SMCI Benefit Guide 2017 2018

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 10

EMPLOYEE BENEFITS GUIDE

Effective

December 1, 2017 - November 30, 2018

Am I eligible?

If you are a Southern Mutual full-time W2

employee, working 30 or more hours per

week, you are eligible to enroll in the bene-

fits described in this guide. Your spouse

and eligible dependents may enroll for medi-

cal, dental, vision and supplemental life in-

surance.

Premiums for all plans are paid thru pre-tax

payroll deductions, resulting in 25 - 30% tax

savings.

When can I make changes?

You are able to make changes during the month of Novem-

ber during our Open Enrollment Period. After November, you

must have a qualified change in status in order to make

changes to the benefits you elect during the plan year.

Qualified changes in status include: marriage, divorce, legal

separation, birth, adoption of a child, change in child’s de-

pendent status, death of spouse or child. Involuntary loss of

other coverage due to a change in spouse employment or

loss of Medicaid eligibility would also apply. Employees have

an open enrollment period during the month of November to

make changes to the medical, dental, vision and supple-

mental life benefits.

What do I have to do?

Medical: You must complete an enrollment form when you are first eligible, electing or waiving

coverage.

Dental: You must complete an enrollment form when you are first eligible, electing or waiving cov-

erage.

Vision (Optional): You must complete an enrollment form to elect coverage.

Long Term & Short Term Disability: You are automatically enrolled in this employer paid bene-

fit.

Group Term Life Insurance: You are automatically enrolled in this employer paid benefit. You

must complete an enrollment form to select a beneficiary.

Supplemental Life / Dependent Life Insurance (Optional): You must complete an enroll-

ment form to elect coverage. To increase coverage, an evidence of insurability form must be sub-

mitted for consideration.

Welcome!

Southern Mutual provides a very comprehensive benefits offering to you and your family members.

Most of your insurance benefits become effective on your full time date of hire; however, if you

elect to purchase optional vision benefits, this coverage becomes effective on the first day of the

month following your date of hire.

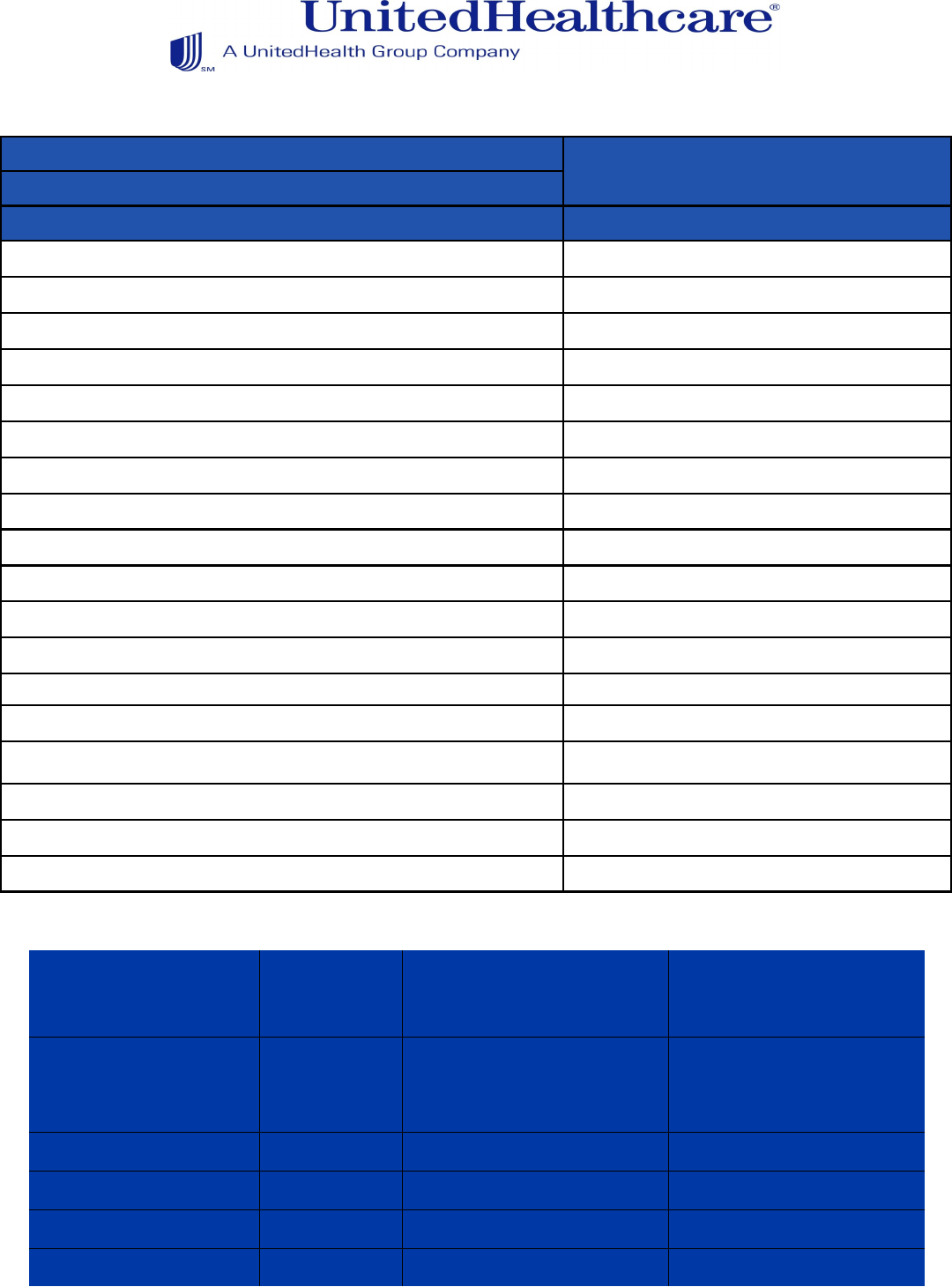

All Savers Medical Benefits

The Benefits Shown are In-Network Benefits United HealthCare

Out-of-Network Benefits are paid at a lower Copay Plan P35003060

rate and members can be balance-billed Covered Insured Pays:

Individual Deductible: $3,500

Family Deductible: $7,000

Aggregate or Embedded Deductible: Embedded

Coinsurance Amount: 0%

Individual Coinsurance Limit: N/A

Family Coinsurance Limit: N/A

Individual Total Out-of-Pocket Maximum: $6,550

Family Total Out-of-Pocket Maximum: $13,100

In & Out Patient Hospital Services: Subject to Deductible

In & Out Patient Testing: Subject to Deductible

Primary Care Office Visit Copay: $30

Specialist Office Visit Copay: $60

Preventive Care Office Visit (In-Network Only): Covered at 100%

Urgent Care: $100

Emergency Care: $300

Prescription Benefits: $15 / $35 / $60 / $100

Mail Order Prescription Benefits: $37.50 / $87.50 / $150.00 / $250

Maximum Lifetime Benefit: Unlimited

This is intended as a brief overview of the benefits. Refer to the full Certificate of Coverage for all binding contractual provisions.

Note: The out-of-network deducble is $7,000, coinsurance 50%, maximum out-of-pocket $14,000, based on reasonable &

customary charges.

SMCI Pays 100% of EE

Cost and 50% of Depend-

ent Cost

Employee Pays 50% of

the Dependent Cost

Coverage Level

UHC AllSavers

Total Monthly

Cost

Semi-Monthly Contribu-

tions SMCI pays on your

behalf

Your Semi-Monthly Pay-

roll Deduction

Employee Only $582.01 $291.01 $0.00

Employee & Spouse $1,244.40 $456.61 $165.60

Employee & Children $1,078.80 $415.21 $124.20

Employee & Family $1,741.21 $580.81 $289.80

Getting Started

Visit: myallsaversmember.com

Track Claims and expenses for your family

Plan ahead for tests and treatments

Stay on top of your medical history

Receive tips for improving your health

Find a doctor

Registration is quick and simple.

Click on Register Now. You’ll need your health plan ID card, or

coverage materials.

Follow the step-by-step instructions.

Stay Well

Trio Motion

F I T

Trio Device & FIT Rewards

Use a free wearable to track steps,

reach goals and earn rewards.

Visit: TrioMotionFit.com

Be Well

RALLY

Rally Wellness

Health survey, missions, challenges,

and rewards.

Visit: rally-support.com/customer

Get Well

Healthiest You

Doctor Connect & Mobile APP

Connect with doctors 24x7, shop and price prescriptions

and so much more.

Download the app, fill in the fields, start using

or call 866-703-1259

Visit: member.healthiestyou.com

What is a Flexible Spending Account? A Medical Flexible Spending Account (FSA) is an account to which you

contribute part of your pay before FICA, State and Federal Income (withholding) Tax to pay for qualified medical,

dental and certain vision expenses for yourself, your spouse, and/or your dependents.

What are qualified expenses? Any IRS Section 213 (D) expenses are eligible to be reimbursed through your

Medical FSA. These expenses include most medical, Rx, dental & vision related services.

Why should I participate in a Medical Reiumbursement FSA? Normally, you would receive an income tax

deduction for qualifying medical, dental and vision expenses that exceed 10% of your adjusted gross family income.

(Few taxpayers ever meet that qualification or receive a tax deduction.)

How can I participate? First determine regular medical, dental and vision expenses you and your dependent(s)

will incur during this plan year (1/1/2018 to 12/31/2018). Enter the amount you want to set aside before taxes on

the Election Form. Each pay period, SMCI will deduct this amount from your paycheck and deposit the funds direct-

ly into your Flexible Spending Account.

Can I revoke my annual election amount? Generally, no. However, if you have a qualified change in status

(marriage, divorce, birth, adoption, unpaid leave of absence, change in employment status of you or your spouse

from full-time to part-time or vice-versa) you can revoke your annual elected amount and make a new election for

the remainder of the plan year.

Do I have a “Use It Or Lose It” rule? You may submit a request for reimbursement for expenses

incurred

through December 31, 2018. You will have a 60-day timeframe to submit the Reimbursement Request Form for ex-

penses incurred during that time. SMCI allows up to $500 of unused funds to be rolled over to the next calendar

year.

When can I elect to participate, and how much may I contribute? Each year, during the Open Enrollment

period and prior to the Plan renewal date, you must complete a new Election Form for the upcoming plan year if

you are making a change. The 2018 annual contribution limit for Healthcare Reimbursement is $2,650.

What expenses are not eligible? Over-the-counter medicines cannot be purchased with FSA money without a

prescription. Cosmetic procedures are also not eligible.

What happens if my request for Medical Care Reimbursement is greater than the amount of money in

my account? The annual amount is available to you from the beginning of the 1/1/2018 plan year, and if you re-

quest more than the annual elected amount, only the elected amount will be available to you.

On-line access: https://tascparticipant.lh1ondemand.com

Mobile App: MyTASC

What you need to know about your Health Flexible Savings Account

through TASC: 800-422-4661

MEDICAL FSA

ELIGIBLE EXPENSES

• Arcial limbs or teeth

• Birth control pills, contracepve devices &

sterilizaon procedures

• Childbirth classes

• Co-pays, co-insurance, & deducbles

• Durable medical equipment

• Dental exams, cleanings & other qualied ser-

vices

• Hearing devices

• Hospital bills

• Insulin, diabec supplies, and test kits

• Medical tests and other services

• Orthodona

• Some over the counter items when accompa-

nied by a prescripon from a medical provider

DENTAL INSURANCE COSTS

PREVENTIVE SERVICES

No Waiting Period

BASIC SERVICES

No Waiting Period

MAJOR SERVICES

No Waiting Period

Zero Deductible

100% Coverage

$50 Calendar Year Deductible

80% Coverage

$50 Calendar Year Deductible

50% Coverage

Oral Exams / Cleanings

(1 per 6 months)

Fillings

Full Mouth X-rays

(1 per 36 months)

Inlays, Onlays, Crowns

Oral Surgery & General Anesthesia

Oral Exams / Problem Focused

(Combined w/ Exam Limit)

Endodontics & Periodontics

(root canals)

Bridges and Dentures

Bitewing x-rays

(<14: 1 per 12 months)

(19+: 1 per 12 months)

Simple Extractions Repair & Maintenance of Crowns,

Bridges & Dentures

Fluoride Treatment

(<16: 1 per 12 months)

Sealants & Space Maintainers

(age & frequency limits apply)

Implants

Welcome to Delta Dental! We are pleased to oer Dental benets for you and your family.

ORTHODONTICS - $1,000 Lifetime Maximum per member (dependents to age 19 only)

Www.deltadental.com

Customer Service:

Website: www.deltadentalsc.com

COVERAGE LEVEL

SMCI Pays

100% of the EE Cost

Semi-Monthly

Contribuons on Your

Behalf

Employee Pays

Dependent Cost Only!

Semi-Monthly

Payroll Deducons

TOTAL

MONTHLY

COST

EMPLOYEE $20.87 $0.00

$41.74

EMPLOYEE & SPOUSE $20.87 $22.09

$85.91

EMPLOYEE & CHILD(REN) $20.87 $26.81

$95.35

EMPLOYEE & FAMILY $20.87 $53.70

$149.13

Calendar Year Annual Maximum: $1,500 per member

- You will be mailed a membership card.

- To find an in-network provider near you, go to www.eyemed.com or call 1.866.939.3633

- Please visit www.eyemed.com for participating refractive surgery providers and discounts.

- To make an appointment, call an in-network provider and let them know that you are an EyeMed member

- You are responsible for payment to the in-network provider of any amount exceeding the material allowance, any

copays and any contact lens fitting fees.

- This is a routine vision program. Medical and surgical treatments of the eyes are not covered benefits.

- Dependent children are covered to age 26 regardless of student status.

TYPE OF COVERAGE

Employee Pays Total Cost

Semi-Monthly Payroll Deductions

EMPLOYEE $4.30

EMPLOYEE & SPOUSE $8.17

EMPLOYEE & CHILD(REN) $8.60

EMPLOYEE & FAMILY $12.63

VISION INSURANCE COSTS:

Welcome to EyeMed! We are pleased to offer Vision benefits for you and your family.

IN NETWORK

• o e sive eye exam eve y 12 months with a $10 co y.

• $150 allowance eve y 12 months towards gl ses and/or contact lens* with a one-time $25 co y.

• After your allowance has been used, receive a 15 discount on glasses contact lens at

• **.

• Discounts of on surgery including A at

• Scontact lens fitting fee of no more than $55 or 10% discount off e usual and fitting for

contact lens*** most ovi s*.

• No claims or to file.

*Material allowance does not cover non-prescription lenses, non-prescription or cosmetic contact lenses, or non-prescription sun-

glasses.

OUT OF NETWORK

• If you choose to use an out-of-network provider, you will be reimbursed the following amounts:

• Exam including contact lens fitting: $40 reimbursement

• Materials: $105 reimbursement

• Benefit is 60% of your weekly pre-disability earnings, to a maximum of $1,500 per week.

• Payable on the 31st day of an accident or the 31st day for an illness.

• 9 Week benefit duration.

• Your benefit will be taxable, as Southern Mutual pays 100% of your monthly premiums.

EMPLOYER PAID SHORT-TERM DISABILITY

• Benefit is 60% of your monthly pre-disability earnings, to a maximum of $7,500 per

month.

• Payable after 90 days of a total or partial disability.

• Own Occupation Period is 24 months.

• Maximum duration of benefits is to Social Security Normal Retirement Age (SSNRA).

• If you remain actively at work beyond your normal retirement age, your benefit will never

be paid for less than 12 months, as long as you remain disabled.

• Unlimited Return to Work Incentive.

• 3 months survivor benefit.

• Your benefit will be taxable, as Southern Mutual pays 100% of your monthly premiums.

EMPLOYER PAID LONG-TERM DISABILITY

Customer Service: (800) 228-7104 Website: www.mutualofomaha.com

Group Number G000AY4G

EMPLOYER PAID BASIC LIFE INSURANCE

Customer Service: (800) 228-7104 Website: www.mutualofomaha.com

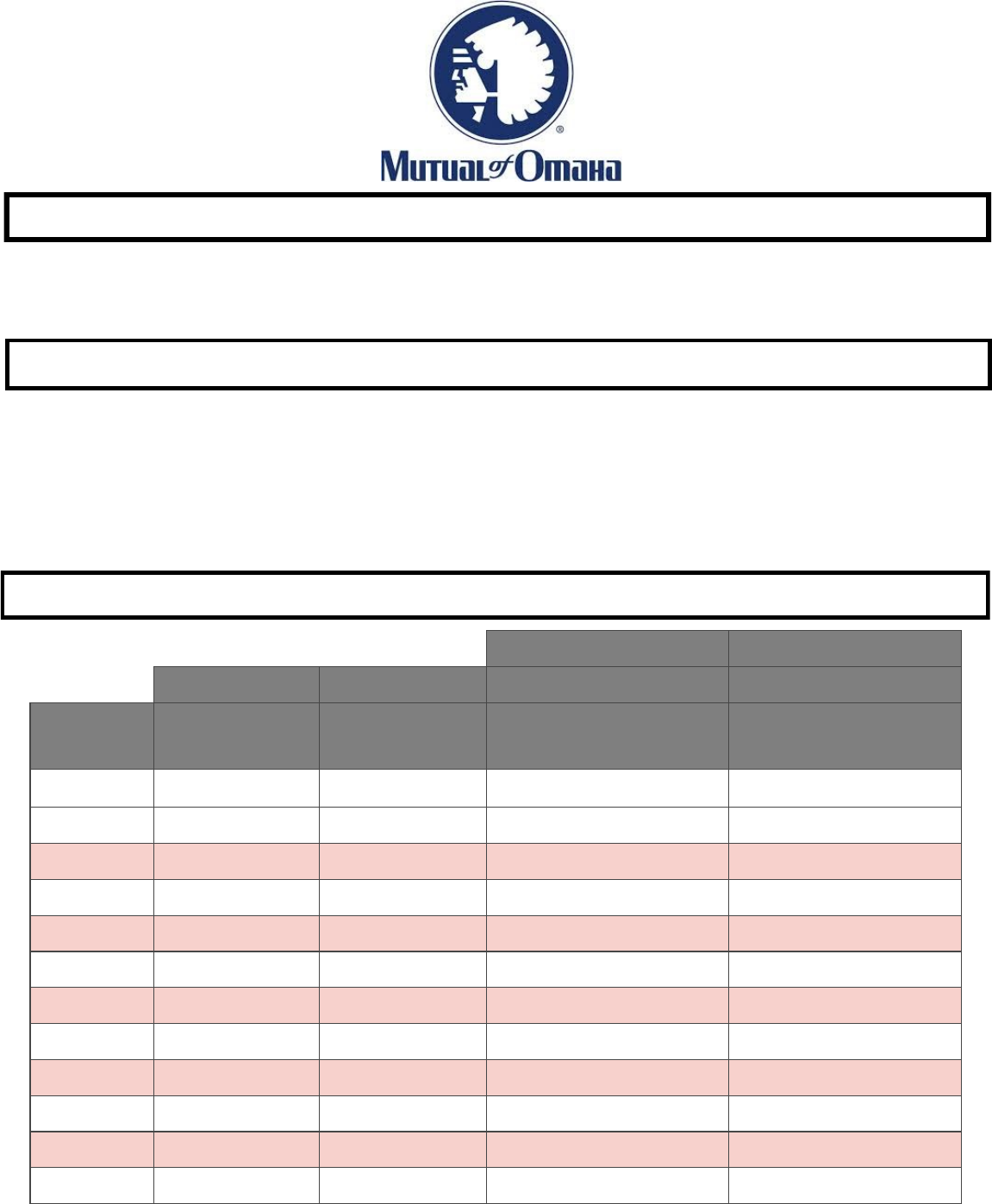

VOLUNTARY LIFE INSURANCE RATES

Sample Employee Sample Employee

Employee Spouse Per-Pay-Period Per-Pay-Period

Age Bracket Monthly Cost Per

$10,000

Monthly Cost Per

$10,000

Cost for $20,000 Cost for $100,000

0-24 $1.12 $1.12 $1.12 $5.60

25-29 $1.25 $1.25 $1.25 $6.25

30-34 $1.33 $1.33 $1.33 $6.65

35-39 $1.56 $1.56 $1.56 $7.80

40-44 $1.95 $1.95 $1.95 $9.75

45-49 $2.72 $2.72 $2.72 $13.60

50-54 $4.18 $4.18 $4.18 $20.90

55-59 $6.77 $6.77 $6.77 $33.85

60-64 $10.42 $10.42 $10.42 $52.10

65-69 $16.88 $16.88 $16.88 $84.40

70-74 $29.18 $29.18 $29.18 $145.90

75-79 $48.80 $48.80 $48.80 $244.00

• Employee Max Benefit - Lesser of 5x annual earnings or $100,000 in increments of

$10,000, rounded to the next higher $1,000

Guarantee Issue for New Hires = $100,000

• Spouse Max Benefit - 50% of employee amount, up to $20,000

Guarantee Issue for Spouses of New Hires = $20,000.

• Child Max Benefit - $10,000, in increments of $2,000

Guarantee Issue for Children of New Hires = $10,000

VOLUNTARY LIFE INSURANCE

• $50,000 Life and Accidental Death & Dismemberment Insurance

• Southern Mutual pays 100% of the premium

Group Number G000AY4G Child Term Life Rate for $10,000: $1.30

CONTACT INFORMATION

This Guide is only intended to offer an outline of benefits. All details and contract obligations of plans

are stated in the group contract/insurance documents. In the event of conflict between this guide and

the group contract/insurance documents, the group contract/insurance documents will prevail. Please

contact your Human Resources Department for further information.

We at Southern Mutual Church Insurance appreciate our employees,

and we hope you agree that our benefits package reflects this.

Assurance Benefits Group, LLC

1898 Calhoun Street #6

Columbia, SC 29201

Carol Iverson

Office (803) 227-8639, x103

Fax (803) 227-8659

Carol@ABG-LLC.com

Tammie J. King, RHU, REBC

Office (803) 227-8639, x102

Cell (803) 738-6858

Fax (803) 227-8659

Tammie@ABG-LLC.com