Tax Guide

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 13

Getting Started

In this guide we have provided explanations and sample forms to assist 2nd-5th year American JETs

with the tax-filing process. For complete details, consult Publication 54 (Tax Guide for U.S. Citizens and

Resident Aliens Abroad), which can be accessed online at the Internal Revenue Service (IRS) website

(www.irs.gov) by searching for Publication 54.

The Internal Revenue Service (IRS) office for U.S. citizens living abroad is located in Austin TX. Send all

tax forms to:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

U.S.A.

Additionally, the IRS website (www.irs.gov) lists a lot of information to help citizens living abroad with

the tax-filing process. Go to 'Information for...Individuals' in the upper right corner and then

'International Taxpayers' on the left sidebar and you will find various topics on “US Citizens and

Resident Aliens Abroad” (in the Filing Requirements section). Also, you can find most of the general

questions about tax law answered at the following address:

http://www.irs.gov/Individuals/International-Taxpayers/U.S.-Citizens-and-Resident-Aliens-Abroad.

You can also contact the Philadelphia International Taxpayer Service Call Center by phone

(1-267-941-1000, not toll-free) or fax (1-267-941-1055). They are operational M-F from 6:00am to 11:00pm

Eastern Time.

Information regarding state taxes is not covered in this packet. Please consult your home state’s tax

agency for information.

The Forms

Here is a summary of what you will need:

* Foreign Earned Income Statement [file with Form 1040]

* 2555-EZ Foreign Earned Income Exclusion [file with Form 1040]

* 8965 Health Coverage Exemptions [file with Form 1040]

* 1040 Individual Income Tax Return [file by June 15]

* Publication 970 (if you've paid deductible interest on student loans in the last year)

* If your address in Japan has changed since you filed last year, you will need to re-file Form 8822

Change of Address form as well (see tax guide for first-year JETs).

* It is not necessary to request an extension to file, but you can do so if you choose by filing Form 4868

Extension of Time to File form (see tax guide for first-year JETs). Filing this form gives you until October

15 to send in your forms.

Foreign Earned Income Statement

Photocopy the small form that your school or BOE gave you showing how much money you made in

2014. It`s called the 源泉徴収票 (gensen choushuu hyou) in Japanese. If you have not received it yet, ask

the accountant in your school or BOE office. This will act as a W-2 for the income you earned in Japan.

Indicate your name and your gross income on the photocopy and write “Foreign Earned Income

Statement” across the top. It should look like this (example taken from GIH):

Foreign Earned Income Statement

2555-EZ Foreign Earned Income Exclusion

This form is used to exempt you from paying U.S. income taxes on the money you earn in Japan.

Part I – You may qualify for the Bona Fide Resident Test, but the qualifications for this test are somewhat

vague and difficult to understand. You will qualify for the Physical Presence Test and Tax Home Test

like you did last year, so we recommend you use this qualification and not bother with the Bona Fide

Resident Test.

Part II – Fill in your address and employment information; write “NA” for Employer's U.S. address.

Your employer is "other"-- put something like "foreign local government office." Follow the instructions

until you get to the part that asks what your tax homes were during the tax year. In this blank, enter

your address in Japan and the date (month and year) you began living there. If you moved during 2014,

make sure to list your former address as well.

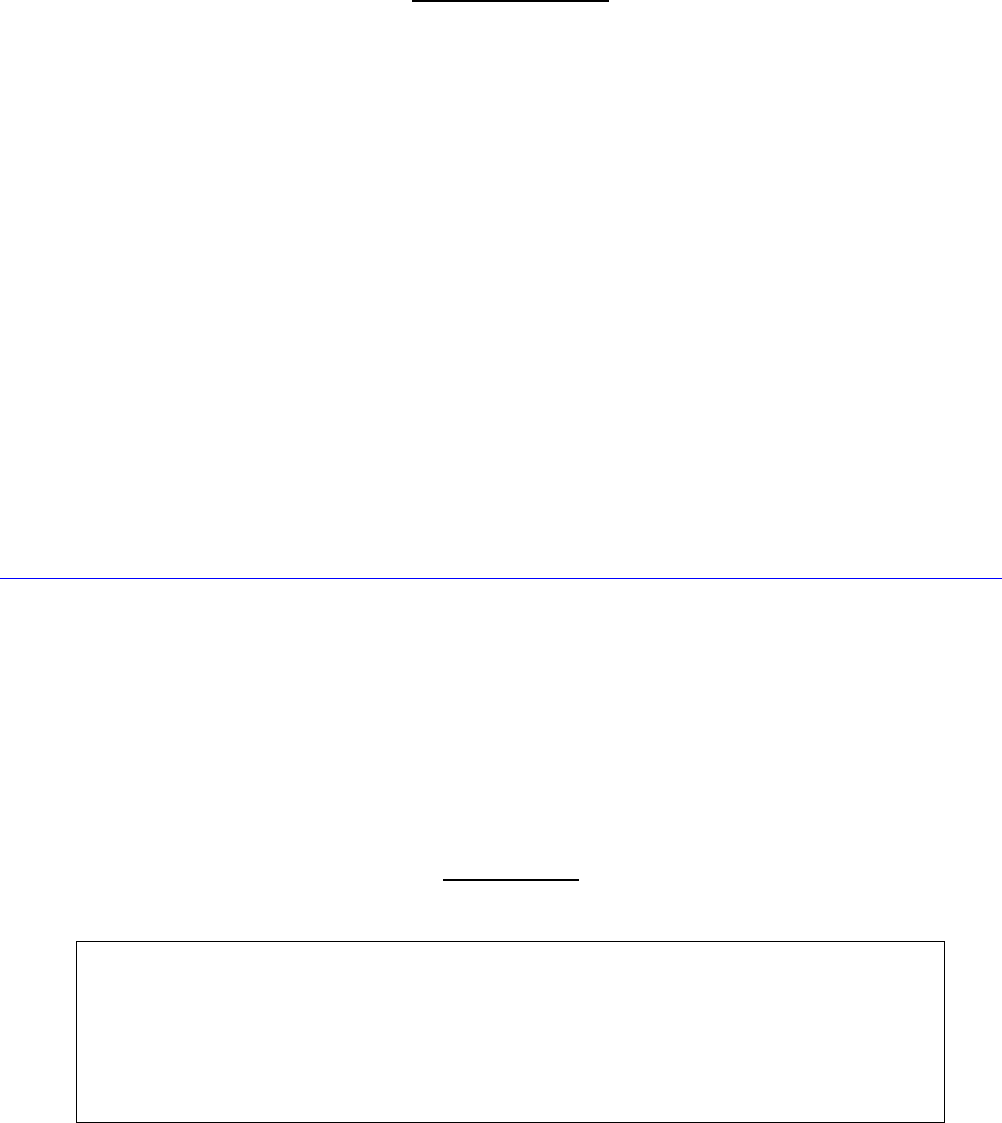

Part III - Under Days Present in the U.S., fill in any time you spent in the U.S. during the 12-month

period you specified under the Physical Presence Test in Part I. If you did not return to the U.S. in 2014,

refer to the example below. If you returned to the U.S. during 2014, refer to the next page.

Part IV - Figure your Foreign Earned Income Exclusion. Use the 12-month period from Part I to calculate

the number of days in your qualifying period that fall within 2014, and enter the number on Line 14.

Convert the amount listed on your Foreign Earned Income Statement to USD and enter that figure on

Line 17. Use the Federal Reserve Bank’s 2014 average Yen/USD exchange rate to make the calculation.

That rate is $1 = ¥105.74. The IRS likes everything you do to be outlined explicitly, so draw an asterisk

and write, "see foreign earned income statement" at the bottom of the page. Then write a statement along

the lines of: “I used the 2014 average Yen/USD exchange rate as reported by the Federal Reserve Bank to

calculate the amount reported on Line 17. That rate was $1 = ¥105.74" And, finally, sign your name to the

note.

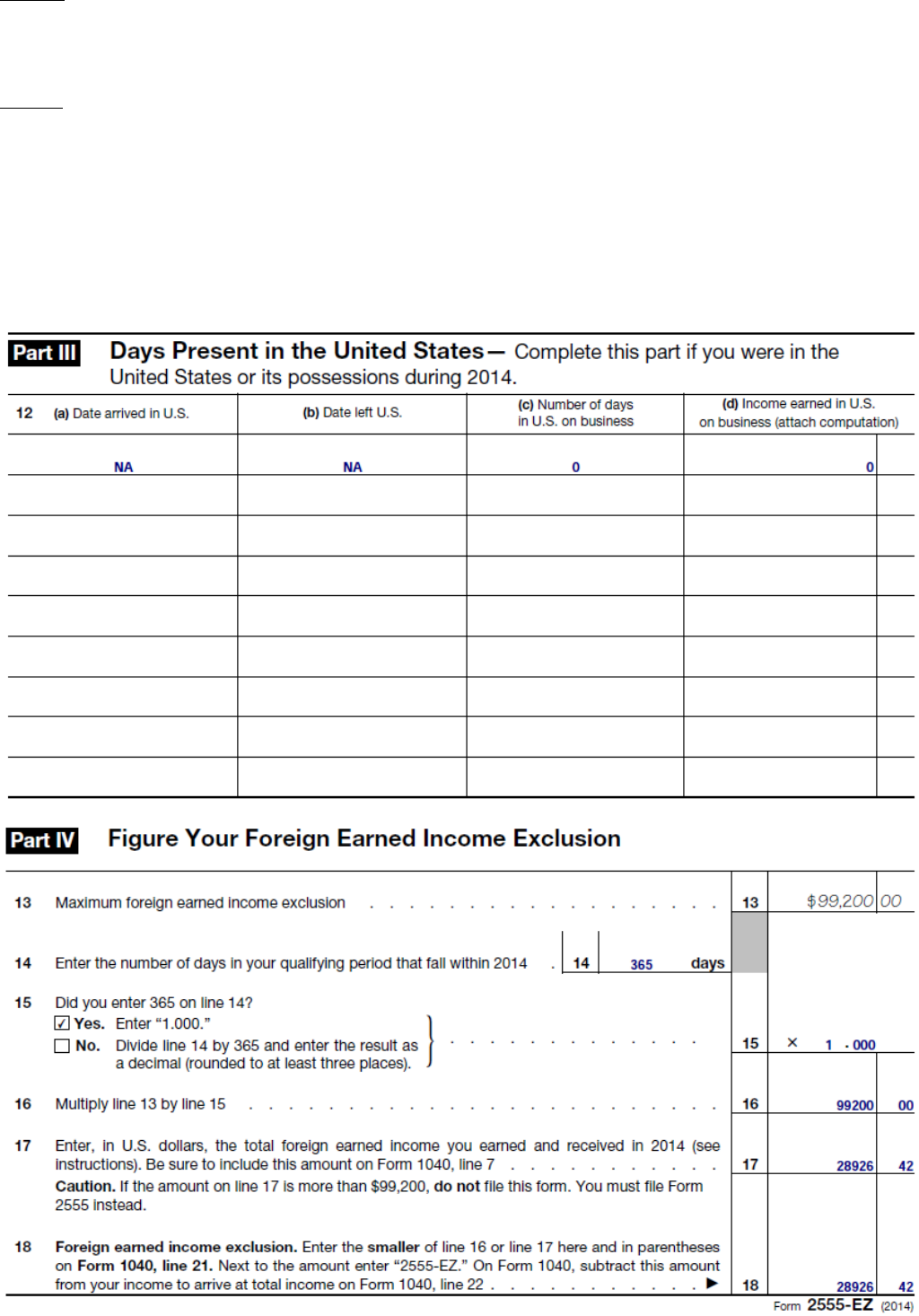

If you returned to the U.S. anytime in 2014, you must note those dates in Part III and subtract them from

the number of days in your qualifying period in Part IV Line 14. Here is an example.*

*Please be aware that if you returned to the U.S. for more than 35 days in 2014, you will have less than

the 330 days necessary to pass the Physical Presence Test. For example, let’s say you made two 20-day

trips to the U.S. in 2014, one in August and one in December. This means that in 2014, you spent only 325

days abroad (365-40=325), five short of the 330 total needed. In this case, you will need to adjust the

12-month period you entered for the Physical Presence Test in Part I to exclude enough days you were in

the U.S. in order to bring your total of days abroad to 330. (This 12-month period does not have to be the

12-month period of 2014; it just has to start or end in 2014.) To exclude the December trip home, you

could set the dates as December 1, 2013 – November 30, 2014. This would give you more than the 330

necessary days abroad and still give you enough days in your qualifying period (Part IV, Line 14) to

exclude your JET income.

8965 Health Coverage Exemptions

New for the 2014 Tax Form is the Health Care: Individual Responsibility line on form 1040 (line 61). As

part of the Affordable Care Act, starting with the 2014 tax year, Americans are required to have health

insurance or face a tax penalty if they do not have any. Luckily, the IRS treats U.S. citizens living abroad

for at least 330 full days in a 12-month period (the same conditions of the form 2555-EZ Physical

Presence Test) as having minimum essential coverage.

In order to avoid paying a penalty, you must file form 8965 along with your return. When filling out the

form, leave Part I blank and check the “no” box for both questions in Part II (JETs will not qualify for

exemptions based on income level). If you did not spend any time in the U.S. in 2014, then you qualify

for a coverage exemption based on your presence abroad (noted below as Exemption Type C) for the full

year and will fill out Part 3 as follows:

Even if you spent some time in the U.S. in 2014, as long as your 12-month period begins in January 2014,

you can qualify for a full-year exemption. Having one day of minimum essential coverage in a given

month is treated as having coverage for the entire month. For example, if your qualifying period from

form 2555-EZ is from January 31, 2014 to January 30, 2015 you still are treated as having minimum

essential coverage for January 2014 in addition to the rest of 2014 and can apply for the full-year

exemption.

If your 12-month period for some reason does not include any days for a given month or months in 2014,

you may still qualify for a short coverage exemption to cover that month or months if the gap in your

coverage period encompasses less than 3 consecutive months. This will be noted on Part III as

Exemption Type B. For example, a JET who was in the U.S. throughout all of January and February and

has their 12-month period begin in March 2014 would fill out their Part III as follows:

JETs who have a valid exemption for every month in 2014 can put 0 on line 61 of Form 1040. You can

leave the full-year coverage box unchecked.

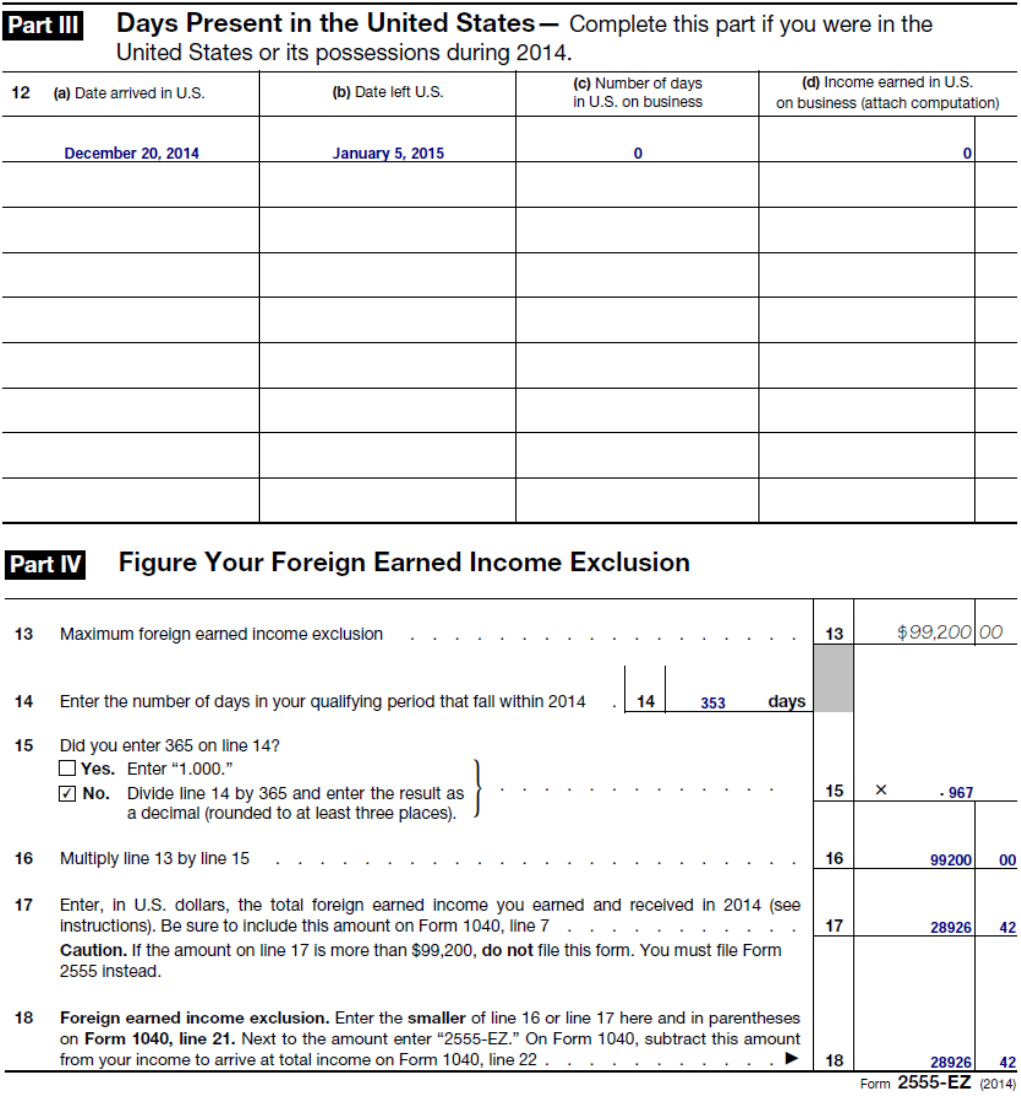

JETs who do not have minimum essential coverage or a valid exemption for a given month in 2014 may

be subject to a tax penalty. In this case, you must still file form 8965 to indicate which months you do

have a valid exemption for and fill out the Shared Responsibility Payment Worksheet (found in the

instructions for form 8965) to figure out your penalty. However, we recommend you look at the

instructions for form 8965 in full to see if there may be other exemptions not mentioned in this document

that you may qualify for.

*Note: When figuring out the value of your household income (line 7 above), it is the total of lines 8b and

37 on form 1040 (which may be zero) and line 18 on form 2555-EZ (your foreign earned income

exclusion, determined based on your Japanese income). So, even though your Japanese income cannot

be taxed, it will still be used to determine any possible penalties for not maintaining minimum essential

coverage while in Japan.

1040 Individual Income Tax Return

This is the form where you report how much total money you earned in 2014. You will figure out if you

get a refund or if you owe more to Uncle Sam. There are a lot of specific questions on Form 1040 that will

be different for each person. What we are explaining here is focused on the specific parts related to living

and working overseas. For the rest of the complicated stuff, it’s best to start at the top and work your

way through line by line. Consult a certified tax preparer and/or the official IRS instructions (online) to

be sure you don't miss something. You can also call or email the IRS on their site.

You also need to attach a signed statement to the 1040 stating that you are claiming the automatic

2-month extension because you reside outside the U.S. and your main place of business is outside the

U.S.

Label and Exemptions – Enter your name and address information, social security #, and filing status.

Claim yourself as an exemption on Line 6.

Income - On Line 7, add your income from Japan (Form 2555-EZ, Line 17) and any U.S. income (most

returning JETs won’t have U.S. income for 2014). The Taxable Interest on Line 8a includes all interest

earned from savings accounts. If you have Taxable Interest, your bank or financial institution will send

you a 1099-INT that tells you how much your taxable interest is. For many people, everything else is

zeroes until you get to Line 21. List your Japan-earned income (Form 2555-EZ, Line 18) in parentheses on

Line 21, and write “2555-EZ” next to it. Add Lines 7-20 and then subtract the amount listed on Line 21

(writing Line 21 in parentheses tells the IRS you are subtracting that amount). Enter the total on Line 22

(enter “0” if the total is a negative number). This total is the amount of taxable income you earned

during 2014.

NOTE: These are made up numbers. Your numbers will be different!

Adjusted Gross Income - If you paid student loan interest, enter on Line 33 the amount of the Student

Loan Interest Deduction from the worksheet in Publication 970 (available online at www.irs.gov).

Many student loan institutions provide this information directly to the students. If you make payments

online, check there first to see if the student loan interest is already figured out for you. Finish following

the instructions for the rest of that section and turn to the next page. Everything else will be zeros for

many JETs.

Page 2 - Everything should be straightforward (tedious, but straightforward) on the second page. By the

time you get here, you've dealt with most of the foreign earned stuff and weeded it out. Just work

through the lines one by one. Use the margin on the left side to figure out your standard deduction on

Line 40 (you are also given the option of filling out Schedule A to get itemized deductions instead of a

standard deduction. Most JETs, though, will probably get more deducted – and save more time – by just

claiming the standard deduction). Line 44 is a bit tricky if you have income other than your JET income.

Refer to the notes below and the 1040 instructions (available online at www.irs.gov) to calculate this

amount.

* Entering numbers in parentheses means it is a negative number.

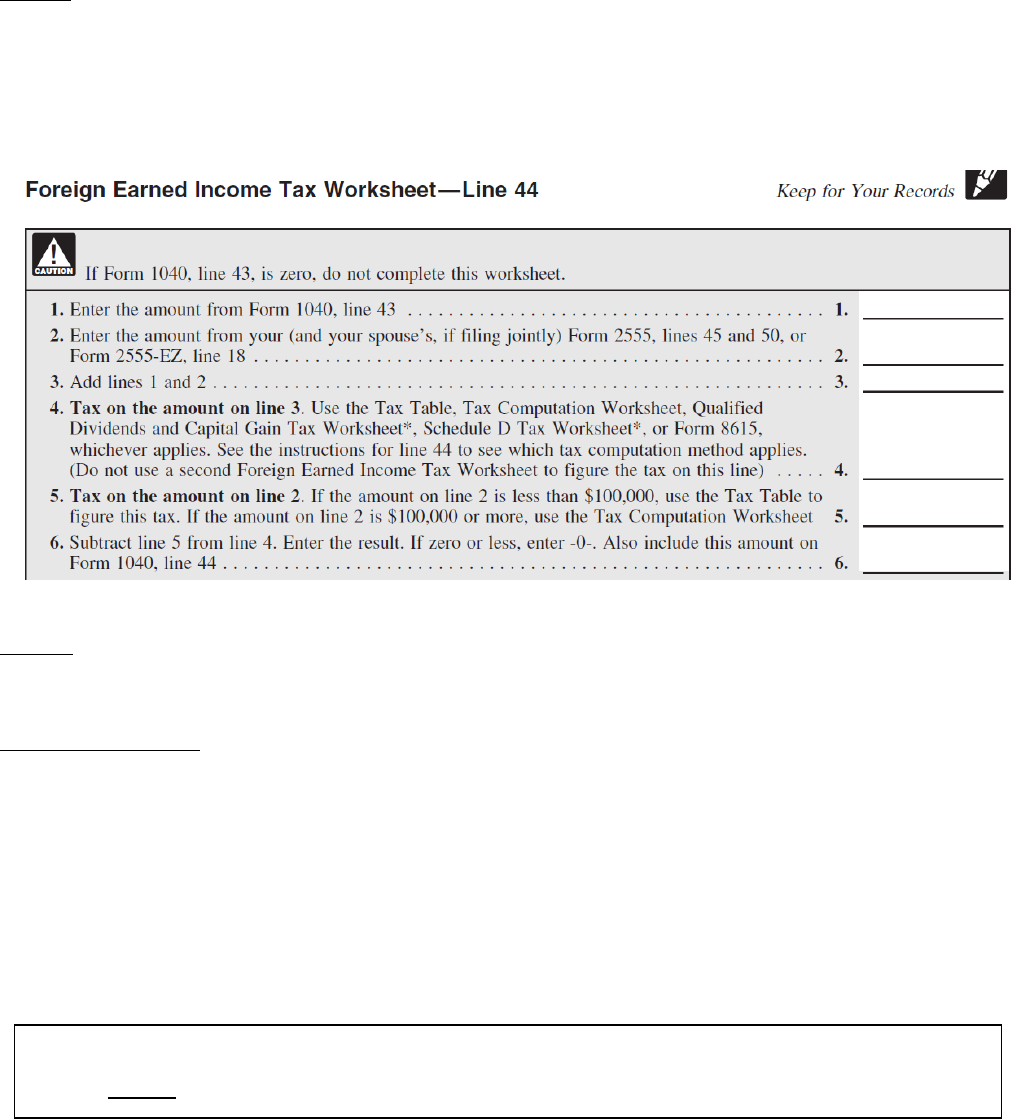

Line 44

If Line 43 is more than zero, then you will have to calculate your tax for Line 44. If Line 43 is zero, then

Line 44 will also be zero. In order to calculate your Tax you will have to make some calculations using

the Foreign Earned Income Tax Worksheet—Line 44 below (from page 41 of the 1040 instructions). For

Lines 4 and 5 you will have to consult the 2014 Tax Table (page 75 of the 1040 instructions).

Line 61 – As mentioned earlier in this document, the Health care: individual responsibility line will be

determined based on how you fill out Form 8965.

Finishing Form 1040 – Most likely, you will not get a refund nor have to pay taxes. In that case go ahead

and sign and date in the box and you should be good to go.

If you are due a refund, congratulations! Fill in your banking information for a direct deposit into your

American bank account. If you have to pay taxes, refer to the 1040 instructions on payment methods and

where to send your payment.

Sign and date the forms and mail them all to the IRS office in Austin by June 15. Your return will

include at least Form 1040, Form 2555-EZ, Form 8965 and the Foreign Earned Income Statement.

Links to Forms

Form 8822 Change of Address (if necessary)

http://www.irs.gov/pub/irs-pdf/f8822.pdf (form and instructions)

Form 4868 Application for Extension of Time to File (if necessary)

http://www.irs.gov/pub/irs-pdf/f4868.pdf (form and instructions)

Form 2555-EZ Foreign Earned Income Exclusion

http://www.irs.gov/pub/irs-pdf/f2555ez.pdf (form)

http://www.irs.gov/pub/irs-pdf/i2555ez.pdf (instructions)

Form 8965 Health Coverage Exemptions

http://www.irs.gov/pub/irs-pdf/f8965.pdf (form)

http://www.irs.gov/pub/irs-pdf/i8965.pdf (instructions)

Form 1040 Individual Income Tax Return

http://www.irs.gov/pub/irs-pdf/f1040.pdf (form)

http://www.irs.gov/pub/irs-pdf/i1040.pdf (instructions)

Publication 54 Tax Guide for U.S. Citizens and Resident Aliens Abroad

http://www.irs.gov/pub/irs-pdf/p54.pdf

Publication 970 Tax Benefits for Education

http://www.irs.gov/pub/irs-pdf/p970.pdf

Publication 5187 Health Care Law: What’s New for Individuals and Families

http://www.irs.gov/pub/irs-pdf/p5187.pdf

Notes and Resources

Other Resources:

The U.S. Embassy in Japan's Tax Page

http://japan.usembassy.gov/e/acs/tacs-7126b.html

List of Tax Preparers in Japan

http://japan.usembassy.gov/e/acs/tacs-tax2.html

IRS info for U.S. Citizens Living Abroad

http://www.irs.gov/Individuals/International-Taxpayers/U.S.-Citizens-and-Resident-Aliens-

Abroad

Individual cases and circumstances will vary. Additional procedures will be necessary if:

-You are married and/or have dependents of your own

-Someone else will claim you as a dependent for the 2014 tax year

-You had over $10,000 in foreign bank accounts at any time during 2014 (in this case you will

have to file a Report of Foreign Bank and Financial Accounts (FBAR) by June 30. It’s pretty

straightforward and shouldn’t take too much time.). You can also file electronically. For more

information go to:

http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Report-of-Foreign-Ban

k-and-Financial-Accounts-FBAR

-You earn income from stocks, bonds, real estate or other investments

-Any number of other circumstances

This guide is in no way affiliated with the IRS or the U.S. Government. The IRS – not this

document - is the final authority on tax-related matters.

The Federal Reserve Bank average annual exchange rate figure of $1 = ¥105.74 can be found at

http://www.federalreserve.gov/Releases/g5a/Current/

This packet is intended to familiarize second to fifth year American JETs with the overseas tax-filing

process. The process will be slightly different for first year American JETs.

It is your responsibility to be aware of the tax filing deadlines and to submit the forms on time. We

will not remind you of the deadlines as they come, so please read through the packet carefully.

We have compiled a list of frequently asked questions (and answers!) regarding the tax-filing

process. These can be viewed on the KumamotoJET website here:

http://kumamotojet.com/U-S--Taxes.php

Please do not hesitate to call or e-mail if you have any questions about the tax filing process.