QuickStream Security Features Guide

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 42

A division of Westpac Banking Corporation ABN 33 007 457 141

QuickStream

Security Features Guide

Page 2

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

Date

Version

Description

Author

03-Feb-2003

7.1

Original Version

Qvalent

15-Sep-2003

7.1

Updated

Qvalent

7-Jul-2004

8.0

Updated for v8.0 software

Qvalent

14-Jul-2004

8.01

Updated

Qvalent

24-Jun-2005

8.1

Updated

Qvalent

8-May-2006

8.2

Updated

Qvalent

16-Aug-2006

8.3

Updated

Qvalent

27-Nov-2006

8.4

Updated

Qvalent

31-Dec-2007

9.0

Updated for v9.0

Qvalent

3-Jun-2008

10.0

Updated with LTM information

Qvalent

16-Jul-2008

10.1

Updated

Qvalent

4-Nov-2008

11.0

Updated

Qvalent

5-Nov-2008

11.1

Updated

Qvalent

22-Feb-2010

11.2

Updated

Qvalent

22-Feb-2010

11.3

Updated with FAQ

Qvalent

12-Mar-2010

11.4

Updated

Qvalent

3-May-2010

11.5

Updated

Qvalent

17-Mar-2011

11.6

Updated

Qvalent

7-Oct-2011

11.7

Updated

Qvalent

12-Oct-2011

11.8

Updated

Qvalent

Document History

- 3 -

Page 3

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Table of Contents

1 Introduction ..................................................................................................... 5

2 Security Features .............................................................................................. 6

2.1 Passwords / Authentication ................................................................................. 6

2.2 Accountability and Auditing ................................................................................. 7

2.3 Single Sign On ................................................................................................... 7

2.4 Role Based Security ........................................................................................... 7

2.5 Intrusion Detection Controls ................................................................................ 7

2.6 Inactivity Controls .............................................................................................. 8

2.7 Encryption ........................................................................................................ 8

3 Web Based Application Development ................................................................ 9

3.1 Secure Coding Practices ...................................................................................... 9

3.2 Web Session Management ................................................................................ 10

4 Messaging Controls......................................................................................... 11

5 Credit Card Processing.................................................................................... 13

5.1 Overview ........................................................................................................ 13

5.2 How Does Qvalent Process Cards?...................................................................... 13

5.3 Credit Card Integration Security ........................................................................ 14

5.4 PCI-DSS Compliance ........................................................................................ 15

6 Banking File Transfer ...................................................................................... 22

7 Data Centre Facilities ...................................................................................... 24

7.1 WAN .............................................................................................................. 25

- 4 -

Page 4

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

7.2 Internet .......................................................................................................... 26

7.3 Network Firewalls ............................................................................................ 26

7.4 BigIP Local Traffic Manager (LTM) ...................................................................... 28

7.5 BigIP Application Security Manger (ASM) ............................................................ 30

7.6 Servers........................................................................................................... 31

7.7 Monitoring and reporting................................................................................... 31

8 Disaster Recovery ........................................................................................... 33

8.1 What are Qvalent‟s disaster recovery plans? ........................................................ 34

9 Backups, Data Storage and Destruction .......................................................... 34

10 General FAQ’s ................................................................................................. 35

11 Glossary ......................................................................................................... 38

- 5 -

Page 5

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

1 Introduction

Qvalent is a 100% owned subsidiary of the Westpac Banking Corporation and

operations the QuickStream platform for Westpac.

Qvalent treats security as a prime concern. As Qvalent is a 100% wholly owned

subsidiary of the Westpac Banking Corporation, it must conform to all Westpac

security policies. This is to ensure that the Customer‟s and Westpac‟s data is secure,

no insecure network applications are used and all communications between Qvalent

applications themselves or external applications are carried out over secure links. In

addition all financial data transmitted between Qvalent (Westpac) must be encrypted

and digitally signed for both the customer and Westpac‟s protection. Some of the key

security measures used by Qvalent consist of:

PCI-DSS Compliant (Level 1).

AS2805 Compliant.

Application firewalls to prevent data leakage.

Single sign on for all users;

All applications share same security code base;

Every page validates a user‟s security;

Users are only allowed to view data for companies that they are associated with;

Message encryption using SSL between both internal and external systems;

Basic authentication for all messages sent between Qvalent and external

systems;

Reverse IP lookup‟s to check to origin of received messages;

Full digital certificate (both client & server) support;

All critical user and financial information is stored encrypted using private keys in

the database;

Access to the database is only allowed through security data access objects;

Multiple firewall cells; and

All ports and IP addresses blocked by default, only specific addresses and ports

are open.

Qvalent‟s wide area network is managed by Optus and its data centre / internal

network by Hewlett Packard. Both of these companies use best of breed

practices.

- 6 -

Page 6

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

2 Security Features

2.1 Passwords / Authentication

The application authenticates users through X.509 certificates or by a user

name/password combination. The database cannot be read to reveal user passwords as

they are held in encrypted form. To this end when a user wishes to change their

password, the system will only transmit the keystrokes encrypted, thus the line cannot

be „sniffed‟ effectively. Once authenticated, the user has a session variable created and

kept as a server-side cookie, which is passed to every page accessed throughout the

user‟s session.

When a user is authenticated, they are assigned user rights within a company. These

security rights can be limited to an individual, group or company level. Access to

information is based on a user‟s security rights and the company administrator controls

this.

Some of Qvalent‟s password management capabilities include:

Minimum of eight characters;

Must contain letters and numbers;

Can only be changed once in a 24 hour period;

Must be changed every 42 days;

Cannot reuse the last 5 password;

Ability to enforce password expiration;

Passwords stored as a hash;

Ability to require automatic password expirations when initially assigned or reset;

Ability to require re-authentication after 15 minutes of inactivity.

Ability to automatically disable accounts after a period of inactivity (120 days);

Ability to manually lock out a user account;

Ability to lock out an account automatically after a defined number of incorrect logins

(5 attempts);

Password suppression (masked) during entry at sign on dialogue;

Passwords are masked from all outputs (e.g. reports, logs, etc);

Passwords cannot be retrieved or viewed from password database;

Ability to permit user-initiated resetting of passwords;

Forced password re-entry verified (old pw, new pw, and new pw again);

Ability to deactivate or change passwords of vendor supplied Ids;

Ability to force password changes; and

Support for One Time Passwords (OTP).

- 7 -

Page 7

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

2.2 Accountability and Auditing

Qvalent products provide the following accountability and auditing functionality;

Audit logs can be secured from unauthorized access;

Ability to log activities performed by specific ID or time of day;

Ability of audit log to time and date stamp all actions for each ID;

Ability to filter the level of logging based on log masks;

Ability to identify and log all subsequent access points - accountability is maintained

throughout session;

Ability to log successful and unsuccessful single sign-on attempts;

Failed access attempts to specific domains, files, directories, URLs can be logged;

Administrative functions can be logged and are auditable;

Ability to maintain the user‟s identity for the duration of the session; and

Ability to prevent the display of passwords on audit logs.

2.3 Single Sign On

Qvalent applications allow external validation systems to be used to replace its standard

login processor. A custom “Authenticator” java class that implements a defined interface

can be created to meet specific customer requirements. Typical uses for this

“Authenticator” revolve around a company having a single sign-on system (SSO) that all

users must log on too. Through the use of an “Authenticator”, Qvalent Procurement can

be integrated with such a system. The creation and deletion of Procurement user

accounts can also be managed through Qvalent‟s iConnect technology. This allows users

to be added, updated or deleted automatically via iConnect integration packages. Once

again these packages can be integrated with SSO systems.

2.4 Role Based Security

All users require individual sign ons to the applications, no generic accounts are allowed.

All user id‟s are role based with particular rights assigned to those roles. Quick Stream

provides a flexible framework that allows organisations to be „self managing‟. This

means that within an organisation rights and roles can be assigned by personnel within

that organisation (Community Administrators).

2.5 Intrusion Detection Controls

The Qvalent suite offers a number of Intrusion Detection Controls. These include:

Ability to set an unsuccessful access attempt limit;

- 8 -

Page 8

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Ability to suspend ID after reaching the unsuccessful access threshold;

Ability to display time/date of last successful logon;

Ability to display number of unsuccessful logon attempts since last successful log-in;

Ability to send alerts to administrators for unauthorized access attempts;

Ability to detect incoming messages from unauthorised sources; and

In addition to software control Hewlett Packard provides comprehensive network

event detection and notification management.

2.6 Inactivity Controls

Qvalent products provide the following inactivity controls:

Automatic logoff of ID after a 15 minute period of session inactivity; and

After lock-out, re-access require password authentication

2.7 Encryption

Externally, all inbound and outbound sensitive data is encrypted and digitally signed. For

file based transfers this is PGP with a 1024bit key. For stream based exchanges this is

over SSL with 128bit certificates.

Internally, Qvalent uses the triple DES algorithm in cipher-feedback mode and AES for

all two-way data encryption. The encrypted information can optionally be returned in a

base 64 encoded string.

- 9 -

Page 9

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

3 Web Based Application Development

3.1 Secure Coding Practices

Qvalent web software and applications development philosophy is based on secure

coding guidelines such as the Open Web Application Security Project guidelines. Review

custom application code to identify coding vulnerabilities. See www.owasp.org - “The Ten

Most Critical Web Application Security Vulnerabilities.” Cover prevention of common coding

vulnerabilities in software development processes, to include:

Unvalidated input - All data is validated by a common framework in the application,

where required fields are checked, along with input length and data format (for non-

free text fields).

Broken Access control – Qvalent applications automatically lock out accounts after a

set number of invalid login attempts to prevent „brute force‟ attacks. Broken

authentication and session management (use of account credentials and session

cookies) - Session IDs are generated using a 128-bit cryptographic pseudo-random

number generator, making guessing the next ID implausible. The session ID is 128-

bits long. The session ID is temporary in nature, and is not stored on the user‟s

disk. It is also only contained in the memory of the application server, and never

written to disk. Sessions are also automatically timed out after a period of inactivity.

Cross Site Scripting (XSS) attacks - Qvalent‟s architecture uses XSL to generate the

HTML displayed to users. The servlets on the application server generate XML which

is then transformed into what the user sees. The underlying technology prevents

this kind of attack, since any dangerous characters in the output (such as

“<script>”) are automatically escaped by the framework. The consequence of this is

that if a user enters “<script>” into an input field, that data will later be sent back to

the browser as “<script>”, which will be displayed as “<script>” by the browser.

Buffer Overflow Attacks - The underlying platform is Java, which is not vulnerable to

using exceptionally long string s to overflow buffers. The application server prevents

requests which would be large enough to fill the entire server memory.

SQL Injection Flaws – Qvalent uses prepared statements for all its SQL. This

prevents SQL statements that are entered into data fields from being executed.

Improper Error Handling - System error messages contain only a reference number

which can be reported to the helpdesk. No stack traces of any kind are included in

the page.

- 10 -

Page 10

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Insecure Storage – All sensitive data is stored encrypted in Qvalent databases. These

databases reside behind multiple firewalls.

Denial Of Service - Qvalent uses Hewlett Packard to host its servers. HP have

intrusion detection systems in place to detect and respond to these kinds of attacks

such as ping of death, tear drop, Syn flood etc. Qvalent web servers also limit the

number off sessions from a particular IP address.

Insecure Configuration Management – All Qvalent servers are built to strict security

standard using a specific build process. All non essential services and accounts are

removed at build time.

Cross Site Request Forgery - Qvalent applications do not allow login on any page -

login is only allowed from the login page. High profile actions (such as making a

payment or changing user details) can only be performed via POST. These pages

also include a random token to prevent automated CRSF attacks.

Failure to restrict URL Access - Qvalent applications use a common authorisation

framework to ensure that users only access pages permitted by their defined user

roles. Internal application server URLs are blocked by the web server - they are not

externally accessible. All Qvalent servers are built to strict security standard using a

specific build process. All non essential services and accounts are removed at build

time.

3.2 Web Session Management

Key features of web session management that are built into Qvalent products:

All sessions timeout after 15 minutes of inactivity. If the user attempts to access

another page after this timeout, they are informed that they must login again.

All session state is stored on the server – no session data is stored in the browser.

The browser only has a non-persistent cookie containing the session ID.

Session id‟s are 256 bits in length and are generated using a secure cryptographic

random number generator.

Application firewalls monitor session IDs for evidence of tampering

Cross site request forgery (CSRF) is prevented through the server requiring HTTP

POST and a random token for pages that perform an action (such as making a

payment or updating data).

- 11 -

Page 11

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

User sessions are under SSL all the way through the untrusted and trusted zones to

the app servers. There is no unencrypted session transmissions on the internal

production network.

4 Messaging Controls

System interfaces involve sharing of data between the various modules of the Qvalent

product suite and systems external to the Qvalent suite. Interfaces between Qvalent

modules involve the following elements:

Extensible Mark-up Language (XML); Hypertext Transport Protocol (HTTP); Secure

HTTP (HTTPS); and XML Remote Procedure Calls (XMLRPC);

Using QXML, cXML or OBI messages transported by HTTP or HTTPS provides

asynchronous communication between modules and Supplier systems. XMLRPC is

used to manage synchronous communication between these systems;

iConnect facilities (iConnect Exchange Manager and iConnect Integration Manager)

provide guaranteed delivery and routing of messages between modules and with

customer business systems;

Interfaces with customer business systems can use a combination of the following

elements - HTTP or HTTPS; XCOM with encryption and signatures using X.509 or

Pretty Good Privacy (PGP); XML, OBI; and flat files (fixed width fields or delimited)

or custom solutions based on Customer requirements;

All external systems sending messages to Qvalent must be pre-registered otherwise

the message will not be accepted (reverse IP lookup is used for all incoming

messages);

All financial data transmitted between the customer and Qvalent must be encrypted

and digitally signed to ensure security and non-repudiation of the source;

All Qvalent messaging is compatible with firewalls and proxy servers.

128-bit SSL is the only available level of encryption. SSL version 2 is not allowed,

and neither is step-down encryption to 56-bit keys. RC4/MD5 is the allowed

combination for 128-bit encryption.

- 12 -

Page 12

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Automated scanning is performed on a 3 monthly basis by an independent security

firm as part of PCI security requirements.

- 13 -

Page 13

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

5 Credit Card Processing

5.1 Overview

Qvalent operates a high performance IP to X.25 card interchange known as P&P Cards.

This is part of the Quick Stream Platform. P&P Cards allows customers to connect to

Westpac via a variety of different technologies over an IP based network and process

card transactions.

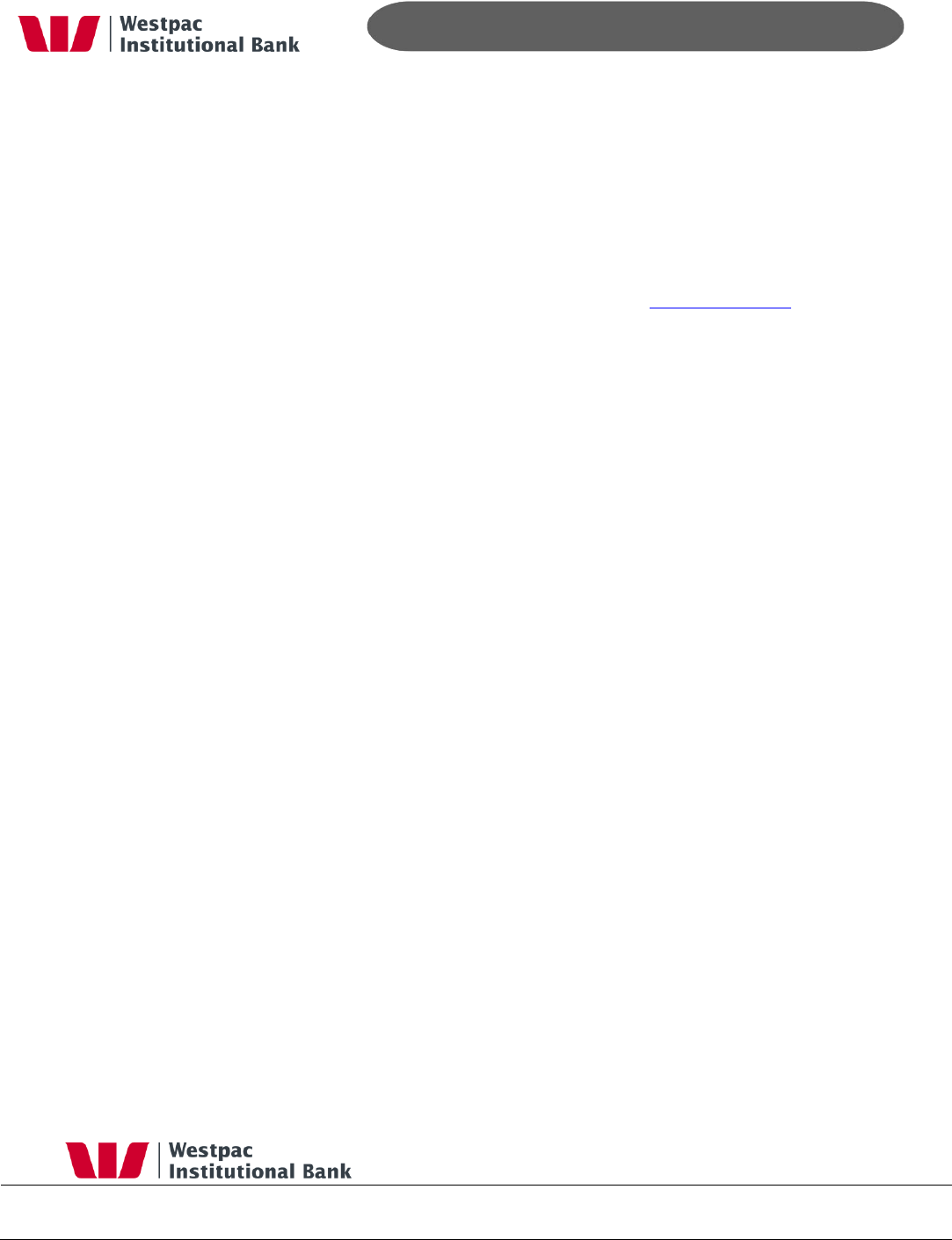

5.2 How Does Qvalent Process Cards?

Qvalent accepts an IP based card request and once security is verified the IP request is

converted into a standard AS2805 message. Once this conversion is complete it is

transmitted directly into Westpac‟s Tandem‟s for processing. In addition to credit card,

Qvalent also has high performance IP based links into Westpac‟s extranet to allow daily

files such as the credit card transaction log to be transmitted to Westpac for end of day

settlement.

Figure 1, Qvalent / Westpac Tandem Links

- 14 -

Page 14

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

5.3 Credit Card Integration Security

For a solution of this nature, security is critical. Qvalent must be absolutely confident that

they are receiving a credit card processing request from an authorised source. To ensure

the source of the request is valid, the following measures will be adopted:

The Customer must be registered before credit card processing will begin. Part of this

registration will be to issue the customer with a username and password. This

username/password combination must be passed in with every request.

Qvalent will only accept requests from certain pre-agreed IP addresses.

For high volume customers Qvalent will recommend that a virtual private network

(VPN) be installed between the customer‟s site and Qvalent‟s data centre.

For added security a card verification number (CVN) can be supplied with the credit

card API call. The CVN is not stored by Qvalent.

All transaction data will be communicated via HTTPS with 128-bit encryption.

In order of preference, the recommended communications infrastructure would be as

follows:

1. Leased line between the customer‟s site and Westpac‟s credit card server. In

this scenario, no data would be transmitted over the Internet. Username /

password are still mandatory.

2. Client certificate exchange with username / password over HTTPS. With client

certificates Westpac can be assured of the source of the request. The Customer

must obtain a 128-bit SSL Certificate from a registered Certificate Authority (eg

Verisign). This may be purchased or an existing, valid certificate may be used for

this purpose. Note: this SSL certificate must have the property “Proves

your identity to a remote computer”. Without this property set on the

certificate, Qvalent will not accept credit card API connection requests.

- 15 -

Page 15

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

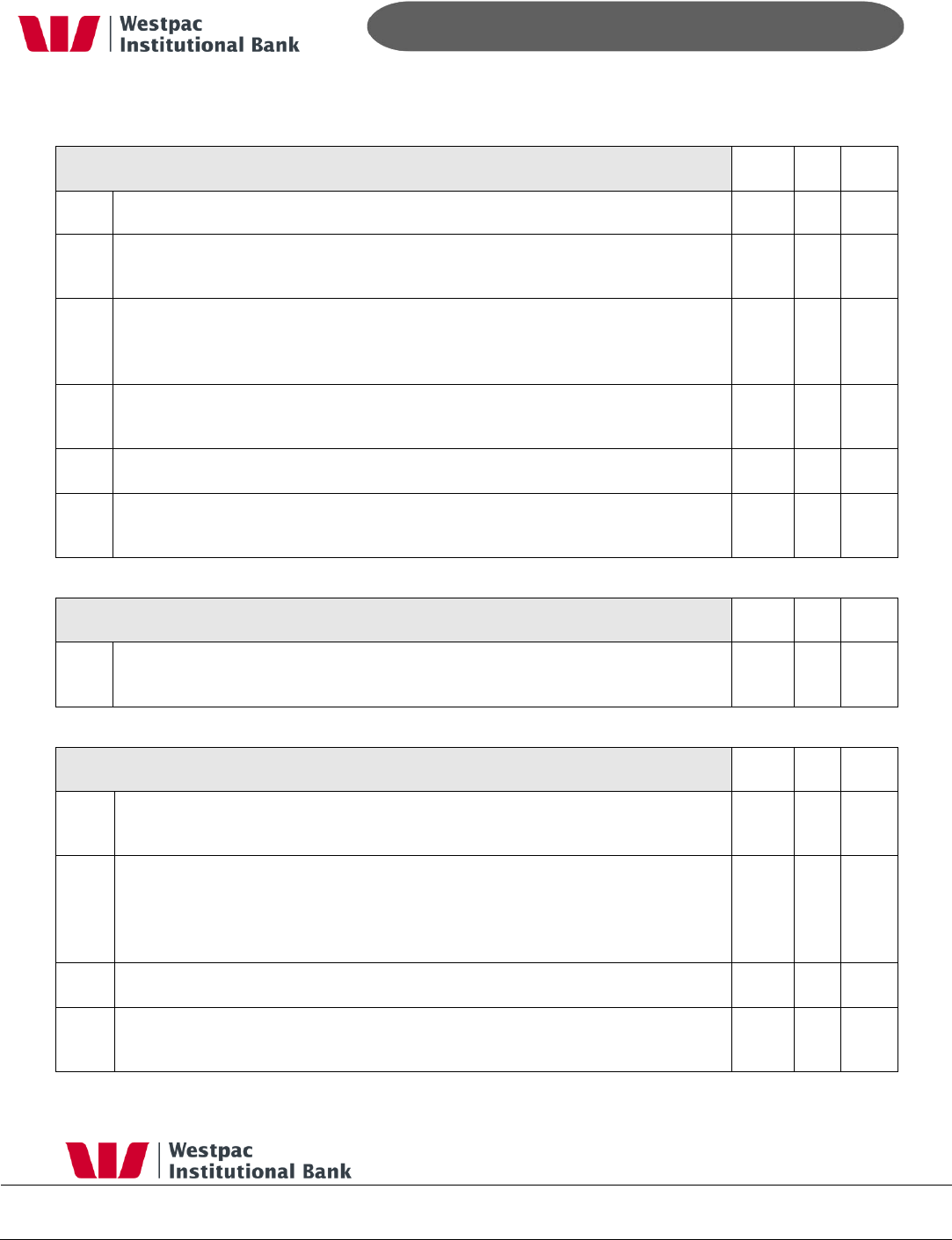

5.4 PCI-DSS Compliance

Qvalent is a tier 1 Interchange and PCI-DSS compliant (Level 1). The below table is

Qvalent‟s answers to the PCI-DSS questionnaire.

Install and maintain a firewall configuration to protect data

Yes

No

N/A

1.1

Are all router, switches, wireless access points, and firewall configurations

secured and do they conform to documented security standards?

√

1.2

If wireless technology is used, is the access to the network limited to

authorized devices?

√

1.3

Do changes to the firewall need authorization and are the changes logged?

√

1.4

Is a firewall used to protect the network and limit traffic to that which is

required to conduct business?

√

1.5

Are egress and ingress filters installed on all border routers to prevent

impersonation with spoofed IP addresses?

√

1.6

Is payment card account information stored in a database located on the

internal network (not the DMZ) and protected by a firewall?

√

1.7

If wireless technology is used, do perimeter firewalls exist between wireless

networks and the payment card environment?

√

1.8

Does each mobile computer with direct connectivity to the Internet have a

personal firewall and anti-virus software installed?

√

1.9

Are Web servers located on a publicly reachable network segment

separated from the internal network by a firewall (DMZ)?

√

1.10

Is the firewall configured to translate (hide) internal IP addresses, using

network address translation (NAT)?

√

- 16 -

Page 16

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Do not use vendor-supplied defaults for system passwords and other security

parameters

Yes

No

N/A

2.1

Are vendor default security settings changed on production systems before

taking the system into production secured and do they conform to

documented security standards?

√

2.2

Are vendor default accounts and passwords disabled or changed on

production systems before putting a system into production?

√

2.3

If wireless technology is used, are vendor default settings changed (i.e. WEP

keys, SSID, passwords, SNMP community strings, disabling SSID

broadcasts)?

√

2.4

If wireless technology is used, is Wi-Fi Protected Access (WPA) technology

implemented for encryption and authentication when WPA-capable?

√

2.5

Are all production systems (servers and network components) hardened by

removing all unnecessary services and protocols installed by the default

configuration?

√

2.6

Are secure, encrypted communications used for remote administration of

production systems and applications?

√

Protect stored data

Yes

No

N/A

3.1

Is sensitive cardholder data securely disposed of when no longer needed?

√

3.2

Is it prohibited to store the full contents of any track from the magnetic stripe

(on the back of the card, in a chip, etc.) in the database, log files, or point-of-

sale products?

√

3.3

Is it prohibited to store the card-validation code (three-digit value printed on

the signature panel of a card) in the database, log files, or point-of-sale

products?

√

3.4

Are all but the last four digits of the account number masked when displaying

cardholder data?

√

3.5

Are account numbers (in databases, logs, files, backup media, etc.) stored

securely for example, by means of encryption or truncation?

√

- 17 -

Page 17

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

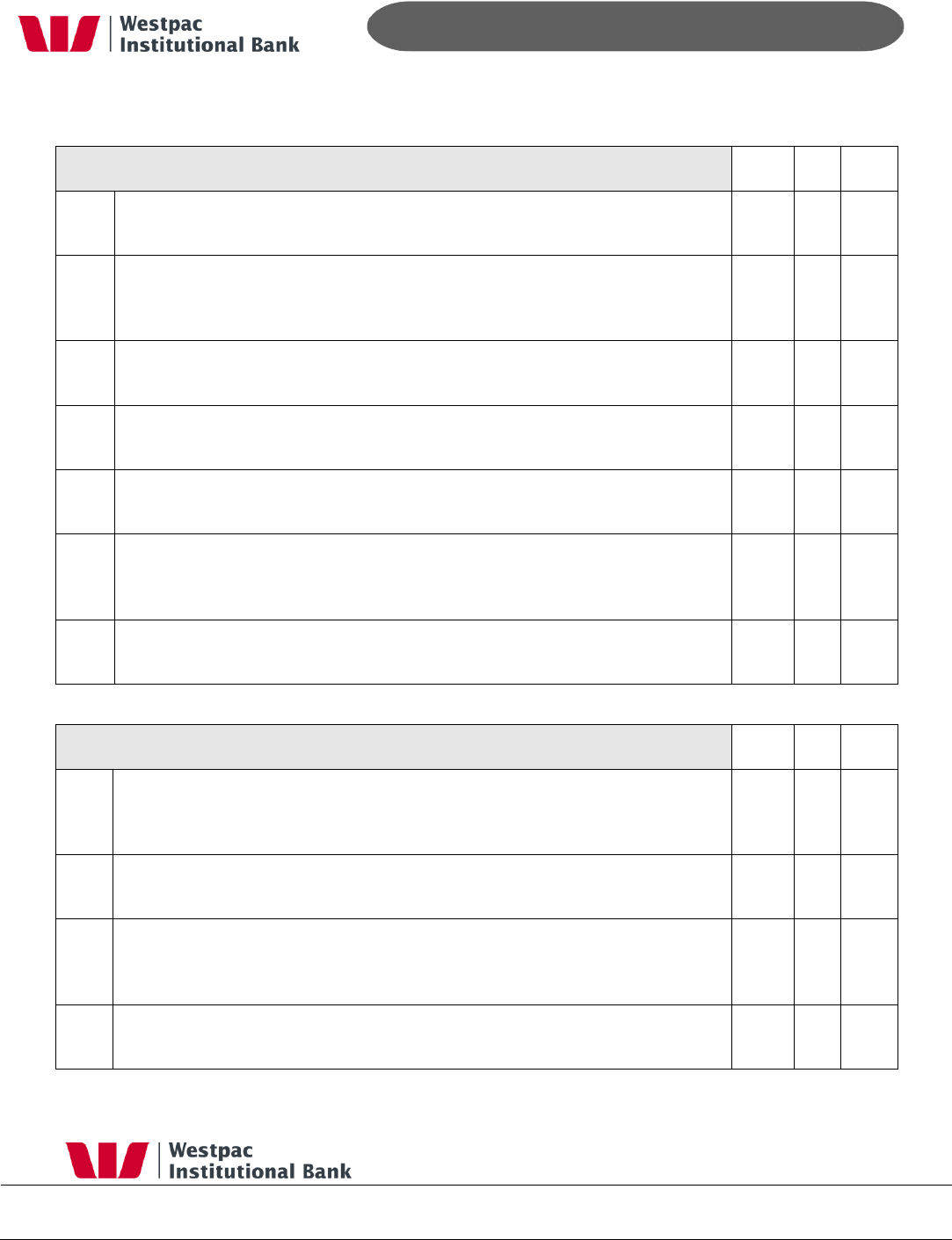

Protect stored data

Yes

No

N/A

3.6

Are account numbers sanitized (removed, truncated or encrypted) before

being logged in the audit log?

√

Encrypt transmission of cardholder data and sensitive information across public

networks

Yes

No

N/A

4.1

Are transmissions of sensitive cardholder data encrypted over public

networks through the use of SSL or other industry acceptable methods?

√

4.2

If SSL is used for transmission of sensitive cardholder data, is it using

version 3.0 with 128-bit encryption?

√

4.3

If wireless technology is used, is the communication encrypted using Wi-Fi

Protected Access (WPA), VPN, SSL at 128-bit, or WEP?

√

4.4

If wireless technology is used, are WEP at 128-bit and additional encryption

technologies in use, and are shared WEP keys rotated quarterly?

√

4.5

Is encryption used in the transmission of account numbers via e-mail?

√

Use and regularly update anti-virus software

Yes

No

N/A

5.1

Is there a virus scanner installed on all servers and on all workstations, and

is the virus scanner regularly updated?

√

Develop and maintain secure systems and applications

Yes

No

N/A

6.1

Are development, testing, and production systems updated with the latest

security-related patches released by the vendors?

√

6.2

Is the software and application development process based on an industry

best practice and is information security included throughout the software

development life cycle (SDLC) process?

√

6.3

If production data is used for testing and development purposes, is sensitive

√

- 18 -

Page 18

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Develop and maintain secure systems and applications

Yes

No

N/A

cardholder data sanitized before usage?

6.4

Are all changes to the production environment and applications formally

authorized, planned, and logged before being implemented?

√

6.5

Were the guidelines commonly accepted by the security community (such as

Open Web Application Security Project group (www.owasp.org)) taken into

account in the development of Web applications?

√

6.6

When authenticating over the Internet, is the application designed to prevent

malicious users from trying to determine existing user accounts?

√

6.7

Is sensitive cardholder data stored in cookies secured or encrypted?

√

6.8

Are controls implemented on the server side to prevent SQL injection and

other bypassing of client side-input controls?

√

Restrict access to data by business need-to-know

Yes

No

N/A

7.1

Is access to payment card account numbers restricted for users on a need-

to-know basis?

√

Assign a unique ID to each person with computer access

Yes

No

N/A

8.1

Are all users required to authenticate using, at a minimum, a unique

username and password?

√

8.2

If employees, administrators, or third parties access the network remotely, is

remote access software (such as PCAnywhere, dial-in, or VPN) configured

with a unique username and password and with encryption and other

security features turned on?

√

8.3

Are all passwords on network devices and systems encrypted?

√

8.4

When an employee leaves the company, are that employees user accounts

and passwords immediately revoked?

√

- 19 -

Page 19

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

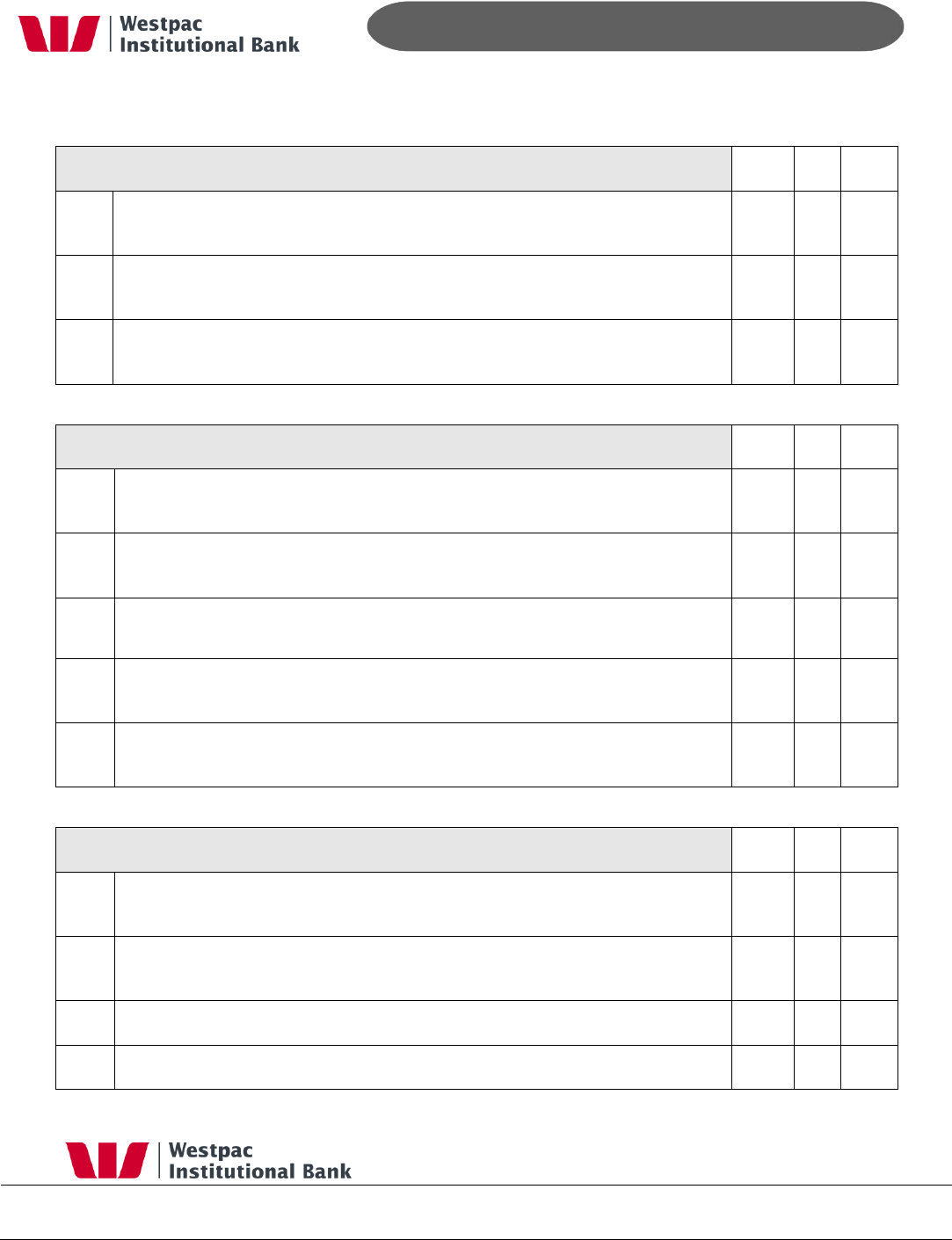

Assign a unique ID to each person with computer access

Yes

No

N/A

8.5

Are all user accounts reviewed on a regular basis to ensure that malicious,

out-of-date, or unknown accounts do not exist?

√

8.6

Are non-consumer accounts that are not used for a lengthy amount of time

(inactive accounts) automatically disabled in the system after a pre-defined

period?

√

8.7

Are accounts used by vendors for remote maintenance enabled only during

the time needed?

√

8.8

Are group, shared, or generic accounts and passwords prohibited for non-

consumer users?

√

8.9

Are non-consumer users required to change their passwords on a pre-

defined regular basis?

√

8.10

Is there a password policy for non-consumer users that enforces the use of

strong passwords and prevents the resubmission of previously used

passwords?

√

8.11

Is there an account-lockout mechanism that blocks a malicious user from

obtaining access to an account by multiple password retries or brute force?

√

Restrict physical access to cardholder data

Yes

No

N/A

9.1

Are there multiple physical security controls (such as badges, escorts, or

mantraps) in place that would prevent unauthorized individuals from gaining

access to the facility?

√

9.2

If wireless technology is used, do you restrict access to wireless access

points, wireless gateways, and wireless handheld devices?

√

9.3

Are equipment (such as servers, workstations, laptops, and hard drives) and

media containing cardholder data physically protected against unauthorized

access?

√

9.4

Is all cardholder data printed on paper or received by fax protected against

unauthorized access?

√

- 20 -

Page 20

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Restrict physical access to cardholder data

Yes

No

N/A

9.5

Are procedures in place to handle secure distribution and disposal of backup

media and other media containing sensitive cardholder data?

√

9.6

Are all media devices that store cardholder data properly inventoried and

securely stored?

√

9.7

Is cardholder data deleted or destroyed before it is physically disposed (for

example, by shredding papers or degaussing backup media)?

√

Track and monitor all access to network resources and cardholder data

Yes

No

N/A

10.1

Is all access to cardholder data, including root/administration access,

logged?

√

10.2

Do access control logs contain successful and unsuccessful login attempts

and access to audit logs?

√

10.3

Are all critical system clocks and times synchronized, and do logs include date and

time stamp?

√

10.4

Are the firewall, router, wireless access points, and authentication server

logs regularly reviewed for unauthorized traffic?

√

10.5

Are audit logs regularly backed up, secured, and retained for at least three

months online and one-year offline for all critical systems?

√

Regularly test security systems and processes

Yes

No

N/A

11.1

If wireless technology is used, is a wireless analyzer periodically run to

identify all wireless devices?

√

11.2

Is a vulnerability scan or penetration test performed on all Internet-facing

applications and systems before they go into production?

√

11.3

Is an intrusion detection or intrusion prevention system used on the network?

√

11.4

Are security alerts from the intrusion detection or intrusion prevention system

(IDS/IPS) continuously monitored, and are the latest IDS/IPS signatures

√

- 21 -

Page 21

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Regularly test security systems and processes

Yes

No

N/A

installed?

Maintain a policy that addresses information security

Yes

No

N/A

12.1

Are information security policies, including policies for access control,

application and system development, operational, network and physical

security, formally documented?

√

12.2

Are information security policies and other relevant security information

disseminated to all system users (including vendors, contractors, and

business partners)?

√

12.3

Are information security policies reviewed at least once a year and updated

as needed

√

12.4

Have the roles and responsibilities for information security been clearly

defined within the company?

√

12.5

Is there an up-to-date information security awareness and training program

in place for all system users?

√

12.6

Are employees required to sign an agreement verifying they have read and

understood the security policies and procedures?

√

12.7

Is a background investigation (such as a credit- and criminal-record check,

within the limits of local law) performed on all employees with access to

account numbers?

√

12.8

Are all third parties with access to sensitive cardholder data contractually

obligated to comply with card association security standards?

√

12.9

Is a security incident response plan formally documented and disseminated

to the appropriate responsible parties?

√

12.10

Are security incidents reported to the person responsible for security

investigation?

√

12.11

Is there an incident response team ready to be deployed in case of a

cardholder data compromise?

√

- 22 -

Page 22

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

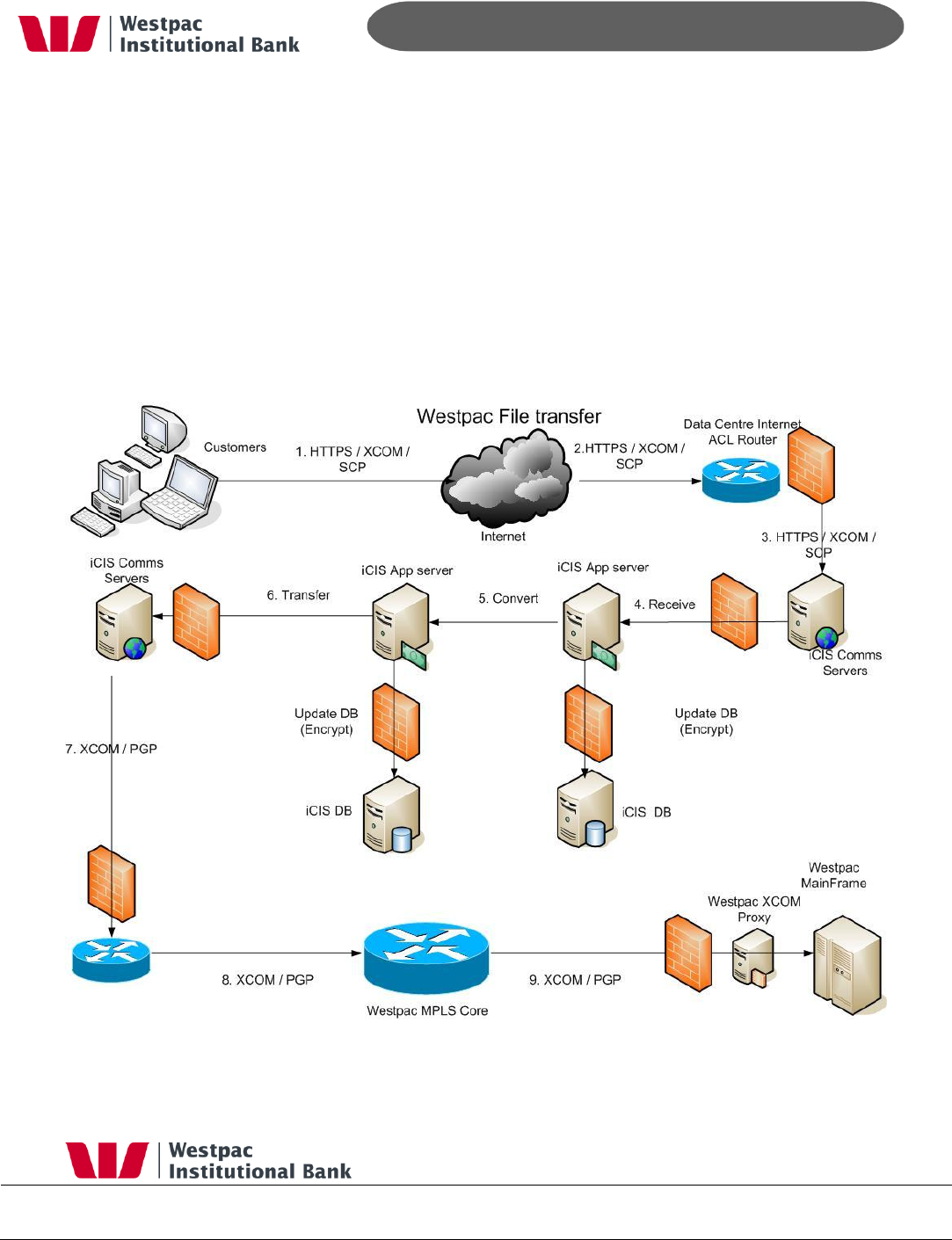

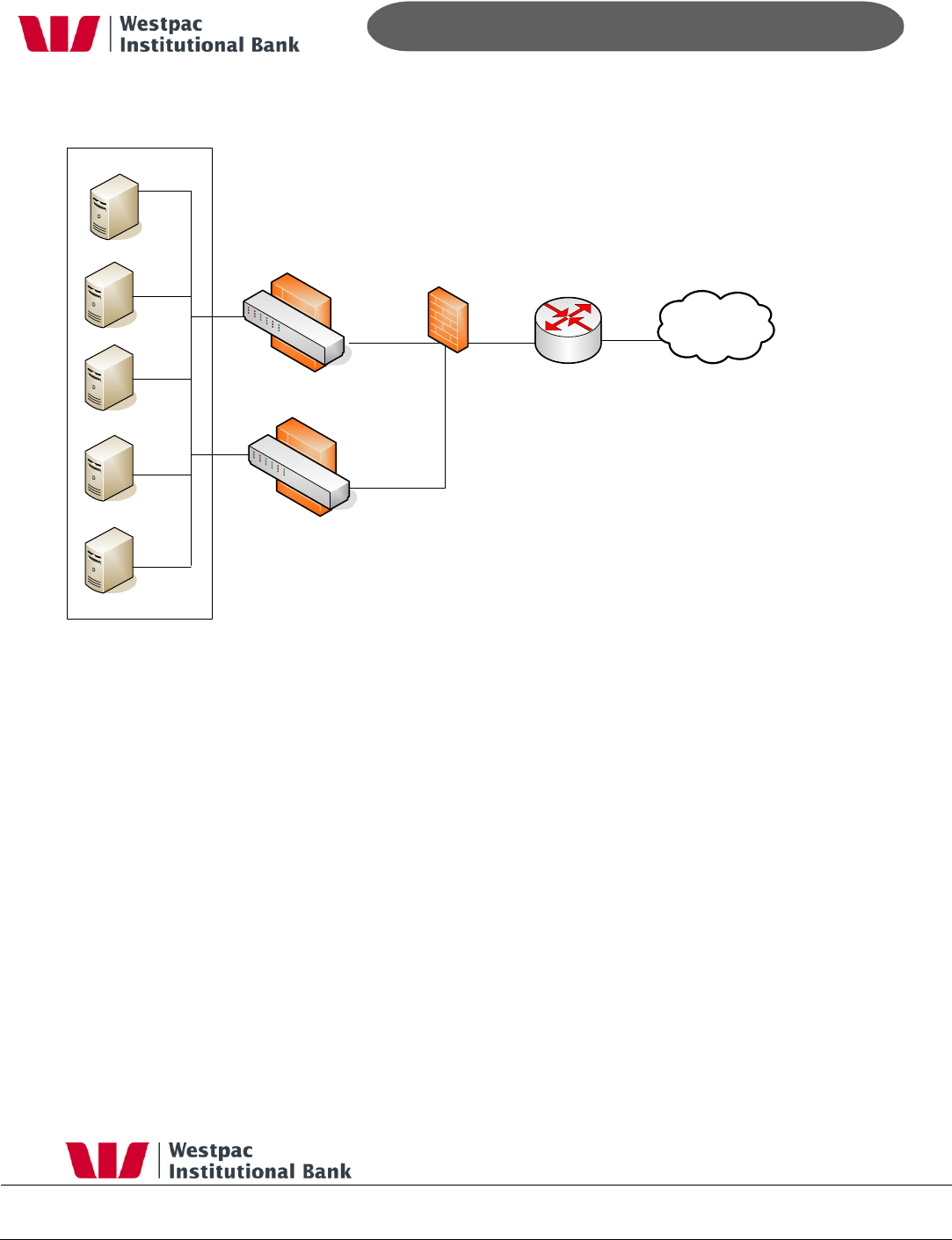

6 Banking File Transfer

Qvalent operates dual redundant Ethernet links into Westpac‟s MPLS network. These links

are with different providers and have automatic failover. Similar Ethernet links are also

installed at Qvalent‟s DR site. Customers transfer files to Qvalent via various means such as

HTTPS, XCOM or SCP either via the internet or leased lines. All received data must be

encrypted. Qvalent in turn encrypts and digitally signs (PGP) all data before sending it onto

Westpac. All transfers are via XCOM over Qvalent‟s secure Ethernet links.

The following steps take place when Customers need to transfer data to Qvalent for

processing. Qvalent then inturn forwards it onto Westpac. This can be a user to system

transfer (via iLinc) or a system to system transfer process:

- 23 -

Page 23

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

1-3 Customers attempt to connect to Qvalent via one of various means such as HTTPS,

XCOM, SCP/SFTP or other mechanism. The data centre internet facing routers screen the

incoming IP addresses against their ACL lists. All connections require security credentials

and the data is checked to ensure that it came from a trusted source.

4. Protocol and port redirection take place through the firewall to the iCIS messaging

hub. This is the central switch for all messaging communications with Qvalent. This data

is then stored encrypted in Qvalent‟s databases.

5-6. The iCIS App server converts the file into the required Westpac format then PGP

encrypts and digitally signs the file. The file is then passed to the iCIS comms server for

transmission.

7-9. The iCIS comms server transmitted the encrypted file via XCOM to the Westpac

proxy server. The Westpac proxy server decrypts the file then passes it to the Westpac

mainframe for processing.

The reverse applies when Westpac sends files back to Qvalent.

- 24 -

Page 24

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

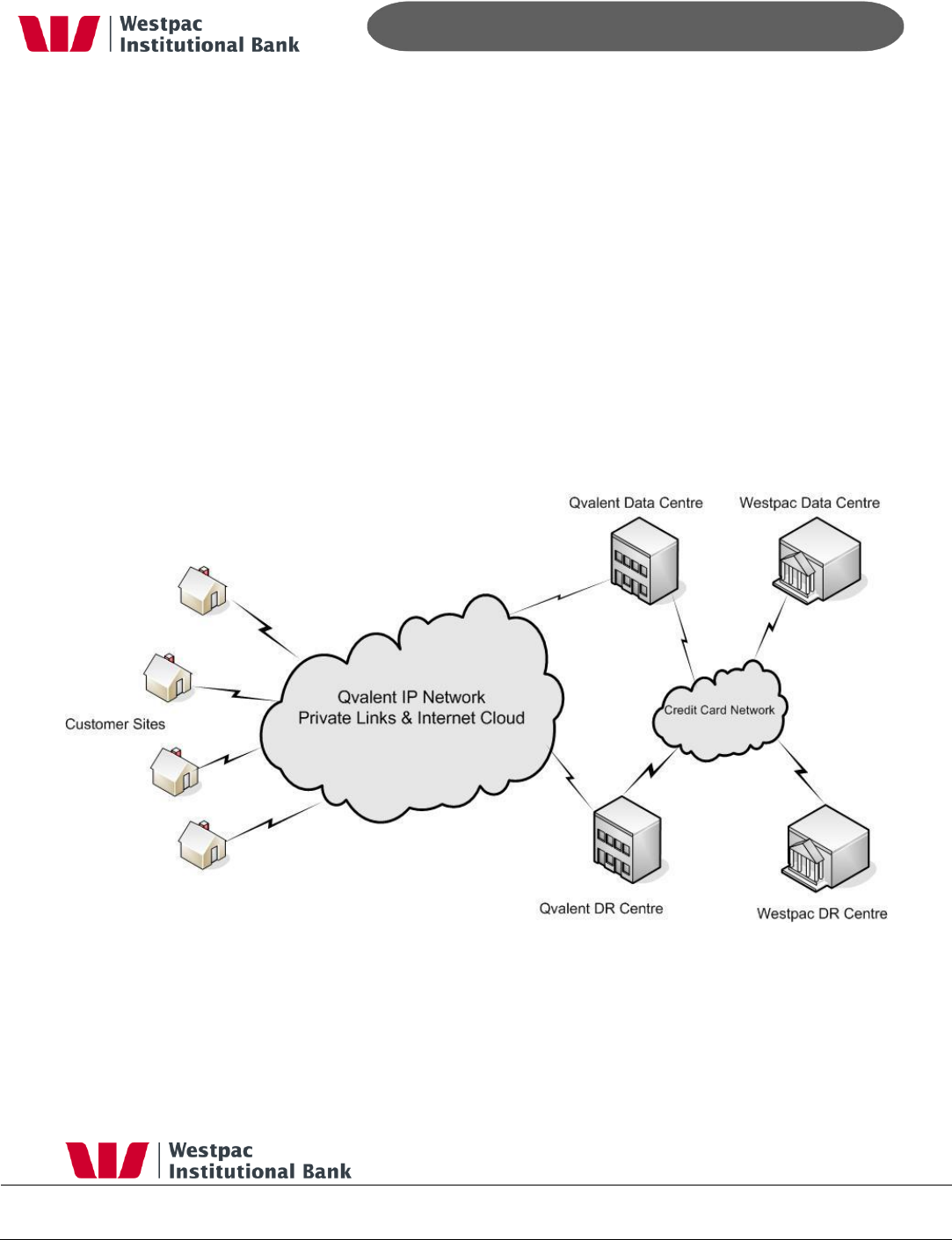

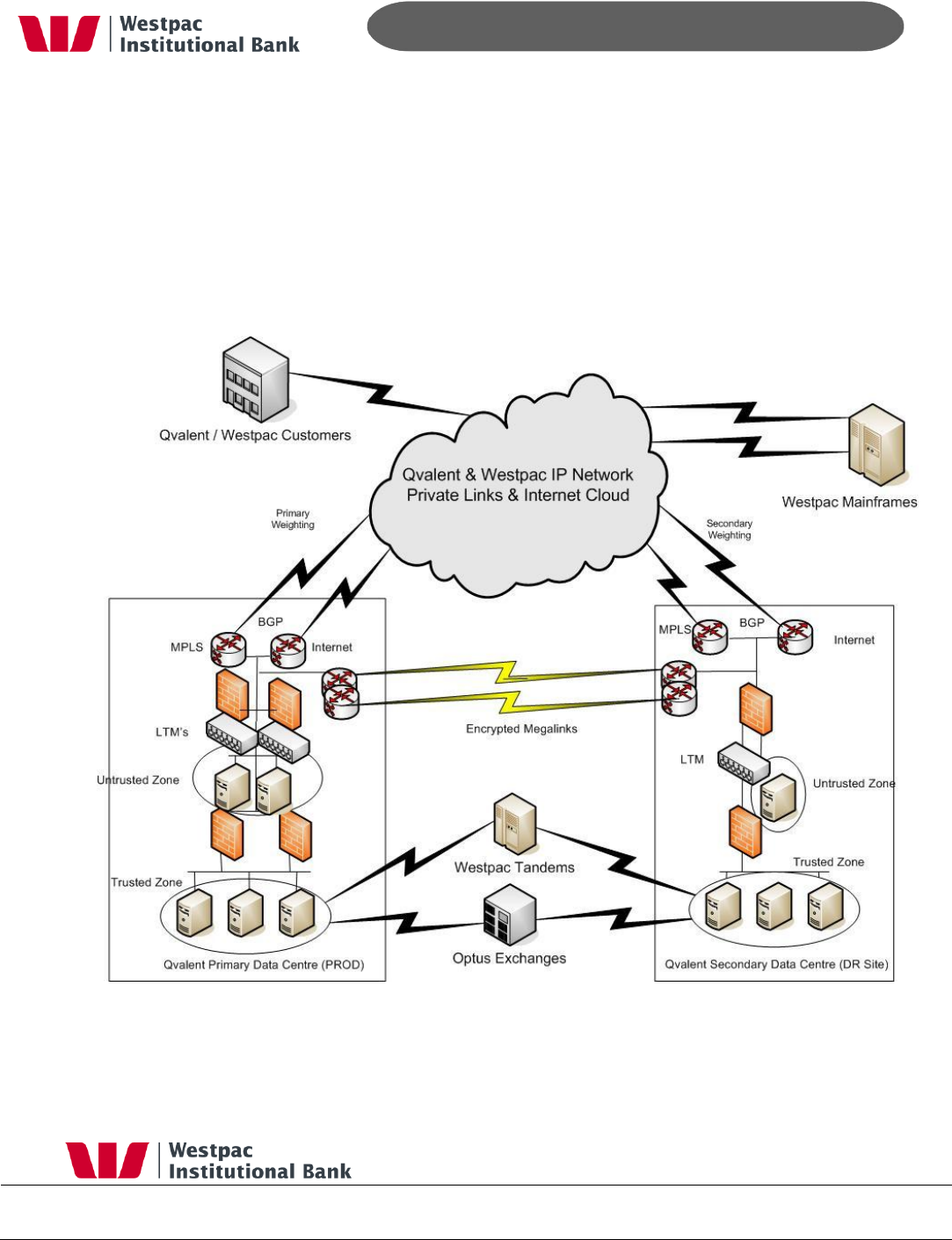

7 Data Centre Facilities

Qvalent is a 100% owned subsidiary of Westpac and operates an A2 class data centre

and associated disaster recovery (DR) facilities for Westpac‟s QuickStream product suite.

This facilities and infrastructure has been designed to ensure the minimum failover time

to the disaster recovery facility in the event that the primary facility becomes

incapacitated.

Qvalent operates an A2 class data centre facility that is managed by Hewlett Packard

(HP) on Qvalent‟s behalf. HP is a world leader in data centre management and brings

world‟s best practices to the daily running of this centre. This data centre has all the

features you would expect in a state of the art facility including 24x7 security, battery

back up, diesel generators and fire suppression systems. Once again, like Qvalent‟s WAN

all paths are redundant with automatic failover.

Figure 2, Qvalent Primary Data Centre

- 25 -

Page 25

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

7.1 WAN

To achieve a successful transition to Qvalent‟s DR facility Qvalent utilises a „hub and spoke‟

network design that allows network traffic to be redirected to the Qvalent DR site without

any hardware changes. In addition to this the network is designed with redundancy in mind.

This ensures that no single point of failure will prevent the network from functioning.

Qvalent utilises Optus‟s MPLS IP based network technology and dual paths with different

internet service providers (Optus and Telstra) to ensure that all network path are redundant

with automatic failover.

The Qvalent infrastructure has been reviewed by Westpac and external auditors against the

AS2805 standard and the Visa / MasterCard PCI standard. As part of these standards

Qvalent submits to yearly security audits and tri-monthly network vulnerability scans.

Figure 3, WAN Network

- 26 -

Page 26

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

7.2 Internet

Qvalent‟s data centre has dual redundant internet links with both Telstra and Optus.

HP‟s internet facing routers run access control lists to limit any Internet addresses (for

example due to a DOS attack) before they hit the firewalls or servers. Internet

connections through the firewalls can only be approved by Qvalent‟s Chief Technology

Officer. Refer to Figure 2, Qvalent Primary Data Centre.

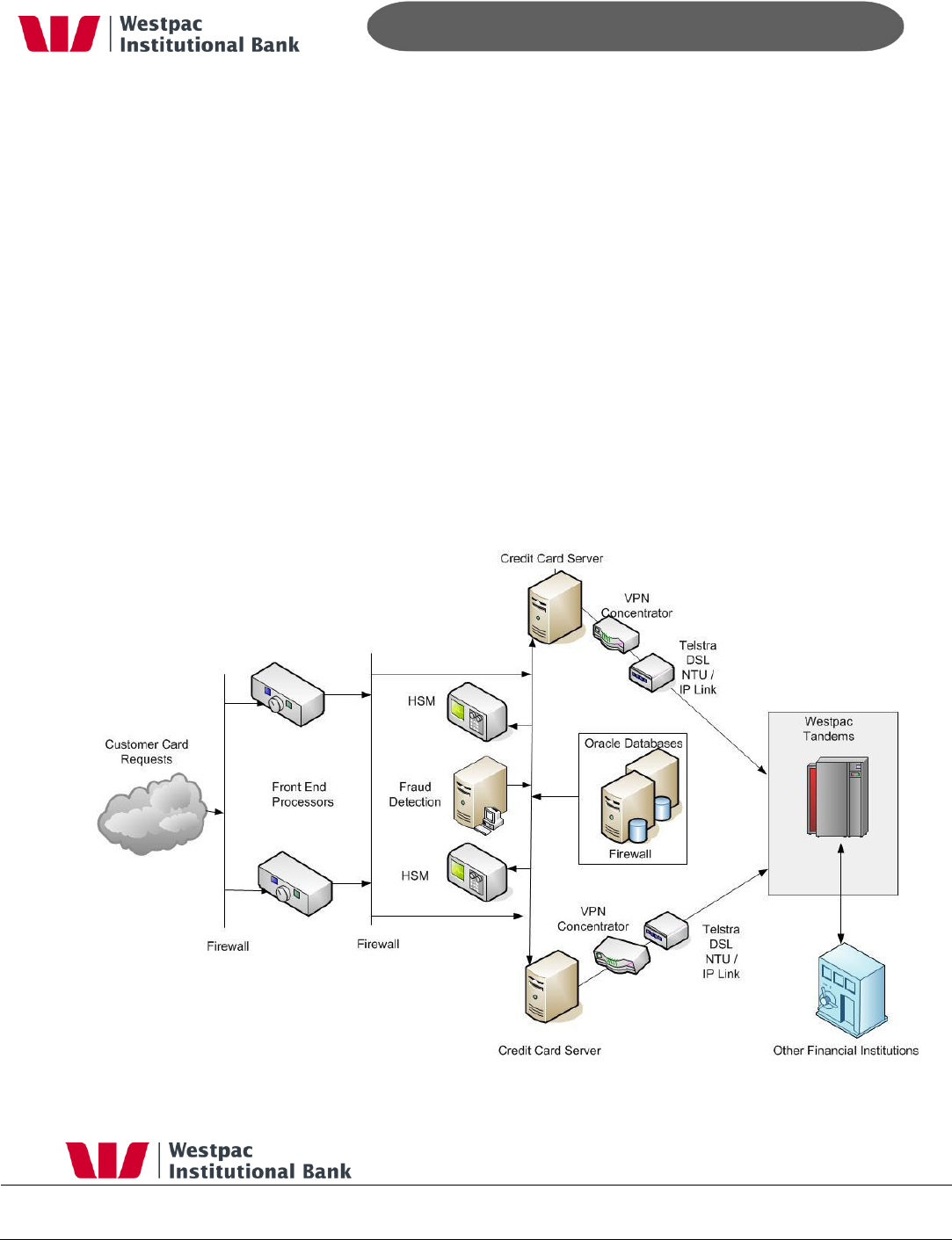

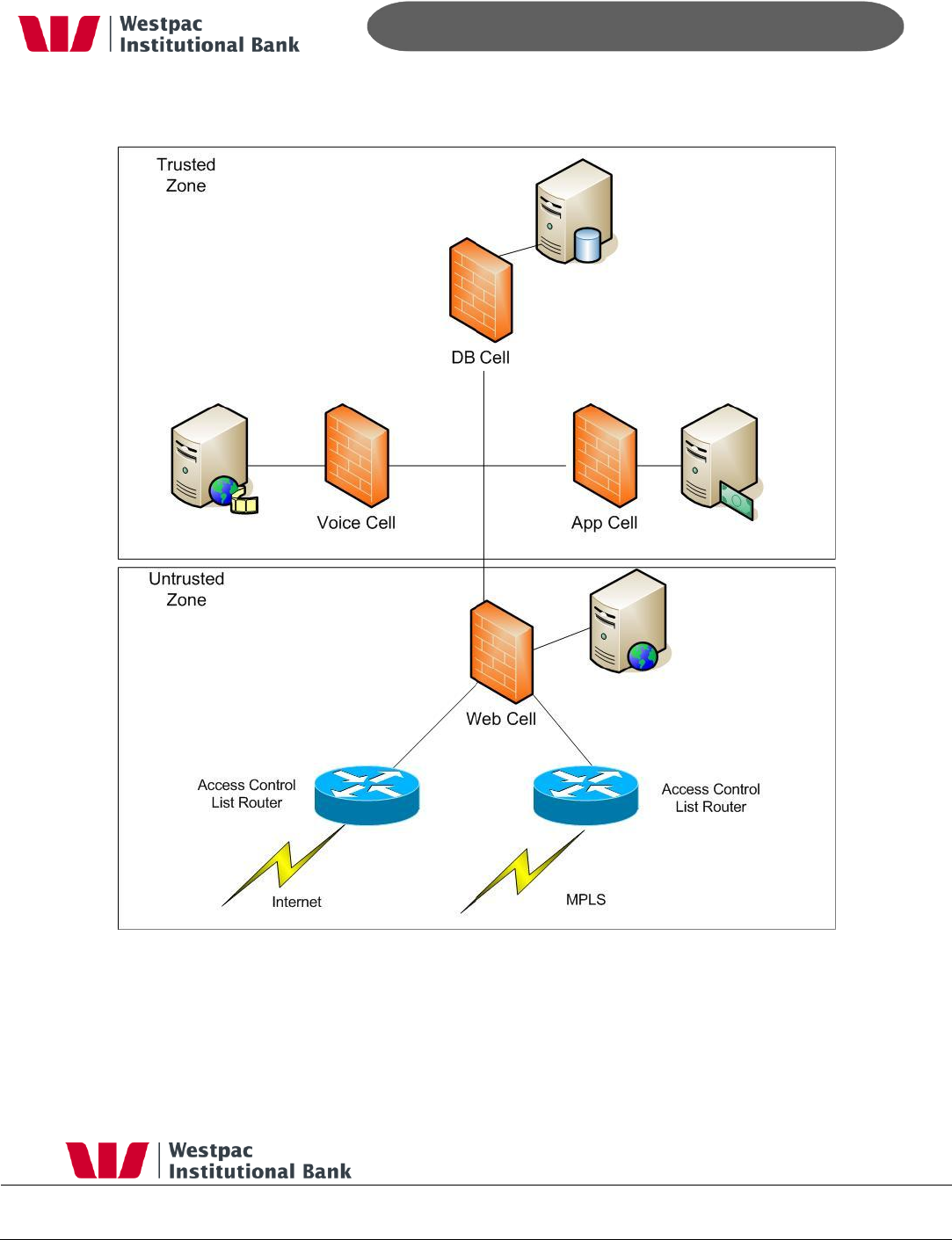

7.3 Network Firewalls

All firewalls within Qvalent‟s data centre are managed by Hewlett Packard. All servers

are partitioned into a three layer firewall model with the web, application and database

cells all being separated by firewalls. No data is kept on the web or application servers.

In addition to this port redirection is used. For example, the web firewall will only let in

port 443 on specified IP addresses, the application cells will only let in tomcat port

numbers on specific addresses and the DB cell will only let in DB port numbers on

specific addresses.

By default, all IP addresses and ports are blocked on all firewalls. Firewall changes can

only be approved by Qvalent‟s Chief Technology Officer (CTO). Dual firewalls are used

between trusted and non-trusted zones. All data received from customers arrives in the

untrusted zone where it is checked, then moved into the trusted zone for processing.

Decryption only takes place in the trusted zone. All firewalls operate in pairs with

automatic failover. An overview of the zones and firewalls are shown in Figure 4,

Firewalls.

- 27 -

Page 27

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Figure 4, Firewalls

- 28 -

Page 28

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

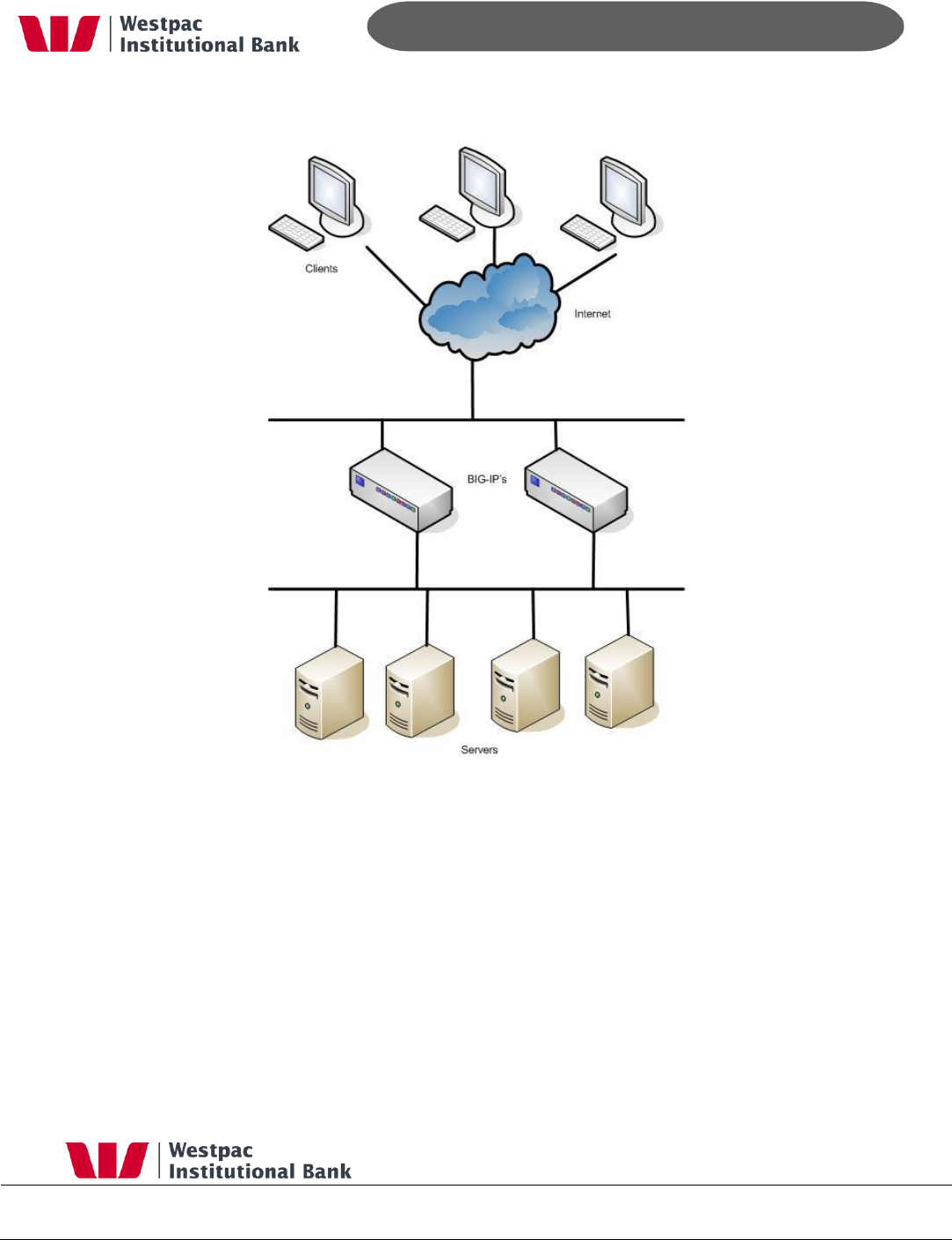

7.4 BigIP Local Traffic Manager (LTM)

The BigIP Local Traffic Manager (LTM) is a major component of our Production and Support

environment BigIP Appliances produced by F5 Networks.

LTMs unlock a variety of benefits to our applications and general system security.

Allows SSL acceleration by offloading SSL processing to the LTM appliance, rather

than the application server

Allows for web applications to be load balanced over a number of server instances to

increase uptime and availability

Reduces the need to complex network outages and redirections through the

implementation of virtual IP addresses to a pool of load balanced servers for a

particular application

Allows for complex network security to be incorporated via BigIP iRules to deny

certain types of traffic from entering the internal network.

- 29 -

Page 29

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Figure 5, Big IP Local Traffic Manager (LTM) Setup

Being the point where clients are redirected to a particular web server after passing through

the firewall, Qvalent vigorously logs all data coming in and out of the BigIP LTM appliances

as it provides us with information regarding

SSL session acceptance/rejection

HTTP Requests and Responses

Allows tracking of which web server instance a particular request was processed and

served on

Provides information on BigIP system messages such as configuration changes,

system restarts, BigIP appliance users being added, deleted or modified, etc.

- 30 -

Page 30

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

This information is of upmost importance to Qvalent in order to maintain our high standards

of information security compliance. This log data is then sent to a variety of different

systems, the most important being securely sending the log information to the RSA enVision

appliance on all Production LTM appliances in order to ensure that the logs are kept tamper-

proof and secure.

7.5 BigIP Application Security Manger (ASM)

The BigIP Application Security Manager (ASM) is an Application Firewall device which

provides a security solution for web and IP-based applications and services. It is designed to

protect against known types of external security threats at the network and application

layer. ASMs main role, is the role of an Application Firewall which specifically protects the

application from malicious attacks and hackers.

ASM works by:

Scrubbing sensitive data and parameters (eg. scrubbing certain Credit Card number

parameters from being returned to the user)

Assists in the cloaking of application infrastructure design specifics from hackers

Ensures that only expected application traffic is allowed, and suspicious or

unexpected application traffic is monitored closely and blocked or denied if need be.

- 31 -

Page 31

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Routers

Physical Firewalls

BigIP ASM Application

Firewall Appliances

Internet

WEB CELL

Figure 6, BigIP ASM Architecture

7.6 Servers

All servers use hardened builds and are constantly updated with the last virus definition

files and security patches. All servers have real-time monitoring installed and report

hourly averages of CPU, I/O and memory usage for performance monitoring and tuning.

All software changes must pass through a development and staging environment before

they can be installed on production servers.

7.7 Monitoring and reporting

All production systems (networks, servers and applications) are monitored 24x7 via HP

Openview. Any alarms generated are reported to a 24x7 help desk that will then contact the

appropriate support personnel.

- 32 -

Page 32

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Monitoring also extends to security and fraud detection systems. These have the ability to

take proactive messages automatically in the event that suspicious behaving is detected.

Daily Performance and capacity figures are collected on network appliances, links and

servers.

- 33 -

Page 33

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

8 Disaster Recovery

Qvalent operates a standby site located in a different location to its primary facility. This

facility runs a replication of all applications that are currently operating in the production

environment. Also, in real time, database transactions are replicated to the DR site to

ensure that standby databases are always up to date. This facility contains all necessary

systems and network links to operate as a production facility.

- 34 -

Page 34

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

8.1 What are Qvalent’s disaster recovery plans?

Qvalent has a comprehensive set of disaster recovery plans for the primary data centre

site and also for the DR site itself. These plans are reviewed every six months and

practised to ensure that any recovery activity takes place smoothly with minimum

impact to customer services.

9 Backups, Data Storage and Destruction

The security of customer‟s data is of primary importance to Qvalent. All critical data

stored in databases is encrypted using AES-256. All servers and databases have full

backups carried out every night. These backups are then transported off site to a secure

storage facility that is PCI-DSS level 1 certified every year. Transport to this facility is

via vehicles with GPS transponders installed so vehicle movements can be tracked. All

backup tapes are scanned in and out of the facility and stored in temperature controlled

vaults. Tapes are not labelled in any way that would identify the customer or what was

stored on the tape. After the seven years of storage the backup tapes are destroyed and

a certificate of destruction is issued.

- 35 -

Page 35

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

10 General FAQ’s

Q) Provide details of your system architecture (Hardware and platforms,

Operating Systems, Server hardware)

A) Qvalent‟s system architecture is based on industry best practice. The architecture is

broken down into zones of trust with the outer zones being least trusted. The zones are

physically separated and all traffic must be authenticated before it can move from one zone

to another. Qvalent‟s systems architecture has been accredited to PCI-DSS level 1

compliant.

Qvalent operates four physically separated (in both hardware and location) environments.

These consist of development, testing, production and DR.

Servers are HP Wintel X64 hardware, networking equipment is CISCO based while load

balancing and application firewalls are F5 based.

Q) Provide details of your system availability, providing actual system availability

figures from 2007 – 2009

A) From 2007 – 2009 Qvalent has offered an SLA of 99.5%. This has been exceeded with an

uptime of 99.98% during this period.

Q) Provide details of the scalability of your systems

A) Qvalent uses F5 Big IP technology for its hardware load balancing and application

firewalls. This allows additional servers to be added in the event that additional capacity is

required without customer impact. Qvalent‟s applications are cluster aware and allow

additional instances to be brought online as capacity requires it.

Reports generated on a daily basis report on current capacity across all production servers.

Q) Provide details of your redundancy processes

A) In Qvalent‟s production facilities all networking equipment is redundant with automatic

failover. WAN routers run BGP to automatically fail over links. The routers themselves run

HSRP to handle hardware failure. Firewalls and load balancers run in master / slave

configuration with automatic fail over.

Multiple instances of applications run with automated failover in the event of an application

becoming unavailable in the load balanced pool.

- 36 -

Page 36

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

What archiving technology exists today?

Real-time:

All data is replicated in real time to Qvalent‟s DR site.

Daily:

All systems have full backups daily which are stored off site

Long term:

Data is available up to 7 years

Q) Provide details of your software development and software release practices

processes

A) The development procedure is based on Rational's Unified Process (RUP). At a high level

the following procedure must be followed:

Requirements are entered into Jira and approved by the Release / Product Manager.

Developer codes solution and builds patch or new version. Unit tests in Dev. Marks

are ready for test in Jira.

All coding and documentation must be stored in Subversion

Patch is installed in SOCT (test) by Operations.

Independent tester performs UAT on the patch and performs a code review before

approving in Jira.

Peer Review control sheet is filled out.

Management approves production release (via product release control sheet).

Operations install into production and record installation.

Release Manager performs post installation check

Q) Is your software written by your organization or acquired from a third party?

A) Qvalent is primarily a software development company. With the exception of its data

base technology (Oracle) all payment processing software is written by Qvalent.

Q) Provide details of your system monitoring capabilities

A) Qvalent‟s data centre‟s are managed by Hewlett Packard. All production equipment is

monitored 24x7 by HP OpenView via HP‟s manned monitoring centres. In the event of an

alarm, HP‟s monitoring centre escalate to the necessary support personnel.

- 37 -

Page 37

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Qvalent monitoring also extends to advising customers if they have not submitted expected

data during a predefined window or if there was an issue with the data submitted via their

remote systems.

Q) Detail any penetration tests that your systems or applications have gone

through. List the most current along with the results of these tests.

A) As part of Qvalent‟s PCI-DSS level 1 compliance requirements penetration tests are

carried out against Qvalent systems every 3 months. This includes both external and

internal tests. Penetration tests results are graded from 1 (informational) to 5 (critical).

Qvalent systems only record a 1 (informational which is considered secure).

Q) Provide details of your capacity planning processes?

A) Capacity reports are generated on a daily basis. These reports then feed into a monthly

capacity report. Each month there is a formal capacity review process that studies

current utilisation, expected growth and recommends any additional capacity increase

requirements.

- 38 -

Page 38

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

11 Glossary

CA-XCOM

CA-XCOM is a cross-platform, value-added

data transport solution, providing high-

performance unattended file transfer with

complete audit trails and reporting. CA-

XCOM provides a single solution for

sending and receiving files, as well as

sending reports and jobs, to a wide range

of platforms. This is Qvalent‟s standard

file transfer mechanism.

Certificate

An electronic document that identifies an

entity (e.g. a person, computer or

company). Each certificate contains the

entity‟s public key, along with details

about which encryption algorithms the

entity can use. Certificates are issued by

Certificate Authorities (CAs) when the CA

verifies the entity requesting the

certificate.

Each certificate contains a subject,

describing who the certificate is for, and

an issuer, describing the organisation that

signed the certificate.

The certificate contains the entity‟s public

key, as well as the digital signature of the

CA. This signature is like a hologram on a

credit card, verifying that the CA has

authenticated the entity‟s identity.

Certificates can be marked for various

purposes, including SSL client, SSL server

and CA. See also Certificate Authority,

Digital Signature, SSL and Public Key

Encryption.

Certificate Authority

A trusted third party that signs certificates

for other parties. Often in internet

communications, the two parties will not

trust each other, but will trust a third

party. Party A can trust party B‟s

certificate if it is signed by that third party

(the certificate authority or CA).

Certain CAs (e.g. Verisign, Thawte) are

automatically trusted by all certificate

software. See also Certificate and

Certificate Hierarchy.

Certificate Hierarchy

The chain of certificates for an entity

consisting of that entity‟s certificate and

any CAs which signed the certificate. All

certificates are signed by another

certificate, generating a hierarchy. This

hierarchy terminates at a root certificate,

which is self-signed. This type of

certificate contains an identical issuer and

subject.

A certificate is trusted by a party if the

certificate chain terminates at a CA which

is trusted by that party. Each party

maintains a list of trusted root CAs. See

also Certificate, Certificate Authority and

Self-signing.

Digital Signature

A process of signing a message

electronically. Normally, the sender of a

message will calculate a message digest,

- 39 -

Page 39

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

then encrypt that digest value with the

sender‟s private key. This resulting value

is the digital signature.

The receiver can verify the signature by

calculating the message digest, and

comparing it to the value obtained by

decrypting the digital signature with the

sender‟s public key. See also Message

Digest and Public Key Encryption.

Encryption/Decryption

The process of scrambling a message so

that it cannot be read by a third party

while in transit. The sender encrypts a

message before sending, and the receiver

decrypts the received message before

reading it.

Many algorithms are available to encrypt

data. Examples include RSA, RC4 and

DES. The algorithm is generally well-

known, but a number (called a key) must

be used with the algorithm to produce an

encrypted result or to decrypt previously

encrypted information. Decryption with

the correct key is simple, whereas without

the key, decryption is almost impossible.

HTTP

Hypertext Transfer Protocol: The

application level protocol that is used to

transfer data on the web. A client sends a

request message to the server, and the

server sends a response message.

Each message consists of a start line

(which is either a request line or a status

line as appropriate), followed by a set of

message headers and finally an optional

message body.

The request line contains the method

(usually GET or POST) used for the

request. GET is a simple request for

information, whereas POST allows the

client to send data to the server in the

request.

A web browser generally sends a GET

request to the server for information, and

the server responds with a HTML

document in the response for the browser

to display.

The HTTP protocol uses the TCP/IP

protocol to transport the information

between client and server. HTTP uses TCP

port 80 by default. See also TCP/IP.

HTTPS

Hypertext Transfer Protocol, Secure: The

HTTP protocol using the Secure Sockets

Layer (SSL), providing encryption and

non-repudiation. HTTPS uses TCP port 443

by default. See also HTTP and SSL.

Message Digest

A mathematical function which generates

a number from a message (also called a

one-way hash). The generated number is

unique for the message, in that changing

any part of the message changes the

resulting number. The function is one-way

in that it is, for all practical purposes,

impossible to determine the message from

the number. Common algorithms are MD5

and SHA-1.

Non-repudiation

Assurance the sender of data is provided

with proof of delivery and the recipient is

provided with proof of the sender's

identity, so neither can later deny having

processed the data.

- 40 -

Page 40

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

Proxy Server

An intermediate server on the client side

of a HTTP transaction which makes

requests on behalf of the client. Proxy

servers improve corporate security by only

exposing the proxy server to the internet,

rather than each individual computer in

the organisation.

The client sends its request to the proxy

server, which then sends the request

(with any modifications) to the server. The

server responds to the proxy, which then

passes the response to the client.

System administrators can restrict which

servers are accessible simply by

configuring the proxy server. See also

HTTP.

Public Key Encryption

An encryption method where different

keys are used for encryption and

decryption. Each party has two keys – a

public key and a private key. Messages

encrypted with the public key can only be

decrypted with the private key, and

messages encrypted with the private key

can only be decrypted by with the public

key. Each party publishes their public key

and keeps their private key secret.

Encryption is accomplished by the sender

encrypting the message with the

receiver‟s public key. The message can

then only be decrypted by the receiver

with his private key.

Non-repudiation is accomplished by the

sender encrypting the message with her

private key. The message can then be

decrypted by anyone with the sender‟s

public key (which is published), but the

receiver can be assured of the message‟s

origin. See also Symmetric Key Encryption

and Encryption.

Self-Signing

Self-signing occurs when the owner of a

key uses his private key to sign his public

key. Self-signing a key establishes some

authenticity for the key, at least for the

user IDs. The user ID of the signature

must match the user ID of the key.

(Where there are multiple user IDs, the ID

of the signature must match the primary

ID of the key.) Also, the key ID of the

signature matches the key ID of the key.

This verifies that whoever placed a user

ID on a public key also possesses the

private key and passphrase. Of course,

this does not verify that the owner of the

key is really who she says she is. That is

done by the signatures of others on the

public key (such as a root CA like

Verisign).

SOAP

Simple Object Access Protocol: An XML-

based protocol allowing remote procedure

calls and asynchronous messaging. SOAP

generally uses HTTP to transport the

messages between computers. SOAP is

becoming popular because of its use of

Client

Proxy Server

Server

request

request

response

response

- 41 -

Page 41

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide

standard internet protocols as its basis.

See XML and HTTP.

SSL

Secure Sockets Layer: A protocol designed

by Netscape to encrypt data, authenticate

the client and server and ensure message

integrity. SSL sits between the application

layer protocol (e.g. HTTP) and above the

TCP/IP network protocol.

The SSL handshake establishes the SSL

connection, setting up the secure channel.

In this process, the server presents its

certificate to the client for authentication:

The server encrypts some data with

its private key and the client then

checks this signature with the public

key from the server‟s certificate.

The client checks that the server DNS

name is the same as that in the

certificate.

The client checks that the server

certificate has not expired.

The client checks that the server‟s

certificate is signed by a trusted CA.

The server can also optionally require the

client to present its certificate to the

server for authentication.

The handshake also allows the client and

server to agree on an encryption

algorithm (a symmetric key algorithm for

speed), and securely exchange the

session key. This session key is used in

the encryption algorithm which encrypts

the data exchanged between the client

and server after the handshake is finished.

The session key length can be 40-bit, 56-

bit or 128-bit, with the longer keys being

more difficult to break. See also TCP/IP.

Symmetric Key Encryption

An encryption method where the sender

and receiver use the same key to encrypt

and decrypt the message. This method

relies on the key being kept secret

between the two parties. If the key is

discovered, anyone can read the

messages in transit, or send false

messages to the receiver.

This type of encryption is often used for

bulk encryption because it is much faster

than public key encryption. See also

Encryption and Public Key Encryption.

TCP/IP

Transmission Control Protocol over

Internet Protocol. IP allows packets of

data to be sent across the internet from

one computer to another. TCP provides a

reliable communication stream between

the two computers, using the Internet

Protocol.

XML

eXtensible Markup Language: A document

formatting language which describes a

standard syntax, but allowing many

different document types. Business

partners can then agree on the specific

documents they will exchange, using the

standard syntax. XML documents contain

a hierarchical list of tags, some of which

contain values.

- 42 -

Page 42

A division of Westpac Banking Corporation.

Copyright © 2011, Westpac Banking Corporation, ABN 33 007 457 141. All rights reserved.

QuickStream Security Features Guide