400 Spesifikasi Kaedah Pengiraan Berkomputer PCB2013

User Manual: 400

Open the PDF directly: View PDF ![]() .

.

Page Count: 46

LEMBAGA HASIL DALAM NEGERI MALAYSIA

AMENDMENT TO:

SPECIFICATION FOR

MONTHLY TAX DEDUCTION (MTD)

CALCULATIONS USING

COMPUTERISED CALCULATION

METHOD FOR

MTD 2013

Revised : dated 29 April 2013

1

A. INTRODUCTION

According to the provision under Rule 3, Income Tax (Deduction from Remuneration) Rules 1994 (MTD

Rules), payroll system that develop by the software provider or developed/customised by the employer

should comply with Monthly Tax Deduction (MTD) specifications determined by the Inland Revenue Board of

Malaysia (IRBM). IRBM should review and issue verification/approval letter to software

providers/employers who comply with MTD specification.

This booklet is to provide guideline and specification for MTD formula that need to develop by the

payroll system or employers who develop/customized their payroll system.

2

PROCEDURE FOR VERIFICATION OF COMPUTERISED CALCULATION METHOD

i. Software providers/employers must comply with specification and provides accurate answer

and calculation for all question of testing formula/specification of MTD calculation through

email.

ii. IRBM shall arrange appointment (if necessary) to verify software providers/employers’ payroll

system if all the answer provided is accurate.

iii. IRBM shall issue verification/approval letter for MTD calculation to software

providers/employers if all answer and calculation presented is comply with the specification.

iv. Employers who using the computerised payroll system provided by software

providers/employers who complied with the MTD calculation specifications need not obtain

further verification from IRBM.

v. IRBM will upload the list of software providers/employers (updated biweekly) who complied with

the MTD calculation specifications in IRBM website.

vi. Please forward application using companys’ letter head to:

Pengarah

Jabatan Pungutan Hasil

Lembaga Hasil Dalam Negeri Malaysia

Aras 15, Wisma Hasil

Persiaran Rimba Permai

Cyber 8, Peti Surat 11833

63000 Cyberjaya

Selangor Darul Ehsan

or, email to:

1. En Anim Omar

e-mail : anim@hasil.gov.my

Tel: 03-8313 8888 – 21507

2. Pn Roshida Daud

e-mail : roshida@hasil.gov. my

Tel: 03-8313 8888 – 21527

3. En Chua Tian Siang

e-mail : ctsiang@hasil.gov.my

Tel: 03-8313 8888 – 21523

3

B. AMENDMENT PRIOR TO REVISE DATE 29 APRIL 2013

1. Category of remuneration

With effective from 1 January 2013, overtime allowance, allowances (variable amount paid monthly) and

commission (variable amount paid monthly) are categorised as normal remuneration.

Only allowance and commission which not paid monthly are categorised as additional remuneration.

Extension of time is prolonged until Jun 2013 to all software provider and employer who

develop/customized the payroll system to take action on these changes. These changes must take into

effect on July 2013.

Previous:

Such additional remuneration includes:

i. overtime allowance

ii. bonus/incentive

iii. arrears of salary or any other arrears paid to an employee

iv. employee’s share option scheme (if employee opts for MTD deduction)

v. tax borne by employer

vi. gratuity

vii. compensation for loss of employment

viii. ex-gratia

ix. director’s fee (not paid monthly)

x. commissions

xi. allowances (variable amount either paid every month or not)

xii. any other payment in addition to normal remuneration for current month

Current:

Such additional remuneration includes:

i. bonus/incentive

ii. arrears of salary or any other arrears paid to an employee

iii. employee’s share option scheme (if employee opts for MTD deduction)

iv. tax borne by employer

v. gratuity

vi. compensation for loss of employment

vii. ex-gratia

viii. director’s fee (not paid monthly)

ix. commissions (not paid monthly)

x. allowances (not paid monthly)

xi. any other payment in addition to normal remuneration for current month

4

C. AMENDMENT TO SPECIFICATION FOR MTD CALCULATIONS USING COMPUTERISED

CALCULATION METHOD FOR 2013

This amendment provides clarification in relation to Budget 2013. Amendments for computerised calculation

method of Monthly Tax Deduction (MTD) 2013 are as follows:

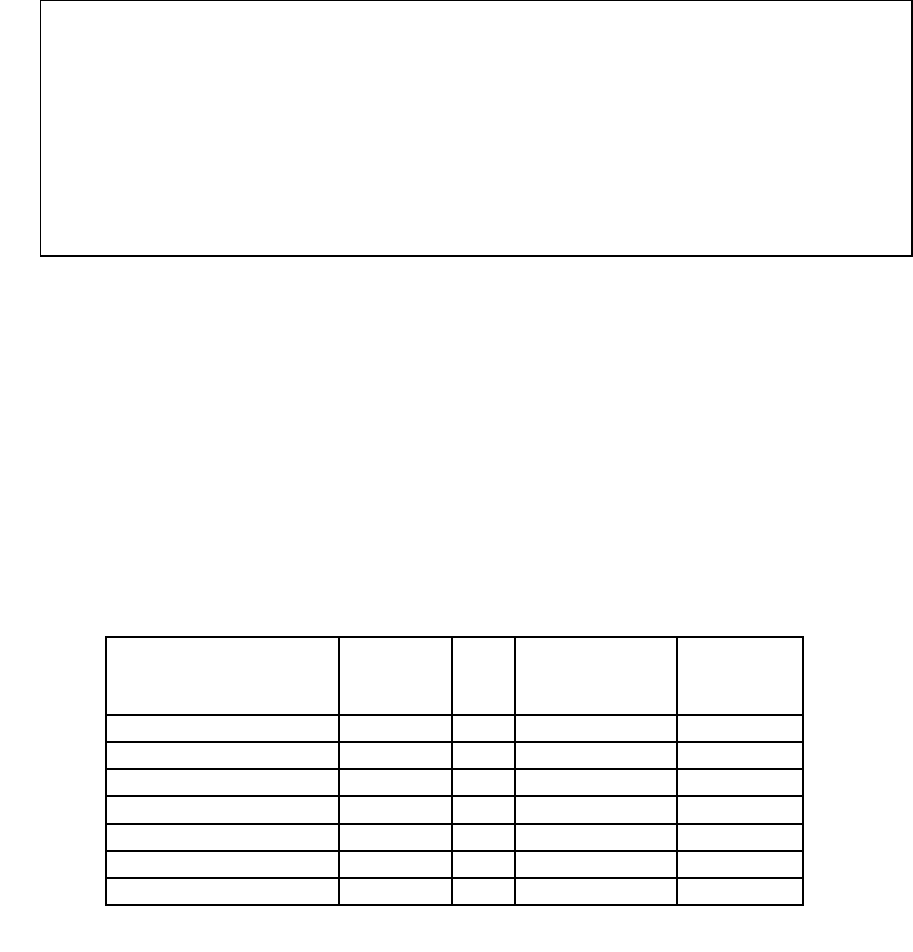

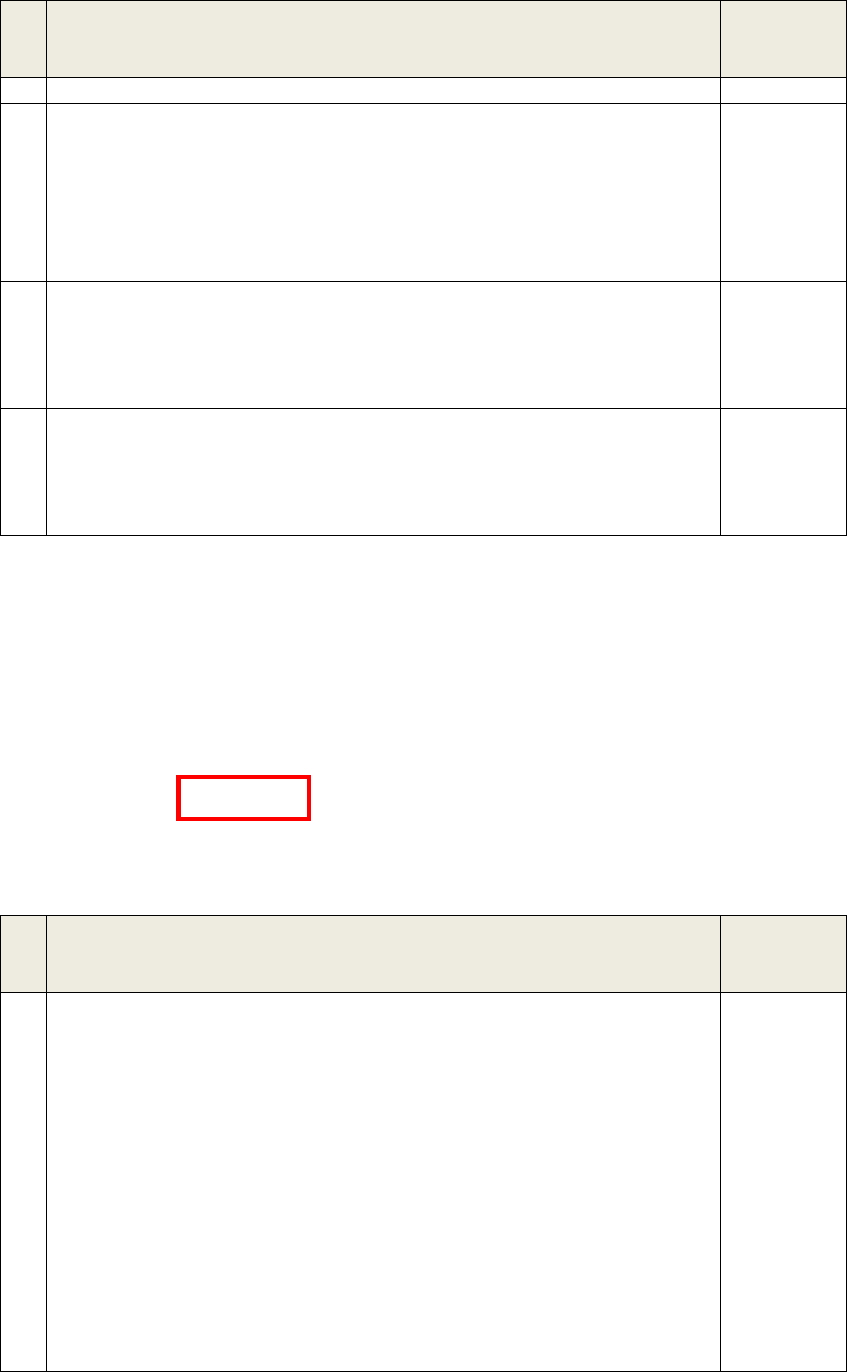

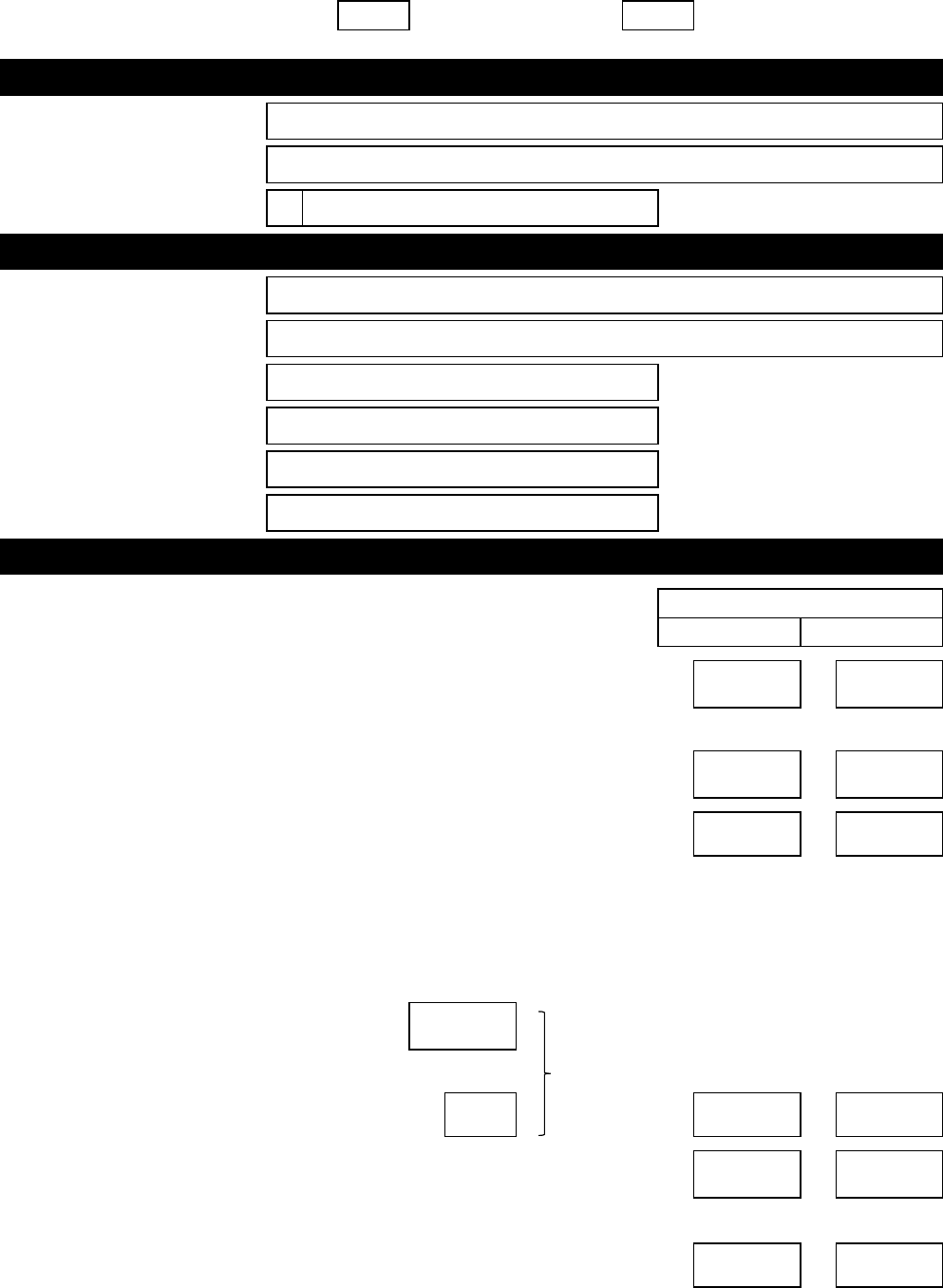

1. Tax Revision on Individual Income

The individual income tax rate be reduced by 1 percentage point for each grouped annual income tax

exceeding RM2,500 to RM50,000 with effective year assessment 2013.

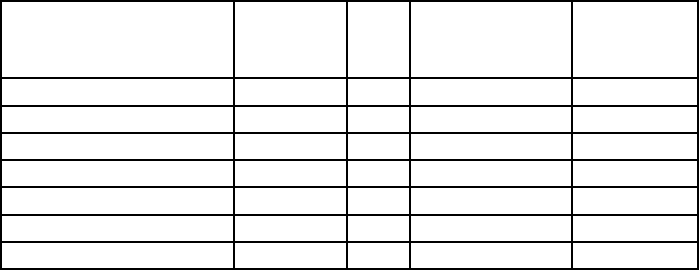

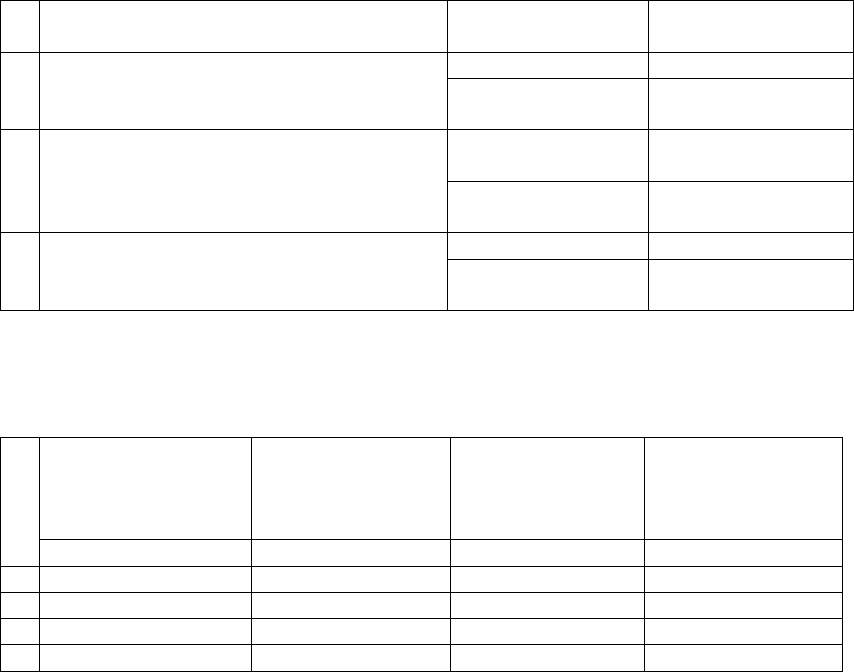

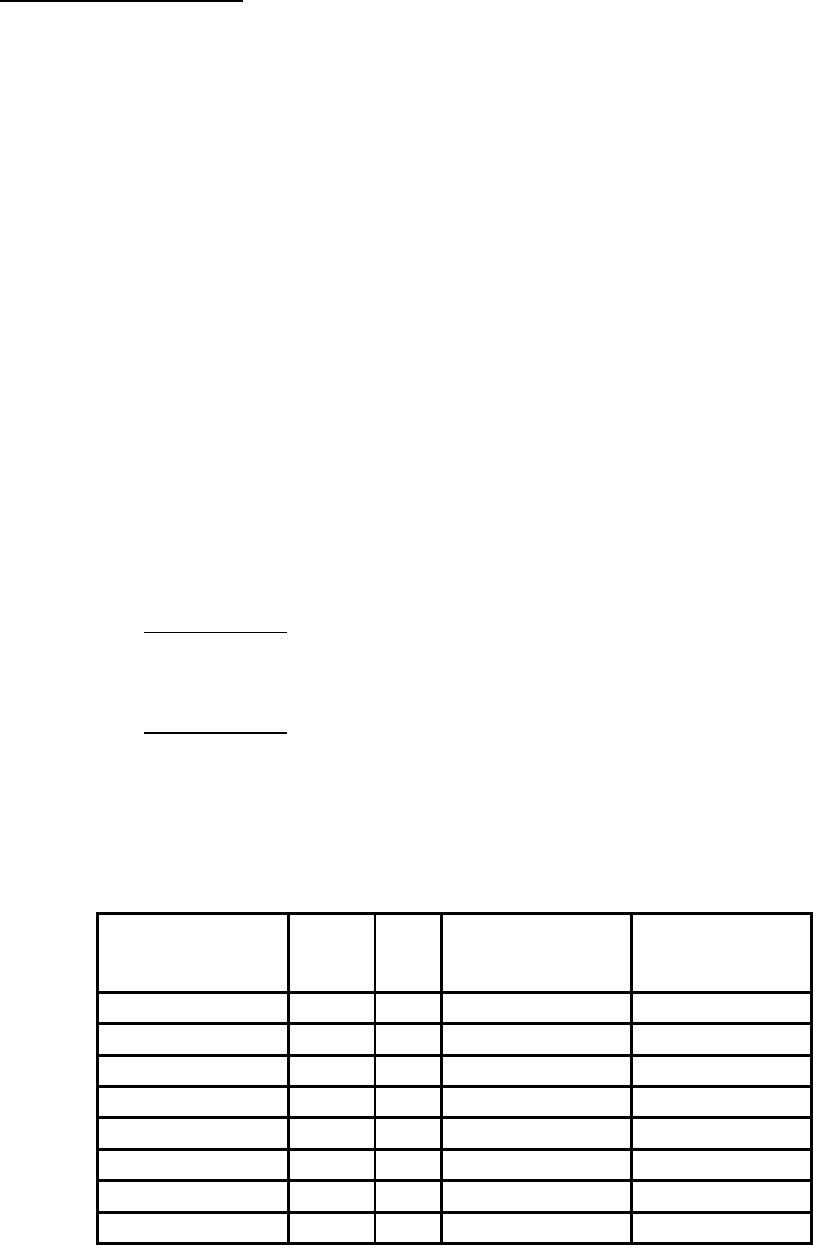

Therefore schedule 1 of the MTD formula should be changed as follows:

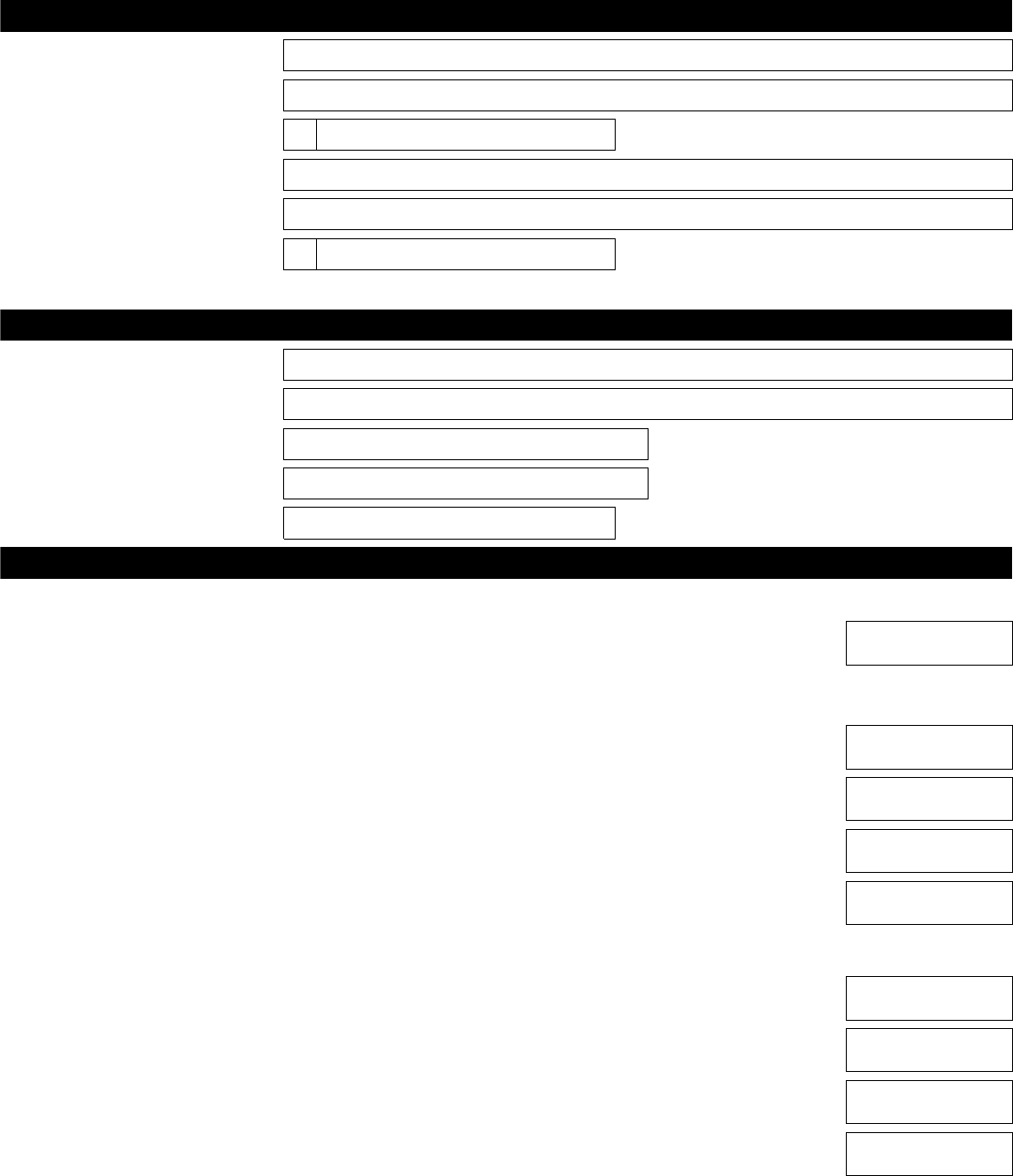

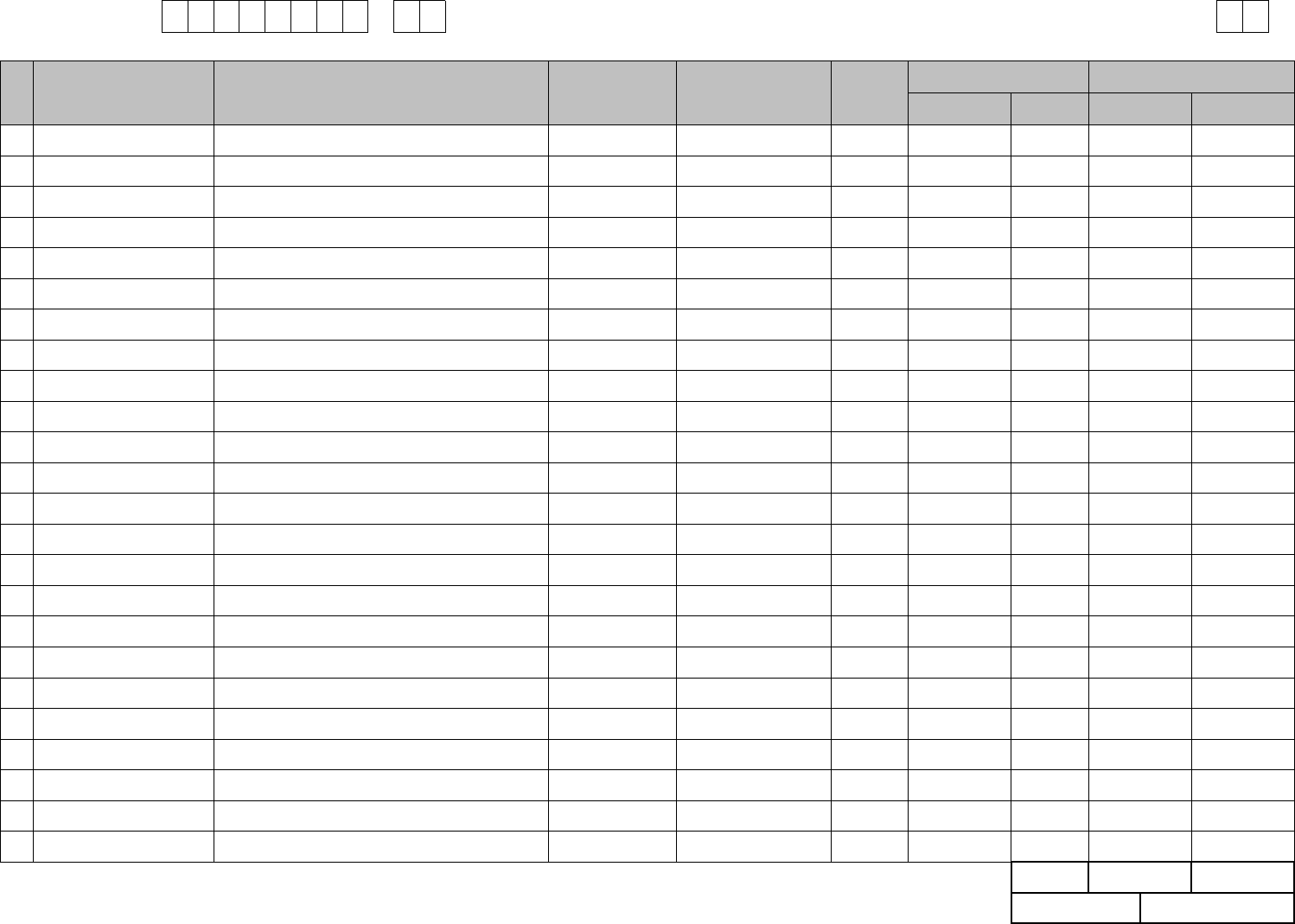

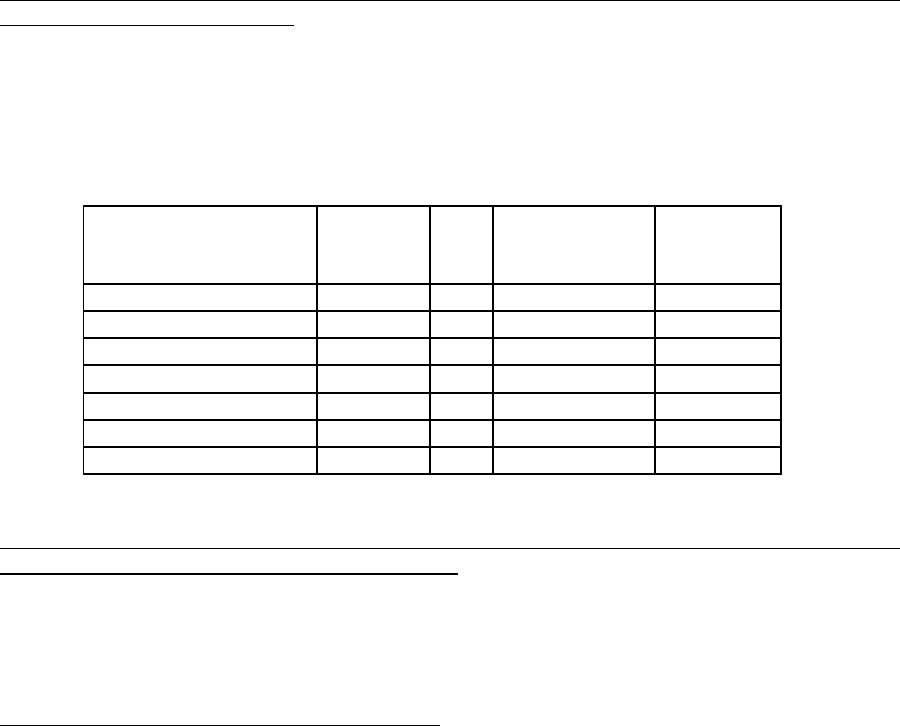

Schedule 1: Value of P, M, R and B

P

(RM)

M

(RM)

R

(%)

B

Category 1 & 3

(RM)

B

Category 2

(RM)

2,500 – 5,000

2,500

0

– 400

– 800

5,001 – 20,000

5,000

2

– 400

– 800

20,001 - 35,000

20,000

6

– 100

– 500

35,001 - 50,000

35,000

11

1,200

1,200

50,001 - 70,000

50,000

19

2,850

2,850

70,001 - 100,000

70,000

24

6,650

6,650

Exceeding 100,000

100,000

26

13,850

13,850

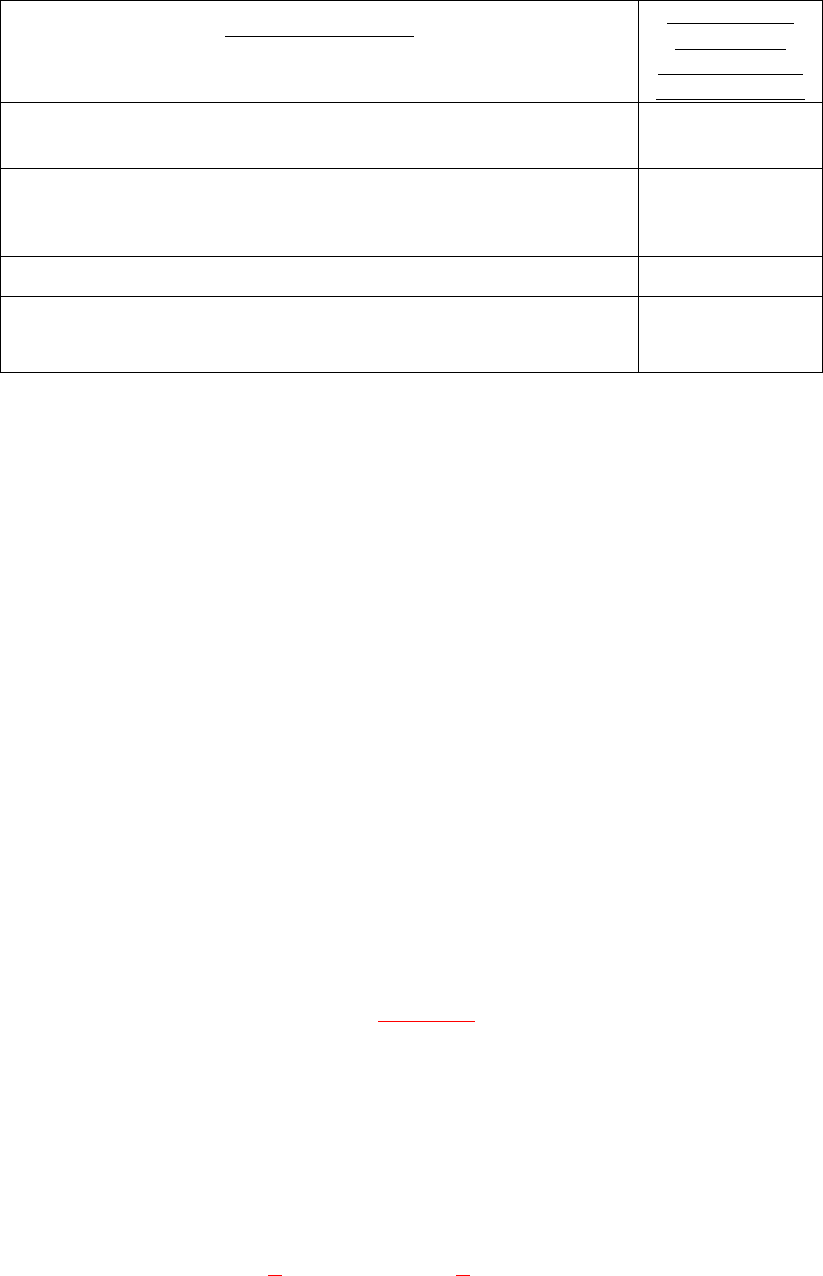

2. Deduction For Children Receiving Full-Time Instruction at Any University, College or Other Higher

Education Institution (Similar to a University Or College).

The existing deduction on the children’s higher education amounting to RM4,000 per person be increased to

RM6,000, commencing from year of assessment 2013.

Where a child falls within these conditions, the employee is treated as having the respective number of

children:

Notice:

All software providers/employers who obtained verification for MTD

2012 should apply the amendment to the specification for MTD

calculations pursuant to Budget 2013 to their payroll system without

obtaining further verification for MTD 2013 from IRBM.

5

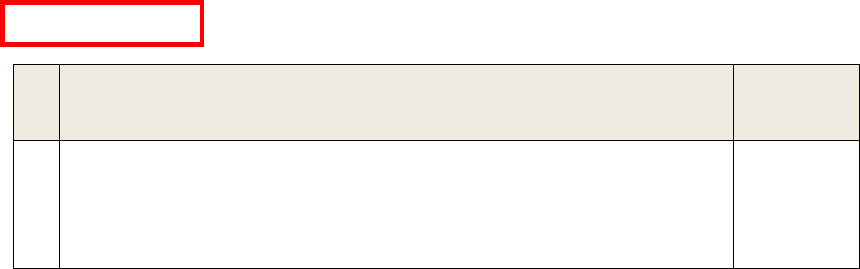

In circumstances where

Deduction to be

given as if the

employee has this

number of children

i. Child over the age of 18 years and receiving full-time instruction at

diploma level onwards in an institution of higher education in Malaysia.

6

ii. Child over the age of 18 years and receiving full-time instruction at

degree level onwards in an institution of higher education outside

Malaysia.

6

iii. Disabled child as certified by the Department of Social Welfare.

5

iv. Disabled child receiving further instruction at diploma level onwards in an

institution of higher education in Malaysia or at degree level onwards in

an institution of higher education outside Malaysia.

11

3. Net Deposit in National Education Savings Scheme/ “Skim Simpanan Pendidikan Nasional” (SSPN)

Current relief of RM3,000 for savings in the National Education Savings Scheme (SSPN) is increased to

RM6,000.

The deduction is effective from year of assessment 2012 until year of assessment 2017.

4. Subscription Fee of Internet Broadband

With effective from year 2013, the subscription fee of internet broadband is no longer a deduction.

Therefore, system should remove or disable the claimed on this deduction.

5. Fi/ levi

With effective from year 2012, employee is no longer can be claimed rebate on fee/levy due to section 6C

Income Tax Act 1967 on fi/levy is deleted with effective from year assessment 2011.

Therefore, system should remove or disable the claimed on this rebate in the following formulas:

Net MTD

Previous :

Net MTD = MTD for current month – zakat and fee/levy for current month

Current :

Net MTD = MTD for current month – zakat for current month

Definition of value Z

Previous :

Z

Accumulated fi/zakat paid other than fi/zakat for current month;

Current:

Z

Accumulated zakat paid other than zakat for current month;

6

Step in formula

Previous :

Step 4 - Determine MTD for current month additional remuneration where total tax (Step 3) less

total MTD for a year (Step 1[D]), zakat and fee/levy which have been paid.

MTD for additional remuneration = Step 3 – [Step 1[D] + zakat and fee/levy which has been paid]

Current:

Step 4 - Determine MTD for current month additional remuneration where total tax (Step 3) less

total MTD for a year (Step 1[D]), zakat which have been paid.

MTD for additional remuneration = Step 3 – [Step 1[D] + zakat which has been paid]

7

MONTHLY TAX DEDUCTION (MTD) FORMULA FOR COMPUTERISED CALCULATION METHOD

Employee’s resident status

The MTD calculation depends on the resident status of the employee. There are 2 types of residency as follows:

a. Non Resident Employee

MTD of an employee who is not resident or not known to be resident in Malaysia shall be calculated at

the rate of 26% of his remuneration.

Example :

Employee is not resident in calendar year 2013.

Total monthly remuneration : RM3,000.00

MTD calculation : RM3,000.00 x 26%

Total MTD : RM780.00

A non-resident employee is eligible to get tax exemption on allowances, benefits and perquisites as

stated in page 15 and 16 in this document. The exempt income shall be excluded from the remuneration

for MTD purposes.

b. Resident Employee

MTD of an employee who is resident or known to be resident in Malaysia is derived after deducting all

allowable deductions under the Act.

MTD formula are categorised into four (4) formulas. The employer may change the category of

remuneration based on the approval from the IRBM. The formulas are:

i. Normal remuneration formula

ii. Additional remuneration formula

iii. Returning Expert Program Formula

iv. Knowledge worker at specified region (ISKANDAR)

i. Normal remuneration formula

“Remuneration” means monthly fixed remuneration paid to an employee whether the amount is

fixed or variable as stated in the employment contract written or otherwise.

If the employee has no salary and only receives a commission, the commission paid is considered

as remuneration.

If the monthly salary is paid on a daily or hourly basis, the total monthly salary paid is considered as

remuneration.

If the monthly salary changes due to the change in currency values, the total monthly salary paid is

also considered as remuneration.

Overtime allowance, allowances (variable amount paid monthly) and commission (variable amount

paid monthly) are categorised as normal remuneration.

However, vendor/employer is given time to implement this changes until July 2013.

8

Formula

MTD for current month = [ (P – M) R + B ] – (Z+ X)

n + 1

Net MTD = MTD for current month – zakat for current month

where P = [∑(Y–K*) + (Y1–K1*) + [(Y2–K2*)n] + (Yt–Kt*)] – [D + S + DU + SU + QC + (∑LP +

LP1)]

P

Total chargeable income for a year;

∑ (Y–K)

Total accumulated net remuneration including net additional remuneration which

has been paid to an employee until before current month including net

remuneration which has been paid by previous employer in the current year (if

any);

Y

Total monthly gross remuneration and additional remuneration which has been

paid including monthly gross remuneration paid by previous employer in the

current year (if any);

K

Total contribution to EPF or other Approved Scheme made on all remuneration

(monthly remuneration, additional remuneration and remuneration from previous

employer in the current year) or life insurance premium or both paid (including

premium claimed under previous employment in the current year, if any) not

exceeding RM6,000.00 per year;

Y1

Current month’s normal remuneration;

K1

Contribution to EPF or other Approved Scheme and life insurance premium paid

for current month’s remuneration subject to total qualifying amount not exceeding

RM6,000.00 per year;

Y2

Estimated remuneration as per Y1 for the following month;

K2

Estimated balance of total contribution to EPF or other Approved Scheme and life

insurance premium paid for the qualifying monthly balance [[RM 6,000 (Limited) –

(K + K1 + Kt)] / n] or K1, whichever is lower;

Yt – Kt

Net additional remuneration for current month;

Yt

Gross additional remuneration for current month;

Kt

Contribution to EPF or other Approved Scheme for current month’s additional

remuneration subject to total qualifying amount not exceeding RM6,000.00 per

year;

* K + K1 + K2 + Kt not exceeding RM6,000.00 per year

n

Remaining working month in a year;

n + 1

Remaining working month in a year including current month;

D

Deduction for individual of RM9,000.00;

S

Deduction for spouse of RM3,000.00;

DU

Deduction for disabled individual RM6,000

SU

Deduction for disabled spouse of RM3,500

Q

Deduction of RM1,000.00 for qualifying children;

C

Number of qualifying children (refer to term and conditions paragraph 12(a)(c);

Value of D, S and C are determined as follows:

9

i. If category 1= Single;

Value of D = RM9,000.00, S = 0 and C = 0;

ii. If category 2 = Married and spouse is not working;

Value of D = RM9,000.00, S = RM3,000.00 and C = Number of qualifying children;

iii. If category 3 = Married and spouse is working;

Value of D = RM9,000.00, S = 0 and C = Number of qualifying children;

∑LP

Other accumulated allowable deductions including from previous employment in

the current year (if any);

LP1

Other allowable deductions for current month;

M

Amount of first chargeable income for every range of chargeable income a year;

R

Percentage of tax rates;

B

Amount of tax on M less tax rebate for individual and spouse (if qualified);

Z

Accumulated zakat paid other than zakat for current month;

X

Accumulated MTD paid in the current year including payment from previous

employment in that year but shall not include additional MTD requested by the

employee and payment of tax installment (CP38).

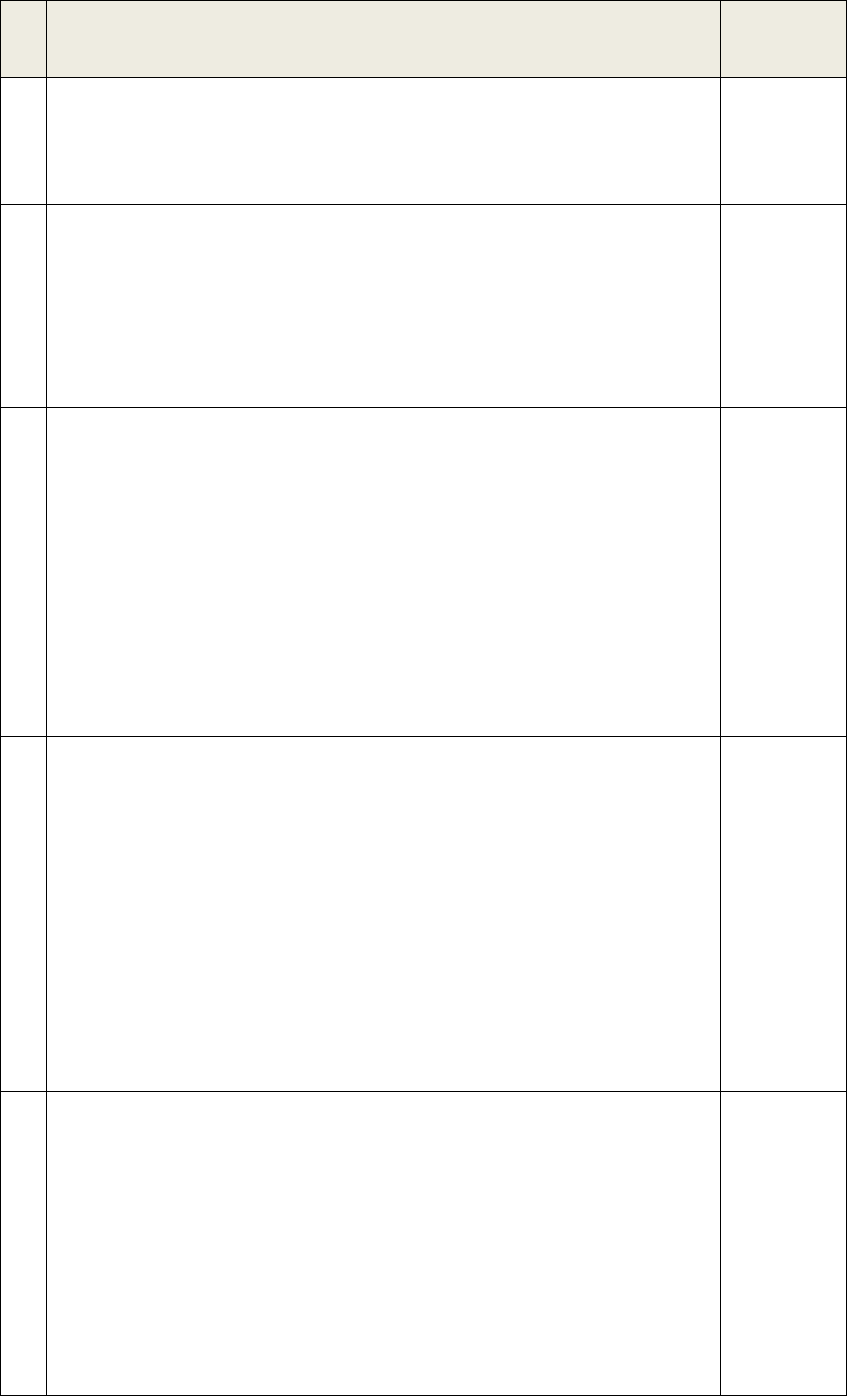

Upon getting value of P, the value of M, R and B are determined based on Schedule 1 below

where value of B depends on category of employee.

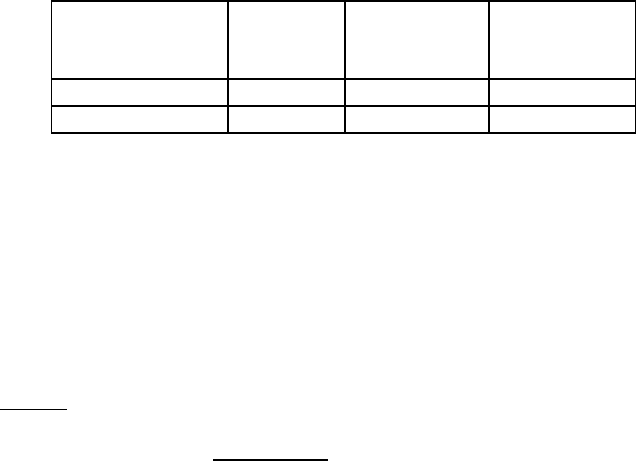

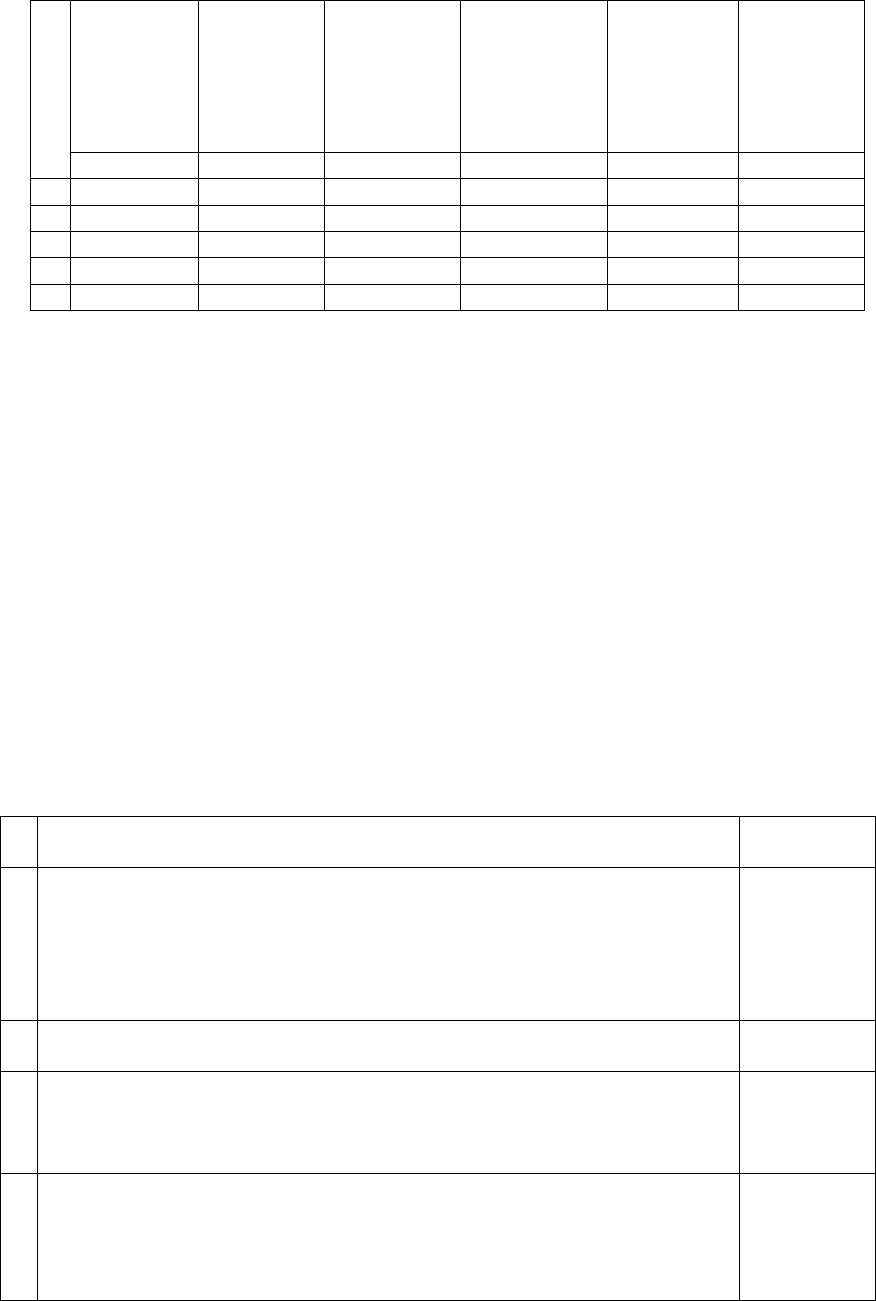

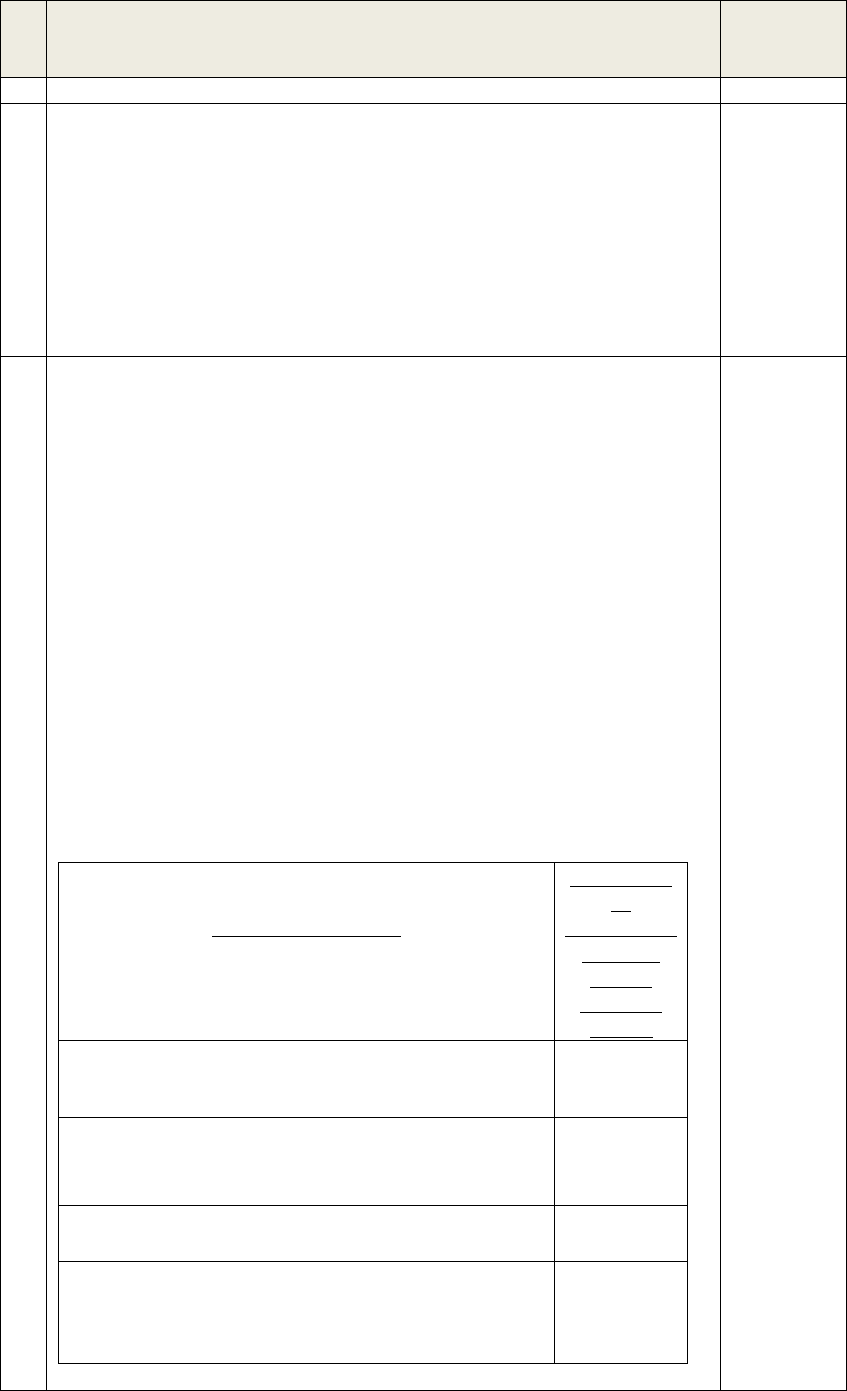

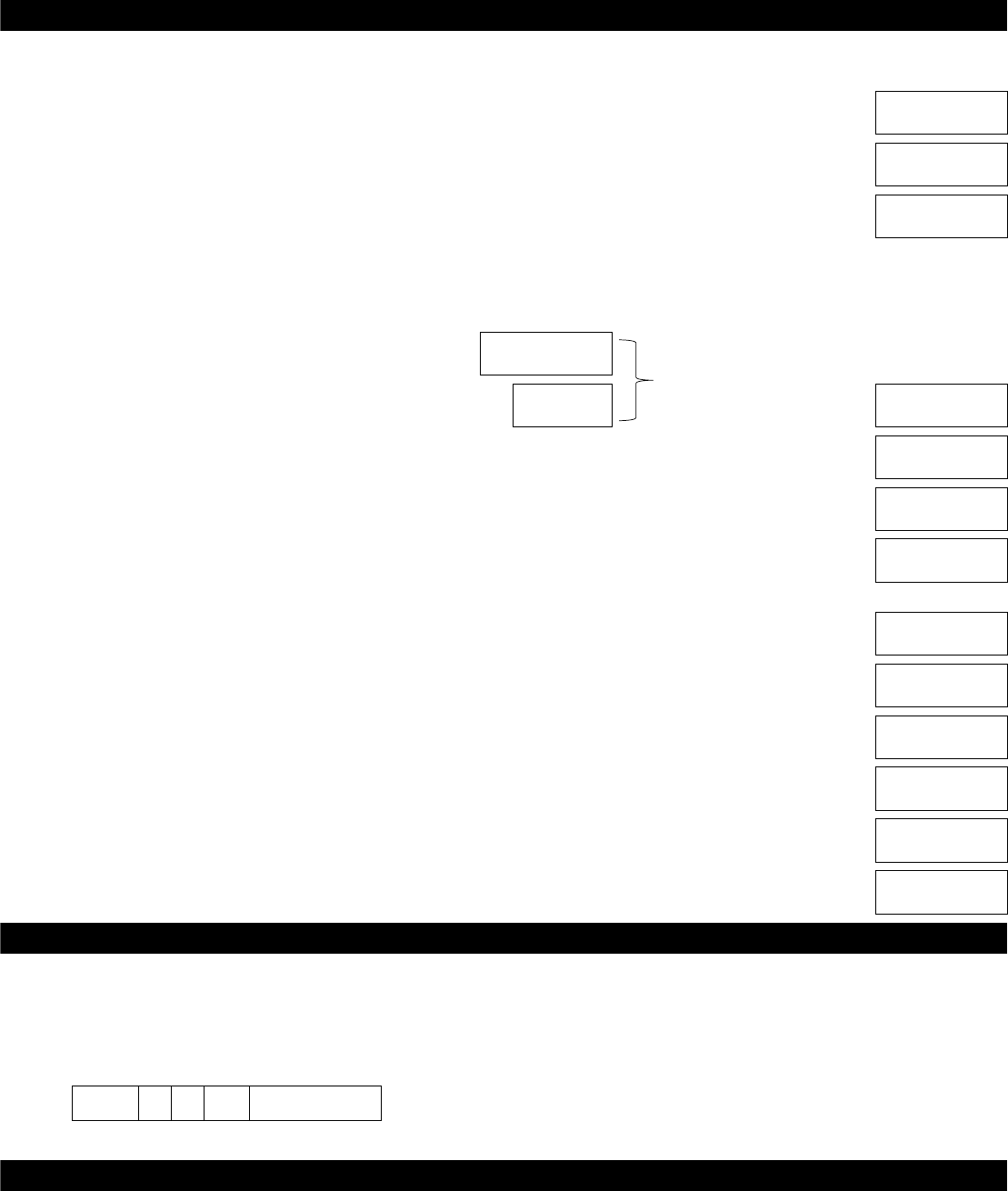

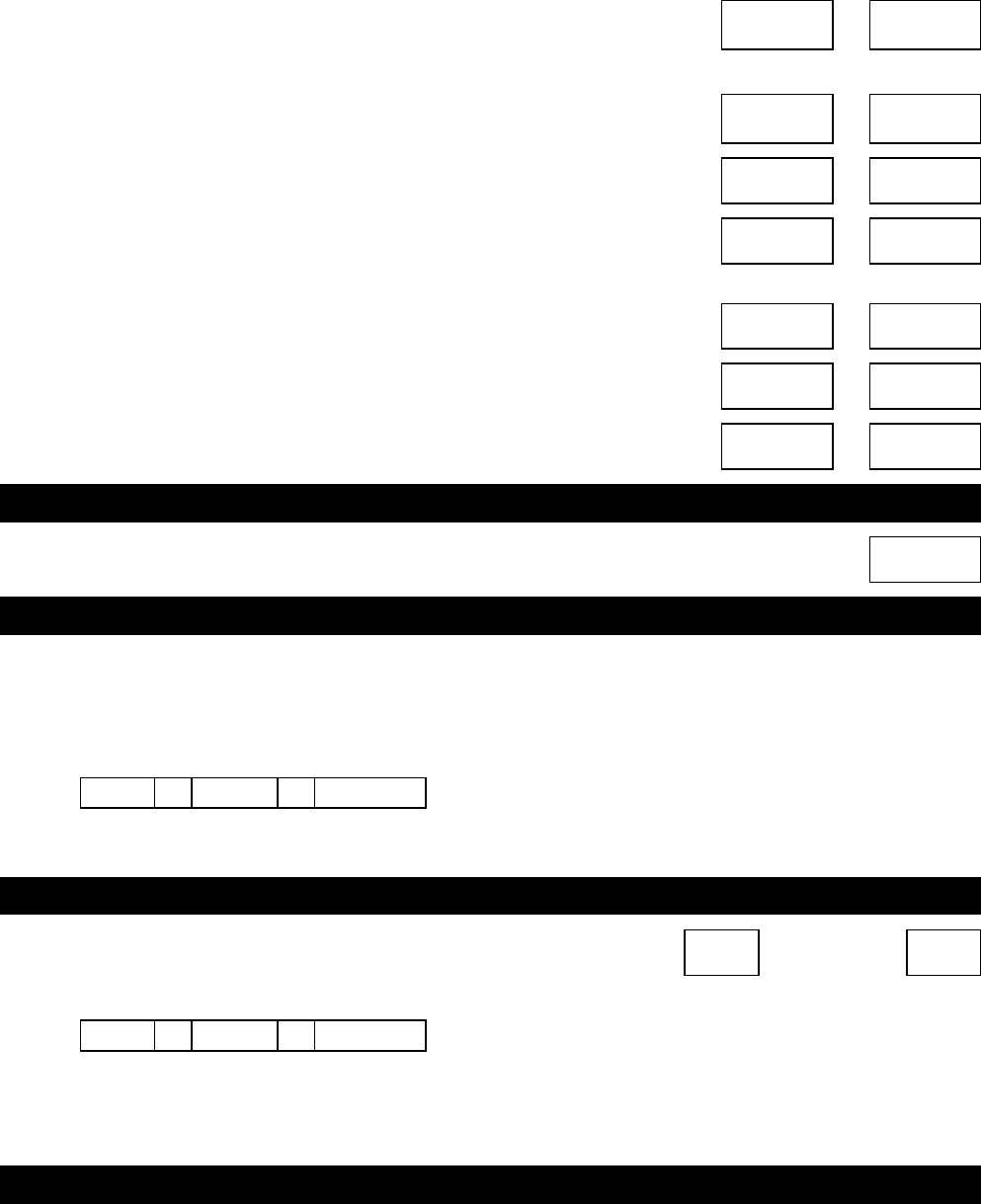

Schedule 1: Value of P, M, R and B

P

(RM)

M

(RM)

R

(%)

B

Category 1 & 3

(RM)

B

Category 2

(RM)

2,500 – 5,000

2,500

0

– 400

– 800

5,001 – 20,000

5,000

2

– 400

– 800

20,001 - 35,000

20,000

6

– 100

– 500

35,001 - 50,000

35,000

11

1,200

1,200

50,001 - 70,000

50,000

19

2,850

2,850

70,001 - 100,000

70,000

24

6,650

6,650

Exceeding 100,000

100,000

26

13,850

13,850

ii. Additional remuneration formula

“Additional remuneration” means any payment paid to an employee either in one lump sum or

periodical or in arrears or non fixed payment or any additional payment to a current month’s normal

remuneration.

Such additional remuneration includes:

i. bonus/incentive

ii. arrears of salary or any other arrears paid to an employee

iii. employee’s share option scheme (if employee opts for MTD deduction)

iv. tax borne by employer

v. gratuity

vi. compensation for loss of employment

vii. ex-gratia

viii. director’s fee (not paid monthly)

ix. commissions (not paid monthly)

x. allowances (not paid monthly)

xi. any other payment in addition to normal remuneration for current month

10

Note :

Bonus and director fee shall, when received in the current year, be treated as part of the gross

income from employment income for the year in which it is received. Therefore, PCB should

calculate based on current year additional remuneration formula and reported together with current

month’s PCB in CP39 text file format.

Additional Remuneration Formula

Step 1 - Determine MTD on net remuneration for a year (not including current month’s

additional remuneration).

[A] Determine category of employee.

[B] Determine chargeable income for a year [P];

P = [∑(Y– K*)+(Y1 – K1*)+[(Y2 – K2*)n] + (Yt – Kt*)] - [D+S+ DU+SU+ QC + (∑LP + LP1)]

where (Yt – Kt ) = 0

[C] Determine monthly MTD for net normal remuneration. Once value of P in Step [B] is

determined, value of M, R and B are determined based on Schedule 1 above.

MTD for current month = [ (P – M) R + B ] – (Z+ X )

n + 1

Net MTD = MTD for current month – zakat for current month

[D] Determine total MTD for a year

Total MTD for a year = Total paid accumulated MTD + [MTD for current month at Step [C] x

remaining month in a year include current month]

= X + [(MTD for current month at Step [C] x (n + 1)]

Step 2 – Determine chargeable income for a year [P] (including additional remuneration for

current month) and additional remuneration which has been paid.

[A] Determine category of employee.

[B] Determine chargeable income for a year [P];

P = [∑(Y–K*)+ (Y1 – K1*)+[(Y2 – K2*)n] + (Yt – Kt*)] – [D+S+DU+SU+ QC + (∑LP + LP1)]

Step 3 – Determine total tax for a year based on value of P in Step 2 [B]. Value of M, R and B

are based on value as per Schedule 1 above.

Total tax for a year = (P – M) R + B

Step 4 - Determine MTD for current month additional remuneration where total tax (Step 3)

less total MTD for a year (Step 1[D]), zakat which have been paid.

MTD for additional remuneration = Step 3 – [Step 1[D] + zakat which has been paid]

11

Step 5 – MTD for current month which shall be paid.

= Net MTD + MTD for current month on additional remuneration

= Step 1[C] + Step 4

iii. Returning Expert Program Formula

An approved employee under REP shall be tax at rate of 15% from its chargeable income. If the

chargeable income does not exceed RM35,000, employee is eligible for individual and spouse

rebate for RM400, respectively.

Duration of the incentive is for five (5) consecutive full years of assessment.

Formula:

MTD for current month = [ (PR – T) – (Z+ X) ]

n + 1

Net MTD = MTD for current month – zakat for current month

Where P = [∑(Y–K*)+(Y1–K1*)+[(Y2–K2*)n]+(Yt–Kt*)]–[D+S+DU+SU+QC+ (∑LP+LP1)]

P

Total chargeable income for a year;

∑ (Y–K)

Total accumulated net remuneration including net additional remuneration which has

been paid to an employee until before current month including net remuneration which

has been paid by previous employer in the current year (if any);

Y

Total monthly gross remuneration and additional remuneration which has been paid

including monthly gross remuneration paid by previous employer in the current year (if

any);

K

Total contribution to EPF or other Approved Scheme made on all remuneration

(monthly remuneration, additional remuneration and remuneration from previous

employer in the current year) and life insurance premium paid (including premium

claimed under previous employment in the current year, if any) not exceeding

RM6,000.00 per year;

Y1

Current month’s normal remuneration;

K1

Contribution to EPF or other Approved Scheme and life insurance premium paid for

current month’s remuneration subject to total qualifying amount not exceeding

RM6,000.00 per year;

Y2

Estimated remuneration as per Y1 for the following month;

K2

Estimated balance of total contribution to EPF or other Approved Scheme and life

insurance premium paid for the qualifying monthly balance [[RM 6,000 (Limited) – (K +

K1 + Kt)] / n] or K1, whichever is lower;

Yt – Kt

Net additional remuneration for current month;

Yt

Gross additional remuneration for current month;

Kt

Contribution to EPF or other Approved Scheme for current month’s additional

remuneration subject to total qualifying amount not exceeding RM6,000.00 per year;

* K + K1 + K2 + Kt not exceeding RM6,000.00 per year

n

Remaining working month in a year;

n + 1

Remaining working month in a year including current month;

12

D

Deduction for individual of RM9,000.00;

S

Deduction for spouse of RM3,000.00;

DU

Deduction for disabled individual RM6,000;

SU

Deduction for disabled spouse of RM3,500;

Q

Deduction of RM1,000.00 for qualifying children;

C

Number of qualifying children (refer to term and conditions paragraph 12(a)(c);

Value of D, S and Q are determined as follows:

i. If category 1= Single;

Value of D = RM9,000.00, S = 0 and Q = 0;

ii. If category 2 = Married and spouse is not working;

Value of D = RM9,000.00, S = RM3,000.00 and Q = Qualifying children;

iii. If category 3 = Married and spouse is working;

Value of D = RM9,000.00, S = 0 and Q = Qualifying children;

∑LP

Other accumulated allowable deductions including from previous employment in the

current year (if any);

LP1

Other allowable deductions for current month;

R

Percentage of tax rates;

T

Individual and spouse rebate (if any);

Z

Accumulated zakat paid in the current year other than zakat for current month;

X

Accumulated MTD paid for previous month including from previous employment in

the current year (including MTD on additional remuneration. MTD amount is not

including additional MTD requested by the employee and CP38.

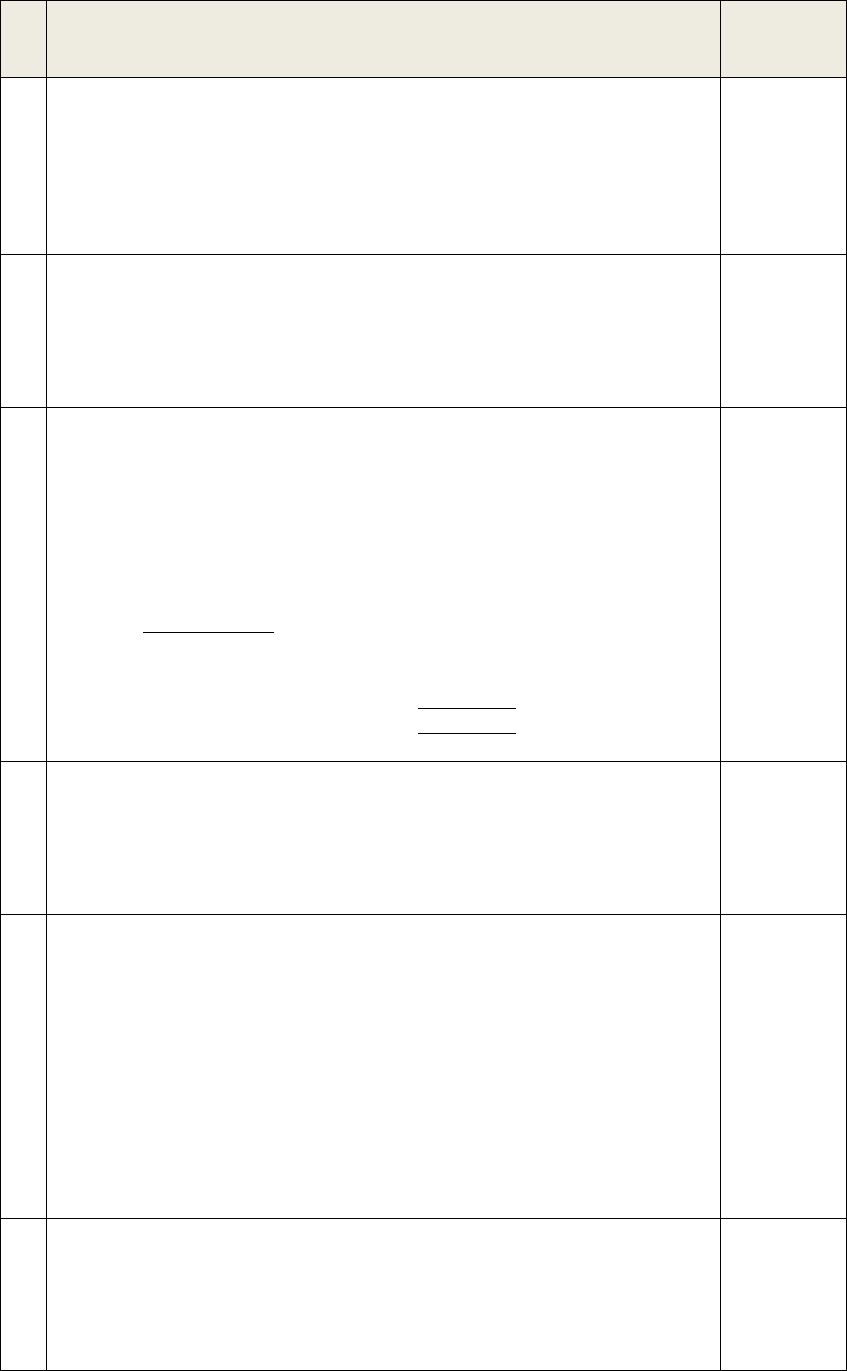

Upon getting value of P, the value of T are determined based on Schedule 2 below where value of

T depends on category of employee.

Jadual 2: Nilai P, R dan T

P

(RM)

R

(%)

T

Kategori 1 & 3

(RM)

T

Kategori 2

(RM)

Kurang 35,000

15

400

800

Melebihi 35,000

15

0

0

iv. Knowledge worker at specified region (ISKANDAR).

Tax rate at 15% is charged to the qualified knowledge worker and work in Iskandar Regional

Development Authority.

The incentive is given to the applicant and start work in Regional Development Authority not later

than 31 December 2015.

Formula:

MTD for current month = [ PR – (Z+ X) ]

n + 1

Net MTD = MTD for current month – zakat for current month

13

Where P = [∑(Y–K*)+(Y1–K1*)+[(Y2–K2*) n]+(Yt–Kt*)]-[D+S+DU+SU+QC+(∑LP+LP1)]

P

Total chargeable income for a year;

∑ (Y–K)

Total accumulated net remuneration including net additional remuneration which has

been paid to an employee until before current month including net remuneration

which has been paid by previous employer in the current year(if any);

Y

Total monthly gross remuneration and additional remuneration which has been paid

including monthly gross remuneration paid by previous employer in the current year

(if any);

K

Total contribution to EPF or other Approved Scheme made on all remuneration

(monthly remuneration, additional remuneration and remuneration from previous

employer in the current year) and life insurance premium paid (including premium

claimed under previous employment in the current year, if any) not exceeding

RM6,000.00 per year;

Y1

Current month’s normal remuneration;

K1

Contribution to EPF or other Approved Scheme and life insurance premium paid for

current month’s remuneration subject to total qualifying amount not exceeding

RM6,000.00 per year;

Y2

Estimated remuneration as per Y1 for the following month;

K2

Estimated balance of total contribution to EPF or other Approved Scheme and life

insurance premium paid for the qualifying monthly balance [[RM 6,000 (Limited) – (K

+ K1 + Kt)] / n] or K1, whichever is lower;

Yt – Kt

Net additional remuneration for current month;

Yt

Gross additional remuneration for current month;

Kt

Contribution to EPF or other Approved Scheme for current month’s additional

remuneration subject to total qualifying amount not exceeding RM6,000.00 per year;

* K + K1 + K2 + Kt not exceeding RM6,000.00 per year

n

Remaining working month in a year;

n + 1

Remaining working month in a year including current month;

D

Deduction for individual of RM9,000.00;

S

Deduction for spouse of RM3,000.00;

DU

Deduction for disabled individual RM6,000;

SU

Deduction for disabled spouse of RM3,500;

Q

Deduction of RM1,000.00 for qualifying children;

C

Number of qualifying children (refer to term and conditions paragraph 12(a)(c);

Value of D, S and Q are determined as follows:

i. If category 1= Single;

Value of D = RM9,000.00, S = 0 and Q = 0;

ii. If category 2 = Married and spouse is not working;

Value of D = RM9,000.00, S = RM3,000.00 and Q = Qualifying children;

iii. If category 3 = Married and spouse is working;

Value of D = RM9,000.00, S = 0 and Q = Qualifying children;

∑LP

Other accumulated allowable deductions including from previous employment in the

current year (if any);

LP1

Other allowable deductions for current month;

R

Percentage of tax rates;

Z

Accumulated zakat paid in the current year other than zakat for current month;

X

Accumulated MTD paid for previous month including from previous employment in the

current year (including MTD on additional remuneration. MTD amount is not including

14

additional MTD requested by the employee and CP38.

D. TERMS AND CONDITIONS

1. Calculations is limited to 2 decimal points, truncate the remaining figure:

Example : 123.4567 = 123.45

2. Final amount of MTD must be rounding up to the highest 5 cents:

1, 2, 3, 4 – rounding to the 5 cents

Example : 287.02 ≈ 287.05

6, 7, 8, 9 – rounding to the 10 cents

Example : 152.06 ≈ 152.10

3. Amount of total MTD and MTD less than RM10 before deductions of zakat is not required to deduct the MTD

payment. However, if the amount of net MTD for the current month (after zakat) is less than RM10, the

employer is required to make the deduction.

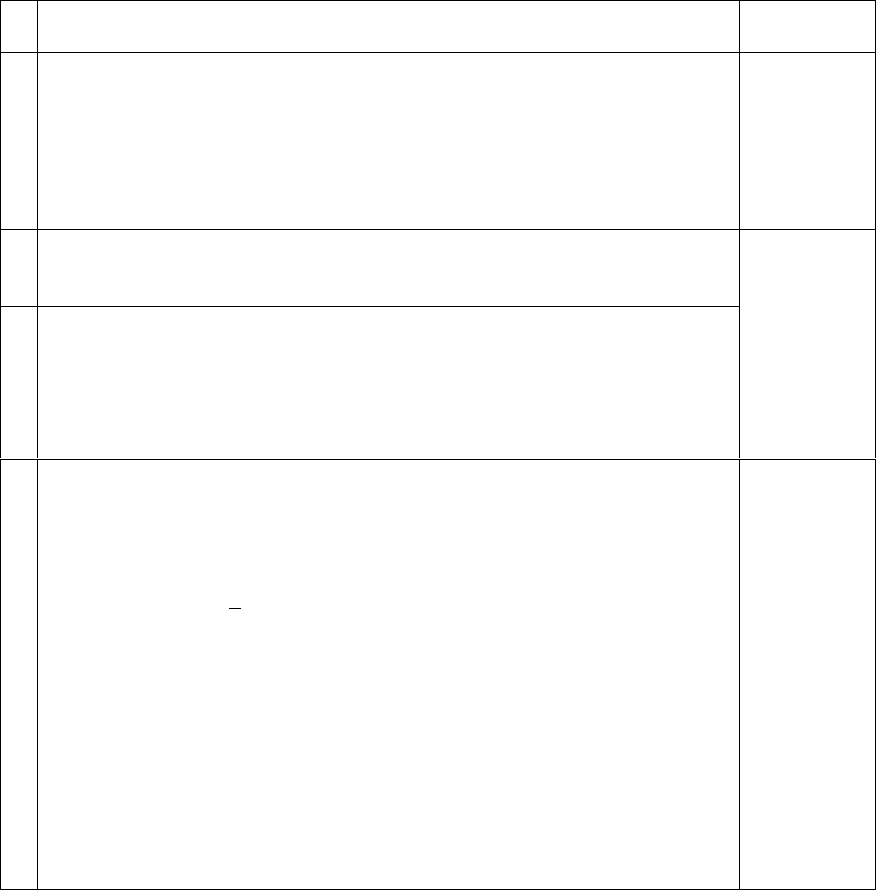

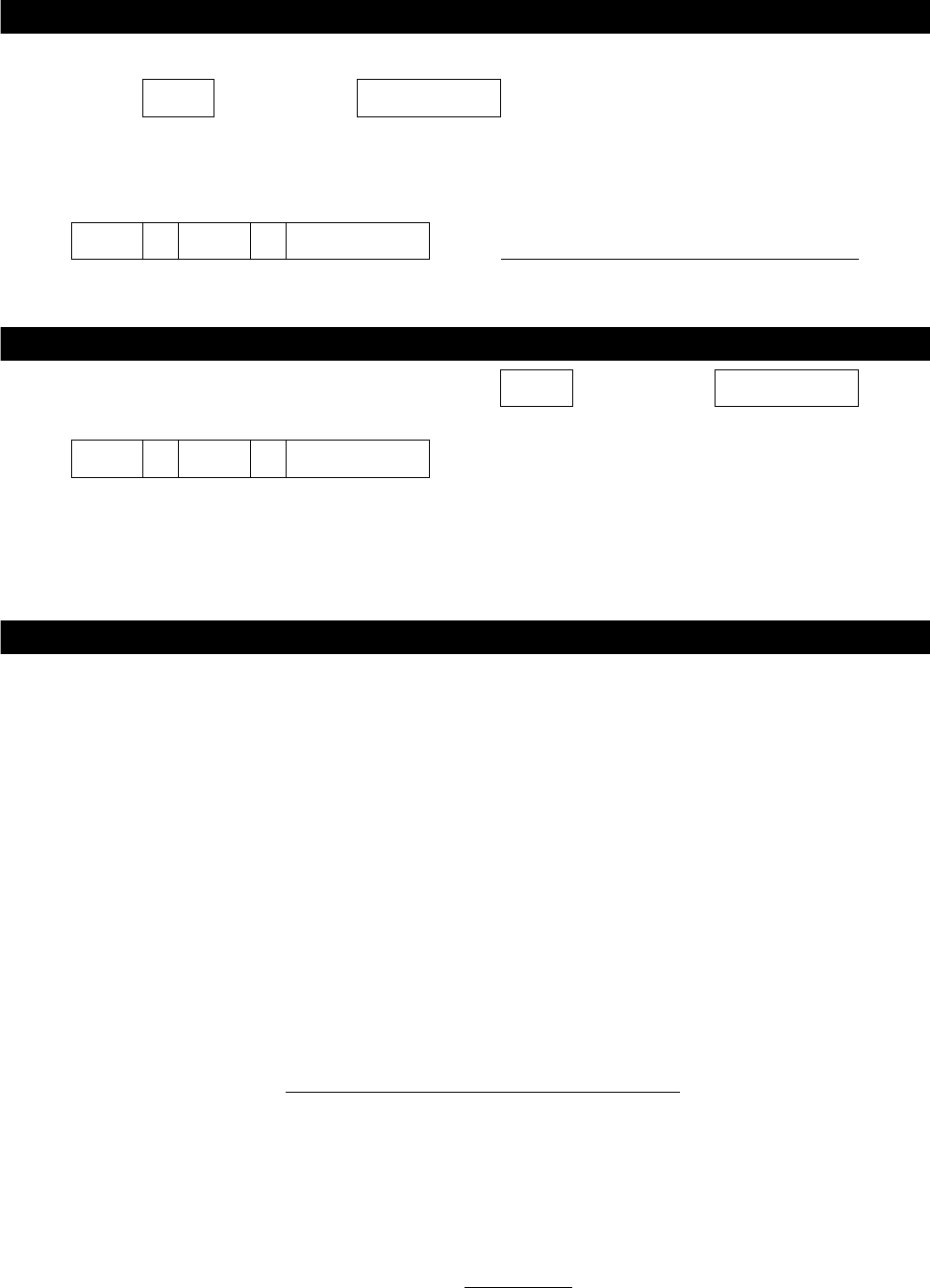

MTD calculation (RM)

MTD amount deducted

(RM)

a.

MTD for current month

< 10

0

≥ 10

Deduct as per MTD

calculation

b.

Net MTD (after zakat/fi deduction for the current

month)

< 10

Deduct as per MTD

calculation

≥ 10

Deduct as per MTD

calculation

c.

MTD for additional remuneration

< 10

0

≥ 10

Deduct as per MTD

calculation

4. Zakat shall be treated as follows:

a) Employees receive only remuneration (without additional remuneration).

MTD for current month

(RM)

Zakat for current

month

(RM)

Net MTD

(RM)

Zakat carried forward

to the following month

(value of Z)

(RM)

(a)

(b)

(a – b = c)

(d)

a.

8.00 ≈ 0.00

5.00

- 5.00 ≈ 0.00

5.00

b.

15.00

20.00

- 5.00 ≈ 0.00

20.00

c.

15.00

8.00

7.00

8.00

d.

120.00

100.00

20.00

100.00

15

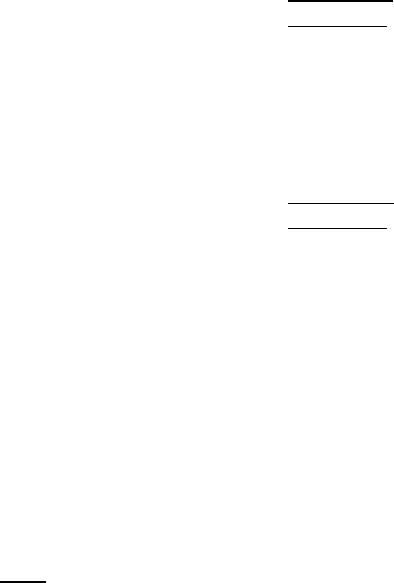

b) Employees receive additional remuneration during the month. Please refer to MTD for additional

remuneration formula.

MTD for

current

month (RM)

Zakat for

current

month

(RM)

Net MTD

(RM)

Step 1(c)

Zakat carried

forward to the

following month

(value of Z)

(RM)

MTD for

additional

remuneration

(RM)

Step 4

MTD for

current

month

(RM)

Step 5

(a)

(b)

(a – b = c)

(d)

(e)

(c + e = f)

a.

8.00 ≈ 0.00

5.00

- 5.00 ≈ 0.00

5.00

9.00 ≈ 0.00

0.00

b.

8.00 ≈ 0.00

5.00

- 5.00 ≈ 0.00

5.00

25.00

20.00

c.

15.00

20.00

- 5.00 ≈ 0.00

20.00

32.55

27.55

d.

15.00

8.00

7.00

8.00

127.30

134.30

e.

120.00

100.00

20.00

100.00

392.25

412.25

5. MTD for computerised calculation method must be paid for the actual amount (including the decimal point

amount).

6. In the situation where employees do not receive any normal remuneration in the current month but only

additional remuneration, then value of Y1 is equal to 0.

7. If additional remuneration paid before the monthly remuneration, value of Y1 shall refer to the monthly

remuneration which will be paid for that month.

8. MTD is to be deducted from the employee’s taxable remuneration only. All the tax exemption on allowances,

benefit-in-kind and perquisites shall be excluded from the remuneration for MTD purposes. Any amount

exceed the restricted amount shall be taxable. Please refer to Explanatory Notes E Form for references.

All the tax exemption on allowances, benefit-in-kind and perquisites shall reported in the EA Form, section G

– TOTAL TAX EXEMPT ALLOWANCES / PERQUISITES / GIFTS / BENEFITS.

Type of benefit-in-kind and perquisites that exempt from tax are as follows:

Allowances / Perquisites / Gifts / Benefits

Restricted

amount (RM)

a.

Petrol card, petrol allowance, travelling allowance or toll payment or any of its

combination for official duties. If the amount received exceeds RM6,000 a year, the

employee can make a further deduction in respect of the amount spent for official

duties. Records pertaining to the claim for official duties and the exempted amount

must be kept for a period of 7 years for audit purpose.

6,000.00

b.

Child care allowance in respect of children up to 12 years of age.

2,400.00

c.

Gift of fixed line telephone, mobile phone, pager or Personal Digital Assistant (PDA)

registered in the name of the employee or employer including cost of registration and

installation.

Limited to

only 1 unit for

each category

of assets

d.

Monthly bills for subscription of broadband, fixed line telephone, mobile phone, pager

and PDA registered in the name of the employee or employer including cost of

registration and installation.

Limited to

only

1 line for each

category

of assets.

16

Allowances / Perquisites / Gifts / Benefits

Restricted

amount (RM)

e.

Perquisite (whether in money or otherwise) provided to the employee pursuant to his

employment in respect of:-

(i) past achievement award;

(ii) service excellence award, innovation award or productivity award; and

(iii) long service award (provided that the employee has exercised an employment for

more than 10 years with the same employer).

2,000

f.

Parking rate and parking allowance. This includes parking rate paid by the

employer directly to the parking operator.

Restricted to

the

actual amount

expended

g.

Meal allowance received on a regular basis and given at the same rate to all

employees. Meal allowance provided for purposes such as overtime or outstation /

overseas trips and other similar purposes in exercising an employment are only

exempted if given based on the rate fixed in the internal circular or written instruction

of the employer.

h.

Subsidised interest for housing, education or car loan is fully exempted from tax if the

total amount of loan taken in aggregate does not exceed RM300,000. If the total

amount of loan exceeds RM300,000, the amount of subsidized interest to be

exempted from tax is limited in accordance with the following formula:

Where;

A x B

C

A = is the difference between the amount of interest to be borne by the employee

and the amount of interest payable by the employee in the basis period for a year of

assessment;

B = is the aggregate of the balance of the principal amount of housing, education or

car loan taken by the employee in the basis period for a year of assessment or

RM300,000, whichever is lower;

C = is the total aggregate of the principal amount of housing, education or car loan

taken by the employee.

Example : Normal remuneration : RM5,000 per month

Car allowance : RM 800 per month

Meal allowance : RM 300 per month (Exempted)

Childcare allowance : RM 300 per month (Exempted – limit to RM2,400 per year)

Total : RM6,400 per month

To determine MTD amount, taxable income as follow:

Normal remuneration : RM5,000 per month

Car allowance : RM 800 per month

Total taxable remuneration : RM5,800 per month

17

9. If payment in arrears and other payments in respect of the preceding years (prior to current years) paid by

the employer to the employee, system must be able to calculate based on the MTD formula for the year

payment supposed to be made.

Preceding PARTICULARS OF PAYMENT IN ARREARS AND OTHER PAYMENTS IN RESPECT OF

PRECEDING YEARS

These methods of calculation in concurrent with section 25

a. If remuneration payment for year 2008 and below. The following formula is applicable:

[A] Determine the tax deduction on monthly remuneration (excluding arrears)

[B] (1/12 x net arrears) + monthly net remuneration

[C] Determine the tax deduction on [B]

[D] ([C] – [A]) x 12

Example:

Employee (married) ]

Spouse working ] Refer CATEGORY 3 / KA 2

2 number of qualifying children ]

Monthly remuneration in Dec the related year RM3,600.00 KWSP: RM 396.00

Arrears RM7,200.00 KWSP: RM 792.00

[A] Determine the tax deduction on monthly remuneration (excluding arrears)

Monthly remuneration RM3,600.00

Minus: EPF RM 396.00*

Net monthly remuneration RM3,204.00

MTD for RM3,204.00 = RM48.00

[B] (1/12 x net arrears) + monthly net remuneration

Arrears RM7,200.00

Minus: EPF RM 104.00* (*RM500.00 - RM396.00)

Net arrears RM7,096.00

(1/12 X RM7,096.00) + RM3,204.00 = RM3,795.00

[C] Determine the tax deduction on [B]

MTD for RM3,795.00 = RM102.00

[D] ([C] – [A]) x 12

(RM102.00 – RM48.00) X 12 = RM648.00

(*Contribution to EPF deduction is limited to a maximum RM500.00 per month)

Note:

Use Formula MTD 2008 and below to determined value of MTD

18

Formula MTD 2008 and below

Step 1:

Determine employee CATEGORY as per schedule.

Step 2:

Calculate CHARGEABLE INCOME (P) for the employee as follows:

CATEGORY 1:

P = [(Total monthly remuneration - *EPF) X 12] - RM8,000.00;

CATEGORY 2:

P = [(Total monthly remuneration - *EPF) X 12] - (Number of children x RM1,000.00) -

RM11,000.00;

CATEGORY 3:

P = [(Total monthly remuneration - *EPF) X 12] - (Number of children X RM1,000.00) -

RM8,000.00;

*EPF limited to RM500.00 per month

Step 3:

Monthly deduction is calculated based on the following formula:

i. Remuneration RM10,000 and BELOW:

[ (P - M) X R + B ] x 0.8

12

ii. Remuneration ABOVE RM10,000:

[ (P - M) X R + B ]

12

Upon getting value of P, the value of M, R and B are determined based on Schedule 1 below

where value of B depends on category of employee.

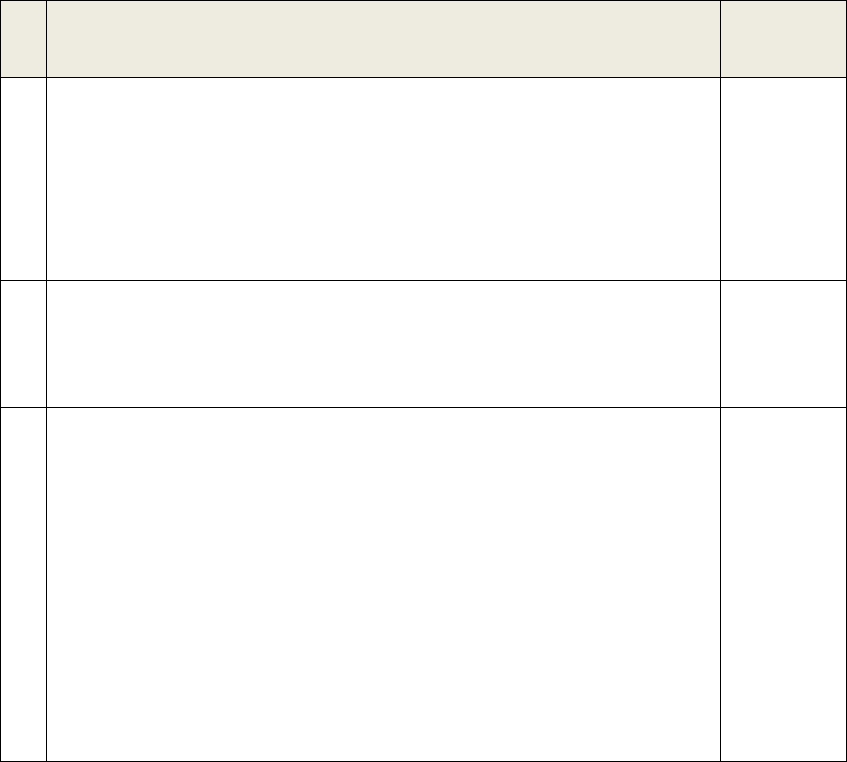

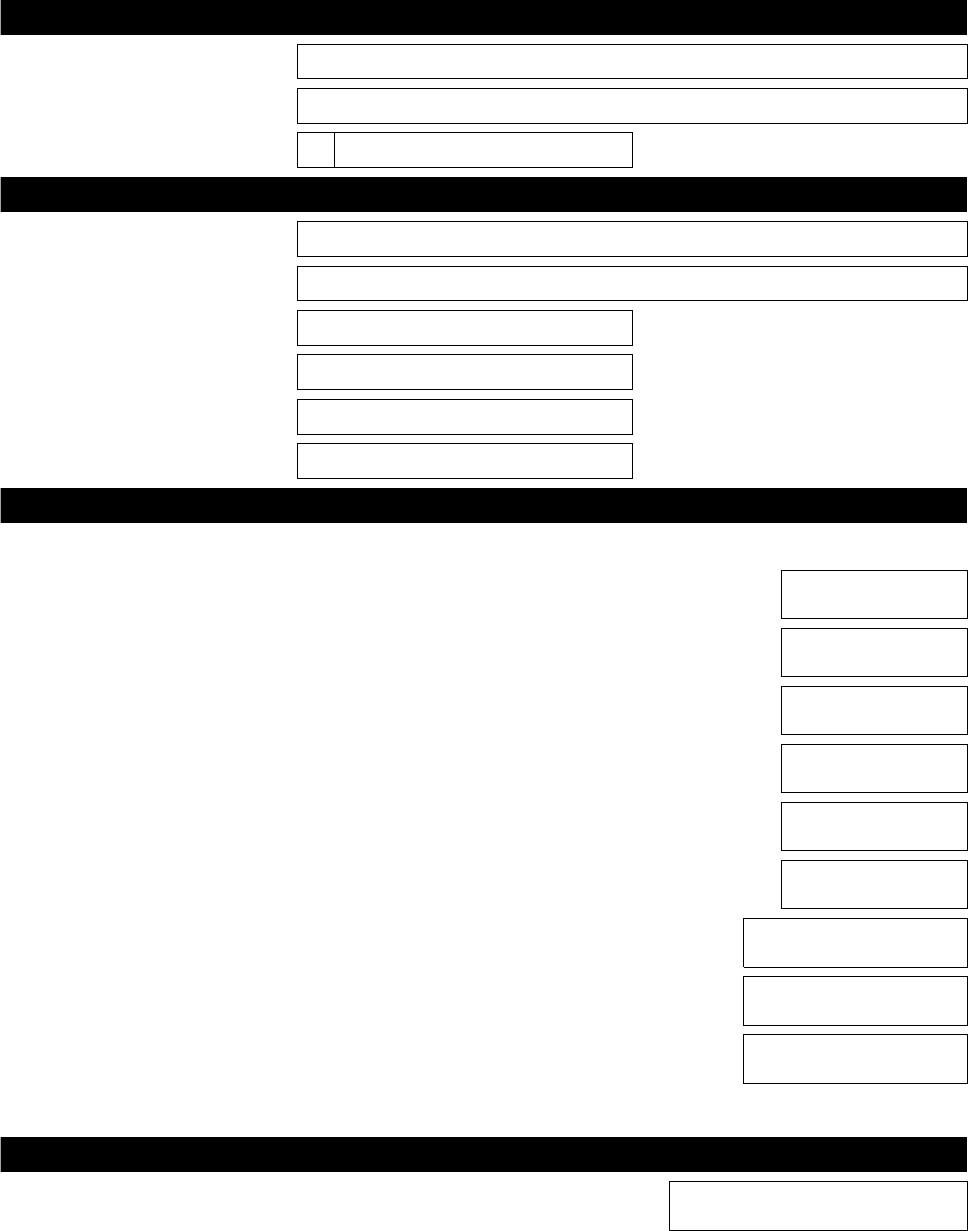

Value of P, M, R and B

P

(RM)

M

(RM)

R

(%)

B

[KATEGORI 1 & 3]

(RM)

B

[KATEGORI 2]

(RM)

2,500 - 5,000

2,500

1

-350

-700

5,001 - 20,000

5,000

3

-325

-675

20,001 - 35,000

20,000

7

125

-225

35,001 - 50,000

35,000

13

1,525

1,525

50,001 - 70,000

50,000

19

3,475

3,475

70,001 - 100,000

70,000

24

7,275

7,275

100,001 - 250,000

100,000

27

14,475

14,475

Melebihi 250,000

250,000

28

54,975

54,975

NOTE:

i. Calculations is limited to the nearest value of RM.

ii. No deduction of MTD if the MTD amount is less than RM20.

19

b. If remuneration payment for year 2009 and above

Using the same formula for additional remuneration with the following conditions:

i. Value of (Y-K) is the cummulative remuneration received during the year (from January until

December that year)

ii. Value of (Y1–K1) = 0

iii. Value of (Y2–K2) = 0

iv. Value of D, S, DU, SU, and QC are value claimed during the year.

v. Value of ∑LP is the total value of deductions claimed by the employee during the year.

vi. Value of LP1 = 0

vii. Only calculate until step 4 to get the value of MTD for additional remuneration.

10. Employee who newly joined the company during the year shall submit TP3 Form (Exhibit 1) to his new

employer to notify information relating to his employment with previous employer in the current year.

The amounts related to the previous employment in the previous employer in the current year are used only

for the purpose of MTD calculation. These amounts shall not appear in the pay slip and EA Form.

The information amount from the TP3 Form shall be treated in the formula as variable (Y–K*), X, Z and ∑LP.

11. Employee who wishes to include benefits-in-kind (BIK) and value of living accommodation (VOLA) as part of

his monthly remuneration shall submit TP2 Form (Exhibit 2) to the employer.

Amount of BIK/VOLA shall be treated as part of Y1 in the MTD calculation during the current year only (year

that the employee claimed through TP2 Form to the employer).

It shall not carry forward to the following year.

Amount of BIK/VOLA are used only for the purpose of MTD calculation. These amounts shall not appear in

the pay slip and EA Form.

There are 2 methods in providing fields to key into the system:

a. Employer input monthly amount and system treated as Y1 in the MTD formula.

b. Employer input the total amount of each BIK/VOLA and system calculate the monthly amount that

system treated as Y1 in the MTD formula. The method of calculation to obtain a monthly amount is

as follow:

Monthly amount = Value of BIK/VOLA for a year

Remaining working month in a year including current month

Example :

Value of car in a year : RM25,000

Month/year of deduction agreed by the employer : April 2012

Remaining working month in a year including

current month : 9 months

Monthly amount : RM25,000

9

: RM2,777.77 ≈ RM2,777.00

20

12. EPF for the purpose of MTD calculation are as follows:

a. If allowances categorized as the remuneration subject to EPF but not subject to tax, all amount of

EPF shall be treated as K1.

Salary : RM2,400.00

Child care allowance : RM300.00 (receives every month – remuneration category)

EPF deducted from the salary : RM297.00

K1 (as per EPF deduction) : RM297.00

b. If allowances categorized as the additional remuneration subject to EPF but not subject to tax,

difference of total EPF with the EPF remuneration shall be treated as Kt.

Salary : RM2,400.00

Meal allowance : RM450.00 (one off payment –additional remuneration

category)

EPF deducted from the salary : RM315.00

K1 (EPF for remuneration) : RM264.00

Kt (difference from total and normal): RM315 –RM264

: RM51.00

c. If there is an additional remuneration

Salary : RM2,400.00

Bonus : RM3,600.00

EPF deducted from the salary : RM660.00

K1 (EPF for remuneration) : RM264.00

Kt (difference from total and normal): RM660 –RM264

: RM396.00

13. All allowable deductions are limited up to the maximum amount under the Income Tax Act 1967. The

amount of allowable deduction shall not appear in the pay slip and EA Form.

a. Compulsory deductions

There are six (6) type of compulsory deductions that affect in the formula as follows:

[D + S + DU + SU + QC + (∑LP + LP1)]

Deductions

Amount

limited to

(RM)

a.

Individual

Deduction of RM9,000.00 for an individual in respect of himself and his

dependent relatives is granted automatically.

9,000.00

21

Deductions

Amount

limited to

(RM)

b.

Husband/Wife

i. Deduction of RM3,000.00 is given in respect of a husband living

together in the basis year on condition that the husband has no source

of income/total income or has elected for joint assessment.

ii. Deduction of RM3,000.00 is given in respect of a wife living together in

the basis year on condition that the wife has no source of income/total

income or has elected for joint assessment.

3,000.00

c.

Child

“Child” means an unmarried dependent legitimate child or stepchild or adopted

child, under the age of 18 years or if above 18 years old, the child must be:

i. receiving full-time instruction at any university, college or other higher

education institution (similar to a university or college); or

ii. serving under articles or indentures with a view to qualifying in a trade or

profession.

Deduction of RM1,000.00 is given for each unmarried child under the age of 18

years in a current year.

Deduction of RM1,000.00 is also given for each unmarried child of 18 years and

above who is receiving full-time education in a current year.

Where a child falls within these conditions, the employee is treated as having the

respective number of children:

In circumstances where

Deduction to

be

given as if the

employee

has this

number of

children

v. Child over the age of 18 years and receiving full-time

instruction at diploma level onwards in an institution of

higher education in Malaysia.

6

vi. Child over the age of 18 years and receiving full-time

instruction at degree level onwards in an institution of

higher education outside Malaysia.

6

vii. Disabled child as certified by the Department of Social

Welfare.

5

viii. Disabled child receiving further instruction at diploma level

onwards in an institution of higher education in Malaysia

or at degree level onwards in an institution of higher

education outside Malaysia.

11

1,000.00

22

Deductions

Amount

limited to

(RM)

d.

Contribution to Employees Provident Fund (EPF) or Other Approved

Scheme and Life Insurance

Total deduction for the payment of contributions to the EPF or any other

Approved Scheme and life insurance premiums is limited to RM6,000.00 per

year.

6,000.00

e.

Disabled Person

A disabled person will be allowed an additional personal deduction of

RM6,000.00.

6,000.00

f.

Disabled Husband/Wife

Additional deduction of RM3,500.00 is given to an individual if a disabled

husband/wife is living together.

3,500.00

b. Optional deductions

Employee can claim deductions and rebates in the relevant month subject to approval by employer by

submitting TP1 Form (Exhibit 3) to the employer.

In the formula, all optional deductions shall be treated as ∑LP for the cummulative deductions and LP1

for the current month deductions. System must show cumulative and current month deduction amount

for the purpose of audit.

[D + S + DU + SU + QC + (∑LP + LP1)]

List of deductions must be provided in the system as follows:

Deductions

Amount

limited to

(RM)

a.

Medical Treatment, Special Needs or Carer Expenses of Parents

Medical treatment, special needs and carer for parents are limited to RM5,000.00

in a basis year. Medical expenses which qualify for deductions includes:

i. medical care and treatment provided by a nursing home; and

ii. dental treatment limited to tooth extraction, filling, scaling and cleaning

but not including cosmetic dental treatment.

The claim must be supported by a certified medical practitioner registered with

the Malaysian Medical Council that the medical conditions of the parents require

medical treatment or special needs or carer.

The parents shall be resident in Malaysia. The medical treatment and care

5,000.00

23

Deductions

Amount

limited to

(RM)

services are provided in Malaysia.

In the case of carer, shall be proved by a written certification, receipt or copy of

carer’s work permit. “Carer” shall not include that individual, husband, wife or the

child of that individual.

b.

Basic Supporting Equipment

The purchase of any supporting equipment for one’s own use, if he/she is a

disabled person or for the use of his/her spouse, child or parent, who is a

disabled person may be claimed but limited to a maximum of RM5,000.00 in a

basis year. Basic supporting equipment includes haemodialysis machine, wheel

chair, artificial leg and hearing aid but exclude optical lenses and spectacles.

5,000.00

c.

Higher Education Fees (Self)

Payment of annual fee limited to RM5,000.00 is allowed as a deduction for any

course of study in an institution or professional body in Malaysia recognized by

the Government of Malaysia or approved by the Minister of Finance for the

purpose of enhancing any skill or qualification:

i. up to tertiary level (other than Masters and Doctorate) in law,

accounting, Islamic finance, technical, vocational, industrial, scientific or

technology; or

ii. any course of study at Masters or Doctorate level.

5,000.00

d.

Medical Expenses on Serious Diseases

Medical expenses on serious diseases include the treatment of acquired immune

deficiency syndrome (AIDS), Parkinson’s disease, cancer, renal failure,

leukaemia and other similar diseases.

‘Other similar diseases’ such as heart attack, pulmonary hypertension, chronic

liver disease, fulminant viral hepatitis, head trauma with neurological deficit, brain

tumour or vascular malformation, major burns, major organ transplant or major

amputation of limbs.

Amount expended on own self, husband/wife or child is deductible up to a

maximum of RM5,000.00.

5,000.00

e.

Complete Medical Examination

Amount expended on own self, husband/wife or child for complete medical

examination is deductible up to a maximum of RM500.00. The total deduction for

medical expenses on serious diseases (no. 4) and complete medical examination

(no. 5) is limited to a maximum of RM5,000.00 a year.

Example :

Claim for deduction in no. 4 is RM4,900.00. Therefore, the balance of deduction

that can be claimed in no. 5 is only RM100.00.

500.00

24

Deductions

Amount

limited to

(RM)

f.

Purchase of Books/Magazines/Journals/Similar Publications

Purchase of books/magazines/journals/other similar publications (in the form of

hard copy or electronic but exclude newspapers or banned reading materials) for

the individual, husband/wife or child. Total deduction is limited to a maximum of

RM1,000.00 per year.

1,000.00

g.

Purchase of Personal Computer

An amount limited to a maximum of RM3,000.00 is deductible in respect of the

purchase of personal computer. No deduction will be granted if the computer is

used for business purpose. This deduction is allowed once in three (3) years.

3,000.00

h.

Net Deposit in Skim Simpanan Pendidikan Nasional (SSPN)

Amount deposited in SSPN by an individual for his children’s education is

deductible up to a maximum of RM6,000.00 per year. The deduction is limited to

the net amount deposited in that basis year only.

This deduction has effect for the years of assessment 2012 until 2017.

Example: In a current year

Deposit in a current year RM2,000.00

Less: Withdrawal in a current year (-) RM1,500.00

Allowable deduction to be claimed RM 500.00

6,000.00

i.

Purchase of Sports Equipment

An amount limited to a maximum of RM300.00 is deductible in respect of

purchase of sports equipment in the basis year by that individual for any sports

activity as defined under the Sports Development Act 1997.

300.00

j.

Payment of Alimony to Former Wife

Payment of alimony to a former wife is deductible provided that the total

deduction for wife (in paragraph 4.4.1 (b)) and alimony payment is limited to

RM3,000.00 per year. Voluntary alimony payment to a former wife under a

mutual agreement but without any formal agreement does not qualify as a

deduction.

Note:

Payment of alimony to former wife is not allowed in the case where the employee

claimed deduction for wife.

3,000.00

k.

Life Insurance

Total deduction for the payment of life insurance premiums and contributions to

the EPF or any other Approved Scheme is limited to RM6,000.00 per year.

6,000.00

25

Deductions

Amount

limited to

(RM)

l.

Contribution to a Private Retirement Scheme and Payment of Deferred

Annuity

Deduction on contribution to Private Retirement Scheme approved by the

Securities Commission under The Capital Markets and Services Act 2007 or

payment of deferred annuity premium or both limited to RM3,000 per year (for 10

years from year assessment 2012 until year assessment 2021).

3,000.00

m.

Education and Medical Insurance

A deduction not exceeding RM3,000.00 per year for insurance premiums in

respect of education or medical benefits for an individual, husband, wife or child.

3,000.00

n.

Interest on Housing Loan

A deduction not exceeding RM10,000 for each basis year is given on housing

loan interest for house purchased from developer or third party subject to the

following conditions:

i. the tax payer is a Malaysian citizen and a resident;

ii. limited to one residential house;

iii. has not derived any income; and

iv. sale and purchase agreement is executed between 10 March 2009 and

31 December 2010.

The tax deduction is given for 3 consecutive years from the first year the housing

loan interest is paid.

10,000.00

14. Rebate on Zakat

There are two type of zakat as follows:

a. Zakat that deducted from the remuneration (payslip)

Amount of zakat should appear in the payslip and EA Form.

b. Zakat claimed through TP1 form

Amount of zakat should not appear in the payslip and EA Form due to employee himself paid

directly to Pusat Zakat.

It is treated as zakat for current month in the month claimed by the employee.

15. TP1, TP2 and TP3 Form can be submitted online by the employee to the employer. All software

provider/employer are recommended to develop online submission of TP1, TP2 and TP3 Form in easing the

compulsory implementation of these submissions by the employee.

Logic of submission is as follow:

a. Unique ID and password to login by each employee.

26

b. Employee’s declaration section

i. Date of employee’s declaration : date of submission via online

ii. Employee signature : employee’s name

c. Approval by employer

i. Date of approval by the employer : date of the employer process the application from

the employees in the payroll system as to generate

the MTD amount.

ii. Name : person in charged for payroll processing

iii. Designation : designation of the person in charged

iv. Employer address : employer address

System must provide list of employee that claimed these TP Form. The list can be print and save. Employee

also can print and save these TP Form.

16. System must be able to generate detail of amount MTD/CP38 deducted from the employee by using PCBII

Form (Exhibit 4).

17. System must able to generate CP39 (Exhibit 5) and CP39A Form (Exhibit 6).

18. System must provide the text file data format (Exhibit 7) for the purpose of MTD submission to the IRBM.

Employer is recommended to submit CP39 and CP39A text file format data via internet banking or e-Data

PCB. Employer can register to use the e-Data PCB at http://eapps.hasil.gov.my/.

Conditions:

For arrears payment related to the prior year (other than current year), employer should submit MTD amount

by using CP39A text file format. Month of deduction shall be declared as 12 and year of deduction shall be

declared as the year of arrears shall be receive.

Example : Arrears for 2008 paid in the current year

: Text file shall be named as xxxxxxxxxx12_2008.txt

EXHIBIT 1

BORANG PCB/TP3 (1/2013)

BAHAGIAN A : MAKLUMAT MAJIKAN

A1 Nama Majikan Terdahulu 1 :

A2 No. Majikan : E

A3 Nama Majikan Terdahulu 2 :

A4 No. Majikan : E

*(Sila gunakan lampiran tambahan bagi majikan ketiga dan seterusnya)

BAHAGIAN B : MAKLUMAT INDIVIDU

B1 Nama :

B2 No. Pengenalan :

B3 No. Pasport :

B4 No. Cukai Pendapatan :

BAHAGIAN C : MAKLUMAT SARAAN, KWSP, ZAKAT DAN PCB (sila nyatakan jumlah keseluruhan daripada majikan-majikan terdahulu)

C1 RM

C2

iRM

ii RM

iii RM

iv RM

vRM

C3 RM

C4 Jumlah Zakat RM

C5 Jumlah PCB (tidak termasuk CP38) RM

Perkuisit dalam bentuk tunai/barangan berkaitan dengan pencapaian perkhidmatan lalu,

anugerah khidmat cemerlang, anugerah inovasi atau anugerah produktiviti atau

perkhidmatan lama dengan syarat pekerja tersebut telah berkhidmat lebih daripada 10 tahun.

Produk yang dikeluarkan oleh perniagaan majikan yang diberi secara percuma atau diberi

pada harga diskaun

Elaun perjalanan, kad petrol atau elaun petrol dan fi tol atas urusan rasmi

Jumlah caruman KWSP atau Kumpulan Wang Lain Yang Diluluskan ke atas semua saraan

(saraan bulanan dan saraan tambahan)

Lain - lain elaun/perkuisit/pemberian/manfaat yang dikecualikan cukai. Sila rujuk nota

penerangan Borang BE.

Elaun penjagaan anak

AMAUN TERKUMPUL

(KAEDAH-KAEDAH CUKAI PENDAPATAN (POTONGAN DARIPADA SARAAN) 1994)

BORANG DITETAPKAN DI BAWAH SEKSYEN 152, AKTA CUKAI PENDAPATAN 1967

Jumlah elaun/perkuisit/pemberian/manfaat yang dikecualikan cukai

LEMBAGA HASIL DALAM NEGERI MALAYSIA

Jumlah saraan kasar bulanan dan saraan tambahan termasuk

elaun/perkuisit/ pemberian/manfaat yang dikenakan cukai

BORANG MAKLUMAT BERKAITAN PENGGAJIAN DENGAN MAJIKAN-MAJIKAN TERDAHULU

DALAM TAHUN SEMASA BAGI TUJUAN POTONGAN CUKAI BULANAN (PCB)

BAHAGIAN D : MAKLUMAT POTONGAN (sila nyatakan jumlah keseluruhan daripada majikan-majikan terdahulu)

D1 TERHAD RM5,000 RM

D2 TERHAD RM5,000 RM

D3 TERHAD RM5,000 RM

D4 RM

D5 RM

D6 TERHAD RM1,000 RM

D7 TERHAD RM3,000 RM

D8 TERHAD RM6,000 RM

D9 TERHAD RM300 RM

D10 TERHAD RM3,000 RM

D11 RM

D12 TERHAD RM3,000 RM

D13 TERHAD RM1,000 RM

D14 Faedah pinjaman perumahan (mesti memenuhi syarat-syarat kelayakan) TERHAD RM10,000 RM

BAHAGIAN E : AKUAN PEKERJA

Tarikh - - ----------------------------------------------------------------------------

Bulan

1.

2.

3.

Yuran pendidikan (sendiri):

(i) peringkat selain Sarjana dan Doktor Falsafah – bidang undang-undang,

perakaunan, kewangan Islam, teknikal, vokasional, industri, saintifik atau

teknologi maklumat; atau

(ii) peringkat Sarjana dan Doktor Falsafah – sebarang bidang atau kursus

pengajian

Pembelian buku/majalah/jurnal/penerbitan ilmiah (selain suratkhabar atau

bahan bacaan terlarang) untuk diri sendiri, suami/isteri atau anak

POTONGAN

TERKUMPUL

HAD TAHUNAN

Pemeriksaan perubatan penuh atas diri

sendiri, suami/isteri atau anak

Borang ini hendaklah diisi oleh pekerja dan satu salinan diserahkan kepada majikan tanpa resit atau dokumen sokongan untuk tujuan

pelarasan pengiraan PCB.

Tabungan bersih dalam Skim Simpanan Pendidikan Nasional (jumlah simpanan

dalam tahun semasa tolak jumlah pengeluaran dalam tahun

Hari

Tahun

TERHAD RM6,000

(termasuk KWSP)

Insurans pendidikan dan perubatan

Saya mengakui bahawa semua maklumat yang dinyatakan dalam borang ini adalah benar, betul dan lengkap. Sekiranya maklumat yang

diberikan tidak benar, tindakan mahkamah boleh diambil ke atas saya di bawah perenggan 113(1)(b) Akta Cukai Pendapatan 1967.

Majikan hanya perlu menyimpan borang ini untuk tempoh 7 tahun. Borang ini perlu dikemukakan sekiranya diminta oleh LHDNM.

NOTA

Tandatangan

Insurans nyawa

Peralatan sokongan asas untuk kegunaan sendiri, suami/isteri, anak atau ibu

bapa yang kurang upaya

Skim Persaraan Swasta dan Anuiti tertunda ('Deferred annuity')

Bayaran alimoni kepada bekas isteri

Perbelanjaan rawatan perubatan, keperluan khas dan penjaga untuk ibu bapa

(keadaan kesihatan disahkan oleh pengamal perubatan)

Majikan hendaklah meminta pekerja mengemukakan borang ini sekiranya pekerja pernah bekerja dengan majikan-majikan lain dalam

tahun semasa.

TERHAD

RM500

Pembelian komputer peribadi untuk individu (potongan dibenarkan sekali dalam

setiap tiga tahun)

Pembelian peralatan sukan untuk aktiviti sukan mengikut Akta Pembangunan

Sukan 1997

Perbelanjaan perubatan bagi penyakit yang sukar

diubati atas diri sendiri, suami/isteri atau anak

semasa)

TERHAD RM5,000

RM

RM

EXHIBIT 2

BORANG PCB/TP2 (1/2013)

BAHAGIAN A : MAKLUMAT MAJIKAN

A1 Nama Majikan :

A2 No. Majikan : E

BAHAGIAN B : MAKLUMAT INDIVIDU

B1 Nama :

B2 No. Pengenalan :

B3 No. Pasport :

B4 No. Cukai Pendapatan :

B5 No. Pekerja/No. Gaji :

BAHAGIAN C : MAKLUMAT MANFAAT BERUPA BARANGAN (MBB)

C1 Kereta RM

C2 Pemandu RM

`

C3 Kelengkapan Rumah, Perkakas dan Perlengkapan RM

C4 Hiburan dan Rekreasi RM

C5 Tukang Kebun RM

C6 Pembantu Rumah RM

C7 Manfaat Percutian RM

C8 Keahlian dalam Kelab Rekreasi RM

C9* Jumlah lain-lain manfaat yang diterima RM

*(Sila nyatakan jenis lain-lain manfaat yang diterima dalam lampiran yang berasingan)

BAHAGIAN D : MAKLUMAT NILAI TEMPAT KEDIAMAN (NTK) YANG DISEDIAKAN OLEH MAJIKAN

D1 Nilai tempat kediaman yang disediakan oleh majikan RM

Amaun Bulanan

LEMBAGA HASIL DALAM NEGERI MALAYSIA

BORANG TUNTUTAN MANFAAT BERUPA BARANGAN DAN

NILAI TEMPAT KEDIAMAN YANG DISEDIAKAN OLEH MAJIKAN

BAGI TUJUAN POTONGAN CUKAI BULANAN (PCB)

(KAEDAH-KAEDAH CUKAI PENDAPATAN (POTONGAN DARIPADA SARAAN) 1994)

BORANG DITETAPKAN DI BAWAH SEKSYEN 152, AKTA CUKAI PENDAPATAN 1967

BAHAGIAN E : AKUAN PEKERJA

Saya bersetuju MBB dan NTK dimasukkan sebagai sebahagian daripada saraan saya mulai

bulan potongan tahun potongan

Tarikh - -

BAHAGIAN F : PERSETUJUAN MAJIKAN

Permohonan pekerja di atas dipersetujui mulai bulan potongan tahun potongan

Tarikh - - Nama :

Jawatan :

Alamat majikan :

1.

2.

3.

4.

5.

6. Kaedah pengiraan MBB dan NTK untuk mendapatkan amaun bulanan adalah seperti berikut:

Baki bulan dalam setahun termasuk bulan semasa

Contoh :

Manfaat Kereta setahun = RM25,000

= April 2008

= 9 bulan

RM25,000

= RM2,777.77

* Nilai MBB/NTK setahun adalah nilai sebenar yang diterima oleh pekerja

Nilai MBB/NTK setahun*

Tandatangan

Bulan

Saya mengaku bahawa semua maklumat yang dinyatakan dalam borang ini adalah benar, betul dan lengkap.

Sekiranya maklumat yang diberikan tidak benar, tindakan mahkamah boleh diambil ke atas saya di bawah perenggan

113(1)(b) Akta Cukai Pendapatan 1967.

Pindaan hanya boleh dilakukan sekiranya terdapat perubahan nilai MBB dan NTK yang diberikan oleh majikan

dalam tahun semasa.

Tahun

Hari

Amaun Bulanan

Bulan/Tahun potongan yang

dipersetujui majikan

9

NOTA PENERANGAN

Borang ini hendaklah diisi oleh pekerja setiap tahun dan satu salinan diserahkan kepada majikan untuk tujuan

pelarasan pengiraan PCB.

Amaun Bulanan

=

=

Pemohonan memasukkan nilai MBB dan NTK sebagai sebahagian daripada saraan bulanan dalam menentukan

amaun PCB tertakluk kepada persetujuan majikan. Pekerja tidak boleh membatalkan pilihan bagi memasukkan

MBB dan NTK sebagai sebahagian daripada saraan yang tertakluk kepada PCB pada tahun semasa dengan

majikan yang sama.

Hari

Bulan

Tahun

Baki bulan dalam setahun

termasuk bulan semasa

MBB adalah manfaat-manfaat berupa barangan yang tidak boleh ditukarkan kepada wang. Manfaat ini

dikategorikan sebagai pendapatan kasar daripada penggajian di bawah perenggan 13(1)(b) Akta Cukai

Pendapatan 1967. Sila rujuk Ketetapan Umum No. 2/2004 dan Tambahan - Manfaat Berupa Barangan untuk

keterangan lanjut.

NTK merupakan tempat kediaman yang disediakan oleh majikan kepada pekerjanya. Manfaat ini dikategorikan

sebagai pendapatan kasar daripada penggajian di bawah perenggan 13(1)(c) Akta Cukai Pendapatan 1967. Sila

rujuk Ketetapan Umum No. 3/2005 dan Tambahan - Manfaat Tempat Kediaman Yang Disediakan Oleh Majikan

Kepada Pekerjanya untuk keterangan lanjut.

Bulan Potongan

Tahun Potongan :

A1 :

A2 :E

B1 :

B2 :

B3 :

B4 :

B5 :

C1 RM RM

C2 RM RM

RM RM

C4 RM

C5 RM RM

C6 RM RM

C7 RM RM

EXHIBIT 3

BORANG PCB/TP1 (1/2013)

BAHAGIAN A : MAKLUMAT MAJIKAN

BAHAGIAN B : MAKLUMAT INDIVIDU

BAHAGIAN C : MAKLUMAT POTONGAN

Nama

No. Pengenalan

BAGI TUJUAN POTONGAN CUKAI BULANAN (PCB)

LEMBAGA HASIL DALAM NEGERI MALAYSIA

TERHAD

RM5,000

No. Cukai Pendapatan

No. Pekerja/No. Gaji

Nama Majikan

No. Majikan

BORANG TUNTUTAN POTONGAN DAN REBAT INDIVIDU

TERKUMPUL

BULAN SEMASA

(KAEDAH-KAEDAH CUKAI PENDAPATAN (POTONGAN DARIPADA SARAAN) 1994)

BORANG DITETAPKAN DI BAWAH SEKSYEN 152, AKTA CUKAI PENDAPATAN 1967

POTONGAN

Peralatan sokongan asas untuk kegunaan sendiri,

suami/isteri, anak atau ibu bapa yang kurang upaya

oleh pengamal perubatan)

No. Pasport

TERHAD

RM3,000

(ii) peringkat Sarjana dan Doktor Falsafah – sebarang

bidang atau kursus pengajian

C3

(i) peringkat selain Sarjana dan Doktor Falsafah – bidang

undang-undang, perakaunan, kewangan Islam, teknikal,

vokasional, industri, saintifik atau teknologi maklumat;

atau

Yuran pendidikan (sendiri):

Perbelanjaan perubatan bagi penyakit

yang sukar diubati atas diri sendiri,

Pemeriksaan perubatan penuh atas diri

sendiri, suami/isteri atau anak

Pembelian buku/majalah/jurnal/penerbitan ilmiah (selain

suratkhabar atau bahan bacaan terlarang) untuk diri

sendiri, suami/isteri atau anak

HAD

TAHUNAN

TERHAD

RM5,000

TERHAD

RM5,000

TERHAD

RM1,000

Pembelian komputer peribadi untuk individu (potongan

dibenarkan sekali dalam setiap tiga tahun)

TERHAD

RM500

TERHAD

RM5,000

Perbelanjaan rawatan perubatan, keperluan khas dan

penjaga untuk ibu bapa (keadaan kesihatan disahkan

suami /isteri atau anak

C8 RM

C9 RM RM

C10 RM RM

C11 RM RM

C12 Insurans pendidikan dan perubatan RM RM

C13 RM RM

C14 RM RM

D1 Zakat selain yang dibayar melalui potongan daripada gaji bulanan RM

Tarikh - - -------------------------------------------------------------------

Bulan

Permohonan tuntutan pekerja di atas adalah dipersetujui bagi bulan potongan tahun potongan

Tarikh - - Nama :

Bulan Jawatan :

Alamat majikan :

1.

2.

3.

4.

5.

6.

BAHAGIAN E : AKUAN PEKERJA

BAHAGIAN F : PERSETUJUAN MAJIKAN

BAHAGIAN D : REBAT

Tahun

jumlah pengeluaran dalam tahun semasa)

Saya mengakui bahawa semua maklumat yang dinyatakan dalam borang ini adalah benar, betul dan lengkap.

Sekiranya maklumat yang diberikan tidak benar, tindakan mahkamah boleh diambil ke atas saya di bawah

perenggan 113(1)(b) Akta Cukai Pendapatan 1967.

Borang ini hendaklah diisi oleh pekerja dan satu salinan diserahkan kepada majikan tanpa resit atau dokumen

sokongan untuk tujuan pelarasan pengiraan PCB.

Permohonan ini adalah tertakluk kepada persetujuan majikan.

TERHAD

RM6,000

TERHAD

RM10,000

Semua resit atau dokumen yang berkaitan dengan tuntutan potongan dan rebat hendaklah disimpan oleh

pekerja bersama dengan salinan borang ini untuk tempoh 7 tahun daripada tahun tuntutan dibuat.

NOTA

Tandatangan

Hari

TERHAD

RM3,000

Skim Persaraan Swasta dan Anuiti tertunda ('Deferred

annuity')

Faedah pinjaman perumahan (mesti memenuhi syarat-

syarat kelayakan)

Pekerja dibenarkan untuk membuat tuntutan potongan yang telah dibelanjakan sehingga had yang dibenarkan

dalam tahun yang sama.

Majikan hanya perlu menyimpan borang tuntutan ini untuk tempoh 7 tahun daripada tahun tuntutan dibuat.

Borang tuntutan ini perlu dikemukakan sekiranya diminta oleh LHDNM.

Majikan tidak perlu menyemak amaun tuntutan potongan dengan resit atau dokumen sokongan.

Tahun

Hari

Tabungan bersih dalam Skim Simpanan Pendidikan

Nasional (jumlah simpanan dalam tahun semasa tolak

Insurans nyawa

TERHAD

RM300

TERHAD

RM3,000

(termasuk KWSP)

TERHAD

RM3,000

TERHAD

RM6,000

Pembelian peralatan sukan untuk aktiviti sukan mengikut

Akta Pembangunan Sukan 1997

Bayaran alimoni kepada bekas isteri

R

R

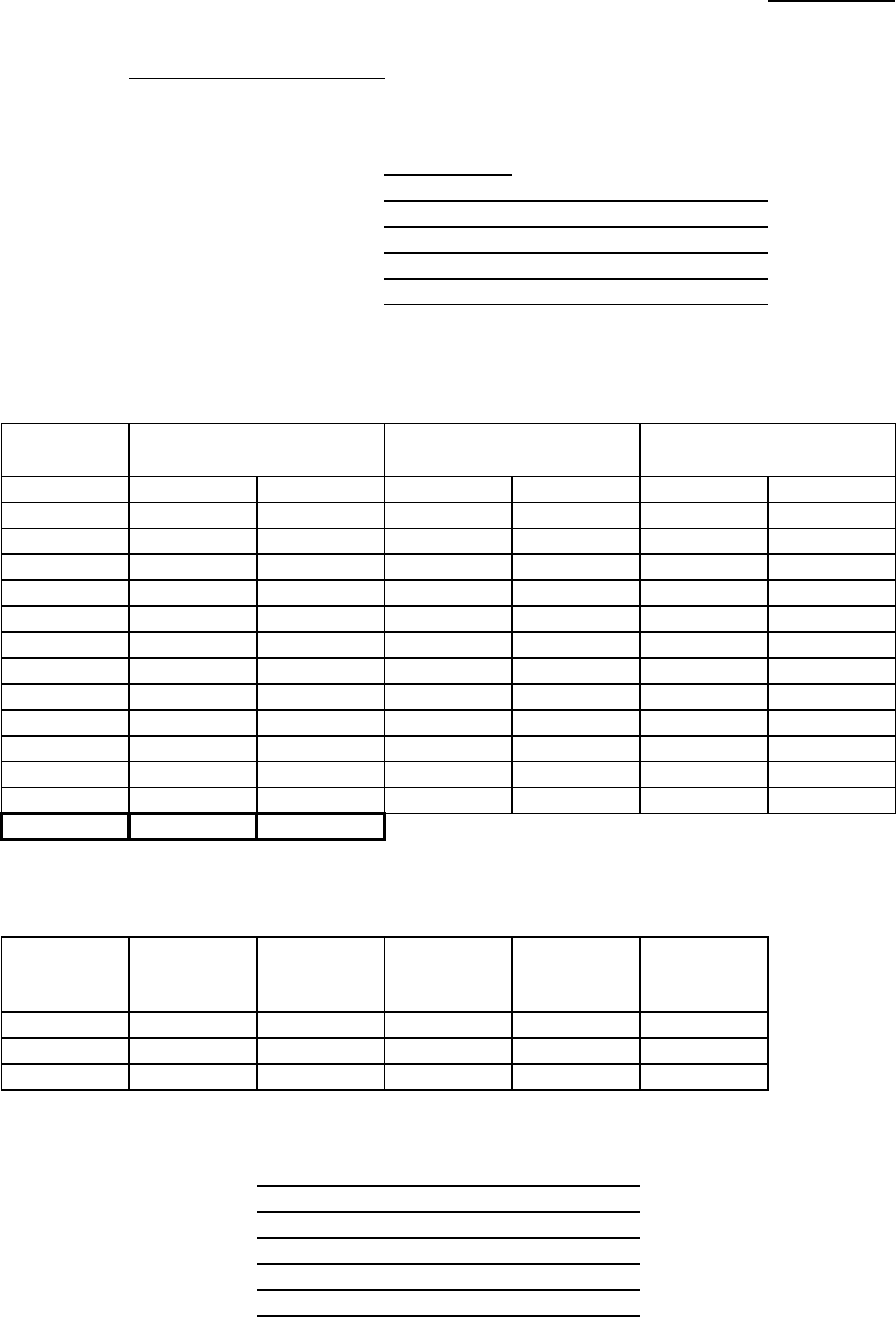

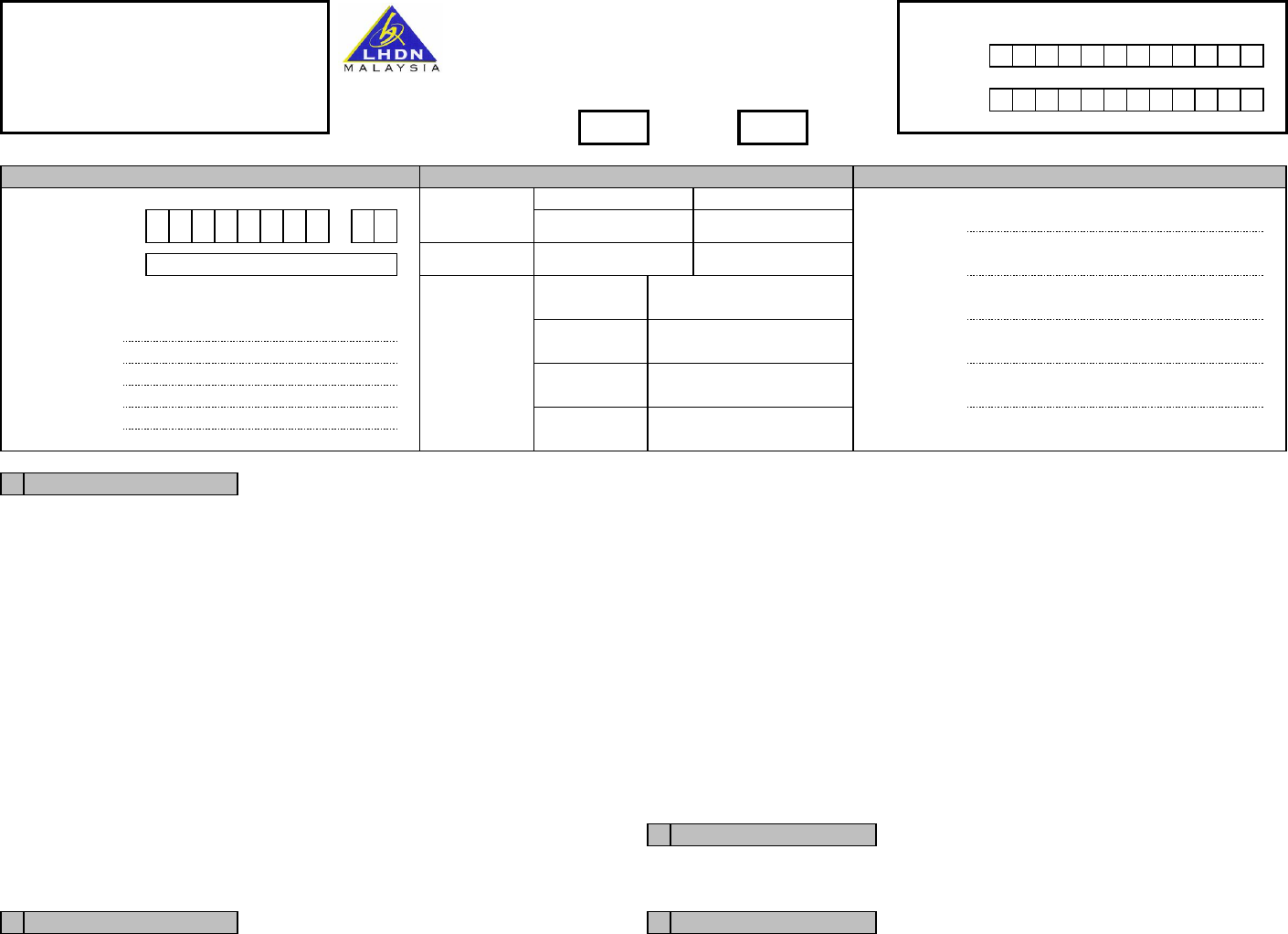

Exhibit 4

PENYATA BAYARAN CUKAI OLEH MAJIKAN PCB 2(II)-Pin. 2010

Kepada: Tarikh:

Ketua Pegawai Eksekutif/Ketua Pengarah Hasil Dalam Negeri

Lembaga Hasil Dalam Negeri Malaysia

Cawangan

Tuan,

Potongan Cukai Yang Dibuat Dalam Tahun

Nama Pekerja

No. Kad Pengenalan/No. Passpot

No. Cukai Pendapatan Pekerja

No. Pekerja

No. Majikan (E)

Dengan hormatnya saya merujuk kepada perkara di atas.

2. Potongan-potongan yang telah dibuat bagi pekerja di atas dalam tahun semasa adalah seperti berikut:

Bulan

PCB CP38 PCB CP38 PCB CP38

Januari

Februari

Mac

April

Mei

Jun

Julai

Ogos

September

Oktober

November

Disember

Jumlah

Jenis

Pendapatan

Bulan Tahun

Amaun PCB

(RM)

No. Resit/

No. Slip Bank/

No. Transaksi

Tarikh Resit/

Tarikh

Transaksi

Sekian. Terima kasih.

Nama pegawai

Jawatan

No. Telefon

Nama Dan Alamat Majikan

Amaun (RM)

No. Resit/No. Slip Bank/No.

Transaksi

Tarikh Resit/Tarikh Transaksi

3. Potongan-potongan yang telah dibuat bagi pendapatan pekerja untuk tahun terdahulu dalam tahun semasa

adalah seperti berikut:

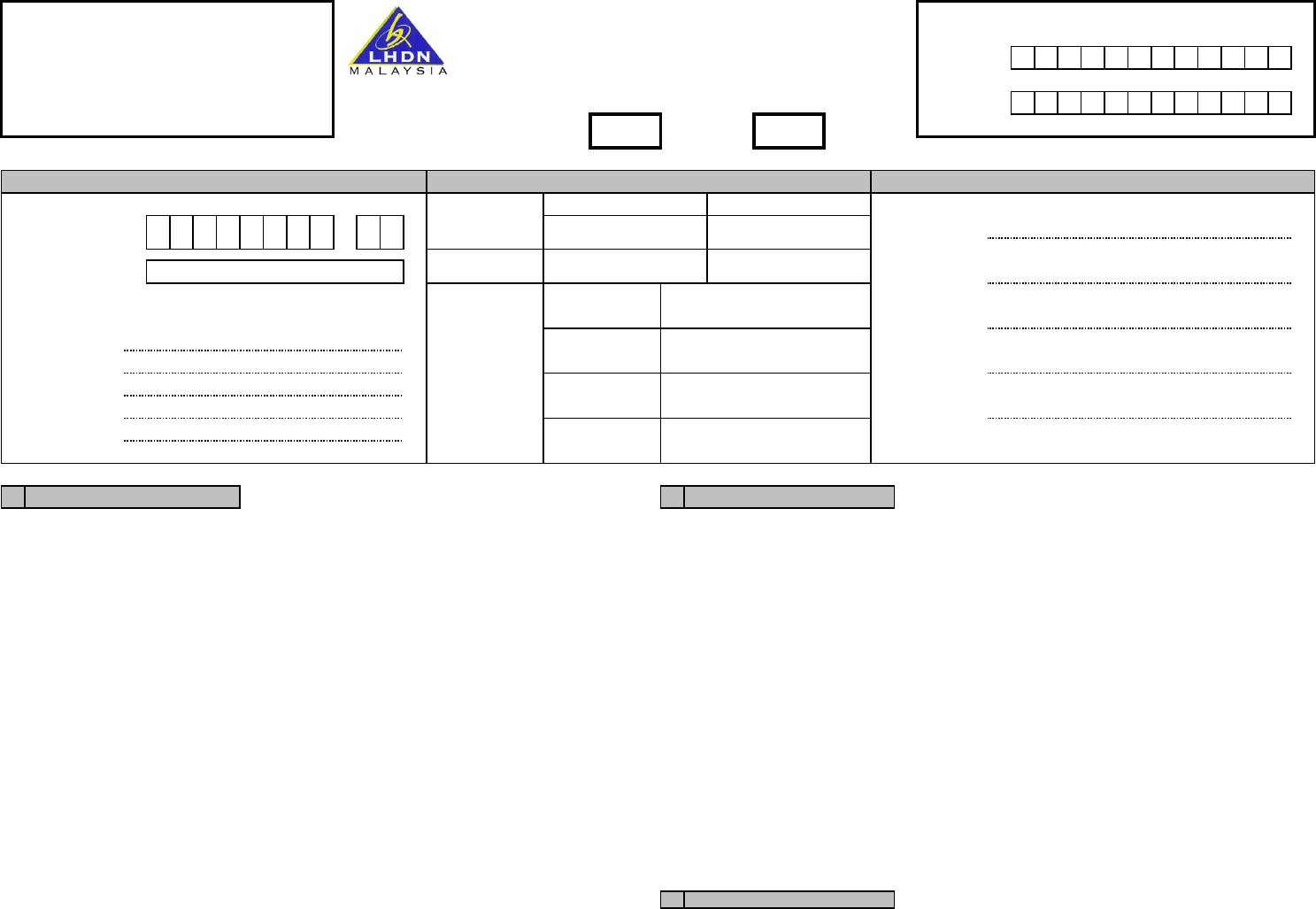

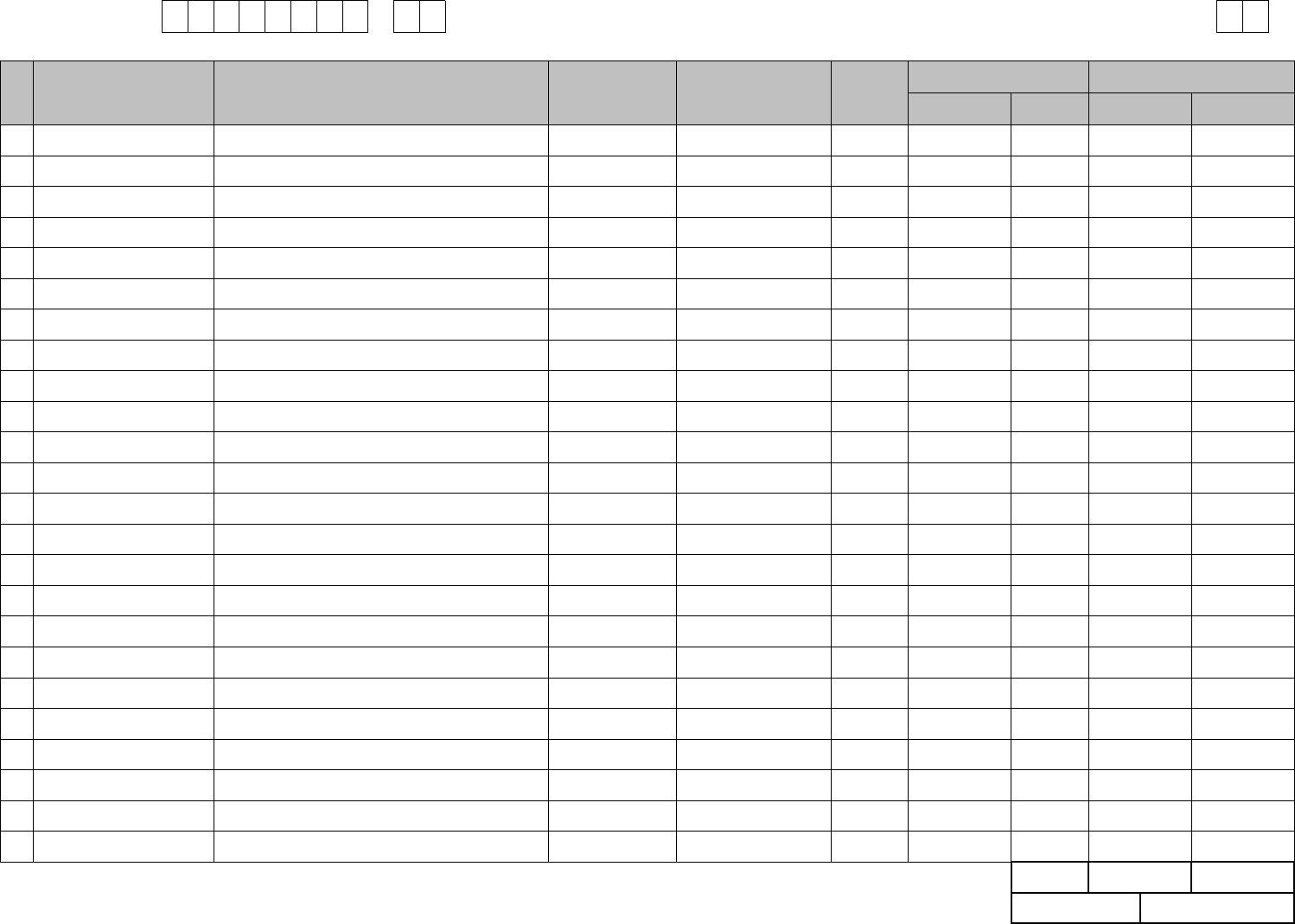

Exhibit 5

Borang ini boleh difotokopi CP39 Pin. 2012

KETUA PENGARAH HASIL DALAM NEGERI

LEMBAGA HASIL DALAM NEGERI

Cawangan Pungutan Kuala Lumpur No. Kelompok

Kaunter Bayaran Dan Tingkat 1, Blok 8A

Kompleks Bangunan Kerajaan, Jalan Duta No. Resit

50600 KUALA LUMPUR

-Tandatangan

Nama Penuh

Nama Syarikat/ No. Pengenalan

Perniagaan

Alamat Syarikat/ Jawatan

Perniagaan

No. Telefon

A B

1. Borang ini mesti diisi dengan lengkap dan betul. 1. Bayaran dan Borang CP39 yang telah lengkap diisi mestilah sampai ke Cawangan Pungutan LHDN selewat-

2. Majikan digalakkan menghantar maklumat potongan melalui e-PCB/e-Data PCB/disket/cakera

lewatnya pada hari kesepuluh bulan berikutnya.

padat/pemacu flash mengikut format yang ditentukan oleh LHDN bagi menggantikan Borang CP39.

Contoh: PCB/CP38 bagi bulan April 2012, tarikh akhirnya ialah pada 10 Mei 2012.

3. No. Cukai Pendapatan: 2. Sediakan borang CP39 beserta cek/bank draf/kiriman wang/wang pos (instrumen bayaran) yang berasingan

3.1 Isikan nombor cukai pendapatan dalam ruangan yang telah disediakan. untuk bulan atau tahun berlainan.

Contoh: SG 2506203-00(0) boleh diisi sebagai SG 02506203000 3. Pastikan jumlah potongan PCB/CP38 adalah betul dan sama dengan nilai instrumen bayaran.

3.2 Bagi pekerja yang layak dikenakan PCB tetapi tiada nombor cukai pendapatan, 4. Instrumen bayaran hendaklah dibayar kepada Ketua Pengarah Hasil Dalam Negeri. Catatkan no. majikan E,

pendaftaran boleh dibuat melalui : Nama Syarikat/Perniagaan dan alamat majikan di belakang instrumen bayaran.

i. majikan atau pekerja boleh mendaftar secara atas talian melalui e-Daftar di www.hasil.gov.my, atau 5. Bayaran untuk Cukai Syarikat, Skim Ansurans (CP500), Penyelesaian Cukai (Pemberhentian Kerja) dan Cukai

ii.

Borang CP22 atau borang in lieu of CP39 dikemukakan ke cawangan LHDNM yang berdekatan. Keuntungan Harta Tanah tidak boleh dibayar bersama dengan bayaran yang menggunakan borang ini.

4. Nama pekerja : 6.

Untuk bayaran bagi Negeri Sabah, sila alamatkan ke :

7. Untuk bayaran bagi Negeri Sarawak, sila alamatkan ke :

Isikan nama penuh pekerja seperti di kad pengenalan/pasport (Jangan senaraikan pekerja yang Cawangan Pungutan Kota Kinabalu Cawangan Pungutan Kuching,

tidak layak dikenakan potongan bagi bulan berkenaan). Wisma Hasil Aras 1, Wisma Hasil,

5.

Nombor Pengenalan : Isikan kedua-dua nombor kad pengenalan baru dan lama (sekiranya ada).

Jalan Tunku Abdul Rahman No. 1, Jalan Padungan,

Contoh: 720403065235 atau A2172122 88600 Kota Kinabalu, Sabah 93100 Kuching, Sarawak

6 Jumlah Potongan Cukai: PCB - Isikan amaun cukai mengikut Potongan Cukai Bulanan. 8.

Sila hubungi talian 1-800-88-LHDN (5436) untuk sebarang pertanyaan lanjut.

CP38 - Isikan amaun potongan cukai mengikut arahan Borang

CP38 (jika ada). C

1. Jika jumlah instrumen bayaran tidak sama dengan jumlah potongan, bayaran akan ditolak.

2. Sekiranya maklumat tidak lengkap dan tidak betul, majikan akan dikenakan kompaun.

Amaun

PERINGATAN

TAHUN

Bilangan Pekerja

Tarikh

Butir-butir / Cek /

Bank / Deraf /

Kiriman Wang /

Wang Pos

Cawangan

PENYATA POTONGAN CUKAI OLEH MAJIKAN

POTONGAN BAGI BULAN

BUTIR-BUTIR MAJIKAN

CUKAI PENDAPATAN MALAYSIA

BORANG CP 39

PEMBAYARAN

UNTUK KEGUNAAN PEJABAT

PCB

BUTIR-BUTIR PEMBAYARAN

PEGAWAI YANG MENYEDIAKAN MAKLUMAT

Nombor

[SEKSYEN 107 AKTA CUKAI PENDAPATAN, 1967

CP38

Jumlah Potongan

KAEDAH CUKAI PENDAPATAN (POTONGAN DARIPADA SARAAN), 1994]

No. Pendaftaran

Perniagaan

No. Majikan E

No. Majikan E -

Borang CP39 boleh diperolehi di laman web : http://www.hasil.gov.my

JUMLAH BESAR

JUMLAH POTONGAN CUKAI

NO. CUKAI PENDAPATAN

NAMA PENUH PEKERJA

BAGI PEKERJA ASING

(SEPERTI DI KAD PENGENALAN ATAU PASPORT)

JUMLAH

Muka Surat

NO. PASPORT

KOD

NEGARA

BIL.

PCB (RM)

CP38 (RM)

NO.

PEKERJA

NO. K/P BARU

NO. K/P LAMA

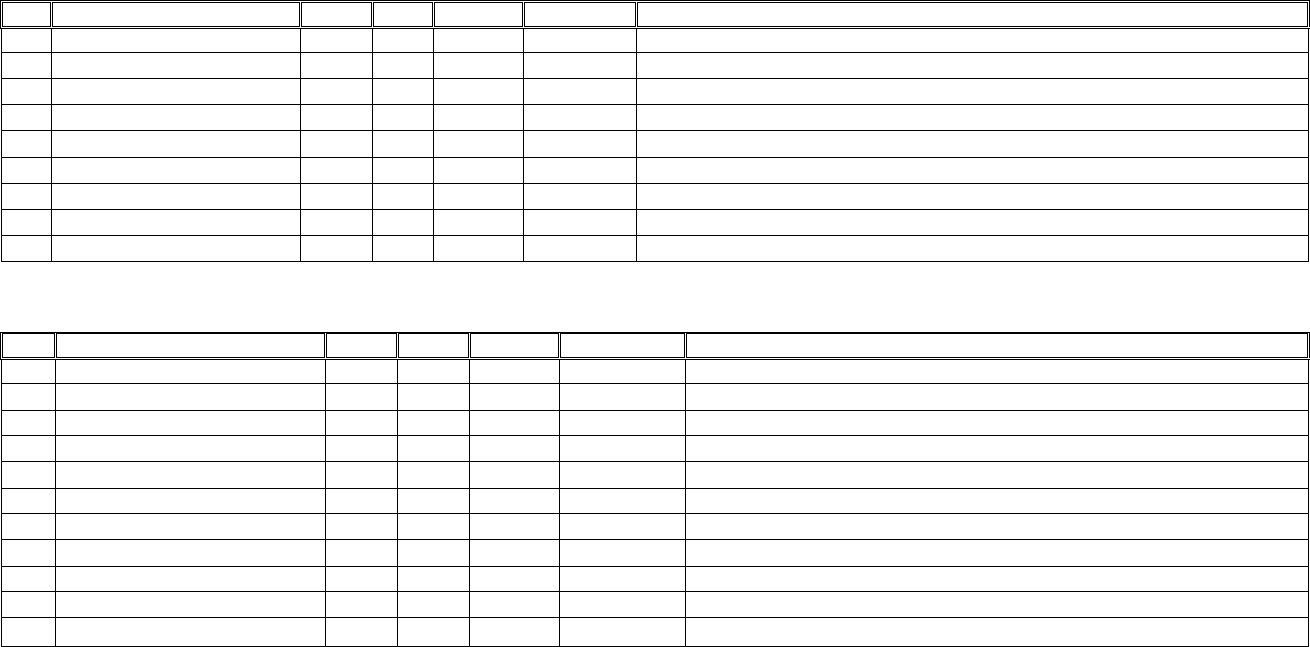

EXHIBIT 6

Borang ini boleh difotokopi CP39A Pin. 2012

KETUA PENGARAH HASIL DALAM NEGERI

LEMBAGA HASIL DALAM NEGERI

Cawangan Pungutan Kuala Lumpur No. Kelompok

Kaunter Bayaran Dan Tingkat 1, Blok 8A

Kompleks Bangunan Kerajaan, Jalan Duta No. Resit

50600 KUALA LUMPUR

-Tandatangan

Nama Penuh

Nama Syarikat/ No. Pengenalan

Perniagaan

Alamat Syarikat/ Jawatan

Perniagaan

No. Telefon

A Contoh:

PCB bagi tunggakan gaji 2011 yang dibayar dalam bulan April 2012, tarikh

1. Borang ini mesti diisi dengan lengkap dan betul. akhirnya ialah pada 10 Mei 2012.

2. Majikan digalakkan menghantar maklumat potongan melalui e-PCB/e-Data PCB/disket/cakera 2.

Sediakan borang CP39A beserta cek/bank draf/kiriman wang/wang pos (instrumen bayaran) yang berasingan

padat/pemacu flash mengikut format yang ditentukan oleh LHDN bagi menggantikan Borang CP39. untuk bulan atau tahun berlainan.

3. No. Cukai Pendapatan: 3. Pastikan jumlah potongan PCB /CP38 adalah betul dan sama dengan nilai instrumen bayaran.

3.1 Isikan nombor cukai pendapatan dalam ruangan yang telah disediakan. 4. Instrumen bayaran hendaklah dibayar kepada Ketua Pengarah Hasil Dalam Negeri. Catatkan no rujukan majikan E,

Contoh: SG 2506203-00(0) boleh diisi sebagai SG 02506203000 Nama Syarikat/Perniagaan dan alamat majikan di belakang instrumen bayaran.

3.2

Bagi pekerja yang layak dikenakan PCB tetapi tiada nombor cukai pendapatan,

5. Bayaran untuk Cukai Syarikat, Skim Ansurans (CP500), Penyelesaian Cukai (Pemberhentian Kerja) dan Cukai

pendaftaran boleh dibuat melalui : Keuntungan Harta Tanah tidak boleh dibayar bersama dengan bayaran yang menggunakan borang ini.

i. majikan atau pekerja boleh mendaftar secara atas talian melalui e-Daftar di www.hasil.gov.my, atau 6. Untuk bayaran bagi Negeri Sabah, sila alamatkan ke : 7. Untuk bayaran bagi Negeri Sarawak, sila alamatkan ke :

ii.

Borang CP22 atau borang in lieu of CP39 dikemukakan ke cawangan LHDNM yang berdekatan. Cawangan Pungutan Kota Kinabalu, Cawangan Pungutan Kuching,

4. Nama pekerja : Wisma Hasil, Aras 1, Wisma Hasil,

Isikan nama penuh pekerja seperti di kad pengenalan/pasport (Jangan senaraikan pekerja yang Jalan Tunku Abdul Rahman, No. 1, Jalan Padungan,

tidak layak dikenakan potongan bagi bulan berkenaan). 88600 Kota Kinabalu, Sabah 93100 Kuching, Sarawak

5. Nombor Pengenalan : Isikan kedua-dua nombor kad pengenalan baru dan lama (sekiranya ada). 8.

Sila hubungi talian 1-800-88-LHDN (5436) untuk sebarang pertanyaan lanjut.

Contoh: 720403065235 atau A2172122

6 Jumlah Potongan Cukai: PCB - Isikan amaun cukai mengikut Potongan Cukai Bulanan. C

CP38 - Isikan amaun potongan cukai mengikut arahan Borang *Tunggakan adalah termasuk ganjaran, pampasan, komisen atau apa-apa bayaran yang dibayar kepada pekerja

CP38 (jika ada).

bagi tahun terdahulu dalam tahun semasa.

B D

1. Bayaran dan Borang CP39A yang telah lengkap diisi mestilah sampai ke Cawangan Pungutan LHDN 1. Jika jumlah instrumen bayaran tidak sama dengan jumlah potongan, bayaran akan ditolak.

selewat-lewatnya pada hari kesepuluh bulan berikutnya. 2. Sekiranya maklumat tidak lengkap dan tidak betul, majikan akan dikenakan kompaun.

PEMBAYARAN

NOTA

Butir-butir / Cek /

Bank / Deraf /

Kiriman Wang /

Wang Pos

Amaun

Nombor

Cawangan

Tarikh

BORANG CP 39A

PERINGATAN

Bilangan Pekerja

No. Majikan E

No. Pendaftaran

Perniagaan

TAHUN

PEGAWAI YANG MENYEDIAKAN MAKLUMAT

PCB

CP38

BUTIR-BUTIR MAJIKAN

BUTIR-BUTIR PEMBAYARAN

Jumlah Potongan

CUKAI PENDAPATAN MALAYSIA

UNTUK KEGUNAAN PEJABAT

PENYATA POTONGAN CUKAI OLEH MAJIKAN

[SEKSYEN 107 AKTA CUKAI PENDAPATAN, 1967

KAEDAH CUKAI PENDAPATAN (POTONGAN DARIPADA SARAAN), 1994]

TUNGGAKAN BAGI BULAN

No. Majikan E -

Borang CP39A boleh diperolehi di laman web : http://www.hasil.gov.my

NO. PASPORT

KOD

NEGARA

PCB (RM)

CP38 (RM)

JUMLAH

JUMLAH BESAR

Muka Surat

BIL.

NO. CUKAI PENDAPATAN

NAMA PENUH PEKERJA

NO. K/P LAMA

NO. K/P BARU

NO.

PEKERJA

BAGI PEKERJA ASING

JUMLAH POTONGAN CUKAI

(SEPERTI DI KAD PENGENALAN ATAU PASPORT)

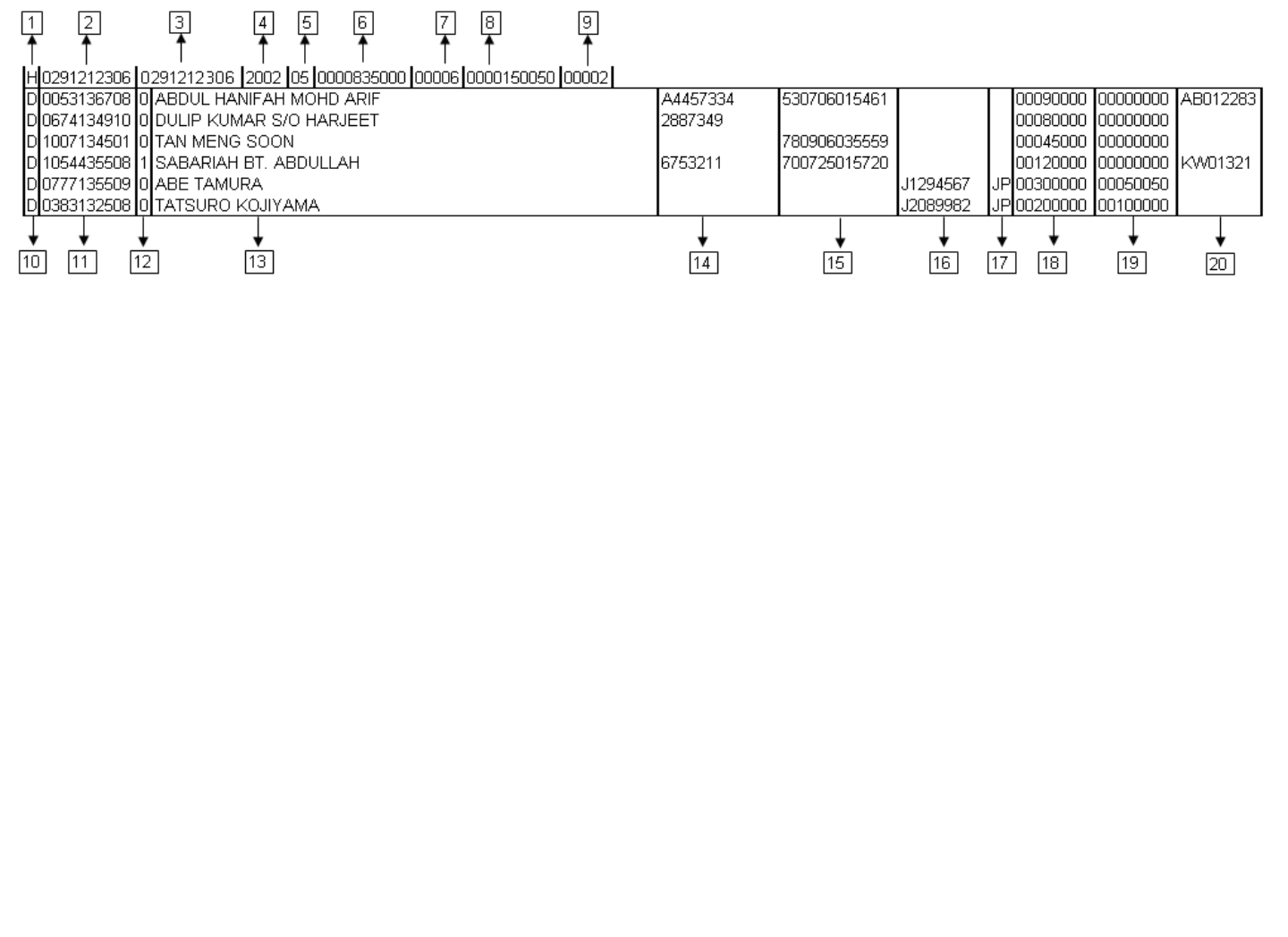

EXHIBIT 7