Form 656 B (Rev. 3 2017) F656b

User Manual: 656

Open the PDF directly: View PDF ![]() .

.

Page Count: 32

Form 656 Booklet

Offer in

Compromise

CONTENTS

■ What you need to know................................................................................. 1

■ Paying for your offer ..................................................................................... 3

■ How to apply ................................................................................................ 3

■ Completing the application package ............................................................ 4

■ Important information ................................................................................... 5

■ Removable Forms - Form 433-A (OIC), Collection Information Statement

for Wage Earners and Self-Employed; Form 433-B (OIC), Collection

Information Statement for Businesses; Form 656, Offer in Compromise ..... 7

■ Application Checklist .................................................................................... 27

IRS contact information

If you want to see if you qualify for an offer before filling out the paperwork, you may use the Offer in

Compromise Pre-Qualifier tool. The questionnaire format assists in gathering the information needed and

provides instant feedback as to your eligibility based on the information you provided. The tool will also assist

you in determining a preliminary offer amount for consideration of an acceptable offer. The Pre-Qualifier tool is

located on our website at www.irs.gov.

If you have questions regarding qualifications for an offer in compromise, please call our toll-free number at

1-800-829-1040. You can get forms and publications by calling 1-800-TAX-FORM (1-800-829-3676), by

visiting your local IRS office, or at www.irs.gov.

Taxpayer resources

The Taxpayer Advocate Service (TAS) is an independent organization within the Internal Revenue Service that

helps taxpayers and protects taxpayer rights. We help taxpayers whose problems with the IRS are causing

financial difficulties, who've tried but haven't been able to resolve their problems with the IRS, or believe an IRS

system or procedure isn't working as it should. And the service is free. Your local advocate's number is in your

local directory and at taxpayeradvocate.irs.gov. You can also call us at 1-877-777-4778. For more information

about TAS and your rights under the Taxpayer Bill of Rights, go to taxpayeradvocate.irs.gov. TAS is your voice

at the IRS.

Low Income Taxpayer Clinics (LITCs) are independent from the IRS. LITCs serve individuals whose income is

below a certain level and who need to resolve a tax problem with the IRS. LITCs provide professional

representation before the IRS or in court on audits, appeals, tax collection disputes, and other issues for free or

for a small fee. For more information and to find an LITC near you, see the LITC page at

www.taxpayeradvocate.irs.gov/litcmap or IRS Publication 4134, Low Income Taxpayer Clinic List. This

Publication is also available by calling the IRS toll-free at 1-800-829-3676 or visiting your local IRS office.

WHAT YOU NEED TO KNOW

What is an Offer? An Offer in Compromise (offer) is an agreement between you (the taxpayer) and

the IRS that settles a tax debt for less than the full amount owed. The offer

program provides eligible taxpayers with a path toward paying off their tax debt

and getting a fresh start. The ultimate goal is a compromise that suits the best

interest of both the taxpayer and the IRS. To be considered, generally you must

make an appropriate offer based on what the IRS considers your true ability to

pay.

Submitting an application does not ensure that the IRS will accept your offer. It

begins a process of evaluation and verification by the IRS, taking into

consideration any special circumstances that might affect your ability to pay.

This booklet will lead you through a series of steps to help you calculate an

appropriate offer based on your assets, income, expenses, and future earning

potential. The application requires you to describe your financial situation in detail,

so before you begin, make sure you have the necessary information and

documentation.

Are You Eligible? Before your offer can be considered, you must (1) file all tax returns you are legally

required to file, (2) have received a bill for at least one tax debt included on your

offer, (3) make all required estimated tax payments for the current year, and (4)

make all required federal tax deposits for the current quarter if you are a business

owner with employees. Your offer will be immediately returned without

consideration if you have not filed all tax returns you are legally required to file.

Note: If it is determined you have not filed all tax returns any initial payment

sent with your offer will be applied to your tax debt and your offer will be

returned along with your application fee.

Bankruptcy If you or your business is currently in an open bankruptcy proceeding, you are not

eligible to apply for an offer. Any resolution of your outstanding tax debts generally

must take place within the context of your bankruptcy proceeding.

If you are not sure of your bankruptcy status, contact the Centralized Insolvency

Operation at 1-800-973-0424. Be prepared to provide your bankruptcy case

number and/or Taxpayer Identification Number.

Can You Pay in Full? Generally, the IRS will not accept an offer if you can pay your tax debt in full or

through an installment agreement and/or equity in assets.

Note: Adjustments or exclusions, such as allowance of $1,000 to a bank

balance or $3,450 against the value of a car, are only applied after it is

determined that you cannot pay your tax debt in full.

Your Future Tax Refunds The IRS will keep any refund, including interest, for tax periods extending through

the calendar year that the IRS accepts the offer. For example, if your offer is

accepted in 2016 and you file your 2016 Form 1040 on April 15, 2017 showing a

refund, IRS will apply your refund to your tax debt. The refund is not considered

as a payment toward your offer.

Doubt as to Liability If you have a legitimate doubt that you owe part or all of the tax debt, complete and

submit a Form 656-L, Offer in Compromise (Doubt as to Liability). The Form

656-L is not included as part of this package. To request a Form 656-L, visit www.

irs.gov or a local IRS office or call toll-free 1-800-TAX-FORM (1-800-829-3676).

1

Other Important Facts Penalties and interest will continue to accrue during consideration of your offer.

After you file your offer, you must continue to timely file and pay all required tax

returns, estimated tax payments, and federal tax payments. Failure to meet your

filing and payment responsibilities during consideration of your offer will result in

your offer being returned. If your offer is accepted, you must continue to stay

current with all tax filing and payment obligations through the fifth year after your

offer is accepted (including any extensions).

Note: If you have filed your tax returns but you have not received a bill for at

least one tax debt included on your offer, your offer may be returned.

An offer cannot be accepted for processing if the IRS has referred your case, or

cases, involving all of the liabilities identified in the offer to the Department of

Justice (DOJ). In addition, the IRS cannot compromise any restitution amount

ordered by a court or a tax debt that has been reduced to judgment.

The law requires the IRS to make certain information from accepted offers

available for public inspection and review. These public inspection files are

located in designated IRS Area Offices.

The IRS may levy your assets up to the time that the IRS official signs and

acknowledges your offer as pending. In addition, the IRS may keep any proceeds

received from the levy. If your assets are levied after your offer is pending,

immediately contact the IRS person whose name and phone number is listed on

the levy.

If you currently have an approved installment agreement, you will not be required

to make your installment agreement payments while your offer is being

considered. If your offer is not accepted and you have not incurred any additional

tax debt, your installment agreement with the IRS will be reinstated with no

additional fee.

2

Trust Fund Taxes If your business owes trust fund taxes, responsible individuals may be held liable

for the trust fund portion of the tax. Trust fund taxes are the money withheld from

an employee's wages, such as income tax, Social Security, and Medicare taxes.

You are not eligible to submit an offer unless the trust fund portion of the tax is

paid or the Trust Fund Recovery Penalty determinations have been made on all

potentially responsible individual(s). However, if you are submitting the offer as a

victim of payroll service provider fraud or failure, the trust fund assessment

discussed above is not required.

Your Rights as a Taxpayer Each and every taxpayer has a set of fundamental rights they should be aware of

when dealing with the IRS. Explore your rights and our obligations to protect them.

For more information on your rights as a taxpayer, go to http://www.irs.gov/

Taxpayer-Bill-of-Rights.

A lien is a legal claim against all your current and future property. When you don’t

pay your first bill for taxes due, a lien is created by law and attaches to your

property. A Notice of Federal Tax Lien (NFTL) provides public notice to creditors

and is filed to establish priority of the IRS claim versus the claims of other

creditors. The IRS may file an NFTL while your offer is being considered. However,

an NFTL will usually not be filed until a final decision has been made on your offer.

Note: A Notice of Federal Tax Lien (NFTL) will not be filed on any individual

shared responsibility payment under the Affordable Care Act.

Notice of Federal Tax Lien

You must select a payment option and include the payment with your offer. The

amount of the initial payment and subsequent payments will depend on the total

amount of your offer and which of the following payment options you choose:

Lump Sum Cash: This option requires 20% of the total offer amount to be paid

with the offer and the remaining balance paid in 5 or fewer payments within 5 or

fewer months of the date your offer is accepted.

Periodic Payment: This option requires the first payment to be paid with the offer

and the remaining balance paid in monthly payments within 6 to 24 months, in

accordance with your proposed offer terms.

Note: Under this option, you must continue to make monthly payments

while the IRS is evaluating your offer. Failure to make these payments will

cause your offer to be returned. There is no appeal. Total payments must

equal the total offer amount.

Exception: If you are an individual, are operating as a sole proprietor, or are a

disregarded single member LLC taxed as a sole proprietor, and your household

income meets the Low Income Certification guidelines, you will not be required to

send the initial payment or make the required monthly payments while your offer is

being considered.

All payments sent in with your offer and made during consideration of the offer will

be applied to your tax debt. The payments cannot be returned to you unless you

pay more than the required payment and designate it as a deposit.

If you do not have sufficient cash to pay for your offer, you may need to consider

borrowing money from a bank, friends, and/or family. Other options may include

borrowing against or selling other assets.

Note: You may not pay your offer amount with an expected or current tax

refund, money already paid, funds attached by any collection action, or

anticipated benefits from a capital or net operating loss. If you are planning

to use your retirement savings from an IRA or 401k plan, you may have

future tax liabilities owed as a result. Contact the IRS or your tax advisor

before taking this action.

HOW TO APPLY

Application Process The application must include:

• Form 656, Offer in Compromise

• Completed Form 433-A (OIC), Collection Information Statement for Wage

Earners and Self-Employed Individuals, if applicable

• Completed Form 433-B (OIC), Collection Information Statement for

Businesses, if applicable

• $186 application fee, unless you meet Low Income Certification

• Initial offer payment, unless you meet Low Income Certification

Note: Your offer(s) cannot be considered without the completed and signed

Collection Information Statement(s), Form 433-A (OIC) and/or 433-B (OIC).

3

Payment Options

PAYING FOR YOUR OFFER

Application Fee Offers require a $186 application fee.

Exception: If you are an individual or are operating as a sole proprietor, or are a

disregarded single member Limited Liability Company (LLC) taxed as a sole

proprietor and your household gross income meets the Low Income Certification

guidelines, you will not be required to send the application fee.

Note: You may be eligible to receive a refund of the application fee if the IRS

either (1) accepts the offer to promote effective tax administration, or (2)

accepts the offer based on doubt as to collectability and determines that

collecting an amount greater than the amount offered would create an

economic hardship. After the IRS processes your offer, the IRS will notify

you if you are eligible to request a refund of the application fee.

COMPLETING THE APPLICATION PACKAGE

Step 1 – Gather Your Information To calculate an offer amount, you will need to gather information about your

financial situation, including cash, investments, available credit, assets, income,

and debt.

You will also need to gather information about your average household's gross

monthly income and expenses. The entire household includes all those in addition

to yourself who contribute money to pay expenses relating to the household such

as, rent, utilities, insurance, groceries, etc. This is necessary for the IRS to

accurately evaluate your offer.

In general, the IRS will not consider expenses for tuition for private schools,

college expenses, charitable contributions, and other unsecured debt payments as

part of the expense calculation.

Step 2 – Fill out Form 433-A

(OIC), Collection Information

Statement for Wage Earners and

Self-Employed Individuals

Fill out Form 433-A (OIC) if you are an individual wage earner and/or operate as a

sole proprietor, a disregarded single member LLC taxed as a sole proprietor or are

submitting an offer on behalf of a deceased individual. This will be used to

calculate an appropriate offer amount based on your assets, income, expenses,

and future earning potential. You will have the opportunity to provide a written

explanation of any special circumstances that affect your financial situation.

4

If You and Your Spouse Owe

Joint and Separate Tax Debts If you and your spouse have joint tax debt(s) and you and/or your spouse are also

responsible for separate tax debt(s), you will each need to send in a separate

Form 656. You will complete one Form 656 for yourself listing all your joint and any

separate tax debts and your spouse will complete one Form 656 listing all his or

her joint tax debt(s) plus any separate tax debt(s), for a total of two Forms 656.

If you and your spouse or ex-spouse have a joint tax debt and your spouse or ex-

spouse does not want to be part of the offer, you on your own may submit a Form

656 to compromise your responsibility for the joint tax debt.

Each Form 656 will require the $186 application fee and initial payment unless you

are an individual, are operating as a sole proprietor, or are a disregarded single

member LLC taxed as a sole proprietor, and meet the Low Income Certification

guidelines.

If You Owe Individual and

Business Tax Debt If you have individual and business tax debt that you wish to compromise, you will

need to send in two Forms 656. Complete one Form 656 for your individual tax

debts and one Form 656 for your business tax debts. Each Form 656 will require

the $186 application fee and initial payment.

Note: A business is defined as a corporation, partnership, or any business

that is operated as other than a sole-proprietorship. An individual's share of

a partnership debt will not be compromised. The partnership must submit an

offer based on the partnership's and partners' ability to pay.

If You Have Tax Debt From a

Limited Liability Company (LLC) Individuals or individuals operating as a disregarded single member LLC taxed as

a sole proprietor, tax debts (including employment taxes) incurred before January

1, 2009 may be included on one Form 656. However, in those instances where an

LLC incurred employment taxes after January 1, 2009 or excise taxes after

January 1, 2008, two Forms 656 must be sent with a separate application fee and

initial payment for each offer, even if the tax debts were reported under the same

Tax Identification Number. One Form 656 will be for the individual tax debts while

the second Form 656 will be for the LLC employment tax debts incurred after

January 1, 2009 and excise tax debts after January 1, 2008.

Step 3 – Fill out Form 433-B (OIC),

Collection Information Statement

for Businesses

Fill out Form 433-B (OIC) if the business is a Corporation, Partnership, LLC

classified as a corporation, single member LLC taxed as a corporation, or other

multi-owner/multi-member LLC. This will be used to calculate an appropriate offer

amount based on the business assets, income, expenses, and future earning

potential. If the business has assets that are used to produce income (for example,

a tow truck used in the business for towing vehicles), the business may be allowed

to exclude equity in these assets.

Step 4 – Attach Required

Documentation You will need to attach supporting documentation with Form(s) 433-A (OIC) and

433-B (OIC). A list of the documents required will be found at the end of each

form. Include copies of all required attachments. Do not send original

documents.

Step 5 – Fill out Form 656, Offer

in Compromise Fill out Form 656. The Form 656 identifies the tax years and type of tax you would

like to compromise. It also identifies your offer amount and the payment terms.

Step 6 – Include Initial Payment

and $186 Application Fee Include a personal check, cashier's check, or money order for your initial payment

based on the payment option you selected (20% of the offer amount for a lump

sum cash offer or the first month's payment for a periodic payment offer).

Include a separate personal check, cashier's check, or money order for the

application fee ($186).

Make both payments payable to the “United States Treasury.” All payments must

be made in U.S. dollars.

If you meet the Low Income Certification guidelines, the initial payment and

application fee are not required.

IMPORTANT INFORMATION

After You Mail Your Application

Continue to: Promptly reply to any requests for additional information within the time frame

specified.

If you selected the Periodic Payment option, you must continue to make the

payments during consideration of your offer, unless you meet the Low Income

Certification. Failure to reply timely or make monthly payments may result in the

return of your offer without appeal rights.

If your offer is accepted, you must continue to timely file all required tax returns

and timely pay all estimated tax payments and federal tax payments that become

due in the future. If you fail to timely file and timely pay any tax obligations that

become due within the five years after your offer is accepted (including any

extensions) your offer may be defaulted. If your offer is defaulted, you will be liable

for the original tax debt, less payments made, and all accrued interest and

penalties. An offer does not stop the accrual of interest and penalties. Please note

that if your final payment is more than the agreed amount by $50 or less the

money will not be returned but will be applied to your tax debt. If your final payment

is more than the agreed amount by more than $50, your money will be returned to

you.

In addition, your offer may be defaulted if you fail to promptly pay any tax debts

assessed after acceptance of your offer for any tax years prior to acceptance that

were not included in your original offer.

5

Step 7 – Mail the Application

Package Make a copy of your application package and keep it for your records.

Mail the application package to the appropriate IRS facility. See page 27,

Application Checklist, for details.

Note: If you are working with an IRS employee, let him or her know you are

sending or have sent an offer to compromise your tax debt(s).

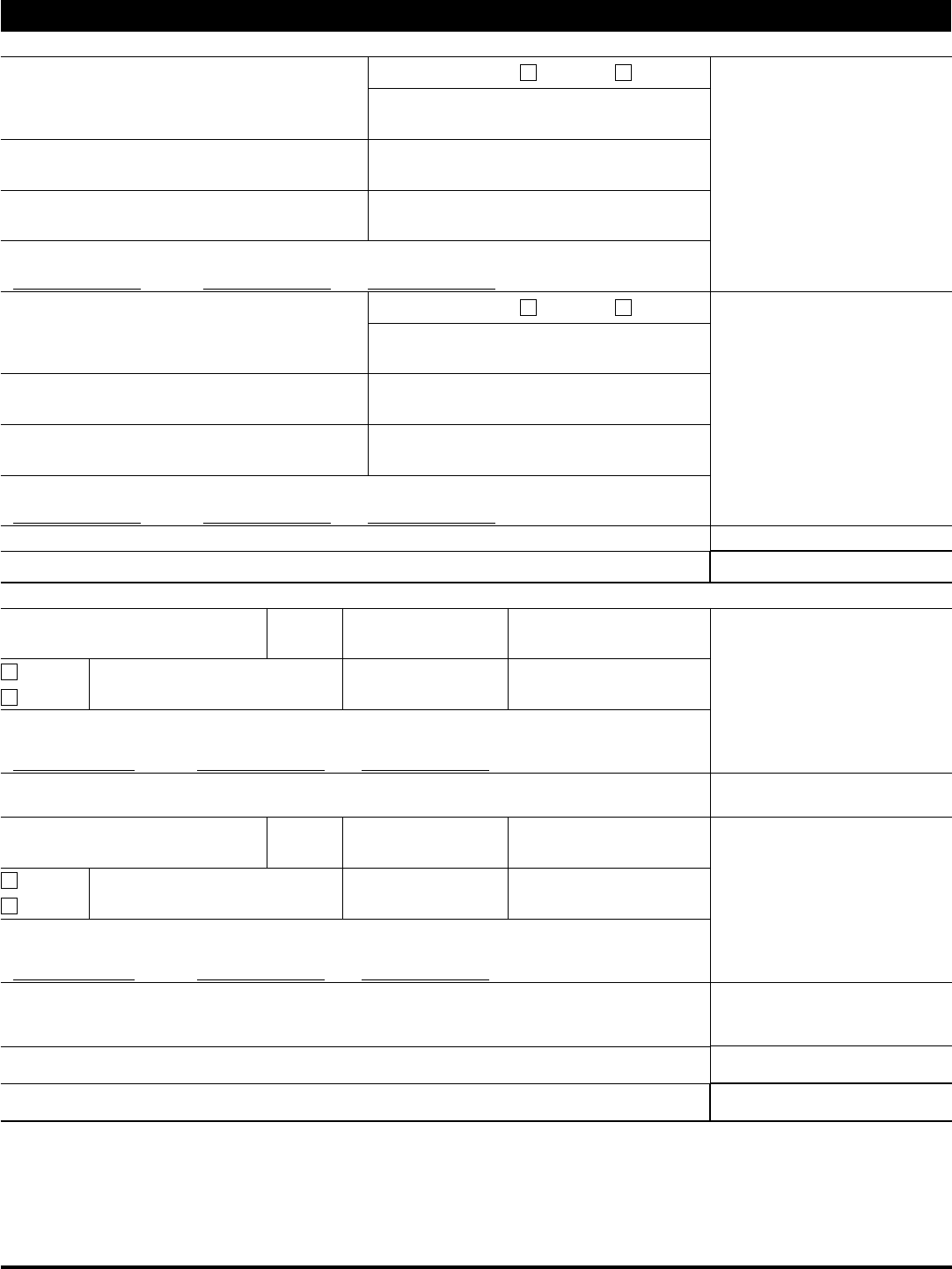

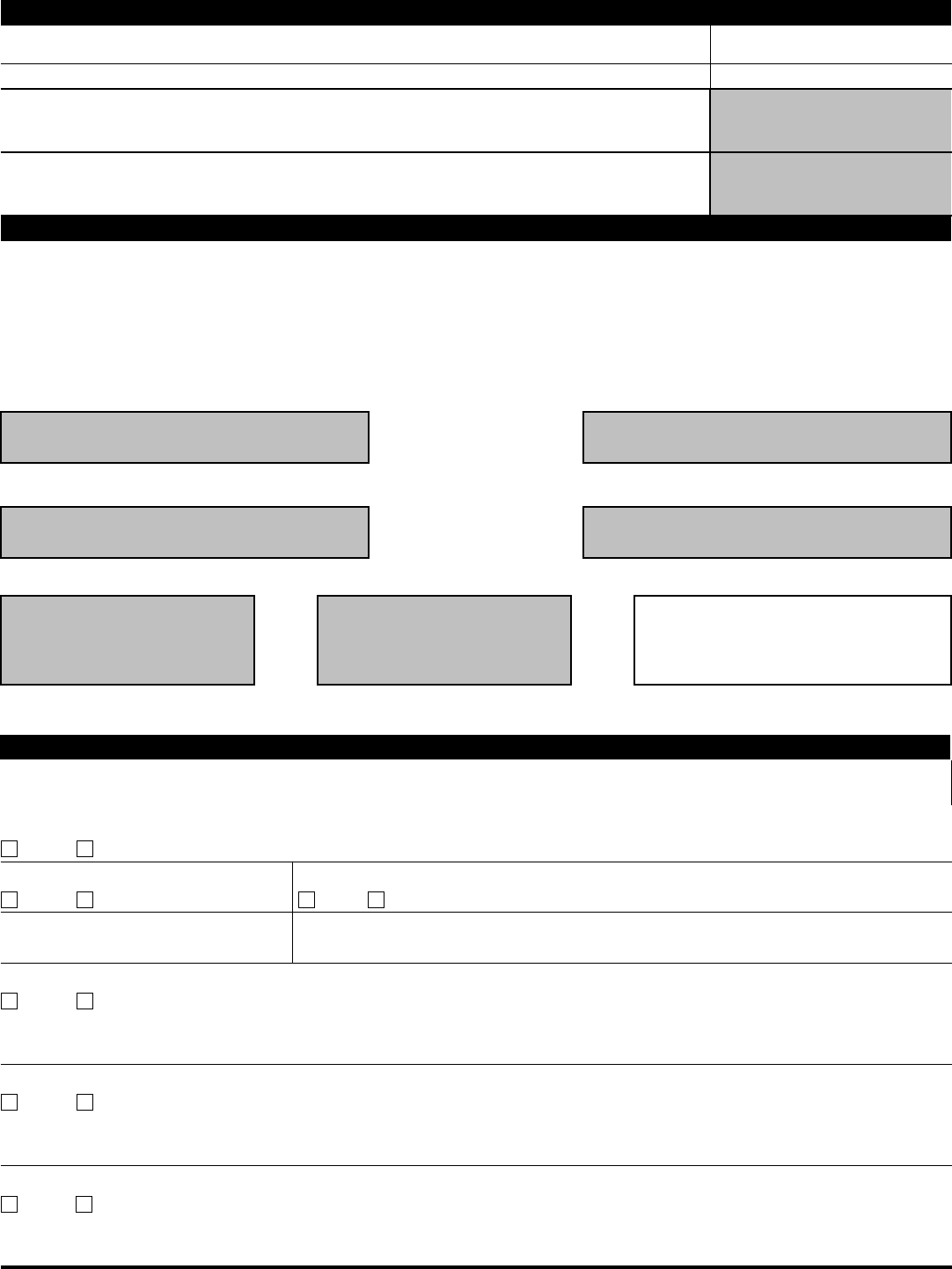

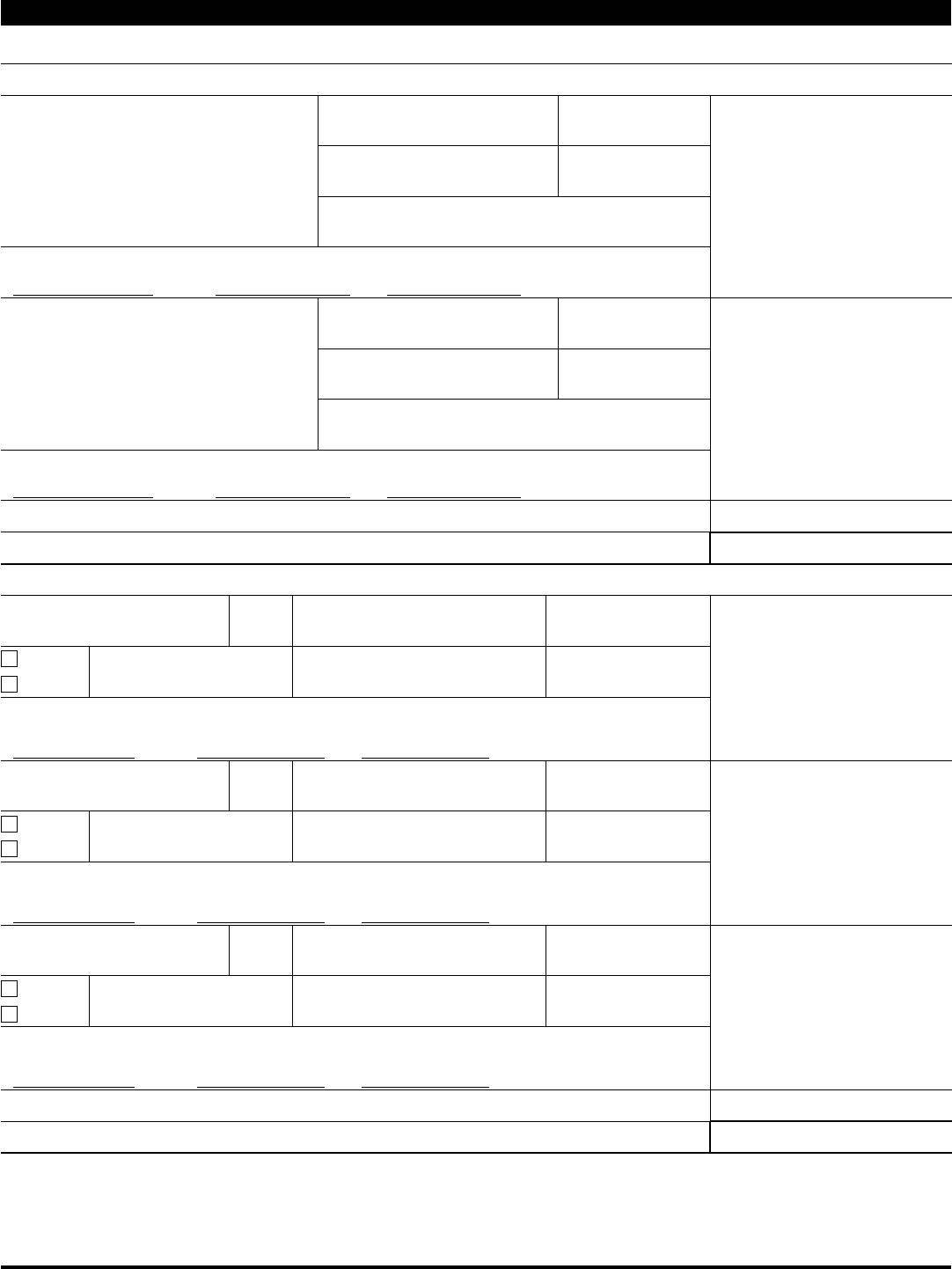

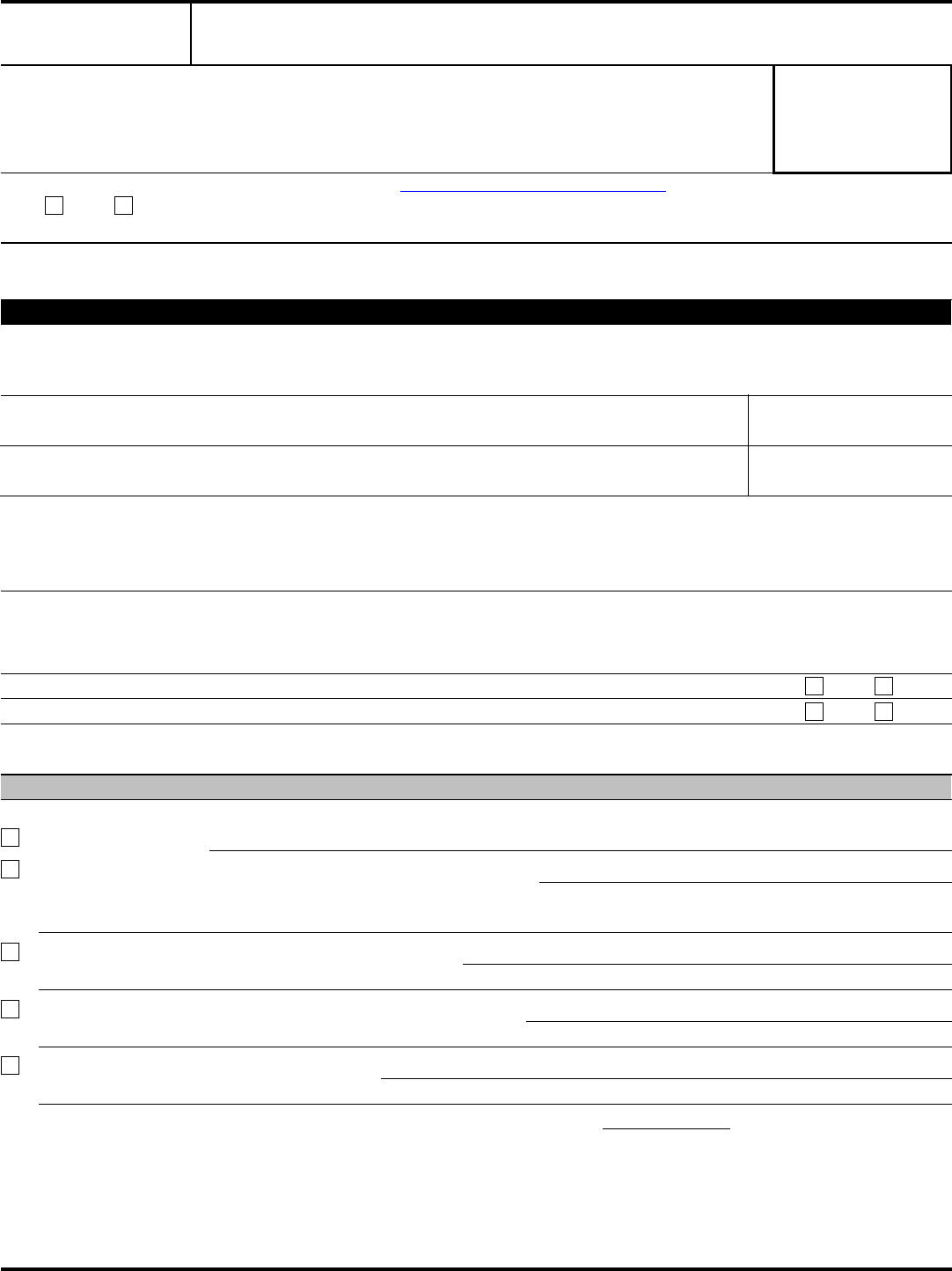

Form 433-A (OIC)

(Rev. March 2017)

Department of the Treasury — Internal Revenue Service

Collection Information Statement for Wage Earners and

Self-Employed Individuals

Use this form if you are

► An individual who owes income tax on a Form 1040, U.S.

Individual Income Tax Return

► An individual with a personal liability for Excise Tax

► An individual responsible for a Trust Fund Recovery Penalty

► An individual who is self-employed or has self-employment

income. You are considered to be self-employed if you are in

business for yourself, or carry on a trade or business.

► An individual who is personally responsible for a partnership

liability (only if the partnership is submitting an offer)

► An individual who operates as a disregarded single member

Limited Liability Company (LLC) taxed as a sole proprietor

► An individual who is submitting an offer on behalf of a

deceased person

Note: Include attachments if additional space is needed to respond completely to any question. This form should only be used with the Form

656, Offer in Compromise.

Section 1 Personal and Household Information

Last Name First Name Date of Birth (mm/dd/yyyy) Social Security Number

- -

Marital status

Unmarried

Married

Home Physical Address (Street, City, State, ZIP Code) Do you:

Own your home Rent

Other (specify e.g., share rent, live with relative, etc.)

County of Residence Primary Phone

( ) -

Secondary Phone

( ) -

Fax Number

( ) -

Home Mailing Address (if different from above or Post Office Box number)

Provide information about your spouse.

Spouse's Last Name Spouse's First Name Date of Birth (mm/dd/yyyy)

Provide information for all other persons in the household or claimed as a dependent.

Name Age Relationship Claimed as a dependent

on your Form 1040? Contributes to

household income?

Yes No Yes No

Yes No Yes No

Yes No Yes No

Yes No Yes No

Social Security Number

- -

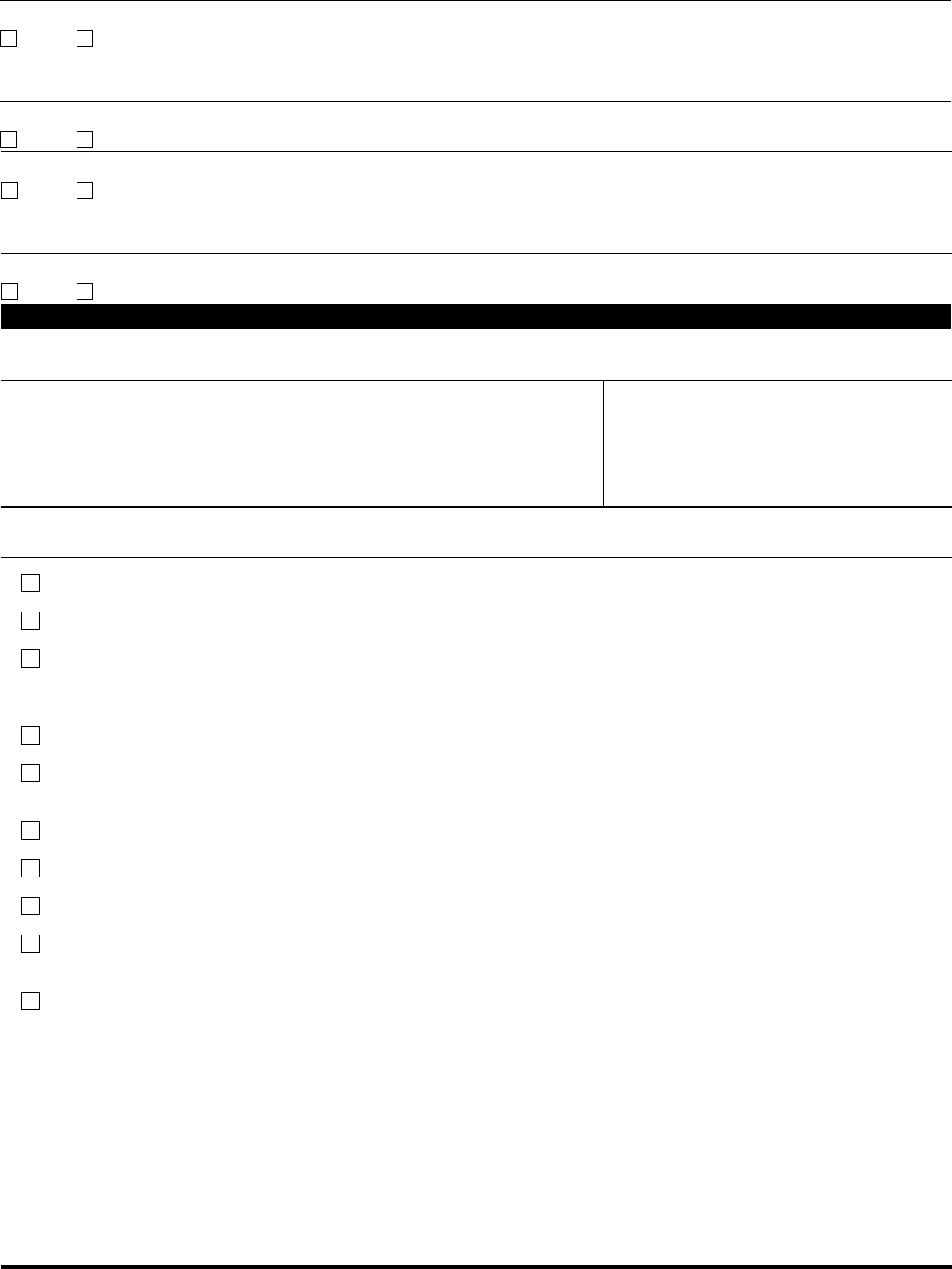

Section 2 Employment Information for Wage Earners

Complete this section if you or your spouse are wage earners and received a Form W-2. If you or your spouse have self-employment income (that is

you file a Schedule C, E, F, etc.) instead of, or in addition to wage income, you must also complete Business Information in Sections 4, 5, and 6.

Your Employer’s Name Employer’s Address (street, city, state, zip code)

Do you have an ownership interest in this

business?

Yes No

If yes, check the business interest that

applies: Partner Officer

Sole proprietor

Your Occupation How long with this employer

(years) (months)

Spouse’s Employer's Name Employer’s Address (street, city, state, zip code)

Does your spouse have an ownership

interest in this business?

Yes No

If yes, check the business interest that

applies: Partner Officer

Sole proprietor

Spouse's Occupation How long with this employer

(years) (months)

Catalog Number 55896Q www.irs.gov Form 433-A (OIC) (Rev. 3-2017)

Page 2 of 8

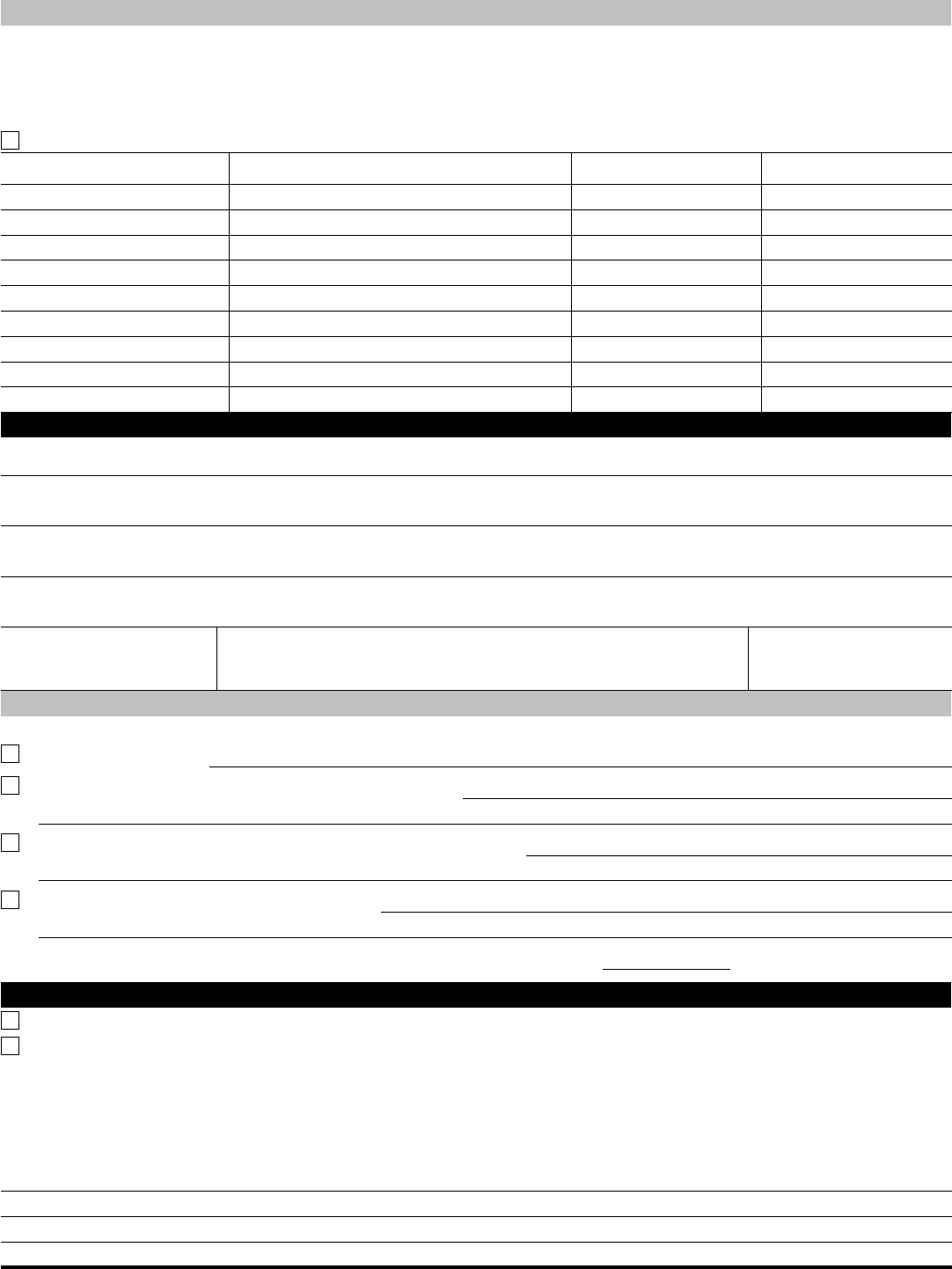

Section 3 Personal Asset Information

Use the most current statement for each type of account, such as checking, savings, money market and online accounts, stored value cards (such as, a

payroll card from an employer), investment and retirement accounts (IRAs, Keogh, 401(k) plans, stocks, bonds, mutual funds, certificates of deposit), life insurance

policies that have a cash value, and safe deposit boxes. Asset value is subject to adjustment by IRS based on individual circumstances. Enter the total

amount available for each of the following (if additional space is needed include attachments).

Round to the nearest dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Cash and Investments (domestic and foreign)

Cash Checking Savings Money Market/CD Online Account Stored Value Card

Bank Name Account Number

(1a) $

Checking Savings Money Market/CD Online Account Stored Value Card

Bank Name Account Number

(1b) $

Total of bank accounts from attachment (1c) $

Add lines (1a) through (1c) minus ($1,000) = (1) $

Investment Account: Stocks Bonds Other

Name of Financial Institution Account Number

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ = (2a) $

Investment Account: Stocks Bonds Other

Name of Financial Institution Account Number

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ = (2b) $

Total investment accounts from attachment. [current market value X.8 minus loan balance(s)] (2c) $

Add lines (2a) through (2c) = (2) $

Retirement Account: 401K IRA Other

Name of Financial Institution Account Number

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ = (3a) $

Retirement Account: 401K IRA Other

Name of Financial Institution Account Number

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ = (3b) $

Total of retirement accounts from attachment. [current market value X .8 minus loan balance(s)] (3c) $

Add lines (3a) through (3c) = (3) $

Cash Value of Life Insurance Policies

Name of Insurance Company Policy Number

Current Cash Value

$

Minus Loan Balance

– $ = (4a) $

Total cash value of life insurance policies from attachment

$

Minus Loan Balance(s)

– $ = (4b) $

Add lines (4a) through (4b) = (4) $

Catalog Number 55896Q www.irs.gov Form 433-A (OIC) (Rev. 3-2017)

Page 3 of 8

Section 3 (Continued) Personal Asset Information

Real Estate (Enter information about any house, condo, co-op, time share, etc. that you own or are buying)

Property Address (Street Address, City, State, ZIP Code) Primary Residence Yes No

Date Purchased

County and Country Date of Final Payment

How title is held (joint tenancy, etc.) Description of Property

Current Market Value

$ X .8 = $

Minus Loan Balance (Mortgages, etc.)

– $ (Total Value of Real Estate) = (5a) $

Property Address (Street Address, City, State, ZIP Code) Primary Residence Yes No

Date Purchased

County and Country Date of Final Payment

How title is held (joint tenancy, etc.) Description of Property

Current Market Value

$ X .8 = $

Minus Loan Balance (Mortgages, etc.)

– $ (Total Value of Real Estate) = (5b) $

Total value of property(s) from attachment [current market value X .8 minus any loan balance(s)] (5c) $

Add lines (5a) through (5c) = (5) $

Vehicles (Enter information about any cars, boats, motorcycles, etc. that you own or lease)

Vehicle Make & Model Year Date Purchased Mileage

Lease

Loan

Name of Creditor Date of Final Payment Monthly Lease/Loan Amount

$

Current Market Value

$ X .8 = $

Minus Loan Balance (Mortgages, etc.)

– $ Total value of vehicle (if the vehicle

is leased, enter 0 as the total value) = (6a) $

Subtract $3,450 from line (6a)

(If line (6a) minus $3,450 is a negative number, enter "0") (6b) $

Vehicle Make & Model Year Date Purchased Mileage

Lease

Loan

Name of Creditor Date of Final Payment Monthly Lease/Loan Amount

$

Current Market Value

$ X .8 = $

Minus Loan Balance (Mortgages, etc.)

– $ Total value of vehicle (if the vehicle

is leased, enter 0 as the total value) = (6c) $

If you are filing a joint offer, subtract $3,450 from line (6c)

(If line (6c) minus $3,450 is a negative number, enter "0")

If you are not filing a joint offer, enter the amount from line (6c)

(6d) $

Total value of vehicles listed from attachment [current market value X .8 minus any loan balance(s)] (6e) $

Total lines (6b), (6d), and (6e) = (6) $

Catalog Number 55896Q www.irs.gov Form 433-A (OIC) (Rev. 3-2017)

Page 4 of 8

Section 3 (Continued) Personal Asset Information

Other valuable items (artwork, collections, jewelry, items of value in safe deposit boxes, interest in a company or business that is not publicly traded, etc.)

Note: Do not include clothing, furniture and other personal effects.

Description of asset:

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ = (7a) $

Description of asset:

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ = (7b) $

Total value of valuable items listed from attachment [current market value X .8 minus any loan balance(s)] (7c) $

Add lines (7a) through (7c) = (7) $

Do not include amount on the lines with a letter beside the number. Round to the nearest whole dollar.

Do not enter a negative number. If any line item is a negative, enter "0" on that line.

Add lines (1) through (7) and enter the amount in Box A =

Box A

Available Individual Equity in

Assets

$

NOTE: If you or your spouse are self-employed, Sections 4, 5, and 6 must be completed before continuing with Sections 7 and 8.

Section 4 Self-Employed Information

If you or your spouse are self-employed (e.g., files Schedule(s) C, E, F, etc.), complete this section.

Is your business a sole proprietorship?

Yes No

Name of Business

Address of Business (If other than personal residence)

Business Telephone Number

( ) -

Employer Identification Number Business Website Trade Name or DBA

Description of Business Total Number of Employees Frequency of Tax Deposits Average Gross Monthly

Payroll $

Do you or your spouse have any other business interests? Include any

interest in an LLC, LLP, corporation, partnership, etc.

Yes (Percentage of ownership: ) Title:

No

Business Address (Street, City, State, ZIP code)

Business Name Business Telephone Number

( ) -

Employer Identification Number

Type of business (Select one)

Partnership LLC Corporation Other

Section 5 Business Asset Information (for Self-Employed)

List business assets such as bank accounts, tools, books, machinery, equipment, business vehicles and real property that is owned/leased/rented. If

additional space is needed, attach a list of items. Do not include personal assets listed in Section 3.

Round to the nearest whole dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Cash Checking Savings Money Market/CD Online Account Stored Value Card

Bank Name Account Number

(8a) $

Cash Checking Savings Money Market/CD Online Account Stored Value Card

Bank Name Account Number

(8b) $

Total bank accounts from attachment (8c) $

Add lines (8a) through (8c) = (8) $

Catalog Number 55896Q www.irs.gov Form 433-A (OIC) (Rev. 3-2017)

Page 5 of 8

Section 5 (Continued) Business Asset Information (for Self-Employed)

Description of asset:

Current Market Value

$ X .8 = $

Minus Loan Balance

– $

(if leased or used in the

production of income, enter 0

as the total value) = (9a) $

Description of asset:

Current Market Value

$ X .8 = $

Minus Loan Balance

– $

(if leased or used in the

production of income, enter 0

as the total value) = (9b) $

Total value of assets listed from attachment [current market value X .8 minus any loan balance(s)] (9c) $

Add lines (9a) through (9c) = (9) $

IRS allowed deduction for professional books and tools of trade – (10) $

Enter the value of line (9) minus line (10). If less than zero enter zero. = (11) $

Notes Receivable

Do you have notes receivable? Yes No

If yes, attach current listing that includes name(s) and amount of note(s) receivable.

Accounts Receivable

Do you have accounts receivable, including e-payment, factoring

companies, and any bartering or online auction accounts? Yes No

If yes, you may be asked to provide a list of your account(s) receivable.

Do not include amounts from the lines with a letter beside the number [for example: (9c)].

Round to the nearest whole dollar.

Do not enter a negative number. If any line item is a negative, enter "0" on that line.

Add lines (8) and (11) and enter the amount in Box B =

Box B

Available Business Equity in

Assets

$

Section 6 Business Income and Expense Information (for Self-Employed)

If you provide a current profit and loss (P&L) statement for the information below, enter the total gross monthly income on line 17 and your monthly

expenses on line 29 below. Do not complete lines (12) - (16) and (18) - (28). You may use the amounts claimed for income and expenses on your most

recent Schedule C; however, if the amount has changed significantly within the past year, a current P&L should be submitted to substantiate the claim.

Round to the nearest whole dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Business Income (You may average 6-12 months income/receipts to determine your Gross monthly income/receipts.)

Gross receipts (12) $

Gross rental income (13) $

Interest income (14) $

Dividends (15) $

Other income (16) $

Add lines (12) through (16) = (17) $

Business Expenses (You may average 6-12 months expenses to determine your average expenses.)

Materials purchased (e.g., items directly related to the production of a product or service) (18) $

Inventory purchased (e.g., goods bought for resale) (19) $

Gross wages and salaries (20) $

Rent (21) $

Supplies (items used to conduct business and used up within one year, e.g., books, office supplies, professional equipment, etc.) (22) $

Utilities/telephones (23) $

Vehicle costs (gas, oil, repairs, maintenance) (24) $

Business Insurance (25) $

Current Business Taxes (e.g., Real estate, excise, franchise, occupational, personal property, sales and employer's portion of

employment taxes) (26) $

Secured debts (not credit cards) (27) $

Other business expenses (include a list) (28) $

Add lines (18) through (28) = (29) $

Round to the nearest whole dollar.

Do not enter a negative number. If any line item is a negative, enter "0" on that line.

Subtract line (29) from line (17) and enter the amount in Box C =

Box C

Net Business Income

$

Catalog Number 55896Q www.irs.gov Form 433-A (OIC) (Rev. 3-2017)

Page 6 of 8

Section 7 Monthly Household Income and Expense Information

Enter your household's gross monthly income. The information below is for yourself, your spouse, and anyone else who contributes to

your household's income. The entire household includes spouse, non-liable spouse, significant other, children, and others who

contribute to the household. This is necessary for the IRS to accurately evaluate your offer.

Monthly Household Income

Note: Entire household income should also include income that is considered not taxable and may not be included on your

tax return. Round to the nearest whole dollar.

Primary taxpayer

Gross Wages

$

Social Security

+ $

Pension(s)

+ $

Other Income (e.g. unemployment)

+ $ Total primary

taxpayer income = (30) $

Spouse

Gross Wages

$

Social Security

+ $

Pension(s)

+ $

Other Income (e.g. unemployment)

+ $ Total spouse

income = (31) $

Additional sources of income used to support the household, e.g., non-liable spouse, or anyone else who may

contribute to the household income, etc. (32) $

Distributions (e.g., income from partnerships, sub-S Corporations, etc.) (34) $

Net rental income (35) $

Net business income from Box C (36) $

Child support received (37) $

Alimony received (38) $

Round to the nearest whole dollar.

Do not enter a negative number. If any line item is a negative, enter "0" on that line.

Add lines (30) through (38) and enter the amount in Box D =

Box D

Total Household Income

$

Monthly Household Expenses

Enter your average monthly expenses.

Note: For expenses claimed in boxes (39) and (45) only, you should list the full amount of the allowable standard even if the

actual amount you pay is less. You may find the allowable standards at http://www.irs.gov/Businesses/Small-Businesses-&-

Self-Employed/Collection-Financial-Standards.

Round to the nearest whole dollar.

Food, clothing, and miscellaneous (e.g., housekeeping supplies, personal care products , minimum payment on credit card).

A reasonable estimate of these expenses may be used. (39) $

Housing and utilities (e.g., rent or mortgage payment and average monthly cost of property taxes, home insurance,

maintenance, dues, fees and utilities including electricity, gas, other fuels, trash collection, water, cable television and internet,

telephone, and cell phone). (40) $

Vehicle loan and/or lease payment(s) (41) $

Vehicle operating costs (e.g., average monthly cost of maintenance, repairs, insurance, fuel, registrations, licenses,

inspections, parking, tolls, etc.). A reasonable estimate of these expenses may be used. (42) $

Public transportation costs (e.g., average monthly cost of fares for mass transit such as bus, train, ferry, taxi, etc.). A

reasonable estimate of these expenses may be used. (43) $

Health insurance premiums (44) $

Out-of-pocket health care costs (e.g. average monthly cost of prescription drugs, medical services, and medical supplies like

eyeglasses, hearing aids, etc.) (45) $

Court-ordered payments (e.g., monthly cost of any alimony, child support, etc.) (46) $

Child/dependent care payments (e.g., daycare, etc.) (47) $

Life insurance premiums (48) $

Current monthly taxes (e.g., monthly cost of federal, state, and local tax, personal property tax, etc.) (49) $

Catalog Number 55896Q www.irs.gov Form 433-A (OIC) (Rev. 3-2017)

Interest and dividends (33) $

Page 7 of 8

Section 7 Monthly Household Income and Expense Information (Continued)

Secured debts (e.g., any loan where you pledged an asset as collateral not previously listed, government guaranteed Student

Loan) (50) $

Enter the amount of your monthly delinquent State and/or Local Tax payment(s) (51) $

Round to the nearest whole dollar.

Do not enter a negative number. If any line item is a negative, enter "0" on that line.

Add lines (39) through (51) and enter the amount in Box E =

Box E

Total Household Expenses

$

Round to the nearest whole dollar.

Do not enter a negative number. If any line item is a negative, enter "0" on that line.

Subtract Box E from Box D and enter the amount in Box F =

Box F

Remaining Monthly Income

$

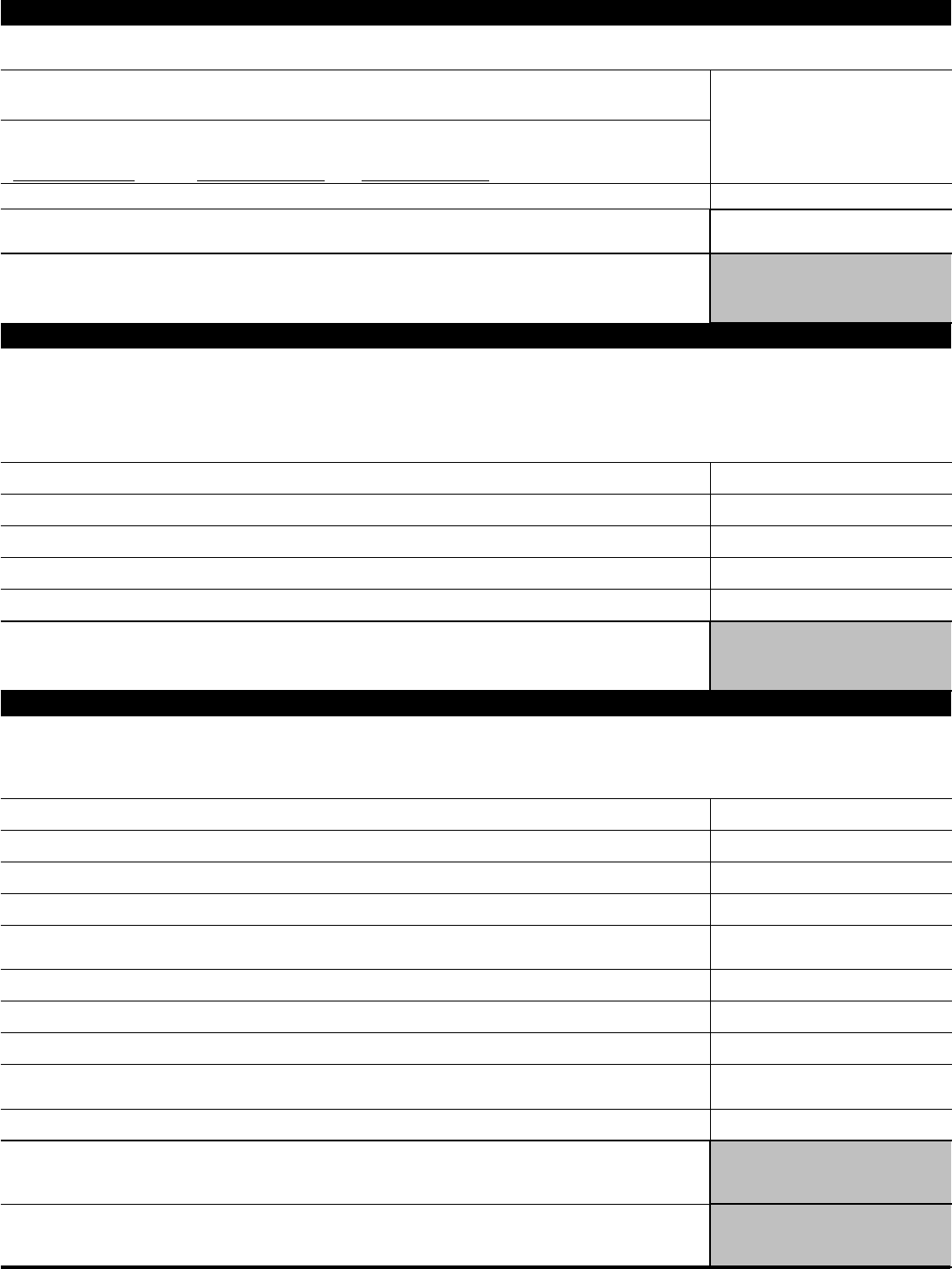

Section 8 Calculate Your Minimum Offer Amount

The next steps calculate your minimum offer amount. The amount of time you take to pay your offer in full will affect your minimum offer amount. Paying

over a shorter period of time will result in a smaller minimum offer amount.

Note: The multipliers below (12 and 24) and the calculated offer amount do not apply if IRS determines you have the ability to pay your tax

debt in full within the legal period to collect.

Round to the nearest whole dollar.

If you will pay your offer in 5 or fewer payments within 5 months or less, multiply "Remaining Monthly Income" (Box F) by 12 to get "Future Remaining

Income" (Box G). Do not enter a number less than $0.

Enter the total from Box F

$X 12 =

Box G Future Remaining Income

$

If you will pay your offer in 6 to 24 months, multiply "Remaining Monthly Income" (Box F) by 24 to get "Future Remaining Income" (Box H). Do not enter

a number less than $0.

Enter the total from Box F

$X 24 =

Box H Future Remaining Income

$

Determine your minimum offer amount by adding the total available assets from Box A and Box B (if applicable) to the amount in either Box G or Box H.

Enter the amount from Box A

plus Box B (if applicable)

$+

Enter the amount from either

Box G or Box H

$=

Offer Amount

Your offer must be more than zero ($0). Do

not leave blank. Use whole dollars only.

$

If you cannot pay the Offer Amount shown above due to special circumstances, explain on the Form 656, Offer in

Compromise, Section 1, Low Income Certification. You must offer an amount more than $0.

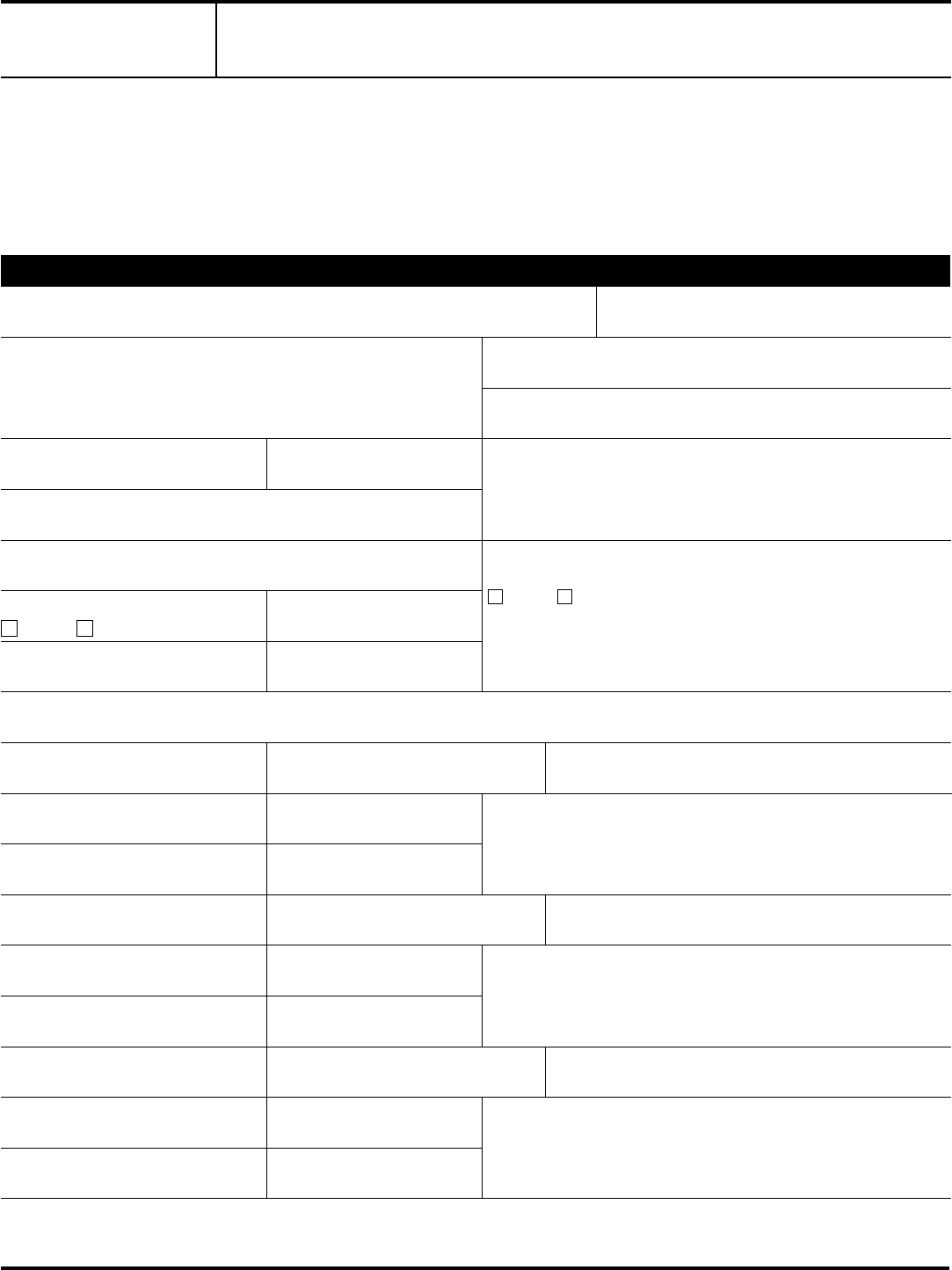

Section 9 Other Information

Additional information IRS needs to consider settlement of your tax debt. If you or your business are currently in a bankruptcy proceeding,

you are not eligible to apply for an offer.

Are you the beneficiary of a trust, estate, or life insurance policy?

Yes No

Are you currently in bankruptcy?

Yes No

Have you filed bankruptcy in the past 10 years?

Yes No

Discharge/Dismissal Date (mm/dd/yyyy) Location Filed

Are you or have you been party to a lawsuit?

If yes and the suit included tax debt, provide the types of tax and periods involved.

NoYes

Are you or have you been party to any lawsuits involving the IRS/United States (including any suits regarding tax matters)?

Yes No

If yes, date the lawsuit was resolved: (mm/dd/yyyy)

In the past 10 years, have you transferred any assets for less than their full value?

Yes No

If yes, provide date, value, and type of asset transferred: (mm/dd/yyyy)

Catalog Number 55896Q www.irs.gov Form 433-A (OIC) (Rev. 3-2017)

Page 8 of 8

Section 10 Signatures

Under penalties of perjury, I declare that I have examined this offer, including accompanying documents, and to the best of my knowledge it

is true, correct, and complete.

Signature of Taxpayer Date (mm/dd/yyyy)

Signature of Spouse Date (mm/dd/yyyy)

Remember to include all applicable attachments listed below.

Copies of the most recent pay stub, earnings statement, etc., from each employer

Copies of the most recent statement for each investment and retirement account

Copies of the most recent statement, etc., from all other sources of income such as pensions, Social Security, rental income,

interest and dividends (including any received from a related partnership, corporation, LLC, LLP, etc.), court order for child

support, alimony, and rent subsidies

Copies of bank statements for the three most recent months

Copies of the most recent statement from lender(s) on loans such as mortgages, second mortgages, vehicles, etc., showing

monthly payments, loan payoffs, and balances

List of Notes Receivable, if applicable

Verification of delinquent State/Local Tax Liability, if applicable

Documentation to support any special circumstances described in the “Explanation of Circumstances” on Form 656, if applicable

Attach a Form 2848, Power of Attorney, if you would like your attorney, CPA, or enrolled agent to represent you and you do not

have a current form on file with the IRS.

Completed and signed Form 656

Catalog Number 55896Q www.irs.gov Form 433-A (OIC) (Rev. 3-2017)

In the past 3 years have you transferred any real property (land, house, etc.)?

Yes No

If yes, list the type of property, value, and date of the transfer.

Have you lived outside the U.S. for 6 months or longer in the past 10 years?

Yes No

Do you have any assets or own any real property outside the U.S.?

Yes No

If yes, provide description, location, and value.

Do you have any funds being held in trust by a third party?

Yes No If yes, how much $ Where:

►

►

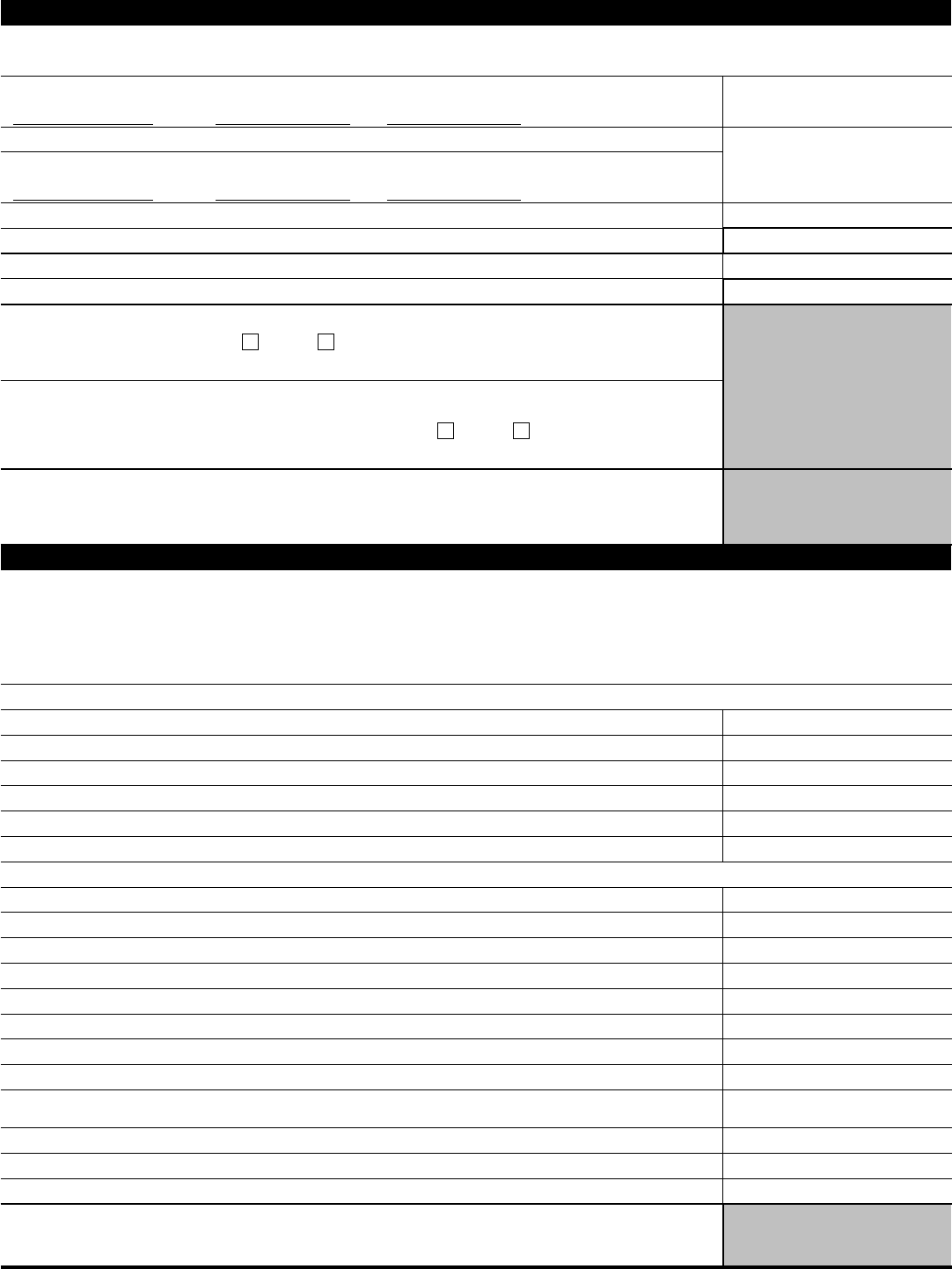

Form 433-B (OIC)

(Rev. March 2017)

Department of the Treasury — Internal Revenue Service

Collection Information Statement for Businesses

Complete this form if your business is a

► Corporation

► Partnership

► Limited Liability Company (LLC) classified as a corporation

► Other multi-owner/multi-member LLC

Note: If your business is a sole proprietorship or a disregarded single member LLC taxed as a sole proprietor (filing Schedule C, D, E, F, etc.),

do not use this form. Instead, complete Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-Employed Individuals.

This form should only be used with the Form 656, Offer in Compromise.

Include attachments if additional space is needed to respond completely to any question.

Section 1 Business Information

Business Name Employer Identification Number

Business Physical Address (street, city, state, zip code)

Primary Phone

( ) -

Secondary Phone

( ) -

Business website address

County of Business Location

Description of Business and DBA or "Trade Name"

Business Mailing Address (if different from above or Post Office Box number)

Fax Number

( ) -

Federal Contractor

Yes No

Total Number of Employees

Frequency of Tax Deposits Average Gross Monthly Payroll

$

Does the business outsource its payroll processing and tax return

preparation for a fee?

Yes No If yes, list provider name and address in box below

(Street, City, State, ZIP Code)

Provide information about all partners, officers, LLC members, major shareholders (foreign and domestic), etc., associated with the business.

Include attachments if additional space is needed.

Last Name First Name Title

Percent of Ownership and Annual Salary Social Security Number

- -

Home Address (Street, City, State, ZIP Code)

Primary Phone

( ) -

Secondary Phone

( ) -

Last Name First Name Title

Percent of Ownership and Annual Salary Social Security Number

- -

Home Address (Street, City, State, ZIP Code)

Primary Phone

( ) -

Secondary Phone

( ) -

Last Name First Name Title

Percent of Ownership and Annual Salary Social Security Number

- -

Home Address (Street, City, State, ZIP Code)

Primary Phone

( ) -

Secondary Phone

( ) -

Catalog Number 55897B www.irs.gov Form 433-B (OIC) (Rev. 3-2017)

Page 2 of 6

Section 2 Business Asset Information

Gather the most current statement from banks, lenders on loans, mortgages (including second mortgages), monthly payments, loan balances, and

accountant's depreciation schedules, if applicable. Also, include make/model/year/mileage of vehicles and current value of business assets. To estimate

the current value, you may consult resources like Kelley Blue Book (www.kbb.com), NADA (www.nada.com), local real estate postings of properties

similar to yours, and any other websites or publications that show what the business assets would be worth if you were to sell them. Asset value is

subject to adjustment by IRS. Enter the total amount available for each of the following (if additional space is needed, please include attachments).

Round to the nearest dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Cash and Investments (domestic and foreign)

Cash Checking Savings Money Market/CD Online Account Stored Value Card

Bank Name Account Number

(1a) $

Cash Checking Savings Money Market/CD Online Account Stored Value Card

Bank Name Account Number

(1b) $

Cash Checking Savings Money Market/CD Online Account Stored Value Card

Bank Name Account Number

(1c) $

Total bank accounts from attachment (1d) $

Add lines (1a) through (1d) = (1) $

Investment Account: Stocks Bonds Other

Name of Financial Institution Account Number

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ = (2a) $

Investment Account: Stocks Bonds Other

Name of Financial Institution Account Number

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ = (2b) $

Total investment accounts from attachment. [current market value X.8 minus loan balance(s)] (2c) $

Add lines (2a) through (2c) = (2) $

Notes Receivable

Do you have notes receivable? Yes No

If yes, attach current listing which includes name, age, and amount of note(s) receivable.

Accounts Receivable

Do you have accounts receivable, including e-payment, factoring

companies, and any bartering or online auction accounts? Yes No

If yes, you may be asked to provide a list of name, age, and amount of the account(s) receivable.

Catalog Number 55897B www.irs.gov Form 433-B (OIC) (Rev. 3-2017)

Page 3 of 6

Section 2 (Continued) Business Asset Information

If the business owns more properties, vehicles, or equipment than shown in this form, please list on a separate attachment.

Real Estate (Buildings, Lots, Commercial Property, etc.)

Property Address (Street Address, City, State, ZIP

Code) Property Description Date Purchased

Name of Creditor Date of Final Payment

County and Country

Current Market Value

$ X .8 = $

Minus Loan Balance (mortgages, etc.)

– $ Total Value of Real Estate = (3a) $

Property Address (Street Address, City, State, ZIP

Code) Property Description Date Purchased

Name of Creditor Date of Final Payment

County and Country

Current Market Value

$ X .8 = $

Minus Loan Balance (mortgages, etc.)

– $ Total Value of Real Estate = (3b) $

Total value of property(s) listed from attachment [current market value X .8 minus any loan balance(s)] (3c) $

Add lines (3a) through (3c) = (3) $

Business Vehicles (cars, boats, motorcycles, trailers, etc.). If additional space is needed, list on an attachment.

Vehicle Make & Model Year Date Purchased Mileage or Use Hours

Lease

Loan

Name of Creditor Date of Final Payment Monthly Lease/Loan Amount

$

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ Total value of vehicle (if the vehicle

is leased, enter 0 as the total value) = (4a) $

Vehicle Make & Model Year Date Purchased Mileage or Use Hours

Lease

Loan

Name of Creditor Date of Final Payment Monthly Lease/Loan Amount

$

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ Total value of vehicle (if the vehicle

is leased, enter 0 as the total value) = (4b) $

Vehicle Make & Model Year Date Purchased Mileage or Use Hours

Lease

Loan

Name of Creditor Date of Final Payment Monthly Lease/Loan Amount

$

Current Market Value

$ X .8 = $

Minus Loan Balance

– $ Total value of vehicle (if the vehicle

is leased, enter 0 as the total value) = (4c) $

Total value of vehicles listed from attachment [current market value X .8 minus any loan balance(s)] (4d) $

Add lines (4a) through (4d) = (4) $

Catalog Number 55897B www.irs.gov Form 433-B (OIC) (Rev. 3-2017)

Page 4 of 6

Section 2 (Continued) Business Asset Information

Other Business Equipment

[If you have more than one piece of equipment, please list on a separate attachment and put the total of all equipment in box (5b)]

Type of equipment

Current Market Value

$ X .8 = $

Minus Loan Balance

– $

Total value of equipment

(if leased or used in the production of

income enter 0 as the total value) = (5a) $

Total value of equipment listed from attachment [current market value X .8 minus any loan balance(s)] (5b) $

Total value of all business equipment

Add lines (5a) and (5b) = (5) $

Do not include amount on the lines with a letter beside the number. Round to the nearest dollar.

Do not enter a negative number. If any line item is a negative number, enter "0" on that line.

Add lines (1) through (5) and enter the amount in Box A =

Box A

Available Equity in Assets

$

Section 3 Business Income Information

Enter the average gross monthly income of your business. To determine your gross monthly income use the most recent 6-12 months documentation of

commissions, invoices, gross receipts from sales/services, etc.; most recent 6-12 months earnings statements, etc., from every other source of income (such as

rental income, interest and dividends, or subsidies); or you may use the most recent 6-12 months Profit and Loss (P&L) to provide the information of income and

expenses.

Note: If you provide a current profit and loss statement for the information below, enter the total gross monthly income in Box B below. Do not

complete lines (6) - (10). Entire household income should also include income that is considered as not taxable and may not be included on your tax

return.

Gross receipts (6) $

Gross rental income (7) $

Interest income (8) $

Dividends (9) $

Other income (Specify on attachment) (10) $

Round to the nearest dollar.

Do not enter a negative number. If any line item is a negative number, enter "0" on that line.

Add lines (6) through (10) and enter the amount in Box B =

Box B

Total Business Income

$

Section 4 Business Expense Information

Enter the average gross monthly expenses for your business using your most recent 6-12 months statements, bills, receipts, or other documents

showing monthly recurring expenses.

Note: If you provide a current profit and loss statement for the information below, enter the total monthly expenses in Box C below. Do not

complete lines (11) - (20).

Materials purchased (e.g., items directly related to the production of a product or service) (11) $

Inventory purchased (e.g., goods bought for resale) (12) $

Gross wages and salaries (13) $

Rent (14) $

Supplies (items used to conduct business and used up within one year, e.g., books, office supplies, professional

equipment, etc.) (15) $

Utilities/telephones (16) $

Vehicle costs (gas, oil, repairs, maintenance) (17) $

Insurance (other than life) (18) $

Current taxes (e.g., real estate, state, and local income tax, excise franchise, occupational, personal property,

sales and employer's portion of employment taxes, etc.) (19) $

Other expenses (e.g., secured debt payments. Specify on attachment. Do not include credit card payments) (20) $

Round to the nearest dollar.

Do not enter a negative number. If any line item is a negative number, enter "0" on that line.

Add lines (11) through (20) and enter the amount in Box C =

Round to the nearest dollar.

Do not enter a negative number. If any line item is a negative number, enter "0" on that line.

Subtract Box C from Box B and enter the amount in Box D =

Box C

Total Business Expenses

$

Box D

Remaining Monthly Income

$

Catalog Number 55897B www.irs.gov Form 433-B (OIC) (Rev. 3-2017)

Page 5 of 6

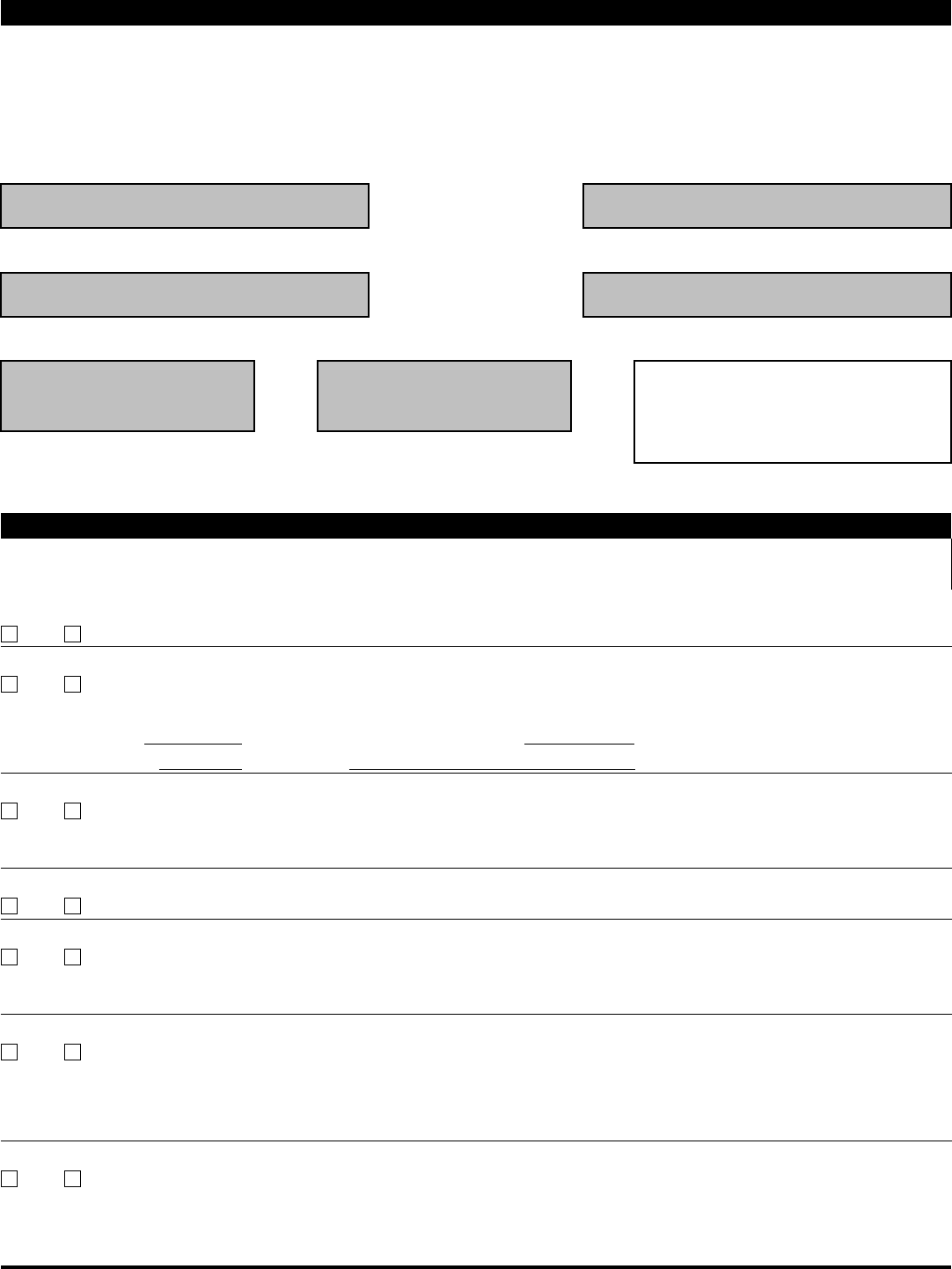

Section 5 Calculate Your Minimum Offer Amount

The next steps calculate your minimum offer amount. The amount of time you take to pay your offer in full will affect your minimum offer amount. Paying

over a shorter period of time will result in a smaller minimum offer amount.

If you will pay your offer in 5 or fewer payments within 5 months or less, multiply "Remaining Monthly Income" (Box D) by 12 to get "Future Remaining

Income." Do not enter a number less than zero.

Note: The multipliers below (12 and 24) and the calculated offer amount do not apply if IRS determines you have the ability to pay your tax

debt in full within the legal period to collect. Round to the nearest whole dollar.

Enter the total from Box D

$X 12 = Box E Future Remaining Income

$

If you will pay your offer in 6 to 24 months, multiply "Remaining Monthly Income" (Box D) by 24 to get "Future Remaining Income". Do not enter a

number less than zero.

Enter the total from Box D

$X 24 = Box F Future Remaining Income

$

Determine your minimum offer amount by adding the total available assets from Box A to the amount in either Box E or Box F. Your offer amount must

be more than zero.

Enter the amount from Box A *

$+

Enter the amount from either

Box E or Box F

$=

Offer Amount

Your offer must be more than zero ($0).

Do not leave blank. Use whole dollars only.

$

You must offer an amount more than $0.

*You may exclude any equity in income producing assets shown in Section 2 of this form.

Section 6 Other Information

Additional information IRS needs to consider settlement of your tax debt. If this business is currently in a bankruptcy proceeding, the

business is not eligible to apply for an offer.

Is the business currently in bankruptcy?

Yes No

Has the business ever filed bankruptcy?

Yes No

If yes, provide:

Date Filed (mm/dd/yyyy) Date Dismissed or Discharged (mm/dd/yyyy)

Petition No. Location Filed

Does this business have other business affiliations (e.g., subsidiary or parent companies)?

Yes No

If yes, list the Name and Employer Identification Number:

Do any related parties (e.g., partners, officers, employees) owe money to the business?

Yes No

Is the business currently, or in the past, a party to a lawsuit?

Yes No

If yes, date the lawsuit was resolved:

In the past 10 years, has the business transferred any assets for less than their full value?

If yes and the suit included tax debt, provide the types of tax and periods involved.

NoYes

Are you or have you been party to any lawsuits involving the IRS/United States (including any suits regarding tax matters)?

Yes No

If yes, provide date, value, and type of asset transferred:

Catalog Number 55897B www.irs.gov Form 433-B (OIC) (Rev. 3-2017)

Page 6 of 6

Section 7 Signatures

Under penalties of perjury, I declare that I have examined this offer, including accompanying documents, and to the best of my knowledge it

is true, correct, and complete.

►

Signature of Taxpayer Title Date (mm/dd/yyyy)

Remember to include all applicable attachments from list below.

A current Profit and Loss statement covering at least the most recent 6–12 month period, if appropriate.

Copies of the three most recent statements for each bank, investment, and retirement account

If an asset is used as collateral on a loan, include copies of the most recent statement from lender(s) on loans, monthly

payments, loan payoffs, and balances.

Copies of the most recent statement of outstanding notes receivable.

Copies of the most recent statements from lenders on loans, mortgages (including second mortgages), monthly payments, loan

payoffs, and balances.

Copies of relevant supporting documentation of the special circumstances described in the “Explanation of Circumstances” on

Form 656, if applicable.

Attach a Form 2848, Power of Attorney, if you would like your attorney, CPA, or enrolled agent to represent you and you do not

have a current form on file with the IRS. Make sure the current tax year is included.

Completed and signed Form 656

Catalog Number 55897B www.irs.gov Form 433-B (OIC) (Rev. 3-2017)

In the past 3 years have you transferred any real property (land, house, etc.)?

Yes No

If yes, list the type of property, value, and date of the transfer.

Has the business been located outside the U.S. for 6 months or longer in the past 10 years?

Yes No

Does the business have any funds being held in trust by a third party?

Yes No If yes, how much $ Where:

Yes No

Does the business have any lines of credit?

If yes, credit limit $ Amount owed $

What property secures the line of credit?

Do you have any assets or own any real property outside the U.S.?

Yes No

If yes, please provide description, location, and value.

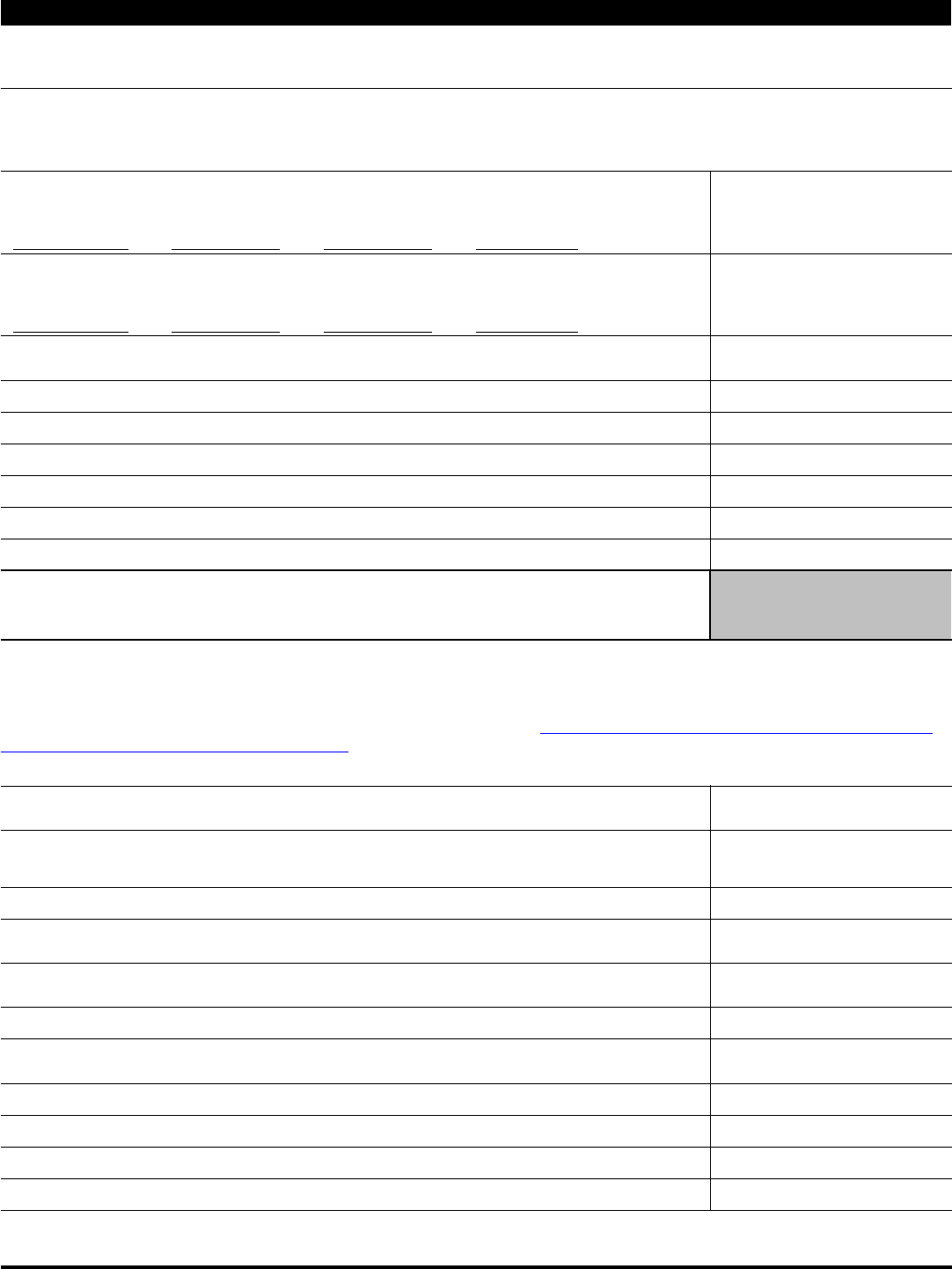

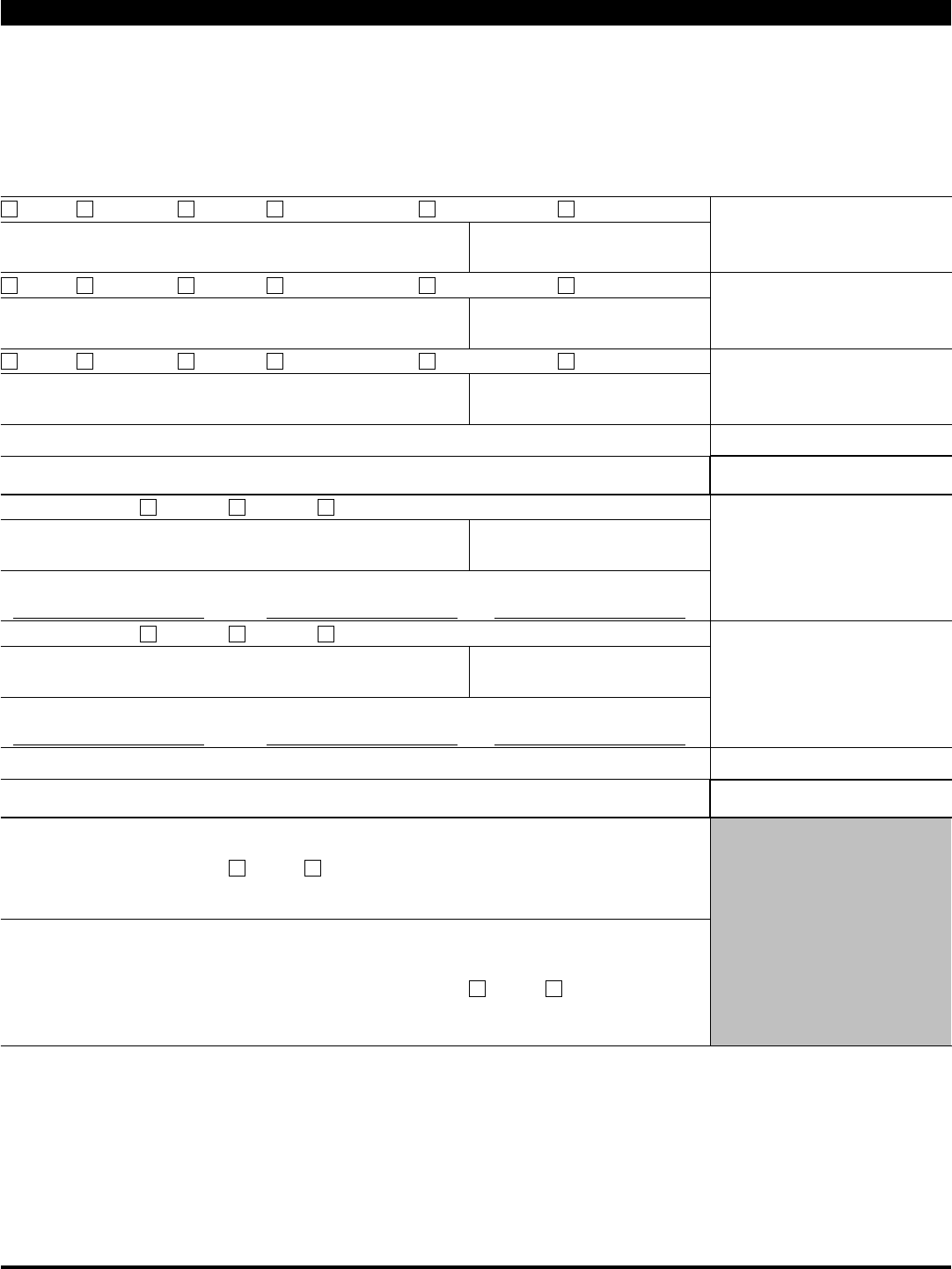

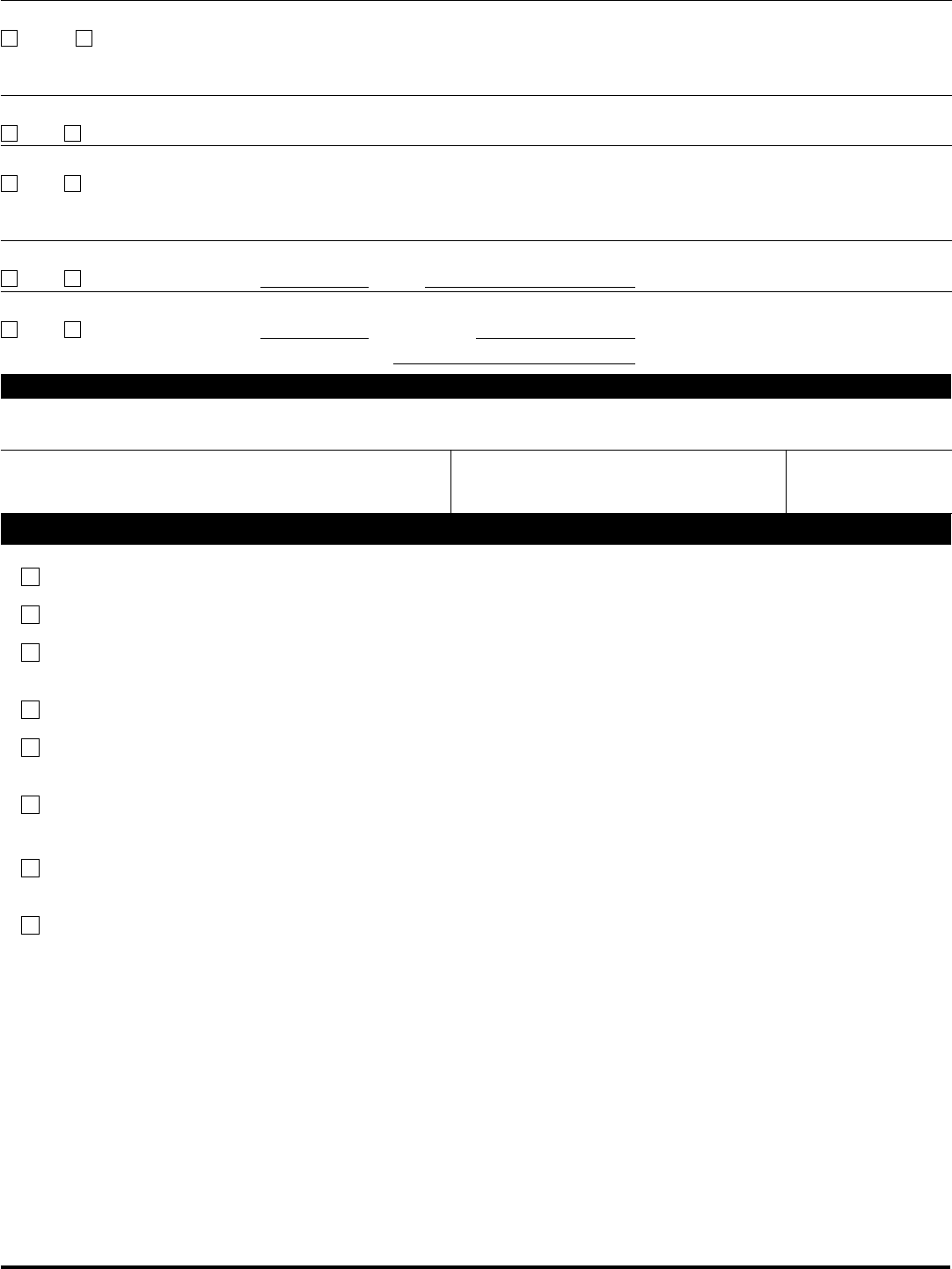

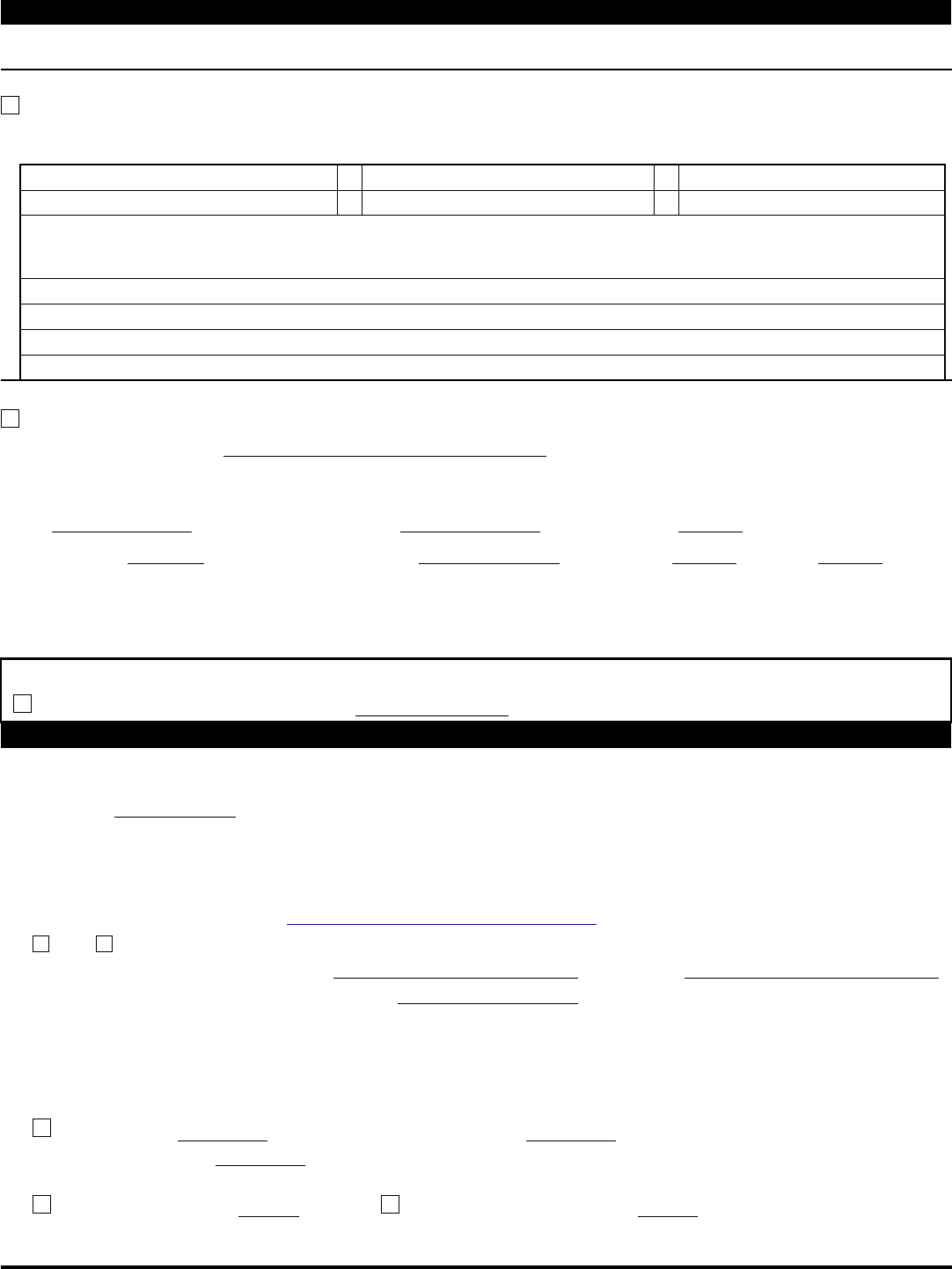

Form 656

(Rev. March 2017) Offer in Compromise

Department of the Treasury — Internal Revenue Service

Did you use the Pre-Qualifier tool located on our website at http://irs.treasury.gov/oic_pre_qualifier/ prior to filling out this form?

Note: The use of the Pre-Qualifier tool is not mandatory before sending in your offer. However, it is recommended.

Yes No

Include the $186 application fee and initial payment (personal check, cashier's check, or money order) with your Form 656. You must also include the

completed Form 433-A (OIC) and/or 433-B (OIC) and supporting documentation. You should fill out either Section 1 or Section 2, but not both,

depending on the tax debt you are offering to compromise.

If you are a 1040 filer, an individual with personal liability for Excise tax, individual responsible for Trust Fund Recovery Penalty, self-employed

individual, individual personally responsible for partnership liabilities, and/or an individual who operates as a single member LLC or a disregarded entity

taxed as a sole proprietorship you should fill out Section 1. You must also include all required documentation including the Form 433-A (OIC), the $186

application fee, and initial payment.

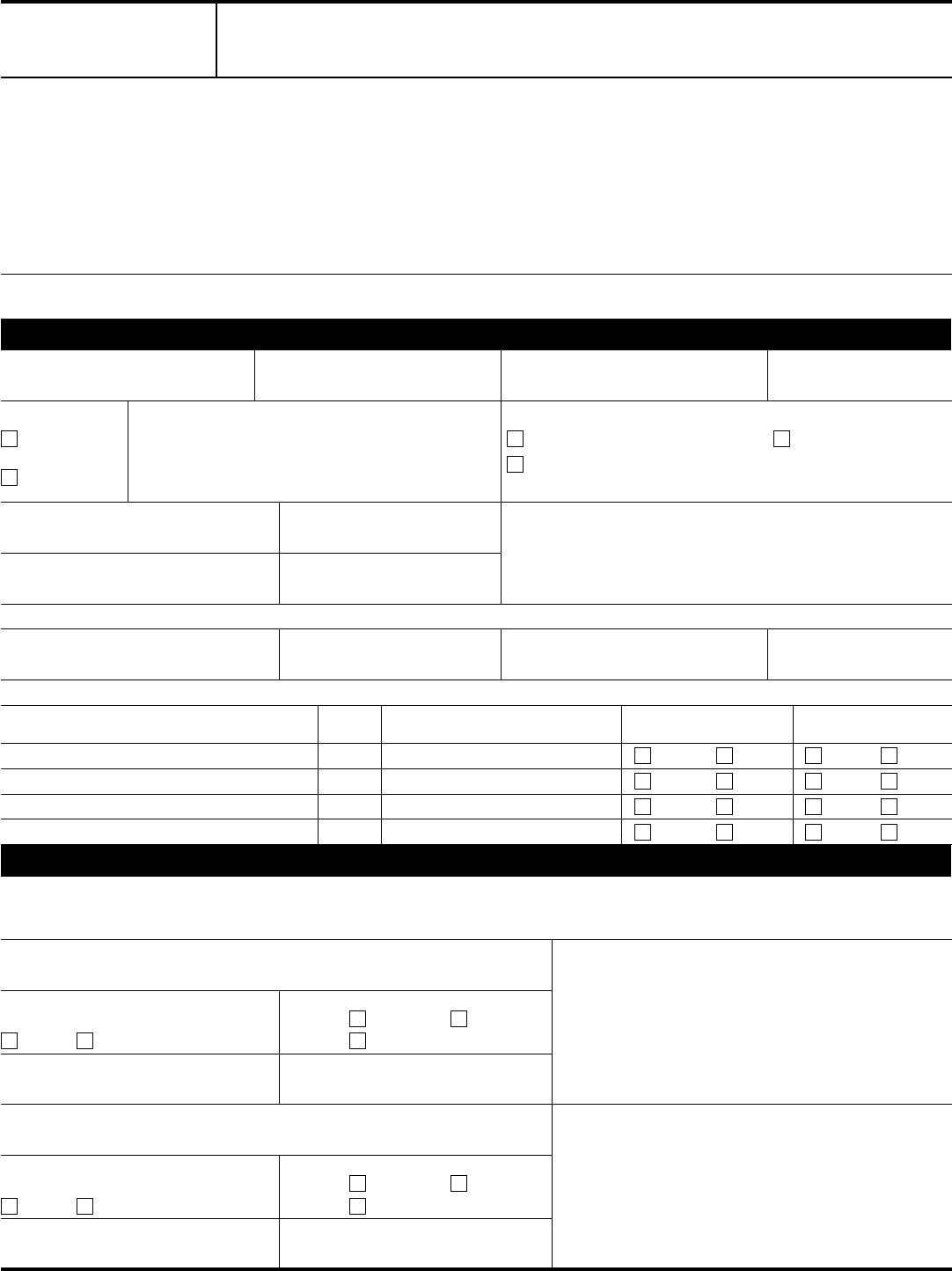

Section 1 Individual Information (Form 1040 filers)

Your First Name, Middle Initial, Last Name Social Security Number (SSN)

- -

If a Joint Offer, Spouse's First Name, Middle Initial, Last Name Social Security Number (SSN)

- -

Your Physical Home Address (Street, City, State, ZIP Code)

Your Home Mailing Address (if different from above or Post Office Box number)

Is this a new address? Yes No

If yes, would you like us to update our records to this address? Yes No

Employer Identification Number

-

Individual Tax Periods

If Your Offer is for Individual Tax Debt Only

1040 Income Tax-Year(s)

Trust Fund Recovery Penalty as a responsible person of (enter business name)

for failure to pay withholding and Federal Insurance Contributions Act taxes (Social Security taxes), for period(s) ending

941 Employer's Quarterly Federal Tax Return - Quarterly period(s)

940 Employer's Annual Federal Unemployment (FUTA) Tax Return - Year(s)

Other Federal Tax(es) [specify type(s) and period(s)]

Note: If you need more space, use attachment and title it “Attachment to Form 656 dated .” Make sure to sign and date the

attachment.

Catalog Number 16728N www.irs.gov Form 656 (Rev. 3-2017)

►

To: Commissioner of Internal Revenue Service

In the following agreement, the pronoun "we" may be assumed in place of "I" when there are joint liabilities and both parties

are signing this agreement.

I submit this offer to compromise the tax liabilities plus any interest, penalties, additions to tax, and additional amounts

required by law for the tax type and period(s) marked in Section 2 or Section 3 below.

IRS Received Date

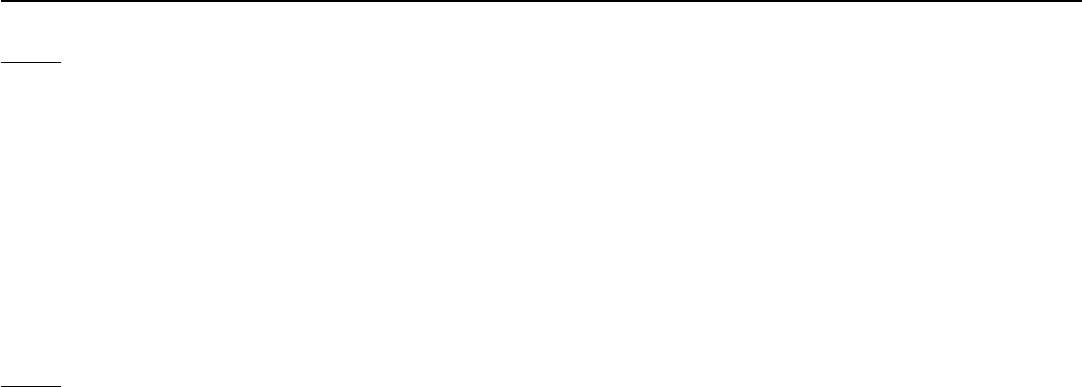

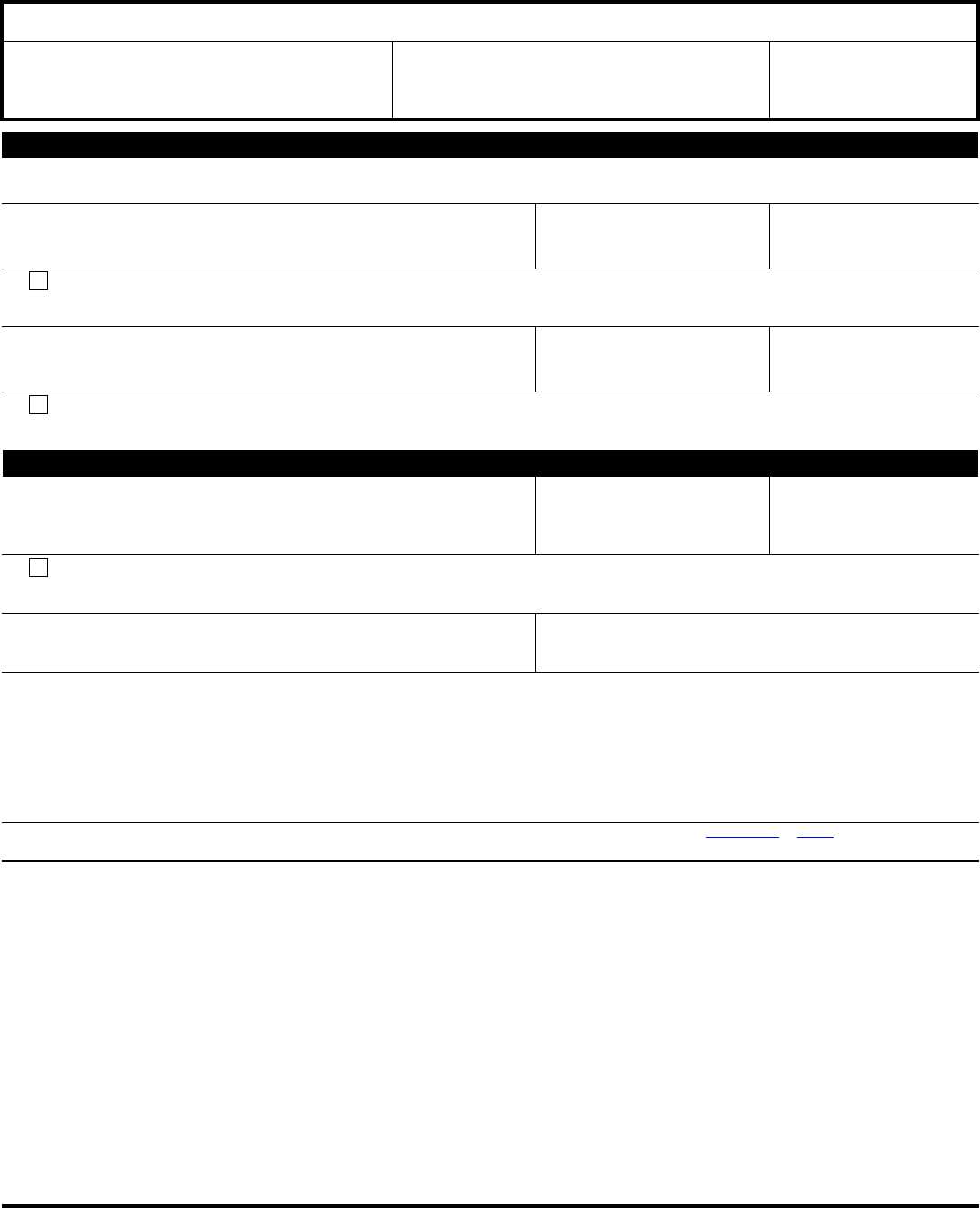

Check this box if your household's gross monthly income is equal to or less than the monthly income shown in the table below.

Size of family unit 48 contiguous states and D.C. Hawaii Alaska

1 $2,513 $2,888 $3,138

2 $3,383 $3,890 $4,227

3 $4,254 $4,892 $5,317

4 $5,125 $5,894 $6,406

5 $5,996 $6,896 $7,496

6 $6,867 $7,898 $8,585

7 $7,738 $8,900 $9,675

8 $8,608 $9,902 $10,765

For each additional person, add $871 $1,002 $1,090

Low-Income Certification (Individuals and Sole Proprietors Only)

Do you qualify for Low-Income Certification? You qualify if your gross monthly household income is less than or equal to the amount shown in the chart

below based on your family size and where you live. If you qualify, you are not required to submit any payments during the consideration of your offer. If

your business is other than a sole proprietor or disregarded single member LLC taxed as a sole proprietor and you owe employment taxes after January 1,

2009, you cannot qualify for the waiver. IRS will determine whether the household income (at the time of the offer submission or at the time the offer is

processed, whichever is lower) and family size support the decision not to pay the application fee.

Business Information (Form 1120, 1065, etc., filers)

Business Tax Periods

If Your Offer is for Business Tax Debt Only

1120 Income Tax-Year(s)

941 Employer's Quarterly Federal Tax Return - Quarterly period(s)

940 Employer's Annual Federal Unemployment (FUTA) Tax Return - Year(s)

Other Federal Tax(es) [specify type(s) and period(s)]

Note: If you need more space, use attachment and title it “Attachment to Form 656 dated .” Make sure to sign and date the

attachment.

Section 2

If your business is a Corporation, Partnership, LLC, or LLP and you want to compromise those tax debts, you must complete this section. You must also

include all required documentation including the Form 433-B (OIC), and a separate $186 application fee, and initial payment.

Business Name

Business Physical Address (Street, City, State, ZIP Code)

Business Mailing Address (Street, City, State, ZIP Code)

Employer Identification Number

(EIN)

-

Name and Title of Primary Contact Telephone Number

( ) -

Section 3 Reason for Offer

Doubt as to Collectibility - I do not have enough in assets and income to pay the full amount.

Exceptional Circumstances (Effective Tax Administration) - I owe this amount and have enough assets to pay the full amount, but due to my

exceptional circumstances, requiring full payment would cause an economic hardship or would be unfair and inequitable. I am submitting a written

narrative explaining my circumstances.

Explanation of Circumstances (Add additional pages, if needed) – The IRS understands that there are unplanned events or special circumstances, such

as serious illness, where paying the full amount or the minimum offer amount might impair your ability to provide for yourself and your family. If this is the

case and you can provide documentation to prove your situation, then your offer may be accepted despite your financial profile. Describe your situation

below and attach appropriate documents to this offer application.

Catalog Number 16728N www.irs.gov Form 656 (Rev. 3-2017)

Page 2 of 6

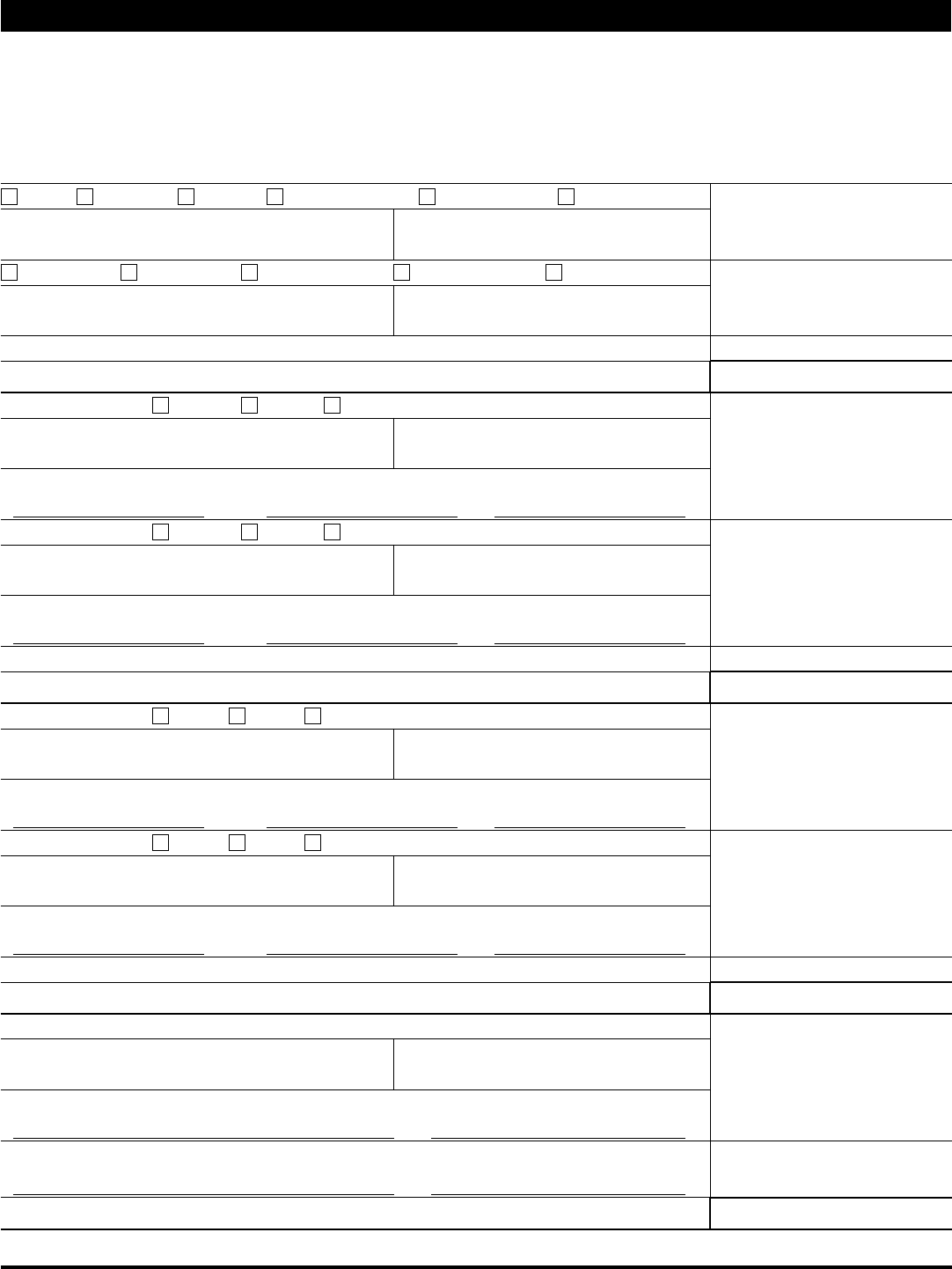

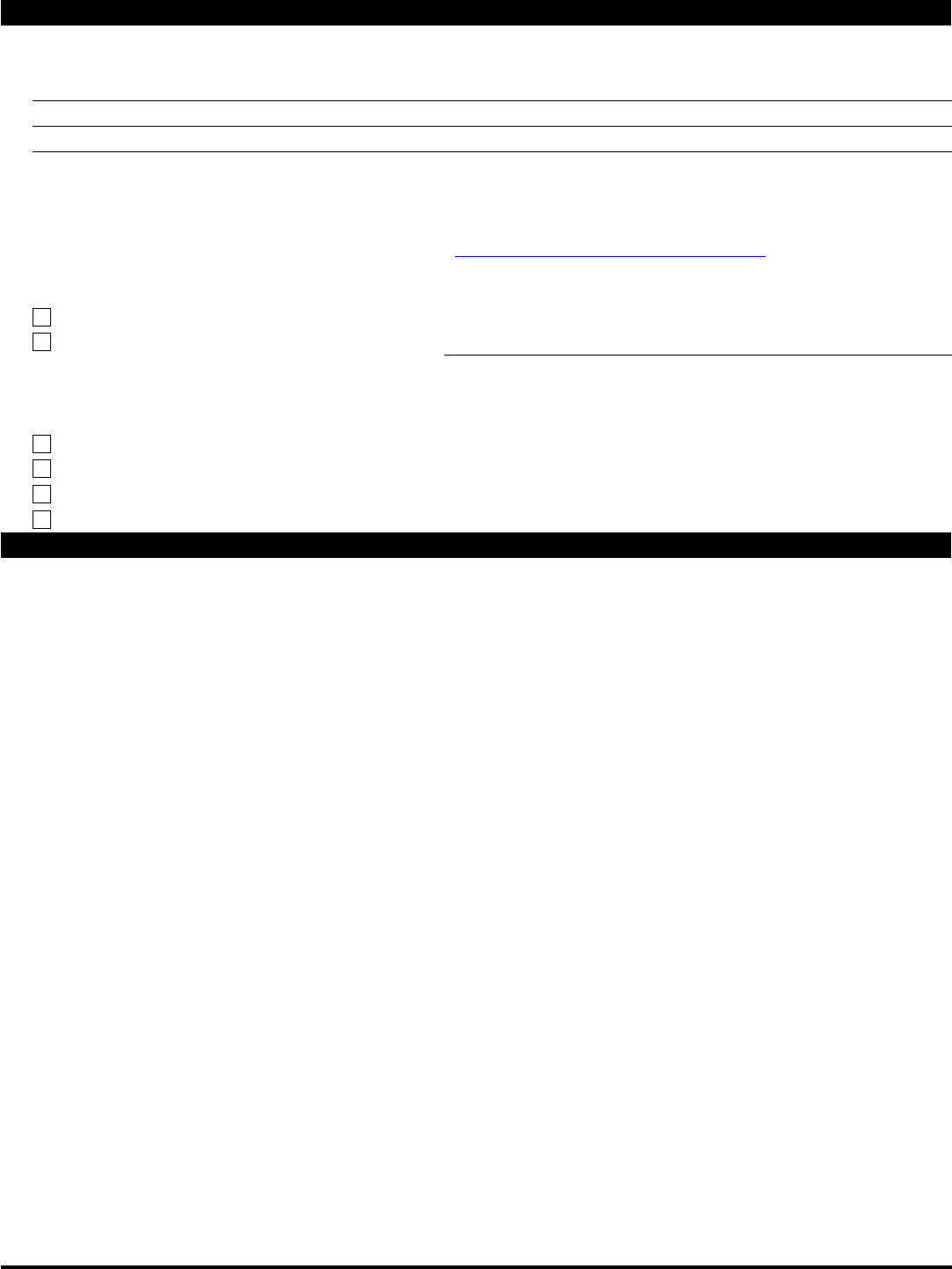

Section 4 Payment Terms

Check one of the payment options below to indicate how long it will take you to pay your offer in full. You must

offer more than $0. The offer amount should be in whole dollars only.

▼ ▼

Lump Sum Cash

Check here if you will pay your offer in 5 or fewer payments within 5 or fewer months from the date of acceptance:

Enclose a check for 20% of the offer amount (waived if you are an individual or sole proprietor and met the requirements for Low Income

Certification) and fill in the amount(s) of your future payment(s).

Total Offer Amount -20% Initial Payment = Remaining Balance

$ - $ = $

You may pay the remaining balance in one payment after acceptance of the offer or up to five payments, but cannot exceed 5

months.

Amount of payment $ payable within Month after acceptance

Amount of payment $ payable within Months after acceptance

Amount of payment $ payable within Months after acceptance

Amount of payment $ payable within Months after acceptance

Amount of payment $ payable within Months after acceptance

Periodic Payment

Check here if you will pay your offer in full in 6 to 24 months.

Enter the amount of your offer $

Note: The total amount must equal all of the proposed payments including the first and last payments.

Enclose a check for the first month's payment.

$ is included with this offer then $ will be sent in on the day of each month thereafter

for a total of months with a final payment of $ to be paid on the day of the month.

Note: The total months may not exceed a total of 24 months, including the first payment. Your first payment is considered to be month

1; therefore, the remainder of the payments must be made within 23 months for a total of 24.

You must continue to make these monthly payments while the IRS is considering the offer (waived if you met the requirements for Low

Income Certification). Failure to make regular monthly payments will cause your offer to be returned with no appeal rights.

IRS Use Only

Attached is an addendum dated (insert date) setting forth the amended offer amount and payment terms.

Page 3 of 6

Section 5 Designation of Payment, Electronic Federal Transfer Payment System (EFTPS), and Deposit

Designation of Payment

If you want your payment to be applied to a specific tax year and a specific tax debt, such as a Trust Fund Recovery Penalty, please tell us the tax

year/quarter . If you do not designate a preference, we will apply any money you send to the government's best interest. If you

want to designate any payments not included with this offer, you must designate a preference for each payment at the time the payment is made.

However, you cannot designate the $186 application fee or any payment after the IRS accepts the offer.

Note: Payments submitted with your offer cannot be designated as estimated tax payments for a current or past tax year.

Did you make your payment through the Electronic Federal Tax Payment System (EFTPS)?

Yes No

If yes, provide the amount of your payment(s) $ , the date paid

and the 15 digit Electronic Funds Transfer (EFT) Number

Note: Any initial payments paid through the EFTPS system must be made the same date your offer is mailed.

,

.

Deposit

If you are paying more than the initial payment with your offer and you want any part of that payment treated as a deposit, check the box below

and insert the amount.

My payment of $ includes the $186 application fee and $ for my first month's payment. I am requesting the

additional amount of $ be held as a deposit.

If your offer is rejected, returned, or withdrawn please check one of the boxes below and let us know what you would like us to do with your deposit.

Return it to you (Initial here )Apply it to your tax debt (Initial here )

CAUTION: Do NOT designate the amounts sent in with your offer to cover the initial payment and application fee as “deposits.” Doing

so will result in the return of your offer with no right to appeal.

Catalog Number 16728N www.irs.gov Form 656 (Rev. 3-2017)

Electronic Federal Transfer Payment System (EFTPS)

Page 4 of 6

Section 6 Source of Funds, Making Your Payment, Filing Requirements, and Tax Payment Requirements

Source of Funds

Tell us where you will obtain the funds to pay your offer. You may consider borrowing from friends and/or family, taking out a loan, or selling assets.

Making Your Payment

Include separate checks for the payment and application fee.

Make checks payable to the “United States Treasury” and attach to the front of your Form 656, Offer in Compromise. All payments must be in U.S.

dollars. Do not send cash. Send a separate application fee with each offer; do not combine it with any other tax payments, as this may delay

processing of your offer. You may also make payments through the Electronic Federal Tax Payment System (EFTPS). Your offer will be returned to

you if the application fee and the required payment are not included, or if your check is returned for insufficient funds.

Filing Requirements

I have filed all required tax returns.

I was not required to file a tax return for the following years:

Note: Do not include original tax returns with your offer. You must either electronically file your tax return or mail it to the appropriate

IRS processing office before sending in your offer.

Tax Payment Requirements (check all that apply)

I have made all required estimated tax payments for the current tax year.

I am not required to make any estimated tax payments for the current tax year.

I have made all required federal tax deposits for the current quarter.

I am not required to make any federal tax deposits for the current quarter.

Section 7 Offer Terms

By submitting this offer, I have read, understand and agree to the following terms and conditions:

Terms, Conditions, and Legal

Agreement a) I request that the IRS accept the offer amount listed in this offer application as payment of my outstanding tax

debt (including interest, penalties, and any additional amounts required by law) as of the date listed on this form. I

authorize the IRS to amend Section 1 and/or Section 2 if I failed to list any of my assessed tax debt or tax debt

assessed before acceptance of my offer. I also authorize the IRS to amend Section 1 and/or Section 2 by

removing any tax years on which there is currently no outstanding liability. I understand that my offer will be

accepted, by law, unless IRS notifies me otherwise, in writing, within 24 months of the date my offer was received

by IRS. I also understand that if any tax debt that is included in the offer is in dispute in any judicial proceeding it/

they will not be included in determining the expiration of the 24-month period.

IRS will keep my payments,

fees, and some refunds. b) I voluntarily submit the payments made on this offer and understand that they will not be returned even if I

withdraw the offer or the IRS rejects or returns the offer. Unless I designate how to apply each required payment

in Section 5, the IRS will apply my payment in the best interest of the government, choosing which tax years and

tax debts to pay off. The IRS will also keep my application fee unless the offer is not accepted for processing.

c) The IRS will keep any refund, including interest, that I might be due for tax periods extending through the

calendar year in which the IRS accepts my offer. I cannot designate that the refund be applied to estimated tax

payments for the following year or the accepted offer amount. If I receive a refund after I submit this offer for any

tax period extending through the calendar year in which the IRS accepts my offer, I will return the refund within 30

days of notification. The refund offset does not apply to offers accepted under the provisions of Effective Tax

Administration or Doubt as to Collectibility with special circumstances based on public policy/equity

considerations.

d) I understand that the amount I am offering may not include part or all of an expected or current tax refund,

money already paid, funds attached by any collection action, or anticipated benefits from a capital or net operating

loss.

e) The IRS will keep any monies it has collected prior to this offer. Under section § 6331(a) the IRS may levy up to

the time that the IRS official signs and acknowledges my offer as pending, which is accepted for processing and

the IRS may keep any proceeds arising from such a levy. No levy will be issued on individual shared responsibility

payments. However, if the IRS served a continuous levy on wages, salary, or certain federal payments under

sections 6331(e) or (h), then the IRS could choose to either retain or release the levy.

f) The IRS will keep any payments that I make related to this offer. I agree that any funds submitted with this offer