Form 4466 (Rev. October 2016) F4466

User Manual: 4466

Open the PDF directly: View PDF ![]() .

.

Page Count: 2

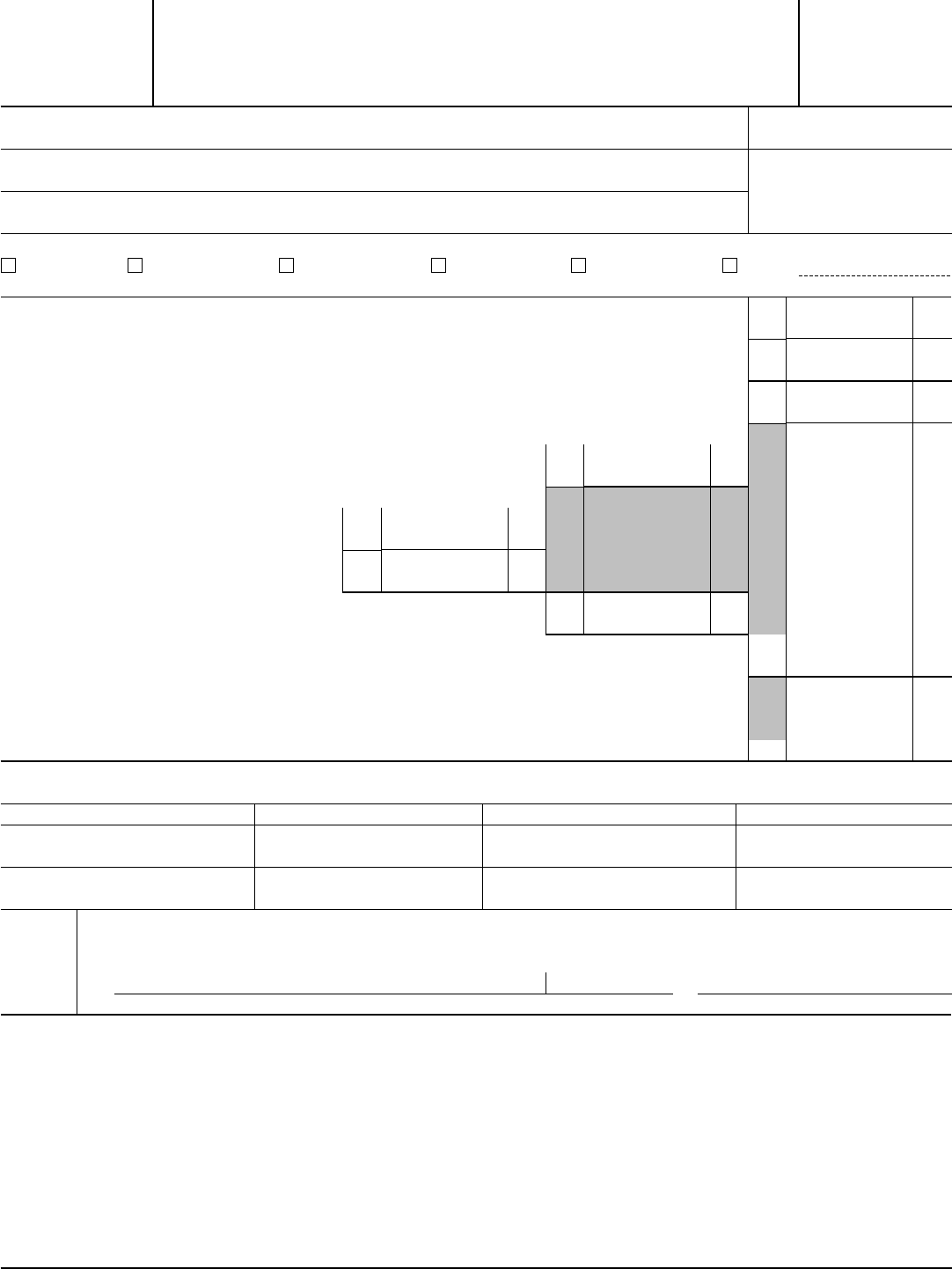

Form 4466

(Rev. October 2016)

Department of the Treasury

Internal Revenue Service

Corporation Application for Quick Refund of

Overpayment of Estimated Tax

▶ Information about Form 4466 and its instructions is available at www.irs.gov/form4466.

For calendar year 20 or tax year beginning , 20 , and ending , 20

OMB No. 1545-0123

Name

Number, street, and room or suite no. (If a P.O. box, see instructions.)

City or town, state, and ZIP code

Employer identification number

Telephone number (optional)

Check type of return to be filed (see instructions):

Form 1120 Form 1120-C Form 1120-F Form 1120-L Form 1120-PC Other ▶

1 Estimated income tax paid during the tax year . . . . . . . . . . . . . . . . 1

2 Overpayment of income tax from prior year credited to this year’s estimated tax . . . . . 2

3 Total. Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Enter total tax from the appropriate line of your tax return. See

instructions.................. 4

5 a Personal holding company tax, if any,

included on line 4 . . . . . . . 5a

b Estimated refundable tax credit for

federal tax on fuels . . . . . . . 5b

6 Total. Add lines 5a and 5b . . . . . . . . . . . . . 6

7 Expected income tax liability for the tax year. Subtract line 6 from line 4 . . . . . . . . 7

8 Overpayment of estimated tax. Subtract line 7 from line 3. If this amount is at least 10% of line

7 and at least $500, the corporation is eligible for a quick refund. Otherwise, do not file this form.

See instructions........................... 8

Record of Estimated Tax Deposits

Date of deposit Amount Date of deposit Amount

Sign

Here

Under penalties of perjury, I declare that I have examined this application, including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete.

▲

Signature Date

▲

Title

General Instructions

Section references are to the Internal Revenue Code.

Who May File

Any corporation that overpaid its estimated tax for the tax year may

apply for a quick refund if the overpayment is:

• At least 10% of the expected tax liability, and

• At least $500.

The overpayment is the excess of the estimated income tax the

corporation paid during the tax year over the final income tax

liability expected for the tax year, at the time this application is filed.

If members of an affiliated group paid their estimated income tax

on a consolidated basis or expect to file a consolidated return for

the tax year, only the common parent corporation may file Form

4466. If members of the group paid estimated income tax

separately, the member who claims the overpayment must file Form

4466.

Note: Form 4466 is not considered a claim for credit or refund.

Cat. No. 12836A Form 4466 (Rev. 10-2016)

Form 4466 (Rev. 10-2016) Page 2

When To File

File Form 4466 after the end of the corporation’s tax year, and no

later than the due date for filing the corporation’s tax return (not

including extensions). Form 4466 must be filed before the

corporation files its tax return. An extension of time to file the

corporation’s tax return will not extend the time for filing Form 4466.

See the instructions for the corporation’s tax return.

How To File

Complete and file an original, signed Form 4466 with the applicable

Internal Revenue Service Center (see Where To File below). The IRS

will act on Form 4466 within 45 days from the date it is filed.

The corporation must also file Form 4466 with its income tax

return. Attach either the signed Form 4466 or an unsigned Form

4466 with the same information stated on the signed Form 4466. If

the corporation submits an unsigned Form 4466, it must retain the

original, signed Form 4466 in its records.

Disallowance of application. Any application that contains

material omissions or errors that cannot be corrected within the

45-day period may be disallowed.

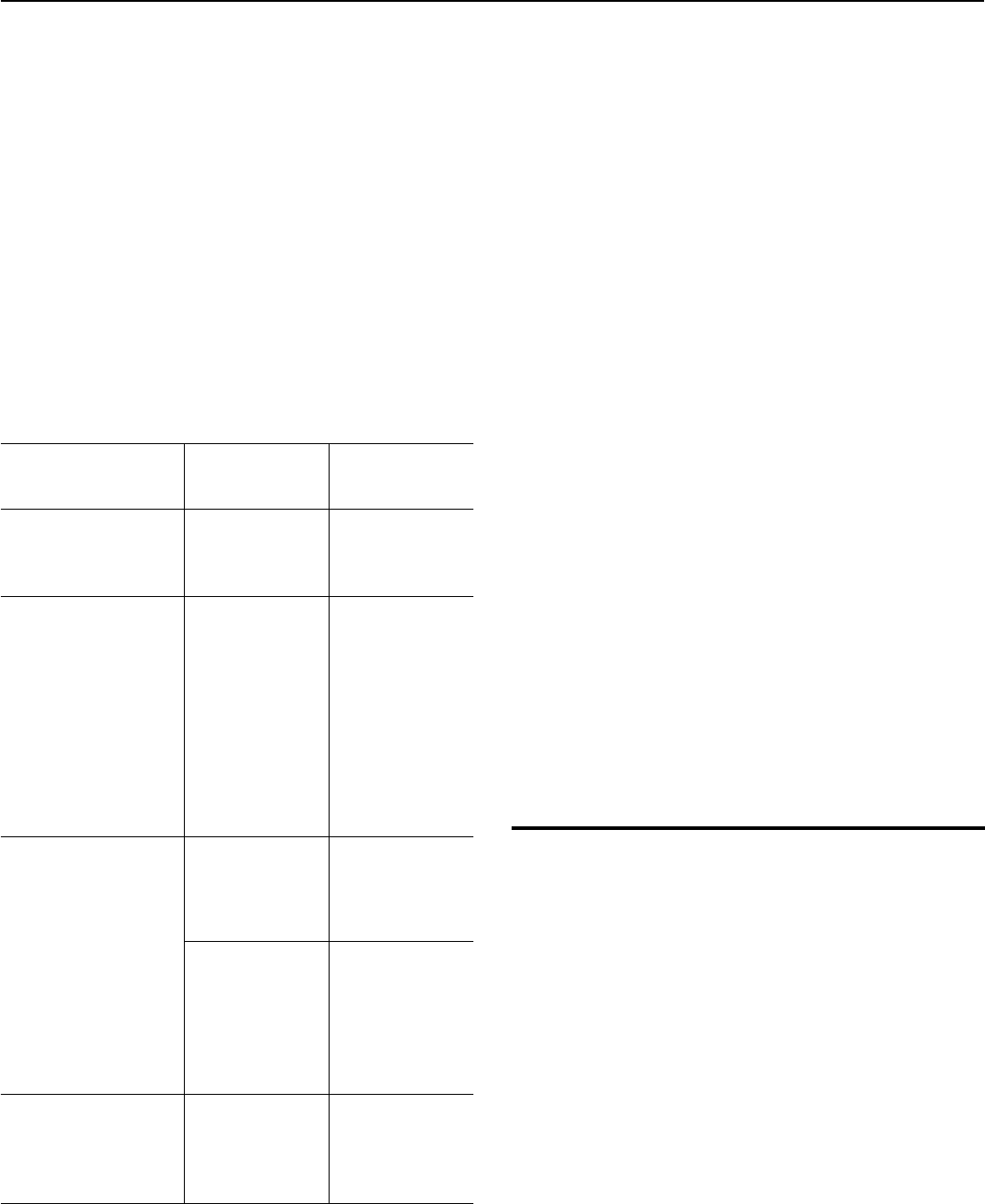

Where To File

File Form 4466 at the applicable address listed below.

Filers of . . .

With total assets

at the end of the

tax year of . . .

Use the following

address:

Forms 990-T, 1120-C, or

1120-PC Any amount

Department of the

Treasury

Internal Revenue

Service Center

Ogden, UT 84201

Forms 1120, 1120-H, 1120-L,

1120-ND, 1120-REIT,

1120-RIC, or 1120-SF with the

corporation’s principal

business, office, or agency

located in Alabama, Alaska,

Arizona, Arkansas, California,

Colorado, Hawaii, Idaho, Iowa,

Kansas, Louisiana, Minnesota,

Mississippi, Missouri, Montana,

Nebraska, Nevada, New

Mexico, North Dakota,

Oklahoma, Oregon, South

Dakota, Texas, Utah,

Washington, Wyoming

Any amount

Department of the

Treasury

Internal Revenue

Service Center

Ogden, UT 84201

Forms 1120, 1120-H, 1120-L,

1120-ND, 1120-REIT,

1120-RIC, or 1120-SF with the

corporation’s principal

business, office, or agency

located in Connecticut,

Delaware, District of Columbia,

Florida, Georgia, Illinois,

Indiana, Kentucky, Maine,

Maryland, Massachusetts,

Michigan, New Hampshire,

New Jersey, New York, North

Carolina, Ohio, Pennsylvania,

Rhode Island, South Carolina,

Tennessee, Vermont, Virginia,

West Virginia, Wisconsin

Less than $10 million

(any amounts for Form

1120-H) and Schedule

M-3 is not filed

Department of the

Treasury

Internal Revenue

Service Center

Cincinnati, OH 45999

$10 million or more

or less than $10 million

and Schedule M-3 is

filed

Department of the

Treasury

Internal Revenue

Service Center

Ogden, UT 84201

Form 1120-F or 1120-FSC, or

the corporation’s principal

business, office, or agency is

located in a foreign country or

U.S. possession

Any amount

Internal Revenue

Service Center

P.O. Box 409101

Ogden, UT 84409

Specific Instructions

Address

Include the suite, room, or other unit number after the street

address.

If the Post Office does not deliver mail to the street address and

the corporation has a P.O. box, show the box number instead.

Note: If a change in address occurs after the corporation files Form

4466, use Form 8822-B, Change of Address — Business, to notify

the IRS of the new address.

Type of Return

Check the box for the type of return the corporation will file.

Other. S corporations that have made protective estimated tax

payments in their first tax year should check the “Other” box.

Corporations that file Forms 1120-FSC, 1120-H, 1120-ND,

1120-REIT, 1120-RIC, or 1120-SF and tax-exempt corporations that

file Form 990-T should also check the “Other” box. Enter the form

number of the return to be filed in the space to the right of the box.

Line 4

Enter the total tax from Form 1120, Schedule J, or the total tax from

your applicable tax return. See the instructions for your applicable

tax return.

Line 8. Overpayment of Estimated Tax

If the application for refund is approved, the overpayment on line 8

may be credited against any tax the corporation owes. The balance,

if any, will be refunded.

Excessive refund or credit. If the refund or credit is later found to

be excessive, the corporation is liable for an addition to tax on the

excessive amount. See section 6655(h).

The excessive amount is the smaller of:

1. The credit or refund, or

2. The excess of:

a. The corporation’s income tax liability (as defined in section

6425(c)) as shown on its return over

b. The estimated tax paid less the refund or credit.

The IRS will compute the addition to tax and bill the corporation.

The addition to tax is figured from the date the refund was paid or

credited, until the original due date of the corporation’s return. The

addition to tax is not deductible for income tax purposes.

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal

Revenue laws of the United States. You are required to give us the

information. We need it to ensure that you are complying with these

laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a

form that is subject to the Paperwork Reduction Act unless the form

displays a valid OMB control number. Books or records relating to a

form or its instructions must be retained as long as their contents

may become material in the administration of any Internal Revenue

law. Generally, tax returns and return information are confidential,

as required by section 6103.

The time needed to complete and file this form will vary

depending on individual circumstances. The estimated burden for

business taxpayers filing this form is approved under OMB control

number 1545-0123 and is included in the estimates shown in the

instructions for their business income tax return.

If you have comments concerning the accuracy of these time

estimates or suggestions for making this form simpler, we would be

happy to hear from you. You can send your comments to

www.irs.gov/formspubs. Click on “More Information” and then on

“Give us feedback.” Or you can send your comments to the Internal

Revenue Service, Tax Forms and Publications, 1111 Constitution

Ave. NW, IR-6526, Washington, DC 20224. Do not send the form to

this address. Instead, see Where To File, earlier.