TM 00111 AFC Saa S Standard User Manual Telecom

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 61

- 1. Introduction

- 2. Naming Files

- 3. AFC FTP Site

- 4. Web Interface

- 5. Transaction Mapping Guidelines

- 6. Frequently Asked Questions

- 7. Support

- 8. Appendix A – Extended Format: Excel and CSV

- 8.1 Input File

- 8.2 Exemption File

- 8.2.1 Exemption File Updates

- 8.2.2 Overview of Exemptions

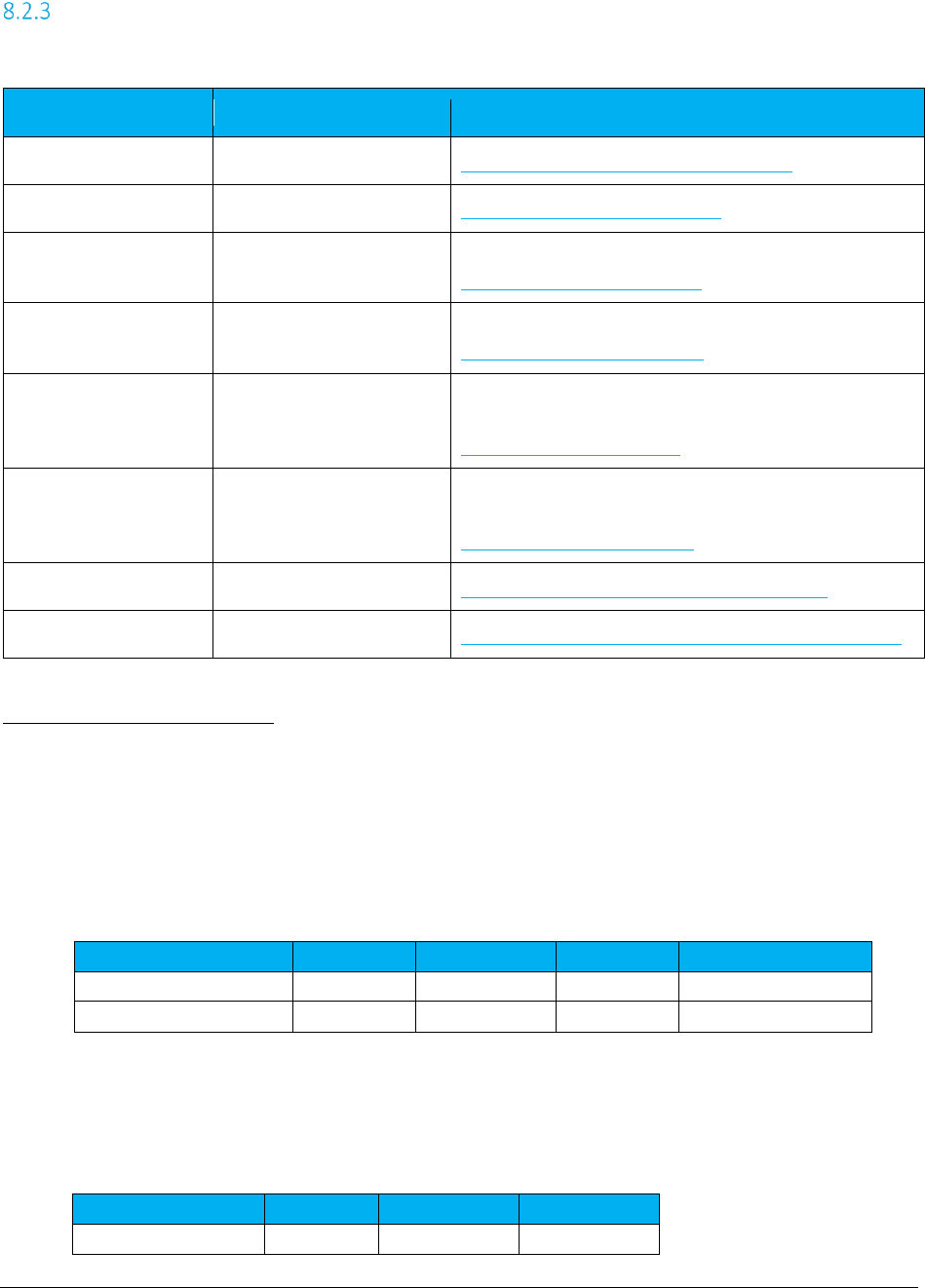

- 8.2.3 Exemption Fields

- 8.2.3.1 Application of Jurisdiction for Exemptions

- 8.2.3.2 Exemption Default Values

- 8.2.3.3 Exemption Use Case Scenarios

- Scenario 001 - apply exemption to all cities within a state - billable only

- Scenario 002 - apply exemption to all states, counties and cities within a country - include non-billable

- Scenario 003 - apply multiple exemptions to all locations within a state

- Scenario 004 - exempt Federal tax only if taxing jurisdiction is within a state

- Scenario 005 - exempt all taxes at Federal level except non-level exemptible

- 8.3 Transaction Default Values

- 8.4 Transaction File Sample

- 8.5 Default File Sample

- 8.6 Specifying a Tax Jurisdiction

- 8.7 Getting the Right Tax Jurisdiction for Local Taxation

- 8.8 Transaction Specifications

- 8.8.1 Specifying Request Type

- 8.8.2 Specifying Jurisdiction PCode

- 8.8.3 Specifying Jurisdiction Address

- 8.8.4 Specifying Jurisdiction FIPS Code

- 8.8.5 Specifying Jurisdiction NPANXX

- 8.8.6 Specifying Transaction / Service Pair

- 8.8.7 Specifying Transaction Date

- 8.8.8 Specifying Transaction Charge

- 8.8.9 Specifying Customer Type

- 8.8.10 Specifying Lines

- 8.8.11 Specifying Sale Type

- 8.8.12 Specifying Incorporated

- 8.8.13 Specifying Level Exemptions

- 8.8.14 Specifying the Regulated Flag

- 8.8.15 Specifying Minutes

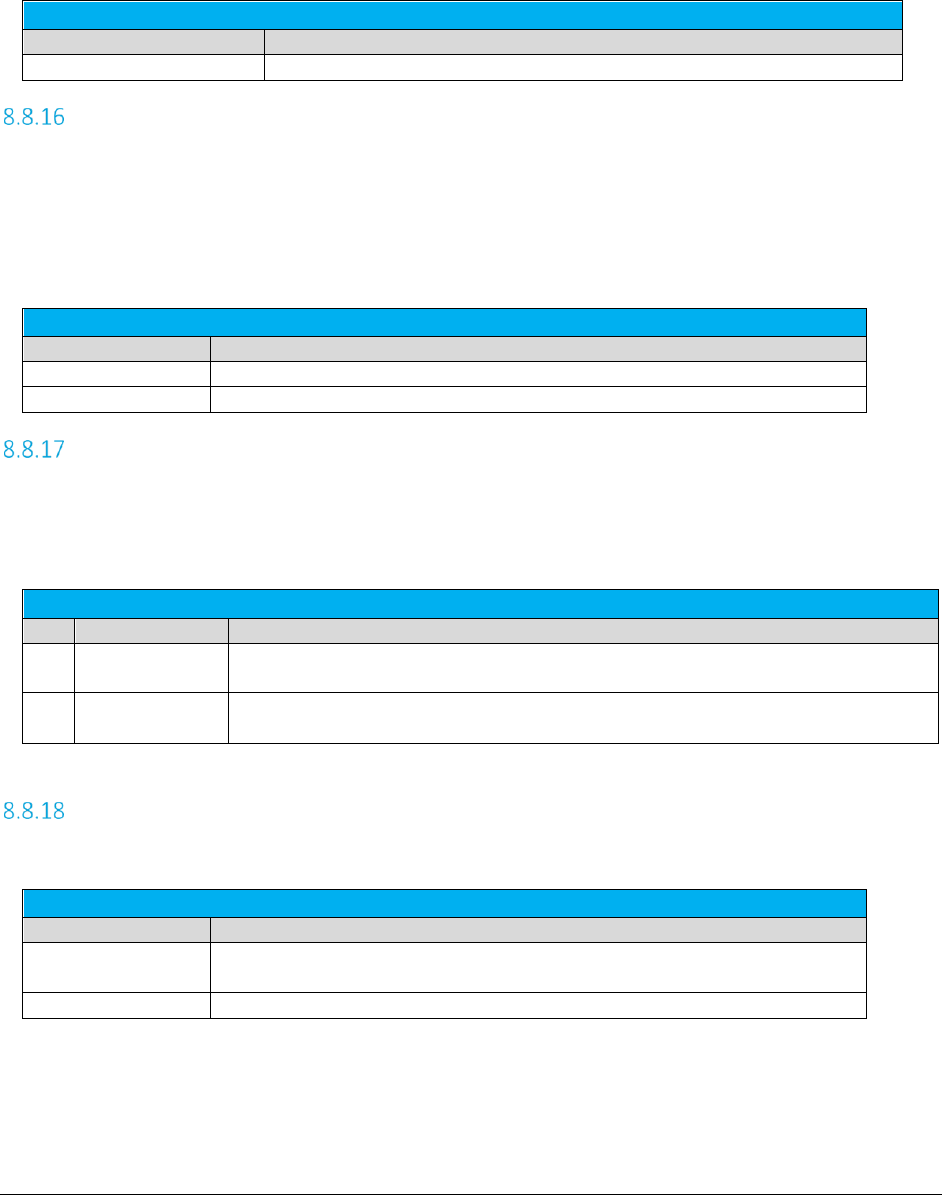

- 8.8.16 Specifying Debit Flag

- 8.8.17 Specifying Service Class

- 8.8.18 Specifying Lifeline Flag

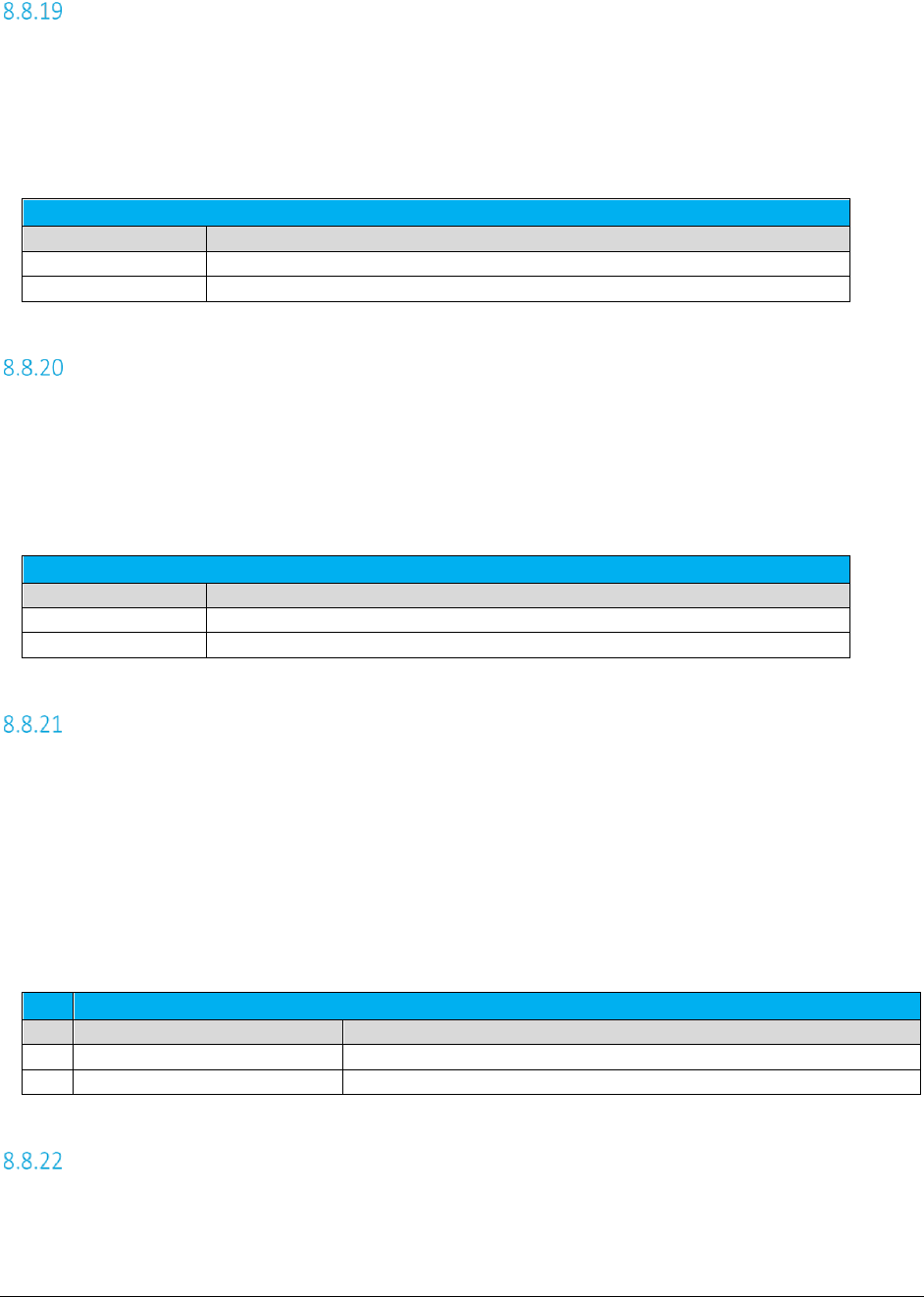

- 8.8.19 Specifying Facilities Flag

- 8.8.20 Specifying Franchise Flag

- 8.8.21 Specifying Business Class

- 8.8.22 Specifying Company Identifier

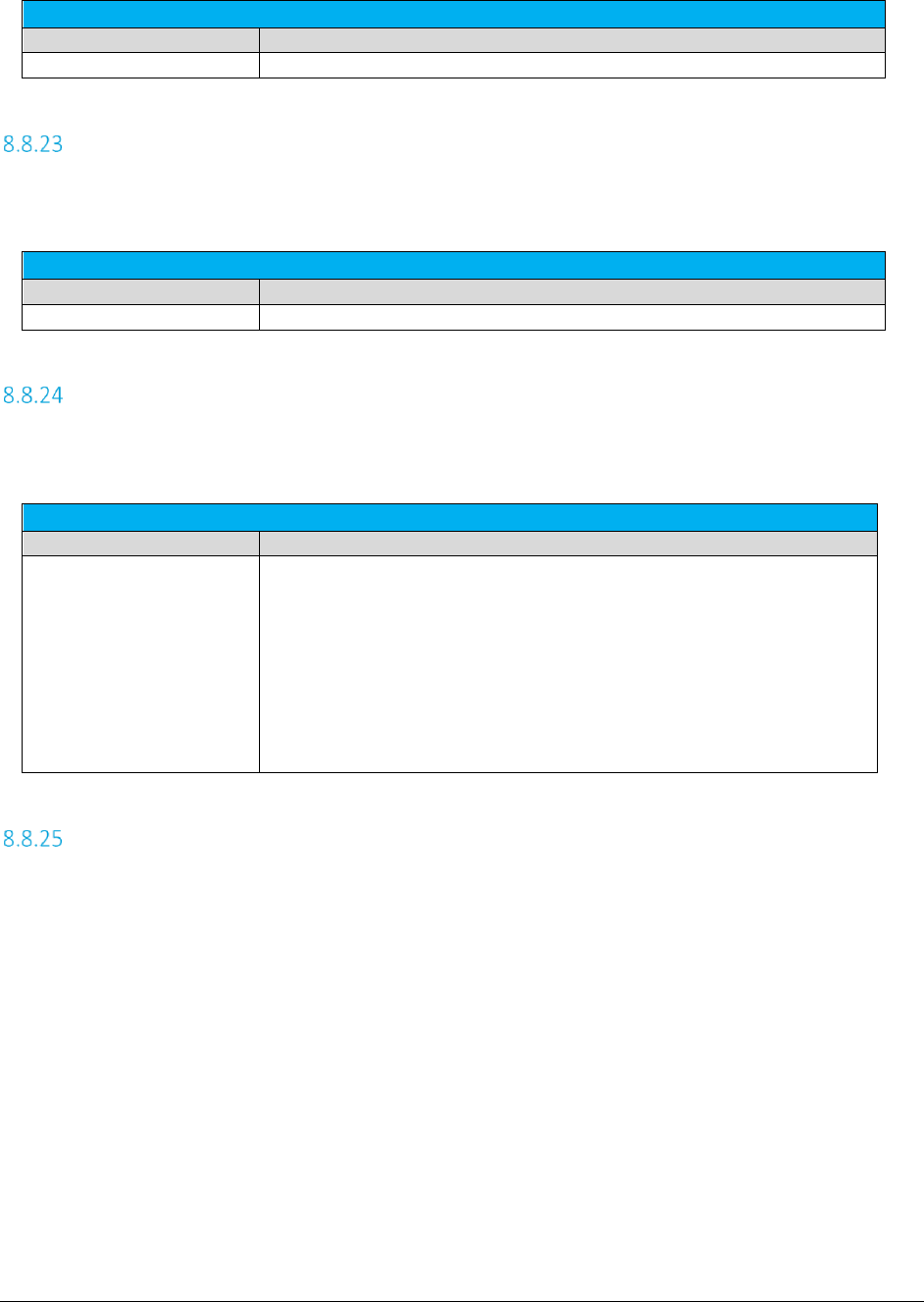

- 8.8.23 Specifying Customer Number

- 8.8.24 Specifying Invoice Number

- 8.8.25 Specifying Discount Type

- 8.8.26 Specifying Exemption Type

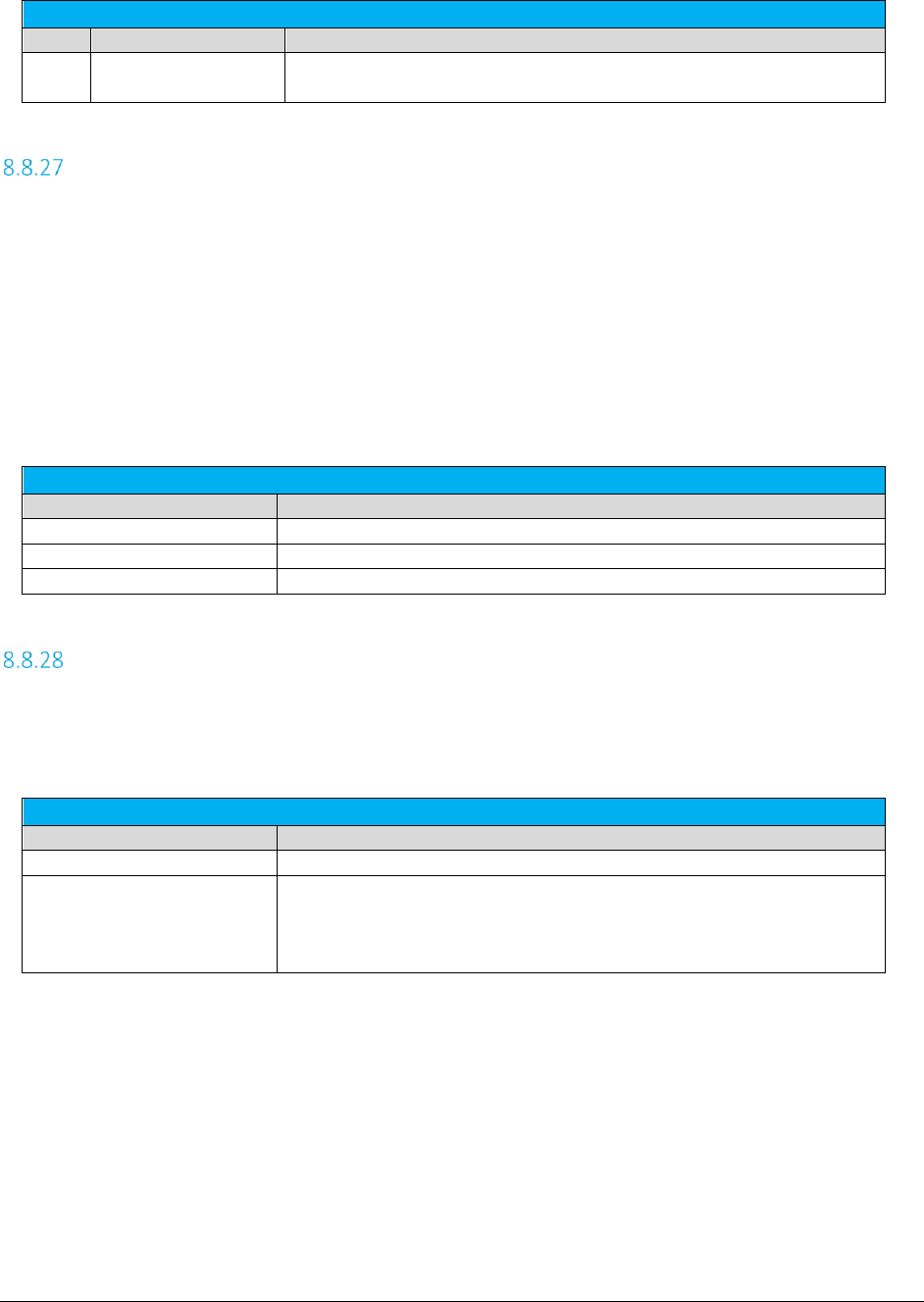

- 8.8.27 Specifying Adjustment Method

- 8.8.28 Specifying Private Line (Point-to-Point)

- 8.8.29 Specifying Proration

- 8.8.30 Specifying Default Optional Reporting Fields

- 8.8.31 Specifying Extended Optional Reporting Fields

- 8.8.32 Specifying Exemption Cross Reference Key

- 8.8.33 Specifying Exemption Jurisdiction

- 8.8.34 Specifying Exemption Domain

- 8.8.35 Specifying Exemption Scope

- 8.8.36 Specifying Exemption Tax Level (Deprecated – Use Domain instead )

- 8.8.37 Specifying Exemption Category

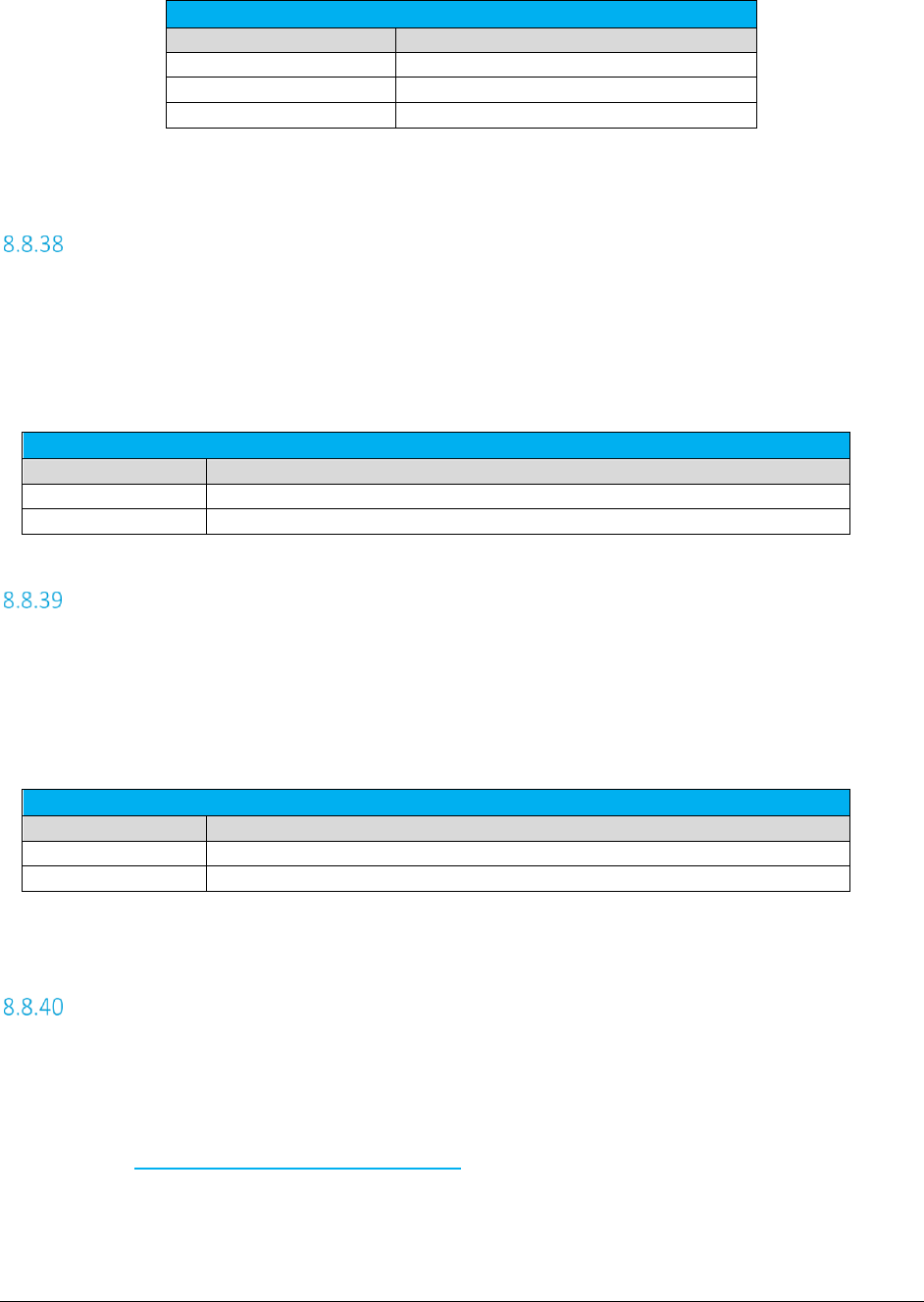

- 8.8.38 Specifying Exemption Exempt Non-billable Flag

- 8.8.39 Specifying Exemption Exempt Non-level-exemptible Flag

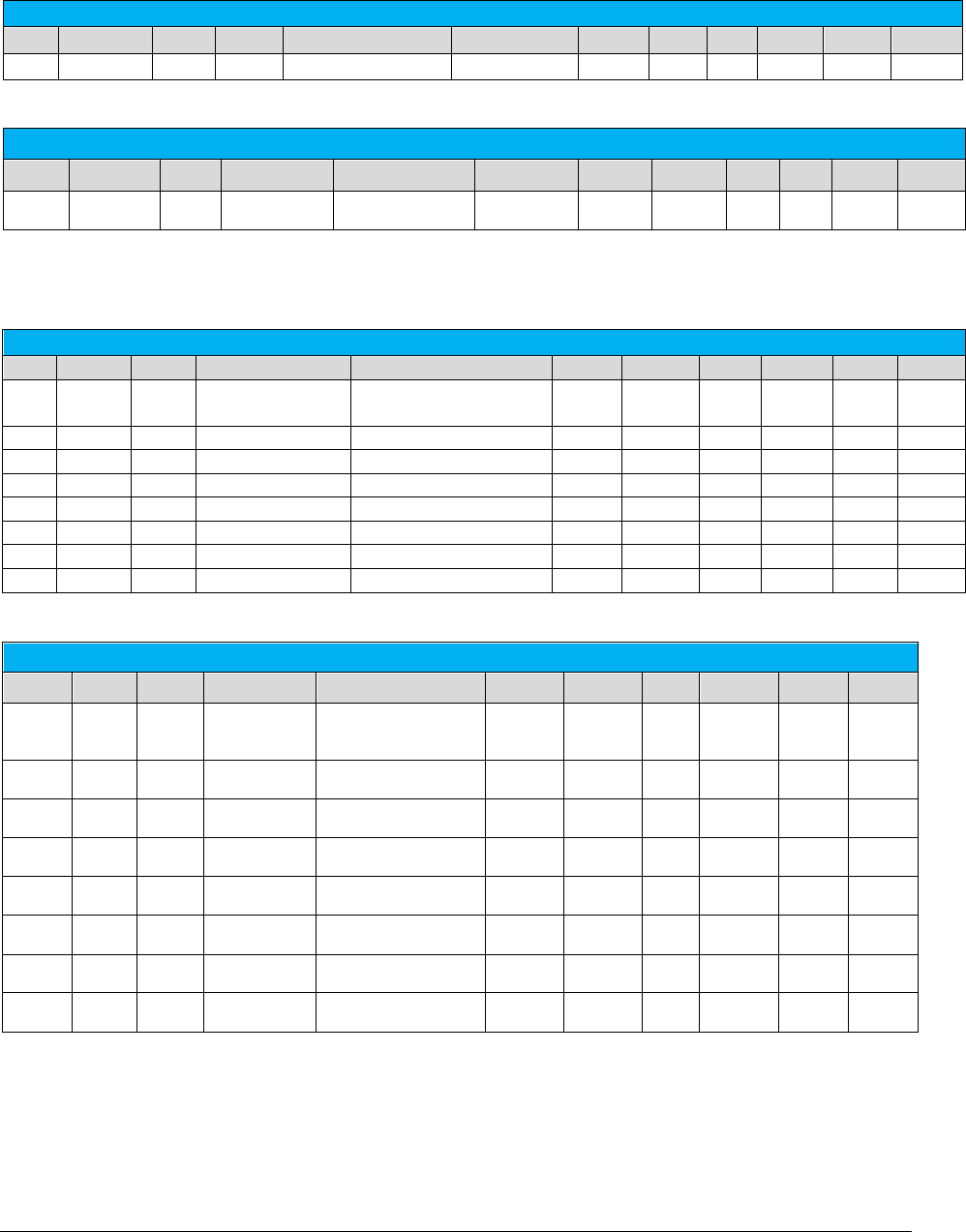

- 8.8.40 Specifying Safe Harbor Overrides for Traffic Studies

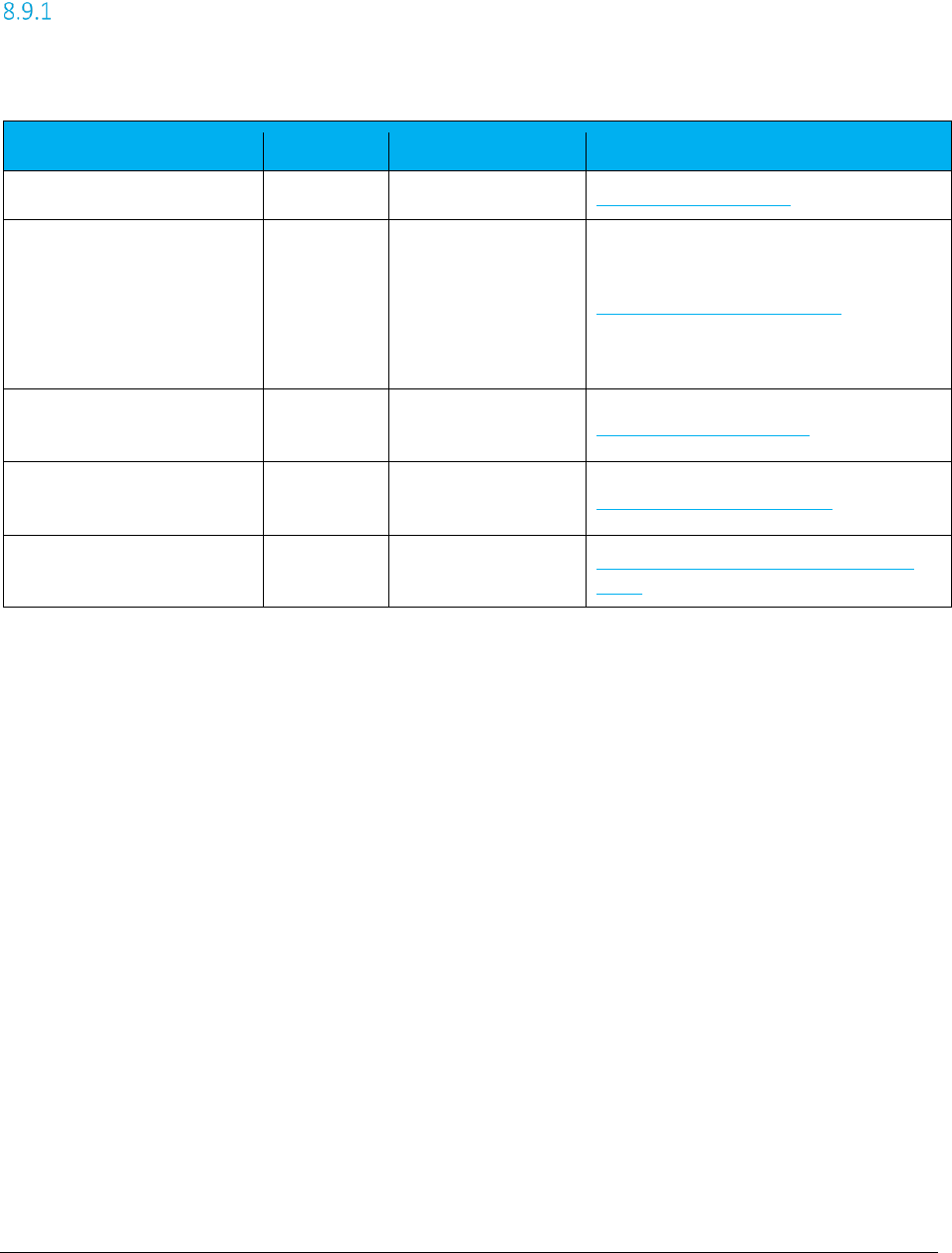

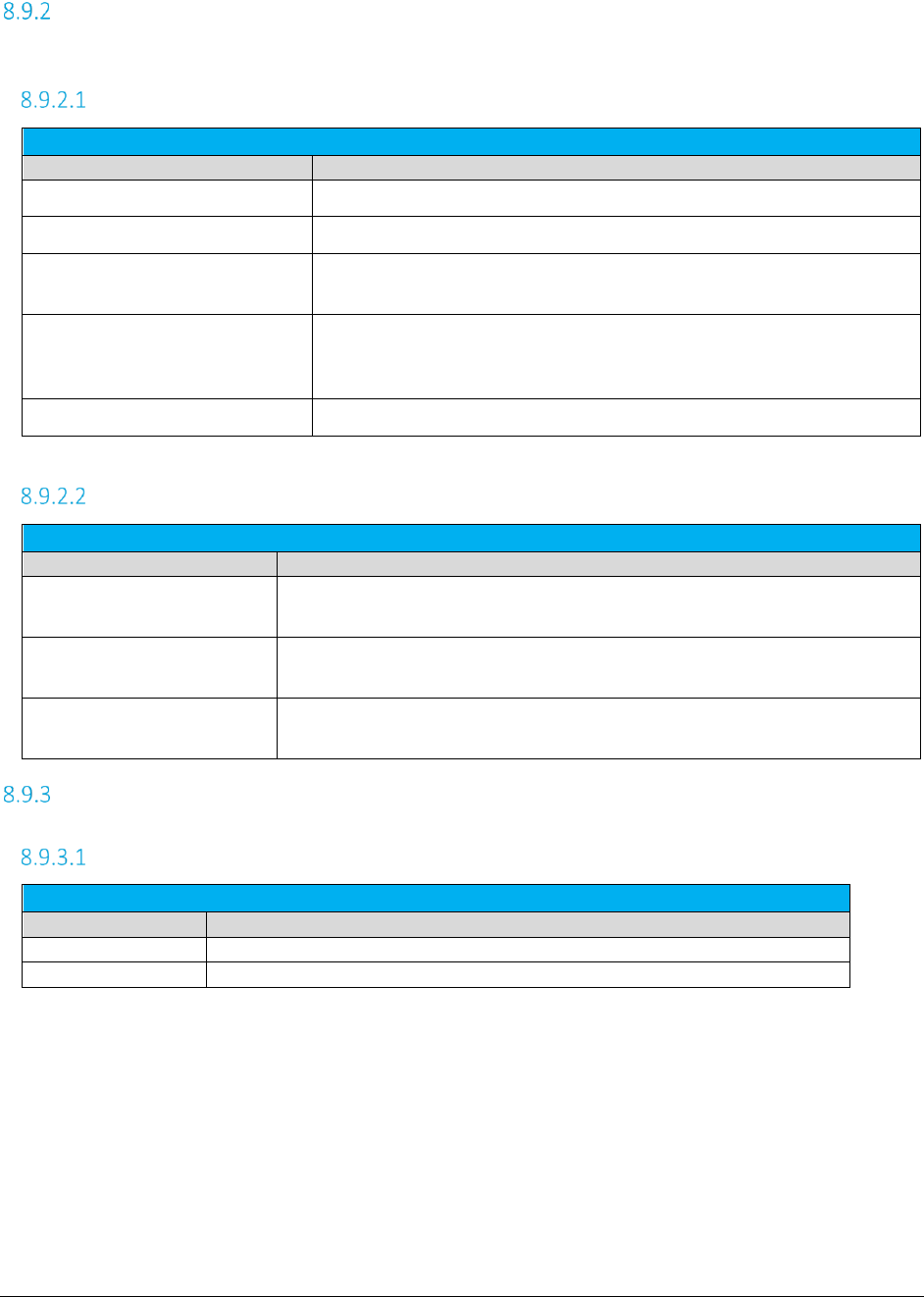

- 8.9 Zip Lookup Requests

- 8.10 Bridge Conference File

- 9. Appendix A – Fixed Format: CDF

- 10. Appendix B – AFC Error Codes

AvaTax for Communications

SaaS Standard User Manual

Release: 9.20.1812.1

Document: TM_00111_0047

Date: 11/21/2018

All trade names referenced herein are either trademarks or registered trademarks of their respective companies.

© Avalara, Inc. 2018. CONFIDENTIAL

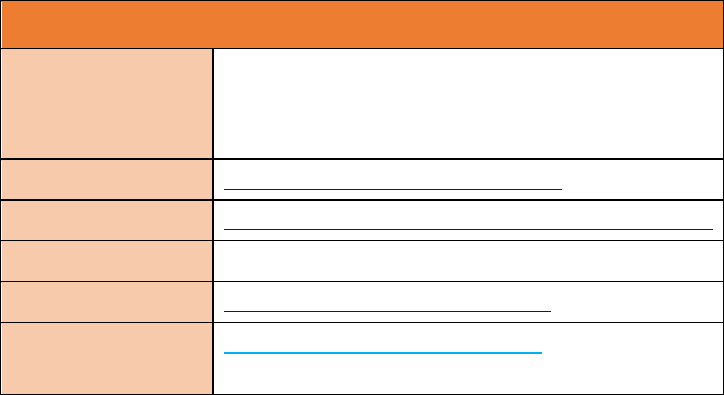

Avalara for Communications - Contact Information

Address

Avalara, Inc.

512 South Mangum Street, Suite 100

Durham, North Carolina, 27701

Email

CommunicationSupport@avalara.com

Help Center

https://help.avalara.com/Avalara_for_Communications

Toll Free

(877) 780-4848

Corporate Web Site

http://communications.avalara.com/

Communications

Customer Portal

https://communications.avalara.net

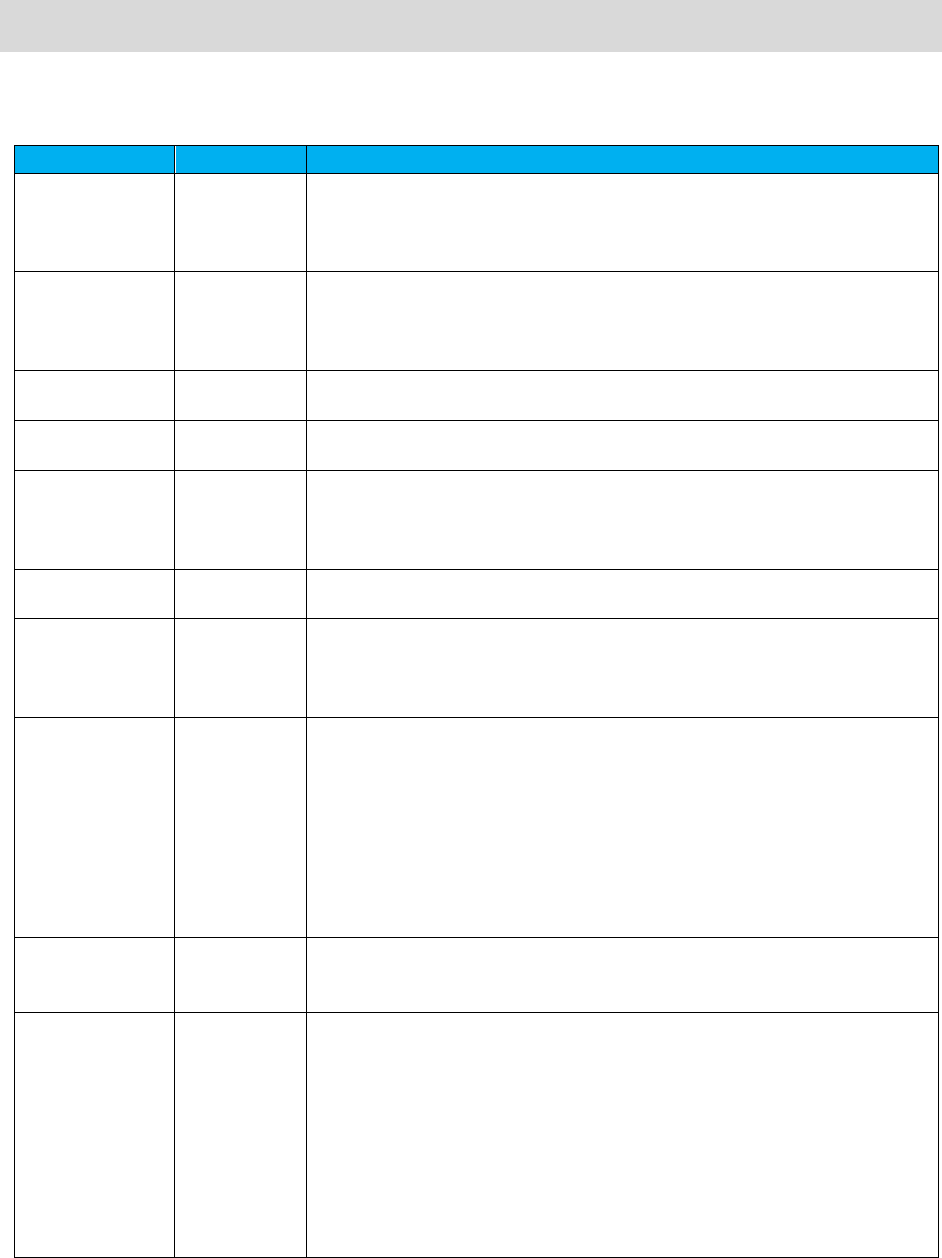

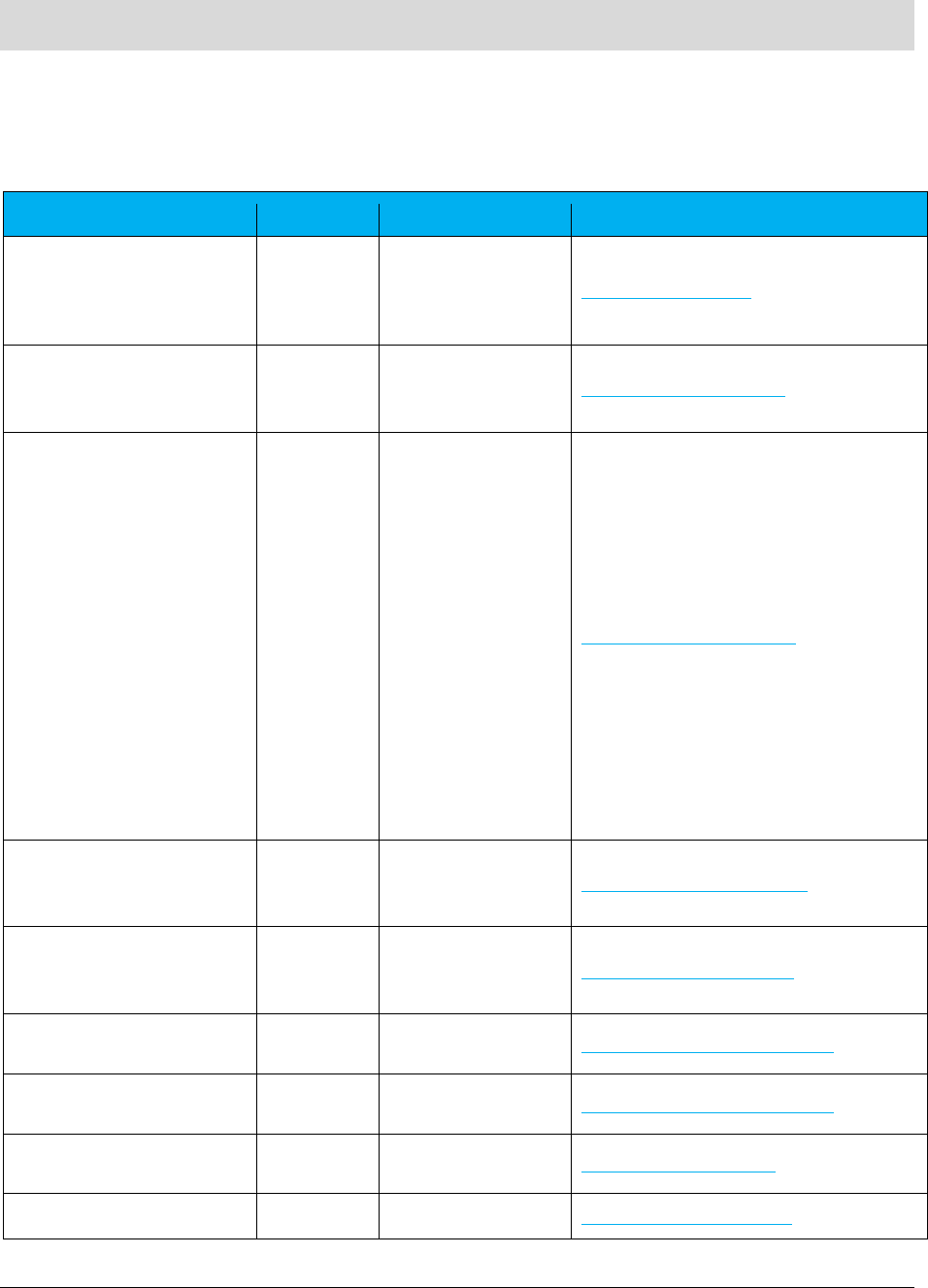

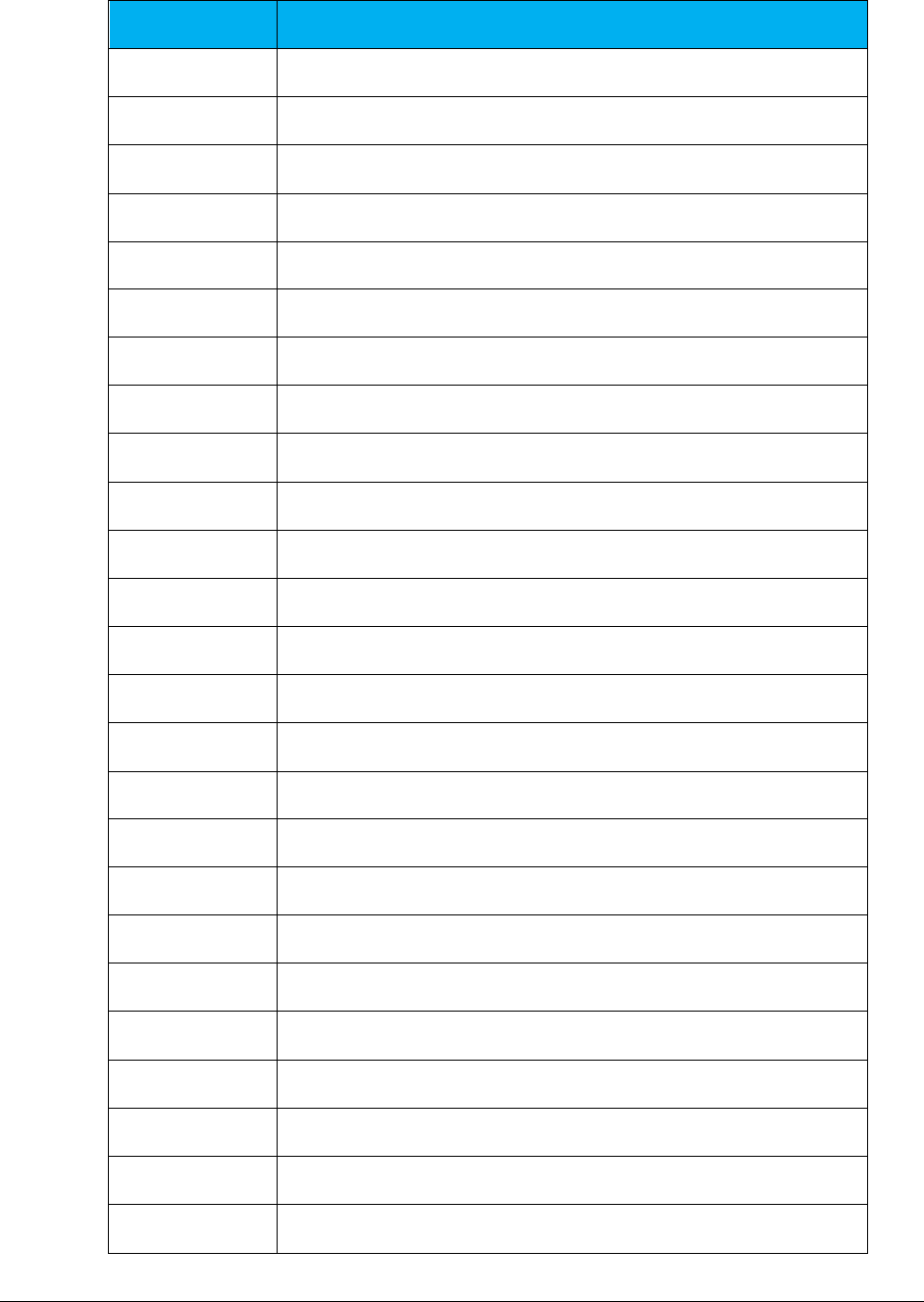

Document Revision History

The Revision History log lists the date and description of the most recent revisions or versions of the

document.

Date

Version

Description

02/15/2016

0024

Avalara branding updates to reflect the transition to the new company and

product names have been incorporated into this document. Please see

Appendix D – Avalara Product Names

for specific changes in product

references and descriptions.

03/01/2016

0025

New Section 3.3.4 Handling Optional Files to address handling of optional

files which can be embedded and/or persisted such as exclusion, override,

exemption and bundle files.

New Section 8.2 Specific Exemption File, and new Section 8.8.29 Proration.

04/05/2016

0026

Updates to Section 3.3.4 Handling Optional Files and Section 3.5 Results to

include use of Custom Sort utility.

05/05/2016

0027

Updates to Section 3.5 Results related to the ability to view output files in

CSV format.

06/13/2016

0028

Updates and new additions throughout Section 8.2 Exemption File to

include Category Exemptions and

Section 8.8.35 Exemptions by Tax

Category.

Update to date formats in

Section 8.8.7 Specifying Transaction

Date.

06/30/2016

0029

Updated NTL filename to match input filename in Section 3.5.2. Added

customsort_log.sta to status files in Section 3.5.3.

08/09/2016

0030

Updated Section 3.5.2 with audit versions of TSR and RTR reports. Updated

Section

8.8.30 Specifying Optional Reporting Fields

and added new

Section

8.8.30.1 Default Optional Fields

and

Section 8.8.30.2 Extended Optional

Fields.

11/15/2016 0031 Updated

Section 2 Naming Files

with note regarding maximum allowed

length for file name. Updated the title to

Section 3.5 Tax Calculation Results

to include zip look up results.

Updated table in

Section 8.1 Input File

to

include zip look up calculation data. Removed Request Type as a default

from the table in

Section 8.3 Default Values.

Updated description in

Section

8.8.12 Specifying Incorporated.

Updated

Section 8.8.30 Specifying Default

Optional Reporting Fields

and

Section

8.8.31 Specifying Extended Optional

Reporting Fields.

Added note regarding federal level exemptions to

8.8.34

Specifying Exemption Tax Level. Added Section 8.9 Zip Lookup Requests.

12/05/2016

0032

Updated Section 8.1 Input File to include additional columns for safe harbor

overrides for traffic studies functionality. Also, added

Section 8.8.37

Specifying Safe Harbor Overrides for Traffic Studies.

02/13/2017

0033

Updated Section 3.3.4 Handling of Optional Files, Section 3.5.2 Report Files

and added

Section 8.10 Bridge Conference

File

to support the ability to

calculate taxes for conference bridges. All references to ‘reverse’ tax

calculations in AFC SaaS Standard have been updated and renamed to

reflect the current naming convention which is ‘tax inclusive’ calculations.

As a result, all request type values in

Section 8.1 Input File

and

8.8.1

Specifying Request Type

have been updated and renamed. Updated

Section

8.8.8 Specifying Transaction Charge

with details related to support for

Excel’s currency/numeric format in the charge field/column.

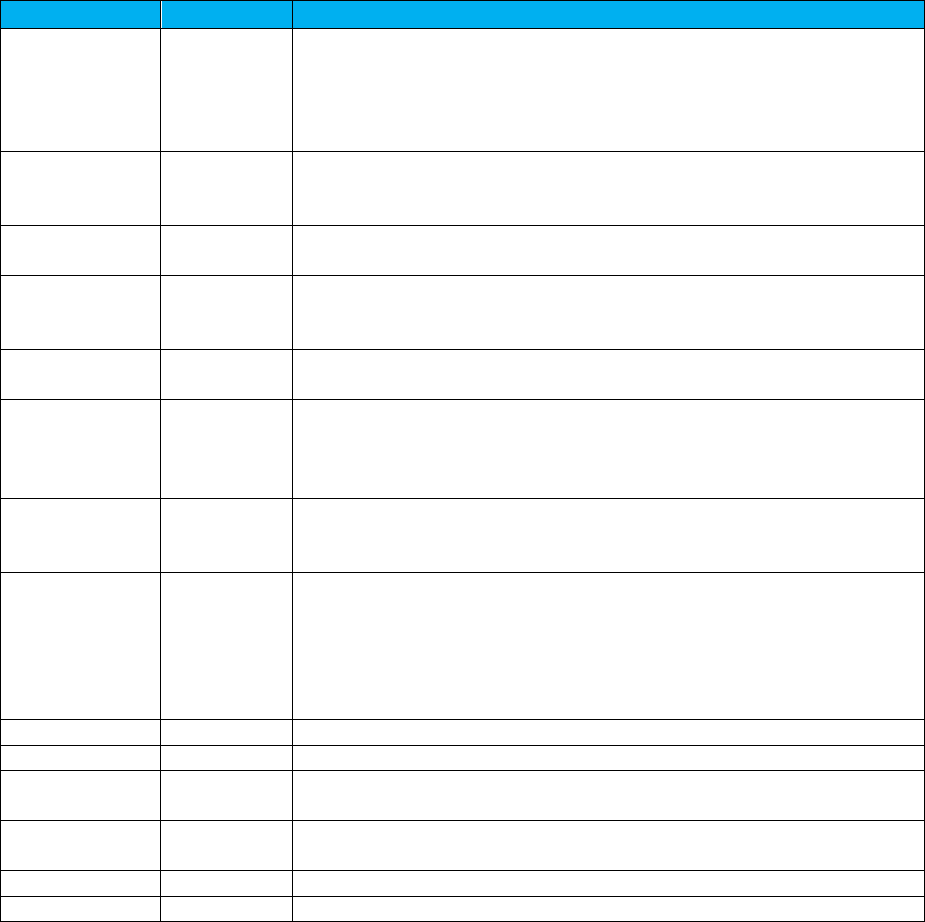

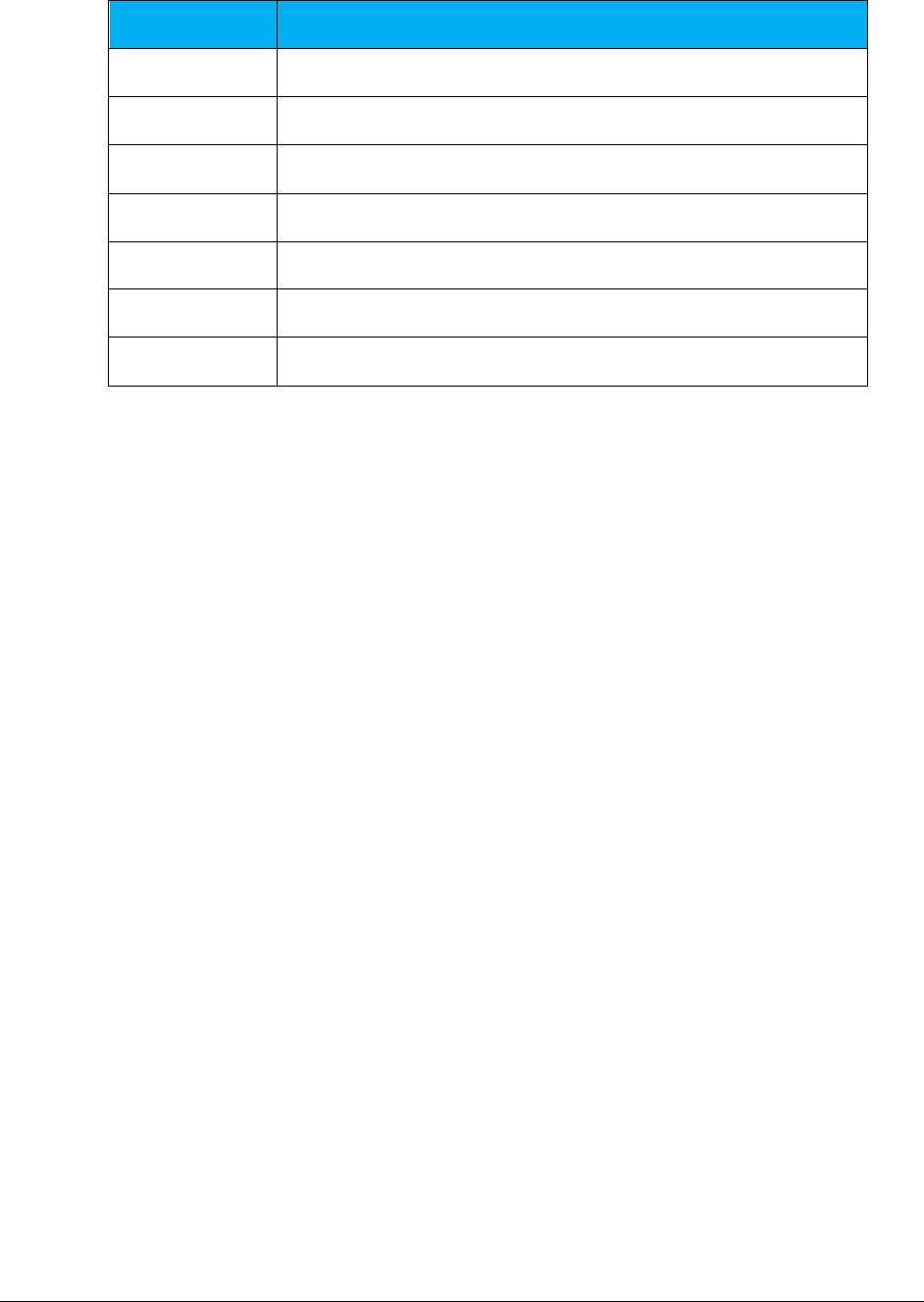

Date

Version

Description

03/09/2017

0034

Added note in Section 8.8.28 Private Line (Point-to-Point) to address support

of adjustment calculations with private line feature. Updated

Section 8.2.1

Specifying Exemption

and

Section 8.8.34 Specifying Exemption Tax Type

with

note regarding availability of wildcard character for tax types. Release

number and version updates.

04/24/2017 0035 Added notes to

Section 4.1 Uploading the ftp.zip

and

Section 8.8.24

Specifying Invoice Number

. Updates throughout tables in

Section 3.5 Tax

Calculation Results. Release number and version updates.

05/19/2017

0036

Updated Section 8.8.11 Specifying Sale Type. Release number and version

updates.

08/28/2017 0037 Added note related to timestamp/invoice date passed in

Section 8.8.7

Specifying Transaction Date

.

Release number and version updates.

10/25/2017 0038 Updated Avalara contact information (address and support site). Removed

Appendix D – Avalara Product Names.

02/23/2018

0039

Updated Section 8.8.10 Specifying Lines to include rounding information for

subscription line count values. Updated information throughout

Section

8.2.2

Category Exemptions

and added

Section

8.8.38

Specifying Exemption

by Tax Category Scope. Made release number and version updates.

04/25/2018

0040

Updated information throughout Section 8.2.2 Category Exemptions and

removed

Section

8.8.38 Specifying Exemption by Tax Category Scope.

Made

release number and version updates.

5/25/2018

0041

Added URL for accessing public resources in sections 1. Introduction and 5.

Transaction Mapping Guidelines

. Updated table in section

3.5.2

KMLR150117AA.zip - Report Files

. Updated values in several tables

throughout section

8.8 Transaction Specifications.

Added error codes -41

through -48

in section

10. Appendix B – AFC Error Codes.

Made release

number and version updates.

6/25/2018

0042

Made release number and version updates.

7/25/2018

0043

Made release number and version updates.

8/24/2018

0044

Updated section 8.2 Exemption File. Made release number and version

updates.

9/25/2018

0045

Updated Avalara contact information. Made release number and version

updates.

10/25/2018

0046

Made release number and version updates.

11/21/2018

0047

Made release number and version updates.

AFC SaaS Standard User Manual | i

Copyright 2018 Avalara, Inc.

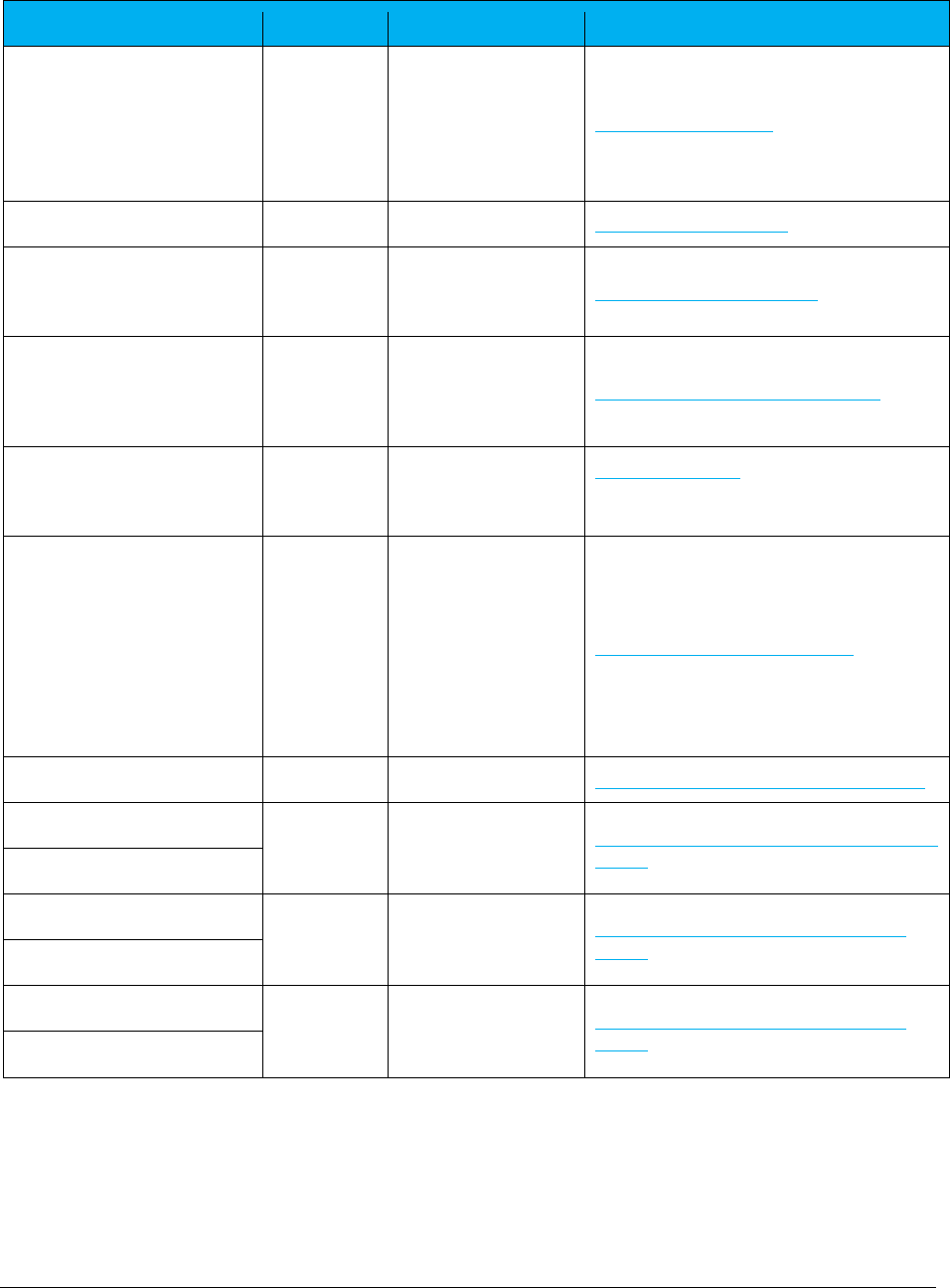

Table of Contents

1. Introduction .................................................................................................................. 1

2. Naming Files .................................................................................................................. 1

2.1 Compliance Month ................................................................................................................... 2

3. AFC FTP Site................................................................................................................... 2

3.1 Accessing the FTP Site .............................................................................................................. 2

3.2 Logging on to the FTP Site......................................................................................................... 2

3.3 Submitting a Request................................................................................................................ 3

Primary File – Transaction Batch Data ............................................................................... 3

Extended Format – Excel, CSV ........................................................................................... 4

Fixed Format – CDF ........................................................................................................... 4

Handling of Optional Files ................................................................................................. 4

3.4 Transferring Files To and From the FTP Site ............................................................................... 6

3.5 Tax Calculation Results ............................................................................................................. 7

KMLS150117AA.zip - Compliance Files .............................................................................. 7

KMLR150117AA.zip - Report Files ...................................................................................... 7

KMLE150117AA.zip - Status Files ....................................................................................... 8

4. Web Interface ................................................................................................................ 9

4.1 Uploading the ftp.zip .............................................................................................................. 10

4.2 Retrieving Files ....................................................................................................................... 12

4.3 Notifications ........................................................................................................................... 13

5. Transaction Mapping Guidelines ....................................................................................... 13

6. Frequently Asked Questions ............................................................................................. 14

7. Support ....................................................................................................................... 14

8. Appendix A – Extended Format: Excel and CSV .................................................................... 15

8.1 Input File ................................................................................................................................ 15

8.2 Exemption File ........................................................................................................................ 18

Exemption File Updates .................................................................................................. 18

Overview of Exemptions ................................................................................................. 19

Exemption Fields............................................................................................................. 20

8.3 Transaction Default Values ..................................................................................................... 23

AFC SaaS Standard User Manual | ii

Copyright 2018 Avalara, Inc.

8.4 Transaction File Sample .......................................................................................................... 24

8.5 Default File Sample ................................................................................................................. 24

8.6 Specifying a Tax Jurisdiction .................................................................................................... 24

Jurisdiction Hierarchy ...................................................................................................... 25

Jurisdiction Data Types.................................................................................................... 25

Jurisdiction Data Type Hierarchy ..................................................................................... 26

8.7 Getting the Right Tax Jurisdiction for Local Taxation ................................................................ 27

8.8 Transaction Specifications....................................................................................................... 27

Specifying Request Type.................................................................................................. 27

Specifying Jurisdiction PCode .......................................................................................... 28

Specifying Jurisdiction Address ........................................................................................ 28

Specifying Jurisdiction FIPS Code ..................................................................................... 29

Specifying Jurisdiction NPANXX ....................................................................................... 30

Specifying Transaction / Service Pair................................................................................ 30

Specifying Transaction Date ............................................................................................ 31

Specifying Transaction Charge ......................................................................................... 31

Specifying Customer Type ............................................................................................... 32

Specifying Lines............................................................................................................... 32

Specifying Sale Type ........................................................................................................ 32

Specifying Incorporated .................................................................................................. 32

Specifying Level Exemptions ............................................................................................ 33

Specifying the Regulated Flag .......................................................................................... 33

Specifying Minutes .......................................................................................................... 33

Specifying Debit Flag ....................................................................................................... 34

Specifying Service Class ................................................................................................... 34

Specifying Lifeline Flag .................................................................................................... 34

Specifying Facilities Flag .................................................................................................. 35

Specifying Franchise Flag................................................................................................. 35

Specifying Business Class ................................................................................................. 35

Specifying Company Identifier ......................................................................................... 35

Specifying Customer Number .......................................................................................... 36

AFC SaaS Standard User Manual | iii

Copyright 2018 Avalara, Inc.

Specifying Invoice Number .............................................................................................. 36

Specifying Discount Type................................................................................................. 36

Specifying Exemption Type.............................................................................................. 37

Specifying Adjustment Method ....................................................................................... 38

Specifying Private Line (Point-to-Point) ............................................................................ 38

Specifying Proration ........................................................................................................ 39

Specifying Default Optional Reporting Fields ................................................................... 39

Specifying Extended Optional Reporting Fields ................................................................ 39

Specifying Exemption Cross Reference Key ...................................................................... 41

Specifying Exemption Jurisdiction .................................................................................... 41

Specifying Exemption Domain ......................................................................................... 42

Specifying Exemption Scope ............................................................................................ 42

Specifying Exemption Tax Level (Deprecated – Use Domain instead)................................ 43

Specifying Exemption Category ....................................................................................... 43

Specifying Exemption Exempt Non-billable Flag ............................................................... 44

Specifying Exemption Exempt Non-level-exemptible Flag ................................................ 44

Specifying Safe Harbor Overrides for Traffic Studies ........................................................ 44

8.9 Zip Lookup Requests ............................................................................................................... 46

Zip Lookup Input File ....................................................................................................... 46

Zip Lookup Results .......................................................................................................... 47

Zip Lookup Specific Transaction Specifications ................................................................. 47

8.10 Bridge Conference File ............................................................................................................ 49

9. Appendix A – Fixed Format: CDF....................................................................................... 50

10. Appendix B – AFC Error Codes .......................................................................................... 52

AFC SaaS Standard User Manual| 1 of 54

Copyright 2018 Avalara, Inc.

1. Introduction

AvaTax for Communications (AFC) SaaS Standard is a tax-rating service bureau. It provides the necessary

link to allow you to transfer files to and from Avalara for processing by the AFC server. AFC SaaS Standard

provides two ways to connect to the AFC server - by using a file-transfer protocol (FTP) connection

through an existing account and typing ‘ftp.billsoft.com’ at the prompt within the FTP session or by

connecting to the web interface at https://ftp.billsoft.com.

For sample files and ftp scripts, see the samples folder and other resources at this URL:

https://github.com/Avalara/Communications-Developer-Content/tree/master/afc_saasstd_tax.

Once your file has been uploaded to the server, AFC begins immediate processing of your data. AFC SaaS

Standard and the AFC server are online - 24 hours a day, 7 days a week - to process your data.

2. Naming Files

Uploaded files MUST be named using the following naming conventions for the base name of the file.

KML150117AA.{ext}

• KML: 3 letter company code

• 15: Year the file is to be uploaded

• 01: Month in which you are processing

• 17: The day of the month the file was created

• AA: Unique identifier that allows for better tracking and maintaining of these files

• T: Special Designator indicating the file is a test run and should not be included in compliance

filing. This is not required but is a good practice as it allows production reports and test reports

to be distinguished.

Note: In addition to the naming convention guidelines, please be aware that the maximum allowed length

for a file name is 19 bytes.

The following formats / extensions are supported:

• Extended Formats

o Excel .xls,.xlsx

o Comma-Separated .csv ABC151116AA.CSV

• Fixed Format

o Customer Detail File .cdf

When uploading your file to the online ftp site (see Uploading the ftp.zip), it must be compressed (i.e.,

“zipped”) into a file named ftp.zip in order to be processed automatically.

AFC SaaS Standard User Manual| 2 of 54

Copyright 2018 Avalara, Inc.

2.1 Compliance Month

The filename is generally the best approach for identifying which tax month the request applies to. If the

billing cycle is for October 2015, then the name ABC1510NN would allow multiple submissions to be

aggregated together for compliance filing.

General Rules:

• Do not mix transactions from different billing cycles in the same request.

• Designate test data by adding a T to the filename. For example, if ABC1510NN is the normal

designation, use ABC1510NNT for testing.

3. AFC FTP Site

3.1 Accessing the FTP Site

AFC SaaS Standard provides two ways to connect to the AFC FTP server - by using a secure file-transfer

protocol (SFTP) or file-transfer protocol (FTP) connection through an existing account and typing

‘ftp.billsoft.com’ at the prompt within the FTP session or by connecting to the web interface at

https://ftp.billsoft.com.

Note Concerning FTP Client Software

Please be aware that web browsers (Microsoft Internet Explorer, Firefox, etc.) cannot be used for

uploading and downloading files via FTP to the AFC FTP site. A FTP client application must be used to

transfer files to and from the AFC FTP site when using our service as FTP.

Windows users:

Microsoft does not currently include convenient FTP client software in its operating systems. It is

assumed you either own a third-party FTP client application such as WS_FTP (a shareware version of

which can be downloaded from http://www.ipswitch.com), or that you are comfortable accessing FTP

sites using command-line syntax.

Linux users:

If using a Linux system to transfer your call-data files, you can use any number of free FTP clients to

contact the AFC FTP site, such as WXFTP, or you can use command-line syntax.

3.2 Logging on to the FTP Site

To log on to the AFC FTP site, you will need the following information:

HOSTNAME/ADDRESS: ‘ftp.billsoft.com’ within a FTP session or via the web at https://ftp.billsoft.com

AFC SaaS Standard User Manual| 3 of 54

Copyright 2018 Avalara, Inc.

USER ID: Your User ID is created and provided to you. Please refer to the Welcome to Avalara email or

contact communicationsupport@avalara.com for your organization’s assigned User ID.

PASSWORD: Your organization’s login password is also provided by your Avalara technical support

contact. For future reference, you may make note of your login details in spaced provided below.

User ID: _____________________________

Password: _____________________________

Company Code: _____________________________

3.3 Submitting a Request

A single ftp.zip file will be submitted containing one and only one primary file and one or more optional

files.

General Submission Rules

• Files submitted must be at the root-level within the zip file and cannot contain any other folders.

• The data must be compressed before you upload it for processing. The AFC FTP server uses PK-

Zip/PK-Unzip version 2.04 for compressing and decompressing files. If you prefer using a

Windows-based compression utility, you can use a product such as WinZip, which is compatible

with the version 2.04 of PK-Zip/PK-Unzip.

• An account can only process a single request at a time. If additional requests are received before

the first request has been completed, they will be rejected.

Primary File – Transaction Batch Data

The primary file contains all transactions to be processed and can be either Fixed Format (.cdf) or

Extended Format (.csv/Excel). The naming convention for the primary file must be named correctly and

uniquely. Submitting the same file name will cause the file to be rejected.

• The 1st through the 3rd characters in the filename should begin with your company's three-letter

code.

• The 4th and 5th characters in the filename should be the current year (2-digits).

• The 6th and 7th characters are the current month.

• The 8th and 9th characters are the current day.

• The 10th through the 13th characters are your unique files identifiers. Please note that ‘T’ is

reserved for test files.

• The final character must be ‘T’ if this a test file. (optional or preferred)

• The file extension must be a supported extension.

AFC SaaS Standard User Manual| 4 of 54

Copyright 2018 Avalara, Inc.

Thus, an example of a correctly named file is KML150117AA.CSV, where KML is the three-letter code for

the company, 15 is the year, 01 is the month and 17 is the day. AA indicates it is the first file uploaded

that day, and .CSV indicates it is a comma delimited file for processing by AFC. Refer to the Compliance

Month section for additional details on compliance processing as well as the importance of naming for

compliance purposes.

Extended Format – Excel, CSV

Extended format supports Excel and CSV (Comma-Separated Values) files. The contents and columns are

identical and are discussed in Appendix A – Extended Format: Excel and CSV File Format for additional

details.

Fixed Format – CDF

The fixed format, or CDF format, supports a limited number of transaction options and is intended for

basic transaction processing. Please refer to Appendix B – Fixed Format: CDF File Format for additional

details.

Handling of Optional Files

Both Extended and Fixed format processing supports several different types of optional files that can be

embedded in the zip file ftp.zip or persisted in your account.

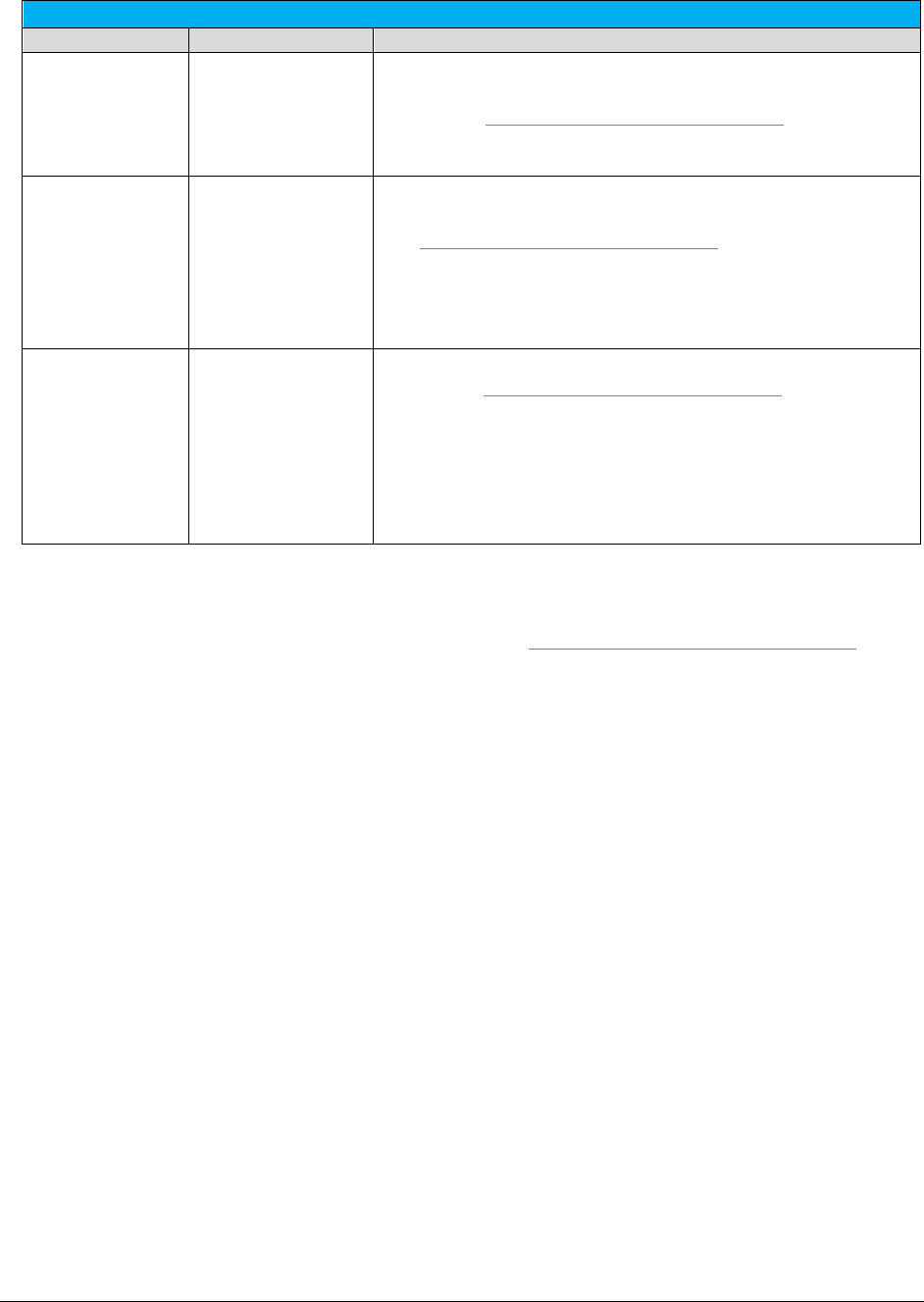

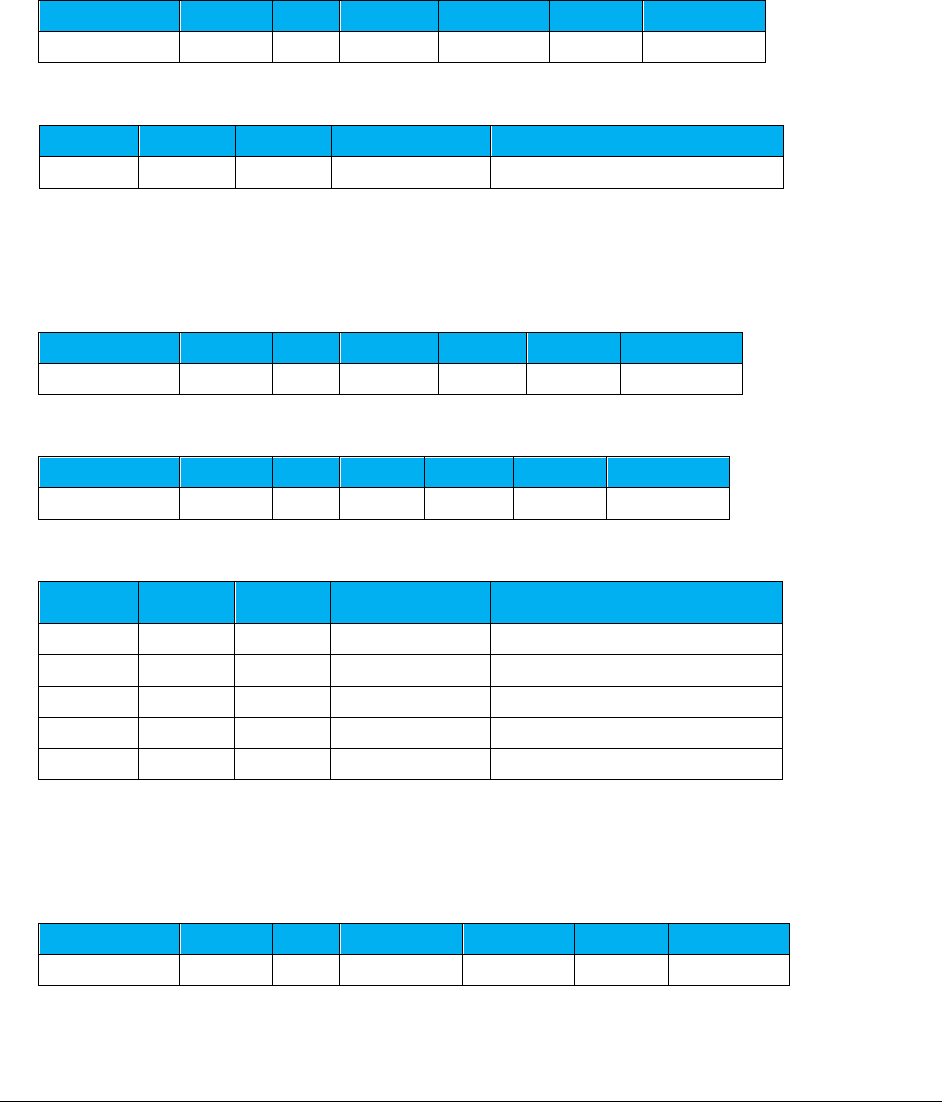

Supported Optional Files

Type

Extension

Reference

Override File

.ovr

• Specify a filename by naming the file with an .ovr extension.

• To make the Override File a persisted file, please contact

communicationsupport@avalara.com to proceed.

• To embed an Override File, place the Override File into your

ftp.zip file along with an Extended Format input file.

• Also, contact communicationsupport@avalara.com for more

information on the RLM (Rate and Logic Modifier) Tool for

creating and/or maintaining override files.

Exemption File

.exm

• Specify a filename by naming the file with an .exm extension.

• To make the Exemption File a persisted file, please contact

communicationsupport@avalara.com to proceed.

• To embed an Exemption File, place the Exemption File into

your ftp.zip file along with an Extended Format input file.

• Refer to Exemption File for additional details.

Bundle File

.bdl

• Specify a filename by naming the file with a .bdl extension.

• To make the Bundle File a persisted file, please contact

communicationsupport@avalara.com to proceed.

AFC SaaS Standard User Manual| 5 of 54

Copyright 2018 Avalara, Inc.

Supported Optional Files

Type

Extension

Reference

• To embed a Bundle File, place the Bundle File into your ftp.zip

file along with an Extended Format input file.

• Contact communicationsupport@avalara.com for more

information on the Bundler Tool for creating and/or

maintaining bundle files.

Exclusion File

.exc

•

Specify a filename by naming the file with an .exc extension.

• To make the Exclusion File a persisted file, please contact

communicationsupport@avalara.com to proceed.

• To embed an Exclusion File, place the Exclusion File into your

ftp.zip file along with an Extended Format input file.

• Refer to

TM_00556_Exclusion File Formats

for additional

information or details.

CustomSort

Configuration File

customsort.cfg

•

To make the customsort.cfg file a persisted file, please

contact communicationsupport@avalara.com to proceed.

Note:

Persisting the customsort.cfg file is the preferred

method of generating the Custom Sort report.

• To embed customsort.cfg, place the customsort.cfg file into

your ftp.zip file along with the input file.

• Refer to

Section 1.2

of

TM_00405_AFC Custom Sort Utility

User Manual for additional information or details.

A request can be made to add a persisted optional file from an authorized representative of the owner of

the account. Please send the request, along with the file, to communicationsupport@avalara.com. Your

account will be updated with the persisted file, and it will apply to all future batch processing.

An embedded optional file is only applied to the current set of transactions contained within the ftp.zip

file.

Order of handling – Persisted vs Embedded

When both a persisted optional file exists and the same type of optional file is embedded in the zip file,

the embedded file will be used. This is designed to support clients testing new files or having special

processing for certain batch files without having to update the persisted file.

Note: All optional files (embedded and persisted) used in the transactions are returned in the report zip.

AFC SaaS Standard User Manual| 6 of 54

Copyright 2018 Avalara, Inc.

3.4 Transferring Files To and From the FTP Site

Once you are connected to the AFC FTP site, you should change to the directory that has the same name

as your company’s three-character code. You are now ready to send your file (which, again, must be

named ftp.zip) for processing (see image below).

Your uploaded file should begin processing within 30 seconds after you finish putting it on the FTP site.

When your file has finished processing, you can either download the output (or "result" file) from the AFC

FTP or get it from the https://ftp.billsoft.com site.

This feature of the AFC SaaS Standard process allows your technical personnel to upload via FTP and your

destination personnel (accountant, etc.) to download the result files via the web interface.

The result file will have a similar name to the input file you uploaded, except that the first character after

the three letter company code (in the file name) will be an "R" - indicating it is a result file. For example, if

your uploaded ftp.zip file contained a file called KML150117AA.CSV, the result file (for downloading)

would be called KMLR150117AA.ZIP.

If the input file you upload is small, you can simply remain connected to the FTP site and wait for the file

to be processed. Otherwise, you should repeat the above steps to connect and log on to the FTP site, and

you can then get your result file.

When successfully

connected to the AFC

FTP site and changed to

your company's file-

transfer directory, you

can send your ftp.zip file

for processing. You can

ignore the index files.

AFC SaaS Standard User Manual| 7 of 54

Copyright 2018 Avalara, Inc.

3.5 Tax Calculation Results

The following zip files would be produced if a file with the base name KML150117AA is uploaded.

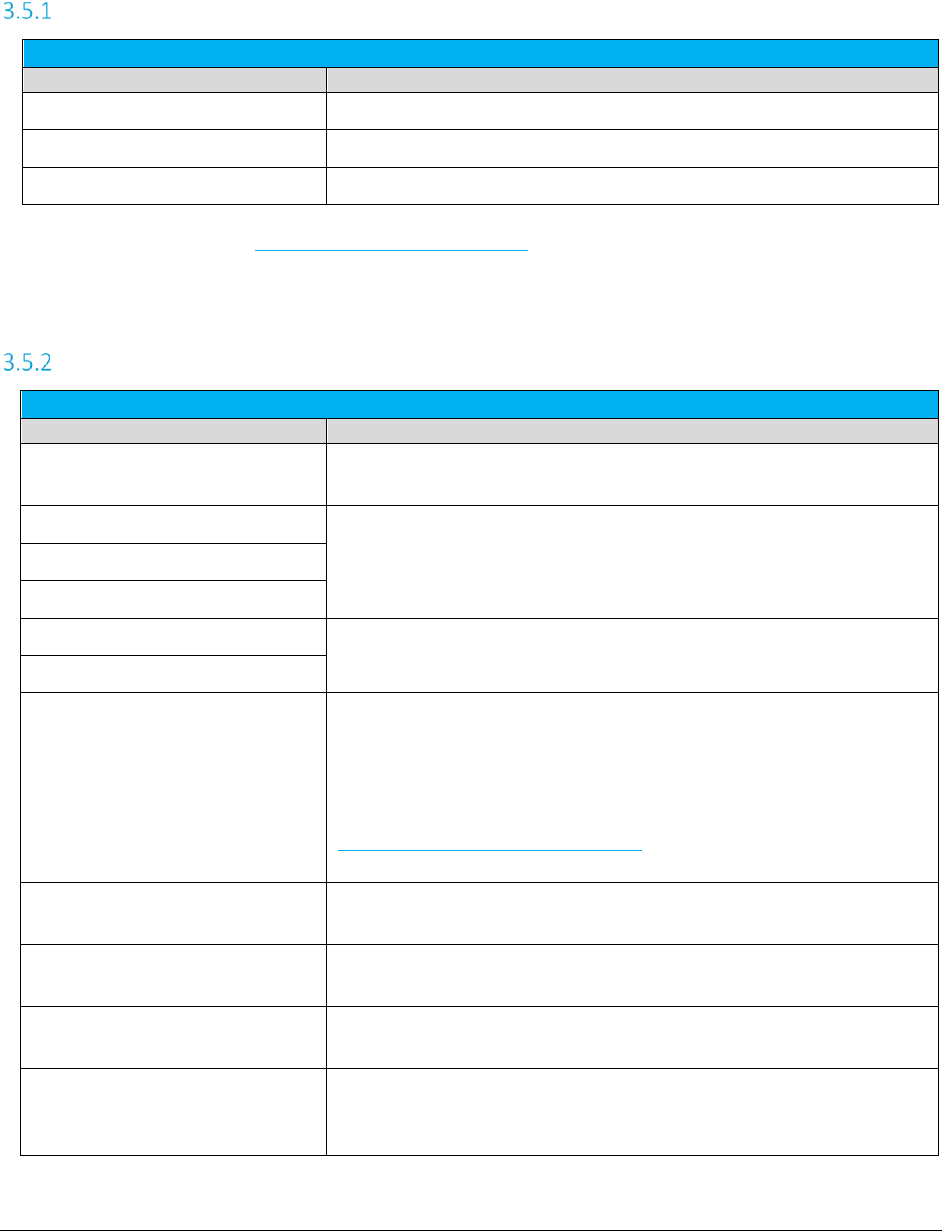

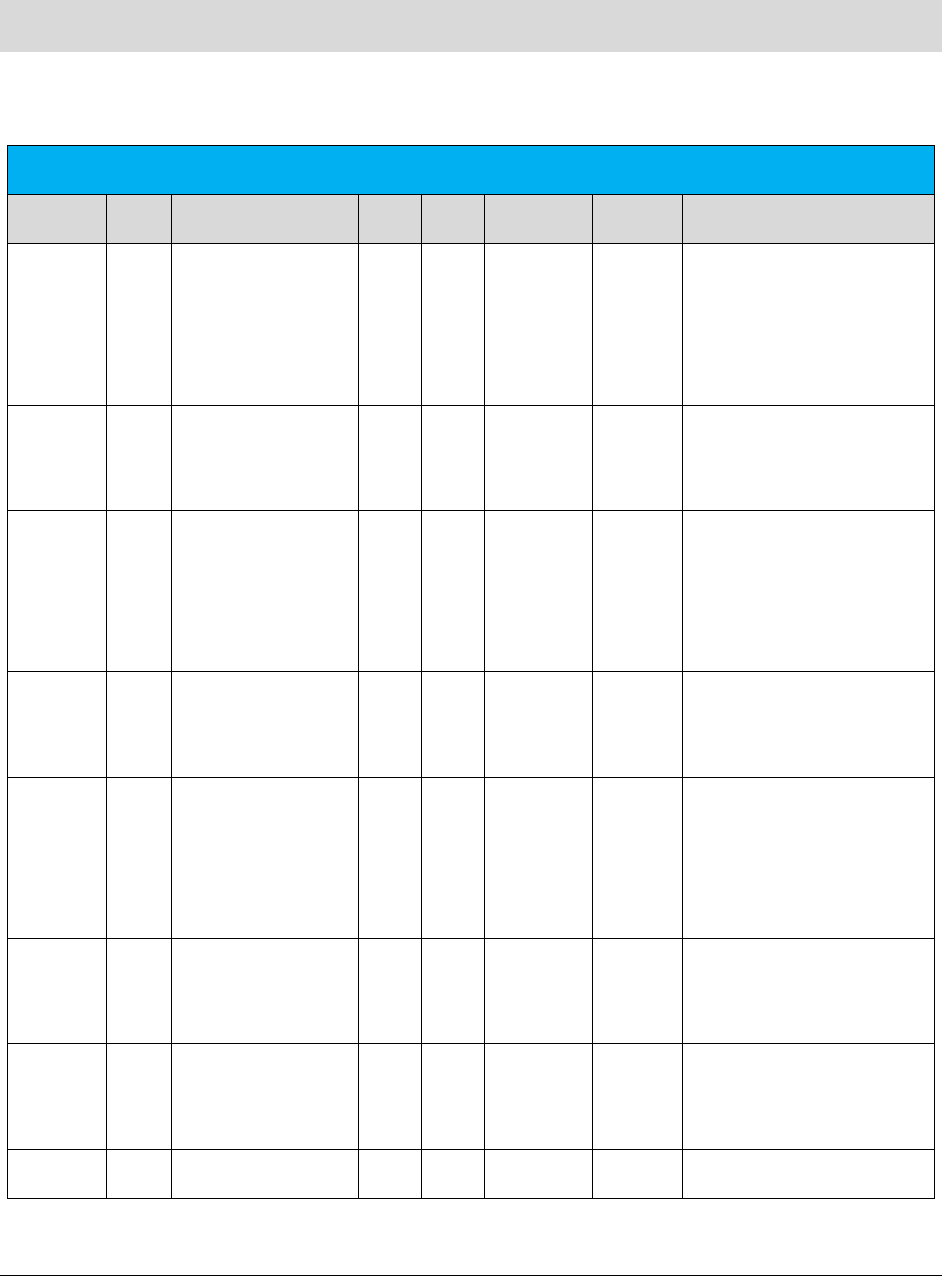

KMLS150117AA.zip - Compliance Files

Compliance Files

File Name

Description

KML150117AA.ssf*

Summarized standard billable tax report.

KML150117AA.nba*

Summarized Non-billable tax report (as applicable).

KML150117AA.nca*

Summarized Non-compliance tax report (as applicable).

*This output file is also available in CSV format; however, the option to generate the CSV format or version must be turned on. To

request this option, please contact communicationsupport@avalara.com for assistance. Please note that the CSV formats are

available in the Report Files output zip file (section 3.5.2)

KMLR150117AA.zip - Report Files

Report Files

File Name

Description

KML150117AA.csf

Summarized fixed position customer info report. Produced for clients

configured for standard compliance reporting.

KML150117AA.tsr*

Transaction/Service Jurisdiction Report. By default, all clients will receive

the tsr report.

KML150117AA.tsr.csv**

KML150117AA._audit.tsr.csv***

KML150117AA.rtr

Tax Inclusive Transaction/Service Jurisdiction Report (as applicable).

Produced if client has requested the rtr report.

KML150117AA._audit.rtr.csv***

KML150117AA _ASCIILOG.CSV

Contents of the tax data log converted to a comma-delimited text file

with header row included. Refer to

Section 5.3.1 asciilog.exe

in

TM_00101_AFC User Manual Telecom.pdf

for more information on this

report.

Note:

Clients wishing to receive this report must submit a request to

communicationsupport@avalara.com for configuration to add this to the

list of reports.

EZTax.license.rpt

Detailed version of the Transaction Count Report. Provides a count of

transactions processed by transaction/service pair.

KML150117AA.ntl

Transaction/Service data that was processed but did not generate any

taxes.

{output_filename_format}.rpt

Custom Sort report metrics. Provides details of the Custom Sort

processing. {output_filename_format} is defined in customsort.cfg.

{output_filename_format}_nca.csv

Non-compliance Custom Sort Report (as applicable based on

customsort.cfg settings). {output_filename_format} is defined in

customsort.cfg.

AFC SaaS Standard User Manual| 8 of 54

Copyright 2018 Avalara, Inc.

Report Files

File Name

Description

{output_filename_format}_nba.csv

Non-billable Custom Sort Report (as applicable based on customsort.cfg

settings). {output_filename_format} is defined in customsort.cfg.

{output_filename_format}_ssf.csv

Compliance Custom Sort Report. {output_filename_format} is defined in

customsort.cfg.

KML150117AA.csv

Request in comma delimited format.

KML150117AA_Default.csv

Request defaults in comma delimited format (as applicable).

KML150117AA_conversion.rpt

Conversion report. Generated if input file is in Excel format. Convert

excel to comma delimited.

KML150117AA_dtl.rpt

Detailed log report. This matches SaaS Pro detailed log report.

KML150117AA.CDF_dtl.csv

KML150117AA_dtl.rpt.csv**

KML150117AA_error.rpt

Processing error report. Produced if errors occur during processing.

Report captures the specific error message and the input line that failed

processing.

KML150117AA_summary.rpt

Processing summary report.

KML150117AA.ssf.csv**

Summarized standard billable tax report.

KML150117AA.nba.csv**

Summarized Non-billable tax report (as applicable).

KML150117AA.nca.csv**

Summarized Non-compliance tax report (as applicable).

*This output file is also available in CSV format; however, the option to generate the CSV format or version must be turned on. To

request this option, please contact communicationsupport@avalara.com for assistance.

**This CSV format version of the file is generated and sent in addition to the existing output format version only if the option has

been activated.

***The audit version of the report contains two additional columns, Start Date and End date, which provide a timestamp for the

report and headers for each column of data are included as well.

Note: All optional files (embedded and persisted) used in the transactions are returned in the report zip.

Please reference Handling of Optional Files for additional information and details.

KMLE150117AA.zip - Status Files

Status Files

File Name

Description

Read_err.sta

Reports problems encountered while reading the input file. Problems

might relate to invalid transaction/service type pairings or an invalid

input file.

Taxer.sta

Reports status during taxing routines. Status messages pertaining to

successful or unsuccessful insertion of overrides or jurisdiction not

found.

AFC SaaS Standard User Manual| 9 of 54

Copyright 2018 Avalara, Inc.

Status Files

File Name

Description

Sorter.sta

Reports status during sorting routines. Status messages pertaining to

successful or unsuccessful sort after taxation has occurred.

KML150117AA_converter.sta

Applies to excel input files. If an error occurs during conversion from

Excel to csv format, this file will be generated with the error message.

KML150117AA_batch.sta

Status from batch processor. Outputs column mappings and any

informational, warning or error level messages.

Customsort_log.sta

Reports status during custom sort processing. Contains processing steps

for the sort and any errors that may have occurred.

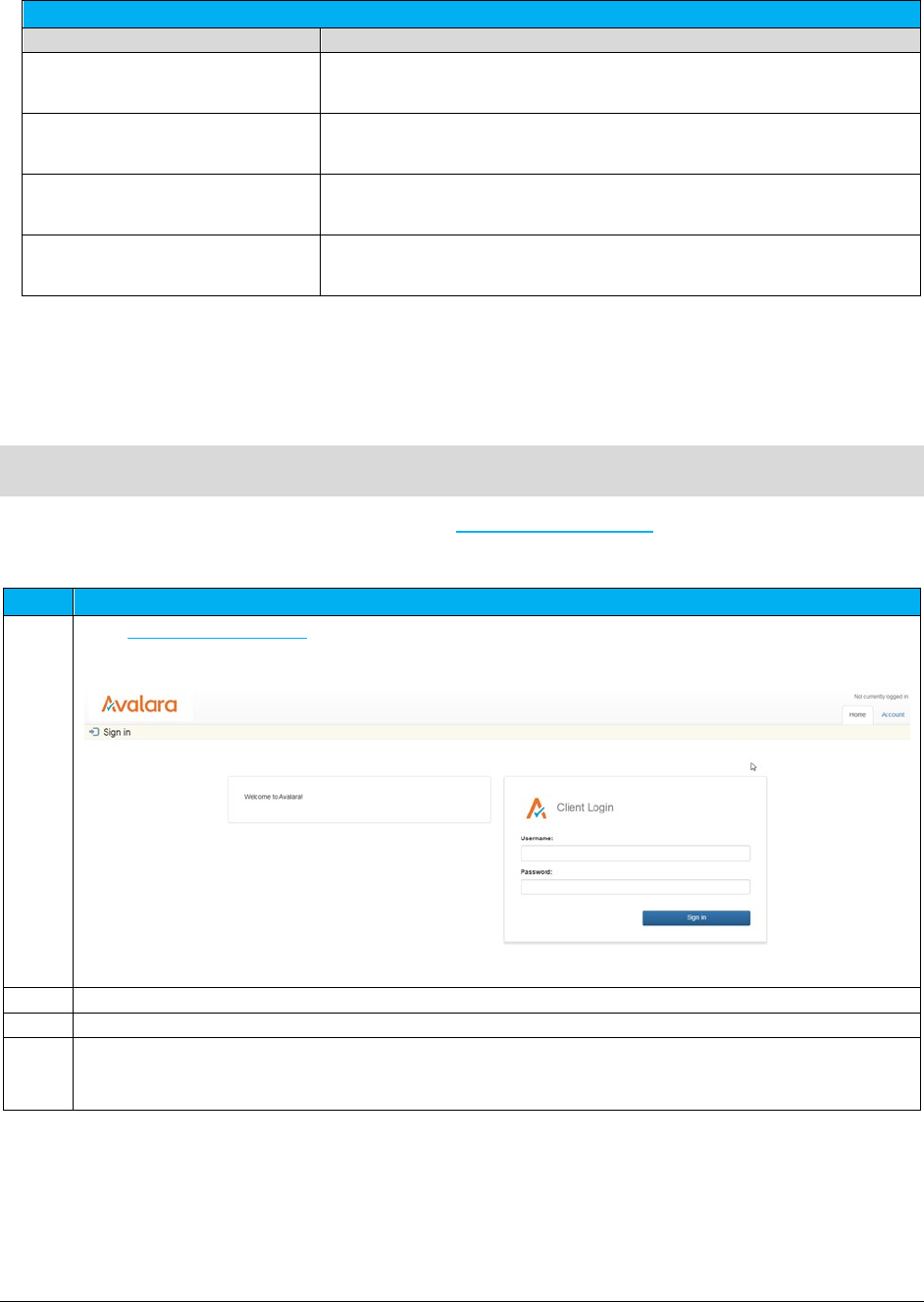

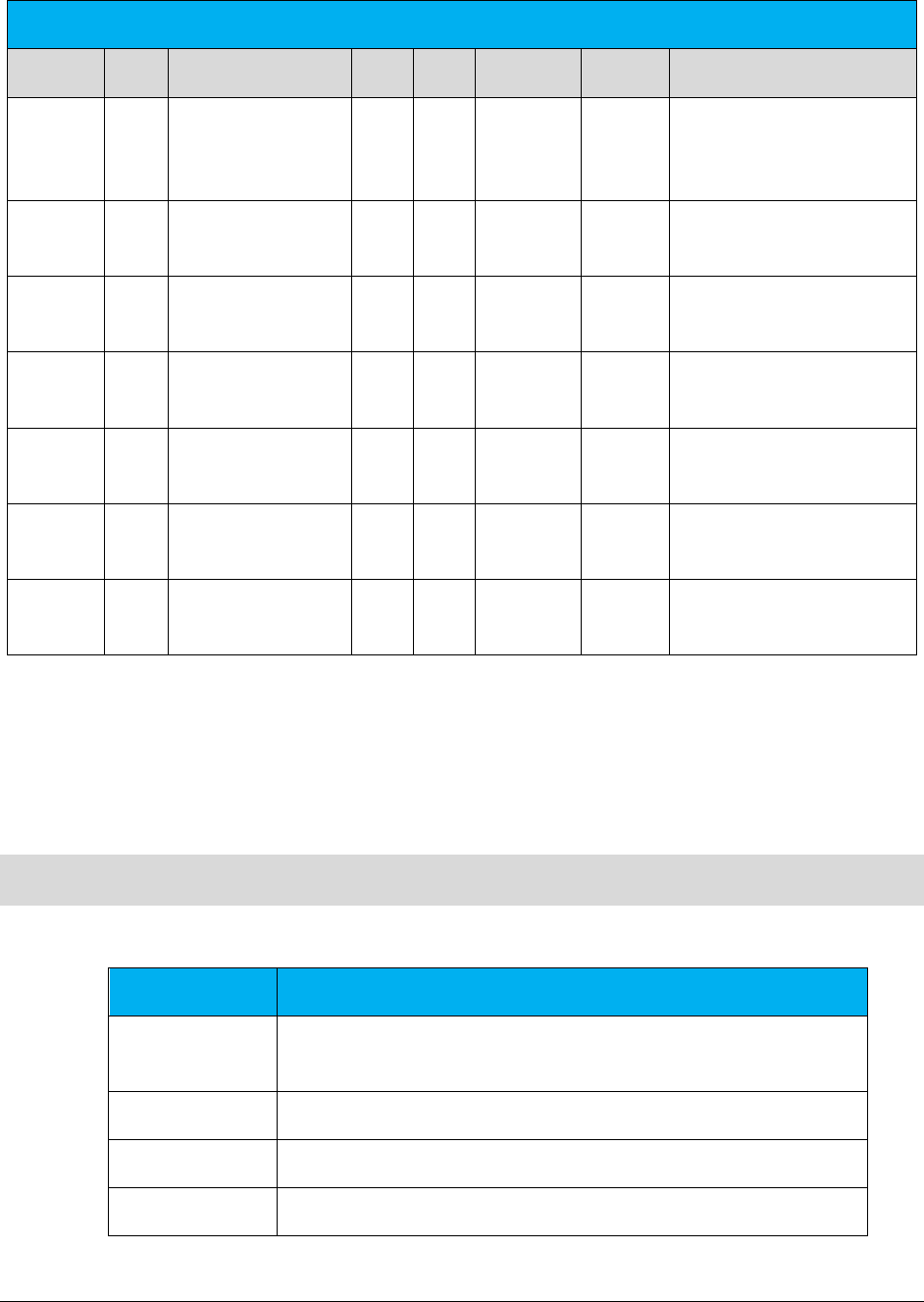

4. Web Interface

AFC SaaS Standard is accessible via web interface at https://ftp.billsoft.com. Please follow the steps

provided to log in.

Step

Action/Result

1

Type https://ftp.billsoft.com in the web browser. The home page appears.

2

Enter the username in the Username field.

3

Enter the password in the Password field.

4

Click Sign In. Once logged in, the File Manager window appears. You will be able to see all of the online

products which your organization is currently subscribing to.

AFC SaaS Standard User Manual| 10 of 54

Copyright 2018 Avalara, Inc.

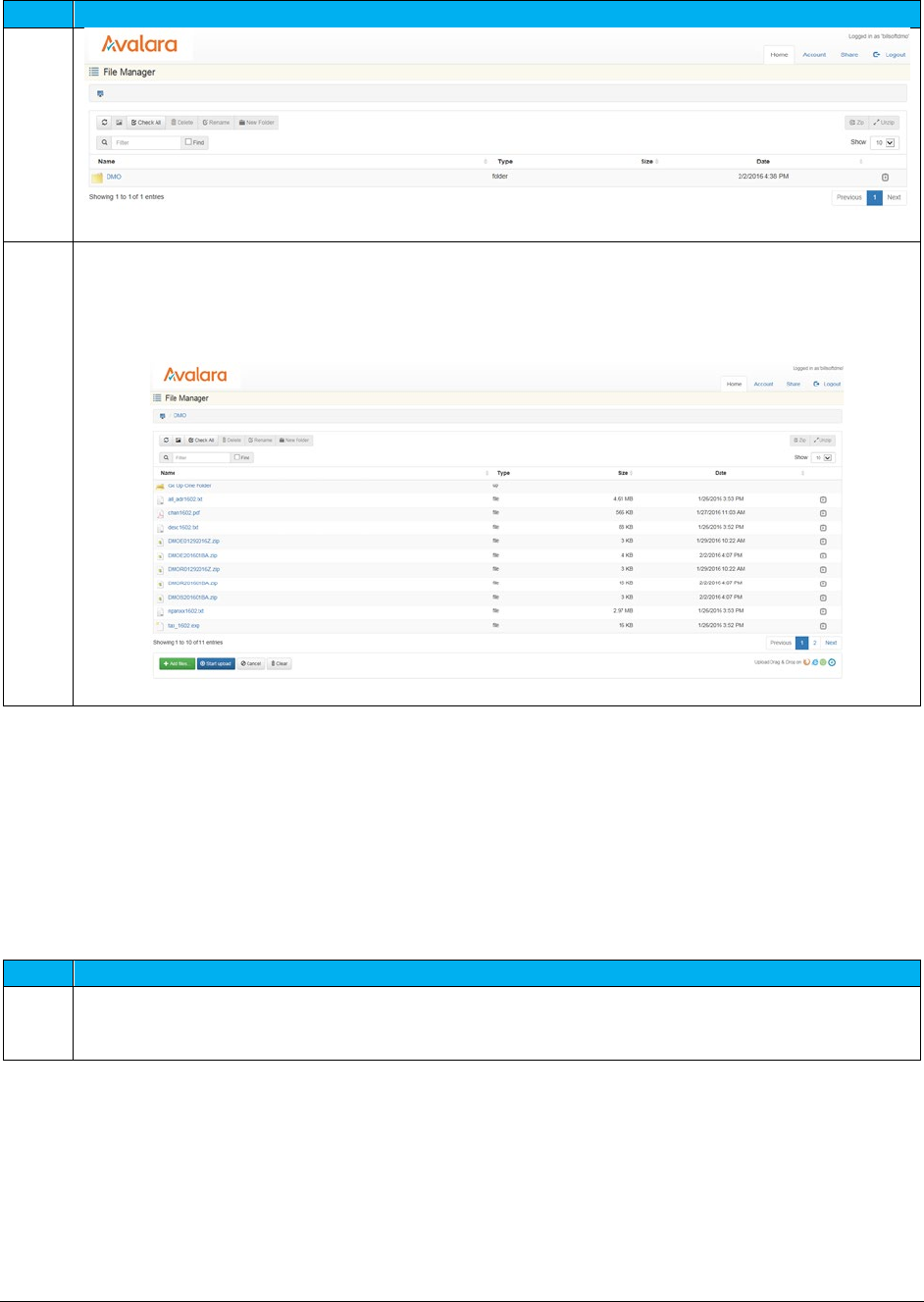

Step

Action/Result

5

Select and click the appropriate client folder such as DMO, which is the example within the screenshot.

All previous output files ran in previous days or sessions will also be visible after clicking on the folder.

You can confirm this by viewing the date or timestamp for each.

4.1 Uploading the ftp.zip

Once on the web interface, follow the steps below to upload the ftp.zip file.

Note: Please be aware that some functions or options are disabled and cannot be clicked or selected.

Disabled options are grayed-out in appearance and users do not have rights to access or utilize those

particular functions.

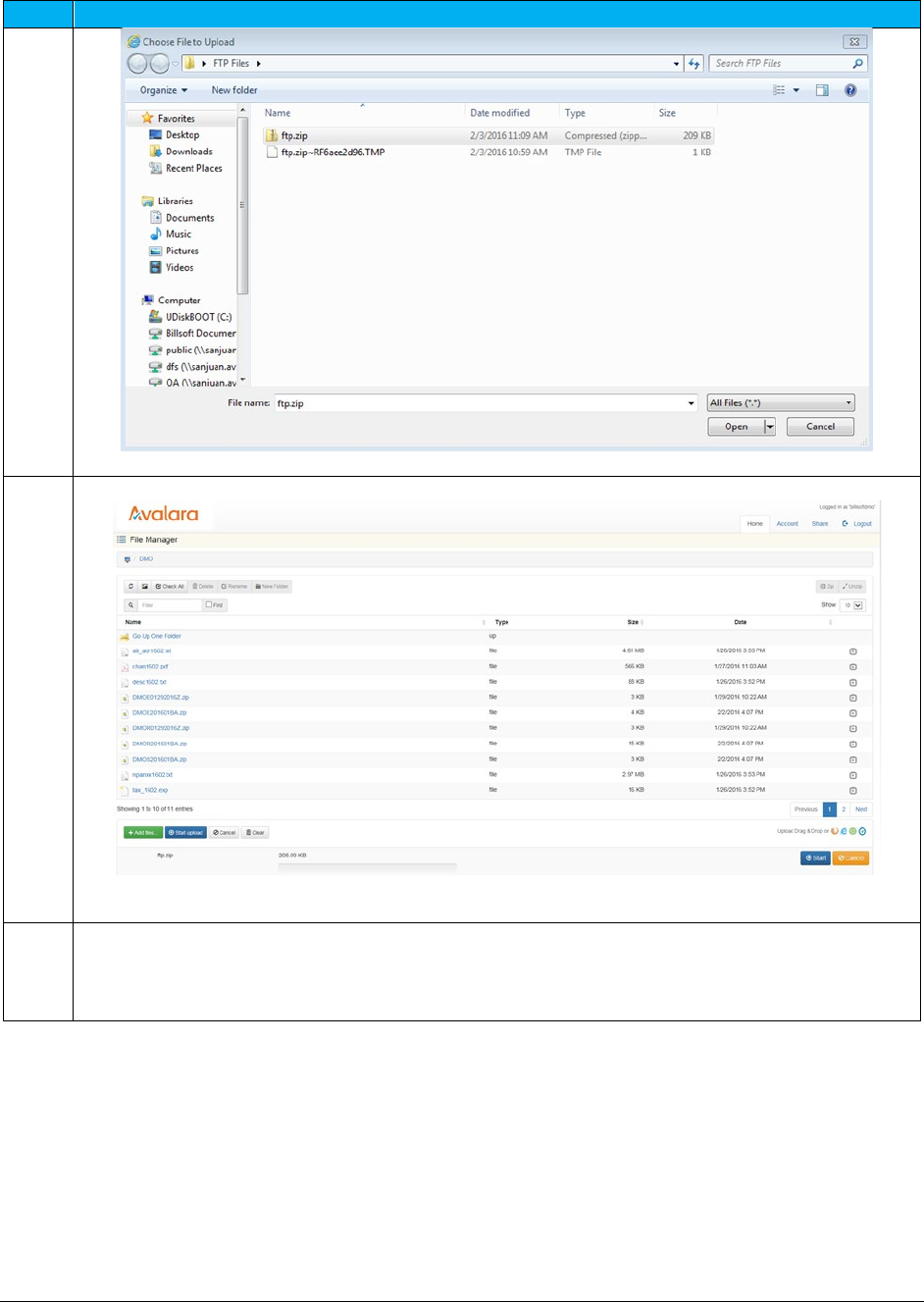

Step

Action/Result

1

Click the green Add files option to open the Choose File to Upload window to your local directory or the

location where the ftp.zip you previously created is stored.

AFC SaaS Standard User Manual| 11 of 54

Copyright 2018 Avalara, Inc.

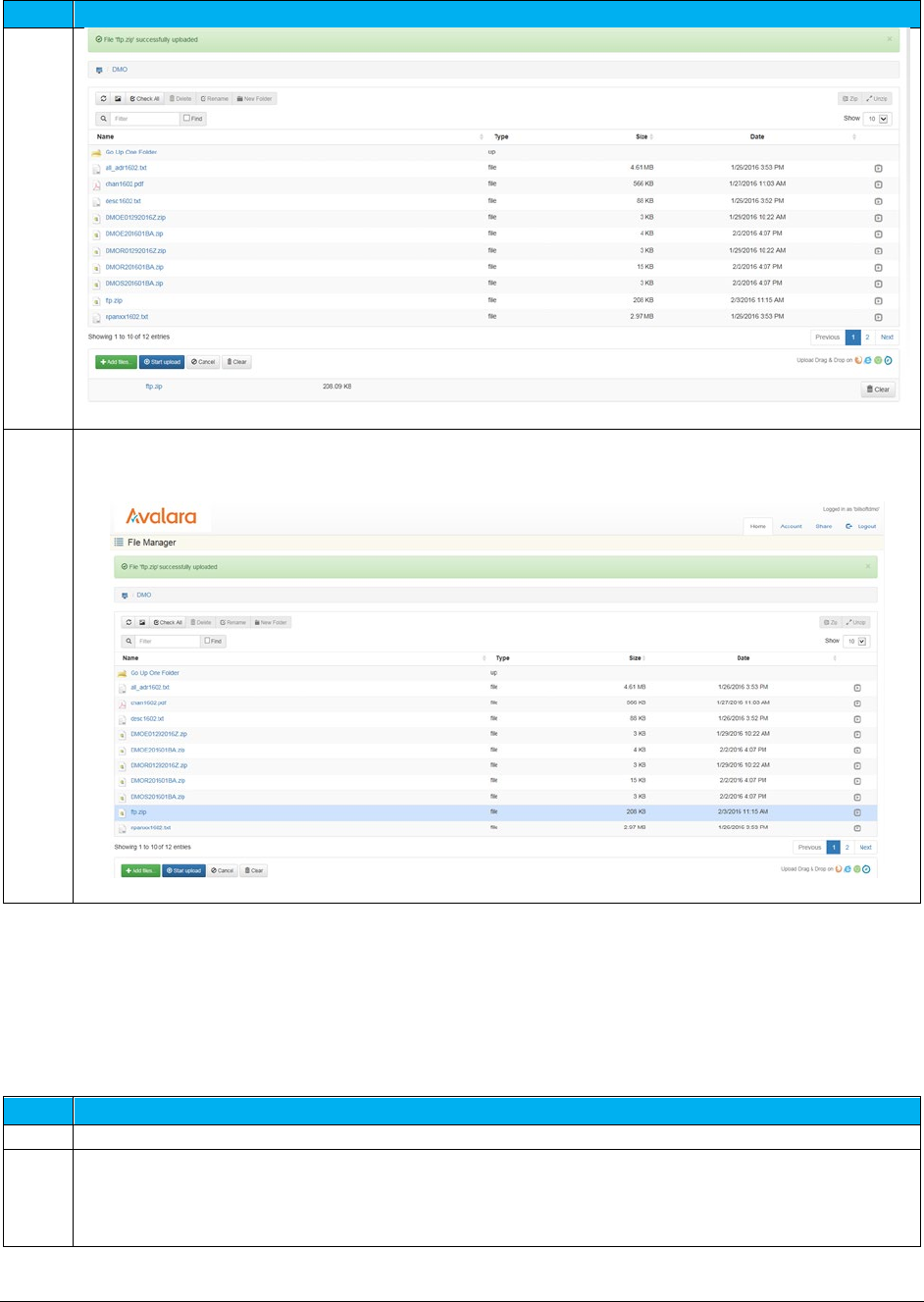

Step

Action/Result

2

Highlight and double-click the filename or click Open.

3

Click the blue

Start upload

or the blue

Start

option. The upload process will begin and status of your

upload will appear as well as verification that the upload was successful near the top of the window

shaded in green.

AFC SaaS Standard User Manual| 12 of 54

Copyright 2018 Avalara, Inc.

Step

Action/Result

4

Once completed, the output files or results will appear (such as the one highlighted in blue in the

screenshot.)

4.2 Retrieving Files

Please follow the steps provided below in order to retrieve or review files.

Step

Action/Result

1

View the completed files processed and locate the file with appropriate date and timestamp.

2

Highlight or double-click the file you wish to open.

AFC SaaS Standard User Manual| 13 of 54

Copyright 2018 Avalara, Inc.

Step

Action/Result

3

Select the Save or Save as option in the window.

Note:

The file must be saved. If the file is opened and closed without being saved, it will no longer be

available on the FTP site to download and save for your records.

4.3 Notifications

The system is set up to automatically provide email notification of updated files and status; however,

please contact communicationsupport@avalara.com with any questions or for additional assistance with

this feature.

5. Transaction Mapping Guidelines

AFC uses a system of numbers to represent the Transaction Types and Service Types for the service you

wish to tax. Passing valid combinations of Transaction Type / Service Type pairs provides AFC part of the

information necessary to produce the appropriate taxes for a specific jurisdiction.

For more information about mapping guidelines, see the document AFC Telecom Mapping Guidelines.pdf,

which is available for download at this URL: https://github.com/Avalara/Communications-Developer-

Content/tree/master/afc_saasstd_tax/support_docs

AFC SaaS Standard User Manual| 14 of 54

Copyright 2018 Avalara, Inc.

6. Frequently Asked Questions

I have a back log of data files I need processed. Can I send them all at once?

No. You can send only one file at a time, and you must wait for that data to be processed before

uploading another file. Otherwise, you face the risk of the data from one file appending or even

overwriting the data from another file.

I uploaded my file quite a while ago, and I still don't see any result file. What's wrong?

The most likely reason for this is an incorrect filename or an incorrect file format. The file must be in the

correct format for the system to process it. Likewise, the file must be named correctly for the system to

recognize it (see the appropriate sections in this manual regarding the naming of files). The filename can

be especially tricky: the actual .CSV or Excel file and .ZIP file (as they appear on your system’s hard drive)

must be named according to the afore-mentioned file-naming convention. Solution: if, after verifying

your file is both formatted and named correctly, you are still having problems - call or email your Avalara

technical support contact.

I’ve connected to the AFC FTP server, but I cannot view the contents of my directory.

If you’re unable to change directories, or if you are unable to list the contents of your transfer directory

or transfer files to/from the FTP server, you are most likely being denied access to the AFC SaaS Standard

server by a firewall or proxy server.

7. Support

Avalara strives to provide the very best in customer support. If you should need assistance or further

information when contacting the AFC FTP site or transferring files, please contact us at

communicationsupport@avalara.com.

If you have an urgent matter outside of the hours of 8 AM to 5 PM CST Monday through Friday, please

leave a message on the Avalara Technical Support contact's voice mail at (913) 221-7320.

AFC SaaS Standard User Manual| 15 of 54

Copyright 2018 Avalara, Inc.

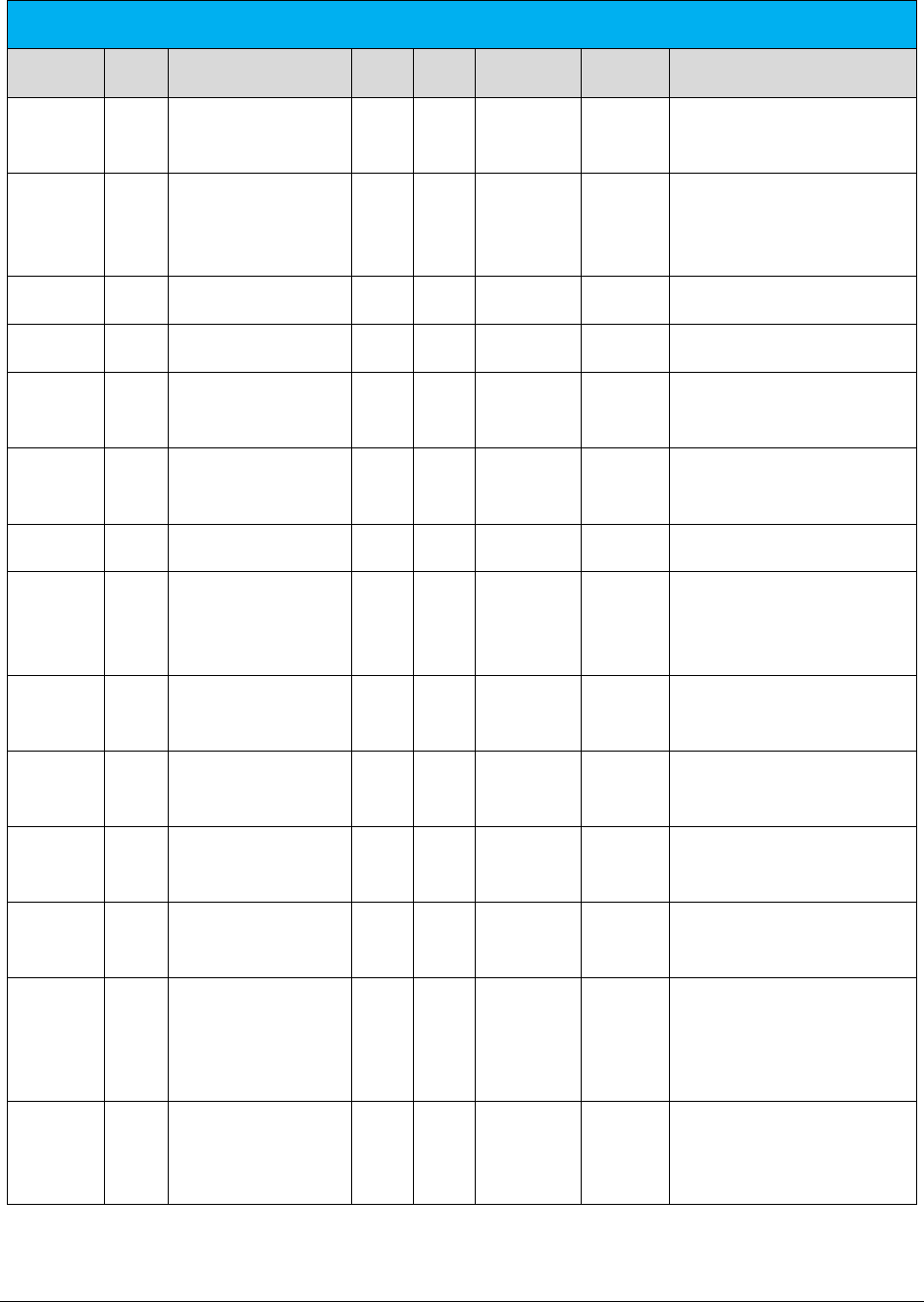

8. Appendix A – Extended Format: Excel and CSV

8.1 Input File

The columns in the Excel and CSV file formats are the same in each format. Column headers are the first

row in each file which describe the data in that particular field or column.

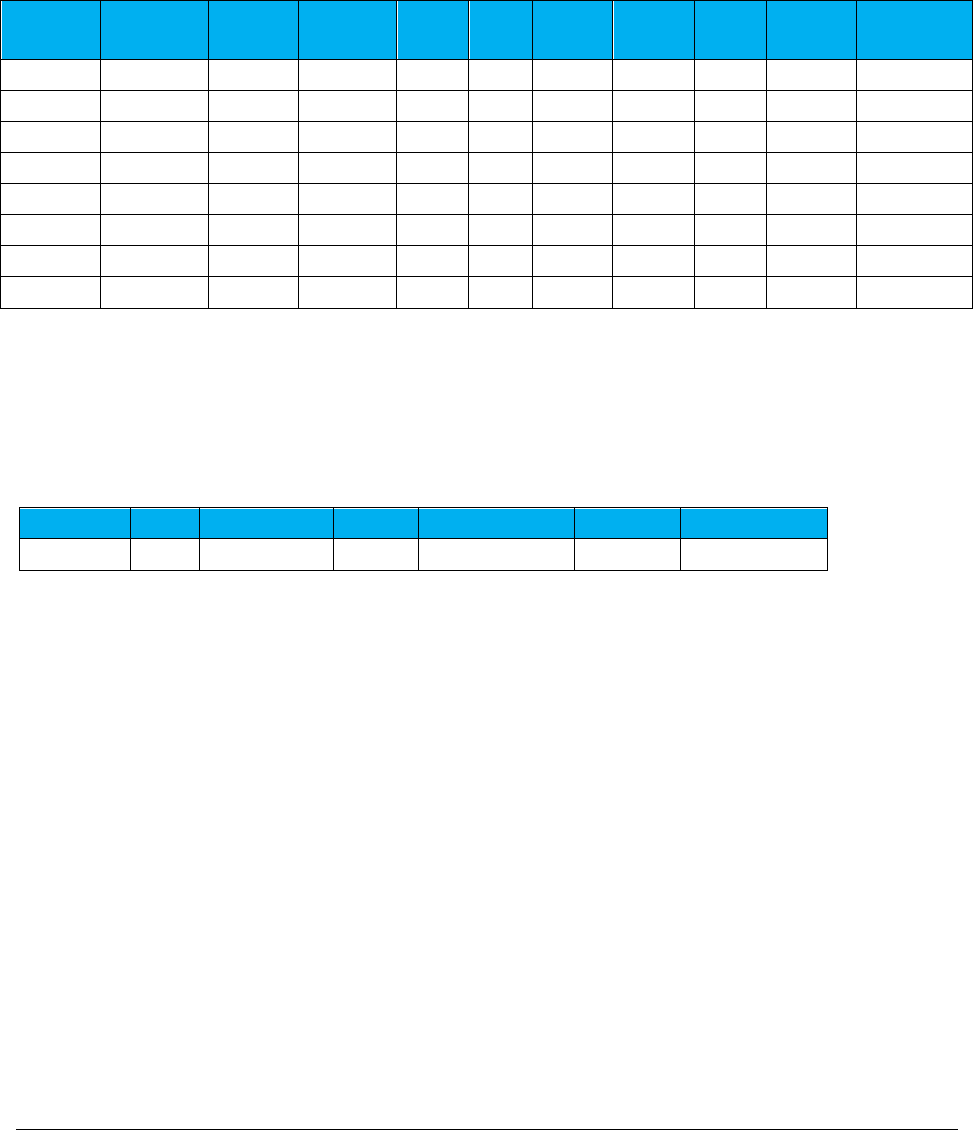

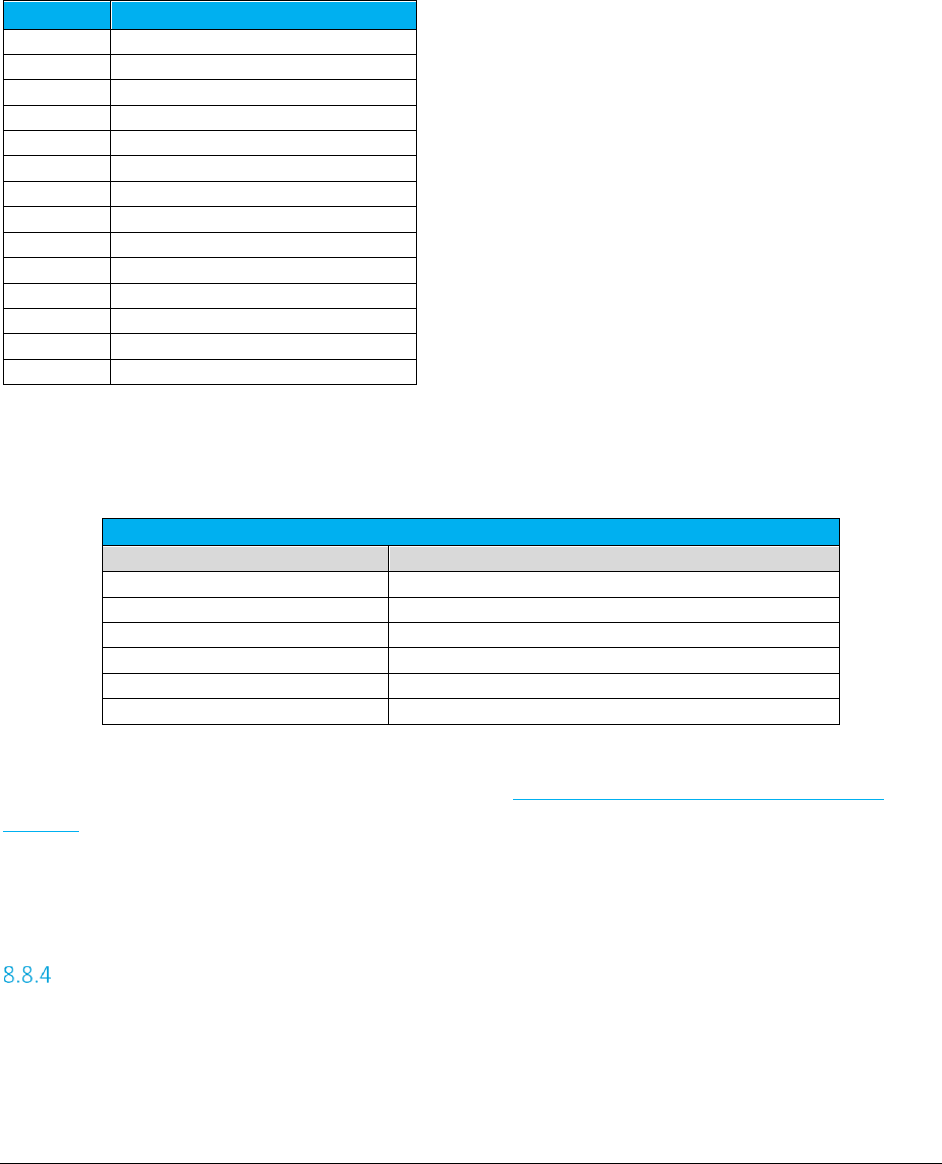

Field

*Required

Value List

Reference

Request Type

R

CalcTaxes

CalcAdj

CalcIncl

CalcInclAdj

Specifying Request Type

BillTo PCode

Origination PCode

Termination PCode

OR

Specifying Jurisdiction PCode

BillTo Country

BillTo State

BillTo County

BillTo Locality

BillTo ZipCode

BillTo ZipP4

Origination CountryI

Origination State

Origination County

Origination Locality

Origination ZipCode

Origination ZipP4

Termination Country

Termination State

Termination County

Termination Locality

Termination ZipCode

Termination ZipP4

OR

Specifying Jurisdiction Address

BillTo Fips Code

Origination Fips Code

Termination Fips Code

OR

Specifying Jurisdiction Fips Code

BillTo NpaNxx

Origination NpaNxx

Termination NpaNxx

OR

Specifying Jurisdiction NpaNxx

Transaction Type

R Specifying Transaction / Service Pair

Service Type

R Specifying Transaction / Service Pair

Date

R YYYYMMDD Specifying Transaction Date

Charge

R

Specifying Transaction Charge

AFC SaaS Standard User Manual| 16 of 54

Copyright 2018 Avalara, Inc.

Field

*Required

Value List

Reference

Customer Type

SR

Business (default)

Residential

Industrial

Senior Citizen

Specifying Customer Type

Lines

D

Integer (default is 0)

Specifying Lines

Sale

D

Sale (default)

Resale

Specifying Sale Type

Incorporated

D

True (default)

False

Specifying Incorporated

Federal Exempt

Federal PCode

State Exempt

State PCode

County Exempt

County PCode

Local Exempt

Local PCode

D Specifying Level Exemptions

Regulated

D

True (default)

False Specifying Regulated Flag

Minutes

D

Number (default is 0)

Specifying Minutes

Debit

D

True

False (default)

Specifying Debit Flag

Service Class

D

Local (default)

Long Distance

Specifying Service Class

Lifeline

D

True

False (default)

Specifying Lifeline Flag

Facilities

D

True (default)

False

Specifying Facilities Flag

Franchise

D

True (default)

False

Specifying Franchise Flag

Business Class

D

CLEC (default)

ILEC

Specifying Business Class

Company Identifier

D

Specifying Company Identifier

Customer Number

D

Specifying Customer Number

Invoice Number

D

Specifying Invoice Number

AFC SaaS Standard User Manual| 17 of 54

Copyright 2018 Avalara, Inc.

*Required:

• R = Required

• OR = Only One Required (Remaining optional)

Field

*Required

Value List

Reference

Discount Type

D

None (Default)

Retail Product

Manufacturer Product

Account Level

Subsidized

Goodwill

Specifying Discount Type

Exemption Type

D

Specifying Exemption Type

Adjustment Method

D

Default (Default)

Least

Most

Specifying Adjustment Method

IsPrivateLine

PrivateLineSplit

D

Percentage allocation

specified as a decimal in

the range 0 to 1.

Specifying Private Line or Point-to-Point

IsProRated

ProRatedPct

D

Percentage allocation

specified as a decimal in

the range 0 to 1.

Specifying Proration

Optional

Optional4

Optional5

Optional6

Optional7

Optional8

Optional9

Optional10

OptionalAlpha1

D Specifying Optional Reporting Fields

Key:{

header

}

O

Specifying Extended Optional Reporting Fields

VoIP Old (Original Fed TAM)

O

TAM value specified as

decimal between 0 and

1.

Specifying Safe Harbor Overrides for Traffic

Studies

VoIP New (Override Fed TAM)

Cellular Old (Original Fed TAM)

O

TAM value specified as

decimal between 0 and

1.

Specifying Safe Harbor Overrides for Traffic

Studies

Cellular New (Override Fed TAM)

Paging Old (Original Fed TAM)

O

TAM value specified as

decimal between 0 and

1.

Specifying Safe Harbor Overrides for Traffic

Studies

Paging New (Override Fed TAM)

AFC SaaS Standard User Manual| 18 of 54

Copyright 2018 Avalara, Inc.

• SR = Strongly Recommended (Default, if applicable)

• O = Optional (No Default)

• D = Optional (Default, if applicable)

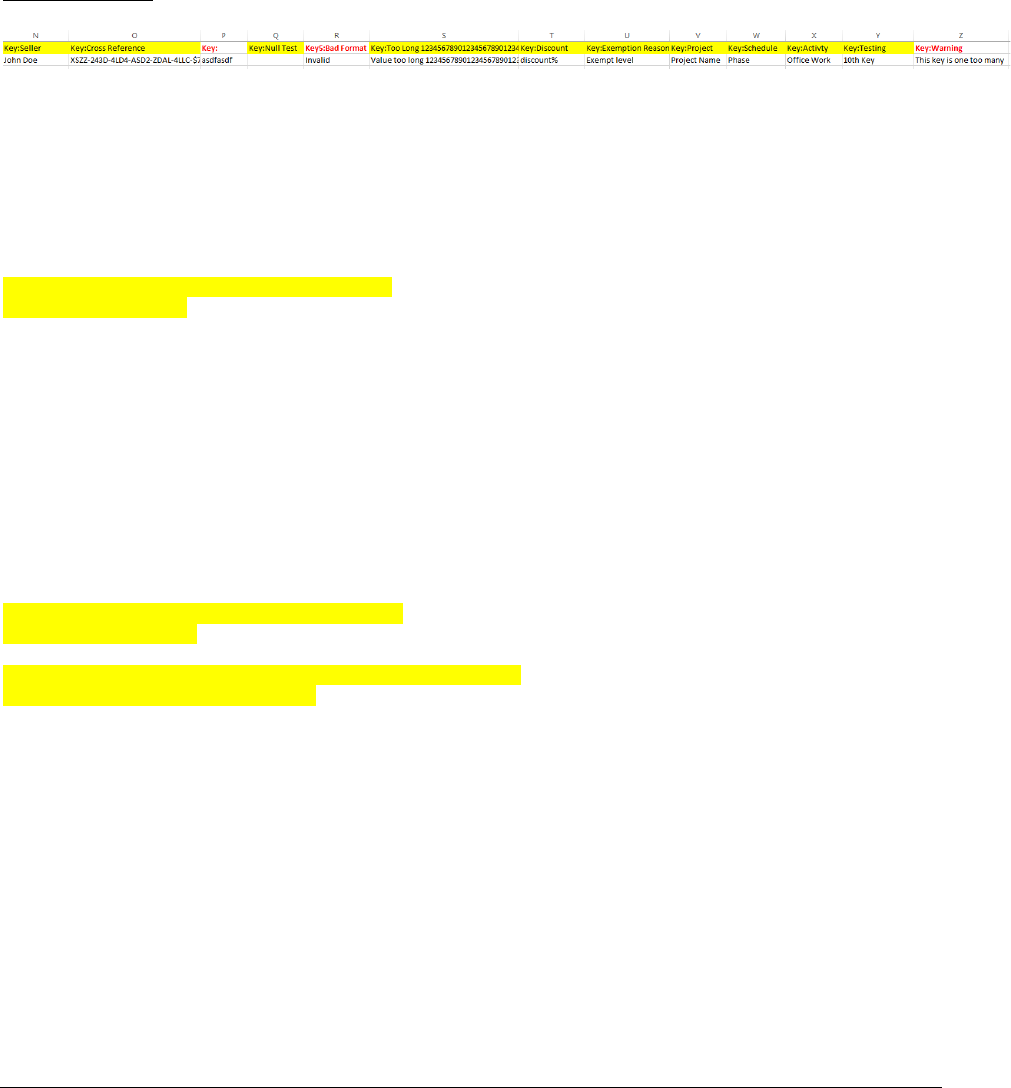

Please see Default Values for additional information on default parameters.

Notes:

• Spacing is ignored in a field name. For example, [Request Type] and [RequestType] would be

considered identical.

• Matching will ignore additional fields or characters beyond the listed value. Example: [Lines] and

[Lines Count] would be considered identical. [Line Count] however would not be considered a

valid column identifier, as it is missing the character [s].

• Column headers are required and must be included in Excel and CSV format.

8.2 Exemption File

The exemption file is an optional input file that identifies tax type exemptions, category exemptions, or

both. The name of the file is user defined, but the extension must be .exm.

Note: While both a tax type and category exemption can be applied to the same transaction within the

input file, the separate exemptions must be specified on individual rows within the exemption file.

Please refer to Handling of Optional Files for additional information.

Exemption File Updates

New Fields – Effective September 2018

Scope – union, user supplied

• One or more of the set { Federal, State, County, Local }

Include Nonbillable – flag, user supplied

• True – nonbillable taxes can be exempted

• False – nonbillable taxes should not be included in exemption

Domain – discrete, user supplied

• Defines the level the taxing jurisdiction must match exemption jurisdiction

• One of the set { Federal, State, County, Local }

• Does not need to correlate to the tax level of the tax being exempted

Ignore Level Exemptible - flag, user supplied

• True (Default) - Tax type wildcard exemptions will exempt taxes tagged not level exemptible

AFC SaaS Standard User Manual| 19 of 54

Copyright 2018 Avalara, Inc.

• False - Tax type wildcard exemptions will exclude taxes tagged not level exemptible from

consideration

The exemption handling has been redesigned to allow more flexibility in how they are used. Wherever

possible backwards compatibility was maintained with the following exception:

Category exemptions and wildcard tax type exemptions by default will no longer exempt non-

billable taxes. The new flag ExemptNB must be set to true if a client wishes to include non-

billable taxes. This change was made to protect clients from applying exemptions beyond the

scope of the exemption certificate(s) for which the customer qualifies. If you have additional

questions on why Avalara changed the default, please contact

CommunicationSupport@avalara.com.

Overview of Exemptions

Setting up exemptions allows for exempting clients from taxes that would normally apply for a given

product for either a specific jurisdiction or a jurisdictional region.

Checklist for creating an exemption

• What - Is the exemption for a specific tax or for a category of taxes?

o Listing of tax types and associated categories can be found in the Mapping Guideline.

o An array of exemptions can be created if multiple tax types and/or categories apply.

o Values of 0 or All defines wildcard for both tax type and categories..

• Where - Does the exemption apply to a specific jurisdiction or to a jurisdiction region?

o This defines the Scope. Regions are Federal (Country), State/Province, County, City.

o You can define multiple regions for Scope such as (State + County + Local)

• When - At what level must the exemption match the taxing jurisdiction?

o This defines the Domain. Domain can be one of (Federal, State, County, Local)

o For example, if you wish to exempt Federal taxes only if the taxing jurisdiction is in Puerto

Rico, then the Domain would be State and the Exemption would be defined for Puerto

Rico. The federal taxes would then only be exempt when the taxing jurisdiction was in

Puerto Rico.

• Who – Define the cross-reference for who the exemption will be applied to

o Exemptions can be tied to transactions by one of the following:

Customer Number

Company Identifier

Optional Alpha1

Exemption Type

AFC SaaS Standard User Manual| 20 of 54

Copyright 2018 Avalara, Inc.

Exemption Fields

Tax Type Exemption Sample File

The samples provided show tax type exemption files processed and properly cross-referenced by the

following key columns:

• Using Company Identifier and PCode

The data within lines 2 – 3 of the previous input file are associated with the sample exemption file

provided below.

Company Identifier

PCode

Tax Type

Domain

Scope

Company A

540000

18

0

Federal

Company A

540000

64

1

Federal+State

• Using Customer Number and LinkTo

The data within lines 2 – 3 of the previous input file are associated with the sample exemption file

provided below.

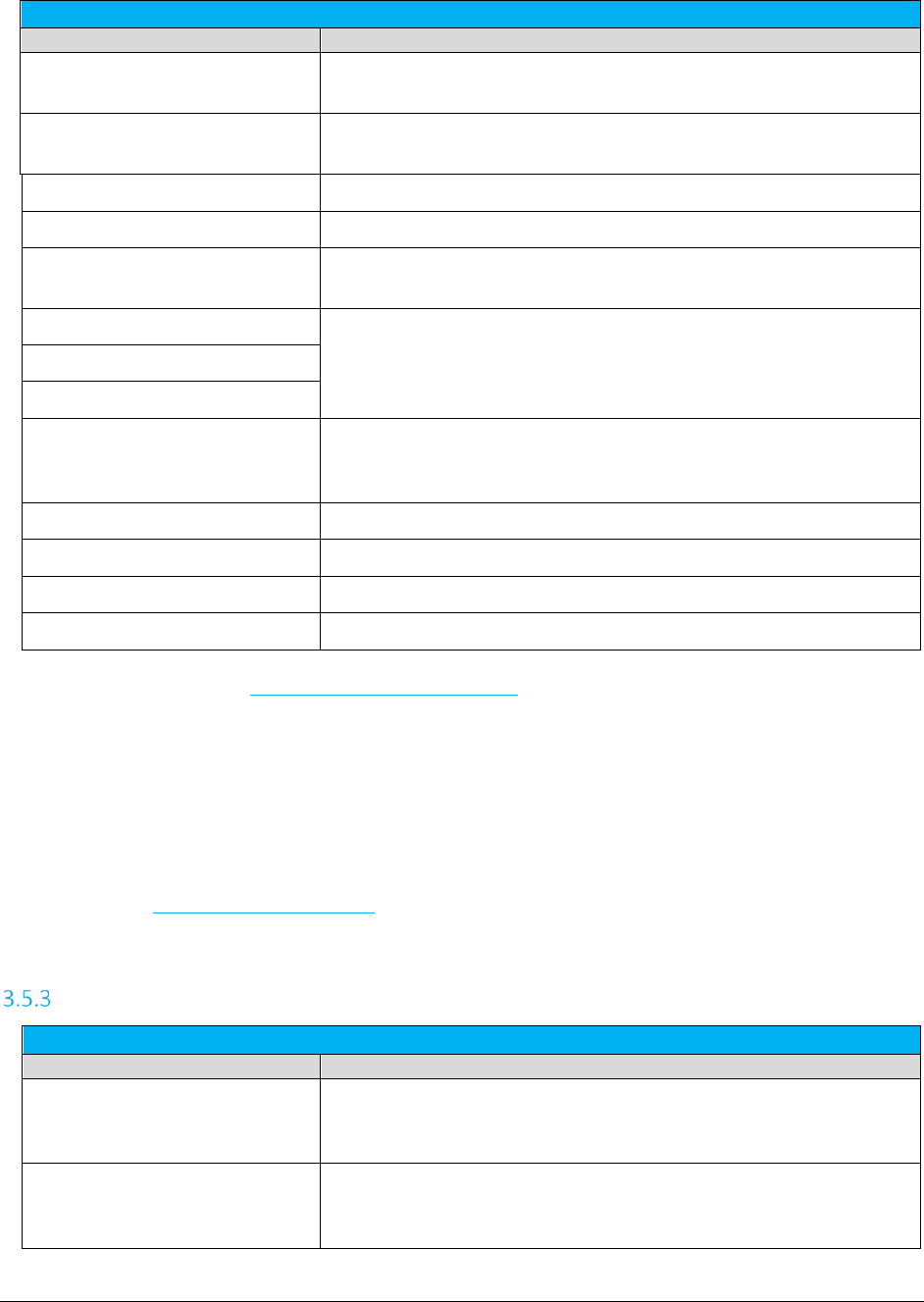

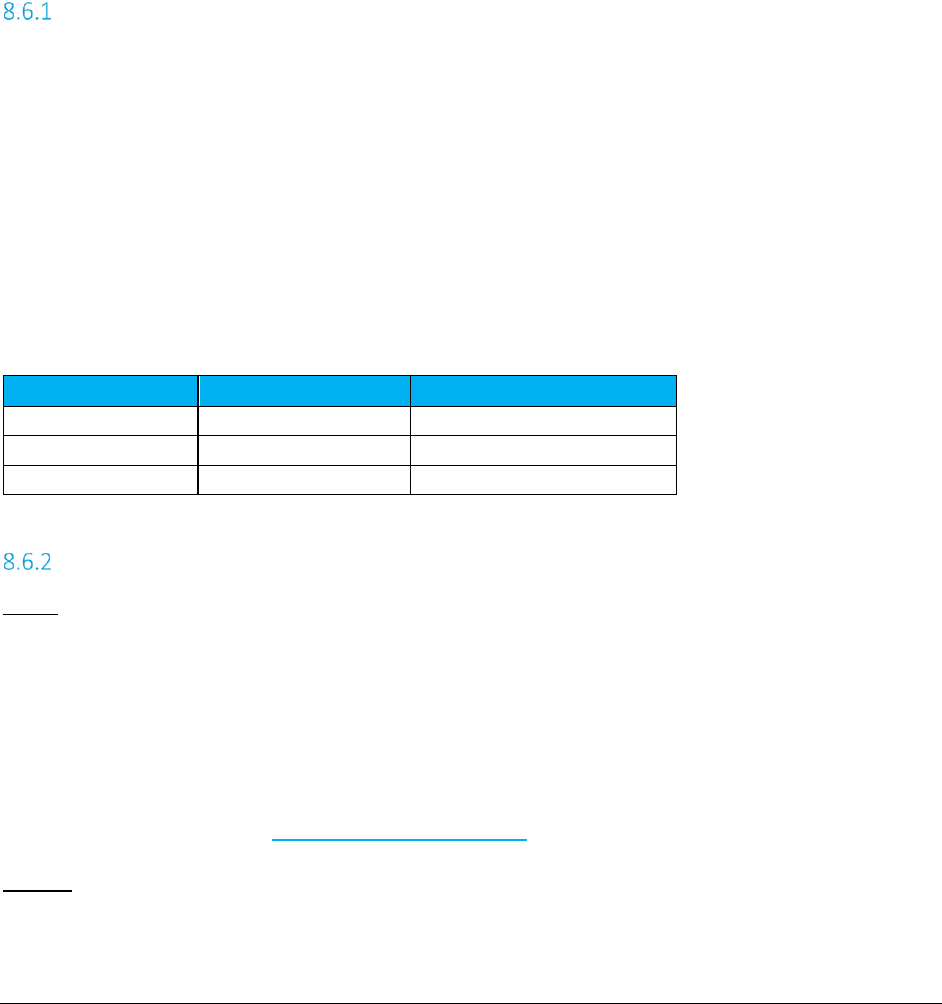

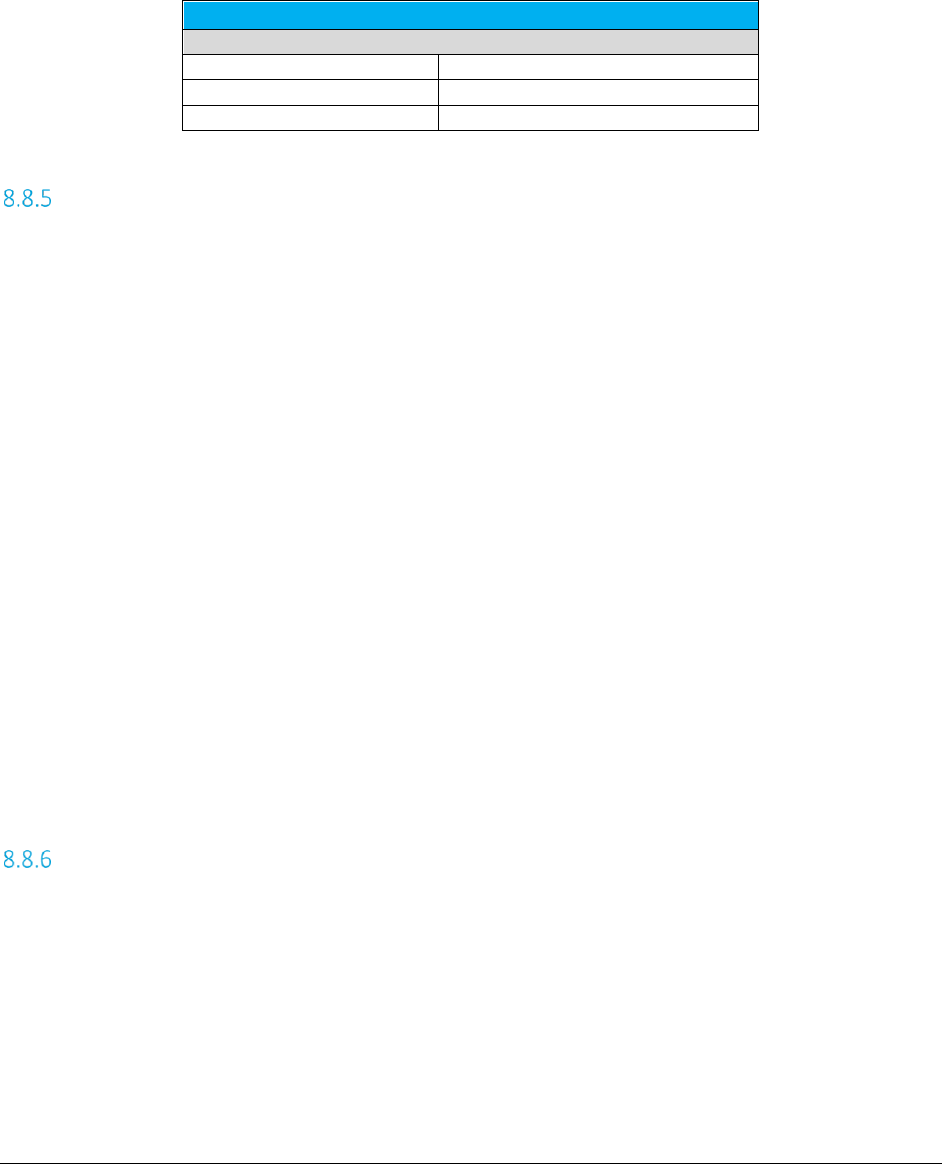

Field

Value List

Reference

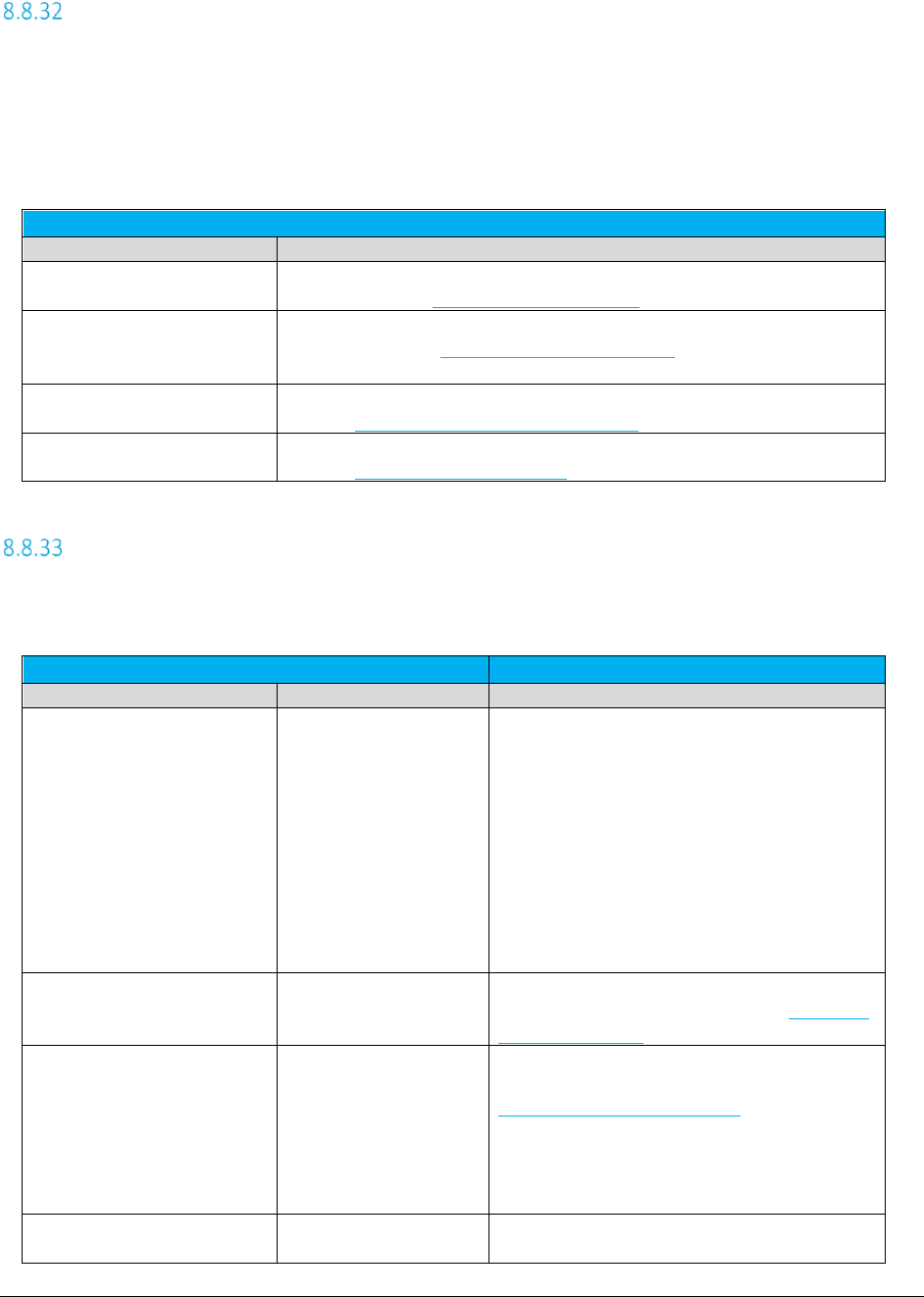

[

Cross Reference Key

]

Specifying Exemption Cross Reference Key

[

Jurisdiction

]

Specifying Exemption Jurisdiction

TaxType

Numeric Tax Type ID

Or “All”

Specifying Exemption Tax Type

TaxCategory

Numeric Category ID

Or “All”

Specifying Exemption Category

Scope

Numeric Scope Value

-or-

Text Scope Value(s)

Specifying Exemption Scope

Domain

Numeric Tax Level ID

-or-

Text Domain Value

Specifying Exemption Domain

ExemptNB

Flag – Boolean

Specifying Exemption Exempt Non-billable Flag

ExemptLvl

Flag – Boolean

Specifying Exemption Exempt Non-level-exemptible Flag

Customer Number

LinkTo

Tax Type

Domain

Customer 1

BillTo

18

0

AFC SaaS Standard User Manual| 21 of 54

Copyright 2018 Avalara, Inc.

• Using Customer Number and Address

The data within lines 2 – 5 of the previous input file are associated with the sample exemption file

provided below.

Customer

Number

Country

State

County

Locality

Zip Code

Tax

Type

Domain

Customer 1

USA

18

0

Customer 1

FL

64

1

Customer 1

USA

FL

Brevard

Cocoa

Beach

32931

64

3

Customer 2

USA

169

Federal

Customer 2

CA

18

Federal

Customer 2

USA

CA

San

Francisc

o

San

Francisc

o

94102

16

Local

Application of Jurisdiction for Exemptions

The exemption jurisdiction should be defined at least to the Domain level specified. If it is not, the

Domain will automatically shift upward to the level the exemption jurisdiction is defined at. So for

example, if the Domain level is specified at city level, but the exemption jurisdiction provided is for the

state of Colorado, the Domain level will shift to State and produce a match if the transaction taxing

jurisdiction is in Colorado.

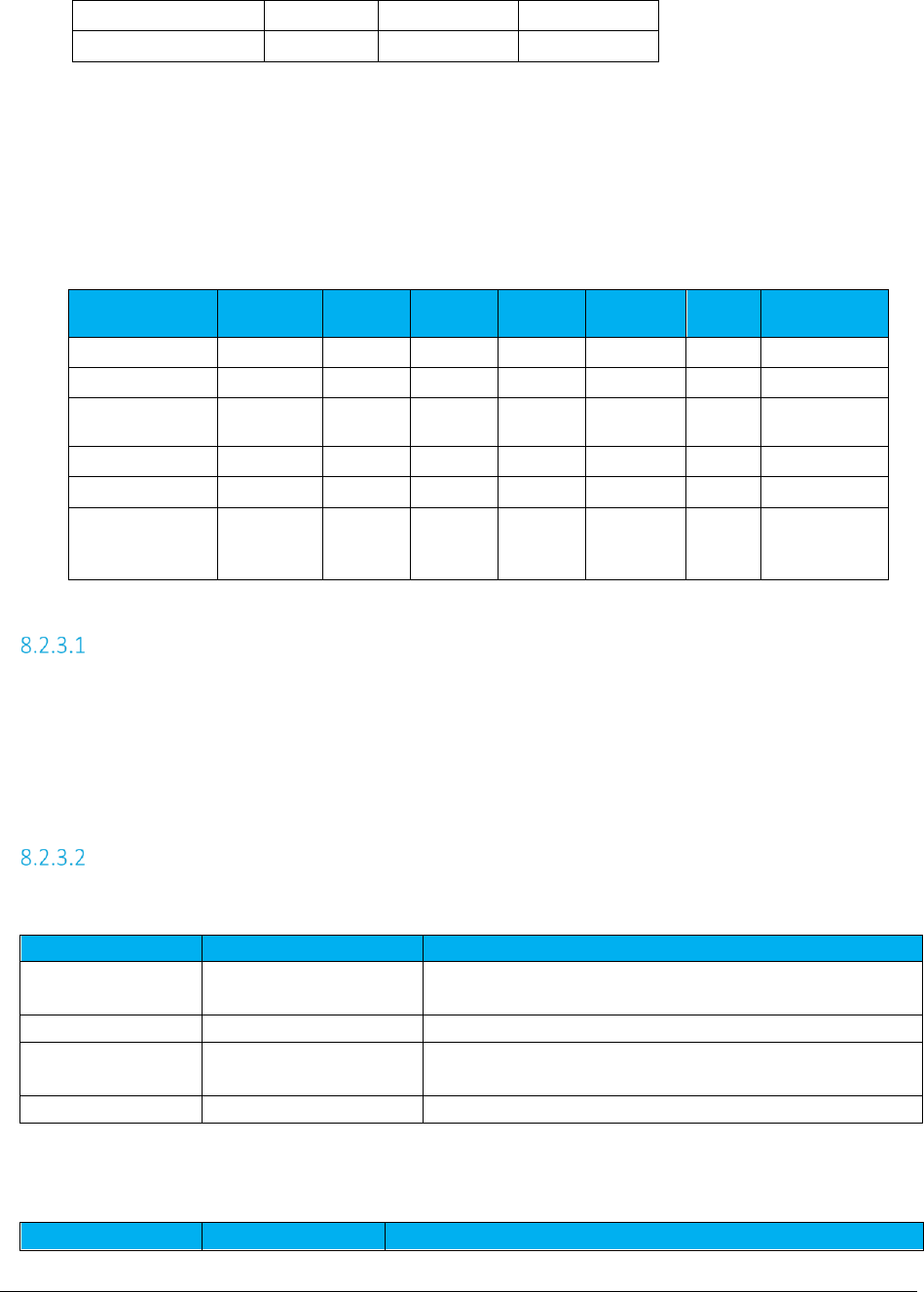

Exemption Default Values

Tax Type defaults (where applicable)

Field

Default

Special Condition

Include

Nonbillable

True

False

Valid tax type specified

Wildcard for tax type used

Scope

Tax Level or Domain

Domain

Tax Level

One or the other is required for Tax Type exemptions.

Domain overrides tax level if both are provided

Force Lvl Exempt

True

Wildcard for tax type used

Category defaults (where applicable)

Field

Default

Special Condition

Customer 1

Origination

64

1

Customer 1

Termination

64

3

AFC SaaS Standard User Manual| 22 of 54

Copyright 2018 Avalara, Inc.

Include

Nonbillable

False

Scope

State+County+City

All

If State or lower level jurisdiction

If Country level jurisdiction

Domain

State

Federal

If State or lower level jurisdiction

If Country level jurisdiction

Exemption Use Case Scenarios

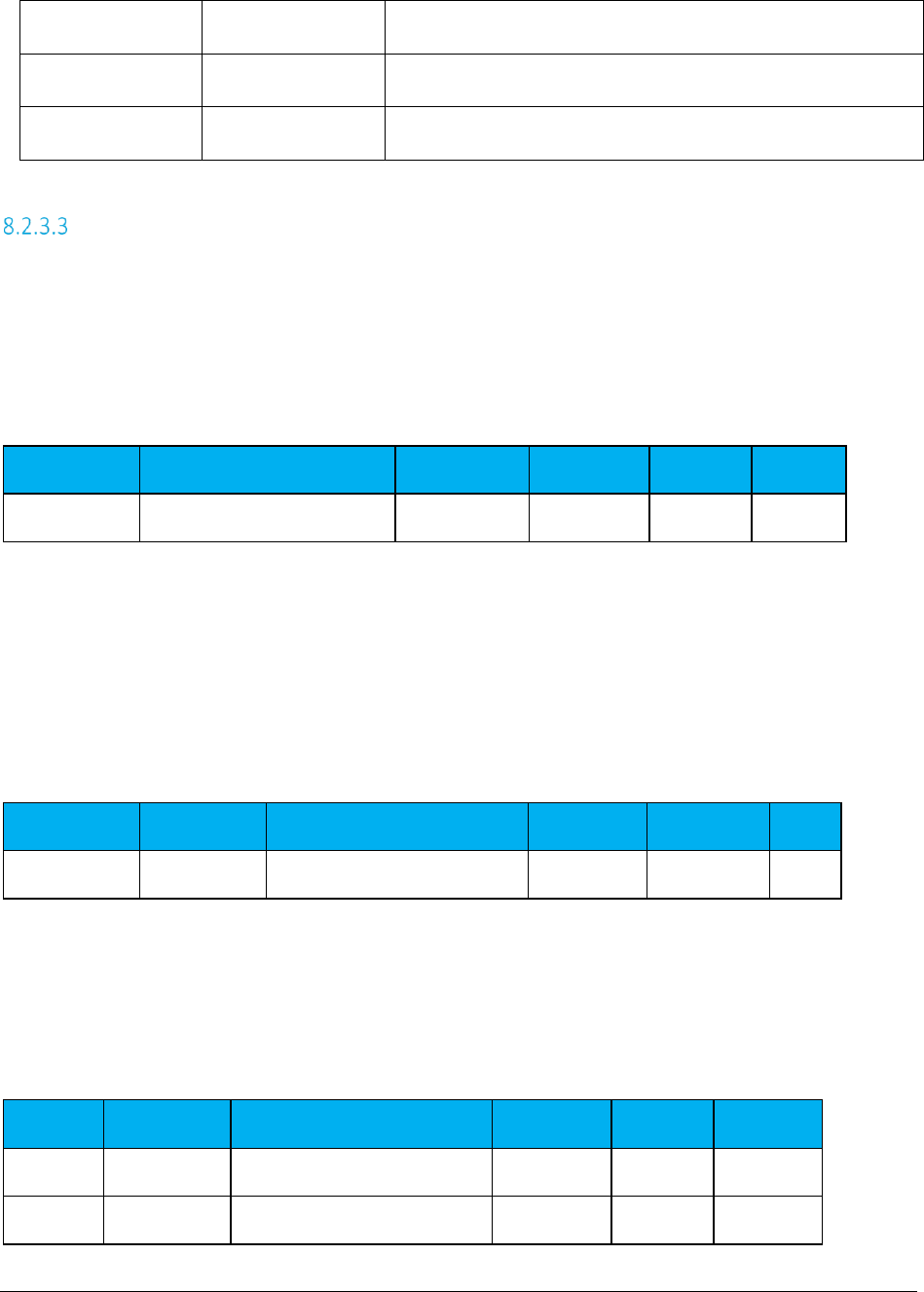

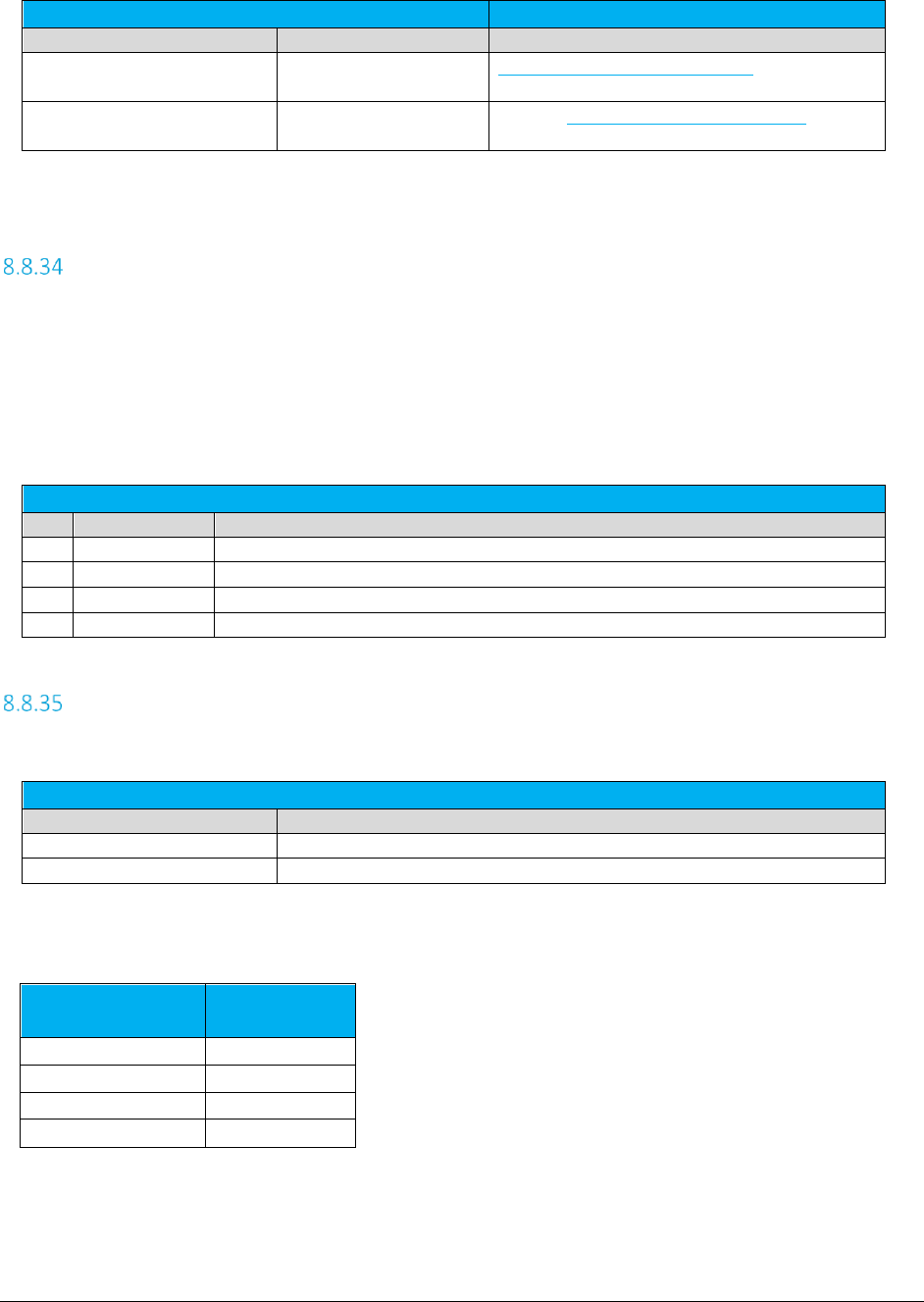

Scenario 001 - apply exemption to all cities within a state - billable only

Client wants all tax categories of type 1 (Sales) exempt at local level for the state of Colorado (billable

only).

Scope local will exempt only local taxes. Domain state will match jurisdiction at the state level (CO). Non-

billable taxes will be excluded from consideration.

TaxCategory

Jurisdiction

Scope

ExemptNB

Domain

ExLvl

1

USA, CO, Boulder, Boulder

1024 (Local)

false

1 (State)

n/a

Scenario 002 - apply exemption to all states, counties and cities within a country - include non-

billable

Client wants all tax categories of type 5 (Connectivity Charges) exempt at state, county and local level for

all states in the USA, billable or non-billable.

Scope will exempt State, County and Local taxes. Domain Federal will match jurisdiction at the Federal

level (USA). Non-billable taxes will be subject to exemption.

TaxCategory

Jurisdiction

Scope

ExemptNB

Domain

ExLvl

5

USA, TX

1792 (State+County+Local)

true

0 (Federal)

n/a

Scenario 003 - apply multiple exemptions to all locations within a state

Client wants billable Sales tax (1) and Use tax (49) exempt at state, county and city level for Washington.

Scope will exempt State, County and Local taxes. Domain State will match jurisdiction at the State level

(WA).

TaxType

Jurisdiction

Scope

ExemptNB

Domain

ExemptLvl

1

USA, WA

1792 (State+County+Local)

n/a

1 (State)

n/a

49

USA, WA

1792 (State+County+Local)

n/a

1 (State)

n/a

AFC SaaS Standard User Manual| 23 of 54

Copyright 2018 Avalara, Inc.

Scenario 004 - exempt Federal tax only if taxing jurisdiction is within a state

Client wants FUSF tax (18) exempt at Federal level but only if transaction is in Puerto Rico.

Scope will exempt Federal taxes. Domain State will match jurisdiction at the State level (PR).

TaxType

Jurisdiction

Scope

ExemptNB

Domain

ExemptLvl

18

USA, PR

128 (Federal)

n/a

1 (State)

n/a

Scenario 005 - exempt all taxes at Federal level except non-level exemptible

Client wants all Federal taxes exempt at Federal level except those marked non-level exemptible. Scope

will exempt Federal taxes. Domain will match at Federal level. Non-billable will be included. Taxes that

are not level-exemptible will be excluded from consideration.

TaxType

Jurisdiction

Scope

ExemptNB

Domain

ExemptLvl

0

USA, PR

128 (Federal)

true

0 (Federal)

false

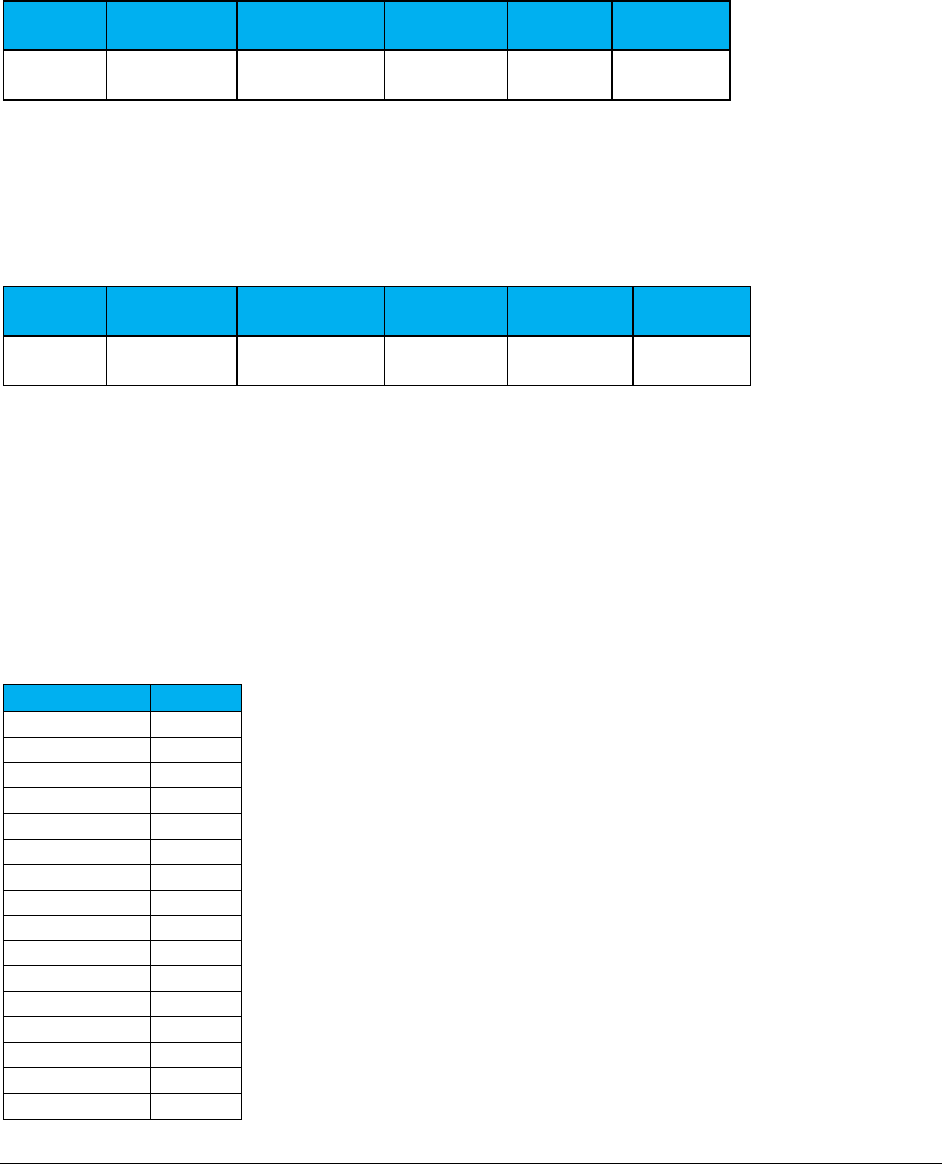

8.3 Transaction Default Values

Clients that use the Excel or CSV format for the input file have the option of including a default file that

will be used to specify what default values should be used. The file must be named Default.{ext} with the

extension being either a valid Excel extension or csv for comma delimited. The default value for each

column specified will be used when the input file does not include the column.

If a customer-provided Default file is not uploaded, the following default values will be used.

Field

Default

Customer Type

Business

Lines

0

Sale

TRUE

Incorporated

TRUE

Federal Exempt

FALSE

State Exempt

FALSE

County Exempt

FALSE

Local Exempt

FALSE

Regulated

FALSE

Minutes

0

Debit

FALSE

Service Class

Local

Lifeline

FALSE

Facilities

TRUE

Franchise

TRUE

Business Class

CLEC

AFC SaaS Standard User Manual| 24 of 54

Copyright 2018 Avalara, Inc.

8.4 Transaction File Sample

The order of columns is not important, but column headers are required.

Request

Type

Origination

PCode

Customer

Type

Date

Charge

Lines

Trans-

action

Type

Service

Type

Sale

Incorpor-

ated

Customer

Number

CalcTaxes

540000

Business

20150715

100

0

19

6

True

True

Customer 1

CalcTaxes

540000

Business

20150715

100

0

19

30

True

True

Customer 1

CalcTaxes

540000

Business

20150715

100

0

19

37

True

True

Customer 1

CalcTaxes

540000

Business

20150715

100

0

19

577

True

True

Customer 1

CalcTaxes

446400

Business

20150715

100

0

19

6

True

True

Customer 2

CalcTaxes

446400

Business

20150715

100

0

19

30

True

True

Customer 2

CalcTaxes

446400

Business

20150715

100

0

19

37

True

True

Customer 2

CalcTaxes

446400

Business

20150715

100

0

19

577

True

True

Customer 2

8.5 Default File Sample

The order of columns is not important, but column headers are required. There should only be a single

line of data indicated what default values to use. You need only define default values for columns that

are not otherwise defined or that are different from the default values used by the service.

Regulated

Debit

Service Class

Lifeline

Facilities Based

Franchise

Business Class

True

False

Local

False

False

False

CLEC

8.6 Specifying a Tax Jurisdiction

For AFC to calculate taxes for transactions correctly, it must first determine the taxing jurisdiction for the

transaction in question. The tax laws of various jurisdictions complicate this. AFC currently supports

multiple unique rules for determination of the correct tax jurisdiction. Jurisdiction determination is

usually based upon three inputs to AFC:

1. The Service Address or the Bill To Number (BTN).

2. The termination location of the transaction (for telephone calls only) to be taxed. The number

called, also known as the "To Number" or the "Termination number" usually specifies this.

3. The origination location of the transaction to be taxed. For telephone calls this is usually

specified by the number called from, also known as the “From Number” or Origination number.

The jurisdiction, for many telecommunications taxes applied by AFC, is determined by the Goldberg or "2

out of 3" rule. With this particular rule, the three jurisdiction inputs pointed out above are compared. If

2 of the 3 jurisdictions supplied match, that is the jurisdictions for which taxes are generated. It is slightly

AFC SaaS Standard User Manual| 25 of 54

Copyright 2018 Avalara, Inc.

more complicated since there are four authority levels for which jurisdictions determination must be

made (i.e. federal, state, county, and local), however; this brief discussion illustrates the concept.

Remember, the Goldberg Rule although the most common, is only one of 10 rules specified for

jurisdiction determination by taxing jurisdictions in the United States.

Jurisdiction information can be supplied to the system in different ways. It can be supplied using a

permanent jurisdiction code (PCode), using a FIPS Code, using an NPANXX, or using zip code and address

information. AFC allows the user to identify the jurisdictions by any of these methods, thereby providing

maximum flexibility. AFC allows the specification of jurisdiction information using any combination of

these methods during the same session.

Jurisdiction Hierarchy

Clients have the option of specifying one, two or all three jurisdictions for a single transaction. If only one

jurisdiction is specified, it will be used for all three. If two jurisdictions are specified, the following

hierarchy will be used for determining which jurisdiction will be used to populate the missing jurisdiction.

High Level Jurisdiction Order of Preference (by Transaction):

1. BillToPCode

2. Origination

3. Termination

The following table of populating missing jurisdiction from jurisdictions is provided.

Missing Jurisdiction

Hierarchy Application

Resulting Jurisdictions Used

BillTo

Uses Origination

Orig, Orig, Term

Origination

Uses BillTo

BillTo, BillTo, Term

Termination

Uses BillTo

BillTo, Orig, BillTo

Jurisdiction Data Types

PCode

PCodes are permanent jurisdiction codes which Avalara provides and allow AFC software users to

populate their databases with jurisdiction information. With PCodes, AFC clients can populate their

customer records with jurisdiction information and never worry about changes of jurisdiction codes. If a

jurisdiction code changes, AFC re-maps the PCodes so clients are not affected. This allows AFC clients to

populate client records with a PCode.

For more information refer to Specifying Jurisdiction PCode.

Address

AFC SaaS Standard User Manual| 26 of 54

Copyright 2018 Avalara, Inc.

The accuracy of the ZIP code method depends upon the amount of data provided for the address as well

as the user’s ability to choose the correct taxing jurisdiction zip code and address. AFC databases contain

numerous duplicate zip codes that cross not only taxing jurisdiction boundaries, but boundaries of

localities as well. Providing a complete address along with the zip code insures the best match possible.

When address information is missing, AFC returns taxes based upon the first match of the provided input

information.

It is appropriate to use the zip code interface or PCode methods for transactions where the jurisdiction

can be positively identified by the calling application. Examples of this type of transaction are product

sales and Internet usage.

For more information refer to Specifying Jurisdiction Address.

FIPS Code

FIPS Codes are issued by the National Institute of Standards and Technology (NIST). AFC provides internal

translation tables from FIPS Codes to PCodes, so that using FIPS Codes is almost as fast and accurate as

using PCodes. Some special taxing districts are not identified in separate FIPS codes, so there is some loss

of accuracy, but the majority of transactions will produce the same tax results with FIP Codes as with

PCodes.

For more information refer to Specifying Jurisdiction Fips Code.

NPANXX

The NpaNxx is the first 6 digits of a phone number.

For more information refer to Specifying Jurisdiction NpaNxx.

Jurisdiction Data Type Hierarchy

If a client supplies more than one data type for a single jurisdiction, the following hierarchy will be used to

determine which jurisdiction data type is used for that jurisdiction.

Jurisdiction Data Type Order of Preference (by Jurisdiction):

1. PCode

2. Address

3. FIPs Code

4. NpaNxx

For example, if a transaction has both an OriginationPCode and an OriginationNpaNxx specified, the

OriginationPCode value will be used for the Origination Jurisdiction.

AFC SaaS Standard User Manual| 27 of 54

Copyright 2018 Avalara, Inc.

8.7 Getting the Right Tax Jurisdiction for Local Taxation

It is important to get the end users location correct for local taxation. People tend to know what they are

charged for local taxes. These taxes also have a tendency to change from one neighborhood to the next.

Avalara provides a comma delimited ASCII file to aid with entry of customers in your system and to help

insure the correct taxing jurisdiction is setup. The file is "all_adr.txt". This comma delimited ASCII files is

provided to allow Avalara clients to populate database tables in their system with this information. The

all address (all_adr.txt) file is a cross-reference of locations to PCodes. The format of the files is

illustrated below.

The "all_adr.txt" file format and example follows:

Pcode,P/A,Country,State,County,City,"Zip code range start","Zip code range end"

3346800,0,USA,PA,LANCASTER,BART,17503,17503

3346900,0,USA,PA,LANCASTER,BAUSMAN,17504,17504

3347000,0,USA,PA,LANCASTER,BIRD IN HAND,17505,17505

3347100,0,USA,PA,LANCASTER,BOWMANSVILLE,17507,17507

3347200,0,USA,PA,LANCASTER,CHRISTIANA,17509,17509

3347300,0,USA,PA,LANCASTER,CHURCHTOWN,17555,17555

3347400,0,USA,PA,LANCASTER,CONESTOGA,17516,17516

3347500,0,USA,PA,LANCASTER,DRUMORE,17518,17518

3347600,0,USA,PA,LANCASTER,EAST EARL,17519,17519

3347700,0,USA,PA,LANCASTER,ELM,17521,17521

3347800,0,USA,PA,LANCASTER,GAP,17527,17527

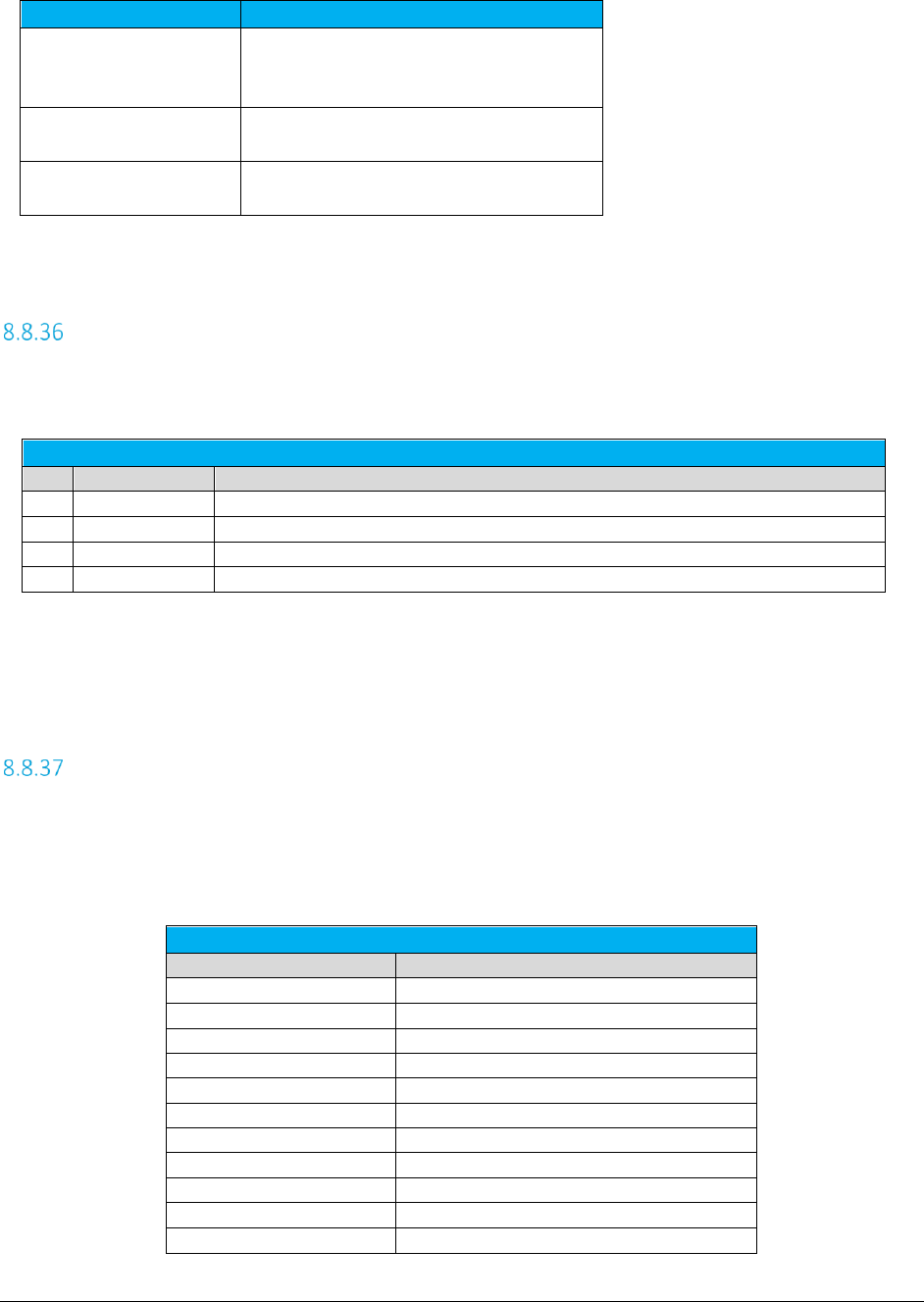

8.8 Transaction Specifications

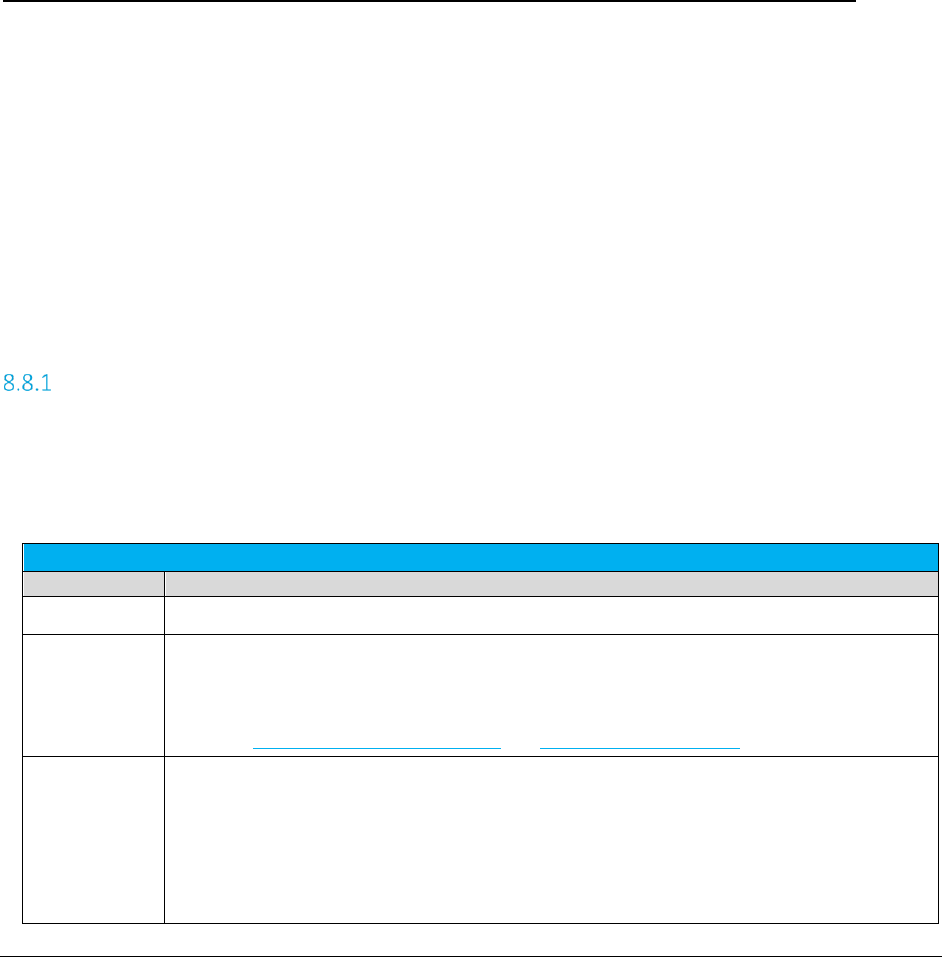

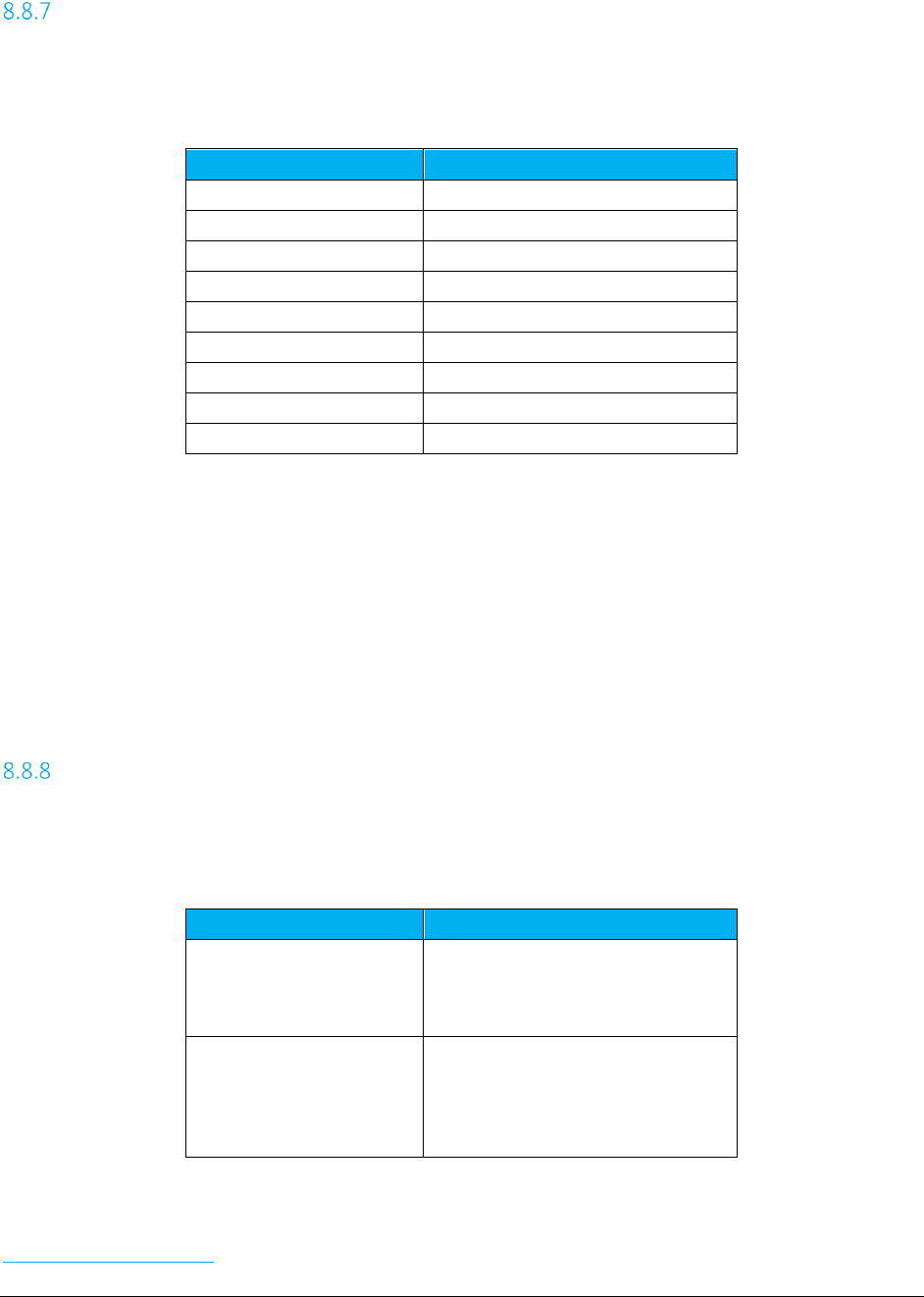

Specifying Request Type

The request type tells the engine what type of calculation should be performed on the transaction data.

The request type is independent of the jurisdiction type, and supports all jurisdiction specifications.

Please refer to the table below to view the request types which are supported.

Request Type

Value

Description

CalcTaxes Perform a standard tax calculation.

CalcAdj Calculate an adjustment for a standard tax calculation. All transaction data, including charge

and transaction date, should be identical to the standard calculation.

Supports Specifying Adjustment Method and Specifying Discount Type.

CalcIncl Perform a tax inclusive calculation. The desired total (charge + taxes) should be placed in the

“Charge” column. The tax calculation method will determine the “base charge” that is

needed such that (base charge + taxes calculated = desired total).

Notes:

• The desired total must be a positive value sufficiently large to cover any fixed taxes

that may apply.

AFC SaaS Standard User Manual| 28 of 54

Copyright 2018 Avalara, Inc.

Request Type

Value

Description

• The calculated base charge will be stored in the optional field as an unsigned long

where: optional = (unsigned long)(base charge * 100)

• Clients using tax inclusive calculations should not use the optional field or the data

in the optional field will be overwritten.

• The standard TSR report uses the calculated base charge. To add the original charge

passed in, a request needs to be made to receive the RTR (Reconciliation

Transaction/Service Report).

CalcInclAdj Calculates an adjustment for a tax inclusive calculation. All transaction data, including charge

and transaction date, should be identical to the tax inclusive calculation. Refer to CalcIncl

Request Type for more details on tax inclusive calculations.

Supports Specifying Adjustment Method and Specifying Discount Type.

Specifying Jurisdiction PCode

A PCode is a persisted numeric identifier for a taxing jurisdiction. It can represent anything from a

country to a special taxing jurisdiction within a local taxing district, such as the Salado Public Library

District in Bell, Texas.

The value can be obtained from either using our Avalara Geo for Communications (AFC Geo) product or

from parsing the PCode from the all_adr.txt file. Getting the Right Tax Jurisdiction for Local Taxation has

more information on the format and contents of this file.

Specifying Jurisdiction Address

When using an address to specify the taxing jurisdiction, the more complete the information provided the

more accurate the lookup will be. For most foreign nations, other than Canada and Brazil, the country is

sufficient for taxation purposes. For USA and Canada, at a minimum the Country, State and Zip Code

must be provided.

If the address is for a USA Territory, it can be handled the same as a USA state by using the provided two

byte state abbreviation.

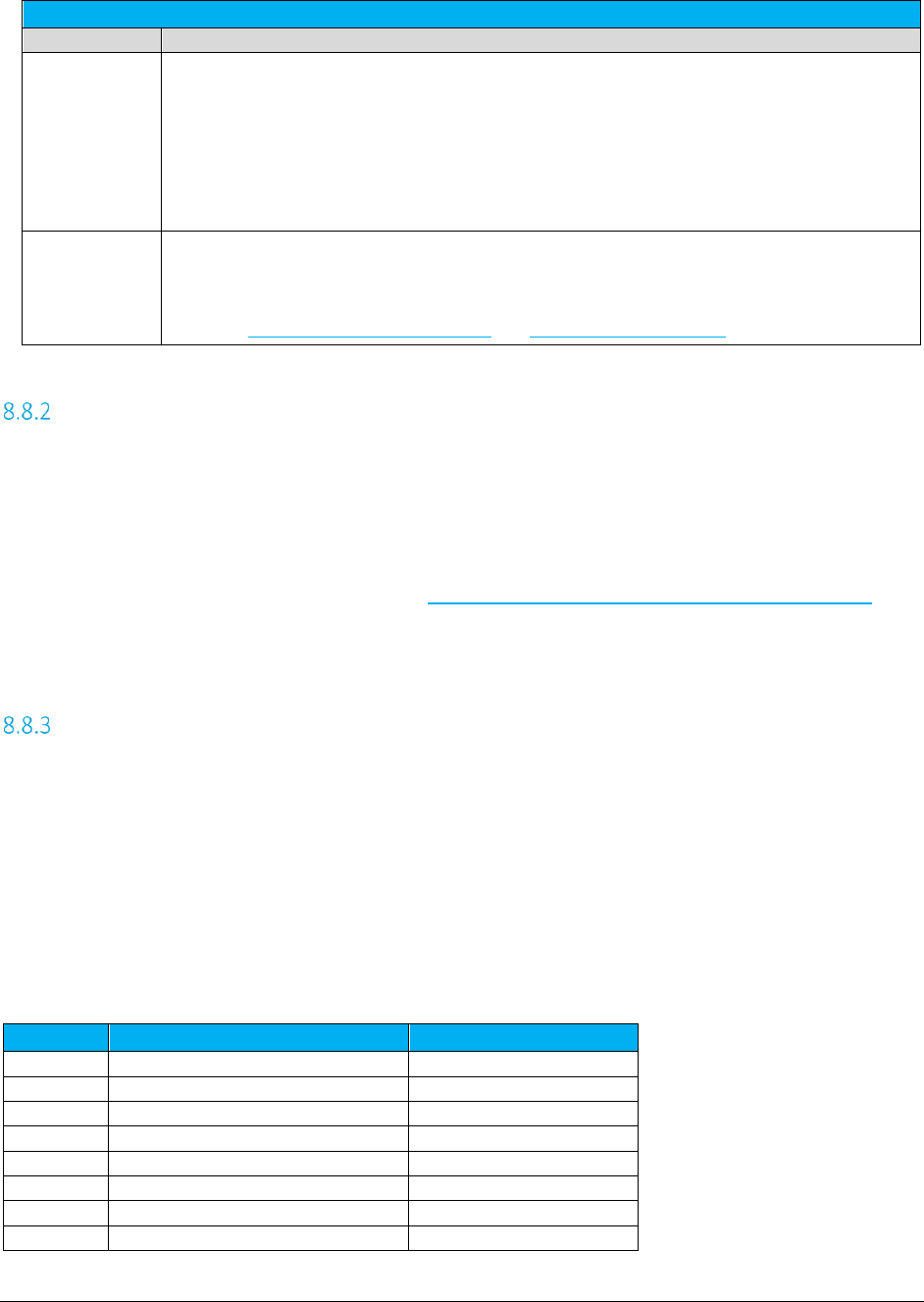

Supported USA Territory abbreviations are provided in the following table.

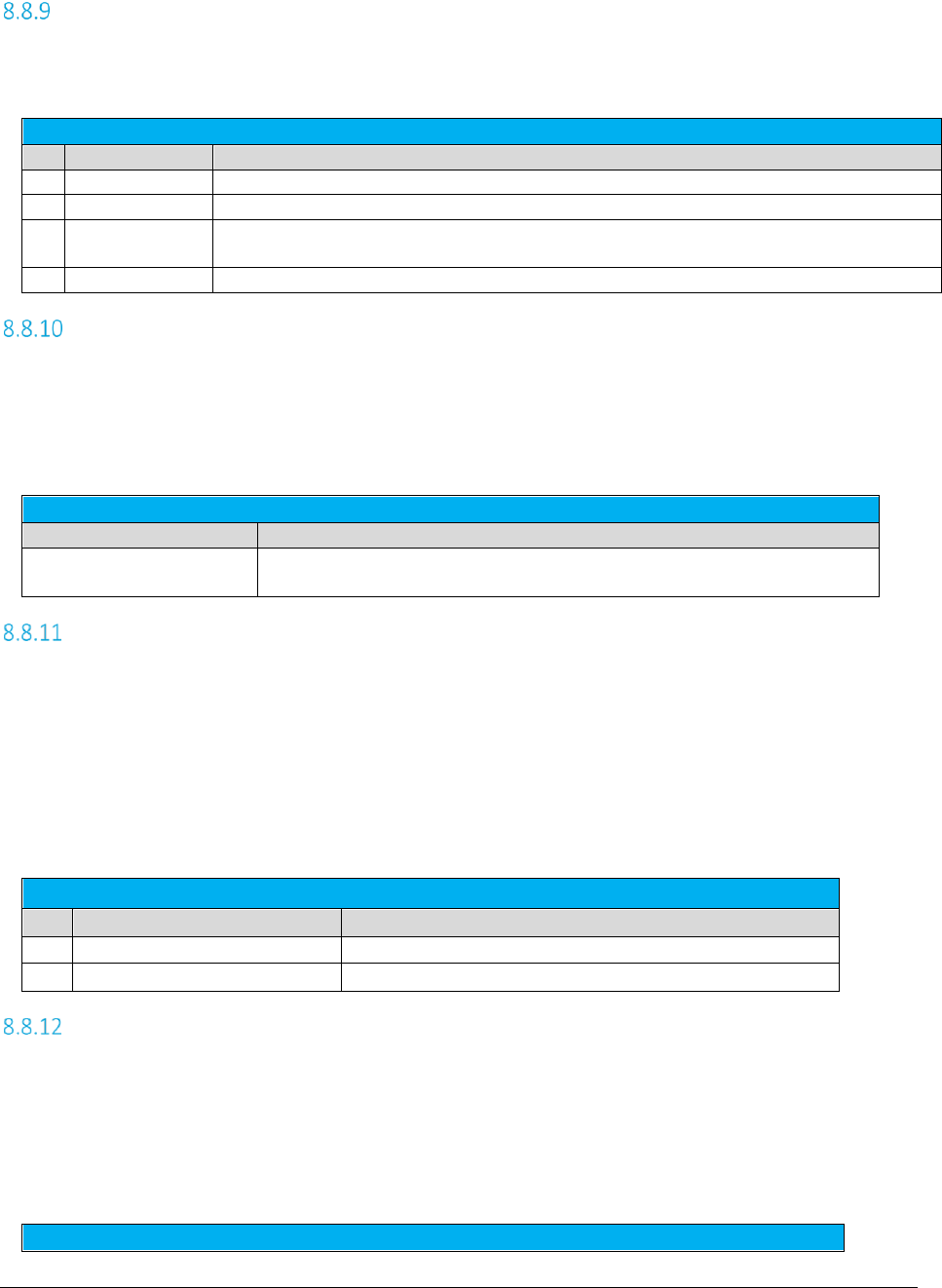

Code

Territory

Special Handling Notes

AS

American Samoa

FM

Fed St of Micronesia

GU

Guam

Leave County blank

MH

Marshall Islands

MP

Northern Mariana Islands

PR

Puerto Rico

Leave County blank

PW

Palau

VI

US Virgin Islands

AFC SaaS Standard User Manual| 29 of 54

Copyright 2018 Avalara, Inc.

For Canada, you may populate the 6 digit Postal Code in the Zip Code field (with or without a dash or

space). Zip plus 4 (ZipP4) is for USA only.

Supported Canadian Province and Territory abbreviations are provided in the following table.

Code

Territory

AB

Alberta

BC

British Columbia

MB

Manitoba

NB

New Brunswick

NL or NF

Newfoundland

AB

Alberta

NS

Nova Scotia

NT

Northwest Territories

NU

Nunavut

ON

Ontario

PE

Prince Edward Island

QC or PQ

Quebec

SK

Saskatchewan

YT

Yukon Territory

A breakdown of the address fields are below. The Column Name should be prefixed with either BillTo,