Utah Pub 14Employer Withholding Tax Guide Due Dates2016

UtahPub%2014Employer%20Withholding%20Tax%20GuideDueDates2016

UtahPub%2014Employer%20Withholding%20Tax%20GuideDueDates2016

UtahPub%2014Employer%20Withholding%20Tax%20GuideDueDates2016

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 28

tax.utah.gov

If you need an accommodation under the Americans

with Disabilities Act, email taxada@utah.gov, or

call 801-297-3811 or TDD 801-297-2020. Please

allow three working days for a response.

The tax tables in this publication have not

changed since Feb. 2008 and will change only

when the Utah income tax rate changes, and

not necessarily on an annual basis. Instructions

are updated as needed.

Utah State Tax Commission

210 North 1950 West

Salt Lake City, Utah 84134

801-297-2200

1-800-662-4335

tax.utah.gov

Employer Withholding Tax Guide

Utah Withholding Information and

Tax Tables

Effective Jan. 1, 2016

Publication 14

Revised 3/16

See page 2 for a sum-

mary of the changes in

this revision of Pub. 14.

Contents

Changes to this Revision ................................................................. 2

General Information ......................................................................... 2

Employment Tax Workshops ...................................................... 2

Who Must Withhold Taxes .......................................................... 2

Employer Withholding Exemption ......................................... 2

Employee Withholding Exclusions ............................................. 2

Interstate Transportation Wages ........................................... 2

Active Duty Service Member’s Nonresident Spouse Wages 3

Defi nitions .................................................................................. 3

Wages ................................................................................... 3

Utah Taxable Wages ............................................................. 3

Withholding Allowance Credit ............................................... 3

Household Employees .......................................................... 3

How to Get a Withholding Account ............................................ 3

Federal Employer Identifi cation Number ............................... 3

Bond Requirements for Utah ................................................ 3

How Much to Withhold ............................................................... 3

Filing Packets ............................................................................. 3

How to File Returns ................................................................... 3

Filing with No Tax Liability (Zero Returns) ............................ 3

Amended Return .................................................................. 4

How to Make Payments ............................................................. 4

Payroll Service Providers ...................................................... 4

Liability .................................................................................. 4

Annual Reconciliation ................................................................ 4

Amended Reconciliations ..................................................... 4

Late and/or Incorrect Filings ................................................. 4

Balancing the Reconciliation ................................................. 4

Withholding Filing Record .......................................................... 5

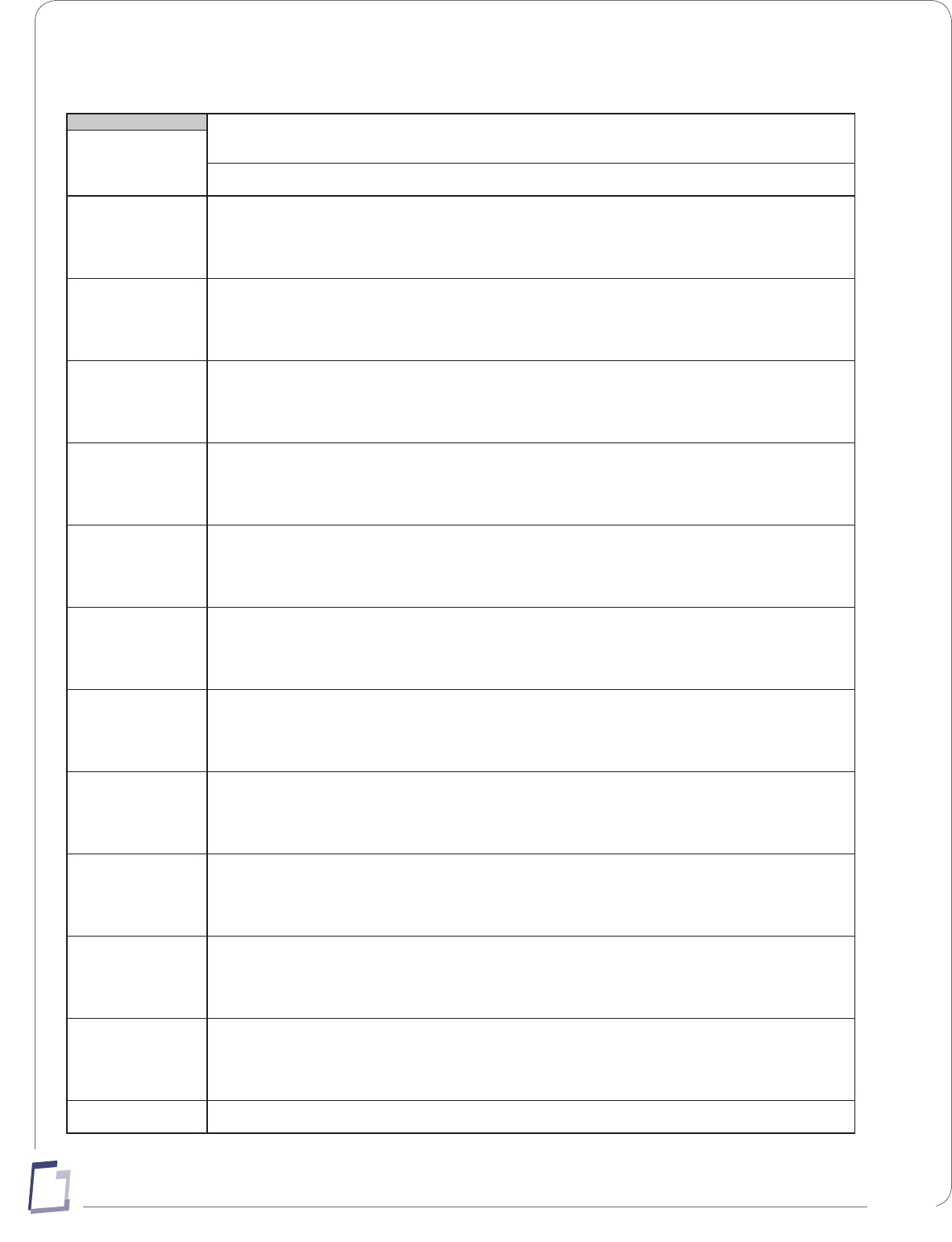

Due Dates .................................................................................. 5

Annual Returns with Annual Payments ................................. 5

Quarterly Returns with Quarterly Payments ......................... 5

Quarterly Returns with Monthly Payments ........................... 5

Annual Reconciliations ......................................................... 5

Filing Status Changes ................................................................ 5

How to Prepare W-2s and 1099Rs ............................................ 5

How to File W-2s and 1099Rs ................................................... 6

Amending W-2s ......................................................................... 6

Penalties and Interest ................................................................ 6

Late Filing and Late Payments ............................................. 6

Annual Reconciliation ........................................................... 6

Interest .................................................................................. 6

Changing an Account ................................................................ 6

How to Close a Withholding Account ......................................... 6

Agencies .......................................................................................... 6

Internal Revenue Service .......................................................... 6

Utah State Tax Commission ....................................................... 7

Social Security Administration ................................................... 7

Utah Dept. of Workforce Services .............................................. 7

Labor Commission of Utah ........................................................ 7

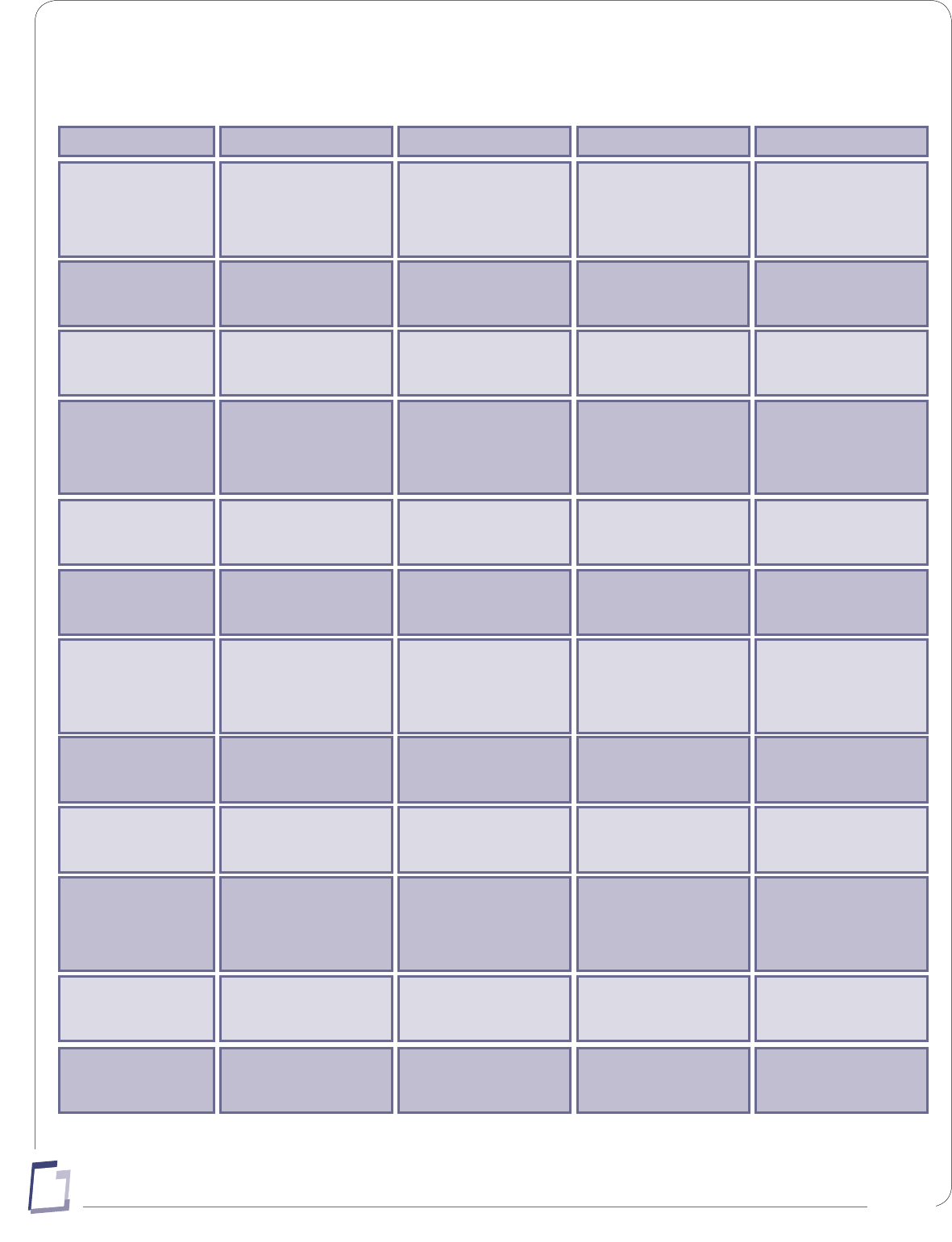

Utah Withholding Taxes Calendar .................................................... 8

Utah Withholding Schedules............................................................ 9

Instructions ................................................................................ 9

Examples of Utah Withholding Calculations ............................ 10

Utah Schedules 1-4 – Weekly, Biweekly, Semimonthly, Monthly 11

Utah Schedules 5-8 – Quarterly, Semiannual, Annual, Daily .. 12

Utah Withholding Tables ................................................................ 13

Single Persons– Weekly Payroll Period ................................... 13

Married Persons – Weekly Payroll Period ................................ 14

Single Persons – Biweekly Payroll Period ................................ 15

Married Persons – Biweekly Payroll Period ............................. 16

Single Persons – Semimonthly Payroll Period ......................... 17

Married Persons – Semimonthly Payroll Period ....................... 18

Single Persons – Monthly Payroll Period ................................. 19

Married Persons – Monthly Payroll Period ............................... 20

Single Persons – Quarterly Payroll Period ............................... 21

Married Persons – Quarterly Payroll Period............................. 22

Single Persons – Semiannual Payroll Period ........................... 23

Married Persons – Semiannual Payroll Period ......................... 24

Single Persons – Annual Payroll Period ................................... 25

Married Persons – Annual Payroll Period ................................ 26

Single Persons – Daily or Miscellaneous Payroll Period .......... 27

Married Persons – Daily or Miscellaneous Payroll Period........ 28

E-Verify for Employers

Employers can help prevent identity theft by verifying the

social security numbers of job applicants. E-Verify is a free

service of the U.S. Department of Homeland Security that

verifi es employment eligibility through the Internet. Employers

can use E-Verify at dhs.gov/E-Verify.

page 2

14

General Information

This publication includes:

• requirements for fi ling and paying Utah withholding tax,

• requirements for fi ling the Utah annual reconciliation,

• requirements for electronic fi ling,

• withholding tax schedules for calculating Utah withhold-

ing tax from employees’ wages, and

• Utah withholding tax tables for quick lookup.

For questions about Utah withholding tax, see tax.utah.gov,

or call us at 801-297-2200 (1-800-662-4335 outside the Salt

Lake area).

This publication does not cover Utah withholding re-

quirements for mineral production or pass-through

entities. See tax.utah.gov/withholding and

tax.utah.gov/Utah-taxes/mineral-production.

This publication does not cover federal withholding

requirements. Contact the Internal Revenue Service (IRS)

(see Agencies, below).

Employment Tax Workshops

The Tax Commission (together with the IRS, Workforce Ser-

vices, and the Labor Commission) holds monthly Employ-

ment Tax Workshops sponsored by the Utah Small Business

Development Centers (SBDC). These workshops teach

employers how to withhold federal and state income taxes

and explain federal and state fi ling and paying requirements.

See Agencies, below, for more information.

Who Must Withhold Taxes

You must withhold Utah income tax (unless the employee has

fi led a withholding exemption certifi cate) if you:

• pay wages to any employee for work done in Utah;

• pay wages to Utah resident employees for work done

outside Utah (you may reduce the Utah tax by any tax

withheld by the other state); or

• make payments reported on forms 1099 (or as required

under Utah Code §59-10-405).

Employer Withholding Exemption

You may be exempt from Utah withholding requirements if

you do business in Utah for 60 days or less in a calendar

year and have Tax Commission approval. If you do business

for more than 60 days, you must withhold taxes for the entire

period unless you can show good cause. In that case, the

Tax Commission may extend the exemption for 30 days. See

Utah Code §59-10-402(2).

Submit exemption requests to:

Auditing Division

Utah State Tax Commission

210 N 1950 W

Salt Lake City, UT 84134-2000

Note: This exemption is for the employer, not the employee.

The employee must still fi le and pay Utah tax on all Utah

wages. Report Utah wages on Form W-2, box 16.

Employee Withholding Exclusions

Interstate Transportation Wages

Wages of interstate transportation employees are taxable

only in the state of their residency (see Public Law 101-322).

To qualify, the employee must:

1. work for an interstate railroad, interstate motor carrier or

interstate private carrier;

2. be a nonresident of Utah;

3. have regularly assigned duties in more than one state;

4. be subject to the jurisdiction of the U.S. Secretary of

Transportation; and

5. be an operator, mechanic or someone directly respon-

sible for the safety of a motor vehicle.

“On-call” or “as-needed” duties are not considered “regularly

assigned duties.”

A qualifi ed employee must give the employer federal Form

W-4, Employee’s Withholding Allowance Certifi cate, with the

following changes:

• Mark “Utah Only – Amtrack Act” at the top of Form W-4, and

• Write the words “Utah Exempt” in box 7.

The employee must notify the employer immediately if they

no longer qualify for the exclusion.

Do not report the employee’s wages as Utah wages in box 16

of Form W-2 and do not withhold any Utah tax on the wages.

Important Reminders

• It is a class B misdemeanor to have Utah employees without

a withholding license. See How to Get a Withholding Ac-

count, below.

• If you fi le federal Form 944, Employer’s Annual Federal

Tax Return, you may fi le and pay your Utah withholding tax

annually.

• If you do not meet the criteria in Utah Code §59-10-402, 404

and 405, you are not required to have a Utah withholding

account or to withhold Utah tax. Also, if you are not required

to withhold Utah tax on a form 1099, you are not required to

submit the 1099 form or to report the wages or compensa-

tion on your Utah withholding or reconciliation forms.

• If you withheld tax from a nonresident professional athlete,

you must complete the Worksheet for Nonresident Profes-

sional Athletes when you electronically fi le your annual rec-

onciliation. Download the worksheet at tax.utah.gov/forms.

Changes to this Revision

• The due date to fi le the annual reconciliation has

changed to January 31.

• Employers must fi le their annual reconciliations

electronically.

• New penalties have been imposed for failure to fi le an-

nual reconciliation W-2s electronically, accurately and

completely by January 31.

• In addition to penalties, failure to fi le your annual recon-

ciliation electronically by January 31 may cause income

tax refund delays for your employees.

page 3

14

Active Duty Service MemberÊs Nonresident

Spouse Wages

If a nonresident active duty military service member and a non-

military spouse have the same domicile and the service mem-

ber moves to Utah under military orders, the spouse’s domicile

does not change when moving to live with the service member.

All of the spouse’s income is exempt from Utah income tax.

A qualifi ed spouse receiving employee wages should give

his or her employer a federal Form W-4, Employee’s With-

holding Allowance Certifi cate, with the following changes:

• Mark “Utah Copy” at the top of Form W-4, and

• Write the words “Utah Exempt” in box 7.

Do not withhold any Utah tax on wages paid to a qualifi ed

spouse. The Utah wages, although tax-exempt, are reported

on Form W-2, box 16.

A qualifi ed spouse must notify the employer immediately if

they no longer qualify for the exclusion.

Definitions

Wages

Wages are payments or compensation for services per-

formed by an employee for an employer. This includes pay-

ments in a form other than cash. Utah defi nes wages by the

Internal Revenue Code, Section 3401(a).

Utah Taxable Wages

Utah calculates withholding tax based on wages subject to

federal withholding tax (as defi ned by the IRS). No subtrac-

tion is made for personal or other withholding allow-

ances claimed on federal form W-4. However, Utah does

allow a withholding allowance credit (see below).

Withholding Allowance Credit

Utah allows a credit for withholding allowances claimed on

federal Form W-4, and for the standard deduction on the

individual income tax return. The credit is:

• phased-out as income increases,

• part of the formula for calculating Utah withholding tax

(see tax schedules on pages 10 and 11), and

• built into the withholding tax amounts (see tax tables on

pages 12 through 27).

See Utah Code §59-10-1018 for more information.

Household Employees

Household employees provide domestic services in pri-

vate homes, college clubs, fraternities, and sororities. Utah

income tax may be withheld from household employees’

wages if both the employer and the employee agree.

How to Get a Withholding Account

If you must withhold Utah taxes, you can get a withholding

tax account by:

1. Going online to the OneStop Online Business Registra-

tion at osbr.utah.gov, or

2. Submitting form TC-69, Utah State Business and Tax

Registration, to the Tax Commission. Get forms online at

tax.utah.gov/forms.

Federal Employer Identification Number

Employers must get a federal employer identifi cation number

(EIN) from the IRS before registering in Utah.

You can request an EIN through the IRS’s Online

EIN Application at www.irs.gov. Contact the IRS at

1-800-829-4933 for more information.

If you change your EIN with the IRS, you must also change

your Utah withholding account number.

If you changed the EIN and Utah withholding account num-

bers during the year, you may need to fi le form TC-941D,

Discrepancy Report. See Balancing the Reconciliation below.

Bond Requirements for Utah

You may have to post a bond of $25,000 to $500,000 if

you have a history of fi ling or paying late. See Utah Code

§59-10-405.5(6).

How Much to Withhold

Withhold amounts based on your employee’s federal W-4

form and the Utah withholding schedules or tables in this

publication. See Utah Rules R865-9I-14 and 15.

Filing Packets

You will receive a withholding packet about 30 days after

opening your Utah withholding account. You will then receive

a new withholding packet after the fi rst of each year. Each

packet contains the Utah withholding tax returns you must

fi le during the year. Contact the Tax Commission if you do

not receive your withholding packet.

Depending on your paying frequency, your packet will con-

tain the following forms:

• Annual – One annual return (TC-941) with payment cou-

pon (TC-941PC).

• Quarterly – Four quarterly returns (TC-941) with pay-

ment coupons (TC-941PC).

• Monthly – Four quarterly returns (TC-941), 12 monthly

payment coupons (TC-941PC).

You can download returns and payment coupons at

tax.utah.gov/forms, or fi le online at taxexpress.utah.gov.

How to File Returns

You must fi le returns and pay all amounts withheld to the Tax

Commission by the due dates.

You must fi le a return for each fi ling period. We may assess

a non-fi ling penalty if you make a payment without fi ling a

return.

A valid federal EIN and Utah withholding account ID num-

ber must be printed on each Utah return and each W-2 and

1099R showing Utah withholding tax.

See the returns for detailed fi ling instructions. File returns

online at taxexpress.utah.gov, or by mail to the Utah State

Tax Commission.

Filing with No Tax Liability (Zero Returns)

If there is no withholding for the period, you must fi le a return

showing zeros. Failing to do so will result in an estimated tax

assessment.

If you have no withholding for the entire year, you must still

fi le an annual reconciliation by January 31 of the following

year. Failure to do so may result in penalties.

page 4

14

Amended Return

An amended return replaces a previously fi led return.

Enter the total corrected amounts, not the amount of the

adjustment. To amend a return, use TC-941 and check

the amended box. File your amended return online at

taxexpress.utah.gov, or get a copy of the return online at

tax.utah.gov/forms.

If you owe additional taxes, pay online at

taxexpress.utah.gov, or mail your payment with a payment

coupon (TC-941PC). Include interest calculated from the

original due date to your payment date. Find interest rates in

Pub 58, Utah Interest and Penalties, at tax.utah.gov/forms.

How to Make Payments

You must send a payment coupon (TC-941PC) with your

withholding payment, unless you pay online. Payments do

not count as returns.

Pay online using:

• Electronic Funds Transfer (EFT) ACH Credit—You initi-

ate this payment through your fi nancial institution (they

may charge a transaction fee). See Pub 43, Electronic

Funds Transfer, online at tax.utah.gov/forms.

• ACH Debit Requests — You authorize the Tax Commis-

sion to initiate this payment (there is no transaction fee).

Go to taxexpress.utah.gov for more information. You will

receive your PIN by email if you are a fi rst-time user.

• Credit Card — Pay electronically with a credit card at

taxexpress.utah.gov. You will be charged a convenience

fee for this service.

Payroll Service Providers

Payroll service providers may handle all withholding record

keeping, payments and reconciliations for an employer.

However, the employer is responsible if returns and pay-

ments are not submitted on time.

Liability

Employers are liable for the tax required to be withheld —

not their employees. If you fail to pay any of the withheld

taxes, we may put a lien on all your business assets and

property.

Annual Reconciliation

You must fi le an annual reconciliation for each year (or

partial year) you have a withholding tax account, even if

you have no employees or withholding to report for the year.

Whether you fi le quarterly or annually, you must fi le an annu-

al reconciliation in addition to your withholding tax return(s).

The annual reconciliation is due January 31 after the year

wages were paid.

IMPORTANT: You must fi le your annual reconciliation

electronically. See Pub 32, Online Filing and Paying of

Withholding and Mineral Production Taxes.

A complete reconciliation includes electronic form

TC-941R, any W-2s with Utah income, and any W-2s or

1099Rs with Utah taxes withheld.

Note: Do not include 1099Rs without Utah taxes withheld.

Amended Reconciliations

An amended return replaces a previously fi led return. Enter

the total corrected amounts, not the amount of the adjust-

ment. To amend a return, use TC-941R and check the

amended box. Do not resubmit W-2s and 1099Rs that were

not added or corrected.

IMPORTANT: You must fi le your amended annual recon-

ciliation electronically.

Late and/or Incorrect Filings

We will assess a penalty if you:

1. fail to fi le a complete an accurate reconciliation by Janu-

ary 31 (see Due Dates),

2. do not correctly prepare your W-2s or 1099Rs (see How

to Prepare W-2 and 1099R), or

3. are an employer and do not fi le electronically.

See Penalties and Interest, below.

Also see Pub 32, Online Filing and Paying of Withholding

and Mineral Production Taxes.

Balancing the Reconciliation

If the total Utah taxes withheld as reported on forms W-2 and

1099R does not match the total Utah taxes reported on your quar-

terly or annual withholding return(s), your reconciliation is unbal-

anced. You may balance the reconciliation in one of three ways.

Method 1:

• Review your records and fi nd the error.

• File an amended withholding tax return(s) to correct the

error. See form TC-941 for instructions.

• File your reconciliation showing the corrected amounts

and ensure that everything balances. Withholding

reported for all periods must equal the Utah withholding

shown on all W-2 and 1099R forms.

• If you underpaid one or more periods, pay the additional

tax due with the amended return, plus interest from the

original due date for the period. See Pub 58, Utah Inter-

est and Penalties. Pay online at taxexpress.utah.gov,

or if you are mailing a check, include the TC-941PC pay-

ment coupon.

• If you overpaid one or more periods, include a letter

with the amended return(s) explaining the error and if

you would like the overpayment refunded or applied to

another tax period.

Method 2:

• Review your records and fi nd the error.

• If you under-reported your withholding on your quarterly or

annual return(s), pay the difference with your annual recon-

ciliation online at taxexpress.utah.gov.

• If the payment is on a late-fi led or amended reconcilia-

tion, you must also pay interest on the under-reported

amount, from the January 31 due date. See Pub 58, Utah

Interest and Penalties, for current interest rates.

• If you over-reported your withholding on your quarterly

or annual return(s), send a letter to the Tax Commission

explaining the error and if you would like the overpayment

refunded or applied to another tax period.

Note: You may use method 2 to balance your reconciliation

when you fi nd occasional errors. Using method 2 to avoid

timely fi ling and paying taxes may result in additional penal-

ties and interest.

page 5

14

Method 3:

• Use this method if you reported and paid Utah withhold-

ing tax during the year under multiple account numbers.

• On forms W-2 and 1099R, use the Utah account number

directly associated with the EIN also used on the with-

holding documents.

• On form TC-941R, line 4 fi led for each account, report

only the Utah withholding tax reported on forms W-2 and

1099R issued with that account number on the withhold-

ing documents.

• On form TC-941R, line 6 fi led for each account, report

only the amount of Utah tax withheld on that account on

the quarterly TC-941 returns.

• Complete form TC-941D, Discrepancy Report, to show

that the total amounts of Utah tax withheld on all forms

TC-941R, lines 4 and 6 balance.

Fax the completed form TC-941D to 801-297-6357, or mail to:

Utah State Tax Commission

Technical Research Unit

210 N 1950 W

Salt Lake City, UT 84134-7000

Withholding Filing Record

Keep a record of taxes withheld and paid to the Tax Commis-

sion for at least four years from the due date of the income

tax return reporting wages.

Due Dates

Anything with a due date that falls on a Saturday, Sun-

day or legal holiday is due the next business day.

Utah does not follow the federal withholding payment periods.

Utah only requires that payments be made monthly, quarterly

or annually. The IRS semiweekly deposit and $100,000 next

day deposit rules do not apply to Utah withholding taxes.

Annual Returns with Annual Payments

If you report federal withholding taxes (and any social security

and Medicare taxes) for household employees on federal

Form 1040, Schedule H, or fi le federal Form 944, you can pay

Utah withholding taxes for these same employees annually.

The Utah return (form TC-941) and payment (form TC-941PC)

are due January 31 after the year wages were paid. Contact

the Tax Commission to request annual fi ling.

Quarterly Returns with Quarterly Payments

If you withhold less than $1,000 each month, fi le and pay

your Utah withholding taxes quarterly. Quarterly returns

(TC-941) and payments (TC-941PC) are due by the last day

of the month after the quarter ends, as follows:

Quarterly Filing Period Due Date

January - March April 30

April - June July 31

July - September October 31

October - December January 31

Quarterly fi lers may voluntarily change to quarterly returns with

monthly payments. See Filing Status Changes in this publication.

Quarterly Returns with Monthly Payments

If you withhold $1,000 or more each month, you must fi le

quarterly, but pay your Utah withholding taxes monthly. Pay-

ments are due the last day of the following month:

Monthly Pymt. Period Due Date

January February 28 (or 29)

February March 31

March April 30

April May 31

May June 30

June July 31

July August 31

August September 30

September October 31

October November 30

November December 31

December January 31

Annual Reconciliations

You must fi le electronically by January 31.

Note: We will not issue income tax refunds to your employ-

ees before March 1 unless you have fi led your complete

reconciliation by January 31 (see Utah Code §59-10-529.1).

Failure to fi le electronically by January 31 may cause refund

delays for your employees.

Filing Status Changes

The Tax Commission reviews each withholding account annually

to determine if the reporting and payment periods should change

(based on the previous year’s fi lings). Quarterly payers may vol-

untarily change to paying monthly by submitting a written request

by fax to 801-297-3573 or by mail to:

Master Records

Utah State Tax Commission

210 N 1950 W

Salt Lake City, UT 84134-3310

How to Prepare W-2s and 1099Rs

In addition to federal requirements, wage and earning docu-

ments reporting Utah income or withholding must include the

following information:

• Your federal Employer Identifi cation Number (EIN).

• The recipient’s federal Employer Identifi cation Number

(EIN or SSN).

• Your Utah withholding account number — the 14-digit

number ending in WTH. (If this number won’t fi t in the

space on your W-2 form, you may leave out the dashes

in the account number.)

• The amount of income from Utah sources.

• The amount of Utah taxes withheld, if any.

Failure to provide all required information on the W-2s or

1099Rs may result in penalties.

page 6

14

How to File W-2s and 1099Rs

You must fi le electronically by January 31.

Employers must give all employees a legible withholding

statement by January 31 of the following year showing taxes

withheld during the year. File copies of all forms W-2 and

1099R issued to employees and payees with your Utah an-

nual reconciliation form. See Annual Reconciliation, above.

You must provide a valid Utah withholding account ID

number and federal EIN on each employee’s W-2 and

1099R form. You may be penalized if you do not provide

this information.

For other Utah withholding requirements information, call

801-297-7626 (1-800-662-4335 ext. 7626 outside the Salt

Lake area).

Amending W-2s

You must fi le electronically.

If you reported incorrect information on an employee’s W-2,

you must fi le a corrected W-2. File the correction as a W-2c.

Only fi le W-2cs for the W-2s you are correcting. When entering

the data on the W-2c, only enter information in the fi elds you

are changing.

Penalties and Interest

Late Filing and Late Payments

We may assess late fi ling and late payment penalties on

non- and late-fi led returns and payments made after the due

date. See Pub 58, Utah Interest and Penalties.

The withholding penalty structure is:

Days Late Penalty Amount - Greater of

1-5 $20 or 2% of the outstanding tax

6-15 $20 or 5% of the outstanding tax

16 or more $20 or 10% of the outstanding tax

Penalties are assessed for failing to fi le a tax due return and

failing to pay tax due. A second penalty will be applied if the

tax is still unpaid 90 days after the due date.

Submitting incorrect forms or forms with missing information

may also result in penalties. See Pub 58, Utah Interest and

Penalties.

Annual Reconciliation

Failing to fi le your annual reconciliation electronically, on time,

accurately and completely will result in the following penalties:

• $50 for a TC-941R.

• $30 for each W-2 and 1099R if between 15 and 30 days

late (up to $75,000).

• $60 for each W-2 and 1099R if fi led between 31 days late

and June 1 (up to $200,000).

• $100 for each W-2 and 1099R if fi led after June 1 (up to

$500,000).

Interest

The interest rate for all taxes and fees is two percentage

points above the federal short-term rate for the prior fourth

calendar quarter. See Pub 58, Utah Interest and Penalties.

Changing an Account

Use TC-69C, Notice of Change for a Tax Account, to:

• Report changes to your business or mailing address

• Change your business name

• Inform the Tax Commission you have stopped paying

wages

• Notify the Tax Commission you have changed your busi-

ness ownership status

• Close your account

Get forms online at tax.utah.gov/forms.

You will not receive a new withholding packet for address

and name changes. Continue using your current forms. The

Tax Commission will update its records and the changes will

be on future correspondence.

You must apply for a new withholding account if you change

ownership status (for example, sole proprietor to partnership).

If you sell your business you must close your withholding ac-

count. Withholding licenses are not transferable. The new

business owner cannot use your withholding forms.

How to Close a Withholding

Account

If you have no employees or stop doing business in Utah,

use form TC-69C, Notice of Change for a Tax Account, to

close your account. If you do not notify the Tax Commission,

you will be assessed an estimated tax, including late penal-

ties and interest. You must fi le TC-941R if your account is

open for any part of the year.

Agencies

Contact the following agencies for more information about

state and federal withholding requirements.

Internal Revenue Service

Federal Income Tax Withholding and

Self-Employment Tax

Internal Revenue Service

50 South 200 East

Salt Lake City, UT 84111

801-799-6963

1-800-829-1040 (for individuals)

1-800-829-4933 (for businesses)

www.irs.gov

Forms and Publications

1-800-829-3676

www.irs.gov/Forms-&-Pubs

Employment Tax Workshops

www.irs.gov/Businesses/Small-

Businesses-&-Self-Employed/

Small-Business-Tax-Workshops-and-Webinars

page 7

14

Utah State Tax Commission

Utah Income Tax Withholding

Utah State Tax Commission

210 North 1950 West

Salt Lake City, UT 84134

801-297-2200

1-800-662-4335 if outside the Salt Lake area

tax.utah.gov

Employment Tax Workshops

Small Business Development Center

801-957-5200 (Sandy)

435-652-7741 (St. George)

tax.utah.gov/training

Forms and Publications

Automated forms ordering:

801-297-6700

1-800-662-4335, ext. 6700 if outside Salt Lake

tax.utah.gov/forms

Social Security Administration

Social Security

175 East 400 South

Salt Lake City, UT 84111

866-851-5275

1-800-772-1213

socialsecurity.gov/employer

Utah Dept. of Workforce Services

Unemployment Compensation

Department of Workforce Services

140 East 300 South

PO Box 45288

Salt Lake City, UT 84145-0288

801-526-9235

1-800-222-2857

jobs.utah.gov/ui/jobseeker/contactus.html

Labor Commission of Utah

Worker’s Compensation

Contact any private insurance company that carries worker’s

compensation insurance, or contact:

Labor Commission of Utah

160 East 300 South, 3rd Floor

PO Box 146610

Salt Lake City, UT 84114-6610

801-530-6800

1-800-530-5090

laborcommission.utah.gov

page 8

14

Utah Withholding Taxes Calendar

NOTE: Returns and full payment must be submitted by the

due date (or next business day if the due date falls on Satur-

day, Sunday or a legal holiday).

The following is a list of important Utah withholding tax

dates. (See federal dates in IRS Publication 15.)

File and pay annual

withholding tax online at

taxexpress.utah.gov, or

fi le TC-941 with TC-941PC

and check

File and pay fourth quarter

withholding tax online at

taxexpress.utah.gov, or

fi le TC-941 with TC-941PC

and check

File fourth quarter return

and pay December

withholding tax online at

taxexpress.utah.gov, or

fi le TC-941 with TC-941PC

and check

Give forms W-2 and 1099R

to employees and payees.

Electronically fi le annual

reconciliation (including

W-2s and 1099Rs).

January 31

Pay February withholding

tax online at taxexpress.

utah.gov, or by check with

TC-941PC

March 31

end of fi rst quarter

Pay April withholding tax

online at taxexpress.

utah.gov, or by check with

TC-941PC

May 31

File and pay second quar-

ter withholding tax online at

taxexpress.utah.gov, or

fi le TC-941 with TC-941PC

and check

File second quarter

return and pay June

withholding tax online at

taxexpress.utah.gov, or

fi le TC-941 with TC-941PC

and check

July 31

Pay August withholding

tax online at taxexpress.

utah.gov, or by check with

TC-941PC

September 30

end of third quarter

Pay October withholding

tax online at taxexpress.

utah.gov, or by check with

TC-941PC

November 30

File and pay fi rst quarter

withholding tax online at

taxexpress.utah.gov, or

fi le TC-941 with TC-941PC

and check

File fi rst quarter

return and pay March

withholding tax online at

taxexpress.utah.gov, or

fi le TC-941 with TC-941PC

and check

April 30

Pay May withholding tax

online at taxexpress.

utah.gov, or by check with

TC-941PC

June 30

end of second quarter

Pay July withholding tax

online at taxexpress.

utah.gov, or by check with

TC-941PC

August 31

File and pay third quarter

withholding tax online at

taxexpress.utah.gov, or

fi le TC-941 with TC-941PC

and check

File third quarter return

and pay September

withholding tax online at

taxexpress.utah.gov, or

fi le TC-941 with TC-941PC

and check

October 31

Annual Payers

Quarterly PayersMonthly PayersAll EmployersDue Date

Pay November withholding

tax online at taxexpress.

utah.gov, or by check with

TC-941PC

December 31

end of fourth quarter

Pay January

withholding tax online at

taxexpress.utah.gov, or

by check with TC-941PC

February 28

page 9

14

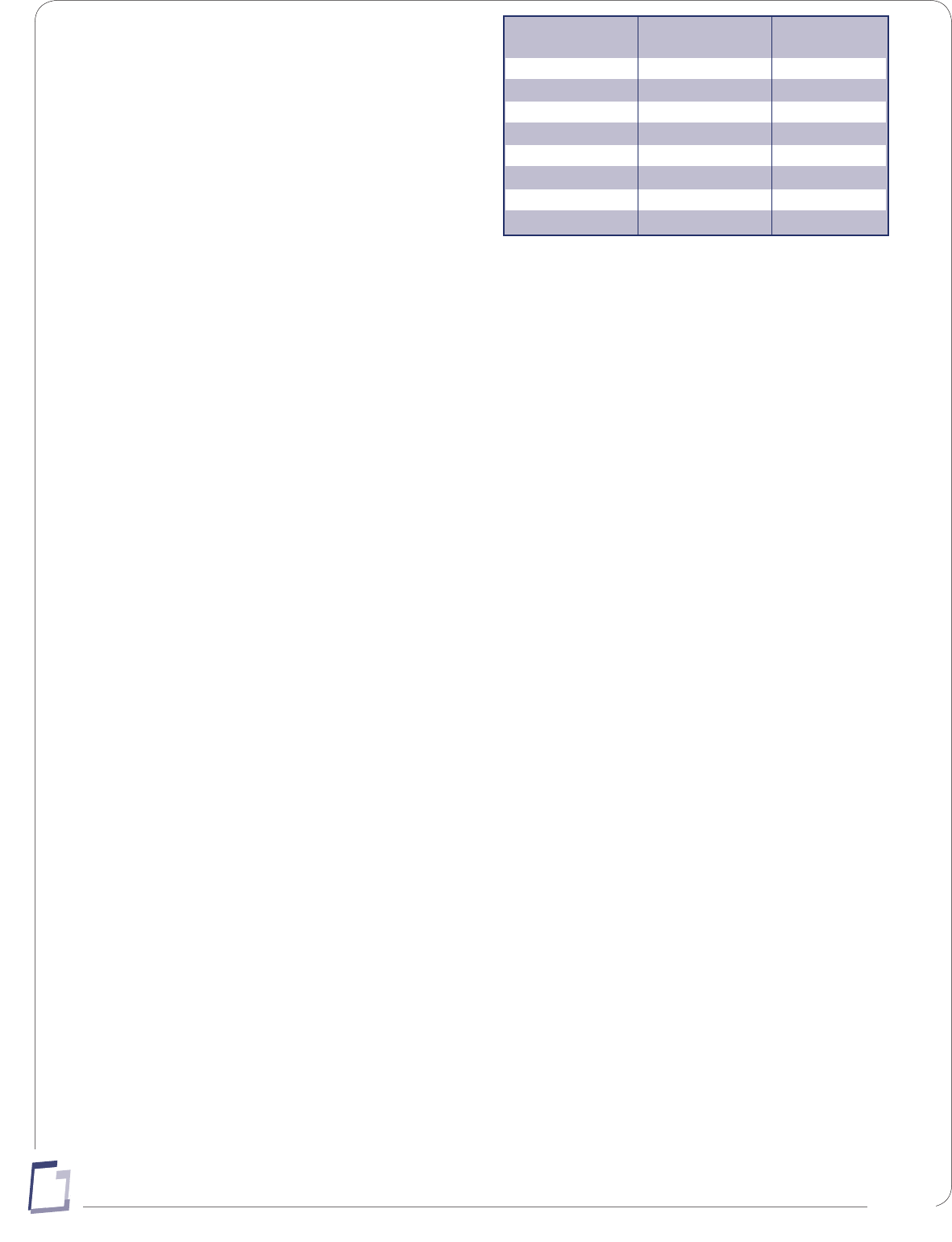

Utah Withholding Schedules

Instructions

Utah law does not follow federal law regarding withhold-

ing tax calculations. There is no deduction for exemption

allowances when calculating taxpayer income (as in the

federal calculation). Instead, Utah allows a credit against the

withholding tax calculated, which is phased-out as income

increases. Utah tax schedules and tables incorporate this

credit and the phase-out is built into the calculations.

Follow the instructions below to compute the employee’s

Utah income tax withholding.

1. Find the appropriate Utah Schedule based on the payroll

period (see following chart) and the employee’s marital

status shown on federal W-4 form.

a) Enter on line 1 the Utah taxable wages.

b) Enter on line 3 the number of withholding allowances

the employee claimed on form W-4.

c) Follow the instructions for each line to complete the

withholding tax calculation.

2. Line 10 of the calculation is the Utah withholding tax for

the pay period.

See examples, below.

Number of pay

If pay period is periods annually Use schedule

Weekly 52 Schedule 1

Biweekly 26 Schedule 2

Semimonthly 24 Schedule 3

Monthly 12 Schedule 4

Quarterly 4 Schedule 5

Semiannual 2 Schedule 6

Annual 1 Schedule 7

Daily Daily Schedule 8

If you have questions about the withholding schedules,

contact:

Taxpayer Services

Utah State Tax Commission

210 North 1950 West

Salt Lake City, UT 84134

801-297-2200

1-800-662-4335 if outside the Salt Lake area

page 10

14

Example 1 - Use Schedule 1 - Weekly / Single Example 4 - Use Schedule 4 - Monthly / Married

Payroll Period Weekly Payroll Period Monthly

Marital Status Single Marital Status Married

Withholding Allowances 1 Withholding Allowances 3

Utah Taxable Wages $400 Utah Taxable Wages $2,500

1. Utah taxable wages 400 1. Utah taxable wages 2,500

2. Multiply line 1 by .05 (5%) 20 2. Multiply line 1 by .05 (5%) 125

3. Number of withholding allowances 1 3. Number of withholding allowances 3

4. Multiply line 3 by $2 2 4. Multiply line 3 by $10 30

5. Base allowance 5 5. Base allowance 31

6. Add lines 4 and 5 7 6. Add lines 4 and 5 61

7. Line 1 less $231 (not less than zero) 169 7. Line 1 less $1,500 (not less than zero) 1,000

8. Multiply line 7 by .013 (1.3%) 2 8. Multiply line 7 by .013 (1.3%) 13

9. Line 6 less line 8 (not less than zero) 5 9. Line 6 less line 8 (not less than zero) 48

10. Withholding tax - line 2 less line 9 15 10. Withholding tax - line 2 less line 9 77

Example 2 - Use Schedule 2 - Biweekly / Single Example 5 - Use Schedule 5 - Quarterly / Single

Payroll Period Biweekly Payroll Period Quarterly

Marital Status Single Marital Status Single

Withholding Allowances 2 Withholding Allowances 1

Utah Taxable Wages $1,000 Utah Taxable Wages $8,000

1. Utah taxable wages 1,000 1. Utah taxable wages 8,000

2. Multiply line 1 by .05 (5%) 50 2. Multiply line 1 by .05 (5%) 400

3. Number of withholding allowances 2 3. Number of withholding allowances 1

4. Multiply line 3 by $5 10 4. Multiply line 3 by $31 31

5. Base allowance 10 5. Base allowance 63

6. Add lines 4 and 5 20 6. Add lines 4 and 5 94

7. Line 1 less $462 (not less than zero) 538 7. Line 1 less $3,000(not less than zero) 5,000

8. Multiply line 7 by .013 (1.3%) 7 8. Multiply line 7 by .013 (1.3%) 65

9. Line 6 less line 8 (not less than zero) 13 9. Line 6 less line 8 (not less than zero) 29

10. Withholding tax - line 2 less line 9 37 10. Withholding tax - line 2 less line 9 371

Example 3 - Use Schedule 3 - Semimonthly / Married Example 6 - Use Schedule 8 - Daily / Married

Payroll Period Semimonthly Payroll Period Daily

Marital Status Married Marital Status Married

Withholding Allowances 4 Withholding Allowances 3

Utah Taxable Wages $855 Utah Taxable Wages $150

1. Utah taxable wages 855 1. Utah taxable wages 150

2. Multiply line 1 by .05 (5%) 43 2. Multiply line 1 by .05 (5%) 8

3. Number of withholding allowances 4 3. Number of withholding allowances 3

4. Multiply line 3 by $5 20 4. Multiply line 3 by $0 0

5. Base allowance 16 5. Base allowance 1

6. Add lines 4 and 5 36 6. Add lines 4 and 5 1

7. Line 1 less $750 (not less than zero) 105 7. Line 1 less $69 (not less than zero) 81

8. Multiply line 7 by .013 (1.3%) 1 8. Multiply line 7 by .013 (1.3%) 1

9. Line 6 less line 8 (not less than zero) 35 9. Line 6 less line 8 (not less than zero) 0

10. Withholding tax - line 2 less line 9 8 10. Withholding tax - line 2 less line 9 8

Examples of Utah Withholding Calculations

Examples of Utah Withholding Calculations

The following examples show different combinations of pay period, taxable

wages, marital status, and withholding allowance credits.

page 11

14

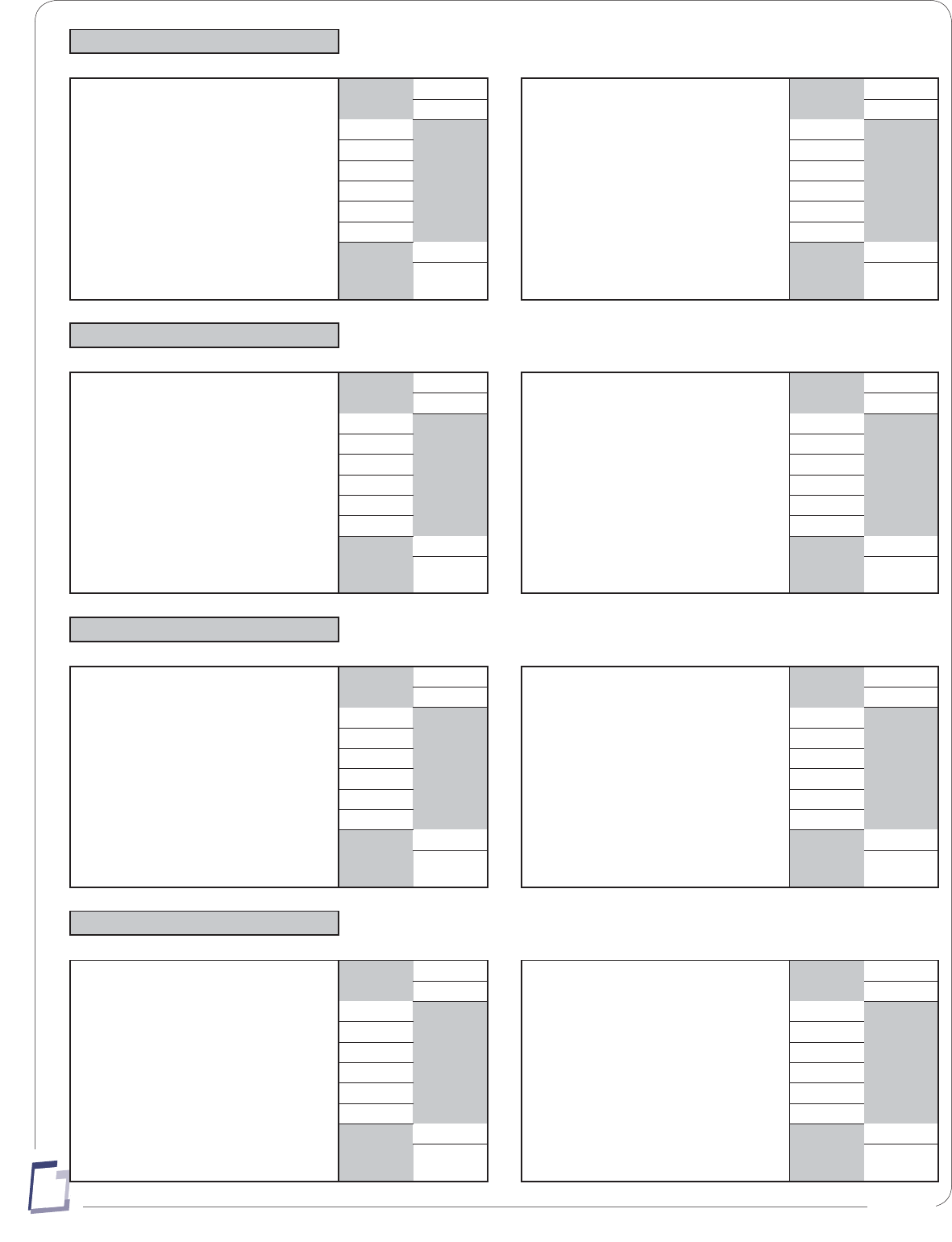

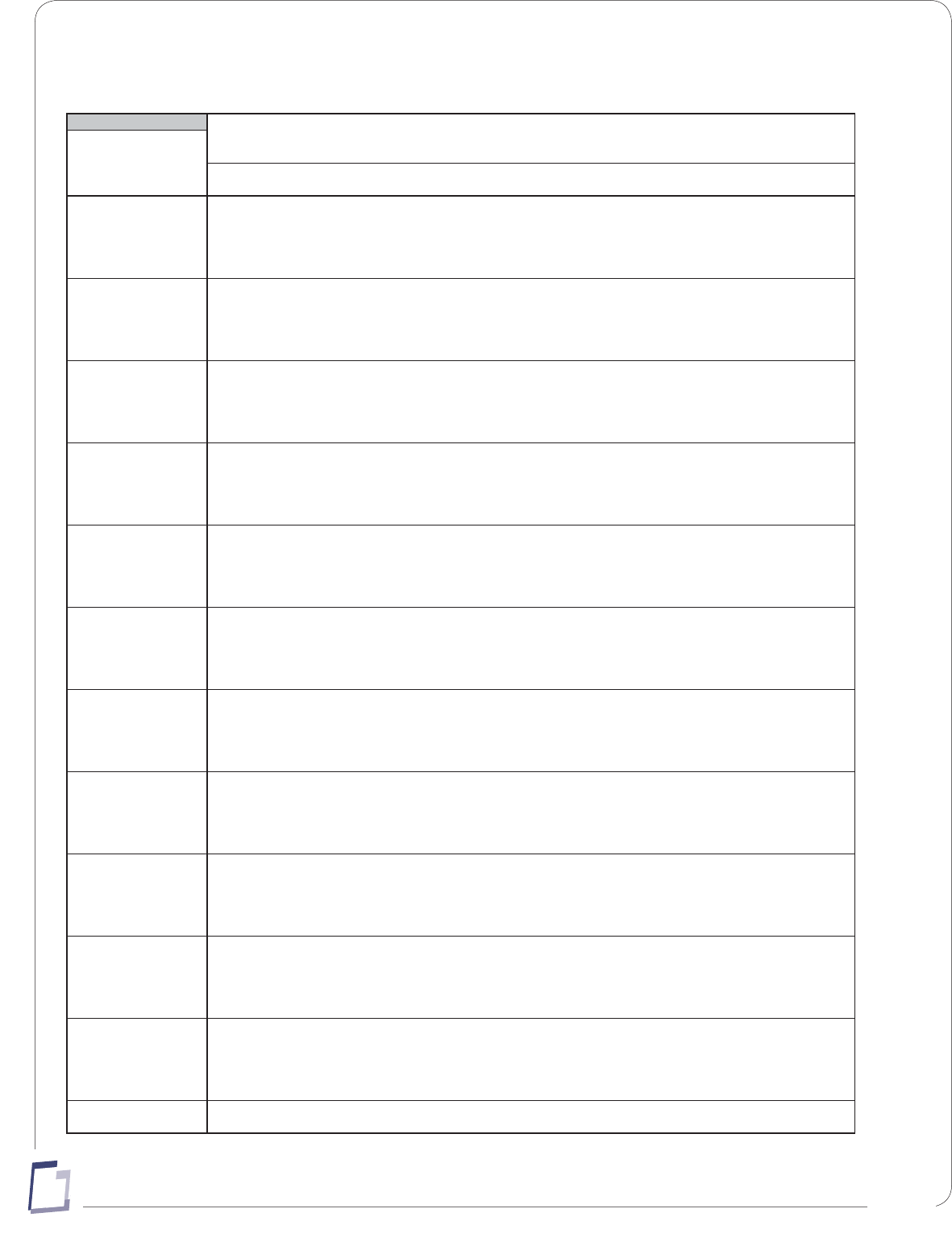

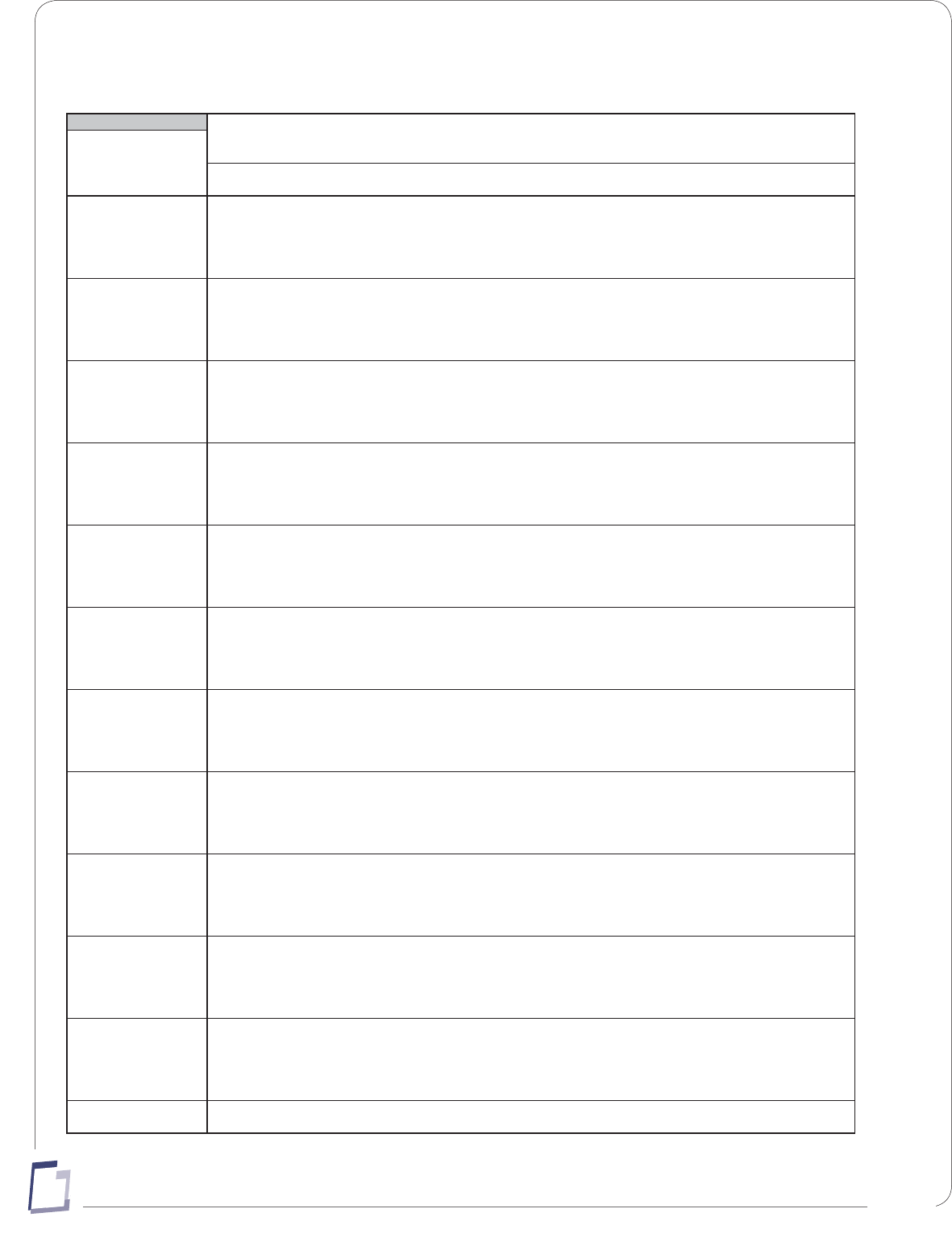

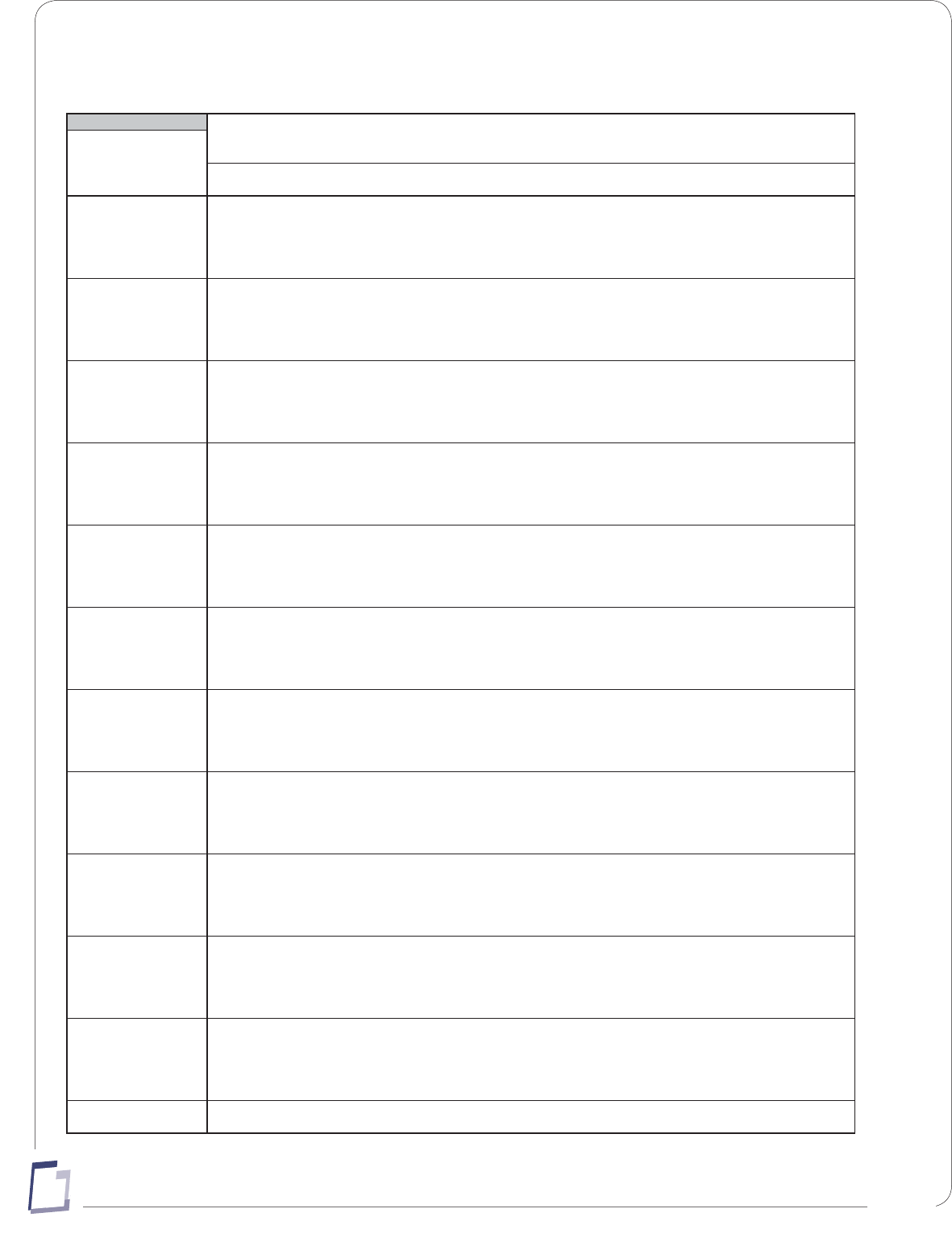

WEEKLY Payroll Period (52 pay periods per year)

SINGLE MARRIED

1. Utah taxable wages 1. Utah taxable wages

2. Multiply line 1 by .05 (5%) 2. Multiply line 1 by .05 (5%)

3. Number of withholding allowances 3. Number of withholding allowances

4. Multiply line 3 by $ 2 4. Multiply line 3 by $ 2

5. Base allowance 5 5. Base allowance 7

6. Add lines 4 and 5 6. Add lines 4 and 5

7. Line 1 less $ 231 (not less than 0) 7. Line 1 less $ 346 (not less than 0)

8. Multiply line 7 by .013 (1.3%) 8. Multiply line 7 by .013 (1.3%)

9. Line 6 less line 8 (not less than 0) 9. Line 6 less line 8 (not less than 0)

10. Withholding tax - line 2 less line 9 10. Withholding tax - line 2 less line 9

(not less than 0) (not less than 0)

BIWEEKLY Payroll Period (26 pay periods per year)

SINGLE MARRIED

1. Utah taxable wages 1. Utah taxable wages

2. Multiply line 1 by .05 (5%) 2. Multiply line 1 by .05 (5%)

3. Number of withholding allowances 3. Number of withholding allowances

4. Multiply line 3 by $ 5 4. Multiply line 3 by $ 5

5. Base allowance 10 5. Base allowance 14

6. Add lines 4 and 5 6. Add lines 4 and 5

7. Line 1 less $ 462 (not less than 0) 7. Line 1 less $ 692 (not less than 0)

8. Multiply line 7 by .013 (1.3%) 8. Multiply line 7 by .013 (1.3%)

9. Line 6 less line 8 (not less than 0) 9. Line 6 less line 8 (not less than 0)

10. Withholding tax - line 2 less line 9 10. Withholding tax - line 2 less line 9

(not less than 0) (not less than 0)

SEMIMONTHLY Payroll Period (24 pay periods per year)

SINGLE MARRIED

1. Utah taxable wages 1. Utah taxable wages

2. Multiply line 1 by .05 (5%) 2. Multiply line 1 by .05 (5%)

3. Number of withholding allowances 3. Number of withholding allowances

4. Multiply line 3 by $ 5 4. Multiply line 3 by $ 5

5. Base allowance 10 5. Base allowance 16

6. Add lines 4 and 5 6. Add lines 4 and 5

7. Line 1 less $ 500 (not less than 0) 7. Line 1 less $ 750 (not less than 0)

8. Multiply line 7 by .013 (1.3%) 8. Multiply line 7 by .013 (1.3%)

9. Line 6 less line 8 (not less than 0) 9. Line 6 less line 8 (not less than 0)

10. Withholding tax - line 2 less line 9 10. Withholding tax - line 2 less line 9

(not less than 0) (not less than 0)

MONTHLY Payroll Period (12 pay periods per year)

SINGLE MARRIED

1. Utah taxable wages 1. Utah taxable wages

2. Multiply line 1 by .05 (5%) 2. Multiply line 1 by .05 (5%)

3. Number of withholding allowances 3. Number of withholding allowances

4. Multiply line 3 by $ 10 4. Multiply line 3 by $ 10

5. Base allowance 21 5. Base allowance 31

6. Add lines 4 and 5 6. Add lines 4 and 5

7. Line 1 less $ 1,000 (not less than 0) 7. Line 1 less $ 1,500 (not less than 0)

8. Multiply line 7 by .013 (1.3%) 8. Multiply line 7 by .013 (1.3%)

9. Line 6 less line 8 (not less than 0) 9. Line 6 less line 8 (not less than 0)

10. Withholding tax - line 2 less line 9 10. Withholding tax - line 2 less line 9

(not less than 0) (not less than 0)

UTAH SCHEDULE 1

UTAH SCHEDULE 2

UTAH SCHEDULE 3

UTAH SCHEDULE 4

page 12

14

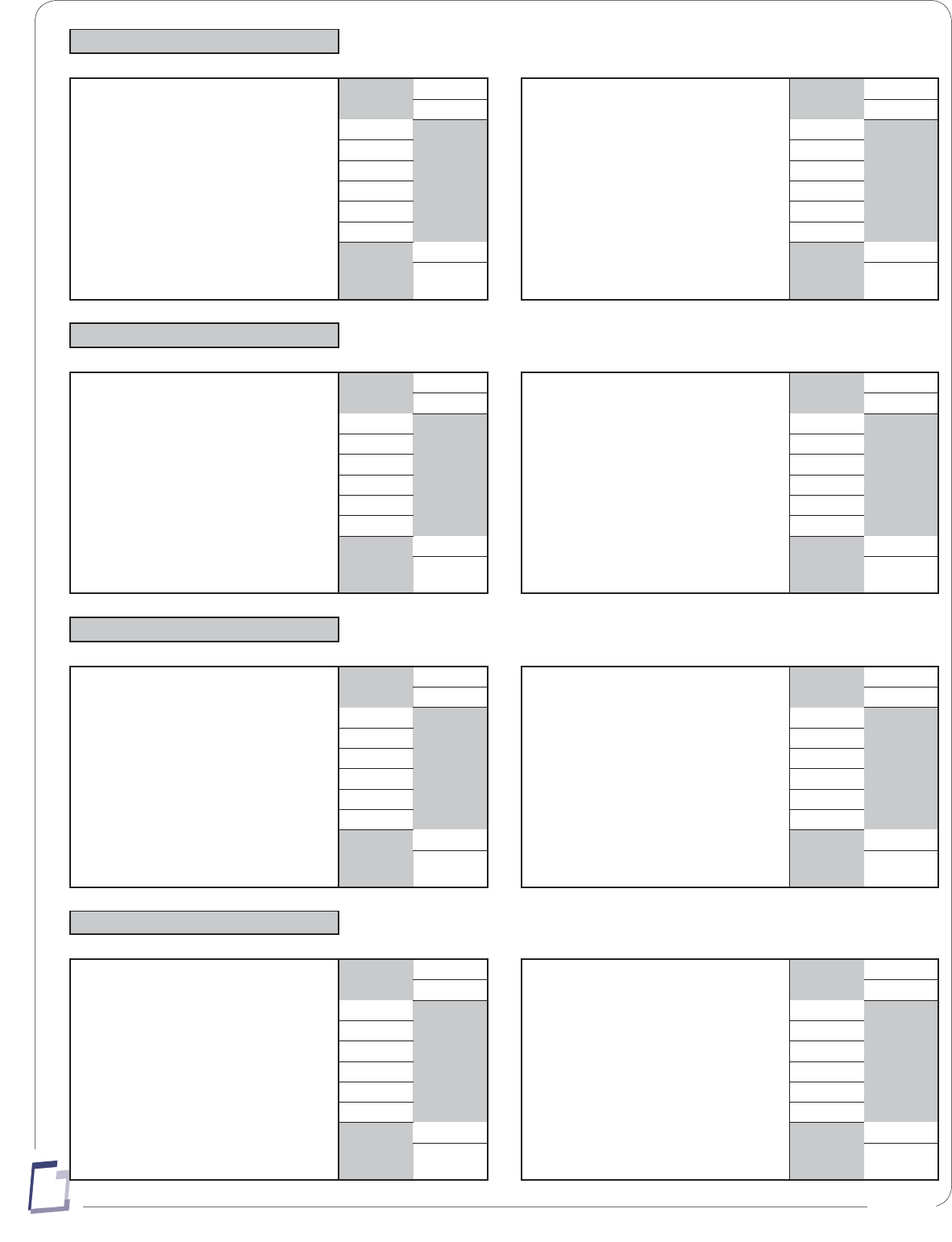

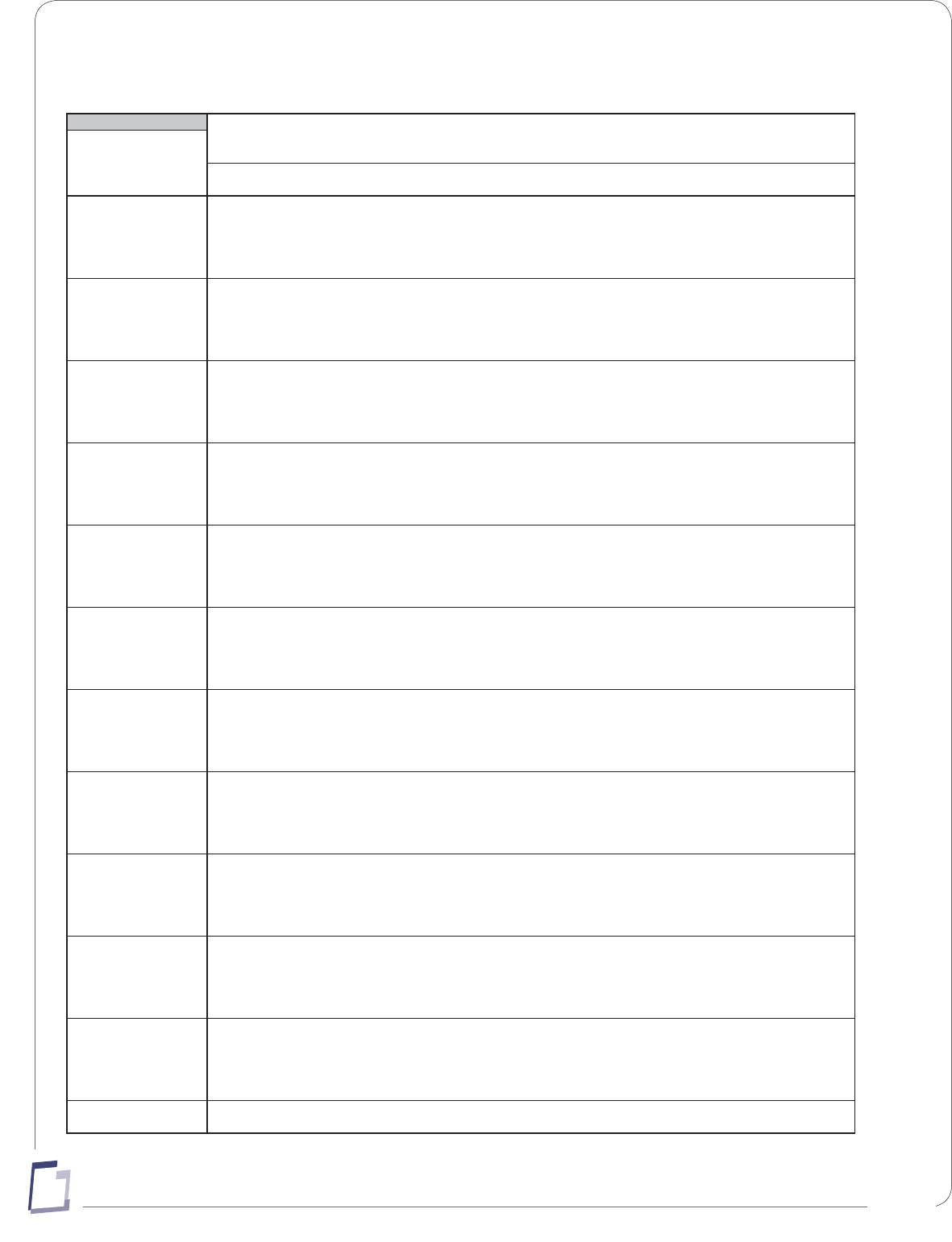

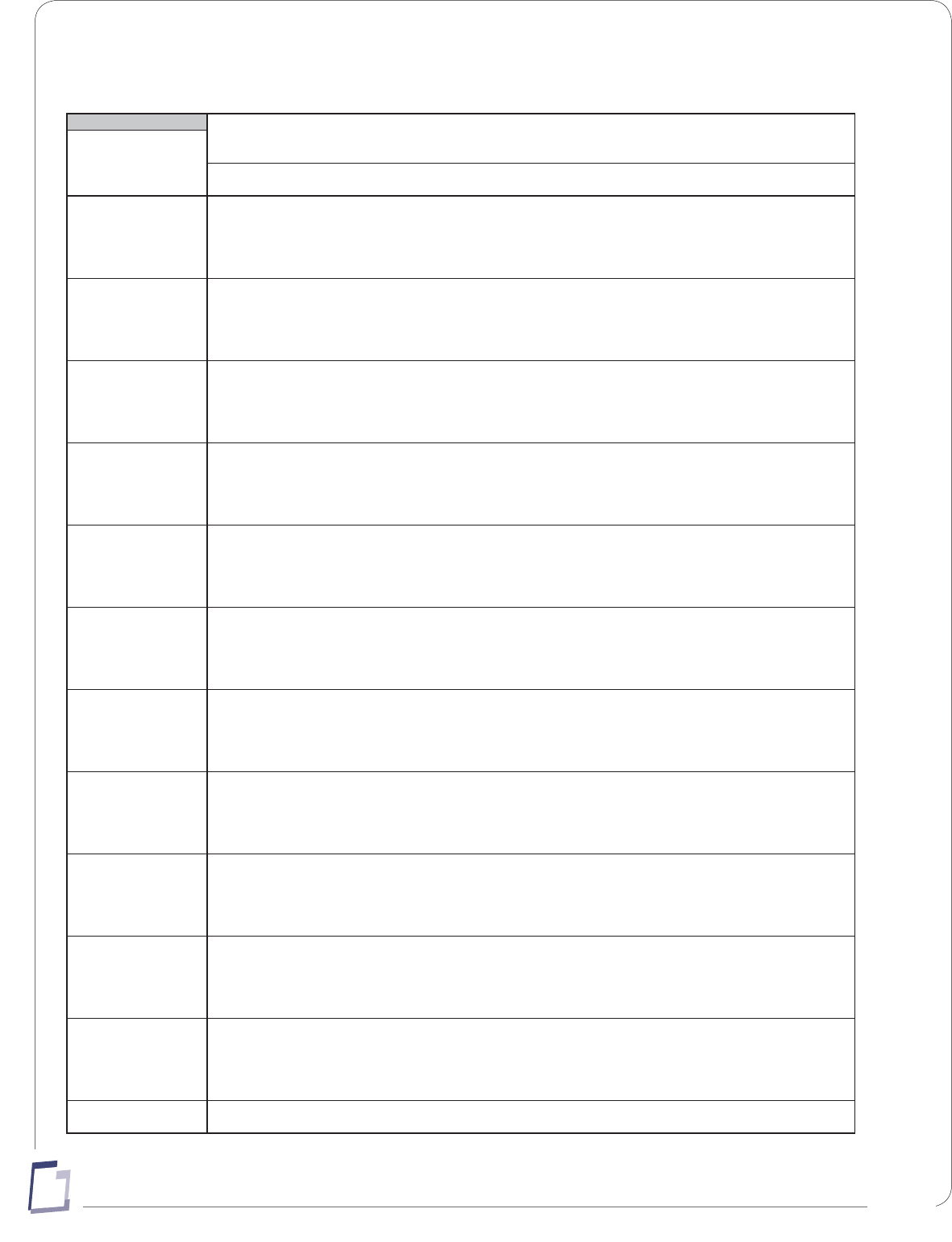

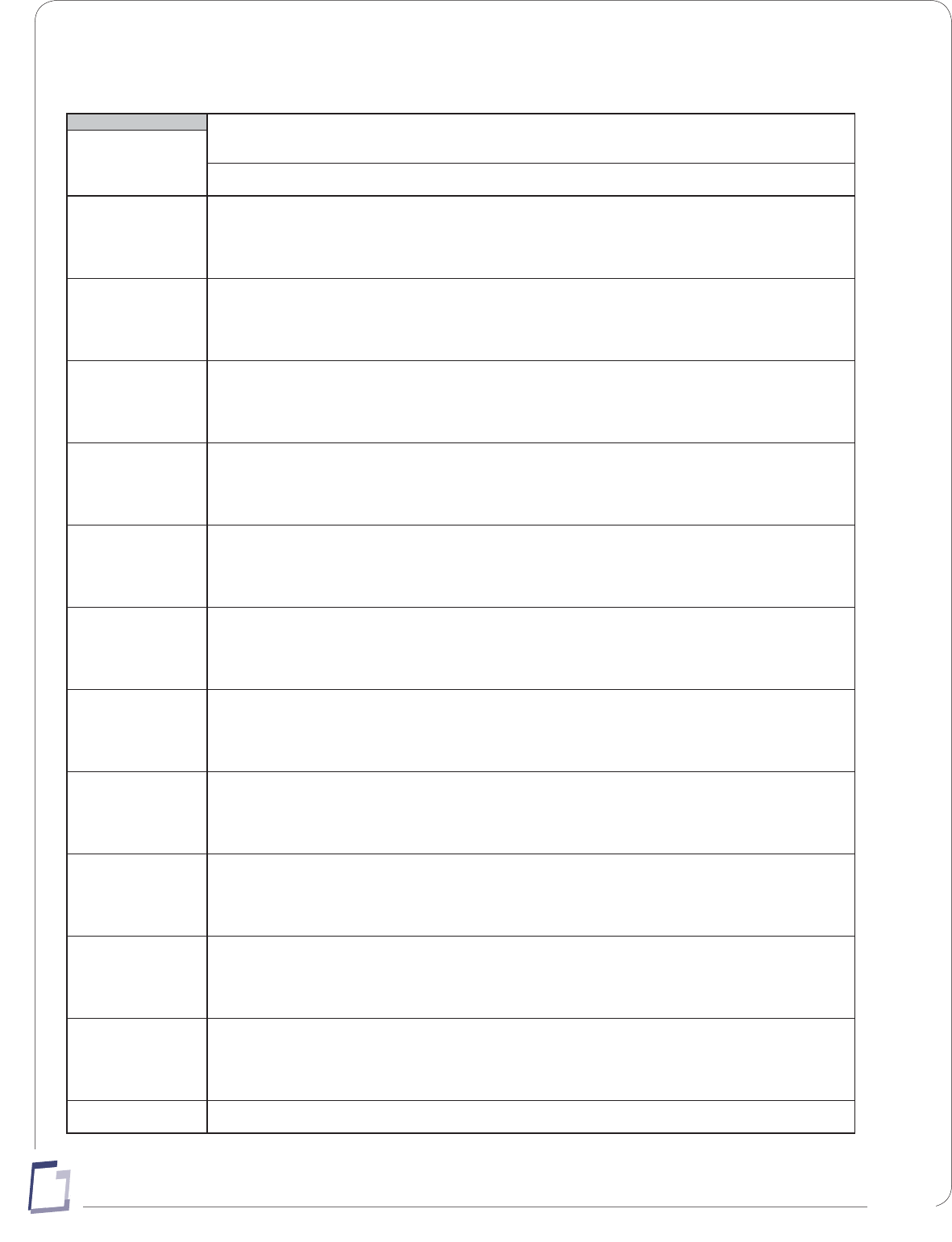

QUARTERLY Payroll Period (4 pay periods per year)

SINGLE MARRIED

1. Utah taxable wages 1. Utah taxable wages

2. Multiply line 1 by .05 (5%) 2. Multiply line 1 by .05 (5%)

3. Number of withholding allowances 3. Number of withholding allowances

4. Multiply line 3 by $ 31 4. Multiply line 3 by $ 31

5. Base allowance 63 5. Base allowance 94

6. Add lines 4 and 5 6. Add lines 4 and 5

7. Line 1 less $ 3,000 (not less than 0) 7. Line 1 less $ 4,500 (not less than 0)

8. Multiply line 7 by .013 (1.3%) 8. Multiply line 7 by .013 (1.3%)

9. Line 6 less line 8 (not less than 0) 9. Line 6 less line 8 (not less than 0)

10. Withholding tax - line 2 less line 9 10. Withholding tax - line 2 less line 9

(not less than 0) (not less than 0)

SEMIANNUAL Payroll Period (2 pay periods per year)

SINGLE MARRIED

1. Utah taxable wages 1. Utah taxable wages

2. Multiply line 1 by .05 (5%) 2. Multiply line 1 by .05 (5%)

3. Number of withholding allowances 3. Number of withholding allowances

4. Multiply line 3 by $ 63 4. Multiply line 3 by $ 63

5. Base allowance 125 5. Base allowance 188

6. Add lines 4 and 5 6. Add lines 4 and 5

7. Line 1 less $ 6,000 (not less than 0) 7. Line 1 less $ 9,000 (not less than 0)

8. Multiply line 7 by .013 (1.3%) 8. Multiply line 7 by .013 (1.3%)

9. Line 6 less line 8 (not less than 0) 9. Line 6 less line 8 (not less than 0)

10. Withholding tax - line 2 less line 9 10. Withholding tax - line 2 less line 9

(not less than 0) (not less than 0)

ANNUAL Payroll Period (1 pay period per year)

SINGLE MARRIED

1. Utah taxable wages 1. Utah taxable wages

2. Multiply line 1 by .05 (5%) 2. Multiply line 1 by .05 (5%)

3. Number of withholding allowances 3. Number of withholding allowances

4. Multiply line 3 by $ 125 4. Multiply line 3 by $ 125

5. Base allowance 250 5. Base allowance 375

6. Add lines 4 and 5 6. Add lines 4 and 5

7. Line 1 less $ 12,000 (not less than 0) 7. Line 1 less $ 18,000 (not less than 0)

8. Multiply line 7 by .013 (1.3%) 8. Multiply line 7 by .013 (1.3%)

9. Line 6 less line 8 (not less than 0) 9. Line 6 less line 8 (not less than 0)

10. Withholding tax - line 2 less line 9 10. Withholding tax - line 2 less line 9

(not less than 0) (not less than 0)

DAILY or MISCELLANEOUS Payroll Period

SINGLE MARRIED

1. Utah taxable wages 1. Utah taxable wages

2. Multiply line 1 by .05 (5%) 2. Multiply line 1 by .05 (5%)

3. Number of withholding allowances 3. Number of withholding allowances

4. Multiply line 3 by $ 0 4. Multiply line 3 by $ 0

5. Base allowance 1 5. Base allowance 1

6. Add lines 4 and 5 6. Add lines 4 and 5

7. Line 1 less $ 46 (not less than 0) 7. Line 1 less $ 69 (not less than 0)

8. Multiply line 7 by .013 (1.3%) 8. Multiply line 7 by .013 (1.3%)

9. Line 6 less line 8 (not less than 0) 9. Line 6 less line 8 (not less than 0)

10. Withholding tax - line 2 less line 9 10. Withholding tax - line 2 less line 9

(not less than 0) (not less than 0)

UTAH SCHEDULE 5

UTAH SCHEDULE 6

UTAH SCHEDULE 7

UTAH SCHEDULE 8

page 13

14

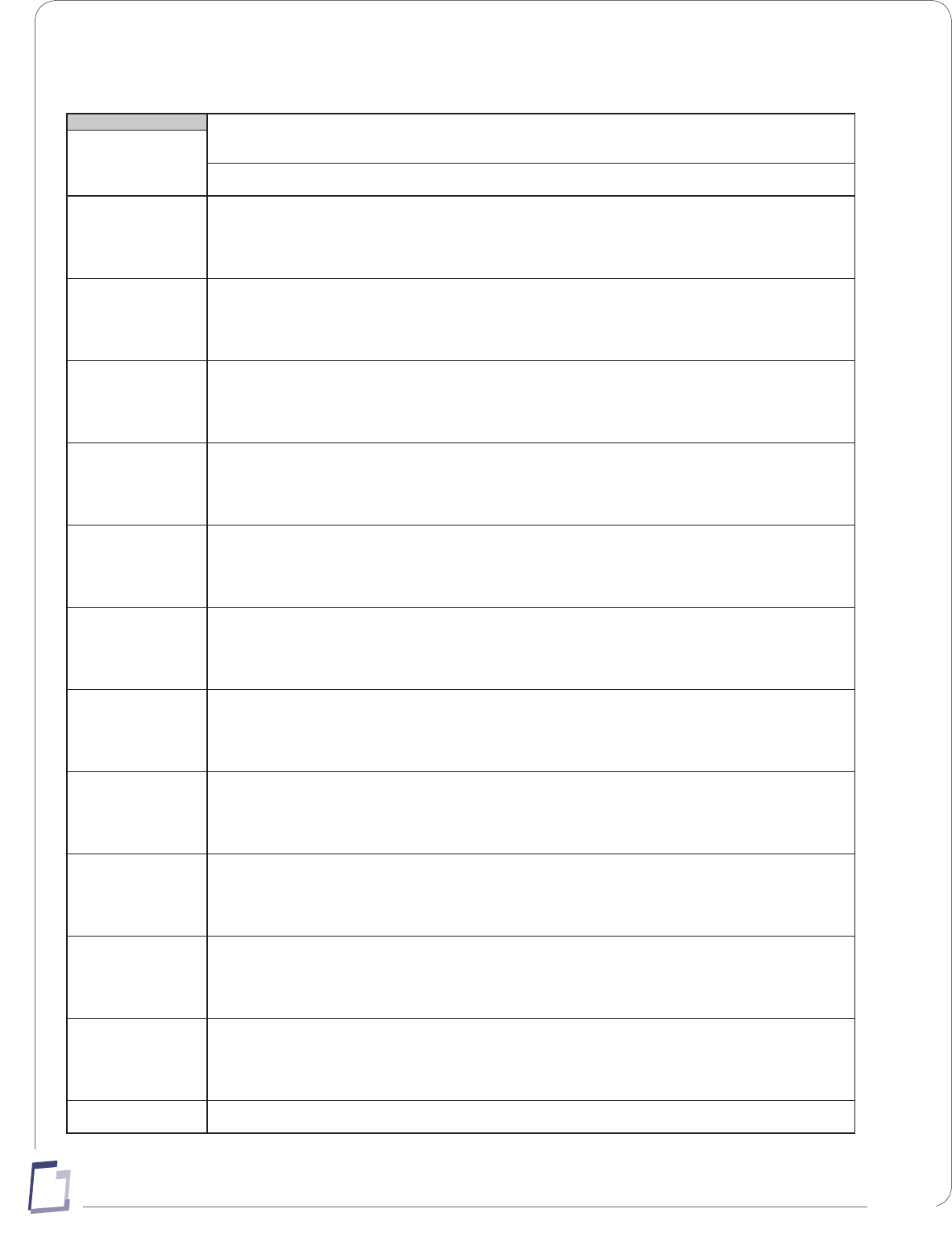

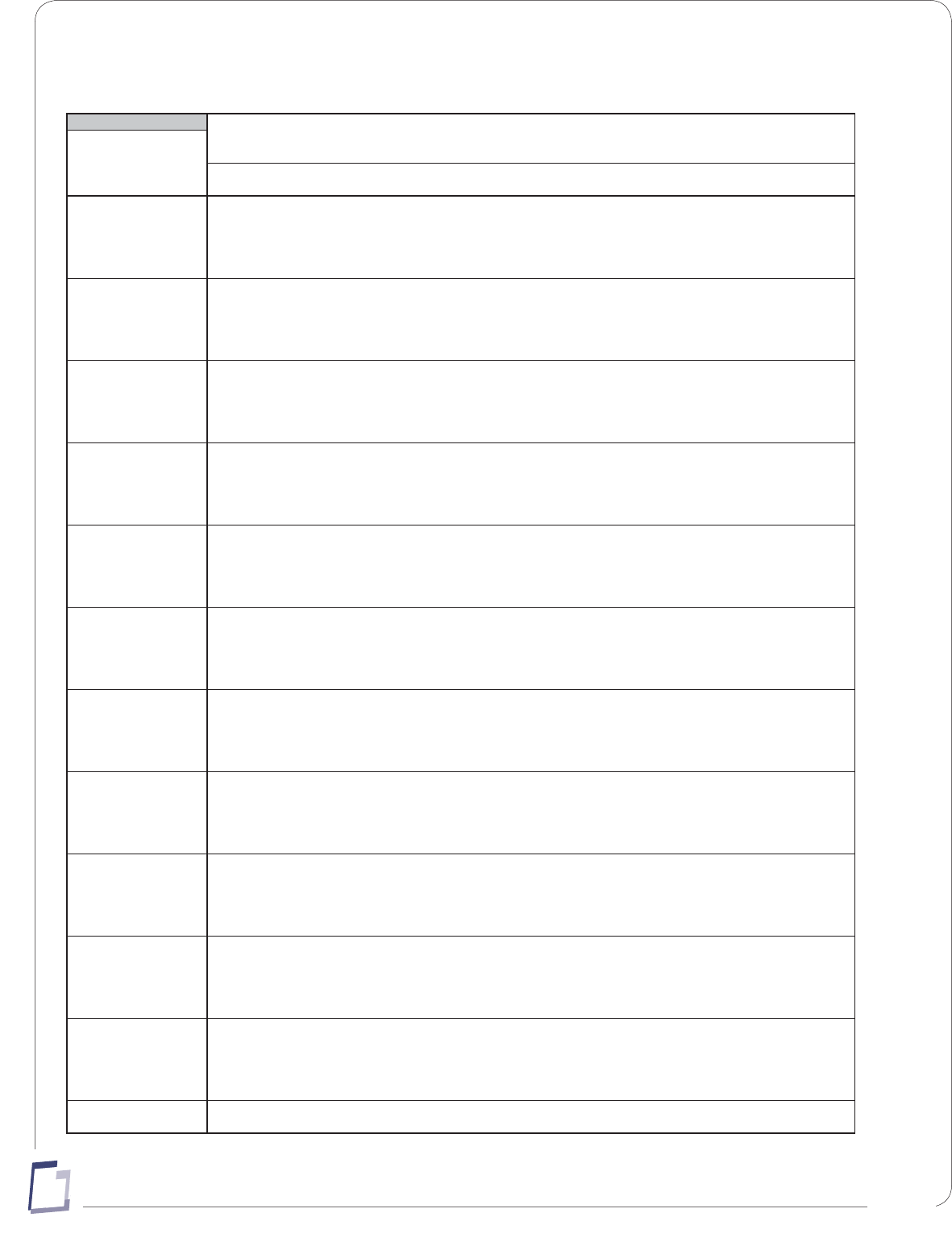

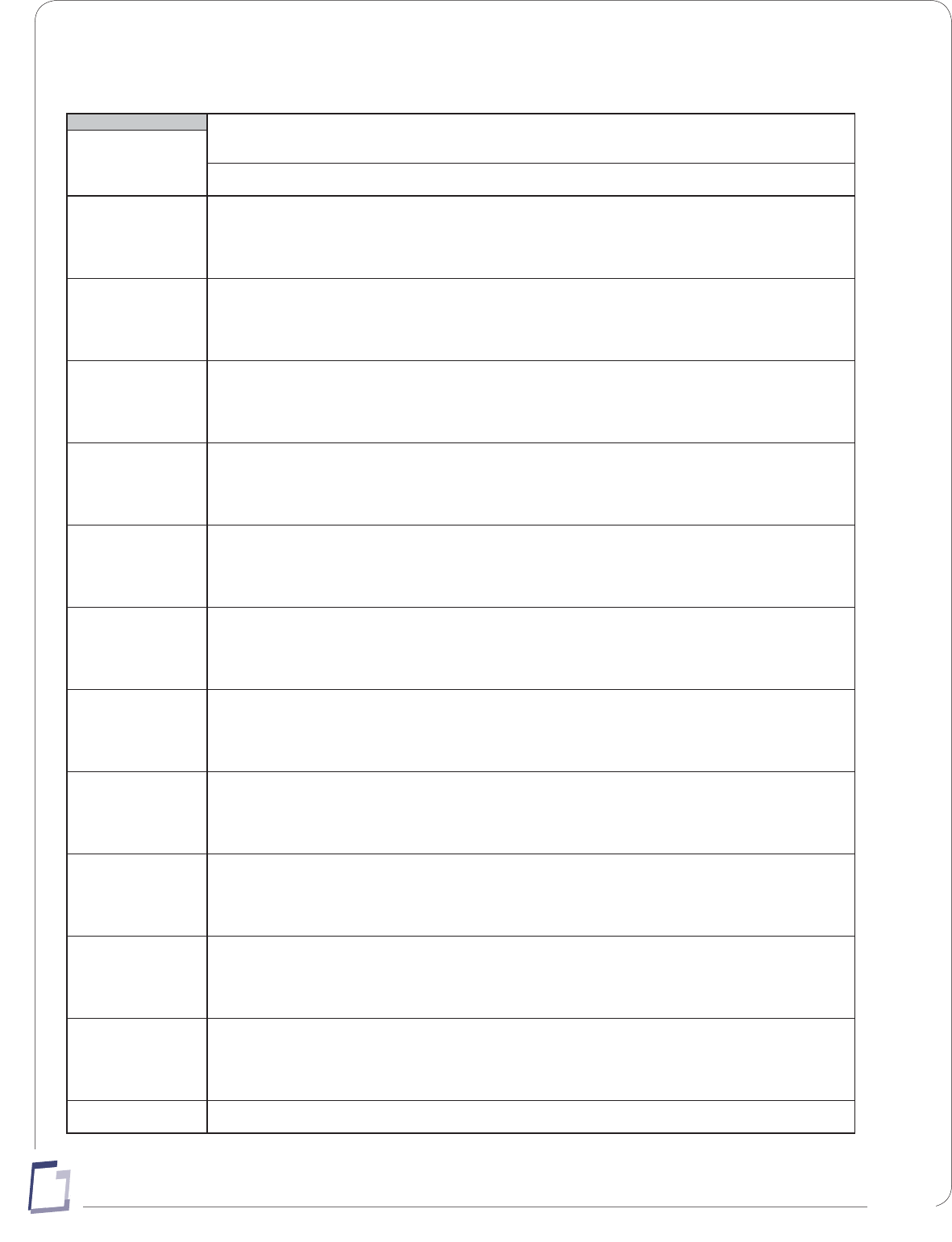

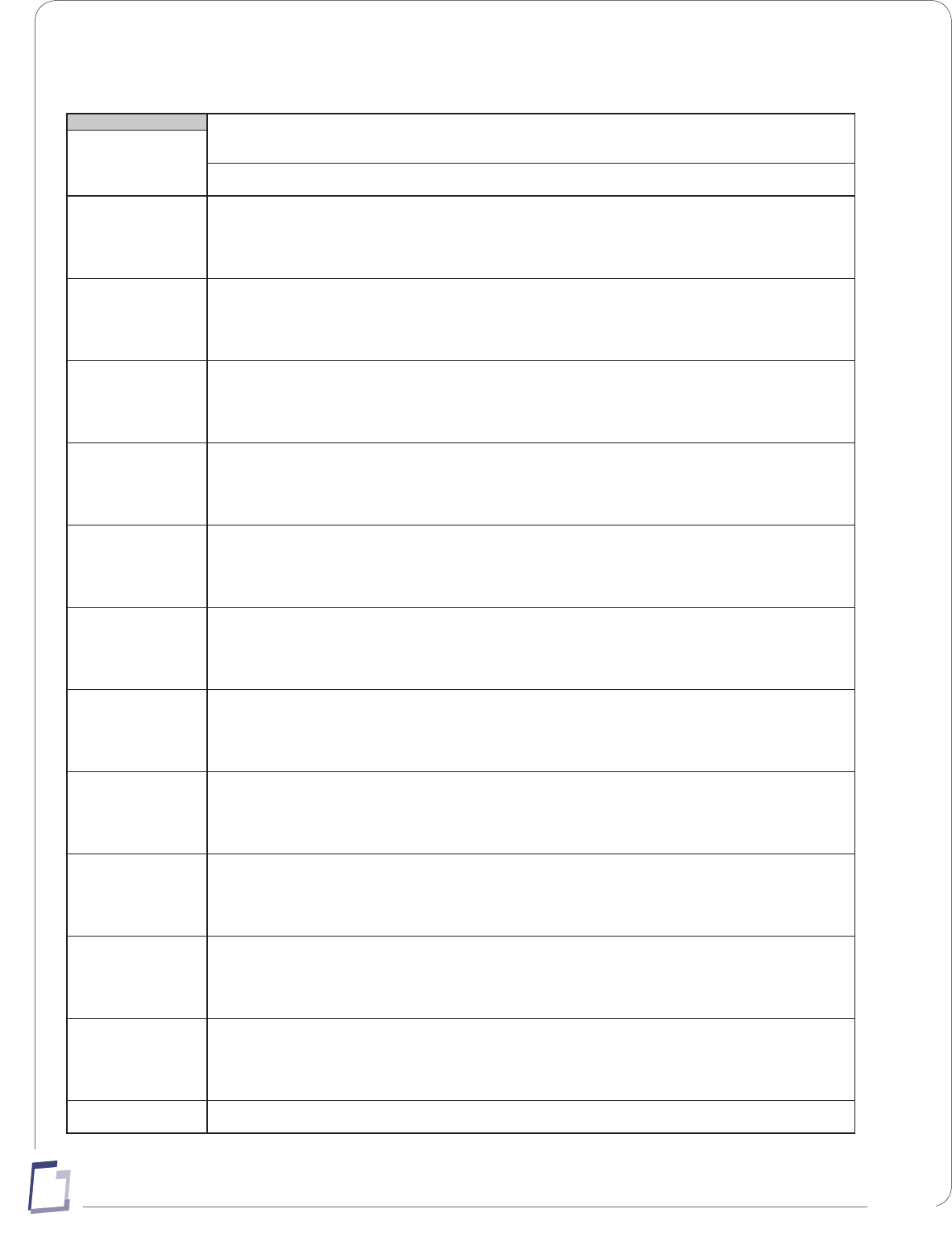

SINGLE Persons - WEEKLY Payroll Period (52 pay periods per year) Feb. 2008

Find wages in "If UT taxable wages are" columns. Find number of withholding allowances claimed on Federal W-4.

Read across table to where the wages row and withholding allowances column intersect. This is amount to withhold.

at but

least less than 0 1 2 3 4 5 6 7 8 9 10 11

$0 $96 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

96 129 1 0 0 0 0 0 0 0 0 0 0 0

129 162 2 0 0 0 0 0 0 0 0 0 0 0

162 194 4 2 0 0 0 0 0 0 0 0 0 0

194 227 6 3 1 0 0 0 0 0 0 0 0 0

227 260 8 5 3 0 0 0 0 0 0 0 0 0

260 292 10 7 5 2 0 0 0 0 0 0 0 0

292 325 12 9 7 4 2 0 0 0 0 0 0 0

325 358 14 11 9 6 4 2 0 0 0 0 0 0

358 390 16 13 11 9 6 4 1 0 0 0 0 0

390 423 18 15 13 11 8 6 3 1 0 0 0 0

423 456 20 17 15 13 10 8 5 3 1 0 0 0

456 488 22 20 17 15 12 10 8 5 3 0 0 0

488 521 24 22 19 17 14 12 10 7 5 2 0 0

521 554 26 24 21 19 16 14 12 9 7 4 2 0

554 587 28 26 23 21 18 16 14 11 9 6 4 2

587 619 30 28 25 23 21 18 16 13 11 9 6 4

619 652 32 30 27 25 23 20 18 15 13 11 8 6

652 685 33 32 29 27 25 22 20 17 15 13 10 8

685 717 35 34 32 29 27 24 22 20 17 15 12 10

717 750 37 36 34 31 29 26 24 22 19 17 14 12

750 783 38 38 36 33 31 28 26 24 21 19 16 14

783 815 40 40 38 35 33 31 28 26 23 21 18 16

815 848 42 42 40 37 35 33 30 28 25 23 21 18

848 881 43 43 42 39 37 35 32 30 27 25 23 20

881 913 45 45 44 41 39 37 34 32 29 27 25 22

913 946 46 46 46 44 41 39 36 34 32 29 27 24

946 979 48 48 48 46 43 41 38 36 34 31 29 26

979 1,012 50 50 50 48 45 43 40 38 36 33 31 28

1,012 1,044 51 51 51 50 47 45 43 40 38 35 33 31

1,044 1,077 53 53 53 52 49 47 45 42 40 37 35 33

1,077 1,110 55 55 55 54 51 49 47 44 42 39 37 35

1,110 1,142 56 56 56 56 54 51 49 46 44 41 39 37

1,142 1,175 58 58 58 58 56 53 51 48 46 44 41 39

1,175 1,208 60 60 60 60 58 55 53 50 48 46 43 41

1,208 1,240 61 61 61 61 60 57 55 52 50 48 45 43

1,240 1,273 63 63 63 63 62 59 57 55 52 50 47 45

1,273 1,306 64 64 64 64 64 61 59 57 54 52 49 47

1,306 1,338 66 66 66 66 66 63 61 59 56 54 51 49

1,338 1,371 68 68 68 68 68 66 63 61 58 56 54 51

1,371 1,404 69 69 69 69 69 68 65 63 60 58 56 53

1,404 1,437 71 71 71 71 71 70 67 65 62 60 58 55

1,437 1,469 73 73 73 73 73 72 69 67 64 62 60 57

1,469 1,502 74 74 74 74 74 74 71 69 67 64 62 59

1,502 1,535 76 76 76 76 76 76 73 71 69 66 64 61

1,535 1,567 78 78 78 78 78 78 75 73 71 68 66 63

1,567 1,600 79 79 79 79 79 79 78 75 73 70 68 66

1,600 1,633 81 81 81 81 81 81 80 77 75 72 70 68

1,633 1,665 82 82 82 82 82 82 82 79 77 74 72 70

1,665 1,698 84 84 84 84 84 84 84 81 79 77 74 72

1,698 1,731 86 86 86 86 86 86 86 83 81 79 76 74

1,731 1,763 87 87 87 87 87 87 87 85 83 81 78 76

1,763 1,796 89 89 89 89 89 89 89 87 85 83 80 78

1,796 1,829 91 91 91 91 91 91 91 90 87 85 82 80

1,829 1,862 92 92 92 92 92 92 92 92 89 87 84 82

1,862 1,894 94 94 94 94 94 94 94 94 91 89 86 84

1,894 1,927 96 96 96 96 96 96 96 96 93 91 89 86

If UT taxable wages are -

UTAH TABLE 1

Withholding Allowances Claimed on Federal Form W-4

Utah Withholding Tables

Single Persons– Weekly Payroll Period

page 14

14

MARRIED Persons - WEEKLY Payroll Period (52 pay periods per year) Feb. 2008

Find wages in "If UT taxable wages are" columns. Find number of withholding allowances claimed on Federal W-4.

Read across table to where the wages row and withholding allowances column intersect. This is amount to withhold.

at but

least less than 0 1 2 3 4 5 6 7 8 9 10 11

$0 $96 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

96 129 0 0 0 0 0 0 0 0 0 0 0 0

129 162 0 0 0 0 0 0 0 0 0 0 0 0

162 194 2 0 0 0 0 0 0 0 0 0 0 0

194 227 3 1 0 0 0 0 0 0 0 0 0 0

227 260 5 3 0 0 0 0 0 0 0 0 0 0

260 292 7 4 2 0 0 0 0 0 0 0 0 0

292 325 8 6 3 1 0 0 0 0 0 0 0 0

325 358 10 7 5 3 0 0 0 0 0 0 0 0

358 390 12 9 7 5 2 0 0 0 0 0 0 0

390 423 14 12 9 7 4 2 0 0 0 0 0 0

423 456 16 14 11 9 6 4 2 0 0 0 0 0

456 488 18 16 13 11 8 6 4 1 0 0 0 0

488 521 20 18 15 13 10 8 6 3 1 0 0 0

521 554 22 20 17 15 13 10 8 5 3 1 0 0

554 587 24 22 19 17 15 12 10 7 5 3 0 0

587 619 26 24 21 19 17 14 12 9 7 5 2 0

619 652 28 26 24 21 19 16 14 12 9 7 4 2

652 685 30 28 26 23 21 18 16 14 11 9 6 4

685 717 32 30 28 25 23 20 18 16 13 11 8 6

717 750 35 32 30 27 25 22 20 18 15 13 10 8

750 783 37 34 32 29 27 25 22 20 17 15 13 10

783 815 39 36 34 31 29 27 24 22 19 17 15 12

815 848 41 38 36 33 31 29 26 24 21 19 17 14

848 881 43 40 38 36 33 31 28 26 24 21 19 16

881 913 45 42 40 38 35 33 30 28 26 23 21 18

913 946 46 44 42 40 37 35 32 30 28 25 23 20

946 979 48 47 44 42 39 37 35 32 30 27 25 22

979 1,012 50 49 46 44 41 39 37 34 32 29 27 25

1,012 1,044 51 51 48 46 43 41 39 36 34 31 29 27

1,044 1,077 53 53 50 48 45 43 41 38 36 33 31 29

1,077 1,110 55 55 52 50 48 45 43 40 38 36 33 31

1,110 1,142 56 56 54 52 50 47 45 42 40 38 35 33

1,142 1,175 58 58 56 54 52 49 47 44 42 40 37 35

1,175 1,208 60 60 59 56 54 51 49 47 44 42 39 37

1,208 1,240 61 61 61 58 56 53 51 49 46 44 41 39

1,240 1,273 63 63 63 60 58 55 53 51 48 46 43 41

1,273 1,306 64 64 64 62 60 58 55 53 50 48 45 43

1,306 1,338 66 66 66 64 62 60 57 55 52 50 48 45

1,338 1,371 68 68 68 66 64 62 59 57 54 52 50 47

1,371 1,404 69 69 69 68 66 64 61 59 56 54 52 49

1,404 1,437 71 71 71 71 68 66 63 61 59 56 54 51

1,437 1,469 73 73 73 73 70 68 65 63 61 58 56 53

1,469 1,502 74 74 74 74 72 70 67 65 63 60 58 55

1,502 1,535 76 76 76 76 74 72 70 67 65 62 60 57

1,535 1,567 78 78 78 78 76 74 72 69 67 64 62 60

1,567 1,600 79 79 79 79 78 76 74 71 69 66 64 62

1,600 1,633 81 81 81 81 81 78 76 73 71 68 66 64

1,633 1,665 82 82 82 82 82 80 78 75 73 71 68 66

1,665 1,698 84 84 84 84 84 82 80 77 75 73 70 68

1,698 1,731 86 86 86 86 86 84 82 79 77 75 72 70

1,731 1,763 87 87 87 87 87 86 84 82 79 77 74 72

1,763 1,796 89 89 89 89 89 88 86 84 81 79 76 74

1,796 1,829 91 91 91 91 91 90 88 86 83 81 78 76

1,829 1,862 92 92 92 92 92 92 90 88 85 83 80 78

1,862 1,894 94 94 94 94 94 94 92 90 87 85 83 80

1,894 1,927 96 96 96 96 96 96 94 92 89 87 85 82

UTAH TABLE 2

Withholding Allowances Claimed on Federal Form W-4

If UT taxable wages are -

Married Persons – Weekly Payroll Period

page 15

14

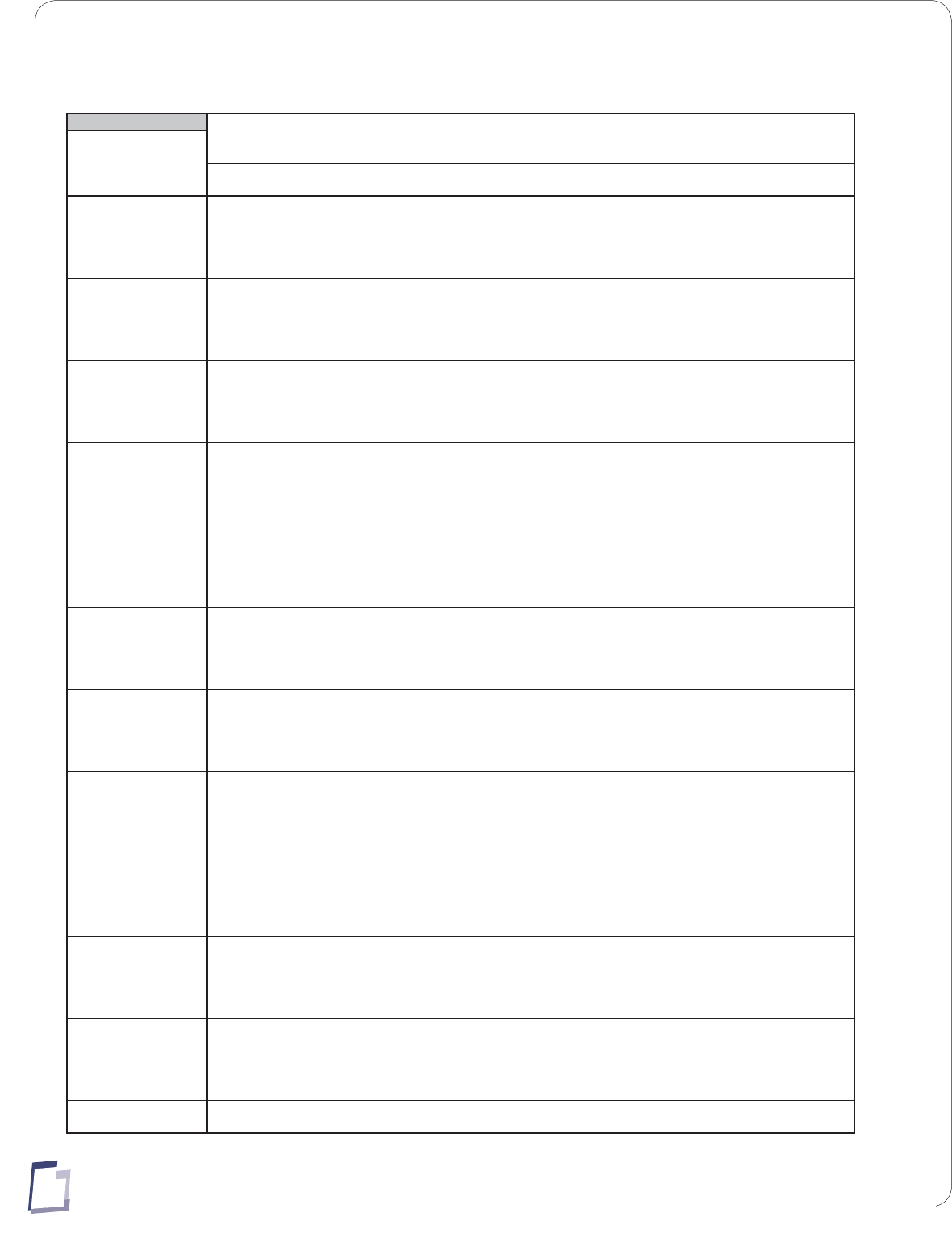

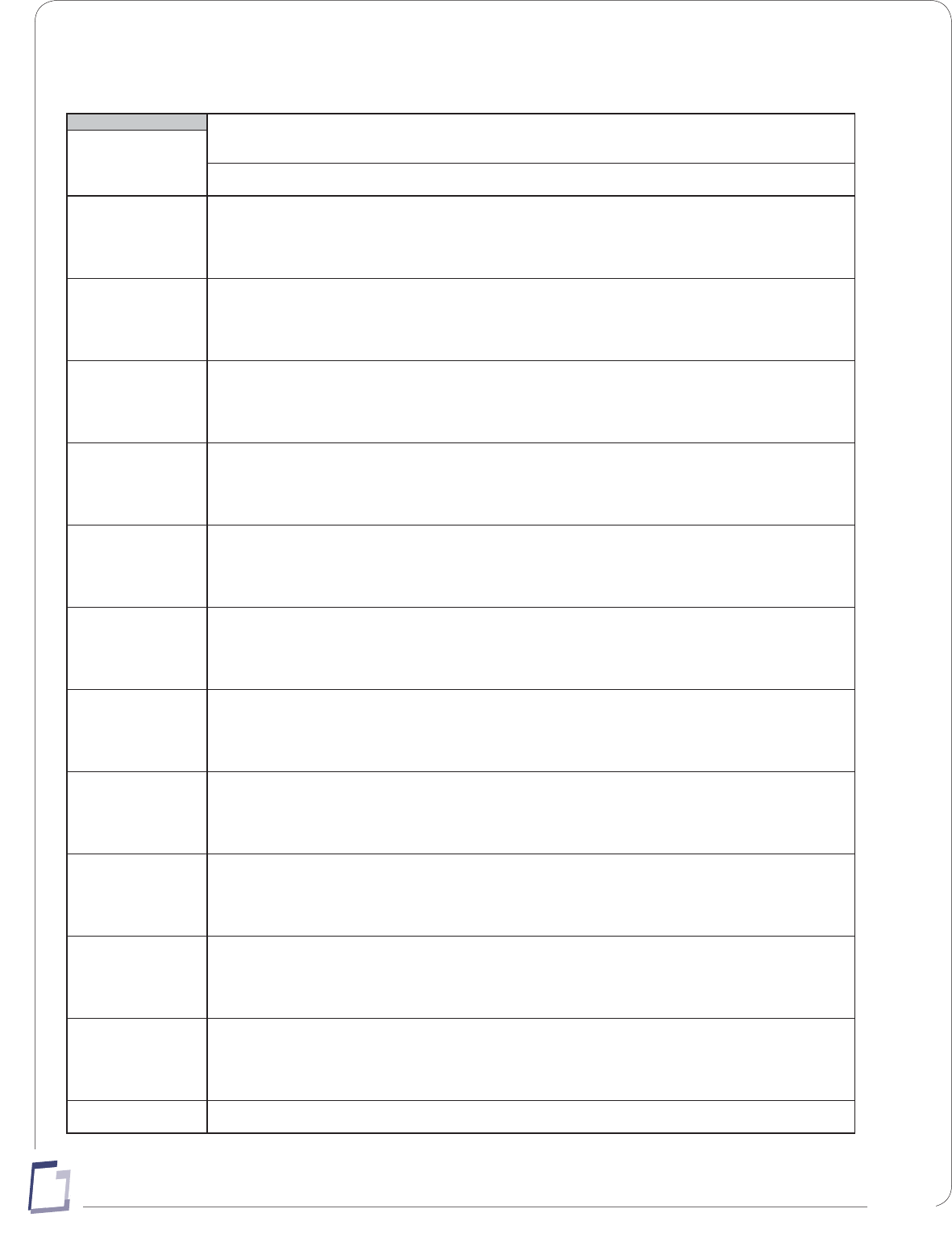

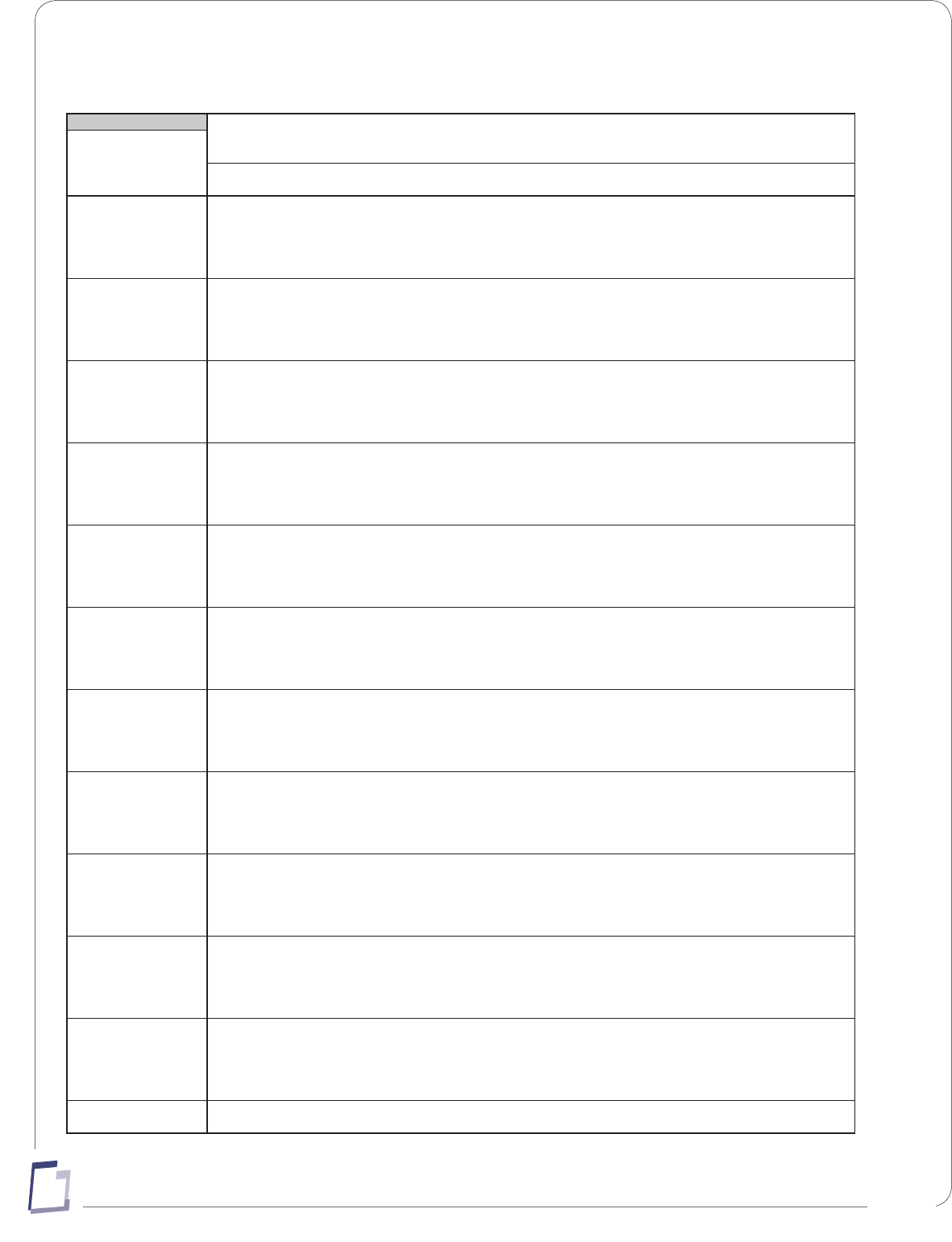

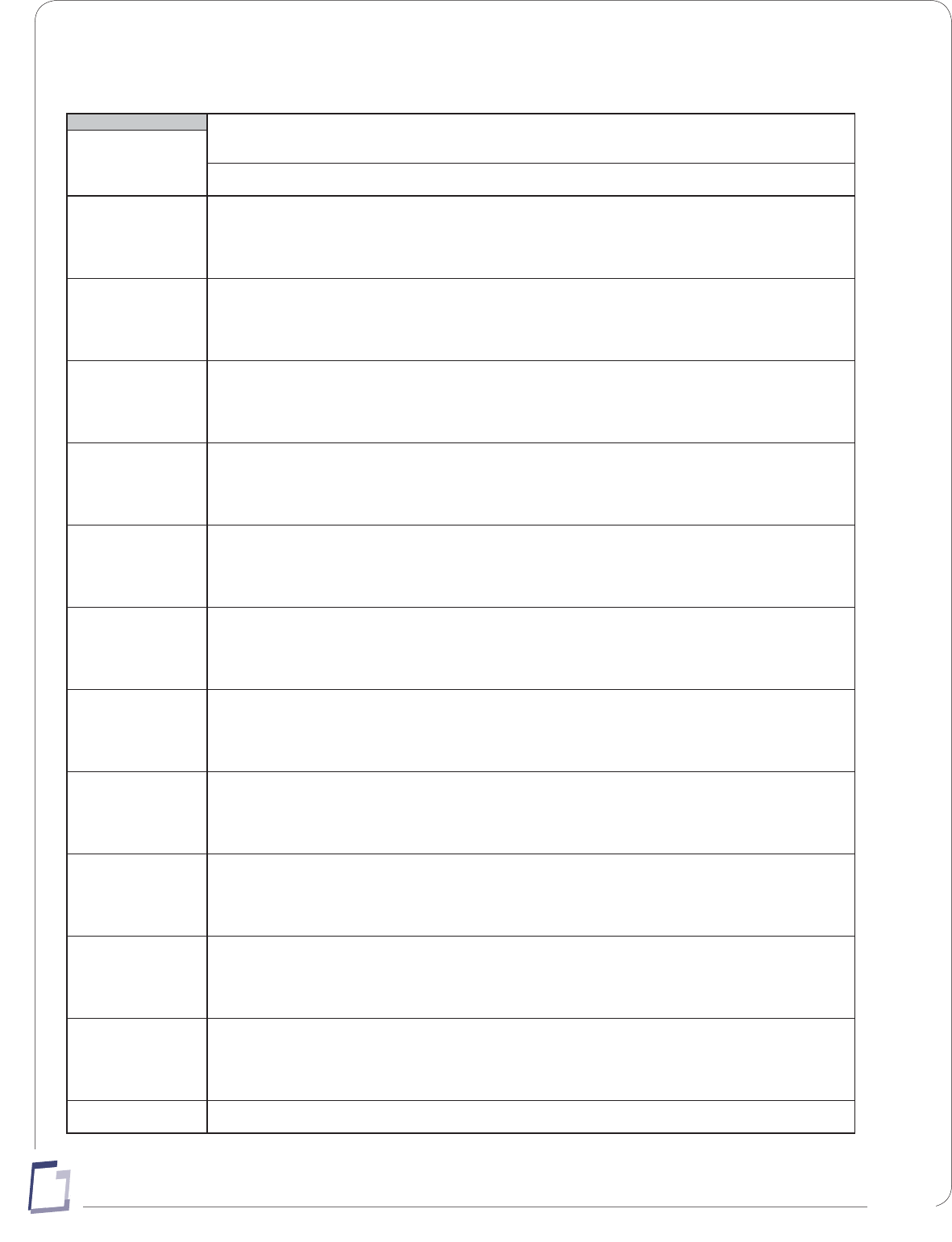

SINGLE Persons - BIWEEKLY Payroll Period (26 pay periods per year) Feb. 2008

Find wages in "If UT taxable wages are" columns. Find number of withholding allowances claimed on Federal W-4.

Read across table to where the wages row and withholding allowances column intersect. This is amount to withhold.

at but

least less than 0 1 2 3 4 5 6 7 8 9 10 11

$0 $192 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

192 258 2 0 0 0 0 0 0 0 0 0 0 0

258 323 5 0 0 0 0 0 0 0 0 0 0 0

323 388 8 3 0 0 0 0 0 0 0 0 0 0

388 454 11 7 2 0 0 0 0 0 0 0 0 0

454 519 15 10 5 1 0 0 0 0 0 0 0 0

519 585 19 14 10 5 0 0 0 0 0 0 0 0

585 650 23 18 14 9 4 0 0 0 0 0 0 0

650 715 27 23 18 13 8 3 0 0 0 0 0 0

715 781 32 27 22 17 12 7 3 0 0 0 0 0

781 846 36 31 26 21 16 12 7 2 0 0 0 0

846 912 40 35 30 25 21 16 11 6 1 0 0 0

912 977 44 39 34 29 25 20 15 10 5 1 0 0

977 1,042 48 43 38 34 29 24 19 14 10 5 0 0

1,042 1,108 52 47 42 38 33 28 23 18 14 9 4 0

1,108 1,173 56 51 47 42 37 32 27 23 18 13 8 3

1,173 1,238 60 56 51 46 41 36 32 27 22 17 12 7

1,238 1,304 64 60 55 50 45 40 36 31 26 21 16 12

1,304 1,369 67 64 59 54 49 45 40 35 30 25 21 16

1,369 1,435 70 68 63 58 53 49 44 39 34 29 25 20

1,435 1,500 73 72 67 62 58 53 48 43 38 34 29 24

1,500 1,565 77 76 71 67 62 57 52 47 42 38 33 28

1,565 1,631 80 80 75 71 66 61 56 51 47 42 37 32

1,631 1,696 83 83 80 75 70 65 60 56 51 46 41 36

1,696 1,762 86 86 84 79 74 69 64 60 55 50 45 40

1,762 1,827 90 90 88 83 78 73 69 64 59 54 49 45

1,827 1,892 93 93 92 87 82 78 73 68 63 58 53 49

1,892 1,958 96 96 96 91 86 82 77 72 67 62 58 53

1,958 2,023 100 100 100 95 91 86 81 76 71 67 62 57

2,023 2,088 103 103 103 99 95 90 85 80 75 71 66 61

2,088 2,154 106 106 106 104 99 94 89 84 80 75 70 65

2,154 2,219 109 109 109 108 103 98 93 88 84 79 74 69

2,219 2,285 113 113 113 112 107 102 97 93 88 83 78 73

2,285 2,350 116 116 116 116 111 106 102 97 92 87 82 77

2,350 2,415 119 119 119 119 115 110 106 101 96 91 86 82

2,415 2,481 122 122 122 122 119 115 110 105 100 95 91 86

2,481 2,546 126 126 126 126 124 119 114 109 104 99 95 90

2,546 2,612 129 129 129 129 128 123 118 113 108 104 99 94

2,612 2,677 132 132 132 132 132 127 122 117 113 108 103 98

2,677 2,742 135 135 135 135 135 131 126 121 117 112 107 102

2,742 2,808 139 139 139 139 139 135 130 126 121 116 111 106

2,808 2,873 142 142 142 142 142 139 134 130 125 120 115 110

2,873 2,938 145 145 145 145 145 143 139 134 129 124 119 115

2,938 3,004 149 149 149 149 149 148 143 138 133 128 123 119

3,004 3,069 152 152 152 152 152 152 147 142 137 132 128 123

3,069 3,135 155 155 155 155 155 155 151 146 141 137 132 127

3,135 3,200 158 158 158 158 158 158 155 150 145 141 136 131

3,200 3,265 162 162 162 162 162 162 159 154 150 145 140 135

3,265 3,331 165 165 165 165 165 165 163 159 154 149 144 139

3,331 3,396 168 168 168 168 168 168 167 163 158 153 148 143

3,396 3,462 171 171 171 171 171 171 171 167 162 157 152 148

3,462 3,527 175 175 175 175 175 175 175 171 166 161 156 152

3,527 3,592 178 178 178 178 178 178 178 175 170 165 161 156

3,592 3,658 181 181 181 181 181 181 181 179 174 169 165 160

3,658 3,723 185 185 185 185 185 185 185 183 178 174 169 164

3,723 3,788 188 188 188 188 188 188 188 187 183 178 173 168

3,788 3,854 191 191 191 191 191 191 191 191 187 182 177 172

UTAH TABLE 3

If UT taxable wages are -

Withholding Allowances Claimed on Federal Form W-4

Single Persons – Biweekly Payroll Period

page 16

14

MARRIED Persons - BIWEEKLY Payroll Period (26 pay periods per year) Feb. 2008

Find wages in "If UT taxable wages are" columns. Find number of withholding allowances claimed on Federal W-4.

Read across table to where the wages row and withholding allowances column intersect. This is amount to withhold.

at but

least less than 0 1 2 3 4 5 6 7 8 9 10 11

$0 $192 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

192 258 0 0 0 0 0 0 0 0 0 0 0 0

258 323 0 0 0 0 0 0 0 0 0 0 0 0

323 388 3 0 0 0 0 0 0 0 0 0 0 0

388 454 7 2 0 0 0 0 0 0 0 0 0 0

454 519 10 5 0 0 0 0 0 0 0 0 0 0

519 585 13 8 4 0 0 0 0 0 0 0 0 0

585 650 16 12 7 2 0 0 0 0 0 0 0 0

650 715 20 15 10 5 0 0 0 0 0 0 0 0

715 781 24 19 14 9 4 0 0 0 0 0 0 0

781 846 28 23 18 13 9 4 0 0 0 0 0 0

846 912 32 27 22 18 13 8 3 0 0 0 0 0

912 977 36 31 26 22 17 12 7 2 0 0 0 0

977 1,042 40 35 31 26 21 16 11 7 2 0 0 0

1,042 1,108 44 39 35 30 25 20 15 11 6 1 0 0

1,108 1,173 48 44 39 34 29 24 20 15 10 5 0 0

1,173 1,238 53 48 43 38 33 29 24 19 14 9 4 0

1,238 1,304 57 52 47 42 37 33 28 23 18 13 9 4

1,304 1,369 61 56 51 46 42 37 32 27 22 18 13 8

1,369 1,435 65 60 55 50 46 41 36 31 26 22 17 12

1,435 1,500 69 64 59 55 50 45 40 35 31 26 21 16

1,500 1,565 73 68 64 59 54 49 44 39 35 30 25 20

1,565 1,631 77 72 68 63 58 53 48 44 39 34 29 24

1,631 1,696 81 77 72 67 62 57 53 48 43 38 33 28

1,696 1,762 85 81 76 71 66 61 57 52 47 42 37 33

1,762 1,827 90 85 80 75 70 66 61 56 51 46 42 37

1,827 1,892 93 89 84 79 75 70 65 60 55 50 46 41

1,892 1,958 96 93 88 83 79 74 69 64 59 55 50 45

1,958 2,023 100 97 92 88 83 78 73 68 64 59 54 49

2,023 2,088 103 101 96 92 87 82 77 72 68 63 58 53

2,088 2,154 106 105 101 96 91 86 81 77 72 67 62 57

2,154 2,219 109 109 105 100 95 90 85 81 76 71 66 61

2,219 2,285 113 113 109 104 99 94 90 85 80 75 70 66

2,285 2,350 116 116 113 108 103 99 94 89 84 79 74 70

2,350 2,415 119 119 117 112 107 103 98 93 88 83 79 74

2,415 2,481 122 122 121 116 112 107 102 97 92 88 83 78

2,481 2,546 126 126 125 121 116 111 106 101 96 92 87 82

2,546 2,612 129 129 129 125 120 115 110 105 101 96 91 86

2,612 2,677 132 132 132 129 124 119 114 110 105 100 95 90

2,677 2,742 135 135 135 133 128 123 118 114 109 104 99 94

2,742 2,808 139 139 139 137 132 127 123 118 113 108 103 99

2,808 2,873 142 142 142 141 136 131 127 122 117 112 107 103

2,873 2,938 145 145 145 145 140 136 131 126 121 116 112 107

2,938 3,004 149 149 149 149 145 140 135 130 125 120 116 111

3,004 3,069 152 152 152 152 149 144 139 134 129 125 120 115

3,069 3,135 155 155 155 155 153 148 143 138 134 129 124 119

3,135 3,200 158 158 158 158 157 152 147 142 138 133 128 123

3,200 3,265 162 162 162 162 161 156 151 147 142 137 132 127

3,265 3,331 165 165 165 165 165 160 156 151 146 141 136 131

3,331 3,396 168 168 168 168 168 164 160 155 150 145 140 136

3,396 3,462 171 171 171 171 171 169 164 159 154 149 145 140

3,462 3,527 175 175 175 175 175 173 168 163 158 153 149 144

3,527 3,592 178 178 178 178 178 177 172 167 162 158 153 148

3,592 3,658 181 181 181 181 181 181 176 171 166 162 157 152

3,658 3,723 185 185 185 185 185 185 180 175 171 166 161 156

3,723 3,788 188 188 188 188 188 188 184 180 175 170 165 160

3,788 3,854 191 191 191 191 191 191 188 184 179 174 169 164

UTAH TABLE 4

If UT taxable wages are -

Withholding Allowances Claimed on Federal Form W-4

Married Persons – Biweekly Payroll Period

page 17

14

SINGLE Persons - SEMIMONTHLY Payroll Period (24 pay periods per year) Feb. 2008

Find wages in "If UT taxable wages are" columns. Find number of withholding allowances claimed on Federal W-4.

Read across table to where the wages row and withholding allowances column intersect. This is amount to withhold.

at but

least less than 0 1 2 3 4 5 6 7 8 9 10 11

$0 $208 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

208 279 2 0 0 0 0 0 0 0 0 0 0 0

279 350 5 0 0 0 0 0 0 0 0 0 0 0

350 421 9 4 0 0 0 0 0 0 0 0 0 0

421 492 12 7 2 0 0 0 0 0 0 0 0 0

492 563 16 11 6 1 0 0 0 0 0 0 0 0

563 633 21 16 10 5 0 0 0 0 0 0 0 0

633 704 25 20 15 10 4 0 0 0 0 0 0 0

704 775 30 24 19 14 9 4 0 0 0 0 0 0

775 846 34 29 24 19 13 8 3 0 0 0 0 0

846 917 39 33 28 23 18 13 7 2 0 0 0 0

917 988 43 38 33 27 22 17 12 7 1 0 0 0

988 1,058 48 42 37 32 27 21 16 11 6 1 0 0

1,058 1,129 52 47 42 36 31 26 21 16 10 5 0 0

1,129 1,200 56 51 46 41 36 30 25 20 15 10 4 0

1,200 1,271 61 56 50 45 40 35 30 24 19 14 9 4

1,271 1,342 65 60 55 50 45 39 34 29 24 19 13 8

1,342 1,413 69 65 59 54 49 44 39 33 28 23 18 13

1,413 1,483 72 69 64 59 53 48 43 38 33 27 22 17

1,483 1,554 76 74 68 63 58 53 48 42 37 32 27 21

1,554 1,625 79 78 73 68 62 57 52 47 42 36 31 26

1,625 1,696 83 82 77 72 67 62 56 51 46 41 36 30

1,696 1,767 87 87 82 77 71 66 61 56 50 45 40 35

1,767 1,838 90 90 86 81 76 71 65 60 55 50 45 39

1,838 1,908 94 94 91 85 80 75 70 65 59 54 49 44

1,908 1,979 97 97 95 90 85 79 74 69 64 59 53 48

1,979 2,050 101 101 100 94 89 84 79 74 68 63 58 53

2,050 2,121 104 104 104 99 94 88 83 78 73 68 62 57

2,121 2,192 108 108 108 103 98 93 88 82 77 72 67 62

2,192 2,263 111 111 111 108 103 97 92 87 82 77 71 66

2,263 2,333 115 115 115 112 107 102 97 91 86 81 76 71

2,333 2,404 118 118 118 117 111 106 101 96 91 85 80 75

2,404 2,475 122 122 122 121 116 111 106 100 95 90 85 79

2,475 2,546 126 126 126 126 120 115 110 105 100 94 89 84

2,546 2,617 129 129 129 129 125 120 114 109 104 99 94 88

2,617 2,688 133 133 133 133 129 124 119 114 108 103 98 93

2,688 2,758 136 136 136 136 134 129 123 118 113 108 103 97

2,758 2,829 140 140 140 140 138 133 128 123 117 112 107 102

2,829 2,900 143 143 143 143 143 138 132 127 122 117 111 106

2,900 2,971 147 147 147 147 147 142 137 132 126 121 116 111

2,971 3,042 150 150 150 150 150 146 141 136 131 126 120 115

3,042 3,113 154 154 154 154 154 151 146 140 135 130 125 120

3,113 3,183 157 157 157 157 157 155 150 145 140 135 129 124

3,183 3,254 161 161 161 161 161 160 155 149 144 139 134 129

3,254 3,325 164 164 164 164 164 164 159 154 149 143 138 133

3,325 3,396 168 168 168 168 168 168 164 158 153 148 143 137

3,396 3,467 172 172 172 172 172 172 168 163 158 152 147 142

3,467 3,538 175 175 175 175 175 175 172 167 162 157 152 146

3,538 3,608 179 179 179 179 179 179 177 172 167 161 156 151

3,608 3,679 182 182 182 182 182 182 181 176 171 166 161 155

3,679 3,750 186 186 186 186 186 186 186 181 175 170 165 160

3,750 3,821 189 189 189 189 189 189 189 185 180 175 169 164

3,821 3,892 193 193 193 193 193 193 193 190 184 179 174 169

3,892 3,963 196 196 196 196 196 196 196 194 189 184 178 173

3,963 4,033 200 200 200 200 200 200 200 198 193 188 183 178

4,033 4,104 203 203 203 203 203 203 203 203 198 193 187 182

4,104 4,175 207 207 207 207 207 207 207 207 202 197 192 187

If UT taxable wages are -

UTAH TABLE 5

Withholding Allowances Claimed on Federal Form W-4

Single Persons – Semimonthly Payroll Period

page 18

14

MARRIED Persons - SEMIMONTHLY Payroll Period (24 pay periods per year) Feb. 2008

Find wages in "If UT taxable wages are" columns. Find number of withholding allowances claimed on Federal W-4.

Read across table to where the wages row and withholding allowances column intersect. This is amount to withhold.

at but

least less than 0 1 2 3 4 5 6 7 8 9 10 11

$0 $208 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

208 279 0 0 0 0 0 0 0 0 0 0 0 0

279 350 0 0 0 0 0 0 0 0 0 0 0 0

350 421 4 0 0 0 0 0 0 0 0 0 0 0

421 492 7 2 0 0 0 0 0 0 0 0 0 0

492 563 11 6 0 0 0 0 0 0 0 0 0 0

563 633 14 9 4 0 0 0 0 0 0 0 0 0

633 704 18 13 7 2 0 0 0 0 0 0 0 0

704 775 21 16 11 6 1 0 0 0 0 0 0 0

775 846 26 20 15 10 5 0 0 0 0 0 0 0

846 917 30 25 20 15 9 4 0 0 0 0 0 0

917 988 35 29 24 19 14 9 3 0 0 0 0 0

988 1,058 39 34 29 23 18 13 8 3 0 0 0 0

1,058 1,129 44 38 33 28 23 17 12 7 2 0 0 0

1,129 1,200 48 43 38 32 27 22 17 12 6 1 0 0

1,200 1,271 52 47 42 37 32 26 21 16 11 6 0 0

1,271 1,342 57 52 47 41 36 31 26 20 15 10 5 0

1,342 1,413 61 56 51 46 41 35 30 25 20 15 9 4

1,413 1,483 66 61 55 50 45 40 35 29 24 19 14 9

1,483 1,554 70 65 60 55 49 44 39 34 29 23 18 13

1,554 1,625 75 70 64 59 54 49 44 38 33 28 23 17

1,625 1,696 79 74 69 64 58 53 48 43 38 32 27 22

1,696 1,767 84 78 73 68 63 58 52 47 42 37 32 26

1,767 1,838 88 83 78 73 67 62 57 52 46 41 36 31

1,838 1,908 93 87 82 77 72 67 61 56 51 46 41 35

1,908 1,979 97 92 87 81 76 71 66 61 55 50 45 40

1,979 2,050 101 96 91 86 81 76 70 65 60 55 49 44

2,050 2,121 104 101 96 90 85 80 75 70 64 59 54 49

2,121 2,192 108 105 100 95 90 84 79 74 69 64 58 53

2,192 2,263 111 110 105 99 94 89 84 78 73 68 63 58

2,263 2,333 115 114 109 104 99 93 88 83 78 73 67 62

2,333 2,404 118 118 113 108 103 98 93 87 82 77 72 67

2,404 2,475 122 122 118 113 107 102 97 92 87 81 76 71

2,475 2,546 126 126 122 117 112 107 102 96 91 86 81 75

2,546 2,617 129 129 127 122 116 111 106 101 96 90 85 80

2,617 2,688 133 133 131 126 121 116 110 105 100 95 90 84

2,688 2,758 136 136 136 131 125 120 115 110 105 99 94 89

2,758 2,829 140 140 140 135 130 125 119 114 109 104 99 93

2,829 2,900 143 143 143 139 134 129 124 119 113 108 103 98

2,900 2,971 147 147 147 144 139 134 128 123 118 113 107 102

2,971 3,042 150 150 150 148 143 138 133 128 122 117 112 107

3,042 3,113 154 154 154 153 148 142 137 132 127 122 116 111

3,113 3,183 157 157 157 157 152 147 142 136 131 126 121 116

3,183 3,254 161 161 161 161 157 151 146 141 136 131 125 120

3,254 3,325 164 164 164 164 161 156 151 145 140 135 130 125

3,325 3,396 168 168 168 168 165 160 155 150 145 139 134 129

3,396 3,467 172 172 172 172 170 165 160 154 149 144 139 134

3,467 3,538 175 175 175 175 174 169 164 159 154 148 143 138

3,538 3,608 179 179 179 179 179 174 168 163 158 153 148 142

3,608 3,679 182 182 182 182 182 178 173 168 163 157 152 147

3,679 3,750 186 186 186 186 186 183 177 172 167 162 157 151

3,750 3,821 189 189 189 189 189 187 182 177 171 166 161 156

3,821 3,892 193 193 193 193 193 192 186 181 176 171 165 160

3,892 3,963 196 196 196 196 196 196 191 186 180 175 170 165

3,963 4,033 200 200 200 200 200 200 195 190 185 180 174 169

4,033 4,104 203 203 203 203 203 203 200 194 189 184 179 174

4,104 4,175 207 207 207 207 207 207 204 199 194 189 183 178

UTAH TABLE 6

Withholding Allowances Claimed on Federal Form W-4

If UT taxable wages are -

Married Persons – Semimonthly Payroll Period

page 19

14

SINGLE Persons - MONTHLY Payroll Period (12 pay periods per year) Feb. 2008

Find wages in "If UT taxable wages are" columns. Find number of withholding allowances claimed on Federal W-4.

Read across table to where the wages row and withholding allowances column intersect. This is amount to withhold.

at but

least less than 0 1 2 3 4 5 6 7 8 9 10 11

$0 $417 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

417 558 4 0 0 0 0 0 0 0 0 0 0 0

558 700 11 0 0 0 0 0 0 0 0 0 0 0

700 842 18 7 0 0 0 0 0 0 0 0 0 0

842 983 25 14 4 0 0 0 0 0 0 0 0 0

983 1,125 33 22 12 1 0 0 0 0 0 0 0 0

1,125 1,267 42 31 21 10 0 0 0 0 0 0 0 0

1,267 1,408 50 40 30 19 9 0 0 0 0 0 0 0

1,408 1,550 59 49 39 28 18 7 0 0 0 0 0 0

1,550 1,692 68 58 47 37 27 16 6 0 0 0 0 0

1,692 1,833 77 67 56 46 36 25 15 4 0 0 0 0

1,833 1,975 86 76 65 55 44 34 24 13 3 0 0 0

1,975 2,117 95 85 74 64 53 43 33 22 12 1 0 0

2,117 2,258 104 94 83 73 62 52 41 31 21 10 0 0

2,258 2,400 113 102 92 82 71 61 50 40 30 19 9 0

2,400 2,542 122 111 101 91 80 70 59 49 38 28 18 7

2,542 2,683 131 120 110 100 89 79 68 58 47 37 27 16

2,683 2,825 138 129 119 108 98 88 77 67 56 46 36 25

2,825 2,967 145 138 128 117 107 97 86 76 65 55 44 34

2,967 3,108 152 147 137 126 116 105 95 85 74 64 53 43

3,108 3,250 159 156 146 135 125 114 104 94 83 73 62 52

3,250 3,392 166 165 155 144 134 123 113 102 92 82 71 61

3,392 3,533 173 173 163 153 143 132 122 111 101 91 80 70

3,533 3,675 180 180 172 162 152 141 131 120 110 99 89 79

3,675 3,817 187 187 181 171 160 150 140 129 119 108 98 88

3,817 3,958 194 194 190 180 169 159 149 138 128 117 107 96

3,958 4,100 201 201 199 189 178 168 158 147 137 126 116 105

4,100 4,242 209 209 208 198 187 177 166 156 146 135 125 114

4,242 4,383 216 216 216 207 196 186 175 165 155 144 134 123

4,383 4,525 223 223 223 216 205 195 184 174 163 153 143 132

4,525 4,667 230 230 230 224 214 204 193 183 172 162 152 141

4,667 4,808 237 237 237 233 223 213 202 192 181 171 160 150

4,808 4,950 244 244 244 242 232 221 211 201 190 180 169 159

4,950 5,092 251 251 251 251 241 230 220 210 199 189 178 168

5,092 5,233 258 258 258 258 250 239 229 218 208 198 187 177

5,233 5,375 265 265 265 265 259 248 238 227 217 207 196 186

5,375 5,517 272 272 272 272 268 257 247 236 226 216 205 195

5,517 5,658 279 279 279 279 277 266 256 245 235 224 214 204

5,658 5,800 286 286 286 286 285 275 265 254 244 233 223 213

5,800 5,942 294 294 294 294 294 284 274 263 253 242 232 221

5,942 6,083 301 301 301 301 301 293 282 272 262 251 241 230

6,083 6,225 308 308 308 308 308 302 291 281 271 260 250 239

6,225 6,367 315 315 315 315 315 311 300 290 279 269 259 248

6,367 6,508 322 322 322 322 322 320 309 299 288 278 268 257

6,508 6,650 329 329 329 329 329 329 318 308 297 287 276 266

6,650 6,792 336 336 336 336 336 336 327 317 306 296 285 275

6,792 6,933 343 343 343 343 343 343 336 326 315 305 294 284

6,933 7,075 350 350 350 350 350 350 345 335 324 314 303 293

7,075 7,217 357 357 357 357 357 357 354 343 333 323 312 302

7,217 7,358 364 364 364 364 364 364 363 352 342 332 321 311

7,358 7,500 371 371 371 371 371 371 371 361 351 340 330 320

7,500 7,642 379 379 379 379 379 379 379 370 360 349 339 329

7,642 7,783 386 386 386 386 386 386 386 379 369 358 348 337

7,783 7,925 393 393 393 393 393 393 393 388 378 367 357 346

7,925 8,067 400 400 400 400 400 400 400 397 387 376 366 355

8,067 8,208 407 407 407 407 407 407 407 406 395 385 375 364

8,208 8,350 414 414 414 414 414 414 414 414 404 394 384 373

If UT taxable wages are -

Withholding Allowances Claimed on Federal Form W-4

UTAH TABLE 7

Single Persons – Monthly Payroll Period

page 20

14

MARRIED Persons - MONTHLY Payroll Period (12 pay periods per year) Feb. 2008

Find wages in "If UT taxable wages are" columns. Find number of withholding allowances claimed on Federal W-4.

Read across table to where the wages row and withholding allowances column intersect. This is amount to withhold.

at but

least less than 0 1 2 3 4 5 6 7 8 9 10 11

$0 $417 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

417 558 0 0 0 0 0 0 0 0 0 0 0 0

558 700 0 0 0 0 0 0 0 0 0 0 0 0

700 842 7 0 0 0 0 0 0 0 0 0 0 0

842 983 14 4 0 0 0 0 0 0 0 0 0 0

983 1,125 21 11 1 0 0 0 0 0 0 0 0 0

1,125 1,267 29 18 8 0 0 0 0 0 0 0 0 0

1,267 1,408 36 25 15 4 0 0 0 0 0 0 0 0

1,408 1,550 43 32 22 11 1 0 0 0 0 0 0 0

1,550 1,692 51 41 31 20 10 0 0 0 0 0 0 0

1,692 1,833 60 50 39 29 19 8 0 0 0 0 0 0

1,833 1,975 69 59 48 38 28 17 7 0 0 0 0 0

1,975 2,117 78 68 57 47 36 26 16 5 0 0 0 0

2,117 2,258 87 77 66 56 45 35 25 14 4 0 0 0

2,258 2,400 96 86 75 65 54 44 33 23 13 2 0 0

2,400 2,542 105 94 84 74 63 53 42 32 22 11 1 0

2,542 2,683 114 103 93 83 72 62 51 41 31 20 10 0

2,683 2,825 123 112 102 92 81 71 60 50 39 29 19 8

2,825 2,967 132 121 111 100 90 80 69 59 48 38 28 17

2,967 3,108 141 130 120 109 99 89 78 68 57 47 36 26

3,108 3,250 150 139 129 118 108 97 87 77 66 56 45 35

3,250 3,392 158 148 138 127 117 106 96 86 75 65 54 44

3,392 3,533 167 157 147 136 126 115 105 94 84 74 63 53

3,533 3,675 176 166 155 145 135 124 114 103 93 83 72 62

3,675 3,817 185 175 164 154 144 133 123 112 102 91 81 71

3,817 3,958 194 184 173 163 152 142 132 121 111 100 90 80

3,958 4,100 201 193 182 172 161 151 141 130 120 109 99 89

4,100 4,242 209 202 191 181 170 160 150 139 129 118 108 97

4,242 4,383 216 211 200 190 179 169 158 148 138 127 117 106

4,383 4,525 223 219 209 199 188 178 167 157 147 136 126 115

4,525 4,667 230 228 218 208 197 187 176 166 155 145 135 124

4,667 4,808 237 237 227 216 206 196 185 175 164 154 144 133

4,808 4,950 244 244 236 225 215 205 194 184 173 163 152 142

4,950 5,092 251 251 245 234 224 213 203 193 182 172 161 151

5,092 5,233 258 258 254 243 233 222 212 202 191 181 170 160

5,233 5,375 265 265 263 252 242 231 221 210 200 190 179 169

5,375 5,517 272 272 272 261 251 240 230 219 209 199 188 178

5,517 5,658 279 279 279 270 260 249 239 228 218 208 197 187

5,658 5,800 286 286 286 279 269 258 248 237 227 216 206 196

5,800 5,942 294 294 294 288 277 267 257 246 236 225 215 205

5,942 6,083 301 301 301 297 286 276 266 255 245 234 224 213

6,083 6,225 308 308 308 306 295 285 274 264 254 243 233 222

6,225 6,367 315 315 315 315 304 294 283 273 263 252 242 231

6,367 6,508 322 322 322 322 313 303 292 282 271 261 251 240

6,508 6,650 329 329 329 329 322 312 301 291 280 270 260 249