16_CoverStory_ Pykhtin, Zhu 2007 A Guide To Ling Counterparty Credit Risk

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 7

Electronic copy available at: http://ssrn.com/abstract=1032522

GLOBAL ASSOCIATION OF RISK PROFESSIONALS

16 JULY/AUGUST 07 ISSUE 3377

C

ounterparty credit risk is the risk that the

counterparty to a financial contract will

default prior to the expiration of the con-

tract and will not make all the payments

required by the contract. Only the con-

tracts privately negotiated between coun-

terparties — over-the-counter (OTC) derivatives and

security financing transactions (SFT) — are subject to

counterparty risk. Exchange-traded derivatives are not

affected by counterparty risk, because the exchange

guarantees the cash flows promised by the derivative to

the counterparties.1

Counterparty risk is similar to other forms of credit

risk in that the cause of economic loss is obligor’s

default. There are, however, two features that set coun-

terparty risk apart from more traditional forms of cred-

it risk: the uncertainty of exposure and bilateral nature

of credit risk. (Canabarro and Duffie [2003] provide an

excellent introduction to the subject.)

In this article, we will focus on two main issues:

modelling credit exposure and pricing counterparty

risk. In the part devoted to credit exposure, we will

define credit exposure at contract and counterparty

levels, introduce netting and margin agreements as risk

management tools for reducing counterparty-level

exposure and present a framework for modelling

credit exposure. In the part devoted to pricing, we will

define credit value adjustment (CVA) as the price of

counterparty credit risk and discuss approaches to its

calculation.

Contract-Level Exposure

If a counterparty in a derivative contract defaults, the

bank must close out its position with the defaulting

counterparty. To determine the loss arising from the

counterparty’s default, it is convenient to assume that

the bank enters into a similar contract with another

counterparty in order to maintain its market posi-

tion.2Since the bank’s market position is unchanged

after replacing the contract, the loss is determined by

the contract’s replacement cost at the time of default.

A Guide to Modelling

Counterparty Credit Risk

What are the steps involved in calculating credit exposure? What are the differences between counterparty

and contract-level exposure? How can margin agreements be used to reduce counterparty credit risk? What

is credit value adjustment and how can it be measured? Michael Pykhtin and Steven Zhu offer a

blueprint for modelling credit exposure and pricing counterparty risk.

Electronic copy available at: http://ssrn.com/abstract=1032522

GLOBAL ASSOCIATION OF RISK PROFESSIONALS

GLOBAL ASSOCIATION OF RISK PROFESSIONALS 17

JULY/AUGUST 07 ISSUE 3377

If the contract value is negative for the bank at the time of

default, the bank

• closes out the position by paying the defaulting coun-

terparty the market value of the contract;

• enters into a similar contract with another counterparty

and receives the market value of the contract; and

• has a net loss of zero.

If the contract value is positive for the bank at the time of

default, the bank

• closes out the position, but receives nothing from the

defaulting counterparty;

• enters into a similar contract with another counterparty

and pays the market value of the contract; and

• has a net loss equal to the contract’s market value.

Thus, the credit exposure of a bank that has a single deriva-

tive contract with a counterparty is the maximum of the con-

tract’s market value and zero. Denoting the value of contract

iat time tas Vi(t), the contract-level exposure is given by

Since the contract value changes unpredictably over time as

the market moves, only the current exposure is known with

certainty, while the future exposure is uncertain. Moreover,

since the derivative contract can be either an asset or a liabili-

ty to the bank, counterparty risk is bilateral between the

bank and its counterparty.

Counterparty-Level Exposure

In general, if there is more than one trade with a defaulted

counterparty and counterparty risk is not mitigated in any

way, the maximum loss for the bank is equal to the sum of

the contract-level credit exposures:

This exposure can be greatly reduced by the means of netting

agreements. A netting agreement is a legally binding contract

between two counterparties that, in the event of default,

allows aggregation of transactions between two counterpar-

ties – i.e., transactions with negative value can be used to off-

set the ones with positive value and only the net positive

value represents credit exposure at the time of default. Thus,

the total credit exposure created by all transactions in a net-

ting set (i.e., those under the jurisdiction of the netting agree-

ment) is reduced to the maximum of the net portfolio value

and zero:

More generally, there can be several netting agreements with

one counterparty. There may also be trades that are not cov-

ered by any netting agreement. Let us denote the k th netting

agreement with a counterparty as NAk. Then, the counter-

party-level exposure is given by

The inner sum in the first term sums values of all trades cov-

ered only by the k th netting agreement (hence, the iNAk

notation), while the outer one sums exposures over all net-

ting agreements. The second term in Equation 4 is simply the

sum of contract-level exposures of all trades that do not

belong to any netting agreement (hence, the i{NA} nota-

tion).

Modelling Credit Exposure

In this section, we describe a general framework for calcu-

lating the potential future exposure on the OTC derivative

products. Such a framework is necessary for banks to com-

pare exposure against limits, to price and hedge counter-

party credit risk and to calculate economic and regulatory

capital.3These calculations may lead to different character-

istics of the exposure distribution — such as expectation,

standard deviation and percentile statistics. The exposure

framework outlined herein is universal because it allows

one to calculate the entire exposure distribution at any

future date. (For more details, see De Prisco and Rosen

[2005] and Pykhtin and Zhu [2006].)

There are three main components in calculating the dis-

tribution of counterparty-level credit exposure:

1. Scenario Generation. Future market scenarios are simu-

lated for a fixed set of simulation dates using evolution

models of the risk factors.

2. Instrument Valuation. For each simulation date and for

each realization of the underlying market risk factors,

instrument valuation is performed for each trade in the

counterparty portfolio.

3. Portfolio Aggregation. For each simulation date and for

each realization of the underlying market risk factors,

counterparty-level exposure is obtained according to

Equation 4 by applying necessary netting rules.

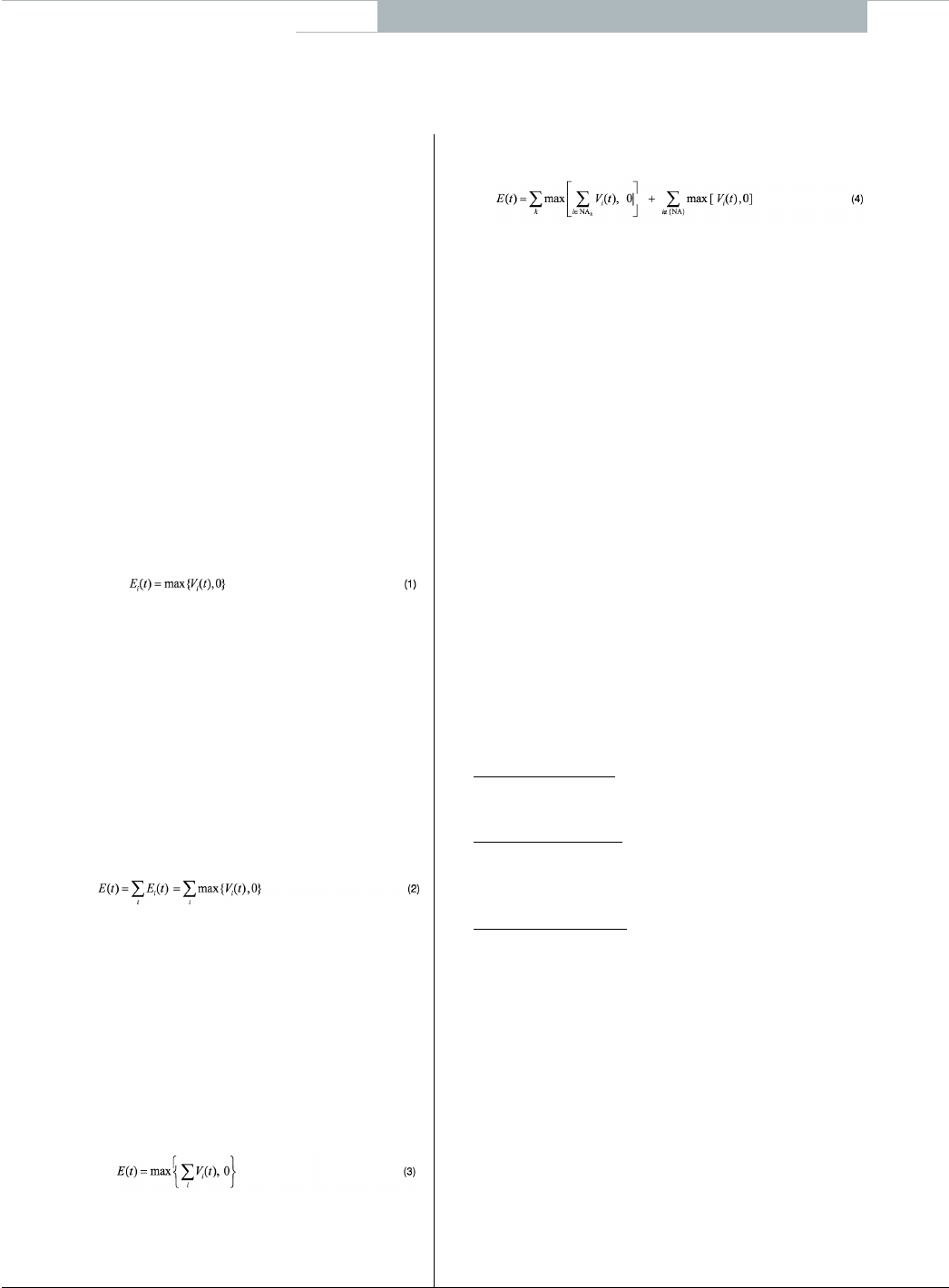

The outcome of this process is a set of realizations of

counterparty-level exposure (each realization corresponds

to one market scenario) at each simulation date, as

schematically illustrated in Figure 1, next page.

Because of the computational intensity required to calcu-

late counterparty exposures — especially for a bank with a

large portfolio — compromises are usually made with

regard to the number of simulation dates and/or the num-

ber of market scenarios. For example, the number of mar-

ket scenarios is limited to a few thousand and the simula-

tion dates (also called “time buckets”) used by most banks

COVER STORY:COUNTERPARTY RISK

GLOBAL ASSOCIATION OF RISK PROFESSIONALS

GLOBAL ASSOCIATION OF RISK PROFESSIONALS

18 JULY/AUGUST 07 ISSUE 3377

COVER STORY:COUNTERPARTY RISK

to calculate credit exposure usually comprise daily or

weekly intervals up to a month, then monthly up to a year

and yearly up to five years, etc.

Figure 1: Simulation Framework for

Credit Exposure

Scenario Generation

The first step in calculating credit exposure is to generate

potential market scenarios at a fixed set of simulation

dates {tk} N

k=1 in the future. Each market scenario is a real-

ization of a set of price factors that affect the values of

the trades in the portfolio. Examples of price factors

include foreign exchange (FX) rates, interest rates, equity

prices, commodity prices and credit spreads.

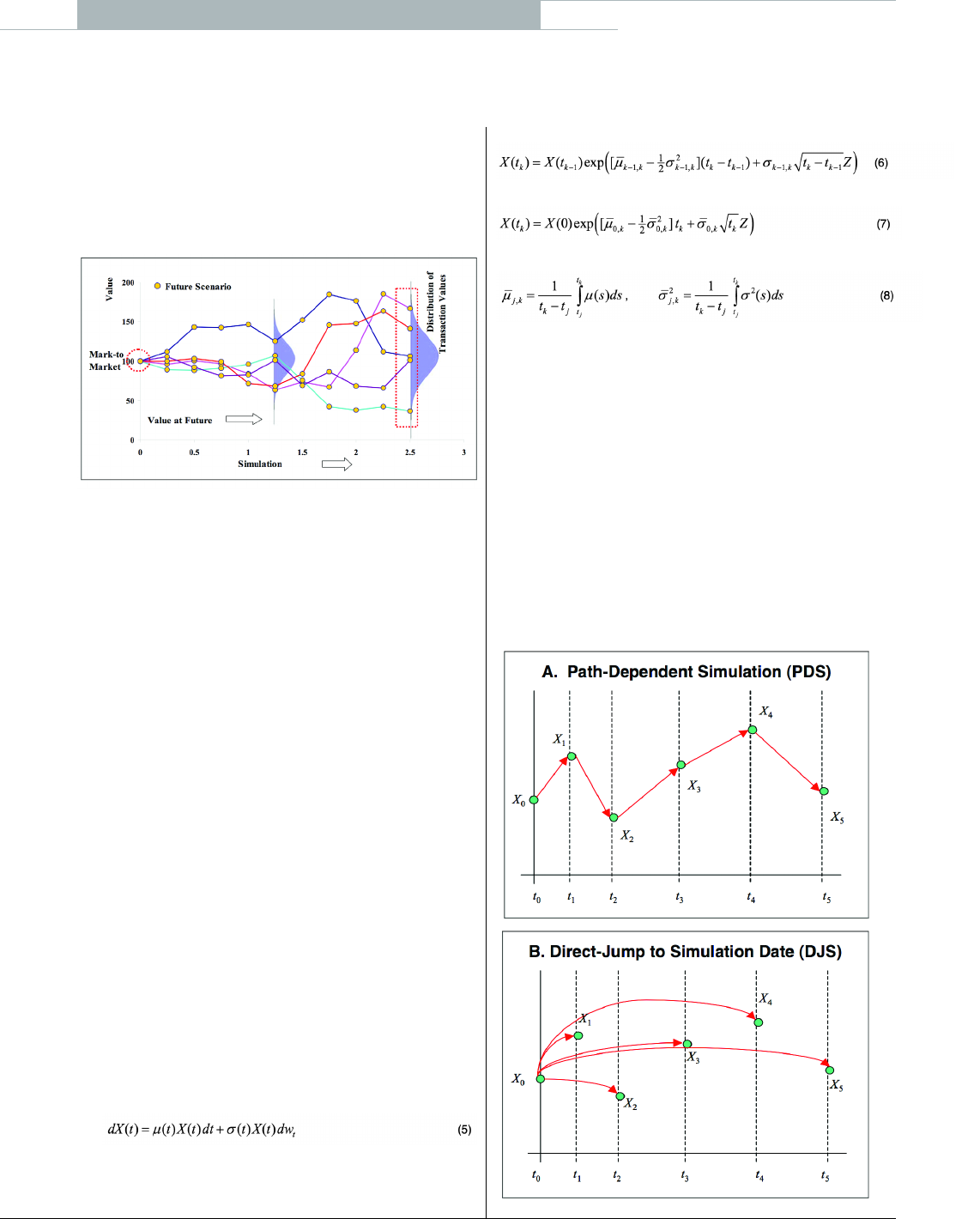

There are two ways that we can generate possible

future values of the price factors. The first is to generate

a “path” of the market factors through time, so that each

simulation describes a possible trajectory from time t=0

to the longest simulation date, t=T. The other method is

to simulate directly from time t=0 to the relevant simula-

tion date t.

We will refer to the first method as “Path-Dependent

Simulation (PDS)” and to the second method as “Direct

Jump to Simulation Date (DJS).” Figure 2A (across, top)

illustrates a sample path for X(ti), while Figure 2B

(across, bottom) illustrates a direct jump to a simulation

date.

Figure 2 (A and B): Two Ways of

Generating Market Scenarios >>

The scenarios are usually specified via stochastic differential

equations (SDE). Typically, these SDEs describe Markovian

processes and are solvable in closed form. For example, a

popular choice for modelling FX rates and stock indices is

the generalized geometric Brownian motion given by

where (t) is time-dependent drift and (t) is time-dependent

deterministic volatility. From the known solution of this

SDE, we can construct either the PDS model:

or the DJS model:

where is a standard normal variable and

The price factor distribution at a given simulation date

obtained using either PDS or DJS is identical. However, a

PDS method may be more suitable for path-dependent,

American/Bermudan and asset-settled derivatives.

Scenarios can be generated either under the real probabili-

ty measure or under the risk-neutral probability measure.

Under the real measure, both drifts and volatilities are cali-

brated to the historical data of price factors. Under the risk-

neutral measure, drifts must be calibrated to ensure there is

no arbitrage of traded securities on the price factors.

Additionally, volatilities must be calibrated to match market-

implied volatilities of options on the price factors.

For example, the risk-neutral drift of an FX spot rate is

simply given by the interest rate difference between domestic

and foreign currencies, and the volatility should be equal to

GLOBAL ASSOCIATION OF RISK PROFESSIONALS

GLOBAL ASSOCIATION OF RISK PROFESSIONALS 19

JULY/AUGUST 07 ISSUE 3377

the FX option implied volatility. Traditionally, the real mea-

sure has been used in risk management modelling of future

events. However, such applications as pricing counterparty

risk may require modelling scenarios under the risk-neutral

measure.

Instrument Valuation

The second step in credit exposure calculation is to value the

instrument at different future times using the simulated sce-

narios. The valuation models used to calculate exposure

could be very different from the front-office pricing models.

Typically, analytical approximations or simplified valuation

models are used.

While the front office can afford to spend several minutes

or even hours for a trade valuation, valuations in the credit

exposure framework must be done much faster, because each

instrument in the portfolio must be valued at many simula-

tion dates for a few thousand market risk scenarios.

Therefore, valuation models such as those that involve

Monte Carlo simulations or numerical solutions of partial

differential equations do not satisfy the requirements on

computation time.

Path-dependent, American/Bermudan and asset-settled

derivatives present additional difficulty for valuation that

precludes direct application of front-office models. The value

of these instruments may depend on either some event that

happened at an earlier time (e.g., exercising an option) or on

the entire path leading to the valuation date (e.g., barrier or

Asian options). This does not present a problem for front-

office valuation, which is always done at the present time

when the entire path prior to the valuation date is known.

For example, front-office systems always know at the valua-

tion time whether an option has been exercised or a barrier

has been hit.

In contrast, risk management valuation is done at a dis-

crete set of future simulation dates, while the value of an

instrument may depend on the full continuous path prior to

the simulation date or on a discrete set of dates different

from the given set of simulation dates. For example, at a

future simulation date, it is often not known with certainty

whether a barrier option is alive or dead or whether a

Bermudan swaption has been exercised.

This problem presents an even greater challenge for the

DJS approach, where scenarios at previous simulation dates

are completely unrelated to scenarios at the current simula-

tion date. As a solution to this problem, Lomibao and Zhu

(2005) proposed the notion of “conditional valuation,”

which is a probabilistic technique that “adjusts” the mark-

to-market valuation model to account for the events that

could happen between the simulation dates.

Let us assume that we know how to price a derivative when

all information about the past is known. We will denote this

mark-to-market (MTM) value at simulation date tk by VMTM

(tk,{X(t)}tⱕtk), where X(t) is the market price factor that affects

the value of the derivative contract. However, the complete

path of the price factor is not known at tk. Under a PDS

approach, the risk factor is only known at a discrete set of sim-

ulation dates, while under a DJS approach, the risk factor is not

known at all between today (t=0) and the simulation date (t=tk).

The idea behind conditional valuation is to average future

MTM values over all continuous paths of price factors con-

sistent with a given simulation scenario. Mathematically, we

set the value of a derivative contract at a future simulation

date equal to the expectation of the MTM value, conditional

on all the information available between today and the simu-

lation date. Under the PDS approach, the scenario is given by

the set of price factor values xjat all simulation dates tj, such

that jⱕk. The conditional valuation is given by

Under the DJS approach, the scenario is given by a single

price factor value xkat the current simulation date tk. The

conditional valuation is given by

Lomibao and Zhu (2005) have shown that these conditional

expectations can be computed in closed form for such instru-

ments as barrier options, average options and physically set-

tled swaptions. The conditional valuation approach described

by Equations 9 and 10 provides a consistent framework with-

in which the transactions of various types can be aggregated

to recognize the benefits of the netting rule across multiple

price factors.

Exposure Profiles

Uncertain future exposure can be visualized by means of

exposure profiles. These profiles are obtained by calculating

certain statistics of the exposure distribution at each simula-

tion date. For example, the expected exposure profile is

obtained by computing the expectation of exposure at each

simulation date, while a potential future exposure profile

(such profiles are popular for measuring exposure against

credit limits) is obtained by computing a high-level (e.g.,

95%) percentile of exposure at each simulation date.

Though profiles obtained from different exposure measures

have different magnitude, they normally have similar shapes.

There are two main effects that determine the credit

exposure over time for a single transaction or for a portfolio

of transactions with the same counterparty: diffusion and

amortization. As time passes, the “diffusion effect” tends to

increase the exposure, since there is greater variability and,

hence, greater potential for market price factors (such as the

FX or interest rates) to move significantly away from current

levels; the “amortization effect,” in contrast, tends to

COVER STORY:COUNTERPARTY RISK

GLOBAL ASSOCIATION OF RISK PROFESSIONALS

GLOBAL ASSOCIATION OF RISK PROFESSIONALS

20 JULY/AUGUST 07 ISSUE 3377

COVER STORY:COUNTERPARTY RISK

decrease the exposure over time, because it reduces the

remaining cash flows that are exposed to default.

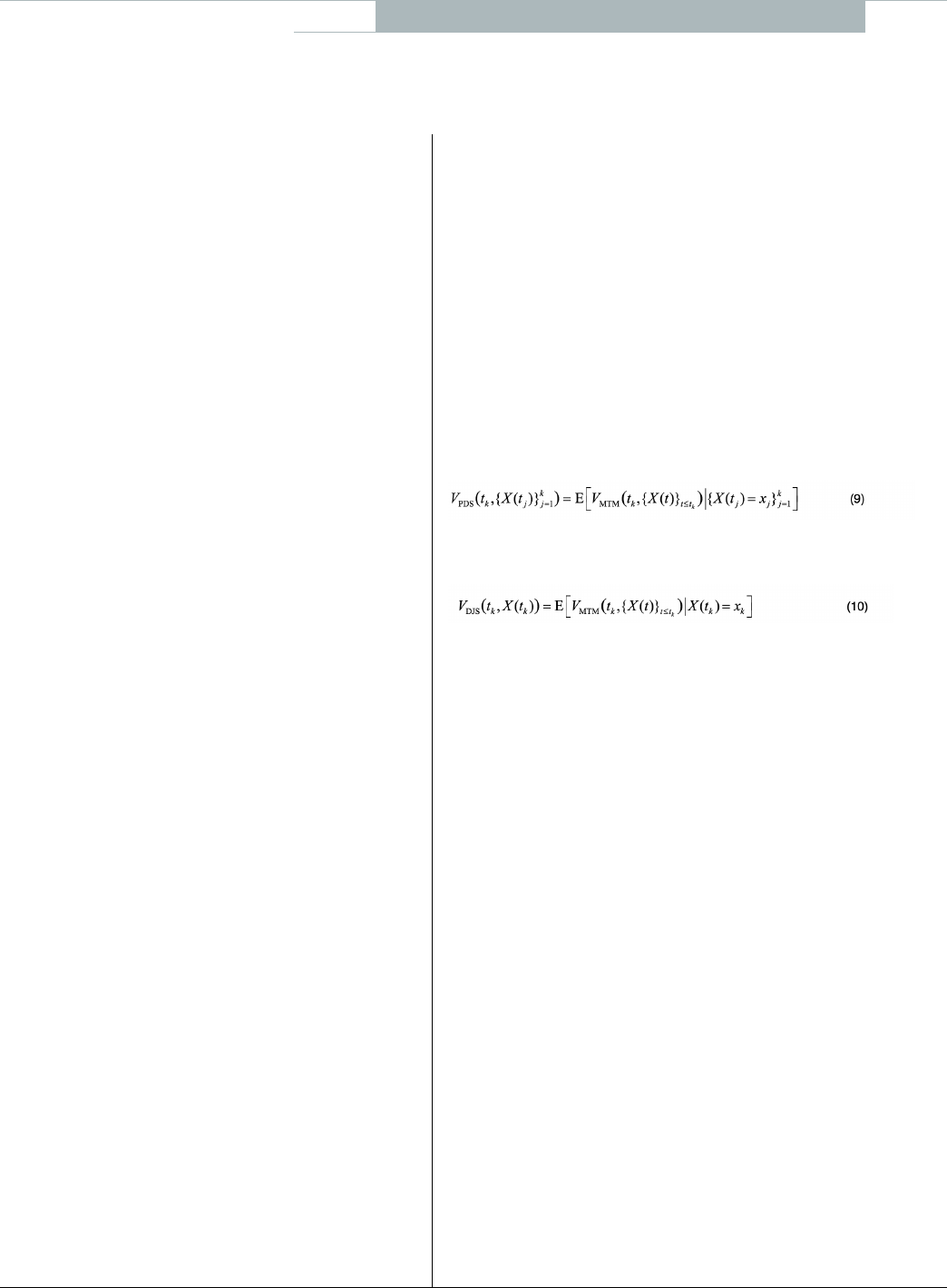

These two effects act in opposite directions — the diffu-

sion effect increases the credit exposure and the amortization

effect decreases it over time. For single cash flow products,

such as FX forwards, the potential exposure peaks at the

maturity of the transaction, because it is driven purely by dif-

fusion effect.4On the other hand, for products with multiple

cash flows, such as interest-rate swaps, the potential expo-

sure usually peaks at one-third to one-half of the way into

the life of the transaction, as shown in the following exhibit:

Figure 3: Exposure Profile of

Interest-Rate Swap

Different types of instruments can generate very different

credit exposure profiles, and the exposure profile of the

same instruments may also vary under different market

conditions. When the yield curve is upward sloping, the

exposure is greater for a payer swap than the same receiver

swap, because the fixed payments in early periods are

greater than the floating payments, resulting in positive for-

ward values on the payer swap. The opposite is true if the

yield curve is downward sloping.

However, for a humped yield curve, it is not clear which

swap carries more risk, because the forward value on a payer

swap is initially positive and then becomes negative (and vice

versa for a receiver swap). The overall effect implies that

both are almost “equally risky” — i.e., the exposure is

roughly the same between a payer swap and a receiver swap.

Counterparty-level exposure profiles usually have a less intu-

itive shape than simple trade-level profiles. These profiles are

very useful in comparing credit exposure against credit limits

and calculating economic and regulatory capital, as well as

in pricing and hedging counterparty risk.

Collateral Modelling for Margined Portfolios

Banks that are active in OTC derivative markets are increas-

ingly using margin agreements to reduce counterparty credit

risk. A margin agreement is a legally binding contract that

requires one or both counterparties to post collateral when

the uncollateralized exposure exceeds a threshold and to

post additional collateral if this excess grows larger. If this

excess of uncollateralized exposure over the threshold

declines, part of the posted collateral (if there is any) is

returned to bring the difference back to the threshold. To

reduce the frequency of collateral exchanges, a minimum

transfer amount (MTA) is specified; this ensures that no

transfer of collateral occurs unless the required transfer

amount exceeds the MTA.

The following time periods are essential for margin

agreements:

• Call Period. The period that defines the frequency at

which collateral is monitored and called for (typically,

one day).

• Cure Period. The time interval necessary to close out the

counterparty and re-hedge the resulting market risk.

• Margin Period of Risk. The time interval from the last

exchange of collateral until the defaulting counterparty

is closed out and the resulting market risk is re-hedged;

it is usually assumed to be the sum of call period and

cure period.

While margin agreements can reduce the counterparty expo-

sure, they pose a challenge in modelling collateralized expo-

sure. Below, we briefly outline a common procedure that has

been used by many banks to model the effect of margin call

and collateral requirements.

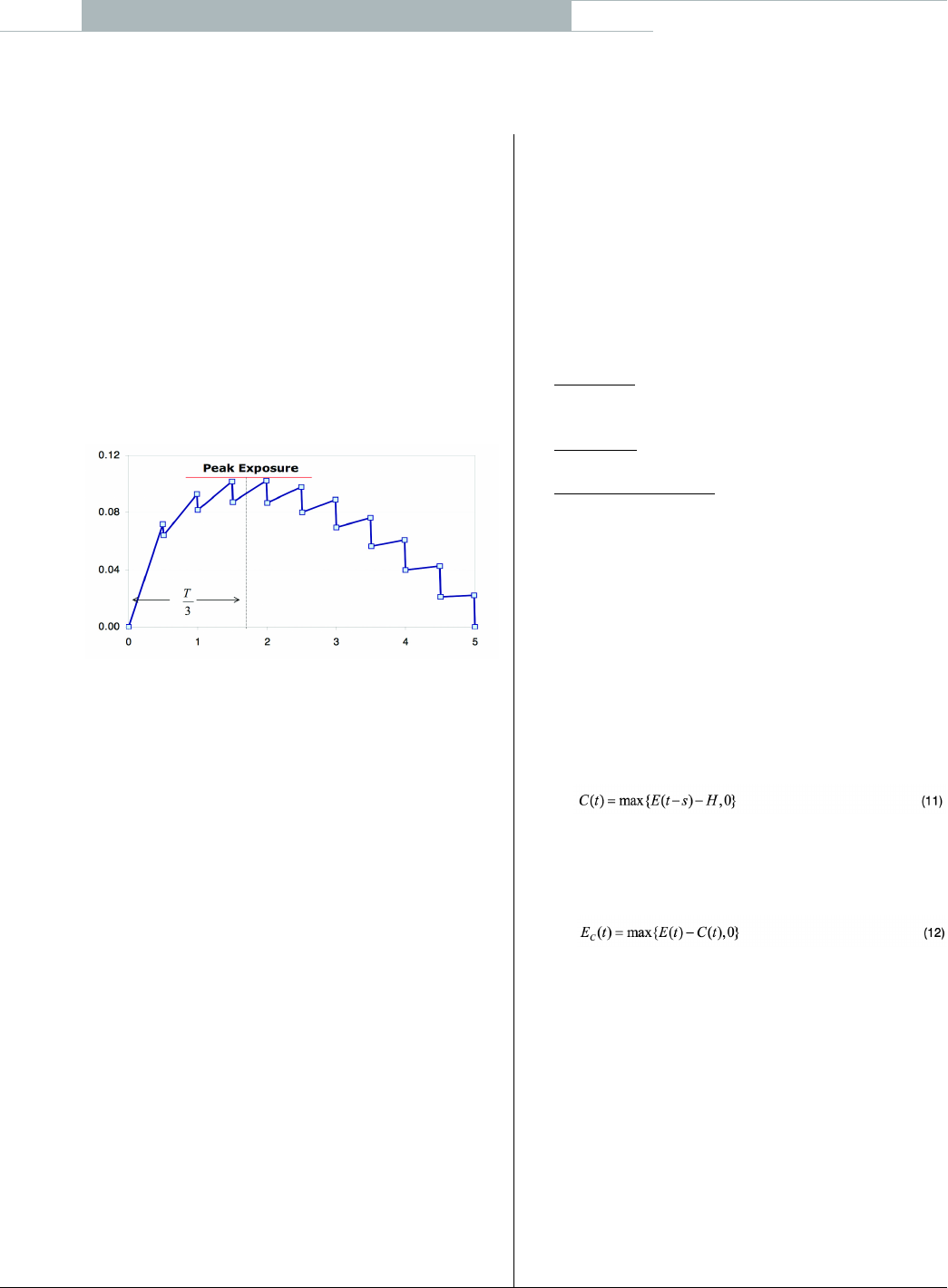

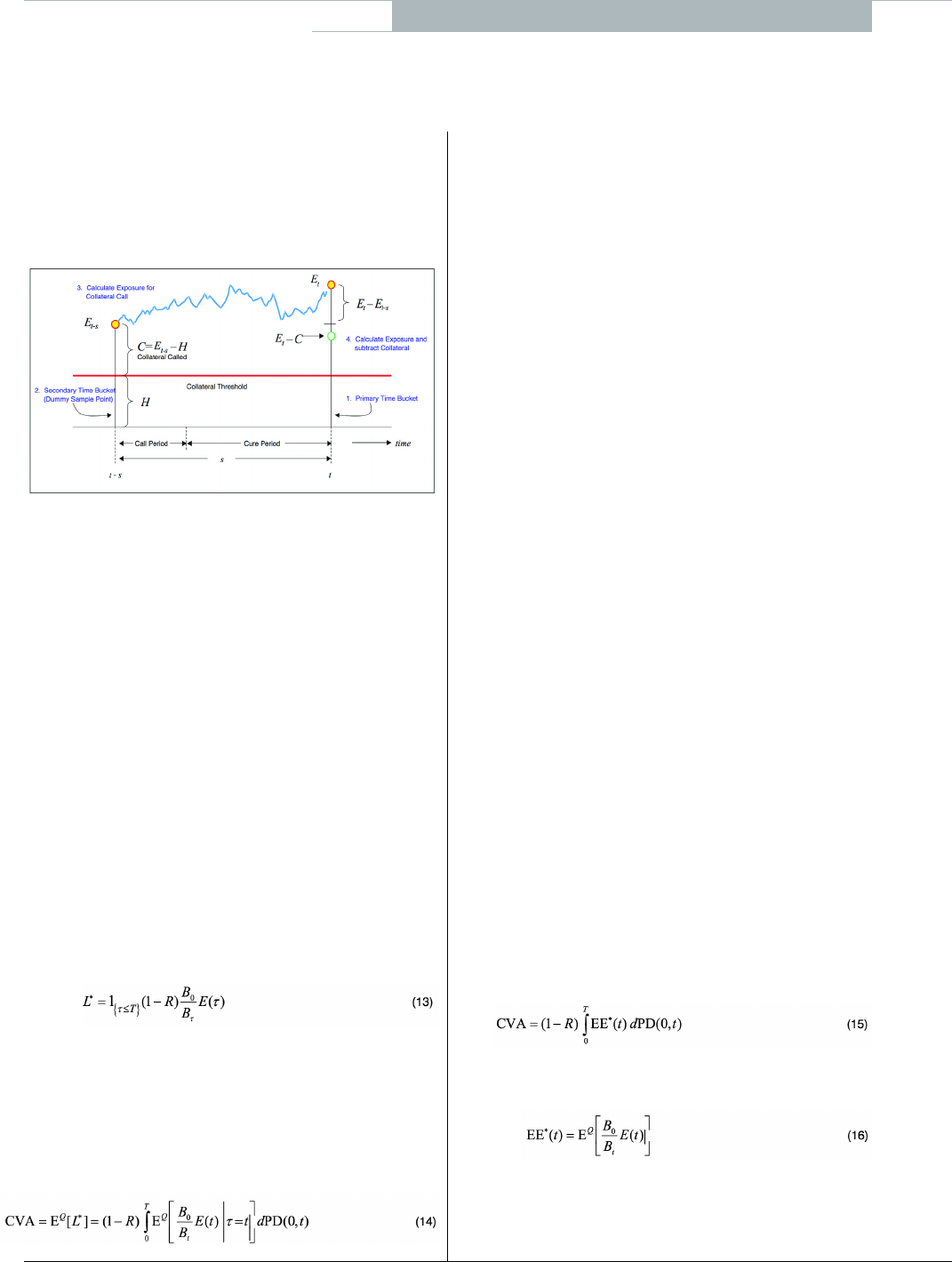

First, the collateral amount C(t) at a given simulation date

tis determined by comparing the uncollateralized exposure

at time t – s against the threshold value H

where sis the margin period of risk, and collateral is set to

zero if it is less than the MTA. Subsequently, the collateralized

exposure at the simulation date tis calculated by subtracting

the collateral C(t) from the uncollateralized exposure

To compute exposure at time t – s, additional simulation

dates (secondary time buckets) are placed prior to the main

simulation dates. Since the margin period of risk can be dif-

ferent for different margin agreements, secondary time

buckets are not fixed. This process is schematically illus-

trated in Figure 4, next page.

Collateral calculation requires the knowledge of exposure

at the secondary time bucket. The obvious approach is calcu-

lating this exposure by the Monte-Carlo simulation. This,

however, would result in doubling the computation time for

margined counterparties. In 2006 (see references), we pro-

posed a simplified approach to modelling the collateral. We

used the concept of the conditional valuation approach of

Lomibao and Zhu (2005) and calculated the exposure value

GLOBAL ASSOCIATION OF RISK PROFESSIONALS

GLOBAL ASSOCIATION OF RISK PROFESSIONALS 21

JULY/AUGUST 07 ISSUE 3377

at the secondary time bucket t – s for each scenario as the

expectation conditional on simulated exposure value at the

primary simulation date(s).

Figure 4: Treatment of Collateral at

Secondary Time Bucket

Credit Value Adjustment

For years, the standard practice in the industry was to mark

derivatives portfolios to market without taking the counter-

party credit quality into account. All cash flows were dis-

counted by the LIBOR curve, and the resulting values were

often referred to as risk-free values.5However, the true port-

folio value must incorporate the possibility of losses due to

counterparty default. Credit value adjustment (CVA) is by

definition the difference between the risk-free portfolio value

and the true portfolio value that takes into account the possi-

bility of a counterparty’s default. In other words, CVA is the

market value of counterparty credit risk.

How do we calculate CVA? Let us assume that a bank has

a portfolio of derivative contracts with a counterparty. We

will denote the bank’s exposure to the counterparty at any

future time tby E(t). This exposure takes into account all

netting and margin agreements between the bank and the

counterparty. If the counterparty defaults, the bank will be

able to recover a constant fraction of exposure that we will

denote by R. Denoting the time of counterparty default by ,

we can write the discounted loss as

where Tis the maturity of the longest transaction in the port-

folio, Btis the future value of one unit of the base currency

invested today at the prevailing interest rate for maturity t.

and 1{.} is the indicator function that takes value one if the

argument is true (and zero otherwise).

Unilateral CVA is given by the risk-neutral expectation of

the discounted loss. The risk-neutral expectation of of

Equation 13 can be written as

where PD(s,t) is the risk neutral probability of counterparty

default between times sand t. These probabilities can be

obtained from the term structure of credit-default swap

(CDS) spreads.

We would like to emphasize that the expectation of the dis-

counted exposure at time tin Equation 14 is conditional on

counterparty default occurring at time t. This conditioning is

material when there is a significant dependence between the

exposure and counterparty credit quality. This dependence is

known as right/wrong-way risk.

The risk is wrong way if exposure tends to increase when

counterparty credit quality worsens. Typical examples of

wrong-way risk include (1) a bank that enters a swap with

an oil producer where the bank receives fixed and pays the

floating crude oil price (lower oil prices simultaneously

worsen credit quality of an oil producer and increase the

value of the swap to the bank); and (2) a bank that buys

credit protection on an underlying reference entity whose

credit quality is positively correlated with that of the coun-

terparty to the trade. As the credit quality of the counterpar-

ty worsens, it is likely that the credit quality of the reference

name will also worsen, which leads to an increase in value of

the credit protection purchased by the bank.

The risk is right way if exposure tends to decrease when

counterparty credit quality worsens. Typical examples of

right-way risk include (1) a bank that enters a swap with an

oil producer where the bank pays fixed and receives the float-

ing crude oil price; and (2) a bank that sells credit protection

on an underlying reference entity whose credit quality is posi-

tively correlated with that of the counterparty to the trade.

While right/wrong-way risk may be important for com-

modity, credit and equity derivatives, it is less significant for

FX and interest rate contracts. Since the bulk of banks’ coun-

terparty credit risk has originated from interest-rate deriva-

tive transactions, most banks are comfortable to assume inde-

pendence between exposure and counterparty credit quality.

Exposure, Independent of Counterparty Default

Assuming independence between exposure and counterpar-

ty’s credit quality greatly simplifies the analysis. Under this

assumption, Equation 14 simplifies to

where EE*(t) is the risk-neutral discounted expected expo-

sure (EE) given by

which is now independent of counterparty default event.

Discounted EE can be computed analytically only at the

contract level for several simple cases. For example, expo-

COVER STORY:COUNTERPARTY RISK

GLOBAL ASSOCIATION OF RISK PROFESSIONALS

GLOBAL ASSOCIATION OF RISK PROFESSIONALS

22 JULY/AUGUST 07 ISSUE 3377

COVER STORY:COUNTERPARTY RISK

sure of a single European option is E(t)=VEO(t), because

European option value VEO(t) is always positive. Since there

are no cash flows between today and option maturity, substi-

tution of this exposure into Equation 16 yields a flat dis-

counted EE profile at the current option value:

EE*EO(t)=VEO(0).

However, calculating discounted EE at the counterparty

level requires simulations. These simulations can be per-

formed according to the exposure modelling framework

described in the previous section. According to this frame-

work, exposure is simulated at a fixed set of simulation dates

{tk} N

k=1. Therefore, the integral in Equation 15 has to be

approximated by the sum:

Since expectation in Equation 16 is risk neutral, scenario

models for all price factors should be arbitrage free. This is

achieved by appropriate calibration of drifts and volatilities

specified in the price-factor evolution model. Drift calibra-

tion depends on the choice of numeraire and probability

measure, while volatilities should be calibrated to the avail-

able prices of options on the price factor.

For PDS scenarios, the same probability measure should be

used across all simulation dates (i.e., the use of spot risk-neu-

tral measure is appropriate). In contrast, the DJS approach

does not require the same probability measure, because sce-

narios at different simulation dates are not directly connected.

A very convenient choice of measure under the DJS approach

is to model exposure under the forward to simulation date

probability measure Pt, which makes it possible to use today’s

zero coupon bond prices B(0,t) for discounting exposure:

In principle, Equation 18 is equivalent to Equation 16 and,

if properly calibrated, they should generate the same result.

Parting Thoughts

Any firm participating in the OTC derivatives market is

exposed to counterparty credit risk. This risk is especially

important for banks that have large derivatives portfo-

lios. Banks manage counterparty credit risk by setting

credit limits at counterparty level, by pricing and hedging

counterparty risk and by calculating and allocating eco-

nomic capital.

Modelling counterparty risk is more difficult than

modelling lending risk, because of the uncertainty of

future credit exposure. In this article, we have discussed

two modelling issues: modelling credit exposure and cal-

culating CVA. Modelling credit exposure is vital for any

risk management application, while modelling CVA is a

necessary step for pricing and hedging counterparty

credit risk. ■

FOOTNOTES

1. There is a much more remote risk of loss if the exchange itself fails with insufficient collateral in hand to cover all its obligations.

2. In reality, the bank may or may not replace the contract, but the loss can always be determined under the replacement assumption.The loss is, of

course, independent of the strategy the bank chooses after the counterparty’s default.

3. Economic and regulatory capital are out of scope of this article because of space limitation. Economic capital for counterparty risk is covered in

Picoult (2004). For regulatory capital,see Fleck and Schmidt (2005).

4. Currency swaps are also an exception to this amortization effect since most (although not all) of the potential value arises from exchange-rate

movements that affect the value of the final payment.

5. This description is not entirely accurate, because LIBOR rates roughly correspond to AA risk rating and incorporate typical credit risk of large banks.

REFERENCES:

Arvanitis,A. and J. Gregory, 2001. Credit. Risk Books, London.

Canabarro, E. and D. Duffie, 2003. “Measuring and Marking Counterparty Risk. In Asset/Liability Management for Financial Institutions,edited by L.

Tilman. Institutional Investor Books.

De Prisco, B. and D. Rosen, 2005. “Modeling Stochastic Counterparty Credit Exposures for Derivatives Portfolios.” In Counterparty Credit Risk

Modeling, edited by M. Pykhtin, Risk Books, London.

Fleck, M. and A. Schmidt, 2005. “Analysis of Basel II Treatment of Counterparty Credit Risk.” In Counterparty Credit Risk Modeling, edited by M.

Pykhtin, Risk Books, London.

Gibson, M., 2005. “Measuring Counterparty Credit Exposure to a Margined Counterparty.” In Counterparty Credit Risk Modeling, edited by M.

Pykhtin, Risk Books, London.

Lomibao,D. and S. Zhu, 2005. “A Conditional Valuation Approach for Path-Dependent Instruments.” In Counterparty Credit Risk Modeling, edited

by M. Pykhtin, Risk Books, London.

Picout, E., March 2004.“Economic Capital for Counterparty Credit Risk.” RMA Journal.

Pykhtin M. and S. Zhu, 2006.“Measuring Counterparty Credit Risk for Trading Products under Basel II.” In The Basel Handbook (2nd edition), edited

by M. K. Ong, Risk Books, London.

✎MICHAEL PYKHTIN and STEVEN ZHU are responsible for credit risk methodology in the risk architecture group of the global mar-

kets risk management department at Bank of America. Pykhtin can be reached at michael.pykhtin@bankofamerica.com and Zhu can be

reached at steven.zhu@bofasecurities.com.The opinions expressed here are those of the authors and do not necessarily reflect the views or

policies of Bank of America, N.A.