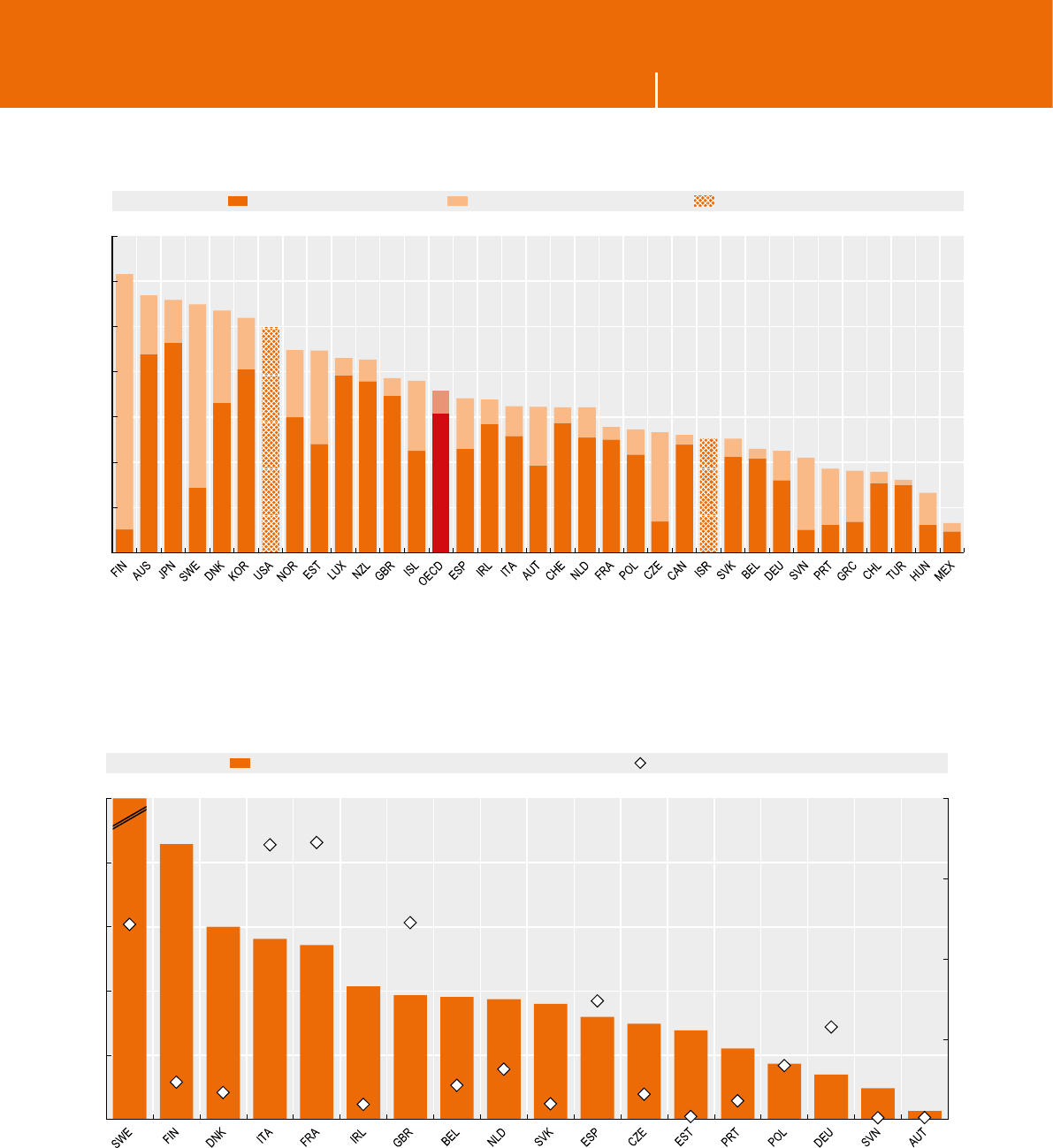

ICTs are fostering innovations across industries and sciences

ICT-producing industries, together with publishing, digital media and content industries,

accounted for about one-quarter of total OECD business expenditure on R&D (BERD) in

2011. In 2014, patents in ICT-related technologies accounted for a third of all applications

to main patent ofces. In the last ten years, the share of data mining in total patents

more than tripled, and the share of machine-to-machine (M2M) communication patents

increased sixtimes.

EXECUTIVE SUMMARY

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 201414

Many emergent technologies rely on innovations in ICTs. In the OECD countries, about

25% of ICT patents also belong to non-ICT areas. For example the deployment of second-

generation genome sequencing techniques with embedded data-mining algorithms

resulted in the cost per human-like genome sequence dropping from a million to a

thousand dollars in just ve years (2009-14).

The digital economy has been resilient in the crisis

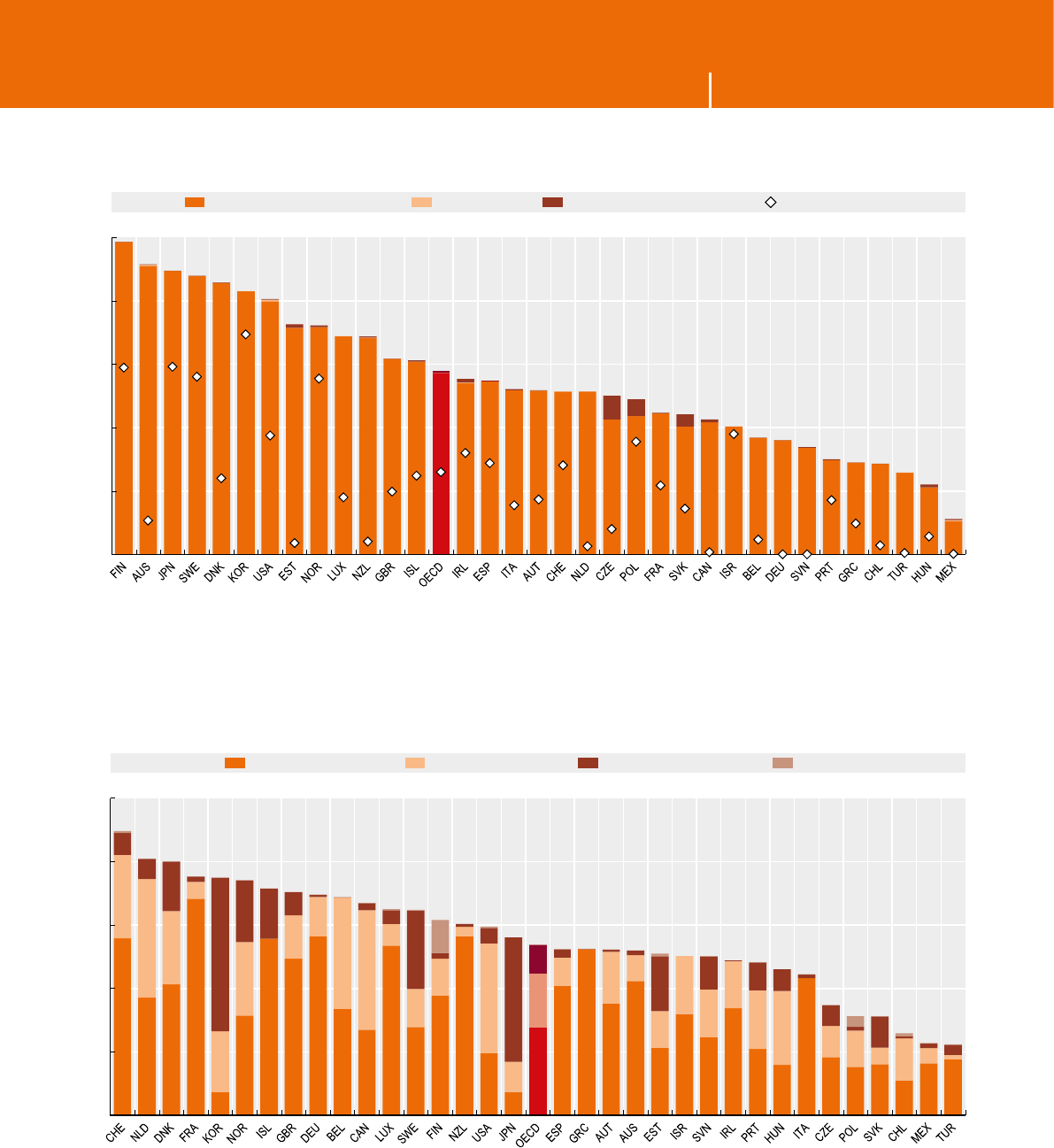

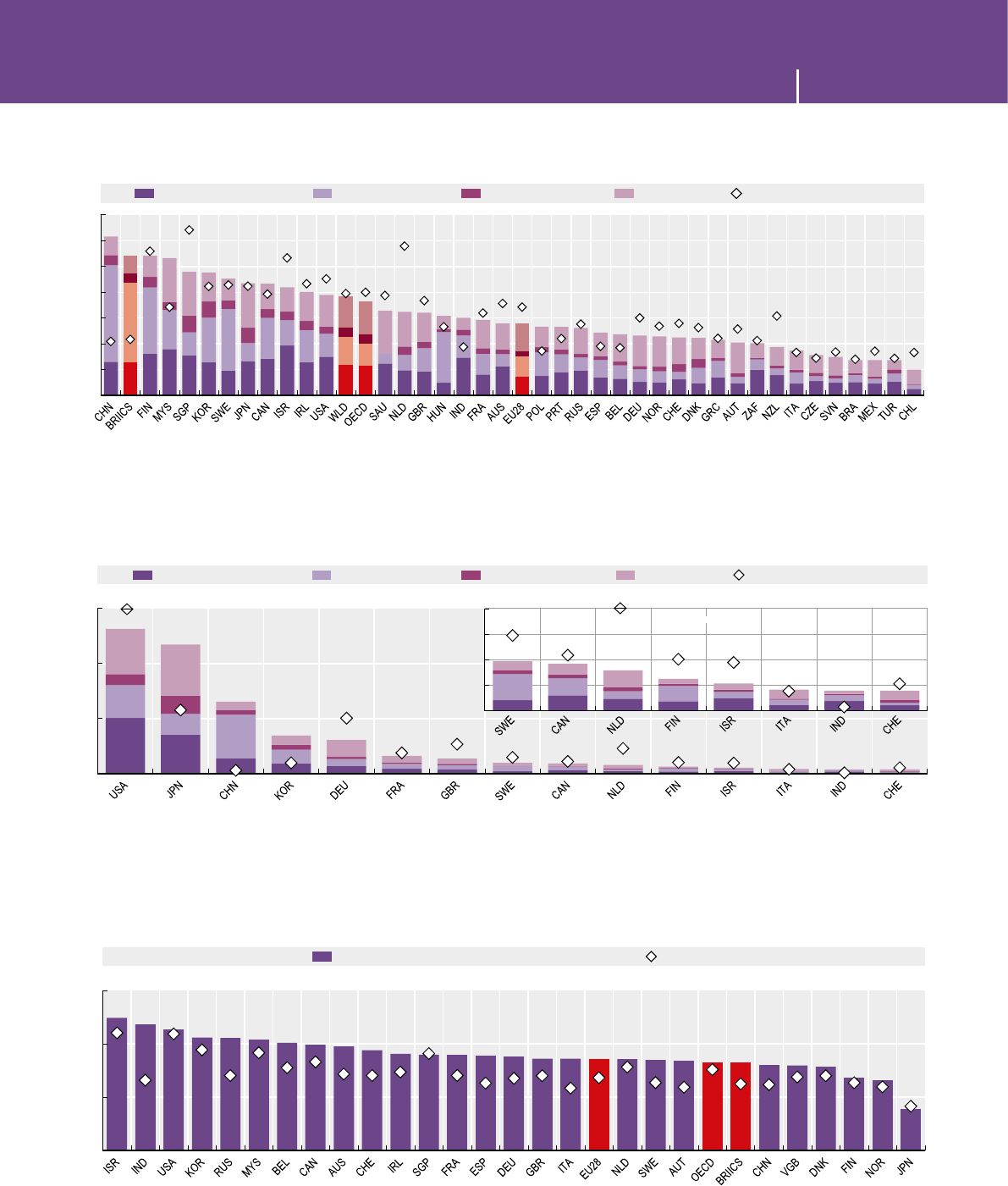

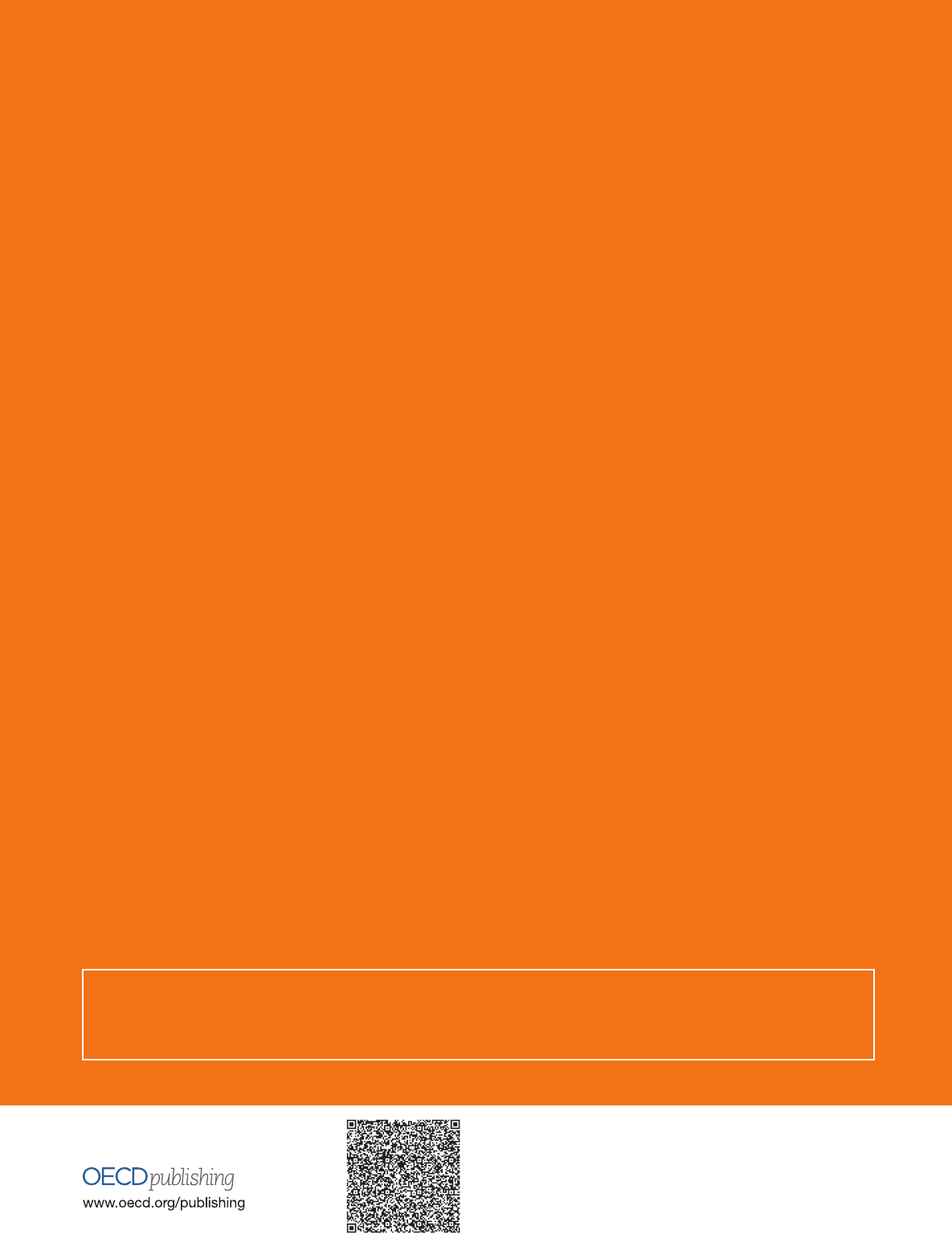

In 2012, information industries accounted for about 6% of total value added, around 4% of

total employment and 12% of total xed investment in the OECD area. Labour productivity

in the information economy sector is about 60% higher than in the total economy.

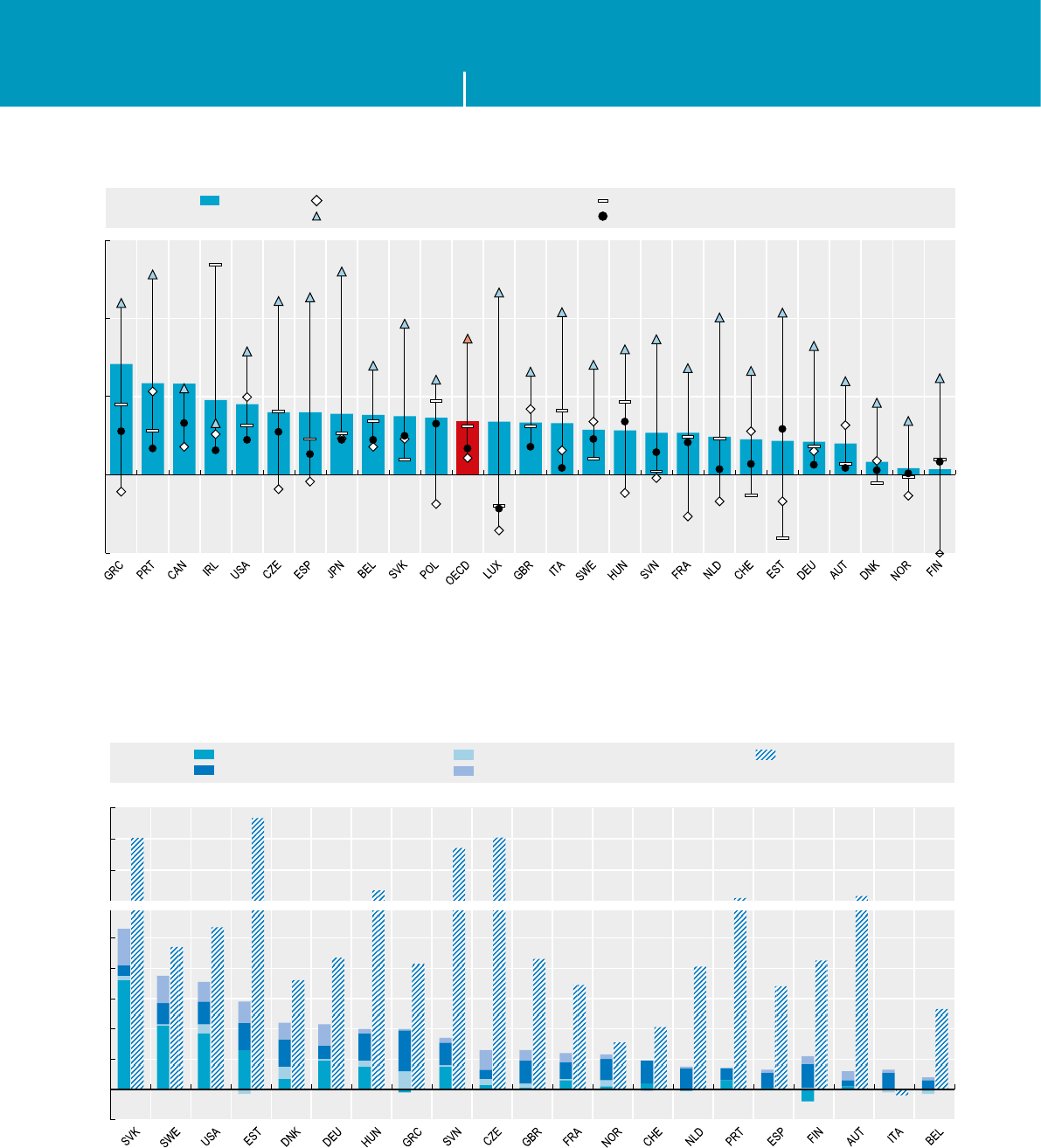

The ICT sector outperformed the rest of the economy in terms of net business population

growth between 2009 and 2012 and involved relatively high shares of medium and

high-growth rms. New ICT enterprises have also higher survival rates than their counter-

parts in manufacturing and services.

The crisis does not seem to have signicantly affected the revenues of the world’s top-250

ICT rms. However, they have substantially reduced their R&D expenditures compared to

the beginning of the decade, perhaps due to the shift from manufacturing to services.

Over 2000-12, computers and peripherals fell from almost 38% to under 30% of world ICT

exports, while the share of communication equipment and consumer electronics grew

from 26% to almost 35%. Over the same period, China’s share in global ICT exports grew

from 4.4% to above 30%. However, in terms of value added, China’s share was only 17%

since it has to import a signicant amount of intermediate goods and services.

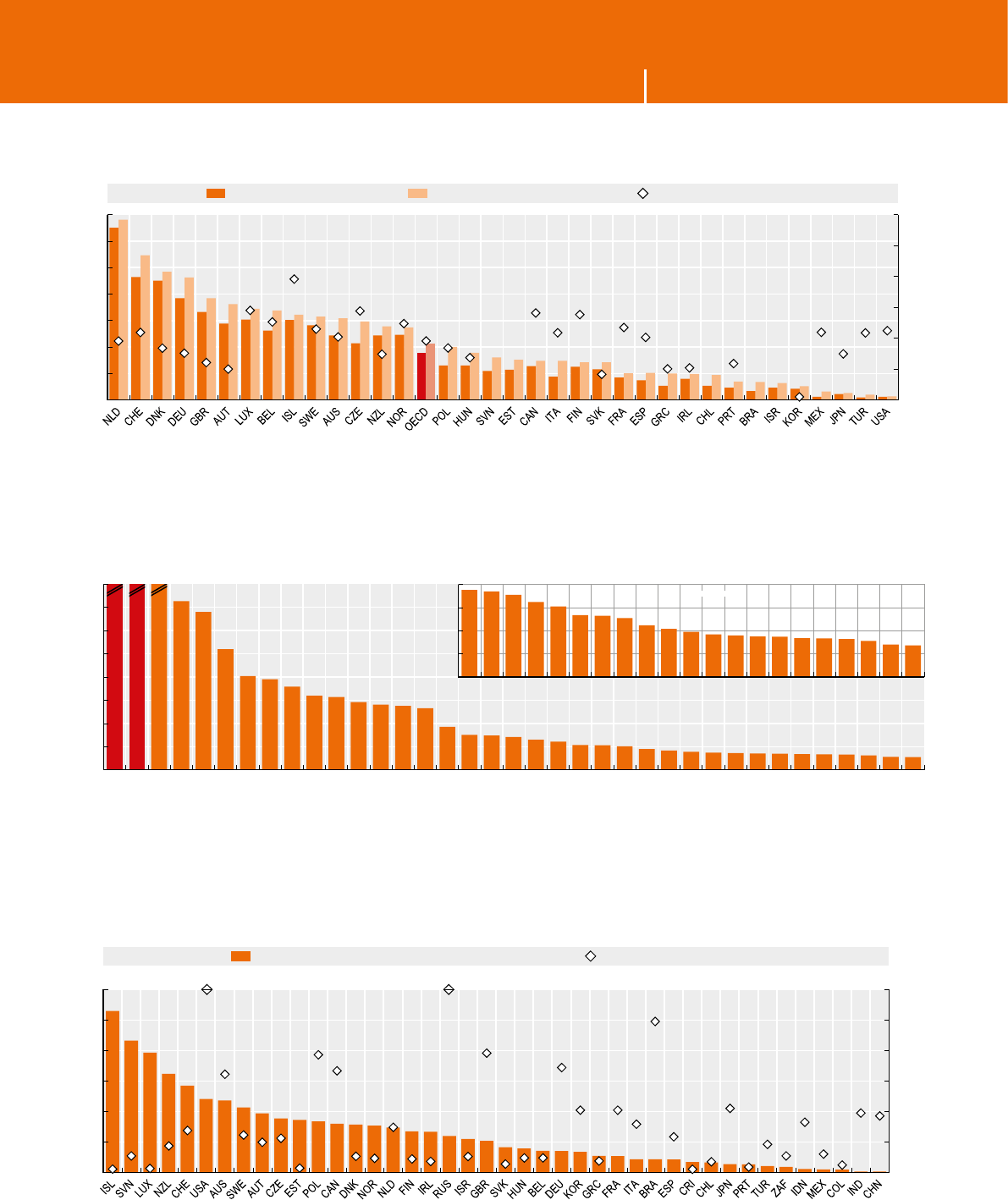

Employment creation has been sluggish

Despite the dynamism of the sector, employment in ICT industries never regained the 2001

peak of 4.1% of total employment and remained just below 3.8% in 2012. These sluggish

employment dynamics reected the downsizing of manufacturing and telecom services

and the growth of IT services. Yet ICT industries account for less than half of ICT-related

occupations in OECD countries.

From 2003 to 2013, employment in ICT occupations grew by 25% or more in Australia and

Canada, about 15% in the United States, and 16% to 30% in OECD countries in Europe,

performing better than total employment through the crisis. Yet, several studies highlight

the potentially disruptive effects of ICTs on employment, given the progress in automation

and machine learning.

New skills for workers, rms and users are required

While the use of ICTs at work is generalised, over 60% of the EU labour force reported their

computer skills as insufcient to apply for a new job, rising to over 80% of people with low

education compared to below 40% of those with a tertiary education. ICT industries employ

on average 30% of business sector researchers, but only 3% of OECD tertiary graduates

attained a degree in computer sciences in 2012.

The Internet has opened up new opportunities for education and training. In 2013, 9.3%

of Internet users followed an online course in the 30 OECD countries for which data are

available, and hundreds of universities now propose online programmes and massive open

online courses (MOOCs).

Security skills also need to be improved. Security is cited as the main reason for not buying

online by over one-third of Internet users in the EuropeanUnion. However, in 2013 only about

one-third of Internet users in the EuropeanUnion had ever changed the security settings

of their browsers. Similarly, in 2010 only 9% of adult Internet users in the EuropeanUnion

used a parental control or web-ltering software to protect their children online.

EXECUTIVE SUMMARY EXECUTIVE SUMMARY

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 15

New statistical tools are needed to measure the digital economy

While existing statistics measure the diffusion of ICTs, they are less able to keep up with

new and rapidly evolving technologies and usage by individuals and rms. A forward-

looking international measurement agenda should bebuilt around six areas:

• Improve the measurement of ICT investment and its link to macroeconomic performance;

• Dene and measure skill needs for the digital economy;

• Develop metrics to monitor issues of security, privacy and consumer protection;

• Promote the measurement of ICT for social goals and the impact of the digital economy

on society;

• Invest in a comprehensive, high-quality data infrastructure for measuring impacts; and

• Build a statistical quality framework suited to exploiting the Internet as a data source.

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 17

A MEASUREMENT AGENDA

FOR THE DIGITAL ECONOMY

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 201418

A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY

THE DIGITAL ECONOMY: TOWARDS A MEASUREMENT AGENDA

Measuring the Digital Economy: A New Perspective maps existing indicators drawn from a wide range of areas

including education, innovation, entrepreneurship and economic outcomes against current digital economy

policy issues, as reected in the OECD Internet Policy Principles OECD (2011b). By doing so, it identies gaps in

the current measurement framework and assesses progress made by some initiatives towards lling these gaps.

Theoverarching objective of Measuring the Digital Economy is to advance the measurement agenda, including in

areas highlighted by the OECD in its broadband metric checklist (see Box1), so as to better monitor the pervasive

role of ICTs and theInternet in the broader economy and their contributions to delivering jobs and growth.

This is a challenge. As the OECD and the broader international community develop international policy guidelines

on the protection of personal data, children or consumers online, and address issues of cybersecurity, a key

question concerns the extent to which existing metrics and measurement tools provide an evidence base to allow

analysis of these policies and their impact across countries.1

The near ubiquitous diffusion of information and communication technologies has led to their convergence

with other technologies such as biotechnologies and nanotechnologies, which in turn have led to innovations in

advanced manufacturing, health care, environmental protection and other applications. The growing interdiscipli-

nary nature of these technologies underscores the need for a consistent measurement framework.

For centuries, technological developments have made old skills obsolete and led to the demand for new skill sets.

ICTs are at the forefront of this transition today and are generating policy interest about new skills needs and

methods to develop these skills. This debate has raised a number of questions: What measures best capture the

range of skills consumers and workers need? Is it possible to dene such ICT skills based on existing metrics and

statistics? Does the use of ICTs improve learning and educational outcomes? To what extent does education play

a role in shaping the skills of future ICT users in the workplace and everyday life?

The digital economy extends beyond businesses and markets – it includes individuals, communities and societies.

This broader conception encompasses new themes such as the rapid growth of social networks and free and rapid

access to social media and other user-created content. This gives rise to a wide range of policy issues including

cyber bullying, the right to have one’s past forgotten and Internet “addiction”, as well as on-going concerns about

the protection of children online and persistent digital divides. The majority of current ICT metrics focus on the

role of ICTs in business performance and fall short in terms of measuring the social impacts of ICTs and their

contributions to social outcomes.

Finally, measuring the digital economy and understanding the various dimensions of its impact often means

improving measurement of the “traditional” economy. For example, price deators for goods and services must be

adjusted to reect changes in quality induced by ICTs so as to permit measurement of changes in key aggregate

statistics, such as productivity, and to assess the contribution of ICTs to overall economic performance.2

To understand the structural impact of ICTs and the changing nature of competition in the digital economy,

it is important to consider price differentials between goods and services sold online versus ofine, as well as

measures of price dispersion across producers using the same distribution method. Furthermore, addressing the

challenge of measuring and valuing outputs is essential in order to identify the impacts of ICTs in service sector

industries where they play a key role.

In the short term, the challenge is to make statistical systems more exible and responsive to the introduction of

new and rapidly evolving concepts driven by ICTs. A number of options exist such as experimenting with satellite

accounts, exploiting the potential of existing micro-data, adding questions to existing surveys, periodically augment-

ing existing surveys with topic-specic modules or developing short turnaround surveys to meet special needs.

Experimental and exible approaches could be developed to meet the specic priorities and resources of countries.

1. The OECD Model Surveys on ICT Access and Usage by Households and Individuals and ICT Usage by Businesses were revised in 2014 to improve

measurement in the areas of cybersecurity and privacy, notably the economics of personal data and security, prevention measures and incident

response. The OECD is also working to improve the international comparability of data generated by Computer Security Incidents Response Teams

(CSIRTs) (see 2.10). Theoverall objective of the work is to develop statistical denitions for a set of indicators (e.g.budget, personnel, skills and

co-operation, along with specic kinds of incidents) that national CSIRTs could report on a voluntary basis, in addition to suggestions for CSIRTs to

better leverage existing data, such as from third-party institutions, for statistical purposes.

2. In particular, the OECD is looking at the feasibility of hedonic prices as an approach to measuring quality changes in communication services

across countries (see 5.5).

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 19

A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY

Good co-ordination will help prevent geographically fragmented research efforts and ensure that the international

community takes up the results of successful experimentation by countries (OECD, 2011a).

Box 1. • Key messages from the OECD Broadband Checklist3

• Develop a broadband denition by speed tier that reects national specicities, to be implemented in

data collection.

• Measure the deployment of broadband networks, including by exploring metrics based on interactive

Internet mapping.

• Improve the measurement of ICT investment, including investment in broadband infrastructure.

• Develop a harmonised methodology to measure broadband performance metrics, such as broadband

speed delivered directly to consumers’ routers.

• Review and update broadband competition metrics such as market shares.

• Improve indicators of mobile broadband uptake via subscription data, use by individuals and businesses

as measured in ICT use surveys, data from mobile operators/regulators on connections, trafc and usage

patterns, and other data from industry stakeholders.

• Improve the collection of mobile broadband supply-side metrics in terms of coverage, capacity, speed and

competition based on data from service providers.

• Develop new approaches to measuring broadband service prices including, in the longer term, work on

hedonic deators for different broadband services bundles.

• Explore the reliability of using Internet-based statistics to develop timely metrics for trafc-ow data or

use of the Web.

• Exploit available micro-data and linking of micro-databases for new indicators on the demand side,

including intensity and sophistication of ICT usage and in particular broadband.

• Review the OECD Model Surveys on ICT usage by households/individuals and by businesses to provide

a richer set of data for analysis of impacts, including on ICT-enabled innovation and the role of ICTs for

social outcomes such as health and education.

• Build on existing initiatives to measure the effect of the Internet on business practices and public

administration, using automated data mining where possible.

• Build on existing OECD productivity measures to improve the underlying statistics for ICT and content

industries.

• Consider over the longer term the possibility of integrating broadband investment and prices within

National Accounts frameworks or satellite accounts, so as to enable analysis of the impact of broadband

on productivity at the macro level.

Source: OECD, summary based on OECD (2012a).

3. In recent years the OECD has organised several technical workshops and debated at length emerging issues in metrics under the aegis of the

Committee on Digital Economy Policy (CDEP) and its Working Parties. This led to the identication of some points for action which are summarised

in the document DSTI/ICCP(2012)7. Some of these actions have already been implemented. For example, the WPCISP (Working Party on Communi-

cation Infrastructure and Service Policy) has adopted an international denition of broadband by speed tiers (OECD, 2012a) and has initiated work

in the area of Internet mapping (see www.oecd.org/sti/broadband/broadbandmapping.htm) and speed tests (see www.oecd.org/sti/broadband/

speed-tests.htm). The WPIIS (Working Party on Indicators for the Information Society), now the WPMADE (Working Party on Measurement and

Analysis of the Digital Economy), has just completed a major revision of its Model Surveys on ICT Access and Usage by Households and Individuals

(OECD, 2014a) and ICT Usage by Businesses (OECD, 2014b) to take into account, among others, some of the priorities highlighted in the broadband

metrics checklist, including the denition of speed tiers (256Kbit/s to less than 1.5/2Mbit/s; 1.5/2Mbit/s to less than 10Mbit/s; 10Mbit/s to less

than 25/30Mbit/s; 25/30Mbit/s to less than 100Mbit/s; 100Mbit/s to less than 1Gbit/s; and 1Gbit/s and above).

In the long term, the challenge for the statistical community is to redesign surveys to address the relevant unit

of analysis. As ICTs and the Internet become basic infrastructure for business and society, it will be increasingly

difcult to measure the digital economy as distinct from the overall economy. This is due in part to the fact that

the Internet enables the creation of non-physical organisations and exible outsourcing of business activities,

within existing sectors of activity and across locations, thus blurring the boundaries between rms and markets

and between work and social life. A higher level of granularity in data will therefore be needed to measure how

businesses and individuals use ICTs on a continuous basis from any location for any type of activity (Lehr, 2012).

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 201420

A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY

The exploitation of ofcial statistics at the “micro” level (enterprise/establishment/organisation, worker,

household/individual) and the use of administrative data will need to become the norm, and existing data collec-

tions will need to be reviewed to maximise data-linking opportunities for research and analysis.4 This will mean

nding ways to provide researchers with access to micro-data while responding to concerns about condentiality.

The envisaged measurement framework will have to be developed and implemented gradually with the involvement

of stakeholders outside the statistical community. Policy makers in co-operation with other stakeholders will need to

dene user needs. Researchers will have to analyse the data, ascertain impacts, and help to develop the appropriate

metrics and data infrastructures. Engagement with organisations, businesses, universities and the public sector

will be indispensable, as the statistical system can only collect what can feasibly be measured inside organisations.

Attention must be paid to minimising the reporting burden by carefully selecting questions, exploiting other ofcial

and administrative data, and making use of new sources of data generated through the use of ICTs.

The OECD Internet Policy Making Principles call on the international community to promote the digital economy and

to develop stakeholder capacity to bring publicly available, reliable data into the policy making process. Thetask

of Measuring the Digital Economy is to propose indicators that can inform policy making in this area, as well as

to offer a fresh perspective by highlighting new data sources, gaps and measurement challenges. The following

paragraphs present key messages and actions to advance the measurement agenda for the digital economy.

Action 1

Improve the measurement of ICT investment including broadband investment and its link to macroeconomic

performance

ICTs need to be implemented in business processes together with other assets to drive performance, and need

to be analysed in the broader context of their contribution to aggregate jobs and economic performance. To this

end, business and individual surveys on ICTs need to be reviewed regularly to take into account the role of ICTs, in

particular broadband, as enablers of innovation and contributors to business performance and consumer welfare.

ICT survey and administrative data need to be aligned with aggregate economic measures to allow the integration

of ICTs within the System of National Accounts (SNA).

The business, statistical and research communities are encouraged to:

• Improve measurement of ICT investment and internationally comparable deators for hardware, software and

communication infrastructure, including the pricing of broadband services bundles;

• Measure and value digitised data as an intangible asset, and analyse its contribution to productivity and

business performance;

• Review regularly the measurement framework for ICT usage to identify and prioritise areas for survey design

and re-design in line with on-going developments and policy priorities.

Action 2

Dene and measure skills needs for the digital economy

The development of the digital economy and its applications, such as “big data” analytics, cloud computing and

mobile applications, may raise demand for new skills, leading to skills shortages in the short term. At work,

shortage of ICT programmers may be compounded by managerial challenges to the development of new business

models, new organisational structures and new working methods. Among users, the capacity to search among

a myriad of mobile applications or protect against digital security risks is increasing demand for new types of

skills. Traditionally, ofcial statistics have used educational attainment or occupational categories as a proxy for

skills, but this approach seems too narrow to address the issue of demand for new skills. More could be gained by

exploiting and harmonising nely detailed national surveys on tasks and skills,5 and by working with the business

community to dene new metrics for skill shortages.

4. The OECD, for instance, has pioneered a distributed approach to micro-data analysis, where the Organisation provides a common research

framework and researchers from different countries run the analysis on their own country’s micro-data. The OECD has also developed a micro-data

lab, which compiles and links large-scale non-condential administrative and commercial datasets at the micro level (see 4.4).

5. Such as the Occupational Information Network (O*NET) in the United States, the UK Skills Surveys (UKSS), the Canadian Essential Skills

program (ES) or the German Qualication and Career Surveys (carried out by the Federal Institute for Vocational Education and Training - BIBB).

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 21

A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY

6. See 3.5 for the measurement challenges related to the activity and protection of children online.

7. This survey is an important outcome of a multi-stakeholder initiative launched by the OECD in 2010 to improve the availability and quality of

health ICT data and guide measurement efforts (see 3.11).

The business, statistical and research communities are encouraged to:

• Exploit the potential of existing public and private statistics on skills, occupations and industry classications,

and to promote the harmonisation of existing national sources on tasks and skills;

• Better exploit existing cross-country surveys (e.g.the European Survey of Working Conditions and the OECD’s

Programme for the International Assessment of Adult Competencies), and promote the linking of datasets

containing information on skills, jobs and activities at the individual level;

• Improve access and use of private online vacancy datasets (e.g. Help Wanted Online by the United States

Conference Board) to measure vacancies in ICT-related occupations, their duration and rate of lling;

• Promote the harmonisation of national programmes currently in place in several OECD countries to assess skills

supply and forecast skills demand.

Action 3

Develop metrics to monitor issues of security, privacy and consumer protection

Management of security and privacy risk online has become a key policy issue as individuals, businesses and

governments shift large parts of their daily activities to the Internet. The analytical framework developed by the

OECD to classify statistics and empirical data related to security and privacy risk highlights the potential for better

indicators in this area, building on an underexploited wealth of empirical data (OECD, 2012b). While some aspects

are currently being developed, such as the harmonisation of statistics from CSIRTs (Computer Security Incidents

Response Team), others need to be explored further.

Statistical information related to online security and privacy risks relies either on self-reporting (e.g.in response

to a survey or assistance sought from a CSIRT) or on Internet-based data, (e.g.malware activities recorded by

a rewall). Measures based on self-reporting suffer from the drawback that not all incidents are identied in

a comparable manner or reported because victims are often reluctant to expose their reputation when facing

privacy and security incidents. Internet-based data is less susceptible to these issues, but its utility is limited

because of restricted coverage of Internet activities as well as multiple security aspects and privacy risks.

A number of steps can be undertaken to address these shortcomings and improve measurement in the areas of

online security and privacy risk, and consumer protection.

The statistical community, regulators and other stakeholders, such as CSIRTs and Internet intermediaries, are

invited to work together and with relevant partners to:

• Test and improve the privacy and security modules in the ICT Users Surveys by Individuals and by Businesses

to increase the quality and rate of response;

• Develop guidance for CSIRTs to produce and report internationally comparable statistics;

• Develop new indicators on the various factors and dimensions of security and privacy risk (including threats,

vulnerabilities, incidents, impact, prevention, response), building on the above-mentioned analytical framework;

• Promote a statistical and regulatory framework for Internet-based data on online security and privacy risk, as

well as consumer protection (see Action5 below).

Action 4

Promote measurement of ICTs for social goals and impacts of the digital economy on society

The current measurement framework focuses on the role of ICTs in economic performance. It has limited capacity

to measure the extent to which new ICTs can help address social goals, such as those associated with health,

ageing population or climate change.

Governments as well as statistical and research communities are encouraged to:

• Develop new statistical tools including self-perceptions surveys to monitor the impact of ICT use by adult

individuals and children6;

• Promote wider implementation of the OECD Model Survey on the Adoption and Use of ICTs in the Health Sector7

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 201422

A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY

and build on existing medical surveys of hospitals, practitioners and patients to improve measurement of

theeffects of e-health;

• Develop the ICT model usage surveys to improve measurement of consumer trust and behaviour in the digital

economy;

• Improve measurement of the impact of ICTs on the environment by enhancing statistical linkages among

ICT-use surveys, consumer expenditure surveys, supply-use tables and industry-level data.

Action 5

Invest in a comprehensive, high-quality data infrastructure for measuring impacts

The rst and best evidence of economic impacts is likely to come from micro-data (data about rms, workers

or consumers) before it shows up in macro-data. To date, measurement has focused mostly on access to and

adoption of ICTs. Since economic effects arise as a consequence of ICT usage, the statistical infrastructure in most

OECD economies, which details adoption behaviour across rms, households, individuals and their characteristics,

provides a good basis for analysing impacts.

It is important to be able to link together existing datasets and exploit the potential of existing administrative

records. This can improve understanding and reduce respondent burden. For example, the ability to link ICT

surveys to datasets (surveys or administrative data) containing information on skills, jobs and activities at the

individual level can substantially improve empirical research on the impacts of ICTs on jobs and skills. The linking

of ICT surveys to business registers and innovation surveys can help to improve understanding of the role of ICTs

in driving innovation and business performance.

Governments and statistical and research communities are encouraged to:

• Promote the exploitation of ofcial statistics at the “micro” level (enterprise, establishment, organisation,

worker, household/individual);

• Explore the statistical potential of administrative records;

• Review existing data collections to maximise data-linking opportunities for research;

• Improve the research community’s access to this infrastructure while ensuring data condentiality.

Action 6

Build a statistical quality framework suited to the Internet as a data source

Given the pace of technological change it is understandable that institutions collecting economic data tend to

fall

behind in measuring the magnitude and scope of ICT impacts on the economy. However, ICTs are themselves

generating enormous ows of information at an unprecedented pace. Statistical information is no exception to

this trend. ICTs have

reduced the complexity and costs of collection, storage and treatment of data. Furthermore,

Internet trafc ows and Web-based data provide a timely source of information on economic and social activities

across the digital economy.

While offering great opportunities for statistics, Internet-based data also raise a number of issues regarding

statistical quality, security, privacy and costs. Addressing these issues requires a signicant range of expertise.

National Statistical Ofces (NSOs), regulators, Internet Service Providers (ISPs) and the Internet community at

large are invited to work together to:

• Develop international statistical standards for the collection of Internet-based data (e.g. sampling) and the

development of statistical indicators (e.g.treatment of Web search results);

• Assess alternative models of co-operation among businesses, Internet intermediaries and NSOs for the collection

and treatment of Internet-based data;

• Promote the emergence of a regulatory framework for the collection and treatment of Internet-based data,

based on consensus among regulators, Internet intermediaries and the Internet technical community;

• Explore technical and regulatory solutions to preserve user security and privacy in the collection and use of

Internet-based data.

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 23

A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY A MEASUREMENT AGENDA FOR THE DIGITAL ECONOMY

References

Lehr, W. (2012), “Measuring the Internet: The Data Challenge”, OECD Digital Economy Papers, No. 194, OECD Publishing.

Doi: http://dx.doi.org/10.1787/5k9bhk5fzvzx-en.

OECD (2014a), “The OECD Model Survey on ICT Access and Usage by Households and Individuals”, Working Party on

Measurement and Analysis of the Digital Economy, DSTI/ICCP/IIS(2013)1/FINAL, OECD, Paris.

OECD (2014b), “The OECD Model Survey on ICT Usage by Businesses”, Working Party on Measurement and Analysis of

the Digital Economy, DSTI/ICCP/IIS(2013)2/FINAL, OECD, Paris.

OECD (2012a), OECD Workshop on Broadband Metrics: Summary of Recommendations, OECD Workshop on Broadband

Metrics, London, 14-15 June, www.oecd.org/site/stibrdbd.

OECD (2012b), “Improving the Evidence Base for Information Security and Privacy Policies: Understanding the

Opportunities and Challenges related to Measuring Information Security, Privacy and the Protection of Children

Online”, OECD Digital Economy Papers, No.214, OECD Publishing. Doi: http://dx.doi.org/10.1787/5k4dq3rkb19n-en.

OECD (2011a), Measuring Innovation: A New Perspective, OECD Publishing. Doi: http://dx.doi.org/10.1787/9789264059474-en.

OECD (2011b), Recommendation of the Council on Principles for Internet Policy Making, acts.oecd.org/Instruments/

ShowInstrumentView.aspx?InstrumentID=270.

References

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 25

Chapter 1

THE DIGITAL ECONOMY TODAY

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 201426

1. THE DIGITAL ECONOMY TODAY 1. THE DIGITAL ECONOMY TODAY

THE DIGITAL ECONOMY TODAY

Mobility, cloud computing, social networking, sensor-nets and big data analytics are some of the most important

trends in the digital economy today. Collectively these trends are making possible the future of “smart everything”

(i.e. grids, homes, business processes, energy, healthcare, transport and government), as well as empowering

businesses, consumers and society at large.

These new and future applications rely on the widespread availability of xed and wireless broadband networks to

meet the growing demands of economies and societies with a concomitant rise in the number of devices connected

over theInternet. In the OECD area, the number of connected devices in households is projected to increase from

an estimated 1.7billion today to 14billion by 2022 (OECD, 2013a).

Collection of data will be facilitated by the expansion of machine-to-machine (M2M) communications with large-

scale processing delivered by “cloud computing” services. New data analytics will be able to process and analyse

large volumes of data, frequently termed “big data”. These phenomena together form the “building blocks of smart

networks”. Thenumbers of devices, data and elements involved in smart networks are orders of magnitude larger

than in previous periods (OECD, 2013a).

The pace at which ICT applications are evolving poses particular challenges for measuring the digital economy.

Todate, measurement has focused on the availability and adoption of ICT technologies, in particular Internet

access. However, as the Internet evolves and becomes basic infrastructure, and the simple “adoption” of ICTs

saturates, metrics for specic (more sophisticated) applications become increasingly relevant (Lehr, 2012).

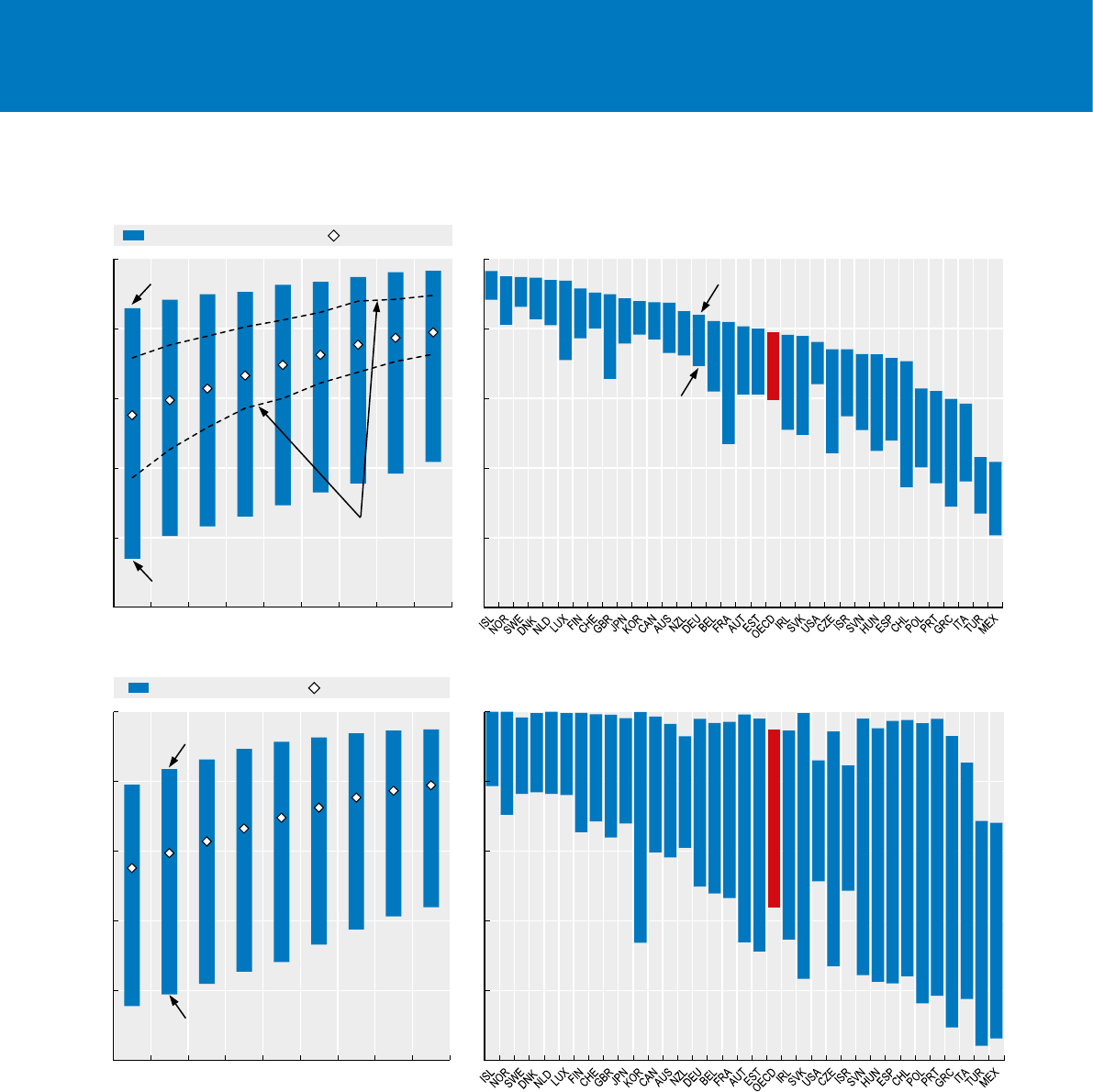

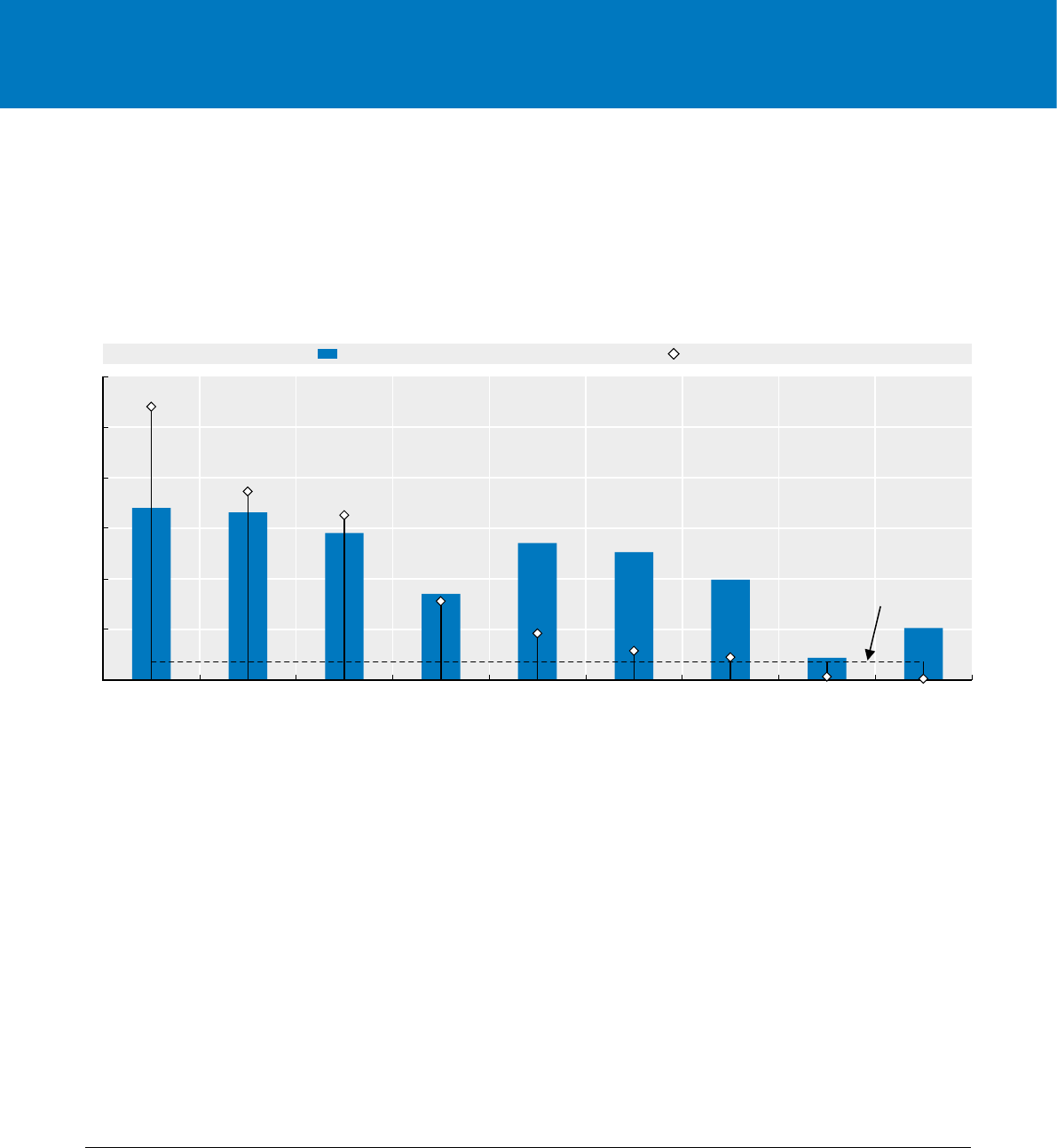

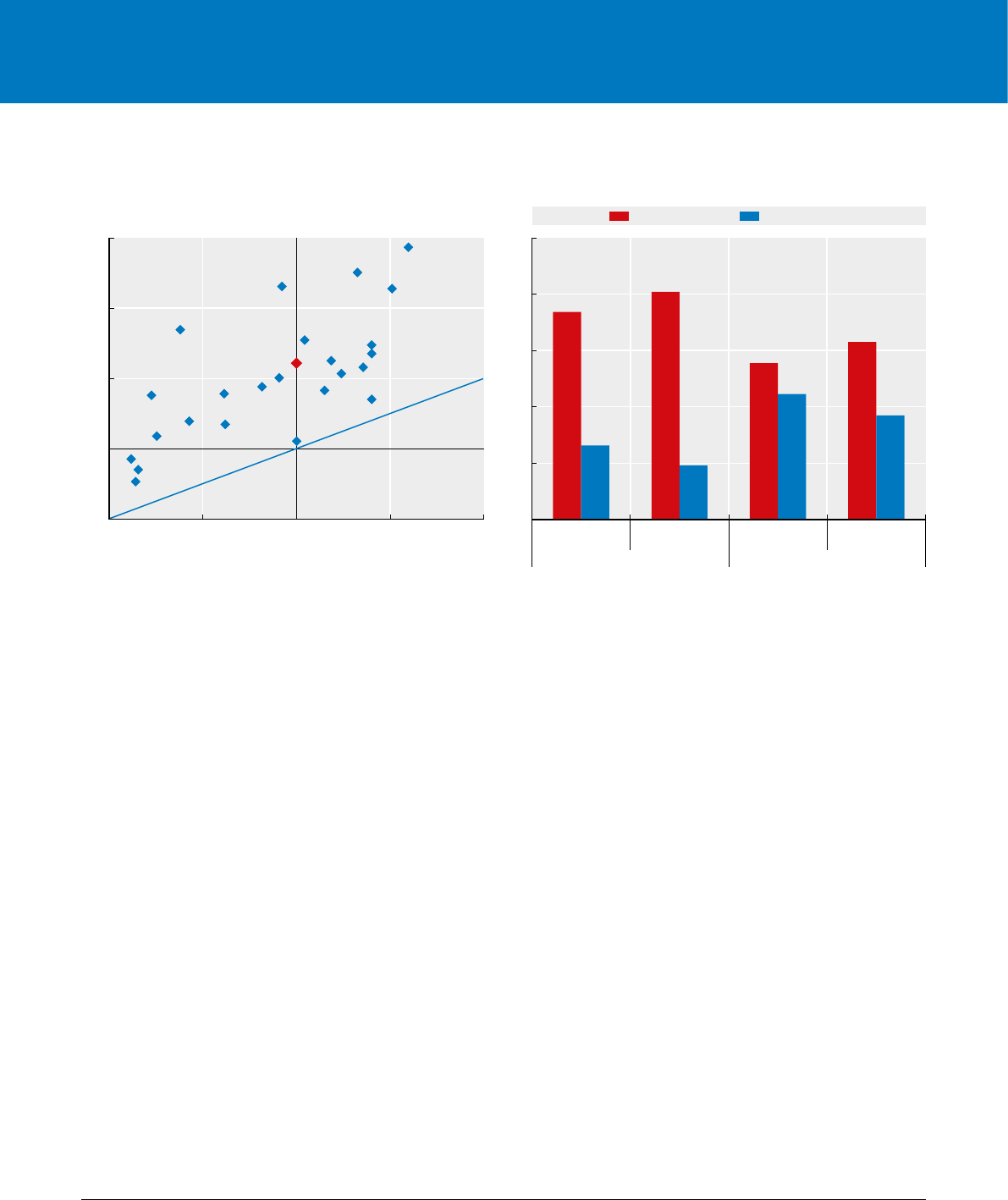

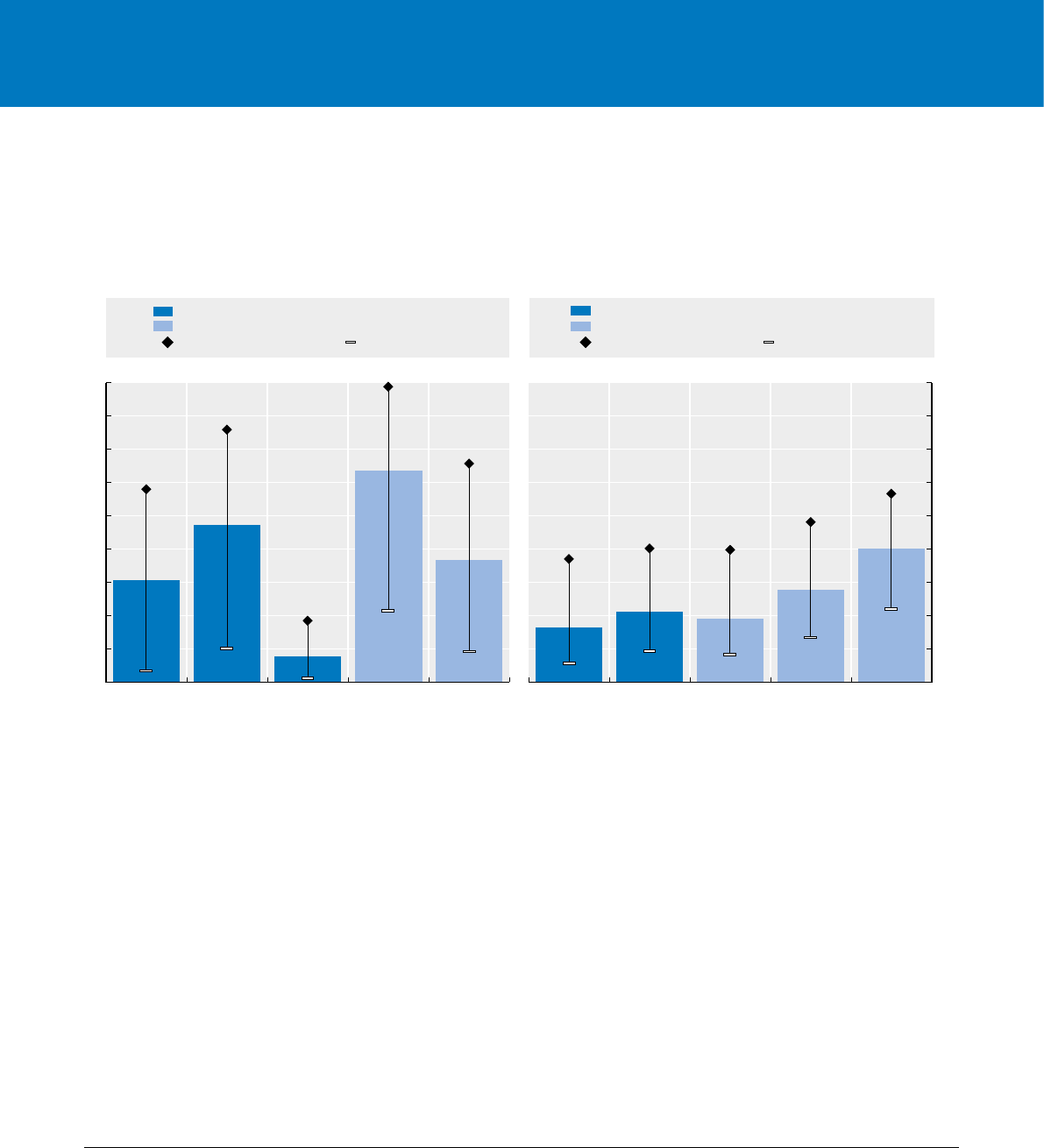

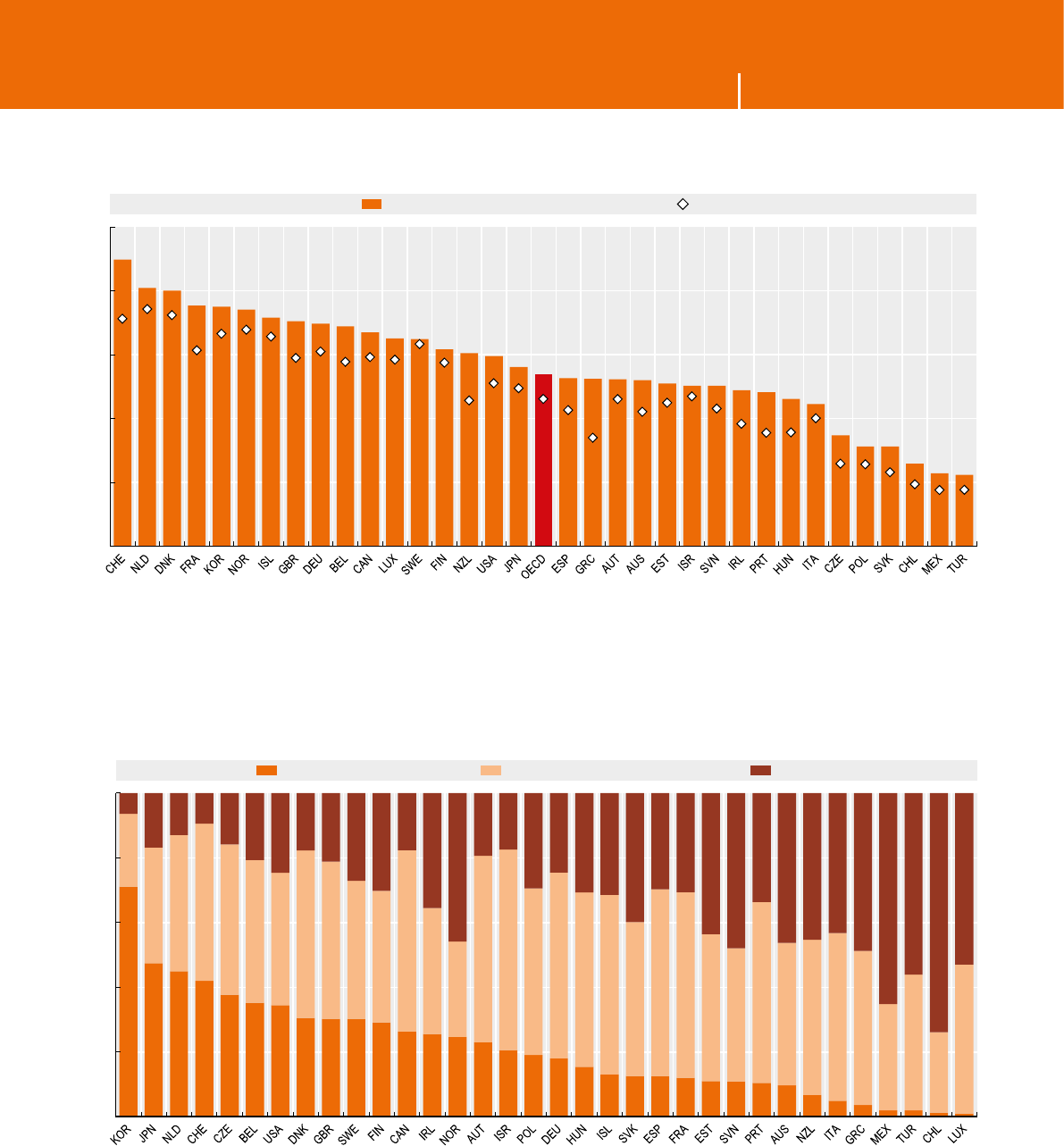

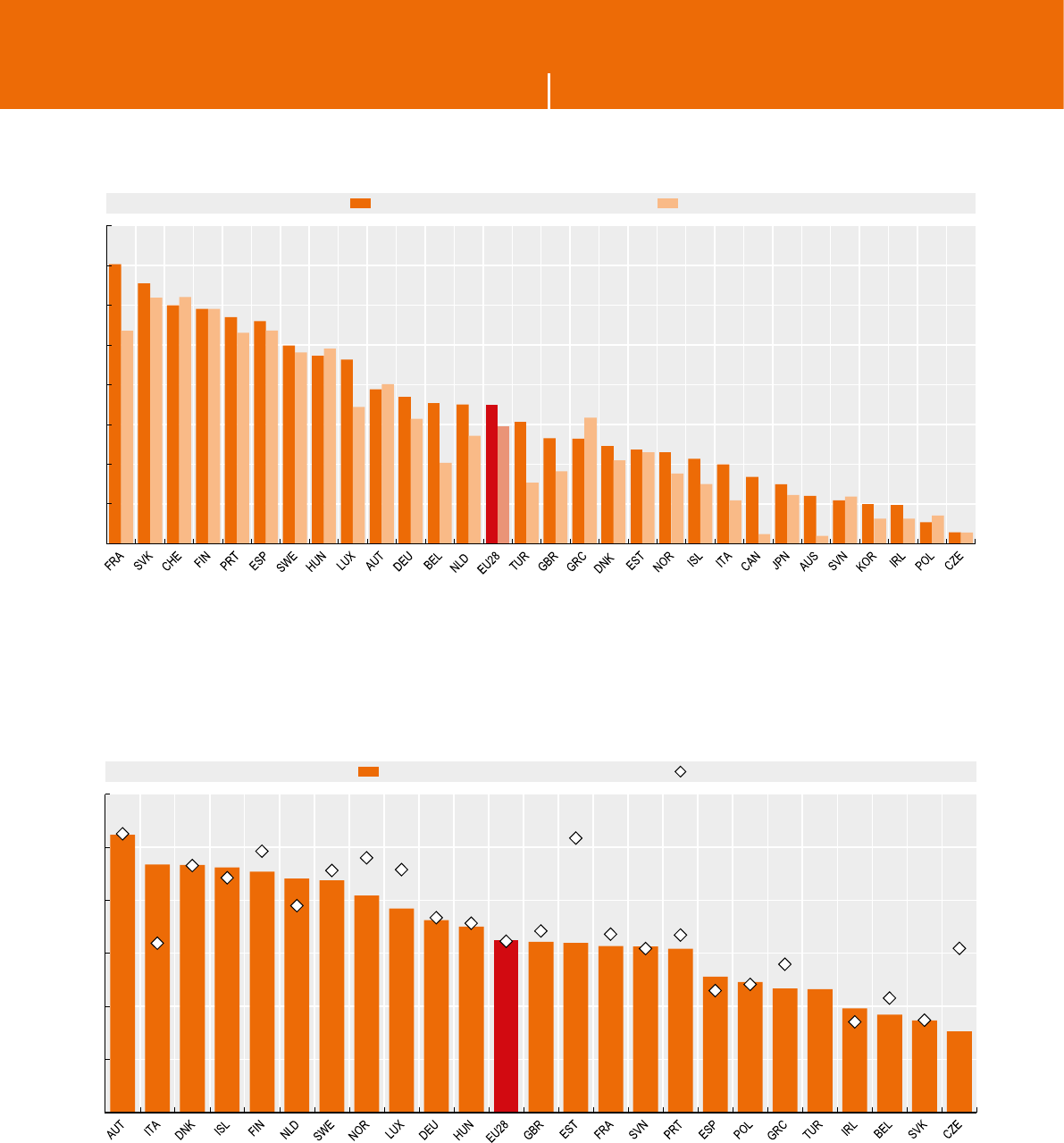

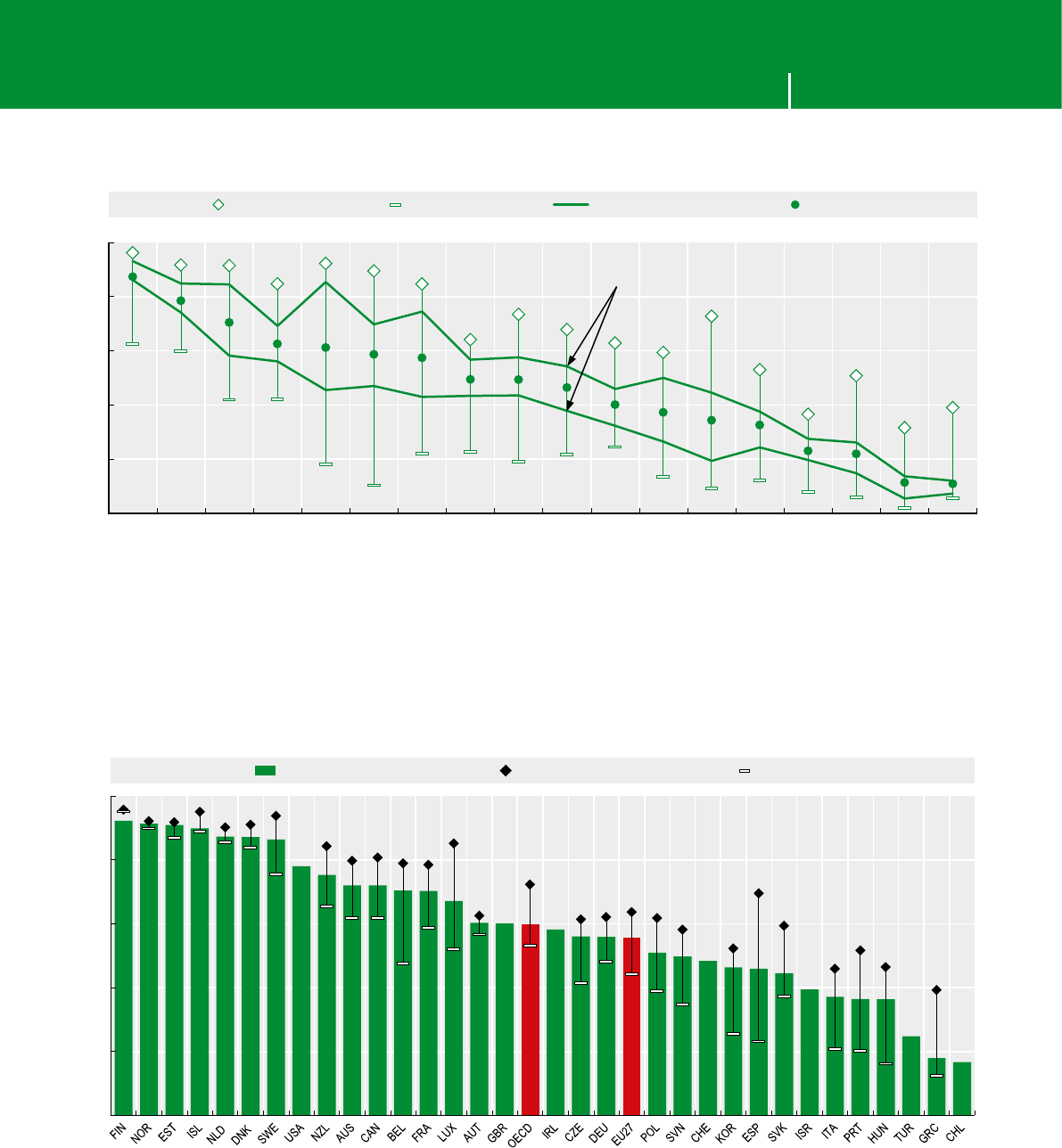

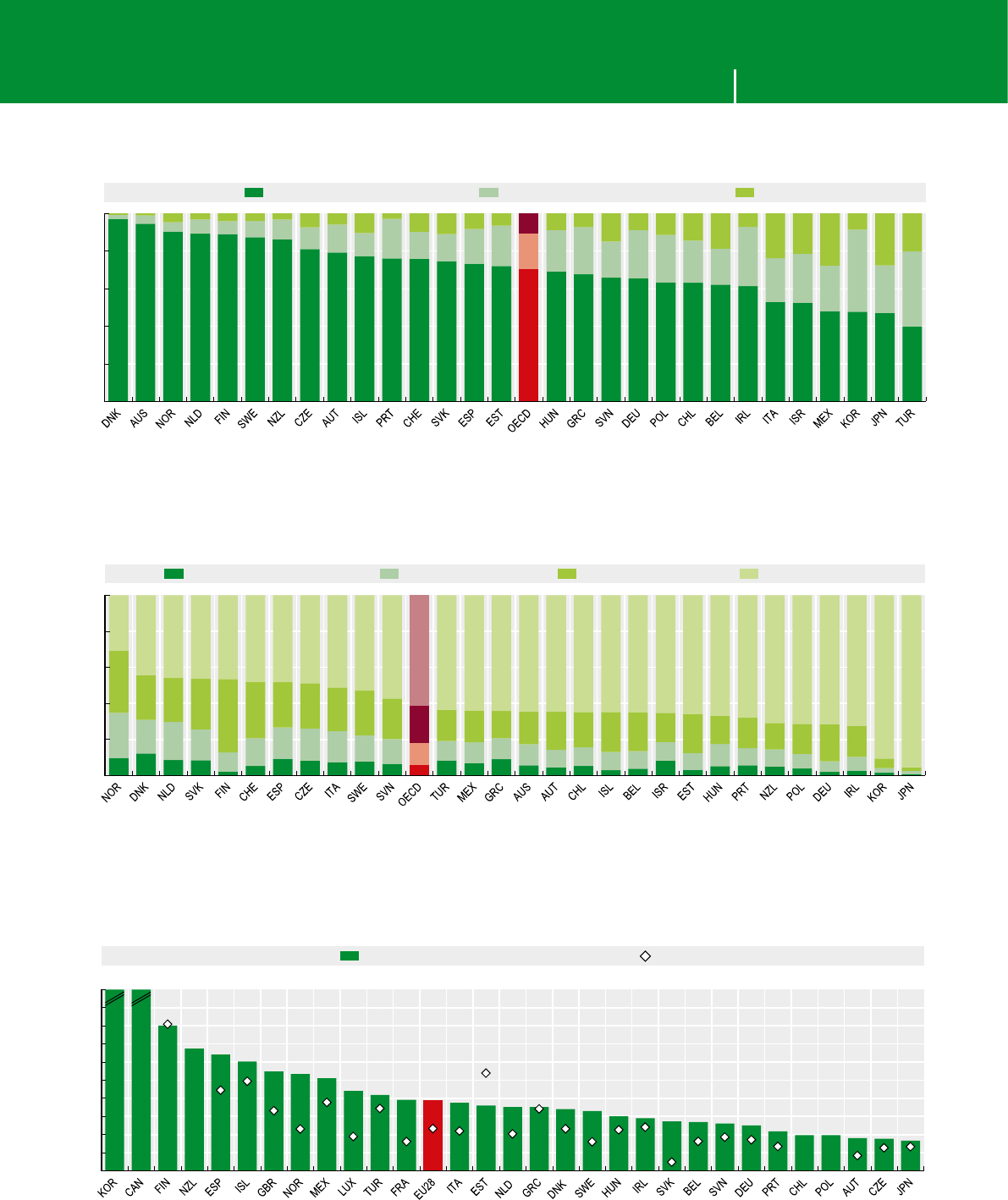

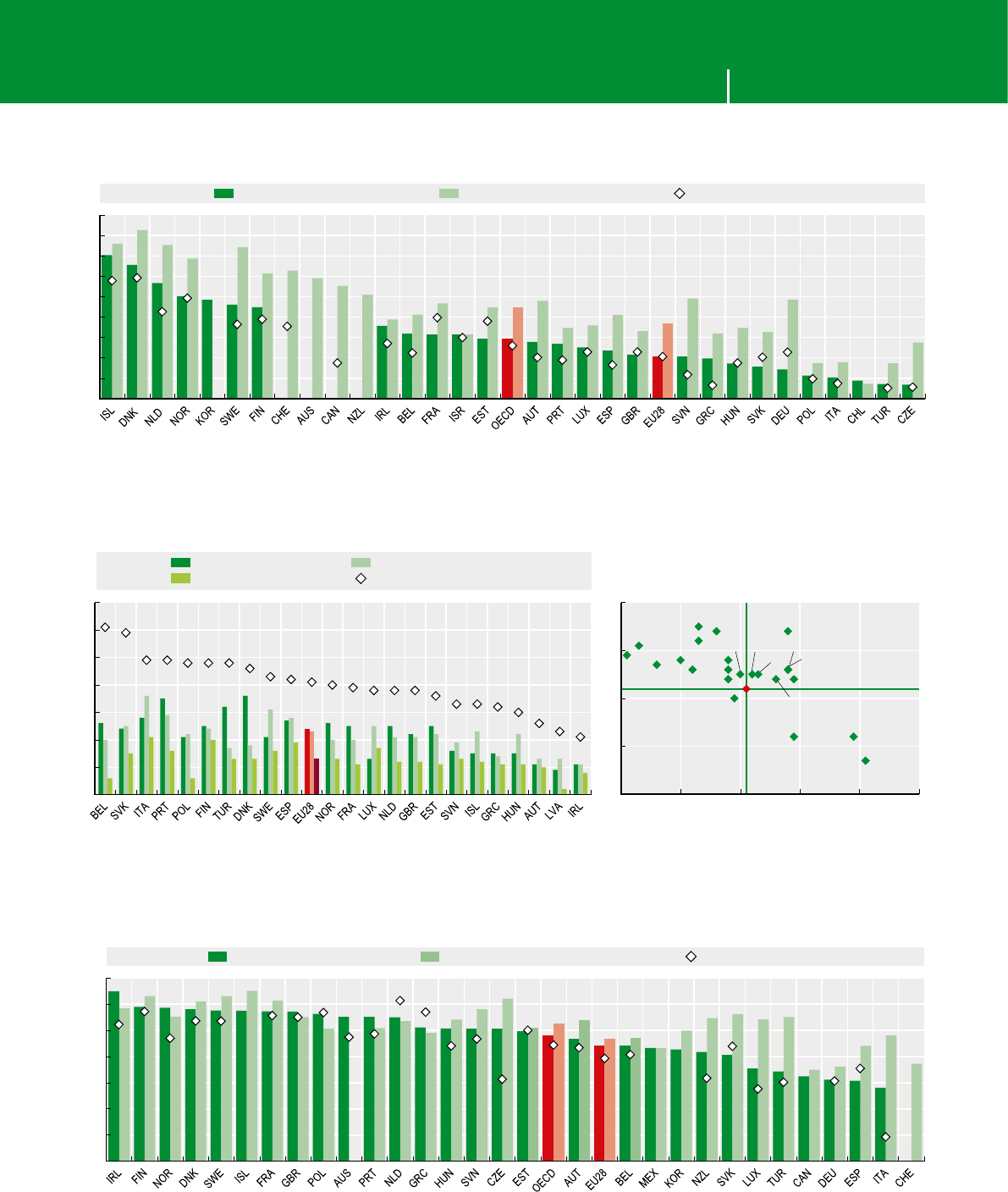

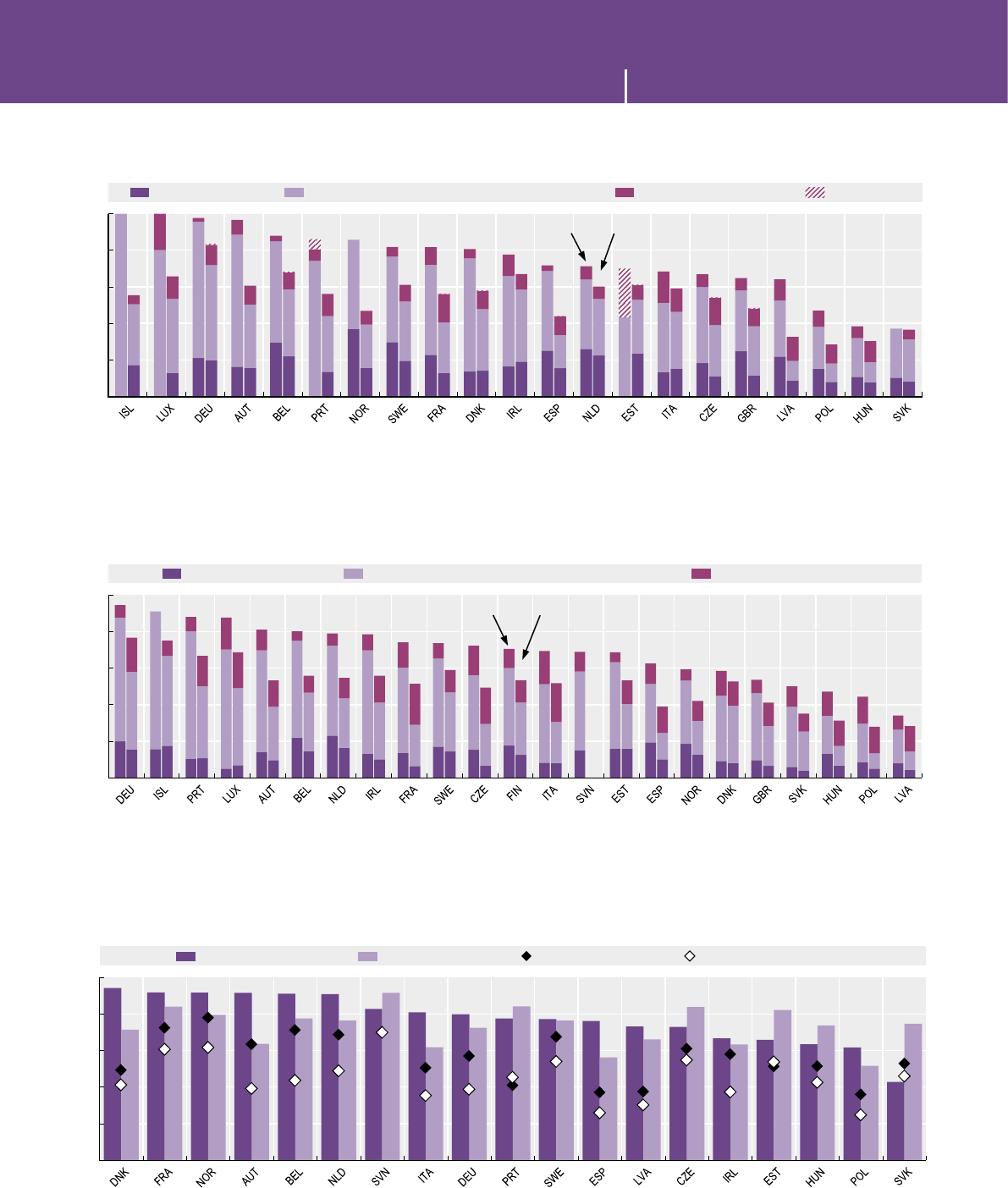

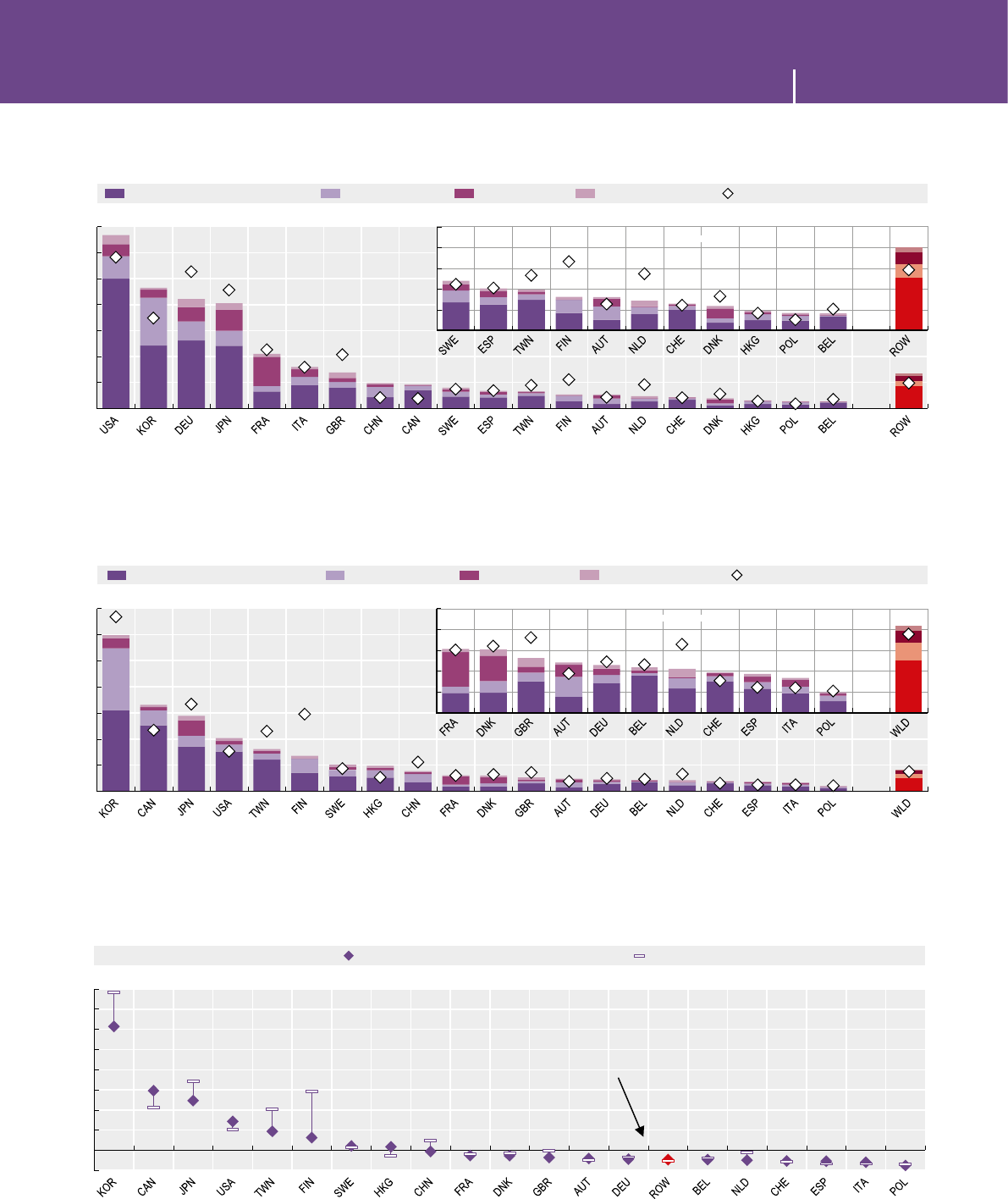

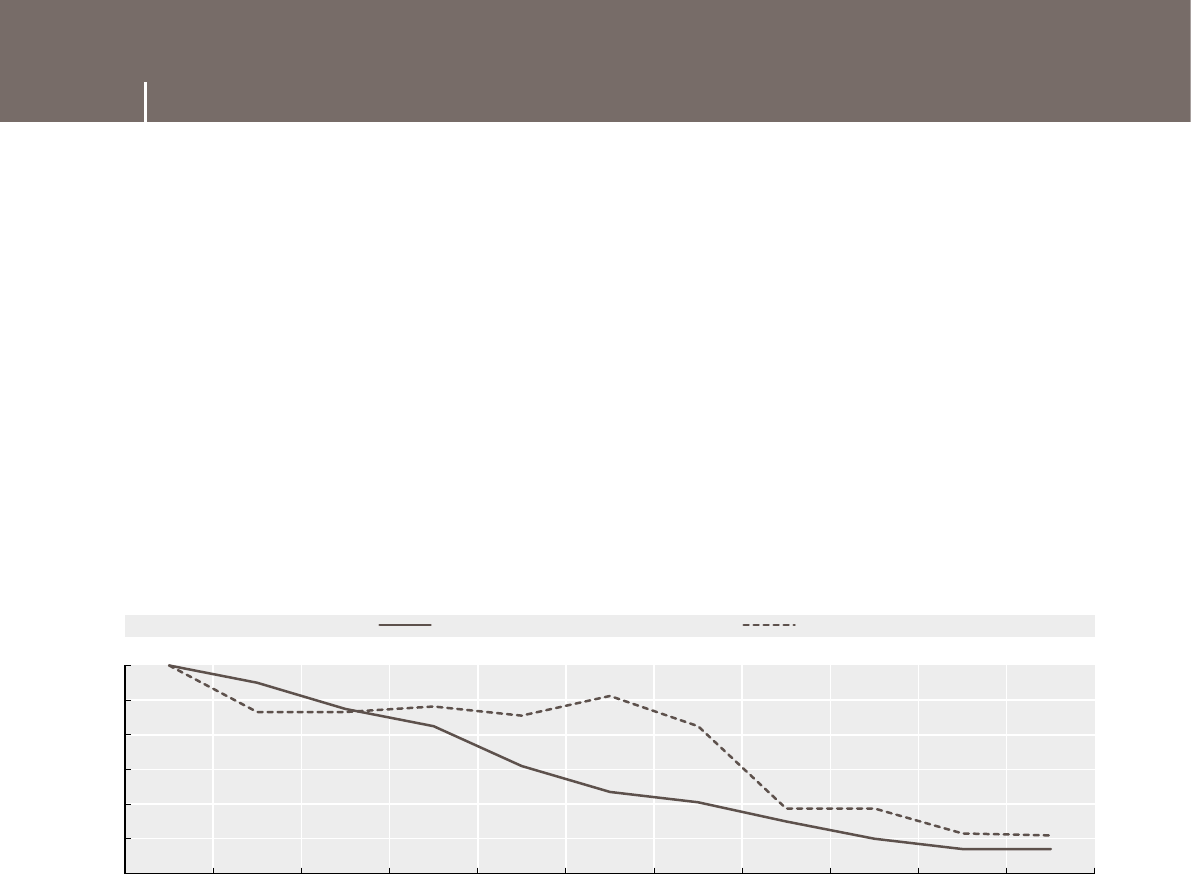

On average about 80% of 16-74 year-olds in OECD countries were Internet users in

2013, compared with less than 60% in 2005. Differences among countries and among

individuals are still large (Figure 1). Internet users are 90% and above of the adult

population in Luxembourg, the Netherlands, the Nordic countries and Switzerland

but less than 60% in Greece, Italy, Mexico and Turkey. These differences are wider for

older generations. Over 75% of 55-74 year-olds in Denmark, Iceland, Luxembourg,

the Netherlands and Sweden reported using the Internet against less than 10% in

Mexico and Turkey.

Education appears to be a much more relevant factor for older people than for younger

people. Usage rates for 55-74 year-olds with tertiary education are generally in line with

those of the overall population, and in leading countries approach that of 16-24 year-olds.

However, these gaps are closing steadily. At the bottom of the OECD range, Mexico

currently has an Internet penetration rate of 40%, while nearly half of all elderly people

in the OECD are now online. The near future will see a further narrowing of these gaps

as technology continues to reduce the cost of online access and as today’s “digital

natives” become adults.

Towards

universal diffusion

of the Internet

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 27

1. THE DIGITAL ECONOMY TODAY 1. THE DIGITAL ECONOMY TODAY

Figure 1. Internet usage trends in the OECD and differences by country (top panel)

and by age groups (bottom panel), 2005-13

Inter country gap: Percentages of 16-74 year-olds; Age gap: 16-24 vs. 65-74 year-olds

0

20

40

60

80

100

2005 2006 2007 2008 2009 2010 2011 2012 2013

%Age gap (percentage points) Average (all individuals)

65-74 year-olds

16-24 year-olds

0

20

40

60

80

100

2005 2006 2007 2008 2009 2010 2011 2012 2013

%Inter-country gap (percentage points) Average (all countries)

Lowest ranking country

Highest ranking country

1st and 3rd quartiles

(The values for half of the countries

are between the two lines)

0

20

40

60

80

100

%By country age gap, 2013

0

20

40

60

80

100

%By country change between 2006 and 2013

2006

2013

Source: OECD computations based on OECD, ICT Database and Eurostat, Information Society Statistics, July 2014. See chapter notes.

1 2 http://dx.doi.org/10.1787/888933147770

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 201428

1. THE DIGITAL ECONOMY TODAY 1. THE DIGITAL ECONOMY TODAY

Source: OECD computations based on Akamai, The State of the Internet, various years, May 2014. See chapter notes.

1 2 http://dx.doi.org/10.1787/888933147787

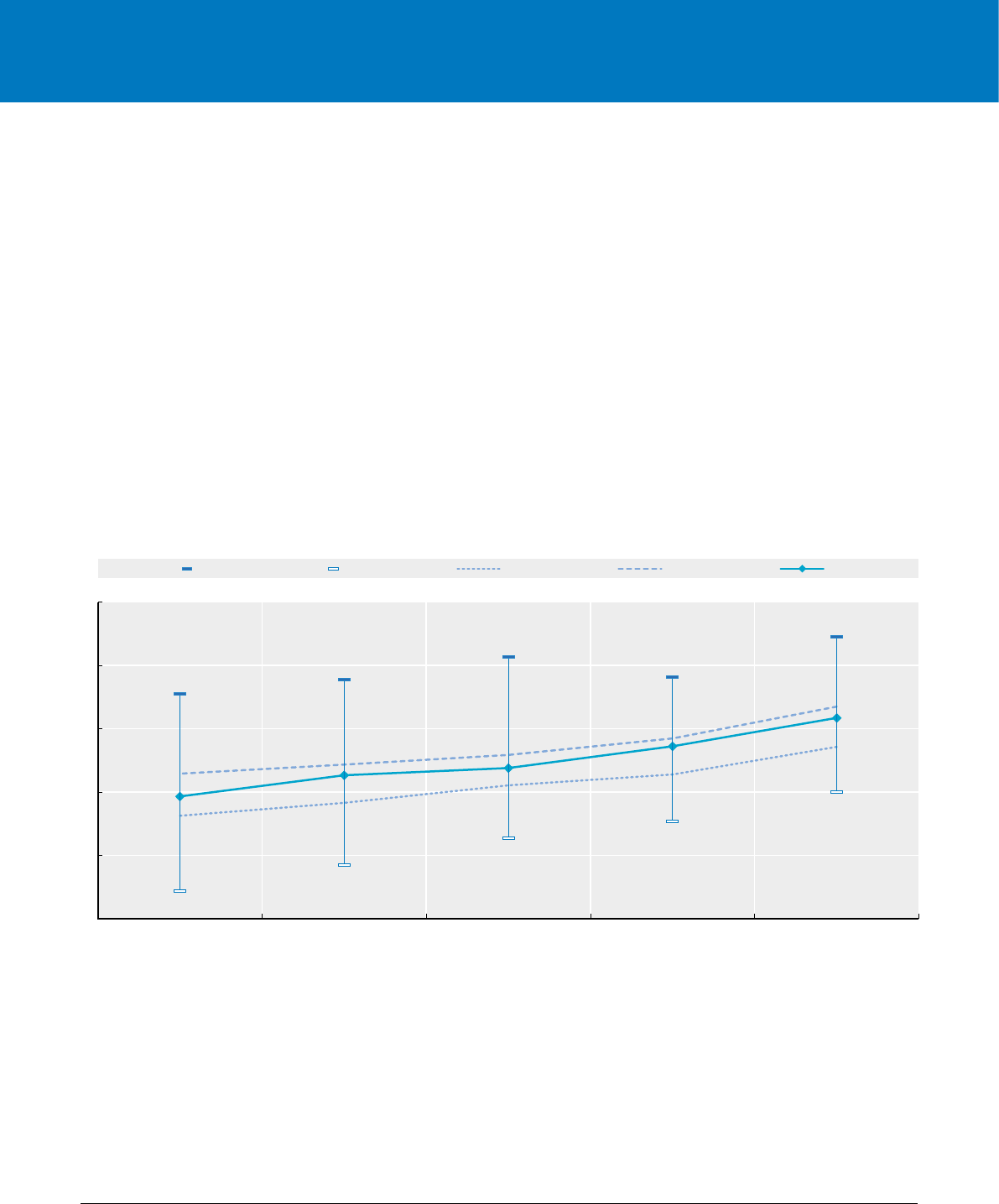

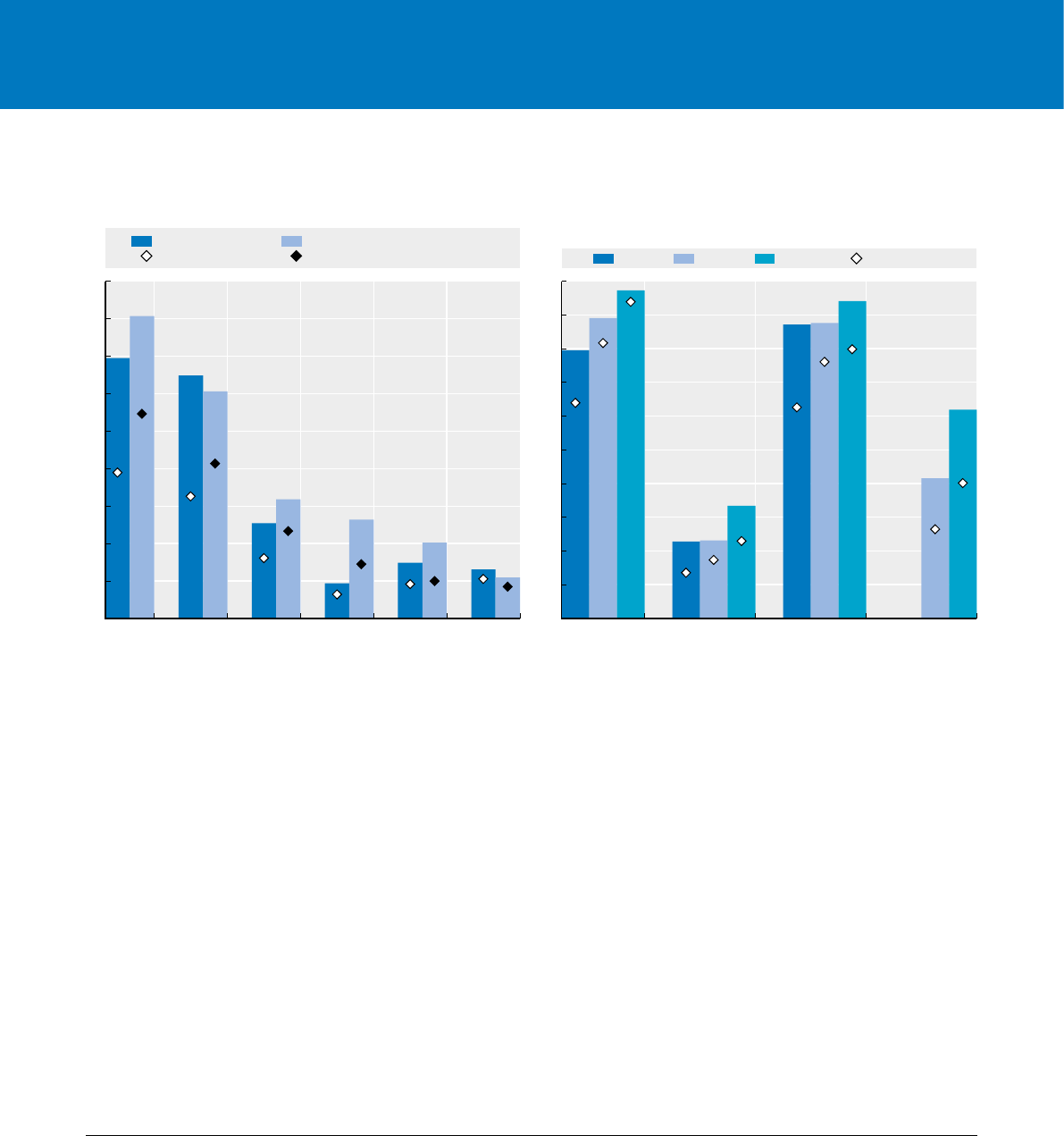

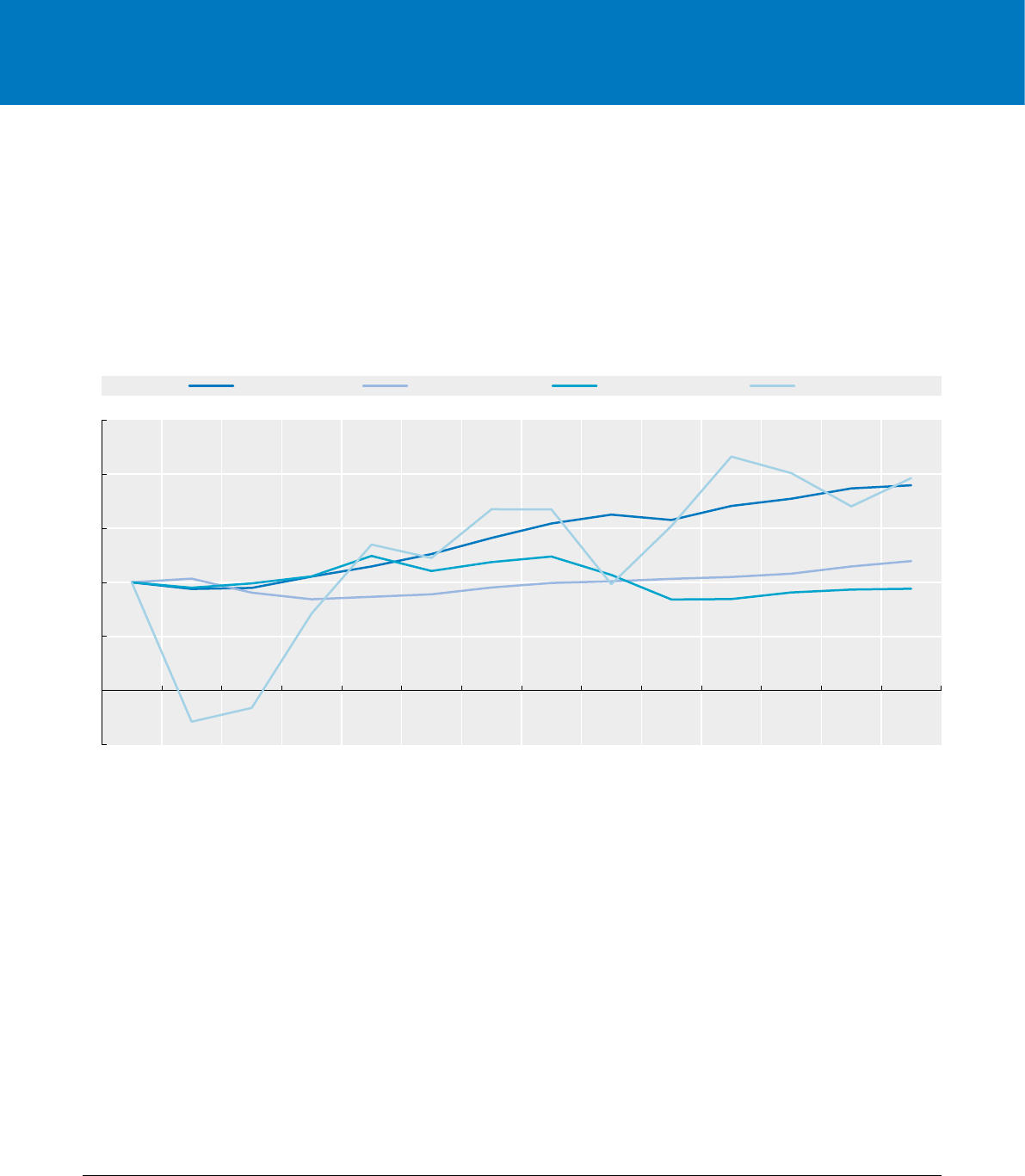

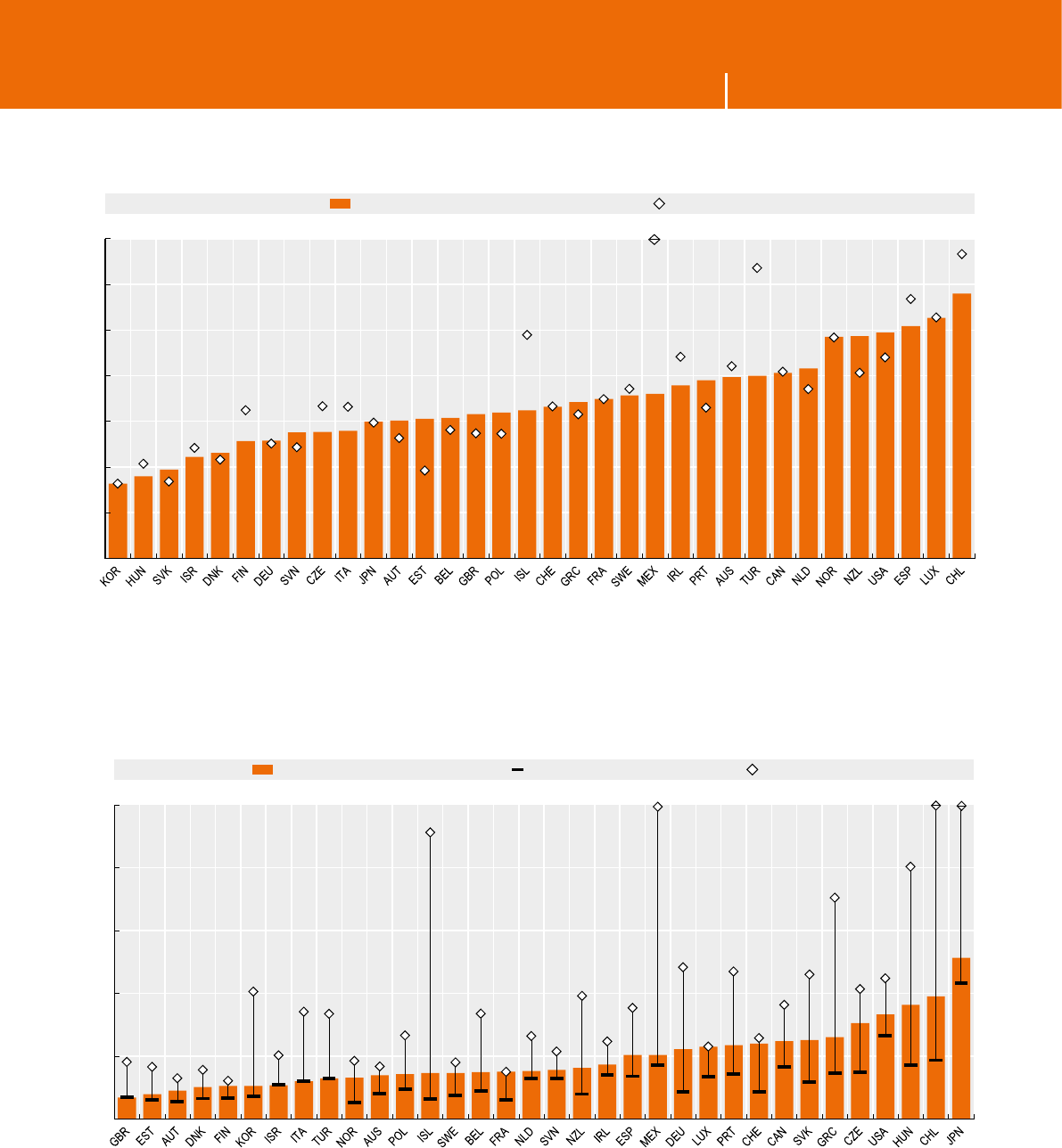

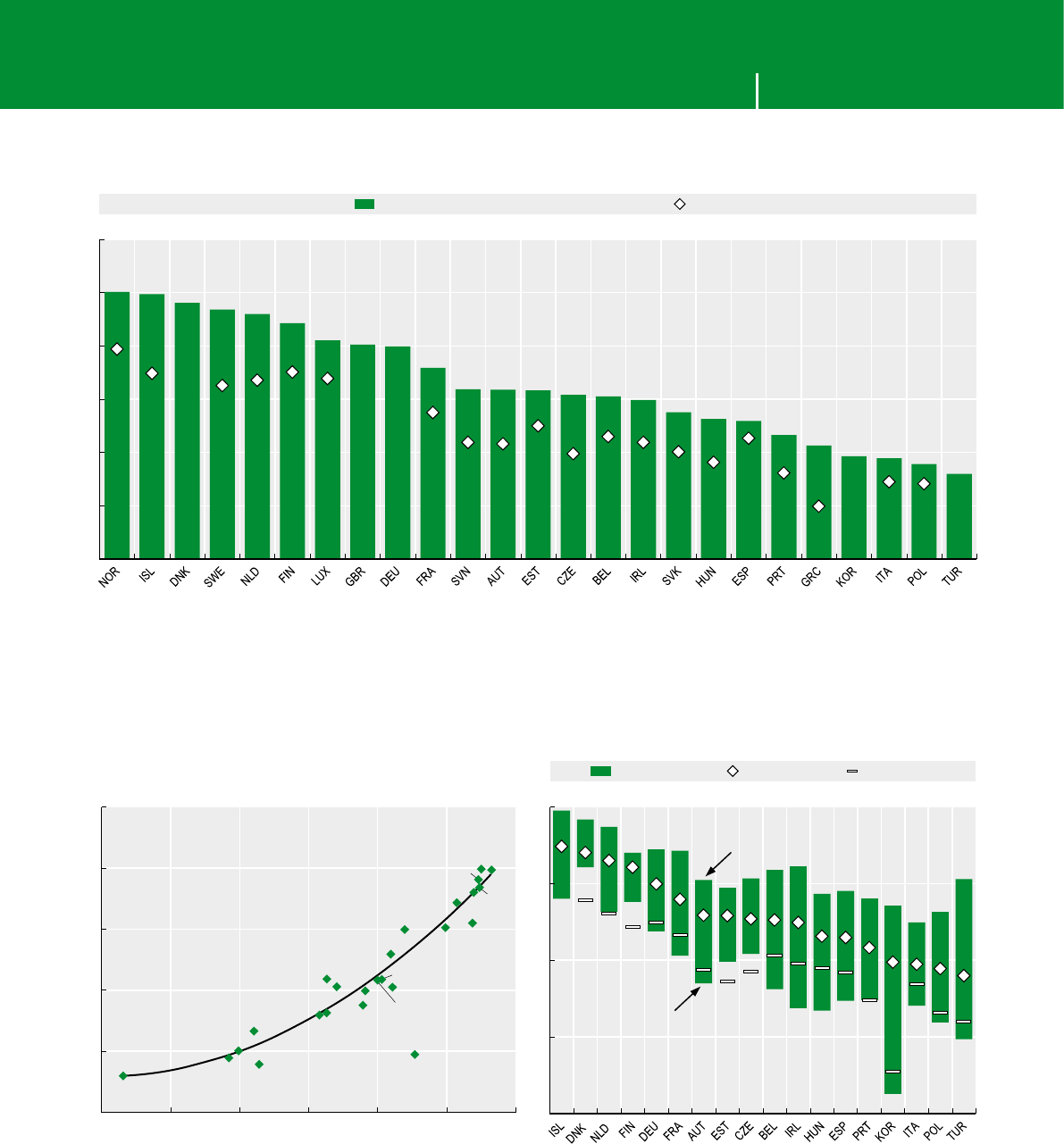

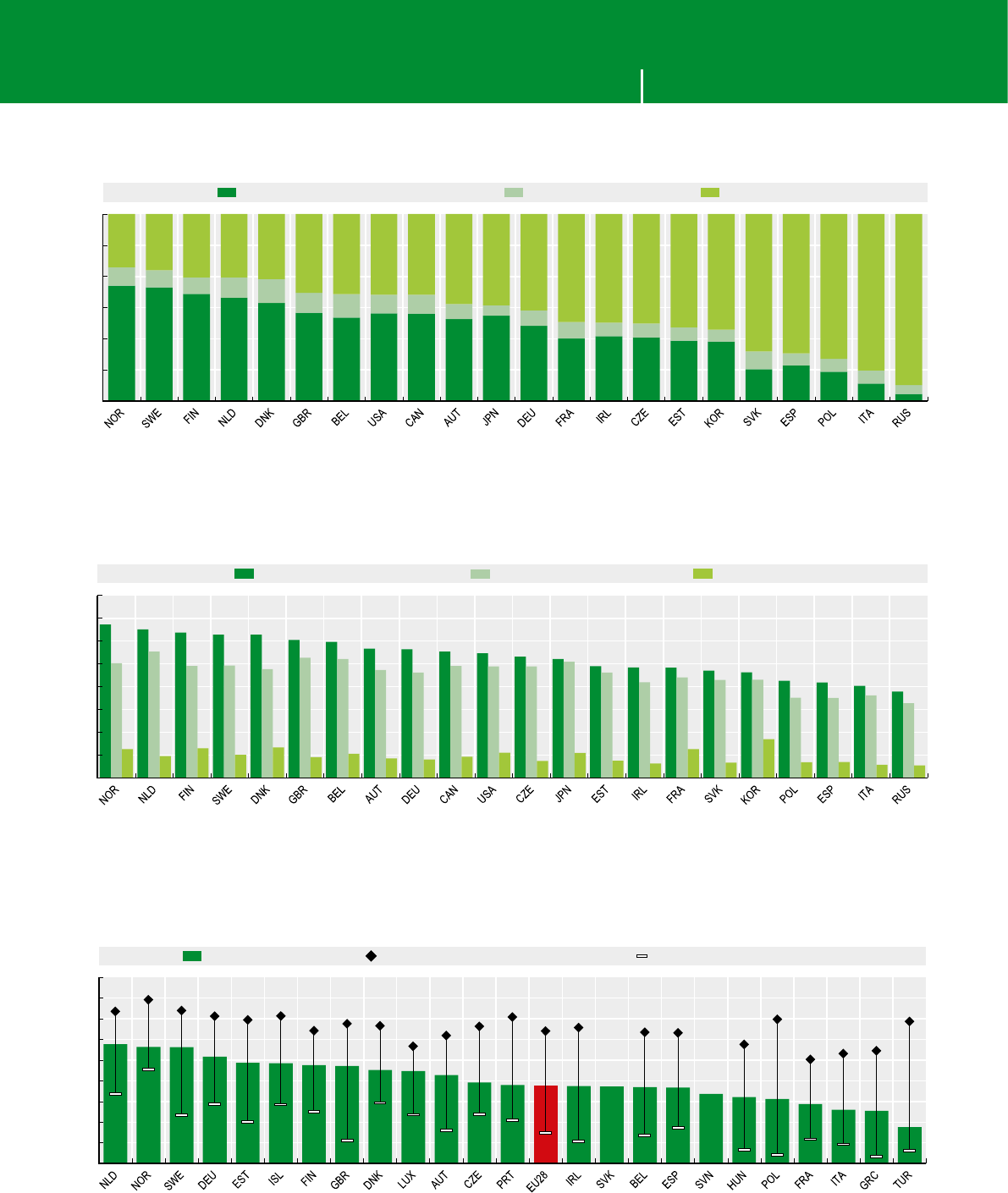

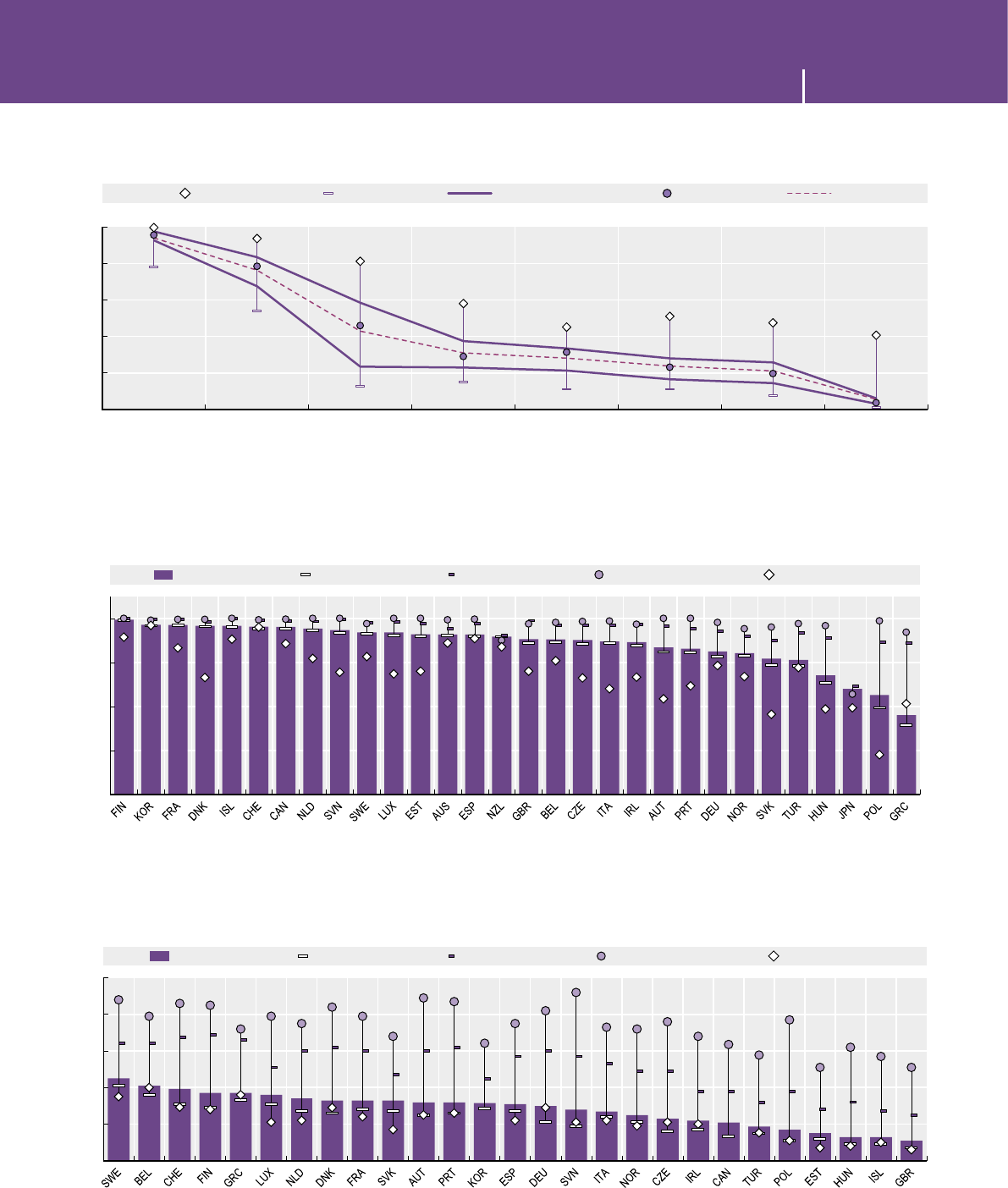

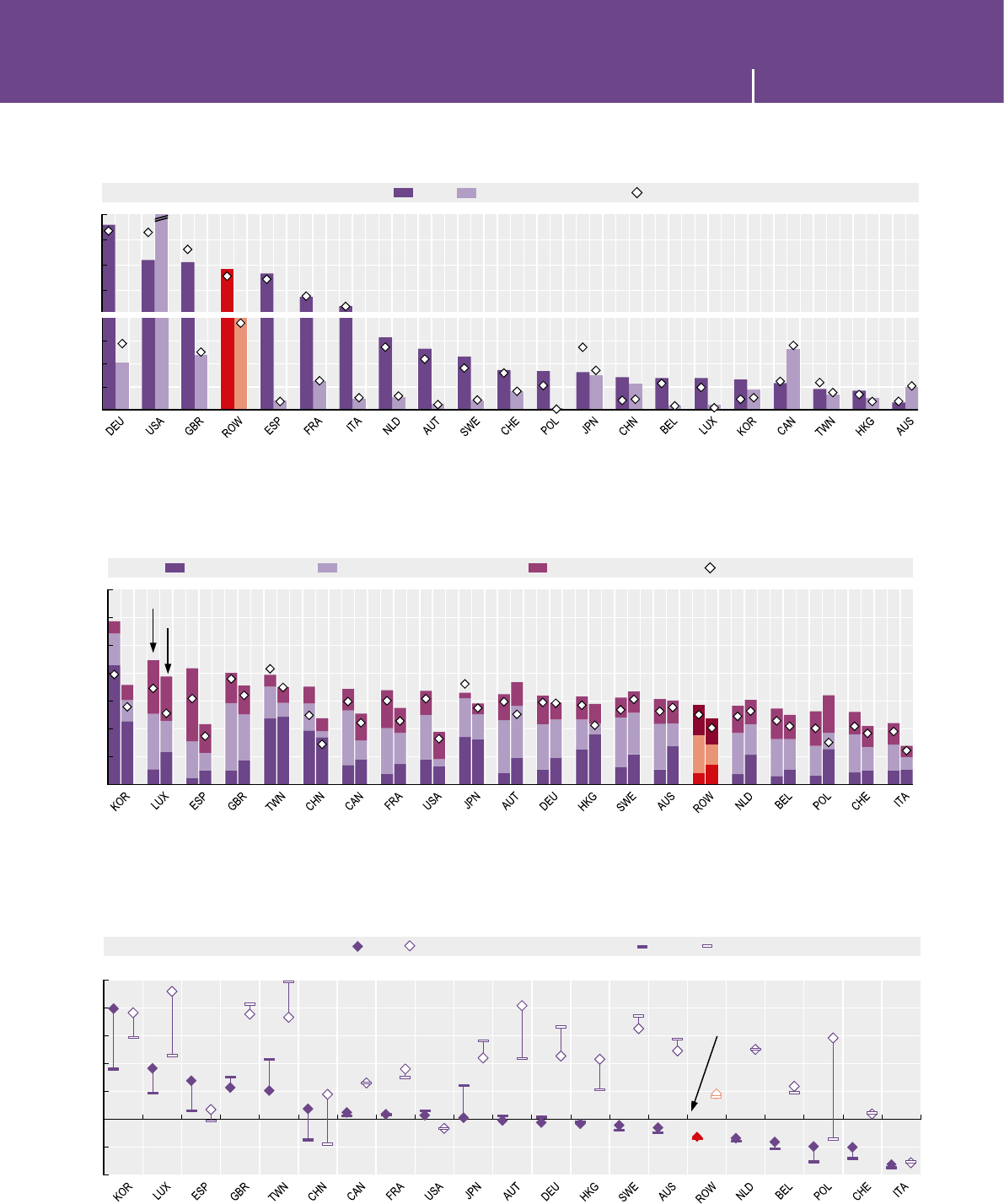

Figure 2. Trends in broadband speed across the OECD, Q4 2009-13

Average download speed in Mbit/s, All technologies combined

1

2

4

8

16

32

Q4 2013Q4 2012Q4 2011Q4 2010Q4 2009

Mbit/s

Highest Lowest 1st quartile 3rd quartile Median

The explosion

of mobile broadband

access…

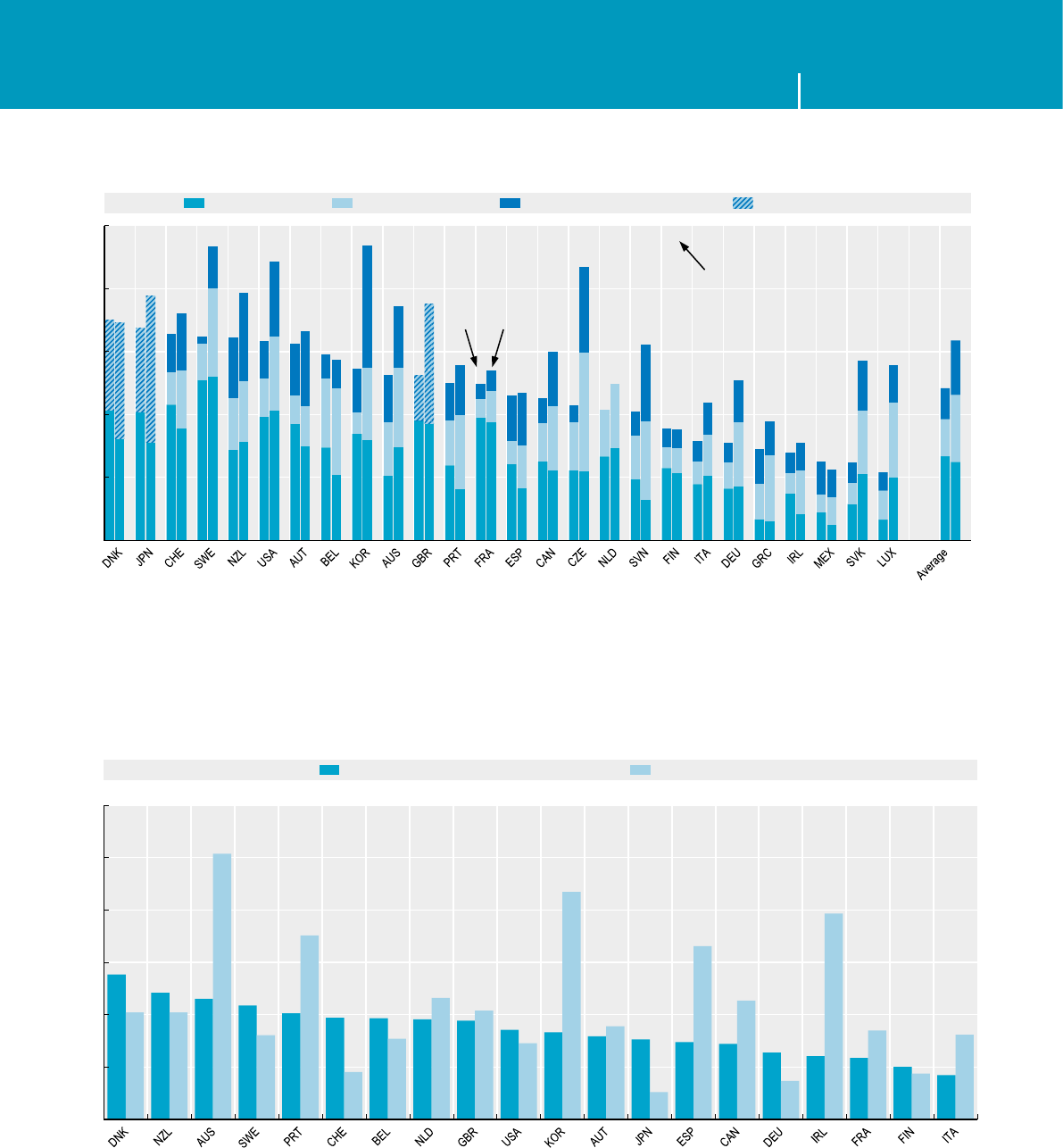

Increasing Internet uptake has greatly beneted from the development of mobile infra-

structures and falling access prices. Wireless broadband subscriptions in the OECD

increased over twofold in just four years, from about 250million to 850million between

2008 and the rst half of 2013. Mobile broadband connectivity is also widely available

in many emerging and less developed countries, enabling these economies to make

substantial increases in Internet access. For example, in sub-Saharan Africa mobile

broadband subscriptions grew from 14million to 117million between 2010 and 2013,

and are estimated to exceed 170million in 2014.1

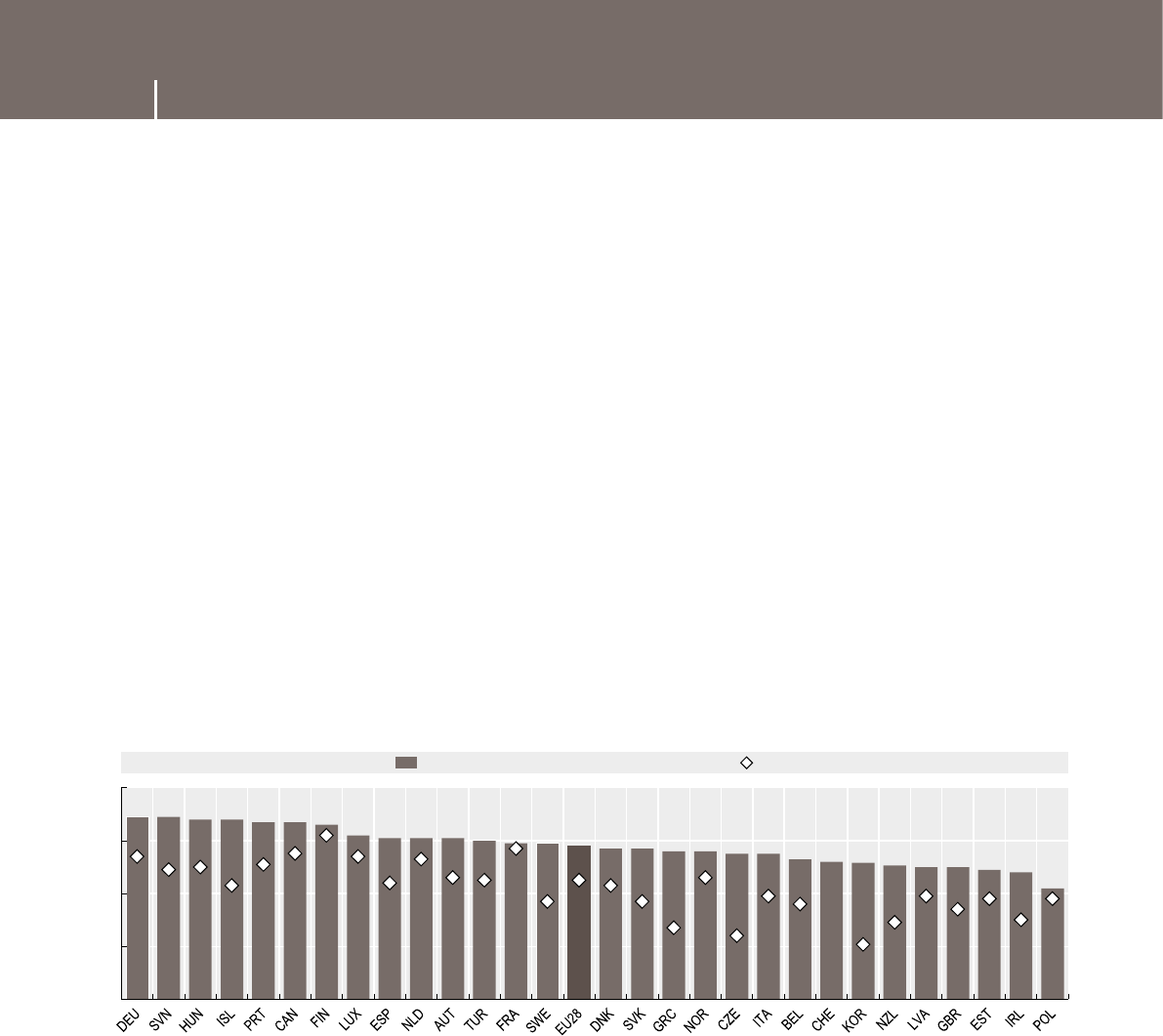

Despite the broad diversity in prices and quality of xed and mobile broadband services

across the OECD, average broadband speeds have risen. Fully reliable datasets for wired

and wireless broadband are not yet available across the OECD (see 2.1 and 2.2). However,

according to data recorded by a major Content Distribution Network (CDN), speeds

increased from about 1.5Mbit/s to 4Mbit/s over a four-year period in Mexico, the OECD

country at the bottom of the range, while Korea, the country at the top of the range,

enjoys speeds in 2013 that are about ve times faster (22Mbit/s) (Figure2).

1. International Telecommunication Union (ITU), World Telecommunication/ICT Indicators Database (www.itu.int/en/ITU-D/Statistics/Documents/

statistics/2014/ITU_Key_2005-2014_ICT_data.xls).

… and related

applications

Progress in the quality of mobile broadband and the massive spread of Wi-Fi over xed

networks has allowed mobile devices to expand the array of applications used over

the Internet, affecting the everyday life of millions of users across the OECD. Inless

than two years, the number of pages viewed from mobile devices, on a sample of

3million websites monitored by Statcounter (gs.statcounter.com, June 2014), rose from

11.7% to 24.3%worldwide, and from about 15% to more than 30% when tablets are included.

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 2014 29

1. THE DIGITAL ECONOMY TODAY 1. THE DIGITAL ECONOMY TODAY

Source: OECD computations based on data from Wikimedia Foundation Statistics, stats.wikimedia.org, June 2014.

1 2 http://dx.doi.org/10.1787/888933147790

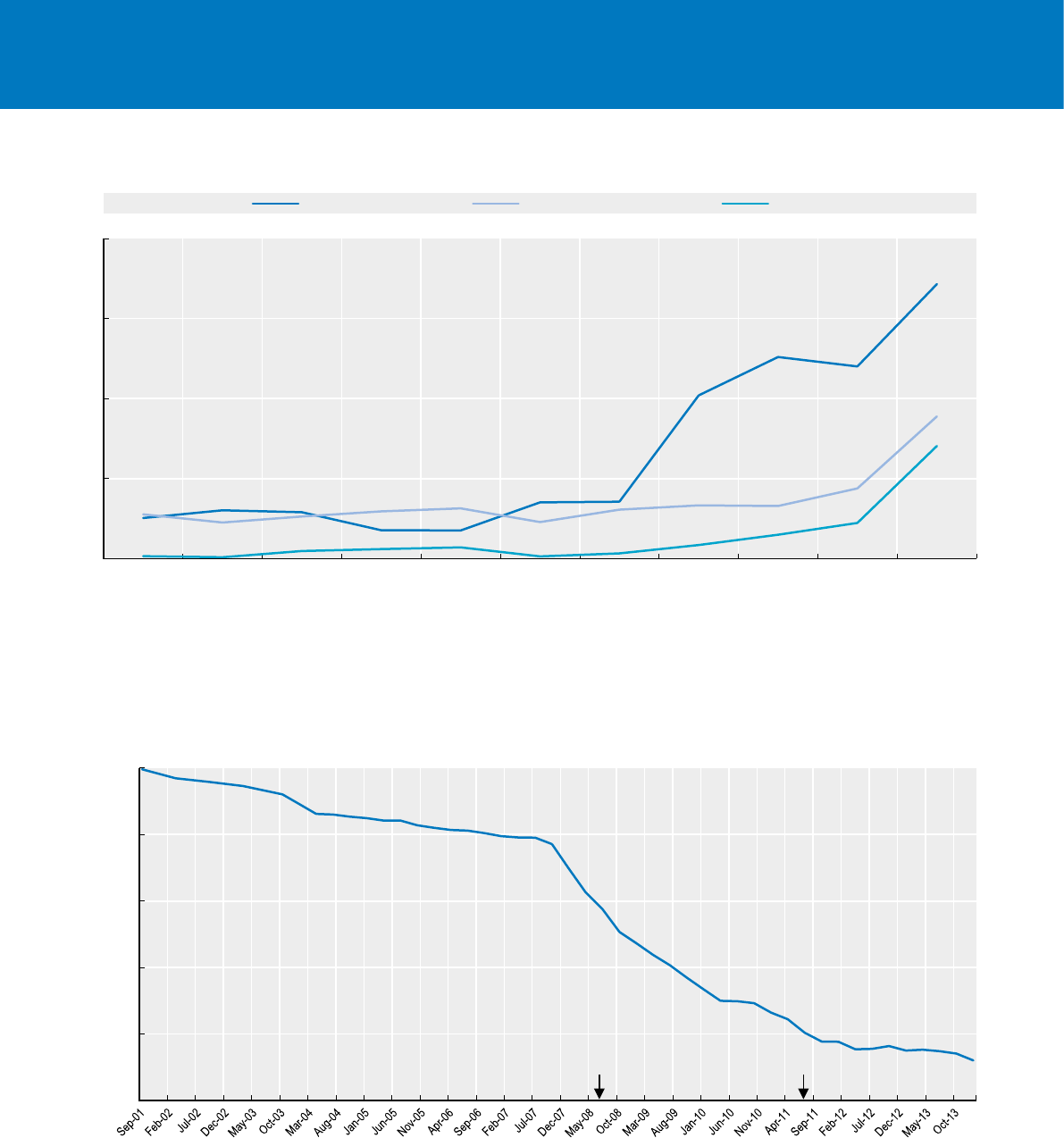

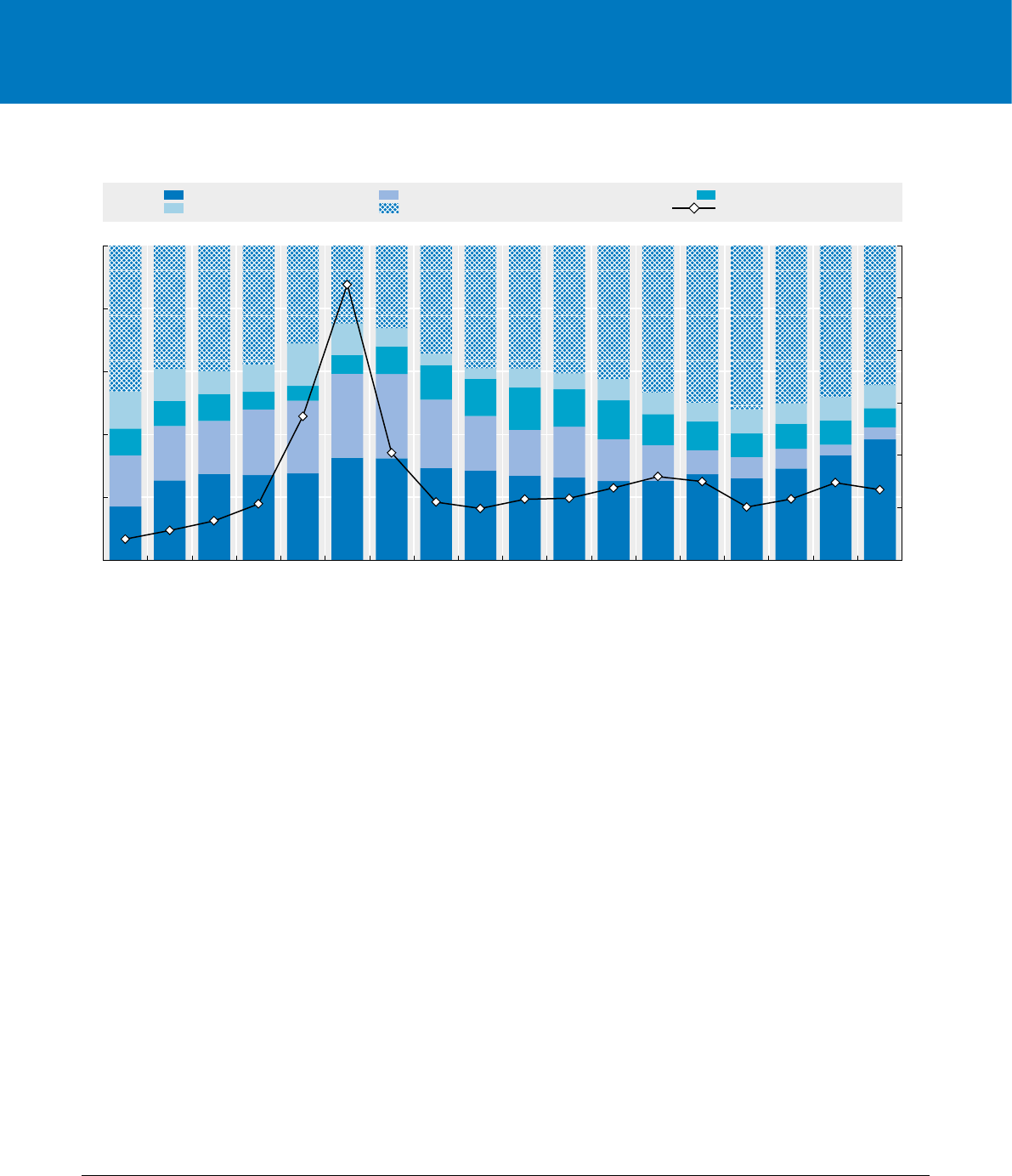

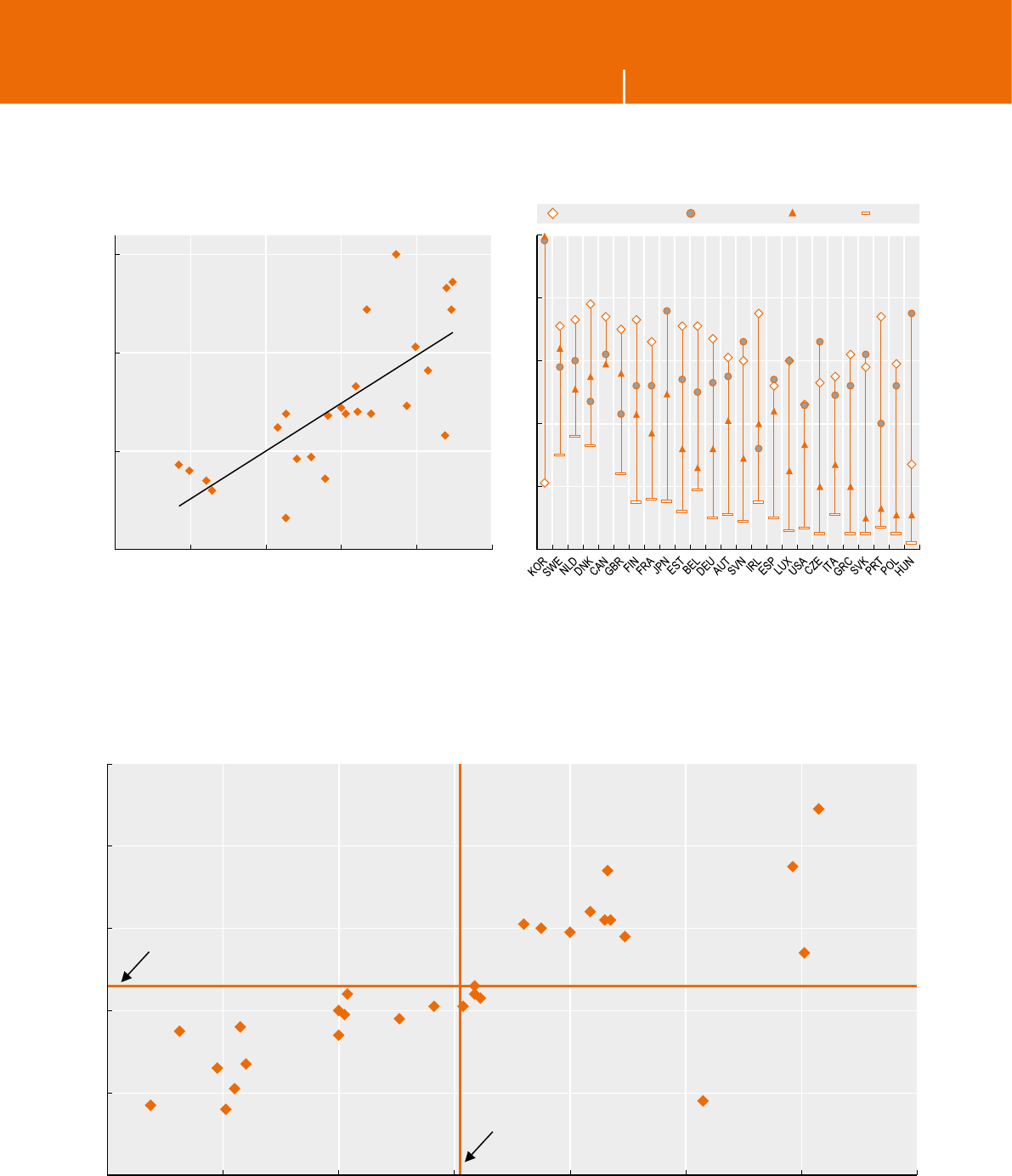

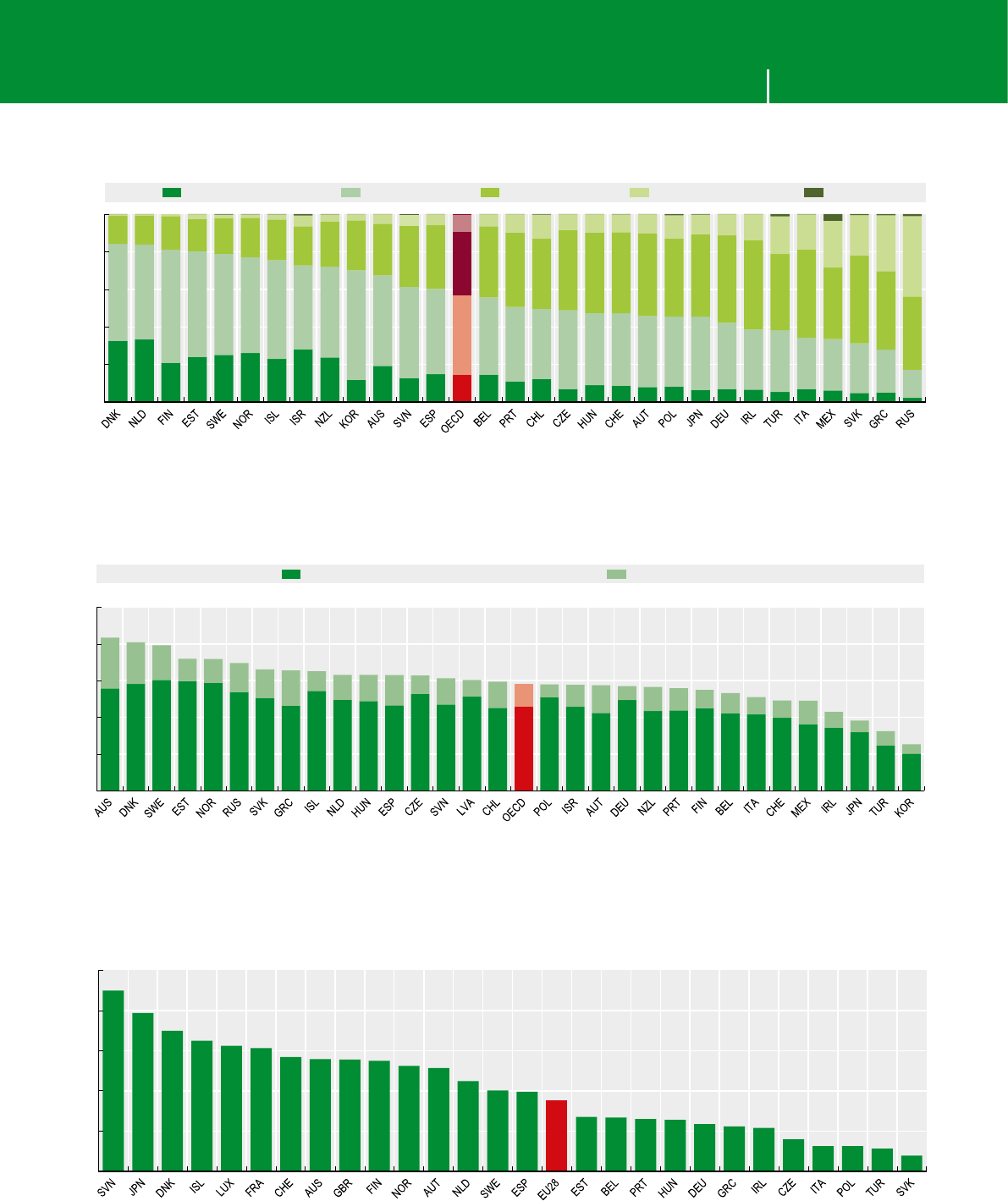

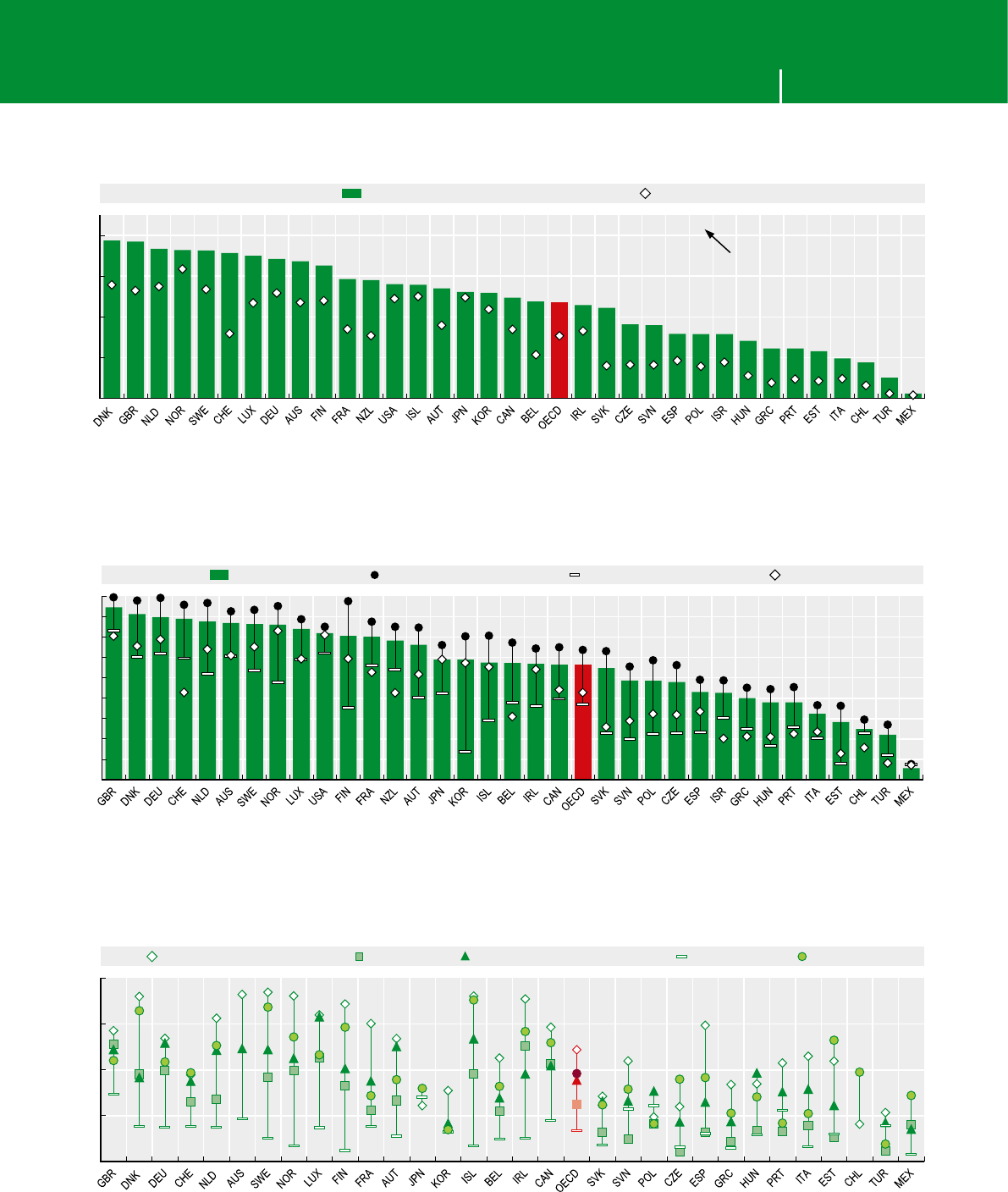

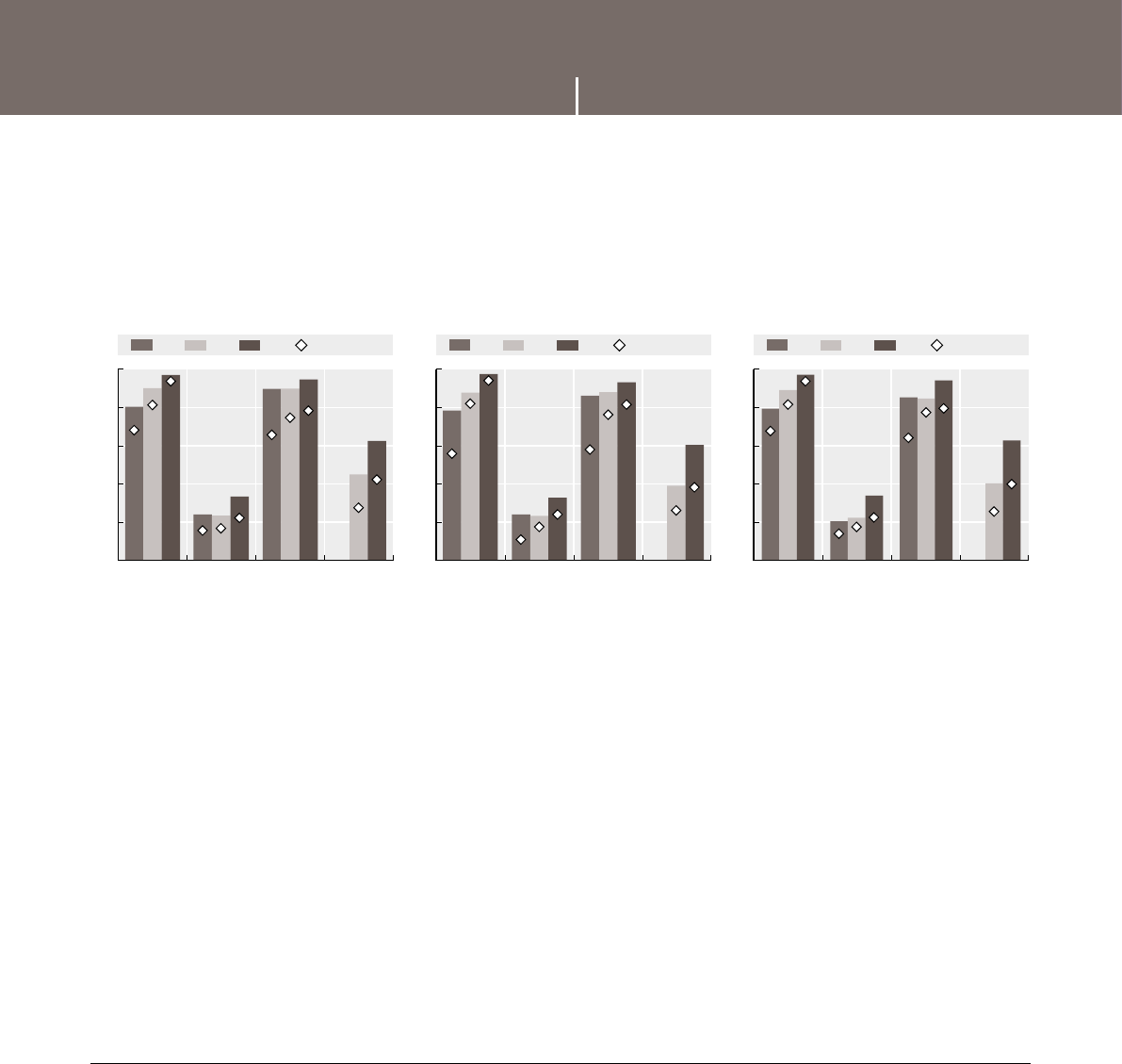

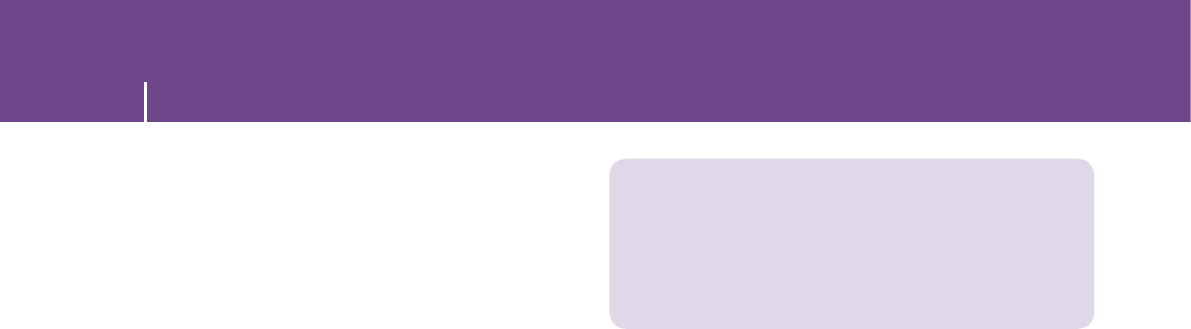

Figure 3. Wikipedia monthly page views on mobile platforms, by language, 2010-13

Percentages (left-hand scale), number in billions (right-hand scale)

0

1

2

3

4

5

0

20

40

60

80

100

Billions

%

English

French

Japanese

Russian

German

Italian

Spanish

Other languages Views on mobile platforms as a percentage of total views

Total views on mobile platforms (right-hand scale)

2. In March 2014, Facebook claimed to have 802million active users a day, 609million of which connect via a mobile device. It is worth noting that

these gures do not portray mobile-only users.

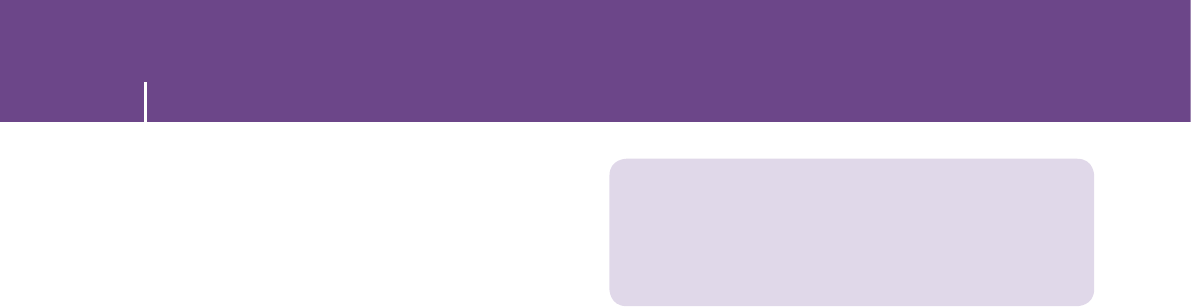

The use of mobile devices is proportionally greater where xed broadband deployment

is scarce: for example, in Africa and Asia page views by mobiles and tablets increased

from about 15% and 20% respectively in 2012, to about 40% in 2014. In Europe, North

America and Oceania, where the development of both xed and mobile infrastructures

is more advanced and average income comparatively high, there has been a signicant

rise in the use of tablets, which now account for up to 10% of web page views.

The same page-view metrics can be applied to individual websites. Wikimedia, the not-

for-prot corporation managing Wikipedia, publishes this information on a monthly

basis. Worldwide gures for Wikipedia show 20billion page views per month, making it

one of the top ten most visited websites across nearly all OECD countries. Page views on

handheld device platforms (tablet and smartphone) grew from about 1billion per month

at the beginning of 2011 to more than 4billion per month at the end of 2013, accounting

for about 20% of total page views. Much of this growth came from views of pages in

languages other than English (Figure3).

The development of mobile usage affects the ICT economy in different ways, sometimes

displacing other segments in ICT markets. For instance, active Facebook users connecting

to the social network with a mobile passed from 28% of all users at the end of 2009 to

over 75% at the end of 2013, while the revenue Facebook declared from mobile adver-

tising rose from 13% of total revenues in 2012 to 40% in 2013.2

MEASURING THE DIGITAL ECONOMY: A NEW PERSPECTIVE © OECD 201430

1. THE DIGITAL ECONOMY TODAY 1. THE DIGITAL ECONOMY TODAY

The integration

of functionality

in devices and

thegrowth of apps

with increasing

performance

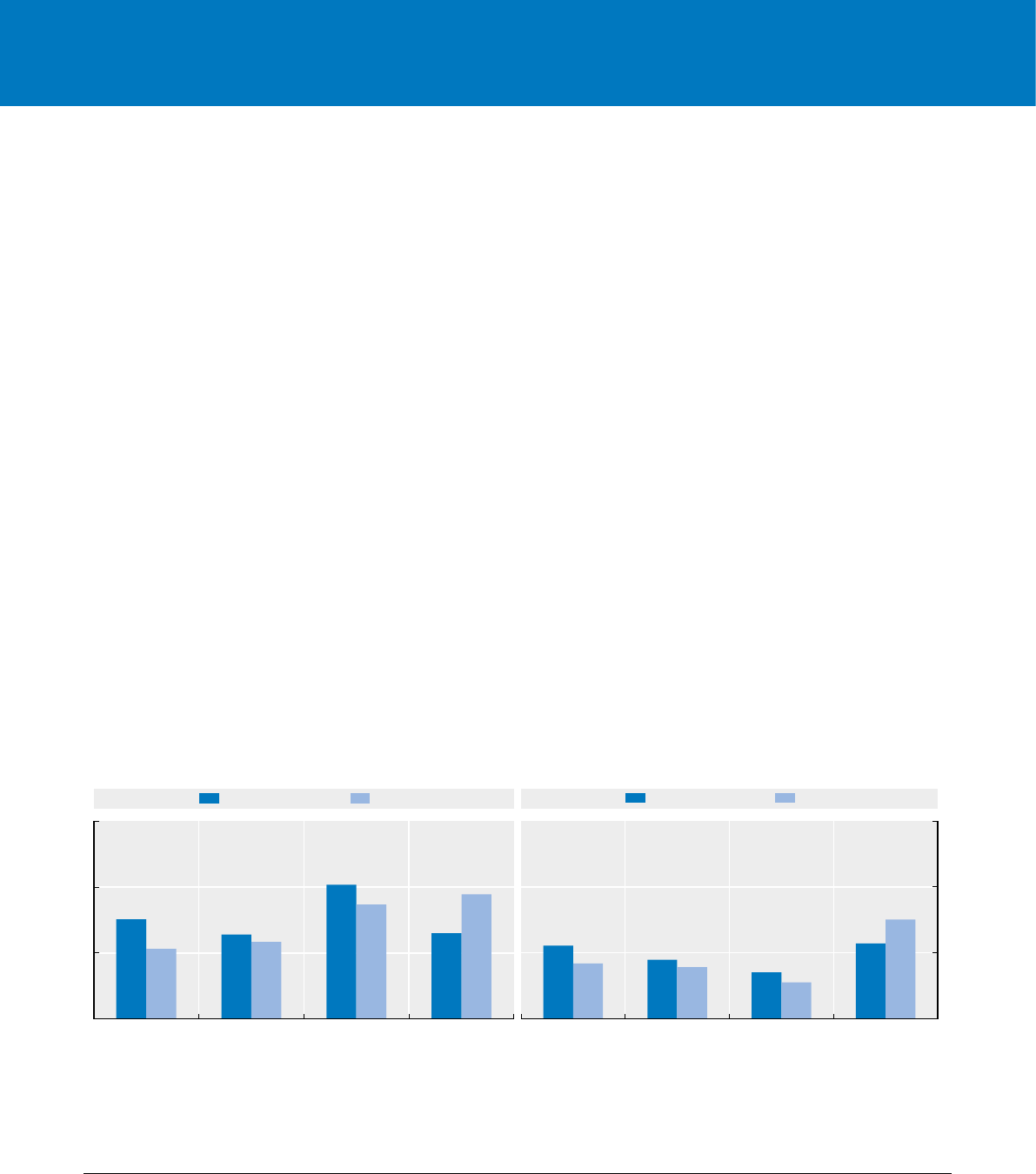

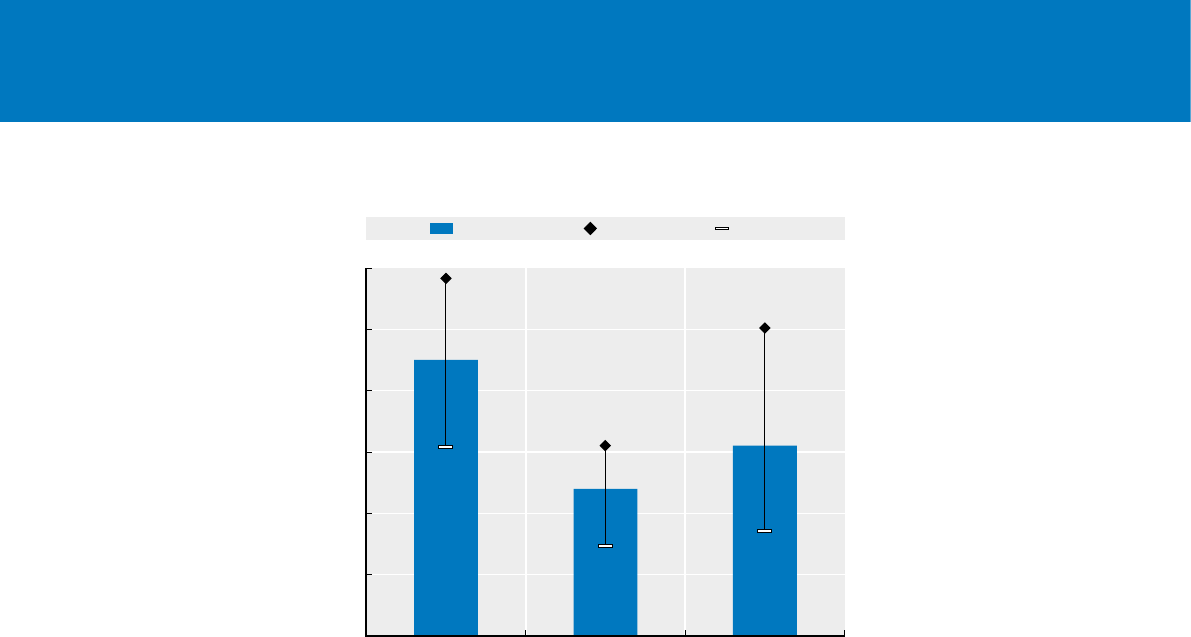

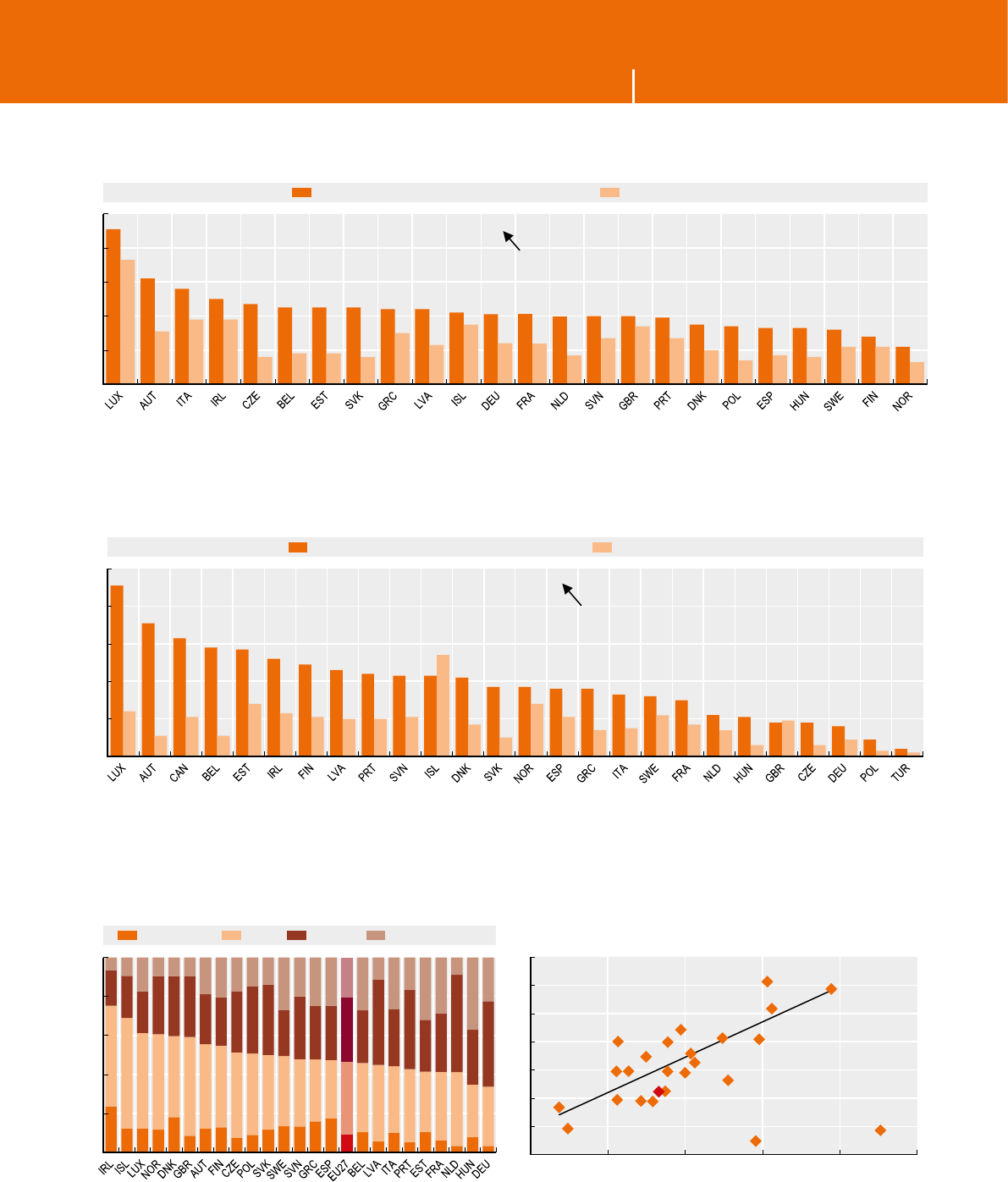

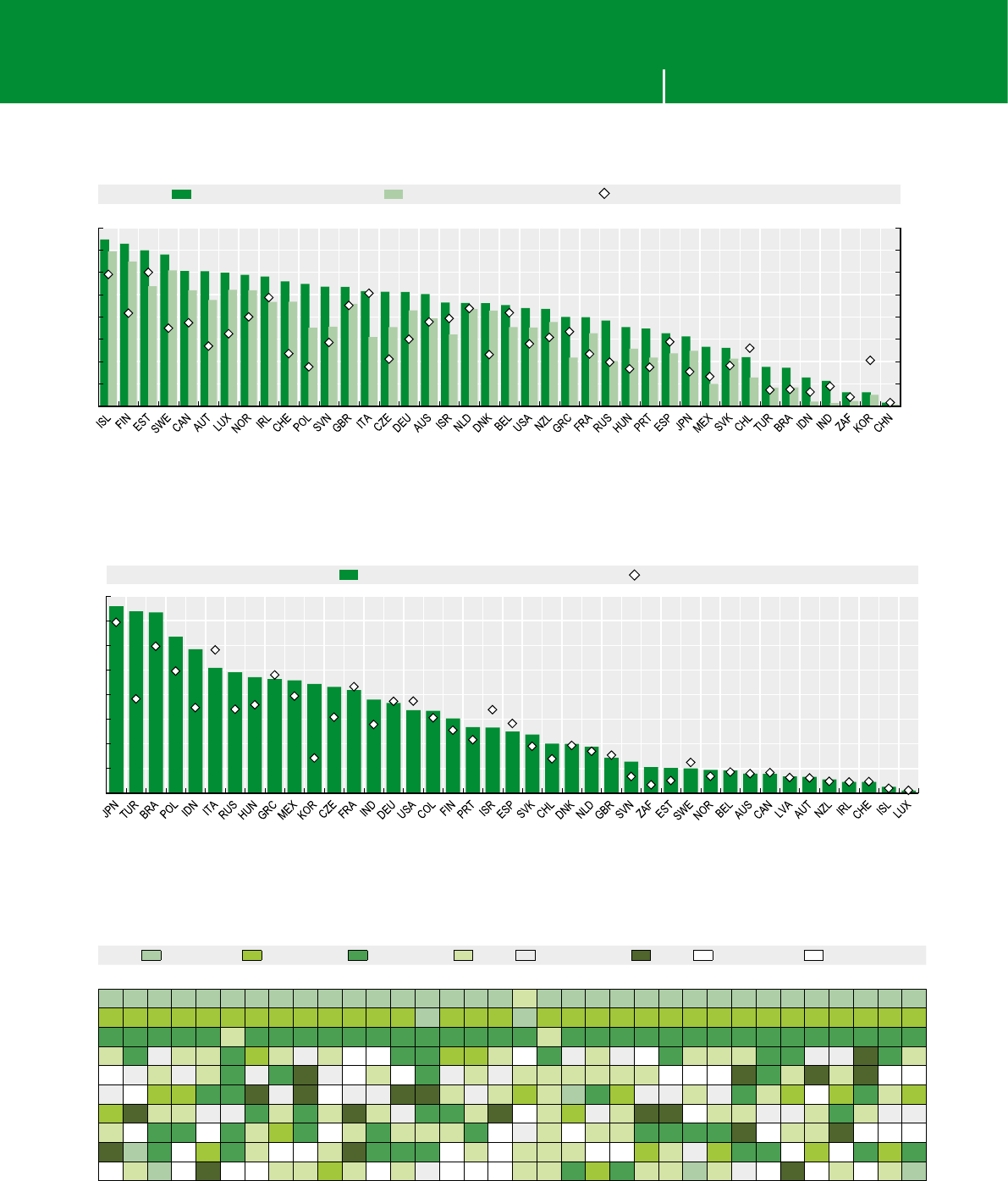

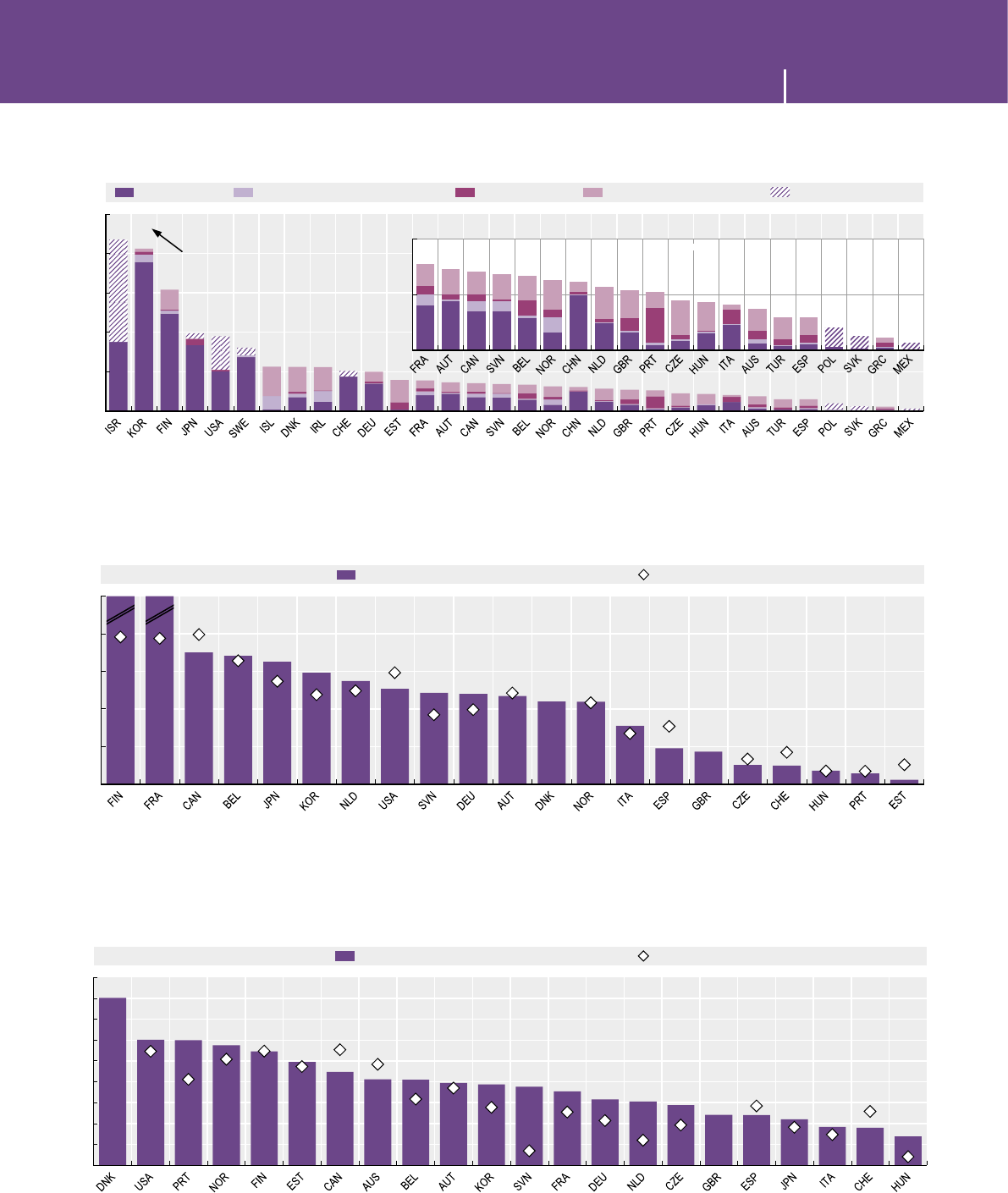

Devices are becoming increasingly powerful and affordable (Figure4). Mobile phones now

have signicant computing power and functionality, with cameras and music players as

standard, and a wide range of available applications. Smartphones now employ touch-

screen technology and include location and speed sensors, as well as an array of other

sensors to improve the user experience.5 Wi-Fi and Bluetooth connectivity for data

transmission is also standard, while RFID transponders allowing near eld communica-

tion (NFC) for mobile payments are also likely to see an increase in use.

Innovations in the pipeline include sensors for monitoring air pollution, ambient conditions

(via UV light sensors) and health diagnostic tools – from microscopes to heartbeat,

pressure and temperature sensors – that would ideally allow for constant monitoring of

physical conditions, including from remote locations. The integration of new functionality

and information has also given birth to a smartphone and tablet ecosystem comprising

an extensive array of new software applications for mobile operating systems, commonly

known as “apps”.6 The growing ubiquity of these applications has also drawn attention to

the importance of effective protection of personal information.

3. Estimates combine different forecasts of private sources, including IHC-technology (press.ihs.com/press-release/design-supply-chain/cloud-

related-spending-businesses-triple-2011-2017), IDC (www.idc.com/getdoc.jsp?containerId=prUS24298013), Gartner (Forrester Research report

quoted in blog.trendmicro.com/forrester-cloud-market-to-hit-240-billion-by-2020/#.U9fM6ygvjl8).

4. Among sources claiming potential savings in this order of magnitude, see for instance the recent report by Computer Economics (www.computer-

economics.com/custom.cfm?name=postPaymentGateway.cfm&id=1931).

5. These typically include a global positioning system (GPS) chip and a magnetometer/digital compass for orientation, often complemented by a barometer

for altitude. These are accompanied by sensors for measuring movement and angular rotation (accelerometers and gyroscopes), with light sensors to

adapt to visibility conditions while saving battery power, and proximity sensors to avoid accidental hitting of the touchscreen when in free hands mode.