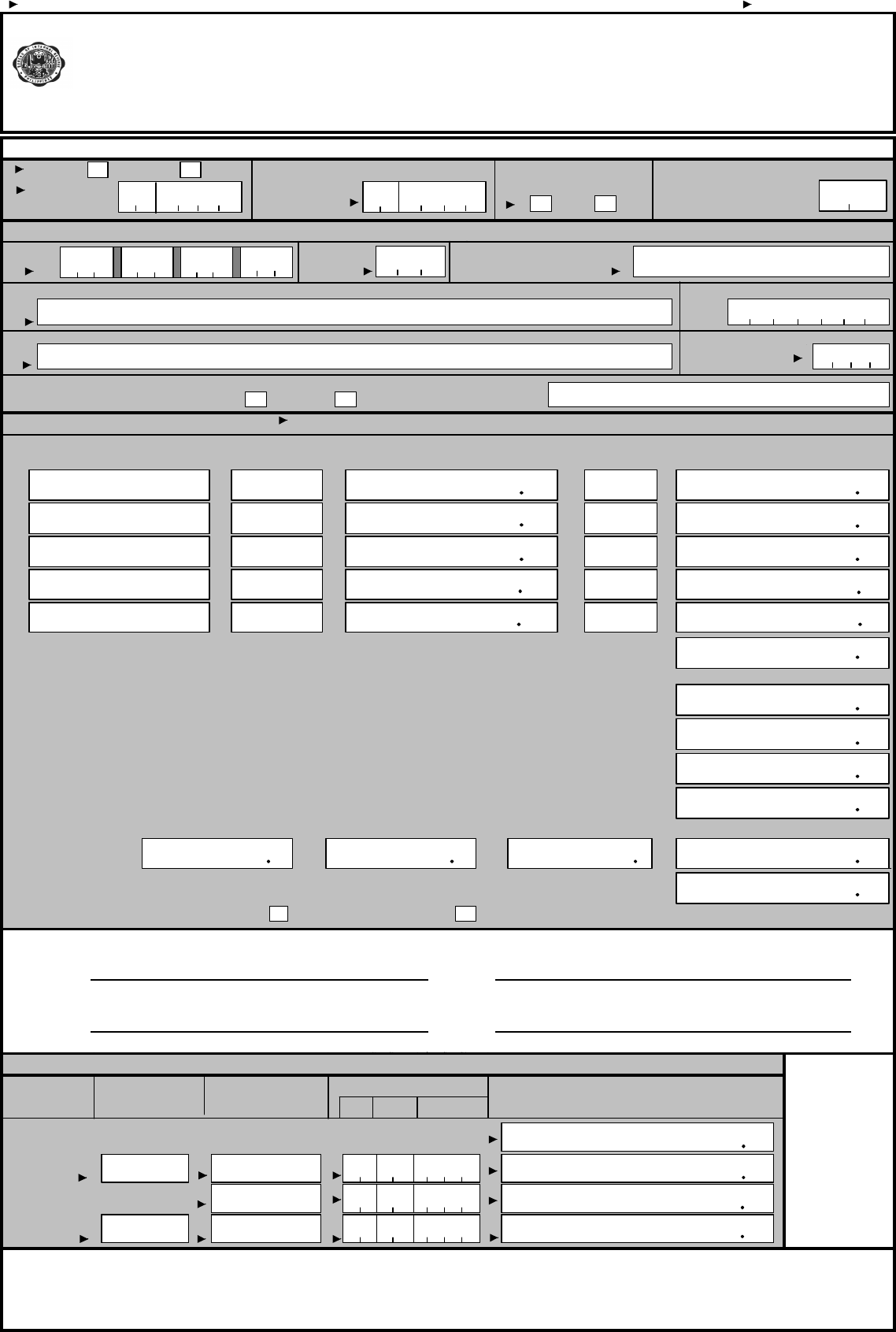

2551M PT 041 Bir46

User Manual: PT-041

Open the PDF directly: View PDF ![]() .

.

Page Count: 2

(To be filled up by the BIR)

DLN: PSIC:

Fill in all applicable spaces. Mark all appropriate boxes with an “X”.

1 For the Calendar Fiscal 3For the month 4 Amended Return 5Number of sheets attached

2 Year ended

Part I B a c k g r o u n d I n f o r m a t i o n

6TIN 7 RDO Code 8Line of Business/

Occupation

9

Taxpayer's Name (For Individual)Last Name, First Name, Middle Name/(For Non-individual) Registered Name

10

Telephone Number

11

Registered Address

12

Zip Code

13

Are you availing of tax relief under Special Law

or International Tax Treaty? Yes No If yes, specify

Part II C o m p u t a t i o n o f T a x

Taxable Transaction/

A T C

Taxable Amount

Tax Rate

Tax Due

Industry Classification

14A

14B

14C

14D

14E

15A

15B

15C

15D

15E

16A

16B

16C

16D

16E

17A

17B

17C

17D

17E

18A

18B

18C

18D

18E

19 Total Tax Due 19

20

Less: Tax Credits/Payments

20A Creditable Percentage Tax Withheld Per BIR Form No. 2307 (See Schedule 1) 20A

20B Tax Paid in Return Previously Filed, if this is an Amended Return 20B

21 Total Tax Credits/Payments (Sum of Items 20A & 20B) 21

22 Tax Payable (Overpayment) (Item 19 less Item 21) 22

23

Add: Penalties

Surcharge

Interest

Compromise

23A

23B

23C

23D

24 Total Amount Payable/(Overpayment) (Sum of Items 22 and 23D) 24

If overpayment, mark one box only: To be Refunded To be issued a Tax Credit Certificate

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

25 26

Part III Details of Payment Stamp of

Drawee Bank/ Date Receiving Office

Particulars Agency Number MM DD YYYY Amount and Date of

27 Cash/Bank 27 Receipt

Debit Memo

28 Check 28A 28B 28C 28D

29 Tax Debit 29A 29B 29C

Memo

30 Others 30A 30B 30C 30D

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

jbd

Signature over Printed Name of Taxpayer/

Taxpayer Authorized Representative

TIN of Tax Agent (if applicable)

Title/Position of Signatory

Tax Agent Accreditation No. (if applicable)

2551M

April 2002 (ENCS)

Monthly Percentage

Tax Return

BIR Form No.

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Yes

No

(MM/YYYY)(MM/YYYY)

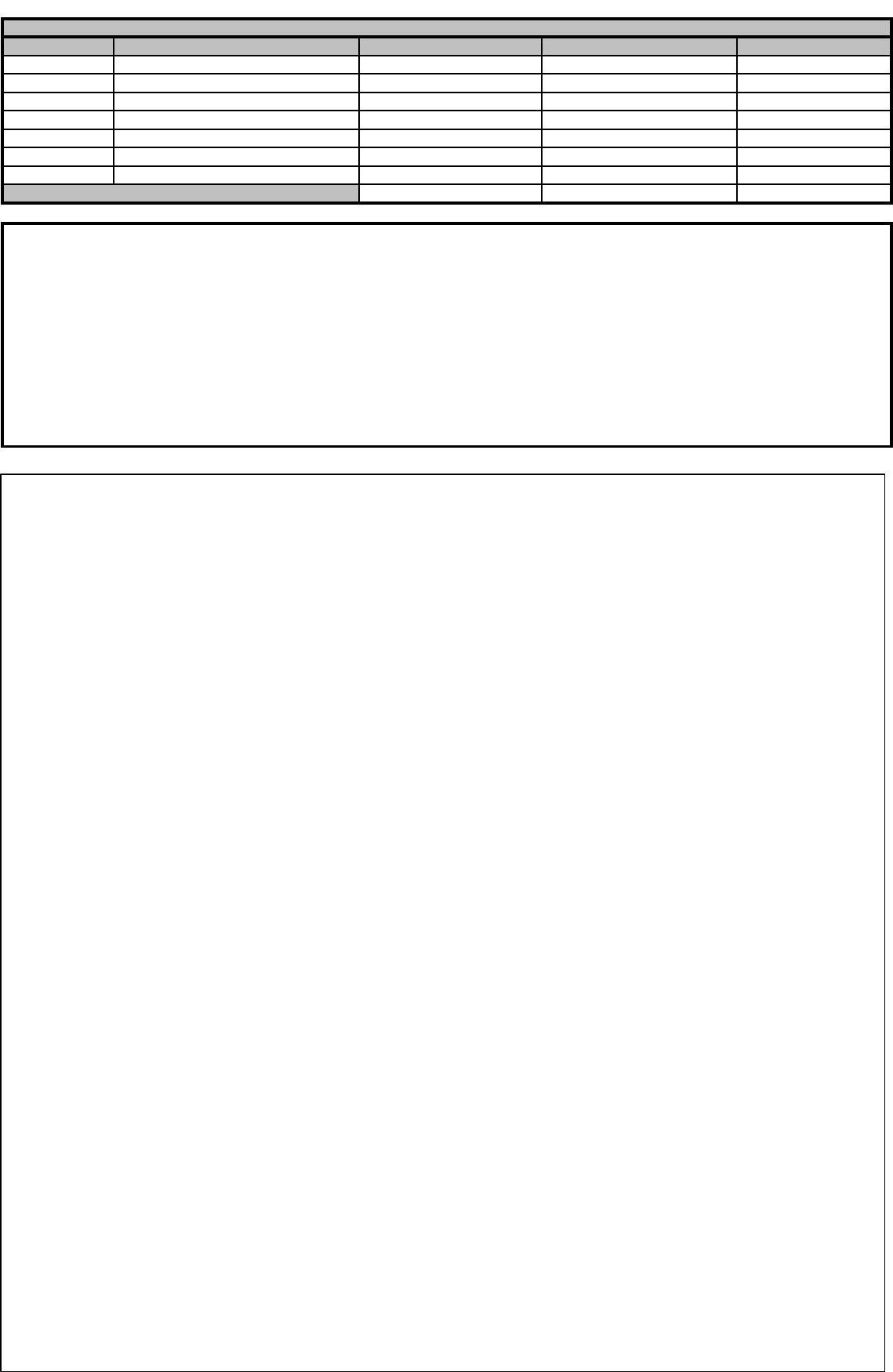

BIR FORM 2551M (ENCS)-PAGE 2

Schedule 1

Total (To Item 20A)

ALPHANUMERIC TAX CODE (ATC)

ATC Percentage Tax On: Tax Rate ATC Percentage Tax On: Tax Rate

PT

010

Persons exempt from VAT under Sec. 109z (Sec. 116)

3%

Tax on finance companies

PT

040

Domestic carriers and keepers of garages

3%

PT 111

1)

On interest, discounts and other items of gross income paid to

PT

041

International Carriers

3%

finance companies and other financial intermediaries not

PT

060

Franchises on electric utilities, gas and water utility

2%

performing quasi-banking functions

5%

PT

070

Franchises on radio/TV broadcasting companies whose

PT 112

2)

On interest, commissions and discounts paid from their loan

annual gross receipts do not exceed P 10 M

3%

transactions from finance companies as well as financial leasing

Tax on banks and non-bank financial intermediaries

based on the remaining maturities of the instruments

5%,3%, 1%,0%

PT 101

1)

On interest, commissions and discounts paid to banks

PT 120

Life Insurance premium

5%

and non-bank financial intermediaries arising out of

Agents of Foreign Insurance Companies

lending activities as well as financial leasing, on the

PT 130

a) Insurance Agents

10%

basis of the remaining maturities of the instrument

5%,3%,1%,0%

PT 131

b) Insurance Agents

5%

PT 102

2)

On dividends

0%

PT 132

c) Owners of property obtaining insurance directly

PT 103

3)

On royalties, rentals of property, real or personal, profits

with foreign insurance companies

5%

from exchange and all other gross income

5%

PT

210

On services rendered by stock, real estate, commercial, customs

and immigration brokers

7%

BIR Form No. 2551M Percentage Tax Return

Guidelines and Instructions

Tax Withheld Claimed as Tax Credit

Applied

Period Covered Name of Withholding Agent Income Payments Tax Withheld

Who Shall File

This return shall be filed in triplicate by the following:

I. Persons whose gross annual sales and/or receipts do not exceed

P550,000 and who are not VAT -registered persons.

2. Domestic carriers and keepers of garages, except owners of bancas and

owners of animal-drawn two wheeled vehicle.

3. Operators of international air and shipping carriers doing business in

the

Philippines.

4. Franchise grantees of electric, gas or water utilities.

5. Franchise grantees of radio and/or television broadcasting companies

whose gross annual receipts of the preceding year do not exceed Ten

Million Pesos (P10,000,000.00) and did not opt to register as VAT

taxpayers.

6. Banks, non-bank financial intermediaries and finance companies.

7. Life insurance companies.

8. Agents of foreign insurance companies.

9. Stock, real estate, commercial, customs and immigration brokers.

Provided that cooperatives shall be exempt from the three percent

(3%) gross receipts tax.

When and Where to File

The return shall be filed not later than the 20th day following the end of

each month, provided, however, that with respect to taxpayers enrolled with

the Electronic Filing and Payment System (EFPS), the deadline for e-filing

and e-paying the tax due thereon shall be five (5) days later than the deadline

set above.

Any person retiring from a business subject to percentage taxes shall notify

the nearest Revenue District Office, file his return and pay the tax due

thereon within twenty (20) days after closing his business.

The return shall be filed with any Authorized Agent Bank (AAB) within

the territorial jurisdiction of the Revenue District Office where the taxpayer is

required to register/conducting business. In places where there are no AABs,

the return shall be filed with the Revenue Collection Officer or duly

Authorized City or Municipal Treasurer within the Revenue District Office

where the taxpayer is required to register/conducting business.

A taxpayer may, at his option, file a separate return for the head office

and for each branch or place of business or a consolidated return for the head

office and all the branches except in the case of large taxpayers where only

one consolidated return is required.

When and Where to Pay

Upon filing this return, the total amount payable shall be paid to the

Authorized Agent Bank (AAB) where the return is filed. In places where

there are no AABs, payment shall be made directly to the Revenue Collection

Officer or duly Authorized City or Municipal Treasurer who shall issue a

Revenue Official Receipt (SIR Form No.2524) therefore.

Where the return is filed with an AAB, the lower portion of the return

must be properly machine-validated and stamped by the Authorized Agent

Bank to

serve as the receipt of payment. The machine validation shall reflect the date

of payment, amount paid and transaction code, and the stamped mark shall

show the name of the bank, branch code, teller's code and teller's initial. The

AAB shall also issue an official receipt or bank debit advice or credit

document, whichever is applicable, as additional proof of payment.

Basis of Tax

The tax is based on gross receipts except on insurance companies where the

basis of tax is the total premium collected.

"Gross receipts" means all amounts received by the prime or principal

contractor, undiminished by any amount paid to any subcontractor under a

subcontract arrangement.

Penalties

There shall be imposed and collected as part of the tax:

I. A surcharge of twenty five percent (25%) for each of the following

violations:

a. Failure to file any return and pay the amount of tax or installment

due on or before the due date;

b. Unless otherwise authorized by the Commissioner, filing a return

with a person or office other than those with whom it is required to be

filed;

c. Failure to pay the full or part of the amount of tax shown on the

return, or the full amount of tax due for which no return is required

to be filed on or before the due date;

d. Failure to pay the deficiency tax within the time prescribed for its

payment in the notice of assessment.

2. A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in

case any payment has been made on the basis of such return before the

discovery of the falsity or fraud, for each of the following violations:

a. Willful neglect to file the return within the period prescribed by the

Code or by rules and regulations; or

b. In case a false or fraudulent return is willfully made.

3. Interest at the rate of twenty percent (20%) per annum, or such higher

rate as may be prescribed by rules and regulations, on any unpaid amount of

tax from the date prescribed for the payment until the amount is fully

paid.

4. Compromise penalty.

Attachments Required

I. Certificate of Creditable Tax Withheld at Source, if applicable;

2. Duly approved Tax Debit Memo, if applicable;

3. Copy of Certificate of Registration issued by Cooperative Development

Authority for cooperatives and from the National Electrification

Administration for electric cooperatives;

4. For amended return, proof of the payment and the return previously filed.

Note: All background Information must be properly filled up.

•

All returns filed by an accredited tax representative on behalf of a

taxpayer

shall bear the following information:

A. For CPAs and others (individual practitioners and members

ofGPPs);

a.1 Taxpayer Identification Number (TIN); and

a.2 Certificate of Accreditation Number, Date of Issuance,

and Date of Expiry .

B. For members of the Philippine Bar (individual

practitioners. members ofGPPs):

b.1 Taxpayer Identification Number (TIN); and

b.2 Attorney's Roll Number or Accreditation Number, if

any.

•

Nos. 1, 2 and 3 of this form refer to transaction period and not the

date of filing this return.

•

.The last 3 digits of the 12-digit TIN refers to the branch code.

•

TIN = Taxpayer Identification Number ENCS