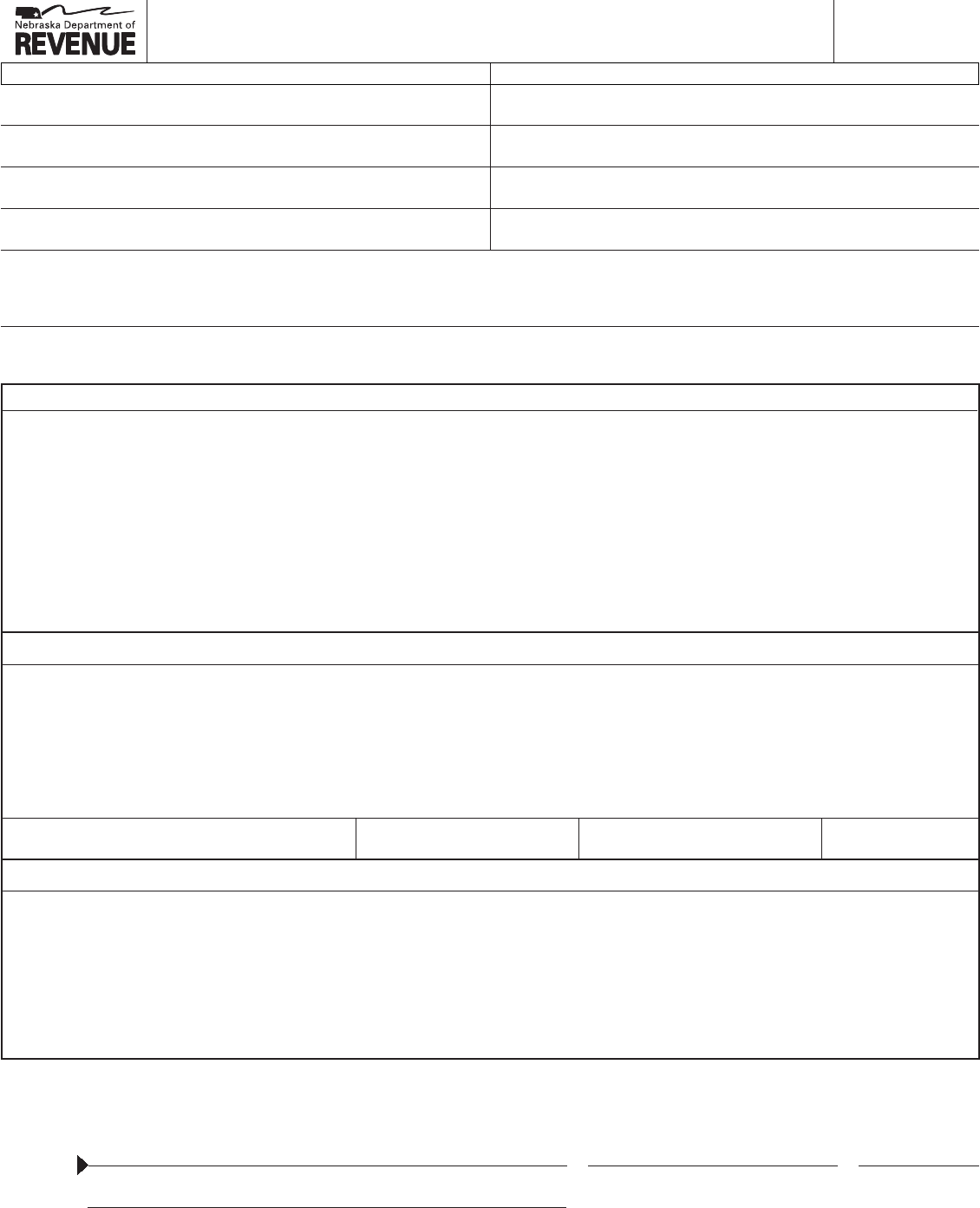

ID 13 F

User Manual: ID-13

Open the PDF directly: View PDF ![]() .

.

Page Count: 2

I further certify that we are engaged in business as a: c Wholesaler c Retailer c Manufacturer c Lessor

of Description of Product or Service Sold, Leased, or Rented

___________________________________________________________________________________________________________________.

My Nebraska Sales Tax Permit Number is 01-_________________________________.

If none, state the reason _____________________________________________________________________________________________________,

or Foreign State Sales Tax Number__________________________________________ State __________________________________________.

for Sales Tax Exemption 13

Nebraska Resale or Exempt Sale Certificate Form

Name and Mailing Address of Seller

Name

Street or Other Mailing Address

City State Zip Code

Name and Mailing Address of Purchaser

Name

Legal Name

Street Address (Do not use PO Box)

City State Zip Code

Check Type of Certificate

c Single Purchase If single purchase is checked, enter the related invoice or purchase order number ______________________________________.

c Blanket If blanket is checked, this certicate is valid until revoked in writing by the purchaser.

Section B — Nebraska Exempt Sale Certificate

Section A — Nebraska Resale Certificate

Any purchaser, agent, or other person who completes this certificate for any purchase which is not for resale, lease, or rental in the regular course of the

purchaser’s business, or is not otherwise exempted from sales and use taxes is subject to a penalty of $100 or ten times the tax, whichever amount is larger, for

each instance of presentation and misuse. With regard to a blanket certificate, this penalty applies to each purchase made during the period the blanket certificate

is in effect. Under penalties of law, I declare that I am authorized to sign this certificate, and to the best of my knowledge and belief, it is correct and complete.

sign

here Authorized Signature Title Date

Section C — For Contractors Only

c As an Option 1 or Option 3 contractor, I hereby certify that the purchase of building materials and xtures from the seller listed above are exempt

from Nebraska sales tax. My Nebraska Sales or Use Tax Permit Number is: _____________________________________________________.

c Yes c No

Do not send this certificate to the Nebraska Department of Revenue. Keep it as part of your records.

Sellers cannot accept incomplete certificates.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

Description of Items Sold

6-134-1970 Rev. 10-2014

Supersedes 6-134-1970 Rev. 3-2009

I hereby certify that the purchase, lease, or rental of ________________________________________________________________from the seller

listed above is exempt from the Nebraska sales tax as a purchase for resale, rental, or lease in the normal course of our business. The property or service

will be resold either in the form or condition in which it was purchased, or as an ingredient or component part of other property or service to be resold.

1. Purchase of building materials or fixtures.

2. Purchases made by an Option 2 contractor under a Purchasing Agent Appointment on behalf of_________________________

________________________________________.

The basis for this exemption is exemption category ______ (insert appropriate number for the category of exemption described on the reverse side).

If exemption category 2 or 5 is claimed, enter the following information:

Description of Items Purchased Intended Use of Items Purchased

_________________________________________________________________________________________________________________________.

If exemption category 3 or 4 is claimed, enter your Nebraska Exemption Certicate number. 05 -______________________________

If exemption category 6 is claimed, the seller must enter the following information and sign this form below:

Date of Seller’s Original Purchase Was tax paid when purchased by seller? Was item depreciable?

I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the Nebraska sales tax for the following reason:

Check One c Purchase for Resale (Complete Section A.) c Exempt Purchase (Complete Section B.) c Contractor (Complete Section C.)

(exempt entity)

Do not enter your Federal Employer ID Number.

c Yes c No

As an Option 2 contractor, I hereby certify that the purchase of building materials and xtures from the seller listed above is exempt from

Nebraska sales tax pursuant to the attached Purchasing Agent Appointment and Delegation of Authority for Sales and Use Tax, Form 17.

Authorized Signature Name (please print)

Description of Property or Service Purchased

RESET FORM

PRINT FORM

Who May Issue a Resale Certificate. Form 13, Section A, is

issued by persons or organizations making purchases of property or

taxable services that will subsequently be resold in the purchaser’s

normal course of business. The property or services must be resold

in the same form or condition as when purchased, or as an ingredient

or component part of other property that will be resold.

Who May Issue an Exempt Sale Certificate. Form 13,

Section B, may only be issued by governmental units and persons or

organizations that are exempt from paying Nebraska sales and use

tax. Nonprot organizations that are exempt from paying sales and

use tax are listed in the Nebraska Sales Tax Exemption Chart.

Enter the appropriate number from the “Categories of Exemption”

in the space provided that properly reflects the basis for your

exemption. If category 2 through 6 is the basis for exemption, you

must complete the information requested in Section B.

For additional information about proper issuance and use of this

certificate, please review Reg-1-013, Sale for Resale – Resale

Certicate, and Reg-1-014, Exempt Sale Certicate.

Contractors. To make tax-exempt purchases of building materials

and fixtures, Option 1 or Option 3 contractors must complete

Form 13, Section C, Part 1.

To make tax-exempt purchases of building materials and xtures

pursuant to a construction project for an exempt governmental unit or

an exempt nonprot organization, Option 2 contractors must complete

Form 13, Section C, Part 2. The contractor must also attach a copy of

a properly completed Purchasing Agent Appointment and Delegation

of Authority for Sales and Use Tax, Form 17, to the Form 13, and

both documents must be given to the supplier when purchasing

building materials. See the contractor information guides for

additional information.

When and Where to Issue. The Form 13 must be given to the

seller at the time of the purchase to document why sales tax does not

apply to the purchase. The Form 13 must be kept with the seller’s

records for audit purposes (see Reg-1-012, Exemptions). Do not

send Forms 13 to the Nebraska Department of Revenue.

Sales Tax Number. A purchaser who is engaged in business

as a wholesaler or manufacturer is not required to provide an

ID number when completing Section A. Out-of-state purchasers

may provide their home state sales tax number. Section B does not

require a Nebraska ID number when exemption category 1, 2, or 5

is indicated.

Fully Completed Resale or Exempt Sale Certificate.

For a resale certificate to be fully completed, it must include:

(1) identification of the purchaser and seller, type of business

engaged in by the purchaser, and reason for the exemption;

(2) sales tax permit number; (3) signature of an authorized person; and

(4) the date of issuance.

For an exempt sale certicate to be fully completed, it must include:

(1) identication of purchaser and seller; (2) a statement that the

certicate is for a single purchase or is a blanket certicate covering

future sales; (3) a statement of the basis for exemption, including

the type of activity engaged in by the purchaser; (4) signature of an

authorized person; and (5) the date of issuance.

Penalties. Any purchaser who gives a Form 13 to a seller for any

purchase which is other than for resale, lease, or rental in the normal

course of the purchaser’s business, or is not otherwise exempted

from sales and use tax under the Nebraska Revenue Act, is subject to

a penalty of $100 or ten times the tax, whichever is greater, for each

instance of presentation and misuse. In addition, any purchaser, or

Instructions

their agent, who fraudulently signs a Form 13 may be found guilty

of a Class IV misdemeanor.

Categories of Exemption

1. Governmental agencies identied in Reg-1-012, Exemptions;

Reg-1-072, United States Government and Federal Corporations;

and Reg-1-093, Governmental Units. Governmental units are not

assigned exemption numbers.

Sales to the United States government, its agencies, instru-

mentalities, and corporations wholly owned by the U.S.

government are exempt from sales tax. However, sales to

institutions chartered or created under federal authority, but

which are not directly operated and controlled by the United

States government for the benet of the public, generally are

taxable. For construction projects for federal agencies, see

Reg-1-017, Contractors.

Purchases by governmental units that are not exempt from

Nebraska sales and use taxes include, but are not limited to:

governmental units of other states; sanitary and improvement

districts; rural water districts; railroad transportation safety

districts; and county historical societies.

2. Purchases when the intended use renders it exempt as stated in

paragraph 012.02D of Reg-1-012, Exemptions. See Nebraska

Sales Tax Exemption Chart. Complete the description of the item

purchased and the intended use on the front of Form 13.

Beginning October 1, 2014, sales of repair and replacement parts

for agricultural machinery and equipment used in commercial

agriculture are exempt from sales and use taxes. When claiming

this exemption, please enter “commercial agriculture” on the

Intended Use of Items Purchased line.

3. Purchases made by organizations that have been issued a

Nebraska Exempt Organization Certificate of Exemption.

Reg-1-090, Nonprofit Organizations; Reg-1-091, Religious

Organizations; and Reg-1-092, Educational Institutions, identify

these organizations. These organizations are issued a Nebraska

state exemption ID number. This exemption number must be

entered in Section B of Form 13.

Nonprot health care organizations that hold a certicate of

exemption are exempt for purchases of items for use at their

facility, or portion of the facility, covered by the license issued

under the Health Care Facility Licensure Act. Only specic types

of health care facilities and activities are exempt. Purchases

of items for use at facilities that are not covered under the

license, or for any other activities that are not specically exempt,

are taxable.

4. Purchases of common or contract carrier motor vehicles, trailers,

and semitrailers; accessories that physically become part of a

common or contract carrier vehicle; and repair and replacement

parts for these vehicles. The exemption number must be entered

in Section B of the Form 13.

5. Purchases of manufacturing machinery and equipment made by a

person engaged in the business of manufacturing, including repair

and replacement parts or accessories, for use in manufacturing.

6. Occasional sales of used business or farm machinery or

equipment productively used by the seller as a depreciable

capital asset for more than one year in his or her business. The

seller must have previously paid tax on the item being sold. The

seller must complete, sign, and give the exemption certicate to

the purchaser.