Training Manual Bookkeeping Financial & Management View Online Aq077e00

User Manual: View Online manual_pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 64

- Acknowledgement

- Preface

- Module 1: The Importance of Bookkeeping

- Background information for the Facilitator

- Objectives

- Time

- Number of Participants

- Materials

- Type of Participants

- LESSON

- A. UNDERSTANDING BUSINESS

- What is a Business?

- In what kind of business are you? (As a group and/or as an Individual)

- Business Ownership

- What Are YOU Encountering as Problems Within Your Own Business?

- Problems Faced By Business Owners

- What is Entrepreneurship?

- Who is an entrepreneur?

- What are some of the characteristics an entrepreneur must possess?

- Understanding Basic Bookkeeping

- What is bookkeeping?

- Understanding the importance of bookkeeping in your business?

- How do you think bookkeeping could help your business?

- Best practices in bookkeeping

- Record Keeping

- The benefits of record keeping

- Characteristics of good record keeping

- What records should be kept

- REVIEW QUESTIONS

- Module 2: The Use of Symbols in Bookkeeping

- Module 3: How to Keep Accounting Records

- Background Information for the Facilitator

- Objective (s): After the completion of this session, you will be able to:

- Time

- Number of Participants

- Materials

- Type of Participants

- LESSON

- Entry Systems in Bookkeeping

- 1. What is a Balance Sheet?

- 2. How is the Balance Sheet Structured?

- 1. Information Provided by the Balance Sheet

- Module 4: How to Calculate Business Profit and Loss

- Background Information for the Facilitator

- Time

- Number of Participants

- Materials

- Type of Participants

- LESSON

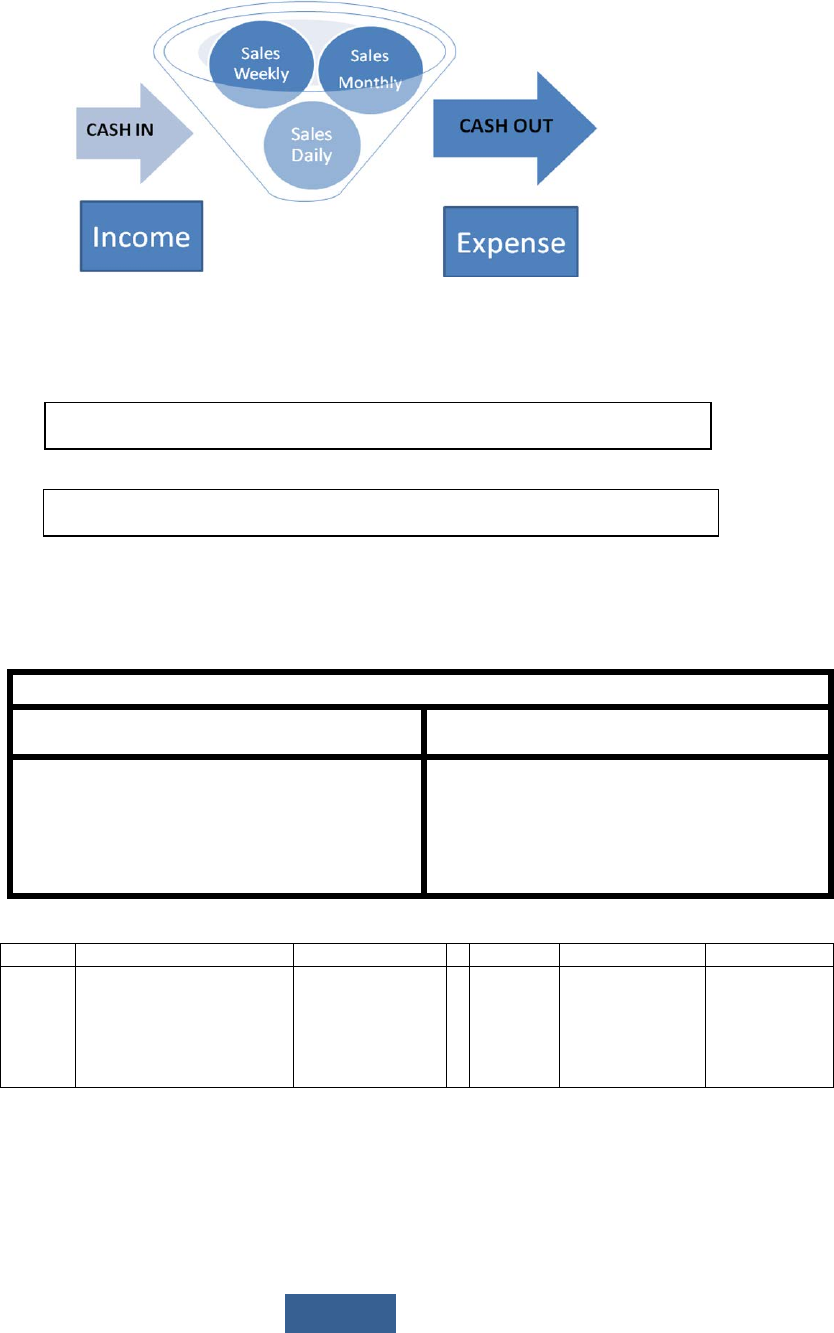

- Calculating Income and Expanses?

- What is Income?

- Explanation

- How does Money come into your Business?

- Other Income Activities

- What is an Expense?

- How does Money goes out of your Business?

- Other Expense Activities

- What are Unnecessary Expenses?

- What is Profit?

- Explanation

- How to Calculate Profit or Loss

- REVIEW QUESTIONS

- Module 5: Managing Business Cash and Accounts

- Module 6: Financial Management

- Background Information for the Facilitator

- Objectives

- Time

- Number of Participants

- Materials

- Type of Participants

- LESSON

- Financial Controls and Systems

- What is Finance?

- How to Ensure Effective Financial Control?

- Key Features of Effective Control and Accountability Systems

- Roles and Responsibilities

- Policies and Procedures Manual

- Balance Between Control and Operational Efficiency

- Monitoring Compliance

- Sources of Funding

- Assessing the Need for a loan

- Procurement and Evaluation

- Suppliers Management

- Hallmarks of Good Procurement Systems

- Financial Planning

- How to save the money? (Handout – 10 Ways to Save Money)

- REVIEW QUESTIONS

- Literature

Moving forward in the

Implementation of Non-Legally

Binding Instrument (NLBI) on All

Types of Forests in Liberia,

Nicaragua and the Philippines:

A contribution to Reducing

Deforestation and forest

degradation

FOREST INSTRUMENT LIBERIA

TRAINING MANUAL

BOOKKEEPING

FINANCIAL

&

MANAGEMENT

With support of

ii

The views expressed in this information product are those of the author(s) and do not

necessarily reflect the views of BMELV, FAO, FDA, FFF.

April 2013

iii

Acknowledgement

This manual has been developed by Avril Fortuin. This document would not have been

possible without the valuable contributions from different people working during the

development and delivery of the training of trainers in the field. Sormongar Zwuen,

National NLBI project coordinator and Joseph Boiwu. FAO Representative Operations

assistant, made contributions for assessment and implementation of the Manual.

Important technical assistance was received from Jhony Zapata, FAO/FFF Rome, Marco

Boscolo, Sophie Grouwels and Fred Kaffero, FAO Rome made valuable contributions to

improve the structure and content of the publication and Marco Perri FAO/FFF for the

layout and formatting.

Sincerest gratitude goes to Ms. Eva Muller Director, Forest Economics, Policy and Products

Division, FAO for her leadership and strategic guidance. Special recognition goes to the

Federal Ministry of Food, Agriculture and Consumer Protection (BMELV) of Germany for

the financial support provided."

iv

Preface

In May 2007, the National Forum on Forests (UNFF) adopted the Non-Legally Binding

Instrument on All Types of Forest (NLB), which is commonly called the “Forest Instrument”. This

significant international consensus was reached to strengthen the implementation of

sustainable forest management (SFM), and thus to maintain and enhance the economic and

environmental values of all types of forests, for the benefit of current and future generation.

Most specifically, the Forest Instrument is to: () Strengthen political commitment and actions at

all levels to implement effectively SFM, (ii) Enhance the contribution of forests to the

achievement of the international agreed development goals including the MDG, and (iii)

Provide a framework for national action and international cooperation.

The overall objective of the project is “to support Liberia, Nicaragua and the Philippines, on a

demonstration basis, to move forward in the implementation of the Non-Legally Binding

Instrument on all types of forest”.

The resources of any country are the lifeblood of that nation. The management of such

resources that will impact the beneficiaries is a key propriety that must not be taken for

granted; as such it must be managed effectively. When resources are available, the people

should have entrepreneurial and financial management skills to manage them. Liberia’s forest

sector is an economic sector that is providing benefits to the local communities through

investment in logging activities where communities get shares from these investments in the

forest sector. Their share of funds provided by these logging companies has been used to

improve the communities. This bookkeeping and financial management guide are intended

to develop and improve the skills of two national and community based organizations known

as the County Forest Forum (CFF) and Community Forestry Development Committee (CFDC);

these two organizations are charged with the responsibilities of managing the funds from the

forest sector and also helping the local communities manage resources from the forest

through entrepreneurship.

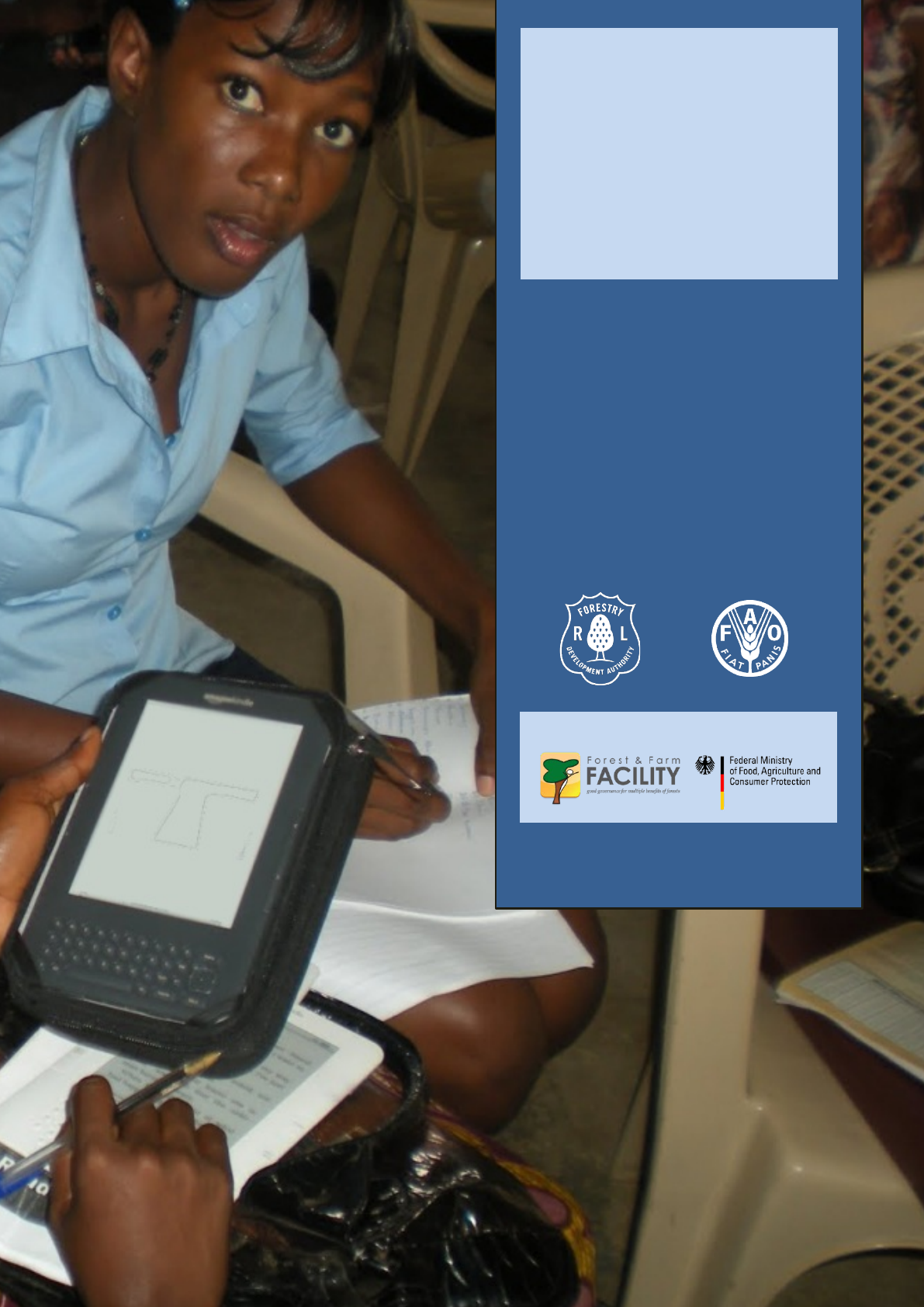

To date the bookkeeping and financial management manual was implemented in Liberia as

part of a pilot program. Training was conducted in two counties: Margibi and River Gee. A

total of 50 beneficiaries from the CFF and CFDC from all 15 counties in Liberia attended the

trainings in these two locations. Following the training a ToT workshop was held (in River Gee)

to hone the skills further of the top beneficiaries. These ToTs implemented the manual on the

local communities in three counties: Ganta, Maryland and River Cess.

The idea of business is aimed at satisfying the needs of customers that lead to the increased

wealth of owners of the business in terms of profit making. This manual focuses on how

entrepreneurial ideas help to improve the businesses. The following key elements are critical

for the improvement of any business; environment of the business, the quality of services

provided to customers, product pricing on the market, separating business assets from

personal assets and access to credit. With these elements combined with bookkeeping and

financial management ideas, including the process of how you manage the money coming

into your business and money going out of your business.

This bookkeeping and financial management manual have six modules that look at the basic

concepts of bookkeeping and financial management. The following modules in this manual

are structured as follows:

1. The Importance of Bookkeeping. This module highlights the forms of business,

problems that are encountered by business owners, the ideas of entrepreneurship

v

in business, understanding basic bookkeeping concepts and best practice in

bookkeeping.

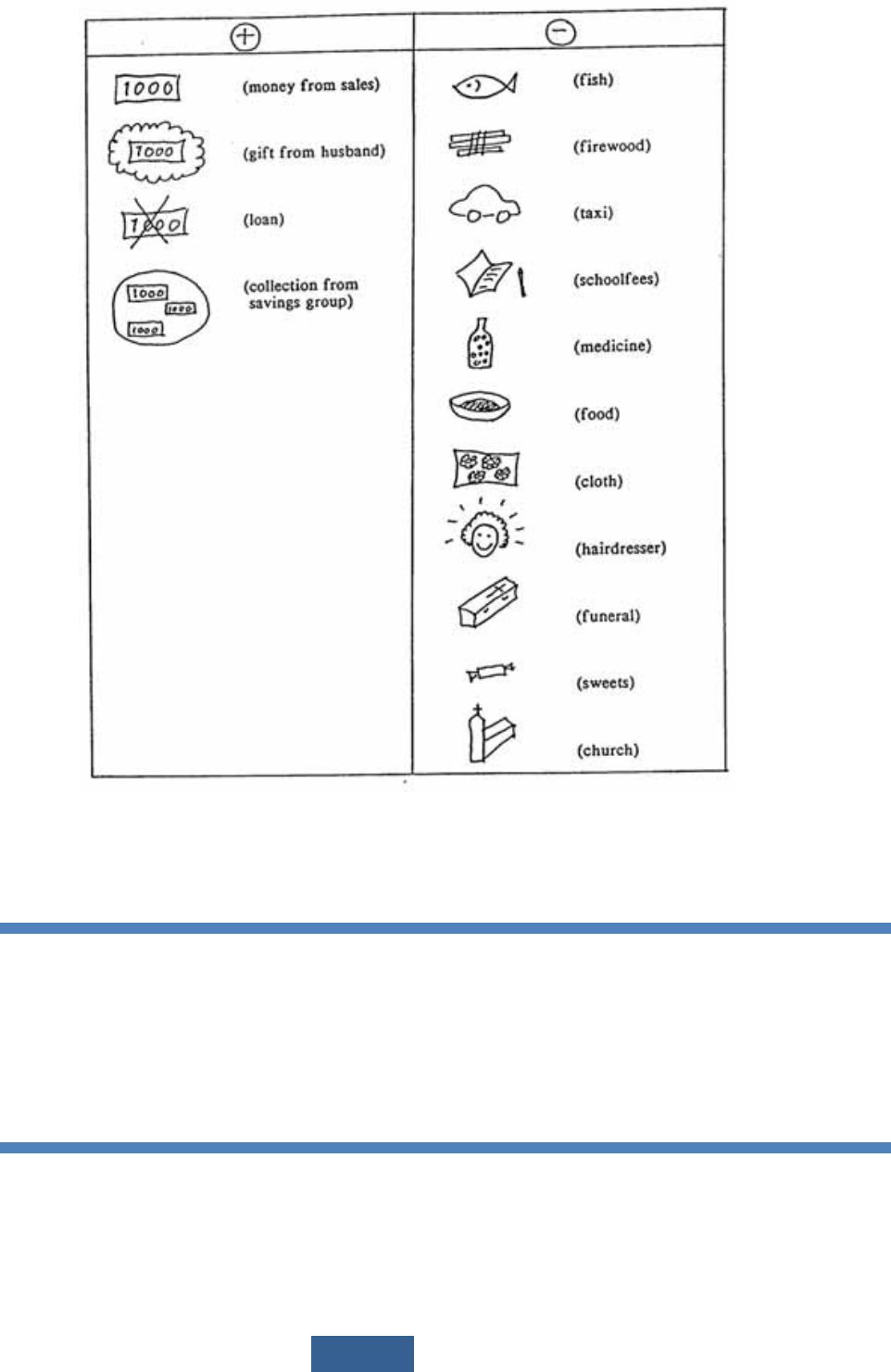

2. Understanding Symbols in Bookkeeping. These modules basic idea is on symbol

recognition, drawing of symbols, symbols for money in and money out,

understanding income and expenses.

3. How to Keep Accounting Records. This module focuses on cash book entry; the

various books to be kept for proper record keeping of your business activities,

entry system in bookkeeping, single entry system, the double entry system; debit

and credit, balance sheets, and operating assets and liabilities.

4. Knowing How to Calculate Business Profit and Loss. This model develops the ability

calculating income and expenses and profit and loss.

5. Managing Business Cash and Accounts. This module explains managing

accounts, managing cash and credit/ loan.

6. Financial Management. The final module concludes the manual with discussing

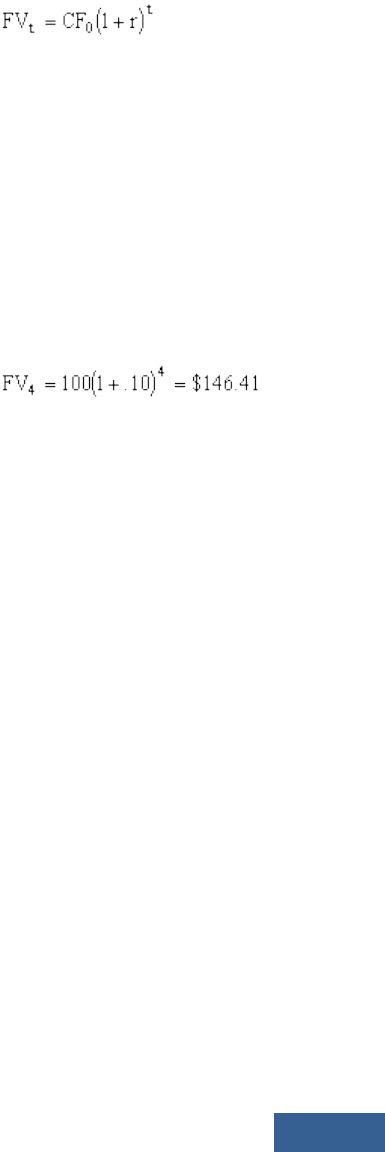

the financial controls and system, sources of finance, time value of money;

present value, future value and annuities, procurement and evaluation, suppliers

management and financial planning.

Those persons having been involved in the development, and testing of the content

material are convinced that the whole exercise was helpful and has undoubtedly

strengthened the bookkeeping and financial management skills of the Liberian

stakeholders. We sincerely hope that the training manual will assist the Liberian

stakeholders to build their capacities.

Jean-Alexandre Scaglia Harrison S. Karnwea,

FAO Representative in Liberia Managing Director a.i., FDA

vi

Table of Contents

Acknowledgement .................................................................................................................. iii

Preface ..................................................................................................................................... iv

Module 1: The Importance of Bookkeeping ........................................................................ 1

Module 2: The Use of Symbols in Bookkeeping ................................................................. 10

Module 3: How to Keep Accounting Records................................................................... 18

Entry Systems in Bookkeeping .............................................................................................. 19

Module 4: How to Calculate Business Profit and Loss ....................................................... 28

Module 5: Managing Business Cash and Accounts ......................................................... 35

Managing Accounts .............................................................................................................. 35

Module 6: Financial Management ...................................................................................... 41

1

Module 1: The Importance of Bookkeeping

Background information for the Facilitator

• Most micro and small scale entrepreneurs do not write down how much money

comes in and how much goes out of their business. They keep everything in their

head. As a result, they do not actually know how much money they are earning,

how much they buy and sell on credit and how they could improve their business.

Objectives

• After completing this section, participants will be able to:

• State what a business is all about

• Know the different business ownerships, their advantages and disadvantages

• Understand entrepreneurship

• Explain the importance of bookkeeping in business operation

• Raise interest in the course

Time

• 8 hours

Number of Participants

• A group preferably to include 10 to 15 persons, but it should not exceed 25

participants. Larger groups make it extremely difficult for the facilitator to track

the progress of individuals.

Materials

• Flip charts, chalk or white board, markers, chalk and a cleaning rag

• Exercise books, pens, pencils, rulers, erasers, calculators for all participants

• Area suitable for writing and learning

Type of Participants

• CFDC, CFF Entrepreneurs such as retailers, wholesalers, farmers and manufacturers

• Village leaders

LESSON

A. UNDERSTANDING BUSINESS

What is a Business?

Let the participants discuss the answers first, before giving suggestions. Any answer

resembling the following is good. (Answer) All activities whereby you try to earn an

income on a regular basis are called businesses.

A business (also known as enterprise or firm) is an organization which is engaged in the

trade of goods, services, or both to satisfy the consumers in order to make a profit.

Businesses are predominant in capitalist economies, where most of them are privately

owned and administered to earn profit to increase the wealth of their owners. Businesses

may also be not-for-profit or state-owned.

2

In what kind of business are you? (As a group and/or as an Individual)

If your participants are working together in a co-operative business, invite individual

participants to dicuss what additional income-generating activities they do at home.

Business Ownership

Ownership forms related to micro, small and medium enterprises are:

• Sole proprietorship (owned by one person)

• Partnership (owned by a few persons, could be 2-20)

• Co-operative (owned by a large group)

a) Sole Proprietorship/ Sole Trader

In this form of ownership, the whole business is owned by a single person.

o The owner enjoys all the profits of the business but also accepts all losses.

o This single owner has complete freedom to manage the affairs of the

business as he desires; he is answerable to nobody.

o The owner’s liability is unlimited. That is in settling the debts of the business

if the business assets are insufficient, the personal assets will also be taken.

o Being owned by a single person, the resources of the business are limited.

b) Partnership

Here, two or more persons join to start a business.

o The owners collectively are called the company, and individually,

partners.

o The profits and losses are shared by the partners in agreed proportions.

o Their liability towards the firm’s debts is unlimited.

o Freedom of conducting the affairs of the business is restricted as the

partner is liable to the other partners.

o Since more than one person is involved, the resources of the firm are

usually more.

o A partnership could also be formed to combine the resources required for

the enterprise. Resources could include skills, money, land, raw material

etc.

A

ctivity: 1

Ask participants to list all the things and resources that are found in a business. This may include

people, machinery, stationery, etc.

Ask a volunteer to talk about his/her business they are operating. Let the volunteer explain to the

group t

he products/ services he/she is selling.

In a group discussion, let participants discuss what products/ services CFDC and CFF are engaged in.

Also let them discuss some possible business opportunities they may engage with in the future

.

3

Example:

Flomo has money to buy palm nuts; Fatu has skills to produce palm oil.

Flomo and Fatu can come together to form a partnership and create a

palm oil processing business.

c) Co-operative and Group Ownership

A co-operative is when people come together to do business with a common

purpose and intent.

o In a co-operative form of ownership, a large number of persons

collectively own the enterprise and are involved in its activities. The part

owners are called members.

o All the members contribute an equal amount towards capital, share the

profits equally and have equal rights.

o Since a large number of owners are involved, the management of the co-

operative is entrusted to a small group of members who are elected by

the many.

o The financial asset is crucial. The liability of the members is limited.

o That is even if the assets of the co-operative are insufficient to satisfy the

debts, the members’ personal assets cannot be touched.

o A co-operative is also much more powerful than individuals or

partnerships.

o A co-operative represents a large group of people and, quite often, this

gives its access to Government programs and developmental agencies,

which offer financial assistance in the form of grants or interest-free loans.

A business owned by multiple individuals may be referred to as a company;

although that term also has a more precise definition.

Note: In these three categories of business ownership, it is essential to establish

appropriate bookkeeping and financial management of the finances of these forms

of business. Money coming in and money going out must be recorded in the various

books of the business for good management of record keeping.

Activity: 2

Ask participants to provide in a table format the advantages and disadvantages of

the type of business they

are managing or would like to start.

Divide participants into groups of five and let them discuss whether the CFDC and CFF are businesses. In the

context of CFDC and CFF explain social enterprise and social entrepreneurship.

Afte

r the exercise, distribute Handout 1.

4

What Are YOU Encountering as Problems Within Your Own Business?

In starting or operating a business, there is no guarantee that the business will run without

any problems. These are some of the problems faced in managing and or starting a

business:

• Lack of funds to buy stock;

• Problems with selling (marketing);

• Money needed for emergency cases;

• People not paying their debts;

• Money needed for ceremonies.

Problems Faced By Business Owners

• Time Management - Time management can become problematic for the owner

of a small business. Small businesses often operate on a extremely tight budget,

precluding the hiring of many employees. The owner is often faced with trying to

manage and grow the business while at the same time having to do the daily

operation. Small business owners can also find themselves so tied up in running

the business that they don't take time to enjoy families, hobbies or other activities.

• Inflexibility - Refusing to let go of an idea and move on to something else is a

common problem for small business owners. For small business owners to succeed,

it is necessary for them to be willing to think like an entrepreneur and explore

many different ideas. Whether it is the need to replace inventory, provide

additional services or go to a new location, a small business owner must remain

flexible if he wants his small business to succeed.

• Obtaining Credit - Access to credit can be an issue for the small business owner,

according to the Washington Post. A business line of credit can provide needed

cash flow during the start-up months. It can also ensure that the owner has the

ability to expand the business with inventory and meet her payroll. A small

business, however, will not always qualify for a large credit line, which can hinder

the owner's ability to succeed.

• Employees Issues - Small business owners often face a dilemma when it comes to

hiring workforce. Staffing enough workers to cover enough the business needs

without destroying the business's profit margin can be a tricky process. Things are

never easy for a small-business owner. No matter how hard you try, there are always

problems to solve and fires to put out. At least you can take comfort in knowing

you're not alone. Every small-business owner goes through the same thing.

• Cost - A study conducted by the National Federation of Independent Business

reported in 2008 that the primary problem that business owners face is the cost of

running the business. The inability to control some costs, including health

insurance, energy bills and inflation, add stress to the business owner's bottom

line. In addition, the cost of paying employees, stocking inventory and basic

overhead can make cash flow issues for the small business owner.

Activity: 3

In their groups ask participants to provide a list of possible businesses they can manage or create in the

forestry sector.

Let them discuss what could be possible hindrances or barriers keeping them from

starting such businesses.

5

What is Entrepreneurship?

Who is an entrepreneur?

• Someone who creates a new business idea

• Someone who has passion and spirit

• Someone with good business ideas

What are some of the characteristics an entrepreneur must possess?

• Positive self-esteem

• Positive self-confidence

• Commitment / Self-discipline

• Independence

• Forward looking

• Motivated

• Innovative

• Creative, risk taker/ courageous

• Initiator

• Opportunist

• Goal/ pace setter

Understanding Basic Bookkeeping

What is bookkeeping?

The bookkeeping system refers primarily to recording the financial effects of financial

transactions only.

In the normal course of business, a document is produced each time a transaction

occurs. Sales and purchases usually have invoices or receipts. Deposit slips are produced

when lodgments (deposits) are made to a bank account. Cheques are written to pay

money out of the account. Bookkeeping involves, first of all, recording the details of all of

these source documents into multi-column journals (also known as books of first entry or

daybooks).

For example, all credit sales are recorded in the sales journal, all cash payments are

recorded in the cash payments journal. Each column in a journal usually corresponds to

an account. In the single entry system, each transaction is recorded only once. Most

individuals who balance their cheque-book each month are using such a system, and

most personal finance software follows this approach.

The difference between manual and any electronic accounting system stems from the

latency between the recording of the financial transaction and the posting in the

relevant account. This delay, lacking in electronic accounting systems due to the

immediate posting into relevant accounts, is not replicated in manual systems, thus giving

rise to primary books of accounts such as Sales Book, Cash Book, Bank Book, Purchase

Book for recording the immediate effect of the financial transaction.

Bookkeeping means that you write down all the money that comes into your business

and all the money that goes out of your business.

6

Understanding the importance of bookkeeping in your business?

The imperative of business records cannot be overemphasized. Every serious entrepreneur

must as a matter of fact be able to maintain proper records of his or her business

transactions. Proper bookkeeping is critical to sustaining and expanding a business.

Without it, the entrepreneur runs the risk of hitting cash flow crunches, wasting money,

and missing out on opportunities to expand his business. When you maintain proper

records of your business transactions, you will be properly positioned to carry out official

business analysis and see how your business is fairing.

The purpose of bookkeeping is to help you manage your business and also to allow tax

agencies to evaluate your business venture. As long as your book keeping achieves both

of these objectives, you are in the right direction. Any financial institution who wants to do

business with you must request your business records. Your ability to make it means you

are serious about your business.

How do you think bookkeeping could help your business?

a) Why bookkeeping?

Many people do not write down how much money comes in and how much money

goes out of their business. This is because they do not know how to do it, and they

do not know that it can improve their business. Therefore, people do not exactly

understand how much money they are earning, how much customers have bought

on credit and how much stock they have bought on credit. Where groups of people

work together, lack of a proper bookkeeping system often leads to mistrust and

accusations between group members. Bookkeeping is beneficial because you

cannot keep everything in your head. People is careless by nature.

b) Of what value is bookkeeping to your business?

o You will know how much money you have received,

o You will know how much money you have spent and how you have spent it;

o You can calculate whether you are making a profit or a loss;

o You will be able to make better decisions on what to buy and sell;

o You can keep records of buying and selling on credit, so that people

cannot trick you;

o You can keep records of money coming in and going out of a group

project and thus prevent abuse of funds and avoid mistrust amongst

group members.

Bookkeeping means that you write down all of the money that comes into your

business and all the money that goes out of your business.

7

Best practices in bookkeeping

Here are best practices to make bookkeeping easier for you:

• Manage to go through your books once a week (preferably at the end of the

week) to do the following:

a) Categorize your expenses

b) Mark invoices as paid by associating them to deposits you've imported or

update invoice status

c) Setup contractors and clients in your contact list

• Reconcile your account(s) at the end of every month.

a. Make sure that the remainder of your account matches what is in your

bank statement.

• Run weekly and/or monthly reports.

• Do not forget to assign personal expenses as non taxable expenses.

• Make sure that you have separate bank accounts for personal and business

purposes.

• Bookkeeping is a extremely valuable process in managing a business.

• The three Best Practices you should install for yourself in understanding the rule of

what is involved in the bookkeeping system to ensure that you provide the service

your business needs in evaluating its financial condition are:

b. Make a firm decision that you will make your bookkeeping.

c. Familiarize yourself with the Accounting Cycle and the Financial

Statements.

d. Become familiar with your Accounts Payable, Accounts Receivable,

Customer Balances, and Aging Reports.

Record Keeping

The benefits of record keeping

• Many people do not write down how much money comes in and how much

money goes out of their business.

Activity: 3

Distribute Activity Handout 2 (role play). Ask participants to divide themselves into groups and conduct the

role play in the handout.

After performing each role

-play ask the participants a question:

Play 1

: What is the woman's problem? What could she have done to avoid this problem? (answer) She had

spent all her money without thinking about the school fees that she had to pay. She does not even remember

what she has spent her money on. She could hav

e kept records of her income and expenses and planned for

the payment of the school fees.

Play 2

: Why was the carpenter cheated? (answer) Because he had no written proof of how much money the

customer owed him.

Play 3

: Why were the group members angry? Wh

at could they have done to avoid this problem? (answer) The

group members were angry because nobody knew what had happened with the money from the bakery. If

they had kept records, they would have known how much money came in and went out of their business

. It

would also have helped them to know whether they were making a profit with the bakery or not

.

8

• This is because they do not know how to do it and they do not know that it can

improve their business.

• What you cannot determine, quantify and record what you cannot monitor and

control.

• There is a limit to how much you can keep in your memory.

• Record keeping, therefore, is a pre-requisite to successful business operation.

a. Advantages of keeping records

o Record-keeping is crucial because you cannot keep everything in your

head.

o Memory is not good enough for proper research and planning.

b. Advantages of regular record-keeping

o You will know how much money you have received, how much you have

spent and how you spend it.

o You can calculate whether you are making a profit or a loss and also

know your break-even point.

o You can keep records of buying and selling on credit. That is, you will

know whom your debtors are and how much they owe you, and who your

creditors are and how much you owe them.

o You can keep records of money coming in and going out of group

businesses or projects. This will prevent misuse of money and avoid mistrust

among group members.

o It can help you in the monitoring and controlling of your stock levels,

knowing when to make a new order and how much to order.

o By comparing your actual record with your planned budget, you can

determine if you are on the right track during your business year.

c. Disadvantages of not keeping records or keeping poor records

o You will not know how much money you are earning, whether your

business is making a profit or losing money.

o You will not know why you are making a profit or losing money.

o You will not be able to make good decisions that will allow you to make

more money and save your business from losing money.

o You will not know which customers owe you money, how much they owe

you or how much you owe someone else.

o Where groups of people work together, lack of a proper record-keeping

system often leads to mistrust and accusations between groups and

members.

Characteristics of good record keeping

A good record keeping system is easy to use and records the necessary information

details. Depending on the complexity of the business, the amount of detail will vary. Some

businesses will want to keep accurate records down to the enterprise or location level.

Recommended documents for a good record keeping system include:

• Business accounts for checking, savings, and investing and credit cards.

• An income and expense ledger or appropriate software program to record all

cash business transactions by date and category.

• Inventory involves the physical counting and valuation. It is done at least annually

at the end of the business fiscal or calendar year.

• A depreciation schedule for all business assets showing asset basis:

o Cost valuation

9

o Market valuation

• A cost and market valuation balance sheet summarizing assets and liabilities of

the firm.

• An income statement listing

o Receipts,

o Expenses,

o Accounts receivable and

o Accounts payable.

• A statement of cash flows showing the source of cash inflows into the business

and where business cash outflows went.

• Enterprise records showing receipts and expenses by enterprises with some level

of profitability analysis.

What records should be kept

When one person or groups of persons choose to run a business, they must establish

measures that will account for money or monies that come in and go out of business. This

is done through the use of record books. There are many reasons why you must write

down all money that comes in and money that goes out of your business:

• You do not combine your personal finances with the business money;

• You will know when you buy on credit;

• You will know when you sell on credit;

• There is transparency in recording the business money;

• Have the fear of one person cheating the others;

• Trust from people who will need to give you a loan like the banks.

These are some of the record books needed for good record keeping:

• Cash Book

• Inventory Record

• Credit Record

• Debtor Book

• Labor Book

The details of these various record books that will help your business improve will be

discussed further in the subsequent modules of this manual.

REVIEW QUESTIONS

At the end of this lesson, ask the following questions to find out whether the participants

have understood the lesson:

• What is a business?

• List some key characteristics of an entrepreneur?

• Which type of businesses would you like to operate?

• What is bookkeeping?

• How can bookkeeping help your business?

• What are useful record books for business operations?

• Of what importance are these record books?

10

11

Module 2: The Use of Symbols in Bookkeeping

Background Information for the Facilitator

When keeping books, you have to write down all the money that comes in to your

business and all the money that goes out of your business. All participants understand

how to write figures and do calculations, but some participants may not be able to read

and write (yet). Therefore, we shall be making use of symbols and drawings.

(Note: if all your participants are literate, you can simply replace the symbols by words.

Where the course is being used together with literacy classes (reading and writing) the

symbols can also be used to illustrate the words.)

Objectives

After completing this section, participants will be able to:

• Identify symbols of money that come in and go out of business.

• State from which source money comes in and goes out of business.

• Point out things that they spend money on in the business.

Time

• 4 hours

Number of Participants

• A group preferably include 10 to 15 persons, but it should not exceed 25

participants. Larger groups make it extremely difficult for the facilitator to track

the progress of individuals.

Materials

• Flip charts, chalk or white board, markers, chalk and a cleaning rag

• Exercise books, pens, pencils, rulers, erasers for all participants

• Area suitable for writing and learning

Type of Participants

• Entrepreneurs such as retailers, wholesalers, farmers and manufacturers

•

Village leaders

LESSON

• Can you mention three sources from which you receive money?

• List any three things on which you spend money?

• If bookkeeping means that you write down all the money that comes in and goes

out, how would you do it?

All answers are good. Explain the following.

You all know how to write figures. Because some of the participants are not able to read

and write yet we shall be making use of highly basic symbols and drawings.

12

Explanation

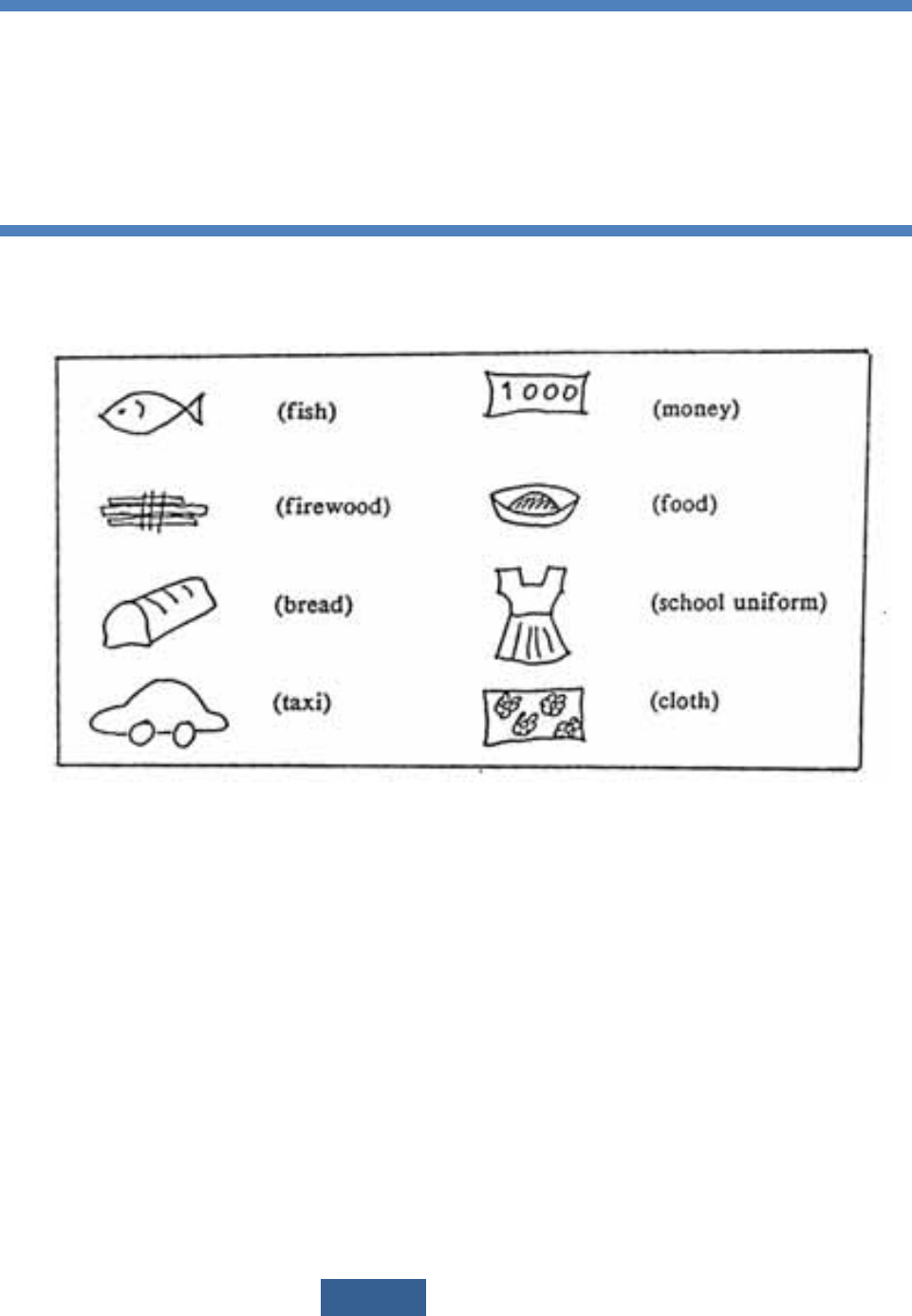

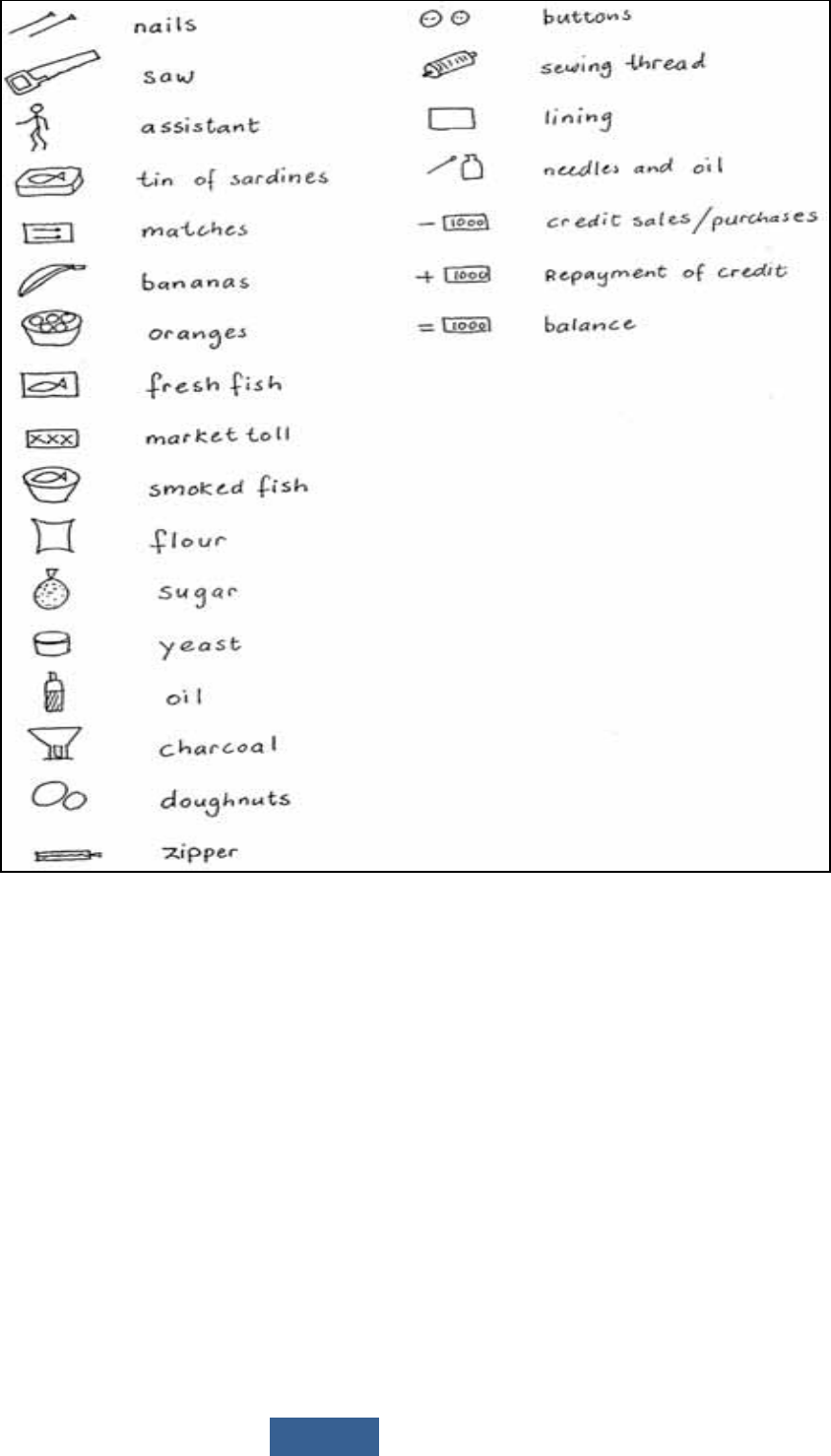

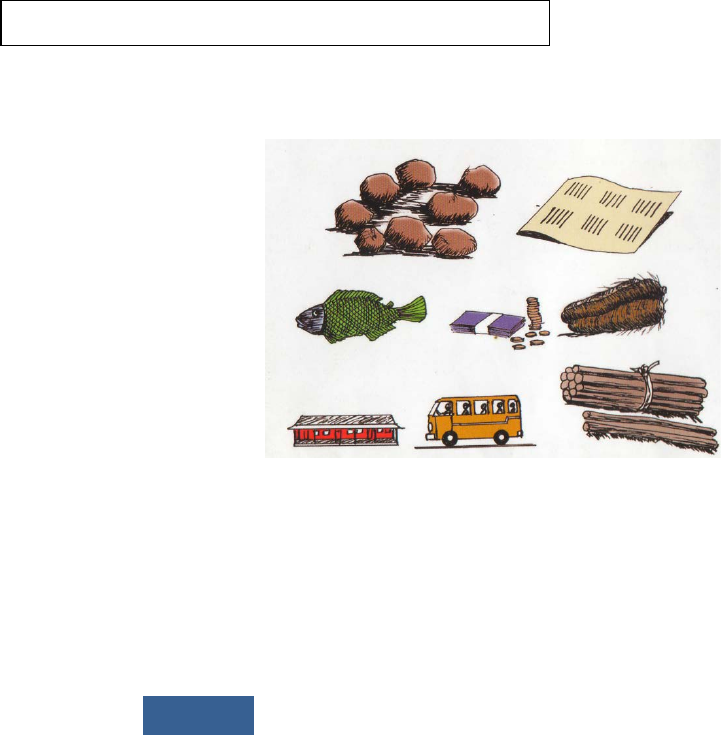

Drawing of Symbols

Below, draw examples of symbols on the chalkboard as shown. Ask the participants what

they see in the pictures.

Explain that they can use any symbol that they find easy to draw as long as they know

that they will remember it ('this resembles a fish for me'). It should be an extremely basic

drawing so that it is easy for them to 'write' it in the exercise books. Throughout they

should keep the same symbol for the same thing.

Spend sufficient time with the participants drawing different symbols on the chalkboard.

They should also try to draw things in their exercise books that they see in their

surroundings (matches, cup, and chair.) (Note: below you will find a list and explanation

of all the symbols that are being used in this book. However, if your participants find it

easier to use another symbol, please adopt that symbol.)

Activity: 3

Invite some of the participants to come to the chalkboard and make a very simple drawing of the following:

•

money

•

fish

•

food

•

transport

•

firewood

13

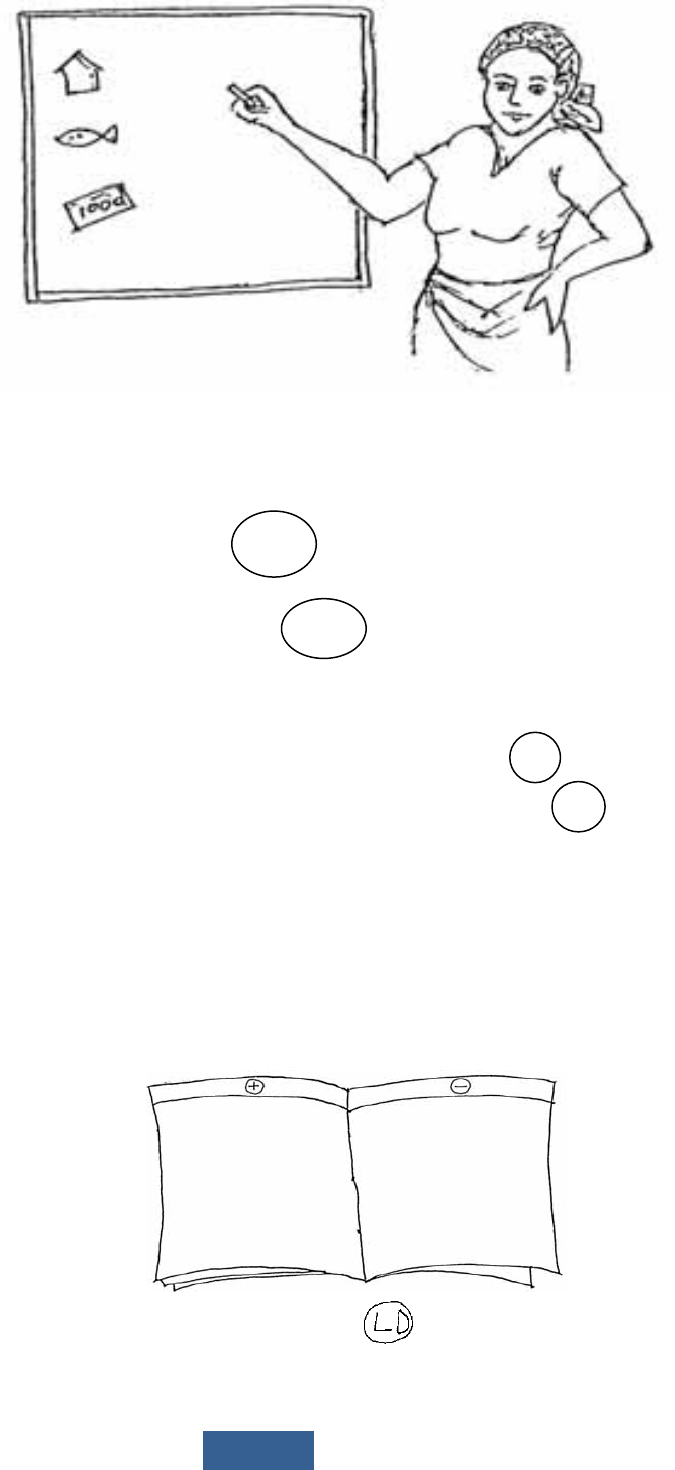

Symbols for 'Money In' and 'Money Out'

Bookkeeping means that you write down all the money that comes in and the money

that goes out. The following symbols will be used:

Examples:

• Liberian dollar symbol

• United States Dollar symbol

These are the two currencies used for our purpose but for now, we will use the Liberian

Dollar currency.

Money In = money becomes more, so we use the addition sign

Money Out = money becomes less, so we use the subtraction sign

The Cash Book

The book in which we write all the money that comes in and goes out is called a 'cash

book'.

You can use an regular arithmetic exercise book as a 'cash book'.

All money that comes in is written on the left page

All money that goes out is written on the right page

Cash book

LD

$

US

+

-

14

Activity 6

Draw a 'cash book' on the chalkboard. Ask the following questions and invite participants to illustrate the

answers by drawing a symbol on the correct side of the 'cash book

'.

(Note: the symbols in this example are meant to give you an idea. Do not just copy them, but use the symbols

that your participants indicate.)

From which sources do you Receive Money?

(Money becomes more

);

Accept all answers. If not men

tioned remind them of:

•

Income from sales

•

Gifts from husband, relatives or friends

•

Loans from banks, money lenders or others

•

Collections from savings group (susu)

What do you spend your Money on?

• (Money becomes less

);

• Accept all

answers. If not mentioned, remind them of:

• Buying of materials (fish, rice, seed)

• Firewood

• Transport (taxi, bus)

• School fees, school uniforms

• medicines, hospital bills

• Food

• Cloth

• Beauty

-products (nail polish, pomade)

• Hairdresser

• Cerem

onies (funerals, weddings, outdoorings)

• Sweets, snacks, ice cream

• Church, fetish

+

-

15

Activity 7: Individual Exercise

This is an individual exercise for all participants. All participants are to take their exercise books and do the

following exercises:

D

raw the symbol for 'money in' on the left side, and the symbol for 'money out' on the right side.

Think about the sources from which you receive money and draw a symbol under 'money in'.

Think about the money that you spend and draw a symbol under 'money o

ut'.

Help the participants where they have difficulties

16

Income and Expenditure

• Money that comes in and goes out of your business;

• Money that goes out of your business for your family and yourself.

Show the picture of the cash book with 'money in' and 'money out' again and ask the

following questions:

Replacement and repair of equipment and utensils:

You will have to keep money separate so that you will be able to pay for things like repair

of a machine, replacement of utensils when they are worn out, or unexpected costs.

Activity

8:

Which money from the picture belongs to your business and which money belongs to your household or

yourself?

Why do you think it is Important to Separate the two?

It is important to keep

the two separate, otherwise you will not be able to calculate whether your business

gives profit or not.

How could you keep the Business and Household Money Separate?

All answers are good. Give the following tip:

You could use a box (tin, purse, or piece o

f cloth) to keep your

Activity

8:

The participants should sit together in pairs of two and do an exercise. They should take their exercise books

and write the symbol for 'money in' on the left page and the symbol for 'money out' on the right page. Each

pa

ir should choose a business that is familiar to them. They should discuss the expenditure involved in making

and selling their product (or giving their service). They should draw symbols of the items that bring in money on

the left page, and symbols of the

items on which they spend money on the right page. When everybody has

finished ask some of the participants to draw a cash book on the chalkboard, explain the outcome of their

discussion, and write the symbols

17

REVIEW QUESTIONS

At the end of this lesson, the participants should be able to draw symbols in their exercise

books to indicate the money that comes in, and the money goes out.

1. Ask the following questions to find out whether they understood the lesson:

2. What is a cash book?

3. Where in the cash book do you write the money that comes in, and goes out?

4. What is income?

5. What is expense?

18

19

Module 3: How to Keep Accounting Records

Background Information for the Facilitator

This system of keeping accounting records will help those attending this workshop to write

down all the money that comes in and goes out of your business.

The accounting records will encourage vender/investors to invest into the business. It also

helps the business for audit purposes.

Objective (s): After the completion of this session, you will be able to:

• Identify the different accounting records to be kept during the operation of

business

• State the advantages and disadvantages of keeping accounting records

• State the characteristics of good record keeping

• Identify transactions and record entries into the various records

Time

• 8 hours

Number of Participants

A group preferably include 10 to 15 persons, but it certainly not exceed 25 participants.

Larger groups make it extremely difficult for the facilitator to track the progress of

individuals.

Materials

• Flip charts, chalk or white board, markers, chalk and a cleaning rag

• Exercise book, pens, pencils, rulers, erasers, calculators for all participants

• Area suitable for writing and learning

Type of Participants

• CFDC, CFF, Entrepreneurs such as retailers, wholesalers, farmers and

manufacturers

• Village leaders

LESSON

Entry Systems in Bookkeeping

Ways to Enter Transactions into the Various Records

The primary bookkeeping record in single-entry bookkeeping is the cash book, which is

similar to a checking account register but allocates the income and expenses to various

income and expense accounts. Separate account records are maintained for petty cash,

accounts payable and receivable, and other related transactions such as inventory and

travel expenses

20

Simple Cash Book Entry

Financial record-keeping means that you write down all the money that comes in and the

money that goes out.

The following symbols are used:

• Money in = Money becomes more, so we use the addition sign (+)

• Money out = Money becomes less, so we use the subtraction sign (-)

The book in which we write all the money that comes in and goes out is called a ‘Cash

Book’. You can use an standard arithmetic exercise book as a ‘cash book’.

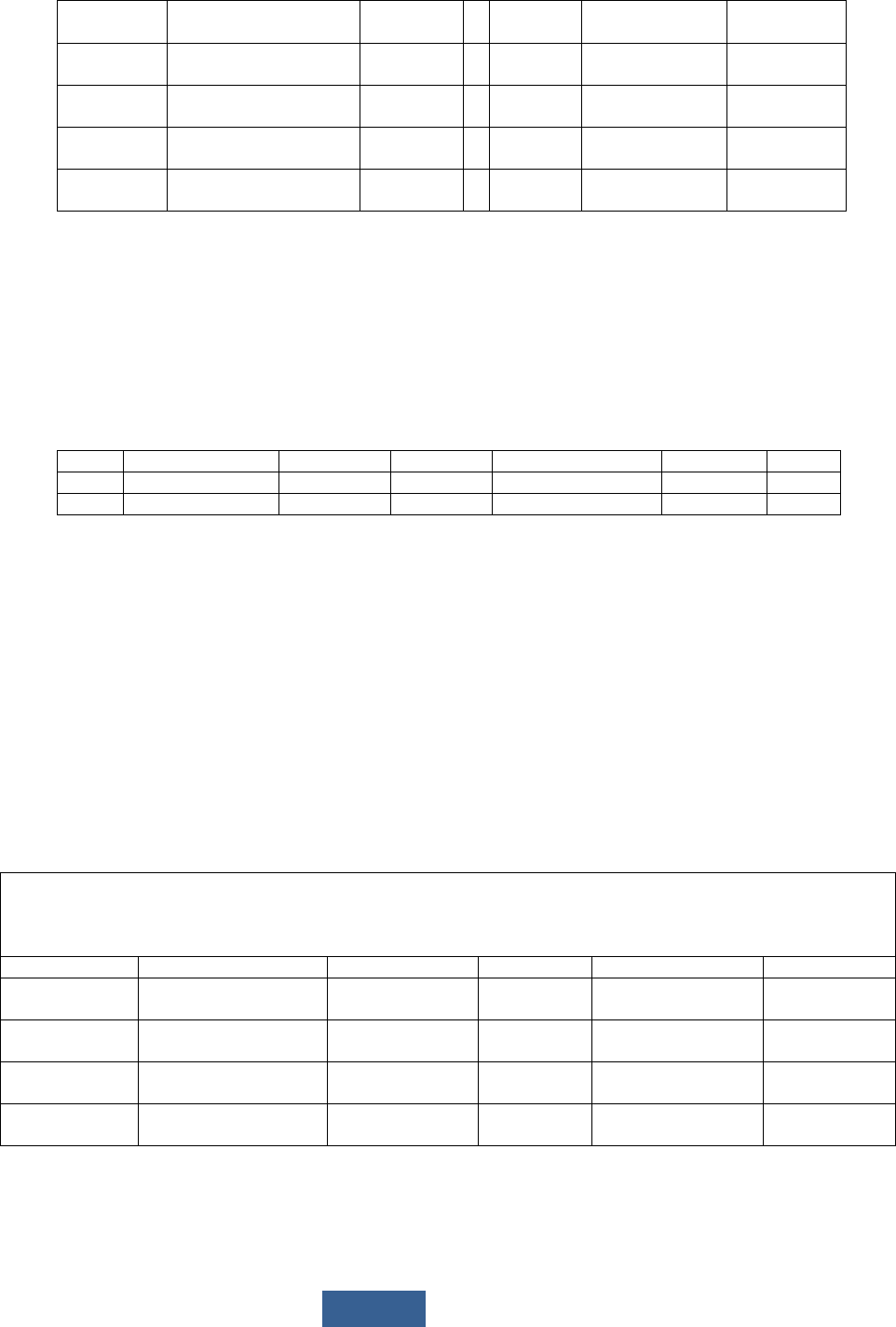

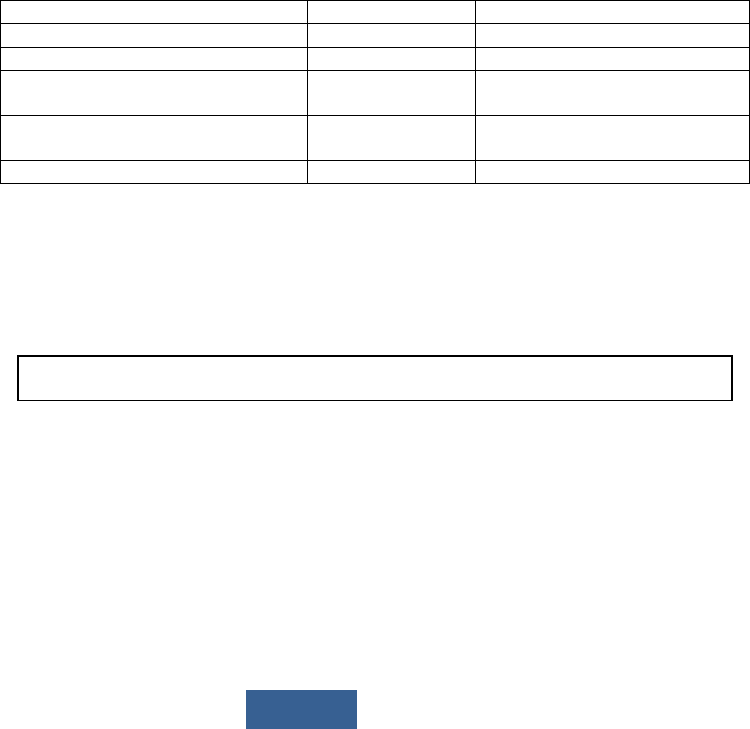

Table1: Example of a Blank Cash book

DATE

MONEY IN

AMOUNT

DATE

MONEY OUT

AMOUNT

Total

Total

CASH BOOK

Left Side = Money In (or income)

Right Side = Money out (or expenditure)

1st Column = Date: the day that you

received the money

2nd Column = Source of Income

3rd Column = How much money

1st Column = Date: the day that you pay

the money

2nd Column = What the money was spent

on

3rd Column = How much money

All money that comes in is written on the left page (LEFT)

All the money that goes out is written on the right page (RIGT)

21

Table 1a: Example of a Filled in Cash Book

DATE

MONEY IN

AMOUNT

(LD)

DATE

MONEY OUT

AMOUNT

(LD)

20-Jan-09

Sold 10pcs of local

planks

2,000

1-Jan-09

Purchased

machinery

3,000

25-Jan-09

Sold 14pcs of local

planks

2,800

7-Jan-09

Payment of

salary

1,200

29-Jan-09

Sold 20pcs of local

planks

4,000

16-Jan-

09

Transportation

800

Total

8,800

Total

5,000

Inventory record

An Inventory Record: keeps a record of physical items that your business has at any point

in time. It includes what you had at the beginning of the year, what has been added to

those items through purchases and production and how much has left your business

through sales, consumption, planned use or losses.

Example of inventory record

No.

Description

Qty

Beginning

Purchases

Sales

Loss

1.

Computers

5

5

2

1

1

2.

Printers

6

2

4

2

2

Credit Book

A Credit Book: Keeps the record of all the money the customers have to repay for goods

and services purchased on credit.

Transactions for credit book

1. June 2, 2011 Credited 5 gallons of honey for LD 900 to Fatu Business Center to be paid

in 15 days.

2. June 15, 2011 Siah credited 2 baskets of snails costing LD 800 from Jumah Business

Enterprise.

3. June 20, 2011 Flomo took 3 pieces of planks for Dweh Plank Center on credit for LD 500

Example of Credit Book

CUSTOMER CREDIT BOOK

NAME:___________________________

ADDRESS:________________________

DATE

DESCRIPTION

CREDIT

PAYMENT

BALANCE

SIGNATURE

June 2, 2011

5 gallons of honey

LD 900

0

LD 900

June 15, 2011

2 Baskets of snails

LD 800

0

LD 800

June 20, 2011

3pcs planks

LD 500

0

LD 500

Total

LD 2,200

0

LD 2,200

22

Debtor Book

A Debtor Book: Keep a record of all whom the business owes (those who have supplied goods

and services to the business on credit).

Transactions

1. June 2, 2011 Credited 5 gallons of honey for LD 900 from Fatu Business Center to be

paid in 15 days.

2. June 15, 2011 Siah Enterprise credited 2 baskets of snails costing LD 800 from Jumah

Business Enterprise.

3. June 20, 2011 Flomo Inc. took 3 pieces of planks for Dweh Plank Center on credit for LD

500 Example of Debtor Book

DATE

DESCRIPTION

DEBT

PAYMENT

BALANCE

June 2, 2011

Fatu Business

5 gallons of honey

LD 900

0

LD 800

June 15, 2011

Siah Enterprise

2 Baskets of snails

LD 800

0

LD 800

June 20, 2011

Flomo Inc.

3pcs planks

LD 500

0

LD 500

Total

LD 2,200

0

LD 2,200

Labor Book

A Labor Book: keeps a record of who had worked for you, how much they have worked

(number of hours, days or quantity of work done), how much they were paid and when they

were paid.

Transactions for labor book

On March 2, 2011, Yarkpawolo Kollie cut down trees for construction of bee keeping material

for Lorpu in the amount of LD 900 for 3 hours.

March 12, 2011 Dweh Dartu brushed Fatu’s farm for the amount of LD 700 for 2 hours.

March 23, 2011 Tarnue Zolu prepared snail raising materials for Kuma Saah for LD 600

Date

Description

Hourly work

Amount

March 2, 2011

Yarkpawolo Kollie

3 hours @ LD 300

per hour

LD 900

March 12, 2011

Dweh Dartu

2 hours @ LD 350

per hour

LD 700

March 23, 2011

Tarnue Zolu

2 hours @ LD 300

per hour

LD 600

Total

LD 2,200

Activity

10:

Distribute Handouts 3, 4, and 5

23

Single-Entry System (Journal)

The primary bookkeeping record in single-entry bookkeeping is the

cash book, which is similar to a checking account register but

allocates the income and expenses to various income and expense

accounts. Separate account records are maintained for petty cash,

accounts payable and receivable, and other relevant transactions

such as inventory and travel expenses.

Transactions

January 2, 2012 Received LD$ 3,000 for sales of goods

January 14, 2012 Received LD$ 6,000 for services rendered to customer

January 22, 2012 Purchased office supplies for LD$ 1,000

January 26, 2012 Pay for advertisement for LD$ 300

January 31, 2012 Bank charges in the amount of LD$ 15

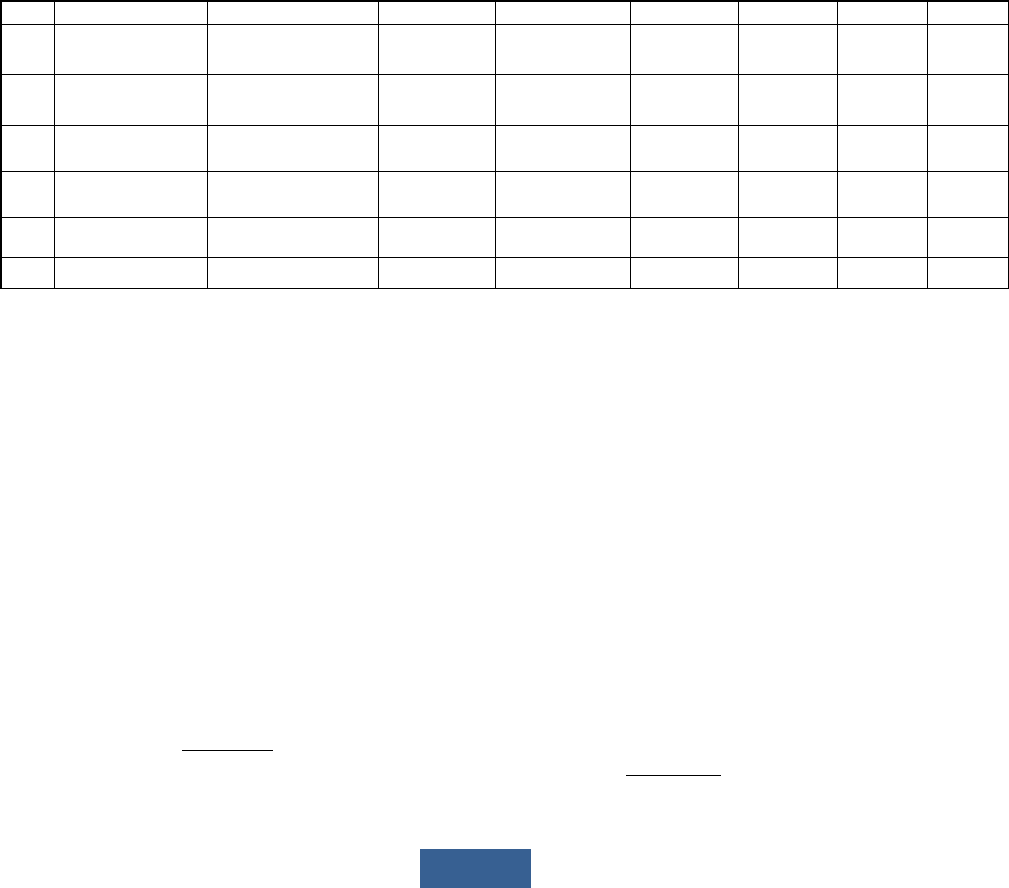

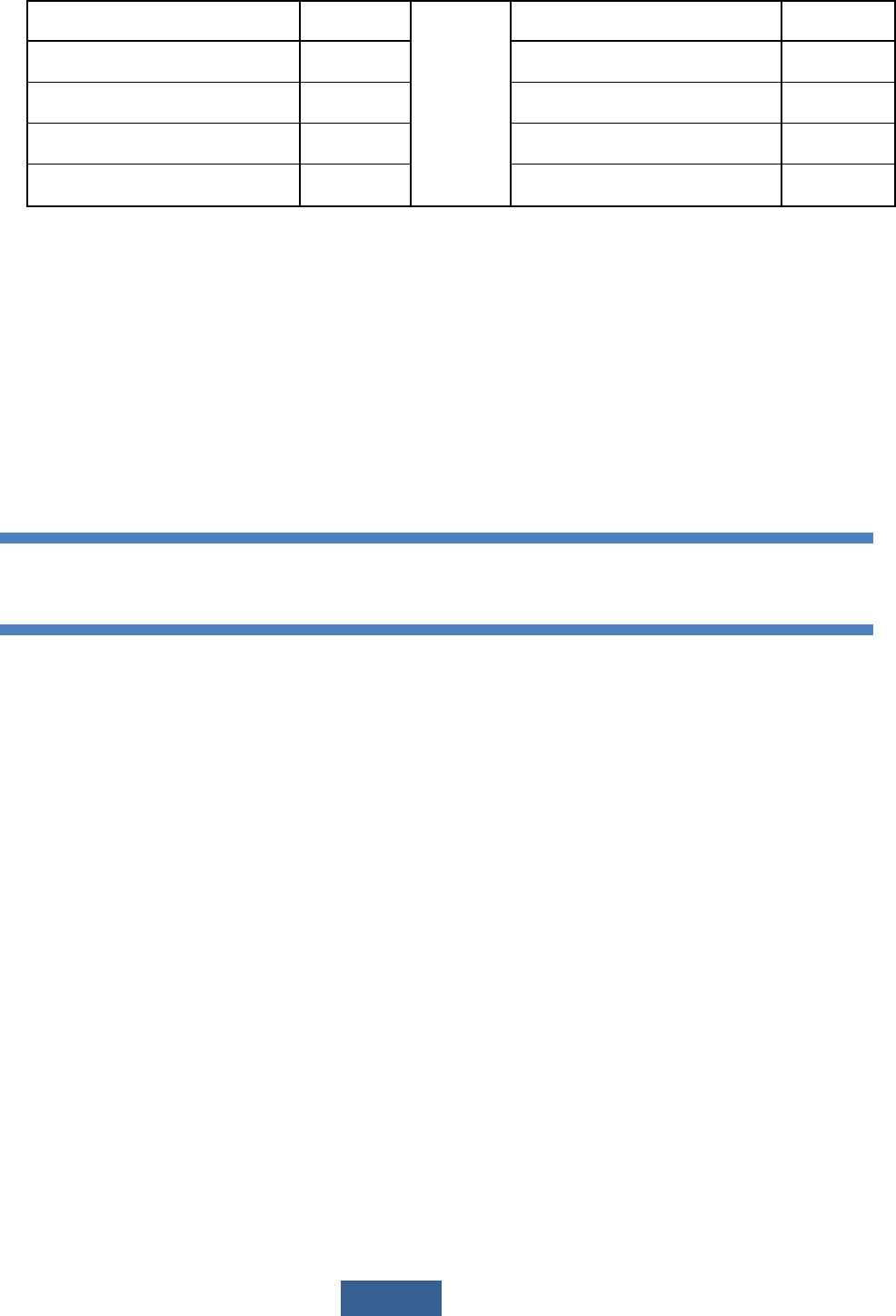

Table: 2 Sample Revenue and Expense Journal for Single-Entry Bookkeeping

No

Date

Description

Revenue

Sales/Serv

Expense

Advert

Supply

Misc

Jan 2, 2012

Sales of goods

3,000

3,000

Jan 14, 2012

Services

6,000

6,000

Jan 22, 2012

Purchase

1,000

1,000

Jan 26, 2012

Office supply

300

300

Jan 31, 2012

Bank charges

15

15

Total

9,000

9,000

1,315

300

1,000

15

Double Entry System

Earlier transactions in the books of accounts were recorded under single entry system. The

system had some shortcomings as there was not a complete record of all the

transactions. Also, problems were faced while preparing final accounts. Problems were

also faced as there was no self balancing method of accounting which could guarantee,

to some extent, the accuracy of the books of accounts. So a need was felt for some

uniformly accepted system of accounting which could help in the verification of the

accuracy of books to some extent. These problems were solved by the Double Entry

System of accounting. This system has totally replaced the single entry system. This system

is now followed everywhere. Under this system of accounting, every transaction in

business involves at least two accounts. That is why this system of accounting is called the

“Double Entry System” Under this system every transaction has two aspects i.e. debit side

and credit side. Under this system, every transaction is entered into at least two accounts

in the Ledger. In one, account, the transaction is entered on the Left hand side i.e. on

the debit side of the account and on the other account an entry for an equal amount is

made on the Right hand side of the account i.e. the credit side of the account.

24

For example, suppose Flomo paid cash salaries to his staff. The two accounts affected are

cash account and salaries account. As cash is going out of it, cash account is credited.

Salaries are expenses for the business, salaries account is debited. Again Gorpu bought

raw material for the production unit, the two accounts involved are Cash account and

Purchases account. She paid carriage to transport goods to her factory; the two

accounts involved are cash account and carriage account. She sold finished goods to

customers on credit, the two accounts involved are the customer's personal account

(debtor) and sales account. She also purchased furniture for her office on credit. The two

accounts involved are furniture account and the personal account of the seller (creditor).

Thus we can see that every transaction has two aspects in the Double entry system of

accountancy. Now which account is debited and which is to be credited depends on

the types of accounts involved and the rules of debit and credit for that type of account.

The basic principle is that for every single transaction there are two entries – one to a

“giving account” and a corresponding one to a “receiving account.” In principle it is said

that you Credit (Cr) the giving account and Debit (Dr) the receiving account.

The equation is termed the fundamental accounting equation because these

relationships are so essential to the analysis and presentation of accounting information.

The relationship between the Income Statement or Profit & Loss Account and the Balance

Sheet is that profit increases an owner’s equity and a loss reduces it. The corresponding

double entry effect is always on the ASSETS, increasing or reducing them.

A number of examples are in Activity 10 to serve as discussion on the accounting entries

and effect of each transaction on the accounting equation.

These are other examples that will help you better understand the double entry system in

bookkeeping:

Transactions on double entry system

January 1, 2012 Purchased office supplies for LD$ 1,000

January 5, 2012 Payment for advertisement in the amount of LD$ 300

January 11, 2012 Payment for goods in the amount of LD$ 6,000

January 15, 2012 Freight charges in the amount of LD$ 700

January 20, 2012 Received LD$ 3,000 for sales of goods

January 25, 2012 Received LD$ 6,000 for services rendered to customer

January 29, 2012 Bank charges for the month in the amount of LD$ 120

ASSETS = LIABILITIES + OWNER’S EQUITY

Activity

11:

Distribute Handout 6

- Exercise

25

Entries for the transactions above

January 1, 2012: Debit Office supplies for LD 1,000 and Credit cash for LD 1,000

January 5, 2012: Debit Advertisement for LD 300 and Credit cash for LD 300

January 11, 2012: Debit Goods for LD 6,000 and Credit cash for LD 6,000

January 15, 2012: Debit Freight charges for LD 700 and Credit LD 700

January 20, 2012: Debit Cash for LD 3,000 and Credit sales for LD 3,000

January 25, 2012: Debit Services for LD 6,000 and Credit Cash for LD 6,000

January 29, 2012: Debit bank charges for LD 120 and Credit cash for LD 120

Remember that to every debit there must be a corresponding credit.

The Balance Sheet

Balance Sheet- Where does the Balance Sheet come from?

1. What is a Balance Sheet?

A balance sheet is a financial report that shows the financial picture of a company at a

given time. Balance sheets are usually done monthly or quarterly depending on the

nature and size of the business. The basic principle of the balance sheet is to show what

you own, what you owe and how much you personally have invested in your business. It

gives you a idea of whether or not you can pay your creditors, how you manage your

inventory and how you manage your billing. What is the worth of your business? This is a

valuable tool to improve your business.

2. How is the Balance Sheet Structured?

There are two columns to a balance sheet. The first column lists what you own, or your

assets. This includes your cash on hand, accounts receivable and inventory. You will also

need to include prepaid and other expenses. You may also have other assets such as a

note that will be due at a later date. In the left column you would list your liabilities. These

include loans that you owe, accounts payable and taxes that you may owe. Both sides of

the sheet are totaled and the owners net worth or investment is added to the liabilities

side and then that column is added again. Both numbers on the sheet should equal each

other, hence the name balance sheet. If they don't, you know you have missed

something and should go back through your accounts again.

Table 3a: Example of a Blank Balance Sheet

ASSETS

AMOUNT

LIABILITIES & OWNER EQUITY

AMOUNT

=

Total

-

Total

-

Left Side = Assets (Property of the Company)

Right Side = Liabilities & Equity(Debt &

Capital of the Company)

26

Table 3b: Example of a Filled in Balance Sheet

Assets

AMOUNT

Liabilities & Owner Equity

AMOUNT

Cash at bank

7,000

Purchased payable

1,200

Sales on credit

3,000

=

Short term loan

3,000

Purchased Goods

5,000

Capital

10,800

Total

15,000

Total

15,000

1. Information Provided by the Balance Sheet

The information on your balance sheet can help a bank decide whether to lend your

business money or not. This is one point you would like to know exactly what's going on all

the time in your business. You have a chance to improve your company, thus making the

sheet more appealing to the bank. It can show you if the financial position of your

company can handle hiring more employees or giving the current ones a raise. And, if

you ever wanted to sell your business the buyers would like to see your balance sheets.

Once you've done the sheets for a year, you can see how your business is growing or if

the market is declining. You can see if there are areas where you want to cut back or

maybe spend more money. Just by maintaining this one financial form, you can have a

wealth of information at your fingertips.

3. Operating Assets and Liabilities

Several different operating assets are needed to carry on the operations of a business.

Several different kinds of operating liabilities are generated as a normal part of its

transaction. Certain assets have to be in place before sales and expense transactions

can be carried on. Inventory has to be purchased or manufactured before it can be

offered for sale to customers. Several expenses have to be prepaid, such as insurance

premium and office supplies.

Other operating assets and liabilities are the result of sales revenue and expense

transactions. Accounts receivable are the result of sale on credit. Accountable are the

results of buying inventory on credit and not paying expenses until sometime after they

are recorded as expenses.

Operating assets don’t earn interest income and operating liabilities don’t require interest

expense, though there are minor exceptions.

Business managers should know which specific operating assets and liabilities are needed.

They should also know that each operating asset and liability should be relative to

revenue and the expenses of the business. Managers should know how high the accounts

receivable balance should be relative to the total invoices in respect of payments that

are not made for the period, given the normal credit terms of the business and the history

of its clients regarding late payment.

Activity

12:

Distribute Handout 7&8

- Exercise

27

REVIEW QUESTIONS

At the end of this lesson ask participants the following questions to find out whether they

have understood the lesson:

• What records should be kept?

• What are three of the benefits of record keeping?

• List two advantages and disadvantages of record keeping.

• Describe the characteristics of good record keeping?

• Which entries are made in the cash book? Give examples?

• What is a balance sheet?

• How is the balance sheet structured?

28

29

Module 4: How to Calculate Business Profit and Loss

Background Information for the Facilitator

This section will help participants know what profit is and how it is calculated.

Objective (s): After the completion of this session, you will be able to:

• Differentiate business profits and personal income

• Identify the importance of separating business finances from private money

• Identify unnecessary expenses

• Calculate profit and loss statement

• Define revenue and earnings

• State and explain the various determinants of profit

Time

• 4 hours

Number of Participants

• A group preferably include 10 to 15 persons but it should definitely not exceed 25

participants. Larger groups make it very difficult for the facilitator to track the progress

of individuals.

Materials

• Flip charts, chalk or white board, markers, chalk and a cleaning rag

• Exercise books, pens, pencils, rulers, erasers, calculators for all participants

• Area suitable for writing and learning

Type of Participants

• CFDC, CFF Entrepreneurs such as retailers, wholesalers, farmers and manufacturers

• Village leaders

LESSON

Calculating Income and Expanses?

What is Income?

Income is the consumption and savings opportunity gained by an entity within a specified

time frame, which is typically expressed in monetary terms. However, for households and

individuals, "income is the sum of all the wages, salaries, profits, interest payments, rents

and other forms of earnings received in a given period of time." For firms, income

generally refers to net-profit: what remains of revenue after expenses have been

subtracted. In the field of public economics, it may refer to the accumulation of both

monetary and non-monetary consumption ability, the former being used as a proxy for

total income.

Income is money that comes into your business.

Explanation

Money into your Business = Income

30

How does Money come into your Business?

• By producing and selling goods

• By buying and selling goods

• By giving a service (like a taxi driver who provides transportation)

• By receiving gifts from friends or family members

• By getting a loan

• By inheritance

Other Income Activities

• Producing and selling palm oil

• Drying and selling fish

• Producing and selling bread

• Weeding mats

• Producing and selling cassava

• Producing and selling rice

• Receiving donations

•

What is an Expense?

Expense is money spent or cost incurred in an organization's efforts to generate revenue,

representing the cost of doing business. Expenses may be in the form of actual cash

payments (such as wages and salaries), a computed expired portion (depreciation) of an

asset, or an amount taken out of earnings (such as bad debts). Expenses are summarized

and charged in the income statement as deductions from the income before assessing

income tax. Whereas all expenses are costs, not all costs (such as those incurred in

acquisition of income generating assets) are expenses.

Expenditure is money that goes out of your business.

How does Money goes out of your Business?

• Materials or ingredients (like fish and firewood for fish smoking, fabric for Dress

making, flour for bread baking);

• Services like:

o Transport (taxi, bus)

o Market toll

o Electricity bills

o Rent payment

• Wages and salary payments

Other Expense Activities

• Purchase of materials

• Office supplies

• Payment for goods

What are Unnecessary Expenses?

Unnecessary expenses are expenses that people make out of temptation, but they are

not really necessary. People often forget about these expenses when they calculate their

business expenses, and therefore their income is less than they expected.

Money out of your Business = Expenditure

31

You are now aware from which sources you earn money and what you spend your money

on. Can you recommend some expenses that are unnecessary, or which you could

reduce?

Accept all answers. Suggest the following:

• Are you tempted to buy snacks, drinks or ice-cream when you go to the market?

• Do people think you to wear a new cloth at every ceremony?

• Do you regularly buy nail polish and other beauty products?

What is Profit?

Profit is the investment gain or reward that entrepreneurs aim to get to reflect the risk that

they take. Profit is also an important signal to other providers of funds to a business. Banks,

suppliers and other lenders are more likely to provide finance to a business that can

demonstrate that it makes a profit (or is very likely to do so in the near future) and that it

can settle debts as they become due. Profit is also an important source of income for a

business. Profits earned which are kept in the business (i.e. not distributed to the owners

via dividends or other payments) are known as Retained Profits.

Retained profits are an important source of income for any business, but especially start-

ups or small businesses. The time a product is sold for more than it cost to produce it, then

a profit is earned which can be reinvested.

Profit can be measured and calculated. So here is the formula:

PROFIT = TOTAL SALES less TOTAL COST

Table: 4: Example of a Filled in Profit or Loss Formula

Sales

Costs

Profit or Loss

LD 100,000

LD 75,000

LD 25,000 (Profit)

LD 100,000

LD 125,000

LD 25,000 (Loss)

Total Sales greater than total

costs

= Profit

Total costs greater than total

sales

=Loss

Total sales = total costs

=Break-even

Explanation

Share ideas with the participants about the symbol to be used for profit and loss in

business.

Then explain the following and draw the symbols on the chalkboard:

Profit - means that there is more money coming in than there is going out.

Loss - means that you spend more money on producing or buying your products than

money you earn by selling the goods.

Money in - Money out = Profit or Loss

32

How to Calculate Profit or Loss

a) Include the title and period. When creating a profit and loss statement, the document is

titled at the top of the page with "Profit & Loss Statement." Under the title, include the

period of time that the statement covers. A profit and loss statement normally covers

one month, one quarter or one year. This is written using words such as "For the Month

Ending January 31, 2011."

b) Record all business transactions. A profit and loss statement should not be created until

all transactions for the period have been recorded and posted into the appropriate

accounts in the company's general ledger.

Activity

13:

Read the followin

g example to the group.

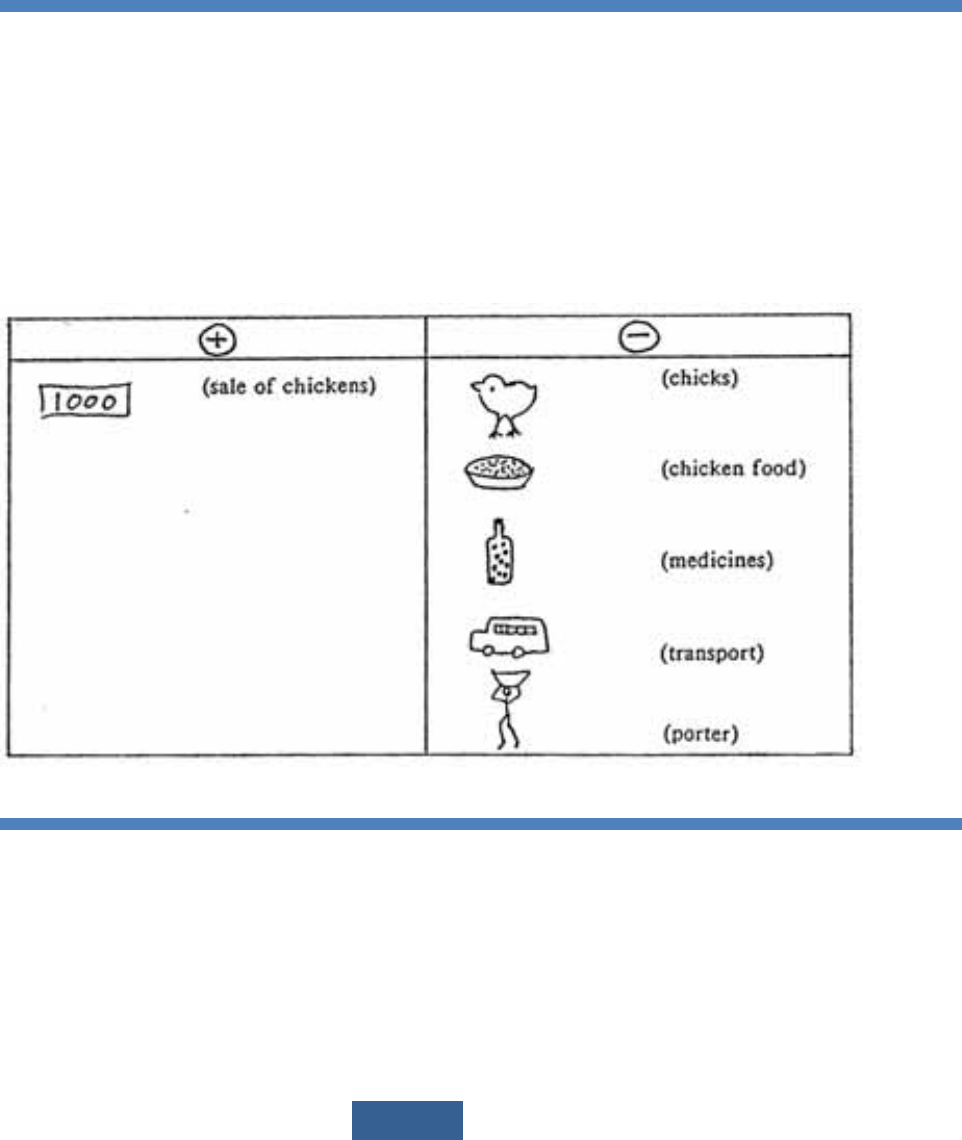

A women's group is running a poultry project. They buy chicks and feed them until they are mature. The

chicken food can easily be bought in the village. Sometimes chickens get sick and they have to buy

medicines. The chickens are so

ld on market days in town, about 15 kilometers from their village. They always

take the bus to get there. In town they pay a porter for carrying the chickens from the bus station to the

market. At the end of the day all the chickens are sold.

Draw a cash b

ook on the chalkboard. Tell the story again, item by item. Let the participants tell you which

actions bring in money and which actions need money. Ask individual participants to draw the appropriate

symbols in the correct columns on the chalkboard.

33

To find out whether you are making a profit or a loss, we will go through the process as

was discussed and as we discuss further. What is the money that goes out of your business

to produce your goods (or provide your service)?

• What materials do you buy;

• What services do you pay for;

• How much do you pay for work someone has done for you;

• How much do you need for replacements and repair of your tools and

equipment?

How much do you receive by selling the same goods (or by providing the Works or

service)?

The cash book will help you to remember how you have spent the money that has gone

out of your business and how much money has come in from your sales or services.

Have a discussion on the following question to get your participants aware of the

importance of wages:

Which of the following group members in the poultry project should be paid for their

work?

• • The members who feed the chickens and clean the chicken house?

• • The members who sell the chickens in town?

• • The members who are part of the group but do not do any work in the

project?

All members that do work on the project should be paid for their work.

If people are helping you in your business they will have to be paid a salary. If household

members are assisting you, you may choose not to pay them, but you will have to pay for

their food and clothing. You also have to think about the amount of money you will be

able to withdraw from your business money as your own 'salary' (or pay), so that you do

not mix up your personal and business expenses. In a group business, you will have to

decide how you will share the benefits between the group-members.

Act

ivity 14:

Brainstorm with the participants on the following questions, or choose other examples of businesses that are

more familiar to your participants:

What is the income and the expenditure concerned with operating a Cook shop?

What is the income and t

he expenditure involved in buying and selling Palm wine?

Go through the following process:

• What materials do you buy?

•

What services do you pay for?

•

To whom do you pay wages?

•

Do you need money for replacements and repair?

For both examples draw a c

ash book on the chalkboard and draw the symbols in the correct columns.

Activity

15:

Distribute Handout 9, 10, 11, 12 and Activity 16 & 17

34

REVIEW QUESTIONS

At the end of this lesson ask participants the following questions to find out whether they

have understood the lesson:

• What is income?

• What is an expense?

• What is profit?

• How to calculate profit and loss?

Why do you have to keep your business finances separate from the money for your

household?

How does money come into your business (income)?

How do you spend the money that goes out of your business (expenditure)?

What are unnecessary expenses?

35

Module 5: Managing Business Cash and Accounts

Background Information for the Facilitator

This cash and accounts management unit, is the most important and vital element in

doing a business. It determines the failure and success of a business.

Objective (s): After the completion of this session, you will be able to:

• State the importance of managing accounts

• Explain the efficiency and effectiveness of managing cash

• Demonstrate how to make entries in the cash flow statement and state the

importance

• Define credit/ loan

• State the importance of selling and buying on credit

• State the advantages and disadvantages of selling and buying on credit

Time

• • 4 hours

Number of Participants

• A group preferably include 10 to 15 persons but it should definitely not exceed 25

participants. Larger groups make it very difficult for the facilitator to track the

progress of individuals.

Materials

• Flip charts, chalk or white board, markers, chalk and a cleaning rag

• Exercise books, pens, pencils, rulers, erasers, calculators for all participants

• Area suitable for writing and learning

Type of Participants

• CFDC, CFF, Entrepreneurs such as retailers, wholesalers, farmers and

manufacturers

•

Village leaders

LESSON

Managing Accounts

The managing of any account of a business is important for the survival of that business

finances. The proper management of the cash flow as it relates to receipts and payment

from the company account will help to improve the business financial management

system. Also the management of the books in terms of cash and bank accounts; bank

reconciliation will serve as a guide for proper financial management.

Managing Cash

Cash is the lifeblood of your business. Managed well, your company remains strong.

Managed poorly, your business goes into cardiac arrest. If you haven't considered cash

management an important issue, then you're probably undermining your business's short-

term stability and its long-term survival. But how can you manage business cash better?

Start with understanding how good cash-management practices can affect your

company's growth and survival of your business. To practice a more elaborate form of

36

cash management, you must be able to accurately assess your current cash position and

get fairly reliable predictions at key intervals about how much you'll need to meet the

company's expenses.

Cash Flow Statement

What is Cash Flow?

In financial accounting, a cash flow statement, also known as statement of cash flows or

funds flow statement, is a financial statement that shows how changes in balance sheet

accounts and income affect cash and cash equivalents, and breaks the analysis down to

operating, investing, and financing activities. Essentially, the cash flow statement is

concerned with the flow of cash in and cash out of the business. The statement captures

both the current operating results and the accompanying changes in the balance sheet.

As an analytical tool, the statement of cash flows is useful in determining the short-term

viability of a company, particularly its ability to pay bills.

People and groups interested in cash flow statements include:

• Accounting personnel, who want to know whether the organization will be able

to cover payroll and other actual expenses

• Potential lenders or creditors, who want a clear picture of a company's ability to

repay

• Potential investors, who want to evaluate whether the company is financially

sound

• Potential employees or contractors, who want to know whether the company will

be able to provide compensation

• Shareholders of the business.

The cash flow statement was formerly known as the Flow of Cash Statement. The cash flow

statement reflects a firm's liquidity.

The balance sheet is a snapshot of a firm's financial resources and obligations at a single

point in time, and the income statement summarizes a firm's financial transactions over an

interval of time. These two financial statements reflect the accrual basis accounting used

by firms to match revenues with the expenses associated with generating those revenues.

The cash flow statement includes only inflows and outflows of cash and cash equivalents;

it excludes transactions that do not directly affect cash receipts and payments. These

non-cash transactions include depreciation or write-offs on bad debts or credit losses to

name a few. The cash flow statement is a cash basis report on three types of financial

activities: operating activities, investing activities, and financing activities. Non-cash

activities are usually reported in footnotes.

The cash flow statement is intended to:

• Provide information on a firm's liquidity and solvency and its ability to change

cash flows in future circumstances

• Provide additional information for evaluating changes in assets, liabilities and

equity

• Improve the comparability of different firms' operating performance by

eliminating the effects of different accounting methods

• Indicate the amount, timing and likelihood of future cash flows

The cash flow statement has been adopted as a standard financial statement because it

eliminates allocations, which might be derived from different accounting methods, such

as various timeframes for depreciating fixed assets.

37

Importance of Cash Flows

In the most general sense, cash flow for a business is simply the flow of cash through the

organization over time. Cash flows are needed for the firm to survive and thrive. Cash is

paid out in return for the inputs that are used in the manufacturing process (materials,