Form Char410 R Open To Public 410

User Manual: 410-R

Open the PDF directly: View PDF ![]() .

.

Page Count: 3

Page 1 of 3 Form CHAR410-R (2010)

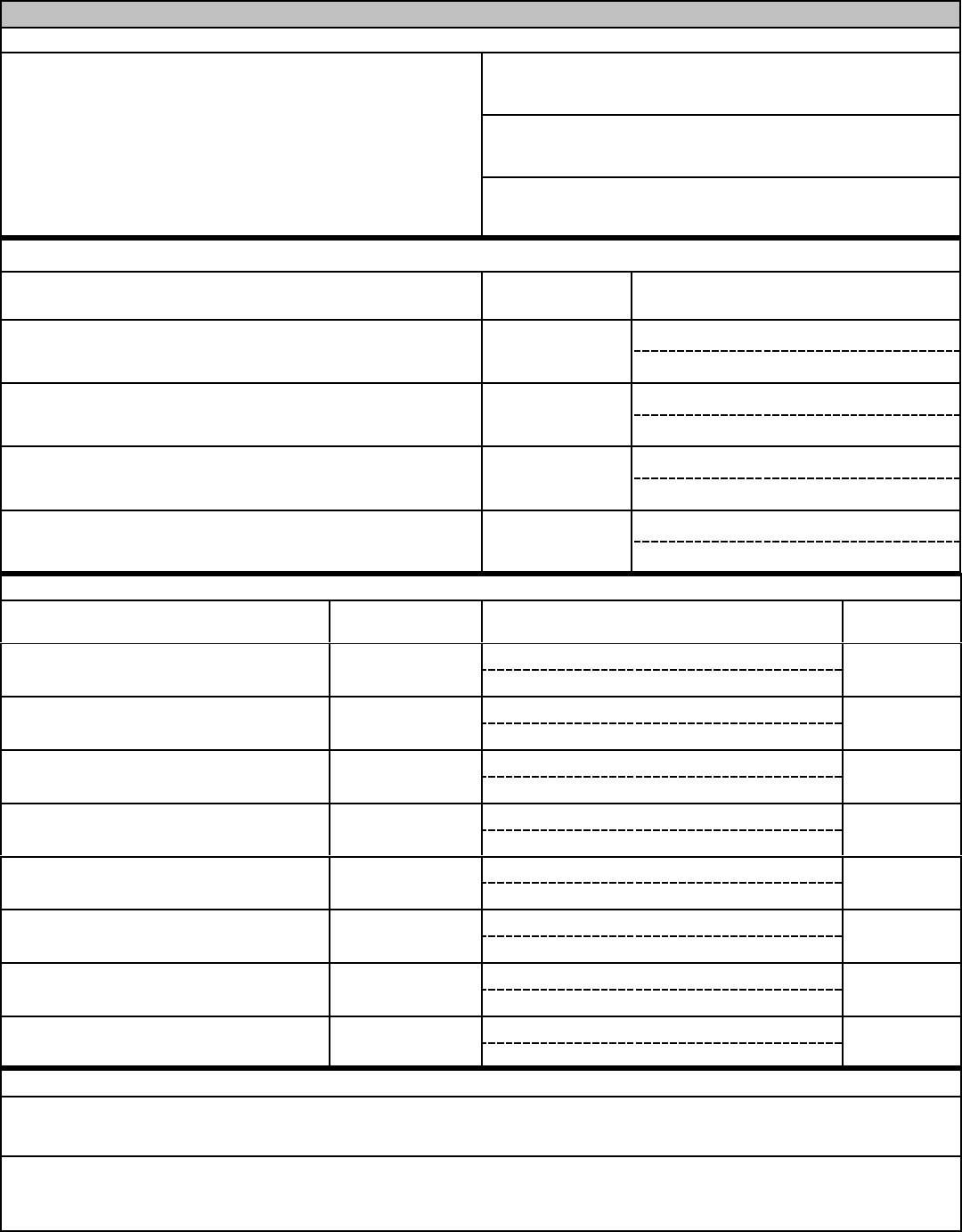

Form CHAR410-R Re-Registration Statement for Charitable Organizations

New York State Department of Law (Office of the Attorney General)

Charities Bureau - Registration Section

120 Broadway

New York, NY 10271

www.charitiesnys.com/

Open to Public

Inspection

For re-registering Article 7-A and

dual registrants whose Article 7-A

registration has been cancelled

(Unregistered use CHAR410,

Amending use CHAR410-A)

Part A - Identification of Registrant

1. Full name of organization (exactly as it appears in your organizing document) 5. Identification numbers

a. Fed. employer ID no. (EIN)

__ __ - __ __ __ __ __ __ __

b. NY State registration no.

__ __ - __ __ - __ __

2. c/o Name (if applicable) 6. Organization’s website

3. Mailing address (Number and street) Room/suite 7. Primary contact

City or town, state or country and ZIP+4 Title

4. Principal NYS address (Number and street) Room/suite Phone Fax

City or town, state or country and ZIP+4 Email

Part B - Certification - Two Signatures Required

We certify under penalties for perjury that we reviewed this Re-Registration Statement, including all schedules and attachments, and to the best of our

knowledge and belief, they are true, correct and complete in accordance with the laws of the State of New York applicable to this statement.

Signature Printed Name Title Date

Signature Printed Name Title Date

Part C - Fee Submitted

All registrants submitting this form must pay $150 re-registration fee. Submit check or money order, payable to

“NYS Department of Law.”

Part D - Attachments - All Documents Required

Attach all of the following documents to this Re-Registration Statement, even if you are claiming an exemption from registration:

• Certificate of incorporation, trust agreement or other organizing document, and any amendments; and

• Bylaws or other organizational rules, and any amendments; and

• IRS Form 1023 or 1024 Application for Recognition of Exemption (if applicable); and

• IRS tax exemption determination letter (if applicable); and

• All delinquent annual filings (annual reports or claims of annual report exemption)

Part E - Request for Registration Exemption

Is the organization requesting exemption from registration under either or both Article 7-A or the EPTL? ......................... G Yes* G No

* If “Yes”, complete and attach Schedule E.

1. President or Authorized Officer/Trustee

2. Chief Financial Officer or Treasurer

Page 2 of 3 Form CHAR410-R (2010)

Part F - Organization Structure

1. Incorporation / formation

a. Type of organization:

Corporation ........................................ G

Limited liability company (LLC) ......................... G

Partnership ........................................ G

Sole proprietorship .................................. G

Trust ............................................. G

Unincorporated association............................ G

* Other ............................................ G

* If Other, describe:

b. Type of corporation if New York not-for-profit corporation

A GB GC GD G

c. Date incorporated if a corporation or formed if other than a corporation

__ __ / __ __ / __ __ __ __

d. State in which incorporated or formed

2. List all chapters, branches and affiliates of your organization (attach additional sheets if necessary)

Name Relationship Mailing address (number and street, room/suite,

City or town, state or country and zip+4)

3. List all officers, directors, trustees and key employees

Name Title Mailing address (number and street, room/suite,

city or town, state or country and zip+4) End of term

(if applicable)

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

_ _ / _ _ / _ _ _ _

4. Other Names and Registration Numbers

a. List all other names used by your organization, including any prior names

b. List all prior New York State charities registration numbers for the organization, including those from the New York State Attorney General’s

Charities Bureau or the New York State Department of State’s Office of Charities Registration

Page 3 of 3 Form CHAR410-R (2010)

Part G - Organization Activities

1. Month the annual accounting period ends (01-12) 2. NTEE code

3. Date organization began doing each of following in New York State:

a. conducting activity ............................................................................ __ __ / __ __ / __ __ __ __

b. maintaining assets............................................................................ __ __ / __ __ / __ __ __ __

c. soliciting contributions (including from residents, foundations, corporations, government agencies, etc.) ......... __ __ / __ __ / __ __ __ __

4. Describe the purposes of your organization

5. Has your organization or any of your officers, directors, trustees or key employees been:

a. enjoined or otherwise prohibited by a government agency or court from soliciting contributions? ......................... G Yes* G No

* If “Yes”, describe:

b. found to have engaged in unlawful practices in connection with the solicitation or administration of charitable assets? ........ G Yes* G No

* If “Yes”, describe:

6. Has your organization’s registration or license been suspended by any government agency? .............................. G Yes* G No

* If “Yes”, describe:

7. Does your organization solicit or intend to solicit contributions (including from residents, foundations, corporations, government

agencies, etc.) in New York State? ............................................................................ G Yes* G No

* If “Yes”, describe the purposes for which contributions are or will be solicited:

8. List all fund raising professionals (FRP) that your organization has engaged for fund raising activity in NY State (attach additional sheets if

necessary)

Name Type of FRP

(see instructions for definitions)

Mailing address (number and street, room/suite,

city or town, state or country and zip+4) Dates of contract

PFR ................ G

FRC ................ G

CCV ................ G

Start date: _ _ / _ _ / _ _ _ _

End date: _ _ / _ _ / _ _ _ _

PFR ................ G

FRC ................ G

CCV ................ G

Start date: _ _ / _ _ / _ _ _ _

End date: _ _ / _ _ / _ _ _ _

PFR ................ G

FRC ................ G

CCV ................ G

Start date: _ _ / _ _ / _ _ _ _

End date: _ _ / _ _ / _ _ _ _

Part H - Federal Tax Exempt Status

1. If applicable, list the date your organization:

a. applied for tax exempt status.................................................................... __ __ / __ __ / __ __ __ __

b. was granted tax exempt status .................................................................. __ __ / __ __ / __ __ __ __

c. was denied tax exempt status ................................................................... __ __ / __ __ / __ __ __ __

d. had its tax exempt status revoked ................................................................ __ __ / __ __ / __ __ __ __

2. Provide Internal Revenue Code provision: 501(c)( ___ )