No Job Name Fource 21100 Efta

User Manual: Fource 21100

Open the PDF directly: View PDF ![]() .

.

Page Count: 72

Regulation E

Electronic Fund Transfer Act

The Electronic Fund Transfer Act (EFTA) (15 U.S.C.

1693 et seq.) of 1978 is intended to protect

individual consumers engaging in electronic fund

transfers (EFTs) and remittance transfers. These

services include

• transfers through automated teller machines

(ATMs);

• point-of-sale (POS) terminals;

• automated clearinghouse (ACH) systems;

• telephone bill-payment plans in which periodic or

recurring transfers are contemplated;

• remote banking programs; and

• remittance transfers.

The EFTA is implemented through Regulation E,

which includes official interpretations.

In 2009, the Federal Reserve Board (Board)

amended Regulation E to prohibit institutions from

charging overdraft fees for ATM and one-time debit

card transactions, unless the consumer opts in or

affirmatively consents to the institution’s overdraft

services (74 Fed. Reg. 59033 (Nov. 17, 2009) and

75 Fed. Reg. 31665 (June 4, 2010)). The Board

also amended Regulation E to restrict fees and

expiration dates on gift cards and to require that

gift card terms be stated clearly (75 Fed. Reg.

16580 (April 1, 2010)).

1

The Dodd−Frank Wall Street Reform and Con-

sumer Protection Act (Dodd−Frank Act) transferred

rulemaking authority under the EFTA from the

Board of Governors of the Federal Reserve System

to the Consumer Financial Protection Bureau

(CFPB).

2

,

3

The Dodd−Frank Act also amended the

EFTA and created a new system of consumer

protections for remittance transfers sent by con-

sumers in the United States to individuals and

businesses in foreign countries. In December

2011, the CFPB restated the Board’s implementing

Regulation E at 12 CFR Part 1005 (76 Fed. Reg.

81020) (December 27, 2011). In February 2012, the

CFPB added subpart B (Requirements for Remit-

tance Transfers) to Regulation E to implement the

new remittance protections set forth in the Dodd−

Frank Act (77 Fed. Reg. 6194) (February 7, 2012),

effective on February 7, 2013.

4

In July 2012, the

CFPB amended the February 2012 rule to effect

certain technical corrections primarily related to

formatting of the model forms in the rule. In August

2012, the CFPB again amended the February 2012

rule to modify the definition of ‘‘remittance transfer

provider.’’ The August amendment also revised

several aspects of the rule regarding remittance

transfers that are scheduled before the date of

transfer, including preauthorized remittance trans-

fers (77 Fed. Reg. 50244) (August 20, 2012). In

January 2013, the rule’s February 21, 2013,

effective date was delayed pending finalization of a

proposal to address three specific issues in the

rule. In May 2013, the CFPB finalized the proposal,

which modified the disclosure requirements for

certain fees and foreign taxes, revised some

aspects of the error resolution requirements, and

established a new effective date of October 28,

2013 (78 Fed. Reg. 30661) (May 22, 2013).

Information in this narrative is provided for

subpart A and subpart B in the order listed below.

Note that the order, particularly as it relates to

subpart A, does not strictly follow the order of the

regulatory text. For ease of use by the examiner,

however, the examination procedures and check-

list follow the order of the regulation.

Subpart A

I. Scope and Key Definitions (12 CFR 1005.2,

1005.3, 1005.17, 1005.20)

II. Disclosures (12 CFR 1005.4, 1005.7, 1005.8,

1005.16, 1005.17, 1005.20)

III. Electronic Transaction Overdraft Service Opt

In (12 CFR 1005.17)

IV. Issuance of Access Devices (12 CFR 1005.5,

1005.18)

V. Consumer Liability and Error Resolution (12

CFR 1005.6, 1005.11)

VI. Receipts and Periodic Statements (12 CFR

1005.9, 1005.18)

VII. Gift Cards (12 CFR 1005.20)

1. The Board also implemented a legislative extension of time

for complying with the gift card disclosure requirements until

January 31, 2011. 75 Fed. Reg. 50683 (August 17, 2010).

2. Dodd−Frank Act §§1002(12)(C), 1024(b)-(c), and 1025(b)-

(c); 12 U.S.C. §§5481(12)(C), 5514(b)-(c), and 5515(b)-(c).

Section 1029 of the Dodd−Frank Act generally excludes from this

transfer of authority, subject to certain exceptions, any rulemaking

authority over a motor vehicle dealer that is predominantly

engaged in the sale and servicing of motor vehicles, the leasing

and servicing of motor vehicles, or both. The transfer of authority

also did not include section 920 of EFTA, which concerns debit

card interchange fees charged to merchants. Section 920 of EFTA

is implemented by Board regulations at 12 CFR Part 235. Section

920 is not addressed here or in the accompanying examination

procedures and checklist.

3. The agency responsible for supervising and enforcing

compliance with Regulation E will depend on the person subject

to the EFTA (e.g., for financial institutions, jurisdiction will depend

on the size and charter of the institution).

4. The amendment designated 12 CFR 1005.1 through 1005.20

as subpart A.

Consumer Compliance Handbook Reg. E • 1 (11/13)

VIII. Other Requirements (12 CFR 1005.10,

1005.14, 1005.15)

IX. Relation to Other Laws (12 CFR 1005.12)

Subpart B

Requirements for remittance transfers

X. Remittance Transfer Definitions (12 CFR

1005.30)

XI. Disclosures (12 CFR 1005.31)

XII. Estimates (12 CFR 1005.32)

XIII. Procedures for Resolving Errors (12 CFR

1005.33)

XIV. Procedures for Cancellation and Refund of

Remittance Transfers (12 CFR 1005.34)

XV. Acts of Agents (12 CFR 1005.35)

XVI. Transfers Scheduled Before the Date of

Transfer (12 CFR 1005.36)

Sections Applicable to Both

Subpart A and Subpart B

XVII. Preemption

XVIII. Administrative Enforcement and Record Re-

tention (12 CFR 1005.13)

XIX. Miscellaneous (EFTA provisions not reflected

in Regulation E)

SUBPART A

I. Scope

Key Definitions—12 CFR 1005.2

Access device is a card, code, or other means of

access to a consumer’s account or a combination

of these used by the consumer to initiate EFTs.

Access devices include debit cards, personal

identification numbers (PINs), telephone transfer

and telephone bill payment codes, and other

means to initiate an EFT to or from a consumer

account (12 CFR 1005.2(a)(1) and 12 CFR Part

1005, Supp. I, Comment 2(a)-1).

Access devices do not include either of the

following:

• magnetic tape or other devices used internally by

a financial institution to initiate electronic trans-

fers

• a check or draft used to capture the MICR

(Magnetic Ink Character Recognition) encoding

or routing, account, and serial numbers to initiate

a one-time ACH debit (Comments 2(a)-1 and

2(a)-2)

Accepted access device is an access device

that a consumer

• requests and receives, signs, or uses (or autho-

rizes another to use) to transfer money between

accounts or to obtain money, property, or

services

• requests to be validated even if it was issued on

an unsolicited basis

• receives as a renewal or substitute for an

accepted access device from either the financial

institution that initially issued the device or a

successor (12 CFR 1005.2(a)(2))

Account includes the following:

• checking, savings, or other consumer asset

accounts held by a financial institution (directly or

indirectly), including certain club accounts, es-

tablished primarily for personal, family, or house-

hold purposes

•payroll card account, established through an

employer (directly or indirectly), to which EFTs of

the consumer’s wages, salary, or other employee

compensation (such as commissions), are made

on a recurring basis. The payroll card account

can be operated or managed by the employer, a

third-party processor, a depository institution, or

any other person. All transactions involving the

transfer of funds to or from a payroll card account

are covered by the regulation (12 CFR 1005.2

(b)(2) and Comment 2(b)-2).

An account does not include:

• an account held by a financial institution under a

bona fide trust agreement

• an occasional or incidental credit balance in a

credit plan

• profit-sharing and pension accounts established

under a bona fide trust agreement

• escrow accounts such as for payments of real

estate taxes, insurance premiums, or completion

of repairs

• accounts for purchasing U.S. savings bonds (12

CFR 1005.2(b)(3) and Comment 2(b)-3)

Apayroll card account does not include a card

used

• solely to disburse incentive-based payments

(other than commissions when they represent the

primary means through which a consumer is

paid) that are unlikely to be a consumer’s primary

source of salary or other compensation;

• solely to make disbursements unrelated to com-

pensation, such as petty cash reimbursements or

travel per diem payments; or

• in isolated instances to which an employer

typically does not make recurring payments

Electronic Fund Transfer Act

2 (11/13) • Reg. E Consumer Compliance Handbook

(Comment 2(b)-2).

Activity means any action that results in an

increase or decrease of the funds underlying a

certificate or card, other than the imposition of a

fee, or an adjustment due to an error or a reversal

of a prior transaction (12 CFR 1005.20(a)(7)).

ATM operator is any person that operates an

ATM at which a consumer initiates an EFT or a

balance inquiry and that does not hold the account

to or from which the transfer is made or about which

the inquiry is made (12 CFR 1005.16(a)).

Dormancy fee and inactivity fee mean a fee for

non-use of or inactivity on a gift certificate, store gift

card, or general-use prepaid card (12 CFR 1005.20

(a)(5)).

Electronic check conversion (ECK) transactions

are transactions where a check, draft, or similar

paper instrument is used as a source of information

to initiate a one-time electronic fund transfer from a

consumer’s account. The consumer must authorize

the transfer (12 CFR 1005.3(b)(2))

Electronic fund transfer (EFT) is a transfer of

funds initiated through an electronic terminal,

telephone, computer (including online banking) or

magnetic tape for the purpose of ordering, instruct-

ing, or authorizing a financial institution to debit or

credit a consumer’s account. EFTs include, but are

not limited to, point-of-sale (POS) transfers; auto-

mated teller machine (ATM) transfers; direct depos-

its or withdrawals of funds; transfers initiated by

telephone; and transfers resulting from debit card

transactions, whether or not initiated through an

electronic terminal (12 CFR 1005.3(b)).

Electronic terminal is an electronic device, other

than a telephone call by a consumer, through

which a consumer may initiate an EFT. The term

includes, but is not limited to, point-of-sale termi-

nals, automated teller machines, and cash-

dispensing machines (12 CFR 1005.2(h)).

Exclusions from gift card definition. The following

cards, codes, or other devices are excluded and

not subject to the substantive restrictions on

imposing dormancy, inactivity, or service fees, or

on expiration dates if they are (12 CFR 1005.20(b))

• usable solely for telephone services;

• reloadable and not marketed or labeled as a gift

card or gift certificate. For purposes of this

exception, the term ‘‘reloadable’’ includes a

temporary non-reloadable card issued solely in

connection with a reloadable card, code, or other

device;

• a loyalty, award, or promotional gift card (except

that these must disclose on the card or device

itself, information such as the date the funds

expire, fee information and a toll-free number) (12

CFR 1005.20(a)(4) and (c)(4));

• not marketed to the general public;

• issued in paper form only; or

• redeemable solely for admission to events or

venues at a particular location or group of

affiliated locations, or to obtain goods or services

in conjunction with admission to such events or

venues, at the event or venue or at specific

locations affiliated with and in geographic prox-

imity to the event or venue.

General-use prepaid card is a card, code, or

other device

• issued on a prepaid basis primarily for personal,

family, or household purposes to a consumer in a

specified amount, whether or not that amount

may be increased or reloaded, in exchange for

payment; and

• that is redeemable upon presentation at multiple,

unaffiliated merchants for goods or services, or

that may be usable at automated teller machines

(12 CFR 1005.20(a)(3)). See ‘‘Exclusions from gift

card definition.’’

Gift certificate is a card, code, or other device

issued on a prepaid basis primarily for personal,

family, or household purposes to a consumer in a

specified amount that may not be increased or

reloaded in exchange for payment and redeem-

able upon presentation at a single merchant or an

affiliated group of merchants for goods or services

(12 CFR 1005.20(a)(1)). See ‘‘Exclusions from gift

card definition.’’

Loyalty, award, or promotional gift card is a card,

code, or other device (1) issued on a prepaid basis

primarily for personal, family, or household pur-

poses to a consumer in connection with a loyalty,

award, or promotional program; (2) that is redeem-

able upon presentation at one or more merchants

for goods or services, or usable at automated teller

machines; and (3) that sets forth certain disclo-

sures, including a statement indicating that the

card, code, or other device is issued for loyalty,

award, or promotional purposes (12 CFR 1005.20

(a)(4)). See ‘‘Exclusions from gift card definition.’’

Overdraft services. A financial institution pro-

vides an overdraft service if it assesses a fee or

charge for paying a transaction (including a check

or other item) when the consumer has insufficient or

unavailable funds in the account to pay the

transaction. However, an overdraft service does

not include payments made from the following:

• a line of credit subject to Regulation Z, such as a

credit card account, a home equity line of credit,

or an overdraft line of credit;

• funds transferred from another account held

individually or jointly by the consumer; or

Electronic Fund Transfer Act

Consumer Compliance Handbook Reg. E • 3 (11/13)

• a line of credit or other transaction from a

securities or commodities account held by a

broker–dealer registered with the Securities and

Exchange Commission (SEC) or the Commodity

Futures Trading Commission (CFTC). (12 CFR

1005.17(a)).

Preauthorized electronic fund transfer is an EFT

authorized in advance to recur at substantially

regular intervals (12 CFR 1005.2(k)).

Service fee means a periodic fee for holding or

use of a gift certificate, store gift card, or general-

use prepaid card. A periodic fee includes any fee

that may be imposed on a gift certificate, store gift

card, or general-use prepaid card from time to time

for holding or using the certificate or card (12 CFR

1005.20(a)(6)). For example, a service fee may

include a monthly maintenance fee, a transaction

fee, an ATM fee, a reload fee, a foreign currency

transaction fee, or a balance inquiry fee, whether or

not the fee is waived for a certain period of time or

is only imposed after a certain period of time.

However, a service fee does not include a one-time

fee or a fee that is unlikely to be imposed more than

once while the underlying funds are still valid, such

as an initial issuance fee, a cash-out fee, a

supplemental card fee, or a lost or stolen certificate

or card replacement fee (Comment 20(a)(6)-1).

State means any state, territory, or possession of

the United States; the District of Columbia; the

Commonwealth of Puerto Rico; or any of their

political subdivisions (12 CFR 1005.2(l)).

Store gift card is a card, code, or other device

issued on a prepaid basis primarily for personal,

family, or household purposes to a consumer in a

specified amount, whether or not that amount may

be increased or reloaded, in exchange for pay-

ment, and redeemable upon presentation at a

single merchant or an affiliated group of merchants

for goods or services (12 CFR 1005.20(a)(2)). See

‘‘Exclusions from gift card definition.’’

Unauthorized electronic fund transfer is an EFT

from a consumer’s account initiated by a person

other than the consumer without authority to initiate

the transfer and from which the consumer receives

no benefit. This does not include an EFT initiated in

any of the following ways:

• by a person who was furnished the access

device to the consumer’s account by the con-

sumer, unless the consumer has notified the

financial institution that transfers by that person

are no longer authorized;

• with fraudulent intent by the consumer or any

person acting in concert with the consumer; or

• by the financial institution or its employee (12

CFR 1005.2(m)).

Coverage—12 CFR 1005.3

Subpart A of Regulation E applies to any electronic

fund transfer (EFT) that authorizes a financial

institution to debit or credit a consumer’s account.

The requirements of subpart A of Regulation E

apply only to accounts for which there is an

agreement for EFT services to or from the account

between (i) the consumer and the financial institu-

tion or (ii) the consumer and a third party, when the

account-holding financial institution has received

notice of the agreement and the fund transfers

have begun (Comment 3(a)-1).

Regulation E applies to all persons, including

offices of foreign financial institutions in the United

States, that offer EFT services to residents of any

state, and it covers any account located in the

United States through which EFTs are offered to a

resident of a state, no matter where a particular

transfer occurs or where the financial institution is

chartered (Comment 3(a)-3). Regulation E does not

apply to a foreign branch of a U.S. financial

institution unless the EFT services are offered in

connection with an account in a state, as defined in

12 CFR 1005.2(l) (Comment 3(a)-3).

Exclusions from Coverage

12 CFR 1005.3(c) describes transfers that are not

EFTs and are therefore not covered by the EFTA

and Regulation E:

• transfers of funds originated by check, draft, or

similar paper instrument;

• check guarantee or authorization services that do

not directly result in a debit or credit to a

consumer’s account;

• any transfer of funds for a consumer within a

system that is used primarily to transfer funds

between financial institutions or businesses, e.g.,

Fedwire or other similar network;

• any transfer of funds that has as its primary

purpose the purchase or sale of securities or

commodities regulated by the SEC or the CFTC,

purchased or sold through a broker−dealer

regulated by the SEC or through a futures

commission merchant regulated by the CFTC, or

held in book-entry form by a Federal Reserve

Bank or federal agency;

• intra-institutional automatic transfers under an

agreement between a consumer and a financial

institution;

• transfers initiated by telephone between a con-

sumer and a financial institution provided the

transfer is not a function of a written plan

contemplating periodic or recurring transfers. A

written statement available to the public, such as

Electronic Fund Transfer Act

4 (11/13) • Reg. E Consumer Compliance Handbook

a brochure, that describes a service allowing a

consumer to initiate transfers by telephone con-

stitutes a written plan; or

• preauthorized transfers to or from accounts at

financial institutions with assets of less than $100

million on the preceding December 31. Such

preauthorized transfers, however, remain subject

to the compulsory use prohibition under Section

913 of the EFTA and 12 CFR 1005.10(e), as well

as the civil and criminal liability provisions of

Sections 915 and 916 of the EFTA. A small

financial institution that provides EFT services

besides preauthorized transfers must comply

with the requirements of subpart A for those other

services (Comment 3(c)(7)-1). For example, a

small financial institution that offers ATM services

must comply with subpart A in regard to the

issuance of debit cards, terminal receipts, peri-

odic statements, and other requirements.

Electronic Check Conversion (ECK) and

Collection of Returned-Item Fees

Subpart A covers electronic check conversion

(ECK) transactions. In an ECK transaction, a

consumer provides a check to a payee and

information from the check is used to initiate a

one-time EFT from the consumer’s account. Al-

though transfers originated by checks are not

covered by subpart A, an ECK is treated as an EFT

and not a payment originated by check. Payees

must obtain the consumer’s authorization for each

ECK transaction. A consumer authorizes a one-

time EFT for an ECK transaction when the con-

sumer receives notice that the transaction will or

may be processed as an EFT and goes forward

with the underlying transaction

5

(12 CFR 1005.3(b)

(2)(i) and (ii) and Comment 3(b)(2)-3).

If a payee re-presents electronically a check

that has been returned unpaid, the transaction is

not an EFT, and subpart A does not apply

because the transaction originated by check

(Comment 3(c)(1)-1).

However, subpart A applies to a fee collected

electronically from a consumer’s account for a

check or EFT returned unpaid. A consumer autho-

rizes a one-time EFT from the consumer’s account

to pay the fee for the returned item or transfer if the

person collecting the fee provides notice to the

consumer stating the amount of the fee and that the

person may electronically collect the fee, and the

consumer goes forward with the underlying trans-

action

6

(12 CFR 1005.3(b)(3)). These authorization

requirements do not apply to fees imposed by the

account-holding financial institution for returning

the check or EFT or paying the amount of an

overdraft (Comment 3(b)(3)-1).

II. Disclosures

Disclosures Generally—12 CFR 1005.4

Required disclosures must be clear and readily

understandable, in writing, and in a form the

consumer may keep. The required disclosures may

be provided to the consumer in electronic form, if

the consumer affirmatively consents after receiving

a notice that complies with the E-Sign Act (12 CFR

1005.4(a)(1)).

Disclosures may be made in a language other

than English, if the disclosures are made available

in English upon the consumer’s request (12 CFR

1005.4(a)(2)).

A financial institution has the option of disclosing

additional information and combining disclosures

required by other laws (for example, Truth in

Lending disclosures) with Regulation E disclosures

(12 CFR 1005.4(b)).

A financial institution may combine required

disclosures into a single statement if a consumer

holds two or more accounts at the financial

institution. Thus, a single periodic statement or

error resolution notice is sufficient for multiple

accounts. In addition, it is only necessary for a

financial institution to provide one set of disclosures

for a joint account (12 CFR 1005.4(c)(l) and (2)).

Two or more financial institutions that jointly

provide EFT services may contract among them-

selves to meet the requirements that the regulation

imposes on any or all of them. When making initial

disclosures (see 12 CFR 1005.7) and disclosures

of a change in terms or an error resolution notice

(see 12 CFR 1005.8), a financial institution in a

shared system only needs to make disclosures that

are within its knowledge and apply to its relation-

ship with the consumer for whom it holds an

account (12 CFR 1005.4(d)).

Initial Disclosure of Terms and

Conditions—12 CFR 1005.7

Financial institutions must provide initial disclo-

sures of the terms and conditions of EFT services

before the first EFT is made or at the time the

consumer contracts for an EFT service. They must

give a summary of various consumer rights under

the regulation, including the consumer’s liability for

unauthorized EFTs, the types of EFTs the consumer

5. For POS transactions, the notice must be posted in a

prominent and conspicuous location and a copy of the notice

must be provided to the consumer at the time of the transaction

(12 CFR 1005.3(b)(2)(i) and (ii) and Comment 3(b)(2)-3).

6. For POS transactions, the notice must be posted in a

prominent and conspicuous location and a copy of the notice

must either be provided to the consumer at the time of the

transaction or mailed to the consumer’s address as soon as

reasonably practicable after the person initiates the EFT to collect

the fee (12 CFR 1005.3(b)(3)).

Electronic Fund Transfer Act

Consumer Compliance Handbook Reg. E • 5 (11/13)

may make, limits on the frequency or dollar amount,

fees charged by the financial institution, and the

error-resolution procedures. Appendix A to Part

1005 provides model clauses that financial institu-

tions may use to provide the disclosures.

Timing of disclosures. Financial institutions must

make the required disclosures at the time a

consumer contracts for an electronic fund transfer

service or before the first electronic fund transfer is

made involving the consumer’s account (12 CFR

1005.7(a)).

Disclosures given by a financial institution earlier

than the regulation requires (for example, when the

consumer opens a checking account) need not be

repeated when the consumer later authorizes an

electronic check conversion or agrees with a third

party to initiate preauthorized transfers to or from

the consumer’s account, unless the terms and

conditions differ from the previously disclosed

term. This interpretation also applies to any notice

provided about one-time EFTs from a consumer’s

account initiated using information from the con-

sumer’s check. On the other hand, if an agreement

for EFT services to be provided by an account-

holding financial institution is directly between the

consumer and the account-holding financial insti-

tution, disclosures must be given in close proximity

to the event requiring disclosure, for example,

when the consumer contracts for a new service

(Comment 7(a)-1).

Where a consumer authorizes a third party to

debit or credit the consumer’s account, an account-

holding financial institution that has not received

advance notice of the transfer or transfers must

provide the required disclosures as soon as

reasonably possible after the first debit or credit is

made, unless the financial institution has previously

given the disclosures (Comment 7(a)-2).

If a consumer opens a new account permitting

EFTs at a financial institution, and the consumer

has already received subpart A disclosures for

another account at that financial institution, the

financial institution need only disclose terms and

conditions that differ from those previously given

(Comment 7(a)-3).

If a financial institution joins an interchange or

shared network system (which provides access to

terminals operated by other financial institutions),

disclosures are required for additional EFT services

not previously available to consumers if the terms

and conditions differ from those previously dis-

closed (Comment 7(a)-4).

A financial institution may provide disclosures

covering all EFT services that it offers, even if some

consumers have not arranged to use all services

(Comment 7(a)-5).

Addition of EFT services. A financial institution

must make disclosures for any new EFT service

added to a consumer’s account if the terms and

conditions are different from those described in the

initial disclosures. ECK transactions may be a new

type of transfer requiring new disclosures (See

Appendix A-2 and Comment 7(c)-1).

Content of disclosures. 12 CFR 1005.7(b) re-

quires a financial institution to provide the following

disclosures as they apply:

•Liability of consumers for unauthorized electronic

fund transfers. The financial institution must

include a summary of the consumer’s liability

(under 12 CFR 1005.6, state law, or other

applicable law or agreement) for unauthorized

transfers (12 CFR 1005.7(b)(1)). A financial

institution does not need to provide the liability

disclosures if it imposes no liability. If it later

decides to impose liability, it must first provide

the disclosures (Comment 7(b)(1)-1). The finan-

cial institution can choose to include advice on

promptly reporting unauthorized transfers or the

loss or theft of the access device (Comment

7(b)(1)-3).

•Telephone number and address. A financial

institution must provide a specific telephone

number and address, on or with the disclosure

statement, for reporting a lost or stolen access

device or a possible unauthorized transfer (Com-

ment 7(b)(2)-2). Except for the telephone number

and address for reporting a lost or stolen access

device or a possible unauthorized transfer, the

disclosure may insert a reference to a telephone

number that is readily available to the consumer,

such as ‘‘Call your branch office. The number is

shown on your periodic statement’’ (Comment

7(b)(2)-2).

•Business days. The financial institution’s busi-

ness days (12 CFR 1005.7(b)(3)).

•Types of transfers; limitations on frequency or

dollar amount. Limitations on the frequency and

dollar amount of transfers generally must be

disclosed in detail (12 CFR 1005.7(b)(4)). If the

confidentiality of certain details is essential to the

security of an account or system, these details

may be withheld (but the fact that limitations exist

must still be disclosed).

7

A limitation on account

activity that restricts the consumer’s ability to

make EFTs must be disclosed even if the

restriction also applies to transfers made by

7. For example, if a financial institution limits cash ATM

withdrawals to $100 per day, the financial institution may disclose

that daily withdrawal limitations apply and need not disclose that

the limitations may not always be in force (such as during periods

when its ATMs are off-line) (Comment 7(b)(4)-1).

Electronic Fund Transfer Act

6 (11/13) • Reg. E Consumer Compliance Handbook

non-electronic means.

8

Financial institutions are

not required to list preauthorized transfers among

the types of transfers that a consumer can make

(Comment 7(b)(4)-3). Financial institutions must

disclose the fact that one-time EFTs initiated

using information from a consumer’s check are

among the types of transfers that a consumer can

make (See Appendix A-2 and Comment 7(b)(4)-

4).

•Fees. A financial institution must disclose all fees

for EFTs or for the right to make EFTs (12 CFR

1005.7(b)(5)). Other fees, for example, minimum-

balance fees, stop-payment fees, account over-

drafts, or ATM inquiry fees, may, but need not, be

disclosed under Regulation E (see Regulation

DD, 12 CFR Part 1030) and (Comment 7(b)(5)-1).

A per-item fee for EFTs must be disclosed even if

the same fee is imposed on non-electronic

transfers. If a per-item fee is imposed only under

certain conditions, such as when the transactions

in the cycle exceed a certain number, those

conditions must be disclosed. Itemization of the

various fees may be on the disclosure statement

or on an accompanying document referenced in

the statement (Comment 7(b)(5)-2).

A financial institution must disclose that net-

works used to complete the EFT as well as an

ATM operator, may charge a fee for an EFT or for

balance inquiries (12 CFR 1005.7(b)(11)).

•Documentation. A summary of the consumer’s

right to receipts and periodic statements, as

provided in 12 CFR 1005.9, and notices regard-

ing preauthorized transfers as provided in 12

CFR 1005.10(a) and 1005.10(d) (12 CFR 1005.7

(b)(6)).

•Stop payment. A summary of the consumer’s

right to stop payment of a preauthorized elec-

tronic fund transfer and the procedure for placing

a stop-payment order, as provided in 12 CFR

1005.10(c) and 12 CFR 1005.7(b)(7).

•Liability of institution. A summary of the financial

institution’s liability to the consumer under Sec-

tion 910 of the EFTA for failure to make or to stop

certain transfers (12 CFR 1005.7(b)(8)).

•Confidentiality. The circumstances under which,

in the ordinary course of business, the financial

institution may provide information concerning

the consumer’s account to third parties (12 CFR

1005.7(b)(9)). A financial institution must de-

scribe the circumstances under which any infor-

mation relating to an account to or from which

EFTs are permitted will be made available to third

parties, not just information concerning those

EFTs. Third parties include other subsidiaries of

the same holding company (Comment 7(b)(9)-1).

•Error resolution. The error-resolution notice must

be substantially similar to Model Form A-3 in

Appendix A of Part 1005. A financial institution

may use different wording so long as the

substance of the notice remains the same, may

delete inapplicable provisions (for example, the

requirement for written confirmation of an oral

notification), and may substitute substantive state

law requirements affording greater consumer

protection than Regulation E (Comment 7(b)(10)-

1). To take advantage of the longer time periods

for resolving errors under 12 CFR 1005.11(c)(3)

(for new accounts as defined in Regulation CC,

transfers initiated outside the United States, or

transfers resulting from POS debit card transac-

tions), a financial institution must have disclosed

these longer time periods. Similarly, a financial

institution relying on the exception from provi-

sional crediting in 12 CFR 1005.11(c)(2) for

accounts relating to extensions of credit by

securities brokers and dealers (Regulation T, 12

CFR Part 220) must disclose accordingly (Com-

ment 7(b)(10)-2).

•ATM fees. A notice that a fee may be imposed by

an automated teller machine operator as defined

in §1005.16(a), when the consumer initiates an

electronic fund transfer or makes a balance

inquiry, and by any network used to complete the

transaction.

Change in Terms; Error Resolution

Notice—12 CFR 1005.8

If a financial institution contemplates a change in

terms, it must mail or deliver a written or electronic

notice to the consumer at least 21 days before the

effective date of any change in a term or condition

required to be disclosed under 12 CFR 1005.7(b) if

the change would result in any of the following:

• increased fees or charges;

• increased liability for the consumer;

• fewer types of available EFTs; or

• stricter limitations on the frequency or dollar

amounts of transfers (12 CFR 1005.8(a)(1)).

If an immediate change in terms or conditions is

necessary to maintain or restore the security of an

EFT system or account, the financial institution

does not need to give prior notice. However, if the

change is to be permanent, the financial institution

must provide notice in writing of the change to the

consumer on or with the next regularly scheduled

periodic statement or within 30 days, unless

disclosures would jeopardize the security of the

8. For example, Regulation D (12 CFR 1004) restricts the

number of payments to third parties that may be made from a

money market deposit account; a financial institution that does not

execute fund transfers in excess of those limits must disclose the

restriction as a limitation on the frequency of EFTs (Comment

7(b)(4)-2).

Electronic Fund Transfer Act

Consumer Compliance Handbook Reg. E • 7 (11/13)

system or account (12 CFR 1005.8(a)(2)).

For accounts to or from which EFTs can be

made, the financial institution must mail, deliver, or

provide electronically to the consumer at least once

each calendar year, the error resolution notice in 12

CFR 1005 Appendix A—Model Form A-3, or one

substantially similar. Alternatively, the financial

institution may include an abbreviated error reso-

lution notice substantially similar to the notice set

out in Appendix A (Model Form A-3) with each

periodic statement (12 CFR 1005.8(b)).

Disclosures at Automated Teller

Machines—12 CFR 1005.16

An ATM operator that charges a fee is required to

provide notice that a fee will be imposed and

disclose the amount of the fee. The notice must be

provided either by showing it on the screen of the

automated teller machine or on paper before the

consumer is committed to paying a fee (12 CFR

1005.16(b) and (c)).

The ‘‘clear and readily understandable standard’’

under 12 CFR 1005.4(a) applies to the content of

the notice. The requirement that the notice be in a

retainable format only applies to printed notices

(not those on the ATM screen).

The fee may be imposed by the ATM operator

only if: (1) the consumer is provided the required

notice, and (2) the consumer elects to continue the

transaction or inquiry after receiving such notice

(12 CFR 1005.16(d)).

These fee disclosures are not required where a

network owner is not charging a fee directly to the

consumer (i.e., some network owners charge an

interchange fee to financial institutions whose

customers use the network) (Comment 7(b)(5)-3). If

the network practices change such that the net-

work charges the consumer directly, these fee

disclosure requirements would apply to the net-

work (12 CFR 1005.7(c)).

Overdraft Service Disclosures—12 CFR

1005.17

Disclosure requirements for overdraft services are

addressed in Section III of this document.

Gift Card Disclosures—12 CFR

1005.20(c)

Disclosures must be clear and conspicuous and

generally in a written or electronic form (except for

certain pre-purchase disclosures, which may be

given orally) that the consumer may retain. The fees

and terms and conditions of expiration that are

required to be disclosed prior to purchase may not

be changed after purchase.

A number of disclosures must be made on the

actual card. Making such disclosures in an accom-

panying terms and conditions document, on pack-

aging surrounding a certificate or card, or on a

sticker or other label affixed to the certificate or

card does not constitute a disclosure on the

certificate or card. Those disclosures include the

following:

• the existence, amount, and frequency of any

dormancy, inactivity, or service fee;

• the expiration date for the underlying funds (or

the fact that the funds do not expire);

• a toll-free telephone number and (if any) a

website that the consumer may use to obtain a

replacement certificate or card if the certificate or

card expires while underlying funds are still

available;

• a statement that the certificate or card expires,

but the underlying funds do not expire or expire

later than the certificate or card, as well as a

statement that the consumer may contact the

issuer for a replacement card;

9

and

• a toll-free telephone number and (if any) a

website that the consumer may use to obtain

information about fees.

Additional disclosure requirements regarding fees.

In addition to the disclosure requirements related to

dormancy, inactivity, or service fees, all other fees

must be disclosed as well. These disclosures must

be provided on or with the certificate or card and

disclosed prior to purchase. The certificate or card

must also disclose a toll-free telephone number

and website, if one is maintained, that a consumer

may use to obtain fee information or replacement

certificates or cards (12 CFR 1005.20(f)).

Disclosure requirements for loyalty, award, or

promotional gift cards (12 CFR 1005.20(a)(4)). To

qualify for the exclusion for loyalty, award, or

promotional gift cards, the following must be

disclosed:

• a statement indicating that the card, code, or

other device is issued for loyalty, award, or

promotional purposes, which must be included

on the front of the card, code, or other device;

• the expiration date for the underlying funds,

which must be included on the front of the card,

code, or other device;

• the amount of any fees that may be imposed in

connection with the card, code, or other device,

and the conditions under which they may be

9. This requirement does not apply to non-reloadable certifi-

cates or cards that expire seven years or more after the date of

manufacture.

Electronic Fund Transfer Act

8 (11/13) • Reg. E Consumer Compliance Handbook

imposed, which must be provided on or with the

card, code, or other device; and

• a toll-free telephone number and, if one is

maintained, a website, that a consumer may use

to obtain fee information, which must be included

on the card, code, or other device.

Amendments to Regulation E were issued on

August 11, 2010. The amendments implemented

legislation that modified the effective date of certain

disclosure and card expiration requirements in the

gift card provisions of the Credit Card Accountabil-

ity Responsibility and Disclosure Act of 2009 for

cards produced prior to April 1, 2010.

The disclosures and card expiration require-

ments are

1. disclosures required to be made prior to pur-

chase (see 12 CFR 1005.20(c)(3));

2. disclosures that must be stated on the certificate

or card regarding the fees and expiration dates

(see 12 CFR 1005.20(d)(2), (e)(1) & (e)(3)); and

3. disclosures that may be provided on or with the

certificate or card (see 12 CFR 1005.20(f)).

Gift cards must comply with all other provisions

of the gift card rule.

Issuers must make the following disclosures on

in-store signs, messages during customer service

calls, websites, and general advertising:

• the funds underlying the gift card do not expire;

• consumers have the right to receive a free

replacement card, along with the packaging and

materials that typically accompany the gift card;

and

• the issuer will charge dormancy, inactivity, or

service fees only if the fee is permitted by the gift

card rule.

The issuer was required to make the disclosures

via customer service call center and website until

January 31, 2013. See 12 CFR 1005.20(h).

III. Electronic Transaction Overdraft

Services Opt-In—12 CFR 1005.17

In recent years overdraft protection services have

been extended to cover overdrafts resulting from

non-check transactions, including ATM withdraw-

als, debit card transactions at point of sale, online

transactions, preauthorized transfers, and ACH

transactions. Generally, institutions charge a flat

fee each time an overdraft is paid, although some

institutions have a tiered fee structure and charge

higher fees based on the amount of the negative

balance at the end of the day or as the number of

overdrafts increases. Institutions commonly charge

the same amount for paying check and ACH

overdrafts as they would if they returned the item

unpaid. Some institutions also impose a fee for

each day the account remains overdrawn. For

debit card overdrafts, the[a0]dollar amount of the

fee and multiple assessments can exceed the

dollar amount of the overdrafts.

In 2005, the agencies

10

issued guidance con-

cerning the marketing, disclosure, and implemen-

tation of overdraft programs. The guidance also

covers safety and soundness considerations, and

establishes a number of best practices financial

institutions should incorporate into their overdraft

programs. The 2009 revisions to Regulation E

supersede portions of the guidance related to ATM

and one-time debit card overdraft transactions.

However, in addition to the revised Regulation E

requirements, institutions should incorporate their

agency’s overdraft guidance into their overdraft

protection programs.

12 CFR 1005.17 was added in the 2009 revision

to Regulation E.

11

It provides consumers with a

choice to opt into their institution’s overdraft

protection program and be charged a fee for

overdrafts for ATM and one-time debit card trans-

actions. It also requires disclosure of the fees and

terms associated with the institution’s overdraft

service. Before an institution may assess overdraft

fees, the consumer must opt in, or affirmatively

consent, to the overdraft service for ATM and

one-time debit card transactions, and the con-

sumer has an ongoing right to revoke consent.

Institutions may not require an opt in for ATM and

one-time debit transactions as a condition to the

payment of overdrafts for checks and other trans-

actions. The account terms, conditions and fea-

tures must be the same for consumers who opt in

and for those who do not.

Opt-in requirement for overdraft services. The

financial institution may assess a fee for paying an

ATM or one-time debit card transaction pursuant to

an overdraft service only if it has met the following

requirements:

• the financial institution has provided the con-

sumer with a written (or, if the consumer agrees,

electronic) notice, segregated from all other

information, describing the overdraft service;

• the financial institution has provided a reason-

able opportunity for the consumer to affirmatively

consent (opt in) to the overdraft service for ATM

10. The Office of the Comptroller of the Currency, the Board of

Governors of the Federal Reserve System, the Federal Deposit

Insurance Corporation, and the National Credit Union Administra-

tion, collectively issued joint guidance concerning a service

offered by insured depository institutions commonly referred to as

‘‘bounced-check protection’’ or ‘‘overdraft protection.’’ This credit

service is sometimes offered on both consumer and small

business transaction accounts as an alternative to traditional

means of covering overdrafts. Joint Guidance on Overdraft

Protection Programs (February 18, 2005).

11. 74 Fed. Reg. 59033, Nov. 17, 2009; 75 Fed. Reg. 31665,

June 4, 2010.

Electronic Fund Transfer Act

Consumer Compliance Handbook Reg. E • 9 (11/13)

and one-time debit card transactions;

• the financial institution has obtained the consum-

er’s affirmative consent (opt in) for ATM and

one-time debit card transactions; and

• the financial institution has mailed or delivered

written (or, if the consumer agrees, electronic)

confirmation of the consent, including a state-

ment informing the consumer of the right to

revoke consent. An institution complies if it

adopts reasonable procedures to ensure that it

assesses overdraft fees only for transactions

paid after mailing or delivering the confirmation to

the consumer (12 CFR 1005.17(b)(1); Comment

17(b)-7).

Fee prohibitions. As a general rule, an institution

may not charge overdraft fees for paying an ATM or

one-time debit card transaction unless the con-

sumer has opted in. The fee prohibition also

applies to an institution that has a policy and

practice of not paying an ATM or one-time debit

card overdraft when it reasonably believes at the

time of the authorization request that the consumer

does not have sufficient funds available to pay the

transaction, although the institution does not have

to comply with the notice and opt-in requirements

(Comment17(b)-1(iv)).

Lack of consent does not prohibit the financial

institution from paying ATM or one-time debit card

overdrafts. However, the financial institution may

charge a fee only if the consumer has consented to

the institution’s overdraft service for ATM and

one-time debit card transactions (Comment 17(b)-

2). Conversely, the financial institution is not

required to pay an ATM or one-time debit card

overdraft even if the consumer has consented to

pay a fee (Comment 17(b)-3).

For a consumer who has not opted in, if a fee or

charge is based on the amount of the outstanding

negative balance, an institution may not charge a

fee for a negative balance that is solely attributable

to an ATM or one-time debit card transaction.

However, an institution may assess a fee if the

negative balance is attributable in whole or in part

to a check, ACH transaction or other type of

transaction not subject to the prohibition on assess-

ing overdraft fees (Comment 17(b)-8).

For a consumer who has not opted in, the

institution may not assess daily or sustained

negative balance, overdraft, or similar fees for a

negative balance, based solely on ATM or one-time

debit card transactions. However, if the negative

balance is attributable in part to a check, ACH

transaction, or other type of transaction not subject

to the prohibition on assessing overdraft fees, the

institution may charge a daily or sustained over-

draft or similar fee, even if the consumer has not

opted in. The date the fee may be charged is

based on the date on which the check, ACH, or

other type of transaction is paid into overdraft

(Comment 17(b)-9).

Contents and format of notice. The notice

describing the overdraft service must be substan-

tially similar to Model Form A-9. The notice must

include all of the following items and may not

contain any other information not expressly speci-

fied or otherwise permitted:

• a brief description of the overdraft service and

the types of transactions for which the financial

institution may charge a fee;

• the dollar amount of any fee that may be charged

for an ATM or one-time debit card transaction,

including any daily or other overdraft fees;

12

• the maximum number of fees that may be

charged per day, or, if applicable, that there is no

limit;

• an explanation of the right to affirmatively consent

to the overdraft service, including the methods by

which the consumer may consent;

13

and

• the availability of a line of credit or a service that

transfers funds from another account to cover

overdrafts, if the financial institution offers those

alternatives

14

(12 CFR 1005.17(d)(1) through

(d)(5)).

The financial institution also may (but is not

required to) include the following information, to the

extent applicable:

• disclosure of the right to opt into, or out of, the

payment of overdrafts for other types of transac-

tions (e.g., checks, ACH transactions, or auto-

matic bill payments) and a means for the

consumer to exercise such choices;

• disclosure of the financial institution’s returned

item fee, as well as the fact that merchants may

charge additional fees; and

• disclosure of the right to revoke consent (12 CFR

1005.17(d)(6)).

Reasonable opportunity to consent. The financial

12. If the amount of the fee may vary based on the number of

times the consumer has overdrawn the account, the amount of the

overdraft, or other factors, the financial institution must disclose

the maximum fee.

13. Institutions may tailor the response portion of Model Form

A-9 to the methods offered. For example, a tear-off portion of

Model Form A-9 is not necessary if consumers may only opt in by

telephone or electronically (Comment 17(d)-3).

14. If the institution offers both a line of credit subject to

Regulation Z (12 CFR Part 1026) and a service that transfers funds

from another account of the consumer held at the institution to

cover overdrafts, the institution must state in its opt-in notice that

both alternative plans are offered. If the institution offers one, but

not the other, it must state in its opt-in notice the alternative plan

that it offers. If the institution does not offer either plan, it should

omit the reference to the alternative plans (Comment 17(d)-5). If

the financial institution offers additional alternatives for paying

overdrafts, it may (but is not required to) disclose those

alternatives (12 CFR 1005.17(d)(5)).

Electronic Fund Transfer Act

10 (11/13) • Reg. E Consumer Compliance Handbook

institution must provide a reasonable opportunity to

consent. Reasonable methods of consent include

mail, if the financial institution provides a form for

the consumer to fill out and mail; telephone, if the

financial institution provides a readily available

telephone line that the consumer may call; elec-

tronic means, if the financial institution provides a

form that can be accessed and processed at its

website, where the consumer may click on a box to

consent and click on a button to affirm consent; or

in person, if the financial institution provides a form

for the consumer to complete and present at a

branch or office (Comment 17(b)-4). The financial

institution may provide the opportunity to consent

and require the consumer to make a choice as a

step to opening an account (Comment 17(b)-5).

Affirmative consent is necessary. An important

feature of the opt in is that the consumer’s

affirmative consent is necessary before the institu-

tion may charge overdraft fees for paying an ATM

or one-time debit card transaction (12 CFR 1005.17

(b)(iii)). The consent must be separate from other

consents or acknowledgments (including a con-

sent to receive disclosures electronically). Check

boxes are allowed, but the check box and the

consumer’s signature may only apply to the

consumer’s consent to opt in. Preprinted disclo-

sures about the overdraft service provided with a

signature card or contract do not constitute affir-

mative consent (Comment 17(b)-6).

Confirmation and consumer’s right to revoke. Not

only must the consumer affirmatively consent, but

the institution must mail or deliver to the consumer

a written confirmation (or electronic, if the con-

sumer agrees) that the consumer has consented,

along with a statement informing the consumer of

the right to revoke the consent at any time (12 CFR

1005.17(b)(iv) and Comment 17(b)-7). An institu-

tion complies with the confirmation requirement if it

has adopted reasonable procedures to ensure that

overdraft fees are assessed only on transactions

paid after the confirmation is mailed or delivered to

the consumer (Comment 17(b)-7)).

Assessing fees. For consumers who have not

opted in, institutions are prohibited from charging

overdraft fees for paying those transactions. This

prohibition applies to daily or sustained overdraft,

negative balance, or similar fees. However, the rule

does not prohibit an institution from assessing

these fees if the negative balance is attributable, in

whole or part, to a check, ACH or other transaction

not subject to the fee prohibition. However, if the

negative balance is attributable in part to an ATM

transaction, for example, and in part to a check, a

fee may be assessed based on the date when the

check is paid into overdraft, not the date of the ATM

or one-time debit transaction.

Conditioning payment of other overdrafts. The

financial institution may not condition the payment

of other types of overdraft transactions on the

consumer’s affirmative consent, and the financial

institution may not decline to pay other types of

overdraft transactions because the consumer has

not affirmatively consented to the payment of ATM

and one-time debit card overdrafts (12 CFR

1005.17(b)(2)). In other words, the financial institu-

tion may not use different criteria for paying other

types of overdraft transactions for consumers who

have consented and for consumers who have not

consented (Comment 17(b)(2)-1).

Same account terms, conditions, and features. In

addition, the financial institution must provide to

consumers who do not affirmatively consent the

same account terms, conditions, and features

(except the payment of ATM and one-time debit

overdrafts) that are available to consumers who do

affirmatively consent (12 CFR 1005.17(b)(3)). That

requirement includes, but is not limited to

• interest rates paid;

• fees assessed;

• the type of ATM or debit card provided to the

depositor;

15

• minimum balance requirements; and

• online bill payment services (Comment

17(b)(3)-1).

Joint accounts. Any one account holder may

consent, or revoke consent, for payment of ATM or

one-time debit card transactions from a joint

account (12 CFR 1005.17(e)).

Continuing right to consent or revoke. A con-

sumer may consent to the payment of ATM and

one-time debit card overdrafts at any time. A

consumer may also revoke consent at any time.

The financial institution must implement a revoca-

tion as soon as reasonably practicable (12 CFR

1005.17(f)). The financial institution need not waive

overdraft fees assessed before it implements the

consumer’s revocation (Comment 17(f)-1).

Duration of consent. Consent remains effective

until the consumer revokes it, unless the financial

institution terminates the overdraft service (12 CFR

1005.17(g)). The financial institution may terminate

the overdraft service, for example, if the consumer

makes excessive use of the service (Comment

17(g)-1).

Effective date. The overdraft services rule be-

came effective on January 19, 2010, and compli-

ance became mandatory on July 1, 2010. For

accounts opened on or after July 1, 2010, the

15. For example, the financial institution may not provide a

PIN-only debit card to consumers who do not opt in and a debit

card with both PIN and signature-debit features to consumers who

do opt in.

Electronic Fund Transfer Act

Consumer Compliance Handbook Reg. E • 11 (11/13)

financial institution must obtain consent before

charging a fee for payment of any ATM or one-time

debit overdraft. However, for accounts opened

before July 1, 2010, the financial institution may not

charge a fee for paying any ATM or one-time debit

overdraft on or after August 15, 2010, unless it has

obtained consent (See 12 CFR 1005.17(c)).

IV. Issuance of Access Devices—

12 CFR 1005.5 and 1005.18

In general, a financial institution may issue an

access device to a consumer only in the following

cases:

• the consumer requested it in writing or orally.

16

• it is a renewal of, or a substitute for, an accepted

access device (as defined in 12 CFR 1005.2(a)).

See 12 CFR 1005.5(a).

Only one renewal or substitute device may

replace a previously issued device. A financial

institution may provide additional devices at the

time it issues the renewal or substitute access

device provided the institution complies with the

requirements for issuing unsolicited access de-

vices for the additional devices (Comments 5(a)

(2)-1 and 5(b)-5).

A financial institution may issue an unsolicited

access device only if the access device meets all

of the following criteria. The access device is

• not validated—that is, it cannot be used to initiate

an EFT.

• accompanied by the explanation that it is not

validated and how the consumer may dispose of

it if the consumer does not wish to validate it.

• accompanied by a complete disclosure, in

accordance with 12 CFR 1005.7, of the consum-

er’s rights and liabilities that will apply if the

access device is validated.

• validated only upon oral or written request from

the consumer and after a verification of the

consumer’s identity by some reasonable means

(12 CFR 1005.5(b)).

The financial institution may use any reasonable

means of verifying the consumer’s identity, but the

consumer is not liable for any unauthorized trans-

fers if an imposter succeeds in validating the

access device (Comment 5(b)-4).

Payroll card access devices. Consistent with 12

CFR 1005.5(a), a financial institution may issue a

payroll card access device only in response to an

oral or written request for the device or as a renewal

or substitute for an accepted access device. A

consumer is deemed to request an access device

for a payroll account when the consumer chooses

to receive salary or other compensation through a

payroll card account (Comment 18(a)-1).

EFT added to credit card. The EFTA and

Regulation E apply when the capability to initiate

EFTs is added to an accepted credit card (as

defined under Regulation Z). The EFTA and

Regulation E also apply to the issuance of an

access device that permits credit extensions under

a preexisting agreement between the consumer

and a financial institution to extend credit only to

cover overdrafts (or to maintain a specified mini-

mum balance). The Truth in Lending Act and

Regulation Z govern the addition of a credit feature

to an accepted access device, and except as

discussed above, the issuance of a credit card that

is also an access device. For information on the

relationship of Regulation E to other laws, including

Truth in Lending, see 12 CFR 1005.12.

V. Consumer Liability and Error

Resolution

Liability of Consumers for Unauthorized

Transfers—12 CFR 1005.6

A consumer may be liable for an unauthorized EFT

(defined in 12 CFR 1005.2(m)) depending on when

the consumer notifies the financial institution and

whether an access device was used to conduct the

transaction. Under the EFTA, there is no bright-line

time limit within which consumers must report

unauthorized EFTs (71 Fed. Reg. 1638, 1653 (Jan.

10, 2006)).

The extent of the consumer’s liability is deter-

mined solely by the consumer’s promptness in

notifying the financial institution (Comment 6(b)-3).

Other factors may not be used as a basis to hold

consumers liable. 12 CFR 1005.6 expressly prohib-

its the following factors as the basis for imposing

greater liability than is permissible: the consumer

was negligent (e.g., wrote a PIN on an ATM card),

an agreement between the consumer and the

financial institution provides for greater liability, or

the consumer is liable for a greater amount under

state law (Comment 6(b)-2 and 6(b)-3).

A consumer may only be held liable for an

unauthorized transaction, within the limitations set

forth in 12 CFR 1005.6(b), if

• the financial institution has provided all of the

following written disclosures to the consumer:

– a summary of the consumer’s liability for

unauthorized EFTs

– the telephone number and address for report-

ing that an unauthorized EFT has been or may

be made

16. For a joint account, a financial institution may issue an

access device to each account holder for whom the requesting

holder specifically requests an access device (Comment

5(a)(1)-1).

Electronic Fund Transfer Act

12 (11/13) • Reg. E Consumer Compliance Handbook

– the financial institution’s business days

• any access device used to affect the EFT was an

accepted access device (as defined in 12 CFR

1005.2(a)).

• the financial institution has provided a means to

identify the consumer to whom the access device

was issued (12 CFR 1005.6(a)).

12 CFR 1005.6 allows, but does not require, the

financial institution to provide a separate means to

identify each consumer of a multiple-user account

(Comment 6(a)-2).

The limitations on the amount of consumer

liability for unauthorized EFTs, the time limits within

which consumers must report unauthorized EFTs,

and the liability for failing to adhere to those time

limits, are listed in the chart below. The financial

institution may impose less consumer liability than

is provided by 12 CFR 1005.6 based on state law or

the deposit agreement (12 CFR 1005.6(b)(6)).

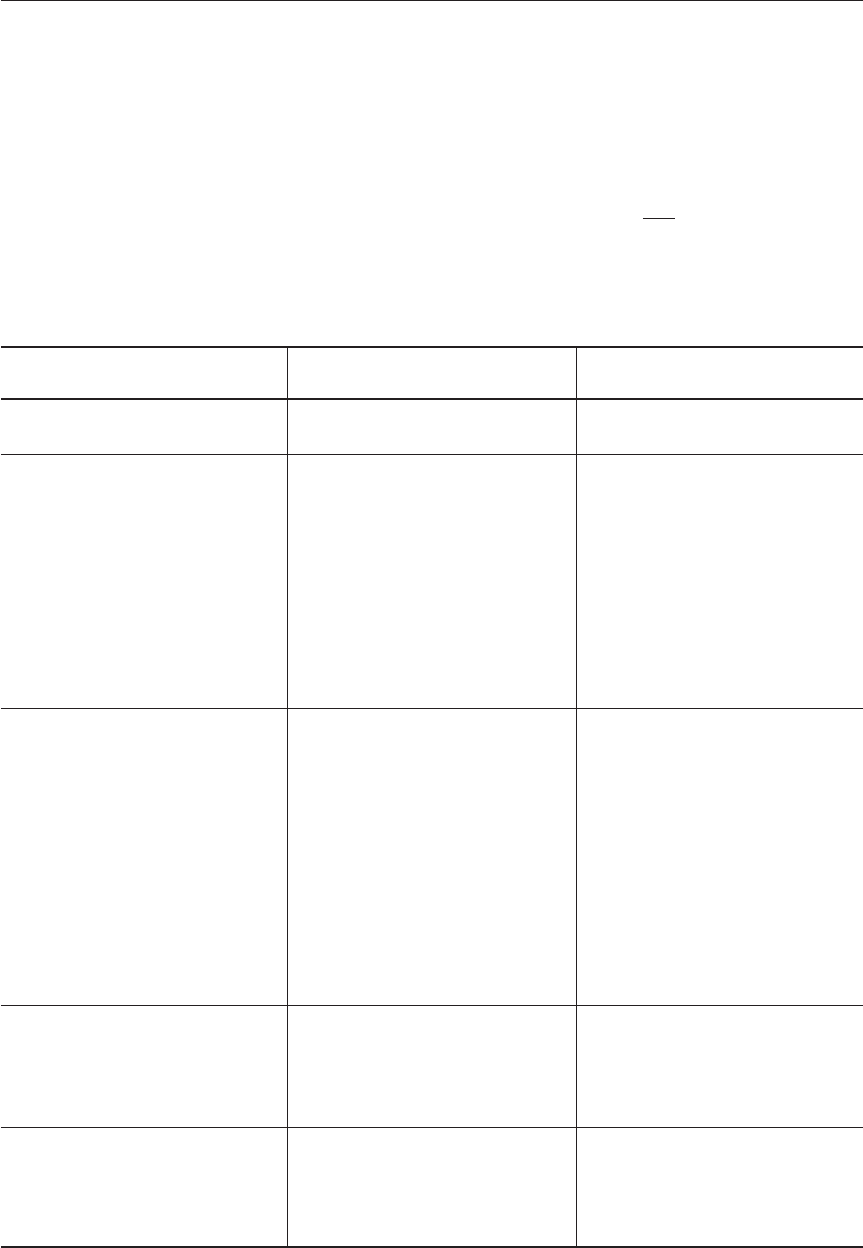

Consumer Liability for Unauthorized Transfers

Event

Timing of Consumer Notice to

Financial Institution Maximum Liability

Loss or theft of access device

1

Within two business days after

learning of loss or theft

Lesser of $50 or total amount of

unauthorized transfers

Loss or theft of access device More than two business days

after learning of loss or theft up

to 60 calendar days after

transmittal of statement showing

first unauthorized transfer made

with access device

Lesser of $500 or the sum of:

(a) $50 or the total amount of

unauthorized transfers

occurring in the first two

business days, whichever is

less, and

(b) The amount of unauthorized

transfers occurring after two

business days and before

notice to the financial

institution.

2

Loss or theft of access device More than 60 calendar days after

transmittal of statement showing

first unauthorized transfer made

with access device

For transfers occurring within the

60-day period, the lesser of $500

or the sum of

(a) Lesser of $50 or the amount

of unauthorized transfers in

first two business days, and

(b) The amount of unauthorized

transfers occurring after two

business days.

For transfers occurring after the

60-day period, unlimited liability

(until the financial institution is

notified).

3

Unauthorized transfer(s) not

involving loss or theft of an

access device

Within 60 calendar days after

transmittal of the periodic

statement on which the

unauthorized transfer first

appears

No liability.

Unauthorized transfer(s) not

involving loss or theft of an

access device

More than 60 calendar days after

transmittal of the periodic

statement on which the

unauthorized transfer first

appears

Unlimited liability for

unauthorized transfers occurring

60 calendar days after the

periodic statement and before

notice to the financial institution.

1. Includes a personal identification number (PIN) if used

without a card in a telephone transaction, for example.

2. Provided the financial institution demonstrates that these

transfers would not have occurred had notice been given within

the two-business-day period.

3. Provided the financial institution demonstrates that these

transfers would not have occurred had notice been given within

the 60-day period.

Electronic Fund Transfer Act

Consumer Compliance Handbook Reg. E • 13 (11/13)

Knowledge of loss or theft. The fact that a

consumer has received a periodic statement

reflecting an unauthorized transaction is a factor,

but not conclusive evidence, in determining whether

the consumer had knowledge of a loss or theft of

the access device (Comment 6(b)(1)-2).

Timing of notice. If a consumer’s delay in

notifying a financial institution was due to extenu-

ating circumstances, such as extended travel or

hospitalization, the time periods for notification

specified above must be extended to a reasonable

time (12 CFR 1005.6(b)(4); Comment 6(b)(4)-1).

Notice to the financial institution. A consumer

gives notice to a financial institution about unau-

thorized use when the consumer takes reasonable

steps to provide the financial institution with the

pertinent information, whether or not a particular

employee actually receives the information (12 CFR

1005.6(b)(5)(i)). Even if the consumer is unable to

provide the account number or the card number,

the notice effectively limits the consumer’s liability if

the consumer sufficiently identifies the account in

question, for example, by giving the name on the

account and the type of account (Comment

6(b)(5)-3). At the consumer’s option, notice may be

given in person, by telephone, or in writing (12 CFR

1005.6(b)(5)(ii)). Notice in writing is considered

given at the time the consumer mails the notice or

delivers the notice for transmission by any other

usual means to the financial institution. Notice may

also be considered given when the financial

institution becomes aware of circumstances lead-

ing to the reasonable belief that an unauthorized

transfer has been or may be made (12 CFR

1005.6(b)(5)(iii)).

Relation of error resolution to Truth in Lending.

The liability and error resolution provisions in 12

CFR 1005.6 and 1005.11 apply to an extension of

credit that occurs under an agreement between the

consumer and a financial institution to extend credit

when the consumer’s account is overdrawn, to

maintain a specified minimum balance in the

consumer’s account, or under an overdraft service

(12 CFR 1005.12(a)(1)(ii)). As provided in 12 CFR

1005.12 and related commentary, for transactions

involving access devices that also function as

credit cards, the liability and error resolution

provisions in 12 CFR 1005.6 and 1005.11 or

Regulation Z will apply depending on the nature of

the transaction:

• If the unauthorized use of a combined access

device−credit card solely involves an extension

of credit, other than an extension of credit

described under 12 CFR 1005.12(a)(1)(iii), and

does not involve an EFT, for example, when the

card is used to draw cash advances directly from

a credit line, only the error resolution provisions of

Regulation Z will apply.

• If the unauthorized use of a combined access

device−credit card involves only an EFT, for

example, debit card purchases or cash withdraw-

als at an ATM from a checking account, only the

error resolution provisions of 12 CFR 1005.6 and

1005.11 will apply.

• If a combined access device−credit card is

stolen and unauthorized transactions are made

by using the card as both a debit card and a

credit card, 12 CFR 1005.6 and 1005.11 will

apply to the unauthorized transactions in which

the card was used as a debit card, and

Regulation Z will apply to the unauthorized

transactions in which the card was used as a

credit card.

Procedures for Resolving Errors—

12 CFR 1005.11

This section defines the term error and describes

the steps the consumer must take when asserting

an error in order to receive the protection of the

EFTA and 12 CFR 1005.11, and the procedures

that a financial institution must follow to resolve an

alleged error under this section.

An error includes any of the following:

• an unauthorized EFT

• an incorrect EFT to or from the consumer’s

account

• the omission from a periodic statement of an EFT

to or from the consumer’s account that should

have been included

• a computational or bookkeeping error made by

the financial institution relating to an EFT

• the consumer’s receipt of an incorrect amount of

money from an electronic terminal

• an EFT not identified in accordance with the

requirements of 12 CFR 1005.9 or 1005.10(a)

• a consumer’s request for any documentation

required by 12 CFR 1005.9 or 1005.10(a) or for

additional information or clarification concerning

an EFT (12 CFR 1005.11(a)(1))

The term error does not include:

• a routine inquiry about the balance in the

consumer’s account or a request for duplicate

copies of documentation or other information that

is made only for tax or other record-keeping

purposes (12 CFR 1005.11(a)(2)(i), (ii), and (iii))

• the fact that a financial institution does not make

a terminal receipt available for a transfer of $15 or

less in accordance with 12 CFR 1005.9(e)

(Comment 11(a)-6)

A financial institution must comply with the error

resolution procedures in 12 CFR 1005.11 with

respect to any oral or written notice of error from the

Electronic Fund Transfer Act

14 (11/13) • Reg. E Consumer Compliance Handbook

consumer that

• the financial institution receives not later than 60

days after sending a periodic statement or other

documentation first reflecting the alleged error

(see 12 CFR 1005.14 and 1005.18)

• enables the financial institution to identify the

consumer’s name and account number

• indicates why the consumer believes the error

exists and, to the extent possible, the type, date,

and amount of the error (12 CFR 1005.11(b)(1))

A financial institution may require a consumer to

give written confirmation of an error within 10

business days of giving oral notice. The financial

institution must provide the address where confir-

mation must be sent (12 CFR 1005.11(b)(2)).

Error resolution procedures. After receiving a

notice of error, the financial institution must do all of

the following:

• promptly investigate the oral or written allegation

of error;

• complete its investigation within 10 business

days (12 CFR 1005.11(c)(1));

• report the results of its investigation within three