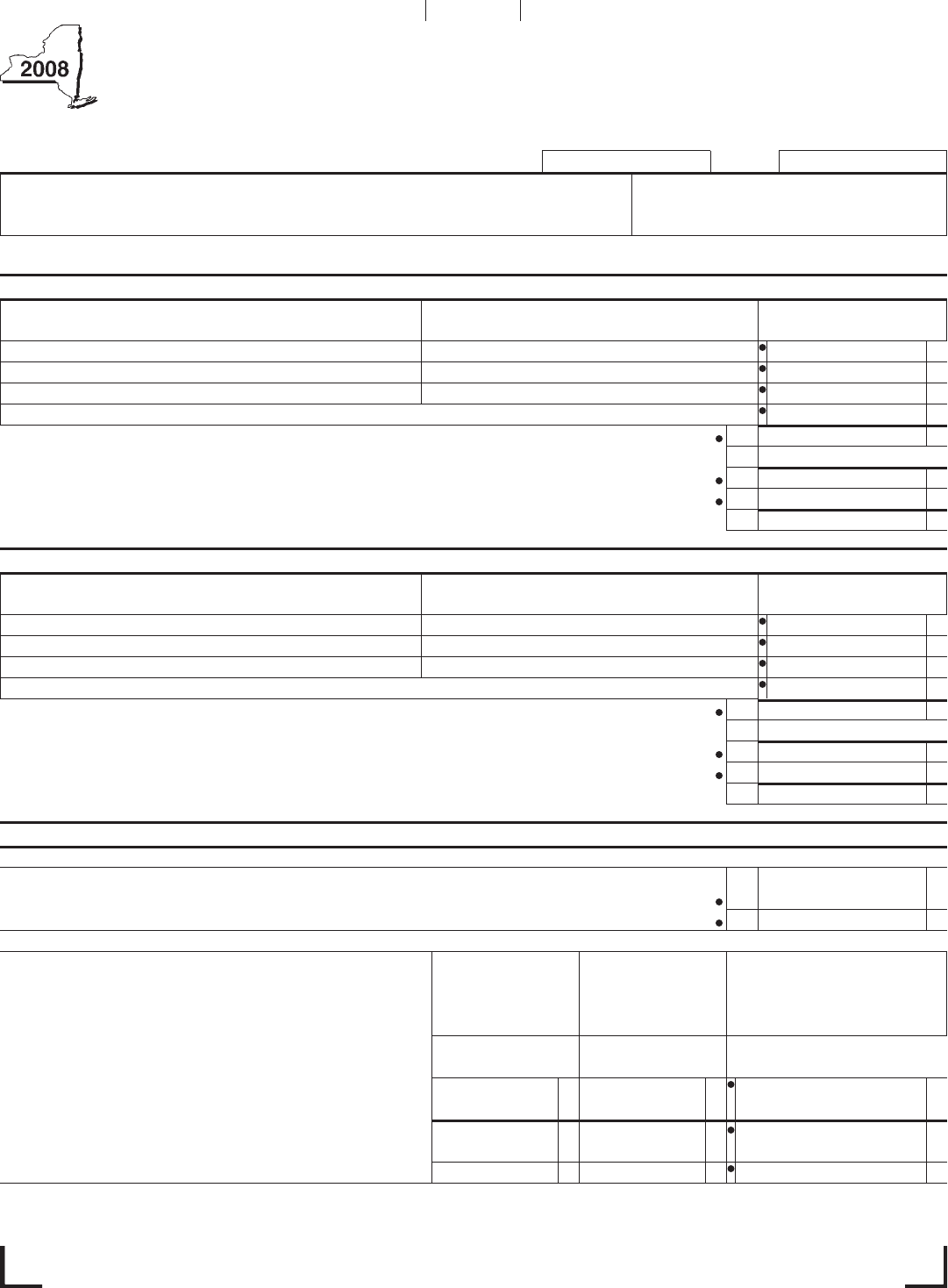

Form CT 602 CT602 2008

User Manual: CT602

Open the PDF directly: View PDF ![]() .

.

Page Count: 2

46201080094

All filers must enter tax period:

CT-602 New York State Department of Taxation and Finance

Claim for EZ Capital Tax Credit

Tax Law — Articles 9-A, 32, and 33

Attach a copy of Empire State Development Corporation

Form Z10, Eligibility to Apply for a Zone Capital Tax Credit.

Name Employer identification number (EIN)

(as shown on the front page of your tax return)

File with corporation franchise tax return Form CT-3, CT-3-A, CT-3-S, CT-32, CT-32-A, CT-32-S, CT-33, CT-33-A, or

CT-33-NL. See Form CT-602-I, Instructions for Form CT-602.

Schedule A — Investments in certified EZ businesses (see instructions)

A B C

Name of certified EZ business Location of zone Amount of investment

Total from additional sheet(s) attached .............................................................................................................

1 Total qualified investments in EZ businesses (add column c amounts) ................................................ 1.

2 Credit rate 25% ................................................................................................................................... 2. .25

3a EZ capital tax credit (multiply line 1 by line 2) ....................................................................................... 3a.

3b Credit from partnership(s) from investments in EZ businesses (see instructions) ............................... 3b.

4 Total credit from investments (add lines 3a and 3b; S corporations: see instructions) .................................. 4.

Schedule B — Monetary contributions to EZ community development projects (see instructions)

A B C

Name of community development project Location of zone

Amount of monetary contributions

Total from additional sheet(s) attached .............................................................................................................

5 Total amount of contributions to EZ community development projects (add column c amounts) .......... 5.

6 Credit rate 25% ................................................................................................................................... 6. .25

7a EZ capital tax credit (multiply line 5 by line 6) ....................................................................................... 7a.

7b

Credit from partnership(s) from contributions to EZ community development projects

(see instructions)

. 7b.

8 Total credit from monetary contributions (add lines 7a and 7b; S corporations: see instructions) ................ 8.

beginning ending

Staple forms here

Schedule C — Limitations of EZ capital tax credit

(New York S corporations do not complete Schedule C)

Part 1 – Fifty percent limitation

9

Tax from Form CT-3, line 78; Form CT-3-A, line 77; Form CT-32, line 5; Form CT-32-A, line 5; Form CT-33,

lesser of line 9a or line 10; Form CT-33-A, lesser of line 10 or line 14; or Form CT-33-NL, line 5

.......... 9.

10 Enter 50% (.5) of line 9 ..................................................................................................................... 10.

Part 2 – Lifetime limitation

11 Limitations per sections 210.20(a),

1456(d)(1), and 1511(h)(1) ........................................... 100,000 100,000 200,000

12 EZ capital tax credit previously allowed, less

any previous recapture (see instructions) .......................

13 EZ capital tax credit still allowable (subtract

line 12 from line 11; see instructions) ..................................

14 EZ capital tax credit allowable this year (see instructions)

A

Investment in

EZ

business

B

Monetary contributions

to community development

projects

C

Total

(column A + column B)

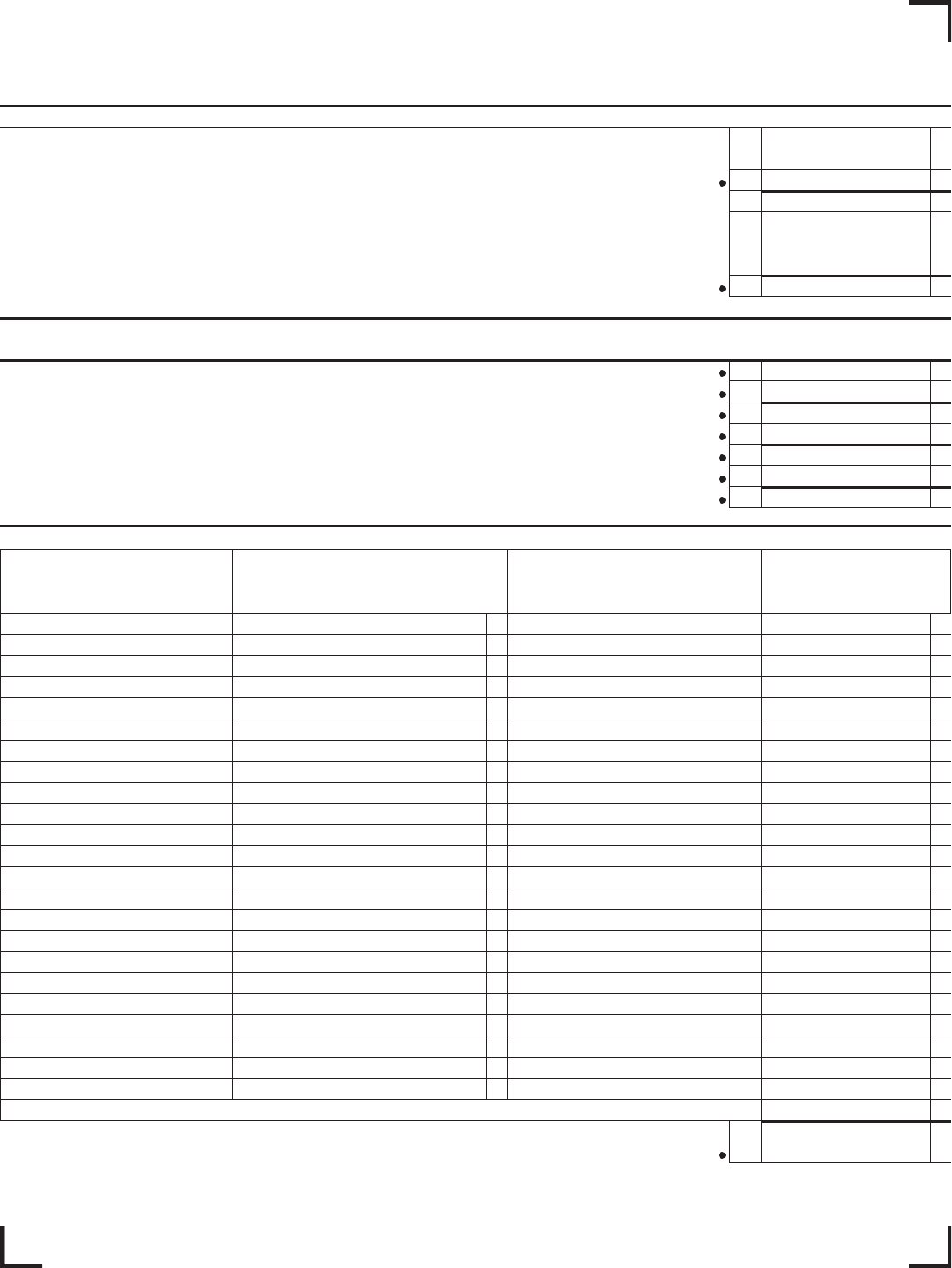

46202080094

Page 2 of 2 CT-602 (2008)

Part 3 – Tax on minimum taxable income/fixed dollar minimum limitation

15 Tax from Form CT-3, line 78; Form CT-3-A, line 77; Form CT-32, line 5; Form CT-32-A, line 5;

Form CT-33, line 9a; Form CT-33-A, line 10; or Form CT-33-NL, line 5 ........................................... 15.

16 Credits claimed before the EZ capital tax credit (see instructions) ...................................................... 16.

17 Balance of tax (subtract line 16 from line 15) ........................................................................................... 17.

18

Tax on minimum taxable income or fixed dollar minimum (Form CT-3, line 81; Form CT-3-A, line 80;

Form CT-32, line 4; Form CT-32-A, line 4; Form CT-33, line 4; Form CT-33-A, line 4; or

Form CT-33-NL, line 4)

..................................................................................................................... 18.

19 Credit limitation (subtract line 18 from line 17) ....................................................................................... 19.

Schedule D – Computation of EZ capital tax credit and carryover (New York S corporations do not

complete Schedule D)

20 EZ capital tax credit allowable this year (from line 14, column C) ......................................................... 20.

21 Unused EZ capital tax credit from previous periods beginning on or after January 1, 1994 ............. 21.

22 Total (add lines 20 and 21) ................................................................................................................... 22.

23 EZ capital tax credit recapture from line 27 ...................................................................................... 23.

24 Net EZ capital tax credit available this year (see instructions) ............................................................. 24.

25 EZ capital tax credit used this year (see instructions) .......................................................................... 25.

26 EZ capital tax credit available for carryforward (see instructions) ........................................................ 26.

Schedule E – Recapture of EZ capital tax credit

A B C D

Tax period EZ capital tax Amount of EZ capital tax Recapture percent Recaptured credit

credit originally allowed credit originally allowed (see instructions)

(column B × column C)

27 Total recaptured EZ capital tax credit (add column D amounts; enter here and on line 23;

New York S corporations and corporate partners, see instructions) .......................................................... 27.

Column D total from additional sheets(s) attached ...........................................................................................