Portico Developer Guide V2.25

PorticoDeveloperGuide_V2.25

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 93

- Table of Contents

- Overview

- Data Security

- Getting Started

- Transactions

- Special Processing Rules

- Address Verification Service (AVS)

- Adjustments

- Alternate Payments

- Auto-substantiation

- Batch Processing

- Card Not Present Transactions

- Card Present Transactions

- Card Verification Value (CVV2)

- Corporate Cards

- Duplicate Checking

- Dynamic Transaction Descriptor

- EMV

- Gratuity

- Industries

- Partial Authorization

- Personal Identification Number (PIN) Block

- Swiped or Proximity Entry

- Transaction Amounts

- Voice Authorization

- Appendices

- Glossary

- Index

Portico Developer Guide

Table of Contents

1. Overview 4

1.1. Payment Application Data Security Standards 4-5

1.2. Connectivity 5

1.3. Protocol 5

1.4. Authentication 5

2. Data Security 6

2.1. Encryption 6-7

2.2. Multi-use Tokenization 7-8

2.2.1. Requesting a Token 8

2.2.2. Using a Token 8

2.2.3. Managing Tokens 8-9

3. Getting Started 10

3.1. Add a Reference 10

3.2. Use the Interface 10

3.3. SoapUI Examples 10-11

3.4. Transaction Basics 11-12

3.5. TestCredentials 12

4. Transactions 13-18

4.1. Credit Card Transactions 18

4.2. Debit Card Transactions 18-19

4.3. Cash Transactions 19

4.4. Check/ACH Transactions 19

4.5. EBT Transactions 19

4.6. Gift Card Transactions 19-20

4.7. PrePaid Card Transactions 20

4.8. Utility Transactions 20

4.9. Batch Transactions 20-21

4.10. Report Transactions 21

4.11. Internal Use Only Transactions 21

5. Special Processing Rules 22

5.1. Address Verification Service (AVS) 22-23

5.2. Adjustments 23

5.3. Alternate Payments 23-24

5.3.1. Alternate Service NameValuePair Request Fields 24-26

Portico Developer Guide 1

© 2016 Heartland Payment Systems, Inc.

5.3.2. Alternate Service Request Field Usage Detail 26-27

5.3.3. Alternate Service NameValuePair Response Fields 27-28

5.3.4. Alternate Service Response Field Usage Detail 28

5.4. Auto-substantiation 28-29

5.5. Batch Processing 29

5.5.1. Settlement 29

5.5.1.1. Auto-close 29

5.5.1.2. Manual Entry 29-30

5.6. Card Not Present Transactions 30

5.7. Card Present Transactions 30

5.8. Card Verification Value (CVV2) 30-31

5.9. Corporate Cards 31

5.10. Duplicate Checking 31

5.10.1. Additional Criteria 31-32

5.10.2. Override Duplicate Checking 32

5.10.3. Portico Services Supporting Duplicate Checking 32

5.11. Dynamic Transaction Descriptor 32-33

5.12. EMV 33

5.12.1. Service Tag Validation 33-34

5.12.2. EMV Conversation Flow 34

5.12.3. Services That Support EMV Tags 34-36

5.12.4. EMV Tags 36

5.12.4.1. EMV Request Tags 36-41

5.12.4.2. EMV Response Tags 41-42

5.12.5. EMV Parameter Data Download 42

5.12.5.1. ParameterDownload Service 42-43

5.12.5.1.1. PDL Request Definition 43-44

5.12.5.1.2. PDL Response Definition 44

5.12.5.1.2.1. PDL Response Table 10—Table Versions and Flags 44-45

5.12.5.1.2.2. PDL Response Tables 30-60 45-46

5.12.5.1.2.2.1. PDL Response Table 30—Terminal Data 46-48

5.12.5.1.2.2.2. PDL Response Table 40—Contact Card Data 48-50

5.12.5.1.2.2.3. PDL Response Table 50—Contactless Card Data 50-53

5.12.5.1.2.2.4. PDL Response Table 60—Public Key Data 53-54

5.12.5.1.2.3. PDL Response - Confirmation 54

5.13. Gratuity 54-55

Portico Developer Guide 2

© 2016 Heartland Payment Systems, Inc.

5.14. Industries 55

5.14.1. Retail 55

5.14.2. Restaurant 55

5.14.3. Lodging 55-56

5.14.4. Healthcare 56

5.14.5. MOTO/eCommerce 56-57

5.15. Partial Authorization 57-58

5.16. Personal Identification Number (PIN) Block 58-59

5.17. Swiped or Proximity Entry 59

5.18. Transaction Amounts 59-60

5.19. Voice Authorization 60

6. Appendices 61

6.1. Register the Client Library 61

6.2. Gateway Response Codes 61-63

6.3. Tokenization-Specific Response Codes 63-64

6.4. Issuer Response Codes 64-66

6.5. Gift Card Response Codes 66

6.6. Status Indicators 66-67

6.7. HMS Gift Card Certification 67

6.7.1. Certification Host Response Matrix 67

6.7.1.1. Amount Response Matrix 67-68

6.7.2. Certification Host Stored Value Accounts 68

6.8. Revision History 68-69

7. Glossary 70-89

8. Index 90-92

Portico Developer Guide 3

© 2016 Heartland Payment Systems, Inc.

1Overview

The Heartland Portico™ Gateway (referred to as Portico in this document) provides an application programming

interface (API) to aid integrators and merchants with processing payment transactions. Portico's API includes services

for a variety or payment methods (credit, debit, check, EBT, gift, loyalty, prepaid, GSB, etc.) and various industries

(retail, restaurant, mail order/telephone order, lodging, eCommerce, and healthcare). Portico also provides integrators

and merchants with several options for securing transaction data.

This document details the services available via the API and provides guidelines on best practices for integrators.

Following these guidelines can reduce integration and certification time, reduce fraud potential, and ensure proper

interchange rates.

This document is based on Portico API version 2.25. The content is split into two distinct sites:

Portico Developer Guide site (this site): This site contains the front matter of the documentation and all

static content. It is the default site when initially linking to the Portico Developer Guide. The title "Portico

Developer Guide" appears above the topic title on each of its pages. Searches performed in this site will

provide results for only this site. A PDF of this content is available here:

Portico Developer Guide only pdf

Portico Schema site: This site contains the content generated from the XML Schema. When you click a link to

the Generated Content site, the page is opened in a new browser tab. For example, if you click a

Request/Response link from the Transactions > Credit Card Transactions page, the page is opened in a new

tab. The titles "Portico Schema" or "posgatewayservice Web Service" appear above the topic title on each of its

pages. Searches performed in this site will provide results for only this site. The nature of this content does not

lend itself to be displayed in a PDF, so no PDF is provided. To get back to the Overview/Front Matter, click on

the other browser tab.

See Revision History (Section 6.8) for descriptions of the changes made to the documentation for this release.

1.1 Payment Application Data Security Standards

The Payment Card Industry (PCI) Security Standards Council (SSC) has released the Payment Application Data Security

Standards (PA-DSS) for payment applications running at merchant locations. The PA-DSS assists software vendors to

ensure their payment applications support compliance with the mandates set by the Bank Card Companies (VISA,

MasterCard, Discover, American Express, and JCB).

In order to comply with the mandates set by the Bank Card Companies, Heartland Payment Systems:

Requires that the account number cannot be stored in the clear in order to meet PCI and PA-DSS regulations. It

must be encrypted while stored using strong cryptography with associated key management processes and

procedures.

NOTE: Refer to PCI DSS Requirements 3.4–3.6* for detailed requirements regarding account number storage.

The retention period for the Account Number in the shadow file and open batch should be defined. At the end

of that period or when the batch is closed and successfully transmitted, the account number and all other

information must be securely deleted. This is a required process regardless of the method of transmission for

the POS.

Requires that, with the exception of the Account Number as described above and the Expiration Date, no other

Track Data is to be stored on the POS if the Card Type is a: VISA, including VISA Fleet; MasterCard, including

MasterCard Fleet; Discover, including JCB, CUP, Carte Blanche, Diner's Club, and PayPal; American Express;

Debit or EBT. This requirement does not apply to Wright Express (WEX), FleetCor, Fleet One, Voyager, or

Aviation cards; Stored Value cards; Proprietary or Private Label cards.

Recommends that software vendors have their applications validated by an approved third party for PA-DSS

compliance.

Requires all software vendors to sign a Developer’s Agreement (Non-Disclosure Agreement).

Portico Developer Guide 4

© 2016 Heartland Payment Systems, Inc.

Requires all software vendors to provide evidence of the application version listed on the PCI Council’s website

as a PA-DSS validated Payment Application or a written certification to HPS Testing of the Developer's

compliance with PA-DSS.

Requires that all methods of cryptography provided or used by the payment application meet PCI SSC's current

definition of "strong cryptography".

*Refer to www.pcisecuritystandards.org for the PCI DSS Requirements document and further details about PA-DSS.

1.2 Connectivity

Connectivity to Portico is through the Internet. A secure socket connection (SSL v3.0 or TLS v1.0/1.1/1.2) is required for

all transactions to ensure the confidentiality of information passed between the merchant and Portico. While this

provides protection for the message in transit, additional protection is still highly recommended for certain data

elements (see Data Security (Section 2) for additional information).

Heartland provides an SSL dial back-up (DBU) using the Point-to-Point Protocol (PPP). This DBU can be defined as a

“dial internet connection”. The POS makes a connection identical to an ISP dial provider. From this point, the POS can

keep using the same URL as if they were on a high speed connection. The maximum possible connection speed for

DBU is 56K baud and the format is 8N1.

Note: SSL v3.0 and TLS 1.0 will be phased out 06/30/16. TLS 1.1 is the new minimum requirement for certification.

1.3 Protocol

This guide covers the Portico Simple Object Access Protocol (SOAP) API. The base elements and data types used in

the Portico schema come from the "http://www.w3.org/2001/XMLSchema" namespace. Additional Portico schema

elements are defined in the "http://Hps.Exchange.PosGateway" namespace.

The full Portico schema (PosGateway.xsd) is provided in the Portico SDK.

1.4 Authentication

The values in the header are used for authentication and validation. Portico responds with an "authentication error"

response when these values are not set correctly. See Gateway Response Codes (Section 6.2) for additional

information.

Portico Credentials

To identify a unique device and determine the permissions of the user on that device, Portico requires a valid

LicenseID, SiteID, DeviceID, UserName, and Password. The license ID is used to chain multiple sites together for

reporting and administration. The site ID is the location and is tied to a specific Merchant Identification Number (MID).

The device ID indicates a unique device at a specific site. The username and password should be protected by the

merchant. The password should never be made public. A temporary password is provided at the time of boarding.

This temporary password should be changed by the merchant before processing any transactions. The password

should then be changed periodically for security.

Credential Token

The credential token is used to indicate a user session. Currently, this option is only available to internal Heartland

applications and should not be used by integrators.

Portico Developer Guide 5

© 2016 Heartland Payment Systems, Inc.

2Data Security

Portico supports multiple methods of securing transmitted and stored data. The following sections cover the details

around the supported encryption and tokenization options. The primary options are Heartland End-to-End Encryption

(E3) and Heartland’s Enterprise Tokenization Service (ETS). These options can be used together or independently.

E3 encrypts card data at the point of entry in a hardware solution such that the POS never handles data in the

clear.

Tokenization allows merchants to store a value that represents a card number for future processing. These

tokens are referred to as multi-use tokens, since they can be used over and over as a reference to the original

card data.

Note: Portico also supports single-use tokens. These are obtained via Heartland’s SecureSubmit product. They are

helpful when the merchant has a client application (browser, mobile application, etc.) obtaining card data and sending

it to a merchant server. If the client first exchanges the payment data for a single-use token and sends this to the

server, the server never handles card data. This requires additional boarding, integration, and certification steps. This

option can be used independently or along with the other data security methods.

2.1 Encryption

Portico supports two methods of encryption for securing PAN and track information: Heartland E3 and AES

using DUKPT.

Heartland E3 is an implementation of the Voltage Identity-Based Encryption methodology offered by Heartland to

allow card data to be encrypted from the moment it is obtained at the POS and throughout Heartland processing.

Since software is vulnerable to intrusions, this technology is hardware based. Using E3 hardware, the merchant's POS

software never sees card data. It also allows the card data to remain encrypted throughout all of Heartland's systems.

This not only removes intrusion threats, it also greatly reduces the scope of PCI audits on the associated merchant

POS software.

AES using DUKPT key management is provided for Heartland mobile by the IdTECH card reader. This technology

offers near end-to-end encryption.

For transactions using either encryption type, additional data must be provided. The EncryptionData element must be

provided including the encryption version being used as well as any additional data items required. The supported

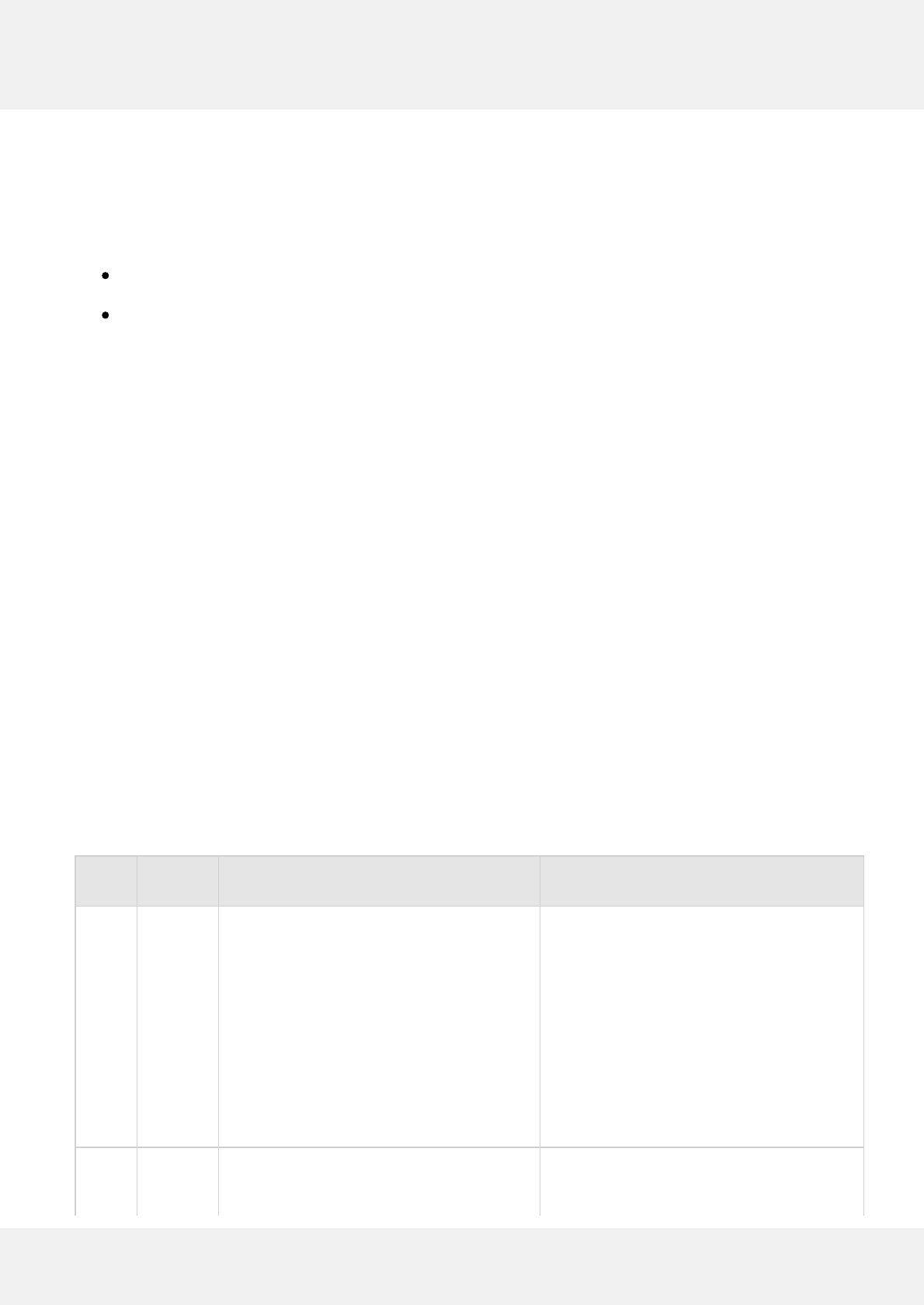

encryption versions and required data items are defined below.

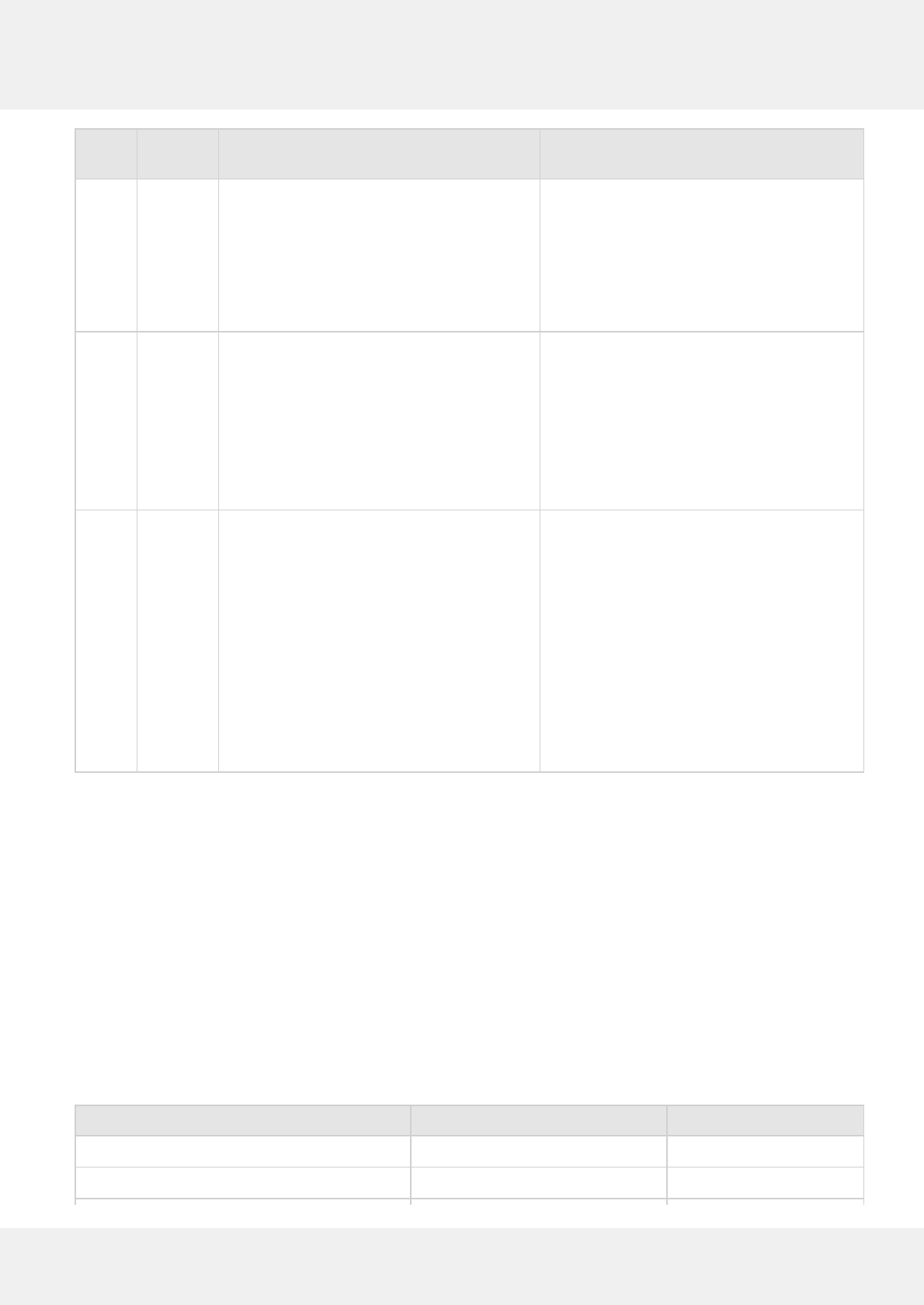

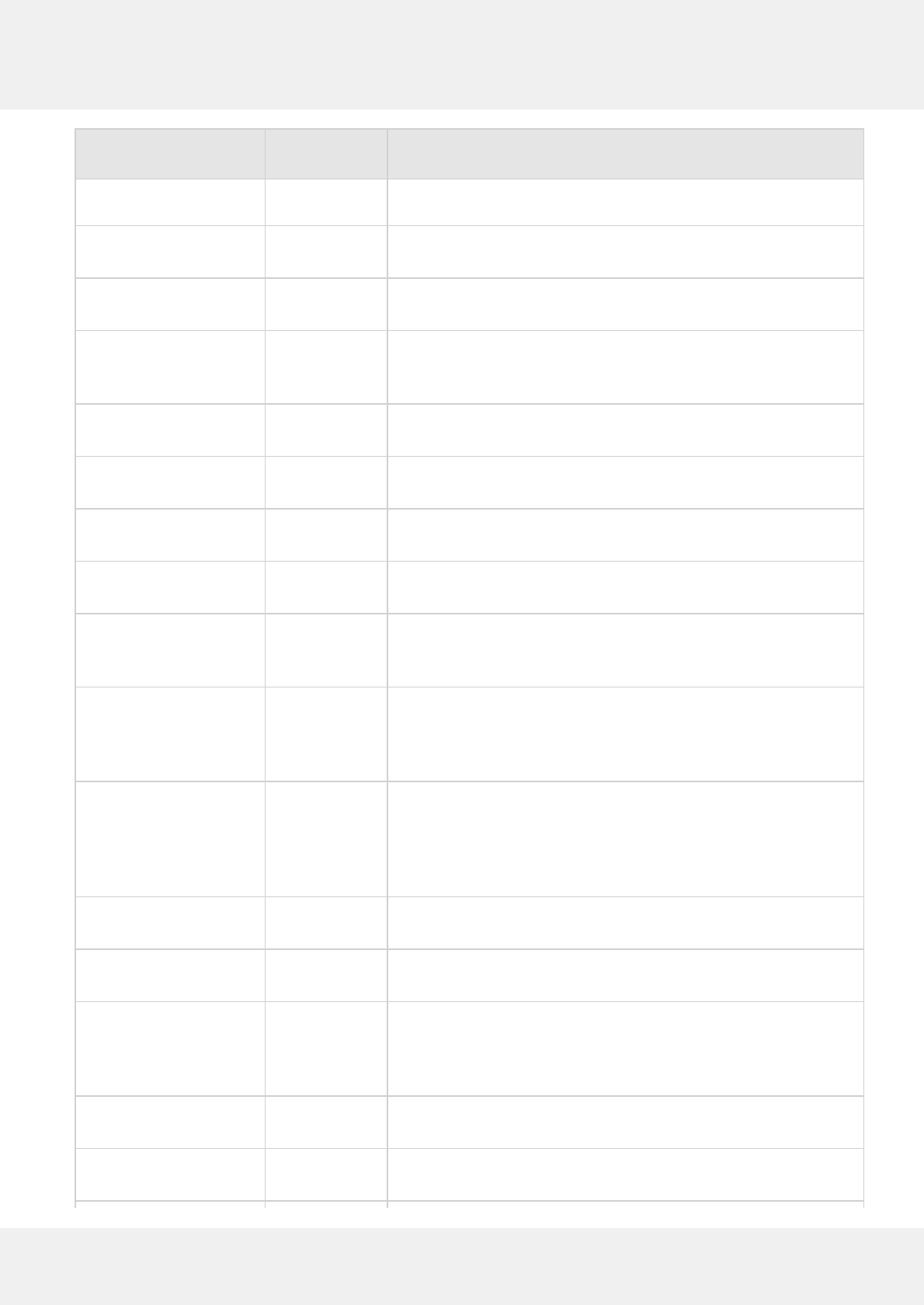

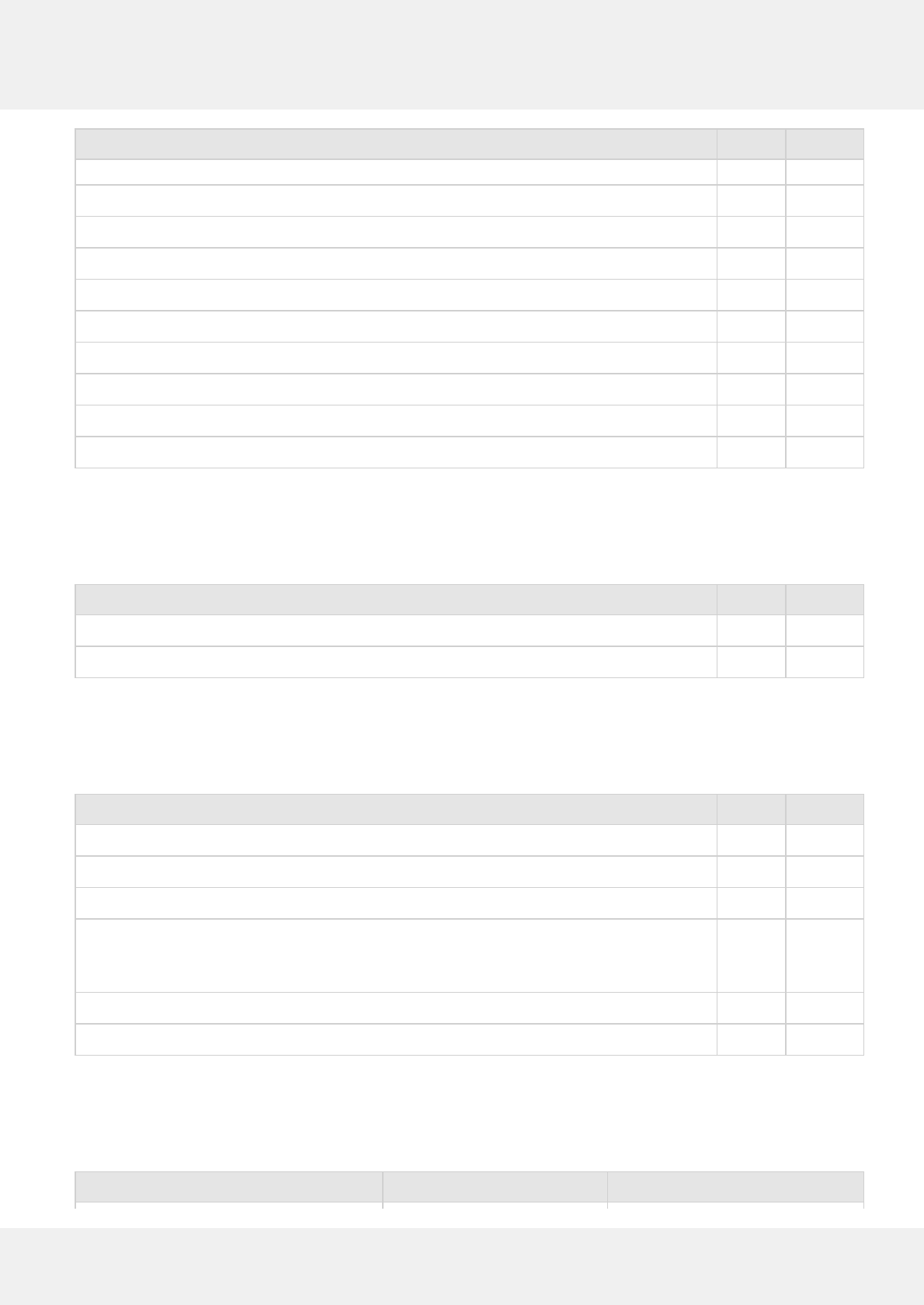

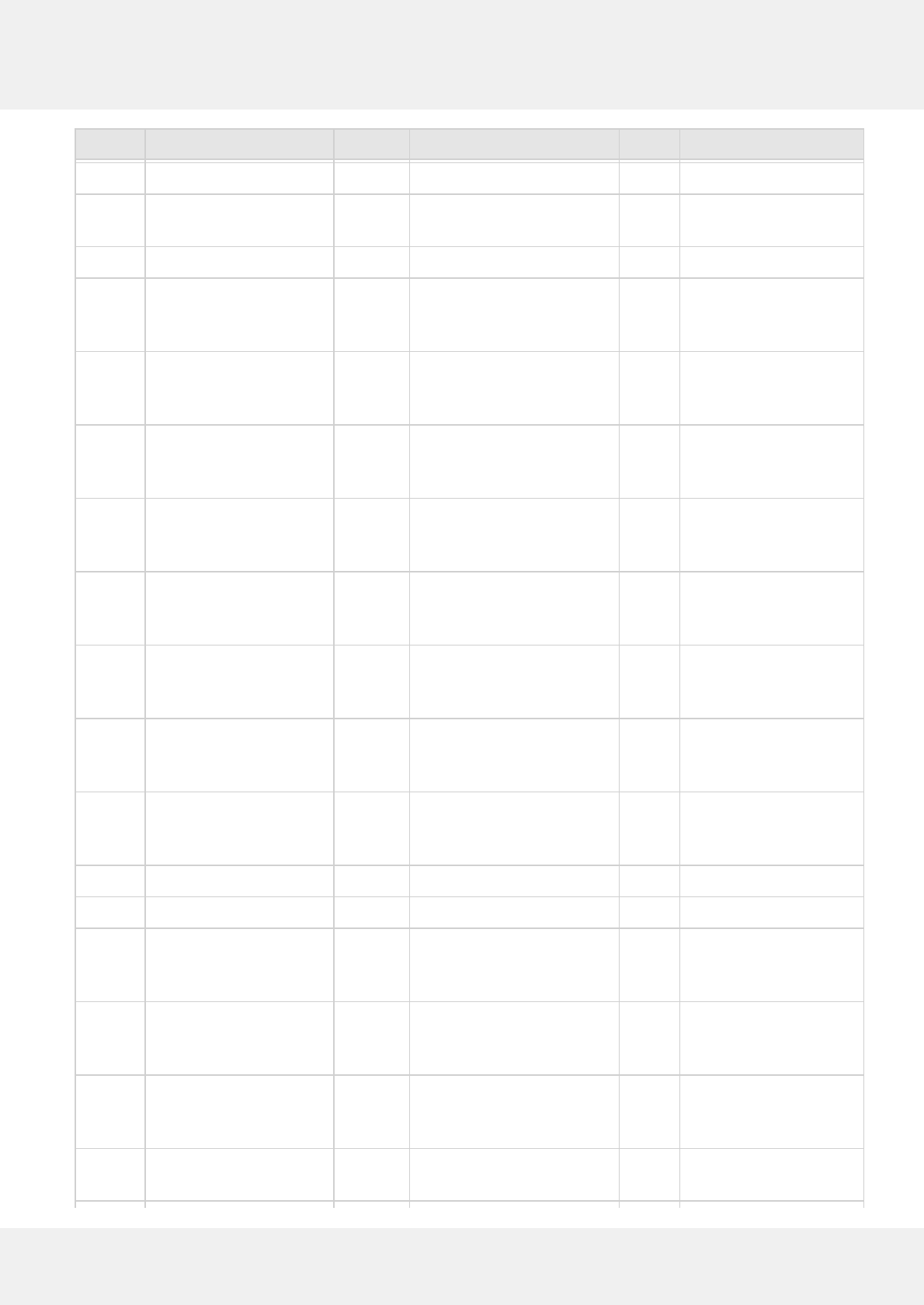

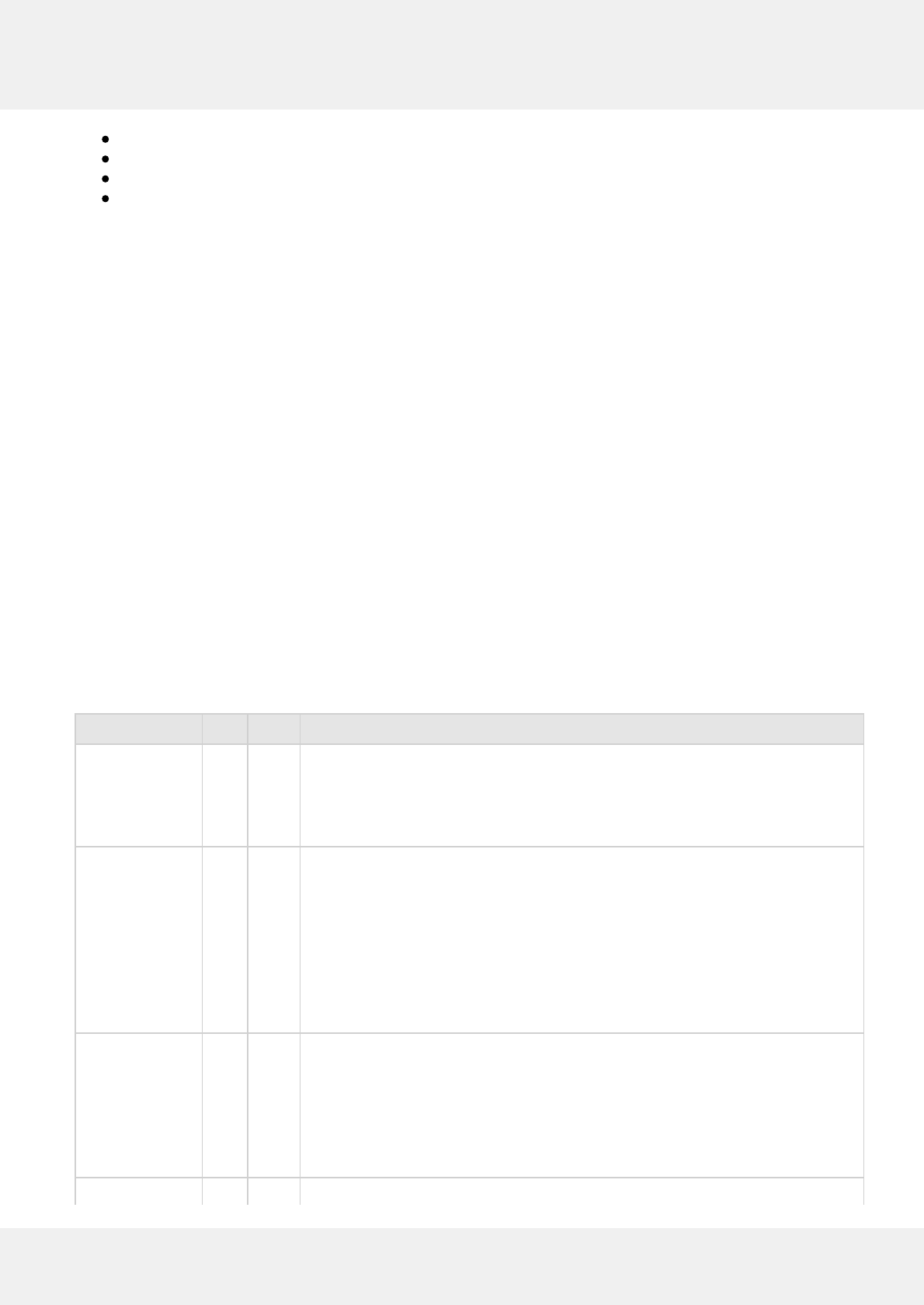

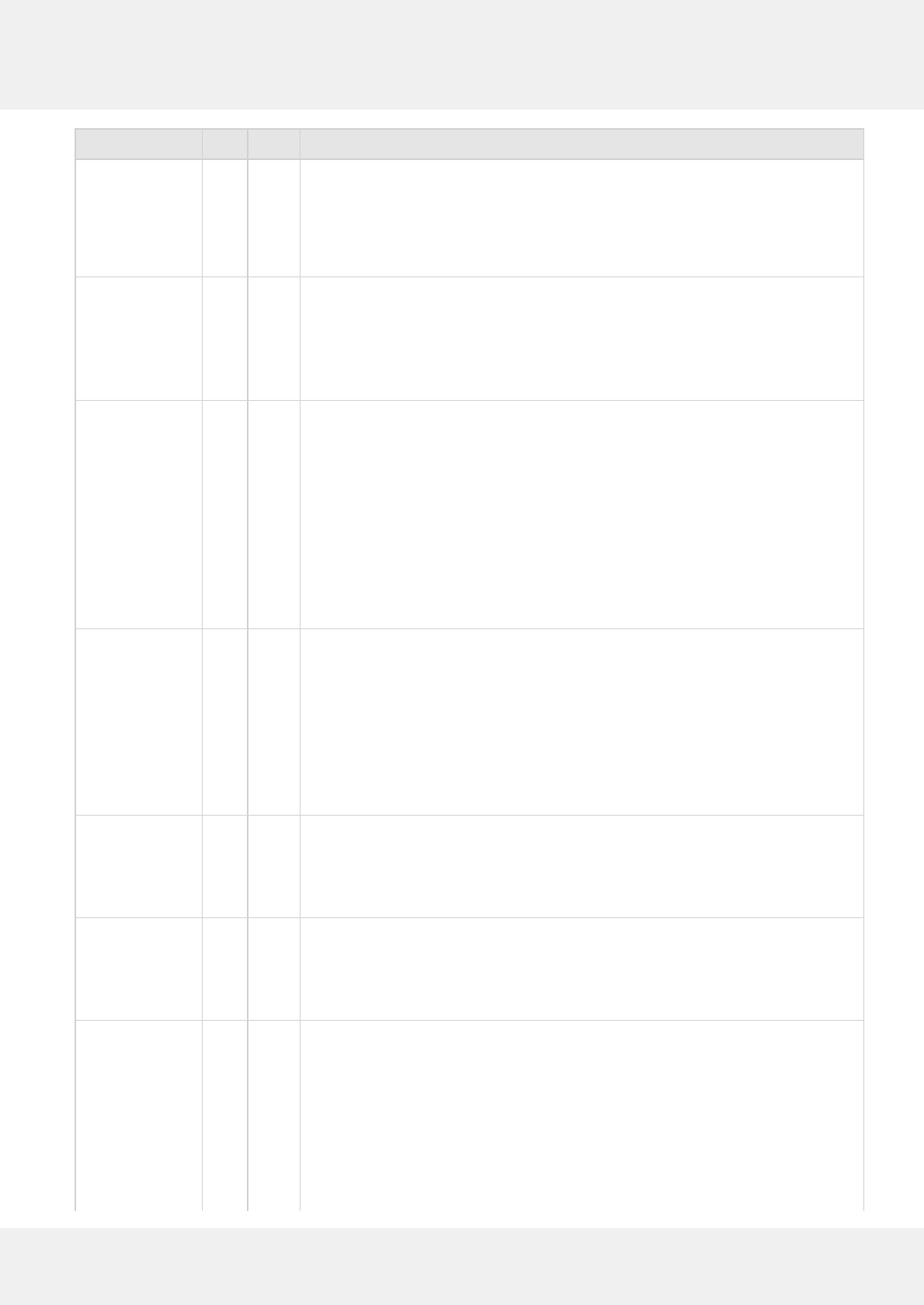

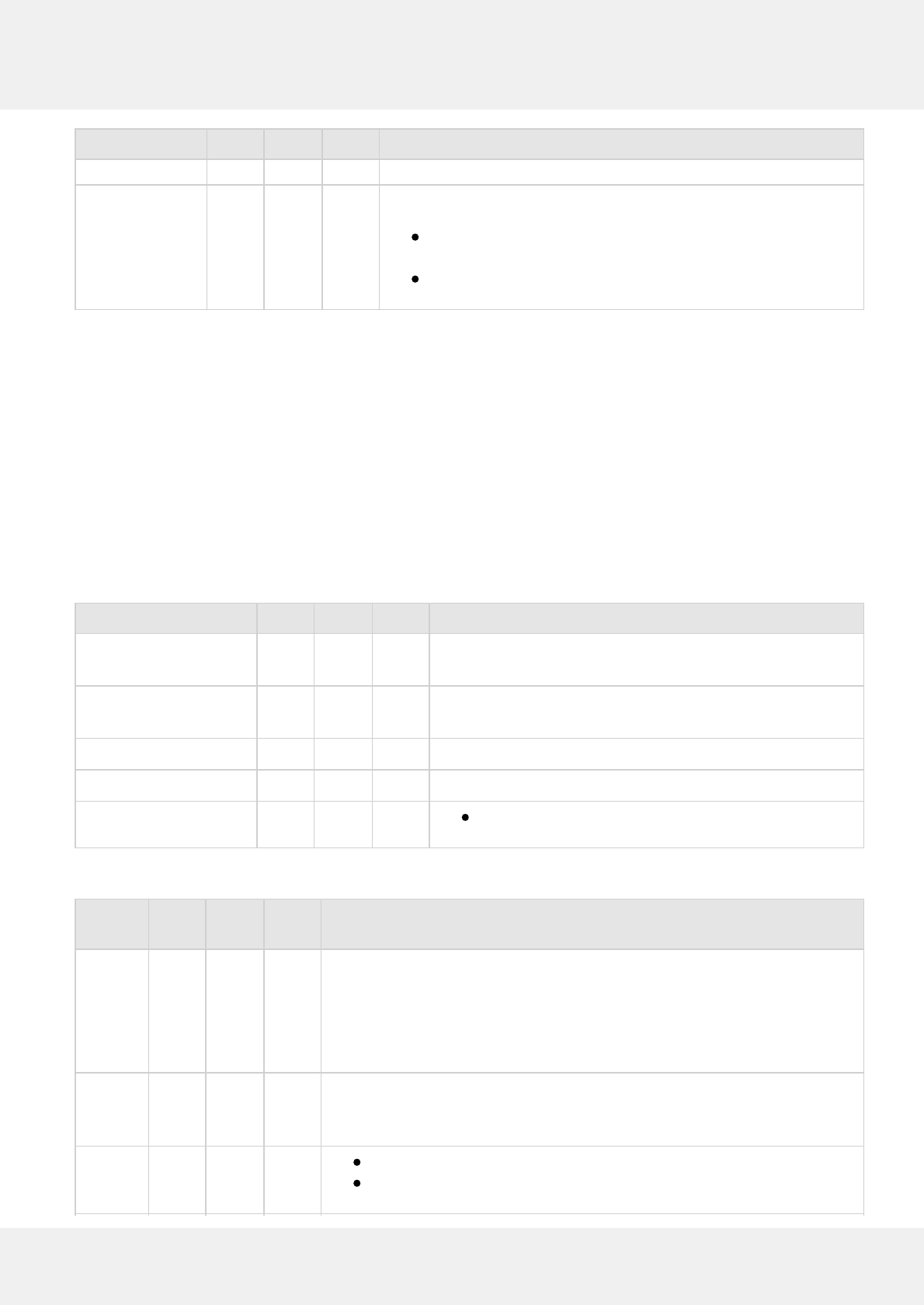

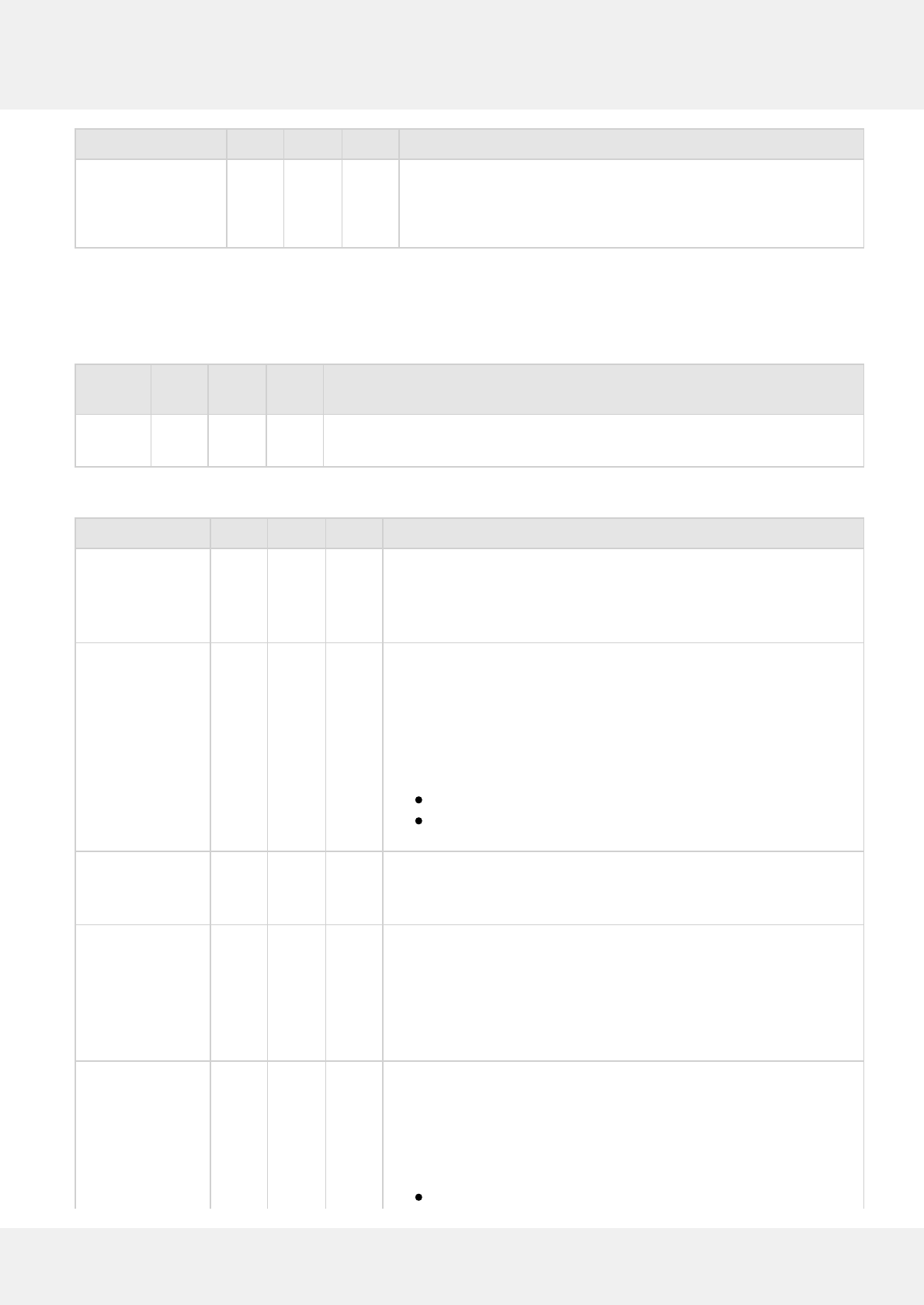

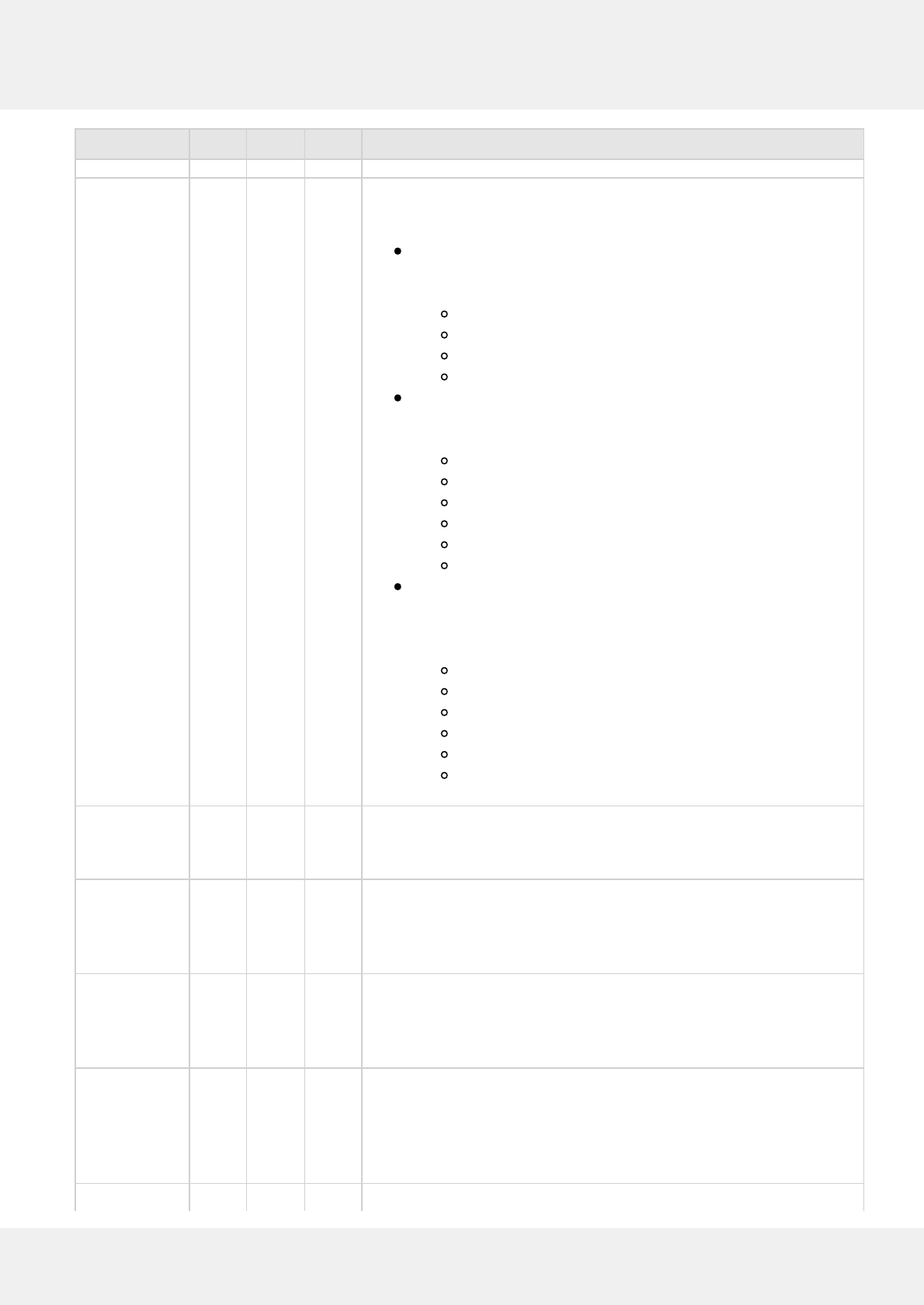

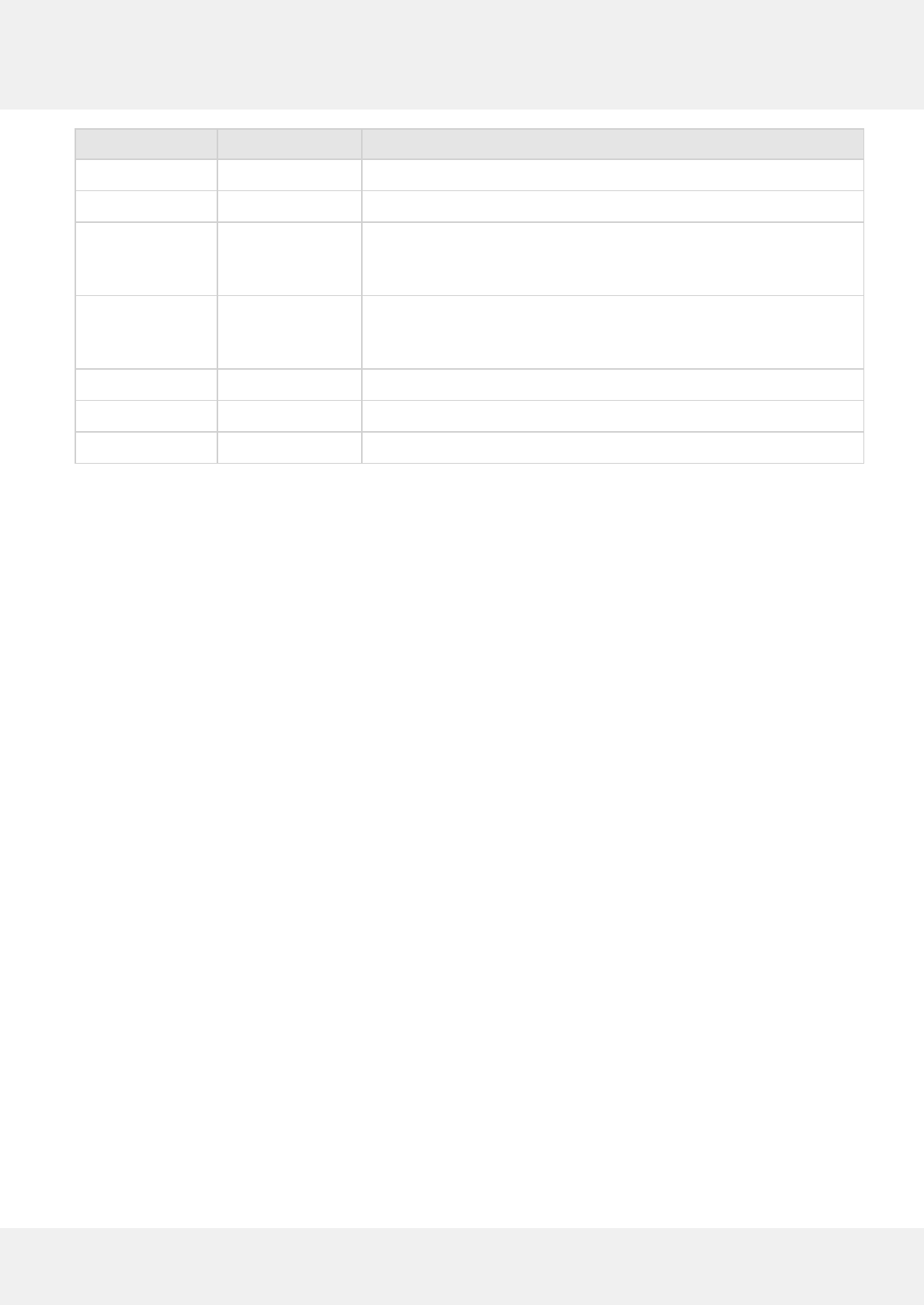

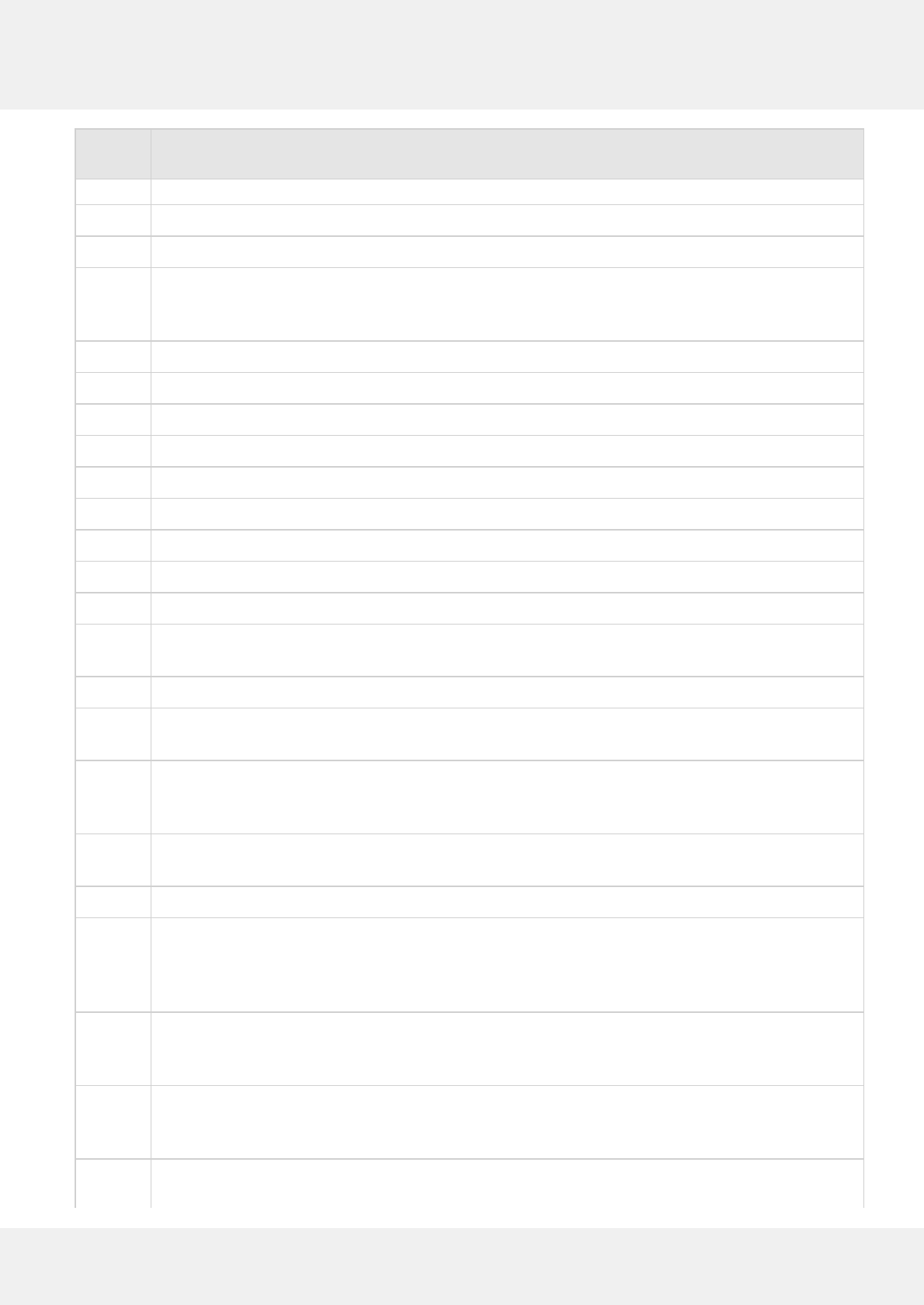

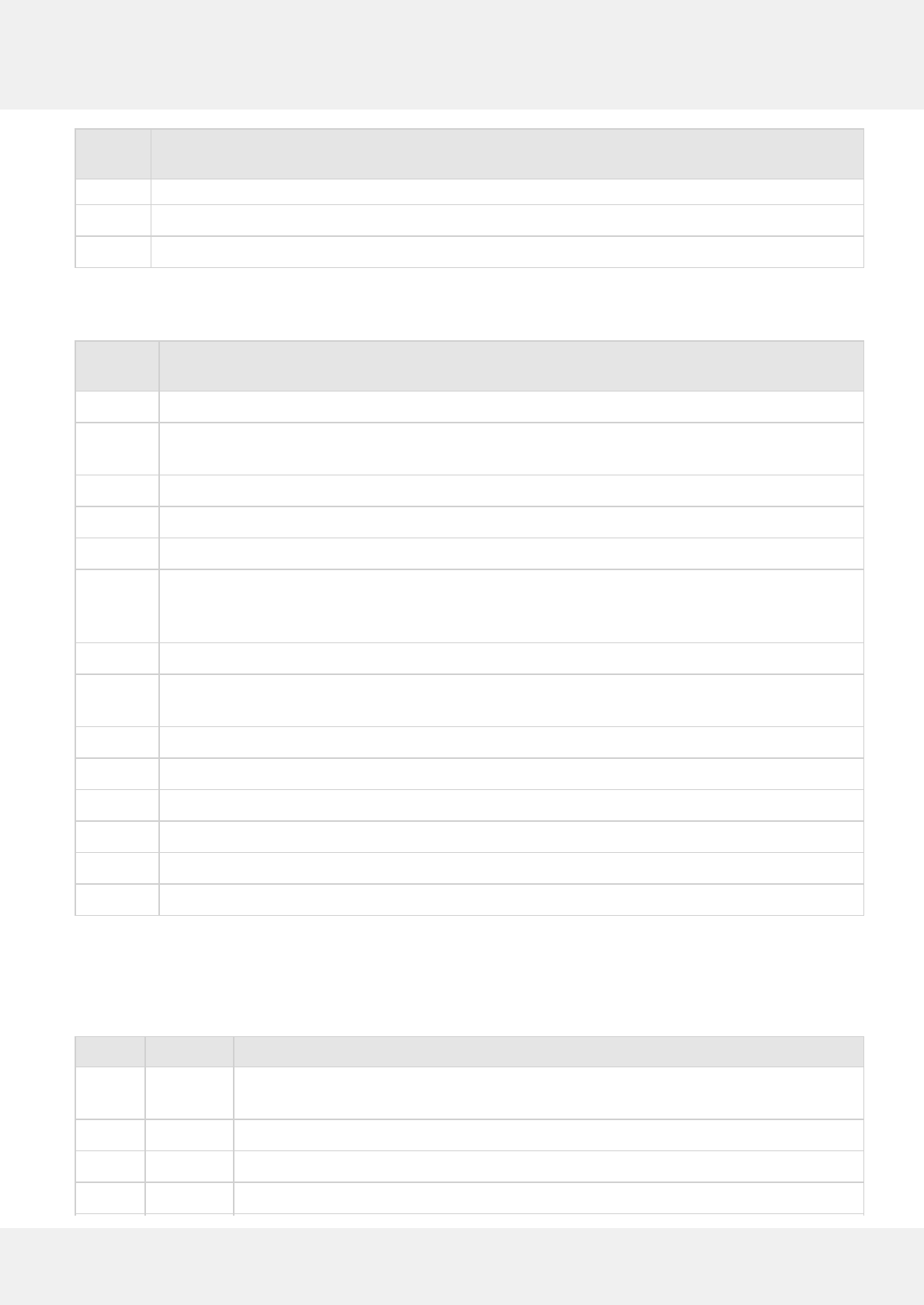

Version Encryption

Type When Encrypting PAN When Encrypting Track Data

01 E3

(Voltage)

Not Supported The EncryptionData element must be provided

with the Version set to "01". No additional

elements need to be provided inside the

EncryptionData element. The TrackData

provided must include the full E3/Voltage

device output stream.

Encryption Version 01 is supported only for

the Heartland E3-M1 magnetic stripe reader

wedge device, functioning in keyboard

emulation mode.

02 E3

(Voltage)

Supported

The EncryptionData element must be

The EncryptionData element must be provided

with the Version set to "02". In addition,

the EncryptedTrackNumber element must be

Portico Developer Guide 6

© 2016 Heartland Payment Systems, Inc.

provided with the Version set to "02". In

addition, the POS must parse the E3 MSR

output and provide the Key Transmission

Block in the KTB element. The CardNbr

provided must only include the encrypted

PAN parsed by the POS from the E3/Voltage

device output stream.

set to "1" for Track 1 data or "2" for Track 2

data, and the POS must parse the E3/Voltage

device output and provide the KTB in the KTB

element. The TrackData provided must only

include the encrypted Track 1 or Track 2 data

parsed by the POS from the E3/Voltage device

output stream.

03 AES Not Supported The EncryptionData element must be provided

with the Version set to "03". In addition,

the EncryptedTrackNumber element must be

set to "1" for Track 1 data or "2" for Track 2

data, and the POS must parse the card reader

output stream and provide the KSN in the KSN

element. Both the KSN and the track data

content must be Base-64 encoded strings.

04 E3

(Voltage)

Supported

The EncryptionData element must be

provided with the Version set to "04". In

addition, the POS must parse the E3 MSR

output and provide the Key Transmission

Block in the KTB element. In addition to the

CardNbr, version “04” expects the CVV2 to be

encrypted. The CardNbr and CVV2 provided

must only include the encrypted PAN and

encrypted CVV2 parsed by the POS from the

E3/Voltage device output stream.

The EncryptionData element must be provided

with the Version set to "04". In addition, the

EncryptedTrackNumber element must be set

to "1" for Track 1 data or "2" for Track 2 data,

and the POS must parse the E3/Voltage device

output and provide the KTB in the KTB

element. The TrackData provided must only

include the encrypted Track 1 or Track 2 data

parsed by the POS from the E3/Voltage device

output stream.

Version Encryption

Type When Encrypting PAN When Encrypting Track Data

2.2 Multi-use Tokenization

Portico supports tokenization of account numbers to provide clients with another layer of security. The tokenization

process consists of the following two basic steps:

1. Request that an account number (from a PAN or track data) be tokenized and the token be returned to the

client POS.

2. The client POS uses the token rather than the PAN or track data in subsequent transactions.

Tokenization provides a means to replace sensitive PAN values with surrogate, non-sensitive values that can be stored

and referenced without the complexities of storing and securing PANs, as required by the PCI-DSS. Tokens thus stored

can then be passed on supported Portico transactions in lieu of the card number. Heartland's tokenization service

manages the association between the token and the PAN.

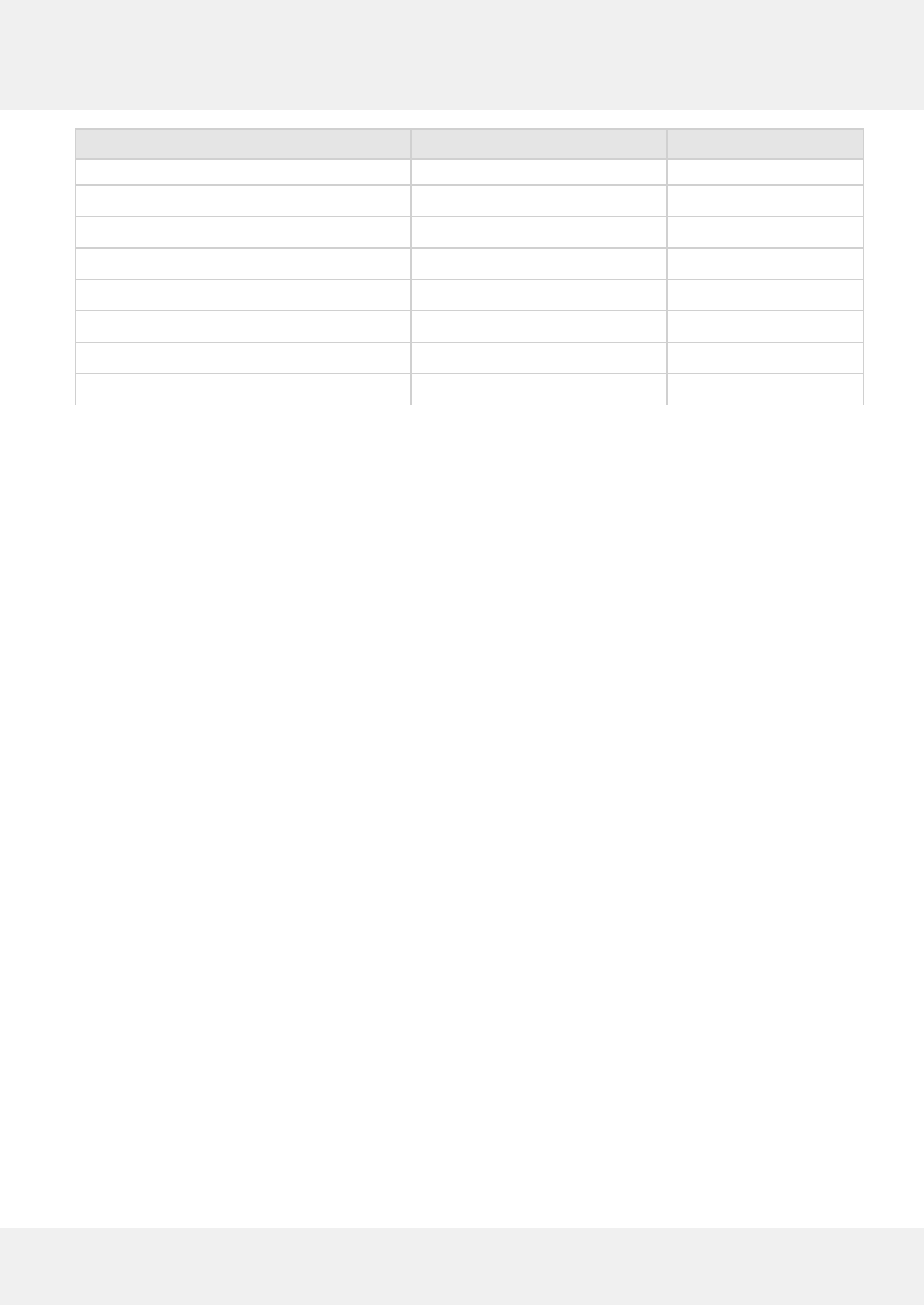

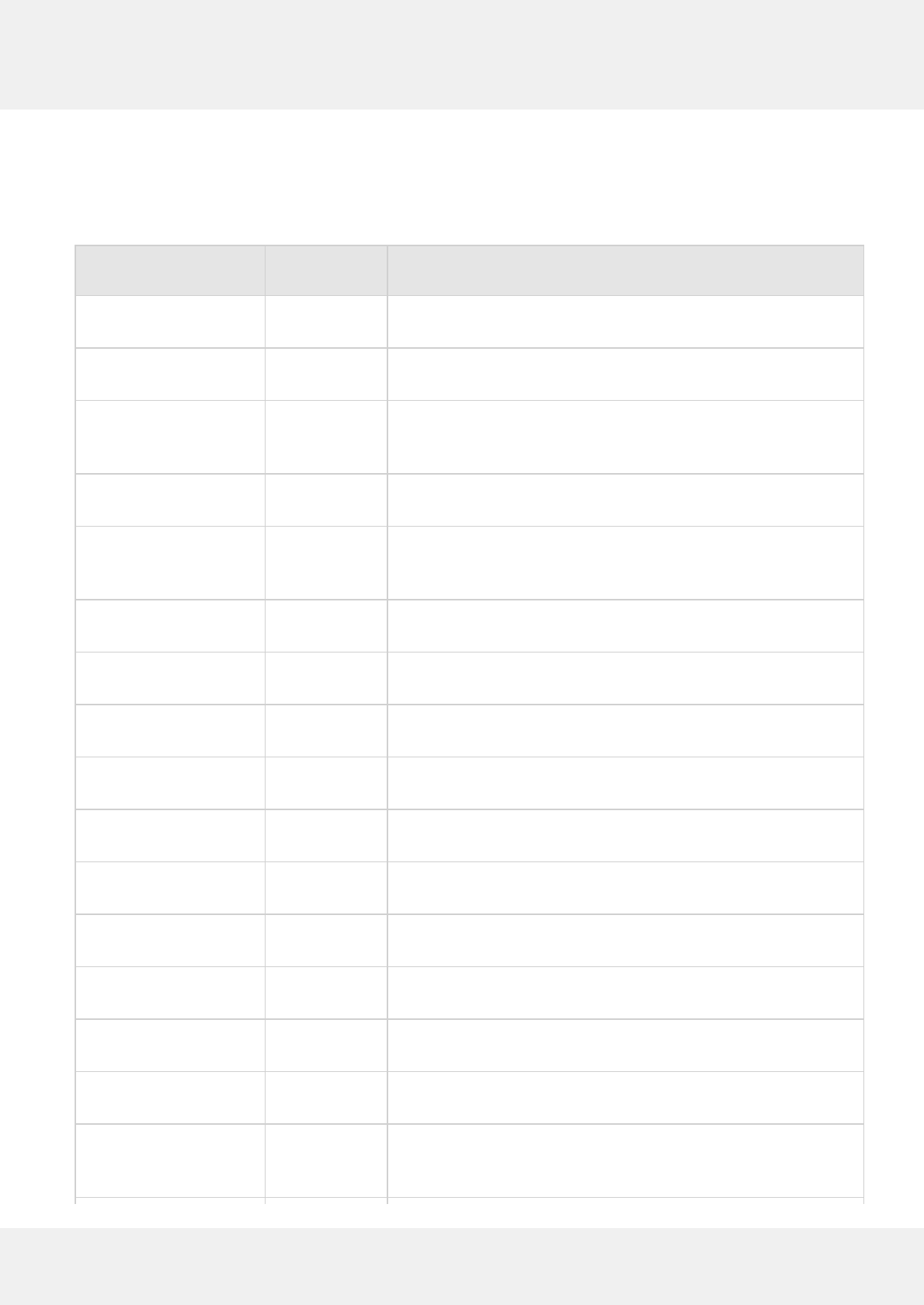

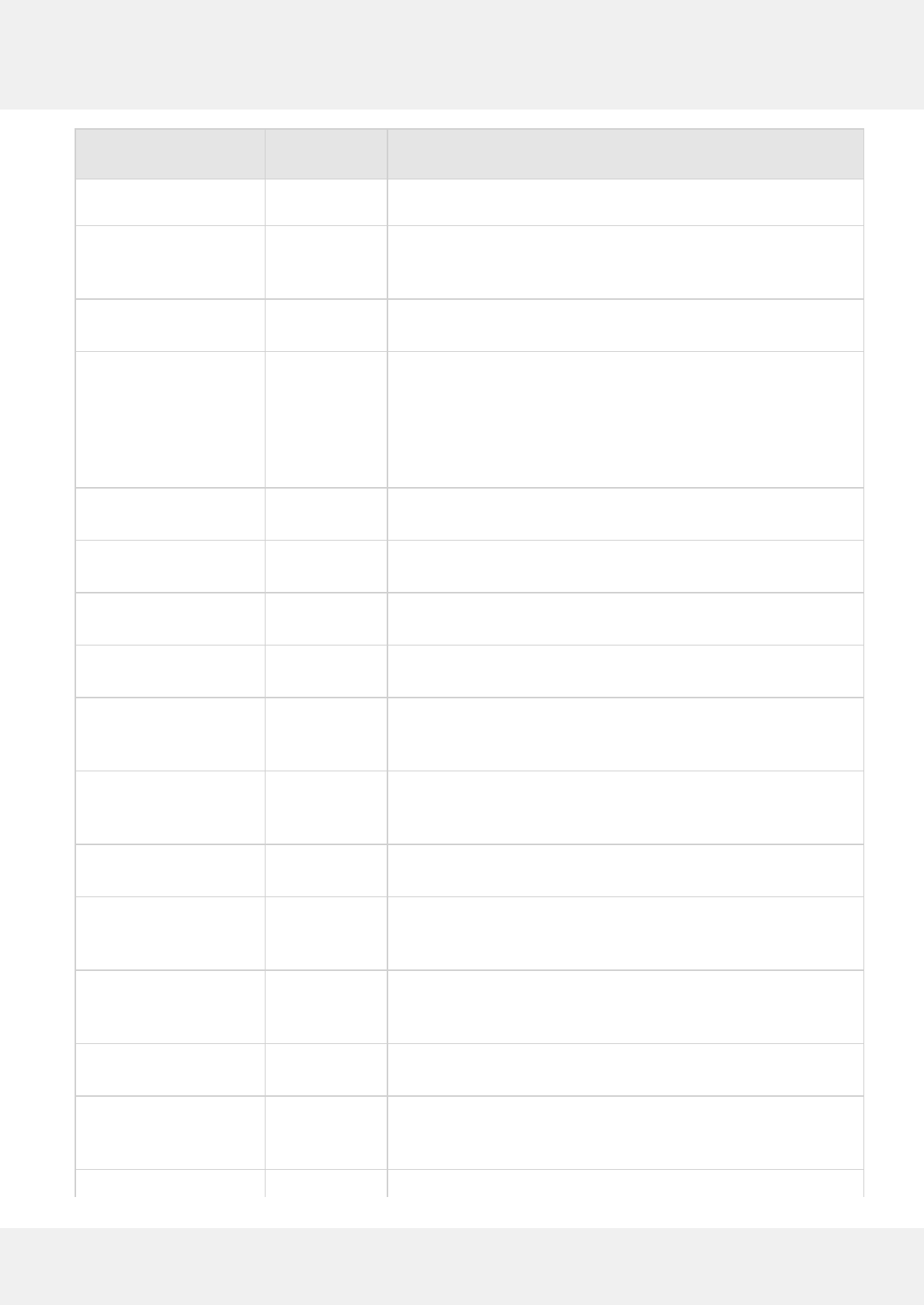

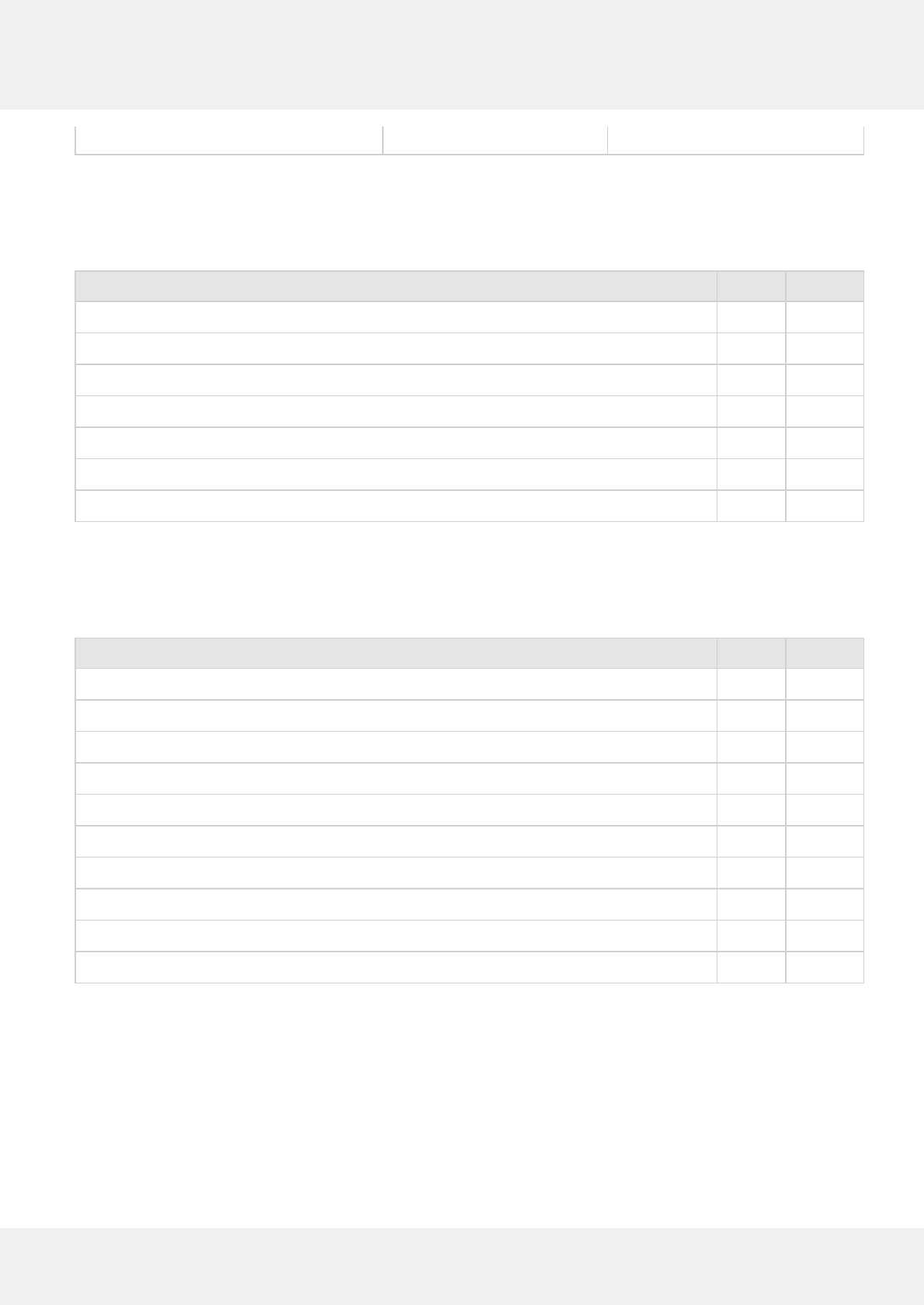

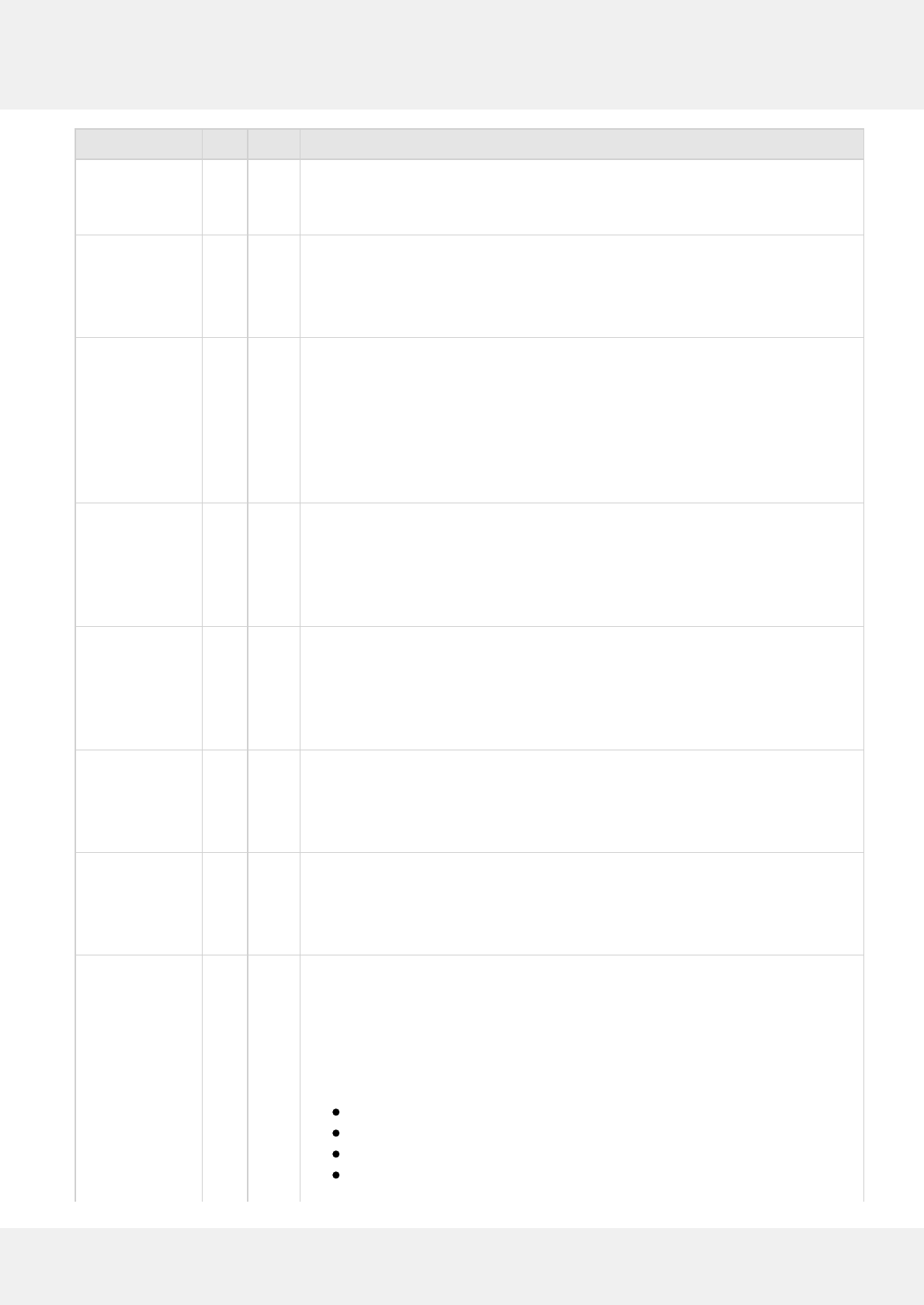

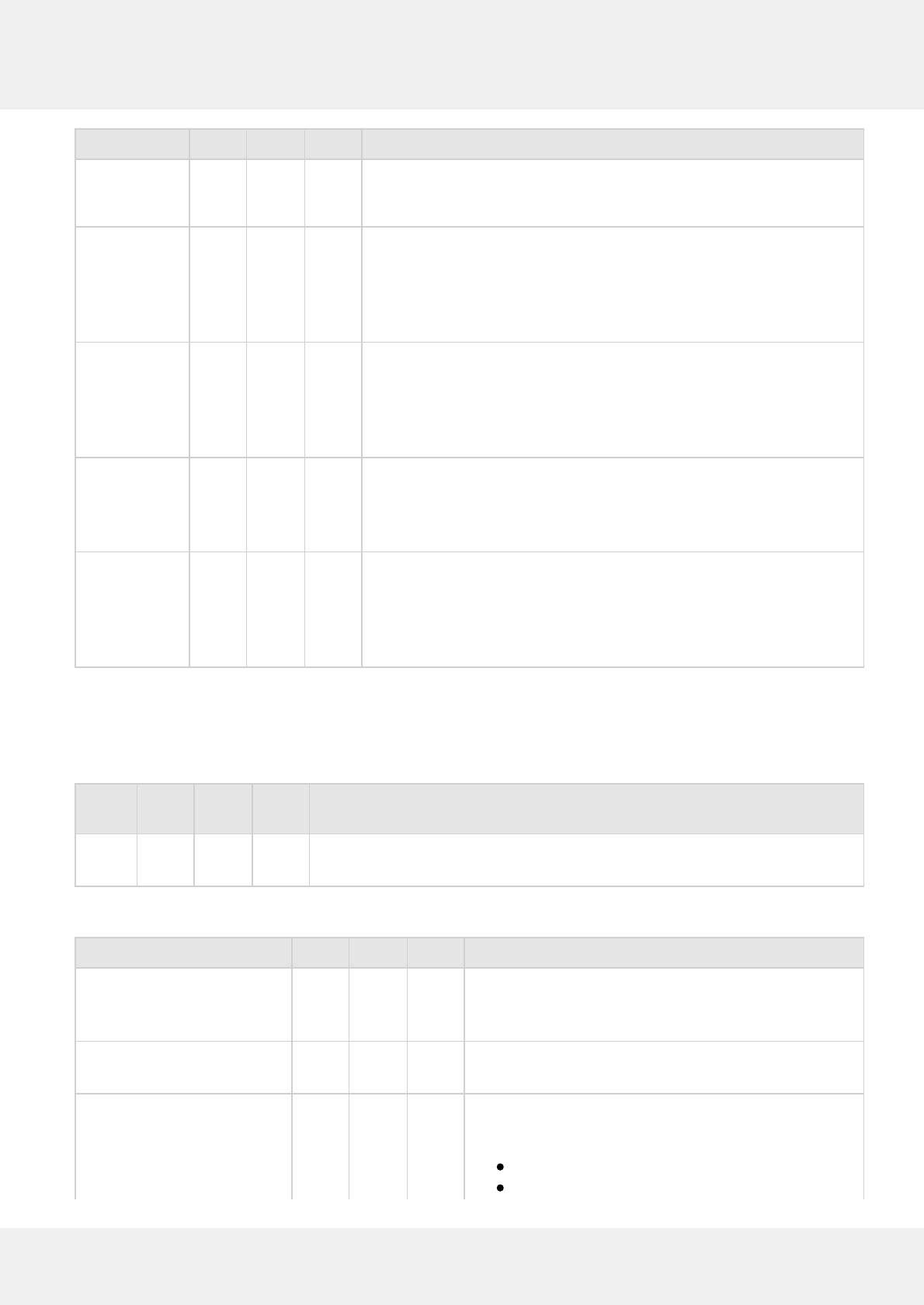

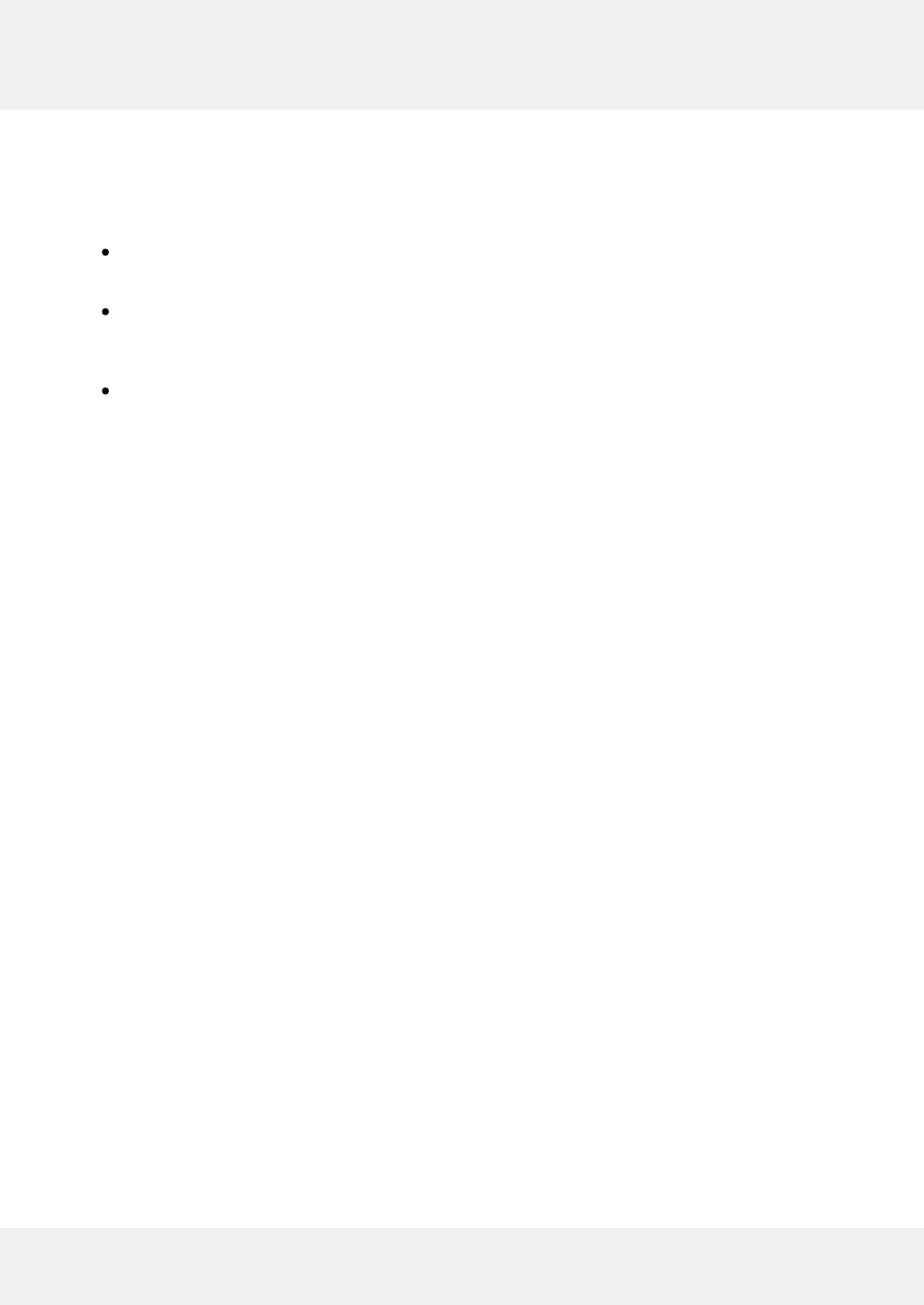

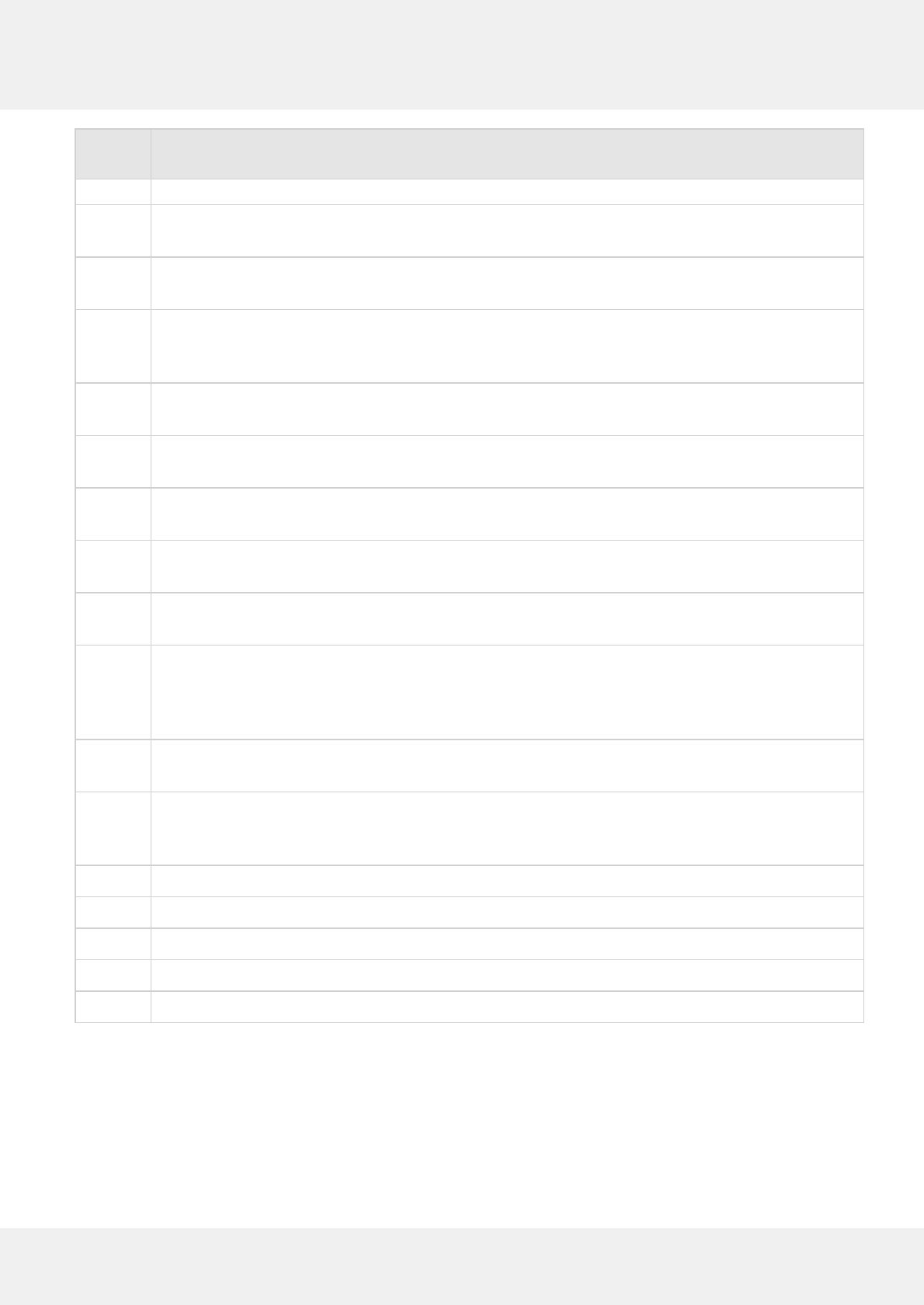

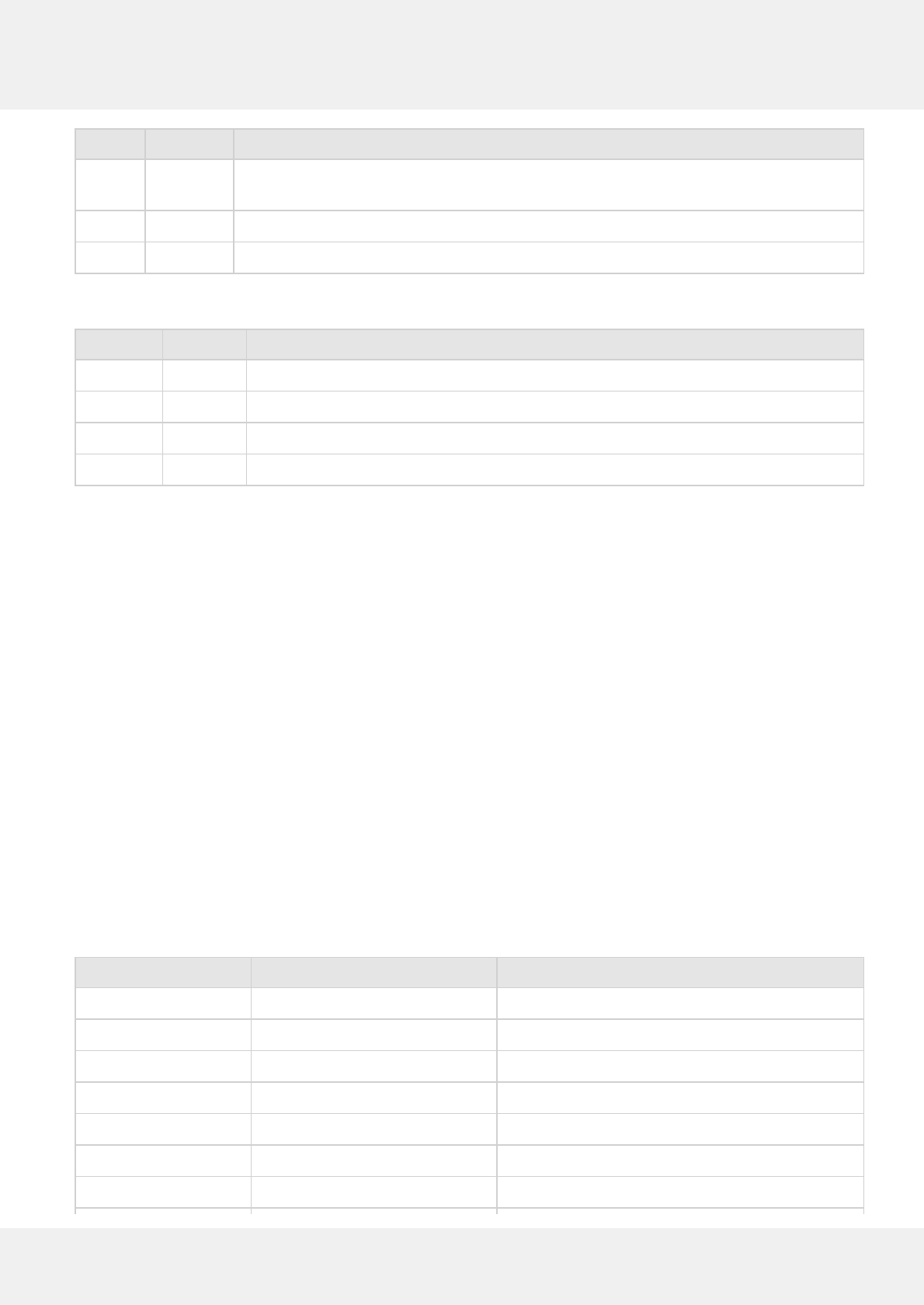

Supported services for tokenization are as follows:

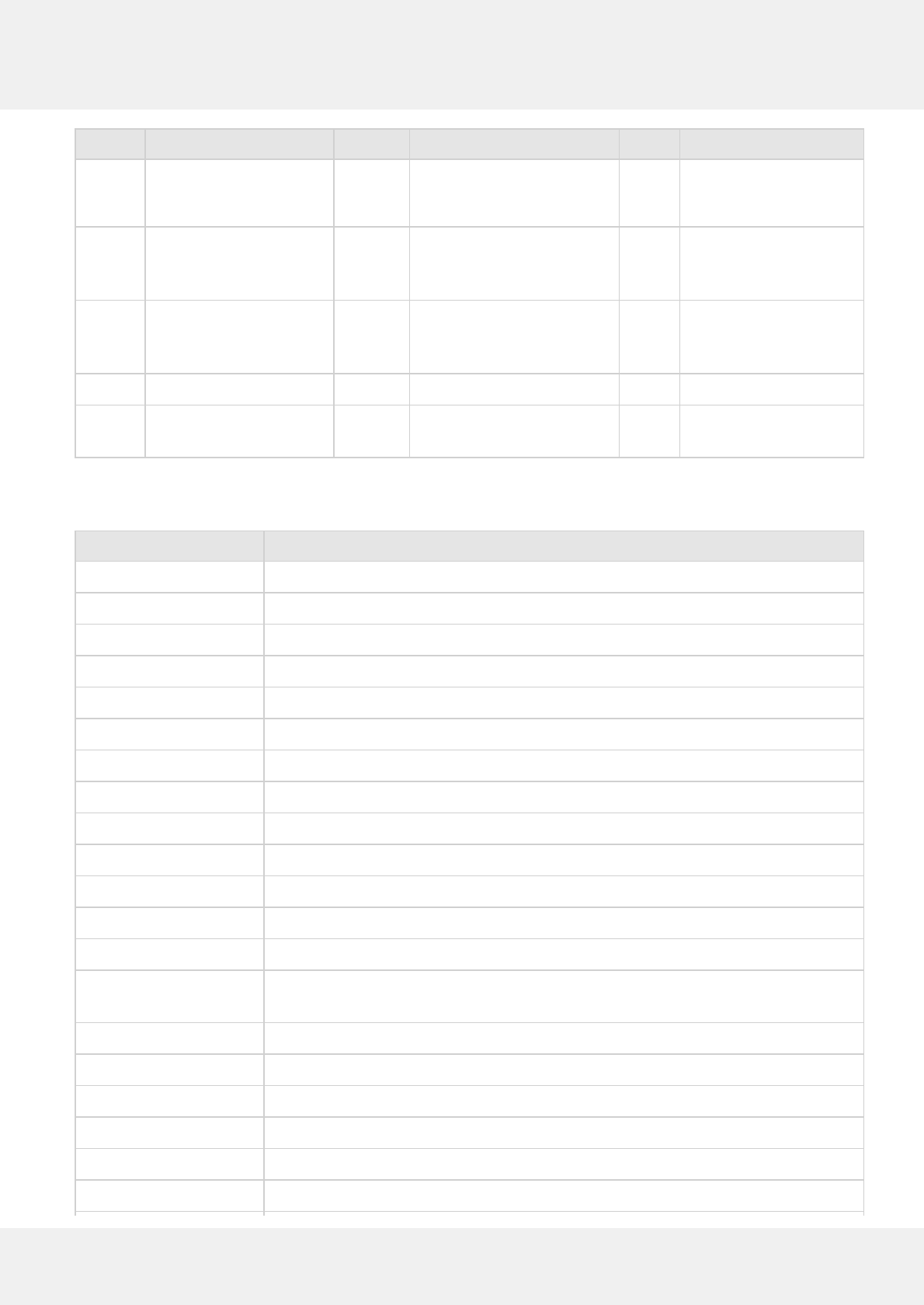

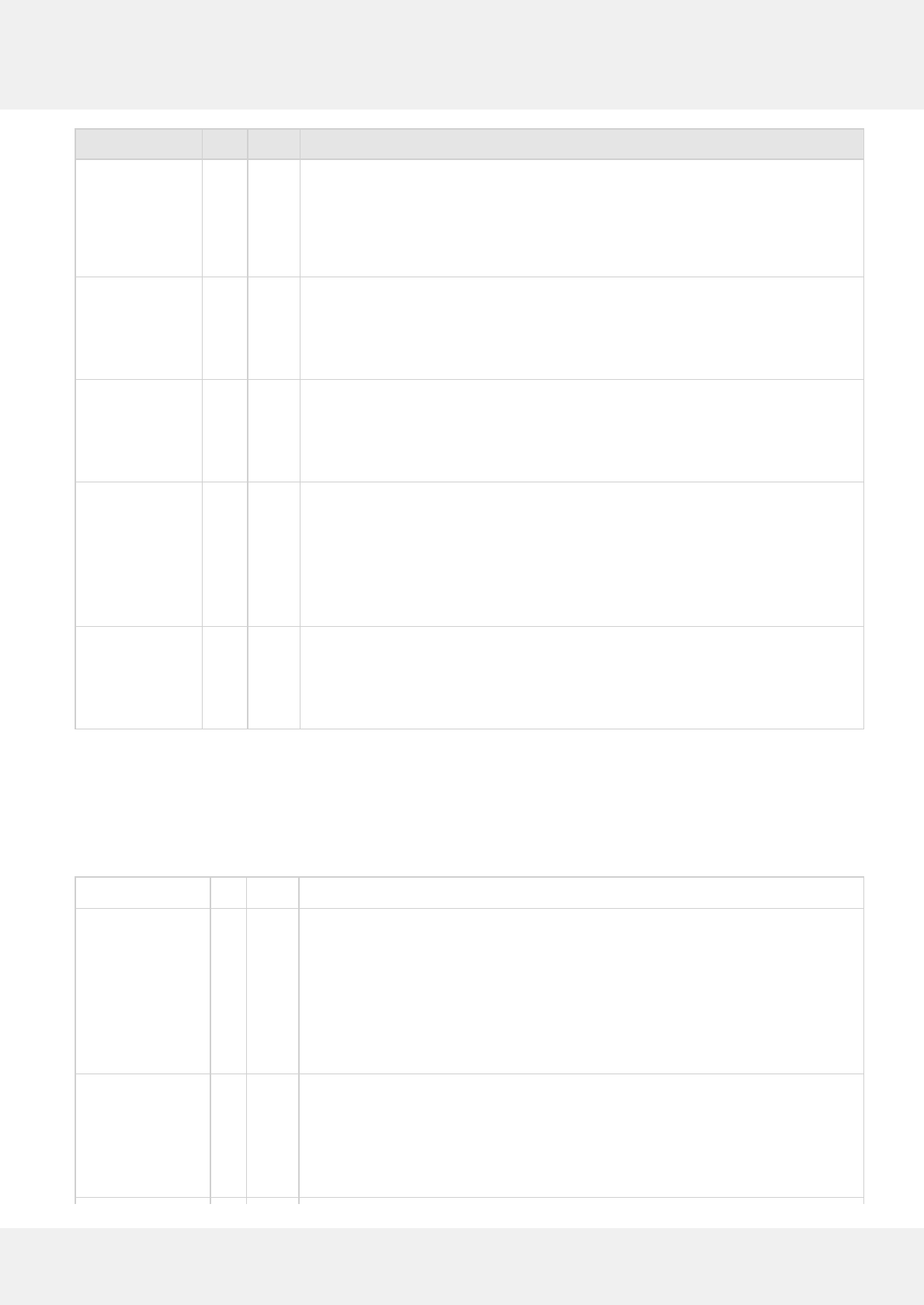

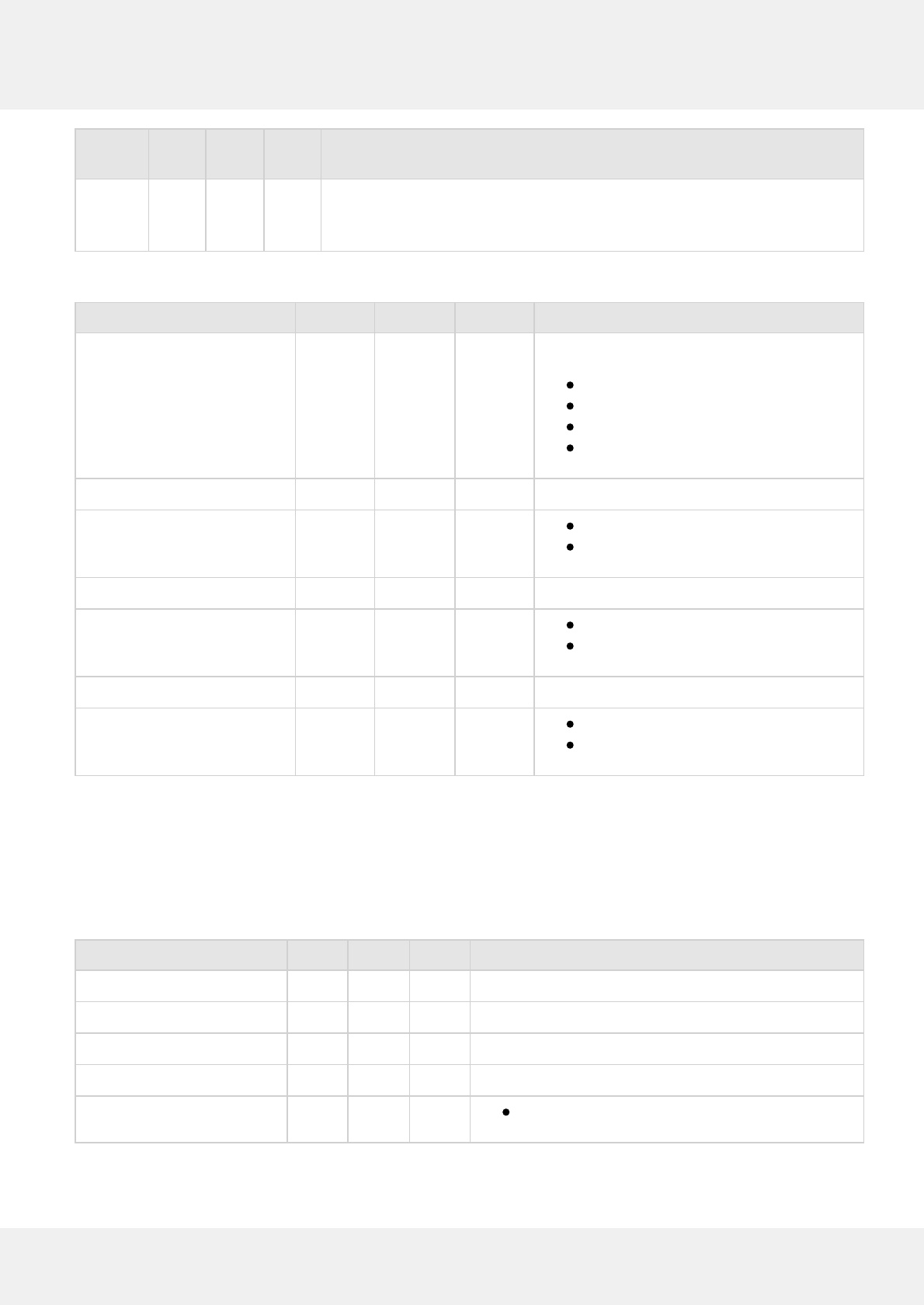

Application Service Request a Token Use a Token

CreditAccountVerify Yes Yes

CreditAuth Yes Yes

Portico Developer Guide 7

© 2016 Heartland Payment Systems, Inc.

CreditOfflineAuth No Yes

CreditOfflineSale No Yes

CreditReturn No Yes

CreditReversal Yes Yes

CreditSale Yes Yes

PrePaidAddValue Yes Yes

PrePaidBalanceInquiry Yes Yes

RecurringBilling Yes Yes

See the message definitions for more information on the token specific fields.

Additional fees apply for the multi-use tokenization service. Please contact your Heartland representative for further

information.

Application Service Request a Token Use a Token

2.2.1 Requesting a Token

When a merchant requests that a token be returned, the associated transaction (auth, sale, reversal, etc.) is processed

before requesting a token. The transaction response is always returned to the merchant POS.

If the associated transaction response is a non-approval, the token request is not processed. This is indicated in the

TokenRspCode returned in the response to the client POS.

If the transaction is approved by the card issuer with a response of APPROVAL, PARTIAL APPROVAL, or CARD OK, a

token is requested from the tokenization service and a TokenData response block is returned to the merchant POS.

The TokenData response block may include the generated token in the TokenValue field depending on the success or

failure of the tokenization request.

When data is tokenized, it includes both the PAN and expiration date.

2.2.2 Using a Token

After a token is successfully returned, the merchant presents this token rather than the account number or track data

in one of the allowed transactions in the TokenDataRsp. Portico attempts to request the account number and

expiration date associated with the provided token from the tokenization service. If the TokenDataRsp included the

expiration date, this overrides what is retrieved from the tokenization service. The included expiration date is only

used for the current transaction and is not stored for future use.

If the PAN and expiration date are obtained successfully, the transaction proceeds.

If the PAN and expiration date cannot be obtained, the transaction is aborted and an error is returned to the

merchant. The error code/text is returned in the GatewayRspCode and GatewayRspMsg fields.

2.2.3 Managing Tokens

Once a token has been created for a particular Merchant/PAN combination, it can be managed through

the ManageTokens service. ManageTokens provides the following actions.

SetAttribute

Portico Developer Guide 8

© 2016 Heartland Payment Systems, Inc.

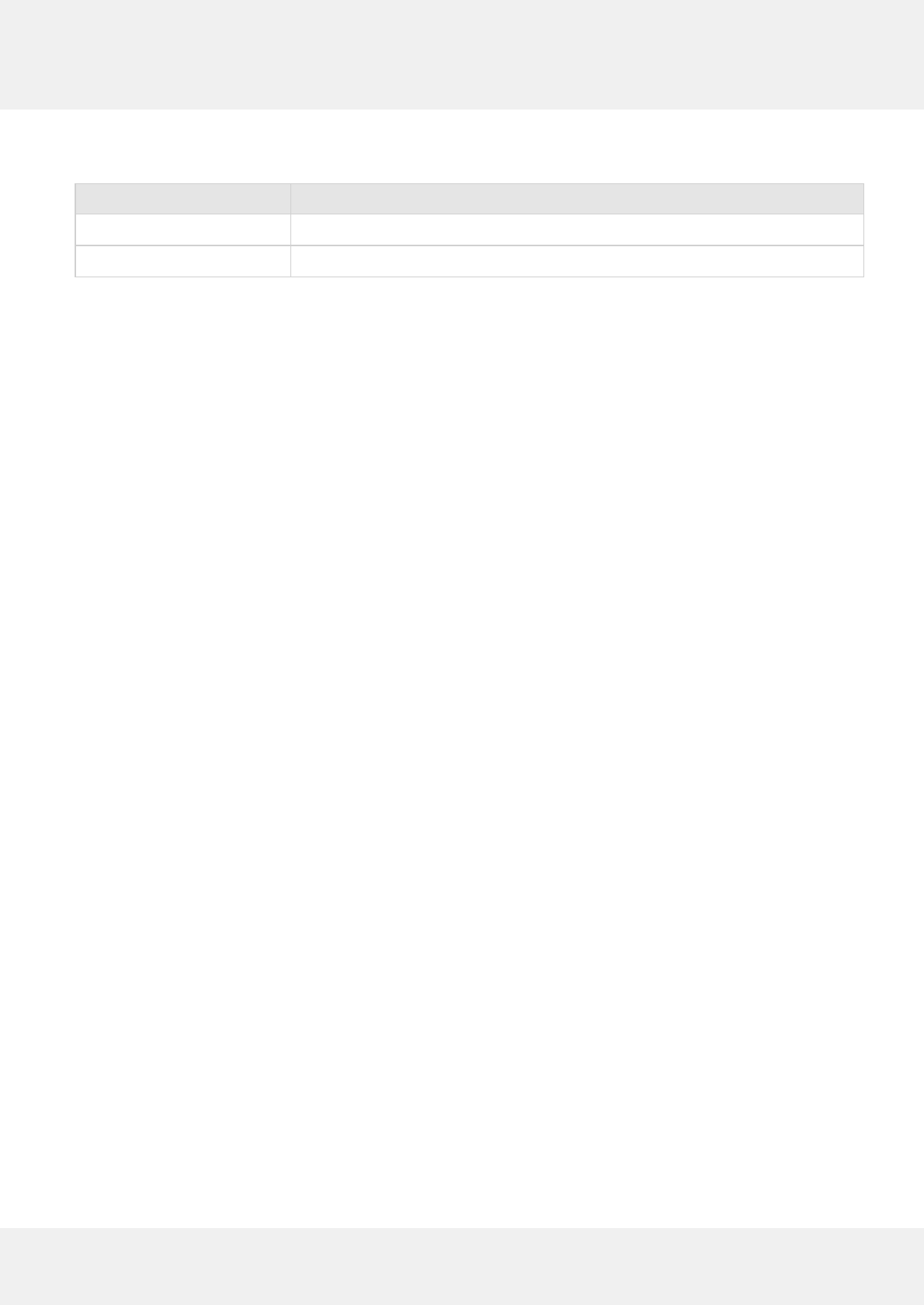

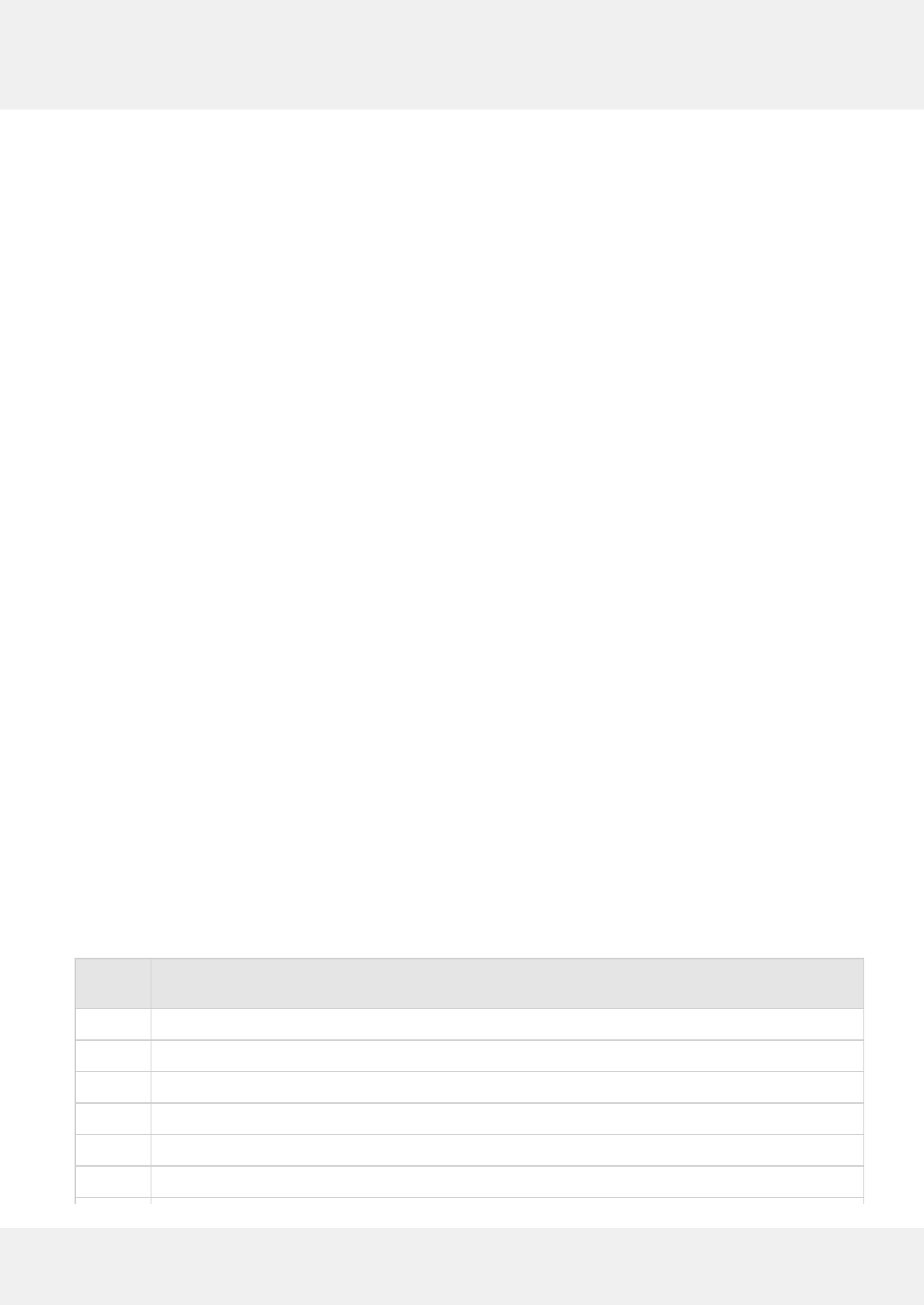

The ManageTokens.Set action adds or updates multiple token attribute name-value pairs. The currently allowed

attribute names are as follows:

Attribute Name Allowed Values

ExpMonth Positive integer in the following range: 1-12

ExpYear Positive integer greater than 1999

DeleteAttribute, DeleteToken

The ManageTokens.Delete action removes multiple attributes or the token itself from the tokenization service

database. If no attributes are provided for a token, the token is deleted.

Portico Developer Guide 9

© 2016 Heartland Payment Systems, Inc.

3 Getting Started

This section is intended to provide an integrator with a starting point. This includes information that is needed to get

started and process the most basic transactions with Portico.

3.1 Add a Reference

Portico provides several ways to begin integration:

Portico Client DLL

Web Services Description Language (WSDL)

XSD

The Portico Client DLL provides an object-oriented interface for integration. This option hides the complexities of the

lower-level protocols and handles serialization and deserialization of the various elements. For managed applications,

integrators can utilize the library by adding a reference to the DLL. For unmanaged applications, the Portico Client DLL

also provides a COM wrapper. To use the COM wrapper, the library must first be registered for use. For additional

information on registering the library, refer to the appendix Register the Client Library (Section 6.1).

The WSDL allows integrators to generate a service reference rather than using the supplied Portico Client DLL. The

WSDL can be accessed by adding "?wsdl" to the end of the URL provided for certification. For example:

https://cert.api2.heartlandportico.com/Hps.Exchange.PosGateway/POSgatewayservice.asmx?wsdl

The W3C XML Schema Definition (XSD) is also available as another alternative for allowing an integrator to generate a

service reference rather than using the supplied Portico Client DLL. The XSD types are defined at

http://www.w3.org/TR/xmlschema-2/.

3.2 Use the Interface

There are three key classes exposed in the interface:

PosGatewayInterface—Handles the interface and communication details with the Portico server

PosRequest—Object representation of the XML Heartland Portico Gateway request document

PosResponse—Object representation of the XML Heartland Portico Gateway response document

The key steps involved when issuing a transaction to Portico are as follows:

Build a PosRequest message object.

Instantiate a PosGatewayInterface object.

Invoke the DoTransaction() method of the PosGatewayInterface object.

Interrogate the PosResponse message object.

The PosRequest and PosResponse classes are based on the PosGateway schema. Referring to this schema helps you

to understand the layout of the PosRequest and PosResponse classes. All transactions described in this document

conform to the schema.

3.3 SoapUI Examples

A sample SoapUI project is included in the SDK to provide working SOAP/XML examples of Portico transactions. The

examples show the raw SOAP/XML and can be run against the certification environment, but SoapUI cannot be used

for final certification.

Portico Developer Guide 10

© 2016 Heartland Payment Systems, Inc.

To install and set up the SoapUI application with Portico samples, do the following:

1. Go to www.soapui.org.

2. Download and install the free, open-source functional testing application, SoapUI.

3. Save the Soap UI project file from Portico SDK to your hard drive.

4. Open the Soap UI project file with SoapUI application.

Portico Soap UI project is organized into TestSuites that match specific chapters in this document. Each TestSuite

contains a collection of TestCases that represent Portico functionality or transactions. Each TestCase contains

individual TestSteps that provide XML samples of detailed scenarios.

To view and use SOAP/XML samples for specific scenarios matching the functionality described in this document, you

drill down in the SoapUI project following the same structure. For example, execute TestSuite – Credit Card

Transaction > TestCase – Credit Sale > Test Steps > CreditSale Request 2 – Swipe – Visa to process a sample request

and response for a credit card sale described in CreditSale.

Note: The SoapUI examples contain properties (e.g., ${#Project#LicenseID-Retail}) that must be replaced with valid

values in your SOAP messages.

3.4 Transaction Basics

Validating Response Codes

All request messages to Portico include a Header and a Transaction block. Responses always include a Header block,

but only include the Transaction block when Portico was able to successfully process the request (i.e.

GatewayRspCode is 0). See Gateway Response Codes (Section 6.2) for additional information.

When present, the Transaction block always includes the Transaction type (i.e. CreditSale).

The GatewayRspCode in the response header can be inspected to determine if the request was fully processed by

Portico. A GatewayRspCode of 0 means that Portico was able to process the request and that the Transaction block is

present. The GatewayRspCode does not indicate approval or decline of the transaction.

To get the final result of the transaction, the Transaction block must be further inspected to see if there is an Issuer

RspCode. See Issuer Response Codes (Section 6.4) for additional information.

Timeouts

For transactions, clients should allow 15 seconds for Portico to respond. Transactions are typically on Heartland

systems for less than 500ms, but Portico waits up to 10 seconds for other back-end systems to reply.

For searching and reports, clients should allow 60 seconds or more for Portico to respond. Actual response times

depend on the amount of data and the type of report or search being done. To improve response times, adjust the

criteria being used to obtain a smaller result set.

Specified Flags for Optional Elements

Optional elements are notated in the XML schema by a minOccurs="0" attribute. In order to provide a value in an

element that is optional, it may be required to also set a "specified" flag. This is required for optional elements that

are of a type that is not nullable. The specified flag is generated in code from the service reference as

<fieldname>Specified.

The problem is that fields in .NET that cannot be null will always have a valid value (i.e. "0"). On the other hand, the

XML schema defines it as optional:

<xs:element minOccurs="0" name="ID" type="xs:int"/>

Given this, there is no way for the .NET client to know whether the value of "0" means there is no value defined or if

Portico Developer Guide 11

© 2016 Heartland Payment Systems, Inc.

the true intent is to send the value "0" to the server.

The Specified flag takes care of this situation:

If the field value is "0" and <field>Specified="false", no value was defined and the element will not be included

in the message that results from serialization.

If the field value is "0" and <field>Specified="true", the element will be included in the message that results

from serialization with the value "0".

Unfortunately, this is not only in the "0" value case. For data types such as xs:int, xs:long, xs:decimal, xs:dateTime, and

xs:string elements with specific enumeration values (i.e. booleanType, currencyType), the specified flag must be set to

true in addition to setting the desired value.

For example, the optional field GatewayTxnId (type xs:int) needs to have an associated flag of GatewayTxnIdSpecified.

To send a transaction id of 1234, the client must set GatewayTxnId="1234" and set GatewayTxnIdSpecified="true".

3.5 TestCredentials

A TestCredentials transaction validates the credentials passed in the transaction, but does not perform an action.

TestCredentials should only be used at the beginning of the certification period to validate credentials and

connectivity to the certification environment.

Note: This should not be used as a "heartbeat" check and it is not required for running transactions.

The TestCredentials transaction includes the transaction request and response headers with only the transaction type

in the Transaction block of the request and response. This represents the least of the possible Portico request and

response messages.

Portico Developer Guide 12

© 2016 Heartland Payment Systems, Inc.

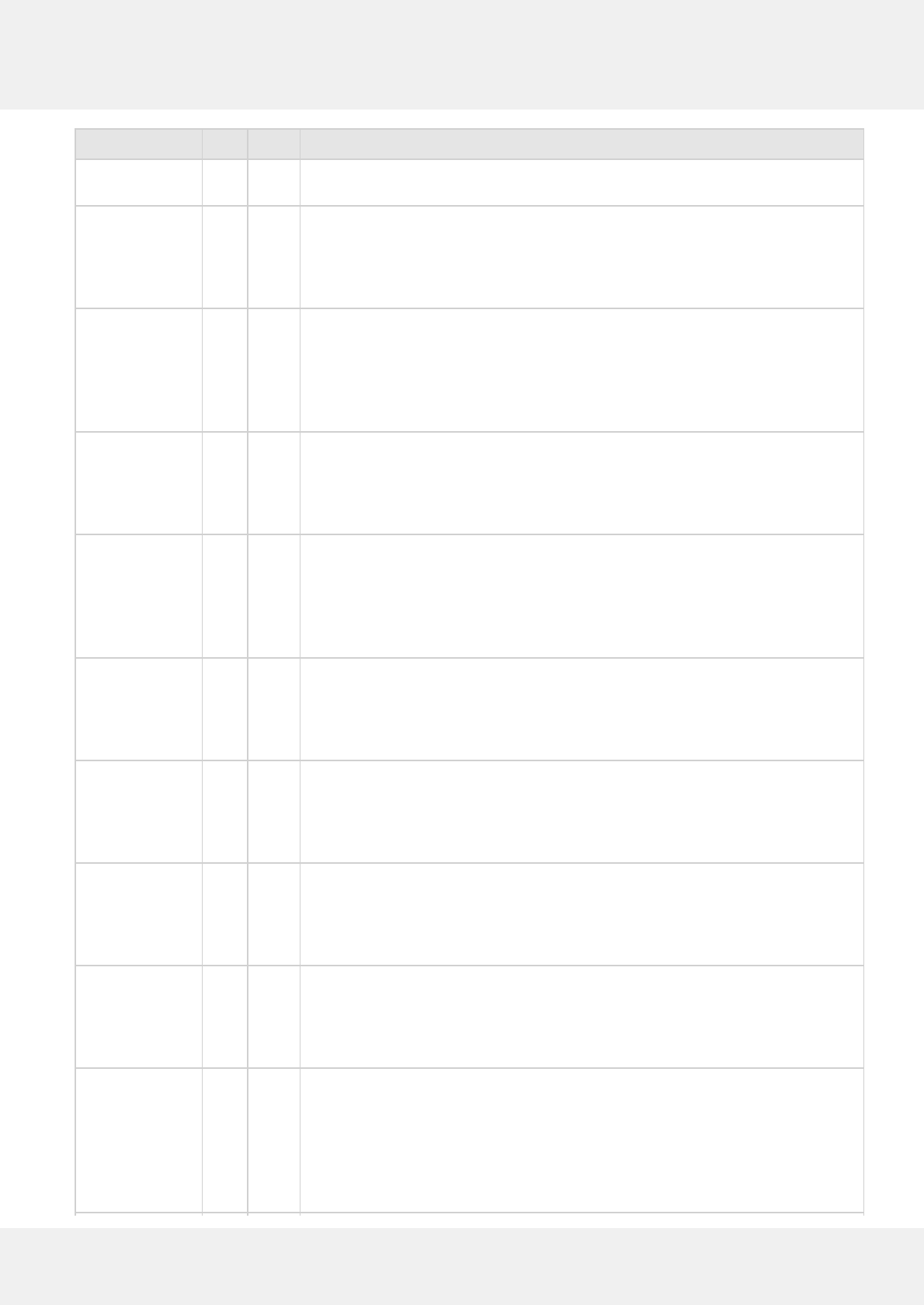

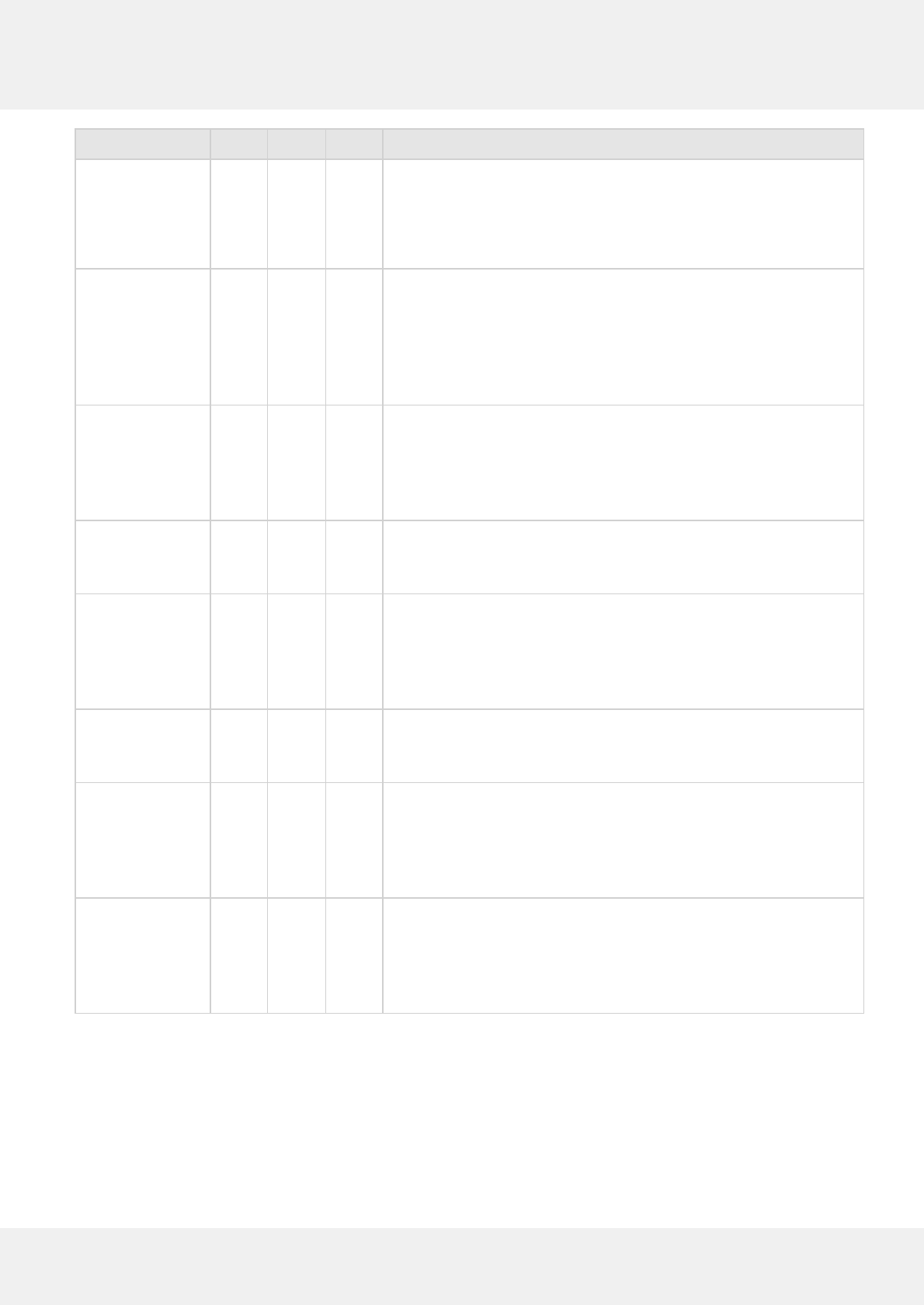

4Transactions

The following list contains all the available Portico transactions with links to their detailed documentation and code

examples.

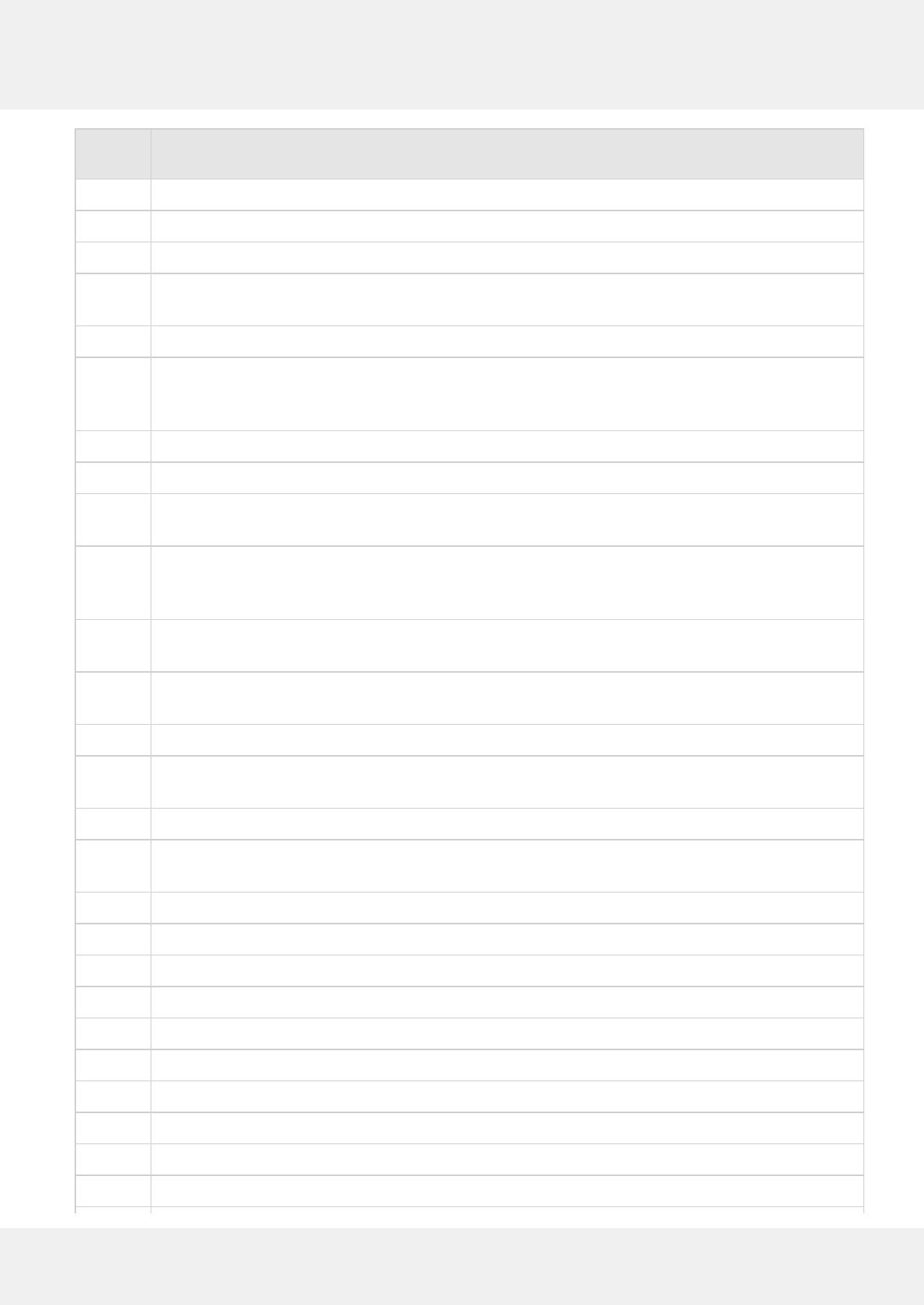

Transaction Schema

Documentation Description

AddAttachment Request

/ Response

AddAttachment can be used to store and associate data (e.g. images,

documents, signature capture, etc.) to a prior transaction.

AltPaymentAuth Request /

Response

AltPaymentAuth takes a unique Session Id and performs an

Authorization transaction.

AltPaymentCapture Request /

Response

AltPaymentCapture takes an existing Order or Auth and captures

some portion of the original transaction and adds that portion to the

open batch.

AltPaymentCreateAuth Request /

Response

AltPaymentCreateAuth takes a previously approved Alternate

Payment transaction and creates an Authorization from it.

AltPaymentCreateSession Request /

Response

AltPaymentCreateSession creates a unique Session for Electronic

Commerce Alternate Payment Processing. This service must be called

first to perform Alternate payment processing.

AltPaymentOrder Request /

Response

AltPaymentOrder takes a unique Session Id and performs an Order

transaction.

AltPaymentReturn Request /

Response

AltPaymentReturn takes a previously Add To Batch transaction and

performs a return against it.

AltPaymentSale Request /

Response

AltPaymentSale takes a unique Session Id and performs a Sale

transaction.

AltPaymentSessionInfo Request /

Response

AltPaymentSessionInfo takes a unique Session Id and returns

information about the session.

AltPaymentVoid Request /

Response

AltPaymentVoid takes a GatewayTxnId and performs a void against

that transaction.

Authenticate Request /

Response

Authenticate is used to authenticate a specific user. For this call the

header must include username and password.

BatchClose Request /

Response

BatchClose is used to settle and close the current open batch.

CancelImpersonation Request /

Response

CancelImpersonation is used to terminate a previously started

impersonation session.

CashReturn Request /

Response

CashReturn creates a log of a transaction that is returning cash to a

customer. This is processed offline.

CashSale Request /

Response

CashSale creates a log of a transaction, in which cash is collected

from a customer. This is processed offline.

CheckSale Request /

Response

CheckSale transactions use bank account information as the payment

method. There are sub-actions that can be taken as part of the

CheckSale as indicated by the CheckAction field.

Portico Developer Guide 13

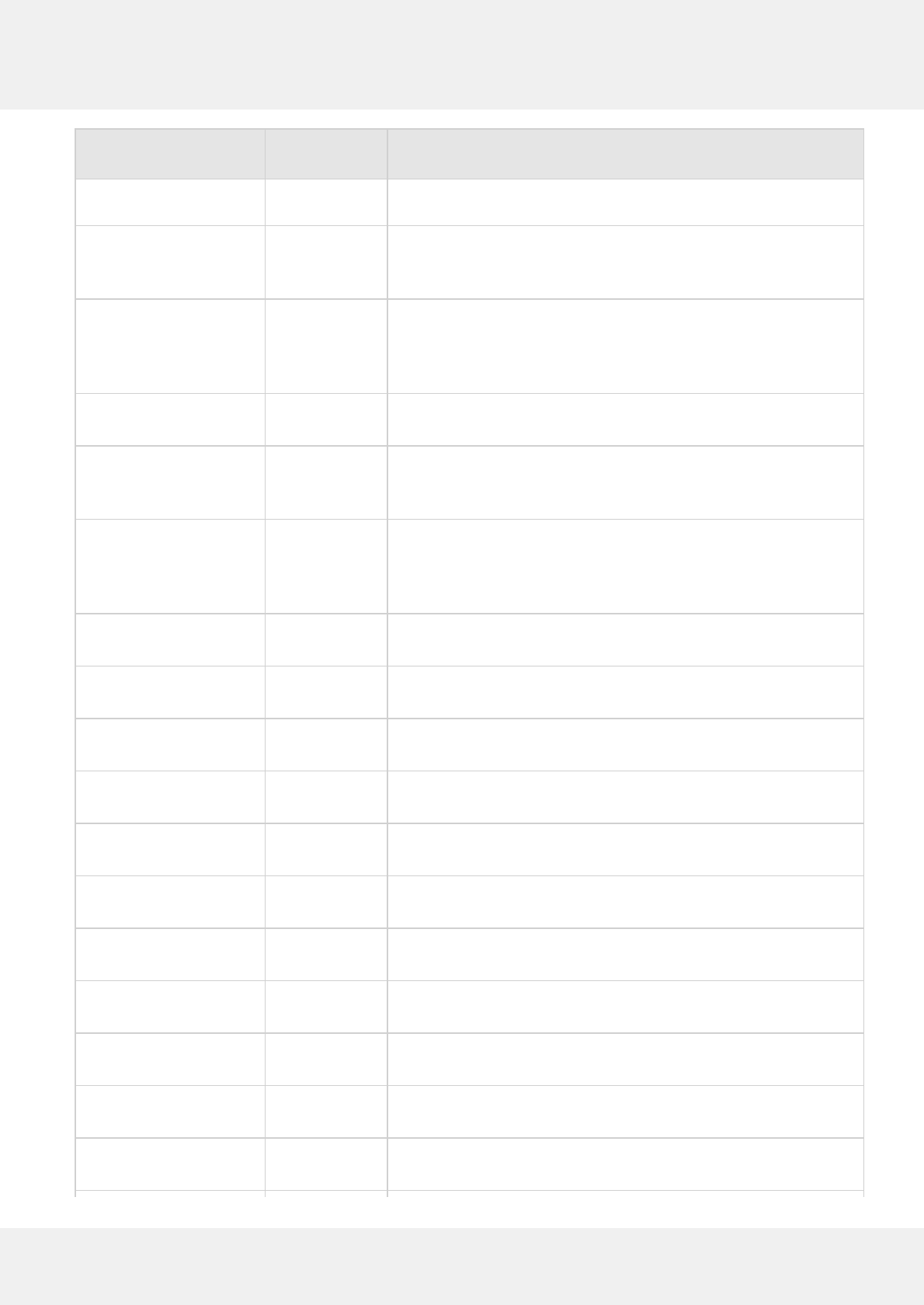

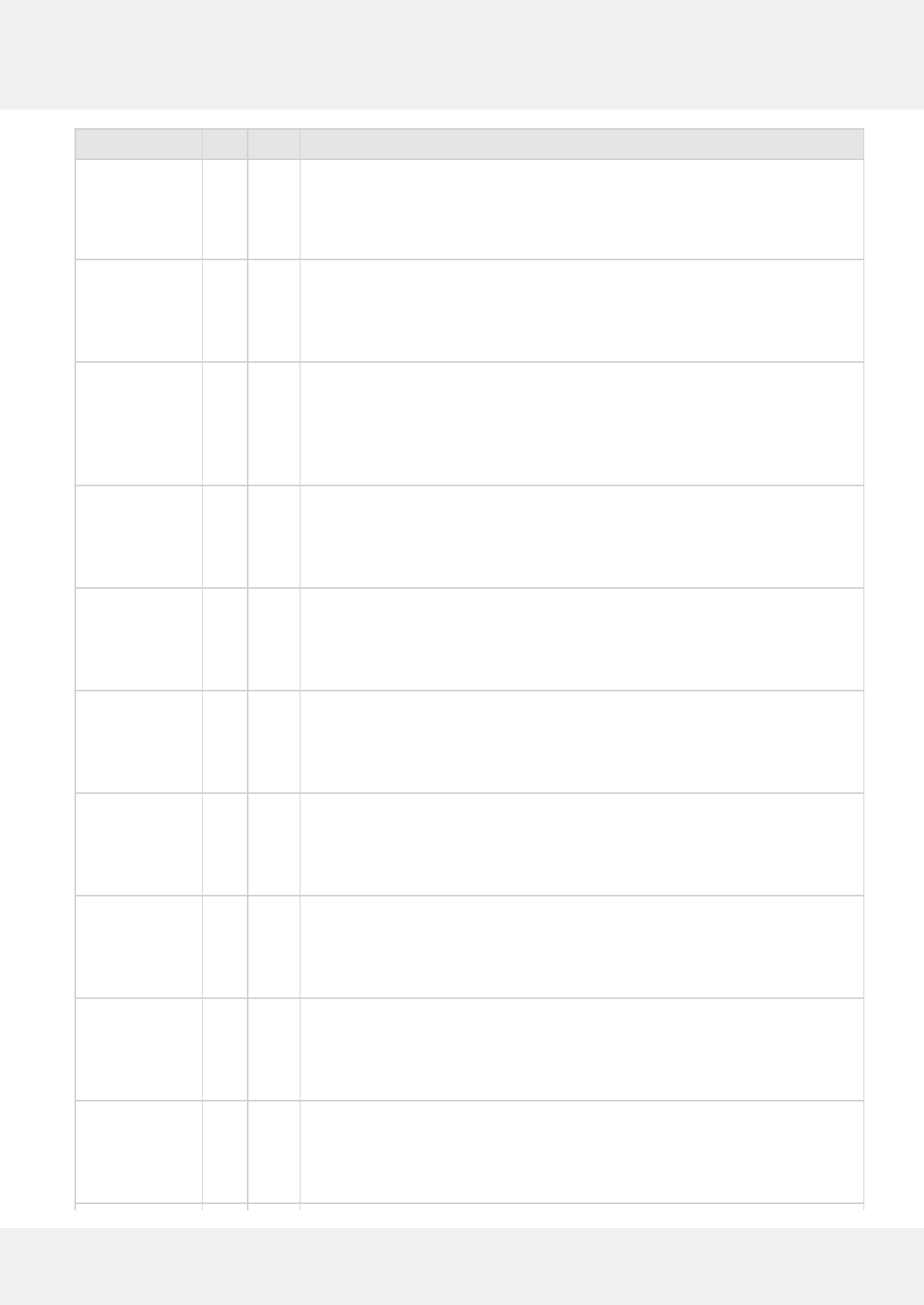

© 2016 Heartland Payment Systems, Inc.

CheckVoid Request /

Response

CheckVoid is used to cancel a previously successful CheckSale

transaction.

ChipCardDecline Request /

Response

ChipCardDecline is used to record an offline decline by an EMV chip

card.

CreditAccountVerify Request /

Response

CreditAccountVerify is used to verify that the associated account is in

good standing with the Issuer.

CreditAdditionalAuth Request /

Response

CreditAdditionalAuth is typically used in a bar or restaurant situation

where the merchant obtains the payment information for an original

CreditAuth but does not want to hold the card or ask for it on each

additional authorization.

CreditAddToBatch Request /

Response

CreditAddToBatch is primarily used to add a previously approved

open authorization (CreditAuth, CreditOfflineAuth, or

OverrideFraudDecline) to the current open batch. If a batch is not

open this transaction will create one. It also provides the opportunity

to alter data associated with the transaction (i.e. add a tip amount).

CreditAuth Request /

Response

CreditAuth authorizes a credit card transaction. These authorization

only transactions are not added to the batch to be settled. They can

be added to a batch at a later time using CreditAddToBatch.

Approved authorizations that have not yet been added to a batch are

called open auths.

CreditCPCEdit Request /

Response

CreditCPCEdit attaches Corporate Purchase Card (CPC) data to a prior

transaction. This information will be passed to the issuer at

settlement when the associated card was a corporate card or an

AMEX card.

CreditIncrementalAuth Request /

Response

CreditIncrementalAuth adds to the authorized amount for a prior

transaction. Incremental authorizations are only allowed for lodging

merchants.

CreditOfflineAuth Request /

Response

CreditOfflineAuth records an authorization obtained outside of the

gateway (e.g., voice authorization, chip card offline approval). These

authorization only transactions are not added to the batch to be

settled. They can be added to a batch at a later time using

CreditAddToBatch. Approved authorizations that have not yet been

added to a batch are called open auths.

CreditOfflineSale Request /

Response

CreditOfflineSale records an authorization obtained outside of the

gateway (e.g., voice authorization, chip card offline approval).

CreditReturn Request /

Response

CreditReturn allows the merchant to return funds back to the

cardholder. Returns can be for the entire amount associated with the

original sale or a partial amount.

CreditReversal Request /

Response

CreditReversal cancels a prior authorization in the current open

batch. This can be used in timeout situations or when a complete

response is not received. In either case, the client is unsure of the

outcome of the prior transaction.

CreditSale Request / CreditSale authorizes a credit card transaction. These authorizations

Transaction Schema

Documentation Description

Portico Developer Guide 14

© 2016 Heartland Payment Systems, Inc.

Response are automatically added to the batch to be settled. If a batch is not

already open this transaction will create one.

CreditTxnEdit Request /

Response

CreditTxnEdit allows the merchant to alter the data on a previously

approved CreditSale, CreditAuth, CreditOfflineSale, or

CreditOfflineAuth (i.e. add a tip amount).

CreditVoid Request /

Response

CreditVoid is used to cancel an open auth or remove a transaction

from the current open batch. The original transaction must be a

CreditAuth, CreditSale, CreditReturn, CreditOfflineAuth,

CreditOfflineSale, RecurringBilling, or OverrideFraudDecline.

DebitAddValue Request /

Response

DebitAddValue increases the amount on a stored value card.

DebitReturn Request /

Response

DebitReturn allows the merchant to return funds from a prior debit

sale back to the cardholder. Returns can be for the entire amount

associated with the original sale or a partial amount.

DebitReversal Request /

Response

DebitReversal cancels a previous DebitSale transaction. This should

be used in timeout situations or when a complete response is not

received. In either case, the client is unsure of the outcome of the

prior transaction.

DebitSale Request /

Response

DebitSale authorizes a debit card transaction.

EBTBalanceInquiry Request /

Response

EBTBalanceInquiry returns the available balance for an EBT account.

EBTCashBackPurchase Request /

Response

EBTCashBackPurchase is used to purchase goods with EBT Cash

Benefits.

EBTCashBenefitWithdrawal Request /

Response

EBTCashBenefitWithdrawal is used to disburse cash from an EBT Cash

Benefits account.

EBTFSPurchase Request /

Response

EBTFSPurchase is used to purchase goods with EBT Food Stamps.

EBTFSReturn Request /

Response

EBTFSReturn is used to credit previously debited funds to an EBT

Food Stamps account for merchandise returned.

EBTVoucherPurchase Request /

Response

EBTVoucherPurchase is obsolete and should no longer be used.

EndToEndTest Request /

Response

EndToEndTest for internal use only.

FindTransactions Request /

Response

FindTransactions is used to search all current gateway transactions

based on provided filter criteria.

GetAttachments Request /

Response

GetAttachments is used to retrieve attachments (i.e. documents,

images, etc.) associated with a particular transaction.

GetUserDeviceSettings Request /

Response

GetUserDeviceSettings is for internal use only.

Transaction Schema

Documentation Description

Portico Developer Guide 15

© 2016 Heartland Payment Systems, Inc.

GetUserSettings Request /

Response

GetUserSettings is for internal use only.

GiftCardActivate Request /

Response

GiftCardActivate is used to activate a new stored value account and

load it with an initial balance.

GiftCardAddValue Request /

Response

GiftCardAddValue loads an amount onto a stored value account.

GiftCardAlias Request /

Response

GiftCardAlias allows the client to manage stored account aliases. An

alias is an alternate identifier used to reference a stored value

account.

GiftCardBalance Request /

Response

GiftCardBalance is used to retrieve the balance(s) for each currency

supported by a stored value account.

GiftCardCurrentDayTotals Request /

Response

GiftCardCurrentDayTotals is used to retrieve stored value transaction

totals for the current day.

GiftCardDeactivate Request /

Response

GiftCardDeactivate is used to deactivate an active stored value

account that otherwise has not been used.

GiftCardPreviousDayTotals Request /

Response

GiftCardPreviousDayTotals is used to retrieve stored value transaction

totals for the previous day.

GiftCardReplace Request /

Response

GiftCardReplace transfers balances from one stored value account to

another. This is typically to replace a lost or stolen account with a new

one or to consolidate two or more accounts into a single account.

GiftCardReversal Request /

Response

GiftCardReversal is used to cancel a prior stored value transaction.

This should be used in timeout situations or when a complete

response is not received. In either case, the client is unsure of the

outcome of the prior transaction.

GiftCardReward Request /

Response

GiftCardReward is used when an account holder makes a payment

using a payment form other than a stored value account (e.g. cash or

credit card). The account holder may present their stored value

account to earn points or other loyalty rewards, which would be

added to their account.

GiftCardSale Request /

Response

GiftCardSale is used to redeem value from a stored value account.

GiftCardTip Request /

Response

GiftCardTip is used to add tip to an existing GiftCardSale.

GiftCardVoid Request /

Response

GiftCardVoid is used to cancel a prior successful transaction. When

voiding a transaction, all changes to the account are reversed,

including any additional value added by rewards programs or

automated promotions.

Impersonate Request /

Response

Impersonate is for internal use only.

InvalidateAuthentication Request /

Response

InvalidateAuthentication is for internal use only.

Transaction Schema

Documentation Description

Portico Developer Guide 16

© 2016 Heartland Payment Systems, Inc.

ManageSettings Request /

Response

ManageSettings is for internal use only.

ManageTokens Request

/ Header

response only

ManageTokens allows merchants to update information referenced

by a specific multi-use token.

ManageUsers Request /

Response

ManageUsers is for internal use only.

OverrideFraudDecline Request

/ Header

response only

OverrideFraudDecline is for internal use only. It is used to process a

CreditSale, CreditReturn or CreditAuth that was previously declined

due to fraud. An override causes the fraud concerns to be ignored.

The use of this function on a client should require management

approval. This can only be done once, and for the original auth

amount.

ParameterDownload Request /

Response

ParameterDownload is used to initiate an EMV parameter download

by clients interfacing to an EMV device.

PrePaidAddValue Request /

Response

PrePaidAddValue is used to increase the balance associated with a

prepaid card.

PrePaidBalanceInquiry Request /

Response

PrePaidBalanceInquiry returns the available balance for a prepaid

card.

RecurringBilling Request /

Response

RecurringBilling authorizes a one-time or scheduled recurring

transaction.

ReportActivity Request /

Response

ReportActivity returns all activity between the client devices and

gateway for a period of time. This can be filtered to a single device if

needed.

ReportBatchDetail Request /

Response

ReportBatchDetail returns information on each transaction currently

associated to the specified batch. This report is for the site and device

referenced in the header.

ReportBatchHistory Request /

Response

ReportBatchHistory returns information about previous batches over

a period of time. This report is for the site referenced in the header.

ReportBatchSummary Request /

Response

ReportBatchSummary returns a batch's status information and totals

broken down by payment type. This report is for the site and device

referenced in the header.

ReportOpenAuths Request /

Response

ReportOpenAuths returns all authorizations that have not been

added to a batch for settlement. This report is for the site referenced

in the header.

ReportSearch Request /

Response

ReportSearch returns transaction information for a specified time

period.

ReportTxnDetail Request /

Response

ReportTxnDetail returns detailed information about a single

transaction. This report is for the site and device referenced in the

header.

SendReceipt Request / SendReceipt is for internal use only. It allows a client to send a receipt

Transaction Schema

Documentation Description

Portico Developer Guide 17

© 2016 Heartland Payment Systems, Inc.

Response from a prior transaction out to specific destinations. The prior

transaction must belong to the site and device referenced in the

header.

TestCredentials Request /

Response

TestCredentials validates the credentials passed in the header, but

does not perform an action.

Transaction Schema

Documentation Description

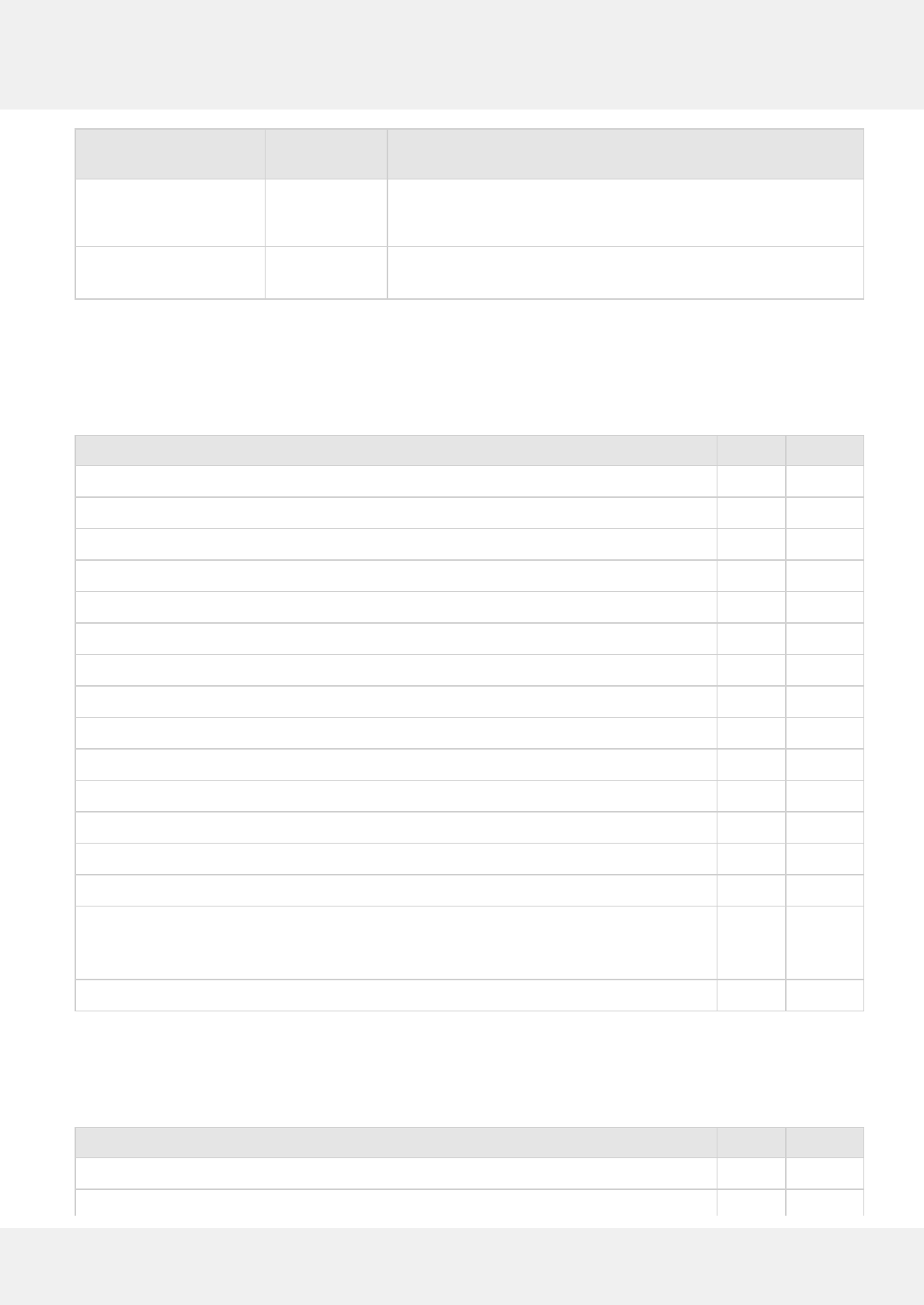

4.1 Credit Card Transactions

The following table provides links to the credit card transactions.

Transaction Name Request Response

ChipCardDecline Request Response

CreditAccountVerify Request Response

CreditAdditionalAuth Request Response

CreditAddToBatch Request Response

CreditAuth Request Response

CreditCPCEdit Request Response

CreditIncrementalAuth Request Response

CreditOfflineAuth Request Response

CreditOfflineSale Request Response

CreditReturn Request Response

CreditReversal Request Response

CreditSale Request Response

CreditTxnEdit Request Response

CreditVoid Request Response

OverrideFraudDecline Request Header

response

only

RecurringBilling (one-time payment) Request Response

4.2 Debit Card Transactions

The following table provides links to the debit card transactions.

Transaction Name Request Response

DebitAddValue Request Response

DebitReturn Request Response

Portico Developer Guide 18

© 2016 Heartland Payment Systems, Inc.

DebitReversal Request Response

DebitSale Request Response

4.3 Cash Transactions

The following table provides links to the cash transactions.

Transaction Name Request Response

CashReturn Request Response

CashSale Request Response

4.4 Check/ACH Transactions

The following table provides links to the check/ACH transaction type pages.

Transaction Name Request Response

CheckSale Request Response

CheckVoid Request Response

RecurringBilling (one-time payment) Request Response

4.5 EBT Transactions

The following table provides links to the EBT transactions.

Transaction Name Request Response

EBTBalanceInquiry Request Response

EBTCashBackPurchase Request Response

EBTCashBenefitWithdrawal Request Response

EBTFSPurchase Request Response

EBTFSReturn Request Response

EBTVoucherPurchase Request Response

4.6 Gift Card Transactions

The following table provides links to the gift card transactions.

Transaction Name Request Response

GiftCardActivate Request Response

GiftCardAddValue Request Response

Portico Developer Guide 19

© 2016 Heartland Payment Systems, Inc.

GiftCardAlias Request Response

GiftCardBalance Request Response

GiftCardCurrentDayTotals Request Response

GiftCardDeactivate Request Response

GiftCardPreviousDayTotals Request Response

GiftCardReplace Request Response

GiftCardReversal Request Response

GiftCardReward Request Response

GiftCardSale Request Response

GiftCardVoid Request Response

Transaction Name Request Response

4.7 PrePaid Card Transactions

The following table provides links to the prepaid card transactions.

Transaction Name Request Response

PrePaidAddValue Request Response

PrePaidBalanceInquiry Request Response

4.8 Utility Transactions

The following table provides links to some utility function transactions.

Transaction Name Request Response

AddAttachment Request Response

FindTransactions Request Response

GetAttachments Request Response

ManageTokens Request Header

response

only

ParameterDownload Request Response

TestCredentials Request Response

4.9 Batch Transactions

The following table provides links to the batch transactions.

Transaction Name Request Response

Portico Developer Guide 20

© 2016 Heartland Payment Systems, Inc.

BatchClose Request Response

4.10 Report Transactions

The following table provides links to the report transactions.

Transaction Name Request Response

ReportActivity Request Response

ReportBatchDetail Request Response

ReportBatchHistory Request Response

ReportBatchSummary Request Response

ReportOpenAuths Request Response

ReportSearch Request Response

ReportTxnDetail Request Response

4.11 Internal Use Only Transactions

The following table provides links to transactions that are only available internal to Heartland.

Transaction Name Request Response

Authenticate Request Response

CancelImpersonation Request Response

EndToEndTest Request Response

GetUserDeviceSettings Request Response

GetUserSettings Request Response

Impersonate Request Response

InvalidateAuthentication Request Response

ManageSettings Request Response

ManageUsers Request Response

SendReceipt Request Response

Portico Developer Guide 21

© 2016 Heartland Payment Systems, Inc.

5 Special Processing Rules

While the schema includes some requirements and restrictions, it also provides many options for the integrator to

choose from. This section is intended to provide additional details around specific processing scenarios that should be

considered during integration. These details include special payment methods and industries, assistance in getting

improved interchange rates, settlement processing, Portico storage rules, card brand and issuer requirements that are

not enforced by the schema, and more.

5.1 Address Verification Service (AVS)

The Address Verification Service is a system that verifies the personal address and billing information provided by a

customer at the time of the transaction against the information the credit card Issuer has on file. AVS enhances fraud

protection and must be present on keyed transactions to receive the best Interchange rates.

Some Issuers decline the sale if the AVS data does not match; however, most Issuers approve the sale and it is up to

the merchant to make a decision to go forward with the sale based upon the AVS response code. It is strongly

recommended that the merchant ask the cardholder for another form of payment if the AVS data does not match ("N"

AVS response).

A POS system may develop logic to reject a transaction when the AVS data does not match. For example, if a

mismatch response is received, the application may generate a CreditReversal for the original CreditSale or CreditAuth

and prompt for another form of payment. Generating a CreditReversal is recommended since the original

authorization was approved even though the AVS data did not match.

Portico only supports AVS for US and Canadian addresses.

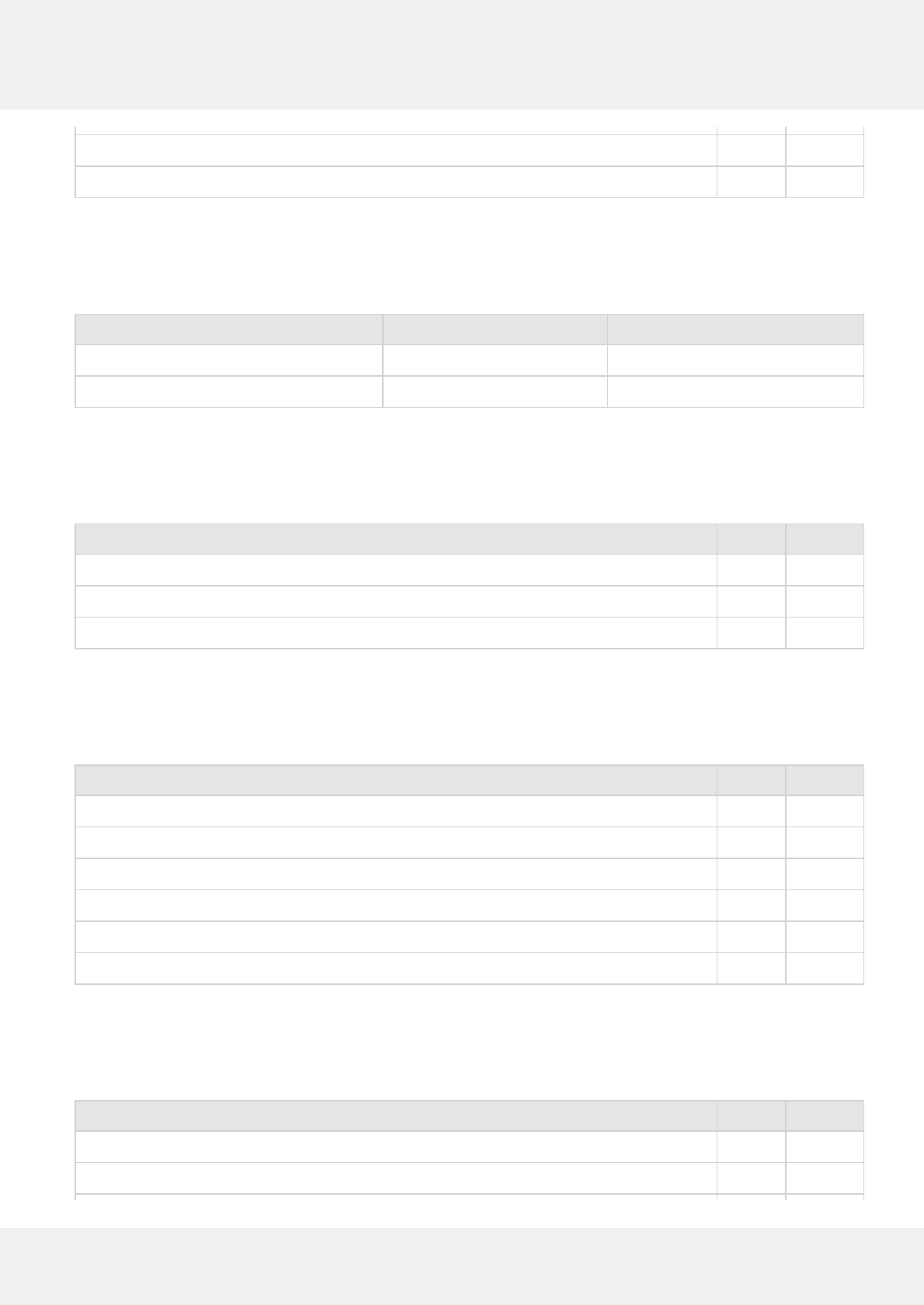

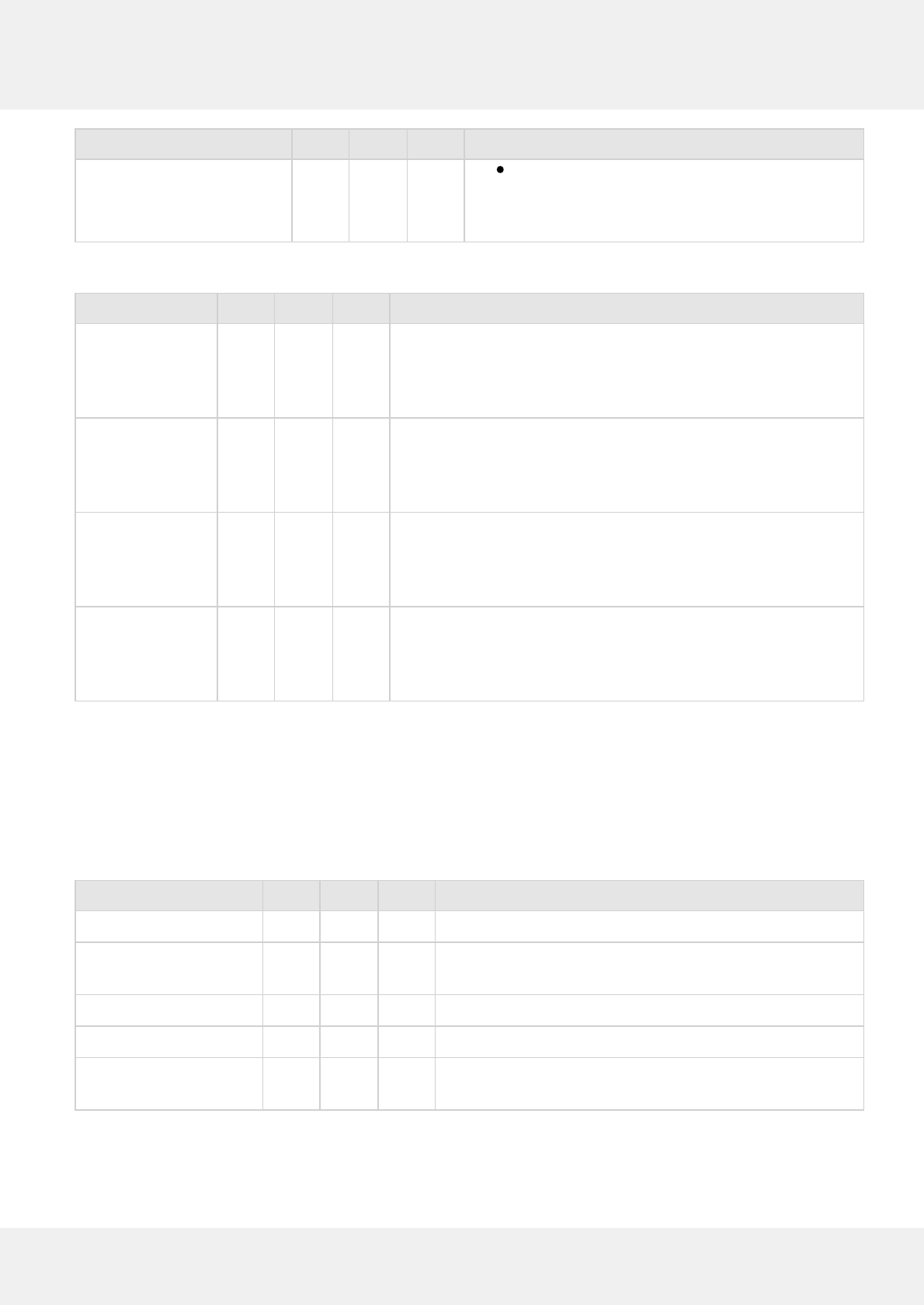

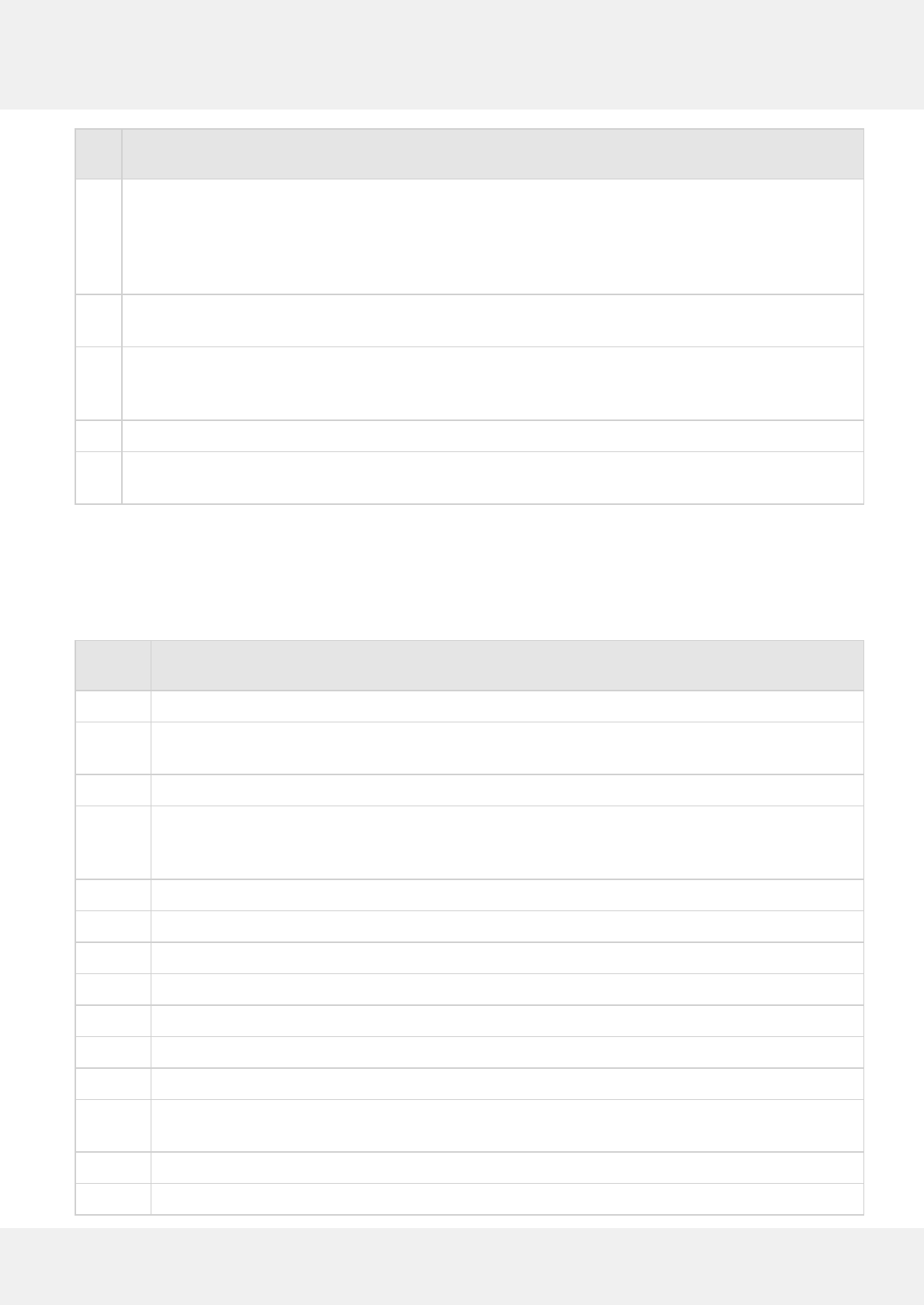

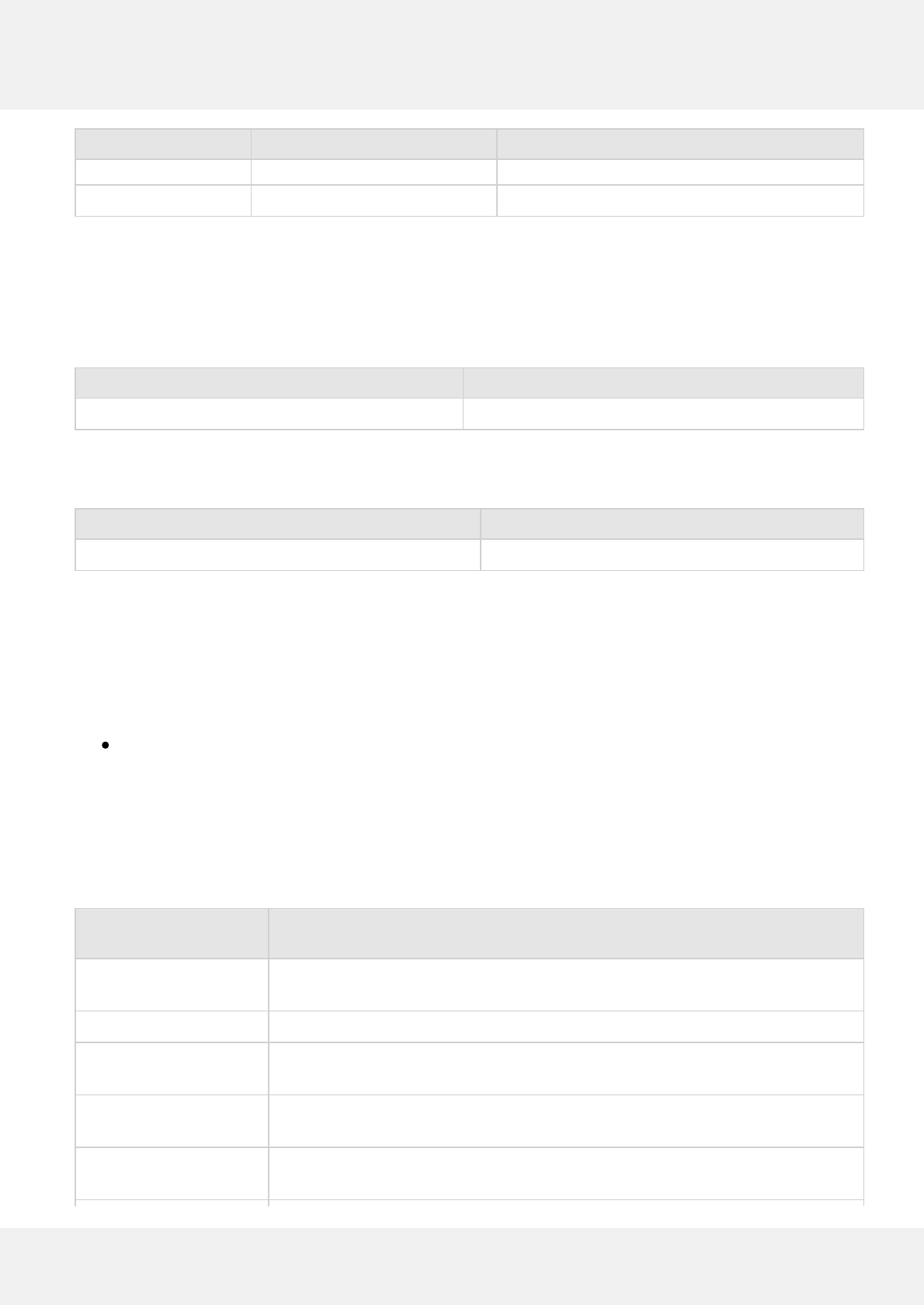

The following table outlines the AVS Response Codes that may be returned by Portico.

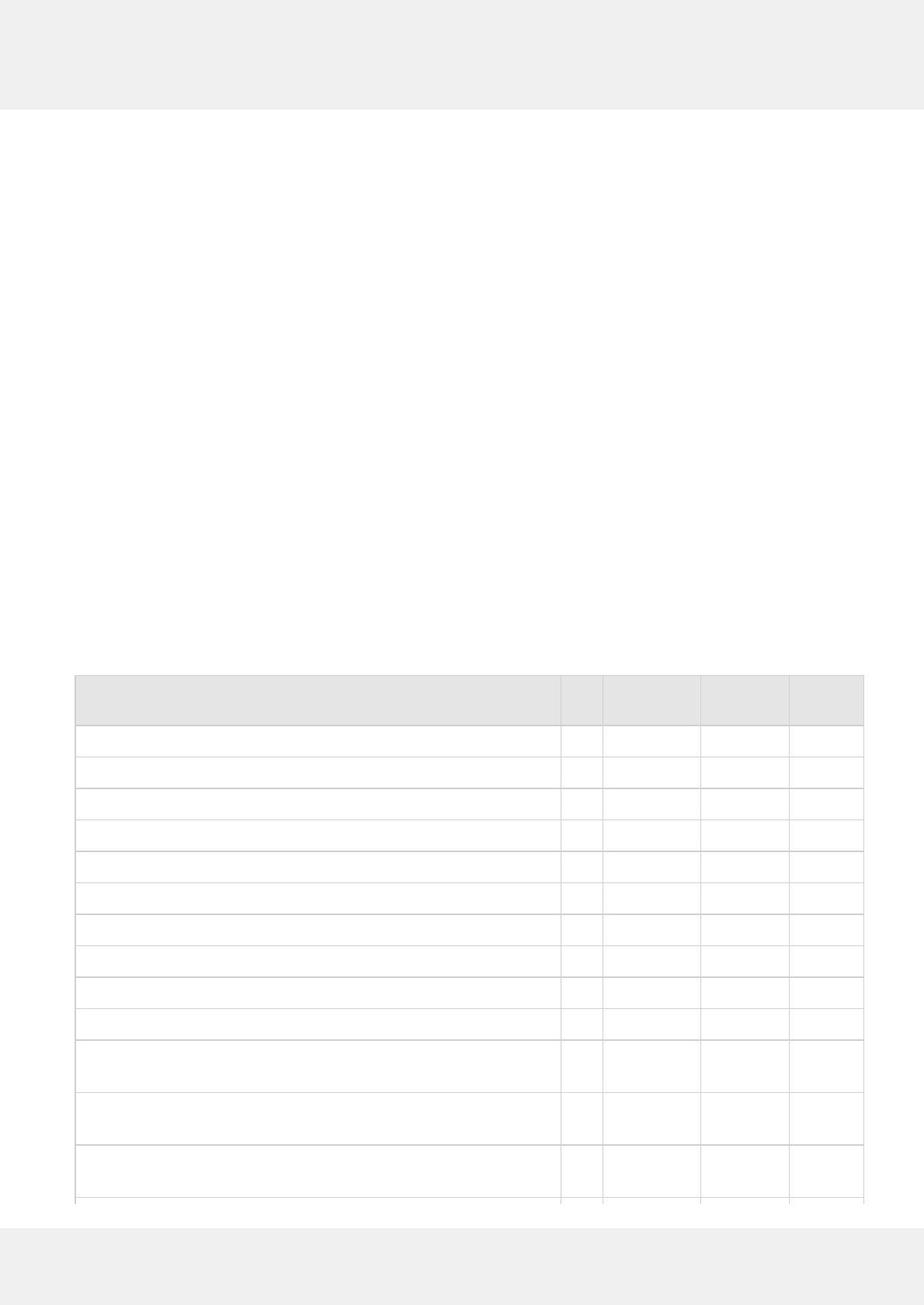

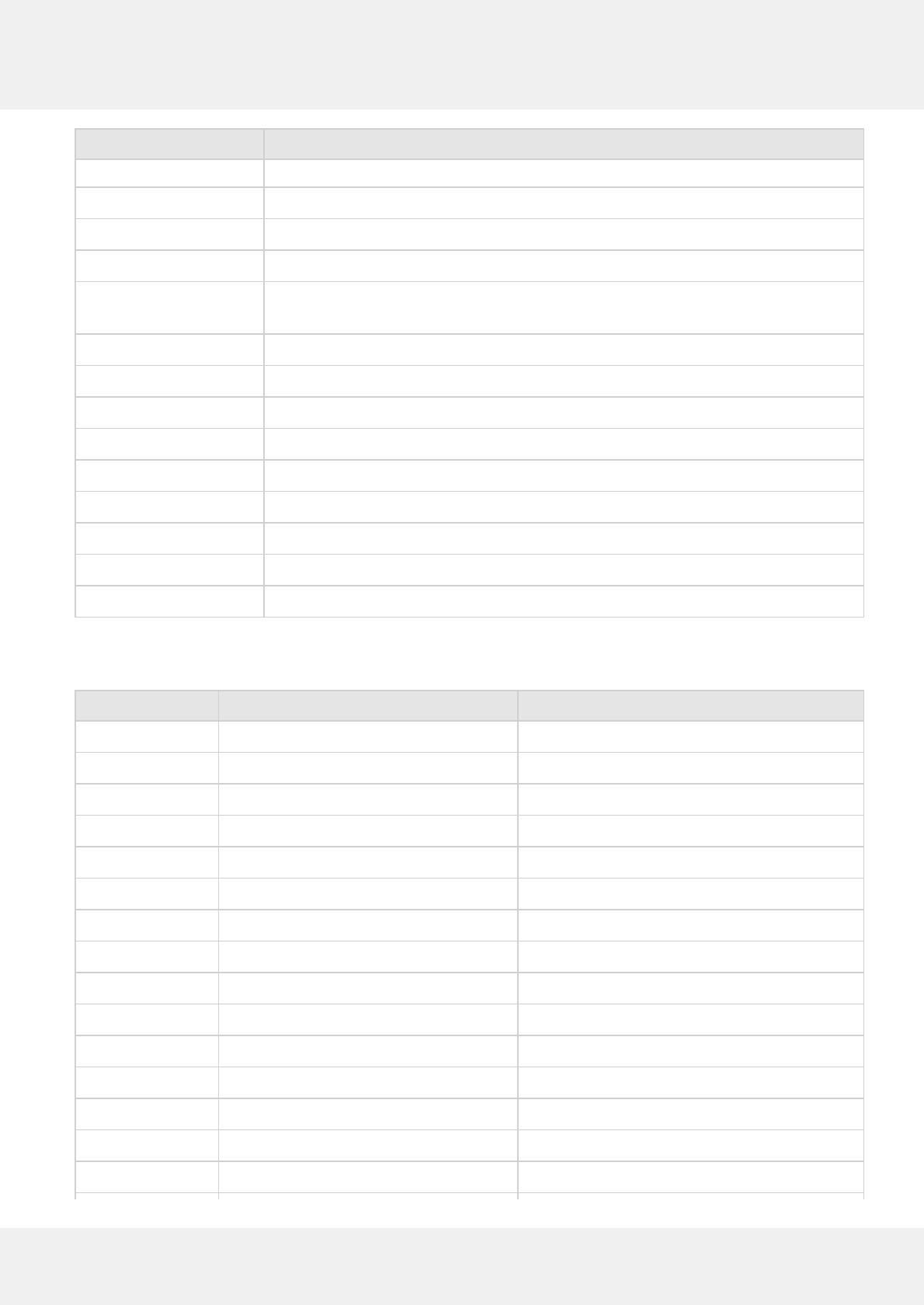

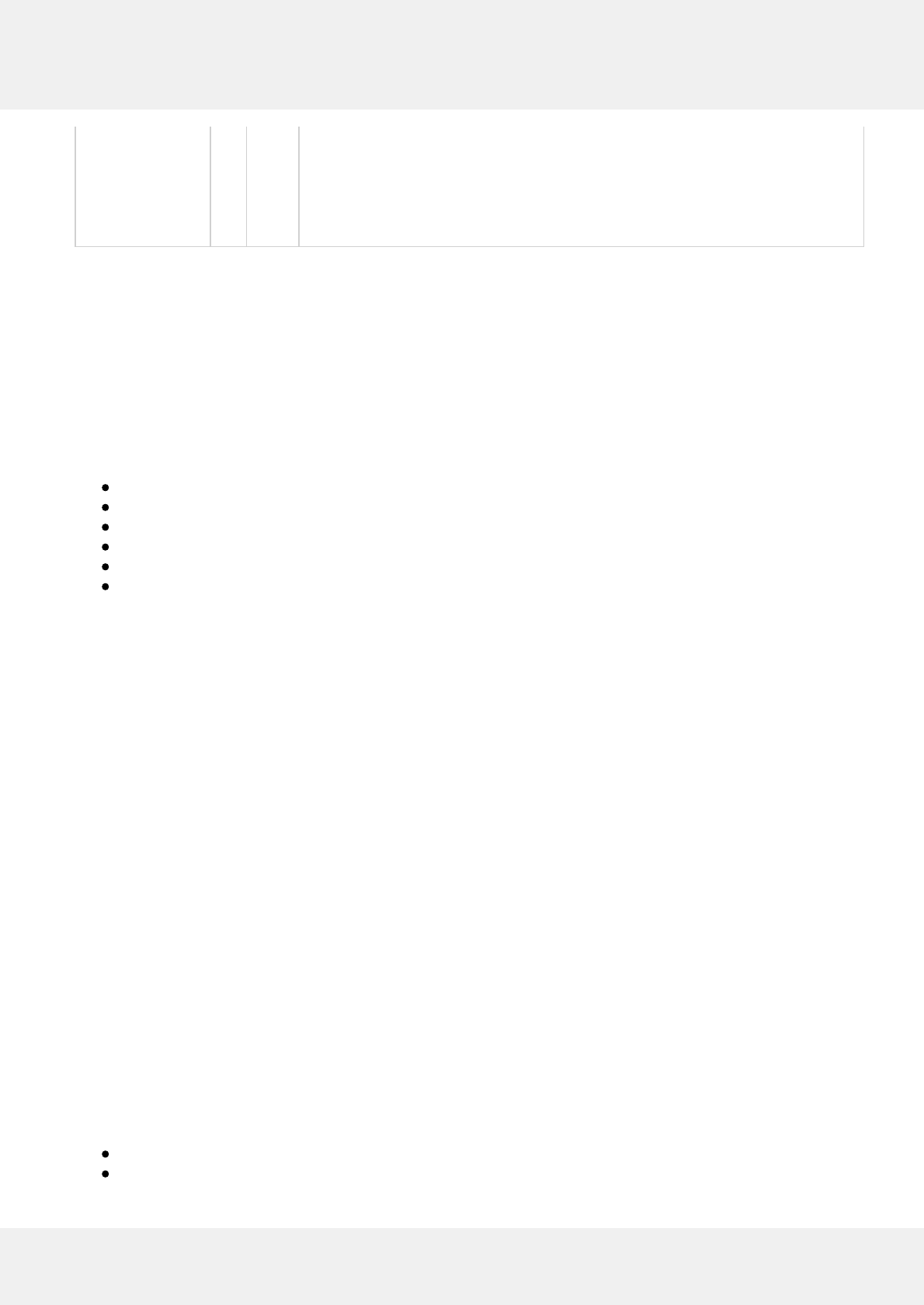

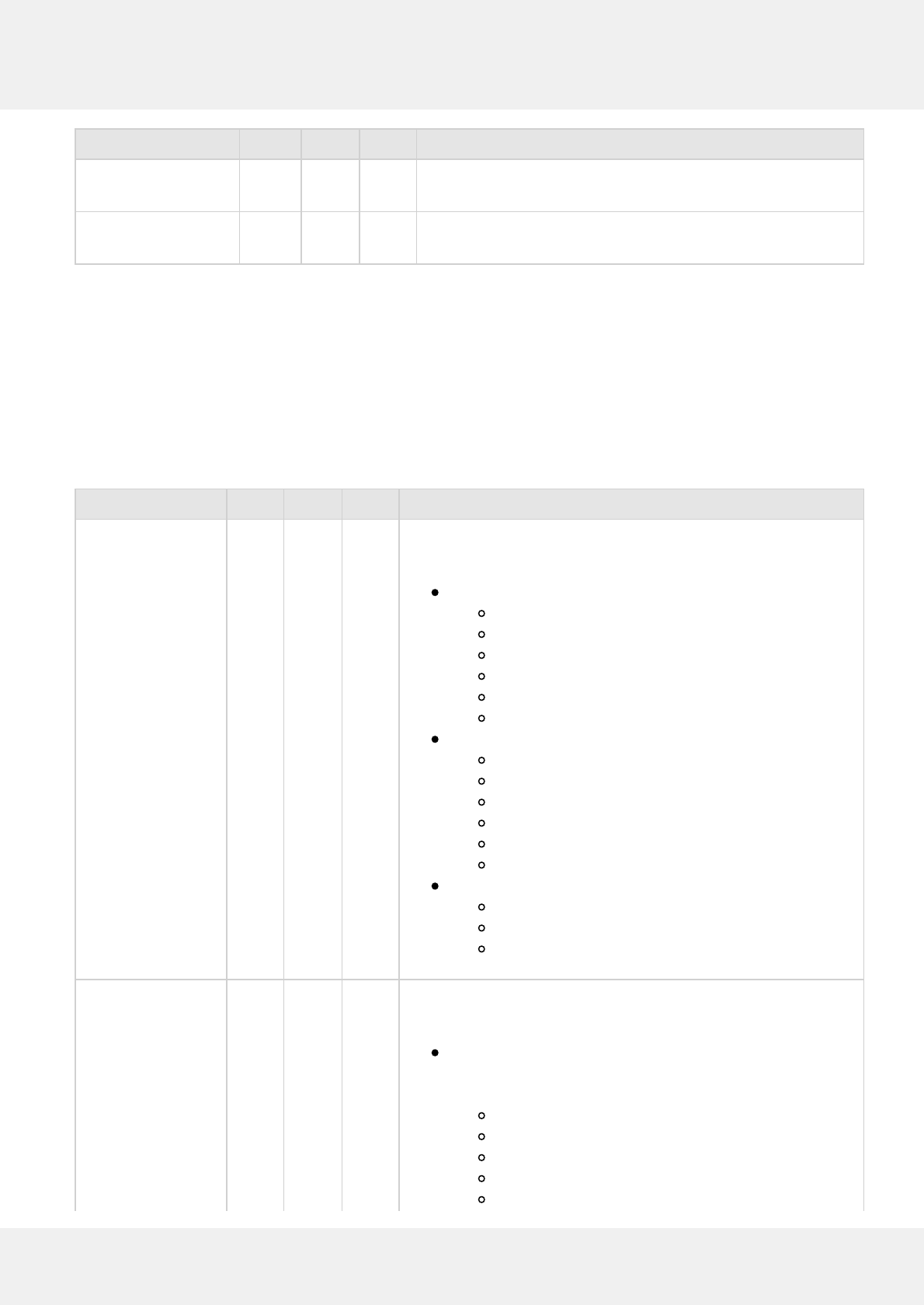

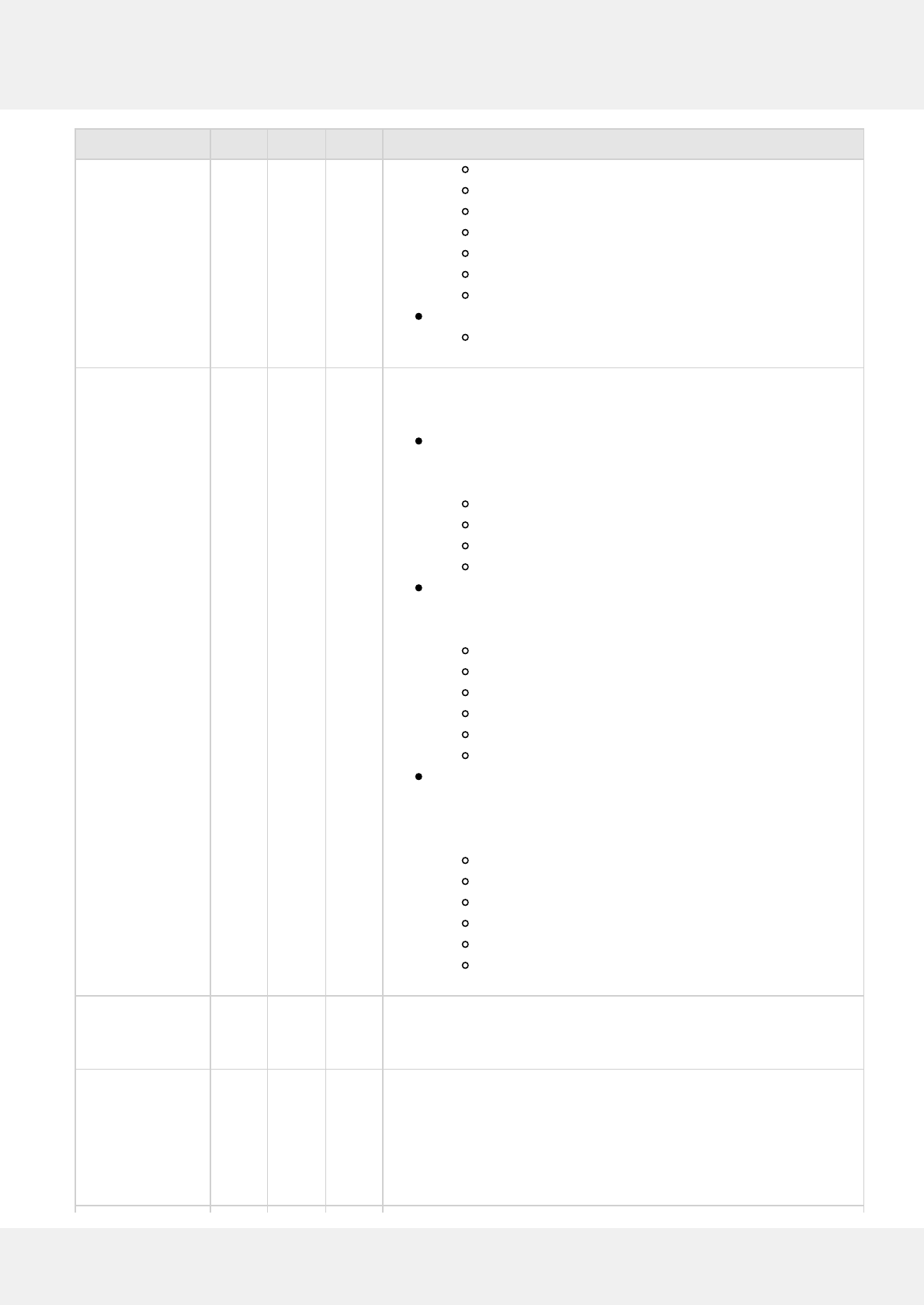

Application Service VISA Discover/JCB MasterCard American

Express

Address matches, zip code does not A A A A

Neither address or zip code match N N N N

Retry - system unable to respond R R R R

AVS not supported U U S S

No data from Issuer/auth system U U U U

9 digit zip code match, address does not match Z Z W W

9 digit zip and address match Y Y X X

5 digit zip and address match Y Y Y Y

5 digit zip code match, address does not match Z Z Z Z

Address information not verified for International transaction G G (N/A) (N/A)

Address matches, postal code does or request does not include postal

code (international address)

A A (N/A) (N/A)

Address match, postal code not verified due to incompatible formats

(international address)

B B (N/A) (N/A)

Address and postal code not verified due to incompatible formats

(international address)

C C (N/A) (N/A)

Portico Developer Guide 22

© 2016 Heartland Payment Systems, Inc.

Street address and postal code match (international address) D D (N/A) (N/A)

Address information not verified for International transaction I I (N/A) (N/A)

Street address and postal code matches M M (N/A) (N/A)

Postal code match

Street address not verified due to incompatible formats (international

address)

P P (N/A) (N/A)

Application Service VISA Discover/JCB MasterCard American

Express

5.2 Adjustments

The original transaction can be adjusted using CreditAddToBatch and CreditTxnEdit. If the edit service is used, the

client will still need to add the transaction to the batch in order for it to settle. Adjustments can be made for

additional charges, gratuity, additional detail, fees, EMV data, etc.

For adjustments regarding corporate card transactions, see Corporate Cards (Section 5.9).

5.3 Alternate Payments

A merchant has the option to accept alternate forms of payment. At present, PayPal is the only form of alternate

payment, but more will be supported in time. Once other alternate payment types are available, this process will be

modified to reflect all options.

The ability to accept PayPal payment through Portico is available with a plug in.

The process flow for Portico to process alternate payments is:

AltPaymentCreateSession—Portico API call that is required to initially start sending transactions to PayPal. Portico’s

service has implemented the SetEC API call from PayPal. The Payment Type (Sale, Order or Authorization) within the

CreateSession data drives the subsequent API call.

NOTE: After AltPaymentCreateSession, the returned RedirectUrl must be used to log into Paypal’s sandbox site and

confirm the payment. This requires a buyer account to be created on the sandbox. The ID (numbers/letters) created

from the ID is used in the SoapUI tests after the Session is created.

AltPaymentSale—Minimal call to complete an Ecommerce transaction with PayPal. Portico has implemented the DoEC

API call from PayPal and sends the Payment Action field (in the paypal request) as Sale.

AltPaymentAuth—Call to send an authorization transaction to PayPal. PayPal authorizes and adjusts the buyer’s open

to buy. Portico has implemented the DoEC API call from PayPal and sends the Payment Action field (in the paypal

request) as Authorization. This transaction requires the AltPaymentCapture to be completed against it.

AltPaymentOrder—Call to send an order transaction to PayPal. PayPal does not authorize or adjust the Buyer’s open

to buy. Portico has implemented the DoEC API call from PayPal and sends the Payment Action field (in the paypal

request) as Order. This transaction requires the AltPaymentCapture to be completed against it.

AltPaymentCapture—Call to send a capture transaction to PayPal. Portico has implemented the DoCapture API call

from PayPal. This transaction is run against an existing Order or Auth and captures some portion of the original

transaction and adds that portion to the open batch. This transaction moves money.

AltPaymentReturn—Call to send a Return transaction to PayPal. Portico has implemented the RefundTransaction API

call from PayPal. This transaction is run against an existing Sale or an existing Capture against an Order or Auth.

Portico adds the return to the open batch. This transaction moves money.

AltPaymentVoid—Call to send a Void transaction to PayPal. Portico has implemented the DoVoid API call from PayPal.

Portico Developer Guide 23

© 2016 Heartland Payment Systems, Inc.

This transaction is run against an existing Order or Auth. This transaction cancels future captures against an Auth or

Order. Existing captures are unaffected.

AltPaymentSessionInfo—Call to send a Session inquiry transaction to PayPal. Portico has implemented the GetEC API

call from PayPal. This transaction is run against an existing SessionId. This transaction is inquiry only and does not

affect any transactions.

AltPaymentCreateAuth—Call to create a stand-alone authorization from an existing Order. Portico has implemented

the DoAuthorization API call from PayPal. This transaction is run against an existing Order transaction. This transaction

requires the AltPaymentCapture to be completed against it.

AltPaymentReversal—Call to reverse a Sale, Capture, Auth or Order, that has not been successfully recorded on

Portico. If Portico has only ever recorded a timeout for a Sale or Capture, send a Return to PayPal. If Portico has only

ever recorded a timeout for an Auth or Order, send a Void transaction to PayPal.

Alternate Service NameValuePair Request Fields (Section 5.3.1)

Alternate Service Request Field Usage Detail (Section 5.3.2)

Alternate Service NameValuePair Response Fields (Section 5.3.3)

Alternate Service Response Field Usage Detail (Section 5.3.4)

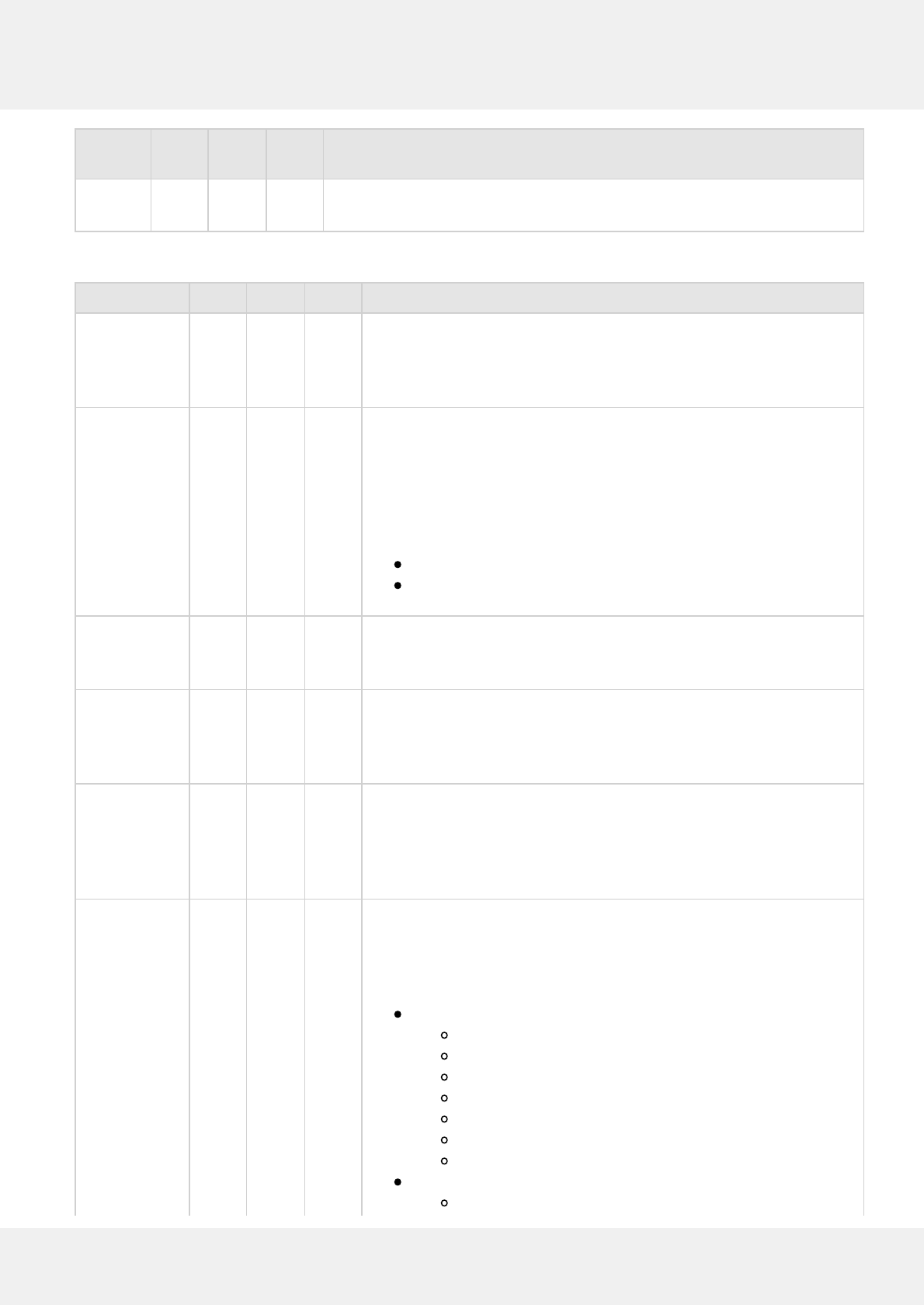

5.3.1 Alternate Service NameValuePair Request Fields

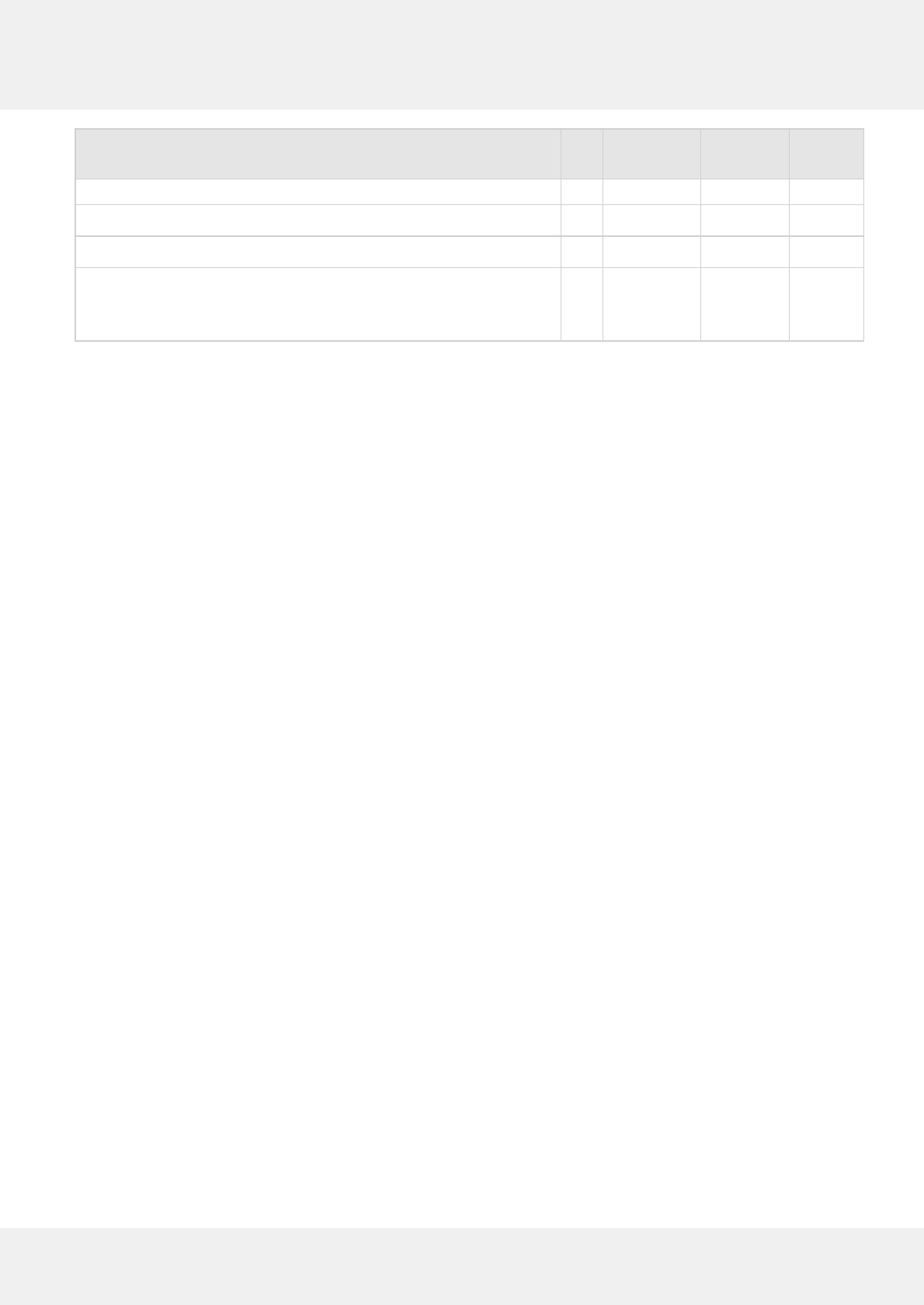

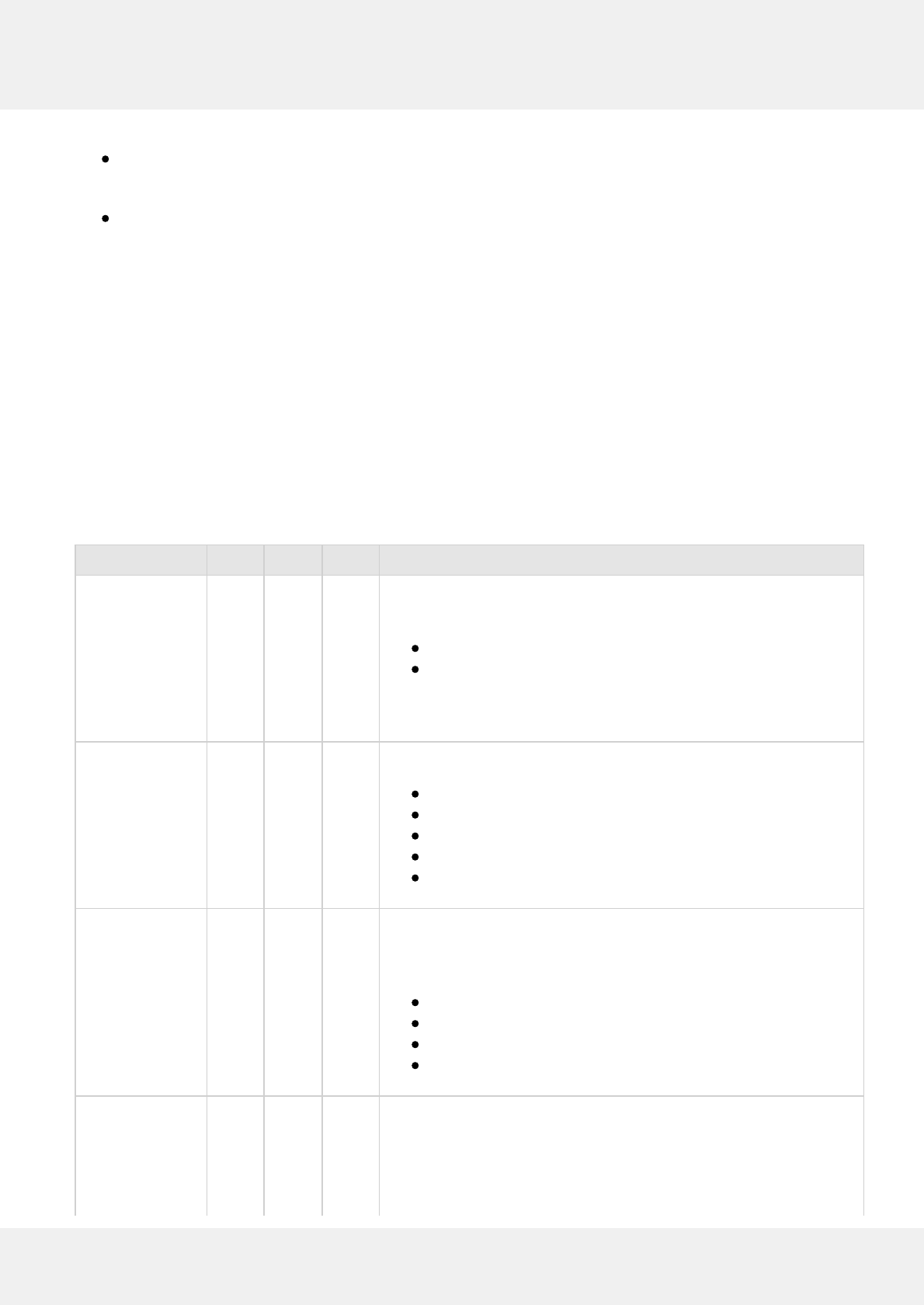

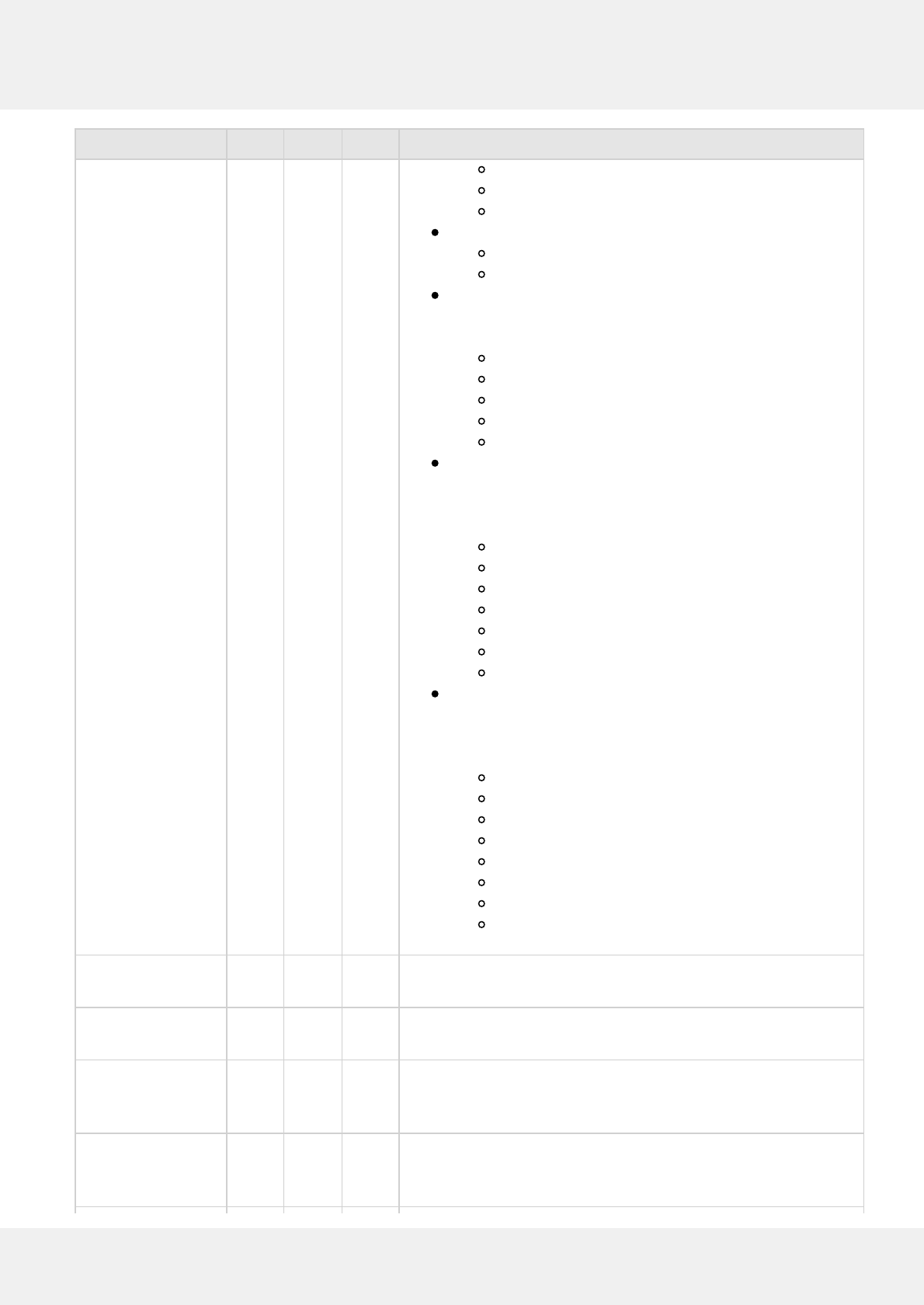

Group NameValuePair name Required Edit Length Used by

Buyer CancelUrl Yes Start with Http: or Https:

Https preferred

2048 AltPaymentCreateSession

ReturnUrl Yes Start with Http: or Https:

Https preferred

2048 AltPaymentCreateSession

BuyerId Yes Valid ascii 100 AltPaymentSale, Auth and

Order

EmailAddress Valid ascii 20 AltPaymentCreateSession

FundingSource Credit. Default is non-credit. N/A AltPaymentCreateSession

MerchantLogoUrl Start with Http: or Https:

Https preferred

2000 AltPaymentCreateSession

Payment ItemAmount Decimal, 12,2 with decimal

point. Total of LineItem

Amounts.

N/A AltPaymentSale, Auth,

Order and CreateAuth

ShippingAmount Decimal, 12,2 with decimal

point.

N/A AltPaymentSale, Auth,

Order and CreateAuth

ShippingAmountDiscount Decimal, 12,2 with decimal

point. Requires negative

amount.

N/A AltPaymentCreateSession,

Auth, Sale and Order

TaxAmount Decimal, 12,2 with decimal

point.

N/A AltPaymentSale, Auth,

Order and CreateAuth

NOTE* ItemAmount, Shipping

Amount, Tax Amount must

equal Amt of the transaction.

AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

PaymentType Order, Authorization or

Sale. Default is Sale.

N/A AltPaymentCreateSession

Portico Developer Guide 24

© 2016 Heartland Payment Systems, Inc.

FullyCapuredFlag True or False N/A AltPaymentCapture

InvoiceNbr Valid ascii. Must be unique

per Session.

256 AltPaymentSale, Auth,

Order and CreateAuth

InstantPaymentOnly True or False N/A AltPaymentCreateSession

Shipping ShipName Valid ascii 128 AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

ShipAddress Valid ascii 100 AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

ShipAddress2 Valid ascii 100 AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

ShipCity Valid ascii 40 AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

ShipState Valid ascii. Valid state. 40 AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

ShipZip Valid ascii. Validated against

state and city and only US

addresses.

20 AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

ShipCountryCode Valid ascii. Valid two

character country.

2 AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

ShipPhoneNbr Valid ascii 20 AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

ShipAllowAddressOverride True or False. Default is True. N/A AltPaymentCreateSession

LineItem Name Valid ascii 127

Description Valid ascii 127 AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

Amount Decimal, 12,2 with decimal

point. Allows Negative sign.

N/A AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

Quantity Up to 10 digits numeric N/A AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

NOTE* Quantity times Amount rolls

up to Payment/ItemAmount.

Group NameValuePair name Required Edit Length Used by

Portico Developer Guide 25

© 2016 Heartland Payment Systems, Inc.

Number Valid ascii 127 AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

TaxAmount Decimal, 12,2 with decimal

point. Allows negative sign.

N/A AltPaymentCreateSession,

Auth, Sale, Order and

CreateAuth

NOTE* Quantity times TaxAmount

rolls up to

Payment/TaxAmount.

Return ReturnType Full or Partial N/A AltPaymentReturn

InvoiceNbr Valid ascii. Must be unique

per Session.

127 AltPaymentReturn

Group NameValuePair name Required Edit Length Used by

5.3.2 Alternate Service Request Field Usage Detail

Field Name Usage

PaymentType Indicates payment type. PayPal is the only valid value.

Amt Amount of request.

SessionId Session Id that is returned from a Create Session response.

GatewayTxnId Unique Portico Transaction Id. Returned in Common header.

CancelUrl Redirect provided by Merchant. Used if Buyer cancels order from PayPal UI.

ReturnUrl Redirect provided by Merchant. Used if Buyer accepts order from PayPal UI.

BuyerId Buyer payer id. Indicates who the PayPal buyer is.

EmailAddress Buyer Email Address.

FundingSource Indicates funding source.

MerchantLogoUrl Logo URL to be displayed when Buyer confirms payment.

ItemAmount Total Item Amount.

ShippingAmount Total Shipping Amount.

TaxAmount Total Tax Amount.

PaymentType Indicates what type of Payment needs to be created during Create Session. Set this

value to the intended follow-up service call.

FullyCapuredFlag Indicates during Capture if this is the final capture.

InvoiceNbr Invoice Number. Must be unique per session id.

ShipName Shipping name

ShipAddress Shipping Address

ShipAddress2 Shipping Address2

ShipCity Shipping City

Portico Developer Guide 26

© 2016 Heartland Payment Systems, Inc.

ShipState Shipping State

ShipZip Shipping Zip

ShipCountryCode Shipping Country Code

ShipPhoneNbr Shipping Phone Number

ShipAllowAddressOverride Indicates if Buyer can alter shipping information on Pay Pal Site. Use during Create

Session.

Name Item Name

Description Item Description

Amount Item Amount

Quantity Item Quantity

Number Item SKU

TaxAmount Item Tax Amount

ReturnType Indicates full or partial return.

InstantPaymentOnly Indicates the merchant expects Instant payment only responses for this transaction.

ShippingAmountDiscount Indicates a Payment level shipping discount.

Field Name Usage

5.3.3 Alternate Service NameValuePair Response Fields

Group NameValuePair Name Used By

Session SessionId AltPaymentCreateSession

RedirectUrl AltPaymentCreateSession

Buyer InvoiceNbr AltPaymentSessionInfo

EmailAddress AltPaymentSessionInfo

BuyerId AltPaymentSessionInfo

Status AltPaymentSessionInfo

CountryCode AltPaymentSessionInfo

BusinessName AltPaymentSessionInfo

FirstName AltPaymentSessionInfo

LastName AltPaymentSessionInfo

PhoneNumber AltPaymentSessionInfo

Shipping ShipName AltPaymentSessionInfo

ShipAddress AltPaymentSessionInfo

ShipAddress2 AltPaymentSessionInfo

ShipCity AltPaymentSessionInfo

Portico Developer Guide 27

© 2016 Heartland Payment Systems, Inc.

ShipState AltPaymentSessionInfo

ShipZip AltPaymentSessionInfo

ShipCountryCode AltPaymentSessionInfo

Payment Amt AltPaymentSessionInfo

ItemAmount AltPaymentSessionInfo

ShippingAmount AltPaymentSessionInfo

TaxAmount AltPaymentSessionInfo

LineItem Name AltPaymentSessionInfo

Description AltPaymentSessionInfo

Amount AltPaymentSessionInfo

Number AltPaymentSessionInfo

Quantity AltPaymentSessionInfo

TaxAmount AltPaymentSessionInfo

Processor Code All Services

Message All Services

Type All Services

Group NameValuePair Name Used By

5.3.4 Alternate Service Response Field Usage Detail

Name Usage

RspCode Response code to validate the Alternate Payers processing. 0 equals Success. 1 equals failure.

RspMessage Alternate Payers processing message.

Status Alternate Payers status of request.

StatusMessage Alternate Payers status message of request.

SessionId PayPal’s session id. Returned from Create Session.

RedirectUrl Redirect URL with Session Id. Use by Merchant to redirect Buyer.

Code PayPal Code for additional Response information.

Message PayPal Message for additional Response information.

Type PayPal Type for additional Response information.

ReturnAmt Return Amount for transction.

TotalReturnAmt Total Return amount of original. Multiple return scenarios.

5.4 Auto-substantiation

Portico Developer Guide 28

© 2016 Heartland Payment Systems, Inc.

An Auto-Substantiation transaction is applied to either a CreditAuth or to a CreditSale transaction. The first additional

amount must be the "Total_Healthcare_Amt" followed by up to three additional optional data amount elements, which

include the amount type and the amount. Valid amount types are as follows:

Total_Healthcare_Amt—Indicates the total of all healthcare amounts

Subtotal_Prescription_Amt—Indicates the subtotal amount of prescriptions

Subtotal_Vision_Optical_Amt—Indicates the subtotal amount of vision/optical

Subtotal_Clinic_Or_Other_Amt—Indicates the subtotal amount of clinic and other qualified medical

Subtotal_Dental_Amt—Indicates the subtotal amount of dental

Note: The value supplied in the Total_Healthcare_Amt is the combined total of the four subtotal amounts. The

Total_Healthcare_Amt can include over-the-counter (OTC) amounts only or, if there are other healthcare expenses, the

total of all categories: OTC, prescriptions, vision, clinic, and dental.

Note: The total amount of the associated transaction must be at least equal to (not less than) the

Total_Healthcare_Amt. It can be greater than the Total_Healthcare_Amt if non-healthcare items are also being

purchased as part of the transaction.

The Auto-Substantiation data also includes a field containing the Merchant Verification Value. It is not necessary to

submit this field. It is populated from the merchant profile by Heartland.

See the AutoSubstantiation Complex Type in the Portico Schema.

5.5 Batch Processing

Portico is a host capture system. This means that Portico is the system of record for transactions, batches, and

settlement details. The POS can use the Portico API to manipulate transactions and batches. It can also request Portico

to close a batch. However, the POS does not provide any additional details or updates in the close request itself.

Batches are maintained at the device level. If a site (merchant) has multiple devices, each is closed individually. If a

device does not have an open batch, the next transaction will create a new open batch.

Batch information will be removed from Portico after 90 days.

5.5.1 Settlement

Portico supports auto and manual batch close options. The POS can use either or both of these options.

5.5.1.1 Auto-close

Each device can be configured with a specific auto-close time at boarding. Portico uses this setting to determine when

to automatically close the device's batch each day. This can be disabled if only the manual close option is desired.

When the auto-close time is reached each day, Portico queues up the associated batch to be closed. There can be a

delay between the chosen auto-close time and the actual processing of the batch. This can vary based on the number

of devices closing at the same time, system issues, or other factors. Portico does provide an option to ensure that no

new transactions are added to a batch after the auto-close time. This can be important to some merchants in the case

that there is a delay in the batch processing after the auto-close time. The default on Portico is to continue to add the

transactions to the same batch until it is processed. This ensures that the maximum number of transactions are

processed at the time of settlement.

5.5.1.2 Manual Entry

Information must be manually keyed into the application when the following is true:

Portico Developer Guide 29

© 2016 Heartland Payment Systems, Inc.

a card is not present

a card or chip reader is unavailable

the magnetic stripe or chip is unreadable

For card present transactions, manual entry is discouraged because it usually results in higher transaction fees for the

merchant and increases the likelihood of keying errors, which result in delays and/or chargebacks.

For card not present transactions, manual entry is the only method for entering the card number. The use of a Mod 10

check routine (also known as the Luhn algorithm) reduces the number of keying errors. The routine is a checksum

formula used to validate the card number that is keyed into your application.

5.6 Card Not Present Transactions

Full AVS (street address and zip code) is required on all Mail Order/Telephone Order (MOTO) and eCommerce

transactions.

5.7 Card Present Transactions

AVS is optional on retail and restaurant card present keyed transactions.

5.8 Card Verification Value (CVV2)

The CVV2 number enhances fraud protection for transactions in order to qualify for the proper interchange rates. It

helps to validate the following two things:

The customer has the credit card in their possession.

The credit card number is legitimate.

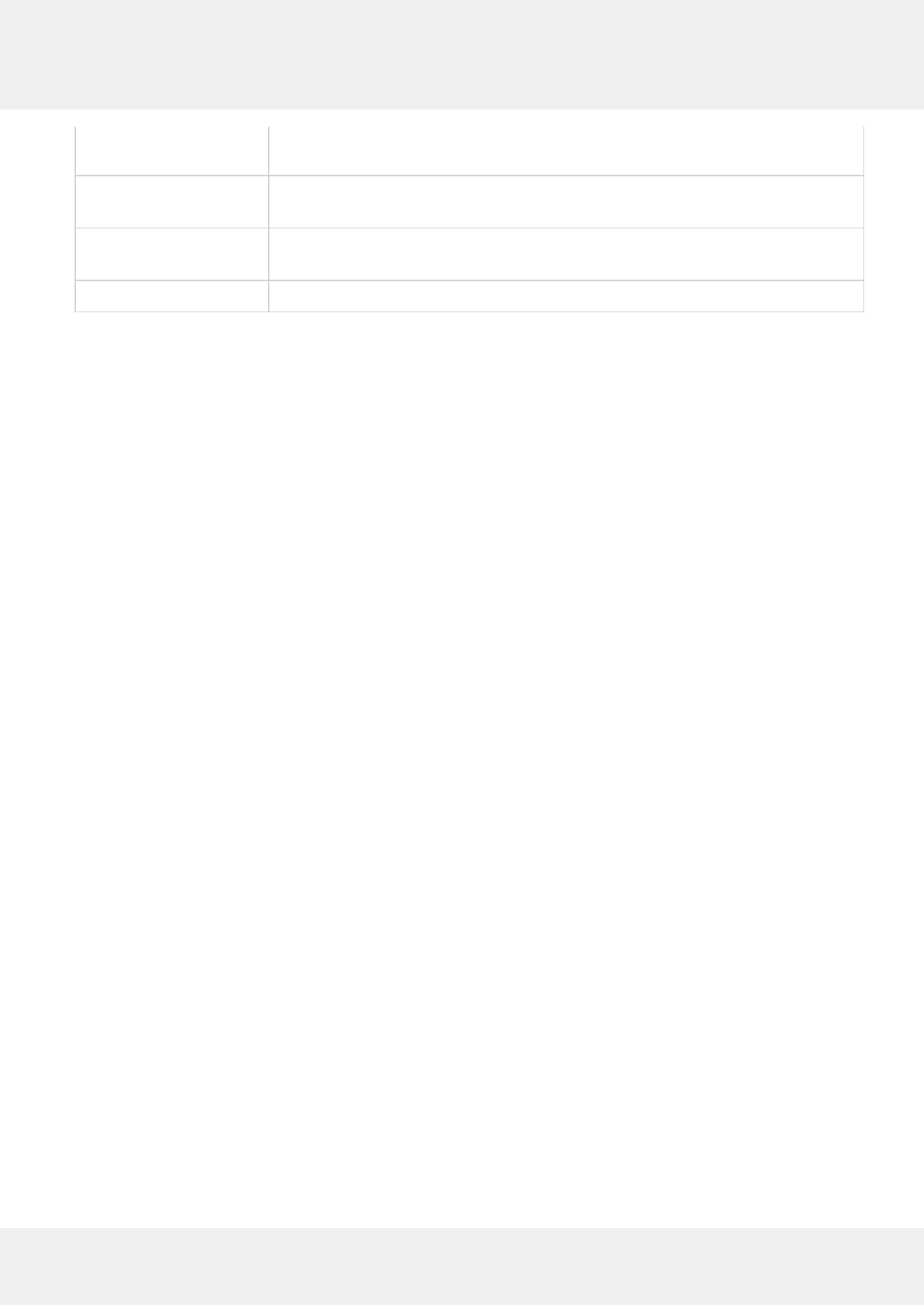

The following table describes how each credit card association implements CVV2 protection.

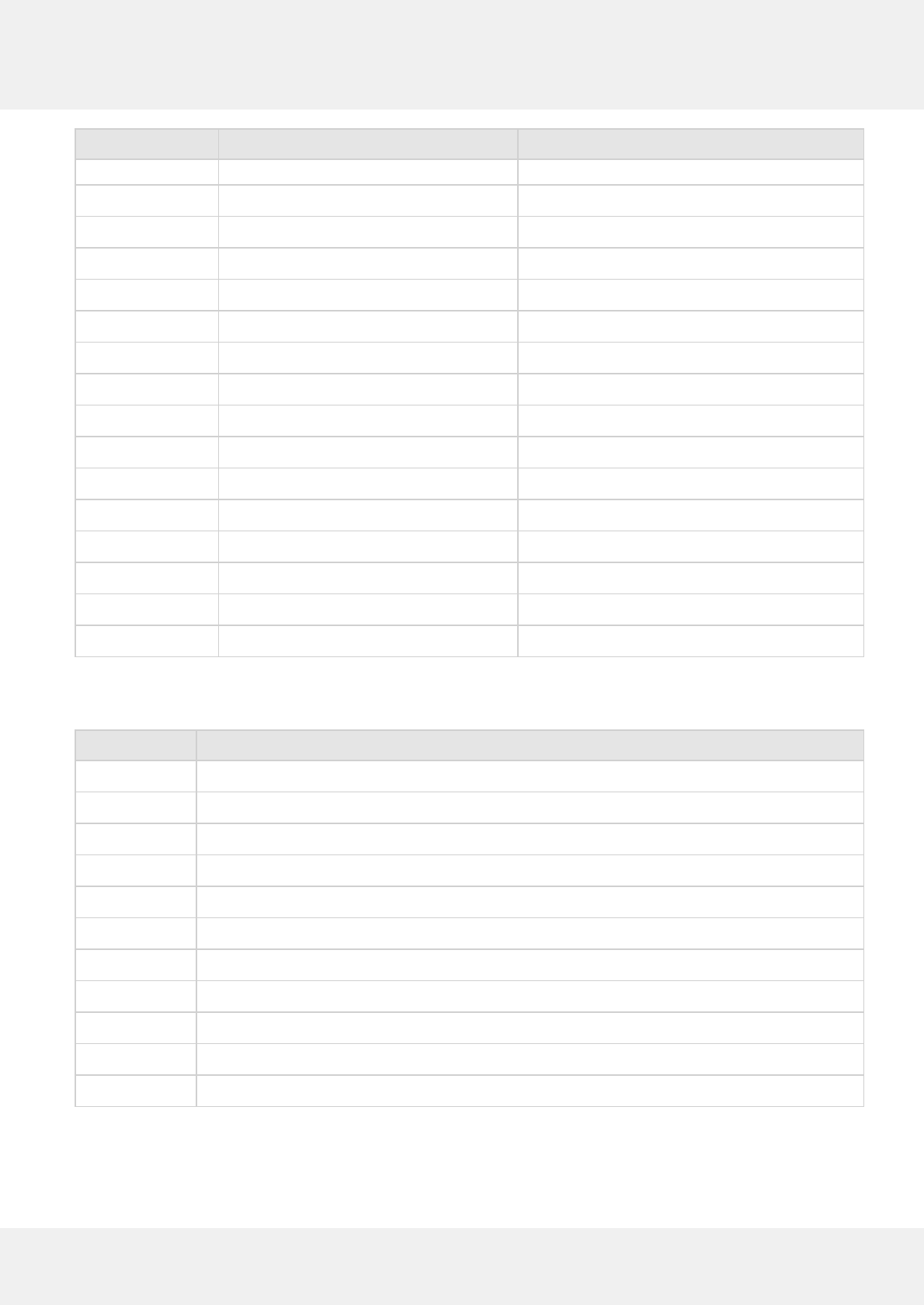

Card Brand CVV2 Name CVV2 Location

VISA Card Verification

Value

Three-digit number printed in the signature space on the back of the

card

MasterCard Card Validation Code Three-digit number printed in the signature space on the back of the

card

American

Express

Card Verification

Value

Four-digit number on front of card

It is printed, not embossed like the card number.

Discover Card Member ID Three-digit number printed in the signature space on the back of the

card

CVV2 protection takes place when a transaction is being processed and the card is not present. For example, when a

cardholder makes a purchase over the telephone or on the Internet. The merchant asks the cardholder to read the

CVV2 code from the card. The merchant adds this code to the transaction being sent to Portico. Entering CVV2

information along with Address Verification Service (AVS) should result in fewer chargebacks and lower Interchange

rates.

CVV2/CID is highly encouraged, but not required for card not present transactions. Discover Card charges $0.50 per

keyed transaction if CID is not present at the time of authorization.

Some Issuers may decline the sale if the CVV code does not match what is on file for the cardholder. Others may

Portico Developer Guide 30

© 2016 Heartland Payment Systems, Inc.

approve the transaction. If the transaction is approved, the merchant needs to make a decision to go forward with the

sale based upon the CVV response. It is strongly recommended that the merchant ask the cardholder for another form

of payment if the CVV code does not match ("N" response).

CVV protects the merchant against chargebacks if the response code is returned as a match and later the transaction

is found to be fraudulent.

The following are the possible CVV2/CID response codes returned by Portico:

Value Description

MCVV Match

N CVV No Match

P Not Processed

S Should Have Been Present

U Issuer is not certified and/or Issuer has not provided Visa with the CVV2 encryption keys

5.9 Corporate Cards

A merchant has the option to participate in Corporate Purchase Card (CPC) transactions. These are also known as

"Level II" transactions and are for B2B purchases. In order to achieve the proper interchange rates for these

transaction types, additional data elements are required to be passed to the card issuer. This is done by populating

the CPCReq field in a CreditSale, CreditAuth, CreditOfflineSale, CreditOfflineAuth, or RecurringBilling transaction. If the

Issuer identifies the associated card as a Corporate Purchase Card, the response message will contain a value in the

CPCInd field indicating the specific card type of business, corporate, or purchasing card. The client inspects the

CPCInd for one of the valid values. If it contains any of the valid values, the client should then prompt for the purchase

order number and tax. This new information must then be passed to Portico using CreditCPCEdit.

CreditAccountVerify is also supported, but when it is used a CreditCPCEdit cannot be used as it does not apply.

CPCData can also be included directly in the RecurringBilling transaction. In this case, the subsequent call to

CreditCPCEdit is not required.

5.10 Duplicate Checking

Duplicate Checking logic checks for duplicate transactions submitted by a device. This provides a safeguard from

submitting the same transaction multiple times within a given time frame. The default time frame used for duplicate

checks is thirty seconds and is configurable per device. The base matching criteria used in the duplicate check consists

of the following criteria:

Portico service used

Cardholder Primary Account Number

Transaction amount

If a transaction is submitted that matches a previously "Approved" transaction based on the above criteria and is

within the configured time frame (e.g. 30 seconds), then a response code/message of "02 -Transaction was rejected

because it is a duplicate." is returned to the caller.

5.10.1 Additional Criteria

Portico Developer Guide 31

© 2016 Heartland Payment Systems, Inc.

The Portico Service, Cardholder Primary Account Number, and Transaction Amount make up the base matching

criteria used when Duplicate Checking is enabled on the customer account. Optionally, Client Transaction ID and

Invoice Number can be added to this matching criterion. This would allow transactions being submitted to the same

service with the same primary account number and transaction amount to succeed given the Client Transaction ID and

Invoice Number are also different.

Client Transaction ID duplicate checking adds the following attributes to the matching criteria when present in the

request transaction.

Header.ClientTxnId

Invoice Number duplicate checking adds the following attributes to the criteria when present in the request

transaction.

DirectMktData.DirectMktInvoiceNbr

AdditionalTxnFields.InvoiceNbr

Note: In the case where Client Transaction ID or Invoice Number matching is enabled and no ClientTxnId,

DirectMktInvoiceNbr, or InvoiceNbr is specified on the request, then only past transactions without a ClientTxnId,

DirectMktInvoiceNbr, or InvoiceNbr are considered a duplicate transaction given the base criteria matches.

5.10.2 Override Duplicate Checking

Duplicate checking can be bypassed on a per transaction basis by sending "Y" in the "AllowDup" attribute of the

request.

5.10.3 Portico Services Supporting Duplicate Checking

The following Services provide Duplicate Checking support:

ChipCardDecline

CreditAdditionalAuth

CreditAuth

CreditOfflineAuth

CreditOfflineSale

CreditReturn

CreditSale

DebitAddValue

DebitReturn

DebitSale

EBTCashBackPurchase

EBTCashBenefitWithdrawal

EBTFSPurchase

EBTFSReturn

EBTVoucherPurchase

OverrideFraudDeclineService

PrePaidAddValueService

RecurringBillingService

5.11 Dynamic Transaction Descriptor

Dynamic Transaction Descriptors allow merchants to define the information that appears on a customer's credit card

statement on a per-transaction basis. Without dynamic descriptors, the merchant DBA name on file with Heartland will

Portico Developer Guide 32

© 2016 Heartland Payment Systems, Inc.

be populated on the cardholder statement. With dynamic descriptors, merchants can add transaction-specific details